0001089113ifrs-full:FinancialAssetsAtAmortisedCostCategoryMemberhsbc:LoansAndAdvancesToCustomersMemberifrs-full:CurrentMemberifrs-full:LifetimeExpectedCreditLossesMemberifrs-full:FinancialInstrumentsNotCreditimpairedMember2021-12-310001089113hsbc:WholesaleLendingSectorMemberhsbc:DownsideScenarioWorstOutcomeMembercountry:GBifrs-full:AccumulatedImpairmentMember2020-12-310001089113ifrs-full:FinancialAssetsAtAmortisedCostCategoryMemberhsbc:IFRS9Memberhsbc:SatisfactoryMemberhsbc:LoansAndAdvancesToBanksMemberifrs-full:GrossCarryingAmountMember2020-12-310001089113ifrs-full:FinancialInstrumentsCreditimpairedAfterPurchaseOrOriginationMemberhsbc:IFRS9Memberhsbc:SatisfactoryMemberhsbc:LoanAndOtherCreditRelatedCommitmentsMemberifrs-full:GrossCarryingAmountMemberifrs-full:LifetimeExpectedCreditLossesMember2020-12-310001089113hsbc:CRRPD9to10Memberhsbc:CommercialRealEstateLoansAndAdvancesIncludingLoanCommitmentsMemberhsbc:LoansAndAdvancesToCustomersAndBanksMembercountry:HKhsbc:WholesaleLendingSectorMemberhsbc:LTV91To100PercentMember2020-12-310001089113ifrs-full:FinancialInstrumentsCreditimpairedAfterPurchaseOrOriginationMemberhsbc:LoansAndAdvancesToCustomersMemberhsbc:FullyCollateralisedMemberifrs-full:LifetimeExpectedCreditLossesMemberhsbc:LTV51To60PercentMemberhsbc:PersonalLendingSectorMember2021-12-310001089113hsbc:TemporaryDifferencesFromInvestmentsInSubsidiariesAndBranchesMember2020-12-310001089113hsbc:HSBCHoldingsMemberifrs-full:LaterThanOneYearAndNotLaterThanTwoYearsMemberifrs-full:DebtSecuritiesMember2020-12-31

As filed with the Securities and Exchange Commission on February 23, 2022.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

| | | | | |

| REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Or

| | | | | |

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2021

Or

| | | | | |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Or

| | | | | |

| SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report ____________

For the transition period from N/A to N/A

Commission file number: 001-14930

HSBC Holdings plc

(Exact name of Registrant as specified in its charter)

| | | | | | | | |

| N/A | | United Kingdom |

| (Translation of Registrant’s name into English) | | (Jurisdiction of incorporation or organisation) |

8 Canada Square

London E14 5HQ

United Kingdom

(Address of principal executive offices)

Jonathan Bingham

8 Canada Square

London E14 5HQ

United Kingdom

Tel +44 (0) 20 3268 4840

Email jonathan.bingham@hsbc.com

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | |

| Ordinary Shares, nominal value US$0.50 each (GB0005405286) | HSBA | London Stock Exchange | |

| 5 | Hong Kong Stock Exchange | |

| HSBC.BH | Bermuda Stock Exchange | |

| HSBC | New York Stock Exchange | * |

| American Depository Shares, each representing 5 Ordinary Shares of nominal value US$0.50 each (US4042804066) | HSBC | New York Stock Exchange | |

| | | | | | | | | | | |

| 7.625% Subordinated Notes due 2032 (US404280AF65) | HSBC/32A | New York Stock Exchange | |

| 7.35% Subordinated Notes due 2032 (US404280AE90) | HSBC/32B | New York Stock Exchange | |

| 6.5% Subordinated Notes 2036 (US404280AG49) | HSBC36 | New York Stock Exchange | |

| 6.5% Subordinated Notes 2037 (US404280AH22) | HSBC37 | New York Stock Exchange | |

| 6.8% Subordinated Notes Due 2038 (US404280AJ87) | HSBC38 | New York Stock Exchange | |

| 4.875% Senior Unsecured Notes Due 2022 (US404280AL34) | HSBC22 | New York Stock Exchange | |

| 6.100% Senior Unsecured Notes due 2042 (US404280AM17) | HSBC42 | New York Stock Exchange | |

| 4.00% Senior Unsecured Notes Due 2022 (US404280AN99) | HSBC22A | New York Stock Exchange | |

| 4.250% Subordinated Notes due 2024 (US404280AP48) | HSBC24 | New York Stock Exchange | |

| 5.250% Subordinated Notes due 2044 (US404280AQ21) | HSBC44 | New York Stock Exchange | |

| 4.250% Subordinated Notes due 2025 (US404280AU33) | HSBC25 | New York Stock Exchange | |

| 4.300% Senior Unsecured Notes due 2026 (US404280AW98) | HSBC26 | New York Stock Exchange | |

| 3.600% Senior Unsecured Notes due 2023 (US404280BA69) | HSBC23 | New York Stock Exchange | |

| 3.900% Senior Unsecured Notes due 2026 (US404280BB43) | HSBC26A | New York Stock Exchange | |

| 2.650% Senior Unsecured Notes due 2022 (US404280BF56) | HSBC22B | New York Stock Exchange | |

| Floating Rate Senior Unsecured Notes due 2022 (US404280BG30) | HSBC22C | New York Stock Exchange | |

| 4.375% Subordinated Notes due 2026 (US404280BH13) | HSBC26B | New York Stock Exchange | |

| 3.262% Fixed Rate/Floating Rate Senior Unsecured Notes due 2023 (US404280BJ78) | HSBC23A | New York Stock Exchange | |

| 4.041% Fixed Rate/Floating Rate Senior Unsecured Notes due 2028 (US404280BK42) | HSBC28 | New York Stock Exchange | |

| 3.033% Fixed Rate/Floating Rate Senior Unsecured Notes due 2023 (US404280BM08) | HSBC23B | New York Stock Exchange | |

| Floating Rate Senior Unsecured Notes due 2024 (US404280BR94) | HSBC24A | New York Stock Exchange | |

| 3.950% Fixed Rate/Floating Rate Senior Unsecured Notes due 2024 (US404280BS77) | HSBC24B | New York Stock Exchange | |

| 4.583% Fixed Rate/Floating Rate Senior Unsecured Notes due 2029 (US404280BT50) | HSBC29 | New York Stock Exchange | |

| 2.175% Resettable Senior Unsecured Notes due 2023 (XS1823595647) | N/A | New York Stock Exchange | |

| Floating Rate Senior Unsecured Notes due 2026 (US404280BW89) | HSBC26D | New York Stock Exchange | |

| 4.292% Fixed Rate/Floating Rate Senior Unsecured Notes due 2026 (US404280BX62) | HSBC26C | New York Stock Exchange | |

| 3.803% Fixed Rate/Floating Rate Senior Unsecured Notes due 2025 (US404280BZ11) | HSBC25A | New York Stock Exchange | |

| Floating Rate Senior Unsecured Notes due 2025 (US404280CA50) | HSBC25B | New York Stock Exchange | |

| 3.000% Resettable Senior Unsecured Notes due 2028 (XS1961843171) | HSBC28A | New York Stock Exchange | |

| 3.973% Fixed Rate/Floating Rate Senior Unsecured Notes due 2030 (US404280CC17) | HSBC30 | New York Stock Exchange | |

| 3.00% Resettable Senior Unsecured Notes due 2030 (XS2003500142) | HSBC30A | New York Stock Exchange | |

| | | | | | | | | | | |

| 2.633% Fixed Rate/Floating Rate Senior Unsecured Notes due 2025 (US404280CE72) | HSBC25C | New York Stock Exchange | |

4.950% Fixed Rate Senior Unsecured Notes due 2030

(US404280CF48) | HSBC30B | New York Stock Exchange | |

2.099% Fixed Rate/Floating Rate Senior Unsecured Notes due 2026

(US404280CG21) | HSBC26E | New York Stock Exchange | |

2.848% Fixed Rate/Floating Rate Senior Unsecured Notes due 2031

(US404280CH04) | HSBC31 | New York Stock Exchange | |

1.645% Fixed Rate/Floating Rate Senior Unsecured Notes due 2026

(US404280CJ69) | HSBC26F | New York Stock Exchange | |

2.357% Fixed Rate/Floating Rate Senior Unsecured Notes due 2031

(US404280CK33) | HSBC31A | New York Stock Exchange | |

2.013% Fixed Rate/Floating Rate Senior Unsecured Notes due 2028

(US404280CL16) | HSBC28B | New York Stock Exchange | |

1.589% Fixed Rate/Floating Rate Senior Unsecured Notes due 2027

(US404280CM98) | HSBC27 | New York Stock Exchange | |

1.750% Fixed Rate/Floating Rate Senior Unsecured Notes due 2027

(XS2322315727) | HSBC27A | New York Stock Exchange | |

0.976% Fixed Rate/Floating Rate Senior Unsecured Notes due 2025

(US404280CS68) | HSBC25 | New York Stock Exchange | |

2.804% Fixed Rate/Floating Rate Senior Unsecured Notes due 2032

(US404280CT42) | HSBC32 | New York Stock Exchange | |

0.732% Fixed Rate/Floating Rate Senior Unsecured Notes due 2024

(US404280CU15) | HSBC24C | New York Stock Exchange | |

2.206% Fixed Rate/Floating Rate Senior Unsecured Notes due 2029

(US404280CV97) | HSBC29A | New York Stock Exchange | |

1.162% Fixed Rate/Floating Rate Senior Unsecured Notes due 2024

(US404280CW70) | HSBC24D | New York Stock Exchange | |

2.251% Fixed Rate/Floating Rate Senior Unsecured Notes due 2027

(US404280CX53) | HSBC27B | New York Stock Exchange | |

2.871% Fixed Rate/Floating Rate Senior Unsecured Notes due 2032

(US404280CY37) | HSBC32A | New York Stock Exchange | |

Floating Rate Senior Unsecured Notes due 2024

(US404280CZ02) | HSBC24E | New York Stock Exchange | |

* Not for trading, but only in connection with the registration of American Depositary Shares.

Securities registered or to be registered pursuant to Section 12(g) of the Securities Exchange Act of 1934: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Securities Exchange Act of 1934: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

Ordinary Shares, nominal value US$0.50 each 20,631,520,439

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. þ Yes ¨ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ¨ Yes þ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. þ Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). þ Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

| | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | þ | Accelerated filer | ¨ | Non-accelerated filer | ¨ | Emerging growth company | ¨ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act.

