INOVA TECHNOLOGY

233 WILSHIRE BLVD., SUITE 400

SANTA MONICA, CA 90401

Linda van Doorn

US Securities and Exchange Commission

Washington, DC 20549

Re: File 0-27397

November 7, 2008

Ms. Van Doorn,

This is in response to your letter of October 23, 2008.

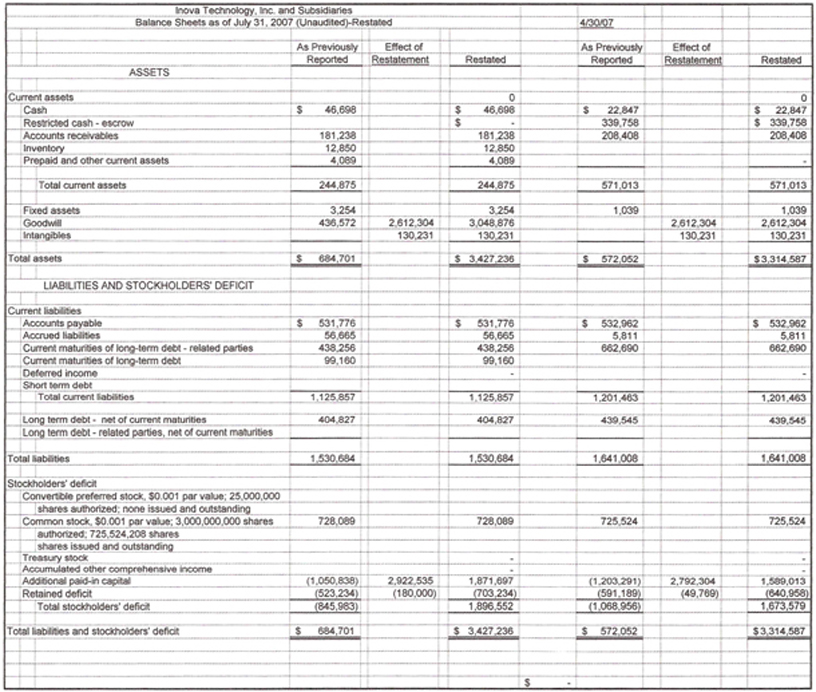

Attached are the restatements that reflect the change to compensation expense for management fees and the Web’s Biggest transaction and your other requested formatting changes.

| | 1. | 10-KSB for April 30, 2007 |

Attached is the filing with the necessary changes

| | 2. | 10-KSB for April 30, 2008 |

Attached is the filing with the necessary changes

Attached are the filings with the necessary changes

As discussed with Jorge Bonilla we would also like the receipt of this correspondence to permit the review and approval of the pending proxy by your legal division.

Please note our new fax number of 419-828-6827

Regards,

Bob Bates, CFO

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-QSB

(Mark One)

| x | QUARTERLY REPORT UNDER SECTION 13OR 15(d)OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the quarterly period ended July 31, 2006 |

| o | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT |

For the transition period from _______________________ to _____________

Commission file number 000-27397

EDGETECH SERVICES INC.

(Exact name of small business issuer in its charter)

| Nevada | 98-0204280 |

| | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

89146 | 2980 S. Rainbow Blvd. #220H Las Vegas, NV 89146 |

| | |

| (Postal Code) | (Address of principal executive offices) |

(Issuer's telephone number) (310) 857 - 6666

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes o No

On July 31, 2006, the number of shares outstanding of the issuer’s common stock was 70,288,450

Transitional Small Business Disclosure Format (Check one): Yes o; No x

Edgetech Services Inc.

Form 10-QSB

TABLE OF CONTENTS

| | | | |

| | PART I | | |

| Item 1. | Financial Statements | | |

| Item 2 | Management's Discussion and Analysis or Plan of Operations | | |

| Item 3. | Controls and Procedures | | |

| | PART II | | |

| Item 1. | Legal Proceedings | | |

| Item 2. | Changes in Securities | | |

| Item 3. | Defaults Upon Senior Securities | | |

| Item 4. | Submission of Matters to a Vote of Security Holders | | |

| Item 5. | Other Information | | |

| Item 6. | Exhibits and Reports on Form 8-K | | |

PART I

Item 1 Financial Statements

Inova Technology, Inc. and Subsidiaries

Consolidated Statements of Operations

For the 3 months ended July 31, 2006

(Unaudited)- RESTATED

| | | As Previously | | Management | | | | | |

| | | Reported | | Fee | | Restated | | 31-Jul-05 | |

| | | | | | | | | | |

| Revenues | | $ | 599,960 | | | | | $ | 599,960 | | | 674,275 | |

| | | | | | | | | | | | | | |

| Cost of revenues | | | (83,875 | ) | | | | $ | (83,875 | ) | | (3,150 | ) |

| Operating expenses | | | (169,427 | ) | | (45,000 | ) | $ | (214,427 | ) | | (225,455 | ) |

| | | | | | | | | | | | | | |

| Operating loss | | | 346,658 | | | (45,000 | ) | | 301,658 | | | 445,670 | |

| | | | | | | | | | | | | | |

| Other income (expense): | | | | | | | | | | | | | |

| Loss on exchange of business assets | | | | | | | | | | | | | |

| Interest income | | | 76 | | | | | $ | 76 | | | 4,113 | |

| Interest expense | | | | | | | | $ | - | | | | |

| | | | | | | | | | | | | | |

| Income (loss) from continuing operations | | | 346,734 | | | (45,000 | ) | | 301,734 | | | 449,783 | |

| | | | | | | | | | | | | | |

| Loss from discontinuing operations | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Net income (loss) | | $ | 346,734 | | $ | (45,000 | ) | $ | 301,734 | | | 449,783 | |

| | | | | | | | | | | | | | |

| Basic and diluted income (loss) per share: | | | | | | | | | |

| | | | | | | | | | | | | | |

| From continuing operations | | $ | 0.00 | | $ | - | | $ | 0.00 | | | - | |

| From discontinued operations | | $ | - | | $ | - | | $ | - | | | - | |

| Total | | $ | 0.00 | | $ | - | | $ | 0.00 | | | 0 | |

| | | | | | | | | | | | | | |

| Weighted average common shares | | | 703,983,450 | | | | | | 703,983,450 | | | 680,644,608 | |

Consolidated Statements of Cash Flows

For the 3 months ended July 31, 2006

(Unaudited)-Restated

| | | As Previously | | | | | |

| | | Reported | | Restated | | 7/05 | |

| | | | | | | | |

| CASH FLOWS OPERATING ACTIVITIES | | | | | | | | | | |

| Net loss | | | 346,734 | | $ | 301,734 | | | 456,083 | |

| Add: income (loss) from discontinued operations | | | | | | | | | | |

| | | | | | | | | | | |

| Loss from continuing operations | | | 346,734 | | | 301,734 | | | | |

| | | | | | | | | | | |

| Additional shares issued for conversion of debt | | | | | | | | | | |

| Depreciation and amortization expense | | | | | | | | | 389 | |

| Changes in operating assets and liabilities: | | | | | | | | | | |

| Increase (decrease) in A/P and accrued expenses | | | | | | - | | | | |

| Decrease (increase) in accounts receivable | | | (303,193 | ) | | (303,193 | ) | | (498,955 | ) |

| Increase (decrease) in deferred income | | | (27,851 | ) | | (27,851 | ) | | (5,631 | ) |

| Increase (decrease) in accrued expense | | | 1,804 | | | 1,804 | | | 984,943 | |

| Increase (decrease) in inventory | | | | | | - | | | | |

| Decrease (increase) in other current assets | | | | | | - | | | (7,621 | ) |

| | | | | | | | | | | |

| Net cash provided by (used in) operating activities | | | 17,494 | | | (27,506 | ) | | | |

| | | | | | | | | | | |

| CASH FLOW INVESTING ACTIVITIES | | | | | | | | | | |

| Increase (decrease) in loans receivable | | | | | | - | | | | |

| Purchase of treasury stock | | | | | | - | | | | |

| Purchase of Right-Tag | | | | | | - | | | | |

| Purchase of fixed assets | | | | | | - | | | (24,801 | ) |

| | | | | | | | | | | |

| Net cash provided by (used in) investing activities - continuing operations | | | - | | | - | | | | |

| | | | | | | | | | | |

| CASH FLOW FINANCING ACTIVITIES | | | | | | | | | | |

| Proceeds from notes payable - related parties | | | | | | - | | | | |

| Proceeds from APIC | | | | | | 45,000 | | | | |

| Translation adjustment | | | 1,233 | | | 1,233 | | | | |

| | | | | | | | | | | |

| Net cash provided by (used in) financing activities - continuing operations | | | 1,233 | | | 46,233 | | | (1,256,822 | ) |

| | | | | | | | | | | |

| NET CASH PROVIDED BY (USED IN) CONTINUING OPERATIONS | | | 18,727 | | | 18,727 | | | | |

| | | | | | | | | | | |

| NET CASH PROVIDED BY DISCONTINUED OPERATIONS | | | | | | | | | | |

| | | | | | | | | | | |

| NET CHANGE IN CASH | | | 18,727 | | | 18,727 | | | (352,415 | ) |

| | | | | | | | | | | |

| CASH AT BEGINNING OF PERIOD | | | 379,600 | | | 379,600 | | | 819,229 | |

| | | | | | | | | | | |

| CASH AT END OF PERIOD | | $ | 398,327 | | $ | 398,327 | | | 466,814 | |

EDGETECH SERVICES INC. and SUBSIDIARY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

JULY 31, 2006

DEFINITIONS

Edgetech Services Inc., a Nevada Corporation, herein referred to as “Edgetech”

Edgetech Services Inc., an Ontario Canada Company

1. BASIS OF PRESENTATION

The accompanying unaudited condensed financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America for interim information and with the instructions to Form 10-QSB and Regulation S-B. Accordingly, they do not include all of the information and footnotes required by accounting principles generally accepted in the United States of America for complete financial statements. In the opinion of management, all adjustments consisting of a normal and recurring nature considered necessary for a fair presentation have been included.

