UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-09447

Jacob Funds Inc.

(Exact name of registrant as specified in charter)

C/O Jacob Asset Management of New York LLC

727 2nd Street #106

Hermosa Beach, CA 90254

(Address of principal executive offices) (Zip code)

Ryan Jacob

C/O Jacob Asset Management of New York LLC

727 2nd Street #106

Hermosa Beach, CA 90254

(Name and address of agent for service)

(424) 237-2164

Registrant's telephone number, including area code

Date of fiscal year end: August 31

Date of reporting period: February 29, 2024

Item 1. Reports to Stockholders.

Jacob Internet Fund

Jacob Small Cap Growth Fund

Jacob Discovery Fund

Jacob Forward ETF

Semi-Annual Report

February 29, 2024

The Jacob Internet Fund, Jacob Small Cap Growth Fund and

Jacob Discovery Fund are mutual funds with the primary investment

objective of long-term growth of capital. The Jacob Forward ETF

is an exchange traded fund with the primary investment objective

of long-term growth of capital.

The Jacob Internet Fund has current income as a secondary objective.

Investment Adviser

Jacob Asset Management of New York LLC

TABLE OF CONTENTS

Letter From the Manager | | | 1 |

Industry Breakdowns | | | 5 |

Schedules of Investments | | | 9 |

Statements of Assets and Liabilities | | | 20 |

Statements of Operations | | | 22 |

Statements of Changes in Net Assets | | | 24 |

Financial Highlights | | | 28 |

Notes to the Financial Statements | | | 34 |

Additional Information on Fund Expenses | | | 52 |

Additional Information | | | 55 |

| | | | |

JACOB FUNDS INC.

LETTER FROM THE MANAGER (Unaudited)

Dear Fellow Investors,

The latest fiscal period began with a steep decline in most equity averages as investors became increasingly concerned about the economy, while an inflation-vigilant Federal Reserve (“Fed”) maintained its restrictive rate posture. By the end of October, the Fed acknowledged publicly that its next move on interest rates would likely be a reduction, likely starting sometime in 2024. This acknowledgement sparked a strong relief rally in markets to end the year, and after a brief pause in January, they have resumed climbing at a modest pace. This recent resilience – in the markets and in the broader economy – has been especially impressive because interest rates have risen across the yield curve and the timeline for future rate cuts has been pushed back. It appears more likely now that we will eventually settle at rate levels that are higher than we’ve been accustomed to for quite some time. However, even with these higher rates, we still believe that healthy economic conditions are likely in the cards for at least the next 6-12 months, and will be most beneficial to the smaller, higher growth companies that we favor. As for the Funds, our decision to push even more aggressively into some of our smaller cap holdings was a key reason for the significant outperformance of most of our funds during the fiscal period.

Jacob Internet Fund

The Jacob Internet Fund was up 22.33% for the fiscal period ended February 29, 2024, while the NASDAQ Composite Index rose 15.09%. After a difficult start, the Fund benefitted from a broad rally across the technology sector and specifically from a handful of smaller companies that rebounded strongly through the period.

The stock that most epitomized this strength was Porch Group, Inc., which was up over 295% in the period. Porch Group, Inc. had previously been struggling with adverse weather events in its insurance business and a continued weak housing market for its various transaction-based software businesses. We had become more comfortable with the company’s financial situation and improved nearer-term bottom line, thanks to its plan to exit unprofitable insurance markets while passing through necessary premium increases to customers in other areas of the country. OptimizeRx Corp., up over 85% in the period, also had some earlier stumbles stemming mostly from a weak ad spending environment for pharmaceutical companies, but eventually showed that these issues were mostly transitory. More recently, the company made a major acquisition that should help them achieve the greater scale necessary to drive higher margins and future profits. The next two most impactful holdings in the fiscal period were Cloudflare, Inc. and DraftKings, Inc., each up over 51% and 46% respectively. Even with a more tempered corporate spending environment, Cloudflare, Inc. has continued to execute and impressively grow its content and security edge network services. DraftKings, Inc., meanwhile, has demonstrated impressive leverage in its financial model, which has proved even more compelling than even our most optimistic original expectations, thanks to a booming legalized sports betting market and the early stages of potential expansion in broader iGaming. Finally, the Fund benefitted from the acquisitions of a few smaller holdings in the period, Transphorm, Inc. and Rover Group, Inc., each up over 78% and 60%, respectively.

Thankfully, many of the worst-performing holdings in the period were relatively small positions and had limited impact on the Fund’s performance. Digital Turbine, Inc., down over 64% in the period, continues to struggle with the weak ad market and its own challenges integrating past acquired assets. We are still hopeful that its Single Tap initiative will start to contribute meaningfully to its financial results, while the company also stands to benefit from a more favorable regulatory environment for alternative, non-Apple/Google app stores. WM Technology, Inc. has had to deal with its own industry troubles as the cannabis market is still far from settled from both a financial and legal standpoint. Down over 40% in the period, we will likely need to see more clarity on the issue of federal declassification and an easing in other impediments for the cannabis market to show a more viable economic path. Finally, the largest negative impact on the Fund in the period was the decline in Inspired Entertainment, Inc., down over 24%. This was mainly the result of an accounting review that has subsequently been closed with only minor adjustments required to its past financial results. Now that this inquiry appears to be behind them, we expect Inspired Entertainment, Inc.’s upcoming reports to better reflect the strength of its online and offline gaming assets and show the kind of strong operating results this long-tenured management team has produced in previous years.

JACOB FUNDS INC.

LETTER FROM THE MANAGER (Unaudited) (Continued)

Jacob Small Cap Growth Fund

The Jacob Small Cap Growth Fund was up 17.60% through February 29, 2024, while the Russell 2000 Growth Index rose 10.21%. As we outlined earlier, the biggest contribution to our outperformance in the period was the broad rally across technology and smaller stocks, especially in the healthcare sector.

Aside from our technology positions in Porch Group, Inc. and OptimizeRx Corp., Codexis, Inc. was our best-performing healthcare name in the period, up over 167%. Although we were considering exiting this position after a management change and the refocusing of its business to RNAi enzyme development, we have been impressed so far with the signing of new partners and hiring of key thought leaders and have decided to hold on to our position to see if more progress is forthcoming. The next two strongest performers in the period were both gene editing companies, Beam Therapeutics, Inc. and CRISPR Therapeutics AG, up over 70% and 68%. This outperformance was widespread among many of the gene editing players after CRISPR Therapeutics AG became the first to achieve FDA approval using the increasingly popular CRISPR-Cas9 technology with its sickle cell treatment, giving more confidence to investors that approval for other indications using is more likely.

The two worst-performing holdings were also Digital Turbine, Inc. and WM Technology, Inc., with Thunderbird Entertainment Group, Inc. close behind, down over 40% in the period. A recent strategic evaluation ended without the sale of the Thunderbird Entertainment Group, Inc. studios that we expected. Also, the content creation business is still challenged by major media companies reducing the number and scale of projects for their traditional and streaming platforms. The last two underperformers in the period, Tela Bio, Inc. and Harrow, Inc., were down more than 30% and 28% in the period. Both companies had salesforce-related hiccups last quarter that have been mostly resolved, and we remain confident that they will be able to gain market share and grow their revenues significantly this year.

Jacob Discovery Fund

The Jacob Discovery Fund was up 6.22% for the fiscal period ended February 29, 2024, while the Russell Microcap Growth Index was up 12.52%. The reasons for our underperformance aren’t entirely clear, although the fund was positioned a bit more cautiously, holding slightly higher levels of cash than our other funds, which dragged down the Fund’s performance on a relative basis.

The Fund did hold larger positions in some of the period’s worst performers – Thunderbird Entertainment Group, Inc., for instance, down 40% and discussed earlier in this letter, was one of our top positions coming into the fiscal period. The lack of a Thunderbird Entertainment Group, Inc. sale was a disappointment to be sure; but we remain confident in the company, its growing array of attractive assets, its talented teams of content creators and its experienced, competent management team.

Other large positions of the Fund that struggled during the period included other names already discussed Harrow, Inc. , Tela Bio, Inc., as well as Hudson Global, Inc., which was down 33% for the period as the company’s major sources of revenue for its recruitment services – tech and healthcare – went through a rather intense period of employment contraction during the past year. We believe Hudson Global, Inc.’s market position remains strong and its valuation too low, especially considering the likely slightly improved prospects for both of those industries in 2024.

Our worst performer in the period wasn’t a huge holding of the Fund but might have been the most disappointing for us. We have long owned shares in CytoSorbents Corp. and believed that its blood filtering technology saved lives and had a bright future, especially given what we thought was a strong likelihood of success in a U.S. clinical trial focused on helping heart surgery patients achieve better outcomes. Unfortunately, the results were underwhelming, and we sold the rest of our stock in CytoSorbents Corp., which was down 57% in the period, believing the lackluster trial outcome will not only make it tough for the company to achieve FDA approval of its treatment, but also potentially harm its sales outside of the U.S., where it currently generates almost all its revenue.

Despite the missteps, we had plenty of successes which led to the Fund’s positive overall return. Most of the strongest performers we have discussed already in this letter: Porch Group, Inc., up 295%; Codexis, Inc., up 167%; and OptimizeRx Corp., one of our largest holdings and up 86%. In addition to those names, we had more than a half-dozen other positions up more than 50% in the period, such as Repositrak, Inc., which continues to take advantage of an upcoming federal regulation that will require grocers and

JACOB FUNDS INC.

LETTER FROM THE MANAGER (Unaudited) (Continued)

supermarkets to keep close track of the perishable items they sell, forcing them to use software and services such as the ones the company offers. Celcuity, Inc. is another long-term holding that continues to impress: It is now well along its important Phase 3 breast cancer trial for its pan-PI3K/mTOR inhibitor that has seen some tremendous success at extending patients’ lives in earlier trials.

Jacob Forward ETF

The Jacob Forward ETF was up 28.32% for the fiscal period ended February 29, 2024, while the S&P 500 Index rose 13.93%. The Fund outperformed its benchmark mainly from its smaller and more aggressive growth profile that led in the period.

As the Jacob Forward ETF combines and incorporates many of the same top holdings as our other three strategies, the best- and worst-performing positions were very similar to the abovementioned holdings. Porch Group, Inc., Codexis, Inc. and OptimizeRx Corp. had the biggest gains in the period, up 295%, 167% and 85%, respectively. Digital Turbine, Inc., Harrow, Inc. and Inspired Entertainment, Inc. were the worst performers in the period, down 64%, 28% and 24% respectively. Please refer to above for additional commentary on each.

