Exhibit 99.10

Business of the Annual and Special Meeting

1. Receipt of the Consolidated Financial Statements

To receive the consolidated financial statements of Manulife Financial Corporation (the “Company”) for the year ended December 31, 2008, together with the reports of the auditor and the actuary on those statements.

2. Election of Directors

The 15 nominees for election to the Company’s Board of Directors and their biographies are listed in the section “Nominees for the Board of Directors”. All of the nominees, with the exception of Donald Guloien, are currently Directors of the Company.

Each successful nominee will be elected to the Board of Directors for a term of one year, which expires at the Company’s Annual Meeting in 2010.

Directors’ attendance at Board and committee meetings held in 2008 is shown in the chart for each Director nominee in the “Nominees for the Board of Directors” section.

3. Appointment of Auditors

The Board of Directors propose that the firm of Ernst & Young LLP be appointed as auditor for the 2009 fiscal year. Ernst & Young LLP has served as the Company’s auditor for more than five years. For 2008, fees charged by Ernst & Young LLP to the Company and its subsidiaries were $21.9 million, compared with $20.8 million in 2007.

| | | | | | | | | | |

| | | Year ended December 31, 2008 ($ in millions) | | | | Year ended December 31, 2007 ($ in millions) | | |

Audit fees1 | | $ | 21.1 | | | | $ | 19.8 | | |

Audit-related fees2 | | | 0.7 | | | | | 0.5 | | |

Tax fees3 | | | 0.1 | | | | | 0.5 | | |

All other fees | | | — | | | | | — | | |

Total | | $ | 21.9 | | | | $ | 20.8 | | |

| 1 | Includes the annual audit,Sarbanes-Oxley Act of 2002 (“SOX”) attestation, reviews of quarterly reports, statutory audits and regulatory filings. |

| 2 | Includes review of product filing registration statements and due diligence in connection with proposed or consummated acquisitions. |

| 3 | Includes tax compliance, tax planning and tax advice services. |

The Company has complied with applicable rules regulating the provision of non-audit services to the Company by its external auditor. All audit and non-audit services provided to the Company by Ernst & Young LLP have been pre-approved by the Audit and Risk Management Committee (the “Audit Committee”). The Audit Committee has reviewed the magnitude and nature of these services to ensure that they are compatible with maintaining the independence of the external auditor.

| 4. Confirmation | | of Amendments to By-Law No. 2 Creating Class 1 Shares |

On February 25, 2009, the Board of Directors approved amendments to By-Law No. 2 of the Company (referred to in By-Law No. 2 as the “Corporation”) to create a new class of shares designated as “Class 1 Shares”.The new Class 1 Shares would rankpari passu with the existing Class A Shares and senior to the existing Class B Shares. The Company has four

series of Class A Shares outstanding, and has authorized but not issued a fifth series of Class A Shares. The Company has not issued any Class B Shares. The new Class 1 Shares provide additional flexibility for the Company to create future series of preferred shares with different rights from those under the existing series.

The amendments approved by the Board of Directors are as follows:

| “1. | By-law No. 2 of the Corporation is hereby amended to create a new class of shares to be designated as “Class 1 Shares” (the “Class 1 Shares”), such shares to be unlimited in number and issuable in series and to have rights, privileges, restrictions and conditions in the form of the rights, privileges, restrictions and conditions presented to the board of directors of the Corporation, as contained in Schedule A attached to this resolution; |

| 2. | section 1.1 of By-law No. 2 of the Corporation is hereby amended by adding the following definition after the definition of “Cancellation Time”: |

“Class 1 Shares” means the Class 1 Shares of any series in the capital of the Corporation, without nominal or par value, now existing or hereafter created;”

| 3. | section 2.1 of By-law No. 2 of the Corporation is hereby deleted in its entirety and the following is substituted therefor: |

“2.1 Authorized Capital

The authorized capital of the Corporation shall consist of an unlimited number of Class A Shares issuable in series, an unlimited number of Class B Shares issuable in series, an unlimited number of Class 1 Shares issuable in series and an unlimited number of Common Shares.”

| 4. | By-law No. 2 of the Corporation is hereby amended to add a new section 7 setting forth the rights, privileges, restrictions and conditions of the Class 1 Shares; |

| 5. | the submission of the foregoing amendments to By-law No. 2 of the Corporation to the shareholders of the Corporation entitled to vote thereon for approval at the next meeting of shareholders of the Corporation is hereby authorized and approved; and |

| 6. | the proper officers of the Corporation are hereby authorized to sign and deliver for and on behalf of the Corporation all such documents and instruments and to do all such other acts and things as may be necessary or desirable to give effect to the foregoing resolutions. |

SCHEDULE A

CLASS 1 SHARES

The Class 1 Shares shall have attached thereto the following rights, privileges, restrictions and conditions:

1.1 Directors’ Right to Issue in One or More Series

The Class 1 Shares may be issued at any time or from time to time in one or more series. Before any shares of a series are issued, the Board of Directors of the Corporation shall fix the

| | | | | | |

| | | | Manulife Financial Corporation Proxy Circular | | 1 |

number of shares that will form such series, if any, and shall, subject to any limitations set out in the by-laws of the Corporation or in the Act, determine the designation, rights, privileges, restrictions and conditions to be attached to the Class 1 Shares of such series, the whole subject to the filing with the Office of the Superintendent of Financial Institutions (Canada) of the particulars of such series, including the rights, privileges, restrictions and conditions determined by the Board of Directors of the Corporation.

1.2 Ranking of Class 1 Shares

Each Series of Class 1 Shares shall rank on a parity with every other series of Class 1 Shares and every series of Class A Shares with respect to dividends and return of capital. The Class 1 Shares shall be entitled to a preference over the Class B Shares, the Common Shares and any other shares ranking junior to the Class 1 Shares with respect to priority in payment of dividends and in the distribution of assets in the event of the liquidation, dissolution or winding-up of the Corporation, whether voluntary or involuntary, or any other distribution of the assets of the Corporation among its shareholders for the specific purpose of winding-up its affairs. If any cumulative dividends, whether or not declared, or declared non-cumulative dividends or amounts payable on return of capital are not paid in full in respect of any series of Class 1 Shares, the Class 1 Shares and Class A Shares of all series shall participate rateably in respect of such dividends in accordance with the sums that would be payable on such shares if all such dividends were declared and paid in full, and in respect of such return of capital in accordance with the sums that would be payable on such return of capital if all sums so payable were paid in full; provided, however, that if there are insufficient assets to satisfy in full all such claims as aforesaid, the claims of the holders of the Class 1 Shares and Class A Shares with respect to return of capital shall be paid and satisfied first and any assets remaining thereafter shall be applied towards the payment and satisfaction of claims in respect of dividends. The Class 1 Shares of any series may also be given such other preferences not inconsistent with the rights, privileges, restrictions and conditions attached to the Class 1 Shares as a class over the Class B Shares, the Common Shares and any other shares ranking junior to the Class 1 Shares as may be determined in the case of such series of Class 1 Shares.

1.3 Voting Rights

Except as hereinafter referred to or as required by law, holders of Class 1 Shares will not be entitled as such to receive notice of or to attend or to vote at any meeting of shareholders of the Corporation unless and until the first time at which the Board of Directors has not declared the dividend in full on the shares of one or more series of Class 1 Shares in respect of a particular period specified for the payment of dividends in the rights, privileges, restrictions and conditions attached to such series. In that event, the holders of such series will be entitled to receive notice of and to attend only meetings of shareholders at which directors are to be elected and will be entitled to one vote for each share of such series held at such meetings, but only in respect of the election of directors voting together with all other shareholders of the Corporation who are entitled to vote at such meetings, and the holders of such series will not be entitled to vote in respect of any other business conducted at such meetings (the “Voting Rights”). The Voting Rights of the

holders of any such series will cease on payment by the Corporation of the first dividend on that series to which the holders thereof are entitled under the rights, privileges, restrictions and conditions attached to such series after the time the Voting Rights first arose in respect of such series, until such time as the Corporation may again fail to declare the dividend in full on such series in any period specified for the payment of dividends in the rights, privileges, restrictions and conditions attached to such series, in which event the Voting Rights will become effective again and so on from time to time.

