UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under Rule 14a-12 |

HealthExtras, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box)

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | | Title of each class of securities to which transaction applies: |

| (2) | | Aggregate number of securities to which transaction applies: |

| (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined.): |

| (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | | Amount Previously Paid: |

| (2) | | Form, Schedule or Registration Statement No.: |

May 1, 2006

Dear Stockholder:

You are cordially invited to attend the 2006 Annual Meeting of Stockholders of HealthExtras, Inc. The meeting will be held at the Ritz-Carlton Tysons Corner, 1700 Tysons Boulevard, McLean, Virginia 22102, on June 6, 2006 at 10:00 a.m., Eastern Time.

The Notice of Annual Meeting of Stockholders and the Proxy Statement appearing on the following pages describe the formal business to be transacted at the meeting. During the meeting, we will also report on the operations of the Company. Directors and officers of the Company, as well as a representative of PricewaterhouseCoopers LLP, the Company’s independent registered public accountants, will be present to respond to appropriate questions from stockholders.

It is important that your shares are represented at this meeting, whether or not you attend the meeting in person and regardless of the number of shares you own. To make sure your shares are represented, we urge you to complete and mail the enclosed proxy card. If you attend the meeting, you may vote in person even if you have previously mailed a proxy card.

We look forward to seeing you at the meeting.

Sincerely,

DAVID T. BLAIR

Chief Executive Officer

HEALTHEXTRAS, INC.

800 King Farm Boulevard

Rockville, Maryland 20850

NOTICE OF 2006 ANNUAL MEETING OF STOCKHOLDERS

The 2006 Annual Meeting of Stockholders of HealthExtras, Inc. (“Company”) will be held at the Ritz-Carlton Tysons Corner, 1700 Tysons Boulevard, McLean, Virginia 22102, on June 6, 2006 at 10:00 a.m., Eastern Time, for the following purposes:

| | 1. | To elect three directors of the Company to the class of directors whose term expires at the annual meeting of stockholders in 2009 and until their successors are elected and qualified; and to elect one director to the class of directors whose term expires at the annual meeting of stockholders in 2008 and until their successors are elected and qualified; |

| | 2. | To approve the HealthExtras, Inc. 2006 Stock Incentive Plan; |

| | 3. | To ratify the appointment of PricewaterhouseCoopers LLP as independent registered public accountants for the Company for the fiscal year ending December 31, 2006; and |

| | 4. | To transact any other business that may properly come before the meeting. |

NOTE: The Board of Directors is not aware of any other business to come before the meeting.

Stockholders of record at the close of business on April 21, 2006 are entitled to receive notice of the Annual Meeting and to vote at the meeting and any adjournment or postponement of the meeting.

Please complete and sign the enclosed proxy card, which is solicited by the Board of Directors, and mail it promptly in the enclosed envelope. The proxy will not be used if you attend the meeting and vote in person.

BY ORDER OF THE BOARD OF DIRECTORS

THOMAS M. FARAH

Corporate Secretary

Rockville, Maryland

May 1, 2006

IMPORTANT: The prompt return of proxies will save the Company the expense of further requests for proxies to ensure a quorum. A self-addressed envelope is enclosed for your convenience. No postage is required if mailed in the United States.

PROXY STATEMENT

OF

HEALTHEXTRAS, INC.

2006 ANNUAL MEETING OF STOCKHOLDERS

June 6, 2006

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of HealthExtras, Inc. (“HealthExtras” or the “Company”) to be voted at the 2006 Annual Meeting of Stockholders (the “Annual Meeting”) of the Company. The Annual Meeting will be held at the Ritz-Carlton Tysons Corner, 1700 Tysons Boulevard, McLean, Virginia 22102, on June 6, 2006 at 10:00 a.m., Eastern Time. This Proxy Statement and the enclosed proxy card are first being mailed to stockholders on or about May 1, 2006.

VOTING AND PROXY PROCEDURE

Who Can Vote

You are entitled to vote your shares of HealthExtras common stock if the records of the Company show that you held your shares as of the close of business on April 21, 2006. As of the close of business on that date, 40,554,564 shares of HealthExtras common stock were outstanding. Each share of common stock is entitled to one vote.

Attending the Meeting

If you are a beneficial owner of HealthExtras common stock held by a broker, bank or other nominee (i.e., in “street name”), you will need proof of ownership to be admitted to the meeting. A recent brokerage statement or letter from your bank or broker are examples of proof of ownership. If you want to vote your shares of HealthExtras common stock held in street name in person at the meeting, you will have to get a written proxy or vote authorization in your name from the broker, bank or other nominee who holds your shares.

Vote Required

A quorum consisting of a majority of the outstanding shares of common stock entitled to vote is required to be represented at the meeting. If you return valid proxy instructions or attend the meeting in person, your shares will be counted for purposes of determining whether there is a quorum, even if you abstain from voting. Broker non-votes also will be counted for purposes of determining the existence of a quorum. A broker non-vote occurs when a broker, bank or other nominee holding shares for a beneficial owner submits a proxy but does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received voting instructions from the beneficial owner.

In voting on Proposal 1 regarding the election of directors, you may vote in favor of all nominees, withhold votes as to all nominees or withhold votes as to specific nominees. There is no cumulative voting for the election of directors. Directors will be elected by a plurality of the votes cast for the election of directors in the applicable class of directors. This means that the nominees for election as directors in a particular class of directors receiving the greatest number of votes will be elected in that class. Votes that are withheld and broker non-votes will have no effect on the outcome of the election.

1

In voting on Proposal 2 regarding approval of the HealthExtras, Inc. 2006 Stock Incentive Plan, you may vote in favor of the proposal, vote against the proposal or abstain from voting. Approval of the 2006 Stock Incentive Plan requires the affirmative vote of a majority of the shares of common stock present or represented by proxy at the Annual Meeting and entitled to be cast on the proposed approval of the Plan. Abstentions will have the same effect as a vote against Proposal 2. Broker non-votes will have no effect on the outcome of Proposal 2.

In voting on Proposal 3 regarding the ratification of the appointment of PricewaterhouseCoopers LLP as independent registered public accountants, you may vote in favor of the proposal, vote against the proposal or abstain from voting. Ratification of the appointment of PricewaterhouseCoopers LLP requires the affirmative vote of a majority of the votes cast on the matter. Votes that are withheld and broker non-votes will have no effect on the outcome of Proposal 3.

Voting by Proxy

This Proxy Statement is being sent to you on behalf of the Board of Directors of HealthExtras for the purpose of requesting that you vote your shares at the Annual Meeting. We encourage you to vote promptly. All stockholders who are entitled to vote on the matters that come before the Annual Meeting have the opportunity to do so whether or not they attend the meeting in person. If you hold your shares through a bank, broker or other holder of record, please refer to the information provided by that entity for instructions on how to vote your shares. Your broker or bank may allow you to deliver your voting instructions via the telephone or the Internet. If you are a registered stockholder and are unable to attend the Annual Meeting, you can vote your shares by marking, dating and signing the enclosed proxy card and returning it promptly by mail in the enclosed postage-paid envelope to allow your shares to be represented and voted in accordance with your instructions at the Annual Meeting by the persons named as proxies on the proxy card.

All shares of HealthExtras common stock represented at the meeting by properly executed proxies will be voted in accordance with the instructions indicated on the proxy card. If you submit a signed proxy card without giving voting instructions, your shares will be voted as recommended by the Company’s Board of Directors.

The Board of Directors recommends a vote FOR each of its nominees for director, FOR approval of the HealthExtras, Inc. 2006 Stock Incentive Plan and FOR ratification of PricewaterhouseCoopers LLP as independent registered public accountants.

If any matters not described in this Proxy Statement are properly presented at the Annual Meeting, the persons named in the proxy card will use their own judgment to determine how to vote your shares. If the Annual Meeting is postponed or adjourned, your HealthExtras common stock may be voted by the persons named in the proxy card on the new meeting date as well, unless you have revoked your proxy. The Company does not know of any other matters to be presented at the meeting.

