| |

(vi) | that within the past year the directors had performed a full annual review of the Seligman Management Agreement, as required by the Investment Company Act of 1940 (“1940 Act”), for the Series (and each Fund) and had determined that they were satisfied with the nature, extent and quality of services provided thereunder and that the management fee rate for each Fund was satisfactory; |

| |

(vii) | the potential benefits to the Series (and each Fund) of the combination of RiverSource and Seligman, including: greater resources to attract and retain high quality investment personnel; greater depth and breadth of investment management capabilities; a continued high level of service to the Series (and each Fund); and the potential for realization of economies of scale over time since the Series (and each Fund) will be part of a much larger fund complex; |

| |

(viii) | the fact that each Fund’s total advisory and administrative fees would not increase by virtue of the Proposed Advisory Agreement, but would remain the same; |

| |

(ix) | that RiverSource, and not the Series or Funds, would bear the costs of obtaining all approvals of the Proposed Advisory Agreement; |

| |

(x) | the qualifications of the personnel of RiverSource and Ameriprise that would provide advisory and administrative services to the Series (and each Fund); |

| |

(xi) | the terms and conditions of the Proposed Advisory Agreement, including the directors’ review of differences from the Seligman Management Agreement; |

| |

(xii) | that RiverSource and Ameriprise have agreed to refrain from imposing or seeking to impose, for a period of two years after the closing of the Transaction, any “unfair burden” (within the meaning of Section 15(f) of 1940 Act) on the Series and each Fund; and |

| |

(xiii) | that certain members of RiverSource’s management have a significant amount of experience integrating other fund families. |

In considering the nature, extent and quality of the services to be provided under the Proposed Advisory Agreement, the directors of the Series considered, among other things, the expected impact of the Transaction on the operations of the Series and each Fund, the information provided by RiverSource with respect to the nature, extent and quality of services to be provided by it, RiverSource’s compliance programs and compliance records, and presentations provided on the quality of RiverSource’s investment research capabilities and the other resources it and Ameriprise have indicated that they would dedicate to performing services for the Series and each Fund.

The directors noted the professional experience and qualifications of the portfolio management team of each Fund and the senior personnel of RiverSource. The directors considered a report by, the Series’ Chief Compliance Officer, assessing RiverSource’s compliance system, which was followed by a private session with the Series’ Chief Compliance Officer. They also discussed RiverSource’s compliance system with the Chief Compliance Officer for the funds managed by RiverSource. The directors also considered RiverSource’s presentation on the selection of brokers and dealers for portfolio transactions. As administrative services (provided under the Seligman Management Agreement) would be provided to the Series (and each Fund) by Ameriprise at no additional cost under a new administrative services agreement rather than pursuant to the Proposed Advisory Agreement, the directors considered Ameriprise’s capability to provide such administrative services as well as RiverSource’s and Ameriprise’s roles in coordinating the activities of the Series’ (and each Fund’s) other service providers. The directors noted that Ameriprise intended to continue Seligman’s practice of sub-contracting administrative services provided by Seligman for the Series (and each Fund) to

Matters Relating to the Directors’

Consideration of the Approval of the

Investment Management Services Agreement

State Street Bank and Trust Company for the foreseeable future. The directors concluded that, overall, they were satisfied with assurances from RiverSource and Ameriprise as to the expected nature, extent and quality of the services to be provided to the Series (and each Fund) under the Proposed Advisory Agreement and the new administrative services agreement.

Costs of Services Provided and Profitability

In considering the costs of services to be provided by RiverSource under the Proposed Advisory Agreement, the directors considered, among other things, the projected pre-tax, pre-distribution expense profitability of RiverSource’s proposed relationship with the Series (and each Fund) and discussed the assumptions of RiverSource and the limitations of the information provided. The directors noted that RiverSource had undertaken to provide profitability information in connection with future contract continuances. The directors also considered RiverSource’s financial condition based on information provided by it.

The directors noted that the proposed fee under the Proposed Advisory Agreement was the same as provided under the Seligman Management Agreement. The directors recognized that it is difficult to make comparisons of profitability from fund advisory contracts because comparative information is not generally publicly available and is affected by numerous factors. In reviewing the projected profitability information, the directors considered the effect of fall-out benefits on RiverSource’s expenses. The directors concluded that they were satisfied that RiverSource’s estimated future profitability from its relationship with each Fund was not excessive.

Fall-Out Benefits

The directors considered that broker-dealer affiliates of RiverSource, including a broker-dealer affiliate of Seligman (which became an affiliate of RiverSource following the closing of the Transaction) will receive 12b-1 fees from each Fund in respect of shares held in certain accounts, and that each Fund’s distributor (which became a subsidiary of RiverSource following the closing of the Transaction) retains a portion of the 12b-1 fees from each Fund and receives a portion of the sales charges on sales or redemptions of certain classes of shares of each Fund. The directors recognized that RiverSource’s profitability would be somewhat lower without these benefits. The directors noted that RiverSource may derive reputational and other benefits from its association with the Funds.