1.4 Constrained Shares

| (a) | The Corporation shall not issue or allot any Class 1 Shares to any person, or any entity controlled by a person, the Corporation shall refuse to allow the entry in the securities register of the Corporation of an issue or transfer of any Class 1 Shares to any person, or any entity controlled by a person, and no person or any entity controlled by a person, shall purchase or otherwise acquire any Class 1 Shares, if such issue, transfer or purchase or other acquisition would cause the person to have a significant interest in the Class 1 Shares. No person who has a significant interest in any class of shares of the Corporation, or entity controlled by a person who has a significant interest in any class of shares of the Corporation, shall, in person or by proxy, exercise any voting rights attached to Class 1 Shares beneficially owned by, or that are subject to agreement pertaining to the exercise of voting rights entered into by, that person or entity. In accordance with the authority granted to the Corporation’s Directors under the Act and the Regulations, the Directors of the Corporation are hereby authorized to make such arrangements as the Directors deem necessary to carry out the intent of the purchase or other acquisition, issue, transfer and voting restrictions contained in the Act, the Regulations and the by-laws. |

| (b) | If the purchase or other acquisition, issue, transfer or voting of any Class 1 Shares would be permitted under the Act and the Regulations, notwithstanding the provisions of subsection 1.4(a), the Directors are hereby authorized, in their discretion, to permit by resolution of the Directors, any such purchase or other acquisition, issue, transfer or exercise of voting rights with respect to such Class 1 Shares. |

| (c) | Subject to subsection 1.4(d), if, after the date of incorporation of the Corporation, the Share Constraint Regime is amended, replaced or deleted, such that the provisions of the subsection 1.4(a) are inconsistent with the Share Constraint Regime resulting from such amendment, replacement or deletion, then the Directors are hereby authorized to amend, replace or delete subsection 1.4(a) such that it will be consistent with the Share Constraint Regime then in effect. The action of the Board of Directors to amend, replace or delete subsection 1.4(a) shall be by resolution of the Board of Directors and such amendment, replacement or deletion of subsection 1.4(a) shall be effective without the approval of the holders of any of the Class 1 Shares, the Class A Shares, the Class B Shares or the Common Shares. Promptly following any amendment, replacement or deletion of subsection 1.4(a) by the Directors, the Corporation shall give notice to the holders of the Class 1 Shares of the amendment, replacement or deletion thereto. |

| | | | | | |

| 2 | | Manulife Financial Corporation Proxy Circular | | | | |

| (d) | If, after the date of incorporation of the Corporation, the Share Constraint Regime is amended or replaced and the Share Constraint Regime then in effect allows the Corporation to determine the application to it and its shareholders of all or any part of such Share Constraint Regime then the provisions of subsection 1.4(a) may only be amended or replaced with approval of the holders of the Class 1 Shares, the Class A Shares, the Class B Shares and the Common Shares as provided in the Act. |

1.5 Amendment With Approval of Holders of Class 1 Shares

The rights, privileges, restrictions and conditions attached to the Class 1 Shares as a class may be added to, changed or removed but only with the approval of the holders of the Class 1 Shares given as hereinafter specified.

1.6 Approval of Holders of Class 1 Shares

The approval of the holders of the Class 1 Shares to add to, change or remove any rights, privilege, restriction or condition attaching to the Class 1 Shares as a class or in respect of any other matter requiring the consent of the holders of the Class 1 Shares may be given in such manner as may then be required by law, subject to a minimum requirement that such approval be given by resolution signed by all the holders of the Class 1 Shares or passed by the affirmative vote of at least two-thirds (2/3) of the votes cast at a meeting of the holders of the Class 1 Shares duly called for that purpose. Notwithstanding anything else in this Section 1, the approval of the holders of the Class 1 Shares, voting separately as a class or series, is not required on a proposal to amend the by-laws of the Corporation to:

| (a) | increase or decrease the maximum number of authorized Class 1 Shares, or increase the maximum number of authorized shares of a class of shares having rights or privileges equal or superior to the Class 1 Shares; |

| (b) | effect the exchange, reclassification or cancellation of all or any part of the Class 1 Shares; or |

| (c) | create a new class of shares equal to or superior to the Class 1 Shares. |

The formalities to be observed with respect to the giving of notice of any such meeting or any continuation of an adjourned meeting, the quorum required therefor and the conduct thereof shall be those from time to time required by the Act as in force at the time of the meeting and those, if any, prescribed by the by-laws or the administrative resolutions of the Corporation with respect to meetings of shareholders. On every poll taken at every meeting of the holders of the Class 1 Shares as a class, or at any joint meeting of the holders of two or more series of Class 1 Shares, each holder of Class 1 Shares entitled to vote thereat shall have one vote in respect of each Class 1 Share held.

1.7 Notice to holders of Class 1 Shares

Any notice, cheque, notice of redemption or other communication from the Corporation herein provided for shall be sent to the holders of the Class 1 Shares by first class mail, postage prepaid at their respective addresses appearing on the securities register of the Corporation or, in the event of the address of any such holder not so appearing, then at the last address of such holder known to the Corporation. Accidental failure to give any such notice, notice of redemption or other communication to one or more holders of Class 1 Shares shall not affect the validity thereof, but, upon such failure being discovered, a copy of the notice, notice of redemption or other communication, as the case may be, shall be sent or delivered forthwith to such holder or holders. Unless otherwise provided herein, any notice, request, certificate, or other communication from a holder of Class 1 Shares herein provided for shall be either sent to the Corporation by first class mail, postage prepaid, or delivered by hand to the Corporation at its registered office.”

To be effective, this amendment must be confirmed by special resolution of the shareholders. This special resolution requires the affirmative vote of not less than two-thirds of the votes cast by holders of common shares present in person or represented by proxy. The Board of Directors recommends that shareholders vote in favour of this special resolution.

Special Resolution of Holders of Common Shares Confirming Amendments to By-Law No. 2 Creating

Class 1 Shares

RESOLVED THAT:

| 1. | The amendments to By-Law No. 2 of the Company creating a new class of shares designated as “Class 1 Shares” approved by the Board of Directors on February 25, 2009 are hereby confirmed. |

| 2. | The proper officers of the Company are hereby authorized to sign and deliver for and on behalf of the Company all such documents and instruments and to do all such other acts and things as may be necessary or desirable to give effect to the foregoing resolution. |

5. Shareholder Proposals

The shareholder proposals submitted for consideration by the shareholders at the Meeting are included in Schedule “C”.

Note: All figures reported in this Proxy Circular are in Canadian currency, unless otherwise indicated.

| | | | | | |

| | | | Manulife Financial Corporation Proxy Circular | | 3 |

Board Renewal and Director Selection

The Board of Directors commenced a renewal process (as disclosed in last year’s proxy circular), to nominate candidates to replace several Directors who will retire over the next four years, having reached the mandatory retirement age of 72. The Corporate Governance and Nominating Committee (the “Governance Committee”), in actively managing the renewal process, considered this an opportune time to engage in a complete review of the Director selection criteria to identify the ideal size and competencies that should be represented on a board of directors of a major global financial services organization. To ensure the smooth transition from the retiring Directors, including maintaining critical competencies, the size of the Board may temporarily increase to allow new Directors to be elected to the Board prior to the retirements being effective.

Due to the forthcoming vacancies, the increased complexity of the Company’s business and the current market, the Board of Directors is developing new selection criteria for director nominees, which will allow the Board over the next four years to: (i) have the flexibility to move quickly if excellent individuals meeting any of the requirements become available; (ii) deliberately recruit against these specifications; and (iii) use these requirements to prioritize and select potential candidates who may come to the Company through merger and acquisition activity.

In addition to having the basic characteristics of integrity, good judgment, financial knowledge, and sufficient time available, the Governance Committee recommended that new nominees have experience in such areas as Risk Management, Investments and Pan-Asia operations or governance. (See the Board Policies in Schedule “B” for the Director Succession and Selection Criteria and the mandatory retirement age policy.) The Governance Committee will retain one or more executive search firms, to assist in identifying qualified candidates who meet the revised selection criteria.

Two Directors will not be seeking re-election to the Board. Arthur Sawchuk retired on October 1, 2008 and his successor, Gail Cook-Bennett, was appointed as Chair of the Board on October 2, 2008. Dominic D’Alessandro will be retiring from his position as President and Chief Executive Officer in May 2009. Following an extensive succession planning process, the Board has selected Donald Guloien, Senior Executive Vice President and Chief Investment Officer to succeed Dominic D’Alessandro as President and Chief Executive Officer.

