UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

| |

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

OR

|

| |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-15395

MARTHA STEWART LIVING OMNIMEDIA, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

| |

| Delaware | 52-2187059 |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

| | |

| 601 West 26th Street, New York, New York | 10001 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code: (212) 827-8000

Securities Registered Pursuant to Section 12(b) of the Act:

|

| |

| Title of Each Class | Name of Each Exchange on Which Registered |

| Class A Common Stock, Par Value $0.01 Per Share | New York Stock Exchange |

Securities Registered Pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 of Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | |

| Large accelerated filer | ¨ | Accelerated filer | þ |

| | | | |

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

The aggregate market value of the voting stock held by non-affiliates of the registrant, computed by reference to the number of shares outstanding and using the price at which the stock was last sold on June 29, 2012, was $96,463,676.*

|

| |

| * | Excludes 12,057,513 shares of our Class A Common Stock, and 25,984,625 shares of our Class B Common Stock, held by directors, officers and 10% stockholders, as of June 30, 2012. Exclusion of shares held by any person should not be construed to indicate that such person possesses the power, direct or indirect, to direct or cause the direction of the management or policies of the Company, or that such person controls, is controlled by or under common control with the Company. |

Number of Shares Outstanding As of February 26, 2013

41,195,945 shares of Class A Common Stock

25,984,625 shares of Class B Common Stock

Documents Incorporated by Reference.

Portions of Martha Stewart Living Omnimedia, Inc.’s Proxy Statement for

Its 2013 Annual Meeting of Stockholders are Incorporated

by Reference into Part III of This Report.

TABLE OF CONTENTS

|

| |

| PART I | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| PART II | |

| |

| |

| |

| |

| |

| |

| |

| |

| PART III | |

| |

| |

| |

| |

| |

| PART IV | |

| |

| |

In this Annual Report on Form 10-K, unless otherwise noted, the terms “we,” “us,” “our,” “MSO” and the “Company” refer to Martha Stewart Living Omnimedia, Inc. and its subsidiaries. References to other companies may include their trademarks, which are the property of their respective owners.

FORWARD-LOOKING STATEMENTS

All statements in this Annual Report on Form 10-K, except to the extent describing historical facts, are “forward-looking statements,” as that term is defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements represent our current beliefs regarding future events, many of which, by their nature, are inherently uncertain and outside of our control. These statements often can be identified by terminology such as “may,” “will,” “should,” “could,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “potential” or “continue” or the negative of these terms or other comparable terminology. Our actual results may differ materially from those projected in these statements, and factors that could cause such differences include those factors discussed in “Risk Factors” in Item 1A of this Annual Report on Form 10-K and those discussed in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Item 7, as well as other factors. Forward-looking statements herein speak only as of the date of filing of this Annual Report on Form 10-K and we caution you not to place undue reliance on such statements. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. You are advised, however, to consult any further disclosures we make on related subjects in the reports we file with the Securities and Exchange Commission (the “SEC”).

PART I

Item 1. Business.

OVERVIEW

We are an integrated media and merchandising company providing consumers with inspiring lifestyle content and well-designed, high-quality products. We are organized into three business segments: Publishing, Merchandising and Broadcasting. This combination enables us to cross-promote our content and products.

Our strategy to generate growth and profitability includes the following imperatives:

| |

| • | Grow our merchandising business by leveraging our brand equity to expand the distribution of product in existing categories, diversify into new categories and distribution channels, and negotiate new partnerships that fully reward us for the value of our brands and our active role in product development and design, both domestically and internationally; and |

| |

| • | Strengthen our media business by using our content across existing and new distribution channels, including international opportunities, and focusing on digital opportunities. |

The media and merchandise we create generally encompasses the following core areas:

| |

| • | Cooking and Entertaining |

| |

| • | Holidays and Celebrations |

| |

| • | Organizing, Office Products and Accessories |

| |

| • | Gardening and Outdoor Living |

| |

| • | Pets (grooming, apparel, feeding and health) |

As of February 8, 2013, we had approximately 497 employees. Our designed and branded products are available in thousands of retail outlets across the country including The Home Depot, Macy’s, Petsmart and Staples.

Total revenues from our three business segments were $197.6 million, $221.4 million and $230.8 million in 2012, 2011 and 2010, respectively. Our revenues from domestic sources were $187.4 million, $211.6 million and $224.3 million in 2012, 2011 and 2010, respectively. Our revenues from foreign sources were $10.2 million, $9.8 million and $6.5 million in 2012, 2011 and 2010, respectively, which was largely comprised of international sales of television content. In the future, we plan to grow international revenues from other areas of our business, primarily our merchandising business. Substantially all of our assets are located within the United States.

HISTORY

Martha Stewart published her first book, Entertaining, in 1982. Over the next eight years she became a well-known authority on the domestic arts, authoring eight more books on a variety of our core content areas. In 1990, Time Publishing Ventures, Inc. (“TPV”), a subsidiary of Time Inc., launched Martha Stewart Living magazine with Ms. Stewart serving as its editor-in-chief. In 1993, TPV began producing a weekly television program, Living, hosted by Ms. Stewart. In late 1996 and early 1997, a series of transactions occurred resulting in MSLO LLC acquiring substantially all Martha Stewart-related businesses. Ms. Stewart was the majority owner of MSLO LLC; TPV retained a small equity interest in the business. On October 22, 1999, MSLO LLC merged into MSO, then a wholly owned subsidiary of MSLO LLC. Immediately following the merger, we consummated an initial public offering.

BUSINESS SEGMENTS

Our three business segments are described below. Additional financial information relating to these segments may be found in Note 13, Industry Segments, in the Notes to Consolidated Financial Statements of this Annual Report on Form 10-K, which information is incorporated herein by reference.

PUBLISHING

In 2012, our Publishing segment accounted for 62% of our total revenues, consisting of operations related to magazine and book publishing and digital distribution, principally through our website, marthastewart.com. Revenues from magazine and digital advertising represented approximately 63% of the segment’s revenues in 2012, while circulation revenues represented approximately 34% of the segment’s revenues.

On November 1, 2012, we announced several restructuring actions in our Publishing segment ("Publishing Restructuring"), which included the transition of the print publication Everyday Food from a stand-alone title to a digital-focused brand distributed across multiple platforms. Everyday Food ceased publication as a stand-alone title with its December 2012 issue, but is currently being issued as an occasional insert to Martha Stewart Living subscribers beginning in 2013. In addition, we discontinued publication of Whole Living with the January/February 2013 issue, and sold the related subscriber list in January 2013. Subsequent to the announcement of our Publishing Restructuring, we also are reducing the frequency of Martha Stewart Living, starting in 2013, from a monthly publication to ten times per year.

Magazines

Martha Stewart Living, our flagship magazine, is the foundation of our publishing business. We published twelve issues of Martha Stewart Living in 2012 with a rate base of 2.05 million. The magazine appeals primarily to the college-educated woman between the ages of 25 and 54 who owns her principal residence. Martha Stewart Living offers lifestyle ideas and original how-to information in a highly visual, upscale editorial environment. The magazine has won numerous prestigious industry awards and is the leading publication for the Martha Stewart brand. Martha Stewart Living generates a majority of our magazine revenues, largely from advertising and circulation.

Martha Stewart Weddings, a quarterly publication, targets the upscale bride and serves as an important vehicle for introducing young women to our brands. Martha Stewart Weddings is distributed primarily through newsstands.

Everyday Food is a digest-sized magazine, which had been published ten times per year, targeted women ages 25 to 49 and featured quick, easy recipes for the everyday cook, along with seasonal menus, cooking instructions, suggestions for healthy, “smart” eating and money-saving shopping tips.

