UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

| | x | Preliminary Proxy Statement |

| | o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | o | Definitive Proxy Statement |

| | o | Definitive Additional Materials |

| | o | Soliciting Material Under Rule 14a-12 |

deltathree, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | x | No fee required. |

| | o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| | 5) | Total fee paid: |

| | |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing: |

| | 1) | Amount previously paid: |

| | 2) | Form, Schedule or Registration Statement No: |

| | 3) | Filing Party: |

| | 4) | Date Filed: |

| | | |

deltathree, Inc.

419 Lafayette Street

Second Floor

New York, New York 10003

Dear Stockholder:

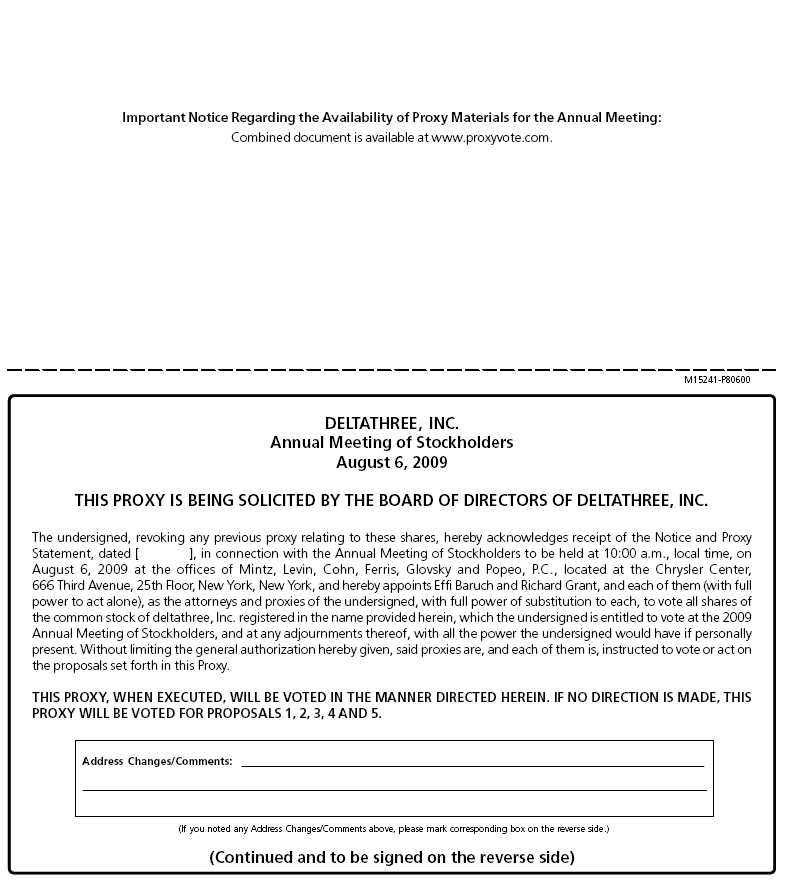

You are cordially invited to attend the Annual Meeting of Stockholders (the “Meeting”) of deltathree, Inc. (the “Company”) to be held at the offices of Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C., Chrysler Center, 666 Third Avenue, 25th Floor, New York, New York 10017, on August 6, 2009, commencing at 10:00 a.m., local time. I urge you to be present in person or represented by proxy at the Meeting.

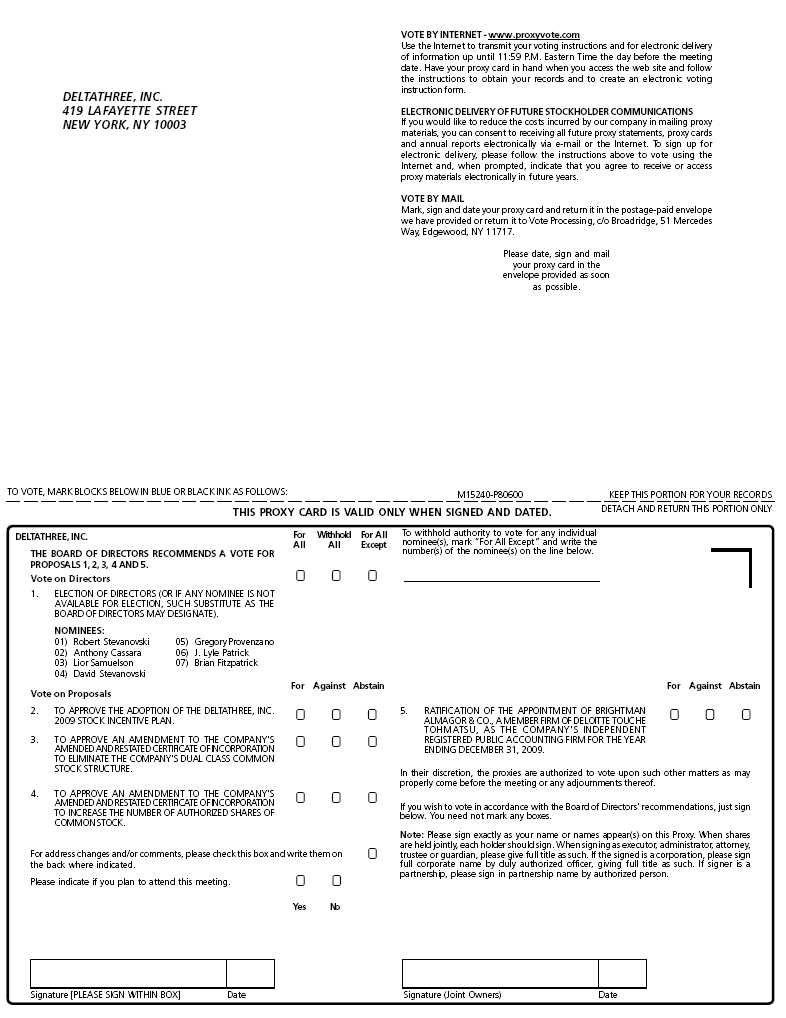

The enclosed Notice of Annual Meeting and Proxy Statement fully describes the business to be transacted at the Meeting, which includes (i) the election of seven directors of the Company, (ii) the proposal to approve the adoption of the deltathree, Inc. 2009 Stock Incentive Plan, (iii) the proposal to approve an amendment to the Company’s Amended and Restated Certificate of Incorporation to eliminate the Company’s dual class common stock structure, (iv) the proposal to approve an amendment to the Company’s Amended and Restated Certificate of Incorporation to increase the number of authorized shares of Common Stock, (v) the ratification of the appointment by the Board of Directors of Brightman Almagor & Co., a member firm of Deloitte Touche Tohmatsu, as the Company’s independent registered public accounting firm for the year ending December 31, 2009, and (vi) the transaction of any other business that may properly be brought before the Meeting or any adjournment or postponement thereof.

Our Board of Directors believes that a favorable vote on each of the matters to be considered at the Meeting is in the best interests of us and our stockholders and unanimously recommends a vote “FOR” each of the matters. Accordingly, we urge you to review the accompanying material carefully and to promptly submit the accompanying proxy by Internet or mail.

We are taking advantage of the rules and regulations adopted by the Securities and Exchange Commission allowing companies to furnish proxy materials over the Internet. The Internet availability notice contains instructions on how to access those documents over the Internet. Please read the Internet availability notice for more information on this alternative, which we believe allows us to provide our stockholders with the information they need while minimizing our costs of delivery. The Internet availability notice also contains instructions on how to request a paper copy of our proxy materials, including the Proxy Statement, our 2008 Annual Report to Stockholders and a form of proxy card or voting instruction card, as applicable.

If you are planning to attend the Meeting in person, due to security procedures you will be required to present government-issued photo identification (e.g. driver’s license or passport) to enter the Meeting. In addition, packages and bags will be inspected, among other measures that may be employed to enhance the security of those attending the Meeting. These procedures may require additional time, so please plan accordingly.

Some or all of our directors and officers will be present to help host the Meeting and to respond to any questions that our stockholders may have. I hope you will be able to attend. Whether or not you are able to attend the Meeting in person, it is important that your shares be represented. We have provided instructions on each of the alternative voting methods in the accompanying Proxy Statement. Stockholders that have accessed these proxy materials on the Internet, as well as those who have received paper copies, may vote by following the instructions included in the Proxy Statement or by following the instructions detailed in the Internet availability notice, as applicable. Please vote as soon as possible. If you attend the Meeting, you may vote in person even if you have previously mailed or submitted a proxy.

| | Sincerely, |

| | |

| | Effi Baruch |

| | Interim Chief Executive Officer and President, Senior Vice President of Operations and Technology |

deltathree, Inc.