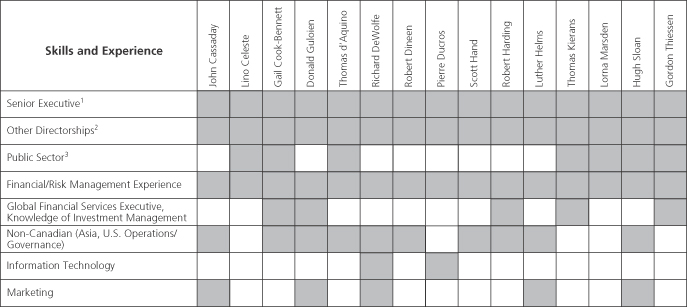

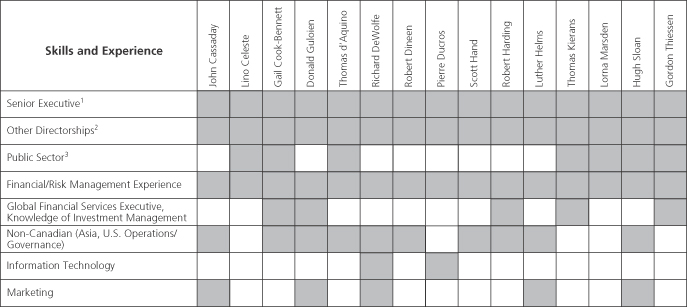

The Directors’ Matrix below is a combination of the previous and the revised selection criteria and reflects the current strengths of the Board as a whole.

Board of Directors’ Matrix

| 1 | Any senior officer or Chair of the Board of a major organization. |

| 2 | Director of a major organization (public, private, non-profit). |

| 3 | Including a Crown Corporation, educational institution, or any non-public, non-private organization. |

| | | | | | |

| 4 | | Manulife Financial Corporation Proxy Circular | | | | |

Nominees for the Board of Directors

The following individuals are the nominees for election to the Board. Important information regarding the nominees relating to committee memberships, meeting attendance, public board memberships and equity ownership is provided in the following charts. All successful nominees for the Board of Directors are elected for a term of one year, expiring at the next Annual Meeting.

Director Nominee Information

| | | | | | | | | | | | | | | |

Gail C.A. Cook-Bennett Age: 68 Toronto, ON Canada Director Since1: 1978 Independent2 | | Gail Cook-Bennett was appointed Chair of the Board on October 2, 2008. Gail Cook-Bennett is past Chair of the

Canada Pension Plan Investment Board, an investment management organization that invests the Canada Pension Plan

fund to help pay the benefits of 17 million Canadians who participate in the Plan, a position she held since 1998. Gail

Cook-Bennett holds a BA (Honours) from Carleton University and a PhD (Economics) from the University of Michigan.

She is a Member of the Order of Canada. She holds a Doctor of Laws Degree(honoris causa) from Carleton University

and is a Fellow of the Institute of Corporate Directors. |

| | Board/Committee Membership: | | Overall

Attendance3 :100% | | | Public Board Membership During Last Five Years: |

| | Board of Directors | | | | 13 of 13 | | 100% | | | Emera Inc. | | 2004 – Present |

| | Corporate Governance & Nominating (Chair)4 | | 6 of 64 | | 100% | | | Petro-Canada5 | | 1991 – Present |

| | Management Resources & Compensation | | 2 of 24 | | 100% | | | Transcontinental Inc. | | 1998 – 2004 |

| | Securities Held: |

| | Year | | Common

Shares6 | | DSUs7 | | Total Common

Shares and DSUs |

| | Total Market Value of Common Shares and DSUs8 | | Minimum Ownership Requirement9 |

| | 2009 | | 15,000 | | 8,831 | | 23,831 | | | $328,868 | | $300,000 |

| | 2008 | | 15,000 | | 8,546 | | 23,546 | | | $841,299 | |

| | Options Held (Director option grants discontinued in 2004): See chart “Outstanding Share-Based Awards” |

| | | | | | | | | | | | | | |

Donald A. Guloien Age: 51 Toronto, ON Canada Not Independent – Management | | Donald Guloien, a 28-year veteran of Manulife, will succeed Dominic D’Alessandro upon his election as President and

Chief Executive Officer on May 7, 2009. Mr. Guloien started his career at Manulife as a Senior Research Analyst,

Corporate Planning and is currently Senior Executive Vice President and Chief Investment Officer, a position he has held

since 2001. He is also Chairman and CEO of MFC Global Investment Management. Mr. Guloien holds a Bachelor of

Commerce from the University of Toronto. He is a former board member of Elliott & Page Limited, the Children’s Aid

Society Foundation, Think First Foundation of Canada, the Governing Council of the University of Toronto and LIMRA

International. Mr. Guloien is a member of the Young Presidents’ Organization and is actively involved with the Rotman

School of Management. He is a 1998 recipient of the Arbor Award for his contributions to the University of Toronto. |

| | Public Board Membership During Last Five Years: |

| | Seamark Asset Management Ltd. | | 2001 – 2006 |

| | Securities Held: |

| | Year | | Common

Shares6 | | DSUs7 | | Total Common

Shares and DSUs | | Total Market Value of Common Shares and DSUs8 | | Minimum Ownership Requirement9 |

| | 2009 | | 123,720 | | 160,686 | | 284,406 | | $3,924,803 | | See Executive Share Ownership Guidelines (page 27) |

| | Options Held: See “Statement of Executive Compensation” Section |

| | | | | | | | | | | | | | | |

John M. Cassaday Age: 55 Toronto, ON Canada Director Since1: 1993 Independent2 | | John Cassaday is President and Chief Executive Officer of Corus Entertainment Inc., a position he has held since 1999.

Corus is a Canadian leader in specialty television and radio and is a global leader in the production of children’s

animation. Mr. Cassaday has also been Executive Vice President of Shaw Communications, President and Chief

Executive Officer of Shaw Media, Star Choice Communications and of CTV Television Network. Mr. Cassaday has an

MBA (Dean’s List) from the Rotman School of Management at the University of Toronto. Mr. Cassaday is also active in

community affairs, principally with St. Michael’s Hospital. |

| | Board/Committee Membership: | | Overall

Attendance3 :100% | | | Public Board Membership During Last Five Years: |

| | Board of Directors | | | | 13 of 13 | | 100% | | | Corus Entertainment Inc. | | 1999 – Present |

| | Corporate Governance & Nominating | | 6 of 6 | | 100% | | | Sysco Corporation | | 2004 – Present |

| | Management Resources & Compensation | | 4 of 410 | | 100% | | | Loblaw Companies Limited | | 1997 – 2004 |

| | | | | | | | | Masonite International Corporation | | 1992 – 2005 |

| | Securities Held: |

| | Year | | Common

Shares6 | | DSUs7 | | Total Common

Shares and DSUs |

| | Total Market Value of Common Shares and DSUs8 | | Minimum Ownership Requirement9 |

| | 2009 | | 40,000 | | 34,751 | | 74,751 | | | $1,031,564 | | $300,000 |

| | 2008 | | 40,000 | | 28,368 | | 68,368 | | | $2,442,789 | |

| | | Options Held (Director option grants discontinued in 2004): See chart “Outstanding Share-Based Awards” |

| | | | | | |

| | | | Manulife Financial Corporation Proxy Circular | | 5 |

| | | | | | | | | | | | | | | |

Lino J. Celeste Age: 71 Saint John, NB Canada Director Since1: 1994 Independent2 | | Lino Celeste is past Chairman of Aliant Inc., the merged Atlantic provinces telephone companies. Prior to assuming the

Chairmanship, Mr. Celeste was President and Chief Executive Officer of New Brunswick Telephone Company Limited.

Mr. Celeste holds a P.Eng. (Electrical Engineering) from the University of New Brunswick. He also served as a director of

New Brunswick Electric Power Commission and as Chairman of the Greater Saint John Community Foundation, a

charitable organization. |

| | Board/Committee Membership: | | Overall

Attendance3: 100% | | | Public Board Membership During Last Five Years: |

| | Board of Directors | | | | 13 of 13 | | 100% | | | None | | |

| | Audit & Risk Management | | 6 of 6 | | 100% | | | | | |

| | Conduct Review & Ethics | | 3 of 3 | | 100% | | | | | |

| | Securities Held: |

| | Year | | Common

Shares6 | | DSUs7 | | Total Common

Shares and DSUs |

| | Total Market Value of Common Shares and DSUs8 | | Minimum Ownership Requirement9 |

| | 2009 | | 12,600 | | 19,022 | | 31,622 | | | $436,384 | | $300,000 |

| | 2008 | | 12,600 | | 15,655 | | 28,255 | | | $1,009,551 | |

| | Options Held (Director option grants discontinued in 2004): See chart “Outstanding Share-Based Awards” |

| | | | | | | | | | | | | | | |

Thomas P. d’Aquino Age: 68 Ottawa, ON Canada Director Since1: 2005 Independent2 | | Thomas d’Aquino is Chief Executive and President of the Canadian Council of Chief Executives (“CCCE”), a research

and advocacy group composed of 150 chief executives of Canada’s leading enterprises. Mr. d’Aquino holds a BA from

the University of British Columbia, an LLB from Queen’s University and the University of British Columbia, an LLM from

the University of London and Doctor of Laws honorary degree from Queen’s University and Wilfrid Laurier University.

