EXHIBIT 10.3

SECOND AMENDED AND RESTATED

LIMITED LIABILITY COMPANY AGREEMENT

of

ACADIA POWER PARTNERS, LLC

Dated as of May 9, 2003

TABLE OF CONTENTS | Page | |

DEFINITIONS | 2 | |

Section 1.1. | Definitions and Usage | 2 |

Section 1.2. | Appendices and Exhibits | 2 |

Section 1.3. | Headings | 2 |

ARTICLE 2 | FORMATION OF COMPANY AND RELATED MATTERS | 3 |

Section 2.1. | Formation | 3 |

Section 2.2. | Name | 3 |

Section 2.3. | General Purposes | 3 |

Section 2.4. | Specific Powers of Company | 3 |

Section 2.5. | Principal Place of Business | 4 |

Section 2.6. | Registered Agent and Office | 4 |

Section 2.7. | No State Law Partnership | 5 |

Section 2.8. | Title to Company Assets | 5 |

Section 2.9. | Term and End of Term | 5 |

ARTICLE 3 | OWNERSHIP INTERESTS AND CAPITAL CONTRIBUTIONS | 6 |

Section 3.1. | Members and Ownership Interests | 6 |

Section 3.2. | Initial Capital Contributions | 6 |

Section 3.3. | Further Contributions | 8 |

Section 3.4. | Election to Not Make Further Capital Contributions | 9 |

Section 3.5. | No Interest on Capital Contributions | 11 |

Section 3.6. | Contribution Loans | 11 |

Section 3.7. | Capital Accounts | 11 |

Section 3.8. | Non-Liability of Members | 12 |

Section 3.9. | Partition | 12 |

-i-

TABLE OF CONTENTS (continued) | Page | |

Section 3.10. | Resignation | 12 |

ARTICLE 4 | MEMBERS AND MANAGEMENT | 12 |

Section 4.1. | General Management Authority | 12 |

Section 4.2. | Day to Day Management Responsibility; Operations and Maintenance | 13 |

Section 4.3. | Management Committee | 16 |

Section 4.4. | Business with Affiliates | 20 |

ARTICLE 5 | JOINT DEVELOPMENT OF PROJECT | 21 |

Section 5.1. | Owner Construct | 21 |

Section 5.2. | Phases of Development | 22 |

Section 5.3. | Project Director | 22 |

Section 5.4. | Members' Phase I Development Responsibilities | 24 |

Section 5.5. | Project Agreements | 26 |

Section 5.6. | Significant Offtake Agreements | 26 |

Section 5.7. | Project Financing | 28 |

Section 5.8. | PPA Managers | 29 |

ARTICLE 6 | BUDGETS, CONTRIBUTIONS AND ACCOUNTING | 30 |

Section 6.1. | Development Funding | 30 |

Section 6.2. | Operations Funding | 31 |

Section 6.3. | Funding of Capital Repairs and Additions | 32 |

Section 6.4. | Approval of Budgets; No Management Committee Deadlock | 33 |

Section 6.5. | Other Matters Relating to Contributions | 34 |

Section 6.6. | Inspection and Audit Rights | 34 |

Section 6.7. | Reporting | 34 |

| Section 6.8. | Financial Statements | 34 |

-ii-

TABLE OF CONTENTS (continued) | Page | |

ARTICLE 7 | POWER MARKETING AND FUEL PROCUREMENT | 34 |

Section 7.1. | Power Marketing Agreement | 34 |

Section 7.2. | Marketing Annual Plan; Revenue and Forecasting Benchmarks | 38 |

Section 7.3. | Member Marketing | 39 |

Section 7.4. | Replacement of Power Marketer | 39 |

Section 7.5. | Fuel Supply by Members | 41 |

ARTICLE 8 | ASSET OPTIMIZATION | 41 |

Section 8.1. | Asset Optimization Committee | 41 |

Section 8.2. | AOC Participation | 41 |

Section 8.3. | AOC Meetings | 42 |

Section 8.4. | Chairman | 42 |

Section 8.5. | Vote Required for Action | 42 |

Section 8.6. | Compensation | 42 |

Section 8.7. | Right to Present Matters to Management Committee | 42 |

ARTICLE 9 | INSURANCE | 43 |

Section 9.1. | Insurance | 43 |

ARTICLE 10 | CASUALTY DAMAGE | 43 |

Section 10.1. | Damage or Destruction | 43 |

Section 10.2. | Option to Terminate | 43 |

ARTICLE 11 | CONDEMNATION | 44 |

Section 11.1. | Condemnation of Substantially All of the Facility | 44 |

Section 11.2. | Condemnation of Part | 44 |

| Section 11.3. | Temporary Taking | 44 |

| Section 11.4. | Survival | 44 |

-iii-

TABLE OF CONTENTS (continued) | Page | |

ARTICLE 12 | DISTRIBUTIONS | 44 |

Section 12.1. | Priority Distributions | 44 |

Section 12.2. | Special Distribution to Calpine on Restatement Date | 45 |

Section 12.3. | Ordinary Distributions | 45 |

Section 12.4. | Restricted Distributions | 45 |

ARTICLE 13 | ALLOCATIONS OF PROFITS AND LOSSES | 45 |

Section 13.1. | Allocations of Profits | 45 |

Section 13.2. | Allocation of Losses | 46 |

Section 13.3. | Allocations Upon Liquidation of the Company | 46 |

Section 13.4. | Substantial Economic Effect of Allocations | 46 |

Section 13.5. | Minimum Gain Chargeback | 46 |

Section 13.6. | Member Minimum Gain Chargeback | 46 |

Section 13.7. | Qualified Income Offset | 47 |

Section 13.8. | Excess Losses | 47 |

Section 13.9. | Member Nonrecourse Deductions | 47 |

Section 13.10. | Nonrecourse Deductions | 47 |

Section 13.11. | Curative Allocations | 47 |

Section 13.12. | Code § 754 Adjustments | 48 |

Section 13.13. | Other Allocation Rules | 48 |

Section 13.14. | Code § 704(c) Allocations | 49 |

Section 13.15. | Special Calpine Allocations | 49 |

| ARTICLE 14 | DISPOSAL OF INTERESTS | 49 |

| Section 14.1. | Disposition by Members | 49 |

| Section 14.2. | Right of First Refusal | 49 |

-iv-

TABLE OF CONTENTS (continued) | Page | |

Section 14.3. | Further Requirements | 50 |

Section 14.4. | Equitable Relief | 51 |

Section 14.5. | Disposee to Become Member | 51 |

Section 14.6. | Sales of Interest in a Member | 51 |

ARTICLE 15 | DISSOLUTION AND WINDING UP | 52 |

Section 15.1. | Events of Dissolution | 52 |

Section 15.2. | Winding Up | 52 |

Section 15.3. | Objective of Winding Up | 54 |

Section 15.4. | Effect of a Member's Bankruptcy | 55 |

Section 15.5. | Application and Distribution of Company Assets | 55 |

Section 15.6. | Capital Account Adjustment | 55 |

Section 15.7. | Termination of the Company | 55 |

Section 15.8. | Deficit Capital Accounts | 55 |

ARTICLE 16 | TAXES | 56 |

Section 16.1. | Tax Matters Partner | 56 |

Section 16.2. | Tax Returns | 56 |

Section 16.3. | Tax Elections | 56 |

Section 16.4. | Survival of Tax Provisions | 57 |

ARTICLE 17 | LIABILITY, EXCULPATION AND INDEMNIFICATION | 57 |

Section 17.1. | Liability | 57 |

Section 17.2. | Exculpation | 57 |

| Section 17.3. | Duties and Liabilities of Covered Persons | 58 |

| Section 17.4. | Indemnification | 58 |

| Section 17.5. | Expenses | 59 |

-v-

TABLE OF CONTENTS (continued) | Page | |

ARTICLE 18 | DEFAULTS AND REMEDIES | 59 |

Section 18.1. | Defaults and Cure Periods | 59 |

Section 18.2. | Remedies of Non-Defaulting Member | 60 |

Section 18.3. | Notice; Termination | 61 |

Section 18.4. | No Pursuit of Project | 61 |

Section 18.5. | Defaulting Party's Loss of Representation and Voting Rights | 61 |

Section 18.6. | Interest on Overdue Obligations and Post-Judgment Interest | 61 |