You may revoke your proxy at any time before the vote is taken at the meeting. To revoke your proxy you must either advise the Secretary of the Company in writing before your shares have been voted at the Annual Meeting, deliver a later dated proxy, or attend the meeting and vote your shares in person. Attendance at the Annual Meeting will not in itself constitute revocation of your proxy.

2

PROPOSAL 1–ELECTION OF DIRECTORS

The Board of Directors currently has nine members and is divided into three classes, each as equal in number as possible. The members of each class serve three-year terms that are staggered with the three-year terms of each of the other two classes such that approximately one-third (1/3) of the Board is elected annually.

On June 7, 2005 the Board of Directors increased its membership from ten to eleven and appointed Michael R. McDonnell to fill the vacancy that was created by that increase. Mr. McDonnell was placed in the class of directors whose terms expire at this Annual Meeting. In addition, on April 6, 2006, the Board of Directors reduced its membership from eleven to nine as a result of the resignations of three Board Members and the appointment of Kenneth A. Samet to fill one of the vacancies created by those resignations. The three directors who resigned were Thomas J. Graf and Deanna D. Strable-Soethout (each of whom was an executive of the Principal Financial Group, Inc. or its operating subsidiary) and Frederick H. Graefe.

In light of these changes in the size of the Board, and the fact that there currently are four Directors in the class of Directors whose terms expire at this Annual Meeting, three of those four directors have been nominated by the Board for election at this Annual Meeting in the class of directors whose terms will expire at the 2009 annual meeting and when their successors are elected and qualified. The fourth director in the 2006 class of directors has been nominated for election as a director in the class of directors whose terms expire at the 2008 annual meeting and when their successors are elected and qualified.

The three nominees whose terms will expire in 2009 are Steven B. Epstein, Michael R. McDonnell and Dale B. Wolf, and the nominee whose term will expire in 2008 is Daniel J. Houston. Mr. Epstein and Mr. Wolf are current members of the Board who have served for at least one full three-year term. Mr. Houston was appointed to the Board on April 29, 2005, and Mr. McDonnell was appointed to the Board on June 7, 2005. The Board has determined that all of the director nominees are independent under the Nasdaq Stock Market Rules.

If any nominee is unable to serve, the persons named as proxies on the proxy card will vote your shares to approve the election of any substitute proposed by the Board of Directors. Alternatively, the Board of Directors may adopt a resolution to reduce the size of the Board. At this time, the Board of Directors knows of no reason why any nominee might be unable to serve.

The Board of Directors recommends a vote FOR the election of all of the nominees.

Directors and Executive Officers

The following table sets forth certain information with respect to the directors, executive officers and nominees for director of the Company as of April 21, 2006.

| | | | | | |

Name | | Age | | Position | | Director Since |

Nominees for terms expiring in 2009 | | | | | | |

Steven B. Epstein | | 62 | | Director | | 2003 |

Michael R. McDonnell(1) | | 42 | | Director | | 2005 |

Dale B. Wolf | | 51 | | Director | | 2003 |

| | | |

Nominee for term expiring in 2008 | | | | | | |

Daniel J. Houston(2) | | 44 | | Director | | 2005 |

| | | |

Continuing Directors whose terms expire in 2008 | | | | | | |

David T. Blair(3) | | 36 | | Director & Chief Executive Officer | | 1999 |

Kenneth A. Samet(4) | | 48 | | Director | | 2006 |

| | | |

Continuing Directors whose terms expire in 2007 | | | | | | |

Thomas L. Blair(3) | | 61 | | Director | | 1999 |

William E. Brock | | 75 | | Director | | 2000 |

Edward S. Civera | | 54 | | Chairman | | 2000 |

3

| | | | | | |

Name | | Age | | Position | | Director Since |

Executive Officers who are not Directors | | | | | | |

Michael P. Donovan | | 47 | | Chief Financial Officer & Treasurer | | |

Thomas M. Farah | | 52 | | General Counsel & Secretary | | |

Nick J. Grujich | | 43 | | Executive Vice President & Chief Operating Officer | | |

| (1) | Mr. McDonnell was appointed to the Board on June 7, 2005 to fill the vacancy created by an increase in the number of seats on the Board of Directors. |

| (2) | Mr. Houston is an employee of Principal Financial Group, Inc. and was appointed to the Board on April 29, 2005 to fill the vacancy created by the resignation of Carey G. Jury, who was also an employee of the Principal Financial Group, Inc. |

| (3) | Thomas L. Blair is the father of David T. Blair. |

| (4) | Mr. Samet was appointed to the Board on April 6, 2006 to fill the vacancy created by the resignation of Frederick H. Graefe. |

Biographical Information of Nominees For Director

For Terms Expiring in 2009

Steven B. Epstein(Director since 2003) is a founding member of the law firm of Epstein Becker & Green, P.C., one of the first law firms to specialize in health care law when established in 1973, and which has since grown to over 350 attorneys with 11 domestic offices. Mr. Epstein currently serves as the senior partner in the firm’s Washington, DC office and is a member of the firm’s Board of Directors and Executive Committee. In 1972, prior to founding Epstein Becker & Green, Mr. Epstein was a legal consultant to the U.S. Department of Health, Education and Welfare. He currently serves on the boards of directors and boards of advisors of numerous health care and venture capital companies and educational institutions, including Emergency Medical Services Corp. (NYSE: EMS) and Discovery Holdings Ltd. (JSE: DSY), a publicly held company in Johannesburg, South Africa.

Michael R. McDonnell(Director since 2005) has served as Executive Vice President and Chief Financial Officer of MCG Capital Corporation (Nasdaq: MCGC), a financial services company providing financing and advisory services to a variety of middle market companies. From 2000 to 2004, Mr. McDonnell served as Chief Financial Officer of EchoStar Communications Corporation (Nasdaq: DISH), and from 1986 to 2000, he was with PricewaterhouseCoopers LLP, where he was admitted as a partner in 1996.

Dale B. Wolf(Director since 2003) was elected Chief Executive Officer and to the Board of Directors of Coventry Health Care, Inc. (NYSE: CVH) effective January 2005. Prior to that, he served as Executive Vice President, Chief Financial Officer and Treasurer of Coventry from 1996 through 2004. From 1995 to 1996, Mr. Wolf was Executive Vice President of SpectraScan Health Services, Inc., a womens’ health care services company. In 1995, Mr. Wolf served as Senior Vice President of Business Development for the MetraHealth Companies, Inc., a managed health care company, and from 1988 to 1994, he was Vice President, Special Operations, of the Managed Care and Employee Benefits Operations of The Travelers, an insurance company.

For Terms Expiring in 2008

Daniel J. Houston(Director since 2005) has served as a Senior Vice President of Principal Financial Group, Inc. (NYSE: PFG) since 2000. Mr. Houston has held several positions with the Principal Financial Group since 1984, including being named Regional Director of Group and Pension Sales in 1990, Regional Vice President in 1993, and Vice President in 1997. He serves on the board of directors for several entities that are affiliates of Principal Financial Group, including Executive Benefit Services, Principal Financial Advisors, Principal Trust Company (Asia) Limited and Principal Bank, as well as a member and Chairman of the Board of Professional Pensions, Inc., Trustar Retirement Services and BCI Group, Inc.

4

Biographical Information of Continuing Directors

Whose Terms Expire in 2008

David T. Blair(Chief Executive Officer and Director since 1999) initially joined a predecessor of HealthExtras in 1997 as Chief Financial Officer. From 1995 to 1997, Mr. Blair was the Finance Manager of United Payors & United Providers, Inc. At United Payors & United Providers, Mr. Blair focused on its initial public offering and several strategic acquisitions. In 1994, Mr. Blair co-founded the Continued Health Care Benefit Program, which administers health care benefits to individuals leaving the United States Armed Forces. In 1995, this program was merged into United Payors & United Providers.

