Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

(Mark One)

☑ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2021

or

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 001-32318

DEVON ENERGY CORPORATION

(Exact name of registrant as specified in its charter)

Delaware | | 73-1567067 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer identification No.) |

| |

333 West Sheridan Avenue, Oklahoma City, Oklahoma | | 73102-5015 |

(Address of principal executive offices) | | (Zip code) |

Registrant’s telephone number, including area code: (405) 235-3611

Former name, address and former fiscal year, if changed from last report: Not applicable

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | Trading Symbol | Name of each exchange on which registered |

Common Stock, par value $0.10 per share | DVN | The New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | |

Large accelerated filer | | ☑ | Accelerated filer | | ☐ | Non-accelerated filer | | ☐ |

Smaller reporting company | | ☐ | Emerging growth company | | ☐ | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

On October 20, 2021, 677.0 million shares of common stock were outstanding.

Table of Contents

DEVON ENERGY CORPORATION

FORM 10-Q

TABLE OF CONTENTS

2

Table of Contents

DEFINITIONS

Unless the context otherwise indicates, references to “us,” “we,” “our,” “ours,” “Devon,” the “Company” and “Registrant” refer to Devon Energy Corporation and its consolidated subsidiaries. All monetary values, other than per unit and per share amounts, are stated in millions of U.S. dollars unless otherwise specified. In addition, the following are other abbreviations and definitions of certain terms used within this Quarterly Report on Form 10-Q:

“Bbl” or “Bbls” means barrel or barrels.

“BKV” means Banpu Kalnin Ventures.

“Boe” means barrel of oil equivalent. Gas proved reserves and production are converted to Boe, at the pressure and temperature base standard of each respective state in which the gas is produced, at the rate of six Mcf of gas per Bbl of oil, based upon the approximate relative energy content of gas and oil. NGL proved reserves and production are converted to Boe on a one-to-one basis with oil.

“Btu” means British thermal units, a measure of heating value.

“Canada” means the division of Devon encompassing oil and gas properties located in Canada. On June 27, 2019, all of Devon’s Canadian operating assets and operations were divested. All dollar amounts associated with Canada are in U.S. dollars, unless stated otherwise.

“Catalyst” means Catalyst Midstream Partners, LLC.

“CDM” means Cotton Draw Midstream, L.L.C.

“DD&A” means depreciation, depletion and amortization expenses.

“ESG” means environmental, social and governance.

“G&A” means general and administrative expenses.

“GAAP” means U.S. generally accepted accounting principles.

“Inside FERC” refers to the publication Inside FERC’s Gas Market Report.

“LOE” means lease operating expenses.

“MBbls” means thousand barrels.

“MBoe” means thousand Boe.

“Mcf” means thousand cubic feet.

“Merger” means the merger of Merger Sub with and into WPX, with WPX continuing as the surviving corporation and a wholly-owned subsidiary of the Company, pursuant to the terms of the Merger Agreement.

“Merger Agreement” means that certain Agreement and Plan of Merger, dated September 26, 2020, by and among the Company, Merger Sub and WPX.

“Merger Sub” means East Merger Sub, Inc., a wholly-owned subsidiary of the Company.

“MMBoe” means million Boe.

“MMBtu” means million Btu.

“MMcf” means million cubic feet.

3

Table of Contents

“N/M” means not meaningful.

“NGL” or “NGLs” means natural gas liquids.

“NYMEX” means New York Mercantile Exchange.

“OPEC” means Organization of the Petroleum Exporting Countries.

“SEC” means United States Securities and Exchange Commission.

“Senior Credit Facility” means Devon’s syndicated unsecured revolving line of credit, effective as of October 5, 2018.

“TSR” means total shareholder return.

“U.S.” means United States of America.

“VIE” means variable interest entity.

“WPX” means WPX Energy, Inc.

“WTI” means West Texas Intermediate.

“/Bbl” means per barrel.

“/d” means per day.

“/Mcf” means per Mcf.

“/MMBtu” means per MMBtu.

4

Table of Contents

INFORMATION REGARDING FORWARD-LOOKING STATEMENTS

This report includes “forward-looking statements” as defined by the SEC. Such statements include those concerning strategic plans, our expectations and objectives for future operations, as well as other future events or conditions, and are often identified by use of the words and phrases “expects,” “believes,” “will,” “would,” “could,” “continue,” “may,” “aims,” “likely to be,” “intends,” “forecasts,” “projections,” “estimates,” “plans,” “expectations,” “targets,” “opportunities,” “potential,” “anticipates,” “outlook” and other similar terminology. All statements, other than statements of historical facts, included in this report that address activities, events or developments that Devon expects, believes or anticipates will or may occur in the future are forward-looking statements. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond our control. Consequently, actual future results could differ materially and adversely from our expectations due to a number of factors, including, but not limited to:

| • | the volatility of oil, gas and NGL prices; |

| • | risks relating to the COVID-19 pandemic or other future pandemics; |

| • | uncertainties inherent in estimating oil, gas and NGL reserves; |

| • | the extent to which we are successful in acquiring and discovering additional reserves; |

| • | regulatory restrictions, compliance costs and other risks relating to governmental regulation, including with respect to environmental matters; |

| • | risks related to regulatory, social and market efforts to address climate change; |

| • | the uncertainties, costs and risks involved in our operations, including as a result of employee misconduct; |

| • | risks related to our hedging activities; |

| • | counterparty credit risks; |

| • | risks relating to our indebtedness; |

| • | our limited control over third parties who operate some of our oil and gas properties; |

| • | midstream capacity constraints and potential interruptions in production; |

| • | the extent to which insurance covers any losses we may experience; |

| • | competition for assets, materials, people and capital; |

| • | risks related to investors attempting to effect change; |

| • | our ability to successfully complete mergers, acquisitions and divestitures; |

| • | risks related to the Merger, including the risk that we may not realize the anticipated benefits of the Merger or successfully integrate the two legacy businesses; and |

All subsequent written and oral forward-looking statements attributable to Devon, or persons acting on its behalf, are expressly qualified in their entirety by the cautionary statements above. We assume no duty to update or revise our forward-looking statements based on new information, future events or otherwise.

5

Table of Contents

Part I. Financial Information

Item 1. Financial Statements

DEVON ENERGY CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE EARNINGS

| | Three Months Ended September 30, | | | Nine Months Ended September 30, | |

| | 2021 | | | 2020 | | | 2021 | | | 2020 | |

| | (Unaudited) | |

Oil, gas and NGL sales | | $ | 2,635 | | | $ | 678 | | | $ | 6,546 | | | $ | 1,909 | |

Oil, gas and NGL derivatives | | | (335 | ) | | | (87 | ) | | | (1,566 | ) | | | 272 | |

Marketing and midstream revenues | | | 1,166 | | | | 476 | | | | 2,953 | | | | 1,367 | |

Total revenues | | | 3,466 | | | | 1,067 | | | | 7,933 | | | | 3,548 | |

Production expenses | | | 555 | | | | 271 | | | | 1,526 | | | | 852 | |

Exploration expenses | | | 3 | | | | 39 | | | | 9 | | | | 163 | |

Marketing and midstream expenses | | | 1,165 | | | | 478 | | | | 2,972 | | | | 1,395 | |

Depreciation, depletion and amortization | | | 578 | | | | 299 | | | | 1,581 | | | | 999 | |

Asset impairments | | | — | | | | — | | | | — | | | | 2,666 | |

Asset dispositions | | | — | | | | — | | | | (119 | ) | | | — | |

General and administrative expenses | | | 95 | | | | 75 | | | | 296 | | | | 256 | |

Financing costs, net | | | 86 | | | | 66 | | | | 243 | | | | 200 | |

Restructuring and transaction costs | | | 18 | | | | 32 | | | | 230 | | | | 32 | |

Other, net | | | 2 | | | | — | | | �� | (41 | ) | | | (35 | ) |

Total expenses | | | 2,502 | | | | 1,260 | | | | 6,697 | | | | 6,528 | |

Earnings (loss) from continuing operations before income taxes | | | 964 | | | | (193 | ) | | | 1,236 | | | | (2,980 | ) |

Income tax expense (benefit) | | | 120 | | | | (90 | ) | | | (85 | ) | | | (510 | ) |

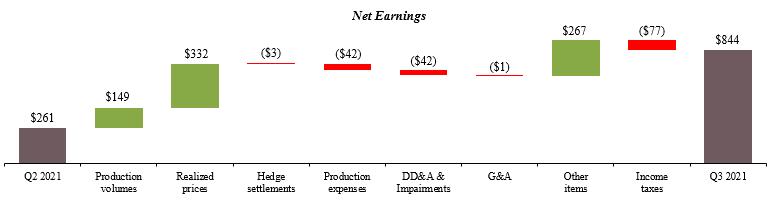

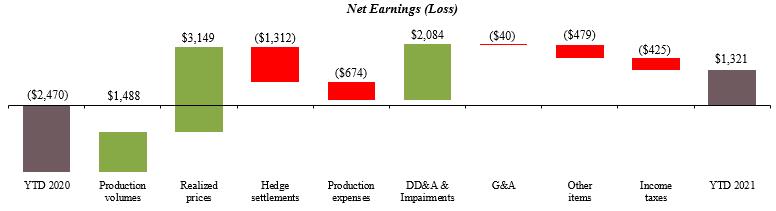

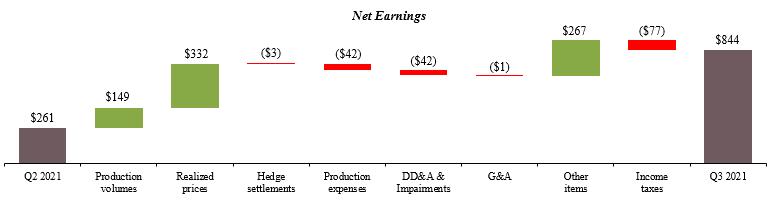

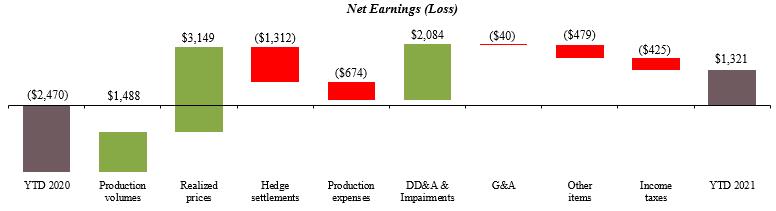

Net earnings (loss) from continuing operations | | | 844 | | | | (103 | ) | | | 1,321 | | | | (2,470 | ) |

