- ZD Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Ziff Davis (ZD) 8-KResults of Operations and Financial Condition

Filed: 8 Nov 07, 12:00am

Investor Presentation

(Based upon Third Quarter 2007 results)

November 7, 2007

Future operating results

Subscriber growth, retention and usage levels

International, Corporate and Voice Service growth

New products, services and features

Corporate spending

Liquidity

Network capacity, coverage and security

Regulatory developments

Taxes

Certain statements in this presentation constitute “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995, particularly those contained in the slide entitled “Financial

Guidance.” These forward-looking statements are based on management’s current expectations or beliefs as

of November 7, 2007 and are subject to numerous assumptions, risks and uncertainties that could cause

actual results to differ materially from those described in the forward-looking statements. We undertake no

obligation to revise or publicly release the results of any revision to these forward-looking statements.

Readers should carefully review the risk factors described in this presentation. Such statements address the

following subjects:

Safe Harbor for Forward-Looking Statements

All information in this presentation speaks as of November 7, 2007 and any

distribution of this presentation after that date is not intended and will not be

construed as updating or confirming such information.

2

Risk Factors

Inability to sustain growth in our customer base, revenue or profitability

Competition in price, quality, features and geographic coverage

Higher than expected tax rates or exposure to additional tax liability

Inability to obtain telephone numbers in sufficient quantities on acceptable terms in desired locations

Enactment of burdensome telecommunications or Internet regulations including increased taxes or fees

Reduced use of fax services due to increased use of email, scanning or widespread adoption of digital signatures

Inadequate intellectual property protection or violations of third party intellectual property rights

System failures or breach of system or network security and resulting harm to our reputation

Inability to adapt to technological change, or third party development of new technologies superior to ours

Economic downturns in industries which rely heavily on fax transmissions

Loss of services of executive officers and other key employees

Inability to maintain existing or enter into new supplier and marketing relationships on acceptable terms

Other factors set forth in our Annual Report on Form 10-K filed on 03/12/07 and the other reports filed by us from

time to time with the Securities and Exchange Commission

The following factors, among others, could cause our business, prospects, financial condition, operating results and

cash flows to be materially adversely affected:

3

All brand names and logos are trademarks of j2 Global Communications, Inc. or its affiliates in the U.S. and/or internationally.

Messaging as a Service

4

Core j2 Global Assets

11.7 million Subscribed Telephone Numbers (DIDs)

1,017,985 Paid DIDs

Global Advanced Messaging Network

> 2,900 cities in 42 countries on 5 continents

17.1MM + unique DIDs worldwide in inventory

Patented Technology

A portfolio of 54 issued patents, and numerous pending U.S. and foreign

patent applications

Licensing programs designed to monetize the portfolio

Expertise

Effective customer acquisition strategies and Web marketing

Breadth, depth and management of a complex network & architecture

Strong Financial Position

11 consecutive years of Revenue growth

5 consecutive years of positive and growing Operating Earnings

$240 MM of cash & investments to fund growth (as of 09/30/07)

No debt

5

Individuals

Targeted marketing (search, online media and radio)

Sold through: eFax.com , j2.com, fax.com, onebox.com, evoice.com and other

brand websites

Use of proprietary Life Cycle Management

Advertising & Calling-Party-Pays revenue supports the Free base

Small to Mid-Sized Businesses (SMBs)

Sold through: eFaxCorporate.com and Onebox and eVoice Receptionist websites

Supported by Telesales

Self-service Web-based broadcast fax engine at jblast.com

Outsourced email, spam & virus protection and archiving

Use of proprietary Life Cycle Management (i.e. usage stimulation)

Enterprise (SMEs)/Large Enterprise/Government

Direct sales force

Marketed through Web and traditional direct selling methods

Designed for > 150 DID accounts

Subscriber Acquisition

6

Six Drivers for Paid DID Additions

Subscribers coming directly to the Company’s Websites/Telesales

Brand awareness driven by demand-generation programs and “word of mouth”

Search engine discovery

Accounts for over 40% monthly paid DID signups

Free-to-Paid subscriber upgrades

Life Cycle Management

eFax Corporate SMB sales

Hybrid Website and human interaction (i.e. Telesales)

