February 18, 2020 Q4 2019 Operations Report Exhibit 99.2

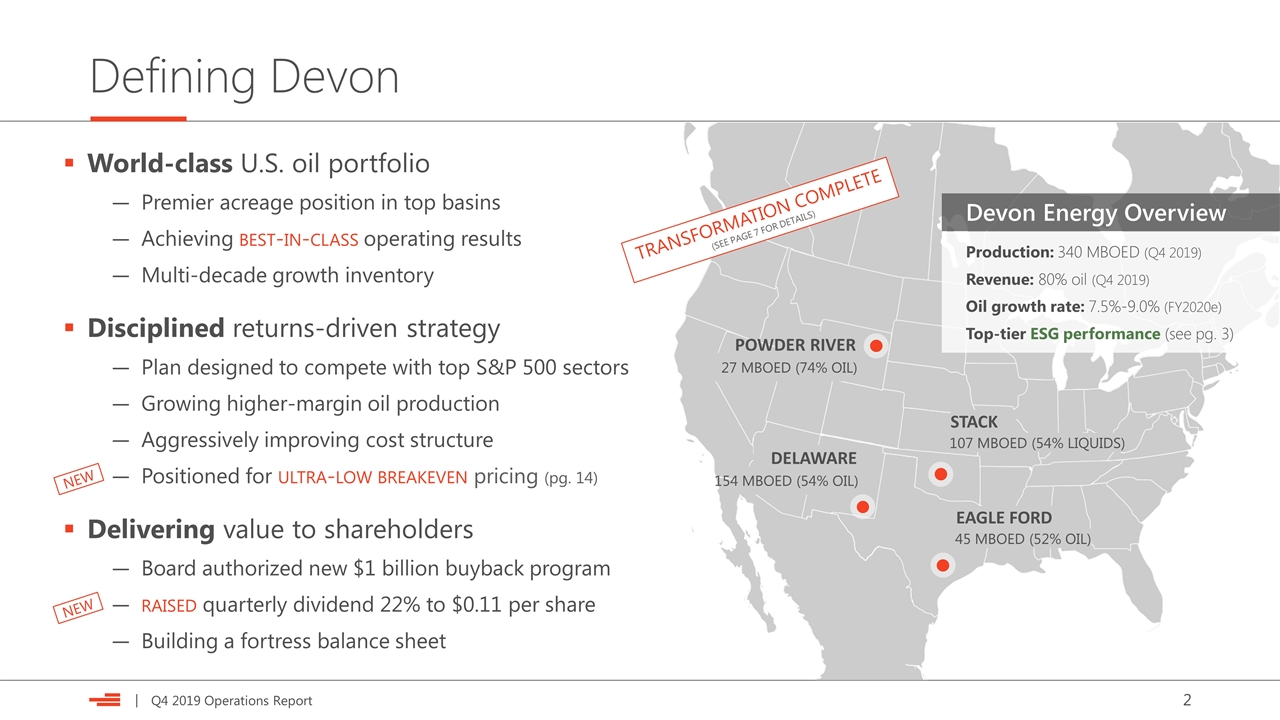

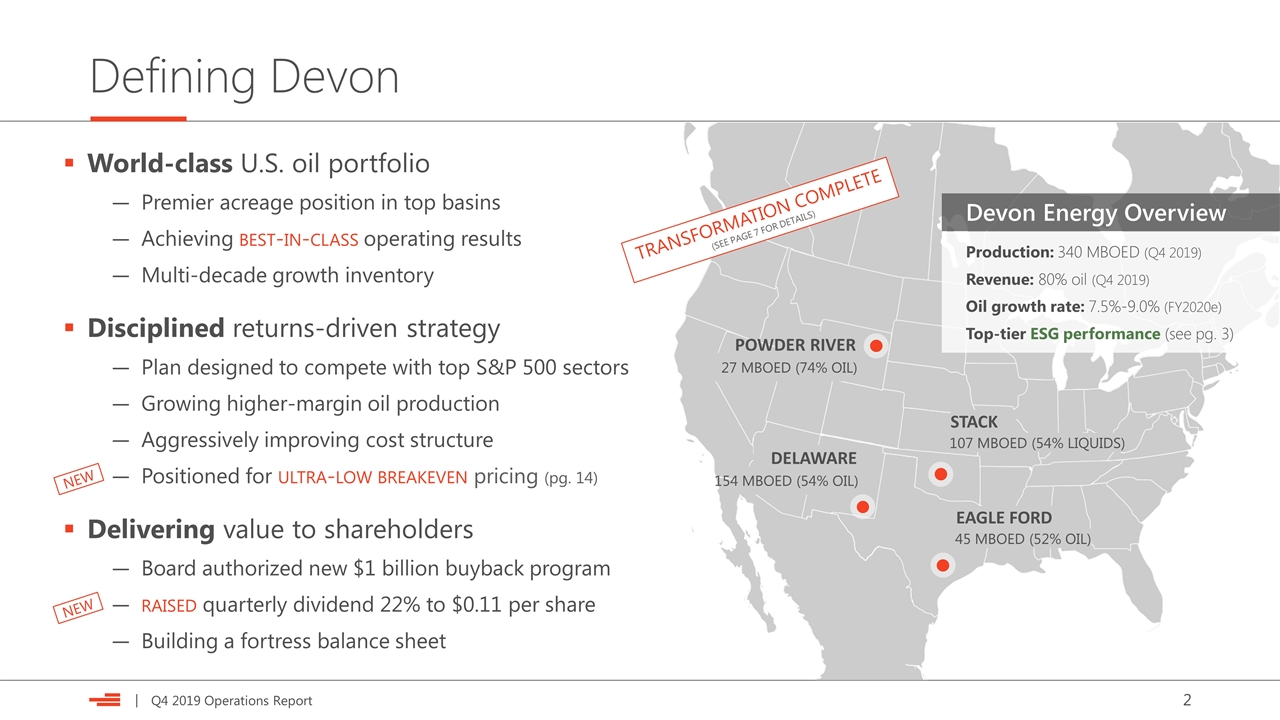

Defining Devon World-class U.S. oil portfolio Premier acreage position in top basins Achieving best-in-class operating results Multi-decade growth inventory Disciplined returns-driven strategy Plan designed to compete with top S&P 500 sectors Growing higher-margin oil production Aggressively improving cost structure Positioned for ultra-low breakeven pricing (pg. 14) Delivering value to shareholders Board authorized new $1 billion buyback program raised quarterly dividend 22% to $0.11 per share Building a fortress balance sheet 27 MBOED (74% OIL) STACK 107 MBOED (54% LIQUIDS) POWDER RIVER EAGLE FORD 45 MBOED (52% OIL) 154 MBOED (54% OIL) DELAWARE Production: 340 MBOED (Q4 2019) Revenue: 80% oil (Q4 2019) Oil growth rate: 7.5%-9.0% (FY2020e) Top-tier ESG performance (see pg. 3) Devon Energy Overview NEW TRANSFORMATION COMPLETE (SEE PAGE 7 FOR DETAILS) NEW

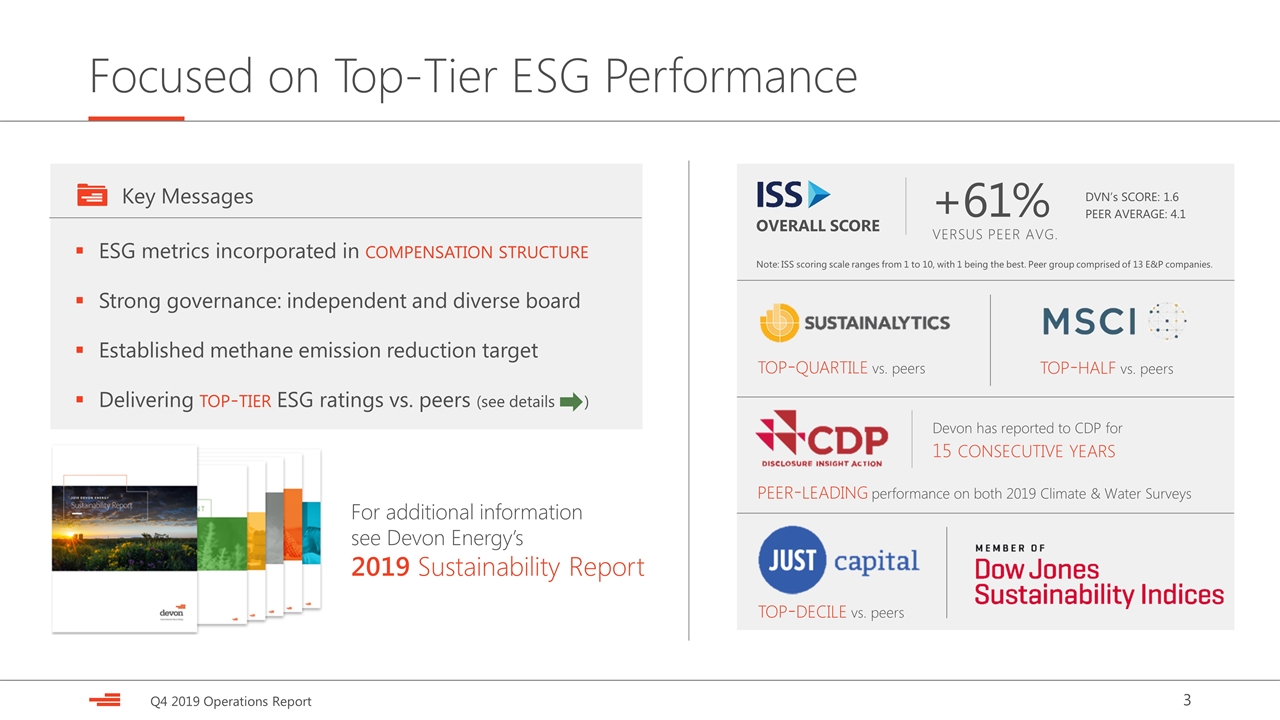

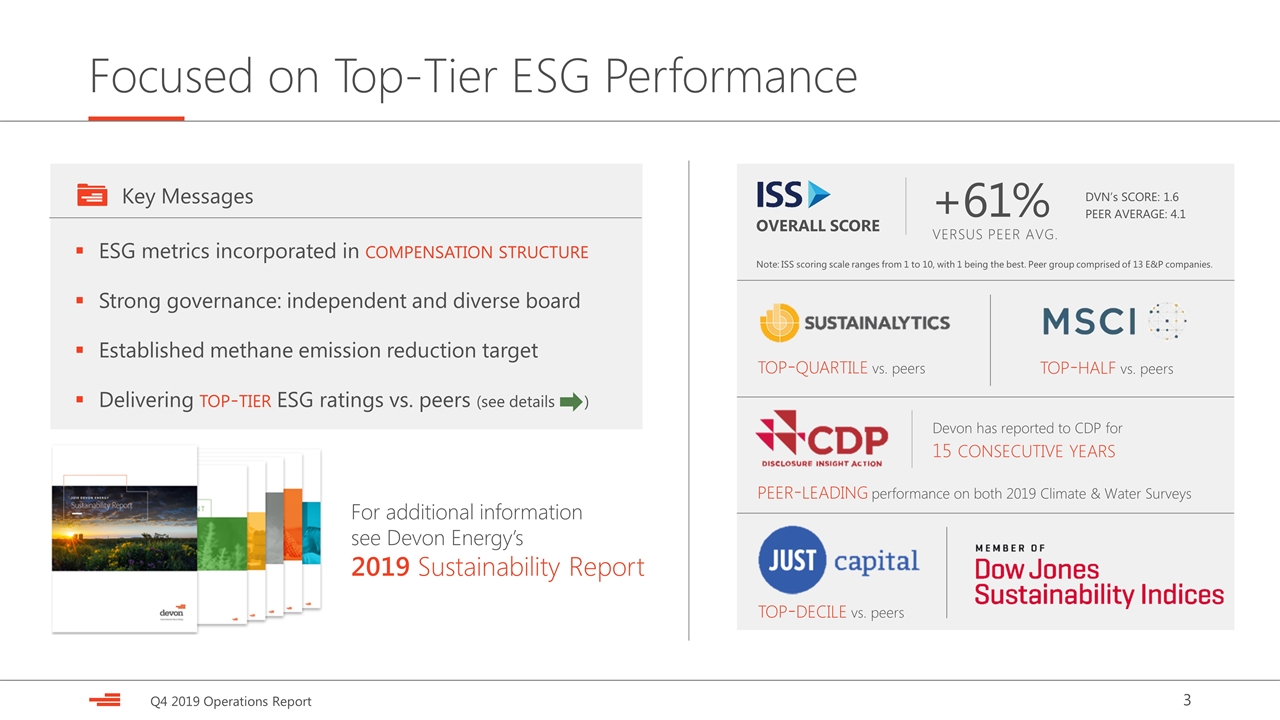

Focused on Top-Tier ESG Performance ESG metrics incorporated in compensation structure Strong governance: independent and diverse board Established methane emission reduction target Delivering top-tier ESG ratings vs. peers (see details ) Key Messages top-quartile vs. peers OVERALL SCORE DVN’s SCORE: 1.6 PEER AVERAGE: 4.1 +61% VERSUS PEER AVG. Note: ISS scoring scale ranges from 1 to 10, with 1 being the best. Peer group comprised of 13 E&P companies. For additional information see Devon Energy’s 2019 Sustainability Report top-half vs. peers Devon has reported to CDP for 15 consecutive years peer-leading performance on both 2019 Climate & Water Surveys top-decile vs. peers

Q4 2019 – Efficiently Advancing the Business OIL VOLUMES EXCEED GUIDANCE (Q4 2019 +3 MBOD vs. midpoint guidance) CAPITAL SPENDING 6% BELOW MIDPOINT (Driven by efficiency gains achieved across asset portfolio) AUTHORIZED NEW $1 BILLION BUYBACK PROGRAM (On track to reduce share count by >35% by year end) FREE CASH FLOW GROWTH ACCELERATES (Operating cash flow of $579 million & free cash flow of $171 million) PORTFOLIO TRANSFORMATION COMPLETE (Barnett Shale divestiture announced in mid-December)

