As filed with the Securities and Exchange Commission on February 15, 2019

File No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

☐ Pre-Effective Amendment No.

☐ Post-Effective Amendment No.

TIAA-CREF FUNDS

(Exact Name of Registrant as Specified in Charter)

730 Third Avenue

New York, New York 10017

(Address of Principal Executive Offices: Number, Street, City, State, Zip Code)

(800) 842-2733

(Area Code and Telephone Number)

Rachael M. Zufall, Esq.

Teachers Advisors, LLC

8500 Andrew Carnegie Blvd.

Charlotte, North Carolina 28262

(Name and Address of Agent for Service)

Copy to:

| | | | |

Christopher P. Harvey, Esq. Adam T. Teufel, Esq. Dechert LLP One International Place, 40th Floor

100 Oliver Street

Boston, Massachusetts 02110 | | Christopher M. Rohrbacher, Esq. Nuveen Fund Advisors, LLC 333 West Wacker Drive Chicago, Illinois 60606 | | Eric F. Fess, Esq. Chapman and Cutler LLP 111 West Monroe Street Chicago, Illinois 60603 |

Approximate date of proposed public offering: As soon as practicable after the effective date of this Registration Statement.

Title of securities being registered: Shares of beneficial interest, par value $0.0001 per share, of the Registrant.

It is proposed that this filing will become effective on March 15, 2019 pursuant to Rule 488 under the Securities Act of 1933, as amended.

No filing fee is required because of reliance on Section 24(f) and an indefinite number of shares have previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940, as amended.

IMPORTANT INFORMATION FOR SHAREHOLDERS OF

NUVEEN STRATEGY CONSERVATIVE ALLOCATION FUND

NUVEEN STRATEGY BALANCED ALLOCATION FUND

NUVEEN STRATEGY GROWTH ALLOCATION FUND

NUVEEN STRATEGY AGGRESSIVE GROWTH ALLOCATION FUND

At a special meeting of shareholders of Nuveen Strategy Conservative Allocation Fund, Nuveen Strategy Balanced Allocation Fund, Nuveen Strategy Growth Allocation Fund and Nuveen Strategy Aggressive Growth Allocation Fund (each, a “Target Fund” and together, the “Target Funds”), each a series of Nuveen Strategy Funds, Inc. (the “Target Corporation”), you will be asked to vote on the proposed reorganization of your Target Fund into a corresponding TIAA-CREF Fund (each, an “Acquiring Fund” and collectively, the “Acquiring Funds”), as illustrated below:

| | | | |

| Target Fund | | | | Acquiring Fund |

| | |

Nuveen Strategy Conservative Allocation Fund | | g | | TIAA-CREF Lifestyle Conservative Fund |

| | |

Nuveen Strategy Balanced Allocation Fund | | g | | TIAA-CREF Lifestyle Moderate Fund |

| | |

Nuveen Strategy Growth Allocation Fund | | g | | TIAA-CREF Lifestyle Growth Fund |

| | |

Nuveen Strategy Aggressive Growth Allocation Fund | | g | | TIAA-CREF Lifestyle Aggressive Growth Fund |

The Target Funds and the Acquiring Funds are collectively referred to herein as the “Funds” and individually as a “Fund.” The reorganizations of the Target Funds and Acquiring Funds are referred to herein as the “Reorganizations” and individually as a “Reorganization.”

The Board of Directors of the Target Corporation (the “Board”), including the independent Board members, unanimously recommends that you vote FOR each proposed Reorganization.

Although we recommend that you read the complete Proxy Statement/Prospectus, for your convenience we have provided the following brief overview of the matter to be voted on.

| Q. | Why are the Reorganizations being proposed? |

| A. | The Target Funds and the Acquiring Funds are managed by affiliated investment advisers. Nuveen Fund Advisors, LLC (“Nuveen Fund Advisors”) serves as each Target Fund’s investment adviser and Nuveen Asset Management, LLC (“Nuveen Asset Management”) serves as each Target Fund’s sub-adviser. Teachers Advisors, LLC (“Teachers Advisors”) serves as the investment adviser of each Acquiring Fund. Nuveen Fund Advisors, Nuveen Asset Management and Teachers Advisors (collectively, the “Advisers”) are each wholly-owned subsidiaries of Nuveen, LLC (“Nuveen”), the investment management arm of Teachers Insurance and Annuity Association of America (“TIAA”). The proposed Reorganizations are an outgrowth of Nuveen’s larger effort to integrate the investment teams responsible for asset allocation strategies across Nuveen, including the teams that manage the Target Funds and the Acquiring Funds. In light of the combination of investment teams, the Advisers determined that maintaining similar asset allocation funds managed by the same investment team would be inefficient and confusing to the marketplace, and therefore proposed that the Target Funds be reorganized into the Acquiring Funds. |

| | The proposed Reorganizations will allow shareholders of the Target Funds to continue their investment in an asset allocation fund with similar investment objectives and strategies and with historical performance over the past five years that is generally superior for most periods. In addition, shareholders of the Target Funds are expected to recognize cost savings as a result of the Acquiring Funds’ lower total annual operating expenses. In addition to considering the benefits to shareholders expected to result from the Reorganizations, the Board considered that Nuveen may realize certain efficiencies by no longer providing certain services to the Target Funds. See the Proxy Statement/Prospectus under “Approval of the Proposed Reorganizations by the Board of Directors of the Target Corporation.” |

| Q. | How will the Reorganizations affect my shares? |

| A. | Upon the closing of each Reorganization, shareholders of each Target Fund will receive shares of the corresponding Acquiring Fund having a total net asset value equal to the total net asset value of the Target Fund shares surrendered by such shareholder. This means that the total value of the Acquiring Fund shares you receive in a Reorganization will be the same as the total value of the Target Fund shares you held immediately prior to the closing of the Reorganization. Holders of Class A shares, Class C shares and Class R3 shares of each Target Fund will receive Retail Class shares of the corresponding Acquiring Fund, and holders of Class I shares of each Target Fund will receive Advisor Class shares of the corresponding Acquiring Fund. See the Proxy Statement/Prospectus under “The Proposed Reorganizations–Description of Securities.” |

| Q. | Will shareholders of the Target Funds incur sales loads, contingent deferred sales charges (“CDSC”) or any other similar fees on Acquiring Fund shares as a result of the Reorganizations? |

| A. | No. All Acquiring Fund shares will be delivered to the corresponding Target Fund without a sales load, commission or any other similar fee being imposed. If your Target Fund shares are subject to a CDSC (which may be the case for purchases of Class A shares of $1 million or more that were not subject to a front-end sales load or Class C shares), that CDSC will not be imposed in connection with the Reorganization and the corresponding Acquiring Fund shares you receive in the Reorganization will not be subject to a CDSC upon redemption. After the completion of each Reorganization, additional purchases of shares of an Acquiring Fund will not be subject to any sales load, CDSC or other similar fees. |

| | Class A shares, Class C shares and Class I shares (but not Class R3 shares) of each Target Fund held directly with the Fund in the following types of accounts with balances under $1,000 are subject to an annual low balance account fee of $15: individual retirement accounts (“IRAs”), Coverdell Education Savings Accounts and accounts established pursuant to the Uniform Transfers to Minors Act or Uniform Gifts to Minors Act. Retail Class shares of each Acquiring Fund held through certain types of accounts, including IRAs and Coverdell Education Savings Accounts, are subject to an annual account maintenance fee of $15 on accounts with balances under $2,000. As a result of each Reorganization, (i) holders of Class A shares and Class C shares of a Target Fund will receive Retail Class shares of the corresponding Acquiring Fund, and such shares will be subject to the $15 annual account maintenance fee if held in certain types of accounts with balances under $2,000; (ii) holders of Class R3 shares of a Target Fund will receive Retail Class shares of the corresponding Acquiring Fund, which will not be subject to an annual account maintenance fee; and (iii) holders of Class I shares of a Target Fund will receive Advisor Class shares of the corresponding Acquiring Fund, which are not subject to an annual account maintenance fee. |

ii

| Q. | Are the Funds managed by the same investment adviser, sub-adviser and portfolio managers? |

| A. | No. The Target Funds and the Acquiring Funds have different investment advisers; the Target Funds have a sub-adviser, while the Acquiring Funds do not; and the Target Funds have a different portfolio management team than the Acquiring Funds. The Target Funds are advised by Nuveen Fund Advisors and sub-advised by Nuveen Asset Management, with Derek B. Bloom, CFA, and Nathan S. Shetty, CFA, serving as the Funds’ portfolio managers. The Acquiring Funds are advised by Teachers Advisors, with John Cunniff, CFA, and Hans Erickson, CFA, serving as the Funds’ portfolio managers. Following each Reorganization, Teachers Advisors will serve as the adviser for each surviving fund and Mr. Cunniff and Mr. Erickson will continue to serve as the portfolio managers for each surviving fund. |

