| | |

OMB APPROVAL |

OMB Number: | | 3235-0570 |

Expires: | | January 31, 2014 |

Estimated average burden |

hours per response: | | 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09477

ING Variable Insurance Trust

|

| (Exact name of registrant as specified in charter) |

| | |

| 7337 E. Doubletree Ranch Rd., Scottsdale, AZ | | 85258 |

| (Address of principal executive offices) | | (Zip code) |

The Corporation Trust Company, 1209 Orange Street, Wilmington, DE 19801

|

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: 1-800-992-0180

Date of fiscal year end: December 31

Date of reporting period: January 1, 2011 to December 31, 2011

| Item 1. | Reports to Stockholders. |

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1):

Annual Report

December 31, 2011

ING GET U.S. Core Portfolio

This report is submitted for general information to shareholders of the ING Funds. It is not authorized for distribution to prospective shareholders unless accompanied or preceded by a prospectus which includes details regarding the funds’ investment objectives, risks, charges, expenses and other information. This information should be read carefully.

MUTUAL FUNDS

| |

TABLE OF CONTENTS

PROXY VOTING INFORMATION

A description of the policies and procedures that the Portfolios use to determine how to vote proxies related to portfolio securities is available: (1) without charge, upon request, by calling Shareholder Services toll-free at (800) 992-0180; (2) on the ING Funds’ website at www.inginvestment.com; and (3) on the U.S. Securities and Exchange Commission’s (“SEC’s”) website at www.sec.gov. Information regarding how the Portfolios voted proxies related to portfolio securities during the most recent 12-month period ended June 30 is available without charge on the ING Funds’ website at www.inginvestment.com and on the SEC’s website at www.sec.gov.

QUARTERLY PORTFOLIO HOLDINGS

The Portfolios file their complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. This report contains a summary portfolio of investments for certain Portfolios. The Portfolios’ Forms N-Q are available on the SEC’s website at www.sec.gov. The Portfolios’ Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330. The Portfolios’ Forms N-Q, as well as a complete portfolio of investments, are available without charge upon request from the Portfolios by calling Shareholder Services toll-free at (800) 992-0180.

PRESIDENT’S LETTER

Euro zone — continued uncertainty

Dear Shareholder,

Recent months have seen headlines and financial markets continue to focus on the ongoing euro zone debt crisis. Acknowledging that the status quo was untenable, in early December, Europe opted to move closer together rather than be torn apart. All 17 nations that use the euro and nine other European Union members agreed to a new fiscal compact that would invite closer scrutiny of individual country budgets. Ratings agencies were mostly unimpressed by these machinations; ultimately, Standard & Poor’s downgraded nine countries in the region, including formerly AAA-rated France.

With the stability of Italy and Spain now in question, the need for an effective policy response has become even more acute. The new governments in both countries will

have but a short grace period in which to demonstrate their resolve; both have been forced to pay yields at euro-era highs for newly issued bonds.

Across the Atlantic, the chasm between the two major political parties in the United States is as wide as ever, most recently evidenced by the failure of the Congressional “supercommittee” on deficit reduction. Notwithstanding the ongoing paralysis in Washington, the U.S. economy is showing new signs of momentum.

We expect the global economy to deliver positive, if uninspiring, growth into 2012 despite the euro zone’s debt problems. We believe interest rates should remain low in major advanced countries. Markets — and risk assets in general — are likely to remain vulnerable to uncertainty until there is confidence that Europe has adequately addressed its issues.

In times of uncertainty investors historically have turned to sovereign credits, especially U.S. Treasury securities. This spotlights the critical role that governments play in defining the parameters of the financial markets and serving as foundations for generating value within economies. The current trend toward fiscal austerity downplays this important function and may prolong the global economic doldrums.

How should you respond to uncertainty in your own investment program? Don’t try to time the markets. Keep your portfolio well diversified, and pay careful attention to the risks you are assuming. Talk to your financial advisor before you make any changes that might detour your portfolio from your long-term goals.

We appreciate your continued confidence in ING Funds, and we look forward to serving your investment needs in the future.

Sincerely,

Shaun Mathews

President and Chief Executive Officer

ING Funds

January 3, 2012

The views expressed in the President’s Letter reflect those of the President as of the date of the letter. Any such

views are subject to change at any time based upon market or other conditions and ING Funds disclaims any

responsibility to update such views. These views may not be relied on as investment advice and because investment

decisions for an ING Fund are based on numerous factors, may not be relied on as an indication of investment intent

on behalf of any ING Fund. Reference to specific company securities should not be construed as recommendations

or investment advice.

International investing poses special risks including currency fluctuation, economic and political risks not found in

investments that are solely domestic.

1

MARKET PERSPECTIVE

In our semi-annual report we described how investor sentiment was generally positive through April. Many of the developed world’s economies including the U.S., seemed to be returning to health, boosted by heavy, ongoing doses of stimulative and monetary medicine. This was despite natural disasters in Japan, the violent uncertainties of the “Arab Spring” in North Africa and the Middle East, not to mention a European sovereign debt crisis.

But the mood darkened in early May 2011. Global equities in the form of the MSCI World IndexSM measured in local currencies, including net reinvested dividends, slid from May through September, losing over 17%, before a remarkable October rally clawed back about half of this. For the whole fiscal year the Index lost 5.49%. (The MSCI World IndexSM returned (5.54)% for the year ended December 31, 2011, measured in U.S. dollars.)

A confluence of factors caused the deterioration in outlook after April. That month the latest unemployment rate was reported at 8.8%, the lowest in 24 months. New private sector jobs, well above 200,000, were added in each of January, February and March. But in May the unemployment rate rebounded to 9.1%. By September the employment report showed zero new jobs created in August. But more upbeat releases in later months revised this up, and by year end the three-month average of jobs created was back to 143,000 from just 35,000 in September.

In the housing market, home prices (based on the S&P/Case-Shiller 20-City Composite Home Price Index) fell every month in the year. Sales were depressed, despite improved affordability and record low mortgage interest rates, by tight credit with many homeowners in negative equity on their properties.

Gross Domestic Product (“GDP”) growth had been reported at 3.1% (quarter-over-quarter, annualized) for the fourth quarter of 2010. On July 29, this was scaled down to 2.3%, among other revisions that showed the recession had been deeper and started earlier than previously thought. Worse, growth in the first quarter of 2011 was a barely perceptible 0.4%. When the second quarter’s figure was finalized at just 1.3%, the common assessment was that the economy was operating at “stall-speed”. There was relief in October when the first estimate of third quarter GDP growth was a much-improved 2.5%, although this was subsequently revised down to 1.8%.

Political deadlock weighed on sentiment throughout. A stopgap agreement to raise the debt ceiling did not stop Standard & Poors from downgrading the country’s credit rating. A bipartisan “Debt Super Committee” appointed to negotiate a more lasting set of budget control measures, admitted defeat on November 21.

Other keenly watched figures like retail sales and wages & salaries were stagnant in the months up to October, improved in that month and were mixed thereafter. Purchasing managers’ indices indicated expansion but not by much. Taken together, the data were inconclusive as the year ended but the consensus was that the once-feared return to recession now looked unlikely.

The euro zone’s sovereign debt crisis continued to move markets. By early August it seemed to be veering out of control. When attention turned from Greece to the much bigger bond markets of Spain and especially Italy, the European Central Bank (“ECB”) stepped in, uneasily, to buy their bonds — and some time. The threat to the euro zone banking system, where vast quantities of Italian and Spanish bonds are held, was clear.

Finally, a baby step towards closer fiscal union among euro zone countries was agreed in December, including restrictions on budget deficits with near automatic disciplinary procedures for violators. Bilateral loans of up to €200 billion would be made to the International Monetary Fund, presumably to fund rescue packages for individual nations. But it provided no lender of last resort with unlimited firepower, nor measures to promote growth and liberalize markets. Investors were under no illusions as the year ended that the crisis had been solved.

In U.S. fixed income markets, the Barclays Capital U.S. Aggregate Bond Index of investment grade bonds rose 7.84% in the fiscal year, while the Barclays Capital High Yield Bond — 2% Issuer Constrained Composite Index gained 4.96%. Most notable within the Barclays Capital U.S. Aggregate Bond Index was the remarkable 29.93% return on long-dated Treasuries, reflecting both the overall decline in risk appetite and quantitative easing.

U.S. equities, represented by the S&P 500® Index, including dividends, returned 2.11% for 2011, almost identical to the dividend yield. Sector returns ranged from (17.06)% for financials to 19.91% for utilities. The operating earnings per share of S&P 500® companies made new records in the second and third quarters of 2011, but estimates for future quarters were coming down as December ended.

