As filed with the Securities and Exchange Commission on April 21, 2006

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Pre-Effective Amendment No.

Post-Effective Amendment No.

(Check appropriate box or boxes.)

TIAA-CREF Institutional Mutual Funds

(Exact Name of Registrant as Specified in Charter)

730 Third Avenue

New York, New York 10017-3206

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (800) 842-2733

Stewart P. Greene, Esq.

TIAA-CREF Institutional Mutual Funds

730 Third Avenue

New York, New York 10017-3206

(Name and Address of Agent for Service)

Copy to:

Steven B. Boehm, Esq.

David S. Goldstein, Esq.

Sutherland Asbill & Brennan LLP

1275 Pennsylvania Avenue, N.W.

Washington, D.C. 20004-2415

Approximate Date of Proposed Public Offering: As soon as practicable after this Registration Statement becomes effective under the Securities Act of 1933.

It is proposed that this filing will become effective on May 21, 2006 pursuant to Rule 488 under the Securities Act of 1933.

Title of securities being registered: Retail Class and Institutional Class shares of beneficial interest, par value $0.0001 per share, of the following series of the Registrant: International Equity Fund, Large-Cap Growth Fund, Growth & Income Fund, Equity Index Fund, Social Choice Equity Fund, Managed Allocation Fund II, Bond Plus Fund II, Short-Term Bond Fund II, High-Yield Fund II, Tax-Exempt Bond Fund II and Money Market Fund.

No filing fee is required because of reliance on Section 24(f) under the Investment Company Act of 1940, as amended, pursuant to which the Registrant has previously registered an indefinite number of shares.

TIAA-CREF MUTUAL FUNDS

730 Third Avenue

New York, New York 10017-3206

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON AUGUST 8, 2006

The TIAA-CREF Mutual Funds will hold a special meeting of the shareholders of each of its investment portfolios (each, a “Retail Fund” and collectively, the “Retail Funds”) to be held on August 8, 2006, at [ a.m.] at 730 Third Avenue, New York, New York (17th floor). At each meeting, shareholders will be asked to vote:

| 1. | | With respect to their Fund, to approve an Agreement and Plan of Reorganization and Termination (the “Plan”), pursuant to which each of the following Retail Funds will be reorganized into the corresponding investment portfolio of the TIAA-CREF Institutional Mutual Funds (each such investment portfolio, an “TIAA-CREF Fund”) listed opposite its name: |

Retail Funds

| | | |

| | TIAA-CREF Funds

|

|---|

| International Equity Fund | | | | ————> | | Institutional International Equity Fund |

| Growth Equity Fund | | | | ————> | | Institutional Large-Cap Growth Fund |

| Growth & Income Fund | | | | ————> | | Institutional Growth & Income Fund |

| Equity Index Fund | | | | ————> | | Institutional Equity Index Fund |

| Social Choice Equity Fund | | | | ————> | | Institutional Social Choice Equity Fund |

| Managed Allocation Fund | | | | ————> | | Institutional Managed Allocation Fund II |

Bond Plus Fund | | | | ————> | | Institutional Bond Plus Fund II |

| Short-Term Bond Fund | | | | ————> | | Institutional Short-Term Bond Fund II |

| High-Yield Bond Fund | | | | ————> | | Institutional High-Yield Fund II |

| Tax-Exempt Bond Fund | | | | ————> | | Institutional Tax-Exempt Bond Fund II |

| Money Market Fund | | | | ————> | | Institutional Money Market Fund |

Under the Plan, each reorganization would be structured as follows: (a) the TIAA-CREF Fund will acquire the assets and assume the liabilities of the corresponding Retail Fund, in exchange for shares of the TIAA-CREF Fund; (b) the Retail Fund will distribute to its shareholders the TIAA-CREF Fund shares received in the transaction described in (a) above in exchange for the shareholders’ Retail Fund shares; and (c) as soon as practicable following the distribution of shares, each Retail Fund will be liquidated.

| 2. | | To address any other business that may properly come before the meeting or any adjournments thereof. |

The Board of Trustees of the TIAA-CREF Mutual Funds has set May 18, 2006 as the record date for determining the number of votes entitled to be cast at the meeting or any adjournments thereof. You may vote at the meeting (or any adjournments of the meeting) for a Retail Fund only if you were a shareholder of that Retail Fund as of May 18, 2006.

By Order of the Board of Trustees,

E. Laverne Jones

Secretary

Please vote as soon as possible before the meeting, even if you plan to attend the meeting. You can vote quickly and easily over the Internet, by telephone, or by mail. Just follow the simple instructions that appear on your enclosed proxy card(s). A separate proxy card is provided for each Retail Fund in which you own shares. Since we cannot hold the meeting unless a quorum is reached, please help avoid the expense of a follow-up mailing by voting today!

If you plan to attend the meeting, please call 1 877-535-3910, ext. 2440 to obtain an admission pass. In accordance with TIAA-CREF’s security procedures, a pass and appropriate picture identification will be required to enter the special meeting. Please note that no laptop computers, recording equipment or cameras will be permitted, and please read the instructions on the pass for additional information.

May [ ], 2006

TIAA-CREF MUTUAL FUNDS

TIAA-CREF INSTITUTIONAL MUTUAL FUNDS

730 Third Avenue

New York, New York 10017-3206

(800) 842-2733

COMBINED PROXY STATEMENT AND PROSPECTUS

Dated: May [ ], 2006

This Combined Proxy Statement and Prospectus (“Proxy Statement/Prospectus”) is being furnished to shareholders of the International Equity Fund, Growth Equity Fund, Growth & Income Fund, Equity Index Fund, Social Choice Equity Fund, Managed Allocation Fund, Bond Plus Fund, Short-Term Bond Fund, High-Yield Bond Fund, Tax-Exempt Bond Fund and Money Market Fund, each of which is an investment portfolio of TIAA-CREF Mutual Funds (each a “Retail Fund” and, collectively, the “Retail Funds”), in connection with the solicitation of proxies by the Board of Trustees of TIAA-CREF Mutual Funds for use at the special meeting of the shareholders of the Retail Funds to be held on August 8, 2006, at [ a.m.] at 730 Third Avenue, New York, New York (17th floor), and at any adjournment(s) of the meeting.

The proposal contained in this Proxy Statement/Prospectus on which you are being asked to vote is part of TIAA-CREF’s ongoing efforts to consolidate operations by offering a streamlined mutual fund family with consistent and sustainable pricing, greater efficiencies and a continued high level of shareholder services. As more fully described in this Proxy Statement/Prospectus, at the meeting, shareholders of each Retail Fund will be asked to vote to approve an Agreement and Plan of Reorganization and Termination (the “Plan”), pursuant to which their Retail Fund will be reorganized into the corresponding investment portfolio of the TIAA-CREF Institutional Mutual Funds (each such investment portfolio, a “TIAA-CREF Fund,” and each such transaction, a “Reorganization”), as described below.

Under the Plan, each Reorganization would be structured as follows: (1) each TIAA-CREF Fund will acquire the assets, and assume the liabilities, of its Retail Fund counterpart, in exchange for shares of the TIAA-CREF Fund; (2) the Retail Fund will distribute to its shareholders the TIAA-CREF Fund shares it has received in exchange for its shares held by Retail Fund shareholders; and (3) as soon as practicable, the Retail Fund will be liquidated. If the Plan is approved, as a Retail Fund shareholder, you will receive on the effective date of the Reorganization a number of full and fractional shares of the corresponding TIAA-CREF Fund having an aggregate value (or total account value) that will equal the total aggregate value of your Retail Fund shares.

This Proxy Statement/Prospectus, which you should retain for future reference, sets forth concisely the information regarding the Retail Funds, the TIAA-CREF Funds and the Reorganizations that you should know before voting. A Statement of Additional Information, dated May [ ], 2006, relating to the Reorganizations (“Reorganization SAI”) has been filed with the Securities and Exchange Commission (“SEC”) and is incorporated

by this reference into the Proxy Statement/Prospectus. The following documents, each of which has additional information about the Retail or TIAA-CREF Funds, also have been filed with the SEC and are incorporated by reference herein:

| 1. | | The Prospectus and Statement of Additional Information of the Retail Funds, each dated May 1, 2006, as supplemented (File Nos. 333-21821, 811-08055); |

| 2. | | The 2005 Annual Report to Shareholders of the Retail Funds for the fiscal year ended December 31, 2005; |

| 3. | | The Retail and Institutional Class Prospectuses and Statement of Additional Information of the TIAA-CREF Funds, each dated February 1, 2006, as supplemented (File Nos. 333-76651, 811-09301); |

| 4. | | The Retail and Institutional Class Prospectuses and Statement of Additional Information of the TIAA-CREF Funds, each dated March 31, 2006, as supplemented (File Nos. 333-76651, 811-09301); and |

| 5. | | The 2005 Retail and Institutional Class Annual Reports to Shareholders of the TIAA-CREF Funds for the fiscal year ended September 30, 2005. |

For a free copy of any of the above documents, please visit the TIAA-CREF Web site at www.tiaa-cref.org or use our on-line request form to request mailed versions. Alternatively, you can call (877) 518-9161 or write to us at 730 Third Avenue, New York, New York 10017-3206 to request free copies of these documents.