Whole Living was a publication featuring "natural living" content and had been published ten times per year. The magazine was acquired in August 2004, at which time we purchased certain assets and liabilities of Body + Soul magazine and Dr. Andrew Weil’s Self Healing newsletter. In 2010, we discontinued publication of Dr. Andrew Weil’s Self Healing newsletter and the related Dr. Weil special interest publications. Effective with the June 2010 issue, we changed the name of Body + Soul/Whole Living magazine to Whole Living. We discontinued Whole Living as part of the Publishing Restructuring.

Magazine Summary

Certain information related to our subscription magazines is as follows:

|

| | | | | | | | | | | | |

| Title | 2010 Rate Base | | 2011 Rate Base | | 2012 Rate Base | | 2013 Rate Base | |

| Martha Stewart Living | 2,025,000 |

| | 2,050,000 |

| (1) | 2,050,000 |

| | 2,050,000 |

| |

Martha Stewart Weddings (2) | n/a |

| (3) | n/a |

| (3) | n/a |

| (3) | n/a |

| (3) |

| Everyday Food | 1,000,000 |

| | 1,025,000 |

| (1) | 1,025,000 |

| | n/a |

| (4) |

| Whole Living | 650,000 |

| | 700,000 |

| (1) | 750,000 |

| (1) | n/a |

| (4) |

(1) Rate base increases are effective with the January issues, which typically are on sale in December of the prior fiscal year.

(2) In addition to the quarterly publication, we anticipate producing two special issues of Martha Stewart Weddings in 2013, similar to 2012, as compared to only one special issue of Martha Stewart Weddings we produced in each of 2011 and 2010.

(3) Does not have a stated rate base.

(4) As a result of the Publishing Restructuring, we are no longer publishing Everyday Food as a stand-alone magazine and are no longer publishing Whole Living.

Special Interest Publications. In addition to our periodic magazines, we occasionally publish special interest magazine editions. Our special interest publications provide in-depth advice and ideas around a particular topic in one of our core content areas, allowing us to leverage our distribution network to generate additional revenues. Our special interest publications are sold at newsstands and may include advertising. In 2012, we published The Best of Martha Stewart Living Organizing, The Best of Martha Stewart Halloween Handbook, Martha Stewart Weddings Real Weddings and Martha Stewart Weddings Destination Weddings and Dream Honeymoons.

Magazine Production, Distribution and Fulfillment. We print most of our domestic magazines under agreements with R.R. Donnelly and currently purchase paper through an agreement with Time Inc. Our agreement with R.R. Donnelly runs through 2017. In the first half of 2012, paper prices declined slightly from 2011, then increased modestly in the second half of 2012, back to pricing levels comparable to 2011. Based on recent information from our paper supplier, we expect prices to remain stable in the first half of 2013 with an expected modest price increase in the second half of 2013. We use no other significant raw materials in our businesses. The vast majority of subscription copies of our magazines are delivered by the U.S. Postal Service. Postages rates for periodicals increased by 2.1% in January 2012 from 2011 rates, and increased again by 2.5% in February 2013. Sales and marketing of the magazines to retailers is handled by Time Warner Retail Sales and Marketing, an affiliate of Time Inc. Billing, collection and distribution services for retail sales of the magazines are handled by Curtis Circulation Company. Both of these newsstand distribution agreements expire in June 2014. Subscription fulfillment services for our magazines are provided by Time Customer Service, another affiliate of Time Inc., under an agreement that also expires in June 2014.

Books

We have a multi-year, multi-book agreement with The Crown Publishing Group to provide Martha Stewart branded books, under the Clarkson Potter, Potter Style or Potter Craft imprints. Under a prior version of this agreement with the same publisher, Martha's American Food was published in 2012.

In August 2008, we announced a multi-year agreement with HarperCollins Publishers to publish ten Emeril Lagasse branded books under the HarperStudio imprint, of which five had been delivered and accepted through December 31, 2012. Kicked-Up Sandwiches was published under this agreement in 2012.

Through our efforts in the books business and the rights we acquired related to Emeril’s book backlist, we now have a library of approximately 93 published books.

Digital

Websites

The marthastewart.com website is the flagship of our digital properties, offering a vast quantity of continually updated articles, recipes and videos developed from several Martha Stewart brands, including our magazine properties. Since the website’s re-launch in 2007 as a content-focused, advertising-driven media website, marthastewart.com has received many industry awards. The website provides engaging experiences in several lifestyle categories: food, entertaining, holidays, home and garden, crafts and pets. The website also serves as a gateway to our other properties, including

marthastewartweddings.com and emerils.com. In 2011, we invested in a re-platforming of our website that allows for additional functionality, which was completed in 2012. The enhancements, which include a responsive website design, allow for improved user engagement and expanded advertising inventory, including views from smartphones and tablets, which, in combination, are expected to drive growth in our audience and revenues. In 2012, we converted over 2,600 hours of archived television shows featuring Martha Stewart, Emeril and other talent into digital format, making this content available for us to serve on our websites and thereby significantly expanding our online video library. In 2012, our collective website properties saw monthly average unique visitors of 6.3 million, a 27% increase over 2011. However, similar with the industry-wide trend of lower average page views per unique visitor, we saw a 15% decline in average monthly page views to 80.9 million, down from 94.9 million in 2011.

Digital Editions and Apps

All of our magazines are available on multiple platforms. In addition to the digital editions of our magazines, we also produce numerous mobile and tablet applications (“apps”) to further distribution of our magazines and provide our content in creative, accessible programs to accommodate the growing popularity of smartphones and tablet devices.

We produce digital editions available through Barnes & Noble's Nook, Amazon's Kindle Fire and through the Zinio platform. In 2012, we built a custom storefront in Apple's iTunes, which allows us to sell subscriptions and single copies of our magazines, only for Apple's iPad products. We further produce iPad versions of Martha Stewart Living and Martha Stewart Weddings, the latter of which was launched in 2012. Digital editions, including iPad versions, currently account for approximately 4% of all our circulation. Revenues from digital editions, which were previously classified as "Other" revenues, are classified as "Circulation" revenues beginning in 2012.

We also produce various apps that provide recipes, how-to, creativity and video content, which we refer to as our companion apps. In 2012, we launched the Craft Studio app available on Apple iTunes. Produced in partnership with Happy Studios, LLC and sponsored by Snapfish, Craft Studios is a richly featured card and craft making tool. In addition, we continue to sell our library of apps we launched in prior years on iTunes, including our Cocktails, Smoothies, Cookies, Egg Dying and Everyday Food Recipe apps, along with updated content bundles. We also introduced a Microsoft Windows 7 version of the Everyday Food Recipe app and a Everyday Food Video app for Windows 8 Tablets.

Video Distribution

In 2012, we entered into several agreements to expand our video distribution. We entered into agreements with Hulu to distribute our long-form content and with AOL to distribute short-form archive and premium video content. We also entered into an agreement with Fullscreen to expand our presence on YouTube through branded channels and network distribution. With these deals, we will either create or expand our branded channels, including Martha Stewart, Emeril, Everyday Food and Mad Hungry, on these websites, and increase the distribution of our video archive.

Competition

Publishing is a highly competitive business. Our magazines, books, websites and digital apps compete not only with other magazines, books and digital apps, but also with other mass media, websites and many other types of leisure-time activities. Competition for advertising dollars in magazine operations is primarily based on advertising rates, as well as editorial and aesthetic quality, the desirability of the magazine’s demographic, reader response to advertisers’ products and services and the effectiveness of the advertising sales staff. Martha Stewart Living competes for readers and advertising dollars with decorating, cooking and women's lifestyle magazines and websites. Martha Stewart Weddings competes for readers and advertising dollars primarily with wedding service magazines and websites. Everyday Food competes for readers and advertising dollars with women’s service and cooking magazines and websites. Our special interest publications can compete with a variety of magazines depending on the focus of the particular issue. Capturing advertising sales for our digital properties is highly competitive as well. marthastewart.com competes with other how-to, food and lifestyle websites. Our challenge is to attract and retain users through an easy-to-use and content-relevant website. Competition for digital advertising is based on the number of unique users we attract each month, the demographic profile of that audience and the number of pages they view on our site.