Net earnings (loss) from discontinued operations, net of income taxes | | | — | | | | 13 | | | | — | | | | (103 | ) |

Net earnings (loss) | | | 844 | | | | (90 | ) | | | 1,321 | | | | (2,573 | ) |

Net earnings attributable to noncontrolling interests | | | 6 | | | | 2 | | | | 14 | | | | 5 | |

Net earnings (loss) attributable to Devon | | $ | 838 | | | $ | (92 | ) | | $ | 1,307 | | | $ | (2,578 | ) |

Basic net earnings (loss) per share: | | | | | | | | | | | | | | | | |

Basic earnings (loss) from continuing operations per share | | $ | 1.24 | | | $ | (0.29 | ) | | $ | 1.95 | | | $ | (6.58 | ) |

Basic earnings (loss) from discontinued operations per share | | | — | | | | 0.04 | | | | — | | | | (0.27 | ) |

Basic net earnings (loss) per share | | $ | 1.24 | | | $ | (0.25 | ) | | $ | 1.95 | | | $ | (6.85 | ) |

Diluted net earnings (loss) per share: | | | | | | | | | | | | | | | | |

Diluted earnings (loss) from continuing operations per share | | $ | 1.24 | | | $ | (0.29 | ) | | $ | 1.95 | | | $ | (6.58 | ) |

Diluted earnings (loss) from discontinued operations per share | | | — | | | | 0.04 | | | | — | | | | (0.27 | ) |

Diluted net earnings (loss) per share | | $ | 1.24 | | | $ | (0.25 | ) | | $ | 1.95 | | | $ | (6.85 | ) |

Comprehensive earnings (loss): | | | | | | | | | | | | | | | | |

Net earnings (loss) | | $ | 844 | | | $ | (90 | ) | | $ | 1,321 | | | $ | (2,573 | ) |

Other comprehensive earnings, net of tax: | | | | | | | | | | | | | | | | |

Pension and postretirement plans | | | 1 | | | | 1 | | | | 27 | | | | 3 | |

Other comprehensive earnings, net of tax | | | 1 | | | | 1 | | | | 27 | | | | 3 | |

Comprehensive earnings (loss): | | | 845 | | | | (89 | ) | | | 1,348 | | | | (2,570 | ) |

Comprehensive earnings attributable to noncontrolling interests | | | 6 | | | | 2 | | | | 14 | | | | 5 | |

Comprehensive earnings (loss) attributable to Devon | | $ | 839 | | | $ | (91 | ) | | $ | 1,334 | | | $ | (2,575 | ) |

See accompanying notes to consolidated financial statements

6

Table of Contents

DEVON ENERGY CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

| | Three Months Ended September 30, | | | Nine Months Ended September 30, | |

| | 2021 | | | 2020 | | | 2021 | | | 2020 | |

| | (Unaudited) | |

Cash flows from operating activities: | | | | | | | | | | | | | | | | |

Net earnings (loss) | | $ | 844 | | | $ | (90 | ) | | $ | 1,321 | | | $ | (2,573 | ) |

Adjustments to reconcile net earnings (loss) to net cash from operating activities: | | | | | | | | | | | | | | | | |

Net (earnings) loss from discontinued operations, net of income taxes | | | — | | | | (13 | ) | | | — | | | | 103 | |

Depreciation, depletion and amortization | | | 578 | | | | 299 | | | | 1,581 | | | | 999 | |

Asset impairments | | | — | | | | — | | | | — | | | | 2,666 | |

Leasehold impairments | | | 1 | | | | 36 | | | | 3 | | | | 149 | |

(Amortization) accretion of liabilities | | | (7 | ) | | | 8 | | | | (21 | ) | | | 24 | |

Total (gains) losses on commodity derivatives | | | 335 | | | | 87 | | | | 1,566 | | | | (272 | ) |

Cash settlements on commodity derivatives | | | (370 | ) | | | 10 | | | | (969 | ) | | | 343 | |

Gains on asset dispositions | | | — | | | | — | | | | (119 | ) | | | — | |

Deferred income tax expense (benefit) | | | 119 | | | | — | | | | (100 | ) | | | (311 | ) |

Share-based compensation | | | 19 | | | | 31 | | | | 80 | | | | 70 | |

Early retirement of debt | | | — | | | | — | | | | (30 | ) | | | — | |

Other | | | 11 | | | | 1 | | | | 13 | | | | 5 | |

Changes in assets and liabilities, net | | | 68 | | | | 58 | | | | (42 | ) | | | (97 | ) |

Net cash from operating activities - continuing operations | | | 1,598 | | | | 427 | | | | 3,283 | | | | 1,106 | |

Cash flows from investing activities: | | | | | | | | | | | | | | | | |

Capital expenditures | | | (474 | ) | | | (204 | ) | | | (1,477 | ) | | | (936 | ) |

Acquisitions of property and equipment | | | (10 | ) | | | — | | | | (15 | ) | | | (5 | ) |

Divestitures of property and equipment | | | 1 | | | | 1 | | | | 65 | | | | 29 | |

WPX acquired cash | | | — | | | | — | | | | 344 | | | | — | |

Distributions from equity method investments | | | 9 | | | | — | | | | 27 | | | | — | |

Net cash from investing activities - continuing operations | | | (474 | ) | | | (203 | ) | | | (1,056 | ) | | | (912 | ) |

Cash flows from financing activities: | | | | | | | | | | | | | | | | |

Repayments of long-term debt | | | — | | | | — | | | | (1,243 | ) | | | — | |

Early retirement of debt | | | — | | | | — | | | | (59 | ) | | | — | |

Repurchases of common stock | | | — | | | | — | | | | — | | | | (38 | ) |

Dividends paid on common stock | | | (329 | ) | | | (43 | ) | | | (761 | ) | | | (119 | ) |

Contributions from noncontrolling interests | | | 1 | | | | 1 | | | | 4 | | | | 12 | |

Distributions to noncontrolling interests | | | (6 | ) | | | (4 | ) | | | (15 | ) | | | (10 | ) |

Acquisition of noncontrolling interests | | | — | | | | — | | | | (24 | ) | | | — | |

Shares exchanged for tax withholdings and other | | | (3 | ) | | | — | | | | (45 | ) | | | (17 | ) |

Net cash from financing activities - continuing operations | | | (337 | ) | | | (46 | ) | | | (2,143 | ) | | | (172 | ) |

Effect of exchange rate changes on cash - continuing operations | | | (5 | ) | | | — | | | | — | | | | — | |

Net change in cash, cash equivalents and restricted cash of continuing operations | | | 782 | | | | 178 | | | | 84 | | | | 22 | |

Cash flows from discontinued operations: | | | | | | | | | | | | | | | | |

Operating activities | | | 0 | | | | 45 | | | | 0 | | | | (129 | ) |

Investing activities | | | 0 | | | | 1 | | | | 0 | | | | 171 | |

Financing activities | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

Effect of exchange rate changes on cash | | | 0 | | | | 4 | | | | 0 | | | | (11 | ) |

Net change in cash, cash equivalents and restricted cash of discontinued operations | | | 0 | | | | 50 | | | | 0 | | | | 31 | |

Net change in cash, cash equivalents and restricted cash | | | 782 | | | | 228 | | | | 84 | | | | 53 | |

Cash, cash equivalents and restricted cash at beginning of period | | | 1,539 | | | | 1,669 | | | | 2,237 | | | | 1,844 | |

Cash, cash equivalents and restricted cash at end of period | | $ | 2,321 | | | $ | 1,897 | | | $ | 2,321 | | | $ | 1,897 | |

| | | | | | | | | | | | | | | | |

Reconciliation of cash, cash equivalents and restricted cash: | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 2,144 | | | $ | 1,707 | | | $ | 2,144 | | | $ | 1,707 | |

Restricted cash | | | 177 | | | | 190 | | | | 177 | | | | 190 | |

Total cash, cash equivalents and restricted cash | | $ | 2,321 | | | $ | 1,897 | | | $ | 2,321 | | | $ | 1,897 | |

See accompanying notes to consolidated financial statements

7

Table of Contents

DEVON ENERGY CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

| | September 30, 2021 | | | December 31, 2020 | |

| | (Unaudited) | | | | | |

ASSETS | | | | | | | | |

Current assets: | | | | | | | | |

Cash, cash equivalents and restricted cash | | $ | 2,321 | | | $ | 2,237 | |

Accounts receivable | | | 1,517 | | | | 601 | |

Income taxes receivable | | | 80 | | | | 174 | |

Other current assets | | | 309 | | | | 248 | |

Total current assets | | | 4,227 | | | | 3,260 | |

Oil and gas property and equipment, based on successful efforts accounting, net | | | 13,613 | | | | 4,436 | |

