UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09689

Wells Fargo Master Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

Catherine Kennedy

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: May 31

Registrant is making a filing for 13 of its series:

Wells Fargo C&B Large Cap Value Portfolio, Wells Fargo Emerging Growth Portfolio, Wells Fargo Index Portfolio, Wells Fargo International Value Portfolio, Wells Fargo Small Company Growth Portfolio, Wells Fargo Small Company Value Portfolio, Wells Fargo Core Bond Portfolio, Wells Fargo Real Return Portfolio, Wells Fargo Diversified Large Cap Growth Portfolio, Wells Fargo Disciplined Large Cap Portfolio, Wells Fargo Disciplined International Developed Markets Portfolio, Wells Fargo Large Company Value Portfolio, and Wells Fargo Managed Fixed Income Portfolio.

Date of reporting period: May 31, 2020

ITEM 1. REPORT TO STOCKHOLDERS

Annual Report

May 31, 2020

Wells Fargo

Managed Fixed Income Portfolio

|

|

|

Reduce clutter. Save trees. |

Sign up for electronic delivery of prospectuses and

shareholder reports at wellsfargo.com/

advantagedelivery |

INVESTMENT PRODUCTS: NOT FDIC INSURED ◾ NO BANK GUARANTEE ◾ MAY LOSE VALUE

Wells Fargo Managed Fixed Income Portfolio | 1

Fund information (unaudited)

Investment objective

The Portfolio seeks long-term capital appreciation.

Manager

Wells Fargo Funds Management, LLC

Subadviser

Galliard Capital Management, Inc.

Portfolio managers

Andrea Johnson, CFA®‡

Brandon Kanz, CFA®‡

| | | | |

|

| Ten largest holdings (%) as of May 31, 20201 | |

| | |

FNMA, 4.50%, 1-1-2051 | | | 3.62 | |

| | |

U.S. Treasury Bond, 2.38%, 11-15-2049 | | | 3.19 | |

| | |

FNMA, 4.00%, 8-1-2051 | | | 3.05 | |

| | |

FNMA, 3.97%, 6-1-2025 | | | 1.67 | |

| | |

FHLMC Series 2018-3 Class MA, 3.50%, 8-25-2057 | | | 1.36 | |

| | |

FHLMC, 4.50%, 11-1-2048 | | | 1.26 | |

| | |

SBA Series 2018-10B Class 1, 3.55%, 9-10-2028 | | | 1.06 | |

| | |

WFRBS Commercial Mortgage Trust Series 2013-C17 Class A4, 4.02%, 12-15-2046 | | | 1.00 | |

| | |

JPMorgan Chase Commercial Mortgage Securities Trust Series 2014-C20 Class A5, 3.80%, 7-15-2047 | | | 0.94 | |

| | |

SBA Series 2018-20H Class 1, 3.58%, 8-1-2038 | | | 0.85 | |

|

|

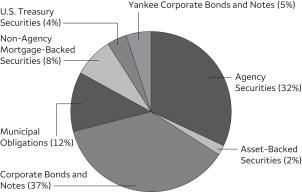

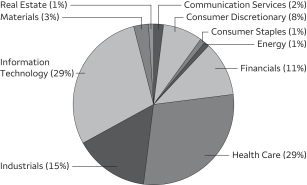

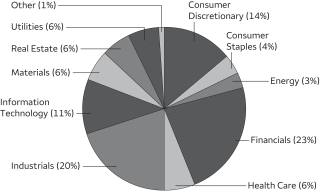

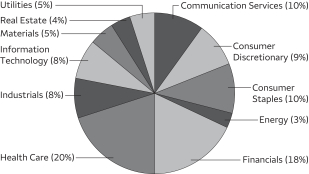

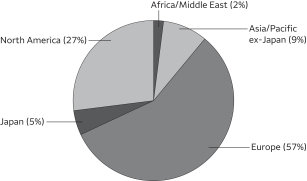

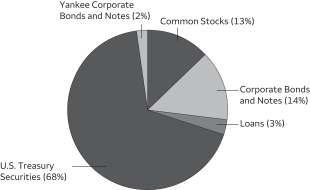

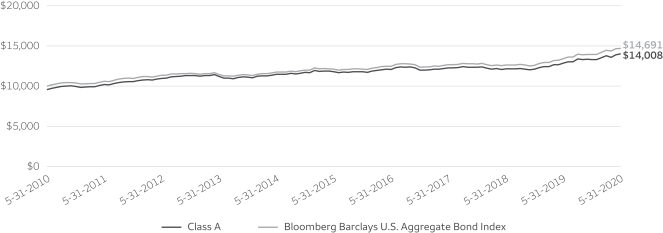

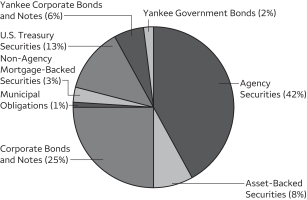

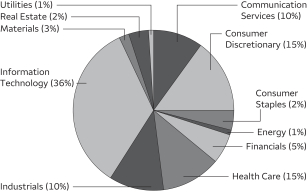

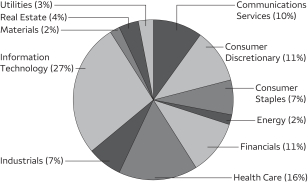

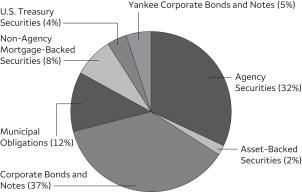

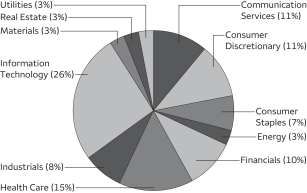

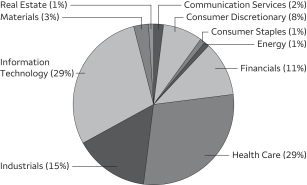

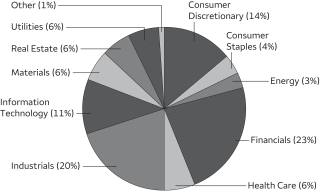

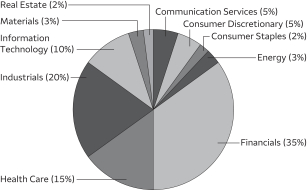

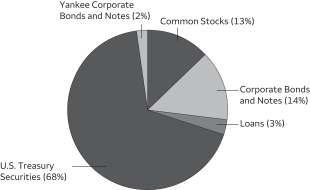

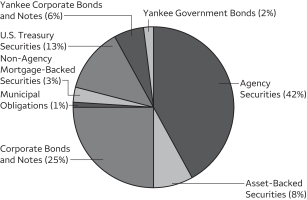

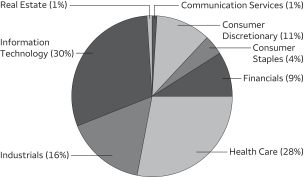

| Portfolio allocation as of May 31, 20202 |

|

|

| ‡ | CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute. |

| 1 | The ten largest holdings, excluding cash, cash equivalents and any money market funds, are calculated based on the value of the investments divided by the total net assets of the Portfolio. Holdings are subject to change and may have changed since the date specified. |

| 2 | Amounts are calculated based on the total long-term investments of the Portfolio. These amounts are subject to change and may have changed since the date specified. |

2 | Wells Fargo Managed Fixed Income Portfolio

Portfolio of investments—May 31, 2020

| | | | | | | | | | | | | | | | |

| | | Interest rate | | | Maturity date | | | Principal | | | Value | |

| Agency Securities: 30.57% | |

FHLMC | | | 3.50 | % | | | 8-1-2049 | | | $ | 978,012 | | | $ | 1,030,932 | |

FHLMC | | | 3.00 | | | | 7-1-2046 | | | | 528,819 | | | | 569,594 | |

FHLMC | | | 3.00 | | | | 7-1-2046 | | | | 704,777 | | | | 754,379 | |

FHLMC | | | 3.00 | | | | 11-1-2049 | | | | 2,635,680 | | | | 2,790,932 | |

FHLMC | | | 3.50 | | | | 4-1-2043 | | | | 880,497 | | | | 955,743 | |

FHLMC | | | 3.50 | | | | 5-1-2044 | | | | 420,278 | | | | 460,297 | |

FHLMC | | | 3.50 | | | | 6-1-2046 | | | | 340,775 | | | | 367,642 | |

FHLMC | | | 3.50 | | | | 2-1-2047 | | | | 2,242,855 | | | | 2,439,146 | |

FHLMC | | | 3.50 | | | | 4-1-2047 | | | | 365,055 | | | | 399,659 | |

FHLMC | | | 3.50 | | | | 12-1-2047 | | | | 1,487,326 | | | | 1,628,316 | |

FHLMC | | | 3.50 | | | | 3-1-2048 | | | | 1,869,558 | | | | 2,014,020 | |

FHLMC | | | 4.00 | | | | 4-1-2044 | | | | 524,690 | | | | 590,860 | |

FHLMC | | | 4.00 | | | | 8-1-2044 | | | | 341,917 | | | | 379,500 | |

FHLMC | | | 4.00 | | | | 6-1-2048 | | | | 2,135,934 | | | | 2,332,260 | |

FHLMC | | | 4.50 | | | | 8-1-2048 | | | | 2,786,871 | | | | 3,015,098 | |

FHLMC | | | 4.50 | | | | 11-1-2048 | | | | 2,875,311 | | | | 3,163,070 | |

FHLMC | | | 4.50 | | | | 11-1-2048 | | | | 5,284,715 | | | | 5,832,805 | |

FHLMC Series 2018-3 Class MA | | | 3.50 | | | | 8-25-2057 | | | | 5,881,010 | | | | 6,276,074 | |

FHLMC Series 2019-3 Class M55D | | | 4.00 | | | | 10-25-2058 | | | | 1,022,928 | | | | 1,112,501 | |

FHLMC Structured Pass-Through Securities Series T-20 Class A6 | | | 7.49 | | | | 9-25-2029 | | | | 18,511 | | | | 19,575 | |

FHLMC Structured Pass-Through Securities Series T-58 Class 4A | | | 7.50 | | | | 9-25-2043 | | | | 668,697 | | | | 797,617 | |