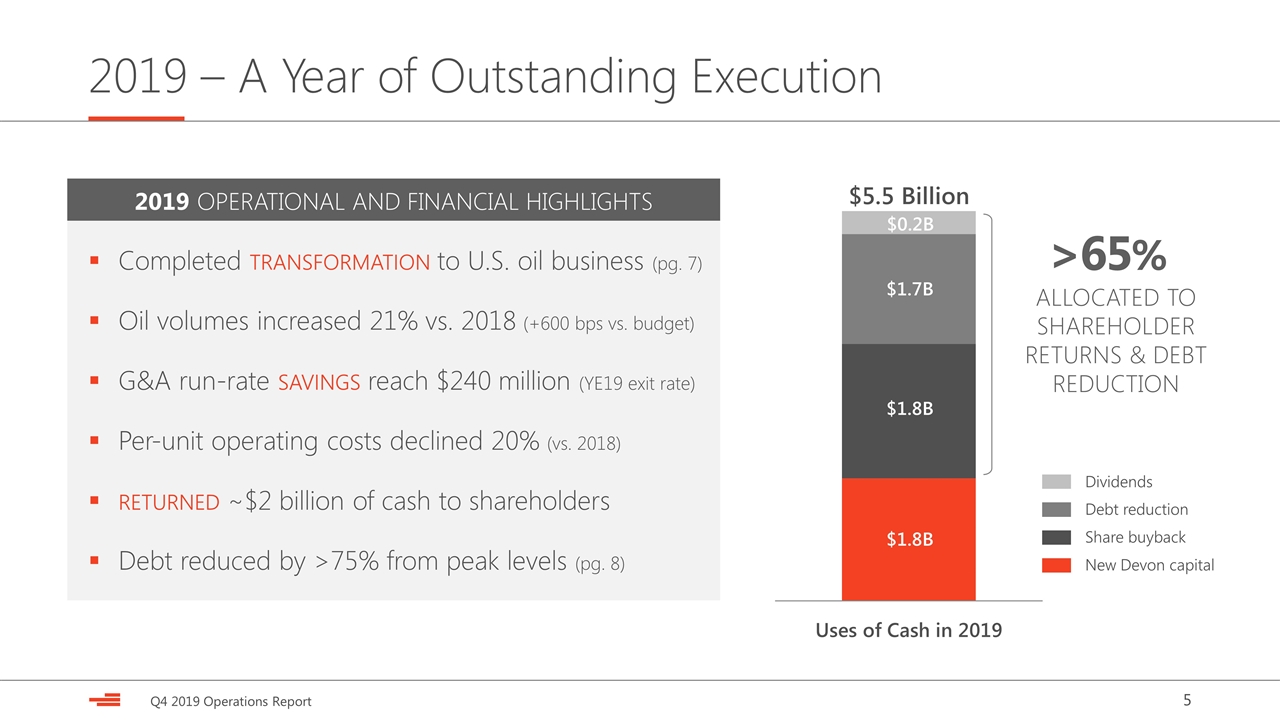

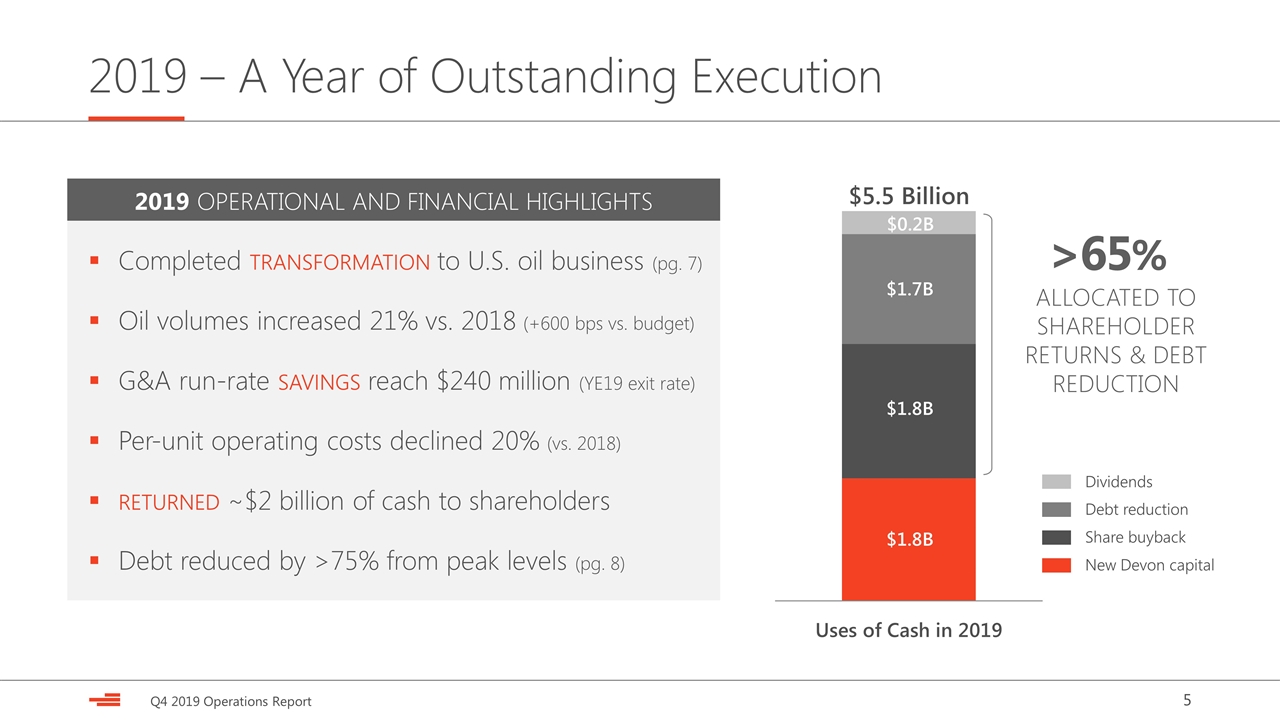

2019 – A Year of Outstanding Execution Completed transformation to U.S. oil business (pg. 7) Oil volumes increased 21% vs. 2018 (+600 bps vs. budget) G&A run-rate savings reach $240 million (YE19 exit rate) Per-unit operating costs declined 20% (vs. 2018) returned ~$2 billion of cash to shareholders Debt reduced by >75% from peak levels (pg. 8) 2019 OPERATIONAL AND FINANCIAL HIGHLIGHTS Share buyback New Devon capital Debt reduction Dividends ALLOCATED TO SHAREHOLDER RETURNS & DEBT REDUCTION >65% $5.5 Billion $1.8B $1.8B $1.7B $0.2B

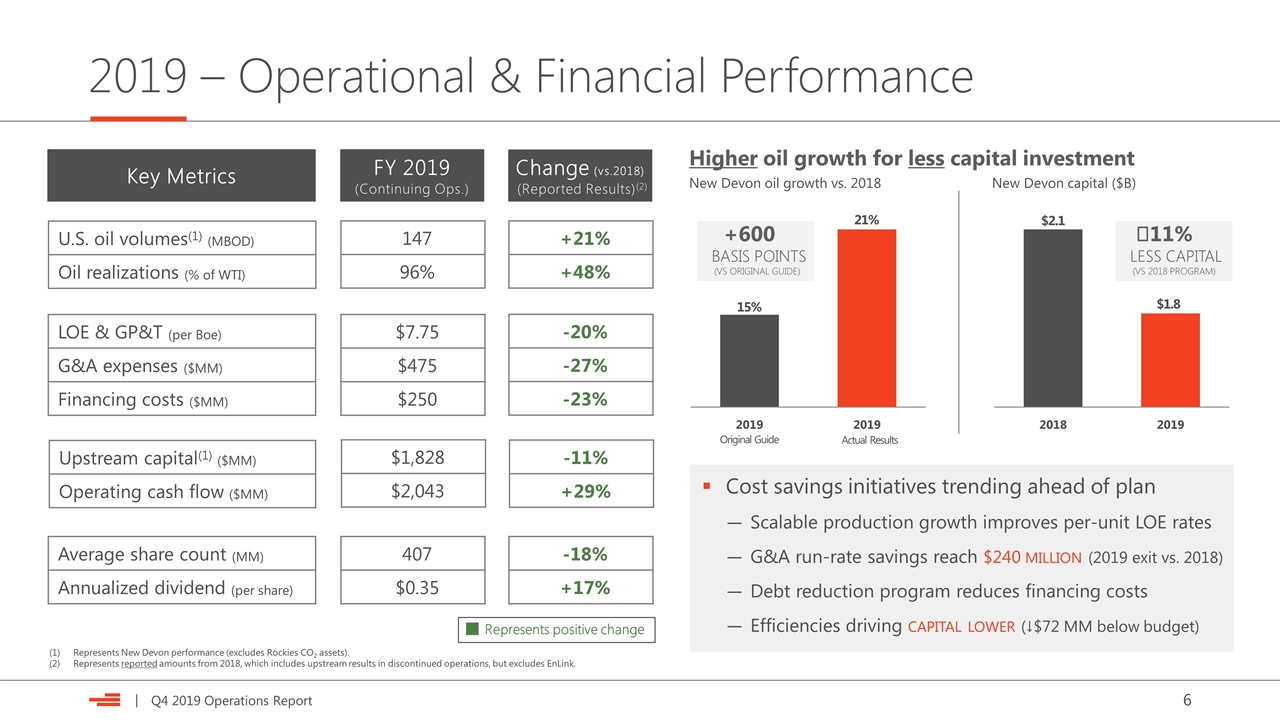

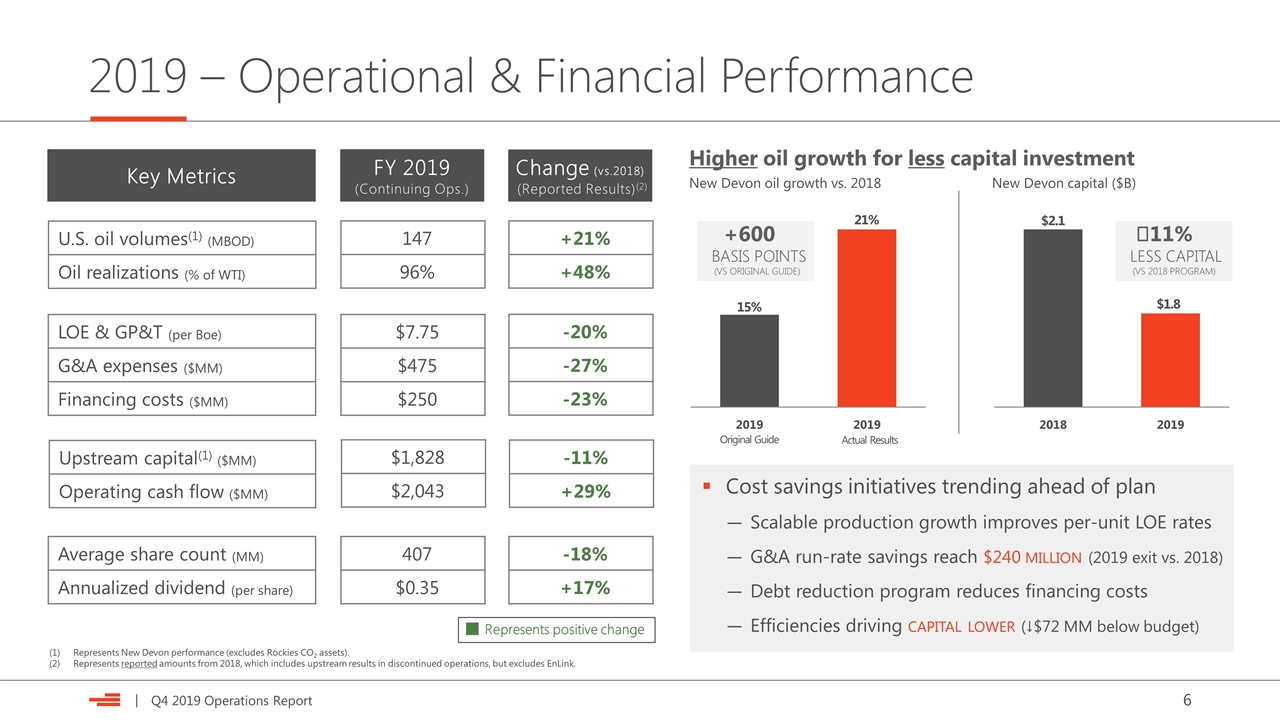

2019 – Operational & Financial Performance LOE & GP&T (per Boe) G&A expenses ($MM) Financing costs ($MM) Upstream capital(1) ($MM) Operating cash flow ($MM) Average share count (MM) Annualized dividend (per share) $7.75 $475 $250 $1,828 $2,043 407 $0.35 -20% -27% -23% -18% +17% U.S. oil volumes(1) (MBOD) Oil realizations (% of WTI) 147 96% +21% +48% Represents New Devon performance (excludes Rockies CO2 assets). Represents reported amounts from 2018, which includes upstream results in discontinued operations, but excludes EnLink. Higher oil growth for less capital investment New Devon oil growth vs. 2018 21% 15% FY 2019 (Continuing Ops.) Change (vs.2018) (Reported Results)(2) Key Metrics -11% +29% Cost savings initiatives trending ahead of plan Scalable production growth improves per-unit LOE rates G&A run-rate savings reach $240 million (2019 exit vs. 2018) Debt reduction program reduces financing costs Efficiencies driving capital lower (↓$72 MM below budget) +600 BASIS POINTS (VS ORIGINAL GUIDE) New Devon capital ($B) $2.1 $1.8 Actual Results Original Guide ↆ11% LESS CAPITAL (VS 2018 PROGRAM) Represents positive change

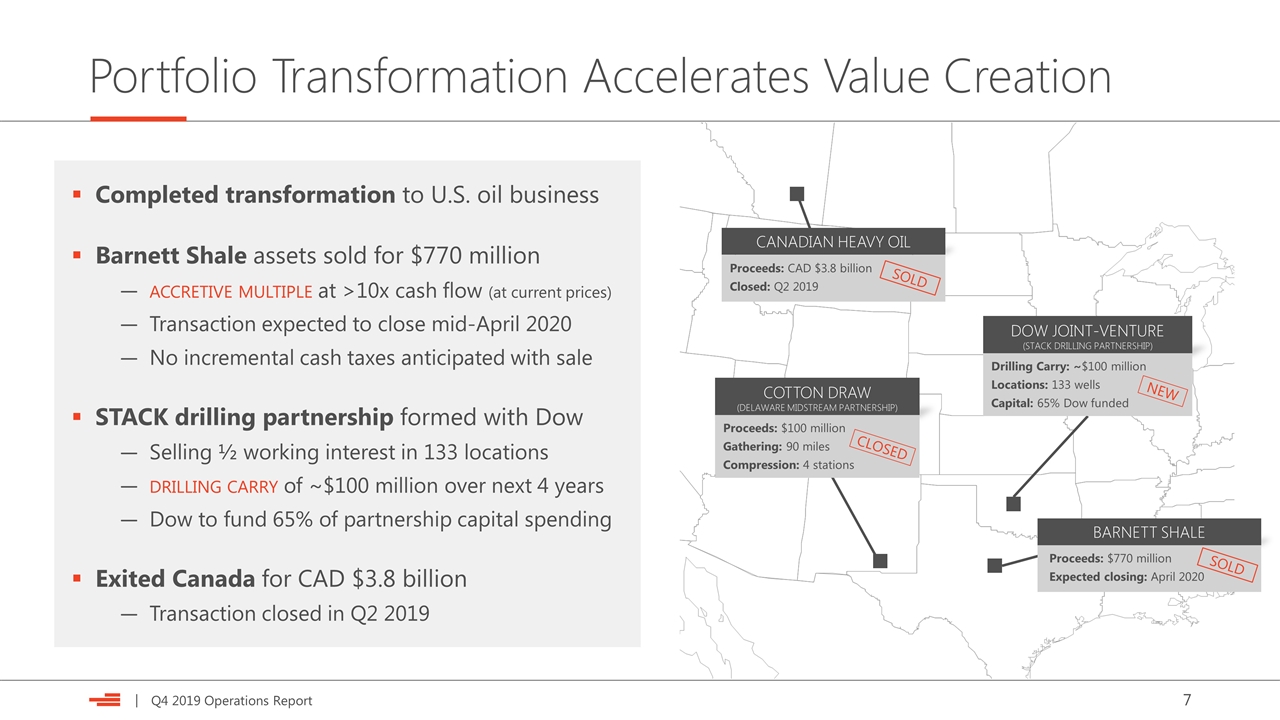

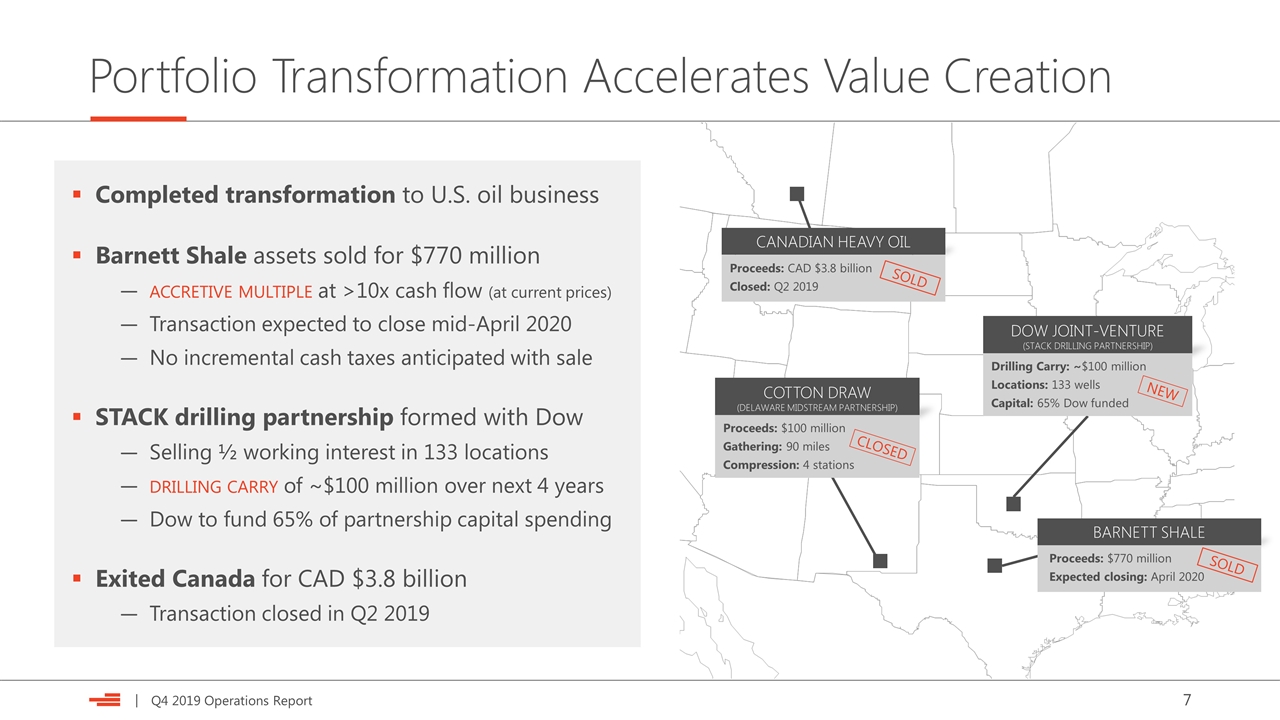

Portfolio Transformation Accelerates Value Creation Cotton draw (DELAWARE Midstream partnership) Proceeds: $100 million Gathering: 90 miles Compression: 4 stations CANADIAN HEAVY OIL Proceeds: CAD $3.8 billion Closed: Q2 2019 DOW JOINT-VENTURE (STACK DRILLING partnership) Drilling Carry: ~$100 million Locations: 133 wells Capital: 65% Dow funded NEW SOLD CLOSED BARNETT SHALE Proceeds: $770 million Expected closing: April 2020 SOLD Completed transformation to U.S. oil business Barnett Shale assets sold for $770 million accretive multiple at >10x cash flow (at current prices) Transaction expected to close mid-April 2020 No incremental cash taxes anticipated with sale STACK drilling partnership formed with Dow Selling ½ working interest in 133 locations drilling carry of ~$100 million over next 4 years Dow to fund 65% of partnership capital spending Exited Canada for CAD $3.8 billion Transaction closed in Q2 2019