Investment Results

The directors received and reviewed detailed performance information on each Fund at each regular Board meeting during the year in addition to the information received for the meeting regarding approval of the Proposed Advisory Agreement. The directors noted that each Fund’s current portfolio management team would continue to advise the Fund after the Transaction.

The directors reviewed performance information on each Fund covering a wide range of periods, including the first six months of the calendar year, the preceding seven calendar years and annualized one-, three- and five-year rolling periods ending June 30, 2008. For these periods the directors reviewed information comparing each Fund to other funds with similar investment objectives as determined by Lipper, with one or more selected securities indices, to a group of competitor funds selected by Seligman and, where applicable, similar RiverSource funds. The directors also reviewed information about portfolio turnover rates of each Fund compared to other investment companies with similar investment objectives, including, where applicable, RiverSource funds.

The directors recognized that it is not possible to predict what effect, if any, consummation of the Transaction would have on the future performance of the Funds.

54

Matters Relating to the Directors’

Consideration of the Approval of the

Investment Management Services Agreement

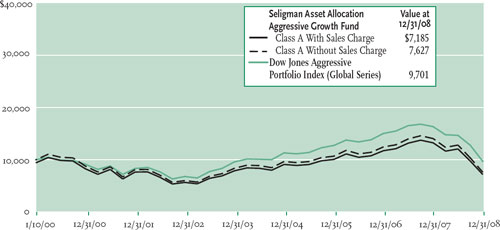

Seligman Asset Allocation Aggressive Growth Fund. The directors reviewed information comparing the Fund to the Lipper Multi-Cap Core Funds Average, the Lipper Fund of Funds (Affiliated), the Dow Jones Aggressive Portfolio Index (Global Series) and the Dow Jones Aggressive Portfolio Index (US Series), as well as performance relative to the other funds in Lipper Multi-Cap Core Funds Average, the Lipper Fund of Funds (Affiliated) and to a group of competitor funds selected by Seligman. The directors noted that the Fund was above the Lipper Multi-Cap Core median for the periods presented, and that the Fund’s results were above each of its benchmarks for the five- and three-year periods, except for the Dow Jones (Global) benchmark for the five-year period, which the Fund lagged slightly. The directors also noted that the Fund’s results had generally exceeded its benchmarks for each calendar year from 2003 through 2007, and exceeded each benchmark for the first six months of 2008, other than the Lipper Fund of Funds (Affiliated). Taking into account these comparisons and the other factors considered, the directors concluded that the Fund’s investment results were satisfactory.

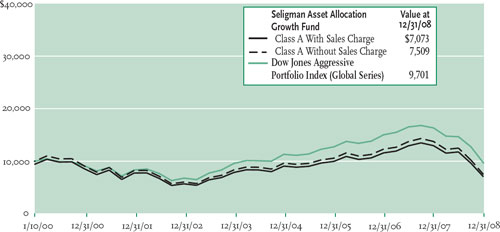

Seligman Asset Allocation Growth Fund. The directors reviewed information comparing the Fund to the Lipper Multi-Cap Core Funds Average, the Lipper Fund of Funds (Affiliated), the Dow Jones Aggressive Portfolio Index (Global Series), the Dow Jones Aggressive Portfolio Index (US Series), as well as performance relative to the other funds in the Lipper Multi-Cap Core Funds Average, the Lipper Fund of Funds (Affiliated) and to a group of competitor funds selected by Seligman. The directors noted that the Fund was above the Lipper Multi-Cap Core median in all periods presented, and that the Fund’s results were above each of its benchmarks for the three- and five-year periods, except for the Dow Jones (Global Series) benchmark, which the Fund lagged in the five-year period. The directors also noted that the Fund’s results had generally exceeded its benchmarks for each calendar year from 2003 through 2007, and exceeded each benchmark for the first six months of 2008, other than the Lipper Fund of Funds (Affiliated). Taking into account these comparisons and the other factors considered, the directors concluded that the Fund’s investment results were satisfactory.

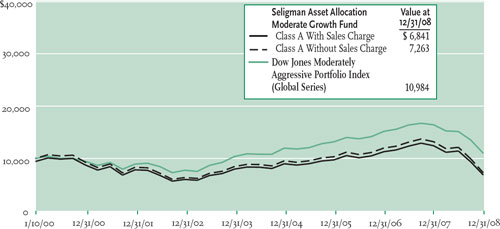

Seligman Asset Allocation Moderate Growth Fund. The directors reviewed information comparing the Fund to the Lipper Multi-Cap Core Funds Average, the Lipper Fund of Funds (Affiliated), the Dow Jones Moderately Aggressive Portfolio Index (Global Series), the Dow Jones Moderately Aggressive Portfolio Index (US Series), as well as the other funds in the Lipper Multi-Cap Core Funds Average, the Lipper Fund of Funds (Affiliated) and to a group of competitor funds selected by Seligman. The directors noted that the Fund was above the Lipper median in both categories for all periods presented, and that the Fund’s results were above each of its benchmarks for the three- and five-year periods, except for the Dow Jones (Global Series) benchmark, which the Fund lagged in the five-year period. The directors also noted that the Fund’s results exceeded each benchmark in 2007, although it lagged most of them slightly for the first six months of 2008, other than the Lipper Multi-Cap Core Funds Average. Taking into account these comparisons and the other factors considered, the directors concluded that the Fund’s investment results were satisfactory.

