QuickLinks -- Click here to rapidly navigate through this documentAs filed with the Securities and Exchange Commission on July 22, 2003

Registration No. 333 -

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-10

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PENGROWTH ENERGY TRUST

(Exact name of Registrant as specified in its charter)

Alberta, Canada

(Province or other jurisdiction of

incorporation or organization) | | 1311

(Primary Standard Industrial

Classification Code Number) | | 98-0185056

(I.R.S. Employer

Identification No.) |

Petro-Canada Centre — East Tower

2900, 111 - 5th Avenue S.W.

Calgary, Alberta T2P 3Y6, Canada

Tel: (403) 233-0224

(Address and telephone number of Registrant's principal executive offices) |

John K. Whelan, Esq.

Carter Ledyard & Milburn LLP, 2 Wall Street, New York, New York 10005

Tel: (212) 732-3200

(Name, address, (including zip code) and telephone number (including area code) of agent for service in the United States)

Copies to: |

Brad D. Markel, Esq.

Bennett Jones LLP

4500 Bankers Hall East

855 - 2nd Street S.W.

Calgary, Alberta T2P 4K7

Canada

Tel: (403) 298-3100 | | David A. Spencer, Esq.

Fraser Milner Casgrain LLP

30th Floor, Fifth Avenue Place

237 - 4th Avenue S.W.

Calgary, Alberta T2P 4X7

Canada

Tel: (403) 268-7000 |

Province of Alberta, Canada

(Principal jurisdiction regulating this offering (if applicable))

Approximate date of commencement of proposed sale to the public:

As soon as possible after this registration statement becomes effective.

It is proposed that this filing shall become effective (check appropriate box)

- A.

- ý upon filing with the Commission, pursuant to Rule 467(a) (if in connection with an offering being made contemporaneously in the United States and Canada)

- B.

- o at some future date (check the appropriate box below)

- 1.

- o pursuant to Rule 467(b) on (date) at (time) (designate a time not sooner than 7 calendar days after filing).

- 2.

- o pursuant to Rule 467(b) on (date) at (time) (designate a time 7 calendar or sooner days after filing) because the securities regulatory authority in the review jurisdiction has issued a receipt or notification of clearance on (date).

- 3.

- o pursuant to Rule 467(b) as soon as practicable after notification of the Commission by the Registrant or the Canadian securities regulatory authority of the review jurisdiction that a receipt or notification of clearance has been issued with respect hereto.

- 4.

- o after the filing of the next amendment to this Form (if preliminary material is being filed).

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to the home jurisdiction's shelf prospectus offering procedures, check the following box.o

CALCULATION OF REGISTRATION FEE

|

Title of each class of securities to be registered

| | Amount to be registered

| | Proposed maximum offering price per unit

| | Proposed maximum aggregate offering price(1)

| | Amount of registration fee

|

|---|

|

| Trust Units | | 8,500,000 | | $12.32 (U.S.)(1) | | $104,720,000 (U.S.) | | $8,471.85 (U.S.) |

|

- (1)

- Estimated solely for the purpose of determining the registration fee. The proposed maximum price per Trust Unit is $16.95 (Canadian), which has been converted into United States dollars using the noon buying rate on July 11, 2003, in New York City for cable transfers in Canadian dollars, as certified for customs purposes by the Federal Reserve Bank of New York ($1 Canadian = $.7266 U.S.).

If, as a result of stock splits, stock dividends or similar transactions, the number of securities purported to be registered on this registration statement changes, the provisions of Rule 416 shall apply to this registration statement.

PART I

INFORMATION REQUIRED TO BE DELIVERED TO OFFEREES OR PURCHASERS

Item 1. Home Jurisdiction Document

This Registration Statement contains two forms of prospectus: one to be used in the United States in connection with the offering of Trust Units (the "U.S. Prospectus") and one to be used in connection with the offering of Trust Units in Canada (the "Canadian Prospectus"). The two forms of prospectus are identical except that they contain different front covers and tables of contents. In addition, only the Canadian Prospectus includes certificates of the Registrant and the Underwriters and the section titled "Statutory Rights of Withdrawal and Rescission," and only the U.S. Prospectus includes the sections titled "Exchange Rate Table," "Presentation of Our Reserve Information," "Certain Canadian Federal Income Tax Considerations — Non-Residents of Canada," "Certain United States Federal Income Tax Considerations," "Available Information," "Documents Filed as Part of the U.S. Registration Statement," "Comments for United States Readers on Differences Between Canadian and United States Reporting Standards" (in Appendix A to the U.S. Prospectus), "Reconciliation of Schedule of Revenue and Expenses associated with the northern British Columbia oil and natural gas assets acquired from the Calpine Canada Natural Gas Partnership by Pengrowth Corporation to United States Generally Accepted Accounting Principles" (in Appendix B of the U.S. Prospectus), and "Reconciliation of Interim Consolidated Financial Statements of Pengrowth Energy Trust for the Three Months Ended March 31, 2003 to United States Generally Accepted Accounting Principles" (Exhibit 4.7 to this Registration Statement). The form of U.S. Prospectus is included in its entirety beginning on the next page and is followed by only those pages in the Canadian Prospectus that differ from those in the U.S. Prospectus.

Item 2. Additional Information

Reconciliations of Canadian financial statements to U.S. GAAP appear (1) on pages 76-80 of the Registrant's 2002 Annual Report, which is Appendix B to the Registrant's Annual Report on Form 40-F for the fiscal year ended December 31, 2002, and (2) as Exhibits 4.7 and 4.8 to this Registration Statement.

Item 3. Informational Legends

The legends required by this Item 3 appear on the front cover page of the U.S. Prospectus.

Item 4. Incorporation of Certain Information by Reference

See the Exhibits 4.1 through 4.6 listed in the Exhibit Index in Part II of this Registration Statement. As noted on page 6 of the U.S. Prospectus, copies of such exhibits may be obtained upon request, without charge, from the Corporate Secretary, Pengrowth Corporation, Petro-Canada Centre — East Tower, 2900, 111 - 5th Avenue S.W., Calgary, Alberta T2P 3Y6, Canada, Telephone (403) 233-0224.

Item 5. List of Documents Filed with the Commission

See the list of documents in the U.S. Prospectus under the caption "Documents Filed as Part of the U.S. Registration Statement."

I-1

PENGROWTH ENERGY TRUST

$144,075,000 (Canadian)

8,500,000 Trust Units

This short form prospectus qualifies the distribution of 8,500,000 trust units of Pengrowth Energy Trust at a price of $16.95 (Canadian) per trust unit. Pengrowth Energy Trust is a publicly traded oil and gas royalty trust created in 1988 that is governed by the laws of the Province of Alberta. The trust units covered by this prospectus will not be offered or sold by the underwriters to the public in the United States.

Our outstanding trust units are listed and posted for trading on the Toronto Stock Exchange (the "TSX") under the symbol PGF.UN, and on the New York Stock Exchange (the "NYSE") under the symbol PGH. On July 21, 2003, the closing price of a trust unit was $16.95 (Canadian) on the TSX and $12.04 (U.S.) on the NYSE. We have applied to list the trust units offered hereby on the TSX and the NYSE. The TSX and the NYSE have conditionally approved the listing of the trust units offered hereby, subject to Pengrowth Energy Trust fulfilling all of the requirements of such exchanges.

We pay distributions on the 15th day of each month to unitholders of record on the 10th business day preceding payment. Subscribers for trust units will be eligible to receive all distributions commencing August 15, 2003.

Pengrowth Energy Trust is a Canadian issuer that is permitted, under a multijurisdictional disclosure system adopted by the U.S. Securities and Exchange Commission, to prepare this prospectus in accordance with the disclosure requirements of Canada. You should be aware that these requirements are different from those of the United States. Pengrowth Energy Trust's consolidated financial statements incorporated by reference in this prospectus have been prepared in accordance with Canadian generally accepted accounting principles, and they are subject to Canadian auditing and auditor independence standards, and thus may not be comparable to financial statements of United States companies. In addition, some of the reserve information incorporated by reference in this prospectus is not comparable to the disclosure of reserves by United States oil and gas producers. See "Presentation of Our Reserve Information" on page 5.

