UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANY

Investment Company Act file number 811-09293

DAVIS VARIABLE ACCOUNT FUND, INC.

(Exact name of registrant as specified in charter)

2949 East Elvira Road, Suite 101

Tucson, AZ 85756

(Address of principal executive offices)

Thomas D. Tays

Davis Selected Advisers, L.P.

2949 East Elvira Road, Suite 101

Tucson, AZ 85756

(Name and address of agent for service)

Registrant’s telephone number, including area code: 520-806-7600

Date of fiscal year end: December 31, 2012

Date of reporting period: December 31, 2012

____________________

ITEM 1. REPORT TO STOCKHOLDERS

| DAVIS VARIABLE ACCOUNT FUND, INC. | Table of Contents |

| Management’s Discussion of Fund Performance: | |

| Davis Value Portfolio | 2 |

| Davis Financial Portfolio | 4 |

| Davis Real Estate Portfolio �� | 6 |

| | |

| Fund Overview: | |

| Davis Value Portfolio | 8 |

| Davis Financial Portfolio | 10 |

| Davis Real Estate Portfolio | 11 |

| | |

| Expense Example | 13 |

| | |

| Schedule of Investments: | |

| Davis Value Portfolio | 14 |

| Davis Financial Portfolio | 18 |

| Davis Real Estate Portfolio | 20 |

| | |

| Statements of Assets and Liabilities | 23 |

| | |

| Statements of Operations | 24 |

| | |

| Statements of Changes in Net Assets | 25 |

| | |

| Notes to Financial Statements | 27 |

| | |

| Federal Income Tax Information | 34 |

| | |

| Financial Highlights: | |

| Davis Value Portfolio | 35 |

| Davis Financial Portfolio | 36 |

| Davis Real Estate Portfolio | 37 |

| | |

| Report of Independent Registered Public Accounting Firm | 38 |

| | |

| Directors and Officers | 39 |

This Annual Report is authorized for use by existing shareholders. Prospective shareholders must receive a current Davis Variable Account Fund, Inc. prospectus, which contains more information about investment strategies, risks, charges, and expenses. Please read the prospectus carefully before investing or sending money.

Shares of the Davis Variable Account Funds are not deposits or obligations of any bank, are not guaranteed by any bank, are not insured by the FDIC or any other agency, and involve investment risks, including possible loss of the principal amount invested.

Portfolio Proxy Voting Policies and Procedures

The Funds have adopted Portfolio Proxy Voting Policies and Procedures under which the Funds vote proxies relating to securities held by the Funds. A description of the Funds’ Portfolio Proxy Voting Policies and Procedures is available (i) without charge, upon request, by calling the Funds toll-free at 1-800-279-0279, (ii) on the Funds’ website at www.davisfunds.com, and (iii) on the SEC’s website at www.sec.gov.

In addition, the Funds are required to file Form N-PX, with their complete proxy voting record for the 12 months ended June 30th, no later than August 31st of each year. The Funds’ Form N-PX filing is available (i) without charge, upon request, by calling the Funds toll-free at 1-800-279-0279, (ii) on the Funds’ website at www.davisfunds.com, and (iii) on the SEC’s website at www.sec.gov.

Form N-Q

The Funds file their complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Form N-Q is available without charge, upon request, by calling 1-800-279-0279, on the Funds’ website at www.davisfunds.com, and on the SEC’s website at www.sec.gov. The Funds’ Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

| DAVIS VARIABLE ACCOUNT FUND, INC. | Management’s Discussion of Fund Performance |

| DAVIS VALUE PORTFOLIO | |

Performance Overview

Davis Value Portfolio delivered a total return on net asset value of 13.08% for the year ended December 31, 2012. Over the same time period, the Standard & Poor’s 500® Index (“Index”) returned 16.00%. The sectors1 within the Index that turned in the strongest performance over the year were Financials and Consumer Discretionary. The sectors within the Index that turned in the weakest performance (but still positive) were Utilities and Energy.

Factors Impacting the Portfolio’s Performance

Energy companies were the most important detractor2 from the Portfolio’s performance. The Portfolio’s Energy companies under-performed the corresponding sector within the Index and had a slightly lower relative average weighting in this weaker performing sector. EOG Resources3 was among the most important contributors to performance. Canadian Natural Resources, Occidental Petroleum, OGX Petroleo e Gas Participacoes, Devon Energy, and China Coal Energy were among the most important detractors from performance. The Portfolio no longer owns OGX Petroleo e Gas Participacoes or China Coal Energy.

Consumer Discretionary companies contributed to the Portfolio’s absolute performance, but detracted from its performance relative to the Index. The Portfolio’s Consumer Discretionary companies under-performed the corresponding sector within the Index and had a lower relative average weighting in this stronger performing sector. Walt Disney was among the most important contributors to performance. Bed Bath & Beyond and Groupon were among the most important detractors from performance.

Financial companies were the most important contributor to the Portfolio’s absolute performance. The Portfolio’s Financial companies under-performed the corresponding sector within the Index, but benefited from a higher relative average weighting in this stronger performing sector. Wells Fargo, Bank of New York Mellon, and American Express were among the most important contributors to performance. Julius Baer Group and Fairfax Financial Holdings were among the most important detractors from performance.

Consumer Staple companies were also an important contributor to the Portfolio’s performance. The Portfolio’s Consumer Staple companies out-performed the corresponding sector within the Index and had a higher relative average weighting. Costco Wholesale, CVS Caremark, and Diageo were among the most important contributors to performance.

The Portfolio had approximately 17% of its net assets invested in foreign companies at December 31, 2012. As a whole, those companies under-performed the domestic companies held by the Portfolio.

Davis Value Portfolio’s investment objective is long-term growth of capital. There can be no assurance that the Portfolio will achieve its objective. Davis Value Portfolio’s principal risks are: stock market risk, manager risk, common stock risk, financial services risk, foreign country risk, emerging market risk, foreign currency risk, trading markets and depositary receipts risk, headline risk, and fees and expenses risk. See the prospectus for a full description of each risk.

1 The companies included in the Standard & Poor’s 500® Index are divided into ten sectors. One or more industry groups make up a sector.

2 A company’s or sector’s contribution to or detraction from the Portfolio’s performance is a product both of its appreciation or depreciation and its weighting within the Portfolio. For example, a 5% holding that rises 20% has twice as much impact as a 1% holding that rises 50%.

3 This Management Discussion of Fund Performance discusses a number of individual companies. The information provided in this report does not provide information reasonably sufficient upon which to base an investment decision and should not be considered a recommendation to purchase or sell any particular security. The Schedule of Investments lists the Portfolio’s holdings of each company discussed.

| DAVIS VARIABLE ACCOUNT FUND, INC. | Management’s Discussion of Fund Performance |

| DAVIS VALUE PORTFOLIO - (CONTINUED) | |

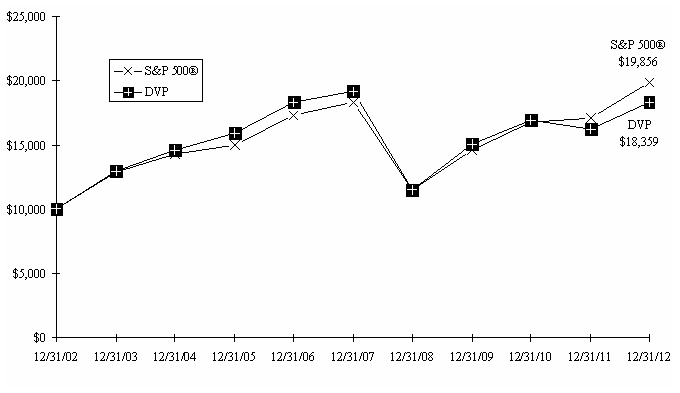

Comparison of a $10,000 investment in Davis Value Portfolio versus the Standard & Poor’s 500® Index

over 10 years for an investment made on December 31, 2002

Average Annual Total Return for periods ended December 31, 2012

| Fund & Benchmark Index | 1-Year | 5-Year | 10-Year | Since Fund’s Inception (07/01/99) | Gross Expense Ratio | Net Expense Ratio |

| Davis Value Portfolio | 13.08% | (0.89)% | 6.26% | 3.27% | 0.64% | 0.64% |

Standard & Poor’s 500® Index | 16.00% | 1.66% | 7.10% | 2.11% | | |

The Standard & Poor’s 500® Index is an unmanaged index of 500 selected common stocks, most of which are listed on the New York Stock Exchange. The Index is adjusted for dividends, weighted towards stocks with large market capitalizations, and represents approximately two-thirds of the total market value of all domestic common stocks. Investments cannot be made directly in the Index.

The performance data for Davis Value Portfolio contained in this report represents past performance, assumes that all distributions were reinvested, and should not be considered as an indication of future performance from an investment in the Portfolio today. The investment return and principal value will fluctuate so that shares may be worth more or less than their original cost when redeemed. Portfolio performance changes over time and current performance may be higher or lower than stated. The operating expense ratio may vary in future years. For more current information please call Davis Funds Investor Services at 1-800-279-0279.

Portfolio performance numbers are net of all Portfolio operating expenses, but do not include any insurance charges imposed by your insurance company’s separate account. If performance included the effect of these additional charges, the return would be lower.

| DAVIS VARIABLE ACCOUNT FUND, INC. | Management’s Discussion of Fund Performance |

| DAVIS FINANCIAL PORTFOLIO | |

Performance Overview

Davis Financial Portfolio delivered a total return on net asset value of 18.83% for the year ended December 31, 2012. Over the same time period, the Standard & Poor’s 500® Index (“Index”) returned 16.00%.

Factors Impacting the Portfolio’s Performance

The Portfolio’s Financial sector holdings under-performed the corresponding sector1 within the Index, but out-performed the Index as a whole. The Financial sector was the strongest performing sector of the Index. The Portfolio also had a limited amount of assets invested in other sectors, which contributed2 to overall performance.

