As filed with the Securities and Exchange Commission on October 17, 2002

Registration No. 333-

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-10

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

PENGROWTH ENERGY TRUST

(Exact name of Registrant as specified in its charter)

| | | | | |

| Alberta, Canada | | 1311 | | N/A |

(State or other jurisdiction

of incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification No.) |

700 SunLife Plaza – East Tower 112 – 4th Avenue South West Calgary, Alberta T2P 0H3 Canada

Tel: (403) 233-0224

(Address and telephone number of registrant’s principal executive offices)

John K. Whelan, Esq.

Carter, Ledyard & Milburn, 2 Wall Street, New York, New York 10005

Tel: (212) 732-3200

(Name, address, (including zip code) and telephone number (including area code) of agent for service)

Copies to:

| | | | | |

Brad D. Markel, Esq.

Bennett Jones LLP

4500 Bankers Hall East

855 – 2nd Street S.W.

Calgary, Alberta T2P 4K7 Canada

Tel: (403) 298-3100 | | David Spencer, Esq.

Fraser Milner Casgrain LLP

30th Floor, Fifth Avenue Place

237 – 4th Avenue S.W.

Calgary, Alberta T2P 4X7 Canada

Tel: (403) 268-7000 | | Thomas P. Mason, Esq.

James M. Prince, Esq.

Vinson & Elkins LLP

1001 Fannin Street

Houston, Texas 77002 U.S.A.

Tel: (713) 758-3710 |

Province of Alberta, Canada

(Principal jurisdiction regulating this offering (if applicable))

Approximate date of commencement of proposed sale to the public:As soon as possible after this registration statement becomes effective.

It is proposed that this filing shall become effective (check appropriate box)

| | | | | |

| A. | | o | | upon filing with the Commission, pursuant to Rule 467(a) (if in connection with an offering being made contemporaneously in the United States and Canada) |

| B. | | x | | at some future date (check the appropriate box below) |

| | | 1. | | o pursuant to Rule 467(b) on (date) at (time) (designate a time not sooner than 7 calendar days after filing). |

| | | 2. | | o pursuant to Rule 467(b) on (date) at (time) (designate a time 7 calendar or sooner days after filing) because the securities regulatory authority in the review jurisdiction has issued a receipt or notification of clearance on (date). |

| | | 3. | | o pursuant to Rule 467(b) as soon as practicable after notification of the Commission by the Registrant or the Canadian securities regulatory authority of the review jurisdiction that a receipt or notification of clearance has been issued with respect hereto. |

| | | 4. | | x after the filing of the next amendment to this Form (if preliminary material is being filed). |

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to the home jurisdiction’s shelf prospectus offering procedures, check the following box. o

CALCULATION OF REGISTRATION FEE

| | | | | | | | | |

|

|

|

| | Proposed | | Proposed maximum | | |

| Title of each class of securities | | Amount to be | | maximum offering | | aggregate offering | | Amount of |

| to be registered | | registered(1) | | price per unit(1) | | price(1) | | registration fee |

|

|

| Trust Units(2) | | 16,906,000 | | $9.28 | | $157,350,000 | | $14,477 |

|

|

| |

| (1) | Estimated solely for the purpose of determining the registration fee and calculated pursuant to Rule 457(c) on the basis of the average of the high and low prices of the Registrant’s Trust Units on the New York Stock Exchange on October 15, 2002. |

| |

| (2) | Includes Trust Units that the Underwriters have an option to purchase to cover over-allotments, if any. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Rule 467 under the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to Section 8(a) of the Securities Act of 1933, may determine.

TABLE OF CONTENTS

PART I

INFORMATION REQUIRED TO BE DELIVERED TO OFFEREES OR PURCHASERS

Explanatory Note

This Registration Statement contains two forms of prospectus: one to be used in connection with the offering of Trust Units in the United States (the “U.S. Prospectus”) and one to be used in connection with the offering of Trust Units in Canada (the “Canadian Prospectus”). The two forms of prospectus are identical except that they contain different front covers, back covers and pages 1. In addition, the Canadian Prospectus includes certificates of the Registrant and the Underwriters and the section titled “Purchasers’ Statutory Rights”. The form of U.S. Prospectus is included herein and is followed by the pages to be used in the Canadian Prospectus that differ from those in the U.S. Prospectus.

| The information in this Prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted. |

Subject to Completion, dated October 16, 2002

PROSPECTUS

PENGROWTH ENERGY TRUST

Trust Units

All of the trust units offered hereby are being sold by Pengrowth Energy Trust (“Pengrowth Trust”) in the United States and Canada.

The trust units are listed on the New York Stock Exchange, Inc. under the symbol PGH and the Toronto Stock Exchange under the symbol PGF.UN. On October , 2002, the closing sale price of the trust units was US$ per unit on the New York Stock Exchange and Cdn$ per unit on the Toronto Stock Exchange. See “Price Range and Trading Volume.”

Investing in the trust units involves significant risks. See “Risk Factors” beginning on page 20.

| | | | | |

| | Per Unit | | Total |

| |

| |

|

| Public offering price | | US$ | | US$160,000,000 |

| Underwriting discounts and commissions | | US$ | | US$ |

| Proceeds to Pengrowth Trust (before expenses) | | US$ | | US$ |

For trust units sold in the United States, the offering price is payable in U.S. dollars at the approximate U.S. dollar equivalent of the Canadian dollar offering price (Cdn$ ) based on the inverse of the noon buying rate of the Federal Reserve Bank of New York on October , 2002 of US$ per Cdn$1.00.

Pengrowth Trust has granted the underwriters a 30-day option to purchase up to additional trust units on the same terms and conditions as set forth above to cover over-allotments, if any.

Pengrowth Trust has prepared this Prospectus in accordance with the disclosure requirements of Canada. You should be aware that these requirements are different from those of the United States. Pengrowth Trust prepares its consolidated financial statements in accordance with Canadian generally accepted accounting principles, and they are subject to Canadian auditing and auditor independence standards, and thus may not be comparable to financial statements of United States companies. In addition, some of the reserve information included in this prospectus is not comparable to the disclosure of reserves by United States oil and gas producers. See “Presentation of Our Reserve Information” on page 2.

Owning trust units may subject you to tax consequences both in the United States and in Canada. This Prospectus may not describe these tax consequences fully. You should read the tax discussion under the caption “Certain Income Tax Consequences.” You should also consult your own tax advisor with respect to your own particular circumstances.

Your ability to enforce civil liabilities under the United States federal securities laws may be affected adversely because Pengrowth Trust is organized under the laws of Alberta, Canada, the officers and directors of Pengrowth Corporation, its administrator, and Pengrowth Management, its manager, and the experts named in this Prospectus are Canadian residents, and most of the assets of Pengrowth Trust and of such other persons may be located in Canada.

Neither the Securities and Exchange Commission nor any state securities regulator has approved or disapproved these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Lehman Brothers and RBC Capital Markets, on behalf of the underwriters expect to deliver the trust units to purchasers on , 2002.

Joint Book-running Managers

| | | |

| LEHMAN BROTHERS | | RBC CAPITAL MARKETS |

UBS WARBURG

| | | |

| MCDONALD INVESTMENTS INC. | | RAYMOND JAMES |

October , 2002

[Map of Pengrowth Principle Properties]

-ii-

The underwriters, as principals, conditionally offer the trust units, subject to prior sale, if, as and when issued by Pengrowth Energy Trust and accepted by the underwriters in accordance with the conditions contained in the underwriting agreements referred to under “Underwriting” and subject to the approval of certain legal matters on behalf of Pengrowth Energy Trust by Bennett Jones LLP, Calgary, Alberta with respect to matters of Canadian law and Carter, Ledyard & Milburn, New York, New York with respect to matters of United States law and on behalf of the underwriters by Fraser Milner Casgrain LLP, Calgary, Alberta with respect to matters of Canadian law and Vinson & Elkins L.L.P., Houston, Texas with respect to matters of United States law.Pengrowth Energy Trust may be considered to be a connected issuer under Canadian securities laws to RBC Dominion Securities Inc., BMO Nesbitt Burns Inc., CIBC World Markets Inc., TD Securities Inc., National Bank Financial Inc., Scotia Capital Inc. and HSBC Securities (Canada) Inc. as they are subsidiaries of Canadian chartered banks which are lenders to Pengrowth Corporation and to which Pengrowth Corporation is presently indebted. See “Relationship Between Pengrowth Corporation and Certain Underwriters”.

The underwriters may over-allot or effect transactions which stabilize or maintain the market price of the trust units at levels other than those which might otherwise prevail in the open market. See “Underwriting”.

Subscriptions for the trust units will be received, subject to rejection or allotment in whole or in part, and the right is reserved to close the subscription books at any time without notice. It is expected that certificates evidencing the trust units will be available for delivery at the closing of this offering, which is expected to take place on or aboutl, 2002, or on such other date as may be agreed upon by Pengrowth Energy Trust and the underwriters, but in any event not later thanl, 2002.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any jurisdiction where the offer is not permitted. You should not assume that the information in this prospectus is accurate as of any date other than the date on the front of this prospectus.

