QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

For the fiscal year ended July 31, 2007

Zale Corporation

A Delaware Corporation

IRS Employer Identification No. 75-0675400

SEC File Number 1-04129

901 W. Walnut Hill Lane

Irving, Texas 75038-1003

(972) 580-4000

Zale Corporation's common stock, par value $.01 per share, is registered pursuant to Section 12 (b) of the Securities Exchange Act of 1934 (the "Act") and is listed on the New York Stock Exchange. Zale Corporation does not have any securities registered under Section 12(g) of the Act. Zale Corporation is required to file reports pursuant to Section 13 of the Act. Zale Corporation (1) has filed all reports required to be filed by Section 13 or 15(d) of the Act during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days.

Disclosure of the delinquent filers pursuant to Item 405 of Regulation S-K will be contained in our definitive Proxy Statement, portions of which are incorporated by reference in Part III of this Form 10-K.

The aggregate market value of Zale Corporation's common stock (based upon the closing sales price quoted on the New York Stock Exchange) held by non-affiliates as of January 31, 2007 was $1,345,627,745. As of September 17, 2007, 49,058,627 shares of Zale Corporation's common stock were outstanding. For this purpose, directors and officers have been assumed to be affiliates.

Zale Corporation is a large accelerated filer and a well-known seasoned issuer.

Zale Corporation is not a shell company.

DOCUMENTS INCORPORATED BY REFERENCE.

Portions of Zale Corporation's definitive Proxy Statement for the 2007 Annual Meeting of Stockholders to be held on November 14, 2007 are incorporated by reference into Part III.

PART I

ITEM 1. BUSINESS

General

We are, through our wholly owned subsidiaries, a leading specialty retailer of fine jewelry. At July 31, 2007, we operated 1,471 specialty retail jewelry stores and 793 kiosks located mainly in shopping malls throughout the United States of America ("U.S."), Canada and Puerto Rico.

We were incorporated in Delaware in 1993. Our principal executive offices are located at 901 W. Walnut Hill Lane, Irving, Texas 75038-1003. Our telephone number at that address is (972) 580-4000, and our internet address iswww.zalecorp.com.

During the fiscal year ended July 31, 2007, we generated $2.4 billion of revenues. We believe we are well-positioned to compete in the approximately $66 billion, combined U.S. and Canadian retail jewelry industry, leveraging our established brand names, economies of scale and geographic and demographic diversity. We have significant brand name recognition as a result of each brand's long-standing presence in the industry and our national and regional advertising campaigns. We believe that brand name recognition is an important advantage in jewelry retailing as jewelry products are generally unbranded and consumers must trust in a retailer's reliability, credibility and commitment to customer service.

Business Segments

We report our operations under three business segments: Fine Jewelry, Kiosk Jewelry and All Other. An overview of each business segment follows below. During fiscal year 2007, our Fine Jewelry segment generated $2.2 billion or approximately 89.0 percent of our revenues. During fiscal year 2007, the Kiosk revenues represented $263 million or approximately 11.0 percent of our revenues.

Fine Jewelry

Our Fine Jewelry segment is comprised of six brands, predominantly focused on the moderate income consumer as our core customer target. Each brand specializes in fine jewelry and watches, with merchandise and marketing emphasis focused on diamond products. Additionally, each brand differentiates itself through a customer experience with different points of emphasis. Our moderate brands, which consist of all brands except Bailey Banks & Biddle, have a centralized merchandising function that creates significant synergies and allows for more teaming across brands. Zales Jewelers® is our national brand in the U.S. providing moderately priced jewelry to a broad range of customers. We have further leveraged the brand strength through Zales Outlet, which focuses on a slightly higher-income female self purchaser in outlet malls and neighborhood power centers. Gordon's Jewelers® is a moderately priced regional jeweler that emphasizes customer relationships. Bailey Banks & Biddle Fine Jewelers® operates jewelry stores that are considered among the finest luxury jewelry stores in their markets, offering designer jewelry and prestige watches to attract more affluent customers. Peoples Jewellers® and Mappins Jewellers® offer moderately priced jewelry in malls throughout Canada. The brands in the Fine Jewelry segment have expanded their presence in the retail market through their e-commerce sites,zales.com, gordonsjewelers.com, andbaileybanksandbiddle.com.

Zales, our national flagship, is a leading brand name in jewelry retailing in the U.S., with 789 stores in 50 states and Puerto Rico, and accounted for approximately 44 percent of our total revenues in fiscal year 2007. Zales' average store size is 1,681 square feet with an average transaction of $371 in fiscal year 2007.

Zales is positioned as "The Diamond Store" given its emphasis on diamond jewelry especially in the bridal and fashion segments. The Zales brand complements the merchandise assortments with a promotional strategy that features "Brilliant Buys" to drive sales during gift-giving occasions and

1

throughout the year. We believe that the prominence of diamond jewelry in our product selection and Zales' reputation for customer service for over 80 years fosters an image of product expertise, quality and trust among consumers.

Zales, a multi-channel retailer, serves the internet customer through its e-commerce site,zales.com, which accounted for approximately two percent of our total revenues in fiscal year 2007.

In Canada, we operate 193 stores in nine provinces and enjoy the largest market share of any specialty jewelry retailer in Canada. Canadian operations consist of two brands, Peoples Jewellers and Mappins Jewellers. Canadian operations accounted for approximately 11 percent of our total revenues in fiscal year 2007. The average store size is 1,600 square feet with an average transaction of $299 in fiscal year 2007.

Peoples Jewellers and Mappins Jewellers are two of the most recognized brand names in Canada. Peoples Jewellers offers jewelry at affordable prices, attracting a wide variety of Canadian customers. Using the trademark "Peoples, the Diamond Store" in Canada, Peoples emphasizes its diamond business while also offering a wide selection of gold jewelry, gemstone jewelry and watches. Since 2000, the Peoples brand has been building recognition with an aggressive television campaign. Over the past four years, Peoples had the largest television campaign of any Canadian jewelry retailer by a wide margin. Seasonal newspaper inserts are also a key element in the Peoples marketing campaign. Mappins Jewellers differentiates itself by offering exclusive merchandise primarily in its bridal assortments. Since 2000, Mappins has utilized newspaper inserts and targeted direct mail offers to reach its customers.

We operated Zales Outlet with stores in 36 states and Puerto Rico which accounted for approximately eight percent of our total revenues in fiscal year 2007. The average store size is 2,398 square feet, with an average transaction of $414 in fiscal year 2007.

The outlet concept has evolved into one of the strongest concepts in retail shopping today, featuring items in every major jewelry category including branded watches, gemstones, gold merchandise, and diamond fashion and solitaire products. The merchandise assortment in a typical Zales Outlet store caters to the higher-income female self purchaser, offering 20 to 70 percent off traditional retail prices every day. We have grown our Zales Outlet concept over the past nine years from four stores in 1998 to the 137 stores in operation at the end of fiscal year 2007.

Although Zales Outlet was established as an extension of the Zales brand and capitalizes on Zales' national advertising and brand recognition, Zales Outlet offers its own unique product assortments and augments this with promotional efforts that are geared specifically to the outlet consumer and consistent with the "off-mall" location.

Gordon's is positioned as our relationship brand in certain regional markets. As of July 31, 2007, Gordon's had 282 stores in 35 states and Puerto Rico and accounted for approximately 14 percent of our total revenues in fiscal year 2007. Average store size is 1,517 square feet with an average transaction of $411 in fiscal year 2007. Gordon's distinguishes itself by emphasizing customer service along with its unique marketing and store design.

We believe the Gordon's customer shares similar demographic characteristics to the Zales customer. Accordingly, we are continuing steps to appropriately position the brand to compete with our external competitors and leverage our corporate strengths to capture market share across both our Zales and Gordon's brands. We believe our initiatives to centralize and streamline the merchandising organization will further support strengthening the Gordon's performance. We believe the opportunity is to differentiate Gordon's customer experience based on their strength in building customer relationships. To

2

leverage our corporate buying power, merchandise will be consistent with Zales in basic merchandise programs such as diamond solitaires and certain bridal categories. However, where appropriate, products will be differentiated to cater to local demographics. During fiscal year 2007, Gordon's Jewelers launched thegordonsjewelers.com e-commerce site to serve its internet customers.

At July 31, 2007, Bailey Banks & Biddle operated 70 upscale jewelry stores in 24 states. We also utilize the trade name Zell Bros® for one location operated by the Bailey Banks & Biddle brand. Average store size is 4,260 square feet with an average transaction of $1,596 in fiscal year 2007. Total revenue at Bailey Banks & Biddle accounted for approximately 12 percent of our total revenues in fiscal year 2007.

