EXHIBIT 13

COMPANY PROFILE

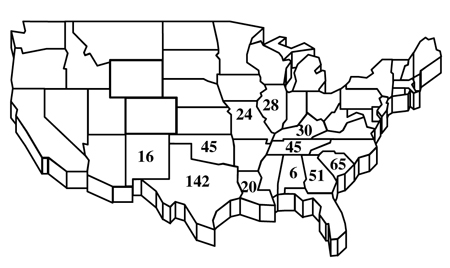

WORLD ACCEPTANCE CORPORATION, founded in 1962, is one of the largest small-loan consumer finance companies in the United States. It offers short-term small loans, medium-term larger loans, related credit insurance products and ancillary products and services to individuals who have limited access to other sources of consumer credit. It also offers income tax return preparation services and refund anticipation loans (through a third party bank) to its customer base and to others.

World emphasizes quality customer service and the building of strong personal relationships with its customers. As a result, a substantial portion of the Company’s business is repeat business from the renewal of loans to existing customers and the origination of new loans to former customers. During fiscal 2003, the Company loaned $763.8 million in the aggregate in 1,112,000 transactions. At March 31, 2003, World had over 407,000 customers. The Company’s loans generally are under $3,000 and have maturities of less than 24 months. World’s average loan in fiscal 2003 was $687, and the average maturity was approximately nine months.

The Company also markets computer software and related services to finance companies through its ParaData Financial Systems subsidiary. The ParaData system is currently used in over 1,055 consumer loan offices, including the Company’s branch offices, and ParaData services over 116 customers.

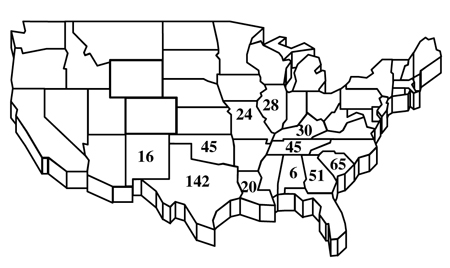

As of June 20, 2003, World operated 472 offices in South Carolina, Georgia, Texas, Oklahoma, Louisiana, Tennessee, Missouri, Illinois, New Mexico, Kentucky and Alabama.

CONTENTS

Financial Highlights | | 1 |

Message to Shareholders | | 2 |

Selected Consolidated Financial and Other Data | | 5 |

Management’s Discussion and Analysis of Financial Condition and Results of Operations | | 6 |

Consolidated Balance Sheets | | 18 |

Consolidated Statements of Operations | | 19 |

Consolidated Statements of Shareholders’ Equity | | 20 |

Consolidated Statements of Cash Flows | | 21 |

Notes to Consolidated Financial Statements | | 22 |

Independent Auditors’ Report | | 38 |

Board of Directors | | 39 |

Company Officers | | 40 |

Corporate Information | | 41 |

FINANCIAL HIGHLIGHTS

(Dollars in thousands, except per share data)

| | | Years Ended March 31,

| | | | |

| | | 2003

| | | 2002

| | | Change

| |

Selected Statement of Operations Data: | | | | | | | | | | |

Total revenues | | $ | 155,671 | | | 136,555 | | | 14.0 | % |

Net income | | | 22,864 | | | 19,339 | | | 18.2 | % |

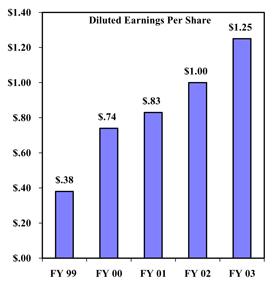

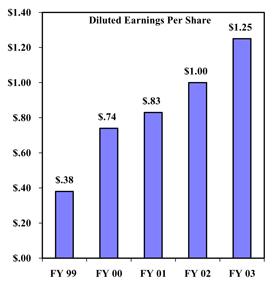

Diluted earnings per share | | | 1.25 | | | 1.00 | | | 25.0 | % |

Selected Balance Sheet Data: | | | | | | | | | | |

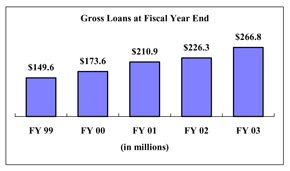

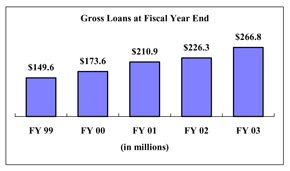

Gross loans receivable | | $ | 266,753 | | | 226,306 | | | 17.9 | % |

Total assets | | | 228,317 | | | 195,247 | | | 16.9 | % |

Total debt | | | 102,532 | | | 83,382 | | | 23.0 | % |

Total shareholders’ equity | | | 116,041 | | | 102,433 | | | 13.3 | % |

Selected Ratios: | | | | | | | | | | |

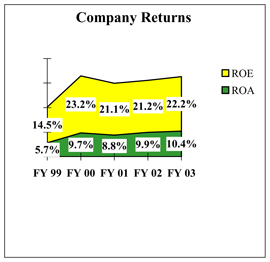

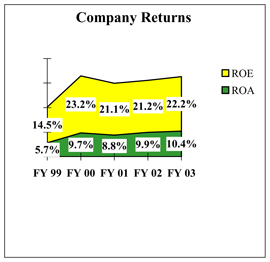

Return on average assets | | | 10.4 | % | | 9.9 | % | | 5.1 | % |

Return on average shareholders’ equity | | | 22.2 | % | | 21.2 | % | | 4.7 | % |

Shareholders’ equity to assets | | | 50.8 | % | | 52.5 | % | | (3.2 | )% |

Statistical Data: | | | | | | | | | | |

Number of customers | | | 407,184 | | | 363,920 | | | 11.9 | % |

Number of loans made | | | 1,112,137 | | | 1,020,042 | | | 9.0 | % |

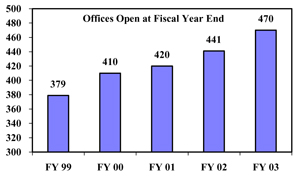

Number of offices | | | 470 | | | 441 | | | 6.6 | % |

| | | World Acceptance Corporation | | 1 |

TO OUR SHAREHOLDERS

During the last few months, the share value of your Company’s stock has risen dramatically, exceeding $15 per share for the first time since 1995. I am very pleased that our continued excellent performance has finally translated into increased recognition of the stock’s value. I believe that the recent increase is justified and long overdue. Over the last five fiscal years, your company’s earnings have grown at a 23.7% annual compounded rate. Last year, net earnings grew by 18.2% while earnings per share rose by 25%.

Fiscal 2003 was an excellent year in many respects. The Company’s return on average assets was 10.4% and its return on average equity equaled 22.2%, both representing improvements over fiscal 2002. We achieved improvements in other areas of operations as well, including: growth in loans, lower expense ratios, increased loan volume and a substantial increase in other revenue.

Net earnings for the year rose to $22.9 million, or $1.25 per diluted share, compared with $19.3 million, or $1.00 per diluted share, during fiscal 2002. This represents an 18.2% increase in earnings and a 25.0% increase in earnings per share. Our earnings growth contributed to a 21.0% increase in book value per share to $6.57 at March 31, 2003.

Our fiscal 2003 earnings benefited from a reduction in certain expense ratios. General and administrative expenses as a percent of total revenues declined to 55.1% during the most recent year from 55.2% in fiscal 2002. We are committed to containing our expenses to keep these ratios at the lowest levels possible. Additionally, interest expense as a percent of revenue decreased dramatically from 4.0% in fiscal 2002 to 2.9% last year due to the reduction in interest rates. These lower rates should also enhance earnings in fiscal 2004.

| 2 | | World Acceptance Corporation | | |

To Our Shareholders

Gross loans receivable, our primary earning asset, increased to $266.8 million at March 31, 2003, up 17.9% over the $226.3 million outstanding at the end of fiscal 2002. Total loan volume grew to $763.8 million during the fiscal year, representing over 1,112,000 separate loan transactions. At the end of the fiscal year, we had open accounts with approximately 407,000 customers.

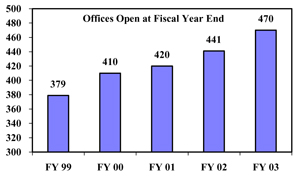

The growth in our loan portfolio continues to be the result of our expanding branch network through de novo openings and acquisitions, as well as through the introduction of new products. During fiscal 2003, we opened 12 new offices and acquired 21 offices. Four offices were merged or sold to improve our operating efficiency in certain markets. This resulted in a net increase of 29 new offices during the year and 470 offices in operation at March 31, 2003.

Acquisitions added approximately $22.6 million in gross loan balances and over 19,900 new customers in 42 separate transactions during fiscal 2003. One of these acquisitions expanded our presence into Alabama. Alabama offers an excellent growth opportunity for us over the next several years. We believe there are numerous potential locations in this state and others, which are conducive to our type of small loans. Our plans are to continue the branch expansion program, adding at least 25 new offices in each of the next two fiscal years. We continue to evaluate potential acquisitions and believe the current economic environment should provide continuing acquisition opportunities in fiscal 2004 and beyond.

