UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material under Rule 14a-12 |

HealthExtras, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box)

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | | Title of each class of securities to which transaction applies: |

| (2) | | Aggregate number of securities to which transaction applies: |

| (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined.): |

| (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | | Amount Previously Paid: |

| (2) | | Form, Schedule or Registration Statement No.: |

April 29, 2005

Dear Stockholder:

You are cordially invited to attend the 2005 Annual Meeting of Stockholders of HealthExtras, Inc. The meeting will be held at the Bethesda North Marriott Hotel & Conference Center, 5701 Marinelli Road, North Bethesda, MD 20852, on June 7, 2005 at 10:00 a.m., Eastern Time.

The Notice of Annual Meeting of Stockholders and the Proxy Statement appearing on the following pages describe the formal business to be transacted at the meeting. During the meeting, we will also report on the operations of the Company. Directors and officers of the Company, as well as a representative of PricewaterhouseCoopers LLP, the Company’s independent registered public accountants, will be present to respond to appropriate questions from stockholders.

It is important that your shares are represented at this meeting, whether or not you attend the meeting in person and regardless of the number of shares you own. To make sure your shares are represented, we urge you to complete and mail the enclosed proxy card. If you attend the meeting, you may vote in person even if you have previously mailed a proxy card.

We look forward to seeing you at the meeting.

Sincerely,

DAVID T. BLAIR

Chief Executive Officer

HEALTHEXTRAS, INC.

800 King Farm Boulevard

Rockville, Maryland 20850

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

The 2005 Annual Meeting of Stockholders of HealthExtras, Inc. (“Company”) will be held at the Bethesda North Marriott Hotel & Conference Center, 5701 Marinelli Road, North Bethesda, MD 20852, on June 7, 2005 at 10:00 a.m., Eastern Time, for the following purposes:

| | 1. | | To elect three directors of the Company to terms expiring at the annual meeting of stockholders in 2008 and until their successors are elected and qualified; |

| | 2. | | To ratify the appointment of PricewaterhouseCoopers LLP as independent registered public accountants for the Company for the fiscal year ending December 31, 2005; and |

��

| | 3. | | To transact any other business that may properly come before the meeting. |

NOTE: The Board of Directors is not aware of any other business to come before the meeting.

Stockholders of record at the close of business on April 28, 2005 are entitled to receive notice of the Annual Meeting and to vote at the meeting and any adjournment or postponement of the meeting.

Please complete and sign the enclosed proxy card, which is solicited by the Board of Directors, and mail it promptly in the enclosed envelope. The proxy will not be used if you attend the meeting and vote in person.

BY ORDER OF THE BOARD OF DIRECTORS

THOMAS M. FARAH

Corporate Secretary

Rockville, Maryland

April 29, 2005

IMPORTANT: The prompt return of proxies will save the Company the expense of further requests for proxies in order to ensure a quorum. A self-addressed envelope is enclosed for your convenience. No postage is required if mailed in the United States.

PROXY STATEMENT

OF

HEALTHEXTRAS, INC.

ANNUAL MEETING OF STOCKHOLDERS

June 7, 2005

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of HealthExtras, Inc. (“HealthExtras” or the “Company”) to be voted at the 2005 Annual Meeting of Stockholders (the “Annual Meeting”) of the Company. The Annual Meeting will be held at the Bethesda North Marriott Hotel & Conference Center, 5701 Marinelli Road, North Bethesda, MD 20852, on June 7, 2005 at 10:00 a.m., Eastern Time. This Proxy Statement and the enclosed proxy card are first being mailed to stockholders on or about May 6, 2005.

VOTING AND PROXY PROCEDURE

Who Can Vote

You are entitled to vote your shares of HealthExtras common stock if the records of the Company show that you held your shares as of the close of business on April 28, 2005. As of the close of business on that date, 38,295,624 shares of HealthExtras common stock were outstanding. Each share of common stock is entitled to one vote.

Attending the Meeting

If you are a beneficial owner of HealthExtras common stock held by a broker, bank or other nominee (i.e., in “street name”), you will need proof of ownership to be admitted to the meeting. A recent brokerage statement or letter from your bank or broker are examples of proof of ownership. If you want to vote your shares of HealthExtras common stock held in street name in person at the meeting, you will have to get a written proxy or vote authorization in your name from the broker, bank or other nominee who holds your shares.

Vote Required

A quorum consisting of a majority of the outstanding shares of common stock entitled to vote is required to be represented at the meeting. If you return valid proxy instructions or attend the meeting in person, your shares will be counted for purposes of determining whether there is a quorum, even if you abstain from voting. Broker non-votes also will be counted for purposes of determining the existence of a quorum. A broker non-vote occurs when a broker, bank or other nominee holding shares for a beneficial owner submits a proxy but does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received voting instructions from the beneficial owner.

In voting on Proposal 1 regarding the election of directors, you may vote in favor of all nominees, withhold votes as to all nominees or withhold votes as to specific nominees. There is no cumulative voting for the election of directors. Directors will be elected by a plurality of the votes cast for the election of directors. This means that the nominees receiving the greatest number of votes will be elected. Votes that are withheld and broker non-votes will have no effect on the outcome of the election.

1

In voting on Proposal 2 regarding the ratification of the appointment of PricewaterhouseCoopers LLP as independent registered public accountants, you may vote in favor of the proposal, vote against the proposal or abstain from voting. Ratification of the appointment of PricewaterhouseCoopers LLP requires the affirmative vote of a majority of the votes cast on the matter. Votes that are withheld and broker non-votes will have no effect on the outcome of Proposal 2.

Voting by Proxy

This Proxy Statement is being sent to you on behalf of the Board of Directors of HealthExtras for the purpose of requesting that you vote your shares at the Annual Meeting. We encourage you to vote promptly. All stockholders who are entitled to vote on the matters that come before the Annual Meeting have the opportunity to do so whether or not they attend the meeting in person.If you hold your shares through a bank, broker or other holder of record, please refer to the information provided by that entity for instructions on how to vote your shares. Your broker or bank may allow you to deliver your voting instructions via the telephone or the Internet.If you are a registered stockholder and are unable to attend the Annual Meeting, you can vote your shares by marking, dating and signing the enclosed proxy card and returning it promptly by mail in the enclosed postage-paid envelope to allow your shares to be represented and voted in accordance with your instructions at the Annual Meeting by the persons named as proxies on the proxy card.

All shares of HealthExtras common stock represented at the meeting by properly executed proxies will be voted in accordance with the instructions indicated on the proxy card. If you vote without giving voting instructions, your shares will be voted as recommended by the Company’s Board of Directors.

The Board of Directors recommends a vote FOR each of its nominees for director and FOR ratification of PricewaterhouseCoopers LLP as independent registered public accountants.

If any matters not described in this Proxy Statement are properly presented at the Annual Meeting, the persons named in the proxy card will use their own judgment to determine how to vote your shares. If the Annual Meeting is postponed or adjourned, your HealthExtras common stock may be voted by the persons named in the proxy card on the new meeting date as well, unless you have revoked your proxy. The Company does not know of any other matters to be presented at the meeting.

You may revoke your proxy at any time before the vote is taken at the meeting. To revoke your proxy you must either advise the Secretary of the Company in writing before your shares have been voted at the Annual Meeting, deliver a later dated proxy, or attend the meeting and vote your shares in person. Attendance at the Annual Meeting will not in itself constitute revocation of your proxy.

2

PROPOSAL 1—ELECTION OF DIRECTORS

The Board of Directors is divided into three classes, each as equal in number as possible, and each serving three-year terms that are staggered with the three-year terms of each of the other two classes such that approximately one-third (1/3) of the Board is elected annually. There are three nominees by the Board of Directors for election as directors at the Annual Meeting in the class of directors with three-year terms expiring with the annual meeting of stockholders in 2008 and until the election and qualification of their successors. Those three nominees are: David T. Blair, Frederick H. Graefe and Thomas J. Graf. Each of these nominees is a current Board member who has served on the Board for at least one full three-year term. The Board has determined that all of the director nominees, except David T. Blair, are independent under theNasdaq Stock Market Rules.