In currency markets, the euro zone’s problems finally took their toll, as the dollar gained 2.34% on the euro in 2011, which dropped sharply after October. The pound was barely changed despite late weakness: the dollar gained 0.10%. But the dollar fell back against the yen by 5.35% despite Bank of Japan intervention as that currency repeatedly breached post-war high levels.

In international markets, the MSCI Japan® Index slumped 18.73% in 2011. The economy contracted for three straight quarters before finally recovering, as it struggled to recover from the earthquake and tsunami of March as well as a strong yen. The MSCI Europe ex UK® Index sank 12.87%, weighed down by the recessionary threat of the sovereign debt crisis. Euro zone growth shrunk to 0.2% in the second and third quarters and unemployment stood at 10.3%, a euro-era high. The MSCI UK® Index slipped just 1.83%. Weak euro zone demand and fiscal austerity at home depressed stocks, within which, however, the well-represented energy, staples and telecoms sectors managed positive average returns.

Parentheses denote a negative number.

All indices are unmanaged and investors cannot invest directly in an index. Past performance does not guarantee future results. The performance quoted represents past performance. Investment return and principal value of an investment will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. The Portfolios’ performance is subject to change since the period’s end and may be lower or higher than the performance data shown. Please call (800) 992-0180 or log on to www.inginvestment.com to obtain performance data current to the most recent month end.

Market Perspective reflects the views of ING’s Chief Investment Risk Officer only through the end of the period, and is subject to change based on market and other conditions.

2

BENCHMARK DESCRIPTIONS

| | |

| Index | | Description |

| MSCI World IndexSM | | An unmanaged index that measures the performance of over 1,400 securities listed on exchanges in the U.S., Europe, Canada, Australia, New Zealand and the Far East. |

S&P/Case-Shiller 20-City Composite Home Price Index | | A composite index of the home price index for the top 20 Metropolitan Statistical Areas in the United States. The index is published monthly by Standard & Poor’s. |

| Barclays Capital U.S. Aggregate Bond Index | | An unmanaged index of publicly issued investment grade U.S. Government, mortgage-backed, asset-backed and corporate debt securities. |

| Barclays Capital High Yield Bond — 2% Issuer Constrained Composite Index | | An unmanaged index that includes all fixed income securities having a maximum rating of Ba1, a minimum amount outstanding of $150 million, and at least one year to maturity. |

| S&P 500® Index | | An unmanaged index that measures the performance of securities of approximately 500 large-capitalization companies whose securities are traded on major U.S. stock markets. |

| MSCI Japan® Index | | A free float-adjusted market capitalization index that is designed to measure developed market equity performance in Japan. |

| MSCI Europe ex UK® Index | | A free float-adjusted market capitalization index that is designed to measure developed market equity performance in Europe, excluding the UK. |

| MSCI UK® Index | | A free float-adjusted market capitalization index that is designed to measure developed market equity performance in the UK. |

| Barclays Capital 1-5 Year Government Bond Index | | An unmanaged index of securities issued by the U.S. Government with a maturity from 1 up to (but not including) 5 years. |

3

| | |

| ING GET U.S. CORE PORTFOLIO SERIES 7-14 | | PORTFOLIO MANAGER’S REPORT |

During the Guarantee Period, the ING GET U.S. Core Portfolio — Series 7, 8, 9, 10, 11, 12, 13, and 14 (each, a “Series” and collectively, “Series”) seek to achieve maximum total return and minimal exposure of the Series’ assets to a market value loss by participating, to the extent possible, in favorable equity market performance during the Guarantee Period. The Series are managed by the following Portfolio Management Team with ING Investment Management Co., LLC — the Sub-Adviser.

Asset Allocation: Paul Zemsky, Portfolio Manager, serves as strategist for the Series and is responsible for overseeing the Series, strategy and the allocation of Series Assets between the Equity and Fixed components.

Equity Component: Vincent Costa, Portfolio Manager — the Equity Component.

Fixed Component: Michael Hyman and Christine Hurtsellers, Portfolio Managers — the Fixed Component.

Note: The Series are closed to new investments.

Performance: Total returns for the year ended December 31, 2011 for Series 7 to 14 are detailed below, along with the S&P 500® Index, and the Barclays Capital U.S. 1-5 Year Government Bond (“Barclays Capital 1-5 Year”) Index.

| | | | |

Series 7 | | | (0.07)% | |

Series 8 | | | (0.48)% | |

Series 9 | | | (0.25)% | |

Series 10 | | | 0.43% | |

Series 11 | | | 0.86% | |

Series 12 | | | 1.07% | |

Series 13 | | | 1.81% | |

Series 14 | | | 3.21% | |

S&P 500® Index | | | 2.11% | |

Barclays Capital 1-5 Year Index | | | 3.21% | |

An investor cannot invest directly in an index.

Portfolio Specifics: Series performance results from a combination of returns on the equity and bond portfolios, and the asset allocation blend between the two components. The asset allocation process seeks to participate in rising equity markets and protect principal on the downside. Historically, stocks have proven to be more volatile than bonds, which was an important consideration in the asset allocation process. Other factors, such as the current level of interest rates, time remaining to maturity date and the ratio of current assets to the underlying guarantee amount are also important. The allocation to equities and fixed income depends on these factors and the paths they take over the guarantee period.

In general, when the time left to maturity is short, or the ratio of assets to the guarantee amount is low, asset allocation will tend to be conservative in order to protect principal from losses. All other factors being equal, a Series generally buys equities (and sells bonds) when the equity market rises and sells equities (and

buys bonds) as the equity market declines. The use of fixed-income reduces the Series’ ability to fully participate in rising equity markets. Series 10, 11, 13 and 14 have become and will remain all fixed income.

The equity component of each of the Series that has one consists of exchange-traded funds (“ETFs”) that closely track the stock market as measured by the S&P 500® Index. Therefore, the equity component’s performance was in line with the index. By design, the mix of investments will change as the market changes. Due to the economic downturn that troughed in March 2009, the equity level in each of the Series remains low. The majority of the assets are in fixed income. The fixed income component of each of the Series invests in a mix of U.S. Treasury and U.S. agency Separate Trading of Registered Interest and Principal Securities (“STRIPs”).

In all cases, the equity component was under 6.5% as of December 31, 2011.

Outlook and Current Strategy: Allocations between equities and fixed income are dependent on our quantitative asset allocation model, which uses the factors previously mentioned and not on a qualitative evaluation of the bond versus the equity markets.

Asset Allocation

as of December 31, 2011

(as a percentage of net assets)

| | | | | | | | | | | | |

| | | Fixed Income | | | Equities | | | Other Assets and Liabilities | |

Series 7 | | | 83.7 | % | | | 3.1 | % | | | 13.2% | |

Series 8 | | | 98.7 | % | | | 1.2 | % | | | 0.1% | |

Series 9 | | | 96.9 | % | | | 3.0 | % | | | 0.1% | |

Series 10 | | | 99.8 | % | | | 0.0 | % | | | 0.2% | |

Series 11 | | | 99.1 | % | | | 0.0 | % | | | 0.9% | |

Series 12 | | | 92.1 | % | | | 6.2 | % | | | 1.7% | |

Series 13 | | | 98.5 | % | | | 0.0 | % | | | 1.5% | |

Series 14 | | | 98.6 | % | | | 0.0 | % | | | 1.4% | |

4

| | |

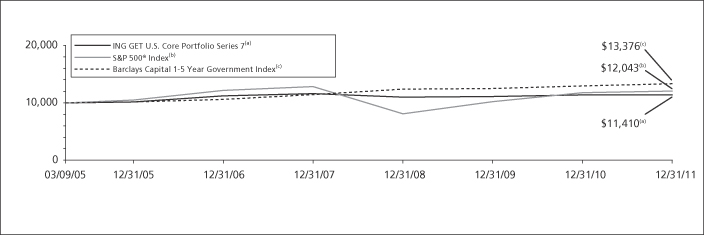

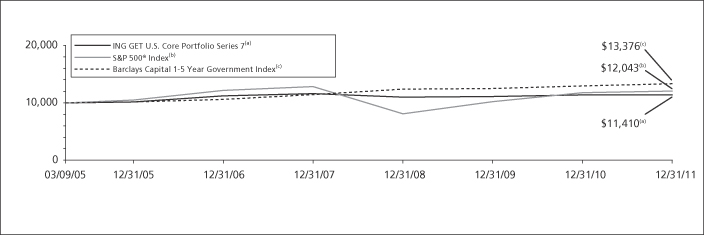

| PORTFOLIO MANAGERS’ REPORT | | ING GET U.S. CORE PORTFOLIO SERIES 7 |

| | | | | | | | | | | | | | | | |

| | | |

| | | Average Annual Returns for the Periods Ended December 31, 2011 | | | |

| | | | | 1 Year | | | 5 Year | | | Since Inception

of Guarantee Period

March 9, 2005 | | | |

| | | ING GET U.S. Core Portfolio Series 7 | | | (0.07 | )% | | | 0.30 | % | | | 1.95 | % | | |

| | | S&P 500® Index | | | 2.11 | % | | | (0.25 | )% | | | 2.76 | %(1) | | |

| | | Barclays Capital 1-5 Year Government Index | | | 3.21 | % | | | 4.76 | % | | | 4.35 | %(1) | | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING GET U.S. Core Portfolio Series 7 against the indices indicated. An index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Series’ performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Series distributions or the redemption of Series shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the Portfolio Managers, only through the end of the period as stated on the cover. The Portfolio Managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

| (1) | | Since inception performance for the index is shown from March 1, 2005. |