In terms of looking ahead, we remain on the lookout for high-quality, high-growth names that have been beaten down and/or ignored by a market seemingly only interested in the safest and largest of companies. We are heartened over this last period as we are finally starting to see signs of a broadening of interest in small caps that has been virtually non-existent for several years. We continue to see many opportunities to invest in attractive, early-stage companies with bright futures, trading at extremely reasonable valuations. As always, we believe that staying true to our investment philosophy and process is still key to obtaining the best possible long-term performance for our shareholders. Thank you again for your continued confidence and trust.

Ryan Jacob

Chairman and Chief Investment Officer

Portfolio Manager

Frank Alexander

Portfolio Manager

Darren Chervitz

Portfolio Manager

Past performance is not a guarantee of future results.

Performance data reflects fee waivers, as applicable, and in the absence of these waivers performance would be reduced.

Diversification does not assure a profit or protect against a loss in a declining market.

Must be accompanied or preceded by a prospectus.

The opinions expressed above are those of the portfolio manager and are subject to change at any time. Forecasts cannot be guaranteed and should not be considered investment advice.

Mutual fund investing involves risk; loss of principal is possible. The Funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater in emerging markets. Growth stocks typically are more volatile than value stocks; however, value stocks have a lower expected growth rate in earnings and sales. There are more specific risks inherent in investing in the internet area, particularly with respect to smaller capitalized companies and the high volatility of internet stocks. The Funds can invest in small-and mid-cap securities which involve additional risks such as limited liquidity and greater volatility. Investments in micro capitalization companies may involve greater risks, as these companies tend to have limited product lines, markets and financial or managerial resources. Micro cap stocks often also have a more limited trading market, such that the Adviser may not be able to sell stocks at an optimal time or price. In addition, less frequently-traded securities may be subject to more abrupt price movements than securities of larger capitalized companies. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer term debt securities.

JACOB FUNDS INC.

LETTER FROM THE MANAGER (Unaudited) (Continued)

Fund holdings are subject to change and should not be construed as a recommendation to buy or sell any security. Current and future portfolio holdings are subject to risk.

Please refer to the schedules of investments for complete Fund holdings information.

The NASDAQ Composite Index is a market capitalization weighted index that is designed to represent performance of the National Market System which includes over 5,000 stocks traded only over-the-counter and not on an exchange. The Russell 2000 Growth Index measures the performance of the small cap growth segment of the U.S. equity universe. It includes those Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values. The Russell Microcap Growth Index measures the performance of the microcap growth segment of the U.S. equity market. It includes Russell Microcap companies that are considered more growth oriented relative to the overall market as defined by Russell’s leading style methodology. The Russell Microcap Growth Index is constructed to provide a comprehensive and unbiased barometer for the microcap growth segment of the market. The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. It is not possible to invest directly in an index.

The Funds are distributed by Quasar Distributors, LLC.

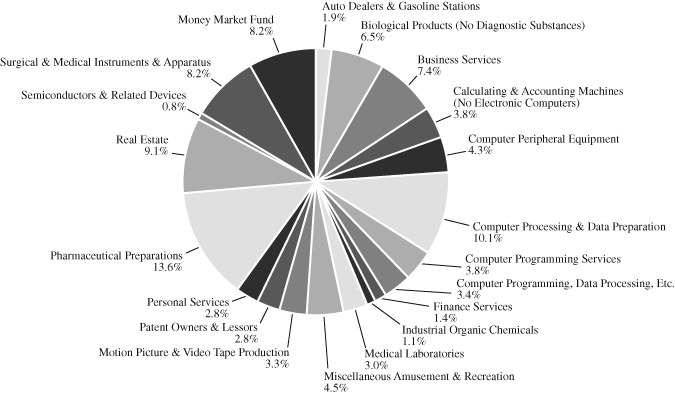

JACOB INTERNET FUND

INDUSTRY BREAKDOWN AS OF FEBRUARY 29, 2024

(as a percentage of total investments)

(Unaudited)

JACOB SMALL CAP GROWTH FUND

INDUSTRY BREAKDOWN AS OF FEBRUARY 29, 2024

(as a percentage of total investments)

(Unaudited)

JACOB DISCOVERY FUND

INDUSTRY BREAKDOWN AS OF FEBRUARY 29, 2024

(as a percentage of total investments)

(Unaudited)

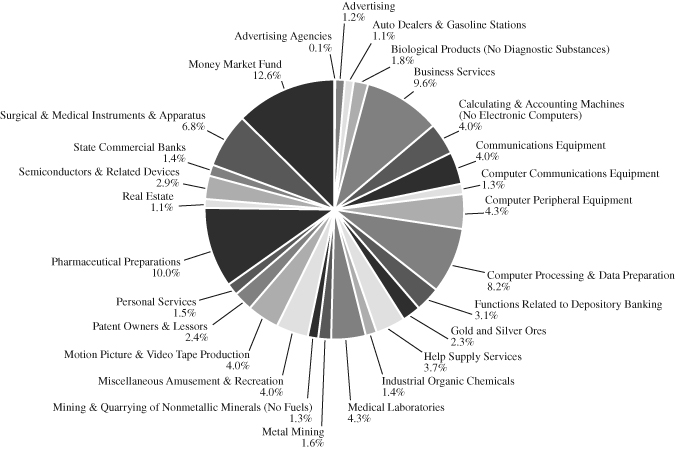

JACOB FORWARD ETF

INDUSTRY BREAKDOWN AS OF FEBRUARY 29, 2024

(as a percentage of total investments)

(Unaudited)

JACOB INTERNET FUND

SCHEDULE OF INVESTMENTS(+)

February 29, 2024 (Unaudited)

| COMMON STOCKS—99.4% | | Shares | | | Value | |

| Auto Dealers & Gasoline Stations—3.3% | | | | | | |

Autohome, Inc.—ADR | | | 50,600 | | | $ | 1,315,094 | |

TrueCar, Inc.(a) | | | 144,000 | | | | 501,120 | |

| | | | | | | | 1,816,214 | |

| Business Services—11.5% | | | | | | | | |

comScore, Inc.(a) | | | 79,750 | | | | 1,573,467 | |

Digital Turbine, Inc.(a) | | | 254,246 | | | | 805,960 | |

OptimizeRx Corp.(a) | | | 229,275 | | | | 3,629,423 | |

Zhihu, Inc.—ADR(a) | | | 501,000 | | | | 400,299 | |

| | | | | | | | 6,409,149 | |

| Calculating & Accounting Machines (No Electronic Computers)—4.4% | | | | | | | | |

Cantaloupe, Inc.(a) | | | 377,200 | | | | 2,451,800 | |

| Communications Equipment—3.7% | | | | | | | | |

Powerfleet, Inc.(a)(b) | | | 648,918 | | | | 2,057,070 | |

| Computer Communications Equipment—2.2% | | | | | | | | |

Lantronix, Inc.(a) | | | 295,600 | | | | 1,197,180 | |

| Computer Peripheral Equipment—5.1% | | | | | | | | |

Identiv, Inc.(a) | | | 326,726 | | | | 2,809,844 | |

| Computer Processing & Data Preparation—11.0% | | | | | | | | |

Doximity, Inc.—Class A(a) | | | 94,700 | | | | 2,673,381 | |

HUYA, Inc.—ADR(a) | | | 300,000 | | | | 1,050,000 | |

Nextdoor Holdings, Inc.(a) | | | 1,087,000 | | | | 2,380,530 | |

| | | | | | | | 6,103,911 | |

| Computer Programming Services—4.6% | | | | | | | | |

HashiCorp, Inc.—Class A(a) | | | 62,500 | | | | 1,629,375 | |

Twilio, Inc.—Class A(a) | | | 15,100 | | | | 899,809 | |

| | | | | | | | 2,529,184 | |

| Computer Programming, Data Processing, Etc.—13.2% | | | | | | | | |

Braze, Inc.—Class A(a) | | | 12,400 | | | | 705,560 | |

Cloudflare, Inc.—Class A(a) | | | 25,100 | | | | 2,473,354 | |

Confluent, Inc.—Class A(a) | | | 49,300 | | | | 1,669,791 | |

MongoDB, Inc.(a) | | | 5,527 | | | | 2,473,775 | |

| | | | | | | | 7,322,480 | |

| Finance Services—6.5% | | | | | | | | |

Block, Inc.(a) | | | 33,000 | | | | 2,622,510 | |

SoFi Technologies, Inc.(a) | | | 106,800 | | | | 959,064 | |

| | | | | | | | 3,581,574 | |

The accompanying notes are an integral part of these financial statements.

JACOB INTERNET FUND

SCHEDULE OF INVESTMENTS(+) (Continued)

February 29, 2024 (Unaudited)

| COMMON STOCKS—(Continued) | | Shares | | | Value | |

| Miscellaneous Amusement & Recreation—11.1% | | | | | | |

DraftKings, Inc. (a) | | | 75,400 | | | $ | 3,266,328 | |

Inspired Entertainment, Inc.(a) | | | 290,043 | | | | 2,871,426 | |

| | | | | | | | 6,137,754 | |

| Patent Owners & Lessors—3.4% | | | | | | | | |

Immersion Corp. | | | 279,011 | | | | 1,883,324 | |

| Personal Services—5.8% | | | | | | | | |

Hello Group, Inc.—ADR | | | 157,400 | | | | 1,037,266 | |

WM Technology, Inc.(a) | | | 978,538 | | | | 880,978 | |

Yelp, Inc.(a) | | | 33,700 | | | | 1,295,428 | |

| | | | | | | | 3,213,672 | |

| Real Estate—10.8% | | | | | | | | |

Leju Holdings Ltd.—ADR(a) | | | 33,903 | | | | 45,091 | |

Porch Group, Inc.(a) | | | 1,218,900 | | | | 4,071,126 | |

Zillow Group, Inc.—Class C(a) | | | 32,875 | | | | 1,845,931 | |

| | | | | | | | 5,962,148 | |

| Semiconductors & Related Devices—2.8% | | | | | | | | |

Atomera, Inc.(a)(b) | | | 154,600 | | | | 973,980 | |

Impinj, Inc.(a) | | | 5,200 | | | | 567,944 | |

| | | | | | | | 1,541,924 | |

| TOTAL COMMON STOCKS (Cost $48,023,199) | | | | | | | 55,017,228 | |

| | | | | | | | | |

| COLLATERAL FOR SECURITIES ON LOAN—5.1% | | | | | | | | |

First American Government Obligations Fund—Class X, 5.23%(c) | | | 2,841,678 | | | | 2,841,678 | |

| TOTAL COLLATERAL FOR SECURITIES ON LOAN (Cost $2,841,678) | | |

| | | | 2,841,678 | |

| TOTAL INVESTMENTS—104.5% (Cost $50,864,877) | | | | | | | 57,858,906 | |

Liabilities in Excess of Other Assets—(4.5)% | | | | | | | (2,469,739 | ) |

| TOTAL NET ASSETS—100.0% | | | | | | $ | 55,389,167 | |

Percentages are stated as a percent of net assets.

| ADR | American Depositary Receipt |

(+) | Schedule of Investments is classified using the U.S. Securities and Exchange Commission’s Standard Industrial Classification (SIC) Code List. |

(a) | Non-income producing security. |

(b) | All or a portion of this security is on loan as of February 29, 2024. The total market value of these securities was $2,802,929 which represented 5.1% of net assets. |

(c) | The rate shown represents the 7-day effective yield as of February 29, 2024. |

The accompanying notes are an integral part of these financial statements.