-iii-

IMPORTANT TERMS USED IN THIS PROSPECTUS

We have avoided the use of technical defined terms in this prospectus whenever possible, but a few frequently recurring terms may be useful for you to have in mind:

Corporate

| | |

| | • | we,us,our andPengrowth refer to Pengrowth Energy Trust and Pengrowth Corporation on a consolidated basis; |

| |

| | • | Pengrowth Trust refers to Pengrowth Energy Trust; |

| |

| | • | Pengrowth Management refers to Pengrowth Management Limited; |

| |

| | • | B.C. Asset Package refers to the northern British Columbia properties we acquired from Calpine Canada Natural Gas Partnership, prior to our sale of certain interests in those properties to Progress Energy Ltd.; |

| |

| | • | New B.C. Properties refers to the northern British Columbia properties we acquired from Calpine Canada Natural Gas Partnership, net of the interests sold to Progress Energy Ltd.; |

| |

| | • | Schedule of Revenue and Expenses refers to the Schedule of Revenue and Expenses associated with the northern British Columbia oil and natural gas assets acquired from Calpine Canada Natural Gas Partnership by Pengrowth Corporation for each of the years in the three year period ended December 31, 2001; and |

| |

| | • | unitholders refers to the holders of trust units issued by Pengrowth Trust. |

Engineering

| | |

| | • | GLJ July Report refers to the report, dated September 18, 2002, prepared by Gilbert Laustsen Jung Associates Ltd., independent petroleum engineers, on the following basis: |

| | |

| | • | in respect of the New B.C. Properties, the report was prepared using detailed engineering evaluations made by Gilbert Laustsen Jung Associates Ltd. effective as of January 1, 2002, adjusted to take into account actual production, and the results of additional development activity, from January 1, 2002 to July 1, 2002; |

| |

| | • | in respect of our properties other than the New B.C. Properties, the report was prepared using detailed engineering evaluations made by Gilbert Laustsen Jung Associates Ltd. effective as of January 1, 2002, adjusted to take into account estimated production, and to reflect the acquisition and disposition of properties, from January 1, 2002 to July 1, 2002; and |

| |

| | • | in respect of each of the above two cases, the report was prepared using two different sets of price and cost assumptions, the first set of assumptions being the constant price and cost basis which assumes that costs remain constant at the costs estimated as at July 1, 2002 by Gilbert Laustsen Jung Associates Ltd. for 2002 and prices for production remain constant at the prices forecast for the fourth quarter of 2002 as set out in the “October 1, 2002 Gilbert Laustsen Jung Associates Ltd. Product Price and Market Forecasts for the Canadian Oil and Gas Industry” constituting part of the GLJ July Report, and the second set of assumptions being the escalated price and cost basis which assumes that prices for production and costs fluctuate in the future as set out in the “October 1, 2002 Gilbert Laustsen Jung Associates Ltd. Product Price and Market Forecasts for the Canadian Oil and Gas Industry” constituting part of the GLJ July Report, all as detailed in notes (7), (9) and (10) under “Business — Reserves — Notes to Reserves”; |

| | |

| | • | proved reserves refers to those reserves estimated as recoverable under current technology and existing economic conditions, in the case of constant pricing, and anticipated economic conditions, in the case of escalated pricing, from that portion of a reservoir which can be reasonably evaluated as economically productive on the basis of analysis of drilling, geological, geophysical and engineering data, including the reserves to be obtained by enhanced recovery processes demonstrated to be economic and technically successful in the subject reservoir; |

| |

| | • | net proved reserves refers to Pengrowth’s working interest share of proved reserves after the deduction of royalties, based on constant price and cost assumptions; |

-iv-

| | |

| | • | probable reserves refers to those reserves which an analysis of drilling, geological, geophysical and engineering data does not demonstrate to be proved under current technology and existing economic conditions, but where such analysis suggests the likelihood of their existence and future recovery. Probable reserves to be obtained by the application of enhanced recovery processes will be the increased recovery over and above that estimated in the proved category which can be realistically estimated for a pool on the basis of enhanced recovery processes which can be reasonably expected to be instituted in the future; |

| |

| | • | risked probable reserves refers to probable reserves discounted by one-half to account for the additional risk of recovery for probable reserves; |

| |

| | • | established reserves refers to proved reserves plus risked probable reserves, before the deduction of royalties and based on escalated price and cost assumptions unless otherwise indicated; |

| |

| | • | gross refers to Pengrowth’s working interest or royalty interest share of reserves or production, as the case may be, before the deduction of royalties and, with respect to land and wells, refers to the total number of acres or wells, as the case may be, in which Pengrowth has a working interest or a royalty interest; |

| |

| | • | net refers to Pengrowth’s working interest share of production or reserves, as the case may be, after the deduction of royalties, and, with respect to land and wells, refers to Pengrowth’s working interest share therein; |

| |

| | • | reserve life refers to the estimated number of years for which a property will remain capable of economic production based on the established reserves of the property; |

| |

| | • | reserve life index refers to the number of years determined by dividing the established reserves of a property by the estimated annual production from the established reserves of the property unless we indicate thatreserve life index is based on net proved reserves, in which case reserve life index refers to the number of years determined by dividing the net proved reserves of a property by the estimated annual net production from the property; |

| |

| | • | working interest refers to the percentage of undivided interest held by a party in an oil and gas property; |

| |

| | • | royalty interest refers to an interest in an oil and gas property consisting of a royalty granted in respect of production from the property; and |

| |

| | • | unitization means a process whereby owners of adjoining properties pool reserves into a single unit operated by one of the owners, typically in order to conduct secondary recovery projects in a manner that promotes improved recovery of reserves from a pool or field. |

We also use the following abbreviations:

| | |

| | • | bbl,bbls,mbbls andmmbbls mean barrel, barrels, thousands of barrels and millions of barrels, respectively; |

| |

| | • | bblpd means barrels per day; |

| |

| | • | boe,mboe andmmboe mean barrels of oil equivalent, thousands of barrels of oil equivalent and millions of barrels of oil equivalent, respectively, on the basis of one boe being equal to one barrel of oil or NGLs or six mcf of natural gas, based upon general practice in the Canadian oil and natural gas industry; |

| |

| | • | boepd means barrels of oil equivalent per day; |

| |

| | • | mmbtu andmmbtupd mean million british thermal units and million british thermal units per day, respectively; |

| |

| | • | mcf,mmcf,bcf andtcf mean thousand cubic feet, million cubic feet, billion cubic feet and trillion cubic feet, respectively; |

| |

| | • | mcfpd andmmcfpd mean thousands of cubic feet per day and millions of cubic feet per day, respectively; and |

| |

| | • | NGLs means natural gas liquids. |

-v-

EXCHANGE RATE TABLE

All dollar amounts set forth in this prospectus are in Canadian dollars, except where otherwise indicated.

The following table sets forth certain exchange rates based on the inverse of the noon buying rate in New York City for cable transfers in Canadian dollars as certified for customs purposes by the Federal Reserve Bank of New York. The rates are set forth as United States dollars per Cdn$1.00. On October 15, 2002, the inverse of the noon buying rate was US$0.6306 per Cdn$1.00.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | Six Months Ended |

| | Year Ended December 31, | | June 30, |

| |

| |

|

| | 1997 | | 1998 | | 1999 | | 2000 | | 2001 | | 2001 | | 2002 |

| |

| |

| |

| |

| |

| |

| |

|

| Rate at end of period | | $ | 0.6999 | | | $ | 0.6504 | | | $ | 0.6925 | | | $ | 0.6669 | | | $ | 0.6279 | | | $ | 0.6590 | | | $ | 0.6583 | |

| Average rate during period | | | 0.7197 | | | | 0.6714 | | | | 0.6745 | | | | 0.6725 | | | | 0.6444 | | | | 0.6515 | | | | 0.6378 | |

| High | | | 0.7487 | | | | 0.7105 | | | | 0.6925 | | | | 0.6969 | | | | 0.6697 | | | | 0.6697 | | | | 0.6619 | |

| Low | | | 0.6945 | | | | 0.6341 | | | | 0.6535 | | | | 0.6410 | | | | 0.6241 | | | | 0.6333 | | | | 0.6200 | |

-vi-

TABLE OF CONTENTS

| | | | | |

| | Page |

| |

|

| Important Terms Used in this Prospectus | | | iv | |

| Exchange Rate Table | | | vi | |

| Presentation of our Financial Information | | | 1 | |

| Presentation of our Reserve Information | | | 2 | |

| Forward-Looking Statements | | | 3 | |

| Summary | | | 4 | |

| Risk Factors | | | 20 | |

| Recent Acquisition | | | 30 | |

| Distributions | | | 33 | |

| Price Range and Trading Volume of Trust Units | | | 35 | |

| Use of Proceeds | | | 36 | |

| Capitalization of Pengrowth Trust | | | 36 | |

| Selected Financial Information | | | 38 | |

| Management’s Discussion and Analysis of Operating Results and Financial Condition | | | 41 | |

| Business | | | 53 | |

| Structure and Organization of Pengrowth | | | 77 | |

| Directors and Officers | | | 84 | |

| Corporate Governance and Conflicts of Interest | | | 88 | |

| Certain Income Tax Considerations | | | 91 | |

| ERISA Considerations | | | 104 | |

| Underwriting | | | 106 | |

| Relationship Between Pengrowth Corporation and Certain Underwriters | | | 110 | |

| Documents Incorporated by Reference | | | 112 | |

| Available Information | | | 113 | |

| Documents filed as part of the U.S. Registration Statement | | | 113 | |

| Auditors, Transfer Agent and Registrar | | | 113 | |

| Eligibility for Investment | | | 114 | |

| Legal Matters | | | 114 | |

| Index to Financial Statements | | | F-1 | |

PRESENTATION OF OUR FINANCIAL INFORMATION

Unless we indicate otherwise, financial information in this prospectus has been prepared in accordance with Canadian generally accepted accounting principles (“GAAP”).Canadian GAAP differs in some significant respects from U.S. GAAP and thus our financial statements may not be comparable to the financial statements of U.S. companies. The principal differences as they apply to us are summarized in note 13 to the audited annual consolidated financial statements of Pengrowth Trust beginning on page F-24, the Reconciliation of Interim Consolidated Financial Statements of Pengrowth Energy Trust for the six months ended June 30, 2002 to United States generally accepted accounting principles beginning on page F-19, note 4 to the unaudited pro forma consolidated financial statements of Pengrowth Energy Trust beginning on page F-2, and note 3 to the Schedule of Revenue and Expenses beginning on page F-50.