Other property and equipment, net ($106 million and $102 million related to CDM in 2021 and 2020, respectively) | | | 1,465 | | | | 957 | |

Total property and equipment, net | | | 15,078 | | | | 5,393 | |

Goodwill | | | 753 | | | | 753 | |

Right-of-use assets | | | 244 | | | | 223 | |

Investments | | | 388 | | | | 12 | |

Other long-term assets | | | 367 | | | | 271 | |

Total assets | | $ | 21,057 | | | $ | 9,912 | |

LIABILITIES AND EQUITY | | | | | | | | |

Current liabilities: | | | | | | | | |

Accounts payable | | $ | 537 | | | $ | 242 | |

Revenues and royalties payable | | | 1,443 | | | | 662 | |

Other current liabilities | | | 1,525 | | | | 536 | |

Total current liabilities | | | 3,505 | | | | 1,440 | |

Long-term debt | | | 6,492 | | | | 4,298 | |

Lease liabilities | | | 256 | | | | 246 | |

Asset retirement obligations | | | 462 | | | | 358 | |

Other long-term liabilities | | | 1,281 | | | | 551 | |

Stockholders' equity: | | | | | | | | |

Common stock, $0.10 par value. Authorized 1.0 billion shares; issued 677 million and 382 million shares in 2021 and 2020, respectively | | | 68 | | | | 38 | |

Additional paid-in capital | | | 8,206 | | | | 2,766 | |

Retained earnings | | | 750 | | | | 208 | |

Accumulated other comprehensive loss | | | (100 | ) | | | (127 | ) |

Total stockholders’ equity attributable to Devon | | | 8,924 | | | | 2,885 | |

Noncontrolling interests | | | 137 | | | | 134 | |

Total equity | | | 9,061 | | | | 3,019 | |

Total liabilities and equity | | $ | 21,057 | | | $ | 9,912 | |

See accompanying notes to consolidated financial statements

8

Table of Contents

DEVON ENERGY CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF EQUITY

| | | | | | | | | | | | | | | | | | Other | | | | | | | | | | | | | |

| | | | | | | | | | Additional | | | | | | | Comprehensive | | | | | | | | | | | | | |

| | Common Stock | | | Paid-In | | | Retained | | | Earnings | | | Treasury | | | Noncontrolling | | | Total | |

| | Shares | | | Amount | | | Capital | | | Earnings | | | (Loss) | | | Stock | | | Interests | | | Equity | |

| | (Unaudited) | |

Three Months Ended September 30, 2021 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance as of June 30, 2021 | | | 677 | | | $ | 68 | | | $ | 8,189 | | | $ | 243 | | | $ | (101 | ) | | $ | — | | | $ | 136 | | | $ | 8,535 | |

Net earnings | | | — | | | | — | | | | — | | | | 838 | | | | — | | | | — | | | | 6 | | | | 844 | |

Other comprehensive earnings, net of tax | | | — | | | | — | | | | — | | | | — | | | | 1 | | | | — | | | | — | | | | 1 | |

Restricted stock grants, net of cancellations | | | — | | | | — | | | | (1 | ) | | | — | | | | — | | | | — | | | | — | | | | (1 | ) |

Common stock repurchased | | | — | | | | — | | | | — | | | | — | | | | — | | | | (1 | ) | | | — | | | | (1 | ) |

Common stock retired | | | — | | | | — | | | | (1 | ) | | | — | | | | — | | | | 1 | | | | — | | | | — | |

Common stock dividends | | | — | | | | — | | | | — | | | | (331 | ) | | | — | | | | — | | | | — | | | | (331 | ) |

Share-based compensation | | | — | | | | — | | | | 19 | | | | — | | | | — | | | | — | | | | — | | | | 19 | |

Contributions from noncontrolling interests | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 1 | | | | 1 | |

Distributions to noncontrolling interests | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (6 | ) | | | (6 | ) |

Balance as of September 30, 2021 | | | 677 | | | $ | 68 | | | $ | 8,206 | | | $ | 750 | | | $ | (100 | ) | | $ | — | | | $ | 137 | | | $ | 9,061 | |

Three Months Ended September 30, 2020 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance as of June 30, 2020 | | | 383 | | | $ | 38 | | | $ | 2,720 | | | $ | 586 | | | $ | (117 | ) | | $ | — | | | $ | 126 | | | $ | 3,353 | |

Net earnings (loss) | | | — | | | | — | | | | — | | | | (92 | ) | | | — | | | | — | | | | 2 | | | | (90 | ) |

Other comprehensive earnings, net of tax | | | — | | | | — | | | | — | | | | — | | | | 1 | | | | — | | | | — | | | | 1 | |

Common stock repurchased | | | — | | | | — | | | | — | | | | — | | | | — | | | | (1 | ) | | | — | | | | (1 | ) |

Common stock retired | | | — | | | | — | | | | (1 | ) | | | — | | | | — | | | | 1 | | | | — | | | | — | |

Common stock dividends | | | — | | | | — | | | | — | | | | (143 | ) | | | — | | | | — | | | | — | | | | (143 | ) |

Share-based compensation | | | — | | | | — | | | | 31 | | | | — | | | | — | | | | — | | | | — | | | | 31 | |

Contributions from noncontrolling interests | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 1 | | | | 1 | |

Distributions to noncontrolling interests | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (4 | ) | | | (4 | ) |

Balance as of September 30, 2020 | | | 383 | | | $ | 38 | | | $ | 2,750 | | | $ | 351 | | | $ | (116 | ) | | $ | — | | | $ | 125 | | | $ | 3,148 | |

Nine Months Ended September 30, 2021 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance as of December 31, 2020 | | | 382 | | | $ | 38 | | | $ | 2,766 | | | $ | 208 | | | $ | (127 | ) | | $ | — | | | $ | 134 | | | $ | 3,019 | |

Net earnings | | | — | | | | — | | | | — | | | | 1,307 | | | | — | | | | — | | | | 14 | | | | 1,321 | |

Other comprehensive earnings, net of tax | | | — | | | | — | | | | — | | | | — | | | | 27 | | | | — | | | | — | | | | 27 | |

Restricted stock grants, net of cancellations | | | 6 | | | | 1 | | | | (2 | ) | | | — | | | | — | | | | — | | | | — | | | | (1 | ) |

Common stock repurchased | | | — | | | | — | | | | — | | | | — | | | | — | | | | (41 | ) | | | — | | | | (41 | ) |

Common stock retired | | | (2 | ) | | | — | | | | (41 | ) | | | — | | | | — | | | | 41 | | | | — | | | | — | |

Common stock dividends | | | — | | | | — | | | | — | | | | (765 | ) | | | — | | | | — | | | | — | | | | (765 | ) |

Common stock issued | | | 290 | | | | 29 | | | | 5,403 | | | | — | | | | — | | | | — | | | | — | | | | 5,432 | |

Share-based compensation | | | 1 | | | | — | | | | 80 | | | | — | | | | — | | | | — | | | | — | | | | 80 | |

Contributions from noncontrolling interests | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 3 | | | | 3 | |

Distributions to noncontrolling interests | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (14 | ) | | | (14 | ) |

Balance as of September 30, 2021 | | | 677 | | | $ | 68 | | | $ | 8,206 | | | $ | 750 | | | $ | (100 | ) | | $ | — | | | $ | 137 | | | $ | 9,061 | |

Nine Months Ended September 30, 2020 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance as of December 31, 2019 | | | 382 | | | $ | 38 | | | $ | 2,735 | | | $ | 3,148 | | | $ | (119 | ) | | $ | — | | | $ | 118 | | | $ | 5,920 | |

Net earnings (loss) | | | — | | | | — | | | | — | | | | (2,578 | ) | | | — | | | | — | | | | 5 | | | | (2,573 | ) |

Other comprehensive earnings, net of tax | | | — | | | | — | | | | — | | | | — | | | | 3 | | | | — | | | | — | | | | 3 | |

Restricted stock grants, net of cancellations | | | 3 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Common stock repurchased | | | — | | | | — | | | | — | | | | — | | | | — | | | | (55 | ) | | | — | | | | (55 | ) |

Common stock retired | | | (3 | ) | | | — | | | | (55 | ) | | | — | | | | — | | | | 55 | | | | — | | | | — | |

Common stock dividends | | | — | | | | — | | | | — | | | | (219 | ) | | | — | | | | — | | | | — | | | | (219 | ) |

Share-based compensation | | | 1 | | | | — | | | | 70 | | | | — | | | | — | | | | — | | | | — | | | | 70 | |

Contributions from noncontrolling interests | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 12 | | | | 12 | |

Distributions to noncontrolling interests | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (10 | ) | | | (10 | ) |

Balance as of September 30, 2020 | | | 383 | | | $ | 38 | | | $ | 2,750 | | | $ | 351 | | | $ | (116 | ) | | $ | — | | | $ | 125 | | | $ | 3,148 | |

See accompanying notes to consolidated financial statements

9

Table of Contents

DEVON ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. | Summary of Significant Accounting Policies |

The accompanying unaudited interim financial statements and notes of Devon have been prepared pursuant to the rules and regulations of the SEC. Pursuant to such rules and regulations, certain disclosures normally included in financial statements prepared in accordance with U.S. GAAP have been omitted. The accompanying unaudited interim financial statements and notes should be read in conjunction with the financial statements and notes included in Devon’s 2020 Annual Report on Form 10-K. The accompanying unaudited interim financial statements in this report reflect all adjustments that are, in the opinion of management, necessary for a fair statement of Devon’s results of operations and cash flows for the three-month and nine-month periods ended September 30, 2021 and 2020 and Devon’s financial position as of September 30, 2021.

