P1YP1YP1YP1Y12.512.5P3Y85.7142.8657.1485.71P3YP3Y2020202020P3YP1YP1YP3Y20202020202020202020P5YP1Y00010891132020FYfalseP2YP3YP5Y0.33332.8P3YP5YP7YP8YP5YP5YP5YP1MP3Y1110001089113country:MXhsbc:CentralScenarioMemberhsbc:RetailLendingMemberhsbc:OtherFinancialAssetsMemberifrs-full:AccumulatedImpairmentMember2019-12-310001089113ifrs-full:FinancialAssetsAtAmortisedCostCategoryMemberhsbc:CreditImpairedMemberhsbc:OtherFinancialAssetsMemberhsbc:IFRS9Memberifrs-full:GrossCarryingAmountMember2020-12-310001089113country:GBhsbc:WholesaleLendingSectorMemberhsbc:OtherCorporateCommercialAndNonbankFinancialInstitutionsLoansAndAdvancesIncludingLoanCommitmentsMemberhsbc:FullyCollateralisedMemberifrs-full:LifetimeExpectedCreditLossesMemberhsbc:LoansAndAdvancesToCustomersAndBanksMemberifrs-full:FinancialInstrumentsCreditimpairedAfterPurchaseOrOriginationMemberhsbc:IFRS9Member2019-12-310001089113ifrs-full:WeightedAverageMemberhsbc:NontradingPortfoliosMemberifrs-full:InterestRateRiskMember2020-12-310001089113ifrs-full:DebtSecuritiesMemberifrs-full:FairValueHedgesMemberhsbc:HSBCHoldingsMemberifrs-full:InterestRateRiskMember2020-12-310001089113ifrs-full:DebtSecuritiesMemberifrs-full:LaterThanTwoYearsAndNotLaterThanFiveYearsMemberhsbc:HSBCHoldingsMember2020-12-31

As filed with the Securities and Exchange Commission on February 24, 2021.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

| | | | | |

| REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Or

| | | | | |

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2020

Or

| | | | | |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Or

| | | | | |

| SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report ____________

For the transition period from N/A to N/A

Commission file number: 001-14930

HSBC Holdings plc

(Exact name of Registrant as specified in its charter)

| | | | | | | | |

| N/A | | United Kingdom |

| (Translation of Registrant’s name into English) | | (Jurisdiction of incorporation or organisation) |

8 Canada Square

London E14 5HQ

United Kingdom

(Address of principal executive offices)

Jonathan Bingham

8 Canada Square

London E14 5HQ

United Kingdom

Tel +44 (0) 20 7991 8888

Fax +44 (0) 20 7992 4880

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | |

| Ordinary Shares, nominal value US$0.50 each (GB0005405286) | HSBA | London Stock Exchange | |

| 5 | Hong Kong Stock Exchange | |

| HSBC.BH | Bermuda Stock Exchange | |

| HSBC | New York Stock Exchange | * |

| American Depository Shares, each representing 5 Ordinary Shares of nominal value US$0.50 each (US4042804066) | HSBC | New York Stock Exchange | |

| | | | | | | | | | | |

| 7.625% Subordinated Notes due 2032 (US404280AF65) | HSBC/32A | New York Stock Exchange | |

| 7.35% Subordinated Notes due 2032 (US404280AE90) | HSBC/32B | New York Stock Exchange | |

| 6.5% Subordinated Notes 2036 (US404280AG49) | HSBC36 | New York Stock Exchange | |

| 6.5% Subordinated Notes 2037 (US404280AH22) | HSBC37 | New York Stock Exchange | |

| 6.8% Subordinated Notes Due 2038 (US404280AJ87) | HSBC38 | New York Stock Exchange | |

| 5.10% Senior Unsecured Notes Due 2021 (US404280AK50) | HSBC21 | New York Stock Exchange | |

| 4.875% Senior Unsecured Notes Due 2022 (US404280AL34) | HSBC22 | New York Stock Exchange | |

| 6.100% Senior Unsecured Notes due 2042 (US404280AM17) | HSBC42 | New York Stock Exchange | |

| 4.00% Senior Unsecured Notes Due 2022 (US404280AN99) | HSBC22A | New York Stock Exchange | |

| 4.250% Subordinated Notes due 2024 (US404280AP48) | HSBC24 | New York Stock Exchange | |

| 5.250% Subordinated Notes due 2044 (US404280AQ21) | HSBC44 | New York Stock Exchange | |

| 4.250% Subordinated Notes due 2025 (US404280AU33) | HSBC25 | New York Stock Exchange | |

| 3.400% Senior Unsecured Notes due 2021 (US404280AV16) | HSBC21A | New York Stock Exchange | |

| 4.300% Senior Unsecured Notes due 2026 (US404280AW98) | HSBC26 | New York Stock Exchange | |

| Floating Rate Senior Unsecured Notes due 2021 (US404280AX71) | HSBC21B | New York Stock Exchange | |

| 2.950% Senior Unsecured Notes due 2021 (US404280AY54) | HSBC21C | New York Stock Exchange | |

| Floating Rate Senior Unsecured Notes due 2021 (US404280AZ20) | HSBC21D | New York Stock Exchange | |

| 3.600% Senior Unsecured Notes due 2023 (US404280BA69) | HSBC23 | New York Stock Exchange | |

| 3.900% Senior Unsecured Notes due 2026 (US404280BB43) | HSBC26A | New York Stock Exchange | |

| 2.650% Senior Unsecured Notes due 2022 (US404280BF56) | HSBC22B | New York Stock Exchange | |

| Floating Rate Senior Unsecured Notes due 2022 (US404280BG30) | HSBC22C | New York Stock Exchange | |

| 4.375% Subordinated Notes due 2026 (US404280BH13) | HSBC26B | New York Stock Exchange | |

| 3.262% Fixed Rate/Floating Rate Senior Unsecured Notes due 2023 (US404280BJ78) | HSBC23A | New York Stock Exchange | |

| 4.041% Fixed Rate/Floating Rate Senior Unsecured Notes due 2028 (US404280BK42) | HSBC28 | New York Stock Exchange | |

| 3.033% Fixed Rate/Floating Rate Senior Unsecured Notes due 2023 (US404280BM08) | HSBC23B | New York Stock Exchange | |

| Floating Rate Senior Unsecured Notes due 2024 (US404280BR94) | HSBC24A | New York Stock Exchange | |

| 3.950% Fixed Rate/Floating Rate Senior Unsecured Notes due 2024 (US404280BS77) | HSBC24B | New York Stock Exchange | |

| 4.583% Fixed Rate/Floating Rate Senior Unsecured Notes due 2029 (US404280BT50) | HSBC29 | New York Stock Exchange | |

| 2.175% Resettable Senior Unsecured Notes due 2023 (XS1823595647) | N/A | New York Stock Exchange | |

| Floating Rate Senior Unsecured Notes due 2026 (US404280BW89) | HSBC26D | New York Stock Exchange | |

| 4.292% Fixed Rate/Floating Rate Senior Unsecured Notes due 2026 (US404280BX62) | HSBC26C | New York Stock Exchange | |

| | | | | | | | | | | |

| 3.803% Fixed Rate/Floating Rate Senior Unsecured Notes due 2025 (US404280BZ11) | HSBC25A | New York Stock Exchange | |

| Floating Rate Senior Unsecured Notes due 2025 (US404280CA50) | HSBC25B | New York Stock Exchange | |

| 3.000% Resettable Senior Unsecured Notes due 2028 (XS1961843171) | HSBC28A | New York Stock Exchange | |

| 3.973% Fixed Rate/Floating Rate Senior Unsecured Notes due 2030 (US404280CC17) | HSBC30 | New York Stock Exchange | |

| 3.00% Resettable Senior Unsecured Notes due 2030 (XS2003500142) | HSBC30A | New York Stock Exchange | |

| 2.633% Fixed Rate/Floating Rate Senior Unsecured Notes due 2025 (US404280CE72) | HSBC25C | New York Stock Exchange | |

4.950% Fixed Rate Senior Unsecured Notes due 2030

(US404280CF48) | HSBC30B | New York Stock Exchange | |

2.099% Fixed Rate/Floating Rate Senior Unsecured Notes due 2026

(US404280CG21) | HSBC26E | New York Stock Exchange | |

2.848% Fixed Rate/Floating Rate Senior Unsecured Notes due 2031

(US404280CH04) | HSBC31 | New York Stock Exchange | |

1.645% Fixed Rate/Floating Rate Senior Unsecured Notes due 2026

(US404280CJ69) | HSBC26F | New York Stock Exchange | |

2.357% Fixed Rate/Floating Rate Senior Unsecured Notes due 2031

(US404280CK33) | HSBC31A | New York Stock Exchange | |

2.013% Fixed Rate/Floating Rate Senior Unsecured Notes due 2028

(US404280CL16) | HSBC28B | New York Stock Exchange | |

1.589% Fixed Rate/Floating Rate Senior Unsecured Notes due 2027

(US404280CM98) | HSBC27 | New York Stock Exchange | |

* Not for trading, but only in connection with the registration of American Depositary Shares.

Securities registered or to be registered pursuant to Section 12(g) of the Securities Exchange Act of 1934: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Securities Exchange Act of 1934: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

Ordinary Shares, nominal value US$0.50 each 20,693,676,408

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. þ Yes ¨ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ¨ Yes þ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. þ Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). þ Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

| | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | þ | Accelerated filer | ¨ | Non-accelerated filer | ¨ | Emerging growth company | ¨ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act.

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. þ

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | | | | | | | | | | | | | | | | |

| U.S. GAAP | ¨ | International Financial Reporting Standards | þ | Other | ¨ |

| | as issued by the International Accounting Standards Board | | | |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow. ¨ Item 17 ¨ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes þ No

Contents

Strategic report

1a Forward-looking statements

1b Approach to ESG reporting

1b Certain defined terms

2 Highlights

4 Who we are

6 Group Chairman’s statement

8 Group Chief Executive’s review

12 Our strategy

16 How we do business

25 Remuneration

26 Financial overview

30 Global businesses

37 Risk overview

Environmental, social and

governance review

43 Our approach to ESG

44 Climate

52 Customers

62 Employees

70 Governance

Financial review

77 Financial summary

99 Global businesses and geographical regions

119 Reconciliation of alternative performance measures

121 Other information

Risk review

132 Our approach to risk

135 Risk elements in the loan portfolio

140 Top and emerging risks

146 Risk factors

157 Areas of special interest

160 Our material banking risks

Corporate governance report

238 Group Chairman’s governance statement

240 Biographies of Directors and senior management

255 Board committees

271 Directors’ remuneration report

Financial statements

311 Report of Independent Registered Public Accounting Firm to the Board of Directors and Shareholders of HSBC Holdings plc

314 Financial statements

324 Notes on the financial statements

Additional information

406 Shareholder information

416 Abbreviations

We have changed how we are reporting this year

We have changed our Annual Report and Accounts to embed the content previously provided in our Environmental, Social and Governance Update, demonstrating that how we do business is as important as what we do.