If any nominee is unable to serve, the persons named as proxies on the proxy card will vote your shares to approve the election of any substitute proposed by the Board of Directors. Alternatively, the Board of Directors may adopt a resolution to reduce the size of the Board. At this time, the Board of Directors knows of no reason why any nominee might be unable to serve.

The Board of Directors recommends a vote FOR the election of all of the nominees.

Directors and Executive Officers

The following table sets forth certain information with respect to the directors, executive officers and nominees for director of the Company as of April 29, 2005.

| | | | | | |

Name

| | Age

| | Position

| | Director Since

|

| | | |

Nominees for terms expiring in 2008 | | | | | | |

David T. Blair(1) | | 35 | | Director & Chief Executive Officer | | 1999 |

Frederick H. Graefe | | 61 | | Director | | 2000 |

Thomas J. Graf(2) | | 56 | | Director | | 1999 |

| | | |

Continuing Directors whose terms expire in 2007 | | | | | | |

William E. Brock | | 74 | | Director | | 2000 |

Edward S. Civera(3) | | 53 | | Director | | 2000 |

Deanna Strable-Soethout(2) | | 36 | | Director | | 2002 |

| | | |

Continuing Directors whose terms expire in 2006 | | | | | | |

Thomas L. Blair(1,3) | | 60 | | Chairman of the Board | | 1999 |

Steven B. Epstein | | 61 | | Director | | 2003 |

Daniel J. Houston(2,4) | | 43 | | Director | | 2005 |

Dale B. Wolf | | 51 | | Director | | 2003 |

| | | |

Executive Officers who are not Directors | | | | | | |

Michael P. Donovan | | 46 | | Chief Financial Officer & Treasurer | | |

Thomas M. Farah | | 51 | | General Counsel & Secretary | | |

Kevin C. Hooks | | 43 | | Executive Vice President | | |

| (1) | | Thomas L. Blair is the father of David T. Blair. |

3

| (2) | | Mr. Graf, Mr. Houston and Ms. Strable-Soethout are employees of Principal Financial Group, Inc. |

| (3) | | The Board of Directors, on April 29, 2005, elected Edward S. Civera as Chairman of the Board, effective immediately following the Annual Meeting. Thomas L. Blair, the current Chairman, will continue to serve as a Director. Mr. Civera worked with Mr. Blair in the formation and development of HealthExtras, and has served on its Board since early 2000. (See biographical information below.) |

| (4) | | Mr. Houston was elected by the Board on April 29, 2005 to fill the vacancy created by the resignation of Carey G. Jury. |

Biographical Information of Nominees For Director Whose Terms Expire in 2005

David T. Blair (Chief Executive Officer and Director since 1999) initially joined a predecessor of HealthExtras in 1997 as Chief Financial Officer. From 1995 to 1997, Mr. Blair was the Finance Manager of United Payors & United Providers Inc. At United Payors & United Providers, Mr. Blair focused on its initial public offering and several strategic acquisitions. In 1994, Mr. Blair co-founded the Continued Health Care Benefit Program, which administers health care benefits to individuals leaving the United States Armed Forces. In 1995, this program was merged into United Payors & United Providers.

Frederick H. Graefe (Director since 2000) is the founder and principal partner of the Law Offices of Frederick H. Graefe, PLLC in Washington, DC From 2002 to 2004, he was a partner in the Washington, DC office of the law firm of Hunton & Williams. From 1988 to 2002, he was a partner in the Washington, DC office of Baker & Hostetler, L.L.P. From 1980 to 1987, he was a partner at Finley, Kumble, Wagner, Heine, Underberg, Manley, Myerson & Casey. He worked for Howrey & Simon from 1975 through 1979 after serving a two-year clerkship for the Honorable Howard F. Corcoran, United States District Judge for the District of Columbia. From 1967 to 1970, Mr. Graefe was a Marine officer on active duty.

Thomas J. Graf (Director since 1999) has served as a Senior Vice President of the Principal Financial Group, Inc. (NYSE: PFG) since January 1994. Mr. Graf has held several executive positions with Principal Financial Group, including Chief Actuary, Chief Information Officer, head of the Group Insurance Business unit and head of Strategic Planning, and currently serves as the head of Investor Relations.

Biographical Information of Directors Whose Terms Will Expire in 2007

William E. Brock (Director since 2000) is Chairman of Intellectual Development Systems, Inc., a firm he founded in 1996. He has served as Senior Counsel and Trustee of the Center for Strategic and International Studies in Washington, DC since 1994. From 1988 to 1994, Mr. Brock served as Chairman of the Brock Group, a consulting firm. From 1988 to 1991, he served as the Chairman of the National Endowment for Democracy. From 1985 to 1987, he served as the United States Secretary of Labor, and from 1981 to 1985, he was United States Trade Representative. Mr. Brock has also served for eight years as a member of the United States House of Representatives and for six years as a member of the United States Senate. Mr. Brock is a director of On Assignment, Inc. (Nasdaq: ASGN).

Edward S. Civera (Chairman of the Board as of June 7, 2005 and Director since 2000) is a business executive with over 30 years of experience in operations, accounting and finance from both the public accounting and corporate perspective. He is currently the Managing General Partner at Civera Investment Partnership, a private investment partnership that consults on financial, as well as merger and acquisition strategies. From 1997 to 2001, Mr. Civera was the Chief Operating Officer and Co-Chief Executive Officer of United Payors & United Providers, Inc., and worked with Thomas L. Blair in the founding of HealthExtras. Prior to his position at United Payors & United Providers, Mr. Civera spent 25 years with Coopers & Lybrand (now PricewaterhouseCoopers LLP), the last 15 years as both a partner and managing partner focused on financial advisory and auditing services.

4

Deanna D. Strable-Soethout (Director since 2002) is a Senior Vice President of Principal Life Insurance Company, the operating, wholly-owned subsidiary of Principal Financial Group, Inc. (NYSE: PFG). Since joining Principal Financial Group in 1989, Ms. Strable-Soethout has served in numerous positions, including Group Dental and Group Vision Product Director, Second Vice President, Chief Financial Officer of Disability Products, and Vice President of the Disability Division. She currently leads the Specialty Benefits Division, which includes the Disability, Group Life, Group Dental and Group Vision businesses.

Biographical Information of Directors Whose Terms Will Expire in 2006

Thomas L. Blair (Chairman of the Board until June 7, 2005 and Director since 1999) is the founder of HealthExtras and its predecessors, and is currently the Chairman of the Board of Directors of both FedMed, Inc. and United Medical Bank, F.S.B. Mr. Blair served as Chairman and Chief Executive Officer or Co-Chief Executive Officer of United Payors & United Providers, Inc. from January 1995 until its acquisition by BCE Emergis Inc. in March 2000. Mr. Blair founded America’s Health Plan, Inc. in 1989 and served as its President and Chief Executive Officer from 1989 to 1992. From 1992 to 1995, Mr. Blair was President of Initial Managers & Investors, Inc., which business was contributed to United Payors & United Providers. From 1977 until 1988, Mr. Blair was a principal of Jurgovan & Blair, Inc., which developed and managed health maintenance organizations.

Steven B. Epstein (Director since 2003) is a founding member of the law firm of Epstein Becker & Green, P.C., one of the first law firms to specialize in health care law when established in 1973, and which has since grown to over 350 attorneys with 11 domestic offices. Mr. Epstein currently serves as the senior partner in the firm’s Washington, DC office and is a member of the firm’s Board of Directors and Executive Committee. In 1972, prior to founding Epstein Becker & Green, Mr. Epstein was a legal consultant to the U.S. Department of Health, Education and Welfare. He currently serves on the boards of directors and boards of advisors of numerous health care and venture capital companies and educational institutions, one of which is Discovery Holdings Ltd. (JSE: DSY), a publicly held company in Johannesburg, South Africa.