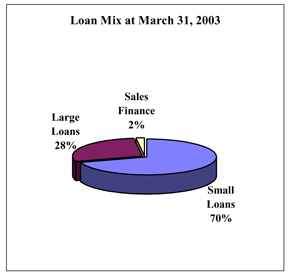

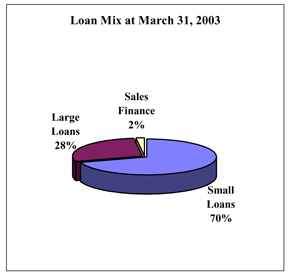

During fiscal 2003 we continued to focus on adding larger loans to diversify our portfolio. This category of loans grew by 24.4% during the year, primarily due to acquisitions. At March 31, 2003, this class of loans amounted to approximately $75.3 million in gross balances and represented 28.2% of the total loans outstanding. These loans provide lower expense and loss ratios, and generally allow the sale of credit insurance and other ancillary products. They are, therefore, very profitable notwithstanding their lower loan yields. While the Company does not intend to change its primary lending focus from its small loan business, it does plan to continue to expand the larger loan product line as part of its ongoing growth strategy.

| | | World Acceptance Corporation | | 3 |

To Our Shareholders

Loan losses continue to be a challenge for your company. Last year our charge-off percentage declined slightly to 14.7% of average loans compared with 14.8% in the prior year. We were pleased to see this slight decline for the year, as losses had been rising for the past several years. We believe that our focus on reducing employee turnover is beginning to pay dividends, as this is a relationship business and retaining employees is crucial to improved performance.

Our computer subsidiary, ParaData Financial Systems, contributed $2.3 million in net revenue and $486,000 in pretax earnings in fiscal 2003. Although ParaData’s pretax earnings were down from $773,000 the prior fiscal year, it continues to fulfill its primary function, which is to provide to us one of the best data processing systems available in the consumer finance industry at very little net cost to the Company.

Our income tax return preparation and electronic filing business has grown from 16,000 returns in fiscal 2000 to over 45,000 returns during the most recent fiscal year. Our net revenues from this business have quadrupled from approximately $1.0 million to approximately $4.0 million over this same period. We remain enthusiastic about the continued growth of this business due to its excellent fit with our customer base, more experience in preparing returns by our branch staff and the timing of this program. The majority of this business is conducted during the six weeks from mid-January to the end of February, our least busy time for regular loan production.

I will be retiring as Chief Executive Officer at this year’s Annual Meeting of the Shareholders. I will continue as Chairman of the Board of Directors and day-to-day direction of the Company will be led by your president, Mr. Doug Jones. I have worked closely with Doug for the past four years and am very confident that through his leadership your Company will continue the excellent performance that you have come to expect. Thank you for your support over the last twelve years and please continue to give this same level of support to Doug.

On behalf of the directors, management, and all of our more than 1,640 dedicated and loyal employees, many of whom are also shareholders, I thank you for your support and continued interest in World Acceptance Corporation.

Sincerely,

Charles D. Walters

Chairman and

Chief Executive Officer

| 4 | | World Acceptance Corporation | | |

SELECTED CONSOLIDATED FINANCIAL AND OTHER DATA

(Dollars in thousands, except per share amounts)

| | | Years Ended March 31,

| |

| | | 2003

| | | 2002

| | | 2001

| | | 2000

| | | 1999

| |

Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | |

Interest and fee income | | $ | 133,256 | | | $ | 117,193 | | | $ | 103,412 | | | $ | 89,052 | | | $ | 80,677 | |

Insurance commissions and other income | | | 22,415 | | | | 19,362 | | | | 17,132 | | | | 16,224 | | | | 11,085 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total revenues | | | 155,671 | | | | 136,555 | | | | 120,544 | | | | 105,276 | | | | 91,76227 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Provision for loan losses | | | 29,570 | | | | 25,688 | | | | 19,749 | | | | 15,697 | | | | 11,707 | |

Legal expense(1) | | | 916 | | | | 449 | | | | 416 | | | | 183 | | | | 5,845 | |

Other general and administrative expenses | | | 84,841 | | | | 74,969 | | | | 67,848 | | | | 61,652 | | | | 57,788 | |

Interest expense | | | 4,493 | | | | 5,415 | | | | 8,260 | | | | 6,015 | | | | 5,534 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total expenses | | | 119,820 | | | | 106,521 | | | | 96,273 | | | | 83,547 | | | | 80,874 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income before income taxes | | | 35,851 | | | | 30,034 | | | | 24,271 | | | | 21,729 | | | | 10,888 | |

Income taxes | | | 12,987 | | | | 10,695 | | | | 8,670 | | | | 7,560 | | | | 3,568 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net income(1) | | $ | 22,864 | | | $ | 19,339 | | | $ | 15,601 | | | $ | 14,169 | | | $ | 7,320 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net income per common share (diluted)(1) | | $ | 1.25 | | | $ | 1.00 | | | $ | 83 | | | $ | 74 | | | $ | 38 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Diluted weighted average common equivalent shares | | | 18,305 | | | | 19,340 | | | | 18,840 | | | | 19,155 | | | | 19,213 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Balance Sheet Data (end of period): | | | | | | | | | | | | | | | | | | | | |

Loans receivable | | $ | 203,175 | | | $ | 172,637 | | | $ | 162,389 | | | $ | 135,660 | | | $ | 117,339 | |

Allowance for loan losses | | | (15,098 | ) | | | (12,926 | ) | | | (12,032 | ) | | | (10,008 | ) | | | (8,769 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Loans receivable, net | | | 188,077 | | | | 159,711 | | | | 150,357 | | | | 125,652 | | | | 108,570 | |

Total assets | | | 228,317 | | | | 195,247 | | | | 183,160 | | | | 153,473 | | | | 133,470 | |

Total debt | | | 102,532 | | | | 83,382 | | | | 91,632 | | | | 78,382 | | | | 71,632 | |

Shareholders’ equity | | | 116,041 | | | | 102,433 | | | | 82,727 | | | | 68,192 | | | | 54,692 | |

| | | | | |

Other Operating Data: | | | | | | | | | | | | | | | | | | | | |

As a percentage of average loans receivable: | | | | | | | | | | | | | | | | | | | | |

Provision for loan losses | | | 15.3 | % | | | 14.8 | % | | | 12.6 | % | | | 12.3 | % | | | 10.4 | % |

Net charge-offs | | | 14.7 | % | | | 14.8 | % | | | 12.0 | % | | | 12.0 | % | | | 9.7 | % |

Number of offices open at year-end | | | 470 | | | | 441 | | | | 420 | | | | 410 | | | | 379 | |

| (1) | | The Company recorded a legal settlement of $5.4 million in fiscal 1999. |

| | | World Acceptance Corporation | | 5 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

General

The Company’s financial performance continues to be dependent in large part upon the growth in its outstanding loans receivable, the ongoing introduction of new products and services for marketing to its customer base, the maintenance of loan quality and acceptable levels of operating expenses. Since March 31, 1998, gross loans receivable have increased at a 15.4% annual compounded rate from $130.6 million to $266.8 million at March 31, 2003. The increase reflects both the higher volume of loans generated through the Company’s existing offices and the contribution of loans generated from new offices opened or acquired over the period. During this same five-year period, the Company has grown from 360 offices to 470 offices as of March 31, 2003. The Company plans to open or acquire at least 25 new offices in each of the next two fiscal years.

The Company continues to identify new products and services for marketing to its customer base. In addition to new insurance-related products, which have been introduced in selected states over the last several years, the Company sells and finances electronic items and appliances to its existing customer base. This program is called the “World Class Buying Club.” Total loan volume under this program amounted to $6.2 million during fiscal 2003, a 37.6% increase from the prior fiscal year. While this represents less than 1% of the Company’s total loan volume, it remains a very profitable program, which the Company plans to continue to emphasize in fiscal 2004 and beyond.

The Company’s ParaData Financial Systems subsidiary provides data processing systems to 116 separate finance companies, including the Company, and currently supports approximately 1,055 individual branch offices in 44 states. ParaData’s revenue is highly dependent upon its ability to attract new customers, which often requires substantial lead time, and as a result its revenue may fluctuate greatly from year to year. During fiscal 2003, its net revenues from system sales and support amounted to $2.3 million, a 10.1% decrease from the $2.5 million in fiscal 2002. As a result, ParaData’s pretax income contribution to the Company also fluctuates greatly and was $486,000, $773,000, and $1.0 million, in fiscal 2003, fiscal 2002, and fiscal 2001, respectively. ParaData’s net revenue and resulting net contribution to the Company will continue to fluctuate on a year to year basis, but management believes this business should remain very profitable over the long term. Additionally, and more importantly, ParaData continues to provide state-of-the-art data processing support for the Company’s in-house integrated computer system at little or no net costs to the Company.