This Strategic Report was approved by the Board on 23 February 2021.

Mark E Tucker

Group Chairman

A reminder

The currency we report in is US dollars.

Adjusted measures

We supplement our IFRS figures with non-IFRS measures used by management internally that constitute alternative performance measures under European Securities and Markets Authority guidance and non-GAAP financial measures defined in and presented in accordance with US Securities and Exchange Commission rules and regulations. These measures are highlighted with the following symbol: <>

Further explanation may be found on page 28.

None of the websites referred to in this Form 20-F for the year ended 31 December 2020 (the ‘Form 20-F’) (including where a link is provided), and none of the information contained on such websites, are incorporated by reference in this report.

Cover image: Opening up a world of opportunity

We connect people, ideas and capital across the world, opening up opportunities for our customers and the communities we serve.

Opening up a world of opportunity

Our ambition is to be the preferred international financial partner for our clients.

We have refined our purpose, ambition and values to reflect our strategy and to support our focus on execution.

Read more on our values, strategy and purpose on pages 4, 12 and 16.

Key themes of 2020

The Group has been – and continues to be – impacted by developments in the external environment, including:

Covid-19

The Covid-19 outbreak has significantly affected the global economic environment and outlook, resulting in adverse impacts on financial performance, downward credit migration and muted demand for lending.

Read more on page 38.

Market factors

Interest rate reductions and market volatility impacted financial performance during 2020. We expect low global interest rates to provide a headwind to improved profitability and returns.

Read more on page 26.

Geopolitical risk

Levels of geopolitical risk increased with heightened US-China tensions and the UK’s trade negotiations with the EU notably impacting business and investor sentiment. We continue to monitor developments closely.

Read more on page 38.

Progress in key areas

The Group continued to make progress in areas of strategic focus during 2020, including:

Supporting customers

We continued to support our customers during the Covid-19 outbreak, providing relief to wholesale and retail customers through both market-wide schemes and HSBC-specific measures.

Read more on page 17.

Strategic progress

We made good progress with our transformation programme in 2020. We have now set out the next phase of our strategic plan.

Read more on page 12.

Climate

In October 2020, we set out an ambitious plan to prioritise sustainable finance and investment that supports the global transition to a net zero carbon economy.

Read more on page 15.

Financial performance

Reported profit after tax

$6.1bn

(2019: $8.7bn)

Basic earnings per share

$0.19

(2019: $0.30)

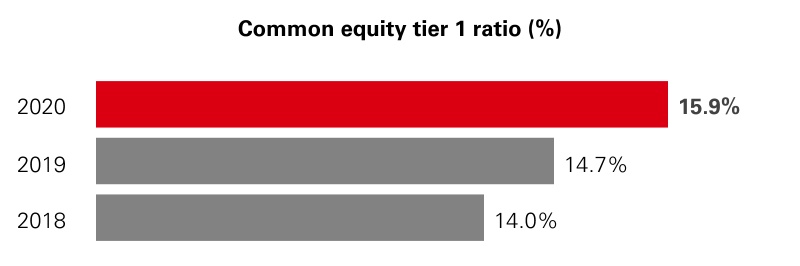

Common equity tier 1 capital ratio

15.9%

(2019: 14.7%)

Read more on our financial overview on page 26.

Non-financial highlights

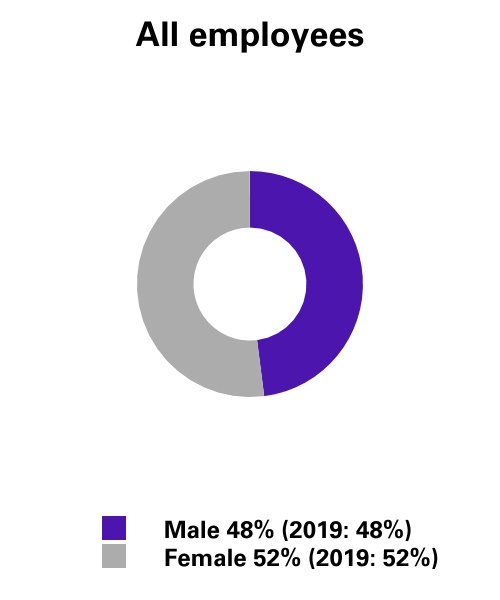

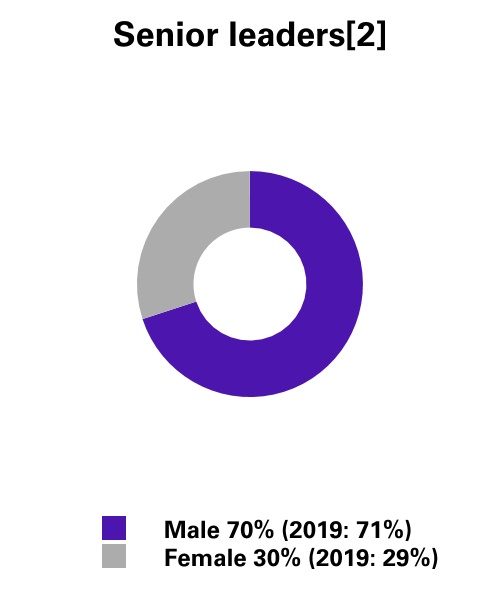

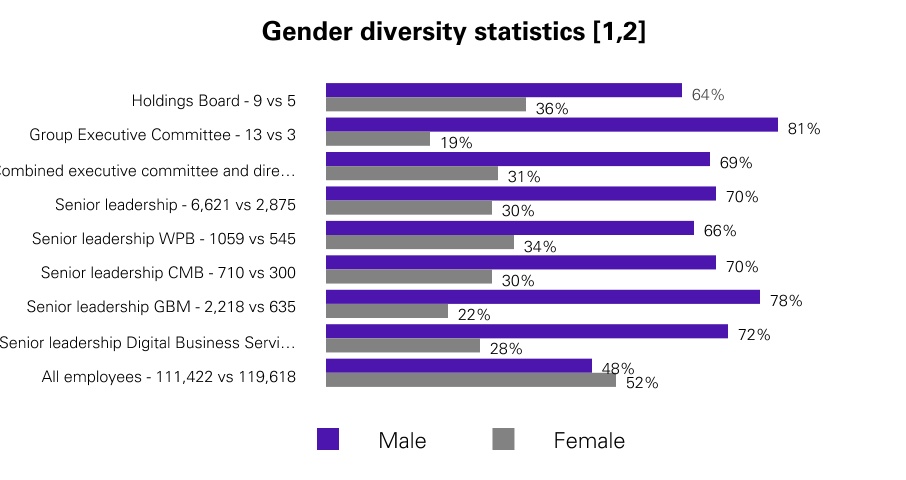

Gender diversity

30.3%

Women in senior leadership roles.

(2019: 29.4%)

Sustainable finance and investment

$93.0bn

Cumulative total provided and facilitated since 2017.

(2019: $52.4bn)

Customer satisfaction

7 out of 8

Wealth and Personal Banking markets sustained top-three and/or improved in customer satisfaction.

5 out of 8

Commercial Banking markets sustained top-three and/or improved in customer satisfaction.

Read more on how we set and define our environmental, social and governance (‘ESG’) metrics on page 18.

| | |

| Cautionary statement regarding forward-looking statements |

This Form 20-F contains certain forward-looking statements with respect to HSBC’s financial condition; results of operations and business, including the strategic priorities; 2021 financial, investment and capital targets; and ESG targets/commitments described herein.

Statements that are not historical facts, including statements about HSBC’s beliefs and expectations, are forward-looking statements. Words such as ‘will’, ‘should’, ‘expects’, ‘targets’, ‘anticipates’, ‘intends’, ‘plans’, ‘believes’, ‘seeks’, ‘estimates’, ‘potential’ and ‘reasonably possible’, variations of these words and similar expressions are intended to identify forward-looking statements. These statements are based on current plans, information, data, estimates and projections, and therefore undue reliance should not be placed on them. Forward-looking statements speak only as of the date they are made. HSBC makes no commitment to revise or update any forward-looking statements to reflect events or circumstances occurring or existing after the date of any forward-looking statements.

Written and/or oral forward-looking statements may also be made in the periodic reports to the US Securities and Exchange Commission, summary financial statements to shareholders, proxy statements, offering circulars and prospectuses, press releases and other written materials, and in oral statements made by HSBC’s Directors, officers or employees to third parties, including financial analysts.