The results for the periods presented are not necessarily indicative of the results for the full year and should be read in conjunction with the audited consolidated financial statements for the year ended April, 2006 included in our Annual report on Form 10K, filed on August 15, 2006. Certain reclassifications were made to conform to the current period presentation.

2. HISTORY AND ORGANIZATION OF THE COMPANY

Edgetech Services Inc. (“Edgetech”) was incorporated under the laws of Nevada on May 16, 1997, as Newsgurus.com, Inc. and changed its name to Secure Enterprise Solutions Inc. on January 10, 2002, and then to Edgetech Services Inc. Edgetech was is in the business of providing information technology (“IT”) security consulting services, and during fiscal 2004, began to sell security hardware. Edgetech operated from offices in Toronto, Canada.

On June 1, 2005, the Registrant entered into an agreement with the shareholders of Web’s Biggest, Inc., (a California Corporation), Mr. Xavier Roy of Los Angeles, California, and Advisors LLC, an Iowa Limited Liability Corporation (collectively, “Web’s Biggest”) which would result in the Registrant issuing 25,000,000 convertible preferred shares to the shareholders of Web’s Biggest in consideration for 100% of the outstanding capital of Web’s Biggest and $250,000 be used for general working capital of the Registrant. This transaction has been recorded as a recapitalization of Edgetech Services, Inc. In substance the merger with Web’s Biggest is considered to be a capital transaction rather than a business combination. Consequently the transaction is considered to be a reverse takeover and the accounting treatment will be as if Web’s Biggest, Inc acquired Edgetech Services, Inc. Accordingly, these financial statements are the historical financial statements of Web’s Biggest, Inc.

Each convertible preferred share is convertible into 25.3533 common shares of the Registrant with all the rights and privileges of the equivalent number of common shares prior and post conversion.

When completed, this transaction resulted in a change of control of the Registrant and the pre merger shareholders of the registrant owning approximately 10% of the newly combined entity.

For further information about this recapitalization, refer to the Form 8-K filed with the Securities and Exchange Commission on June 2, 2005.Audited financial statements of Web’s Biggest for fiscal years 2003, 2004, and 2005 were also filed in this Form 8-K.

Following the acquisition of Web’s Biggest, Inc. by Edgetech, the Web’s Biggest, Inc. shareholders became the controlling shareholders of Edgetech. As a result, the financial information provided for the 2006 fiscal year for the purpose of comparison with the 2005 fiscal year only includes financial information relating to Edgetech Services, Inc. from June 30 2005.

Prior to the merger Edgetech had an IT hardware reseller business and an IT consulting business (both headquartered in an office on Toronto). At the time of the merger Web’s Biggest, Inc. invested $250,000 into the two IT businesses that existed in Edgetech prior to the merger. These funds were invested in an attempt to assist this business to remain viable and avoid closure due to unsustainable losses. While this investment enabled the business to pay some creditors the management of this business unit was unable to restructure this business into a viable business and the $250,000 invested by Web’s Biggest could not be recovered. As a result, the new management of Edgetech chose not invest additional funds into this business and decided to close the Toronto office, close the IT hardware reseller business and restructure and maintain the IT consulting business. The Company is negotiating settlements with various creditors of the closed IT hardware reseller business. The continuing IT consulting business is now profitable.

In a duly organized meeting of the Board of Directors of the Company on Wednesday, November 23, 2005, Mr. Xavier Roy resigned as Chairman, President, CEO and Director of the Company. Adam Radly, formerly the General Manager of Web’s Biggest, was appointed Director, CEO and President. Paul Aunger has been appointed Director, Secretary and Treasurer. Mr. Radly and Mr. Aunger hold all Director and Officer positions of the Company and all of its subsidiaries. Mr. Roy no longer holds any Director or Officer positions of the Company or any of its subsidiaries.

On June 1, 2005, Edgetech Services, Inc. acquired all of the outstanding common stock of Web's Biggest, Inc. For accounting purposes, the acquisition has been treated as a recapitalization of Web's Biggest with Web's Biggest as the acquirer (a reverse acquisition). The historical financial statements prior to June 1, 2005, are those of Web's Biggest. Pro forma information giving effect to the acquisition, as if the acquisition took place May 1, 2005 (the beginning of Edgetech’s fiscal year), is set forth below.

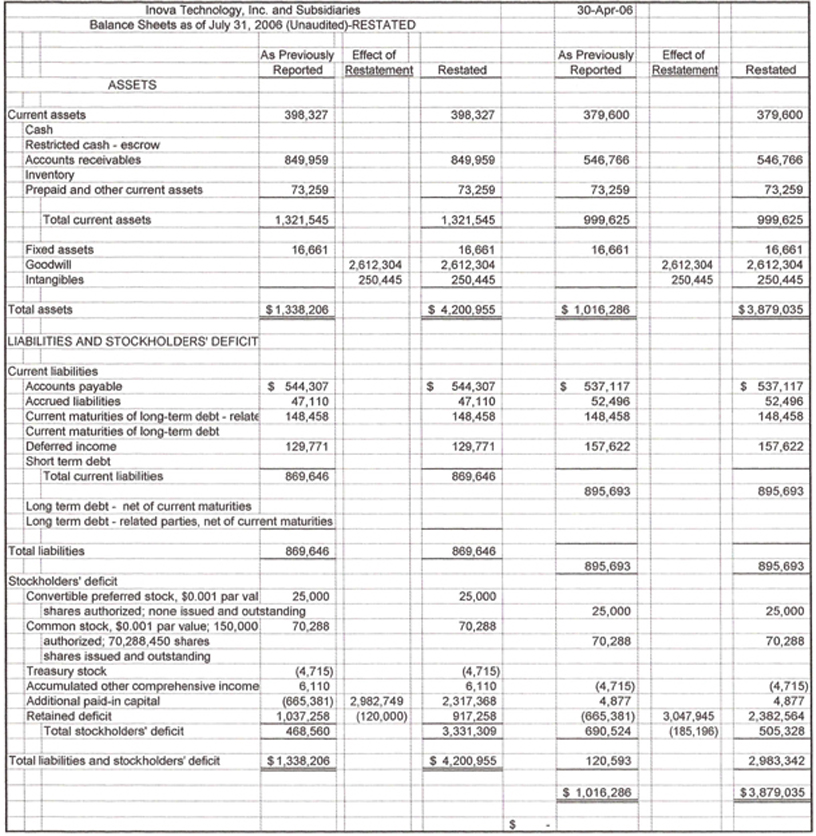

a) Restatement of Previously Issued Financial Statements

The Company restated its consolidated financial statements, as more fully discussed in Item 9. The Company restated its consolidated balance sheet, its consolidated statements of income, of changes in shareholders' equity and of cash flows as of July 31, 2006. The restatement corrects for errors made in the financial statements related to management fees and goodwill from the Web’s Biggest transaction.

3. SIGNIFICANT ACCOUNTING POLICIES

The significant accounting policies adopted by Edgetech are as follows:

Principles of consolidation

These consolidated financial statements include the accounts of Edgetech Services Inc., a Nevada Corporation and its wholly-owned subsidiaries. Significant inter-company transactions have been eliminated upon consolidation. These companies include “Edgetech Services Inc., an Ontario Canada company”, “Edgetech Services LLC, an Iowa company”, “Web’s Biggest Inc., a California corporation”, and “Directories LLC, an Iowa limited liability company.”

Use of estimates

The preparation of financial statements in accordance with generally accepted accounting principles in the United States of America requires management to make estimates and assumptions that affect the reported amount of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements and the reported amount of revenues and expenses during the year. Actual results could differ from these estimates. Estimates are used when accounting for items and matters such as allowance for uncollectible accounts receivable, inventory obsolescence, and amortization.

Foreign currency translation

Edgetech has operations in a Canadian subsidiary whose functional currency is the Canadian dollar. These consolidated financial statements are stated in United States dollars. Assets and liabilities denominated in Canadian dollars are translated to United States dollars using the exchange rate in effect at the date of the financial statements. Revenue and expenses are translated to United States dollars using the average rate of exchange for the respective period.