Since fiscal 1997, the Company has expanded its product line to include larger balance, lower risk, and lower yielding individual consumer loans. These loans typically average $2,500 to $3,000, with terms of 18 to 24 months compared to $300 to $500, with 8 to 12 month terms for the smaller loans. The Company offers these loans in all states except Texas, where they are not profitable under our lending criteria and strategy. Additionally, the Company has purchased numerous larger loan offices and has made several bulk purchases of larger loans receivable. As of March 31, 2003, the larger loan category amounted to approximately $75.3 million of gross loans receivable, a 24.4% increase over the balance outstanding at March 31, 2002. As a result of these efforts, this portfolio has grown to 28.2 % of the total loan balances as of the end of the fiscal year. Management believes that these loans provide lower expense and loss ratios, thus providing positive contributions. While the Company does not intend to change its primary lending focus from its small-loan business, it does intend to continue expanding the larger loan product line as part of its ongoing growth strategy.

In fiscal 1999, the Company tested an income tax return preparation and refund anticipation loan program in 40 of its offices. Based on the results of this test, the Company expanded this program in fiscal 2000 into substantially all of its offices. Since that time, the program has grown dramatically, with the Company preparing approximately 16,000 returns, 34,000 returns, 40,000 returns, and 45,000 returns in fiscal 2000, 2001, 2002, and 2003, respectively. Net revenue generated by the Company from this program during this four-year period rose from approximately $1.0 million in fiscal 2000, to approximately $4.0 million in fiscal 2003. The Company believes that this profitable business provides a beneficial service to its existing customer base and plans to promote and expand the program in the future.

| 6 | | World Acceptance Corporation | | |

Management’s Discussion and Analysis

The following table sets forth certain information derived from the Company’s consolidated statements of operations and balance sheets, as well as operating data and ratios, for the periods indicated.

| | | Years Ended March 31,

| |

| | | 2003

| | | 2002

| | | 2001

| |

| | | (Dollars in thousands) | |

Average gross loans receivable(1) | | $ | 257,595 | | | 228,400 | | | 204,789 | |

Average loans receivable(2) | | | 193,898 | | | 173,192 | | | 156,850 | |

| | | |

Expenses as a percentage of total revenue: | | | | | | | | | | |

Provision for loan losses | | | 19.0 | % | | 18.8 | % | | 16.4 | % |

General and administrative | | | 55.1 | % | | 55.2 | % | | 56.6 | % |

Total interest expense | | | 2.9 | % | | 4.0 | % | | 6.9 | % |

| | | |

Operating margin(3) | | | 25.9 | % | | 26.0 | % | | 27.0 | % |

Return on average assets | | | 10.4 | % | | 9.9 | % | | 8.8 | % |

| | | |

Offices opened and acquired, net | | | 29 | | | 21 | | | 10 | |

Total offices (at period end) | | | 470 | | | 441 | | | 420 | |

| (1) | | Average gross loans receivable have been determined by averaging month-end gross loans receivable over the indicated period. |

| (2) | | Average loans receivable have been determined by averaging month-end gross loans receivable less unearned interest and deferred fees over the indicated period. |

| (3) | | Operating margin is computed as total revenues less provision for loan losses and general and administrative expenses as a percentage of total revenues. |

Comparison of Fiscal 2003 Versus Fiscal 2002

Net income amounted to $22.9 million during fiscal 2003, an 18.2% increase over the $19.3 million earned during fiscal 2002. This increase resulted from an increase in operating income (revenue less provision for loan losses and general and administrative expense) of $4.9 million, or 13.8%, combined with a decrease in interest expense and partially offset by an increase in income taxes.

Interest and fee income during fiscal 2003 increased by $16.1 million, or 13.7%, over fiscal 2002. This increase resulted from an increase of $20.7 million, or 12.0%, in average loans receivable between the two fiscal years. The increase in average loans receivable, especially the larger loans, was partially due to several acquisitions during the year. The Company acquired approximately $16.7 million in net loans in 42 separate transactions during fiscal 2003.

Insurance commissions and other income increased by $3.1 million, or 15.8%, over the two fiscal years. Insurance commissions increased by $1.8 million, or 20.8%, as a result of the increase in loan volume in states where credit insurance may be sold. Other income increased by $1.2 million, or 11.7%, over the two years.

Total revenues increased to $155.7 million in fiscal 2003, a $19.1 million, or 14.0%, increase over the $136.6 million in fiscal 2002. Revenues from the 412 offices open throughout both fiscal years increased by 8.5%. At March 31, 2003, the Company had 470 offices in operation, an increase of 29 net offices from March 31, 2002.

The provision for loan losses during fiscal 2003 increased by $3.9 million, or 15.1%, from the previous year. This increase resulted from a combination of increases in both the general allowance for loan losses and the amount of loans charged off. Net charge-offs for fiscal 2003 amounted to $28.4 million, a 10.8% increase over the $25.7 million charged off during fiscal 2002, and net charge-offs as a percentage of average loans declined slightly from 14.8% to 14.7% when comparing the two annual periods.

General and administrative expenses during fiscal 2003 increased by $10.3 million, or 13.7%, over the previous fiscal year. This increase was due primarily to costs associated with the new offices opened or acquired during the fiscal year. General and administrative expenses, when divided by average open offices, increased by 6.8% when comparing the two fiscal years and, overall, general and administrative expenses as a percent of total revenues decreased from 55.2% in fiscal 2002 to 55.1% during fiscal 2003.

| | | World Acceptance Corporation | | 7 |

Management’s Discussion and Analysis

Interest expense decreased by $922,000, or 17.0%, during fiscal 2003, as compared to the previous fiscal year as a result of the continued decline in interest rates.

The Company’s effective income tax rate increased to 36.2% during fiscal 2003 from 35.6% during the previous fiscal year. This increase resulted primarily from increased state income taxes.

Comparison of Fiscal 2002 Versus Fiscal 2001

Net income was $19.3 million in fiscal 2002, a $3.7 million, or 24.0%, increase over the $15.6 million earned during fiscal 2001. This increase resulted from an increase in operating income of $2.9 million, or 9.0%, combined with a reduction in interest expense of $2.8 million, or 34.4%, offset by an increase of $2.0 million in income taxes.

Interest and fee income during fiscal 2002 increased by $13.8 million, or 13.3%, over fiscal 2001. This increase resulted primarily from an increase of $16.3 million, or 10.4%, in average loans receivable between the two fiscal years. The increase in interest and fee income was also aided by favorable changes in state laws and regulations in three states during the past 21 months. In Tennessee, on loans less than $1,000, the interest and fees allowed were substantially increased, while the sale of credit insurance and other ancillary products was eliminated. In Texas, the $10 initial charge was made non-refundable. In Georgia, there was an increase in the monthly maintenance charge and the allowed late charge, as well as a change in the restricted period on loan renewals. While these changes became effective during fiscal 2001, they were in force during the entire fiscal 2002, contributing to the increase in loan yields over the two fiscal periods.

Insurance commissions and other income amounted to $19.4 million in fiscal 2002, a $2.2 million, or 13.0%, increase over the $17.1 million earned in fiscal 2001. Insurance commissions increased by $280,000, or 3.3%, and other income increased by $1.9 million, or 22.4%. The increase in insurance commissions resulted from the growth in the loan portfolio in Kentucky, where credit insurance is sold in conjunction with the loan, partially offset by the elimination of credit insurance on loans less than $1,000 in Tennessee. The increase in other income was due primarily to the introduction of certain ancillary products, such as motor club and accidental death insurance in Kentucky during fiscal 2002, combined with an increase of approximately $1.4 million in net fees from the tax preparation program.

Total revenues were $136.6 million during fiscal 2002, a 13.3% increase over the $120.5 million in the prior fiscal year. Revenues from the 397 offices that were open throughout both fiscal years increased by 9.9%.

The provision for loan losses during fiscal 2002 increased by $5.9 million, or 30.1%, from the previous year. This increase resulted primarily from an increase in loan losses over the two fiscal periods. As a percentage of average loans receivable, net charge-offs rose to 14.8% during fiscal 2002 from 12.0% during fiscal 2001. This increase was due to the maturing of the larger loan portfolio, resulting in higher losses in this category, as well as an increase in overall losses due primarily to the decline in the economy.

General and administrative expenses increased by $7.2 million, or 10.5%, over the two fiscal years. The Company’s profitability benefited by improved expense ratios as total general and administrative expense as a percent of total revenues decreased from 56.6% in fiscal 2001 to 55.2% in fiscal 2002. This ratio improved because the average general and administrative expense per open office rose by 7.5% over the two fiscal years, while the average revenue increased 10.3%.

