UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Under Rule 14a-12 |

deltathree, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing: |

| 1) | Amount previously paid: |

| 2) | Form, Schedule or Registration Statement No: |

deltathree, Inc.

75 Broad Street

31st Floor

New York, New York 10004

July 31, 2006

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders (the “Meeting”) of deltathree, Inc. (the “Company”) to be held at the offices of Mintz Levin Cohn Ferris Glovsky and Popeo, P.C., Chrysler Center, 666 Third Avenue, 25th Floor, New York, New York 10017, on September 8, 2006, commencing at 10:30 a.m., local time. I urge you to be present in person or represented by proxy at the Meeting.

The enclosed Notice of Annual Meeting and Proxy Statement fully describes the business to be transacted at the Meeting, which includes (i) the election of five directors of the Company, (ii) the proposal to adopt the 2006 Non-Employee Director Stock Plan, (iii) the ratification of the appointment by the Board of Directors of Brightman Almagor & Co., a member firm of Deloitte & Touche, as independent auditors for the year ending December 31, 2006, and (iv) the transaction of any other business that may properly be brought before the Meeting or any adjournment or postponement thereof.

Our Board of Directors believes that a favorable vote on each of the matters to be considered at the Meeting is in the best interests of us and our stockholders and unanimously recommends a vote “FOR” each of the matters. Accordingly, we urge you to review the accompanying material carefully and to return the enclosed proxy promptly.

The Board of Directors has fixed the close of business on July 31, 2006 as the record date for the determination of the stockholders entitled to notice of and to vote at the Meeting. Accordingly, only stockholders of record at the close of business on that date will be entitled to vote at the Meeting. A list of the stockholders entitled to vote at the Meeting will be located at our offices, 75 Broad Street, 31st Floor, New York, New York 10004, at least ten days prior to the Meeting and will also be available for inspection at the Meeting.

If you are planning to attend the meeting in person, because of security procedures, you will be required to present government-issued photo identification (e.g. driver’s license or passport) to enter the Meeting. In addition, packages and bags will be inspected, among other measures that may be employed to enhance the security of those attending the Meeting. These procedures may require additional time, so please plan accordingly.

Some or all of our directors and officers will be present to help host the Meeting and to respond to any questions that our stockholders may have. I hope you will be able to attend. Even if you expect to attend the Meeting, please sign, date and return the enclosed proxy card without delay. If you attend the Meeting, you may vote in person even if you have previously mailed a proxy.

| | | Sincerely, |

| | | |

| | | /s/ Shimmy Zimels |

| | | Shimmy Zimels |

| | | Chief Executive Officer and President |

deltathree, Inc.

75 Broad Street

31st Floor

New York, New York 10004

NOTICE OF 2006 ANNUAL MEETING OF STOCKHOLDERS

To Be Held on September 8, 2006

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the “Meeting”) of deltathree, Inc. (the “Company”) will be held at the offices of Mintz Levin Cohn Ferris Glovsky and Popeo, P.C., Chrysler Center, 666 Third Avenue, 25th Floor, New York, New York 10017, on September 8, 2006, commencing at 10:30 a.m., local time. A proxy card and a Proxy Statement for the Meeting are enclosed.

The Meeting is for the purpose of considering and acting upon:

| 1. | The election of five directors for a one-year term expiring at our Annual Meeting of Stockholders in 2007 and until their successors are duly elected and qualified; |

| 2. | The proposal to adopt the 2006 Non-Employee Director Stock Plan; |

| 3. | The ratification of the appointment by the Board of Directors of Brightman Almagor & Co., a member firm of Deloitte & Touche, as independent auditors for the year ending December 31, 2006; and |

| 4. | Such other matters as may properly come before the Meeting or any adjournment or postponement thereof. |

The close of business on July 31, 2006 has been fixed as the record date for determining stockholders entitled to notice of and to vote at the Meeting or any adjournment or postponement thereof. For a period of at least 10 days prior to the Meeting, a complete list of stockholders entitled to vote at the Meeting shall be available for examination by any stockholder during ordinary business hours at our offices at 75 Broad Street, 31st Floor, New York, New York 10004.

Information concerning the matters to be acted upon at the Meeting is set forth in the accompanying Proxy Statement.

A copy of our Annual Report for 2005, which includes our audited financial statements, is being mailed together with this proxy material.

Your vote is important. Whether or not you plan to attend the meeting in person, please complete, date, sign and return the enclosed proxy card in the accompanying pre-addressed reply envelope, which requires no postage if mailed in the united states.

| | | By Order of the Board of Directors, |

| | | |

| | | /s/ Eugene Serban |

| | | Eugene Serban |

| | | Secretary |

New York, New York

July 31, 2006

TABLE OF CONTENTS

| | | Page |

| Information About the Annual Meeting | | 1 |

| General | | 1 |

| Solicitation and Voting of Proxies | | 1 |

| Record Date and Voting Securities | | 1 |

| Quorum and Voting | | 2 |

| Security Ownership of Management and Principal Stockholders | | 4 |

| Board of Directors and Committees of the Board | | 5 |

| Shareholder Communications to the Board | | 6 |

| Audit Committee Report | | 6 |

| Proposal # 1. Election of Directors | | 8 |

| General | | 8 |

| Vote Required and Recommendation of the Board of Directors | | 8 |

| Nominees for Director | | 8 |

| Independent Directors | | 9 |

| Proposal # 2. Adoption of 2006 Non-Employee Director Stock Plan | | 10 |

| General | | 10 |

| Material Features of the 2004 Plan | | 10 |

| Federal Income Tax Considerations | | 13 |

| New Plan Benefits | | 13 |

| Vote Required and Recommendation of the Board of Directors | | 13 |

| Proposal # 3. Ratification of Appointment of Independent Auditors | | 14 |

| General | | 14 |

| Vote Required and Recommendation of the Board of Directors | | 14 |

| Audit and Non-Audit Fees | | 14 |

| Policy on Audit Committee Pre-Approval and Permissible Non-audit Services of Independent Auditors | | 14 |

| Executive Officers | | 15 |

| Executive Compensation and Other Information | | 16 |

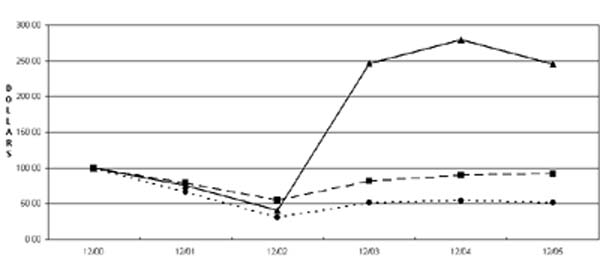

| Stock Performance Chart | | 23 |

| Certain Relationships and Related Transactions | | 24 |

| Section 16(a) Beneficial Ownership Reporting Compliance | | 24 |

| Code of Conduct and Ethics | | 24 |

| Stockholder Proposals for 2007 Annual Meeting | | 24 |

| Other Matters | | 25 |

| Miscellaneous | | 25 |

deltathree, Inc.

75 Broad Street

31st Floor

New York, New York 10004

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

To Be Held September 8, 2006

______________________

INFORMATION ABOUT THE ANNUAL MEETING

General

This Proxy Statement and accompanying proxy materials are being first mailed on or about August 3, 2006 to stockholders of deltathree, Inc. (the “Company”) at the direction of our Board of Directors (the “Board”) to solicit proxies in connection with the 2006 Annual Meeting of Stockholders (the “Meeting”). The Meeting will be held at the offices of Mintz Levin Cohn Ferris Glovsky and Popeo, P.C., Chrysler Center, 666 Third Avenue, 25th Floor, New York, New York 10017, on September 8, 2006, commencing at 10:30 a.m., local time, or at such other time and place to which the Meeting may be adjourned or postponed.