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. þ

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | | | | | | | | | | | | | | | | |

| U.S. GAAP | ¨ | International Financial Reporting Standards | þ | Other | ¨ |

| | as issued by the International Accounting Standards Board | | | |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow. ¨ Item 17 ¨ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes þ No

Contents

Strategic report

1a Forward-looking statements

1c Approach to ESG reporting

1d Certain defined terms

2 Highlights

4 Who we are

6 Group Chairman’s statement

8 Group Chief Executive’s review

12 Our strategy

15 How we do business

25 Remuneration

26 Financial overview

30 Global businesses

37 Risk overview

Environmental, social and

governance (‘ESG’) review

43 Our approach to ESG

45 Environmental

66 Social

79 Governance

Financial review

90 Financial summary

110 Global businesses and geographical regions

131 Reconciliation of alternative performance measures

134 Other information

Risk review

145 Our approach to risk

148 Top and emerging risks

155 Risk factors

167 Areas of special interest

171 Our material banking risks

Corporate governance report

254 Group Chairman’s governance statement

256 Biographies of Directors and senior management

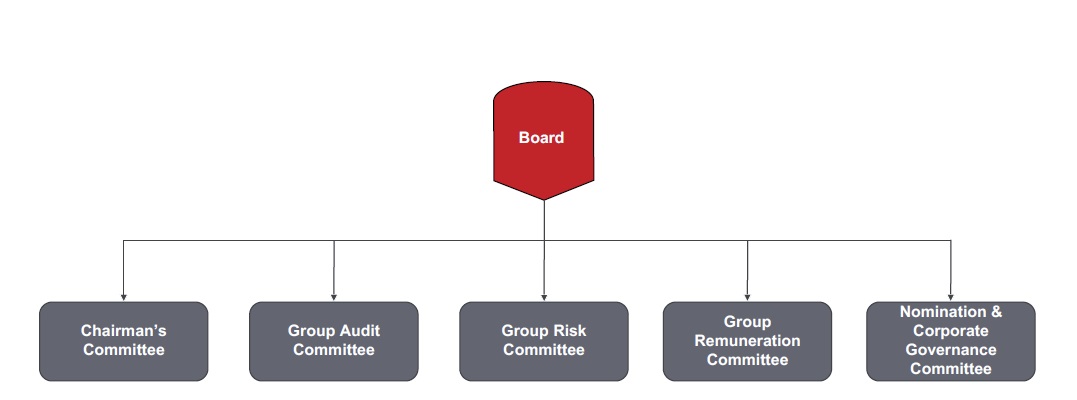

273 Board committees

290 Directors’ remuneration report

Financial statements

334 Report of Independent Registered Public Accounting Firm to the Board of Directors and Shareholders of HSBC Holdings plc

(PCAOB ID 876)

336 Financial statements

346 Notes on the financial statements

Additional information

425 Shareholder information

435 Abbreviations

We have changed how we provide the disclosures against the Task Force on Climate-related Disclosures (‘TCFD’) framework by embedding the content previously provided in our stand-alone TCFD Update within this Form 20-F for the year ended 31 December 2021. The summary TCFD disclosure can be found on page 19.

This Strategic Report was approved by the Board on 22 February 2022.

Mark E Tucker

Group Chairman

A reminder

The currency we report in is US dollars.

Adjusted measures

We supplement our IFRSs figures with non-IFRSs measures used by management internally that constitute alternative performance measures under European Securities and Markets Authority guidance and non-GAAP financial measures defined in and presented in accordance with US Securities and Exchange Commission rules and regulations. These measures are highlighted with the following symbol: <>

Further explanation may be found on page 28.

None of the websites referred to in this Form 20-F for the year ended 31 December 2021 (the ‘Form 20-F’) (including where a link is provided), and none of the information contained on such websites, are incorporated by reference in this report.

Cover image: Opening up a world of opportunity

We connect people, ideas and capital across the world, opening up opportunities for our customers and the communities we serve.

Opening up a world of opportunity

Our ambition is to be the preferred international financial partner for our clients.

Our purpose, ambition and values reflect our strategy and support our focus on execution.

Read more on our values, strategy and purpose on pages 4, 12 and 15.

Key themes of 2021

The Group continued to make progress on our strategic aims, although challenges remain:

Financial performance

Performance reflected an improvement in global economic conditions, which resulted in releases of expected credit loss allowances, the impact of lower interest rates, and continued cost discipline. All of our regions were profitable, and our Asia operations continued to perform strongly. The outlook for net interest income is now significantly more positive.

Read more on pages 2 and 26.

Strategic transformation

We have made progress in areas of strength and expanded our digital capabilities across key products. During the year, we announced a number of strategic transactions including the planned sale of our retail banking business in France and our exit of mass market retail in the US. We also announced acquisitions in Singapore and India to develop our wealth capabilities across Asia.

Read more on page 12.

Climate ambition

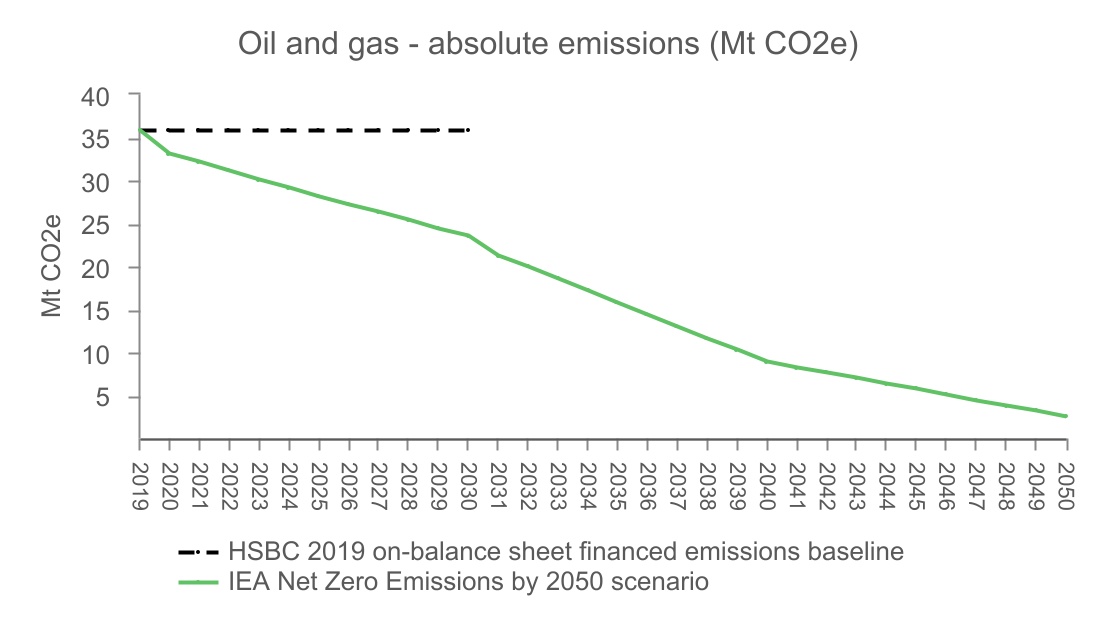

We are helping to mobilise the transition to a net zero global economy. Since 2020, we have supported our customers’ transition to net zero and a sustainable future by providing and facilitating sustainable finance and investment. We have published our thermal coal phase-out policy and have set targets to reduce our on-balance sheet financed emissions of two priority sectors: oil and gas, and power and utilities by 2030.

Read more on page 18.

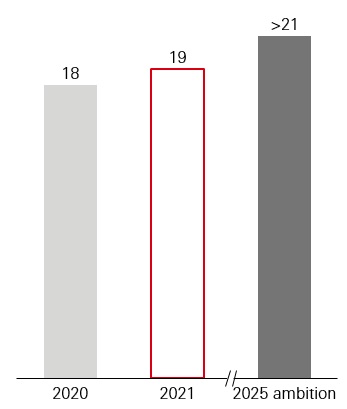

Delivery against our financial targets

Return on average tangible equity <>

8.3%

Target: ≥10% over the medium term.

(2020: 3.1%)

Adjusted operating expenses <>

$32.1bn

Updated target: 2022 adjusted operating expenses in line with 2021.

Previous target: ≤$31bn in 2022 (at December 2020 foreign exchange rates).

(2020: $32.4bn)

Gross RWA reduction

$104bn

Since the start of the programme. Updated target: >$110bn by end of 2022.

Common equity tier 1 capital ratio

15.8%

Target: >14%, managing in the range of 14% to 14.5% in the medium term; and manage the range down further long term.

(2020: 15.9%)

Dividend per share

$0.25

2021 payout ratio: 40.3%

Target: sustainable cash dividends with a payout ratio of 40% to 55% from 2022 onwards.

For our financial targets, we define medium term as three to four years and long term as five to six years, commencing 1 January 2020.

Further explanation of performance against Group financial targets may be found on page 26.

ESG performance indicators and targets

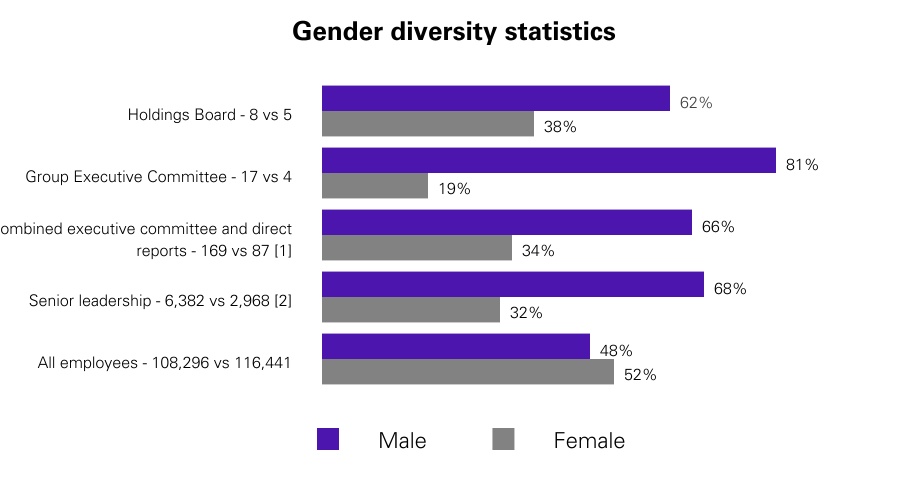

Gender diversity

31.7%

Women in senior leadership roles.

(2020: 30.3%)

Sustainable finance and investment

$126.7bn

Cumulative total provided and facilitated since January 2020.