We present our financial information in Canadian dollars. In this prospectus, except where we indicate otherwise, all dollar amounts are in Canadian dollars.References to “$” or “Cdn$” are to Canadian dollars and references to “US$” are to U.S. dollars. This prospectus contains a translation of some Canadian dollar amounts into U.S. dollars at specified exchange rates solely for your convenience. Unless we indicate otherwise, U.S. dollar amounts have been translated from Canadian dollars at US$0.6306 per Cdn$1.00, which was the inverse of the noon buying rate of the Federal Reserve Bank of New York on October 15, 2002.

The pro forma consolidated balance sheet was prepared as if the (i) acquisition of the B.C. Asset Package, (ii) the disposition of a portion of the B.C. Asset Package to Progress Energy Ltd., (iii) the issuance of 17,123,287 trust units for net proceeds of $234.25 million in this offering, and (iv) the other transactions described in the notes to the pro forma financial statements, had occurred on June 30, 2002 and the pro forma combined statements of income and distributable income for the year ended December 31, 2001 and for the six months ended June 30, 2002 were prepared as if such transactions had occurred on the first day of the period presented.

1

PRESENTATION OF OUR RESERVE INFORMATION

The United States Securities and Exchange Commission (SEC) generally permits oil and gas companies, in their filings with the SEC, to disclose only proved reserves after the deduction of royalties and interests of others which are those reserves that a company has demonstrated by actual production or conclusive formation tests to be economically producible under existing economic and operating conditions. Canadian securities laws permit oil and gas companies, in their filings with Canadian securities regulators, to disclose not only proved reserves but also probable reserves, and to disclose reserves and production on a gross basis before deducting royalties. Probable reserves are of a higher risk and are generally believed to be less likely to be accurately estimated or recovered than proved reserves. Because we are permitted to prepare this prospectus in accordance with Canadian disclosure requirements, we have disclosed in this prospectus and in the documents incorporated by reference reserves designated as “probable” and “established”. The SEC’s guidelines strictly prohibit reserves in these categories from being included in filings with the SEC that are required to be prepared in accordance with U.S. disclosure requirements. Moreover, we have determined and disclosed estimated future net cash flow from our reserves using both constant and escalated prices and costs, whereas the SEC generally requires that prices and costs be held constant at levels in effect at the date of the reserve report. In addition, the estimates of reserves included in this prospectus based on constant prices and costs, as reflected in the GLJ July Report, were prepared using forecast prices for the fourth quarter of 2002, as set out in the “October 1, 2002 Gilbert Laustsen Jung Associates Ltd. Product Price and Market Forecasts for the Canadian Oil and Gas Industry” constituting part of the GLJ July Report, held constant for the economic life of the reserves, whereas the SEC guidelines would require that the reserve estimates be prepared using prices in effect as of July 1, 2002, the effective date of the GLJ July Report, held constant for the economic life of the reserves (the actual price of West Texas Intermediate crude oil at Cushing, Oklahoma at July 1, 2002 was US$26.83 whereas the forecast price of West Texas Intermediate crude oil at Cushing, Oklahoma for the fourth quarter of 2002 was US$28.00). For a description of these and additional differences between Canadian and U.S. standards of reporting reserves, see “Risk Factors — Canadian and United States practices differ in reporting reserves and production” and “Important Terms Used in This Prospectus”.

References to pro forma reserves in this prospectus give pro forma effect the acquisition of the New B.C. Properties effective as of July 1, 2002.

Reserve information contained in this prospectus, other than reserve information incorporated by reference in this prospectus, has been derived from the GLJ July Report dated September 18, 2002, prepared by Gilbert Laustsen Jung Associates Ltd., independent petroleum engineers, on the following basis: (i) in respect of the New B.C. Properties, the report was prepared using detailed engineering evaluations made by Gilbert Laustsen Jung Associates Ltd. effective as of January 1, 2002, adjusted to take into account actual production, and the results of additional development activity, from January 1, 2002 to July 1, 2002; (ii) in respect of our properties other than the New B.C. Properties, the report was prepared using detailed engineering evaluations made by Gilbert Laustsen Jung Associates Ltd. effective as of January 1, 2002, adjusted to take into account estimated production, and to reflect the acquisition and disposition of properties, from January 1, 2002 to July 1, 2002; and (iii) in respect of each of the foregoing two cases, the report was prepared using two different sets of price and cost assumptions, the first set of assumptions being the constant price and cost basis which assumes that costs remain constant at the costs estimated as at July 1, 2002 by Gilbert Laustsen Jung Associates Ltd. for 2002 and prices for production remain constant at the prices forecast for the fourth quarter of 2002 as set out in the “October 1, 2002 Gilbert Laustsen Jung Associates Ltd. Product Price and Market Forecasts for the Canadian Oil and Gas Industry” constituting part of the GLJ July Report, and the second set of assumptions being the escalated price and cost basis which assumes that prices for production and costs fluctuate in the future as set out in the “October 1, 2002 Gilbert Laustsen Jung Associates Ltd. Product Price and Market Forecasts for the Canadian Oil and Gas Industry” constituting part of the GLJ July Report, all as detailed in notes (7), (9) and (10) under “Business — Reserves — Notes to Reserves”. Please note that the escalated pricing assumptions include bothincreases anddecreases in future commodity prices and costs.

In this prospectus, all estimates of reserves and production are before royalties, unless otherwise indicated.

2

Although the definitions of proved reserves under United States Regulation S-X and Canadian National Policy 2-B are different, in the opinion of Gilbert Laustsen Jung Associates Ltd., estimates of net proved reserves using constant price and cost assumptions in this prospectus are, in all material respects, equivalent to those which would be determined under SEC Regulation S-X. This prospectus has not been, and will not be, reviewed by the SEC.

All reserve evaluations have been stated prior to any provision for income taxes and general and administrative costs. The estimated present worth values of net production revenue contained in this prospectus may not be representative of the fair market value of the reserves. Actual reserves may be greater than or less than the estimates provided herein.

FORWARD-LOOKING STATEMENTS

Certain statements contained in this prospectus, including certain documents incorporated by reference in this prospectus, constitute forward-looking statements. The use of any of the words “anticipate”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “should”, “believe” and similar expressions are intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in our forward-looking statements. We believe the expectations reflected in those forward-looking statements are reasonable. However, we cannot assure you that these expectations will prove to be correct. You should not unduly rely on forward-looking statements included, or incorporated by reference, in this prospectus. These statements speak only as of the date of this prospectus or as of the date specified in the documents incorporated by reference in this prospectus, as the case may be.

In particular, this prospectus, including the documents incorporated by reference, contains forward-looking statements pertaining to the following:

| | |

| | • | the size of our reserves; |

| |

| | • | projections of market prices and costs; |

| |

| | • | supply and demand for oil and natural gas; |

| |

| | • | expectations regarding the ability to raise capital and to continually add to our reserves through acquisitions and exploration and development; and |

| |

| | ��� | treatment under governmental regulatory regimes. |

Our actual results could differ materially from those anticipated in these forward-looking statements as a result of the risk factors set forth below and elsewhere in this prospectus, including under “Risk Factors”:

| | |

| | • | volatility in market prices for oil and natural gas; |

| |

| | • | liabilities inherent in our oil and gas operations; |

| |

| | • | uncertainties associated with estimating reserves; |

| |

| | • | competition for, among other things, capital, reserves, undeveloped lands and skilled personnel; |

| |

| | • | incorrect assessments of the value of our acquisitions; and |

| |

| | • | geological, technical, drilling and processing problems. |

These factors should not be construed as exhaustive. We undertake no obligation to publicly update or revise any forward-looking statements.

3

SUMMARY

This summary highlights selected information contained in greater detail elsewhere in this prospectus. You should read the entire prospectus carefully, including the audited consolidated, interim unaudited consolidated and unaudited pro forma consolidated financial statements, the Schedule of Revenue and Expenses and the notes to those financial statements. You should read “Risk Factors” beginning on page 19 for more information about important factors that you should consider before investing in our trust units. Please see “Important Terms Used in this Prospectus” for an explanation of certain terms used in this Prospectus.

All dollar amounts set forth in this Prospectus are in Canadian dollars, except where otherwise indicated. In this prospectus, all estimates of reserves and production are before royalties, unless otherwise indicated.