Exchange gains and losses arising from this translation are excluded from the determination of income and are reported as a foreign currency translation adjustment in stockholders' equity included under “comprehensive gain/loss”.

Cash

Our cash is composed for free cash and restricted cash as follows:

| Free Cash | | $ | 244,174 | |

| | | | | |

| Restricted Cash | | $ | 154,153 | |

| | | | | |

| Total Cash | | | | |

Accounts receivable

Trade and other accounts receivable are carried at face value less any allowance for doubtful accounts and provisions considered necessary. Accounts receivable primarily includes trade receivables from customers and Goods and Services Tax receivable in Canada. Edgetech estimates doubtful accounts on an item-to-item basis and includes over aged accounts as part of allowance for doubtful accounts, which are generally accounts that are ninety-days overdue. The allowance for bad debt expense was increased by $35,000 for the period ending July 31, 2006.

Property and equipment are recorded at cost, less accumulated depreciation. For Edgetech Services, an Ontario Canada Company, depreciation is recorded annually on a declining balance basis at the following annual rates:

| Office equipment and furniture | | | 20 | % |

| Computer equipment | | | 30 | % |

For Web’s Biggest Inc. and subsidiaries, depreciation is recorded annually on a straight-line basis.

Impairment of long-lived assets

Long-lived assets and certain identifiable recorded intangibles are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of an asset to future net cash flows expected to be generated by the asset. If such assets are considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the assets exceeds the fair value of the assets. Assets to be disposed of are reported at the lower of the carrying amount and the fair value less costs to sell. At July 31, 2006 and 2005, Edgetech does not have any long-lived assets reported on its consolidated balance sheets.

Revenue recognition

Edgetech Services Inc., an Ontario Canada Company, has two sources of revenues: IT consulting services and sales of hardware. Edgetech recognizes revenue when it is realized or realizable and earned. Edgetech considers revenue realized or realizable and earned when it has persuasive evidence of an arrangement, the product has been shipped or the services have been provided to the client, the sales price is fixed or determinable, and ability to collect is reasonably assured. Revenues from IT consulting services only fluctuate from the original arrangements when the customer requires additional services. Revenues from hardware sales is recognized when the product is shipped to the client and when there are no unfulfilled Company obligations that affect the client’s final acceptance of the arrangement. Edgetech does not have any multiple-element arrangements.

Web’s Biggest Inc. recognizes product revenue at the time it is earned. The company collects from its customers on a quarterly basis and enters this into the Deferred Sales account. This revenue is then accounted for monthly as the deferred income account is debited.

EDGETECH SERVICES INC. and SUBSIDIARY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

July 31, 2006

3. SIGNIFICANT ACCOUNTING POLICIES (cont’d…)

Net income per share

Basic loss per share is computed using the weighted average number of common shares outstanding during the periods. Diluted income per share is computed using the weighted average number of common shares and potentially dilutive common stock equivalents, including convertible preferred stock outstanding during the period.

Comparative figures

Certain comparative figures have been reclassified to conform to the presentation adopted in the current year.

| | | Jul 31, 2006 | |

| | | | |

| Due from entity associated with the President and CEO | | $ | 73,259 | |

| Due to entities associated with related parties. | | | 184,323 | |

EDGETECH SERVICES INC. and SUBSIDIARY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

July 31, 2006

5. CAPITAL STOCK

Common stock

Holders of common stock are entitled to one vote for each share held. There are no restrictions that limit Edgetech’s ability to pay dividends on its common stock. Web’s Biggest (accounting parent) has made distributions since being formed, while Edgetech has not paid dividends since incorporation. Edgetech’s common stock has no par value. However, for reporting purposes, Edgetech has assigned a per share amount of $0.001 to common stock.

During the quarter covered by this report, Edgetech did not repurchase any shares of its common stock.

6. INCOME TAX

Most of the company’s profits are derived from one foreign subsidiary which is not required to pay taxes on profits. In the event that funds accumulated in the foreign subsidiary are repatriated to the United States, the corporation would be required to pay income tax on the repatriated funds. The subsidiary, Edgetech Services (an Ontario company) has no tax liability due to the fact that it has net operating losses.

7. RELATED PARTY TRANSACTIONS

Occasionally the company uses the services of a company associated with one of the officers of the Company to assist in processing credit card transactions. The officers do not profit from these transactions.

8. CONTINGENCIES

During October 2005 Edgetech began a restructuring of the Edgetech Services Canadian IT operation, and the Canadian offices were closed. The Canadian IT operations are being managed from the Edgetech offices in Santa Monica while Edgetech continued the restructuring of the IT operations. During the restructuring, the Canadian IT consultants continue to service the Edgetech Canada contracts and are being paid by Edgetech. The lease payments on the Canadian offices and office equipment have been accrued through July 31, 2006 while management negotiates settlements with lessors and creditors.

9. CONCENTRATIONS

The IT consulting business has certain customer concentrations. 100% of revenue for the IT consulting business is generated from two Canadian based customers. There is no material customer concentration in the revenue generated by Web’s Biggest.

Item 2. Management Discussion and Analysis

The information contained in this Management's Discussion and Analysis of Financial Condition and Results of Operation contains "forward looking statements." Actual results may materially differ from those projected in the forward looking statements as a result of certain risks and uncertainties set forth in this report. Although our management believes that the assumptions made and expectations reflected in the forward looking statements are reasonable, there is no assurance that the underlying assumptions will, in fact, prove to be correct or that actual future results will not be materially different from the expectations expressed in this Annual Report. The following discussion should be read in conjunction with the unaudited Consolidated Financial Statements and related Notes included in Item 1.

RESULTS OF OPERATIONS FOR THE THREE MONTH PERIOD ENDED JULY 31, 2006

Net revenues decreased from $674,275 in the three-month period ending July 31, 2005 to $620,795 for the three-month period ending July 31, 2006. This decline is due primarily to the loss of the revenue that had been generated from the Edgetech IT hardware reseller business. However, the Company closed down the IT hardware reseller business in September 2005 due to its persistent losses.

Selling, general and administrative expenses were reduced from $224,787 for the three months ending July 31, 2005 to $180,163 for the same period in 2006 due to the cost reduction program implemented after the merger between Edgetech and Web’s Biggest. Total expenses decreased from $225,455 for the three months ending July 31, 2005 to $214,427 for the same period in 2006. Many of the reductions in expenses resulted from the closure of our Toronto office in September 2005. The Toronto office housed our IT hardware reseller business. All employees at the Toronto office were terminated at this time. We decide to close the Toronto office due to a persistent lack of profitability. The Company is negotiating settlements with various creditors of the closed IT hardware reseller business.

Net income decreased from $449,783 for the three months ending July 31, 2005 to $301,734 for the same period in 2006. The decrease in profit is due to the additional expenses involved in managing Edgetech that did not exist prior to the merger with Web’s Biggest. Overall, Management is pleased with the Company’s results since the Web’s Biggest merger. Management has closed and restructured certain business units that were generating losses and terminated the Company’s previous management. Since the merger, the Company’s new management has reported five consecutive quarters of profitability.

LIQUIDITY AND CAPITAL RESOURCES

Our operating activities for the three months ended July 31, 2006, generated adequate cash to meet our operating needs. As of July 31, 2006, we had cash and cash equivalents totaling $398,327, and accounts receivable of $849,959.

As at July 31, 2006 the Company had total current assets of $1,321,545 and current liabilities of $869,646 representing an excess of current assets over current liabilities of $451,899.

Management believes existing cash, cash equivalents and investments in marketable debt securities, together with any cash generated from operations will be sufficient to meet normal operating requirements including capital expenditures for the next twelve months. However, we may sell additional equity or debt securities or obtain credit facilities to further enhance our liquidity position and/or finance acquisitions, and the sale of additional equity securities could result in additional dilution to our stockholders.

Our current management team, composed of Adam Radly and Paul Aunger, have elected not to be paid any salaries or fees since the Web’s Biggest merger in order to preserve the Company’s cash reserves and maximize the Company’s profitability. However, Messrs. Radly and Aunger may elect to receive salaries or fees in the future.

Item 3. Controls and Procedures

(a) Evaluation of disclosure controls and procedures.

Our management evaluated the disclosure controls and procedures of the Company, and found them to be operating efficiently and effectively to ensure that information required to be disclosed by our Company under the general rules and regulations promulgated under the Securities Exchange Act of 1934, is recorded, processed, summarized and reported for the period covered by this report. These disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by our Company is accumulated and communicated to the management of our Company, including its principal executive officer and principal financial officer as appropriate to allow timely decisions regarding required disclosure.

(b) Changes in internal controls

There were no unusual or material changes in internal controls that we can detect for the period covered by this report other than those that are a result of the change in control of Edgetech. This change of control resulted in a change in management, a dismissal of the previous officers, and the replacement of personnel. The new officers of the company have implemented enhanced policies and procedures since the merger with Web’s Biggest, Inc.

