Benchmark Descriptions

Composite indices and averages were created by the Manager using widely recognized indices and established Lipper averages. These benchmarks were selected because the Manager believes they correlate, based on asset class, to the underlying Seligman Funds in which each Fund invests. The benchmarks use the same allocations to each asset class targeted by each Fund in the Seligman Time Horizon/Harvester Series. These benchmarks are used in the charts and tables that follow. All benchmarks exclude the effects of taxes and sales charges. The composite indices also exclude the effects of fees. Investors cannot invest directly in a composite index or average.

COMPOSITE INDICES

The Horizon 30 Composite Index consists of the following indices: 30% Russell 2000 Index (US Small-Cap Stocks), 30% Russell Midcap Index (US Midcap Stocks), 10% S&P 500 Composite Stock Index “S&P 500” (US Large-Cap Stocks), 15% Citigroup Extended Markets Index World Ex US (International Small-Company Stocks), 10% Morgan Stanley Capital International “MSCI” Emerging Markets Free Index (Emerging Market Stocks), 5% MSCI Europe Australasia Far East “EAFE” Index (International Large-Cap Stocks).

The Horizon 20 Composite Index consists of the following indices: 25% Russell 2000 Index, 25% Russell Midcap Index, 20% S&P 500, 10% Citigroup Extended Markets Index World Ex US, 10% MSCI Emerging Markets Free Index, 10% MSCI EAFE Index.

The Horizon 10 Composite Index consists of the following indices: 15% Russell 2000 Index, 25% Russell Midcap Index, 20% S&P 500, 5% Citigroup Extended Markets Index World Ex US, 5% MSCI Emerging Markets Free Index, 10% MSCI EAFE Index, 15% Citigroup High Yield Market Index (High-Yield Corporate Bonds), 5% Lehman Brothers Government/Credit Bond Index (Investment-Grade Corporate Bonds).

The Harvester Composite Index consists of the following indices: 10% Russell Midcap Index, 35% S&P 500, 15% MSCI EAFE Index, 15% Citigroup High Yield Market Index, 15% Lehman Brothers Government/ Credit Bond Index, 10% Lehman Brothers Government Bond Index (US Government Securities).

LIPPER COMPOSITE AVERAGES

The Lipper Composite Average for Time Horizon 30 Fund consists of the following Lipper Averages: 3% Small Cap Growth Funds Average, 13% Small Cap Value Funds Average, 16% Science & Technology Funds Average, 22% Mid Cap Growth Funds Average, 3% Large Cap Growth Funds Average, 3% Large Cap Value Funds Average, 10% Emerging Markets Fund Average, 25% Global Small Companies Funds Average, 5% International Funds Average.

The Lipper Composite Average for Time Horizon 20 Fund consists of the following Lipper Averages: 3% Small Cap Growth Funds Average, 12% Small Cap Value Funds Average, 10% Science & Technology Funds Average, 20% Mid Cap Growth Funds Average, 9% Large Cap Growth Funds Average, 9% Large Cap Value Funds Average, 10% Emerging Markets Funds Average, 17% Global Small Companies Funds Average, 10% International Funds Average.

The Lipper Composite Average for Time Horizon 10 Fund consists of the following Lipper Averages: 3% Small Cap Growth Funds Average, 6% Small Cap Value Funds Average, 10% Science & Technology Funds Average, 20% Mid Cap Growth Funds Average, 9% Large Cap Growth Funds Average, 9% Large Cap Value Funds Average, 5% Emerging Markets Funds Average, 8% Global Small Companies Funds Average, 10% International Funds Average, 15% High Current Yield Funds Average, 5% Corporate Debt Funds BBB-Rated Average.

The Lipper Composite Average for Harvester Fund consists of the following Lipper Averages: 10% Mid Cap Growth Funds Average, 11% Large Cap Growth Funds Average, 11% Large Cap Value Funds Average, 15% Large Cap Core Funds Average, 5% Global Funds Average, 12% International Funds Average, 15% High Current Yield Funds Average, 15% Corporate Debt Funds BBB-Rated Average, 10% US Government Bond Funds Average.

Index and Average Returns

For Periods Ended December 31, 2003 | | Six

Months* | One

Year | Since

Inception

1/10/00** |

|

Russell 2000 Index | | | 24.92 | % | | 47.25 | % | | 4.03 | % |

Russell Midcap Index | | | 21.30 | | | 40.06 | | | 4.57 | |

S&P 500 | | | 15.14 | | | 28.67 | | | (5.19 | ) |

Citigroup Extended Markets Index World Ex US | | | 30.79 | | | 53.73 | | | 1.80 | |

Citigroup High Yield Market Index | | | 9.05 | | | 30.62 | | | 6.34 | † |

MSCI EAFE Index | | | 26.69 | | | 39.17 | | | (4.72 | ) |

MSCI EMF Index | | | 34.57 | | | 56.28 | | | (1.04 | ) |

Lehman Brothers Government Bond Index | | | (1.23 | ) | | 2.36 | | | 8.60 | |

Lehman Brothers Government/Credit Bond Index | | | (0.53 | ) | | 4.67 | | | 9.07 | |

Lipper Small Cap Growth Funds Average | | | 22.93 | | | 44.77 | | | (3.25 | )ø |

Lipper Small Cap Value Funds Average | | | 24.12 | | | 42.29 | | | 15.47 | ø |

Lipper Science & Technology Funds Average | | | 24.77 | | | 55.75 | | | (19.62 | )ø |

Lipper Mid Cap Growth Funds Average | | | 17.23 | | | 35.93 | | | (7.11 | )ø |

Lipper Large Cap Growth Funds Average | | | 12.89 | | | 26.75 | | | (11.52 | )ø |

Lipper Large Cap Value Funds Average | | | 15.66 | | | 28.44 | | | 1.20 | ø |

Lipper Large Cap Core Funds Average | | | 13.71 | | | 25.53 | | | (6.48 | )ø |

Lipper Emerging Markets Funds Average | | | 34.51 | | | 55.24 | | | (0.06 | )ø |

Lipper Global Small Companies Funds Average | | | 26.60 | | | 46.05 | | | (1.56 | )ø |

Lipper Global Funds Average | | | 19.69 | | | 32.06 | | | (4.09 | )ø |

Lipper International Funds Average | | | 23.95 | | | 34.75 | | | (5.65 | )ø |

Lipper High Current Yield Funds Average | | | 8.39 | | | 24.36 | | | 3.87 | ø |

Lipper General US Government Bond Funds Average | | | (1.11 | ) | | 1.39 | | | 7.52 | ø |

Lipper Corporate Debt BBB-Rated Funds Average | | | 1.38 | | | 8.61 | | | 8.09 | ø |

|

|

* | Not annualized. |

** | Annualized. |

† | From December 31, 1999. |

ø | From January 13, 2000. |

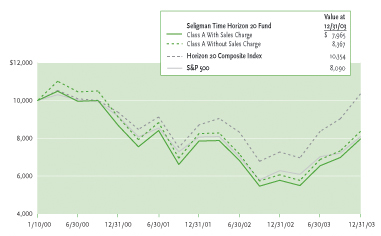

Performance Overview |

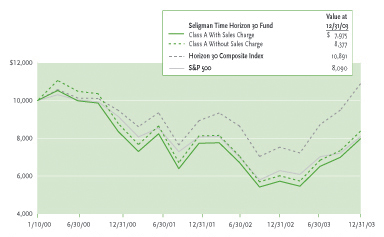

Seligman Time Horizon 30 Fund |

This chart compares a $10,000 hypothetical investment made in Seligman Time Horizon 30 Fund Class A shares since the commencement of operations on January 10, 2000, through December 31, 2003, to $10,000 investments made in the Horizon 30 Composite Index and the S&P 500 for the same period. The results for Seligman Time Horizon 30 Fund Class A shares were determined with and without the initial 4.75% maximum sales charge, and assume that all distributions within the period are invested in additional shares. The performances of Seligman Time Horizon 30 Fund Class B, Class C, and Class D shares are not shown in this chart but are included in the table on page 7. This chart does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future investment results. It is important to keep in mind that the Horizon 30 Composite Index and the S&P 500 exclude the effects of taxes, fees and sales charges.