419 Lafayette Street

Second Floor

New York, New York 10003

NOTICE OF 2009 ANNUAL MEETING OF STOCKHOLDERS

To Be Held on August 6, 2009

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the “Meeting”) of deltathree, Inc. (the “Company”) will be held at the offices of Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C., Chrysler Center, 666 Third Avenue, 25th Floor, New York, New York 10017, on August 6, 2009, commencing at 10:00 a.m., local time. A proxy card and a Proxy Statement for the Meeting are enclosed.

The Meeting is for the purpose of considering and acting upon:

| | 1. | The election of seven directors for a one-year term expiring at our Annual Meeting of Stockholders in 2010 and until their successors are duly elected and qualified; |

| | 2. | The proposal to approve the adoption of the deltathree, Inc. 2009 Stock Incentive Plan; |

| | 3. | The proposal to approve an amendment to the Company’s Amended and Restated Certificate of Incorporation to eliminate the Company’s dual class common stock structure; |

| | 4. | The proposal to approve an amendment to the Company’s Amended and Restated Certificate of Incorporation to increase the number of authorized shares of Common Stock; |

| | 5. | The ratification of the appointment by the Board of Directors of Brightman Almagor & Co., a member firm of Deloitte Touche Tohmatsu, as the Company’s independent registered public accounting firm for the year ending December 31, 2009; and |

| | 6. | Such other matters as may properly come before the Meeting or any adjournment or postponement thereof. |

The close of business on June 11, 2009, has been fixed as the record date for determining stockholders entitled to notice of and to vote at the Meeting or any adjournment or postponement thereof. Accordingly, only stockholders of record at the close of business on that date will be entitled to vote at the Meeting.

Information concerning the matters to be acted upon at the Meeting is set forth in the accompanying Proxy Statement. A copy of our Annual Report for 2008, which includes our audited financial statements, is being provided together with this proxy material.

You are cordially invited to attend the Meeting in person. Whether or not you expect to attend the meeting, please vote on the Internet as instructed in these materials or, if this Proxy Statement was mailed to you, complete, date, sign and return the enclosed proxy card or vote on the Internet as instructed in these materials, as promptly as possible in order to ensure your representation at the Meeting. A return envelope (which is postage prepaid if mailed in the United States) has been provided with the proxy card. Even if you have voted by proxy, you may still vote in person if you attend the Meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the Meeting, you must obtain a proxy card issued in your name from that record holder.

| By Order of the Board of Directors, |

| |

|

| Peter Friedman |

| General Counsel and Secretary |

Jerusalem, Israel

[_____________] , 2009

TABLE OF CONTENTS

| | | Page |

| INFORMATION ABOUT THE ANNUAL MEETING | | 1 |

| | General | | 1 |

| | Notice Regarding the Availability of Proxy Materials | | 2 |

| | Solicitation and Voting of Proxies | | 2 |

| | Record Date and Voting Securities | | 2 |

| | Quorum and Voting | | 2 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | | 4 |

| BOARD OF DIRECTORS AND COMMITTEES OF THE BOARD | | 6 |

| CHANGE IN CONTROL | | 6 |

| LEGAL PROCEEDINGS | | 6 |

SHAREHOLDER COMMUNICATIONS TO THE BOARD | | 8 |

| AUDIT COMMITTEE REPORT | | 9 |

| PROPOSAL #1 ELECTION OF DIRECTORS | | 10 |

| | General | | 10 |

| | Vote Required and Recommendation of the Board of Directors | | 10 |

| | Nominees for Director | | 10 |

| PROPOSAL #2 APPROVE THE ADOPTION OF THE DELTATHREE, INC. 2009 STOCK INCENTIVE PLAN | | 11 |

| | General | | 11 |

| | Description of 2009 Plan | | 12 |

| | Summary of U.S. Federal Income Tax Consequences | | 14 |

| | Summary of Israeli Income Tax Consequences | | 15 |

| | New Plan Benefits | | 17 |

| | Vote Required and Recommendation of the Board of Directors | | 17 |

| PROPOSAL #3 APPROVE AN AMENDMENT TO THE COMPANY’S AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO ELIMINATE THE COMPANY’S DUAL CLASS COMMON STOCK STRUCTURE | | 17 |

| | General | | 17 |

| | Vote Required and Recommendation of the Board of Directors | | 18 |

| PROPOSAL #4 APPROVE AN AMENDMENT TO THE COMPANY’S AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK | | 19 |

| | General | | 19 |

| | Vote Required and Recommendation of the Board of Directors | | 19 |

PROPOSAL #5 RATIFICATION OF THE APPOINTMENT OF THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEAR ENDING DECEMBER 31, 2009 | | 20 |

| | General | | 20 |

| | Vote Required and Recommendation of the Board of Directors | | 20 |

| | Audit and Non-Audit Fees | | 20 |

| | Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm | | 21 |

EXECUTIVE OFFICERS AND KEY EMPLOYEES | | 21 |

| EXECUTIVE COMPENSATION AND OTHER INFORMATION | | 22 |

| | Summary Compensation Table | | 22 |

| | Outstanding Equity Awards at Fiscal Year-End | | 24 |

| | Director Compensation | | 25 |

| | Equity Compensation Plan Information | | 27 |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | | 27 |

| SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | | 28 |

| CODE OF CONDUCT AND ETHICS | | 28 |

| STOCKHOLDER PROPOSALS FOR 2010 ANNUAL MEETING | | 28 |

| OTHER MATTERS | | 29 |

| MISCELLANEOUS | | 29 |

| APPENDIX A: | DELTATHREE, INC. 2009 STOCK INCENTIVE PLAN |

| APPENDIX B: | AMENDMENT TO THE AMENDED AND RESTATED CERTIFICATE OF INCORPORATION (MARKED TO REFLECT ALL CHANGES TO BE MADE TO ARTICLE FOURTH OF THE AMENDED AND RESTATED CERTIFICATE OF INCORPORATION) |

deltathree, Inc.

419 Lafayette Street

Second Floor

New York, New York 10003

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

To Be Held August 6, 2009

______________________

INFORMATION ABOUT THE ANNUAL MEETING

General

This Proxy Statement and accompanying proxy materials are being made available on or about [______], 2009, to stockholders of deltathree, Inc. (the “Company”) at the direction of our Board of Directors (the “Board”) to solicit proxies in connection with the 2009 Annual Meeting of Stockholders (the “Meeting”). The Meeting will be held at the offices of Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C., Chrysler Center, 666 Third Avenue, 25th Floor, New York, New York 10017, on August 6, 2009, commencing at 10:00 a.m. local time, or at such other time and place to which the Meeting may be adjourned or postponed.

If you have received a printed copy of these materials by mail, you may simply complete, date, sign and return your proxy card or follow the instructions below to submit your proxy on the Internet. If you did not receive a printed copy of these materials by mail and are accessing them on the Internet, you may simply follow the instructions below to submit your proxy on the Internet.

We intend to mail a printed copy of this Proxy Statement and proxy card to certain of our stockholders of record on or about [____], 2009. All other stockholders will receive a Notice Regarding Internet Availability of Proxy Matters (sometimes referred to herein as the “Internet Availability Notice”), which will also be mailed on or about [_____], 2009.

Notice Regarding the Availability of Proxy Materials

In accordance with rules and regulations adopted by the Securities and Exchange Commission, instead of mailing a printed copy of our proxy materials to each stockholder of record we furnish proxy materials to our stockholders over the Internet. You will not receive a printed copy of the proxy materials unless you specifically request it or have previously requested that we mail all such materials to you.

If you received an Internet Availability Notice by mail, you will not receive a printed copy of the proxy materials. Instead, the Internet Availability Notice will instruct you as to how you may access and review over the Internet all of the important information contained in the proxy materials. The Internet Availability Notice also instructs you as to how you may submit your proxy on the Internet. If you received an Internet Availability Notice by mail and would like to receive a printed copy of our proxy materials, including a proxy card, you should follow the instructions for requesting such materials included in the Internet Availability Notice.