Seasonality

Our Publishing segment can experience fluctuations in quarterly performance due to variations in the publication schedule from year to year, timing of direct mail expenses, delivery and acceptance of books under our long-term book contracts and variability of audience and traffic on marthastewart.com, as well as other seasonal factors. Not all of our magazines are published on a regularly scheduled basis throughout the year. Additionally, the publication schedule for our special interest publications can vary and lead to quarterly fluctuations in the Publishing segment’s results. Advertising revenue in our magazines and on marthastewart.com is typically highest in the fourth quarter of the year due to higher consumer

demand for our holiday content, and corresponding higher advertiser demand to reach our audience with their marketing messages. Certain newsstand costs vary from quarter to quarter, particularly newsstand marketing costs associated with the distribution of our magazines. These costs typically have a three-year life cycle, but can vary significantly throughout the term.

MERCHANDISING

Our Merchandising segment contributed 29% of our total revenues in 2012. The segment consists of operations related to the design of merchandise and related packaging, collateral and advertising materials, and the licensing of various proprietary trademarks, in connection with retail programs conducted through a number of retailers and manufacturers. Pursuant to agreements with our retail and manufacturing partners, we are typically responsible for the design of all merchandise and/or related packaging, signage, advertising and collateral materials. Our retail partners source the products through a manufacturer base and are mostly responsible for the promotion of the product. Our manufacturing partners source and/or produce the branded products sometimes together with other lines they make or sell. Our licensing agreements do not require us to maintain any inventory nor incur any significant expenses other than employee compensation. We own all trademarks for each of our branded merchandising programs and generally retain all intellectual property rights related to the designs of the merchandise, packaging, signage and collateral materials developed for the various programs.

Select Retail Licensees

The Home Depot

In 2010, we launched the Martha Stewart Living program at The Home Depot, which is currently available at all of The Home Depot’s stores in the United States and Canada, as well as on www.homedepot.com and Home Decorators Collection catalog, online and retail stores. The Martha Stewart Living program at The Home Depot encompasses a broad range of home décor, paint, storage and organization products, outdoor furniture, window treatments, kitchen cabinetry, countertops, carpet and seasonal holiday décor. In February 2012, we renewed our agreement with The Home Depot for an additional term ending March 2016.

Macy’s

In September 2007, we introduced the Martha Stewart Collection at Macy’s. It is currently available at the nearly 650 Macy’s stores in the United States that offer home products, as well on www.macys.com. The Martha Stewart Collection line encompasses a broad range of home goods, including bed and bath textiles, housewares, food preparation and other kitchen items, tabletop and holiday decorating items. See Item 3. Legal Proceedings in this Annual Report on Form 10-K for discussion of litigation related to Macy's.

J.C. Penney

In December 2011, we entered into a strategic alliance with J.C. Penney Corporation, Inc. (“J.C. Penney”) and plan to launch certain home products in J.C. Penney department stores throughout the United States and through www.jcp.com in the spring of 2013. For information regarding J.C. Penney's investment in our company, see Note 7, Shareholders' Equity, in the Notes to Consolidated Financial Statements of this Annual Report on Form 10-K. Also see Item 3. Legal Proceedings in this Annual Report on Form 10-K for discussion of litigation related to J.C. Penney.

Select Manufacturing Licensees

Martha Stewart Crafts

In May 2007, we launched Martha Stewart Crafts, a paper-based crafting program with our manufacturing partner, Wilton Properties Inc. (formerly UCG Paper Crafts Properties Inc. and EK Success), at Michaels stores in the United States. The program consists of tools, embellishments, paper/albums, and other seasonal products. Distribution for this program has expanded to include multiple specialty and independent craft chains in the United States and internationally.

In 2011, we further expanded our Martha Stewart Crafts portfolio by introducing a line of craft paints with Plaid Enterprises and a line of yarns and looms with Orchard Yarn and Thread, Inc. (d/b/a Lion Brand Yarn).

Martha Stewart Pets

In July 2010, we launched the Martha Stewart Pets line, developed in partnership with Age Group Ltd and sold currently at Petsmart stores. The program consists of a wide range of pet accessories, including apparel, collars, leashes, bedding, grooming supplies and toys.

Martha Stewart Home Office

In December 2011, we began shipping products for Martha Stewart Home Office with Avery and launched the line in February 2012. The Martha Stewart Home Office line is sold currently at Staples in the U.S. and U.K., on www.staples.com, and at Officeworks in Australia. The line encompasses a range of home office products, including surface organization, journals, portable filing, pantry organization and the recently launched line of bags and totes.

Martha Stewart Homes

We have had a partnership with KB Home for the development of Martha Stewart Homes since 2005. The KB Home communities created with Martha Stewart feature homes with unique exterior and interior details that are inspired by Martha Stewart’s own homes. The Martha Stewart Homes are located at multiple communities in California, Colorado, North Carolina, Georgia, Texas and Florida. We also offer a range of design options, featured exclusively at KB Home Studios nationwide.

Select Emeril Lagasse Manufacturing Licensees

We acquired certain licensing agreements in connection with our April 2008 acquisition of specific Emeril Lagasse assets and have entered into new licensing agreements following the acquisition. These licensing agreements are primarily associated with partnerships with various food and kitchen preparation manufacturers that produce products under the Emeril Lagasse brand.

Emerilware

Introduced in August 2000, Emerilware by All-Clad consists of lines of high-quality, gourmet cookware and barbeque tools available at department stores and specialty retail outlets across the United States, as well as through the Home Shopping Network.

We also have a line of Emerilware products by T-FAL, launched in November 2006, which consists of small kitchen appliances available at department stores and specialty retail outlets across the United States, as well as through the Home Shopping Network.

Emeril’s Original

In September 2000, Emeril Lagasse introduced with B&G Foods, Emeril’s Original, a signature line of seasonings, salad dressings, basting sauces and marinades, mustards, salsas, pasta sauces, pepper sauces, spice rubs, cooking sprays and stocks available at supermarkets and specialty markets across the United States, as well as through the Home Shopping Network.

Emeril’s Gourmet Coffee

Launched in September 2007, Emeril’s Gourmet Coffee with Timothy’s World Coffee is a single-cup coffee program comprised of flavored coffees inspired by Emeril Lagasse. The program is available in department and specialty stores nationwide, as well as in certain national hotel chains.

Other

In 2010, we introduced a variety of new partnerships, including Emerilware Cutlery with SED International Inc. (formerly Lehrhoff ABL Inc.), which is a branded cutlery collection that includes knives and cutting boards. We also introduced Emeril's Red Marble Steaks with Allen Brothers which is a line of hand-selected, aged steaks. The line, launched in the spring of 2010, is available through catalog, online and the Home Shopping Network. In 2012, we launched Emeril by Snapware, which is branded food storage, on the Home Shopping Network. In 2013, we plan to launch a line of bagged coffees with White Coffee.

Competition

The retail business is highly competitive and the principal competition for all of our merchandising lines consists of mass-market and department stores that compete with the mass-market, home improvement and department stores in which our Merchandising segment products are sold. Our merchandising lines also compete within the mass-market, home improvement and department stores that carry our product lines with other products offered by these stores in the respective product categories, including with products sold under our partners' private labels. Competitive factors include numbers and locations of stores, brand awareness, quality and price. We also compete with the internet businesses of these stores and other websites that sell similar retail goods.