Edgetech Services Inc. is currently a party to two legal proceedings.

Two former officers and directors of Edgetech, Tae Ho Kim and Sang Ho Kim, filed suit against the Company and its Canadian subsidiary in March 2006 in the Ontario Superior Court of Justice. The Kims claim in their lawsuit that the Company breached an alleged employment agreement with them, as well as the separation agreement that the Company and the Kims entered into upon the termination of the Kims’ employment with the Company. The Company’s Canadian subsidiary was only recently served with this lawsuit. The lawsuit claims compensatory damages in the amount of CDN$694,000 and bad faith and punitive damages of CDN$800,000.

However, following an investigation into the Kims’ management of the Company conducted by the Company’s legal counsel, the Company found that the Kims wrongfully retained Company property upon their separation from the Company and also issued themselves 25 million shares of Edgetech stock without complying with the terms of the corporate resolution granting them this stock. The Company believes that these actions represented a breach of fiduciary duty to the Company and a violation of the separation agreement. Furthermore, the Company believes that the Ontario court in which the Kims filed their lawsuit does not have jurisdiction to hear the case. As a result, the Company believes that it has several strong defenses to the Kims’ lawsuit.

Nonetheless, in order to reduce the uncertainty and expense of prolonged litigation, the Company is currently negotiating a possible settlement with the Kims.

The other legal proceeding in which the Company is engaged involves Mr. Charles Roy (the son of our former CEO, Xavier Roy). At approximately the same time as Mr. Xavier Roy resigned as CEO, the Company discovered that Xavier Roy had executed a consulting agreement that committed the Company to pay Mr. Charles Roy $4,500 per month for 24 months. The agreement also states that the Company must pay a minimum of $108,000 in the event that Mr. Charles Roy is terminated.

In February 2006, Mr. Charles Roy sued the Company in the Superior Court of the State of California for the County of Los Angeles. The lawsuit alleges that the Company breached the consulting agreement by not paying him the amounts contained in the agreement and seeks monetary damages of $90,000. The Company is vigorously defending itself against the lawsuit and is challenging the circumstances under which Mr. Charles Roy’s consulting agreement was executed. The lawsuit is currently in the discovery phase and is set for trial in April 2007.

None

Not Applicable.

None

Management of the Company believes that the Company should grow through acquisitions. As a result, Management is currently assessing various acquisition candidates in the Internet and information technology industry. However, there is no assurance that the Company will be able to successfully negotiate an acquisition with another company or raise sufficient capital to fund the acquisition. Even if such an acquisition is negotiated, the final result will depend on due diligence, financing, and regulatory and shareholder approvals, none of which are assured. In the event that the Company chooses to raise capital to fund an acquisition, the issue of new stock may significantly dilute shareholders. Shareholders and potential investors are therefore cautioned to rely only on Edgetech’s current financial condition and business operations without regard to the possibility of an acquisition.

Restatements

The company determined that the original accounting for the merger with Web’s Biggest was incorrect. The company should have accounted for the merger as a reverse acquisition whereby the shares retained by the registrant’s shareholders would be fair valued using the closing price of the registrant’s shares (purchase price) and compared to the fair value of the net assets at the time of merger. The company determined the purchase price was (70,425,950 shares x 6/1/05 closing price of $.035 = $2,464,908). The fair value of the net assets was $236,917 resulting in goodwill of $2,227,991. Therefore the net assets and equity will be increased by this amount.

Also, there were management fees of $15,000 per month from May, 2006 through July, 2006 which were not paid but which are now being realized as an increase in expense and in paid in capital. This is a total of $45,000, which is a reduction of net income and increase to equity.

Item 6. Exhibits

(A) Exhibits

Exhibit Number | Description |

| 31.1 | Certification of the Chief Executive Officer required by Rule 13a - 14(a) or Rule 15d - 14(a). |

| 31.2 | Certification of the Chief Financial Officer required by Rule 13a - 14(a) or Rule 15d - 14(a). |

| 32.1 | Certification of the Chief Executive Officer required by Rule 13a - 14(b) or Rule 15d - 14(b) and 18 U.S.C. 1350. |

| 32.2 | Certification of the Chief Financial Officer required by Rule 13a - 14(b) or Rule 15d - 14(b) and 18 U.S.C. 1350. |

In accordance with the requirements of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

EDGETECH SERVICES INC.

By: /s/ Adam Radly

Adam Radly, President & CEO

Date: September 14, 2006

By: /s/ Paul Aunger

Paul Aunger, Treasurer -

Date: September 14, 2006

Exhibit 31.1

REQUIRED BY RULE 13A - 14(A) OR RULE 15D - 14(A)

I, Adam Radly, Chief Executive Officer, certify that:

1. I have reviewed this quarterly report on Form 10-QSB of Edgetech Services Inc.

2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3. Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the small business issuer as of, and for, the periods presented in this report;

4. The small business issuer's other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) for the small business issuer and have

(a) Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the small business issuer, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

(b) Evaluated the effectiveness of the small business issuer's disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

(c) Disclosed in this report any change in the small business issuer's internal control over financial reporting that occurred during the small business issuer's most recent fiscal quarter (the small business issuer's fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the small business issuer's internal control over financial reporting; and

5.The small business issuer's other certifying officer(s) and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the small business issuer's auditors and the audit committee of the small business issuer's board of directors (or persons performing the equivalent functions):

(a)All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the small business issuer's ability to record, process, summarize and report financial information; and

(b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the small business issuer's internal control over financial reporting.

Date: September 14, 2006 | /s/ Adam Radly |

| | Chief Executive Officer |

Exhibit 31.2

REQUIRED BY RULE 13A - 14(A) OR RULE 15D - 14(A)

I, Paul Aunger, Chief Financial Officer, certify that:

1. I have reviewed this quarterly report on Form 10-QSB of Edgetech Services Inc.

2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3. Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the small business issuer as of, and for, the periods presented in this report;

4. The small business issuer's other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) for the small business issuer and have

(a) Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the small business issuer, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

(b) Evaluated the effectiveness of the small business issuer's disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

(c) Disclosed in this report any change in the small business issuer's internal control over financial reporting that occurred during the small business issuer's most recent fiscal quarter (the small business issuer's fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the small business issuer's internal control over financial reporting; and

5.The small business issuer's other certifying officer(s) and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the small business issuer's auditors and the audit committee of the small business issuer's board of directors (or persons performing the equivalent functions):

(a)All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the small business issuer's ability to record, process, summarize and report financial information; and

(b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the small business issuer's internal control over financial reporting.

Date: September 14, 2006 | /s/ Paul Aunger |

| | TREASURER |

Exhibit 32.1

REQUIRED BY RULE 13A - 14(B) OR RULE 15D - 14(B) AND 18 U.S.C. 1350

In connection with the Quarterly Report of Edgetech Services Inc.

On Form 10-QSB for the period ended July 31, 2006, as filed with the Securities and

that:

(1) The Report fully complies with the requirements of section 13(a) or 15(d) of the Securities Exchange Act of 1934; and

(2) The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company.

| | By: /s/ Adam Radly | |

| | Adam Radly | |

| | Chief Executive Officer | |

| | September 14, 2006 | |

Exhibit 32.2

REQUIRED BY RULE 13A - 14(B) OR RULE 15D - 14(B) AND 18 U.S.C. 1350

In connection with the Quarterly Report of Edgetech Services Inc.

On Form 10-QSB for the period ended July 31, 2006, as filed with the Securities and

Exchange Commission on the date hereof (the "Report" ), I, Paul Aunger, TREASURER of the Company, certify, pursuant to 18 U.S.C. Sec. 1350, that:

(1) The Report fully complies with the requirements of section 13(a) or 15(d) of the Securities Exchange Act of 1934; and

(2) The information contained in the Report fairly presents, in all

material respects, the financial condition and results of operations of the Company.

| | By: /s/ Paul Aunger | |

| | Paul Aunger | |

| | | |

| | September 14, 2006 | |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-QSB

(Mark One)

| x | QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended October 31 , 2006 |

| o | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT |

For the transition period from _______________________ to _____________

Commission file number 000-27397

EDGETECH SERVICES INC.