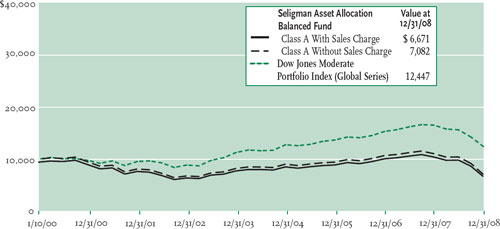

Seligman Asset Allocation Balanced Fund. The directors reviewed information comparing the Fund to the Lipper Mixed-Asset Target Allocation Moderate Funds Average, the Lipper Fund of Funds (Affiliated), the Dow Jones Moderate Portfolio Index (Global Series) and the Dow Jones Moderate Portfolio Index (US Series), as well as performance relative to the other funds in the Lipper Mixed-Asset Target Allocation Moderate Funds Average, the Lipper Fund of Funds (Affiliated) and to a group of competitor funds selected by Seligman. The directors noted that the Fund’s results were mixed, although generally lagging the benchmarks for most periods, but also that the Fund equaled or exceeded each of its benchmarks except the Dow Jones Moderate Portfolio Index (Global Series) for the first six months of 2008. Taking into account these comparisons and the other factors considered, the directors concluded that the Fund’s investment results were satisfactory.

55

Matters Relating to the Directors’

Consideration of the Approval of the

Investment Management Services Agreement

Management Fee and Other Expenses

The directors considered the proposed advisory fee rate to be paid by each Fund to RiverSource, which is the same as the management fee rate paid by each Fund under the Seligman Management Agreement. In addition to the materials provided by Seligman, RiverSource provided information regarding the fees for each of the RiverSource funds and managed accounts. With respect to each Fund, the directors noted that the proposed advisory fee rate for such Fund was higher than certain RiverSource funds in the same Lipper category and lower than others, and that the RiverSource equity fund fee rates are generally subject to adjustments based on investment performance whereas the proposed fee rate for each Fund, consistent with those in the Seligman Management Agreement, does not reflect performance adjustments. The directors recognized that it is difficult to make comparisons of advisory and management fees because there are variations in the services that are included in the fees paid by other funds.

The directors compared each Fund’s proposed advisory fee rate to the rate paid by other funds in its Lipper category (the “peer group”). In considering the proposed advisory fee rate, the directors noted that the management fee rate under the Seligman Management Agreement covers administrative services provided by Seligman, whereas the Proposed Advisory Agreement does not include such services, but that Ameriprise will provide such services to each Fund pursuant to a separate administrative services agreement initially without a fee. The directors further considered that the administrative fees, since they are not included in an advisory agreement, could be increased without stockholder approval, although RiverSource noted that, at that time, it did not have an intention to seek an increase, and that any such administrative fee increase would require board approval. The directors also noted RiverSource’s and Ameriprise’s covenants in the Transaction’s stock purchase agreement regarding compliance with Section 15(f) of the 1940 Act.

The directors also considered the total expense ratio of each Fund in comparison to the fees and expenses of funds within its peer group. In considering the expense ratios of the Funds, the directors noted that the Funds have elected to have shareholder services provided at cost by Seligman Data Corp. (“SDC”). The directors also reviewed each Fund’s total expense ratio as compared to the fees and expenses of funds within its peer group. In considering the expense ratios of each Fund, the directors noted that each Fund has elected to have shareholder services provided at cost by SDC. SDC provided services exclusively to the Seligman Group of Funds, and the directors believed that the arrangement with SDC has provided each Fund and its shareholders with a consistently high level of service. The directors noted that RiverSource had previously indicated that no changes to the arrangements with SDC were being proposed at the time by RiverSource.

For each Fund, the directors noted that they had concluded in their most recent continuance considerations that the management fee and total expense ratio were at an acceptable level in light of the quality of services provided to the Fund and in comparison to the Fund’s peer group; that the advisory fee would not be increased and would stay the same for all but one of the Funds; that the total expense ratio had not changed materially since that determination; and that RiverSource had represented that the overall expenses for each Fund were not expected to be adversely affected by the Transaction. On that basis, the directors concluded that the total expense ratio and proposed advisory fee for each such Fund anticipated to result from the proposed arrangements with RiverSource was acceptable. The directors also noted the Funds that currently had the benefit of waiver and reimbursement policies of Seligman, that RiverSource had agreed to continue such waiver and reimbursement policies for the periods announced by Seligman.