The performances of Class B, Class C, and Class D shares will differ from the performance shown for Class A shares, based on the differences in sales charges and fees paid by shareholders.

|

See footnotes on page 14. |

Performance Overview |

Seligman Time Horizon 30 Fund |

Investment Results

Total Returns |

For Periods Ended December 31, 2003 |

|

| | | | Average Annual | |

| | | |

| |

| | Six Months* | | One Year | | Since Inception† | |

|

Class A** | | | | | | | |

|

With Sales Charge | | | 16.63 | % | | | 32.71 | % | | | (5.53 | )% | |

Without Sales Charge | | | 22.41 | | | | 39.22 | | | | (4.36 | ) | |

Class B** | | | | | | | | | | | | | |

|

With CDSC*** | | | 17.08 | | | | 33.60 | | | | (5.60 | ) | |

Without CDSC | | | 22.08 | | | | 38.60 | | | | (4.85 | ) | |

Class C** | | | | | | | | | | | | | |

|

With Sales Charge and CDSC | | | 19.75 | | | | 36.23 | | | | (6.72 | ) | |

Without Sales Charge and CDSC | | | 22.08 | | | | 38.60 | | | | (6.47 | ) | |

Class D** | | | | | | | | | | | | | |

|

With 1% CDSC | | | 21.08 | | | | 37.60 | | | | n/a | | |

Without CDSC | | | 22.08 | | | | 38.60 | | | | (6.56 | ) | |

Benchmarks | | | | | | | | | | | | | |

|

Horizon 30 Composite Index(1) | | | 24.79 | | | | 44.71 | | | | 2.30 | | |

Horizon 30 Lipper Composite Average(1) | | | 23.73 | | | | 44.10 | | | | (2.63 | ) | |

S&P 500(2) | | | 15.14 | | | | 28.67 | | | | (5.19 | ) | |

|

Net Asset Value Per Share | | | | | | | |

| | | | | | | |

|

| | 12/31/03 | | 6/30/03 | | 12/31/02 | |

Class A | | $ | 5.68 | | $ | 4.64 | | $ | 4.08 | |

Class B | | | 5.53 | | | 4.53 | | | 3.99 | |

Class C | | | 5.53 | | | 4.53 | | | 3.99 | |

Class D | | | 5.53 | | | 4.53 | | | 3.99 | |

|

See footnotes on page 14. |

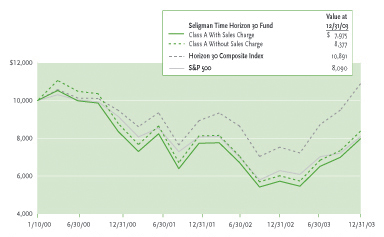

Performance Overview |

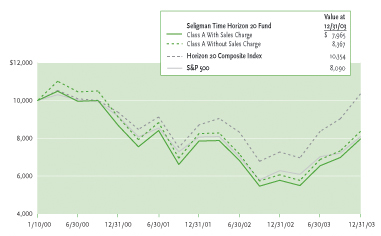

Seligman Time Horizon 20 Fund |

This chart compares a $10,000 hypothetical investment made in Seligman Time Horizon 20 Fund Class A shares since the commencement of operations on January 10, 2000, through December 31, 2003, to $10,000 investments made in the Horizon 20 Composite Index and the S&P 500 for the same period. The results for Seligman Time Horizon 20 Fund Class A shares were determined with and without the initial 4.75% maximum sales charge, and assume that all distributions within the period are invested in additional shares. The performances of Seligman Time Horizon 20 Fund Class B, Class C, and Class D shares are not shown in this chart but are included in the table on page 9. This chart does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future investment results. It is important to keep in mind that the Horizon 20 Composite Index and the S&P 500 exclude the effects of taxes, fees and sales charges.

The performances of Class B, Class C, and Class D shares will differ from the performance shown for Class A shares, based on the differences in sales charges and fees paid by shareholders.

|

See footnotes on page 14. |

Performance Overview |

Seligman Time Horizon 20 Fund |

Investment Results

Total Returns | | | | | | | | | | | | | |

For Periods Ended December 31, 2003 | | | | | | | | | | | | | |

|

| | | | Average Annual | |

| | | |

|

| | Six Months* | | One Year | | Since Inception† | |

|

Class A** | | | | | | | |

|

With Sales Charge | | | 15.95 | % | | | 31.55 | % | | | (5.56 | )% | |

Without Sales Charge | | | 21.67 | | | | 37.96 | | | | (4.39 | ) | |

Class B** | | | | | | | | | | | | | |

|

With CDSC*** | | | 16.46 | | | | 32.25 | | | | (8.69 | ) | |

Without CDSC | | | 21.46 | | | | 37.25 | | | | (7.99 | ) | |

Class C** | | | | | | | | | | | | | |

|

With Sales Charge and CDSC | | | 19.14 | | | | 34.90 | | | | (5.86 | ) | |

Without Sales Charge and CDSC | | | 21.46 | | | | 37.25 | | | | (5.63 | ) | |

Class D** | | | | | | | | | | | | | |

|

With 1% CDSC | | | 20.46 | | | | 36.25 | | | | n/a | | |

Without CDSC | | | 21.46 | | | | 37.25 | | | | (5.74 | ) | |

Benchmarks | | | | | | | | | | | | | |

|

Horizon 20 Composite Index(1) | | | 23.79 | | | | 42.48 | | | | 1.00 | | |

Horizon 20 Lipper Composite Average(1) | | | 22.44 | | | | 40.97 | | | | (2.32 | ) | |

S&P 500(2) | | | 15.14 | | | | 28.67 | | | | (5.19 | ) | |

|

| | | | | | | | | | | | | | | | | | |

Net Asset Value Per Share | | | | | | | | | | |

| | | | | | | | | | |

|

| | 12/31/03 | | 6/30/03 | | 12/31/02 | |

Class A | | $ | 5.67 | | | $ | 4.64 | | | $ | 4.11 | | |

Class B | | | 5.49 | | | | 4.53 | | | | 4.00 | | |

Class C | | | 5.49 | | | | 4.53 | | | | 4.00 | | |

Class D | | | 5.49 | | | | 4.53 | | | | 4.00 | | |

| | | | | | | | | | | | | | | | |

|

See footnotes on page 14. |

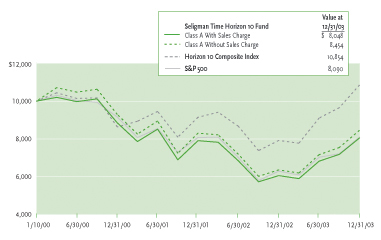

Performance Overview |

Seligman Time Horizon 10 Fund |

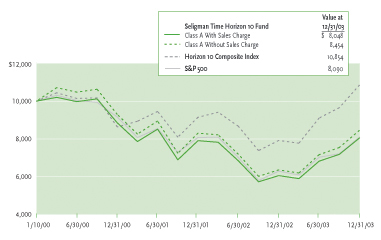

This chart compares a $10,000 hypothetical investment made in Seligman Time Horizon 10 Fund Class A shares since the commencement of operations on January 10, 2000, through December 31, 2003, to $10,000 investments made in the Horizon 10 Composite Index and the S&P 500 for the same period. The results for Seligman Time Horizon 10 Fund Class A shares were determined with and without the initial 4.75% maximum sales charge, and assume that all distributions within the period are invested in additional shares. The performances of Seligman Time Horizon 10 Fund Class B, Class C, and Class D shares are not shown in this chart but are included in the table on page 11. This chart does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future investment results. It is important to keep in mind that the Horizon 10 Composite Index and the S&P 500 exclude the effects of taxes, fees and sales charges.

The performances of Class B, Class C, and Class D shares will differ from the performance shown for Class A shares, based on the differences in sales charges and fees paid by shareholders.

|

See footnotes on page 14. |

Performance Overview |

Seligman Time Horizon 10 Fund |

Investment Results

Total Returns | | | | | | | | | | | | | |

For Periods Ended December 31, 2003 | | | | | | | | | | | | | |

|

| | | | | | Average Annual | |

| | | | | |

| |

| | Six Months* | | One Year | | Since Inception† | |

|

Class A** | | | | | | | |

|

With Sales Charge | | | 12.32 | % | | | 26.61 | % | | | (5.32 | )% | |

Without Sales Charge | | | 18.03 | | | | 32.96 | | | | (4.14 | ) | |

Class B** | | | | | | | | | | | | | |

|

With CDSC*** | | | 12.58 | | | | 26.71 | | | | (6.31 | ) | |

Without CDSC | | | 17.58 | | | | 31.71 | | | | (5.62 | ) | |

Class C** | | | | | | | | | | | | | |

|

With Sales Charge and CDSC | | | 15.34 | | | | 29.47 | | | | (7.39 | ) | |

Without Sales Charge and CDSC | | | 17.58 | | | | 31.71 | | | | (7.14 | ) | |

Class D** | | | | | | | | | | | | | |

|

With 1% CDSC | | | 16.58 | | | | 30.71 | | | | n/a | | |

Without CDSC | | | 17.58 | | | | 31.71 | | | | (5.90 | ) | |

Benchmarks | | | | | | | | | | | | | |

|

Horizon 10 Composite Index(1) | | | 19.36 | | | | 37.08 | | | | 2.14 | | |

Horizon 10 Lipper Composite Average(1) | | | 18.20 | | | | 35.61 | | | | (2.11 | ) | |

S&P 500(2) | | | 15.14 | | | | 28.67 | | | | (5.19 | ) | |

|

| | | | | | | | | | | | | | | | | | |

Net Asset Value Per Share |

|

|

| | 12/31/03 | | 6/30/03 | | 12/31/02 | |

Class A | | | $ | 5.53 | | | | $ | 4.72 | | | | $ | 4.19 | | |

Class B | | | | 5.47 | | | | | 4.66 | | | | | 4.16 | | |

Class C | | | | 5.47 | | | | | 4.66 | | | | | 4.16 | | |

Class D | | | | 5.47 | | | | | 4.66 | | | | | 4.16 | | |

|

See footnotes on page 14. |

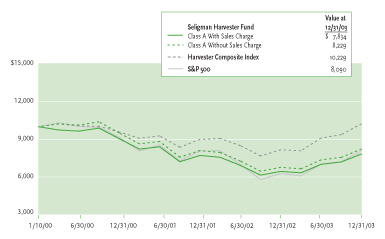

Performance Overview |

Seligman Harvester Fund |

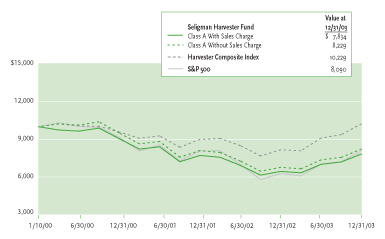

This chart compares a $10,000 hypothetical investment made in Seligman Harvester Fund Class A shares since the commencement of operations on January 10, 2000, through December 31, 2003, to $10,000 investments made in the Harvester Composite Index and the S&P 500 for the same period. The results for Seligman Harvester Fund Class A shares were determined with and without the initial 4.75% maximum sales charge, and assume that all distributions within the period are invested in additional shares. The performances of Seligman Harvester Fund Class B, Class C, and Class D shares are not shown in this chart but are included in the table on page 13. This chart does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future investment results. It is important to keep in mind that the Harvester Composite Index and the S&P 500 exclude the effects of taxes, fees and sales charges.