Daniel J. Houston (Director since 2005) has served as a Senior Vice President of Principal Financial Group, Inc. (NYSE: PFG) since 2000. Mr. Houston has held several positions with the company since 1984, including being named Regional Director of Group and Pension Sales in 1990, Regional Vice President in 1993, and Vice President in 1997. He is on the board of directors for several entities that are affiliates of Principal Financial Group, including Executive Benefit Services, Principal Financial Advisors, Principal Trust Company (Asia) Limited and Principal Bank, as well as a member and Chairman of the Board of Professional Pensions, Inc., Trustar Retirement Services and BCI Group, Inc.

Dale B. Wolf (Director since 2003) was elected Chief Executive Officer and to the Board of Directors of Coventry Health Care, Inc. (NYSE: CVH) effective January 2005. Prior to that, he served as Executive Vice President, Chief Financial Officer and Treasurer of Coventry from 1996 through 2004. From 1995 to 1996, Mr. Wolf was Executive Vice President of SpectraScan Health Services, Inc., a women’s health care services company. In 1995, Mr. Wolf served as Senior Vice President of Business Development for the MetraHealth Companies, Inc., a managed health care company, and from 1988 to 1994, he was Vice President, Special Operations, of the Managed Care and Employee Benefits Operations of The Travelers, an insurance company.

Biographical Information of Executive Officers Who Are Not Directors

Michael P. Donovan joined HealthExtras in April 1999 as Chief Financial Officer. From early 1998 until early 1999, Mr. Donovan was engaged in a variety of technology and business development activities for HealthExtras. From 1992 to 1997, Mr. Donovan served as Senior Vice President of Business and Technology Development for PHP Healthcare Corporation. From 1989 to 1992, Mr. Donovan served as Chief Financial Officer of Direct Health, Inc. Prior to that, Mr. Donovan was a Senior Manager for KPMG, LLP, then KPMG Peat Marwick, responsible for a variety of technology and health care clients.

5

Thomas M. Farah joined HealthExtras in March 2002 as General Counsel, and was appointed Corporate Secretary of the Company in March 2003. Prior to joining HealthExtras, Mr. Farah was General Counsel of Federal Medical, Inc. From 1986 through 2000, Mr. Farah was a member, and from 1978 to 1986 he was an associate, of the law firm of Epstein Becker & Green, P.C. in its Washington, DC office. Mr. Farah’s practice involved providing legal advice to health care companies on regulatory, corporate and transactional matters.

Kevin C. Hooks is the Executive Vice President of HealthExtras and the President of Catalyst Rx, a wholly-owned subsidiary of HealthExtras. He founded Catalyst Rx in 1994 and has since served in his current capacity as its President. Prior to founding Catalyst Rx, Mr. Hooks served as General Manager and Marketing Director for Horizon Healthcare from 1982 to 1994. Mr. Hooks is a licensed clinical pharmacist.

PROPOSAL 2—RATIFICATION OF THE APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

The Audit Committee has appointed PricewaterhouseCoopers LLP to be the independent registered public accountants of the Company for the 2005 fiscal year, subject to ratification by the stockholders. A representative of PricewaterhouseCoopers LLP is expected to be present at the Annual Meeting to respond to appropriate questions from stockholders and will have the opportunity to make a statement should he or she desire to do so.

If the ratification of the appointment of the independent registered public accountants is not approved by a majority of the votes cast by stockholders at the Annual Meeting, other independent registered public accountants will be considered by the Audit Committee.

The Audit Committee and the Board of Directors recommend that stockholders vote FOR the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accountants.

Audit Fees

The aggregate fees the Company paid to PricewaterhouseCoopers LLP for the annual audit and for the review of the Company’s Form 10-Q quarterly reports for the year ended December 31, 2004, for comfort letters, consents and other services related to the Company’s Form S-3 registration statement, and the audit of management’s report on the effectiveness of the Company’s internal control over financial reporting, as required by Section 404 of theSarbanes-Oxley Act of 2002, totaled approximately $1.1 million.

All Other Fees

The aggregate fees the Company paid to PricewaterhouseCoopers LLP for all other non-audit services, including tax-related services for the year ended 2004, totaled approximately $28,500. The Audit Committee believes that these non-audit fees are compatible with PricewaterhouseCoopers LLP maintaining its independence with respect to the Company.

OTHER MATTERS

The Board of Directors knows of no other matters that are likely to be brought before the Annual Meeting. If any other matters should be properly brought before the meeting, it is the intention of the persons named as proxies on the enclosed proxy card to vote, or otherwise act, in accordance with their judgment on such matters.

CORPORATE GOVERNANCE

Board and Committee Meetings

The Board of Directors conducts business through meetings and the activities of the Board and its committees, including taking actions by unanimous written consent. During the fiscal year ended December 31, 2004, the Board met five times. All of the members of the Board attended at least 75% of the meetings held during their tenure, including meetings of committees on which they served.

6

Director Independence

The Board reviewed each director’s other affiliations and relationships, and has affirmatively determined that eight of the Board’s ten directors (including all of those standing for re-election at the Annual Meeting, except for David T. Blair) are independent under theNasdaq Stock Market Rules, which are the director independence standards adopted and applied by the Board. In making this determination, the Board consulted with the Company’s General Counsel to ensure that the Board’s determinations were consistent with all applicable laws and regulations, including theNasdaq Stock Market Rules. Mr. David Blair, because he is an employee of the Company, and Mr. Thomas Blair, because he is Mr. David Blair’s father, are not considered independent.

Code of Ethics and Conduct

The Company, together with its subsidiaries, insists that all of its directors, officers and employees adhere to high ethical standards and comply with all applicable legal requirements when engaging in business on behalf of the Company. Accordingly, the Board adopted a Code of Ethics and Conduct which complies with theSarbanes-Oxley Act of 2002 and theNasdaq Stock Market Rules, and is applicable to all of the Company’s directors, officers and employees. A copy of the Code of Ethics and Conduct will be furnished without charge upon written request to the Corporate Secretary, HealthExtras, Inc., 800 King Farm Boulevard, 4th Floor, Rockville, Maryland 20850.

The Company has established a toll-free telephone number for employees to use on a confidential basis to advise the General Counsel of any questions, reports or concerns regarding possible violations of the Company’s Code of Ethics and Conduct or of any Company policies or procedures. Employees are also invited to write to the General Counsel on a confidential basis regarding such matters. In addition, the Audit Committee, in compliance with theSarbanes-Oxley Act of 2002, has established procedures for the receipt, retention and treatment of complaints regarding accounting, internal controls or auditing matters, and to allow for the confidential, anonymous submission by employees of concerns regarding any such matters (see also “Stockholder Communications with the Board”). In no event will any action be taken against an employee for, in good faith, making a complaint or reporting known or suspected violations.

Nominating Committee

On January 13, 2004, the Board of Directors established the Nominating Committee to identify individuals qualified to become Board members and to recommend to the Board individuals to be nominated by the Board for election as directors at the annual meeting of stockholders. Current members of the Nominating Committee are Steven B. Epstein (Chairman), Frederick H. Graefe and Deanna Strable-Soethout, all of whom are independent directors for purposes of the requirements of theNasdaq Stock Market Rules. Two meetings of the Committee were held during 2004, each of which was attended by all directors serving on the Committee.

The Nominating Committee considers the following criteria in selecting individuals for recommendation to the Board as nominees: independence; financial, regulatory and business experience; character and integrity; education, background and skills; judgment; and, the ability to provide practical insights regarding the business of the Company. In addition, prior to recommending a current director for re-election to the Board of Directors, the Nominating Committee considers and reviews the current director’s Board and committee attendance and performance, length of Board service and knowledge of the business of the Company.

The vote of a majority of the independent directors of the Board of Directors is required to nominate an individual for the Board of Directors.