Kenneth A. Samet (Director since April 2006) has served as the President & Chief Operating Officer of MedStar Health, Inc., the largest integrated health care delivery system in the Mid-Atlantic region since 2000. From 1990 to 2000 Mr. Samet was the President of Washington Hospital Center, and from the mid-1980’s to 1990 he held a variety of executive leadership positions with the Medlantic Healthcare Group, which merged with Helix Health in 1998 to create MedStar Health, Inc. In 1996, Mr. Samet was named the nationalYoung Healthcare Administrator of the Year by the American College of Healthcare Executives. Previously, Mr. Samet served as the Treasurer of the Maryland Hospital Association’s Executive Committee, as a member of the boards of the National Committee for Quality Health Care, the Capital Community Health Plan and the University of Maryland School of Nursing, and chaired the board of the District of Columbia Hospital Association. Mr. Samet currently serves on the board of directors of the American Hospital Association and as the Chairman of the AHA Regional III Policy Board.

Whose Terms Expire in 2007

Thomas L. Blair(Chairman of the Board until June 7, 2005 and Director since 1999) is the founder of HealthExtras and its predecessors, and is currently the Chairman of the Board of Directors of both FedMed, Inc. and United Medical Bank, F.S.B. Mr. Blair served as Chairman and Chief Executive Officer of United Payors & United Providers, Inc., a publicly traded company. In 1989, Mr. Blair founded America’s Health Plan, Inc. and served as its President and Chief Executive Officer from 1989 to 1992. From 1977 until 1988, Mr. Blair was a principal of Jurgovan & Blair, Inc., which developed and managed health maintenance organizations.

William E. Brock(Director since 2000) is the founder and senior partner of The Brock Offices, a consulting firm specializing in international trade, investment and human resources. He is Senior Counselor for, and Trustee of, the Center for Strategic and International Studies in Washington, DC. A founder of the National Endowment for Democracy, he served as its Chairman from 1988 to 1991. From 1985 to 1987, he served as the United States Secretary of Labor, and from 1981 to 1985, he was United States Trade Representative. Mr. Brock also served for eight years as a member of the United States House of Representatives and for six years as a member of the United States Senate. He was recognized by the Financial Times of London, among others, as a principal ‘father’ of the Uruguay Round of Trade Negotiations and of its result, the World Trade Organization. Mr. Brock currently serves as a director on the boards of On Assignment, Inc. (Nasdaq: ASGN), Strayer Education, Inc. (Nasdaq: STRA) and Res-Care Inc. (Nasdaq: RSCR).

Edward S. Civera(Chairman of the Board as of June 7, 2005 and Director since 2000) is a business executive with over 30 years of experience in operations, accounting and finance from both the public accounting and corporate perspective. He is currently the Managing General Partner at Civera Investment Partnership, a private investment partnership that consults on financial, as well as merger and acquisition strategies. From 1997 to 2001, Mr. Civera was the Chief Operating Officer and Co-Chief Executive Officer of United Payors & United Providers, Inc., and worked with Thomas L. Blair in the founding of HealthExtras. Prior to his position at United Payors & United Providers, Mr. Civera spent 25 years with Coopers & Lybrand (now PricewaterhouseCoopers LLP), the last 15 years as both a partner and managing partner focused on financial advisory and auditing services. Mr. Civera also currently serves on the boards of directors of MCG Capital Corporation (Nasdaq: MCGC), The Mills Corporation (NYSE: MLS) and MedStar Health, Inc., a non-profit health care delivery organization.

5

Biographical Information of Executive Officers Who Are Not Directors

Michael P. Donovan joined HealthExtras in April 1999 as Chief Financial Officer. From early 1998 until early 1999, Mr. Donovan was engaged in a variety of technology and business development activities for HealthExtras. From 1992 to 1997, Mr. Donovan served as Senior Vice President of Business and Technology Development for PHP Healthcare Corporation. From 1989 to 1992, Mr. Donovan served as Chief Financial Officer of Direct Health, Inc. Prior to that, Mr. Donovan was a Senior Manager for KPMG, LLP, then KPMG Peat Marwick, responsible for a variety of technology and health care clients.

Thomas M. Farah joined HealthExtras in March 2002 as General Counsel, and was appointed Corporate Secretary of the Company in March 2003. Prior to joining HealthExtras, Mr. Farah was General Counsel of Federal Medical, Inc. From 1986 through 2000, Mr. Farah was a member, and from 1978 to 1986 he was an associate, of the law firm of Epstein Becker & Green, P.C. in its Washington, DC office. Mr. Farah’s practice involved providing legal advice to health care companies on regulatory, corporate and transactional matters.

Nick J. Grujich joined HealthExtras in June 2005 as Executive Vice President and Chief Operating Officer of the Company. Mr. Grujich has been responsible for the operations of the Company’s subsidiary, Catalyst Rx, since February 2005. From 1997 to 2005, Mr. Grujich served in various positions including Director of Finance, Senior Director of Finance and Vice President of Finance and Administration for Eckerd Health Services, a division of Eckerd Corporation (which, until August 2004, was a subsidiary of J.C. Penney Company, Inc.), specializing in pharmacy benefits management and mail order pharmacy services. From 1994 to 1997, Mr. Grujich served as Assistant Controller, Director of Finance, and Director of Practice Management of Penn Group Medical Associates, an affiliate of HealthAmerica, a subsidiary of Coventry Health Care, Inc.

PROPOSAL 2–APPROVAL OF THE 2006 STOCK INCENTIVE PLAN

General

On April 6, 2006, the Board of Directors adopted, subject to stockholder approval at the Annual Meeting, the HealthExtras, Inc. 2006 Stock Incentive Plan (the “2006 Plan” or the “Plan”). The 2006 Plan will become effective as of the date it is approved by the Company’s stockholders.

Our Board of Directors has determined that the ability to provide key personnel and outside directors with equity-based compensation is an important element of our overall compensation strategy and that equity-based compensation will allow us to attract and retain qualified directors, officers and employees. As of March 31, 2006, only 446,234 shares remain available for the grant of options and as awards of restricted stock to employees, and no shares remain available for the grant of options to outside directors under our existing stock plans. As of that date, there were outstanding options to purchase 3,847,352 shares of common stock, with a weighted average exercise price of $7.07 and remaining term of 6.09 years, and 522,750 shares of unvested restricted stock outstanding. The maximum number of shares that we may issue pursuant to awards granted under the 2006 Plan is 1,500,000, subject to reduction depending on the type of awards granted. The Board of Directors believes that the additional shares authorized by the 2006 Plan are needed to meet the Company’s recruitment and retention goals.

A summary of the 2006 Plan is set forth below. This summary is qualified in its entirety by the full text of the 2006 Plan, which is attached to this Proxy Statement as Exhibit A.

Summary of the Plan

Purpose. The purpose of the 2006 Plan is to encourage and enable selected employees, outside directors and independent contractors to acquire or increase their holdings of common stock and other proprietary interests in us in order to promote a closer identification of their interests with the interests of our stockholders, thereby further stimulating their efforts to enhance our efficiency, soundness, profitability, growth and stockholder value.

6

Eligibility.All employees, outside directors and selected independent contractors are eligible to participate in the 2006 Plan.

Administration. The 2006 Plan will be administered by our Board of Directors or a committee appointed by the Board of Directors.The Board of Directors or designated committee will have the authority to: designate participants; determine the type or types of awards to be granted to each participant and the number, terms and conditions thereof; establish, adopt or revise any rules and regulations it deems advisable to administer the Plan; and make all other decisions and determinations that may be required under the Plan. All decisions made by the Board of Directors or committee shall be made in the sole discretion of the Board or committee and will be binding on HealthExtras, Inc. and the 2006 Plan participants.