56

Matters Relating to the Directors’

Consideration of the Approval of the

Investment Management Services Agreement

Economies of Scale

The directors noted that the management fee schedules for the Funds do not have breakpoints that reduce the fee rate on assets above specified levels. The directors recognized that there is no direct relationship between the economies of scale realized by funds and those realized by their investment advisers as assets increase. The directors do not believe that there is a uniform methodology for establishing breakpoints that give effect to fund-specific economies of scale with respect to services provided by fund advisers. The directors also observed that in the investment company industry as a whole, as well as among funds similar to each Fund, there is no uniformity or pattern in the fees and asset levels at which breakpoints (if any) apply, and that the advisory agreements for many competitor funds do not have breakpoints at all. The directors noted that RiverSource had indicated that no changes to the Funds’ breakpoint arrangements were proposed to be made at the time. Having taken these factors into account, the directors concluded that each Fund’s breakpoint arrangements were acceptable under the Fund’s circumstances. The directors also recognized that the Funds may benefit from certain economies of scale over time from becoming a part of the larger RiverSource fund complex, based on potential future synergies of operations.

57

Proxy Results

Shareholders of Seligman Asset Allocation Series, Inc. voted on two proposals at a Special Meeting of Shareholders held on November 3, 2008. Shareholders voted in favor of each of the proposals. The description of each proposal and number of shares voted are as follows:

Proposal 1

To consider and vote upon the proposed Investment Management Services Agreement with RiverSource Investments, LLC:

| | | | | | | |

| | For | | Against | | Abstain | |

|

Asset Allocation Aggressive Growth Fund | | 1,056,843.008 | | 79,650.467 | | 80,037.117 | |

|

|

|

|

|

|

|

|

Asset Allocation Growth Fund | | 1,897,851.568 | | 57,022.798 | | 75,462.365 | |

|

|

|

|

|

|

|

|

Asset Allocation Moderate Growth Fund | | 2,024,927.322 | | 67,588.900 | | 99,921.899 | |

|

|

|

|

|

|

|

|

Proposal 2

To elect ten directors to the Board:

| | | | | |

| | For | | Withheld | |

|

Kathleen Blatz | | 8,595,749.076 | | 4,135,77.407 | |

|

|

|

|

|

|

Arne H. Carlson | | 8,600,232.747 | | 4,090,93.736 | |

|

|

|

|

|

|

Pamela G. Carlton | | 8,596,803.149 | | 4,125,23.334 | |

|

|

|

|

|

|

Patricia M. Flynn | | 8,602,945.392 | | 4,063,81.091 | |

|

|

|

|

|

|

Anne P. Jones | | 8,596,803.149 | | 4,125,23.334 | |

|

|

|

|

|

|

Jeffrey Laikind | | 8,593,036.431 | | 4,162,90.052 | |

|

|

|

|

|

|

Stephen R. Lewis, Jr. | | 8,599,178.674 | | 4,101,47.809 | |

|

|

|

|

|

|

Catherine James Paglia | | 8,595,749.076 | | 4,135,77.407 | |

|

|

|

|

|

|

Alison Taunton-Rigby | | 8,595,492.076 | | 4,148,34.407 | |

|

|

|

|

|

|

William F. Truscott | | 8,592,581.316 | | 4,167,45.167 | |

|

|

|

|

|

|

The Meeting was adjourned until November 6, 2008, at which the following proposal was voted on by shareholders and approved:

Proposal 1

To consider and vote upon the proposed Investment Management Services Agreement with RiverSource Investments, LLC:

| | | | | | | |

| | For | | Against | | Abstain | |

|

Asset Allocation Balanced Fund | | 1,241,872.929 | | 37,427.172 | | 158,873.270 | |

|

|

|

|

|

|

|

|

58

Directors and Officers

Shareholders elect a Board of Directors that oversees the Series’ operations. In connection with the acquisition of the Funds’ prior investment manager, J. & W. Seligman & Co. Incorporated, by RiverSource Investments, LLC, shareholders of the Funds voted at a Special Meeting of Shareholders held on November 3, 2008 to elect 10 members to the Series’ Board. Messrs. Maher and Richie served on the Series’ Board prior to the acquisition and will continue to do so.

Each member of the Board oversees 163 portfolios in the fund complex managed by RiverSource Investments, which includes 59 Seligman Funds and 104 RiverSource Funds. The address of each Director is 901 S. Marquette Ave., Minneapolis, MN 55402.