The Nominating Committee will consider suggestions from stockholders for nominees to the Board of Directors that are timely received in proper written form. To be timely, such suggestions must be delivered to the Corporate Secretary within the same time frame required to have proposals included in the proxy statement in the

7

subsequent section of this Proxy Statement, entitled “Stockholder Proposals”. To be in proper written form, a stockholder’s notice should set forth in writing (i) as to each person whom the stockholder proposes to be nominated for election as a director, all information relating to such person that is required to be included in a proxy statement filed pursuant to the proxy rules of the SEC, including such person’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected and such person’s qualifications and biographical information, and (ii) as to the stockholder giving the notice (x) the name and address of such stockholder, as they appear on the Company’s books, and (y) the class and number of shares of the Company that are beneficially owned by such stockholder.

The process that the Nominating Committee follows when it identifies and evaluates individuals to be recommended to the Board of Directors for nomination is, as follows:

Identification. For purposes of identifying nominees for the Board of Directors, the Nominating Committee relies on personal contacts of the Committee members and other members of the Board of Directors. The Nominating Committee will also consider director candidates recommended by stockholders in accordance with the policy and procedures set forth above. The Nominating Committee has not previously used an independent search firm to identify nominees, but reserves the right to do so.

Evaluation. In evaluating potential nominees, the Nominating Committee determines whether the candidate is eligible, qualified and interested for service on the Board of Directors by evaluating the candidate under the selection criteria set forth above. In addition, the Nominating Committee may conduct a check of the individual’s background and interview the candidate.

A copy of the Nominating Committee charter was included as Exhibit C to the Company’s proxy statement of April 29, 2004, and will be furnished without charge upon written request to the Corporate Secretary, HealthExtras, Inc., 800 King Farm Boulevard, 4th Floor, Rockville, Maryland 20850.

Mr. Houston was recommended to the Nominating Committee by Principal Financial Group, Inc. to serve the remainder of Mr. Jury’s term, which expires in 2006.

Executive Committee

The Executive Committee acts for the Board of Directors when Board action is required between meetings. The current members of the Executive Committee are Thomas L. Blair (Chairman of the Committee until June 7, 2005), Edward S. Civera (Chairman of the Committee as of June 7, 2005) and Thomas J. Graf. Four meetings of the Committee were held during 2004, each of which was attended by all directors serving on the Committee.

Audit Committee

Current members of the Audit Committee are William E. Brock, Edward S. Civera (Chairman), Frederick H. Graefe and Dale B. Wolf. All members of the Audit Committee meet the standards of independence for audit committee members established by theNasdaq Stock Market Rules and theSarbanes-Oxley Act of 2002. In addition, the Board has determined that Mr. Civera is the “audit committee financial expert” for purposes of the Securities and Exchange Commission’s (“SEC”) rules. Acting under a revised written charter adopted by the Board of Directors on October 9, 2003, the Audit Committee annually reviews the qualifications of, and appoints the Company’s independent registered public accountants. The Audit Committee approves the planning and fees for, and the results of, the annual audit of the Company’s financial statements. The Committee held nine meetings in 2004, each of which was attended by all directors serving on the Committee at that time. A copy of the Audit Committee charter was included as Exhibit D to the Company’s proxy statement of April 29, 2004, and will be furnished without charge upon written request to the Corporate Secretary, HealthExtras, Inc., 800 King Farm Boulevard, 4th Floor, Rockville, Maryland 20850.

8

Compensation Committee

The Compensation Committee consists of William E. Brock (Chairman), Daniel J. Houston and Edward S. Civera, all of whom are independent for purposes of the requirements of theNasdaq Stock Market Rules. On April 29, 2005, the Board of Directors appointed Daniel J. Houston to fill the Compensation Committee vacancy created by Mr. Jury’s resignation from the Board. The Compensation Committee has the responsibility of evaluating the performance of, and recommending to the Board of Directors salary and incentive compensation for, executive officers and senior management of the Company. The Compensation Committee held five meetings in 2004. All of the members of the Committee attended at least 75% of the meetings held during their tenure with Messrs. Brock and Civera attending all such meetings. A copy of the Compensation Committee charter was included as Exhibit E to the Company’s proxy statement of April 29, 2004, and will be furnished without charge upon written request to the Corporate Secretary, HealthExtras, Inc., 800 King Farm Boulevard, 4th Floor, Rockville, Maryland 20850.

Independent Directors’ Meetings

All directors deemed independent under theNasdaq Stock Market Rules meet at least twice per year in scheduled semi-annual executive sessions. During 2004, Mr. Civera served as the lead director to preside over the meetings of the independent directors. Non-scheduled sessions of the independent directors may also be held from time to time. Among other things, the independent directors have developed topics and matters for management to address at future Board meetings. Their activities, to the extent they choose to report them, are reflected in reports from the lead director. The independent directors met three times in executive session in 2004. All of the independent directors attended at least 75% of the meetings held during their tenure.

Director Compensation

Directors who were not employees of the Company, who did not have a beneficial interest in 10% or more of the Company’s common stock and who were not officers or employees of organizations that owned 10% or more of the Company’s common stock (“Qualifying Directors”) were, beginning July 1, 2004, paid a quarterly retainer of $12,000 ($48,000 per year). During 2004, five of the Board’s ten directors met the definition of directors qualifying for the retainer. All directors, however, are reimbursed for reasonable travel and incidental expenses incurred in attending meetings and carrying out their duties as directors. The retainer (along with the Director Options described below) constitutes payment for all Board and committee meetings and responsibilities, regardless of the number of such meetings or the extent of such responsibilities. Qualifying Directors are also the only directors entitled to stock option grants under the Amended & Restated 2000 Directors’ Stock Option Program. Pursuant to that Program, each Qualifying Director at the time of election or appointment is entitled to be granted a Director Option to purchase 15,000 shares. Subsequent grants of options for 5,000 shares of Company common stock are granted automatically on the day after each annual meeting of stockholders without further action by the Board of Directors to each Qualifying Director who has been a director since the previous annual meeting of stockholders. The exercise price of options granted under the Director’s Stock Option Program is set at the fair market value of the Company’s common stock on the date of grant. Mr. Thomas Blair and the directors employed by Principal Financial Group, Inc. originally waived their right to compensation for performance of their services as directors of the Company, and the Board has since, by unanimous vote, made their exclusion from compensation a part of the Board’s current compensation policy described above.

Stockholder Communications with the Board

Any person who wishes to communicate with the entire Board of Directors, an individual director, a committee of the Board or the independent directors as a group, should mark such communication “confidential” and address it to the specific intended recipient(s) c/o Thomas M. Farah, Corporate Secretary & General Counsel, HealthExtras, Inc., 800 King Farm Boulevard, 4th Floor, Rockville, Maryland, 20850. All correspondence will be reviewed by the Corporate Secretary/General Counsel to determine the nature and subject matter of the communication, and the corresponding appropriate recipient (e.g., the appropriate committee, committee

9

chairman or other individual director). Items unrelated to the duties and responsibilities of the Board, such as ordinary service or product complaints or inquiries, job inquiries, business solicitations, mass mailings or other material considered, in the reasonable judgment of the Corporate Secretary/General Counsel, unsuitable or unrelated to the responsibilities of the Board may be excluded. Communications relating to accounting, internal controls or auditing matters will be treated on a confidential basis according to the Audit Committee’s policies and procedures regarding such matters and delivered to the Chairman of the Audit Committee.

In addition, the Board of Directors encourages directors to attend annual meetings of stockholders as a means of promoting communication between stockholders and directors. In furtherance of this policy, the Company has historically scheduled a meeting of the Board of Directors to immediately follow each annual meeting of stockholders. At the 2004 annual meeting of stockholders, all of the directors were present.