The performances of Class B, Class C, and Class D shares will differ from the performance shown for Class A shares, based on the differences in sales charges and fees paid by shareholders.

|

See footnotes on page 14. |

Performance Overview |

Seligman Harvester Fund |

Investment Results |

|

Total Returns |

For Periods Ended December 31, 2003 |

|

| | | | Average Annual | |

| | | |

| |

| | Six Months* | | One Year | | Since Inception† | |

|

Class A** | | | | | | | | | | | | | |

|

With Sales Charge | | | 6.40 | % | | | 15.77 | % | | | (5.96 | )% | |

Without Sales Charge | | | 11.69 | | | | 21.44 | | | | (4.79 | ) | |

Class B** | | | | | | | | | | | | | |

|

With CDSC*** | | | 6.28 | | | | 15.55 | | | | (6.51 | ) | |

Without CDSC | | | 11.28 | | | | 20.55 | | | | (5.85 | ) | |

Class C** | | | | | | | | | | | | | |

|

With Sales Charge and CDSC | | | 9.10 | | | | 18.44 | | | | (5.91 | ) | |

Without Sales Charge and CDSC | | | 11.28 | | | | 20.55 | | | | (5.68 | ) | |

Class D** | | | | | | | | | | | | | |

|

With 1% CDSC | | | 10.28 | | | | 19.55 | | | | n/a | | |

Without CDSC | | | 11.28 | | | | 20.55 | | | | (6.09 | ) | |

Benchmarks | | | | | | | | | | | | | |

|

Harvester Composite Index(1) | | | 12.59 | | | | 24.45 | | | | 0.66 | | |

Harvester Lipper Composite Average(1) | | | 10.95 | | | | 22.33 | | | | (1.48 | ) | |

S&P 500(2) | | | 15.14 | | | | 28.67 | | | | (5.19 | ) | |

|

Net Asset Value Per Share |

|

|

| | 12/31/03 | | 6/30/03 | | 12/31/02 | |

Class A | | | $ | 5.13 | | | | $ | 4.63 | | | | $ | 4.29 | | |

Class B | | | | 5.13 | | | | | 4.63 | | | | | 4.29 | | |

Class C | | | | 5.13 | | | | | 4.63 | | | | | 4.29 | | |

Class D | | | | 5.13 | | | | | 4.63 | | | | | 4.29 | | |

Dividend, Capital Loss, and Yield

Information Per Share |

For the Periods Ended December 31, 2003 |

|

Dividends Paidø | | Capital Loss | | | | SEC Yield‡‡ | |

$ | 0.069 | | Realized | | $ | (0.116 | ) | | 1.29 | % | |

| 0.035 | | Unrealized | | | (0.357 | )‡ | | 0.61 | | |

| 0.035 | | | | | | | | 0.61 | | |

| 0.035 | | | | | | | | 0.61 | | |

|

See footnotes on page 14. |

Performance Overview

The rates of return will vary and the principal value of an investment will fluctuate. Shares, if redeemed, may be worth more or less than their original cost. Performance data quoted does not reflect the deduction of taxes that an investor may pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future investment results.

J. & W. Seligman & Co. Incorporated is currently waiving its investment management fee and reimbursing a portion of the Fund’s expenses, other than distribution and service fees, that exceed 0.50% per annum of the Fund’s average daily net assets pursuant to a contractual undertaking. Absent such waivers and reimbursements, the Fund’s returns would have been lower.

* | | Returns for periods of less than one year are not annualized. |

** | | Return figures reflect any change in price per share and assume the investment of dividend and capital gain distributions. Return figures for Class A shares are calculated with and without the effect of the initial 4.75% maximum sales charge. Returns for Class B shares are calculated with and without the effect of the maximum 5% contingent deferred sales charge (“CDSC”), charged on redemptions made within one year of the date of purchase, declining to 1% in the sixth year and 0% thereafter. Returns for Class C shares are calculated with and without the effect of the initial 1% maximum sales charge and the 1% CDSC, charged on redemptions made within 18 months of the date of purchase. Returns for Class D shares are calculated with and without the effect of the 1% CDSC, charged on redemptions made within one year of the date of purchase. |

*** | | The CDSC is 5% for periods of one year or less and 3% since inception. |

† | | Commencement of investment operations for Class A shares was 1/10/00. Class A share returns were computed from the commencement of investment operations. Class B, C, and D shares were offered to the public on 1/10/00, but were first issued at the dates indicated below. Total returns for Class B, C, and D shares of the Fund have been computed from the commencement of investment operations and incorporate the total return of Class A shares of the Fund from the commencement of investment operations through the initial issuance date of each of the other classes of shares, adjusted to reflect the higher expenses associated with the Administration, Shareholder Services and Distribution Plan for those classes that would have been incurred had they first been issued on the commencement of investment operations date. The total returns of Class B, C, and D shares from their individual initial issuance dates would be different, and may be lower, than those shown. See the Financial Highlights tables beginning on page 32 for total returns for each class of shares from their individual initial issuance dates. |

| | Class B | | Class C | | Class D | |

| |

Time Horizon 30 Fund | | | 4/24/00 | | | 2/8/00 | | | 2/14/00 | |

Time Horizon 20 Fund | | | 3/21/00 | | | 1/18/00 | | | 1/21/00 | |

Time Horizon 10 Fund | | | 2/18/00 | | | 3/6/00 | | | 2/15/00 | |

Harvester Fund | | | 2/17/00 | | | 1/18/00 | | | 2/29/00 | |

ø | | Represents per share amount paid or declared for the year ended December 31, 2003. |

(1) | | See page 4 for benchmark descriptions. |

(2) | | The S&P 500 is an unmanaged benchmark that assumes the investment of dividends and excludes the effect of taxes, fees and sales charges. Investors cannot invest directly in an index. |

‡ | | Represents the per share amount of net unrealized depreciation of portfolio securities as of December 31, 2003. |

‡‡ | | Current yield, representing the annualized yield for the 30-day period ended December 31, 2003, has been computed in accordance with SEC regulations and will vary. During the period, the Manager waived its fees and reimbursed other expenses. Without these waivers/reimbursements, the yields would be as follows: |

Class A | | Class B | | Class C | Class D | |

|

1.25% | | 0.58% | | 0.58% | 0.58% | |

Portfolios of Investments |

December 31, 2003 |

Seligman Time Horizon 30 Fund

| | Shares | | Value | |

Domestic Equity Funds 60.9% | | | | | | | |

|

Seligman Capital Fund* | | | 87,978 | | $ | 1,553,691 | |

Seligman Communications and Information Fund* | | | 48,982 | | | 1,126,096 | |

Seligman Frontier Fund* | | | 17,540 | | | 209,077 | |

Seligman Growth Fund* | | | 57,516 | | | 211,084 | |

Seligman Large-Cap Value Fund | | | 21,321 | | | 214,702 | |

Seligman Small-Cap Value Fund* | | | 65,825 | | | 941,298 | |

|

| | | | | | 4,255,948 | |

|

Global Equity Funds 41.4% | | | | | | | |

|

Seligman Emerging Markets Fund* | | | 104,287 | | | 738,352 | |

Seligman Global Smaller Companies Fund* | | | 143,025 | | | 1,793,533 | |

Seligman International Growth Fund* | | | 33,928 | | | 358,280 | |

|

| | | | | | 2,890,165 | |

|

Total Investments (Cost $6,980,697) 102.3% | | | | | | 7,146,113 | |

|

Other Assets Less Liabilities (2.3)% | | | | | | (160,525 | ) |

|

Net Assets 100.0% | | | | | $ | 6,985,588 | |

|

Seligman Time Horizon 20 Fund

| | Shares | | Value | |

Domestic Equity Funds 61.3% | | | | | | | |

|

Seligman Capital Fund* | | | 160,159 | | $ | 2,828,408 | |

Seligman Communications and Information Fund* | | | 61,510 | | | 1,414,115 | |

Seligman Frontier Fund* | | | 35,494 | | | 423,088 | |

Seligman Growth Fund* | | | 346,312 | | | 1,270,965 | |

Seligman Large-Cap Value Fund | | | 126,956 | | | 1,278,447 | |

Seligman Small-Cap Value Fund* | | | 118,039 | | | 1,687,958 | |

|

| | | | | | 8,902,981 | |

|

Global Equity Funds 36.3% | | | | | | | |

|

Seligman Emerging Markets Fund* | | | 203,038 | | | 1,437,509 | |

Seligman Global Smaller Companies Fund* | | | 192,412 | | | 2,412,847 | |

Seligman International Growth Fund* | | | 134,188 | | | 1,417,025 | |

|

| | | | | | 5,267,381 | |

|

Total Investments (Cost $14,842,220) 97.6% | | | | | | 14,170,362 | |

|

Other Assets Less Liabilities 2.4% | | | | | | 348,502 | |

|

Net Assets 100.0% | | | | | $ | 14,518,864 | |

|

|

* Non-income producing security; security has paid or may pay capital gain distributions. |