Diversified Financial companies were the largest contributor to the Portfolio’s performance. The Portfolio’s Diversified Financial companies under-performed the corresponding industry group within the Index. American Express3, Visa, Bank of New York Mellon, Brookfield Asset Management, and Goldman Sachs Group were among the most important contributors to performance. Julius Baer Group and First Marblehead were among the most important detractors from performance.

Insurance companies were the second largest contributor to the Portfolio’s performance. The Portfolio’s Insurance companies under-performed the corresponding industry group within the Index. Transatlantic Holdings, Everest Re Group, and Alleghany were among the most important contributors to performance. Transatlantic Holdings was acquired by Alleghany in March of 2012.

Banking companies were the third largest contributor to the Portfolio’s performance. The Portfolio’s Banking companies out-performed the corresponding industry group within the Index. Wells Fargo and State Bank of India were among the most important contributors to performance.

Canadian Natural Resources was the single most important detractor from the Portfolio’s performance during the year. Sino-Forest and Bed Bath & Beyond were also among the most important detractors from the Portfolio’s performance. The Portfolio no longer owns Sino-Forest.

The Portfolio had approximately 23% of its net assets invested in foreign companies at December 31, 2012. As a whole, those companies under-performed the domestic companies held by the Portfolio.

Davis Financial Portfolio’s investment objective is long-term growth of capital. There can be no assurance that the Portfolio will achieve its objective. Davis Financial Portfolio’s principal risks are: stock market risk, manager risk, common stock risk, concentrated portfolio risk, financial services risk, focused portfolio risk, foreign country risk, emerging market risk, foreign currency risk, trading markets and depositary receipts risk, under $10 billion market capitalization risk, interest rate sensitivity risk, credit risk, headline risk, and fees and expenses risk. See the prospectus for a full description of each risk.

Davis Financial Portfolio concentrates its investments in the financial sector, and it may be subject to greater risks than a portfolio that does not concentrate its investments in a particular sector. The Portfolio’s investment performance, both good and bad, is expected to reflect the economic performance of the financial sector more than a portfolio that does not concentrate its investments.

1 The companies included in the Standard & Poor’s 500® Index are divided into ten sectors. One or more industry groups make up a sector.

2 A company’s or sector’s contribution to or detraction from the Portfolio’s performance is a product both of its appreciation or depreciation and its weighting within the Portfolio. For example, a 5% holding that rises 20% has twice as much impact as a 1% holding that rises 50%.

3 This Management Discussion of Fund Performance discusses a number of individual companies. The information provided in this report does not provide information reasonably sufficient upon which to base an investment decision and should not be considered a recommendation to purchase or sell any particular security. The Schedule of Investments lists the Portfolio’s holdings of each company discussed.

| DAVIS VARIABLE ACCOUNT FUND, INC. | Management’s Discussion of Fund Performance |

| DAVIS FINANCIAL PORTFOLIO - (CONTINUED) | |

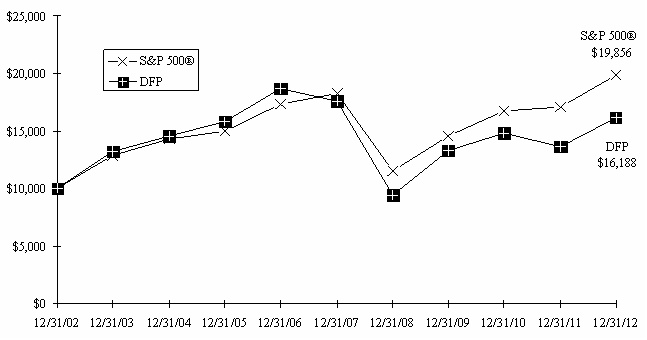

Comparison of a $10,000 investment in Davis Financial Portfolio versus the Standard & Poor’s 500® Index

over 10 years for an investment made on December 31, 2002

Average Annual Total Return for periods ended December 31, 2012

| Fund & Benchmark Index | 1-Year | 5-Year | 10-Year | Since Fund’s Inception (07/01/99) | Gross Expense Ratio | Net Expense Ratio |

| Davis Financial Portfolio | 18.83% | (1.65)% | 4.93% | 2.88% | 0.69% | 0.69% |

Standard & Poor’s 500® Index | 16.00% | 1.66% | 7.10% | 2.11% | | |

The Standard & Poor’s 500® Index is an unmanaged index of 500 selected common stocks, most of which are listed on the New York Stock Exchange. The Index is adjusted for dividends, weighted towards stocks with large market capitalizations, and represents approximately two-thirds of the total market value of all domestic common stocks. Investments cannot be made directly in the Index.

The performance data for Davis Financial Portfolio contained in this report represents past performance, assumes that all distributions were reinvested, and should not be considered as an indication of future performance from an investment in the Portfolio today. The investment return and principal value will fluctuate so that shares may be worth more or less than their original cost when redeemed. Portfolio performance changes over time and current performance may be higher or lower than stated. The operating expense ratio may vary in future years. For more current information please call Davis Funds Investor Services at 1-800-279-0279.

Portfolio performance numbers are net of all Portfolio operating expenses, but do not include any insurance charges imposed by your insurance company’s separate account. If performance included the effect of these additional charges, the return would be lower.

| DAVIS VARIABLE ACCOUNT FUND, INC. | Management’s Discussion of Fund Performance |

| DAVIS REAL ESTATE PORTFOLIO | |

Performance Overview

Davis Real Estate Portfolio delivered a total return on net asset value of 17.15% for the year ended December 31, 2012. Over the same time period, the Wilshire U.S. Real Estate Securities Index (“Index”) returned 17.55%. Every sub-industry1 within the Index delivered positive returns. Industrial REITs and Retail REITs turned in the strongest performances while Hotels, Resorts & Cruise Lines and Residential REITs turned in the weakest (but still positive) performances over the year.

Factors Impacting the Portfolio’s Performance

Retail REITs were the most important contributor2 to the Portfolio’s absolute performance. The Portfolio’s Retail REITs performed in-line with the corresponding sub-industry within the Index, but a lower relative average weighting in this stronger performing sub-industry detracted from performance relative to the Index. Simon Property Group3, CBL & Associates Properties, and DDR were among the most important contributors to performance. Taubman Centers was among the weakest performers, turning in a small positive performance.

The Portfolio had more invested in Office REITs than in any other sub-industry and they were another important contributor to the Portfolio’s absolute performance. The Portfolio’s Office REITs out-performed the corresponding sub-industry within the Index, but a higher relative average weighting compared to the Index detracted from relative performance. Coresite Realty and Brandywine Realty Trust were among the most important contributors to performance. DuPont Fabros Technology was among the most important detractors from performance. The Portfolio no longer owns Coresite Realty.

Other important contributors to the Portfolio’s performance were Forest City Enterprises, Weyerhaeuser, and DCT Industrial Trust. LaSalle Hotel Properties and HCP detracted from the Portfolio’s performance. The Portfolio’s bond holdings also contributed to the Portfolio’s performance lagging the Index. The Portfolio no longer owns Weyerhaeuser.

Davis Real Estate Portfolio’s investment objective is total return through a combination of growth and income. There can be no assurance that the Portfolio will achieve its objective. Davis Real Estate Portfolio’s principal risks are: stock market risk, manager risk, common stock risk, concentrated portfolio risk, real estate risk, focused portfolio risk, foreign country risk, under $10 billion market capitalization risk, variable current income risk, headline risk, and fees and expenses risk. See the prospectus for a full description of each risk.

Davis Real Estate Portfolio concentrates its investments in the real estate sector, and it may be subject to greater risks than a portfolio that does not concentrate its investments in a particular sector. The Portfolio’s investment performance, both good and bad, is expected to reflect the economic performance of the real estate sector much more than a portfolio that does not concentrate its investments.

Davis Real Estate Portfolio is allowed to focus its investments in fewer companies, and it may be subject to greater risks than a more diversified portfolio that is not allowed to focus its investments in a few companies. Should the portfolio manager determine that it is prudent to focus the Portfolio’s investments in a few companies, the Portfolio’s investment performance, both good and bad, is expected to reflect the economic performance of its more focused portfolio.

1 The companies included in the Wilshire U.S. Real Estate Securities Index are divided into eight sub-industries.

2 A company’s or sector’s contribution to or detraction from the Portfolio’s performance is a product both of its appreciation or depreciation and its weighting within the Portfolio. For example, a 5% holding that rises 20% has twice as much impact as a 1% holding that rises 50%.