Solicitation and Voting of Proxies

All shares represented by valid proxies at the Meeting, unless the stockholder otherwise specifies, will be voted (i) FOR the election of the seven persons named under “Proposal 1–Election of Directors” as nominees for election as our directors for a one-year term expiring at our annual meeting of stockholders in 2010 and until their successors are duly elected and qualified, (ii) FOR the proposal to approve the adoption of the deltathree, Inc. 2009 Stock Incentive Plan, discussed under “Proposal 2—Approve the adoption of the deltathree, Inc. 2009 Stock Incentive Plan,” (iii) FOR the proposal to approve an amendment to the Company’s Amended and Restated Certificate of Incorporation to eliminate the Company’s dual class common stock structure, discussed under “Proposal 3—Approve an amendment to the Company’s Amended and Restated Certificate of Incorporation to eliminate the Company’s dual class common stock structure,” (iv) FOR the proposal to amend the Company’s Amended and Restated Certification of Incorporation to increase the number of authorized shares of Common Stock, discussed under “Proposal 4—Approve an amendment to the Company’s Amended and Restated Certificate of Incorporation to increase the number of authorized shares of Common Stock,” (v) FOR the ratification of the appointment by the Board of the independent registered public accounting firm named under “Proposal 5–Ratification of the appointment of the Company’s independent registered public accounting firm for year ending December 31, 2009” and (vi) at the discretion of the proxy holders with regard to any matter not known to the Board on the date of mailing this Proxy Statement that may properly come before the Meeting or any adjournment or postponement thereof. In cases where a stockholder has appropriately specified how a proxy is to be voted, it will be voted accordingly. The Board has designated Effi Baruch and Richard Grant as proxies for the solicitation on behalf of the Board of proxies of our stockholders, to vote on all matters as may properly come before the Meeting and any adjournment of the Meeting.

You may revoke your proxy at any time before it is voted at the Meeting by: (i) properly submitting a subsequent proxy in one of the manners authorized and described in this Proxy Statement (such as via the Internet pursuant to the voting procedures described below), (ii) giving written notice of revocation to us prior to the Meeting, or (iii) attending and voting at the Meeting. A stockholder wishing to revoke a proxy by written notice must submit such revocation to us at deltathree, Inc., 419 Lafayette Street, Second Floor, New York, New York 10003.

Record Date and Voting Securities

The close of business on June 11, 2009, has been fixed as the record date (the “Record Date”) for determining the stockholders entitled to vote at the Meeting. At the close of business on June 11, 2009, we had issued and outstanding [________] shares of our Class A common stock, par value $0.001 per share, (the “Class A Common Stock”), held by [________] holders of record. No shares of our Class B common stock, par value $0.001 per share (the “Class B Common Stock”) are outstanding. The Class A Common Stock constitutes the only outstanding class of voting securities entitled to be voted at the Meeting.

Quorum and Voting

The presence at the Meeting, in person or by proxy relating to any matter, of the holders of a majority of the outstanding shares of Class A Common Stock is necessary to constitute a quorum. For purposes of the quorum and the discussion below regarding the vote necessary to take stockholder action, stockholders of record who are present at the Meeting in person or by proxy and who abstain, including brokers holding customers’ shares of record who cause abstentions to be recorded at the Meeting, are considered stockholders who are present and entitled to vote at the Meeting, and the shares of Class A Common Stock held by such stockholders will count toward the attainment of a quorum. If a quorum will not be present, the Meeting will be adjourned from time to time until a quorum is obtained.

Each share of Class A Common Stock entitles the holder thereof to one vote with respect to each proposal to be voted on at the Meeting.

The accompanying proxy card is designed to permit each holder of Class A Common Stock as of the close of business on the Record Date to vote on each of the matters to be considered at the Meeting. A stockholder is permitted to vote in favor of, or to withhold authority to vote for, any or all of the nominees for election to the Board and to vote in favor of or against or to abstain from voting with respect to all of the other proposals included in this Proxy Statement.

Brokers holding shares of record for customers generally are not entitled to vote on certain matters unless they receive voting instructions from their customers. As used herein, “uninstructed shares” means shares held by a broker who has not received instructions from its customers on such matters, if the broker has so notified us on a proxy form in accordance with industry practice or has otherwise advised us that it lacks voting authority. As used herein, “broker non-votes” means the votes that could have been cast on the matter in question by brokers with respect to uninstructed shares if the brokers had received their customers’ instructions. We intend to treat broker non-votes in the manner described in each of the Proposals set forth herein.

If at the close of business on June 11, 2009, your shares were held in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name” and the Internet Availability Notice or proxy materials, as applicable, are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Meeting. As a beneficial owner, you have the right to direct that organization on how to vote the shares in your account.

If you are a stockholder of record, you may vote in person at the Meeting. We will give you a ballot when you arrive.

If you do not wish to vote in person or you will not be attending the Meeting, you may vote by proxy. If you received a printed copy of these proxy materials by mail, you may vote by proxy using the enclosed proxy card or vote by proxy on the Internet. If you received an Internet Availability Notice by mail, you may vote by proxy over the Internet. The procedures for voting by proxy are as follows:

| | · | to vote by proxy on the Internet, go to www.proxyvote.com to complete an electronic proxy card; or |

| | · | to vote by proxy using the enclosed proxy card (if you received a printed copy of these proxy materials by mail), complete, date, sign and return your proxy card promptly in the envelope provided. |

If you vote by proxy, your vote must be received by 11:59 p.m. Eastern Time on August 5, 2009, to be counted.

If you are a beneficial owner of shares held in street name and you received a printed copy of these proxy materials by mail, you should have received a proxy card and voting instructions with these proxy materials from the organization that is the record owner of your shares rather than from us. If you are a beneficial owner of shares held in street name and you received an Internet Availability Notice by mail, you should have received the Internet Availability Notice from the organization that is the record owner of your shares rather than from us. Beneficial owners that received a printed copy of these proxy materials by mail from the record owner may complete and mail that proxy card or may vote over the Internet as instructed by that organization in the proxy card. Beneficial owners that received an Internet Availability Notice by mail from the record owner should follow the instructions included in the Internet Availability Notice to view the proxy statement and transmit their voting instructions. For a beneficial owner to vote in person at the Meeting, you must obtain a valid proxy from the record owner. To request the requisite proxy form, follow the instructions provided by your broker or contact your broker.

As permitted under the federal securities laws, we or brokers holding shares on behalf of our stockholders will send a single set of our proxy statement to multiple stockholders sharing an address who have requested that we mail them such materials. Each such stockholder will continue to receive a separate proxy card or voting instruction card. Once stockholders receive notice from their brokers or from us that communications to their addresses will be “householded,” we will continue to do so until we have received contrary instructions from one or more of the security holders.

Stockholders whose households received a single set of our proxy statement this year but who would like to receive additional copies may contact our transfer agent, American Stock Transfer and Trust Company, at the address set forth below, and we will deliver promptly upon oral or written request a separate copy of the disclosure documents. Stockholders who do not wish to participate in “householding” and would like to receive their own sets of our proxy statement in future years should follow the instructions described below. Stockholders who share an address with another stockholder of the Company and who would like to receive only a single set of our proxy statements should follow these instructions:

| | · | stockholders whose shares are registered in their own name should contact American Stock Transfer and Trust Company by telephone at 1-800-937-5449 or by mail at 6201 15th Avenue, Brooklyn, N.Y. 11219, and inform it of their request; and |

| | · | stockholders whose shares are held by a broker or other nominee should contact the broker or other nominee directly and inform them of their request. Stockholders should be sure to include their name, the name of their brokerage firm and their account number. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

As of May 26, 2009, there were 71,932,405 shares of our Class A Common Stock issued and outstanding. Each share of Class A Common Stock entitles the holder thereof to one vote with respect to each item to be voted on by holders of the shares of Class A Common Stock. We have no other securities, voting or nonvoting, outstanding.

The following table sets forth information with respect to the beneficial ownership of shares of our Class A Common Stock as of May 26, 2009 by:

| | · | each person whom we know beneficially owns more than 5% of the Class A Common Stock; |

| | · | each of our directors and director nominees individually; |

| | · | each of our named executive officers (as defined below) individually; and |

| | · | all of our current directors and executive officers as a group. |

Unless otherwise indicated, to our knowledge, all persons listed below have sole voting and investment power with respect to their shares of Class A Common Stock. Each person listed below disclaims beneficial ownership of their shares, except to the extent of their pecuniary interests therein. Shares of Class A Common Stock that an individual or group has the right to acquire within 60 days of May 26, 2009 pursuant to the exercise of options or restricted stock are deemed to be outstanding for the purpose of computing the percentage ownership of such person or group, but are not deemed outstanding for the purpose of calculating the percentage owned by any other person listed.