Pengrowth Energy Trust

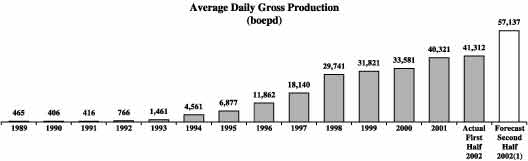

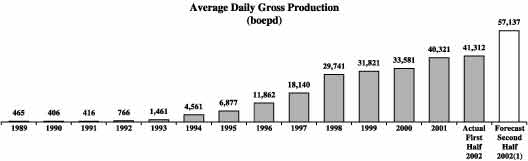

Pengrowth Trust is one of the largest conventional oil and gas royalty trusts in North America with an enterprise value of approximately $1.9 billion as at October 1, 2002. We are an actively managed Canadian royalty trust that holds interests in oil and gas properties in the Western Canadian Sedimentary Basin and offshore eastern Canada. These properties are characterized by high working interests, established production histories and long life reserves relative to typical Canadian properties. Since inception in 1988, we have purchased approximately $1.8 billion of oil and natural gas interests in Canada in more than 48 separate transactions and have increased our production from 465 boepd in 1989 to 57,137 boepd (44,510 boepd net) forecast for the second half of 2002, including the New B.C. Properties, based on the GLJ July Report.

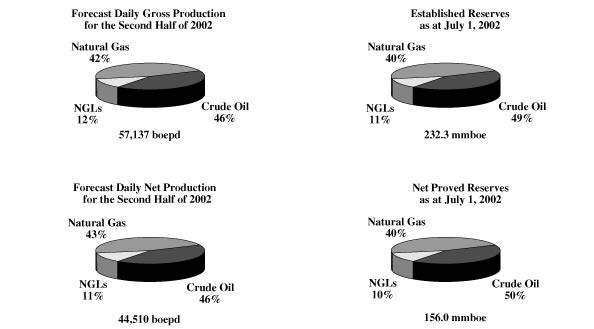

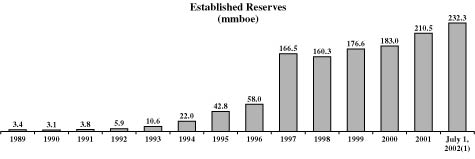

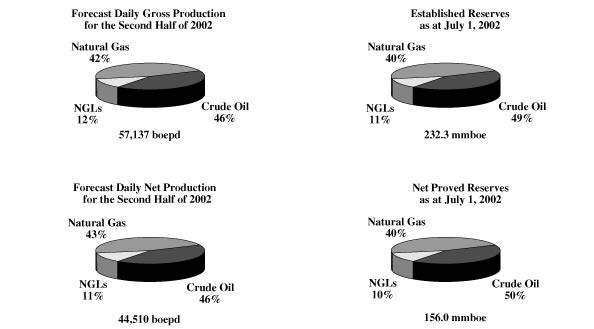

Based on the GLJ July Report, Pengrowth Trust has pro forma established reserves of 232.3 mmboe and pro forma net proved reserves of 156.0 mmboe, in each case after giving effect to the acquisition of the New B.C. Properties. We have interests in approximately 70 properties. Our portfolio reserve life index is 9.5 years on a net proved reserves basis and 11.1 years on an established reserves basis. Approximately 59% of our established reserves and 70% of our net proved reserves are in the proved producing category. Based on the GLJ July Report, we have the following allocations of production and reserves, on a boe basis:

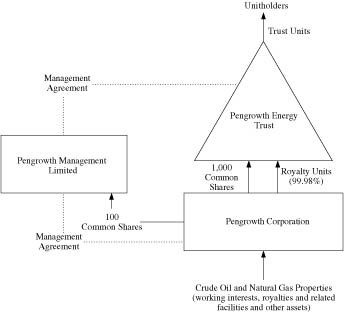

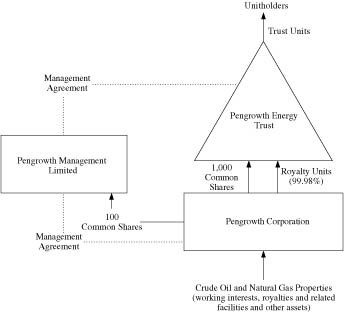

Pengrowth Trust is a publicly traded Canadian oil and gas royalty trust created in 1988. The assets of Pengrowth Trust include 90.9% of the outstanding equity shares of Pengrowth Corporation and 99.98% of the outstanding royalty units of Pengrowth Corporation. Pengrowth Corporation acquires, owns and operates

4

working interests and royalty interests in oil and natural gas properties. The royalty units of Pengrowth Corporation entitle the holders thereof to receive a 99% share of the royalty income related to the oil and natural gas interests of Pengrowth Corporation. Royalty income represents essentially all of the revenues received by Pengrowth Corporation from its oil and natural gas interests, less operating costs, royalties, general and administrative expenses, management fees, debt service charges, taxes, and any amount retained as a reserve. Pengrowth Trust’s share of royalty income, together with any lease, interest and other income of Pengrowth Trust, less general and administrative expenses, management fees, debt repayment, taxes and other expenses (provided that there is no duplication of expenses already deducted from royalty income), forms the distributable income of Pengrowth Trust. Pengrowth Trust distributes this distributable income on a monthly basis to the holders of trust units. See “Distributions”.

Our Canadian royalty trust structure allows us to effectively acquire new oil and natural gas interests and to engage in operations to maximize the returns on our existing interests. Pengrowth Trust and Pengrowth Corporation generally do not pay income taxes, either in Canada or in the United States. Tax deductions available to Pengrowth Trust reduce the taxable component of distributions to Canadian resident unitholders as well as the proportion of distributions to unitholders other than Canadian residents which are subject to withholding taxes. Pengrowth Trust has elected to be treated as a partnership for United States income tax purposes which will also reduce the taxable component of distributions payable to unitholders resident in the United States. See “Certain Income Tax Considerations”.

Pengrowth Trust and Pengrowth Corporation are managed by Pengrowth Management under a management agreement. Pengrowth Management earns a management fee based on net production revenue and an acquisition fee based on the cost of acquisitions. All expenses incurred by Pengrowth Management on behalf of Pengrowth are reimbursable by Pengrowth. All significant transactions undertaken by Pengrowth are subject to the approval of the board of directors of Pengrowth Corporation. The management agreement must be considered by unitholders every three years at the annual meeting, which will occur next in 2003, and may be terminated upon three years notice or amended upon agreement with Pengrowth Management. Our unitholders are entitled to elect a majority of the board of directors of Pengrowth Corporation at annual shareholder meetings and to exercise in excess of 99.98% of all of the voting rights at any meeting of the shareholders of Pengrowth Corporation.

The following chart illustrates the organization and structure of Pengrowth:

5

Business Strategy

Our goal is to maximize cash distributions to our unitholders while maintaining the value of the trust units. We do not explore for oil and natural gas. Instead we focus on making effective acquisitions and maximizing the value of our mature property base by reducing operating costs, implementing applicable development technologies, including three dimensional seismic and tertiary recovery operations and implementing other operational efficiencies.

Our business model is designed to increase distributions to our unitholders. Our ability to pay out distributions while enhancing unitholder value over time is dependent upon effective operations and our ability to make acquisitions which yield returns that exceed our estimated cost of capital. We evaluate acquisition opportunities based on the following general acquisition criteria:

Financial

| | |

| | • | Acquisitions should increase distributions on a per trust unit basis based upon current economics. |

| |

| | • | The aggregate purchase price of all properties acquired in a single transaction should not exceed the undiscounted aggregate projected net cash flow from the properties from the date of purchase plus a reasonable rate of return in the circumstances. |

| |

| | • | The oil and gas producing properties to be acquired should, in the context of the market, have an attractive rate of return and a low reserve cost. |

Operational

| | |

| | • | Properties to be acquired should be high quality, proven producing properties in unitized areas which have long life reserves relative to typical Canadian properties. Pengrowth gives priority to properties with: |

| | |

| | — | low capital expenditures relative to cash generation potential; |

| |

| | — | low operating costs or high margins; |

| |

| | — | experienced well-regarded operators or where operatorship may be assumed by Pengrowth; |

| |

| | — | favourable production history; |

| |

| | — | upside potential through infill drilling, improved field operations and other development activities; |

| |

| | — | long reserve life; and |

| |

| | — | low environmental and site remediation risk. |

Independent Verification

| | |

| | • | Each purchase of new properties will be based on an independent engineering report except for properties where the purchase price is less than $5 million. |

Our structure, tax effectiveness and cost of capital allow us to bid competitively for oil and natural gas properties against taxable corporations and other taxable entities. Opportunities to acquire oil and gas properties generally arise from sellers looking to reduce indebtedness, seeking funds for higher risk reward exploration and development activities, exiting the business, or fulfilling other strategic objectives.

6

History of Growth

Through the execution of our business strategy, we have increased our production and reserves each year over the 14-year history of Pengrowth. Cumulative cash distributions total $22.60 per trust unit from inception up to and including the October 15, 2002 distribution. Our initial public offering price in 1988 was $10.00 per trust unit.