(2020: $44.1bn)

Net zero in our own operations

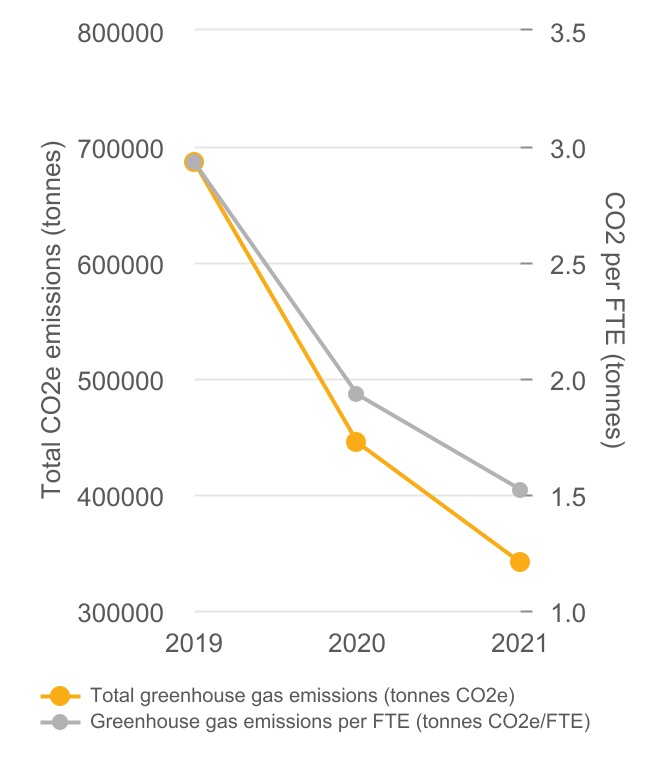

50.3%

Cumulative reduction in absolute greenhouse gas emissions from 2019 baseline.

Financed emissions targets by 2030

34%

Mt CO2e reduction in oil and gas absolute on-balance sheet financed emissions

0.14

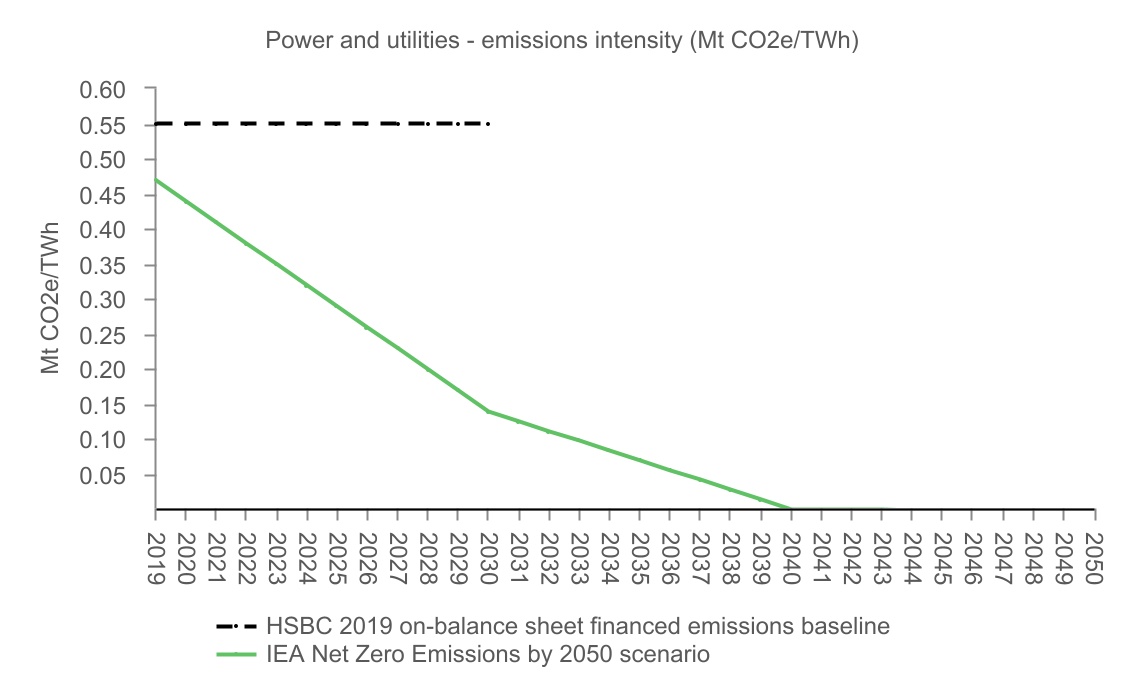

Mt CO2e/TWh power and utilities on-balance sheet financed emissions intensity, representing 75% reduction from 2019

Customer satisfaction

6 out of 10

Wealth and Personal Banking markets that sustained top-three rank and/or improved in customer satisfaction.

4 out of 13

Commercial Banking markets that sustained top-three rank and/or improved in customer satisfaction.

Read more on how we set and define our environmental, social and governance metrics on page 17.

Read more on our financed emissions scope, methodology and terminology on page 47 and our definition of sustainable finance and investment on page 53.

Cautionary statement regarding forward-looking statements

This Form 20-F contains certain forward-looking statements with respect to HSBC’s financial condition; results of operations and business, including the strategic priorities; financial, investment and capital targets; and ESG targets, commitments and ambitions described herein.

Statements that are not historical facts, including statements about HSBC’s beliefs and expectations, are forward-looking statements. Words such as ‘may’, ‘will’, ‘should’, ‘expects’, ‘targets’, ‘anticipates’, ‘intends’, ‘plans’, ‘believes’, ‘seeks’, ‘estimates’, ‘potential’ and ‘reasonably possible’, or the negative thereof, other variations thereon or similar expressions are intended to identify forward-looking statements. These statements are based on current plans, information, data, estimates and projections, and therefore undue reliance should not be placed on them. Forward-looking statements speak only as of the date they are made. HSBC makes no commitment to revise or update any forward-looking statements to reflect events or circumstances occurring or existing after the date of any forward-looking statements. Written and/or oral forward-looking statements may also be made in the periodic reports to the US Securities and Exchange Commission, summary financial statements to shareholders, proxy statements, offering circulars and prospectuses, press releases and other written materials, and in oral statements made by HSBC’s Directors, officers or employees to third parties, including financial analysts. Forward-looking statements involve inherent risks and uncertainties. Readers are cautioned that a number of factors could cause actual results to differ, in some instances materially, from those anticipated or implied in any forward-looking statement. These include, but are not limited to:

•changes in general economic conditions in the markets in which we operate, such as new recessions and fluctuations in employment and creditworthy customers beyond those factored into consensus forecasts (including, without limitation, as a result of the Covid-19 pandemic); the Covid-19 pandemic, which may continue to have adverse impacts on our income due to lower lending and transaction volumes, lower wealth and insurance manufacturing revenue, and volatile interest rates in markets where we operate, as well as, more generally, the potential for material adverse impacts on our financial condition, results of operations, prospects, liquidity, capital position and credit ratings; deviations from the market and economic assumptions that form the basis for our ECL measurements (including, without limitation, as a result of the Covid-19 pandemic); potential changes in HSBC’s dividend policy; changes in foreign exchange rates and interest rates, including the accounting impact resulting from financial reporting in respect of hyperinflationary economies; volatility in equity markets; lack of liquidity in wholesale funding or capital markets, which may affect our ability to meet our obligations under financing facilities or to fund new loans, investments and businesses; geopolitical tensions or diplomatic developments producing social instability or legal uncertainty, such as diplomatic tensions, including between China and the US, the UK, the EU, India and other countries, and developments in Hong Kong and Taiwan, alongside other potential areas of tension, which may affect the Group by creating regulatory, reputational and market risks; the efficacy of government, customer, and HSBC's actions in managing and mitigating ESG risks, in particular climate risk, nature-related risks and human rights risks, each of which can impact HSBC both directly and indirectly through our customers and which may result in potential financial and non-financial impacts; illiquidity and downward price pressure in national real estate markets; adverse changes in central banks’ policies with respect to the provision of liquidity support to financial markets; heightened market concerns over sovereign creditworthiness in over-indebted countries; adverse changes in the funding status of public or private defined benefit pensions; societal shifts in customer financing and investment needs, including consumer perception as to the continuing availability of credit; exposure to counterparty risk, including third parties using us as a conduit for illegal activities without our knowledge; the discontinuation of certain key Ibors and the development of near risk-free benchmark rates, as well as the transition of legacy Ibor contracts to near risk free benchmark rates, which exposes HSBC to material execution risks, and increases some financial and non-financial risks; and price competition in the market segments we serve;

•changes in government policy and regulation, including the monetary, interest rate and other policies of central banks and other regulatory authorities in the principal markets in which we operate and the consequences thereof (including, without limitation, actions taken as a result of the Covid-19 pandemic); initiatives to change the size, scope of activities and interconnectedness of financial institutions in connection with the implementation of stricter regulation of financial institutions in key markets worldwide; revised capital and liquidity benchmarks, which could serve to deleverage bank balance sheets and lower returns available from the current business model and portfolio mix; changes to tax laws and tax rates applicable to HSBC, including the imposition of levies or taxes designed to change business mix and risk appetite; the practices, pricing or responsibilities of financial institutions serving their consumer markets; expropriation, nationalisation, confiscation of assets and changes in legislation relating to foreign ownership; the UK’s relationship with the EU following the UK’s withdrawal from the EU, which may continue to be characterised by uncertainty, particularly with respect to the regulation of financial services, despite the signing of the Trade and Cooperation Agreement between the UK and the EU; passage of the Hong Kong national security law and restrictions on telecommunications, as well as the US Hong Kong Autonomy Act, which have caused tensions between China, the US and the UK; general changes in government policy that may significantly influence investor decisions; the costs, effects and outcomes of regulatory reviews, actions or litigation, including any additional compliance requirements; and the effects of competition in the markets where we operate including increased competition from non-bank financial services companies; and

•factors specific to HSBC, including our success in adequately identifying the risks we face, such as the incidence of loan losses or delinquency, and managing those risks (through account management, hedging and other techniques); our ability to achieve our financial, investment, capital and ESG targets, commitments and ambitions (including with respect to the commitments set forth in our thermal coal phase-out policy and our targets to reduce our on-balance sheet financed emissions in the oil and gas and power and utilities sectors), which may result in our failure to achieve any of the expected benefits of our strategic priorities; model limitations or failure, including, without limitation, the impact that the

consequences of the Covid-19 pandemic have had on the performance and usage of financial models, which may require us to hold additional capital, incur losses and/or use compensating controls, such as judgemental post model adjustments, to address model limitations; changes to the judgements, estimates and assumptions we base our financial statements on; changes in our ability to meet the requirements of regulatory stress tests; a reduction in the credit ratings assigned to us or any of our subsidiaries, which could increase the cost or decrease the availability of our funding and affect our liquidity position and net interest margin; changes to the reliability and security of our data management, data privacy, information and technology infrastructure, including threats from cyber-attacks, which may impact our ability to service clients and may result in financial loss, business disruption and/or loss of customer services and data; changes in insurance customer behaviour and insurance claim rates; our dependence on loan payments and dividends from subsidiaries to meet our obligations; changes in accounting standards, including the implementation of IFRS 17 ‘Insurance Contracts’, which may have a material impact on the way we prepare our financial statements and (with respect to IFRS 17) may negatively affect the profitability of HSBC’s insurance business; changes in our ability to manage third-party, fraud and reputational risks inherent in our operations; employee misconduct, which may result in regulatory sanctions and/or reputational or financial harm; changes in skill requirements, ways of working and talent shortages, which may affect our ability to recruit and retain senior management and diverse and skilled personnel; and changes in our ability to develop sustainable finance and climate-related products consistent with the evolving expectations of our regulators, and our capacity to measure the climate impact from our financing activity (including as a result of data limitations and changes in methodologies), which may affect our ability to achieve our climate ambition, our targets to reduce financed emissions in our oil and gas and power and utilities portfolio and the commitments set forth in our thermal coal phase-out policy, and increase the risk of greenwashing. Effective risk management depends on, among other things, our ability through stress testing and other techniques to prepare for events that cannot be captured by the statistical models it uses; our success in addressing operational, legal and regulatory, and litigation challenges; and other risks and uncertainties we identify in ‘Top and emerging risks’ on pages 148 to 167.