FNMA | | | 3.00 | | | | 4-1-2047 | | | | 2,377,974 | | | | 2,514,422 | |

FNMA | | | 2.50 | | | | 8-1-2031 | | | | 296,807 | | | | 311,458 | |

FNMA | | | 2.50 | | | | 2-1-2035 | | | | 1,076,469 | | | | 1,133,603 | |

FNMA | | | 2.50 | | | | 2-1-2035 | | | | 1,490,815 | | | | 1,567,145 | |

FNMA ±± | | | 2.54 | | | | 5-1-2023 | | | | 293,152 | | | | 305,962 | |

FNMA | | | 2.73 | | | | 1-1-2023 | | | | 532,466 | | | | 554,908 | |

FNMA | | | 2.73 | | | | 9-1-2023 | | | | 550,472 | | | | 579,074 | |

FNMA | | | 3.00 | | | | 12-1-2032 | | | | 36,588 | | | | 38,952 | |

FNMA | | | 3.00 | | | | 7-1-2046 | | | | 415,300 | | | | 447,185 | |

FNMA | | | 3.00 | | | | 12-1-2049 | | | | 2,565,605 | | | | 2,716,734 | |

FNMA | | | 3.00 | | | | 12-1-2049 | | | | 2,201,314 | | | | 2,330,984 | |

FNMA ±± | | | 3.04 | | | | 9-1-2025 | | | | 3,469,112 | | | | 3,768,964 | |

FNMA | | | 3.07 | | | | 2-1-2026 | | | | 360,000 | | | | 396,163 | |

FNMA | | | 3.08 | | | | 1-1-2026 | | | | 480,000 | | | | 528,034 | |

FNMA ±± | | | 3.09 | | | | 11-1-2022 | | | | 206,683 | | | | 215,417 | |

FNMA | | | 3.35 | | | | 1-1-2028 | | | | 274,536 | | | | 314,034 | |

FNMA ±± | | | 3.35 | | | | 11-1-2026 | | | | 3,256,872 | | | | 3,588,572 | |

FNMA ±± | | | 3.40 | | | | 12-1-2027 | | | | 1,210,837 | | | | 1,376,562 | |

FNMA | | | 3.50 | | | | 10-1-2032 | | | | 537,438 | | | | 578,239 | |

FNMA | | | 3.50 | | | | 11-1-2042 | | | | 220,584 | | | | 241,235 | |

FNMA | | | 3.50 | | | | 11-1-2042 | | | | 260,895 | | | | 283,239 | |

FNMA | | | 3.50 | | | | 2-1-2043 | | | | 141,923 | | | | 154,078 | |

FNMA | | | 3.50 | | | | 11-1-2045 | | | | 1,306,770 | | | | 1,421,259 | |

FNMA | | | 3.50 | | | | 4-1-2046 | | | | 174,907 | | | | 190,239 | |

FNMA | | | 3.50 | | | | 7-1-2046 | | | | 493,248 | | | | 536,484 | |

FNMA | | | 3.50 | | | | 11-1-2046 | | | | 571,319 | | | | 621,401 | |

FNMA | | | 3.50 | | | | 8-1-2047 | | | | 2,651,370 | | | | 2,881,778 | |

FNMA | | | 3.62 | | | | 1-1-2026 | | | | 1,973,228 | | | | 2,202,028 | |

FNMA | | | 3.62 | | | | 1-1-2026 | | | | 1,660,637 | | | | 1,853,192 | |

FNMA | | | 3.97 | | | | 6-1-2025 | | | | 6,885,033 | | | | 7,729,046 | |

FNMA | | | 4.00 | | | | 11-1-2040 | | | | 258,167 | | | | 280,923 | |

FNMA | | | 4.00 | | | | 4-1-2041 | | | | 337,249 | | | | 366,971 | |

FNMA | | | 4.00 | | | | 8-1-2046 | | | | 369,995 | | | | 401,628 | |

FNMA | | | 4.00 | | | | 3-1-2049 | | | | 1,392,776 | | | | 1,516,992 | |

FNMA | | | 4.00 | | | | 8-1-2051 | | | | 12,848,845 | | | | 14,103,046 | |

The accompanying notes are an integral part of these financial statements.

Wells Fargo Managed Fixed Income Portfolio | 3

Portfolio of investments—May 31, 2020

| | | | | | | | | | | | | | | | |

| | | Interest rate | | | Maturity date | | | Principal | | | Value | |

| Agency Securities (continued) | |

FNMA | | | 4.00 | % | | | 7-1-2056 | | | $ | 476,346 | | | $ | 528,741 | |

FNMA | | | 4.50 | | | | 8-1-2048 | | | | 2,016,303 | | | | 2,183,953 | |

FNMA | | | 4.50 | | | | 1-1-2051 | | | | 14,962,156 | | | | 16,726,116 | |

FNMA | | | 4.50 | | | | 6-1-2056 | | | | 379,738 | | | | 425,585 | |

FNMA | | | 4.50 | | | | 6-1-2056 | | | | 570,260 | | | | 639,109 | |

FNMA | | | 4.50 | | | | 6-1-2056 | | | | 407,121 | | | | 456,276 | |

FNMA | | | 5.00 | | | | 9-1-2033 | | | | 108,154 | | | | 123,782 | |

FNMA | | | 5.50 | | | | 2-1-2036 | | | | 65,590 | | | | 71,656 | |

FNMA Series 2002-90 Class A2 | | | 6.50 | | | | 11-25-2042 | | | | 295,978 | | | | 346,600 | |

FNMA Series 2002-T4 Class A2 | | | 7.00 | | | | 12-25-2041 | | | | 114,844 | | | | 135,357 | |

FNMA Series 2002-W4 Class A4 | | | 6.25 | | | | 5-25-2042 | | | | 1,037,694 | | | | 1,218,287 | |

FNMA Series 2003-W4 Class 3A ±± | | | 5.63 | | | | 10-25-2042 | | | | 176,761 | | | | 205,454 | |

FNMA Series 2004-T2 Class 1A1 | | | 6.00 | | | | 11-25-2043 | | | | 382,036 | | | | 446,475 | |

FNMA Series 2004-T3 Class A1 | | | 6.00 | | | | 2-25-2044 | | | | 600,078 | | | | 707,164 | |

FNMA Series 2004-W01 Class 2A2 | | | 7.00 | | | | 12-25-2033 | | | | 98,238 | | | | 116,402 | |

FNMA Series 2004-W11 Class 1A3 | | | 7.00 | | | | 5-25-2044 | | | | 601,147 | | | | 691,367 | |

FNMA Series 2004-W8 Class 3A | | | 7.50 | | | | 6-25-2044 | | | | 170,634 | | | | 204,685 | |

GNMA | | | 6.50 | | | | 10-15-2023 | | | | 7,057 | | | | 7,754 | |

GNMA | | | 6.50 | | | | 11-15-2023 | | | | 3,931 | | | | 4,320 | |

GNMA | | | 6.50 | | | | 11-15-2023 | | | | 1,805 | | | | 1,983 | |

GNMA | | | 6.50 | | | | 12-15-2023 | | | | 6,533 | | | | 7,179 | |

GNMA | | | 6.50 | | | | 1-15-2024 | | | | 9,372 | | | | 10,298 | |

GNMA | | | 7.00 | | | | 8-15-2027 | | | | 41,237 | | | | 47,095 | |

SBA Series 2006-20B Class 1 | | | 5.35 | | | | 2-1-2026 | | | | 165,756 | | | | 178,720 | |

SBA Series 2006-20H Class 1 | | | 5.70 | | | | 8-1-2026 | | | | 75,522 | | | | 81,969 | |

SBA Series 2007-20J Class 1 | | | 5.57 | | | | 10-1-2027 | | | | 202,384 | | | | 218,379 | |

SBA Series 2013-20A Class 1 | | | 2.13 | | | | 1-1-2033 | | | | 248,592 | | | | 255,735 | |

SBA Series 2013-20J Class 1 | | | 3.37 | | | | 10-1-2033 | | | | 275,821 | | | | 293,633 | |

SBA Series 2014-10A Class 1 | | | 3.19 | | | | 3-10-2024 | | | | 208,050 | | | | 215,483 | |

SBA Series 2014-10B Class 1 | | | 3.02 | | | | 9-10-2024 | | | | 319,268 | | | | 331,960 | |

SBA Series 2014-20A Class 1 | | | 3.46 | | | | 1-1-2034 | | | | 254,048 | | | | 272,146 | |

SBA Series 2015-10B Class 1 | | | 2.83 | | | | 9-10-2025 | | | | 335,566 | | | | 351,694 | |

SBA Series 2015-20C Class 1 | | | 2.72 | | | | 3-1-2035 | | | | 339,394 | | | | 352,134 | |

SBA Series 2015-20E Class 1 | | | 2.77 | | | | 5-1-2035 | | | | 509,621 | | | | 535,286 | |

SBA Series 2015-20F Class 1 | | | 2.98 | | | | 6-1-2035 | | | | 372,646 | | | | 397,815 | |

SBA Series 2017-10A Class 1 | | | 2.85 | | | | 3-10-2027 | | | | 447,627 | | | | 468,529 | |

SBA Series 2017-20F Class 1 | | | 2.81 | | | | 6-1-2037 | | | | 243,448 | | | | 257,590 | |

SBA Series 2018-10B Class 1 | | | 3.55 | | | | 9-10-2028 | | | | 4,572,783 | | | | 4,896,162 | |

SBA Series 2018-20E Class 1 | | | 3.50 | | | | 5-1-2038 | | | | 2,135,919 | | | | 2,335,052 | |

SBA Series 2018-20G Class 1 | | | 3.54 | | | | 7-1-2038 | | | | 2,654,269 | | | | 2,906,250 | |

SBA Series 2018-20H Class 1 | | | 3.58 | | | | 8-1-2038 | | | | 3,586,863 | | | | 3,929,340 | |

SBA Series 2018-20K Class 1 | | | 3.87 | | | | 11-1-2038 | | | | 2,449,426 | | | | 2,730,753 | |

| |

Total Agency Securities (Cost $131,541,267) | | | | 141,294,239 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Asset-Backed Securities: 1.66% | | | | | | | | | | | | |

ECMC Group Student Loan Trust Series 16-1A Class A (1 Month LIBOR +1.35%) 144A± | | | 1.52 | | | | 7-26-2066 | | | | 310,378 | | | | 301,876 | |

ECMC Group Student Loan Trust Series 18-2A Class A (1 Month LIBOR +0.80%) 144A± | | | 0.97 | | | | 9-25-2068 | | | | 2,355,093 | | | | 2,250,268 | |

Ford Credit Auto Owner Trust Series 2015-2 Class A 144A | | | 2.44 | | | | 1-15-2027 | | | | 600,000 | | | | 600,818 | |

Ford Credit Auto Owner Trust Series 2018-2 Class A 144A | | | 3.47 | | | | 1-15-2030 | | | | 3,200,000 | | | | 3,322,852 | |

MMAF Equipment Finance LLC Series 2017-AA Class A5 144A | | | 2.68 | | | | 7-16-2027 | | | | 695,000 | | | | 698,860 | |

South Carolina Student Loan Corporation Series 2014-1 Class B (1 Month LIBOR +1.50%) ± | | | 1.87 | | | | 8-1-2035 | | | | 500,000 | | | | 479,882 | |

| |

Total Asset-Backed Securities (Cost $7,638,552) | | | | 7,654,556 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

4 | Wells Fargo Managed Fixed Income Portfolio

Portfolio of investments—May 31, 2020

| | | | | | | | | | | | | | | | |

| | | Interest rate | | | Maturity date | | | Principal | | | Value | |

Corporate Bonds and Notes: 36.69% | | | | | | | | | | | | | | | | |

| | | | |

Communication Services: 1.46% | | | | | | | | | | | | | | | | |

| | | | |

| Diversified Telecommunication Services: 0.91% | | | | | | | | | | | | |

AT&T Incorporated | | | 2.75 | % | | | 6-1-2031 | | | $ | 535,000 | | | $ | 538,690 | |

AT&T Incorporated | | | 4.75 | | | | 5-15-2046 | | | | 1,280,000 | | | | 1,492,292 | |

AT&T Incorporated | | | 5.25 | | | | 3-1-2037 | | | | 60,000 | | | | 73,299 | |

Verizon Communications Incorporated | | | 4.50 | | | | 8-10-2033 | | | | 40,000 | | | | 49,604 | |

Verizon Communications Incorporated | | | 4.81 | | | | 3-15-2039 | | | | 1,500,000 | | | | 1,924,830 | |

Verizon Communications Incorporated | | | 5.25 | | | | 3-16-2037 | | | | 110,000 | | | | 148,013 | |

| | | | |

| | | | | | | | | | | | | | | 4,226,728 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Entertainment: 0.13% | | | | | | | | | | | | |

Walt Disney Company | | | 2.65 | | | | 1-13-2031 | | | | 540,000 | | | | 575,875 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Media: 0.42% | | | | | | | | | | | | |

CCO Holdings LLC 144A | | | 5.75 | | | | 2-15-2026 | | | | 425,000 | | | | 443,139 | |

Comcast Corporation | | | 1.95 | | | | 1-15-2031 | | | | 550,000 | | | | 550,721 | |

Lamar Media Corporation | | | 5.75 | | | | 2-1-2026 | | | | 895,000 | | | | 931,919 | |

| | | | |

| | | | | | | | | | | | | | | 1,925,779 | |

| | | | | | | | | | | | | | | | |

| | | | |

Consumer Discretionary: 4.14% | | | | | | | | | | | | | | | | |

| | | | |

| Auto Components: 0.36% | | | | | | | | | | | | |

Allison Transmission Incorporated 144A | | | 5.00 | | | | 10-1-2024 | | | | 1,655,000 | | | | 1,667,413 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Automobiles: 0.16% | | | | | | | | | | | | |