Devon and WPX completed an all-stock merger of equals on January 7, 2021. On the closing date of the Merger, each share of WPX common stock was automatically converted into the right to receive 0.5165 of a share of Devon common stock. The transaction has been accounted for using the acquisition method of accounting, with Devon being treated as the accounting acquirer. See Note 2 for further discussion.

As further discussed in Note 17, Devon closed on the sale of its Barnett Shale assets in October 2020. Prior to December 31, 2020, activity relating to Devon’s Barnett Shale assets is classified as discontinued operations within Devon’s consolidated statements of comprehensive earnings and consolidated statements of cash flows.

As of September 30, 2021, Devon classified approximately $165 million of cash as restricted cash on the consolidated balance sheets for obligations retained related to the Barnett Shale assets and the Canadian business. Cash payments for these charges related to the Barnett assets and Canada business total approximately $10 million per quarter.

Variable Interest Entity

Cotton Draw Midstream, L.L.C. (“CDM”) is a joint venture entity formed by Devon and an affiliate of QL Capital Partners, LP. CDM provides gathering, compression and dehydration services for natural gas production in the Cotton Draw area of the Delaware Basin. Devon holds a controlling interest in CDM and the portions of CDM’s net earnings and equity not attributable to Devon’s controlling interest are shown separately as noncontrolling interests in the accompanying consolidated statements of comprehensive earnings and consolidated balance sheets. CDM is considered a VIE to Devon. The assets of CDM cannot be used by Devon for general corporate purposes and are included in, and disclosed parenthetically, on Devon's consolidated balance sheets. The carrying amount of liabilities related to CDM for which the creditors do not have recourse to Devon's assets are also included in, and disclosed parenthetically, if material, on Devon's consolidated balance sheets.

Investments

In conjunction with the Merger, Devon acquired an interest in Catalyst which is a joint venture established between WPX and Howard Energy Partners (“HEP”) to develop oil gathering and natural gas processing infrastructure in the Stateline area of the Delaware Basin. Under the terms of the arrangement, Devon and HEP each have a 50 percent voting interest in the joint venture legal entity, and HEP serves as the operator. Through 2038, Devon’s production from 50,000 net acres in the Stateline area of the Delaware Basin has been dedicated to Catalyst subject to fixed-fee oil gathering and natural gas processing agreements. The agreements do not include any minimum volume commitments. Devon accounts for the investment in Catalyst as an equity method investment. Devon’s investment in Catalyst is shown within investments on the consolidated balance sheet and Devon’s share of Catalyst earnings are reflected as a component of other, net in the accompanying consolidated statements of comprehensive earnings.

10

Table of Contents

DEVON ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(Unaudited)

Disaggregation of Revenue

The following table presents revenue from contracts with customers that are disaggregated based on the type of good or service.

| | Three Months Ended September 30, | | | Nine Months Ended September 30, | |

| | 2021 | | | 2020 | | | 2021 | | | 2020 | |

Oil | | $ | 1,900 | | | $ | 504 | | | $ | 4,917 | | | $ | 1,462 | |

Gas | | | 309 | | | | 79 | | | | 699 | | | | 221 | |

NGL | | | 426 | | | | 95 | | | | 930 | | | | 226 | |

Oil, gas and NGL sales | | | 2,635 | | | | 678 | | | | 6,546 | | | | 1,909 | |

| | | | | | | | | | | | | | | | |

Oil | | | 649 | | | | 233 | | | | 1,758 | | | | 702 | |

Gas | | | 196 | | | | 100 | | | | 477 | | | | 275 | |

NGL | | | 321 | | | | 143 | | | | 718 | | | | 390 | |

Marketing and midstream revenues | | | 1,166 | | | | 476 | | | | 2,953 | | | | 1,367 | |

Total revenues from contracts with customers | | $ | 3,801 | | | $ | 1,154 | | | $ | 9,499 | | | $ | 3,276 | |

2.Acquisitions and Divestitures

WPX Merger

On January 7, 2021, Devon and WPX completed an all-stock merger of equals. WPX was an oil and gas exploration and production company with assets in the Delaware Basin in Texas and New Mexico and the Williston Basin in North Dakota. On the closing date of the Merger, each share of WPX common stock was automatically converted into the right to receive 0.5165 of a share of Devon common stock. No fractional shares of Devon’s common stock were issued in the Merger, and holders of WPX common stock instead received cash in lieu of fractional shares of Devon common stock, if any. Based on the closing price of Devon’s common stock on January 7, 2021, the total value of Devon common stock issued to holders of WPX common stock as part of this transaction was approximately $5.4 billion. The Merger was structured as a tax-free reorganization for United States federal income tax purposes.

Purchase Price Allocation

The transaction has been accounted for using the acquisition method of accounting, with Devon being treated as the accounting acquirer. Under the acquisition method of accounting, the assets and liabilities of WPX and its subsidiaries have been recorded at their respective fair values as of the date of completion of the Merger and added to Devon’s. The preliminary purchase price assessment remains an ongoing process and is subject to change for up to one year subsequent to the closing date of the Merger. Determining the fair value of the assets and liabilities of WPX requires judgment and certain assumptions to be made, the most significant of these being related to the valuation of WPX’s oil and gas properties. The inputs and assumptions related to the oil and gas properties are categorized as level 3 in the fair value hierarchy.

11

Table of Contents

DEVON ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(Unaudited)

The following table represents the preliminary allocation of the total purchase price of WPX to the identifiable assets acquired and the liabilities assumed based on the fair values as of the acquisition date.

| | Preliminary Purchase | |

| | Price Allocation | |

| | as of September 30, 2021 | |

Consideration: | | | | |

WPX Common Stock outstanding | | | 561.2 | |

Exchange Ratio | | | 0.5165 | |

Devon common stock issued | | | 289.9 | |

Devon closing price on January 7, 2021 | | $ | 18.57 | |

Total common equity consideration | | | 5,383 | |

Share-based replacement awards | | | 49 | |

Total consideration | | $ | 5,432 | |

Assets acquired: | | | | |

Cash, cash equivalents and restricted cash | | $ | 344 | |

Accounts receivable | | | 425 | |

Other current assets | | | 49 | |

Right-of-use assets | | | 38 | |

Proved oil and gas property and equipment | | | 7,017 | |

Unproved and properties under development | | | 2,362 | |

Other property and equipment | | | 485 | |

Investments | | | 400 | |

Other long-term assets | | | 43 | |

Total assets acquired | | $ | 11,163 | |

Liabilities assumed: | | | | |

Accounts payable | | $ | 346 | |

Revenue and royalties payable | | | 223 | |

Other current liabilities | | | 454 | |

Debt | | | 3,562 | |

Lease liabilities | | | 38 | |

Asset retirement obligations | | | 94 | |

Deferred income taxes | | | 249 | |

Other long-term liabilities | | | 765 | |

Total liabilities assumed | | | 5,731 | |

Net assets acquired | | $ | 5,432 | |

WPX Revenues and Earnings

The following table represents WPX’s revenues and earnings included in Devon’s consolidated statements of comprehensive earnings subsequent to the closing date of the Merger.

| | Three Months Ended September 30, | | | Nine Months Ended September 30, | |

| | 2021 | | | 2021 | |

Total revenues | | $ | 1,564 | | | $ | 3,977 | |

Net earnings | | $ | 414 | | | $ | 969 | |

Pro Forma Financial Information

Due to the Merger closing on January 7, 2021, all activity in the first nine months of 2021 except for the first six days of January is included in Devon’s consolidated statements of comprehensive earnings for the nine months ended September 30, 2021. The following unaudited pro forma financial information for the three and nine months ended September 30, 2020 is based on our historical consolidated financial statements adjusted to reflect as if the Merger had occurred on January 1, 2020. The information below reflects pro forma adjustments to conform WPX’s historical financial information to Devon’s financial statement presentation.

12

Table of Contents

DEVON ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(Unaudited)

The unaudited pro forma financial information is not necessarily indicative of what would have occurred if the Merger had been completed as of the beginning of the periods presented, nor is it indicative of future results.

| | Three Months Ended September 30, | | | Nine Months Ended September 30, | |

Continuing operations: | | 2020 | | | 2020 | |

Total revenues | | $ | 1,540 | | | $ | 5,452 | |

Net loss | | $ | (281 | ) | | $ | (3,247 | ) |

Basic net loss per share | | $ | (0.42 | ) | | $ | (4.87 | ) |

Divestitures

In the first quarter of 2021, Devon completed the sale of non-core assets in the Rockies for proceeds of $9 million, net of purchase price adjustments, and recognized a $35 million gain related to the sale. The transaction includes contingent earnout payments of up to $8 million. The total estimated proved reserves associated with these divested assets was approximately 3 MMBoe. As of December 31, 2020, the associated assets and liabilities were classified as assets held for sale and included in other current assets and other current liabilities, respectively.

In the fourth quarter of 2020, Devon completed the sale of its Barnett Shale assets to BKV for proceeds, net of purchase price adjustments, of $490 million. The agreement with BKV also provides for contingent earnout payments to Devon of up to $260 million based upon future commodity prices, with upside participation beginning at a $2.75 Henry Hub natural gas price or a $50 WTI oil price. The contingent payment period commenced on January 1, 2021 and has a term of four years. The valuation of the future contingent earnout payments included within other current assets and other long-term assets in the September 30, 2021 consolidated balance sheet was $46 million and $85 million, respectively. During the first nine months of 2021, Devon recorded a $65 million increase to the fair value within asset dispositions on the consolidated statements of comprehensive earnings. The value was derived utilizing a Monte Carlo valuation model and qualifies as a level 3 fair value measurement. Additional information can be found in Note 17.