| Q. | How do the Funds’ investment objectives, principal investment strategies and principal risks compare? |

| A. | The Funds’ investment objectives and principal investment strategies are similar. The Funds are structured as “funds of funds,” varying their allocations among funds based on the Funds’ different risk-return profiles. In pursuit of their investment objectives, the Target Funds invest primarily in other mutual funds advised by Nuveen Fund Advisors (“Nuveen Underlying Funds”), whereas the Acquiring Funds invest primarily in other mutual funds advised by Teachers Advisors (“TIAA-CREF Underlying Funds”). The Funds’ investment objectives and principal investment strategies are listed and compared in the Proxy Statement/Prospectus under “Comparison of Investment Objectives and Principal Investment Strategies.” |

| | Given the Funds’ similar investment objectives and strategies, an investment in each Fund is subject to many of the same principal risks (e.g., asset allocation risk, active management risk and underlying funds risk). The risks applicable to the Funds are listed and compared in the Proxy Statement/Prospectus under “Risk Factors.” |

| Q. | How will the Reorganizations impact fees and expenses? |

| A. | If a Reorganization had taken place as of November 30, 2018, the date in the Fees and Expenses tables in the Proxy Statement/Prospectus, the pro forma total annual fund operating expenses of each Acquiring Fund following the applicable Reorganization would have been lower than the corresponding Target Fund’s total annual fund operating expenses across all share classes, both before and after fee waivers and expense reimbursements. Pro forma amounts are estimated; actual operating expenses will vary based on asset size and other factors. Data is provided as of November 30, 2018 which this is the date of the most recent shareholder report for the Acquiring Funds. See the Proxy Statement/Prospectus under “Further Comparison of the Funds—Fees and Expenses.” |

| Q. | Will shareholders of the surviving fund receive the same shareholder services that shareholders of the Target Funds currently receive? |

| A. | Yes, the shareholder services and shareholder programs of the Funds are substantially the same. However, because the Acquiring Funds are no-load funds, the Acquiring Funds do not have the same privileges (e.g., rights of accumulation or letters of intent) as the Target Funds. Target Fund shareholders who hold shares of other Nuveen mutual funds will not be permitted to |

iii

| | consider shares held in the TIAA-CREF Fund Complex for purposes of rights of accumulation or letters of intent applicable to purchases of other Nuveen mutual funds. Once the Reorganizations are completed, shareholders would have the right to exchange their Acquiring Fund shares for shares of the same class of other TIAA-CREF funds, but would not have the right to exchange their shares back into other Nuveen mutual funds. |

| Q. | Will the portfolios of each Target Fund be repositioned prior to the Reorganizations? |

| A. | Yes. Prior to each Reorganization, each Target Fund’s portfolio will be liquidated and repositioned into the TIAA-CREF Underlying Funds held by the corresponding Acquiring Fund. The transaction costs associated with the Target Funds’ portfolio repositionings are expected to be minimal, as the shares of the underlying funds in which the Target Funds and the Acquiring Funds invest are not subject to commissions or other sales charges when purchased or redeemed. If the portfolio repositionings had taken place as of November 30, 2018, it is estimated that the Nuveen Strategy Conservative Allocation Fund, Nuveen Strategy Balanced Allocation Fund, Nuveen Strategy Growth Allocation Fund and Nuveen Strategy Aggressive Growth Allocation Fund would have incurred transaction costs of $633, $1,907, $1,517 and $877, respectively, in each case less than $0.01 per share of the applicable Target Fund, in connection with closing out certain futures contracts held by each Target Fund. |

| Q. | Will the Reorganizations have tax consequences to me? |

| A. | Each Reorganization is intended to qualify as a tax-free reorganization for federal income tax purposes. Therefore, it is expected that you will recognize no gain or loss for federal income tax purposes as a direct result of a Reorganization. However, prior to the closing of each Reorganization, each Target Fund expects to distribute all its undistributed net investment income and net capital gains, if any. Such distributions will generally be taxed as ordinary income or capital gains for federal income tax purposes, unless you are investing through a tax-advantaged account such as an IRA or 401(k) plan (in which case you may be taxed upon withdrawal of your investment from such account). These distributions will be reinvested in additional shares of the applicable Target Fund unless a shareholder has made an election to receive distributions in cash. The tax character of such distributions will be the same regardless of whether they are paid in cash or reinvested in additional shares. |

| | The repositioning of each Target Fund’s portfolio prior to the applicable Reorganization may result in increased distributions of capital gains (long-term and short-term). If these repositionings had occurred as of November 30, 2018, it is estimated that they would have resulted in capital gains of approximately $2.5 million, $18.6 million, $10.8 million and $5.9 million, respectively, which would result in capital gains distributions of $0.40, $1.05, $1.18 and $1.48 per share, respectively, for Nuveen Strategy Conservative Allocation Fund, Nuveen Strategy Balanced Allocation Fund, Nuveen Strategy Growth Allocation Fund and Nuveen Strategy Aggressive Growth Allocation Fund. See the Proxy Statement/Prospectus under “The Proposed Reorganizations—Material Federal Income Tax Consequences.” |

| Q. | Who will bear the costs of the Reorganizations? |

| A. | Nuveen will bear the direct costs of each Reorganization, which are estimated to be approximately $280,000, $312,300, $293,500 and $280,400 for the Nuveen Strategy Conservative Allocation Fund, Nuveen Strategy Balanced Allocation Fund, Nuveen Strategy Growth Allocation Fund and Nuveen Strategy Aggressive Growth Allocation Fund, |

iv

| | respectively, whether or not each Reorganization is approved or completed. The Target Funds will bear the costs associated with repositioning their portfolios in advance of the Reorganizations; such costs are expected to be minimal, as the shares of the underlying funds in which the Target Funds and the Acquiring Funds invest are not subject to commissions or other sales charges when purchased or redeemed. |

| Q. | What is the timetable for the Reorganizations? |

| A. | The Reorganization of each Target Fund is expected to occur at the close of business on June 14, 2019, or as soon as practicable thereafter if approved by its shareholders at the special meeting of shareholders on April 30, 2019. |

General

| Q. | Whom do I call if I have questions? |

| A. | If you need any assistance, or have any questions regarding the proposals or how to vote your shares, please call Computershare Fund Services, the proxy solicitor hired by each Target Fund, at (866) 864-0471 weekdays during its business hours of 9:00 a.m. to 11:00 p.m. and Saturdays 12:00 p.m. to 6:00 p.m. Eastern time. Please have your proxy materials available when you call. |

| Q. | How do I vote my shares? |

| A. | You may vote in person, by mail, by telephone or over the internet: |

| | • | | To vote in person, please attend the special meeting of shareholders and bring your photographic identification. If you hold your Target Fund shares through a bank, broker or other nominee, you must also bring satisfactory proof of ownership of those shares and a “legal proxy” from the nominee. |

| | • | | To vote by mail, please mark, sign, date and mail the enclosed proxy card. No postage is required if mailed in the United States. |

| | • | | To vote by telephone, please call the toll-free number located on your proxy card and follow the recorded instructions, using your proxy card as a guide. |

| | • | | To vote over the internet, go to the internet address provided on your proxy card and follow the instructions, using your proxy card as a guide. |

| Q. | Will anyone contact me? |

| A. | You may receive a call from Computershare Fund Services, the proxy solicitor hired by each Target Fund, to verify that you received your proxy materials, to answer any questions you may have about the proposals and to encourage you to vote your proxy. |

| | We recognize the inconvenience of the proxy solicitation process and would not impose on you if we did not believe that the matters being proposed were important. Once your vote has been registered with the proxy solicitor, your name will be removed from the solicitor’s follow-up contact list. |

v

| Q. | How does the Board suggest that I vote? |

| A. | After careful consideration, the Board has agreed unanimously that each proposed Reorganization is in the best interests of the applicable Target Fund and recommends that you vote “FOR” each proposed Reorganization. |

| Q. | What will happen if shareholders in my Target Fund do not approve the Reorganization? |

| A. | If shareholders do not approve a Reorganization, the Board will take such action as it deems to be in the best interests of each applicable Target Fund, including continuing to operate the Target Fund as a stand-alone Fund, liquidating the Target Fund or such other options the Board may consider. |

| | Your vote is very important. We encourage you as a shareholder to participate in your Fund’s governance by returning your vote as soon as possible. If enough shareholders fail to cast their votes, your Fund may not be able to hold its shareholder meeting or the vote on the proposals, and additional solicitation costs will be incurred in order to obtain sufficient shareholder participation. |

vi

March 15, 2019

NUVEEN STRATEGY CONSERVATIVE ALLOCATION FUND

NUVEEN STRATEGY BALANCED ALLOCATION FUND

NUVEEN STRATEGY GROWTH ALLOCATION FUND

NUVEEN STRATEGY AGGRESSIVE GROWTH ALLOCATION FUND

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL 30, 2019

To the Shareholders:

