The Board has determined Messrs. McLoughlin and Josephson each qualify as an “audit committee financial expert” as that term is defined by the rules and regulations of the Commission. The Board has further determined that Ms. Luscombe is financially literate as required within the applicable rules of the NYSE.

The Audit Committee has adopted procedures for its receipt, retention, and treatment of concerns and complaints regarding accounting, internal accounting controls, or auditing matters. The Audit Committee has overseen the creation of a telephone hotline. All submissions may be made on a confidential, anonymous basis, but the Audit Committee encourages that anyone making a submission supply his or her contact information to facilitate follow-up, clarification and assistance with investigations of the concern or complaint. We do not permit retaliation or discrimination of any kind against employees for any complaints submitted in good faith.

Human Resources Committee. The current members of the Human Resources Committee are Messrs. Huff (Chairman), Kelly and McLoughlin. Mr. Fiondella served as the Chairman of the Human Resources Committee through February 22, 2006, when he retired from the Board of Directors due to health reasons. The Human Resources Committee performs the functions of a compensation committee, including approval of the compensation paid to the Chief Executive Officer and other executive officers and the administration of our various stock option and other compensation plans. A copy of the Charter of the Human Resources Committee is available on our website – http://www.pxre.com. In 2005, the Human Resources Committee met 3 times.

Nominating/Corporate Governance Committee. The current members of the Nominating/Corporate Governance Committee are Messrs. Browne (Chairman), Josephson, Kelly and Stavis. Mr. Fiondella served as a member of the Nominating/Corporate Governance Committee through February 22, 2006, when he retired from the Board of Directors due to health reasons. The Nominating/Corporate Governance Committee identifies, evaluates and recommends to the Board individuals who have credentials qualifying them to be directors of PXRE’s Board, either for appointment to the Board or to stand for election at a meeting of the shareholders, and develops and recommends to the Board corporate governance guidelines for PXRE. A copy of the Charter of the Nominating/Corporate Governance Committee is available on our website – http://www.pxre.com. The Nominating/Corporate Governance Committee met 3 times in 2005.

The Nominating/Corporate Governance Committee considers recommendations for director nominees from a variety of sources, including members of our Board and those of our subsidiaries, business contacts, significant shareholders, community leaders, third-party advisory services and members of management. The Nominating/Corporate Governance Committee also considers shareholder recommendations for director nominees that are properly received in accordance with our Bye-Laws and the applicable rules and regulations of the Commission.

The Board believes that all of its members should have the highest personal integrity and have a record of exceptional ability and judgment. The Board also believes that its members should ideally reflect a mix of experience and other qualifications. At a minimum, any director candidate must satisfy all applicable requirements under the Exchange Act and the listing standards of the NYSE for members of committees of boards of directors. In addition, the Nominating/Corporate Governance Committee may take into consideration a director candidate’s experience, wisdom, integrity, ability to make independent analytical inquiries, understanding of our business, willingness and ability to devote time to board and committee duties, financial literacy, risk management skills, and, for incumbent members of the Board, his or her past performance.

The Nominating/Corporate Governance Committee will consider director candidates recommended by shareholders. Recommendations must be in writing and sent to our corporate secretary at P.O. Box 1282, Hamilton HM FX, Bermuda, Attn: Secretary, not later than 60 days prior to the first anniversary of the date on which notice of the prior year’s annual meeting was first mailed to shareholders. The shareholder’s notice must set forth for a

Back to Contents

person proposed to be nominated, the person’s consent to being named in the Proxy Statement as a nominee and to serving as a director if elected and (i) the name, age, business address and residence address of the person, (ii) the principal occupation or employment of the person, (iii) the class and number of shares of the Company which are beneficially owned by the person, (iv) any other information relating to the person that is required to be disclosed under applicable rules and regulations of the Commission, including the written consent of the person proposed to be nominated to being named in the Proxy Statement as a nominee and to serving as a director if elected. The shareholder’s notice must also set forth as to the shareholder making the nomination and the beneficial owner, if any, on whose behalf the nomination is made (i) the name and address of such shareholder, as they appear on our books, and of such beneficial owner, and (ii) the class and number of Common Shares that are owned of record by such shareholder and beneficially by such beneficial owner.

Investment Committee. The members of the Investment Committee are Ms. Luscombe (Chairwoman) and Messrs. Browne, Cooper and Stavis. The members of the Investment Committee are responsible for monitoring and approving the investment policies and the investments of PXRE and our reinsurance subsidiaries, including PXRE Reinsurance Ltd. (“PXRE Bermuda”) and PXRE Reinsurance Company (“PXRE Reinsurance”), and for overseeing investment management, which during 2005, was carried out by General Re – New England Asset Management, Inc. and by Mariner Investment Group, Inc. In 2005, the Investment Committee met 4 times.

Executive Committee. The current members of the Executive Committee are Messrs. G. Radke, J. Radke, Cooper and Huff. Mr. Fiondella served as a member of the Executive Committee through February 22, 2006, when he retired from the Board of Directors due to health reasons. The Executive Committee is vested with the authority to exercise the powers of the full Board of Directors during the intervals between its meetings. The Executive Committee did not meet in 2005.

Code of Ethics. We have adopted a Code of Business Conduct and Ethics for our directors, officers and employees. This code meets the definition of “code of ethics” under the rules and regulations of the Commission.

We have posted the code on our website – http://www.pxre.com and included it as an exhibit to our annual report on Form 10-K for fiscal 2005, which we have filed with the Commission.

Report of the Audit Committee of the Board of Directors of PXRE |

The Audit Committee of the PXRE Board of Directors (the “Audit Committee”) is composed of three independent directors, within the meaning of the rules of the Commission and the NYSE, and operates under a written charter adopted by the Board of Directors on February 11, 2003 and as amended on February 10, 2004. A copy of the Charter of the Audit Committee is available on our website – http://www.pxre.com. As of the date of this Report, the members of the Audit Committee are Philip R. McLoughlin (Chairman), Mural R. Josephson and Wendy Luscombe. Mr. Fiondella served as a member of the Audit Committee through February 22, 2006, when he retired from the Board of Directors due to health reasons. The Board has determined Messrs. McLoughlin and Josephson each qualify as an “audit committee financial expert” as that term is defined by the rules and regulations of the Commission, and that Ms. Luscombe is financially literate as required within the applicable rules of the NYSE. The Audit Committee met 7 times in 2005. The Audit Committee, subject to shareholder approval, appoints PXRE’s independent auditors and oversees their performance.

Management is responsible for PXRE’s financial reporting process, including the establishment and effectiveness of its system of internal controls, and for the preparation of consolidated financial statements in accordance with applicable laws, regulations and accounting principles generally accepted in the United States of America. PXRE’s independent auditors are responsible for performing an independent audit of the financial

16

Back to Contents

statements in accordance with the standards of the Public Company Accounting Oversight Board (United States), expressing an opinion as to the conformity of such financial statements with generally accepted accounting principles and auditing management’s assessment of the effectiveness of internal control over financial reporting. The independent auditors have free access to the Audit Committee to discuss any matters they deem appropriate. Our responsibility is to assist the Board of Directors in the monitoring and oversight of these processes. It is not our duty or our responsibility to conduct auditing or accounting reviews or procedures. We have relied, without independent verification, on management’s representation that the financial statements have been prepared with integrity and objectivity and in conformity with accounting principles generally accepted in the United States of America and on the representations of the independent auditors included in their report on PXRE’s financial statements. Furthermore, our considerations and discussions with management and the independent auditors do not assure that PXRE’s financial statements are presented in accordance with generally accepted accounting principles in the United States of America, that the audit of PXRE’s financial statements has been carried out in accordance with generally accepted auditing standards or that PXRE’s independent auditors are in fact “independent.”

In performing our oversight role, we have reviewed and discussed PXRE’s consolidated financial statements, with particular attention to losses incurred in the fourth quarter in connection with Hurricanes Katrina, Rita and Wilma, with management and the independent auditors. We discussed with the independent auditors matters required to be discussed by Statement on Auditing Standards No. 61 (Communications with Audit Committees), as modified or supplemented. PXRE’s independent auditors also provided us with the written disclosures required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), as modified or supplemented, and we discussed with the independent auditors that firm’s independence including a review of audit and non-audit fees.

During fiscal year 2005, the Audit Committee performed all of its duties and responsibilities under the Audit Committee Charter. Based upon our discussions with management and the independent auditors and our review of the representations of management and the report of the independent auditors to the Committee, we recommended to the Board of Directors that the PXRE’s audited consolidated financial statements be included in the PXRE’s Annual Report on Form 10-K for the year ended December 31, 2005 for filing with the Securities and Exchange Commission.