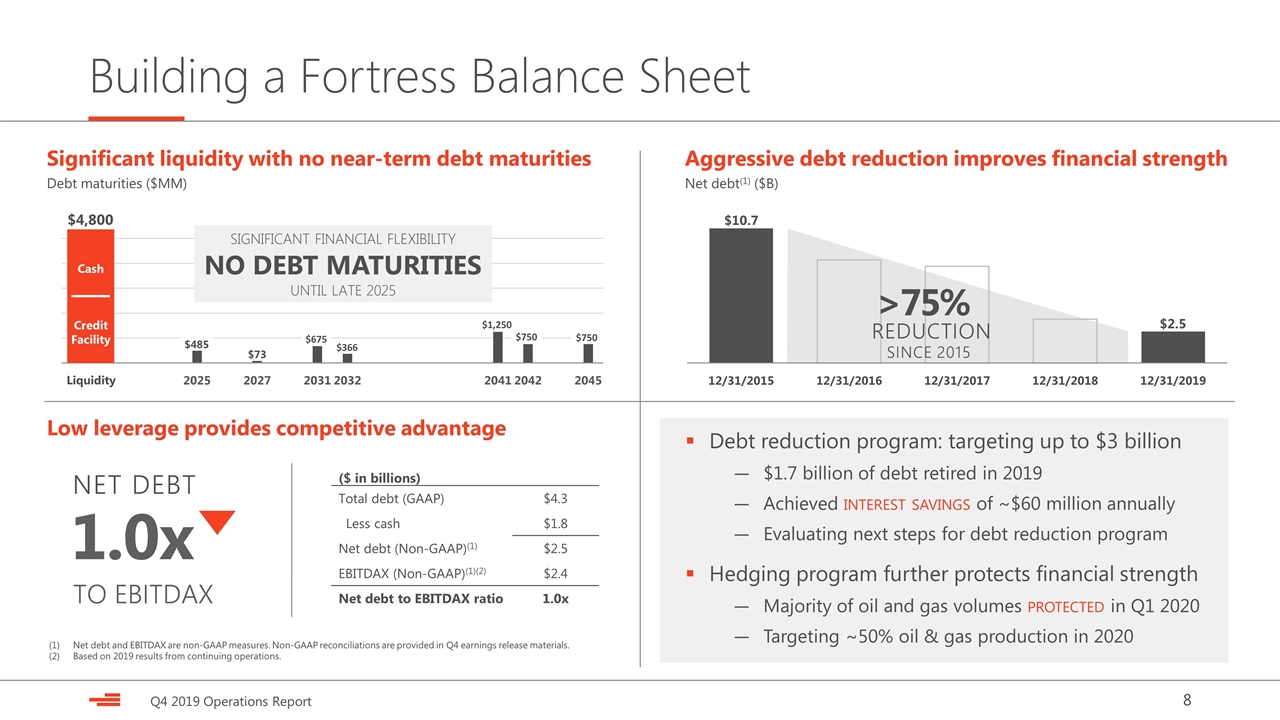

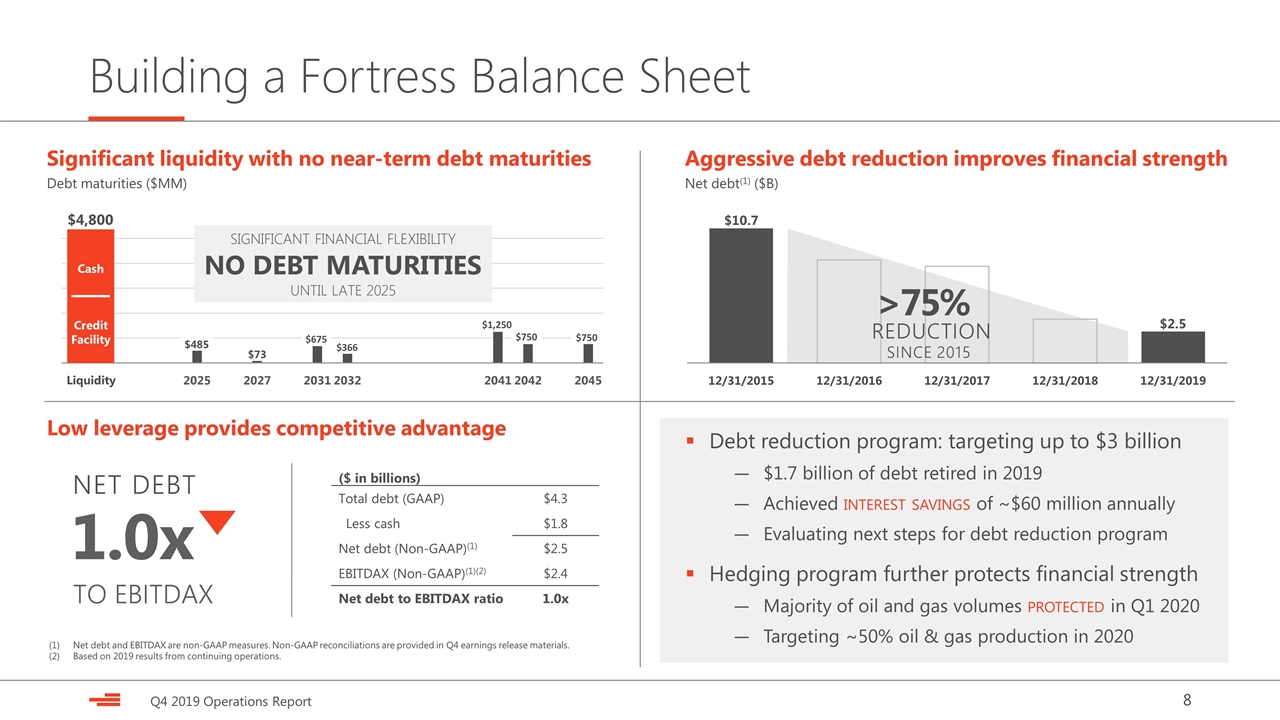

Building a Fortress Balance Sheet Aggressive debt reduction improves financial strength Net debt(1) ($B) ($ in billions) Total debt (GAAP) $4.3 Less cash $1.8 Net debt (Non-GAAP)(1) $2.5 EBITDAX (Non-GAAP)(1)(2) $2.4 Net debt to EBITDAX ratio 1.0x Low leverage provides competitive advantage $485 $73 Significant liquidity with no near-term debt maturities Debt maturities ($MM) $4,800 1.0x NET DEBT TO EBITDAX Liquidity NO DEBT MATURITIES SIGNIFICANT FINANCIAL FLEXIBILITY UNTIL LATE 2025 Cash Credit Facility Debt reduction program: targeting up to $3 billion $1.7 billion of debt retired in 2019 Achieved interest savings of ~$60 million annually Evaluating next steps for debt reduction program Hedging program further protects financial strength Majority of oil and gas volumes protected in Q1 2020 Targeting ~50% oil & gas production in 2020 Net debt and EBITDAX are non-GAAP measures. Non-GAAP reconciliations are provided in Q4 earnings release materials. Based on 2019 results from continuing operations. $10.7 $2.5 >75% SINCE 2015 REDUCTION

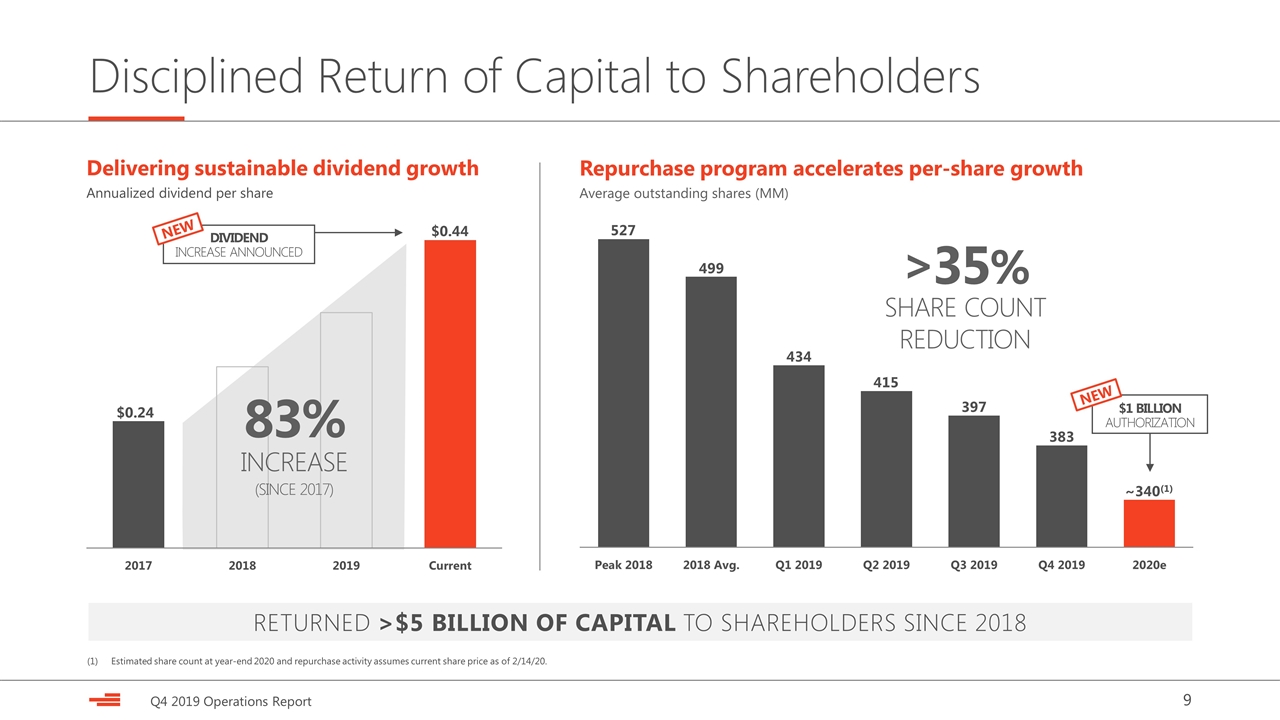

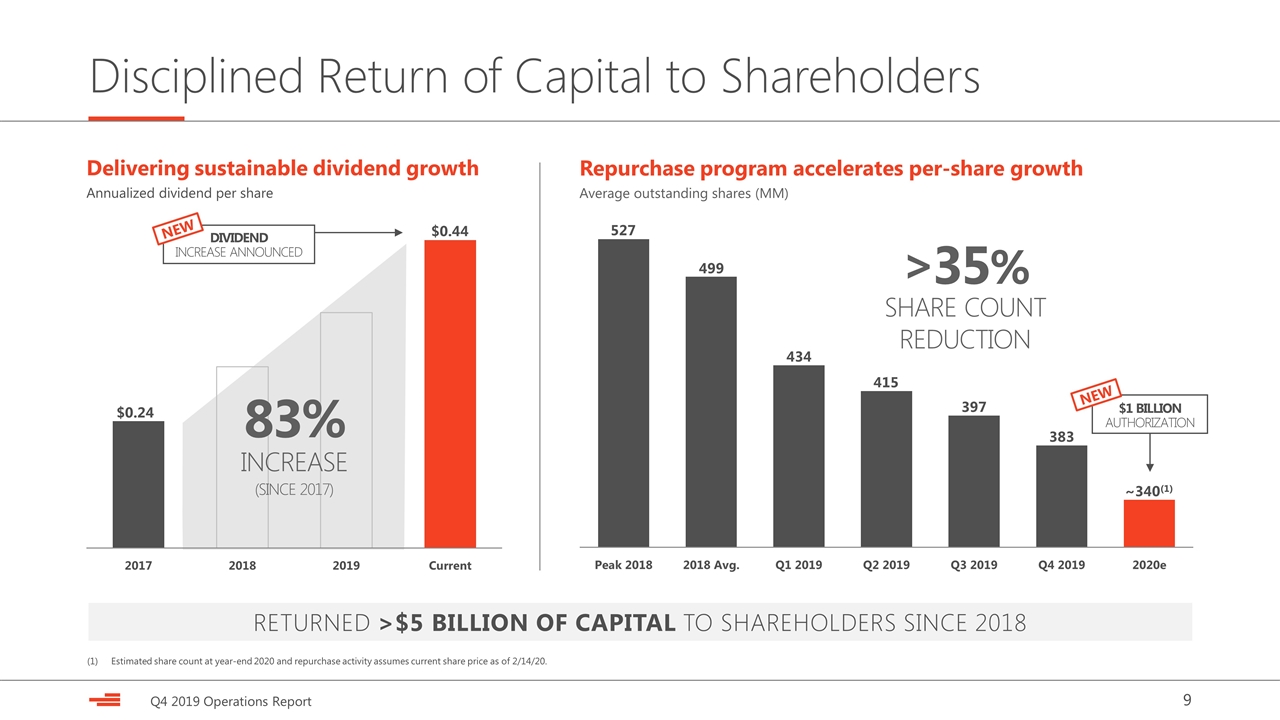

Disciplined Return of Capital to Shareholders 527 499 434 Delivering sustainable dividend growth Annualized dividend per share $0.44 $0.24 83% INCREASE (SINCE 2017) RETURNED >$5 BILLION OF CAPITAL TO SHAREHOLDERS SINCE 2018 415 397 383 ~340(1) Estimated share count at year-end 2020 and repurchase activity assumes current share price as of 2/14/20. 35% SHARE COUNT REDUCTION > DIVIDEND INCREASE ANNOUNCED $1 BILLION AUTHORIZATION Repurchase program accelerates per-share growth Average outstanding shares (MM) NEW NEW

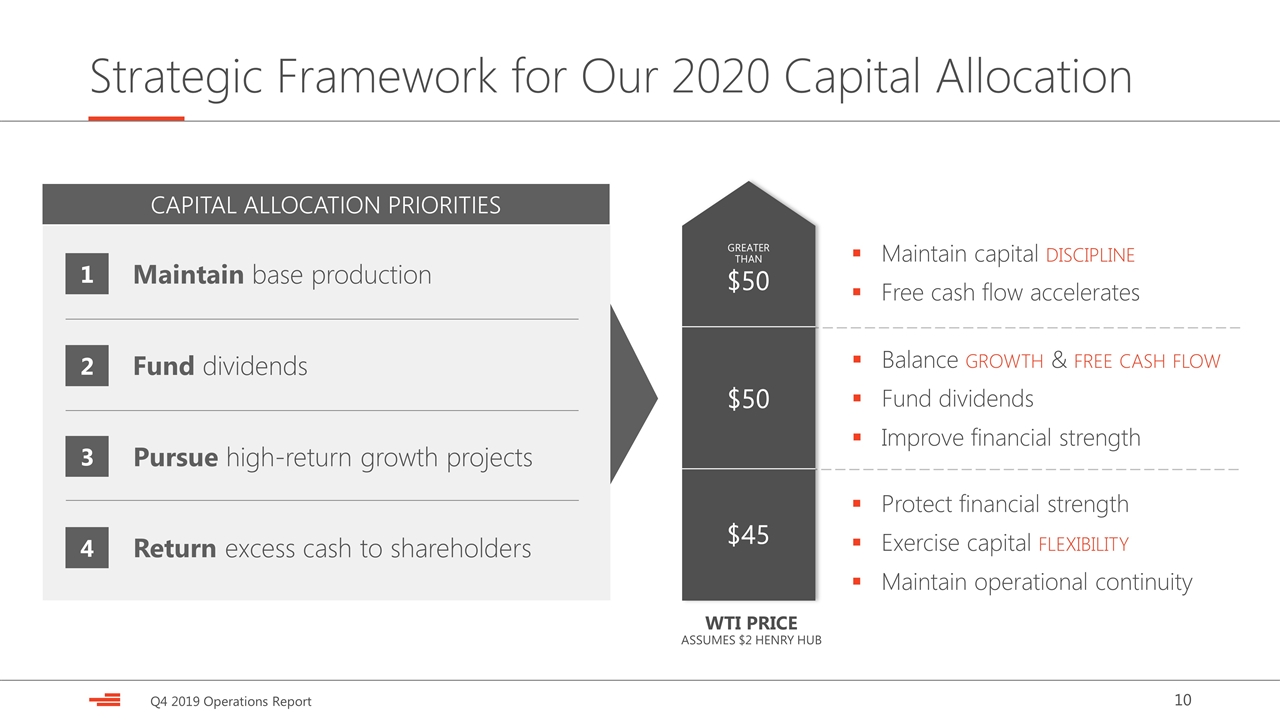

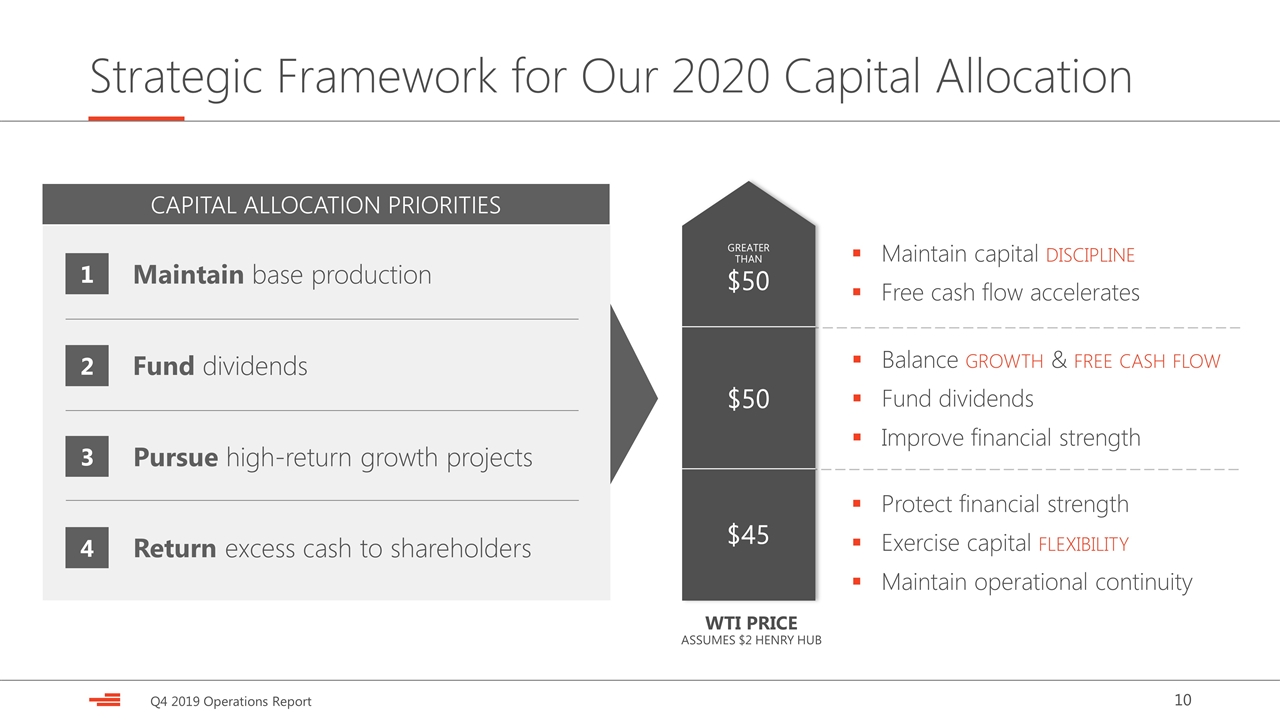

Strategic Framework for Our 2020 Capital Allocation CAPITAL ALLOCATION PRIORITIES Maintain base production Pursue high-return growth projects Return excess cash to shareholders Fund dividends 1 2 3 4 Maintain capital discipline Free cash flow accelerates GREATER THAN $50 $50 $45 Protect financial strength Exercise capital flexibility Maintain operational continuity Balance growth & free cash flow Fund dividends Improve financial strength WTI PRICE ASSUMES $2 HENRY HUB