3 This Management Discussion of Fund Performance discusses a number of individual companies. The information provided in this report does not provide information reasonably sufficient upon which to base an investment decision and should not be considered a recommendation to purchase or sell any particular security. The Schedule of Investments lists the Portfolio’s holdings of each company discussed.

| DAVIS VARIABLE ACCOUNT FUND, INC. | Management’s Discussion of Fund Performance |

| DAVIS REAL ESTATE PORTFOLIO - (CONTINUED) | |

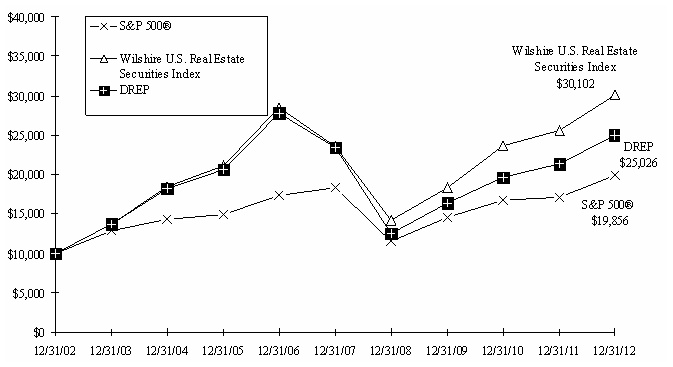

Comparison of a $10,000 investment in Davis Real Estate Portfolio versus the

Standard & Poor’s 500® Index and the Wilshire U.S. Real Estate Securities Index

over 10 years for an investment made on December 31, 2002

Average Annual Total Return for periods ended December 31, 2012

| Fund & Benchmark Indices | 1-Year | 5-Year | 10-Year | Since Fund’s Inception (07/01/99) | Gross Expense Ratio | Net Expense Ratio |

| Davis Real Estate Portfolio | 17.15% | 1.32% | 9.61% | 8.67% | 0.77% | 0.77% |

Standard & Poor’s 500® Index | 16.00% | 1.66% | 7.10% | 2.11% | | |

Wilshire U.S. Real Estate Securities Index | 17.55% | 5.08% | 11.65% | 10.91% | | |

The Standard & Poor’s 500® Index is an unmanaged index of 500 selected common stocks, most of which are listed on the New York Stock Exchange. The Index is adjusted for dividends, weighted towards stocks with large market capitalizations, and represents approximately two-thirds of the total market value of all domestic common stocks. Investments cannot be made directly in the Index.

The Wilshire U.S. Real Estate Securities Index is a broad measure of the performance of publicly traded real estate securities. It reflects no deduction for fees or expenses. Investments cannot be made directly in the Index.

The performance data for Davis Real Estate Portfolio contained in this report represents past performance, assumes that all distributions were reinvested, and should not be considered as an indication of future performance from an investment in the Portfolio today. The investment return and principal value will fluctuate so that shares may be worth more or less than their original cost when redeemed. Portfolio performance changes over time and current performance may be higher or lower than stated. The operating expense ratio may vary in future years. For more current information please call Davis Funds Investor Services at 1-800-279-0279.

Portfolio performance numbers are net of all Portfolio operating expenses, but do not include any insurance charges imposed by your insurance company’s separate account. If performance included the effect of these additional charges, the return would be lower.

| DAVIS VARIABLE ACCOUNT FUND, INC. | Fund Overview |

| DAVIS VALUE PORTFOLIO | December 31, 2012 |

| Portfolio Composition | | Industry Weightings |

| (% of Fund’s 12/31/12 Net Assets) | | (% of 12/31/12 Long-Term Portfolio) |

| | | | | | |

| | | | | | Fund | S&P 500® |

| Common Stock (U.S.) | 78.19% | | Diversified Financials | 18.12% | | 6.45% |

| Common Stock (Foreign) | 17.32% | | Insurance | 12.43% | | 3.99% |

| Convertible Bonds (Foreign) | 0.03% | | Food & Staples Retailing | 11.59% | | 2.35% |

| Short-Term Investments | 4.19% | | Energy | 9.85% | | 10.94% |

| Other Assets & Liabilities | 0.27% | | Information Technology | 9.08% | | 18.96% |

| | 100.00% | | Materials | 7.27% | | 3.61% |

| | | | Food, Beverage & Tobacco | 6.21% | | 5.91% |

| | | | Banks | 6.10% | | 2.84% |

| | | | Retailing | 5.46% | | 4.13% |

| | | | Health Care | 3.01% | | 12.38% |

| | | | Transportation | 2.92% | | 1.62% |

| | | | Media | 2.65% | | 3.54% |

| | | | Other | 2.65% | | 14.81% |

| | | | Capital Goods | 1.35% | | 7.80% |

| | | | Commercial & Professional Services | 1.31% | | 0.67% |

| | | | | 100.00% | | 100.00% |

Top 10 Long-Term Holdings

(% of Fund’s 12/31/12 Net Assets)

| | | |

| CVS Caremark Corp. | Food & Staples Retailing | 6.42% |

| Wells Fargo & Co. | Commercial Banks | 5.83% |

| American Express Co. | Consumer Finance | 5.68% |

| Bank of New York Mellon Corp. | Capital Markets | 5.07% |

| Costco Wholesale Corp. | Food & Staples Retailing | 4.37% |

| Google Inc., Class A | Software & Services | 4.01% |

| Loews Corp. | Multi-line Insurance | 2.87% |

| Berkshire Hathaway Inc., Class A | Property & Casualty Insurance | 2.83% |

| EOG Resources, Inc. | Energy | 2.78% |

| Bed Bath & Beyond Inc. | Retailing | 2.68% |

| DAVIS VARIABLE ACCOUNT FUND, INC. | Fund Overview |

| DAVIS VALUE PORTFOLIO - (CONTINUED) | December 31, 2012 |

New Positions Added (01/01/12-12/31/12)

(Highlighted positions are those greater than 0.30% of the Fund’s 12/31/12 net assets)

| Security | Industry | Date of 1st Purchase | % of Fund’s 12/31/12 Net Assets |

| Emerson Electric Co. | Capital Goods | 05/02/12 | | 0.40% |

| Groupon, Inc. | Retailing | 03/14/12 | | 0.16% |

| International Business Machines Corp. | Software & Services | 11/07/12 | | 0.32% |

| Laboratory Corp. of America Holdings | Health Care Equipment & Services | 10/25/12 | | 0.12% |

| Sysco Corp. | Food & Staples Retailing | 03/06/12 | | 0.28% |

| Tiffany & Co. | Retailing | 01/23/12 | | 0.30% |

| Walgreen Co. | Food & Staples Retailing | 01/24/12 | | – |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Positions Closed (01/01/12-12/31/12)

(Gains and losses greater than $1,000,000 are highlighted)

| Security | Industry | Date of Final Sale | | | Realized Gain(Loss) |

| Baxter International Inc. | Health Care Equipment & Services | 07/13/12 | | $ | 215,253 |

| Becton, Dickinson and Co. | Health Care Equipment & Services | 06/15/12 | | | 227,854 |

| China Coal Energy Co., Ltd. - H | Energy | 10/11/12 | | | 557,642 |

| China Shipping Development Co., Ltd. - H | Transportation | 10/16/12 | | | (1,850,329) |

| Expedia, Inc. | Retailing | 11/20/12 | | | 1,258,653 |

| Johnson & Johnson | Pharmaceuticals, Biotechnology & | | | | |

| | Life Sciences | 07/03/12 | | | 1,021,280 |

| Kraft Foods Inc., Class A | Food, Beverage & Tobacco | 06/18/12 | | | 548,737 |

| Li & Fung Ltd. | Retailing | 08/10/12 | | | 125,432 |

| LLX Logistica S.A. | Transportation | 06/15/12 | | | (43,343) |

| Lockheed Martin Corp. | Capital Goods | 07/18/12 | | | 568,964 |

| Merck & Co., Inc. | Pharmaceuticals, Biotechnology & | | | | |

| | Life Sciences | 07/09/12 | | | 4,672,686 |

| MMX Mineracao e Metalicos S.A., Pfd. | Materials | 02/02/12 | | | 11,603 |

| OGX Petroleo e Gas Participacoes S.A. | Energy | 12/28/12 | | | (893,356) |

| Roche Holding AG - Genusschein | Pharmaceuticals, Biotechnology & | | | | |

| | Life Sciences | 07/20/12 | | | 808,892 |

| Sealed Air Corp. | Materials | 11/13/12 | | | 383,887 |

| Sino-Forest Corp. | Materials | 07/10/12 | | | (4,503,143) |

| Sino-Forest Corp., Restricted | Materials | 07/10/12 | | | (141,083) |

| Transatlantic Holdings, Inc. | Reinsurance | 03/06/12 | | | 96,317 |

| TripAdvisor Inc. | Retailing | 04/17/12 | | | 330,578 |

| Walgreen Co. | Food & Staples Retailing | 11/20/12 | | | 31,860 |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| DAVIS VARIABLE ACCOUNT FUND, INC. | Fund Overview |

| DAVIS FINANCIAL PORTFOLIO | December 31, 2012 |

| Portfolio Composition | | Industry Weightings |

| (% of Fund’s 12/31/12 Net Assets) | | (% of 12/31/12 Stock Holdings) |

| | | | | | |

| | | | | | Fund | S&P 500® |

| Common Stock (U.S.) | 75.41% | | Diversified Financials | 39.08% | 6.45% |

| Common Stock (Foreign) | 23.41% | | Insurance | 31.80% | 3.99% |

| Short-Term Investments | 1.36% | | Banks | 19.50% | 2.84% |

| Other Assets & Liabilities | (0.18)% | | Energy | 2.99% | 10.94% |

| | 100.00% | | Food & Staples Retailing | 2.94% | 2.35% |

| | | | Information Technology | 2.35% | 18.96% |

| | | | Retailing | 1.34% | 4.13% |

| | | | Health Care | – | 12.38% |

| | | | Capital Goods | – | 7.80% |

| | | | Food, Beverage & Tobacco | – | 5.91% |

| | | | Other | – | 24.25% |

| | | | | 100.00% | 100.00% |

| | | | | | |

Top 10 Long-Term Holdings

(% of Fund’s 12/31/12 Net Assets)

| | | |

| American Express Co. | Consumer Finance | 10.61% |

| Wells Fargo & Co. | Commercial Banks | 8.89% |

| State Bank of India Ltd., GDR | Commercial Banks | 6.12% |

| Bank of New York Mellon Corp. | Capital Markets | 5.85% |

| Markel Corp. | Property & Casualty Insurance | 5.60% |

| Loews Corp. | Multi-line Insurance | 5.51% |

| Julius Baer Group Ltd. | Capital Markets | 4.91% |

| Alleghany Corp. | Reinsurance | 4.82% |

| American International Group, Inc. | Multi-line Insurance | 4.65% |

| Brookfield Asset Management Inc., Class A | Capital Markets | 4.53% |

New Positions Added (01/01/12-12/31/12)