Seasonality

Revenues from the Merchandising segment can vary significantly from quarter to quarter due to new product launches and the seasonality of many product lines.

BROADCASTING

Our Broadcasting business segment accounted for 9% of our total revenues in 2012. The segment consisted of operations relating to the production of television programming, the domestic and international distribution of our library of programming in existing and repurposed formats and the operations of our satellite radio channel. While certain revenue derived from the provision of talent services was included in the Broadcasting segment in 2012 and prior years, we are now recording, beginning in 2012, new agreements for talent services in our Merchandising segment. We generally own the copyrights in the programs we produce for television and radio distribution.

In 2012, we significantly restructured the Broadcasting segment, which included the termination of our live audience television production operations. We expect that the operations of this segment in 2013 and beyond will consist of television content library licensing, satellite radio operations and limited television production operations. While future revenues and assets from these operations are not expected to be significant, we plan to continue reporting activities under the Broadcasting segment to provide historical context.

The Martha Stewart Show, in its format with a live audience, concluded on the Hallmark Channel with the completion of season 7 in September 2012. Revenues for The Martha Stewart Show on Hallmark Channel were mostly comprised of advertising, product integration and international licensing revenues. We own the television content we produced for the Hallmark Channel and we have the right in the future to further monetize these assets. While the Hallmark Channel retains certain rights to some of our programming other than The Martha Stewart Show (“companion programming”) through September 2013, we completed the delivery of all of our companion programming to the Hallmark Channel by December 31, 2011. Revenues for the companion programs on Hallmark Channel generally consisted of licensing revenue.

In 2012, we produced two seasons of a new weekly half-hour series, Martha Stewart’s Cooking School. The show debuted on PBS in October and was produced in our studio prior to the end of our studio lease on June 30, 2012. Revenues for Martha Stewart's Cooking School, which consists of sponsorship revenue, for the first season were recognized in 2012, with additional revenue expected to be recognized in 2013 with the airing of the second season.

Emeril Lagasse also provides various television services for us. In 2012, Emeril Lagasse hosted a new show, Emeril's Florida, on the Cooking Channel, returned as a co-host on Top Chef and continued providing talent services as the recurring Food Correspondent for Good Morning America.

The Martha Stewart Living Radio channel launched on Sirius Satellite Radio, now known as Sirius XM Radio, in November 2005 providing programming 24 hours a day, seven days a week, of which 65 hours each week was original programming created by our experts. In November 2011, we renewed our agreement with Sirius XM Radio for a one-year term that ended December 31, 2012 at a reduced license fee, along with a reduction of original programming to approximately 40 hours each week. In addition, our agreement with Sirius XM provided for all radio advertising on the Martha Stewart Living Radio channel to be sold, and all revenue from such advertising retained, by Sirius XM, except for a portion of the revenue from radio advertising sold in the fourth quarter of 2012. On January 31, 2013, we announced a new agreement with Sirius XM Radio at a further reduced license fee, along with a reduction of original programming to approximately 10 hours each week. The new agreement with Sirius XM Radio replaces the Martha Stewart Living Radio channel with a new, daily radio show hosted by Martha Stewart on SiriusXM Stars.

Competition

Broadcasting is a highly competitive business. Overall competitive factors in this segment include programming content, quality and distribution as well as the demographic appeal of the programming. Competition for television and radio advertising dollars is based primarily on advertising rates, audience size and demographic composition, viewer response to advertisers’ products and services and the effectiveness of the advertising sales staffs. Our television programs competed directly for viewers, distribution and/or advertising dollars with other lifestyle and how-to television programs, as well as with general programming on other television stations and all other competing forms of media. Our radio programs compete for listeners with similarly themed programming on both satellite and terrestrial radio.

Seasonality

Our Broadcasting segment has experienced fluctuations in quarterly performance due to, among other things, seasonal advertising patterns, seasonal influences on people’s viewing habits and audience increases for our programming during

holiday seasons. Because television seasons run 12 months beginning and ending in the middle of September, the 2012 results include nine months of season 7 of The Martha Stewart Show on the Hallmark Channel. While repeat episodes air over the summer, original episodes usually run September to May and typically generate higher ratings and revenues.

INTELLECTUAL PROPERTY

We use multiple trademarks to distinguish our various publications and brands, including Martha Stewart Living (the name of our flagship publication as well as the trademark for products sold at The Home Depot), Martha Stewart Collection (for goods sold at Macy’s), Martha Stewart Crafts, Martha Stewart Weddings, Everyday Food, Mad Hungry and Emeril. These and numerous other trademarks are the subject of registrations and pending applications filed by us for use with a variety of products and other content, both domestically and internationally, and we continue to expand our worldwide usage and registration of related trademarks. We also register, both offensively and defensively, key domain names containing our trademarks, such as www.marthastewart.com, www.marthastewartweddings.com, www.emerils.com and www.everydayfood.com.

We regularly file copyrights regarding our proprietary designs and editorial content. We have also applied for, and in some instances are now the owners of, domestic and international design and utility patents covering certain of our Martha Stewart Crafts paper punches.

We regard our rights in and to our trademarks, our proprietary designs and editorial content as valuable assets in the marketing of our products. Accordingly, we vigorously police and protect our trademarks against infringement and denigration by third parties. We also work with our licensees to assure that our trademarks are used properly. We own and license the perpetual rights to the “Martha Stewart” portion of our marks pursuant to an agreement between us and Ms. Stewart, the description of which is incorporated by reference into Item 13 of this Annual Report on Form 10-K.

AVAILABLE INFORMATION

Our flagship website can be found on the Internet at www.marthastewart.com. Our proxy statements, Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K and any amendments to these documents, as well as certain other forms we file with or furnish to the SEC, can be viewed and downloaded free of charge as soon as reasonably practicable after they have been filed with the SEC by accessing www.sec.gov, or www.marthastewart.com and clicking on Investor Relations and SEC Filings. Please note that information on, or that can be accessed through, our website is not deemed “filed” with the SEC and is not incorporated by reference into any of our filings under the Securities Act of 1933, as amended (the “Securities Act”), or the Securities Exchange Act of 1934, as amended (the “Exchange Act”), irrespective of any general incorporation language contained in such filing.

Item 1A. Risk Factors

A wide range of factors could materially affect our performance. Like other companies, we are susceptible to macroeconomic changes that may affect the general economic climate and our performance, the performance of those with whom we do business, and the appetite of consumers for products and publications. Similarly, the price of our stock is impacted by general equity market conditions, the relative attractiveness of our market sector, differences in results of operations from estimates and projections, and other factors beyond our control. In addition to the factors affecting specific business operations identified in connection with the description of those operations and the financial results of those operations elsewhere in this report, the factors listed below could adversely affect our operations. Although the risk factors listed below are the risk factors that Company management considers significant, material risk factors that are not presently known to Company management may also adversely affect our operations.

Our success depends in part on the popularity of our brands and the reputation and popularity of Martha Stewart and Emeril Lagasse. Any adverse reactions to publicity relating to Ms. Stewart or Mr. Lagasse, or the loss of either of their services, could adversely affect our revenues, results of operations and our ability to maintain or generate a consumer base.

While we believe there has been significant consumer acceptance for our products as stand-alone brands, the image, reputation, popularity and talent of Martha Stewart and Emeril Lagasse remain important factors.

Ms. Stewart’s efforts, personality and leadership, including her services as an officer and director of MSLO, have been, and continue to be, critical to our success. While we have managed our business without her daily participation at times in the past, the repeated diminution or loss of her services due to disability, death or some other cause, or any repeated or sustained shifts in public or industry perceptions of her, could have a material adverse effect on our business. In a July 2012 letter, we and Ms. Stewart agreed to extend the term of Ms. Stewart's current employment agreement until June 30, 2017. Under this letter, the parties have agreed to negotiate mutually acceptable adjustments to the terms of the employment agreement to take effect at

July 1, 2013 (or such earlier date as the parties may agree). Under the letter, if the parties do not reach an agreement regarding mutually acceptable adjustments, we can choose to have the employment agreement continue in effect through June 30, 2017 or to allow it to lapse at June 30, 2013.

