UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year endedDecember 31, 2014

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report to

Commission file number 001-14928

Santander UK plc

(Exact name of Registrant as specified in its charter)

England

(Jurisdiction of incorporation or organization)

2 Triton Square, Regent’s Place, London NW1 3AN, England

(Address of principal executive offices)

Julian Curtis

2 Triton Square, Regent’s Place, London NW1 3AN, England

Tel +44 (0) 870 607 6000

Fax +44 (0) 20 7756 5628

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| | |

| 1.650% Notes due September 29, 2017, issued by Abbey National Treasury Services plc * | | New York Stock Exchange |

| Floating Rate Notes due September 29, 2017, issued by Abbey National Treasury Services plc * | | New York Stock Exchange |

| 2.350% Notes due September 10, 2019, issued by Abbey National Treasury Services plc * | | New York Stock Exchange |

| 1.375% Notes due March 13, 2017, issued by Abbey National Treasury Services plc * | | New York Stock Exchange |

| 4.000% Notes due March 13, 2024, issued by Abbey National Treasury Services plc * | | New York Stock Exchange |

| Floating Rate Notes due March 13, 2017, issued by Abbey National Treasury Services plc * | | New York Stock Exchange |

| | |

| 3.050% Notes due August 23, 2018, issued by Abbey National Treasury Services plc * | | New York Stock Exchange |

| 4.000% Notes due April 27, 2016, issued by Abbey National Treasury Services plc * | | New York Stock Exchange |

| * | Guaranteed by Santander UK plc |

Securities registered or to be registered pursuant to Section 12 (g) of the Act.

None

Securities registered or to be registered pursuant to Section 15 (d) of the Act.

7.95% Term Subordinated Securities due October 26, 2029

Subordinated Guarantee by Santander UK plc (as successor in interest to Abbey National plc) of the 8.963% Non-Cumulative Perpetual Preferred Limited Partnership Interests issued by Abbey National Capital LP I

Subordinated Guarantee by Santander UK plc (as successor in interest to Abbey National plc) of the 8.963% Non-Cumulative Trust Preferred Securities issued by Abbey National Capital Trust I

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

| | |

| Ordinary shares of nominal value of £0.10 each* | | 31,051,768,866 |

| 10 3/8% Non-cumulative Preference Shares of nominal value of £1 each | | 200,000,000 |

| 8 5/8% Non-cumulative Preference Shares of nominal value of £1 each | | 125,000,000 |

| Series A Fixed/Floating Rate Non-cumulative Preference Shares of nominal value of £1 each | | 34,933 |

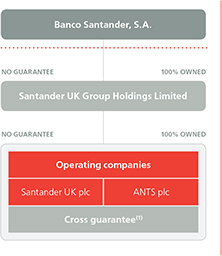

| * | All of the issued and outstanding ordinary shares of Santander UK plc are held by Santander UK Group Holdings Limited. |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | |

| Large accelerated filer ¨ | | Accelerated filer ¨ | | Non-accelerated filer x |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | | | |

| ¨ U.S. GAAP | | x International Financial Reporting Standards as issued by the International Accounting Standards Board | | ¨ Other |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

| | | | | | | | | | | | | | |

| | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | |

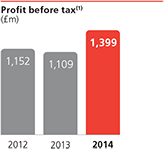

| | 2014 business and

financial highlights | | We are pleased to report strong results for 2014, with continued improvement in profitability and strong commercial momentum. We are gaining more personal current account switchers than any other UK bank, while broadening the range of products and services we offer to UK companies. | | |

| | | | Net interest income | | | | Profit before tax | | | | Banking NIM(1) | | |

| | | | | | | |

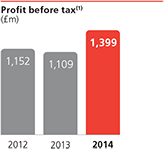

| | | | £3,434m | | | | £1,399m | | | | 1.82% | | |

| | | | | | | |

| | | | Up 16% in 2014, with higher margins and increased lending across all core segments. | | | | Up 26% in 2014, with continued growth in net interest income, a strong focus on efficiency and well performing retail and corporate loan portfolios. �� | | | | Up 27 basis points in 2014, largely due to lower cost of retail liabilities. | | |

| | | | | | | |

| | | | | | | | | | | | | | |

| | | | Cost-to-income ratio | | | | CET 1 capital ratio | | | | Loan-to-deposit ratio | | |

| | | | | | | |

| | | | 54% | | | | 11.9% | | | | 124% | | |

| | | | | | | |

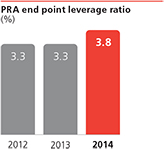

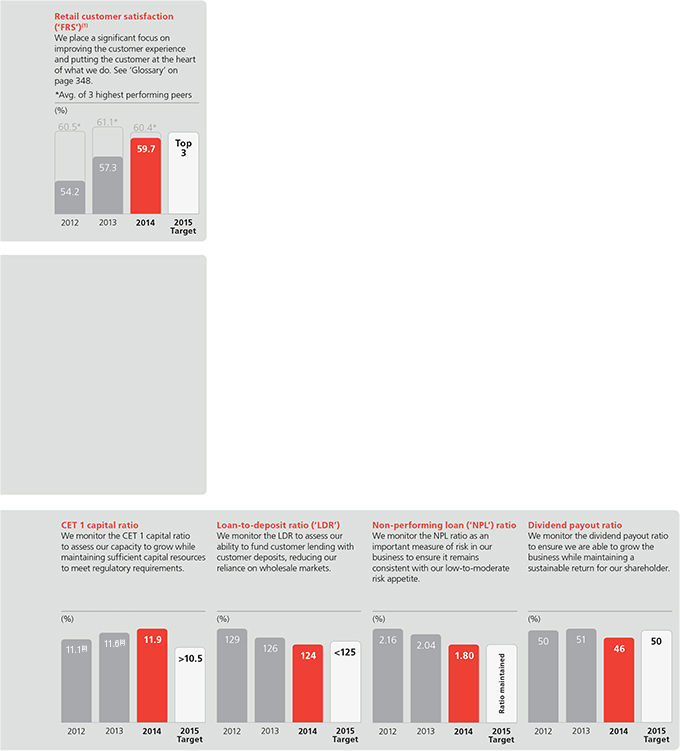

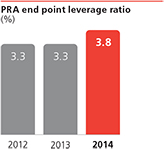

| | | | Unchanged in 2014 with cost efficiency maintained to accommodate investment. Income grew by two percentage points more than expenses. | | | | Up from 11.6%(1), with the PRA end point T1 leverage ratio at 3.8% from 3.3% in 2013. | | | | Improved two percentage points in 2014, reflecting strong growth in current account balances. | | |

| | | | | | | |

| | | | | | | | | | | | | | |

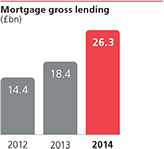

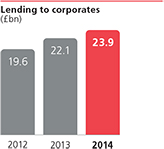

| | | | Gross mortgage lending | | | | Lending to corporates | | | | Retail customer satisfaction | | |

| | | | | | | |

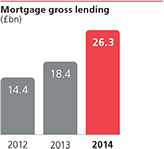

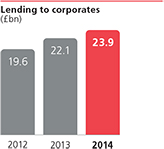

| | | | +43% | | | | +8% | | | | 59.7% | | |

| | | | | | | |

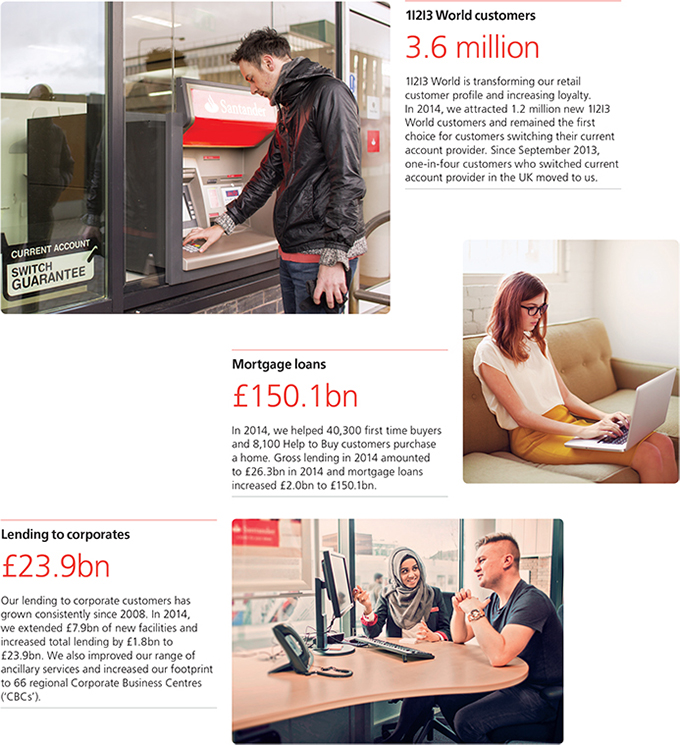

| | | | Gross mortgage lending of £26.3bn in 2014 with net mortgage lending of £2.0bn. | | | | Up by a net £1.8bn in 2014 to a total of £23.9bn, maintaining positive momentum in an increasingly competitive market. | | | | Gap between Santander UK and the average of 3 highest performing peers largely closed. Santander UK was the most improved bank since December 2012(2). | | |

| | | | | | | |

| | | | | | | | | | | | | | |

| | This Annual Report contains forward-looking statements that involve inherent risks and uncertainties. Actual results may differ materially from those contained in such forward-looking statements. See ‘Forward-looking Statements’ on page 353. For definitions of terms used in this Annual Report, see ‘Glossary’ on page 348. | | |

| | |

| | Santander UK plc (the ‘Company’) and its subsidiaries (collectively ‘Santander UK’ or the ‘Santander UK group’) operate primarily in the UK, are regulated by the UK Prudential Regulation Authority (‘PRA’) and the Financial Conduct Authority (‘FCA’) and are part of the Banco Santander, S.A. group (the ‘Banco Santander group’). (1) Non-IFRS measure. See page 355. (2) Retail customer satisfaction as measured by the Financial Research Survey (‘FRS’) run by GfK NOP. See ‘Glossary’ on page 348. | | |

| | | | | | | | | | | | | | |

Strategic report

| | |

Our heritage | | Santander UK, a key subsidiary of the Banco Santander group, was formed from the acquisition of three former building societies. |

|

| | | | | | | | | | |

Abbey National Building Society formed with the merger of two long-standing building societies | | Bradford & Bingleysavings business and branches acquired by Santander UK plc | | Abbey, Alliance & Leicester and Bradford & Bingley rebranded asSantander UK |

1944 | | 1989 | | 2004 | | 2008 | | 2009 | | 2010 |

| | | Abbey National plc incorporated in 1998. Listed on the London | | Abbey National plc acquired byBanco Santander, S.A. | | | | Alliance & Leicester plc transferred to Santander UK plc (acquired by Banco | | |

| | Stock Exchange in 1989 | | | | | | Santander, S.A. in 2008) | | |

| | Banco Santander group customers 117 million Banco Santander group is a retail and commercial bank, based in Spain, with a presence in ten main markets and is the largest bank in the eurozone by market capitalisation. Founded in 1857, the Banco Santander group has over 12,000 branches and 185,000 employees across the globe. The Banco Santander group is also the largest private financial group in Latin America and has a significant presence in the UK, Portugal, Germany, Poland and the US. The Banco Santander group operates a subsidiary model across the group where businesses, such as Santander UK, are responsible for their own liquidity, funding and capital, but benefit from shared resources, operational capability and branding. |

| | |

| | See page 182 on the subsidiary model |

| | |

Banco Santander group attributable profit €5.8bn Up 39% from€4.2bn in 2013, with the UK region contributing 17% of the global total. | |

|

| | | | | | | | | | | | |

Our heritage and Santander UK today | | Chair’s review | | Chief Executive Officer’s review | | KPIs | | Chief Financial Officer’s review | | Corporate Governance review | | An overview of our history and heritage and a snapshot of Santander UK today |

| | | | | | |

| | | | | | | | | | | | | |

| | |

Santander UK today | | As one of the leading financial services providers in the UK, serving more than 14 million active customers with 20,000 employees, our purpose is to help people and businesses prosper. |

| | |

| Strategic report | | Helping people and businesses prosper |

Chair’s review

“Since becoming Chair in 2002, the UK banking landscape has changed significantly. As I hand over the stewardship, Santander UK is well placed to succeed in a challenging environment.”