5

| | |

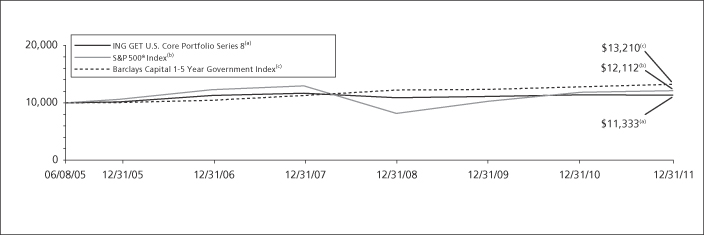

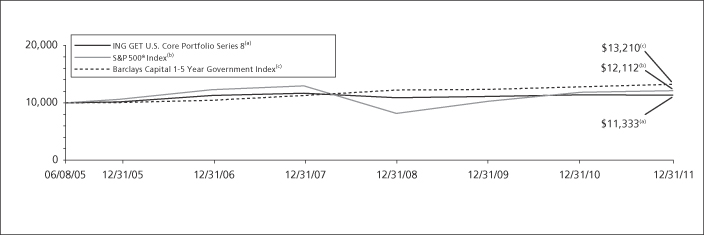

| ING GET U.S. CORE PORTFOLIO SERIES 8 | | PORTFOLIO MANAGERS’ REPORT |

| | | | | | | | | | | | | | | | |

| | | |

| | | Average Annual Returns for the Periods Ended December 31, 2011 | | | |

| | | �� | | 1 Year | | | 5 Year | | | Since Inception

of Guarantee Period

June 8, 2005 | | | |

| | | ING GET U.S. Core Portfolio Series 8 | | | (0.48 | )% | | | 0.14 | % | | | 1.93 | % | | |

| | | S&P 500® Index | | | 2.11 | % | | | (0.25 | )% | | | 2.95 | %(1) | | |

| | | Barclays Capital 1-5 Year Government Index | | | 3.21 | % | | | 4.76 | % | | | 4.32 | %(1) | | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING GET U.S. Core Portfolio Series 8 against the indices indicated. An index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Series’ performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Series distributions or the redemption of Series shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the Portfolio Managers, only through the end of the period as stated on the cover. The Portfolio Managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

| (1) | | Since inception performance for the index is shown from June 1, 2005. |

6

| | |

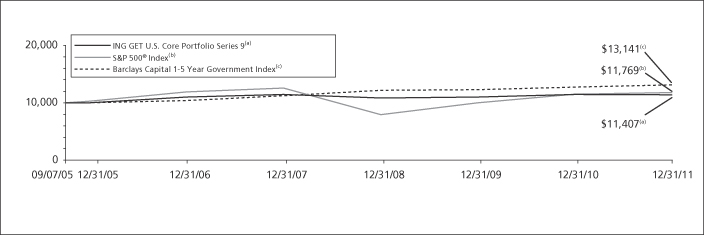

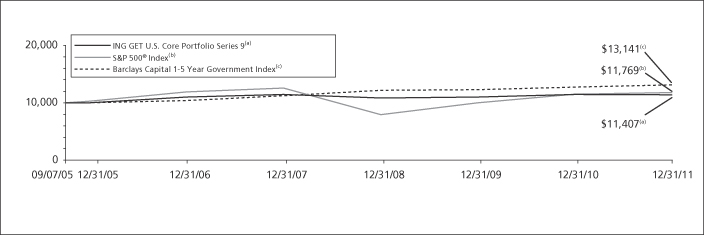

| PORTFOLIO MANAGERS’ REPORT | | ING GET U.S. CORE PORTFOLIO SERIES 9 |

| | | | | | | | | | | | | | | | |

| | | |

| | | Average Annual Returns for the Periods Ended December 31, 2011 | | | |

| | | | | 1 Year | | | 5 Year | | | Since Inception

of Guarantee Period

September 7, 2005 | | | |

| | | ING GET U.S. Core Portfolio Series 9 | | | (0.25 | )% | | | 0.71 | % | | | 2.11 | % | | |

| | | S&P 500® Index | | | 2.11 | % | | | (0.25 | )% | | | 2.60 | %(1) | | |

| | | Barclays Capital 1-5 Year Government Index | | | 3.21 | % | | | 4.76 | % | | | 4.41 | %(1) | | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING GET U.S. Core Portfolio Series 9 against the indices indicated. An index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Series’ performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Series distributions or the redemption of Series shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the Portfolio Managers, only through the end of the period as stated on the cover. The Portfolio Managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

| (1) | | Since inception performance for the index is shown from September 1, 2005. |

7

| | |

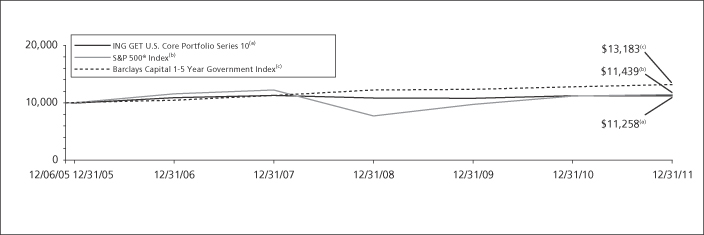

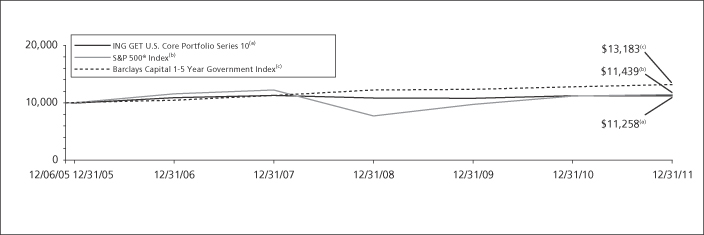

| ING GET U.S. CORE PORTFOLIO SERIES 10 | | PORTFOLIO MANAGERS’ REPORT |

| | | | | | | | | | | | | | | | |

| | | |

| | | Average Annual Returns for the Periods Ended December 31, 2011 | | | |

| | | | | 1 Year | | | 5 Year | | | Since Inception

of Guarantee Period

December 6, 2005 | | | |

| | | ING GET U.S. Core Portfolio Series 10 | | | 0.43 | % | | | 0.63 | % | | | 1.97 | % | | |

| | | S&P 500® Index | | | 2.11 | % | | | (0.25 | )% | | | 2.24 | %(1) | | |

| | | Barclays Capital 1-5 Year Government Index | | | 3.21 | % | | | 4.76 | % | | | 4.65 | %(1) | | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING GET U.S. Core Portfolio Series 10 against the indices indicated. An index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Series’ performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Series distributions or the redemption of Series shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the Portfolio Managers, only through the end of the period as stated on the cover. The Portfolio Managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

| (1) | | Since inception performance for the index is shown from December 1, 2005. |