Based on the GLJ July Report, our forecast average daily production for the second half of 2002 is 57,137 boepd, including the New B.C. Properties, representing an annual increase on an annual compound basis of 45% since 1989.

| |

| (1) | Forecast average daily gross production for the second half of 2002, including the New B.C. Properties, based on the GLJ July Report. |

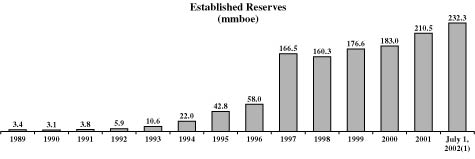

Based on the GLJ July Report our established reserves have increased from 3.4 mmboe on December 31, 1989 to 232.3 mmboe on July 1, 2002, including the New B.C. Properties, an annual increase on an annual compound basis of 40%.

| |

| (1) | As at July 1, 2002, including the New B.C. Properties, based on the GLJ July Report. |

| |

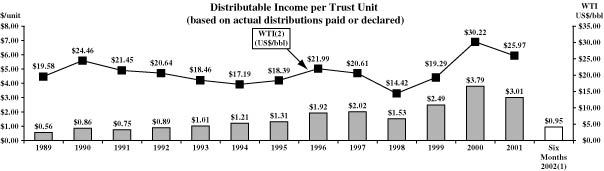

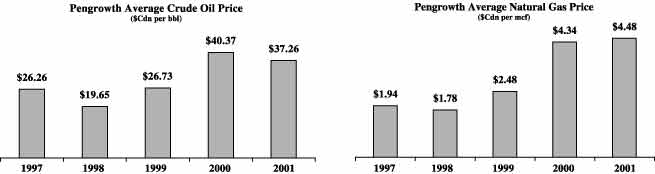

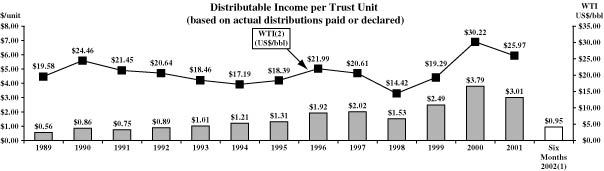

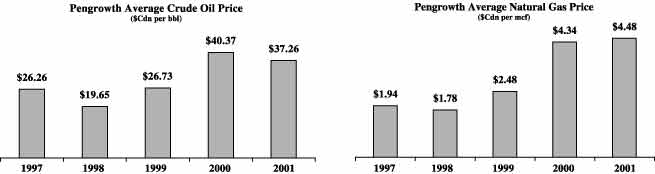

| (1) | As of June 30, 2002. |

| |

| (2) | Average daily closing price of West Texas Intermediate at Cushing, Oklahoma. |

7

| |

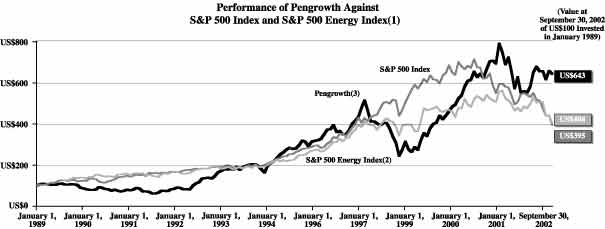

| (1) | Up to and including the October 15, 2002 distribution declared September 19, 2002. |

| |

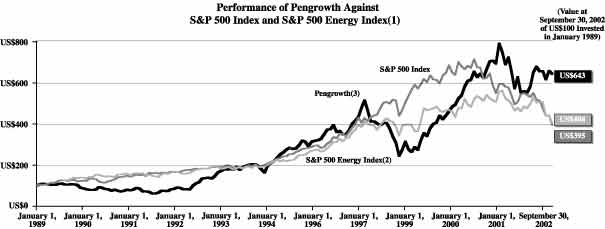

| (1) | Assumes the reinvestment of distributions and/or dividends. |

| |

| (2) | The S&P 500 Energy Index began in September 1989 at the level of the S&P 500 Index due to the lack of historical data. |

| |

| (3) | Based on weekly closing price of our trust units on the Toronto Stock Exchange, converted to US$ at the Bank of Canada exchange rate on such date. |

| |

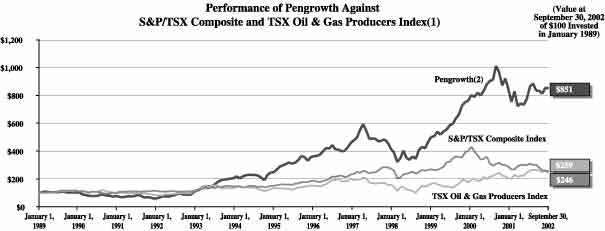

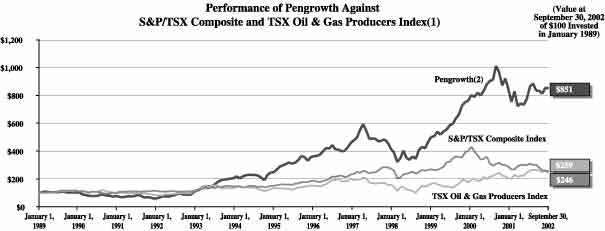

| (1) | Assumes the reinvestment of distributions and/or dividends. |

| |

| (2) | Based on the weekly closing price of our trust units on the Toronto Stock Exchange. |

8

Recent Acquisition

On October 1, 2002, with an effective date of July 1, 2002, we acquired substantially all of the oil and natural gas properties and related infrastructure held by Calpine Canada Natural Gas Partnership in northern British Columbia for $387.5 million, before adjustments. On October 4, 2002, we sold certain of these properties to Progress Energy Ltd. for $25.4 million, before adjustments. Our net purchase price following the sale to Progress Energy Ltd. was $345.6 million, after adjustments. Based on the GLJ July Report, forecast production for the New B.C. Properties for the second half of 2002 is 39.1 mmcfpd (29.5 mmcfpd net) of natural gas and 9,268 bblpd (6,975 bblpd net) of oil and NGLs for a total of 15,785 boepd (11,901 boepd net). Also based on the GLJ July Report, the acquisition of the New B.C. Properties increased our forecast daily production for the second half of 2002 by 38% from 41,352 boepd (32,466 boepd net) to 57,137 boepd (44,510 boepd net). Established reserves associated with the New B.C. Properties are estimated to be 36.1 mmboe, of which approximately 49% is natural gas, and net proved reserves are estimated to be 23.9 mmboe, of which 46% is natural gas, based on the GLJ July Report. Operating costs for the New B.C. Properties for the first half of 2002 were approximately $3.70 per boe, well below our average of $7.77 per boe for the first half of 2002 (see also “Business — Reserves” and “Recent Acquisition”).

The New B.C. Properties are expected to provide us with several significant benefits. These properties allow us to expand our operations into northern British Columbia with a significant number of proved producing properties that will provide us with additional development opportunities. The relatively high production rates and shorter reserve lives associated with these properties provide a balance to our existing portfolio of properties that are characterized by relatively lower production rates and longer reserve lives. The New B.C. Properties have a reserve life index of approximately 6.3 years (5.3 years on a net proved reserves basis) and as a result our portfolio reserve life index decreased from 13.0 years (11.2 years on a net proved reserves basis) to approximately 11.1 years (9.5 years on a net proved reserves basis).

The New B.C. Properties include 247,700 net undeveloped acres with farmout potential. On October 4, 2002, we farmed-out 30,500 net acres to Progress Energy Ltd. under terms which include a $10 million exploration commitment on this acreage over the next 18 months. Under this agreement Progress Energy Ltd. will be required to incur all of the exploration expenses in respect of 100% of the shared acreage to earn an interest in our share of this acreage. This farmout provides Pengrowth with upside exposure to high impact prospects without the associated exploration risk.

Due to the relatively higher production rates from the New B.C. Properties and the current level of commodity prices that can be obtained for the production from these properties, we anticipate that in the near term this acquisition will allow us to increase distributions while establishing a reserve from funds retained in Pengrowth Corporation in an amount equivalent to approximately 10% of distributable income of Pengrowth Trust for future capital obligations and future distributions. This policy of withholding a portion of cash flow as a reserve will be reviewed by the board of directors of Pengrowth Corporation from time to time based on commodity prices and capital and other commitments.

9

Properties

Our portfolio of properties consists primarily of long life, unitized oil and gas properties with established production profiles. Approximately 68% of our total gross production in 2001 was derived from eight core areas located in the Provinces of Alberta and Saskatchewan and offshore the Province of Nova Scotia. In 2001, we increased our established reserves from 183 mmboe (123 mmboe on a net proved reserves basis) to 211 mmboe (146 mmboe on a net proved reserves basis) through drilling and other optimization strategies and we acquired 48.4 mmboe of new established reserves at an average cost of $5.72 per boe for an overall finding and development cost of $6.85 per boe. Substantially all of the reserves we acquired in 2001 related to interests in the Sable Offshore Energy Project, a large natural gas project located offshore the Province of Nova Scotia operated by ExxonMobil Canada Properties. We raised average production from 33,581 boepd in 2000 to 40,320 boepd in 2001, and to 57,137 boepd (44,510 boepd net) forecast for the second half of 2002, including the New B.C. Properties, based on the GLJ July Report, an increase of approximately 20% and 40%, respectively. Based on the GLJ July Report, our pro forma established reserves are 232.2 mmboe (156.0 mmboe on a net proved reserves basis), consisting of 553.2 bcf (368.6 bcf on a net proved reserves basis) of natural gas and 140.1 mmbbls (94.5 mmbbls on a net proved reserves basis) of oil and NGLs.