Approach to ESG reporting

The information set out in the ESG review on pages 42 to 88, taken together with other information relating to ESG issues included in this Form 20-F, aims to provide key ESG information and data relevant to our operations for the year ended 31 December 2021. The data is compiled for the financial year 1 January to 31 December 2021 unless otherwise specified. Measurement techniques and calculations are explained next to data tables where necessary. There are no significant changes from the previous reporting period in terms of scope, boundary or measurement of our reporting of ESG matters. Where relevant, rationale is provided for any restatement of information or data that has been previously published. We have also considered our obligations under the Environmental, Social and Governance Reporting Guide contained in Appendix 27 to The Rules Governing the Listing of Securities on the Stock Exchange of Hong Kong Limited (‘ESG Guide’) and under LR9.8.6R(8) of the Financial Conduct Authority’s (‘FCA’) Listing Rules. We will continue to develop and refine our reporting and disclosures on ESG matters in line with feedback received from our investors and other stakeholders, and in view of our obligations under the ESG Guide and the FCA’s Listing Rules.

ESG Guide

We comply with the ‘comply or explain’ provisions in the ESG Guide, save for certain items, which we describe in more detail below:

•A1(b) on relevant laws/regulations relating to air and greenhouse gas emissions, discharges into water and land, and generation of hazardous and non-hazardous waste: Taking into account the nature of our business, we do not believe that there are relevant laws and regulations in these areas that have significant impacts on HSBC.

•A1.3 on total hazardous waste produced, A1.4 on total non-hazardous waste produced: Taking into account the nature of our business, we do not consider hazardous waste to be a material issue for our stakeholders. As such, we report only on total waste produced, which includes hazardous and non-hazardous waste.

•A1.6 on handling hazardous and non-hazardous waste: Taking into account the nature of our business, we do not consider this to be a material issue for our stakeholders. Notwithstanding this, we continue to focus on the reduction and recycling of all waste. Building on the success of our previous operational environmental strategy, we are identifying key opportunities where we can lessen our wider environmental impact, including waste management. For further details, please see our ESG review on page 51.

•A2.4 on sourcing water issue: Taking into account the nature of our business, we do not consider this to be a material issue for our stakeholders. Notwithstanding this, we have implemented measures to further reduce water consumption through the installation of flow restrictors, auto-taps and low or zero flush sanitary fittings and continue to track our water consumption.

•A2.5 on packaging material, B2.2 on lost days due to work injury, B6(b) on issues related to health and safety and labelling relating to products and services provided, B6.1 on percentage of total products sold or shipped subject to recalls for safety and health reasons and B6.4 in recall procedures: Taking into account the nature of our business, we do not consider these to be material issues for our stakeholders.

This is aligned with the materiality reporting principle that is set out in the ESG Guide. See ‘How we decide what to measure’ on page 44 for further information on how we determine what matters are material to our stakeholders.

TCFD recommendations and recommended disclosures

As noted on page 19, we have considered our ‘comply or explain’ obligation under the FCA’s Listing Rules, and confirm that we have made disclosures consistent with the TCFD Recommendations and Recommended Disclosures in this Annual Report and Accounts 2021 save for certain items, which we describe below:

Targets setting

Metrics and targets (c) relating to short-term targets: Given that climate scenarios are mainly focused on medium- to long-term horizons, rather than short term, we have set interim 2030 targets for on-balance sheet financed emissions for the oil and gas, and power and utilities sectors. HSBC intends to review the financed emissions baseline and targets annually, where relevant, to help ensure that they are aligned with market practice and current climate science.

Impacts on financial planning and performance

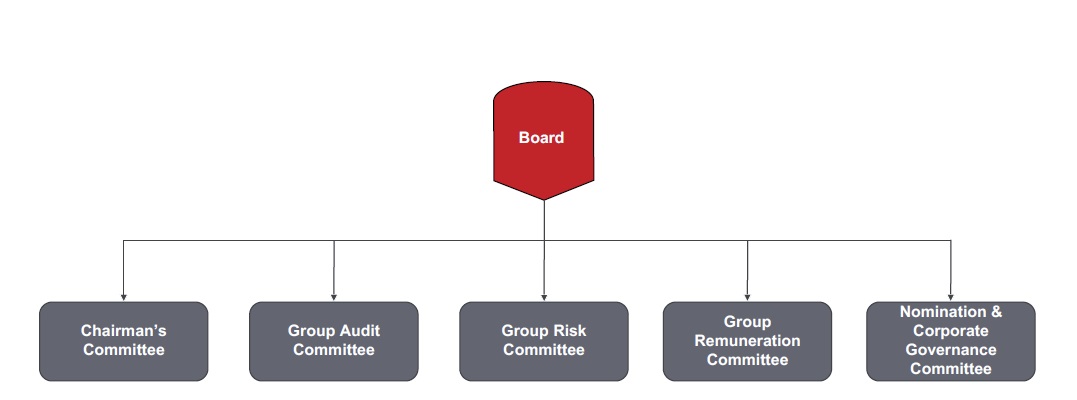

Strategy (b) relating to financial planning and performance: We do not currently fully disclose the impacts of climate-related issues on financial planning, how these serve as an input to the financial planning process, the impact of climate-related issues on our financial performance (for example, revenues and costs) and financial position (for example, assets and liabilities), in each case due to transitional challenges including data and system limitations.

Metrics and targets (a) relating to internal carbon prices and climate-related opportunities metrics: We do not currently fully disclose the proportion of revenue or proportion of assets, or other business activities aligned with climate-related opportunities, including revenue from products and services, forward-looking metrics consistent with our business or strategic planning time horizons, or internal carbon prices, in each case due to transitional challenges including data and system limitations.

We expect the data and system limitations related to financial planning and performance, internal carbon prices and climate-related opportunities metrics to be addressed in the medium term as more reliable data becomes available and technology solutions are implemented.

Impacts of transition and physical risk

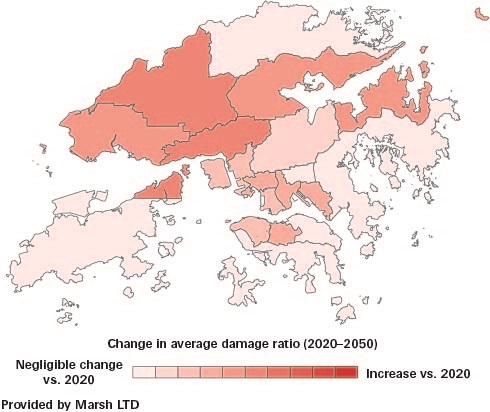

Strategy (c) relating to quantitative scenario analysis: We do not currently fully disclose the impacts of transition and physical risk quantitatively, due to transitional challenges including data limitations and evolving science and methodologies.

Metrics and targets (a) relating to detailed climate-related risk exposure metrics for retail and wholesale: We do not fully disclose metrics used to assess the impact of climate-related risks on retail lending, parts of wholesale lending and other financial intermediary business activities (specifically credit exposure, equity and debt holdings, or trading positions, each broken down by industry, geography, credit quality, average tenor). This is due to transitional challenges including data limitations.

Metrics and targets (c) on targets related to physical risk: We do not currently disclose targets used to measure and manage physical risk. This is due to transitional challenges including data limitations.

We expect the data limitations related to quantitative scenario analysis, specific risk metrics and physical risk targets to be addressed in the medium term as more reliable data becomes available and technology solutions are implemented.

Scope 3 emissions disclosure

Metrics and targets (b) relating to scope 3 emissions metrics: We currently disclose partial scope 3 greenhouse gas emissions including business travel and financed emissions. In relation to financed emissions, we are disclosing scope 3 greenhouse gas emissions for the oil and gas, and the power and utilities sectors. Future disclosure on scope 3 financed emissions (customers) and supply chain emissions (suppliers), and related risks is reliant on both our customers and suppliers publicly disclosing their carbon emissions and related risks. We aim to disclose financed emissions for additional sectors by 2023.

Our approach to disclosure of financed emissions for additional sectors can be found on: www.hsbc.com/who-we-are/esg-and-responsible-business/esg-reporting-centre.

Other matters

Strategy (b) relating to acquisitions/divestments and access to capital: We have considered the impact of climate-related issues on our businesses, strategy, and financial planning, but not specifically in relation to acquisitions/divestments or access to capital. Due to transitional challenges such as process limitations, we do not disclose the climate-related impact in these areas. We will aim to further enhance our processes in relation to acquisitions/divestments and access to capital in the medium term.

Metrics and targets (c) relating to water usage target: We have described the targets used by the organisation to manage climate-related risks and opportunities and performance against targets. However, taking into account the nature of our business, we do not consider water usage to be a material target for our business and, therefore, we have not included a target in this year’s disclosure.

With respect to our obligations under LR9.8.6R(8) of the FCA’s Listing Rules, as part of considering what to measure and publicly report, we perform an assessment to ascertain the appropriate level of detail to be included in the climate-related financial disclosures that are set out in our Annual Report and Accounts. Our assessment takes into account factors such as the level of our exposure to climate-related risks and opportunities, the scope and objectives of our climate-related strategy, transitional challenges, and the nature, size and complexity of our business. See ‘How we decide what to measure’ on page 44 for further information.