On February 12, 2009, we issued to D4 Holdings, LLC, a Delaware limited liability company (“D4 Holdings”) an aggregate of 39,000,000 shares of our Class A Common Stock and a warrant to purchase up to an additional 30,000,000 shares of our Class A Common Stock at an exercise price of $0.04 per share (the “Warrant”) pursuant to the terms of a Securities Purchase Agreement between us and D4 Holdings (the “Purchase Agreement”). As a result, D4 Holdings currently owns approximately 54.2% of our outstanding Class A Common Stock. Therefore, if D4 Holdings elects to vote all of the shares of Class A Common Stock it owns on any proposal submitted to a vote of our stockholders at the Meeting, it will control the outcome of any such vote.

| | | Number | | | Percentage(1) | |

| | | Shares of deltathree Class A Common Stock Beneficially Owned | |

| Principal Stockholders: | | | | | | |

| D4 Holdings, LLC (2) | | | 69,000,000 | | | | 67.7 | % |

| 349-L Copperfield Blvd., #407 | | | | | | | | |

| Concord, NC 28025 | | | | | | | | |

| | | | | | | | | |

| Abraham Ziv-Tal (3) | | | 10,347,677 | | | | 14.4 | % |

P.O. Box 514 Rishon, Israel 46915 | | | | | | | | |

| | | | | | | | | |

| Executive Officers and Directors: | | | | | | | | |

| Shimmy Zimels (4) | | | 306,476 | | | | * | |

| Dror Gonen (5) | | | 9,000 | | | | * | |

| Effi Baruch (6) | | | 245,733 | | | | * | |

| Richard Grant (7) | | | 122,500 | | | | * | |

| Dan Antebi (8) | | | 100,000 | | | | * | |

| Robert Stevanovski (2) | | | 69,000,000 | | | | 67.7 | % |

| Anthony Cassara (9) | | | 69,000,000 | | | | 67.7 | % |

| Lior Samuelson (10) | | | 592,000 | | | | * | |

| Benjamin Broder (11) | | | 52,000 | | | | * | |

| David Stevanovski (9)(12) | | | 69,000,000 | | | | 67.7 | % |

| Gregory Provenzano (9)(12) | | | 69,000,000 | | | | 67.7 | % |

| J. Lyle Patrick (12) | | | 0 | | | | * | |

| Brian Fitzpatrick (13) | | | 0 | | | | * | |

| All current directors and executive officers as a group (10 persons) (14) | | | 70,112,233 | | | | 68. 8 | % |

__________________

* Less than 1%.

| (1) | Percentage of beneficial ownership is based on 71,932,405 shares of Common Stock outstanding as of May 26, 2009. |

| (2) | Ownership is based on a Schedule 13D filed February 23, 2009 by D4 Holdings, Manna Holdings, LLC (“Manna Holdings”), Praescient, LLC (“Praescient”) and Robert Stevanovski and includes 30,000,000 shares of Class A Common Stock issuable under the Warrant. Robert Stevanovski is the manager of Praescient, which serves as the sole manager of D4 Holdings and as the managing member of Manna Holdings. Manna Holdings is the sole member of D4 Holdings. As such, Mr. Stevanovski, Praescient and Manna Holdings may be deemed to beneficially own the securities reported in the table. Each of Mr. Stevanovski, Praescient and Manna Holdings disclaims beneficial ownership of such securities, and the information reported herein shall not be deemed an admission that such reporting person is the beneficial owner of the securities for any purpose, except to the extent of such person’s pecuniary interest therein. |

| (3) | Ownership is based on a Schedule 13D/A filed December 24, 2008. |

| (4) | Includes (a) 82,769 shares of Class A Common Stock and (b) options to purchase 223,707 shares of Class A Common Stock. Mr. Zimels resigned as Chief Executive Officer, President and Chief Financial Officer effective as of May 14, 2008. |

| (5) | Includes 9,000 shares of Class A Common Stock. Mr. Gonen served as Chief Executive Officer and President from May 14, 2008, to December 9, 2008. |

| (6) | Includes (a) options to purchase 229,583 shares of Class A Common Stock, (b) 9,150 restricted shares of Class A Common Stock and (c) restricted units to purchase 7,000 shares of Class A Common Stock. |

| (7) | Includes (a) options to purchase 112,500 shares of Class A Common Stock and (b) restricted units to purchase 5,600 shares of Class A Common Stock. |

| (8) | Includes options to purchase 100,000 shares of Class A Common Stock. |

| (9) | The securities reported in the table are held directly by D4 Holdings and include 30,000,000 shares of Class A Common Stock issuable under the Warrant. Each of Anthony Cassara, David Stevanovski and Gregory Provenzano indirectly owns a membership interest in Manna Holdings, which is the sole member of D4 Holdings. As such, each of Messrs. Cassara, Stevanovski and Provenzano may be deemed to beneficially own the securities reported herein and owned directly by D4 Holdings. Each of Messrs. Cassara, Stevanovski and Provenzano disclaims beneficial ownership of such securities, and the information reported herein shall not be deemed an admission that such reporting person is the beneficial owner of the securities for any purpose, except to the extent of his pecuniary interest therein. |

| (10) | Includes (a) 220,000 shares of Class A Common Stock, (b) options to purchase 350,000 shares of Class A Common Stock and (c) 22,000 restricted shares of Class A Common Stock. |

| (11) | Includes (a) options to purchase 20,000 shares of Class A Common Stock and (b) 32,000 restricted shares of Class A Common Stock. |

| (12) | Appointed by the Board to serve as a director effective on March 28, 2009. |

| (13) | Mr. Fitzpatrick is a nominee to be presented at the Meeting for election to the Board of Directors. |

| (14) | Includes (a) 39,220,000 shares of Class A Common Stock, (b) options to purchase 735,000 shares of Class A Common Stock, (c) 63,200 restricted shares of Class A Common Stock, (d) restricted units to purchase 12,600 shares of Class A Common Stock and (e) a warrant to purchase 30,000,000 shares of Class A Common Stock held directly (or deemed to be beneficially owned) by the executive officers and directors as a group. |

CHANGE IN CONTROL

As a result of the transaction between the Company and D4 Holdings described above under “Security Ownership of Certain Beneficial Owners and Management”, D4 Holdings obtained a controlling interest in the Company. The Company knows of no other arrangement the operation of which may at a subsequent date result in a change in control of the Company.

LEGAL PROCEEDINGS

The Company is not aware of any legal proceedings in which any director, nominee, officer or affiliate of the Company, any owner of record or beneficially of more than five percent of any class of voting securities of the Company, or any associate of any such director, nominee, officer, affiliate of the Company, or security holder is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries.

BOARD OF DIRECTORS AND COMMITTEES OF THE BOARD

Our Amended and Restated Certificate of Incorporation provides that the number of members of our Board of Directors shall be not less than three and not more than thirteen. There are currently seven directors on the Board. At each annual meeting of stockholders, directors are elected to hold office for a term of one year and until their respective successors are elected and qualified.

The Board had five regular meetings and four special meetings during the fiscal year ended December 31, 2008. During the fiscal year ended December 31, 2008, each member of the Board participated in at least 75% of all Board and applicable committee meetings held during the period for which he was a director. None of our other directors attended our 2008 Annual Stockholder Meeting with the exception of Mr. Gonen, who at the time of the meeting served as a member of the Board of Directors. The Board has established an Audit Committee and a Compensation Committee, but dissolved the Nominating and Governance Committee as of September 11, 2006. The functions of the remaining committees and their current members are set forth below.

