| o | REGISTRATION STATEMENT PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934. |

| þ | ANNUAL REPORT PURSUANT TO SECTION 13(a) OF THE SECURITIES EXCHANGE ACT OF 1934 |

(Province or other jurisdiction of incorporation or organization)

| 1311 | None | |

| (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

Calgary, Alberta Canada T2P 0B4

(403) 233-0224

(Address and telephone number of Registrant’s principal executive offices)

111-8th Avenue, New York, New York 10011

(212) 894-8940

of agent for service in the United States)

| Brad D. Markel Bennett Jones LLP 4500 Bankers Hall East 855 — 2nd Street SW Calgary, Alberta T2P 4K7 Canada (403) 298-3100 | Edwin S. Maynard Paul, Weiss, Rifkind, Wharton & Garrison LLP 1285 Avenue of the Americas New York, New York 10019-6064 USA (212) 373-3000 |

| Title of each class | Name of each exchange on which registered | |

| Trust Units | New York Stock Exchange |

| Appendix | Documents | |

| A | Pengrowth Energy Trust Annual Information Form for the year ended December 31, 2007. | |

| B | Management’s Discussion and Analysis. | |

| C | Consolidated Financial Statements of Pengrowth Energy Trust, including Management’s Report to Unitholders, the Auditors’ Reports and note 23 thereof which includes a reconciliation of the Consolidated Financial Statements to United States generally accepted accounting principles. | |

| D | Comments by Auditors for U.S. Readers on Canada — U.S. Reporting Differences. | |

| E | Oil and Gas Producing Activities Prepared in Accordance with SFAS No. 69 — “Disclosures about Oil and Gas Producing Activities”. | |

| F | Pengrowth Energy Trust Code of Business Conduct and Ethics dated February 19, 2008. |

| Date: March 19, 2008 | PENGROWTH ENERGY TRUST by its Administrator PENGROWTH CORPORATION | |||

| By: | /s/ James S. Kinnear | |||

| James S. Kinnear | ||||

| Chairman, President and Chief Executive Officer | ||||

ENDED DECEMBER 31, 2007

For the year ended December 31, 2007

GLOSSARY OF TERMS AND ABBREVIATIONS | 1 | |||

| Corporate | 1 | |||

| Engineering | 2 | |||

| Abbreviations | 3 | |||

CONVERSION | 4 | |||

PRESENTATION OF OUR FINANCIAL INFORMATION | 5 | |||

PRESENTATION OF OUR RESERVE INFORMATION | 5 | |||

FORWARD-LOOKING STATEMENTS | 5 | |||

PENGROWTH ENERGY TRUST | 7 | |||

| Introduction | 7 | |||

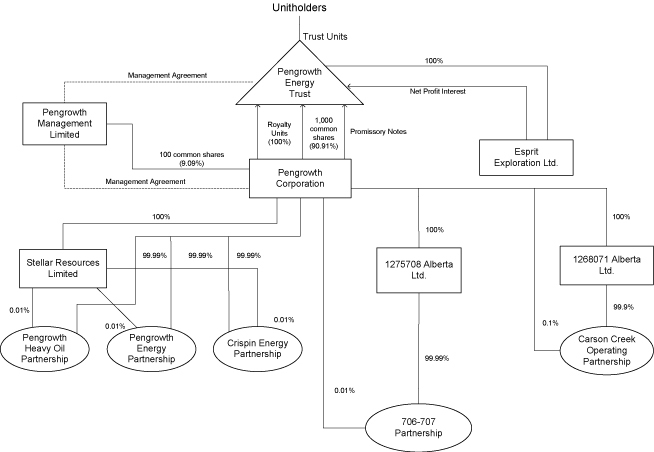

| The Trust | 7 | |||

| The Corporation | 7 | |||

| The Trust’s Subsidiaries | 7 | |||

| The Corporation’s Subsidiaries | 8 | |||

| The Manager | 8 | |||

| Intercorporate Relationships | 8 | |||

| Business Strategy and Strengths | 9 | |||

| SIFT Legislation Considerations | 11 | |||

GENERAL DEVELOPMENT OF PENGROWTH ENERGY TRUST | 12 | |||

| Recent Developments | 12 | |||

| Historical Developments | 16 | |||

| Trends | 19 | |||

PENGROWTH MANAGEMENT LIMITED | 20 | |||

| Business | 20 | |||

| Management Agreement | 20 | |||

| Bonus Pool | 21 | |||

| Management Agreement Second Term | 22 | |||

PENGROWTH – OPERATIONAL INFORMATION | 23 | |||

| Principle Properties | 23 | |||

| Light Oil Properties | 24 | |||

| Heavy Oil Properties | 27 | |||

| Conventional Gas Properties | 28 | |||

| Shallow Gas Properties | 31 | |||

| Offshore Gas Properties | 33 | |||

| Statement of Oil and Gas Reserves and Reserves Data | 35 | |||

| Additional Information Relating to Reserves Data | 45 | |||

| Future Development Costs | 47 | |||

| Finding, Development and Acquisition Costs | 47 | |||

| Future Development Capital | 48 | |||

| Other Oil and Gas Information | 49 | |||

| Additional Information Concerning Abandonment & Reclamation Costs | 50 | |||

| Costs Incurred | 51 | |||

| Exploration and Development Activities | 51 | |||

| Production Estimates | 51 | |||

| Production History (Netback) | 52 | |||

| Replacement of Properties | 52 | |||

TRUST UNITS | 53 | |||

| The Trust Indenture | 53 | |||

| The Trustee | 54 | |||

| Stock Exchange Listings | 54 | |||

| Ownership Restrictions | 54 | |||

| Redemption Right | 54 |

| Conversion Rights | 55 | |||

| Voting at Meetings of Unitholders | 55 | |||

| Voting at Meetings of Corporation | 55 | |||

| Termination of the Trust | 55 | |||

| Unitholder Limited Liability | 56 | |||

THE ROYALTY INDENTURE | 57 | |||

| Royalty Units | 57 | |||

| The Royalty | 57 | |||

| The Trustee | 58 | |||

EXCHANGEABLE SHARES | 58 | |||

DISTRIBUTIONS | 59 | |||

| General | 59 | |||

| Historical Distributions | 59 | |||

| Restrictions on Distributions | 60 | |||

CERTAIN CANADIAN FEDERAL INCOME TAX CONSIDERATIONS | 64 | |||

| Taxation of Unitholders Resident in Canada | 65 | |||

| Taxation of Unitholders who are Non-Residents of Canada | 66 | |||

UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS | 67 | |||

| Classification of Pengrowth Energy Trust as a Partnership | 68 | |||

| Possible Classification as a Corporation; PFIC Rules | 68 | |||

| Consequences of Possible PFIC Classification | 69 | |||

| Tax Consequences of Trust Unit Ownership | 70 | |||

| Tax Treatment of Trust Operations | 71 | |||

| Disposition of Trust Units | 73 | |||

| Disposition of Trust Units by Redemption | 74 | |||

| Uniformity of Trust Units | 75 | |||

| Tax-Exempt Organizations | 75 | |||

| Administrative Matters | 75 | |||

| Reportable Transactions | 76 | |||

| Foreign Partnership Reporting | 76 | |||

INDUSTRY CONDITIONS | 76 | |||

| Government Regulation | 76 | |||

| Pricing and Marketing — Oil | 76 | |||

| Pricing and Marketing — Natural Gas | 77 | |||

| Pricing and Marketing — Natural Gas Liquids | 77 | |||

| Environmental Regulation | 78 | |||

RISK FACTORS | 80 | |||

MARKET FOR SECURITIES | 93 | |||

DIRECTORS AND OFFICERS | 94 | |||

| Directors and Officers of the Manager | 94 | |||

| Principal Holders of Shares of the Manager | 94 | |||

| Directors and Officers of the Corporation | 94 | |||

| Corporate Cease Trade Orders or Bankruptcies | 96 | |||

| Personal Bankruptcies | 97 | |||

| Penalties or Sanctions | 97 | |||

AUDIT COMMITTEE | 97 | |||

| Principal Accountant Fees and Services | 98 | |||

| Pre-approval Policies and Procedures | 98 |

- iii -

CONFLICTS OF INTEREST | 99 | |||

LEGAL PROCEEDINGS | 99 | |||

INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 99 | |||

INTERESTS OF EXPERTS | 100 | |||

AUDITORS, TRANSFER AGENT AND REGISTRAR | 100 | |||

MATERIAL CONTRACTS | 100 | |||

CODE OF ETHICS | 101 | |||

OFF-BALANCE SHEET ARRANGEMENTS | 101 | |||

DISCLOSURE PURSUANT TO THE REQUIREMENTS OF THE NEW YORK STOCK EXCHANGE | 101 | |||

ADDITIONAL INFORMATION | 102 |

Appendix B — Report on Management and Directors on Oil and Gas Disclosure on Form 51-101F3

Appendix C — Audit Committee Terms of Reference

- iv -

- 2 -

- 3 -

| To Convert From | To | Multiply by | ||||||

| Mcf | cubic metre | 28.174 | ||||||

| cubic metre | cubic feet | 35.494 | ||||||

| bbls | cubic metre | 0.159 | ||||||

| cubic metre | bbls | 6.29 | ||||||

| feet | metre | 0.305 | ||||||

| metre | feet | 3.281 | ||||||

| miles | kilometre | 1.609 | ||||||

| kilometre | miles | 0.621 | ||||||

| acres | hectares | 0.405 | ||||||

| hectares | acres | 2.471 | ||||||

- 4 -

- 5 -

- 6 -

- 7 -

- 8 -

- 9 -

| • | Acquisitions should be accretive on a per Trust Unit basis based upon current forecast parameters. In determining whether an acquisition is accretive, we examine the profile of production, operating costs, capital costs, abandonment expenses and other key variables and compare that with our existing asset base to understand the impact over time in terms of production, reserves and distributions on a per Trust Unit basis. | ||

| • | The undiscounted aggregate projected future net cash flow from the properties should exceed the aggregate purchase price of the properties and provide a reasonable rate of return. | ||

| • | Properties to be acquired should be high quality, relatively long life and proven producing properties. Pengrowth gives priority to properties with: |

| o | low anticipated capital expenditures relative to the cash generation potential of the properties; | ||

| o | relatively low operating costs or high netbacks; | ||

| o | experienced, well regarded industry operators or where operatorship may be assumed by Pengrowth; | ||

| o | favourable production history; | ||

| o | upside potential through infill drilling, improved field operations and other development activities; | ||

| o | potential synergies with our current properties and areas of our core expertise; and | ||

| o | low environmental and site remediation risk. |

| • | Each purchase of new properties must be based on an independent engineering report except for properties where the purchase price is less than $5 million. |

| • | Development investments should provide a high rate of return and provide production within a short period of time, or be necessary to maintain existing production operations. Pengrowth prioritizes its development investments based on: |