Direct SME/Enterprise/Government

Through the outside Corporate Sales team

Direct domestic marketing spend for paid subscribers

Targeted marketing program across various media

International marketing programs

Paid Subscription Drivers

7

Operations Update

8

Voice Services Update

Voice Services Paid DIDs Represents ~ 7.5% of the Paid DID

Base at October 2007 vs. ~ 5% at Q2 2007

DID Growth Rate from Q2 - Q3 2007 > 32%, YoY > 128%

Receptionist ARPU is ~ $12.00 per DID per Month

Current Target Customer is SMB with 2-15 Persons

Marketing Consists Primarily of Internal Cross Selling, Paid

Search and Radio Advertising

Launching Localized Receptionist Services in EU Early Next Year

9

Q3 YoY DID growth > 21%

SMB growth > 23%

Fortune 100 Customers Increased 78% YoY to 41

3 Large Accounts Signed in Q3, Bringing Total to 35

50 Large Accounts in the Pipeline (8 in Europe)

Corporate Sales Update

10

Q3 YoY DID growth > 40%

Launching Localized Receptionist Service in Early 2008

Continuing Investment in International Business

Currently 7 languages available

Multi-byte capability expected in 2008

Localized services and physical presence in Asia in 2008 (Japan first)

Q3 YoY EU employee growth from 29 to 44 (52%)

SAC costs ~ $50 USD despite building brand awareness

International Web Update

11

Financial Highlights

12

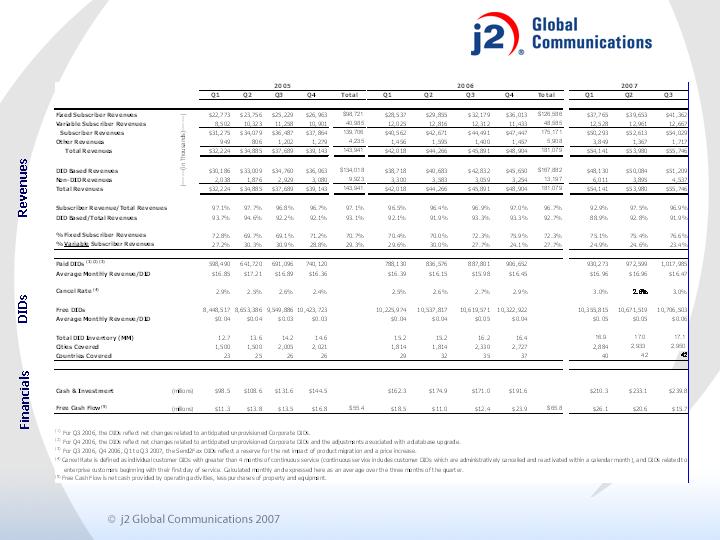

GAAP Revenues

$55.7 MM

Gross Profit/Margin (1)

$44.7 MM

80.3%

Operating Profit/Margin (1)

$23.1 MM

41.5%

Non-GAAP EPS

$0.38 Per Share

Free Cash Flow (3)

$15.7 MM

Cash and Investments

$240 MM

Margin

(1) Excludes SFAS 123(R) non-cash compensation expense. See slide 19 for a reconciliation to the nearest GAAP financial measure.

(2) Excludes SFAS 123(R) non-cash compensation expense, net of tax benefit. Based on an estimated effective annual tax rate of

28% and 51.4 million fully diluted shares outstanding. Non-GAAP EPS also benefitted from the inclusion of $0.02 per share from

an approximate $1.1M required release of an income tax reserve. See slide 19 for a reconciliation to the nearest GAAP financial

measure.

(3) See slide 18 for a reconciliation to the nearest GAAP financial measure.

Q3 2007 Non-GAAP Financial Results

13

Operating margins for 2004 to 2006 are based on Modified earnings. Q1

2007 to Q3 2007 excludes SFAS 123(R) non-cash compensation, net of tax

benefit. See slides 19 and 20 for reconciliations to the nearest GAAP

financial measures.

Margin Trends by Year

14

Financial Guidance

(1) Excludes SFAS 123(R) non-cash compensation, net of tax benefit. Assumes an effective annual tax rate of approximately

30% and 51.4 million fully diluted shares outstanding.

$0.36 - $0.37

$56.1 - $57.6

Q4

2007

Non-GAAP EPS (1)

Revenues (MM)

2008 Outlook

Expect revenue to Grow ~ 17% over FY 2007

EPS Expected to Grow at Least as Fast as Revenues

15

Supplemental Information

16

Metrics

17

(1) Net cash provided by operating activities, less purchases of property & equipment. Free Cash Flow amounts are not meant

as a substitute for GAAP, but are solely for informational purposes.