Notice is hereby given that a special meeting of shareholders of Nuveen Strategy Conservative Allocation Fund, Nuveen Strategy Balanced Allocation Fund, Nuveen Strategy Growth Allocation Fund and Nuveen Strategy Aggressive Growth Allocation Fund (each, a “Target Fund” and collectively, the “Target Funds”), each a series of Nuveen Strategy Funds, Inc. (the “Target Corporation”), a Minnesota corporation, will be held at the offices of Nuveen, LLC, 333 West Wacker Drive, Chicago, Illinois 60606, on April 30, 2019, at 2:00 p.m., Central Time (the “Special Meetings”), for the purposes described below.

| | 1. | To approve the Agreement and Plan of Reorganization (and the related transactions), which provides for the transfer of all the assets of each Target Fund to a corresponding TIAA-CREF Fund (each, an “Acquiring Fund” and collectively, the “Acquiring Funds”), as illustrated below: |

| | | | |

| Target Fund | | | | Acquiring Fund |

| | |

| Nuveen Strategy Conservative Allocation Fund | | g | | TIAA-CREF Lifestyle Conservative Fund |

| | |

| Nuveen Strategy Balanced Allocation Fund | | g | | TIAA-CREF Lifestyle Moderate Fund |

| | |

| Nuveen Strategy Growth Allocation Fund | | g | | TIAA-CREF Lifestyle Growth Fund |

| | |

| Nuveen Strategy Aggressive Growth Allocation Fund | | g | | TIAA-CREF Lifestyle Aggressive Growth Fund |

| | | Holders of Class A shares, Class C shares and Class R3 shares of each Target Fund will receive Retail Class shares of the corresponding Acquiring Fund and holders of Class I shares of each Target Fund will receive Advisor Class shares of the corresponding Acquiring Fund in complete liquidation and termination of each Target Fund (each, a “Reorganization” and collectively, the “Reorganizations”). A vote in favor of a Reorganization will be considered a vote in favor of an amendment to the Target Corporation’s Articles of Incorporation effecting the Reorganization. |

| | 2. | To transact such other business as may properly come before the Special Meeting. |

Only shareholders of record as of the close of business on March 8, 2019, are entitled to vote at the Special Meeting or any adjournments or postponements thereof.

All shareholders are cordially invited to attend the Special Meeting. In order to avoid delay and additional expense and to assure that your shares are represented, please vote as promptly as possible, whether or not you plan to attend the Special Meeting. You may vote by mail, by telephone or over the internet.

| | • | | To vote by mail, please mark, sign, date and mail the enclosed proxy card. No postage is required if mailed in the United States. |

| | • | | To vote by telephone, please call the toll-free number located on your proxy card and follow the recorded instructions, using your proxy card as a guide. |

| | • | | To vote over the internet, go to the internet address provided on your proxy card and follow the instructions, using your proxy card as a guide. |

You may also vote in person at the Special Meeting. If you are a record holder of a Target Fund’s shares, in order to gain admission to the Special Meeting you must show photographic identification, such as your driver’s license. If you hold your shares through a bank, broker or other nominee, in order to gain admission to the Special Meeting you must show photographic identification, such as your driver’s license, and satisfactory proof of ownership of shares of a Target Fund, such as your voting instruction form (or a copy thereof) or broker’s statement indicating ownership as of a recent date. If you hold your shares in a brokerage account or through a bank or other nominee, you will not be able to vote in person at the Special Meeting unless you have previously requested and obtained a “legal proxy” from your broker, bank or other nominee and present it at the Special Meeting.

Very truly yours,

Christopher M. Rohrbacher

Vice President and Secretary

ii

March 15, 2019

Dear Shareholders:

We are pleased to invite you to a special meeting of shareholders of Nuveen Strategy Conservative Allocation Fund, Nuveen Strategy Balanced Allocation Fund, Nuveen Strategy Growth Allocation Fund and Nuveen Strategy Aggressive Growth Allocation Fund (each, a “Target Fund” and collectively, the “Target Funds”), each a series of Nuveen Strategy Funds, Inc. (the “Target Corporation”). The Special Meeting is scheduled for April 30, 2019, at 2:00 p.m., Central Time, at the offices of Nuveen, LLC, 333 West Wacker Drive, Chicago, Illinois 60606 (the “Special Meeting”).

At the Special Meeting, you will be asked to consider and approve the reorganization of your Target Fund into a corresponding TIAA-CREF Fund (each, an “Acquiring Fund” and collectively, the “Acquiring Funds”), as illustrated below:

| | | | |

| Target Fund | | | | Acquiring Fund |

| | |

| Nuveen Strategy Conservative Allocation Fund | | g | | TIAA-CREF Lifestyle Conservative Fund |

| | |

| Nuveen Strategy Balanced Allocation Fund | | g | | TIAA-CREF Lifestyle Moderate Fund |

| | |

| Nuveen Strategy Growth Allocation Fund | | g | | TIAA-CREF Lifestyle Growth Fund |

| | |

| Nuveen Strategy Aggressive Growth Allocation Fund | | g | | TIAA-CREF Lifestyle Aggressive Growth Fund |

The Target Funds and the Acquiring Funds are collectively referred to herein as the “Funds” and individually as a “Fund.” The reorganizations of the Target Funds and Acquiring Funds are referred to herein as the “Reorganizations” and individually as a “Reorganization.”

The Target Funds and the Acquiring Funds are managed by affiliated investment advisers. Nuveen Fund Advisors, LLC (“Nuveen Fund Advisors”) serves as each Target Fund’s investment adviser, and Nuveen Asset Management, LLC (“Nuveen Asset Management”) serves as each Target Fund’s sub-adviser. Teachers Advisors, LLC (“Teachers Advisors”) serves as the investment adviser of each Acquiring Fund. Nuveen Fund Advisors, Nuveen Asset Management and Teachers Advisors (collectively, the “Advisers”) are each wholly-owned subsidiaries of Nuveen, LLC (“Nuveen”), the investment management arm of Teachers Insurance and Annuity Association of America (“TIAA”). The proposed Reorganizations are an outgrowth of Nuveen’s larger effort to integrate the investment teams responsible for asset allocation strategies across Nuveen, including the teams that manage the Target Funds and the Acquiring Funds. In light of the combination of investment teams, the Advisers determined that maintaining similar asset allocation funds managed by the same investment team would be inefficient and confusing to the marketplace, and therefore proposed that the Target Funds be reorganized into the Acquiring Funds.

The proposed Reorganizations will allow shareholders of the Target Funds to continue their investment in an asset allocation fund with similar investment objectives and strategies and with historical performance over the past five years that is generally superior for most periods. In addition, shareholders of the Target Funds are expected to recognize cost savings as a result of the Acquiring Funds’ lower total annual operating expenses.

1

The Board of Directors of the Target Corporation believes each Reorganization is in the best interests of each Target Fund and recommends that you vote “FOR” each proposed Reorganization.

The attached Proxy Statement/Prospectus has been prepared to give you information about the proposed Reorganizations.

All shareholders are cordially invited to attend the Special Meeting. In order to avoid delay and additional expense and to assure that your shares are represented, please vote as promptly as possible, whether or not you plan to attend the Special Meeting. You may vote by mail, by telephone or over the internet.

| | • | | To vote by mail, please mark, sign, date and mail the enclosed proxy card. No postage is required if mailed in the United States. |

| | • | | To vote by telephone, please call the toll-free number located on your proxy card and follow the recorded instructions, using your proxy card as a guide. |

| | • | | To vote over the internet, go to the internet address provided on your proxy card and follow the instructions, using your proxy card as a guide. |

You may also vote in person at the Special Meeting. If you are a record holder of a Target Fund’s shares, in order to gain admission to the Special Meeting you must show photographic identification, such as your driver’s license. If you hold your shares through a bank, broker or other nominee, in order to gain admission to the Special Meeting you must show photographic identification, such as your driver’s license, and satisfactory proof of ownership of shares of a Target Fund, such as your voting instruction form (or a copy thereof) or broker’s statement indicating ownership as of a recent date. If you hold your shares in a brokerage account or through a bank or other nominee, you will not be able to vote in person at the Special Meeting unless you have previously requested and obtained a “legal proxy” from your broker, bank or other nominee and present it at the Special Meeting.