Your acquisition of trust units may subject you to tax consequences, both in the United States and in Canada. This prospectus may not describe these tax consequences fully. You should read the tax discussion under the caption "Certain United States Federal Income Tax Considerations." You should also consult your own tax advisor with respect to your own particular circumstances.

Your ability to enforce civil liabilities under the United States federal securities laws may be affected adversely because Pengrowth Energy Trust is organized under the laws of Alberta, Canada, the officers and directors of its administrator — Pengrowth Corporation — and its manager — Pengrowth Management — and the experts named in this prospectus are Canadian residents, and most of the assets of Pengrowth Energy Trust and of such other persons may be located in Canada.

Neither the Securities and Exchange Commission nor any state securities regulator has approved or disapproved these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

PRICE: $16.95 (Canadian) per Trust Unit

| | Offering Price

| | Underwriters' Fee

| | Net Proceeds to Pengrowth Energy Trust(1)

|

|---|

| | (Dollar Amounts are in Canadian dollars)

|

|---|

| Per Trust Unit | | $16.95 | | $0.8475 | | $16.1025 |

| Total | | $144,075,000 | | $7,203,750 | | $136,871,250 |

Notes:

- (1)

- Before deducting expenses of this offering estimated to be $300,000 (Canadian), which, together with the underwriters' fee, will be paid from the general funds of Pengrowth Energy Trust.

RBC Dominion Securities Inc. (as lead underwriter), BMO Nesbitt Burns Inc., CIBC World Markets Inc., TD Securities Inc., National Bank Financial Inc., HSBC Securities (Canada) Inc., Scotia Capital Inc., Canaccord Capital Corporation, Dundee Securities Corporation, Raymond James Ltd., FirstEnergy Capital Corp. and Peters & Co. Limited, as principals, conditionally offer the trust units, subject to prior sale, if, as and when issued by us and accepted by them in accordance with the conditions contained in the underwriting agreement referred to under "Plan of Distribution" and subject to the approval of certain legal matters by Bennett Jones LLP, on our behalf, and by Fraser Milner Casgrain LLP, on behalf of the underwriters.Pengrowth Energy Trust may be considered to be a connected issuer under Canadian securities laws to RBC Dominion Securities Inc., BMO Nesbitt Burns Inc., CIBC World Markets Inc., TD Securities Inc., National Bank Financial Inc., HSBC Securities (Canada) Inc. and Scotia Capital Inc. as these underwriters are subsidiaries of Canadian chartered banks which are lenders to Pengrowth Corporation and to which Pengrowth Corporation is presently indebted. See "Relationship Between Pengrowth Corporation and Certain Underwriters".

The underwriters may over-allot or effect transactions which stabilize or maintain the market price of the trust units at levels other than those which might otherwise prevail in the open market. See "Plan of Distribution".

Subscriptions will be received subject to rejection or allotment, in whole or in part, and the right is reserved to close the subscription books at any time without notice. Closing of this offering is expected to occur on or about July 23, 2003, or such later date as Pengrowth Energy Trust and the underwriters may agree, but in any event not later than July 31, 2003. Definitive certificates representing the trust units will be available for delivery at closing.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any jurisdiction where the offer is not permitted. You should not assume that the information in this prospectus is accurate as of any date other than the date on the front of this prospectus.

TABLE OF CONTENTS

|

| | Page

|

|---|

| Exchange Rate Table | | 3 |

| Important Terms Used in this Prospectus | | 4 |

| Presentation of Our Reserve Information | | 5 |

| Documents Incorporated by Reference | | 6 |

| Forward-Looking Statements | | 7 |

| Pengrowth Energy Trust | | 8 |

| Recent Developments | | 9 |

| Use of Proceeds | | 12 |

| Capitalization of Pengrowth Trust | | 12 |

| Trust Units | | 13 |

| Distributions | | 14 |

| Plan of Distribution | | 15 |

| Relationship Between Pengrowth Corporation and Certain Underwriters | | 15 |

| Certain Canadian Federal Income Tax Considerations | | 17 |

| Certain United States Federal Income Tax Considerations | | 21 |

| Risk Factors | | 28 |

| Auditors, Transfer Agent and Registrar | | 28 |

| Available Information | | 28 |

| Documents Filed as Part of the U.S. Registration Statement | | 29 |

| Eligibility for Investment | | 29 |

| Legal Matters | | 30 |

| Interests of Experts | | 30 |

| Appendix A — | Compilation Report of KPMG LLP and Unaudited Pro Forma Consolidated Financial Statements of Pengrowth Trust | | A-1 |

| Appendix B — | Auditors' Report of KPMG LLP and Schedule of Revenues and Expenses | | B-1 |

2

EXCHANGE RATE TABLE

All dollar amounts set forth in this prospectus and in the documents incorporated by reference herein are Canadian dollars, except where otherwise indicated.

The following table sets forth certain exchange rates based on the inverse of the noon buying rate in New York City for cable transfers in Canadian dollars as certified for customs purposes by the Federal Reserve Bank of New York. The rates are set forth as United States dollars per $1.00 (Canadian). On July 21, 2003, the inverse of the noon buying rate was $0.7116 (U.S.) per $1.00 (Canadian).

| | Year ended December 31,

| | Three months ended March 31,

|

|---|

| | 1998

| | 1999

| | 2000

| | 2001

| | 2002

| | 2002

| | 2003

|

|---|

| Rate at end of period | | $ | 0.6504 | | $ | 0.6925 | | $ | 0.6669 | | $ | 0.6279 | | $ | 0.6329 | | $ | 0.6266 | | $ | 0.6805 |

| Average rate during period* | | | 0.6714 | | | 0.6745 | | | 0.6725 | | | 0.6444 | | | 0.6368 | | | 0.6260 | | | 0.6689 |

| High | | | 0.7105 | | | 0.6925 | | | 0.6969 | | | 0.6697 | | | 0.6612 | | | 0.6342 | | | 0.6822 |

| Low | | | 0.6341 | | | 0.6535 | | | 0.6410 | | | 0.6241 | | | 0.6209 | | | 0.6200 | | | 0.6349 |

- *

- The average of exchange rates on the last day of each month during these periods.

3

IMPORTANT TERMS USED IN THIS PROSPECTUS

We have avoided the use of technical defined terms in this prospectus whenever possible, but a few frequently recurring terms may be useful for you to have in mind:

- •

- Computershare refers to Computershare Trust Company of Canada;

- •

- Pengrowth Trust refers to Pengrowth Energy Trust;

- •

- Pengrowth Management refers to Pengrowth Management Limited;

- •

- unitholders refers to the holders of trust units issued by Pengrowth Trust; and

- •

- we,us,our andPengrowth refer to Pengrowth Energy Trust and Pengrowth Corporation on a consolidated basis.

All dollar amounts in this prospectus are expressed in Canadian dollars, except where otherwise indicated. References to "$" or "Cdn$" are to Canadian dollars and references to "US$" are to United States dollars.

4

PRESENTATION OF OUR RESERVE INFORMATION

The United States Securities and Exchange Commission (the "SEC") generally permits oil and gas companies, in their filings with the SEC, to disclose only proved reserves after the deduction of royalties and interests of others which are those reserves that a company has demonstrated by actual production or conclusive formation tests to be economically producible under existing economic and operating conditions. Canadian securities laws permit oil and gas companies, in their filings with Canadian securities regulators, to disclose not only proved reserves but also probable reserves, and to disclose reserves and production on a gross basis before deducting royalties. Probable reserves are of a higher risk and are generally believed to be less likely to be accurately estimated or recovered than proved reserves. Because we are permitted to prepare this prospectus and the documents incorporated by reference herein in accordance with Canadian disclosure requirements, we have disclosed in the documents incorporated by reference reserves designated as "probable" and "established." The SEC's guidelines strictly prohibit reserves in these categories from being included in filings with the SEC that are required to be prepared in accordance with U.S. disclosure requirements. Moreover, we have determined and disclosed estimated future net cash flow from our reserves using both constant and escalated prices and costs, whereas the SEC generally requires that prices and costs be held constant at levels in effect at the date of the reserve report. In addition, the estimates of reserves included in the documents incorporated by reference based on constant prices and costs, as reflected in the report prepared by Gilbert Laustsen Jung Associates Ltd. dated February 7, 2003 having an effective date of December 31, 2002, were prepared using prices in effect as of December 31, 2002, held constant for the economic life of the reserves. For a description of these and additional differences between Canadian and U.S. standards of reporting reserves, see "Risk Factors — Canadian and United States practices differ in reporting reserves and production" in our Renewal Annual Information Form dated May 15, 2003, which is a document incorporated by reference in this prospectus.