TIAA-CREF Mutual Funds and TIAA-CREF Institutional Mutual Funds are both open-end management investment companies, and each of their portfolios are considered to be diversified. Additional information about TIAA-CREF Mutual Funds and TIAA-CREF Institutional Mutual Funds has been filed with the SEC. You can copy and review information about the Retail Funds and the TIAA-CREF Funds at the SEC’s Public Reference Room in Washington, DC. You may obtain information on the operation of the Public Reference Room by calling the SEC at (800) SEC-0330. Reports and other information about the Retail and TIAA-CREF Funds are available on the EDGAR Database on the SEC’s Internet site at http://www.sec.gov. You may obtain copies of this information, after paying a duplicating fee, by electronic request at the following e-mail address: publicinfo@sec.gov, or by writing the SEC’s Public Reference Branch, Office of Consumer Affairs and Information Services, Washington, DC 20549.

THE SEC HAS NOT APPROVED OR DISAPPROVED THE SECURITIES DESCRIBED IN THIS PROXY STATEMENT/PROSPECTUS, OR DETERMINED IF THIS PROXY STATEMENT/PROSPECTUS IS ACCURATE OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. |

TABLE OF CONTENTS

SYNOPSIS | | | | | 1 | |

What is being proposed? | | | | | 1 | |

Why are you seeking to reorganize the Retail Funds? | | | | | 2 | |

What are the key details of the proposed Reorganizations? | | | | | 3 | |

How does each Retail Fund compare to its corresponding

TIAA-CREF Fund? | | | | | 4 | |

If approved, when would the Reorganizations occur? | | | | | 4 | |

Has the Board of Trustees approved the Reorganizations? | | | | | 5 | |

What level of shareholder support is needed to approve

the Reorganizations? | | | | | 5 | |

What are the fees and expenses of each Retail Fund and what are they expected to be after the Reorganizations? | | | | | 6 | |

What are the general tax consequences of the Reorganizations? | | | | | 21 | |

How do the investment objectives and principal strategies of the Retail and TIAA-CREF Funds compare? | | | | | 21 | |

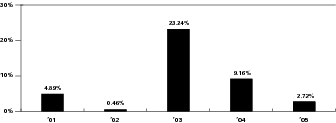

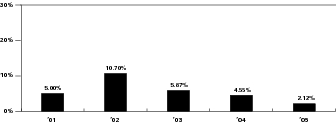

How have the Retail and TIAA-CREF Funds performed? | | | | | 28 | |

Are there differences in the oversight and organization of the Retail Funds and TIAA-CREF Funds? | | | | | 40 | |

Will any other service providers to the Retail or TIAA-CREF Funds change after the Reorganizations? | | | | | 41 | |

How do I purchase, redeem or exchange shares Retail Class shares of the TIAA-CREF Funds and will it be different than for Retail Fund shares? | | | | | 42 | |

How do I purchase, redeem or exchange shares of the Institutional Class of the TIAA-CREF Funds? | | | | | 43 | |

How do the dividend and distribution policies of the Retail and TIAA-CREF Funds compare? | | | | | 44 | |

COMPARISON OF RISK FACTORS | | | | | 45 | |

INFORMATION ABOUT THE REORGANIZATION | | | | | 47 | |

What are the reasons for the Reorganizations and what did the Board consider in determining to recommend the Reorganizations? | | | | | 47 | |

What are the terms of the Plan? | | | | | 52 | |

What TIAA-CREF Fund shares will I receive under the Reorganizations? | | | | | 54 | |

What are the tax consequences of the Reorganizations? | | | | | 54 | |

What is the capitalization of each Retail Fund and its corresponding TIAA-CREF Fund (net assets, net asset value and shares outstanding)? | | | | | 55 | |

i

| |

COMPARATIVE FINANCIAL HIGHLIGHTS | | | | | 59 | |

| |

VOTING INFORMATION | | | | | 60 | |

| |

ADDITIONAL INFORMATION | | | | | 62 | |

Additional Information About the TIAA-CREF Funds | | | | | 62 | |

Beneficial Ownership | | | | | 62 | |

Means of Soliciting Proxies | | | | | 62 | |

Proposals of Persons with Voting Rights | | | | | 62 | |

Legal Matters | | | | | 63 | |

Available Information | | | | | 63 | |

Annual Reports | | | | | 63 | |

| |

EXHIBIT A: Form of Agreement and Plan of Reorganization

and Termination | | | | | A-1 | |

| |

EXHIBIT B: Portfolio Management Teams of the Retail Funds and

TIAA-CREF Funds | | | | | B-1 | |

| |

EXHIBIT C: TIAA-CREF Funds’ Management Fees and Current

Expense Caps | | | | | C-1 | |

| |

EXHIBIT D: Comparative Financial Highlights | | | | | D-1 | |

| |

EXHIBIT E: Principal Holders of Retail Fund Shares | | | | | E-1 | |

| |

EXHIBIT F: Principal Holders of TIAA-CREF Fund Shares | | | | | F-1 | |

| |

APPENDIX: ADDITIONAL INFORMATION ABOUT THE

TIAA-CREF FUNDS | | | | | Appendix-1 | |

ii

PROPOSAL — APPROVAL OF REORGANIZATIONS

The Board of Trustees of TIAA-CREF Mutual Funds believes that the Reorganizations would be in the best interests of the shareholders of each Retail Fund and unanimously recommends that shareholders of each of the Retail Funds vote “FOR” the Reorganizations.

Shareholders of each Retail Fund are being asked to approve the Reorganization of their Retail Fund into a corresponding TIAA-CREF Fund whereby: (1) the assets and liabilities of the Retail Fund will be acquired and assumed by the corresponding TIAA-CREF Fund; and (2) shareholders of the Retail Fund will become shareholders of the TIAA-CREF Fund.

Regarding this proposal, it is important to note the following points:

| • | | This proposal is the second step in TIAA-CREF’s ongoing efforts to consolidate and streamline operations by offering a mutual fund family with consistent and sustainable pricing, greater efficiencies and a continued high level of shareholder services. As part of the first step of this process, the TIAA-CREF Funds recently sought and obtained Institutional Trust Board and shareholder approval to: (1) amend the investment management agreement to increase the management fees on the actively-managed TIAA-CREF Funds; (2) add a 12b-1 distribution plan on Retail Class shares to finance distribution; and (3) reallocate to the Funds the responsibility for payment of most of the Funds’ “other expenses” from Teachers Advisors, Inc. (the “Advisor”), the investment adviser to the Retail Funds and the TIAA-CREF Funds. |

| • | | As the second step in TIAA-CREF’s overall plan, the Reorganizations contained in this proposal are intended to eliminate potential investor confusion with respect to duplicative offerings and assist in the growth and viability of its funds. Over time, the relatively low fees of the Retail Funds have led to ongoing losses by the Advisor, which the Advisor believes are unsustainable. The recently approved increases in the investment management fee for certain of the actively managed TIAA-CREF Funds, in contrast, are designed to provide the Advisor with reasonable profits to sustain its services to the Funds. |

| • | | If shareholders of a Retail Fund approve the Reorganization, shareholders will become shareholders of the corresponding TIAA-CREF Fund after the closing of the Reorganization. The effect of this action is that your investment will change from an investment in a Retail Fund whose fee structure leads to losses for the Advisor to an investment in a very similar TIAA-CREF Fund whose fees allow the Advisor to make a reasonable profit. |

1

The Reorganizations would occur pursuant to the Plan (which is described below and attached as Exhibit A), for each of the following pairs of corresponding Funds:

Retail Funds

|

|

|

|

|

| TIAA-CREF Funds

|

|---|

| International Equity Fund | | | | ————————————> | | Institutional International Equity Fund |

| Growth Equity Fund | | | | ————————————> | | Institutional Large-Cap Growth Fund |

| Growth & Income Fund | | | | ————————————> | | Institutional Growth & Income Fund |

| Equity Index Fund | | | | ———���————————> | | Institutional Equity Index Fund |

| Social Choice Equity Fund | | | | ————————————> | | Institutional Social Choice Equity Fund |

| Managed Allocation Fund | | | | ————————————> | | Institutional Managed Allocation Fund II |

Bond Plus Fund | | | | ————————————> | | Institutional Bond Plus Fund II |

| Short-Term Bond Fund | | | | ————————————> | | Institutional Short-Term Bond Fund II |

| High-Yield Bond Fund | | | | ————————————> | | Institutional High-Yield Fund II |

| Tax-Exempt Bond Fund | | | | ————————————> | | Institutional Tax-Exempt Bond Fund II |

| Money Market Fund | | | | ————————————> | | Institutional Money Market Fund |

Upon shareholder approval and the closing of a Reorganization with respect to your Retail Fund, you will become a shareholder of a TIAA-CREF Fund with an investment objective and strategies that are very similar to the Retail Fund you currently own. Your investment, however, will be subject to the fee and expense structure of the TIAA-CREF Funds, which have an unbundled fee and expense structure, resulting in higher total operating expenses. Additionally, Retail Class shares of the TIAA-CREF Funds are subject to a 12b-1 distribution plan, leading to potentially higher total expense ratios than those of the Retail Funds.

Shareholders of the Growth Equity Fund are not being asked to approve a Reorganization of their Fund into the Institutional Growth Equity Fund because shareholders of the Institutional Growth Equity Fund did not approve an amendment to their Fund’s investment management agreement. Because the expense structure of the Institutional Growth Equity Fund continues to be unsustainable for the Advisor, shareholders of the Growth Equity Fund are being asked to approve a Reorganization of their Fund into the Institutional Large-Cap Growth Fund, which has the same investment objective and strategies as the Institutional Growth Equity Fund.

Why are you seeking to reorganize the Retail Funds?