Dated: March 15, 2006

AUDIT COMMITTEE

Philip R. McLoughlin (Chairman)

Mural R. Josephson

Wendy Luscombe

Compensation of Directors |

Cash Compensation. In 2005, each non-employee director, other than the Chairman, received an annual retainer of $35,000. The Audit Committee Chairperson received an additional retainer of $12,000. All other Committee Chairpersons and the Vice Chairman of the Board received additional retainers of $6,000. In addition, the directors receive Board meeting fees of $2,000 per day that the director attends meetings. During the 2005 fiscal year, we paid a total of $760,000 in directors’ fees. See “Other Compensation” below. Our Chairman, Gerald Radke, was paid a $50,000 chairman fee for the period of July 1, 2004 through June 30, 2005 pursuant to a consulting services agreement which expired on June 30, 2005. See “Certain Relationships and Related Party Transactions – Consulting Services Agreement – Gerald Radke.” Upon expiration of the consulting services agreement, the Board of Directors determined that the Chairman of the Board would be paid an annual retainer of

17

Back to Contents

$50,000 and directed payment of $25,000 be paid to Mr. Gerald Radke on July 1, 2005, representing the pro rated portion of the annual retainer for the period of July 1, 2005 through December 31, 2005.

Other Compensation. Under the PXRE Director Equity and Deferred Compensation Plan (the “Director Compensation Plan”), non-employee directors may elect to defer receipt of the annual retainer and fees for services as a member of the Board of Directors and such directors are allowed to elect, prior to the subject year, to receive all or a portion of the annual retainer amount and the fee-for-services amount in our Common Shares or options to purchase our Common Shares. Deferred amounts are credited with earnings (losses) mirroring the fund or funds provided in our 401(k) Savings and Investments Plan that are designated by the director. The number of shares that may be awarded to a director upon such director’s election to receive Common Shares is the number of whole shares equal to (i) the amount elected to be deferred divided by (ii) the fair market value per Common Share, as determined pursuant to the Director Compensation Plan.

The number of whole Common Shares subject to an option grant under the Director Compensation Plan is determined by dividing the amount elected by the “option value”, as determined pursuant to the Director Compensation Plan. The exercise price per share under each option is equal to the fair market value per share, as determined pursuant to the Director Compensation Plan. Options granted under the Director Compensation Plan are immediately exercisable and may be exercised until the tenth anniversary of the date of grant. In the event a director terminates service on the Board, such person’s options are exercisable for three years after the date of termination of service, but not beyond the original expiration date. In the event of death of a director after terminating service on the Board of Directors, any outstanding options expire on the later of the date the director could have exercised the option at the time the director terminated service or one year from the date of death, provided that in no event may an option be exercised beyond its original expiration date.

During the 2005 fiscal year, no Common Shares or options to purchase Common Shares were awarded pursuant to the Director Compensation Plan.

The Director Compensation Plan is administered by the Board of Directors. The Board of Directors has full power and authority to construe and interpret the Director Compensation Plan and adopt and amend such rules and regulations for the administration of the Director Compensation Plan as it deems desirable. The Board of Directors may amend the Director Compensation Plan as it deems advisable, provided that shareholder approval is required for any amendment to the Director Compensation Plan that (i) materially increases the benefit accruing to participants under the Director Compensation Plan, (ii) increases the number of securities that may be issued under the Director Compensation Plan or (iii) materially modifies the requirements for participants in the Director Compensation Plan. Additionally, no amendment may materially and adversely affect any right of a director with respect to any option previously granted without such director’s written consent. The Board of Directors may terminate the Director Compensation Plan at any time. If not earlier terminated by the Board of Directors, the Director Compensation Plan will terminate immediately following the annual general meeting of shareholders in 2007.

Under the PXRE Director Stock Plan, as amended (the “Director Stock Plan”), each non-employee director is automatically granted, on the date of each annual general meeting, an option exercisable (subject to a three-year vesting period) for the purchase of 5,000 Common Shares at a price per share equal to the market value at the date of grant. The option vests ratably over a period of three years from the date of grant (other than in the case of a “change of control” (as defined in the Director Stock Plan), the Common Shares of PXRE ceasing to be publicly traded or the death, disability or retirement of the director, which will result in a lapse of the restriction). In addition, upon the termination of service on the Board of Directors by a non-employee director as a result of disability (as determined by the Board of Directors) or retirement (as defined under the Director Stock Plan),

18

Back to Contents

which termination occurs six months following the prior annual general meeting of shareholders, the director will receive a fully vested option exercisable for the purchase of 5,000 Common Shares on the last day of service as a director at a price per share equal to the fair market value at the date of grant. In the event a director terminates service on the Board of Directors by reason of death, retirement or disability, the total number of option shares will become immediately exercisable and will continue to be exercisable for three years (but not beyond its original expiration date). In the event a director terminates service on the Board of Directors other than by reason of death, disability or retirement, such person’s options (to the extent vested and exercisable upon such termination) will be exercisable for three months after the date of termination of service, but not beyond the original expiration date. In the event of death of a director after terminating service on the Board of Directors, any outstanding options will expire on the later of the date the director could have exercised the option at the time the director terminated service or one year from the date of death, provided that in no event may an option be exercised beyond its original expiration date. No option may be re-priced after the date of grant (other than in connection with an adjustment in our Common Shares, as provided in the Director Stock Plan).

Additionally, commencing in 2004, under the Director Stock Plan each non-employee director was automatically granted, on the date of each annual general meeting of shareholders, 2,500 Common Shares subject to certain restrictions. The restrictions on the restricted shares lapse ratably over a period of three years from the date of grant (other than in the case of a “change of control” (as defined in the Director Stock Plan), the Common Shares of PXRE ceasing to be publicly traded or the death, disability or retirement of the director, which will result in a lapse of the restriction). In addition, upon the termination of service on the Board of Directors by a non-employee director as a result of disability or retirement that occurs at least six months following the prior annual general meeting of shareholders, the director will receive 1,000 fully vested Common Shares on the director’s last day of service.

As of the Record Date, options for a total of 244,667 Common Shares had been granted, net of cancellations and exercises, pursuant to the Director Stock Plan, of which a total of 164,660 Common Shares are currently exercisable. As of the Record Date, 112,999 restricted Common Shares had been granted, net of cancellations, pursuant to the Director Stock Plan, 73,992 of which are currently vested. Directors who are granted restricted Common Shares under the Director Stock Plan are entitled to receive dividends on and to vote such Common Shares during the restricted period.

Pursuant to the terms of the Director Stock Plan, a total of 22,500 restricted Common Shares and options to acquire 45,000 Common Shares were due to be granted to directors at the upcoming Annual General Meeting on May 9, 2006. As of the Record Date, only 54,668 Common Shares remain authorized and unissued under the Director Stock Plan, leaving a deficit of 12,832 Common Shares. The Board of Directors has therefore determined to amend the Director Stock Plan to provide a pro rata reduction of the scheduled grant of options to acquire Common Shares and each non-employee director will therefore only receive options to acquire 3,574 Common Shares on May 9, 2006.

PXRE announced on February 17, 2006 that the Board of Directors had decided to explore strategic alternatives and had engaged Lazard to assist us in the process. This decision was made as a result of the occurrence of significant losses during the fourth quarter of 2005 and the downgrade of PXRE’s credit rating to a level that is generally unacceptable to our reinsurance clients and brokers.

As part of the Board’s strategic evaluation, the Human Resources Committee of the Board of Directors will be undertaking a comprehensive re-assessment of PXRE’s director compensation policies and practices to ensure that such policies and practices are consistent with whatever strategic objectives the Board of Directors ultimately decides to pursue. This review will include an evaluation of the Director Stock Plan.

19

Back to Contents

The Director Stock Plan is administered by the Board of Directors, which is authorized to interpret the Director Stock Plan, but has no authority with respect to the selection of directors to receive options, the number of Common Shares subject to the Director Stock Plan or to each grant thereunder, or the option price for Common Shares subject to options. The Board of Directors may amend the Director Stock Plan as it deems advisable, but may not, without further approval of the shareholders, increase the maximum number of Common Shares under the Director Stock Plan or options or restricted Common Shares to be granted thereunder, change the option price or price of the restricted Common Shares provided in the Director Stock Plan, extend the period during which options or restricted Common Shares may be granted or exercised, or change the class of persons eligible to receive options or restricted Common Shares.