Certain defined terms

Unless the context requires otherwise, ‘HSBC Holdings’ means HSBC Holdings plc and ‘HSBC’, the ‘Group’, ‘we’, ‘us’ and ‘our’ refer to HSBC Holdings together with its subsidiaries. Within this document the Hong Kong Special Administrative Region of the People’s Republic of China is referred to as ‘Hong Kong’. When used in the terms ‘shareholders’ equity’ and ‘total shareholders’ equity’, ‘shareholders’ means holders of HSBC Holdings ordinary shares and those preference shares and capital securities issued by HSBC Holdings classified as equity. The abbreviations ‘$m’, ‘$bn’ and ‘$tn’ represent millions, billions (thousands of millions) and trillions of US dollars, respectively.

This page is intentionally left blank

Highlights

Financial performance reflected improved global economic conditions, and we continued to make progress against our four strategic pillars.

Financial performance (vs 2020)

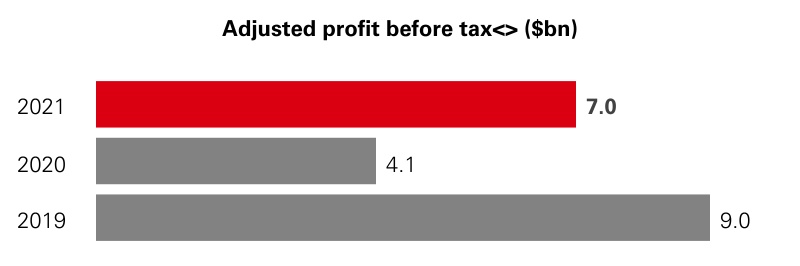

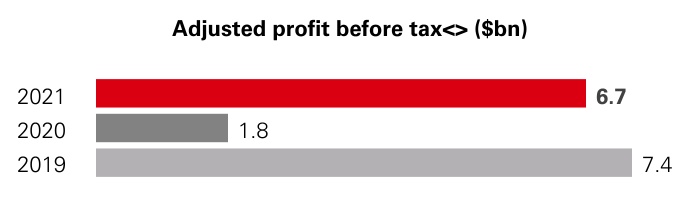

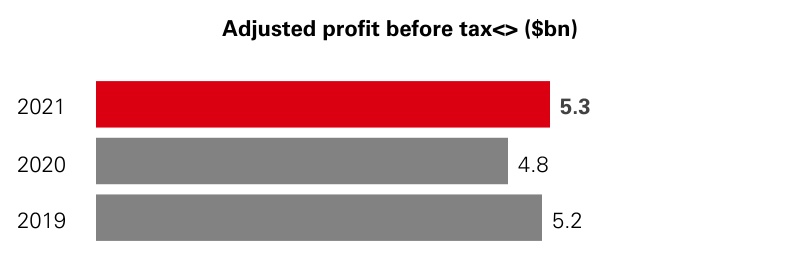

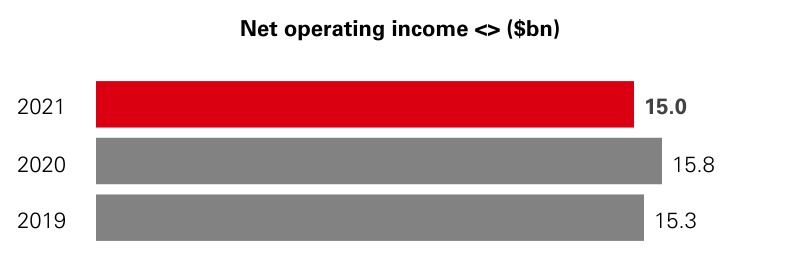

•Reported profit after tax up $8.6bn to $14.7bn and reported profit before tax up $10.1bn to $18.9bn. The increase was driven by a net release of expected credit losses and other credit impairment charges (‘ECL’) and a higher share of profit from our associates. Adjusted profit before tax up 79% to $21.9bn.

•All regions were profitable in 2021, notably HSBC UK Bank plc, where reported profit before tax increased by $4.5bn to $4.8bn. Our Asia operations contributed $12.2bn to reported profit before tax and all other regions reported a material recovery in profitability, reflecting favourable ECL movements.

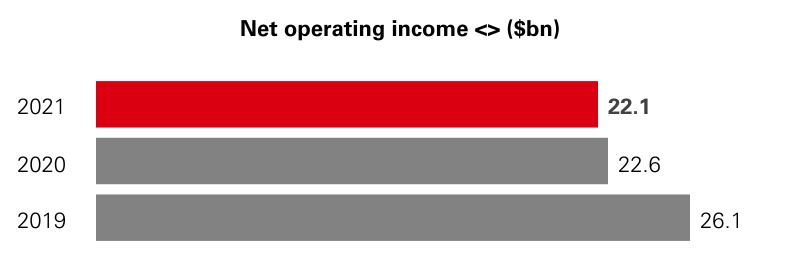

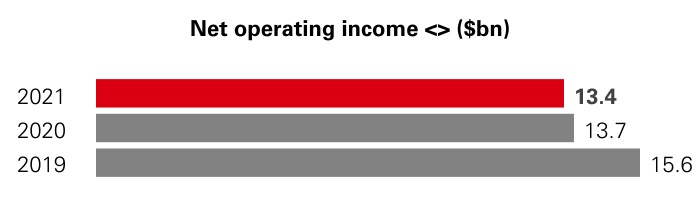

•Reported revenue down 2% to $49.6bn, primarily reflecting the impact of lower global interest rates and a decrease in revenue in Markets and Securities Services (‘MSS’) compared with a strong comparative period. Notwithstanding these factors, we saw revenue growth in areas of strategic focus, including Wealth, in part due to favourable market impacts in life insurance manufacturing, and Global Trade and Receivables Finance (‘GTRF’). Adjusted revenue down 3% to $50.1bn.

•Net interest margin (‘NIM’) of 1.20%, down 12 basis points (‘bps’) from 2020, with stabilisation in the second half of 2021.

•Reported ECL were a net release of $0.9bn, compared with an $8.8bn charge in 2020, reflecting an improvement in economic conditions relative to 2020, and better than expected levels of credit performance. In the fourth quarter of 2021, we recognised a net ECL charge of $450m, which included an increase in allowances to reflect recent developments in China’s commercial real estate sector.

•Reported operating expenses broadly unchanged at $34.6bn. Adjusted operating expenses down 1% to $32.1bn, despite inflationary pressures, as the impact of our cost-saving initiatives and a reduction in the UK bank levy charge absorbed higher performance-related pay and continued growth in technology investment.

•Customer lending balances in 2021 up $8bn on a reported basis and $23bn on a constant currency basis, primarily driven by growth in mortgage balances, mainly in the UK and Hong Kong.

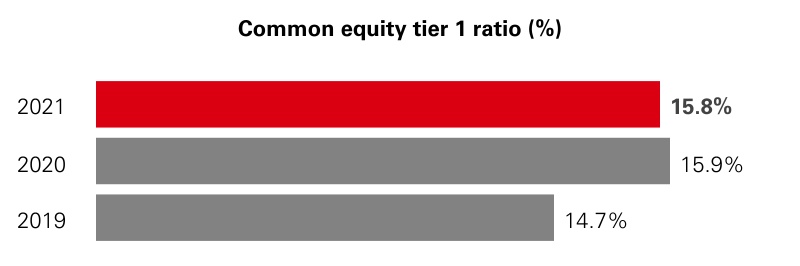

•Common equity tier 1 (‘CET1’) capital ratio of 15.8%, down 0.1 percentage points. Capital generation was more than offset by dividends, the up to $2bn share buy-back announced in October, foreign exchange movements and other deductions. Risk-weighted assets (‘RWAs’) reduced despite new Pillar 1 requirements for structural foreign exchange, reflecting actions under our transformation programme.

•The Board has approved a second interim dividend of $0.18 per share, making a total for 2021 of $0.25 per share. We also intend to initiate a further share buy-back of up to $1bn, to commence after the existing up to $2bn buy-back has concluded.

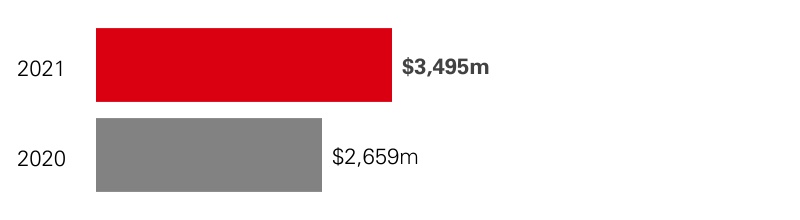

Strategic progress

•In our wealth business in Asia, we attracted net new invested assets of $36bn in 2021. We also announced acquisitions in Singapore and India to develop our wealth capabilities across the region.

•Our cost-reduction programme continues to progress with $2.2bn of cost savings recognised in 2021. Since the start of the programme in 2020, we have delivered savings of $3.3bn, with costs to achieve of $3.6bn.

•In line with our climate change resolution, we published our thermal coal phase-out policy and have set on-balance sheet financed emission targets for our oil and gas, and power and utilities sectors.

•In 2021, we continued to support our customers in the transition to net zero and a sustainable future. Since 1 January 2020, we have provided and facilitated $126.7bn towards our ambition of $750bn to $1tn by 2030.

•We continued the transformation of our US business and HSBC Bank plc, our UK non-ring-fenced bank and Europe, reducing costs and RWAs. Furthermore, we announced the exit of mass market retail in the US, and the planned sale of our retail operations in France. During 2022, we expect to recognise a pre-tax loss, excluding transaction costs, of around $2.7bn upon the classification of our France retail operations as ‘held for sale’.

Outlook

We carry good business momentum into 2022 in most areas and expect mid-single-digit lending growth over the year. However, we expect a weaker Wealth performance in Asia in the first quarter of 2022.

We expect ECL charges to normalise towards 30bps of average loans in 2022, based on current consensus economic forecasts and default experience, noting we retain $0.6bn of Covid-19-related allowances as at the end of 2021. Uncertainty remains given recent developments in China’s commercial real estate sector, while inflationary pressures persist in many of our markets.

We continue to target 2022 adjusted operating expenses in line with 2021, despite inflationary pressures, with cost to achieve spend of $3.4bn expected to generate over $2bn of cost savings in 2022. In 2023, we intend to manage growth in adjusted

operating expenses to within a range of 0% to 2%, compared with 2022 (on an IFRS 4 basis), with cost savings of at least $0.5bn from actions taken in 2022 helping to offset inflation.

We expect mid-single-digit RWA growth in 2022 through a combination of business growth, acquisitions and regulatory changes, partly offset by additional RWA savings. This growth, together with capital returns are expected to normalise our CET1 position to be within our 14% to 14.5% target operating range during 2022.

Our net interest income outlook is now significantly more positive. If policy rates were to follow the current implied market consensus, we would expect to deliver a RoTE of at least 10% for 2023, one year ahead of our previous expectations.