Forward-looking statements involve inherent risks and uncertainties. Readers are cautioned that a number of factors could cause actual results to differ, in some instances materially, from those anticipated or implied in any forward-looking statement. These include, but are not limited to:

• changes in general economic conditions in the markets in which we operate, such as continuing or deepening recessions and fluctuations in employment and creditworthy customers beyond those factored into consensus forecasts (including, without limitation, as a result of the Covid-19 pandemic); the Covid-19 pandemic, which is expected to continue to have adverse impacts on our income due to lower lending and transaction volumes, lower wealth and insurance manufacturing revenue, and lower or negative interest rates in markets where we operate, as well as, more generally, the potential for material adverse impacts on our financial condition, results of operations, prospects, liquidity, capital position and credit ratings; deviations from the market and economic assumptions that form the basis for our ECL measurements (including, without limitation, as a result of the Covid-19 pandemic or the UK's exit from the EU); potential changes in dividend policy; changes in foreign exchange rates and interest rates, including the accounting impact resulting from financial reporting in respect of hyperinflationary economies; volatility in equity markets; lack of liquidity in wholesale funding or capital markets, which may affect our ability to meet our obligations under financing facilities or to fund new loans, investments and businesses; geopolitical tensions or diplomatic developments producing social instability or legal uncertainty, such as the unrest in Hong Kong, the continuing US-China tensions and the emerging challenges in UK-China relations, which in turn may affect demand for our products and services and could result in (among other things) regulatory, reputational and market risks for HSBC; the efficacy of government, customer, and HSBC's actions in managing and mitigating climate change and in supporting the global transition to net zero carbon emissions, which may cause both idiosyncratic and systemic risks resulting in potential financial and non-financial impacts; illiquidity and downward price pressure in national real estate markets; adverse changes in central banks’ policies with respect to the provision of liquidity support to financial markets; heightened market concerns over sovereign creditworthiness in over-indebted countries; adverse changes in the funding status of public or private defined benefit pensions; societal shifts in customer financing and investment needs, including consumer perception as to the continuing availability of credit; exposure to counterparty risk, including third parties using us as a conduit for illegal activities without our knowledge; the expected discontinuation of certain key Ibors and the development of near risk-free benchmark rates, which may require us to enhance our capital position and/or position additional capital in specific subsidiaries; and price competition in the market segments we serve;

• changes in government policy and regulation, including the monetary, interest rate and other policies of central banks and other regulatory authorities in the principal markets in which we operate and the consequences thereof (including, without limitation, actions taken as a result of the Covid-19 pandemic); initiatives to change the size, scope of activities and interconnectedness of financial institutions in connection with the implementation of stricter regulation of financial institutions in key markets worldwide; revised capital and liquidity benchmarks, which could serve to deleverage bank balance sheets and lower returns available from the current business model and portfolio mix; imposition of levies or taxes designed to change business mix and risk appetite; the practices, pricing or responsibilities of financial institutions serving their consumer markets; expropriation, nationalisation, confiscation of assets and changes in legislation relating to foreign ownership; the UK’s exit from the EU, which may result in a prolonged period of uncertainty, unstable economic conditions and market volatility, including currency fluctuations; passage of the Hong Kong national security law and restrictions on telecommunications, as well as the US Hong Kong Autonomy Act, which have caused tensions between China, the US and the UK; general changes in government policy that may significantly influence investor decisions; the costs, effects and outcomes of regulatory reviews, actions or litigation, including any additional compliance requirements; and the effects of competition in the markets where we operate including increased competition from non-bank financial services companies; and

• factors specific to HSBC, including our success in adequately identifying the risks we face, such as the incidence of loan losses or delinquency, and managing those risks (through account management, hedging and other techniques); our ability to achieve our financial, investment, capital and ESG targets/commitments, which may result in our failure to achieve any of the expected benefits of our strategic priorities; model limitations or failure, including, without limitation, the impact that the consequences of the Covid-19 pandemic have had on the performance and usage of financial models, which may require us to hold additional capital, incur losses and/or use compensating controls, such as overlays and overrides, to address model limitations; changes to the judgements, estimates and assumptions we base our financial statements on; changes in our ability to meet the requirements of regulatory stress tests; a reduction in the credit ratings assigned to us or any of our subsidiaries, which could increase the cost or decrease the availability of our funding and affect our liquidity position and net interest margin; changes to the reliability and security of our data management, data privacy, information and technology infrastructure, including threats from cyber-attacks, which may impact our ability to service clients and may result in financial loss, business disruption and/or loss of

customer services and data; changes in insurance customer behaviour and insurance claim rates; our dependence on loan payments and dividends from subsidiaries to meet our obligations; changes in accounting standards, which may have a material impact on the way we prepare our financial statements; changes in our ability to manage third-party, fraud and reputational risks inherent in our operations; employee misconduct, which may result in regulatory sanctions and/or reputational or financial harm; changes in skill requirements, ways of working and talent shortages, which may affect our ability to recruit and retain senior management and diverse and skilled personnel; and changes in our ability to develop sustainable finance products and our capacity to measure the climate impact from our financing activity, which may affect our ability to achieve our climate ambition. Effective risk management depends on, among other things, our ability through stress testing and other techniques to prepare for events that cannot be captured by the statistical models it uses; and our success in addressing operational, legal and regulatory, and litigation challenges; and other risks and uncertainties we identify in ‘Top and emerging risks’ on pages 140 to 157.

| | |

| Approach to ESG reporting |

The information set out in the ESG review on pages 42 to 75, taken together with other information relating to ESG issues, aims to provide key ESG information and data relevant to our operations for the year ended 31 December 2020. In this context, we have also considered our obligations under the Environmental, Social and Governance Reporting Guide contained in Appendix 27 to The Rules Governing the Listing of Securities on the Stock Exchange of Hong Kong Limited (‘ESG Guide’). We comply with the ‘comply or explain’ provisions in the ESG Guide, save with respect to the following:

•A1(b) on emissions laws/regulations: we are fully compliant with our publication of information regarding scope 1 and 2 carbon emissions, but we only partially publish information on scope 3 carbon emissions, as the data required for that publication is not yet fully available. Our progress on publishing information with respect to scope 3 is referenced on page 45;

•A1.3 on total hazardous waste produced, A1.6 on the handling of hazardous and non-hazardous waste, A2.2 on water consumption and A2.5 on packaging material: taking into account the nature of our business, we do not consider these to be material issues for our stakeholders; and

•A2.1 on direct energy consumption: taking into account the nature of our business, we do not consider this to be a material issue for our stakeholders. We report on what we consider to be our most relevant operational sustainability KPIs as set out on page 47.

This is aligned with the materiality reporting principle that is set out in the ESG Guide. See ‘How we decide what to measure’ on page 43 for further information on how we determine what issues are material to our stakeholders.

We will continue to develop and refine our reporting and disclosures on ESG issues in line with feedback received from our investors and other stakeholders, and in view of our obligations under the ESG Guide.

Unless the context requires otherwise, ‘HSBC Holdings’ means HSBC Holdings plc and ‘HSBC’, the ‘Group’, ‘we’, ‘us’ and ‘our’ refer to HSBC Holdings together with its subsidiaries. Within this document the Hong Kong Special Administrative Region of the People’s Republic of China is referred to as ‘Hong Kong’. When used in the terms ‘shareholders’ equity’ and ‘total shareholders’ equity’, ‘shareholders’ means holders of HSBC Holdings ordinary shares and those preference shares and capital securities issued by HSBC Holdings classified as equity. The abbreviations ‘$m’, ‘$bn’ and ‘$tn’ represent millions, billions (thousands of millions) and trillions of US dollars, respectively.

Highlights

Financial performance in 2020 was impacted by the Covid-19 outbreak, together with the resultant reduction in global interest rates. Nevertheless, performance in Asia remained resilient and our Global Markets business delivered revenue growth.

Delivery against our financial targets

Return on average tangible equity <>

3.1%

February 2020 target: in the range of 10% to 12% in 2022.

(2019: 8.4%)

Adjusted operating expenses <>

$31.5bn

Target: ≤$31bn in 2022.

(2019: $32.5bn)

Gross RWA reduction

$61.1bn

Target: >$100bn by end-2022.

Further explanation of performance against Group financial targets may be found on page 26.

Financial performance (vs 2019)

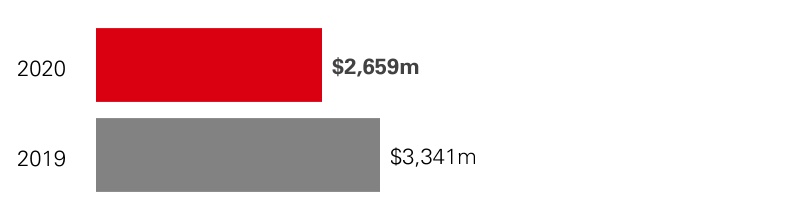

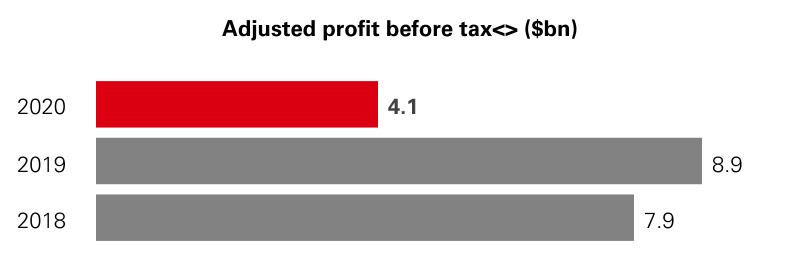

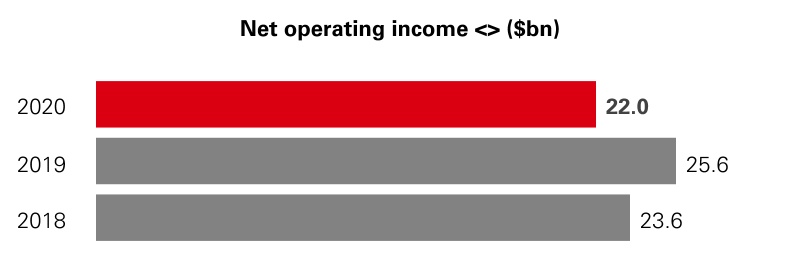

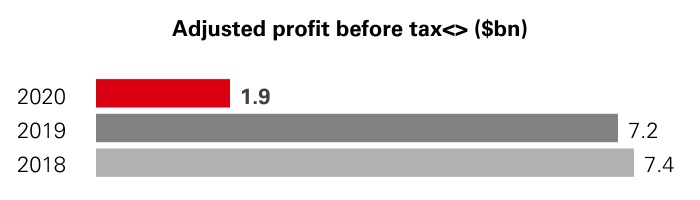

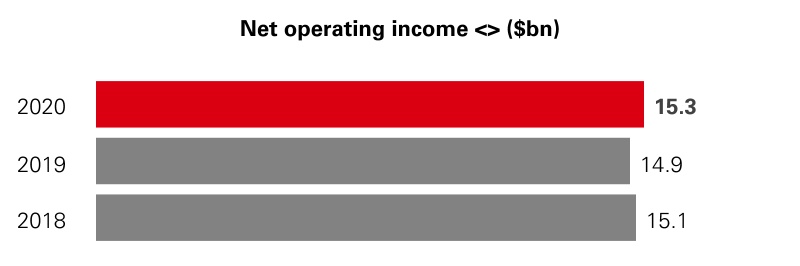

•Reported profit after tax down 30% to $6.1bn and reported profit before tax down 34% to $8.8bn from higher expected credit losses and other credit impairment charges (‘ECL’) and lower revenue, partly offset by a fall in operating expenses. Reported results in 2020 included a $1.3bn impairment of software intangibles, while reported results in 2019 included a $7.3bn impairment of goodwill. Adjusted profit before tax down 45% to $12.1bn.