Lord Burns

Chair

24 February 2015

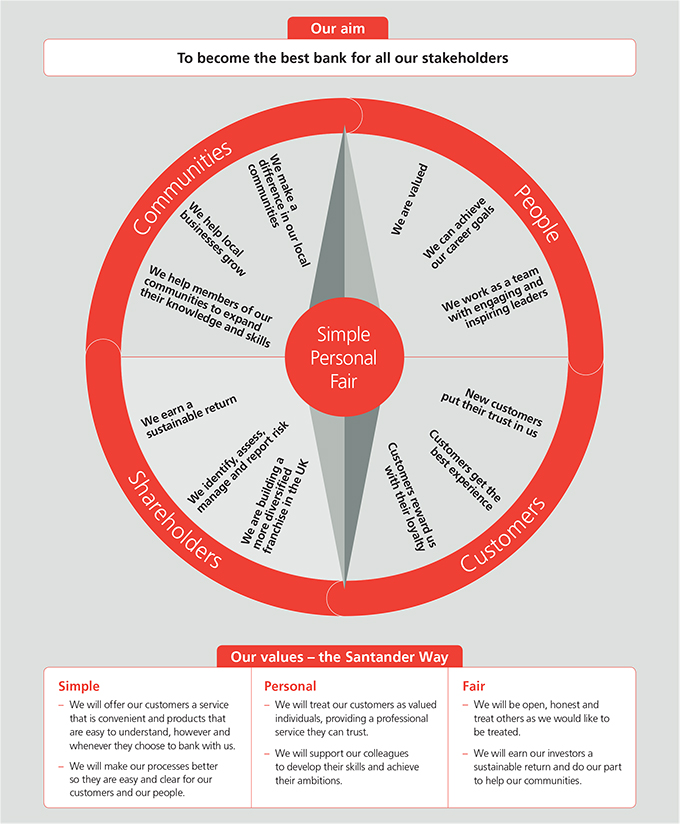

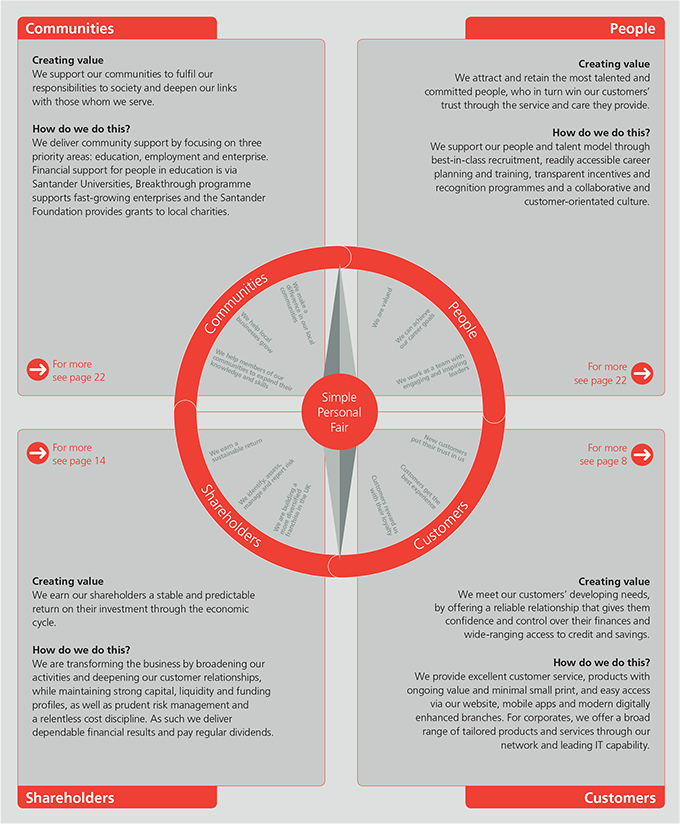

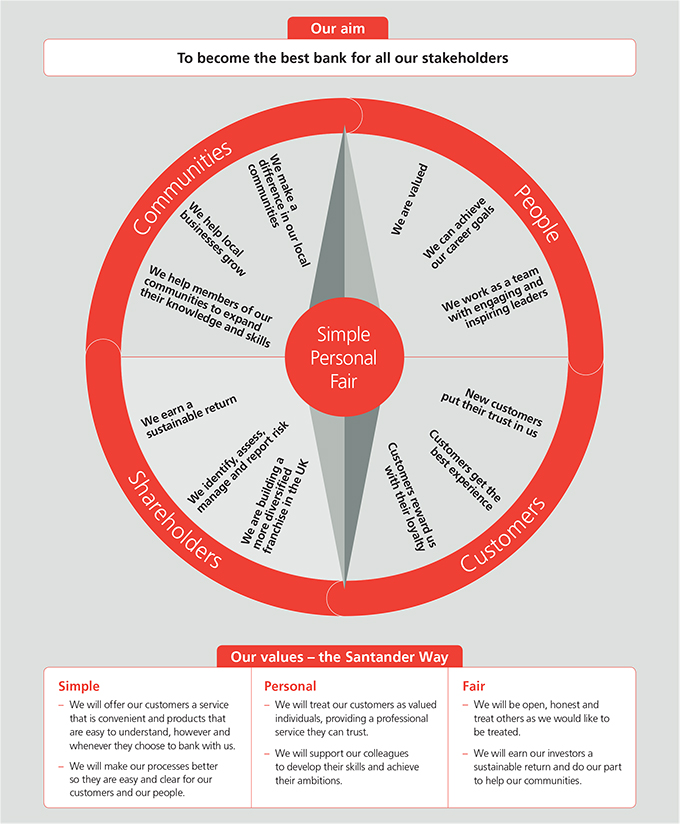

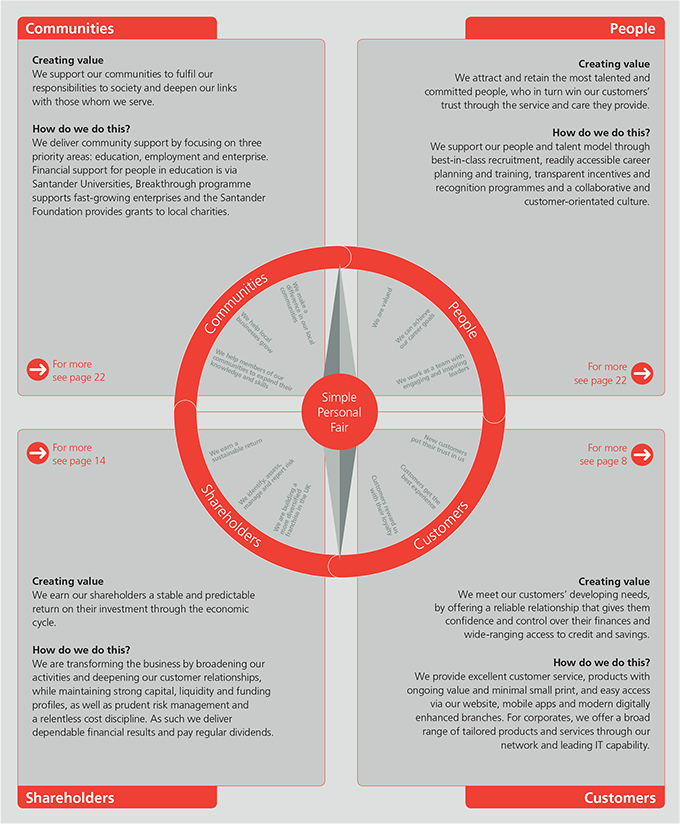

Our purpose is to help people and businesses prosper as we build the Best Bank in the UK – a bank that is Simple, Personal and Fair.

Overview

2014 was a year of many important milestones along our strategic transformation journey. We remain committed to building a bank that is simple to deal with, has personal understanding of its customers and treats everyone fairly. Our business model is well aligned to these goals and to addressing the opportunities and trends in the economy. In 2014, we continued to improve our profitability and to strengthen further our balance sheet, underpinned by the strategic transformation of the business in the last few years.

The Board

There have been a number of important leadership changes during the year. As Chief Executive Officer (‘CEO’) of Santander UK, Ana Botín led the business until her appointment as Executive Chairman of Banco Santander in September 2014. During her tenure, she did much, alongside the management team, to drive the business transformation and she left a great legacy and a clear strategy which we will continue to implement. We welcomed back Nathan Bostock as Deputy CEO in August 2014 and the following month he succeeded Ana as CEO upon her appointment as Executive Chairman of Banco Santander. An overview of the CEO appointment process is outlined on the next page.

On 1 January 2015, Shriti Vadera joined the Board as Joint Deputy Chair and will succeed me as Non-Executive Chair on 30 March 2015. We are proud and excited to welcome Shriti; her banking experience and deep expertise in UK and global economic issues ensure that she is well placed to develop and lead the Board. I know she is committed to building on our record as a scale challenger in UK banking, and our purpose to help people and businesses prosper.

A number of other significant changes also took place. In April 2014, José Maria Nus left the Board to take up a senior role at Banco Santander, S.A.. On 12 February 2015, Bruce Carnegie-Brown was appointed First Vice Chairman and lead Independent Director of the Banco Santander group Board, at which point he ceased to be independent in the UK. Bruce will, however, remain on our Board as a Non-Executive Director.

Our culture and people

This year, we continued to embed Simple, Personal, Fair: the Santander Way into our culture, setting out how everyone is expected to act and conduct themselves. We also launched a framework called ‘the Compass’, which is outlined on pages 6 and 7. It helps track our progress against our strategic priorities and the aim of meeting the expectations of our main stakeholders.

Empowering our people

95%

Staff took advantage of the wide training resources available, with 95% undertaking some form of learning in 2014.