(Highlighted positions are those greater than 4.00% of the Fund’s 12/31/12 net assets)

| Security | Industry | Date of 1st Purchase | % of Fund’s 12/31/12 Net Assets |

| ACE Ltd. | Property & Casualty Insurance | 04/02/12 | 2.55% | |

| American International Group, Inc. | Multi-line Insurance | 10/24/12 | 4.65% | |

| Google Inc., Class A | Software & Services | 04/16/12 | 2.32% | |

| PNC Financial Services Group, Inc. | Commercial Banks | 01/18/12 | – | |

| Toronto-Dominion Bank | Commercial Banks | 04/02/12 | 2.61% | |

Positions Closed (01/01/12-12/31/12)

(Gains and losses greater than $500,000 are highlighted)

| Security | Industry | Date of Final Sale | | Realized Gain(Loss) |

| Banco Santander Brasil S.A., ADS | Commercial Banks | 02/22/12 | $ | (56,657) |

| PNC Financial Services Group, Inc. | Commercial Banks | 02/22/12 | | 18,658 |

| RHJ International | Diversified Financial Services | 02/28/12 | | (853,941) |

| Sino-Forest Corp. | Materials | 07/10/12 | | (1,287,807) |

| T. Rowe Price Group Inc. | Capital Markets | 02/24/12 | | 156,681 |

| Transatlantic Holdings, Inc. | Reinsurance | 03/06/12 | | 81,870 |

| DAVIS VARIABLE ACCOUNT FUND, INC. | Fund Overview |

| DAVIS REAL ESTATE PORTFOLIO | December 31, 2012 |

| Portfolio Composition | | Industry Weightings |

| (% of Fund’s 12/31/12 Net Assets) | | (% of 12/31/12 Long-Term Portfolio) |

| | | | | | |

| | | | | | Wilshire U.S. Real Estate Securities Index |

| Common Stock | 84.41% | | | |

| Preferred Stock | 6.59% | | | | Fund |

| Convertible Bonds | 2.47% | | Office REITs | 29.13% | | 14.55% |

| Short-Term Investments | 6.22% | | Residential REITs | 21.97% | | 18.31% |

| Other Assets & Liabilities | 0.31% | | Specialized REITs | 18.11% | | 27.82% |

| | 100.00% | | Retail REITs | 16.97% | | 25.72% |

| | | | Industrial REITs | 6.60% | | 5.04% |

| | | | Real Estate Operating Companies | 3.90% | | 1.55% |

| | | | Diversified REITs | 3.32% | | 6.65% |

| | | | Hotels, Resorts & Cruise Lines | – | | 0.36% |

| | | | | 100.00% | | 100.00% |

| | | | | | |

Top 10 Long-Term Holdings

(% of Fund’s 12/31/12 Net Assets)

| | | |

| American Campus Communities, Inc. | Residential REITs | 5.19% |

| Simon Property Group, Inc. | Retail REITs | 4.97% |

| Digital Realty Trust, Inc. | Office REITs | 4.41% |

| Alexandria Real Estate Equities, Inc. | Office REITs | 4.41% |

| Rayonier Inc. | Specialized REITs | 3.44% |

| Forest City Enterprises, Inc., Class A | Real Estate Operating Companies | 3.25% |

Alexandria Real Estate Equities, Inc., 7.00%, Series D, Cum. Conv. Pfd. | Office REITs | 3.15% |

| Vornado Realty Trust | Diversified REITs | 3.11% |

| AvalonBay Communities, Inc. | Residential REITs | 2.95% |

| Ventas, Inc. | Specialized REITs | 2.81% |

| DAVIS VARIABLE ACCOUNT FUND, INC. | Fund Overview |

| DAVIS REAL ESTATE PORTFOLIO - (CONTINUED) | December 31, 2012 |

New Positions Added (01/01/12-12/31/12)

(Highlighted positions are those greater than 1.50% of the Fund’s 12/31/12 net assets)

| Security | Industry | Date of 1st Purchase | % of Fund’s 12/31/12 Net Assets |

| American Tower Corp. | Specialized REITs | 01/05/12 | | 1.69% |

| BRE Properties, Inc. | Residential REITs | 11/01/12 | | 2.57% |

| DuPont Fabros Technology Inc., | | | | |

| 7.625%, Series B, Pfd. | Office REITs | 01/13/12 | | 0.41% |

| Home Properties, Inc. | Residential REITs | 04/23/12 | | 0.96% |

| Host Hotels & Resorts Inc. | Specialized REITs | 01/13/12 | | 2.48% |

| LaSalle Hotel Properties | Specialized REITs | 07/20/12 | | 1.63% |

| Potlatch Corp. | Specialized REITs | 04/27/12 | | – |

| Sunstone Hotel Investors, Inc. | Specialized REITs | 01/13/12 | | – |

| Taubman Centers, Inc. | Retail REITs | 06/25/12 | | 1.03% |

| Taubman Centers, Inc., 6.50%, Series J, Pfd. | Retail REITs | 08/03/12 | | 0.36% |

| Weyerhaeuser Co. | Specialized REITs | 04/27/12 | | – |

| | | | |

| | | | |

| | | | |

Positions Closed (01/01/12-12/31/12)

(Gains and losses greater than $100,000 are highlighted)

| Security | Industry | Date of Final Sale | | | Realized Gain (Loss) |

| Coresite Realty Corp. | Office REITs | 10/15/12 | | $ | 352,542 |

| CubeSmart | Specialized REITs | 06/29/12 | | | 19,439 |

| Plum Creek Timber Co., Inc. | Specialized REITs | 06/27/12 | | | (174) |

| Potlatch Corp. | Specialized REITs | 09/17/12 | | | 32,959 |

| SL Green Operating Partnership L.P., 144A | | | | | |

| Conv. Sr. Notes, 3.00%, 03/30/27 | Office REITs | 03/30/12 | | | 1,359 |

| Sunstone Hotel Investors, Inc. | Specialized REITs | 06/08/12 | | | 33,042 |

| Weyerhaeuser Co. | Specialized REITs | 10/03/12 | | | 198,305 |

| DAVIS VARIABLE ACCOUNT FUND, INC. | Expense Example |

Example

As a shareholder of each Fund, you incur ongoing costs only, including advisory and administrative fees and other Fund expenses. The Expense Example is intended to help you understand your ongoing costs (in dollars) of investing in each Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Expense Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period indicated, which for each Fund is for the six-month period ended December 31, 2012. Please note that the Expense Example is general and does not reflect charges imposed by your insurance company’s separate account or account specific costs, which may increase your total costs of investing in the Fund. If these charges or account specific costs were included in the Expense Example, the expenses would have been higher.

Actual Expenses

The information represented in the row entitled “Actual” provides information about actual account values and actual expenses. You may use the information in this row, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information represented in the row entitled “Hypothetical” provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the information in the row entitled “Hypothetical” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | Beginning Account Value | | Ending Account Value | | Expenses Paid During Period* |

| | (07/01/12) | | (12/31/12) | | (07/01/12-12/31/12) | |

| | | | | | | |

| Davis Value Portfolio | | | | | | |

| (annualized expense ratio 0.64%**) | | | | | | |

| Actual | $1,000.00 | | $1,059.94 | | $3.31 | |

| Hypothetical | $1,000.00 | | $1,021.92 | | $3.25 | |

| | | | | | | |

| Davis Financial Portfolio | | | | | | |

| (annualized expense ratio 0.68%**) | | | | | | |

| Actual | $1,000.00 | | $1,068.39 | | $3.54 | |

| Hypothetical | $1,000.00 | | $1,021.72 | | $3.46 | |

| | | | | | | |

| Davis Real Estate Portfolio | | | | | | |

| (annualized expense ratio 0.76%**) | | | | | | |

| Actual | $1,000.00 | | $1,023.10 | | $3.86 | |

| Hypothetical | $1,000.00 | | $1,021.32 | | $3.86 | |

| Hypothetical assumes 5% annual return before expenses. |

| |

| *Expenses are equal to the Fund’s annualized operating expense ratio, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). |

| |

| **The expense ratios reflect the impact, if any, of certain reimbursements from the Adviser. |

| DAVIS VARIABLE ACCOUNT FUND, INC. | Schedule of Investments |

| DAVIS VALUE PORTFOLIO | December 31, 2012 |

| | Shares | | Value (Note 1) |

|

| CONSUMER DISCRETIONARY – (8.81%) |

| | | Automobiles & Components – (0.67%) |

| | | | Harley-Davidson, Inc. | | | | | |

| | Consumer Durables & Apparel – (0.39%) |

| | | Compagnie Financiere Richemont S.A., Bearer Shares, Unit A (Switzerland) | | | | | |