5

DOCUMENTS INCORPORATED BY REFERENCE

Information has been incorporated by reference in this prospectus from documents filed with securities commissions or similar authorities in Canada. Copies of the documents incorporated by reference may be obtained on request without charge from the Corporate Secretary of Pengrowth Corporation at 2900, 111 - 5th Avenue S.W., Calgary, Alberta T2P 3Y6 (telephone: (403) 233-0224). For the purpose of the Province of Québec, this simplified prospectus contains information to be completed by consulting the permanent information record. A copy of the permanent information record may be obtained from the Corporate Secretary of Pengrowth Corporation at the above-mentioned address and telephone number. These documents are also available through the internet on the System for Electronic Document Analysis and Retrieval (SEDAR) which can be accessed atwww.sedar.com.

The following documents of Pengrowth Trust filed with securities commissions or similar authorities in Canada and the U.S. Securities and Exchange Commission are incorporated by reference into this prospectus:

- (a)

- Renewal Annual Information Form dated May 15, 2003;

- (b)

- Management's Discussion and Analysis for the year ended December 31, 2002 contained on pages 40 to 53, inclusive, of the 2002 Annual Report of Pengrowth Trust;

- (c)

- Comparative financial statements for the years ended December 31, 2002, together with the report of the auditors thereon, contained on pages 58 to 80 of the 2002 Annual Report of Pengrowth Trust;

- (d)

- Information Circular — Proxy Statement dated May 12, 2003 for the Special and Annual Meeting of Pengrowth Trust unitholders held on June 17, 2003 (excluding Schedule B-5 and those portions which appear under the headings "Part I — General Information for all Meetings — Executive Compensation — Performance Graph" and "Part II — Corporate Governance");

- (e)

- Management's Discussion and Analysis for the three month period ended March 31, 2003, contained on pages 4 to 9, inclusive, of the First Quarter Results March 31, 2003 of Pengrowth Trust; and

- (f)

- Comparative unaudited interim financial statements for the three month period ended March 31, 2003, contained on pages 10 to 17, inclusive, of the First Quarter Results March 31, 2003 of Pengrowth Trust.

Any material change reports (excluding confidential reports), comparative interim financial statements, comparative annual financial statements and the auditors' report thereon and information circulars (excluding those portions that are not required pursuant to National Instrument 44-101 of the Canadian Securities Administrators to be incorporated by reference herein) filed by Pengrowth Trust with a securities commission or similar authority in Canada after the date of this prospectus and prior to the termination of the distribution, shall be deemed to be incorporated by reference into this prospectus.

Any statement contained in a document incorporated or deemed to be incorporated by reference in this prospectus shall be deemed to be modified or superseded, for purposes of this prospectus, to the extent that a statement contained in this prospectus or in any other subsequently filed document that also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of a modifying or superseding statement shall not be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it is made. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

6

FORWARD-LOOKING STATEMENTS

Certain statements contained in this prospectus, including certain documents incorporated by reference in this prospectus, constitute forward-looking statements. The use of any of the words "anticipate", "continue", "estimate", "expect", "may", "will", "project", "should", "believe" and similar expressions are intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in our forward-looking statements. We believe the expectations reflected in those forward-looking statements are reasonable. However, we cannot assure you that these expectations will prove to be correct. You should not unduly rely on forward-looking statements included, or incorporated by reference, in this prospectus. These statements speak only as of the date of this prospectus or as of the date specified in the documents incorporated by reference in this prospectus, as the case may be. We undertake no obligation to publicly update or revise any forward-looking statements.

In particular, this prospectus, including the documents incorporated by reference, contains forward-looking statements pertaining to the following:

- •

- the size of our reserves;

- •

- oil and natural gas production levels;

- •

- projections of market prices and costs and the related sensitivities of distributions;

- •

- supply and demand for oil and natural gas;

- •

- expectations regarding the ability to raise capital and to continually add to our reserves through acquisitions and exploration and development; and

- •

- treatment under governmental regulatory regimes.

Our actual results could differ materially from those anticipated in these forward-looking statements as a result of the risk factors set forth below and elsewhere in this prospectus:

- •

- volatility in market prices for oil and natural gas;

- •

- liabilities inherent in our oil and gas operations;

- •

- uncertainties associated with estimating reserves;

- •

- competition for, among other things, capital, reserves, undeveloped lands and skilled personnel;

- •

- incorrect assessments of the value of our acquisitions;

- •

- geological, technical, drilling and processing problems; and

- •

- the other factors discussed under "Risk Factors" in our Renewal Annual Information Form dated May 15, 2003.

These factors should not be construed as exhaustive. We undertake no obligation to publicly update or revise any forward-looking statements.

7

PENGROWTH ENERGY TRUST

Introduction

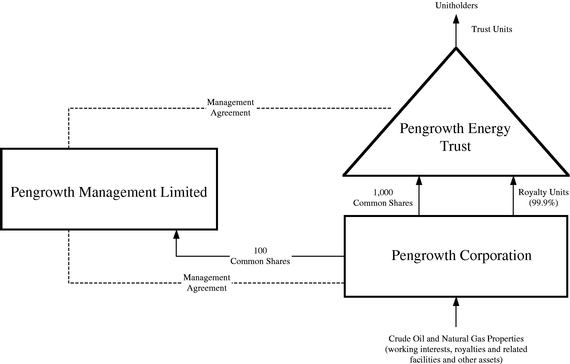

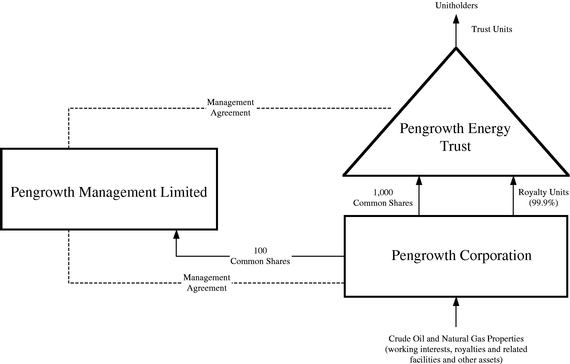

Pengrowth Trust is an oil and gas royalty trust that was created under the laws of the Province of Alberta on December 2, 1988. The purpose of Pengrowth Trust is to purchase and hold royalty units issued by Pengrowth Corporation, its majority owned subsidiary, and to issue trust units to members of the public. Pengrowth Corporation acquires, owns and manages working interests and royalty interests in oil and natural gas properties. Pengrowth Trust and Pengrowth Corporation are managed by Pengrowth Management.

Pengrowth Energy Trust

Pengrowth Trust is governed by a trust indenture between Pengrowth Corporation and Computershare, as trustee. In 1996, Pengrowth Trust's original name, "Pengrowth Gas Income Fund", was changed to "Pengrowth Energy Trust".

Under the trust indenture, Pengrowth Trust has issued trust units to unitholders. The beneficiaries of Pengrowth Trust are the unitholders. Each trust unit represents a fractional undivided beneficial interest in Pengrowth Trust. Our unitholders are entitled to receive monthly distributions in respect of the royalty Pengrowth Corporation pays to the holders of the royalty units it has issued, and in respect of investments that are held directly by us.

Pengrowth Trust presently holds 90.9% of the outstanding common shares and approximately 99.9% of the royalty units issued by Pengrowth Corporation. In addition, Pengrowth Trust holds other permitted investments, including oil and gas processing facilities and cash.

Pengrowth Corporation

Pengrowth Corporation was created under the laws of the Province of Alberta on December 30, 1987. The name of Pengrowth Corporation was changed from "Pengrowth Gas Corporation" to "Pengrowth Corporation" in 1998. Pengrowth Corporation has 1,100 common shares outstanding, 1,000 of which are owned by Pengrowth Trust and 100 of which are owned by Pengrowth Management.

Pengrowth Corporation acquires, owns and operates working interests and royalty interests in oil and natural gas properties. Pengrowth Corporation has issued royalty units which entitle the holders thereof to receive a 99% share of the "royalty income" related to the oil and natural gas interests of Pengrowth Corporation.

