Matters Relating to the Directors’

Consideration of the Continuance of the

Management Agreement

| 10. | the professional experience and qualifications of the Funds’ portfolio management team and other senior personnel of the Manager; and |

| | |

| 11. | the terms of the Management Agreement. |

In their deliberations, the directors did not identify any particular information that was all-important or controlling, and directors attributed different weights to the various factors.

The directors determined that the overall arrangements between the Funds and the Manager, as provided in the Management Agreement, were fair and reasonable in light of the services performed, expenses incurred and such other matters as the directors considered relevant in the exercise of their reasonable judgment.

The material factors and conclusions that formed the basis for the directors’ reaching their determination to approve the continuance of the Management Agreement in respect of each Fund (including their determinations that the Manager should continue to be the investment adviser for the Funds, and that the fees payable to the Manager pursuant to the Management Agreement are appropriate) were separately discussed by the directors.

Nature, Extent and Quality of Services Provided by the Manager

The directors noted that, under the Management Agreement, the Manager, subject to the control of the directors, administers the Funds’ business and other affairs. The Manager manages the investment of the assets of the Funds, including making purchases and sales of portfolio securities consistent with the Funds’ investment objective and policies. The Manager also provides the Funds with such office space, administrative and other services (exclusive of, and in addition to, any such services provided by any others retained by the Funds) and executive and other personnel as are necessary for the Funds’ operations. The Manager pays all of the compensation of directors of the Series who are employees or consultants of the Manager and of the officers and employees of the Series, including the Funds’ chief compliance officer. The Manager also provides senior management for Seligman Data Corp. (“SDC”), a company owned by certain of the investment companies in the Seligman Group of Funds that provides shareholder services to the Funds and other investment companies in the Seligman Group of Funds at cost.

The directors considered the scope and quality of services provided by the Manager under the Management Agreement and noted that the scope of services provided had expanded over time as a result of regulatory and other developments. The directors noted that, for example, the Manager is responsible for maintaining and monitoring its own and the Funds’ compliance programs, and these compliance programs have recently been refined and enhanced in light of recently adopted regulatory requirements. The directors considered the quality of the investment research capabilities of the Manager and the other resources they have dedicated to performing services for the Funds. The quality of administrative and other services, including the Manager’s role in coordinating the activities of the Funds’ other service providers, also were considered. The directors concluded that, overall, they were satisfied with the nature, extent and quality of services provided (and expected to be provided) to the Funds under the Management Agreement.

On an ongoing basis, the Manager reports to the directors on the status of various matters relating to market timing activity affecting certain funds in the Seligman Group of Funds. In connection with the continuance review, the Manager and its counsel and the directors' special counsel also addressed, among other matters: the action brought by the Manager and its president against the Attorney General of the State of New York seeking an order enjoining the Attorney General from, among other things, investigating the fees paid by the Funds in the Seligman Group of Funds to the Manager; the ex parte application filed by the Attorney General to seek further discovery and appoint a special referee to supervise the Attorney General’s investigation relating to market timing; and the indication by the Staff of the New York Office of the Securities and

Matters Relating to the Directors’

Consideration of the Continuance of the

Management Agreement

Exchange Commission (“SEC”) that it was considering recommending that the SEC institute a formal action against the Manager and Seligman Advisors, Inc. relating to market timing. After a detailed presentation by the Manager and further discussion with the Manager, the Manager’s counsel, the directors' special counsel and other experienced counsel independent of the Manager, the independent directors concluded that they retained confidence in the integrity of the Manager and its ability to provide management services to the Funds.

Costs of Services Provided and Profitability to the Manager

At the request of the directors, the Manager provided information concerning profitability of the Manager’s investment advisory and investment company activities and its financial condition based on historical information for 2004 and 2005 (through September 30) and estimates for full-year 2005. The information considered by the directors included operating profit margin information for the Manager’s investment company business alone (i.e., excluding results of its other businesses) and on a consolidated basis. The directors also reviewed the Manager’s profitability data and estimated profitability data for the Funds. The directors reviewed with the Manager’s chief financial officer the assumptions and methods of allocation used by the Manager in preparing the profitability data. The Manager stated its belief that the methods of allocation used were reasonable, but it noted that there are limitations inherent in allocating costs to multiple individual advisory products served by an organization such as the Manager where each of the advisory products draws on, and benefits from, the research and other resources of the organization.