We continue to target dividends within our 40% to 55% dividend payout ratio range.

Key financial metrics

| | | | | | | | | | | |

| For the year ended |

| Reported results | 2021 | 2020 | 2019 |

| Reported revenue ($m) | 49,552 | | 50,429 | | 56,098 | |

| Reported profit before tax ($m) | 18,906 | | 8,777 | | 13,347 | |

| Reported profit after tax ($m) | 14,693 | | 6,099 | | 8,708 | |

| Profit attributable to the ordinary shareholders of the parent company ($m) | 12,607 | | 3,898 | | 5,969 | |

| Cost efficiency ratio (%) | 69.9 | | 68.3 | | 75.5 | |

| Net interest margin (%) | 1.20 | | 1.32 | | 1.58 | |

| Basic earnings per share ($) | 0.62 | | 0.19 | | 0.30 | |

| Diluted earnings per share ($) | 0.62 | | 0.19 | | 0.30 | |

| Dividend per ordinary share (in respect of the period) ($) | 0.25 | | 0.15 | | 0.30 | |

Dividend payout ratio (%)1 | 40.3 | | 78.9 | | 100.0 | |

| Alternative performance measures <> | | | |

| Adjusted revenue ($m) | 50,090 | | 51,770 | | 56,435 | |

| Adjusted profit before tax ($m) | 21,916 | | 12,271 | | 22,681 | |

| | | |

| Adjusted cost efficiency ratio (%) | 64.2 | | 62.6 | | 59.5 | |

| Expected credit losses and other credit impairment charges (‘ECL’) as % of average gross loans and advances to customers (%) | (0.09) | | 0.87 | | 0.26 | |

| Return on average ordinary shareholders’ equity (%) | 7.1 | | 2.3 | | 3.6 | |

Return on average tangible equity (%)2 | 8.3 | | 3.1 | | 8.4 | |

| At 31 December |

| Balance sheet | 2021 | 2020 | 2019 |

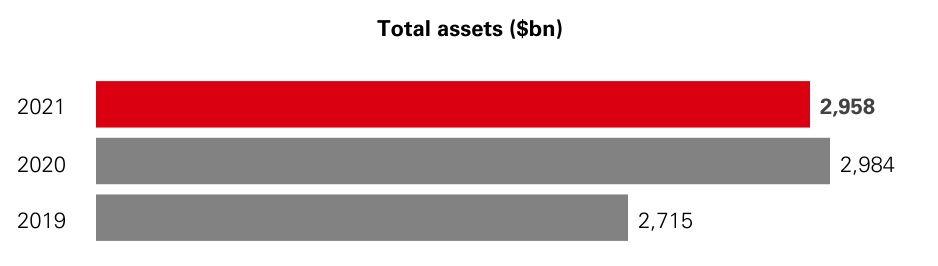

| Total assets ($m) | 2,957,939 | | 2,984,164 | | 2,715,152 | |

| Net loans and advances to customers ($m) | 1,045,814 | | 1,037,987 | | 1,036,743 | |

| Customer accounts ($m) | 1,710,574 | | 1,642,780 | | 1,439,115 | |

| Average interest-earning assets ($m) | 2,209,513 | | 2,092,900 | | 1,922,822 | |

| Loans and advances to customers as % of customer accounts (%) | 61.1 | | 63.2 | | 72.0 | |

| Total shareholders’ equity ($m) | 198,250 | | 196,443 | | 183,955 | |

| Tangible ordinary shareholders’ equity ($m) | 158,193 | | 156,423 | | 144,144 | |

| Net asset value per ordinary share at period end ($) | 8.76 | | 8.62 | | 8.00 | |

| Tangible net asset value per ordinary share at period end ($) | 7.88 | | 7.75 | | 7.13 | |

| Capital, leverage and liquidity | | | |

Common equity tier 1 capital ratio (%)3 | 15.8 | | 15.9 | | 14.7 | |

Risk-weighted assets ($m)3 | 838,263 | | 857,520 | | 843,395 | |

Total capital ratio (%)3 | 21.2 | | 21.5 | | 20.4 | |

Leverage ratio (%)3 | 5.2 | | 5.5 | | 5.3 | |

| High-quality liquid assets (liquidity value) ($bn) | 717 | | 678 | | 601 | |

| Liquidity coverage ratio (%) | 138 | | 139 | | 150 | |

| Share count | | | |

| Period end basic number of $0.50 ordinary shares outstanding (millions) | 20,073 | | 20,184 | | 20,206 | |

| Period end basic number of $0.50 ordinary shares outstanding and dilutive potential ordinary shares (millions) | 20,189 | | 20,272 | | 20,280 | |

| Average basic number of $0.50 ordinary shares outstanding (millions) | 20,197 | | 20,169 | | 20,158 | |

For reconciliations of our reported results to an adjusted basis, including lists of significant items, see page 110. Definitions and calculations of other alternative performance measures are included in our ‘Reconciliation of alternative performance measures’ on page 131.

1 Dividend per ordinary share, in respect of the period, expressed as a percentage of basic earning per share.

2 Profit attributable to ordinary shareholders, excluding impairment of goodwill and other intangible assets and changes in present value of in-force insurance contracts (‘PVIF’) (net of tax), divided by average ordinary shareholders’ equity excluding goodwill, PVIF and other intangible assets (net of deferred tax).

3 Unless otherwise stated, regulatory capital ratios and requirements are based on the transitional arrangements of the Capital Requirements Regulation in force at the time. These include the regulatory transitional arrangements for IFRS 9 ‘Financial Instruments’, which are explained further on page 231. Leverage ratios are calculated using the end point definition of capital and the IFRS 9 regulatory transitional arrangements. References to EU regulations and directives (including technical standards) should, as applicable, be read as references to the UK’s version of such regulation and/or directive, as onshored into UK law under the European Union (Withdrawal) Act 2018, and as may be subsequently amended under UK law.

Who we are

About HSBC

With assets of $3.0tn and operations in 64 countries and territories at 31 December 2021, HSBC is one of the largest banking and financial services organisations in the world. Approximately 40 million customers bank with us and we employ around 220,000 full-time equivalent staff. We have around 187,000 shareholders in 128 countries and territories.

Our values

Our values help define who we are as an organisation, and are key to our long-term success.

We value difference

Seeking out different perspectives

We succeed together

Collaborating across boundaries

We take responsibility

Holding ourselves accountable and taking the long view

We get it done

Moving at pace and making things happen

> For further details on our strategy and purpose, see pages 12 and 15.

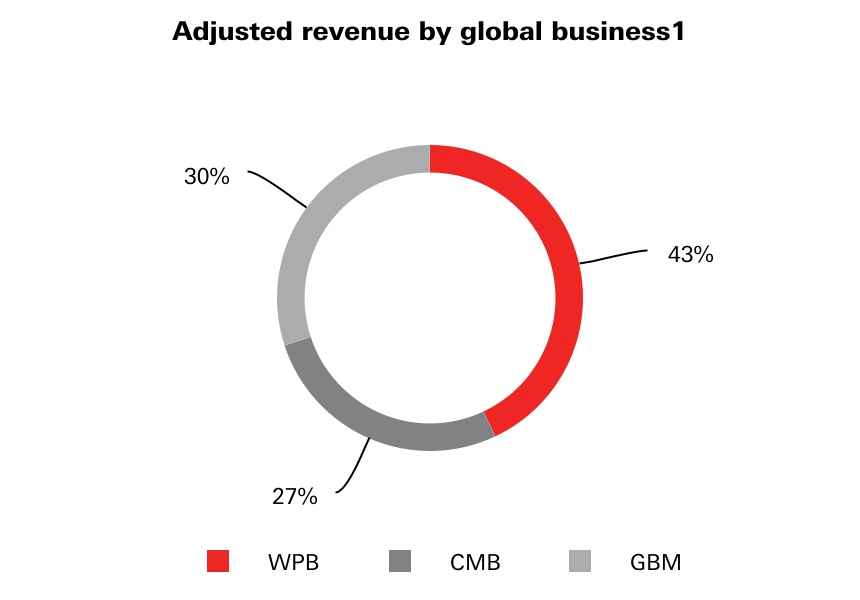

Our global businesses

We serve our customers through three global businesses. On pages 30 to 36 we provide an overview of our performance in 2021 for each of our global businesses, as well as our Corporate Centre. In each of our global businesses, we focus on delivering growth in areas where we have distinctive capabilities and have significant opportunities.

Each of the chief executive officers of our global businesses reports to our Group Chief Executive, who in turn reports to the Board of HSBC Holdings plc.

> For further information on how we are governed, see our corporate governance report on page 253.

Wealth and Personal Banking (’WPB’)

We help millions of our customers look after their day-to-day finances and manage, protect and grow their wealth.

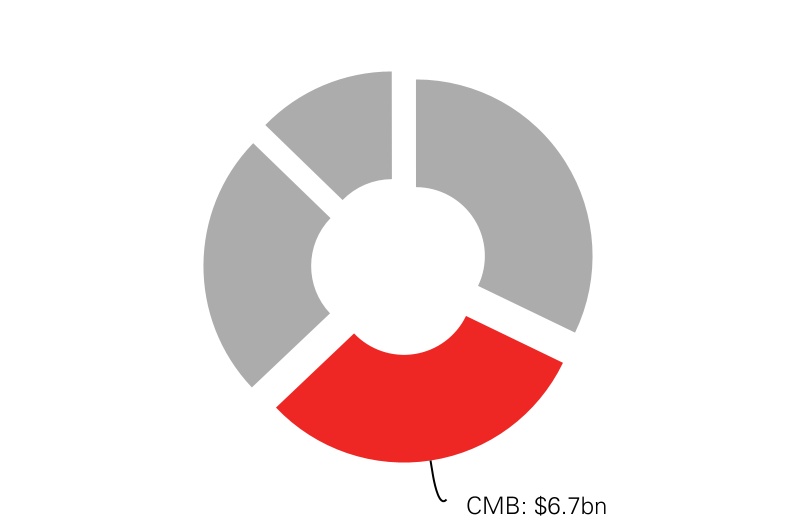

Commercial Banking (‘CMB’)

Our global reach and expertise help domestic and international businesses around the world unlock their potential.