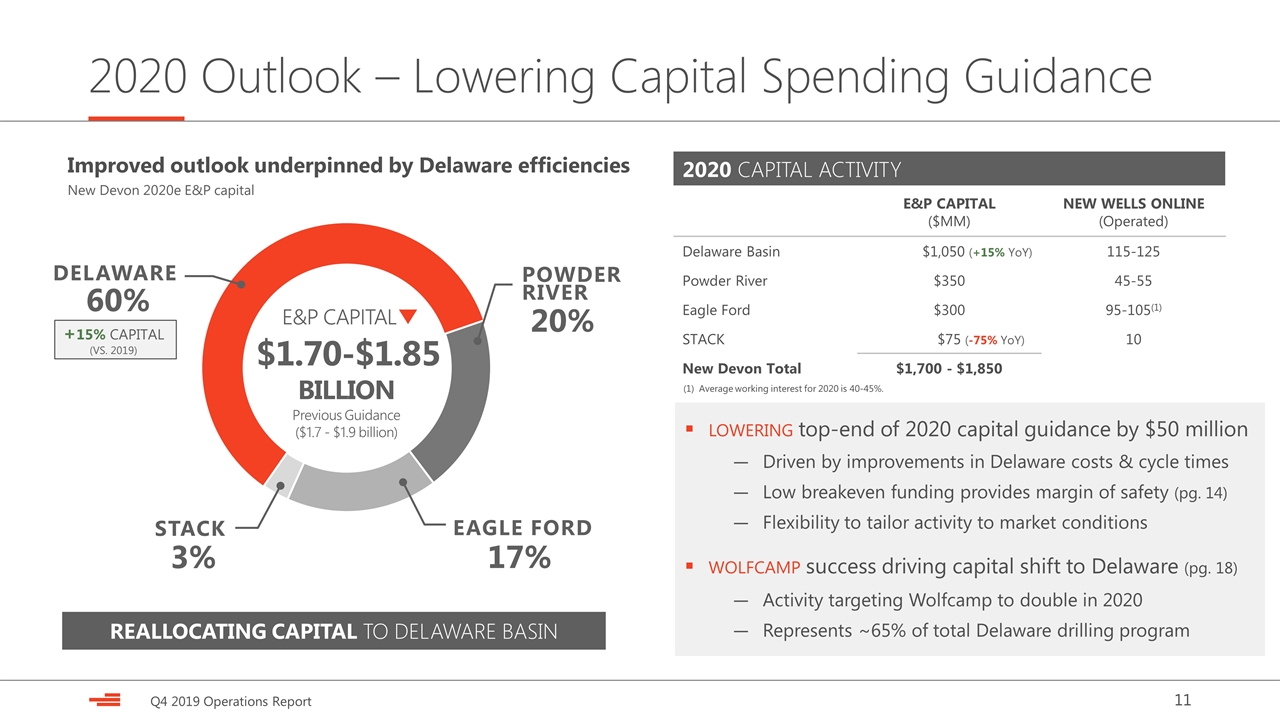

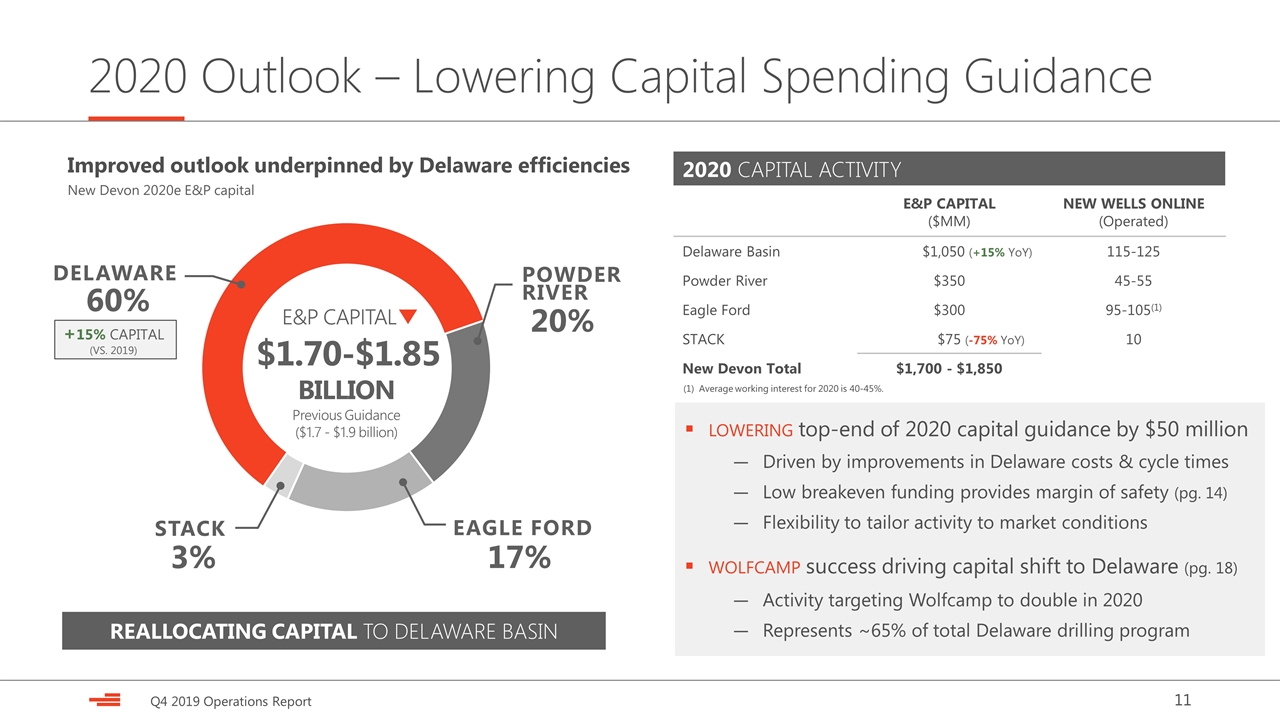

2020 CAPITAL ACTIVITY E&P CAPITAL ($MM) NEW WELLS ONLINE (Operated) Delaware Basin $1,050 (+15% YoY) 115-125 Powder River $350 45-55 Eagle Ford $300 95-105(1) STACK $75 (-75% YoY) 10 New Devon Total $1,700 - $1,850 lowering top-end of 2020 capital guidance by $50 million Driven by improvements in Delaware costs & cycle times Low breakeven funding provides margin of safety (pg. 14) Flexibility to tailor activity to market conditions wolfcamp success driving capital shift to Delaware (pg. 18) Activity targeting Wolfcamp to double in 2020 Represents ~65% of total Delaware drilling program 2020 Outlook – Lowering Capital Spending Guidance Improved outlook underpinned by Delaware efficiencies New Devon 2020e E&P capital 60% DELAWARE 17% EAGLE FORD 20% POWDER RIVER 3% STACK REALLOCATING CAPITAL TO DELAWARE BASIN +15% CAPITAL (VS. 2019) $1.70-$1.85 E&P CAPITAL BILLION Previous Guidance ($1.7 - $1.9 billion) (1) Average working interest for 2020 is 40-45%.

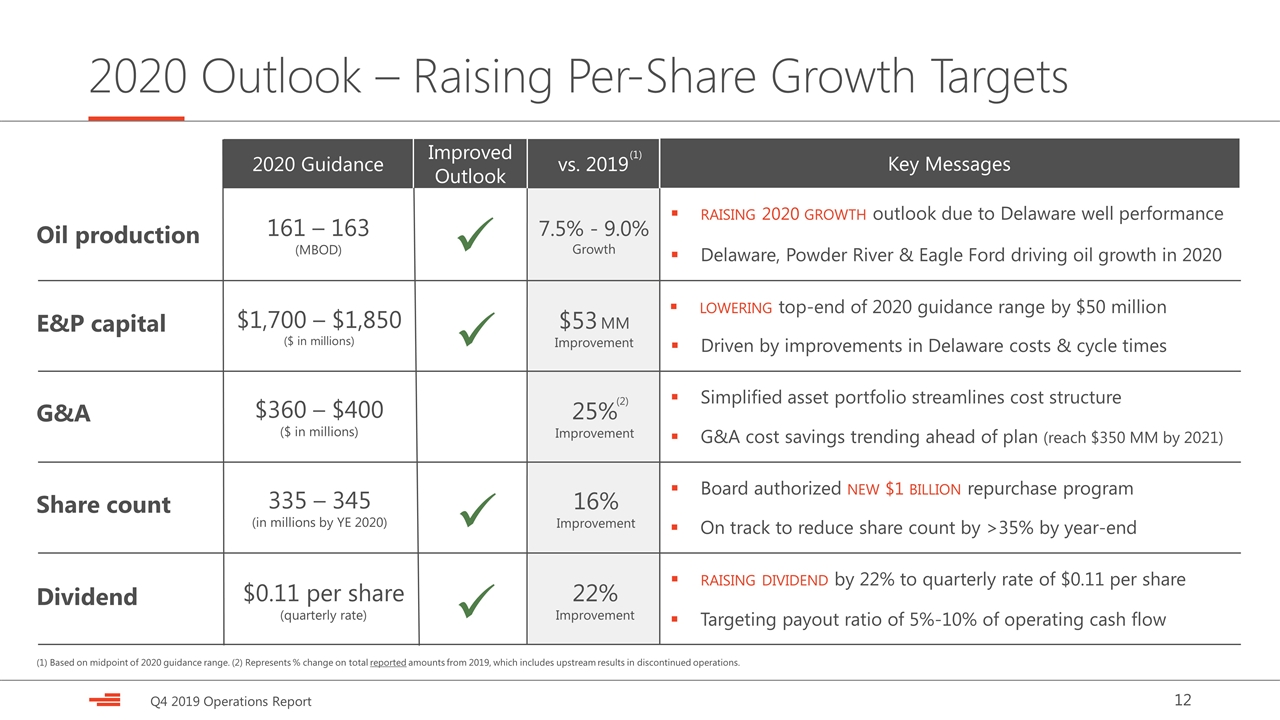

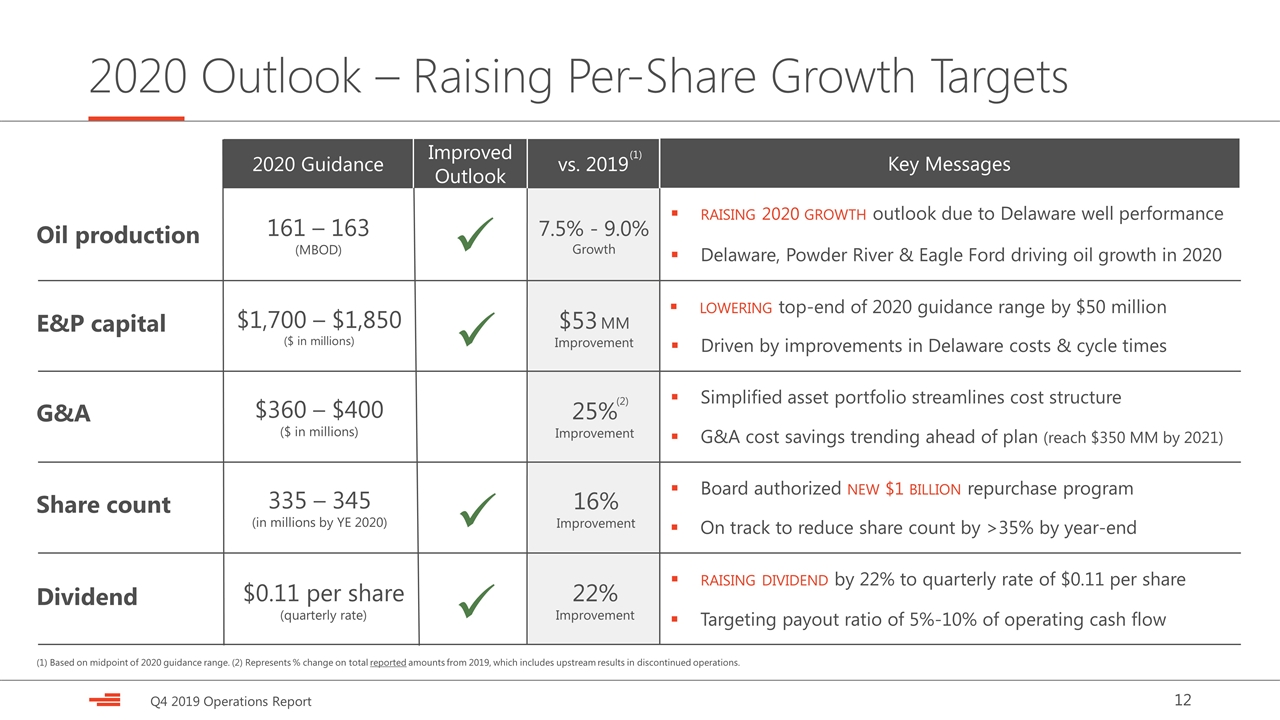

2020 Outlook – Raising Per-Share Growth Targets lowering top-end of 2020 guidance range by $50 million G&A cost savings trending ahead of plan (reach $350 MM by 2021) Board authorized new $1 billion repurchase program E&P capital G&A Share count Simplified asset portfolio streamlines cost structure Driven by improvements in Delaware costs & cycle times Delaware, Powder River & Eagle Ford driving oil growth in 2020 raising 2020 growth outlook due to Delaware well performance Oil production raising dividend by 22% to quarterly rate of $0.11 per share Dividend Targeting payout ratio of 5%-10% of operating cash flow 2020 Guidance 161 – 163 (MBOD) $1,700 – $1,850 ($ in millions) $360 – $400 ($ in millions) vs. 2019 Key Messages (1) Based on midpoint of 2020 guidance range. (2) Represents % change on total reported amounts from 2019, which includes upstream results in discontinued operations. $53 MM Improvement 25% Improvement 16% Improvement On track to reduce share count by >35% by year-end 7.5% - 9.0% Growth (1) 335 – 345 (in millions by YE 2020) Improved Outlook ü ü $0.11 per share (quarterly rate) ü 22% Improvement ü (2)