For over 170 years, Bailey Banks & Biddle has combined classic jewelry with contemporary designs, offering a compelling shopping environment for the high-end luxury consumer. Bailey Banks & Biddle locations are among the preeminent stores in their markets. They carry both exclusive and recognized branded and designer merchandise selections to appeal to the more affluent customer. The Bailey Banks & Biddle merchandise assortments are carefully selected to provide treasures that will be appreciated for generations with a focus on diamonds, precious gemstones, gold, and branded designer jewelry, complemented by an extensive assortment of prestige watch brands and giftware.

Kiosk Jewelry

The Kiosk Jewelry segment operates primarily under the brand names Piercing Pagoda®, Plumb Gold™, and Silver and Gold Connection® through mall-based kiosks and reaches the opening price point select jewelry customer. At July 31, 2007, Piercing Pagoda operated 793 locations in 42 states and Puerto Rico. The Kiosk Jewelry segment specializes in gold and silver products that capitalize on the latest fashion trends.

At the entry-level price point, the Kiosk Jewelry segment targets a young, fashion forward customer. The kiosk segment offers an extensive collection of popularly-priced bracelets, earrings, charms, rings, and 14 karat and 10 karat gold chains, as well as a selection of silver and diamond jewelry, all in basic styles at moderate prices. In addition, trained associates perform ear-piercing services on site.

Kiosks are generally located in high traffic locations that are easily accessible and visible within regional shopping malls. The kiosk locations average 188 square feet in size, with an average transaction of $39 in fiscal year 2007.

All Other

We provide insurance and reinsurance facilities for various types of insurance coverage, which typically are marketed to our private label credit card customers, through Zale Indemnity Company, Zale Life Insurance Company and Jewel Re-Insurance Ltd. The three companies are the insurers (either through direct written or reinsurance contracts) of our customer credit insurance coverage. In addition to providing merchandise replacement coverage for certain perils, credit insurance coverage provides protection to the creditor and cardholder for losses associated with the disability, involuntary unemployment, leave of absence or death of the cardholder. Zale Life Insurance Company also provides group life insurance coverage for our eligible employees. Zale Indemnity Company, in addition to writing direct credit insurance contracts, has certain discontinued lines of insurance that it continues to service. Credit insurance operations are dependent on our retail sales through our private label credit cards. In fiscal year 2007, 35.5 percent of our private label credit card purchasers purchased some form of credit insurance. Under the current private label arrangement with Citibank U.S.A., N.A. ("Citi"), our insurance affiliates continue to provide insurance to holders of our private label credit cards and receive payments for such insurance products. In fiscal year 2007, the All Other Segment accounted for less than one percent of our total revenues.

3

Industry and Competition

Jewelry retailing is highly fragmented and competitive. We compete with a large number of independent regional and local jewelry retailers, as well as with other national jewelry chains. We also compete with other types of retailers who sell jewelry and gift items such as department stores, discounters, direct mail suppliers, online retailers and television home shopping programs. Certain of our competitors are non-specialty retailers, which are larger and have greater financial resources than we do. The malls where most of our stores are located typically contain competing national chains, independent jewelry stores and/or department store jewelry departments. We believe that we are also competing for consumers' discretionary spending dollars and, therefore, compete with retailers who offer merchandise other than jewelry or giftware. Therefore, we compete primarily on the basis of our reputation for high quality products, brand recognition, store location, distinctive and value-priced merchandise, personalized customer service and ability to offer private label credit card programs to customers wishing to finance their purchases. Our success is also dependent on our ability to both react to and create customer demand for specific merchandise categories.

The U.S. and Canadian retail jewelry industry accounted for approximately $66 billion of sales in 2006, according to publicly available data. We have a four percent market share in the combined U.S. and Canadian markets. The largest jewelry retailer in the combined U.S. and Canadian markets is believed to be Wal-Mart Stores, Inc. Other significant segments of the fine jewelry industry include national chain department stores (such as J.C. Penney Company, Inc. and Sears, Roebuck and Co.), mass merchant discount stores (such as Wal-Mart Stores, Inc.), other general merchandise stores and apparel and accessory stores. The remainder of the retail jewelry industry is comprised primarily of catalog and mail order houses, direct-selling establishments, TV shopping networks (such as QVC, Inc.) and online jewelers.

Historically, retail jewelry store sales have exhibited limited cyclicality. TheUnited States Census Bureau has recorded only three years of negative growth in specialty retail jewelry store sales from 1984 to 2006.

We hold no material patents, licenses, franchises or concessions; however, our established trademarks and trade names are essential to maintaining our competitive position in the retail jewelry industry.

4

Operations by Brand

The following table presents revenues, average sales per location and the number of locations for each of our brands for the periods indicated.

| | Year Ended July 31,

|

|---|

Revenues (in thousands):

|

|---|

| | 2007

| | 2006

| | 2005

|

|---|

| Zales (includingzales.com) | | $ | 1,088,516 | | $ | 1,092,625 | | $ | 1,079,230 |

| Zales Outlet | | | 193,132 | | | 177,736 | | | 166,000 |

| Gordon's (includinggordonsjewelers.com) | | | 328,786 | | | 339,510 | | | 324,854 |

| Bailey Banks & Biddle (includingbaileybanksandbiddle.com)(a) | | | 284,289 | | | 309,311 | | | 320,869 |

| Peoples(b) | | | 266,147 | | | 229,574 | | | 198,308 |

| Piercing Pagoda | | | 259,872 | | | 268,936 | | | 274,296 |

| Peoples II | | | 2,755 | | | 7,683 | | | 6,601 |

| Insurance Revenues | | | 13,578 | | | 13,602 | | | 12,908 |

| | |

| |

| |

|

| | | $ | 2,437,075 | | $ | 2,438,977 | | $ | 2,383,066 |

| | |

| |

| |

|

Average Sales Per Location(c):

|

|

|

|

|

|

|

|

|

|

| Zales | | $ | 1,368,000 | | $ | 1,383,000 | | $ | 1,366,000 |

| Zales Outlet | | | 1,417,000 | | | 1,360,000 | | | 1,249,000 |

| Gordon's | | | 1,164,000 | | | 1,200,000 | | | 1,112,000 |

| Bailey Banks & Biddle | | | 3,843,000 | | | 3,738,000 | | | 3,474,000 |

| Peoples | | | 1,620,000 | | | 1,397,000 | | | 1,140,000 |

| Piercing Pagoda | | | 324,000 | | | 332,000 | | | 343,000 |

| Peoples II | | | 116,000 | | | 82,000 | | | 100,000 |

5

| | Locations by Brand

|

|---|

Year Ended July 31, 2007:

| | Locations Opened During Period

| | Locations Closed During Period

| | Locations at End of Period

|

|---|

| Zales | | 21 | | 16 | | 789 |

| Zales Outlet | | 6 | | — | | 137 |

| Gordon's | | 3 | | 14 | | 282 |

| Bailey Banks & Biddle | | 2 | | 5 | | 70 |

| Peoples | | 19 | | 1 | | 193 |

| Piercing Pagoda | | 14 | | 38 | | 793 |

| Peoples II | | — | | 76 | | — |

| | |

| |

| |

|

| | | 65 | | 150 | | 2,264 |

| | |

| |

| |

|

Year Ended July 31, 2006:

|

|

|

|

|

|

|

| Zales | | 24 | | 20 | | 784 |

| Zales Outlet | | 7 | | 1 | | 131 |

| Gordon's | | 17 | | 11 | | 293 |

| Bailey Banks & Biddle | | 1 | | 32 | | 73 |

| Peoples | | 7 | | — | | 175 |

| Piercing Pagoda | | 38 | | 33 | | 817 |

| Peoples II | | 16 | | 9 | | 76 |

| Master Jewelry Repair | | 3 | | 3 | | — |

| | |

| |

| |

|

| | | 113 | | 109 | | 2,349 |

| | |

| |

| |

|

Year Ended July 31, 2005:

|

|

|

|

|

|

|

| Zales | | 24 | | 14 | | 767 |

| Zales Outlet | | 18 | | 1 | | 138 |

| Gordon's | | 13 | | 13 | | 287 |

| Bailey Banks & Biddle | | — | | 4 | | 104 |

| Peoples | | 6 | | 1 | | 168 |

| Piercing Pagoda | | 50 | | 36 | | 812 |

| Peoples II | | 71 | | 2 | | 69 |

| | |

| |

| |

|

| | | 182 | | 71 | | 2,345 |

| | |

| |

| |

|

- (a)

- Includes revenues of $24.3 million and $49.8 million for fiscal years 2006, and 2005, respectively, related to the Bailey Banks & Biddle store closings in the second quarter of fiscal year 2006.