3.Derivative Financial Instruments

Objectives and Strategies

Devon enters into derivative financial instruments with respect to a portion of its oil, gas and NGL production to hedge future prices received. Additionally, Devon periodically enters into derivative financial instruments with respect to a portion of its oil, gas and NGL marketing activities. These commodity derivative financial instruments include financial price swaps, price swaptions, basis swaps, costless price collars and call options. Devon periodically enters into interest rate swaps to manage its exposure to interest rate volatility. As of September 30, 2021, Devon did not have any open interest rate swap contracts.

Devon does not intend to hold or issue derivative financial instruments for speculative trading purposes and has elected not to designate any of its derivative instruments for hedge accounting treatment.

Counterparty Credit Risk

By using derivative financial instruments, Devon is exposed to credit risk. Credit risk is the failure of the counterparty to perform under the terms of the derivative contract. To mitigate this risk, the hedging instruments are placed with a number of counterparties whom Devon believes are acceptable credit risks. It is Devon’s policy to enter into derivative contracts only with investment-grade rated counterparties deemed by management to be competent and competitive market makers. Additionally, Devon’s derivative contracts generally contain provisions that provide for collateral payments if Devon’s or its counterparty’s credit rating falls below certain credit rating levels. As of September 30, 2021, Devon neither held cash collateral of its counterparties 0r posted cash collateral to its counterparties.

13

Table of Contents

DEVON ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(Unaudited)

Commodity Derivatives

As of September 30, 2021, Devon had the following open oil derivative positions. The first table presents Devon’s oil derivatives that settle against the average of the prompt month NYMEX WTI futures price. The second table presents Devon’s oil derivatives that settle against the respective indices noted within the table.

| | Price Swaps | | | Price Swaptions | | | Price Collars | | | Call Options Sold | |

Period | | Volume (Bbls/d) | | | Weighted Average Price ($/Bbl) | | | Volume (Bbls/d) | | | Weighted Average Price ($/Bbl) | | | Volume (Bbls/d) | | | Weighted Average Floor Price ($/Bbl) | | | Weighted Average Ceiling Price ($/Bbl) | | | Volume (Bbls/d) | | | Weighted Average Price ($/Bbl) | |

Q4 2021 | | | 66,460 | | | $ | 41.24 | | | | — | | | $ | — | | | | 48,250 | | | $ | 38.82 | | | $ | 48.82 | | | | 5,000 | | | $ | 39.50 | |

Q1-Q4 2022 | | | 26,112 | | | $ | 43.75 | | | | 10,000 | | | $ | 46.67 | | | | 20,233 | | | $ | 46.41 | | | $ | 56.41 | | | | — | | | $ | — | |

| | Oil Basis Swaps | |

Period | | Index | | Volume (Bbls/d) | | | Weighted Average Differential to WTI ($/Bbl) | |

Q4 2021 | | Midland Sweet | | | 23,000 | | | $ | 0.84 | |

Q4 2021 | | Guernsey Light Sweet | | | 4,000 | | | $ | (1.49 | ) |

Q4 2021 | | BRENT | | | 1,000 | | | $ | (8.00 | ) |

Q4 2021 | | NYMEX Roll | | | 13,000 | | | $ | 0.39 | |

Q1-Q4 2022 | | BRENT | | | 1,000 | | | $ | (7.75 | ) |

Q1-Q4 2022 | | NYMEX Roll | | | 29,000 | | | $ | 0.45 | |

As of September 30, 2021, Devon had the following open natural gas derivative positions. The first table presents Devon’s natural gas derivatives that settle against the Inside FERC first of the month Henry Hub index and the end of month NYMEX index. The second table presents Devon’s natural gas derivatives that settle against the respective indices noted within the table.

| | Price Swaps (1) | | | Price Swaptions (2) | | | Price Collars (2) | | | Call Options Sold (2) | |

Period | | Volume (MMBtu/d) | | | Weighted Average Price ($/MMBtu) | | | Volume (MMBtu/d) | | | Weighted Average Price ($/MMBtu) | | | Volume (MMBtu/d) | | | Weighted Average Floor Price ($/MMBtu) | | | Weighted Average Ceiling Price ($/MMBtu) | | | Volume (MMBtu/d) | | | Weighted Average Price ($/MMBtu) | |

Q4 2021 | | | 254,000 | | | $ | 2.63 | | | | — | | | $ | — | | | | 133,000 | | | $ | 2.55 | | | $ | 3.05 | | | | 50,000 | | | $ | 2.68 | |

Q1-Q4 2022 | | | 3,452 | | | $ | 2.85 | | | | 100,000 | | | $ | 2.70 | | | | 145,507 | | | $ | 2.69 | | | $ | 3.40 | | | | — | | | $ | — | |

Q1-Q4 2023 | | | — | | | $ | — | | | | — | | | $ | — | | | | 10,603 | | | $ | 3.11 | | | $ | 4.56 | | | | — | | | $ | — | |

| (1) | Related to the 2021 open positions, 14,000 MMBtu/d settle against the Inside FERC first of month Henry Hub index at an average price of $2.85 and 240,000 MMBtu/d settle against the end of month NYMEX index at an average price of $2.62. All 2022 open positions settle against the Inside FERC first of month Henry Hub index. |

| (2) | Price swaptions and call options settle against end of month NYMEX index. Price collars settle against the Inside FERC first of month Henry Hub Index. |

| | Natural Gas Basis Swaps | |

Period | | Index | | Volume (MMBtu/d) | | | Weighted Average Differential to Henry Hub ($/MMBtu) | |

Q4 2021 | | El Paso Natural Gas | | | 35,000 | | | $ | (0.92 | ) |

Q4 2021 | | WAHA | | | 80,000 | | | $ | (0.65 | ) |

Q1-Q4 2022 | | WAHA | | | 70,000 | | | $ | (0.57 | ) |

Q1-Q4 2023 | | WAHA | | | 70,000 | | | $ | (0.51 | ) |

Q1-Q4 2024 | | WAHA | | | 40,000 | | | $ | (0.51 | ) |

14

Table of Contents

DEVON ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(Unaudited)

As of September 30, 2021, Devon had the following open NGL derivative positions. Devon’s NGL positions settle against the average of the prompt month OPIS Mont Belvieu, Texas index.

| | | | Price Swaps | |

Period | | Product | | Volume (Bbls/d) | | | Weighted Average Price ($/Bbl) | |

Q4 2021 | | Natural Gasoline | | | 1,000 | | | $ | 47.57 | |

Q4 2021 | | Normal Butane | | | 1,000 | | | $ | 31.40 | |

Q4 2021 | | Propane | | | 1,000 | | | $ | 27.88 | |

Financial Statement Presentation

All derivative financial instruments are recognized at their current fair value as either assets or liabilities in the consolidated balance sheets. Amounts related to contracts allowed to be netted upon payment subject to a master netting arrangement with the same counterparty are reported on a net basis in the consolidated balance sheets. The tables below present a summary of these positions as of September 30, 2021 and December 31, 2020.

| September 30, 2021 | | | December 31, 2020 | | | |

| Gross Fair Value | | | Amounts Netted | | | Net Fair Value | | | Gross Fair Value | | | Amounts Netted | | | Net Fair Value | | | Balance Sheet Classification |

Commodity derivatives: | | | | | | | | | | | | | | | | | | | | | | | | | |

Short-term derivative asset | $ | 3 | | | $ | (1 | ) | | $ | 2 | | | $ | 23 | | | $ | (18 | ) | | $ | 5 | | | Other current assets |

Long-term derivative asset | | — | | | | — | | | | — | | | | 1 | | | | — | | | | 1 | | | Other long-term assets |

Short-term derivative liability | | (984 | ) | | | 1 | | | | (983 | ) | | | (161 | ) | | | 18 | | | | (143 | ) | | Other current liabilities |

Long-term derivative liability | | (103 | ) | | | — | | | | (103 | ) | | | (5 | ) | | | — | | | | (5 | ) | | Other long-term liabilities |

Total derivative liability | $ | (1,084 | ) | | $ | — | | | $ | (1,084 | ) | | $ | (142 | ) | | $ | — | | | $ | (142 | ) | | |

4.Share-Based Compensation

The table below presents the share-based compensation expense included in Devon’s accompanying consolidated statements of comprehensive earnings. The vesting for certain share-based awards was accelerated in conjunction with the reduction of workforce described in Note 6 and is included in restructuring and transaction costs in the accompanying consolidated statements of comprehensive earnings.

| | Nine Months Ended September 30, | |

| | 2021 | | | 2020 | |

G&A | | $ | 58 | | | $ | 58 | |

Exploration expenses | | | 1 | | | | 1 | |

Restructuring and transaction costs | | | 21 | | | | 11 | |

Total | | $ | 80 | | | $ | 70 | |

Related income tax benefit | | $ | 8 | | | $ | — | |

15

Table of Contents

DEVON ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(Unaudited)

Under its approved long-term incentive plan, Devon grants share-based awards to certain employees. The following table presents a summary of Devon’s unvested restricted stock awards and units, performance-based restricted stock awards and performance share units granted under the plan.