18

Computation of Free Cash Flow

($ in millions)

Q1 '06

Q2 '06

Q3 '06

Q4 '06

Q1 '07

Q2 '07

Q3 '07

Net cash provided by operating activities

$19.245

$14.250

$13.607

$25.903

$26.659

$23.113

$18.656

Purchases of property & equipment

(0.757)

(3.288)

(1.181)

(1.973)

(0.529)

(2.506)

(2.940)

Free Cash Flow

(1)

$18.488

$10.962

$12.426

$23.930

$26.130

$20.607

$15.716

GAAP Reconciliation

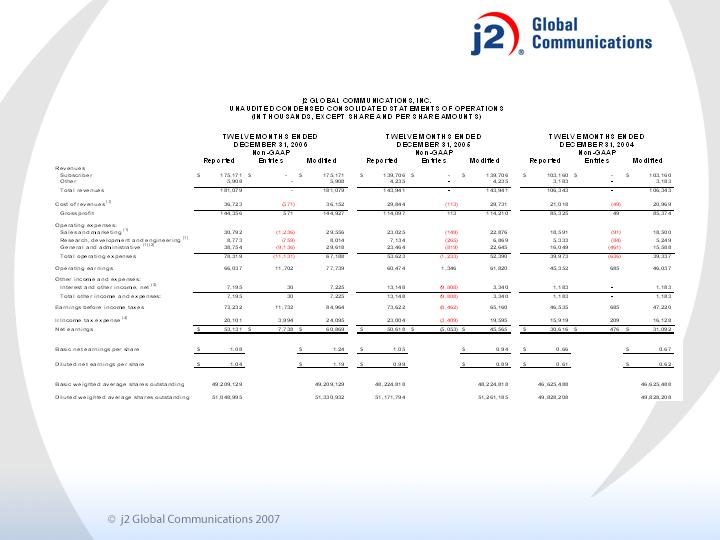

(1) Stock-based compensation is as follows: for Q3, Cost of revenues is $169K, Sales and Marketing is $304K, R&D is $186K, and G&A is $1,209K, for

Q2, Cost of revenues is $140K, Sales and Marketing is $264K, R&D is $184K, and G&A is $1,114K and for Q1, Cost of revenues is $182K, Sales and

Marketing is $278K, R&D is $173K, and G&A is $1,097K.

(2) Income tax expense is adjusted for the net impact of item 1 above.

19

GAAP Reconciliation

(1) Stock-based compensation and charges for payroll tax and employee compensation liabilities associated with inadvertent measurement date errors in prior stock option grants are as follows: 2006

Adjustments - Cost of revenues is $571K, Sales and Marketing is $1,236K, R&D is $759K, and G&A is $4,998K, 2005 Adjustments - Cost of revenues is $113K, Sales and Marketing is $149K, R&D is $265K,

and G&A is $819K, 2004 Adjustments - Cost of revenues is $49K, Sales and Marketing is $91K, R&D is $84K and G&A is $461K.

(2) 2006 G&A also includes adjustments of $2.9M pre-tax ($1.7M after-tax) for stock option investigation and $1.3M pre-tax ($0.8M after-tax) for G&A costs related to enhancement of internal controls relating to

global tax structure.

(3) 2006 Other Income and Expense includes an adjustment for $30K related to payroll tax and employee compensation liabilities associated with stock option investigation. 2005 Other Income excludes gains

from sale of investment of $9,808K.

(4) Income tax expense is adjusted for the net impact of items 1, 2 and 3 above.

20

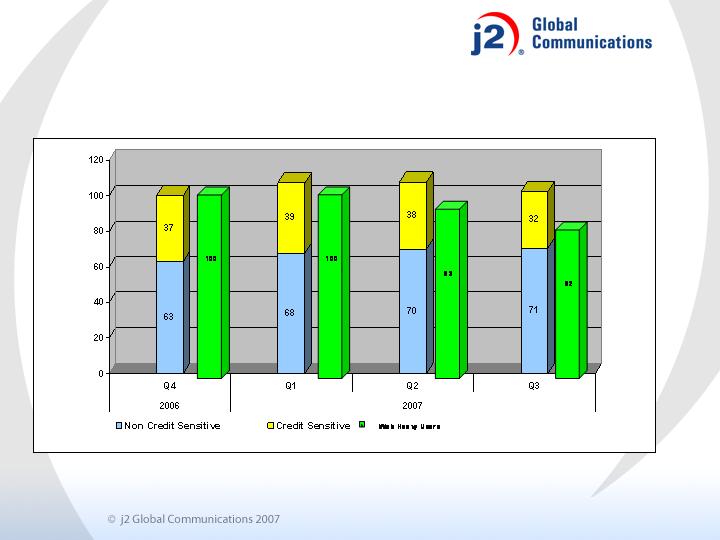

Usage Pattern of Corporate and Web High

Volume Users

21