| o | rate of return; | ||

| o | timing of production; | ||

| o | potential for continued development; and | ||

| o | those investments necessary to maintain existing facilities and wells. |

- 10 -

- 11 -

| Planned Capital Expenditures | ($ millions) | (% of Total) | ||||||

| Drilling and Completions | $ | 281 | 80 | % | ||||

| Plant and Facilities | $ | 44 | 12 | % | ||||

| Land and Seismic | $ | 25 | 7 | % | ||||

Other (e.g., CO2 Pilot) | $ | 5 | 1 | % | ||||

Total Development Capital | $ | 355 | 100 | % | ||||

| Long Term Investments (Lindbergh, Building, IT) | $ | 32 | ||||||

Total Capital | $ | 387 | ||||||

| Average Daily Production Volume (boepd) | 80,000 - 82,000(1) | |||||||

Operating Costs (per boe) | $ | 13.20 | (2) | |||||

General and Administrative Costs (per boe) | $ | 2.20 | (3) | |||||

| (1) | The 2008 estimate excludes potential additions through acquisitions. | |

| (2) | Assuming production targets for 2008 are achieved. | |

| (3) | Includes management fees of approximately $0.40 per boe. |

- 12 -

- 13 -

- 14 -

- 15 -

- 16 -

- 17 -

- 18 -

- 19 -

| • | two distinct three-year terms with a declining fee structure in the second three year term; | ||

| • | a base fee determined on a sliding scale: |

| o | in the first three year contract term: |

| § | two percent of the first $200 million of Income; and | ||

| § | one percent of the balance of Income over $200 million; and |

| o | in the second three year contract term: |

| § | 1.5 percent of the first $200 million of Income; and | ||

| § | 0.5 percent of the balance of Income over $200 million. |

| For these purposes, “Income” means the aggregate of net production revenue of the Corporation and any other income earned from permitted investments of the Trust (excluding interest on cash or near-cash deposits or similar investments). |

| • | a performance based fee based on total returns received by Unitholders which essentially compensates the Manager for total annual returns which average in excess of eight percent per annum over a three year period; | ||

| • | a ceiling on total fees payable determined in reference to a percentage of the fees paid under the previous management agreement: 80 percent each year in the first three year contract term and 60 percent each year in the second three year contract term and subject to a further ceiling essentially equivalent to $12 million annually during the second three year contract term; |

- 20 -

| • | requirement for the Manager to pay certain expenses of the Corporation and the Trust of approximately $2 million per year; | ||

| • | an annual minimum management fee of $3.6 million comprised of $1.6 million of management fees and $2.0 million of expenses; | ||

| • | key man provisions in respect of James S. Kinnear, the President of the Manager; | ||

| • | an annual bonus pool based on 10 percent of the Manager’s base fee and performance fee for employees of, and special consultants to, the Corporation; and | ||

| • | an optional buyout of the Management Agreement at the election of the Board of Directors upon the expiry of the first three year contract term with a termination payment of approximately 2/3 of the management fee paid during the first three year contract term plus expenses of termination. |

| • | reviewing and negotiating acquisitions for the Corporation and the Trust; | ||

| • | providing written reports to the Board of Directors to keep the Corporation fully informed about the acquisition, exploration, development, operation and disposition of properties, the marketing of petroleum substances, risk management practices and forecasts as to market conditions; | ||

| • | supervising the Corporation in connection with it acting as operator of certain of its properties; | ||

| • | arranging for, and negotiating on behalf of, and in the name of, the Corporation all contracts with third parties for the proper management and operation of the properties of the Corporation; | ||

| • | supervising, training and providing leadership to the employees and consultants of the Corporation and assisting in recruitment of key employees of the Corporation; | ||

| • | arranging for professional services for the Corporation and the Trust; | ||

| • | arranging for borrowings by the Corporation and equity issuances by the Trust; and | ||

| • | conducting general Unitholder services, including investor relations, maintaining regulatory compliance, providing information to Unitholders in respect of material changes in the business of the Corporation or the Trust and all other reports required by law, and calling, holding and distributing material in respect of meetings of Unitholders and Royalty Unitholders. |

- 21 -

| • | The termination fee payable to the Manager on termination of the Management Agreement; | ||

| • | The estimated cost of internal management, until June 30, 2009, in the event of a termination of the Management Agreement; | ||

| • | The estimated maximum management fees that would be payable to the Manager over the final three years of the term of the Management Agreement; | ||

| • | The advice of its financial advisor; | ||

| • | The management fee ceiling applicable during the final three years of the Management Agreement, which will result in lower management fees in the second term of the Management Agreement ending June 30, 2009 as compared to the first term of the Management Agreement ended June 30, 2006; and | ||

| • | The commitment by the Manager to certain key governance standards relating to the conduct of the affairs of the Trust and a continuing commitment to overall corporate governance practices (as such practices would apply to Pengrowth in an internalized management structure); and a further commitment to assist and work with the Board in establishing a plan for the orderly transition to a traditional corporate management structure at the end of the final term of the Management Agreement on June 30, 2009. |

- 22 -

at December 31, 2007(1)

(Forecast Prices and Costs)

| P+P | ||||||||||||||||||||||||||||||||

| Value | ||||||||||||||||||||||||||||||||

| Reserve | Before Tax | |||||||||||||||||||||||||||||||

| P+P | Remaining | Life | at 10% | 2007 Oil | 2007 Gas | 2007 NGL | 2007 Total | |||||||||||||||||||||||||

| Reserves(3) | Reserve Life | Index | Discount | Production | Production | Production | Production | |||||||||||||||||||||||||

| Field | (Mboe) | (years) | (years) | ($MM) | (bblpd) | (MMcfd) | (bblpd) | (boepd)(3) | ||||||||||||||||||||||||

Light Oil | ||||||||||||||||||||||||||||||||

| Judy Creek | 40,447 | 50 | 13.3 | 797.9 | 7,359 | 4.1 | 1,529 | 9,564 | ||||||||||||||||||||||||

| Weyburn | 21,966 | 44 | 21.1 | 345.0 | 2,779 | — | — | 2,779 | ||||||||||||||||||||||||

| Swan Hills | 17,593 | 50 | 20.1 | 255.1 | 1,968 | 1.5 | 280 | 2,505 | ||||||||||||||||||||||||

| Carson Creek | 15,194 | 34 | 11.9 | 311.6 | 2,031 | 3.8 | 505 | 3,169 | ||||||||||||||||||||||||

| Fenn Big Valley | 5,998 | 28 | 8.8 | 104.5 | 632 | 6.1 | 54 | 1,703 | ||||||||||||||||||||||||

| Deer Mountain | 5,264 | 45 | 19.7 | 101.4 | 543 | 0.1 | 60 | 618 | ||||||||||||||||||||||||

Other(2) | 35,143 | 9.8 | 883.8 | 8,908 | 9.8 | 708 | 11,256 | |||||||||||||||||||||||||

Sub-Total | 141,605 | 13.1 | 2,799.3 | 24,220 | 25.4 | 3,136 | 31,594 | |||||||||||||||||||||||||

Heavy Oil | ||||||||||||||||||||||||||||||||

| Jenner | 7,728 | 23 | 7.2 | 155.1 | 2,890 | 1.5 | 4 | 3,144 | ||||||||||||||||||||||||

| Bodo | 7,658 | 41 | 12.6 | 107.9 | 1,439 | 2.5 | — | 1,862 | ||||||||||||||||||||||||

| Tangleflags | 5,321 | 25 | 7.3 | 56.2 | 1,910 | 0.2 | — | 1,951 | ||||||||||||||||||||||||

Other(2) | 5,060 | 8.6 | 61.9 | 970 | 5.6 | — | 1,902 | |||||||||||||||||||||||||

Sub-Total | 25,767 | 8.6 | 381.1 | 7,209 | 9.9 | 4 | 8,859 | |||||||||||||||||||||||||

Conventional Gas | ||||||||||||||||||||||||||||||||

| Olds | 26,615 | 48 | 16.4 | 293.1 | 12 | 25.0 | 769 | 4,952 | ||||||||||||||||||||||||

| Harmattan | 10,857 | 36 | 7.9 | 178.8 | 346 | 10.3 | 932 | 2,993 | ||||||||||||||||||||||||

| Dunvegan | 6,204 | 40 | 10.4 | 85.0 | 35 | 8.1 | 444 | 1,835 | ||||||||||||||||||||||||

| Quirk Creek | 5,134 | 38 | 10.5 | 77.9 | — | 3.6 | 214 | 820 | ||||||||||||||||||||||||

| Kaybob | 4,078 | 38 | 13.7 | 45.6 | — | 4.2 | 37 | 736 | ||||||||||||||||||||||||

| McLeod River | 3,688 | 41 | 7.1 | 61.1 | 7 | 6.4 | 250 | 1,316 | ||||||||||||||||||||||||

| Blackstone | 3,588 | 24 | 10.3 | 49.4 | — | 6.1 | — | 1,025 | ||||||||||||||||||||||||

| Carson Creek | 2,958 | 39 | 5.2 | 50.6 | — | 6.2 | 397 | 1,430 | ||||||||||||||||||||||||

Other(2) | 18,788 | 7.3 | 309.1 | 523 | 43.7 | 1,332 | 9,137 | |||||||||||||||||||||||||

Sub-Total | 81,910 | 9.7 | 1,150.6 | 923 | 113.7 | 4,375 | 24,242 | |||||||||||||||||||||||||

Shallow Gas | ||||||||||||||||||||||||||||||||

| Three Hills/Twining | 13,704 | 50 | 10.2 | 218.2 | 537 | 17.7 | 447 | 3,939 | ||||||||||||||||||||||||

| Coal Bed Methane | 9,312 | 41 | 11.3 | 123.9 | 1 | 6.2 | 6 | 1,032 | ||||||||||||||||||||||||

| Monogram | 8,044 | 32 | 8.9 | 127.0 | — | 12.1 | — | 2,015 | ||||||||||||||||||||||||

| Jenner | 7,435 | 33 | 9.4 | 90.7 | 4 | 11.5 | 2 | 1,922 | ||||||||||||||||||||||||

| Lethbridge | 3,685 | 50 | 7.6 | 51.2 | — | 7.2 | — | 1,193 | ||||||||||||||||||||||||

Other(2) | 16,728 | 10.0 | 247.5 | 600 | 30.2 | 18 | 5,713 | |||||||||||||||||||||||||

- 23 -

| P+P | ||||||||||||||||||||||||||||||||

| Value | ||||||||||||||||||||||||||||||||

| Reserve | Before Tax | |||||||||||||||||||||||||||||||

| P+P | Remaining | Life | at 10% | 2007 Oil | 2007 Gas | 2007 NGL | 2007 Total | |||||||||||||||||||||||||

| Reserves(3) | Reserve Life | Index | Discount | Production | Production | Production | Production | |||||||||||||||||||||||||

| Field | (Mboe) | (years) | (years) | ($MM) | (bblpd) | (MMcfd) | (bblpd) | (boepd)(3) | ||||||||||||||||||||||||