See Notes to Financial Statements. |

Portfolios of Investments |

December 31, 2003 |

Seligman Time Horizon 10 Fund

| | Shares | | Value | |

Domestic Equity Funds 55.0% | | | | | |

|

Seligman Capital Fund* | | | 179,392 | | $ | 3,168,063 | |

Seligman Communications and Information Fund* | | | 68,316 | | | 1,570,585 | |

Seligman Frontier Fund* | | | 39,333 | | | 468,849 | |

Seligman Growth Fund* | | | 383,903 | | | 1,408,924 | |

Seligman Large-Cap Value Fund | | | 140,986 | | | 1,419,729 | |

Seligman Small-Cap Value Fund* | | | 69,893 | | | 999,470 | |

|

| | | | | | 9,035,620 | |

|

Global Equity Funds 23.3% | | | | | | | |

|

Seligman Emerging Markets Fund* | | | 129,719 | | | 918,411 | |

Seligman Global Smaller Companies Fund* | | | 106,721 | | | 1,338,281 | |

Seligman International Growth Fund* | | | 149,466 | | | 1,578,361 | |

|

| | | | | | 3,835,053 | |

|

Fixed-Income Funds 18.9% | | | | | | | |

|

Seligman High-Yield Bond Series | | | 661,279 | | | 2,347,540 | |

Seligman Investment Grade Fixed Income Fund | | | 104,526 | | | 764,087 | |

|

| | | | | | 3,111,627 | |

|

Total Investments (Cost $16,842,402) 97.2% | | | | | | 15,982,300 | |

|

Other Assets Less Liabilities 2.8% | | | | | | 454,289 | |

|

Net Assets 100.0% | | | | | $ | 16,436,589 | |

|

Seligman Harvester Fund

| | Shares | | Value | |

Domestic Equity Funds 44.0% | | | | | | | |

|

Seligman Capital Fund* | | | 89,894 | | $ | 1,587,528 | |

Seligman Common Stock Fund | | | 162,272 | | | 1,690,874 | |

Seligman Growth Fund* | | | 462,938 | | | 1,698,982 | |

Seligman Large-Cap Value Fund | | | 174,783 | | | 1,760,065 | |

|

| | | | | | 6,737,449 | |

|

Global Equity Funds 17.8% | | | | | | | |

|

Seligman Global Growth Fund* | | | 119,986 | | | 801,507 | |

Seligman International Growth Fund* | | | 182,005 | | | 1,921,973 | |

|

| | | | | | 2,723,480 | |

|

Fixed-Income Funds 37.9% | | | | | | | |

|

Seligman High-Yield Bond Series | | | 616,702 | | | 2,189,292 | |

Seligman Investment Grade Fixed Income Fund | | | 298,569 | | | 2,182,539 | |

Seligman U.S. Government Securities Series | | | 197,343 | | | 1,426,790 | |

|

| | | | | | 5,798,621 | |

|

Total Investments (Cost $16,323,426) 99.7% | | | | | | 15,259,550 | |

|

Other Assets Less Liabilities 0.3% | | | | | | 53,326 | |

|

Net Assets 100.0% | | | | | $ | 15,312,876 | |

|

|

* Non-income producing security; security has paid or may pay capital gain distributions. |

See Notes to Financial Statements. |

Statements of Assets and Liabilities |

December 31, 2003 |

| | Seligman

Time Horizon

30 Fund | | Seligman

Time Horizon

20 Fund | | Seligman

Time Horizon

10 Fund | | Seligman

Harvester

Fund | |

Assets | | | | | | | | | | | | | |

| |

Investments in Underlying Funds, at value

(see portfolios of investments) | | $ | 7,146,113 | | $ | 14,170,362 | | $ | 15,982,300 | | $ | 15,259,550 | |

Cash | | | 56,728 | | | 317,038 | | | 384,814 | | | 72,721 | |

Prepaid registration fees | | | 21,401 | | | 22,063 | | | 21,876 | | | 21,226 | |

Receivable for Capital Stock sold | | | 12,745 | | | 50,341 | | | 61,378 | | | 28,477 | |

Dividends receivable | | | — | | | — | | | 7,488 | | | 10,293 | |

Receivable from Manager | | | 17,752 | | | 13,481 | | | 13,765 | | | 9,627 | |

Other | | | 180 | | | 407 | | | 496 | | | 614 | |

| |

Total Assets: | | | 7,254,919 | | | 14,573,692 | | | 16,472,117 | | | 15,402,508 | |

| |

| | | | | | | | | | | | | |

Liabilities: | | | | | | | | | | | | | |

| |

Payable for investments purchased | | | — | | | 9,180 | | | — | | | — | |

Dividends payable | | | — | | | 140 | | | 254 | | | 10,979 | |

Payable for Capital Stock repurchased | | | 251,111 | | | 13,801 | | | — | | | 45,791 | |

Distribution and service fees payable | | | 3,007 | | | 6,541 | | | 8,459 | | | 8,496 | |

Accrued expenses and other | | | 15,213 | | | 25,166 | | | 26,815 | | | 24,366 | |

| |

Total Liabilities | | | 269,331 | | | 54,828 | | | 35,528 | | | 89,632 | |

| |

Net Assets | | $ | 6,985,588 | | $ | 14,518,864 | | $ | 16,436,589 | | $ | 15,312,876 | |

| |

| | | | | | | | | | | | | |

Composition of Net Assets: | | | | | | | | | | | | | |

| |

Capital Stock, at $0.001 par value: | | | | | | | | | | | | | |

Class A | | $ | 476 | | $ | 821 | | $ | 798 | | $ | 601 | |

Class B | | | 269 | | | 537 | | | 754 | | | 805 | |

Class C | | | 377 | | | 1,037 | | | 1,190 | | | 1,298 | |

Class D | | | 128 | | | 222 | | | 254 | | | 279 | |

Additional paid-in capital | | | 6,988,360 | | | 15,674,637 | | | 20,055,895 | | | 17,929,791 | |

Undistributed (dividends in excess of) net

investment income | | | (1,556 | ) | | (1,572 | ) | | (1,583 | ) | | 11,806 | |

Accumulated net realized loss | | | (167,882 | ) | | (484,960 | ) | | (2,760,617 | ) | | (1,567,828 | ) |

Net unrealized appreciation (depreciation)

of investments | | | 165,416 | | | (671,858 | ) | | (860,102 | ) | | (1,063,876 | ) |

| |

Net Assets | | $ | 6,985,588 | | $ | 14,518,864 | | $ | 16,436,589 | | $ | 15,312,876 | |

| |

| | | | | | | | | | | | | |

Net Assets: | | | | | | | | | | | | | |

| |

Class A | | $ | 2,703,009 | | $ | 4,657,497 | | $ | 4,414,532 | | $ | 3,084,911 | |

Class B | | | 1,489,859 | | | 2,948,508 | | | 4,123,195 | | | 4,132,667 | |

Class C | | | 2,085,873 | | | 5,695,498 | | | 6,510,363 | | | 6,664,699 | |

Class D | | | 706,847 | | | 1,217,361 | | | 1,388,499 | | | 1,430,599 | |

| | | | | | | | | | | | | |

(Continued on page 18.) | | | | | | | | | | | | | |

Statements of Assets and Liabilities |

December 31, 2003 |

| | Seligman

Time Horizon

30 Fund | | Seligman

Time Horizon

20 Fund | | Seligman

Time Horizon

10 Fund | | Seligman

Harvester

Fund | |

Shares of Capital Stock Outstanding: | | | | | | | | | | | | | |

|

Class A | | | 475,581 | | | 820,829 | | | 797,801 | | | 600,762 | |

Class B | | | 269,440 | | | 536,822 | | | 753,651 | | | 804,816 | |

Class C | | | 377,236 | | | 1,036,971 | | | 1,189,971 | | | 1,297,917 | |

Class D | | | 127,831 | | | 221,641 | | | 253,798 | | | 278,603 | |

| | | | | | | | | | | | | |

Net Asset Value per Share: | | | | | | | | | | | | | |

|

Class A | | | $5.68 | | | $5.67 | | | $5.53 | | | $5.13 | |

Class B | | | $5.53 | | | $5.49 | | | $5.47 | | | $5.13 | |

Class C | | | $5.53 | | | $5.49 | | | $5.47 | | | $5.13 | |

Class D | | | $5.53 | | | $5.49 | | | $5.47 | | | $5.13 | |

|

See Notes to Financial Statements. |

Statements of Operations |

For the Year Ended December 31, 2003 |

| | | Seligman

Time Horizon

30 Fund | | | Seligman

Time Horizon

20 Fund | | | Seligman

Time Horizon

10 Fund | | | Seligman

Harvester

Fund | |

Investment Income: | | | | | | | | | | | | | |

| |

Dividends from Underlying Funds | | $ | 1,720 | | $ | 10,084 | | $ | 184,760 | | $ | 276,914 | |

| |

| | | | | | | | | | | | | |

Expenses: | | | | | | | | | | | | | |

| |

Management fees | | | 5,375 | | | 11,361 | | | 13,391 | | | 13,686 | |

Distribution and service fees | | | 26,074 | | | 60,441 | | | 77,254 | | | 84,110 | |

