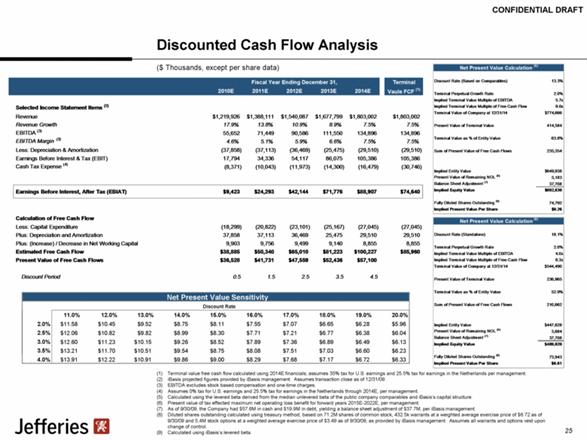

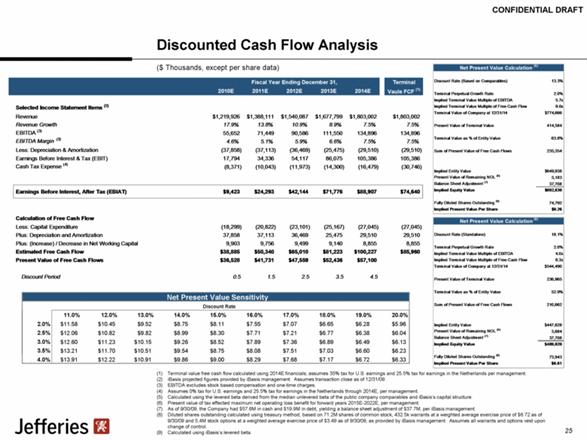

| Discounted Cash Flow Analysis ($ Thousands, except per share data) (1) Terminal value free cash flow calculated using 2014E financials; assumes 35% tax for U.S. earnings and 25.5% tax for earnings in the Netherlands per management. (2) iBasis projected figures provided by iBasis management. Assumes transaction close as of 12/31/09. (3) EBITDA excludes stock based compensation and one-time charges. (4) Assumes 0% tax for U.S. earnings and 25.5% tax for earnings in the Netherlands through 2014E, per management. (5) Calculated using the levered beta derived from the median unlevered beta of the public company comparables and iBasis‘s capital structure. (6) Present value of tax effected maximum net operating loss benefit for forward years 2015E-2022E, per management. (7) As of 9/30/09, the Company had $57.6M in cash and $19.9M in debt, yielding a balance sheet adjustment of $37.7M, per iBasis management. (8) Diluted shares outstanding calculated using treasury method, based on 71.2M shares of common stock, 432.5k warrants at a weighted average exercise price of $6.72 as of 9/30/09 and 5.4M stock options at a weighted average exercise price of $3.49 as of 9/30/09, as provided by iBasis management. Assumes all warrants and options vest upon change of control. (9) Calculated using iBasis’s levered beta. 25 Discount Rate (Based on Comparables) 13.3% Terminal Perpetual Growth Rate 2.0% Implied Terminal Value Multiple of EBITDA 5.7x Implied Terminal Value Multiple of Free Cash Flow 9.0x Terminal Value of Company at 12/31/14 $774,666 Present Value of Terminal Value 414,584 Terminal Value as % of Entity Value 63.8% Sum of Present Value of Free Cash Flows 235,354 Implied Entity Value $649,938 Present Value of Remaining NOL (6) 5,183 Balance Sheet Adjustment (7) 37,708 Implied Equity Value $692,830 Fully Diluted Shares Outstanding (8) 74,792 Implied Present Value Per Share $9.26 Net Present Value Calculation (5) Fiscal Year Ending December 31, Terminal 2010E 2011E 2012E 2013E 2014E Vaule FCF (1) Selected Income Statement Items (2) Revenue $1,219,926 $1,388,111 $1,540,087 $1,677,799 $1,803,002 $1,803,002 Revenue Growth 17.9% 13.8% 10.9% 8.9% 7.5% 7.5% EBITDA (3) 55,652 71,449 90,586 111,550 134,896 134,896 EBITDA Margin (3) 4.6% 5.1% 5.9% 6.6% 7.5% 7.5% Less: Depreciation & Amortization (37,858) (37,113) (36,469) (25,475) (29,510) (29,510) Earnings Before Interest & Tax (EBIT) 17,794 34,336 54,117 86,075 105,386 105,386 Cash Tax Expense (4) (8,371) (10,043) (11,973) (14,300) (16,479) (30,746) Earnings Before Interest, After Tax (EBIAT) $9,423 $24,293 $42,144 $71,776 $88,907 $74,640 Calculation of Free Cash Flow Less: Capital Expenditure (18,299) (20,822) (23,101) (25,167) (27,045) (27,045) Plus: Depreciation and Amortization 37,858 37,113 36,469 25,475 29,510 29,510 Plus: (Increase) / Decrease in Net Working Capital 9,903 9,756 9,499 9,140 8,855 8,855 Estimated Free Cash Flow $38,885 $50,340 $65,010 $81,223 $100,227 $85,960 Present Value of Free Cash Flows $36,528 $41,731 $47,559 $52,436 $57,100 Discount Period 0.5 1.5 2.5 3.5 4.5 Terminal Growth Rate Discount Rate (Standalone) 18.1% Terminal Perpetual Growth Rate 2.0% Implied Terminal Value Multiple of EBITDA 4.0x Implied Terminal Value Multiple of Free Cash Flow 6.3x Terminal Value of Company at 12/31/14 $544,490 Present Value of Terminal Value 236,965 Terminal Value as % of Entity Value 52.9% Sum of Present Value of Free Cash Flows 210,662 Implied Entity Value $447,628 Present Value of Remaining NOL (6) 3,684 Balance Sheet Adjustment (7) 37,708 Implied Equity Value $489,020 Fully Diluted Shares Outstanding (8) 73,943 Implied Present Value Per Share $6.61 Net Present Value Calculation (9) |