8

| | |

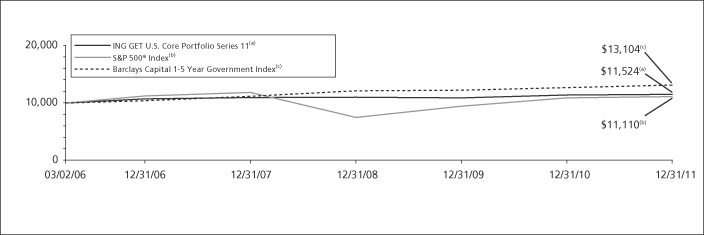

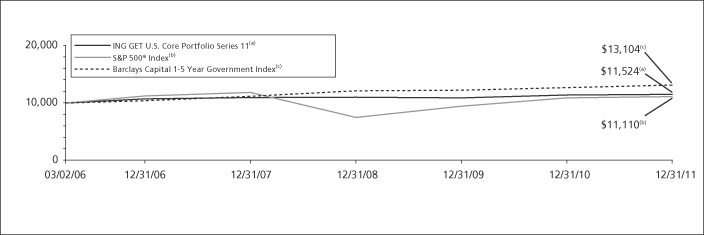

| PORTFOLIO MANAGERS’ REPORT | | ING GET U.S. CORE PORTFOLIO SERIES 11 |

| | | | | | | | | | | | | | | | |

| | | |

| | | Average Annual Returns for the Periods Ended December 31, 2011 | | | |

| | | | | 1 Year | | | 5 Year | | | Since Inception

of Guarantee Period

March 2, 2006 | | | |

| | | ING GET U.S. Core Portfolio Series 11 | | | 0.86 | % | | | 1.48 | % | | | 2.46 | % | | |

| | | S&P 500® Index | | | 2.11 | % | | | (0.25 | )% | | | 1.82 | %(1) | | |

| | | Barclays Capital 1-5 Year Government Index | | | 3.21 | % | | | 4.76 | % | | | 4.74 | %(1) | | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING GET U.S. Core Portfolio Series 11 against the indices indicated. An index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Series’ performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Series distributions or the redemption of Series shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the Portfolio Managers, only through the end of the period as stated on the cover. The Portfolio Managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

| (1) | | Since inception performance for the index is shown from March 1, 2006. |

9

| | |

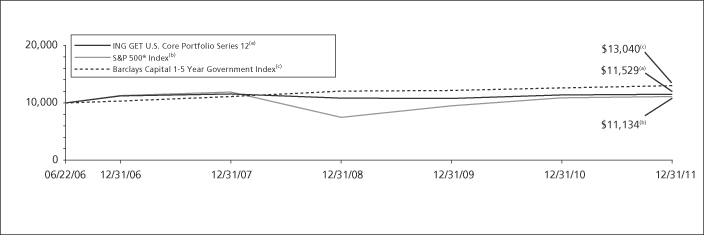

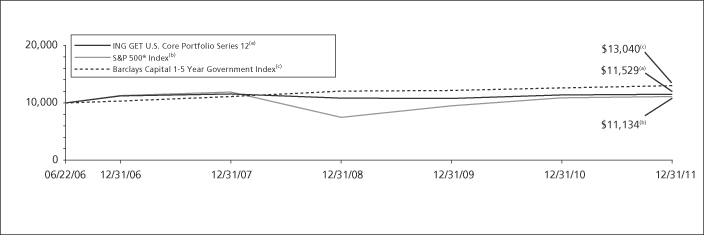

| ING GET U.S. CORE PORTFOLIO SERIES 12 | | PORTFOLIO MANAGERS’ REPORT |

| | | | | | | | | | | | | | | | |

| | | |

| | | Average Annual Returns for the Periods Ended December 31, 2011 | | | |

| | | | | 1 Year | | | 5 Year | | | Since Inception

of Guarantee Period

June 22, 2006 | | | |

| | | ING GET U.S. Core Portfolio Series 12 | | | 1.07 | % | | | 0.53 | % | | | 2.60 | % | | |

| | | S&P 500® Index | | | 2.11 | % | | | (0.25 | )% | | | 1.97 | %(1) | | |

| | | Barclays Capital 1-5 Year Government Index | | | 3.21 | % | | | 4.76 | % | | | 4.94 | %(1) | | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING GET U.S. Core Portfolio Series 12 against the indices indicated. An index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Series’ performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Series distributions or the redemption of Series shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the Portfolio Managers, only through the end of the period as stated on the cover. The Portfolio Managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

| (1) | | Since inception performance for the index is shown from July 1, 2006. |

10

| | |

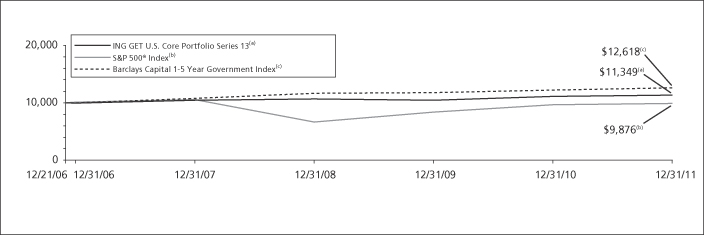

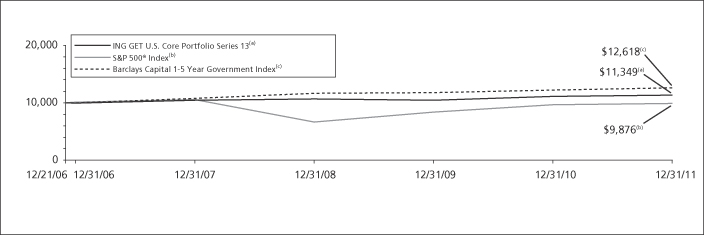

| PORTFOLIO MANAGERS’ REPORT | | ING GET U.S. CORE PORTFOLIO SERIES 13 |

| | | | | | | | | | | | | | | | |

| | | |

| | | Average Annual Returns for the Periods Ended December 31, 2011 | | | |

| | | | | 1 Year | | | 5 Year | | | Since Inception

of Guarantee Period

December 21, 2006 | | | |

| | | ING GET U.S. Core Portfolio Series 13 | | | 1.81 | % | | | 2.68 | % | | | 2.55 | % | | |

| | | S&P 500® Index | | | 2.11 | % | | | (0.25 | )% | | | (0.25 | )%(1) | | |

| | | Barclays Capital 1-5 Year Government Index | | | 3.21 | % | | | 4.76 | % | | | 4.76 | %(1) | | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING GET U.S. Core Portfolio Series 13 against the indices indicated. An index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Series’ performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Series distributions or the redemption of Series shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the Portfolio Managers, only through the end of the period as stated on the cover. The Portfolio Managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

| (1) | | Since inception performance for the indices is shown from January 1, 2007. |

11

| | |

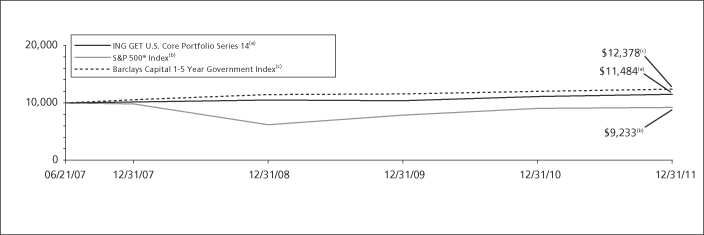

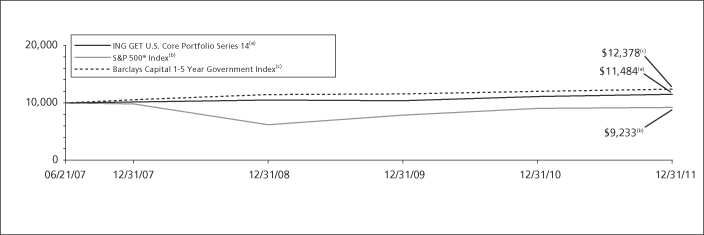

| ING GET U.S. CORE PORTFOLIO SERIES 14 | | PORTFOLIO MANAGERS’ REPORT |

| | | | | | | | | | | | |

| | |

| | | Average Annual Returns for the Periods Ended December 31, 2011 |

| | | | | 1 Year | | | Since Inception

of Guarantee Period

June 21, 2007 | | | |

| | | ING GET U.S. Core Portfolio Series 14 | | | 3.21 | % | | | 3.10 | % | | |

| | | S&P 500® Index | | | 2.11 | % | | | (1.76 | )%(1) | | |

| | | Barclays Capital 1-5 Year Government Index | | | 3.21 | % | | | 4.85 | %(1) | | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING GET U.S. Core Portfolio Series 14 against the indices indicated. An index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Series’ performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Series distributions or the redemption of Series shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a

projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 992-0180 to get performance through the most recent month end.