Independent Directors

| | | |

Name, (Age), Position(s)

held with Series | | Principal Occupation(s) During Past Five Years, Directorships

and Other Information |

|

|

|

|

Kathleen Blatz (54)1,2,6,7 | | Attorney. Formerly, Chief Justice, Minnesota Supreme Court, 1998-2006. |

• | Director: From

November 7, 2008 | | |

|

|

|

|

Arne H. Carlson (74)1,2,3,5,6 | | Formerly, Chairman, RiverSource Funds, 1999-2006; Governor of Minnesota. |

• | Director: From

November 7, 2008 | |

|

|

|

|

Pamela G. Carlton (54)4,6,7 | | President, Springboard — Partners in Cross Cultural Leadership (consulting company). |

• | Director: From | |

| November 7, 2008 | | |

|

|

|

|

Patricia M. Flynn (58)1,3,6 | | Trustee Professor of Economics and Management, Bentley College. Formerly, Dean, McCallum Graduate School of Business, Bentley College. |

• | Director: From | |

| November 7, 2008 | |

|

|

|

|

Anne P. Jones (73) | | Attorney and Consultant. |

• | Director: From

November 7, 2008 | | |

| | | |

|

|

|

|

Jeffrey Laikind, CFA (73)4,6,7 | | Director, American Progressive Insurance. Formerly, Managing Director, Shikiar Asset Management. |

• | Director: From

November 7, 2008 | |

|

|

|

|

Stephen R. Lewis, Jr. (69)1,2,3,4,6 | | President Emeritus and Professor of Economics, Carleton College; Director, Valmont Industries, Inc. (manufactures irrigation systems). |

• | Director and Chairman

of the Board: From

November 7, 2008 | |

|

|

|

|

John F. Maher (64)4,6,7 | | Retired President and Chief Executive Officer, and former Director, Great Western Financial Corporation (bank holding company) and its principal subsidiary, Great Western Bank (a federal savings bank). |

• | Director: December 2006 | |

| to Date | |

|

|

|

|

| | | |

|

See footnotes on page 60. |

59

Directors and Officers

Independent Directors (continued)

| | | |

Name, (Age), Position(s)

held with Series | | Principal Occupation(s) During Past Five Years, Directorships

and Other Information |

|

|

|

|

Catherine James Paglia

(56)2,3,4,5,6 | | Director, Enterprise Asset Management, Inc. (private real estate and asset management company). |

• | Director: From

November 7, 2008 | |

|

|

|

|

Leroy C. Richie (66)3,4,6 | | Counsel, Lewis & Munday, P.C. (law firm); Director, Vibration Control Technologies, LLC (auto vibration technology); Lead Outside Director, Digital Ally Inc. (digital imaging) and Infinity, Inc. (oil and gas exploration and production); Director and Chairman, Highland Park Michigan Economic Development Corp.; and Chairman, Detroit Public Schools Foundation; Director, OGE Energy Corp. (energy and energy services provider). Formerly, Chairman and Chief Executive Officer, Q Standards Worldwide, Inc. (library of technical standards); Director, Kerr-McGee Corporation (diversified energy and chemical company); Trustee, New York University Law Center Foundation; and Vice Chairman, Detroit Medical Center and Detroit Economic Growth Corp. |

• | Director: 2000 to Date | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

|

|

|

Alison Taunton-Rigby (64)3,4,5,6 | | Chief Executive Officer and Director, RiboNovix, Inc. since 2003 (biotechnology); Director, Idera Pharmaceutical, Inc. (biotechnology); Healthways, Inc. (health management programs). Formerly, President, Forester Biotech. |

• | Director: From

November 7, 2008 | |

| | |

|

|

|

|

| | | |

Interested Director* |

| | | |

|

|

|

|

William F. Truscott (48)*6 | | President — US Asset Management and Chief Investment Officer, Ameriprise Financial, Inc. and President, Chairman of the Board, and Chief Investment Officer, RiverSource Investments, LLC; Director, President and Chief Executive Officer, Ameriprise Certificate Company; and Chairman of the Board, Chief Executive Officer, and President, RiverSource Distributors, Inc. Formerly, Senior Vice President — Chief Investment Officer, Ameriprise Financial, Inc.; and Chairman of the Board and Chief Investment Officer, RiverSource Investments, LLC, 2001-2005. |