The directors recognized that it is difficult to make comparisons of profitability from fund management contracts because comparative information is not generally publicly available and is affected by numerous factors, including the structure of the particular adviser, the types of funds it manages, its business mix, numerous assumptions regarding allocations and the adviser’s capital structure and cost of capital. In considering profitability information, the directors considered the effect of fall-out benefits on the Manager’s expenses, as well as the “revenue sharing” arrangements the Manager has entered into with certain entities that distribute shares of the Seligman Group of Funds. The directors focused on profitability of the Manager’s relationships with the Funds before taxes and distribution expenses. The directors recognized that the Manager should, in the abstract, be entitled to earn a reasonable level of profits for the services it provides to the Funds and, based on their review, concluded that they were satisfied that the Manager’s level of profitability from its relationship with the Funds was not excessive.

Fall-Out Benefits

The directors considered that a broker-dealer affiliate of the Manager receives 12b-1 fees from the Funds in respect of shares held in accounts for which there is no other broker of record, and that the Funds’ distributor (another affiliate of the Manager) retains a portion of the 12b-1 fees from the Seligman Group of Funds and receives a portion of the sales charges on sales or redemptions of certain classes of shares.

The directors recognized that the Manager’s profitability would be somewhat lower if its affiliates did not receive the other benefits described above. The directors noted that the Manager derives reputational and other benefits from its association with the Funds.

Investment Results

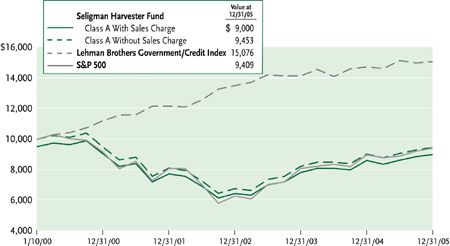

In addition to the information received by the directors for the meeting, the directors receive detailed performance information for the Funds at each regular Board meeting during the year. The directors reviewed information showing performance of each Fund compared to other funds in the Lipper Multi-Cap Core Funds Average, the Lipper Funds of Funds (Affiliated) Average, the Standard & Poor’s 500 Index and, in the case of

Matters Relating to the Directors’

Consideration of the Continuance of the

Management Agreement

the Harvester Fund, the Lehman Brothers Government/Credit Index. The directors also compared each Fund to a group of competitor funds selected by the Manager. The Manager selected five competitor funds for the Time Horizon 30 Fund and the Time Horizon 20 Fund, and thirteen competitor funds for the Time Horizon 10 Fund and the Harvester Fund. The comparisons in each case were over the annualized rolling three- and five-year periods ended September 30, 2005, for each calendar year in the 2001-to-2004 period, and for the first nine months of 2005, as applicable. The directors recognized that due to the nature of the Funds’ investment processes and philosophy, the comparative information provided comparing the Funds’ performance to their respective Lipper categories, benchmarks and competitor funds was of limited utility. The directors also noted that in addition to the evaluation in connection with their annual continuance consideration, they review the investment process for the Funds with the Manager at least annually.

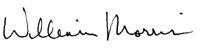

Seligman Time Horizon 30 Fund — The comparative information showed that the Time Horizon 30 Fund’s investment results were above the S&P 500, both Lipper averages and the competitor average for the rolling three-year period and for 2003, 2004 and the nine months of 2005. Despite results that were in some cases substantially below the benchmarks in 2002, the Fund also exceeded the S&P 500 and was very close to the Lipper Multi-Cap Core Funds Average for the rolling five-year period, although it lagged the other benchmarks over that period. Based on their review, the directors concluded that the Time Horizon 30 Fund’s relative investment performance over time was satisfactory.