Under the PXRE Non-Employee Director Deferred Stock Plan (the “Director Plan”), our eligible non-employee directors upon becoming directors are each granted the right to receive 2,000 Common Shares (subject to anti-dilution adjustments) at certain specified times following their respective terminations as directors. Effective as of January 1, 2003, the Director Plan was terminated; however, the terms of the Director Plan will continue to apply to those awards that have previously been granted to the non-employee directors but pursuant to which Common Shares have not yet been delivered. As of the Record Date, our eligible non-employee directors as a group have the right to receive a total of 12,000 Common Shares pursuant to the terms of the Director Plan.

On each date that dividends are paid to holders of our Common Shares, each director who was granted the right to receive Common Shares under the Director Plan is paid an amount in cash equal to the product of (i) the dividend per Common Shares for the applicable dividend payment date and (ii) the number of Common Shares that have been granted to the director, but that have not yet been delivered.

The Director Plan is administered by the Board of Directors, which may amend or terminate the Director Plan at any time. However, no such amendment or termination may reduce the number of Common Shares granted to the directors prior to such amendment or termination. As discussed above, effective January 1, 2003, the Board of Directors terminated the Director Plan.

Stock Ownership Guidelines |

We have implemented stock ownership guidelines in order to better align the long-term interests of the members of our Board of Directors with our interests. The guidelines, which may be achieved over a five-year period from the time the director becomes subject to these guidelines, would result in each member of the Board of Directors owning Common Shares or options to purchase Common Shares with a value equal to three times the annual retainer amount. This policy is not applicable to the Class IV Directors.

20

Back to Contents

PROPOSAL 2:

REAPPOINTMENT OF INDEPENDENT AUDITORS

The Audit Committee of the Board of Directors is recommending that the firm of KPMG LLP (“KPMG”) be reappointed as our independent auditors for the fiscal year ending December 31, 2006. This recommendation is being presented to the shareholders for their approval at the Annual General Meeting. KPMG has audited our financial statements since June 2001. A representatives of KPMG is expected to attend the annual general meeting, with the opportunity to make a statement if he or she so desires and to respond to questions. Shareholders at the annual general meeting will also be asked to vote to refer the determination of the auditors’ remuneration to the Audit Committee of the Board of Directors.

Fees Paid to Independent Auditors |

The following table sets forth the aggregate fees billed to the Company and its subsidiaries by KPMG, our independent auditors, for each of the fiscal years ended December 31, 2005 and 2004:

Category | | December 31, 2005 | | December 31, 2004 | |

| |

|

| |

|

| |

| Audit Fees(1) | | $ | 1,038,922 | | $ | 1,411,928 | |

| Audit-Related Fees(2) | | $ | 0 | | $ | 0 | |

| Tax Fees(3) | | $ | 64,020 | | $ | 16,963 | |

| All Other Fees(4) | | $ | 2,400 | | $ | 1,900 | |

| Total | | $ | 1,105,342 | | $ | 1,430,791 | |

| | | | | | | | |

| (1) | The aggregate audit fees billed by KPMG were for professional services rendered for the audit of our annual consolidated financial statements and review of the consolidated financial statements included in our Forms 10-Q, including services related thereto such as fees for statutory audits required by insurance regulatory authorities, comfort letters, consents, assistance with and review of documents filed with the Commission, work done by tax professionals in connection with the audit or quarterly review, and accounting consultations billed as audit services, as well as other accounting and financial reporting consultation and research work necessary to comply with generally accepted auditing standards. |

| (2) | There were no Audit-Related fees billed in 2005 or 2004. |

| (3) | Services comprising Tax Fees relate to tax compliance and expatriate tax services (including tax advice and tax planning). |

| (4) | Services comprising All Other Fees relate to the purchase of online accounting research software. |

Pre-approval Policies and Procedures. The Audit Committee has adopted policies and procedures to pre-approve all audit and permitted non-audit services performed by our independent auditor. These policies and procedures are set forth in our Audit Committee Charter.

Applicable Commission rules and regulations permit waiver of the pre-approval requirements for services other than audit, review or attest services if certain conditions are met. Out of the services characterized above as Audit-Related, Tax and All Other, none were billed pursuant to these provisions in fiscal 2005 and 2004 without pre-approval.

21

Back to Contents

THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE REAPPOINTMENT OF KPMG AS INDEPENDENT AUDITORS FOR THE FISCAL YEAR ENDING DECEMBER 31, 2006 AND THE REFERRAL TO THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS OF THE DETERMINATION OF THE AUDITORS’ REMUNERATION.

22

Back to Contents

EXECUTIVE COMPENSATION

The following tables and narrative text describe the compensation paid in 2005 and the two prior fiscal years to each person who was the Chief Executive Officer during 2005 and our four other most highly compensated executive officers. Also described below is certain future compensation such individuals may be eligible to receive upon retirement or following certain terminations of employment or certain changes of control.

Summary Compensation Table

| | | Annual Compensation

| | Long-Term Compensation

| |

Name and

Principal Position | | Year | | Salary | | Bonus($) | | Other Annual

Compensation($) | | Restricted

Stock

Awards($) | | Securities

Underlying

Stock

Options(#)(1) | | All Other

Compensation($) | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | | | | | | | | | | | | | |

| Jeffrey Radke (2) | | | 2005 | | $ | 669,904 | | $ | 284,077 | | $ | 109,385 | | $ | 359,315 | | | 0 | | $ | 73,495 | |

| President and | | | 2004 | | $ | 530,769 | | $ | 328,555 | | $ | 92,770 | | $ | 158,344 | | | 0 | | $ | 79,607 | |

| Chief Executive Officer | | | 2003 | | $ | 430,024 | | $ | 538,294 | | $ | 92,770 | | $ | 315,100 | | | 107,979 | | $ | 20,885 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Bruce J. Byrnes (3) | | | 2005 | | $ | 378,491 | | $ | 113,358 | | | — | | $ | 490,000 | | | 0 | | $ | 40,423 | |

| General Counsel | | | 2004 | | $ | 367,393 | | $ | 143,257 | | | — | | $ | 462,012 | | | 0 | | $ | 35,015 | |

| and Secretary | | | 2003 | | $ | 340,471 | | $ | 341,206 | | | — | | $ | 248,658 | | | 23,508 | | $ | 23,700 | |

| PXRE Corporation | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| John Daly (4) | | | 2005 | | $ | 338,323 | | $ | 83,471 | | $ | 130,000 | | $ | 447,998 | | | 0 | | $ | 42,756 | |

| Executive Vice President | | | 2004 | | $ | 333,077 | | $ | 85,556 | | $ | 115,000 | | $ | 420,000 | | | 0 | | $ | 55,853 | |

| PXRE International Operations | | | 2003 | | $ | 311,351 | | $ | 216,519 | | $ | 82,500 | | $ | 75,118 | | | 0 | | $ | 40,174 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Guy D. Hengesbaugh (5) | | | 2005 | | $ | 430,249 | | $ | 108,190 | | $ | 130,000 | | $ | 518,009 | | | 0 | | $ | 58,613 | |

| Chief Operating Officer | | | 2004 | | $ | 392,659 | | $ | 175,189 | | $ | 120,000 | | $ | 489,991 | | | 0 | | $ | 30,119 | |

| and President of PXRE | | | 2003 | | $ | 363,462 | | $ | 259,405 | | $ | 120,000 | | $ | 263,715 | | | 24,933 | | $ | 18,173 | |

| Reinsurance Ltd. | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| John M. Modin (6) | | | 2005 | | $ | 374,749 | | $ | — | | $ | 81,600 | | $ | 200,111 | | | 0 | | $ | 36,796 | |

| Executive Vice President | | | 2004 | | $ | 369,401 | | $ | 107,140 | | $ | 81,600 | | $ | 1,294,645 | | | 0 | | $ | 34,522 | |

| and Chief Financial Officer | | | 2003 | | $ | 324,549 | | $ | 243,463 | | | — | | $ | 182,367 | | | 14,571 | | $ | 10,835 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Robert P. Myron (7) | | | 2005 | | $ | 246,265 | | $ | 66,125 | | $ | 35,000 | | $ | 201,612 | | | 0 | | $ | 44,142 | |

| Executive Vice President | | | 2004 | | $ | 224,332 | | $ | 127,240 | | $ | 15,000 | | $ | 168,512 | | | 0 | | $ | 16,723 | |

| and Chief Financial Officer | | | 2003 | | $ | 188,373 | | $ | 121,740 | | $ | 13,750 | | $ | 45,990 | | | 6,476 | | $ | 6,154 | |

| (1) | Consists of non-qualified options granted in respect of our Common Shares pursuant to the 2002 and 1992 Officer Incentive Plans. |

| (2) | With respect to Mr. Radke: |

| | a. | “Bonus” amounts consist of a cash bonus award in 2006 in respect of fiscal year 2005 of $174,033 and a cash bonus award in 2005 in respect of fiscal year 2004 of $218,511, in each case, pursuant to PXRE’s 2004 Incentive Bonus Compensation Plan (the “Bonus Plan”). In respect of year 2003, the Bonus amounts consist of a cash bonus award pursuant to the Restated Employee Annual Incentive Bonus Plan (the “Terminated Bonus Plan”) of $330,750. In addition for each of 2005, 2004 and 2003, the Bonus amounts also include one third of the bonus earned pursuant to the Terminated Bonus Plan in excess of 150% of target in years 2002 and 2003 of $110,044, $110,044 and $110,044, respectively. In addition, for 2003, the Bonus amounts also include a retention bonus paid pursuant to a retention agreement of $97,500. |

| | b. | “Other Annual Compensation” consists of amounts paid to provide Bermuda housing. |