Registration | | | 49,483 | | | 52,000 | | | 52,904 | | | 52,641 | |

Custody and related services | | | 3,420 | | | 2,130 | | | 4,845 | | | 2,701 | |

Shareholder account services | | | 3,055 | | | 6,835 | | | 7,694 | | | 8,982 | |

Audit and legal fees | | | 13,123 | | | 12,607 | | | 21,085 | | | 13,523 | |

Directors’ fees and expenses | | | 5,632 | | | 5,774 | | | 5,821 | | | 5,829 | |

Shareholder reports and communications | | | 2,507 | | | — | | | — | | | 979 | |

Miscellaneous | | | 2,454 | | | 1,647 | | | 2,932 | | | 745 | |

| |

Total Expenses Before Waiver/Reimbursement | | | 111,123 | | | 152,795 | | | 185,926 | | | 183,196 | |

| |

Waiver/reimbursement of expenses (Note 4) | | | (58,171 | ) | | (35,551 | ) | | (41,716 | ) | | (30,661 | ) |

| |

Total Expenses After Waiver/Reimbursement | | | 52,952 | | | 117,244 | | | 144,210 | | | 152,535 | |

| |

Net Investment Income (Loss) | | | (51,232 | ) | | (107,160 | ) | | 40,550 | | | 124,379 | |

| |

| | | | | | | | | | | | | |

Net Realized and Unrealized Gain (Loss)

on Investments: | | | | | | | | | | | | | |

| |

Net realized loss on investments | | | (167,882 | ) | | (48,397 | ) | | (1,716,123 | ) | | (343,438 | ) |

Capital gain distribution from Underlying Funds | | | — | | | — | | | 9,127 | | | 26,595 | |

Net change in unrealized depreciation of

investments | | | 2,055,324 | | | 3,932,438 | | | 5,408,198 | | | 2,827,868 | |

| |

Net Gain on Investments | | | 1,887,442 | | | 3,884,041 | | | 3,701,202 | | | 2,511,025 | |

| |

Increase in Net Assets from Operations | | $ | 1,836,210 | | $ | 3,776,881 | | $ | 3,741,752 | | $ | 2,635,404 | |

| |

|

See Notes to Financial Statements. |

Statements of Changes in Net Assets

| | Seligman

Time Horizon 30 Fund | | Seligman

Time Horizon 20 Fund | |

| |

| |

| |

| | Year Ended

December 31, | | Year Ended

December 31, | |

| |

| |

| |

| | 2003 | | 2002 | | 2003 | | 2002 | |

| |

Operations: | | | | | | | | | | | | | |

| |

Net investment loss | | $ | (51,232 | ) | $ | (43,870 | ) | $ | (107,160 | ) | $ | (111,080 | ) |

Net realized loss on investments and distributions from

underlying funds | | | (167,882 | ) | | — | | | (48,397 | ) | | (436,563 | ) |

| |

Net change in unrealized depreciation of investments | | | 2,055,324 | | | (1,350,010 | ) | | 3,932,438 | | | (3,033,261 | ) |

| |

Increase (decrease) in Net Assets from Operations | | | 1,836,210 | | | (1,393,880 | ) | | 3,776,881 | | | (3,580,904 | ) |

| |

| | | | | | | | | | | | | |

Capital Share Transactions: | | | | | | | | | | | | | |

| |

Net proceeds from sales of shares | | | 1,570,854 | | | 1,609,021 | | | 2,973,683 | | | 3,806,150 | |

Exchanged from associated funds | | | 453,916 | | | 631,899 | | | 845,465 | | | 577,604 | |

| |

Total | | | 2,024,770 | | | 2,240,920 | | | 3,819,148 | | | 4,383,754 | |

| |

Cost of shares repurchased | | | (835,559 | ) | | (714,537 | ) | | (2,401,227 | ) | | (1,964,612 | ) |

Exchanged into associated funds | | | (381,492 | ) | | (213,397 | ) | | (255,549 | ) | | (637,309 | ) |

| |

Total | | | (1,217,051 | ) | | (927,934 | ) | | (2,656,776 | ) | | (2,601,921 | ) |

| |

Increase in Net Assets from Capital Share

Transactions | | | 807,719 | | | 1,312,986 | | | 1,162,372 | | | 1,781,833 | |

| |

Increase (decrease) in Net Assets | | | 2,643,929 | | | (80,894 | ) | | 4,939,253 | | | (1,799,071 | ) |

| |

| | | | | | | | | | | | | |

Net Assets: | | | | | | | | | | | | | |

| |

Beginning of year | | | 4,341,659 | | | 4,422,553 | | | 9,579,611 | | | 11,378,682 | |

| |

End of Year* | | $ | 6,985,588 | | $ | 4,341,659 | | $ | 14,518,864 | | $ | 9,579,611 | |

| |

|

* | Including undistributed (net of dividends in excess

of) net investment income as follows | | $ | (1,556 | ) | $ | (1,245 | ) | $ | (1,572 | ) | $ | (1,259 | ) |

See Notes to Financial Statements. | | | | | | | | | | | | | |

Statements of Changes in Net Assets

| | Seligman

Time Horizon 10 Fund | | Seligman

Harvester Fund | |

| |

| |

| |

| | Year Ended

December 31, | | Year Ended

December 31, | |

| |

| |

| |

| | 2003 | | 2002 | | 2003 | | 2002 | |

| |

Operations: | | | | | | | | | | | | | |

| |

Net investment income | | $ | 40,550 | | $ | 62,169 | | $ | 124,379 | | $ | 166,331 | |

Net realized loss on investments and distributions

from underlying funds | | | (1,706,996 | ) | | (1,082,356 | ) | | (316,843 | ) | | (838,378 | ) |

Net change in unrealized depreciation of investments | | | 5,408,198 | | | (3,408,643 | ) | | 2,827,868 | | | (1,963,668 | ) |

| |

Increase (decrease) in Net Assets from Operations | | | 3,741,752 | | | (4,428,830 | ) | | 2,635,404 | | | (2,635,715 | ) |

| |

| | | | | | | | | | | | | |

Distributions to Shareholders: | | | | | | | | | | | | | |

| |

Net investment income: | | | | | | | | | | | | | |

| Class A | | | (29,507 | ) | | (29,176 | ) | | (39,597 | ) | | (40,463 | ) |

| Class B | | | (6,747 | ) | | (9,149 | ) | | (29,963 | ) | | (25,232 | ) |

| Class C | | | (10,716 | ) | | (20,214 | ) | | (51,067 | ) | | (87,522 | ) |

| Class D | | | (2,245 | ) | | (3,630 | ) | | (10,159 | ) | | (13,114 | ) |

| |

Total | | | (49,215 | ) | | (62,169 | ) | | (130,786 | ) | | (166,331 | ) |

| |

Dividends in excess of net investment income: | | | | | | | | | | | | | |

| Class A | | | — | | | (36 | ) | | — | | | (19,751 | ) |

| Class B | | | — | | | (43 | ) | | — | | | (23,990 | ) |

| Class C | | | — | | | (89 | ) | | — | | | (71,004 | ) |

| Class D | | | — | | | (14 | ) | | — | | | (11,155 | ) |

| |

Total | | | — | | | (182 | ) | | — | | | (125,900 | ) |

| |

Return of capital: | | | | | | | | | | | | | |

| Class A | | | — | | | (8,007 | ) | | — | | | (9,643 | ) |

| Class B | | | — | | | (9,546 | ) | | — | | | (12,896 | ) |

| Class C | | | — | | | (19,926 | ) | | — | | | (28,781 | ) |

| Class D | | | — | | | (3,050 | ) | | — | | | (5,084 | ) |

| |

Total | | | — | | | (40,529 | ) | | — | | | (56,404 | ) |

| |

Decrease in Net Assets from Distributions | | | (49,215 | ) | | (102,880 | ) | | (130,786 | ) | | (348,635 | ) |

| |

| | | | | | | | | | | | | |

(Continued on page 22.) | | | | | | | | | | | | | |

Statements of Changes in Net Assets

| | Seligman

Time Horizon 10 Fund | | Seligman

Harvester Fund | |

| |

| |

| |

| | Year Ended

December 31, | | Year Ended

December 31, | |

| |

| |

| |

| | 2003 | | 2002 | | 2003 | | 2002 | |

| |

Capital Share Transactions: | | | | | | | | | | | | | |

| |

Net proceeds from sales of shares | | | 2,801,522 | | | 3,686,916 | | | 1,695,882 | | | 4,068,593 | |

Exchanged from associated funds | | | 1,121,482 | | | 1,950,517 | | | 2,720,233 | | | 1,732,043 | |

Investment of dividends | | | 46,590 | | | 94,676 | | | 100,618 | | | 309,077 | |

| |

Total | | | 3,969,594 | | | 5,732,109 | | | 4,516,733 | | | 6,109,713 | |

| |

Cost of shares repurchased | | | (3,905,659 | ) | | (2,979,737 | ) | | (3,266,536 | ) | | (3,283,643 | ) |