The Advisor, which serves as investment adviser to both the Retail Funds and the TIAA-CREF Funds, has been incurring substantial losses on its mutual funds business since the Retail Funds were launched in 1997. Among the many factors contributing to these losses is that the fees charged by the Advisor did not cover the actual expenses incurred by the Advisor to manage and operate the Retail Funds. As part of the larger effort to continue offering competitively priced mutual funds, the Advisor is seeking to combine duplicative

2

mutual funds through the Reorganizations. Streamlining its mutual fund offerings at a reasonable and sustainable fee and expense structure will allow the Advisor to continue offering high quality, lower cost Funds to our shareholders for the foreseeable future. The Reorganizations are designed to accomplish the following:

| • | | Reduce potential investor confusion through the consolidation of duplicative funds with similar names and investment objectives and strategies; |

| • | | Enable shareholders to benefit over the long term from future economies of scale that are expected to result from combining the assets of the Retail and TIAA-CREF Funds; |

| • | | Maintain overall fees at a level that keeps the combined Funds competitive with the lower-priced offerings in the industry, while reflecting the costs associated with operating the Funds and maintaining a high level of service to Fund shareholders; |

| • | | Provide continuity of investment management, since both the Retail and TIAA-CREF Funds are managed by the same investment adviser and portfolio management teams; and |

| • | | Allow for the exchange of Fund shares through a process that is intended to qualify as a tax-free event for Retail Fund shareholders for federal income tax purposes. |

What are the key details of the proposed Reorganizations?

The following is a summary of certain information contained in this Proxy Statement/Prospectus and the Plan. The Plan that would govern the terms of each of the Reorganizations is attached as Exhibit A. Any description herein of that Plan is qualified by the actual terms of the Plan.

As set forth in the Plan, each Reorganization between a Retail Fund and its corresponding TIAA-CREF Fund will involve the following steps:

| • | | the TIAA-CREF Fund will acquire the assets and assume the liabilities of its Retail Fund counterpart, in exchange for shares of the TIAA-CREF Fund having an aggregate value equal to the net asset value of the Retail Fund as of the day of the Reorganization; |

| • | | the TIAA-CREF Fund shares received by the Retail Fund will be distributed pro rata (on an anticipated tax-free basis for federal income tax purposes) to each Retail Fund shareholder in an amount equal in value to the holder’s Retail Fund shares as of the day of the Reorganization; and |

| • | | as soon as practicable, the Retail Fund will be liquidated. |

If a Reorganization with respect to a Retail Fund and its TIAA-CREF Fund counterpart is approved, shareholders of that Retail Fund will receive Retail Class shares of the TIAA-CREF Fund. However, shareholders who meet the eligibility requirements for purchasing Institutional Class shares will receive Institutional Class shares of that TIAA-CREF Fund. For further details on the share class you may receive under the

3

Reorganizations, please see “Information About the Reorganizations — What TIAA-CREF Fund shares will I receive in the Reorganization” on page 54.

Who will bear the costs incurred in connection with the Reorganizations?

All costs incurred in connection with effecting the Reorganizations, including the costs associated with the drafting, printing and mailing of this Proxy Statement/Prospectus, the solicitation of proxies, the holding of the special meeting, and the subsequent termination of the Retail Funds, will be borne by the Advisor, and not by any of the Retail Funds or TIAA-CREF Funds.

How does each Retail Fund compare to its corresponding TIAA-CREF Fund?

As described in more detail below, each Retail Fund and its corresponding TIAA-CREF Fund:

| • | | have very similar investment objectives and principal investment strategies; |

| • | | have very similar investment restrictions; |

| • | | have a very similar portfolio composition; and |

| • | | are managed by the same portfolio management teams. |

If the Reorganization is implemented with respect to your Retail Fund, your shares will be subject to the expense structure of the corresponding TIAA-CREF Fund, which has a different expense structure and higher total operating expenses. In addition, Retail Class shares of the TIAA-CREF Funds are subject to a 12b-1 distribution plan. The fees and expenses are more fully described below, under the section entitled “What are the fees and expenses of each Retail Fund and what are they expected to be after the Reorganization?” on page 6.

If approved, when would the Reorganizations occur?

If approved, each Reorganization would occur by the end of the third quarter of 2006, or another date selected by the Retail and TIAA-CREF Funds (the “Closing Date”). See “Information About the Reorganizations” on page 47 and “Voting Information” on page 60.

4

Has the Board of Trustees of the Retail Funds approved the Reorganizations?

The Board of Trustees of the Retail Funds has unanimously approved the Plan and associated Reorganizations with respect to each Retail and TIAA-CREF Fund. The proposal to approve the Reorganizations and present them to shareholders for their approval was carefully considered by the Board of Trustees of the Retail Funds over the course of a number of meetings. General discussions of the Advisor’s recommendation to combine the Funds began in December 2004 and continued at meetings held on May 17, 2005, and July 19, 2005. The Board made its ultimate decision to approve the Reorganizations at a meeting held on February 14, 2006. During this process the Trustees, who were advised by independent counsel, deliberated over the Advisor’s comprehensive plan to restructure the Funds and their expense structure to help ensure that the Advisor could continue to manage them. At the meeting held on February 14, 2006, the Board of Trustees of the Retail Funds considered and approved the Plan and each Reorganization.

For the reasons set forth below under “Information About the Reorganizations — What are the reasons for the Reorganizations and what did the Board consider in determining to recommend the Reorganizations” on page 47, the Board of Trustees of the Retail Funds, which is comprised entirely of Trustees who are not “interested persons” of the Retail Funds or the Advisor (as that term is defined in the 1940 Act), determined that each Reorganization would be in the best interests of the Retail Fund and its shareholders. In addition, the Board determined with respect to each Reorganization that the interests of Retail Fund shareholders would not be diluted as a result of the Reorganization.

Accordingly, the Board of Trustees of the Retail Funds unanimously recommends that shareholders of the Retail Funds vote to approve the Reorganizations.

Likewise, the Board of Trustees of the TIAA-CREF Funds, which is comprised of the same individuals as the Board of Trustees of the Retail Funds, determined that each Reorganization would be in the best interests of the shareholders of the corresponding TIAA-CREF Fund and would not dilute the value of their shares. After careful consideration, the Board of Trustees of the TIAA-CREF Funds unanimously approved the Plan and each Reorganization at a meeting held on February 14, 2006.

What level of shareholder support is needed to approve the Reorganizations?

Each Reorganization must be approved by shareholders of each respective Retail Fund, and will require the affirmative vote of the lesser of either (1) more than 50% of the outstanding voting shares of the Fund, or (2) 67% or more of the outstanding voting shares present (in person or by proxy) at the meeting, if more than 50% of the outstanding voting shares are present at the meeting. Approval of a Reorganization with respect to a Retail Fund and its corresponding TIAA-CREF Fund is not contingent on shareholder approval of one or more Reorganizations of other Retail Funds and their corresponding TIAA-CREF Funds. Therefore, in the event that a Reorganization with

5

respect to a particular Retail Fund is not approved by its shareholders, or if such Reorganization is not completed for any other reason, the remaining Reorganizations will proceed as planned to the extent such Reorganizations are approved by their respective Retail Fund shareholders.

What are the fees and expenses of each Retail Fund and what are they expected to be after the Reorganizations?

It is important to note that if the Reorganizations are implemented, your shares will be subject to the fee and expense structure of the TIAA-CREF Funds, which have a different, unbundled expense structure and higher total operating expenses. In addition, Retail Class shares of the TIAA-CREF Funds are subject to a 12b-1 distribution plan. The Funds’ comparative fees and expenses are more fully described below. For more information on the differences between a “bundled” pricing structure and an “unbundled” (or “unitary”) pricing structure, please see page 7.

Shareholder Fees

Shares of the Retail Funds and TIAA-CREF Funds are not currently, and after the Reorganizations (on a pro forma basis) will not be, subject to any front-end or deferred sales charges (loads), redemption fees or exchange fees.

Annual Expenses

Expenses of mutual funds are generally measured by their expense ratios: the ratio of their total expenses for a year divided by their average daily net asset value over the same year. The main components of a fund’s expense ratio are investment advisory fees, distribution fees and “other expenses.” Below is a summary of the Retail and TIAA-CREF Funds’ current and proposed expense arrangements and comparative expense charts.

Investment Management Arrangements. The Advisor is the investment adviser to both the Retail and the TIAA-CREF Funds. The Advisor manages the assets of the Funds under the supervision of the Retail and Institutional Trusts’ respective Board of Trustees pursuant to the terms of the Funds’ investment management agreement. The Advisor is a wholly owned indirect subsidiary of Teachers Insurance and Annuity Association of America (“TIAA”) and is registered as an investment adviser with the SEC under the Investment Advisers Act of 1940. The Advisor also manages the investments of TIAA Separate Account VA-1 and the TIAA-CREF Life Funds. Through an affiliated investment advisor, TIAA-CREF Investment Management, LLC (“Investment Management”), the personnel of the Advisor also manage the investment accounts of the College Retirement Equities Fund (“CREF”). As of April 30, 2006, the Advisor and Investment Management together had $[ ] billion of registered investment company assets under management. The Advisor is located at 730 Third Avenue, New York, NY 10017.

6

The Retail and TIAA-CREF Funds each are managed by a team of portfolio managers, who are jointly responsible for the day-to-day management of the Fund, and who have expertise in the area(s) applicable to the Fund’s investments. Each Retail Fund and its counterpart TIAA-CREF Fund are managed by the same team of portfolio managers. A list of the current members of the management teams primarily responsible for managing each Fund’s investments, along with their relevant experience, is found in Exhibit B.