Mr. d’Aquino has served as Special Assistant to the Prime Minister of Canada and a Professor Adjunct on the law of

international business transactions. As well as CEO, he is the CCCE’s chief policy officer and strategist responsible for

fiscal, taxation, competitiveness, international trade and environmental issues. He is currently Chair of Lawrence

National Centre for Policy and Management at the Richard Ivey School of Business and he also chairs The National

Gallery of Canada Foundation. |

| | Board/Committee Membership: | | Overall

Attendance3: 95% | | | Public Board Membership During Last Five Years: |

| | Board of Directors | | | | 12 of 13 | | 92% | | | CGI Inc. | | 2006 – Present |

| | Audit & Risk Management | | 4 of 410 | | 100% | | | | | |

| | Conduct Review & Ethics | | 2 of 210 | | 100% | | | | | |

| | Management Resources & Compensation | | 2 of 210 | | 100% | | | | | |

| | Securities Held: |

| | Year | | Common

Shares6 | | DSUs7 | | Total Common

Shares and DSUs |

| | Total Market Value of Common Shares and DSUs8 | | Minimum Ownership Requirement9 |

| | 2009 | | 6,190 | | 17,330 | | 23,520 | | | $324,576 | | $300,000 |

| | 2008 | | 6,190 | | 11,454 | | 17,644 | | | $630,420 | |

| | Options Held (Director option grants discontinued in 2004): Nil |

| | | | | | | | | | | | | | | |

Richard B. DeWolfe11 Age: 65 Westwood, MA U.S.A. Director Since1: 2004 Independent2 | | Richard DeWolfe is Managing Partner of DeWolfe & Company, LLC, a real estate management and investment

consulting firm. Mr. DeWolfe holds a BAS, Marketing and Finance from Boston University. He is also a director of The

Boston Foundation; Trustee of Boston University; Trustee of the 17136 Marine Biological Laboratory; and an honorary

director of The Boston Center for Community and Justice. He was formerly Chairman and CEO of The DeWolfe

Companies, Inc., the largest homeownership organization in New England, which was previously listed on the

American Stock Exchange and acquired by Cendant Corporation in 2002. Mr. DeWolfe was formerly Chairman and

Founder of Reliance Relocations Services, Inc. and was formerly Chairman of the Board of Trustees, Boston University. |

| | Board/Committee Membership: | | Overall Attendance3: 100% | | | Public Board Membership During Last Five Years: |

| | Board of Directors | | | | 13 of 13 | | 100% | | | Avantair, Inc. | | 2009 – Present |

| | Audit & Risk Management (Chair) | | 6 of 6 | | 100% | | | John Hancock Financial Services, Inc. | | 2002 – 2004 |

| | Conduct Review & Ethics | | 3 of 3 | | 100% | | | | | |

| | Corporate Governance & Nominating | | 1 of 112 | | 100% | | | | | |

| | Securities Held: |

| | Year | | Common

Shares6 | | DSUs7 | | Total Common

Shares and DSUs |

| | Total Market Value of Common Shares and DSUs8 | | Minimum Ownership Requirement9 |

| | 2009 | | 14,000 | | 29,992 | | 43,992 | | | $607,090 | | $300,000 |

| | 2008 | | 14,000 | | 21,424 | | 35,424 | | | $1,265,700 | |

| | | Options Held (Director option grants discontinued in 2004): Nil |

| | | | | | |

| 6 | | Manulife Financial Corporation Proxy Circular | | | | |

| | | | | | | | | | | | | | | |

Robert E. Dineen, Jr. Age: 68 New York, NY U.S.A. Director Since1: 1999 Independent2 | | Robert Dineen was Of Counsel to Shearman & Sterling LLP, a leading international law firm headquartered in New York

where he was a partner from 1974 until his retirement in December 2005. Mr. Dineen holds a BA from Brown

University and an LLB from Syracuse University. Mr. Dineen led several of the firm’s corporate groups, including groups

in Latin America and Asia and its project finance work worldwide. Mr. Dineen has extensive experience in public

finance transactions in the oil and gas pipeline business, and as a specialist in U.S. and international private banking

and financial transactions. |

| | Board/Committee Membership: | | Overall

Attendance3: 100% | | | Public Board Membership During Last Five Years: |

| | Board of Directors | | | | 13 of 13 | | 100% | | | Nova Chemicals Corporation | | 1998 – Present |

| | Audit & Risk Management | | 6 of 6 | | 100% | | | | | |

| | Conduct Review & Ethics | | 3 of 3 | | 100% | | | | | |

| | Securities Held: |

| | Year | | Common

Shares6 | | DSUs7 | | Total Common

Shares and DSUs |

| | Total Market Value of Common Shares and DSUs8 | | Minimum Ownership Requirement9 |

| | 2009 | | 29,000 | | 33,513 | | 62,513 | | | $862,679 | | $300,000 |

| | 2008 | | 29,000 | | 32,429 | | 61,429 | | | $2,194,858 | |

| | Options Held (Director option grants discontinued in 2004): See chart “Outstanding Share-Based Awards” |

| | | | | | | | | | | | | | | |

Pierre Y. Ducros Age: 69 Montreal, QC Canada Director Since1: 1999 Independent2 | | Pierre Ducros is President of P. Ducros & Associates Inc. in Montréal. Previously, he was Chairman, President and Chief

Executive Officer of DMR Group Inc. which he co-founded in 1973, and Vice-Chairman of the Task Force on The Future

of The Canadian Financial Services Sector (MacKay Task Force). Mr. Ducros holds a BA from the Université de Paris at

Collège Stanislas in Montréal and a B.Eng. (Communications) from McGill University. |

| | Board/Committee Membership: | | Overall

Attendance3: 86% | | | Public Board Membership During Last Five Years: |

| | Board of Directors | | | | 11 of 13 | | 85% | | | Rona Inc. | | 2005 – Present |

| | Corporate Governance & Nominating | | 4 of 512 | | 80% | | | Telus | | 2005 – Present |

| | Management Resources & Compensation | | 4 of 410 | | 100% | | | Cognos Incorporated13 | | 1986 – 2008 |

| | | | | | | | | | | Emergis Inc. | | 1998 – 2008 |

| | | | | | | | | | | eNGENUITY Technologies Inc. | | 2002 – 2005 |

| | | | | | | | | | | Nstein Technologies Inc. | | 2002 – 2006 |

| | Securities Held: |

| | Year | | Common

Shares6 | | DSUs7 | | Total Common

Shares and DSUs |

| | Total Market Value of Common Shares and DSUs8 | | Minimum Ownership Requirement9 |

| | 2009 | | 55,600 | | 31,920 | | 87,520 | | | $1,207,776 | | $300,000 |

| | 2008 | | 55,600 | | 28,310 | | 83,910 | | | $2,998,104 | |

| | Options Held (Director option grants discontinued in 2004): See chart “Outstanding Share-Based Awards” |

| | | | | | | | | | | | | | | |

Scott M. Hand Age: 66 Toronto, ON Canada Director Since1: 2007 Independent2 | | Scott Hand was the Chairman and Chief Executive Officer of Inco Limited (“Inco”) from April 2002 until he retired in

January 2007. Prior to that, Mr. Hand was the President of Inco and held positions in Strategic Planning, Business

Development and Law. Inco has been a major global Canadian-based resources enterprise and a leading producer and

marketer of nickel and other metals. Mr. Hand serves on the boards of Juno Special Situations Corporation (mining

resource investment) and Boyd Technologies LLC (paper non-woven materials). He is also a member of the board of

directors of the World Wildlife Fund Canada. Mr. Hand received a BA from Hamilton College and a JD from Cornell

University. |

| | Board/Committee Membership: | | Overall

Attendance3: 95% | | | Public Board Membership During Last Five Years: |

| | Board of Directors | | 12 of 13 | | 92% | | | Fronteer Development Group Inc. | | 2007 – Present |

| | Audit & Risk Management | | 2 of 210 | | 100% | | | Inco Limited | | 1991 – 2007 |

| | Conduct Review & Ethics | | 1 of 110 | | 100% | | | Independence Community Bank Corp. | | 1987 – 2006 |

| | Management Resources & Compensation | | 4 of 410 | | 100% | | | | |

| | Securities Held: |

| | Year | | Common

Shares6 | | DSUs7 | | Total Common

Shares and DSUs |

| | Total Market Value of Common Shares and DSUs8 | | Minimum Ownership Requirement by 20129 |

| | 2009 | | 30,000 | | 3,918 | | 33,918 | | | $468,068 | | $300,000 |

| | 2008 | | 20,000 | | 1,242 | | 21,242 | | | $758,977 | |

| | Options Held (Director option grants discontinued in 2004): Nil |

| | | | | | |

| | | | Manulife Financial Corporation Proxy Circular | | 7 |

| | | | | | | | | | | | | | | | |

Robert J. Harding Age: 51 Toronto, ON Canada Director Since1: 2008 Independent2 | | Robert Harding is Chairman of Brookfield Asset Management Inc., a position he has held since 1997. He has held

various executive positions with Brookfield (and its predecessor companies) since 1984, including Chief Financial Officer

and President and Chief Executive Officer. In his role as Chairman, Mr. Harding represents Brookfield’s interests on the

boards of its various affiliates as a director and Chairman of Norbord Inc. and as a director of Fraser Papers Inc. and