JACOB SMALL CAP GROWTH FUND

SCHEDULE OF INVESTMENTS(+)

February 29, 2024 (Unaudited)

| COMMON STOCKS—99.7% | | Shares | | | Value | |

| Auto Dealers & Gasoline Stations—2.1% | | | | | | |

Autohome, Inc.—ADR | | | 6,500 | | | $ | 168,935 | |

| Biological Products (No Diagnostic Substances)—7.0% | | | | | | | | |

Beam Therapeutics, Inc.(a) | | | 1,500 | | | | 59,235 | |

CRISPR Therapeutics AG(a) | | | 800 | | | | 67,376 | |

Krystal Biotech, Inc.(a) | | | 1,422 | | | | 226,766 | |

Precision BioSciences, Inc.(a) | | | 11,557 | | | | 213,805 | |

| | | | | | | | 567,182 | |

| Business Services—8.0% | | | | | | | | |

Digital Turbine, Inc.(a) | | | 32,447 | | | | 102,857 | |

OptimizeRx Corp.(a) | | | 31,135 | | | | 492,867 | |

Zhihu, Inc.—ADR(a) | | | 64,000 | | | | 51,136 | |

| | | | | | | | 646,860 | |

| Calculating & Accounting Machines (No Electronic Computers)—4.1% | | | | | | | | |

Cantaloupe, Inc.(a) | | | 51,569 | | | | 335,198 | |

| Computer Peripheral Equipment—4.7% | | | | | | | | |

Identiv, Inc.(a) | | | 43,800 | | | | 376,680 | |

| Computer Processing & Data Preparation—11.0% | | | | | | | | |

DouYu International Holdings Ltd.—ADR(a) | | | 120,000 | | | | 90,288 | |

Doximity, Inc.—Class A(a) | | | 12,200 | | | | 344,406 | |

HUYA, Inc.—ADR(a) | | | 38,800 | | | | 135,800 | |

Nextdoor Holdings, Inc.(a) | | | 144,500 | | | | 316,455 | |

| | | | | | | | 886,949 | |

| Computer Programming Services—4.1% | | | | | | | | |

HashiCorp, Inc.—Class A(a) | | | 8,000 | | | | 208,560 | |

Twilio, Inc.—Class A(a) | | | 2,100 | | | | 125,139 | |

| | | | | | | | 333,699 | |

| Computer Programming, Data Processing, Etc.—3.7% | | | | | | | | |

Braze, Inc.—Class A(a) | | | 1,500 | | | | 85,350 | |

Confluent, Inc.—Class A(a) | | | 6,300 | | | | 213,381 | |

| | | | | | | | 298,731 | |

| Finance Services—1.6% | | | | | | | | |

SoFi Technologies, Inc.(a)(b) | | | 14,200 | | | | 127,516 | |

| Industrial Organic Chemicals—1.2% | | | | | | | | |

Codexis, Inc.(a) | | | 20,146 | | | | 93,679 | |

| Medical Laboratories—3.2% | | | | | | | | |

CareDx, Inc.(a) | | | 24,317 | | | | 258,733 | |

The accompanying notes are an integral part of these financial statements.

JACOB SMALL CAP GROWTH FUND

SCHEDULE OF INVESTMENTS(+) (Continued)

February 29, 2024 (Unaudited)

| COMMON STOCKS—(Continued) | | Shares | | | Value | |

| Miscellaneous Amusement & Recreation—4.8% | | | | | | |

Inspired Entertainment, Inc.(a) | | | 39,592 | | | $ | 391,961 | |

| Motion Picture & Video Tape Production—3.6% | | | | | | | | |

Thunderbird Entertainment Group, Inc.(a) | | | 220,000 | | | | 290,400 | |

| Patent Owners & Lessors—3.0% | | | | | | | | |

Immersion Corp. | | | 36,491 | | | | 246,314 | |

| Personal Services—3.1% | | | | | | | | |

Hello Group, Inc.—ADR | | | 19,300 | | | | 127,187 | |

WM Technology, Inc.(a) | | | 132,579 | | | | 119,361 | |

| | | | | | | | 246,548 | |

| Pharmaceutical Preparations—14.8% | | | | | | | | |

Apellis Pharmaceuticals, Inc.(a) | | | 100 | | | | 6,197 | |

Arcturus Therapeutics Holdings, Inc.(a) | | | 1,380 | | | | 53,489 | |

Esperion Therapeutics, Inc.(a)(b) | | | 109,000 | | | | 273,590 | |

Harrow, Inc.(a) | | | 24,314 | | | | 263,199 | |

Heron Therapeutics, Inc.(a)(b) | | | 143,497 | | | | 381,702 | |

Ideaya Biosciences, Inc.(a) | | | 2,899 | | | | 129,585 | |

Schrodinger, Inc.(a) | | | 3,400 | | | | 86,564 | |

| | | | | | | | 1,194,326 | |

| Real Estate—9.9% | | | | | | | | |

Porch Group, Inc.(a) | | | 167,989 | | | | 561,083 | |

Zillow Group, Inc.—Class C(a) | | | 4,300 | | | | 241,445 | |

| | | | | | | | 802,528 | |

| Semiconductors & Related Devices—0.9% | | | | | | | | |

Impinj, Inc.(a) | | | 664 | | | | 72,522 | |

| Surgical & Medical Instruments & Apparatus—8.9% | | | | | | | | |

Alphatec Holdings, Inc.(a) | | | 26,863 | | | | 360,770 | |

Tela Bio, Inc.(a) | | | 53,200 | | | | 359,632 | |

| | | | | | | | 720,402 | |

| TOTAL COMMON STOCKS (Cost $7,132,703) | | | | | | | 8,059,163 | |

The accompanying notes are an integral part of these financial statements.

JACOB SMALL CAP GROWTH FUND

SCHEDULE OF INVESTMENTS(+) (Continued)

February 29, 2024 (Unaudited)

| COLLATERAL FOR SECURITIES ON LOAN—8.9% | | Shares | | | Value | |

First American Government Obligations Fund—Class X, 5.23%(c) | | | 720,203 | | | $ | 720,203 | |

| TOTAL COLLATERAL FOR SECURITIES ON LOAN (Cost $720,203) | | |

| | | | 720,203 | |

| TOTAL INVESTMENTS—108.6% (Cost $7,852,906) | | | | | | | 8,779,366 | |

Liabilities in Excess of Other Assets—(8.6)% | | | | | | | (697,880 | ) |

| TOTAL NET ASSETS—100.0% | | | | | | $ | 8,081,486 | |

Percentages are stated as a percent of net assets.

| ADR | American Depositary Receipt |

(+) | Schedule of Investments is classified using the U.S. Securities and Exchange Commission’s Standard Industrial Classification (SIC) Code List. |

(a) | Non-income producing security. |

(b) | All or a portion of this security is on loan as of February 29, 2024. The total market value of these securities was $654,772 which represented 8.1% of net assets. |

(c) | The rate shown represents the 7-day effective yield as of February 29, 2024. |

The accompanying notes are an integral part of these financial statements.

JACOB DISCOVERY FUND

SCHEDULE OF INVESTMENTS(+)

February 29, 2024 (Unaudited)

| COMMON STOCKS—97.7% | | Shares | | | Value | |

| Advertising—1.3% | | | | | | |

IZEA Worldwide, Inc.(a) | | | 124,650 | | | $ | 249,300 | |

| Auto Dealers & Gasoline Stations—1.2% | | | | | | | | |

TrueCar, Inc.(a) | | | 65,000 | | | | 226,200 | |

| Biological Products (No Diagnostic Substances)—2.0% | | | | | | | | |

Krystal Biotech, Inc.(a) | | | 710 | | | | 113,224 | |

Precision BioSciences, Inc.(a) | | | 13,589 | | | | 251,396 | |

| | | | | | | | 364,620 | |

| Business Services—10.8% | | | | | | | | |

comScore, Inc.(a) | | | 38,305 | | | | 755,757 | |

OptimizeRx Corp.(a) | | | 67,654 | | | | 1,070,962 | |

Zhihu, Inc.—ADR(a) | | | 220,000 | | | | 175,780 | |

| | | | | | | | 2,002,499 | |

| Calculating & Accounting Machines (No Electronic Computers)—4.5% | | | | | | | | |

Cantaloupe, Inc.(a) | | | 128,325 | | | | 834,113 | |

| Communications Equipment—4.5% | | | | | | | | |

Powerfleet, Inc.(a)(b) | | | 263,121 | | | | 834,094 | |

| Computer Communications Equipment—1.5% | | | | | | | | |

Lantronix, Inc.(a) | | | 66,679 | | | | 270,050 | |

| Computer Peripheral Equipment—4.8% | | | | | | | | |

Identiv, Inc.(a) | | | 104,555 | | | | 899,173 | |

| Computer Processing & Data Preparation—9.3% | | | | | | | | |

DouYu International Holdings Ltd.—ADR(a) | | | 260,000 | | | | 195,624 | |

HUYA, Inc.—ADR(a) | | | 65,000 | | | | 227,500 | |

Nextdoor Holdings, Inc.(a) | | | 120,000 | | | | 262,800 | |

Park City Group, Inc.(b) | | | 68,512 | | | | 1,029,735 | |

| | | | | | | | 1,715,659 | |

| Functions Related to Depository Banking—3.5% | | | | | | | | |

Usio, Inc.(a) | | | 369,100 | | | | 649,616 | |

| Gold and Silver Ores—2.5% | | | | | | | | |

Solitario Zinc Corp.(a) | | | 884,300 | | | | 468,679 | |

| Help Supply Services—4.1% | | | | | | | | |

Hudson Global, Inc.(a) | | | 54,454 | | | | 769,980 | |

| Industrial Organic Chemicals—1.6% | | | | | | | | |

Codexis, Inc.(a) | | | 64,875 | | | | 301,669 | |

The accompanying notes are an integral part of these financial statements.