General Motors Company | | | 4.88 | | | | 10-2-2023 | | | | 400,000 | | | | 413,823 | |

Volkswagen Group of America Incorporated 144A | | | 2.85 | | | | 9-26-2024 | | | | 300,000 | | | | 308,731 | |

| | | | |

| | | | | | | | | | | | | | | 722,554 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Diversified Consumer Services: 2.78% | | | | | | | | | | | | |

Duke University | | | 3.20 | | | | 10-1-2038 | | | | 1,175,000 | | | | 1,263,632 | |

Johns Hopkins University | | | 2.81 | | | | 1-1-2060 | | | | 420,000 | | | | 417,998 | |

Massachusetts Institute of Technology | | | 3.96 | | | | 7-1-2038 | | | | 1,780,000 | | | | 2,203,363 | |

Massachusetts Institute of Technology | | | 4.68 | | | | 7-1-2114 | | | | 120,000 | | | | 172,699 | |

Massachusetts Institute of Technology | | | 7.25 | | | | 11-2-2096 | | | | 500,000 | | | | 866,220 | |

Northwestern University | | | 3.66 | | | | 12-1-2057 | | | | 105,000 | | | | 129,715 | |

Northwestern University | | | 3.69 | | | | 12-1-2038 | | | | 1,915,000 | | | | 2,123,612 | |

President and Fellows of Harvard College | | | 3.62 | | | | 10-1-2037 | | | | 275,000 | | | | 321,800 | |

President and Fellows of Harvard College | | | 4.88 | | | | 10-15-2040 | | | | 183,000 | | | | 249,853 | |

President and Fellows of Harvard College | | | 5.63 | | | | 10-1-2038 | | | | 525,000 | | | | 754,826 | |

Princeton University | | | 5.70 | | | | 3-1-2039 | | | | 1,640,000 | | | | 2,492,988 | |

Service Corporation International | | | 7.50 | | | | 4-1-2027 | | | | 440,000 | | | | 488,400 | |

University of Southern California | | | 3.03 | | | | 10-1-2039 | | | | 1,250,000 | | | | 1,345,719 | |

| | | | |

| | | | | | | | | | | | | | | 12,830,825 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Hotels, Restaurants & Leisure: 0.30% | | | | | | | | | | | | |

Cedar Fair LP | | | 5.38 | | | | 6-1-2024 | | | | 1,480,000 | | | | 1,406,311 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Textiles, Apparel & Luxury Goods: 0.54% | | | | | | | | | | | | |

HanesBrands Incorporated 144A | | | 4.63 | | | | 5-15-2024 | | | | 200,000 | | | | 203,500 | |

HanesBrands Incorporated 144A | | | 4.88 | | | | 5-15-2026 | | | | 1,250,000 | | | | 1,265,625 | |

The William Carter Company 144A | | | 5.63 | | | | 3-15-2027 | | | | 100,000 | | | | 102,149 | |

Wolverine World Wide Incorporated 144A | | | 5.00 | | | | 9-1-2026 | | | | 1,000,000 | | | | 947,500 | |

| | | | |

| | | | | | | | | | | | | | | 2,518,774 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

Wells Fargo Managed Fixed Income Portfolio | 5

Portfolio of investments—May 31, 2020

| | | | | | | | | | | | | | | | |

| | | Interest rate | | | Maturity date | | | Principal | | | Value | |

Consumer Staples: 0.31% | | | | | | | | | | | | | | | | |

| | | | |

| Beverages: 0.21% | | | | | | | | | | | | |

Anheuser-Busch InBev Worldwide Incorporated | | | 4.70 | % | | | 2-1-2036 | | | $ | 870,000 | | | $ | 991,963 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Food Products: 0.10% | | | | | | | | | | | | |

Ingredion Incorporated | | | 2.90 | | | | 6-1-2030 | | | | 320,000 | | | | 334,352 | |

Kraft Heinz Foods Company | | | 4.63 | | | | 1-30-2029 | | | | 120,000 | | | | 129,449 | |

| | | | |

| | | | | | | | | | | | | | | 463,801 | |

| | | | | | | | | | | | | | | | |

| | | | |

Energy: 5.09% | | | | | | | | | | | | | | | | |

| | | | |

| Energy Equipment & Services: 0.52% | | | | | | | | | | | | |

Baker Hughes LLC | | | 3.34 | | | | 12-15-2027 | | | | 1,500,000 | | | | 1,557,197 | |

Halliburton Company | | | 2.92 | | | | 3-1-2030 | | | | 820,000 | | | | 751,377 | |

Halliburton Company | | | 3.80 | | | | 11-15-2025 | | | | 92,000 | | | | 97,339 | |

| | | | |

| | | | | | | | | | | | | | | 2,405,913 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Oil, Gas & Consumable Fuels: 4.57% | | | | | | | | | | | | |

Antero Resources Corporation | | | 5.00 | | | | 3-1-2025 | | | | 1,750,000 | | | | 997,500 | |

Chevron Corporation | | | 2.24 | | | | 5-11-2030 | | | | 490,000 | | | | 516,404 | |

Cimarex Energy Company | | | 3.90 | | | | 5-15-2027 | | | | 500,000 | | | | 488,044 | |

Enable Midstream Partners | | | 4.95 | | | | 5-15-2028 | | | | 790,000 | | | | 669,264 | |

EnLink Midstream Partners LP | | | 4.85 | | | | 7-15-2026 | | | | 1,325,000 | | | | 1,066,625 | |

Enterprise Products Operating LLC | | | 3.75 | | | | 2-15-2025 | | | | 1,500,000 | | | | 1,649,932 | |

Enterprise Products Operating LLC | | | 4.15 | | | | 10-16-2028 | | | | 260,000 | | | | 296,406 | |

Florida Gas Transmission Company 144A | | | 4.35 | | | | 7-15-2025 | | | | 1,521,000 | | | | 1,704,431 | |

Gulfstream Natural Gas System LLC 144A | | | 6.19 | | | | 11-1-2025 | | | | 210,000 | | | | 243,986 | |

Hess Corporation | | | 4.30 | | | | 4-1-2027 | | | | 800,000 | | | | 804,893 | |

Magellan Midstream Partners LP | | | 5.00 | | | | 3-1-2026 | | | | 170,000 | | | | 192,119 | |

Marathon Oil Corporation | | | 3.85 | | | | 6-1-2025 | | | | 1,030,000 | | | | 975,689 | |

Marathon Petroleum Corporation | | | 5.13 | | | | 12-15-2026 | | | | 1,500,000 | | | | 1,685,616 | |

MPLX LP | | | 4.13 | | | | 3-1-2027 | | | | 1,500,000 | | | | 1,549,269 | |

Newfield Exploration Company | | | 5.38 | | | | 1-1-2026 | | | | 959,000 | | | | 849,985 | |

Newfield Exploration Company | | | 5.63 | | | | 7-1-2024 | | | | 249,000 | | | | 226,731 | |

NuStar Logistics LP | | | 6.00 | | | | 6-1-2026 | | | | 600,000 | | | | 576,000 | |

Occidental Petroleum Corporation | | | 3.20 | | | | 8-15-2026 | | | | 1,070,000 | | | | 780,779 | |

Range Resources Corporation | | | 5.00 | | | | 3-15-2023 | | | | 1,800,000 | | | | 1,628,262 | |

Southwestern Energy Company | | | 6.20 | | | | 1-23-2025 | | | | 945,000 | | | | 848,799 | |

Transcontinental Gas Pipe Line Company LLC 144A | | | 3.25 | | | | 5-15-2030 | | | | 790,000 | | | | 840,679 | |

Transcontinental Gas Pipe Line Company LLC | | | 7.85 | | | | 2-1-2026 | | | | 1,200,000 | | | | 1,522,828 | |

Western Midstream Operating LP | | | 4.05 | | | | 2-1-2030 | | | | 1,100,000 | | | | 986,920 | |

| | | | |

| | | | | | | | | | | | | | | 21,101,161 | |

| | | | | | | | | | | | | | | | |

| | | | |

Financials: 5.46% | | | | | | | | | | | | | | | | |

| | | | |

| Banks: 2.35% | | | | | | | | | | | | |

Bank of America Corporation (3 Month LIBOR +1.51%) ± | | | 3.71 | | | | 4-24-2028 | | | | 1,440,000 | | | | 1,585,334 | |

Bank of America Corporation | | | 3.88 | | | | 8-1-2025 | | | | 700,000 | | | | 784,843 | |

Citigroup Incorporated (U.S. SOFR +2.11%) %%± | | | 2.57 | | | | 6-3-2031 | | | | 370,000 | | | | 369,629 | |

Citigroup Incorporated | | | 3.30 | | | | 4-27-2025 | | | | 1,000,000 | | | | 1,090,052 | |

Citigroup Incorporated | | | 3.40 | | | | 5-1-2026 | | | | 1,000,000 | | | | 1,083,074 | |

Citigroup Incorporated | | | 4.40 | | | | 6-10-2025 | | | | 65,000 | | | | 71,900 | |

Citizens Bank NA | | | 2.25 | | | | 4-28-2025 | | | | 405,000 | | | | 413,234 | |

JPMorgan Chase & Company (U.S. SOFR +1.89%) ± | | | 2.18 | | | | 6-1-2028 | | | | 310,000 | | | | 311,934 | |

JPMorgan Chase & Company | | | 3.20 | | | | 6-15-2026 | | | | 500,000 | | | | 545,731 | |

JPMorgan Chase & Company (3 Month LIBOR +1.34%) ± | | | 3.78 | | | | 2-1-2028 | | | | 1,100,000 | | | | 1,215,342 | |

The accompanying notes are an integral part of these financial statements.

6 | Wells Fargo Managed Fixed Income Portfolio

Portfolio of investments—May 31, 2020

| | | | | | | | | | | | | | | | |

| | | Interest rate | | | Maturity date | | | Principal | | | Value | |

| | | | |

| Banks (continued) | | | | | | | | | | | | |

JPMorgan Chase & Company (3 Month LIBOR +1.26%) ± | | | 4.20 | % | | | 7-23-2029 | | | $ | 600,000 | | | $ | 686,205 | |

JPMorgan Chase & Company (3 Month LIBOR +1.33%) ± | | | 4.45 | | | | 12-5-2029 | | | | 470,000 | | | | 548,628 | |

KeyCorp | | | 2.25 | | | | 4-6-2027 | | | | 690,000 | | | | 690,002 | |

National Capital Commerce Incorporated (3 Month LIBOR +0.98%) ± | | | 2.41 | | | | 4-1-2027 | | | | 400,000 | | | | 344,108 | |

PNC Bank | | | 4.05 | | | | 7-26-2028 | | | | 1,000,000 | | | | 1,147,306 | |

| | | | |

| | | | | | | | | | | | | | | 10,887,322 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Capital Markets: 1.25% | | | | | | | | | | | | |

Goldman Sachs Capital II (3 Month LIBOR +0.77%) ± | | | 4.00 | | | | 12-29-2049 | | | | 6,000 | | | | 5,090 | |

Goldman Sachs Group Incorporated | | | 3.50 | | | | 1-23-2025 | | | | 1,100,000 | | | | 1,180,681 | |

Goldman Sachs Group Incorporated | | | 3.75 | | | | 2-25-2026 | | | | 1,500,000 | | | | 1,646,737 | |

Goldman Sachs Group Incorporated | | | 4.25 | | | | 10-21-2025 | | | | 120,000 | | | | 133,355 | |

Morgan Stanley | | | 3.88 | | | | 1-27-2026 | | | | 1,000,000 | | | | 1,125,135 | |

Morgan Stanley | | | 3.95 | | | | 4-23-2027 | | | | 1,000,000 | | | | 1,113,432 | |