10

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth the cash and non-cash compensation paid to, or earned by, the Chief Executive Officer during 2004 and the other executive officers of the Company as of December 31, 2004 who received more than $100,000 during 2004.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | Long-Term Compensation

| | All Other Compensation ($)(2)

|

| | | | | Annual Compensation

| | Awards

| |

Name & Principal Positions

| | Fiscal

Year

| | Salary ($)

| | Bonus ($)

| | Other Annual Compensation ($)(1)

| | Restricted Stock Awards ($)

| | Securities Underlying Options (No.)

| |

David T. Blair Chief Executive Officer | | 2004

2003

2002 | | $

| 350,000

320,000

280,000 | | $

| 350,000

103,177

33,181 | | $

| —

—

— | | $

| —

—

— | | $

| —

—

1,000,000 | | $

| —

2,500

6,000 |

| | | | | | | |

Michael P. Donovan Chief Financial Officer | | 2004

2003

2002 | |

| 280,000

240,000

240,000 | |

| 150,000

75,000

28,000 | |

| —

—

— | |

| —

—

— | |

| —

—

400,000 | |

| 7,000

6,500

6,000 |

| | | | | | | |

Thomas M. Farah General Counsel & Secretary | | 2004

2003

2002 | |

| 230,000

200,000

112,500 | |

| 60,000

40,000

20,000 | |

| —

—

— | |

| —

—

— | |

| —

—

125,000 | |

| 6,344

5,625

— |

| | | | | | | |

Kevin C. Hooks Executive Vice

President | | 2004

2003

2002 | |

| 250,000

225,000

150,000 | |

| 150,000

—

20,000 | |

| —

—

— | |

| —

—

— | |

| 250,000

—

— | |

| 7,000

6,500

6,000 |

| (1) | | Does not include the aggregate amount of perquisites and other personal benefits that did not exceed the lesser of $50,000 or 10% of any individual’s total salary and bonus for the year. |

| (2) | | Represents matching 401(k) contribution. |

Option Grants in Last Fiscal Year

No stock option grants were made to Messrs. Blair, Donovan or Farah during the year ended December 31, 2004. Pursuant to Mr. Hooks’ employment agreement, on March 9, 2004 Mr. Hooks was granted the option to purchase 250,000 shares of the Company’s common stock under the 2003 Equity Incentive Plan, with 50% of such options vesting on the first anniversary of the grant date, and the remaining 50% vesting on the second anniversary of the grant date.

| | | | | | | | | | | | | | | | |

Name

| | No. of

Shares of

Common

Stock

Underlying

Options

Granted(1)

| | % of Total Options Granted to Employees in 2004

| | | Exercise Price Per Share(2)

| | Expiration Date

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(3)

|

| | | | | | 5%

| | 10%

|

David T. Blair | | — | | — | | | $ | — | | — | | $ | — | | $ | — |

Michael P. Donovan | | — | | — | | | | — | | — | | | — | | | — |

Thomas M. Farah | | — | �� | — | | | | — | | — | | | — | | | — |

Kevin C. Hooks | | 250,000 | | 26 | % | | | 10.10 | | 03/09/14 | | | 1,587,959 | | | 4,024,200 |

| (1) | | These options granted to Mr. Hooks vest over a two-year period and expire on the tenth anniversary of the date of grant. |

| (2) | | The exercise price of options of HealthExtras may be paid in cash or in shares of the Company’s common stock, valued at fair market value on the exercise date. All stock options were granted with an exercise price equal to the closing price of the Company’s stock on the grant date. |

11

| (3) | | The potential realizable value is calculated based on the term of the option at its time of grant (ten years). It is calculated assuming that the fair market value of the Company’s common stock on the date of grant appreciates at the indicated annual rate compounded annually for the entire term of the option and that the option is exercised and sold on the last day of its term for the appreciated stock price. |

Option Value at Fiscal Year End

The following table provides information regarding unexercised stock options for Messrs. Blair, Donovan, Farah and Hooks as of December 31, 2004. Messrs. Blair, Donovan, Farah and Hooks did not exercise any stock options during the year ended December 31, 2004.

| | | | | | | | | | |

| | | Number of Securities Underlying Unexercised Options at Fiscal Year-End (No.)

| | Value of Unexercised In the Money Options at Fiscal Year-End ($)(1)

|

Name

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

David T. Blair | | 1,000,000 | | 500,000 | | $ | 10,675,000 | | $ | 4,840,000 |

Michael P. Donovan | | 600,000 | | 200,000 | | | 6,604,000 | | | 1,936,000 |

Thomas M. Farah | | 62,500 | | 62,500 | | | 847,750 | | | 847,750 |

Kevin C. Hooks | | 300,000 | | 350,000 | | | 2,925,000 | | | 2,525,000 |

| (1) | | Value of an unexercised in-the-money option is determined by subtracting the exercise price per share from the fair market value per share for the underlying shares as of December 31, 2004, multiplied by the number of such underlying shares. The fair market value of the Company’s common stock is based upon the last reported sale price as reported on the Nasdaq National Market on December 31, 2004 ($16.30 per share). |

Employment Agreements

HealthExtras has executed employment agreements with David T. Blair, Michael P. Donovan and Kevin C. Hooks.

The employment agreement for Messrs. Blair and Donovan, both of which were initially effective January 1, 2000, are substantially similar, and provide for three-year terms and automatically renew for an additional two years unless a notice of non-renewal is given six months prior to the expiration date. Pursuant to his employment agreement, and Compensation Committee actions taken consistent with that agreement, Mr. Blair’s base salary is currently $350,000 per year, and Mr. Blair was granted a cash bonus of $350,000 related to 2004 performance. Pursuant to his employment agreement, and Compensation Committee actions taken consistent with that agreement, Mr. Donovan’s base salary is currently $280,000 per year, and Mr. Donovan was granted a cash bonus of $150,000 related to 2004 performance. The Compensation Committee reviews salaries for executive officers annually and, pursuant to the employment agreements for Messrs. Blair and Donovan, can increase Mr. Blair’s base salary as Chief Executive Officer and, on the recommendation of the Chief Executive Officer, can increase Mr. Donovan’s base salary. In addition to base salary, the employment agreements provide for, among other things, participation by the executives in employee benefit plans, an automobile allowance and other fringe benefits, and reimbursement of reasonable expenses incurred in advancing the Company’s business.

The employment agreement for Mr. Hooks is effective January 1, 2004, and is substantially similar to those executed by Messrs. Blair and Donovan. Mr. Hooks’ employment agreement provides for a term expiring on December 31, 2005, without automatic renewal. Mr. Hooks’ base salary is currently $250,000 per year, and his bonus is based on certain revenue and profit targets.

Upon an executive’s termination for cause, or upon an executive’s voluntary resignation, that executive shall be entitled only to such compensation and benefits as shall have accrued through the date of the executive’s termination or resignation, as the case may be. In the event that an executive is terminated for any reason other than for cause or voluntary resignation, including termination by reason of death or disability, then in the cases of

12

Messrs. Blair or Donovan, that executive shall receive payments under the employment agreement due for the remaining term of the employment agreement, provided that such payment shall not be less than the payment due for a 12-month period; or in the case of Mr. Hooks, such salary and benefits shall be provided to Mr. Hooks or his estate for the balance of the initial term of the agreement. Upon an executive’s voluntary resignation or termination for cause during the term of the agreement, each employment agreement generally provides that, for a period of two years from the date of termination, the executive will not compete directly or indirectly with HealthExtras’ business, nor will the executive solicit or contract with entities contracting with HealthExtras.

The Compensation Committee has engaged an independent outside consulting firm, expert in the subject of executive compensation, to advise and assist the Compensation Committee with respect to the development of new employment agreements for Messrs. Blair and Donovan that will be completed and executed in 2005.

The report of the Compensation Committee, the report of the Audit Committee and the stock performance graph set forth below shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933, or the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed filed under those Acts.

COMPENSATION COMMITTEE REPORT

The Compensation Committee of the Board of Directors is responsible for the establishment and administration of the compensation programs for the Company’s Chief Executive Officer, Mr. David T. Blair, and other executive officers, including the executive officers whose compensation is reported in the Summary Compensation Table of this Proxy Statement.

No member of the Compensation Committee is an officer or employee of the Company, and all are independent directors within the meaning of theNasdaq Stock Market Rules. These outside directors are responsible for setting and administering the policies and programs that govern annual compensation and long-term incentives.