Shares Available for Awards/Limitations on Awards.Subject to adjustment as provided in the 2006 Plan, the maximum aggregate number of shares of Company common stock available under the 2006 Plan is 1,500,000. In order to allow maximum flexibility in designing an appropriate equity compensation strategy, the proposed plan provides that awards of stock options and Stock Appreciation Rights (“SARs”) will be counted against the maximum number of shares 1-to-1 ratio and awards other than stock options and SARs will be counted in a 1.45-to-1 ratio. For example, if we wish to issue 100 shares of restricted stock, the maximum number of remaining shares available for grant under the 2006 Plan would be reduced by 145 shares of common stock. In addition, SARs exercised and settled in shares of common stock will be counted in the full amount exercised against the number of shares available for grant under the 2006 Plan, regardless of the number of net shares issued upon settlement of the SARs. In other words, if an SAR related to 100 shares was exercised and settled by the issuance of 70 shares, the maximum number of shares remaining available for award under the 2006 Plan would be reduced by 100 shares.

The maximum number of shares of Company common stock that we may issue under the 2006 Plan pursuant to the grant of incentive stock options is 1,500,000 or, if less, the maximum number of shares issuable under the 2006 Plan. In addition, (i) we may not grant to any participant options and SARs that are not related to an option for more than 1,000,000 shares of common stock in any thirty six (36) month period; (ii) we may not grant to any participant restricted, performance share and phantom stock awards for more than 500,000 shares of common stock in any thirty-six (36) month period; and (iii) participants may not be paid more than $2,000,000 with respect to any cash-denominated performance units granted in any single calendar year, subject to adjustments as provided in the 2006 Plan. For purposes of these restrictions, we will treat an option and related SAR as a single award.

The following will not reduce the remaining shares available for issuance pursuant to awards under the 2006 Plan: (i) dividends, including dividends paid in shares of common stock, or dividend equivalents paid in cash in connection with outstanding awards; (ii) awards which by their terms are settled in cash rather than the issuance of shares; and (iii) any shares subject to an award under the 2006 Plan that is forfeited, cancelled, terminated, expires or lapses for any reason and shares subject to an award that are repurchased or reacquired by us.

Permissible Awards. We may grant awards under our 2006 Plan which include incentive stock options and nonqualified stock options; SARs; restricted awards in the form of restricted stock awards and restricted stock units; performance awards in the form of performance shares and performance units; phantom stock awards; and dividend equivalent awards. We discuss the material terms of each type of award below.

Options. Our 2006 Plan authorizes the grant of both incentive stock options and nonqualified stock options, both of which are exercisable for shares of common stock, although incentive stock options may only be granted to our employees. The Board of Directors or committee will determine the option price at which a participant may exercise an option, and the option price must be no less than 100% of the fair market value per share of our common stock on the date of grant, or 110% of the fair market value with respect to incentive stock options granted to an employee who owns stock representing more than 10% of the total voting power of all classes of our stock or stock of our parent or subsidiary corporation, if any.

7

Unless an individual award agreement provides otherwise, a participant may pay the option exercise price in the form of cash or cash equivalent; in addition, where the Board of Directors or committee and applicable laws, rules and regulations permit, a participant may also make payment:

| | • | | by delivery of shares of common stock the participant, if acceptable by the Board or the committee; |

| | • | | by shares of common stock withheld upon exercise; |

| | • | | by delivery of written notice of exercise to the corporate secretary of the HealthExtras Board of Directors and irrevocable instructions to a broker to deliver to HealthExtras the funds to pay the option price; |

| | • | | by such other payment methods as the Board of Directors or the committee may approve and which are acceptable under applicable law; or |

| | • | | by any combination of these methods. |

At the time of option grant, the Board of Directors or committee will determine the term and conditions of an option and the period or periods during which a participant may exercise an option and the option term for each option (which may not exceed 10 years for incentive and non-qualified stock options, or five years for incentive stock options with respect to an employee who owns stock and who possesses more than 10% of the total combined voting power of all classes of our stock or stock of our parent or subsidiary corporation, if any). Options are also subject to certain restrictions on exercise if the participant terminates employment or service. The Board of Directors or committee has authority to establish other terms and conditions related to options.

Stock Appreciation Rights. Under the terms of our 2006 Plan, we may grant SARs to the holder of an option with respect to all or a portion of the shares of common stock subject to the option or we may grant SARs separately. Upon the exercise of a SAR, the holder may receive consideration paid either (i) in cash; (ii) shares of common stock valued at fair market value on the date of the SAR exercise; or (iii) a combination of cash and shares of common stock, as the administrator determines. Upon exercise of an SAR, a participant is entitled to receive from us consideration in an amount determined by multiplying the difference between the fair market value of a share of common stock on the date of exercise of the SAR over the base price of the SAR by the number of shares of common stock with respect to which the SAR is being exercised.

Notwithstanding the foregoing, the Board of Directors or committee may limit the amount payable in its discretion. The base price may be no less than 100% of the fair market value per share of the common stock on the date the SAR is granted. To the extent required by Internal Revenue Code Section 409A, SARs will be structured in a manner designed to be exempt from, or to comply with, the requirements of Internal Revenue Code Section 409A.

SARs are exercisable according to the terms established by the Board of Directors or committee and stated in the applicable award agreement. Upon the exercise of an SAR granted to the holder of an option, the related option is deemed to be cancelled to the extent of the number of shares as to which the holder of an option exercises the SAR. No participant may exercise an SAR more than 10 years after it was granted, or such shorter period as may apply to related options. Each award agreement will set forth the extent to which the holder of an SAR will have the right to exercise an SAR following termination of the holder’s employment or service with HealthExtras, Inc.

Restricted Awards. Subject to the limitations of our 2006 Plan, the Board of Directors (or committee) may in its sole discretion grant restricted awards to such individuals in such numbers, upon such terms and at such times as the Board or committee shall determine. Restricted awards may be in the form of restricted stock awards and/or restricted stock units that are subject to certain conditions, which conditions must be met in order for the restricted award to vest and be earned, in whole or in part, and no longer subject to forfeiture. Restricted stock awards may be payable in shares of common stock. Restricted stock units may be payable in cash or shares of common stock, or partly in cash and partly in shares of common stock, in accordance with the terms of our 2006 Plan and the discretion of the Board or committee.

8

The Board of Directors or committee has authority to determine the nature, length and starting date of the period during which a participant may earn a restricted award and will determine the conditions that must be met in order for a restricted award to be granted or to vest or be earned. These conditions may include: (i) attainment of performance objectives; (ii) continued service or employment for a certain period of time or a combination of attainment of performance objectives and continued service; (iii) retirement; (iv) disability; (v) death; or (vi) any combination of such conditions.

Subject to the terms of the 2006 Plan and the requirements of Internal Revenue Code Section 409A, the Board or committee has authority to determine whether and to what degree restricted awards have vested and been earned and are payable. The Board or committee also may, subject to Internal Revenue Code Section 409A, accelerate the date that any restricted award will be deemed vested or earned, without any obligation to accelerate such date with respect to other restricted awards. If a participant’s employment or service is terminated for any reason and all or any part of a restricted award has not vested or been earned pursuant to the terms of our 2006 Plan and the individual award, the participant will forfeit the award unless the Board or committee determines otherwise.

Performance Awards. Subject to the limitations of our 2006 Plan, the Board of Directors or committee may in its discretion grant performance awards to such eligible individuals upon such terms and conditions and at such times as the Board or committee shall determine. Performance awards may be in the form of performance shares and/or performance units. An award of a performance share is a grant of a right to receive shares of our common stock, the cash value thereof or a combination thereof in the administrator’s discretion, which is contingent upon the achievement of performance or other objectives during a specified period and which has a value on the date of grant equal to the fair market value of a share of our common stock. An award of a performance unit is a grant of a right to receive shares of our common stock or a designated dollar value amount of common stock that is contingent upon the achievement of performance or other objectives during a specified period, and that has an initial value determined in a dollar amount established by the Board or committee at the time of grant.