MSCI Incorporated 144A | | | 5.75 | | | | 8-15-2025 | | | | 535,000 | | | | 555,373 | |

| | | | |

| | | | | | | | | | | | | | | 5,759,803 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Consumer Finance: 1.33% | | | | | | | | | | | | |

BMW US Capital LLC Company 144A | | | 3.15 | | | | 4-18-2024 | | | | 965,000 | | | | 1,008,945 | |

Capital One Financial Corporation | | | 3.20 | | | | 1-30-2023 | | | | 160,000 | | | | 165,841 | |

Capital One Financial Corporation | | | 3.30 | | | | 10-30-2024 | | | | 1,500,000 | | | | 1,573,655 | |

Daimler Finance North America LLC 144A | | | 2.70 | | | | 6-14-2024 | | | | 740,000 | | | | 740,907 | |

Daimler Finance North America LLC 144A | | | 3.35 | | | | 2-22-2023 | | | | 1,490,000 | | | | 1,523,386 | |

Ford Motor Credit Company LLC | | | 5.58 | | | | 3-18-2024 | | | | 1,130,000 | | | | 1,124,011 | |

| | | | |

| | | | | | | | | | | | | | | 6,136,745 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Diversified Financial Services: 0.19% | | | | | | | | | | | | |

EMD Finance LLC 144A | | | 3.25 | | | | 3-19-2025 | | | | 830,000 | | | | 890,658 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Insurance: 0.34% | | | | | | | | | | | | |

Minnesota Life Insurance Company 144A | | | 8.25 | | | | 9-15-2025 | | | | 650,000 | | | | 804,767 | |

NLV Financial Corporation 144A | | | 7.50 | | | | 8-15-2033 | | | | 565,000 | | | | 755,887 | |

| | | | |

| | | | | | | | | | | | | | | 1,560,654 | |

| | | | | | | | | | | | | | | | |

| | | | |

Health Care: 4.01% | | | | | | | | | | | | | | | | |

| | | | |

| Biotechnology: 0.31% | | | | | | | | | | | | |

AbbVie Incorporated 144A | | | 4.55 | | | | 3-15-2035 | | | | 1,200,000 | | | | 1,413,561 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Health Care Equipment & Supplies: 0.29% | | | | | | | | | | | | |

Hill-Rom Holdings Incorporated 144A | | | 5.00 | | | | 2-15-2025 | | | | 1,065,000 | | | | 1,094,288 | |

Teleflex Incorporated | | | 4.88 | | | | 6-1-2026 | | | | 250,000 | | | | 257,500 | |

| | | | |

| | | | | | | | | | | | | | | 1,351,788 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Health Care Providers & Services: 2.83% | | | | | | | | | | | | |

Advocate Health Corporation | | | 4.27 | | | | 8-15-2048 | | | | 290,000 | | | | 357,595 | |

BayCare Health System Incorporated | | | 3.83 | | | | 11-15-2050 | | | | 145,000 | | | | 169,745 | |

Cleveland Clinic Foundation | | | 4.86 | | | | 1-1-2114 | | | | 894,000 | | | | 1,270,279 | |

CVS Health Corporation | | | 4.30 | | | | 3-25-2028 | | | | 1,300,000 | | | | 1,482,304 | |

CVS Health Corporation | | | 5.05 | | | | 3-25-2048 | | | | 130,000 | | | | 166,901 | |

Kaiser Foundation Hospitals | | | 3.27 | | | | 11-1-2049 | | | | 480,000 | | | | 519,417 | |

Mayo Clinic | | | 4.13 | | | | 11-15-2052 | | | | 810,000 | | | | 958,382 | |

MEDNAX Incorporated 144A | | | 5.25 | | | | 12-1-2023 | | | | 1,380,000 | | | | 1,352,400 | |

Memorial Health Services | | | 3.45 | | | | 11-1-2049 | | | | 820,000 | | | | 809,022 | |

Memorial Sloan Kettering Cancer Center | | | 4.20 | | | | 7-1-2055 | | | | 788,000 | | | | 987,969 | |

The accompanying notes are an integral part of these financial statements.

Wells Fargo Managed Fixed Income Portfolio | 7

Portfolio of investments—May 31, 2020

| | | | | | | | | | | | | | | | |

| | | Interest rate | | | Maturity date | | | Principal | | | Value | |

| | | | |

| Health Care Providers & Services (continued) | | | | | | | | | | | | |

NYU Hospitals Center | | | 3.38 | % | | | 7-1-2055 | | | $ | 690,000 | | | $ | 644,251 | |

OhioHealth Corporation | | | 3.04 | | | | 11-15-2050 | | | | 320,000 | | | | 333,648 | |

Southern Baptist Hospital | | | 4.86 | | | | 7-15-2045 | | | | 625,000 | | | | 741,720 | |

Stanford Health Care | | | 3.80 | | | | 11-15-2048 | | | | 275,000 | | | | 322,802 | |

Texas Health Resources | | | 4.33 | | | | 11-15-2055 | | | | 1,115,000 | | | | 1,356,480 | |

The New York-Presbyterian Hospital | | | 3.56 | | | | 8-1-2036 | | | | 750,000 | | | | 780,132 | |

The New York-Presbyterian Hospital | | | 4.06 | | | | 8-1-2056 | | | | 570,000 | | | | 665,748 | |

UnitedHealth Group Incorporated | | | 1.25 | | | | 1-15-2026 | | | | 150,000 | | | | 152,186 | |

| | | | |

| | | | | | | | | | | | | | | 13,070,981 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Health Care Technology: 0.10% | | | | | | | | | | | | |

IQVIA Incorporated 144A | | | 5.00 | | | | 10-15-2026 | | | | 445,000 | | | | 471,144 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Life Sciences Tools & Services: 0.14% | | | | | | | | | | | | |

Agilent Technologies Incorporated | | | 2.75 | | | | 9-15-2029 | | | | 600,000 | | | | 633,228 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Pharmaceuticals: 0.34% | | | | | | | | | | | | |

Bayer US Finance LLC 144A | | | 3.38 | | | | 10-8-2024 | | | | 240,000 | | | | 256,866 | |

Bayer US Finance LLC 144A | | | 4.38 | | | | 12-15-2028 | | | | 1,170,000 | | | | 1,338,796 | |

| | | | |

| | | | | | | | | | | | | | | 1,595,662 | |

| | | | | | | | | | | | | | | | |

| | | | |

Industrials: 4.05% | | | | | | | | | | | | | | | | |

| | | | |

| Aerospace & Defense: 1.08% | | | | | | | | | | | | |

BAE Systems Holdings Incorporated 144A | | | 3.80 | | | | 10-7-2024 | | | | 1,345,000 | | | | 1,454,128 | |

Boeing Company | | | 5.15 | | | | 5-1-2030 | | | | 155,000 | | | | 165,514 | |

Boeing Company | | | 5.71 | | | | 5-1-2040 | | | | 110,000 | | | | 120,401 | |

Hexcel Corporation | | | 3.95 | | | | 2-15-2027 | | | | 1,302,000 | | | | 1,339,803 | |

Lockheed Martin Corporation | | | 1.85 | | | | 6-15-2030 | | | | 80,000 | | | | 81,859 | |

Moog Incorporated 144A | | | 4.25 | | | | 12-15-2027 | | | | 700,000 | | | | 667,828 | |

Raytheon Tech Corporation | | | 2.25 | | | | 7-1-2030 | | | | 360,000 | | | | 368,788 | |

The Boeing Company | | | 2.70 | | | | 2-1-2027 | | | | 840,000 | | | | 782,039 | |

| | | | |

| | | | | | | | | | | | | | | 4,980,360 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Air Freight & Logistics: 0.07% | | | | | | | | | | | | |

Fedex Corporation | | | 3.90 | | | | 2-1-2035 | | | | 280,000 | | | | 299,137 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Building Products: 0.10% | | | | | | | | | | | | |

Fortune Brands Home & Security Incorporated | | | 4.00 | | | | 9-21-2023 | | | | 240,000 | | | | 259,886 | |

Masco Corporation | | | 6.50 | | | | 8-15-2032 | | | | 150,000 | | | | 176,310 | |

| | | | |

| | | | | | | | | | | | | | | 436,196 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Commercial Services & Supplies: 0.32% | | | | | | | | | | | | |

ACCO Brands Corporation 144A | | | 5.25 | | | | 12-15-2024 | | | | 600,000 | | | | 603,000 | |

Clean Harbors Incorporated 144A | | | 4.88 | | | | 7-15-2027 | | | | 425,000 | | | | 439,875 | |

Stericycle Incorporated 144A | | | 5.38 | | | | 7-15-2024 | | | | 420,000 | | | | 429,450 | |

| | | | |

| | | | | | | | | | | | | | | 1,472,325 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Construction & Engineering: 0.02% | | | | | | | | | | | | |

Valmont Industries Incorporated | | | 5.00 | | | | 10-1-2044 | | | | 110,000 | | | | 112,244 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Electrical Equipment: 0.24% | | | | | | | | | | | | |

Carrier Global Corporation 144A | | | 2.49 | | | | 2-15-2027 | | | | 780,000 | | | | 756,533 | |

Emerson Electric Company | | | 1.95 | | | | 10-15-2030 | | | | 370,000 | | | | 371,924 | |

| | | | |

| | | | | | | | | | | | | | | 1,128,457 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

8 | Wells Fargo Managed Fixed Income Portfolio

Portfolio of investments—May 31, 2020

| | | | | | | | | | | | | | | | |

| | | Interest rate | | | Maturity date | | | Principal | | | Value | |

| Industrial Conglomerates: 0.03% | | | | | | | | | | | | |

Honeywell International | | | 1.95 | % | | | 6-1-2030 | | | $ | 150,000 | | | $ | 153,490 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Machinery: 0.96% | | | | | | | | | | | | |

Actuant Corporation | | | 5.63 | | | | 6-15-2022 | | | | 1,660,000 | | | | 1,659,751 | |

Briggs & Stratton Corporation | | | 6.88 | | | | 12-15-2020 | | | | 850,000 | | | | 278,375 | |

Caterpillar Financial Service Corporation | | | 1.45 | | | | 5-15-2025 | | | | 270,000 | | | | 276,752 | |

Fortive Corporation | | | 2.35 | | | | 6-15-2021 | | | | 215,000 | | | | 216,963 | |

Mueller Water Products Incorporated 144A | | | 5.50 | | | | 6-15-2026 | | | | 950,000 | | | | 978,500 | |

Oshkosh Corporation | | | 3.10 | | | | 3-1-2030 | | | | 490,000 | | | | 475,422 | |

Oshkosh Corporation | | | 4.60 | | | | 5-15-2028 | | | | 200,000 | | | | 213,829 | |

Vessel Management Services Incorporated | | | 3.43 | | | | 8-15-2036 | | | | 281,000 | | | | 326,445 | |

| | | | |

| | | | | | | | | | | | | | | 4,426,037 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Professional Services: 0.49% | | | | | | | | | | | | |

Equifax Incorporated | | | 3.95 | | | | 6-15-2023 | | | | 1,700,000 | | | | 1,808,165 | |

Relx Capital Incorporated | | | 3.00 | | | | 5-22-2030 | | | | 70,000 | | | | 73,523 | |

Relx Capital Incorporated | | | 3.50 | | | | 3-16-2023 | | | | 110,000 | | | | 116,427 | |

Relx Capital Incorporated | | | 4.00 | | | | 3-18-2029 | | | | 240,000 | | | | 268,410 | |

| | | | |

| | | | | | | | | | | | | | | 2,266,525 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Road & Rail: 0.35% | | | | | | | | | | | | |

Norfolk Southern Corporation | | | 5.10 | | | | 12-31-2049 | | | | 760,000 | | | | 975,555 | |

Ryder System Incorporated | | | 3.65 | | | | 3-18-2024 | | | | 620,000 | | | | 653,198 | |

| | | | |

| | | | | | | | | | | | | | | 1,628,753 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Transportation Infrastructure: 0.39% | | | | | | | | | | | | |