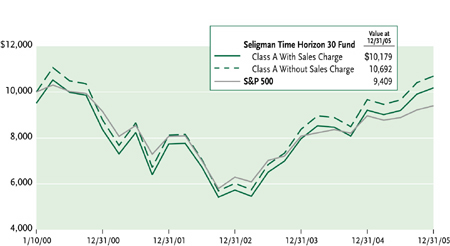

Seligman Time Horizon 20 Fund — The comparative information showed that the Time Horizon 20 Fund’s investment results were above the S&P 500, both Lipper averages and the competitor average for the rolling three-year period and for 2003, 2004 and the nine months of 2005. Despite results that were in some cases substantially below the benchmarks in 2002, the Fund also exceeded the S&P 500 for the rolling five-year period, although it lagged the other benchmarks over that period. Based on their review, the directors concluded that the Time Horizon 20 Fund’s relative investment performance over time was satisfactory.

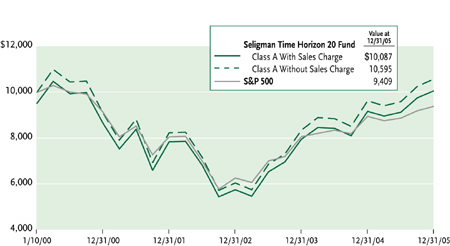

Seligman Time Horizon 10 Fund — The comparative information showed that the Time Horizon 10 Fund’s investment results were above the S&P 500, both Lipper averages and the competitor average for the rolling three-year period and for 2003, 2004 and the nine months of 2005. Despite results that were in some cases substantially below the benchmarks in 2001 and 2002, the Fund also exceeded the S&P 500 for the rolling five-year period, although it lagged the other benchmarks over that period. Based on their review, the directors concluded that the Time Horizon 10 Fund’s relative investment performance over time was satisfactory.

Seligman Harvester Fund — The comparative information showed that the Harvester Fund’s investment results were below the S&P 500, the Lehman Index, both Lipper averages and the competitor average for the rolling five-year period and (except for the Lehman Index) the rolling three-year period. The directors noted that the Harvester Fund’s more recent results appeared to show some improvement, and that the Fund was above the competitor average for 2003 and 2004, above the Lehman Index for 2003, 2004 and the nine months of 2005, and also above the S&P 500 for the nine months of 2005. Based on their review, the directors concluded that the Harvester Fund’s relative investment performance over time was acceptable.

Management Fees and Other Expenses

The directors considered the management fee rate paid by the Funds to the Manager. The directors recognized that it is difficult to make comparisons of management fees because there are variations in the services that are included in the fees paid by other funds.

The peer group for each Fund consisted of the funds in the Lipper Fund of Funds (Affiliated) category having between $4 million and $100 million of average net assets attributable to Class A shares in their most

Matters Relating to the Directors’

Consideration of the Continuance of the

Management Agreement

recent fiscal year. The information showed that each Fund’s asset allocation fee rate of 0.10% (before waivers) was less than the median, and substantially less than the average, for the 69 funds in such group. The Manager noted that, for each fund in the peer group (including the Funds), the fund’s management company would also earn management fees from the affiliated underlying funds in which the fund invests, and that the comparative information did not take those amounts into account.

The directors also reviewed each Fund’s total expense ratio for the most recent fiscal year, as compared to the expense ratios for other funds in the peer group. The directors recognized that the expense ratio information for the Funds potentially reflected on the Manager’s provision of services, as the Manager is responsible for coordinating services provided to the Funds by others. The directors noted that, effective April 1, 2005 and continuing until at least December 31, 2006, the Manager had undertaken to reimburse each Fund’s expenses (other than 12b-1 fees and extraordinary expenses) to the extent such expenses exceed 0.40% per annum (in the case of the Time Horizon 30 Fund and the Time Horizon 20 Fund) or 0.25% per annum (in the case of the Time Horizon 10 Fund and the Harvester Fund) of average daily net assets, and that the effect of this undertaking was not reflected in the expense ratio information they reviewed.

In considering the expense ratios of the Funds, the directors noted the Funds have elected to have shareholder services provided at cost by SDC and that the Manager provides senior management of SDC as part of the services covered by its management fees. SDC provides services exclusively to the Seligman Group of Funds, and the directors noted that the arrangement with SDC has provided the Funds and its shareholders with a consistently high level of service.

The directors noted that each Fund’s expense ratio was lower (and, giving effect to the contractual waiver, materially lower) than the peer group median and average. The Manager explained that its decision to cap expenses was due to the small size of each Fund. The directors were satisfied that each Fund’s expense ratio was satisfactory.