The Committee believes that the compensation program should align compensation with the executives’ management skills, Company performance and stockholder returns. The following goals underlie the Committee’s policies:

| | 1. | | To attract and retain key executives who possess the management skills and experience vital to the long-term success of the Company; |

| | 2. | | To provide compensation that is competitive and consistent with executive compensation levels found in similar companies; |

| | 3. | | To motivate executives to enhance long-term stockholder value by building their ownership in the Company; and |

| | 4. | | To make the compensation program an integral part of the Company’s long-term planning and management process. |

The key components of the compensation program are base salary, annual bonus compensation and long-term incentive awards comprised of equity participation. These components allow the Company to provide competitive compensation and benefits, recognize individual performance and tie management’s interest in the Company with the interest of the Company’s stockholders. The Committee has retained an independent compensation consulting firm to assist in the development, benchmarking and implementation of the Company’s compensation policies. This engagement also provides the Committee with ongoing access to current information on important developments in executive compensation. The Committee has implemented incentive compensation plans which are tied to detailed annual performance objectives, both quantitative and qualitative, established for the Company. The Company’s compensation policies for 2005 generally call for the use of restricted stock grants, and the discontinuance of the use of stock options, as a component of overall long-term compensation.

13

Base Salary

The Company’s compensation policy for its executive officers is to provide a base salary, which is reviewed annually by the Compensation Committee. It is the Compensation Committee’s intent that the salaries of the Company’s executives be competitive with those of executives with like responsibilities in companies of a similar size and industry.

Incentive Compensation

Incentive compensation for executive officers of the Company has included grants under the Company’s stockholder-approved stock option and equity incentive plans, annual cash incentive bonuses and, in certain circumstances, additional discretionary cash bonuses in recognition of exceptional strategic contributions and performance. The Committee considers the appropriateness of performance bonuses for all executives based on the executive team’s development and execution of strategic initiatives, its mentoring of employees and its exercise of corporate leadership, as well as to recognize an individual executive for his or her specific contributions to the executive team. The performance measures, both quantitative and qualitative, are all drawn from the Company’s annual performance objectives established as of the beginning of the year.

The bonuses, as shown in the Summary Compensation Table, were awarded based on the achievement of financial objectives, the successful implementation of strategic initiatives endorsed by the Board and the completion and integration of recent acquisitions. These bonuses were also evaluated in concert with base compensation paid during the year, other benefits received by the executives and prevailing levels of incentive cash compensation paid to an executive with comparable levels of responsibility in similar businesses and industries.

Chief Executive Officer Compensation

Mr. David Blair’s 2004 compensation was based on the Company’s accomplishment of strategic, operational and financial objectives during the year. The Committee’s compensation recommendations were developed with the assistance of independent outside compensation consultants and reviewed with the full Board.

For 2004, the Committee established Mr. Blair’s base cash compensation at $350,000. Pursuant to the guidelines and policies established in the Company’s incentive compensation plan, Mr. Blair was also awarded cash incentive compensation of $350,000 based on financial and leadership performance measures as described below.

HealthExtras delivered record financial performance in 2004 with revenues increasing by 36% to $521.3 million and net income growing by 59% to $16.4 million over prior year results. In addition, the Company completed the acquisition of Managed Healthcare Systems, Inc., raised equity capital in a secondary offering and continued to successfully integrate previously acquired businesses. During 2004, the Company also added significant new business in each of its market segments, expanded its product offerings and opened three new regional offices.

Internally, HealthExtras continued to focus on developing the capabilities of it senior management team. HealthExtras emphasizes the importance of quality initiatives and the related impact on client retention, marketplace reputation and customer service. The Company’s commitment to quality in all its products and services is the cornerstone of its successful retention of existing customers and the key to its ongoing growth.

COMPENSATION COMMITTEE

WILLIAM E. BROCK, CHAIRMAN

EDWARD S. CIVERA

CAREY G. JURY

14

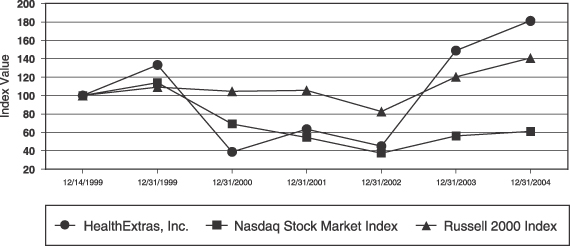

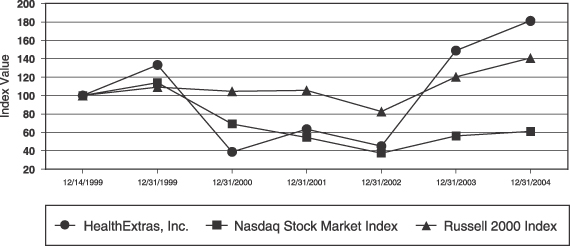

PERFORMANCE GRAPH

The following graph compares the performance of the Company’s common stock with the cumulative total return of companies in the Nasdaq Stock Market (U.S. Companies) Index and the Russell 2000 Index. All indices shown in the graph have been reset to a base of 100 as of December 14, 1999 and assume an investment of $100 on that date and the reinvestment of dividends paid since that date. The Company has never paid cash dividends on its common stock.

Comparative Returns

HealthExtras, Inc., Nasdaq Stock Market Index & Russell 2000 Index

Summary

| | | | | | | | | | | | | | | | | | | | | |

| | | 12/14/99

| | 12/31/99

| | 12/31/00

| | 12/31/01

| | 12/31/02

| | 12/31/03

| | 12/31/04

|

HealthExtras, Inc. | | $ | 100.00 | | $ | 133.33 | | $ | 38.89 | | $ | 63.44 | | $ | 45.00 | | $ | 148.89 | | $ | 181.11 |

Nasdaq Stock Market Index | | | 100.00 | | | 113.93 | | | 69.17 | | | 54.61 | | | 37.39 | | | 56.09 | | | 60.91 |

Russell 2000 Index | | | 100.00 | | | 109.08 | | | 104.49 | | | 105.56 | | | 82.79 | | | 120.35 | | | 140.80 |

| (1) | | The lines represent the index levels as of the dates set forth. |

| (2) | | If a specified date is not a trading day, the preceding trading day is used. |

| (3) | | The index level for all series was set to $100.00 on December 14, 1999, the first day of trading for HealthExtras, Inc. common stock. The common stock closed at $9.00 per share on that date. |

15

AUDIT COMMITTEE REPORT

In accordance with its written charter adopted by the Board of Directors, the Audit Committee provides independent review and oversight of the quality and integrity of the Company’s accounting and financial reporting processes and published financial statements, the system of internal controls that management and the Board of Directors have established, the audit process and the results of operations of the Company and its financial condition.

The Committee appointed PricewaterhouseCoopers LLP as the Company’s independent registered public accountants for the year ended December 31, 2004. The Committee has reviewed with the Company’s financial management and independent registered public accountants the overall audit scope and plans, results of the audits of the Company’s financial statements and the Company’s internal control over financial reporting, the quality of the Company’s financial statements, and other matters required to be discussed by Statement on Auditing Standards No. 61,Communications with Audit Committees, as amended.

In addition, the Audit Committee received written disclosures and the letter from PricewaterhouseCoopers as required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees, as amended, and has considered the compatibility of non-audit services with auditors’ independence.

The Committee met nine times during fiscal year 2004, which included meetings with the Company’s management and independent registered public accountants, and, whenever appropriate, executive sessions with the Company’s independent registered public accountants without management. Management has represented to the Committee that the Company’s consolidated financial statements for the year ended December 31, 2004, were prepared in accordance with generally accepted accounting principles. Management has also advised the Committee that there were no significant deficiencies in the design and operation of the Company’s internal controls that could adversely affect the Company’s ability to record, process, summarize and report financial data. Management was required to advise the Committee of any instances of fraud relating to employees who had a significant role in the Company’s internal controls.