Sub-Total | 58,908 | 9.9 | 858.4 | 1,142 | 84.8 | 533 | 15,813 | |||||||||||||||||||||||||

Offshore Gas | ||||||||||||||||||||||||||||||||

| Sable Island | 11,731 | 9 | 4.3 | 266.6 | — | 33.2 | 1,362 | 6,895 | ||||||||||||||||||||||||

Sub-Total | 11,731 | 4.3 | 266.6 | — | 33.2 | 1,362 | 6,895 | |||||||||||||||||||||||||

Total | 319,921 | 10.4 | 5,455.9 | 33,495 | 267.0 | 9,409 | 87,401 | |||||||||||||||||||||||||

| (1) | The estimates of reserves and future net revenue for individual properties may not reflect the same confidence level as estimates of reserves and future net revenue for all properties, due to the effects of aggregation. |

| (2) | “Other” includes Pengrowth’s Working Interests and Royalty Interests in approximately 100 other properties. |

| (3) | Natural gas has been converted to barrels of oil equivalent on the basis of six Mcf of natural gas being equal to one barrel of oil. |

- 24 -

- 25 -

- 26 -

- 27 -

- 28 -

- 29 -

- 30 -

- 31 -

- 32 -

- 33 -

- 34 -

- 35 -

| • | SIFT tax starting January 2011 at 26.5 percent (and 25 percent in 2012 and thereafter) and corporate taxes as currently expected; | ||

| • | Annual general and administration expenses at the current level; | ||

| • | Interest expense at the current level; | ||

| • | Inclusion of tax pools and deductions at the trust level as well as at the operating entity level; | ||

| • | Royalties paid to the Trust in the amount of the operating income; | ||

| • | Distributions to Unitholders; and | ||

| • | Any such other additional deductions and adjustments as is and would be consistent with the manner in which Pengrowth files and would file future tax returns.See“Canadian Income Tax Considerations”. |

- 36 -

as of December 31, 2007

(Forecast Prices and Costs)

| Light and Medium Oil | Heavy Oil | Natural Gas Liquids | ||||||||||||||||||||||||||||||||||

| Company | Gross | Net | Company | Gross | Net | Company | Gross | Net | ||||||||||||||||||||||||||||

| Interest | Interest | Interest | Interest | Interest | Interest | Interest | Interest | Interest | ||||||||||||||||||||||||||||

| Reserves Category | (Mbbls) | (Mbbls) | (Mbbls) | (Mbbls) | (Mbbls) | (Mbbls) | (Mbbls) | (Mbbls) | (Mbbls) | |||||||||||||||||||||||||||

Proved Reserves | ||||||||||||||||||||||||||||||||||||

| Proved Developed Producing | 73,509 | 73,350 | 63,961 | 14,682 | 14,674 | 13,196 | 19,920 | 19,813 | 14,312 | |||||||||||||||||||||||||||

| Proved Developed Non-Producing | 482 | 482 | 406 | 30 | 30 | 29 | 504 | 504 | 325 | |||||||||||||||||||||||||||

| Proved Undeveloped | 18,986 | 18,985 | 15,690 | 2,194 | 2,194 | 1,899 | 1,361 | 1,361 | 1,053 | |||||||||||||||||||||||||||

Total Proved Reserves | 92,977 | 92,817 | 80,057 | 16,906 | 16,898 | 15,124 | 21,786 | 21,677 | 15,691 | |||||||||||||||||||||||||||

| Probable Reserves | 31,211 | 31,180 | 26,533 | 4,885 | 4,883 | 4,273 | 7,208 | 7,185 | 5,195 | |||||||||||||||||||||||||||

Total Proved Plus Probable Reserves | 124,188 | 123,997 | 106,590 | 21,792 | 21,781 | 19,397 | 28,994 | 28,862 | 20,885 | |||||||||||||||||||||||||||

| Natural Gas | Coal Bed Methane | Total Oil Equivalent Basis(1) | ||||||||||||||||||||||||||||||||||

| Company | Gross | Net | Company | Gross | Net | Company | Gross | Net | ||||||||||||||||||||||||||||

| Interest | Interest | Interest | Interest | Interest | Interest | Interest | Interest | Interest | ||||||||||||||||||||||||||||

| Reserves Category | (bcf) | (bcf) | (bcf) | (bcf) | (bcf) | (bcf) | (Mboe) | (Mboe) | (Mboe) | |||||||||||||||||||||||||||

Proved Reserves | ||||||||||||||||||||||||||||||||||||

| Proved Developed Producing | 547,462 | 543,054 | 437,824 | 21,257 | 20,460 | 19,101 | 202,898 | 201,755 | 167,624 | |||||||||||||||||||||||||||

| Proved Developed Non-Producing | 21,168 | 21,084 | 16,044 | 2,712 | 2,632 | 2,405 | 4,997 | 4,968 | 3,835 | |||||||||||||||||||||||||||

| Proved Undeveloped | 50,351 | 50,224 | 41,057 | 14,049 | 13,911 | 12,341 | 33,275 | 33,230 | 27,542 | |||||||||||||||||||||||||||

Total Proved Reserves | 618,981 | 614,363 | 494,925 | 38,018 | 37,002 | 33,847 | 241,169 | 239,953 | 199,000 | |||||||||||||||||||||||||||

| Probable Reserves | 195,282 | 193,874 | 155,116 | 17,402 | 17,115 | 15,579 | 78,752 | 78,414 | 64,450 | |||||||||||||||||||||||||||

Total Proved Plus Probable Reserves | 814,263 | 808,237 | 650,041 | 55,420 | 54,117 | 49,426 | 319,921 | 318,367 | 263,450 | |||||||||||||||||||||||||||

| Note: | ||

| (1) | Natural gas has been converted to barrels of oil equivalent on the basis of six Mcf of natural gas being equal to one barrel of oil. |

- 37 -

of Future Net Revenue

as of December 31, 2007

Before and After Income Taxes

(Forecast Prices and Costs)

| Unit Value Before Income Tax | ||||||||||||||||||||||||||||

| Before Income Taxes Discounted At (%/Year) | Discounted At 10%/Year(1) | |||||||||||||||||||||||||||

| 0% | 5% | 10% | 15% | 20% | ||||||||||||||||||||||||

| Reserves Category | ($MM) | ($MM) | ($MM) | ($MM) | ($MM) | $/boe | $/Mcfe | |||||||||||||||||||||

Proved Reserves | ||||||||||||||||||||||||||||

| Proved Developed Producing | 6,212 | 4,744 | 3,885 | 3,321 | 2,921 | 23.18 | 3.86 | |||||||||||||||||||||

| Proved Developed Non-Producing | 134 | 100 | 79 | 65 | 55 | 20.57 | 3.43 | |||||||||||||||||||||

| Proved Undeveloped | 1,126 | 688 | 459 | 322 | 234 | 16.66 | 2.78 | |||||||||||||||||||||

Total Proved Reserves | 7,473 | 5,532 | 4,423 | 3,708 | 3,210 | 22.22 | 3.70 | |||||||||||||||||||||

| Probable Reserves | 2,960 | 1,602 | 1,033 | 740 | 565 | 16.03 | 2.67 | |||||||||||||||||||||

Total Proved Plus Probable Reserves | 10,433 | 7,134 | 5,456 | 4,448 | 3,775 | 20.71 | 3.45 | |||||||||||||||||||||

| After Income Taxes Discounted At (%/Year) | ||||||||||||||||||||

| 0% | 5% | 10% | 15% | 20% | ||||||||||||||||

| Reserves Category | ($MM) | ($MM) | ($MM) | ($MM) | ($MM) | |||||||||||||||

Proved Reserves | ||||||||||||||||||||

| Proved Developed Producing | 5,478 | 4,344 | 3,638 | 3,149 | 2,793 | |||||||||||||||

| Proved Developed Non-Producing | 99 | 77 | 63 | 53 | 46 | |||||||||||||||

| Proved Undeveloped | 707 | 439 | 293 | 206 | 149 | |||||||||||||||

Total Proved Reserves | 6,284 | 4,860 | 3,994 | 3,408 | 2,988 | |||||||||||||||

| Probable Reserves | 1,813 | 1,001 | 667 | 493 | 387 | |||||||||||||||

Total Proved Plus Probable Reserves | 8,097 | 5,861 | 4,661 | 3,901 | 3,375 | |||||||||||||||

| Note: | ||

| (1) | Unit values are based on Pengrowth’s Net reserves |

- 38 -

(undiscounted)

as of December 31, 2007

(Forecast Prices and Costs)

| Future Net | ||||||||||||||||||||||||||||||||

| Revenue | ||||||||||||||||||||||||||||||||

| Capital | Before | Future net | ||||||||||||||||||||||||||||||

| Operating | Development | Abandonment | Income | Income | Revenue | |||||||||||||||||||||||||||

| Revenue | Royalties(1) | Costs | Costs | Costs(2) | Taxes | Tax | After Income | |||||||||||||||||||||||||

| Reserves category | ($MM) | ($MM) | ($MM) | ($MM) | ($MM) | ($MM) | ($MM) | Taxes($MM) | ||||||||||||||||||||||||

| Proved Reserves | 15,750 | 2,600 | 4,898 | 566 | 214 | 7,473 | 1,189 | 6,284 | ||||||||||||||||||||||||

| Total Proved Plus Probable Reserves | 21,467 | 3,584 | 6,391 | 819 | 240 | 10,433 | 2,336 | 8,097 | ||||||||||||||||||||||||

| Notes: | ||

| (1) | Royalties payable to the provinces of Alberta, British Columbia, Saskatchewan and Nova Scotia. Does not include the impact of the proposed royalty regime announced by the Government of Alberta on October 25, 2007, to become effective on January 1, 2009. Based on the interpretations by GLJ of the proposed royalty changes and based on the January 2008 commodity price assumptions of GLJ, it is anticipated that the new royalty regime will result in a 12 to 18 percent increase in the total royalties paid to all parties by Pengrowth as compared to the current royalty structure. | |

| (2) | Includes downhole abandonment cost but does not include surface reclamation costs. See "Pengrowth – Operational Information – Additional Information Concerning Abandonment & Reclamation Costs”. |