In addition, in 2008 we acquired the assets relating to Emeril Lagasse’s businesses other than his restaurants and foundation. The value of these assets is largely related to the ongoing popularity and participation of Mr. Lagasse in the activities related to exploiting these assets. Therefore, the continued value of these assets could be materially adversely affected if Mr. Lagasse were to lose popularity with the public or be unable to participate in our business, forcing us potentially to write-down a significant amount of the value we paid for these assets.

Our management turnover creates uncertainty.

Our continued success depends to a large degree upon our ability to attract and retain key management executives, as well as upon a number of members of creative, technology, and sales and marketing staffs. In the last several years, we have had members of the senior management team leave the Company and we have recruited new members who are part of our current management team. We are currently in a search for a new Chief Executive Officer. The loss of key members of our management team could have a negative impact on our ability to manage and grow our business effectively. As a result, we may face challenges in effectively managing our operations during this period of transition. If members of senior management leave the Company, we cannot assure you that we would be able to replace them in a timely manner, or at all, on acceptable terms. In addition, our search for replacements for departed executives may cause uncertainty regarding the future of our business, impact employee hiring and retention, increase the volatility in our stock price and adversely impact our revenue, operating results and financial condition.

Failure of the economy to sustain a recovery or difficulties in the financial markets could significantly impact our business, financial condition, results of operations and cash flows, and could adversely affect the value of our assets or hamper our ability to raise additional funds.

The economy experienced considerable disruption during the three years in the period ended December 31, 2012, including volatility in securities prices and a general reduction in credit availability. These events led to increased unemployment, a downturn in the housing market, declines in consumer confidence and declines in personal income and consumer spending, particularly discretionary spending. These adverse consumer trends led to reduced spending on general merchandise, homes and home improvement projects—categories in which we license our brands—resulting in weaker revenues from our licensed products in our Merchandising business.

We depend on advertising revenue in our Publishing business. We cannot control how much or where companies choose to advertise. Since 2009, we have seen a significant downturn in advertising dollars generally in the marketplace, and more competition for the reduced dollars. During the course of the advertising recession, we experienced a decline in advertising revenues, and a permanent reversal of that trend is not assured. If advertisers continue to spend less money, or if they advertise elsewhere in lieu of our magazines or websites, our business and revenues will be materially adversely affected. Furthermore, if our licensees experience financial hardship, they may be unwilling or unable to pay us royalties or continue selling our products, regardless of their contractual obligations. We cannot predict the future health and viability of the companies with which we do business and upon which we depend for royalty revenues, advertising dollars and credit.

Although economic conditions have recently stabilized and shown some indications of improvement, it is difficult to judge the scope and sustainability of any general economic recovery. This makes it difficult for us to forecast consumer and product demand trends and companies’ willingness to spend money to advertise in our media properties. While consumer spending and confidence have improved, consumer spending remains constrained. Unemployment remains and is expected to remain at high levels and the housing market remains weak and may in fact further deteriorate. If consumer confidence, consumer spending and the housing market do not rebound and/or if the companies with which we do business experience ongoing problems, our revenues may not grow as planned. An extended period of reduced cash flows could increase our need for credit at a time when such credit may not be available. Because of residual uncertainties regarding the economy, our operating results will be difficult to predict, and prior results will not necessarily be indicative of results to be expected in future periods.

In addition, we have a significant intangible asset recorded on our balance sheet, as well as goodwill and other assets. We evaluate the recoverability of the carrying amount of our goodwill, intangible and other assets on an ongoing basis, and we may in the future incur substantial impairment charges, which would adversely affect our financial results. Impairment assessment inherently involves the exercise of judgment in determining assumptions about expected future cash flows and the impact of market conditions on those assumptions. Although we believe the assumptions we have used in testing for impairment are reasonable, significant changes in any one of our assumptions could produce a significantly different result. Future events and changing market conditions may prove our assumptions to be wrong with respect to prices, costs, holding periods or other

factors. Differing results may amplify impairment charges in the future. As reported in our Quarterly Report on Form 10-Q for the period ended September 30, 2012, we performed an interim review of goodwill for impairment and determined that the goodwill associated with the Publishing segment was impaired as of September 30, 2012. The non-cash goodwill impairment charge of $44.3 million was the result of the Publishing segment experiencing slower than anticipated growth in advertising. For further details on our goodwill impairment charge, see the Notes to Consolidated Financial Statements in this Annual Report on Form 10-K, specifically Note 2, Summary of Significant Accounting Policies under the heading "Goodwill and intangible assets."

We may not be able to successfully implement our anticipated growth strategies.

As part of our growth strategy, we seek to extend our brands and merchandise categories and expand our geographic coverage. If we were to create a new brand, or expand an existing brand, we may be required to increase expenditures to accelerate the development process with the goal of achieving longer-term cost savings and improved profitability. Brand developments may increase expenses if we hire additional personnel to manage our growth. These investments also would require significant time commitments from our senior management and place a strain on their ability to manage our existing businesses.

Achievement of our growth strategies require investment in new capabilities, distribution channels and technologies worldwide. These investments may result in short-term costs without accompanying current revenues and therefore, may be dilutive to our earnings in the short term. Although we believe that our strategy will lead to profitability, the anticipated benefits may not be fully realized.

As an example, we have been accelerating our shift in focus from print magazines to digital distribution of our content. We want to ensure that our brands are platform agnostic and that consumers can access our content in a variety of different formats, following consumer trends of greater digital consumption and less demand for printed publications. While we expect to see significant savings in editorial, production and distribution costs as a result of the Publishing Restructuring, we will have offsetting increased costs due to the increased production of digital content. Ultimately the success of this strategy will depend on our ability to monetize this digital content effectively.

We are expanding our merchandising and licensing programs into new areas and products, the failure of any of which could diminish the perceived value of our brand, impair our ability to grow and adversely affect our prospects.

Our growth depends to a significant degree upon our ability to develop new or expand existing retail merchandising programs. We have entered into several new merchandising and licensing agreements in the past few years. Some of these agreements include exclusivity provisions and have a duration of many years. While we require that our licensees maintain the quality of our respective brands through specific contractual provisions, we cannot be certain that our licensees, or their manufacturers and distributors, will honor their contractual obligations or that they will not take other actions that will diminish the value of our brands.

There is also a risk that our extension into new business areas will meet with disapproval from consumers. We cannot guarantee that these programs will be fully implemented, or, if implemented, that they will be successful. If the licensing or merchandising programs do not succeed, we may be prohibited from seeking different channels for our products due to the exclusivity provisions and multi-year terms of these agreements. Disputes with new or existing licensees may arise that could hinder our ability to grow or expand our product lines. Disputes also could prevent or delay our ability to collect the licensing revenue that we expect in connection with these products. If such developments occur or our merchandising programs are otherwise not successful, the value and recognition of our brands, as well as our business, financial condition and prospects, could be materially adversely affected.