Solicitation and Voting of Proxies

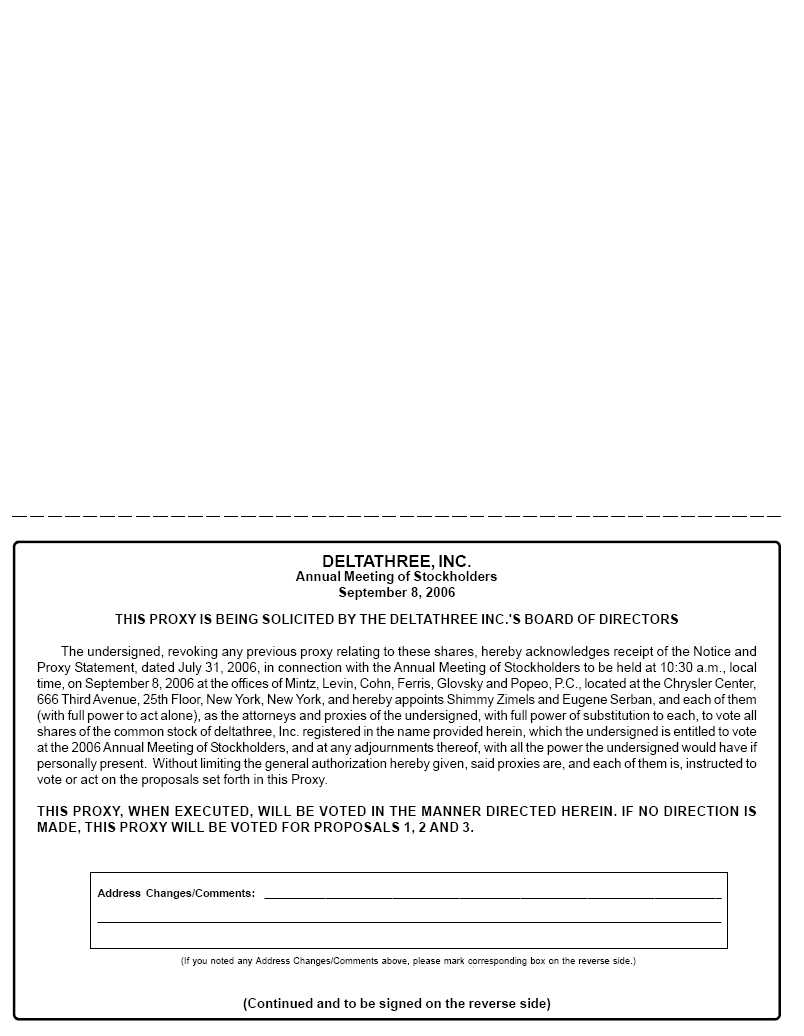

All shares represented by valid proxies at the Meeting, unless the stockholder otherwise specifies, will be voted (i) FOR the election of the five persons named under “Proposal 1-Election of Directors” as nominees for election as our directors for a one-year term expiring at our annual meeting of stockholders in 2007 and until their successors are duly elected and qualified, (ii) FOR the proposal to adopt the 2006 Non-Employee Director Stock Plan, named under “Proposal 2—Adoption of 2006 Non-Employee Director Stock Plan,” (iii) FOR the ratification of the appointment by the Board of the independent auditors named under “Proposal 3-Ratification of Appointment of Independent Auditors” and (iv) at the discretion of the proxy holders, with regard to any matter not known to the Board on the date of mailing this Proxy Statement that may properly come before the Meeting or any adjournment or postponement thereof. Where a stockholder has appropriately specified how a proxy is to be voted, it will be voted accordingly. The Board has designated Eugene Serban and Shimmy Zimels, as proxies for the solicitation on behalf of the Board of proxies of our stockholders, to vote on all matters as may properly come before the Meeting and any adjournment of the Meeting.

A proxy may be revoked at any time by providing written notice of such revocation to deltathree, Inc., 75 Broad Street, 31st Floor, New York, New York 10004, which notice must be received prior to the Meeting. If notice of revocation is not received prior to the Meeting, a stockholder may nevertheless revoke a proxy if he or she attends the Meeting and votes in person.

Record Date and Voting Securities

The close of business on July 31, 2006 is the record date (the “Record Date”) for determining the stockholders entitled to vote at the Meeting. At the close of business on July 26, 2006, we had issued and outstanding approximately 29,789,564 shares of our Class A Common Stock, par value $0.001 (the “Common Stock”), held by approximately 124 holders of record. No shares of our Class B Common Stock are outstanding. The Common Stock constitutes the only outstanding class of voting securities entitled to be voted at the Meeting.

Quorum and Voting

The presence at the Meeting, in person or by proxy relating to any matter, of the holders of a majority of the outstanding shares of Common Stock is necessary to constitute a quorum. For purposes of the quorum and the discussion below regarding the vote necessary to take stockholder action, stockholders of record who are present at the Meeting in person or by proxy and who abstain, including brokers holding customers’ shares of record who cause abstentions to be recorded at the Meeting, are considered stockholders who are present and entitled to vote at the Meeting, and thus, shares of Common Stock held by such stockholders will count toward the attainment of a

quorum. If a quorum should not be present, the Meeting may be adjourned from time to time until a quorum is obtained.

Each share of Common Stock entitles the holder thereof to one vote with respect to each proposal to be voted on at the Meeting.

Atarey Hasharon Chevra Lepituach Vehashkaot Benadlan (1991) Ltd., an Israeli company (“Atarey”) beneficially owns approximately 40% of our outstanding Common Stock. Therefore, Atarey will influence the outcome of any matter submitted to a vote of our stockholders, including the election of the directors at the Meeting.

The accompanying proxy card is designed to permit each holder of Common Stock as of the close of business on the Record Date to vote on each of the matters to be considered at the Meeting. A stockholder is permitted to vote in favor of, or to withhold authority to vote for, any or all of the nominees for election to the Board and to vote in favor of or against or to abstain from voting with respect to all of the other proposals included in this Proxy Statement.

Brokers holding shares of record for customers generally are not entitled to vote on certain matters unless they receive voting instructions from their customers. As used herein, “uninstructed shares” means shares held by a broker who has not received instructions from its customers on such matters, if the broker has so notified us on a proxy form in accordance with industry practice or has otherwise advised us that it lacks voting authority. As used herein, “broker non-votes” means the votes that could have been cast on the matter in question by brokers with respect to uninstructed shares if the brokers had received their customers’ instructions. Although there are no controlling precedents under Delaware law regarding the treatment of broker non-votes in certain circumstances, we intend to treat broker non-votes in the manner described in the Proposals set forth herein.

In December 2000, the Securities and Exchange Commission (“SEC”) adopted a rule concerning the delivery of annual disclosure documents. The rule allows us or brokers holding shares on behalf of our stockholders to send a single set of our annual report and proxy statement to any household at which two or more of our stockholders reside, if either we or the brokers believe that the stockholders are members of the same family. This practice, referred to as “householding,” benefits both stockholders and us. It reduces the volume of duplicate information received by stockholders and helps to reduce our expenses. The rule applies to our annual reports, proxy statements and information statements. Once stockholders receive notice from their brokers or from us that communications to their addresses will be “householded,” the practice will continue until stockholders are otherwise notified or until they revoke their consent to the practice. Each stockholder will continue to receive a separate proxy card or voting instruction card.

Stockholders whose households received a single set of disclosure documents this year, but who would prefer to receive additional copies, may contact our transfer agent, American Stock Transfer and Trust Company, by calling the toll free number, 1-800-937-5449.