By Production Group

as of December 31, 2007

(Forecast Prices and Costs)

| Future Net | ||||||||||||||

| Revenue Before | ||||||||||||||

| Income Taxes | ||||||||||||||

| (discounted at 10%/yr) | Unit Value(3) | |||||||||||||

| Reserves Category | Production Group | ($MM) | ($/Boe) | ($/Mcf) | ||||||||||

| Total Proved Reserves | Light and Medium Crude Oil (including solution gas and other by-products)(1) | 2,365 | 25.57 | 4.26 | ||||||||||

| Heavy Oil (including solution gas and other by-products) (1) | 305 | 18.07 | 3.01 | |||||||||||

| Natural Gas (including by-products but excluding solution gas from oil wells)(2) | 1,645 | 19.85 | 3.31 | |||||||||||

| Non-conventional Oil & Gas Activities | 108 | 15.94 | 2.66 | |||||||||||

| Total | 4,423 | 22.22 | 3.70 | |||||||||||

| Total Proved Plus Probable Reserves | Light and Medium Crude Oil (including solution gas and other by-products) (1) | 2,881 | 23.53 | 3.92 | ||||||||||

| Heavy Oil (including solution gas and other by-products)(1) | 369 | 17.03 | 2.84 | |||||||||||

| Natural Gas (including by-products but excluding solution gas from oil wells)(2) | 2,065 | 18.89 | 3.15 | |||||||||||

| Non-conventional Oil & Gas Activities | 141 | 14.52 | 2.42 | |||||||||||

| Total | 5,456 | 20.74 | 3.46 | |||||||||||

| Notes: | ||

| (1) | NGL’s associated with the production of solution gas are included as a by-product. | |

| (2) | NGL’s associated with the production of natural gas are included as a by-product. | |

| (3) | Unit values are based on Pengrowth’s Net reserves. |

- 39 -

as of December 31, 2007

(Constant Prices and Costs)

| Height and Medium Oil | Heavy Oil | Natural Gas Liquids | ||||||||||||||||||||||||||||||||||||||

| Company | Gross | Net | Company | Gross | Net | Company | Gross | Net | ||||||||||||||||||||||||||||||||

| Interest | Interest | Interest | Interest | Interest | Interest | Interest | Interest | Interest | ||||||||||||||||||||||||||||||||

| Reserves Category | (Mbbls) | (Mbbls) | (Mbbls) | (Mbbls) | (Mbbls) | (Mbbls) | (Mbbls) | (Mbbls) | (Mbbls) | |||||||||||||||||||||||||||||||

Proved Reserves | ||||||||||||||||||||||||||||||||||||||||

| Proved Developed Producing | 73,715 | 73,550 | 64,184 | 14,591 | 14,583 | 13,185 | 19,922 | 19,814 | 14,274 | |||||||||||||||||||||||||||||||

| Proved Developed Non- Producing | 1,040 | 1,040 | 914 | 95 | 95 | 89 | 559 | 558 | 381 | |||||||||||||||||||||||||||||||

| Proved Undeveloped | 19,014 | 19,013 | 15,555 | 2,194 | 2,194 | 1,899 | 1,363 | 1,363 | 1,053 | |||||||||||||||||||||||||||||||

Total Proved Reserves | 93,769 | 93,603 | 80,653 | 16,880 | 16,872 | 15,173 | 21,845 | 21,736 | 15,708 | |||||||||||||||||||||||||||||||

| Probable Reserves | 31,338 | 31,311 | 26,655 | 4,863 | 4,861 | 4,260 | 7,203 | 7,180 | 5,186 | |||||||||||||||||||||||||||||||

Total Proved Plus Probable Reserves | 125,107 | 124,914 | 107,308 | 21,744 | 21,733 | 19,433 | 29,048 | 28,916 | 20,893 | |||||||||||||||||||||||||||||||

| Natural Gas | Coal Bed Methane | Total Oil Equivalent Basis(1) | ||||||||||||||||||||||||||||||||||||||

| Company | Gross | Net | Company | Gross | Net | Company | Gross | Net | ||||||||||||||||||||||||||||||||

| Interest | Interest | Interest | Interest | Interest | Interest | Interest | Interest | Interest | ||||||||||||||||||||||||||||||||

| RESERVES CATEGORY | (bcf) | (bcf) | (bcf) | (bcf) | (bcf) | (bcf) | (Mboe) | (Mboe) | (Mboe) | |||||||||||||||||||||||||||||||

Proved Reserves | ||||||||||||||||||||||||||||||||||||||||

| Proved Developed Producing | 546,528 | 542,127 | 437,085 | 21,173 | 20,376 | 19,026 | 202,845 | 201,698 | 167,661 | |||||||||||||||||||||||||||||||

| Proved Developed Non- Producing | 21,555 | 21,462 | 16,328 | 2,797 | 2,716 | 2,481 | 5,752 | 5,722 | 4,519 | |||||||||||||||||||||||||||||||

| Proved Undeveloped | 50,778 | 50,646 | 41,437 | 14,049 | 13,911 | 12,341 | 33,376 | 33,330 | 27,470 | |||||||||||||||||||||||||||||||

Total Proved Reserves | 618,861 | 614,234 | 494,850 | 38,019 | 37,003 | 33,848 | 241,974 | 240,751 | 199,650 | |||||||||||||||||||||||||||||||

| Probable Reserves | 195,196 | 193,799 | 155,060 | 17,403 | 17,116 | 15,579 | 78,838 | 78,505 | 64,541 | |||||||||||||||||||||||||||||||

Total Proved Plus Probable Reserves | 814,057 | 808,033 | 649,910 | 55,422 | 54,119 | 49,427 | 320,812 | 319,256 | 264,191 | |||||||||||||||||||||||||||||||

| Note: | ||

| (1) | Natural gas has been converted to barrels of oil equivalent on the basis of six Mcf of natural gas being equal to one barrel of oil. |

- 40 -

of Future Net Revenue

as of December 31, 2007

Before and After Income Tax

(Constant Prices and Costs)

| Unit Value Before Income | ||||||||||||||||||||||||||||

| Tax Discounted at | ||||||||||||||||||||||||||||

| Before Income Taxes Discounted at (%/Year) | 10%/Year(1) | |||||||||||||||||||||||||||

| 0% | 5% | 10% | 15% | 20% | ||||||||||||||||||||||||

| Reserves Category | ($MM) | ($MM) | ($MM) | ($MM) | ($MM) | $/boe | $/Mcfe | |||||||||||||||||||||

Proved Reserves | ||||||||||||||||||||||||||||

| Proved Developed Producing | 6,463 | 4,900 | 3,984 | 3,383 | 2,959 | 23.76 | 3.96 | |||||||||||||||||||||

| Proved Developed Non-Producing | 170 | 124 | 96 | 79 | 66 | 21.34 | 3.56 | |||||||||||||||||||||

| Proved Undeveloped | 1,205 | 747 | 505 | 359 | 263 | 18.37 | 3.06 | |||||||||||||||||||||

Total Proved Reserves | 7,839 | 5,770 | 4,585 | 3,821 | 3,288 | 22.96 | 3.83 | |||||||||||||||||||||

| Probable Reserves | 2,810 | 1,574 | 1,034 | 747 | 572 | 16.02 | 2.67 | |||||||||||||||||||||

Total Proved Plus Probable Reserves | 10,649 | 7,345 | 5,619 | 4,567 | 3,861 | 21.27 | 3.54 | |||||||||||||||||||||

| After Income Taxes Discounted at (%/u/c year) | ||||||||||||||||||||

| 0% | 5% | 10% | 15% | 20% | ||||||||||||||||

| Reserves Category | ($MM) | ($MM) | ($MM) | ($MM) | ($MM) | |||||||||||||||

Proved Reserves | ||||||||||||||||||||

| Proved Developed Producing | 5,614 | 4,423 | 3,681 | 3,171 | 2,802 | |||||||||||||||

| Proved Developed Non-Producing | 122 | 83 | 75 | 63 | 54 | |||||||||||||||

| Proved Undeveloped | 668 | 413 | 279 | 197 | 141 | |||||||||||||||

Total Proved Reserves | 6,404 | 4,929 | 4,035 | 3,431 | 2,997 | |||||||||||||||

| Probable Reserves | 1,823 | 1,054 | 717 | 534 | 422 | |||||||||||||||

Total Proved Plus Probable Reserves | 8,227 | 5,983 | 4,752 | 3,965 | 3,419 | |||||||||||||||

| Note: | ||

| (1) | Unit values are based on Pengrowth’s Net reserves. |

- 41 -

(undiscounted)

as of December 31, 2007

(Constant Prices and Costs)

| Future Net | ||||||||||||||||||||||||||||||||

| Capital | Future Net | Revenue | ||||||||||||||||||||||||||||||

| Operating | Development | Abandonment | Revenue Before | After Income | ||||||||||||||||||||||||||||

| Revenue | Royalties(1) | Costs | Costs | Costs(2) | Income Taxes | Income Tax | Taxes | |||||||||||||||||||||||||

| Reserves Category | ($MM) | ($MM) | ($MM) | ($MM) | ($MM) | ($MM) | ($MM) | ($MM) | ||||||||||||||||||||||||

| Proved Reserves | 15,186 | 2,526 | 4,131 | 526 | 164 | 7,839 | 1,435 | 6,404 | ||||||||||||||||||||||||

| Total Proved Plus Probable Reserves | 20,154 | 3,402 | 5,175 | 758 | 170 | 10,649 | 2,422 | 8,227 | ||||||||||||||||||||||||

| Notes: | ||

| (1) | Royalties payable to the provinces of Alberta, British Columbia, Saskatchewan and Nova Scotia. Does not include the impact of the proposed royalty regime announced by the Government of Alberta on October 25, 2007, to become effective on January 1, 2009. Based on the interpretations by GLJ of the proposed royalty changes and based on the January 2008 commodity price assumptions of GLJ, it is anticipated that the new royalty regime will result in a 12 to 18 percent increase in the total royalties paid to all parties by Pengrowth as compared to the current royalty structure. | |

| (2) | Includes downhole abandonment cost but does not include surface reclamation costs. See "Pengrowth – Operational Information – Additional Information Concerning Abandonment & Reclamation Costs”. |

By Production Group

as of December 31, 2007

(Constant Prices and Costs)

| Future Net Revenue | ||||||||||||||

| Before Income Taxes | ||||||||||||||

| (discounted at 10%/yr) | Unit Value(3) | |||||||||||||

| Reserves Category | Production Group | ($MM) | ($/boe) | ($/Mcf) | ||||||||||

| Total Proved Reserves | Light and Medium Crude Oil (including solution gas and other by-products)(1) | 2,755 | 29.58 | 4.93 | ||||||||||

| Heavy Oil (including solution gas and other by-products) (1) | 241 | 14.19 | 2.37 | |||||||||||

| Natural Gas (including by-products but excluding solution gas from oil wells)(2) | 1,500 | 18.11 | 3.02 | |||||||||||

| Non-conventional Oil & Gas Activities | 89 | 13.16 | 2.19 | |||||||||||

| Total | 4,585 | 22.96 | 3.83 | |||||||||||

| Total Proved Plus Probable Reserves | Light and Medium Crude Oil (including solution gas and other by-products) (1) | 3,340 | 27.11 | 4.52 | ||||||||||

| Heavy Oil (including solution gas and other by-products)(1) | 291 | 13.42 | 2.24 | |||||||||||

| Natural Gas (including by-products but excluding solution gas from oil wells)(2) | 1,873 | 17.14 | 2.86 | |||||||||||

| Non-conventional Oil & Gas Activities | 114 | 11.75 | 1.96 | |||||||||||

| Total | 5,619 | 21.29 | 3.55 | |||||||||||

| Notes: | ||

| (1) | NGL’s associated with the production of solution gas are included as a by-product. | |

| (2) | NGL’s associated with the production of natural gas are included as a by-product. | |

| (3) | Unit values are based on Pengrowth’s Net reserves. |

- 42 -

| Oil | Natural Gas | Natural Gas Liquids(1) | ||||||||||||||||||||||

| WTI | Edmonton | Cromer | Hardisty | |||||||||||||||||||||

| Cushing | Par Price | Medium | Heavy 120 | AECO Gas | Pentanes | Inflation | Exchange | |||||||||||||||||

| Oklahoma | 400API | 29.30API | API | Price | Propane | Butane | Plus | Rates(2) | Rate(3) | |||||||||||||||

| Year | ($US/bbl) | ($Cdn/bbl) | ($Cdn/bbl) | ($Cdn/bbl) | ($Cdn/MMbtu) | ($Cdn/bbl) | ($Cdn/bbl) | ($Cdn/bbl) | (%/Year) | ($US/Cdn) | ||||||||||||||