It is important to note that the Portfolio has a limited operating history. Performance over a longer period of time may be more meaningful than short-term performance.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the Portfolio Managers, only through the end of the period as stated on the cover. The Portfolio Managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

| (1) | | Since inception performance for the indices is shown from July 1, 2007. |

12

| | |

| INVESTMENT STRATEGYAND PRINCIPAL RISKS | | ING GET U.S. CORE PORTFOLIO |

What is the Investment Strategy During the Guarantee Period?

ING GET U.S. Core Portfolio — Series 7, 8, 9, 10, 11, 12, 13, 14 (“Series”) invest at least 80% of their net assets in equities and fixed-income securities issued by U.S. companies or the U.S. government or its agencies. The Series do not implement an “investment strategy” in a conventional sense. Rather, the Series’ asset allocation strategy seeks to optimize the exposure of the Series to the equity component (“Equity Component”) while protecting Series assets. Assets allocated to the Equity Component may be reduced or eliminated in order to conserve assets at a level equal to or above the present value of the guarantee (“Guarantee”). The Series allocate their assets among the following asset classes:

During the Guarantee Period, the Series’ assets are allocated between the:

| | • | | Equity Component, consisting of common stocks included in the S&P 500® Index, futures contracts on the S&P 500® Index, and when the Equity Component’s market value is $5 million or less, investments in exchange traded funds (“ETFs”) that can reasonably be expected to have at least a 95% correlation ratio with the S&P 500® Index, in S&P 500® Index futures, or in a combination of S&P 500® Index futures and ETFs, subject to any limitation on the Series’ investments in such securities; and the |

| | • | | Fixed component (“Fixed Component”) consisting primarily of short- to intermediate-duration U.S. government securities. |

The Series’ asset allocation strategy is implemented by allocating assets appropriately to the Equity Component and to the Fixed Component to optimize exposure to the Equity Component while controlling the risk that an insurance company may be required to make payment under the Guarantee. Consequently, there can be no assurance as to the percentage of assets, if any, allocated to the Equity Component, even when the equity market is doing well, or to any investment returns generated by the Series.

How does the Series’ Asset Allocation work?

ING Investment Management Co. LLC (“IIM” or “Sub-Adviser”), the Sub-Adviser to the Series, uses a proprietary computer model to determine on a daily basis the percentage of assets allocated to the Equity Component and to the Fixed Component. The model evaluates a number of factors, including the then current market value of the Series, the then prevailing level of interest rates, equity market volatility, the Series’ total annual expenses, insurance company separate account expenses, and the maturity date (“Maturity Date”). The model determines the initial allocation between the Equity Component and the Fixed Component on the first day of the Guarantee Period and provides direction for any reallocations on a daily basis thereafter. Generally, as the value of the Equity Component rises, more assets are allocated to the Equity Component; as the value of the Equity Component declines, more assets are allocated to the Fixed Component. The amount directed to the Equity Component is always restricted so that even if it were to experience a “material decline” in value on a given day and before being redirected to the Fixed Component, the remaining assets would still be sufficient to meet the Guarantee. At the commencement of the Guarantee Period, the Series defined a “material decline” in value as a decline in the value of the Equity Component of at least 20% but no more than 30%. If a Series defined the “material decline” at 20%, fewer assets will likely be allocated to the Equity Component than if the “material decline” was defined at 30%. The allocation to the Equity Component or the Fixed Component may be zero under certain circumstances.

Equity Component: IIM manages the Equity Component by overweighting those stocks in the S&P 500® Index that it believes will outperform the S&P 500® Index and underweighting (or avoiding altogether) those stocks it believes will underperform the S&P 500® Index (“Enhanced Index Strategy”). Stocks IIM believes are likely to match the performance of the S&P 500® Index are invested in proportion to their representation in the S&P 500® Index. To determine which stocks to weight more or less heavily, IIM uses internally developed quantitative computer models to evaluate various criteria, such as the financial strength of each company and its potential for strong, sustained earnings growth. IIM expects that there will be a close correlation between the performance of the Equity Component and that of the S&P 500® Index in both rising and falling markets.

Under normal market conditions, up to 20% of the Equity Component’s net assets may be invested in futures contracts for hedging purposes or to maintain liquidity to meet shareholder redemptions and minimize trading costs. Futures contracts provide for the future sale by one party and purchase by another party of a specified amount of a

13

| | |

| ING GET U.S. CORE PORTFOLIO | | INVESTMENT STRATEGYAND PRINCIPAL RISKS |

financial instrument or a specific stock market index for a specified price on a designated date. During the Guarantee Period, the Series may only invest in futures contracts on the S&P 500® Index and futures contracts on U.S. Treasury securities.

If the Equity Component’s market value is $5 million or less, in order to replicate an investment in stocks listed in the S&P 500® Index, IIM may invest the entire amount of the Equity Component’s assets in S&P 500® Index futures, in ETFs, or in a combination of S&P 500® Index futures and ETFs, subject to any limitation on the Series’ investment in such securities (subject to the rules, regulations and exemptive orders imposed by the Investment Company Act of 1940, as amended “1940 Act”). ETFs are passively managed investment companies traded on a securities exchange whose goal is to track or replicate a desired index. IIM will not employ an Enhanced Index Strategy when it invests in S&P 500® Index futures and ETFs.

Fixed Component: IIM seeks to select investments for the Fixed Component with financial characteristics that will, at any point in time, closely resemble those of a portfolio of zero coupon bonds which mature within three months of the Maturity Date. Generally, at least 55% of the Fixed Component will consist of securities issued or guaranteed by the U.S. government, its agencies or instrumentalities, including Separate Trading of Registered Interest and Principal of Securities (“STRIPS”). Although the Series invest in securities insured or guaranteed by the U.S. government, the Series shares are not themselves issued or guaranteed by the U.S. government. STRIPS are created by the Federal Reserve Bank by separating the interest and principal components of an outstanding U.S. Treasury or agency bond and selling them as individual securities. The Fixed Component may also consist of mortgage-backed securities (including commercial mortgage-backed securities) which are rated AAA or Aaa at the time of purchase by Standard & Poor’s (“S&P® “) or Moody’s Investors Service, Inc. (“Moody’s® “), respectively, and corporate obligations which are rated at the time of purchase A- or higher by S&P® and/or Aa3 or higher by Moody’s®. The Fixed Component may also include U.S. Treasury futures and money market instruments. The Series may also invest in other investment companies to the extent permitted under the 1940 Act.

What are the Principal Guarantee Period Risks?

Asset Allocation: If, at the inception of, or any time during, the Guarantee Period interest rates are low, the Series’ assets may be largely invested in the Fixed Component in order to decrease the likelihood that an insurance company would be required to make any payment under the Guarantee. The effect of low interest rates on the Series would likely be more pronounced at the inception of the Guarantee Period, as the initial allocation of assets would include more fixed-income securities. In addition, if during the Guarantee Period the equity markets experienced a material decline, the Series’ assets may become largely invested in the Fixed Component. In fact, if the value of the Equity Component were to decline by a significant amount, a complete reallocation to the Fixed Component would likely occur. In the event of a reallocation of 100% of the assets to the Fixed Component, the Series would not reallocate any assets into the Equity Component prior to the Maturity Date. Use of the Fixed Component reduces the Series’ ability to participate as fully in upward equity market movements, and therefore represents some loss of opportunity, or opportunity cost, compared to a portfolio that is fully invested in equities.

Active Asset Allocation May Underperform Static Strategies: An active asset allocation strategy may underperform a more static strategy due to the impact of transaction costs. The asset allocation process results in transaction costs from the purchase and sale of securities. Volatile periods in the market may increase these costs. High transaction costs may have an adverse effect on the performance of the Series.

Opportunity Costs: There are substantial opportunity costs associated with an investment in the Series. The Series may allocate a substantial portion, and under certain circumstances all, of the Series’ assets to the Fixed Component in order to conserve Series assets to a level equal to or above the present value of the Guarantee. Initially, if interest rates are low, the allocation to the Fixed Component may be over 70% of the Series’ assets. If the market value of the Equity Component rises, the percentage of the Series’ assets allocated to the Equity Component generally will also rise. However, the relative volatility of these two Components as well as the past performance of the Series will affect these allocations. For example, if the Series incurs early losses, the Series may allocate 100% of the Series’ assets to the Fixed Component for the entire Guarantee Period, irrespective of the subsequent upward movements in the equity markets and/or the Equity Component.