Stockholders who do not wish to participate in “householding” and would like to receive their own sets of our annual disclosure documents in future years, should follow the instructions described below. Stockholders who share an address with another stockholder of the Company and who would like to receive only a single set of our annual disclosure documents, should follow these instructions:

| · | Stockholders whose shares are registered in their own name should contact our transfer agent, American Stock Transfer and Trust Company, and inform them of their request by calling them at 1-800-937-5449 or writing them at 6201 15th Avenue, Brooklyn, NY 11219. |

| · | Stockholders whose shares are held by a broker or other nominee should contact the broker or other nominee directly and inform them of their request. Stockholders should be sure to include their name, the name of their brokerage firm and their account number. |

SECURITY OWNERSHIP OF MANAGEMENT AND PRINCIPAL STOCKHOLDERS

The following table sets forth information with respect to the beneficial ownership of shares of our Common Stock as of July 26, 2006 by:

| | • | each person who we know owns beneficially more than 5% of our Common Stock; |

| | • | each of our directors individually; |

| | • | each of our named executive officers individually; and |

| | • | all of our executive officers and directors as a group. |

Unless otherwise indicated, to our knowledge, all persons listed below have sole voting and investment power with respect to their shares of Common Stock. Shares of Common Stock that an individual or group has the right to acquire within 60 days of July 26, 2006 pursuant to the exercise of options are deemed to be outstanding for the purpose of computing the percentage ownership of such person or group, but are not deemed outstanding for the purpose of calculating the percentage owned by any other person listed.

| | | Number | | Percentage(1) | |

| | | Shares of deltathree Class A Common Stock Beneficially Owned | |

| | | | | | |

Principal Stockholder: | | | | | |

| Atarey Hasharon Chevra Lepituach Vehashkaot Benadlan (1991) Ltd. | | | 11,927,677 | | | 40 | % |

7 Giborey Israel St., P.O. Box 8468. | | | | | | | |

| South Netanya Industrial Zone 42504, Israel. | | | | | | | |

| | | | | | | | |

Executive Officers and Directors: | | | | | | | |

Noam Bardin(2)(3) | | | 716,304 | | | 2.4 | % |

Shimmy Zimels(2)(4) | | | 672,407 | | | 2.2 | % |

Guy Gussarsky(2)(5) | | | 105,011 | | | * | |

Noam Ben-Ozer (2)(5) | | | 44,848 | | | * | |

Ilan Biran (2)(5) | | | 74,848 | | | * | |

Benjamin Broder (2)(5) | | | 20,000 | | | * | |

Joshua Maor (2)(6) | | | 90,999 | | | * | |

Lior Samuelson (2)(5) | | | 50,000 | | | * | |

All Directors and Executive Officers as a group (8 persons)(7) | | | 1,774,417 | | | 5.9 | % |

_________

| (1) | Percentage of beneficial ownership is based on 29,789,564 shares of Common Stock outstanding as of July 26, 2006. |

| (2) | The address for the director or executive officer listed is c/o the Company. |

| (3) | Includes (a) 187,366 shares of Common Stock and (b) options to purchase 528,938 shares of Common Stock. |

| (4) | Includes (a) 64,469 shares of Common Stock and (b) options to purchase 607,938 shares of Common Stock. |

| (5) | Represents options to purchase shares of Common Stock. |

| (6) | Includes (a) 16,151 shares of Common Stock and (b) options to purchase 74,848 shares of Common Stock. |

| (7) | Includes (a) 267,986 shares of Common Stock and (b) options to purchase 1,506,431 shares of Common Stock. |

BOARD OF DIRECTORS AND COMMITTEES OF THE BOARD

Our Amended and Restated Certificate of Incorporation provides that the number of members of our Board shall be not less than three and not more than thirteen. There are currently seven directors on the Board, but our Board has approved to decrease the number of members on our Board after our Meeting to five members. Accordingly, five director nominees are submitted for election at our Meeting. At each annual meeting of stockholders, directors will be elected to hold office for a term of one year and until their respective successors are elected and qualified. All of the officers identified below under “Executive Officers” serve at the discretion of our Board.

The Board had six regular and no special meetings during the fiscal year ended December 31, 2005. During the fiscal year ended December 31, 2005, each member of the Board participated in at least 75% of all Board and applicable committee meetings held during the period for which he was a director. One of our directors attended our annual meeting of stockholders held in 2005. The Board established a Compensation Committee, a Nominating and Governance Committee and an Audit Committee. The functions of these committees and their current members are set forth below.

Compensation Committee. The Compensation Committee is responsible for evaluating our compensation policies, determining our executive compensation policies and guidelines and administering our compensation plans. The Compensation Committee is responsible for the determination of the compensation of our Chief Executive Officer, and conducts its decision making process with respect to that issue without the presence of the Chief Executive Officer. All members of the Compensation Committee qualify as independent under the definition promulgated by the Nasdaq Stock Market. The Compensation Committee had five meetings during 2005. Benjamin Broder (Chairman), Noam Ben-Ozer, and Joshua Maor are the current members of the Compensation Committee. Please see also the report of the Compensation Committee set forth elsewhere in this Proxy Statement.

Nominating and Governance Committee. The Nominating and Governance Committee is responsible for assisting, identifying and recommending qualified candidates for director nominees to the Board, and leading the Board in its annual review of the Board’s performance. All members of the Nominating Committee qualify as independent under the definition promulgated by the Nasdaq Stock Market. The Nominating and Governance Committee had one meeting during 2005. Joshua Maor (Chairman), Benjamin Broder, and Noam Bardin are the current members of the Nominating and Governance Committee. The Nominating and Governance Committee may consider candidates recommended by stockholders as well as from other sources such as other directors or officers, third party search firms or other appropriate sources. For all potential candidates, the Nominating and Governance Committee may consider all factors it deems relevant, such as a candidate’s personal integrity and sound judgment, business and professional skills and experience, independence, knowledge of the industry in which we operate, possible conflicts of interest, diversity, the extent to which the candidate would fill a present need in the Board, and concern for the long-term interests of the stockholders.

In general, persons recommended by stockholders will be considered on the same basis as candidates from other sources. If a stockholder wishes to nominate a candidate to be considered for election as a director at the 2007 Annual Meeting of Stockholders using the procedures set forth in the Company's By-laws, it must follow the procedures described in the By-laws under the heading "Nomination of Directors." If a stockholder wishes simply to propose a candidate for consideration as a nominee by the Nominating and Governance Committee, it should submit any pertinent information regarding the candidate to the Chairman of the Nominating and Governance Committee by mail at 75 Broad Street, New York, New York 10004. A copy of the Nominating Committee's written charter is publicly available on the Company's website at www.deltathree.com.

Audit Committee. The Audit Committee recommends to the Board the appointment of the firm selected to serve as our independent auditors and monitors the performance of such firm; reviews and approves the scope of the annual audit and evaluates with the independent auditors our annual audit and annual financial statements; reviews with management the status of internal accounting controls; evaluates issues having a potential financial impact on us which may be brought to the Audit Committee’s attention by management, the independent auditors or the Board; evaluates our public financial reporting documents; reviews the non-audit services to be performed by the independent auditors, if any; and considers the effect of such performance on the auditor's independence. Ilan Biran (Chairman), Noam Ben-Ozer and Lior Samuelson are the current members of the Audit Committee. All members of the Audit Committee satisfy the current independence standards promulgated by the SEC and by the Nasdaq Stock Market, as such standards apply specifically to members of audit committees. The Board has determined that each of Mr. Ben-Ozer, Mr. Biran and Mr. Samuelson are “audit committee financial experts,” as the SEC has defined that term in Item 401 of Regulation S-K. The Audit Committee had five meetings during 2005.

SHAREHOLDER COMMUNICATIONS TO THE BOARD

The Board of Directors recommends that stockholders initiate any communications with the Board in writing and send them in care of our Secretary, at 75 Broad Street, 31st Floor, New York, NY 10004. This centralized process will assist the Board in reviewing and responding to stockholder communications in an appropriate manner. The name of any specific intended Board recipient should be noted in the communication. The Board has instructed our Secretary to forward such correspondence only to the intended recipients; however, the Board has also instructed our Secretary, prior to forwarding any correspondence, to review such correspondence and, in his or her discretion, not to forward certain items if they are deemed of a commercial or frivolous nature or otherwise inappropriate for the Board’s consideration. In such cases, some of that correspondence may be forwarded elsewhere in the Company for review and possible response.