- (b)

- Peoples (including Mappins) and Peoples II reflects all revenue from Canadian operations, which constitutes all our foreign operations. Long-lived assets from foreign operations totaled approximately $37.5 million, $29.3 million and $27.6 million at July 31, 2007, 2006 and 2005, respectively.

- (c)

- Based on merchandise sales for locations open a full 12 months during the applicable year.

Business Segment Data

Information concerning sales and segment income attributable to each of our business segments is set forth in Item 6, "Selected Financial Data," in Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations," and in "Notes to Consolidated Financial Statements," all of which are incorporated herein by reference.

Store Operations

Our stores are designed to differentiate our brands, create an attractive environment, make shopping convenient and enjoyable, and maximize operating efficiencies, all of which enhance the customer

6

experience. We focus on store layout, with particular focus on arrangement of display cases, lighting, and choice of materials to optimize merchandise presentation. Promotional displays are changed periodically to provide variety or to reflect seasonal events.

Each of our stores is led by a store manager who is responsible for store-level operations, including overall store sales and personnel matters. Administrative matters, including purchasing, distribution and payroll, are consolidated at the corporate level in an effort to maintain efficiency and low operating costs at the store level. In addition to selling jewelry, each store also offers standard warranties and return policies, and provides extended warranty coverage that may be purchased at the customer's option. In order to facilitate sales, stores will hold merchandise in layaway, generally requiring a deposit of not less than 20 percent of the purchase price at the inception of the layaway transaction.

We have implemented inventory control systems, extensive security systems and loss prevention procedures to maintain low inventory losses. We screen employment applicants and provide our store personnel with training in loss prevention. Despite such precautions, we experience losses from theft from time to time, and maintain insurance to cover such external losses.

We believe it is important to provide knowledgeable and responsive customer service and we maintain a strong focus on connecting with the customer, both through advertising and in-store communications and service. Our goal is to service the customer from the first sale by maintaining a customer connection through client services. We have a centralized customer service call center to effectively address customer phone calls at lower aggregate cost.

We continue to focus on the level and frequency of our employee training programs, particularly with store managers and key sales associates. We also provide training in sales techniques for new employees, on-the-job training for all store personnel and management training for store managers. Under the banner of Zale Corporation University, we offer training to employees at every level of the organization.

Purchasing and Inventory

We purchase the majority of our merchandise in finished form from a network of established suppliers and manufacturers located primarily in the United States, Southeast Asia and Italy. In addition, we procure approximately 34 percent of our merchandise from our internal sourcing organization which consists of both assembled goods and factory direct goods. All purchasing is done through buying offices at our headquarters. Consignment inventory has historically consisted of test programs, merchandise at higher price points or merchandise that otherwise does not warrant the risk of ownership. Consignment merchandise can be returned to the vendor at any time or converted to owned inventory if it meets certain productivity thresholds. We had $159.2 million and $175.1 million of consignment inventory on hand at July 31, 2007 and 2006, respectively. During fiscal years 2007 and 2006, we purchased approximately 18 percent and 22 percent, respectively, of our finished merchandise from our top five vendors, including five percent from one vendor in 2007. If our supply with these top vendors were disrupted, particularly at certain critical times during the year, our sales could be adversely affected in the short term until alternative supply arrangements could be established. During fiscal year 2007, our direct sourcing organization accounted for approximately 12 percent of our merchandise requirements.

As a specialty retail jeweler, we could be affected by industry-wide fluctuations in the prices of diamonds, gold, and other metals and stones. The supply and prices of diamonds in the principal world markets are significantly influenced by a single entity, the Diamond Trading Company, which has traditionally controlled the marketing of a substantial majority of the world's supply of diamonds and sells rough diamonds to worldwide diamond cutters at prices determined in its sole discretion. The availability of diamonds to the Diamond Trading Company and our suppliers is to some extent dependent on the political situation in diamond-producing countries and on continuation of prevailing supply and marketing arrangements for raw diamonds. Until alternate sources are developed, any sustained interruption in the supply of diamonds could adversely affect us and the retail jewelry industry as a whole. The inverse is true

7

with respect to any oversupply from diamond-producing countries, which could cause diamond prices to fall.

Proprietary Credit

Our private label credit card program helps facilitate the sale of merchandise to customers who wish to finance their purchases rather than use cash or other payment sources. We offer revolving and interest free credit programs under our private label credit card program. Approximately 39 percent and 41 percent of our U.S. total sales excluding Piercing Pagoda, which does not offer proprietary credit, were generated by proprietary credit cards in fiscal years 2007 and 2006, respectively. Our Canadian propriety credit card sales represented approximately 25 percent and 27 percent of Canadian total sales for fiscal years 2007 and 2006, respectively.

In fiscal year 2007, we continued our proprietary credit offerings of same-as-cash, revolving and interest free programs, all of which allowed our sales personnel to provide the customer additional financing options.

In July 2000, we entered into a 10-year agreement with Citi whereby Citi issues private label credit cards branded with appropriate trademarks, and provides financing for our customers to purchase merchandise in exchange for payment by us of a merchant fee based on a percentage of each credit card sale. The merchant fee varies according to the credit plan that is chosen by the customer (i.e., revolving, interest free, same-as-cash).

Employees

As of July 31, 2007, we had approximately 17,600 employees, approximately 11 percent of whom were Canadian employees and less than one percent of whom were represented by unions. Additionally, we usually hire temporary employees during each Holiday season.

Seasonality

As a specialty retailer of fine jewelry, our business is seasonal in nature, with our second quarter, which includes the months of November through January, typically generating a proportionally greater percentage of annual sales, earnings from operations and cash flow than the other three quarters. We expect such seasonality to continue.

Information Technology

Our technology systems provide information necessary for (i) store operations; (ii) sales and margin management; (iii) inventory control; (iv) profitability monitoring by many measures (merchandise category, buyer, store); (v) customer care; (vi) expense control programs; and (vii) overall management decision support. Significant data processing systems include point-of-sale reporting, purchase order management, replenishment, warehouse management, merchandise planning and control, payroll, general ledger, sales audit, and accounts payable. Bar code ticketing and scanning are used at all point-of-sale terminals to ensure accurate sales and margin data compilation and to provide for inventory control monitoring. Information is made available online to merchandising staff on a timely basis, thereby increasing the merchants' ability to be responsive to changes in customer behavior. We are also improving the connectivity between stores and our corporate headquarters to enhance operating efficiencies and speed of transmission.

8

Our information technology systems and processes allow management to monitor, review and control operational performance on a daily, monthly, quarterly and annual basis for each store and each transaction. Senior management can review and analyze activity by store, amount of sale, terms of sale or employees who sell the merchandise.

We have a data center operations services agreement with a third party for the management of our mainframe processing operations, client server systems, Local Area Network operations, Wide Area Network management and e-commerce hosting. The agreement requires fixed payments totaling $30.0 million over an 84-month period plus a variable amount based on usage, and extends through 2012. We believe that by outsourcing our data center operations, we are focusing our resources on developing and enhancing the strategic initiatives discussed in the Business and Strategy section.

We have historically upgraded, and expect to continue to upgrade, our information systems to improve operations and support future growth. We estimate we will make capital expenditures of approximately $20 million in fiscal year 2008 for enhancements to our information systems and infrastructure.

Regulation

Our operations are affected by numerous federal and state laws that impose disclosure and other requirements upon the origination, servicing and enforcement of credit accounts and limitations on the maximum amount of finance charges that may be charged by a credit provider. In addition to our private label credit cards, credit to our customers is provided primarily through bank cards such as Visa®, MasterCard®, and Discover®. Any change in the regulation of credit which would materially limit the availability of credit to our traditional customer base could adversely affect our results of operations or financial condition.

We are subject to the jurisdiction of various state and other taxing authorities. From time to time, these taxing authorities conduct reviews or audits of the Company.

The sale of insurance products by us is also highly regulated. State laws currently impose disclosure obligations with respect to our sale of credit and other insurance. In addition, our sale of insurance products in connection with our private label credit cards appears to be subject to certain disclosure and other requirements under the Gramm-Leach-Bliley Act of 1999. Our and our competitors' practices are also subject to review in the ordinary course of business by the Federal Trade Commission and our and other retail companies' credit cards are subject to regulation by state and federal banking regulators. We believe that we are currently in material compliance with all applicable state and federal regulations.