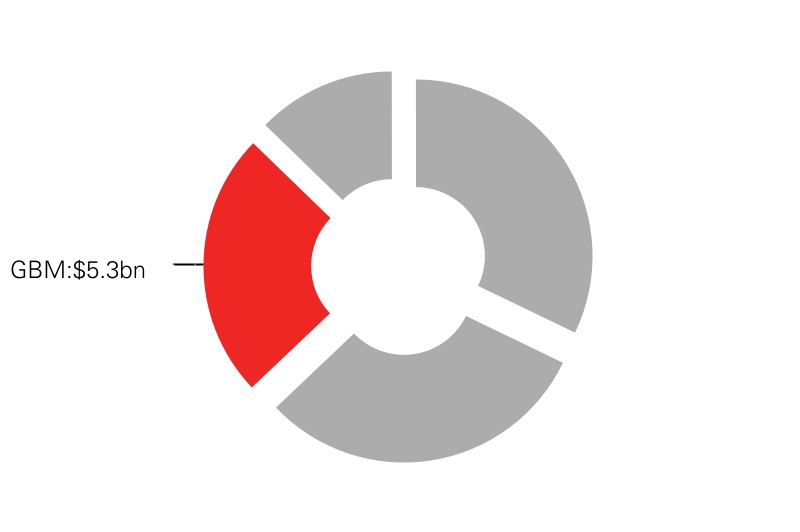

Global Banking and Markets (’GBM’)

We provide a comprehensive range of financial services and products to corporates, governments and institutions.

1 Calculation is based on adjusted revenue of our global businesses excluding Corporate Centre, which is also excluded from the total adjusted revenue number. Corporate Centre had negative adjusted revenue of $437m in 2021.

Our global functions

Our business is supported by a number of corporate functions and our Digital Business Services teams. The global functions include Corporate Governance and Secretariat, Communications and Brand, Finance, Human Resources, Internal Audit, Legal, Risk and Compliance, Sustainability and Strategy. Digital Business Services provides real estate, procurement, technology and operational services to the business.

Our global reach

We aim to create long-term value for our shareholders and capture opportunity. One of our goals is to lead in wealth, with a particular focus on Asia and the Middle East. Taking advantage of our international network, we aspire to lead in cross-border banking flows, and to serve mid-market corporates globally. We continue to maintain a strong capital, funding and liquidity position with a diversified business model.

Value of customer accounts by geography

North America 10%

Latin America 2%

Rest of Europe 8%

UK 31%

Middle East and North Africa 2%

Rest of Asia 11%

Hong Kong 33%

Mainland China 3%

See page 99 for further information on our customers and approach to geographical information.

Engaging with our stakeholders

Customers

Employees

Investors

Communities

Regulators and governments

Suppliers

Building strong relationships with our stakeholders helps enable us to deliver our strategy in line with our long-term values, and operate the business in a sustainable way. Our stakeholders are the people who work for us, bank with us, own us, regulate us, and live in the societies we serve and the planet we all inhabit. These human connections are complex and overlap. Many of our employees are customers and shareholders, while our business customers are often suppliers. We aim to serve, creating value for our customers and shareholders. Our size and global reach mean our actions can have a significant impact. We are committed to doing business responsibly, and thinking for the long term. This is key to delivering our strategy.

Multi-award winning

We have won industry awards around the world for a variety of reasons – ranging from the quality of the service we provide to customers, to our efforts to support diversity and inclusion in the workplace.

Euromoney Awards for Excellence 2021

Best Bank for Sustainable Finance in Asia

Best Bank for Sustainable Finance in the Middle East

Best Bank for Transaction Services in Asia

Best Bank for Transaction Services in the Middle East

Western Europe’s Best Bank for SMEs

Euromoney Trade Finance Survey 2021

Number 1 Trade Finance Bank in the UK

The Banker, Transaction Banking Awards 2021

Transaction Bank of the Year for Asia-Pacific

Transaction Bank of the Year for Middle East

Asiamoney Global RMB Poll 2021

Best overall bank for global, onshore and offshore RMB products and services

Asian Private Banker Awards for Distinction 2021

Best Private Bank – Asia Pacific

Best Private Bank – Wealth Continuum

Payments Awards 2021

B2B Payments Innovation of the Year

Group Chairman’s statement

The progress we made in 2021 means that HSBC is well placed to open up a world of opportunity for our customers as economic recovery continues.

2021 was another challenging year. While Covid-19 vaccines were rolled out globally, some countries dealt with very significant outbreaks and many more operated under various restrictions at different points. As in 2020, this took a huge toll on our customers, our people, the communities we serve and our shareholders.

My colleagues once again demonstrated their resilience, their professionalism and, above all, their exceptional commitment to serving our customers. Our purpose as an organisation is to open up a world of opportunity. Our people have brought this to life in the way they have supported our customers and each other. On behalf of the Board, I would like to thank them warmly for everything they have done, and continue to do.

ESG was another major theme of 2021. The pandemic has exposed the fragility of the planet and society as a whole. It has also created a catalyst for change and highlighted the associated commercial opportunities. Businesses, governments, regulators and investors all continued along their ESG journeys in 2021, as public awareness grew and activism around climate change in particular increased. HSBC has long understood that good ESG performance goes hand-in-hand with good financial performance, and it is now abundantly clear that the action businesses take on sustainability is an important lens through which they are being viewed and assessed by their stakeholders.

Progress

HSBC delivered a good financial performance in 2021. Reported profit before tax was $18.9bn, an increase of $10.1bn as compared with 2020, while adjusted profit before tax was $21.9bn, up 79%. All of our regions were profitable in 2021, supported by the global economic recovery, demonstrating the value of our global network. There was also good growth in focus areas such as Asia wealth and trade. In line with the dividend policy announced in February 2021, the Board approved a second interim dividend for 2021 of $0.18, meaning the full year dividends for 2021 are $0.25.

Good progress has been made in executing our strategic plan. A number of key milestones were reached in 2021 – including resolving the future of our retail businesses in France and the US, the organic build-out of HSBC Personal Wealth Planning in mainland China, and acquisitions in Singapore and India to accelerate the development of our wealth capabilities across Asia. At the same time, our work to digitise HSBC and to play a leading role in the net zero transition has continued at pace. There is more to do – and it will be important to see successive consecutive quarters of growth – but good momentum exists across our businesses.

Board of Directors

Due to ongoing travel restrictions and safety concerns, the Board has not been able to meet in person for two years. We look forward to reconnecting with each other and welcoming those Board members we are yet to meet in person. At the same time, we have come to appreciate the benefits of this new way of working – which include more regular dialogue, less travel and reduced costs – and we will therefore use a hybrid model going forward.

“HSBC has long understood that good ESG performance goes hand-in-hand with good financial performance.”

We were pleased to hold our first hybrid AGM in May 2021, which the majority of shareholders attended virtually. It is a matter of deep regret to me, and to the Board as a whole, that we have been unable to meet our loyal Hong Kong shareholders face-to-face. We look forward to doing so again as soon as it is practicable and safe. In the meantime, a hybrid meeting does at least allow for constructive engagement and discussions with shareholders, which we continue to value highly.

At the 2021 AGM, Laura Cha, Henri de Castries and Heidi Miller all retired from the Board. We also recently announced that Irene Lee and Pauline van der Meer Mohr will step down from the Board at the conclusion of our 2022 AGM in April. I am enormously grateful to them all for their important and valuable contributions to the Board, the committees and the subsidiary entities on which they have served. We welcomed Dame Carolyn Fairbairn and Rachel Duan to the Board on 1 September. Both Carolyn and Rachel bring a wealth of skills and expertise that will be of great value to the Board’s discussions.

External environment

The roll-out of vaccines around the world and a robust global economic recovery mean we entered 2022 in a better state than we might have expected a year ago. There are clearly still significant challenges ahead, foremost among which is the uncertainty caused by the spread of the Omicron variant, and potentially other variants in the future. Supply chain bottlenecks, high energy and food prices, surging consumer demand and higher wages have combined to drive up inflation. Central banks have already begun to respond by tightening monetary policy and this is likely to continue in 2022.

Global economic growth forecasts are fairly resilient – our own forecast is 4.1% global GDP growth in 2022. However, there remains a great deal of uncertainty given the wide range of responses from governments to the different challenges they face.

After China’s strong recovery, growth slowed in the second half of 2021. As a result, we expect China’s government to take action to ease monetary and fiscal policies, with the aim of shoring up growth. Meanwhile, India’s economy is set to grow rapidly, but growth is expected to be slower in the UK and the US.

Global trade performed well in 2021, with volumes rising above pre-pandemic levels despite ongoing supply chain disruptions. Looking forward, trade growth could be further boosted by the lifting of restrictions on movement that remain in place in some countries. There are also signs that supply chain bottlenecks will ease as the year goes on, although when and how remains uncertain. The Regional Comprehensive Economic Partnership is expected to reinforce Asia’s central role in global trade. Along with the bilateral trade deals being struck by some countries, it also shows that trade liberalisation continues to advance in some parts of the world.

Although there is currently no long-term agreement between the UK and the EU on access to financial services, we have worked for a number of years to ensure we will be able to maintain a full service for our clients under all potential scenarios. Ideally, the temporary arrangements on access to financial services will be retained so as to minimise disruption and enable the UK financial services industry to continue to offer the many benefits it brings to the UK and EU economies. However, we are well prepared for a broad range of outcomes.

As a global bank operating in more than 60 countries and territories, with a history stretching back more than 156 years, we always have experienced – and always will experience – geopolitical tensions. However, we remain alive to the potential impact that geopolitics can have on our business, as well as on our clients. The relationship between the US and China remains a prominent feature of the external environment, but we do not currently expect it to change significantly in the near future. We also expect the mutual economic benefits brought by the UK-China relationship to outweigh any short-term pressures. We continue to engage with all governments and remain focused on serving the needs of our customers in both East and West, and the many points in between.

Stakeholder engagement

Our purpose of opening up a world of opportunity is equally applicable to our different stakeholders. For our people, it can mean helping them to develop new skills and advance in their careers, as well as being diverse and inclusive. For our shareholders, it can mean creating sustainable returns and value. For our suppliers, it can mean supporting them to grow their businesses and strengthen their own supply chains. And for the communities we serve, it can mean being a responsible citizen and leading the net zero transition.

Stakeholder engagement has been a priority for the Board in 2021. For example, the Board oversaw HSBC’s continuing work in support of our ambition to align our financed emissions to net zero by 2050 or sooner. This included engaging shareholders and leading NGOs ahead of the 2021 AGM, when our special resolution on the next steps in relation to our climate ambition was overwhelmingly approved. We also reviewed and approved a new thermal coal phase-out policy, which we announced in December 2021 and is designed to allow HSBC to help facilitate the transition to net zero in both developed and developing markets.

Thank you

Finally, I would like to reiterate how grateful I am to all my colleagues for the great dedication and care they have shown to our customers and to each other over the past year. Their tremendous efforts have, above everything else, made us what we are today – and will shape what we become tomorrow.

Mark E Tucker

Group Chairman

22 February 2022

Group Chief Executive’s review

We are making good progress transforming and growing HSBC, which is helping us to open up a world of opportunity for our customers, our colleagues and our shareholders.