Management has reviewed the audited financial statements in the annual report on Form 10-K with the Audit Committee, including a discussion of the quality, not just the acceptability, of the accounting principles, reasonableness of significant accounting judgments and estimates, and the clarity of disclosures in the financial statements. In addressing the quality of management accounting judgments, members of the Audit Committee asked for management’s representations and reviewed certifications prepared by the Chief Executive Officer and Chief Financial Officer that the unaudited quarterly and audited consolidated financial statements of the Company fairly present, in all material respects, the financial condition and results of operations of the Company.

In performing all of these functions, the Audit Committee acts only in an oversight capacity. The Committee reviews the Company’s quarterly and annual reporting on Form 10-Q and Form 10-K prior to filing with the SEC. In its oversight role the Committee relies on the work and assurances of the Company’s management, which has the primary responsibility for financial statements and reports, and of the independent registered public accountants who, in their report, express an opinion on the conformity of the Company’s annual financial statements to generally accepted accounting principles.

The following fees were paid to our independent registered public accountants for the years ended December 31, 2004 and 2003, and we have determined that the provisions for these services is compatible with maintaining the independence of the independent registered public accountants:

| | | | | | |

| | | 2004

| | 2003

|

Audit Fees(1) | | $ | 1,112,500 | | $ | 266,000 |

Tax Fees(2) | | | 28,462 | | | 24,381 |

All Other Fees(3) | | | — | | | 21,515 |

16

| (1) | | Includes (i) the audit of the Company’s consolidated financial statements included in its Form 10-K annual report and services attendant to, or required by, statute or regulation; (ii) the review of interim condensed consolidated financial statements included in the Company’s quarterly reports on Form 10-Q; (iii) comfort letters, consents and other services related to filings with the SEC and other regulatory bodies; (iv) accounting consultation attendant to the audit; and (v) the audit of management’s report on the effectiveness of the Company’s internal control over financial reporting, as required by Section 404 of theSarbanes-Oxley Act of 2002. |

| (2) | | Includes U.S. federal, state and local income tax planning, tax advice, and compliance, including the preparation and review of tax returns. |

| (3) | | Includes executive compensation services rendered and a software license for accounting research software rendered. There were no other professional services rendered in 2004. |

Based on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2004, for filing with the SEC. The Audit Committee has appointed PricewaterhouseCoopers LLP to be the independent registered public accountants for the Company for the year ending December 31, 2005, and has recommended that the Board of Directors submit such selection to the stockholders for ratification.

AUDIT COMMITTEE

EDWARD S. CIVERA, CHAIRMAN

WILLIAM E. BROCK

FREDERICK H. GRAEFE

DALE B. WOLF

17

STOCK OWNERSHIP

The following table provides information as of April 15, 2005, derived from beneficial ownership reports filed with the SEC and furnished to the Company, and other information provided to the Company, about the shares of HealthExtras common stock that may be considered to be owned beneficially, within the meaning of Rule 13d-3 of theSecurities Exchange Act of 1934, by each beneficial owner of more than 5% of the Company’s outstanding common stock, by each director or nominee for director of the Company, by each of the named executive officers in the executive compensation table, and by all directors and executive officers of the Company as a group. Unless otherwise indicated, each of the named individuals has sole voting power and sole investment power with respect to the shares shown, and the business address of such person is HealthExtras, Inc., 800 King Farm Boulevard, 4th Floor, Rockville, Maryland 20850.

| | | | | |

Name

| | Number of Shares Owned

| | Percent of Common Stock Outstanding

| |

Principal Financial Group, Inc.(1) | | 7,977,500 | | 20.9 | % |

Thomas L. Blair(2) | | 6,153,700 | | 16.1 | % |

David T. Blair(3) | | 1,150,500 | | 3.0 | % |

Michael P. Donovan(4) | | 830,700 | | 2.2 | % |

Thomas M. Farah(5) | | 103,500 | | * | |

Kevin C. Hooks(6) | | 527,853 | | 1.4 | % |

William E. Brock(7) | | 35,000 | | * | |

Edward S. Civera(8) | | 30,000 | | * | |

Steven B. Epstein(9) | | 20,000 | | * | |

Frederick H. Graefe(10) | | 30,100 | | * | |

Thomas J. Graf(1,11) | | 20,000 | | * | |

Daniel J. Houston(1,11) | | — | | — | |

Carey G. Jury(1,11) | | — | | — | |

Deanna Strable-Soethout(1,11) | | 100 | | * | |

Dale B. Wolf(12) | | 22,000 | | * | |

All directors and executive officers as a group (13 persons)(11,13) | | 8,923,453 | | 23.4 | % |

| * | | Less than 1% of outstanding shares. |

| (1) | | Thomas J. Graf, Daniel J. Houston (director since April 29, 2005), Carey G. Jury (resigned as director on April 29, 2005) and Deanna Strable-Soethout, directors of HealthExtras, are employed by Principal Financial Group, Inc. or one of its affiliates. The business address for these directors is in care of Principal Financial Group, Inc., 711 High Street, Des Moines, Iowa 50392. |

| (2) | | Thomas L. Blair and his wife may be deemed the beneficial owners of an aggregate of 6,153,700 shares of common stock. Of the total shares, Mr. Blair has sole power, or joint power with Mrs. Blair, to vote and to invest 3,343,700 shares, and Mrs. Blair has sole power to vote and to invest 2,810,000 shares in her capacity as trustee. Mr. Blair granted an option to an unrelated corporation (“Option Holder”) to purchase up to 3,230,000 of those shares of HealthExtras common stock, subject to certain terms and conditions. Mr. Blair had the right to repurchase this option from the Option Holder for $16,860,600 during the month of June 2004. Prior to exercising his right to repurchase the option, Mr. Blair became aware that the Option Holder appeared to have violated the terms of the option, and there was a lack of certitude as to whether the option remained valid. To protect his rights to repurchase the option, Mr. Blair placed $16,860,600 with the Clerk of the Circuit Court for Montgomery County, Maryland, and gave notice of his exercise of such right of repurchase, subject to a determination of the identity of the person or entity, if any, currently holding such option, and the continued validity of such option. On September 20, 2004 the Circuit Court for Montgomery County issued an order that stated, in pertinent part, that, “by complying with Maryland Rule 2-221 and paying into Court the sum necessary to complete the repurchase of all outstanding option |

18

| | rights, Blair has properly exercised his right to repurchase the option to acquire 3,230,000 shares of HealthExtras stock. . .” It is now before the Court to determine whether the Option Holder violated the terms of the option and, hence, whether the $16,860,600 should be returned to Mr. Blair in that there was no need for Mr. Blair to repurchase an option, on HealthExtras shares held by him, that had been voided. |

| (3) | | Includes 1,112,500 shares of common stock, which may be acquired within sixty days upon exercise of outstanding options at a weighted average price of $5.97. |

| (4) | | Includes 700,000 shares of common stock, which may be acquired within sixty days upon exercise of outstanding options at a weighted average price of $5.48. |

| (5) | | Includes 87,500 shares of common stock, which may be acquired within sixty days upon exercise of outstanding options at a weighted average price of $2.65. |

| (6) | | Includes 425,000 shares of common stock, which may be acquired within sixty days upon exercise of outstanding options at a weighted average price of $7.59, and 28,603 shares of common stock held solely by his wife, 9,375 shares of which may be acquired within sixty days upon exercise of outstanding options at a weighted average price of $3.31. Mr. Hooks disclaims beneficial ownership of all Company shares and options held solely by his wife. |

| (7) | | Includes 35,000 shares of common stock, which may be acquired within sixty days upon exercise of outstanding options at a weighted average price of $7.20. |

| (8) | | Includes 30,000 shares of common stock, which may be acquired within sixty days upon exercise of outstanding options at a weighted average price of $5.68. |

| (9) | | Includes 20,000 shares of common stock, which may be acquired within sixty days upon exercise of outstanding options at a weighted average price of $8.75. |

| (10) | | Includes 30,000 shares of common stock, which may be acquired within sixty days upon exercise of outstanding options at a weighted average price of $6.25. |

| (11) | | Mr. Graf, Mr. Houston, Mr. Jury and Ms. Strable-Soethout disclaim any beneficial ownership with respect to the shares beneficially owned by Principal Financial Group, Inc. |

| (12) | | Includes 20,000 shares of common stock, which may be acquired within sixty days upon exercise of outstanding options at a weighted average price of $8.75. |

| (13) | | Includes shares of common stock which may be acquired within sixty days upon the exercise of outstanding options. |

The Company has established a stock trading plan in accordance with the guidelines specified in Rule 10b5-1 of theSecurities Exchange Act of 1934. The Rule 10b5-1 plan is designed to enable executives of the Company to avoid any real or perceived conflict of interest in connection with the trading of the Company’s securities.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of theSecurities Exchange Act of 1934 requires the Company’s executive officers, directors and persons who own more than 10% of a registered class of the Company’s equity securities, to file reports of ownership and changes in ownership with the SEC. Executive officers, directors and greater than 10% stockholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file.