2007(4) | 72.24 | 77.02 | 66.30 | 44.37 | 6.65 | 46.85 | 58.35 | 77.33 | — | — | ||||||||||||||

| 2008 | 92.00 | 91.10 | 79.26 | 54.02 | 6.75 | 58.30 | 72.88 | 92.92 | 2.0 | 1.00 | ||||||||||||||

| 2009 | 88.00 | 87.10 | 75.78 | 51.61 | 7.55 | 55.74 | 69.68 | 88.84 | 2.0 | 1.00 | ||||||||||||||

| 2010 | 84.00 | 83.10 | 72.30 | 49.19 | 7.60 | 53.18 | 66.48 | 84.76 | 2.0 | 1.00 | ||||||||||||||

| 2011 | 82.00 | 81.10 | 70.56 | 47.98 | 7.60 | 51.90 | 64.88 | 82.72 | 2.0 | 1.00 | ||||||||||||||

| 2012 | 82.00 | 81.10 | 70.56 | 47.98 | 7.60 | 51.90 | 64.88 | 82.72 | 2.0 | 1.00 | ||||||||||||||

| 2013 | 82.00 | 81.10 | 70.56 | 49.04 | 7.60 | 51.90 | 64.88 | 82.72 | 2.0 | 1.00 | ||||||||||||||

| 2014 | 82.00 | 81.10 | 70.56 | 50.09 | 7.80 | 51.90 | 64.88 | 82.72 | 2.0 | 1.00 | ||||||||||||||

| 2015 | 82.00 | 81.10 | 70.56 | 51.15 | 7.97 | 51.90 | 64.88 | 82.72 | 2.0 | 1.00 | ||||||||||||||

| 2016 | 82.02 | 81.12 | 70.57 | 52.21 | 8.14 | 51.91 | 64.89 | 82.74 | 2.0 | 1.00 | ||||||||||||||

| 2017 | 83.66 | 82.76 | 72.00 | 53.29 | 8.31 | 52.97 | 66.21 | 84.42 | 2.0 | 1.00 | ||||||||||||||

| Thereafter | +2.0%/yr | +2.0%/yr | +2.0%/yr | +2.0%/yr | +2.0%/yr | +2.0%/yr | +2.0%/yr | +2.0%/yr | 2.0 | 1.00 | ||||||||||||||

| Notes: | ||

| (1) | FOB Edmonton. | |

| (2) | Inflation rates for forecasting prices and costs. | |

| (3) | The exchange rates used to generate the benchmark reference prices in this table. | |

| (4) | Actual average prices for 2007. |

| Oil | Natural Gas | Natural Gas Liquids(1) | ||||||||||||||||||||||||||||||||||

| WTI | Edmonton | Cromer | LLB Crude | |||||||||||||||||||||||||||||||||

| Cushing | Par Price | Medium | Oil at | AECO Gas | Pentanes | Exchange | ||||||||||||||||||||||||||||||

| Oklahoma | 40o API | 29.3o API | Hardisty | Price | Propane | Butane | Plus | Rate(2) | ||||||||||||||||||||||||||||

| Year | ($US/bbl) | ($Cdn/bbl) | ($Cdn/bbl) | ($Cdn/bbl) | ($Cdn/MMbtu) | ($Cdn/bbl) | ($Cdn/bbl) | ($Cdn/bbl) | ($US/Cdn) | |||||||||||||||||||||||||||

| December 31, 2007 | 95.92 | 93.39 | 74.26 | 53.74 | 6.63 | 59.77 | 74.71 | 94.24 | 1.012 | |||||||||||||||||||||||||||

| Notes: | ||

| (1) | FOB Edmonton. | |

| (2) | The exchange rate used to generate the benchmark reference prices in this table. |

- 43 -

By Principle Product Type

(Forecast Prices and Costs)

| Light and Medium Oil | Heavy Oil | Natural Gas Liquids | ||||||||||||||||||||||||||||||||||

| Gross | ||||||||||||||||||||||||||||||||||||

| Gross | Gross | Proved | ||||||||||||||||||||||||||||||||||

| Gross | Gross | Proved Plus | Gross | Gross | Proved Plus | Gross | Gross | Plus | ||||||||||||||||||||||||||||

| Proved | Probable | Probable | Proved | Probable | Probable | Proved | Probable | Probable | ||||||||||||||||||||||||||||

| (Mbbls) | (Mbbls) | (Mbbls) | (Mbbls) | (Mbbls) | (Mbbls) | (Mbbls) | (Mbbls) | (Mbbls) | ||||||||||||||||||||||||||||

December 31, 2006 | 84,648 | 27,467 | 112,115 | 14,236 | 4,090 | 18,326 | 22,400 | 6,682 | 29,082 | |||||||||||||||||||||||||||

| Extensions | 932 | (141 | ) | 791 | 30 | 10 | 40 | 496 | (1 | ) | 495 | |||||||||||||||||||||||||

| Infill Drilling | 1,188 | 956 | 2,144 | — | — | — | 235 | 160 | 395 | |||||||||||||||||||||||||||

| Improved Recovery | 482 | 421 | 903 | — | — | — | 25 | 15 | 40 | |||||||||||||||||||||||||||

| Technical Revisions | 3,119 | (1,421 | ) | 1,698 | 742 | (177 | ) | 565 | 591 | 174 | 765 | |||||||||||||||||||||||||

| Discoveries | — | — | — | — | — | — | 23 | 3 | 26 | |||||||||||||||||||||||||||

| Acquisitions | 14,256 | 4,893 | 19,149 | 5,939 | 1,542 | 7,481 | 2,828 | 629 | 3,457 | |||||||||||||||||||||||||||

| Dispositions | (2,227 | ) | (993 | ) | (3,220 | ) | (1,432 | ) | (582 | ) | (2,014 | ) | (1,509 | ) | (478 | ) | (1,987 | ) | ||||||||||||||||||

| Economic Factors | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||

| Production | (9,582 | ) | — | (9,582 | ) | (2,616 | ) | — | (2,616 | ) | (3,411 | ) | — | (3,411 | ) | |||||||||||||||||||||

December 31, 2007 | 92,817 | 31,180 | 123,997 | 16,898 | 4,883 | 21,781 | 21,677 | 7,185 | 28,862 | |||||||||||||||||||||||||||

| Natural Gas | Coal Bed Methane | Total Oil Equivalent Basis(1) | ||||||||||||||||||||||||||||||||||

| Gross | ||||||||||||||||||||||||||||||||||||

| Gross | Gross | Proved | ||||||||||||||||||||||||||||||||||

| Gross | Gross | Proved Plus | Gross | Gross | Proved Plus | Gross | Gross | Plus | ||||||||||||||||||||||||||||

| Proved | Probable | Probable | Proved | Probable | Probable | Proved | Probable | Probable | ||||||||||||||||||||||||||||

| (MMcf) | (MMcf) | (MMcf) | (MMcf) | (MMcf) | (MMcf) | (Mboe) | (Mboe) | (Mboe) | ||||||||||||||||||||||||||||

December 31, 2006 | 608,105 | 191,206 | 799,311 | 14,230 | 9,427 | 23,657 | 225,007 | 71,677 | 296,684 | |||||||||||||||||||||||||||

| Extensions | 16,729 | 5,195 | 21,924 | 14,055 | 4,883 | 18,938 | 6,588 | 1,548 | 8,136 | |||||||||||||||||||||||||||

| Infill Drilling | 11,350 | 7,846 | 19,196 | — | — | 3,314 | 2,424 | 5,738 | ||||||||||||||||||||||||||||

| Improved Recovery | 508 | 221 | 729 | — | — | — | 592 | 472 | 1,064 | |||||||||||||||||||||||||||

| Technical Revisions | 14,661 | (19,175 | ) | (4,514 | ) | 1,791 | (1,543 | ) | 248 | 7,193 | (4,877 | ) | 2,316 | |||||||||||||||||||||||

| Discoveries | 519 | 234 | 753 | 338 | 112 | 450 | 165 | 62 | 227 | |||||||||||||||||||||||||||

| Acquisitions | 155,961 | 36,584 | 192,545 | 8,434 | 4,235 | 12,669 | 50,422 | 13,867 | 64,289 | |||||||||||||||||||||||||||

| Dispositions | (99,088 | ) | (28,236 | ) | (127,324 | ) | — | — | — | (21,682 | ) | (6,760 | ) | (28,442 | ) | |||||||||||||||||||||

| Economic Factors | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||

| Production | (94,384 | ) | — | (94,384 | ) | (1,845 | ) | — | (1,845 | ) | (31,648 | ) | — | (31,648 | ) | |||||||||||||||||||||

December 31, 2007 | 614,363 | 193,874 | 808,237 | 37,002 | 17,115 | 54,117 | 239,953 | 78,413 | 318,366 | |||||||||||||||||||||||||||

| Note: | ||

| (1) | Natural gas has been converted to barrels of oil equivalent on the basis of six Mcf of natural gas being equal to one barrel of oil. |