Section 18.7. | No Waivers | 62 |

ARTICLE 19 | REPRESENTATIONS, WARRANTIES AND COVENANTS | 62 |

Section 19.1. | Due Organization | 62 |

Section 19.2. | Power and Authority | 62 |

Section 19.3. | Due Authorization | 62 |

Section 19.4. | Consents | 62 |

Section 19.5. | Binding Obligation | 62 |

Section 19.6. | No Violation | 62 |

Section 19.7. | No Litigation | 63 |

Section 19.8. | Taxes | 63 |

Section 19.9. | Authorized Signatory | 63 |

ARTICLE 20 | DISPUTE RESOLUTION | 63 |

Section 20.1. | Settlement By Mutual Agreement | 63 |

| Section 20.2. | Arbitration | 64 |

| Section 20.3. | Emergency Relief | 64 |

| Section 20.4. | Survival | 64 |

| ARTICLE 21 | TIME, APPROVALS AND CONSENTS | 64 |

-vi-

TABLE OF CONTENTS (continued) | Page | |

Section 21.1. | Time | 64 |

Section 21.2. | Approvals and Consents; Standards for Review | 64 |

ARTICLE 22 | GENERAL PROVISIONS | 65 |

Section 22.1. | Actual Damages | 65 |

Section 22.2. | Amendment | 65 |

Section 22.3. | Binding Effect | 65 |

Section 22.4. | Complete Agreement | 65 |

Section 22.5. | Confidentiality | 65 |

Section 22.6. | Counterparts | 66 |

Section 22.7. | Further Assurances | 66 |

Section 22.8. | Governing Law | 66 |

Section 22.9. | Headings; Table of Contents | 66 |

Section 22.10. | Interpretation and Reliance | 66 |

Section 22.11. | Notices | 66 |

Section 22.12. | Method and Timing of Payment | 66 |

Section 22.13. | Intellectual Property License | 67 |

Section 22.14. | Public Announcements | 67 |

Section 22.15. | Severability | 67 |

Section 22.16. | Third Party Beneficiaries | 67 |

| Section 22.17. | Purchase Procedures | 68 |

APPENDICES AND EXHIBITS | ||

| APPENDICES: | ||

| APPENDIX A | Glossary of Defined Terms and Rules as to Usage | |

| APPENDIX B | Members' Contributed Assets | |

APPENDIX C | Addresses for Notices; Description of Accounts |

-vii-

TABLE OF CONTENTS (continued) | Page | |

APPENDIX D | Arbitration Procedures | |

APPENDIX E | Members' Phase I Development Responsibilities | |

APPENDIX F | Reimbursable Member Expenses as of 1/31/00 | |

APPENDIX G | Required Provisions of Asset Management Policy Manual | |

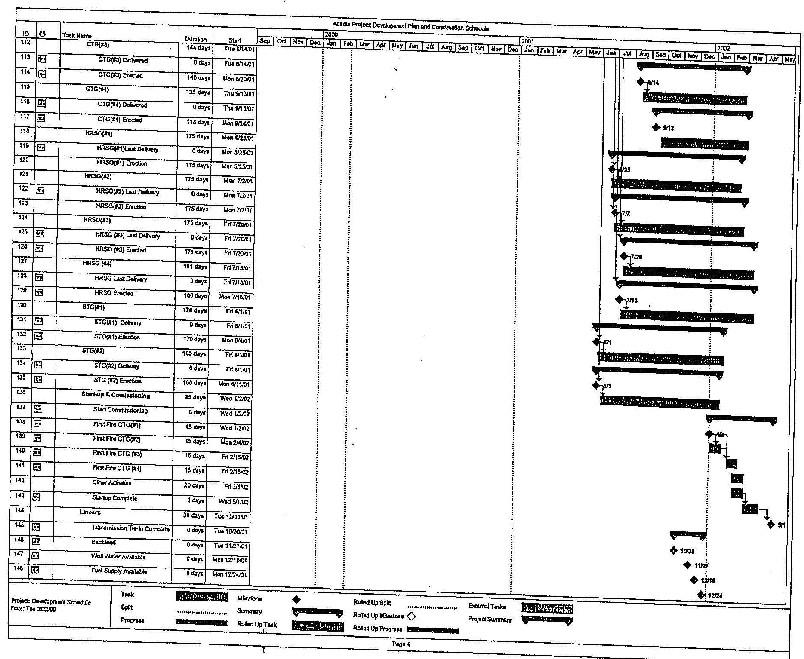

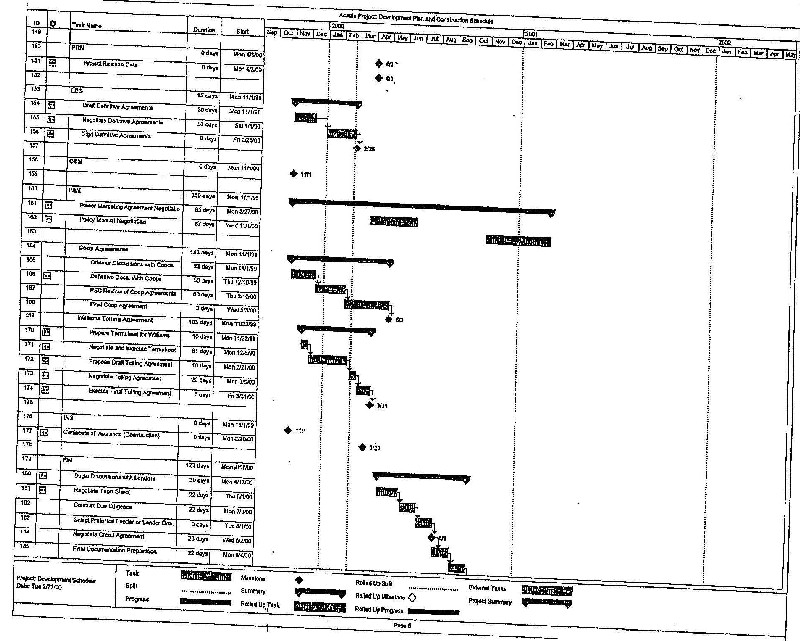

APPENDIX H | Development Plan and Construction Schedule | |

| EXHIBITS: | ||

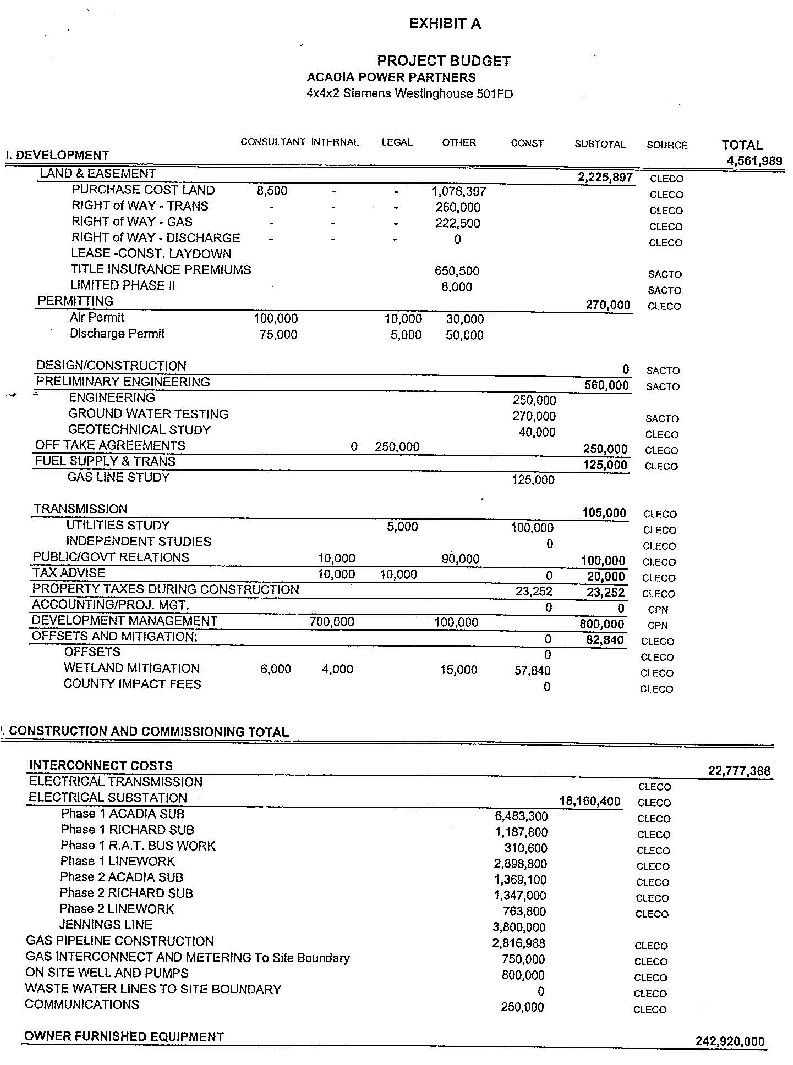

EXHIBIT A | Project Budget | |

EXHIBIT B | Initial Operating Budget | |

EXHIBIT C | Insurance Plan | |

EXHIBIT D | Legal Description of Facility Site |

-viii-

SECOND AMENDED AND RESTATED

LIMITED LIABILITY COMPANY AGREEMENT

OF

ACADIA POWER PARTNERS, LLC

PREAMBLE

LIMITED LIABILITY COMPANY AGREEMENT

OF

ACADIA POWER PARTNERS, LLC

PREAMBLE

This Second Amended and Restated Limited Liability Company Agreement (this "Agreement") of Acadia Power Partners, LLC, a Delaware limited liability company (the "Company"), is made as of May 9, 2003 ("Restatement Date"), by and between Calpine Acadia Holdings, LLC, a Delaware limited liability company ("Calpine"), and Acadia Power Holdings, LLC, a Louisiana limited liability company ("Acadia Holdings"), as the sole members of the Company.