Supporting our communities

2,700

The Santander UK Foundation provides grants to UK registered charities, and in 2014 over 2,700 charities benefited from this.

| | | | | | | | | | | | |

Our heritage and Santander UK today | | Chair’s review | | Chief Executive Officer’s review | | KPIs | | Chief Financial Officer’s review | | Corporate Governance review | | Lord Burns sets out changes to the Board and gives an overview of our people and our culture |

| | | | | | |

| | | | | | | | | | | | | |

| | |

| | See Governance report on page 145 |

| |

| | See Corporate Social Responsibility review on page 22 |

To help embed the Compass, win the support of our staff for this framework and ultimately progress towards our strategic goals, the CEO and executives delivered a series of roadshows across the country. This was supported by communication packs and newsletters that explained our key objectives.

In May 2014, our crowd-sourcing platform, Better Together, was enhanced so that staff could submit ideas or proposals at any time to make Santander UK more simple, personal and fair. Our employees have responded enthusiastically and so far over 650 ideas have been submitted covering all four compass quadrants. Of the ideas analysed, almost 30% have already being taken forward or delivered, with the rest under review for potential future delivery. To stimulate debate on how to help transform our business we also provided regular updates through CEO comms, corporate newsletters and blogs.

We have continued our transformation towards becoming a sustainable customer-focused business. We have built many more loyal and satisfied customer relationships

while at the same time we have created a corporate banking capability on which we can build a broader and stronger business. We can be pleased with the growth we have achieved and with the progress in our transformation, and we have positioned the business for further improvements going forward.

I would like to thank all of my colleagues, who have responded so well to Simple, Personal, Fair: the Santander Way. They have done so much to further transform the business in the past year. Their pride, commitment and loyalty has been admirable and underpins the success of our business.

Looking forward

I remain confident that Santander UK has the right strategy and leadership so that we can continue to deliver value for our people, customers, shareholders and communities. On the following pages, I outline how we use the Compass to measure progress towards our strategic priorities and how our business model creates value for all stakeholders.

| | |

CEO succession | | |

| | |

We spent a great deal of time throughout 2014 ensuring that a strong succession pipeline was in place, and the appointment of Nathan Bostock as Deputy CEO in August 2014 represented a key step in ensuring that we were well positioned. In September 2014, Ana Botín was appointed to the role of Group Executive Chairman of Banco Santander, S.A. following the death of Emilio Botín. While the Board undertook an orderly process to identify a new CEO in the UK, Nathan Bostock, Deputy CEO, became responsible for ensuring continuity in all operations and strategy during the transition period. Upon the conclusion of the search process, the Board selected Nathan as CEO in September 2014, and Ana subsequently transitioned to a Non-Executive role. Nathan brings a wealth of experience and an excellent track record in banking, operating at executive levels in the banking sector for over 22 years. He will be vital to the delivery of our transformation programme. | |

|

| | |

| Strategic report | | Helping people and businesses prosper |

| | |

Chair’s review continued | | Our purpose is to help people and businesses prosper. The Compass keeps us on track and helps measure progress towards our strategic priorities. |

| | | | | | | | | | | | |

Our heritage and Santander UK today | | Chair’s review | | Chief Executive Officer’s review | | KPIs | | Chief Financial Officer’s review | | Corporate Governance review | | Lord Burns introduces what we need to do to achieve our goals and how we will operate and create value |

| | | | | | | | | | | | | |

| | |

| | Our business model creates value for our people, our customers, our shareholders and our communities. |

| | |

| Strategic report | | Helping people and businesses prosper |

Chief Executive

Officer’s review

“It was an honour to be appointed CEO of Santander UK and to lead a great team that is helping people and businesses prosper across the UK.”

Nathan Bostock

Chief Executive Officer

24 February 2015

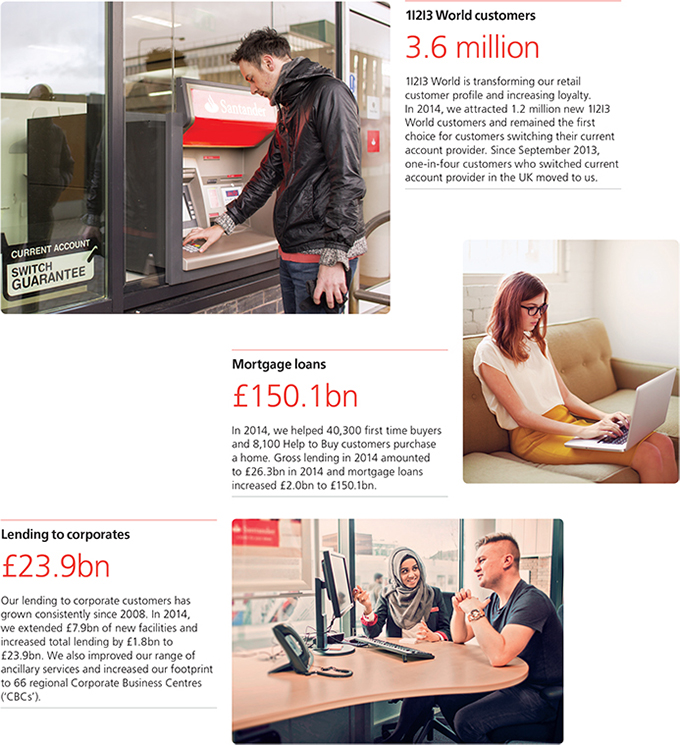

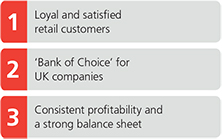

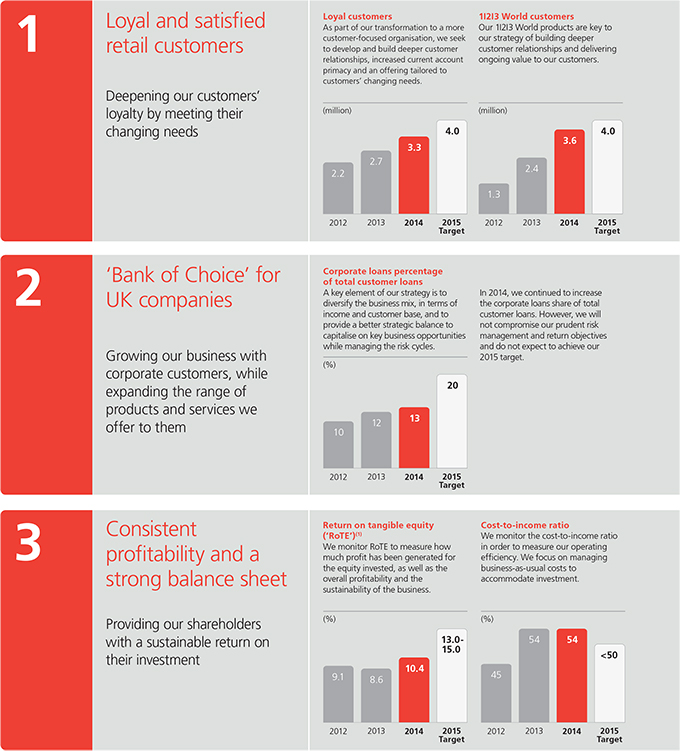

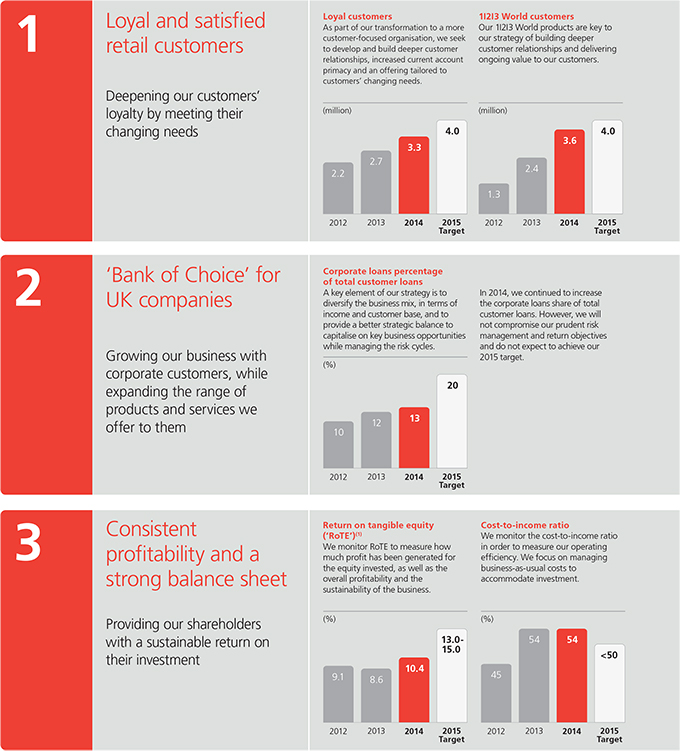

Our strategic priorities

Our 2014 results demonstrate a strong commercial momentum. We attracted 1.2 million customers to our 1I2I3 World, taking the total to 3.6 million. We also increased lending to UK companies by a net £1.8bn, to £23.9bn, while broadening the range of products and services we offer to them.

Economic and market backdrop

The UK economic climate in 2014 was more positive than it has been for several years. Economic growth strengthened to 2.6%, the unemployment rate fell much faster than the Bank of England had expected and inflation ran below the 2% target throughout the year. Falling oil prices meant that inflation hit a 14-year low at the end of 2014.

The strong growth in the housing market eased as the year progressed, reflecting both fundamental consumer factors – affordability and speculation about rising interest rates – and regulatory action. At the same time, annual corporate borrowing growth continued to show negative readings during the year. Nonetheless, lending activity for UK banks as a whole remains subdued relative to the pre-recession pace and we have done well to maintain the growth of our retail and commercial businesses with a conservative risk appetite.

2014 saw the volume of regulatory demands facing the UK banking sector increase. Most significant of these is the UK Government’s proposals for major banks to separate their wholesale and investment banking functions from their retail operations – a material reform of banking structures in the future.

Also in 2014, the Financial Policy Committee finalised the design for the Leverage Ratio framework and the Prudential Regulation Authority introduced annual concurrent stress testing.

Across each of these developments, we have been heavily engaged in the formal policy consultation process and in close dialogue with our regulators. We support proportionate developments in regulation which increase competition in the market and lead to better outcomes for our customers.

Our customer focused strategy, low risk approach and fewer legacy issues leave us well aligned to the reform agenda. We are satisfied we can meet all of the requirements well within the time frames set. At the same time, we have done much to recover customer confidence, improve customer satisfaction and to begin embedding our cultural values.

Maintaining control of both costs and credit quality and building our digital business remain key priorities for us as is further improvements to customer satisfaction. I am confident Santander UK offers a strong challenge and can continue to grow both its retail and corporate banking propositions profitably.

Loyal and satisfied retail customers

In 2014, we continued to develop more targeted products and services which, alongside a significant investment in branch refurbishment, has seen us deliver a number of improvements to our digital and physical offering. Digital improvements include better online and mobile banking platforms, a new public website and a new online bank interface.