Western Forest Products Limited. Brookfield Asset Management is a specialist asset management company focused on

property, power and other infrastructure assets. Mr. Harding holds a B. Mathematics and a Doctor of Laws honorary

degree from the University of Waterloo and is a Fellow of the Institute of Chartered Accountants. He is Chair of the

Board of Governors of the University of Waterloo, Chair of the Board of Trustees for the United Way of Greater

Toronto, a member of the Board of Trustees for the Hospital for Sick Children and a trustee for the Art Gallery of

Ontario. |

| | Board/Committee Membership: | | Overall

Attendance3: 86% | | | Public Board Membership During Last Five Years: |

| | Board of Directors | | | | 2 of 3 | 14 | | 67% | | | Brookfield Asset Management Inc. | | 1992 – Present |

| | Audit & Risk Management | | | | 3 of 3 | 14 | | 100% | | | Fraser Papers Inc. | | 2004 – Present |

| | Conduct Review & Ethics | | 1 of 1 | 14 | | 100% | | | Norbord Inc. | | 1998 – Present |

| | | | | | | | | | | | | | Western Forest Products Inc. | | 2006 – Present |

| | | | | | | | | | | | | | BPO Properties Inc. | | 1999 – 2004 |

| | | | | | | | | | | | | | Burlington Resources Inc. | | 2002 – 2006 |

| | | | | | | | | | | | | | Falconbridge Ltd. | | 2000 – 2005 |

| | | | | | | | | | | | | | Noranda Inc. | | 1995 – 2005 |

| | Securities Held: |

| | Year | | Common

Shares6 | | DSUs7 | | Total Common

Shares and DSUs |

| | Total Market Value of Common Shares and DSUs8 | | Minimum Ownership Requirement by 20139 |

| | 2009 | | 16,000 | | 2,027 | | 18,027 | | | $248,773 | | $300,000 |

| | Options Held (Director option grants discontinued in 2004): Nil |

| | | | | | | | | | | | | | | |

Luther S. Helms Age: 65 Scottsdale, AZ U.S.A. Director Since1: 2007 Independent2 | | Luther Helms has been the Managing Director of Sonata Capital Group (“Sonata”) since 2000. Sonata is a

privately-owned registered investment advisory firm. Mr. Helms has extensive banking and financial services experience,

holding various positions at Bank of America Corporation, including Vice Chairman from 1993-1998 and was the Vice

Chairman of KeyBank from 1998-2000. Mr. Helms was a director of Lifelock, an identity theft protection company.

Mr. Helms has an MBA from the University of Santa Clara and a BA in History and Economics from the University of

Arizona. |

| | Board/Committee Membership: | | Overall

Attendance3: 100% | | | Public Board Membership During Last Five Years: |

| | Board of Directors | | | | 13 of 13 | | 100% | | | ABM Industries Incorporated | | 1995 – Present |

| | Audit & Risk Management | | 6 of 6 | | 100% | | | | | |

| | Conduct Review & Ethics | | 3 of 3 | | 100% | | | | | |

| | Securities Held: |

| | Year | | Common

Shares6 | | DSUs7 | | Total Common

Shares and DSUs |

| | Total Market Value of Common Shares and DSUs8 | | Minimum Ownership Requirement by 20129 |

| | 2009 | | 2,100 | | 9,086 | | 11,186 | | | $154,367 | | $300,000 |

| | 2008 | | 2,100 | | 2,610 | | 4,710 | | | $168,288 | |

| | Options Held (Director option grants discontinued in 2004): Nil |

| | | | | | | | | | | | | | | |

Thomas E. Kierans15 Age: 68 Toronto, ON Canada Director Since1: 1990 Independent2 | | Thomas Kierans is Chair of Council and Vice President of the Social Sciences and Humanities Research Council. Mr.

Kierans holds a BA (Honours) from McGill University and an MBA (Finance), Dean’s Honours List, from the University of

Chicago. Mr. Kierans has also been Chairman of The Canadian Journalism Foundation, Chairman of CSI-Global

Education Inc., Chairman of the Canadian Institute for Advanced Research, Chairman of the Board of the Toronto

International Leadership Centre for Financial Sector Supervisors, Chairman of Moore Corporation Limited, Chairman of

Petro-Canada, President and Chief Executive Officer of the C.D. Howe Institute and President of McLeod Young Weir

Limited (later ScotiaMcLeod Inc.). |

| | Board/Committee Membership: | | Overall

Attendance3: 96% | | | Public Board Membership During Last Five Years: |

| | Board of Directors | | | | 12 of 13 | | 92% | | | Petro-Canada5 | | 1991 – Present |

| | Audit & Risk Management | | 6 of 6 | | 100% | | | BCE Inc. | | 1999 – 2004 |

| | Conduct Review & Ethics (Chair) | | 3 of 3 | | 100% | | | Inmet Mining Corporation | | 1996 – 2004 |

| | Corporate Governance & Nominating | | 6 of 6 | | 100% | | | Telesat Canada | | 1999 – 2004 |

| | Securities Held: |

| | Year | | Common

Shares6 | | DSUs7 | | Total Common

Shares and DSUs |

| | Total Market Value of Common Shares and DSUs8 | | Minimum Ownership Requirement9 |

| | 2009 | | 61,376 | | 0 | | 61,376 | | | $846,989 | | $300,000 |

| | 2008 | | 61,376 | | 0 | | 61,376 | | | $2,192,964 | |

| | Options Held (Director option grants discontinued in 2004): See chart “Outstanding Share-Based Awards” |

| | | | | | |

| 8 | | Manulife Financial Corporation Proxy Circular | | | | |

| | | | | | | | | | | | | | | |

Lorna R. Marsden Age: 67 Toronto, ON Canada Director Since1: 1995 Independent2 | | Lorna Marsden is President Emerita and Professor of York University. Prior to her retirement in May 2007, she was

President and Vice-Chancellor and a member of the Board of Governors of York University. Dr. Marsden was President

and Vice-Chancellor of Wilfrid Laurier University and served as a member of the Senate of Canada. Dr. Marsden holds a

BA from the University of Toronto and a PhD from Princeton University. She is a recipient of honorary Doctor of Laws

degrees from the University of New Brunswick, the University of Winnipeg, Queen’s University and the University of

Toronto. Dr. Marsden serves as a director of several private and non-profit organizations. Dr. Marsden was appointed

to the Order of Ontario in 2009. |

| | Board/Committee Membership: | | Overall

Attendance3: 100% | | | Public Board Membership During Last Five Years: |

| | Board of Directors | | | | 13 of 13 | | 100% | | | SNC-Lavalin Group Inc. | | 2006 – Present |

| | Management Resources & Compensation | | 6 of 6 | | 100% | | | | | |

| | Securities Held: |

| | Year | | Common

Shares6 | | DSUs7 | | Total Common

Shares and DSUs |

| | Total Market Value of Common Shares and DSUs8 | | Minimum Ownership Requirement9 |

| | 2009 | | 38,664 | | 17,529 | | 56,193 | | | $775,463 | | $300,000 |

| | 2008 | | 38,664 | | 14,455 | | 53,119 | | | $1,897,942 | |

| | Options Held (Director option grants discontinued in 2004): See chart “Outstanding Share-Based Awards” |

| | | | | | | | | | | | | | | |

Hugh W. Sloan, Jr. Age: 68 Bloomfield Village, MI

U.S.A. Director Since1: 1985 Independent2 | | Hugh Sloan is Retired Deputy Chairman of Woodbridge Foam Corporation, a manufacturer of automobile parts, where

he held various management positions for more than 20 years. Mr. Sloan holds a BA (Honours) from Princeton