An example of such risks is a dispute with a current licensee is a lawsuit that was filed on January 23, 2012, against us in the Supreme Court of the State of New York, County of New York titled Macy's, Inc. and Macy's Merchandising Group, Inc. v. Martha Stewart Living Omnimedia, Inc. In this lawsuit, Macy's Inc. and Macy's Merchandising Group, Inc. (together, the “Macy's plaintiffs”) claim that our planned activities under the agreement governing our strategic alliance with J.C. Penney materially breach the agreement between us and Macy's Merchandising Group, Inc. dated April 3, 2006 (the “Macy's Agreement”). The Macy's plaintiffs seek a declaratory judgment, preliminary and permanent injunctive relief, and incidental and other damages. The Court entered a preliminary injunction on July 31, 2012 which limited our activities with J.C. Penney in certain respects. In November 2012, the Macy's plaintiffs amended their complaint to assert a second claim which alleges additional breaches of the Macy's Agreement. In January 2013, the lawsuit was consolidated with an action titled Macy's Inc. and Macy's Merchandising Group, Inc. v. J.C. Penney Corporation, Inc. The trial of the consolidated cases began on February 20, 2013 and is currently ongoing. See Item 3. Legal Proceedings in this Annual Report on Form 10-K for details regarding this lawsuit. Depending on the outcome of the trial or any settlement discussions, some of the future benefits we anticipate receiving from our relationship with either Macy's or J. C. Penney could be reduced.

If we are unable to predict, respond to and influence trends in what the public finds appealing, our business will be adversely affected.

Our continued success depends on our ability to provide creative, useful and attractive ideas, information, concepts, programming, content and products that strongly appeal to a large number of consumers, as well as distributing the content through the latest technology and traditional channels. In order to accomplish this, we must be able to respond quickly and effectively to changes in consumer tastes for ideas, information, concepts, programming, technology, content and products. The strength of our brands and our business units depends in part on our ability to influence tastes through print publication, television and digital distribution and merchandising. We cannot be sure that our new ideas and content will have the appeal and garner the acceptance that they have in the past, or that we will be able to respond quickly to changes in the tastes of homemakers and other consumers and their appetite for new technology.

Absence of new product launches may reduce our earnings or generate losses.

Our future success will depend in part on our ability to continue offering new products and services that successfully gain market acceptance by addressing the needs of our current and future customers. Our efforts to introduce new products or integrate acquired products may not be successful or profitable. The process of internally researching and developing, launching, gaining acceptance and establishing profitability for a new product, or assimilating and marketing an acquired product, is both risky and costly. New products generally incur initial operating losses. Costs related to the development of new products and services are generally expensed as incurred and, accordingly, our profitability from year to year may be adversely affected by the number and timing of new product launches. Other businesses and brands that we may develop may also prove not to be successful.

We have an advertising-revenue-based website which is dependent on a large consumer audience and resulting page views. Failure to achieve growth could adversely affect our brand and business prospects.

Our growth depends to a significant degree upon the continued development and growth of our digital properties and our ability to monetize them. We continue to enhance and upgrade the marthastewart.com site. We cannot be certain that the ongoing changes we make will enable us to sustain growth for our website in the long term. In addition, the competition for advertising dollars has intensified and we have experienced continuous pressure on digital advertising revenue pricing from various sources, including advertising networks, real time bidding and competitive websites. In order for our digital properties to succeed, we must, among other things maintain and continue to:

| |

| • | significantly increase our online audience; |

| |

| • | monetize the growth from website traffic to increase advertising revenue; |

| |

| • | attract and retain a base of frequent visitors to our website; |

| |

| • | expand the content, products and interactive experiences we offer on our website; |

| |

| • | respond to competitive developments while maintaining a distinct brand identity; |

| |

| • | develop and upgrade our technologies so that they can support more efficient and effective migration of content from the print platform and provide a more robust user experience; and |

| |

| • | bring innovative product features to market in a timely manner. |

We cannot be certain that we will be successful in achieving these and other necessary objectives. If we are not successful in achieving these objectives, our business, financial condition and prospects could be materially adversely affected.

Our principal print business vendors are consolidating and this may adversely affect our business and operations.

We rely on certain principal vendors in the print portion of our Publishing segment and their ability or willingness to sell goods and services to us at favorable prices and other terms. Many factors outside our control may harm these relationships and the ability and willingness of these vendors to sell these goods and services to us on favorable terms. Our principal vendors include paper suppliers, printers, subscription fulfillment houses, subscription agents and national newsstand wholesalers, distributors and retailers. Each of these industries in recent years has experienced consolidation among its principal participants. Further consolidation may result in decreased competition, which may lead to greater dependence on certain vendors and increased prices; as well as interruptions and delays in services provided by such vendors, all of which could adversely affect our results of operations.

We may be adversely affected by fluctuations in paper, postage and distribution costs.

In our Publishing segment, our principal raw material is paper for the print portion of that business. Paper prices have fluctuated over the past several years. We generally purchase paper from major paper suppliers who adjust the price periodically. We have not entered, and do not currently plan to enter, into long-term forward price or option contracts for paper. Accordingly, significant increases in paper prices would adversely affect our future results of operations.

Postage for magazine distribution is also one of our significant expenses. We primarily use the U.S. Postal Service to distribute magazine subscriptions. In recent years, postage rates have increased, and a significant further increase in postage prices could adversely affect our future results of operations. Postage rates for periodicals increased by 2.1% in January 2012 from 2011 rates, and have increased again by 2.5% in February 2013. We may not be able to recover, in whole or in part, paper or postage cost increases.

Distribution of magazines to newsstands and bookstores is conducted primarily through companies known as wholesalers. Wholesalers have in the past advised us that they intended to increase the price of their services. We have not experienced any material increase to date; however, some wholesalers have experienced credit and going concern risks. It is possible that other wholesalers likewise may seek to increase the price of their services or discontinue operations. An increase in the price of our wholesalers’ services could have a material adverse effect on our results of operations. The need to change wholesalers could cause a disruption or delay in deliveries, which could adversely impact our results of operations.

We may be adversely affected by a continued weakening of newsstand sales.

The magazine industry has seen a weakening of newsstand sales during the past few years. A continuation of this decline would adversely affect our financial condition and results of operations by further reducing our circulation revenue and causing us to either incur higher circulation expenses to maintain our rate bases, or to reduce our rate bases, which would in turn negatively impact our revenue.

Our websites and internal networks may be vulnerable to unauthorized persons accessing our systems, which could disrupt our operations and result in the theft of our proprietary information.

Our website activities involve the storage and transmission of proprietary information, which we endeavor to protect from third party access. However, it is possible that unauthorized persons may be able to circumvent our protections and misappropriate proprietary information or cause interruptions or malfunctions in our digital operations. We may be required to spend significant capital and other resources to protect against or remedy any such security breaches. Accordingly, security breaches could expose us to a risk of loss due to business interruption, or litigation. Our security measures and contractual provisions attempting to limit our liability in these areas may not be successful or enforceable.

Martha Stewart controls our Company through her stock ownership, enabling her to elect most of our board of directors, and potentially to block matters requiring stockholder approval, including any potential changes of control.

Ms. Stewart controls all of our outstanding shares of Class B Common Stock, which provides Ms. Stewart with approximately 87% of our voting power. The Class B Common Stock has ten votes per share, while Class A Common Stock, which is the stock available to the public, has one vote per share. Because of this dual-class structure, Ms. Stewart has a disproportionately influential vote. As a result, Ms. Stewart has the ability to control unilaterally the outcome of all matters requiring stockholder approval, including the election and removal of all directors, other than the two directors whose election is controlled by J.C. Penney, and generally any merger, consolidation or sale of all or substantially all of our assets, and indirectly the ability to control our management and affairs. Ms. Stewart’s concentrated control could, among other things, discourage others from initiating any potential merger, takeover or other change of control transaction that may otherwise be beneficial to our businesses and stockholders.

Our intellectual property may be infringed upon or others may accuse us of infringing on their intellectual property, either of which could adversely affect our business and result in costly litigation.