Merchandise in the retail jewelry industry is frequently sold at a discount off the "regular" or "original" price. We are subject to federal and state regulations requiring retailers offering merchandise at promotional prices to offer the merchandise at regular or original prices for stated periods of time. Additionally, we are subject to certain truth-in-advertising and various other laws, including consumer protection regulations that regulate retailers generally and/or the promotion and sale of jewelry in particular. We monitor changes in those laws and believe that we are in material compliance with applicable laws with respect to such practices.

Available Information

We provide links to our filings with the Securities and Exchange Commission ("SEC") and to the SEC filings (Forms 3, 4 and 5) of our directors and executive officers under Section 16 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), free of charge, on our website atwww.zalecorp.com, under the heading "SEC Filings" in the "Shareholder Information" section. These links are automatically updated, so the filings also are available immediately after they are made publicly available by the SEC. These filings also are available through the SEC's EDGAR system atwww.sec.gov.

9

Our certificate of incorporation and bylaws as well as the charters for the compensation, audit, nominating and corporate governance committees of our Board of Directors and the corporate governance guidelines are available on our website atwww.zalecorp.com, under the heading "Corporate and Social Responsibility."

We have a Code of Business Conduct and Ethics (the "Code"). All of our directors, executive officers and employees are subject to the Code. The Code is available on our web site atwww.zalecorp.com, under the heading "Corporate and Social Responsibility-Code of Business Conduct and Ethics." Waivers of the Code for directors and executive officers will be disclosed in a SEC filing on Form 8-K.

ITEM 1A. RISK FACTORS

We make forward-looking statements in the Annual Report on Form 10-K and in other reports we file with the SEC. In addition, members of our senior management make forward-looking statements orally in presentations to analysts, investors, the media and others. Forward-looking statements include statements regarding our objectives and expectations with respect to our financial plan, sales and earnings, merchandising and marketing strategies, store opening, renovation, remodeling and expansion, inventory management and performance, liquidity and cash flows, capital structure, capital expenditures, development of our information technology and telecommunications plans and related management information systems, e-commerce initiatives, human resource initiatives, potential sale of the Bailey Banks & Biddle brand and other statements regarding our plans and objectives. In addition, the words "plans to," "anticipate," "estimate," "project," "intend," "expect," "believe," "forecast," "can," "could," "should," "will," "may," or similar expressions may identify forward-looking statements, but some of these statements may use other phrasing. These forward-looking statements are intended to relay our expectations about the future, and speak only as of the date they are made. We disclaim any obligation to update or revise publicly or otherwise any forward-looking statements to reflect subsequent events, new information or future circumstances.

Forward-looking statements are not guarantees of future performance and a variety of factors could cause our actual results to differ materially from the anticipated or expected results expressed in or suggested by these forward-looking statements.

If the general economy performs poorly, discretionary spending on goods that are, or are perceived to be "luxuries" may not grow and may even decrease.

Jewelry purchases are discretionary and may be affected by adverse trends in the general economy (and consumer perceptions of those trends). In addition, a number of other factors affecting consumers such as employment, wages and salaries, business conditions, energy costs, credit availability and taxation policies, for the economy as a whole and in regional and local markets where we operate, can impact sales and earnings.

The concentration of a substantial portion of our sales in three relatively brief selling periods means that our performance is more susceptible to disruptions.

A substantial portion of our sales are derived from three selling periods—Holiday (Christmas), Valentine's Day, and Mother's Day. Because of the briefness of these three selling periods, the opportunity for sales to recover in the event of a disruption or other difficulty is limited, and the impact of disruptions and difficulties can be significant. For instance, adverse weather (such as a blizzard or hurricane), a significant interruption in the receipt of products (whether because of vendor or other product problems), or a sharp decline in mall traffic occurring during one of these selling periods could materially impact sales for the affected period and, because of the importance of each of these selling periods, commensurately impact overall sales and earnings.

Most of our sales are of products that include diamonds, precious metals and other commodities. Fluctuations in the availability and pricing of commodities could impact our ability to obtain and produce

10

products at favorable prices, and consumer awareness regarding the issue of "conflict diamonds" may affect consumer demand for diamonds.

The supply and price of diamonds in the principal world market are significantly influenced by a single entity, which has traditionally controlled the marketing of a substantial majority of the world's supply of diamonds and sells rough diamonds to worldwide diamond cutters at prices determined in its sole discretion. The availability of diamonds also is somewhat dependent on the political conditions in diamond-producing countries and on the continuing supply of raw diamonds. Any sustained interruption in this supply could have an adverse affect on our business.

We are also affected by fluctuations in the price of diamonds, gold and other commodities. We historically have engaged in hedging against fluctuations in the cost of gold. A significant change in prices of key commodities could adversely affect our business by reducing operating margins or decreasing consumer demand if retail prices are increased significantly.

Our sales are dependent upon mall traffic.

Our stores, kiosks, and carts are located primarily in shopping malls throughout the U.S., Canada and Puerto Rico. Our success is in part dependent upon the continued popularity of malls as a shopping destination and the ability of malls, their tenants and other mall attractions to generate customer traffic. Accordingly, a significant decline in this popularity, especially if it is sustained, would substantially harm our sales and earnings.

We operate in a highly competitive and fragmented industry.

The retail jewelry business is highly competitive and fragmented, and we compete with nationally recognized jewelry chains as well as a large number of independent regional and local jewelry retailers and other types of retailers who sell jewelry and gift items, such as department stores, mass merchandisers and catalog showrooms. We also compete with internet sellers of jewelry. Because of the breadth and depth of this competition, we are constantly under competitive pressure that both constrains pricing and requires extensive merchandising efforts in order for us to remain competitive.

Any failure by us to manage our inventory effectively will negatively impact sales and earnings.

We purchase much of our inventory well in advance of each selling period. In the event we misjudge consumer preferences or demand, we will experience lower sales than expected and will have excessive inventory that may need to be written down in value or sold at prices that are less than expected.

Because of our dependence upon a small concentrated number of landlords for a substantial number of our locations, any significant erosion of our relationships with those landlords would negatively impact our ability to obtain and retain store locations.

We are significantly dependent on our ability to operate stores in desirable locations with capital investment and lease costs that allow us to earn a reasonable return on our locations. We depend on the leasing market and our landlords to determine supply, demand, lease cost and operating costs and conditions. We cannot be certain as to when or whether desirable store locations will become or remain available to us at reasonable lease and operating costs. Further, several large landlords dominate the ownership of prime malls, and we are dependent upon maintaining good relations with those landlords in order to obtain and retain store locations on optimal terms. From time to time, we do have disagreements with our landlords and a significant disagreement, if not resolved, could have an adverse impact on our business.

Changes in regulatory requirements relating to the extension of credit may increase the cost of or adversely affect our operations.

Our operations are affected by numerous U.S. and Canadian federal and state or provincial laws that impose disclosure and other requirements upon the origination, servicing and enforcement of credit

11

accounts and limitations on the maximum aggregate amount of finance charges that may be charged by a credit provider. Any change in the regulation of credit (including changes in the application of current laws) which would materially limit the availability of credit to our customer base could adversely affect our sales and earnings.

Any disruption in, or changes to, our private label credit card arrangement with Citi may adversely affect our ability to provide consumer credit and write credit insurance.

Our agreement with Citi, through which Citi provides financing for our customers to purchase merchandise through private label credit cards, enhances our ability to provide consumer credit and write credit insurance. Any disruption in, or change to, this agreement could have an adverse effect on our business, especially to the extent that it materially limits credit availability to our customer base.

Acquisitions and dispositions involve special risk, including the risk that we may not be able to complete proposed acquisitions or dispositions or that such transactions may not be beneficial to us.

We have made significant acquisitions in the past and may in the future make additional acquisitions and dispositions. Difficulty integrating an acquisition into our existing infrastructure and operations may cause us to fail to realize expected return on investment through revenue increases, cost savings, increases in geographic or product presence and customer reach, and/or other projected benefits from the acquisition. In addition, we may not achieve anticipated cost savings or may be unable to find attractive investment opportunities for funds received in connection with a disposition. Additionally, attractive acquisition or disposition opportunities may not be available at the time or pursuant to terms acceptable to us and we may be unable to complete acquisitions or dispositions.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable.