On October 1, 2002, with an effective date of July 1, 2002, we acquired the New B.C. Properties, adding new established reserves of 36.1 mmboe at an average cost of $10.03 per boe (US$6.32) and net proved reserves of 23.9 mmboe at an average cost of $15.15 per boe (US$9.55). The New B.C. Properties have working interests averaging 65%, based on reserves, and are characterized by multi-zone potential at a moderate drilling depth and a mature marketing and transportation infrastructure for crude oil and natural gas. Based on the GLJ July Report, forecast production from the New B.C. Properties for the second half of 2002 is 39.1 mmcfpd (29.5 mmcfpd net) of natural gas and 9,268 bblpd (6,975 bblpd net) of crude oil and NGLs. For the second half of 2002, the New B.C. Properties are forecast to contribute 25% of our natural gas production and 30% of crude oil and NGL production, before royalties, based on the GLJ July Report.

10

The following table provides certain information relating to our principal properties based on the GLJ July Report.You should read the information below in conjunction with “Business — Reserves — Notes to Reserves”. For a description of certain differences between estimating reserves under U.S. reserve disclosure guidelines and Canadian reserve disclosure guidelines, please read “Presentation of Our Reserve Information.”

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | Canadian Presentation | | United States Presentation |

| | | |

| |

|

| | | | | | Established | | July 1, | | Estimated | | Net Proved | | July 1, | | Estimated |

| | | | Remaining | | Reserve | | 2002 | | Future | | Reserve | | 2002 | | Future |

| | | | Reserve | | Life | | Established | | Cash Flows(3) | | Life | | Net Proved | | Cash Flows(5) |

| | Operated | | Life(1) | | Index(2) | | Reserves | | (PV-10) | | Index(4) | | Reserves | | (PV-10) |

| Area | | By | | (years) | | (years) | | (mboe) | | ($000) | | (years) | | (mboe) | | ($000) |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Principal Properties (before the New B.C. Properties were acquired) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Judy Creek BHL Unit | | Pengrowth | | | 50 | | | | 14 | | | | 47,911 | | | | 302,773 | | | | | | | | 32,176 | | | | 408,103 | |

| Judy Creek West BHL Unit | | Pengrowth | | | 50 | | | | 16 | | | | 10,841 | | | | 62,958 | | | | | | | | 7,509 | | | | 92,423 | |

| Weyburn Unit | | EnCana Corporation | | | 39 | | | | 20 | | | | 14,463 | | | | 65,574 | | | | | | | | 8,017 | | | | 44,251 | |

| Swan Hills Unit No. 1 | | Devon Canada Corporation | | | 50 | | | | 22 | | | | 14,303 | | | | 64,840 | | | | | | | | 9,617 | | | | 93,471 | |

| Enchant | | Pengrowth | | | 50 | | | | 19 | | | | 6,939 | | | | 33,440 | | | | | | | | 5,147 | | | | 43,837 | |

| Dunvegan Gas Unit No. 1 | | Devon Canada Corporation | | | 50 | | | | 16 | | | | 6,863 | | | | 35,289 | | | | | | | | 4,280 | | | | 30,478 | |

| McLeod River | | Pengrowth | | | 35 | | | | 7 | | | | 4,929 | | | | 40,359 | | | | | | | | 2,798 | | | | 36,794 | |

| Nipisi Non-Unit | | Pengrowth | | | 23 | | | | 8 | | | | 3,783 | | | | 31,268 | | | | | | | | 2,607 | | | | 43,627 | |

| Monogram Gas Unit | | EnCana Corporation | | | 38 | | | | 10 | | | | 4,683 | | | | 46,825 | | | | | | | | 3,913 | | | | 44,770 | |

| Goose River Unit No. 1 | | Conoco Canada Resources Limited | | | 31 | | | | 5 | | | | 3,832 | | | | 31,992 | | | | | | | | 2,284 | | | | 37,323 | |

| Other(6) | | | | | 50 | | | | 13 | | | | 77,688 | | | | 528,290 | | | | | | | | 53,567 | | | | 554,305 | |

| | | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Subtotal | | | | | 50 | (7) | | | 13 | (7) | | | 196,235 | | | | 1,243,608 | | | | 11 | (7)(8) | | | 131,914 | | | | 1,429,382 | |

| | | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

New B.C. Properties | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Rigel | | Pengrowth | | | 29 | | | | 4 | | | | 6,558 | | | | 92,549 | | | | | | | | 4,300 | (9) | | | 109,200 | (9) |

| Oak | | Pengrowth | | | 48 | | | | 11 | | | | 6,845 | | | | 58,865 | | | | | | | | 4,600 | (9) | | | 70,800 | (9) |

| Bulrush | | Pengrowth | | | 43 | | | | 9 | | | | 1,923 | | | | 17,035 | | | | | | | | 1,200 | (9) | | | 17,300 | (9) |

| Squirrel | | Pengrowth | | | 23 | | | | 5 | | | | 5,698 | | | | 78,049 | | | | | | | | 4,200 | (9) | | | 96,300 | (9) |

| Tupper | | Pengrowth | | | 37 | | | | 4 | | | | 1,136 | | | | 14,733 | | | | | | | | 700 | (9) | | | 13,100 | (9) |

| Other(10) | | Pengrowth | | | 50 | | | | 9 | | | | 13,944 | | | | 123,408 | | | | | | | | 8,800 | (9) | | | 126,000 | (9) |

| | | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Subtotal | | | | | 50 | (7) | | | 6 | (7) | | | 36,104 | | | | 384,639 | | | | 5 | (7)(8) | | | 24,072 | (9) | | | 436,609 | (9) |

| | | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

Total | | | | | 50 | (7) | | | 11 | (7) | | | 232,339 | | | | 1,628,247 | | | | 10 | (7)(8) | | | 155,986 | | | | 1,865,991 | |

| | | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| |

| (1) | The estimated number of years for which a property will remain capable of economic production based on the established reserves of the property. |

| |

| (2) | The number of years determined by dividing the established reserves as at July 1, 2002 of each property by the estimated annual production. |

| |

| (3) | PV-10 is the present value of the estimated future cash flows to Pengrowth before income taxes from established reserves, discounted at 10% per year, calculated using escalated price and cost assumptions, as detailed in note (7) under “Business — Reserves — Notes to Reserves”. PV-10 is not necessarily indicative of actual future cash flows. |

11

| |

| (4) | The net proved reserve life index has not been determined by area. |

| |

| (5) | PV-10 is the present value of the estimated future net cash flows to Pengrowth before income taxes from net proved reserves, discounted at 10% per year, calculated using constant price and cost assumptions, based on the GLJ July Report. The constant prices used consist of oil at US$28.00 per bbl for WTI at Cushing, Oklahoma FOB and at $42.75 per bbl for light, sweet crude oil at Edmonton FOB and gas at $4.85 per mcf for natural gas (Alberta average) and $43.25, $24.75 and $30.75 per bbl of condensate, propane and butane, respectively, at Edmonton FOB. PV-10 is not necessarily indicative of actual future cash flows. |

| |

| (6) | Includes Pengrowth Corporation’s 99.99% royalty interest in the 8.4% working interest in the Sable Offshore Energy Project held by Emera Offshore Incorporated (a subsidiary of Emera Inc.) and 28 other properties. In accordance with the confidentiality agreement between Pengrowth Corporation, Emera Offshore Incorporated and the other Sable Offshore Energy Project owners, Pengrowth Corporation is precluded from presenting certain information with respect thereto except on a consolidated basis. |

| |

| (7) | Average calculated on a weighted basis based on boe reserves. |

| |

| (8) | The number of years determined by dividing the net proved reserves as at July 1, 2002 by the estimated annual net production. |

| |

| (9) | The net proved reserves and the estimated future cash flows presented using constant price and cost assumptions for the New B.C. Properties by area are approximate and the sum of the reserves and cash flows presented by area do not equal the respective subtotals which represent the aggregate net proved reserves and estimated future cash flows, respectively, for the New B.C. Properties. |

| |

| (10) | Includes 26 properties. |

12

The Offering

| | |

Trust units offered by

Pengrowth Trust | | l trust units |

| |

| Over-allotment option | | l trust units |

| |

Trust units outstanding after

the offering | | l trust units

(l trust units if the over-allotment option is exercised in full) |

| |

| Use of Proceeds | | The net proceeds from this offering will be provided by Pengrowth Trust to Pengrowth Corporation and will be used by Pengrowth Corporation to repay existing outstanding indebtedness pursuant to interim facilities obtained to fund the acquisition of the New B.C. Properties. RBC Dominion Securities Inc. and RBC Dain Rauscher Inc. are subsidiaries of the lender that provided these interim facilities, and which will receive the net proceeds of this offering to repay all, or a portion, of these additional facilities. See “Underwriting” and “Relationship between Pengrowth Corporation and Certain Underwriters”. |

| |

| Toronto Stock Exchange Symbol | | PGF.UN |

| |

| New York Stock Exchange Symbol | | PGH |

| |

| Cash Distributions | | We pay cash distributions on the 15th day of each month to our unitholders of record on the 10th business day immediately proceeding the payment date. The first distribution to which subscribers for trust units in this offering will be entitled will be payable on December 15, 2002. |

| |

| Estimated ratio of taxable income to distributions (Canada) | | We estimate that approximately 30% to 35% of distributions paid in 2002 will be taxable to Canadian residents for 2002 based on distributions paid in 2002, including the October 15, 2002 distribution declared September 19, 2002, current commodity prices, forecast production for the remainder of 2002 based on the GLJ July Report, including the New B.C. Properties, and the receipt of net proceeds of $234.25 million pursuant to this offering. See “Certain Income Tax Considerations — Certain Canadian Income Tax Considerations”. |

| |

| Estimated ratio of taxable income to distributions (United States) | | We estimate that subscribers resident in the United States who hold the trust units purchased in this offering through December 31, 2003, will be able to reduce the component of their distributions which are subject to United States federal taxable income for that period by approximately US$0.68 for depreciation and depletion based upon a hypothetical issuance price equal to the closing price of the trust units of US$9.07 on the New York Stock Exchange on October 10, 2002. See “Certain Income Tax Considerations — Certain United States Income Tax Considerations”. |