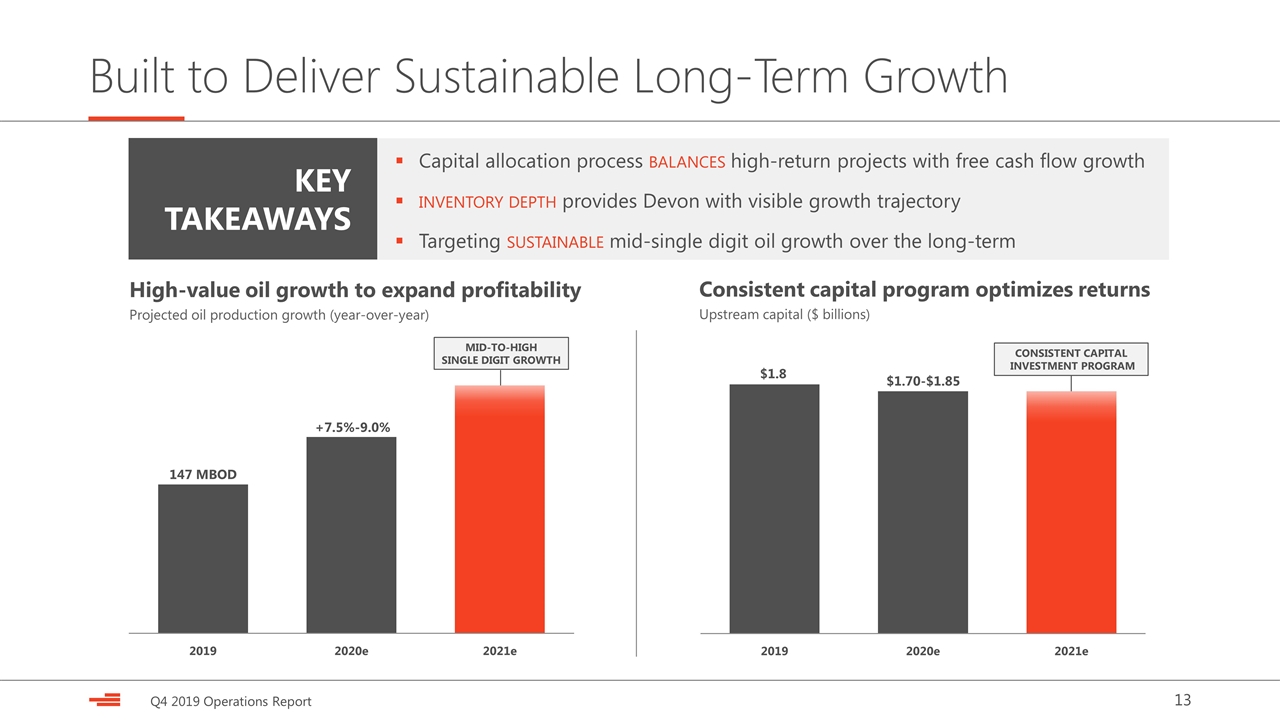

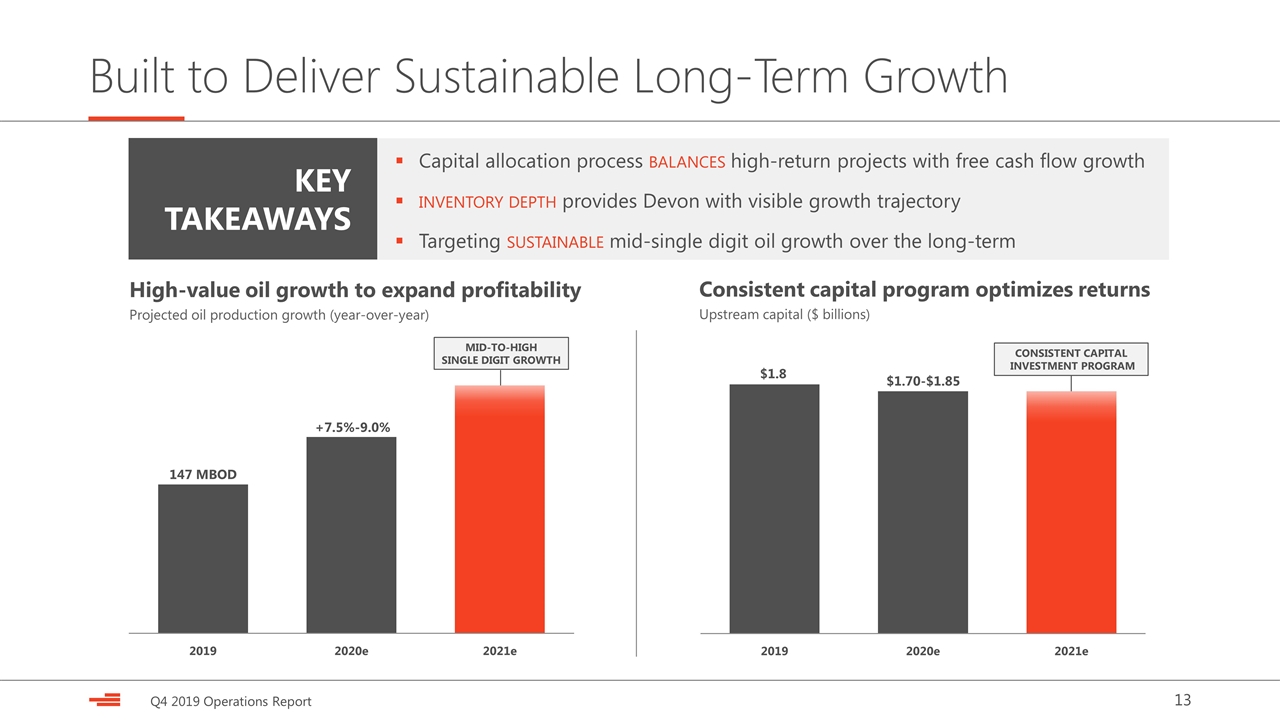

Consistent capital program optimizes returns Upstream capital ($ billions) High-value oil growth to expand profitability Projected oil production growth (year-over-year) Built to Deliver Sustainable Long-Term Growth +7.5%-9.0% $1.8 $1.70-$1.85 KEY TAKEAWAYS Capital allocation process balances high-return projects with free cash flow growth inventory depth provides Devon with visible growth trajectory Targeting sustainable mid-single digit oil growth over the long-term CONSISTENT CAPITAL INVESTMENT PROGRAM MID-TO-HIGH SINGLE DIGIT GROWTH

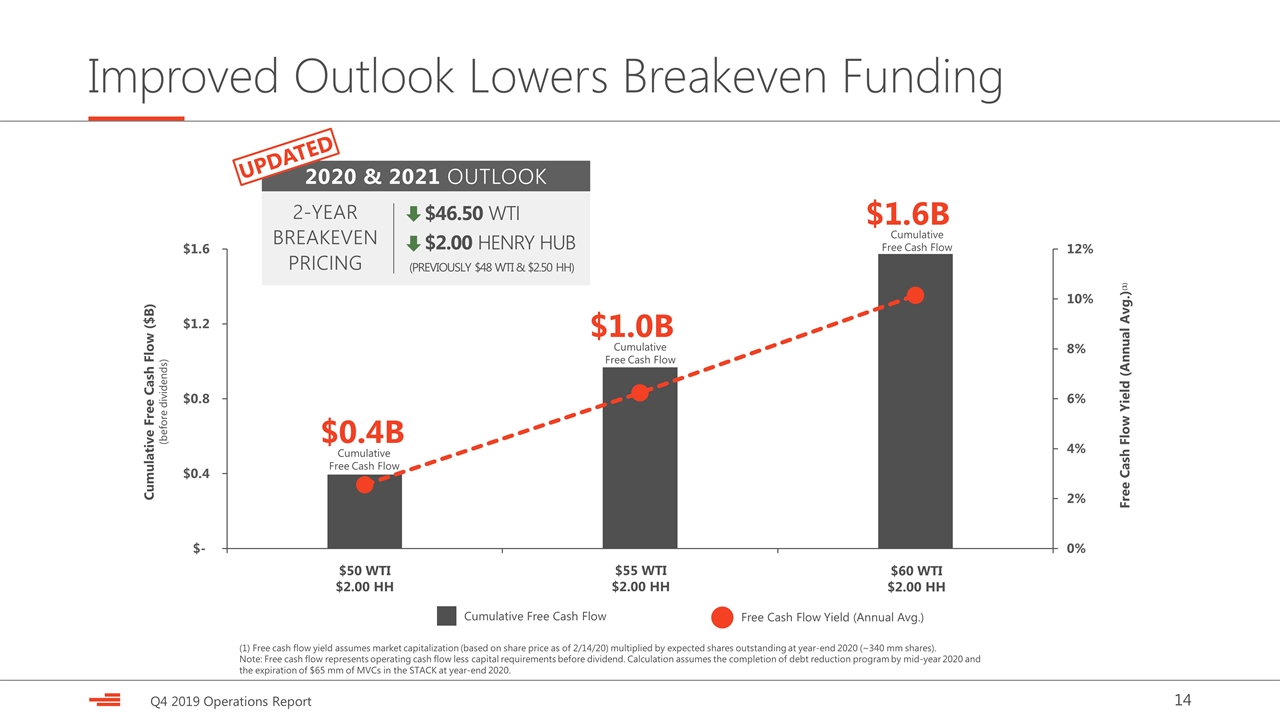

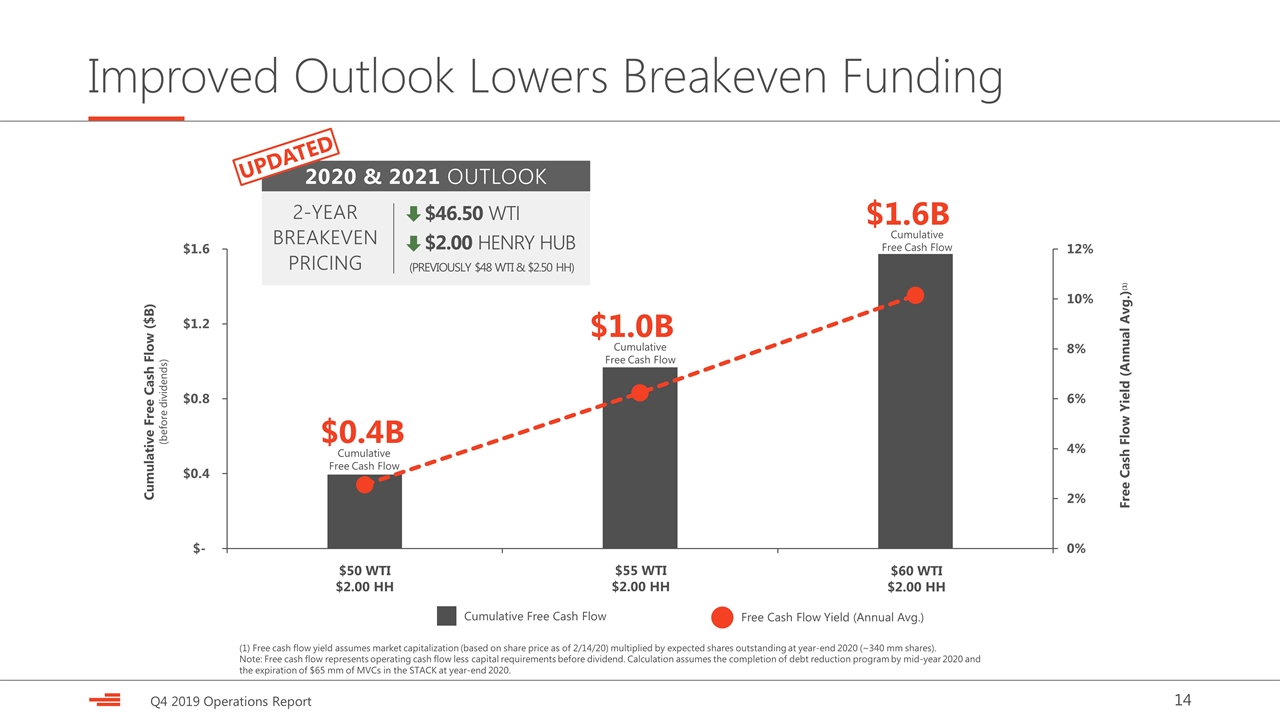

Improved Outlook Lowers Breakeven Funding $1.6B Cumulative Free Cash Flow ($B) (before dividends) $1.0B Free Cash Flow Yield (Annual Avg.)(1) Cumulative Free Cash Flow Free Cash Flow Yield (Annual Avg.) $0.4B Cumulative Free Cash Flow Cumulative Free Cash Flow Cumulative Free Cash Flow (1) Free cash flow yield assumes market capitalization (based on share price as of 2/14/20) multiplied by expected shares outstanding at year-end 2020 (~340 mm shares). Note: Free cash flow represents operating cash flow less capital requirements before dividend. Calculation assumes the completion of debt reduction program by mid-year 2020 and the expiration of $65 mm of MVCs in the STACK at year-end 2020. $50 WTI $2.00 HH $55 WTI $2.00 HH $60 WTI $2.00 HH 2020 & 2021 OUTLOOK UPDATED $46.50 WTI $2.00 HENRY HUB 2-YEAR BREAKEVEN PRICING (PREVIOUSLY $48 WTI & $2.50 HH)

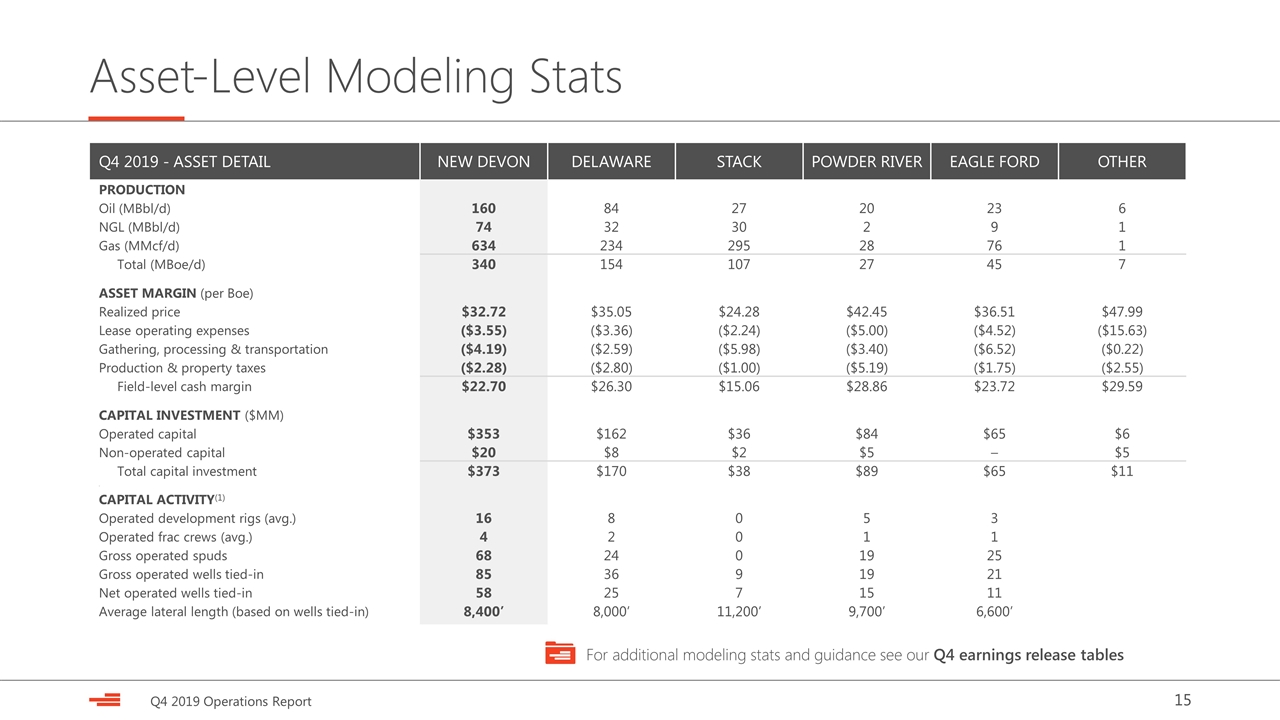

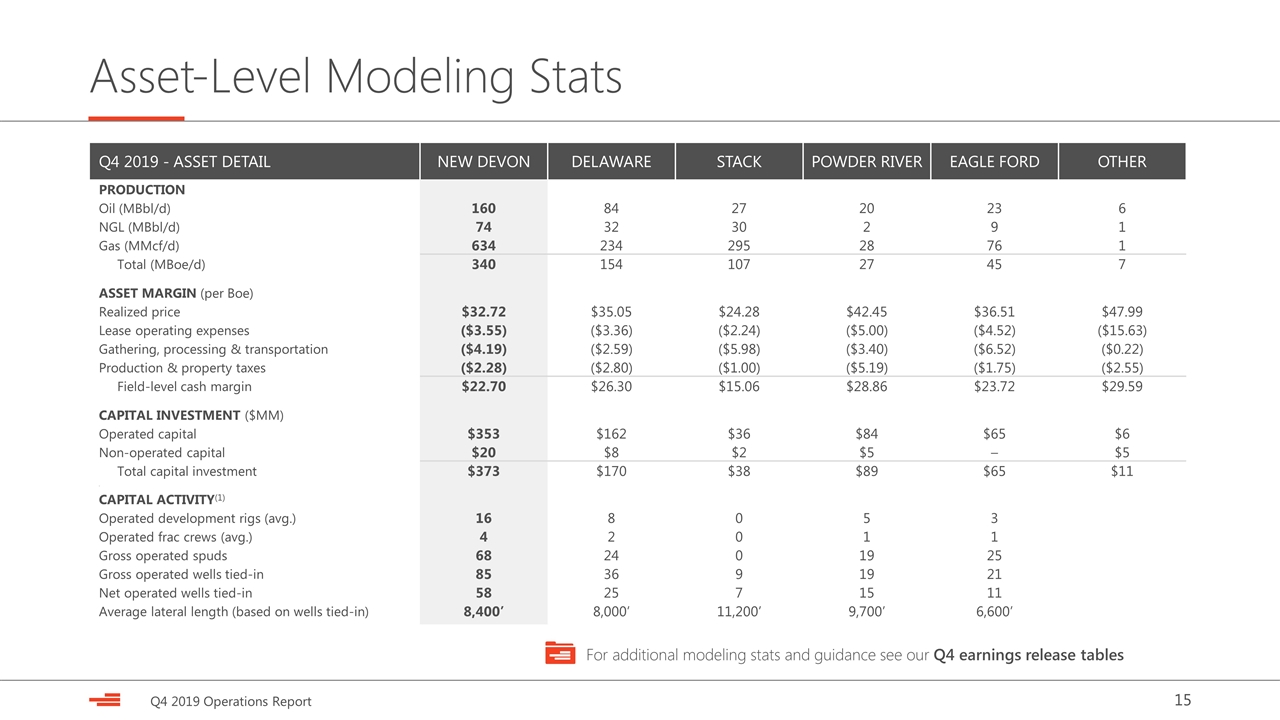

Q4 2019 - ASSET DETAIL NEW DEVON DELAWARE STACK POWDER RIVER EAGLE FORD OTHER PRODUCTION Oil (MBbl/d) 160 84 27 20 23 6 NGL (MBbl/d) 74 32 30 2 9 1 Gas (MMcf/d) 634 234 295 28 76 1 Total (MBoe/d) 340 154 107 27 45 7 ASSET MARGIN (per Boe) Realized price $32.72 $35.05 $24.28 $42.45 $36.51 $47.99 Lease operating expenses ($3.55) ($3.36) ($2.24) ($5.00) ($4.52) ($15.63) Gathering, processing & transportation ($4.19) ($2.59) ($5.98) ($3.40) ($6.52) ($0.22) Production & property taxes ($2.28) ($2.80) ($1.00) ($5.19) ($1.75) ($2.55) Field-level cash margin $22.70 $26.30 $15.06 $28.86 $23.72 $29.59 CAPITAL INVESTMENT ($MM) Operated capital $353 $162 $36 $84 $65 $6 Non-operated capital $20 $8 $2 $5 – $5 Total capital investment $373 $170 $38 $89 $65 $11 . CAPITAL ACTIVITY(1) Operated development rigs (avg.) 16 8 0 5 3 Operated frac crews (avg.) 4 2 0 1 1 Gross operated spuds 68 24 0 19 25 Gross operated wells tied-in 85 36 9 19 21 Net operated wells tied-in 58 25 7 15 11 Average lateral length (based on wells tied-in) 8,400’ 8,000’ 11,200’ 9,700’ 6,600’ Asset-Level Modeling Stats For additional modeling stats and guidance see our Q4 earnings release tables