Interest expense was $5.4 million in fiscal 2002, a decrease of $2.8 million, or 34.4%, from $8.3 million in fiscal 2001. This decrease was due to the reduction in interest rates during the year. Average debt outstanding increased by 0.6% over the two fiscal years. Because a major portion of the Company’s debt is floating rate, the Company benefited greatly by the reduction in interest rates during fiscal 2002.

The Company’s effective income tax rate remained approximately the same at 35.7% and 35.6% during fiscal 2001 and 2002, respectively.

| 8 | | World Acceptance Corporation | | |

Management’s Discussion and Analysis

Critical Accounting Policies

The Company’s accounting and reporting policies are in accordance with accounting principles generally accepted in the United States of America and conform to general practices within the finance company industry. The significant accounting policies used in the preparation of the consolidated financial statements are discussed in Note 1 to the consolidated financial statements. Certain critical accounting policies involve significant judgment by the Company’s management, including the use of estimates and assumptions which affect the reported amounts of assets, liabilities, revenues, and expenses. As a result, changes in these estimates and assumptions could significantly affect the Company’s financial position and results of operations. The Company considers its policies regarding the allowance for loan losses to be its most critical accounting policy due to the significant degree of management judgment. The Company has developed policies and procedures for assessing the adequacy of the allowance for loan losses which takes into consideration various assumptions and estimates with respect to the loan portfolio. The Company’s assumptions and estimates may be affected in the future by changes in economic conditions, among other factors. For additional discussion concerning the allowance for loan losses, see “Credit Quality” below.

Credit Quality

The Company’s delinquency and net charge-off ratios reflect, among other factors, changes in the mix of loans in the portfolio, the quality of receivables, the success of collection efforts, bankruptcy trends and general economic conditions.

Delinquency is computed on the basis of the date of the last full contractual payment on a loan (known as the recency method) and on the basis of the amount past due in accordance with original payment terms of a loan (known as the contractual method). Management closely monitors portfolio delinquency using both methods to measure the quality of the Company’s loan portfolio and the probability of credit losses.

The following table classifies the gross loans receivable of the Company that were delinquent on a recency and contractual basis for at least 60 days at March 31, 2003, 2002, and 2001:

| | | At March 31,

| |

| | | 2003

| | | 2002

| | | 2001

| |

| | | (Dollars in thousands) | |

Recency basis: | | | | | | | | | | |

60-89 days past due | | $ | 4,960 | | | 4,010 | | | 3,213 | |

90 days or more past due | | | 1,661 | | | 1,627 | | | 1,624 | |

| | |

|

|

| |

|

| |

|

|

Total | | $ | 6,621 | | | 5,637 | | | 4,837 | |

| | |

|

|

| |

|

| |

|

|

Percentage of period-end gross loans receivable | | | 2.5 | % | | 2.5 | % | | 2.3 | % |

| | |

|

|

| |

|

| |

|

|

Contractual basis: | | | | | | | | | | |

60-89 days past due | | $ | 6,169 | | | 5,111 | | | 4,297 | |

90 days or more past due | | | 5,060 | | | 4,708 | | | 4,080 | |

| | |

|

|

| |

|

| |

|

|

Total | | $ | 11,229 | | | 9,819 | | | 8,377 | |

| | |

|

|

| |

|

| |

|

|

Percentage of period-end gross loans receivable | | | 4.2 | % | | 4.3 | % | | 4.0 | % |

| | |

|

|

| |

|

| |

|

|

Loans are charged off at the earlier of when such loans are deemed to be uncollectible or when six months have elapsed since the date of the last full contractual payment. The Company’s charge-off policy has been consistently applied, and no significant changes have been made to the policy during the periods reported. Management considers the charge-off policy when evaluating the appropriateness of the allowance for loan losses.

At the end of fiscal 2003, the Company experienced a slight decrease in contractual delinquency from 4.3% at March 31, 2002 to 4.2% at the end of the current fiscal year. On a recency basis, delinquency remained flat at 2.5% at the end of the two fiscal years. Additionally, charge-offs as a percent of average loans decreased from 14.8% in fiscal 2002 to 14.7% in fiscal 2003.

| | | World Acceptance Corporation | | 9 |

Management’s Discussion and Analysis

In fiscal 2003, approximately 86.6% of the Company’s loans were generated through renewals of outstanding loans and the origination of new loans to previous customers. A renewal represents a new loan transaction with a present customer in which a portion of the new loan proceeds is used to repay the balance of an existing loan and the remaining portion is advanced to the customer. For fiscal 2001, 2002, and 2003, the percentages of the Company’s loan originations that were renewals of existing loans were 78.5%, 79.0%, and 77.1%, respectively. The Company’s renewal policies are determined based on state regulations and customer payment history. A renewal is considered a current renewal if the customer is no more than 45 days delinquent on a contractual basis. Delinquent renewals may be extended to customers that are more than 45 days past due on a contractual basis if the customer completes a new application and the manager believes that the customer’s ability and intent to repay has improved. It is the Company’s policy to not renew delinquent loans in amounts greater than the original amounts financed. In all cases, a customer must complete a new application every two years. During fiscal 2003, delinquent renewals represented less than 3% of the Company’s total loan volume.

Charge-offs, as a percentage of loans made by category, are greatest on loans made to new borrowers and less on loans made to former borrowers and renewals. This is as expected due to the payment history experience available on repeat borrowers. However, as a percentage of total loans charged off, renewals represent the greatest percentage due to the volume of loans made in this category. The following table depicts the charge-offs as a percent of loans made by category and as a percent of total charge-offs during fiscal 2003:

| | | Loan Volume

by Category

| | | Percent of

Total Charge-

offs

| | | Percent of

Loans Made

| |

Renewals | | 77.1 | % | | 69.7 | % | | 5.9 | % |

Former Borrowers | | 9.5 | % | | 5.7 | % | | 3.9 | % |

New Borrowers | | 13.4 | % | | 24.6 | % | | 10.5 | % |

| | |

|

| |

|

| | | |

| | | 100.0 | % | | 100.0 | % | | | |

| | |

|

| |

|

| | | |

The Company maintains an allowance for loan losses in an amount that, in management’s opinion, is adequate to cover losses inherent in the existing loan portfolio. The Company charges against current earnings, as a provision for loan losses, amounts added to the allowance to maintain it at levels expected to cover probable losses of principal. When establishing the allowance for loan losses, the Company takes into consideration the growth of the loan portfolio, the mix of the loan portfolio, current levels of charge-offs, current levels of delinquencies, and current economic factors. In accordance with Statement of Accounting Standards No. 5 “Accounting for Contingencies” (SFAS No. 5), the Company accrues an estimated loss if it is probable and can be reasonably estimated. It is probable that there are losses in the existing portfolio. To estimate the losses, the Company uses historical information for net charge-offs and average loan life by loan type. This methodology is based on the fact that many customers renew their loans prior to the contractual maturity. Average contractual loan terms are approximately nine months and the average life is approximately four months. Based on this methodology, the Company had an allowance for loan losses that approximated six months of average net charge-offs at March 31, 2003 and March 31, 2002, and eight months of average net charge-offs at March 31, 2001. Therefore, at each year end the Company had an allowance for loan losses that covers estimated losses for its existing loans based on historical charge-offs and average lives. In addition, the entire loan portfolio turns over approximately 3.5 times during a typical twelve-month period. Therefore, a large percentage of loans that are charged off during any fiscal year are not on the Company’s books at the beginning of the fiscal year. The Company believes that it is not appropriate to provide for losses on loans that have not been originated, that twelve months of net charge-offs is not needed in the allowance, and that the methodology employed is in accordance with generally accepted accounting principles.

For the years ended March 31, 2003, 2002 and 2001, the Company recorded adjustments of approximately $1.0 million, $889,000 and $1.0 million, respectively, to the allowance for loan losses in connection with our acquisitions in accordance generally accepted accounting principles. These adjustments represent the allowance for loan losses on acquired loans.

| 10 | | World Acceptance Corporation | | |

Management’s Discussion and Analysis

The Company records acquired loans at fair value based on current interest rates, less allowances for uncollectibility and collection costs. The Company normally records all acquired loans on its books, however, the acquired loan portfolios generally include some loans that the Company deems uncollectible but which do not have an allowance assigned to them. An allowance for loan losses is then estimated based on a review of the loan portfolio, considering delinquency levels, charge-offs, loan mix and other current economic factors. The Company then records the acquired loans at their gross value and records the related allowance for loan losses as an adjustment to their allowance for loan losses. This is reflected as purchase accounting acquisitions in the table below. Subsequent charge-offs related to acquired loans are reflected in the purchase accounting acquisition adjustment in the year of acquisition.

The Company believes that its allowance for loan losses is adequate to cover losses in the existing portfolio at March 31, 2003.