WHEREAS, Cleco Midstream Resources, LLC, a Louisiana limited liability company ("CMR"), and IEP USA Holdings, L.L.C., a Delaware limited liability company ("IEP"), formed the Company as a Delaware limited liability company pursuant to the Delaware Limited Liability Company Act, 6 Del. Code § 18-101, etseq., as amended from time to time (the "Delaware Act"), by filing a Certificate of Formation of the Company with the office of the Secretary of State of the State of Delaware on October 13, 1999; and

WHEREAS, CMR and IEP adopted the initial Limited Liability Company Agreement of the Company on October 13, 1999 (the "Original Agreement"); and

WHEREAS, in the following order: (i) IEP conveyed its entire thirty percent (30%) Ownership Interest to Acadia Holdings by Assignment of LLC Interest dated effective as of February 28, 2000, (ii) CMR conveyed a twenty percent (20%) Ownership Interest to Acadia Holdings by Assignment of LLC Interest dated effective as of February 29, 2000, and (iii) CMR conveyed a fifty percent (50%) Ownership Interest to Calpine by Assignment of LLC Interest dated effective as of February 29, 2000 (together, the "Initial Conveyances"), with the resulting Ownership Interests in the Company being held fifty percent (50%) by Acadia Holdings and fifty percent (50%) by Calpine; and

WHEREAS, as part of the consideration for the Initial Conveyances, and as a condition thereto, Calpine and Acadia Holdings entered into the Amended and Restated Limited Liability Company Agreement of Acadia Power Partners LLC, dated as of February 29, 2000, which became effective upon the consummation of the last of the Initial Conveyances (the "Effective Time") as a comprehensive amendment and restatement of the Original Agreement, which Amended and Restated Limited Liability Company Agreement of Acadia Power Partners, LLC was subsequently amended by the First Amendment to Amended and Restated Limited Liability Company Agreement of Acadia Power Partners, LLC dated August 15, 2000, the Second Amendment to Amended and Restated Limited Liability Company Agreement of Acadia Power Partners, LLC dated November 3, 2000, the Third Amendment to Amended and Restated Limited Liability Company Agreement of Acadia Power Partners, LLC dated July 26, 2001 and the Fourth Amendment to Amended and Restated Limited Liability Company Agreement of

Acadia Power Partners, LLC dated July 27, 2001 (as amended through the Restatement Date, the "First Amended and Restated Agreement"); and

WHEREAS, the parties desire to amend and restate the First Amended and Restated Agreement hereby; and

WHEREAS, the parties hereto desire that, from and after the Effective Time, the Company shall continue to be governed by the Delaware Act and this Agreement;

NOW, THEREFORE, in consideration of the agreements and obligations set forth herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and intending to be legally bound, the parties agree as follows:

ARTICLE 1

DEFINITIONS

DEFINITIONS

Section 1.1. Definitions and Usage. Unless the context shall otherwise require, capitalized terms used in this Agreement shall have the meanings assigned to them in the Glossary of Defined Terms attached to this Agreement as Appendix A, which also contains rules as to usage that shall be applicable to this Agreement.

Section 1.2. Appendices and Exhibits. This Agreement consists of this document itself and the following Appendices and Exhibits which are specifically made a part of this Agreement by reference:

Appendix A Glossary of Defined Terms and Rules as to Usage

Appendix B Members' Contributed Assets

Appendix C Addresses for Notices; Description of Accounts

Appendix D Arbitration Procedures

Appendix E Members' Phase I Development Responsibilities

Appendix F Reimbursable Member Expenses as of 1/31/00

Appendix G Required Provisions of Asset Management Policy Manual

Appendix H Development Plan and Construction Schedule

Appendix B Members' Contributed Assets

Appendix C Addresses for Notices; Description of Accounts

Appendix D Arbitration Procedures

Appendix E Members' Phase I Development Responsibilities

Appendix F Reimbursable Member Expenses as of 1/31/00

Appendix G Required Provisions of Asset Management Policy Manual

Appendix H Development Plan and Construction Schedule

Exhibits:

Exhibit A Project Budget

Exhibit B Initial Operating Budget

Exhibit C Insurance Plan

Exhibit D Legal Description of Facility Site

Exhibit B Initial Operating Budget

Exhibit C Insurance Plan

Exhibit D Legal Description of Facility Site

Section 1.3. Headings. The headings and subheadings in this Agreement are included for convenience and identification only and in no way are intended to describe, interpret, define or limit the scope, extent or intent of this Agreement or any provision hereof.

-2-

Section 2.1. Formation. The Company was formed as a limited liability company under the laws of the State of Delaware on October 13, 1999, by the filing with the Secretary of State of Delaware of the Certificate of Formation under and pursuant to the Delaware Act and the issuance of a certificate of organization for the Company by the Secretary of State of Delaware. In connection therewith, CMR and IEP entered into the Original Agreement as the governing agreement for the Company. In connection with the acquisition by Calpine and Acadia Holdings of their respective fifty percent (50%) Ownership Interests in the Company, Calpine and Acadia Holdings, as the sole Members of the Company have entered into this Agreement, which is a comprehensive amendment and restatement of the Original Agreement in its entirety and shall supersede the Original Agreement effective as of the Effective Time.

Section 2.2. Name. The name of the Company is Acadia Power Partners, LLC. The business of the Company may be conducted upon compliance with Applicable Law under any other name designated by the Management Committee.

Section 2.3. General Purposes. The Company was formed for the object and purpose of, and the nature of the business to be conducted and promoted by the Company is, the design, development, procurement, construction, ownership, start-up, operation, management, Maintenance, repair and replacement as needed of the Facility and any portions thereof (the "Project") and the engagement in any and all activities necessary, incidental or related to the foregoing. As used in this Agreement, the term "Facility" refers to the following: a nominally rated one thousand megawatt (1,000 MW) natural gas-fired electric generation plant and all related equipment on the Facility Site and all other equipment, facilities and real property rights at or adjacent to the Facility Site reasonably necessary for operation of the Facility, including (a) the combustion and steam turbine generators, HRSGs, auxiliary equipment and control room, (b) the Interconnection Facilities and the associated easements and rights of way adjacent to the Facility Site, (c) all wastewater easements, systems and associated improvements, and (d) valves, switches, meters, wires, towers and control equipment.

Section 2.4. Specific Powers of Company. The Company shall have the power and authority to take any and all actions necessary, appropriate, proper, advisable, incidental or convenient to or for the furtherance of the purposes set forth in Section 2.3, including the power to:

-3-

Section 2.5. Principal Place of Business. The principal place of business of the Company shall initially be located in care of Cleco Midstream Resources, LLC, 2005 Vandevelde Avenue, Alexandria, Louisiana 71303 until such time as there is a business office and mailing address at the Facility Site in Acadia Parish, Louisiana. The Management Committee may, at any time, change the principal place of business of the Company and shall give notice to the Members of such change.

Section 2.6. Registered Agent and Office. The registered agent for service of process on the Company in the State of Delaware is Corporation Service Company, 1013 Centre Road, Wilmington, New Castle County, Delaware 19805, and the registered office of the Company in

-4-

the State of Delaware is Corporation Service Company at the same address. The Management Committee may, at any time, change the registered agent of the Company or the location of such registered office and shall give notice to the Members of such change.

Section 2.7. No State Law Partnership. Other than for federal tax and state income tax purposes, the Company shall not be considered a partnership (including a limited partnership) or joint venture, no Member shall be a partner or joint venturer of the other Member for any purposes other than federal tax and state income tax purposes, and this Agreement shall not be construed to suggest otherwise.

Section 2.8. Title to Company Assets. All property and assets, whether real, personal or mixed, or tangible or intangible, owned by the Company ("Company Assets") shall be deemed to be owned by the Company as an entity, and no Member, individually, shall have any ownership of such assets. All the Company Assets, including all the assets and properties contributed by the Members to the Company pursuant to this Agreement, shall be recorded as the property of the Company on its books and records, and all the Company Assets shall be held by the Company in its own name.

Section 2.9. Term and End of Term . The term of the Company's existence as a separate legal entity commenced upon the filing of the Certificate of Formation and shall, unless earlier terminated pursuant to the provisions hereof, continue in perpetuity (the "Term"). Notwithstanding the foregoing, no later than one (1) year prior to the fiftieth (50th) anniversary of the Commercial Operation Date (such period being the "Initial Term"), the Management Committee shall meet to determine whether to continue the operation of the Facility or to dissolve the Company and trigger the Windup Events.