University. Mr. Sloan serves as a director of a number of Canadian and American corporate, community and charitable

organizations. He is a former Staff Assistant to President Richard Nixon and a former Trustee of Princeton University. |

| | Board/Committee Membership: | | Overall

Attendance3: 100% | | | Public Board Membership During Last Five Years: |

| | Board of Directors | | | | 13 of 13 | | 100% | | | Spartan Motors, Inc. | | 2007 – Present |

| | Corporate Governance & Nominating | | 6 of 6 | | 100% | | | Wescast Industries Inc. | | 1998 – Present |

| | Management Resources & Compensation10 | | 6 of 6 | | 100% | | | Virtek Vision International, Inc. | | 2000 – 2005 |

| | Securities Held: |

| | Year | | Common

Shares6 | | DSUs7 | | Total Common Shares and DSUs | | | Total Market Value of Common Shares and DSUs8 | | Minimum Ownership Requirement9 |

| | 2009 | | 14,420 | | 26,047 | | 40,467 | | | $558,445 | | $300,000 |

| | 2008 | | 14,420 | | 22,010 | | 36,430 | | | $1,301,644 | |

| | | | | | | | | | | | |

| | Options Held (Director option grants discontinued in 2004): See chart “Outstanding Share-Based Awards” |

| | | | | | | | | | | | | | | |

Gordon G. Thiessen Age: 70 Ottawa, ON Canada Director Since1: 2002 Independent2 | | Gordon Thiessen joined the Board following a distinguished career with the Bank of Canada that began in 1963 and

culminated in a seven-year term as the Bank’s Governor. He was Chairman of the Canadian Public Accountability

Board, the oversight body for the auditing profession in Canada from 2002 to 2008. Mr. Thiessen holds a BA (Honours)

and an MA from the University of Saskatchewan and a PhD from the London School of Economics. Mr. Thiessen also

serves as a director of the Institute for Research on Public Policy. |

| | Board/Committee Membership: | | Overall

Attendance3: 90% | | | Public Board Membership During Last Five Years: |

| | Board of Directors | | | | 11 of 13 | | 85% | | | IPSCO Inc. | | 2001 – 2007 |

| | Corporate Governance & Nominating | | 1 of 112 | | 100% | | | | | |

| | Management Resources & Compensation (Chair)10 | | 6 of 6 | | 100% | | | | | |

| | Securities Held: |

| | Year | | Common

Shares6 | | DSUs7 | | Total Common Shares and DSUs | | | Total Market Value of Common Shares and DSUs8 | | Minimum Ownership Requirement9 |

| | 2009 | | 1,000 | | 26,804 | | 27,804 | | | $383,695 | | $300,000 |

| | 2008 | | 1,000 | | 23,131 | | 24,131 | | | $862,201 | |

| | Options Held (Director option grants discontinued in 2004): See chart “Outstanding Share-Based Awards” |

1 | “Director Since” refers to the year the Director was first elected to either the Board of the Company or Manufacturers Life. When Manufacturers Life demutualized in 1999, it became a wholly-owned subsidiary of the Company. |

2 | “Independent” refers to the standards of independence established under Section 303A.02 of the New York Stock Exchange Listed Company Manual, Section 301 of SOX, Section 1.2 of Canadian Securities Administrators’ (“CSA”) National Instrument 58-101 – Disclosure of Corporate Governance Practices and Section 1.4 of the CSA National Instrument 52-110 – Audit Committees. The Board, in its annual review of Director independence, considers employment status of the Director (and his or her spouse and children, if applicable), other board memberships, Company shareholdings and business relationships, to determine whether there are any circumstances which might interfere with a Director’s ability to exercise independent judgment. |

3 | It is the policy of the Company that Directors attend the Annual Meeting and all meetings of the Board and its committees on which they sit, unless circumstances make it impossible to do so. |

| | | | | | |

| | | | Manulife Financial Corporation Proxy Circular | | 9 |

4 | At the Board meeting on May 8, 2008, Gail Cook-Bennett resigned from the Management Resources and Compensation Committee. On October 2, 2008, Gail Cook-Bennett was appointed Chair of the Board. The Chair of the Board is also Chair of the Corporate Governance and Nominating Committee. As Vice-Chair and then as Chair of the Board, Gail Cook-Bennett was invited to attend all other Committee meetings at the invitation of the Chair of each committee. |

5 | Gail Cook-Bennett and Thomas Kierans also serve together on the board (but not on any of the same committees) of Petro-Canada. No other Directors serve on the same board of directors other than the Board of Directors of the Company and the Board of Directors of Manufacturers Life. |

6 | “Common Shares” refers to the number of Common Shares beneficially owned, or over which control or direction is exercised by the Director, as of March 17, 2009 and March 18, 2008, respectively. |

7 | “DSUs” refers to the number of deferred share units held by the Director as of March 17, 2009 and March 18, 2008, respectively. |

8 | The “Total Market Value of Common Shares and DSUs” is determined by multiplying the closing price of the Common Shares on the Toronto Stock Exchange (“TSX”) on each of March 17, 2009 ($13.80) and March 18, 2008 ($35.73), respectively, times the number of Common Shares and DSUs outstanding as of March 17, 2009 and March 18, 2008. |

9 | All Directors are required to hold an equity position in the Company having a minimum value of $300,000 within five years of joining the Board. Common and preferred shares and DSUs are considered equity for this purpose, but stock options are not. Directors must take 50% of the Board Retainer in DSUs until the minimum threshold is met. Directors’ share ownership will be valued using the higher of grant price or current market price for the purposes of meeting the share ownership guidelines. This measure was introduced on an interim basis due to the extreme volatility of market conditions and the significant reduction in the Company’s Common Share price (see Schedule “A” Statement of Corporate Governance Practices – Director Share Ownership). The minimum required for Donald Guloien, as President and CEO, will be equal to seven times his base salary (see “Compensation Discussion and Analysis – Executive Share Ownership Guidelines”). Mr. Guloien currently meets this requirement. |

10 | At the Board meeting on May 8, 2008: John Cassaday, Pierre Ducros and Scott Hand were appointed to the Management Resources and Compensation Committee (Mr. Hand resigned from the Audit and Risk Management Committee and the Conduct Review and Ethics Committee); Gordon Thiessen was appointed Chair of the Management Resources and Compensation Committee (Hugh Sloan resigned as Chair of the Committee); and Thomas d’Aquino was appointed to the Audit and Risk Management Committee and the Conduct Review and Ethics Committee (Mr. d’Aquino resigned from the Management Resources and Compensation Committee). |

11 | Richard DeWolfe was a director of Response U.S.A., Inc. until October 2000. In May 2001, Response U.S.A., Inc. commenced proceedings under applicable bankruptcy statutes in the United States. |

12 | At the Board Meeting on November 6, 2008, Pierre Ducros resigned from the Corporate Governance and Nominating Committee. Richard DeWolfe and Gordon Thiessen were appointed to the Corporate Governance and Nominating Committee effective December 1, 2008. |

13 | Pierre Ducros was a director of Cognos Incorporated (“Cognos”) during the period from November 2005 to July 2006, during which time the United States Securities and Exchange Commission (“SEC”) conducted a review of the revenue recognition policy used by Cognos in its periodic reports. During the course of the SEC review, Cognos delayed filing its financial statements. As a result of this filing delay, the Ontario Securities Commission (“OSC”) imposed a management and insider cease trade order against Cognos on June 14, 2006. The SEC review was concluded in July 2006 without objection to Cognos’ revenue recognition policy. The management and cease trade order imposed by the OSC was lifted on August 4, 2006, two full business days after Cognos filed its delayed financial statements with the OSC. |

14 | Robert Harding was appointed to the Board of Directors at the Board Meeting on August 7, 2008 which appointment became effective October 2, 2008. While the Board requires 100% attendance except in unusual circumstances, it also recognizes that when a Director first joins a Board, there may be pre-existing commitments that cannot be re-arranged. The Board accepts these conditions, particularly in situations where a highly skilled candidate becomes available to join the Board as was the case with Mr. Harding. Mr. Harding advised the Board, prior to his appointment, of certain conflicts which would prevent him from attending certain Board and Committee meetings during his first two years as a Director. |

15 | Thomas Kierans was a director of Teleglobe Inc. during the period from December 2000 until April 23, 2002. On May 15, 2002, Teleglobe Inc. announced that it had obtained creditor protection under theCompanies Creditors Arrangement Act (Canada) and that it had initiated ancillary filings in the United States and the United Kingdom. |

| | | | | | |

| 10 | | Manulife Financial Corporation Proxy Circular | | | | |

Schedule “A” – Statement of Corporate Governance Practices

The corporate governance practices of Manulife Financial Corporation (the “Company”) meet or exceed the standards set out in the Insurance Companies Act (Canada) (“Insurance Companies Act”), Canadian Securities Administrators’ Multilateral Instrument 52-109 (the “Certification Instrument”), Canadian Securities Administrators’ National Instrument 52-110 – Audit Committees (the “Audit Committee Instrument”) and the corporate governance standards and disclosure requirements in Canadian Securities Administrators’ National Policy 58-201 – Corporate Governance Guidelines and National Instrument 58-101 – Disclosure of Corporate Governance Practices (the “Governance Instrument”). The Company’s corporate governance practices also comply with applicable requirements of the Sarbanes-Oxley Act of 2002 (“SOX”), including any U.S. Securities and Exchange Commission (“SEC”) rules under SOX, and in all material respects with the domestic issuer standards of the New York Stock Exchange Corporate Governance Rules (the “NYSE Rules”).