The following is a summary of the changes in the allowance for loan losses for the years ended March 31, 2003, 2002, and 2001:

| | | March 31,

| |

| | | 2003

| | | 2002

| | | 2001

| |

Balance at the beginning of the year | | $ | 12,925,644 | | | 12,031,622 | | | 10,008,257 | |

Provision for loan losses | | | 29,569,889 | | | 25,687,989 | | | 19,748,604 | |

Loan losses | | | (30,987,772 | ) | | (27,774,830 | ) | | (20,433,464 | ) |

Recoveries | | | 2,541,785 | | | 2,092,032 | | | 1,682,681 | |

Purchase accounting acquisitions | | | 1,048,234 | | | 888,831 | | | 1,025,544 | |

| | |

|

|

| |

|

| |

|

|

Balance at the end of the year | | $ | 15,097,780 | | | 12,925,644 | | | 12,031,622 | |

| | |

|

|

| |

|

| |

|

|

Allowance as a percentage of loans receivable | | | 7.4 | % | | 7.5 | % | | 7.4 | % |

Net charge-offs as a percentage of average loans receivable(1) | | | 14.7 | % | | 14.8 | % | | 12.0 | % |

| (1) | | Average loans receivable have been determined by averaging month-end gross loans receivable less unearned interest and deferred fees over the indicated period. |

Quarterly Information and Seasonality

The Company’s loan volume and corresponding loans receivable follow seasonal trends. The Company’s highest loan demand typically occurs from October through December, its third fiscal quarter. Loan demand has generally been the lowest and loan repayment highest from January to March, its fourth fiscal quarter. Loan volume and average balances typically remain relatively level during the remainder of the year. This seasonal trend affects quarterly operating performance through corresponding fluctuations in interest and fee income and insurance commissions earned and the provision for loan losses recorded, as well as fluctuations in the Company’s cash needs. Consequently, operating results for the Company’s third fiscal quarter generally are significantly lower than in other quarters and operating results for its fourth fiscal quarter significantly higher than in other quarters.

The following table sets forth, on a quarterly basis, certain items included in the Company’s unaudited consolidated financial statements and shows the number of offices open during fiscal years 2002 and 2003.

| | | At or for the Three Months Ended

|

| | | June 30,

2001

| | Sept. 30,

2001

| | Dec. 31,

2001

| | March 31,

2002

| | June 30,

2002

| | Sept. 30,

2002

| | Dec. 31,

2002

| | March 31,

2003

|

| | | (Dollars in thousands) |

Total revenues | | $ | 30,394 | | 31,324 | | 34,765 | | 40,072 | | 34,819 | | 36,146 | | 39,034 | | 45,672 |

Provision for loan losses | | | 5,204 | | 6,902 | | 8,572 | | 5,010 | | 6,363 | | 7,605 | | 10,209 | | 5,393 |

General and administrative expenses | | | 17,958 | | 17,274 | | 20,277 | | 19,910 | | 20,186 | | 20,205 | | 22,451 | | 22,915 |

Net income | | | 3,655 | | 3,673 | | 3,039 | | 8,972 | | 4,668 | | 4,624 | | 3,352 | | 10,220 |

Gross loans receivable | | $ | 221,714 | | 228,878 | | 257,243 | | 226,307 | | 247,203 | | 255,187 | | 300,751 | | 266,753 |

Number of offices open | | | 424 | | 434 | | 441 | | 441 | | 454 | | 461 | | 470 | | 470 |

| | | World Acceptance Corporation | | 11 |

Management’s Discussion and Analysis

Current Accounting Issues

Goodwill and Other Intangible Assets

Effective April 1, 2002, the Company adopted the provisions of Statement of Financial Accounting Standards (“SFAS”) No. 142 “Goodwill and Other Intangible Assets” (“SFAS 142”), which requires that goodwill and intangible assets with indefinite useful lives no longer be amortized. Instead, these amounts are tested for impairment at least annually in accordance with the provisions of SFAS 142. SFAS 142 also requires that intangible assets with definite useful lives be amortized over their respective estimated useful lives to their estimated residual values and reviewed for impairment in accordance with SFAS No. 144 “Accounting for the Impairment or Disposal of Long-Lived Assets” (“SFAS 144”).

In connection with the transitional goodwill, SFAS 142 requires the Company to perform an assessment of whether there is an indication that goodwill is impaired as of April 1, 2002. To accomplish this, the Company had to identify its reporting units and determine the carrying value of each reporting unit by assigning the assets and liabilities, including the existing goodwill and intangible assets, to those reporting units as of the date of adoption. The Company had until September 30, 2002 to determine the fair value of each reporting unit and compare it to the reporting unit’s carrying amount. To the extent a reporting unit’s carrying amount exceeds its fair value, an indication exists that the reporting unit’s goodwill may be impaired, and a second step of this transitional impairment test must be performed. In the second step, the implied fair value of the reporting unit’s goodwill, determined by allocating the reporting unit’s fair value to all of it assets (recognized and unrecognized) and liabilities in a manner similar to a purchase price allocation in accordance with SFAS No. 141, “Business Combinations” (“SFAS 141”), is compared to its carrying amount, both of which would be measured as of April 1, 2002. Upon completion of the Company’s analysis of the fair value of its intangible assets, management determined that the fair value of the reporting unit exceeded its carrying value.

Following the April 1, 2002 adoption of SFAS 142, the Company had unamortized goodwill in the amount of $774,000 and unamortized identifiable intangible assets in the amount of $13.2 million related to loan office purchases. Under SFAS 142, the goodwill will no longer be amortized. Amortization expense related to goodwill was $166,000 ($107,000 after tax) for 2002 and 2001. The company will continue to amortize the identifiable intangible assets, which relates to non-compete agreements and customer lists.

The following presents the details for goodwill amortization expense and net income (in thousands, except share data) for the years ended March 31:

| | | 2003

| | 2002

| | 2001

|

Net income | | $ | 22,864 | | 19,339 | | 15,601 |

Amortization of goodwill, net of tax | | | — | | 107 | | 107 |

| | |

|

| |

| |

|

Adjusted net income | | | 22,864 | | 19,446 | | 15,708 |

| | |

|

| |

| |

|

Net income per common share, basic | | $ | 1.28 | | 1.03 | | .84 |

Amortization of goodwill, net of tax | | | — | | 01 | | — |

| | |

|

| |

| |

|

Adjusted net income per common share, basic | | | 1.28 | | 1.04 | | .84 |

| | |

|

| |

| |

|

Net income per common share, diluted | | $ | 1.25 | | 1.00 | | .83 |

Amortization of goodwill, net of tax | | | — | | 01 | | — |

| | |

|

| |

| |

|

Adjusted net income per common share, diluted | | | 1.25 | | 1.01 | | .83 |

| | |

|

| |

| |

|

Accounting for the Impairment of Long-Lived Assets

Effective April 1, 2002, the Company adopted SFAS 144, which addresses financial accounting and reporting for the impairment of long-lived assets and for long-lived assets to be disposed of. SFAS 144 supersedes SFAS No. 121 “Accounting for the Impairment of Long-Lived Assets and for Long-Lived Assets to be Disposed Of.”

| 12 | | World Acceptance Corporation | | |

Management’s Discussion and Analysis

Reclassification of Losses on Early Extinguishment of Debt

In April 2002, the FASB issued SFAS No. 145, “Recission of FASB Statements No. 4, 44, and 64, Amendments of FASB Statement No. 13, and Technical Corrections” (“SFAS 145”). SFAS 145 rescinds SFAS No. 4, “Reporting Gains and Losses from Extinguishments of Debt,” and an amendment of SFAS 4, SFAS No. 64, “Extinguishments of Debt Made to Satisfy Sinking-Fund Requirements.” SFAS 145 requires that gains and losses from extinguishments of debt should be classified as an extraordinary item only if they meet the criteria of FASB Opinion No. 30, “Reporting the Results of Operations-Reporting the Effects of Disposal of a Segment of Business, and Extraordinary, Unusual and Infrequently Occurring Events and Transactions” (“FASB Opinion 30”). Applying the provisions of FASB Opinion 30 will distinguish transactions that are part of an entity’s recurring operations from those that are unusual or infrequent or that meet the criteria for classification as an extraordinary item.

The provisions of SFAS 145 are effective for financial statements issued for fiscal years beginning after May 15, 2002, and interim periods within those fiscal years, and early adoption is encouraged. Any gain or loss on extinguishments of debt that was classified as an extraordinary item in prior periods presented that does not meet the criteria in FASB Opinion 30 for classification as an extraordinary item will be reclassified. The adoption of SFAS 145 had no impact on the financial statements of the Company.