Economies of Scale

The directors noted that none of the Funds’ management fee schedules contain breakpoints that reduce the fee rate on assets above specified levels. The directors recognized that there is no direct relationship between the economies of scale realized by funds and those realized by the Manager as assets increase, largely because economies of scale are realized (if at all) by the Manager across a variety of products and services, and not only in respect of a single fund. The directors do not believe there is a uniform methodology for establishing breakpoints that give effect to fund-specific services provided by the Manager and to the economies of scale that the Manager may realize in its overall mutual fund business or those components of it which directly or indirectly affect a fund’s operations. The directors observed that in the mutual fund industry as a whole, as well as among funds similar to the Funds, there is no uniformity or pattern in the fees and asset levels at which breakpoints (if any) apply. Depending on the age and size of a particular fund and its manager’s cost structure, different conclusions can be drawn as to whether there are economies of scale to be realized at any particular level of assets, notwithstanding the intuitive conclusion that such economies exist, or will be realized at some level of total assets. Moreover, because different managers have different cost structures and service models, it is difficult to draw meaningful conclusions from the breakpoints that may have been adopted by comparable funds. The directors also noted that the advisory agreements for many competitor funds do not have breakpoints at all and that, in any event, the Funds have not benefited from significant net sales in recent times. Having taken these factors into account, the directors concluded that the absence of breakpoints in each Fund’s fee rate schedule was acceptable under each Fund’s circumstances.

Directors and Officers

Information pertaining to the Directors and Officers of Seligman Time Horizon/Harvester Series is set forth below.

Independent Directors

Name, (Age), Position(s) held with Fundø | Principal Occupation(s) During Past Five Years, Directorships and Other Information |

| | |

John R. Galvin (76)1,3 • Director: 1999 to Date • Oversees 58 Portfolios in Fund Complex | Dean Emeritus, Fletcher School of Law and Diplomacy at Tufts University; Director or Trustee of each of the investment companies of the Seligman Group of Funds†; and Chairman Emeritus, American Council on Germany. Formerly, Governor of the Center for Creative Leadership; Director, Raytheon Co. (defense and commercial electronics) and USLIFE Corporation (life insurance); and Trustee, Institute for Defense Analyses. From June 1987 to June 1992, Mr. Galvin was the Supreme Allied Commander, NATO, and the Commander-in-Chief, United States European Command. |

| | |

Alice S. Ilchman (70)2,3 • Director: 1999 to Date • Oversees 58 Portfolios in Fund Complex | President Emerita, Sarah Lawrence College; Director or Trustee of each of the investment companies of the Seligman Group of Funds†; Director, Jeannette K. Watson Summer Fellowship (summer internships for college students); Trustee, Committee for Economic Development; Governor, Court of Governors, London School of Economics; and Director, Public Broadcasting Service (PBS). Formerly, Trustee, Save the Children (non-profit child assistance organization). From January 1998 until December 2000, Chairman, The Rockefeller Foundation (charitable foundation). From September 1987 until September 1997, Director, New York Telephone Company. |

| | |

Frank A. McPherson (72)2,3 • Director: 1999 to Date • Oversees 58 Portfolios in Fund Complex | Retired Chairman of the Board and Chief Executive Officer of Kerr-McGee Corporation (diversified energy and chemical company); Director or Trustee of each of the investment companies of the Seligman Group of Funds†; and Director, DCP Midstream GP, LLP (natural gas processing), Integris Health (owner of various hospitals), Oklahoma Chapter of the Nature Conservancy, Oklahoma Medical Research Foundation, Boys and Girls Clubs of Oklahoma, Oklahoma City Public Schools Foundation, and Oklahoma Foundation for Excellence in Education. Formerly, Director, ConocoPhillips (integrated international oil corporation), Kimberly-Clark Corporation (consumer products), BOK Financial (bank holding company), and the Federal Reserve System’s Kansas City Reserve Bank. |

| | |

Betsy S. Michel (63)1,3 • Director: 1999 to Date • Oversees 58 Portfolios in Fund Complex | Attorney; Director or Trustee of each of the investment companies of the Seligman Group of Funds†; and Trustee, The Geraldine R. Dodge Foundation (charitable foundation). Formerly, Chairman of the Board of Trustees of St. George’s School (Newport, RI); and Trustee, World Learning, Inc. (international educational training), and Council of New Jersey Grantmakers. |

__________

See footnotes on page 56.