The following Statement of Corporate Governance Practices highlights various elements of the Company’s corporate governance program.

Mandate of the Board of Directors

The Board of Directors of the Company is responsible for the stewardship of the Company and for the supervision of the management of the business and affairs of the Company. The Board’s general responsibilities are set out in the Board Mandate and the Board Policies. The Mandate of the Board and the Board Policies are attached as Schedule “B”. The Mandate of the Board and the Board Policies are on the Corporate Governance page of the Company’s website and are available upon request from the Corporate Secretary.

Independence of the Board

The Board has established the policy that at least a majority of Directors must satisfy the applicable independence requirements of the laws governing the Company, the stock exchanges on which the Company’s securities are listed and applicable securities regulatory authorities. The Board annually reviews and makes a determination as to the independence of each Director. The Board reviews the Directors’ employment status (and the Director’s spouse and children, as applicable), other board memberships, Company shareholdings and business relationships to determine whether there are any circumstances which might interfere with a Director’s ability to exercise independent judgment.

The Board has determined that 14 of the 15 current members of the Board are independent under Section 303A.02 of the NYSE Rules, Section 301 of SOX, Section 1.2 of the Governance Instrument and Section 1.4 of the Audit Committee Instrument. Dominic D’Alessandro is not independent because he is the Company’s President and CEO. Upon successful election to the Board of Directors, Donald Guloien will not be independent as he will succeed Dominic D’Alessandro as the President and CEO.

Independence of the Chair of the Board

| n | | The positions of the Chair and the CEO are separate. |

| n | | The Chair is an independent Director. |

| n | | The Chair’s mandate provides that the Chair is accountable for ensuring that the Board carries out its responsibilities effectively and separately from management. |

| n | | The Chair’s principal accountabilities include managing the affairs of the Board, developing the composition, structure and renewal of the Board, guiding the Board’s deliberations on strategic and policy matters and ensuring proper oversight by the Board is exercised. |

Nomination of Directors

The Corporate Governance and Nominating Committee (the “Governance Committee”) is responsible for identifying qualified candidates for nomination to the Board. The Governance Committee:

| n | | Develops and recommends to the Board criteria for the selection of new Directors, periodically reviews the criteria adopted by the Board and recommends changes to such criteria, which includes professional experience and personal characteristics. |

| n | | Maintains a Directors’ Matrix identifying the desired competencies, expertise, skills, background and personal qualities of the Directors and potential candidates. |

| n | | Annually reviews the skills, areas of expertise, backgrounds, independence and qualifications of the members of the Board. |

| n | | Identifies and recommends to the Board individuals qualified and suitable to become Board members, taking into consideration any gaps identified in the Directors’ Matrix. |

| n | | Maintains an evergreen list of suitable candidates for the Board who the Governance Committee believes meet the identified criteria and whose skills and characteristics complement the existing mix. The Chair is responsible for approaching Board candidates. Candidates meet with the Chair and the CEO prior to nomination or appointment to review expected contributions and commitment requirements. |

| n | | Directors must retire at 72 and may not be nominated for re-election. |

The Board will consider a nomination of a candidate for the Company’s Board of Directors from a shareholder that is submitted in accordance with the Insurance Companies Act.A proper nomination must be submitted by shareholder proposal, signed by one or more registered or beneficial holders of shares representing in aggregate not less than five percent of the shares of the Company entitled to vote at the meeting to which the proposal is being submitted.

Majority Election of Directors Policy

The Governance Committee’s Majority Election of Directors Policy, provides that Director nominees who do not receive a majority of votes in favour in an uncontested election will be required to immediately submit their resignation to the Govern-

| | | | | | |

| | | | Manulife Financial Corporation Proxy Circular | | 11 |

ance Committee. The Board will, in the absence of extenuating circumstances, accept the resignation within 90 days of the Annual Meeting and issue a press release confirming the Director’s resignation or the reason for not accepting it. In filling the vacancy resulting from a Director resignation, the Directors may appoint a new Director whom the Board considers will have the confidence of the shareholders or call a special meeting of shareholders to elect a Director or wait until the next Annual Meeting.

Position Descriptions for Chair, Committee Chairs, CEO and Individual Directors

The Board has developed position descriptions outlining the accountabilities for the Chair, the Chairs of Board committees, the CEO and the individual Directors. The position descriptions can be found on the Corporate Governance page of the Company’s website or can be obtained by contacting the Corporate Secretary.

Director Education and Orientation

The Company provides an education program for all Directors, including a detailed orientation program for new Directors, which incorporates the following:

| n | | New Directors are provided with detailed information about the Company, including its business strategies, corporate information, structure and the roles and expectations of the Board and individual Directors. |

| n | | New Directors receive a manual which provides information about the Company, including the Annual Information Form, the Proxy Circular, Annual Report, Manufacturers Life’s Report to Policyholders, organizational information about the Board and its meetings and the Directors’ information requirements required pursuant to applicable insurance and securities regulations. |

| n | | New independent Directors are initially appointed to the Audit Committee as part of the Directors’ orientation to the Company’s business. As an Audit Committee member, the Director will be exposed to all aspects of the financial and risk management elements of the Company. This is intended to assist the new independent Directors in learning the business model more quickly. All Directors have a standing invitation to attend committee meetings and new Directors are encouraged to do so to assist in their orientation. |

| n | | New Directors meet with the Chair, the CEO and other members of management to discuss the Company’s strategies, operations and functions. |

| n | | The Directors’ Orientation materials include the positions descriptions, the Board Mandate, Board Policies, committee charters, the regulatory compliance program, by-laws, administrative resolutions, Directors’ policies, Company policies, the Code of Business Conduct and Ethics and organization charts. |

| n | | Directors’ seminars and divisional presentations to the Board to provide in-depth reviews of key businesses and functions. In 2008, seminars included: Alternative Asset Class Management; U.S. Regulation; Pay and Performance; and Update on the Current Financial Condition and Regulatory Capital Provisions. |

| n | | On-site visits to the Company’s operations scheduled in conjunction with a Board meeting. On-site meetings incorporate senior management presentations on the business divisions’ strategies and operations. In 2008 the Directors visited the Company’s United States operations in Boston, Massachusetts. |

| n | | In 2008, all Directors were members of the Institute of Corporate Directors, a recognized educational organization for directors to enhance their knowledge of directors’ responsibilities and current governance trends. |

| n | | Directors may seek additional professional development education at the expense of the Company. In 2008, certain Directors continued to be members of organizations relating to human resources and women on boards and attended a conference for directors on board compensation issues. |

Board Access to Management

The Company provides both formal and informal means for the Board to interact with management. Directors have access to management and are encouraged to raise any questions or concerns directly with management.

Board Committee Membership Standards

The Board relies on its committees to assist in fulfilling its mandate and meet its responsibilities. Committees of the Board allow Directors to share responsibility and devote the necessary resources to a particular area or issue. There are currently four standing committees of the Board: the Audit and Risk Management Committee (“Audit Committee”); the Conduct Review and Ethics Committee (“Ethics Committee”); the Governance Committee; and the Management Resources and Compensation Committee (“Compensation Committee”). All committees have the following common characteristics:

| n | | Comprised solely of independent Directors. |

| n | | Have a written charter setting out the responsibilities of each committee. Each committee tracks its compliance with its charter at each meeting throughout the year. The charters and the scorecards are available on the Company’s website or by writing to the Corporate Secretary. |

| n | | Report to and seek approvals as required from the Board after each of its meetings. Committees meet without any members of management present (“in camera”) at each meeting. |

| n | | Reviews its performance and its charter annually. |

| n | | Has its membership reviewed by the Board and rotated as requirements of the committees and the Directors dictate. |

Audit and Risk Management Committee

The Board has reviewed the membership of the Audit Committee and has determined that no member serves on more than two other audit committees of publicly traded companies and that no member’s ability to serve the Audit Committee is impaired in any way.

Financial statements are presented for review by the Audit Committee at meetings scheduled prior to Board meetings. The Audit Committee provides a report and recommendation to the Board with respect to financial disclosure of the Company.

| | | | | | |

| 12 | | Manulife Financial Corporation Proxy Circular | | | | |

The Audit Committee has established the Protocol for Approval of Audit and Permitted Non-Audit Services. Under this Protocol, the Audit Committee annually reviews and pre-approves recurring audit and non-audit services that are identifiable for the coming year. This Protocol also requires that any audit or non-audit services that are proposed during the year be approved by the Audit Committee or by a member appointed by the Audit Committee for this purpose.