13

Selected Historical and Pro Forma Financial and Operating Data

The following table presents summary consolidated historical financial data for the years ended December 31, 1999, 2000 and 2001 and for the six month periods ended June 30, 2001 and 2002, in each case derived from the consolidated financial statements of Pengrowth Trust at each of these dates and for the periods then ended, as well as the Reconciliation of Interim Consolidated Financial Statements of Pengrowth Energy Trust for the six months ended June 30, 2002 to United States generally accepted accounting principles and from the unaudited pro forma consolidated balance sheet of Pengrowth Trust at June 30, 2002 and the unaudited pro forma combined statements of income and distributable income of Pengrowth Trust for the year ended December 31, 2001 and for the six months ended June 30, 2002. The unaudited pro forma consolidated balance sheet was prepared as if the (i) acquisition of the B.C. Asset Package, (ii) the disposition of a portion of the B.C. Asset Package to Progress Energy Ltd., (iii) the issuance of 17,123,287 trust units for net proceeds of $234.25 million and (iv) the other transactions described in the notes to the pro forma financial statements, had occurred on June 30, 2002 and the pro forma combined statements of income and distributable income for the year ended December 31, 2001 and for the six months ended June 30, 2002 were prepared as if such transactions had occurred on the first day of the period presented. The consolidated financial statements of Pengrowth Trust as at and for the years ended December 31, 1999, 2000 and 2001 have been audited by KPMG LLP. The pro forma consolidated financial statements of Pengrowth Trust have not been audited but have been reviewed, as to compilation only, by KPMG LLP. See “Comments for United States Readers on Differences between Canadian and United States Reporting Standards” included in the pro forma consolidated financial statements.

You should read the following data along with “Management’s Discussion and Analysis of Operating Results and Financial Condition” and the consolidated financial statements and related notes of Pengrowth Trust, as well as the Reconciliation of Interim Consolidated Financial Statements of Pengrowth Energy Trust for the six months ended June 30, 2002 to United States generally accepted accounting principles, included in this prospectus. You should also read the pro forma information together with the unaudited pro forma consolidated financial statements and related notes of Pengrowth Trust included in this prospectus.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Pro Forma |

| | | | | | Six Months Ended | | Six Months |

| | Years Ended December 31, | | Pro Forma | | June 30, | | Ended |

| |

| | Year Ended | |

| | June 30, |

| | 1999 | | 2000 | | 2001 | | December 31, 2001 | | 2001 | | 2002 | | 2002 |

| |

| |

| |

| |

| |

| |

| |

|

| | |

| | (In thousands of Canadian dollars, except per unit amounts) |

INCOME AND DISTRIBUTABLE

INCOME STATEMENT DATA | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenues: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Oil and gas sales | | | 252,408 | | | | 416,228 | | | | 469,929 | | | | 717,542 | | | | 264,004 | | | | 203,178 | | | | 284,652 | |

| | Processing and other income | | | 3,715 | | | | 5,520 | | | | 7,071 | | | | 7,071 | | | | 3,359 | | | | 3,036 | | | | 3,036 | |

| | Royalties and mineral taxes | | | (31,886 | ) | | | (76,588 | ) | | | (71,960 | ) | | | (116,102 | ) | | | (45,940 | ) | | | (27,439 | ) | | | (45,118 | ) |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| | Operating Revenues, after royalties | | | 224,237 | | | | 345,160 | | | | 405,040 | | | | 608,511 | | | | 221,423 | | | | 178,775 | | | | 242,570 | |

| | Interest and other income | | | 1,144 | | | | 5,788 | | | | 1,348 | | | | 1,348 | | | | 1,063 | | | | (525 | ) | | | (525 | ) |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| | Net Revenue | | | 225,381 | | | | 350,948 | | | | 406,388 | | | | 609,859 | | | | 222,486 | | | | 178,250 | | | | 242,045 | |

| Expenses: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Operating | | | 57,642 | | | | 65,195 | | | | 104,943 | | | | 134,777 | | | | 43,790 | | | | 58,057 | | | | 68,618 | |

| | Amortization of injectants for miscible floods | | | 13,964 | | | | 32,463 | | | | 47,448 | | | | 47,448 | | | | 22,518 | | | | 23,454 | | | | 23,454 | |

| | General and administrative | | | 5,972 | | | | 7,081 | | | | 7,467 | | | | 7,467 | | | | 3,627 | | | | 5,219 | | | | 5,219 | |

| | Management fee | | | 4,490 | | | | 6,873 | | | | 7,120 | | | | 11,461 | | | | 4,714 | | | | 3,140 | | | | 4,471 | |

| | Depletion, depreciation and future site restoration | | | 80,981 | | | | 96,865 | | | | 132,737 | | | | 192,040 | | | | 60,304 | | | | 67,872 | | | | 98,729 | |

| | Interest | | | 10,882 | | | | 17,354 | | | | 18,806 | | | | 26,380 | | | | 9,929 | | | | 6,165 | | | | 8,126 | |

| | Capital taxes and other | | | 1,227 | | | | 1,902 | | | | 2,717 | | | | 3,175 | | | | 1,852 | | | | 297 | | | | 490 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| | Total Expenses | | | 175,158 | | | | 227,733 | | | | 321,238 | | | | 422,748 | | | | 146,734 | | | | 164,204 | | | | 209,107 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

14

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Pro Forma |

| | | | | | Six Months Ended | | Six Months |

| | Years Ended December 31, | | Pro Forma | | June 30, | | Ended |

| |

| | Year Ended | |

| | June 30, |

| | 1999 | | 2000 | | 2001 | | December 31, 2001 | | 2001 | | 2002 | | 2002 |

| |

| |

| |

| |

| |

| |

| |

|

| | |

| | (In thousands of Canadian dollars, except per unit amounts) |

| Net Income: | | | 50,223 | | | | 123,215 | | | | 85,150 | | | | 187,111 | | | | 75,752 | | | | 14,046 | | | | 32,938 | |

| Add: depletion, depreciation and future site restoration | | | 80,981 | | | | 96,865 | | | | 132,737 | | | | 192,040 | | | | 60,304 | | | | 67,872 | | | | 98,729 | |

| Deduct: remediation expenses and other | | | (3,032 | ) | | | (1,740 | ) | | | (2,100 | ) | | | (2,100 | ) | | | (590 | ) | | | (659 | ) | | | (659 | ) |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Distributable income | | | 128,172 | | | | 218,340 | | | | 215,787 | | | | 377,051 | (1) | | | 135,466 | | | | 81,259 | | | | 131,008 | (1) |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Net Income per unit: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Basic | | | $0.98 | | | | $2.21 | | | | $1.20 | | | | $2.13 | | | | $1.15 | | | | $0.17 | | | | 0.33 | |

| | Diluted | | | $0.98 | | | | $2.19 | | | | $1.20 | | | | $2.12 | | | | $1.14 | | | | $0.17 | | | | 0.33 | |

| Distributable income per unit: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Based on weighted average units outstanding | | | $2.50 | | | | $3.92 | | | | $3.04 | | | | $4.28 | (1) | | | $2.06 | | | | $0.97 | | | | 1.30 | (1) |

| | Based on actual distributions paid or declared | | | $2.49 | | | | $3.79 | | | | $3.01 | | | | | | | | $1.97 | | | | $0.95 | | | | | |

US GAAP(2) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Income | | | 78,741 | | | | 150,654 | | | | 110,748 | | | | 215,933 | | | | 87,974 | | | | 26,170 | | | | 46,983 | |

| Net Income per unit: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Basic | | | 1.54 | | | | 2.71 | | | | 1.56 | | | | 2.45 | | | | 1.34 | | | | 0.31 | | | | 0.47 | |

| | Diluted | | | 1.54 | | | | 2.67 | | | | 1.56 | | | | 2.45 | | | | 1.33 | | | | 0.31 | | | | 0.47 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Pro Forma |

| | | | | | Six Months Ended | | Six Months |

| | Years Ended December 31, | | Pro Forma | | June 30, | | Ended |

| |

| | Year Ended | |

| | June 30, |

| | 1999 | | 2000 | | 2001 | | December 31, 2001 | | 2001 | | 2002 | | 2002 |

| |

| |

| |

| |

| |

| |

| |

|

| | |

| | (In thousands of Canadian dollars, except per unit amounts and operating data) |