Pursuant to a unanimous shareholder agreement among Pengrowth Management, Pengrowth Trust, Pengrowth Corporation and Computershare, our unitholders and the holders of royalty units of Pengrowth Corporation (other than Pengrowth Trust) are entitled to notice of, and to attend and vote at, all meetings of shareholders of Pengrowth Corporation, including voting on the election of the directors of Pengrowth Corporation (with the exception of two directors which are appointed by Pengrowth Management), approving its financial statements, appointing its auditor and appointing the auditor of Pengrowth Trust.

At the annual and special meeting of shareholders of Pengrowth Corporation and the annual and special meeting of unitholders, both of which were held on June 17, 2003, the creation of exchangeable shares of Pengrowth Corporation was authorized. The exchangeable shares will have economic and voting rights equivalent to the trust units of Pengrowth Trust and will be exchangeable for trust units at any time. They do not receive dividends and will not receive distributions from Pengrowth Trust, but will receive additional exchangeable shares in lieu of distributions. These additional exchangeable shares would be distributed by way of a stock split. To facilitate voting rights for the exchangeable shares, a special voting unit of Pengrowth Trust has been authorized which will be entitled at any meeting of unitholders to a number of votes equal to the number of outstanding exchangeable shares (not including exchangeable shares held by Pengrowth Trust or its subsidiaries). There are presently no issued or outstanding exchangeable shares.

Investing in our trust units is subject to certain restrictions, including the restriction on ownership of trust units by non-residents. See "Trust Units — Limitation on Non-Resident Ownership". In addition, certain institutional investors are precluded from holding trust units due to the uncertainty in the law relating to trusts regarding the limited liability of unitholders for the obligations of Pengrowth Trust. Non-resident investors may be subject to withholding taxes and other taxes which may not be deductible in the jurisdiction of residence of the investor or reclaimable by the investor. These restrictions have the effect of limiting the potential investors in Pengrowth Trust, thereby restricting the availability of financing for Pengrowth Trust. The exchangeable shares will be equivalent to trust units, but may not be subject to these restrictions, including the non-resident ownership restriction, and will thereby provide greater access to additional equity financing for Pengrowth Trust.

Pengrowth Management

Pengrowth Management was created under the laws of the Province of Alberta on December 16, 1982.

The principal business of Pengrowth Management is that of a specialty fund manager. Pengrowth Management currently provides advisory, management, and administrative services to Pengrowth Trust and to Pengrowth Corporation. Pengrowth Management also attends to the acquisition, development, operation and disposition of oil and natural gas properties and other related assets.

8

James S. Kinnear, President and a director of Pengrowth Management and Chairman, President, Chief Executive Officer and a director of Pengrowth Corporation, owns, directly or indirectly, all of the issued and outstanding voting securities of Pengrowth Management.

The following chart illustrates our organization and structure.

RECENT DEVELOPMENTS

Borrowing and Interest Rate Swaps

On April 23, 2003, Pengrowth completed a US$200 million private placement of senior unsecured notes to a group of U.S. investors. The notes were offered in two tranches: US$150 million at 4.93% due April 23, 2010 and US$50 million at 5.47% due April 23, 2013. Interest on the notes is payable semi-annually. Proceeds from the notes were used to pay down existing bank debt.

In June 2003, Pengrowth Corporation negotiated a $225 million revolving credit facility syndicated among eight financial institutions. This credit facility is extendible on a 364 day revolving basis which if not extended will result in a two year amortization term. In addition, Pengrowth Corporation has a $35 million demand operating line of credit.

Pengrowth had previously hedged the interest rates in respect of $125 million of bank debt using fixed rate swaps. Following the successful private placement of the senior unsecured notes to the U.S. investors, Pengrowth terminated $75 million in swaps at a cost of approximately $1 million including accrued interest. Pengrowth has two fixed rate swaps that remain outstanding on a total of $50 million of bank debt. The first swap on $25 million of debt has a fixed rate of 4.22% and expires November 30, 2004. The second swap on $25 million of debt has a fixed rate of 4.34% and expires March 4, 2005.

SOEP Processing Facilities Acquisition

On May 7, 2003, Pengrowth Corporation acquired an 8.4% working interest in the four Sable Offshore Energy Project ("SOEP") production facilities downstream of the Thebaud Central Platform from SOEP co-venturers ExxonMobil Canada Properties, Shell Canada Resources Limited, Imperial Oil Limited and Mosbacher Operating Company Ltd. in conjunction with the adjustment of various operating and processing expenses (in respect of SOEP interests previously held by Pengrowth Corporation) with Emera Offshore Inc. for net consideration of approximately $57 million. As a result of this acquisition Pengrowth Corporation will no longer be paying transportation and processing fees in respect to the downstream facilities (not including the offshore platforms) and the economic interests of Pengrowth Corporation will be better aligned with those of the other SOEP co-venturers. Pengrowth Corporation will continue to pay Emera Offshore Inc. processing fees for the use of its 8.4% interest in the SOEP platform facilities upstream of and including the Thebaud Central Platform.

The SOEP production facilities downstream of the Thebaud Central Platform are comprised of:

- •

- a sub-sea pipeline from the Thebaud Central Platform to shore;

9

- •

- the Goldboro Gas Plant;

- •

- a natural gas liquids pipeline between the Goldboro Gas Plant and the Point Tupper Fractionation Facility; and

- •

- the Point Tupper Fractionation Facility.

Amended Management Agreement

Approval

At the annual and special meeting of unitholders and the special meeting of royalty unitholders, both of which were held on June 17, 2003, both the unitholders and the royalty unitholders approved an amended management agreement governing both Pengrowth Trust and Pengrowth Corporation.

Alignment with Unitholders

The amended management agreement enhances the alignment of the interests of Pengrowth Management with those of the unitholders through:

- •

- a reduced management fee base;

- •

- the elimination of acquisition fees;

- •

- a performance based fee based on total returns received by unitholders which essentially compensates Pengrowth Management for total returns exceeding 8% over a 3-year period;

- •

- a ceiling on total fees payable determined in reference to a percentage of the fees paid under the previous management agreement;

- •

- two distinct 3-year terms with a declining fee structure in the second 3-year term;

- •

- key man provisions in respect of James S. Kinnear, the President of Pengrowth Management;

- •

- enhanced corporate governance; and

- •

- an enhanced bonus structure for employees and special consultants of Pengrowth Corporation.

Responsibilities

The responsibilities of Pengrowth Management under the amended management agreement include:

- •

- reviewing and negotiating acquisitions for Pengrowth Corporation and Pengrowth Trust;

- •

- providing written reports to the Board of Directors of Pengrowth Corporation to keep Pengrowth Corporation fully informed about the acquisition, exploration, development, operation and disposition of properties, the marketing of petroleum substances, risk management practices and forecasts as to market conditions;

- •

- providing services for Pengrowth Corporation in connection with its acting as operator of certain of its properties;

- •

- maintaining records in respect of the activities of Pengrowth Corporation and Pengrowth Trust;

- •

- supervising, training and providing leadership to the employees and consultants of Pengrowth Corporation and assisting in recruitment of key employees of Pengrowth Corporation;

- •

- arranging for professional services for Pengrowth Corporation and Pengrowth Trust, including arranging audit, legal, insurance, petroleum engineering and geological services;

- •

- arranging for and negotiating on behalf of and in the name of Pengrowth Corporation all contracts with third parties for the proper management and operation of the properties of Pengrowth Corporation;

- •

- arranging for borrowings by Pengrowth Corporation and equity issuances by Pengrowth Trust;

- •

- promoting the reputation of Pengrowth Corporation and Pengrowth Trust through investor relations and through sponsorship and other charitable activities; and

- •

- conducting general unitholder services, including accounting in respect of distributions to unitholders and the preparation of related audited financial statements, maintaining regulatory compliance, providing information to unitholders in respect of material changes in the business of Pengrowth Corporation or Pengrowth Trust and all other reports required by law, and calling, holding and distributing material in respect of meetings of holders of trust units and royalty units.

10

Despite the broad authority of Pengrowth Management, approval of the Board of Directors of Pengrowth Corporation is required on decisions relating to any offerings, including the issuance of additional trust units, acquisitions in excess of $5 million, annual operating and capital expenditure budgets, the establishment of credit facilities, the determination of cash distributions to the holders of trust units, the amendment of any of the constating documents of Pengrowth Corporation or Pengrowth Trust and the amount of the assumed expenses of Pengrowth Management which are a portion of the compensation of Pengrowth Management.