JACOB DISCOVERY FUND

SCHEDULE OF INVESTMENTS(+) (Continued)

February 29, 2024 (Unaudited)

| COMMON STOCKS—(Continued) | | Shares | | | Value | |

| Medical Laboratories—4.8% | | | | | | |

CareDx, Inc.(a) | | | 20,000 | | | $ | 212,800 | |

Celcuity, Inc.(a) | | | 43,209 | | | | 672,332 | |

| | | | | | | | 885,132 | |

| Metal Mining—1.8% | | | | | | | | |

Western Copper & Gold Corp.(a)(b) | | | 263,950 | | | | 337,856 | |

| Mining & Quarrying of Nonmetallic Mineral (No Fuels)—1.5% | | | | | | | | |

Azimut Exploration, Inc.(a) | | | 463,480 | | | | 274,148 | |

| Miscellaneous Amusement & Recreation—4.5% | | | | | | | | |

Inspired Entertainment, Inc.(a) | | | 84,336 | | | | 834,926 | |

| Motion Picture & Video Tape Production—4.4% | | | | | | | | |

Thunderbird Entertainment Group, Inc.(a) | | | 625,135 | | | | 825,179 | |

| Patent Owners & Lessors—2.7% | | | | | | | | |

Immersion Corp. | | | 75,182 | | | | 507,479 | |

| Personal Services—1.6% | | | | | | | | |

WM Technology, Inc.(a) | | | 336,788 | | | | 303,210 | |

| Pharmaceutical Preparations—11.2% | | | | | | | | |

Arcturus Therapeutics Holdings, Inc.(a) | | | 4,870 | | | | 188,761 | |

Cannabist Co. Holdings, Inc.(a) | | | 147,500 | | | | 53,100 | |

DiaMedica Therapeutics, Inc.(a) | | | 140,730 | | | | 422,190 | |

Esperion Therapeutics, Inc.(a)(b) | | | 135,000 | | | | 338,850 | |

Harrow, Inc.(a) | | | 36,206 | | | | 391,930 | |

Heron Therapeutics, Inc.(a)(b) | | | 94,960 | | | | 252,594 | |

Ideaya Biosciences, Inc.(a) | | | 6,985 | | | | 312,230 | |

NeuBase Therapeutics, Inc.(a) | | | 15,655 | | | | 13,463 | |

SCYNEXIS, Inc.(a) | | | 65,000 | | | | 105,300 | |

| | | | | | | | 2,078,418 | |

| Real Estate—1.2% | | | | | | | | |

Porch Group, Inc.(a) | | | 68,550 | | | | 228,957 | |

| Semiconductors & Related Devices—3.2% | | | | | | | | |

Atomera, Inc.(a)(b) | | | 63,800 | | | | 401,940 | |

Impinj, Inc.(a) | | | 460 | | | | 50,241 | |

Transphorm, Inc.(a) | | | 31,174 | | | | 149,947 | |

| | | | | | | | 602,128 | |

| State Commercial Banks—1.5% | | | | | | | | |

BM Technologies, Inc.(a) | | | 160,000 | | | | 281,600 | |

The accompanying notes are an integral part of these financial statements.

JACOB DISCOVERY FUND

SCHEDULE OF INVESTMENTS(+) (Continued)

February 29, 2024 (Unaudited)

| COMMON STOCKS—(Continued) | | Shares | | | Value | |

| Surgical & Medical Instruments & Apparatus—7.7% | | | | | | |

Alphatec Holdings, Inc.(a) | | | 35,200 | | | $ | 472,736 | |

Tela Bio, Inc.(a) | | | 139,775 | | | | 944,879 | |

| | | | | | | | 1,417,615 | |

| TOTAL COMMON STOCKS (Cost $24,609,380) | | | | | | | 18,162,300 | |

| | | | | | | | | |

| PREFERRED STOCKS—0.1% | | | | | | | | |

| Advertising Agencies—0.1% | | | | | | | | |

SRAX, Inc., 0.00%(c) | | | 368,541 | | | | 10,577 | |

| TOTAL PREFERRED STOCKS (Cost $18,017) | | | | | | | 10,577 | |

| | | | | | | | | |

| MONEY MARKET FUNDS—2.5% | | | | | | | | |

First American Government Obligations Fund—Class X, 5.23%(d) | | | 456,872 | | | | 456,872 | |

| TOTAL MONEY MARKET FUNDS (Cost $456,872) | | | | | | | 456,872 | |

| | | | | | | | | |

| COLLATERAL FOR SECURITIES ON LOAN—11.6% | | | | | | | | |

First American Government Obligations Fund—Class X, 5.23%(d) | | | 2,162,055 | | | | 2,162,055 | |

| TOTAL COLLATERAL FOR SECURITIES ON LOAN (Cost $2,162,055) | | |

| | | | 2,162,055 | |

| TOTAL INVESTMENTS—111.9% (Cost $27,246,324) | | | | | | | 20,791,804 | |

Liabilities in Excess of Other Assets—(11.9)% | | | | | | | (2,210,338 | ) |

| TOTAL NET ASSETS—100.0% | | | | | | $ | 18,581,466 | |

Percentages are stated as a percent of net assets.

| ADR | American Depositary Receipt |

(+) | Schedule of Investments is classified using the U.S. Securities and Exchange Commission’s Standard Industrial Classification (SIC) Code List. |

(a) | Non-income producing security. |

(b) | All or a portion of this security is on loan as of February 29, 2024. The total market value of these securities was $2,045,264 which represented 11.0% of net assets. |

(c) | Fair value determined using significant unobservable inputs in accordance with procedures established by and under the supervision of the Adviser, acting as Valuation Designee. These securities represented $10,577 or 0.1% of net assets as of February 29, 2024. |

(d) | The rate shown represents the 7-day effective yield as of February 29, 2024. |

The accompanying notes are an integral part of these financial statements.

JACOB FORWARD ETF

SCHEDULE OF INVESTMENTS(+)

February 29, 2024 (Unaudited)

| COMMON STOCKS—100.0% | | Shares | | | Value | |

| Auto Dealers & Gasoline Stations—1.9% | | | | | | |

Autohome, Inc.—ADR | | | 2,407 | | | $ | 62,557 | |

| Biological Products (No Diagnostic Substances)—4.8% | | | | | | | | |

Beam Therapeutics, Inc.(a) | | | 688 | | | | 27,169 | |

CRISPR Therapeutics AG(a) | | | 403 | | | | 33,941 | |

Krystal Biotech, Inc.(a) | | | 620 | | | | 98,872 | |

| | | | | | | | 159,982 | |

| Business Services—7.4% | | | | | | | | |

Digital Turbine, Inc.(a) | | | 11,981 | | | | 37,980 | |

OptimizeRx Corp.(a) | | | 11,982 | | | | 189,675 | |

Zhihu, Inc.—ADR(a) | | | 21,500 | | | | 17,179 | |

| | | | | | | | 244,834 | |

| Computer Peripheral Equipment—4.0% | | | | | | | | |

Identiv, Inc.(a) | | | 15,595 | | | | 134,117 | |

| Computer Processing & Data Preparation—8.8% | | | | | | | | |

Doximity, Inc.—Class A(a) | | | 4,520 | | | | 127,599 | |

HUYA, Inc.—ADR(a) | | | 14,016 | | | | 49,056 | |

Nextdoor Holdings, Inc.(a) | | | 52,825 | | | | 115,687 | |

| | | | | | | | 292,342 | |

| Computer Programming Services—3.7% | | | | | | | | |

HashiCorp, Inc.—Class A(a) | | | 2,941 | | | | 76,672 | |

Twilio, Inc.—Class A(a) | | | 780 | | | | 46,480 | |

| | | | | | | | 123,152 | |

| Computer Programming, Data Processing, Etc.—10.6% | | | | | | | | |

Braze, Inc.—Class A(a) | | | 514 | | | | 29,247 | |

Cloudflare, Inc.—Class A(a) | | | 1,203 | | | | 118,544 | |

Confluent, Inc.—Class A(a) | | | 2,403 | | | | 81,390 | |

MongoDB, Inc.(a) | | | 268 | | | | 119,950 | |

| | | | | | | | 349,131 | |

| Finance Services—5.3% | | | | | | | | |

Block, Inc.(a) | | | 1,635 | | | | 129,933 | |

SoFi Technologies, Inc.(a)(b) | | | 5,190 | | | | 46,606 | |

| | | | | | | | 176,539 | |

| Industrial Organic Chemicals—1.1% | | | | | | | | |

Codexis, Inc.(a) | | | 8,184 | | | | 38,056 | |

| Medical Laboratories—3.3% | | | | | | | | |

CareDx, Inc.(a) | | | 10,401 | | | | 110,667 | |

The accompanying notes are an integral part of these financial statements.

JACOB FORWARD ETF

SCHEDULE OF INVESTMENTS(+) (Continued)

February 29, 2024 (Unaudited)

| COMMON STOCKS—(Continued) | | Shares | | | Value | |

| Miscellaneous Amusement & Recreation—9.4% | | | | | | |

DraftKings, Inc. (a) | | | 3,800 | | | $ | 164,616 | |

Inspired Entertainment, Inc.(a) | | | 14,656 | | | | 145,094 | |

| | | | | | | | 309,710 | |

| Patent Owners & Lessors—2.9% | | | | | | | | |

Immersion Corp. | | | 14,000 | | | | 94,500 | |

| Personal Services—1.3% | | | | | | | | |

Hello Group, Inc.—ADR | | | 6,650 | | | | 43,824 | |

| Pharmaceutical Preparations—15.8% | | | | | | | | |

Apellis Pharmaceuticals, Inc.(a) | | | 68 | | | | 4,214 | |

Arcturus Therapeutics Holdings, Inc.(a) | | | 646 | | | | 25,039 | |

Esperion Therapeutics, Inc.(a)(b) | | | 47,012 | | | | 117,999 | |

Harrow, Inc.(a) | | | 10,188 | | | | 110,285 | |

Heron Therapeutics, Inc.(a)(b) | | | 63,624 | | | | 169,239 | |

Ideaya Biosciences, Inc.(a) | | | 1,241 | | | | 55,473 | |

Schrodinger, Inc.(a) | | | 1,510 | | | | 38,445 | |

| | | | | | | | 520,694 | |

| Real Estate—9.4% | | | | | | | | |

Porch Group, Inc.(a) | | | 66,148 | | | | 220,934 | |

Zillow Group, Inc.—Class C(a) | | | 1,594 | | | | 89,503 | |

| | | | | | | | 310,437 | |

| Semiconductors & Related Devices—0.8% | | | | | | | | |

Impinj, Inc.(a) | | | 230 | | | | 25,121 | |

| Surgical & Medical Instruments & Apparatus—9.5% | | | | | | | | |

Alphatec Holdings, Inc.(a) | | | 11,687 | | | | 156,957 | |

Tela Bio, Inc.(a) | | | 23,020 | | | | 155,615 | |

| | | | | | | | 312,572 | |

| TOTAL COMMON STOCKS (Cost $3,574,161) | | | | | | | 3,308,235 | |

The accompanying notes are an integral part of these financial statements.