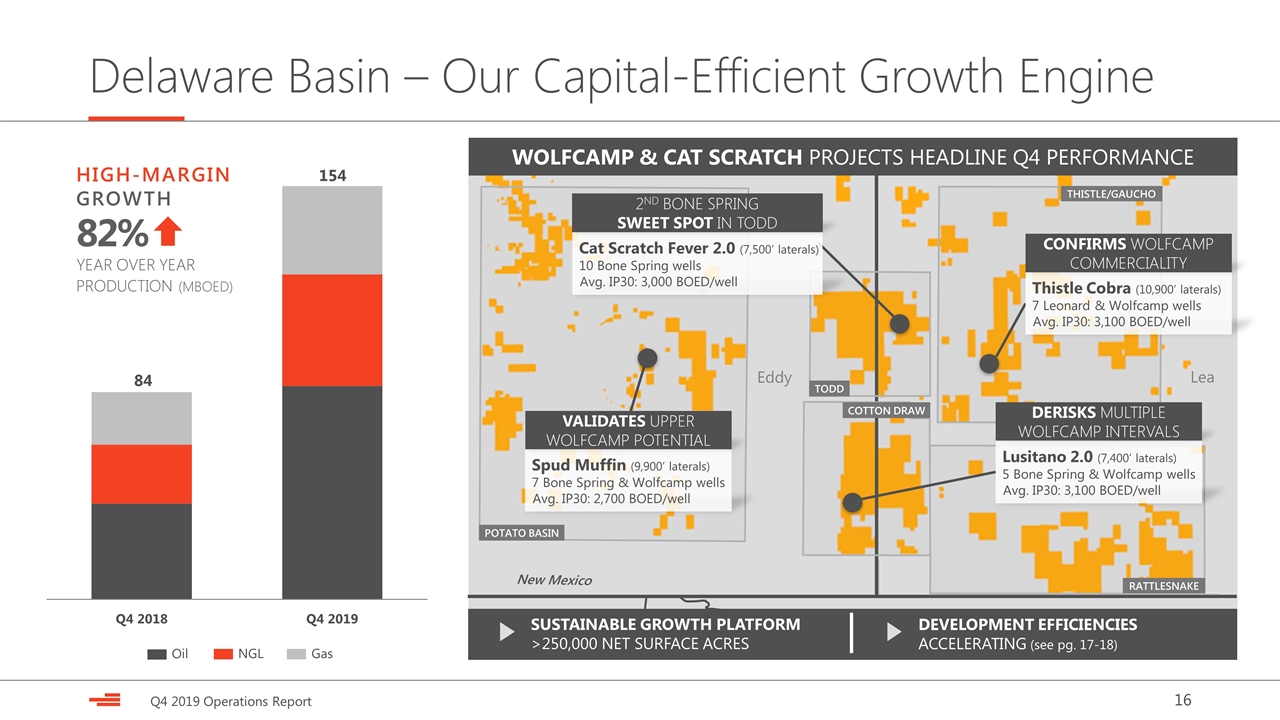

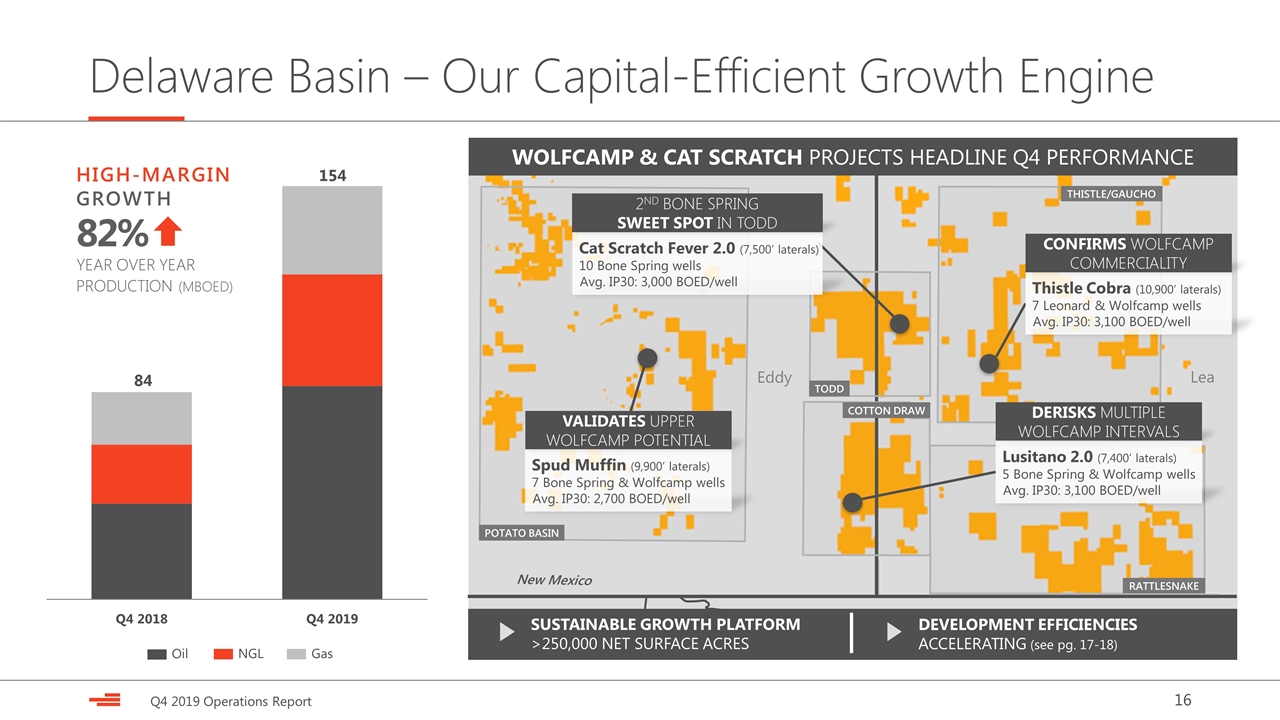

Delaware Basin – Our Capital-Efficient Growth Engine Eddy New Mexico Lea POTATO BASIN THISTLE/GAUCHO RATTLESNAKE COTTON DRAW TODD Lusitano 2.0 (7,400’ laterals) 5 Bone Spring & Wolfcamp wells Avg. IP30: 3,100 BOED/well Cat Scratch Fever 2.0 (7,500’ laterals) 10 Bone Spring wells Avg. IP30: 3,000 BOED/well DERISKS MULTIPLE WOLFCAMP INTERVALS Thistle Cobra (10,900’ laterals) 7 Leonard & Wolfcamp wells Avg. IP30: 3,100 BOED/well CONFIRMS WOLFCAMP COMMERCIALITY 2ND BONE SPRING SWEET SPOT IN TODD Gas NGL Oil Spud Muffin (9,900’ laterals) 7 Bone Spring & Wolfcamp wells Avg. IP30: 2,700 BOED/well WOLFCAMP & CAT SCRATCH PROJECTS HEADLINE Q4 PERFORMANCE VALIDATES upper WOLFCAMP potential SUSTAINABLE GROWTH PLATFORM >250,000 NET SURFACE ACRES DEVELOPMENT EFFICIENCIES ACCELERATING (see pg. 17-18) HIGH-MARGIN GROWTH 82% PRODUCTION (MBOED) YEAR OVER YEAR

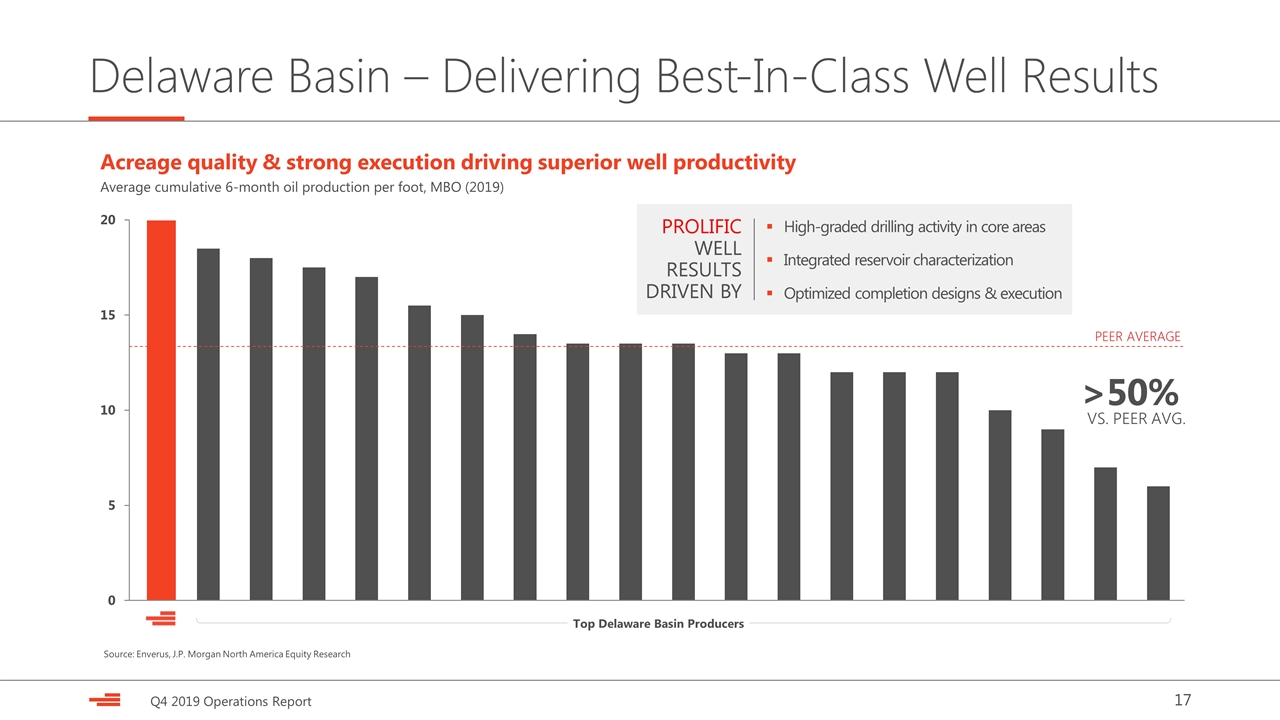

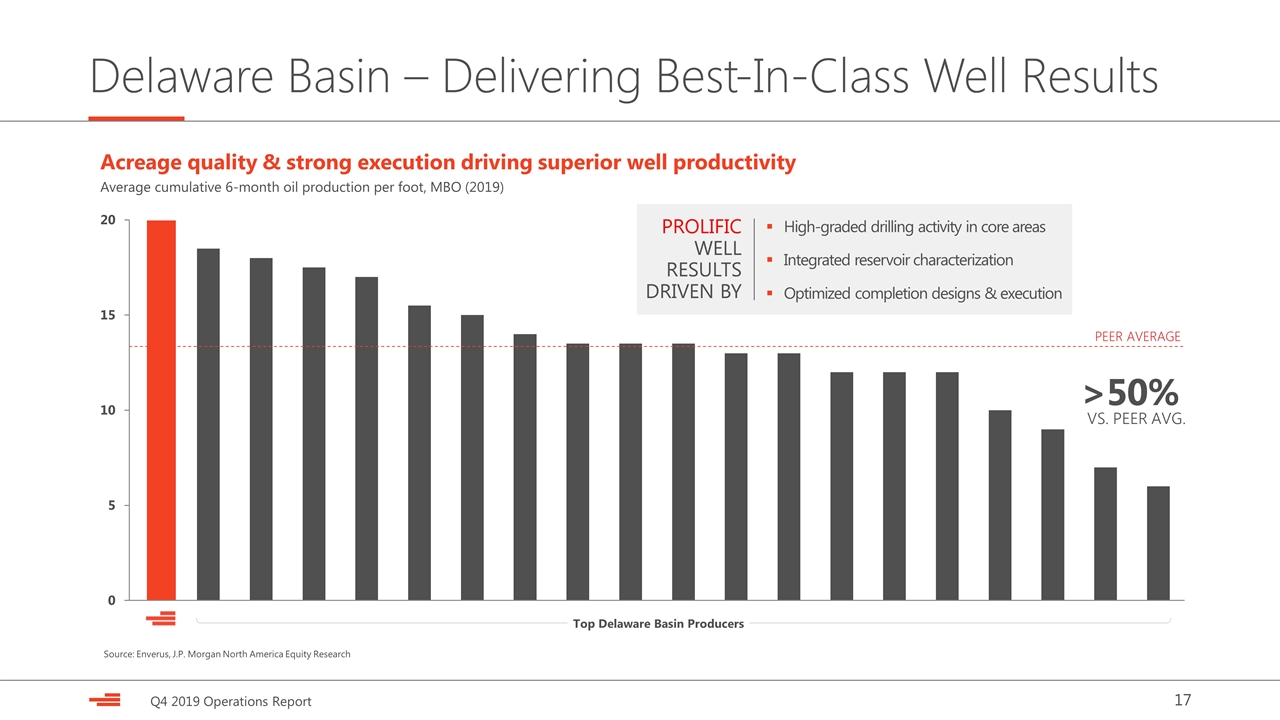

Delaware Basin – Delivering Best-In-Class Well Results PEER AVERAGE Source: Enverus, J.P. Morgan North America Equity Research Acreage quality & strong execution driving superior well productivity Average cumulative 6-month oil production per foot, MBO (2019) PROLIFIC WELL RESULTS DRIVEN BY >50% VS. PEER AVG. High-graded drilling activity in core areas Integrated reservoir characterization Optimized completion designs & execution Top Delaware Basin Producers