Our business is highly dependent upon our creativity and resulting intellectual property. We are susceptible to others imitating our products and infringing our intellectual property rights. We may not be able to successfully protect our intellectual property rights, upon which we depend. In addition, the laws of many foreign countries do not protect intellectual property rights to the same extent as do the laws of the United States. Imitation of our products or infringement of our intellectual property rights could diminish the value of our brands or otherwise adversely affect our revenues. If we are alleged to have infringed the intellectual property rights of another party, any resulting litigation could be costly, affecting our finances and our reputation. Litigation also diverts the time and resources of management, regardless of the merits of the claim. There can be no assurance that we would prevail in any litigation relating to our intellectual property. If we were to lose such a case, and be

required to cease the sale of certain products or the use of certain technology or if we were forced to pay monetary damages, the results could adversely affect our financial condition and our results of operations.

We operate in two highly competitive businesses: Publishing and Merchandising, each of which subjects us to competitive pressures and other uncertainties.

We face intense competitive pressures and uncertainties in each of our two principal businesses.

Our magazines, books, digital products and other publishing products compete not only with other magazines, books, digital products and other publishing products, but also with other mass media, websites, and many other types of leisure-time activities. We face significant competition from a number of print and website publishers, some of which have greater financial and other resources than we have, which may enhance their ability to compete in the markets we serve. As advertising budgets have diminished and the number of media offerings have grown, the competition for advertising dollars has intensified. Competition for advertising revenue in publications is primarily based on advertising rates, the nature and scope of readership, reader response to the promotions for advertisers’ products and services, the desirability of the magazine’s demographic and the effectiveness of advertising sales teams. Other competitive factors in publishing include product positioning, editorial quality, circulation, price, customer service, circulation revenues and, ultimately, advertising revenues. Our websites compete with other how-to, food and lifestyle websites. Our challenge is to attract and retain users through an easy-to-use and content-relevant website. Competition for digital adverting is based on the number of unique users we attract each month, the demographic profile of that audience and the number of pages they view on our site. Because some forms of media have relatively low barriers to entry, we anticipate that additional competitors, some of which have greater resources than we do, may enter these markets and intensify competition.

Our Merchandising segment competitors consist of mass-market and department stores that compete with the mass-market, home improvement and department stores in which our Merchandising segment products are sold. Our merchandising lines also compete within the mass-market, home improvement and department stores that carry our product lines with other products offered by these stores in the respective product categories, including with products sold under our partners' private labels. We also compete with the internet businesses of these stores and other websites that sell similar retail goods.

Our failure to meet the competitive pressures in any of these segments could negatively impact our results of operations and financial condition.

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

Information concerning the location, use and approximate square footage of our principal facilities as of December 31, 2012, all of which are leased, is set forth below:

|

| | | |

| Location | Use | Approximate Area in Square Feet |

601 West 26th Street New York, NY | Publishing segment editorial and production offices (includes magazines, digital and books), advertising sales offices, product design facilities, photography studio, test kitchens, property storage, principal executive and administrative offices and corporate offices | 225,042 |

|

| | | |

| Satellite Sales Offices in Michigan, Illinois and California | Advertising sales offices | 6,302 |

|

We vacated our television production facilities at 221 West 26th Street and our executive and administrative office for television production at 226 West 26th Street at the end of the second quarter of 2012. The other leases for our offices and facilities expire between 2015 and 2018, and some of these leases are subject to our renewal.

We also have certain property rights under an intangible asset agreement covering our use of various residences owned by Martha Stewart for our editorial, creative and product development processes. These living laboratories allow us to experiment with new designs and new products, such as garden layouts, help generate ideas for new content available to all of our media outlets and serve as locations for photo spreads and video segments. The description of this intangible asset agreement is incorporated by reference into Item 13 and disclosed in the related party transaction disclosure in Note 10, Related Party Transactions, in the Notes to Consolidated Financial Statements of this Annual Report on Form 10-K.

We believe that our existing facilities are well maintained and in good operating condition.

Item 3. Legal Proceedings

On January 23, 2012, Macy's Inc. and Macy's Merchandising Group, Inc. filed a lawsuit against us in the Supreme Court of the State of New York, County of New York titled Macy's, Inc. and Macy's Merchandising Group, Inc. v. Martha Stewart Living Omnimedia, Inc. In such lawsuit, the Macy's plaintiffs claim that our planned activities under our commercial agreement with J.C. Penney materially breach the agreement between us and Macy's Merchandising Group, Inc. dated April 3, 2006. The Macy's plaintiffs seek a declaratory judgment, preliminary and permanent injunctive relief, and incidental and other damages. The Court entered a preliminary injunction on July 31, 2012 which limited our activities with J.C. Penney in certain respects. In November 2012, the Macy's plaintiffs amended their complaint to assert a second claim which alleges additional breaches of the Agreement. In January 2013, the lawsuit was consolidated with an action titled Macy's Inc. and Macy's Merchandising Group, Inc. v. J.C. Penney Corporation, Inc. The trial of the consolidated cases began on February 20, 2013 and is currently ongoing. We believe that we have meritorious defenses to the claims made by the Macy's plaintiffs, and we are vigorously defending such claims. Litigation costs in this matter are significant.

We are party to legal proceedings in the ordinary course of business, including product liability claims for which we are indemnified by our licensees. Other than Macy's, none of these proceedings is deemed material.

Item 4. Mine Safety Disclosures.

Not applicable.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market for the Common Stock

Our Class A Common Stock is listed and traded on The New York Stock Exchange (the “NYSE”). Our Class B Common Stock is not listed or traded on any exchange, but is convertible into Class A Common Stock at the option of its owner on a share-for-share basis. The following table sets forth the high and low sales price of our Class A Common Stock as reported by the NYSE for each of the periods listed.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Q1

2011 | | Q2

2011 | | Q3

2011 | | Q4

2011 | | Q1

2012 | | Q2

2012 | | Q3

2012 | | Q4

2012 |

| High Sales Price | $ | 4.54 |

| | $ | 5.49 |

| | $ | 4.75 |

| | $ | 5.19 |

| | $ | 4.89 |

| | $ | 3.94 |

| | $ | 3.81 |

| | $ | 3.24 |

|

| Low Sales Price | $ | 3.40 |

| | $ | 3.45 |

| | $ | 2.97 |

| | $ | 2.77 |

| | $ | 3.70 |

| | $ | 2.95 |

| | $ | 2.87 |

| | $ | 2.28 |

|

As of February 20, 2013, there were 7,508 record holders of our Class A Common Stock and one record holder of our Class B Common Stock. This does not include the number of persons whose stock is in nominee or “street name” accounts through brokers.

Dividends

We do not pay regular quarterly dividends. However, in December 2011, our Board of Directors declared and paid a special one-time dividend of $0.25 per share of common stock for a total dividend payment of $16.7 million.

Recent Sales of Unregistered Securities and Use of Proceeds

None.

Issuer Purchases of Equity Securities

None.