23

Back to Contents

| | c. | “Restricted Stock Awards” include an award made pursuant to the Terminated Bonus Plan for 2003 of 6,067 restricted Common Shares. Such restricted Common Shares will vest and become 100% non-forfeitable in one installment on February 11, 2007. Restricted Stock Awards also include awards for 2005, 2004 and 2003 under the 2002 Officer Incentive Plan of 14,124, 5,631 and 8,299 restricted Common Shares, respectively. Pursuant to the 2002 Officer Incentive Plan, such restricted Common Shares will vest in four equal annual installments, with the final installment on February 24, 2009. The aggregate holdings and market value of restricted Common Shares held by Mr. Radke on December 31, 2005 was 34,105 restricted Common Shares with a market value of $442,001 as of such date. |

| | d. | “All Other Compensation” consists of $33,495, $25,556 and $20,885 that we contributed in 2005, 2004 and 2003 to the 401(k) Plan and the related defined contribution portion of the Supplemental Executive Retirement Plan (“SERP”), $24,000 and $15,750 contributed to the 401(k) plan and SERP for in 2005 and 2004, respectively, representing a profit sharing contribution and $38,100 paid for the purchase of a car in 2004. In 2005, “All Other Compensation” also included a $16,000 home leave travel allowance. |

| (3) | With respect to Mr. Byrnes: |

| | a. | “Bonus” amounts consist of a cash bonus award in 2006 in respect of fiscal year 2005 of $45,227 and a cash bonus award in 2005 in respect of fiscal year 2004 of $75,126, in each case, pursuant to the Bonus Plan. In respect of 2003, the Bonus amounts consist of a cash bonus award pursuant to the Terminated Bonus Plan of $190,575. In addition for each of 2005, 2004 and 2003, the Bonus amounts also include one third of the bonus earned pursuant to the Terminated Bonus Plan in excess of 150% of target in years 2002 and 2003 of $68,131, $68,131 and $68,131, respectively. In addition, for 2003, the Bonus amounts also include a retention bonus paid pursuant to a retention agreement of $75,000. |

| | b. | “Restricted Stock Awards” include awards made pursuant to the Terminated Bonus Plan for 2003 of 3,496 restricted Common Shares, which restricted Common Shares will vest and become 100% non-forfeitable in one installment on February 11, 2007. Restricted Stock Awards also include awards for 2005, 2004 and 2003 under the 2002 Officer Incentive Plan of 19,261, 16,430 and 7,022 restricted Common Shares. Pursuant to the 2002 Officer Incentive Plan, such restricted Common Shares will vest in four equal annual installments, with the final installment on February 24, 2009. The aggregate holdings and market value of restricted Common Shares held by Mr. Byrnes on December 31, 2005 was 42,558 restricted Common Shares with a market value of $551,552 as of such date. |

| | c. | “All Other Compensation” consists of $21,883, $17,315 and $16,500 that we contributed in 2005, 2004 and 2003, respectively, to the 401(k) Plan and SERP, $11,340 and $10,500 contributed to the 401(k) plan for 2005 and 2004, respectively, representing a 3% profit sharing contribution and $7,200 paid by PXRE during each of 2005, 2004 and 2003, respectively, in respect to a car allowance. |

| (4) | With respect to Mr. Daly: |

| | a. | “Bonus” amounts consist of a cash bonus award in 2006 in respect of fiscal year 2005 of $40,202 and a cash bonus award in 2005 in respect of fiscal year 2004 of $42,287, in each case, pursuant to the Bonus Plan. In respect of 2003, the Bonus amounts consist of a cash bonus awards pursuant to the Terminated Bonus Plan of $173,250. In addition for each of 2005, 2004 and 2003, the Bonus amounts also include $43,269, which is equal to one third of the bonus earned pursuant to the Terminated Bonus Plan in excess of 150% of target in years 2003 and 2002 combined. |

| | b. | “Other Annual Compensation” consists of amounts paid to provide Bermuda housing. |

| | c. | “Restricted Stock Awards” include awards made pursuant to the Terminated Bonus Plan for 2003 of 3,178 restricted Common Shares, which restricted Common Shares will vest and become 100% non-forfeitable in one installment on February 11, 2007. Restricted Stock Awards also include awards for 2005 and 2004 under the 2002 Officer Incentive Plan of 17,610 and 14,936 restricted Common Shares. Pursuant to the |

24

Back to Contents

| | | 2002 Officer Incentive Plan, such restricted Common Shares will vest in four equal annual installments, with the final installment on February 24, 2009. The aggregate holdings and market value of restricted Common Shares held by Mr. Daly on December 31, 2005 was 32,536 restricted Common Shares with a market value of $421,667 as of such date. |

| | d. | “All Other Compensation” consists of $16,676, $16,422 and $13,269 that we contributed in 2005, 2004 and 2003 to the Bermuda Pension Scheme, $10,080 and $9,600 contributed to the Bermuda Pension Scheme in 2005 and 2004, respectively, representing a 3% profit sharing contribution. In addition, All Other Compensation includes $29,831 and $6,905 paid in 2004 and 2003 under the PXRE relocation policy in respect to family leave and $20,000 paid for the purchase of a car in 2003. Mr. Daly joined PXRE in November of 2002. In 2005, All Other Compensation also included a $16,000 home leave travel allowance. |

| | e. | On April 4, 2006, the Company provided Mr. Daly with notice of non-renewal under the Daly Agreement. Mr. Daly’s employment will, therefore, terminate on September 1, 2006. Pursuant to the terms of the Daly Agreement, Mr. Daly has been placed on “garden leave” until September 1, 2006. |

| (5) | With respect to Mr. Hengesbaugh: |

| | a. | “Bonus” amounts consist of a cash bonus award in 2006 in respect of fiscal year 2005 of $50,910 and a cash bonus award in 2005 in respect of fiscal year 2004 of $117,909, in each case, pursuant to the Bonus Plan. In respect of 2003, the Bonus amounts consist of a cash bonus award pursuant to the Terminated Bonus Plan of $202,125. In addition for each of 2005, 2004 and 2003, the Bonus amounts also include $57,280, which is equal to one third of the bonus earned pursuant to the Terminated Bonus Plan in excess of 150% of target in years 2003 and 2002 combined. |

| | b. | “Other Annual Compensation” consists of amounts paid to provide Bermuda housing. |

| | c. | “Restricted Stock Awards” include awards made pursuant to the Terminated Bonus Plan for 2003 of 3,708 restricted Common Shares, which restricted Common Shares will vest and become 100% non-forfeitable in one installment on February 11, 2007. Restricted Stock Awards also include awards for 2005, 2004 and 2003 under the 2002 Officer Incentive Plan of 20,362, 17,425 and 7,447 restricted Common Shares, respectively. Pursuant to the 2002 Officer Incentive Plan, such restricted Common Shares will vest in four equal annual installments, with the final installment on February 24, 2009. The aggregate holdings and market value of restricted Common Shares held by Mr. Hengesbaugh on December 31, 2005 was 42,614 restricted Common Shares with a market value of $552,277 as of such date. |

| | d. | “All Other Compensation” consists of $20,848, $19,019 and $18,173 that we contributed in 2005, 2004 and 2003, respectively, to the Bermuda Pension Scheme, and $12,765 and $11,100 contributed to the Bermuda Pension Scheme for 2005 and 2004, respectively, representing a 3% profit sharing contribution. In 2005, All Other Compensation includes $25,000 paid in respect of a car allowance. |

| (6) | With Respect to Mr. Modin: |

| | a. | Mr. Modin resigned from PXRE effective as of January 6, 2006. PXRE has elected to enforce the non-competition and non-solicitation covenants contained in Mr. Modin’s employment agreement, under the terms of which Mr. Modin will be prohibited from engaging in various competitive activities and from soliciting clients and employees of PXRE for one year. In return, PXRE is required to pay Mr. Modin an amount equal to his base salary of $372,600 in bi-weekly intervals over the next year with an additional lump sum payment equal to his base salary of $372,600 payable in January, 2007. In addition, PXRE is to continue to provide Mr. Modin with certain employee benefits or their economic equivalents for a one year period. |