Due to a decrease in the number of members of the Board after our 2006 Annual Stockholders Meeting, our Board members determined that it is efficient and important for each member to actively participate in all matters that were previously the responsibility of the Nominating and Governance Committee. As such, each of our Board members participates in, among other matters, the following nominating and governance-related matters:

| | · | identifying and recommending qualified candidates for director, and recommending the director nominees for our annual meetings of stockholders; |

| | · | conducting an annual review of the Board’s performance; |

| | · | recommending the director nominees for each of the Board committees; and |

| | · | developing and recommending our company’s corporate governance guidelines. |

Furthermore, our Board adopted a nominating and governance policy that was based on the former Nominating and Governance Committee Charter. This policy outlines our Board’s goals, responsibilities, and procedures related to nominating and governance matters. In this regard, our Board may consider candidates recommended by stockholders as well as from other sources such as other directors or officers, third party search firms or other appropriate sources. For all potential candidates, the Board may consider all factors it deems relevant, such as a candidate’s personal integrity and sound judgment, business and professional skills and experience, independence, knowledge of the industry in which we operate, possible conflicts of interest, diversity, the extent to which the candidate would fill a present need in the Board, and concern for the long-term interests of our stockholders. In general, persons recommended by stockholders will be considered on the same basis as candidates from other sources. If a stockholder wishes to nominate a candidate to be considered for election as a director at our 2010 Annual Meeting of Stockholders using the procedures set forth in the Company's Amended and Restated By-laws, it must follow the procedures described under “Stockholder Proposals for 2010 Annual Meeting” and as set forth in our Amended and Restated By-laws. If a stockholder wishes simply to propose a candidate for consideration as a nominee by our Board, it should submit any pertinent information regarding the candidate to the Chairman of the Board by mail care of our Secretary at 419 Lafayette Street, New York, New York 10003.

The Compensation Committee is responsible for:

| | · | evaluating our compensation policies; |

| | · | determining executive compensation, and establishing executive compensation policies and guidelines; and |

| | · | administering our stock option and compensation plans. |

As part of these responsibilities, the Compensation Committee determines the compensation of our Chief Executive Officer, and conducts its decision making process with respect to this issue without the presence of the Chief Executive Officer. The Compensation Committee had three meetings during 2008. The Compensation Committee has a charter, a copy of which is available to our stockholders at the Corporate Governance section of our website located at www.deltathree.com. During the course of the 2008 fiscal year, Benjamin Broder and (until his resignation from the board on November 2, 2008) Ilan Biran served on the Compensation Committee. The Board intends to appoint Brian Fitzpatrick to serve as the Chairman of the Compensation Committee following his election to the Board of Directors at the Meeting and each of J. Lyle Patrick and Lior Samuelson to serve as members of the Compensation Committee immediately following the Meeting.

The Audit Committee is responsible for:

| | · | recommending to the Board the appointment of the firm selected to serve as our independent registered public accounting firm and monitoring the performance of such firm; |

| | · | reviewing and approving the scope of the annual audit and evaluating with the independent registered public accounting firm our annual audit and annual financial statements; |

| | · | reviewing with management the status of internal accounting controls; |

| | · | evaluating issues having a potential financial impact on us which may be brought to the Audit Committee’s attention by management, the independent registered public accounting firm or the Board; |

| | · | evaluating our public financial reporting documents; and |

| | · | reviewing the non-audit services to be performed by the independent registered public accounting firm, if any, and considering the effect of such performance on the auditor's independence. |

The Audit Committee had four meetings during 2008. The Audit Committee has a charter, a copy of which is available to our stockholders at the Corporate Governance section of our website located at www.deltathree.com. During the course of the 2008 fiscal year, Noam Bardin and (until his resignation from the board on November 2, 2008) Ilan Biran and (until such time as he was appointed Chairman of the Board) Lior Samuelson served on the Audit Committee. Following the resignation of Noam Bardin on February 12, 2009, there were no members of the Audit Committee. Mr. Patrick was appointed by the Board to serve as the Chairman of the Audit Committee effective March 28, 2009. The Board of Directors has determined that Mr. Patrick meets the requirements of the applicable Securities and Exchange Commission rules for membership on the Audit Committee, including Rule 10A-3(b) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), is “independent” as defined in Rule 5605(a)(2) of the Nasdaq Marketplace Rules, and qualifies as an “audit committee financial expert” as defined in Item 407 of Regulation S-K. In June 2009, the Board appointed Anthony Cassara and Lior Samuelson to serve as additional members of the Audit Committee. The Board intends to appoint Brian Fitzpatrick to replace Mr. Cassara on the Audit Committee following Mr. Fitzpatrick’s election to the Board of Directors at the Meeting. Mr. Fitzpatrick qualifies as “independent” as defined in Rule 5605(a)(2) of the Nasdaq Marketplace Rules.

As discussed below under “Director Independence”, we are not currently subject to the Nasdaq continued listing requirements or the requirements of any other national securities exchange, including the independence requirements for audit committees. The Board of Directors has not reached an affirmative conclusion that Messrs. Cassara or Samuelson are “independent” as such term is described in the Nasdaq Marketplace Rules. However, the Board of Directors determined that their membership on the Audit Committee is in the best interest of the Company and its stockholders in light of their extensive experience in financial and related matters in our industry and the fact that the Audit Committee was composed of only one other member. In connection with these appointments, the Board has waived the independence requirements set forth in the Audit Committee Charter with respect to Messrs. Cassara and Samuelson. The Board also intends to waive the independence requirements in the Compensation Committee Charter with respect to Mr. Samuelson in connection with his appointment to the Compensation Committee immediately following the Meeting.

Director Independence

Our Class A Common Stock is currently quoted on the OTC Bulletin Board and is not listed on the Nasdaq Stock Market or any other national securities exchange. Accordingly, we are not currently subject to the Nasdaq continued listing requirements or the requirements of any other national securities exchange. Nevertheless, in determining whether a director or nominee for director should be considered “independent” the board utilizes the definition of independence set forth in Rule 5605(a)(2) of the Nasdaq Marketplace Rules. The board has determined that J. Lyle Patrick and Brian Fitzpatrick each qualify as “independent” under this rule.

Our company also would qualify as a “controlled company” under Rule 5615(c)(2) of the Nasdaq Marketplace Rules because D4 Holdings holds more than 50% of the voting power of our company. Accordingly, we would have the option to be exempt from the requirements under Rule 5605 to have:

| | · | a majority of independent directors; |

| | · | a compensation committee composed solely of independent directors; |

| | · | compensation of our executive officers determined by a majority of independent directors or a compensation committee composed solely of independent directors; |

| | · | a nominating committee composed solely of independent directors; and |

| | · | director nominees selected, or recommended for the Board's selection, either by a majority of the independent directors or a nominating committee composed solely of independent directors. |

Because we are not currently subject to the Nasdaq continued listing requirements we have not determined to what extent we would rely on the “controlled company” exemption from any of the foregoing requirements if we were subject to these requirements.

SHAREHOLDER COMMUNICATIONS TO THE BOARD

The Board of Directors recommends that stockholders initiate any communications with the Board in writing and send them care of our Secretary at deltathree, Inc., 419 Lafayette Street, Second Floor, New York, N.Y. 10003. This centralized process will assist the Board in reviewing and responding to stockholder communications in an appropriate manner. The name of any specific intended Board recipient should be noted in the communication. The Board has instructed our Secretary to forward such correspondence only to the intended recipients; however, the Board has also instructed our Secretary, prior to forwarding any correspondence, to review such correspondence and, in his or her discretion, not to forward certain items if they are deemed of a commercial or frivolous nature or otherwise inappropriate for the Board’s consideration. In such cases, some of that correspondence may be forwarded elsewhere in the Company for review and possible response.

AUDIT COMMITTEE REPORT

The Audit Committee of the Board of Directors has furnished the following report:

The Audit Committee assists the Board in overseeing and monitoring the integrity of the Company’s financial reporting process, its compliance with legal and regulatory requirements and the quality of its internal and external audit processes. The roles and responsibilities of the Audit Committee are set forth in a written charter that was adopted by the Board. The Audit Committee is responsible for overseeing the Company’s overall financial reporting process and for the appointment, compensation, retention and oversight of the work of the Company’s independent registered public accounting firm. In fulfilling its responsibilities for the financial statements for the fiscal year ended December 31, 2008, the Audit Committee, among other activities, reviewed and discussed the Company’s audited financial statements for such fiscal year with management and with Brightman Almagor & Co., the Company’s independent registered public accounting firm. The Audit Committee has discussed with Brightman Almagor & Co. the matters required to be discussed by the statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1, AU section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T. The Audit Committee has received the written disclosures and the letter from Brightman Almagor & Co. required by applicable requirements of the Public Company Accounting Oversight Board regarding Brightman Almagor & Co.’s communications with the audit committee concerning independence, and has discussed with Brightman Almagor & Co. their independence. The Audit Committee has considered the compatibility of the provision of non-audit services with maintaining the auditor’s independence.