• | Director and Vice

President: From

November 7, 2008 | |

| | |

| | |

| | |

| | |

|

|

|

|

| |

|

* | Mr. Truscott is considered an “interested person” of the Series, as defined in the Investment Company Act of 1940, as amended, by virtue of his position with Ameriprise Financial, Inc. and its affiliates. |

| | | | |

Member: | | 1 Board Governance Committee | | |

| | 2 Compliance Committee | | |

| | 3 Contracts Committee | | |

| | 4 Distribution Committee | | |

| | 5 Executive Committee | | |

| | 6 Investment Review Committee | | |

| | 7 Joint Audit Committee | | |

60

Fund Officers

The Board appoints officers who are responsible for day-to-day business decisions based on policies it has established. The officers serve at the pleasure of the Board. In addition to Mr. Truscott, who is a Director and Vice President of the Series, the Series’ other officers are:

| | | |

Name, (Age), Position(s)

held with Series, Address | | Principal Occupation(s) During Past Five Years |

|

|

|

|

Patrick T. Bannigan (43) | | Director and Senior Vice President — Asset Management, Products and Marketing, RiverSource Investments, LLC; Director and Vice President - Asset Management, Products and Marketing, RiverSource Distributors, Inc. Formerly, Managing Director and Global Head of Product, Morgan Stanley Investment Management, 2004-2006; President, Touchstone Investments, 2002-2004. |

• | President: From

November 7, 2008 | |

• | 172 Ameriprise Financial

Center

Minneapolis, MN 55474 | |

|

|

|

|

Michelle M. Keeley (44) | | Executive Vice President — Equity and Fixed Income, Ameriprise Financial, Inc. and RiverSource Investments, LLC; Vice President — Investments, Ameriprise Certificate Company. Formerly, Senior Vice President — Fixed Income, Ameriprise Financial, Inc., 2002-2006 and RiverSource Investments, LLC, 2004-2006. |

• | Vice President: From

November 7, 2008 | |

• | 172 Ameriprise Financial

Center

Minneapolis, MN 55474 | |

|

|

|

|

Amy K. Johnson (43) | | Vice President — Asset Management and Trust Company Services, RiverSource Investments, LLC. Formerly, Vice President — Operations and Compliance, RiverSource Investments, LLC, 2004-2006; Director of Product Development — Mutual Funds, Ameriprise Financial, Inc., 2001-2004. |

• | Vice President: From

November 7, 2008 | |

• | 5228 Ameriprise

Financial Center

Minneapolis, MN 55474 | |

|

|

|

|

Scott R. Plummer (49) | | Vice President and Chief Counsel — Asset Management, Ameriprise Financial, Inc.; Chief Counsel, RiverSource Distributors, Inc. and Chief Legal Officer and Assistant Secretary, RiverSource Investments, LLC; Vice President, General Counsel, and Secretary, Ameriprise Certificate Company. Formerly, Vice President — Asset Management Compliance, Ameriprise Financial, Inc., 2004-2005; Senior Vice President and Chief Compliance Officer, USBancorp Asset Management, 2002-2004. |

• | Vice President, General

Counsel and Secretary:

From November 7, 2008 | |

• | 5228 Ameriprise

Financial Center

Minneapolis, MN 55474 | |

|

|

|

|

Lawrence P. Vogel (52) | | Treasurer of each of the investment companies of the Seligman Group of Funds since 2000; and Treasurer, Seligman Data Corp. since 2000. Formerly, Senior Vice President, J. & W. Seligman & Co. Incorporated and Vice President of each of the investment companies of the Seligman Group of Funds, 1992-2008. |

• | Treasurer: 2000 to Date | |

• | 100 Park Avenue

New York, NY 10017 | |

|

|

|

|

61

Fund Officers (continued)

| | | |

Name, (Age), Position(s)

held with Series, Address | | Principal Occupation(s) During Past Five Years |

|

|

|

|

Eleanor T.M. Hoagland (56) | | Chief Compliance Officer, RiverSource Investments, LLC (J. & W. Seligman & Co. Incorporated prior to November 7, 2008), of each of the investment companies of the Seligman Group of Funds since 2004; Money Laundering Prevention Officer and Identity Theft Prevention Officer, RiverSource Investments, LLC for each of the investment companies of the Seligman Group of Funds since November 7, 2008. Formerly, Managing Director, J. & W. Seligman & Co. Incorporated and Vice President of each of the investment companies of the Seligman Group of Funds, 2004-2008. |

• | Chief Compliance

Officer: 2004 to Date | |

• | Money Laundering

Prevention Officer

and Identity Theft

Prevention Officer: From

November 7, 2008 | |

• | 100 Park Avenue

New York, NY 10017 | |

|

|

|

|

The Series’ Statement of Additional Information (SAI) includes additional information about Series directors and is available, without charge, upon request. You may call toll-free (800) 221-2450 in the US or call collect (212) 682-7600 outside the US to request a copy of the SAI, to request other information about the Funds, or to make shareholder inquiries.