Current account switchers(1)

One-in-four

We gained more customers than any other UK bank as part of the Current Account Switch Scheme (‘CASS’) launched in September 2013.

| (1) | Current Account Switch Service participant data, Payments Council, published quarterly six months in arrears, Q2 2014, Q1 2014 and Q4 2013. |

| (2) | Financial Research Survey, GfK NOP, December 2014. |

Retail customer satisfaction (‘FRS’)(2)

Most improved

We are the most improved bank for customer satisfaction since December 2012.

| | | | | | | | | | | | |

Our heritage and Santander UK today | | Chair’s review | | Chief ExecutiveOfficer’s review | | KPIs | | Chief Financial Officer’s review | | Corporate Governance review | | Nathan Bostock reports on the backdrop to our business and performance in 2014 |

| | | | | | |

| | | | | | | | | | | | | |

Our loyal customer base grew further, supported by the continued success of the 1I2I3 Current Account. Total deposits held by primary banking customers increased 34%, to £70.3bn at 31 December 2014, enabling us to manage a reduction in higher cost, less loyal customer deposits.

We made a significant improvement in retail customer satisfaction. The gap between Santander UK and the average of the three highest performing peers reduced to 0.7 percentage points in December 2014 from 3.8 percentage points a year ago(1).

‘Bank of Choice’ for UK companies

We want to increase the business we do with SMEs as well as larger corporates. To this end, we have continued to invest in new regional Corporate Business Centres and to recruit more relationship managers, while expanding the range of products and services we offer. We now have 66 regional Corporate Business Centres (up from 28 in 2011) and 729 relationship managers (up from 457 in 2011) around the UK to support local businesses.

Commercial bank account openings increased by 33% in 2014 with an acceleration in the usage of our corporate banking platform,

completed in 2013. Business customers benefited from additional services, such as a new corporate internet banking capability, a new trade portal, the Santander Passport and other international financial services.

We continued to deliver improvements in overall corporate customer satisfaction in 2014, rising 8 percentage points to 58%(2). This made us the most improved bank in corporate customer satisfaction over the last year.

In addition, our pioneering Breakthrough programme, aimed at helping the UK’s fast growth companies, has now supported 39 SMEs with £38m of growth capital and £88m of other growth-related finance. This helped these companies prosper and the opportunity to create over 1,300 jobs in the UK.

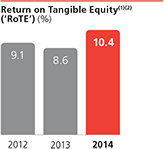

Consistent profitability and a strong balance sheet

Profit before tax increased 26% to £1,399m in 2014, a strong result in an increasingly competitive environment. The improvement in income supported the increase we have seen in the banking net interest margin. This is a useful measure of profitability and rose by 27 basis points in the year to 1.82%(3).

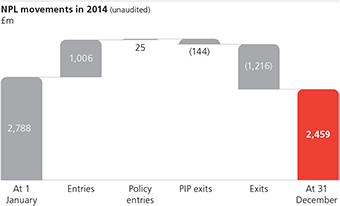

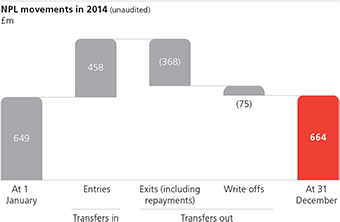

The ratio of non-performing loans to total customer loans of 1.80% at 31 December 2014 continued to improve (declining from 2.04% in 2013), with retail and corporate loans performing well in a benign credit environment.

We reaffirmed our position as one of the strongest and safest banks on the high street. Our capital position has further improved with an increase of both the Common Equity Tier 1 capital ratio to 11.9% and the leverage ratio to 3.8% at 31 December 2014. We also exceeded the Prudential Regulation Authority stress test threshold of 4.5%, with a stressed Common Equity Tier 1 capital ratio of 7.9%, after PRA allowed management actions.

Looking forward

We look forward to continued improvement in the UK economy, which remains supportive of our business, and prompt completion of the banking reforms under way that will help us to fully contribute to the UK’s economic recovery. A summary of our Key Performance Indicators (‘KPIs’) follows on the next page.

See ‘Glossary’ on page 348 for definition of customer satisfaction measures.

| (1) | Financial Research Survey, GfK NOP, December 2014. |

| (2) | Business Banking Survey, Charterhouse UK Q3 2014. |

| (3) | Non-IFRS measure. See page 355. |

| | |

| Strategic report | | Helping people and businesses prosper |

| | |

Performance against our KPIs | | KPIs help us measure progress towards our 2015 targets. They were set in 2012 and aligned to our strategic priorities. |

|

(1) Non-IFRS measure. See page 355.

| | | | | | | | | | | | |

Our heritage and Santander UK today | | Chair’s review | | Chief Executive Officer’s review | | KPIs | | Chief Financial Officer’s review | | Corporate Governance review | | Nathan Bostock explains our KPI performance and the progress made against our strategic priorities |

| | | | | | |

| | | | | | | | | | | | | |

| (1) | Financial Research Survey, GFK NOP, December 2014 |

| (2) | Non-IFRS measure. See page 355. |

| | |

| Strategic report | | Helping people and businesses prosper |

| | |

Operating environment | | The operating environment has a direct impact on our performance and the strategic transformation of the business. |

See ‘Strategic risk’ on page 36.

See ‘Strategic risk’ on page 36.

| | |

Key developments in 2014 | | |

| |

| Macroeconomy | | Economic growth impacts our customers’ expectations, confidence and their ability and propensity to save, spend and meet their financial commitments. Persistent low interest rates and low rate expectations have contributed to the economic recovery and a more benign credit environment. |

| |

| | Economic growth strengthened in 2014 and there were improvements in the labour market and in consumer and business confidence. However, the economic outlook remains subject to uncertainty, and recent falls in inflation and financial market volatility have affected policy expectations. |

| |

| | The second half of 2014 saw increased debate around the UK’s relationship with the EU, including within the context of the 2015 UK general election. Significant changes in the political structure and UK Government policy changes following the general election could impact our business. |

| |

| Competition | | The UK personal financial services market is increasingly competitive, most obviously for mortgages and current accounts. Price-led competition has brought mortgage loan rates down, and a focus on retail banking has led other UK banks to introduce new products with a wider value appeal, and in part as a response to the success of our 1I2I3 World proposition. |

| |

| | In 2014, we benefited from the industry-wide Current Account Switch Service and our customer numbers and balances have grown strongly. New entrants to the market, including other challenger banks, specialist lenders and technology firms, will impact traditional banking business models. |

| |

| | Innovations in technology are likely to continue at a rapid pace. In response, we continue to develop our digital capabilities and increase channel flexibility to allow our customers to interact with us however and whenever it best suits them. |

| |

| Regulation | | In the aftermath of the financial crisis, a large volume of additional regulation has emerged in the UK and other jurisdictions. Consultation, implementation and compliance has been costly both in financial terms and with respect to senior executive and management time and focus. |

| |

| | The UK Competition & Markets Authority retail banking investigation offers the prospect of stronger opportunities in personal current accounts and banking services to SMEs, where Santander UK is a scale challenger. |

| |

| | Santander UK exceeded the threshold requirements of the PRA stress test results released in December 2014, demonstrating our balance sheet and credit strength. The implementation of CRD IV, FPC policy recommendations, accounting changes, and Independent Commission on Banking (‘ICB’) recommendations will necessitate changes to banks’ operating models and structures, increase capital requirements and could impact risk profiles. |

| |

| Operations | | In recent years there have been several instances of high-profile technology and data security failures which impacted banking customers in the UK. The level of fraud, cyber-crime and denial-of-service attacks has also increased. |

| |

| | Continued focus on conduct issues across the UK banking industry could lead to further provisions for remediation, as well as impacting the products and services banks are able to offer at the right level of return. |

| |

| | Santander UK will continue to develop a simple and understandable product range provided on a stable and reliable platform with integrated and flexible service channels to support business growth as well as to further improve customer satisfaction and loyalty. Good progress has been made in embedding enterprise wide risk management across the bank. |

| | | | | | | | | | | | |

Our heritage and Santander UK today | | Chair’s review | | Chief ExecutiveOfficer’s review | | KPIs | | Chief Financial Officer’s review | | Corporate Governance review | | Nathan Bostock discusses the impact of operating environment on strategy and the top risks we face |

| | | | | | |

| | | | | | | | | | | | | |

Top risks in 2014

| | |

| | See page 36 for more on |

| top risks |

Strategic priorities:

| | |

| | Loyal and satisfied retail customers |

| |

| | ‘Bank of Choice’ for UK companies |

| |

| | Consistent profitability and a strong balance sheet |

| | | | | | |

Risk indicator | | | | Risk features, impacts and developments in 2014 | | Strategic priorities |

Capital | | CET 1 ratio %

| | Capital risk has the potential to disrupt our business model and stop the normal functions of Santander UK. Failure to meet the capital requirements of regulators could lead them to constrain dividend payments or to resolve Santander UK. The latest PRA stress test results released in December 2014 showed that Santander UK exceeded the PRA’s 2014 stress test threshold requirement of 4.5%, with a stressed CET 1 ratio of 7.9% after PRA-allowed management actions.  See ‘Capital risk’ on page 117. See ‘Capital risk’ on page 117.

| |

|

| | | |

| Conduct | | Remaining provision £m

| | Conduct risk is a key factor in determining if we are meeting our aim to be the best bank for our customers. During 2014, a review of claims activity indicated that claims are expected to continue for longer than originally anticipated and therefore, we topped up our PPI provision by £95m. There was also a net £45m of additional provisions charged in 2014, principally for wealth and investment products.  See ‘Conduct risk’ on page 129. See ‘Conduct risk’ on page 129.

| |

|

| | | |

| Credit | | NPL ratio %

| | Credit risk could reduce the value of our assets as well as increase write-offs and impairment loan loss allowances. Throughout 2014, we experienced robust retail and corporate portfolio credit quality, with loans performing well in a benign credit environment of low interest rates, rising house prices and falling unemployment.  See ‘Credit risk’ on page 39. See ‘Credit risk’ on page 39.

| |

|

| | | |

| Liquidity | | LCR %

| | Liquidity risk could affect our ability to meet our financial obligations as well as disrupt our day-to-day operations, business model or lead to the insolvency of Santander UK. During 2014, the LCR eligible liquidity pool significantly exceeded wholesale funding of less than one year, with a coverage ratio of 171%. Overall, the cost of wholesale funding continued to fall during the year, as lower cost new issuance replaced more expensive maturing funding in a more stable capital markets environment.  See ‘Liquidity risk’ on page 101. See ‘Liquidity risk’ on page 101.

| |

|

| | | |

| Operational | | Operational risk losses £m

| | Operational risk could impact any aspect of our business or support processes associated with people, systems or external events which could prevent us from achieving our desired business objectives. During 2014, the majority of Santander UK’s £171m (2013: £221m) of operational risk losses arose within the clients, products and business practices category. These principally represented conduct redress payouts (excluding related costs).  See ‘Operational risk’ on page 126. See ‘Operational risk’ on page 126.

| |

|

| | | |

| Pension | | Defined benefit pension scheme deficit/surplus £m

| | Pension risk arises to the extent that the assets of the defined benefit pension schemes do not fully match the timing and amount of the schemes’ liabilities and can impact our financial results and capital metrics. The Scheme’s accounting position improved by £670m to a surplus of £156m at 31 December 2014, attributable to positive asset returns, additional contributions by Santander UK, and a £218m net gain recorded in the first half of the year.  See ‘Pension risk’ on page 125. See ‘Pension risk’ on page 125.

| |

|

| (1) | Non-IFRS measure. See page 355. |

| | |

| Strategic report | | Helping people and businesses prosper |

Chief Financial

Officer’s review

“Our 2014 results show increased profitability and a further improved balance sheet. They demonstrate the consistency and strength of Santander UK, and position us well for future growth”

Stephen Jones

Chief Financial Officer

24 February 2015

Our main business segments:

Corporate & Institutional Banking

Profit before tax increased by 26% to £1,399m in 2014 with continued growth in net interest income, well-controlled underlying costs and robust credit quality.