(Exact name of small business issuer in its charter)

| Nevada | 98-0204280 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | |

89146 | 2980 S. Rainbow Blvd. #220H Las Vegas, NV 89146 |

| (Postal Code) | (Address of principal executive offices) |

(Issuer's telephone number) (310) 857 - 666

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes o No

On October 31, 2006, the number of shares outstanding of the issuer’s common stock was 70,288,450

Transitional Small Business Disclosure Format (Check one): Yes o; No x

Inova Technology, Inc. and Subsidiaries

Consolidated Statements of Operations

For the 6 months ended October 31, 2006

(Unaudited)-Restated

| | | As Previously | | Management | | | | | |

| | | Reported | | Fee | | Restated | | 10/31/05 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Revenues | | $ | 1,082,381 | | | | | $ | 1,082,381 | | | 1,463,679 | |

| | | | | | | | | | | | | | |

| Cost of revenues | | | (204,798 | ) | | | | $ | (204,798 | ) | | (294,572 | ) |

| Operating expenses | | | (367,279 | ) | | (90,000 | ) | $ | (457,279 | ) | | (367,908 | ) |

| | | | | | | | | | | | | | |

| Operating loss | | | 510,304 | | | (90,000 | ) | | 420,304 | | | 801,199 | |

| | | | | | | | | | | | | | |

| Other income (expense): | | | | | | | | | | | | | |

| Loss on exchange of business assets | | | | | | | | | | | | | |

| Interest income | | | 217 | | | | | $ | 217 | | | 5,658 | |

| Interest expense | | | | | | | | $ | - | | | (67,236 | ) |

| | | | | | | | | | | | | | |

| Income (loss) from continuing operations | | | 510,521 | | | (90,000 | ) | | 420,521 | | | 739,621 | |

| | | | | | | | | | | | | | |

| Loss from discontinuing operations | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Net income (loss) | | $ | 510,521 | | $ | (90,000 | ) | $ | 420,521 | | | 739,621 | |

| | | | | | | | | | | | | | |

| Basic and diluted income (loss) per share: | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| From continuing operations | | $ | 0.00 | | $ | (0.00 | ) | $ | 0.00 | | | 0 | |

| From discontinued operations | | $ | - | | $ | - | | $ | - | | | 0 | |

| Total | | $ | 0.00 | | $ | (0.00 | ) | $ | 0.00 | | | 0 | |

| | | | | | | | | | | | | | |

| Weighted average common shares | | | 703,983,450 | | | 703,983,450 | | | 703,983,450 | | | 680,644,608 | |

Inova Technology, Inc. and Subsidiaries

Consolidated Statements of Operations

For the 3 months ended October 31, 2006

(Unaudited)-Restated

| | | As Previously | | Management | | | | | |

| | | Reported | | Fee | | Restated | | 10/31/2005 | |

| | | | | | | | | | |

| Revenues | | $ | 482,421 | | | | | $ | 482,421 | | | 789,404 | |

| | | | | | | | | | | | | | |

| Cost of revenues | | | (120,923 | ) | | | | $ | (120,923 | ) | | (297,722 | ) |

| Operating expenses | | | (197,852 | ) | | (45,000 | ) | $ | (242,852 | ) | | (142,453 | ) |

| | | | | | | | | | | | | | |

| Operating loss | | | 163,646 | | | (45,000 | ) | | 118,646 | | | 349,229 | |

| | | | | | | | | | | | | | |

| Other income (expense): | | | | | | | | | | | | | |

| Loss on exchange of business assets | | | | | | | | | | | | | |

| Interest income | | | 141 | | | | | $ | 141 | | | 1,545 | |

| Interest expense | | | | | | | | $ | - | | | (67,236 | ) |

| | | | | | | | | | | | | | |

| Income (loss) from continuing operations | | | 163,787 | | | (45,000 | ) | | 118,787 | | | 283,538 | |

| | | | | | | | | | | | | | |

| Loss from discontinuing operations | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Net income (loss) | | $ | 163,787 | | $ | (45,000 | ) | $ | 118,787 | | | | |

| | | | | | | | | | | | | | |

| Basic and diluted income (loss) per share: | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| From continuing operations | | $ | 0.00 | | $ | (0.00 | ) | $ | 0.00 | | | - | |

| From discontinued operations | | $ | - | | $ | - | | $ | - | | | - | |

| Total | | $ | 0.00 | | $ | (0.00 | ) | $ | 0.00 | | | 0 | |

| | | | | | | | | | | | | | |

| Weighted average common shares | | | 703,983,450 | | | 703,983,450 | | | 703,983,450 | | | 680,644,608 | |

Consolidated Statements of Cash Flows

For the 3 months ended October 31, 2006

(Unaudited)-Restated

| | | As Previously | | | | | |

| | | Reported | | Restated | | 10/31/2005 | |

| | | | | | | | |

| CASH FLOWS OPERATING ACTIVITIES | | | | | | | | | | |

| Net loss | | | 510,520 | | $ | 420,521 | | | 733,321 | |

| Add: income (loss) from discontinued operations | | | | | | | | | | |

| | | | | | | | | | | |

| Loss from continuing operations | | | 510,520 | | | 420,521 | | | | |

| | | | | | | | | | | |

| Additional shares issued for conversion of debt | | | | | | | | | | |

| Depreciation and amortization expense | | | | | | | | | 826 | |

| Changes in operating assets and liabilities: | | | | | | | | | | |

| Increase (decrease) in A/P and accrued expenses | | | | | | - | | | (204,386 | ) |

| Decrease (increase) in accounts receivable | | | 272,386 | | | 272,386 | | | (189,405 | ) |

| Increase (decrease) in deferred income | | | (22,987 | ) | | (22,987 | ) | | 160,076 | |

| Increase (decrease) in accrued expense | | | (132,499 | ) | | (132,499 | ) | | | |

| Increase (decrease) in inventory | | | | | | - | | | | |

| Decrease (increase) in prepaid expense and other current assets | | | 9,000 | | | 9,000 | | | 8,313 | |

| | | | | | | | | | | |

| Net cash provided by (used in) operating activities - continuing operations | | | 636,420 | | | 546,421 | | | | |

| | | | | | | | | | | |

| CASH FLOW INVESTING ACTIVITIES | | | | | | | | | | |

| Increase (decrease) in loans receivable | | | | | | - | | | | |

| Purchase of treasury stock | | | | | | - | | | | |

| Purchase of Right-Tag | | | | | | - | | | | |

| Purchase of fixed assets | | | | | | - | | | | |

| | | | | | | | | | | |

| Net cash provided by (used in) investing activities - continuing operations | | | - | | | - | | | | |

| | | | | | | | | | | |

| CASH FLOW FINANCING ACTIVITIES | | | | | | | | | | |

| Proceeds from notes payable - related parties | | | | | | - | | | (64,253 | ) |

| Proceeds from APIC | | | | | | 90,000 | | | | |

| Translation adjustment | | | (2,190 | ) | | (2,190 | ) | | | |

| | | | | | | | | | | |

| Net cash provided by (used in) financing activities - continuing operations | | | (2,190 | ) | | 87,810 | | | | |

| | | | | | | | | | | |

| NET CASH PROVIDED BY (USED IN) CONTINUING OPERATIONS | | | 634,230 | | | 634,231 | | | 444,492 | |

| | | | | | | | | | | |

| NET CASH PROVIDED BY DISCONTINUED OPERATIONS | | | | | | | | | | |

| | | | | | | | | | | |

| NET CHANGE IN CASH | | | 634,230 | | | 634,231 | | | | |

| | | | | | | | | | | |

| CASH AT BEGINNING OF PERIOD | | | 379,600 | | | 379,600 | | | 15,367 | |

| | | | | | | | | | | |

| CASH AT END OF PERIOD | | $ | 1,013,830 | | $ | 1,013,831 | | | 459,859 | |

EDGETECH SERVICES INC. and SUBSIDIARY

(Unaudited)

OCTOBER 31, 2006

DEFINITIONS

Edgetech Services Inc., a Nevada Corporation, herein referred to as “Edgetech”

Edgetech Services Inc., an Ontario Canada Company

1. BASIS OF PRESENTATION

The accompanying unaudited condensed financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America for interim information and in the United States of America for complete financial statements. In the opinion of management, all adjustments consisting of a normal and recurring nature considered necessary for a fair presentation have been included.

The results for the periods presented are not necessarily indicative of the results for the full year and should be read in conjunction with the audited consolidated financial statements for the year ended April 30, 2006 included in our Annual report on Form 10K, filed on August 15, 2006.

2. HISTORY AND ORGANIZATION OF THE COMPANY

Edgetech Services Inc. (“Edgetech”) was incorporated under the laws of Nevada on May 16, 1997, as Newsgurus.com, Inc. and changed its name to Secure Enterprise Solutions Inc. on January 10, 2002, and then to Edgetech Services Inc. Edgetech was is in the business of providing information technology (“IT”) security consulting services, and during fiscal 2004, began to sell security hardware. Edgetech operated from offices in Toronto, Canada. Edgetech is no longer selling security hardware.

On June 1, 2005, the Registrant entered into an agreement with the shareholders of Web’s Biggest, Inc., (a California Corporation), Mr. Xavier Roy of Los Angeles, California, and Advisors LLC, an Iowa Limited Liability Corporation (collectively, “Web’s Biggest”) which would result in the Registrant issuing 25,000,000 convertible preferred shares to the shareholders of Web’s Biggest in consideration for 100% of the outstanding capital of Web’s Biggest and $250,000 be used for general working capital of the Registrant. This transaction has been recorded as a recapitalization of Edgetech Services, Inc. In substance the merger with Web’s Biggest is considered to be a capital transaction rather than a business combination. Consequently the transaction is considered to be a reverse takeover and the accounting treatment will be as if Web’s Biggest, Inc acquired Edgetech Services, Inc. Accordingly, these financial statements are the historical financial statements of Web’s Biggest, Inc. Each convertible preferred share is convertible into 25.3533 common shares of the Registrant with all the rights and privileges of the equivalent number of common shares prior and post conversion.