14

| | |

| INVESTMENT STRATEGYAND PRINCIPAL RISKS | | ING GET U.S. CORE PORTFOLIO |

The extent to which the Series participates in upward movements in the Equity Component during the Guarantee Period will depend on the performance of the Series, the performance and volatility of the Fixed and Equity Components, interest rates, expenses of the Series and the separate account under the variable annuity contract, and other factors. The Series might capture a material portion, very little or none of any Equity Component increase.

It is possible that on the Maturity Date, a contract-holder or participant could receive only the guaranteed amount even though the equity markets, as well as the Equity Component, has had significant positive performance during the Guarantee Period.

The opportunity cost of not allocating assets to the Equity Component will be particularly high if early in the Guarantee Period: (a) the Series’ net asset value (“NAV”) decreases, or (b) the value of the Equity Component declines. In either case, all or substantially all of the Series’ assets could be allocated to the Fixed Component for the remainder of the Guarantee Period.

Company: The price of a given company’s stock could decline or underperform for many reasons including, among others, poor management, financial problems, or business challenges. If a company declares bankruptcy or becomes insolvent, its stock could become worthless.

Credit: Prices of bonds and other debt securities can fall if the issuer’s actual or perceived financial health deteriorates, whether because of broad economic or issuer-specific reasons. In severe cases, the issuer could be late in paying interest or principal, or could fail to pay altogether.

Interest Rate: With bonds and other fixed rate debt securities, a rise in interest rates generally causes values to fall; conversely, values generally rise as interest rates fall. The higher the credit quality of the security, and the longer its maturity or duration, the more sensitive it is likely to be to interest rate risk.

Investment Model: The Sub-Adviser’s proprietary model may not adequately allow for existing or unforeseen market factors or the interplay between such factors. The proprietary models used by a Sub-Adviser to evaluate securities or securities markets are based on the Sub-Adviser’s understanding of the interplay of market factors and do not assure successful investment. The markets, or the price of individual securities, may be affected by factors not foreseen in developing the models.

Liquidity: If a security is illiquid, the adviser or Sub-Adviser might be unable to sell the security at a time when the Series’ Sub-Adviser might wish to sell, and the security could have the effect of decreasing the overall level of the Series’ liquidity. Further, the lack of an established secondary market may make it more difficult to value illiquid securities, which could vary from the amount a Series could realize upon disposition. A Series may make investments that become less liquid in response to market developments or adverse investor perception. A Series could lose money if it cannot sell a security at the time and price that would be most beneficial to the Series.

Other Investment Companies: The main risk of investing in other investment companies, including exchange-traded funds, is the risk that the value of the securities underlying an investment company might decrease. Because a Series may invest in other investment companies, you will pay a proportionate share of the expenses of that other investment company (including management fees, administration fees and custodial fees) in addition to the expenses of the Series. Other investment companies include exchange-traded funds (“ETFs”) and Holding Company Depositary Receipts (“HOLDRs”), among others. ETFs are exchange-traded investment companies that are, in many cases, designed to provide investment results corresponding to an equity index. The main risk of investing in other investment companies is that the value of the underlying securities held by the investment company might decrease. The value of the underlying securities can fluctuate in response to activities of individual companies or in response to general market and/or economic conditions. Additional risks of investments in ETFs include: (i) the market price of an ETF’s shares may trade at a discount to its net asset value; (ii) an active trading market for an ETF’s shares may not develop or be maintained; or (iii) trading may be halted if the listing exchanges’ officials deem such action appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts trading generally. Because HOLDRs concentrate in the stock of a particular industry, trends in that industry may have a dramatic impact on their value.

U.S. Government Securities and Obligations: U.S. government securities are obligations of, or guaranteed by, the U.S. government, its agencies or government-sponsored enterprises. U.S. government securities are subject to market

15

| | |

| ING GET U.S. CORE PORTFOLIO | | INVESTMENT STRATEGYAND PRINCIPAL RISKS |

and interest rate risk, and may be subject to varying degrees of credit risk. Some U.S. government securities are backed by the full faith and credit of the U.S. government and are guaranteed as to both principal and interest by the U.S. Treasury. These include direct obligations of the U.S. Treasury such as U.S. Treasury notes, bills and bonds, as well as indirect obligations including certain securities of the Government National Mortgage Association, the Small Business Administration and the Farmers Home Administration, among others. Other U.S. government securities are not direct obligations of the U.S. Treasury, but rather are backed by the ability to borrow directly from the U.S. Treasury, including certain securities of the Federal Financing Bank, the Federal Home Loan Bank and the U.S. Postal Service. Still other agencies and instrumentalities are supported solely by the credit of the agency or instrumentality itself and are neither guaranteed nor insured by the U.S. government. These include securities issued by the Federal Home Loan Bank and the Federal Farm Credit Bank, among others. Consequently, the investor must look principally to the agency issuing or guaranteeing the obligation for ultimate repayment. No assurance can be given that the U.S. government would provide financial support to such agencies if it is not obligated to do so by law. U.S. government securities may be subject to varying degrees of credit risk and all U.S. government securities may be subject to price declines due to changing interest rates. Securities directly supported by the full faith and credit of the U.S. government have less credit risk. The discussion below includes risks that are not described in the Series’ summary but which, nevertheless, are a risk to the Series.

Counterparty: The entity with whom a Series conducts Series-related business (such as trading or securities lending), or that underwrites, distributes or guarantees investments or agreements that the Series owns or is otherwise exposed to, may refuse or may become unable to honor its obligations under the terms of a transaction or agreement. As a result, that Series may sustain losses and be less likely to achieve its investment objective. These risks may be greater when engaging in over-the-counter transactions.

Futures Contracts: The Series may invest in futures contracts, which provide for the future sale by one party and purchase by another party of a specified amount of a financial instrument or a specific stock market index for a specified price on a designated date. The Series uses futures for hedging purposes or to temporarily increase or limit exposure to a particular asset class. The main risk with futures contracts is that they can amplify a gain or loss, potentially earning or losing substantially more money than the actual investment made in the futures contract.

Risks of Using Derivatives: Certain securities in which the Series may invest, including futures contracts, are derivative instruments. In general terms, a derivative instrument is a financial contract whose value is derived, at least in part, from the performance of an underlying asset, interest rate, or index. If the issuer of a derivative does not pay the amount owed on the contract when due, the Series can lose money on the investment. The underlying investment on which the derivative is based, and the derivative itself, might not perform in the manner the Sub-Adviser expected, which could cause the Series’ share price to decline. Markets underlying securities may move in a direction not anticipated by the Sub-Adviser, which may result in the Series realizing a lower return than expected on an investment. Some derivatives are also subject to the risk that counterparties will not perform their duties.

16

SHAREHOLDER EXPENSE EXAMPLES (UNAUDITED)

As a shareholder of a Series, you incur two types of costs: (1) transaction costs, including redemption fees and exchange fees (if applicable); and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Series expenses. These Examples are intended to help you understand your ongoing costs (in dollars) of investing in a Series and to compare these costs with the ongoing costs of investing in other mutual funds.

The Examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2011 to December 31, 2011, unless otherwise indicated. The Series’ expenses are shown without the imposition of any charges which are, or may be, imposed under your variable annuity contract, variable life insurance policy, qualified pension or retirement plan. Expenses would have been higher if such charges were included.