Based on the Audit Committee’s review of the audited financial statements and the review and discussions described in the foregoing paragraph, the Audit Committee recommended to the Board of Directors that the audited financial statements for the fiscal year ended December 31, 2008, be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2008, for filing with the Securities and Exchange Commission.

| | The Audit Committee |

| | |

| | J. Lyle Patrick (Chairman) |

The Audit Committee Report in this Proxy Statement shall not be deemed filed or incorporated by reference into any other filings by us under the Securities Act of 1933 or the Securities Exchange Act of 1934 except to the extent that we specifically incorporate this information by reference.

PROPOSAL # 1

ELECTION OF DIRECTORS

(Notice Item 1)

General

At the Meeting, seven directors will be elected to the Board to serve until our next annual meeting of stockholders and until their respective successors have been elected and qualified.

Our Amended and Restated Certificate of Incorporation provides that a director shall hold office until the annual meeting for the year in which his or her term expires except in the case of elections to fill vacancies or newly created directorships. Each director is elected for a one-year term. Each of the nominees except for Brian Fitzpatrick is currently serving as a director on our Board.

In connection with the completion of the private placement to D4 Holdings pursuant to the Purchase Agreement, Noam Bardin resigned as a director and the board of directors appointed Robert Stevanovski and Anthony Cassara to serve on the Board. In addition, Lior Samuelson resigned as Chairman of the Board and remained a director, and Robert Stevanovski was appointed to serve as Chairman. Following the closing of the transaction, our Board of Directors appointed David Stevanovski, Gregory Provenzano and Lyle Patrick to serve on the Board, effective on March 28, 2009.

Vote Required and Recommendation of the Board of Directors

Under our Amended and Restated By-laws, directors are elected by a majority of the outstanding shares of common stock present in person or represented by proxy at the Meeting, and thus the seven nominees for election as directors who receive the most votes cast will be elected. Instructions withholding authority and broker non-votes will not be taken into account in determining the outcome of the election of directors.

Unless authority to vote for any of the nominees named above is withheld, the shares represented by the enclosed proxy will be voted “FOR” the election as directors of such nominees. In the event that any nominee shall become unable or unwilling to serve, the shares represented by the enclosed proxy will be voted for the election of such other person as the Board of Directors may recommend in that nominee’s place. The Board has no reason to believe that any nominee will be unable or unwilling to serve.

The Board of Directors unanimously recommends that the stockholders vote FOR each of the seven nominees listed herein.

Nominees for Director

Set forth below are the name, age and the positions and offices held by each of our director-nominees, his principal occupation and business experience during at least the past five years and the names of other publicly-held companies of which he serves as a director.

Robert Stevanovski, 45. Mr. Stevanovski was appointed as a director and Chairman of the Board on February 12, 2009. He is one of the co-founders of ACN, Inc. (“ACN”), and has served as Chairman of ACN since its founding in 1993. Mr. Stevanovski has served as Chairman of the Board of WorldGate Communications, Inc. (“Worldgate”), a provider of video phone products, since April 6, 2009, and as the Interim Chief Executive Officer and President of Worldgate since April 10, 2009. Mr. Stevanovski is the brother of David Stevanovski.

Anthony Cassara, 54. Mr. Cassara was appointed as a director on February 12, 2009. Mr. Cassara currently serves as President of Cassara Management Group, Inc., a privately held business counseling practice focused on the telecommunications industry. Prior to founding Cassara Management Group, Mr. Cassara was President of the Carrier Services division at Frontier Corporation and later at Global Crossing. Mr. Cassara has served as a director of WorldGate since April 9, 2009.

Lior Samuelson, 60. Mr. Samuelson served as Chairman of the Board from January 2008 until February 2009, and has served as a director of deltathree since August 2001. Since August 1999, Mr. Samuelson has served as a Co-Founder and Principal of Mercator Capital. His experience includes advising clients in the Technology, Communications and Consumer sectors on mergers, acquisitions and private placements. From March 1997 to August 1999, Mr. Samuelson was the President and Chief Executive Officer of PricewaterhouseCoopers Securities. Prior to that, he was the President and Chief Executive Officer of The Barents Group, a merchant bank specializing in advising and investing in companies in emerging markets. Mr. Samuelson was also the Co-Chairman of Peloton Holdings, a Private Equity management company. Before that, he was a managing partner with KPMG and a senior consultant at Booz, Allen & Hamilton.

David Stevanovski, 43. Mr. Stevanovski was appointed to serve on the board effective March 28, 2009. He has served in a number of positions at ACN, and currently serves as Chief Operating Officer of ACN North America. Mr. Stevanovski has served as a director of WorldGate since April 9, 2009. Mr. Stevanovski is the brother of Robert Stevanovski.

Gregory Provenzano, 49. Mr. Provenzano was appointed to serve on the board effective March 28, 2009. Mr. Provenzano is one of the co-founders of ACN and has served as President of ACN since its founding in 1993. Mr. Provenzano has served as a director of WorldGate since April 9, 2009.

J. Lyle Patrick, 56. Mr. Patrick was appointed to serve on the board effective March 28, 2009. Mr. Patrick has served as chief financial officer of a number of telecommunications companies, including, most recently, US LEC, a competitive telecommunications company, from June 2005 to March 2007, and MetroPCS, a wireless communications provider, from May 2004 to March 2005. Mr. Patrick is a Certified Public Accountant.

Brian Fitzpatrick, 47. Mr. Fitzpatrick serves as Managing Director of BT Wholesale Markets, which is the sales, marketing, implementation, project and in-life contract management operating division of BT Group Plc. Mr. Fitzpatrick’s areas of responsibility also include BT Group plc’s global media and satellite broadcast operations. Mr. Fitzpatrick serves as a member of the BT Wholesale Executive Board. Prior to joining BT Wholesale Markets in November 2005, Mr. Fitzpatrick was the President of Worldwide Commercial Operations for Teleglobe International, Ltd.

PROPOSAL # 2

APPROVE THE ADOPTION OF THE DELTATHREE, INC. 2009 STOCK INCENTIVE PLAN

(Notice Item 2)

General

We are asking our stockholders to approve the adoption of our 2009 Stock Incentive Plan (the “2009 Plan”). The Board of Directors adopted the 2009 Plan on June 10, 2009, subject to stockholder approval. A copy of the 2009 Plan, as proposed to be approved, is attached as Appendix A to this Proxy Statement.

We currently maintain two separate stock incentive plans, consisting of our Amended and Restated 2004 Stock Incentive Plan (the “2004 Plan”) and our Amended and Restated 2006 Non-Employee Director Stock Plan (the “2006 Director Plan”). The 2009 Plan is intended to replace our current stock incentive plans. If the adoption of the 2009 Plan is approved by stockholders, the 2004 Plan and the 2006 Director Plan will be terminated (except with respect to outstanding awards previously granted thereunder) and no additional awards will be made under those plans.

The Board of Directors believes that in order to successfully attract and retain the best possible candidates for positions of responsibility we must continue to offer a competitive equity incentive program. We are asking stockholders to approve the proposed 2009 Plan so that we will have a sufficient number of shares available for the issuance of stock options and other equity awards and to ensure that the 2009 Plan will be in compliance with Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”). Our Board of Directors believes that the ability of the Company to grant equity awards is important in enabling us to offer competitive compensation packages and to make the most effective use of the shares our stockholders authorize for incentive purposes. Therefore, the Board of Directors recommends that stockholders vote to approve the adoption of the 2009 Plan.

Description of 2009 Plan

The following summary of the 2009 Plan, as proposed to be approved by stockholders in this Proposal 2, is qualified in its entirety by the specific language of the 2009 Plan, a copy of which is attached as Appendix A to this Proxy Statement.

For purposes of this summary, we assumed that no award will be considered “deferred compensation” as that term is defined for purposes of the federal tax rules governing nonqualified deferred compensation arrangements (Section 409A of the Code). We also assumed that if any award were considered to any extent to constitute deferred compensation, its terms would comply with the requirements of that legislation (in general, by limiting any flexibility in the time of payment). For example, the award of a nonstatutory option with an exercise price which is less than the fair market value of the stock covered by the option would constitute deferred compensation. If an award includes deferred compensation, and its terms do not comply with the requirements of the legislation, then any deferred compensation component of the award will be taxable when it is earned and vested (even if not then payable) and the recipient will be subject to a 20% additional tax.