When completed, this transaction resulted in a change of control of the Registrant and the pre merger shareholders of the registrant owning approximately 10% of the newly combined entity.

For further information about this recapitalization, refer to the Form 8-K filed with the Securities and Exchange Commission on June 2, 2005.Audited financial statements of Web’s Biggest for fiscal years 2003, 2004, and 2005 were also filed in this Form 8-K.

Following the acquisition of Web’s Biggest, Inc. by Edgetech, the Web’s Biggest, Inc. shareholders became the controlling shareholders of Edgetech. As a result, the financial information provided for the 2006 fiscal year for the purpose of comparison with the 2005 fiscal year only includes financial information relating to Edgetech Services, Inc. from June 30 2005.

Prior to the merger Edgetech had an IT hardware reseller business and an IT consulting business (both headquartered in an office on Toronto). At the time of the merger Web’s Biggest, Inc. invested $250,000 into the two IT businesses that existed in Edgetech prior to the merger. These funds were invested in an attempt to assist this business to remain viable and avoid closure due to unsustainable losses. While this investment enabled the business to pay some creditors the management of this business unit was unable to restructure this business into a viable business and the $250,000 invested by Web’s Biggest could not be recovered. As a result, the new management of Edgetech chose not to invest additional funds into this business and decided to close the Toronto office, close the IT hardware reseller business and restructure and maintain the IT consulting business. The Company is negotiating settlements with various creditors of the closed IT hardware reseller business. The continuing IT consulting business is now profitable.

In a duly organized meeting of the Board of Directors of the Company on Wednesday, November 23, 2005, Mr. Xavier Roy resigned as Chairman, President, CEO and Director of the Company. Adam Radly, formerly the General Manager of Web’s Biggest, was appointed Director, CEO and President. Paul Aunger has been appointed Director, Secretary and Treasurer. Mr. Radly and Mr. Aunger hold all Director and Officer positions of the Company and all of its subsidiaries. Mr. Roy no longer holds any Director or Officer positions of the Company or any of its subsidiaries.

On June 1, 2005, Edgetech Services, Inc. acquired all of the outstanding common stock of Web's Biggest, Inc. For accounting purposes, the acquisition has been treated as a recapitalization of Web's Biggest with Web's Biggest as the acquirer (a reverse acquisition).

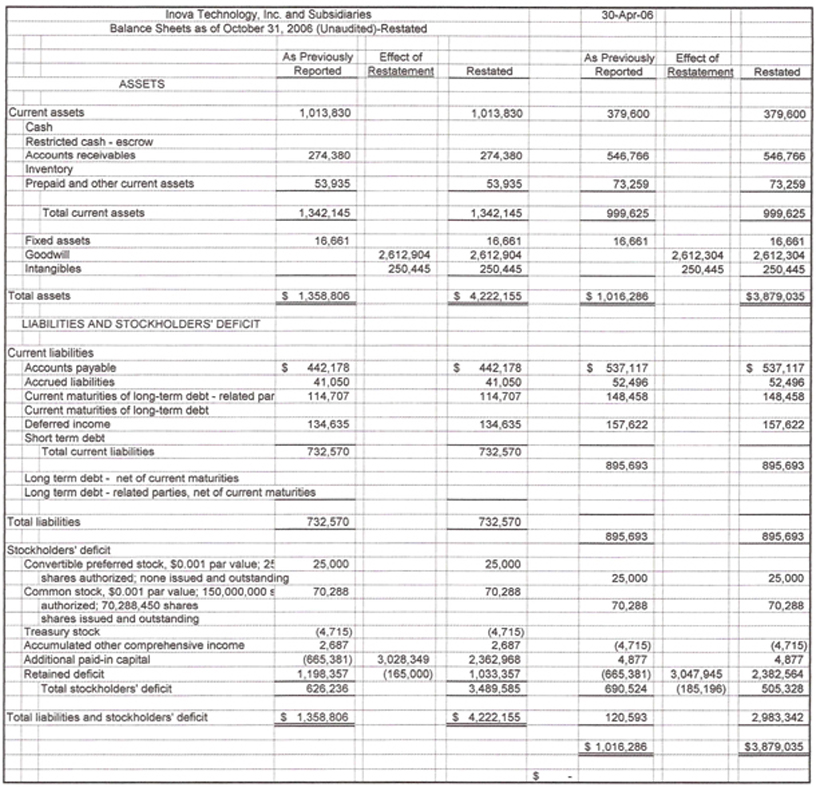

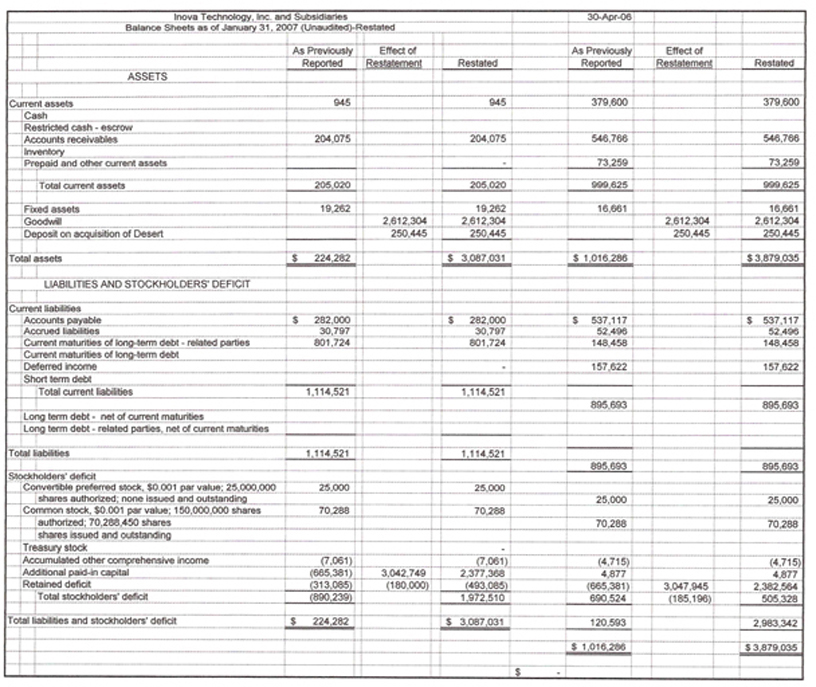

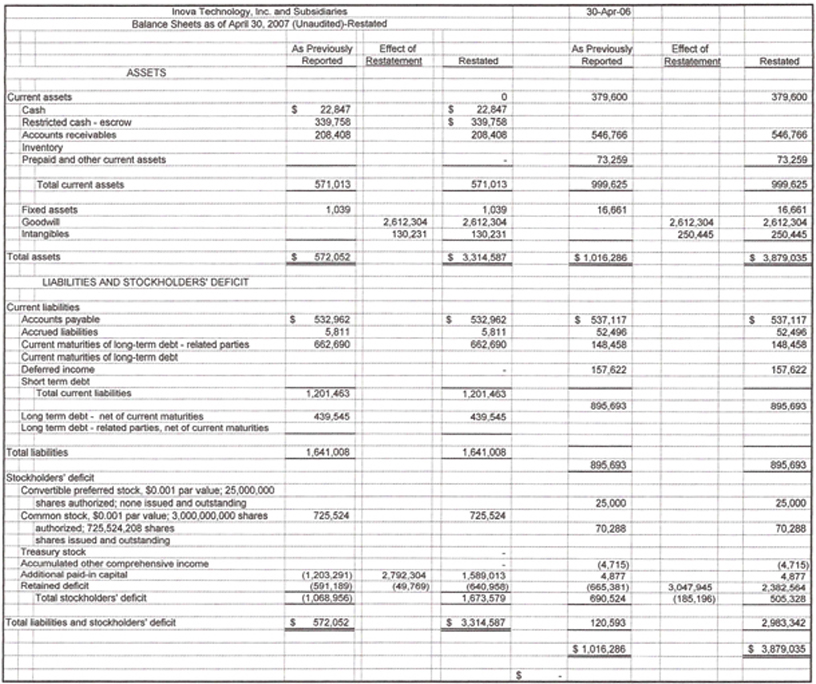

Restatement of Previously Issued Financial Statements

The Company restated its consolidated financial statements, as more fully discussed in Item 9. The Company restated its consolidated balance sheet, its consolidated statements of income, of changes in shareholders' equity and of cash flows as of October 31, 2006. The restatement corrects for errors made in the financial statements related to management fees and goodwill from the Web’s Biggest transaction.

The significant accounting policies adopted by Edgetech are as follows:

Principles of consolidation

These consolidated financial statements include the accounts of Edgetech Services Inc., a Nevada Corporation and its wholly-owned subsidiaries. Significant inter-company transactions have been eliminated upon consolidation. These companies include “Edgetech Services Inc., an Ontario, Canada company”, “Edgetech Services LLC, an Iowa company”, “Web’s Biggest Inc., a California corporation”, and “Directories LLC, an Iowa limited liability company.”