Actual Expenses

The left section of the table shown below, “Actual Series Return,” provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The right section of the table shown below, “Hypothetical (5% return before expenses)”, provides information about hypothetical account values and hypothetical expenses based on a Series’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not a Series’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Series and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, redemption fees or exchange fees. Therefore, the hypothetical lines of the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different mutual funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual Series Return | | | Hypothetical (5% return before expenses) | |

ING GET

U.S. Core Portfolio | | Beginning

Account

Value

July 1, 2011 | | | Ending

Account

Value

December 31, 2011 | | | Annualized

Expense

Ratio | | | Expenses Paid

During the

Period Ended

December 31, 2011* | | | Beginning

Account

Value

July 1, 2011 | | | Ending

Account

Value

December 31, 2011 | | | Annualized

Expense

Ratio | | | Expenses Paid

During the

Period Ended

December 31, 2011* | |

Series 7 | | $ | 1,000.00 | | | $ | 997.40 | | | | 1.00 | % | | $ | 5.03 | | | $ | 1,000.00 | | | $ | 1,020.16 | | | | 1.00 | % | | $ | 5.09 | |

Series 8 | | $ | 1,000.00 | | | $ | 992.30 | | | | 1.00 | % | | $ | 5.02 | | | $ | 1,000.00 | | | $ | 1,020.16 | | | | 1.00 | % | | $ | 5.09 | |

Series 9 | | $ | 1,000.00 | | | $ | 991.10 | | | | 1.00 | % | | $ | 5.02 | | | $ | 1,000.00 | | | $ | 1,020.16 | | | | 1.00 | % | | $ | 5.09 | |

Series 10 | | $ | 1,000.00 | | | $ | 1,000.00 | | | | 1.00 | % | | $ | 5.04 | | | $ | 1,000.00 | | | $ | 1,020.16 | | | | 1.00 | % | | $ | 5.09 | |

Series 11 | | $ | 1,000.00 | | | $ | 1,001.30 | | | | 1.00 | % | | $ | 5.04 | | | $ | 1,000.00 | | | $ | 1,020.16 | | | | 1.00 | % | | $ | 5.09 | |

Series 12 | | $ | 1,000.00 | | | $ | 1,000.00 | | | | 1.00 | % | | $ | 5.04 | | | $ | 1,000.00 | | | $ | 1,020.16 | | | | 1.00 | % | | $ | 5.09 | |

Series 13 | | $ | 1,000.00 | | | $ | 1,006.20 | | | | 1.00 | % | | $ | 5.06 | | | $ | 1,000.00 | | | $ | 1,020.16 | | | | 1.00 | % | | $ | 5.09 | |

Series 14 | | $ | 1,000.00 | | | $ | 1,013.90 | | | | 1.00 | % | | $ | 5.08 | | | $ | 1,000.00 | | | $ | 1,020.16 | | | | 1.00 | % | | $ | 5.09 | |

| * | | Expenses are equal to each Series’ respective annualized expense ratios multiplied by the average account value over the period, multiplied by 184/365 to reflect the most recent fiscal half-year. |

17

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Shareholders and Board of Trustees

ING Variable Insurance Trust

We have audited the accompanying statements of assets and liabilities, including the portfolios of investments, of ING GET U.S. Core Portfolio – Series 7, 8, 9, 10, 11, 12, 13, and 14, each a series of ING Variable Insurance Trust (the Series), as of December 31, 2011, and the related statements of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years or periods in the five-year period then ended. These financial statements and financial highlights are the responsibility of management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2011, by correspondence with the custodian. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the aforementioned Series as of December 31, 2011, and the results of their operations, the changes in their net assets, and the financial highlights for the periods specified in the first paragraph above, in conformity with U.S. generally accepted accounting principles.

Boston, Massachusetts

February 17, 2012

18

STATEMENTS OF ASSETS AND LIABILITIESASOF DECEMBER 31, 2011

| | | | | | | | | | | | | | | | |

| | | ING GET U.S. Core Portfolio | |

| | | Series 7 | | | Series 8 | | | Series 9 | | | Series 10 | |

ASSETS: | | | | | | | | | | | | | | | | |

Investments in securities at value* | | $ | 13,507,026 | | | $ | 9,655,162 | | | $ | 7,872,375 | | | $ | 6,076,773 | |

Short-term investments at value*** | | | 2,014,000 | | | | 33,000 | | | | 23,000 | | | | 22,000 | |

Cash | | | 909 | | | | 613 | | | | 453 | | | | 800 | |

Receivables: | | | | | | | | | | | | | | | | |

Fund shares | | | 64,209 | | | | — | | | | — | | | | — | |

Dividends | | | 3,144 | | | | 701 | | | | 1,469 | | | | 3 | |

Reimbursement due from manager | | | 1,590 | | | | 1,479 | | | | 1,297 | | | | 1,133 | |

| | | | | | | | | | | | | | | | |

Total assets | | | 15,590,878 | | | | 9,690,955 | | | | 7,898,594 | | | | 6,100,709 | |

| | | | | | | | | | | | | | | | |

LIABILITIES: | | | | | | | | | | | | | | | | |

Payable for fund shares redeemed | | | 492 | | | | 560 | | | | 718 | | | | 292 | |

Payable to affiliates | | | 12,031 | | | | 7,468 | | | | 6,081 | | | | 4,688 | |

Payable for trustee fees | | | 77 | | | | 48 | | | | 39 | | | | 30 | |

Other accrued expenses and liabilities | | | 14,590 | | | | 10,543 | | | | 9,559 | | | | 7,574 | |

| | | | | | | | | | | | | | | | |

Total liabilities | | | 27,190 | | | | 18,619 | | | | 16,397 | | | | 12,584 | |

| | | | | | | | | | | | | | | | |

NET ASSETS | | $ | 15,563,688 | | | $ | 9,672,336 | | | $ | 7,882,197 | | | $ | 6,088,125 | |

| | | | | | | | | | | | | | | | |

NET ASSETS WERE COMPRISED OF: | | | | | | | | | | | | | | | | |

Paid-in capital | | $ | 19,616,528 | | | $ | 12,475,437 | | | $ | 9,777,534 | | | $ | 7,745,569 | |

Undistributed net investment income | | | 276,157 | | | | 131,408 | | | | 133,773 | | | | 130,633 | |

Accumulated net realized loss | | | (4,587,285 | ) | | | (3,019,717 | ) | | | (2,210,361 | ) | | | (1,944,074 | ) |

Net unrealized appreciation | | | 258,288 | | | | 85,208 | | | | 181,251 | | | | 155,997 | |

| | | | | | | | | | | | | | | | |

NET ASSETS | | $ | 15,563,688 | | | $ | 9,672,336 | | | $ | 7,882,197 | | | $ | 6,088,125 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

* Cost of investments in securities | | $ | 13,248,738 | | | $ | 9,569,954 | | | $ | 7,691,124 | | | $ | 5,920,776 | |

*** Cost of short-term investments | | $ | 2,014,000 | | | $ | 33,000 | | | $ | 23,000 | | | $ | 22,000 | |

| | | | | | | | | | | | | | | | |

Net assets | | $ | 15,563,688 | | | $ | 9,672,336 | | | $ | 7,882,197 | | | $ | 6,088,125 | |

Shares authorized | | | unlimited | | | | unlimited | | | | unlimited | | | | unlimited | |

Par value | | $ | 0.001 | | | $ | 0.001 | | | $ | 0.001 | | | $ | 0.001 | |

Shares outstanding | | | 2,009,311 | | | | 1,243,999 | | | | 1,009,772 | | | | 764,853 | |

Net asset value and redemption price per share | | $ | 7.75 | | | $ | 7.78 | | | $ | 7.81 | | | $ | 7.96 | |

See Accompanying Notes to Financial Statements

19

STATEMENTS OF ASSETS AND LIABILITIESASOF DECEMBER 31, 2011 (CONTINUED)

| | | | | | | | | | | | | | | | |

| | | ING GET U.S. Core Portfolio | |

| | | Series 11 | | | Series 12 | | | Series 13 | | | Series 14 | |

ASSETS: | | | | | | | | | | | | | | | | |

Investments in securities at value* | | $ | 7,995,968 | | | $ | 11,282,084 | | | $ | 19,515,739 | | | $ | 43,398,474 | |

Short-term investments at value*** | | | 156,000 | | | | 209,000 | | | | 346,000 | | | | 688,000 | |

Cash | | | 788 | | | | 746 | | | | 188 | | | | — | |

Receivables: | | | | | | | | | | | | | | | | |

Dividends | | | 5 | | | | 4,399 | | | | 19 | | | | — | |

Interest | | | — | | | | — | | | | — | | | | 3 | |

Reimbursement due from manager | | | 1,183 | | | | 1,638 | | | | 2,254 | | | | 3,498 | |

| | | | | | | | | | | | | | | | |

Total assets | | | 8,153,944 | | | | 11,497,867 | | | | 19,864,200 | | | | 44,089,975 | |

| | | | | | | | | | | | | | | | |

LIABILITIES: | | | | | | | | | | | | | | | | |

Payable for fund shares redeemed | | | 69,980 | | | | 540 | | | | 914 | | | | 8,386 | |

Payable to affiliates | | | 6,737 | | | | 8,858 | | | | 15,456 | | | | 34,205 | |