The Board annually reviews the membership of the Audit Committee to confirm that all members are financially literate, as required by the Audit Committee Instrument and the NYSE Rules and that at least one member can be designated as a financial expert as required by SOX. The Board has determined that all members are financially literate and that Messrs. DeWolfe, Celeste, Dineen, Harding, Helms and Kierans possess the necessary qualifications to be designated as Audit Committee Financial Experts.

The Audit Committee has direct communication andin camera meetings with each of the internal auditor, the independent auditor, the Appointed Actuary, the General Counsel and the Company’s principal regulator, the Office of the Superintendent of Financial Institutions (Canada). The Audit Committee also meets with management.

The Board considers all principal risks facing the Company, as well as the measures either proposed or already implemented to manage these risks. The Audit Committee ensures that comprehensive risk management policies and processes, internal controls and management information systems are in place and updated regularly to mitigate the Company’s exposures.

Conduct Review and Ethics Committee

The Ethics Committee oversees the procedures relating to conflicts of interest, customer complaints, related party transactions and protection of confidential information.

The Ethics Committee annually reviews the Company’s Code of Business Conduct and Ethics, the Related Party Procedures, the Conflict of Interest Procedures, the Confidential Information Procedures and Complaint Handling Practices.

Management Resources and Compensation Committee

The Compensation Committee oversees the Company’s global human resources strategy and the effective utilization of human resources, focusing on management succession, development and compensation. The Compensation Committee is responsible for:

| n | | Approving the appointment of and providing proper development, compensation and review of senior management. |

| n | | Reviewing the objectives, performance and compensation of the President and CEO. Beginning in 2009, the Compensation Committee assumed this responsibility. |

| n | | Reviewing and approving annually the appointment, succession, remuneration and performance of the senior executives. |

| n | | Reviewing annually the Company’s compensation policies, including base pay, incentive, pension and benefit plans and making recommendations to the Board. |

Corporate Governance and Nominating Committee

The Governance Committee is responsible for:

| n | | Developing director selection criteria. |

| n | | Identifying and recommending to the Board qualified director nominees. |

| n | | Overseeing the Company’s corporate governance program. |

| n | | Developing governance policies, practices and procedures. |

| n | | Reviewing the structure, mandate and composition of the Board and Board committees. |

| n | | Reviewing and evaluating the effectiveness of the Board, the committees, the Chair and the Directors. |

Independent Directors’ Meetings

Each meeting of the Board and of its committees is followed by anin camera meeting. Non-independent Directors and management do not attend.

The Board also holds meetings at which non-independent Directors and members of management are not in attendance. In 2008, five meetings of the independent Directors were held.

Shareholders wishing to contact independent Directors of the Company may write to the Chair of the Board, in care of the Corporate Secretary, at the head office of the Company.

Retention of Outside Advisors by Directors

The Board and its committees may retain outside advisors at the Company’s expense, as they deem necessary.

The Governance, Compensation and Audit Committees retained outside advisors in 2008.

Individual Directors may also retain outside advisors, at the Company’s expense, to provide advice on any matter before the Board or a Board committee with the approval of the Governance Committee.

Director Compensation

The Board, with the assistance of the Governance Committee and independent external advisors, undertakes a biennial review of Director compensation to ensure that it meets the objective of properly aligning the interests of Directors with the long-term interests of the Company.

Director Share Ownership

To align Director’s compensation with the long-term interests of the Company, Directors are required to hold an equity position in the Company having a minimum value of $300,000 within five years of joining the Board. Common Shares, preferred shares of the Company and DSUs are considered equity for this purpose, while stock options are not. Directors are required to take 50% of their Board Retainer in shares or DSUs until the minimum value is met. Directors’ share ownership will be valued using the higher of grant price or current market price for the purposes of meeting the share ownership guidelines. This measure was introduced on an interim basis due to the extreme volatility of market conditions and the significant reduction in the Company’s Common Share price. All Directors who have been on the Board for five years have satisfied the minimum equity ownership amount.

No stock options have been granted after 2002 to non-employee Directors and in 2004 the Board of Directors resolved to permanently discontinue stock option grants to non-employee Directors.

| | | | | | |

| | | | Manulife Financial Corporation Proxy Circular | | 13 |

Board Evaluation

The Governance Committee conducts annual, formal evaluations of the Board, Board committees, the Chair and the individual Directors. The process includes:

| n | | Annual evaluation meetings between the Chair and each Director to discuss Board performance, including a peer review. |

| n | | Each Director completes biennial written Board Effectiveness and Director Self-Assessment Surveys. |

| n | | The Board and Board committees are assessed against their mandates and charters. |

| n | | Contributions of individual Directors are assessed against the applicable position descriptions and the Directors’ Matrix setting out the skills each individual Director is expected to bring to the Board. |

| n | | The assessments of the Board, the committees and the Directors, focus on identifying areas for improvement. |

| n | | The results of the assessments are presented to the Governance Committee and the Board. The Governance Committee identifies objectives for the coming year. |

| n | | Annualin camerameeting of the independent Directors to review the results of the evaluations and to approve the Governance Committee’s objectives for the coming year. |

| n | | Review of overall size and operation of the Board and its committees to ensure that they operate effectively. |

| n | | Annual determination of whether a Director’s ability to serve the Company is impaired by external obligations or by changes in his or her principal occupation or country of residence. |

CEO Evaluation

Beginning in 2009, the Compensation Committee and the CEO annually set financial and non-financial objectives for the CEO, which are approved by the Board. The CEO’s performance is evaluated annually by the Compensation Committee based on these objectives and on the Company’s performance. This was previously the responsibility of the Governance Committee.

Ethical Business Conduct

The Company has adopted the Code of Business Conduct and Ethics (“Code”), which applies to Directors, officers, employees and those who perform services for or on behalf of the Company.

The Code complies with the requirements of the NYSE Rules, the SEC rules and the Governance Instrument.

The Code is available on the Company’s website at www.manulife.com.

The Board annually reviews the Code and the compliance with the Code with the assistance of the Ethics Committee.

All employees of the Company and the Directors annually review the Code, complete an online training course, certify compliance with the Code and disclose any conflicts of interest.

The Board, through the Governance and Compensation Committees, annually reviews the integrity of the CEO and the Executive Officers, and their promotion of a culture of integrity.

CEO and CFO Certification of Financial Statements

The CEO and Chief Financial Officer certify the annual financial statements and quarterly financial statements as required by SOX and the Certification Instrument.

The CEO provides an annual certification to the NYSE stating the CEO is not aware of any violations of the governance requirements in the NYSE Rules.

The Company submits Written Affirmations as required by the NYSE Rules.

Communication Policies

Policies have been established relating to the treatment and disclosure of information about the Company on a timely, accurate, understandable and broadly disseminated basis. Information relating to the Company is reviewed by the Legal, Investor Relations and Corporate Communications departments, senior management and others as required, for a determination of materiality and, if appropriate, public disclosure.

The Company has reviewed its disclosure policies and practices to ensure full, fair and timely disclosure of information.

The Company communicates with individual shareholders, institutional investors and financial analysts through its Investor Relations department and to the media and employees through its Corporate Communications department.

The Investor Relations department provides an information report at each Board meeting on share performance, issues raised by shareholders and analysts, the Company’s institutional shareholder base and a summary of recent Investor Relations activities.

The Company’s website, www.manulife.com, features webcasts of the quarterly investor conference calls and presentations made by senior management to the investment community, as well as annual reports and other investor information.

Shareholders can access voting results of all shareholder votes at the Company’s website or at www.sedar.com.

| | | | | | |

| 14 | | Manulife Financial Corporation Proxy Circular | | | | |

Risk Management

Overview

Manulife Financial’s goal in managing risk is to strategically optimize risk taking and risk management to support long term revenue and earnings growth, and shareholder value growth. We achieve this by capitalizing on business opportunities that are aligned with the Company’s risk taking philosophy, risk appetite and return expectations, by identifying, monitoring and measuring all key risks taken, and by proactively executing effective risk control and mitigation programs.

We target to assume risks at levels prudent in relation to the Company’s capital strength and earnings capacity, that are aligned with our operational capabilities, meet our corporate ethical standards, allow us to remain diversified across risk categories, businesses and geographies, and for which we are appropriately compensated over the long term. We must manage risks effectively to safeguard our reputation and capital, and to meet the expectations of our shareholders, customers and regulators.

We employ an enterprise-wide approach to all risk taking and risk management activities globally. The enterprise risk management framework sets out policies and standards of practice related to risk governance, risk identification and monitoring, risk measurement, and risk control and mitigation. With an overall goal of effectively executing risk management activities, we continuously invest to attract and retain qualified risk professionals, and to build and maintain the necessary processes, tools and systems.