Subject to the terms of the 2006 Plan and the requirements of Internal Revenue Code Section 409A, the Board or committee has the authority to determine the nature, length and starting date of the period during which a participant may earn a performance award and will determine the conditions that must be met in order for a performance award to be granted or to vest or be earned. These conditions may include specific performance objectives, continued service or employment for a certain period of time, or a combination of such conditions. Performance Awards granted under the 2006 Plan may be based on one or more of the following business criteria: (i) earnings before interest, taxes, depreciation and/or amortization; (ii) operating income or profit; (iii) return on equity, assets, capital, capital employed or investment; (iv) after tax operating income; (v) net income; (vi) earnings or book value per share of the Company’s common stock; (vii) cash flow(s); (viii) total sales or revenues or sales or revenues per employee; (ix) stock price or total shareholder return; (x) dividends; (xi) strategic business objectives, consisting of one or more objectives based on meeting specified cost targets, business expansion goals, and goals relating to acquisitions or divestitures; or (xii) a combination of these measures. Each goal may be expressed on an absolute and/or relative basis, may be based on or otherwise employ comparisons based on internal targets, past performance of the Company or any subsidiary, operating unit or division of the Company and/or the past or current performance of other companies, and in the case of earnings-based measures, may use or employ comparisons relating to capital, stockholders’ equity and/or shares of common stock outstanding, or to assets or net assets.

No later than 90 days following the commencement of a performance period (or such other time as may be required by 162(m) of the Internal Revenue Code), the Committee shall, in writing (i) select the performance goal or goals applicable to the performance period, (ii) establish the various targets and bonus amounts which may be earned for such performance period, and (iii) specify the relationship between the performance goals and targets and the amounts to be earned by each participant for the performance period.

9

Phantom Stock Awards. Subject to the limitations of our 2006 Plan, the Board of Directors or committee may in its discretion grant phantom stock awards to such eligible individuals in such numbers, upon such terms and at such times as the Board or committee shall determine. An award of phantom stock is an award of a number of hypothetical share units with respect to shares of our common stock, with a value per unit based on the fair market value of a share of common stock.

Subject to the terms of the 2006 Plan and the requirements of Internal Revenue Code Section 409A, the Board or committee has the authority to determine whether and to what degree phantom stock awards have vested and are payable. Upon vesting of all or part of a phantom stock award and satisfaction of other terms and conditions that the Board or committee determines, the holder of a phantom stock award will be entitled to a payment of an amount equal to the fair market value of one share of our common stock with respect to each such phantom stock unit that has vested and is payable. HealthExtras may make payment in cash, shares of common stock, or a combination of cash and stock, as determined by the Board or committee. The Board or committee may determine the forms and terms of payment of phantom stock awards in accordance with our 2006 Plan. If a participant’s employment or service is terminated for any reason and all or any part of a phantom stock award has not vested and become payable pursuant to the terms of our 2006 Plan and the individual award, the participant will forfeit the award unless HealthExtras determines otherwise.

Dividend and Dividend Equivalents. The Board of Directors or committee may provide that awards granted under our 2006 Plan earn dividends or dividend equivalents. HealthExtras may pay such dividends or dividend equivalents currently or credit such dividends or dividend equivalents to a participant’s account, subject to any requirements under Internal Revenue Code Section 409A and such restrictions and conditions as the Board or committee may establish with respect to the crediting of an account, including reinvestment in additional shares of common stock or share equivalents.

Effects of a Change in Control. Upon a change in control as defined in our 2006 Plan, and unless Internal Revenue Code Section 409A requires otherwise, our 2006 Plan provides that the Board of Directors shall have the sole discretion to determine the effect, if any, on awards granted under the 2006 Plan, including the vesting, earning and/or exercisability of the award. The Board’s discretion includes the discretion to determine that an award shall vest, be earned or become exercisable in whole or in part, shall be assumed or substituted for another award, shall be cancelled without the payment of consideration, shall be cancelled in exchange for a cash payment or other consideration, or that other actions or no actions shall be taken with respect to the award. The Board of Directors also has discretion to determine that acceleration shall be subject to both a change of control and termination of employment or service.

Adjustments.In the event of a stock split, a dividend payable in shares of common stock, or a combination or consolidation of the common stock into a lesser number of shares, the share authorization limits under the Plan will automatically be adjusted proportionately, and the shares then subject to each award will automatically be adjusted proportionately without any change in the aggregate purchase price for such award. If the Company is involved in another corporate transaction or event that affects the common stock, such as an extraordinary cash dividend, recapitalization, reorganization, merger, consolidation, split-up, spin-off, combination or exchange of shares, the share authorization limits under the Plan will be adjusted proportionately, and the Board of Directors or the committee may adjust the Plan and outstanding awards to preserve the benefits or potential benefits of the awards.

Termination and Amendment. The Board of Directors may, at any time and from time to time, terminate or amend the plan, but if an amendment to the 2006 Plan would materially increase the number of shares of stock issuable under the Plan, expand the types of awards provided under the Plan, materially expand the class of participants eligible to participate in the Plan, materially extend the term of the Plan or otherwise constitute a material amendment requiring stockholder approval under applicable listing requirements, laws, policies or regulations, then such amendment will be subject to stockholder approval. In addition, the Board of Directors may condition any amendment on the approval of the Company’s stockholders for any other reason. No termination or amendment of the Plan may adversely affect any award previously granted under the Plan without the written consent of the participant.

10

The Committee may amend or terminate outstanding awards; however, such amendments may require the consent of the participant and, unless approved by the Company’s stockholders or otherwise permitted by the anti-dilution provisions of the Plan, the exercise price of an outstanding option may not be reduced, directly or indirectly, and the original term of an option may not be extended.

Certain Federal Tax Effects

Under certain federal laws in general recipients of awards and grants of nonqualified stock options, SARs, restricted stock, dividend equivalents, performance awards and stock payments under our 2006 Plan are taxable under the Internal Revenue Code upon their actual or constructive receipt of common stock or cash with respect to such awards or grants and, subject to Section 162(m) of the Internal Revenue Code and certain reporting requirements, we will be entitled to an income tax deduction with respect to the amounts taxable as ordinary income to such recipients. Under Sections 421 and 422 of the Internal Revenue Code, recipients of incentive stock options are generally not taxed on their receipt of common stock upon their exercises of incentive stock options if the option stock is held for specified minimum holding periods and, in such event, we would not be entitled to income tax deductions with respect to such exercises. If Internal Revenue Code Section 409A is deemed to apply to the 2006 Plan or any award, and the 2006 Plan and award do not, when considered together, satisfy the requirements of Section 409A during a taxable year, the participant will have ordinary income on the amount of all deferrals subject to Section 409A in the year of non-compliance to the extent that the award is not subject to a substantial risk of forfeiture. The participant will be subject to an additional tax of 20 percent on all amounts includible in income and may also be subject to interest charges under Section 409A. Subject to Section 162(m) of the Internal Revenue Code and certain reporting requirements, we will be entitled to an income tax deduction with respect to the amount of compensation includible as income to the participant.

Internal Revenue Code Section 409A Requirements. The 2006 Plan is intended to comply with Section 409A of the Internal Revenue Code. To the extent that Section 409A is deemed to apply to the 2006 Plan or any award, the 2006 Plan and all such awards will, to the extent practicable, be construed in accordance with Section 409A. Section 409A imposes certain requirements on compensation that is deemed under Section 409A to involve deferred compensation.

Performance Based Compensation—Section 162(m) Requirements. Our 2006 Plan is structured to comply with the requirements imposed by Section 162(m) of the Internal Revenue Code and related regulations in order to preserve, to the extent practicable, our tax deduction for awards made under our 2006 Plan to covered employees. Section 162(m) of the Internal Revenue Code generally denies an employer a deduction for compensation paid to covered employees, who are generally the named executive officers, of a publicly held corporation in excess of $1,000,000 unless the compensation is exempt from the $1,000,000 limitation because it is performance-based compensation.