The preparation of financial statements in accordance with generally accepted accounting principles in the United States of America requires management to make estimates and assumptions that affect the reported amount of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements and the reported amount of revenues and expenses during the year. Actual results could differ from these estimates. Estimates are used when accounting for items and matters such as allowance for uncollectible accounts receivable, inventory obsolescence, and amortization.

Foreign currency translation

Edgetech has operations in a Canadian subsidiary whose functional currency is the Canadian dollar. These consolidated financial statements are stated in United States dollars. Assets and liabilities denominated in Canadian dollars are translated to United States dollars using the exchange rate in effect at the date of the financial statements. Revenue and expenses are translated to United States dollars using the average rate of exchange for the respective period.

Exchange gains and losses arising from this translation are excluded from the determination of income and are reported as a foreign currency translation adjustment in stockholders' equity included under “comprehensive gain/loss”.

Cash

Our cash is composed of free cash and restricted cash as follows:

| Free Cash | | $ | 673,936 | |

| Restricted Cash | | | 339,894 | |

| Total Cash | | $ | 1,013,830 | |

Accounts receivable

Trade and other accounts receivable are carried at face value less any allowance for doubtful accounts and provisions considered necessary. Accounts receivable primarily includes trade receivables from customers for consulting services in Canada. Edgetech estimates doubtful accounts on an item-to-item basis and includes over aged accounts as part of allowance for doubtful accounts, which are generally accounts that are ninety-days overdue.

Property and equipment are recorded at cost, less accumulated depreciation. For Edgetech Services, an Ontario Canada Company, depreciation is recorded annually on a declining balance basis at the following annual rates:

| Office equipment and furniture | | | 20 | % |

| Computer equipment | | | 30 | % |

For Web’s Biggest Inc. and subsidiaries, depreciation is recorded annually on a straight-line basis.

Impairment of long-lived assets

Long-lived assets and certain identifiable recorded intangibles are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of an asset to future net cash flows expected to be generated by the asset. If such assets are considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the assets exceeds the fair value of the assets. Assets to be disposed of are reported at the lower of the carrying amount and the fair value less costs to sell. At October 31, 2006 and 2005, Edgetech does not have any long-lived assets reported on its consolidated balance sheets.

Revenue recognition

Edgetech Services Inc., an Ontario Canada Company, has one source of revenues: IT consulting services. Edgetech recognizes revenue when it is realized or realizable and earned. Edgetech considers revenue realized or realizable and earned when it has persuasive evidence of an arrangement, the services have been provided to the client, the sales price is fixed or determinable, and ability to collect is reasonably assured. Revenues from IT consulting services only fluctuate from the original arrangements when the customer requires additional services. Revenues are recognized when there are no unfulfilled Company obligations that affect the client’s final acceptance of the arrangement. Edgetech does not have any multiple-element arrangements.

Web’s Biggest Inc. recognizes product revenue at the time it is earned. The company collects from its customers on a quarterly basis and enters this into the Deferred Sales account. This revenue is then accounted for monthly as the deferred income account is debited.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

October 31, 2006

3. SIGNIFICANT ACCOUNTING POLICIES (cont’d…)

Net income per share

Basic and diluted income per share is computed using the weighted average number of common shares outstanding during the periods. Because convertible preferred stock has voting rights, the basic and diluted shares are the same.

Comparative figures

Certain comparative figures have been reclassified to conform to the presentation adopted in the current year.

| | | Oct 31, 2006 | |

| Due from entity associated with the President and CEO | | $ | 53,935 | |

| Due to entities associated with related parties. | | | 114,707 | |

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

October 31, 2006

5. CAPITAL STOCK

Common stock

Holders of common stock and convertible preferred stock are entitled to one vote for each share held or convertible. There are no restrictions that limit Edgetech’s ability to pay dividends on its common stock. Web’s Biggest (accounting parent) has made distributions since being formed, while Edgetech has not paid dividends since incorporation. No dividends were paid for the period end October 31, 2006. Edgetech’s common stock has no par value. However, for reporting purposes, Edgetech has assigned a per share amount of $0.001 to common stock.

During the quarter covered by this report, Edgetech did not repurchase any shares of its common stock.

6. INCOME TAX

Most of the company’s profits are derived from one foreign subsidiary which is not required to pay taxes on profits. In the event that funds accumulated in the foreign subsidiary are repatriated to the United States, the corporation would be required to pay income tax on the repatriated funds. The subsidiary, Edgetech Services (an Ontario company) has no tax liability due to the fact that it has net operating losses.

7. RELATED PARTY TRANSACTIONS

Occasionally the company uses the services of a company associated with one of the officers of the Company to assist in processing credit card transactions. The officers do not profit from these transactions.

8. CONTINGENCIES

During October 2005 Edgetech began a restructuring of the Edgetech Services Canadian IT operation, and the Canadian offices were closed. The Canadian IT operations are being managed from the Edgetech offices in Santa Monica while Edgetech continued the restructuring of the IT operations. During the restructuring, the Canadian IT consultants continue to service the Edgetech Canada contracts and are being paid by Edgetech. The lease payments on the Canadian offices and office equipment have been accrued through October 31, 2006 while management negotiates settlements with lessors and creditors.

9. CONCENTRATIONS

The IT consulting business has certain customer concentrations. 90% of revenue for the IT consulting business is generated from two Canadian based customers. There is no material customer concentration in the revenue generated by Web’s Biggest.

10. LITIGATION

There are 2 alleged contract violations. Management does not believe these will materialize. However, management has accrued estimated legal fees for defending against these suits. See note below Part II, Section 1

SUBSEQUENT EVENT

Entry into a Material Definitive Agreement

On October 18, 2006, the Registrant entered into an agreement to sell Web’s Biggest Limited to Advisors LLC. The Board of Directors has approved the sale of 100% of the stock of Web’s Biggest Limited (“WB”) and all of its assets and subsidiaries to Advisors LLC in exchange for 25 million convertible preferred shares of Edgetech Services, Inc. held by Advisors LLC. Advisors LLC is a company related to Mr. Paul Aunger, a director and officer of Edgetech. The shares received from the sale of WB represent approximately 90% of the voting stock of Edgetech on a fully diluted basis.

Each preferred share is convertible into 25.3533 common shares of the registrant with all the rights and privileges of the equivalent number of common shares.

On October 18, 2006 the Registrant entered into an agreement with the shareholders of Data Management, Inc. (“DM”, a Nevada corporation) to acquire DM. The Board of Directors has approved the acquisition of 100% of the stock of Data Management, Inc. (“DM”) in exchange for 25 million convertible preferred shares of Edgetech Services Inc. The convertible shares used to acquire DM represent approximately 90% of the voting stock of Edgetech on a fully diluted basis. The sellers of DM are entities associated with Mr Adam Radly and Mr Paul Aunger, both officers and directors of the Registrant.

Each preferred share shall be convertible into 25.3533 common shares of the registrant with all the rights and privileges of the equivalent number of common shares. Each share of convertible preferred stock carries voting power equivalent to 25.3533 common shares, without regard to whether the preferred shares have been converted.

Prior to the transactions described above the Registrant was controlled by Advisors LLC, an entity associated with Mr. Paul Aunger, an officer and director of the registrant. When the transactions described above are completed, this will result in a change of control of the Registrant and the controlling shareholder will be Southbase LLC, an entity associated with Mr. Adam Radly, an officer and director of the Registrant. Prior to these transactions, the unaffiliated shareholders of Edgetech owned approximately 10% of the Registrant and they will continue to own approximately 10% of the Registrant on a fully diluted basis after these transactions are completed.

Pursuant to Nevada law, the transactions described above do not require shareholder approval. Therefore, resolutions in the preliminary proxy filed on October 19, 2006 relating to this transaction and requiring shareholder approval have been removed from the proxy for 2006. An amended proxy was filed on December 1, 2006. These transactions have been approved by the Board of Directors and all agreements have been duly executed as at December 1, 2006.

The shareholder meeting of Edgetech that was held on October 28, 2006 included a resolution that provided the Board of Directors with authorization to increase the number of authorized shares of the Company to 3,000,000,000 and this resolution was approved by the shareholders. On December 4, 2006 the Board of Directors approved a board resolution to increase the number of authorized shares to 3,000,000,000.

Item 2.01 - Acquisition or Disposition of Assets

Disposition of assets

The Company currently has two business units - IT services and Internet search. There are no synergies between both businesses and the Company’s Board feels that more value would be created for shareholders if Edgetech could focus its business operations on one industry. This would ultimately involve selling one business unit. Although the Company had previously taken the view that the Internet search business was the preferred business to keep and that the IT services business would be sold, the Company’s Internet search business (WebsBiggest.com) has not demonstrated the growth rate that we anticipated over the previous twelve months. Revenue for the Internet search business fell during the year ending April, 2006. Net revenue for the Internet search business fell from $1.739 million for the year ending April, 2005 to $1.434 million for the year ending April, 2006.