| | | Hunter Douglas N.V. (Netherlands) | | | | | |

| | | | 1,343,458 |

| | Media – (2.53%) |

| | | Grupo Televisa S.A.B., ADR (Mexico) | | | | | |

| | | Walt Disney Co. | | | | | |

| | | | 8,753,451 |

| | Retailing – (5.22%) |

| | | Bed Bath & Beyond Inc. * | | | | | |

| | | CarMax, Inc. * | | | | | |

| | | Groupon, Inc. * | | | | | |

| | | Liberty Interactive Corp., Series A * | | | | | |

| | | Liberty Ventures, Series A * | | | | | |

| | | Netflix Inc. * | | | | | |

| | | Tiffany & Co. | | | | | |

| | | | 18,033,630 |

| Total Consumer Discretionary | | | | |

| CONSUMER STAPLES – (17.23%) |

| | Food & Staples Retailing – (11.07%) |

| | | Costco Wholesale Corp. | | | | | |

| | | CVS Caremark Corp. | | | | | |

| | | Sysco Corp. | | | | | |

| | | | 38,248,847 |

| | Food, Beverage & Tobacco – (5.93%) |

| | | Coca-Cola Co. | | | | | |

| | | Diageo PLC, ADR (United Kingdom) | | | | | |

| | | Heineken Holding N.V. (Netherlands) | | | | | |

| | | Nestle S.A. (Switzerland) | | | | | |

| | | Philip Morris International Inc. | | | | | |

| | | Unilever N.V., NY Shares (Netherlands) | | | | | |

| | | | 20,512,419 |

| | Household & Personal Products – (0.23%) |

| | | Natura Cosmeticos S.A. (Brazil) | | | | | |

| Total Consumer Staples | | | | |

| ENERGY – (9.41%) |

| | | Canadian Natural Resources Ltd. (Canada) | | | | | |

| | | Devon Energy Corp. | | | | | |

| | | EOG Resources, Inc. | | | | | |

| | | Occidental Petroleum Corp. | | | | | |

| | | Schlumberger Ltd. | | | | | |

| | | Transocean Ltd. | | | | | |

| Total Energy | | | | |

| DAVIS VARIABLE ACCOUNT FUND, INC. | Schedule of Investments |

| DAVIS VALUE PORTFOLIO - (CONTINUED) | December 31, 2012 |

| | Shares | | Value (Note 1) |

COMMON STOCK – (CONTINUED) |

| FINANCIALS – (36.09%) |

| | Banks – (5.83%) |

| | | Commercial Banks – (5.83%) |

| | | | | | | |

| | Diversified Financials – (17.31%) |

| | Capital Markets – (9.97%) |

| | | | Ameriprise Financial, Inc. | | | | | |

| | Bank of New York Mellon Corp. | | | | | |

| | Brookfield Asset Management Inc., Class A (Canada) | | | | | |

| | | | | | | |

| | Goldman Sachs Group, Inc. | | | | | |

| | Julius Baer Group Ltd. (Switzerland) | | | | | |

| | | 34,435,817 |

| | Consumer Finance – (5.68%) |

| | | | | | | |

| | Diversified Financial Services – (1.66%) |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | 5,730,507 |

| | | | 59,802,584 |

| | Insurance – (11.88%) |

| | Insurance Brokers – (0.18%) |

| | | | | | | |

| | Multi-line Insurance – (3.57%) |

| | Fairfax Financial Holdings Ltd. (Canada) | | | | | |

| | Fairfax Financial Holdings Ltd., 144A (Canada)(a) | | | | | |

| | | | | | | |

| | | 12,323,530 |

| | Property & Casualty Insurance – (6.44%) |

| | | | | | | |

| | Berkshire Hathaway Inc., Class A * | | | | | |

| | | | | | | |

| | | | | | | |

| | | 22,245,915 |

| | Reinsurance – (1.69%) |

| | | | | | | |

| | | | | | | |

| | | 5,853,938 |

| | | | 41,036,095 |

| | Real Estate – (1.07%) |

| | Hang Lung Group Ltd. (Hong Kong) | | | | | |

| Total Financials | | | | |

| HEALTH CARE – (2.88%) |

| | Health Care Equipment & Services – (2.24%) |

| | Express Scripts Holding Co. * | | | | | |

| | Laboratory Corp. of America Holdings * | | | | | |

| | | | 7,727,493 |

| DAVIS VARIABLE ACCOUNT FUND, INC. | Schedule of Investments |

| DAVIS VALUE PORTFOLIO - (CONTINUED) | December 31, 2012 |

| | Shares | | Value (Note 1) |

COMMON STOCK – (CONTINUED) |

| HEALTH CARE – (CONTINUED) |

| | Pharmaceuticals, Biotechnology & Life Sciences – (0.64%) |

| | | Agilent Technologies, Inc. | | | | | |

| | | | | | | |

| | | | 2,217,190 |

| Total Health Care | | | | |

| INDUSTRIALS – (5.33%) |

| | Capital Goods – (1.29%) |

| | | | | | | |

| | | | | | | |

| | | | 4,443,638 |

| | Commercial & Professional Services – (1.25%) |

| | | | | | | |

| | Transportation – (2.79%) |

| | China Merchants Holdings International Co., Ltd. (China) | | | | | |

| | Kuehne & Nagel International AG (Switzerland) | | | | | |

| | | | 9,640,125 |

| Total Industrials | | | | |

| INFORMATION TECHNOLOGY – (8.68%) |

| | Semiconductors & Semiconductor Equipment – (1.76%) |

| | | | | | | |

| | | | | | | |

| | | | 6,060,097 |

| | Software & Services – (6.63%) |

| | Activision Blizzard, Inc. | | | | | |

| | | | | | | |

| | International Business Machines Corp. | | | | | |

| | | | | | | |

| | | | | | | |

| | | | 22,918,376 |

| | Technology Hardware & Equipment – (0.29%) |

| | | | | | | |

| Total Information Technology | | | | |

| MATERIALS – (6.91%) |

| | Air Products and Chemicals, Inc. | | | | | |

| | BHP Billiton PLC (United Kingdom) | | | | | |

| | | | | | | |

| | Martin Marietta Materials, Inc. | | | | | |

| | | | | | | |

| | Potash Corp. of Saskatchewan Inc. (Canada) | | | | | |

| | | | | | | |

| | Rio Tinto PLC (United Kingdom) | | | | | |

| Total Materials | | | | |

| TELECOMMUNICATION SERVICES – (0.17%) |

| | America Movil S.A.B. de C.V., Series L, ADR (Mexico) | | | | | |

| Total Telecommunication Services | | | | |

| | TOTAL COMMON STOCK – (Identified cost $204,173,084) | | | |

| DAVIS VARIABLE ACCOUNT FUND, INC. | Schedule of Investments |

| DAVIS VALUE PORTFOLIO - (CONTINUED) | December 31, 2012 |

| | Principal | | Value (Note 1) |

CONVERTIBLE BONDS – (0.03%) |

| MATERIALS – (0.03%) |

| | Sino-Forest Corp., Conv. Sr. Notes, 5.00%, 08/01/13 (Canada) (b)(c) | | | | | | |

| | | | TOTAL CONVERTIBLE BONDS – (Identified cost $736,000) | | | |

SHORT-TERM INVESTMENTS – (4.19%) |

| | Banc of America Securities LLC Joint Repurchase Agreement, 0.18%, 01/02/13, dated 12/31/12, repurchase value of $6,290,063 (collateralized by: U.S. Government agency mortgages in a pooled cash account, 3.50%-4.50%, 04/01/42-11/01/42, total market value $6,415,800) | | | | | |

| | Mizuho Securities USA Inc. Joint Repurchase Agreement, 0.27%, 01/02/13, dated 12/31/12, repurchase value of $8,187,123 (collateralized by: U.S. Government agency mortgages in a pooled cash account, 4.00%, 09/20/40-10/15/40, total market value $8,350,740) | | | | | |

| | TOTAL SHORT-TERM INVESTMENTS – (Identified cost $14,477,000) | | | |

| | Total Investments – (99.73%) – (Identified cost $219,386,084) – (d) | | | 344,606,722 |

| | Other Assets Less Liabilities – (0.27%) | | | 949,155 |

| Net Assets – (100.00%) | | | $ | 345,555,877 |

| | ADR: American Depositary Receipt | |

| | | |

| | * | Non-Income producing security. |

| | | |

| | (a) | This security is subject to Rule 144A. The Board of Directors of the Fund has determined that there is sufficient liquidity in this security to realize current valuations. This security amounted to $897,547 or 0.26% of the Fund's net assets as of December 31, 2012. |

| | | |

| | (b) | Restricted Security – See Note 7 of the Notes to Financial Statements. |

| | | |

| | (c) | This security is in default. See Note 1 of the Notes to Financial Statements. |

| | | |

| | (d) | Aggregate cost for federal income tax purposes is $220,972,911. At December 31, 2012 unrealized appreciation (depreciation) of securities for federal income tax purposes is as follows: |

| | Unrealized appreciation | | $ | 126,395,998 |

| | Unrealized depreciation | | | (2,762,187) |

| | | | | Net unrealized appreciation | | $ | 123,633,811 |

| See Notes to Financial Statements |

| DAVIS VARIABLE ACCOUNT FUND, INC. | Schedule of Investments |

| DAVIS FINANCIAL PORTFOLIO | December 31, 2012 |

| | Shares/Units | | Value (Note 1) |

|

| CONSUMER DISCRETIONARY – (1.32%) |

| | Retailing – (1.32%) |

| | | | | | | | | |

| Total Consumer Discretionary | | | | |

| CONSUMER STAPLES – (2.91%) |

| | Food & Staples Retailing – (2.91%) |

| | | | | | | |

| Total Consumer Staples | | | | |

| ENERGY – (2.96%) |

| | Canadian Natural Resources Ltd. (Canada) | | | | | |

| Total Energy | | | | |

| FINANCIALS – (89.31%) |

| | Banks – (19.27%) |

| | Commercial Banks – (19.27%) |

| | ICICI Bank Ltd., ADR (India) | | | | | |

| | State Bank of India Ltd., GDR (India) | | | | | |

| | Toronto-Dominion Bank (Canada) | | | | | |

| | | | | | | |

| | | | | | | |

| | | | 12,957,716 |

| | Diversified Financials – (38.62%) |

| | Capital Markets – (22.09%) |

| | Ameriprise Financial, Inc. | | | | | |

| | Bank of New York Mellon Corp. | | | | | |

| | Brookfield Asset Management Inc., Class A (Canada) | | | | | |

| | | | | | | |

| | Goldman Sachs Group, Inc. | | | | | |

| | Julius Baer Group Ltd. (Switzerland) | | | | | |

| | Oaktree Capital Group LLC, Class A | | | | | |

| | | 14,853,256 |

| | Consumer Finance – (10.83%) |

| | | | | | | |

| | | | | | | |

| | | 7,285,333 |

| | Diversified Financial Services – (5.70%) |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | 3,833,081 |