- 44 -

on Total Oil Equivalent Basis

(Forecast Prices and Costs)

| Proved Plus | ||||||||||||

| Proved Producing | Proved | Probable | ||||||||||

| Reserves | Reserves | Reserves | ||||||||||

| (Mboe)(1) | (Mboe)(1) | (Mboe)(1) | ||||||||||

December 31, 2006 | 188,961 | 225,875 | 297,774 | |||||||||

| Extensions | 4,898 | 6,588 | 8,136 | |||||||||

| Infill Drilling | 3,956 | 3,314 | 5,738 | |||||||||

| Improved Recovery | 755 | 592 | 1,180 | |||||||||

| Technical Revisions | 11,094 | 7,170 | 2,094 | |||||||||

| Discoveries | 109 | 165 | 227 | |||||||||

| Acquisitions | 44,721 | 51,046 | 65,115 | |||||||||

| Dispositions | (19,696 | ) | (21,682 | ) | (28,442 | ) | ||||||

| Production | (31,901 | ) | (31,901 | ) | (31,901 | ) | ||||||

December 31, 2007 | 202,897 | 241,169 | 319,921 | |||||||||

| Note: | ||

| (1) | Natural gas has been converted to barrels of oil equivalent on the basis of six Mcf of natural gas being equal to one barrel of oil. |

| • | Reserve additions from drilling activity, improved recovery and technical revisions replaced 2007 production by 56 percent and 54 percent for Total Proved and Proved Plus Probable Reserves, respectively. Based on all changes, including acquisitions and dispositions, reserve replacement was 148 percent and 169 percent for Total Proved and Proved Plus Probable Reserves, respectively. | ||

| • | The net increase of 36.7 MMboe from acquisitions and dispositions accounted for approximately 68 percent of the Total Proved Plus Probable Reserves added in 2007. Acquisition adds were almost entirely from the ConocoPhillips properties acquired in January 2007. Acquisitions were offset by the planned sale of non-core assets closing at various times during 2007. | ||

| • | New reserves were added from development activity. Most significant were drilling extensions for Horseshoe Canyon CBM and infill drilling and drilling extensions at Twining, Harmattan and Monogram. Reserve increases in the Proved Producing category also resulted from reclassification of Proved and Probable Undeveloped Reserves primarily for additional drilling and tie-in of Horseshoe Canyon CBM, infill drilling at Monogram and infill drilling and improved recovery in the Weyburn and Swan Hills miscible flood projects. | ||

| • | Various performance related revisions were made to previous estimates resulting in a net positive change. The largest revisions to Proved Reserves occurred at Sable Island (+1,308 Mboe), Fenn Big Valley (+965 Mboe), Jenner (+887 Mboe) and Winnifred (-520 Mboe). |

- 45 -

Company Gross Reserves

Reserves First Attributed By Year

| Units | Prior | 2005 | 2006 | 2007 | Total | |||||||||||||||||||

Proved Undeveloped | ||||||||||||||||||||||||

| Light & Medium Oil | Mbbl | 8,498 | 7,221 | 1,334 | 1,932 | 18,985 | ||||||||||||||||||

| Heavy Oil | Mbbl | 1,852 | — | — | 342 | 2,194 | ||||||||||||||||||

| Natural Gas | MMcf | 7,236 | 3,508 | 18,575 | 20,905 | 50,224 | ||||||||||||||||||

| Natural Gas Liquids | Mbbl | 120 | — | 843 | 398 | 1,361 | ||||||||||||||||||

| Coal Bed Methane | MMcf | — | — | 2,555 | 11,356 | 13,911 | ||||||||||||||||||

Total | Mboe(1) | 11,754 | 7,730 | 5,698 | 8,048 | 33,230 | ||||||||||||||||||

| �� | ||||||||||||||||||||||||

Probable Undeveloped | ||||||||||||||||||||||||

| Light & Medium Oil | Mbbl | 5,995 | 3,123 | 1,315 | 3,065 | 13,498 | ||||||||||||||||||

| Heavy Oil | Mbbl | 1,343 | — | 200 | 726 | 2,269 | ||||||||||||||||||

| Natural Gas | MMcf | 2,744 | 3,598 | 33,258 | 25,386 | 64,986 | ||||||||||||||||||

| Natural Gas Liquids | Mbbl | 112 | 648 | 1,286 | 670 | 2,716 | ||||||||||||||||||

| Coal Bed Methane | MMcf | — | — | 1,985 | 8,170 | 10,155 | ||||||||||||||||||

Total | Mboe(1) | 7,907 | 4,371 | 8,674 | 10,054 | 31,006 | ||||||||||||||||||

| Note: | ||

| (1) | Natural gas has been converted to barrels of oil equivalent on the basis of six Mcf of natural gas being equal to one barrel of oil. |

- 46 -

| Undiscounted | Discounted | |||||||||||||||||||||||||||||||

| 2008 | 2009 | 2010 | 2011 | 2012 | Remainder | Total | at 10% Total | |||||||||||||||||||||||||

| Reserve Category | ($MM) | ($MM) | ($MM) | ($MM) | ($MM) | ($MM) | ($MM) | ($MM) | ||||||||||||||||||||||||

| Proved Reserves (Constant Prices and Costs) | 183 | 103 | 63 | 33 | 18 | 126 | 526 | 393 | ||||||||||||||||||||||||

| Proved Reserves (Forecast Prices and Costs) | 183 | 105 | 65 | 35 | 19 | 158 | 566 | 408 | ||||||||||||||||||||||||

| Proved & Probable Reserves (Forecast Prices and Costs) | 230 | 180 | 100 | 47 | 29 | 234 | 819 | 584 | ||||||||||||||||||||||||

- 47 -

- 48 -

Company Interest Reserves

| Proved plus | ||||||||

| Proved | Probable | |||||||

FD&A Costs Excluding Future Development Capital | ||||||||

| Exploration and Development Capital Expenditures ($thousands) | $ | 283,100 | $ | 283,100 | ||||

| Exploration and Development Reserve Additions including Revisions (Mboe) | 17,830 | 17,376 | ||||||

| Finding and Development Cost ($/boe) | $ | 15.88 | $ | 16.29 | ||||

| Net Acquisition Capital ($thousands) | $ | 577,100 | $ | 577,100 | ||||

| Net Acquisition Reserve Additions (Mboe) | 29,364 | 36,673 | ||||||

| Net Acquisition Cost ($/boe) | $ | 19.65 | $ | 15.74 | ||||

| Total Capital Expenditures including Net Acquisitions ($thousands) | $ | 860,200 | $ | 860,200 | ||||

| Reserve Additions including Net Acquisitions (Mboe) | 47,194 | 54,049 | ||||||

| Finding Development and Acquisition Cost ($/boe) | $ | 18.23 | $ | 15.92 | ||||

FD&A Costs Including Future Development Capital | ||||||||

| Exploration and Development Capital Expenditures ($thousands) | $ | 283,100 | $ | 283,100 | ||||

| Exploration and Development Change in FDC ($thousands) | $ | 8,000 | $ | 20,000 | ||||

| Exploration and Development Capital including Change in FDC ($thousands) | $ | 291,100 | $ | 303,100 | ||||

| Exploration and Development Reserve Additions including Revisions (Mboe) | 17,830 | 17,376 | ||||||

| Finding and Development Cost ($/boe) | $ | 16.33 | $ | 17.44 | ||||

| Net Acquisition Capital ($thousands) | $ | 577,100 | $ | 577,100 | ||||

| Net Acquisition FDC ($thousands) | $ | 115,000 | $ | 145,000 | ||||

| Net Acquisition Capital including FDC ($thousands) | $ | 692,100 | $ | 722,100 | ||||

| Net Acquisition Reserve Additions (Mboe) | 29,364 | 36,673 | ||||||

| Net Acquisition Cost ($/boe) | $ | 23.57 | $ | 19.69 | ||||

| Total Capital Expenditures including Net Acquisitions ($thousands) | $ | 860,200 | $ | 860,200 | ||||

| Total Change in FDC ($thousands) | $ | 123,000 | $ | 165,000 | ||||

| Total Capital including Change in FDC ($thousands) | $ | 983,300 | $ | 1,025,300 | ||||

| Reserve Additions including Net Acquisitions (Mboe) | 47,194 | 54,049 | ||||||

| Finding Development and Acquisition Cost including FDC ($/boe) | $ | 20.83 | $ | 18.97 | ||||

| Note: | ||

| (1) | Natural gas has been converted to barrels of oil equivalent on the basis of six Mcf of natural gas being equal to one barrel of oil. |

| Producing | Non-Producing | |||||||||||||||

| Gross | Net | Gross | Net | |||||||||||||

Crude Oil Wells | ||||||||||||||||

| Alberta | 2,346 | 1,473 | 473 | 277 | ||||||||||||

| British Columbia | 151 | 105 | 47 | 43 | ||||||||||||

| Saskatchewan | 1,134 | 279 | 187 | 81 | ||||||||||||

| Nova Scotia | — | — | — | — | ||||||||||||

Natural Gas Wells | ||||||||||||||||

| Alberta | 5,515 | 2,827 | 571 | 322 | ||||||||||||

| British Columbia | 124 | 77 | 25 | 27 | ||||||||||||

| Saskatchewan | �� | 51 | 48 | 87 | 47 | |||||||||||

| Nova Scotia | 19 | 1 | — | — | ||||||||||||

Other(1) | ||||||||||||||||

Alberta | 250 | 217 | 165 | 115 | ||||||||||||

| British Columbia | — | — | 50 | 46 | ||||||||||||

| Saskatchewan | 14 | 10 | 22 | 19 | ||||||||||||

Total | 9,604 | 5,038 | 1,627 | 976 | ||||||||||||

- 49 -

| Note: | ||

| (1) | Pengrowth cannot classify these wells as either oil or gas. |

as at December 31, 2007

| Net Area May Expire | ||||||||||||

| Location | Gross Acres | Net Acres | During 2008 | |||||||||

| Alberta | 1,095,994 | 754,253 | 129,887 | |||||||||

| British Columbia | 255,172 | 116,763 | 13,847 | |||||||||

| Ontario | 4,766 | — | — | |||||||||

| Saskatchewan | 90,989 | 76,335 | 30,039 | |||||||||

| Montana | 3,520 | 3,520 | 3,520 | |||||||||

| Nova Scotia | 200,650 | 15,957 | — | |||||||||

Total | 1,651,091 | 966,828 | 177,293 | |||||||||

| 2008 | 2009 | 2010 | Remainder | Total | ||||||||||||||||

| ($M) | ($M) | ($M) | ($M) | ($M) | ||||||||||||||||

| Total Abandonment, Reclamation, Remediation & Dismantling | 17,287 | 18,046 | 21,363 | 1,958,381 | 2,015,077 | |||||||||||||||

| Discounted at 10 percent | 16,483 | 15,642 | 16,834 | 220,908 | 269,867 | |||||||||||||||