25

Back to Contents

| | b. | In respect of years 2004 and 2003, the “Bonus” amounts consist of cash bonus awards pursuant to the Terminated Bonus Plan of $45,590 and $181,913, respectively. In addition for 2004 and 2003, the Bonus amounts also include $61,550, which is equal to one third of the bonus earned pursuant to the Terminated Bonus Plan in excess of 150% of target in years 2002 and 2003 combined. |

| | c. | “Other Annual Compensation” consists of amounts paid to provide Bermuda housing. |

| | d. | “Restricted Stock Awards” include awards made pursuant to the Terminated Bonus Plan for 2003 of 3,337 restricted Common Shares. Such restricted Common Shares were forfeited upon Mr. Modin’s resignation. Restricted Stock Awards also include awards for 2005, 2004 and 2003 under the 2002 Officer Incentive Plan of 7,866, 46,040 and 4,352 restricted Common Shares, respectively. All restricted Common Shares granted to Mr. Modin under the 2002 Officer Incentive Plan were forfeited upon his resignation. |

| | e. | “All Other Compensation” consists of $18,418, $16,972 and $3,635 that we contributed in 2005, 2004 and 2003, respectively, to the 401(k) Plan and SERP, $11,178 and $10,350 contributed to the 401(k) plan for 2005 and 2004, respectively, representing a 3% profit sharing contribution and $7,200 paid by PXRE during each of 2005, 2004 and 2003 in respect of a car allowance. |

| (7) | With Respect to Mr. Myron: |

| | a. | “Bonus” amounts consist of a cash bonus award in 2006 in respect of fiscal year 2005 of $38,885 and a cash bonus award in 2005 in respect of fiscal year 2004 of $100,000, in each case, pursuant to the Bonus Plan. In respect of 2003, the Bonus amounts consist of a cash bonus awards pursuant to the Terminated Bonus Plan of $94,500. In addition for each of 2005, 2004 and 2003, the Bonus amounts also include $27,240 which is equal to one third of the bonus earned pursuant to the Terminated Bonus Plan in excess of 150% of target in years 2002 and 2003 combined. |

| | b. | “Other Annual Compensation” consists of amounts paid to provide Bermuda housing. |

| | c. | “Restricted Stock Awards” include awards made pursuant to the Terminated Bonus Plan for 2003 of 1,734 restricted Common Shares, which restricted Common Shares will vest and become 100% non-forfeitable in one installment on February 11, 2007. Restricted Stock Awards also include awards for 2005, 2004 and 2003 under the 2002 Officer Incentive Plan of 7,925, 4,552 and 1,934 restricted Common Shares, respectively. Pursuant to the 2002 Officer Incentive Plan, such restricted Common Shares will vest in four equal annual installments, with the final installment on February 24, 2009. The aggregate holdings and market value of restricted Common Shares held by Mr. Myron on December 31, 2005 was 14,041 restricted Common Shares with a market value of $181,971 as of such date. |

| | d. | “All Other Compensation” consists of $11,896, $10,423 and $6,154 that we contributed in 2005, 2004 and 2003, respectively, to the Bermuda Pension Scheme, and $7,245 and $6,300 contributed to the Bermuda Pension Scheme for 2005 and 2004, respectively, representing a 3% profit sharing contribution. In 2005, includes $25,000 paid in respect of a car allowance. |

Option Grants in Last Fiscal Year

No stock options were granted to executive officers in 2005.

26

Back to Contents

Aggregated Stock Option Exercises in the Last Fiscal Year

and Stock Option Values at December 31, 2005

Name | | Shares

Acquired on

Exercise(#) | | Value

Realized($) | | Number of Securities

Underlying Unexercised

Stock Options at

12/31/05 (#)

Exercisable/Unexercisable | | Value of Unexercised

In-the-Money Stock

Options at 12/31/05 ($)(1)

Exercisable/Unexercisable | |

| |

|

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | | | | |

| Jeffrey Radke (2) | | | 0 | | $ | 0 | | | 221,910/106,069 | | | 23,000/0 | |

| Bruce J. Byrnes (3) | | | 56,250 | | $ | 456,417 | | | 21,754/20,504 | | | 0/0 | |

| John Daly (4) | | | 0 | | $ | 0 | | | 37,500/12,500 | | | 0/0 | |

| Guy Hengesbaugh (5) | | | 0 | | $ | 0 | | | 31,216/18,717 | | | 0/0 | |

| John Modin (6) | | | 0 | | $ | 0 | | | 22,285/0 | | | 0/0 | |

| Robert P. Myron (7) | | | 0 | | $ | 0 | | | 3,238/3,238 | | | 0/0 | |

| | | | | | | | | | | | | | |

| (1) | Represents the difference between the closing price of our Common Shares as reported on the NYSE on December 31, 2005, which was $12.96, and the exercise prices of the options. |

| (2) | For Mr. J. Radke, consists of options for 327,979 Common Shares granted in 2000 through 2003 pursuant to our 1992 Officer Incentive Plan and 2002 Officer Incentive Plan at exercise prices ranging from $12.50 to $23.78 per share, 221,910 of which options were exercisable at December 31, 2005. |

| (3) | For Mr. Byrnes, consists of options for 42,258 Common Shares granted in 2001 through 2003 pursuant to our 1992 Officer Incentive Plan and 2002 Officer Incentive Plan at exercise prices ranging from $15.95 to $23.78 per share, 21,754 of which options were exercisable at December 31, 2005. |

| (4) | For Mr. Daly, consists of options for 50,000 Common Shares granted in 2002 pursuant to the 2002 Officer Incentive Plan at an exercise price of $19.88 per share, 37,500 of which were exercisable at December 31, 2005. |

| (5) | For Mr. Hengesbaugh, consists of options for 49,933 Common Shares granted in 2002 and 2003 pursuant to the 2002 Officer Incentive Plan at exercise prices ranging from $20.23 to $23.78 per share, 31,216 of which options were exercisable at December 31, 2005. |

| (6) | Mr. Modin resigned effective January 6, 2006 and, as a result of such termination, forfeited unvested options for 12,286 Common Shares. The exercisable options to acquire 22,285 Common Shares were granted in 2003 and 2002 pursuant to the 2002 Officer Incentive Plan at exercise prices ranging from $23.78 to $24.17 per share. As a result of Mr. Modin’s resignation, such options will expire in March 2006. |

| (7) | For Mr. Myron, consists of options for 6,476 Common Shares granted in 2003 pursuant to the 2002 Officer Incentive Plan at an exercise price of $23.78 per share, 3,238 of which options were exercisable at December 31, 2005. |

The PXRE Reinsurance Company Retirement Plan and the Supplemental Executive Retirement Plan were frozen effective April 1, 2004 (the “Freeze Date”). No employee will become eligible to participate in the plans after that date and benefits will not be increased as a result of service credited or compensation earned after the Freeze Date. Employees who are employed by PXRE Reinsurance Company or an affiliate after the Freeze Date will continue to be credited with years of service for vesting purposes, eligibility for early retirement, disability retirement and pre-retirement death benefits under the plans. As of December 31, 2005, Mr. Radke was vested in his accrued pension benefits, but Messrs. Byrnes, Daly, Hengesbaugh and Modin had not yet satisfied the service requirement for vesting in the plans. The total annual accrued benefits under the PXRE Reinsurance Company

27

Back to Contents

Retirement Plan and the Supplemental Executive Retirement Plan as a life annuity upon retirement at age 65 as of the Freeze Date is as follows: Mr. Radke: $59,460; Mr. Byrnes; $37,140; Mr. Daly: $15,852; Mr. Hengesbaugh: $22,128 and Mr. Modin: $18,384.