PERFORMANCE GRAPH

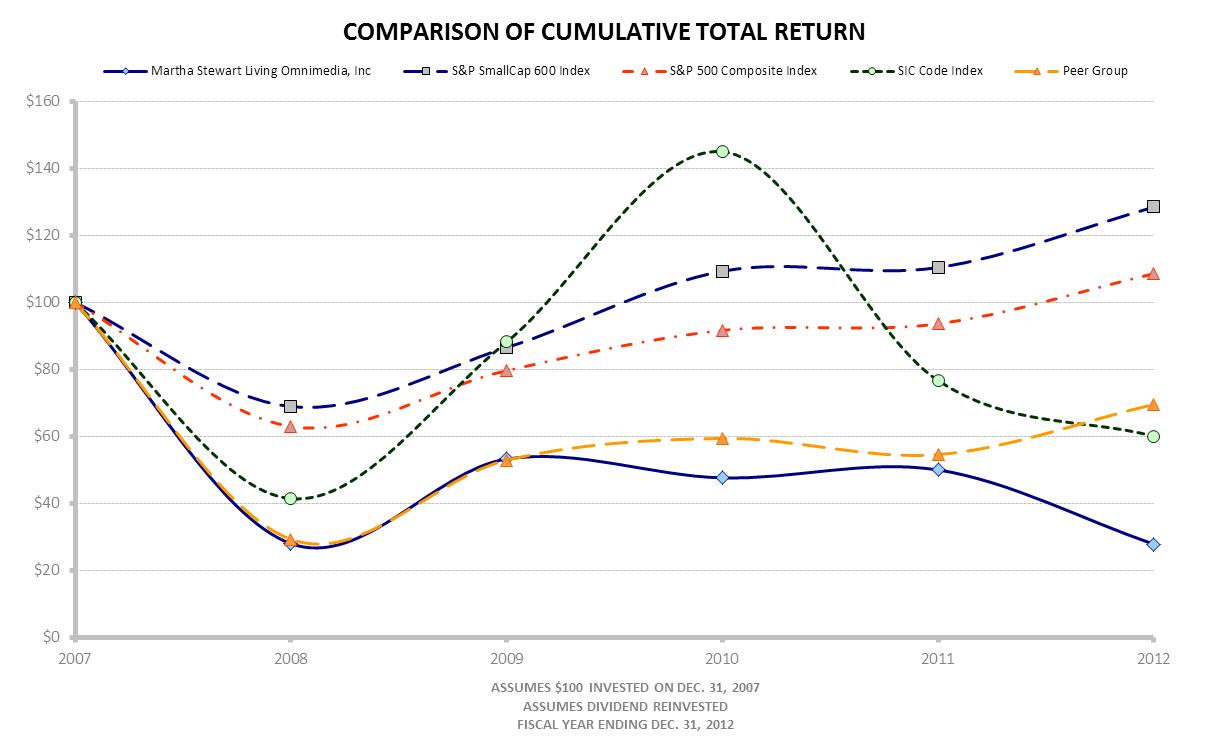

The following graph compares the performance of our Class A Common Stock during the period commencing on January 1, 2008 and ending on December 31, 2012, with that of the Standard & Poor’s 500 Stock Index (“S&P 500 Composite Index”) and the stocks included in the Media General Financial Services database under the Standard Industry Code 2721 (Publishing-Periodicals) (the “SIC Code Index”). In 2012, we revised the performance graph to include a comparison with the Standard & Poor's SmallCap 600 Index ("S&P SmallCap 600 Index") and with a peer group of companies engaged in multimedia and licensing businesses similar to ours ("Peer Group").

The addition of the S&P SmallCap 600 Index and the Peer Group in 2012 was the result of updating the comparison of the performance of our Class A Common Stock with indices that are more closely aligned with our businesses and size. The S&P SmallCap 600 Index is comprised of 600 domestic (United States) companies with a market capitalization in the range of $300 million to $1.4 billion in the financial, information technology, consumer discretionary and industrials sectors covering approximately 3% of the domestic equities market and is weighted by market capitalization. The Peer Group selected by us, which is also weighted by market capitalization, is comprised of Gannett Co. Inc., Iconix Brand Group, Inc., Kenneth Cole Productions, Lifetime Brands, Inc., Meredith Corporation, Scholastic Corp. and XO Group Inc.

For comparative purposes, we have included the SIC Code Index and the S&P 500 Composite Index, but we do not plan to include these indices in the future. The SIC Code Index consists of companies that are primarily publishers of periodicals, although many also conduct other businesses, including owning and operating television stations and cable networks. The hypothetical investment assumes investment in a portfolio of equity securities that mirror the composition of the SIC Code Index and is weighted according to market capitalization of the companies in the index.

The graph assumes that $100 was invested in each of our Class A Common Stock, the S&P SmallCap 600 Index, the Peer Group, the S&P 500 Composite Index and the SIC Code Index at the closing prices on December 31, 2007 and assumes reinvestment of dividends. The performance shown in the graph represents past performance and should not be considered an indication of future performance.

Item 6. Selected Financial Data.

The information set forth below for the five years ended December 31, 2012 is not necessarily indicative of results of future operations, and should be read in conjunction with Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and related notes thereto incorporated by reference into Item 8 of this Annual Report on Form 10-K. The Notes to Selected Financial Data below include certain factors that may affect the comparability of the information presented below (in thousands, except share per share amounts).

|

| | | | | | | | | | | | | | | | | | | |

| | 2012 | | 2011 | | 2010 | | 2009 | | 2008 |

| INCOME STATEMENT DATA REVENUES | | | | | | | | | |

| Publishing | $ | 122,540 |

| | $ | 140,857 |

| | $ | 145,573 |

| | $ | 146,100 |

| | $ | 179,116 |

|

| Merchandising | 57,574 |

| | 48,614 |

| | 42,806 |

| | 52,566 |

| | 57,866 |

|

| Broadcasting | 17,513 |

| | 31,962 |

| | 42,434 |

| | 46,111 |

| | 47,328 |

|

| Total revenues | 197,627 |

| | 221,433 |

| | 230,813 |

| | 244,777 |

| | 284,310 |

|

| Operating loss | (56,396 | ) | | (18,594 | ) | | (8,663 | ) | | (11,968 | ) | | (10,857 | ) |

| Net loss | $ | (56,085 | ) | | $ | (15,519 | ) | | $ | (9,596 | ) | | $ | (14,578 | ) | | $ | (15,665 | ) |

| PER SHARE DATA | | | | | | | | | |

| Loss per share: | | | | | | | | | |

| Basic and diluted—Net loss | $ | (0.83 | ) | | $ | (0.28 | ) | | $ | (0.18 | ) | | $ | (0.27 | ) | | $ | (0.29 | ) |

| Weighted average common shares outstanding: | | | | | | | | | |

| Basic and diluted | 67,231,463 |

| | 55,880,896 |

| | 54,440,490 |

| | 53,879,785 |

| | 53,359,538 |

|

| Dividends per common share | $ | — |

| | $ | 0.25 |

| | $ | — |

| | $ | — |

| | $ | — |

|

| FINANCIAL POSITION | | | | | | | | | |

| Cash and cash equivalents | $ | 19,925 |

| | $ | 38,453 |

| | $ | 23,204 |

| | $ | 25,384 |

| | $ | 50,204 |

|

| Short-term investments | 29,182 |

| | 11,051 |

| | 10,091 |

| | 13,085 |

| | 9,915 |

|

| Total assets | 154,260 |

| | 216,120 |

| | 222,314 |

| | 229,791 |

| | 261,285 |

|

| Long-term obligations | — |

| | — |

| | 7,500 |

| | 13,500 |

| | 19,500 |

|

| Shareholders’ equity | 95,516 |

| | 147,947 |

| | 139,033 |

| | 143,820 |

| | 150,995 |

|

| OTHER FINANCIAL DATA | | | | | | | | | |

| Cash flow provided by / (used in) operating activities | $ | 239 |

| | $ | (2,220 | ) | | $ | 1,872 |

| | $ | (9,273 | ) | | $ | 39,699 |

|

| Cash flow (used in) / provided by investing activities | (18,918 | ) | | 6,886 |

| | 153 |

| | (9,617 | ) | | (38,856 | ) |

| Cash flow provided by / (used in) financing activities | 151 |

| | 10,583 |

| | (4,205 | ) | | (5,930 | ) | | 18,825 |

|

NOTES TO SELECTED FINANCIAL DATA

Loss from continuing operations

2012 results include a non-cash goodwill impairment charge related to the Publishing segment of approximately $44.3 million and restructuring charges of approximately $4.8 million.

2011 results include restructuring charges of approximately $5.1 million.