(c) In the event that each Member wishes to purchase the other Member's Ownership Interest at the end of the Initial Term or the Extension Term then in effect, then the Members will be deemed to have decided to continue the operation of the Facility, and the Term of the Company will continue for an additional period of five (5) years ("Extension Term") commencing on the next day after the last day of the Initial Term or the previous Extension Term

-5-

Section 3.1. Members and Ownership Interests. Upon the making of the initial Capital Contributions set forth in Section 3.2, the Members shall have the following initial Ownership Interests in the Company:

Members | Ownership Interests |

Calpine | 50% |

Acadia Holdings | 50% |

3.2.1. Initial Capitalization. Contemporaneously with the execution and delivery of the Original Agreement, each Member made, or caused its Affiliate to make on its behalf, a Capital Contribution in cash in the following respective amounts:

Calpine | $1,000 |

Acadia Holdings | $1,000 |

These amounts have been added to the Capital Account of each respective Member.

3.2.2. In-Kind Contributions. On the Contribution Date (as defined below), each Member contributed, or caused its Affiliate to contribute on its behalf, to the Company the

-6-

respective assets and properties identified on Appendix B. All such assets and properties were contributed with warranties of title by, through or under the contributing Member, but not otherwise, free and clear of any and all liens or security interests or other claims by third parties, and any and all additional Encumbrances which could adversely affect the Company's ability, in keeping with the Operating Standards, to incorporate into, or use such asset or property in connection with, the Project. Upon such contribution, there was added to the Capital Account of each respective Member an amount equal to the sum of all Third Party Expenses incurred by the contributing Member in acquiring each such asset, as approved by the Management Committee, and the Members agreed that such an amount was the Fair Market Value as of the date of contribution of each such asset. Each Member shall keep accurate and complete records of all Third Party Expenses incurred by it or its Affiliates in acquiring assets that are contributed to the Company and, to assist the Management Committee in determining the amount to be added to the contributing Member's Capital Account with respect to each contributed asset, each Member shall provide such documentation of its expenses as the Management Committee may request. The Members agree that the aggregate Third Party Expenses incurred as of January 31, 2000 by each Member in acquiring the assets identified on Exhibit B to be contributed by such Member to the Company are the amounts set forth on Exhibit B. Upon conveyance, such assets and property shall become Company Assets. On the Contribution Date (after the appropriate additions to the Capital Accounts have been made), the Member whose Capital Account balance was lower contributed, or caused its Affiliate to contribute on its behalf, cash in an amount equal to the difference between its Capital Account balance and the other Member's Capital Account balance so that, as a result, the Members' Capital Accounts was equal on the Contribution Date.

3.2.3. Actions Prior to Contribution Date . From and after the Effective Time, as part of its Phase I development responsibilities under Appendix E, Calpine covenants to (i) pursue negotiations with each respective vendor as to the final form of the Combustion Turbine Purchase Contract, the Steam Turbine Purchase Contract and the HRSG Purchase Contract and (ii) make all payments that (1) may be required by such vendors in order to reserve such equipment prior to the date such contracts are executed by the Company or (2) may be required under such contracts once signed by Calpine on the Management Committee's direction, prior to the date such contracts are contributed and assigned by Calpine to the Company, in each case as necessary to timely secure such equipment for the Project in accordance with the Development Plan and Construction Schedule attached as Appendix J (the "Development Plan"). Payments made by Calpine pursuant to clause (ii) of the preceding sentence shall constitute Third Party Expenses, the amount of which shall be added to Calpine's Capital Account in accordance with Section 3.2.2. The Combustion Turbine Purchase Contract, the Steam Turbine Purchase Contract and the HRSG Purchase Contract shall each require the approval of the Management Committee in advance of their execution. These contracts are anticipated to be entered into by and between the Company and the respective vendors on or after the Contribution Date; however, if so directed by the Management Committee, Calpine will enter into one or more of such contracts on or before the Contribution Date, and if so, in accordance with the provisions of Section 3.2.4, Calpine will assign and contribute such contracts to the Company (and obtain all necessary consents from such vendors as may be required for such assignment). Calpine guarantees that the purchase price for each of the four (4) F class combustion turbine generators to be purchased under the Combustion Turbine Purchase Contract will not exceed $34,500,000 (except to the extent changes in the scope of the Project result in a higher cost), and Calpine will

-7-

pay any amount per turbine in excess of such price without being entitled to reimbursement by the Company or to any addition to its Capital Account for such excess cost.

3.2.4. Contribution Date; Contribution Deadline. The “Contribution Deadline” shall be the date that is forty-five (45) days after the Effective Time or, if such day is not a Business Day, the next Business Day. The “Contribution Date” shall be the date that is three (3) Business Days after the date on which both the Company and Siemens Westinghouse Power Corporation have executed the Combustion Turbine Purchase Contract (or, as the case may be, the date on which the Combustion Turbine Purchase Contract previously executed by Calpine, on the Management Committee’s direction, and Siemens Westinghouse Power Corporation is assigned by Calpine to the Company). If the Combustion Turbine Purchase Contract is not executed by the Company (or executed by Calpine and assigned to the Company) on or before the Contribution Deadline, Acadia Holdings, in its sole discretion, may elect, by written notice to Calpine, either to (a) extend the Contribution Deadline for a reasonable time in order for the Combustion Turbine Purchase Contract to be executed by the Company (or executed by Calpine and assigned to the Company, if the Management Committee so directs), not to exceed sixty (60) days after the original Contribution Deadline, or (b) trigger the Windup Events in accordance with Article 15. Failure by Acadia Holdings to provide notice in the foregoing circumstance within five (5) Business Days following the original Contribution Deadline shall be deemed an election to extend the Contribution Deadline until the sixtieth (60th) day after the original Contribution Deadline. If Acadia Holdings elects to extend the Contribution Deadline, but the Combustion Turbine Purchase Contract is not executed by the Company (or executed by Calpine and assigned to the Company) on or before the extended Contribution Deadline, the Windup Events shall be commenced in accordance with Article 15. If the Windup Events are commenced under this Section 3.2.4, then, notwithstanding anything to the contrary in Section 15.2.3, following reasonable advance notice by Acadia Holdings to Calpine, within three (3) Business Days after Acadia Holdings tenders reimbursement to Calpine for all payments made by Calpine to the steam turbine generator vendor to reserve the steam turbine generators for the Project and under the Steam Turbine Purchase Contract, Calpine shall assign to Acadia Holdings the Steam Turbine Purchase Contract (provided the Steam Turbine Purchase Contract was previously entered into by Calpine).

3.3.1. Maximum Aggregate Capital Contributions. Subject to the provisions of Section 3.4, each Member agrees to make such further Pro Rata Capital Contributions necessary to fund the Project Costs as they are incurred in accordance with the drawdown schedule attached to the Project Budget and Section 6.1; provided, however, that each Member's aggregate Capital Contribution obligations, including all contributions pursuant to Section 3.2.2, shall not exceed the amount set forth below opposite such Member's name unless otherwise agreed to by such Member:

Calpine | $250,000,000 |

Acadia Holdings | $250,000,000 |

-8-

3.3.2. Maximum Aggregate Capital Contribution Reduced by Guarantees. Notwithstanding Section 3.3.1, the maximum aggregate Capital Contribution obligations set forth above for a Member shall be reduced (but not below zero) on a dollar-for-dollar basis by the maximum aggregate payment obligation then currently guaranteed from time to time by such Member or such Member’s Affiliate or Affiliates under Third Party Guarantee(s) for so long as such Third Party Guarantee(s) continue to be in effect.

3.3.3. Payments by Affiliate Guarantors Prior to Commercial Operation Date. Any amount actually paid before the Commercial Operation Date by an Affiliated Guarantor under a Third Party Guarantee will be (i) deemed to be a Capital Contribution of the Member that is, or is an Affiliate of, such Affiliated Guarantor, (ii) applied against and reduce such Member's obligations to make Capital Contributions that next come due following the date of payment, and (iii) added to the Capital Account of such Member in accordance with Section 3.7(a) as of the date of payment. The foregoing shall be in lieu of any rights of subrogation or similar rights that the Affiliated Guarantor may otherwise have under Applicable Law.

3.3.4. Payments by Affiliate Guarantors On or After Commercial Operation Date. Any amount actually paid on or after the Commercial Operation Date by an Affiliated Guarantor under a Third Party Guarantee will, as of the date of payment, automatically become a Subordinated Obligation (as defined in Section 3.3.5) in favor of such Affiliated Guarantor.

3.3.5. Subordinated Obligations. For purposes of this Section 3.3, "Subordinated Obligation" means an obligation of the Company that is subordinated in right of payment to all operating expenses of the Company and to all debt service owing to any Person that is not a Member or an Affiliate of any Member, but that is senior in right of payment to any and all other debt service or debt obligations of the Company to any Member or any Affiliate of any Member (including any Contribution Loan) and senior in right of payment to all distributions in respect of Ownership Interests. If the Company's available cash at any time is insufficient to pay all outstanding Subordinated Obligations at that time, the available cash shall be applied to the outstanding Subordinated Obligations pro-rata according to the respective outstanding amounts of the Subordinated Obligations. Any amount owing as a Subordinated Obligation hereunder shall accrue interest at the Default Rate from the date such obligation arose by virtue of an Affiliate Guarantor's payment under a Third Party Guarantee until the date the Company repays the applicable Affiliated Guarantor.