AUDIT COMMITTEE REPORT

The Audit Committee of the Board of Directors, which consisted entirely of directors who met the independence and experience requirements as promulgated by the SEC and the Nasdaq Stock Market and as in effect on the date of the filing of the Company’s Annual Report on Form 10-K, furnished the following report:

The Audit Committee assists the Board in overseeing and monitoring the integrity of the Company’s financial reporting process, its compliance with legal and regulatory requirements and the quality of its internal and external audit processes. The role and responsibilities of the Audit Committee are set forth in a written Charter adopted by the Board. The Audit Committee reviews and reassesses the Charter annually and recommends any changes to the Board for approval. The Audit Committee is responsible for overseeing the Company’s overall financial reporting process, and for the appointment, compensation, retention and oversight of the work of the Company’s independent auditors, Brightman Almagor & Co., a member firm of Deloitte & Touche. In fulfilling its responsibilities for the financial statements for the fiscal year ended 2005, the Audit Committee, among other activities, reviewed and discussed our audited financial statements for such fiscal year with management and with Brightman Almagor & Co. The Audit Committee has discussed with Brightman Almagor & Co. the matters required to be discussed by American Institute of Certified Public Accountants Auditing Standards Board Statement on Auditing Standards No. 61 (“Communications with Audit Committees”) relating to the conduct of the audit. The Audit Committee has received written disclosures and a letter from Brightman Almagor & Co. including disclosures required by the Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees,” and has discussed with Brightman Almagor & Co. their independence. The Audit Committee has considered the compatibility of the provision of non-audit services with maintaining the auditor’s independence.

Based on the Audit Committee’s review of the audited financial statements and the review and discussions described in the foregoing paragraph, the Audit Committee recommended to the Board of Directors that the audited

financial statements for the fiscal year ended December 31, 2005 be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2005 for filing with the Securities and Exchange Commission.

| | | The Audit Committee |

| | | |

| | | Noam Ben-Ozer |

| | | Ilan Biran |

| | | Lior Samuelson |

The Audit Committee Report in this Proxy Statement shall not be deemed filed or incorporated by reference into any other filings by us under the Securities Act of 1933 or the Securities Exchange Act of 1934 except to the extent that we specifically incorporate this information by reference.

PROPOSAL # 1

ELECTION OF DIRECTORS

(Notice Item 1)

General

At the Meeting, five directors will be elected to the Board to serve until our next annual meeting of stockholders and until their respective successors have been elected and qualified.

Our Amended and Restated Certificate of Incorporation provides that a director shall hold office until the annual meeting for the year in which his or her term expires except in the case of elections to fill vacancies or newly created directorships. Each director is elected for a one-year term. Each of the nominees is now serving as a director on our Board.

Vote Required and Recommendation of the Board of Directors

Under our Amended and Restated By-laws, directors are elected by a majority of the outstanding shares of Common Stock present in person or represented by proxy at the Meeting, and thus, the five nominees for election as directors who receive the most votes cast will be elected. Instructions withholding authority and broker non-votes will not be taken into account in determining the outcome of the election of directors.

Unless authority to vote for any of the nominees named above is withheld, the shares represented by the enclosed proxy will be voted FOR the election as directors of such nominees. In the event that any nominee shall become unable or unwilling to serve, the shares represented by the enclosed proxy will be voted for the election of such other person as the Board of Directors may recommend in that nominee’s place. The Board has no reason to believe that any nominee will be unable or unwilling to serve.

The Board of Directors unanimously recommends that the stockholders vote FOR each of the five nominees listed herein.

Nominees for Director

Set forth below is certain information regarding each nominee as of July 26, 2006, including such individual’s age and principal occupation, a brief account of such individual’s business experience during at least the last five years and other directorships currently held.

Noam Bardin, 34 - Chairman of the Board. Mr. Bardin co-founded deltathree and served as Chief Executive Officer and President from July 2000 through June 2002. Mr. Bardin has served as Chairman of the Board since April

2002. Mr. Bardin served as Vice President of Technology and Chief Technology Officer of deltathree since June 1997 before being named President and Chief Executive Officer in April 2000. He served as Global Network Director from

November 1996 to May 1997. Prior to founding deltathree, he served as Director of Operations at Ambient Corporation. Mr. Bardin earned a B.A. in Economics from the Hebrew University (Jerusalem) and an M.P.A. from the Harvard University Kennedy School of Government.

Ilan Biran, 59 - Director. Mr. Biran has served as a director of deltathree since December 2003. Mr. Biran brings a wealth of business and management experience from the telecom and defense industries. From January

2004 through July 2006, Mr. Biran served as the Chairman of YES Satellite Television, one of the leading satellite television companies in Israel. From 1999 to 2003, Mr. Biran served as the President and CEO of Bezeq Ltd. - the Israeli PTT, with annual sales of over $2 billion and approximately 16,000 employees. Mr. Biran holds the rank of Major General (res.) in the Israeli Defense Force where, as Commander of the IDF's Central Command, he played an active role in reaching the peace agreements with Jordan. From 1996 to 1999, he served as the Director General of the Israeli Ministry of Defense, and prior to that command, he held a wide variety of senior-level positions in other Israeli units, since 1964. Mr. Biran holds a B.A. in Economics and Business Administration from Bar-Ilan University, and holds an Associate Diploma in Strategy and Political Economic Research from Georgetown University. He is also a graduate of the U.S. Marine Corps Command and Staff College. In addition, Mr. Biran's public activities include: serving as the Israeli Prime Minister's Special Coordinator for POWs and MIAs, and since 1996, has served as the Chairman of the Board of Directors of the Israeli Oil Refineries, Ltd.

Benjamin Broder, 42 - Director. Mr. Broder has served as a director of deltathree since July 24, 2005. As of 2002, Mr. Broder has served as the Finance Director of Atarey. From 1996 to 2001, Mr. Broder worked as the chief financial officer of a telecom start-up company and a bio-tech start-up company. Previously, Mr. Broder also held various positions with several leading banks, including HSBC, Bank Hapoalim, and Bank of Israel. Mr. Broder earned a B.S. degree in Economics from University of London. Mr. Broder is a Chartered Accountant in the U.K. and a C.P.A. in Israel.

Lior Samuelson, 56 - Director. Mr. Samuelson has served as a director of deltathree since August 2001. Since August 1999, Mr. Samuelson has served as a Co-Founder and Principal of Mercator Capital. His experience includes advising clients in the Technology, Communications and Consumer sectors on mergers, acquisitions and private placements. From March 1997 to August 1999, Mr. Samuelson was the President and CEO of PricewaterhouseCoopers Securities. Prior to that, he was the President and CEO of The Barents Group, a merchant bank specializing in advising and investing in companies in emerging markets. Mr. Samuelson was also the Co-Chairman of Peloton Holdings, a Private Equity management company. Before that, he was a managing partner with KPMG and a senior consultant at Booz, Allen & Hamilton. Mr. Samuelson earned B.S. and M.S. degrees in Economics from Virginia Polytechnic University.

Shimmy Zimels, 40 - President and Chief Executive Officer and Director. Mr. Zimels has served as Chief Executive Office and President since June 2002, and served as Vice President of Operations and Chief Operating Officer of deltathree since June 1997, before being named President and Chief Executive Officer in June 2002. Prior to joining deltathree, Mr. Zimels was the Controller and Vice President of Finance at Net Media Ltd., a leading Israel based Internet Service Provider, from June 1995 to June 1997. From April 1991 to May 1995, Mr. Zimels was a senior tax auditor for the Income Tax Bureau of the State of Israel. Mr. Zimels graduated with distinction from Hebrew University with a degree in Economics and Accounting and holds a Masters in Economics from Hebrew University.

Independent Directors

Our Board has determined that each member of the Board other than Mr. Zimels is independent under the definition promulgated by the Nasdaq Stock Market for independent board members. In addition, the Board has determined that the members of the Audit Committee meet the additional independence criteria required for audit committee membership.

PROPOSAL # 2

ADOPTION OF 2006 NON-EMPLOYEE DIRECTOR STOCK PLAN

(Notice Item 2)

General

We are asking our stockholders to approve our deltathree 2006 Non-Employee Director Stock Plan (the “2006 Stock Plan”). On July 5, 2006, our Board of Directors approved, subject to approval of our stockholders at the Meeting, the 2006 Stock Plan to allow for awards to non-employee directors of restricted shares of our Common Stock. If the stockholders approve the 2006 Stock Plan, it will replace our deltathree 2004 Non-Employee Director Stock Option Plan, as amended (the “2004 Option Plan”), which will be terminated, except with respect to outstanding options previously granted thereunder. The 2004 Option Plan permits only the grant of options to purchase shares of our Common Stock. The aggregate number of shares of restricted stock that may be issued under the 2006 Stock Plan shall be 500,000 shares, which represents the number of additional shares underlying option grants under the 2004 Option Plan approved for issuance by our stockholders at our 2005 annual stockholders’ meeting. As of this date, we have not issued options representing any of the 500,000 shares that were approved for issuance under our 2004 Option Plan. Since February 2006, no options have been granted under the 2004 Option Plan.