Accounting for Exit or Disposal Activities

In June 2002, the Financial Accounting Standards Board (“FASB”) issued SFAS No. 146, “Accounting for Costs Associated with Exit or Disposal Activities” (“SFAS 146”), which addresses financial accounting and reporting for costs associated with exit or disposal activities and nullifies Emerging Issues Task force Issue No. 94-3, “Liability Recognition for Certain Employee Termination Benefits and Other Costs to Exit an Activity (including Certain Costs Incurred in a Restructuring).” SFAS 146 applies to costs associated with an exit activity that do not involve an entity newly acquired in a business combination or with a disposal activity covered by SFAS No. 144, “Accounting for the Impairment or Disposal of Long-Lived Assets.” Those costs include, but are not limited to, the following: a) termination benefits provided to current employees that are involuntarily terminated under the terms of a benefit arrangement that, in substance, is not an ongoing benefit arrangement or an individual deferred compensation contract (hereinafter referred to as one-time termination benefits); b) costs to terminate a contract that is not a capital lease; and c) costs to consolidate facilities or relocate employees. This Statement does not apply to costs associated with the retirement of a long-lived asset covered by SFAS No. 143, “Accounting for Asset Retirement Obligations.” A liability for a cost associated with an exit or disposal activity shall be recognized and measured initially at its fair value in the period in which the liability is incurred. A liability for a cost associated with an exit or disposal activity is incurred when the definition of a liability is met in accordance with FASB Concepts Statements No. 6, “Elements of Financial Statements.” The provisions of this Statement are effective for exit or disposal activities that are initiated after December 31, 2002.

Recently Issued Accounting Pronouncements

Accounting for Guarantees

In November 2002, the FASB issued FASB Interpretation No. 45, “Guarantor’s Accounting and Disclosure Requirements for Guarantees, Including Indirect Guarantees of Indebtedness of Others” (“FIN 45”). FIN 45 elaborates on the disclosure to be made by a guarantor in its interim and annual financial statements about its obligations under certain guarantees that it has issued. It also clarifies that a guarantor is required to recognize, at the inception of a guarantee, a liability for the fair value of the obligation undertaken in issuing the guarantee. FIN 45 clarifies that a guarantor is required to disclose (a) the nature of the guarantee; (b) the maximum potential amount of future payments under the grantee; (c) the carrying amount of the liability; and (d) the nature and extent of any recourse provisions or available collateral that would enable the guarantor to recover the amounts paid under the guarantee. FIN 45 also clarifies that a guarantor is required to recognize, at inception of a guarantee, a liability for the obligation it has undertaken in issuing the guarantee at its inception.

| | | World Acceptance Corporation | | 13 |

Management’s Discussion and Analysis

The initial recognition and initial measurement provisions of FIN 45 are applicable on a prospective basis to guarantees issued or modified after December 31, 2002. The disclosure requirements in FIN 45 are effective for financial statements ending after December 15, 2002. The Company adopted the initial recognition and initial measurement provisions of FIN 45 effective as of January 1, 2003, and adopted the disclosure requirements effective as of March 31, 2003.

Accounting for Variable Interest Entities

In January 2003, the FASB issued FASB Interpretation No. 46, (“FIN 46”), “Consolidation of Variable Interest Entities,” which addresses consolidation by business enterprises of variable interest entities. Under FIN 46, an enterprise that holds significant variable interest in a variable interest entity but is not the primary beneficiary is required to disclose the nature, purpose, size, and activities of the variable interest entity, its exposure to loss as a result of the variable interest holder’s involvement with the entity, and the nature of its involvement with the entity and date when the involvement began. The primary beneficiary of a variable interest entity is required to disclose the nature, purpose, size, and activities of the variable interest entity, the carrying amount and classification of consolidated assets that are collateral for the variable interest entity’s obligations, and any lack of recourse by creditors (or beneficial interest holders) of a consolidated variable interest entity to the general creditors (or beneficial interest holders) of a consolidated variable entity to the general creditor of the primary beneficiary. FIN 46 is effective for the first fiscal year or interim period beginning after June 15, 2003. The impact to the Company upon adoption is not expected to be material.

Accounting for Loans or Certain Debt Securities Acquired in a Transfer

Statement of Position 03-1 (“SOP 03-01”) “Accounting for Loans or Certain Debt Securities Acquired in a Transfer” addresses accounting for differences between contractual cash flows and cash flows expected to be collected from an investor’s initial investment in loans or debt securities (“loans”) acquired in purchase business combinations and applies to all nongovernmental entities. SOP 03-1 limits the yield that may be accreted to the excess of the investor’s estimate of undiscounted expected principal, interest, and other cash flows over the investor’s initial investment in the loan. SOP 03-1 requires that the excess of contractual cash flows over cash flows expected to be collected not be recognized as an adjustment of yield, loss accrual, or valuation allowance. SOP 03-1 prohibits investors from displaying the accretable yield and non-accretable difference in the balance sheet. Subsequent increases in cash flows expected to be collected generally would be recognized prospectively through adjustment of the loan’s yield over its remaining life. Deceases in cash flows expected to be collected would be recognized as an impairment.

For loans acquired in a transfer, whether or not there is a concern about credit quality, SOP 03-1 prohibits “carry over” or creation of valuation allowances in the initial accounting. The prohibition of the valuation allowance carryover applies to the purchase of an individual loan, a pool of loans, a group of loans, and loans acquired in a purchase business combination. SOP 03-1 is effective for transfers of loans acquired in fiscal years beginning after December 15, 2003, with early adoption encouraged.

Liquidity and Capital Resources

The Company has financed its operations, acquisitions and office expansion through a combination of cash flow from operations and borrowings from its institutional lenders. The Company has generally applied its cash flow from operations to fund its increasing loan volume, fund acquisitions, repay long-term indebtedness, and repurchase its common stock. As the Company’s gross loans receivable increased from $173.6 million at March 31, 2000 to $266.8 million at March 31, 2003, net cash provided by operating activities for fiscal years 2001, 2002, and 2003 was $39.1 million, $48.3 million, and $55.1 million, respectively.

The Company’s primary ongoing cash requirements relate to the funding of new offices and acquisitions, the overall growth of loans outstanding, the repayment of long-term indebtedness and the repurchase of its common stock. The Company repurchased 1,986,000 shares of its common stock under its repurchase program, for an aggregate purchase price of approximately $16.0 million, between February 1996 and October 1996. Because of certain loan agreement restrictions, the Company suspended its stock repurchases in October 1996. The stock repurchase program was reinstated in January 2000, and 144,000 shares were repurchased in fiscal 2000, 275,000

| 14 | | World Acceptance Corporation | | |

Management’s Discussion and Analysis

shares in fiscal 2001, 252,000 shares in fiscal 2002 and 1,623,549 shares in fiscal 2003 for respective aggregate purchase prices of $724,000, $1,434,000, $2,179,000 and $12,000,000. The Company believes stock repurchases to be a viable component of the Company’s long-term financial strategy and an excellent use of excess cash when the opportunity arises. In addition, the Company plans to open or acquire at least 25 new offices in each of the next two fiscal years. Expenditures by the Company to open and furnish new offices generally averaged approximately $20,000 per office during fiscal 2003. New offices have also required from $100,000 to $400,000 to fund outstanding loans receivable originated during their first 12 months of operation.

The Company acquired 21 offices and a number of loan portfolios from competitors in eight states in 42 separate transactions during fiscal 2003. Gross loans receivable purchased in these transactions were approximately $22.6 million in the aggregate at the dates of purchase. The Company believes that attractive opportunities to acquire new offices or receivables from its competitors or to acquire offices in communities not currently served by the Company will continue to become available as conditions in local economies and the financial circumstances of owners change.

The Company has a $125.0 million base credit facility with a syndicate of banks. In addition to the base revolving credit commitment, there is a $15 million seasonal revolving credit commitment available November 15 of each year through March 31 of the immediately succeeding year to cover the increase in loan demand during this period. The credit facility will expire on September 30, 2004. Funds borrowed under the revolving credit facility bear interest, at the Company’s option, at either the agent bank’s prime rate per annum or the LIBOR rate plus 1.85% per annum. At March 31, 2003, the interest rate on borrowings under the revolving credit facility was 3.18%. The Company pays a commitment fee equal to 0.375% per annum of the daily unused portion of the revolving credit facility. Amounts outstanding under the revolving credit facility may not exceed specified percentages of eligible loans receivable. On March 31, 2003, $98.1 million was outstanding under this facility, and there was $26.9 million of unused borrowing availability under the borrowing base limitations.

The Company is currently in negotiations with its banks to extend the maturity date of its credit facility to September 30, 2005 and to increase the amount available under its base commitment. The Company does not anticipate any problems in getting these changes approved, but will not know definitely until some time in the second quarter of fiscal 2004.

The Company has $4.0 million of senior subordinated secured notes with an insurance company. These notes mature in annual installments of $2.0 million on June 30, 2003 and 2004, and bear interest at 10.0%, payable quarterly. The notes were issued at a discounted price equal to 99.6936% and may be prepaid subject to certain prepayment penalties. Borrowings under the revolving credit facility and the senior subordinated notes are secured by a lien on substantially all the tangible and intangible assets of the Company and its subsidiaries pursuant to various security agreements.