Exchanged into associated funds | | | (540,936 | ) | | (1,425,135 | ) | | (927,825 | ) | | (937,375 | ) |

| |

Total | | | (4,446,595 | ) | | (4,404,872 | ) | | (4,194,361 | ) | | (4,221,018 | ) |

| |

Increase (decrease) in Net Assets from Capital Share

Transactions | | | (477,001 | ) | | 1,327,237 | | | 322,372 | | | 1,888,695 | |

| |

Increase (decrease) in Net Assets | | | 3,215,536 | | | (3,204,473 | ) | | 2,826,990 | | | (1,095,655 | ) |

| |

| | | | | | | | | | | | | |

Net Assets: | | | | | | | | | | | | | |

| |

Beginning of year | | | 13,221,053 | | | 16,425,526 | | | 12,485,886 | | | 13,581,541 | |

| |

End of Year* | | $ | 16,436,589 | | $ | 13,221,053 | | $ | 15,312,876 | | $ | 12,485,886 | |

| |

|

* | Including undistributed (net of dividends in excess

of) net investment income as follows | | $ | (1,583 | ) | $ | (1,228 | ) | $ | 11,806 | | $ | (1,264 | ) |

See Notes to Financial Statements. | | | | | | | | | | | | | |

Notes to Financial Statements

1. | Multiple Classes of Shares — Seligman Time Horizon/Harvester Series, Inc. (the “Series”) consists of four separate funds: Seligman Time Horizon 30 Fund (“Time Horizon 30 Fund”), Seligman Time Horizon 20 Fund (“Time Horizon 20 Fund”), Seligman Time Horizon 10 Fund (“Time Horizon 10 Fund”), and Seligman Harvester Fund (“Harvester Fund”). Each Fund invests in a combination of Class A shares of other Seligman mutual funds (the “Underlying Funds”). |

| |

| Each Fund of the Series offers four classes of shares — Class A shares, Class B shares, Class C shares, and Class D shares. Class A shares are sold with an initial sales charge of up to 4.75%. Class A shares purchased in an amount of $1,000,000 or more are sold without an initial sales charge but are subject to a contingent deferred sales charge (“CDSC”) of 1% on redemptions within 18 months of purchase. |

| |

| Class B shares are sold without an initial sales charge but are subject to a distribution fee of 0.75% on an annual basis, and a CDSC, if applicable, of 5% on redemptions in the first year of purchase, declining to 1% in the sixth year and 0% thereafter. Class B shares will automatically convert to Class A shares on the last day of the month that precedes the eighth anniversary of their date of purchase. |

| |

| Class C shares are sold primarily with an initial sales charge of up to 1% and a CDSC, if applicable, of 1% imposed on redemptions made within 18 months of purchase. Effective November 25, 2003, shares purchased through certain financial intermediaries may be bought without an initial sales charge and with a 1% CDSC on redemptions made within 12 months of purchase. All Class C shares are subject to a distribution fee of up to 0.75% on an annual basis. |

| |

| Class D shares are sold without an initial sales charge but are subject to a distribution fee of up to 0.75% on an annual basis, and a CDSC, if applicable, of 1% imposed on redemptions made within one year of purchase. |

| |

| The four classes of shares for each Fund represent interests in the same portfolio of investments, have the same rights and are generally identical in all respects except that each class bears its separate distribution and certain other class-specific expenses, and has exclusive voting rights with respect to any matter on which a separate vote of any class is required. |

| |

2. | Significant Accounting Policies — The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. Actual results may differ from these estimates. The following summarizes the significant accounting policies of the Series: |

| |

| a. | Security Valuation — Underlying Funds owned by a Fund are valued at their respective net asset values. US Government securities and short-term obligations, with more than 60 days remaining to maturity, are valued at current market values. Short-term holdings maturing in 60 days or less are generally valued at amortized cost. |

| | |

| b. | Federal Taxes — Each Fund in the Series has elected to be taxed as a regulated investment company and intends to distribute substantially all taxable net income and net gain realized. |

| | |

| c. | Security Transactions and Related Investment Income — Investment transactions are recorded on trade dates. Identified cost of investments sold is used for both financial statement and federal income tax purposes. Dividends receivable and payable are recorded on ex-dividend dates. Interest income is recorded on an accrual basis. |

| | |

| d. | Multiple Class Allocations — Each Fund’s income, expenses (other than class-specific expenses), and realized and unrealized gains or losses are allocated daily to each class of shares of that Fund based upon the relative value of the shares of each class. Class-specific expenses, which include |

Notes to Financial Statements

| | distribution and service fees and any other items that are specifically attributed to a particular class, are charged directly to such class. For the year ended December 31, 2003, distribution and service fees were the only class-specific expenses. |

| | |

| e. | Distributions to Shareholders — The treatment for financial statement purposes of distributions made to shareholders during the year from net investment income or net realized gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense, or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations, or net asset values per share of any Fund of the Series. |

| | |

3. | Purchases and Sales of Securities — Purchases and sales of portfolio securities (underlying funds), excluding short-term investments, for the year ended December 31, 2003, were as follows: |

| Fund | | Purchases | | Sales | | | Fund | | Purchases | | Sales | |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Time Horizon 30 Fund | | $ | 1,121,641 | | | $ 91,977 | | | Time Horizon 10 Fund | | $ | 998,263 | | $ | 1,882,446 | |

| Time Horizon 20 Fund | | | 866,305 | | | 174,132 | | | Harvester Fund | | | 1,318,880 | | | 768,762 | |

| At December 31, 2003, the cost of investments for federal income tax purposes, and the tax basis gross unrealized appreciation and depreciation of portfolio securities were as follows: |

| Fund | | Cost | | Total

Unrealized

Appreciation | | Total

Unrealized

Depreciation | |

|

|

|

|

|

|

|

|

|

| Time Horizon 30 Fund | | $ | 6,980,697 | | | $ | 487,949 | | | | $ | 322,533 | | |

| Time Horizon 20 Fund | | | 14,855,270 | | | | 1,003,223 | | | | | 1,688,131 | | |

| Time Horizon 10 Fund | | | 17,134,008 | | | | 641,807 | | | | | 1,793,515 | | |

| Harvester Fund | | | 16,754,942 | | | | 79,920 | | | | | 1,575,312 | | |

| The tax basis cost was greater than the cost for financial reporting purposes primarily due to the tax deferral of losses on wash sales of $13,050, $291,606, and $431,516 for Time Horizon 20 Fund, Time Horizon 10 Fund, and Harvester Fund, respectively. |

4. | Management Fee, Distribution Services, and Other Transactions — J. & W. Seligman & Co. Incorporated (the “Manager”) manages the affairs of the Series and provides the necessary personnel and facilities. Compensation of all officers of the Series, all directors of the Series who are employees of the Manager, and all personnel of the Series and the Manager is paid by the Manager. The Manager receives a fee, calculated daily and payable monthly, equal to 0.10% per annum of each Fund’s average daily net assets. The Manager has contractually undertaken to waive its fee and reimburse each Fund’s expenses, other than distribution and service fees, that exceed 0.50% per annum of the Fund’s average daily net assets through December 31, 2003 and that exceed 0.75% per annum of average daily net assets from January 1, 2004 through December 31, 2010. |

| |

| Seligman Advisors, Inc. (the “Distributor”), agent for the distribution of the Series’ shares and an affiliate of the Manager, received the following concessions for sales of Class A shares after commissions were paid to dealers for sales of Class A and Class C shares: |

| |

Notes to Financial Statements

| Fund | | Distributor

Concessions | | Dealer

Commissions | | | Fund | | Distributor

Concessions | | Dealer

Commissions | |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Time Horizon 30 Fund | | | $ | 3,120 | | | | $ | 27,347 | | | | Time Horizon 10 Fund | | | $ | 3,413 | | | | | $36,152 | | |

| Time Horizon 20 Fund | | | | 3,575 | | | | | 38,415 | | | | Harvester Fund | | | | 1,657 | | | | | 21,841 | | |

| Each Fund of the Series has an Administration, Shareholder Services and Distribution Plan (the “Plan”) with respect to distribution of its shares. Under the Plan, with respect to Class A, Class B, Class C, and Class D shares, service organizations can enter into agreements with the Distributor and receive a continuing fee (12b-1 fee) of up to 0.25% per annum of the average daily net assets attributable to the particular service organizations for providing personal services and/or the maintenance of shareholder accounts. To avoid any duplication of the 12b-1 fee, the 12b-1 fees to be paid by each class of a Fund will be reduced by the dollar amount of any 12b-1 fees paid by the Underlying Funds with respect to shares owned by the Fund. |

| |

| For the year ended December 31, 2003, 12b-1 fees incurred by the Time Horizon 30 Fund, Time Horizon 20 Fund, Time Horizon 10 Fund, and the Harvester Fund (net of 12b-1 fees paid by underlying funds), aggregated $130, $160, $190, and $129, respectively, or 0.01% per annum of the average daily net assets of Class A shares. |

| |

| With respect to Class C and Class D shares, service organizations may receive up to 0.75% per annum of the average daily net assets for providing other distribution assistance. Such fees are paid monthly by the Funds to the Distributor pursuant to the Plan. |

| |

| With respect to Class B shares, a distribution fee of 0.75% per annum of the average daily net assets is payable monthly by the Funds to the Distributor; however, the Distributor has sold its rights to this fee to third parties (the “Purchasers”), which provide funding to the Distributor to enable it to pay commissions to dealers at the time of the sale of the related Class B shares. |

| |

| For the year ended December 31, 2003, the 12b-1 fees incurred under the Plan (net of 12b-1 fees paid by Underlying Funds), and their equivalent per annum percentage of the average daily net assets of Class B, Class C, and Class D shares, were as follows: |

| Fund | | Class B | | Class C | | Class D | | Fee Rate | |

|

|

|

|

|

|

|

|

|

|

|

| Time Horizon 30 Fund | | $ | 8,341 | | $ | 14,030 | | $ | 3,573 | | | 0.75 | % | |

| Time Horizon 20 Fund | | | 16,709 | | | 36,020 | | | 7,552 | | | 0.75 | | |

| Time Horizon 10 Fund | | | 25,573 | | | 43,469 | | | 8,022 | | | 0.75 | | |

| Harvester Fund | | | 27,375 | | | 47,328 | | | 9,278 | | | 0.75 | | |

| The Distributor is entitled to retain any CDSC imposed on certain redemptions of Class A, Class C and Class D shares. For the year ended December 31, 2003, such charges amounted to $603 for Time Horizon 30 Fund, $1,344 for Time Horizon 20 Fund, $2,531 for Time Horizon 10 Fund and $6,362 for Harvester Fund. |

| |

| The Distributor has sold its rights to the Purchasers to collect any CDSC imposed on redemptions of Class B shares. In connection with the sale of its rights to collect any CDSC and the distribution fees with respect to Class B shares described above, the Distributor receives payments from the Purchasers based on the value of Class B shares sold. The aggregate of such payments retained by the Distributor for the year ended December 31, 2003, were as follows: |