The 2006 Stock Plan is intended to help the Company attract and retain highly qualified individuals to serve as non-employee directors, and to align further their interests with the long-term interests of the Company’s stockholders by paying non-employee director compensation in the form of restricted stock. The restricted stock must generally be held by the non-employee director for one year while still a member of the Board or the non-employee director will forfeit a certain portion of the restricted shares based on the number of days remaining in such year following termination of service as a member of the Board. If the Company reacquires (at not more than its original issuance price) any shares of restricted stock or if any shares of restricted stock are forfeited, or otherwise cancelled or terminated, such shares which were subject to such restricted stock award shall again be available for issuance from time to time pursuant to the 2006 Stock Plan.

Historically, our non-employee directors have generally only been granted stock options as long-term equity compensation. The Company proposes to adopt the 2006 Stock Plan in order to grant awards of restricted stock, instead of granting awards of stock options under the current 2004 Option Plan. The stockholders are now being asked to approve the Plan.

The essential features of the 2006 Stock Plan, as proposed, are summarized below. The summary is qualified in its entirety by reference to the full text of the 2006 Stock Plan, as proposed to be adopted, which is attached as Appendix A to this Proxy Statement.

Because our non-employee directors are otherwise eligible to receive restricted stock grants under the proposed 2006 Stock Plan, they have an interest in this proposal.

Material Features of the 2006 Stock Plan

The following paragraphs provide a summary of the principal features of our 2006 Stock Plan and its operation.

The purposes of the 2006 Stock Plan are to enable us to attract, maintain and motivate qualified directors and to enhance a long-term mutuality of interest between our directors and stockholders of our Common Stock by granting our directors restricted stock.

General. The 2006 Stock Plan provides for the automatic grant of restricted stock. The aggregate number of shares of restricted stock that may be issued under the 2006 Stock Plan shall be 500,000 shares. A grant of restricted stock is a grant of shares of the Company’s Common Stock that, at the time of issuance, are subject to certain forfeiture provisions, and thus are restricted as to transferability until such forfeiture restrictions have lapsed. The restrictions on the restricted stock issued pursuant to the Plan relate to continued service on the Company’s board of directors (lapsing on a monthly basis). If the Company reacquires (at not more than its original issuance price) any shares of restricted stock or if any shares of restricted stock are forfeited, or otherwise cancelled or terminated, such shares which were subject to such restricted stock award shall again be available for issuance from time to time pursuant to the 2006 Stock Plan.

Except to the extent restricted under the terms of the 2006 Stock Plan, a non-employee director granted a restricted stock award will have the right to receive dividends or any other distributions paid with respect to those shares. During the restricted period (i.e., prior to the lapse of applicable forfeiture provisions), the restricted stock generally may not be sold, transferred, pledged, hypothecated, margined, or otherwise encumbered by the non-employee director.

Administration. The 2006 Stock Plan is administered by the Board. The Board may delegate its powers and functions hereunder to a duly appointed committee of the Board. The Board shall have full authority to interpret the Plan; to establish, amend and rescind rules for carrying out the Plan; to administer the Plan; to incorporate in any option agreement such terms and conditions, not inconsistent with the Plan, as it deems appropriate; to construe the respective restricted stock agreements and the Plan; and to make all other determinations and to take such steps in connection with the Plan as the Board, in its discretion, deems necessary or desirable for administering the Plan.

Non-Discretionary Grants

Initial Restricted Stock Awards. Each director who is not an employee of the Company will be granted 4,000 shares of restricted stock on the date he or she joins the Board.

Subsequent Restricted Stock Awards. On the first business day after each annual meeting of stockholders of the Company occurring during the term of the Plan commencing with the Meeting, each non-employee director who meets the guidelines for Board service and who continues to be a non-employee director following such annual meeting shall automatically be granted 4,000 shares of restricted stock; provided that no Subsequent Restricted Stock Award shall be made to any non-employee director who has not served as a director of the Company, as of the time of such annual meeting, for at least six months.

Committee Chairman Awards. Each non-employee director who is appointed as chairman of a standing committee of the Board (and has not served as the chairman of such committee immediately prior to the appointment) shall be automatically granted 4,000 shares of restricted stock on the date of such appointment. Each non-employee director who serves as a chairman of the full Board or of a standing committee of the Board other than the audit committee, and who meets the guidelines for Board service, immediately following each annual meeting of the Company’s stockholders, commencing with the Meeting, shall be granted an additional 4,000 shares of restricted stock; provided that no Committee Chairman Award shall be made to: any non-employee director who has not served as a director of the Company, as of the time of such annual meeting, for at least six months, and no Committee Chairman Award shall be made to any Eligible Director who has received a Committee Chairman award for such service on the same committee within the past six months.

Audit Committee Service Awards. Each non-employee director who is appointed as a member of the audit committee of the Board (and has not served as a member of such committee immediately prior to that appointment) shall be automatically granted 4,000 shares of restricted stock on the date of such appointment. Each non-employee director who serves as a member of the audit committee of the Board, and who meets the guidelines for Board service, immediately following each annual meeting of the Company’s stockholders, commencing with the Meeting, shall be granted an additional 4,000 shares of restricted stock; provided that: no Audit Committee Service Award shall be made to any non-employee director who has not served as a director of the Company, as of the time of such annual meeting, for at least six months, and no Audit Committee Award shall be made to any Eligible Director who has received an Audit Committee award for such service within the past six months. In addition, the chairman of the audit committee of the Board shall be granted an additional 2,000 shares of restricted stock.

Annual Limitation. Notwithstanding the foregoing, a non-employee director shall receive a maximum of 12,000 shares of restricted stock during any single calendar year.

Forfeiture. Each share of restricted stock under the Plan shall become fully vested and nonforfeitable upon the first anniversary of the date of grant. If a non-employee director ceases to serve as a member of the Board for any reason (including, resignation, failure to stand for re-election or failure to be re-elected), any award of restricted stock shall become vested and nonforfeitable as to that number of shares which is equal to the number of shares of common stock subject to such award times a fraction, the numerator of which is the number of days actually served as a director during the restricted period and the denominator of which is the total number of days during the restricted period. Any portion of any restricted stock that has not become nonforfeitable at the date of a non-employee director’s termination of service shall be forfeited as of such date.

Change in Control. Notwithstanding anything to the contrary in the Plan, shares of restricted stock granted pursuant to the Plan will become fully vested and nonforfeitable in full upon a “change in control.” A “change in control” shall arise if, at any time while the non-employee director is a member of the Company’s Board any one or more of the following events occurs:

(i) The Company is merged, consolidated or reorganized into or with another corporation, or other entity and, as a result thereof, less than 50% of the outstanding stock or other capital interests of the surviving, resulting or acquiring corporation, person, or other entity is owned, in the aggregate, by the stockholder or stockholders of the Company immediately prior to such merger, consolidation or reorganization;

(ii) The Company sells all or substantially all of its business or assets (or both) to any other corporation, person, or other entity, less than 50% of the outstanding, voting stock or other capital interests of which are owned, in the aggregate, by the stockholders of the Company, directly or indirectly, immediately prior to or after such sale; or

(iii) Any “Person” (as such term is used in Sections 13(d) and 14(d) of the Securities Exchange Act of 1934, as amended) other than a Person who is an affiliate as of the effective date of the Plan becomes the “Beneficial Owner” (as defined in Rule 13d-3 under said Act), directly or indirectly, of securities of the Company representing 50% or more of the total voting power represented by the Company’s then outstanding voting securities (excluding for this purpose the Company or its Affiliates or any employee benefit plan of the Company) pursuant to a transaction or a series of related transactions which the Board of Directors does not approve.