Compensation and Fees

Under the amended management agreement, Pengrowth Management receives a base fee and a performance fee.

Base Fee. The base fee is an amount equal to: (A) for each full calendar year and each partial calendar year in the first three-year contract term: (i) 2% of the first $200 million of Income; and (ii) 1% of the balance of Income over $200 million; and (B) for each full calendar year and each partial calendar year in the second three-year contract term: (i) 1.5% of the first $200 million of Income; and (ii) 0.5% of the balance of Income over $200 million. For these purposes, "Income" means the aggregate of net production revenue of Pengrowth Corporation and any other income earned from permitted investments of Pengrowth Trust (excluding interest on cash or near-cash deposits or similar investments).

Performance Fee. The performance fee is an amount equal to: (A) for each full calendar year and each partial calendar year in the first three-year contract term, 3% of the Average Excess Return Amount; and (B) for each full calendar year and each partial calendar year in the second three-year contract term, 1.5% of the Average Excess Return Amount. For these purposes: (1) "Average Excess Return Amount" means an amount equal to the product of: (A) the average of Excess Return Percentage for the relevant year (or portion thereof) and the two immediately preceding calendar years; and (B) the Three Year Market Capitalization for the relevant year (or portion thereof); (2) "Excess Return Percentage" means, for a period, (A) the rate of return percentage to a unitholder, based on (i) the difference between the 20 day weighted average trading price of our trust units at the end of the period and the 20 day weighted average trading price of our trust units at the beginning of the period, plus the cash distributions per trust unit over the period, divided by (ii) the 20 day weighted average trading price of our trust units at the beginning of the period, minus (B) eight percent (8%); and (3) "Three Year Market Capitalization" for a period, means an amount equal to the weighted average number of trust units outstanding over the period and the two immediately preceding calendar years, taken as a whole, and multiplied by the 20 day weighted average trading price at the beginning of the earlier of such preceding calendar years.

Annual Maximum Fee. During each full or partial calendar year during the first three-year contract term, the maximum fee (base fee plus performance fee) shall be 80% of the aggregate fees that would have been payable under the previous management agreement as if it continued in force (the "Old Fee"). During each full or partial calendar year during the second three-year contract term, the maximum fee (base fee plus performance fee) shall be 60% of the Old Fee, not to exceed $12 million in any calendar year, provided that the maximum fee for the calendar year 2006, taken as a whole, will not exceed 80% of the Old Fee for the first six months, plus the lesser of: (A) 60% of the Old Fee for the second six months; and (B) $6 million.

Expenses. Pengrowth Management is required to incur and pay, without reimbursement by Pengrowth Corporation or Pengrowth Trust, approximately $2.0 million per year of expenses, subject to adjustment from time to time by Pengrowth Management and the Board of Directors of Pengrowth Corporation (the "Assumed Expenses"), subject to the approval of the Board of Directors of Pengrowth Corporation, for the general benefit of Pengrowth Corporation and/or Pengrowth Trust, of a character similar to those presently incurred by Pengrowth Management, specifically including all bonus pool payments. Pengrowth Management will provide quarterly reports to the Board of Directors of Pengrowth Corporation summarizing the Assumed Expenses. In the event that the Assumed Expenses aggregate less than $2.0 million per calendar year, the total of the base fee and performance fee for such year will be reduced by the amount such expenses are less than $2.0 million per calendar year. If the Assumed Expenses are more than $2.0 million per calendar year, such excess will be reimbursed by Pengrowth Corporation.

Annual Minimum Fee. Pengrowth Management is entitled to a minimum annual management fee of $3.6 million comprised of $1.6 million in management fees (base fees plus performance fees) and $2.0 million in Assumed Expenses.

Bonus Pool

As an incentive to officers, employees and special consultants of Pengrowth Corporation (other than James S. Kinnear), 10% of the aggregate of the base fee and performance fee will be used by Pengrowth Management to fund a bonus pool which will be paid as directed by Pengrowth Management in consultation with, and in certain cases subject to the approval of, the Corporate Governance/Compensation Committee of the Board of Directors of Pengrowth Corporation.

Term and Termination

The amended management agreement commenced on July 1, 2003 for 2 three-year contract terms. The agreement does not obligate Pengrowth Trust to compensate Pengrowth Management after the expiry of the second term.

11

Pengrowth Corporation may terminate the amended management agreement at any time from October 1, 2005 until March 31, 2006 by written notice to Pengrowth Management, at the sole discretion of the independent directors of Pengrowth Corporation, upon payment of an amount equal to the sum of: (A) two-thirds of the aggregate management fees (base fee plus performance fee) paid in the first three-year term; and (B) an amount in respect of severance reasonably attributable to the employees, consultants, services or equipment employed by Pengrowth Management in the provision of services under the amended management agreement. If the agreement is so terminated, Pengrowth Management shall continue to provide the services contemplated by the amended management agreement, and the amended management agreement shall remain in full force and effect, until June 30, 2006. Pengrowth Management may terminate the amended management agreement on six (6) months notice without penalty or other amount.

Key Man Provisions

The amended management agreement provides that Pengrowth Management shall cause James S. Kinnear to devote that amount of his time and attention to the provision of the services by Pengrowth Management, as is consistent with past practice. The amended management agreement also provides that Pengrowth Corporation may terminate the agreement if Mr. Kinnear dies or otherwise fails or becomes unable to devote that amount of time and attention as is consistent with past practice, provided that certain fees are payable to Pengrowth Management if the agreement is terminated before June 30, 2006.

USE OF PROCEEDS

The estimated net proceeds that we will receive from this offering, after deducting the estimated expenses of this offering of $300,000 and the underwriters' fee of $7,203,750, will be $136,571,250. The net proceeds from this offering will be paid by Pengrowth Trust to Pengrowth Corporation all or primarily through the subscription for additional royalty units of Pengrowth Corporation, with any remainder to be paid by Pengrowth Trust to Pengrowth Corporation as a loan or otherwise provided to Pengrowth Corporation, such allocation to be determined based upon the relevant tax balances in Pengrowth Corporation. Pengrowth Corporation will, in turn, use a portion of such funds to reduce outstanding indebtedness under our credit facilities, a portion of which was incurred to acquire an 8.4% working interest in the SOEP processing facilities downstream of the Thebaud Central Platform (see "Recent Developments"), and the remainder will be used to fund future acquisitions and capital expenditures, and for general corporate purposes.

CAPITALIZATION OF PENGROWTH TRUST

The following table sets forth the consolidated capitalization of Pengrowth at December 31, 2002 and as at March 31, 2003 (both before and after giving effect to this offering):

Description and Amount Authorized

| | As at

December 31, 2002

| | As at

March 31, 2003

| | As at March 31, 2003,

after giving effect to

this offering

| |

|---|

| | (audited,

in thousands)

| | (unaudited,

in thousands)

| | (unaudited,

in thousands)

| |

|---|

| Long-term Debt(1) | | $ | 316,501 | | $ | 307,226 | | $ | 170,655 | (3)(4) |

| Unitholders' Equity(2) | | $ | 1,053,939 | | $ | 1,024,162 | | $ | 1,160,733 | (3) |

| Trust units (500,000,000 maximum)(2) | | | 110,562 | | | 111,021 | | | 119,521 | (3) |

Notes:

- (1)

- In April 2003, Pengrowth Corporation closed a US$200 million private placement of senior unsecured notes to a group of U.S. institutional investors. The notes are in two tranches: US$150 million 4.93% senior notes due April 23, 2010 and US$50 million 5.47% senior notes due April 23, 2013. In addition, Pengrowth Corporation has a $225 million revolving credit facility syndicated among eight financial institutions that is extendible on June 18, 2004 for a 364 day revolving period, which if not extended will result in a two year amortization term. These arrangements replace a single $540 million revolving credit facility that had been in place on December 31, 2002. Pengrowth Corporation also has a $35 million demand operating line of credit.

- (2)

- As at December 31, 2002 and March 31, 2003, we had outstanding options and rights to acquire an aggregate of 6,415,231 and 6,297,734 trust units, respectively, pursuant to our Trust Unit Option Plan and Trust Unit Rights Incentive Plan.