| |

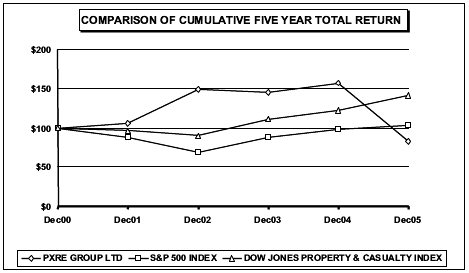

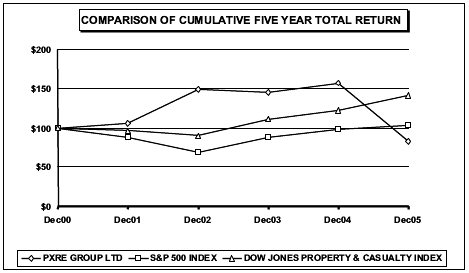

COMPARISON OF FIVE-YEAR CUMULATIVE TOTAL

RETURN AMONG PXRE, S&P 500 AND

DOW JONES PROPERTY AND CASUALTY INDEX |

| | | | | | | | | | | | | | | | | | | | |

Company / Index | | 2000 | | 2001 | | 2002 | | 2003 | | 2004 | | 2005 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| PXRE GROUP LTD | | | 100 | | | 106.07 | | | 148.92 | | | 144.96 | | | 156.56 | | | 82.26 | |

| S&P 500 INDEX | | | 100 | | | 88.11 | | | 68.64 | | | 88.33 | | | 97.94 | | | 102.75 | |

| DOW JONES PROPERTY & CASUALTY INDEX | | | 100 | | | 96.06 | | | 89.37 | | | 111.05 | | | 122.35 | | | 140.51 | |

The total return assumes that dividends were reinvested quarterly and is based on a $100 investment on December 31, 2000. For each subsequent year, our total return and the total return for each index is stated as of December 31 of such year.

Report of the Human Resources Committee of the Board of Directors of PXRE |

PXRE announced on February 17, 2006 that the Board of Directors had decided to explore strategic alternatives and had engaged Lazard to assist us in the process. This decision was made as a result of the occurrence of significant losses during the fourth quarter of 2006 and the downgrade of PXRE’s credit rating to a level that is generally unacceptable to our reinsurance clients and brokers.

28

Back to Contents

As part of the Board’s strategic evaluation, the Human Resources Committee of the Board of Directors will be undertaking a comprehensive re-assessment of PXRE’s compensation policies and practices to ensure that such policies and practices are consistent with whatever strategic objectives the Board of Directors ultimately decides to pursue.

The following is a summary of our compensation practices and policies in 2005.

The Human Resources Committee performs the functions of a compensation committee. We have implemented compensation policies, plans and programs that seek to increase our profitability, and thus shareholder value, by closely aligning the financial interests of our executive officers with those of our shareholders. Emphasis is placed on our achievements as an integrated unit.

The Human Resources Committee has established an executive compensation program to achieve the following goals:

| | (a) | To attract and retain key executives critical to our success; |

| | | |

| | (b) | To promote the enhancement of shareholder value; |

| | | |

| | (c) | To reward executives for long-term strategic management; and |

| | | |

| | (d) | To support a performance-oriented environment resulting in above-average total compensation for above-average Company results. |

Our executive compensation program consists of three components (base salary, annual incentives and long-term incentives) designed to promote the above-stated goals.

Base Salary. Base salary is targeted at the competitive median for our competitors in the reinsurance industry. For the purpose of establishing base salary levels, we, from time to time, compare the levels of executive base salary paid by us to those levels paid to the executives of other public and private reinsurance companies in the United States and Bermuda.

The Human Resource Committee reviews executive salaries in the first quarter of each year. Our Chief Executive Officer submits an annual salary plan to the Human Resources Committee and the Human Resources Committee reviews the plan and determines any appropriate modifications. Any increases in an individual executive’s salary from year to year are based on (i) increases in an individual’s responsibilities and contributions to the company, and (ii) increases in median competitive pay levels. These determinations for 2006 will take into account the strategic alternatives being considered by the Board of Directors and will be tailored to reflect decisions made in this regard. Based upon these factors, the Committee determined during the first quarter of 2005 that it was appropriate to increase executive base salaries by an average of 7.2% in 2005. As discussed below, on July 1, 2003, the Committee determined to enter into a new employment contract with Mr. Radke for the period of June 23, 2005 through December 31, 2007. Pursuant to the new employment agreement, the Chief Executive Officer’s annual base salary was increased by 52% from $525,000 to $800,000.

Annual Incentives. PXRE Group Ltd.’s 2004 Incentive Bonus Compensation Plan (the “Bonus Plan”), adopted in 2004, is intended to reflect our belief that executive compensation should be based on the achievement of corporate performance goals. The Human Resources Committee believes that return on equity is the critical measure of corporate performance, but the Human Resources Committee also believes that it is important in evaluating management’s performance to have the flexibility to set performance targets related to other measures

29

Back to Contents

such as net revenues, earnings per share, pre-tax or after-tax net income, pre-tax operating income, book value per share, market price per share, earnings available to common shareholders, operating expenses, reinsurance operating ratios or other strategic business criteria. The Human Resources Committee also established target bonuses based on a percentage of base salary (100% for the Chief Executive Officer, 65% for the Chief Operating Officer and 55% for Executive Vice Presidents). Executive officers had the opportunity to earn 0 to 240% of their target bonus based on the achievement of the designated corporate performance goals. 30% of the bonus award payable in excess of 100% of target is payable in restricted shares. The maximum cash and restricted stock bonus awards that a participant who was a “covered employee” at the end of the year for purposes of Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”) may receive was $1 million.

The Human Resources Committee established performance goals for the 2005 fiscal year relating to return on equity, catastrophe and risk excess loss ratios, expense ratios and adverse development. The bonuses payable with respect to 2005 were determined by comparing actual corporate performance relative to the pre-established performance goals. The only performance target met or exceeded in 2005 was a target related to the Company’s gross expense ratio. As a result, bonuses equal to 21.8% of target was payable to the Company’s senior officers and bonuses equal to 26% of target were payable to junior officers and non-officer employees with respect to 2005.

Prior to 2004, annual bonuses were payable pursuant to the Restated Employee Annual Incentive Bonus Plan (the “Terminated Bonus Plan”), which was terminated in February 2004. Under the Terminated Bonus Plan, the bonus percentage in excess of 150% of the target bonus was deferred into a future bonus pool that is payable in any subsequent year or years in which the full target bonus was not achieved. In each of 2002 and 2003, the bonus percentage under the Terminated Bonus Plan exceeded 150% and the portion of the bonus in excess of 150% of the target bonus was deferred in accordance with the terms of such plan. Upon termination of the Terminated Bonus Plan, the Human Resources Committee determined to pay out such deferred amounts in three equal annual installments to officers and in a single lump sum for non-officers in each case subject to their continued employment with the Company commencing in March, 2004.

Long-Term Incentives. At the 2002 annual general meeting of our shareholders, the 2002 Officer Incentive Plan was approved to replace the 1992 Officer Incentive Plan which expired in 2002. The 1992 Officer Incentive Plan and the 2002 Officer Incentive Plan are substantially similar in all material respects. The 2002 Officer Incentive Plan provides the Human Resources Committee with the flexibility to grant long-term incentives in two forms: stock options and restricted stock.

Each year, the Human Resources Committee determines whether it is appropriate to grant stock option and/or restricted stock awards to eligible executive officers. Grants for each officer are determined based on industry norms, with the Human Resources Committee having the flexibility to adjust individual awards. Awards are considered in conjunction with the annual salary plan and the overall goals of our executive compensation program. The Human Resources Committee believes that its past long-term incentive awards have focused, and its future awards will continue to focus, management’s attention on building shareholder value. In February 2004, the Human Resources Committee determined that it would move towards restricted stock awards and cease issuing stock options.

The Human Resources Committee granted 214,312 Restricted Shares in February 2005 to the Company’s officers pursuant to the 2002 Officer Incentive Plan. Such grants were made pursuant to the Human Resources Committee’s evaluation of each grantee’s base salary and position with the Company, the fair market value of the Common Shares on the date of grant and competitive compensation levels within the industry.

30

Back to Contents

Equity Ownership. The Board of Directors believes that it is in the best interest of PXRE and its shareholders to align the financial interests of our senior officers with those of our shareholders. In the past, PXRE has sought to promote this alignment of interests through equity- based compensation plans. In order to further this policy and clarify its intent for senior officers, the Board of Directors believed that it was appropriate to adopt formal guidelines concerning the amount of shares that PXRE expects its senior officers to hold over the long term. Accordingly, on February 10, 2004, the Board established the following Equity Ownership Guidelines for the amount of stock that executives (as a multiple of base salary) should hold:

Title | | Multiple | | Time to Attain | | Minimum No. of Shares | |

| |

|

| |

|

| |

|

| |

| Chief Executive Officer | | | 3X | | | 3 years | | | 40,000 | |

| Executive Vice President | | | 2X | | | 3 years | | | 25,000 | |

| Senior Vice Presidents | | | 1.5X | | | 3 years | | | 10,000 | |

A copy of the Equity Ownership Guidelines is available on our website – http://www.pxre.com.