3.4.1. Opt-Out Notice and Non-Electing Member's Election. Notwithstanding the provisions of Section 3.3, at any time prior to the Commercial Operation Date, either Member (the "Electing Member") may make a one-time election to terminate its obligation to fund any future Capital Contributions by delivering notice thereof (the "Opt-Out Notice") to the other Member (the "Non-Electing Member"), and upon completion of the procedures in this Section 3.4, to terminate all its obligations to make any future Capital Contributions to the Company. In such event, any future failure to fund Capital Contributions by the Electing Member (except as required in this Section 3.4) shall not constitute an Event of Default hereunder. The Opt-Out Notice shall state that the Electing Member has elected to terminate its

-9-

obligation to fund any future Capital Contributions required under this Agreement and shall either (i) offer to sell to the Non-Electing Member or its designee all of the Electing Member's Ownership Interest for a sum equal to ninety-seven and one half percent (97.5%) of the Electing Member's Capital Account balance as of the date of the Opt-Out Notice plus one hundred percent (100%) of such Member's Capital Contributions funded following delivery of the Opt-Out Notice or (ii) request that the Non-Electing Member assume the Electing Member's obligation to fund its Pro Rata share of all future Capital Contributions required under this Agreement following the thirtieth (30th) day after delivery of the Opt-Out Notice. An Opt-Out Notice shall be irrevocable. Regardless of which option the Electing Member offers the Non-Electing Member, the Electing Member shall continue to be obligated to fund its Pro Rata share of all Capital Contributions required under this Agreement during the thirty (30) day period following delivery of the Opt-Out Notice. On or before the thirtieth (30th) day following delivery of the Opt-Out Notice, the Non-Electing Member shall, by notice to the Electing Member, either (a) accept the offer given the Non-Electing Member to buy, or cause its designee to buy, the Electing Member's Ownership Interest or fund the Electing Member's Pro Rata share of future Capital Contributions or (b) elect to trigger the Windup Events in accordance with Article 15. Failure by the Non-Electing Member to deliver such notice shall be deemed an election to trigger the Windup Events. In the event the Non-Electing Member elects to trigger the Windup Events, the Electing Member's election to terminate its obligations hereunder shall be deemed null and void, and all Members shall continue to be bound by their respective obligations hereunder until the Windup Events have been concluded and the Company is terminated.

3.4.2. Buy-Out of Ownership Interest. In the event the Electing Member offers to sell its Ownership Interest to the Non-Electing Member and the Non-Electing Member accepts such offer, the purchase and sale of the Electing Member’s Ownership Interest shall close on the date that is ninety (90) days following receipt by the Non-Electing Member of the Electing Member’s Opt-Out Notice. The purchase price for the Electing Member’s Ownership Interest, calculated in accordance with clause (i) of the third sentence of Section 3.4.1, shall be paid at closing. The Electing Member shall convey its Ownership Interest to the Non-Electing Member or its designee at closing free and clear of any and all Encumbrances or claims by third parties (other than a security interest securing any Project Financing previously or concurrently approved by the Management Committee), and the Electing Member shall give such warranties and representations of title, corporate authority and due authorization to the Non-Electing Member as are customary in a sale of a membership interest in a closely held limited liability company.

3.4.3. Funding of Electing Member’s Pro Rata Share. In the event the Electing Member offers the Non-Electing Member the right to assume the Electing Member’s obligation to fund its Pro Rata share of Capital Contributions required under this Agreement, and the Non-Electing Member accepts such offer, the Non-Electing Member shall be obligated to fund the Electing Member’s Pro Rata share of all future Capital Contributions required by this Agreement, as an additional Capital Contribution, following the thirtieth (30th) day following receipt by the Non-Electing Member of the Electing Member’s Opt-Out Notice. Upon each such contribution, the Ownership Interests of the Members shall be automatically adjusted to correspond to the percentage each Member’s Capital Contributions bears to the aggregate of all

-10-

Members' Capital Contributions. The Management Committee shall give all Members notice of such adjustment to the Ownership Interests and the Capital Accounts.

Section 3.7. Capital Accounts. Separate Capital Accounts shall be maintained for each Member and shall consist of the sum of (a) the cumulative amount of any cash contributed or deemed to have been contributed to the capital of the Company by such Member; plus (b) the Gross Asset Value, as of the date of contribution, of any property other than cash contributed to the capital of the Company by such Member (net of liabilities secured by such contributed property that the Company is considered to assume or take subject to under Section 752 of the Code); plus (c) the cumulative amount of the Company’s Profits that has been allocated to such Member hereunder; plus (d) any items in the nature of income or gain which are specially or curatively allocated pursuant to Sections 13.3 through 13.10; plus (e) the amount of any Company liabilities assumed by such Member or which are secured by any asset of the Company distributed to such Member; minus (f) the cumulative amount of cash and the Gross Asset Value, as of the date of distribution, of all other property that has been distributed to such Member or deemed to have been distributed to such Member hereunder by the Company (net of liabilities

-11-

secured by such distributed property that the Member is considered to assume or take subject to under Section 752 of the Code); minus (g) the cumulative amount of the Company's Losses that have been allocated to such Member hereunder; minus (h) any items in the nature of deductions or losses which are specially or curatively allocated pursuant to Sections 13.3 through 13.10 hereof; minus (i) the amount of any liabilities of such Member assumed by the Company or which are secured by any property contributed by such Member to the Company. All of the provisions of this Agreement relating to the maintenance of Capital Accounts are intended to comply with Treasury Regulations Section 1.704-1(b) or any successor Treasury Regulations governing the treatment of capital accounts and shall be interpreted and applied in a manner consistent with such Treasury Regulations.

Section 3.8. Non-Liability of Members. No Member shall be liable for the debts, liabilities, contracts or other obligations of the Company except to the extent of any unpaid Capital Contributions such Member is required to make to the Company pursuant to the terms of this Agreement and such Member’s share of the assets (including undistributed revenues) of the Company.

Section 3.9. Partition. Each Member waives any and all rights that it may have to maintain an action for partition of the Company Assets.

Section 3.10. Resignation. Except as provided herein, a Member may not resign from the Company prior to the dissolution of the Company and conclusion of the Windup Events.

ARTICLE 4

MEMBERS AND MANAGEMENT

MEMBERS AND MANAGEMENT

Section 4.1. General Management Authority. The business of the Company shall be managed by the Management Committee which shall have exclusive authority and full discretion with respect to management of the business of the Company, the right to exercise the powers of the Company described in Section 2.4 and the right and authority to delegate any of its powers to one or more delegees. Any reference in this Agreement to voting by the Members shall mean voting by the Management Committee. No Member shall have authority to act for, or to assume any obligation or responsibility on behalf of, the Company except with the prior approval of the Management Committee. Without limiting its general powers under this Section 4.1 and subject to the other provisions hereof, the Management Committee is hereby specifically empowered to:

(d) Approve any expenditures out of contingency funds and requests for additional Capital Contributions;

-12-

Section 4.2. Day to Day Management Responsibility; Operations and Maintenance. Except to the extent delegated by the Management Committee pursuant to this Agreement, the Project Management Agreement or otherwise, responsibility for the day to day management of the business affairs of the Company shall remain with the Management Committee.

4.2.1. O&M Arrangements. Not later than three hundred sixty-five (365) days before the anticipated Commercial Operation Date, the Management Committee shall negotiate and cause the Company to enter into one or more Affiliate Contracts or commercially reasonable contractual arrangements with one or more third parties for the provision of O&M Services at the Facility (the "O&M Arrangements") by the Operator. Consideration of the proposed O&M Arrangements, even if they include one or more Affiliate Contracts, will not be a Disqualified Matter. The O&M Arrangements shall provide for O&M Services to be performed under the direction of the Plant Manager, who shall be an employee of the Project Management Company. The O&M Arrangements will impose upon the Plant Manager reasonable duties to report to the Management Committee and keep it regularly informed as to Facility operations. "O&M

-13-

Services" will consist of all routine Maintenance for the Facility and other operational functions designated by the Management Committee, which may include the following:

(n) Preparing and maintaining for the Company complete written operating instructions and Maintenance procedures required for the Facility (including a preventive Maintenance program); and

-14-

If the Management Committee does not agree on the final form of the O&M Arrangements, the matter shall constitute a Dispute or Controversy that shall be resolved in accordance with Article 20.

4.2.2. Major Maintenance Arrangements. Not later than one-hundred eighty (180) days before the Commercial Operation Date, the Management Committee shall negotiate and cause the Company to enter into one or more Affiliate Contracts or commercially reasonable contractual arrangements with one or more third parties for the provision of Major Maintenance Services at the Facility (“Major Maintenance Arrangements”). Consideration of the proposed Major Maintenance Arrangements, even if they include one or more Affiliate Contracts, will not be a Disqualified Matter. “Major Maintenance Services” will consist of all non-routine Maintenance for the Facility, including overhauls and major Maintenance work required for the combustion turbine generators, steam turbine generators and heat recovery steam generators, and other similar or related functions designated by the Management Committee. Because each Member is qualified and willing to provide certain of the Major Maintenance Services to the Project below the market rate for such services, the Management Committee shall give special preference to (a) an Affiliate Contract with Calpine or its Affiliate for the performance of major Maintenance work on the Facility’s combustion turbine generators and (b) an Affiliate Contract with Acadia Holdings or its Affiliate for the performance of the other Major Maintenance Services. If the Management Committee does not agree on the final form of the Maintenance Arrangements, the matter shall constitute a Dispute or Controversy that shall be resolved in accordance with Article 20.