Payable for trustee fees | | | 41 | | | | 57 | | | | 99 | | | | 219 | |

Other accrued expenses and liabilities | | | 7,948 | | | | 9,635 | | | | 16,202 | | | | 29,252 | |

| | | | | | | | | | | | | | | | |

Total liabilities | | | 84,706 | | | | 19,090 | | | | 32,671 | | | | 72,062 | |

| | | | | | | | | | | | | | | | |

NET ASSETS | | $ | 8,069,238 | | | $ | 11,478,777 | | | $ | 19,831,529 | | | $ | 44,017,913 | |

| | | | | | | | | | | | | | | | |

NET ASSETS WERE COMPRISED OF: | | | | | | | | | | | | | | | | |

Paid-in capital | | $ | 9,961,580 | | | $ | 16,445,233 | | | $ | 21,211,099 | | | $ | 43,581,737 | |

Undistributed net investment income | | | 153,302 | | | | 241,907 | | | | 382,079 | | | | 1,101,646 | |

Accumulated net realized loss | | | (2,254,308 | ) | | | (5,833,785 | ) | | | (3,117,098 | ) | | | (3,455,716 | ) |

Net unrealized appreciation | | | 208,664 | | | | 625,422 | | | | 1,355,449 | | | | 2,790,246 | |

| | | | | | | | | | | | | | | | |

NET ASSETS | | $ | 8,069,238 | | | $ | 11,478,777 | | | $ | 19,831,529 | | | $ | 44,017,913 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

* Cost of investments in securities | | $ | 7,787,304 | | | $ | 10,656,662 | | | $ | 18,160,290 | | | $ | 40,608,228 | |

*** Cost of short-term investments | | $ | 156,000 | | | $ | 209,000 | | | $ | 346,000 | | | $ | 688,000 | |

| | | | | | | | | | | | | | | | |

Net assets | | $ | 8,069,238 | | | $ | 11,478,777 | | | $ | 19,831,529 | | | $ | 44,017,913 | |

Shares authorized | | | unlimited | | | | unlimited | | | | unlimited | | | | unlimited | |

Par value | | $ | 0.001 | | | $ | 0.001 | | | $ | 0.001 | | | $ | 0.001 | |

Shares outstanding | | | 1,020,538 | | | | 1,473,729 | | | | 2,028,955 | | | | 4,312,613 | |

Net asset value and redemption price per share | | $ | 7.91 | | | $ | 7.79 | | | $ | 9.77 | | | $ | 10.21 | |

See Accompanying Notes to Financial Statements

20

STATEMENTS OF OPERATIONSFORTHEYEARENDED DECEMBER 31, 2011

| | | | | | | | | | | | | | | | |

| | | ING GET U.S. Core Portfolio | |

| | | Series 7 | | | Series 8 | | | Series 9 | | | Series 10 | |

INVESTMENT INCOME: | | | | | | | | | | | | | | | | |

Dividends | | $ | 13,676 | | | $ | 6,815 | | | $ | 9,493 | | | $ | 80 | |

Interest | | | 438,971 | | | | 234,553 | | | | 217,103 | | | | 199,377 | |

| | | | | | | | | | | | | | | | |

Total investment income | | | 452,647 | | | | 241,368 | | | | 226,596 | | | | 199,457 | |

| | | | | | | | | | | | | | | | |

EXPENSES: | | | | | | | | | | | | | | | | |

Investment management fees | | | 104,512 | | | | 64,684 | | | | 54,335 | | | | 39,969 | |

Distribution and service fees: | | | 43,546 | | | | 26,952 | | | | 22,639 | | | | 16,653 | |

Transfer agent fees | | | 73 | | | | 69 | | | | 66 | | | | 44 | |

Administrative service fees | | | 9,580 | | | | 5,929 | | | | 4,980 | | | | 3,664 | |

Shareholder reporting expense | | | 2,266 | | | | 1,707 | | | | 1,947 | | | | 806 | |

Professional fees | | | 25,938 | | | | 18,211 | | | | 16,361 | | | | 13,604 | |

Custody and accounting expense | | | 2,281 | | | | 1,812 | | | | 1,246 | | | | 1,460 | |

Trustee fees | | | 546 | | | | 337 | | | | 289 | | | | 208 | |

Miscellaneous expense | | | 1,300 | | | | 2,265 | | | | 2,503 | | | | 2,342 | |

Interest expense | | | 19 | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Total expenses | | | 190,061 | | | | 121,966 | | | | 104,366 | | | | 78,750 | |

Net waived and reimbursed fees | | | (15,640 | ) | | | (13,943 | ) | | | (13,589 | ) | | | (11,934 | ) |

| | | | | | | | | | | | | | | | |

Net expenses | | | 174,421 | | | | 108,023 | | | | 90,777 | | | | 66,816 | |

| | | | | | | | | | | | | | | | |

Net investment income | | | 278,226 | | | | 133,345 | | | | 135,819 | | | | 132,641 | |

| | | | | | | | | | | | | | | | |

REALIZED AND UNREALIZED GAIN (LOSS) : | | | | | | | | | | | | | | | | |

Net realized gain (loss) on: | | | | | | | | | | | | | | | | |

Investments | | | 340,156 | | | | 163,816 | | | | 194,877 | | | | 58,004 | |

| | | | | | | | | | | | | | | | |

Net realized gain | | | 340,156 | | | | 163,816 | | | | 194,877 | | | | 58,004 | |

| | | | | | | | | | | | | | | | |

Net change in unrealized appreciation (depreciation) on: | | | | | | | | | | | | | | | | |

Investments | | | (631,165 | ) | | | (344,674 | ) | | | (354,073 | ) | | | (157,666 | ) |

| | | | | | | | | | | | | | | | |

Net change in unrealized appreciation (depreciation) | | | (631,165 | ) | | | (344,674 | ) | | | (354,073 | ) | | | (157,666 | ) |

| | | | | | | | | | | | | | | | |

Net realized and unrealized loss | | | (291,009 | ) | | | (180,858 | ) | | | (159,196 | ) | | | (99,662 | ) |

| | | | | | | | | | | | | | | | |

Increase (decrease) in net assets resulting from operations | | $ | (12,783 | ) | | $ | (47,513 | ) | | $ | (23,377 | ) | | $ | 32,979 | |

| | | | | | | | | | | | | | | | |

See Accompanying Notes to Financial Statements

21

STATEMENTS OF OPERATIONSFORTHEYEARENDED DECEMBER 31, 2011 (CONTINUED)

| | | | | | | | | | | | | | | | |

| | | ING GET U.S. Core Portfolio | |

| | | Series 11 | | | Series 12 | | | Series 13 | | | Series 14 | |

INVESTMENT INCOME: | | | | | | | | | | | | | | | | |

Dividends | | $ | 104 | | | $ | 14,814 | | | $ | 220 | | | $ | — | |

Interest | | | 245,546 | | | | 357,491 | | | | 613,413 | | | | 1,593,872 | |

| | | | | | | | | | | | | | | | |

Total investment income | | | 245,650 | | | | 372,305 | | | | 613,633 | | | | 1,593,872 | |

| | | | | | | | | | | | | | | | |

EXPENSES: | | | | | | | | | | | | | | | | |

Investment management fees | | | 54,079 | | | | 76,906 | | | | 137,478 | | | | 293,842 | |

Distribution and service fees: | | | 22,533 | | | | 32,044 | | | | 57,282 | | | | 122,434 | |

Transfer agent fees | | | 29 | | | | 41 | | | | 39 | | | | 72 | |

Administrative service fees | | | 4,957 | | | | 7,050 | | | | 12,602 | | | | 26,935 | |

Shareholder reporting expense | | | 419 | | | | 994 | | | | 3,244 | | | | 6,709 | |

Professional fees | | | 17,009 | | | | 22,066 | | | | 33,424 | | | | 61,604 | |

Custody and accounting expense | | | 1,639 | | | | 1,799 | | | | 2,648 | | | | 5,116 | |

Trustee fees | | | 281 | | | | 404 | | | | 723 | | | | 1,539 | |

Miscellaneous expense | | | 2,107 | | | | 2,230 | | | | 2,605 | | | | 2,738 | |

Interest expense | | | — | | | | — | | | | 51 | | | | — | |

| | | | | | | | | | | | | | | | |

Total expenses | | | 103,053 | | | | 143,534 | | | | 250,096 | | | | 520,989 | |

Net waived and reimbursed fees | | | (12,737 | ) | | | (15,149 | ) | | | (20,578 | ) | | | (30,539 | ) |

| | | | | | | | | | | | | | | | |

Net expenses | | | 90,316 | | | | 128,385 | | | | 229,518 | | | | 490,450 | |

| | | | | | | | | | | | | | | | |

Net investment income | | | 155,334 | | | | 243,920 | | | | 384,115 | | | | 1,103,422 | |

| | | | | | | | | | | | | | | | |