Section 83(b) Elections. Participants may elect, under Section 83(b) of the Internal Revenue Code, within 30 days of the grant of stock, to recognize taxable ordinary income on the date of grant equal to the excess of the fair market value of the shares of restricted stock (determined without restrictions) over the purchase price of the restricted stock. If a participant makes an election under Section 83(b), the holding period will commence on the date of grant, the tax bases will be equal to the fair market value of the shares on such date (determined without regard to restrictions) and HealthExtras will be entitled to a deduction equal to the amount that is taxable as ordinary income to the participant in the year such income is taxable.

Prohibition on Repricing

Under the 2006 Plan, outstanding stock options or SARs cannot be repriced, directly or indirectly, without the prior consent of the Company’s stockholders. We acknowledge that the following actions are considered to be indirect repricing, and therefore, would require the prior consent of our stockholders:

| | • | | Canceling options and/or SARs and granting lower priced options and/or SARs; |

11

| | • | | Canceling options and/or SARs and replacing the canceled awards with a full-value award; and |

New Benefits to Named Executive Officers and Others

No awards have been granted under the 2006 Plan. However, on April 6, 2006, the Board expressed its intent to grant each qualifying director an award of 2,000 shares of restricted stock as of the day after the annual meeting of stockholders. These shares of restricted stock would vest in equal annual installments over two years. It is anticipated that such grants to directors would be recurring as of each annual meeting of stockholders. Currently, Messrs. Brock, Civera, Epstein, McDonnell, Samet, and Wolf are qualifying directors for the purpose of the receipt of such awards. All awards under the 2006 Plan will be made at the discretion of the Board of Directors (or committee or other delegated authority). Therefore, except as described above with respect to directors, it is not presently possible to determine the benefits or amounts that will be received by any individual or groups pursuant to the 2006 Plan in the future, or the benefits or amounts that would have been received by any individuals or groups for the last completed fiscal year if the 2006 Plan had been in effect.

Vote Required

The affirmative vote of the holders of a majority of the shares represented in person or by proxy and entitled to vote on this item is required for approval. A properly executed proxy marked “Abstain” with respect to any such matter will not be voted. Any abstentions will have the effect of votes against this item. Any broker non-votes will not have any effect on this item.

Equity Compensation Plan Information

The following table sets forth information regarding the Company’s equity compensation plans as of December 31, 2005. Share data is in thousands.

| | | | | | | |

Plan category | | Number of securities to be

issued upon exercise of

outstanding options, warrants and rights | | Weighted average exercise

price of outstanding options, warrants and rights | | Number of securities

remaining available for future issuance |

Equity compensation plans approved by security holders | | 4,434 | | $ | 6.89 | | 539 |

Equity compensation plans not approved by security holders | | — | | | — | | — |

| | | | | | | |

Total | | 4,434 | | $ | 6.89 | | 539 |

The Board of Directors recommends a vote FOR the adoption of the 2006 Stock Incentive Plan.

PROPOSAL 3–RATIFICATION OF THE APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

The Audit Committee has appointed PricewaterhouseCoopers LLP to be the independent registered public accountants of the Company for the 2006 fiscal year, subject to ratification by the stockholders. A representative of PricewaterhouseCoopers LLP is expected to be present at the Annual Meeting to respond to appropriate questions from stockholders and will have the opportunity to make a statement should he or she desire to do so.

If the ratification of the appointment of the independent registered public accountants is not approved by a majority of the votes cast by stockholders at the Annual Meeting, other independent registered public accountants will be considered by the Audit Committee.

12

The Audit Committee and the Board of Directors recommend that stockholders vote FOR the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accountants.

Audit Fees

The aggregate fees the Company paid to PricewaterhouseCoopers LLP for the review of the Company’s Form 10-Q quarterly reports and for the annual audit for the year ended December 31, 2005, and the audit of management’s report on the effectiveness of the Company’s internal control over financial reporting, as required by Section 404 of the Sarbanes-Oxley Act of 2002, totaled approximately $836,500.

All Other Fees

The aggregate fees the Company paid to PricewaterhouseCoopers LLP for all other non-audit services, including tax-related services for the year ended 2005, totaled approximately $146,108. The Audit Committee believes that these non-audit fees are compatible with PricewaterhouseCoopers LLP maintaining its independence with respect to the Company.

OTHER MATTERS

The Board of Directors knows of no other matters that are likely to be brought before the Annual Meeting. If any other matters should be properly brought before the meeting, it is the intention of the persons named as proxies on the enclosed proxy card to vote, or otherwise act, in accordance with their judgment on such matters.

CORPORATE GOVERNANCE

Board and Committee Meetings

The Board of Directors conducts business through meetings and the activities of the Board and its committees, including taking actions by unanimous written consent. During the fiscal year ended December 31, 2005, the Board met seven times. All of the current members of the Board attended at least 75% of the meetings held during their tenure, including meetings of committees on which they served.

Director Independence

The Board reviewed each director’s other affiliations and relationships, and has affirmatively determined that seven of the Board’s nine directors (including all of those standing for re-election at the Annual Meeting) are independent under the Nasdaq Stock Market Rules, which are the director independence standards adopted and applied by the Board. In making this determination, the Board consulted with the Company’s General Counsel to ensure that the Board’s determinations were consistent with all applicable laws and regulations, including the Nasdaq Stock Market Rules. Mr. David Blair, because he is an employee of the Company, and Mr. Thomas Blair, because he is Mr. David Blair’s father, are not considered independent.

Code of Ethics & Conduct

The Company, together with its subsidiaries, insists that all of its directors, officers and employees adhere to high ethical standards and comply with all applicable legal requirements when engaging in business on behalf of the Company. Accordingly, the Board adopted a Code of Ethics & Conduct which complies with the Sarbanes-Oxley Act of 2002 and the Nasdaq Stock Market Rules, and is applicable to all of the Company’s directors, officers and employees. A copy of the Code of Ethics & Conduct will be furnished without charge upon written request to the Corporate Secretary, HealthExtras, Inc., 800 King Farm Boulevard, 4th Floor, Rockville, Maryland 20850.

13

The Company has established a toll-free telephone number for employees to use on a confidential basis to advise the General Counsel of any questions, reports or concerns regarding possible violations of the Company’s Code of Ethics & Conduct or of any Company policies or procedures. Employees are also invited to write to the General Counsel on a confidential basis regarding such matters. The Audit Committee, in compliance with the Sarbanes-Oxley Act of 2002, has established procedures for the receipt, retention and treatment of complaints regarding accounting, internal controls or auditing matters. The Ethics, Governance & Nominating Committee has established procedures for the receipt, retention and treatment of complaints regarding all other ethics and governance related matters. Both Committees allow for the confidential, anonymous submission by employees of concerns regarding such matters (see also “Stockholder Communications with the Board”). In no event will any action be taken against an employee for, in good faith, making a complaint or reporting known or suspected violations.

Ethics, Governance & Nominating Committee

On April 6, 2006, the Board of Directors established the Ethics, Governance & Nominating Committee (the “Ethics & Nominating Committee”, or for purposes of this section, the “Committee”), consolidating the functions of the Nominating Committee with those of the Ethics & Compliance Committee, which was established by the Board on October 27, 2005. Current members of the Committee are Daniel J. Houston (Chairman), Steven B. Epstein and Dale B. Wolf, all of whom are independent directors for purposes of the requirements of the Nasdaq Stock Market Rules. In addition to identifying candidates for the Board, this newly consolidated committee will focus on a continuation of employee training and continued development of policies and procedures that range from business ethics to marketing practices and the protection of client information. During 2005, the Nominating Committee held two meetings. The Ethics & Compliance Committee was only formed in October of 2005 and held no formal meetings in 2005. However, the members of that Committee reviewed the Company’s corporate compliance program and reported on that review to the Board. The Board is in the process of developing the charter for this Committee. Until that process is completed, this Committee operates under the previous charters of the Nominating Committee and the Ethics & Compliance Committee, which were combined to form this Committee. The charter for the Nominating Committee was appended to the Company’s proxy statement for its 2004 Annual Meeting of Stockholders. In addition, a copy of both the Nominating Committee Charter and the Ethics & Compliance Committee Charter will be furnished without charge upon written request to the Corporate Secretary, HealthExtras, Inc., 800 King Farm Boulevard, 4th Floor, Rockville, Maryland 20850.