- (3)

- Based on the issuance of 8,500,000 trust units by Pengrowth Trust in this offering for estimated net proceeds of $136,571,250, after deducting the underwriters' fees of $7,203,750 and the other expenses of the issue estimated to be $300,000 and the application of the proceeds therefrom as detailed under "Use of Proceeds".

- (4)

- Long-term debt as at March 31, 2003, after giving effect to this offering, is net of the entire net proceeds of this offering, a portion of which will not be applied to long-term debt but will be used to fund future acquisitions and capital expenditures, and for general corporate purposes.

12

TRUST UNITS

The Trust Indenture

Trust units are issued under the terms of the trust indenture between Pengrowth Corporation and Computershare, as trustee. A maximum of 500,000,000 trust units may be created and issued pursuant to the trust indenture, of which 112,325,588 trust units were outstanding on July 7, 2003. Each trust unit represents a fractional undivided beneficial interest in Pengrowth Trust.

The trust indenture, among other things, provides for the establishment of Pengrowth Trust, the issue of trust units, the permitted investments of Pengrowth Trust, the procedures respecting distributions to unitholders, the appointment and removal of Computershare as trustee, Computershare's rights and restrictions, the calling of meetings of unitholders, the conduct of business at such meetings, notice provisions, the form of trust unit certificates and the termination of Pengrowth Trust.

The trust indenture may be amended from time to time. Most amendments to the trust indenture, including the early termination of Pengrowth Trust and the sale or transfer of the property of Pengrowth Trust as an entirety or substantially as an entirety, require approval by an extraordinary resolution of the unitholders. An extraordinary resolution of the unitholders requires the approval of not less than 662/3% of the votes cast by unitholders at a meeting of unitholders held in accordance with the trust indenture at which two or more holders of at least 5% of the aggregate number of trust units then outstanding are represented.

Voting at Meetings of Pengrowth Trust

Meetings of unitholders may be called on 21 days notice and may be called at any time by Computershare, as trustee, or upon written request of unitholders holding in the aggregate not less than 5% of the trust units, and shall be called by Computershare and held annually. At all meetings of the unitholders, each holder is entitled to one vote in respect of each trust unit held. Unitholders may attend and vote at all meetings of the unitholders either in person or by proxy and a proxy holder need not be a unitholder. Two persons present in person either holding personally or representing as proxies at least 5% of the outstanding trust units constitute a quorum for the transaction of business at all such meetings. Except as otherwise provided in the trust indenture, matters requiring the approval of the unitholders must be approved by extraordinary resolution.

Unitholders are entitled to pass resolutions that will bind Computershare, as trustee, with respect to a limited number of matters, including but, not limited to, the following: (i) the removal or appointment of Computershare as trustee; (ii) the removal or appointment of the auditor of Pengrowth Trust; (iii) the amendment of the trust indenture; (iv) the approval of subdivisions or consolidations of trust units; (v) the sale of the assets of Pengrowth Trust as an entirety or substantially as an entirety; and (vi) termination of Pengrowth Trust.

Voting at Meetings of Pengrowth Corporation

The unitholders, along with holders of royalty units (other than Pengrowth Trust) are entitled to voting rights at meetings of shareholders of Pengrowth Corporation on the basis of one vote for each trust unit (or royalty unit) held.

Redemption Right

Trust units are redeemable by Computershare, as trustee, at the request of a unitholder when properly endorsed for transfer and when accompanied by a duly completed and properly executed notice requesting redemption. The redemption right permits unitholders in the aggregate to redeem trust units for maximum proceeds of $25,000 in any calendar month provided that such limitation may be waived at the discretion of the board of directors of Pengrowth Corporation.

Limitation on Non-Resident Ownership

In order for Pengrowth Trust to maintain its status as a mutual fund trust under theIncome Tax Act (Canada), Pengrowth Trust must not be established or maintained primarily for the benefit of non-residents of Canada ("non-residents") within the meaning of that Act. If Computershare, as trustee of Pengrowth Trust, becomes aware as a result of requiring declarations as to beneficial ownership that the beneficial owners of 49% of the trust units then outstanding are or may be non-residents or that such a situation is imminent, Computershare may make a public announcement thereof and shall not accept a subscription for trust units from or issue or register a transfer of trust units to a person unless the person provides a declaration that the person is not a non-resident. If, notwithstanding the foregoing, Computershare determines that a majority of the trust units are held by non-residents, Computershare may send a notice to non-resident holders of trust units, chosen in inverse order to the order of acquisition or registration or in such other manner as Computershare may consider equitable and practicable, requiring them to sell their trust units or a portion thereof within a specified period of not less than 60 days. If the unitholders receiving such notice have not sold the specified number of trust units or provided Computershare with satisfactory evidence that they are not non-residents within such period, Computershare may on behalf of such unitholders sell such trust units and, in the interim, shall suspend the voting and distribution rights attached to such trust

13

units. Upon such sale, the affected holders shall cease to be holders of trust units and their rights shall be limited to receiving the net proceeds of sale upon surrender of the certificates representing such trust units.

Unitholder Limited Liability

The trust indenture between Pengrowth Corporation and Computershare, as trustee, provides that no unitholder will be subject to any personal liability in connection with Pengrowth Trust or its obligations and affairs, and the satisfaction of claims of any nature arising out of or in connection therewith is only to be made out of Pengrowth Trust's assets. Additionally, the trust indenture states that no unitholder is liable to indemnify or reimburse Computershare for any liabilities incurred by Computershare with respect to any taxes payable by or liabilities incurred by Pengrowth Trust or Computershare, and all such liabilities will be enforceable only against, and will be satisfied only out of, Pengrowth Trust's assets. It is intended that the operations of Pengrowth Trust will be conducted, upon the advice of counsel, in such a way and in such jurisdictions as to avoid as far as possible any material risk of liability on the unitholders for claims against Pengrowth Trust. Notwithstanding the foregoing, because of uncertainties in the law relating to trusts such as Pengrowth Trust, there is a risk that a unitholder could be held personally liable for obligations of Pengrowth Trust to the extent that claims are not satisfied by Pengrowth Trust.

Special Voting Unit

The authorized trust units include the special voting trust unit which entitles the holder thereof to a number of votes equal to the number of outstanding exchangeable shares of Pengrowth Corporation at any meeting of the trust unitholders. The special voting unit is not entitled to receive distributions from Pengrowth Trust. The special voting trust unit is intended to provide voting rights to the holders of exchangeable shares of Pengrowth Corporation equivalent to the voting rights attached to trust units. As of the date hereof, the special voting trust unit has not been issued.

DISTRIBUTIONS

Subscribers for trust units in this offering will be eligible to receive distributions commencing August 15, 2003.

We make monthly payments to our unitholders on the 15th of each month or the first business day following the 15th. The record date for any distribution is ten business days prior to the distribution date. In accordance with stock exchange rules, an ex-distribution date occurs three days prior to the record date to permit time for settlement of trades of securities and distributions must be declared a minimum of seven trading days before the record date.

Distributions declared and paid to unitholders for the completed financial quarters in 2003 and for the preceding five fiscal years were as follows:

| | Distributable Cash Per Trust Unit(1)(2)

|

|---|

| | 2003

| | 2002

| | 2001

| | 2000

| | 1999

| | 1998

|

|---|

| First Quarter | | $ | 0.750 | | $ | 0.410 | | $ | 1.140 | | $ | 0.890 | | $ | 0.467 | | $ | 0.430 |

| Second Quarter(3) | | | — | | | 0.540 | | | 0.830 | | | 0.825 | | | 0.599 | | | 0.355 |

| Third Quarter | | | — | | | 0.520 | | | 0.630 | | | 0.960 | | | 0.680 | | | 0.330 |

| Fourth Quarter | | | — | | | 0.600 | | | 0.410 | | | 1.110 | | | 0.740 | | | 0.410 |

| | |

| |

| |

| |

| |

| |

|

| Total | | $ | 0.750 | (3) | $ | 2.070 | | $ | 3.010 | | $ | 3.785 | | $ | 2.486 | | $ | 1.525 |

| | |

| |

| |

| |

| |

| |

|

Notes:

- (1)

- Based on actual distributions paid or declared.

- (2)

- Note that distributable cash may be different than distributions paid primarily because distributions are paid in the month following computation of distributable cash.