- 50 -

| Amount | ||||

| Nature of Cost | ($MM) | |||

Acquisition Costs(1) | ||||

| Proved | 823,566 | |||

| Unproved | 212,317 | |||

| Exploration Costs | 21,192 | |||

| Development Costs | 261,866 | |||

| Total | 1,318,941 | |||

| Note: | ||

| (1) | Based on the values assigned to property, plant and equipment in the purchase price allocations for the CP Acquisition and for several minor property acquisitions. |

| Development | Exploration | Total | ||||||||||||||||||||||

| Gross | Net | Gross | Net | Gross | Net | |||||||||||||||||||

Wells | ||||||||||||||||||||||||

| Gas | 383 | 130.7 | 6 | 2.2 | 389 | 132.9 | ||||||||||||||||||

| Oil | 84 | 19.9 | 6 | 5.3 | 90 | 25.2 | ||||||||||||||||||

| Service | 15 | 8.4 | — | — | 15 | 8.4 | ||||||||||||||||||

| Dry | 12 | 5.6 | 5 | 2.6 | 17 | 8.2 | ||||||||||||||||||

Total | 494 | 164.6 | 17 | 10.1 | 511 | 174.7 | ||||||||||||||||||

| Estimated Production | ||||||||||||||||

| Constant Prices and Costs | Forecast Prices and Costs | |||||||||||||||

| Total Proved Plus | Total Proved Plus | |||||||||||||||

| Total Proved | Probable | Total Proved | Probable | |||||||||||||

| Light and Medium Crude Oil (bblpd) | 24,933 | 26,169 | 24,933 | 26,169 | ||||||||||||

| Heavy Oil (bblpd) | 6,485 | 6,711 | 6,485 | 6,711 | ||||||||||||

| Natural Gas (Mcfpd) | 245,006 | 255,631 | 245,007 | 255,631 | ||||||||||||

| Natural Gas Liquids (bblpd) | 8,250 | 8,526 | 8,250 | 8,526 | ||||||||||||

- 51 -

| Quarter Ended | ||||||||||||||||

| March 31, | June 30, | September 30, | December 31, | |||||||||||||

| 2007 | 2007 | 2007 | 2007 | |||||||||||||

Light Crude Oil | ||||||||||||||||

Average Daily Oil Production(1) (bblpd) | 27,461 | 27,083 | 24,903 | 25,892 | ||||||||||||

| Sales Price (net of hedging gains/losses) ($/bbl) | 67.24 | 71.81 | 75.10 | 73.69 | ||||||||||||

| Processing and other income ($/bbl) | 0.39 | 0.42 | 0.90 | 0.69 | ||||||||||||

| Royalties ($/bbl) | (9.88 | ) | (11.90 | ) | (10.65 | ) | (13.86 | ) | ||||||||

| Amortization of injectants ($/bbl) | (3.84 | ) | (3.51 | ) | (3.69 | ) | (3.14 | ) | ||||||||

Production Costs(2)($/bbl) | (13.31 | ) | (15.11 | ) | (16.93 | ) | (15.69 | ) | ||||||||

| Operating Netback ($/bbl) | 40.60 | 41.71 | 44.73 | 41.69 | ||||||||||||

Heavy Oil | ||||||||||||||||

Average Daily Oil Production(1) (bblpd) | 6,773 | 7,254 | 7,205 | 7,434 | ||||||||||||

| Sales Price (net of hedging gains/losses) ($/bbl) | 41.54 | 43.52 | 47.30 | 45.47 | ||||||||||||

| Processing and other income ($/bbl) | 0.18 | 0.18 | 0.50 | 0.19 | ||||||||||||

| Royalties ($/bbl) | (5.23 | ) | (5.33 | ) | (6.90 | ) | (5.91 | ) | ||||||||

Production Costs(2)($/bbl) | (13.15 | ) | (15.37 | ) | (9.43 | ) | (12.92 | ) | ||||||||

| Operating Netback ($/bbl) | 23.34 | 23.00 | 31.47 | 26.83 | ||||||||||||

NGLs | ||||||||||||||||

Average Daily NGL Production(1) (bblpd) | 9,918 | 8,519 | 9,883 | 9,319 | ||||||||||||

| Sales Price (net of hedging gains/losses) ($/bbl) | 49.67 | 56.42 | 61.69 | 67.64 | ||||||||||||

| Royalties ($/bbl) | (14.05 | ) | (17.53 | ) | (18.82 | ) | (23.61 | ) | ||||||||

Production Costs(2)($/bbl) | (12.02 | ) | (13.57 | ) | (10.96 | ) | (14.29 | ) | ||||||||

| Operating Netback ($/bbl) | 23.60 | 25.32 | 31.91 | 29.74 | ||||||||||||

Natural Gas | ||||||||||||||||

Average Daily Gas Production(1) (Mcfpd) | 275,495 | 280,667 | 261,976 | 250,117 | ||||||||||||

| Sales Price (net of hedging gains/losses) ($/Mcf) | 7.91 | 7.61 | 6.67 | 6.90 | ||||||||||||

| Processing and other income ($/Mcf) | 0.15 | 0.16 | 0.19 | 0.18 | ||||||||||||

| Royalties ($/Mcf) | (1.67 | ) | (1.47 | ) | (0.92 | ) | (1.22 | ) | ||||||||

Production Costs(2)($/Mcf) | (2.10 | ) | (2.24 | ) | (1.58 | ) | (2.11 | ) | ||||||||

| Operating Netback ($/Mcf) | 4.29 | 4.06 | 4.36 | 3.75 | ||||||||||||

Barrels of Oil Equivalent Basis(3) | ||||||||||||||||

Average Daily Production(1) (boepd) | 90,068 | 89,633 | 85,654 | 84,331 | ||||||||||||

| Sales Price (net of hedging gains/losses) ($/boe) | 53.30 | 54.39 | 53.34 | 54.58 | ||||||||||||

| Processing and other income ($/boe) | 0.58 | 0.66 | 0.90 | 0.76 | ||||||||||||

| Royalties ($/boe) | (10.06 | ) | (10.30 | ) | (8.67 | ) | (11.01 | ) | ||||||||

| Amortization of injectants ($/boe) | (1.17 | ) | (1.06 | ) | (1.07 | ) | (0.97 | ) | ||||||||

Production Costs(2) ($/boe) | (12.78 | ) | (14.13 | ) | (11.84 | ) | (13.80 | ) | ||||||||

| Operating Netback ($/boe) | 29.87 | 29.56 | 32.66 | 29.56 | ||||||||||||

| Notes: | ||

| (1) | Before the deduction of royalties. | |

| (2) | Includes transportation costs. Net of processing and other income. | |

| (3) | Natural gas has been converted to barrels of oil equivalent on the basis of six Mcf of natural gas being equal to one boe. |

- 52 -

| ($ thousands, | ||||

| unless otherwise indicated) | ||||

| Value of Total Proved Plus Probable Reserves | 5,455,881 | |||

Undeveloped lands(1) | 239,893 | |||

Working capital deficit(2) | (34,423 | ) | ||

| Reclamation funds | 18,094 | |||

| Long-term debt | (1,203,236 | ) | ||

Fair value of risk management contracts(3) | (79,401 | ) | ||

Other liabilities(4) | (87,192 | ) | ||

Asset retirement obligations(5) | (206,868 | ) | ||

| Net asset value | 4,102,748 | |||

| Units outstanding (000’s) | 246,846 | |||

| NAV per unit | $ | 16.62 | ||

| Notes: | ||

| (1) | Pengrowth’s internal estimate, calculated using the average land sale prices paid in 2007 in Alberta, Saskatchewan and British Columbia. | |

| (2) | Excludes distributions payable, current portion of risk management contracts and future income taxes. | |

| (3) | Represents the total fair value of risk management contracts at December 31, 2007. | |

| (4) | Other liabilities include convertible debt and non-current contract liabilities. | |

| (5) | The asset retirement obligation is based on Pengrowth’s estimate of future site restoration and abandonment liabilities, discounted at 10 percent, less that portion of the asset retirement obligations costs that are included in the value of Total Proved Plus Probable Reserves. |

- 53 -

- 54 -

| • | a vote may be held only if: (i) requested in writing by the holders of not less than 25 percent of the Trust Units and class A trust units, in the aggregate; or (ii) if the Trust Units and the class A trust units have become ineligible for investment by RRSPs, RRIFs, RESPs and DPSPs; | ||

| • | the termination must be approved by extraordinary resolution of the Unitholders; and |

- 55 -

| • | a quorum representing 5 percent of the issued and outstanding Trust Units and class A trust units, in the aggregate, must be present or represented by proxy at the meeting at which the vote is taken. |

- 56 -

| • | operating costs and capital expenditures; | ||

| • | general and administrative costs; | ||

| • | management fees and debt service charges; | ||

| • | taxes or other charges payable by the Corporation; and | ||

| • | any amounts paid into the “reserve”. |

- 57 -

- 58 -

| 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | |||||||||||||||||||

| First Quarter | $ | 0.75 | $ | 0.75 | $ | 0.69 | $ | 0.63 | $ | 0.75 | $ | 0.41 | ||||||||||||

| Second Quarter | 0.75 | 0.75 | 0.69 | 0.64 | 0.67 | 0.54 | ||||||||||||||||||

| Third Quarter | 0.75 | 0.75 | 0.69 | 0.67 | 0.63 | 0.52 | ||||||||||||||||||

| Fourth Quarter | 0.675 | (1) | 0.75 | 0.75 | 0.69 | 0.63 | 0.60 | |||||||||||||||||

| Total | $ | 2.93 | $ | 3.00 | $ | 2.82 | $ | 2.63 | $ | 2.68 | $ | 2.07 | ||||||||||||

| Notes: | ||

| (1) | On October 15, 2007, November 15, 2007 and December 15, 2007, the monthly distribution paid to Unitholders was $0.225 per Trust Unit, representing a reduction of 10 percent from the monthly distribution of $0.25 per Trust Unit for the first three quarters of 2007. | |

| (2) | Based on actual distributions declared. |

- 59 -

| 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | |||||||||||||||||||

Taxable Income(1)(per Trust Unit) | $ | 2.78 | $ | 2.40 | $ | 2.22 | $ | 1.43 | $ | 1.47 | $ | 0.45 | ||||||||||||

| (percent of distributions classified as taxable income) | (95 | %) | (80 | %) | (80 | %) | (55 | %) | (55 | %) | (22 | %) | ||||||||||||

| Note: | ||

| (1) | For Canadian residents, amounts treated as a return of capital generally are not required to be included in a Unitholder’s income but such amounts will reduce the adjusted cost base to the Unitholder of the Trust Units. |

- 60 -

| • | the ratio of Consolidated Senior Debt (as defined below) to Consolidated EBITDA (as defined below) at the end of any fiscal quarter shall not exceed 3:1, except that upon the completion of a Material Acquisition (as defined below), and for a period extending to the end of the second full fiscal quarter thereafter, this limit increases to 3.5:1; | ||

| • | the ratio of Consolidated Total Debt (as defined below) to Consolidated EBITDA at the end of any fiscal quarter shall not exceed 3.5:1; except that upon the completion of a Material Acquisition, and for a period extending to the end of the second full fiscal quarter thereafter, this limit increases to 4:1; and | ||

| • | the ratio of Consolidated Senior Debt (as defined below) to Total Capitalization (as defined below) shall not exceed 50 percent, except that upon the completion of a Material Acquisition, and for a period extending to the end of the second full fiscal quarter thereafter, this limit increases to 55 percent. |

| Consolidated Senior Debt: | All obligations, liabilities and indebtedness that would be classified as debt on the consolidated balance sheet of the Trust, including, without limitation, certain items including all indebtedness for borrowed money, but excluding certain items. | |

| Consolidated Total Debt: | The aggregate of Consolidated Senior Debt and Subordinated Debt. | |

| Consolidated EBITDA: | The aggregate of the last four quarters’ net income from operations plus the sum of: | |