OTHER FINANCIAL DATA | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Distributions to Unitholders | | | 114,163 | | | | 197,826 | | | | 241,590 | | | | — | | | | 142,115 | | | | 72,420 | | | | — | |

| | EBITDA(3) | | | 143,313 | | | | 239,336 | | | | 239,410 | | | | 408,706 | | | | 147,837 | | | | 88,380 | | | | 140,283 | |

OPERATING DATA | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Daily gross production | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Oil (bblpd) | | | 17,570 | | | | 17,599 | | | | 19,726 | | | | 28,658 | | | | 20,039 | | | | 18,302 | | | | 27,588 | |

| | Gas (mcfpd) | | | 61,494 | | | | 70,098 | | | | 91,764 | | | | 146,303 | | | | 74,709 | | | | 106,936 | | | | 142,353 | |

| | Natural gas liquids (bblpd) | | | 3,927 | | | | 4,205 | | | | 5,258 | | | | 6,262 | | | | 4,385 | | | | 5,176 | | | | 5,820 | |

| | Oil equivalent (boepd) | | | 31,821 | | | | 33,581 | | | | 40,320 | | | | 59,346 | | | | 36,933 | | | | 41,312 | | | | 57,145 | |

15

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | As at December 31, | | | | |

| |

| | As at June | | Pro Forma as at |

| | 1999 | | 2000 | | 2001 | | 30, 2002 | | June 30, 2002 |

| |

| |

| |

| |

| |

|

| | |

| | (In thousands of Canadian dollars, except per unit amounts and ratios) |

BALANCE SHEET DATA | | | | | | | | | | | | | | | | | | | | |

| Assets: | | | | | | | | | | | | | | | | | | | | |

| | Current assets | | | 27,269 | | | | 46,145 | | | | 34,343 | | | | 36,689 | | | | 36,689 | |

| | Remediation Trust Fund | | | 3,785 | | | | 5,515 | | | | 6,470 | | | | 6,808 | | | | 6,808 | |

| | Property, Plant and Equipment and other assets | | | 826,860 | | | | 1,038,823 | | | | 1,208,526 | | | | 1,145,197 | | | | 1,493,897 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| | | | 857,914 | | | | 1,090,483 | | | | 1,249,339 | | | | 1,188,694 | | | | 1,537,394 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Liabilities and Unitholders’ Equity: | | | | | | | | | | | | | | | | | | | | |

| | Current Liabilities | | | 50,447 | | | | 90,900 | | | | 54,089 | | | | 64,455 | | | | 64,455 | |

| | Long-term debt | | | 230,333 | | | | 286,823 | | | | 345,456 | | | | 219,123 | | | | 333,573 | |

| | Future site restoration costs | | | 18,544 | | | | 25,285 | | | | 32,591 | | | | 37,903 | | | | 37,903 | |

| | Future income taxes | | | — | | | | 45,510 | | | | — | | | | — | | | | — | |

| | Trust Unitholders’ Equity | | | 558,590 | | | | 641,965 | | | | 817,203 | | | | 867,213 | | | | 1,101,463 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| | | | 857,914 | | | | 1,090,483 | | | | 1,249,339 | | | | 1,188,694 | | | | 1,537,394 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

US GAAP(2) | | | | | | | | | | | | | | | | | | | | |

| | Trust Unitholders’ Equity | | | 208,739 | | | | 319,553 | | | | 520,899 | | | | 583,033 | | | | 817,283 | |

OTHER BALANCE SHEET DATA | | | | | | | | | | | | | | | | | | | | |

| Debt to total book capitalization(4) | | | 29.3% | | | | 30.9% | | | | 29.7% | | | | 20.4% | | | | 23.4% | |

US GAAP(2) | | | | | | | | | | | | | | | | | | | | |

| | Debt to total book capitalization(4) | | | 52.5% | | | | 47.3% | | | | 39.9% | | | | 27.3% | | | | 29.2% | |

| |

| (1) | Pro forma distributable income for the year ended December 31, 2001 and the six months ended June 30, 2002 does not take into account the reserve to be established in Pengrowth Corporation. See “Distributions.” |

| |

| (2) | Please see note 13 to the consolidated financial statements as at and for the years ended December 31, 2000 and 2001, note 13 to the consolidated financial statements as at and for the years ended December 31, 1999 and 2000, the U.S. GAAP Reconciliation in respect of the interim consolidated financial statements as at June 30, 2002 and for the six months ended June 30, 2001 and 2002, and note 4 to the unaudited pro forma consolidated financial statements for the periods ended December 31, 2001 and June 30, 2002. |

| |

| (3) | EBITDA represents earnings before interest expense, taxes, depreciation and amortization. We have calculated EBITDA as net income plus the following expenses: interest, capital taxes and other, and depletion, depreciation and future site restoration. EBITDA is presented because we believe it is frequently used by security analysts and others in evaluating companies and their ability to service debt. However, EBITDA should not be considered as an alternative to net revenue as a measure of liquidity or as an alternative to net income as an indicator of our operating performance or any other measure of performance in accordance with Canadian GAAP or United States GAAP. EBITDA, as we use the term herein, may not be comparable to EBITDA as reported by other entities. |

| |

| (4) | Long-term debt divided by long-term debt plus trust unitholders’ equity. |

16

Selected Reserve Information

The following tables show selected oil and natural gas reserve data for the New B.C. Properties as well as Pengrowth on a pro forma basis as at July 1, 2002 including the New B.C. Properties. We have derived the following tables from the GLJ July Report.These tables should be read together with the information set out under “Business — Reserves” and, in particular, the notes set out under “Business — Reserves — Notes to Reserves”. The bold face information in the following tables indicates the information ordinarily disclosed in accordance with U.S. reserves disclosure guidelines. For a description of certain differences between estimating reserves under U.S. reserve disclosure guidelines and Canadian reserve disclosure guidelines, please read “Presentation of Our Reserve Information.”

The tables below summarize the reserves as at July 1, 2002 associated with the New B.C. Properties.

New B.C. Properties Reserves

Constant Prices and Costs(1)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | Estimated Future Net Cash Flow |

| | | | | | Before Income Tax |

| | Gross Reserves | | Net Reserves | | ($ Millions) |

| |

| |

| |

|

| | | | Natural | | | | | | Natural | | | | | | |

| | | | Gas | | Natural | | | | | | Gas | | Natural | | | | | | Discounted at |

| | Oil | | Liquids | | Gas | | BOE | | Oil | | Liquids | | Gas | | BOE | | Undis- | |

|

| | (mbbls) | | (mbbls) | | (bcf) | | (mbbls) | | (mbbls) | | (mbbls) | | (bcf) | | (mbbls) | | counted | | 10% | | 12% | | 15% | | 18% |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Proved Producing | | | 10,593 | | | | 1,157 | | | | 58.7 | | | | 21,530 | | | | 8,712 | | | | 920 | | | | 45.5 | | | | 17,216 | | | | 457 | | | | 337 | | | | 321 | | | | 300 | | | | 283 | |

| Proved Non-Producing | | | 3,664 | | | | 273 | | | | 26.8 | | | | 8,411 | | | | 3,054 | | | | 216 | | | | 20.4 | | | | 6,663 | | | | 176 | | | | 96 | | | | 87 | | | | 77 | | | | 68 | |

Total Proved | | | 14,257 | | | | 1,430 | | | | 85.5 | | | | 29,941 | | | | 11,766 | | | | 1,136 | | | | 65.9 | | | | 23,879 | | | | 633 | | | | 433 | | | | 408 | | | | 377 | | | | 351 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Risked Probable | | | 2,550 | | | | 302 | | | | 21.1 | | | | 6,367 | | | | 2,050 | | | | 240 | | | | 16.2 | | | | 4,999 | | | | 133 | | | | 67 | | | | 61 | | | | 54 | | | | 47 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Total Established | | | 16,807 | | | | 1,732 | | | | 106.6 | | | | 36,308 | | | | 13,861 | | | | 1,376 | | | | 82.1 | | | | 28,878 | | | | 766 | | | | 500 | | | | 469 | | | | 431 | | | | 398 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| |

| (1) | Assuming prices remain constant for oil at US$28.00 per bbl for West Texas Intermediate at Cushing, Oklahoma FOB and at $42.75 per bbl for light, sweet crude oil at Edmonton FOB and for gas at $4.85 per mcf for natural gas (Alberta average) and $43.25, $24.75 and $30.75 per bbl of condensate, propane and butane respectively, at Edmonton FOB. |

New B.C. Properties Reserves

Escalated Prices and Costs

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | Estimated Future Net Cash Flow |

| | | | | | Before Income Tax |

| | Gross Reserves | | Net Reserves | | ($ Millions) |

| |

| |

| |

|

| | | | Natural | | | | | | Natural | | | | | | |

| | | | Gas | | Natural | | | | | | Gas | | Natural | | | | | | Discounted at |

| | Oil | | Liquids | | Gas | | BOE | | Oil | | Liquids | | Gas | | BOE | | Undis- | |

|

| | (mbbls) | | (mbbls) | | (bcf) | | (mbbls) | | (mbbls) | | (mbbls) | | (bcf) | | (mbbls) | | counted | | 10% | | 12% | | 15% | | 18% |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Proved Producing | | | 10,499 | | | | 1,150 | | | | 58.3 | | | | 21,369 | | | | 8,636 | | | | 915 | | | | 45.3 | | | | 17,094 | | | | 346 | | | | 264 | | | | 253 | | | | 239 | | | | 226 | |