Directors and Officers

Independent Directors (continued)

Name, (Age), Position(s) held with Fundø | Principal Occupation(s) During Past Five Years, Directorships and Other Information |

| | |

Leroy C. Richie (64)1,3 • Director: 2000 to Date • Oversees 57 Portfolios in Fund Complex | Counsel, Lewis & Munday, P.C. (law firm); Chairman and Chief Executive Officer, Q Standards Worldwide, Inc. (library of technical standards); Director or Trustee of each of the investment companies of the Seligman Group of Funds† (with the exception of Seligman Cash Management Fund, Inc.); Director, Kerr-McGee Corporation (diversified energy and chemical company), Infinity, Inc. (oil and gas services and exploration), and Vibration Control Technologies, LLC (auto vibration technology); Lead Outside Director, Digital Ally Inc. (digital imaging); Director and Chairman, Highland Park Michigan Economic Development Corp.; and Chairman, Detroit Public Schools Foundation, and Detroit Economic Growth Corp. Formerly, Trustee, New York University Law Center Foundation; and Vice Chairman, Detroit Medical Center. From 1990 until 1997, Vice President and General Counsel, Automotive Legal Affairs, Chrysler Corporation. |

| | |

Robert L. Shafer (73)2,3 • Director: 1999 to Date • Oversees 58 Portfolios in Fund Complex | Ambassador and Permanent Observer of the Sovereign Military Order of Malta to the United Nations; and Director or Trustee of each of the investment companies of the Seligman Group of Funds†. Formerly, Director, USLIFE Corporation (life insurance); and Vice President, Pfizer Inc. (pharmaceuticals). |

| | |

James N. Whitson (70)1,3 • Director: 1999 to Date • Oversees 58 Portfolios in Fund Complex | Director or Trustee of each of the investment companies of the Seligman Group of Funds†; and Director, CommScope, Inc. (manufacturer of coaxial cable). Retired Executive Vice President and Chief Operating Officer, Sammons Enterprises, Inc. (a diversified holding company). Formerly, Director and Consultant, Sammons Enterprises, Inc. and Director, C-SPAN (cable television network). |

__________

See footnotes on page 56.

Directors and Officers

Interested Directors and Principal Officers

Name, (Age), Position(s) held with Fundø | Principal Occupation(s) During Past Five Years, Directorships and Other Information |

| | |

William C. Morris (67)* • Director and Chairman of the Board: 1999 to Date • Oversees 58 Portfolios in Fund Complex | Chairman, J. & W. Seligman & Co. Incorporated; Chairman of the Board and Director or Trustee of each of the investment companies of the Seligman Group of Funds†; Chairman, Seligman Advisors, Inc., Seligman Services, Inc. and Carbo Ceramics Inc. (manufacturer of ceramic proppants for oil and gas industry); Director, Seligman Data Corp.; and President and Chief Executive Officer of The Metropolitan Opera Association. Formerly, Director, Kerr-McGee Corporation (diversified energy and chemical company) and Chief Executive Officer of each of the investment companies of the Seligman Group of Funds. |

| | |

Brian T. Zino (53)* • Director and President: 1999 to Date • Chief Executive Officer: 2002 to Date • Oversees 57 Portfolios in Fund Complex | Director and President, J. & W. Seligman & Co. Incorporated; President and Chief Executive Officer of each of the investment companies of the Seligman Group of Funds†; Director or Trustee of each of the investment companies of the Seligman Group of Funds (with the exception of Seligman Cash Management Fund, Inc.); Director, Seligman Advisors, Inc. and Seligman Services, Inc.; Chairman, Seligman Data Corp.; Member of the Board of Governors of the Investment Company Institute; and Director (formerly Chairman), ICI Mutual Insurance Company. |