Transferability of Awards. No shares of restricted stock under the Plan shall be transferable by the non-employee otherwise than by will or under the applicable laws of descent and distribution, unless such transfer shall be (a) acceptable under Rule 16b-3 and is approved by the Board or its authorized delegate or (b) if the restricted stock agreement pursuant to which the restricted stock grant is made so provides, by gift or domestic relations order, to (i) the spouse, children or grandchildren of such non-employee director (collectively, “Family Members”), (ii) a trust or trusts for the exclusive benefit of such Family Members, or (iii) a partnership or limited liability company in which such Family Members and trusts for the exclusive benefit of such Family Members are the only partners or members, as the case may be.

Termination and Amendment. This Plan shall terminate at the close of business on September 23, 2014, unless sooner terminated by action of the Board or stockholders of the Company. The Board at any time or from time to time may amend this Plan to effect (i) amendments necessary or desirable in order that this Plan and the options granted thereunder shall conform to all applicable laws and regulations and (ii) any other amendments deemed appropriate. Notwithstanding the foregoing, (i) the provisions of the Plan relating to (A) the number of shares to be granted under the Plan or subject to any restricted stock award granted to any non-employee director, (B) the timing of any restricted stock grant and (C) the material terms of the restricted stock (including, without limitation, the time of any such grant) may not be amended without the approval of the Company’s stockholders and (ii) the Board may not effect any amendment that would require the approval of the stockholders of the Company under any applicable laws or the listing requirements of The Nasdaq Stock Market (if applicable to the Company at the time such amendment is adopted or will be effective) unless such approval is obtained.

Federal Income Tax Considerations

The following summary of the federal income tax consequences of the 2006 Stock Plan transactions is based upon federal income tax laws in effect on the date of this Proxy Statement. This summary does not purport to be complete, and does not discuss, state, local or non-U.S. tax consequences.

No taxable income is recognized by a recipient of a restricted stock award upon the grant of such award. However, a recipient of a restricted stock award under the 2006 Stock Plan will incur taxable income based on the fair market value of the Company’s common stock when the forfeiture provisions on his or her award, or any portion thereof, lapse. Such taxable income will generally be recognized as ordinary income.

The recipient may, however, elect under Section 83(b) of the Internal Revenue Code to include as ordinary income in the year he or she receives the restricted stock award the fair market value of the award on the date of issuance. If the Section 83(b) election is made, the recipient will not recognize any additional income as and when the forfeiture provisions lapse.

New Plan Benefits

The following table shows the estimated restricted stock awards to be issued under the 2006 Stock Plan following the Meeting during the remainder of 2006 (and in each subsequent calendar year) to all current director nominees who are not executive officers.

NEW PLAN BENEFITS

2006 Stock Plan

Name and Position | Number of Shares |

| Non-Executive Directors | 120,000 |

Vote Required and Recommendation of the Board of Directors

The affirmative vote of a majority of the shares present or represented by proxy and entitled to vote for this proposal at the Meeting is required to approve the 2006 Non-Employee Director Stock Plan. Proxies solicited by the Board of Directors will be voted in favor of this proposal unless a stockholder has indicated otherwise on the proxy. Abstentions will be treated as votes against this proposal. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name on this proposal, therefore, any shares not voted by a customer will be treated as a broker non-vote, such broker non-votes will have no effect on the results of this vote.

The Board of Directors unanimously recommends that stockholders vote FOR the approval of the adoption of the 2006 Non-Employee Director Stock Plan.

PROPOSAL # 3

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

(Notice Item 3)

General

Subject to ratification by our stockholders, on the recommendation of the Audit Committee, the Board has reappointed Brightman Almagor & Co., a member firm of Deloitte & Touche, as independent auditors to audit our financial statements for the fiscal year ending December 31, 2006.

Representatives of Brightman Almagor & Co. are invited to the Meeting and will have an opportunity to make a statement if they so desire and may be available to respond to appropriate questions.

Vote Required and Recommendation of the Board of Directors

The ratification of the selection of Brightman Almagor & Co. as our independent auditors for the fiscal year ending December 31, 2006 will require the affirmative vote of the holders of a majority of the outstanding shares of Common Stock present at the Meeting, in person or represented by proxy, and entitled to vote. In determining whether the proposal has received the requisite number of affirmative votes, abstentions will be counted and will have the same effect as a vote against the proposal. Broker non-votes will be disregarded and will have no effect on the outcome of the vote.

The Board believes that a vote for the proposal to ratify the appointment by the Board of the independent auditors as described above is in the best interests of our stockholders and us and unanimously recommends a vote “FOR” such proposal.

Audit and Non-Audit Fees

The following table presents fees for professional audit services rendered by Brightman Almagor & Co. for the audit of the Company's annual financial statements for the years ended December 31, 2005, and December 31, 2004, and fees billed for other services rendered by Brightman Almagor & Co. during those periods.

| | | 2005 | | 2004 | |

Audit fees | | $ | 62,000 | | $ | 54,000 | |

Audit related fees | | | − | | | 3,000 | |

Tax fees | | | 9,000 | | | 11,000 | |

All Other Fees | | | − | | | − | |

Total | | $ | 71,000 | | $ | 68,000 | |

In the above table, in accordance with the SEC’s definitions and rules, “audit fees” are fees we paid Brightman Almagor & Co. for professional services for the audit of our annual financial statements and review of financial statements included in our quarterly reports filed with the SEC, as well as work generally only the independent auditor can reasonably be expected to provide, such as statutory audits and consultation regarding financial accounting and/or reporting standards; “audit-related fees” are fees billed by Brightman Almagor & Co. for assurance and related services that are reasonably related to the performance of the audit or review of our financial statements, “tax fees” are fees for tax compliance, tax advice and tax planning; and “all other fees” are fees billed by Brightman Almagor & Co for any services not included in the first three categories.

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-audit Services of Independent Auditors

Consistent with SEC policies regarding auditor independence, the Audit Committee has responsibility for appointing, setting compensation and overseeing the work of the independent auditor. In recognition of this responsibility, the Audit Committee has established a policy to pre-approve all audit and permissible non-audit services provided by the independent auditor.

Prior to engagement of the independent auditor for the next year's audit, management will submit an aggregate of services expected to be rendered during that year for each of four categories of services to the Audit Committee for approval.

1. Audit services include audit work performed in the preparation of financial statements, as well as work that generally only the independent auditor can reasonably be expected to provide, including comfort letters, statutory audits, and attest services and consultation regarding financial accounting and/or reporting standards.

2. Audit-Related services are for assurance and related services that are traditionally performed by the independent auditor, including due diligence related to mergers and acquisitions, employee benefit plan audits, and special procedures required to meet certain regulatory requirements.

3. Tax services include all services performed by the independent auditor's tax personnel except those services specifically related to the audit of the financial statements, and includes fees in the areas of tax compliance, tax planning, and tax advice.

4. Other Fees are those associated with services not captured in the other categories. The Company generally does not request such services from the independent auditor.

Prior to engagement, the Audit Committee pre-approves these services by category of service. The fees are budgeted and the Audit Committee requires the independent auditor and management to report actual fees versus the budget periodically throughout the year by category of service. During the year, circumstances may arise when it may become necessary to engage the independent auditor for additional services not contemplated in the original pre-approval. In those instances, the Audit Committee requires specific pre-approval before engaging the independent auditor.

The Audit Committee may delegate pre-approval authority to one or more of its members. The member to whom such authority is delegated must report, for informational purposes only, any pre-approval decisions to the Audit Committee at its next scheduled meeting.

EXECUTIVE OFFICERS

Set forth below is a brief description of the present and past business experience of each of the persons who serve as our executive officers or key employees who are not also serving as directors.

Guy Gussarsky, 34, Executive Vice President of Sales and Business Development. Mr. Gussarsky joined deltathree in August 2000, and most recently became Executive Vice President of Sales and Business Development in January 2006. Mr. Gussarsky is responsible for all aspects of the Company's worldwide sales and business development activities. Prior to assuming this role, Mr. Gussarsky held several other positions within deltathree, including Vice President of Business Development for Europe, Middle East and Africa (EMEA) as well as Director of Products. Prior to joining deltathree, Mr. Gussarsky worked at I Gornitzky and Co., a leading Israeli law firm, and also served as an officer in the Israeli Special Forces. Mr. Gussarsky graduated with a distinction from Hebrew University with a degree in Law and Accounting.