An important reason for the difference in the expenses of the Retail and TIAA-CREF Funds is that they have different arrangements with the Advisor. These differences are outlined below:

| • | | The Retail Funds. Under its investment management agreement with the Retail Funds, the Advisor provides, or obtains at its own expense, virtually all of the services needed for the operation of each Retail Fund for a single set fee, also described as a “bundled” or “unitary” fee. The Advisor’s duties include conducting research, recommending investments and placing orders to buy and sell securities, as well as providing or obtaining distribution, custodial, administrative, transfer agency, portfolio accounting, dividend disbursing, auditing, and ordinary legal services for the Retail Funds. The Advisor also acts as liaison among the various service providers to the Retail Funds, including custodians, portfolio accounting agents, portfolio managers and transfer agents and pays for the services of each service provider out of its management fee. |

| • | | The TIAA-CREF Funds. Under its investment management agreement with the TIAA-CREF Funds, the Advisor receives an annual fee for managing the assets of each TIAA-CREF Fund. The Advisor conducts research, recommends investments and places orders to buy and sell securities. However, since the TIAA-CREF Funds’ investment management fee is not “bundled” or “unitary,” certain expenses of the TIAA-CREF Funds, such as transfer agency, audit fees, custody, and other operational expenses, are not paid by the Advisor out of its management fee, but rather by the TIAA-CREF Funds directly (and therefore, incurred indirectly by the shareholders of the TIAA-CREF Funds and not by the Advisor). These expenses (i.e., the TIAA-CREF Funds’ “other expenses”) can vary based on actual cost. This direct payment of “other expenses” by the TIAA-CREF Funds is more customary in the mutual fund industry. |

The Advisor has contractually agreed to various waivers and reimbursements on the investment management fees, “other expenses” and total annual operating expenses of the TIAA-CREF Funds. These waivers and reimbursements would continue in effect after the Reorganizations, so that shareholders of the Retail Funds merging into the TIAA-CREF Funds would receive the benefit of these fee reductions. If these waivers and reimbursements are not extended, they will expire on September 30, 2007 (or April 30, 2010 in the case of the Institutional Equity Index Fund). Thereafter, the Board, in consultation with the Advisor, will consider at least annually the appropriate levels for such waivers and reimbursements.

7

The Advisor’s current fee waivers and reductions for the TIAA-CREF Funds’ include:

| • | | An agreement that the Institutional Large-Cap Growth Fund and Institutional Growth & Income Fund pay an investment management fee of only 0.08%, instead of their contractual fee rate of 0.45%, through at least September 30, 2007. Thereafter, this waiver may be adjusted or discontinued by the Advisor based on the Board’s continuing review of the performance of these Funds. |

| • | | An agreement capping the “other expenses” of the Institutional Class shares of the TIAA-CREF Funds at the levels set forth in Exhibit C through at least September 30, 2007 (or April 30, 2010 in the case of the Institutional Equity Index Fund). |

| • | | An agreement capping the total annual operating expenses of the Retail Class shares of the TIAA-CREF Funds at the levels set forth in Exhibit C through at least September 30, 2007 (or April 30, 2010 in the case of the Institutional Equity Index Fund). |

Please see the expense tables below beginning on page 10 for a comparison of the current investment management fees paid by the Retail and TIAA-CREF Funds and the proposed investment management fees of the combined Funds.

Distribution Arrangements. The Retail Class of the TIAA-CREF Funds has adopted a distribution plan pursuant to Rule 12b-1 of the 1940 Act (“Distribution Plan”). Under the terms of the Distribution Plan, Teachers Personal Investors Services, Inc. (“TPIS”), the TIAA-CREF Funds’ distributor, can be reimbursed for all or part of certain expenses that it incurs in connection with the promotion and distribution of the Retail Class shares, as approved by the Board, up to an annual rate of 0.25% of the average daily net asset value of shares of the Retail Class. Because this is a reimbursement plan, TPIS will only be paid for amounts actually spent on the distribution and marketing of Retail Class shares and approved by the Board; it will not necessarily receive the full 0.25% fee automatically every year. Reimbursements by the Retail Class shares under the Distribution Plan are calculated daily and paid monthly. The expenses eligible for reimbursement under the Distribution Plan include, but are not limited to, compensation of dealers and others for the expenses of their various activities primarily intended to promote the sale of its shares, and for providing personal and account maintenance services to holders of shares and salaries and other expenses relating to account servicing efforts.

TPIS has contractually agreed not to seek reimbursement under the Distribution Plan through September 30, 2007, unless extended to a later date. This agreement would continue in effect after the Reorganizations, so that Retail Fund shareholders merging into the Retail Class of the TIAA-CREF Funds also would receive the benefit of this agreement. The level of reimbursements by the Funds under the Distribution Plan would be reviewed by the Board at least annually.

Expense Tables. Below are tables showing the current expense ratios of each Retail Fund and its corresponding TIAA-CREF Fund. In addition, the tables show the anticipated

8

expenses of the Retail and Institutional Class of the TIAA-CREF Funds if the Reorganization of each Retail Fund into its corresponding TIAA-CREF Fund occurs (labeled as “pro forma combined”). The tables enable you to compare and contrast the recent expense levels for the Retail Funds and the TIAA-CREF Funds and obtain a general idea of what the expense levels would be if the Reorganizations occur.

The expenses set forth below are based on the expenses of the Retail Funds for the fiscal year ended December 31, 2005 and the recently-approved new expense structure of the TIAA-CREF Funds as if the new expenses had been in effect for the Funds’ fiscal year ended September 30, 2005 (i.e., on a pro forma basis). The pro forma information for the TIAA-CREF Funds reflects the anticipated effect of the Reorganizations. These figures include current fee and expense waivers and reimbursements set to expire on September 30, 2007 (or April 30, 2010 in the case of the Institutional Equity Index Fund), unless extended, and the full amounts authorized for reimbursement under the Distribution Plan for the Retail Class shares of the TIAA-CREF Funds. The TIAA-CREF Funds’ distributor has agreed not to seek any reimbursement under the Distribution Plan until September 30, 2007. This means that Retail Class shares of the TIAA-CREF Funds would not pay any 12b-1 fees until that time.

The terms used in the expense tables have the following meanings:

| • | | “Management Fees” means investment advisory fees or any other management or administrative fees paid to the advisor or its affiliates that are not included in “other expenses.” |

| • | | “Distribution (12b-1) Fees” means all distribution and other expenses incurred by a Fund under a plan adopted pursuant to Rule 12b-1 of the 1940 Act. |

| • | | “Other Expenses” means all expenses not otherwise disclosed in the table that are deducted from Fund assets or charged to all shareholder accounts (not including any extraordinary expenses). |

| • | | “Total Annual Fund Operating Expenses” means the sum of a Fund’s “Management Fees,” “Distribution (12b-1) Fees,” and “Other Expenses.” |

| • | | “Expense Reimbursements and Waivers” means the aggregate amount of expenses that are not actually paid by a Fund due to contractual waivers and reimbursements. |

| • | | “Net Annual Fund Operating Expenses” means the amount of expenses actually paid by Fund shareholders after the “Expense Reimbursements and Waivers” category is subtracted from the Fund’s expenses. |

9

Examples of Fund Expenses. Following each expense ratio table is an expense example intended to help you compare and contrast the cost of investing in: (1) a Retail Fund as it currently exists; (2) the Retail Class and Institutional Class of its corresponding TIAA-CREF Fund as they currently exist; and (3) the Retail Class and Institutional Class of the same TIAA-CREF Fund if a Reorganization occurs (i.e., the “pro forma” figure).

The examples assume that you make an investment of $10,000 in shares of the Retail Funds or the indicated classes of the TIAA-CREF Funds for the time periods indicated and then redeem all of your shares at the end of those periods. The examples also assume a 5% annual return each year and that there will be no expense reimbursements or waivers in place after one year. Your actual costs may be higher or lower. The “pro forma” categories correspond to what the expenses of the TIAA-CREF Funds are expected to be if the Retail Funds are reorganized into the TIAA-CREF Funds.

International Equity Fund and Institutional International Equity Fund

|

|

|

| Retail

Fund

|

| TIAA-CREF

Fund

(Retail

Class)

|

| TIAA-CREF

Fund

(Institutional

Class)

|

| Pro Forma

Combined

Institutional

Fund

(Retail

Class)

|

| Pro Forma

Combined

Institutional

Fund

(Institutional

Class)

|

|---|

| Management Fees | | | | | 0.49 | % | | | 0.50 | %1 | | | 0.50 | %1 | | | 0.50 | %1 | | | 0.50 | %1 |

| Distribution (12b-1) Fees | | | | | N/A | | | | 0.25 | %2 | | | N/A | | | | 0.25 | %2 | | | N/A | |

| Other Expenses | | | | | 0.00 | % | | | 0.13 | %3 | | | 0.12 | % | | | 0.13 | %3 | | | 0.13 | % |

Total Annual

Operating Expenses | | | | | 0.49 | % | | | 0.88 | % | | | 0.62 | % | | | 0.88 | % | | | 0.63 | % |

| Expense Reimbursements and Waivers | | | | | 0.00 | % | | | 0.25 | %4 | | | 0.02 | %4 | | | 0.25 | %4 | | | 0.03 | %4 |