•Reported revenue down 10% to $50.4bn, primarily due to the progressive impact of lower interest rates across our global businesses, in part offset by higher revenue in Global Markets. Adjusted revenue down 8% to $50.4bn.

•Net interest margin of 1.32% in 2020, down 26 basis points (‘bps’) from 2019, due to the impact of lower global interest rates.

•Reported ECL up $6.1bn to $8.8bn, mainly due to the impact of the Covid-19 outbreak and the forward economic outlook. Allowance for ECL on loans and advances to customers up from $8.7bn at 31 December 2019 to $14.5bn at 31 December 2020.

•Reported operating expenses down 19% to $34.4bn, mainly due to the non-recurrence of a $7.3bn impairment of goodwill. Adjusted operating expenses down 3% to $31.5bn, as cost-saving initiatives and lower performance-related pay and discretionary expenditure more than offset the growth in investment spend.

•During 2020, deposits grew by $204bn on a reported basis and $173bn on a constant currency basis, with growth in all global businesses.

•Common equity tier 1 (‘CET1’) ratio of 15.9%, up 1.2 percentage points from 14.7% at 31 December 2019, which included the impact of the cancellation of the fourth interim dividend of 2019 and changes to the capital treatment of software assets.

•After considering the requirements set out in the UK Prudential Regulation Authority’s ('PRA') temporary approach to shareholder distributions for 2020, the Board has announced an interim dividend for 2020 of $0.15 per ordinary share, to be paid in cash with no scrip alternative.

Outlook and strategic update

In February 2020, we outlined our plan to upgrade the return profile of our risk-weighted assets (‘RWAs’), reduce our cost base and streamline the organisation. Despite the significant headwinds posed by the impact of the Covid-19 outbreak, we have made good progress in implementing our plan.

However, we recognise a number of fundamental changes, including the prospect of prolonged low interest rates, the significant increase in digital engagement from customers and the enhanced focus on the environment.

We have aligned our strategy accordingly. We intend to increase our focus on areas where we are strongest. We aim to increase and accelerate our investments in technology to enhance the capabilities we provide to customers and improve efficiency to drive down our cost base. We also

intend to continue the transformation of our underperforming businesses. As part of our climate ambitions, we have set out our plans to capture the opportunities presented by the transition to a low-carbon economy.

We will continue to target an adjusted cost base of $31bn or less in 2022. This reflects a further reduction in our cost base, which has been broadly offset by the adverse impact of foreign currency translation due to the weakening US dollar towards the end of 2020. We will also continue to target a gross RWA reduction of over $100bn by the end of 2022. Given the significant changes in our operating environment during 2020, we no longer expect to reach our return on average tangible equity (‘RoTE’) target of between 10% and 12% in 2022 as originally planned. The Group will now target a RoTE of greater than or equal to 10% in the medium term.

We intend to maintain a CET1 ratio above 14%, managing in the range of 14% to 14.5% in the medium term and managing this range down in the longer term. The Board has adopted a policy designed to provide sustainable dividends going forward. We intend to transition towards a target payout ratio of between 40% and 55% of reported earnings per ordinary share (‘EPS’) from 2022 onwards, with the flexibility to adjust EPS for non-cash significant items such as goodwill or intangibles impairments. We will no longer offer a scrip dividend option, and will pay dividends entirely in cash.

Key financial metrics

| | | | | | | | | | | | | | |

| | For the year ended |

| Reported results | Footnotes | 2020 | 2019 | 2018 |

| Reported revenue ($m) | | 50,429 | | 56,098 | | 53,780 | |

| Reported profit before tax ($m) | | 8,777 | | 13,347 | | 19,890 | |

| Reported profit after tax ($m) | | 6,099 | | 8,708 | | 15,025 | |

| Profit attributable to the ordinary shareholders of the parent company ($m) | | 3,898 | | 5,969 | | 12,608 | |

| Cost efficiency ratio (%) | | 68.3 | | 75.5 | | 64.4 | |

| Basic earnings per share ($) | | 0.19 | | 0.30 | | 0.63 | |

| Diluted earnings per share ($) | | 0.19 | | 0.30 | | 0.63 | |

| Net interest margin (%) | | 1.32 | | 1.58 | | 1.66 | |

| Alternative performance measures | | | | |

| Adjusted revenue ($m) | | 50,366 | | 54,944 | | 52,098 | |

| Adjusted profit before tax ($m) | | 12,149 | | 22,149 | | 21,199 | |

| | | | |

| Adjusted cost efficiency ratio (%) | | 62.5 | | 59.2 | | 60.9 | |

| Expected credit losses and other credit impairment charges (‘ECL’) as % of average gross loans and advances to customers (%) | | 0.81 | | 0.25 | | 0.16 | |

| Return on average ordinary shareholders’ equity (%) | | 2.3 | | 3.6 | | 7.7 | |

| Return on average tangible equity (%) | 1 | 3.1 | | 8.4 | | 8.6 | |

| | At 31 December |

| Balance sheet | | 2020 | 2019 | 2018 |

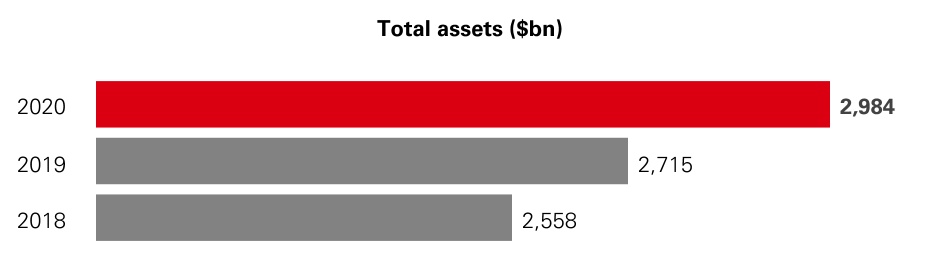

| Total assets ($m) | | 2,984,164 | | 2,715,152 | | 2,558,124 | |

| Net loans and advances to customers ($m) | | 1,037,987 | | 1,036,743 | | 981,696 | |

| Customer accounts ($m) | | 1,642,780 | | 1,439,115 | | 1,362,643 | |

| Average interest-earning assets ($m) | | 2,092,900 | | 1,922,822 | | 1,839,346 | |

| Loans and advances to customers as % of customer accounts (%) | | 63.2 | | 72.0 | | 72.0 | |

| Total shareholders’ equity ($m) | | 196,443 | | 183,955 | | 186,253 | |

| Tangible ordinary shareholders’ equity ($m) | | 156,423 | | 144,144 | | 140,056 | |

| Net asset value per ordinary share at period end ($) | | 8.62 | | 8.00 | | 8.13 | |

| Tangible net asset value per ordinary share at period end ($) | 2 | 7.75 | | 7.13 | | 7.01 | |

| Capital, leverage and liquidity | | | | |

| Common equity tier 1 capital ratio (%) | 3 | 15.9 | | 14.7 | | 14.0 | |

| Risk-weighted assets ($m) | 3 | 857,520 | | 843,395 | | 865,318 | |

| Total capital ratio (%) | 3 | 21.5 | | 20.4 | | 20.0 | |

| Leverage ratio (%) | 3 | 5.5 | | 5.3 | | 5.5 | |

| High-quality liquid assets (liquidity value) ($bn) | | 678 | | 601 | | 567 | |

| Liquidity coverage ratio (%) | | 139 | | 150 | | 154 | |

| Share count | | | | |

| Period end basic number of $0.50 ordinary shares outstanding (millions) | | 20,184 | | 20,206 | | 19,981 | |

| Period end basic number of $0.50 ordinary shares outstanding and dilutive potential ordinary shares (millions) | | 20,272 | | 20,280 | | 20,059 | |

| Average basic number of $0.50 ordinary shares outstanding (millions) | | 20,169 | | 20,158 | | 19,896 | |

| Dividend per ordinary share (in respect of the period) ($) | 4 | 0.15 | | 0.30 | | 0.51 | |

For reconciliations of our reported results to an adjusted basis, including lists of significant items, see page 99. Definitions and calculations of other alternative performance measures are included in our ‘Reconciliation of alternative performance measures’ on page 119.

1 Profit attributable to ordinary shareholders, excluding impairment of goodwill and other intangible assets and changes in present value of in-force insurance contracts (‘PVIF’) (net of tax), divided by average ordinary shareholders’ equity excluding goodwill, PVIF and other intangible assets (net of deferred tax).

2 Excludes impact of $0.10 per share dividend in the first quarter of 2019, following a June 2019 change in accounting practice on the recognition of interim dividends, from the date of declaration to the date of payment.

3 Unless otherwise stated, regulatory capital ratios and requirements are based on the transitional arrangements of the Capital Requirements Regulation in force at the time. These include the regulatory transitional arrangements for IFRS 9 ‘Financial Instruments’, which are explained further on page 215. Leverage ratios are calculated using the end point definition of capital and the IFRS 9 regulatory transitional arrangements. Following the end of the transition period after the UK’s withdrawal from the EU, any reference to EU regulations and directives (including technical standards) should be read as a reference to the UK’s version of such regulation and/or directive, as onshored into UK law under the European Union (Withdrawal) Act 2018, as amended.

4 The fourth interim dividend of 2019, of $0.21 per ordinary share, was cancelled in response to a written request from the PRA. 2019 has been re-presented accordingly.

Who we are

About HSBC

With assets of $3.0tn and operations in 64 countries and territories at 31 December 2020, HSBC is one of the largest banking and financial services organisations in the world. More than 40 million customers bank with us and we employ around 226,000 full-time equivalent staff. We have around 194,000 shareholders in 130 countries and territories.

Our values

Our values help define who we are as an organisation, and are key to our long-term success.

We value difference

Seeking out different perspectives

We succeed together

Collaborating across boundaries

We take responsibility

Holding ourselves accountable and taking the long view

We get it done

Moving at pace and making things happen

For further details on our strategy and purpose, see pages 12 and 16.