Income statement highlights(A)

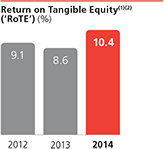

Profit after tax for the year increased 25% to £1,110m in 2014, with RoTE(2) improving to 10.4% (2013: 8.6%).

Net interest income was 16% higher in 2014, driven by margin and volume improvements. Management continued to focus on reducing the cost of retail liabilities, replacing maturing tranches of higher cost eSaver savings products in the second half of 2013 and originating new lower cost ISAs in 2014. In addition, there was increased retail and corporate lending.

Non-interest income was 3% lower in 2014, reflecting lower net banking fees in Retail Banking and lower demand for interest rate and foreign exchange risk management products from Commercial Banking customers.

Cost efficiency was maintained in 2014, with our focus on managing business-as-usual administrative expenses to accommodate investment. We continued to invest in the growth of the businesses serving SME and corporate customers, as well as in the refurbishment of the branch network and enhancements to our digital channels.

Impairment losses on loans and advances were 46% lower in 2014. Credit quality in the retail and corporate loan books continued to

be strong, supported by the improving economic environment and reflecting prudent risk management.

Provisions for other liabilities and charges were 66% higher at £416m in 2014. Excluding the specific charges outlined below, provisions for other liabilities and charges decreased 10% to £226m driven by a reduced provision for restructuring, partially offset by an increase in FSCS charges and UK Bank Levy costs.

Specific gains, expenses and charges

As a result of defined benefit pension scheme changes that limit future entitlements and provide for the longer-term sustainability of our staff pension arrangements, a net gain of £218m arose in administrative expenses.

Following the implementation of our new digital platform and the completion of our product simplification programme, we made write-offs for the decommissioning of redundant systems and charged investment costs, totalling £304m. This included software write-offs of £206m charged to depreciation, amortisation and impairment, and investment costs of £98m relating to technology and digital capability build out, which cannot be capitalised and are therefore charged in administrative expenses.

| | | | | | | | | | |

(A) | | Income statement highlights(1) | | | | | | | | |

| | | |

| | | | | 2014

£m | | | 2013(3)

£m | |

| | | |

| | Net interest income | | | 3,434 | | | | 2,963 | |

| | Non-interest income | | | 1,036 | | | | 1,066 | |

| | Operating expenses | | | (2,397 | ) | | | (2,195) | |

| | Total operating provisions and charges | | | (674 | ) | | | (725) | |

| | Profit before tax from continuing operations | | | 1,399 | | | | 1,109 | |

| | Profit after tax | | | 1,110 | | | | 890 | |

| | | |

(1) Income statement highlights statistics reflect continuing operations, and therefore exclude the results and loss on sale of discontinued operations. See Note 11 to the Consolidated Financial Statements. | |

(2) Non-IFRS measure. See page 355. | |

(3) Adjusted to reflect the adoption of IFRIC 21, as described in Note 1 to the Consolidated Financial Statements. | |

| |

| |

| |

| | | | | | | | | | | | |

Our heritage and Santander UK today | | Chair’s review | | Chief Executive Officer’s review | | KPIs | | Chief Financial Officer’s review | | Corporate Governance review | | Stephen Jones outlines the financial results for 2014. |

| | | | | | | | | | | | | |

| (1) | Adjusted to reflect the retrospective adoption of IFRIC 21. |

| (2) | Non-IFRS measure. See page 355. |

Provisions for other liabilities and charges were impacted by £190m. These included a £50m provision relating to the costs for our ongoing branch de-duplication programme. There was also a further provision of £140m, including related costs, for conduct remediation. Of this, £95m related to PPI following a review of recent claims activity, which indicated that claims are now expected to continue for longer than originally anticipated. There was also a net £45m charge relating to existing remediation activities and an additional provision principally for wealth and investment products.

Changes to business segments

The basis of presentation of our 2014 segmental results has been changed, and prior periods restated, to:

| – | Designate three distinct main customer business segments, which reflect how we now manage and operate the bank, namely: Retail Banking, Commercial Banking and Corporate & Institutional Banking; and, |

| – | Allocate indirect income, expenses and charges, previously held in Corporate Centre, which can be attributed to the three distinct customer segments. This included a review of the internal transfer pricing policy which resulted in a further allocation of funding and liquidity costs, central operating expenses and other provisions such as conduct, branch de-duplication, UK Bank Levy and FSCS charges. |

With the allocation of indirect income, expenses and charges from Corporate Centre and with the three distinct main customer business segments at differing stages of commercial maturity, we are now able to identify better the key drivers of our business performance. This enables a more targeted apportionment of capital and other resources in line with the individual strategies and objectives of each business segment.

| | | | |

Holding company established | | | | |

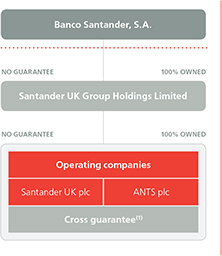

We established Santander UK Group Holdings Limited (‘HoldCo’) as the immediate holding company of Santander UK plc in January 2014. This constituted the start of our transition to a Bank of England recommended configuration for a ‘single point of entry’ resolution entity, which aims to resolve banks without disrupting activities of the operating company (‘OpCo’), thereby maintaining continuity of services for customers. As part of this transition, we issued two Additional Tier 1 (‘AT1’) private placements to our parent Banco Santander, S.A. both of which were downstreamed to OpCo as AT1. In June 2014, we issued £500m of 35 year perpetual capital securities priced at 6.625%, and in December £300m priced at 7.600%. Both notes were independently evaluated by two investment banks and reflected current market conditions when issued, with terms and conditions clearly outlined on our public website. | | In the second quarter of 2015, upon publication of the HoldCo 2014 Annual Report, the attainment of credit ratings and regulatory approvals, we will have the capability to commence public debt issuance out of HoldCo. Our plans focus on all subordinated debt issuance from HoldCo, and a high likelihood of some of our senior unsecured issuance requirement from HoldCo over the medium term. Covered bonds and other securitised funding, as well as our short-term programmes will continue to be made from OpCo. When we start issuing publicly from HoldCo later in 2015, we intend to be fully transparent regarding the terms of the downstreaming of HoldCo debt to OpCo, to ensure investors understand their position in the creditor hierarchy. (1) The cross guarantees have the effect of aligning the interests of the class of creditors covered by the cross guarantees across the operating companies. The current cross guarantees expire on 30 June 2015. | |

|

| | |

| Strategic report | | Helping people and businesses prosper |

Chief Financial

Officer’s review

continued

Customer balances(B)

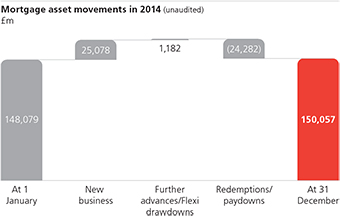

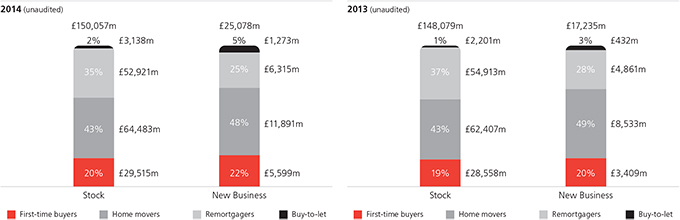

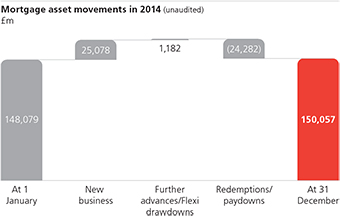

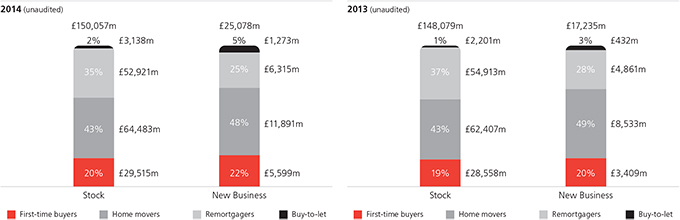

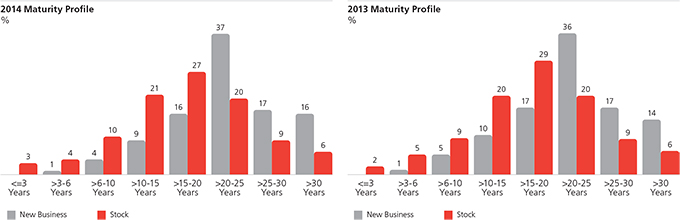

Customer assets of £190.7bn grew by £3.6bn in 2014. Mortgage lending balances increased £2.0bn, maintaining the positive momentum that commenced in the second quarter of 2014. In an increasingly competitive, and still contracting market, corporate lending balances increased £1.8bn. These increases were partially offset by a reduction in the non-core corporate and legacy portfolios.

Customer deposits increased £6.0bn to £152.4bn in 2014, as we focused on retaining and originating accounts held by more loyal customers. Current account balances in Retail Banking grew £13.2bn to a total of £41.1bn, partially offset by lower savings balances as we focused on reducing more price-sensitive retail deposits. Commercial Banking deposits grew by £1.5bn, through enhanced capabilities and building upon strong customer relationships.

The loan-to-deposit ratio (‘LDR’) of 124% was 2 percentage points better, reflecting particularly strong growth in retail current account balances. The customer funding gap reduced £2.4bn to £38.3bn at 31 December 2014 (2013: £40.7bn), with lending growth fully funded by deposit growth.

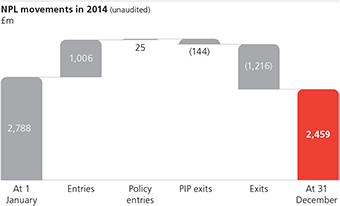

Credit quality(C)

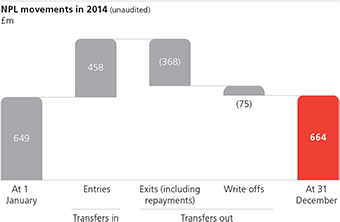

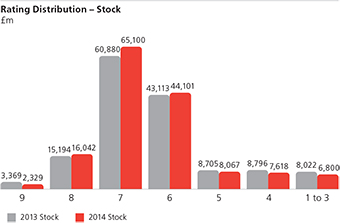

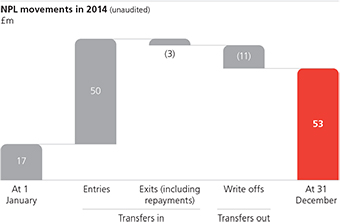

The Retail Banking NPL ratio fell to 1.62% at 31 December 2014, with an improvement across all of the principal portfolios. The mortgage NPL ratio decreased to 1.64%, with a further fall in NPLs and a growing mortgage book. The banking and consumer credit NPL ratio also reduced due to a continuation of the general improvement in the credit quality of the unsecured portfolios.