Director Nominations

The Ethics & Nominating Committee, as was previously done by the Nominating Committee, will consider the following criteria in selecting individuals for recommendation to the Board as nominees: independence; financial, regulatory and business experience; character and integrity; education, background and skills; judgment; and, the ability to provide practical insights regarding the business of the Company. In addition, prior to recommending a current director for re-election to the Board of Directors, the Committee will consider and review the current director’s Board and committee attendance and performance, length of Board service and knowledge of the business of the Company. The vote of a majority of the independent directors of the Board of Directors is required to nominate an individual for the Board of Directors.

The Ethics & Nominating Committee will consider suggestions from stockholders for nominees to the Board of Directors that are timely received in proper written form. To be timely, such suggestions must be delivered to the Corporate Secretary within the same time frame required to have proposals included in the proxy statement as identified in the subsequent section of this Proxy Statement, entitled “Stockholder Proposals”. To be in proper written form, a stockholder’s notice regarding a stockholder nomination should set forth in writing (i) as to each person whom the stockholder proposes to be nominated for election as a director, all information relating to such person that is required to be included in a proxy statement filed pursuant to the proxy rules of the SEC, including such person’s written consent to being named in the proxy statement as a nominee and to serving

14

as a director if elected and such person’s qualifications and biographical information, and (ii) as to the stockholder giving the notice (x) the name and address of such stockholder, as they appear on the Company’s books, and (y) the class and number of shares of the Company that are beneficially owned by such stockholder.

The process that the Ethics & Nominating Committee will follow, as previously applied to the Nominating Committee, when it identifies and evaluates individuals to be recommended to the Board of Directors for nomination will be, as follows:

Identification. For purposes of identifying nominees for the Board of Directors, the Ethics & Nominating Committee will rely on personal contacts of the Committee members and other members of the Board of Directors. The Committee will also consider director candidates recommended by stockholders in accordance with the policy and procedures set forth above. The Ethics & Nominating Committee has not previously used an independent search firm to identify nominees, but reserves the right to do so.

Evaluation. In evaluating potential nominees, the Ethics & Nominating Committee will determine whether the candidate is eligible, qualified and interested for service on the Board of Directors by evaluating the candidate under the selection criteria set forth above. In addition, the Ethics & Nominating Committee may conduct a check of the individual’s background and interview the candidate.

Mr. Houston was recommended to the predecessor Nominating Committee by directors who were employees of Principal Financial Group, Inc. to serve the remainder of Mr. Jury’s term, which expires in 2006. Mr. McDonnell, a director nominee whose term expires in 2006, was recommended to the predecessor Nominating Committee by an independent director to fill the vacancy created in June 2005 by an increase in the number of seats on the Board. Mr. Samet was recommended to the Board by an independent director to serve the remainder of Mr. Graefe’s term, which expires in 2008.

Ethics and Corporate Governance

The primary role of the Committee in regards to ethics and corporate governance is general oversight of the Company’s compliance with applicable laws and regulations, with the Company’s Code of Ethics & Conduct and its Business Ethics Policies & Procedures, as well as a periodic review of the effectiveness of, and recommendation of changes to, the Code or the Policies and Procedures. Notwithstanding the foregoing, the Committee defers to the Audit Committee on all matters related to compliance with financial reporting and disclosure requirements, or securities laws and regulations. Should the division of responsibilities between the Audit Committee and the Ethics & Nominating Committee be uncertain from time to time with respect to specific matters or areas of oversight, the chairpersons of each of the committees will meet and confer to allocate duties and responsibilities; provided, however, that the Audit Committee, due to the more stringent standard of independence applied to its membership, shall have final authority in determining those matters which should be assigned to or addressed by the Audit Committee.

The function of the Ethics & Nominating Committee is oversight and advice. It is not the duty or responsibility of the Committee to conduct compliance audits, although it may initiate compliance investigations as it deems appropriate. Management is responsible for the Company’s compliance with laws and regulations. The Committee and each of its members shall be entitled to rely on the expertise and knowledge of management, the Company’s Compliance Officer and the Company’s General Counsel, as well as other persons with professional or expert competence. Communications between the Committee and the Company’s legal counsel (whether internal or outside counsel) shall be considered to be subject to the attorney-client privilege.

Executive Committee

The Executive Committee acts for the Board of Directors when Board action is required between meetings. The current members of the Executive Committee are Edward S. Civera (Chairman of the Committee as of June 7, 2005), Thomas L. Blair and William E. Brock. One meeting of the Committee was held during 2005.

15

Audit Committee

Current members of the Audit Committee are Michael R. McDonnell (Chairman), William E. Brock, Kenneth A. Samet and Dale B. Wolf. All members of the Audit Committee meet the standards of independence for audit committee members established by the Nasdaq Stock Market Rules and the Sarbanes-Oxley Act of 2002. The Board has determined that at least one Audit Committee Member, Mr. McDonnell, is an audit committee financial expert for purposes of SEC requirements. Acting under a charter adopted by the Board of Directors, the Audit Committee annually reviews the qualifications of and appoints the Company’s independent registered public accountants. The Audit Committee approves the planning and fees for the annual audit of the Company’s financial statements, and provides independent review and oversight of the quality and integrity of the Company’s accounting and financial reporting processes and published financial statements and system of internal controls. The Committee held six meetings in 2005. A copy of the Audit Committee charter was appended to the proxy statement for the 2004 annual meeting of stockholders and will be furnished without charge upon written request to the Corporate Secretary, HealthExtras, Inc., 800 King Farm Boulevard, 4th Floor, Rockville, Maryland 20850.

Compensation Committee

Current members of the Compensation Committee are Dale B. Wolf (Chairman), Steven B. Epstein, Daniel J. Houston, Michael R. McDonnell and Kenneth A. Samet, all of whom are independent for purposes of the requirements of the Nasdaq Stock Market Rules. The Compensation Committee has the responsibility of evaluating the performance of, and recommending to the Board of Directors salary and incentive compensation for, executive officers and senior management of the Company. The Compensation Committee held three meetings in 2005. A copy of the Compensation Committee charter was appended to the proxy statement for the 2004 annual meeting of stockholders and will be furnished without charge upon written request to the Corporate Secretary, HealthExtras, Inc., 800 King Farm Boulevard, 4th Floor, Rockville, Maryland 20850.

Independent Directors’ Meetings

All directors deemed independent under the Nasdaq Stock Market Rules meet at least twice per year in scheduled semi-annual executive sessions. During 2005, Mr. Civera served as the lead director to preside over the meetings of the independent directors. Non-scheduled sessions of the independent directors may also be held from time to time. Among other things, the independent directors have developed topics and matters for management to address at future Board meetings. Their activities, to the extent they choose to report them, are reflected in reports from the lead director. The independent directors met three times in executive session in 2005.

Director Compensation

On April 6, 2006, the Company revised its cash and equity compensation for directors for 2006.

For 2005, directors who were not employees of the Company, who did not have a beneficial interest in 10% or more of the Company’s common stock and who were not officers or employees of organizations that owned 10% or more of the Company’s common stock (“Qualifying Directors”) were paid a quarterly retainer of $12,000 ($48,000 per year) for their service as directors and on committees of the Board. During 2005, Messrs. Brock, Civera, Epstein, Graefe, McDonnell and Wolf met the definition of directors qualifying for the retainer. Thomas L. Blair, based on his beneficial ownership of the Company’s common stock, David T. Blair, Chief Executive Officer, and Thomas J. Graf, Daniel J. Houston and Deanna Strable-Soethout, based on their employment by the Principal Financial Group, Inc., a significant stockholder of the Company, receive no compensation for service.