| | | | | Performance-Based | | | Performance | |

| | Restricted Stock Awards & Units | | | Restricted Stock Awards | | | Share Units | |

| | Awards/Units | | | | | Weighted Average Grant-Date Fair Value | | | Awards | | | Weighted Average Grant-Date Fair Value | | | Units | | | | | Weighted Average Grant-Date Fair Value | |

| | (Thousands, except fair value data) | |

Unvested at 12/31/20 | | | 5,316 | | | | | $ | 25.82 | | | | 44 | | | $ | 44.70 | | | | 1,994 | | | | | $ | 31.89 | |

Granted | | | 7,711 | | | (1 | ) | $ | 19.69 | | | | — | | | $ | — | | | | 861 | | | | | $ | 18.08 | |

Vested | | | (5,006 | ) | | | | $ | 22.35 | | | | (44 | ) | | $ | 44.70 | | | | (754 | ) | | | | $ | 37.40 | |

Forfeited | | | (126 | ) | | | | $ | 23.21 | | | | — | | | $ | — | | | | (25 | ) | | | | $ | 36.04 | |

Unvested at 9/30/21 | | | 7,895 | | | | | $ | 22.08 | | | | — | | | $ | — | | | | 2,076 | | | (2 | ) | $ | 24.12 | |

| (1) | Due to the closing of the Merger, each share of WPX common stock was automatically converted into the right to receive 0.5165 of a share of Devon common stock. As a result, approximately 4.9 million awards relate to the conversion of WPX equity awards to Devon equity awards. |

| (2) | A maximum of 4.2 million common shares could be awarded based upon Devon’s final TSR ranking. |

The following table presents the assumptions related to the performance share units granted in 2021, as indicated in the previous summary table.

| | 2021 | |

Grant-date fair value | | $ | 18.08 | |

Risk-free interest rate | | 0.18% | |

Volatility factor | | 67.8% | |

Contractual term (years) | | 2.89 | |

The following table presents a summary of the unrecognized compensation cost and the related weighted average recognition period associated with unvested awards and units as of September 30, 2021.

| | | | | | | | |

| | Restricted Stock | | | Performance | |

| | Awards/Units | | | Share Units | |

Unrecognized compensation cost | | $ | 97 | | | $ | 15 | |

Weighted average period for recognition (years) | | | 2.5 | | | | 1.9 | |

5.Asset Impairments

The following table presents a summary of Devon’s asset impairments. Unproved impairments shown below are included in exploration expenses in the consolidated statements of comprehensive earnings.

| | Three Months Ended September 30, | | | Nine Months Ended September 30, | |

| | 2021 | | | 2020 | | | 2021 | | | 2020 | |

Proved oil and gas assets | | $ | — | | | $ | — | | | $ | — | | | $ | 2,664 | |

Other assets | | | — | | | | — | | | | — | | | | 2 | |

Total asset impairments | | $ | — | | | $ | — | | | $ | — | | | $ | 2,666 | |

| | | | | | | | | | | | | | | | |

Unproved impairments | | $ | 1 | | | $ | 36 | | | $ | 3 | | | $ | 149 | |

16

Table of Contents

DEVON ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(Unaudited)

Proved Oil and Gas and Other Asset Impairments

Due to the reduced demand from the COVID-19 pandemic causing an unprecedented downturn in the price of oil and reductions in near-term capital investment, Devon recognized approximately $2.7 billion of proved asset impairments during the first quarter of 2020. These impairments related to the Anadarko Basin and Rockies fields in which the cost basis included acquisitions completed in 2016 and 2015, respectively, when commodity prices were much higher. During the first quarter of 2020, Devon also recognized $2 million of product line fill impairments.

Unproved Impairments

Due to the downturn in the commodity price environment and reduced near-term investment as discussed above, Devon also recognized $149 million of unproved impairments during the first nine months of 2020, primarily in the Rockies field.

6.Restructuring and Transaction Costs

The following table summarizes Devon’s restructuring and transaction costs.

| | Three Months Ended September 30, | | | Nine Months Ended September 30, | |

| | 2021 | | | 2020 | | | 2021 | | | 2020 | |

Restructuring costs | | $ | 16 | | | $ | 32 | | | $ | 182 | | | $ | 32 | |

Transaction costs | | | 2 | | | | — | | | | 48 | | | | — | |

Total costs | | $ | 18 | | | $ | 32 | | | $ | 230 | | | $ | 32 | |

In conjunction with the Merger closing, Devon recognized $182 million of restructuring expenses during the first nine months of 2021 related to employee severance and termination benefits, settlements and curtailments from defined retirement benefits and contract terminations. Of these expenses, $65 million related to non-cash charges which primarily consisted of settlements and curtailments of defined retirement benefits of $40 million and the accelerated vesting of share-based grants of $21 million. Additionally, in conjunction primarily with the Merger closing, Devon recognized $48 million of transaction costs primarily comprised of bank, legal and accounting fees.

In the third quarter of 2020, Devon recognized $32 million of restructuring expenses. Of these expenses, $11 million resulted from the accelerated vesting of share-based grants, which are non-cash charges.

The following table summarizes Devon’s restructuring liabilities.

| | Other | | | Other | | | | | |

| | Current | | | Long-term | | | | | |

| | Liabilities | | | Liabilities | | | Total | |

Balance as of December 31, 2020 | | $ | 35 | | | $ | 137 | | | $ | 172 | |

Changes related to 2021 merger integration | | | 27 | | | | — | | | | 27 | |

Changes related to prior years' restructurings | | | (8 | ) | | | (18 | ) | | | (26 | ) |

Balance as of September 30, 2021 | | $ | 54 | | | $ | 119 | | | $ | 173 | |

| | | | | | | | | | | | |

Balance as of December 31, 2019 | | $ | 20 | | | $ | 1 | | | $ | 21 | |

Changes related to prior years' restructurings | | | (3 | ) | | | — | | | | (3 | ) |

Balance as of September 30, 2020 | | $ | 17 | | | $ | 1 | | | $ | 18 | |

17

Table of Contents

DEVON ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(Unaudited)

7.Income Taxes

The following table presents Devon’s total income tax expense (benefit) and a reconciliation of its effective income tax rate to the U.S. statutory income tax rate.

| | Three Months Ended September 30, | | | Nine Months Ended September 30, | |

| | 2021 | | | 2020 | | | 2021 | | | 2020 | |

Earnings (loss) from continuing operations before income taxes | | $ | 964 | | | $ | (193 | ) | | $ | 1,236 | | | $ | (2,980 | ) |

| | | | | | | | | | | | | | | | |

Current income tax expense (benefit) | | $ | 1 | | | $ | (90 | ) | | $ | 15 | | | $ | (199 | ) |

Deferred income tax expense (benefit) | | | 119 | | | | — | | | | (100 | ) | | | (311 | ) |

Total income tax expense (benefit) | | $ | 120 | | | $ | (90 | ) | | $ | (85 | ) | | $ | (510 | ) |

U.S. statutory income tax rate | | | 21 | % | | | 21 | % | | | 21 | % | | | 21 | % |

State income taxes | | | 0 | % | | | 0 | % | | | 0 | % | | | 1 | % |

Unrecognized tax benefits | | | 0 | % | | | 18 | % | | | 0 | % | | | 0 | % |

Deferred tax asset valuation allowance | | | (9 | %) | | | 4 | % | | | (33 | %) | | | (7 | %) |

Other | | | 0 | % | | | 4 | % | | | 5 | % | | | 2 | % |

Effective income tax rate | | | 12 | % | | | 47 | % | | | (7 | %) | | | 17 | % |

The deferred income tax benefit recognized in the first nine months of 2021 primarily relates to the Merger and a reduced valuation allowance due to increased earnings. As shown in Note 2, Devon recognized $249 million of deferred tax liabilities to account for the Merger. The recognition of these deferred tax liabilities caused a decrease to Devon’s net deferred tax assets and a corresponding decrease to the valuation allowance Devon has recognized on its U.S. Federal deferred tax assets. Additionally, improved commodity prices and post-merger operating performance are causing reductions to Devon’s net operating losses, which also cause corresponding decreases to the associated deferred tax assets and valuation allowance.

As of September 30, 2021, Devon continued to maintain a valuation allowance against certain U.S. deferred tax assets. Devon continues to assess its valuation allowance position every quarter. Subject to any additional objective negative evidence or the addition of subjective evidence such as forecasted income, Devon may continue to adjust the valuation allowance on its deferred tax assets in future periods.

In the fourth quarter of 2020, Devon recorded a deferred tax asset representing the deductible outside basis difference in its investment in a consolidated subsidiary. In the second quarter of 2021, Devon realized this deferred tax asset, increasing its U.S. federal net operating loss carryforwards by $1.8 billion.