JACOB FORWARD ETF

SCHEDULE OF INVESTMENTS(+) (Continued)

February 29, 2024 (Unaudited)

| MONEY MARKET FUNDS—0.1% | | Shares | | | Value | |

First American Government Obligations Fund—Class X, 5.23%(c) | | | 3,621 | | | $ | 3,621 | |

| TOTAL MONEY MARKET FUNDS (Cost $3,621) | | | | | | | 3,621 | |

| | | | | | | | | |

| COLLATERAL FOR SECURITIES ON LOAN—7.7% | | | | | | | | |

First American Government Obligations Fund—Class X, 5.23%(c) | | | 256,437 | | | | 256,437 | |

| TOTAL COLLATERAL FOR SECURITIES ON LOAN (Cost $256,437) | | |

| | | | 256,437 | |

| TOTAL INVESTMENTS—107.8% (Cost $3,834,219) | | | | | | | 3,568,293 | |

Liabilities in Excess of Other Assets—(7.8)% | | | | | | | (256,762 | ) |

| TOTAL NET ASSETS—100.0% | | | | | | $ | 3,311,531 | |

Percentages are stated as a percent of net assets.

| ADR | American Depositary Receipt |

(+) | Schedule of Investments is classified using the U.S. Securities and Exchange Commission’s Standard Industrial Classification (SIC) Code List. |

(a) | Non-income producing security. |

(b) | All or a portion of this security is on loan as of February 29, 2024. The total market value of these securities was $232,300 which represented 7.0% of net assets. |

(c) | The rate shown represents the 7-day effective yield as of February 29, 2024. |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

STATEMENTS OF ASSETS AND LIABILITIES

February 29, 2024 (Unaudited)

| | | | | | Jacob | | | | |

| | | Jacob | | | Small Cap | | | Jacob | |

| | | Internet Fund | | | Growth Fund | | | Discovery Fund | |

| Assets: | | | | | | | | | |

| Investments, at value (cost $50,864,877, $7,852,906 and $27,246,324, respectively) | | $ | 57,858,906 | * | | $ | 8,779,366 | * | | $ | 20,791,804 | * |

| Receivable for capital shares sold | | | 6,271 | | | | 250 | | | | 208 | |

| Receivable for investments sold | | | 667,058 | | | | 72,465 | | | | 116,080 | |

| Receivable for securities lending | | | 4,201 | | | | 232 | | | | 2,884 | |

| Dividend and interest receivable | | | 49,626 | | | | 6,385 | | | | 725 | |

| Prepaid expenses and other assets | | | 19,193 | | | | 20,452 | | | | 24,518 | |

| Total Assets | | | 58,605,255 | | | | 8,879,150 | | | | 20,936,219 | |

| | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | |

| Collateral on securities loaned | | | 2,841,678 | | | | 720,203 | | | | 2,162,055 | |

| Payable for securities purchased | | | 89,572 | | | | — | | | | 22,192 | |

| Payable for capital shares repurchased | | | 69,935 | | | | — | | | | 105,466 | |

| Payable for investment adviser fees | | | 53,399 | | | | — | | | | 9,413 | |

| Payable to custodian | | | 60,419 | | | | 41,733 | | | | — | |

| Payable for distribution and shareholder servicing expenses-Investor Class (see Note 7) | | | 10,680 | | | | 668 | | | | 1,961 | |

| Accrued accounting fees | | | 5,817 | | | | 5,814 | | | | 5,840 | |

| Accrued administration fees | | | 6,768 | | | | 5,660 | | | | 8,849 | |

| Accrued audit fees | | | 7,687 | | | | 7,687 | | | | 7,687 | |

| Accrued directors fees | | | 16,614 | | | | 2,210 | | | | 6,134 | |

| Accrued legal fees | | | 27,187 | | | | 3,827 | | | | 11,193 | |

| Accrued transfer agent fees | | | 19,275 | | | | 9,436 | | | | 10,214 | |

| Accrued expenses and other liabilities | | | 7,057 | | | | 426 | | | | 3,749 | |

| Total Liabilities | | | 3,216,088 | | | | 797,664 | | | | 2,354,753 | |

| Net Assets | | $ | 55,389,167 | | | $ | 8,081,486 | | | $ | 18,581,466 | |

| | | | | | | | | | | | | |

| Net Assets Consist Of: | | | | | | | | | | | | |

| Capital stock | | $ | 59,689,872 | | | $ | 9,481,380 | | | $ | 47,736,591 | |

| Total accumulated losses | | | (4,300,705 | ) | | | (1,399,894 | ) | | | (29,155,125 | ) |

| Total Net Assets | | $ | 55,389,167 | | | $ | 8,081,486 | | | $ | 18,581,466 | |

| | | | | | | | | | | | | |

| Institutional Class | | | | | | | | | | | | |

| Net Assets | | $ | — | | | $ | 4,537,054 | | | $ | 8,865,601 | |

Shares outstanding(1) | | | — | | | | 230,550 | | | | 361,311 | |

Net asset value, redemption price and offering price per share(2) | | $ | — | (3) | | $ | 19.68 | | | $ | 24.54 | |

| | | | | | | | | | | | | |

| Investor Class | | | | | | | | | | | | |

| Net Assets | | $ | 55,389,167 | | | $ | 3,544,432 | | | $ | 9,715,865 | |

Shares outstanding(1) | | | 10,536,610 | | | | 187,439 | | | | 440,756 | |

Net asset value, redemption price and offering price per share(2) | | $ | 5.26 | | | $ | 18.91 | | | $ | 22.04 | |

_______________

| * | Includes loaned securities with market value totaling $2,802,929, $654,772 and $2,045,264 for the Jacob Internet Fund, Jacob Small Cap Growth Fund and Jacob Discovery Fund, respectively. |

(1) | 20 billion shares of $0.001 par value authorized for the Trust. |

(2) | Redemption of shares held less than 30 days may be charged a 2% redemption fee. See Note 3. |

(3) | The Jacob Internet Fund Institutional Class shares liquidated on November 17, 2023. |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

STATEMENTS OF ASSETS AND LIABILITIES (Continued)

February 29, 2024 (Unaudited)

| | | Jacob | |

| | | Forward ETF | |

| Assets: | | | |

| Investments, at value (cost $3,834,219) | | $ | 3,568,293 | * |

| Receivable for investments sold | | | 38,399 | |

| Dividend and interest receivable | | | 2,386 | |

| Receivable for Securities Lending | | | 92 | |

| Total Assets | | | 3,609,170 | |

| | | | | |

| Liabilities: | | | | |

| Collateral on securities loaned | | | 256,437 | |

| Payable for securities purchased | | | 40,010 | |

| Payable for investment adviser fees | | | 1,192 | |

| Total Liabilities | | | 297,639 | |

| Commitments and contingencies (See Note 10) | | | | |

| | | | | |

| Net Assets | | $ | 3,311,531 | |

| | | | | |

| Net Assets Consist Of: | | | | |

| Capital stock | | $ | 6,697,685 | |

| Total accumulated losses | | | (3,386,154 | ) |

| Total Net Assets | | $ | 3,311,531 | |

| | | | | |

| Net Asset Value | | | | |

| Net Assets | | $ | 3,311,531 | |

Shares outstanding(1) | | | 300,000 | |

Net asset value, redemption price and offering price per share(2) | | $ | 11.04 | |

_______________

* | Includes loaned securities with market value totaling $232,300. |

(1) | 20 billion shares of $0.001 par value authorized for the Trust. |

(2) | Redemption of shares may be charged for a redemption fee by the Fund. See Note 3. |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

STATEMENTS OF OPERATIONS

For the Six Months Ended February 29, 2024 (Unaudited)

| | | | | | Jacob | | | | |

| | | Jacob | | | Small Cap | | | Jacob | |

| | | Internet Fund | | | Growth Fund | | | Discovery Fund | |

| Investment Income: | | | | | | | | | |

| Dividend income | | $ | 74,455 | | | $ | 6,802 | | | $ | 5,157 | |

| Interest income | | | 6,539 | | | | 1,136 | | | | 8,327 | |

| Securities lending income | | | 21,023 | | | | 524 | | | | 19,593 | |

| Total Investment Income | | | 102,017 | | | | 8,462 | | | | 33,077 | |

| | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | |

| Investment adviser fees | | | 304,915 | | | | 27,492 | | | | 104,886 | |

| Distribution and shareholder servicing expenses – Investor Class (See Note 7) | | | 85,373 | | | | 5,113 | | | | 18,187 | |

| Administration fees | | | 40,626 | | | | 25,885 | | | | 32,741 | |

| Fund accounting fees | | | 17,257 | | | | 17,745 | | | | 17,809 | |

| Transfer agent fees | | | 60,680 | | | | 23,252 | | | | 30,271 | |

| Custody fees | | | 3,775 | | | | 3,567 | | | | 3,637 | |

| Federal and state registration | | | 16,073 | | | | 15,947 | | | | 16,748 | |

| Insurance expense | | | 3,065 | | | | 464 | | | | 1,675 | |

| Audit fees | | | 7,686 | | | | 7,686 | | | | 7,686 | |

| Legal fees | | | 45,899 | | | | 6,408 | | | | 18,031 | |

| Printing and mailing of reports to shareholders | | | 11,247 | | | | 1,483 | | | | 4,759 | |

| Directors’ fees | | | 31,995 | | | | 4,403 | | | | 10,432 | |

| Miscellaneous expenses | | | 2,887 | | | | 930 | | | | 2,478 | |

| Total Expenses | | | 631,478 | | | | 140,375 | | | | 269,340 | |

| Expense Waiver (See Note 6) | | | — | | | | (27,492 | ) | | | (57,853 | ) |

| Distribution and Shareholder Servicing Expense Waiver (See Note 7) | | | (24,392 | ) | | | (1,461 | ) | | | (5,196 | ) |

| Net Expenses | | | 607,086 | | | | 111,422 | | | | 206,291 | |

| Net Investment Loss | | | (505,069 | ) | | | (102,960 | ) | | | (173,214 | ) |

| | | | | | | | | | | | | |

| Realized and Unrealized Gain on Investments: | | | | | | | | | | | | |

| Net realized gain (loss) on: | | | | | | | | | | | | |

| Investments | | | 1,481,291 | | | | 501,895 | | | | (1,706,685 | ) |

| Foreign Currency Transactions | | | — | | | | (179 | ) | | | (45 | ) |

| Change in net unrealized appreciation (depreciation) on investments | | | 9,228,408 | | | | 776,449 | | | | 2,789,650 | |

| Net realized and unrealized gain on investments | | | 10,709,699 | | | | 1,278,165 | | | | 1,082,920 | |

| Net Increase in Net Assets Resulting from Operations | | $ | 10,204,630 | | | $ | 1,175,205 | | | $ | 909,706 | |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