Shares Authorized under the Plan and Administration of the Plan

Under the proposed 2009 Plan, the maximum number of shares available for awards under the 2009 Plan is 10,000,000 shares. The 2009 Plan is administered by the Compensation Committee of our Board of Directors, which has the authority to, among other things, determine eligibility to receive awards, the types and number of shares of stock subject to the awards, the price and timing of awards and the acceleration or waiver of any vesting, performance, or forfeiture restriction. As used in this Proxy Statement, the term “administrator” means the Compensation Committee.

Participants and Terms of Awards

Awards under the 2009 Plan may be made to employees, officers, directors and consultants of the Company or any entity controlling or controlled by the Company. Subject to adjustments for stock splits and similar events, the maximum number of shares of Common Stock subject to options or other awards that can be awarded to any eligible individual under the 2009 Plan is 1,000,000 shares per calendar year.

The Plan authorizes the grant of stock options and restricted stock awards (collectively referred to as “Awards”) to eligible participants, except that only employees of our company or any parent or subsidiary of our company is eligible for a grant of incentive stock options. Awards are subject to the terms of the 2009 Plan and the applicable award agreement setting forth such terms as the Compensation Committee may prescribe. Awards under the 2009 Plan may not be transferred other than: (i) by will or by the laws of descent and distribution; or (ii) by gift to a participant’s family member or certain entities in which the participant or his or her family members own a majority of the voting or beneficial interests.

Stock Options

Stock options may be granted under the 2009 Plan, including incentive stock options, as defined under Section 422 of the Code, and nonqualified stock options. The option exercise price of all stock options granted under the 2009 Plan will be determined by the administrator, except that the exercise price for any stock option shall be no less than 100% of the fair market value of the stock on the date of grant. For any incentive stock option, the exercise price will not be less than 100% of the fair market value of the stock on the date of grant or not less than 110% of the fair market value for a holder of 10% of our stock. Stock options may be exercised as determined by the administrator, but in no event after the tenth anniversary of the date of grant, or with respect to incentive stock options after the fifth anniversary for a holder of 10% of our stock.

Upon the exercise of a stock option, the purchase price must be paid in full in either cash or its equivalent. The administrator may also allow payment by tendering previously acquired shares of our common stock with a fair market value at the time of exercise equal to the exercise price or pursuant to broker-assisted cashless exercises and may authorize loans for the purpose of exercise as permitted under applicable law.

Restricted Stock Awards

A restricted stock award is the grant of shares of our Common Stock currently at a price determined by the administrator (including zero), that is nontransferable and is subject to substantial risk of forfeiture until specific conditions or goals are met. Conditions may be based on continuing employment or achieving performance goals. During the period of restriction, participants holding shares of restricted stock shall, except as otherwise provided in an individual award agreement, have full voting and may have dividend rights with respect to such shares. The restrictions will lapse in accordance with a schedule or other conditions determined by the administrator.

Adjustment Provisions and Change of Control

In the event of any corporate event or transaction such as a reorganization, recapitalization, reclassification, stock dividend, stock split, or similar distribution with respect to our Common Stock, or any similar corporate event or transaction, the Compensation Committee, in order to prevent dilution or enlargement of participants’ rights under the 2009 Plan, may make equitable and appropriate adjustments and substitutions, as applicable, to the number and kind of shares subject to outstanding Awards, the exercise price for such shares, the number and kind of shares available for future issuance under the 2009 Plan, and other determinations applicable to outstanding awards. The Compensation Committee will have the power and sole discretion to determine the adjustment to be made in each case.

In the event of (i) any merger or consolidation with another entity in which our stock is converted into or exchanged for the right to receive cash or other property, (ii) the sale or exchange of all of our stock for cash or other property, (iii) the sale, transfer or other disposition of all or substantially all of our assets, or (iv) a liquidation or dissolution of our company, outstanding Awards under the 2009 Plan will terminate unless the successor corporation assumes or substitutes the Awards. However, the Committee may take one or more of the following actions in its sole discretion in connection with any such transaction with respect to all or any portion of outstanding Awards:

| | · | provide that outstanding options shall be assumed, or substituted with substantially equivalent rights, by the acquiring or succeeding entity; |

| | · | provide that unexercised options shall terminate immediately prior to the transaction unless exercised within a specified period following notice to the holder of the transaction; |

| | · | provide that outstanding options shall become exercisable in whole or in part prior to or upon the transaction; |

| | · | provide for cash payments (net of applicable tax withholdings) to be made to holders equal to the excess, if any, of the per share acquisition price over the exercise price of the option, upon which the option shall terminate; |

| | · | provide that, in connection with a liquidation or dissolution of the Company, options shall convert into the right to receive liquidation proceeds net of the exercise price thereof and any applicable tax withholdings; |

| | · | provide for the release of the repurchase rights or other risk of forfeiture with respect to some or all restricted stock awards prior to or upon consummation of the transaction; and |

| | · | provide that, with respect to restricted stock awards, the repurchase and other rights of the Company shall inure to the benefit of the successor company and shall, unless the Committee determines otherwise, apply to the cash, securities or other property which the stock was converted into or exchanged in the same manner and to the same extent as they applied to the Award. |

The Committee has the authority to provide for the full or partial automatic vesting and exercisability of some or all of the outstanding Awards under the 2009 Plan upon the occurrence of an actual or anticipated corporate transaction or change of control.

Amendment and Termination

The Board may terminate, amend, or modify the 2009 Plan as it deems advisable at any time; however, stockholder approval will be obtained for any amendment to the extent necessary and desirable to comply with any applicable law, regulation, or stock exchange rule. Unless the Board expressly provides, no amendment shall affect the terms of any outstanding Award and no termination or amendment may, without the consent of any Award recipient, adversely affect the rights of the Award recipient. The administrator may amend the terms of any Award granted, prospectively or retroactively, provided that the amendment is consistent with the terms of the 2009 Plan.

The 2009 Plan provides that the Board or the administrator has the authority to implement an award exchange program in which (i) outstanding Awards are surrendered or cancelled in exchange for awards of the same type (which may have lower exercise prices, different terms, and a different amount of stock subject to the new award), awards of a different type, and/or cash, and/or (ii) the exercise price of an outstanding Award is reduced (including through an amendment of an outstanding Award). The terms and conditions of any exchange program will be determined by the administrator in its sole discretion.

The 2009 Plan has a term of ten years from the date of adoption of the plan by our Board of Directors.

Summary of U.S. Federal Income Tax Consequences

The following summary is intended only as a general guide to the federal income tax consequences under current U.S. law of participation in the 2009 Plan and does not describe all possible U.S. federal or other tax consequences of such participation or tax consequences based on particular circumstances. Participants in the 2009 Plan should refer to the actual text of the 2009 Plan set forth in Appendix A to this Proxy Statement and should consult their own tax advisors as to specific questions relating to the tax consequences of participation.

Incentive Stock Options. An optionee recognizes no taxable income for regular income tax purposes as a result of the grant or exercise of an incentive stock option qualifying under Section 422 of the Code. Optionees who neither dispose of their shares within two years following the date the option was granted nor within one year following the exercise of the option will normally recognize a capital gain or loss upon a sale of the shares equal to the difference, if any, between the sale price and the purchase price of the shares. If an optionee satisfies such holding periods upon a sale of the shares, the Company will not be entitled to any deduction for federal income tax purposes. If an optionee disposes of shares within two years after the date of grant or within one year after the date of exercise (a “disqualifying disposition”), the difference between the fair market value of the shares on the exercise date and the option exercise price (not to exceed the gain realized on the sale if the disposition is a transaction with respect to which a loss, if sustained, would be recognized) will be taxed as ordinary income at the time of disposition. Any gain in excess of that amount will be a capital gain. If a loss is recognized, there will be no ordinary income, and such loss will be a capital loss. Any ordinary income recognized by the optionee upon the disqualifying disposition of the shares generally should be deductible by the Company for federal income tax purposes, except to the extent such deduction is limited by applicable provisions of the Code.