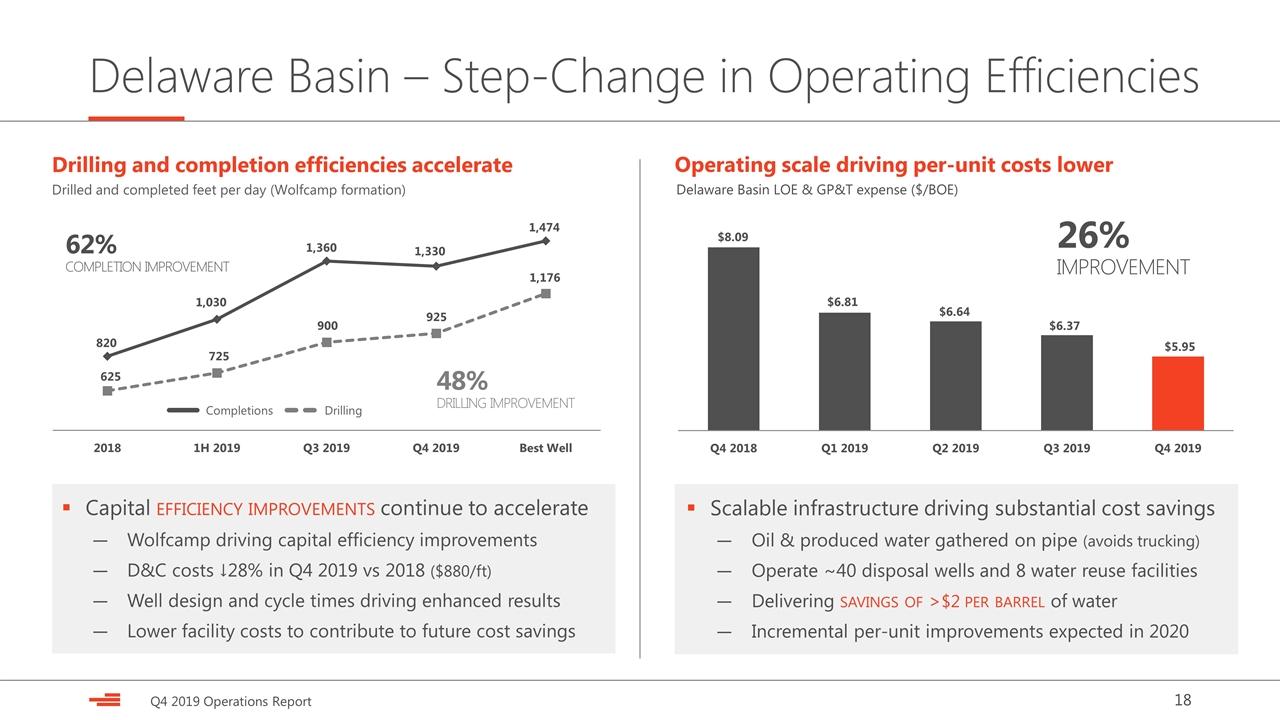

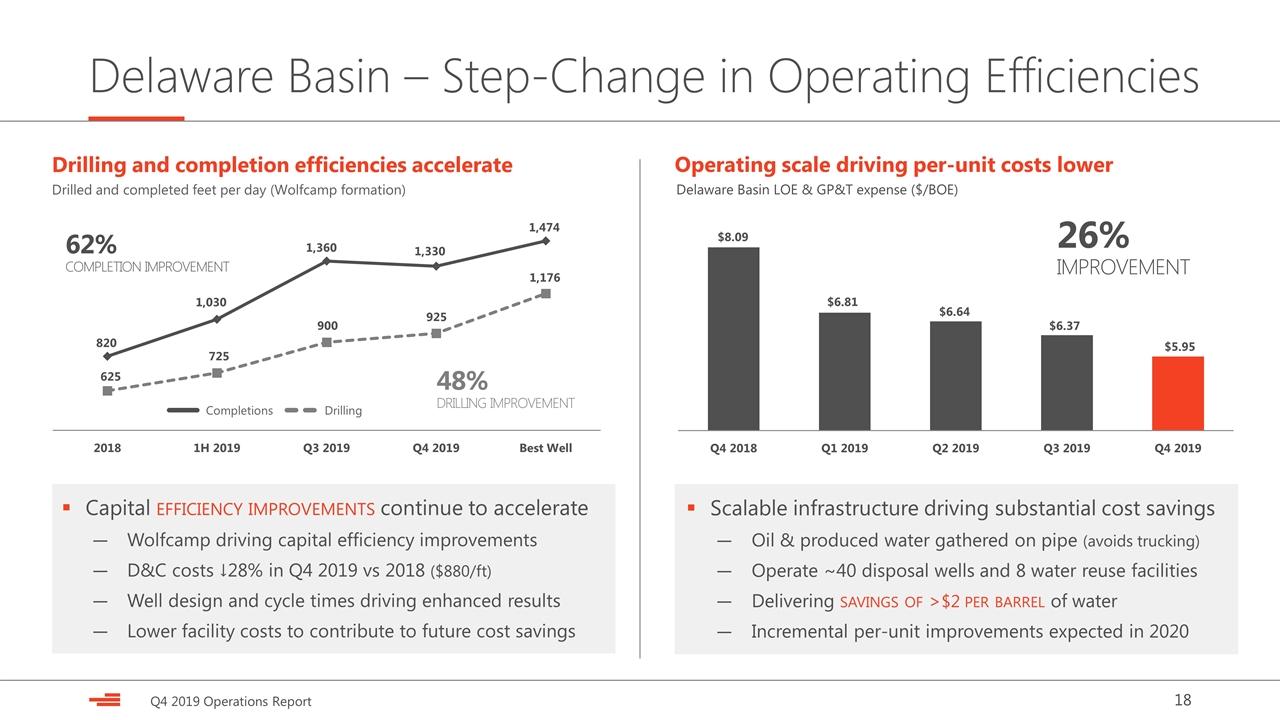

Delaware Basin – Step-Change in Operating Efficiencies Drilling and completion efficiencies accelerate Drilled and completed feet per day (Wolfcamp formation) 62% COMPLETION IMPROVEMENT Drilling Completions 48% DRILLING IMPROVEMENT 925 900 625 1,176 Operating scale driving per-unit costs lower Delaware Basin LOE & GP&T expense ($/BOE) 26% IMPROVEMENT Scalable infrastructure driving substantial cost savings Oil & produced water gathered on pipe (avoids trucking) Operate ~40 disposal wells and 8 water reuse facilities Delivering savings of >$2 per barrel of water Incremental per-unit improvements expected in 2020 725 Capital efficiency improvements continue to accelerate Wolfcamp driving capital efficiency improvements D&C costs ↓28% in Q4 2019 vs 2018 ($880/ft) Well design and cycle times driving enhanced results Lower facility costs to contribute to future cost savings

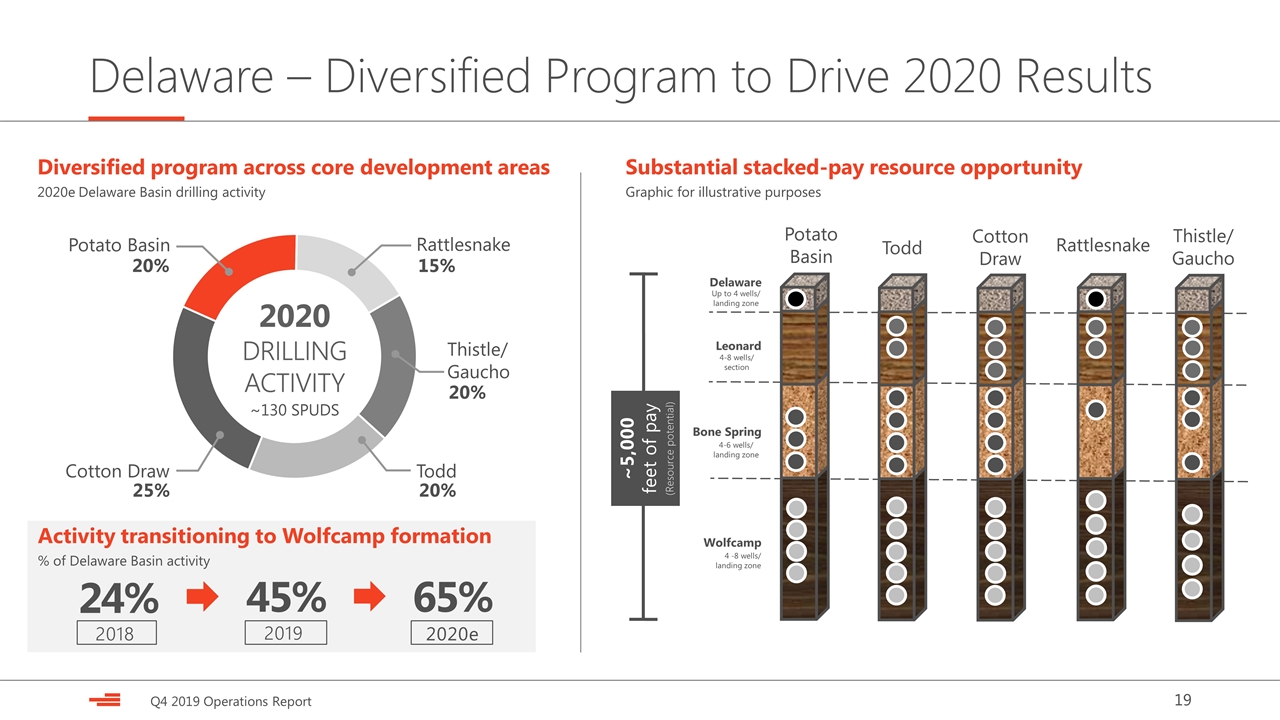

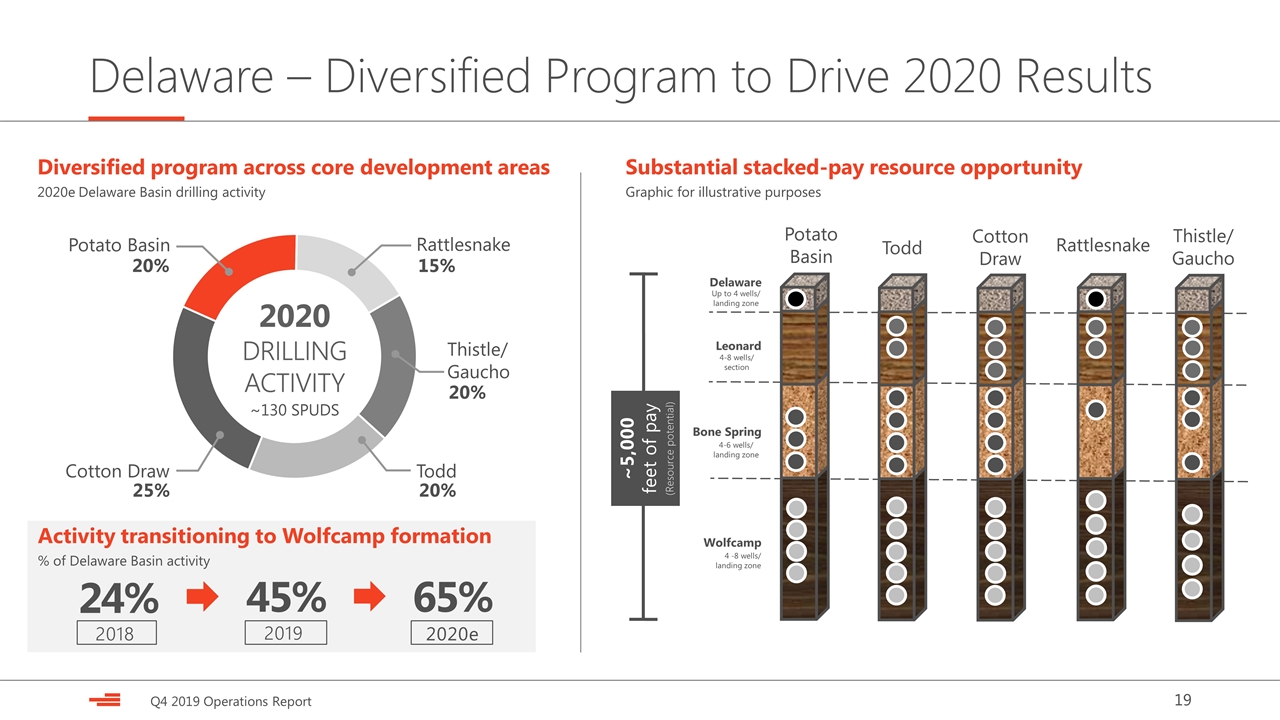

Delaware – Diversified Program to Drive 2020 Results Diversified program across core development areas 2020e Delaware Basin drilling activity Potato Basin Rattlesnake Thistle/ Gaucho Cotton Draw Todd 2020 DRILLING ACTIVITY 20% 25% 15% 20% 20% ~130 SPUDS Substantial stacked-pay resource opportunity Graphic for illustrative purposes Delaware Leonard Bone Spring Wolfcamp Thistle/ Gaucho Cotton Draw Todd Potato Basin Rattlesnake ~5,000 feet of pay (Resource potential) 4-8 wells/ section 4-6 wells/ landing zone 4 -8 wells/ landing zone Up to 4 wells/ landing zone Activity transitioning to Wolfcamp formation % of Delaware Basin activity 24% 45% 65% 2018 2019 2020e

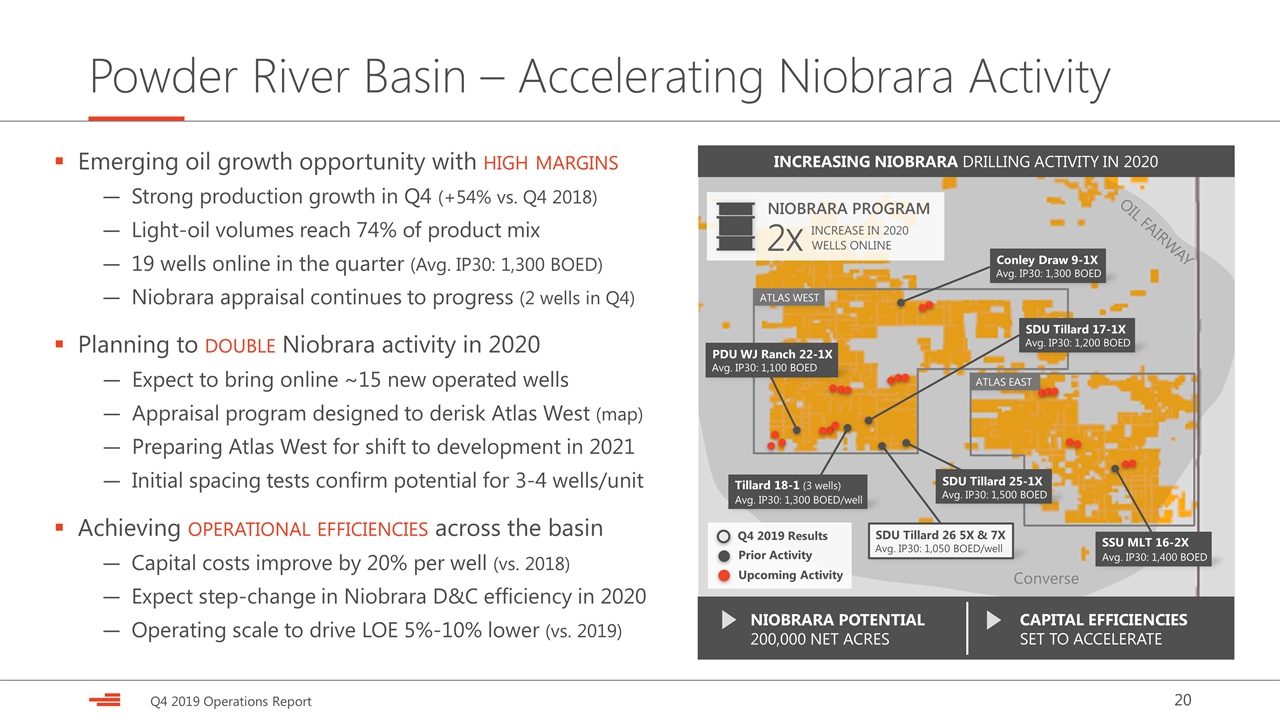

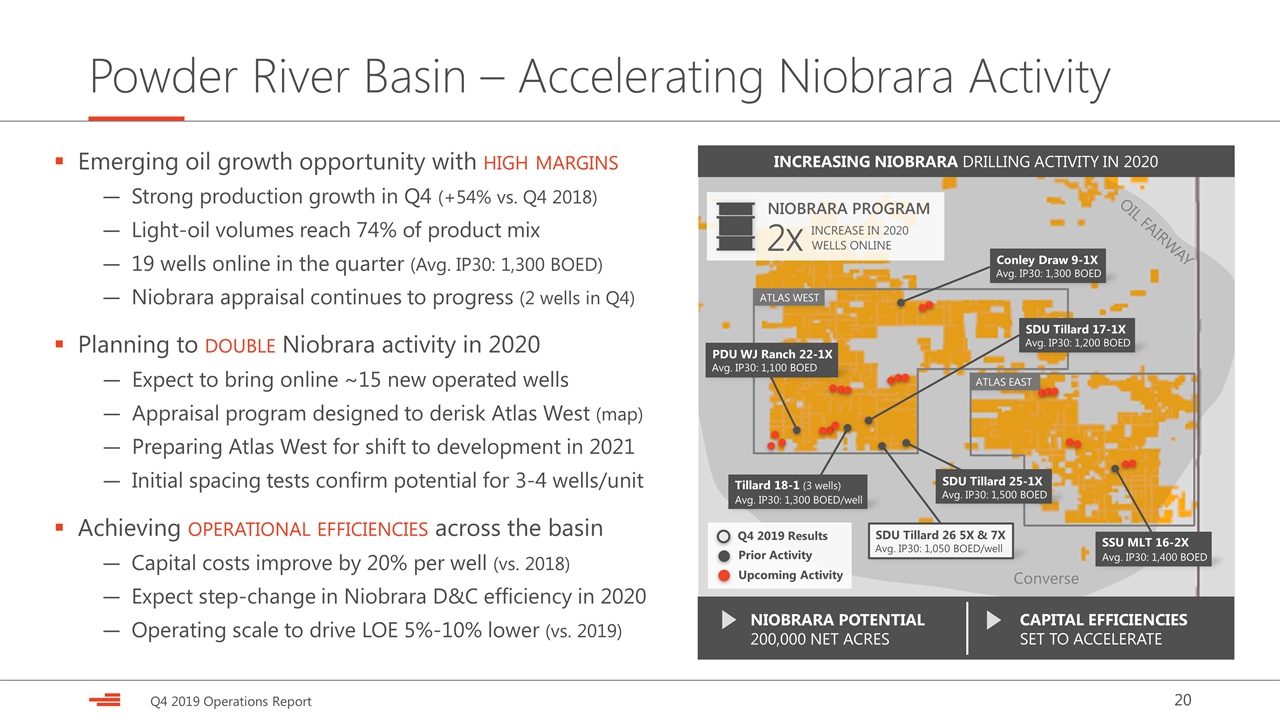

Powder River Basin – Accelerating Niobrara Activity Emerging oil growth opportunity with high margins Strong production growth in Q4 (+54% vs. Q4 2018) Light-oil volumes reach 74% of product mix 19 wells online in the quarter (Avg. IP30: 1,300 BOED) Niobrara appraisal continues to progress (2 wells in Q4) Planning to double Niobrara activity in 2020 Expect to bring online ~15 new operated wells Appraisal program designed to derisk Atlas West (map) Preparing Atlas West for shift to development in 2021 Initial spacing tests confirm potential for 3-4 wells/unit Achieving operational efficiencies across the basin Capital costs improve by 20% per well (vs. 2018) Expect step-change in Niobrara D&C efficiency in 2020 Operating scale to drive LOE 5%-10% lower (vs. 2019) STACKED PAY POSITION IN OIL FAIRWAY NIOBRARA POTENTIAL 200,000 NET ACRES CAPITAL EFFICIENCIES SET TO ACCELERATE INCREASING NIOBRARA DRILLING ACTIVITY IN 2020 Converse OIL FAIRWAY Conley Draw 9-1X Avg. IP30: 1,300 BOED SDU Tillard 17-1X Avg. IP30: 1,200 BOED ATLAS WEST ATLAS EAST Q4 2019 Results Prior Activity Upcoming Activity NIOBRARA PROGRAM 2x INCREASE IN 2020 WELLS ONLINE SSU MLT 16-2X Avg. IP30: 1,400 BOED SDU Tillard 26 5X & 7X Avg. IP30: 1,050 BOED/well SDU Tillard 25-1X Avg. IP30: 1,500 BOED Tillard 18-1 (3 wells) Avg. IP30: 1,300 BOED/well PDU WJ Ranch 22-1X Avg. IP30: 1,100 BOED