We appreciate your attention to this matter and we urge you to vote at your earliest convenience.

Very truly yours,

Christopher M. Rohrbacher

Vice President and Secretary

2

PROXY STATEMENT/PROSPECTUS

DATED MARCH 15, 2019

Relating to the Respective Acquisition of the Assets and Liabilities of

NUVEEN STRATEGY CONSERVATIVE ALLOCATION FUND

NUVEEN BALANCED ALLOCATION FUND

NUVEEN STRATEGY GROWTH ALLOCATION FUND

NUVEEN STRATEGY AGGRESSIVE GROWTH ALLOCATION FUND

by

TIAA-CREF LIFESTYLE CONSERVATIVE FUND

TIAA-CREF LIFESTYLE MODERATE FUND

TIAA-CREF LIFESTYLE GROWTH FUND

TIAA-CREF LIFESTYLE AGGRESSIVE GROWTH FUND

This Proxy Statement/Prospectus is being furnished to shareholders of Nuveen Strategy Conservative Allocation Fund, Nuveen Strategy Balanced Allocation Fund, Nuveen Strategy Growth Allocation Fund and Nuveen Strategy Aggressive Growth Allocation Fund (each, a “Target Fund” and collectively, the “Target Funds”), each a series of Nuveen Strategy Funds, Inc. (the “Target Corporation”), a Minnesota corporation and an open-end investment company registered under the Investment Company Act of 1940 Act, as amended (the “1940 Act”), and relates to the special meeting of shareholders of each Target Fund to be held at the offices of Nuveen, LLC, 333 West Wacker Drive, Chicago, Illinois 60606, on April 30, 2019, at 2:00 p.m., Central Time, and at any and all adjournments and postponements thereof (the “Special Meeting”). This Proxy Statement/Prospectus is provided in connection with the solicitation by the Board of Directors of the Target Corporation of proxies to be voted at the Special Meeting. The purpose of the Special Meeting is to allow the shareholders of each Target Fund to consider and vote on the proposed reorganizations (each, a “Reorganization” and collectively, the “Reorganizations”) of a Target Fund into a corresponding TIAA-CREF Fund (each, an “Acquiring Fund” and collectively, the “Acquiring Funds”), each a series of TIAA-CREF Funds (the “Acquiring Trust”), as illustrated below:

| | | | |

| Target Fund | | | | Acquiring Fund |

| | |

| Nuveen Strategy Conservative Allocation Fund | | g | | TIAA-CREF Lifestyle Conservative Fund |

| | |

| Nuveen Strategy Balanced Allocation Fund | | g | | TIAA-CREF Lifestyle Moderate Fund |

| | |

| Nuveen Strategy Growth Allocation Fund | | g | | TIAA-CREF Lifestyle Growth Fund |

| | |

| Nuveen Strategy Aggressive Growth Allocation Fund | | g | | TIAA-CREF Lifestyle Aggressive Growth Fund |

Each Target Fund and each Acquiring Fund are collectively referred to herein as the “Funds” and individually as a “Fund.”

If shareholders of each Target Fund approve the applicable Reorganization and it is completed, each shareholder of each Target Fund will receive shares of the corresponding Acquiring Fund having a total net asset value equal to the total net asset value of the applicable Target Fund shares surrendered by such shareholder. This means that the total value of the Acquiring Fund shares you receive in a Reorganization will be the same as the total value of the Target Fund shares you held immediately prior to the closing of the Reorganization. Holders of Class A shares, Class C shares and Class R3

shares of each Target Fund will receive Retail Class shares of the corresponding Acquiring Fund, and holders of Class I shares of each Target Fund will receive Advisor Class shares of the corresponding Acquiring Fund. The Board of Directors of the Target Corporation has determined that each Reorganization is in the best interests of each Target Fund. The address and telephone number of the principal executive office of the Target Funds and the Target Corporation is 333 West Wacker Drive, Chicago, Illinois 60606, (800) 257-8787.

The enclosed proxy and this Proxy Statement/Prospectus are first being sent to shareholders of each Target Fund on or about March 20, 2019. Shareholders of record as of the close of business on March 8, 2019, are entitled to vote at the Special Meeting.

The Securities and Exchange Commission has not approved or disapproved these securities or determined whether the information in this Proxy Statement/Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This Proxy Statement/Prospectus concisely sets forth the information shareholders of each Target Fund should know before voting on the applicable Reorganization (in effect, investing in Retail Class or Advisor Class shares of the applicable Acquiring Fund) and constitutes an offering of Retail Class and Advisor Class shares of beneficial interest, par value $0.0001 per share, of each applicable Acquiring Fund. Please read it carefully and retain it for future reference.

The following documents contain additional information about the Funds and have been filed with the SEC and are incorporated into this Proxy Statement/Prospectus by reference:

| | (i) | the Acquiring Funds’ prospectus dated October 1, 2018, as supplemented through the date of this Proxy Statement/Prospectus, only insofar as it relates to each Acquiring Fund (Accession No. 0000930413-18-002949); |

| | (ii) | the unaudited financial statements contained in the Acquiring Funds’ semi-annual report, only insofar as they relate to each Acquiring Fund, for the six months ended November 30, 2018 (Accession No. 0000930413-19-000174); |

| | (iii) | the Statement of Additional Information (“SAI”) relating to the Reorganizations, dated March 15, 2019 (the “Reorganization SAI”); |

| | (iv) | the Target Funds’ prospectus dated December 31, 2018, as supplemented through the date of this Proxy Statement/Prospectus (Accession No. 0001193125-18-360094); |

| | (v) | the Target Funds’ SAI dated December 31, 2018, as supplemented through the date of this Proxy Statement/Prospectus (Accession No. 0001193125-18-360094); |

| | (vi) | the audited financial statements contained in the Target Funds’ annual report for the fiscal year ended August 31, 2018 (Accession No. 0001193125-18-320616); |

| | (vii) | the Acquiring Funds’ SAI dated October 1, 2018, as supplemented through the date of this Proxy Statement/Prospectus, only insofar as it relates to each Acquiring Fund (Accession No. 0000930413-18-002949); and |

ii

| | (viii) | the audited financial statements contained in the Acquiring Funds’ annual report, only insofar as they relate to each Acquiring Fund, for the fiscal year ended May 31, 2018 (Accession No. 0000930413-18-002342). |

No other parts of the Funds’ annual reports or semi-annual reports are incorporated by reference herein.

Each Target Fund prospectus, SAI and annual report, as well as the Reorganization SAI, is available at no charge on the Target Funds’ website at https://www.nuveen.com/mutual-funds, by calling (800) 257-8787 or by writing to the Target Funds at 333 West Wacker Drive, Chicago, Illinois 60606. Each Acquiring Fund prospectus, SAI, annual report and semi-annual report is available at no charge at https://www.tiaa.org, by calling (877) 518-9161 or by writing to the Acquiring Funds at TIAA-CREF Funds, P.O. Box 1259, Charlotte, North Carolina 28201.

The Target Corporation and Acquiring Trust are subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and the 1940 Act, and, in accordance therewith, file reports and other information with the SEC. Reports, proxy statements, registration statements and other information filed by the Target Corporation and Acquiring Trust (including the Registration Statement relating to each Acquiring Fund on Form N-14 of which this Proxy Statement/Prospectus is a part) may be inspected without charge and copied (for a duplication fee at prescribed rates) at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549 or at the SEC’s Northeast Regional Office (3 World Financial Center, New York, New York 10281) or Midwest Regional Office (175 W. Jackson Boulevard, Suite 900, Chicago, Illinois 60604). You may call the SEC at (202) 551-8090 for information about the operation of the Public Reference Room. You may obtain copies of this information, with payment of a duplication fee, by electronic request at the following e-mail address: publicinfo@sec.gov, or by writing the SEC’s Public Reference Branch, Office of Consumer Affairs and Information Services, Securities and Exchange Commission, Washington, D.C. 20549. You may also access reports and other information about the Funds on the EDGAR database on the SEC’s internet site at http://www.sec.gov.

iii

TABLE OF CONTENTS

i

REORGANIZATIONS OF THE TARGET FUNDS INTO THE ACQUIRING FUNDS

Summary

The following is a summary of, and should be read in conjunction with, the more complete information contained in this Proxy Statement/Prospectus and the information attached hereto or incorporated herein by reference, including the form of Agreement and Plan of Reorganization. As discussed more fully below and elsewhere in this Proxy Statement/Prospectus, the Board of Directors of the Target Corporation believes each proposed Reorganization is in the best interests of the applicable Target Fund and that the interests of the applicable Target Fund’s existing shareholders would not be diluted as a result of the Reorganization. If shareholders of a Target Fund approve the applicable Reorganization and it is completed, the Target Fund’s shareholders will become shareholders of the corresponding Acquiring Fund and will cease to be shareholders of the Target Fund.