Notes to Financial Statements

| Fund | | Amount | | | Fund | | Amount | |

|

|

|

|

| |

|

|

|

|

| Time Horizon 30 Fund | | | $ | 1,370 | | | | Time Horizon 10 Fund | | | $ | 1,998 | | |

| Time Horizon 20 Fund | | | | 2,596 | | | | Harvester Fund | | | | 795 | | |

| Seligman Services, Inc., an affiliate of the Manager, is eligible to receive commissions from certain sales of shares of the Series, as well as distribution and service fees pursuant to the Plan. For the year ended December 31, 2003, Seligman Services, Inc. received commissions from the sale of shares of each Fund and distribution and service fees, pursuant to the Plan, as follows: |

| Fund | | Commissions | | Distribution and

Service Fees | | | Fund | | Commissions | | Distribution and

Service Fees | |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Time Horizon 30 Fund | | | $ | 186 | | | | $ | 276 | | | | Time Horizon 10 Fund | | | $ | 100 | | | | $ | 264 | | |

| Time Horizon 20 Fund | | | | 262 | | | | | 566 | | | | Harvester Fund | | | | — | | | | | 244 | | |

| Seligman Data Corp., which is owned by certain associated investment companies, charged the Series at cost the following amounts for shareholder account services in accordance with a methodology approved by the Series’ directors: |

| Fund | | Amount | | | Fund | | Amount | |

|

|

|

|

| |

|

|

|

|

| Time Horizon 30 Fund | | | $ | 3,055 | | | | Time Horizon 10 Fund | | | $ | 7,694 | | |

| Time Horizon 20 Fund | | | | 6,835 | | | | Harvester Fund | | | | 8,982 | | |

| Certain officers and directors of the Series are officers or directors of the Manager, the Distributor, Seligman Services, Inc., and/or Seligman Data Corp. |

| |

| The Series has a compensation arrangement under which directors who receive fees may elect to defer receiving such fees. Directors may elect to have their deferred fees accrue interest or earn a return based on the performance of selected Funds of the Series or other funds in the Seligman Group of Investment Companies. Deferred fees and related accrued earnings are not deductible by the Fund for federal income tax purposes until such amounts are paid. The cost of such fees and earnings/loss accrued theron is included in directors’ fees and expenses, and the accumulated balances thereof at December 31, 2003, included in other liabilities, were as follows: |

| Fund | | Amount | | | Fund | | Amount | |

|

|

|

|

| |

|

|

|

|

| Time Horizon 30 Fund | | | $ | 1,556 | | | | Time Horizon 10 Fund | | | $ | 1,583 | | |

| Time Horizon 20 Fund | | | | 1,572 | | | | Harvester Fund | | | | 1,579 | | |

5. | Capital Loss Carryforward — At December 31, 2003, each Fund had net capital loss carryforwards for federal income tax purposes which are available for offset against future taxable net capital gains as follows: |

| Expiration | | 2009 | | 2010 | | 2011 | | Total | |

|

|

|

|

|

|

|

|

|

|

|

| Time Horizon 30 Fund | | | | | | | | $ | 167,882 | | $ | 167,882 | |

| Time Horizon 20 Fund | | | | | | | | | 471,909 | | | 471,909 | |

| Time Horizon 10 Fund | | | | | $ | 927,755 | | | 1,535,613 | | | 2,463,368 | |

| Harvester Fund | | $ | 262,299 | | | | | | 872,160 | | | 1,134,459 | |

| Accordingly, no capital gains distributions are expected to be paid to shareholders of these Funds until net capital gains have been realized in excess of the available capital loss carryforward. |

Notes to Financial Statements

6. | Other Matters — The Manager has been conducting an extensive internal review in response to recent developments regarding disruptive or illegal trading practices within the mutual fund industry. The Manager’s review noted one market timing relationship that was in the process of being closed down by the Manager before the first proceedings relating to trading practices within the mutual fund industry were publicly announced in September 2003. Additionally, the Manager identified three other market timing arrangements, all of which had been terminated, the most recent in September 2002. The Manager is confident that any financial impact of these arrangements on any Seligman Fund was minimal. The Securities and Exchange Commission (the “SEC”) and the Attorney General of the State of New York also are reviewing these matters. |

| |

| In connection with the Manager’s internal review, the Manager has also reviewed its practice of placing some of the Seligman Equity Funds’ orders to buy and sell portfolio securities with brokerage firms in recognition of their sales of Seligman Funds. This is a common practice and permissible when done properly. Although the Manager believes that the execution of all such orders was consistent with its best execution obligations, the Manager may have violated applicable requirements for certain of such orders as a result of compensation arrangements that the Distributor had with certain brokerage firms. The Manager is con-fident that the Seligman Equity Funds did not pay higher brokerage commissions than they would otherwise have paid for comparable transactions. The Manager is also responding to information requests from the SEC relating to the Manager’s use of revenue sharing and fund portfolio brokerage commissions. |

| |

| The Independent Directors of the Board of the Series have been reviewing, and will continue to review, the foregoing matters. If the Series has incurred financial harm as a result of violations of law or internal policies by the Manager or its personnel, the Manager will make restitution to the Series. |

| |

7. | Capital Stock Share Transactions — The Board of Directors, at its discretion, may classify any unissued shares of Capital Stock among any Fund of the Series. At December 31, 2003, 4,000,000,000 shares were authorized for the Series, all at a par value of $0.001 per share. Transactions in shares of Capital Stock were as follows: |

| | Year Ended December 31, | |

| |

|

|

Time Horizon 30 Fund | | 2003 | | 2002 | |

|

|

|

|

|

|

Class A | | Shares | | Amount | | Shares | | Amount | |

|

|

|

|

|

|

|

|

|

|

Sales of shares | | | 131,701 | | $ | 618,274 | | | 77,828 | | $ | 383,641 | |

Exchanged from associated funds | | | 63,463 | | | 324,395 | | | 99,975 | | | 472,873 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total | | | 195,164 | | | 942,669 | | | 177,803 | | | 856,514 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares repurchased | | | (26,461 | ) | | (121,333 | ) | | (32,647 | ) | | (157,812 | ) |

Exchanged into associated funds | | | (68,817 | ) | | (323,590 | ) | | (23,571 | ) | | (118,606 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total | | | (95,278 | ) | | (444,923 | ) | | (56,218 | ) | | (276,418 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase | | | 99,886 | | $ | 497,746 | | | 121,585 | | $ | 580,096 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | |

Class B | | Shares | | Amount | | Shares | | Amount | |

|

|

|

|

|

|

|

|

|

|

Sales of shares | | | 86,220 | | $ | 392,342 | | | 100,219 | | $ | 452,852 | |

Exchanged from associated funds | | | 15,638 | | | 72,430 | | | 14,374 | | | 65,139 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total | | | 101,858 | | | 464,772 | | | 114,593 | | | 517,991 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares repurchased | | | (28,285 | ) | | (133,690 | ) | | (19,660 | ) | | (95,309 | ) |

Exchanged into associated funds | | | (5,920 | ) | | (26,094 | ) | | (18,052 | ) | | (86,658 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total | | | (34,205 | ) | | (159,784 | ) | | (37,712 | ) | | (181,967 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase | | | 67,653 | | $ | 304,988 | | | 76,881 | | $ | 336,024 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes to Financial Statements

| | Year Ended December 31, | |

| |

|

|

Time Horizon 30 Fund | | 2003 | | 2002 | |

|

|

|

|

|

|

Class C | | Shares | | Amount | | Shares | | Amount | |

|

|

|

|

|

|

|

|

|

|

Sales of shares | | | 83,458 | | $ | 377,835 | | | 126,077 | | $ | 621,631 | |

Exchanged from associated funds | | | 2,568 | | | 13,442 | | | 3,918 | | | 20,195 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total | | | 86,026 | | | 391,277 | | | 129,995 | | | 641,826 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares repurchased | | | (114,495 | ) | | (544,149 | ) | | (75,524 | ) | | (315,636 | ) |

Exchanged into associated funds | | | (7,127 | ) | | (29,760 | ) | | (524 | ) | | (2,343 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total | | | (121,622 | ) | | (573,909 | ) | | (76,048 | ) | | (317,979 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase (decrease) | | | (35,596 | ) | $ | (182,632 | ) | | 53,947 | | $ | 323,847 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | |

Class D | | Shares | | Amount | | Shares | | Amount | |

|

|

|

|

|

|

|

|

|

|

Sales of shares | | | 39,170 | | $ | 182,403 | | | 31,964 | | $ | 150,897 | |

Exchanged from associated funds | | | 8,003 | | | 43,649 | | | 15,549 | | | 73,692 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total | | | 47,173 | | | 226,052 | | | 47,513 | | | 224,589 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares repurchased | | | (7,793 | ) | | (36,387 | ) | | (30,070 | ) | | (145,780 | ) |

Exchanged into associated funds | | | (512 | ) | | (2,048 | ) | | (1,087 | ) | | (5,790 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total | | | (8,305 | ) | | (38,435 | ) | | (31,157 | ) | | (151,570 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase | | | 38,868 | | $ | 187,617 | | | 16,356 | | $ | 73,019 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes to Financial Statements

| | Year Ended December 31, | |

| |

|

|

Time Horizon 20 Fund | | 2003 | | 2002 | |

|

|

|

|

|

|

Class A | | Shares | | Amount | | Shares | | Amount | |

|

|

|

|

|

|

|

|

|

|

Sales of shares | | | 179,991 | | $ | 846,219 | | | 186,494 | | $ | 923,058 | |

Exchanged from associated funds | | | 104,852 | | | 520,780 | | | 76,541 | | | 365,331 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total | | | 284,843 | | | 1,366,999 | | | 263,035 | | | 1,288,389 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares repurchased | | | (85,211 | ) | | (414,748 | ) | | (81,132 | ) | | (385,546 | ) |

Exchanged into associated funds | | | (32,039 | ) | | (139,096 | ) | | (37,384 | ) | | (177,720 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total | | | (117,250 | ) | | (553,844 | ) | | (118,516 | ) | | (563,266 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase | | | 167,593 | | $ | 813,155 | | | 144,519 | | $ | 725,123 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | |

Class B | | Shares | | Amount | | Shares | | Amount | |

|

|

|

|

|

|

|

|

|

|

Sales of shares | | | 169,840 | | $ | 737,420 | | | 161,123 | | $ | 776,154 | |

Exchanged from associated funds | | | 25,375 | | | 125,649 | | | 17,906 | | | 80,873 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total | | | 195,215 | | | 863,069 | | | 179,029 | | | 857,027 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares repurchased | | | (39,785 | ) | | (188,534 | ) | | (40,938 | ) | | (190,563 | ) |

Exchanged into associated funds | | | (8,346 | ) | | (36,159 | ) | | (15,207 | ) | | (70,108 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total | | | (48,131 | ) | | (224,693 | ) | | (56,145 | ) | | (260,671 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase | | | 147,084 | | $ | 638,376 | | | 122,884 | | $ | 596,356 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | |

Class C | | Shares | | Amount | | Shares | | Amount | |

|

|

|

|

|

|

|

|

|

|

Sales of shares | | | 269,329 | | $ | 1,197,233 | | | 342,333 | | $ | 1,688,692 | |

Exchanged from associated funds | | | 25,549 | | | 128,492 | | | 17,749 | | | 92,840 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total | | | 294,878 | | | 1,325,725 | | | 360,082 | | | 1,781,532 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares repurchased | | | (347,569 | ) | | (1,529,054 | ) | | (286,664 | ) | | (1,206,068 | ) |

Exchanged into associated funds | | | (11,805 | ) | | (48,604 | ) | | (69,788 | ) | | (298,676 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total | | | (359,374 | ) | | (1,577,658 | ) | | (356,452 | ) | | (1,504,744 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase (decrease) | | | (64,496 | ) | $ | (251,933 | ) | | 3,630 | | $ | 276,788 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | |

Class D | | Shares | | Amount | | Shares | | Amount | |

|

|

|

|

|

|

|

|

|

|

Sales of shares | | | 44,113 | | $ | 192,811 | | | 90,028 | | $ | 418,246 | |

Exchanged from associated funds | | | 14,344 | | | 70,544 | | | 7,958 | | | 38,560 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total | | | 58,457 | | | 263,355 | | | 97,986 | | | 456,806 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares repurchased | | | (62,098 | ) | | (268,891 | ) | | (38,787 | ) | | (182,435 | ) |

Exchanged into associated funds | | | (8,084 | ) | | (31,690 | ) | | (18,720 | ) | | (90,805 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total | | | (70,182 | ) | | (300,581 | ) | | (57,507 | ) | | (273,240 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase (decrease) | | | (11,725 | ) | $ | (37,226 | ) | | 40,479 | | $ | 183,566 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes to Financial Statements

| | Year Ended December 31, | |

| |

|

|

Time Horizon 10 Fund | | 2003 | | 2002 | |

|

|

|

|

|

|

Class A | | Shares | | Amount | | Shares | | Amount | |

|

|

|

|

|

|

|

|

|

|

Sales of shares | | | 224,022 | | $ | 1,075,623 | | | 175,829 | | $ | 866,883 | |

Exchanged from associated funds | | | 74,693 | | | 363,261 | | | 49,140 | | | 237,218 | |

Shares issued in payment of dividends | | | 5,324 | | | 28,621 | | | 8,444 | | | 35,887 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total | | | 304,039 | | | 1,467,505 | | | 233,413 | | | 1,139,988 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares repurchased | | | (125,746 | ) | | (552,128 | ) | | (122,370 | ) | | (551,188 | ) |

Exchanged into associated funds | | | (7,047 | ) | | (30,935 | ) | | (27,699 | ) | | (128,895 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total | | | (132,793 | ) | | (583,063 | ) | | (150,069 | ) | | (680,083 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase | | | 171,246 | | $ | 884,442 | | | 83,344 | | $ | 459,905 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | |

Class B | | Shares | | Amount | | Shares | | Amount | |

|

|

|

|

|

|

|

|

|

|

Sales of shares | | | 122,441 | | $ | 571,419 | | | 119,407 | | $ | 588,191 | |

Exchanged from associated funds | | | 38,900 | | | 189,631 | | | 94,435 | | | 463,379 | |

Shares issued in payment of dividends | | | 1,096 | | | 5,845 | | | 3,608 | | | 15,228 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total | | | 162,437 | | | 766,895 | | | 217,450 | | | 1,066,798 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares repurchased | | | (137,961 | ) | | (628,749 | ) | | (169,162 | ) | | (788,856 | ) |

Exchanged into associated funds | | | (17,789 | ) | | (74,711 | ) | | (76,923 | ) | | (344,345 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total | | | (155,750 | ) | | (703,460 | ) | | (246,085 | ) | | (1,133,201 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase (decrease) | | | 6,687 | | $ | 63,435 | | | (28,635 | ) | $ | (66,403 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | |

Class C | | Shares | | Amount | | Shares | | Amount | |

|

|

|

|

|

|

|

|

|

|

Sales of shares | | | 200,181 | | $ | 942,079 | | | 415,066 | | $ | 2,084,780 | |

Exchanged from associated funds | | | 81,938 | | | 383,291 | | | 211,222 | | | 911,850 | |

Shares issued in payment of dividends | | | 1,894 | | | 10,088 | | | 9,048 | | | 38,127 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total | | | 284,013 | | | 1,335,458 | | | 635,336 | | | 3,034,757 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares repurchased | | | (589,107 | ) | | (2,571,245 | ) | | (291,950 | ) | | (1,286,032 | ) |

Exchanged into associated funds | | | (64,139 | ) | | (292,425 | ) | | (225,392 | ) | | (946,411 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total | | | (653,246 | ) | | (2,863,670 | ) | | (517,342 | ) | | (2,232,443 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase (decrease) | | | (369,233 | ) | $ | (1,528,212 | ) | | 117,994 | | $ | 802,314 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | |

Class D | | Shares | | Amount | | Shares | | Amount | |

|

|

|

|

|

|

|

|

|

|

Sales of shares | | | 44,997 | | $ | 212,401 | | | 31,001 | | $ | 147,062 | |

Exchanged from associated funds | | | 39,228 | | | 185,299 | | | 66,155 | | | 338,070 | |

Shares issued in payment of dividends | | | 382 | | | 2,036 | | | 1,288 | | | 5,434 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total | | | 84,607 | | | 399,736 | | | 98,444 | | | 490,566 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares repurchased | | | (35,068 | ) | | (153,537 | ) | | (78,212 | ) | | (353,661 | ) |

Exchanged into associated funds | | | (34,429 | ) | | (142,865 | ) | | (1,212 | ) | | (5,484 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total | | | (69,497 | ) | | (296,402 | ) | | (79,424 | ) | | (359,145 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase | | | 15,110 | | $ | 103,334 | | | 19,020 | | $ | 131,421 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes to Financial Statements

| | Year Ended December 31, | |

| |

|

|

Harvester Fund | | 2003 | | 2002 | |

|

|

|

|

|

|

Class A | | Shares | | Amount | | Shares | | Amount | |

|

|

|

|

|

|

|

|

|

|

Sales of shares | | | 95,670 | | $ | 449,253 | | | 302,783 | | $ | 1,436,218 | |

Exchanged from associated funds | | | 80,502 | | | 362,825 | | | 67,728 | | | 312,816 | |

Shares issued in payment of dividends | | | 7,123 | | | 33,101 | | | 12,384 | | | 59,420 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|