• income taxes; | ||

• interest expense; | ||

• all provisions for federal, provincial or other income and capital taxes; | ||

• depreciation, depletion and amortization expense; and | ||

• other non-cash amounts. | ||

| Material Acquisition: | An acquisition or series of acquisitions which increases the consolidated tangible assets of Pengrowth by more than 5 percent. | |

| Subordinated Debt: | Debt which, by its terms, is subordinated to the obligations to the lenders under the Credit Facility. |

- 61 -

| Total Capitalization: | The aggregate of Consolidated Total Debt and the Unitholders’ equity (calculated in accordance with GAAP as shown on the Trust’s consolidated balance sheet) |

| • | the ratio of Consolidated EBITDA (as defined below) to interest expense for the four immediately preceding fiscal quarters shall be not less than 4:1; | ||

| • | with respect to the 2003 U.S. Senior Notes and the U.K. Senior Notes only, the Consolidated Total Debt (as defined below) is limited to 60 percent of the Consolidated Total Established Reserves (as defined below) determined and calculated not later than the last day of the first fiscal quarter of the next succeeding fiscal year of the Trust; | ||

| • | with respect to the 2007 U.S. Senior Notes only, the Consolidated Total Debt (as defined below) to Total Capitalization (as defined below) shall not exceed 55 percent at the end of each fiscal quarter; and | ||

| • | the ratio of Consolidated Total Debt to Consolidated EBITDA for each period of four consecutive fiscal quarters shall not exceed 3.5:1. |

| Consolidated EBITDA: | The sum of the last four quarters of: (i) net income determined in accordance with GAAP; (ii) all provisions for federal, provincial or other income and capital taxes; (iii) all provisions for depletion, depreciation, and amortization; (iv) interest expense; and (v) non-cash items. | |

| Consolidated Total Debt: | Has substantially the same meaning as “Consolidated Senior Debt” in the definitions relating to the Credit Facility. | |

| Consolidated Total Established Reserves: | The sum of: (i) 100 percent of the present value of Pengrowth’s proved reserves; and (ii) 50 percent of the present value of Pengrowth’s probable reserves. | |

| Total Capitalization: | Consolidated Total Debt plus Unitholder equity in the Trust. |

- 62 -

| • | the Trust is required to punctually pay or cause to be paid all principal, premium and interest amounts as prescribed by the Debenture Indenture, as amended; | ||

| • | the Trust is required to pay the trustee under the Debenture Indenture reasonable remuneration for its services as trustee and repay on demand all monies which have been paid by the trustee in execution of its obligations thereunder; | ||

| • | the Trust is required to provide the trustee under the Debenture Indenture with notification immediately upon obtaining knowledge of any Event of Default; | ||

| • | the Trust is required to carry on its business in a proper, efficient and business-like manner and in accordance with good business practices; | ||

| • | the Trust is required to deliver to the trustee under the Debenture Indenture, within 120 days of the end of each calendar year, an officer’s certificate as to compliance with the terms and conditions of the Debenture Indenture; and | ||

| • | the Trust is prohibited from issuing additional debentures, which are convertible at the option of the holder into Trust Units of equal ranking to the Debentures if the principal amount of all issued and outstanding convertible debentures of the Trust would exceed 25 percent of the Trust’s total market capitalization after the issuance of such additional debentures. |

- 63 -

- 64 -

- 65 -

- 66 -

- 67 -

- 68 -

| • | the excess distribution or gain would be allocated ratably over the United States holder’s holding period; | ||

| • | the amount allocated to the current taxable year and any year prior to the first year in which we were a PFIC would be taxed as ordinary income in the current year; | ||

| • | the amount allocated to each of the other taxable years in the United States holder’s holding period would be subject to tax at the highest rate of tax in effect for the applicable class of taxpayer for that year; and | ||

| • | an interest charge for the deemed deferral benefit would be imposed with respect to the resulting tax attributable to each such other taxable year. |

- 69 -

- 70 -

- 71 -

- 72 -

- 73 -

- 74 -

- 75 -

- 76 -

- 77 -

- 78 -

- 79 -

| • | global energy policy, including the ability of OPEC to set and maintain production levels for oil; | ||

| • | political conditions in the Middle East; | ||

| • | worldwide economic conditions; | ||

| • | weather conditions including weather-related disruptions to the North American natural gas supply; | ||

| • | the supply and price of foreign oil and natural gas; |

- 80 -

| • | the level of consumer demand; | ||

| • | the price and availability of alternative fuels; | ||

| • | the proximity to, and capacity of, transportation facilities; | ||

| • | the effect of worldwide energy conservation measures; and | ||

| • | government regulation. |

| • | historical production from the area compared with production rates from similar producing areas; | ||

| • | the assumed effect of government regulation; | ||

| • | assumptions about future commodity prices, exchange rates, production and development costs, capital expenditures, abandonment costs, environmental liabilities, and applicable royalty regimes; | ||

| • | initial production rates; | ||

| • | production decline rates; | ||

| • | ultimate recovery of reserves; |

- 81 -

| • | marketability of production; and | ||

| • | other government levies that may be imposed over the producing life of reserves. |

- 82 -

- 83 -

- 84 -

- 85 -

| • | The Trust Units would cease to be a qualified investment for trusts governed by RRSPs, RRIFs, RESPs and DPSPs, as defined in the Tax Act. Where, at the end of a month, a RRSP, RRIF, RESP or DPSP holds Trust Units that ceased to be a qualified investment, the RRSP, RRIF, RESP or DPSP, as the case may be, must, in respect of that month, pay a tax under Part XI.1 of the Tax Act equal to 1 percent of the fair market value of the Trust Units at the time such Trust Units were acquired by the RRSP, RRIF, RESP or DPSP. In addition, trusts governed by a RRSP or a RRIF which hold Trust Units that are not qualified investments will be subject to tax on the income attributable to the Trust Units while they are non-qualified investments, including the full capital gains, if any, realized on the disposition of such Trust Units. Where a trust governed by a RRSP or a RRIF acquires Trust Units that are not qualified investments, the value of the investment will be included in the income of the annuitant for the year of the acquisition. Trusts governed by RESPs which hold Trust Units that are not qualified investments can have their registration revoked by the Canada Revenue Agency. | ||

| • | The Trust would be required to pay a tax under Part XII.2 of the Tax Act. The payment of Part XII.2 tax by the Trust may have adverse income tax consequences for certain Unitholders, including non-resident persons and residents of Canada who are exempt from Part I tax. | ||

| • | The Trust would not be entitled to use the capital gains refund mechanism otherwise available for mutual fund trusts. | ||

| • | The Trust Units would constitute “taxable Canadian property” for the purposes of the Tax Act, potentially subjecting non-residents of Canada to tax pursuant to the Tax Act on the disposition (or deemed disposition) of such Trust Units. |

- 86 -

| • | will enforce judgments of United States courts obtained in actions against the Trust or such persons predicated upon the civil liability provisions of the United States federal securities laws or the securities or “blue sky” laws of any state within the United States; or | ||

| • | will enforce, in original actions, liabilities against the Trust or such persons predicated upon the United States federal securities laws or any such state securities or blue sky laws. |

- 87 -

| • | We have elected under applicable United States Treasury Regulations to be treated as a partnership for United States federal income tax purposes. Section 7704 of the Internal Revenue Code of 1986, as amended (the “Code”) provides that publicly-traded partnerships such as the Trust will, as a general rule, be taxed as corporations. We will not be treated as a corporation for U.S. federal income tax purposes only if 90 percent or more of its gross income consists of “qualifying income”. Although we expect to satisfy the 90 percent requirement at all times, if we fail to satisfy this requirement, we will be treated as a foreign corporation. Such conversion will be taxable unless a certain filing is made. | ||

| • | If we were treated as a foreign corporation, we could be a passive foreign investment company or “PFIC”. If we were considered a PFIC, United States holders of Trust Units could be subject to substantially increased United States tax liability, including an interest charge upon the sale or other disposition of the United States holder’s Trust Units, or upon the receipt of “excess distributions” from the Trust. Certain elections may be available to a United States holder if we were classified as a PFIC to alleviate these adverse tax consequences. | ||

| • | We treat the Royalty between the Trust and the Corporation as a royalty interest for all legal purposes, including United States federal income tax purposes. The Royalty Indenture in some respects differs from more conventional “net profits” interests as to which the courts and the IRS have ruled regarding the federal income tax treatment as a royalty, and as a result the propriety of such treatment is not free from doubt. It is possible that the IRS could contend, for example, that we should be considered to have a working interest in the properties of the Corporation. If the IRS were successful in making such a contention, the United States federal income tax consequences to United States holders could be different, perhaps materially worse, than indicated in the discussion herein, which generally assumes that the Royalty Indenture will be respected as a royalty. | ||

| • | Gain or loss will be recognized on a sale of Trust Units equal to the difference between the amount realized and the United States holder’s tax basis for the Trust Units sold. Gain or loss recognized by a United States holder on the sale or exchange of Trust Units will generally be taxable as capital gain or loss, and will be long-term capital gain or loss if such United States holder’s holding period of the Trust Units exceeds one year. A portion of any amount realized on a sale or exchange of Trust Units (which portion could be substantial) will be separately computed and taxed as ordinary income under Section 751 of the Code to the extent attributable to the recapture of depletion or depreciation deductions. Ordinary income attributable to depletion deductions and depreciation recapture could exceed net taxable gain realized upon the sale of the Trust Units and may be recognized even if there is a net taxable loss realized on the sale of the Trust Units. Thus, a United States holder may recognize both ordinary income and a capital loss upon a taxable disposition of Trust Units. |

- 88 -

| • | We have registered as a “tax shelter” with the United States Secretary of the Treasury because of the absence of assurance that we will not be subject to tax shelter registration and in light of the substantial penalties which otherwise might be imposed if we failed to register and it were subsequently determined that registration was required. Registration as a “tax shelter” may increase the risk of an IRS audit of us or a Unitholder. Any Unitholder owning less than a 1 percent profits interest in us has very limited rights to participate in the income tax audit process. Further, any adjustments in our tax returns will lead to adjustments in our Unitholders’ tax returns and may lead to audits of Unitholders’ tax returns and adjustments of items unrelated to us. You will bear the cost of any expense incurred in connection with an examination of your personal tax return. | ||

| • | Because we cannot match transferors and transferees of Trust Units, we must maintain uniformity of the economic and tax characteristics of the Trust Units to a purchaser of these Trust Units. In the absence of such uniformity, the Trust may be unable to comply completely with a number of federal income tax requirements. A lack of uniformity, however, can result from a literal application of some Treasury regulations. If any non-uniformity was required by the IRS, it could have a negative impact on the value of the Trust Units. | ||

| • | The Trust may not be an appropriate investment for certain types of entities. For example, there is a risk that some of the Trust’s income could be unrelated business taxable income with respect to tax-exempt organizations. Prospective purchasers of Trust Units that are tax-exempt organizations are encouraged to consult their tax advisors regarding investments in Trust Units. | ||