ITEM 2. PROPERTIES

We lease a 430,000 square foot corporate headquarters facility, which lease extends through 2018. The facility is located in Las Colinas, a planned business development in Irving, Texas, near the Dallas/Fort Worth International Airport. We lease approximately 40,000 square feet of warehouse space that in June 2003 was subleased to a third party through the remainder of the lease term, which extends through March 2009. We expanded our Canadian distribution and production operations in July 2005 by leasing a 26,280 square foot facility in Toronto, Ontario with a lease term through November 2014. We also lease a 20,000 square foot distribution and warehousing facility in Irving, Texas with a lease term through June 2009 that serves as the Piercing Pagoda distribution center.

We rent our store retail space under leases that generally range in terms from 5 to 10 years and may contain minimum rent escalation clauses, while kiosk leases generally range from three to five years. Most of the store leases provide for the payment of base rentals plus real estate taxes, insurance, common area maintenance fees and merchants association dues, as well as percentage rents based on the stores' gross sales.

We lease 18.5 percent of our store and kiosk locations from Simon Property Group and 15 percent of our store and kiosk locations from General Growth Management, Inc. Otherwise, we have no relationship with any lessor relating to 10 percent or more of our store and kiosk locations.

12

The following table indicates the expiration dates of the current terms of our leases as of July 31, 2007:

Term Expires

| | Stores

| | Kiosks

| | Other(1)

| | Total

| | Percentage

of Total

| |

|---|

| 2008 and prior | | 280 | | 266 | | 1 | | 547 | | 24.1 | % |

| 2009 | | 154 | | 167 | | 1 | | 322 | | 14.2 | % |

| 2010 | | 179 | | 174 | | 1 | | 354 | | 15.6 | % |

| 2011 | | 179 | | 105 | | — | | 284 | | 12.5 | % |

| 2012 and thereafter | | 679 | | 81 | | 4 | | 764 | | 33.6 | % |

| | |

| |

| |

| |

| |

| |

| | | 1,471 | | 793 | | 7 | | 2,271 | | 100.0 | % |

| | |

| |

| |

| |

| |

| |

- (1)

- Other includes warehouses, distribution centers, storage facilities, and one location that opened August 1, 2007.

Management believes substantially all of the store leases expiring in fiscal year 2008 that it wishes to renew (including leases which expired earlier and are currently being operated under month-to-month extensions) will be renewed. Generally, although rents continue to increase, we otherwise expect leases will be renewed on terms not materially less favorable to us than the terms of the expiring or expired leases. Management believes our facilities are suitable and adequate for our business as presently conducted.

ITEM 3. LEGAL PROCEEDINGS

Information regarding legal proceedings is incorporated by reference from note 12 to our consolidated financial statements set forth in Part IV of this report.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

Not applicable.

13

ITEM 4A. EXECUTIVE OFFICERS AND KEY EMPLOYEES OF THE REGISTRANT

The following individuals serve as our executive officers or are other key employees of the Company. Officers are elected by the Board of Directors annually, each to serve until his or her successor is elected and qualified, or until his or her earlier resignation, removal from office or death.

Name

| | Age

| | Position

|

|---|

| Executive Officers: | | | | |

| Mary E. Burton | | 55 | | President, Chief Executive Officer and Director |

| Rodney Carter | | 49 | | Executive Vice President, Chief Administrative Officer and Chief Financial Officer |

| Charles Fieramosca | | 59 | | Corporate Senior Vice President and President, Bailey Banks & Biddle |

| Gilbert P. Hollander | | 54 | | Executive Vice President and Chief Sourcing and Supply Chain Officer |

| Stephen R. Lang | | 39 | | Group Senior Vice President and Chief Merchandise Officer |

Key Employees: |

|

|

|

|

| Mary Ann Doran | | 51 | | Senior Vice President, Human Resources |

| Cynthia T. Gordon | | 43 | | Senior Vice President, Controller |

| Steven Larkin | | 49 | | Senior Vice President, E-Commerce |

| Stephen C. Massanelli | | 51 | | Senior Vice President, Real Estate |

| Susann C. Mayo | | 55 | | Senior Vice President, Supply Chain |

| Hilary Molay | | 53 | | Senior Vice President, General Counsel and Secretary |

| Sterling Pope | | 52 | | Senior Vice President, Store Operations |

| George J. Slicho | | 58 | | Senior Vice President, Loss Prevention |

| Mark A. Stone | | 49 | | Senior Vice President, Chief Information Officer |

Executive Officers

The following is a brief description of the business experience of the Company's executive officers for at least the past five years.

Ms. Mary E. Burton was appointed President and Chief Executive Officer effective July 2006. Ms. Burton served as Acting Chief Executive Officer from January 2006 through July 2006. Ms. Burton has served as a director of the Company since August 1, 2003. Prior to being appointed Acting Chief Executive Officer of the Company, Ms. Burton's principal occupation was serving as Chief Executive Officer of BB Capital, Inc., a retail advisory and management services company. Ms. Burton was Chief Executive Officer of the Cosmetic Center, Inc., a chain of 250 specialty retail stores, from June 1998 to April 1999. Prior to occupying that position, she served as Chief Executive Officer of PIP Printing from July 1991 to July 1992, and as Chief Executive Officer of Supercuts, Inc. from September 1987 to June 1991. She is also a director of Staples, Inc.

Mr. Rodney Carter was appointed Executive Vice President, Chief Administrative Officer and Chief Financial Officer effective September 2007. Prior to that appointment, Mr. Carter served as Group Senior Vice President and Chief Financial Officer from October 2006 through September 2007. Prior to joining the Company, Mr. Carter was the Senior Vice President and Chief Financial Officer of PETCO Animal Supplies, Inc., and prior to that position, was the Executive Vice President and Chief Financial Officer for CEC Entertainment, Inc. Prior to his position at CEC Entertainment, Inc, Mr. Carter held various positions with J.C. Penney, including Chief Financial Officer of JCPenney Credit and Chief Financial Officer of JCPenney Direct Marketing Services.

14

Mr. Charles E. Fieramosca joined the Company in April 2001 as Senior Vice President and President of Bailey Banks & Biddle Fine Jewelers. In the 10 years prior to joining the Company, Mr. Fieramosca founded and served as the CEO of Ascend Consulting, a product and brand development company. Prior to his role at Ascend Consulting, Mr. Fieramosca held various positions with Jones New York Menswear, BASCO All American Sportswear, and Macy's.

Mr. Gilbert P. Hollander was appointed Executive Vice President and Chief Sourcing and Supply Chain Officer in September 2007. Prior to that appointment, Mr. Hollander served as President, Corporate Sourcing/Piercing Pagoda in May 2006, and was given the additional title of Group Senior Vice President in August 2006. From January 2005 to August 2006, he served as President, Piercing Pagoda. Prior to and up until that appointment, Mr. Hollander served as Vice President of Divisional Merchandise for Piercing Pagoda, to which he was appointed in August 2003. Mr. Hollander served as Senior Vice President of Merchandising for Piercing Pagoda from February 2000 to August 2003. Prior to February 2000, Mr. Hollander held various management positions within Piercing Pagoda beginning in May of 1997.

Mr. Stephen R. Lang was promoted to Group Senior Vice President and Chief Merchandising Officer in August 2007. From January 2007 until August 2007, Mr. Lang served as Senior Vice President of Gordon's Jeweler's and from August 2004 through December 2006, he served as Vice President and Division Merchandise Manager of various brands within the Company. Prior to rejoining the Company in 2004, Mr. Lang held various positions with Freidman's Jewelers from 2000 through 2004.

Key Employees

Ms. Mary Ann Doran was promoted to Senior Vice President of Human Resources in February 2005. Ms. Doran previously held the position of Vice President of Organizational Development & Recruitment, to which she was appointed in August 1997. Ms. Doran began her career with the Company in October 1996 as Vice President, Personnel Development & Staffing. Prior to joining the Company, Ms. Doran held positions with Kenzer Corporation, Bombay Company and the Jordan Marsh Company, where she served as Vice President of Human Resources.

Ms. Cynthia T. Gordon was promoted to Senior Vice President, Controller in February 2003. From April 2001 to July 2003, Ms. Gordon served as Vice President of Corporate Planning. From 1998 to 2001, Ms. Gordon served as Senior Director of Investor Relations. Ms. Gordon joined the Company in October 1994 as the Director of Corporate Planning. Prior to joining the Company in 1994, Ms. Gordon served in various positions, including Director of Investor Relations and External Reporting for A Pea in the Pod, a maternity wear retailer, and in the audit division of Ernst & Young LLP in Dallas, Texas.