4.2.3. Owner's Representative. Under Section 4.5 of the O&M Agreement, the Company has the right to determine that Cleco may substitute one of its (or its Affiliates') employees for an employee of the operator under the O&M Agreement in a supervisory level position under the Plant Manager. In the event that the Management Committee reaches a deadlock on the issue of whether to allow Cleco to make such a substitution under the O&M Agreement, Acadia Holdings shall have the right (without the consent or approval of any other Member) to place an employee of Cleco (or one of its Affiliates) at the Facility Site as an Owner's representative.

4.2.4. Replacement Upon Event of Default and Termination of PPA. If (i) there occurs an Event of Default (as defined in the 2001 PPA or the 2003 PPA) by Calpine Energy, or any successor or assignee to Calpine Energy under the 2001 PPA or the 2003 PPA that is an Affiliate of Calpine Parent, and (ii) the Company terminates one or both PPAs due to such Event of Default, then upon request by Acadia Holdings, within thirty (30) days following the date of such request:

-15-

This Section 4.2.4 constitutes the prior written consent of the Company to the foregoing assignment and assumption in accordance with Section 12.1 of the O&M Agreement and Section 12.1 of the Project Management Agreement.

4.3.1. Member’s Representatives. The Management Committee shall consist of two (2) representatives for each of Calpine and Acadia Holdings (each a “Representative”). There shall also be one alternate designated for each Representative (each an “Alternate”), who shall have authority to act in the absence of either or both of its Representatives. Any Member may at any time, by prior notice to the other Member, remove its Representative(s) or Alternate(s) on the Management Committee and designate a new Representative(s) or Alternate(s). Each Representative shall serve on the Management Committee until his or her successor shall be duly designated or until his or her death, resignation or removal by the Member that appointed him or her. Any right or privilege of a Representative hereunder may, in the absence of the Representative, be exercised by its Alternate, and references herein to any rights or privileges of a Representative shall mean the “Representative or its Alternate acting on behalf of the Representative.” The participation and acts (including the execution of any documents) by an Alternate shall be deemed to be the act of the Representative(s) for whom such Alternate is acting without any evidence of the absence or unavailability of such Representative(s). Any decision by the Management Committee, and any action taken by the Company in compliance with the direction of the Management Committee pursuant to its authority hereunder, shall be binding on the Company and each Member, whether such direction was approved in accordance with the provisions hereof by the Representatives or one or more of the Alternates acting on behalf of their respective Representative(s). Each Member shall promptly give notice to the other of any change in the business address or business telephone of any of its Representatives or Alternates. As of the Restatement Date, the Members designate the following individuals as their Representatives and Alternates:

Position | Calpine | Acadia Holdings |

Representative | Woody Saylor | Samuel Charlton, III |

Representative | Robert Regan | Bill Fontenot |

Alternate | Andre K. Walker | Keith Johnson |

Alternate | Steve Dowdy | Chuck Murray |

The Management Committee may adopt such rules of order, by-laws and policy statements and directives as it considers necessary or appropriate for the conduct of its business and that of the Company. Each Member shall use reasonable efforts to cause its Representatives or Alternates to attend each meeting of the Management Committee, and no Member shall withhold the presence or participation of its Representatives or Alternates to forestall decisions in matters relating to the Project. An Alternate may take the place of one or both of its Member's Representatives at a meeting. Other employees or agents of the Members may also attend meetings.

-16-

4.3.2. No Fiduciary Duties of Representatives and Alternates. To the fullest extent permitted by Applicable Law, including Section 18-1101(c) of the Delaware Act, each Representative and each Alternate shall be deemed an agent of the Member that designated such Representative or Alternate and shall have no duty (fiduciary or otherwise) to the Company or to the other Member. Each Member, by execution of this Agreement, agrees to, consents to, and acknowledges the delegation of powers and authority to the Management Committee, and to actions and decisions of the Management Committee within the scope of the Management Committee’s authority as provided herein.

4.3.3. Regular Meetings. Unless otherwise agreed by the Management Committee, the Management Committee shall meet at least once each Month on the third Tuesday of the Month.

4.3.4. Special Meetings. In addition to its regular monthly meetings, special meetings of the Management Committee may be called by the Chairman of the Management Committee upon the request of a Member, any Representative, the Project Director, the Construction Manager or the Plant Manager, as applicable.

4.3.5. Telephonic Meetings Permitted. Representatives and Alternates, or any committee designated by the Management Committee, may participate in a meeting thereof by means of conference telephone or similar communications equipment by means of which all persons participating in the meeting can hear each other, and such participation in a meeting shall constitute presence in person at such meeting.

(a) A Calpine Representative shall act as Chairman of the Management Committee from the Effective Time until the Commercial Operation Date. As of the Restatement Date, Samuel Charlton, III has been designated as the Chairman of the Management Committee. Chairmanship of the Management Committee shall rotate between the Members every two (2) Fiscal Years during the Term, such rotation to be effective on January 1 of every other Fiscal Year. The Chairman shall at all times be one of the Representatives. The Chairman of the Management Committee shall provide notice to each Representative stating the place, date and hour of each meeting of the Management Committee, together with an agenda for the meeting, not less than ten (10) days before the date of the meeting (unless such notice is waived by each Member's Representatives either at the meeting or by written consent). The Chairman of the Management Committee shall include on the agenda any items that a Member or a Representative requests in advance to be included. At least five (5) days before each meeting (or if the meeting is called on shorter notice, as far in advance as is practicable under the circumstances), detailed information on the matters to be considered by the Management Committee will be provided to each Representative. The Chairman shall have the authority to sign for and bind the Company to all agreements, subject to the prior approval of the Management Committee. The Chairman will have the same voting power as the other Representatives and will not have any right to cast any tie-breaking or special vote of any kind.

-17-

commencement of such meeting, shall have no power to vote on any matters but may participate in discussions in accordance with the Management Committee's rules of order.

4.3.7. Voting of Ownership Interest. Each Representative’s vote shall represent one half (½) of the Ownership Interest in the Company then owned by the Member that appointed such Representative. If only one Representative of a Member is present, in person or by telephonic means, at a Management Committee meeting, such Representative shall be entitled to cast two (2) votes that together represent the full Ownership Interest then owned by the Member that appointed such Representative.

4.3.8. Quorum; Simple Majority Vote Required for Action. The Management Committee may act only if a quorum is present, whether in person or by telephonic means. A quorum shall consist of Representatives representing a Simple Majority. Except as set forth in Sections 4.3.9 and 4.3.10, the Management Committee shall act by a Simple Majority vote cast by the Representative(s) at a meeting at which a quorum of the Representative(s) are present. In the event that a Simple Majority vote is not reached on a matter before the Management Committee requiring a Simple Majority vote, such event shall constitute a Dispute or Controversy, and either Member may seek resolution of such matter under the terms of Article 20. In the event that a Simple Majority decision is reached, the matter shall be acted upon by the Company.

4.3.9. Super Majority Vote on Certain Matters. The following matters shall require a Super Majority vote by the Representative(s) at a meeting at which a quorum of the Representative(s) are present in order to be acted upon by the Company:

By contrast to matters requiring approval by a Simple Majority vote under Section 4.3.8, failure to secure a Super Majority vote on any matter that requires approval by Super Majority vote under this Section 4.3.9 shall not constitute a Dispute or Controversy and shall not be subject to resolution under the terms of Article 20.

-18-

4.3.10. Unanimous Approval Required. The following matters shall require a vote of one hundred percent (100%) of the Ownership Interests in order to be acted upon by the Company:

By contrast to matters requiring approval by a Simple Majority vote under Section 4.3.8, failure to secure a unanimous vote on any matter that requires approval by unanimous vote under this Section 4.3.10 shall not constitute a Dispute or Controversy and shall not be subject to resolution under the terms of Article 20.

4.3.11. Action Without a Meeting. Any action required by the Delaware Act to be taken at a meeting of the Members, or any action which may be taken at a meeting of the Management Committee or of any committee established by the Management Committee, may be taken without a meeting if all Representatives, or all members of such committee established by the Management Committee, consent thereto in writing, and the writing or writings are filed with the minutes of the proceedings of the Management Committee or such committee, as the case may be. A telegram, telex, cablegram or similar transmission by a Representative, or a photographic, photostatic, facsimile or similar reproduction of a writing signed by a Representative, shall be regarded as signed by the Representative for purposes of this Section 4.3.11.

4.3.12. Management Committee Compensation. Representatives and Alternates shall not be entitled to any compensation for their services as members of the Management Committee.