Chief Executive Compensation |

The Human Resources Committee annually reviews and approves corporate goals and objectives relevant to Chief Executive Officer compensation and evaluates the Chief Executive Officer’s performance in light of those goals and objectives and establishes the individual elements of the Chief Executive Officer’s total compensation based on this evaluation. The Human Resources Committee also considers relevant peer group data for U.S. and Bermuda insurance and reinsurance companies. In determining the long-term incentive component of the Chief Executive Officer compensation, the Human Resources Committee considers PXRE’s performance and shareholder returns relative to comparable companies, the value of similar incentive awards to chief executive officers at comparable companies and the awards given to the Chief Executive Officer in past years.

In February 2005, the Chief Executive Officer received a restricted share grant of 14,124 Common Shares under the 2002 Officer Incentive Plan. As discussed above, such grant was determined pursuant to the Human Resources Committee’s evaluation of his base salary and position, the fair market value of the Common Shares on the date of grant and competitive CEO compensation levels within the industry.

In early 2005, the Human Resources Committee undertook the renegotiation of the Chief Executive’s employment contract, which was due to expire on June 30, 2005. In connection with the renegotiation, the Committee reviewed the base salary, bonus and equity compensation paid to the chief executive officers of the Company’s primary Bermuda competitors, including the relative weight of such compensation components among the Company’s competitors. The Committee also considered net income, revenue, equity and market capitalization of the various competitors included within its study relative to PXRE. The Committee also reviewed the various terms of the employment contracts for such chief executive officers. Based on such review and Mr. Jeffrey Radke’s performance since his appointment as the Company’s Chief Executive Officer on July 1, 2003, the Committee determined to enter into a new employment contract with Mr. Radke for the period of June 23, 2005 through December 31, 2007. Pursuant to the new employment agreement, the Chief Executive Officer’s (i) annual base salary was increased by 52% from $525,000 to $800,000, (ii) target bonus was increased from 80% of base salary to 100% of base salary, and (iii) annual equity grant was adjusted such that the target equity grant would be one-half of the sum of the Chief Executive Officer’s base salary and performance bonus with respect to the prior fiscal year.

The Chief Executive Officer was paid a bonus of $174,033 under the Bonus Plan with respect to 2005, representing 21.8% of his target bonus, based on the Company’s actual performance as measured against

31

Back to Contents

performance goals established for the 2005 fiscal year relating to return on equity, catastrophe and risk excess loss ratio, gross expense ratios and adverse development and his individual achievements. In this regard, the only performance goal achieved during 2005 was the goal related to the Company’s gross expense ratio. As a result of the termination of the Terminated Bonus Plan, the Chief Executive Officer was also paid $110,044, representing one-third of the bonus amounts deferred with respect to the 2002 and 2003 bonuses under such Plan.

The Code has set certain limitations on the deductibility of compensation paid to a public company’s five most highly compensated executive officers. Provided that other compensation objectives are met, it is the Committee’s intention that executive compensation be deductible for federal income tax purposes to the extent that such executive’s compensation is paid by one of our U.S. subsidiaries.

Human Resources Committee:

Craig A. Huff (Chairman)

Jonathan Kelly

Philip R. McLoughlin

March 16, 2006

Compensation Committee Interlocks and Insider Participation |

Employment Agreements; Termination and Change of Control Arrangements |

Employment Agreement – Jeffrey Radke. In connection with Jeffrey Radke’s service as our Chief Executive Officer, we entered into a new employment agreement with him, dated June 23, 2005 (the “Employment Agreement”), for the period June 23, 2005 through December 31, 2007. The Employment Agreement will be automatically extended for successive one year periods, unless written notice is provided by either party at least six months prior to each scheduled expiration date. Pursuant to the Employment Agreement, Jeffrey Radke will receive an annual base salary equal to $800,000 for his services as our President and Chief Executive Officer. In addition, Jeffrey Radke’s annual bonus target is equal to 100% of salary and he will be eligible to receive an annual equity grant of restricted Common Shares with a fair market value equal to one-half of the sum of (i) Jeffrey Radke’s base salary on December 31 of the prior calendar year, plus (ii) the annual bonus Jeffrey Radke earned with the respect to the prior calendar year. Jeffrey Radke also receives a housing, car and home leave allowance.

In the event that we terminate Jeffrey Radke’s employment without “cause” (as defined in the Employment Agreement) or he terminates the Employment Agreement for “good reason” (as described below), subject to his continued compliance with the confidentiality, non- compete and non-solicitation provisions of the Employment Agreement, and conditioned on the execution of a release of claims against us, he will be entitled to receive a severance payment equal to two times his base salary, plus one year of continued employee benefits and housing allowance and the vesting of all unvested equity awards. “Good reason” is generally defined as: a decrease in his base salary; our failure to pay material compensation due to him; our failure to obtain an agreement from a successor to assume the Employment Agreement; the assignment of duties which result in a diminution in his position, authority, duties or responsibilities; a relocation of his primary office outside of Bermuda or within fifty (50) miles of the borough of Manhattan in New York City; a material reduction in his benefits; or any material breach of the Employment Agreement. The Employment Agreement prohibits Jeffrey Radke from competing with us or soliciting our customers or employees for the one-year period following his termination. We have agreed to

32

Back to Contents

provide Jeffrey Radke with a gross up payment in the event that any payments received in connection with a change in control would be subject to excise taxes under Section 4999 of the Code.

Each of Messrs. Byrnes, Daly, Hengesbaugh and Myron (each an “Executive”) have entered into employment agreements with PXRE Group Ltd. and/or its subsidiaries as follows: (i) Employment Agreement, dated April 4, 2006, by and between PXRE Reinsurance Company and Bruce J. Byrnes, General Counsel & Secretary of PXRE Reinsurance Company (the “Byrnes Agreement”); (ii) the Daly Agreement; (iii) Employment Agreement, dated January 16, 2006, by and between PXRE Reinsurance Ltd. and Guy D. Hengesbaugh, President & Chief Operating Officer of PXRE Reinsurance Ltd. (the “Hengesbaugh Agreement”); and (iv) Employment Agreement, dated December 27, 2005, by and between PXRE Group Ltd. and Robert Myron, Executive Vice President & Chief Financial Officer of PXRE Group Ltd. (the “Myron Agreement”, and collectively with the Byrnes Agreement, Daly Agreement and Hengesbaugh Agreement, the “Executive Employment Agreements”). Except as otherwise noted, the terms of the Executive Employment Agreements are substantively identical. The Byrnes Agreement is for a twenty-one month term, the other Executive Employment Agreements are for two-year terms. The annual base salaries payable pursuant the Executive Employment Agreements are: Mr. Byrnes, $378,000 during 2006 with Mr. Byrnes’ annual base salary increased to $400,000 in 2007; Mr. Daly, $336,000; Mr. Hengesbaugh, $425,000; Mr. Myron, $325,000. The Executive Employment Agreements further provide each Executive with an annual incentive bonus target of 55% of base salary (in Mr. Byrnes’ case, with respect to calendar year 2007 and based on the base salary in effect on December 31, 2007) under the Company’s 2004 Incentive Bonus Compensation Plan (65% in the case of Mr. Hengesbaugh) and a long-term incentive multiple of 1.4 of base salary for purposes of determining restricted stock grants to be awarded under the Company’s 2002 Officer Incentive Plan. Under the Byrnes Agreement, if Mr. Byrnes is not awarded restricted stock grants during the first five months of 2007 with a fair market value equal to at least 1.4 times Mr. Byrnes’ base salary, then Mr. Byrnes will be paid a cash amount equal to $140,000 on December 31, 2007. Pursuant to the Executive Employment Agreements, Messrs. Hengesbaugh, Daly and Myron are entitled to housing and car allowances and Mr. Byrnes is entitled to a car allowance.

On April 4, 2006, the Company provided Mr. Daly with notice of non-renewal under the Daly Agreement. Mr. Daly’s employment will, therefore, terminate on September 1, 2006. Pursuant to the terms of the Daly Agreement, Mr. Daly has been placed on “garden leave” until September 1, 2006.