Mr. Steven Larkin joined the Company in January 2006 as Senior Vice President, E-Commerce. Prior to joining the Company, Mr. Larkin held positions of Vice President, Merchandising for Benchmark Brands (2003 - 2004) and Shop NBC (2001 - 2002). Mr. Larkin also held the position of Vice President, E-Commerce for Broadband Sports.com from 2000 through 2001, and Chief Merchandising Officer at The Fingerhut Corporation from 1995 through 2000.

Mr. Stephen C. Massanelli was appointed Senior Vice President, Real Estate in May 2004. Mr. Massanelli joined the Company in June 1997 as Senior Vice President, Treasurer. From 1993 to 1997, Mr. Massanelli was a principal and member of the Board of Directors of Treadstone Partners, LLP, a private merchant banking organization in Dallas. Prior to 1993, Mr. Massanelli served in various financial roles at AMRESCO, Inc. and NationsBank of Texas, predecessor to Bank of America.

Ms. Susann C. Mayo joined the Company in October 2005 as Senior Vice President, Supply Chain. Prior to joining the Company, Ms. Mayo was the Vice President of Logistics & Distribution for The Bombay Company from 2001 through February 2005. Prior to 2001, Ms. Mayo held various positions at Sears, Roebuck & Co. from 1973 through 2001.

15

Ms. Hilary Molay was promoted to Senior Vice President, General Counsel and Secretary of the Company in September 2005. Prior to her most recent promotion, Ms. Molay served as Vice President, General Counsel and Secretary of the Company from August 2002 through August 2005. Ms. Molay also serves as Secretary to the Zale Board of Directors.

Mr. Sterling Pope was promoted to Senior Vice President, Store Operations in August 2007. From February 2007 through July 2007, Mr. Pope served as Senior Vice President, Store Operations. From January 2002 through December 2006, Mr. Pope served as Senior Vice President, Store Operations for Peoples Jewellers, and prior to that appointment, Mr. Pope served in various roles within the Peoples Jewellers organization.

Mr. George J. Slicho was promoted to the position of Senior Vice President, Loss Prevention in November 2000. Mr. Slicho began his career with the Company in March 1991 as Vice President of Loss Prevention. Prior to joining the Company, Mr. Slicho held various positions in corporate security, including Vice President of Loss Prevention and Audit for P.A. Bergner & Company. In addition, Mr. Slicho served as a special agent in various field offices of the Federal Bureau of Investigation.

Mr. Mark A. Stone was promoted to Senior Vice President, Chief Information Officer in May 2006. From August 2003 through April 2006, Mr. Stone held the position of Vice President, Planning and Analysis. From March 2002 through July 2003, Mr. Stone held the position of Senior Director, Pagoda Distribution. Mr. Stone joined the Company in January 1995 and held various positions within the Information Technology group until February 2002. Prior to joining the Company, Mr. Stone was Director of Financial Operations for the Resolution Trust Corporation from January 1990 to January 1995.

16

PART II

ITEM 5. MARKET FOR THE REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock is listed on the New York Stock Exchange under the symbol "ZLC." The following table sets forth the high and low sale prices as reported on the NYSE for the common stock for each fiscal quarter during the two most recent fiscal years.

| | 2007

| | 2006

|

|---|

| | High

| | Low

| | High

| | Low

|

|---|

| First | | $ | 28.88 | | $ | 25.34 | | $ | 34.42 | | $ | 25.62 |

| Second | | $ | 31.42 | | $ | 26.71 | | $ | 29.95 | | $ | 24.28 |

| Third | | $ | 29.96 | | $ | 25.19 | | $ | 28.61 | | $ | 23.54 |

| Fourth | | $ | 28.78 | | $ | 21.06 | | $ | 27.75 | | $ | 21.01 |

As of September 17, 2007, the outstanding shares of common stock were held by approximately 685 holders of record. We have not paid dividends on the common stock since its initial issuance on July 30, 1993. In addition, our long-term debt limits our ability to pay dividends or repurchase our common stock if borrowing availability under our $500 million U.S. revolving credit facility is less than $75 million. At July 31, 2007, we had borrowing availability under the revolving credit agreement of $278.8 million. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources" and "Notes to the Consolidated Financial Statements—Debt."

17

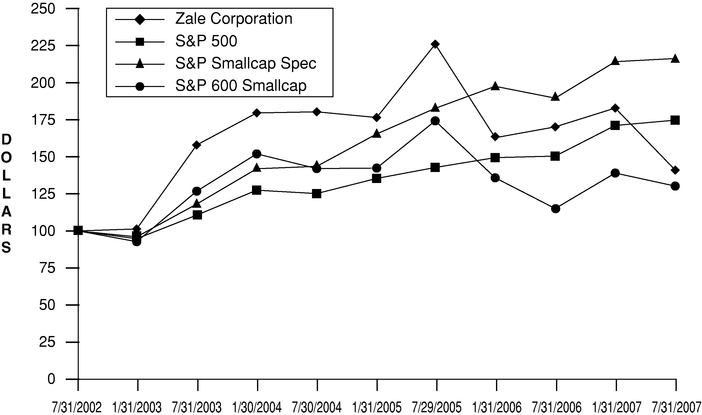

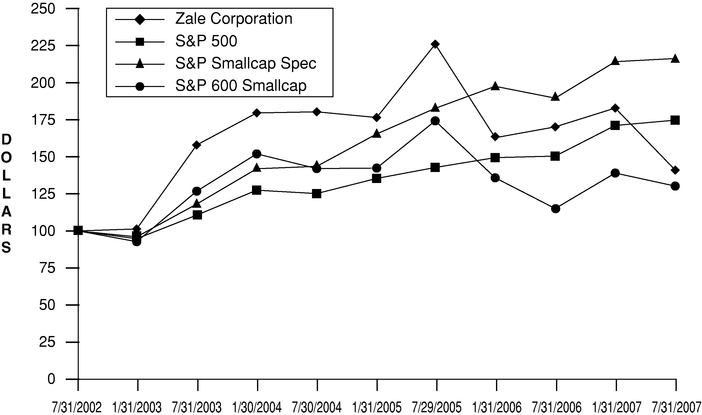

Corporate Performance Graph

The following graph shows a comparison of cumulative total returns for the Company, the S&P 500 Index, the S&P Smallcap Specialty Store Index and the S&P 600 Smallcap Index for the period from August 1, 2002 to July 31, 2007. The comparison assumes $100 was invested on August 1, 2002 in the Company's common stock and in each of the three indices and, for the S&P 500 Index, the S&P Smallcap Specialty Store Index and the S&P 600 Smallcap Index, assumes reinvestment of dividends. The Company has not paid any dividends during this period.

| | 7/31/02

| | 1/31/03

| | 7/31/03

| | 1/31/04

| | 7/31/04

| | 1/30/05

| | 7/30/05

| | 1/31/06

| | 7/29/06

| | 1/31/07

| | 7/31/07

|

|---|

| Zale Corporation | | 100 | | 101.33 | | 157.97 | | 179.57 | | 180.33 | | 176.48 | | 225.91 | | 162.86 | | 170.17 | | 182.86 | | 141.06 |

| S&P 500 | | 100 | | 94.74 | | 110.64 | | 127.47 | | 125.19 | | 135.40 | | 142.78 | | 149.44 | | 150.45 | | 171.11 | | 174.71 |

| S&P Smallcap Spec | | 100 | | 96.01 | | 118.11 | | 141.94 | | 143.53 | | 165.41 | | 182.66 | | 197.53 | | 189.55 | | 214.14 | | 216.29 |

| S&P 600 Smallcap | | 100 | | 92.75 | | 126.80 | | 151.96 | | 142.06 | | 142.39 | | 174.23 | | 135.83 | | 115.10 | | 139.03 | | 130.24 |

The stock price performance depicted in the above graph is not necessarily indicative of future price performance. The Corporate Performance Graph shall not be deemed "soliciting material" or to be "filed" with the SEC, nor shall such information be incorporated by reference into any future filing by the Company under the Securities Act or the Exchange Act, except to the extent that the Company specifically incorporates the graph by reference in such filing.