62

Additional Fund Information

| | |

Fund Symbols | |

Aggressive Growth Fund | |

Class A: STHAX | |

Class B: SBTHX | |

Class C: STHCX | |

| |

Growth Fund | |

Class A: SATWX | |

Class B: STWBX | |

Class C: STWCX | |

| |

Moderate Growth Fund | |

Class A: SANAX | |

Class B: SANBX | |

Class C: STNCX | |

| |

Balanced Fund | |

Class A: SATVX | |

Class B: STVBX | |

Class C: STVCX | |

| |

Manager | |

From November 7, 2008 | |

RiverSource Investments, LLC | |

200 Ameriprise Financial Center | |

Minneapolis, MN 55474 | |

| |

Until November 6, 2008 | |

J. & W. Seligman & Co. | |

Incorporated | |

100 Park Avenue | |

New York, NY 10017 | |

| |

Shareholder Service Agent | |

Seligman Data Corp. | |

100 Park Avenue | |

New York, NY 10017 | |

| |

Mail Inquiries to: | |

P.O. Box 9759 | |

Providence, RI 02940-9759 | |

| |

General Distributor | |

RiverSource Fund Distributors, Inc. | |

(formerly Seligman Advisors, Inc.) | |

100 Park Avenue | |

New York, NY 10017 | |

| |

Independent Registered Public | |

Accounting Firm | |

Deloitte & Touche LLP | |

| |

Important Telephone Numbers | |

(800) 221-2450 | Shareholder Services | |

(800) 445-1777 | Retirement Plan | |

| Services | |

(212) 682-7600 | Outside the | |

| United States | |

(800) 622-4597 | 24-Hour Automated | |

| Telephone Access | |

| Service | |

|

|

|

|

Quarterly Schedule of Investments

A complete schedule of portfolio holdings owned by the Series will be filed with the SEC for the first and third quarter of each fiscal year on Form N-Q, and will be available to shareholders (i) without charge, upon request, by calling toll-free (800) 221-2450 in the US or collect (212) 682-7600 outside the US or (ii) on the SEC’s website at www.sec.gov.1 In addition, the Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330. Certain of the information contained in the Fund’s Form N-Q is also made available to shareholders on Seligman’s website at www.seligman.com.1

Proxy Voting

A description of the policies and procedures used by the Series to determine how to vote proxies relating to portfolio securities as well as information regarding how the Series voted proxies relating to portfolio securities during the 12-month period ended June 30 of each year will be available (i) without charge, upon request, by calling toll-free (800) 221-2450 in the US or collect (212) 682-7600 outside the US and (ii) on the SEC’s website at www.sec.gov.1 Information for each new 12-month period ending June 30 will be available no later than August 31 of that year.

| |

|

1 | These website references are inactive textual references and information contained in or otherwise accessible through these websites does not form a part of this report or the Series’ prospectus or statement of additional information. |

63

This report is intended only for the information of shareholders or those who have received the offering prospectus covering shares of Capital Stock of Seligman Asset Allocation Series, Inc., which contains information about the investment objectives, risks, charges, and expenses of the Series, each of which should be considered carefully before investing or sending money.

THF2 12/08

| ITEM 2. | CODE OF ETHICS. |

| | As of December 31, 2008, the registrant has adopted a code of ethics that applies to its principal executive and senior financial officers. The registrant adopted a revised code of ethics on November 13, 2008, which is attached as an exhibit to this Form N-CSR. The new code of ethics is substantially the same as the prior code of ethics. |

| |

| |

| ITEM 3. | AUDIT COMMITTEE FINANCIAL EXPERT. |

| | The Registrant's board of directors has determined that independent directors Pamela G. Carlton, Jeffrey Laikind, John F. Maher and Anne P. Jones, each qualify as audit committee financial experts. |

| |

| ITEM 4. | PRINCIPAL ACCOUNTANT FEES AND SERVICES. |

| | (a) – (d) Aggregate fees billed to the registrant for the last two fiscal years for professional services rendered by the registrant’s principal accountant were as follows: |

| |

| | | 2008 | | 2007 | |

| Audit Fees | | $59,020 | | $53,923 | |

| Audit-Related Fees | | – | | – | |

| Tax Fees | | 11,000 | | 9,400 | |

| All Other Fees | | – | | 2,333 | |

| | | | | | |

| | Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Tax fees include amounts related to tax compliance, tax planning, and tax advice. Other fees include the registrant's pro-rata share of amounts for services related to the assessment of procedures for compliance with anti-money laundering regulations by the registrant and certain other associated investment companies. |

| | |

| | Aggregate fees billed by the registrant’s principal accountant for the last two fiscal years for non-audit services provided to the registrant’s investment adviser (not including a sub-adviser whose role is primarily portfolio management and is sub-contracted or overseen by another investment adviser) and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registered investment company, where the engagement relates directly to the operations and financial reporting of the registrant, were as follows: |

| | |

| | | 2008 | | 2007 | |

| Audit-Related Fees | | $144,330 | | $141,440 | |

| Tax Fees | | 8,500 | | 9,000 | |

| All Other Fees | | – | | 15,000 | |

| | | | | | |

| | Audit-related fees include amounts for (i) attestation services for the registrant’s shareholder service agent; (ii) testing of the registrant’s shareholder service agent’s conversion to a new record-keeping system and (iii) performance of certain agreed-upon procedures relating to certain services performed by the registrant’s distributor. Tax fees include amounts related to amounts paid by the registrant’s investment adviser for the preparation of the registrant’s 2007 |