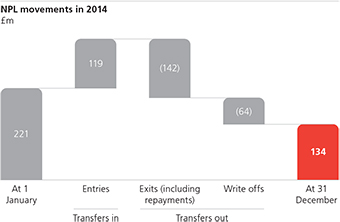

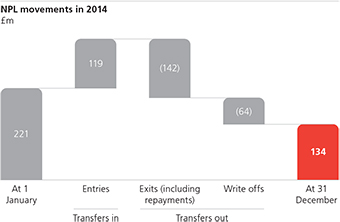

The Commercial Banking NPL ratio decreased to 3.56% at 31 December 2014, with credit quality remaining strong. We continue to adhere to our prudent lending criteria as we grow lending.

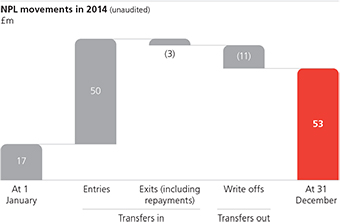

The Corporate & Institutional Banking NPL ratio increased to 1.01% at 31 December 2014, due to a single infrastructure loan which moved into non-performance.

Liquidity and funding(D)

The LCR eligible liquidity pool increased £6.7bn, to £39.5bn at 31 December 2014 with an LCR of 110%. Wholesale funding with a residual maturity of less than one year increased £1.9bn, to £23.1bn, due to the timing of secured funding maturities. LCR eligible liquidity pool assets significantly exceeded wholesale funding of less than one year, with a coverage ratio of 171% at 31 December 2014.

| | | | | | | | | | |

(B) | | Customer balances | | | | | | | | |

| | | |

| | | 31 December | | 2014

£bn | | | 2013

£bn | |

| | | |

| | Total customer loans | | | 190.7 | | | | 187.1 | |

| | Total customer deposits | | | 152.4 | | | | 146.4 | |

| | Loan-to-deposit ratio | | | 124% | | | | 126% | |

| | | |

| | | |

(C) | | Credit quality | | | | | | | | |

| | | |

| | | 31 December | | 2014

% | | | 2013

% | |

| | | |

| | Retail Banking NPL ratio | | | 1.62 | | | | 1.89 | |

| | Commercial Banking NPL ratio | | | 3.56 | | | | 3.83 | |

| | Corporate & Institutional Banking NPL ratio | | | 1.01 | | | | 0.33 | |

| | Corporate Centre NPL ratio | | | 1.62 | | | | 2.36 | |

| | Total NPL ratio | | | 1.80 | | | | 2.04 | |

| | | |

| | | | | | | | | | | | |

Our heritage and Santander UK today | | Chair’s review | | Chief Executive Officer’s review | | KPIs | | Chief Financial Officer’s review | | Corporate Governance review | | Stephen Jones outlines the financial results for 2014. |

| | | | | | | | | | | | | |

Medium-term funding (‘MTF’) issuance of £12.9bn (sterling equivalent) in 2014 included £7.7bn of senior unsecured issuance. Overall the cost of wholesale funding continued to fall during the year, as lower cost new issuance replaced more expensive maturing funding in a more stable capital markets environment.

Capital and leverage(D)

The CET 1 capital ratio improved to 11.9% at 31 December 2014 (2013: 11.6%(3)), with the PRA end-point T1 leverage ratio at 3.8% (2013: 3.3%). During 2014, we issued £800m of AT1 capital, and redeemed £265m of preferred shares.

RWAs increased £4.6bn to £82.3bn at 31 December 2014, reflecting higher customer loans, a recalibration of risk models in Commercial Banking and a small increase in mortgage risk weights.

PRA stress test results

The latest PRA stress test results were released in December 2014. Santander UK exceeded the PRA’s 2014 stress test threshold requirement of 4.5%, with a stressed CET 1 ratio of 7.9% after PRA-allowed management actions.

The PRA stress test centred on an unprecedented UK housing market stress and therefore was particularly focused on banks with significant UK residential mortgage exposure. Notwithstanding this focus, the outcome demonstrated Santander UK’s continuing resilience, robust balance sheet and credit strength.

Outlook

We expect the developments in the business, and investments made to date to help maintain our strong performance.

A further reduction in the overall cost of deposits is expected to compensate for any further asset margin declines. Our tight control of business-as-usual costs will continue, while we invest further in the transformation of our business.

The momentum of the UK economy should continue to be supportive of our business, although there is evidence of increasing liquidity in the market resulting in competitive pressures in many business lines which may impact margins and slow the rate of growth.

We believe that our performance over time should continue to demonstrate the consistency and strength of Santander UK.

| | | | | | | | | | |

(D) | | Liquidity, funding, capital and leverage – CRD IV | | | | | | | | |

| | | |

| | | 31 December | | 2014

£bn | | | 2013

£bn | |

| | | |

| | LCR eligible liquidity pool | | | 39.5 | | | | 32.8 | |

| | LCR | | | 110% | | | | 103%(3) | |

| | CET 1 capital | | | 9.8 | | | | 9.0(3) | |

| | CET 1 capital ratio | | | 11.9% | | | | 11.6%(3) | |

| | Risk Weighted Assets (‘RWAs’) | | | 82.3 | | | | 77.7(1) | |

| | PRA end-point Tier 1 leverage ratio(2) | | | 3.8% | | | | 3.3% | |

| | | |

| | | | |

(1) Adjusted for consistency to reflect the CRD IV rules as if they had applied on 31 December 2013 as described in ‘Risk-weighted assets’ in the Risk review on page 123. |

(2) The leverage ratio defined by the PRA uses an exposure measure consistent with the Basel Committee’s January 2014 Leverage Ratio Framework. |

(3) Non-IFRS measure. See page 355. |

| | |

| Strategic report | | Helping people and businesses prosper |

Corporate

Governance review

Lord Burns

Chair

| | |

| | See page 152 for details

of the activities of the Board,

its Committees and their

composition |

| |

| | See page 146 for list of

directors at 31 December

2014 |

| |

| | See page 153 for details

of changes to the Board |

During 2014, the Board continued to devote a significant amount of time to driving our strategic transformation.

Corporate governance

Santander UK, as a subsidiary of the Banco Santander group, has its own autonomous operating framework and is regulated in the UK by the PRA and the FCA.

At Santander UK, we remain committed to achieving the highest standard of corporate governance. We have complied with the UK Corporate Governance Code in a manner appropriate to our ownership and have adopted an integrated approach to corporate governance across the group to ensure effective management and control.

The Board and its committees

The roles of Chair and CEO are separated and clearly defined. The CEO has delegated authority from the Board for the day-to-day operation of the business and implementation of the Board’s strategy and business plan. In turn he delegates a number of duties to his

direct reports. The CEO and his direct reports are supported by a number of senior level committees to assist them in executing their duties.

The Board delegates certain responsibilities to its Committees which comprise independent Non-Executive Directors. These committees play a central role in supporting the Board to discharge its duties and implement its vision and strategy while providing focused oversight of key aspects of the business.

| | |

Board composition at 31 December 2014 |

| |

Chair | | Deputy Chair |

| |

Lord Burns(1) | | Juan Rodríguez Inciarte |

| |

Executive Directors | | |

| |

Nathan Bostock | | Stephen Jones |

Chief Executive Officer | | Chief Financial Officer |

Steve Pateman | | |

Head of UK Banking | | |

| |

Non-Executive Directors | | |

| |

Ana Botín | | José María Fuster |

José María Carballo | | Manuel Soto |

Antonio Escámez | | |

| |

Independent Non-Executive Directors | | |

| |

Mike Amato | | Alain Dromer |

Roy Brown | | Rosemary Thorne |

Bruce Carnegie-Brown(2) | | Scott Wheway |

(1) On 1 January 2015, Shriti Vadera was appointed Non-Executive Director and Joint Deputy Chair. She will succeed Lord Burns as Chair on 30 March 2015 |

(2) Bruce Carnegie-Brown ceased to be deemed independent upon his appointment to the Board of Banco Santander, S.A. on 12 February 2015. |

| | | | | | | | | | | | |

Our heritage and Santander UK today | | Chair’s review | | Chief Executive Officer’s review | | KPIs | | Chief Financial Officer’s review | | Corporate Governance review | | Lord Burns sets out an overview of our Corporate Governance, the Board and how it spent its time in 2014 and looks forward to 2015. |

| | | | | | | | | | | | | |

How the Board spent its time in 2014

During 2014, the Board continued to devote a significant amount of time to driving Santander UK’s strategic transformation, focusing on the three strategic priorities.

The Board reviewed global trends in financial markets, with particular emphasis on the implications for the UK banking sector. This also informed the Board’s assessment of our forward plan and vision during its annual Strategy Day, held in May 2014.

Another significant area of effort for the Board in 2014 was the increasing regulatory agenda, in particular the banking reform proposals which will impact our business model and legal structure, proposed leverage requirements, and regulatory scrutiny of competition in financial services.

The Board also closely monitored the effectiveness of the risk management framework and internal controls through enhanced risk management information and reporting.

The Board maintained close attention on customer experience as well as the continuing development of the Santander UK culture, with the aim of ensuring good outcomes for our customers. Following the launch of the Santander Way, the Board also continued to review the process of implementation and embedding of a strong and effective customer-centric culture.

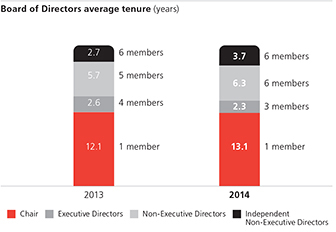

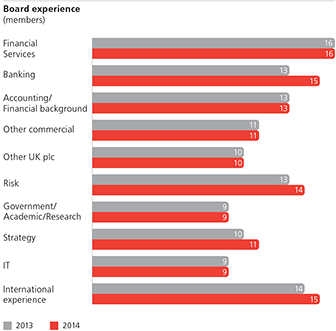

Lastly, the Board has continued to review its composition to ensure an appropriate mix of skills and experience, and to ensure effective succession planning.

Priorities for 2015

For 2015, the Board will continue to focus on helping people and businesses prosper and working to achieve our strategic priorities. Banking reform will be a particular area of attention, together with the ongoing embedding of an effective risk culture, digital innovation programme and the Santander Way. By remaining concentrated on continuous improvement, the Board will aim to further enhance its effectiveness.

| | | | | | |

| Santander UK Group Holdings Limited |

|

| Santander UK Board |

| | | |

| | | | | | |

| | | |

| Board Audit | | Board Nomination | | Board Remuneration | | Board Risk |

Committee | | Committee | | Oversight Committee | | Committee |

| | | |

Oversight of financial reporting and internal control matters. | | Oversight of Board and Board Committee composition and effectiveness, and Board and Executive appointments and succession plans. | | Oversight of overarching principles and parameters of remuneration policy. | | Oversight and advice to the Board on current and future risk exposures and management of overall risk appetite. |

| | |

| Strategic report | | Helping people and businesses prosper |

Corporate

Governance review

continued

| | |

| | See Directors’ Remuneration

report on page 170 |

Remuneration

Santander UK’s success depends upon the performance and commitment of our employees. Our remuneration approach is designed to attract, retain and motivate high-calibre individuals to deliver our business strategy in line with our values.