Based solely on a review of copies of such reports of ownership furnished to the Company, or written representations that no forms were necessary, the Company believes that during the past fiscal year, its executive officers, directors and greater than 10% beneficial owners complied with all applicable filing requirements.

CERTAIN TRANSACTIONS

During 2004, the Company received legal services from Epstein Becker & Green, P.C. (“EBG”), a law firm in which Mr. Steven Epstein, a Director of the Company, is both a shareholder and executive committee member. Before Mr. Epstein was elected to the Board of the Company, the Company engaged EBG for legal services on a variety of matters and has continued to do so since that time. EBG, one of several law firms routinely providing

19

services to the Company on an as-needed basis, renders its services at the hourly rates typically charged to its other clients, and there is no retainer agreement or other form of contract obligating the use of EBG or creating a financial penalty for not using EBG. The Company’s legal fees from EBG were approximately $157,000 in 2004. The Board has determined that Mr. Epstein’s status as a shareholder and executive committee member of EBG does not affect his independence as a member of the Company’s Board or Nominating Committee.

In March of 2004, the Company entered into an agreement to purchase all of the assets of Diabetic Sense, a company specializing in diabetes management programs, from its Executive Vice President, Kevin C. Hooks, in exchange for 74,250 shares of the Company’s common stock. The 74,250 shares of stock were valued at $749,925 on the date of the agreement. Diabetic Sense provides specialty services to certain enrolled members who participate in arrangements for discounted purchasing of diabetes test meters, insulin and other related supplies. The programs are offered to existing client groups of HealthExtras, as well as to other clients who do not otherwise contract with HealthExtras or its affiliates for pharmacy benefit management services. The transaction closed on June 24, 2004.

Both of the foregoing related-party transactions have been reviewed and approved by the Audit Committee.

MISCELLANEOUS

The Company will pay the cost of this proxy solicitation. The Company will reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending proxy materials to the beneficial owners of HealthExtras common stock. In addition to soliciting proxies by mail, directors, officers and regular employees of the Company may solicit proxies personally or by telephone. None of these persons will receive additional compensation for these activities.

The Company’s Annual Report to Stockholders has been mailed to stockholders of record as of the close of business on April 28, 2005. Any stockholder who has not received a copy of the annual report may obtain a copy by writing to the Secretary of the Company. The annual report is not to be treated as part of the proxy solicitation material or as having been incorporated herein by reference.

If you and others who share your address own your shares in street name, your broker or other holder of record may be sending only one annual report and proxy statement to your address. This practice, known as “householding,” is designed to reduce printing and postage costs. However, if any such stockholder residing at your address wishes to receive a separate annual report or proxy statement in the future, he or she should contact the broker or other holder of record. If you own your shares in street name and are receiving multiple copies of our annual report and proxy statement, you can request householding by contacting your broker or other holder of record. If you are a beneficial owner who did not receive your own copy of the Proxy Statement or annual report for the Annual Meeting and want such a copy, you may contact us by calling or writing to us and giving us your name, mailing address, and name of the record holder of your stock. The address you should write to is: HealthExtras, Inc., 800 King Farm Boulevard, 4th Floor, Rockville, MD 20850, Attn: Thomas M. Farah, Corporate Secretary. Our phone number is (301) 548-2900.

Copies of the Company’s Form 10-K (without exhibits) for the fiscal year ended December 31, 2004, as filed with the SEC, will be furnished without charge to stockholders of record upon written request to Corporate Secretary, HealthExtras, Inc., 800 King Farm Boulevard, 4th Floor, Rockville, Maryland 20850.

STOCKHOLDER PROPOSALS

Proposals for Inclusion in the 2006 Proxy Statement

Proposals that stockholders seek to have included in the proxy statement for the Company’s annual meeting of stockholders to be held in 2006 must be received by the Company no later than December 30, 2005. Any such proposals will be subject to the requirements of the proxy rules adopted by the SEC.

20

Other Stockholder Proposals for Consideration at the 2006 Annual Meeting of Stockholders

The Bylaws of the Company provide an advance notice procedure for certain business to be brought before an annual meeting. In order for a stockholder to properly bring business before an annual meeting, the stockholder must deliver written notice to the Secretary of the Company at the principal executive offices of the Company not less than 90 days before the time originally fixed for such meeting; provided, however, that in the event that less than 100 days’ notice or prior public disclosure of the date of the meeting is given or made to stockholders, notice by the stockholder to be timely must be received not later than the close of business on the tenth day following the day on which such notice of the date of the annual meeting was mailed or such public disclosure was made. In order for the notice of a stockholder proposal for consideration at the Company’s 2006 annual meeting of stockholders to be timely, the Company would have to receive such notice no later than March 8, 2006 assuming the annual meeting is held on or about June 6, 2006 and that the Company provides at least 100 days’ notice or public disclosure of the date of the meeting. The notice must include the stockholder’s name and address, as it appears on the Company’s record of stockholders, a brief description of the proposed business, the reason for conducting such business at the annual meeting, the class and number of shares of the Company’s common stock that are beneficially owned by such stockholder and any material interest of such stockholder in the proposed business. In the case of nominations to the Board, the nominating stockholder must also provide all information regarding the nominee as required by Regulation 14A under theSecurities Exchange Act of 1934, including the nominee’s written consent to being named in the proxy statement as a nominee and to serve as a director.

21

0

Proof #1

HEALTHEXTRAS, INC.

2005 ANNUAL MEETING OF STOCKHOLDERS

June 7, 2005

10:00 a.m. Eastern Time

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS.

The undersigned hereby appoints Edward S. Civera and Thomas L. Blair, and each of them, each with full power of substitution, to act as proxies for the undersigned, and to vote all shares of common stock of HealthExtras, Inc. which the undersigned is entitled to vote at the Annual Meeting of Stockholders, to be held on June 7, 2005, at 10:00 a.m. Eastern Time, at the Bethesda North Marriott Hotel & Conference Center, 5701 Marinelli Road, North Bethesda, MD 20852, and at any and all adjournments thereof, with all of the powers the undersigned would possess if personally present at such meeting, as follows:

(Continued and to be signed on the reverse side)

14475

ANNUAL MEETING OF STOCKHOLDERS OF

HEALTHEXTRAS, INC.

Proof #1

June 7, 2005

Please date, sign and mail

your proxy card in the

envelope provided as soon

as possible.

ê Please detach along perforated line and mail in the envelope provided.ê

| | | | | | | | | | | | | | |

| THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” ALL OF THE NOMINEES AND “FOR” ALL OF THE PROPOSALS. |

PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS

SHOWN HEREx |

| | | | | | | | | | | | | | |

| | | | | | | | | FOR | | AGAINST | | ABSTAIN |

1. The election as directors of all nominees listed (except as marked to the contrary below). NOMINEES: | | 2. The ratification of the appointment of PricewaterhouseCoopers LLP as independent registered public accountants of HealthExtras, Inc. for the fiscal year ending December 31, 2005. | | ¨ | | ¨ | | ¨ |