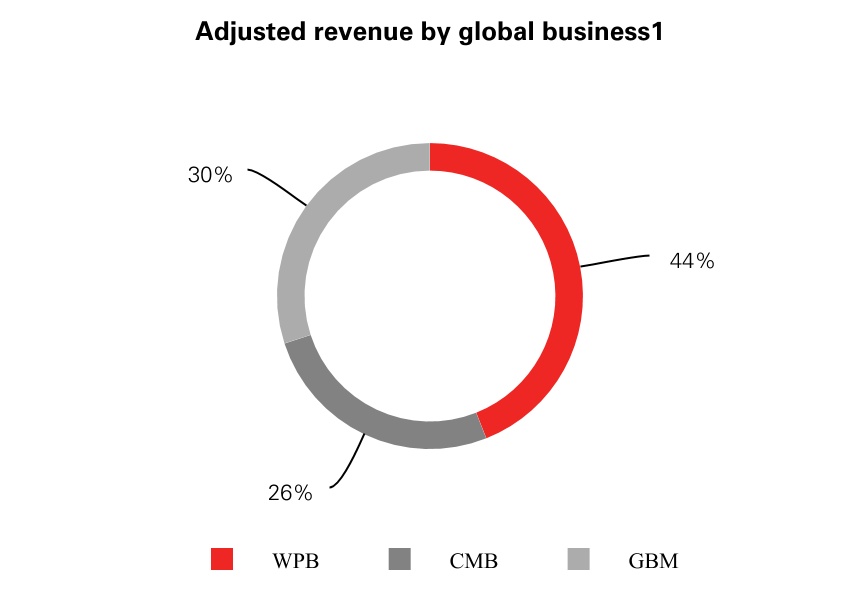

Our global businesses

We serve our customers through three global businesses. On pages 30 to 36 we provide an overview of our performance in 2020 for each of our global businesses, as well as our Corporate Centre.

During the year, we simplified our organisational structure by combining Global Private Banking and Retail Banking and Wealth Management to form Wealth and Personal Banking. We also renamed our Balance Sheet Management function as Markets Treasury to reflect the activities it undertakes more accurately and its relationship to our Group Treasury function more broadly. These changes followed realignments within our internal reporting and include the reallocation of Markets Treasury, hyperinflation accounting in Argentina and HSBC Holdings net interest expense from Corporate Centre to the global businesses.

Each of the chief executive officers of our global businesses reports to our Group Chief Executive, who in turn reports to the Board of HSBC Holdings plc.

For further information on how we are governed, see our corporate governance report on page 237.

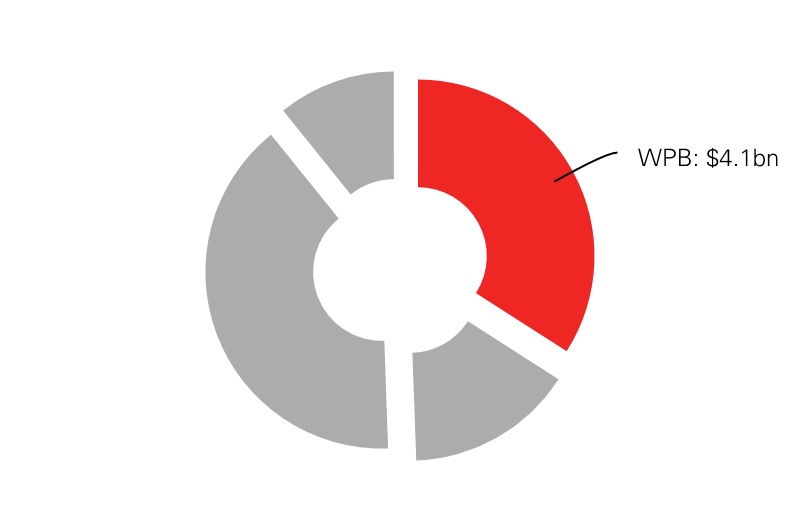

Wealth and Personal Banking (’WPB’)

We help millions of our customers look after their day-to-day finances and manage, protect and grow their wealth.

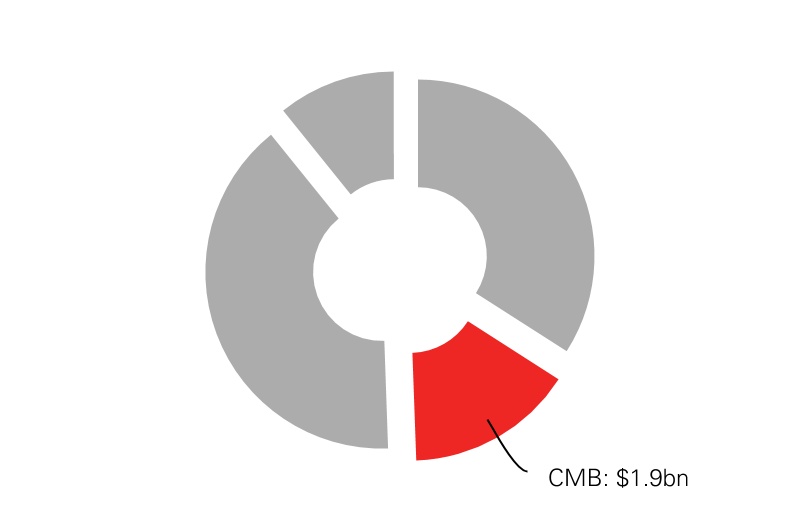

Commercial Banking (‘CMB’)

Our global reach and expertise help domestic and international businesses around the world unlock their potential.

Global Banking and Markets (’GBM’)

We provide a comprehensive range of financial services and products to corporates, governments and institutions.

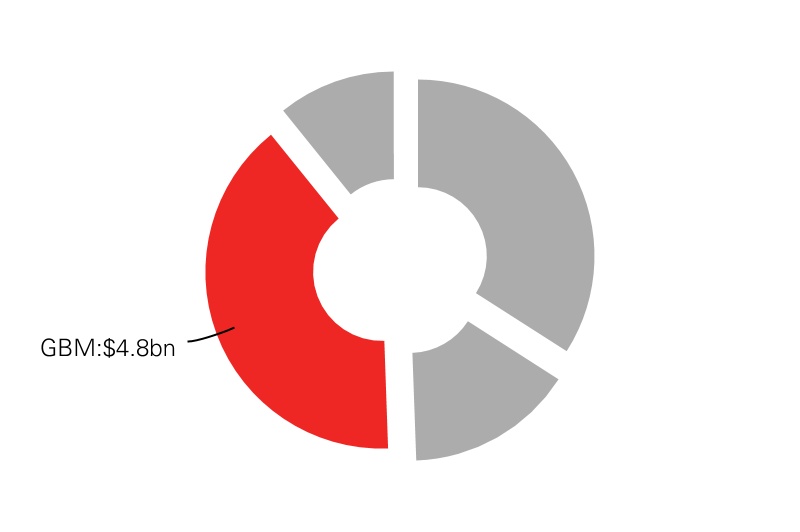

1 Calculation is based on adjusted revenue of our global businesses excluding Corporate Centre, which is also excluded from the total adjusted revenue number. Corporate Centre had negative adjusted revenue of $262m in 2020.

Our global functions

Our business is supported by a number of corporate functions and our Digital Business Services teams, formerly known as HSBC Operations, Services and Technology. The global functions include Corporate Governance and Secretariat, Communications, Finance, Compliance, Human Resources, Internal Audit, Legal, Marketing, Risk and Strategy. Digital Business Services provides real estate, procurement, technology and operational services to the business.

Our global reach

We aim to create long-term value for our shareholders and capture opportunity. Our goal is to lead in wealth, with a particular focus on Asia and the Middle East. Taking advantage of our international network, we aspire to lead in cross-border banking flows, and to serve mid-market corporates globally. We continue to maintain a strong capital, funding and liquidity position with a diversified business model.

Value of customer accounts by geography

North America 11%

Latin America 2%

Rest of Europe 8%

UK 30%

Middle East and North Africa 3%

Rest of Asia 11%

Hong Kong 32%

Mainland China 3%

See page 86 for further information on our customers and approach to geographical information.

Multi-award winning

We have won industry awards around the world for a variety of reasons – ranging from the quality of the service we provide to customers, to our efforts to support diversity and inclusion in the workplace.

A selection of the awards recognising our support of customers during the Covid-19 outbreak includes:

Euromoney Awards for Excellence 2020

Global Excellence in Leadership

Excellence in Leadership in Asia

Excellence in Leadership in the Middle East

Greenwich Associates 2020 – Standout Bank for Corporates in Asia During Crisis

Most Distinctive in Helping to Mitigate Impact of Covid-19

We highlight a selection of our other recent wins below.

Euromoney Awards for Excellence 2020

World’s Best Bank for Sustainable Finance

World’s Best Bank for Transaction Services

Hong Kong’s Best Bank

The Banker Innovation in Digital Banking Awards 2020

Best Digital Bank in Asia

Asia Insurance Industry Awards 2020

Life Insurance Company of the Year

PWM Wealth Tech Awards 2020

Best Global Private Bank for Digital Customer Experience

Stonewall

Stonewall Top Global Employers List – 2020

Engaging with our stakeholders

Customers

Employees

Investors

Communities

Regulators and governments

Suppliers

•Building strong relationships with our stakeholders helps enable us to deliver our strategy in line with our long-term values, and operate the business in a sustainable way. Our stakeholders are the people who work for us, bank with us, own us, regulate us, and live in the societies we serve and the planet we all inhabit. These human connections are complex and overlap. Many of our employees are customers and shareholders, while our business customers are often suppliers. We aim to serve, creating value for our customers and shareholders. Our size and global reach mean our actions can have a significant impact. We are committed to doing business responsibly, and thinking for the long term. This is key to delivering our strategy.

Group Chairman’s statement

The past year brought unprecedented challenges, but our people responded exceptionally well and our performance has been resilient.

In 2020, we experienced economic and social upheaval on a scale unseen in living memory. Even before the year began, the external environment was being reshaped by a range of factors – including the impact of trade tensions between the US and China, Brexit, low interest rates and rapid technological development. The spread of the Covid-19 virus made that environment all the more complex and challenging.

The Covid-19 pandemic has severely impacted our customers, our colleagues, our shareholders and the communities we serve. The first priority was, and remains, dealing with the public health crisis, but the economic crisis that unfolded simultaneously has also been unprecedented in recent times. The financial services industry has been at the forefront of helping businesses and individuals through the difficulties they have faced, working with governments and regulators towards expected recovery and future growth. I am enormously proud of the professionalism, dedication and energy that my colleagues around the world have demonstrated as they helped ensure our customers received the support they needed – all the while managing their own, at times extremely difficult, situations at home. On behalf of the Board, I would like to express my deepest thanks to them all for the exceptional way they are responding to these most challenging circumstances.