18

Table of Contents

DEVON ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(Unaudited)

8. | Net Earnings (Loss) Per Share from Continuing Operations |

The following table reconciles net earnings (loss) from continuing operations and weighted-average common shares outstanding used in the calculations of basic and diluted net earnings (loss) per share from continuing operations.

| | Three Months Ended September 30, | | | Nine Months Ended September 30, | |

| | 2021 | | | 2020 | | | 2021 | | | 2020 | |

Net earnings (loss) from continuing operations: | | | | | | | | | | | | | | | | |

Net earnings (loss) from continuing operations | | $ | 838 | | | $ | (105 | ) | | $ | 1,307 | | | $ | (2,475 | ) |

Attributable to participating securities | | | (6 | ) | | | (2 | ) | | | (11 | ) | | | (3 | ) |

Basic and diluted earnings (loss) from continuing operations | | $ | 832 | | | $ | (107 | ) | | $ | 1,296 | | | $ | (2,478 | ) |

Common shares: | | | | | | | | | | | | | | | | |

Common shares outstanding - total | | | 677 | | | | 383 | | | | 670 | | | | 383 | |

Attributable to participating securities | | | (6 | ) | | | (6 | ) | | | (6 | ) | | | (6 | ) |

Common shares outstanding - basic | | | 671 | | | | 377 | | | | 664 | | | | 377 | |

Dilutive effect of potential common shares issuable | | | 2 | | | | — | | | | 2 | | | | — | |

Common shares outstanding - diluted | | | 673 | | | | 377 | | | | 666 | | | | 377 | |

Net earnings (loss) per share from continuing operations: | | | | | | | | | | | | | | | | |

Basic | | $ | 1.24 | | | $ | (0.29 | ) | | $ | 1.95 | | | $ | (6.58 | ) |

Diluted | | $ | 1.24 | | | $ | (0.29 | ) | | $ | 1.95 | | | $ | (6.58 | ) |

9.Other Comprehensive Earnings (Loss)

Components of other comprehensive earnings (loss) consist of the following:

| | Three Months Ended September 30, | | | Nine Months Ended September 30, | |

| | 2021 | | | 2020 | | | 2021 | | | 2020 | |

Pension and postretirement benefit plans: | | | | | | | | | | | | | | | | |

Beginning accumulated pension and postretirement benefits | | $ | (101 | ) | | $ | (117 | ) | | $ | (127 | ) | | $ | (119 | ) |

Recognition of net actuarial loss and prior service cost in earnings (1) | | | 1 | | | | 1 | | | | 2 | | | | 4 | |

Settlement of pension benefits (2) | | | — | | | | — | | | | 18 | | | | — | |

Income tax expense | | | — | | | | — | | | | — | | | | (1 | ) |

Other (3) | | | — | | | | — | | | | 7 | | | | — | |

Accumulated other comprehensive loss, net of tax | | $ | (100 | ) | | $ | (116 | ) | | $ | (100 | ) | | $ | (116 | ) |

| (1) | Recognition of net actuarial loss and prior service cost are included in the computation of net periodic benefit cost, which is a component of other, net in the accompanying consolidated statements of comprehensive earnings. |

| (2) | The Merger triggered settlement payments to certain plan participants, and the expense associated with this settlement is recognized as a component of restructuring and transaction costs in the accompanying consolidated statements of comprehensive earnings. |

| (3) | Other includes a remeasurement of the pension obligation due to the Merger, which was partially offset by a change in mortality assumption. |

19

Table of Contents

DEVON ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(Unaudited)

10. | Supplemental Information to Statements of Cash Flows |

| | Three Months Ended September 30, | | | Nine Months Ended September 30, | |

| | 2021 | | | 2020 | | | 2021 | | | 2020 | |

Changes in assets and liabilities, net: | | | | | | | | | | | | | | | | |

Accounts receivable | | $ | (332 | ) | | $ | 21 | | | $ | (495 | ) | | $ | 339 | |

Income tax receivable | | | (40 | ) | | | — | | | | 94 | | | | (112 | ) |

Other current assets | | | 21 | | | | 18 | | | | (36 | ) | | | 10 | |

Other long-term assets | | | 14 | | | | (9 | ) | | | (9 | ) | | | (33 | ) |

Accounts payable and revenues and royalties payable | | | 469 | | | | 100 | | | | 557 | | | | (160 | ) |

Other current liabilities | | | (49 | ) | | | 15 | | | | (30 | ) | | | (82 | ) |

Other long-term liabilities | | | (15 | ) | | | (87 | ) | | | (123 | ) | | | (59 | ) |

Total | | $ | 68 | | | $ | 58 | | | $ | (42 | ) | | $ | (97 | ) |

Supplementary cash flow data - total operations: | | | | | | | | | | | | | | | | |

Interest paid | | $ | 100 | | | $ | 64 | | | $ | 319 | | | $ | 194 | |

Income taxes paid (refunded) | | $ | (4 | ) | | $ | (2 | ) | | $ | (116 | ) | | $ | 170 | |

As of September 30, 2021, Devon had approximately $200 million of accrued capital expenditures included in total property and equipment, net and accounts payable on the consolidated balance sheets. As of December 31, 2020 (pre-merger), Devon had approximately $100 million of accrued capital expenditures in total property and equipment, net and accounts payable on the consolidated balance sheets. As of January 7, 2021 (date of Merger closing), Devon assumed approximately $150 million of accrued capital expenditures included in accounts payable.

Components of accounts receivable include the following:

| | September 30, 2021 | | | December 31, 2020 | |

Oil, gas and NGL sales | | $ | 986 | | | $ | 335 | |

Joint interest billings | | | 150 | | | | 57 | |

Marketing and midstream revenues | | | 371 | | | | 195 | |

Other | | | 22 | | | | 25 | |

Gross accounts receivable | | | 1,529 | | | | 612 | |

Allowance for doubtful accounts | | | (12 | ) | | | (11 | ) |

Net accounts receivable | | $ | 1,517 | | | $ | 601 | |

12.Property, Plant and Equipment

The following table presents the aggregate capitalized costs related to Devon’s oil and gas and non-oil and gas activities.

| | September 30, 2021 | | | December 31, 2020 | |

Property and equipment: | | | | | | | | |

Proved | | $ | 36,489 | | | $ | 27,589 | |

Unproved and properties under development | | | 2,169 | | | | 392 | |

Total oil and gas | | | 38,658 | | | | 27,981 | |

Less accumulated DD&A | | | (25,045 | ) | | | (23,545 | ) |

Oil and gas property and equipment, net | | | 13,613 | | | | 4,436 | |

Other property and equipment | | | 2,113 | | | | 1,737 | |

Less accumulated DD&A | | | (648 | ) | | | (780 | ) |

Other property and equipment, net (1) | | | 1,465 | | | | 957 | |

Property and equipment, net | | $ | 15,078 | | | $ | 5,393 | |

| (1) | $106 million and $102 million related to CDM in 2021 and 2020, respectively. |

20

Table of Contents

DEVON ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(Unaudited)

13. | Debt and Related Expenses |

See below for a summary of debt instruments and balances. The notes and debentures are senior, unsecured obligations of Devon.

| | September 30, 2021 | | | December 31, 2020 | |

8.25% due August 1, 2023 (1) | | $ | 242 | | | $ | — | |

5.25% due September 15, 2024 (1) | | | 472 | | | | — | |

5.85% due December 15, 2025 | | | 485 | | | | 485 | |

7.50% due September 15, 2027 | | | 73 | | | | 73 | |

5.25% due October 15, 2027 (1) | | | 390 | | | | — | |

5.875% due June 15, 2028 (1) | | | 325 | | | | — | |

4.50% due January 15, 2030 (1) | | | 585 | | | | — | |

7.875% due September 30, 2031 | | | 675 | | | | 675 | |

7.95% due April 15, 2032 | | | 366 | | | | 366 | |

5.60% due July 15, 2041 | | | 1,250 | | | | 1,250 | |

4.75% due May 15, 2042 | | | 750 | | | | 750 | |

5.00% due June 15, 2045 | | | 750 | | | | 750 | |

Net premium (discount) on debentures and notes | | | 160 | | | | (20 | ) |

Debt issuance costs | | | (31 | ) | | | (31 | ) |

Total long-term debt | | $ | 6,492 | | | $ | 4,298 | |

| (1) | These instruments were assumed by Devon in January 2021 in conjunction with the Merger. Subsequent to debt retirements and the obligor exchange transaction completed during the first nine months of 2021, approximately $51 million of these instruments remain the unsecured and unsubordinated obligation of WPX, a wholly-owned subsidiary of Devon. |

Debt maturities as of September 30, 2021, excluding debt issuance costs, premiums and discounts, are as follows:

| | Total | |

2022 | | $ | — | |

2023 | | | 242 | |

2024 | | | 472 | |

2025 | | | 485 | |

2026 | | | — | |

Thereafter | | | 5,164 | |

Total | | $ | 6,363 | |

The following schedule includes the summary of the WPX debt Devon assumed upon closing of the Merger on January 7, 2021.

| | Face Value | | | Fair Value | | | Optional Redemption(1) |

6.00% due January 15, 2022 | | $ | 43 | | | $ | 44 | | | |

8.25% due August 1, 2023 | | | 242 | | | | 281 | | | June 1, 2023 |

5.25% due September 15, 2024 | | | 472 | | | | 530 | | | June 15, 2024 |

5.75% due June 1, 2026 | | | 500 | | | | 529 | | | June 1, 2021 |

5.25% due October 15, 2027 | | | 600 | | | | 646 | | | October 15, 2022 |

5.875% due June 15, 2028 | | | 500 | | | | 554 | | | June 15, 2023 |

4.50% due January 15, 2030 | | | 900 | | | | 978 | | | January 15, 2025 |

| | $ | 3,257 | | | $ | 3,562 | | | |

| (1) | At any time prior to these dates, Devon has or had the option to redeem (i) some or all of the notes at a specified "make whole" premium and (ii) a portion of certain of the notes at applicable redemption prices, in each case as described in the indenture documents governing the notes to be redeemed. On or after these dates, Devon has or had the option to redeem the notes, in whole or in part, at the applicable redemption prices set forth in the indenture documents, plus accrued and unpaid interest thereon to the redemption date as more fully described in such documents. |

21

Table of Contents

DEVON ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(Unaudited)

Retirement of Senior Notes

In the first nine months of 2021, Devon redeemed $43 million of the 6.00% senior notes due 2022, $175 million of the 5.875% senior notes due 2028, $315 million of the 4.50% senior notes due 2030, $210 million of the 5.25% senior notes due 2027 and $500 million of the 5.75% senior notes due 2026. In the first nine months of 2021, Devon recognized $30 million of gains on early retirement of debt, consisting of $89 million of non-cash premium accelerations, partially offset by $59 million of cash retirement costs. The gain on early retirement is included in financing costs, net in the consolidated statements of comprehensive earnings.