- (3)

- April and May distributable cash per trust unit was $0.25 and $0.21, respectively.

All amounts distributed to unitholders from the inception of Pengrowth Trust to December 31, 2002 have been treated as a return of capital, except that in 1996, 1999, 2000, 2001 and 2002, respectively, Pengrowth Trust had taxable income per trust unit of $0.2044, $0.6742, $1.9831, $1.7951 and $0.4252, respectively, which was allocated to unitholders representing 12.2%, 30.4%, 55.8%, 51.4% and 22.0% of total cash distributions for those years. For Canadian residents, amounts which are treated as a return of capital generally are not required to be included in a unitholder's income but such amounts will reduce the adjusted cost base to the unitholder of the trust units. See "Certain Canadian Federal Income Tax Considerations — Taxation of Unitholders".

14

At the special meeting of the royalty unitholders of Pengrowth Corporation held on April 23, 2002, the royalty unitholders amended the royalty indenture to permit the board of directors of Pengrowth Corporation to establish a holdback, within Pengrowth Corporation, of up to 20% of its gross revenue if the board of directors of Pengrowth Corporation determines that it would be advisable to do so in accordance with prudent business practices to provide for the payment of future capital expenditures or for the payment of royalty income in any future period. Subsequent to this royalty unitholder action, the board of directors of Pengrowth Corporation authorized the establishment of a holdback to fund future capital obligations and future payments of royalty income to Pengrowth Trust comprised of funds retained within Pengrowth Corporation in an amount equivalent to approximately 10% of the distributable cash of Pengrowth Trust calculated as if the reserve had not been established.

PLAN OF DISTRIBUTION

Pursuant to an underwriting agreement dated July 9, 2003 among Pengrowth Management, Pengrowth Corporation, Pengrowth Trust and RBC Dominion Securities Inc. (as lead underwriter), BMO Nesbitt Burns Inc., CIBC World Markets Inc., TD Securities Inc., National Bank Financial Inc., HSBC Securities (Canada) Inc., Scotia Capital Inc., Canaccord Capital Corporation, Dundee Securities Corporation, Raymond James Ltd., FirstEnergy Capital Corp. and Peters & Co. Limited, we have agreed to sell, and the underwriters have agreed to purchase, on July 23, 2003, or on such other date not later than July 31, 2003 as may be agreed upon, subject to the terms and conditions contained therein, 8,500,000 trust units at a price of $16.95 per trust unit. The purchase price of $16.95 per trust unit is payable by the underwriters to us against delivery of the trust units and was determined by negotiation among Pengrowth Management, Pengrowth Corporation, on behalf of Pengrowth Trust, and the underwriters. We have agreed to pay the underwriters a fee of 5% of the gross proceeds or $0.8475 per trust unit purchased by the underwriters. The obligations of the underwriters under the underwriting agreement are several and may be terminated at their discretion upon the occurrence of certain stated events. The underwriters are, however, obligated to take up and pay for all of the trust units if any are purchased under the underwriting agreement. The 8,500,000 trust units to be purchased by the underwriters include 1,500,000 trust units to be issued as a result of the exercise on July 15, 2003 of an option granted by us to the underwriters in the underwriting agreement. This prospectus also qualifies the grant of this option and the distribution of the 1,500,000 trust units that will be issued pursuant to the exercise of the option.

The TSX and the NYSE have conditionally approved the listing of the trust units offered hereby, subject to Pengrowth Energy Trust fulfilling all of the requirements of such exchanges.

Pursuant to policy statements of certain securities commissions, the underwriters may not, throughout the period of distribution under this prospectus, bid for or purchase trust units. The foregoing restriction is subject to exceptions, including a bid or purchase permitted under the by-laws and rules of the TSX relating to market stabilization and passive market making activities and a bid or purchase made for or on behalf of a customer where the order was not solicited during the period of distribution, provided that the bid or purchase was not engaged in for the purpose of creating actual or apparent trading in, or raising the price of, the trust units. In connection with this offering, and subject to the foregoing, the underwriters may effect transactions which stabilize or maintain the market price of the trust units at levels other than those which might otherwise prevail in the open market. Such transactions, if commenced, may be discontinued at any time.

We intend to register the trust units offered hereby in the United States pursuant to the multi-jurisdictional disclosure system to permit resales of the trust units into the United States.

Pengrowth Trust and Pengrowth Management have agreed that they will not, without the prior consent of RBC Dominion Securities Inc., on behalf of the underwriters, pursuant to the underwriting agreement, which consent may not be unreasonably withheld, authorize, issue or sell any trust units or any securities giving the right to acquire trust units (other than the trust units offered hereby, options and rights granted under our Trust Unit Option Plan and Trust Unit Rights Incentive Plan and trust units issuable pursuant to the exercise of options and rights granted under such plans, and trust units issuable pursuant to our Distribution Reinvestment and Trust Unit Purchase Plan, securities issued in connection with an arm's length acquisition, merger, consolidation or amalgamation with any company or companies or the exchange of royalty units for trust units), or agree or announce any intention to do so, at any time prior to 90 days after the closing.

RELATIONSHIP BETWEEN PENGROWTH CORPORATION AND CERTAIN UNDERWRITERS

Pengrowth Trust may be considered under Canadian securities legislation to be a connected issuer of RBC Dominion Securities Inc., BMO Nesbitt Burns Inc., CIBC World Markets Inc., TD Securities Inc., National Bank Financial Inc., HSBC Securities (Canada) Inc. and Scotia Capital Inc. as these underwriters are subsidiaries of banks (the "Banks") which are part of a syndicate of lenders to Pengrowth Corporation and to which Pengrowth Corporation is presently indebted. As of the date hereof, the amount drawn on the syndicated facility is $70.0 million, of which the Banks' portion is $60.5 million. Pengrowth Corporation is in compliance with terms of its credit facilities. The decision to distribute the trust units pursuant to this offering and the determination of the terms of distribution were made through negotiations among Pengrowth Management, Pengrowth Corporation, on behalf of Pengrowth Trust, and the underwriters. The Banks did not have any involvement in the decision to distribute the trust units pursuant to this offering or in the determination of the terms of the distribution, but have been advised of the offering and the terms thereof. As a consequence of this

15

issuance, each of RBC Dominion Securities Inc., BMO Nesbitt Burns Inc., CIBC World Markets Inc., TD Securities Inc., National Bank Financial Inc., HSBC Securities (Canada) Inc. and Scotia Capital Inc. will receive its share of the underwriters' fee and the Banks will receive certain proceeds of this offering as the repayment of a portion of the indebtedness outstanding pursuant to the syndicated facility. See "Plan of Distribution".

Mr. John Zaozirny, a director of Pengrowth Corporation, is the Vice-Chairman of Canaccord Capital Corporation, which will receive its share of the underwriters' fee.

16

CERTAIN CANADIAN FEDERAL INCOME TAX CONSIDERATIONS

In the opinion of Bennett Jones LLP and Fraser Milner Casgrain LLP, the following summary describes the principal Canadian federal income tax considerations generally applicable to a unitholder who acquires trust units pursuant to this offering and who, for the purposes of theIncome Tax Act (Canada) (the "Tax Act"), holds the trust units as capital property and deals at arm's length with Pengrowth Trust. Generally, the trust units will be considered to be capital property to a unitholder provided the unitholder does not hold the trust units in the course of carrying on a business and has not acquired them in one or more transactions considered to be an adventure in the nature of trade. Certain unitholders who might not otherwise be considered to hold their trust units as capital property may, in certain circumstances, be entitled to have them treated as capital property by making the election permitted by subsection 39(4) of the Tax Act. This summary is not applicable to: (i) a unitholder that is a "financial institution", as defined in the Tax Act for purposes of the "mark-to-market" rules; (ii) a unitholder an interest in which would be a "tax shelter" or "tax shelter investment" as defined in the Tax Act; or (iii) a unitholder that is a "specified financial institution" as defined in the Tax Act. Any such unitholder should consult its own tax advisor with respect to an investment in trust units.

This summary is based upon the provisions of the Tax Act in force as of the date hereof, the Income Tax Regulations, all specific proposals to amend the Tax Act and the Income Tax Regulations that have been publicly announced prior to the date hereof, theAlberta Corporate Tax Act, and counsels' understanding of the current published administrative and assessing policies of the Canada Customs and Revenue Agency, including the advance income tax rulings obtained by Pengrowth Trust from the Canada Customs and Revenue Agency.