EXECUTIVE COMPENSATION AND OTHER INFORMATION

Summary Compensation Table

The following table sets forth certain summary information concerning the compensation paid or awarded for services rendered during each of our last three fiscal years to our chief executive officer and each of our other most highly compensated executive officers in 2003, 2004 and 2005 whose total salary and bonus exceeded $100,000. These two executive officers are referred to in this report as “named executive officers”.

| | | Annual Compensation | | Long-Term Compensation | |

Name and Principal Position | | Year | | Salary ($) | | Bonus ($) | | Securities Underlying Options (#) | | All Other Compensation | |

Shimmy Zimels President and Chief Executive Officer and former Chief Operating Officer | | | 2005 2004 2003 | | $ | 248,800 180,000 180,000 | (1) | $ $ | 50,000 125,050 — | | | 0 80,000 85,000 | | | — — — | |

Paul C. White (2) Chief Financial Officer | | | 2005 2004 2003 | | $ | 235,300 180,000 180,000 | | | — $ 94,100 — | (3) | | — 75,000 65,000 | | | — — — | |

Guy Gussarsky Executive Vice President of Sales and Business Development | | | 2005 2004 | | $ | 182,000 142,000 | | $ $ | 30,000 53,000 | | | 0 50,000 | | | — — | |

| (1) | $48,800 was deferred by Mr. Zimels until mid-2006. |

| (2) | Mr. White resigned effective as of February 28, 2006. |

| (3) | In connection with Mr. White’s resignation, Mr. White received certain severance and benefits in lieu of any bonuses for his performance during 2005. For additional information about the severance and benefits, please see the information under “Executive Compensation - Employment Agreements, Termination of Employment and Change-in-Control Arrangements.” |

Option Exercises in Fiscal 2005 and Year-End Option Values

The following table sets forth information for the named executive officers with respect to option exercises during 2005 and the value as of December 31, 2005 of unexercised in-the-money options held by each of the named executive officers.

Name | Shares Acquired On Exercise (#) | | Value Realized ($) | | Number of Securities underlying Unexercised Options at Year End (#) Exercisable /Unexercisable | | Value of Unexercised In-The-Money Options at Year-End ($) Exercisable /Unexercisable |

| Shimmy Zimels | 41,000 | | 196,775 | | 526,271/81,667 | | 1,599,864/248,268 |

| Paul C. White | 56,598 | | 287,704 | | 50,000/293,402 (1) | | 826,074/217,868 |

| Guy Gussarsky | 39,999 | | 155,463 | | 58,344/46,667 | | 177,335/141,868 |

(1) In connection with Mr. White’s resignation, unvested stock options for 21,667 shares of our common stock were accelerated to vest on February 28, 2006, his separation date. For additional information, please see the information under “Executive Compensation - Employment Agreements, Termination of Employment and Change-in-Control Arrangements.”

Equity Compensation Plan Information

The following table provides certain aggregate information with respect to shares of our common stock that may be issued under our equity compensation plans in effect as of December 31, 2005.

| Plan Category | Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights | Weighted Average Exercise Price of Outstanding Options, Warrants and Rights | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (excluding securities reflected in first column) |

| Equity Compensation Plans Approved by Security Holders (1) | 2,762,686 | $2.58 | 3,114,950 |

| Equity Compensation Plans not Approved by Security Holders | N/A | N/A | N/A |

| Total | 2,762,686 | $2.58 | 3,114,950 |

| (1) | These plans consist of our 2004 Stock Incentive Plan and 2004 Non-Employee Director Stock Option Plan. The table also includes information for equity compensation plans that have expired. Our 1999 Directors’ Plan and our 1999 Employee Stock Incentive Plan have expired. As of December 31, 2005 under our expired 1999 Employee Stock Incentive Plan, a total of 1,935,284 shares of our common stock were issuable upon the exercise of outstanding vested options, and 101,176 shares of our common stock will be issuable upon vesting of such options. As of December 31, 2005 under our expired 1999 Directors’ Plan, a total of 119,392 shares of our common stock were issuable upon the exercise of outstanding vested options, and 0 shares of our common stock will be issuable upon vesting of such options. |

Compensation Committee Interlocks and Insider Participation

Executive compensation decisions in 2005 were made by the Compensation Committee. During 2005, no interlocking relationship existed between our Board and the board of directors or compensation committee of any other company.

Director Compensation

At our Annual Meeting on December 20, 2005, each of our non-management directors became eligible to receive $10,000 for their services as directors, through the next Annual Meeting date. We paid $10,000 to each outside director in 2006. Directors are reimbursed for the expenses they incur in attending meetings of the Board and Board committees.

Currently, our non-employee directors also receive options to purchase our Common Stock under our 2004 Non-Employee Director Stock Option Plan. A new equity compensation plan is being submitted to our stockholders for approval at our Meeting, which is described in Proposal number 2 of this Proxy Statement.

2004 Non-Employee Director Stock Option Plan

The purposes of the 2004 Non-Employee Director Stock Option Plan, as amended, are to enable us to attract, maintain and motivate qualified directors and to enhance a long-term mutuality of interest between our directors and stockholders of our Common Stock by granting our directors options to purchase our shares.

This plan provides for the automatic grant of nonstatutory stock options. Options granted under this plan are not intended to qualify as “incentive stock options” within the meaning of Section 422 of the Code. The aggregate number of shares of Common Stock that may be issued under this plan cannot exceed (a) 851,216 shares, plus (b) such additional shares of Common Stock as are represented by Options previously granted under the 1999 Directors Plan which are cancelled or expire after the date of stockholder approval of this plan without delivery of shares of stock by the Company.

Initial Option Awards. Each director who is not an employee of the Company will be granted options to acquire 10,000 shares of Common Stock on the date he or she joins the Board.

Subsequent Option Awards. On the first business day after each annual meeting of stockholders of the Company occurring during the term of this plan, each non-employee director who meets the guidelines for Board service and who continues to be a non-employee director following such annual meeting shall automatically be granted an option to purchase 10,000 shares of Common Stock; provided that no Subsequent Option Award shall be made to any non-employee director who has not served as a director of the Company, as of the time of such annual meeting, for at least six months.

Committee Chairman Awards. Each non-employee director who is appointed as chairman of a standing committee of the Board (and has not served as the chairman of such committee immediately prior to the appointment) shall be automatically granted an option to purchase 10,000 shares of Common Stock on the date of such appointment. Each non-employee director who serves as a chairman of the full Board or of a standing committee of the Board other than the audit committee, and who meets the guidelines for Board service, immediately following each annual meeting of the Company’s stockholders, shall be granted an option to purchase an additional 10,000 shares of Common Stock; provided that no Committee Chairman Award shall be made to: any non-employee director who has not served as a director of the Company, as of the time of such annual meeting, for at least six months, and no Committee Chairman Award shall be made to any Eligible Director who has received a Committee Chairman award for such service on the same committee within the past six months.

Audit Committee Service Awards. Each non-employee director who is appointed as a member of the audit committee of the Board (and has not served as a member of such committee immediately prior to that appointment) shall be automatically granted an option to purchase 10,000 shares of Common Stock on the date of such appointment. Each non-employee director who serves as a member of the audit committee of the Board, and who meets the guidelines for Board service, immediately following each annual meeting of the Company’s stockholders, shall be granted an option to purchase an additional 10,000 shares of Common Stock; provided that: no Audit Committee Service Award shall be made to any non-employee director who has not served as a director of the Company, as of the time of such annual meeting, for at least six months, and no Audit Committee Award shall be made to any Eligible Director who has received an Audit Committee award for such service within the past six months. In addition, the chairman of the audit committee of the Board shall be granted an additional option to purchase 5,000 shares of Common Stock.