Net Annual Fund

Operating Expenses | | | | | 0.49 | % | | | 0.63 | % | | | 0.60 | % | | | 0.63 | % | | | 0.60 | % |

| (1) | | This management fee has breakpoints that gradually reduce the fee rates indicated in the chart (both current and pro forma) from the amounts indicated in the chart as the Fund’s assets grow. To see the full breakpoint schedule see Exhibit C. |

| (2) | | Retail Class shares are subject to a Distribution (12b-1) Plan. The Plan provides for a maximum annual reimbursement rate of 0.25% of average daily net assets of the Fund. TPIS has contractually agreed not to seek any reimbursements under the Plan through September 30, 2007, so the table reflects the waiver of this whole amount. |

| (3) | | As this class of this particular TIAA-CREF Fund will have been in existence substantially less than a year prior to the Reorganizations, the “Other Expenses” for this class are estimated. |

| (4) | | The Advisor has contractually agreed to certain fee waivers and reimbursements that cap the amount of “Other Expenses” or “Total Annual Fund Operating Expenses” the TIAA-CREF Funds would pay through at least September 30, 2007. Please see Exhibit C for more information on the levels of these waivers and reimbursements. |

10

International Equity Fund and Institutional International Equity Fund

|

|

|

| 1 year

|

| 3 years

|

| 5 years

|

| 10 years

|

|---|

Retail Fund | | | | $ | 50 | | | $ | 157 | | | $ | 274 | | | $ | 616 | |

TIAA-CREF Fund (Retail Class) | | | | $ | 64 | | | $ | 256 | | | $ | 463 | | | $ | 1,061 | |

TIAA-CREF Fund (Institutional Class) | | | | $ | 61 | | | $ | 197 | | | $ | 344 | | | $ | 772 | |

Pro Forma Combined TIAA-CREF Fund (Retail Class) | | | | $ | 64 | | | $ | 256 | | | $ | 463 | | | $ | 1,061 | |

Pro Forma Combined TIAA-CREF Fund

(Institutional Class) | | | | $ | 61 | | | $ | 199 | | | $ | 348 | | | $ | 783 | |

Growth Equity Fund and Institutional Large-Cap Growth Fund

|

|

|

| Retail

Fund

|

| TIAA-CREF

Fund

(Retail

Class)

|

| TIAA-CREF

Fund

(Institutional

Class)

|

| Pro Forma

Combined

Institutional

Fund

(Retail

Class)

|

| Pro Forma

Combined

Institutional

Fund

(Institutional

Class)

|

|---|

| Management Fees | | | | | 0.45 | % | | | 0.45 | %1 | | | 0.45 | %1 | | | 0.45 | %1 | | | 0.45 | %1 |

| Distribution (12b-1) Fees | | | | | N/A | | | | 0.25 | %2 | | | N/A | | | | 0.25 | %2 | | | N/A | |

| Other Expenses | | | | | 0.00 | % | | | 0.16 | %3 | | | 0.37 | %3 | | | 0.16 | %3 | | | 0.38 | %3 |

Total Annual

Operating Expenses | | | | | 0.45 | % | | | 0.86 | % | | | 0.82 | % | | | 0.86 | % | | | 0.83 | % |

| Expense Reimbursements and Waivers | | | | | 0.00 | % | | | 0.62 | %4 | | | 0.69 | %4 | | | 0.62 | %4 | | | 0.70 | %4 |

Net Annual Fund

Operating Expenses | | | | | 0.45 | % | | | 0.24 | % | | | 0.13 | % | | | 0.24 | % | | | 0.13 | % |

| (1) | | This management fee has breakpoints that gradually reduce the fee rates indicated in the chart (both current and pro forma) from the amounts indicated in the chart as the Fund’s assets grow. To see the full breakpoint schedule see Exhibit C. Notwithstanding these breakpoints, the Advisor has contractually agreed to waive the investment management fees to 0.08% through at least April 30, 2007. |

| (2) | | Retail Class shares are subject to a Distribution (12b-1) Plan. The Plan provides for a maximum annual reimbursement rate of 0.25% of average daily net assets of the Fund. TPIS has contractually agreed not to seek any reimbursements under the Plan through September 30, 2007, so the table reflects the waiver of this whole amount. |

| (3) | | As this class of this particular TIAA-CREF Fund will have been in existence substantially less than a year prior to the Reorganizations, the “Other Expenses” for this class are estimated. |

| (4) | | The Advisor has contractually agreed to certain fee waivers and reimbursements that cap the amount of “Other Expenses” or “Total Annual Fund Operating Expenses” the TIAA-CREF Funds would pay through at least September 30, 2007. Please see Exhibit C for more information on the levels of these waivers and reimbursements. |

11

Growth Equity Fund and Institutional Large-Cap Growth Fund

|

|

|

| 1 year

|

| 3 years

|

| 5 years

|

| 10 years

|

|---|

Retail Fund | | | | $ | 46 | | | $ | 144 | | | $ | 252 | | | $ | 567 | |

TIAA-CREF Fund (Retail Class) | | | | $ | 25 | | | $ | 212 | | | | — | | | | — | |

TIAA-CREF Fund (Institutional Class) | | | | $ | 13 | | | $ | 193 | | | | — | | | | — | |

Pro Forma Combined TIAA-CREF Fund (Retail Class) | | | | $ | 25 | | | $ | 212 | | | | — | | | | — | |

Pro Forma Combined TIAA-CREF Fund

(Institutional Class) | | | | $ | 13 | | | $ | 195 | | | | — | | | | — | |

Growth & Income Fund and Institutional Growth & Income Fund

|

|

|

| Retail

Fund

|

| TIAA-CREF

Fund

(Retail

Class)

|

| TIAA-CREF

Fund

(Institutional

Class)

|

| Pro Forma

Combined

Institutional

Fund

(Retail

Class)

|

| Pro Forma

Combined

Institutional

Fund

(Institutional

Class)

|

|---|

| Management Fees | | | | | 0.43 | % | | | 0.45 | %1 | | | 0.45 | %1 | | | 0.45 | %1 | | | 0.45 | %1 |

| Distribution (12b-1) Fees | | | | | N/A | | | | 0.25 | %2 | | | N/A | | | | 0.25 | %2 | | | N/A | |

| Other Expenses | | | | | 0.00 | % | | | 0.63 | %3 | | | 0.07 | % | | | 0.63 | %3 | | | 0.07 | % |

Total Annual

Operating Expenses | | | | | 0.43 | % | | | 1.33 | % | | | 0.52 | % | | | 1.33 | % | | | 0.52 | % |

| Expense Reimbursements and Waivers | | | | | 0.00 | % | | | 0.90 | %4 | | | 0.39 | %4 | | | 0.90 | %4 | | | 0.39 | %4 |

Net Annual Fund

Operating Expenses | | | | | 0.43 | % | | | 0.43 | % | | | 0.13 | % | | | 0.43 | % | | | 0.13 | % |

| (1) | | This management fee has breakpoints that gradually reduce the fee rates indicated in the chart (both current and pro forma) from the amounts indicated in the chart as the Fund’s assets grow. To see the full breakpoint schedule see Exhibit C. Notwithstanding these breakpoints, the Advisor has contractually agreed to waive the investment management fees of these Funds to 0.08% through at least April 30, 2007. |

| (2) | | Retail Class shares are subject to a Distribution (12b-1) Plan. The Plan provides for a maximum annual reimbursement rate of 0.25% of average daily net assets of the Fund. TPIS has contractually agreed not to seek any reimbursements under the Plan through September 30, 2007, so the table reflects the waiver of this whole amount. |

| (3) | | As this class of this particular TIAA-CREF Fund will have been in existence substantially less than a year prior to the Reorganizations, the “Other Expenses” for this class are estimated. |

| (4) | | The Advisor has contractually agreed to certain fee waivers and reimbursements that cap the amount of “Other Expenses” or “Total Annual Fund Operating Expenses” the TIAA-CREF Funds would pay through at least September 30, 2007. Please see Exhibit C for more information on the levels of these waivers and reimbursements. |

12

Growth & Income Fund and Institutional Growth & Income Fund

|

|

|

| 1 year

|

| 3 years

|

| 5 years

|

| 10 years

|

|---|

Retail Fund | | | | $ | 44 | | | $ | 138 | | | $ | 241 | | | $ | 542 | |

TIAA-CREF Fund (Retail Class) | | | | $ | 44 | | | $ | 332 | | | $ | 642 | | | $ | 1,523 | |

TIAA-CREF Fund (Institutional Class) | | | | $ | 13 | | | $ | 127 | | | $ | 252 | | | $ | 615 | |

Pro Forma Combined TIAA-CREF Fund (Retail Class) | | | | $ | 44 | | | $ | 332 | | | $ | 642 | | | $ | 1,523 | |

Pro Forma Combined TIAA-CREF Fund

(Institutional Class) | | | | $ | 13 | | | $ | 127 | | | $ | 252 | | | $ | 615 | |

Equity Index Fund and Institutional Equity Index Fund

|

|

|

| Retail

Fund

|

| TIAA-CREF

Fund

(Retail

Class)

|

| TIAA-CREF

Fund

(Institutional

Class)

|

| Pro Forma

Combined

Institutional

Fund

(Retail

Class)

|

| Pro Forma

Combined

Institutional

Fund

(Institutional

Class)

|

|---|

| Management Fees | | | | | 0.26 | % | | | 0.04 | % | | | 0.04 | % | | | 0.04 | % | | | 0.04 | % |

| Distribution (12b-1) Fees | | | | | N/A | | | | 0.25 | %1 | | | N/A | | | | 0.25 | %1 | | | N/A | |

| Other Expenses | | | | | 0.00 | % | | | 0.28 | %2 | | | 0.04 | % | | | 0.28 | %2 | | | 0.05 | % |