4.3.13. Duties of Members. Each Member and its Affiliates, in connection with the business and affairs of the Company, and in exercising such Member's discretion under this Agreement, shall to the fullest extent permitted by Section 18-1101(c) of the Delaware Act, be entitled to consider such interests and factors as such Member desires, including its own interest and the interest of its Affiliates, and shall have no duty or obligation to give any consideration to any interest of, or factors affecting, the Company or any other Member.

4.4.1. Arms' Length Basis for Affiliate Contracts. The Members or their Affiliates shall not be precluded from providing goods and/or services to the Project. All contracts for the provision of goods and/or services to the Project by a Member or an Affiliate thereof ("Affiliate Contracts") shall be negotiated and administered in good faith on an arms' length basis and, at the time of execution, have terms at least as favorable to the Project as those available in the market from unaffiliated third parties. Except as provided below, upon execution

-19-

of any Affiliate Contract approved by the Management Committee, each Member shall be deemed to have waived any right to object to the terms of such Affiliate Contract on the grounds of the absence of good faith, lack of arms' length negotiations or the presence of terms not at least as favorable to the Project as those available in the market from unaffiliated third parties; provided, however, that (a) if a Member whose Representative(s) voted against approval of an Affiliate Contract owned less than a forty-five percent (45%) Ownership Interest in the Company at the time of such vote, such Member shall not be deemed to have waived any right to object to the terms of the Affiliate Contract on the grounds of the absence of good faith, lack of arms' length negotiations or the presence of terms not at least as favorable to the Project as those available in the market from unaffiliated third parties and (b) such Member's objection to the terms of such Affiliate Contract shall constitute a Dispute or Controversy for resolution in accordance with Article 20.

4.4.2. Disqualified Matters. So long as each Member owns at least a forty-five percent (45%) Ownership Interest, in the event that a Member or any of its Affiliates is a party to an Affiliate Contract, then (a) such Member's Representatives on the Management Committee shall be disqualified from voting on decisions or actions involving a Disqualified Matter as to the Affiliate Contract and (b) the Representatives who are not disqualified shall vote on such Disqualified Matter in accordance with the best interests of the Company. "Disqualified Matters" means actions by the Company or by the Management Committee on behalf of the Company in response to a breach of or default (or alleged breach or default) under the subject Affiliate Contract (such as a waiver of the breach or default, notice of breach or event of default or notice of termination for breach in accordance with the terms of the Affiliate Contract) or enforcement or exercise of any of the Company's rights or remedies in respect to such breach or default (or alleged breach or default). Disqualified Matters shall not include the initial approval of an Affiliate Contract or matters other than those relating to a breach or default that may arise during the term of an Affiliate Contract, such as an amendment of the terms thereof requested by any party thereto, renewal or extension of the Affiliate Contract or the terms applicable to the renewal period, or a decision to select or approve the Project Director, Construction Manager, Asset Manager or Plant Manager. In the event a proposal includes Disqualified Matters and matters other than Disqualified Matters, then such matters shall be presented as separate proposals to the Management Committee. The Representatives who are disqualified from voting on a Disqualified Matter shall not be excluded from discussions of the Disqualified Matter, and shall receive notice of the intent to vote on the Disqualified Matter and an opportunity to be heard on the matter prior to such vote. Nothing herein shall prohibit the counterparty to any Affiliate Contract from enforcing its rights under the Affiliate Contract or contesting any determination of a breach or default under the Affiliate Contract.

4.4.3. Liability for Actions. In the event that an Affiliate that was determined by the Management Committee to be in breach or default of an Affiliate Contract pursuant to a vote on a Disqualified Matter is subsequently found, in a final, nonappealable judgment or binding arbitral decision, not to have been in such breach or default to the extent claimed by the Management Committee, the Member who was not disqualified from voting with respect to such matter shall indemnify and hold the Company harmless against any liability or damages due to the Affiliate as a result thereof.

-20-

4.4.4. Conflicts of Interest; Competition with Project. Subject to the other express provisions of this Agreement, each Member and its Affiliates, at any time and from time to time may possess business interests and engage in business activities in addition to those relating to the Project, including business interests and activities in direct competition with the Project. Neither Member nor its Affiliates shall have any rights by virtue of this Agreement in any outside business ventures of the other Member or its Affiliates. No Member or its Affiliates shall have any obligation to offer the other Member or any Affiliate thereof the right to participate in any outside business venture and in no event shall such Member or Affiliate have any liability to the other Member or any Affiliate thereof under the "corporate opportunity" or similar doctrine.

4.4.5. Substitution for Credit Support. As of the Effective Time, Calpine Parent entered into the Calpine Limited Guaranty and Cleco entered into the Cleco Limited Guaranty. Each of Calpine and Cleco shall have the right at any time during the Term to substitute and replace such guaranty or credit support with such assurances and other credit support as are acceptable to both Members.

4.4.6. Certain Actions Under Calpine 2001 PPA Guaranty. Under Section 6(d) of the Calpine 2001 PPA Guaranty, the Company has the right in specified circumstances to take certain actions and make certain elections with respect to credit support to be provided by or on behalf of Calpine Parent. Notwithstanding anything to the contrary, Acadia Holdings shall have the sole right on behalf of the Company (without the consent or approval of any other Member) to take all actions and make all elections provided for on the Company's part in Section 6(d) of the Calpine 2001 PPA Guaranty and all such actions taken and elections made by Acadia Holdings shall be binding on the Company.

Section 5.1. Owner Construct. By entering into this Agreement the Members have committed to the construction and operation of the Facility subject to the terms and conditions of this Agreement. It is understood and agreed that the Company intends to construct the Facility on an "owner construct" basis by entering into the Construction Agreements, and there will not be a turnkey contract for the design, procurement, construction or commissioning of the Facility, subject to the Company entering into the Construction Agreements (including provisions adequately addressing matters such as schedule and performance guarantees and associated liquidated damages and remedies, warranties, allocation of risk for Force Majeure and other matters, step-in rights in the case of non-performance or inadequate performance, and credit support) in form and substance acceptable to the Management Committee and sufficient to support a Project Financing on commercially reasonable terms.

Section 5.2. Phases of Development. The Project shall be developed by the Company in the following phases, each of which is outlined in detail below:

-21-

(if any) of the Project (the "Phase I Activities"), including (i) due diligence, (ii) updating of the Development Plan, (iii) updating of the Project Budget and Initial Operating Budget, (iv) preparation, negotiation and execution of the Project Agreements, (v) applying for and obtaining Necessary Regulatory Approvals (other than those which cannot be applied for or obtained until after the Commercial Operation Date), (vi) negotiation of and entering into such other arrangements and contracts as are necessary or advisable to construct or operate the Facility, and (vii) design and engineering activities. The Phase I Activities shall exclude the Phase II Activities.

5.3.1. Role of Project Director. Responsibility for coordinating Phase I Activities shall rest primarily with the Project Director, who shall be the Company’s individual representative authorized and empowered to act for and on behalf of the Company on matters relating to the development of the Project (the “Project Director”), in compliance with the Development Plan. The Project Director shall be subject to and shall follow the overall direction of the Management Committee. In the event of an inconsistency between the directives of the Management Committee and the Project Management Company or any other Person (other than a Governmental Authority), the Project Director shall follow the Management Committee’s directives. The prior authorization of the Management Committee shall be required before the Project Director may make any commitments or take on any liabilities or obligations that are binding on the Company. Without limiting the general nature of his or her accountability to the Company, and subject to the other provisions of this Section 5.3, the Project Director shall (a) lead in planning and conducting negotiations with the counterparties to any Project Agreement as to which neither Member has responsibility under Section 5.4, (b) co-ordinate all activities for which each Member has responsibilities under Section 5.4, (c) establish formal lines of communications with the Management Committee to coordinate his or her activities and keep the Management Committee and the Members informed on a timely basis of matters relating to the Project, and (d) carry out any other function in relation to the Project delegated to or required of him or her by the Management Committee.

5.3.2. Powers and Authority. The Project Director shall have all necessary powers and authority to enable him or her to execute and carry out the day to day administration of the Project until the Project Director Discharge Date. For the period of his or her service as Project Director, the Company shall be bound by the written communications, directions,

-22-

requests and decisions given or made by the Project Director (to the extent approved by the Management Committee), and all third parties engaged in connection with the development of the Project, including the Project Management Company, shall be entitled to rely thereon.

5.3.3. Reporting Responsibilities. The Project Director shall furnish monthly progress reports to the Management Committee and otherwise consult with the Management Committee on a regular basis as to its directives and the progress of the Project. In addition, the Project Director will hold weekly status meetings in order to keep all participants fully informed as to Project activities. All the individuals identified on Appendix E as having responsibility for a Phase I Activity, and any other individuals requested by a Member, may participate in such meetings in person or by telephone via a 1-800 conference call to be arranged by the Project Director. The Project Director shall use good faith efforts to keep Acadia Holdings informed on a regular basis with regard to all aspects of the Phase I Activities, and shall notify Acadia Holdings of meetings with any third parties relating to the Phase I Activities. (The Project Director shall not be required to notify Acadia Holdings of meetings involving only Calpine and its Affiliates.) Acadia Holdings will identify for the Project Director an individual as its representative for such purpose, which individual may be replaced from time to time upon notice by Acadia Holdings to the Project Director. Neither compliance, nor failure to comply, with the preceding two sentences shall limit the authority of the Project Director, constitute a condition to performance of any of his or her obligations hereunder or under the Project Management Agreement, or create any liability for the Project Director or Calpine.