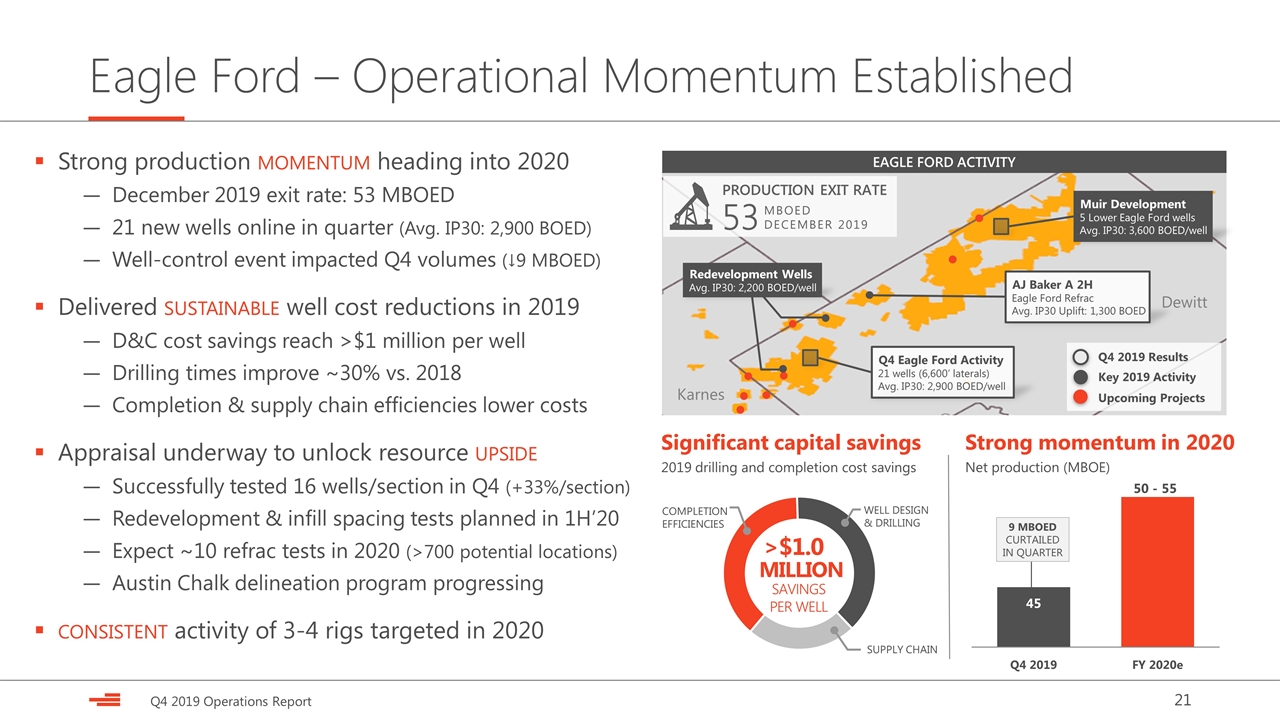

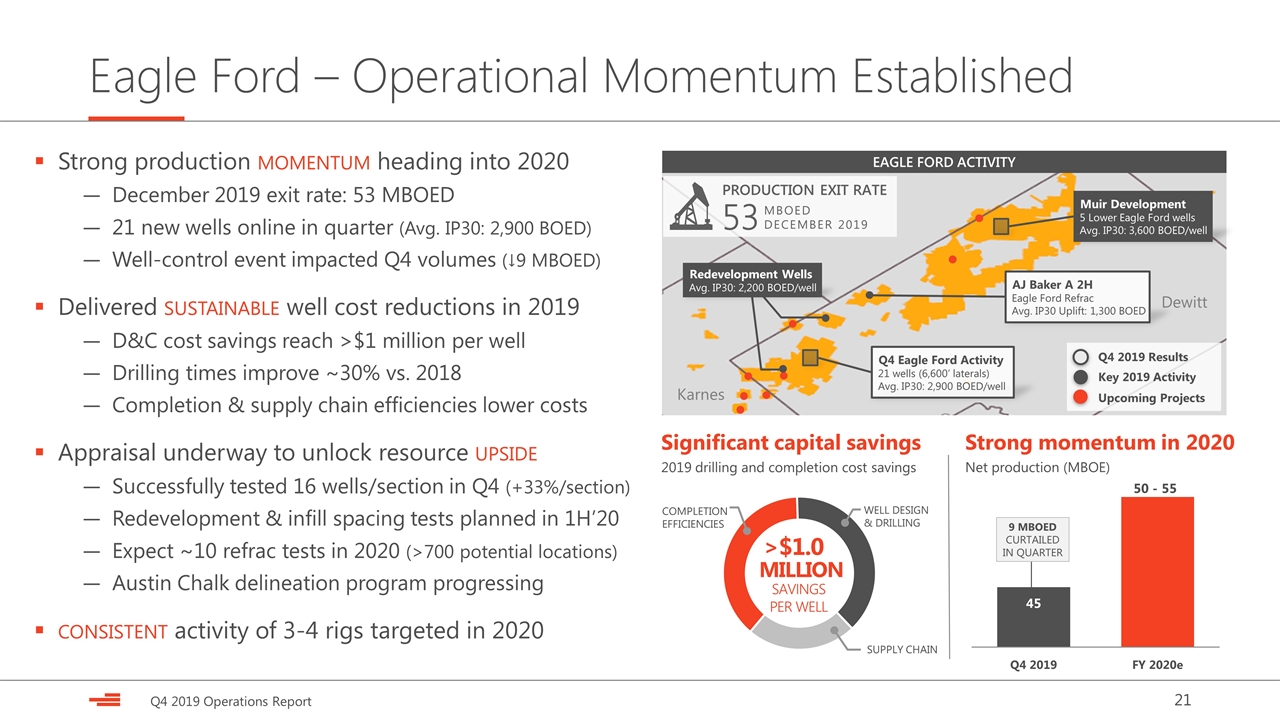

Eagle Ford – Operational Momentum Established Strong production momentum heading into 2020 December 2019 exit rate: 53 MBOED 21 new wells online in quarter (Avg. IP30: 2,900 BOED) Well-control event impacted Q4 volumes (↓9 MBOED) Delivered sustainable well cost reductions in 2019 D&C cost savings reach >$1 million per well Drilling times improve ~30% vs. 2018 Completion & supply chain efficiencies lower costs Appraisal underway to unlock resource upside Successfully tested 16 wells/section in Q4 (+33%/section) Redevelopment & infill spacing tests planned in 1H’20 Expect ~10 refrac tests in 2020 (>700 potential locations) Austin Chalk delineation program progressing consistent activity of 3-4 rigs targeted in 2020 Strong momentum in 2020 Net production (MBOE) Significant capital savings 2019 drilling and completion cost savings $1.0 SAVINGS PER WELL MILLION WELL DESIGN & DRILLING COMPLETION EFFICIENCIES > SUPPLY CHAIN EAGLE FORD ACTIVITY Dewitt Karnes Q4 Eagle Ford Activity 21 wells (6,600’ laterals) Avg. IP30: 2,900 BOED/well Key 2019 Activity Upcoming Projects PRODUCTION EXIT RATE 53 MBOED DECEMBER 2019 Redevelopment Wells Avg. IP30: 2,200 BOED/well Muir Development 5 Lower Eagle Ford wells Avg. IP30: 3,600 BOED/well Q4 2019 Results AJ Baker A 2H Eagle Ford Refrac Avg. IP30 Uplift: 1,300 BOED

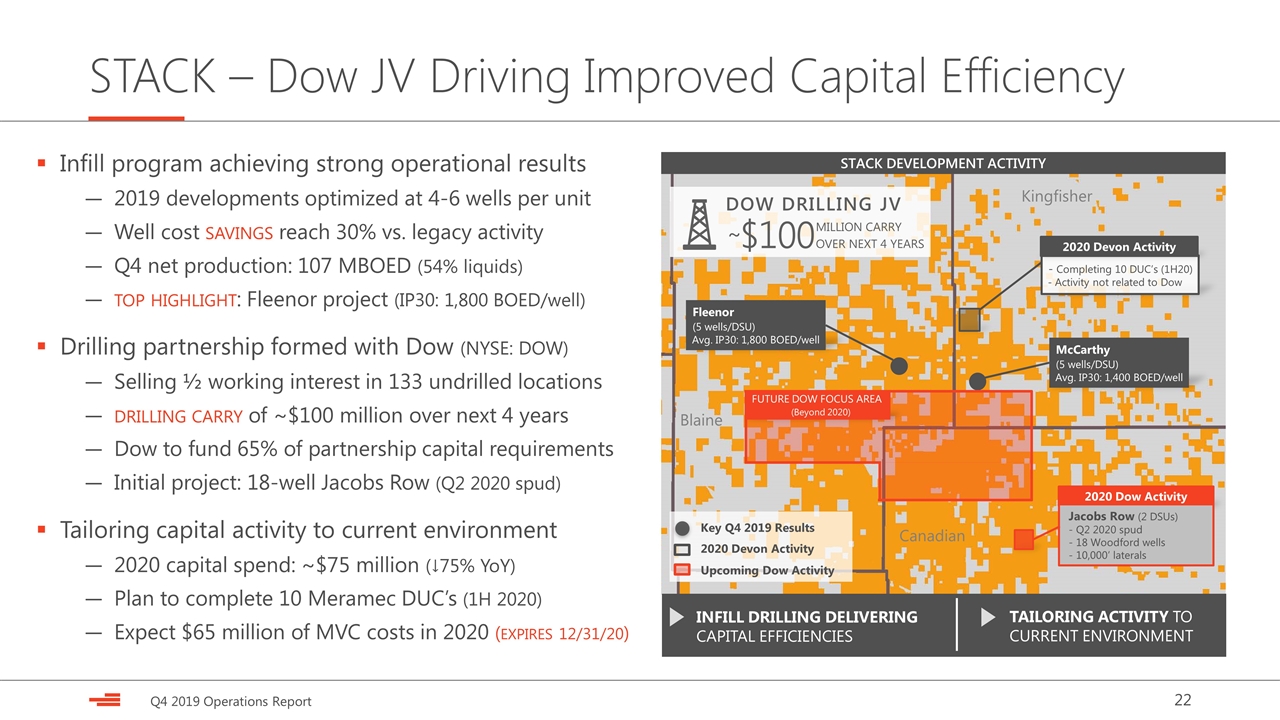

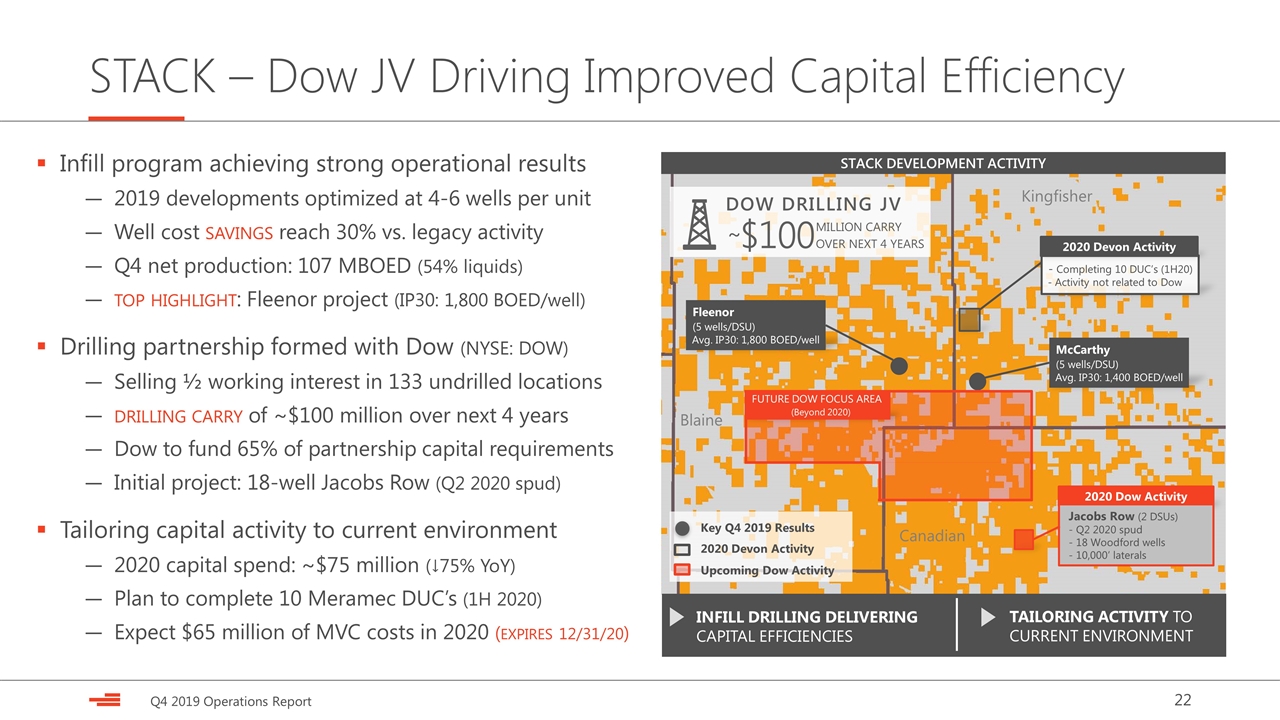

STACK – Dow JV Driving Improved Capital Efficiency Infill program achieving strong operational results 2019 developments optimized at 4-6 wells per unit Well cost savings reach 30% vs. legacy activity Q4 net production: 107 MBOED (54% liquids) top highlight: Fleenor project (IP30: 1,800 BOED/well) Drilling partnership formed with Dow (NYSE: DOW) Selling ½ working interest in 133 undrilled locations drilling carry of ~$100 million over next 4 years Dow to fund 65% of partnership capital requirements Initial project: 18-well Jacobs Row (Q2 2020 spud) Tailoring capital activity to current environment 2020 capital spend: ~$75 million (↓75% YoY) Plan to complete 10 Meramec DUC’s (1H 2020) Expect $65 million of MVC costs in 2020 (expires 12/31/20) STACK DEVELOPMENT ACTIVITY Blaine Canadian McCarthy (5 wells/DSU) Avg. IP30: 1,400 BOED/well Kingfisher 2020 Devon Activity Key Q4 2019 Results Fleenor (5 wells/DSU) Avg. IP30: 1,800 BOED/well Upcoming Dow Activity INFILL DRILLING DELIVERING CAPITAL EFFICIENCIES TAILORING ACTIVITY TO CURRENT ENVIRONMENT 2020 Dow Activity Jacobs Row (2 DSUs) - Q2 2020 spud - 18 Woodford wells - 10,000’ laterals FUTURE DOW FOCUS AREA (Beyond 2020) - Completing 10 DUC’s (1H20) - Activity not related to Dow 2020 Devon Activity DOW DRILLING JV ~ MILLION CARRY OVER NEXT 4 YEARS $100

Investor Contacts & Notices Investor Relations Contacts Scott CoodyChris Carr VP, Investor RelationsManager, Investor Relations 405-552-4735405-228-2496 Email: investor.relations@dvn.com Forward-Looking Statements This presentation includes “forward-looking statements” as defined by the Securities and Exchange Commission (the “SEC”). Such statements include those concerning strategic plans, our expectations and objectives for future operations, as well as other future events or conditions, and are often identified by use of the words and phrases “expects,” “believes,” “will,” “would,” “could,” “continue,” “may,” “aims,” “likely to be,” “intends,” “forecasts,” “projections,” “estimates,” “plans,” “expectations,” “targets,” “opportunities,” “potential,” “anticipates,” “outlook” and other similar terminology. All statements, other than statements of historical facts, included in this presentation that address activities, events or developments that Devon expects, believes or anticipates will or may occur in the future are forward-looking statements. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond our control. Consequently, actual future results could differ materially from our expectations due to a number of factors, including, but not limited to: the volatility of oil, gas and NGL prices; uncertainties inherent in estimating oil, gas and NGL Investor Notices reserves; the extent to which we are successful in acquiring and discovering additional reserves; the uncertainties, costs and risks involved in our operations, including as a result of employee misconduct; regulatory restrictions, compliance costs and other risks relating to governmental regulation, including with respect to environmental matters; risks related to regulatory, social and market efforts to address climate change; risks related to our hedging activities; counterparty credit risks; risks relating to our indebtedness; cyberattack risks; our limited control over third parties who operate some of our oil and gas properties; midstream capacity constraints and potential interruptions in production; the extent to which insurance covers any losses we may experience; competition for assets, materials, people and capital; risks related to investors attempting to effect change; our ability to successfully complete mergers, acquisitions and divestitures; and any of the other risks and uncertainties discussed in our Form 10-K and other filings with the SEC. All subsequent written and oral forward-looking statements attributable to Devon, or persons acting on its behalf, are expressly qualified in their entirety by the cautionary statements above. We assume no duty to update or revise our forward-looking statements based on new information, future events or otherwise. Use of Non-GAAP Information This presentation may include non-GAAP financial measures. Such non-GAAP measures are not alternatives to GAAP measures, and you should not consider these non-GAAP measures in isolation or as a substitute for analysis of our results as reported under GAAP. For additional disclosure regarding such non-GAAP measures, including reconciliations to their most directly comparable GAAP measure, please refer to Devon’s fourth-quarter 2019 earnings materials at www.devonenergy.com and 2019 Form 10-K filed with the SEC. Cautionary Note to Investors The SEC permits oil and gas companies, in their filings with the SEC, to disclose only proved, probable and possible reserves that meet the SEC's definitions for such terms, and price and cost sensitivities for such reserves, and prohibits disclosure of resources that do not constitute such reserves. This presentation may contain certain terms, such as high-return inventory, potential locations, risked and unrisked locations, estimated ultimate recovery (EUR), exploration target size and other similar terms. These estimates are by their nature more speculative than estimates of proved, probable and possible reserves and accordingly are subject to substantially greater risk of being actually realized. Investors are urged to consider closely the disclosure in our Form 10-K, available at www.devonenergy.com or the SEC’s website.