Shareholders should read the entire Proxy Statement/Prospectus carefully together with the applicable Acquiring Fund’s prospectus, which is incorporated herein by reference. This Proxy Statement/Prospectus constitutes an offering of Retail Class and Advisor Class shares of the applicable Acquiring Funds.

Background

The Target Funds and the Acquiring Funds are managed by affiliated investment advisers. Nuveen Fund Advisors, LLC (“Nuveen Fund Advisors”) serves as each Target Fund’s investment adviser, and Nuveen Asset Management, LLC (“Nuveen Asset Management”) serves as each Target Fund’s sub-adviser. Teachers Advisors, LLC (“Teachers Advisors”) serves as the investment adviser of each Acquiring Fund. Nuveen Fund Advisors, Nuveen Asset Management and Teachers Advisors (collectively, the “Advisers”) are each wholly-owned subsidiaries of Nuveen, LLC (“Nuveen”), the investment management arm of Teachers Insurance and Annuity Association of America (“TIAA”). The proposed Reorganizations are an outgrowth of Nuveen’s larger effort to integrate the investment teams responsible for asset allocation strategies across Nuveen, including the teams that manage the Target Funds and the Acquiring Funds. In light of the combination of investment teams, the Advisers determined that maintaining similar asset allocation funds managed by the same investment team would be inefficient and confusing to the marketplace, and therefore proposed that the Target Funds be reorganized into the Acquiring Funds.

The proposed Reorganizations will allow shareholders of the Target Funds to continue their investment in an asset allocation fund with similar investment objectives and strategies and with historical performance over the past five years that is generally superior for most periods. In addition, shareholders of the Target Funds are expected to recognize cost savings as a result of the Acquiring Funds’ lower total annual operating expenses. In addition to considering the benefits to shareholders expected to result from the Reorganizations, the Board of Directors of the Target Corporation considered that Nuveen may realize certain efficiencies by no longer providing certain services to the Target Funds. See “Approval of the Proposed Reorganizations by the Board of Directors of the Target Corporation.”

The Reorganizations

This Proxy Statement/Prospectus is being furnished to shareholders of each Target Fund in connection with the proposed combination of each Target Fund into the corresponding Acquiring Fund

pursuant to the terms and conditions of the Agreement and Plan of Reorganization to be entered into by (i) the Target Corporation, on behalf of each Target Fund, (ii) the Acquiring Trust, on behalf of each Acquiring Fund, (iii) Nuveen Fund Advisors and (iv) Teachers Advisors (the “Agreement”).

The Agreement provides for (i) the transfer of all the assets of each Target Fund to the corresponding Acquiring Fund in exchange solely for Retail Class and Advisor Class shares of beneficial interest, par value $0.0001 per share, of the applicable Acquiring Fund and the assumption by the Acquiring Fund of all the liabilities of the Target Fund; and (ii) the pro rata distribution of (x) Retail Class shares of the Acquiring Fund to the holders of Class A, Class C and Class R3 shares of the Target Fund and (y) Advisor Class shares of the Acquiring Fund to the holders of Class I shares of the Target Fund, in complete liquidation and termination of the Target Fund.

If shareholders of a Target Fund approve the applicable Reorganization and it is completed, shareholders of the Target Fund will become shareholders of the corresponding Acquiring Fund. The Board of Directors of the Target Corporation has determined that each Reorganization is in the best interests of the applicable Target Fund and that the interests of the Target Fund’s existing shareholders would not be diluted as a result of the Reorganization. The Board of Directors of the Target Corporation unanimously approved each Reorganization and the Agreement at a meeting held on December 13, 2018. The Board of Directors of the Target Corporation recommends a vote “FOR” each Reorganization. Each Reorganization and the Agreement was also unanimously approved by the Board of Trustees of the Acquiring Trust at a meeting held on December 4, 2018.

Nuveen will bear the direct costs of each Reorganization, which are estimated to be approximately $280,000, $312,300, $293,500 and $280,400 for the Nuveen Strategy Conservative Allocation Fund, Nuveen Strategy Balanced Allocation Fund, Nuveen Strategy Growth Allocation Fund and Nuveen Strategy Aggressive Growth Allocation Fund, respectively, whether or not each Reorganization is approved or completed. Prior to each Reorganization, each Target Fund’s portfolio will be liquidated and repositioned into the TIAA-CREF Underlying Funds held by the corresponding Acquiring Fund, and each Target Fund will bear the transaction costs associated with its portfolio repositioning. However, such costs are expected to be minimal, as the shares of the underlying funds in which the Target Funds and the Acquiring Funds invest are not subject to commissions or other sales charges when purchased or redeemed. If the portfolio repositionings had taken place as of November 30, 2018, it is estimated that the Nuveen Strategy Conservative Allocation Fund, Nuveen Strategy Balanced Allocation Fund, Nuveen Strategy Growth Allocation Fund and Nuveen Strategy Aggressive Growth Allocation Fund would have incurred transaction costs of $633, $1,907, $1,517 and $877, respectively, in each case less than $0.01 per share of the applicable Target Fund, in connection with closing out certain futures contracts held by each Target Fund.

The Board of Directors of the Target Corporation is asking shareholders of each Target Fund to approve the applicable Reorganization at the Special Meeting to be held on April 30, 2019. Approval of a Reorganization requires the affirmative vote of the holders of a majority of the total number of the applicable Target Fund’s shares outstanding and entitled to vote, voting as a single class. See “Voting Information and Requirements.”

If shareholders of a Target Fund approve the applicable Reorganization, it is expected that the Reorganization will occur at the close of business on June 14, 2019, or such other date as agreed to by the parties (each closing date referred to herein as the “Closing Date”). If a Reorganization is not approved, the Board of Directors of the Target Corporation will take such action as it deems to be in

2

the best interests of the applicable Target Fund, including continuing to operate the Target Fund as a stand-alone fund, liquidating the Target Fund or such other options as the Board of Directors of the Target Corporation may consider. The Closing Date may be delayed and a Reorganization may be abandoned at any time by the mutual agreement of the parties. In addition, either a Target Fund or an Acquiring Fund may, at its option, terminate the Agreement at or before the closing of the applicable Reorganization due to (i) a breach by any other party of any representation, warranty or agreement contained herein to be performed at or before the closing, if not cured within 30 days of notification to the breaching party and prior to the Closing Date, (ii) a condition precedent to the obligations of the terminating party that has not been met or waived and it reasonably appears that it will not or cannot be met or (iii) a determination by the Board of Directors of the Target Corporation or the Board of Trustees of the Acquiring Trust that the consummation of the transactions contemplated by the Agreement is not in the best interests of its respective Fund.

Shareholders of the Target Fund shall approve each Reorganization individually. The Reorganization of each Target Fund into its corresponding Acquiring Fund is not contingent on the Reorganization of any (or all) other Target Fund into its corresponding Acquiring Fund.

Comparison of Investment Objectives and Principal Investment Strategies

Investment Objectives.

The Funds’ investment objectives are similar, as reflected in the table below.

| | | | | | |

| Target Fund Investment Objective | | Acquiring Fund Investment Objective |

|

| Nuveen Strategy Conservative Allocation Fund | | To seek a high level of current income consistent with limited risk to capital. | | To seek long-term total return, consisting of current income and capital appreciation. | | TIAA-CREF Lifestyle Conservative Fund |

| | | |

| Nuveen Strategy Balanced Allocation Fund | | To seek both capital growth and current income. | | To seek long-term total return, consisting of capital appreciation and current income. | | TIAA-CREF Lifestyle Moderate Fund |

| | | |

| Nuveen Strategy Growth Allocation Fund | | To seek capital growth with a moderate level of current income. | | To seek long-term growth of capital with some current income. | | TIAA-CREF Lifestyle Growth Fund |

| | | |

| Nuveen Strategy Aggressive Growth Allocation Fund | | To seek a high level of capital growth. | | To seek long-term growth of capital. | | TIAA-CREF Lifestyle Aggressive Growth Fund |

The investment objective of each Fund is non-fundamental, which means that it may be changed with approval of the Fund’s Board of Directors/Trustees, but without the approval of the Fund’s respective shareholders. Following completion of each Reorganization, each surviving fund will have the same non-fundamental investment objective as its corresponding Acquiring Fund.

Principal Investment Strategies.