Notwithstanding the foregoing, a non-employee director shall receive a maximum of options to purchase 30,000 shares of Common Stock during any single calendar year. The exercise price per share of Common Stock of each option granted pursuant to this plan shall be equal to the fair market value per share on the date of grant. If not previously exercised, each option shall expire on the earlier of (i) the tenth anniversary of the date of the grant thereof and (ii) on the first anniversary of the termination of the non-employee director’s status as a director of the Company. Each option granted under this plan shall become fully vested and exercisable on the first anniversary of the date of grant. In addition, options granted pursuant to this plan will become exercisable in full upon a “change in control” as defined in this plan. This plan terminates at the close of business on September 23, 2014, unless sooner terminated by action of the Board or stockholders of the Company.

We are asking our stockholders to approve the 2006 Stock Plan at the Meeting. If the stockholders approve the 2006 Stock Plan, the terms of such plan shall govern immediately following the Meeting, and the 2004 Non-Employee Director Stock Option Plan will be terminated.

Employment Agreements, Termination of Employment and Change-in-Control Arrangements

We currently have an employment agreement in place with Mr. Zimels, with the following principal terms:

| · | The agreement is effective from April 26, 2004 through August 31, 2006 and, thereafter, is automatically extended for the same duration on the expiration date and on each expiration date thereafter unless either party provides the other party with written notice of non-renewal at least ninety days prior to expiration of a term, provided that the executive provides notice of renewal to the Compensation Committee six months prior to expiration of the term. |

| · | Pursuant to the agreement, Mr. Zimels was entitled to receive a base salary of $248,800 during 2005. Such base salary is increased on each January 1, commencing January 1, 2005, by an amount equal to the base salary then in effect, multiplied by the applicable cost of living index during the prior year. The employee’s base salary, as adjusted for cost of living increases, may be further increased at the option and in the discretion of our Board. As such, in 2006, Mr. Zimels is entitled to receive a base salary of $258,000. |

| · | The employee’s options are immediately exercisable in full upon a change of control. The employee’s options, following any termination of the employee’s employment, other than for cause, remain exercisable for the lesser of two years and the remaining term of the options. |

| · | If employee’s employment is terminated by us without cause or by the employee for good reason (which includes, without limitation, a reduction in salary and/or bonus opportunity, a change of control and a material reduction in duties and responsibilities), the employee is entitled to receive previously earned, but unpaid salary, vested benefits and a payment equal to their annual base salary as in effect immediately prior to the termination date. |

| · | If employee dies or is unable to perform his duties, he or his representative, estate or beneficiary will be paid, in addition to any previously earned but unpaid salary and vested benefits, 12 months’ total base salary reduced, in the case of disability, by any disability benefits they receive. |

In connection with Paul White's resignation from our company, a Separation and Release Agreement was approved by the Compensation Committee of our Board and executed by us and Mr. White on February 13, 2006. The Separation Agreement provides that Mr. White's resignation as an employee of the Company will be effective as of February 28, 2006, or the separation date, and that Mr. White will continue to be available to us in order to ensure a smooth transition for a reasonable time period after the separation date. In addition, the Separation Agreement provides that Mr. White: (i) will continue to receive his base salary until the separation date; (ii) will receive a lump sum separation payment of $90,000; (iii) will continue to participate in our benefit plans at his current levels until the earlier of the date he enrolls in a comparable benefits plan with another employer or a period of six (6) months after the separation date; (iv) will have his unvested stock options for 21,667 shares of our common stock at the exercise price of $1.75 accelerated to vest on the separation date; and (v) will be entitled to expense reimbursement due through the separation date. Mr. White will not be entitled to any other payments, bonuses, severance, vacation pay or any other amounts that are, or may be, due to him under his employment agreement with us, as amended, or any other agreement. Mr. White will not be eligible for any bonus for 2005 under our 1999 Performance Incentive Plan or under any other plan. Under the terms of the Separation Agreement, neither we nor Mr. White have any further obligations under his employment agreement with us other than the parties' obligations in connection with non-competition and non-solicitation, confidentiality, company property, no disparagement, our obligation of indemnification, and any additional items specifically provided in the Separation Agreement. In addition, we have agreed that in the event of Mr. White's death after the date of the Separation Agreement, his surviving spouse shall be entitled to certain unpaid payment amounts, as long as he did not breach of the Separation Agreement prior to his death. Pursuant to the Separation Agreement, Mr. White has provided us with a general liability release of all claims arising out of his employment and separation from our Company.

Compensation Committee Report on Executive Compensation

The Compensation Committee is responsible for recommending to the Board of Directors the overall executive compensation strategy of the Company and for the ongoing monitoring of the compensation strategy’s implementation. In addition to recommending and reviewing the compensation of the executive officers, it is the responsibility of the Compensation Committee to recommend new incentive compensation plans and to implement changes and improvements to existing compensation plans, including the 1999 Performance Incentive Plan, the 1999 Amended and Restated Performance Incentive Plan, the 2004 Stock Incentive Plan, as amended, and the 2004 Non-Employee Director’s Plan, as amended. The Compensation Committee makes its compensation determinations based upon its own analysis of information it compiles and the business experience of its members.

Overall Policy

The Compensation Committee believes that the stability of the Company’s management team, as well as the Company’s ability to continue to incentivize management and to attract and retain highly qualified executives for its expanding operations, will be a contributing factor to the Company’s continued growth and success. In order to promote stability, growth and performance, and to attract new executives, the Company’s strategy is to compensate its executives with an overall package that the Company believes is competitive with those offered by similarly situated companies and which consists of (i) a stable base salary set at a sufficiently high level to retain and motivate these officers but generally targeted to be in the lower half of its peer group comparables, (ii) an annual bonus linked to the Company’s overall performance each year and to the individual executive’s performance each year and (iii) equity-related compensation which aligns the financial interests of the Company’s executive officers with those of the Company’s stockholders by promoting stock ownership and stock performance through the grant of stock options and stock appreciation rights, restricted stock and other equity and equity-based interests under the Company’s various plans.

Executive officers are also entitled to customary benefits generally available to all employees of the Company, including group medical and life insurance. Base salary, bonuses and benefits are paid by the Company and its subsidiaries.

Federal Income Tax Deductibility of Executive Compensation

Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), limits the amount of compensation a publicly held corporation may deduct as a business expense for Federal income tax purposes. The limit, which applies to a company’s chief executive officer and the four other most highly compensated executive officers, is $1 million (the “Deductibility Limit”), subject to certain exceptions. The exceptions include the general exclusion of performance-based compensation from the calculation of an executive officer’s compensation for purposes of determining whether his or her compensation exceeds the Deductibility Limit. The Compensation Committee has determined that compensation payable to the executive officers should generally meet the conditions required for full deductibility under section 162(m) of the Code. While the Company does not expect to pay its executive officers compensation in excess of the Deductibility Limit, the Compensation Committee also recognizes that in certain instances it may be in the best interest of the Company to provide compensation that is not fully deductible.

Base Salary

The base salary for Mr. Zimels is pursuant to his employment agreement with us. The base salary for Mr. Gussarsky is set at a level that is commensurate with his responsibilities and competitive with similar positions at other comparable companies.

Annual Incentive Bonuses

The Board established the 1999 Performance Incentive Plan to enable the Company and its subsidiaries to attract, retain, motivate and reward the best qualified executive officers and key employees by providing them with the opportunity to earn competitive compensation directly linked to the Company’s performance. The Performance Incentive Plan is effective through and including the year 2005, unless extended or earlier terminated by the Board of Directors. As part of the Performance Incentive Plan, the Compensation Committee may determine that any bonus payable under the Performance Incentive Plan be paid in cash, in shares of Common Stock or in any combination thereof, provided that at least 50% of such bonus is required to be paid in cash. In addition, the Performance Incentive Plan permits a participant to elect to defer payment of his or her bonus on terms and conditions established by the Compensation Committee. No more than 400,000 shares of Common Stock may be issued under the Performance Incentive Plan.

Under the 1999 Performance Incentive Plan, bonuses may be payable if the Company meets any one or more of the following performance criteria, which are set annually by the Compensation Committee: (i) revenues; (ii) operating income; (iii) gross profit margin; (iv) net income; (v) earnings per share; (vi) maximum capital or marketing expenditures; or (vii) targeted levels of customers.