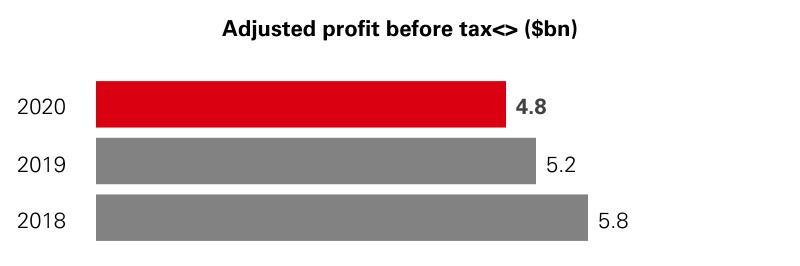

Against this backdrop, HSBC demonstrated a resilient performance. Reported profit before tax was $8.8bn, a fall of 34%, and adjusted profit before tax was $12.1bn, down 45%. Within this, Global Banking and Markets performed particularly well, while Asia was once again by far the most profitable region. Deposits also increased significantly across the Group, reinforcing the strength of our funding and liquidity positions.

In response to a request from the UK’s Prudential Regulation Authority, we cancelled the fourth interim dividend for 2019. We also announced that, until the end of 2020, we would make no quarterly or interim dividend payments or accruals in respect of ordinary shares. This was a difficult decision and we deeply regret the impact it has had on our shareholders. We are therefore pleased to restart dividend payments at the earliest opportunity. The Board has announced an interim dividend of $0.15 for 2020, and adopted a policy designed to provide sustainable dividends in the future.

Board of Directors

The confirmation of Noel Quinn as permanent Group Chief Executive underlined the Board’s belief that he is the best person to lead the delivery of the strategic plan. We look forward to working closely with Noel and the management team as they focus on executing our strategic priorities in 2021.

Jamie Forese, Steve Guggenheimer and Eileen Murray joined the Board as independent non-executive Directors in 2020. All three have already demonstrated the valuable skills, expertise and experience they bring across a wide range of areas, including technology. We have also announced that Dame Carolyn Fairbairn will join the Board as an independent non-executive Director. Carolyn will bring a wealth of relevant experience, and her appointment will be effective from 1 September 2021.

As reported in the Annual Report and Accounts 2019, Sir Jonathan Symonds and Kathleen Casey retired from the Board last year. Today we also announced that Laura Cha will step down from the Board immediately after our 2021 Annual General Meeting (‘AGM’) in May. I would like to thank Jon, Kathy and Laura for the enormous contributions they made to HSBC during their years of service. We are now in the advanced stages of a search for suitable candidates to join and strengthen the Board, and I will update further on the outcome of this search in due course.

Like the rest of the Group, the Board had to adapt its ways of working in 2020. We met virtually for much of the year, which brought benefits including less travel and more frequent, shorter meetings. It will be important for us to consider how we retain what has worked well over the last year once restrictions are lifted and it becomes possible to travel once again.

The Board enjoys the constructive discussions that we have with shareholders at the AGM in the UK and the Informal Shareholders’ Meeting in Hong Kong, so it was a matter of regret that we did not meet in person in 2020. While we did maintain regular contact with shareholders throughout the year, we will resume our face-to-face engagement with shareholders in the UK, Hong Kong and more widely, as soon as is practicable.

External environment

After the significant deterioration in global economic conditions in the first half of the year due to the Covid-19 pandemic, there were signs of improvement in the second half, especially in Asia. The most impressive economic recovery has been in China – still the biggest driver of global growth – where international trade is rebounding most strongly. The signing of the Regional Comprehensive Economic Partnership should further boost intra-regional activity across Asia, while the recent political agreement between the EU and China on an investment deal should, once ratified, bolster the already significant two-way investment flows.

Covid-19 infection levels remain very high in Europe, the US and Latin America, and new variants of the virus have spread quickly. This has necessitated new lockdown measures in the UK and other countries. While the deployment of multiple vaccines means we are more optimistic about the future, there is clearly still some way to go before life can return to something like normality. Recovery will therefore take longer in these economies, with growth more likely later in 2021 in these economies.

The agreement of a trade deal between the UK and EU prior to the end of 2020 provides some certainty for cross-border trade. However, the reduced access for financial services under these new arrangements means that further work is needed to maintain the level playing field that has existed until now. Given the many benefits that the UK financial services industry brings to the UK and EU economies, equivalence must be a key priority for both parties.

The geopolitical environment remains challenging – in particular for a global bank like HSBC – and we continue to be mindful of the potential impact that it could have on our strategy. We continue to engage fully and frequently with all governments as we seek to do everything we possibly can to help our customers navigate an increasingly complex world.

Capturing future opportunities

Given the external environment, it is vital we stay focused on what we can control. The Board is confident there are many opportunities ahead for a bank with HSBC’s competitive strengths. This makes it all the more important that we position ourselves to capture them.

While we prioritised supporting our customers and our people during the pandemic, we made good progress against the three strategic priorities announced in February 2020 – reallocating capital from underperforming parts of the business, reducing costs and simplifying the organisation. In

particular, the Board worked closely with the management team over the course of the year on plans to accelerate progress and investment in key areas of growth, which include our Asian franchise, our wealth business and new technology across the Group.

We are today unveiling the outcome of extensive consultation with our people and customers on the Group’s purpose and values. Being clear about who we are, what we stand for and how this connects to our strategy is an important part of how we align and energise the organisation to create long-term value for all those we work with and for – our investors, customers, employees, suppliers and the communities we serve. The Board fully endorses the outcome of this work.

Our commitment to create sustainable value is demonstrated by the new climate ambitions we announced in October 2020. The most significant contribution that HSBC can make to the fight against climate change is to bring our customers with us on the transition to a low-carbon future. Our goal of being net zero for our financed emissions by 2050 sends an important signal to our investors, our customers and our people - if our clients are prepared to change their business models and make that transition, we will help and support them to do so. HSBC was also delighted to be one of the founding signatories of the Terra Carta, which was launched last month by HRH The Prince of Wales’ Sustainable Markets Initiative. Further details about all of the steps we are taking towards a more sustainable future are set out in the ESG review, which for the first time is included within the Annual Report and Accounts 2020.

Finally, 2020 underlined once again that our people are the driving force behind our business. I would like to reiterate how enormously grateful I am to my colleagues for the great dedication and care they showed to our customers and to each other during such testing times. Further empowering and enabling them to do their jobs and execute our strategic priorities is the key to our future success.

Mark E Tucker

Group Chairman

23 February 2021

“There are many opportunities ahead for a bank with HSBC’s competitive strengths.”

Group Chief Executive’s review

With a blueprint for the future and a renewed purpose to guide us, we are building a dynamic, efficient and agile global bank with a digital-first mindset, capable of providing a world-leading service to our customers and strong returns for our investors.

In 2020, HSBC had a very clear mandate – to provide stability in a highly unstable environment for our customers, communities and colleagues. I believe we achieved that in spite of the many challenges presented by the Covid-19 pandemic and heightened geopolitical uncertainty.

Our people delivered an exceptional level of support for our customers in very tough circumstances, while our strong balance sheet and liquidity gave reassurance to those who rely on us. We achieved this while delivering a solid financial performance in the context of the pandemic – particularly in Asia – and laying firm foundations for our future growth. I am proud of everything our people achieved and grateful for the loyalty of our customers during a very turbulent year.

2020

Helping our customers emerge from the Covid-19 pandemic in a sustainable position was our most pressing priority. We did this by equipping our colleagues to work from home at the height of the pandemic, and keeping the vast majority of our branches and all of our contact centres open. Our investment in our digital capabilities – both in 2020 and in previous years – enabled our customers to access more services remotely, and we worked closely with our regulators around the world to open new digital channels in a safe and secure way. In total, we provided more than $26bn of relief to our personal customers and more than $52bn to our wholesale customers, both through government schemes and our own relief initiatives. We also played a vital role in keeping capital flowing for our clients, arranging more than $1.9tn of loan, debt and equity financing for our wholesale customers during 2020.

Even in the middle of the pandemic, we continued to look to the future. In October, we announced our ambition to become a net zero bank by 2050, supporting customers through the transition to a low-carbon economy and helping to unlock next-generation climate solutions. If the Covid-19 pandemic provided a shock to the system, a climate crisis has the potential to be much more drastic in its consequences and longevity. We are therefore stepping up support for our clients in a material way, working together to build a thriving low-carbon economy and focusing our business on helping achieve that goal.

The actions we outlined in February 2020 are largely on track or ahead of where we intended them to be, despite the complications of the pandemic. We renewed and re-energised the senior management team, with around three-quarters of the Group Executive Committee in post for just over a year or less. Our business is more streamlined than it was a year ago, with three global businesses instead of four and increased back-office consolidation. Costs are down materially, with over $1bn of gross operating costs removed during 2020. We are also already more than half-way towards our target to reduce at least $100bn of gross risk-weighted assets by 2022.

Unfortunately, the changed interest-rate environment means we are no longer able to achieve a return on tangible equity of 10% to 12% by 2022. We will now target a return on tangible equity of 10% or above over the medium term.

The world around us changed significantly in 2020. Central bank interest rates in many countries fell to record lows. Pandemic-related lockdowns led to a rapid acceleration in the shift from physical to digital banking. Like many businesses, we learned that our people could be just as productive working from home as in the office. Also, as the world resolved to build back responsibly from the pandemic, governments, businesses and customers united to accelerate a low-carbon transition that works for all.

“Helping our customers emerge from the Covid-19 pandemic in a sustainable position was our most pressing priority.“

All of these things caused us to adjust and reinforce elements of our strategy to fit this new environment. The growth plans that we have developed are a natural progression of our February 2020 plans. They aim to play to our strengths, especially in Asia; to accelerate our technology investment plans to deliver better customer service and increased productivity; to energise our business for growth; and to invest further in our own low-carbon transition and that of our customers. They are also designed to deliver a 10% return on tangible equity over the medium term in the current low interest-rate environment.

Our purpose

As we charted the next stage of HSBC’s journey, we also reflected on our purpose as a business. We consulted widely both internally and externally, speaking to thousands of colleagues and customers, and looked deeply into our history. The same themes came up again and again.

HSBC has always focused on helping customers pursue the opportunities around them, whether as individuals or businesses. Sometimes those opportunities are clear and visible, and sometimes they are far from obvious. Sometimes they arise in the next street, and sometimes on the next continent. Sometimes they exist in the status quo, and sometimes they are a product of great social or economic change. But always, they represent a chance for our customers to grow and to help those close to them – protecting, nurturing, building.