18

ITEM 6. SELECTED FINANCIAL DATA

The following selected financial data is qualified in its entirety by our Consolidated Financial Statements (and the related Notes thereto) contained elsewhere in this Form 10-K and should be read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations." The income statement and balance sheet data for each of the fiscal years ended July 31, 2007, 2006, 2005, 2004, and 2003 has been derived from our audited Consolidated Financial Statements.

| | Year Ended July 31,

| |

|---|

| | 2007

| | 2006

| | 2005

| | 2004

| | 2003

| |

|---|

| | (amounts in thousands, except per share amounts)

| |

|---|

| Revenues(a) | | $ | 2,437,075 | | $ | 2,438,977 | | $ | 2,383,066 | | $ | 2,304,440 | | $ | 2,212,241 | |

| | |

| |

| |

| |

| |

| |

| Costs and expenses: | | | | | | | | | | | | | | | | |

| | Cost of sales(b) | | | 1,187,601 | | | 1,215,636 | | | 1,157,226 | | | 1,122,946 | | | 1,101,030 | |

| | Selling, general and administrative(c) | | | 1,070,478 | | | 1,087,458 | | | 982,113 | | | 942,796 | | | 884,069 | |

| | Cost of insurance operations | | | 6,798 | | | 6,699 | | | 6,084 | | | 5,963 | | | 8,228 | |

| | Depreciation and amortization | | | 61,887 | | | 59,771 | | | 59,840 | | | 56,381 | | | 55,690 | |

| | Impairment of goodwill | | | — | | | — | | | — | | | — | | | 136,300 | |

| | Benefit from settlement of retirement plan | | | — | | | (13,403 | ) | | — | | | — | | | — | |

| | Derivatives loss | | | 7,184 | | | 1,681 | | | — | | | — | | | — | |

| | |

| |

| |

| |

| |

| |

| Operating earnings | | | 103,127 | | | 81,135 | | | 177,803 | | | 176,354 | | | 26,924 | |

| Interest expense | | | 18,969 | | | 11,185 | | | 7,725 | | | 7,528 | | | 6,319 | |

| Costs of early retirement of debt | | | — | | | — | | | — | | | — | | | 5,910 | |

| | |

| |

| |

| |

| |

| |

| Earnings before income taxes | | | 84,158 | | | 69,950 | | | 170,078 | | | 168,826 | | | 14,695 | |

| Income taxes(d) | | | 24,906 | | | 16,328 | | | 63,303 | | | 62,353 | | | 55,340 | |

| | |

| |

| |

| |

| |

| |

| | | Net earnings (loss) | | $ | 59,252 | | $ | 53,622 | | $ | 106,775 | | $ | 106,473 | | $ | (40,645 | ) |

| | |

| |

| |

| |

| |

| |

Earnings (loss) per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Basic | | $ | 1.22 | | $ | 1.10 | | $ | 2.08 | | $ | 2.02 | | $ | (0.63 | ) |

| | |

| |

| |

| |

| |

| |

| | Diluted | | $ | 1.21 | | $ | 1.09 | | $ | 2.05 | | $ | 1.99 | | $ | (0.63 | ) |

| | |

| |

| |

| |

| |

| |

Weighted average number of common shares outstanding(e): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Basic | | | 48,694 | | | 48,808 | | | 51,280 | | | 52,650 | | | 64,528 | |

| | |

| |

| |

| |

| |

| |

| | Diluted | | | 48,995 | | | 49,211 | | | 51,975 | | | 53,519 | | | 64,528 | |

| | |

| |

| |

| |

| |

| |

Balance Sheet Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Working capital | | $ | 797,860 | | $ | 649,219 | | $ | 611,561 | | $ | 582,888 | | $ | 532,443 | |

| | Total assets | | | 1,613,946 | | | 1,462,568 | | | 1,380,900 | | | 1,342,084 | | | 1,294,106 | |

| | Long-term debt | | | 227,306 | | | 202,813 | | | 129,800 | | | 197,500 | | | 184,400 | |

| | Total stockholders investment | | | 902,573 | | | 804,353 | | | 817,588 | | | 726,114 | | | 652,323 | |

- (a)

- Revenues for fiscal years 2006, 2005, 2004 and 2003 include $24.3 million, $49.8 million, $48.1 million and $46.3 million, respectively, of revenues generated in the closed Bailey Banks & Biddle stores.

- (b)

- In fiscal year 2006, cost of sales includes charges of $26.9 million related to the accelerated markdown of discontinued merchandise and $21.4 million related to closing certain Bailey Banks & Biddle stores (including a $6.2 million charge on inventory).

19

- (c)

- In fiscal year 2006, selling, general and administrative includes (1) $12.1 million in executive severance costs, (2) $28.0 million related to Bailey Banks & Biddle store closings, (3) $5.3 million related to adoption of SFAS 123(R), (4) $5.2 million related to termination of an IT initiative and (5) $4.6 million related to asset impairment charges.

- (d)

- Income taxes in fiscal year 2006 decreased primarily due to lower earnings, tax benefits related to the American Jobs Creation Act repatriation and reduced tax rates in Canada. Income taxes in fiscal year 2007 includes an $8.5 million benefit associated with our decision to indefinitely reinvest certain undistributed foreign earnings outside the U.S.

- (e)

- Ending share amounts have been adjusted to give retroactive effect for a two-for-one stock split completed on June 8, 2004.

20

Segment Data

We report our business under three segments: Fine Jewelry, Kiosk Jewelry and All Other. We group our brands into segments based on the similarities in commodity characteristics of the merchandise and the product mix. The All Other segment includes insurance and reinsurance operations. Segment revenues are not provided by product type or geographically as we believe such disclosure is not consistent with the manner in which we make decisions.

Operating earnings by segment are calculated before unallocated corporate overhead, interest and taxes but include an internal charge for inventory carrying cost to evaluate segment profitability. Unallocated costs are before income taxes and include corporate employee related costs, administrative costs, information technology costs, corporate facilities costs and depreciation and amortization.

| | Year Ended July 31,

| |

|---|

Selected Financial Data by Segment

| |

|---|

| | 2007

| | 2006

| | 2005

| | 2004

| | 2003

| |

|---|

| | (amounts in thousands)

| |

|---|

| Revenues: | | | | | | | | | | | | | | | | |

| | Fine Jewelry(a) | | $ | 2,160,870 | | $ | 2,149,217 | | $ | 2,089,261 | | $ | 2,022,214 | | $ | 1,939,454 | |

| | Kiosk(b) | | | 262,627 | | | 276,619 | | | 280,897 | | | 269,660 | | | 256,665 | |

| | All Other | | | 13,578 | | | 13,141 | | | 12,908 | | | 12,566 | | | 16,122 | |

| | |

| |

| |

| |

| |

| |

| | | Total revenues | | $ | 2,437,075 | | $ | 2,438,977 | | $ | 2,383,066 | | $ | 2,304,440 | | $ | 2,212,241 | |

| | |

| |

| |

| |

| |

| |

Depreciation and amortization: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Fine Jewelry | | $ | 45,224 | | $ | 43,273 | | $ | 44,410 | | $ | 41,757 | | $ | 40,915 | |

| | Kiosk | | | 5,625 | | | 5,571 | | | 4,708 | | | 4,199 | | | 4,653 | |

| | All Other | | | — | | | — | | | — | | | — | | | — | |

| | Unallocated | | | 11,038 | | | 10,927 | | | 10,722 | | | 10,425 | | | 10,122 | |

| | |

| |

| |

| |

| |

| |

| | | Total depreciation and amortization | | $ | 61,887 | | $ | 59,771 | | $ | 59,840 | | $ | 56,381 | | $ | 55,690 | |

| | |

| |

| |

| |

| |

| |

Operating earnings (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Fine Jewelry | | $ | 109,110 | | $ | 108,082 | | $ | 147,414 | | $ | 153,739 | | $ | 151,650 | |

| | Kiosk(c) | | | 6,646 | | | 20,402 | | | 29,030 | | | 25,951 | | | (125,629 | ) |

| | All Other | | | 6,780 | | | 6,443 | | | 6,824 | | | 6,603 | | | 7,894 | |

| | Unallocated(d) | | | (19,409 | ) | | (53,792 | ) | | (5,465 | ) | | (9,939 | ) | | (6,991 | ) |

| | |

| |

| |

| |

| |

| |

| | | Total operating earnings | | $ | 103,127 | | $ | 81,135 | | $ | 177,803 | | $ | 176,354 | | $ | 26,924 | |

| | |

| |

| |

| |

| |

| |

Assets(e): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Fine Jewelry(f) | | $ | 1,262,716 | | $ | 1,119,679 | | $ | 1,103,142 | | $ | 1,055,755 | | $ | 1,036,080 | |

| | Kiosk(g) | | | 125,680 | | | 124,415 | | | 117,125 | | | 111,238 | | | 96,485 | |

| | All Other | | | 42,352 | | | 39,261 | | | 35,670 | | | 37,737 | | | 38,217 | |

| | Unallocated | | | 183,198 | | | 179,213 | | | 124,963 | | | 137,354 | | | 123,324 | |

| | |

| |

| |

| |

| |

| |

| | | Total assets | | $ | 1,613,946 | | $ | 1,462,568 | | $ | 1,380,900 | | $ | 1,342,084 | | $ | 1,294,106 | |

| | |

| |

| |

| |

| |

| |

Capital expenditures: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Fine Jewelry | | $ | 54,619 | | $ | 54,942 | | $ | 59,587 | | $ | 42,535 | | $ | 27,064 | |

| | Kiosk | | | 3,036 | | | 7,750 | | | 8,650 | | | 6,038 | | | 6,383 | |

| | All Other | | | — | | | — | | | — | | | — | | | — | |

| | Unallocated | | | 28,791 | | | 20,026 | | | 14,887 | | | 12,215 | | | 10,132 | |

| | |

| |

| |

| |

| |

| |

| | | Total capital expenditures | | $ | 86,446 | | $ | 82,718 | | $ | 83,124 | | $ | 60,788 | | $ | 43,579 | |

| | |

| |

| |

| |

| |

| |

- (a)

- Includes $272.0, $229.6, $198.3, $174.1 and $150.4 million in fiscal years 2007, 2006, 2005, 2004 and 2003, respectively, related to foreign operations.