In the event that the Company terminates an Executive’s employment without “cause” (as defined in the Executive Employment Agreement) or the Executive terminates the Executive Employment Agreement for “good reason” (as described below), subject to the Executive’s continued compliance with the confidentiality, non-compete and non-solicitation provisions of the Executive Employment Agreement, and conditioned on the execution of a release of claims against us, he will be entitled to receive a severance payment equal to two times his base salary (50% of his annual base salary in the case of Mr. Byrnes), plus one year of continued employee benefits. Mr. Byrnes would also receive his retention bonus as described below. All unvested stock options and restricted shares previously granted to any such Executive under the Company’s various equity plans would also immediately vest upon such termination. “Good reason” is generally defined as: a decrease in his base salary; our failure to pay material compensation due to him; our failure to obtain an agreement from a successor to assume the Executive Employment Agreement; the assignment of duties which result in a diminution in his position, authority, duties or responsibilities; a relocation of his primary office; a material reduction in his benefits; or any material breach of the Employment Agreement. Under Mr. Myron’s and Mr. Hengesbaugh’s Employment Agreements, such Executives would also be entitled to the foregoing severance payments if they are terminated or their employment contracts are not renewed following a “change of control” (as defined in the respective Executive Employment Agreements). Under the Byrnes’ Agreement, “good reason” also includes a “change of

33

Back to Contents

control”, provided that Mr. Byrnes provides written notice of his resignation within 60 days of such change of control. The Executive Employment Agreements prohibits each Executive from competing with us or soliciting our customers or employees for the one-year period following his termination. Mr. Hengesbaugh’s Employment Agreement permits Mr. Hengesbaugh to terminate his Employment Agreement within 90 days of following the occurrence of a “material adverse event” (as defined in the Hengesbaugh Employment Agreement) and, in the event of such a termination, (a) Mr. Hengesbaugh would be entitled to receive a severance payment equal to two times his base salary, plus one year of continued employee benefits, provided that any severance payments made to Mr. Hengesbaugh would be reduced by the amount of any other compensation received by Mr. Hengesbaugh from any other insurer, reinsurer or broker during the 24 month period following termination, and (b) Mr. Hengesbaugh would not be prohibited from competing with us or soliciting our customers, but would be prohibited from soliciting our employees for a one-year period following his termination.

| |

Termination and Change of Control Arrangements |

On March 3, 2006, the Human Resources Committee approved various retention bonuses to assist the Company to retain certain key employees to explore strategic alternatives and to implement any strategic alternative the Company elects to pursue. Among those to whom retention bonuses were awarded were three executive officers of the Company: Guy D. Hengesbaugh, Executive Vice President & Chief Operating Officer of the Company; Robert P. Myron, Executive Vice President and Chief Financial Officer of the Company; and Bruce J. Byrnes, General Counsel and Secretary of PXRE Reinsurance Company.

Mr. Hengesbaugh will receive a retention bonus of $212,750 on December 31, 2006 if he remains in the employ of the Company through such date, provided that if Mr. Hengesbaugh’s employment is terminated without cause by the Company prior to December 31, 2006, he will be paid that amount upon termination.

Mr. Myron will receive retention bonuses of $162,500 on September 1, 2006 and $162,500 on March 15, 2007 if he remains in the employ of the Company through those dates, provided that if Mr. Myron’s employment is terminated without cause by the Company prior to those dates, he will be paid those amounts upon termination. In addition, on March 15, 2007, Mr. Myron will be paid his target bonus of $178,750 under the Company’s 2004 Incentive Bonus Compensation Plan if he remains in the employ of the Company through that date, provided that if Mr. Myron’s employment is terminated without cause by the Company prior to March 15, 2007, he will be paid that amount upon termination.

Mr. Byrnes will receive a retention bonus of $189,000 on September 1, 2006 if he remains in the employ of PXRE Reinsurance Company through that date, provided that if Mr. Byrnes’ employment is terminated without cause by PXRE Reinsurance Company or for good reason by Mr. Byrnes prior to such date, he will be paid that amount upon termination. In addition, on March 15, 2007, Mr. Byrnes will be paid his target bonus of $207,900 under the Company’s 2004 Incentive Bonus Compensation Plan if he remains in the employ of PXRE Reinsurance Company through that date, provided that if Mr. Byrnes’ employment is terminated without cause by PXRE Reinsurance Company or for good reason by Mr. Byrnes prior to March 15, 2007, he will be paid that amount upon termination.

2002 Officer Incentive Plan. The 2002 Officer Incentive Plan was adopted by the Board of Directors and approved by the shareholders at the May 30, 2002 Annual General Meeting of Shareholders. The 2002 Officer Incentive Plan replaced the 1992 Officer Incentive Plan, which terminated on May 21, 2002. The terms and provisions of the 2002 Officer Incentive Plan are substantially similar to those in the 1992 Officer Incentive Plan.

34

Back to Contents

The 2002 Officer Incentive Plan provides for the grant of incentive stock options, non-qualified stock options, and awards of restricted Common Shares (“Restricted Shares”). The 2002 Officer Incentive Plan is administered by a committee appointed by the Board of Directors. Subject to certain adjustments as provided in the 2002 Officer Incentive Plan, a maximum of 1,000,000 Common Shares are reserved for issuance upon the exercise of options and grants of Restricted Shares under the 2002 Officer Incentive Plan, plus any option terminating or expiring for any reason prior to its exercise in full, or any Restricted Shares which are forfeited under the 1992 Officer Incentive Plan, up to a maximum of 1,555,691 Common Shares Authorized but unissued shares may be used for grants of options or Restricted Shares under the 2002 Officer Incentive Plan.

The 2002 Officer Incentive Plan provides that upon the earlier of (i) a change of control or (ii) our Common Shares ceasing to be publicly traded, any unexercised portion of an option shall become exercisable and any Restricted Period (as defined in such plan) applicable to Restricted Shares shall immediately lapse.

In addition, the committee that administers the 2002 Officer Incentive Plan may, for a period of up to 60 days following a change of control or the date that our Common Shares cease to be publicly traded, allow certain participants under the 2002 Officer Incentive Plan the right to surrender all or part of his or her option and receive a cash payment equal to the greater of (i) the excess of the fair market value of the shares subject to the surrendered option over the exercise price or (ii) except for incentive stock options, the excess of the per share net worth (as determined under the 2002 Officer Incentive Plan) of the shares to which the surrendered option pertains on the date of surrender over the per share net worth of such shares on the date the option was granted.

The 2002 Officer Incentive Plan also provides that if a participant does not make an election under either of the above provisions on or before the 60th day following a change of control resulting from certain mergers and consolidations, the sale of all or substantially all of our assets, our liquidation or dissolution, or such cessation of public trading, the participant will be deemed to have made such election as of such 60th day and the participant will receive the cash payment that would be due upon such an election and the participant’s option and surrender rights will be deemed to have been canceled.

1992 Officer Incentive Plan. As described above, the 1992 Officer Incentive Plan (which was replaced by the 2002 Officer Incentive Plan) is substantially similar in all material respects to the 2002 Officer Incentive Plan, including the terms and conditions relating to a change of control. No more awards may be granted under the 1992 Officer Incentive Plan, though outstanding awards granted thereunder continue to be governed by its terms.

Restated Employee Annual Incentive Bonus Plan. Adopted in 1992, the Restated Employee Annual Incentive Bonus Plan, as amended (the “Terminated Bonus Plan”), provided for annual employee incentive awards comprised of cash and, in the case of senior and other executives, Restricted Shares.

Upon the earlier of a change of control or our shares ceasing to be publicly traded, any remaining Restricted Period applicable to Restricted Shares issued under the Terminated Bonus Plan will immediately lapse.

35

Back to Contents

Equity Compensation Plan Information Table. The following table sets forth information regarding all of our compensation plans as of December 31, 2005:

EQUITY COMPENSATION PLAN INFORMATION

Plan Category | | Number Of Securities To

Be Issued Upon Exercise

Of Outstanding Options,

Warrants And Rights

(a) | | Weighted-Average

Exercise Price Of

Outstanding Options,

Warrants And Rights

(b) | | Number Of Securities

Remaining Available For

Future Issuance Under

Equity Compensation

Plans (Excluding

Securities Reflected In

Column (a))

(c) | |

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | |

| Equity compensation plans approved by security holders | | | 2,063,723 | | $ | 20.43 | | | 1,106,082 | |

| Equity compensation plans not approved by security holders | | | 0 | | | 0 | | | 0 | |

| | |

|

| |

|

| |

|

| |

| Total | | | 2,063,723 | | $ | 20.43 | | | 1,106,082 | |

PROPOSAL 3:

AMENDMENT OF THE COMPANY’S BYE-LAWS