| | tax return and tax compliance, tax planning, and tax advice for and an evaluation of certain tax reporting procedures of the registrant’s shareholder service agent. Other fees include the amounts for services related to the assessment of procedures for compliance with anti-money laundering regulations by certain of the registrant’s affiliates. |

| | |

| | (e) (1) The Audit Committee is required to preapprove audit and non-audit services performed for the registrant by the principal accountant in order to assure that the provision of such services does not impair the principal accountant’s independence. The Audit Committee also is required to preapprove certain non-audit services performed by the registrant’s principal accountant for the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser) and certain of the adviser’s affiliates that provide services directly related to the operations and financial reporting of the registrant. Unless a type of service to be provided by the principal accountant has received preapproval, it will require specific preapproval by the Audit Committee. |

| | |

| | Notwithstanding the foregoing, under certain circumstances, preapproval of non-audit services of a de minimis amount is not required. |

| | |

| | (2) No services included in (b) – (d) above were approved pursuant to the waiver provisions of paragraphs (c)(7)(i)(C) or (c)(7)(ii) of Rule 2-01 of Regulation S-X. |

| | |

| | (f) Not applicable. |

| | |

| | (g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser (not including any subadviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $163,830 and $177,173, respectively. |

| | |

| | (h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, the audit committee considered whether these services were compatible with maintaining the principal accountant’s independence. |

| | |

| ITEM 5. | AUDIT COMMITTEE OF LISTED REGISTRANTS. |

| | Not applicable. |

| |

| ITEM 6. | INVESTMENTS. |

| | (a) | Schedule I - Investments in securities of unaffiliated issuers. Included in Item 1 above. |

| | | |

| | (b) | Not applicable. |

| |

| ITEM 7. | DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

| | Not applicable. |

| |

| ITEM 8. | PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

| | Not applicable. |

| |

| ITEM 9. | PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS. |

| | Not applicable. |

| ITEM 10. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS. |

| | Effective November 7, 2008, the duties of the Nominating Committee of the Board of Directors of the registrant have been assumed by the Board Governance Committee of the Board. The Board Governance Committee would recommend to the Board the size, structure and composition of the Board and its committees. This committee would also review candidates for Board membership including candidates recommended by stockholders. |

| | |

| ITEM 11. | CONTROLS AND PROCEDURES. |

| | (a) The registrant's principal executive officer and principal financial officer have concluded, based upon their evaluation of the registrant's disclosure controls and procedures as conducted within 90 days of the filing date of this report, that these disclosure controls and procedures provide reasonable assurance that material information required to be disclosed by the registrant in the report it files or submits on Form N-CSR is recorded, processed, summarized and reported, within the time periods specified in the Commission's rules and forms and that such material information is accumulated and communicated to the registrant's management, including its principal executive officer and principal financial officer, as appropriate, in order to allow timely decisions regarding required disclosure. |

| | |

| | (b) The registrant’s principal executive officer and principal financial officer are aware of no changes in the registrant’s internal control over financial reporting that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting. |

| | |

| ITEM 12. | EXHIBITS. |

| | |

| | (a)(1) | Code of Ethics for Principal Executive and Senior Financial Officers. |

| | |

| | (a)(2) | Certifications of principal executive officer and principal financial officer as required by Rule 30a-2(a) under the Investment Company Act of 1940. |

| | |

| | (a)(3) | Not applicable. |

| | |

| | (b) | Certifications of chief executive officer and chief financial officer as required by Rule 30a-2(b) under the Investment Company Act of 1940. |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| SELIGMAN ASSET ALLOCATION SERIES, INC. |

| | |

| | |

| By: | /S/ PATRICK T. BANNIGAN |

| | Patrick T. Bannigan |

| | President and Chief Executive Officer |

| | |

Date: March 9, 2009 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| | |

| By: | /S/ PATRICK T. BANNIGAN |

| | Patrick T. Bannigan |

| | President and Chief Executive Officer |

| | |

Date: March 9, 2009 |

| | |

| By: | /S/ LAWRENCE P.VOGEL |

| | Lawrence P. Vogel |

| | Treasurer and Chief Financial Officer |

| | |

Date: March 9, 2009 |

| SELIGMAN ASSET ALLOCATION SERIES, INC. |

| | | |

| | | |

| EXHIBIT INDEX |

| | | |

| (a)(1) | | Code of Ethics for Principal Executive and Senior Financial Officers. |

| |

| (a)(2) | | Certifications of principal executive officer and principal financial officer as required by Rule 30a-2(a) under the Investment Company Act of 1940. |

| | | |

| (b) | | Certification of chief executive officer and chief financial officer as required by Rule 30a-2(b) of the Investment Company Act of 1940. |

| | | |