| | | | 25,971,670 |

| | Insurance – (31.42%) |

| | Multi-line Insurance – (10.16%) |

| | American International Group, Inc. * | | | | | |

| | | | | | | |

| | | 6,836,238 |

| | Property & Casualty Insurance – (12.35%) |

| | | | | | | |

| | | | | | | |

| DAVIS VARIABLE ACCOUNT FUND, INC. | Schedule of Investments |

| DAVIS FINANCIAL PORTFOLIO - (CONTINUED) | December 31, 2012 |

| | Shares/Principal | | Value (Note 1) |

COMMON STOCK – (CONTINUED) |

| FINANCIALS – (CONTINUED) |

| | | Insurance – (Continued) |

| | | | Property & Casualty Insurance – (Continued) |

| | | | | | | | | |

| | | 8,304,407 |

| | Reinsurance – (8.91%) |

| | | | | | | |

| | | | | | | |

| | | 5,994,311 |

| | | | 21,134,956 |

| | Total Financials | | | | |

| INFORMATION TECHNOLOGY – (2.32%) |

| | Software & Services – (2.32%) |

| | | | | | | |

| | Total Information Technology | | | | |

| | | TOTAL COMMON STOCK – (Identified cost $49,949,605) | | | |

| |

SHORT-TERM INVESTMENTS – (1.36%) |

| | Banc of America Securities LLC Joint Repurchase Agreement, 0.18%, 01/02/13, dated 12/31/12, repurchase value of $398,004 (collateralized by: U.S. Government agency mortgages in a pooled cash account, 3.50%-4.50%, 04/01/42-11/01/42, total market value $405,960) | $ | | | | |

| | Mizuho Securities USA Inc. Joint Repurchase Agreement, 0.27%, 01/02/13, dated 12/31/12, repurchase value of $519,008 (collateralized by: U.S. Government agency mortgages in a pooled cash account, 4.00%, 09/20/40-10/15/40, total market value $529,380) | | | | | |

| | | TOTAL SHORT-TERM INVESTMENTS – (Identified cost $917,000) | | | |

| | Total Investments – (100.18%) – (Identified cost $50,866,605) – (a) | | | 67,373,741 |

| | Liabilities Less Other Assets – (0.18%) | | | (119,167) |

| | | | | | Net Assets – (100.00%) | | $ | 67,254,574 |

| | ADR: American Depositary Receipt | |

| | | |

| | GDR: Global Depositary Receipt | |

| | | | |

| * Non-Income producing security. |

| | (a) | Aggregate cost for federal income tax purposes is $51,219,863. At December 31, 2012 unrealized appreciation (depreciation) of securities for federal income tax purposes is as follows: |

| | Unrealized appreciation | | $ | 20,455,073 |

| | Unrealized depreciation | | | (4,301,195) |

| | | | | | Net unrealized appreciation | | $ | 16,153,878 |

| See Notes to Financial Statements |

| DAVIS VARIABLE ACCOUNT FUND, INC. | Schedule of Investments |

| DAVIS REAL ESTATE PORTFOLIO | December 31, 2012 |

| | Shares | | Value (Note 1) |

|

| | FINANCIALS – (84.41%) |

| | Real Estate – (84.41%) |

| | Real Estate Investment Trusts (REITs) – (81.16%) |

| | Diversified REITs – (3.11%) |

| | | | | | | | |

| | Industrial REITs – (5.10%) |

| | DCT Industrial Trust Inc. | | | | | | |

| | EastGroup Properties, Inc. | | | | | | |

| | | | | | | | |

| | | 1,432,016 |

| | Office REITs – (20.73%) |

| | Alexandria Real Estate Equities, Inc. | | | | | | |

| | BioMed Realty Trust, Inc. | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | Corporate Office Properties Trust | | | | | | |

| | Digital Realty Trust, Inc. | | | | | | |

| | DuPont Fabros Technology Inc. | | | | | | |

| | | | | | | | |

| | | 5,816,969 |

| | Residential REITs – (20.54%) |

| | American Campus Communities, Inc. | | | | | | |

| | AvalonBay Communities, Inc. | | | | | | |

| | | | | | | | |

| | Education Realty Trust, Inc. | | | | | | |

| | | | | | | | |

| | Essex Property Trust, Inc. | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | 5,763,716 |

| | Retail REITs – (14.76%) |

| | CBL & Associates Properties, Inc. | | | | | | |

| | | | | | | | |

| | Federal Realty Investment Trust | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | Simon Property Group, Inc. | | | | | | |

| | | | | | | | |

| | | 4,143,460 |

| | Specialized REITs – (16.92%) |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | Host Hotels & Resorts Inc. | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| DAVIS VARIABLE ACCOUNT FUND, INC. | Schedule of Investments |

| DAVIS REAL ESTATE PORTFOLIO - (CONTINUED) | December 31, 2012 |

| | Shares/Principal | | Value (Note 1) |

COMMON STOCK – (CONTINUED) |

| FINANCIALS – (CONTINUED) |

| | Real Estate – (Continued) |

| | | Real Estate Investment Trusts (REITs) – (Continued) |

| | | | Specialized REITs – (Continued) |

| | | | | | | | |

| | | 4,750,311 |

| | | 22,778,543 |

| | Real Estate Management & Development – (3.25%) |

| | Real Estate Operating Companies – (3.25%) |

| | Forest City Enterprises, Inc., Class A * | | | | | | |

| Total Financials | | | | |

| | TOTAL COMMON STOCK – (Identified cost $21,158,641) | | | |

PREFERRED STOCK – (6.59%) |

| FINANCIALS – (6.59%) |

| | Real Estate – (6.59%) |

| | Real Estate Investment Trusts (REITs) – (6.59%) |

| | Industrial REITs – (1.07%) |

| | Prologis, Inc., 6.75%, Series M | | | | | | |

| | Office REITs – (4.42%) |

| | Alexandria Real Estate Equities, Inc., 7.00%, Series D, Cum. Conv. Pfd. | | | | | | |

| | Digital Realty Trust, Inc., 5.50%, Series D, Cum. Conv. Pfd. | | | | | | |

| | DuPont Fabros Technology Inc., 7.625%, Series B | | | | | | |

| | | 1,241,772 |

| | Retail REITs – (1.10%) |

| | CBL & Associates Properties, Inc., 7.375%, Series D | | | | | | |

| | Taubman Centers, Inc., 6.50%, Series J | | | | | | |

| | | 307,944 |

| Total Financials | | | | |

| | TOTAL PREFERRED STOCK – (Identified cost $932,240) | | | |

CONVERTIBLE BONDS – (2.47%) |

| FINANCIALS – (2.47%) |

| | Real Estate – (2.47%) |

| | Real Estate Investment Trusts (REITs) – (2.08%) |

| | Office REITs – (2.08%) |

| | Digital Realty Trust, L.P., 144A Conv. Sr. Notes, 5.50%, 04/15/29 (a) | | | | | | |

| | Real Estate Management & Development – (0.39%) |

| | Real Estate Operating Companies – (0.39%) |

| | Forest City Enterprises, Inc., Conv. Sr. Notes, 5.00%, 10/15/16 | | | | | | |

| Total Financials | | | | |

| | TOTAL CONVERTIBLE BONDS – (Identified cost $424,000) | | | |

| DAVIS VARIABLE ACCOUNT FUND, INC. | Schedule of Investments |

| DAVIS REAL ESTATE PORTFOLIO - (CONTINUED) | December 31, 2012 |

| | Principal | | Value (Note 1) |

SHORT-TERM INVESTMENTS – (6.22%) |

| | Banc of America Securities LLC Joint Repurchase Agreement, 0.18%, 01/02/13, dated 12/31/12, repurchase value of $759,008 (collateralized by: U.S. Government agency mortgages in a pooled cash account, 3.50%-4.50%, 04/01/42-11/01/42, total market value $774,180) | $ | | | | |

| | Mizuho Securities USA Inc. Joint Repurchase Agreement, 0.27%, 01/02/13, dated 12/31/12, repurchase value of $987,015 (collateralized by: U.S. Government agency mortgages in a pooled cash account, 4.00%, 09/20/40-10/15/40, total market value $1,006,740) | | | | | |

| | | | TOTAL SHORT-TERM INVESTMENTS – (Identified cost $1,746,000) | | | |

| | Total Investments – (99.69%) – (Identified cost $24,260,881) – (b) | | | 27,980,193 |

| | Other Assets Less Liabilities – (0.31%) | | | 88,120 |

| | Net Assets – (100.00%) | | | $ | 28,068,313 |

| | * | Non-Income producing security. |

| | | |

| | (a) | This security is subject to Rule 144A. The Board of Directors of the Fund has determined that there is sufficient liquidity in this security to realize current valuations. This security amounted to $583,295 or 2.08% of the Fund's net assets as of December 31, 2012. |

| | | |

| | (b) | Aggregate cost for federal income tax purposes is $24,337,068. At December 31, 2012 unrealized appreciation (depreciation) of securities for federal income tax purposes is as follows: |

| | Unrealized appreciation | | $ | 3,849,186 |

| | Unrealized depreciation | | | (206,061) |

| | | Net unrealized appreciation | | | $ | 3,643,125 |

| |

| See Notes to Financial Statements |

| DAVIS VARIABLE ACCOUNT FUND, INC. | Statements of Assets and Liabilities |

| | At December 31, 2012 |

| | | | Davis Value Portfolio | | | Davis Financial Portfolio | | | Davis Real Estate Portfolio | |

| ASSETS: | | | | | | | | | | |

Investments in securities at value* (see accompanying Schedules of Investments) | | $ | 344,606,722 | | $ | 67,373,741 | | $ | 27,980,193 | |