Crowley Conro LLC | | | 4.18 | | | | 8-15-2043 | | | | 1,438,200 | | | | 1,809,825 | |

| | | | | | | | | | | | | | | | |

| | | | |

Information Technology: 1.81% | | | | | | | | | | | | | | | | |

| | | | |

| Electronic Equipment, Instruments & Components: 0.20% | | | | | | | | | | | | |

Jabil Incorporated | | | 3.95 | | | | 1-12-2028 | | | | 900,000 | | | | 930,207 | |

| | | | | | | | | | | | | | | | |

| | | | |

| IT Services: 0.20% | | | | | | | | | | | | |

Verisign Incorporated | | | 4.75 | | | | 7-15-2027 | | | | 900,000 | | | | 939,942 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Semiconductors & Semiconductor Equipment: 0.81% | | | | | | | | | | | | |

Applied Materials Incorporated | | | 1.75 | | | | 6-1-2030 | | | | 320,000 | | | | 319,756 | |

KLA Tencor Corporation | | | 4.10 | | | | 3-15-2029 | | | | 150,000 | | | | 173,331 | |

Maxim Integrated Products Incorporated | | | 3.45 | | | | 6-15-2027 | | | | 1,550,000 | | | | 1,652,518 | |

Microchip Technology Incorporated | | | 4.33 | | | | 6-1-2023 | | | | 1,500,000 | | | | 1,571,049 | |

| | | | |

| | | | | | | | | | | | | | | 3,716,654 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Software: 0.35% | | | | | | | | | | | | |

CDK Global Incorporated | | | 5.88 | | | | 6-15-2026 | | | | 185,000 | | | | 194,713 | |

Fair Isaac Corporation 144A | | | 5.25 | | | | 5-15-2026 | | | | 1,330,000 | | | | 1,433,979 | |

| | | | |

| | | | | | | | | | | | | | | 1,628,692 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Technology Hardware, Storage & Peripherals: 0.25% | | | | | | | | | | | | |

Apple Incorporated | | | 1.65 | | | | 5-11-2030 | | | | 735,000 | | | | 744,132 | |

Hewlett Packard Enterprise Company | | | 4.90 | | | | 10-15-2025 | | | | 375,000 | | | | 421,992 | |

| | | | |

| | | | | | | | | | | | | | | 1,166,124 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

Wells Fargo Managed Fixed Income Portfolio | 9

Portfolio of investments—May 31, 2020

| | | | | | | | | | | | | | | | |

| | | Interest rate | | | Maturity date | | | Principal | | | Value | |

Materials: 3.69% | | | | | | | | | | | | | | | | |

| | | | |

| Chemicals: 2.65% | | | | | | | | | | | | |

Air Products & Chemicals | | | 2.05 | % | | | 5-15-2030 | | | $ | 565,000 | | | $ | 585,863 | |

Albemarle Corporation | | | 4.15 | | | | 12-1-2024 | | | | 1,390,000 | | | | 1,475,647 | |

Axalta Coating Systems Limited 144A | | | 4.88 | | | | 8-15-2024 | | | | 550,000 | | | | 556,875 | |

DuPont de Nemours Incorporated | | | 4.73 | | | | 11-15-2028 | | | | 930,000 | | | | 1,104,747 | |

DuPont de Nemours Incorporated | | | 4.49 | | | | 11-15-2025 | | | | 430,000 | | | | 487,839 | |

FMC Corporation | | | 3.20 | | | | 10-1-2026 | | | | 1,120,000 | | | | 1,207,879 | |

Ingevity Corporation 144A | | | 4.50 | | | | 2-1-2026 | | | | 2,015,000 | | | | 1,949,513 | |

Mosaic Company | | | 4.05 | | | | 11-15-2027 | | | | 1,090,000 | | | | 1,108,825 | |

PPG Industries Incorporated | | | 2.55 | | | | 6-15-2030 | | | | 770,000 | | | | 786,608 | |

Scotts Miracle-Gro Company | | | 5.25 | | | | 12-15-2026 | | | | 1,410,000 | | | | 1,464,638 | |

The Sherwin-Williams Company | | | 2.95 | | | | 8-15-2029 | | | | 450,000 | | | | 477,167 | |

The Sherwin-Williams Company | | | 3.30 | | | | 2-1-2025 | | | | 100,000 | | | | 107,211 | |

Valvoline Incorporated 144A | | | 4.25 | | | | 2-15-2030 | | | | 720,000 | | | | 718,200 | |

W.R. Grace & Company 144A | | | 5.63 | | | | 10-1-2024 | | | | 200,000 | | | | 203,500 | |

| | | | |

| | | | | | | | | | | | | | | 12,234,512 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Construction Materials: 0.10% | | | | | | | | | | | | |

CRH America Finance Incorporated 144A | | | 3.40 | | | | 5-9-2027 | | | | 200,000 | | | | 205,615 | |

Martin Marietta Material | | | 2.50 | | | | 3-15-2030 | | | | 280,000 | | | | 271,815 | |

| | | | |

| | | | | | | | | | | | | | | 477,430 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Containers & Packaging: 0.69% | | | | | | | | | | | | |

Graphic Packaging International Company | | | 4.13 | | | | 8-15-2024 | | | | 500,000 | | | | 515,000 | |

Sealed Air Corporation 144A | | | 5.50 | | | | 9-15-2025 | | | | 200,000 | | | | 217,000 | |

Sealed Air Corporation 144A | | | 6.88 | | | | 7-15-2033 | | | | 100,000 | | | | 118,000 | |

Westrock Company | | | 3.00 | | | | 9-15-2024 | | | | 1,680,000 | | | | 1,721,361 | |

WRKCo Incorporated | | | 3.90 | | | | 6-1-2028 | | | | 560,000 | | | | 601,768 | |

| | | | |

| | | | | | | | | | | | | | | 3,173,129 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Metals & Mining: 0.10% | | | | | | | | | | | | |

Freeport-McMoRan Copper & Gold Incorporated | | | 4.55 | | | | 11-14-2024 | | | | 475,000 | | | | 483,313 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Paper & Forest Products: 0.15% | | | | | | | | | | | | |

Georgia Pacific LLC 144A | | | 2.30 | | | | 4-30-2030 | | | | 695,000 | | | | 709,956 | |

| | | | | | | | | | | | | | | | |

| | | | |

Real Estate: 3.32% | | | | | | | | | | | | | | | | |

| | | | |

| Equity REITs: 3.32% | | | | | | | | | | | | |

Alexandria Real Estate Equities Incorporated | | | 3.95 | | | | 1-15-2027 | | | | 240,000 | | | | 264,383 | |

Alexandria Real Estate Equities Incorporated | | | 4.30 | | | | 1-15-2026 | | | | 1,500,000 | | | | 1,669,496 | |

Boston Properties LP | | | 2.75 | | | | 10-1-2026 | | | | 1,500,000 | | | | 1,545,169 | |

Boston Properties LP | | | 3.20 | | | | 1-15-2025 | | | | 250,000 | | | | 262,380 | |

Digital Realty Trust LP | | | 4.45 | | | | 7-15-2028 | | | | 510,000 | | | | 598,626 | |

Duke Realty LP | | | 3.25 | | | | 6-30-2026 | | | | 1,500,000 | | | | 1,595,419 | |

Duke Realty LP | | | 4.00 | | | | 9-15-2028 | | | | 230,000 | | | | 258,462 | |

HCP Incorporated | | | 3.50 | | | | 7-15-2029 | | | | 560,000 | | | | 568,482 | |

Healthcare Trust of America Incorporated | | | 3.50 | | | | 8-1-2026 | | | | 255,000 | | | | 262,511 | |

Host Hotels & Resorts Incorporated | | | 3.88 | | | | 4-1-2024 | | | | 265,000 | | | | 262,717 | |

Kimco Realty Corporation | | | 3.30 | | | | 2-1-2025 | | | | 1,500,000 | | | | 1,519,168 | |

Mid-America Apartments LP | | | 3.60 | | | | 6-1-2027 | | | | 845,000 | | | | 902,401 | |

Mid-America Apartments LP | | | 4.20 | | | | 6-15-2028 | | | | 160,000 | | | | 177,483 | |

National Retail Properties Incorporated | | | 4.30 | | | | 10-15-2028 | | | | 370,000 | | | | 376,064 | |

UDR Incorporated | | | 3.75 | | | | 7-1-2024 | | | | 915,000 | | | | 955,001 | |

Ventas Realty LP | | | 3.50 | | | | 2-1-2025 | | | | 150,000 | | | | 149,315 | |

The accompanying notes are an integral part of these financial statements.

10 | Wells Fargo Managed Fixed Income Portfolio

Portfolio of investments—May 31, 2020

| | | | | | | | | | | | | | | | |

| | | Interest rate | | | Maturity date | | | Principal | | | Value | |

| | | | |

| Equity REITs (continued) | | | | | | | | | | | | |

Ventas Realty LP | | | 3.85 | % | | | 4-1-2027 | | | $ | 1,500,000 | | | $ | 1,482,733 | |

Vornado Realty Trust | | | 3.50 | | | | 1-15-2025 | | | | 1,500,000 | | | | 1,442,978 | |

Welltower Incorporated | | | 3.63 | | | | 3-15-2024 | | | | 580,000 | | | | 593,143 | |

Welltower Incorporated | | | 2.70 | | | | 2-15-2027 | | | | 460,000 | | | | 441,960 | |

| | | | |

| | | | | | | | | | | | | | | 15,327,891 | |

| | | | | | | | | | | | | | | | |

| | | | |

Utilities: 3.35% | | | | | | | | | | | | | | | | |

| | | | |

| Electric Utilities: 2.77% | | | | | | | | | | | | |

Duke Energy Carolinas LLC | | | 6.05 | | | | 4-15-2038 | | | | 830,000 | | | | 1,195,589 | |

Entergy Arkansas Incorporated | | | 3.05 | | | | 6-1-2023 | | | | 1,055,000 | | | | 1,108,323 | |

Evergy Metro Incorporated | | | 2.25 | | | | 6-1-2030 | | | | 350,000 | | | | 359,436 | |

Florida Power & Light Company | | | 4.95 | | | | 6-1-2035 | | | | 1,000,000 | | | | 1,391,901 | |

ITC Holdings Corporation | | | 3.65 | | | | 6-15-2024 | | | | 120,000 | | | | 129,645 | |

MidAmerican Energy Holdings Company | | | 5.80 | | | | 10-15-2036 | | | | 900,000 | | | | 1,231,594 | |

Monongahela Power Company 144A | | | 4.10 | | | | 4-15-2024 | | | | 1,660,000 | | | | 1,818,475 | |

Northern States Power Company of Minnesota | | | 5.35 | | | | 11-1-2039 | | | | 1,580,000 | | | | 2,222,352 | |

PacifiCorp | | | 3.35 | | | | 7-1-2025 | | | | 130,000 | | | | 142,086 | |

Public Service Electric & Gas Company | | | 5.70 | | | | 12-1-2036 | | | | 590,000 | | | | 807,995 | |

Rochester Gas & Electric Corporation 144A | | | 3.10 | | | | 6-1-2027 | | | | 1,790,000 | | | | 1,909,739 | |

Southern California Edison Company | | | 6.00 | | | | 1-15-2034 | | | | 188,000 | | | | 250,894 | |

Trans-Allegheny Interstate Line Company 144A | | | 3.85 | | | | 6-1-2025 | | | | 200,000 | | | | 221,927 | |

| | | | |

| | | | | | | | | | | | | | | 12,789,956 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Gas Utilities: 0.33% | | | | | | | | | | | | |

AmeriGas Partners LP | | | 5.50 | | | | 5-20-2025 | | | | 450,000 | | | | 468,000 | |

AmeriGas Partners LP | | | 5.88 | | | | 8-20-2026 | | | | 500,000 | | | | 530,250 | |