This summary is not exhaustive of all possible Canadian federal income tax considerations and does not take into account any changes in the law, whether by legislative, governmental or judicial action. This summary does not take into account provincial, territorial or foreign tax considerations, which may differ significantly from those discussed herein.

This summary is of a general nature only and is not intended to be legal or tax advice to any particular unitholder. Consequently, prospective unitholders should consult their own tax advisors with respect to their particular circumstances.

This summary assumes that Pengrowth Trust qualifies as a "unit trust" and a "mutual fund trust" within the meaning of the Tax Act on the date of closing, and will continue to qualify thereafter, as a mutual fund trust for the duration of its existence. In order to so qualify, there must be at least 150 unitholders each of whom owns not less than one "block" of trust units having a fair market value of not less than $500. A "block" of trust units means 100 trust units if the fair market value of one trust unit is less than $25 and 25 trust units if the fair market value of one trust unit is greater than $25 and less than $100. In order to qualify as a mutual fund trust, Pengrowth Trust cannot, and may not at any time, reasonably be considered to be established or maintained primarily for the benefit of non-resident persons. In addition, the undertakings of Pengrowth Trust must be restricted to the investing of its funds in property (other than real property or an interest in real property), the acquiring, holding, maintaining, improving, leasing or managing of any real property (or interest in real property) that is capital property of Pengrowth Trust, or a combination of these activities. This summary assumes that these requirements will be satisfied so that Pengrowth Trust will qualify as a mutual fund trust at all relevant times. In the event that Pengrowth Trust were not to qualify as a mutual fund trust, the income tax considerations would, in some respects, be materially different from those described below.

If Pengrowth Trust ceases to qualify as a mutual fund trust, the trust units will cease to be a qualified investment for trusts governed by RRSPs, RRIFs, RESPs and DPSPs as defined in the Tax Act. Where, at the end of a month, a RRSP, RRIF, RESP or DPSP holds trust units that ceased to be a qualified investment, the RRSP, RRIF, RESP or DPSP, as the case may be must, in respect of that month, pay a tax under Part XI.1 of the Tax Act equal to 1% of the fair market value of the trust units at the time such trust units were acquired by the RRSP, RRIF, RESP or DPSP. In addition, trusts governed by a RRSP or a RRIF which acquire trust units that are not qualified investments will be subject to tax on the income attributable to the trust units while they are non-qualified investments, including the full capital gains, if any, realized on the disposition of such trust units. Where a trust governed by a RRSP or a RRIF acquires trust units that are not qualified investments, the value of the investment will be included in the income of the annuitant for the year of the acquisition. Trusts governed by RESPs which hold trust units that are not qualified investments can have their registration revoked by the Canada Customs and Revenue Agency. Additionally, if Pengrowth Trust ceases to qualify as a mutual fund trust, it will be required to pay a tax under Part XII.2 of the Tax Act. The payment of Part XII.2 tax by Pengrowth Trust may have adverse income tax consequences for certain unitholders, including non-resident persons and RRSPs, RRIFs, RESPs and DPSPs that acquire an interest in the trust units directly or indirectly from another unitholder.

Taxation of Pengrowth Trust

Pengrowth Trust is subject to taxation in each taxation year on its income or loss for the year as though it were a separate individual. The taxation year of Pengrowth Trust is the calendar year.

Pengrowth Trust will be required to include in its income for each taxation year all amounts that it receives in respect of the royalty paid by Pengrowth Corporation, including amounts paid by it to Pengrowth Corporation in respect of reimbursed Crown charges, any interest on indebtedness owed by Pengrowth Corporation and any other interest in respect of its other investments that accrues to the

17

end of the year, or becomes receivable or is received by it before the end of the year, except to the extent that such amount was included in computing its income for a preceding taxation year. Other types of income from Pengrowth Trust's investments, including its oil and natural gas facilities, is generally required to be included in income on an accrual basis. Pursuant to proposed amendments to the Tax Act, Pengrowth Trust will be required to report its income in respect of the royalty paid by Pengrowth Corporation on an accrual basis, rather than a cash basis.

In computing its income for tax purposes, Pengrowth Trust may deduct reasonable administrative expenses and management fees, capital cost allowance in respect of its oil and natural gas facilities in an amount generally equal to the lesser of the prescribed rate and the net leasing income attributable to such property, an amount not exceeding 10% of its cumulative Canadian oil and gas property expense account, determined on a declining balance basis, 20% of the total issue expenses of this offering and prior offerings to the extent that the expenses were not otherwise deductible in a preceding year and, subject to the comments below, a resource allowance in each taxation year generally equal to 25% of Pengrowth Trust's "adjusted resource profits" within the meaning of the Income Tax Regulations. On June 9, 2003, the Department of Finance released draft legislation affecting the resource sector (the "Resource Proposals"). Pursuant to the Resource Proposals, the deduction for resource allowance will gradually be reduced from 25% to nil over a 5 year period commencing in 2003 and ending in 2007. In conjunction with the changes to resource allowance, the Resource Proposals allow a deduction for Crown charges, which are not currently deductible under the provisions of the Tax Act, from nil to 100% over the same time period. The impact of these changes, if enacted as proposed, is uncertain and will vary depending on the difference between the non-deductible resource allowance and the deductible Crown charges for each taxation year.

Pengrowth Trust will be entitled to deduct from its income for a taxation year otherwise determined, after taking into account the inclusions and deductions outlined above, the portion thereof that is paid or becomes payable in the year to unitholders, including the amount which generally represents the excess, if any, of reimbursed Crown charges paid by Pengrowth Trust over the resource allowance deductible for the year to the extent that such excess amount is designated to the unitholders for that year. In accordance with the terms of the trust indenture between Pengrowth Corporation and Computershare, as trustee, Computershare has agreed to designate the full amount of such excess amount annually in favour of unitholders. An amount will be considered to be payable to a unitholder in a taxation year if it is paid in the year by Pengrowth Trust or the unitholder is entitled in the year to enforce payment of the amount. The trust indenture provides that Computershare, on behalf of Pengrowth Trust, shall claim the maximum permissible deductions for the purposes of computing the income of Pengrowth Trust pursuant to the Tax Act to the extent required to reduce the taxable income of Pengrowth Trust to nil or to the extent desirable in the best interests of unitholders. As a result, Computershare may choose not to claim all deductions in computing income and taxable income to the maximum extent permitted by the Tax Act in order to utilize losses from prior taxation years.

Pengrowth Trust is entitled to claim Alberta royalty credit, which under current legislation is based on a price-sensitive formula linked to crude oil prices. Credits are generally 25% of Alberta Crown royalties unless the reference price of oil falls below $210 per cubic metre, in which case the royalty rate increases on a sliding scale to a maximum of 75% when the reference price of oil falls below $100 per cubic metre. The maximum annual Alberta Crown royalty to which the rate applies is $2,000,000 per applicant or associated group of applicants. As a result of the Resource Proposals, all or a portion of the Alberta royalty credit will be included in the income of Pengrowth Trust, subject to certain transitional rules.

Taxation of Unitholders

A unitholder will generally be required to include in computing income for a particular taxation year of the unitholder the portion of the net income of Pengrowth Trust for a taxation year that is paid or becomes payable to the unitholder in that particular taxation year, including all amounts designated to the unitholder as reimbursed Crown charges in excess of the resource allowance deducted in computing Pengrowth Trust's income. An amount will be considered payable to a unitholder in a taxation year if the unitholder is entitled in the year to enforce payment of the amount. For the purposes of the Tax Act, income of a unitholder from the trust units will generally be deemed to be income from property and not resource income. Any deduction or loss of Pengrowth Trust for purposes of the Tax Act cannot be allocated to, or treated as a deduction or loss of, a unitholder. As discussed above, Computershare, as trustee may claim a deduction in computing income for a taxation year in an amount less than Pengrowth Trust's income for the year payable to unitholders in order to utilize losses from prior years, subject to certain limitations under the Tax Act.

The cost to a unitholder of trust units acquired pursuant to this offering will equal the purchase price of the trust units plus the amount of any other reasonable costs incurred in connection therewith. This cost will be averaged with the cost of all other trust units held by the unitholder to determine the adjusted cost base of each trust unit.