The Company’s credit agreements contain a number of financial covenants, including minimum net worth and fixed charge coverage requirements. The credit agreements also contain certain other covenants, including covenants that impose limitations on the Company with respect to (i) declaring or paying dividends or making distributions on or acquiring common or preferred stock or warrants or options; (ii) redeeming or purchasing or prepaying principal or interest on subordinated debt; (iii) incurring additional indebtedness; and (iv) entering into a merger, consolidation or sale of substantial assets or subsidiaries. The senior subordinated notes are also subject to prepayment penalties. The Company was in compliance with these agreements at March 31, 2003 and does not believe that these agreements will materially limit its business and expansion strategy.

| | | World Acceptance Corporation | | 15 |

Management’s Discussion and Analysis

The following table summarizes the Company’s contractual cash obligations by period (in thousands):

| | | Fiscal Year Ended March 31,

|

| | | 2004

| | 2005

| | 2006

| | 2007

| | 2008

| | Thereafter

| | Total

|

Maturities of Notes Payable | | $ | 2,482 | | 100,050 | | — | | — | | — | | — | | 102,532 |

Minimum Lease Payments | | | 3,841 | | 2,405 | | 1,019 | | 177 | | 59 | | 32 | | 7,533 |

| | |

|

| |

| |

| |

| |

| |

| |

|

Total | | $ | 6,323 | | 102,455 | | 1,019 | | 177 | | 59 | | 32 | | 110,065 |

| | |

|

| |

| |

| |

| |

| |

| |

|

The Company believes that cash flow from operations and borrowings under its revolving credit facility will be adequate to fund the expected cost of opening or acquiring new offices, including funding initial operating losses of new offices and funding loans receivable originated by those offices and the Company’s other offices and the scheduled repayment of the senior subordinated notes. Management is not currently aware of any trends, demands, commitments, events or uncertainties that it believes will result in, or are reasonably likely to result in, the Company’s liquidity increasing or decreasing in any material way. From time to time, the Company has needed and obtained, and expects that it will continue to need on a periodic basis, an increase in the borrowing limits under its revolving credit facility. The Company has successfully obtained such increases in the past and anticipates that it will be able to do so in the future as the need arises; however, there can be no assurance that this additional funding will be available (or available on reasonable terms) if and when needed.

Quantitative and Qualitative Disclosures About Market Risk

The Company’s financial instruments consist of the following: cash, loans receivable, senior notes payable and subordinated notes payable. Fair value approximates carrying value for all of these instruments. Loans receivable are originated at prevailing market rates and have an average life of approximately four months. Given the short-term nature of these loans, they are continually repriced at current market rates. Our revolving credit facility has a variable rate based on a margin over LIBOR and reprices with any changes in LIBOR. The interest rate on the subordinated notes is 10%, which is considered to be a market rate for this type of instrument. The Company’s outstanding debt under its revolving credit facility was $98.1 million at March 31, 2003. Interest on borrowings under this facility is based, at the Company’s option, on the prime rate or LIBOR plus 1.85%. Based on the outstanding balance at March 31, 2003, a change of 1% in the interest rate would cause a change in interest expense of approximately $981,000 on an annual basis.

Inflation

The Company does not believe that inflation has a material adverse effect on its financial condition or results of operations. The primary impact of inflation on the operations of the Company is reflected in increased operating costs. While increases in operating costs would adversely affect the Company’s operations, the consumer lending laws of three of the ten states in which the Company operates allow indexing of maximum loan amounts to the Consumer Price Index. These provisions will allow the Company to make larger loans at existing interest rates in those states, which could partially offset the potential increase in operating costs due to inflation.

Legal Matters

At March 31, 2003, the Company and certain of its subsidiaries have been named as defendants in various legal actions arising from their normal business activities in which damages in various amounts are claimed. Although the amount of any ultimate liability with respect to such matters cannot be determined, the Company believes that any such liability will not have a material adverse effect on the Company’s consolidated financial statements taken as a whole.

| 16 | | World Acceptance Corporation | | |

Management’s Discussion and Analysis

Forward-Looking Statements

This annual report, including “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” may contain various “forward-looking statements,” within the meaning of Section 21E of the Securities Exchange Act of 1934, that are based on management’s beliefs and assumptions, as well as information currently available to management. When used in this document, the words “anticipate,” “estimate,” “plan,” “expect,” “believe,” “may,” “will,” “should,” and similar expressions may identify forward-looking statements. Although the Company believes that the expectations reflected in any such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to be correct. Any such statements are subject to certain risks, uncertainties and assumptions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, the Company’s actual financial results, performance or financial condition may vary materially from those anticipated, estimated or expected. Among the key factors that could cause the Company’s actual financial results, performance or condition to differ from the expectations expressed or implied in such forward-looking statements are the following: changes in interest rates; risks inherent in making loans, including repayment risks and value of collateral; recently enacted or proposed legislation; the timing and amount of revenues that may be recognized by the Company; changes in current revenue and expense trends (including trends affecting charge-offs); changes in the Company’s markets and general changes in the economy (particularly in the markets served by the Company); the unpredictable nature of litigation; and other matters discussed in this annual report and the Company’s filings with the Securities and Exchange Commission.

| | | World Acceptance Corporation | | 17 |

CONSOLIDATED BALANCE SHEETS

| | | March 31,

| |

| | | 2003

| | | 2002

| |

| Assets | | | | | | | |

Cash | | $ | 4,022,686 | | | 3,222,266 | |

Gross loans receivable | | | 266,752,662 | | | 226,306,409 | |

Less: | | | | | | | |

Unearned interest and deferred fees | | | (63,578,130 | ) | | (53,669,912 | ) |

Allowance for loan losses | | | (15,097,780 | ) | | (12,925,644 | ) |

| | |

|

|

| |

|

|

Loans receivable, net | | | 188,076,752 | | | 159,710,853 | |

Property and equipment, net | | | 8,297,859 | | | 6,920,824 | |

Other assets, net | | | 13,321,175 | | | 11,425,691 | |

Intangible assets, net | | | 14,598,808 | | | 13,967,315 | |

| | |

|

|

| |

|

|

| | | $ | 228,317,280 | | | 195,246,949 | |

| | |

|

|

| |

|

|

| Liabilities and Shareholders’ Equity | | | | | | | |

Liabilities: | | | | | | | |

Senior notes payable | | | 98,050,000 | | | 76,900,000 | |

Subordinated notes payable | | | 4,000,000 | | | 6,000,000 | |

Other note payable | | | 482,000 | | | 482,000 | |

Income taxes payable | | | 2,047,017 | | | 2,615,536 | |

Accounts payable and accrued expenses | | | 7,697,233 | | | 6,816,033 | |

| | |

|

|

| |

|

|

Total liabilities | | | 112,276,250 | | | 92,813,569 | |

| | |

|

|

| |

|

|

Shareholders’ equity: | | | | | | | |

Preferred stock, no par value | | | | | | | |

Authorized 5,000,000 shares, no shares issued or outstanding | | | — | | | — | |

Common stock, no par value | | | | | | | |

Authorized 95,000,000 shares; issued and outstanding 17,663,189 and 18,879,218 shares at March 31, 2003 and 2002, respectively | | | — | | | — | |

Additional paid-in capital | | | 1,048,721 | | | 681,354 | |

Retained earnings | | | 114,992,309 | | | 101,752,026 | |

| | |

|

|

| |

|

|

Total shareholders’ equity | | | 116,041,030 | | | 102,433,380 | |

| | |

|

|

| |

|

|

Commitments and contingencies | | | | | | | |

| | | $ | 228,317,280 | | | 195,246,949 | |

| | |

|

|

| |

|

|

See accompanying notes to consolidated financial statements.