STATEMENT OF OPERATIONS (Continued)

For the Six Months Ended February 29, 2024 (Unaudited)

| | | Jacob | |

| | | Forward ETF | |

| Investment Income: | | | |

| Dividend income | | $ | 2,663 | |

| Interest income | | | 58 | |

| Securities lending income | | | 201 | |

| Total Investment Income | | | 2,922 | |

| | | | | |

| Expenses: | | | | |

| Investment adviser fees | | | 10,009 | |

| Net Expenses | | | 10,009 | |

| Net Investment Loss | | | (7,087 | ) |

| | | | | |

| Realized and Unrealized Gain (Loss) on Investments: | | | | |

| Net realized gain (loss) on: | | | | |

| Investments | | | (410,457 | ) |

| In-kind redemptions | | | 34,502 | |

| Change in net unrealized appreciation (depreciation) on investments | | | 1,053,135 | |

| Net realized and unrealized gain on investments | | | 677,180 | |

| Net Increase in Net Assets Resulting from Operations | | $ | 670,093 | |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

JACOB INTERNET FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | Six Months Ended | | | | |

| | | February 29, 2024 | | | Year Ended | |

| | | (Unaudited) | | | August 31, 2023 | |

| Operations: | | | | | | |

| Net investment loss | | $ | (505,069 | ) | | $ | (1,090,923 | ) |

| Net realized gain (loss) on investment transactions | | | 1,481,291 | | | | (9,833,400 | ) |

| Change in net unrealized appreciation (depreciation) on investments | | | 9,228,408 | | | | 3,978,901 | |

| Net increase (decrease) in net assets resulting from operations | | | 10,204,630 | | | | (6,945,422 | ) |

| | | | | | | | | |

| Distributions to Shareholders: | | | | | | | | |

| Investor Class | | | — | | | | — | |

| Net decrease in net assets resulting from distributions paid | | | — | | | | — | |

| | | | | | | | | |

| Capital Share Transactions: (Note 3) | | | | | | | | |

| Proceeds from shares sold | | | 978,283 | | | | 1,342,164 | |

| Cost of shares redeemed | | | (5,333,877 | ) | | | (8,091,604 | ) |

| Redemption fees | | | 487 | | | | 5,207 | |

| Net decrease in net assets resulting from capital share transactions | | | (4,355,107 | ) | | | (6,744,233 | ) |

| | | | | | | | | |

| Net Increase (Decrease) in Net Assets | | | 5,849,523 | | | | (13,689,655 | ) |

| Net Assets: | | | | | | | | |

| Beginning of period/year | | | 49,539,644 | | | | 63,229,299 | |

| End of period/year | | $ | 55,389,167 | | | $ | 49,539,644 | |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

JACOB SMALL CAP GROWTH FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | Six Months Ended | | | | |

| | | February 29, 2024 | | | Year Ended | |

| | | (Unaudited) | | | August 31, 2023 | |

| Operations: | | | | | | |

| Net investment loss | | $ | (102,960 | ) | | $ | (200,746 | ) |

| Net realized gain (loss) on investment transactions: | | | | | | | | |

| Investments | | | 501,895 | | | | (1,336,688 | ) |

| Foreign currency transactions | | | (179 | ) | | | — | |

| Change in net unrealized appreciation (depreciation) on investments | | | 776,449 | | | | 1,249,457 | |

| Net increase (decrease) in net assets resulting from operations | | | 1,175,205 | | | | (287,977 | ) |

| | | | | | | | | |

| Capital Share Transactions: (Note 3) | | | | | | | | |

| Proceeds from shares sold | | | 553,120 | | | | 109,455 | |

| Cost of shares redeemed | | | (898,889 | ) | | | (1,118,319 | ) |

| Redemption fees | | | 3,836 | | | | 140 | |

| Net decrease in net assets resulting from capital share transactions | | | (341,933 | ) | | | (1,008,724 | ) |

| | | | | | | | | |

| Net Increase (Decrease) in Net Assets | | | 833,272 | | | | (1,296,701 | ) |

| Net Assets: | | | | | | | | |

| Beginning of period/year | | | 7,248,214 | | | | 8,544,915 | |

| End of period/year | | $ | 8,081,486 | | | $ | 7,248,214 | |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

JACOB DISCOVERY FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | Six Months Ended | | | | |

| | | February 29, 2024 | | | Year Ended | |

| | | (Unaudited) | | | August 31, 2023 | |

| Operations: | | | | | | |

| Net investment loss | | $ | (173,214 | ) | | $ | (523,247 | ) |

| Net realized gain (loss) on: | | | | | | | | |

| Investments | | | (1,706,685 | ) | | | (6,780,618 | ) |

| Foreign currency transactions | | | (45 | ) | | | 34 | |

| Change in net unrealized appreciation (depreciation) on investments | | | 2,789,650 | | | | 5,310,117 | |

| Net increase (decrease) in net assets resulting from operations | | | 909,706 | | | | (1,993,714 | ) |

| | | | | | | | | |

| Capital Share Transactions: (Note 3) | | | | | | | | |

| Proceeds from shares sold | | | 422,150 | | | | 5,170,016 | |

| Cost of shares redeemed | | | (5,033,508 | ) | | | (16,069,451 | ) |

| Redemption fees | | | 11 | | | | 4,772 | |

| Net decrease in net assets resulting from capital share transactions | | | (4,611,347 | ) | | | (10,894,663 | ) |

| | | | | | | | | |

| Net Decrease in Net Assets | | | (3,701,641 | ) | | | (12,888,377 | ) |

| Net Assets: | | | | | | | | |

| Beginning of period/year | | | 22,283,107 | | | | 35,171,484 | |

| End of period/year | | $ | 18,581,466 | | | $ | 22,283,107 | |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

JACOB FORWARD ETF

STATEMENTS OF CHANGES IN NET ASSETS

| | | Six Months Ended | | | | |

| | | February 29, 2024 | | | Year Ended | |

| | | (Unaudited) | | | August 31, 2023 | |

| Operations: | | | | | | |

| Net investment loss | | $ | (7,087 | ) | | $ | (16,214 | ) |

| Net realized gain (loss) on: | | | | | | | | |

| Investments | | | (410,457 | ) | | | (1,721,895 | ) |

| In-kind redemptions | | | 34,502 | | | | 77,369 | |

| Change in net unrealized appreciation (depreciation) on investments | | | 1,053,135 | | | | 1,401,376 | |

| Net increase (decrease) in net assets resulting from operations | | | 670,093 | | | | (259,364 | ) |

| | | | | | | | | |

| Capital Share Transactions: (Note 3) | | | | | | | | |

| Proceeds from shares sold | | | 106,399 | | | | 174,810 | |

| Cost of shares redeemed | | | (299,694 | ) | | | (496,908 | ) |

| Net decrease in net assets resulting from capital share transactions | | | (193,295 | ) | | | (322,098 | ) |

| | | | | | | | | |

| Net Increase (Decrease) in Net Assets | | | 476,798 | | | | (581,462 | ) |

| Net Assets: | | | | | | | | |

| Beginning of period/year | | | 2,834,733 | | | | 3,416,195 | |

| End of period/year | | $ | 3,311,531 | | | $ | 2,834,733 | |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

JACOB INTERNET FUND – INVESTOR CLASS

FINANCIAL HIGHLIGHTS

The table below sets forth financial data for a share of the Fund outstanding throughout each period/year presented.

| | | Six Months Ended | | | Year Ended August 31, | |

| | | February 29, 2024 | | | 2023 | | | 2022 | | | 2021 | | | 2020 | | | 2019 | |

| | | (Unaudited) | | | | | | | | | | | | | | | | |

| Per Share Data: | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period/year | | $ | 4.30 | | | $ | 4.84 | | | $ | 10.63 | | | $ | 7.18 | | | $ | 5.22 | | | $ | 5.40 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss(1) | | | (0.05 | ) | | | (0.09 | ) | | | (0.16 | ) | | | (0.19 | ) | | | (0.12 | ) | | | (0.10 | ) |

| Net realized and unrealized gain (loss) | | | | | | | | | | | | | | | | | | | | | | | | |

| on investment transactions | | | 1.01 | | | | (0.45 | ) | | | (5.34 | ) | | | 4.81 | | | | 2.65 | | | | 0.29 | |

| Total from investment operations | | | 0.96 | | | | (0.54 | ) | | | (5.50 | ) | | | 4.62 | | | | 2.53 | | | | 0.19 | |

| Less distributions from net realized gains | | | — | | | | — | | | | (0.29 | ) | | | (1.19 | ) | | | (0.57 | ) | | | (0.37 | ) |

Paid in capital from redemption fees(2) | | | 0.00 | (3) | | | 0.00 | (3) | | | 0.00 | (3) | | | 0.02 | | | | 0.00 | (3) | | | 0.00 | (3) |

Net asset value, end of period/year | | $ | 5.26 | | | $ | 4.30 | | | $ | 4.84 | | | $ | 10.63 | | | $ | 7.18 | | | $ | 5.22 | |

Total return | | | 22.33 | %(4) | | | -11.16 | % | | | -53.13 | % | | | 71.34 | % | | | 55.45 | % | | | 4.61 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period/year (in thousands) | | $ | 55,389 | | | $ | 49,535 | | | $ | 63,096 | | | $ | 170,119 | | | $ | 69,126 | | | $ | 49,766 | |

Ratio of Gross operating expenses | | | | | | | | | | | | | | | | | | | | | | | | |