Total Annual

Operating Expenses | | | | | 0.26 | % | | | 0.57 | % | | | 0.08 | % | | | 0.57 | % | | | 0.09 | % |

| Expense Reimbursements and Waivers | | | | | 0.00 | % | | | 0.33 | %3 | | | 0.00 | %3 | | | 0.33 | %3 | | | 0.01 | %3 |

Net Annual Fund

Operating Expenses | | | | | 0.26 | % | | | 0.24 | % | | | 0.08 | % | | | 0.24 | % | | | 0.08 | % |

| (1) | | Retail Class shares are subject to a Distribution (12b-1) Plan. The Plan provides for a maximum annual reimbursement rate of 0.25% of average daily net assets of the Fund. TPIS has contractually agreed not to seek any reimbursements under the Plan through September 30, 2007, so the table reflects the waiver of this whole amount. |

| (2) | | As this class of this particular TIAA-CREF Fund will have been in existence substantially less than a year prior to the Reorganizations, the “Other Expenses” for this class are estimated. |

| (3) | | The Advisor has contractually agreed to certain fee waivers and reimbursements that cap the amount of “Other Expenses” or “Total Annual Fund Operating Expenses” the TIAA-CREF Funds would pay through at least April 30, 2010. Please see Exhibit C for more information on the levels of these waivers and reimbursements. |

13

Equity Index Fund and Institutional Equity Index Fund

|

|

|

| 1 year

|

| 3 years

|

| 5 years

|

| 10 years

|

|---|

Retail Fund | | | | $ | 27 | | | $ | 84 | | | $ | 146 | | | $ | 331 | |

TIAA-CREF Fund (Retail Class) | | | | $ | 25 | | | $ | 77 | | | $ | 176 | | | $ | 576 | |

TIAA-CREF Fund (Institutional Class) | | | | $ | 8 | | | $ | 26 | | | $ | 45 | | | $ | 103 | |

Pro Forma Combined TIAA-CREF Fund (Retail Class) | | | | $ | 25 | | | $ | 77 | | | $ | 176 | | | $ | 576 | |

Pro Forma Combined TIAA-CREF Fund

(Institutional Class) | | | | $ | 8 | | | $ | 26 | | | $ | 46 | | | $ | 111 | |

Social Choice Equity Fund and Institutional Social Choice Equity Fund

|

|

|

| Retail

Fund

|

| TIAA-CREF

Fund

(Retail

Class)

|

| TIAA-CREF

Fund

(Institutional

Class)

|

| Pro Forma

Combined

Institutional

Fund

(Retail

Class)

|

| Pro Forma

Combined

Institutional

Fund

(Institutional

Class)

|

|---|

| Management Fees | | | | | 0.27 | % | | | 0.15 | % | | | 0.15 | % | | | 0.15 | % | | | 0.15 | % |

| Distribution (12b-1) Fees | | | | | N/A | | | | 0.25 | %1 | | | N/A | | | | 0.25 | %1 | | | N/A | |

| Other Expenses | | | | | 0.00 | % | | | 0.11 | %2 | | | 0.06 | % | | | 0.11 | %2 | | | 0.07 | % |

Total Annual

Operating Expenses | | | | | 0.27 | % | | | 0.51 | % | | | 0.21 | % | | | 0.51 | % | | | 0.22 | % |

| Expense Reimbursements and Waivers | | | | | 0.00 | % | | | 0.25 | %3 | | | 0.01 | %3 | | | 0.25 | %3 | | | 0.02 | %3 |

Net Annual Fund

Operating Expenses | | | | | 0.27 | % | | | 0.26 | % | | | 0.20 | % | | | 0.26 | % | | | 0.20 | % |

| (1) | | Retail Class shares are subject to a Distribution (12b-1) Plan. The Plan provides for a maximum annual reimbursement rate of 0.25% of average daily net assets of the Fund. TPIS has contractually agreed not to seek any reimbursements under the Plan through September 30, 2007, so the table reflects the waiver of this whole amount. |

| (2) | | As this class of this particular TIAA-CREF Fund will have been in existence substantially less than a year prior to the Reorganizations, the “Other Expenses” for this class are estimated. |

| (3) | | The Advisor has contractually agreed to certain fee waivers and reimbursements that cap the amount of “Other Expenses” or “Total Annual Fund Operating Expenses” the TIAA-CREF Funds would pay through at least September 30, 2007. Please see Exhibit C for more information on the levels of these waivers and reimbursements. |

14

Social Choice Equity Fund and Institutional Social Choice Equity Fund

|

|

|

| 1 year

|

| 3 years

|

| 5 years

|

| 10 years

|

|---|

Retail Fund | | | | $ | 28 | | | $ | 87 | | | $ | 152 | | | $ | 343 | |

TIAA-CREF Fund (Retail Class) | | | | $ | 27 | | | $ | 138 | | | $ | 260 | | | $ | 616 | |

TIAA-CREF Fund (Institutional Class) | | | | $ | 20 | | | $ | 67 | | | $ | 117 | | | $ | 267 | |

Pro Forma Combined TIAA-CREF Fund (Retail Class) | | | | $ | 27 | | | $ | 138 | | | $ | 260 | | | $ | 616 | |

Pro Forma Combined TIAA-CREF Fund

(Institutional Class) | | | | $ | 20 | | | $ | 69 | | | $ | 122 | | | $ | 278 | |

Managed Allocation Fund and Institutional Managed Allocation Fund II

|

|

|

| Retail

Fund

|

| TIAA-CREF

Fund

(Retail

Class)

|

| TIAA-CREF

Fund

(Institutional

Class)

|

| Pro Forma

Combined

Institutional

Fund

(Retail

Class)

|

| Pro Forma

Combined

Institutional

Fund

(Institutional

Class)

|

|---|

| Management Fees | | | | | 0.00 | %1 | | | 0.00 | %1 | | | 0.00 | %1 | | | 0.00 | %1 | | | 0.00 | %1 |

| Distribution (12b-1) Fees | | | | | N/A | | | | 0.25 | %2 | | | N/A | | | | 0.25 | %2 | | | N/A | |

| Other Expenses | | | | | 0.49 | %1 | | | 0.62 | %1 | | | 0.57 | %1 | | | 0.62 | %1 | | | 0.57 | %1 |

Total Annual

Operating Expenses | | | | | 0.49 | % | | | 0.87 | % | | | 0.57 | % | | | 0.87 | % | | | 0.57 | % |

| Expense Reimbursements and Waivers | | | | | 0.00 | % | | | 0.50 | % | | | 0.20 | % | | | 0.50 | % | | | 0.20 | % |

Net Annual Fund

Operating Expenses | | | | | 0.49 | % | | | 0.37 | % | | | 0.37 | % | | | 0.37 | % | | | 0.37 | % |

| (1) | | The Advisor does not and will not receive a management fee for its services to the Managed Allocation Fund and Institutional Managed Allocation Fund II. However, shareholders in these Funds currently bear, and will continue to bear after the Reorganization, indirectly their pro rata shares of the fees and expenses incurred by the underlying funds in which these Funds invest. The expenses in the table are based on the Retail Managed Allocation Fund’s allocations during 2005 and the current allocations of the Institutional Managed Allocation Fund II. Based upon the current expected allocations of the Retail Managed Allocation Fund and Institutional Managed Allocation Fund II, the underlying fund expenses are expected to be 0.49% and 0.37%, respectively (each of which includes waivers and reimbursements of the underlying funds’ expenses). |

| (2) | | Retail Class shares are subject to a Distribution (12b-1) Plan. The Plan provides for a maximum annual reimbursement rate of 0.25% of average daily net assets of the Fund. TPIS has contractually agreed not to seek any reimbursements under the Plan through September 30, 2007, so the table reflects the waiver of this whole amount. |

| (3) | | As this class of this particular TIAA-CREF Fund will have been in existence substantially less than a year prior to the Reorganizations, the “Other Expenses” for this class are estimated. |

15

Managed Allocation Fund and Institutional Managed Allocation Fund II

|

|

|

| 1 year

|

| 3 years

|

| 5 years

|

| 10 years

|

|---|

Retail Fund | | | | $ | 50 | | | $ | 157 | | | $ | 274 | | | $ | 616 | |

TIAA-CREF Fund (Retail Class) | | | | $ | 38 | | | $ | 228 | | | | — | | | | — | |

TIAA-CREF Fund (Institutional Class) | | | | $ | 38 | | | $ | 162 | | | | — | | | | — | |

Pro Forma Combined TIAA-CREF Fund (Retail Class) | | | | $ | 38 | | | $ | 228 | | | | — | | | | — | |

Pro Forma Combined TIAA-CREF Fund

(Institutional Class) | | | | $ | 38 | | | $ | 162 | | | | — | | | | — | |

Bond Plus Fund and Institutional Bond Plus Fund II

|

|

|

| Retail

Fund

|

| TIAA-CREF

Fund

(Retail

Class)

|

| TIAA-CREF

Fund

(Institutional

Class)

|

| Pro Forma

Combined

Institutional

Fund

(Retail

Class)

|

| Pro Forma

Combined

Institutional

Fund

(Institutional

Class)

|

|---|

| Management Fees | | | | | 0.30 | % | | | 0.30 | %1 | | | 0.30 | %1 | | | 0.30 | %1 | | | 0.30 | %1 |

| Distribution (12b-1) Fees | | | | | N/A | | | | 0.25 | %2 | | | N/A | | | | 0.25 | %2 | | | N/A | |

| Other Expenses | | | | | 0.00 | % | | | 0.09 | %3 | | | 0.23 | %3 | | | 0.09 | %3 | | | 0.24 | %3 |