We operate and apply a consistent reward methodology for employees ensuring that we remain within the parameters of the PRA Remuneration Code.

Remuneration reporting

Santander UK wishes to build on its previous commitment to enhance its pay transparency. To expand on extensive voluntary disclosures made in our 2013 report, we have continued to improve understanding of the link between performance and pay.

The full Directors’ Remuneration report, in which we outline remuneration and fees paid to the Executive and Non-Executive Directors for 2014, is shown on pages 170 to 181.

Directors’ remuneration(E)

The Board, through its Remuneration Oversight Committee, continued to review and enhance the quality and performance of the remuneration structures for the Executive Directors and throughout the business.

We remain aware that remuneration for executives generally, and in the financial services sector specifically, has been under close scrutiny from many stakeholders in recent years and remains a key topic for regulators and shareholders.

As we report, the Board continues to believe that our remuneration policies at all levels, including those for the Executive Directors, need to encourage staff to deliver strong, long-term sustainable growth, robust risk management processes and appropriate behaviours, as well as the right customer outcomes.

Additionally, the remuneration for our Non-Executive Directors, including the Chair, is reviewed annually, taking into account fees paid in similar companies, and time commitment for the role to ensure we can attract and retain individuals of the right calibre needed to successfully deliver the Board’s strategy.

| | | | | | | | | | |

(E) | | Directors’ remuneration | | | | | | | | |

| | | |

| | | Aggregate Directors’ remuneration | | 2014 £ | | | 2013 £ | |

| | | |

| | Salaries and fees | | | 6,697,041 | | | | 6,183,203 | |

| | Performance-related payments(1) | | | 5,459,000 | | | | 4,800,051 | |

| | Other taxable benefits | | | – | | | | – | |

| | | |

| | Total remuneration excluding pension contributions | | | 12,156,041 | | | | 10,983,254 | |

| | Pension contributions | | | – | | | | – | |

| | Compensation for loss of office | | | – | | | | – | |

| | | |

| | | | | 12,156,041 | | | | 10,983,254 | |

| | | |

| | (1) In accordance with the PRA Remuneration Code, a proportion of the performance-related payment was deferred. | |

| | | | | | | | | | | | |

Our heritage and Santander UK today | | Chair’s review | | Chief Executive Officer’s review | | KPIs | | Chief Financial Officer’s review | | Corporate Governance review | | Lord Burns provides some examples of digital innovation in Santander UK. |

| | | | | | | | | | | | | |

| | | | |

| Digital innovation | | |

| | |

Our philosophy is to ensure banking is Simple, Personal and Fair, and available to all customers, when and where they require it. In 2014, we continued to invest in branch refurbishments and digital technology, allowing customers to interact with us in the way that suits them best; face to face, by phone, through our ATMs or by dedicated in-branch online booths. Our new ‘smart’ ATMs, introduced this year, allow customers to view detailed transactions history and save regular transactions to their profile so they can make their usual withdrawal quickly from the welcome screen. We have also refreshed our online banking platform in response to customer feedback. The new award-winning website is simpler, clearer and easier to use and can be tailored to personalise the customer experience. We began the roll-out of contactless debit and credit cards so our customers can take advantage of this technology, which is becoming more widespread as a payment option among retailers. Contactless payments are a convenient option for customers and are increasingly popular for every day purchases and our customers can also earn cashback by using their cards to pay for journeys on the London Underground. Active mobile users 1,000 new users each day | |

|

| |

| | SmartBank is our new free student specific mobile banking platform. Available on both android and iOS smartphones, SmartBank shows a snapshot of a user’s account including activity for the previous seven days, a breakdown of spending and provides weekly and monthly spending patterns. The app has received great customer feedback – averaging 5 stars on Google play store and Apple app store. Mortgage customers 1-in-5 refinance loans online |

| | | |

| | | |

| | We have also introduced Connect, a new online platform for our corporate customers. Connect gives our customers the flexibility to use their accounts 24/7, wherever they are, and can be tailored to meet their needs as well as offer a full range of UK and international payment services. In the future, capability for trade transactions and supplier payments on our UK systems will be provided so we can deliver bespoke pricing for foreign exchange. Personal current accounts 232,000 opened online |

| | |

| Strategic report | | Helping people and businesses prosper |

Corporate Social

Responsibility review

Training development

95%

Staff took advantage of the wide training resources available, with 95% undertaking some form of learning in 2014.

We recognise the importance of social responsibility and are committed to maintaining the highest ethical standards and conducting business in a responsible way.

Our culture

Santander UK is committed to maintaining high ethical standards, adhering to laws and regulations, conducting business in a responsible way and treating all stakeholders with honesty and integrity. These principles are reflected in our Ethical Code of Conduct which sets out clearly the standards expected of all our people and is implemented through the Santander Way.

We are also committed to protecting and respecting human rights, with our Human Rights Policy applying to employees, customers and suppliers as well as the communities in which we operate. As we continue to operate in accordance with the highest international standards, the policy remains aligned with international standards and regulations regarding labour, social and environmental affairs.

Our people

Our goal to be the best bank for our customers is only achievable if we reach our aspiration to become the best bank for our people. Key to this is having a workplace that provides excellent opportunities for career progression and that encourages accountability and teamwork.

In 2014, we recorded an average of five training days per employee (2013: four days), and more than 95% of staff undertook either face-to-face or eLearning modules. The employee turnover and average length of service were broadly stable at 13% and 8.3 years respectively.

We also focus on creating a safe and healthy working environment and provide training, coaching and practical advice to all colleagues on health, safety and wellbeing. We provide employees and immediate family members with an Employee Assistance Programme offering free, confidential telephone advice and support, including face-to-face counselling.

Schemes such as Flexi Working, Flexi Leave, Voluntary Home Working and Career Break are also in place to support work-life balance of our staff.

Communication and consultation

We continue to involve and inform employees on matters that affect them. Through our intranet, team meetings, regional roadshows and national conferences, we keep employees informed of company news and strategic developments and through initiatives such as Better Together we seek the ideas of our people to build on this work.

We are particularly pleased with a successful history of working in partnership with our recognised trade unions, Advance and the Communication Workers Union, whom we consult on significant proposals and change initiatives at both national and local levels.

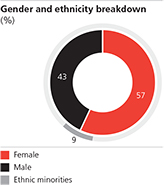

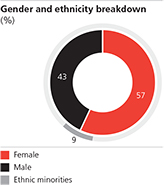

Diversity and inclusion(F)

We believe in supporting diversity and creating an inclusive culture where all our people feel valued and able to fulfil their potential. During 2014, more than 250 senior leaders attended our Inclusive Leadership course and we launched a mentoring programme for all colleagues to help them fulfil their potential.

| | | | | | | | | | | | | | | | | | | | | | |

(F) | | Diversity and inclusion | | | | | | | | | | | | | | | | | | | | |

| | | |

| | | 31 December | | Total | | | Female No. | | | Female % | | | Male No. | | | Male % | |

| | | |

| | Board Directors | | | 16 | | | | 2 | | | | 12 | | | | 14 | | | | 88 | |

| | Senior managers(1) | | | 233 | | | | 39 | | | | 17 | | | | 194 | | | | 83 | |

| | Employees | | | 20,676 | | | | 11,829 | | | | 57 | | | | 8,847 | | | | 43 | |

| | | |

| | (1) In accordance with sections 414C(9) and 414C(10) of the Companies Act 2006, a senior manager is defined as an employee of the Company with responsibility for planning, directing or controlling the activities of the Company, or a strategically significant part of the Company, including directors of significant subsidiaries. | |

| | | | | | | | | | | | |

Our heritage and Santander UK today | | Chair’s review | | Chief Executive Officer’s review | | KPIs | | Chief Financial Officer’s review | | Corporate Governance review | | Lord Burns gives an overview of our Corporate Social Responsibility Report. |

| | | | | | | | | | | | | |

Our Embrace, Enable, Women in Business and Cultural Awareness networks encourage colleagues to connect on issues related to sexuality, disability, gender and culture and to feel confident and supported in being who they are. In 2014 we invested in online functionality and user experience for our networks to make sure they are simple to navigate and more personal for members. The lesbian, gay, bisexual and transgender (‘LGBT‘) network expanded as a result of these enhancements and we now have actively involved champions in the business across the LGBT spectrum.

Gender equality is a focus area for us and in addition to our Women in Business network we continued our partnership with Everywoman, giving our staff access to tools and networks to help them develop their careers. In 2014 Santander UK was recognised as one of the Top 30 Employers for Working Families(1) and one of The Times Top 50 Employers for Women. In 2014, we also introduced a policy to ensure there is a female candidate on all short lists for senior roles within the business.

We remain mindful of Lord Davies’ report ‘Women on Boards’ published in 2011 and its aspirational target of 25% female representation on the FTSE 100 companies Boards by 2015. Following the adoption of the Board diversity policy in March 2014, our Board committed to have 25% female representation by 2017. With the appointment of Shriti Vadera, our female Board representation is now 18%.

Our communities

Support for society at Santander UK is focused on three priority areas: education, employment and enterprise. Support for students is co-ordinated via Santander Universities, Breakthrough assists SMEs and the Santander UK Foundation provides grants to local charities. Together through these three flagship programmes and further funding we contributed £21m to society in 2014.

The Santander UK Foundation provides grants to UK registered charities particularly in communities where Santander branches, business centres and offices are located. Through its three grant programmes focused on funding for education, training and financial capability projects more than 2,700 charities benefited over the year.

At the end of 2014, Santander Universities had partnerships with 77 UK universities providing funding to students and staff to support their studies, with £10m contributed to the sector in the UK.

Through our Breakthrough programme we provide fast-growth companies with the resources and knowledge they need to achieve their growth potential. During 2014, more than 370 businesses benefited from overseas trade missions, roundtable events, master classes and internships. This programme also supported 39 SMEs with £38m of Growth Capital and £88m of other growth-related finance providing these companies with the opportunity and support to create over 1,300 jobs in the UK economy.

Our community priorities:

|

Female Board members January 2015 18% We have improved our female Board representation and remain committed to 25% target by 2017. (1) Top Employers for Working Families Awards 2014, announced 22 September 2014 |

|

Community Day volunteering projects +250 4,200 employees dedicated their time to Community Days in 2014. |

| | |

| Strategic report | | Helping people and businesses prosper |

Corporate Social

Responsibility review

continued

|

Waste recycling 98% We recycle paper, plastic, aluminium and general waste produced at our offices and branches. |

We also encourage our people to give back to local communities through our Community Day volunteering projects. Santander UK also co-sponsored the ‘Blood Swept Lands and Seas of Red’ installation at the Tower of London at which many Santander UK people volunteered their time to plant ceramic poppies to mark the 100th anniversary of the beginning of the First World War.

The environment(G)

We are committed to creating a strong business that is not achieved at the expense of the environment. Our Environmental Management System defines responsibilities and processes in relation to waste, energy, water, travel and supply chain management at our 14 major offices. Our head office is also ISO 14001 compliant.