| 18 | | World Acceptance Corporation | | |

CONSOLIDATED STATEMENTS OF OPERATIONS

| | | Years Ended March 31,

|

| | | 2003

| | 2002

| | 2001

|

Revenues: | | | | | | | |

Interest and fee income | | $ | 133,255,872 | | 117,192,857 | | 103,411,761 |

Insurance commissions and other income | | | 22,414,951 | | 19,362,244 | | 17,131,920 |

| | |

|

| |

| |

|

Total revenues | | | 155,670,823 | | 136,555,101 | | 120,543,681 |

| | |

|

| |

| |

|

Expenses: | | | | | | | |

Provision for loan losses | | | 29,569,889 | | 25,687,989 | | 19,748,604 |

| | |

|

| |

| |

|

General and administrative expenses: | | | | | | | |

Personnel | | | 55,537,903 | | 48,454,298 | | 43,878,217 |

Occupancy and equipment | | | 9,026,611 | | 8,225,000 | | 7,627,080 |

Data processing | | | 1,765,844 | | 1,659,144 | | 1,518,501 |

Advertising | | | 5,755,145 | | 4,929,249 | | 3,967,213 |

Legal | | | 916,288 | | 448,654 | | 415,594 |

Amortization of intangible assets | | | 2,172,584 | | 1,986,090 | | 1,797,425 |

Other | | | 10,582,817 | | 9,715,740 | | 9,060,353 |

| | |

|

| |

| |

|

| | | | 85,757,192 | | 75,418,175 | | 68,264,383 |

Interest expense | | | 4,493,219 | | 5,414,790 | | 8,259,794 |

| | |

|

| |

| |

|

Total expenses | | | 119,820,300 | | 106,520,954 | | 96,272,781 |

| | |

|

| |

| |

|

Income before income taxes | | | 35,850,523 | | 30,034,147 | | 24,270,900 |

Income taxes | | | 12,987,000 | | 10,695,000 | | 8,670,000 |

| | |

|

| |

| |

|

Net income | | $ | 22,863,523 | | 19,339,147 | | 15,600,900 |

| | |

|

| |

| |

|

Net income per common share: | | | | | | | |

Basic | | $ | 1.28 | | 1.03 | | .84 |

| | |

|

| |

| |

|

Diluted | | $ | 1.25 | | 1.00 | | .83 |

| | |

|

| |

| |

|

Weighted average shares outstanding: | | | | | | | |

Basic | | | 17,860,101 | | 18,786,529 | | 18,670,597 |

| | |

|

| |

| |

|

Diluted | | | 18,304,976 | | 19,339,764 | | 18,839,620 |

| | |

|

| |

| |

|

See accompanying notes to consolidated financial statements.

| | | World Acceptance Corporation | | 19 |

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

| | | Additional

Paid-in

Capital

| | | Retained

Earnings

| | | Total

| |

Balances at March 31, 2000 | | $ | 267,958 | | | 67,924,428 | | | 68,192,386 | |

| | | |

Proceeds from exercise of stock options (76,400 shares), including tax benefits of $41,355 | | | 367,161 | | | — | | | 367,161 | |

Common stock repurchases (275,000 shares) | | | (321,464 | ) | | (1,112,449 | ) | | (1,433,913 | ) |

Net income | | | — | | | 15,600,900 | | | 15,600,900 | |

| | |

|

|

| |

|

| |

|

|

Balances at March 31, 2001 | | | 313,655 | | | 82,412,879 | | | 82,726,534 | |

| | | |

Proceeds from exercise of stock options (442,136 shares), including tax benefits of $526,469 | | | 2,546,634 | | | — | | | 2,546,634 | |

Common stock repurchases (251,891 shares) | | | (2,178,935 | ) | | — | | | (2,178,935 | ) |

Net income | | | — | | | 19,339,147 | | | 19,339,147 | |

| | |

|

|

| |

|

| |

|

|

Balances at March 31, 2002 | | | 681,354 | | | 101,752,026 | | | 102,433,380 | |

| | | |

Proceeds from exercise of stock options (416,734 shares), including tax benefits of $392,945 | | | 2,745,120 | | | — | | | 2,745,120 | |

Common stock repurchases (1,623,549 shares) | | | (2,377,753 | ) | | (9,623,240 | ) | | (12,000,993 | ) |

Net income | | | — | | | 22,863,523 | | | 22,863,523 | |

| | |

|

|

| |

|

| |

|

|

Balances at March 31, 2003 | | $ | 1,048,721 | | | 114,992,309 | | | 116,041,030 | |

| | |

|

|

| |

|

| |

|

|

See accompanying notes to consolidated financial statements.

| 20 | | World Acceptance Corporation | | |

CONSOLIDATED STATEMENTS OF CASH FLOWS

| | | Years Ended March 31,

| |

| | | 2003

| | | 2002

| | | 2001

| |

Cash flows from operating activities: | | | | | | | | | | |

Net income | | $ | 22,863,523 | | | 19,339,147 | | | 15,600,900 | |

Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | | | |

Amortization of intangible assets | | | 2,172,584 | | | 1,986,090 | | | 1,797,425 | |

Amortization of loan costs and discounts | | | 123,086 | | | 124,943 | | | 62,452 | |

Provision for loan losses | | | 29,569,889 | | | 25,687,989 | | | 19,748,604 | |

Depreciation | | | 1,726,424 | | | 1,712,251 | | | 1,569,905 | |

Deferred tax benefit | | | (1,685,000 | ) | | (914,000 | ) | | (808,000 | ) |

Change in accounts: | | | | | | | | | | |

Other assets, net | | | (333,570 | ) | | (802,517 | ) | | (819,170 | ) |

Income taxes payable | | | (175,574 | ) | | 103,892 | | | 1,020,027 | |

Accounts payable and accrued expenses | | | 881,200 | | | 1,052,221 | | | 924,811 | |

| | |

|

|

| |

|

| |

|

|

Net cash provided by operating activities | | | 55,142,562 | | | 48,290,016 | | | 39,096,954 | |

| | |

|

|

| |

|

| |

|

|

Cash flows from investing activities: | | | | | | | | | | |

Increase in loans receivable, net | | | (41,272,627 | ) | | (24,272,545 | ) | | (28,815,645 | ) |

Net assets acquired from office acquisitions, primarily loans | | | (16,874,896 | ) | | (10,884,531 | ) | | (15,653,874 | ) |

Increase in intangible assets from acquisitions | | | (2,804,077 | ) | | (2,815,098 | ) | | (3,827,255 | ) |

Purchases of property and equipment, net | | | (2,891,724 | ) | | (1,979,310 | ) | | (1,340,245 | ) |

| | |

|

|

| |

|

| |

|

|

Net cash used by investing activities | | | (63,843,324 | ) | | (39,951,484 | ) | | (49,637,019 | ) |

| | |

|

|

| |

|

| |

|

|

Cash flows from financing activities: | | | | | | | | | | |

Proceeds (repayment) of senior revolving notes payable, net | | | 21,150,000 | | | (6,250,000 | ) | | 15,250,000 | |

Repayment of subordinated notes payable | | | (2,000,000 | ) | | (2,000,000 | ) | | (2,000,000 | ) |

Proceeds from exercise of stock options | | | 2,352,175 | | | 2,020,165 | | | 325,806 | |

Repurchase of common stock | | | (12,000,993 | ) | | (2,178,935 | ) | | (1,433,913 | ) |

| | |

|

|

| |

|

| |

|

|

Net cash provided by (used in) financing activities | | | 9,501,182 | | | (8,408,770 | ) | | 12,141,893 | |

| | |

|

|

| |

|

| |

|

|

Increase (decrease) in cash | | | 800,420 | | | (70,238 | ) | | 1,601,828 | |

Cash at beginning of year | | | 3,222,266 | | | 3,292,504 | | | 1,690,676 | |

| | |

|

|

| |

|

| |

|

|

Cash at end of year | | $ | 4,022,686 | | | 3,222,266 | | | 3,292,504 | |

| | |

|

|

| |

|

| |

|

|

See accompanying notes to consolidated financial statements.

| | | World Acceptance Corporation | | 21 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| (1) | | Summary of Significant Accounting Policies |

The Company’s accounting and reporting policies are in accordance with accounting principles generally accepted in the United States of America and conform to general practices within the finance company industry. The following is a description of the more significant of these policies used in preparing the consolidated financial statements.

Nature of Operations

The Company is a small-loan consumer finance company head-quartered in Greenville, South Carolina that offers short-term small loans, medium-term larger loans, related credit insurance products and ancillary products and services to individuals who have limited access to other sources of consumer credit. It also offers income tax return preparation services and refund anticipation loans (through a third party bank) to is customer base and to others.

The Company also markets computer software and related services to finance companies through its ParaData Financial Systems (“ParaData”) subsidiary.

As of March 31, 2003, the Company operated 470 offices in South Carolina, Georgia, Texas, Oklahoma, Louisiana, Tennessee, Missouri, Illinois, New Mexico, Kentucky and Alabama.

Principles of Consolidation

The consolidated financial statements include the accounts of World Acceptance Corporation and its wholly owned subsidiaries (the “Company”). Subsidiaries consist of operating entities in various states, ParaData, a software company acquired during fiscal 1994, and WAC Insurance Company, Ltd., a captive reinsurance company established in fiscal 1994. All significant intercompany balances and transactions have been eliminated in consolidation.

Business Segments

The Company reports operating segments in accordance with SFAS No. 131, “Disclosures about Segments of an Enterprise and Related Information” (“SFAS No. 131”). Operating segments are components of an enterprise about which separate financial information is available that is evaluated regularly by the chief operating decision maker in deciding how to allocate resources and assess performance. SFAS 131 requires that a public enterprise report a measure of segment profit or loss, certain specific revenue and expense items, segment assets information about the way that the operating segments were determined and other items.