'Opening up a world of opportunity' both captures this aim and lays down a challenge for the future. Opportunity never stands still. It changes and evolves with the world around us. It is our job to keep making the most of it, and to find and capture it with a spirit of entrepreneurialism, innovation and internationalism that represents HSBC at its very best. This is the essence of what our plans intend to deliver, and what we intend to keep delivering for our customers, colleagues and communities as we navigate change and complexity together.

Financial performance

The pandemic inevitably affected our 2020 financial performance. The shutdown of much of the global economy in the first half of the year caused a large rise in expected credit losses, and cuts in central bank interest rates reduced revenue in rate-sensitive business lines. We responded by accelerating the transformation of the Group, further reducing our operating costs and moving our focus from interest-rate sensitive business lines towards fee-generating businesses. Our expected credit losses stabilised in the second half of the year in line with the changed economic outlook, but the revenue environment remained muted.

As a consequence, the Group delivered $8.8bn of reported profit before tax, down 34% on 2019, and $12.1bn of adjusted profits, down 45%. Our Asia business was again the major contributor, delivering $13bn of adjusted profit before tax in 2020.

Adjusted revenue was 8% lower than in 2019. This was due mainly to the impact of interest rate cuts at the start of the year on our deposit franchises in all three global businesses. By contrast, our Global Markets business benefited from increased customer activity due to market volatility throughout the year, growing adjusted revenue by 27%.

We made strong progress in reducing our operating expenses. A combination of our cost-saving programmes, cuts in performance-related pay and lower discretionary spending due to the Covid-19 pandemic helped to reduce our adjusted operating expenses by $1.1bn or 3%.

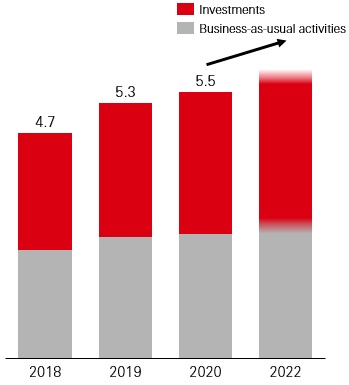

Our investment plans remain essential to the future of the business. We continued to invest heavily in technology while managing costs down, spending $5.5bn during 2020.

Our funding, liquidity and capital remain strong. We grew deposits by $173bn on a constant currency basis, with increases across all three global businesses. Our common equity tier one ratio was 15.9% on 31 December 2020.

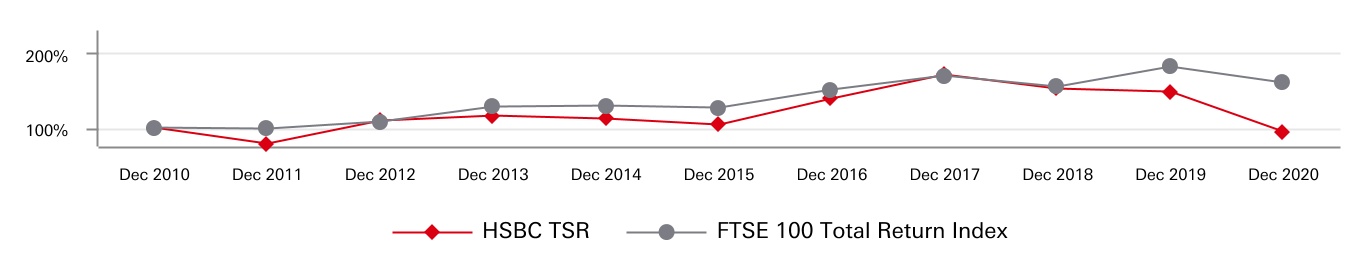

Our shareholders

It was a difficult year for our shareholders. The Covid-19 pandemic and the impact of geopolitics weighed heavily on our share price throughout 2020. In March, we cancelled the payment of our fourth interim dividend for 2019 at the request of our lead regulator, and also agreed not to make any quarterly or interim dividend payments until the end of 2020. This particularly affected shareholders who rely on our dividend for income. It was a priority for the management team to get back to being able to pay dividends by the end of the year, and we were pleased to be able to recommend the payment of an interim dividend for 2020.

Dividends are hugely important, but so is capacity for growth. To deliver both, we are adopting a new policy designed to provide sustainable dividends, offering good income while giving management the flexibility to reinvest capital to grow the firm over the medium term. We will consider share buy-backs, over time and not in the near term, where no immediate opportunity for capital redeployment exists. We will also no longer offer a scrip dividend option, and will pay dividends entirely in cash.

The last 12 months were tough, but I am highly focused on turning our performance around in 2021 and beyond. I strongly believe that the combination of our growth plans and our new dividend policy will unlock greater value for our shareholders in the years to come.

Opening up a world of opportunity

‘Opening up a world of opportunity’ is more than a purpose – it is a statement of intent. Everything that we plan to do over the next decade is designed to unlock opportunity for our stakeholders, whether customers, colleagues, shareholders or communities. We intend to do this by building a dynamic, efficient and agile global bank with a digital-first mindset, capable of providing a world-leading service to our customers and strong returns for our investors. We will also need to focus intently on the areas where we excel, and to foster a commercial and entrepreneurial culture with a conviction to get things done. We believe we can achieve this in four ways.

First, we plan to focus on and invest in the areas in which we are strongest. In Wealth and Personal Banking, we aim to become a market-leader for high net worth and ultra high net worth clients in Asia and the Asian diaspora, and to invest in our biggest retail markets where the opportunity is greatest. In Commercial Banking, we want to remain a global leader in cross-border trade, and to lead the world in serving mid-market corporates internationally. In Global Banking and Markets, we intend to invest to capture trade and capital flows into and across Asia, while connecting global clients to Asia and the Middle East through our international network.

Second, we intend to increase the pace at which we digitise HSBC through higher levels of technology investment. This underpins everything that we want to achieve. It is how we intend to win new customers and retain them, to become more agile and efficient, to create richer, seamless customer journeys, and to build strong and innovative partnerships that deliver excellent benefits for our customers. We have an opportunity to meet the growing market need for sophisticated, robust and rapid payment solutions, and to lead our industry in applying digital solutions to analogue services, such as trade. We therefore intend to protect technology investment throughout the cycle, even as we reduce spending elsewhere.

Third, we want to energise HSBC for growth through a strong culture, simple ways of working, and by equipping our colleagues with the future skills they need. Giving life to our purpose will be critical to building the dynamic, entrepreneurial and inclusive culture that we want to create, as will removing the remaining structural barriers that sometimes stop our people from delivering for our customers. We need to change the way we hire to build skills and capabilities in areas that are different to what we have needed historically, including data, artificial intelligence, and sustainable business models. Our expanded HSBC University will also help to upskill and reskill our people, while fostering more of the softer skills that technology can never replace.

Fourth, we will seek to help our customers and communities to capture the opportunities presented by the transition to a low-carbon economy. Accelerating this transition is the right thing to do for the environment, but also the right thing commercially. We intend to build on our market-leading position in sustainable finance, supporting our clients with $750bn to $1tn of sustainable financing and investment over the next 10 years. We also intend to unlock new climate solutions by building one of the world’s leading climate managers – HSBC Pollination Climate Asset Management – and helping to transform sustainable infrastructure into a global asset class. These will help us achieve our ambition to align our portfolio of financed emissions to the Paris Agreement goal to achieve net zero by 2050.

Championing inclusion

I believe passionately in building an inclusive organisation in which everyone has the opportunity to fulfil their potential. Failing to do so isn’t just wrong, it is totally self-defeating. It means you don’t get the best out of the talent you have, and sends the wrong signals to the people you want to recruit. An inclusive environment is the foundation of a truly diverse organisation, with all of the rewards that brings.

Response to Covid-19

Our operations have stayed highly resilient and we are participating in several Covid-19 relief measures.

Approximately

85%

of our employees are now equipped to work from home.

We provided over

$26bn

of relief to our personal customers.

”I believe passionately in building an inclusive organisation in which everyone

has the opportunity to fulfil their potential.”

There is much still to do, but we are moving in the right direction. More than 30% of our senior leaders are female, in line with the goal we set to achieve by the end of 2020. I want that number to increase to at least 35% by 2025, and we have a number of initiatives in place to help achieve it. In May, we launched a new global ethnicity inclusion programme to better enable careers and career progression for colleagues from ethnic minorities, and in July, we made a series of commitments to address feedback from Black colleagues in particular. These included a commitment to more than double our number of Black senior leaders by 2025.

I am particularly proud that during a difficult year, which included a large-scale redundancy programme, employee sentiment improved within HSBC. Around 71% of my colleagues said that they found HSBC to be a great place to work, up from 66% in 2019. However, the view varies across employees from different groups. We know, for example, that employees with disabilities or who identify as ethnic minorities do not feel as engaged as others. I take these gaps very seriously. Better demographic data globally will help us benchmark and measure our progress more effectively, and we are taking concerted steps to be able to capture that information where possible.

2021 outlook

We have had a good start to 2021, and I am cautiously optimistic for the year ahead. While a spike in Covid-19 infection rates led to renewed lockdown measures in many places at the start of 2021, the development of multiple vaccines gives us hope that the world will return to some form of normality before long. Nonetheless, we remain reactive to the ebb and flow of the Covid-19 virus and prepared to take further steps to manage the economic impact where necessary.

The geopolitical uncertainty that prevailed during 2020 remains a prominent feature of our operating environment. We are hopeful that this will reduce over the course of 2021, but mindful of the potential impact on our business if levels remain elevated. We remain focused on serving the needs of our customers, colleagues and communities in all our markets.

Our people

I would like to pay tribute to my colleagues and all those who supported them throughout a difficult year. HSBC is a community of around 226,000 colleagues – but it relies just as much on the family, friends and support networks that help them be the best they can be. Our people did extraordinary things in 2020, but it asked a lot of those around them. I am hugely grateful to everyone who helped HSBC – whether directly or indirectly – in supporting our customers, communities and each other over the last 12 months.

Noel Quinn

Group Chief Executive

23 February 2021

Our strategy

With continued delivery against our February 2020 commitments, we are now in the next stage of our strategic plan, which responds to the significant shifts during the year and aligns to our refreshed purpose, values and ambition.

Progress on our 2020 commitments

In February 2020, we outlined our plan to upgrade our returns profile through recycling risk-weighted assets (‘RWAs’) out of low-return franchises into higher-performing ones, reducing our cost base and streamlining our organisation.