The Funds’ principal investment strategies are similar. The Target Funds and the Acquiring Funds are structured as “funds of funds.” In pursuit of their investment objectives, the Target Funds

3

invest primarily in other mutual funds advised by Nuveen Fund Advisors (“Nuveen Underlying Funds”), whereas the Acquiring Funds invest primarily in other mutual funds advised by Teachers Advisors (“TIAA-CREF Underlying Funds”). The tables below set forth each Fund’s principal investment strategies and target allocations as of December 31, 2018, for the Target Funds and as of June 30, 2018, for the Acquiring Funds. The Funds’ actual allocations may be adjusted within the allocation ranges set forth in the following tables to take advantage of current or expected market conditions.

Target Funds / Acquiring Funds

| | | | |

Principal Investment Strategy | | Target Fund | | Acquiring Fund |

| Overview | | Nuveen Strategy Conservative Allocation Fund: The Fund seeks to achieve its investment objective by providing a high allocation to underlying funds that invest primarily in fixed-income securities, but also has a limited exposure to underlying funds that invest primarily in equities, which is designed to help offset inflation and provide a source for potential increases in income over time. | | TIAA-CREF Lifestyle Conservative Fund: The Fund is designed for investors seeking long-term total return, consisting of current income and capital appreciation, through a relatively stable asset allocation strategy targeting a conservative risk-return profile. |

| | |

| | Nuveen Strategy Balanced Allocation Fund: The Fund seeks to achieve its objective by generally providing significant allocations both to underlying funds that invest primarily in equity securities and to underlying funds that invest primarily in fixed income securities, but having a higher allocation to equity funds under most market conditions. | | TIAA-CREF Lifestyle Moderate Fund: The Fund is designed for investors seeking long-term total return, consisting of capital appreciation and current income, through a relatively stable asset allocation strategy targeting a moderate risk-return profile. |

4

| | | | |

Principal Investment Strategy | | Target Fund | | Acquiring Fund |

| | |

| | Nuveen Strategy Growth Allocation Fund: The Fund seeks to achieve its objective by providing high allocations to various underlying funds that invest primarily in equity securities, including small company and international company equity securities, with a limited exposure to underlying funds that invest primarily in fixed-income securities. | | TIAA-CREF Lifestyle Growth Fund: The Fund is designed for investors seeking long-term growth of capital with some current income through a relatively stable asset allocation strategy targeting a growth-oriented risk-return profile. |

| | |

| | Nuveen Strategy Aggressive Growth Allocation Fund: The Fund seeks to achieve its objective by providing high allocations to various underlying funds that invest primarily in equity securities, including small company and international company equity securities, with relatively little emphasis on underlying funds that invest primarily in fixed-income securities. | | TIAA-CREF Lifestyle Aggressive Growth Fund: The Fund is designed for investors seeking long-term growth of capital through a relatively stable asset allocation strategy targeting an aggressive growth risk-return profile. |

| | | | | | |

| | | | | Nuveen Strategy

Conservative

Allocation Fund | | TIAA-CREF Lifestyle

Conservative Fund |

Asset Allocation—Target (Range) | | Equity | | 31% (10-55%) | | 40% (30-50%) |

| | Fixed Income | | 67% (30-90%) | | 60% (50-70%) |

| | Other Securities* | | 2% (0-10%) | | N/A |

| | Cash Equivalents | | 0% (0-35%) | | N/A

|

| | | | | | |

| | | | | Nuveen Strategy

Balanced Allocation Fund | | TIAA-CREF Lifestyle Moderate Fund |

| | Equity | | 59% (30-75%) | | 60% (50-70%) |

| | Fixed Income | | 38% (15-70%) | | 40% (30-50%) |

| | Other Securities* | | 3% (0-10%) | | N/A |

| | Cash Equivalents | | 0% (0-35%) | | N/A |

5

| | | | | | |

| | | | | Nuveen Strategy

Growth Allocation Fund | | TIAA-CREF Lifestyle Growth Fund |

| | Equity | | 74% (45-90%) | | 80% (70-90%) |

| | Fixed Income | | 23% (0-55%) | | 20% (10-30%) |

| | Other Securities* | | 3% (0-10%) | | N/A |

| | Cash Equivalents | | 0% (0-35%) | | N/A |

| | | | | | |

| | | Allocation | | Nuveen Strategy

Aggressive Growth

Allocation Fund:

Target (Range) | | TIAA-CREF Lifestyle

Aggressive Growth

Fund: Target (Range) |

Asset Allocation Target (Range) | | Equity | | 87% (55-100%) | | 100% (90-100%) |

| | Fixed Income | | 9% (0-45%) | | 0% (0-10%) |

| | Other Securities* | | 4% (0-10%) | | N/A |

| | Cash Equivalents | | 0% (0-35%) | | N/A |

| * | Includes ETFs, closed-end investment companies, and other non-money market investment companies not affiliated with the Target Fund, and securities that provide the Target Funds with exposure to the performance of commodities. |

The Target Funds invest primarily in Nuveen Underlying Funds, whereas the Acquiring Funds invest primarily in TIAA-CREF Underlying Funds. The table below lists the Nuveen Underlying Funds in which the Target Funds may invest as of December 31, 2018, and the TIAA-CREF Underlying Funds in which the Acquiring Funds may invest as of October 1, 2018, respectively:

| | |

Target Funds’ Underlying Funds | | Acquiring Funds’ Underlying Funds |

Equity Funds Nuveen Dividend Value Fund Nuveen Global Infrastructure Fund Nuveen International Growth Fund Nuveen Large Cap Core Fund Nuveen Large Cap Growth Fund Nuveen Large Cap Select Fund Nuveen Large Cap Value Fund Nuveen Mid Cap Growth Opportunities Fund Nuveen Mid Cap Value Fund Nuveen NWQ International Value Fund Nuveen NWQ Large-Cap Value Fund Nuveen NWQ Multi-Cap Value Fund Nuveen NWQ Small-Cap Value Fund Nuveen NWQ Small/Mid-Cap Value Fund Nuveen Real Asset Income Fund Nuveen Real Estate Securities Fund Nuveen Santa Barbara Dividend Growth Fund Nuveen Santa Barbara Global Dividend Growth Fund Nuveen Santa Barbara International Dividend Growth Fund Nuveen Small Cap Growth Opportunities Fund Nuveen Small Cap Select Fund Nuveen Small Cap Value Fund Nuveen Winslow Large-Cap Growth Fund | | Equity Funds TIAA-CREF Emerging Markets Equity Fund TIAA-CREF Growth & Income Fund TIAA-CREF International Equity Fund TIAA-CREF International Opportunities Fund TIAA-CREF Large-Cap Growth Fund TIAA-CREF Large-Cap Value Fund TIAA-CREF Quant International Equity Fund TIAA-CREF Quant International Small-Cap Equity Fund TIAA-CREF Quant Large-Cap Growth Fund TIAA-CREF Quant Large-Cap Value Fund TIAA-CREF Quant Small-Cap Equity Fund TIAA-CREF Quant Small/Mid-Cap Equity Fund Fixed Income Funds TIAA-CREF Bond Fund TIAA-CREF Bond Plus Fund TIAA-CREF High-Yield Fund TIAA-CREF International Bond Fund TIAA-CREF Money Market Fund TIAA-CREF Short-Term Bond Fund |

6

| | |

Target Funds’ Underlying Funds | | Acquiring Funds’ Underlying Funds |

Fixed-Income Funds Nuveen All-American Municipal Bond Fund Nuveen Core Bond Fund Nuveen Core Plus Bond Fund Nuveen High Income Bond Fund Nuveen High Yield Municipal Bond Fund Nuveen Inflation Protected Securities Fund Nuveen NWQ Flexible Income Fund Nuveen Preferred Securities and Income Fund Nuveen Short Term Bond Fund Nuveen Symphony Credit Opportunities Fund Nuveen Strategic Income Fund Commodity Strategy Fund Nuveen Gresham Diversified Commodity Strategy Fund | | |

Prior to the closing of the Reorganizations, each Target Fund is expected to reposition its portfolio from Nuveen Underlying Funds to TIAA-CREF Underlying Funds held by the Acquiring Funds. Accordingly, in connection with its approval of the Reorganizations, the Board of Directors of the Target Corporation also approved investment policy changes permitting the Target Funds to invest in TIAA-CREF Underlying Funds in excess of the limits set forth in the 1940 Act. In anticipation of the Reorganizations, in the Target Funds’ prospectus, the list of underlying funds in which the Target Funds may invest has been adjusted to list the TIAA-CREF Underlying Funds. See the Target Funds’ prospectus dated December 31, 2018, as supplemented.