Boardwalk Pipelines Company | | | 5.95 | | | | 6-1-2026 | | | | 550,000 | | | | 554,760 | |

| | | | |

| | | | | | | | | | | | | | | 1,553,010 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Independent Power & Renewable Electricity Producers: 0.08% | | | | | | | | | | | | |

AES Corporation | | | 5.13 | | | | 9-1-2027 | | | | 335,000 | | | | 354,778 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Multi-Utilities: 0.17% | | | | | | | | | | | | |

Black Hills Corporation | | | 4.35 | | | | 5-1-2033 | | | | 710,000 | | | | 791,269 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Corporate Bonds and Notes (Cost $159,724,600) | | | | | | | | | | | | | | | 169,598,855 | |

| | | | | | | | | | | | | | | | |

| | | | |

Municipal Obligations: 11.23% | | | | | | | | | | | | | | | | |

| | | | |

California: 1.38% | | | | | | | | | | | | | | | | |

| | | | |

| GO Revenue: 1.28% | | | | | | | | | | | | |

Alameda County CA Series A | | | 3.70 | | | | 8-1-2031 | | | | 275,000 | | | | 305,850 | |

Coast Community College District California | | | 2.89 | | | | 8-1-2035 | | | | 1,165,000 | | | | 1,218,695 | |

Oxnard CA Union High School District | | | 1.87 | | | | 8-1-2030 | | | | 800,000 | | | | 784,576 | |

San Diego CA Community College District Series B | | | 2.88 | | | | 8-1-2033 | | | | 1,935,000 | | | | 2,082,215 | |

San Jose CA Disaster Preparedness Taxable Bonds Series B | | | 2.60 | | | | 9-1-2027 | | | | 1,460,000 | | | | 1,535,015 | |

| | | | |

| | | | | | | | | | | | | | | 5,926,351 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Tax Revenue: 0.10% | | | | | | | | | | | | |

San Jose CA RDA Senior Taxable Refunding Bonds Series A-T | | | 3.38 | | | | 8-1-2034 | | | | 455,000 | | | | 464,077 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 6,390,428 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

Wells Fargo Managed Fixed Income Portfolio | 11

Portfolio of investments—May 31, 2020

| | | | | | | | | | | | | | | | |

| | | Interest rate | | | Maturity date | | | Principal | | | Value | |

Delaware: 0.33% | | | | | | | | | | | | | | | | |

| | | | |

| Miscellaneous Revenue: 0.33% | | | | | | | | | | | | |

Delaware Bonds Series 2010C | | | 4.45 | % | | | 7-1-2028 | | | $ | 1,250,000 | | | $ | 1,520,963 | |

| | | | | | | | | | | | | | | | |

| | | | |

Florida: 0.44% | | | | | | | | | | | | | | | | |

| | | | |

| Airport Revenue: 0.17% | | | | | | | | | | | | |

Broward County FL Airport System Series C | | | 2.38 | | | | 10-1-2026 | | | | 775,000 | | | | 766,646 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Water & Sewer Revenue: 0.27% | | | | | | | | | | | | |

Florida Water Pollution Control Financing Corporation Series A | | | 2.60 | | | | 1-15-2030 | | | | 1,175,000 | | | | 1,251,175 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 2,017,821 | |

| | | | | | | | | | | | | | | | |

| | | | |

Georgia: 0.13% | | | | | | | | | | | | | | | | |

| | | | |

| GO Revenue: 0.13% | | | | | | | | | | | | |

Cherokee County GA School System Build America Bonds | | | 5.87 | | | | 8-1-2028 | | | | 500,000 | | | | 596,860 | |

| | | | | | | | | | | | | | | | |

| | | | |

Idaho: 0.04% | | | | | | | | | | | | | | | | |

| | | | |

| Miscellaneous Revenue: 0.04% | | | | | | | | | | | | |

Idaho Building Authority State Office Campus Project Series B | | | 3.28 | | | | 9-1-2028 | | | | 170,000 | | | | 184,363 | |

| | | | | | | | | | | | | | | | |

| | | | |

Illinois: 0.04% | | | | | | | | | | | | | | | | |

| | | | |

| GO Revenue: 0.04% | | | | | | | | | | | | |

Lake County IL Community Consolidated School District Series A | | | 3.40 | | | | 11-1-2027 | | | | 150,000 | | | | 164,714 | |

| | | | | | | | | | | | | | | | |

| | | | |

Indiana: 0.62% | | | | | | | | | | | | | | | | |

| | | | |

| Education Revenue: 0.27% | | | | | | | | | | | | |

Indiana University Taxable Consolidated Bonds Series B | | | 3.07 | | | | 6-1-2060 | | | | 1,195,000 | | | | 1,219,330 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Health Revenue: 0.28% | | | | | | | | | | | | |

Indiana Finance Authority Community Foundation | | | 3.63 | | | | 3-1-2039 | | | | 1,235,000 | | | | 1,309,878 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Miscellaneous Revenue: 0.07% | | | | | | | | | | | | |

Indianapolis IN Local Public Improvement Bonds Series A-2 | | | 6.00 | | | | 1-15-2040 | | | | 235,000 | | | | 328,147 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 2,857,355 | |

| | | | | | | | | | | | | | | | |

| | | | |

Massachusetts: 0.23% | | | | | | | | | | | | | | | | |

| | | | |

| GO Revenue: 0.23% | | | | | | | | | | | | |

Boston MA Series C Qualified School Construction Bonds | | | 4.40 | | | | 4-1-2026 | | | | 380,000 | | | | 389,409 | |

Massachusetts Taxable Consolidated Loan Series H | | | 2.90 | | | | 9-1-2049 | | | | 650,000 | | | | 687,278 | |

| | | | |

| | | | | | | | | | | | | | | 1,076,687 | |

| | | | | | | | | | | | | | | | |

| | | | |

Michigan: 0.21% | | | | | | | | | | | | | | | | |

| | | | |

| Health Revenue: 0.21% | | | | | | | | | | | | |

Michigan Finance Authority Trinity Health Credit Group Series T | | | 3.08 | | | | 12-1-2034 | | | | 930,000 | | | | 994,709 | |

| | | | | | | | | | | | | | | | |

| | | | |

Mississippi: 0.07% | | | | | | | | | | | | | | | | |

| | | | |

| Education Revenue: 0.07% | | | | | | | | | | | | |

Mississippi Higher Education Assistance Corporation Series 2014-1 Class A1 (1 Month LIBOR +0.68%) ± | | | 0.85 | | | | 10-25-2035 | | | | 344,897 | | | | 333,216 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

12 | Wells Fargo Managed Fixed Income Portfolio

Portfolio of investments—May 31, 2020

| | | | | | | | | | | | | | | | |

| | | Interest rate | | | Maturity date | | | Principal | | | Value | |

Missouri: 0.48% | | | | | | | | | | | | | | | | |

| | | | |

| Education Revenue: 0.48% | | | | | | | | | | | | |

Missouri HEFA Washington University Series A | | | 3.65 | % | | | 8-15-2057 | | | $ | 500,000 | | | $ | 585,960 | |

Missouri Higher Education Loan Authority Notes Class A-1 (3 Month LIBOR +0.85%) ± | | | 1.21 | | | | 8-27-2029 | | | | 162,966 | | | | 159,366 | |

Missouri Higher Education Loan Authority Notes Class A-1 (1 Month LIBOR +0.83%) ± | | | 1.32 | | | | 1-26-2026 | | | | 1,586,563 | | | | 1,451,880 | |

| | | | |

| | | | | | | | | | | | | | | 2,197,206 | |

| | | | | | | | | | | | | | | | |

| | | | |

New Jersey: 0.19% | | | | | | | | | | | | | | | | |

| | | | |

| Miscellaneous Revenue: 0.19% | | | | | | | | | | | | |

Hudson County NJ Improvement Authority Hudson County Lease Project (AGM Insured) | | | 7.40 | | | | 12-1-2025 | | | | 760,000 | | | | 870,527 | |

| | | | | | | | | | | | | | | | |

| | | | |

New York: 0.64% | | | | | | | | | | | | | | | | |

| | | | |

| GO Revenue: 0.35% | | | | | | | | | | | | |

New York Refunding Bond Series B | | | 2.65 | | | | 2-15-2030 | | | | 1,505,000 | | | | 1,603,322 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Miscellaneous Revenue: 0.07% | | | | | | | | | | | | |

New York State Taxable Bonds Series 2010C | | | 5.62 | | | | 3-1-2040 | | | | 250,000 | | | | 344,925 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Tax Revenue: 0.22% | | | | | | | | | | | | |

New York City NY Transitional Finance Authority | | | 2.21 | | | | 5-1-2027 | | | | 1,000,000 | | | | 1,019,160 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 2,967,407 | |

| | | | | | | | | | | | | | | | |

| | | | |

North Carolina: 0.55% | | | | | | | | | | | | | | | | |

| | | | |

| Education Revenue: 0.55% | | | | | | | | | | | | |

North Carolina Education Assistance Authority Student Loan (3 Month LIBOR +0.90%) ± | | | 1.89 | | | | 7-25-2041 | | | | 1,569,373 | | | | 1,507,288 | |

North Carolina Education Assistance Authority Student Loan Series A-3 (3 Month LIBOR +0.90%) ± | | | 1.89 | | | | 10-25-2041 | | | | 470,856 | | | | 452,624 | |

University of North Carolina Chapel Hill Refunding Bonds Series C | | | 3.33 | | | | 12-1-2036 | | | | 500,000 | | | | 565,585 | |

| | | | |

| | | | | | | | | | | | | | | 2,525,497 | |

| | | | | | | | | | | | | | | | |

| | | | |

Ohio: 0.57% | | | | | | | | | | | | | | | | |

| | | | |

| Education Revenue: 0.30% | | | | | | | | | | | | |

Ohio State University Build America Bonds | | | 4.91 | | | | 6-1-2040 | | | | 1,000,000 | | | | 1,370,730 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Health Revenue: 0.16% | | | | | | | | | | | | |

Ohio Hospital Facility Refunding Bond Cleveland Clinic | | | 3.28 | | | | 1-1-2042 | | | | 725,000 | | | | 744,394 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Miscellaneous Revenue: 0.11% | | | | | | | | | | | | |

Jobsohio Beverage System Ohio Statewide Senior Lien Liquor Profits Series A | | | 2.83 | | | | 1-1-2038 | | | | 515,000 | | | | 533,782 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 2,648,906 | |

| | | | | | | | | | | | | | | | |

| | | | |

Oklahoma: 0.17% | | | | | | | | | | | | | | | | |

| | | | |

| Water & Sewer Revenue: 0.17% | | | | | | | | | | | | |

Oklahoma Water Resources Board Refunding Bond Series 2019 (Oklahoma Credit Enhancement Reserve Fund Insured) | | | 2.56 | | | | 4-1-2031 | | | | 770,000 | | | | 793,832 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

Wells Fargo Managed Fixed Income Portfolio | 13

Portfolio of investments—May 31, 2020

| | | | | | | | | | | | | | | | |

| | | Interest rate | | | Maturity date | | | Principal | | | Value | |

Oregon: 0.58% | | | | | | | | | | | | | | | | |

| | | | |

| Education Revenue: 0.44% | | | | | | | | | | | | |

Oregon State Taxable Higher Education Series A | | | 5.90 | % | | | 8-1-2038 | | | $ | 1,500,000 | | | $ | 2,014,755 | |

| | | | | | | | | | | | | | | | |

| | | | |

| GO Revenue: 0.14% | | | | | | | | | | | | |

Oregon Board of Higher Education Build America Bonds Series C | | | 5.38 | | | | 8-1-2039 | | | | 500,000 | | | | 657,800 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 2,672,555 | |

| | | | | | | | | | | | | | | | |

| | | | |

Pennsylvania: 0.95% | | | | | | | | | | | | | | | | |

| | | | |

| Education Revenue: 0.69% | | | | | | | | | | | | |

Pennsylvania HEFAR Refunding Taxable Bonds Series B | | | 2.94 | | | | 8-15-2039 | | | | 1,000,000 | | | | 1,024,260 | |