21

- (b)

- Includes $2.8, $7.7 and $6.6 million in fiscal years 2007, 2006 and 2005, respectively, related to foreign operations. There were no foreign operations in the segment prior to fiscal year 2005.

- (c)

- Includes impairment of goodwill of $136.3 million in fiscal year 2003.

- (d)

- Fiscal year 2006 includes $36.7 million related to the special charge, $13.4 million benefit related to the settlement of certain retirement plan obligations, $12.1 million for executive severance, $5.3 million related to share-based compensation expense and $2.4 million related to accrued percentage rent. Also, includes $80.8, $70.9, $71.0, $65.9 and $63.3 million in fiscal years 2007, 2006, 2005, 2004 and 2003, respectively, to offset internal carrying costs charged to the segments.

- (e)

- Assets allocated to segments include fixed assets, inventories and goodwill. Unallocated assets include cash, prepaid assets such as rent, corporate office improvements and technology infrastructure.

- (f)

- Includes $37.5, $28.8, $27.2, $23.2 and $20.0 million of fixed assets in fiscal years 2007, 2006, 2005, 2004 and 2003, respectively, related to foreign operations.

- (g)

- Includes $466,000 and $390,000 of fixed assets in fiscal years 2006 and 2005, respectively, related to foreign operations. There were no foreign operations in the segment prior to 2005 and all fixed assets were disposed of in fiscal year 2007.

The segments are not organized based on product differences or geographic areas and, accordingly, it is not practicable to report revenues based on such organization.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

With respect to forward-looking statements made in this Management's Discussion and Analysis of Financial Condition and Results of Operations see "Item 1A—Risk Factors."

Overview

We are a leading specialty retailer of fine jewelry in North America. At July 31, 2007, we operated 1,471 fine jewelry stores and 793 kiosk locations primarily in shopping malls throughout the United States of America, Canada and Puerto Rico. Our operations are divided into three business segments: Fine Jewelry, Kiosk Jewelry and All Other.

The Fine Jewelry segment focuses primarily on diamond product, but differentiates its six brands through customer service, merchandise assortments, store design and marketing. Zales Jewelers (includingzales.com), our national brand in the U.S., provides moderately priced jewelry to a broad range of customers. Zales Outlet caters to the slightly higher-income female self purchaser in malls and neighborhood power centers. Gordon's Jewelers (includinggordonsjewelers.com) is a moderately priced regional jeweler focusing on customer relationships. Bailey Banks & Biddle Fine Jewelers (includingbaileybanksandbiddle.com) operates jewelry stores that are considered among the finest luxury jewelry stores in their markets, offering designer jewelry and prestige watches to attract more affluent customers. Peoples Jewellers and Mappins Jewellers are two of the most recognized brand names in Canada, providing moderately priced jewelry to a wide variety of Canadian customers.

The Kiosk Jewelry segment reaches the opening price point fine jewelry customer primarily through mall-based kiosks under the name Piercing Pagoda.

The All Other segment consists primarily of our insurance operations, which provide insurance and reinsurance facilities for various types of insurance coverage offered primarily to our private label credit card customers.

Comparable store sales exclude revenue recognized from warranty sales, internet sales and insurance premiums related to credit insurance policies sold to customers who purchase merchandise under our proprietary credit program. The sales results of new stores are included beginning their thirteenth full

22

month of operation. The results of stores that have been relocated, renovated or refurbished are included in the calculation of comparable store sales on the same basis as other stores. However, stores closed for more than 90 days due to unforeseen events (hurricanes, etc.) are excluded from the calculation of comparable store sales. Beginning in fiscal year 2008, comparable store sales will include internet sales. This approach is consistent with improving our multi-channel experience and leveraging the best of our real estate footprint with internet sales. The following table shows comparable store sales as reported and including internet sales for fiscal year 2007:

| | As Reported

| | Including

Internet Sales

| |

|---|

| First quarter | | 0.4 | % | 1.0 | % |

| Second quarter | | 1.4 | % | 2.3 | % |

| Third quarter | | (3.4 | )% | (2.8 | )% |

| Fourth quarter | | (0.5 | )% | 0.1 | % |

| Full year | | (0.2 | )% | 0.5 | % |

During fiscal year 2007, we focused on several key areas including repositioning of the Zales brand, improving gross margins through direct sourcing, investing in our people and launching key system initiatives.

The Zales brand expanded its diamond assortment by investing approximately $100 million in diamond fashion and solitaire jewelry prior to the 2006 calendar Holiday season. These investments were deemed necessary to position the brand as "The Diamond Store." While Holiday sales were positive, the inventory investments did result in overstock positions of core product that will be sold in lieu of replenishment of certain styles through fiscal year 2008. Our direct sourcing strategy includes both internal procurement and assembly and importing directly from factories. Direct sourced goods accounted for 34 percent and 28 percent of purchases in fiscal years 2007 and 2006, respectively. The margin improvements were largely offset by aggressive promotional discounting in the Holiday selling season that did not result in the desired incremental revenues. We tested investments in payroll to strengthen the team of associates and improve the customer experience. While the payroll investment in experienced jewelry sales associates appears effective, additional investments in store coverage will be reduced in fiscal year 2008. Additionally, we launched several key system initiatives to support the needs of the business as well as to facilitate implementation of some of our strategic initiatives. We introduced an online vendor portal that allows vendors to view and set up new items online. We implemented year one of our three year plan to install the Oracle Merchandise System and we are beginning a three year roll-out of the new and improved proprietary point-of-sale platform.

In addition, we introduced a lifetime warranty plan that replaced a two-year product offering. The new lifetime warranty was initially tested in the Zales and Peoples and Mappins brands during the second quarter of fiscal year 2007. The product was subsequently adopted by Gordon's and Outlet in the third quarter. The plan was well received by customers as the attachment rate increased from 41.6 percent in fiscal year 2006 to 49.5 percent in fiscal year 2007. Increases in both price and unit sales resulted in an increase of $33.1 million in warranty sales to $110.7 million in fiscal year 2007 as compared to $77.6 million in fiscal year 2006. However, the introduction of the lifetime warranty plan required us to change the revenue recognition methodology from recognizing revenues based on the rate services were incurred over a two-year period to recognizing revenues on a straight-line basis over a period of five years. As a result, recognized revenues decreased $25.9 million from $74.1 million in fiscal year 2006 to $48.2 million in fiscal year 2007. While the revenue recognized related to warranties negatively impacts revenues in the short-term, the cash from sales of warranties has increased over prior years. For additional information related to warranties, see note 13 to our consolidated financial statements set forth in Part IV of this report.

23

We have identified several key strategies which are centered on improving our return on capital over time as we move into fiscal year 2008. These strategies include improving the profitability of our existing core mall business, growth in our Canadian brands and outside of the mall and migrating to a more centralized and streamlined organization.

We believe improving our core mall business is a significant opportunity to drive shareholder value. We intend to achieve this goal by creating a superior customer experience through increased emphasis on customer interactions, in-store "comfort" and increased associate training. In addition to focusing on the core business we will continue to invest in our most profitable brands: the Canadian mall-based brands and the growth opportunity outside the traditional mall. We intend to build on our success with Zales Outlet that has a proven track record of profitability. We also plan to continue to build our internet business with a focus on online customer experience and multi-channel execution. The last component of our strategy is to migrate to a more centralized and streamlined organization. The centralized organization will result in a focus on three core competencies that are consistent to executing our strategic objectives: merchandising, supply chain and store operations.