Smart meter technology is installed across the business and we are able to track the individual performance of our properties. This allows us to monitor ongoing consumption profiles, and alter plant operational times in line with the requirements of each property,

reducing energy wastage. We are very pleased with 2014 results which show energy usage in 2014 continued to reduce with electricity across the estate reducing by 2% and gas reducing by 12%. We recycle 98% of the paper, plastic, aluminium and general waste produced at our offices and branches.

Climate change

The main greenhouse gas generated as a result of running our business is carbon dioxide, generated from our use of fuels in heating, cooling and lighting for our offices and branches, and through business travel.

We are committed to reducing carbon dioxide emissions and our electricity was sourced solely from green supplies in 2014 which has zero-rated carbon dioxide emissions. On the British mainland our electricity is sourced from bio-mass via Haven Power and in Northern Ireland from wind and other forms of natural green energy via Airtricity. In 2014, we launched a ‘No Travel Week’ campaign for our employees highlighting video and telephone conferencing technology as alternatives to business travel.

| | | | | | | | | | |

(G) | | The environment | | | | | | | | |

| | | |

| | Emissions data | |

| 2014

Tonnes CO2e |

(1) | |

| 2013

Tonnes CO2e(1) |

|

| | | |

| | CO2 from fuel | | | 7,017 | | | | 8,000 | |

| | CO2 from business travel | | | 8,415 | | | | 10,450 | |

| | | |

| | Total | | | 15,432 | | | | 18,450 | |

| | | |

| | CO2 released per FTE | | | 0.63 | | | | 0.76 | |

| | | |

| | (1) Department for Environment, Food & Rural Affairs (‘DEFRA’) conversion factors for greenhouse gas reporting. DEFRA Standard Set 2013 | |

The Strategic Report, on pages 2 to 24, incorporates our heritage and Santander UK today, the Chair’s review, the Chief Executive Officer’s review, the Chief Financial Officer’s review, and the Corporate Governance and Corporate Social Responsibility review.

By order of the Board.

Nathan Bostock

Chief Executive Officer

24 February 2015

Risk review

This Risk review contains audited financial information except as otherwise marked as unaudited. The audited financial information in this Risk review forms an integral part of the Consolidated Financial Statements.

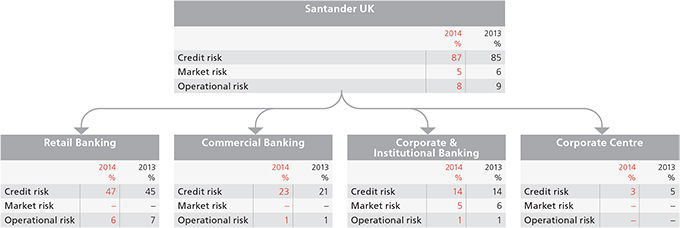

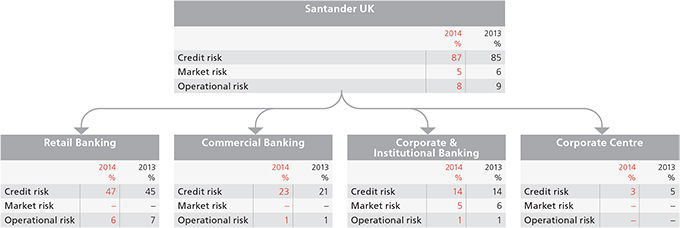

Following a strategic review, the segmental financial information reported to the Board (Santander UK’s chief operating decision maker) was revised in the fourth quarter of 2014, and prior periods restated, principally to designate three distinct main customer business segments, which reflect how we now manage and operate: Retail Banking, Commercial Banking and Corporate & Institutional Banking, as well as Corporate Centre. The financial information in this Risk review has been presented on this basis for all periods. See Note 2 to the Consolidated Financial Statements.

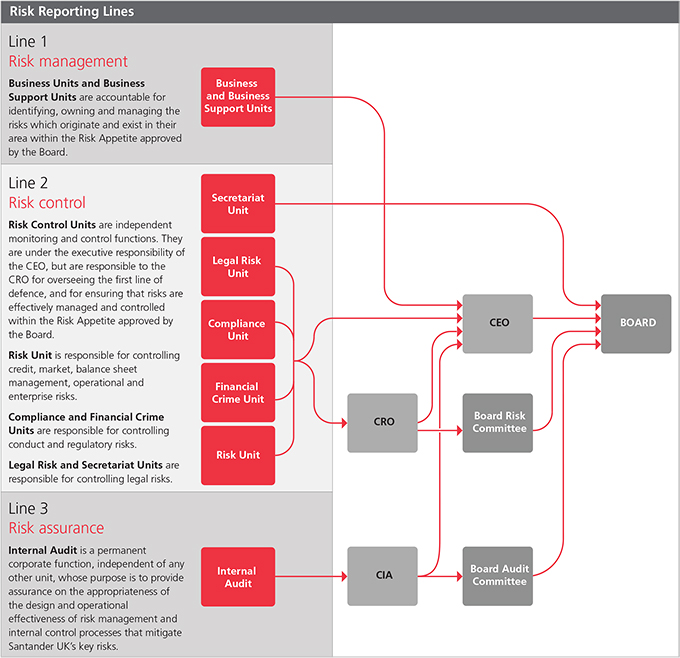

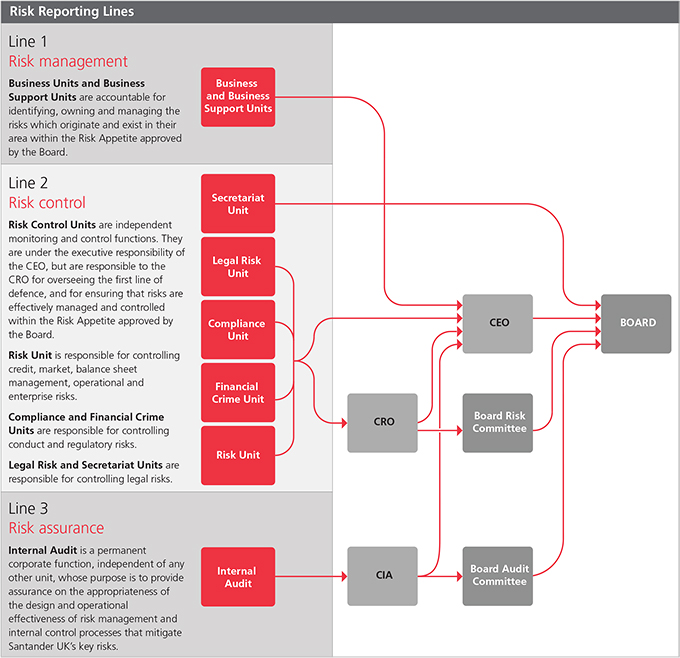

Risk governance

As a significant financial services provider, risk is at the core of Santander UK’s day-to-day activities. The understanding and control of risk on an enterprise-wide basis is critical for the effective management of the business. Santander UK aims to employ a prudent approach and advanced risk management techniques to facilitate the delivery of robust financial performance, and ultimately build sustainable value for all our stakeholders.

Santander UK aims to maintain a predictable medium-low risk profile, consistent with its business model, which is key to the successful achievement of our strategic objectives.

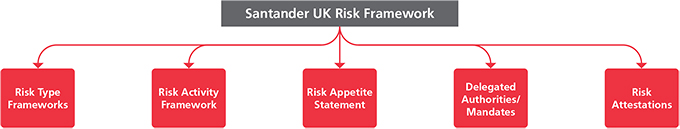

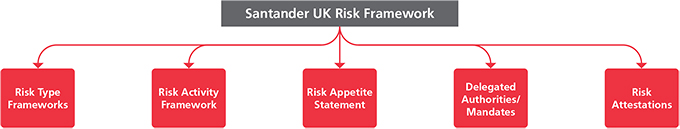

RISK FRAMEWORK

In December 2013, the Board approved an updated Risk Framework, which was implemented and embedded during 2014. This framework was not significantly changed from the framework set out in the 2013 Annual Report. The key components include:

| – | Risk culture, overriding principles and minimum standards; |

| – | Governance, roles and responsibilities; and |

| – | Internal control system. |

Good progress has been made in implementing the Risk Framework and embedding enterprise-wide risk management. Progress has been reviewed by Board Risk Committee, linked to annual Risk Framework attestations which are evidence based and approved by Executive Committee members. Risk management is becoming more effective as a result through the improved identification, assessment, management and reporting of risk.

The key changes introduced as part of this new framework included improvements to the risk definitions, including a simplification of the key risk types, and enhancements of the governance structure, including a streamlining of the lines of defence model. There was no change to the overriding principles. The main changes were:

With respect to risk definition and structure:

| – | The main risks types were simplified as: Credit, Trading Market, Balance Sheet Management (previously known as Structural) including Banking Market (previously known as Non-traded Market), Operational, Conduct, Regulatory and Legal; and |

| – | The additional classification of financial / non-financial risks was removed as this was deemed as unnecessary. |

With respect to governance, roles and responsibilities:

| – | A Risk Culture Statement was included in order to formalise standards across Santander UK; and |

| – | The three lines of defence model was simplified. |

Further updates to the Risk Framework were approved by the Board in December 2014, and included:

| – | The addition of Strategic, Reputational and Model risk as risk types; |

| – | The adoption of the Risk Framework by Santander UK Group Holdings Limited; and |

| – | The rationalisation of the risk management committee structure. |

| | | | | | | | | | | | |

Risk | | Top and | | Credit risk | | Market risk | | Balance sheet | | Other | | Areas of focus |

governance | | emerging risks | | | | | | management risk | | important risks | | and other items |

| | | | | | | | | | | | |

| | | | | | | | | | | | | |

Risk definition

Risk is defined as the uncertainty around Santander UK’s ability to achieve its business objectives. It specifically equates to a number of risk factors that have the potential to adversely impact Santander UK’s financial resources. Enterprise-wide risk (‘EWR’) is defined as the overall combined set of risks to the objectives of the enterprise. The main risks are:

| | |

Risk | | Definition |

Credit risk | | The risk of financial loss arising from the default or credit quality deterioration of a customer or counterparty to which Santander UK has directly provided credit, or for which it has assumed a financial obligation. |

Market risk | | Trading market risk is the risk of losses in on- and off-balance sheet trading positions, arising from movements in market prices or other external factors. |

Balance sheet

management risk | | Balance sheet management risk comprises banking market risk, pension risk, liquidity risk and capital risk. Banking market risk is the risk of loss of income or economic value arising from changes to interest rates in the banking book or to changes in exchange rates, where such changes would affect Santander UK’s net worth through an adjustment to revenues, assets, liabilities and off-balance sheet exposures in the banking book. |

| | | Pension risk is the risk caused by Santander UK’s contractual or other liabilities to or with respect to a pension scheme (whether established for its employees or those of a related company or otherwise). It also refers to the risk that Santander UK will make payments or other contributions to or with respect to a pension scheme because of a moral obligation or because it needs to do so for some other reason. |

| | | Liquidity risk is the risk that Santander UK, although solvent, does not have sufficient liquid financial resources available to enable it to meet its obligations as they fall due, or can only secure such resources at excessive cost. It is generally split into three types of risk: |