The difference between the option exercise price and the fair market value of the shares on the exercise date of an incentive stock option is treated as an adjustment in computing the optionee’s alternative minimum taxable income and may be subject to an alternative minimum tax which is paid if such tax exceeds the regular tax for the year. Special rules may apply with respect to certain subsequent sales of the shares in a disqualifying disposition, certain basis adjustments for purposes of computing the alternative minimum taxable income on a subsequent sale of the shares, and certain tax credits that may arise with respect to optionees subject to the alternative minimum tax.

Nonstatutory Stock Options. Options not designated or qualifying as incentive stock options will be nonstatutory stock options having no special tax status. An optionee generally recognizes no taxable income as the result of the grant of such an option. Upon exercise of a nonstatutory stock option, the optionee normally recognizes ordinary income in the amount of the difference between the option exercise price and the fair market value of the shares on the exercise date. If the optionee is an employee, such ordinary income generally is subject to withholding of income and employment taxes. Upon the sale of stock acquired by the exercise of a nonstatutory stock option, any gain or loss, based on the difference between the sale price and the fair market value on the exercise date, will be taxed as capital gain or loss. No tax deduction is available to the Company with respect to the grant of a nonstatutory stock option or the sale of the stock acquired pursuant to such grant. The Company generally should be entitled to a deduction equal to the amount of ordinary income recognized by the optionee as a result of the exercise of a nonstatutory stock option, except to the extent such deduction is limited by applicable provisions of the Code.

Restricted Stock. A participant acquiring restricted stock generally will recognize ordinary income equal to the fair market value of the shares on the “determination date.” The “determination date” is the date on which the restricted stock is acquired unless the shares are subject to a substantial risk of forfeiture (for example, where the restricted stock award is subject to vesting conditions such as service requirements or performance criteria prior to the satisfaction of which the shares remain subject to forfeiture) and are not transferable, in which case the determination date is the earlier of (i) the date on which the shares become transferable or (ii) the date on which the shares are no longer subject to a substantial risk of forfeiture. If the participant is an employee, such ordinary income generally is subject to withholding of income and employment taxes. If the determination date is after the date on which the participant acquires the shares, the participant may elect, pursuant to Section 83(b) of the Code, to have the date of acquisition be the determination date by filing an election with the Internal Revenue Service no later than 30 days after the date the shares are acquired. Upon the sale of shares acquired pursuant to a restricted stock award, any gain or loss, based on the difference between the sale price and the fair market value on the determination date, will be taxed as capital gain or loss. The Company generally should be entitled to a deduction equal to the amount of ordinary income recognized by the participant on the determination date, except to the extent such deduction is limited by applicable provisions of the Code.

Summary of Israeli Income Tax Consequences

The following summary is intended only as a general guide to the income tax consequences under current Israeli law of participation in the 2009 Plan and does not describe all possible Israeli or other tax consequences of such participation or tax consequences based on particular circumstances. Participants in the 2009 Plan should refer to the actual text of the 2009 Plan set forth in Appendix A to this Proxy Statement and should consult their own tax advisors as to specific questions relating to the tax consequences of participation.

Recipients of grants who are Israeli residents or who are liable to Israeli income tax will receive grants under the 2009 Plan subject to the terms of Appendix A to the 2009 Plan (“Appendix A”), the relevant provisions of the Israeli Income Tax Ordinance (New Version), 1961, as amended (the “Ordinance”) and, if applicable, the Income Tax Rules (Tax Benefits Regarding the Grant of Options to Employees), 2003 (the “Rules”) and any other relevant regulations promulgated thereunder, as now existing and as amended from time to time. Appendix A has been structured to comply with the requirements set forth under the Ordinance and the Rules as well as the Israeli Securities Law, 1968, and the rules and regulations promulgated thereunder. It is intended to provide certain tax benefits available to Israeli employees, officers and directors under Section 102 of the Ordinance (“Section 102”), and also includes certain provisions relating to restrictions on the sale of Awards and the depositing of Awards with a trustee designated by the Company (the “Trustee”).

Section 102 - Capital Gains Track. We intend to seek the necessary approvals from the Israel Tax Authority to grant eligible Israeli employees, officers and directors stock options and/or restricted stock awards under the “capital gains track” set forth in Section 102(b)(2) of the Ordinance (the “Capital Gains Track”). Participants receiving grants of Awards under the Capital Gains Track will be subject to tax for such Awards at such time as the shares of Common Stock underlying such Awards are sold or withdrawn from the Trustee. Entitlement to the benefits under the Capital Gains Track is contingent upon the recipient depositing an Award or any shares of Common Stock issued thereunder with the Trustee for a period of at least twenty-four months from the date of grant.

Income derived from Awards granted in compliance with the Capital Gains Track will generally be taxed as a capital gain, currently set at the rate of 25%. However, in the event that the exercise price of a stock option is lower than the average closing price of our Common Stock during the thirty trading days immediately prior to the date of the grant of the Award (the “Israeli Fair Market Value”) the difference will generally be taxed, at the time of the sale of the underlying shares of Common Stock, as employment income at the applicable income tax rate of the recipient and will be subject to applicable mandatory withholding requirements. In the case of restricted stock awards, the difference between the purchase price (usually zero) of the restricted stock award and the Israeli Fair Market Value will generally be taxed, at the time of the sale of the underlying shares of Common Stock, as employment income. Also, in the event that the recipient withdraws such Award or the underlying shares of Common Stock (or sells such shares of Common Stock) prior to the expiration of the twenty-four month holding period, any gain will be treated as ordinary income and will be taxed at the applicable income rate of the recipient.

Recipients of Awards under the Capital Gains Track are required to execute an award agreement acknowledging the terms and conditions applying to such grant and the tax implications governing such Awards.

The Company is not entitled to a deduction for Israeli income tax purposes with respect to Awards made under the Capital Gains Track. However, the Company may recognize a deductible expense for tax purposes (subject to satisfying certain conditions) equal to the difference between the exercise price of a stock option or the purchase price of a restricted stock award (as applicable) and the Israeli Fair Market Value of such Award.

Section 102 - Unapproved Awards. We may at any time grant eligible Israeli employees, officers and directors Awards under Section 102(c) of the Ordinance that will not be deposited with the Trustee (an “Unapproved 102 Award”). Participants receiving grants of Unapproved 102 Awards will be subject to tax for such Awards at such time as the shares of Common Stock underlying such Awards are sold.

Any income derived from the sale of the shares of Common Stock underlying such Awards will be taxed as employment income at the applicable income tax rate of the recipient and will be subject to applicable mandatory withholding requirements. A participant receiving an Unapproved 102 Award is required under the provisions of Section 102 to provide the Company, upon termination of employment with the Company, with a form of collateral or guarantee (in a form satisfactory to the Company) to secure payment of any applicable tax that will be due upon the sale of the underlying shares of Common Stock.

The Company is not entitled to a deduction for Israeli income tax purposes with respect to Awards granted as Unapproved 102 Awards.

3(i) Options. All Israeli taxpayers who are not eligible to receive Awards under Section 102 are subject to taxation under Section 3(i) of the Ordinance with respect to stock options granted to them (“3(i) Options”) under the 2009 Plan. Under Section 102, stock options may only be granted to employees, officers and directors of the Company who are not “controlling shareholders” (as defined in the Ordinance). The difference (if any) between the fair market value of the shares of Common Stock received at the time of exercise of a 3(i) Option and the amount paid by the recipient for such shares at the time of exercise is subject to tax at the applicable income tax rate of the recipient and other applicable mandatory withholding requirements. The difference (if any) between the fair market value of the shares of Common Stock at the time of exercise and the consideration received by the participant upon the sale of such shares is subject to capital gains tax and no withholding requirements apply.

The Company is not entitled to a deduction for Israeli income tax purposes with respect to 3(i) Options.

New Plan Benefits

In connection with its adoption of the 2009 Plan, the Board of Directors approved a grant of options to purchase 100,000 shares of our Common Stock under the 2009 Plan to each of the members of the Board, which option grant will be effective upon the approval of the 2009 Plan by our stockholders at the Meeting. Each of Robert Stevanovski, David Stevanovski and Gregory Provenzano has elected to waive their right to receive such grant. The participants and types of Awards under the 2009 Plan are subject to the discretion of the Compensation Committee and, as a result, the benefits or amounts that will be received by any participant or groups of participants if the 2009 Plan is approved are currently not determinable. As of May 26, 2009, there were three executive officers, seven non-employee directors, and approximately 40 employees who were eligible to participate in the 2009 Plan.

Vote Required and Recommendation of the Board of Directors