A year ago, we refreshed our core purpose as an organisation. ‘Opening up a world of opportunity’ was the outcome of extensive consultation with colleagues and customers around the globe. I have been delighted by the way it has been embraced across HSBC – and in the many conversations I have had with colleagues, I have been greatly encouraged by how they see their roles contributing towards it.

Opening up a world of opportunity draws heavily on HSBC’s past, but it also encapsulates what we need to focus on to succeed now and in the future. Opportunities have always come in many shapes and forms, some of which have required us to change and evolve to make the most of them. We need to keep challenging ourselves to find and capture these opportunities. This is how we will help our customers to grow and succeed over the long term.

As we do so, we will be guided by the values underpinning our purpose – we value difference, we succeed together, we take responsibility and we get it done. These are the behaviours that will help us to identify and unlock new opportunities – and together they represent the kind of organisation we want HSBC to be.

With our purpose and values firmly in mind, we made good progress in 2021 against all four of our strategic pillars: focus on our strengths, digitise at scale, energise for growth and transition to net zero. Delivering against them contributed to a strong financial performance, which was supported by the global economic recovery. All of our regions were profitable and we have built a strong platform for future growth.

For some of our customers, the first priority has remained navigating the ongoing impact of Covid-19, particularly in markets that suffered severe outbreaks or faced restrictions during the course of 2021. To this end, I must again offer my deep thanks to my colleagues, who have exemplified our values in supporting our customers and each other, all the while continuing to deal with the pandemic themselves.

As economies recovered and opened up, we have helped more and more of our customers to look beyond the immediate horizon and towards the opportunities we can open up for them. In 2021, we helped almost 269,000 personal customers to buy their first homes. We lent $47bn to help our business banking customers to run, grow and digitise their businesses. We launched new products and services that make it easier for our customers to bank with us, and allow us to focus our efforts on serving them. We facilitated $799bn of trade, which has helped businesses and economies around the world to recover and grow again.

As our people also began to look to the future, we created opportunities for them too. We helped more than 30,000 colleagues move into new roles in 2021, and over 115,000 colleagues to develop future-ready skills through our learning programmes. An increasing number of these programmes focused on building skills and capabilities in areas like data and sustainability, which are essential to our future.

“The opportunities of the future will be defined by the single greatest challenge

of our time – the need for everyone to make the low-carbon transition.“

More than anything else, the opportunities of the future will be defined by the single greatest challenge of our time – the need for everyone to make the low-carbon transition. To seize them, we must change, adapt, invest and innovate. Since 2019, we have reduced greenhouse gas emissions across our operations by more than half. We also provided and facilitated $82.6bn of sustainable finance and investment – bringing the cumulative total since 1 January 2020 to $126.7bn, towards our ambition of $750bn to $1tn by 2030. Furthermore, we have collaborated with other banks and financial institutions to help accelerate the transition through initiatives including the Net-Zero Banking Alliance, the Glasgow Financial Alliance for Net Zero and the Sustainable Markets Initiative’s Financial Services Taskforce.

Financial performance

The global economic recovery supported our 2021 financial performance, as the release of expected credit losses resulted in an improvement in the profitability of the Group and all global businesses. Our interest-rate sensitive business lines continued to be adversely impacted by low interest rates, but our net interest margin remained broadly stable during 2021 and the outlook is now significantly more positive. After absorbing the impact of low interest rates for some time, we believe we have turned the corner on revenue. We have also seen good fee income growth, good growth in mortgage balances and our lending pipelines across both retail and wholesale remain strong. Our insurance business also continues to perform well, notably in Asia where we have seen strong growth in value of new business, despite the border between Hong Kong and mainland China remaining closed.

As a consequence, the Group delivered $18.9bn of reported profit before tax, up $10.1bn on the prior year, and $21.9bn of adjusted profits, up 79%. We were profitable in every region, with Asia leading the way and material increases in profits in the UK, continental Europe, the US and the Middle East.

Adjusted revenue was down 3%, due mainly to the impact of interest rate cuts. However, trade balances grew by 23% overall, while loans and advances increased by $23bn for the year.

Our cost reduction programmes were able to absorb increased technology investment and higher performance-related pay, with adjusted operating expenses down by 1%. Return on tangible equity was 8.3%. If rates follow the path currently implied by the market, we would expect to reach a return on tangible equity of at least 10% for 2023, one year ahead of our previous expectations.

In the fourth quarter of 2021, we took a charge on expected credit losses, due to changing market conditions in the mainland China commercial real estate sector. Since the year end, there has been some positive sentiment as a consequence of new policy actions. They will take time to impact the market and we will continue to support our clients, with whom we have good and long-standing relationships.

Our funding, liquidity and capital all remain strong. We grew deposits by $90bn on a constant currency basis, with growth in all three global businesses. Our common equity tier 1 ratio was 15.8%. As a consequence, we are able to announce a second interim dividend of $0.18, bringing the full-year dividends for 2021 to $0.25 per ordinary share. This is within our target payout ratio, and our aim is for a sustainable dividend in 2022.

Strategic progress

In 2021, we made good progress against our strategic pillars.

We brought in

$36.2bn

of net new invested assets in Asia Wealth.

We provided and facilitated

$82.6bn

of sustainable finance and investment.

Our strong capital position and confidence in the business enabled us to announce a share buy-back of up to $2bn in October 2021. We also intend to initiate a further share buy-back of up to $1bn, to commence after the existing buy-back of up to $2bn has concluded.

We are also helping to create sustainable returns for shareholders by driving underlying growth across the business. We have much more to do, but I am encouraged by what we have achieved so far.

Focus on our strengths

We have made good progress restructuring our portfolio of businesses, with the aim of investing in those areas in which we are strongest and withdrawing from those areas in which we lack the necessary scale to compete.

Over the last two years, we reduced gross risk-weighted assets by a cumulative $104bn, against our original three-year target of $110bn. Given this progress, we now expect to exceed this target by the end of 2022. In Global Banking and Markets, adjusted risk-weighted assets were 10% lower in 2021, as we moved capital and resources mainly into Asia and the Middle East. The extensive work undertaken to transform this business since 2019 was also designed to mitigate the impact of Basel III reforms.

We reached two key milestones for our transformation as we took steps to resolve the future of our businesses in the US and continental Europe. In the US, we entered into an agreement to sell our mass market retail business, which has now been completed on schedule. We also entered into an agreement to sell our retail banking activities in France, which we expect to complete in 2023. Both deals will help our US and continental Europe businesses to become more focused, better aligned to the Group and the international needs of our wholesale and wealth management customers.

In Asia, we continued to enhance our wealth proposition, including through the launch of HSBC Greater Bay Area Connect and more than 30 new asset management products across the region. In December, we received regulatory approval to acquire the remaining 50% stake in HSBC Life China, our joint venture insurance company in mainland China. All of this is enabling us to significantly expand our capabilities to serve the growing wealth and insurance needs of our customers in China, particularly in the Greater Bay Area.

We accelerated the development of our wealth capabilities across the rest of Asia by several years through two acquisitions. We entered into an agreement to buy AXA Singapore, which was completed earlier this month and will expand our insurance and wealth franchise in our ASEAN regional hub. We also agreed to buy L&T Investment Management to strengthen our asset management business in India. Both deals represent significant steps towards our ambition of being a leading wealth manager in Asia.

The overall investment we have made in Asia wealth was evidenced by strong customer acquisition, and significantly increased assets and balances, year-on-year. Net new invested assets in Asia wealth were $36.2bn, which was more than double the previous year.

In Commercial Banking, we grew our lending by $11bn and our international account opening increased by 13% in 2021, while trade balances grew by 30% and are now above pre-pandemic levels.

Digitise at scale

We invested $6bn in technology in 2021, as we continued to drive change in the way we approach technology across the organisation and ultimately improve the customer experience.

Around 97% of transactions are now fully automated. For example, automated credit and lending systems processed around $15bn of personal loans in 2021. Our use of the Cloud increased to cover 27% of technology services, giving us more processing power and speed, while we also increased our use of Agile across technology roles.

Almost half of our retail customers are now active on mobile, and we have developed new products and improved existing ones so we can better meet their needs. Our revamped mobile app is now available across 24 markets and Global Money was extended to more markets, allowing more of our international retail customers to hold, manage and send funds in various currencies. Corporate customers carried out over 9 million payments through the HSBCnet app – an increase of 58% year-on-year. HSBC Kinetic – our award-winning mobile banking app for business customers in the UK – has acquired more than 24,000 customers since it was launched.

Energise for growth

We have taken further steps to create a dynamic and inclusive culture, which helps us to attract and retain the best people.

After listening to our people, we introduced a hybrid working model, wherever appropriate, which allows us to strike the right balance between office-based work and home-based work. We have also taken the opportunity during Covid-19 to reconfigure much of our head office workspace to better facilitate team-based Agile working methods. We are still learning about what works, but we believe that trusting our colleagues to find the right balance is integral to building the culture we aspire to at HSBC. As a consequence of hybrid working, we will need less office space. In 2021, we reduced our global office footprint by more than 3.4 million square feet – equivalent to 18%.

We were pleased to exceed our target for 30% women in leadership roles globally in 2020, and we set a new target of 35% by 2025. HSBC was named in the Bloomberg Gender-Equality Index last month, with our overall score increasing by 21 percentage points in 2021 and outperforming the financial services average by 15 percentage points. We also continued to work to improve ethnicity representation, especially for Black colleagues. However, we still have a way to go to get to where we want, and need, to be on both measures.

”We were profitable in every region, with Asia leading the way and material increases in profits in the UK, continental Europe, the US and the Middle East.”

In our most recent colleague survey, our employee engagement index was 72%, which is unchanged on 2020 and 4 percentage points above the average for the financial services sector.

Transition to net zero

The industrial landscape of the world is being transformed by the transition to net zero. I am determined that HSBC will play a leading role in driving this change.

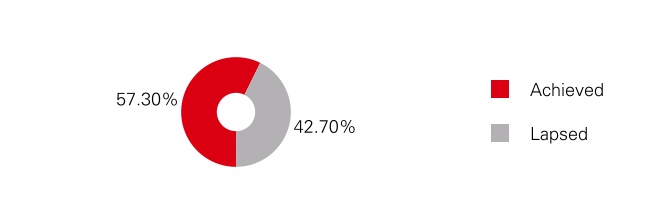

At the 2021 AGM, 99.7% of shareholders backed our special resolution on climate change, providing a strong endorsement of our climate plan and our commitment to support our customers on their transitions to a low-carbon future. However, we do not take this support for granted, and we have taken a number of further steps to maintain our leadership role.