(prior to waivers) to average net assets | | | 2.59 | %(5) | | | 2.54 | % | | | 2.12 | % | | | 2.03 | % | | | 2.60 | % | | | 2.42 | % |

Ratio of net operating expenses | | | | | | | | | | | | | | | | | | | | | | | | |

(after waivers) to average net assets(6) | | | 2.49 | %(5) | | | 2.44 | % | | | 2.02 | % | | | 1.93 | % | | | 2.50 | % | | | 2.32 | % |

Ratio of net investment loss | | | | | | | | | | | | | | | | | | | | | | | | |

(prior to waivers) to average net assets | | | (2.17 | )%(5) | | | (2.18 | )% | | | (2.11 | )% | | | (1.98 | )% | | | (2.52 | )% | | | (2.18 | )% |

Ratio of net investment loss | | | | | | | | | | | | | | | | | | | | | | | | |

(after waivers) to average net assets(6) | | | (2.07 | )%(5) | | | (2.08 | )% | | | (2.01 | )% | | | (1.88 | )% | | | (2.42 | )% | | | (2.08 | )% |

Portfolio turnover rate | | | 23 | %(4) | | | 45 | % | | | 42 | % | | | 44 | % | | | 52 | % | | | 50 | % |

_______________

(1) | Net investment loss per share represents net investment loss divided by the average shares outstanding throughout the period/year. |

(2) | Paid in capital from redemption fees per share represents redemption fees divided by the average shares outstanding throughout the period/year. |

(3) | Less than $0.01 per share. |

(4) | Not annualized. |

(5) | Annualized. |

(6) | For the period September 1, 2011 through January 5, 2025, the Adviser has contractually agreed to waive its advisory fee in an amount up to an annual rate of 0.10% of the Fund’s average daily net assets, to the extent that the Fund’s gross operating expense ratio exceeds 2.95%, excluding any taxes, interest, brokerage fees, acquired fund fees and expenses, and extraordinary expenses. The Fund has adopted a distribution and service plan (the “Plan”) pursuant to Rule 12b-1 under the 1940 Act, under which the Fund may pay Plan related expenses up to 0.35% of average daily net assets on an annual basis. The Adviser has agreed to waive 0.10% of the 0.35% Plan fee. |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

JACOB SMALL CAP GROWTH FUND – INSTITUTIONAL CLASS

FINANCIAL HIGHLIGHTS

The table below sets forth financial data for a share of the Fund outstanding throughout each period/year presented.

| | | Six Months Ended | | | Year Ended August 31, | |

| | | February 29, 2024 | | | 2023 | | | 2022 | | | 2021 | | | 2020 | | | 2019 | |

| | | (Unaudited) | | | | | | | | | | | | | | | | |

| Per Share Data: | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period/year | | $ | 16.71 | | | $ | 17.29 | | | $ | 43.52 | | | $ | 30.80 | | | $ | 23.91 | | | $ | 28.81 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss(1) | | | (0.24 | ) | | | (0.41 | ) | | | (0.52 | ) | | | (0.68 | ) | | | (0.42 | ) | | | (0.39 | ) |

| Net realized and unrealized gain (loss) | | | | | | | | | | | | | | | | | | | | | | | | |

| on investment transactions | | | 3.20 | | | | (0.17 | ) | | | (20.09 | ) | | | 18.37 | | | | 7.98 | | | | (4.26 | ) |

| Total from investment operations | | | 2.96 | | | | (0.58 | ) | | | (20.61 | ) | | | 17.69 | | | | 7.56 | | | | (4.65 | ) |

| Less distributions from net realized gains | | | — | | | | — | | | | (5.62 | ) | | | (5.02 | ) | | | (0.67 | ) | | | (0.25 | ) |

Paid in capital from redemption fees(2) | | | 0.01 | | | | 0.00 | (3) | | | 0.00 | (3) | | | 0.05 | | | | 0.00 | (3) | | | — | |

Net asset value, end of period/year | | $ | 19.68 | | | $ | 16.71 | | | $ | 17.29 | | | $ | 43.52 | | | $ | 30.80 | | | $ | 23.91 | |

Total return | | | 17.77 | %(4) | | | -3.35 | % | | | -53.74 | % | | | 62.04 | % | | | 32.23 | % | | | -16.17 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period/year (in thousands) | | $ | 4,537 | | | $ | 4,261 | | | $ | 5,057 | | | $ | 12,782 | | | $ | 12,799 | | | $ | 10,825 | |

Ratio of gross operating expenses | | | | | | | | | | | | | | | | | | | | | | | | |

(prior to waiver) to average net assets | | | 3.94 | %(5) | | | 3.63 | % | | | 2.46 | % | | | 1.84 | % | | | 2.56 | % | | | 2.22 | % |

Ratio of net operating expenses | | | | | | | | | | | | | | | | | | | | | | | | |

(after waiver) to average net assets(6) | | | 3.14 | %(5) | | | 2.83 | % | | | 1.95 | % | | | 1.74 | % | | | 1.95 | % | | | 1.95 | % |

Ratio of net investment loss | | | | | | | | | | | | | | | | | | | | | | | | |

(prior to waiver) to average net assets | | | (3.69 | )%(5) | | | (3.23 | )% | | | (2.37 | )% | | | (1.80 | )% | | | (2.32 | )% | | | (1.81 | )% |

Ratio of net investment loss | | | | | | | | | | | | | | | | | | | | | | | | |

(after waiver) to average net assets(6) | | | (2.89 | )%(5) | | | (2.43 | )% | | | (1.86 | )% | | | (1.70 | )% | | | (1.71 | )% | | | (1.54 | )% |

Portfolio turnover rate | | | 34 | %(4) | | | 64 | % | | | 45 | % | | | 71 | % | | | 89 | % | | | 88 | % |

_______________

(1) | Net investment loss per share represents net investment loss divided by the average shares outstanding throughout the period/year. |

(2) | Paid in capital from redemption fees per share represents redemption fees divided by the average shares outstanding throughout the period/year. |

(3) | Less than $0.01 per share. |

(4) | Not annualized. |

(5) | Annualized. |

(6) | The Adviser has contractually agreed, effective November 12, 2012 (date of reorganization) through January 5, 2025, to waive up to 100% of its advisory fee to the extent that the Fund’s gross operating expense ratio exceeds 1.95%, excluding any taxes, interest, brokerage fees, acquired fund fees and expenses, and extraordinary expenses. |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

JACOB SMALL CAP GROWTH FUND – INVESTOR CLASS

FINANCIAL HIGHLIGHTS

The table below sets forth financial data for a share of the Fund outstanding throughout each period/year presented.

| | | Six Months Ended | | | Year Ended August 31, | |

| | | February 29, 2024 | | | 2023 | | | 2022 | | | 2021 | | | 2020 | | | 2019 | |

| | | (Unaudited) | | | | | | | | | | | | | | | | |

| Per Share Data: | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period/year | | $ | 16.08 | | | $ | 16.68 | | | $ | 42.33 | | | $ | 30.14 | | | $ | 23.48 | | | $ | 28.36 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss(1) | | | (0.25 | ) | | | (0.44 | ) | | | (0.61 | ) | | | (0.76 | ) | | | (0.49 | ) | | | (0.46 | ) |

| Net realized and unrealized gain (loss) | | | | | | | | | | | | | | | | | | | | | | | | |

| on investment transactions | | | 3.07 | | | | (0.16 | ) | | | (19.42 | ) | | | 17.92 | | | | 7.82 | | | | (4.19 | ) |

| Total from investment operations | | | 2.82 | | | | (0.60 | ) | | | (20.03 | ) | | | 17.16 | | | | 7.33 | | | | (4.65 | ) |

| Less distributions from net realized gains | | | — | | | | — | | | | (5.62 | ) | | | (5.02 | ) | | | (0.67 | ) | | | (0.25 | ) |

Paid in capital from redemption fees(2) | | | 0.01 | (3) | | | 0.00 | (3) | | | 0.00 | (3) | | | 0.05 | | | | 0.00 | (3) | | | 0.02 | |

Net asset value, end of period/year | | $ | 18.91 | | | $ | 16.08 | | | $ | 16.68 | | | $ | 42.33 | | | $ | 30.14 | | | $ | 23.48 | |

Total return | | | 17.60 | %(4) | | | -3.60 | % | | | -53.90 | % | | | 61.60 | % | | | 31.83 | % | | | -16.35 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period/year (in thousands) | | $ | 3,544 | | | $ | 2,987 | | | $ | 3,488 | | | $ | 17,384 | | | $ | 5,037 | | | $ | 4,538 | |

Ratio of gross operating expenses | | | | | | | | | | | | | | | | | | | | | | | | |

(prior to waiver) to average net assets | | | 4.28 | %(5) | | | 3.98 | % | | | 2.70 | % | | | 2.07 | % | | | 2.91 | % | | | 2.57 | % |

Ratio of net operating expenses | | | | | | | | | | | | | | | | | | | | | | | | |

(after waiver) to average net assets(6) | | | 3.38 | %(5) | | | 3.08 | % | | | 2.25 | % | | | 1.93 | % | | | 2.25 | % | | | 2.25 | % |

Ratio of net investment loss | | | | | | | | | | | | | | | | | | | | | | | | |

(prior to waiver) to average net assets | | | (4.04 | )%(5) | | | (3.57 | )% | | | (2.62 | )% | | | (2.03 | )% | | | (2.67 | )% | | | (2.15 | )% |

Ratio of net investment loss | | | | | | | | | | | | | | | | | | | | | | | | |

(after waiver) to average net assets(6) | | | (3.14 | )%(5) | | | (2.67 | )% | | | (2.17 | )% | | | (1.89 | )% | | | (2.01 | )% | | | (1.83 | )% |

Portfolio turnover rate | | | 34 | %(4) | | | 64 | % | | | 45 | % | | | 71 | % | | | 89 | % | | | 88 | % |

_______________

(1) | Net investment loss per share represents net investment loss divided by the average shares outstanding throughout the period/year. |

(2) | Paid in capital from redemption fees per share represents redemption fees divided by the average shares outstanding throughout the period/year. |

(3) | Less than $0.01 per share. |

(4) | Not annualized. |

(5) | Annualized. |

(6) | The Adviser has contractually agreed, effective November 12, 2012 (date of reorganization) through January 5, 2025, to waive up to 100% of its advisory fee to the extent that the Fund’s gross operating expense ratio exceeds 2.25%, excluding any taxes, interest, brokerage fees, acquired fund fees and expenses, and extraordinary expenses. The Adviser has agreed to waive 0.10% of the 0.35% Plan fee. |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