At its meeting on April 6, 2006, the Board determined that for 2006, Qualifying Directors (other than the Chairman of the Board) will continue to be paid quarterly an annual retainer of $48,000. In addition, those

16

Qualifying Directors will be paid quarterly a retainer for each Board committee on which they serve; however, no additional fees are paid for attendance by directors at Board and committee meetings. The Chairman of the Board is to be paid a total annual retainer of $160,000, payable in equal quarterly installments, for his service as Chairman and on any Committees.

The following table shows the annual amount of retainers for service by chairs and members on the various committees:

| | | |

Committee | | Annual Retainer |

Audit Committee | | | |

Chair | | $ | 14,000 |

Member | | | 8,000 |

Compensation Committee | | | |

Chair | | | 10,000 |

Member | | | 6,000 |

Ethics, Governance & Nominating Committee | | | |

Member | | | 5,000 |

Executive Committee | | | |

Member | | | 10,000 |

In addition, the Amended & Restated 2000 Directors’ Stock Option Program (the “Director Option Program”) previously provided for each Qualifying Director, to the extent of available shares under the Director Option Program, at the time of election or appointment to receive a Director Option to purchase 15,000 shares, and on the day after each annual meeting of stockholders, generally to receive an automatic subsequent grant, without further Board action, of non-qualified stock options to purchase 5,000 shares of the Company’s common stock at the fair market value of a share of the Company’s common stock on the date of grant, provided he or she had been a director since the previous annual meeting of stockholders. Those options would vest one year from the date of grant. There are no shares remaining available for the grant of options under the Director Option Program.

On April 6, 2006, the Board expressed its intent to replace the stock option grants under the Director Option Program with grants to each Qualifying Director, as of the day after the annual meeting of stockholders, of 2,000 shares of restricted stock, which would vest in equal annual installments over two years. Those grants would be made pursuant to the HealthExtras, Inc. 2006 Stock Incentive Plan (the “2006 Plan” or the “Plan”), which the Board adopted on April 6, 2006 subject to the approval of the Company’s stockholders. The 2006 Plan is submitted for such approval at this Annual Meeting. For further information on the Plan, please see the section entitled, “Proposal 2—Approval of the 2006 Stock Incentive Plan” and Exhibit A to this Proxy Statement.

All directors are reimbursed for reasonable travel and incidental expenses incurred in attending meetings and carrying out their duties as directors. The retainer, along with the restricted stock grants described above, constitutes payment for all Board and committee meetings and responsibilities.

Stockholder Communications with the Board

Any person who wishes to communicate with the entire Board of Directors, an individual director, a committee of the Board or the independent directors as a group, should mark such communication “confidential” and address it to the specific intended recipient(s) c/o Thomas M. Farah, Corporate Secretary & General Counsel, HealthExtras, Inc., 800 King Farm Boulevard, 4th Floor, Rockville, Maryland 20850. All correspondence will be reviewed by the Corporate Secretary/General Counsel to determine the nature and subject matter of the communication, and the corresponding appropriate recipient (e.g., the appropriate committee, committee chairman or other individual director). Items unrelated to the duties and responsibilities of the Board, such as

17

ordinary service or product complaints or inquiries, job inquiries, business solicitations, mass mailings or other material considered, in the reasonable judgment of the Corporate Secretary/General Counsel, unsuitable or unrelated to the responsibilities of the Board may be excluded. Communications relating to accounting, internal controls or auditing matters will be treated on a confidential basis according to the Audit Committee’s policies and procedures regarding such matters and delivered to the Chairman of the Audit Committee. Communications relating to ethical conduct will be treated on a confidential basis according to the Ethics, Governance & Nominating Committee’s or the Audit Committee’s policies and procedures regarding such matters, as appropriate, and delivered to the chairman of the appropriate committee. All communications concerning the Corporate Secretary/General Counsel should be marked “confidential” and addressed to the Chairman of the Ethics & Compliance Committee or the Chairman of the Audit Committee, as appropriate, c/o David T. Blair, Chief Executive Officer, HealthExtras, Inc., 800 King Farm Boulevard, 4th Floor, Rockville, Maryland 20850.

In addition, the Board of Directors encourages directors to attend annual meetings of stockholders as a means of promoting communication between stockholders and directors. In furtherance of this policy, the Company has historically scheduled a meeting of the Board of Directors to immediately follow each annual meeting of stockholders. At the 2005 annual meeting of stockholders, all of the directors were present.

18

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth, for the years indicated, the cash and non-cash compensation paid to, or earned by, the Chief Executive Officer during 2005 and the other executive officers of the Company as of December 31, 2005.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | Long-Term Compensation | | All Other Compensation ($)(3) |

| | | | | Annual Compensation | | Awards | |

Name & Principal

Positions | | Fiscal

Year | | Salary ($) | | Bonus ($) | | Other Annual Compensation ($)(1) | | Restricted Stock Awards ($)(2) | | Securities Underlying Options (No.) | |

David T. Blair Chief Executive Officer | | 2005

2004

2003 | | $

| 350,000

350,000

320,000 | | $

| 380,000

350,000

103,177 | | $

| —

—

— | | $

| 1,189,200

—

— | | $

| —

—

— | | $

| 7,500

—

2,500 |

| | | | | | | |

Michael P. Donovan Chief Financial Officer & Treasurer | | 2005

2004

2003 | |

| 280,000

280,000

240,000 | |

| 150,000

150,000

75,000 | |

| —

—

— | |

| 594,600

—

— | |

| —

—

— | |

| 7,500

7,000

6,500 |

| | | | | | | |

Thomas M. Farah General Counsel & Secretary | | 2005

2004

2003 | |

| 230,000

230,000

200,000 | |

| 65,000

60,000

40,000 | |

| —

—

— | |

| —

—

— | |

| —

—

— | |

| 9,500

6,344

5,625 |

| | | | | | | |

Nick J. Grujich Executive Vice President & Chief Operating Officer | | 2005

2004

2003 | |

| 217,808

—

— | |

| 100,000

—

— | |

| —

—

— | |

| —

—

— | |

| 100,000

—

— | |

| 7,500

—

— |

| (1) | Does not include the aggregate amount of perquisites and other personal benefits that did not exceed the lesser of $50,000 or 10% of any individual’s total salary and bonus for the year. |

| (2) | Represents 60,000 and 30,000 shares of restricted common stock awarded to Messrs. Blair and Donovan, respectively, with a value of $19.82 per share on the date of grant, which vest in equal installments over three years. Dividends, if any, are paid on the shares of restricted stock. The value of such shares as of December 31, 2005 was $1,506,000 and $753,000, respectively. |

| (3) | Represents matching 401(k) contribution. |

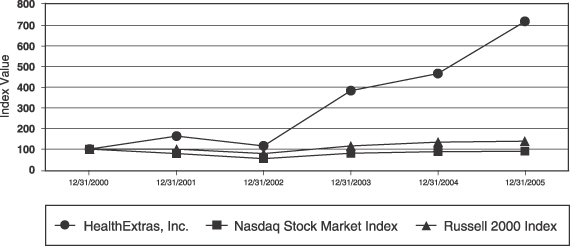

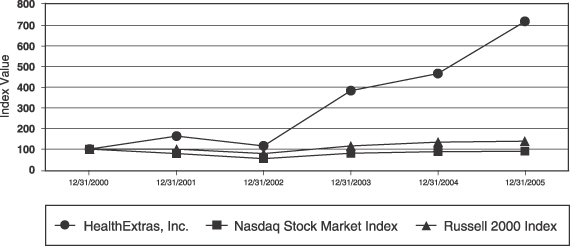

Option Grants in Last Fiscal Year