Fundamental Investment Restrictions

A Fund’s fundamental investment restrictions may not be changed without the approval of the holders of a majority of the Fund’s outstanding voting shares. For this purpose, a majority of a Fund’s outstanding voting shares means the lesser vote of (1) 67% of the shares of the Fund present at a meeting where more than 50% of the outstanding shares are present in person or by proxy, or (2) more than 50% of the outstanding shares of the Fund. Although there are minor differences in how the Target Funds and Acquiring Funds articulate their fundamental investment restrictions, these differences are not material, and the Funds’ fundamental investment restrictions are substantively the same.

Purchase, Redemption and Exchange of Shares

The table below contains information about purchasing, redeeming and exchanging shares of a Target Fund or shares of an Acquiring Fund, respectively. Any eligibility requirements, investment minimums and other requirements detailed in the chart below are waived as applied to the Reorganizations. The Acquiring Fund limits and minimums will apply going forward.

| | | | |

| | | Target Fund | | Acquiring Fund |

| Share classes involved in the Reorganizations | | Class A, Class C and Class R3 | | g Retail Class |

| | Class I | | g Advisor Class |

7

| | | | |

| | | Target Fund | | Acquiring Fund |

| | |

Purchase of shares and eligibility | | Class A and Class C shares may be purchased by any investor through a financial advisor or other financial intermediary. Class R3 shares may be purchased only by retirement plans through a financial advisor or other financial intermediary or directly from the Fund. | | Retail Class shares are available for purchase through certain financial intermediaries or from the Acquiring Fund directly. |

| | Class I shares may be purchased only through fee-based programs and certain retirement plans, and by other limited categories of investors, through a financial advisor or other financial intermediary or directly from the Fund. | | Advisor Class shares are available for purchase through certain financial intermediaries, employee benefit plans and insurance company separate accounts. |

Investment minimum | | Class A and Class C shares: $3,000, except as follows: • $2,500 for traditional/Roth individual retirement accounts (“IRAs”) • $2,000 for Coverdell Education Savings Accounts • $250 for accounts opened through fee-based programs • No minimum for retirement plans Except for retirement plans, subsequent investments for Class A and Class C shares must be at least $100. Class R3 shares: There are no minimum initial or subsequent investment requirements. | | The minimum initial investment for Retail Class shares: $2,000 per Fund account for Traditional IRA, Roth IRA and Coverdell accounts and $2,500 for all other account types. Subsequent investments for all account types must be at least $100. |

| | | Class I shares: $100,000, except as follows: • $250 for clients of financial intermediaries and family offices that have accounts holding Class I shares with an aggregate value of at least $100,000 (or that are expected to reach this level) • No minimum for eligible retirement plans and certain other categories of eligible investors | | Advisor Class shares: There are no minimum initial or subsequent investment requirements. |

8

| | | | |

| | | Target Fund | | Acquiring Fund |

Redemptions | | All share classes may be redeemed on any day the New York Stock Exchange (“NYSE”) is open for business. Shareholders may sell shares, subject to any applicable sales charge, through a financial advisor or directly to a Target Fund by mail, over the internet, or by telephone. | | All share classes may be redeemed on any day that the NYSE or its affiliated exchanges, NYSE Arca Equities or NYSE American, are open for trading, subject to any applicable restrictions imposed by a financial intermediary or employee benefit plan, by mail, over the internet, by telephone, or (for shareholders holding at least $5,000 of Retail Class shares) by TIAA’s systematic redemption plan. For shareholders holding Advisor Class shares through an employee benefit plan, a redemption can be part of an exchange into (i) another TIAA-CREF Fund available through the employee benefit plan, or (ii) another account or IRA. |

Exchanges | | Shareholders may exchange shares into an identically registered account for the same class of another Nuveen mutual fund for which they are eligible to invest on any day that the NYSE is open for business, subject to minimum purchase requirements of the new fund and certain other limitations as set forth in the prospectus. Shareholders may also, under limited circumstances, exchange between certain classes of shares of the same fund, subject to the payment of any applicable contingent deferred sales charge (“CDSC”). If your Target Fund shares are subject to a CDSC (which may be the case for purchases of Class A shares of $1 million or more that were not subject to a front-end sales load or Class C shares), that CDSC will not be imposed in connection with the Reorganization and the corresponding Acquiring Fund shares you receive in the Reorganization will not be subject to a CDSC upon redemption. | | Shareholders may exchange shares for another series of the Acquiring Trust for which they are eligible on any day that the NYSE or its affiliated exchanges, NYSE Arca Equities or NYSE American, are open for trading, subject to certain limitations as set forth in the prospectus. |

9

| | | | |

| | | Target Fund | | Acquiring Fund |

Low Balance Fees | | Class A shares, Class C shares and Class I shares (but not Class R3 shares) of each Target Fund held directly with the Fund in the following types of accounts with balances under $1,000 are subject to an annual low balance account fee of $15: IRAs, Coverdell Education Savings Accounts and accounts established pursuant to the Uniform Transfers to Minors Act or Uniform Gifts to Minors Act. | | Retail Class shares (but not Advisor Class shares) of each Acquiring Fund held through certain types of accounts, including IRAs and Coverdell Education Savings Accounts, are subject to an annual account maintenance fee of $15 on accounts with balances under $2,000. |

Upon the completion of a Reorganization, shareholders of the Target Fund will have the right to exchange shares of the Acquiring Fund received in the Reorganization for shares of the same class of other funds in the Acquiring Trust. However, Target Fund shareholders will not have the right to exchange their shares back into other Nuveen mutual funds. In addition, in the event that a Target Fund shareholder holds shares of another Nuveen mutual fund, Acquiring Fund shares will not be applicable for purposes of rights of accumulation or letters of intent with respect to such funds. The rights, privileges and shareholder services for share classes of the Acquiring Funds will not otherwise change in connection with the Reorganizations. See “Further Comparison of the Funds—Purchase, Redemption and Exchange of Shares” and “Further Comparison of the Funds—Distributions.”

Material Federal Income Tax Consequences of the Reorganizations

As a condition to closing each Reorganization, each Target Fund and each Acquiring Fund will receive an opinion from Dechert LLP, subject to certain representations, assumptions and conditions, substantially to the effect that each Reorganization will qualify as a tax-free reorganization under Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”). Accordingly, it is expected that no Target Fund and no Acquiring Fund will recognize any gain or loss for federal income tax purposes as a direct result of each Reorganization. However, prior to the close of regular trading on the NYSE on the applicable Closing Date, each Target Fund will declare a distribution of all its net investment income and net capital gains, if any. All or a portion of such a distribution may be taxable to shareholders of each Target Fund for federal income tax purposes.

Prior to the Closing Date of each Reorganization, each Target Fund’s portfolio will be liquidated and repositioned into the TIAA-CREF Underlying Funds held by the corresponding Acquiring Fund.

The repositioning of each Target Fund’s portfolio may result in increased distributions of capital gains (long-term and short-term). If these repositionings had occurred as of November 30, 2018, it is estimated that they would have resulted in capital gains of approximately $2.5 million, $18.6 million, $10.8 million and $5.9 million, respectively, and which would result in capital gains distributions of $0.40, $1.05, $1.18 and $1.48 per share, respectively, for Nuveen Strategy Conservative Allocation Fund, Nuveen Strategy Balanced Allocation Fund, Nuveen Strategy Growth Allocation Fund and Nuveen Strategy Aggressive Growth Allocation Fund.

10

For a more detailed discussion of the federal income tax consequences of the Reorganizations, please see “The Proposed Reorganizations—Material Federal Income Tax Consequences.”

Risk Factors

In evaluating a Reorganization, you should consider carefully the risks of the Acquiring Fund to which you will be subject if the Reorganization is approved and completed. The Acquiring Fund is exposed to the risks of the TIAA-CREF Underlying Funds in which it invests in direct proportion to the amount of assets the Acquiring Fund allocates to each TIAA-CREF Underlying Fund. Investing in a mutual fund involves risk, including the risk that you may receive little or no return on your investment or even that you may lose part or all of your investment. Because of these and other risks, you should consider an investment in the Acquiring Fund to be a long-term investment. An investment in the Acquiring Fund may not be appropriate for all shareholders. For a complete description of the risks of an investment in the Acquiring Fund, see the section in the Acquiring Fund’s prospectus entitled “Principal Investment Risks.”