Total Annual

Operating Expenses | | | | | 0.30 | % | | | 0.64 | % | | | 0.53 | % | | | 0.64 | % | | | 0.54 | % |

| Expense Reimbursements and Waivers | | | | | 0.00 | % | | | 0.25 | %4 | | | 0.18 | %4 | | | 0.25 | %4 | | | 0.19 | %4 |

Net Annual Fund

Operating Expenses | | | | | 0.30 | % | | | 0.39 | % | | | 0.35 | % | | | 0.39 | % | | | 0.35 | % |

| (1) | | This management fee has breakpoints that gradually reduce the fee rates indicated in the chart (both current and pro forma) from the amounts indicated in the chart as each Fund’s assets grow. To see the full breakpoint schedule see Exhibit C. |

| (2) | | Retail Class shares are subject to a Distribution (12b-1) Plan. The Plan provides for a maximum annual reimbursement rate of 0.25% of average daily net assets of the Fund. TPIS has contractually agreed not to seek any reimbursements under the Plan through September 30, 2007, so the table reflects the waiver of this whole amount. |

| (3) | | As this class of this particular TIAA-CREF Fund will have been in existence substantially less than a year prior to the Reorganizations, the “Other Expenses” for this class are estimated. |

| (4) | | The Advisor has contractually agreed to certain fee waivers and reimbursements that cap the amount of “Other Expenses” or “Total Annual Fund Operating Expenses” the TIAA-CREF Funds would pay through at least September 30, 2007. Please see Exhibit C for more information on the levels of these waivers and reimbursements. |

16

Bond Plus Fund and Institutional Bond Plus Fund II

|

|

|

| 1 year

|

| 3 years

|

| 5 years

|

| 10 years

|

|---|

Retail Fund | | | | $ | 31 | | | $ | 97 | | | $ | 169 | | | $ | 381 | |

TIAA-CREF Fund (Retail Class) | | | | $ | 40 | | | $ | 180 | | | | — | | | | — | |

TIAA-CREF Fund (Institutional Class) | | | | $ | 36 | | | $ | 152 | | | | — | | | | — | |

Pro Forma Combined TIAA-CREF Fund (Retail Class) | | | | $ | 40 | | | $ | 180 | | | | — | | | | — | |

Pro Forma Combined TIAA-CREF Fund

(Institutional Class) | | | | $ | 36 | | | $ | 154 | | | | — | | | | — | |

Short-Term Bond Fund and Institutional Short-Term Bond Fund II

|

|

|

| Retail

Fund

|

| TIAA-CREF

Fund

(Retail

Class)

|

| TIAA-CREF

Fund

(Institutional

Class)

|

| Pro Forma

Combined

Institutional

Fund

(Retail

Class)

|

| Pro Forma

Combined

Institutional

Fund

(Institutional

Class)

|

|---|

| Management Fees | | | | | 0.30 | % | | | 0.25 | %1 | | | 0.25 | %1 | | | 0.25 | %1 | | | 0.25 | %1 |

| Distribution (12b-1) Fees | | | | | N/A | | | | 0.25 | %2 | | | N/A | | | | 0.25 | %2 | | | N/A | |

| Other Expenses | | | | | 0.00 | % | | | 0.24 | %3 | | | 0.13 | %3 | | | 0.24 | %3 | | | 0.143 | |

Total Annual

Operating Expenses | | | | | 0.30 | % | | | 0.74 | % | | | 0.38 | % | | | 0.74 | % | | | 0.39 | % |

| Expense Reimbursements and Waivers | | | | | 0.00 | % | | | 0.29 | %4 | | | 0.08 | %4 | | | 0.29 | %4 | | | 0.09 | %4 |

Net Annual Fund

Operating Expenses | | | | | 0.30 | % | | | 0.45 | % | | | 0.30 | % | | | 0.45 | % | | | 0.30 | % |

| (1) | | This management fee has breakpoints that gradually reduce the fee rates indicated in the chart (both current and pro forma) from the amounts indicated in the chart as each Fund’s assets grow. To see the full breakpoint schedule see Exhibit C. |

| (2) | | Retail Class shares are subject to a Distribution (12b-1) Plan. The Plan provides for a maximum annual reimbursement rate of 0.25% of average daily net assets of the Fund. TPIS has contractually agreed not to seek any reimbursements under the Plan through September 30, 2007, so the table reflects the waiver of this whole amount. |

| (3) | | As this class of this particular TIAA-CREF Fund will have been in existence substantially less than a year prior to the Reorganizations, the “Other Expenses” for this class are estimated. |

| (4) | | The Advisor has contractually agreed to certain fee waivers and reimbursements that cap the amount of “Other Expenses” or “Total Annual Fund Operating Expenses” the TIAA-CREF Funds would pay through at least September 30, 2007. Please see Exhibit C for more information on the levels of these waivers and reimbursements. |

17

Short-Term Bond Fund and Institutional Short-Term Bond Fund II

|

|

|

| 1 year

|

| 3 years

|

| 5 years

|

| 10 years

|

|---|

Retail Fund | | | | $ | 31 | | | $ | 97 | | | $ | 169 | | | $ | 381 | |

TIAA-CREF Fund (Retail Class) | | | | $ | 46 | | | $ | 207 | | | | — | | | | — | |

TIAA-CREF Fund (Institutional Class) | | | | $ | 31 | | | $ | 114 | | | | — | | | | — | |

Pro Forma Combined TIAA-CREF Fund (Retail Class) | | | | $ | 46 | | | $ | 207 | | | | — | | | | — | |

Pro Forma Combined TIAA-CREF Fund

(Institutional Class) | | | | $ | 31 | | | $ | 116 | | | | — | | | | — | |

High-Yield Bond Fund and Institutional High-Yield Fund II

|

|

|

| Retail

Fund

|

| TIAA-CREF

Fund

(Retail

Class)

|

| TIAA-CREF

Fund

(Institutional

Class)

|

| Pro Forma

Combined

Institutional

Fund

(Retail

Class)

|

| Pro Forma

Combined

Institutional

Fund

(Institutional

Class)

|

|---|

| Management Fees | | | | | 0.34 | % | | | 0.35 | %1 | | | 0.35 | %1 | | | 0.35 | %1 | | | 0.35 | %1 |

| Distribution (12b-1) Fees | | | | | N/A | | | | 0.25 | %2 | | | N/A | | | | 0.25 | %2 | | | N/A | |

| Other Expenses | | | | | 0.00 | % | | | 0.06 | %3 | | | 0.10 | %3 | | | 0.06 | %3 | | | 0.11 | %3 |

Total Annual

Operating Expenses | | | | | 0.34 | % | | �� | 0.66 | % | | | 0.45 | % | | | 0.66 | % | | | 0.46 | % |

| Expense Reimbursements and Waivers | | | | | 0.00 | % | | | 0.25 | %4 | | | 0.05 | %4 | | | 0.25 | %4 | | | 0.05 | %4 |

Net Annual Fund

Operating Expenses | | | | | 0.34 | % | | | 0.41 | % | | | 0.40 | % | | | 0.41 | % | | | 0.40 | % |

| (1) | | This management fee has breakpoints that gradually reduce the fee rates indicated in the chart (both current and pro forma) from the amounts indicated in the chart as each Fund’s assets grow. To see the full breakpoint schedule see Exhibit C. |

| (2) | | Retail Class shares are subject to a Distribution (12b-1) Plan. The Plan provides for a maximum annual reimbursement rate of 0.25% of average daily net assets of the Fund. TPIS has contractually agreed not to seek any reimbursements under the Plan through September 30, 2007, so the table reflects the waiver of this whole amount. |

| (3) | | As this class of this particular TIAA-CREF Fund will have been in existence substantially less than a year prior to the Reorganizations, the “Other Expenses” for this class are estimated. |

| (4) | | The Advisor has contractually agreed to certain fee waivers and reimbursements that cap the amount of “Other Expenses” or “Total Annual Fund Operating Expenses” the TIAA-CREF Funds would pay through at least September 30, 2007. Please see Exhibit C for more information on the levels of these waivers and reimbursements. |

18

High-Yield Bond Fund and Institutional High-Yield Fund II

|

|

|

| 1 year

|

| 3 years

|

| 5 years

|

| 10 years

|

|---|

Retail Fund | | | | $ | 35 | | | $ | 109 | | | $ | 191 | | | $ | 431 | |

TIAA-CREF Fund (Retail Class) | | | | $ | 42 | | | $ | 186 | | | | — | | | | — | |

TIAA-CREF Fund (Institutional Class) | | | | $ | 41 | | | $ | 139 | | | | — | | | | — | |

Pro Forma Combined TIAA-CREF Fund (Retail Class) | | | | $ | 42 | | | $ | 186 | | | | — | | | | — | |

Pro Forma Combined TIAA-CREF Fund

(Institutional Class) | | | | $ | 41 | | | $ | 142 | | | | — | | | | — | |

Tax-Exempt Bond Fund and Institutional Tax-Exempt Bond Fund II

|

|

|

| Retail

Fund

|

| TIAA-CREF

Fund

(Retail

Class)

|

| TIAA-CREF

Fund

(Institutional

Class)

|

| Pro Forma

Combined

Institutional

Fund

(Retail

Class)

|

| Pro Forma

Combined

Institutional

Fund

(Institutional

Class)

|

|---|

| Management Fees | | | | | 0.30 | % | | | 0.30 | %1 | | | 0.30 | %1 | | | 0.30 | %1 | | | 0.30 | %1 |

| Distribution (12b-1) Fees | | | | | N/A | | | | 0.25 | %2 | | | N/A | | | | 0.25 | %2 | | | N/A | |

| Other Expenses | | | | | 0.00 | % | | | 0.10 | %3 | | | 0.20 | %3 | | | 0.10 | %3 | | | 0.21 | %3 |