| Cash | | | 1,960 | | | 1,077 | | | 1,603 | |

| Receivables: | | | | | | | | | | |

| | Capital stock sold | | | 18,182 | | | 494 | | | 4,626 | |

| | Dividends and interest | | | 281,005 | | | 8,742 | | | 137,933 | |

| | Investment securities sold | | | 1,028,377 | | | – | | | – | |

| Prepaid expenses | | | 7,205 | | | 1,311 | | | 625 | |

Total assets | | | | 345,943,451 | | | 67,385,365 | | | 28,124,980 | |

| LIABILITIES: | | | | | | | | | | |

| Payables: | | | | | | | | | | |

| | Capital stock redeemed | | | 172,700 | | | 72,671 | | | 18,380 | |

| Accrued audit fees | | | 14,080 | | | 12,280 | | | 12,280 | |

| Accrued custodian fees | | | 21,323 | | | 6,700 | | | 4,700 | |

| Accrued management fees | | | 165,000 | | | 32,043 | | | 15,149 | |

| Other accrued expenses | | | 14,471 | | | 7,097 | | | 6,158 | |

Total liabilities | | | | 387,574 | | | 130,791 | | | 56,667 | |

NET ASSETS | | $ | 345,555,877 | | $ | 67,254,574 | | $ | 28,068,313 | |

SHARES OUTSTANDING | | | 31,621,397 | | | 5,823,353 | | | 2,591,099 | |

NET ASSET VALUE, offering, and redemption price per share (Net assets ÷ Shares outstanding) | | $ | 10.93 | | $ | 11.55 | | $ | 10.83 | |

NET ASSETS CONSIST OF: | | | | | | | | | | |

| Par value of shares of capital stock | | $ | 31,621 | | $ | 5,823 | | $ | 2,591 | |

Additional paid-in capital | | | 218,206,370 | | | 53,268,962 | | | 32,887,218 | |

Undistributed (overdistributed) net investment income | | | 270,037 | | | (8,925) | | | 179,150 | |

Accumulated net realized gains (losses) from investments | | | 1,827,193 | | | (2,518,362) | | | (8,719,958) | |

Net unrealized appreciation on investments and foreign currency transactions | | | 125,220,656 | | | 16,507,076 | | | 3,719,312 | |

| Net Assets | | | $ | 345,555,877 | | $ | 67,254,574 | | $ | 28,068,313 | |

| | | | | | | | | | | | |

| *Including: | | | | | | | | | | |

| | Cost of investments | | $ | 219,386,084 | | $ | 50,866,605 | | $ | 24,260,881 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| See Notes to Financial Statements |

| | | | | | | | | | | | |

| DAVIS VARIABLE ACCOUNT FUND, INC. | Statements of Operations |

| | For the year ended December 31, 2012 |

| | | | Davis Value Portfolio | | | Davis Financial Portfolio | | | Davis Real Estate Portfolio | |

| INVESTMENT INCOME: | | | | | | | | | | |

| Income: | | | | | | | | | | |

| Dividends* | | $ | 8,014,208 | | $ | 1,093,909 | | $ | 604,862 | |

| Interest | | | 35,713 | | | 7,713 | | | 26,887 | |

| | Total income | | | 8,049,921 | | | 1,101,622 | | | 631,749 | |

| | | | | | | | | | | | |

| Expenses: | | | | | | | | | | |

| Management fees (Note 3) | | | 1,951,591 | | | 362,657 | | | 149,763 | |

| Custodian fees | | | 97,088 | | | 24,691 | | | 16,416 | |

| Transfer agent fees | | | 20,862 | | | 9,133 | | | 5,817 | |

| Audit fees | | | 20,640 | | | 18,240 | | | 18,240 | |

| Legal fees | | | 9,500 | | | 1,765 | | | 735 | |

| Accounting fees (Note 3) | | | 6,000 | | | 2,004 | | | 2,004 | |

| Reports to shareholders | | | 47,444 | | | 8,450 | | | 570 | |

| Directors’ fees and expenses | | | 86,722 | | | 18,460 | | | 9,299 | |

| Registration and filing fees | | | 300 | | | 55 | | | 22 | |

| Miscellaneous | | | 15,500 | | | 8,765 | | | 7,803 | |

| Total expenses | | | 2,255,647 | | | 454,220 | | | 210,669 | |

| Expenses paid indirectly (Note 4) | | | (11) | | | (6) | | | (4) | |

| | Net expenses | | | 2,255,636 | | | 454,214 | | | 210,665 | |

| Net investment income | | | 5,794,285 | | | 647,408 | | | 421,084 | |

| | | | | | | | | | | | |

REALIZED & UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY TRANSACTIONS: | | | | | | | | | | |

| Net realized gain (loss) from: | | | | | | | | | | |

| | Investment transactions | | | 12,134,644 | | | (277,384) | | | 3,153,765 | |

| | Foreign currency transactions | | | (7,084) | | | 374 | | | (316) | |

| Net realized gain (loss) | | | 12,127,560 | | | (277,010) | | | 3,153,449 | |

| Net increase in unrealized appreciation | | | 25,803,494 | | | 10,754,760 | | | 616,385 | |

| | Net realized and unrealized gain on investments and foreign currency transactions | | | 37,931,054 | | | 10,477,750 | | | 3,769,834 | |

Net increase in net assets resulting from operations | | $ | 43,725,339 | | $ | 11,125,158 | | $ | 4,190,918 | |

| | | | | | | | | | | | |

| *Net of foreign taxes withheld as follows | | $ | 110,276 | | $ | 16,241 | | $ | – | |

| | | | | | | | | | | | |

| See Notes to Financial Statements |

| DAVIS VARIABLE ACCOUNT FUND, INC. | Statements of Changes in Net Assets |

| | For the year ended December 31, 2012 |

| | | | Davis Value Portfolio | | | Davis Financial Portfolio | | | Davis Real Estate Portfolio |

| | | | | | | | | | | |

| OPERATIONS: | | | | | | | | | |

| Net investment income | | $ | 5,794,285 | | $ | 647,408 | | $ | 421,084 |

Net realized gain (loss) from investments and foreign currency transactions | | | 12,127,560 | | | (277,010) | | | 3,153,449 |

Net increase in unrealized appreciation on investments and foreign currency transactions | | | 25,803,494 | | | 10,754,760 | | | 616,385 |

| | Net increase in net assets resulting from operations | | | 43,725,339 | | | 11,125,158 | | | 4,190,918 |

| | | | | | | | | | | |

| DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS FROM: | | | | | | | | | |

| Net investment income | | | (5,672,379) | | | (1,319,573) | | | (285,310) |

| Realized gains from investment transactions | | | (20,797,749) | | | (7,861) | | | – |

| Return of capital | | | – | | | (411,358) | | | – |

| | | | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | | |

Net decrease in net assets resulting from capital share transactions (Note 5) | | | (23,067,869) | | | (2,965,665) | | | (62,833) |

| | Total increase (decrease) in net assets | | | (5,812,658) | | | 6,420,701 | | | 3,842,775 |

| | | | | | | | | | | |

| NET ASSETS: | | | | | | | | | |

| Beginning of year | | | 351,368,535 | | | 60,833,873 | | | 24,225,538 |

End of year* | | $ | 345,555,877 | | $ | 67,254,574 | | $ | 28,068,313 |

| | | | | | | | | | | |

*Including undistributed (overdistributed) net investment income of | | $ | 270,037 | | $ | (8,925) | | $ | 179,150 |

| See Notes to Financial Statements |

| DAVIS VARIABLE ACCOUNT FUND, INC. | Statements of Changes in Net Assets |

| | For the year ended December 31, 2011 |

| | | | Davis Value Portfolio | | | Davis Financial Portfolio | | | Davis Real Estate Portfolio |

| | | | | | | | | | | |

| OPERATIONS: | | | | | | | | | |

| Net investment income | | $ | 4,593,836 | | $ | 713,290 | | $ | 377,173 |

Net realized gain from investments and foreign currency transactions | | | 48,575,205 | | | 10,106,393 | | | 3,630,195 |

Net decrease in unrealized appreciation on investments and foreign currency transactions | | | (68,379,428) | | | (16,489,959) | | | (1,898,899) |

| | Net increase (decrease) in net assets resulting from operations | | | (15,210,387) | | | (5,670,276) | | | 2,108,469 |

| | | | | | | | | | | |

DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS FROM: | | | | | | | | | |

| Net investment income | | | (3,162,493) | | | (872,599) | | | (332,205) |

| | | | | | | | | | |

| Realized gains from investment transactions | | | (27,598,703) | | | – | | | – |

| | | | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | | |

Net decrease in net assets resulting from capital share transactions (Note 5) | | | (75,394,092) | | | (15,025,823) | | | (2,820,012) |

| | Total decrease in net assets | | | (121,365,675) | | | (21,568,698) | | | (1,043,748) |

| | | | | | | | | | | |

| NET ASSETS: | | | | | | | | | |

| Beginning of year | | | 472,734,210 | | | 82,402,571 | | | 25,269,286 |

End of year* | | $ | 351,368,535 | | $ | 60,833,873 | | $ | 24,225,538 |

| | | | | | | | | | | |

| *Including undistributed net investment income of | | $ | 117,705 | | $ | 528,054 | | $ | 43,692 |

| See Notes to Financial Statements |

| DAVIS VARIABLE ACCOUNT FUND, INC. | Notes to Financial Statements |

| | December 31, 2012 |

NOTE 1 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The Davis Variable Account Fund, Inc. (a Maryland corporation), consists of three series of funds, Davis Value Portfolio, Davis Financial Portfolio, and Davis Real Estate Portfolio (collectively “Funds”). Davis Value Portfolio and Davis Financial Portfolio are registered under the Investment Company Act of 1940 (“40 Act”), as amended, as diversified, open-end management investment companies. Davis Real Estate Portfolio is registered under the 40 Act, as amended, as a non-diversified, open-end management investment company. Only insurance companies, for the purpose of funding variable annuity or variable life insurance contracts, may purchase shares of the Funds. The Funds account separately for the assets, liabilities, and operations of each series. The following is a summary of significant accounting policies followed by the Funds in the preparation of their financial statements.