Although an investment in a Target Fund is subject to many of the same principal risks as an investment in the corresponding Acquiring Fund (e.g., asset allocation risk, active management risk and underlying funds risks), there are certain differences in principal risks between the Funds as set forth in the table below.

| | | | | | | | |

Principal Investment Risks | | Each Target

Fund | | | Each

Acquiring

Fund | |

Allocation Risk / Asset Allocation Risk | | | X | | | | X | |

Active Management Risk | | | X | | | | X | |

Derivatives Risk(1) | | | X | | | | X | |

Commodities Risk | | | X | | | | | |

Cybersecurity Risk(3) | | | X | | | | X | |

Fund of Funds Risk / Risks Associated with the Underlying Funds | | | X | | | | X | |

| | |

Underlying Funds Risks: | | | | | | | | |

Issuer Risk / Credit Risk | | | X | | | | X | |

Interest Rate Risk | | | X | | | | X | |

Income Risk / Income Volatility Risk | | | X | | | | X | |

Call Risk | | | X | | | | X | |

Extension Risk | | | X | (2) | | | X | |

Market Risk / Equity Security Risk | | | X | | | | X | |

Foreign Investment Risk / Non-U.S./Emerging Markets Risk / Currency Risk | | | X | | | | X | |

Bond Market Liquidity Risk / Valuation Risk(3) | | | X | | | | X | |

Credit Spread Risk | | | X | | | | | |

High Yield Securities Risk(3) | | | X | | | | X | |

Municipal Securities Risk | | | X | | | | | |

Smaller Company Risk(3) | | | X | | | | X | |

| (1) | See discussion of derivatives risk in the section entitled “Additional information on investment strategies and risks of the Funds and Underlying Funds” of the Acquiring Funds’ prospectus. |

| (2) | Extension Risk for the Target Funds is incorporated in each Target Fund’s Interest Rate Risk disclosure. |

| (3) | The Acquiring Fund discloses this risk as a non-principal risk. |

11

The following list contains descriptions of the principal investment risks for the Target Funds as those descriptions appear in the summary prospectus:

Allocation Risk—The Fund’s ability to achieve its investment objectives depends upon the sub-adviser’s skill in determining the Fund’s allocation to different underlying funds. There is the risk that the sub-adviser’s evaluations and assumptions used in making such allocations may be incorrect.

Active Management Risk—The Fund’s sub-adviser actively manages the Fund’s investments. Consequently, the Fund is subject to the risk that the investment techniques and risk analyses employed by the Fund’s sub-adviser may not produce the desired results. This could cause the Fund to lose value or its investment results to lag relevant benchmarks or other funds with similar objectives.

Derivatives Risk—The use of derivatives involves additional risks and transaction costs which could leave the Fund or an underlying fund in a worse position than if it had not used these instruments. Derivative instruments can be used to acquire or to transfer the risk and returns of a security or other asset without buying or selling the security or asset. These instruments may entail investment exposures that are greater than their cost would suggest. As a result, a small investment in derivatives can result in losses that greatly exceed the original investment. Derivatives can be highly volatile, illiquid and difficult to value. An over-the-counter derivative transaction between the Fund or an underlying fund and a counterparty that is not cleared through a central counterparty also involves the risk that a loss may be sustained as a result of the failure of the counterparty to the contract to make required payments. The payment obligation for a cleared derivative transaction is guaranteed by a central counterparty, which exposes the Fund or an underlying fund to the creditworthiness of the central counterparty.

Commodities Risk—Commodities markets historically have been extremely volatile, and the performance of securities and other instruments that provide exposure to those markets therefore also may be highly volatile. In addition, certain underlying funds invest in commodity-linked derivative instruments. Such instruments have a high degree of price variability and are subject to rapid and substantial price changes. Commodity-linked derivative instruments may employ leverage, which creates the possibility for losses greater than the amount invested.

Cybersecurity Risk—Cybersecurity risk is the risk of an unauthorized breach and access to Fund assets, customer data (including private shareholder information) or proprietary information, or the risk of an incident occurring that causes the Fund, its investment adviser or sub-adviser, custodian, transfer agent, distributor or other service provider or a financial intermediary to suffer a data breach, data corruption or lose operational functionality. Successful cyber-attacks or other cyber-failures or events affecting the Fund or its service providers may adversely impact the Fund or its shareholders. Additionally, a cybersecurity breach could affect the issuers in which the Fund invests, which may cause the Fund’s investments to lose value.

Risks Associated with the Underlying Funds—Because the Fund’s assets are invested primarily in shares of the underlying funds, the Fund’s investment performance and risks are directly related to the investment performance and risks of the underlying funds. There is no guarantee that the underlying funds will achieve their respective investment objectives. The risks of the underlying funds

12

are listed alphabetically below. Certain underlying funds are subject to additional principal risks, which are described in the Fund’s prospectus under “How We Manage Your Money—What the Risks Are.”

| | – | Credit Risk—Credit risk is the risk that an issuer of a debt security may be unable or unwilling to make interest and principal payments when due and the related risk that the value of a debt security may decline because of concerns about the issuer’s ability or willingness to make such payments. |

| | – | Interest Rate Risk—Interest rate risk is the risk that the value of an underlying fund’s portfolio will decline because of rising interest rates. An underlying fund may be subject to a greater risk of rising interest rates than would normally be the case due to the possibility that the current period of historically low rates may be ending and the effect of potential government fiscal policy initiatives and resulting market reaction to those initiatives. When interest rates change, the values of longer-duration debt securities usually change more than the values of shorter-duration debt securities. Rising interest rates also may lengthen the duration of debt securities with call features, since exercise of the call becomes less likely as interest rates rise, which in turn will make the securities more sensitive to changes in interest rates and result in even steeper price declines in the event of further interest rate increases. |

| | – | Income Risk—An underlying fund’s income could decline during periods of falling interest rates or when the underlying fund experiences defaults on debt securities it holds. |

| | – | Call Risk—If, during periods of falling interest rates, an issuer calls higher-yielding debt instruments held by an underlying fund, an underlying fund may have to reinvest in securities with lower yields, which may adversely impact the Fund’s performance. |

| | – | Equity Security Risk—Equity securities in an underlying fund’s portfolio may decline significantly in price over short or extended periods of time, and such declines may occur because of declines in the equity market as a whole, or because of declines in only a particular country, company, industry or sector of the market. From time to time, an underlying fund may invest a significant portion of its assets in companies in one or more related sectors or industries which would make the underlying fund more vulnerable to adverse developments affecting such sectors or industries. |

| | – | Non-U.S./Emerging Markets Risk—Non-U.S. issuers or U.S. issuers with significant non-U.S. operations may be subject to risks in addition to those of issuers located in or that principally operate in the United States as a result of, among other things, political, social and economic developments abroad and different legal, regulatory and tax environments. These additional risks may be heightened for securities of issuers located in, or with significant operations in, emerging market countries as such countries may have a higher degree of economic instability, unsettled securities laws and inconsistent regulatory systems. |

| | – | Currency Risk—Changes in currency exchange rates will affect the value of non-U.S. dollar denominated securities, the value of dividends and interest earned from such securities, gains and losses realized on the sale of such securities and derivative transactions tied to such securities. A strong U.S. dollar relative to these other currencies will adversely affect the value of an underlying fund’s portfolio. |

| | – | Bond Market Liquidity Risk—Dealer inventories of bonds, which provide an indication of the ability of financial intermediaries to “make markets” in those bonds, are at or near historic lows in relation to market size. This reduction in market making capacity has the |

13

| | potential to decrease liquidity and increase price volatility in the fixed-income markets in which an underlying fund invests, particularly during periods of economic or market stress. In addition, recent federal banking regulations may cause certain dealers to reduce their inventories of bonds, which may further decrease an underlying fund’s ability to buy or sell bonds. As a result of this decreased liquidity, an underlying fund may have to accept a lower price to sell a security, sell other securities to raise cash or give up an investment opportunity, any of which could have a negative effect on performance. If an underlying fund needed to sell large blocks of bonds to meet shareholder redemption requests or to raise cash, those sales could further reduce the bonds’ prices and hurt performance. |

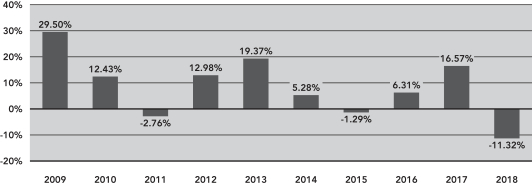

| | – | Valuation Risk—The debt securities in which an underlying fund invests typically are valued by a pricing service utilizing a range of market-based inputs and assumptions, including readily available market quotations obtained from broker-dealers making markets in such instruments, cash flows and transactions for comparable instruments. There is no assurance that an underlying fund will be able to sell a portfolio security at the price established by the pricing service, which could result in a loss to the underlying fund. Pricing services generally price debt securities assuming orderly transactions of an institutional “round lot” size, but some trades may occur in smaller, “odd lot” sizes, often at lower prices than institutional round lot trades. Different pricing services may incorporate different assumptions and inputs into their valuation methodologies, potentially resulting in different values for the same securities. As a result, if an underlying fund were to change pricing services, or if an underlying fund’s pricing service were to change its valuation methodology, there could be a material impact, either positive or negative, on the underlying fund’s net asset value. |