The Board feels that more value will be created for the Company’s shareholders by selling the Internet search business and acquiring IT businesses that have synergies with the Company’s existing IT business and have potential for growth.

Under the terms of an acquisition agreement dated October 18, 2006, the Registrant has agreed to sell 100% of the stock of Web’s Biggest Limited (“WB”) and all of its assets and subsidiaries to Advisors LLC in exchange for 25 million convertible preferred shares of Edgetech Services, Inc. Advisors LLC is a company related to Mr. Paul Aunger, a Director and officer of Edgetech. The shares received from the sale of WB represent approximately 90% of the voting stock of Edgetech on a fully diluted basis.

Each preferred share is convertible into 25.3533 common shares of the registrant with all the rights and privileges of the equivalent number of common shares.

Acquisition of assets

Under the terms of an acquisition agreement dated October 18, 2006, the Registrant has agreed to acquire 100% of the stock of Data Management, Inc. (“DM”) in exchange for 25 million convertible preferred shares of Edgetech Services, Inc. The convertible shares used to acquire DM represent approximately 90% of the voting stock of Edgetech on a fully diluted basis.

DM sells data management and storage products and services to large corporate and government customers.

Revenue for DM (on a pro forma basis) for the year ended December 2005 was approximately $5.2 million and net income was approximately $380,000. During 2005 revenue increased by 77% from revenue of approximately $2.9 million for the year ended December 2004 on a pro forma basis. Net income for 2004 was approximately $290,000. Pro forma figures are determined as if DM were a stand-alone company in fiscal years 2004 and 2005.

DM’s customers include the following:

Central Government

| § | Federal Communications Commission |

| § | Securities and Exchange Commission |

| § | Department of Health and Human Services |

| § | Department of Commerce/NOAA |

| § | National Institute of Health |

| § | Metropolitan Transit Authority |

Defense

| § | Defense Communications Electronic Evaluation & Test Activity (Defense Ceeta) |

| § | Naval Medical Logistics Command |

| § | US Army Contracting Agency |

| § | Naval research laboratory |

| § | Naval Air Warfare Center |

Corporate

| § | Computer Sciences Corporation |

| § | Boeing Information Services |

| § | Bureau of National Affairs |

The sellers of DM are companies associated with Mr. Adam Radly and Mr. Paul Aunger, officers and directors of Edgetech.

The sale of WB and the acquisition of DM are not dilutive to shareholders. The total number of shares issued in each class of stock will not change as a result of the sale of WB and the acquisition of DM.

The information contained in this Management's Discussion and Analysis of Financial Condition and Results of Operation contains "forward looking statements." Actual results may materially differ from those projected in the forward looking statements as a result of certain risks and uncertainties set forth in this report. Although our management believes that the assumptions made and expectations reflected in the forward looking statements are reasonable, there is no assurance that the underlying assumptions will, in fact, prove to be correct or that actual future results will not be materially different from the expectations expressed in this Annual Report. The following discussion should be read in conjunction with the unaudited Consolidated Financial Statements and related Notes included in Item 1.

RESULTS OF OPERATIONS FOR THE THREE MONTH PERIOD ENDED OCTOBER 31, 2006

Net revenues decreased from $789,404 in the three-month period ending October 31, 2005 to $482,421 for the three-month period ending October 31, 2006. This decline is due primarily to the loss of the revenue that had been generated from the Edgetech IT hardware reseller business. However, the Company closed down the IT hardware reseller business in September 2005 due to its persistent losses.

Selling, general and administrative expenses increased from $70,174 for the three months ending October 31, 2005 to $238,270 for the same period in 2006 due to the cost reduction program implemented after the merger between Edgetech and Web’s Biggest. Total expenses increased from $142,453 for the three months ending October 31, 2005 to $242,852 for the same period in 2006. This quarter there were some one-time intercompany and reconciliation issues causing additional expense, but in general expenses are lower. Many of the reductions in expenses resulted from the closure of our Toronto office in September 2005. The Toronto office housed our IT hardware reseller business. All employees at the Toronto office were terminated at this time. We decided to close the Toronto office due to a persistent lack of profitability. The Company is negotiating settlements with various creditors of the closed IT hardware reseller business.

Net income decreased from $283,538 for the three months ending October 31, 2005 to $118,787 for the same period in 2006. The decrease in profit is due to the additional expenses involved in managing Edgetech that did not exist prior to the merger with Web’s Biggest. Overall, Management is pleased with the Company’s results since the Web’s Biggest merger. Management has closed and restructured certain business units that were generating losses and terminated the Company’s previous management. Since the merger, the Company’s new management has reported five consecutive quarters of profitability.

RESULTS OF OPERATIONS FOR THE SIX MONTH PERIOD ENDED OCTOBER 31, 2006

Net revenues decreased from $1,463,679 in the six-month period ending October 31, 2005 to $1,082,381 for the six-month period ending October 31, 2006.

Selling, general and administrative expenses increased from $295,629 for the six months ending October 31, 2005 to $373,434 for the same period in 2006 due to the cost reduction program implemented after the merger between Edgetech and Web’s Biggest. Total expenses decreased from $367,908 for the six months ending October 31, 2005 to $457,279 for the same period in 2006.

Net income decreased from $733,321 for the six months ending October 31, 2005 to $420,521 for the same period in 2006.

LIQUIDITY AND CAPITAL RESOURCES

Our operating activities for the three months ended October 31, 2006, generated adequate cash to meet our operating needs. As of October 31, 2006, we had cash and cash equivalents totaling $1,013,830, and accounts receivable of $274,380.

As at October 31, 2006 the Company had total current assets of $1,342,145 and current liabilities of $732,570 representing an excess of current assets over current liabilities of $609,575.

Management believes existing cash, cash equivalents and investments in marketable debt securities, together with any cash generated from operations will be sufficient to meet normal operating requirements including capital expenditures for the next twelve months. However, we may sell additional equity or debt securities or obtain credit facilities to further enhance our liquidity position and/or finance acquisitions, and the sale of additional equity securities could result in additional dilution to our stockholders.

Our current management team, composed of Adam Radly and Paul Aunger, have elected not to be paid any salaries or fees since the Web’s Biggest merger in order to preserve the Company’s cash reserves and maximize the Company’s profitability. However, Messrs. Radly and Aunger may elect to receive salaries or fees in the future.

Restatements

The company determined that the original accounting for the merger with Web’s Biggest was incorrect. The company should have accounted for the merger as a reverse acquisition whereby the shares retained by the registrant’s shareholders would be fair valued using the closing price of the registrant’s shares (purchase price) and compared to the fair value of the net assets at the time of merger. The company determined the purchase price was (70,425,950 shares x 6/1/05 closing price of $.035 = $2,464,908). The fair value of the net assets was $236,917 resulting in goodwill of $2,227,991. Therefore the net assets and equity will be increased by this amount.

Also, there were management fees of $15,000 per month from August, 2006 through October, 2006 which were not paid but which are now being realized as an increase in expense and in paid in capital. This is a total of $45,000, which is a reduction of net income and increase to equity. Item 3. Controls and Procedures

(a) Evaluation of disclosure controls and procedures.

Our management evaluated the disclosure controls and procedures of the Company, and found them to be operating efficiently and effectively to ensure that information required to be disclosed by our Company under the general rules and regulations promulgated under the Securities Exchange Act of 1934, is recorded, processed, summarized and reported for the period covered by this report. These disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by our Company is accumulated and communicated to the management of our Company, including its principal executive officer and principal financial officer as appropriate to allow timely decisions regarding required disclosure.

(b) Changes in internal controls

There were no unusual or material changes in internal controls that we can detect for the period covered by this report other than those that are a result of the change in control of Edgetech. This change of control resulted in a change in management, a dismissal of the previous officers, and the replacement of personnel. The new officers of the company have implemented enhanced policies and procedures since the merger with Web’s Biggest, Inc.

Edgetech Services Inc. is currently a party to two legal proceedings.

Two former officers and directors of Edgetech, Tae Ho Kim and Sang Ho Kim, filed suit against the Company and its Canadian subsidiary in March 2006 in the Ontario Superior Court of Justice. The Kims claim in their lawsuit that the Company breached an alleged employment agreement with them, as well as the separation agreement that the Company and the Kims entered into upon the termination of the Kims’ employment with the Company. The Company’s Canadian subsidiary was only recently served with this lawsuit. The lawsuit claims compensatory damages in the amount of CDN$694,000 and bad faith and punitive damages of CDN$800,000.

However, following an investigation into the Kims’ management of the Company conducted by the Company’s legal counsel, the Company found that the Kims wrongfully retained Company property upon their separation from the Company and also issued themselves 25 million shares of Edgetech stock without complying with the terms of the corporate resolution granting them this stock. The Company believes that these actions represented a breach of fiduciary duty to the Company and a violation of the separation agreement. Furthermore, the Company believes that the Ontario court in which the Kims filed their lawsuit does not have jurisdiction to hear the case. As a result, the Company believes that it has several strong defenses to the Kims’ lawsuit.