| | |

Eleanor T. M. Hoagland (54) • Vice President and Chief Compliance Officer: 2004 to Date | Managing Director, J. & W. Seligman & Co. Incorporated; and Vice President and Chief Compliance Officer of each of the investment companies of the Seligman Group of Funds†. Formerly, Managing Director, Partner and Chief Portfolio Strategist, AMT Capital Management. |

| | |

Charles W. Kadlec (59) • Vice President and Portfolio Manager: 1999 to Date | Managing Director and Director of J. & W. Seligman & Co. Incorporated and Director and President of Seligman Advisors, Inc. and Seligman Services, Inc.; Vice President and Co-Portfolio Manager of Seligman TargetHorizon ETF Portfolios, Inc. Mr. Kadlec is the architect of several investment strategies, chief among them Seligman Time Horizon Matrix and Seligman Harvester. |

__________

See footnotes on page 56.

Directors and Officers

Interested Directors and Principal Officers (continued)

Name, (Age), Position(s) held with Fundø | Principal Occupation(s) During Past Five Years, Directorships and Other Information |

| | |

Thomas G. Rose (48) • Vice President: 2000 to Date | Managing Director, Chief Financial Officer, and Treasurer, J. & W. Seligman & Co. Incorporated; Senior Vice President, Finance, Seligman Advisors, Inc. and Seligman Data Corp.; and Vice President of each of the investment companies of the Seligman Group of Funds†, Seligman Services, Inc. and Seligman International, Inc. |

| | |

Lawrence P. Vogel (49) • Vice President: 1999 to Date • Treasurer: 2000 to Date | Senior Vice President and Treasurer, Investment Companies, J. & W. Seligman & Co. Incorporated; Vice President and Treasurer of each of the investment companies of the Seligman Group of Funds†; and Treasurer of Seligman Data Corp. |

| | |

Frank J. Nasta (41) • Secretary: 1999 to Date | Director, Managing Director, General Counsel and Corporate Secretary, J. & W. Seligman & Co. Incorporated; Secretary of each of the investment companies of the Seligman Group of Funds†; and Corporate Secretary, Seligman Advisors, Inc., Seligman Services, Inc., Seligman International, Inc., and Seligman Data Corp. |

The Fund’s Statement of Additional Information (SAI) includes additional information about Fund directors and is available, without charge, upon request. You may call toll-free (800) 221-2450 in the US or collect (212) 682-7600 outside the US to request a copy of the SAI, to request other information about the Fund, or to make shareholder inquiries.

__________

| ø | The address for each of the directors and officers is 100 Park Avenue, 8th floor, New York, NY 10017. Each Director serves for an indefinite term, until the election and qualification of a successor or until his or her earlier death, resignation or removal. Each officer is elected annually by the Board of Directors. |

| | |

| † | The Seligman Group of Funds consists of 24 registered investment companies. |

| | |

| * | Messrs. Morris and Zino are considered “interested persons” of the Fund, as defined in the Investment Company Act of 1940, as amended, by virtue of their positions with J. & W. Seligman & Co. Incorporated and its affiliates. |

| Member: | 1 Audit Committee |

| | 2 Director Nominating Committee |

| | 3 Board Operations Committee |

Additional Fund Information

Quarterly Schedule of Investments

A complete schedule of portfolio holdings owned by the Fund will be filed with the SEC for the first and third quarter of each fiscal year on Form N-Q, and will be available to shareholders (i) without charge, upon request, by calling toll-free (800) 221-2450 in the US or collect (212) 682-7600 outside the US or (ii) on the SEC’s website at www.sec.gov.1 In addition, the Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330. Certain of the information contained in the Fund’s Form N-Q is also made available to shareholders on Seligman’s website at www.seligman.com.1

Proxy Voting

A description of the policies and procedures used by the Fund to determine how to vote proxies relating to portfolio securities as well as information regarding how the Fund voted proxies relating to portfolio securities during the 12-month period ended June 30 of each year will be available (i) without charge, upon request, by calling toll-free (800) 221-2450 in the US or collect (212) 682-7600 outside the US and (ii) on the SEC’s website at www.sec.gov.1 Information for each new 12-month period ending June 30 will be available no later than August 31 of that year.

__________

1 These website references are inactive textual references and information contained in or otherwise accessible through these websites does not form a part of this report or the Fund’s

prospectus or statement of additional information.