JACOB DISCOVERY FUND – INSTITUTIONAL CLASS

FINANCIAL HIGHLIGHTS

The table below sets forth financial data for a share of the Fund outstanding throughout each period/year presented.

| | | Six Months Ended | | | Year Ended August 31, | |

| | | February 29, 2024 | | | 2023 | | | 2022 | | | 2021 | | | 2020 | | | 2019 | |

| | | (Unaudited) | | | | | | | | | | | | | | | | |

| Per Share Data: | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period/year | | $ | 23.06 | | | $ | 24.48 | | | $ | 45.90 | | | $ | 27.00 | | | $ | 19.26 | | | $ | 18.50 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss(1) | | | (0.18 | ) | | | (0.40 | ) | | | (0.61 | ) | | | (0.65 | ) | | | (0.35 | ) | | | (0.29 | ) |

| Net realized and unrealized gain (loss) | | | | | | | | | | | | | | | | | | | | | | | | |

| on investment transactions | | | 1.66 | | | | (1.02 | ) | | | (19.91 | ) | | | 21.69 | | | | 8.09 | | | | 1.05 | |

| Total from investment operations | | | 1.48 | | | | (1.42 | ) | | | (20.52 | ) | | | 21.04 | | | | 7.74 | | | | 0.76 | |

| Less distributions from net investment income | | | — | | | | — | | | | (0.18 | ) | | | — | | | | — | | | | — | |

| Less distributions from net realized gains | | | — | | | | — | | | | (0.73 | ) | | | (2.24 | ) | | | — | | | | — | |

Paid in capital from redemption fees(2) | | | 0.00 | (3) | | | 0.00 | (3) | | | 0.01 | | | | 0.10 | | | | 0.00 | (3) | | | — | |

Net asset value, end of period/year | | $ | 24.54 | | | $ | 23.06 | | | $ | 24.48 | | | $ | 45.90 | | | $ | 27.00 | | | $ | 19.26 | |

Total return | | | 6.42 | %(4) | | | -5.80 | % | | | -45.51 | % | | | 82.06 | % | | | 40.19 | % | | | 4.11 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period/year (in thousands) | | $ | 8,866 | | | $ | 10,013 | | | $ | 13,274 | | | $ | 30,536 | | | $ | 13,249 | | | $ | 9,840 | |

Ratio of gross operating expenses | | | | | | | | | | | | | | | | | | | | | | | | |

(prior to waiver) to average net assets | | | 2.63 | %(5) | | | 2.30 | % | | | 1.80 | % | | | 1.74 | % | | | 2.90 | % | | | 2.90 | % |

Ratio of net operating expenses | | | | | | | | | | | | | | | | | | | | | | | | |

(after waiver) to average net assets(6) | | | 2.00 | %(5) | | | 2.00 | % | | | 1.80 | % | | | 1.67 | % | | | 2.00 | % | | | 2.00 | % |

Ratio of net investment loss | | | | | | | | | | | | | | | | | | | | | | | | |

(prior to waiver) to average net assets | | | (2.29 | )%(5) | | | (1.97 | )% | | | (1.80 | )% | | | (1.66 | )% | | | (2.60 | )% | | | (2.52 | )% |

Ratio of net investment loss | | | | | | | | | | | | | | | | | | | | | | | | |

(after waiver) to average net assets(6) | | | (1.66 | )%(5) | | | (1.67 | )% | | | (1.80 | )% | | | (1.59 | )% | | | (1.70 | )% | | | (1.62 | )% |

Portfolio turnover rate | | | 11 | %(4) | | | 16 | % | | | 23 | % | | | 32 | % | | | 83 | % | | | 73 | % |

_______________

(1) | Net investment loss per share represents net investment loss divided by the average shares outstanding throughout the period/year. |

(2) | Paid in capital from redemption fees per share represents redemption fees divided by the average shares outstanding throughout the period/year. |

(3) | Less than $0.01 per share. |

(4) | Not annualized. |

(5) | Annualized. |

(6) | The Adviser has contractually agreed, effective December 29, 2016 through at least January 5, 2025, to waive up to 100% of its advisory fee to the extent that the Fund’s gross operating expense ratio exceeds 2.00%, excluding any taxes, interest, brokerage fees, acquired fund fees and expenses, and extraordinary expenses. |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

JACOB DISCOVERY FUND – INVESTOR CLASS

FINANCIAL HIGHLIGHTS

The table below sets forth financial data for a share of the Fund outstanding throughout each period/year presented.

| | | Six Months Ended | | | Year Ended August 31, | |

| | | February 29, 2024 | | | 2023 | | | 2022 | | | 2021 | | | 2020 | | | 2019 | |

| | | (Unaudited) | | | | | | | | | | | | | | | | |

| Per Share Data: | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period/year | | $ | 20.75 | | | $ | 22.09 | | | $ | 41.51 | | | $ | 24.65 | | | $ | 17.62 | | | $ | 16.96 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss(1) | | | (0.19 | ) | | | (0.43 | ) | | | (0.64 | ) | | | (0.69 | ) | | | (0.38 | ) | | | (0.32 | ) |

| Net realized and unrealized gain (loss) | | | | | | | | | | | | | | | | | | | | | | | | |

| on investment transactions | | | 1.48 | | | | (0.91 | ) | | | (17.99 | ) | | | 19.66 | | | | 7.41 | | | | 0.96 | |

| Total from investment operations | | | 1.29 | | | | (1.34 | ) | | | (18.63 | ) | | | 18.97 | | | | 7.03 | | | | 0.64 | |

| Less distributions from net investment income | | | — | | | | — | | | | (0.07 | ) | | | — | | | | — | | | | — | |

| Less distributions from net realized gains | | | — | | | | — | | | | (0.73 | ) | | | (2.24 | ) | | | — | | | | — | |

Paid in capital from redemption fees(2) | | | 0.00 | (3) | | | 0.00 | (3) | | | 0.01 | | | | 0.13 | | | | 0.00 | (3) | | | 0.02 | |

Net asset value, end of period/year | | $ | 22.04 | | | $ | 20.75 | | | $ | 22.09 | | | $ | 41.51 | | | $ | 24.65 | | | $ | 17.62 | |

Total return | | | 6.22 | %(4) | | | -6.07 | % | | | -45.66 | % | | | 81.58 | % | | | 39.90 | % | | | 3.89 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period/year (in thousands) | | $ | 9,716 | | | $ | 12,270 | | | $ | 21,897 | | | $ | 81,297 | | | $ | 7,674 | | | $ | 4,254 | |

Ratio of gross operating expenses | | | | | | | | | | | | | | | | | | | | | | | | |

(prior to waiver) to average net assets | | | 2.98 | %(5) | | | 2.64 | % | | | 2.11 | % | | | 1.97 | % | | | 3.25 | % | | | 3.25 | % |

Ratio of net operating expenses | | | | | | | | | | | | | | | | | | | | | | | | |

(after waiver) to average net assets(6) | | | 2.30 | %(5) | | | 2.30 | % | | | 2.01 | % | | | 1.85 | % | | | 2.30 | % | | | 2.30 | % |

Ratio of net investment loss | | | | | | | | | | | | | | | | | | | | | | | | |

(prior to waiver) to average net assets | | | (2.64 | )%(5) | | | (2.32 | )% | | | (2.11 | )% | | | (1.86 | )% | | | (2.93 | )% | | | (2.87 | )% |

Ratio of net investment loss | | | | | | | | | | | | | | | | | | | | | | | | |

(after waiver) to average net assets(6) | | | (1.95 | )%(5) | | | (1.98 | )% | | | (2.01 | )% | | | (1.74 | )% | | | (1.98 | )% | | | (1.92 | )% |

Portfolio turnover rate | | | 11 | %(4) | | | 16 | % | | | 23 | % | | | 32 | % | | | 83 | % | | | 73 | % |

_______________

(1) | Net investment loss per share represents net investment loss divided by the average shares outstanding throughout the period/year. |

(2) | Paid in capital from redemption fees per share represents redemption fees divided by the average shares outstanding throughout the period/year. |

(3) | Less than $0.01 per share. |

(4) | Not annualized. |

(5) | Annualized. |

(6) | The Adviser has contractually agreed, effective December 29, 2016 through at least January 5, 2025, to waive up to 100% of its advisory fee to the extent that the Fund’s gross operating expense ratio exceeds 2.30%, excluding any taxes, interest, brokerage fees, acquired fund fees and expenses, and extraordinary expenses. The Adviser has agreed to waive 0.10% of the Plan fee. |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

JACOB FORWARD ETF

FINANCIAL HIGHLIGHTS

The table below sets forth financial data for a share of the Fund outstanding throughout each period/year presented.

| | | Six Months Ended | | | Year Ended August 31, | | | Period Ended | |

| | | February 29, 2024 | | | 2023 | | | 2022 | | | August 31, 2021(1) | |

| | | (Unaudited) | | | | | | | | | | |

| Per Share Data: | | | | | | | | | | | | |

Net asset value, beginning of period/year | | $ | 8.59 | | | $ | 9.23 | | | $ | 20.94 | | | $ | 20.00 | |

| | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | |

Net investment loss(2) | | | (0.02 | ) | | | (0.05 | ) | | | (0.11 | ) | | | (0.02 | ) |

| Net realized and unrealized gain (loss) | | | | | | | | | | | | | | | | |

| on investment transactions | | | 2.47 | | | | (0.59 | ) | | | (11.53 | ) | | | 0.96 | |

| Total from investment operations | | | 2.45 | | | | (0.64 | ) | | | (11.64 | ) | | | 0.94 | |

| Less distributions from net investment income | | | — | | | | — | | | | (0.07 | ) | | | — | |

Net asset value, end of period/year | | $ | 11.04 | | | $ | 8.59 | | | $ | 9.23 | | | $ | 20.94 | |

| | | | | | | | | | | | | | | | | |

| Total returns: | | | | | | | | | | | | | | | | |

Net Asset Value(3) | | | 28.50 | %(4) | | | -6.96 | % | | | -55.75 | % | | | 4.70 | %(4) |

Market Value(5) | | | 28.32 | %(4) | | | -7.12 | % | | | -55.59 | % | | | 4.55 | %(4) |

| | | | | | | | | | | | | | | | | |

| Supplemental data and ratios: | | | | | | | | | | | | | | | | |

Net assets, end of period/year (in thousands) | | $ | 3,312 | | | $ | 2,835 | | | $ | 3,416 | | | $ | 7,538 | |