Total Annual

Operating Expenses | | | | | 0.30 | % | | | 0.65 | % | | | 0.50 | % | | | 0.65 | % | | | 0.51 | % |

| Expense Reimbursements and Waivers | | | | | 0.00 | % | | | 0.25 | %4 | | | 0.15 | %4 | | | 0.25 | %4 | | | 0.16 | %4 |

Net Annual Fund

Operating Expenses | | | | | 0.30 | % | | | 0.40 | % | | | 0.35 | % | | | 0.40 | % | | | 0.35 | % |

| (1) | | This management fee has breakpoints that gradually reduce the fee rates indicated in the chart (both current and pro forma) from the amounts indicated in the chart as each Fund’s assets grow. To see the full breakpoint schedule see Exhibit C. |

| (2) | | Retail Class shares are subject to a Distribution (12b-1) Plan. The Plan provides for a maximum annual reimbursement rate of 0.25% of average daily net assets of the Fund. TPIS has contractually agreed not to seek any reimbursements under the Plan through September 30, 2007, so the table reflects the waiver of this whole amount. |

| (3) | | As this class of this particular TIAA-CREF Fund will have been in existence substantially less than a year prior to the Reorganizations, the “Other Expenses” for this class are estimated. |

| (4) | | The Advisor has contractually agreed to certain fee waivers and reimbursements that cap the amount of “Other Expenses” or “Total Annual Fund Operating Expenses” the TIAA-CREF Funds would pay through at least September 30, 2007. Please see Exhibit C for more information on the levels of these waivers and reimbursements. |

19

Tax-Exempt Bond Fund and Institutional Tax-Exempt Bond Fund II

|

|

|

| 1 year

|

| 3 years

|

| 5 years

|

| 10 years

|

|---|

Retail Fund | | | | $ | 31 | | | $ | 97 | | | $ | 169 | | | $ | 381 | |

TIAA-CREF Fund (Retail Class) | | | | $ | 41 | | | $ | 183 | | | | — | | | | — | |

TIAA-CREF Fund (Institutional Class) | | | | $ | 36 | | | $ | 145 | | | | — | | | | — | |

Pro Forma Combined TIAA-CREF Fund (Retail Class) | | | | $ | 41 | | | $ | 183 | | | | — | | | | — | |

Pro Forma Combined TIAA-CREF Fund

(Institutional Class) | | | | $ | 36 | | | $ | 147 | | | | — | | | | — | |

Money Market Fund and Institutional Money Market Fund

|

|

|

| Retail

Fund

|

| TIAA-CREF

Fund

(Retail

Class)

|

| TIAA-CREF

Fund

(Institutional

Class)

|

| Pro Forma

Combined

Institutional

Fund

(Retail

Class)

|

| Pro Forma

Combined

Institutional

Fund

(Institutional

Class)

|

|---|

| Management Fees | | | | | 0.29 | % | | | 0.10 | % | | | 0.10 | % | | | 0.10 | % | | | 0.10 | % |

| Distribution (12b-1) Fees | | | | | N/A | | | | 0.25 | %1 | | | N/A | | | | 0.25 | %1 | | | N/A | |

| Other Expenses | | | | | 0.00 | % | | | 0.04 | %2 | | | 0.05 | % | | | 0.04 | %2 | | | 0.05 | % |

Total Annual

Operating Expenses | | | | | 0.29 | % | | | 0.39 | % | | | 0.15 | % | | | 0.39 | % | | | 0.15 | % |

| Expense Reimbursements and Waivers | | | | | 0.00 | % | | | 0.25 | %3 | | | 0.00 | %3 | | | 0.25 | %3 | | | 0.00 | %3 |

Net Annual Fund

Operating Expenses | | | | | 0.29 | % | | | 0.14 | % | | | 0.15 | % | | | 0.14 | % | | | 0.15 | % |

| (1) | | Retail Class shares are subject to a Distribution (12b-1) Plan. The Plan provides for a maximum annual reimbursement rate of 0.25% of average daily net assets of the Fund. TPIS has contractually agreed not to seek any reimbursements under the Plan through September 30, 2007, so the table reflects the waiver of this whole amount. |

| (2) | | As this class of this particular TIAA-CREF Fund will have been in existence substantially less than a year prior to the Reorganizations, the “Other Expenses” for this class are estimated. |

| (3) | | The Advisor has contractually agreed to certain fee waivers and reimbursements that cap the amount of “Other Expenses” or “Total Annual Fund Operating Expenses” the TIAA-CREF Funds would pay through at least September 30, 2007. Please see Exhibit C for more information on the levels of these waivers and reimbursements. |

Money Market Fund and Institutional Money Market Fund

|

|

|

| 1 year

|

| 3 years

|

| 5 years

|

| 10 years

|

|---|

Retail Fund | | | | $ | 30 | | | $ | 93 | | | $ | 163 | | | $ | 368 | |

TIAA-CREF Fund (Retail Class) | | | | $ | 14 | | | $ | 100 | | | $ | 194 | | | $ | 468 | |

TIAA-CREF Fund (Institutional Class) | | | | $ | 15 | | | $ | 48 | | | $ | 85 | | | $ | 192 | |

Pro Forma Combined TIAA-CREF Fund (Retail Class) | | | | $ | 14 | | | $ | 100 | | | $ | 194 | | | $ | 468 | |

Pro Forma Combined TIAA-CREF Fund

(Institutional Class) | | | | $ | 15 | | | $ | 48 | | | $ | 85 | | | $ | 192 | |

20

What are the general tax consequences of the Reorganizations?

As a condition to the closing of the Reorganizations, the Retail Funds and the TIAA-CREF Funds will receive an opinion of Sutherland Asbill & Brennan LLP to the effect that each Reorganization between a Retail Fund and its corresponding TIAA-CREF Fund will qualify as a tax-free reorganization within the meaning of Section 368(a)(1) of the Internal Revenue Code of 1986, as amended (the “Code”). It is expected that neither the Retail Funds nor their respective shareholders will recognize any gain or loss as a result of the Reorganizations. If a Retail Fund sells securities prior to the closing date of the Reorganizations, there may be net realized gains or losses to the Retail Fund. Any net realized gains would increase the amount of the distribution made to the shareholders of the Retail Fund prior to the closing date of the Reorganizations. See “Information About the Reorganizations — Federal Income Tax Issues,” below. In addition, for more information on the TIAA-CREF Funds’ treatment of taxes, see the Appendix.

How do the investment objectives and principal strategies of the Retail and TIAA-CREF Funds compare?

Each Retail Fund and its corresponding TIAA-CREF Fund have substantially similar investment objectives and principal investment strategies, as described below. These investment objectives and principal investment strategies are not fundamental (except where specifically noted), which means that they may be changed by the Retail or Institutional Trust Boards of Trustees at any time without shareholder approval.

International Equity Fund and Institutional International Equity Fund

The International Equity Fund and the Institutional International Equity Fund have very similar investment objectives and principal investment strategies. Their common investment objective is favorable long-term total return, mainly through capital appreciation, and they both pursue this objective by investing in a broadly diversified portfolio that consists primarily of equity securities of foreign issuers. The Institutional International Equity Fund normally invests at least 80% of its assets in equity securities of foreign issuers and has a policy of investing in at least three countries other than the United States, while International Equity Fund has a very similar policy of investing at least 80% of its assets in equity securities of companies located in at least three countries other than the United States. Each may invest in emerging market securities or hold a significant amount of stocks of smaller, lesser-known companies. Furthermore, each has the same benchmark index, the Morgan Stanley Capital International EAFE® (Europe, Australasia, Far East) Index (the “MSCI EAFE® Index”). Additionally, each Fund may occasionally invest a portion of its assets through quantitative techniques to maintain similar overall financial characteristics to its benchmark index and to control risk.

21

Growth Equity Fund and Institutional Large-Cap Growth Fund

The Growth Equity Fund and the Institutional Large-Cap Growth Fund share a very similar investment objective of seeking favorable long-term return, mainly through capital appreciation, primarily from equity securities. Normally, each Fund invests at least 80% of its assets in equity securities that the managers believe present the opportunity for growth. With respect to the Large-Cap Growth Fund’s 80% policy, such investments must be considered to be “large-cap” securities (generally securities included in the Russell 1000® Index). However, this is not a substantive difference from the Growth Equity Fund since the Growth Equity Fund also predominantly invests in “large-cap” securities. Generally, these equity securities will be those of large capitalized companies in new and emerging areas of the economy, and companies with distinctive products or promising markets. With respect to each Fund, the active managers look for companies that they believe have the potential for strong earnings or sales growth, or that appear to be mispriced based on current earnings, assets or growth prospects. Each Fund can invest in companies expected to benefit from prospective acquisitions, reorganizations, corporate restructurings or other special situations. Foreign investments can be up to 20% of each Fund’s portfolio. The benchmark index for each Fund is the Russell 1000® Growth Index (Russell 1000® is a trademark and a service mark of the Frank Russell Company). Additionally, each Fund may occasionally invest a portion of its assets through quantitative techniques to maintain similar overall financial characteristics to its benchmark index and to control risk.

Growth & Income Fund and Institutional Growth & Income Fund