5.3.4. Standard of Conduct. The Project Director shall (a) devote sufficient time to the Project in order to perform fully and effectively his or her duties as described in this Agreement and (b) perform his or her duties in an effective and professional manner and in the best interests of the Company, according to accepted industry standards for project management. If Calpine or an Affiliate of Calpine is the Project Management Company, Calpine shall cause the Project Management Company to provide the Project Director with the necessary resources to accomplish his or her responsibilities hereunder. If Acadia Holdings or an Affiliate of Acadia Holdings is the Project Management Company, Acadia Holdings shall cause the Project Management Company to provide the Project Director with the necessary resources to accomplish his or her responsibilities hereunder. The Project Director shall have no liability for his or her failure to perform his or her obligations hereunder and the sole recourse of the Members and the Company shall be to cause the Management Committee on behalf of the Company and each Member, in accordance with Section 5.3.5, to remove the acting Project Director and replace him or her with an individual approved by the Management Committee.

5.3.5. Appointment and Removal of Project Director.

-23-

5.4.1. Assignment of Phase I Responsibilities to Members. Specific Phase I development responsibility shall be allocated among the Members, and may be reallocated from time to time, by the Management Committee in order to optimize the handling of specific responsibilities. The initial responsibilities allocated to each Member as of the Effective Time are set forth on Appendix E. Each Member agrees to the following with respect to the tasks assigned to it:

-24-

The foregoing Member responsibilities may be expanded, limited or terminated at any time by the Management Committee.

5.4.2. Reimbursement of Reimbursable Member Expenses. Each Member shall be entitled to reimbursement by the Company for all Reimbursable Member Expenses incurred in connection with its Phase I responsibilities, to the extent included in the Project Budget, in accordance with Section 6.1.3(b). Notwithstanding the foregoing, each Member shall bear its own internal costs and expenses that are incurred in connection with the preparation and execution of this Agreement and the Definitive Agreements, or in excess of the amounts included in the Project Budget, and the Capital Account of each such Member shall not be increased for such costs and expenses. Expenses incurred by a Member or any of its Affiliates in performing any contract with the Company shall not be included as Reimbursable Member Expenses to be reimbursed pursuant to this Section 5.4.2, but shall be governed by the contract under which they are incurred.

5.4.3. Standard of Conduct of Individuals Assigned by Responsible Member. The individuals responsible for performing the tasks assigned to them by either Member shall (a) devote sufficient time to the Project in order to perform fully and effectively the assigned responsibilities and (b) perform his or her duties in an effective and professional manner and in the best interests of the Company, according to accepted industry standards. The Member responsible for each task shall provide each such individuals the necessary resources to accomplish his or her responsibilities hereunder. No individual assigned to perform a task identified on Appendix E shall have any liability for his or her failure to perform his or her respective obligations, and the sole recourse of the Members and the Company shall be to cause the Management Committee, on behalf of the Company, to remove the individual assigned to such task and replace him or her with an individual approved by the Management Committee.

-25-

5.4.4. Appointment and Removal of Individuals. The appointment of any of the individuals responsible for performing the tasks assigned to them by either Member may be earlier terminated by the Management Committee (a) if he or she has failed to follow the directions of the Management Committee in any material instance or to observe any provision of this Agreement, after notice to the Member and the Project Director that appointed such individual specifying the infraction and the actions to be taken to remedy the same, and a reasonable opportunity to cure such infraction has elapsed without remedying the infraction, by a vote of the Management Committee (with such matter considered a Disqualified Matter on which the Member appointing such individual shall have no vote) or (b) if said individual dies, becomes incapacitated or ceases working for a Member or its Affiliate. In the event the appointment of any individual is being terminated, the Member to whom his or her responsibility was assigned under Section 5.4.1 shall provide the Company with a plan for succession and orderly transition of the individual's responsibility so that at no point will such responsibility be unassigned, including, in the event an individual's appointment is terminated under clause (b) above, the temporary appointment of a qualified individual (which shall not require Management Committee approval) who shall undertake the responsibility in the interim until the Management Committee shall have approved a replacement.

Section 5.5. Project Agreements. During Phase I, Project Agreements will be negotiated by the Member that has been delegated responsibility for the applicable Project Agreement pursuant to Section 5.4.1, or as otherwise designated by the Management Committee, and the Member to whom the lead responsibility is assigned for the applicable Project Agreement shall cause the appropriate individuals to negotiate the applicable Project Agreements, unless and until the Management Committee reassigns such responsibility. Following the completion of the Phase I Activities, except as provided in Section 5.6 (regarding, without limitation, Significant Offtake Agreements presented by the Members) and Article 7 (regarding, without limitation, the responsibilities of the Power Marketer), the Project Management Company shall be primarily responsible for negotiating all remaining Project Agreements subject to the direction of the Management Committee. All Project Agreements shall be subject to the approval of the Management Committee.

Section 5.6. Significant Offtake Agreements. No Member may enter into any Offtake Agreement, or any binding term sheet for an Offtake Agreement, on behalf of the Company. In addition to the provisions of Section 5.5 (regarding, without limitation, negotiation of Project Agreements) and Article 7 (regarding, without limitation, the responsibilities of the Power Marketer), either Member may, from time to time during the Term, present proposed Significant Offtake Agreements to the Management Committee for consideration. A Significant Offtake Agreement proposed for execution by the Company shall be submitted to the Management Committee for approval either at a regular meeting of the Management Committee or a special meeting of the Management Committee called for that purpose. In either event, in order for a Significant Offtake Agreement to be considered by the Management Committee, the proposing Member shall provide a copy of the agreement to the Chairman no less than seven (7) days before the date of the meeting. The Chairman shall distribute the Significant Offtake Agreement along with the detailed information on matters to be considered by the Management Committee at such meeting to be distributed to the Representatives at least five (5) days before the meeting in accordance with Section 4.3.6(a). The foregoing requirement that a copy of the proposed Significant Offtake Agreement be delivered to the Representatives in advance of a meeting of the

-26-

Management Committee may be waived if done so in writing by all the Representatives attending such meeting. Provided the proposed Significant Offtake Agreement has been delivered to the Members in advance of the meeting (or such requirement is waived), the proposed agreement shall be considered by the Management Committee at the meeting. The Management Committee shall in its discretion:

5.6.1. Procedure Prior to Project Financing. The provisions of this Section 5.6.1 are applicable during the period from the Effective Time until the earlier to occur of (a) the first drawdown of funds under the Company’s initial Project Financing, and (b) the date either Member acquires control of a Simple Majority. During this period, if, after consideration of a Prequalified Significant Offtake Agreement proposed by either Member, the Management Committee does not agree on a course of action pursuant to clauses (a), (b) or (c) of Section 5.6, within fifteen (15) Business Days after the proposed Prequalified Significant Offtake Agreement was first considered at a meeting of the Management Committee, the Management Committee shall be deemed to have voted to approve the proposed Prequalified Significant Offtake Agreement, and, except as provided below, the Chairman shall execute the Prequalified Significant Offtake Agreement on behalf of the Company. The term “Prequalified Significant Offtake Agreement” means a Significant Offtake Agreement, (a) with any Person (including an Affiliate of either Member) as the offtaker having a Standard & Poor’s credit rating of BBB- or better, or the Moody’s equivalent thereof, and (b) that, when analyzed using the Base Model, is projected (on a stand alone basis) to result in a nine percent (9%) unlevered internal rate of return to the Company, after income taxes (assuming an overall income tax rate of 38.25%), based on the Project Costs, Operating Expenses (including fuel costs), Capital Expenses, Tax depreciation and other items allocable to the Capacity and Energy sold under the proposed Prequalified Significant Offtake Agreement. “Base Model” means the Project’s spreadsheet financial model

-27-

that will be reasonably agreed upon by the Management Committee within sixty (60) days after the Effective Time. Notwithstanding anything to the contrary herein, the Representatives that do not agree that the Prequalified Significant Offtake Agreement should be entered into by the Company may specify particular revisions to the terms of the proposed Prequalified Significant Offtake Agreement that they require for approval of the agreement, in which event the proposing Member shall endeavor, in good faith within a reasonable time not to exceed thirty (30) days, to negotiate those terms requested by the dissenting Representatives, and the Company shall not enter into the proposed Prequalified Significant Offtake Agreement until the proposing Member has so endeavored to negotiate the requested terms. Regardless whether the requested terms are or are not included in the proposed Prequalified Significant Offtake Agreement following such good faith endeavors, at the end of such thirty (30) day period, the Chairman shall execute such Prequalified Significant Offtake Agreement as provided above in the form then negotiated for the Company by the proposing Member.

Section 5.7. Project Financing.