During 2020, in spite of significant headwinds posed by the impact of the Covid-19 outbreak across our network, we made significant progress on delivering against the ambitions we outlined. We delivered $1bn of cost programme saves. We also reduced gross RWAs by $52bn, including $24bn from our non-ring-fenced bank in Europe and the UK, and are currently on track to meet the greater than $100bn target outlined by 2022.

We took bold steps to simplify our organisation, including the merger of Retail Banking and Wealth Management and Global Private Banking to form Wealth and Personal Banking. We also reduced management layers in Global Banking and Markets and our non-ring-fenced bank in Europe and the UK. We have built a strong capital position, ending the year with a CET1 ratio of 15.9%. Our return on tangible equity (‘RoTE’) of 3.1% was negatively impacted by the Covid-19 outbreak and the challenging macroeconomic environment, including lower interest rates and higher expected credit losses.

Responding to the new environment

There was a set of fundamental shifts in 2020 that profoundly impacted our organisation as well as the wider financial services sector. We have adapted our strategy accordingly.

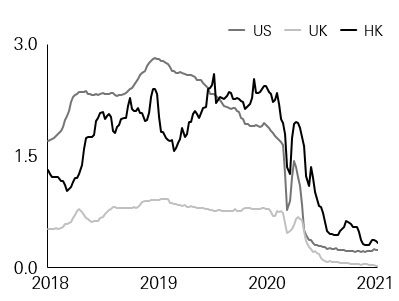

Low interest-rate environment

Interest rates are expected to remain lower for longer, resulting in a more difficult revenue environment for the financial services sector.

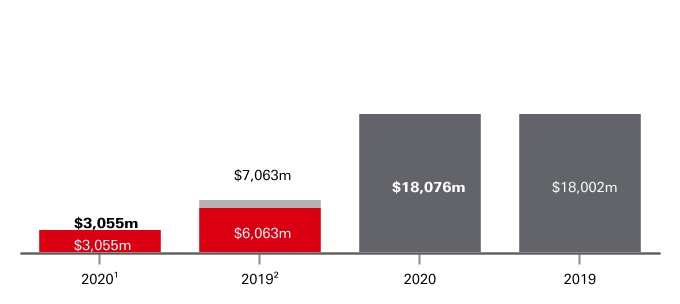

Evolution of major interbank rates1

Three-month interbank offered rates (%)

We are responding by targeting fee income growth in wealth and wholesale banking products and improving cost efficiencies.

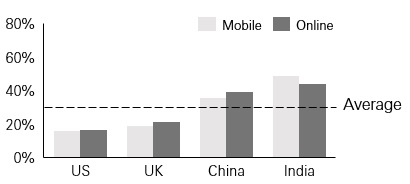

The new digital experience economy

Remote working and global lockdowns due to the Covid-19 outbreak have increased our customers’ propensity and preference to engage digitally.

Digital banking usage up c.30%2 in the industry

% customers increasing digital usage, mid-2020 vs pre-Covid-19

HSBC customer trends

125%

Increase in HSBCnet mobile downloads3

253%

Increase in HSBCnet mobile payments3

We are responding by increasing investments in technology across our customer platforms.

Increased focus on sustainability

The demand for sustainable solutions and green finance rose to new highs in 2020.

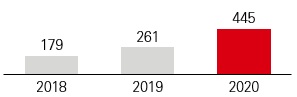

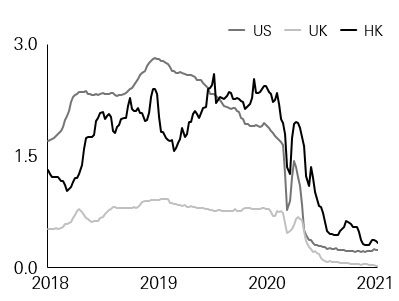

Green, social and sustainability (‘GSS’) bond market4

$bn

GSS share of global debt capital markets 2.7% 3.6% 5.0%

Companies with disclosed climate action targets 228 (in 2018) 1,106 (in 2020)

under the Science Based Targets Initiative

We stepped up our climate ambitions – we aim to be a net zero bank and support our clients in their transition with $750bn to $1tn of financing.

1 Source: Datastream.

2 Source: Bain & Company Covid-19 Pulse Survey, July 2020; Overall sample: 10,000.

3 Fourth quarter of 2020 vs fourth quarter of 2019.

4 Source: Dealogic.

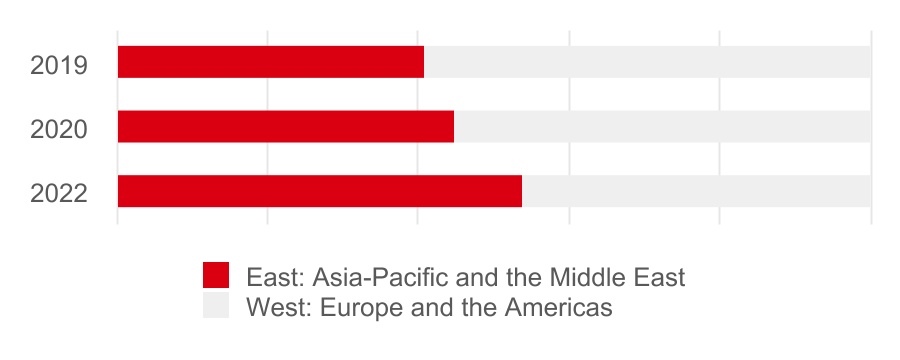

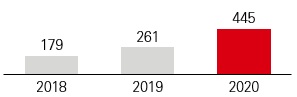

Shifting capital to areas with the highest returns and growth

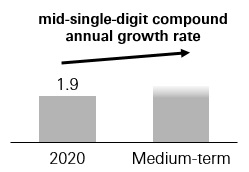

We are responding to the changes in our operating environment, and building on our 2020 commitments. Our strategy includes accelerating the shift of capital to areas, principally Asia and wealth, that have demonstrated the highest returns and where we have sustainable advantage through scale. Our international network remains a key competitive advantage and we will continue to support cross-border banking flows between major trade corridors. Supported by these shifts, we are aiming to reach mid-single-digit revenue growth in the medium to long term1, with a higher proportion of our revenue coming from fee and insurance income.

Capital allocation

Asia

(as a % of Group tangible equity2)

Wealth and Personal Banking

(as a % of Group tangible equity3)

Fees and insurance

(as a % of total revenue)

1 Medium term is three to four years; long term is five to six years.

2 Based on tangible equity of the major legal entities excluding associates, Holdings companies, consolidation adjustments, and any potential inorganic actions.

3 WPB tangible equity as a share of tangible equity allocated to the global businesses (excluding Corporate Centre). Excludes Holdings companies, consolidation adjustments, and any potential inorganic actions.

Group targets, dividend and capital policy

To support the ambitions of our strategy, we have revised our Group targets, dividend and capital policy.

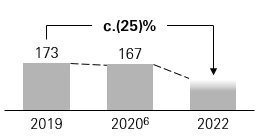

Adjusted costs in 2022

≤$31bn

(on December 2020 average exchange rate; or ≤$30bn using full year 2020 average exchange rate)

Gross RWA reduction by end of 20221

>$100bn

CET1 ratio

≥14%

(manage in 14% to 14.5% range over the medium term2; and manage the range down further long term2)

Sustainable cash dividends with a payout ratio3 of

40% to 55%

from 2022 onwards

RoTE over medium term <>

≥10%

(vs 10% to 12% in 2022 in February 2020 commitment)

We have increased our 2022 cost reduction target by $1bn and we plan to keep costs stable from 2022. We also plan to reduce tangible equity in the US and in our non-ring-fenced-bank in Europe and the UK, and increase tangible equity in Asia and in Wealth and Personal Banking. Dividends could be supplemented by buy-backs or special dividends, over time and not in the near term4. We will also no longer offer a scrip dividend option, and will pay dividends entirely in cash. Given the significant changes in our operating environment during 2020, we no longer expect to reach our RoTE target of between 10% and 12% in 2022 as originally planned.

1 Excludes any inorganic actions.

2 Medium term is three to four years; long term is five to six years.

3 We intend to transition towards a target payout ratio of between 40% and 55% of reported earnings per ordinary share (‘EPS’) from 2022 onwards, with the flexibility to adjust EPS for non-cash significant items, such as goodwill or intangibles impairments.

4 Should the Group find itself in an excess capital position absent compelling investment opportunities to deploy that excess.

Our strategy

We have embedded our purpose, values and ambition into our strategy. Our purpose is 'Opening up a world of opportunity'. Our values are: we value difference; we succeed together; we take responsibility; and we get it done. Our ambition is to be the preferred international financial partner for our clients. Our strategy centres around four key areas: focus on our areas of strengths; digitise at scale to adapt our operating model for the future; energise our organisation for growth; and support the transition to a net zero global economy.

Focus on our strengths

In our global businesses

In each of our global businesses, we will focus on areas where we are strongest and have significant opportunities for growth. We aim to invest approximately $6bn in Asia1, where we intend to drive double-digit growth in profit before tax in the region in the medium to long term2.

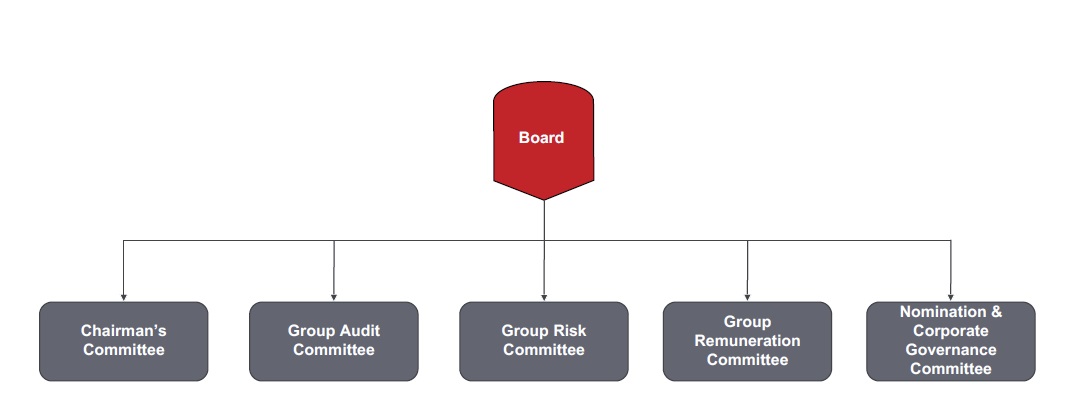

Wealth and Personal Banking