Pennsylvania Higher Education Authority Class A (1 Month LIBOR +1.15%) 144A± | | | 1.32 | | | | 9-25-2065 | | | | 1,020,080 | | | | 985,561 | |

University Pittsburgh Pennsylvania Series A | | | 3.65 | | | | 9-15-2036 | | | | 1,100,000 | | | | 1,196,877 | |

| | | | |

| | | | | | | | | | | | | | | 3,206,698 | |

| | | | | | | | | | | | | | | | |

| | | | |

| GO Revenue: 0.26% | | | | | | | | | | | | |

Northampton County PA Series C | | | 2.54 | | | | 10-1-2028 | | | | 1,100,000 | | | | 1,183,061 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 4,389,759 | |

| | | | | | | | | | | | | | | | |

| | | | |

Rhode Island: 0.52% | | | | | | | | | | | | | | | | |

| | | | |

| Education Revenue: 0.52% | | | | | | | | | | | | |

Rhode Island Student Loan Authority Class A-1 (1 Month LIBOR +0.90%) ± | | | 1.27 | | | | 7-1-2031 | | | | 2,425,979 | | | | 2,419,113 | |

| | | | | | | | | | | | | | | | |

| | | | |

Texas: 1.04% | | | | | | | | | | | | | | | | |

| | | | |

| Education Revenue: 0.27% | | | | | | | | | | | | |

University of Texas Build America Bonds Series A | | | 5.26 | | | | 7-1-2039 | | | | 550,000 | | | | 779,488 | |

University of Texas Build America Bonds Series C | | | 4.79 | | | | 8-15-2046 | | | | 120,000 | | | | 164,500 | |

University of Texas Build America Bonds Series D | | | 5.13 | | | | 8-15-2042 | | | | 215,000 | | | | 301,275 | |

| | | | |

| | | | | | | | | | | | | | | 1,245,263 | |

| | | | | | | | | | | | | | | | |

| | | | |

| GO Revenue: 0.50% | | | | | | | | | | | | |

Hidalgo County TX Refunding Bonds Series 2018C | | | 4.04 | | | | 8-15-2030 | | | | 1,270,000 | | | | 1,438,212 | |

Houston TX Pension Obligation Bonds Series 2017 | | | 3.73 | | | | 3-1-2030 | | | | 110,000 | | | | 122,420 | |

Stafford TX Municipal School District Refunding Bond Series B | | | 3.08 | | | | 8-15-2041 | | | | 750,000 | | | | 747,015 | |

| | | | |

| | | | | | | | | | | | | | | 2,307,647 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Miscellaneous Revenue: 0.20% | | | | | | | | | | | | |

Texas Transportation Commission Highway Improvement Series A | | | 4.63 | | | | 4-1-2033 | | | | 750,000 | | | | 944,423 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Tax Revenue: 0.07% | | | | | | | | | | | | |

Texas Transportation Commission Series B | | | 5.18 | | | | 4-1-2030 | | | | 250,000 | | | | 318,503 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 4,815,836 | |

| | | | | | | | | | | | | | | | |

| | | | |

Utah: 0.57% | | | | | | | | | | | | | | | | |

| | | | |

| Education Revenue: 0.57% | | | | | | | | | | | | |

State Board of Regents of Utah Series 1-A (1 Month LIBOR +0.75%) ± | | | 1.24 | | | | 9-25-2056 | | | | 2,737,901 | | | | 2,654,669 | |

| | | | | | | | | | | | | | | | |

| | | | |

Vermont: 0.03% | | | | | | | | | | | | | | | | |

| | | | |

| Housing Revenue: 0.03% | | | | | | | | | | | | |

Vermont Housing Finance Agency | | | 3.80 | | | | 11-1-2037 | | | | 110,000 | | | | 121,156 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

14 | Wells Fargo Managed Fixed Income Portfolio

Portfolio of investments—May 31, 2020

| | | | | | | | | | | | | | | | |

| | | Interest rate | | | Maturity date | | | Principal | | | Value | |

Virginia: 0.18% | | | | | | | | | | | | | | | | |

| | | | |

| Education Revenue: 0.15% | | | | | | | | | | | | |

University of Virginia Build America Bonds | | | 6.20 | % | | | 9-1-2039 | | | $ | 315,000 | | | $ | 487,018 | |

University of Virginia Revenue Bond Series C | | | 4.18 | | | | 9-1-2117 | | | | 155,000 | | | | 202,630 | |

| | | | |

| | | | | | | | | | | | | | | 689,648 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Housing Revenue: 0.03% | | | | | | | | | | | | |

Virginia Housing Development Authority | | | 3.10 | | | | 6-25-2041 | | | | 136,655 | | | | 139,168 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 828,816 | |

| | | | | | | | | | | | | | | | |

| | | | |

Washington: 0.74% | | | | | | | | | | | | | | | | |

| | | | |

| GO Revenue: 0.69% | | | | | | | | | | | | |

King County WA Build America Bonds Series B | | | 6.05 | | | | 12-1-2030 | | | | 350,000 | | | | 446,261 | |

King County WA Economic Development Taxable Bond Series C | | | 5.03 | | | | 12-1-2023 | | | | 230,000 | | | | 256,393 | |

Washington Build America Bonds Series D | | | 5.48 | | | | 8-1-2039 | | | | 1,000,000 | | | | 1,369,030 | |

Washington Series T | | | 3.45 | | | | 8-1-2029 | | | | 1,000,000 | | | | 1,135,150 | |

| | | | |

| | | | | | | | | | | | | | | 3,206,834 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Tax Revenue: 0.05% | | | | | | | | | | | | |

Washington Build America Bonds | | | 5.09 | | | | 8-1-2033 | | | | 175,000 | | | | 224,198 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 3,431,032 | |

| | | | | | | | | | | | | | | | |

| | | | |

West Virginia: 0.10% | | | | | | | | | | | | | | | | |

| | | | |

| Tax Revenue: 0.10% | | | | | | | | | | | | |

Ohio County WV Special District Excise Tax Series A | | | 8.25 | | | | 3-1-2035 | | | | 425,000 | | | | 463,480 | |

| | | | | | | | | | | | | | | | |

| | | | |

Wisconsin: 0.43% | | | | | | | | | | | | | | | | |

| | | | |

| GO Revenue: 0.37% | | | | | | | | | | | | |

Wisconsin State Refunding Bond Series 1 | | | 2.50 | | | | 5-1-2032 | | | | 1,705,000 | | | | 1,723,141 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Miscellaneous Revenue: 0.06% | | | | | | | | | | | | |

Wisconsin General Fund Annual Appropriation Series A | | | 2.30 | | | | 5-1-2028 | | | | 250,000 | | | | 257,623 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 1,980,764 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Municipal Obligations (Cost $49,199,494) | | | | | | | | | | | | | | | 51,917,671 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Non-Agency Mortgage-Backed Securities: 7.46% | | | | | | | | | | | | |

Commercial Mortgage Pass-Through Certificate Series 2010-C1 Class A3 144A | | | 4.21 | | | | 7-10-2046 | | | | 49,880 | | | | 49,994 | |

Commercial Mortgage Pass-Through Certificate Series 2012-CR2 Class A4 | | | 3.15 | | | | 8-15-2045 | | | | 550,000 | | | | 564,631 | |

Commercial Mortgage Pass-Through Certificate Series 2012-UBS5 Class A3 | | | 3.55 | | | | 9-10-2047 | | | | 538,554 | | | | 557,679 | |

Commercial Mortgage Pass-Through Certificate Series 2013-CR12 Class ASB | | | 3.62 | | | | 10-10-2046 | | | | 388,273 | | | | 399,440 | |

Commercial Mortgage Pass-Through Certificate Series 2013-CR13 Class A4 ±± | | | 4.19 | | | | 11-10-2046 | | | | 600,000 | | | | 647,028 | |

Commercial Mortgage Pass-Through Certificate Series 2014-CR17 Class A5 | | | 3.98 | | | | 5-10-2047 | | | | 1,795,000 | | | | 1,936,700 | |

Commercial Mortgage Pass-Through Certificate Series 2014-CR21 Class A3 | | | 3.53 | | | | 12-10-2047 | | | | 2,684,674 | | | | 2,867,720 | |

Commercial Mortgage Pass-Through Certificate Series 2014-UBS5 Class A4 | | | 3.84 | | | | 9-10-2047 | | | | 620,000 | | | | 662,794 | |

Goldman Sachs Mortgage Securities Trust Series 2011-GC3 Class A4 144A | | | 4.75 | | | | 3-10-2044 | | | | 400,569 | | | | 405,088 | |

Goldman Sachs Mortgage Securities Trust Series 2011-GC5 Class A4 | | | 3.71 | | | | 8-10-2044 | | | | 545,000 | | | | 552,250 | |

Goldman Sachs Mortgage Securities Trust Series 2012-GCJ7 Class A4 | | | 3.38 | | | | 5-10-2045 | | | | 424,856 | | | | 431,023 | |

Goldman Sachs Mortgage Securities Trust Series 2013-GC14 Class A5 | | | 4.24 | | | | 8-10-2046 | | | | 615,000 | | | | 660,810 | |

Goldman Sachs Mortgage Securities Trust Series 2013-GC16 Class A4 | | | 4.27 | | | | 11-10-2046 | | | | 350,000 | | | | 376,400 | |

Goldman Sachs Mortgage Securities Trust Series 2014-GC26 Class A5 | | | 3.63 | | | | 11-10-2047 | | | | 2,565,000 | | | | 2,765,317 | |

JPMorgan Chase Commercial Mortgage Securities Trust Series 2010-C2 Class A3 144A | | | 4.07 | | | | 11-15-2043 | | | | 203,103 | | | | 203,081 | |

The accompanying notes are an integral part of these financial statements.

Wells Fargo Managed Fixed Income Portfolio | 15

Portfolio of investments—May 31, 2020

| | | | | | | | | | | | | | | | |

| | | Interest rate | | | Maturity date | | | Principal | | | Value | |

| | | | |

| Non-Agency Mortgage-Backed Securities (continued) | | | | | | | | | | | | |

JPMorgan Chase Commercial Mortgage Securities Trust Series 2014-C19 Class A4 | | | 4.00 | % | | | 4-15-2047 | | | $ | 450,000 | | | $ | 484,465 | |

JPMorgan Chase Commercial Mortgage Securities Trust Series 2014-C20 Class A5 | | | 3.80 | | | | 7-15-2047 | | | | 4,065,000 | | | | 4,359,828 | |

JPMorgan Chase Commercial Mortgage Securities Trust Series 2014-GC26 Class A4 | | | 3.49 | | | | 1-15-2048 | | | | 1,338,000 | | | | 1,429,685 | |

Morgan Stanley Bank of America Merrill Lynch Trust Series 2014-C15 Class ASB | | | 3.65 | | | | 4-15-2047 | | | | 441,785 | | | | 460,080 | |

Morgan Stanley Bank of America Merrill Lynch Trust Series 2014-C19 Class A4 | | | 3.53 | | | | 12-15-2047 | | | | 1,790,000 | | | | 1,902,549 | |

Morgan Stanley Capital I Trust Series 2011-C2 Class A4 144A | | | 4.66 | | | | 6-15-2044 | | | | 478,042 | | | | 489,820 | |

Morgan Stanley Capital I Trust Series 2011-C3 Class A4 | | | 4.12 | | | | 7-15-2049 | | | | 359,247 | | | | 366,240 | |

Towd Point Mortgage Trust Series 2016-2 Class A1A 144A±± | | | 2.75 | | | | 8-25-2055 | | | | 159,181 | | | | 161,888 | |

Towd Point Mortgage Trust Series 2016-3 Class A1 144A±± | | | 2.25 | | | | 4-25-2056 | | | | 197,078 | | | | 198,443 | |

Towd Point Mortgage Trust Series 2018-3 Class A1 144A±± | | | 3.75 | | | | 5-25-2058 | | | | 2,168,205 | | | | 2,279,118 | |