Credit Lines

Devon has a $3.0 billion Senior Credit Facility. As of September 30, 2021, Devon had 0 outstanding borrowings under the Senior Credit Facility and had issued $2 million in outstanding letters of credit under this facility. The Senior Credit Facility contains only one material financial covenant. This covenant requires Devon’s ratio of total funded debt to total capitalization, as defined in the credit agreement, to be no greater than 65%. Under the terms of the credit agreement, total capitalization is adjusted to add back non-cash financial write-downs such as impairments. As of September 30, 2021, Devon was in compliance with this covenant with a debt-to-capitalization ratio of 25.1%.

Net Financing Costs

The following schedule includes the components of net financing costs.

| | Three Months Ended September 30, | | | Nine Months Ended September 30, | |

| | 2021 | | | 2020 | | | 2021 | | | 2020 | |

Interest based on debt outstanding | | $ | 93 | | | $ | 65 | | | $ | 296 | | | $ | 195 | |

Gain on early retirement of debt | | | — | | | | — | | | | (30 | ) | | | — | |

Interest income | | | (1 | ) | | | (5 | ) | | | (2 | ) | | | (12 | ) |

Other | | | (6 | ) | | | 6 | | | | (21 | ) | | | 17 | |

Total net financing costs | | $ | 86 | | | $ | 66 | | | $ | 243 | | | $ | 200 | |

14.Leases

The following table presents Devon’s right-of-use assets and lease liabilities as of September 30, 2021 and December 31, 2020.

| | September 30, 2021 | | | December 31, 2020 | |

| | Finance | | | Operating | | | Total | | | Finance | | | Operating | | | Total | |

Right-of-use assets | | $ | 214 | | | $ | 30 | | | $ | 244 | | | $ | 220 | | | $ | 3 | | | $ | 223 | |

Lease liabilities: | | | | | | | | | | | | | | | | | | | | | | | | |

Current lease liabilities (1) | | $ | 8 | | | $ | 20 | | | $ | 28 | | | $ | 8 | | | $ | 1 | | | $ | 9 | |

Long-term lease liabilities | | | 246 | | | | 10 | | | | 256 | | | | 244 | | | | 2 | | | | 246 | |

Total lease liabilities | | $ | 254 | | | $ | 30 | | | $ | 284 | | | $ | 252 | | | $ | 3 | | | $ | 255 | |

(1)Current lease liabilities are included in other current liabilities on the consolidated balance sheets.

Devon’s right-of-use operating lease assets are for certain leases related to real estate, drilling rigs and other equipment related to the exploration, development and production of oil and gas. Devon’s right-of-use financing lease assets are related to real estate.

22

Table of Contents

DEVON ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(Unaudited)

15. | Asset Retirement Obligations |

The following table presents the changes in Devon’s asset retirement obligations.

| | Nine Months Ended September 30, | |

| | 2021 | | | 2020 | |

Asset retirement obligations as of beginning of period | | $ | 369 | | | $ | 398 | |

Assumed WPX obligations | | | 98 | | | | — | |

Liabilities incurred | | | 28 | | | | 15 | |

Liabilities settled and divested | | | (52 | ) | | | (24 | ) |

Revision of estimated obligation | | | 11 | | | | 4 | |

Accretion expense on discounted obligation | | | 21 | | | | 15 | |

Asset retirement obligations as of end of period | | | 475 | | | | 408 | |

Less current portion | | | 13 | | | | 10 | |

Asset retirement obligations, long-term | | $ | 462 | | | $ | 398 | |

WPX Merger

On January 7, 2021, Devon and WPX completed an all-stock merger of equals. On the closing date of the Merger, each share of WPX common stock was automatically converted into the right to receive 0.5165 of a share of Devon common stock. Consequently, Devon issued approximately 290 million shares of Devon common stock to holders of WPX common stock to effect the Merger on January 7, 2021.

Share Repurchases

The table below provides information regarding purchases of Devon’s common stock that were made in 2020 under a share repurchase program that expired at the end of 2020 (shares in thousands).

| | Total Number of Shares Purchased | | | Dollar Value of Shares Purchased | | | Average Price Paid per Share | |

| | | | | | | | | | | | |

First quarter 2020 | | | 2,243 | | | $ | 38 | | | $ | 16.85 | |

Total | | | 2,243 | | | $ | 38 | | | $ | 16.85 | |

In November 2021, Devon authorized a share repurchase program to buy up to $1.0 billion of common stock. This program expires December 31, 2022.

23

Table of Contents

DEVON ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(Unaudited)

Dividends

Upon completion of the Merger, Devon continued its commitment to pay a quarterly dividend at a fixed rate and instituted a variable quarterly dividend, which is dependent on quarterly cash flows, among other factors. The following table summarizes Devon’s fixed and variable dividends for the first nine months of 2021 and 2020, respectively.

| Fixed | | | Variable | | | Total | | | Rate Per Share | |

2021: | | | | | | | | | | | | | | | |

First quarter | $ | 76 | | | $ | 127 | | | $ | 203 | | | $ | 0.30 | |

Second quarter | | 75 | | | | 154 | | | | 229 | | | $ | 0.34 | |

Third quarter | | 74 | | | | 255 | | | | 329 | | | $ | 0.49 | |

Total year-to-date | $ | 225 | | | $ | 536 | | | $ | 761 | | | | | |

2020: | | | | | | | | | | | | | | | |

First quarter | $ | 34 | | | $ | — | | | $ | 34 | | | $ | 0.09 | |

Second quarter | | 42 | | | | — | | | | 42 | | | $ | 0.11 | |

Third quarter | | 43 | | | | — | | | | 43 | | | $ | 0.11 | |

Total year-to-date | $ | 119 | | | $ | — | | | $ | 119 | | | | | |

In November 2021, Devon announced a cash dividend in the amount of $0.84 per share payable in the fourth quarter of 2021. The dividend consists of a fixed quarterly dividend in the amount of approximately $74 million (or $0.11 per share) and a variable quarterly dividend in the amount of approximately $494 million (or $0.73 per share).

Noncontrolling Interests

The noncontrolling interests’ share of CDM’s net earnings and the contributions from and distributions to the noncontrolling interests are presented as components of equity.

17. | Discontinued Operations |

On October 1, 2020, Devon completed the sale of its Barnett Shale assets to BKV for proceeds, net of purchase price adjustments, of $490 million. Additionally, the agreement provides for contingent earnout payments to Devon of up to $260 million based upon future commodity prices, with upside participation beginning at a $2.75 Henry Hub natural gas price or a $50 WTI oil price. The contingent payment period commenced on January 1, 2021 and has a term of four years.

The following table presents the amounts reported in the consolidated statements of comprehensive earnings as discontinued operations.

| Three Months Ended September 30, 2020 | | | Nine Months Ended September 30, 2020 | |

Oil, gas and NGL sales | $ | 94 | | | $ | 263 | |

Total revenues | | 94 | | | | 263 | |

Production expenses | | 66 | | | | 214 | |

Asset impairments (1) | | 3 | | | | 182 | |

Asset dispositions | | — | | | | (2 | ) |

General and administrative expenses | | 2 | | | | 3 | |

Financing costs, net | | (1 | ) | | | (3 | ) |

Other, net | | 26 | | | | 19 | |

Total expenses | | 96 | | | | 413 | |

Loss from discontinued operations before income taxes | | (2 | ) | | | (150 | ) |

Income tax benefit | | (15 | ) | | | (47 | ) |

Net earnings (loss) from discontinued operations, net of tax | $ | 13 | | | $ | (103 | ) |

24

Table of Contents

DEVON ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(Unaudited)

| (1) | Devon recognized $182 million of asset impairments in the first nine months of 2020 related to the Barnett Shale assets primarily due to the difference between the net carrying value and the purchase price, net of estimated customary purchase price adjustments, which qualified as a level 2 fair value measurement. |

18. | Commitments and Contingencies |

Devon is party to various legal proceedings and other matters that may result in future payment obligations or other adverse consequences to its business. Matters that are probable of an unfavorable outcome to Devon and which any related potential payment obligation or other liability can be reasonably estimated are accrued. Such accruals are based on information known about the matters, Devon’s estimates of the outcomes of such matters and its experience in contesting, litigating and settling similar matters. While management does not believe any current matter is likely to involve future amounts that would be material to Devon’s financial position or results of operations after consideration of recorded accruals, the ultimate outcome of such matters and the amounts involved could differ materially from management’s estimates.

Royalty Matters

Numerous oil and natural gas producers and related parties, including Devon, have been named in various lawsuits alleging royalty underpayments. Devon is currently defending against a number of such lawsuits, either as a named defendant in the action or pursuant to indemnity obligations for the benefit of a third party. Plaintiffs in some of these lawsuits are seeking class certification. Among the allegations typically asserted in these suits are claims that Devon used below-market prices, made improper deductions, failed to “enhance” the value of gas through processing, used improper measurement techniques, entered into purchase and midstream arrangements with affiliates that resulted in underpayment of royalties or otherwise failed to prudently market oil, natural gas and NGLs produced and sold and pay royalties on the highest obtainable price. Devon is also involved in governmental agency proceedings and royalty audits and is subject to related contracts and regulatory controls in the ordinary course of business, some that may lead to additional royalty claims. Devon does not currently believe that it is subject to material exposure with respect to such royalty matters.

Environmental and Climate Change Matters