Security Valuation - The Funds calculate the net asset value of their shares as of the close of the New York Stock Exchange (“Exchange”), normally 4:00 P.M. Eastern time, on each day the Exchange is open for business. Securities listed on the Exchange (and other national exchanges) are valued at the last reported sales price on the day of valuation. Securities traded in the over-the-counter market (e.g. NASDAQ) and listed securities for which no sale was reported on that date are stated at the average of closing bid and asked prices. Securities traded on foreign exchanges are valued based upon the last sales price on the principal exchange on which the security is traded prior to the time when the Funds’ assets are valued. Fixed income securities with more than 60 days to maturity are generally valued using evaluated prices or matrix pricing methods determined by an independent pricing service which takes into consideration factors such as yield, maturity, liquidity, ratings, and traded prices in identical or similar securities. Securities (including restricted securities) for which market quotations are not readily available or securities whose values have been materially affected by what Davis Selected Advisers, L.P. (“Davis Advisors” or “Adviser”), the Funds’ investment adviser, identifies as a significant event occurring before the Funds’ assets are valued, but after the close of their respective exchanges will be fair valued using a standardized fair valuation methodology applicable to the security type or the significant event as previously approved by the Funds’ Pricing Committee and Board of Directors. The Pricing Committee considers all facts it deems relevant that are reasonably available, through either public information or information available to the Adviser’s portfolio management team, when determining the fair value of a security. To assess the continuing appropriateness of security valuations, the Adviser may compare prior day prices, prices of comparable securities, and sale prices to the prior or current day prices and challenge those prices exceeding certain tolerance levels with the third-party pricing service or broker source. Fair value determinations are subject to review, approval, and ratification by the Funds’ Board of Directors at its next regularly scheduled meeting covering the period in which the fair valuation was determined.

Short-term securities purchased within 60 days to maturity are valued at amortized cost, which approximates market value.

The Funds’ valuation procedures are reviewed and subject to approval by the Board of Directors. There have been no significant changes to the fair valuation procedures during the period.

Value Measurements - Fair value is defined as the price that the Funds would receive upon selling an investment in an orderly transaction to an independent buyer in the principal market for the investment. Various inputs are used to determine the fair value of the Funds’ investments. These inputs are summarized in the three broad levels listed below.

| Level 1 – | quoted prices in active markets for identical securities |

| Level 2 – | other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| Level 3 – | significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodologies used for valuing securities are not necessarily an indication of the risks associated with investing in those securities nor can it be assured that the Funds can obtain the fair value assigned to a security if they were to sell the security.

| DAVIS VARIABLE ACCOUNT FUND, INC. | Notes to Financial Statements – (Continued) |

| | December 31, 2012 |

NOTE 1 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES – (CONTINUED)

Value Measurements - (Continued)

The following is a summary of the inputs used as of December 31, 2012 in valuing each Fund’s investments carried at value:

| | Investments in Securities at Value |

| | | | | | |

| | Davis Value | | Davis Financial | | Davis Real Estate |

| | Portfolio | | Portfolio | | Portfolio |

Valuation inputs | | | | | | | | |

| Level 1 – Quoted Prices: | | | | | | | | |

Equity securities: | | | | | | | | |

| Consumer discretionary | $ | 29,108,935 | | $ | 888,731 | | $ | – |

| Consumer staples | | 55,529,314 | | | 1,957,208 | | | – |

| Energy | | 32,520,499 | | | 1,985,967 | | | – |

| Financials | | 113,387,917 | | | 52,644,706 | | | 25,297,151 |

| Health care | | 9,944,683 | | | – | | | – |

| Industrials | | 8,780,516 | | | – | | | – |

| Information technology | | 29,977,840 | | | 1,560,493 | | | – |

| Materials | | 18,885,190 | | | – | | | – |

| Telecommunication services | | 594,235 | | | – | | | – |

Total Level 1 | | 298,729,129 | | | 59,037,105 | | | 25,297,151 |

| | | | | | | | | |

| Level 2 – Other Significant Observable Inputs: | | | | | | | | |

| Convertible debt securities | | 109,940 | | | – | | | 693,545 |

Equity securities*: | | | | | | | | |

| Consumer discretionary | | 1,343,458 | | | – | | | – |

| Consumer staples | | 4,019,546 | | | – | | | – |

| Financials | | 11,299,640 | | | 7,419,636 | | | 243,497 |

| Industrials | | 9,640,125 | | | – | | | – |

| Materials | | 4,987,884 | | | – | | | – |

| Short-term securities | | 14,477,000 | | | 917,000 | | | 1,746,000 |

Total Level 2 | | 45,877,593 | | | 8,336,636 | | | 2,683,042 |

| | | | | | | | | |

| Level 3 – Significant Unobservable Inputs: | | | | | | | | |

Total Level 3 | | – | | | – | | | – |

Total Investments | $ | 344,606,722 | | $ | 67,373,741 | | $ | 27,980,193 |

| | | | | | | | | |

| | | | | | | | | |

Level 1 to Level 2 Transfers**: | | | | | | | | |

| Consumer discretionary | $ | 1,343,458 | | $ | – | | $ | – |

| Consumer staples | | 4,019,546 | | | – | | | – |

| Financials | | 11,299,640 | | | 7,419,636 | | | – |

| Industrials | | 9,640,125 | | | – | | | – |

| Materials | | 4,987,884 | | | – | | | – |

Total | $ | 31,290,653 | | $ | 7,419,636 | | $ | – |

| | | | | | | | | |

| | | | | | | | | |

Level 2 to Level 1 Transfers**: | | | | | | | | |

| Financials | $ | – | | $ | 1,305,563 | | $ | – |

*Includes certain securities trading primarily outside the U.S. whose value the Fund adjusted as a result of significant market movements following the close of local trading.

**Application of fair value procedures for securities traded on foreign exchanges and the initial public offering of an investment triggered the transfers of investments between Level 1 and Level 2 of the fair value hierarchy during the year ended December 31, 2012.

| DAVIS VARIABLE ACCOUNT FUND, INC. | Notes to Financial Statements – (Continued) |

| | December 31, 2012 |

NOTE 1 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES – (CONTINUED)

Value Measurements - (Continued)

The following table reconciles the valuation of assets in which significant unobservable inputs (Level 3) were used in determining fair value during the year ended December 31, 2012:

| | | Davis Value Portfolio | | Davis Financial Portfolio |

| Investment Securities: | | | | | | |

| Beginning balance | | $ | 208,691 | | $ | 136,620 |

| Net realized loss | | | (4,644,226) | | | (1,287,807) |

| Decrease in unrealized depreciation | | | 4,435,535 | | | 1,151,187 |

Ending balance | | $ | – | | $ | – |

| | | | | | | |

There were no transfers of investments into or out of Level 3 of the fair value hierarchy during the period. Realized and unrealized gains (losses) are included in the related amounts on investments in the Statements of Operations.

Master Repurchase Agreements - The Funds, along with other affiliated funds, may transfer uninvested cash balances into one or more master repurchase agreement accounts. These balances are invested in one or more repurchase agreements, secured by U.S. Government securities. A custodian bank holds securities pledged as collateral for repurchase agreements until the agreements mature. Each agreement requires that the market value of the collateral be sufficient to cover payments of interest and principal; however, in the event of default by the other party to the agreement, retention of the collateral may be subject to legal proceedings.

Currency Translation - The market values of all assets and liabilities denominated in foreign currencies are recorded in the financial statements after translation to the U.S. Dollar based upon the mean between the bid and offered quotations of the currencies against U.S. Dollars on the date of valuation. The cost basis of such assets and liabilities is determined based upon historical exchange rates. Income and expenses are translated at average exchange rates in effect as accrued or incurred.

Foreign Currency - The Funds may enter into forward purchases or sales of foreign currencies to hedge certain foreign currency denominated assets and liabilities against declines in market value relative to the U.S. Dollar. Forward currency contracts are marked-to-market daily and the change in market value is recorded by the Funds as an unrealized gain or loss. When the forward currency contract is closed, the Funds record a realized gain or loss equal to the difference between the value of the forward currency contract at the time it was opened and value at the time it was closed. Investments in forward currency contracts may expose the Funds to risks resulting from unanticipated movements in foreign currency exchange rates or failure of the counter-party to the agreement to perform in accordance with the terms of the contract.

Reported net realized foreign exchange gains or losses arise from the sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions, the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Funds’ books, and the U.S. Dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments in securities at fiscal year end, resulting from changes in the exchange rate. The Funds include foreign currency gains and losses realized on the sales of investments together with market gains and losses on such investments in the Statements of Operations.

| DAVIS VARIABLE ACCOUNT FUND, INC. | Notes to Financial Statements – (Continued) |

| | December 31, 2012 |

NOTE 1 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES – (CONTINUED)

Federal Income Taxes - It is each Fund’s policy to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies, and to distribute substantially all of its taxable income, including any net realized gains on investments not offset by loss carryovers, to shareholders. Therefore, no provision for federal income or excise tax is required. The Adviser has analyzed the Funds’ tax positions taken on federal and state income tax returns for all open tax years and has concluded that as of December 31, 2012, no provision for income tax is required in the Funds’ financial statements related to these tax positions. The Funds’ federal and state (Arizona) income and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue. The earliest tax year that remains subject to examination by these jurisdictions is 2009.