Towd Point Mortgage Trust Series 2019-4 Class A1 144A±± | | | 2.90 | | | | 10-25-2059 | | | | 2,559,500 | | | | 2,646,029 | |

WFRBS Commercial Mortgage Trust Series 2013-C17 Class A4 | | | 4.02 | | | | 12-15-2046 | | | | 4,370,000 | | | | 4,626,750 | |

WFRBS Commercial Mortgage Trust Series 2014-C20 Class A5 | | | 4.00 | | | | 5-15-2047 | | | | 1,876,047 | | | | 2,008,063 | |

| | | | |

Total Non-Agency Mortgage-Backed Securities (Cost $33,017,959) | | | | | | | | | | | | | | | 34,492,913 | |

| | | | | | | | | | | | | | | | |

| | | | |

| U.S. Treasury Securities: 4.34% | | | | | | | | | | | | |

U.S. Treasury Bond | | | 2.38 | | | | 11-15-2049 | | | | 11,953,000 | | | | 14,730,205 | |

U.S. Treasury Bond | | | 4.25 | | | | 5-15-2039 | | | | 1,890,000 | | | | 2,920,419 | |

U.S. Treasury Bond | | | 4.50 | | | | 5-15-2038 | | | | 1,540,000 | | | | 2,426,884 | |

| | | | |

Total U.S. Treasury Securities (Cost $19,620,301) | | | | | | | | | | | | | | | 20,077,508 | |

| | | | | | | | | | | | | | | | |

| | | | |

Yankee Corporate Bonds and Notes: 4.65% | | | | | | | | | | | | | | | | |

| | | | |

Consumer Staples: 0.12% | | | | | | | | | | | | | | | | |

| | | | |

| Beverages: 0.12% | | | | | | | | | | | | |

Diageo Capital plc | | | 2.00 | | | | 4-29-2030 | | | | 540,000 | | | | 548,565 | |

| | | | | | | | | | | | | | | | |

| | | | |

Energy: 0.50% | | | | | | | | | | | | | | | | |

| | | | |

| Oil, Gas & Consumable Fuels: 0.50% | | | | | | | | | | | | |

BP Capital Markets plc | | | 3.28 | | | | 9-19-2027 | | | | 155,000 | | | | 168,154 | |

Cenovus Energy Incorporated | | | 4.25 | | | | 4-15-2027 | | | | 1,025,000 | | | | 930,275 | |

Equinor ASA | | | 1.75 | | | | 1-22-2026 | | | | 70,000 | | | | 71,495 | |

Petroleos Mexicanos | | | 2.29 | | | | 2-15-2024 | | | | 110,000 | | | | 113,284 | |

Petroleos Mexicanos | | | 2.83 | | | | 2-15-2024 | | | | 230,000 | | | | 239,095 | |

Petroleos Mexicanos | | | 6.38 | | | | 1-23-2045 | | | | 1,080,000 | | | | 800,280 | |

| | | | |

| | | | | | | | | | | | | | | 2,322,583 | |

| | | | | | | | | | | | | | | | |

| | | | |

Financials: 1.97% | | | | | | | | | | | | | | | | |

| | | | |

| Banks: 1.16% | | | | | | | | | | | | |

Bank of Nova Scotia | | | 4.50 | | | | 12-16-2025 | | | | 80,000 | | | | 89,460 | |

BNP Paribas SA (3 Month LIBOR +1.11%) 144A± | | | 2.82 | | | | 11-19-2025 | | | | 820,000 | | | | 842,137 | |

BNP Paribas SA 144A | | | 4.40 | | | | 8-14-2028 | | | | 520,000 | | | | 593,601 | |

Cooperatieve Rabobank U.A. 144A | | | 3.88 | | | | 9-26-2023 | | | | 300,000 | | | | 325,287 | |

HSBC Holdings plc (3 Month LIBOR +1.06%) ± | | | 3.26 | | | | 3-13-2023 | | | | 220,000 | | | | 227,302 | |

HSBC Holdings plc (3 Month LIBOR +1.35%) ± | | | 4.29 | | | | 9-12-2026 | | | | 950,000 | | | | 1,049,708 | |

HSBC Holdings plc (3 Month LIBOR +1.53%) ± | | | 4.58 | | | | 6-19-2029 | | | | 1,500,000 | | | | 1,701,304 | |

Mitsubishi UFJ Financial Group Incorporated | | | 3.76 | | | | 7-26-2023 | | | | 350,000 | | | | 374,753 | |

Royal Bank of Canada | | | 4.65 | | | | 1-27-2026 | | | | 120,000 | | | | 137,845 | |

| | | | |

| | | | | | | | | | | | | | | 5,341,397 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

16 | Wells Fargo Managed Fixed Income Portfolio

Portfolio of investments—May 31, 2020

| | | | | | | | | | | | | | | | |

| | | Interest rate | | | Maturity date | | | Principal | | | Value | |

| Capital Markets: 0.45% | | | | | | | | | | | | |

Credit Suisse Group AG (3 Month LIBOR +1.41%) 144A± | | | 3.87 | % | | | 1-12-2029 | | | $ | 1,500,000 | | | $ | 1,617,682 | |

Credit Suisse Group AG (3 Month LIBOR +1.24%) 144A± | | | 4.21 | | | | 6-12-2024 | | | | 450,000 | | | | 480,562 | |

| | | | |

| | | | | | | | | | | | | | | 2,098,244 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Consumer Finance: 0.36% | | | | | | | | | | | | |

UBS Group Funding Switzerland 144A | | | 4.25 | | | | 3-23-2028 | | | | 1,500,000 | | | | 1,678,215 | |

| | | | | | | | | | | | | | | | |

| | | | |

Health Care: 0.28% | | | | | | | | | | | | | | | | |

| | | | |

| Pharmaceuticals: 0.28% | | | | | | | | | | | | |

Teva Pharmaceutical Finance BV | | | 2.20 | | | | 7-21-2021 | | | | 150,000 | | | | 147,068 | |

Teva Pharmaceutical Finance BV | | | 2.80 | | | | 7-21-2023 | | | | 900,000 | | | | 850,500 | |

Teva Pharmaceutical Finance BV | | | 3.15 | | | | 10-1-2026 | | | | 350,000 | | | | 314,405 | |

| | | | |

| | | | | | | | | | | | | | | 1,311,973 | |

| | | | | | | | | | | | | | | | |

| | | | |

Industrials: 0.60% | | | | | | | | | | | | | | | | |

| | | | |

| Aerospace & Defense: 0.24% | | | | | | | | | | | | |

Embraer Netherlands Finance BV | | | 5.05 | | | | 6-15-2025 | | | | 1,200,000 | | | | 1,092,240 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Electrical Equipment: 0.06% | | | | | | | | | | | | |

Sensata Technologies BV 144A | | | 5.63 | | | | 11-1-2024 | | | | 265,000 | | | | 277,232 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Machinery: 0.30% | | | | | | | | | | | | |

CNH Industrial NV | | | 4.50 | | | | 8-15-2023 | | | | 600,000 | | | | 628,303 | |

Ingersoll-Rand Luxembourg SA | | | 3.50 | | | | 3-21-2026 | | | | 700,000 | | | | 752,920 | |

| | | | |

| | | | | | | | | | | | | | | 1,381,223 | |

| | | | | | | | | | | | | | | | |

| | | | |

Information Technology: 0.18% | | | | | | | | | | | | | | | | |

| | | | |

| Software: 0.18% | | | | | | | | | | | | |

Experian Finance plc 144A | | | 4.25 | | | | 2-1-2029 | | | | 510,000 | | | | 569,157 | |

OpenText Corporation 144A | | | 3.88 | | | | 2-15-2028 | | | | 260,000 | | | | 256,602 | |

| | | | |

| | | | | | | | | | | | | | | 825,759 | |

| | | | | | | | | | | | | | | | |

| | | | |

Materials: 1.00% | | | | | | | | | | | | | | | | |

| | | | |

| Chemicals: 0.04% | | | | | | | | | | | | |

Nutrien Limited | | | 2.95 | | | | 5-13-2030 | | | | 180,000 | | | | 187,852 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Metals & Mining: 0.96% | | | | | | | | | | | | |

Anglo American Capital plc 144A | | | 4.75 | | | | 4-10-2027 | | | | 1,000,000 | | | | 1,066,673 | |

ArcelorMittal SA | | | 6.13 | | | | 6-1-2025 | | | | 1,500,000 | | | | 1,628,374 | |

Vale Overseas Limited | | | 6.25 | | | | 8-10-2026 | | | | 1,500,000 | | | | 1,715,027 | |

| | | | |

| | | | | | | | | | | | | | | 4,410,074 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Yankee Corporate Bonds and Notes (Cost $20,509,079) | | | | | | | | | | | | | | | 21,475,357 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | | |

| | | Yield | | | | | | Shares | | | | |

| Short-Term Investments: 2.79% | | | | | | | | | | | | |

| | | | |

| Investment Companies: 2.79% | | | | | | | | | | | | |

Wells Fargo Government Money Market Fund Select Class (l)(u)## | | | 0.12 | | | | | | | | 12,907,842 | | | | 12,907,842 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Short-Term Investments (Cost $12,907,842) | | | | | | | | | | | | | | | 12,907,842 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | |

| Total investments in securities (Cost $434,159,094) | | | 99.39 | % | | | 459,418,941 | |

| | |

Other assets and liabilities, net | | | 0.61 | | | | 2,829,721 | |

| | | | | | | | |

| Total net assets | | | 100.00 | % | | $ | 462,248,662 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

Wells Fargo Managed Fixed Income Portfolio | 17

Portfolio of investments—May 31, 2020

| ±± | The coupon of the security is adjusted based on the principal and interest payments received from the underlying pool of mortgages as well as the credit quality and the actual prepayment speed of the underlying mortgages. |

| 144A | The security may be resold in transactions exempt from registration, normally to qualified institutional buyers, pursuant to Rule 144A under the Securities Act of 1933. |

| ± | Variable rate investment. The rate shown is the rate in effect at period end. |

| %% | The security is purchased on a when-issued basis. |

| (l) | The issuer of the security is an affiliated person of the Portfolio as defined in the Investment Company Act of 1940. |

| (u) | The rate represents the 7-day annualized yield at period end. |

| ## | All or a portion of this security is segregated for when-issued securities. |

Abbreviations:

| AGM | Assured Guaranty Municipal |

| FHLMC | Federal Home Loan Mortgage Corporation |

| FNMA | Federal National Mortgage Association |

| GNMA | Government National Mortgage Association |

| HEFA | Health & Educational Facilities Authority |

| HEFAR | Higher Educational Facilities Authority Revenue |

| LIBOR | London Interbank Offered Rate |

| RDA | Redevelopment Authority |

| REIT | Real Estate Investment Trust |

| SOFR | Secured Overnight Financing Rate |

Investments in Affiliates

An affiliated investment is an investment in which the Portfolio owns at least 5% of the outstanding voting shares of the issuer or as a result of other relationships, such as the Portfolio and the issuer having the same adviser or investment manager. Transactions with issuers that were either affiliated persons of the Portfolio at the beginning of the period or the end of the period were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Shares, beginning of period | | | Shares purchased | | | Shares sold | | | Shares, end of period | | | Net realized gains (losses) | | | Net change in unrealized gains (losses) | | | Income from affiliated securities | | | Value, end of period | | | % of net assets | |

| | | | | | | | | |

| Short-Term Investments | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investment Companies | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Securities Lending Cash Investments LLC * | | | 5,121,429 | | | | 17,800,239 | | | | (22,921,668 | ) | | | 0 | | | $ | 25 | | | $ | 0 | | | $ | 50,250 | # | | $ | 0 | | | | | |

Wells Fargo Government Money Market Fund Select Class | | | 3,089,575 | | | | 190,947,911 | | | | (181,129,644 | ) | | | 12,907,842 | | | | 0 | | | | 0 | | | | 129,592 | | | | 12,907,842 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |