UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811- 09525

Rydex Dynamic Funds

(Exact name of registrant as specified in charter)

702 King Farm Boulevard, Suite 200

Rockville, Maryland 20850

(Address of principal executive offices) (Zip code)

Amy J. Lee

Rydex Dynamic Funds

702 King Farm Boulevard, Suite 200

Rockville, Maryland 20850

(Name and address of agent for service)

Registrant's telephone number, including area code:1-301-296-5100

Date of fiscal year end:March 31

Date of reporting period:September 30, 2019

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The registrant’s semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows:

9.30.2019

Rydex Funds Semi-Annual Report

Domestic Equity Funds |

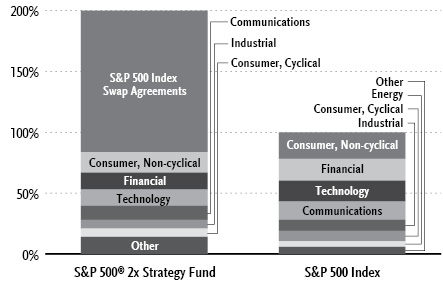

S&P 500® 2x Strategy Fund | | |

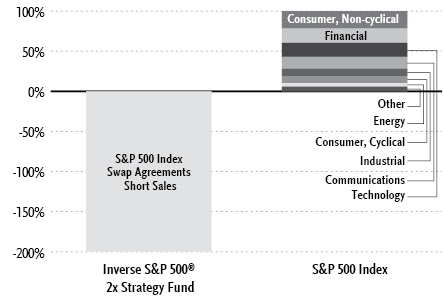

Inverse S&P 500® 2x Strategy Fund | | |

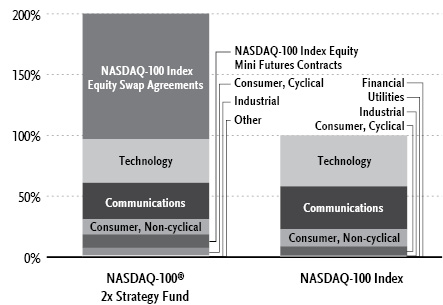

NASDAQ-100® 2x Strategy Fund | | |

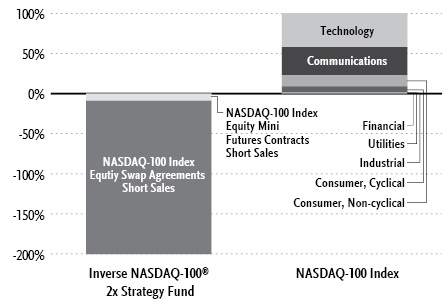

Inverse NASDAQ-100® 2x Strategy Fund | | |

Dow 2x Strategy Fund | | |

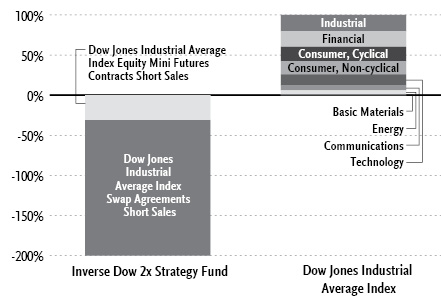

Inverse Dow 2x Strategy Fund | | |

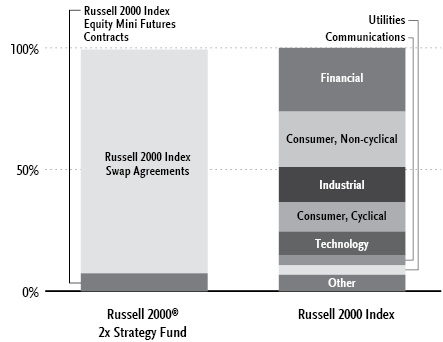

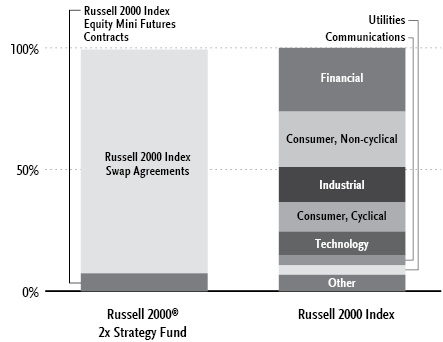

Russell 2000® 2x Strategy Fund | | |

Inverse Russell 2000® 2x Strategy Fund | | |

Beginning on January 1, 2021, paper copies of the Funds’ annual and semi-annual shareholder reports may no longer be sent by mail, unless you specifically request paper copies of the reports from a fund or from your financial intermediary. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. At any time, you may elect to receive reports and other communications from a fund electronically by calling 800.820.0888, going to GuggenheimInvestments.com/myaccount, or by contacting your financial intermediary.

You may elect to receive all future shareholder reports in paper free of charge. If you hold shares of a fund directly, you can inform the Fund that you wish to receive paper copies of reports by calling 800.820.0888. If you hold shares of a fund through a financial intermediary, please contact the financial intermediary to make this election. Your election to receive reports in paper will apply to all Guggenheim Funds in which you are invested and may apply to all funds held with your financial intermediary.

GuggenheimInvestments.com | DYN-SEMI-0919x0320 |

| | |

DEAR SHAREHOLDER | 2 |

ECONOMIC AND MARKET OVERVIEW | 3 |

A BRIEF NOTE ON THE COMPOUNDING OF RETURNS | 5 |

ABOUT SHAREHOLDERS’ FUND EXPENSES | 6 |

S&P 500® 2x STRATEGY FUND | 9 |

INVERSE S&P 500® 2x STRATEGY FUND | 21 |

NASDAQ-100® 2x STRATEGY FUND | 28 |

INVERSE NASDAQ-100® 2x STRATEGY FUND | 36 |

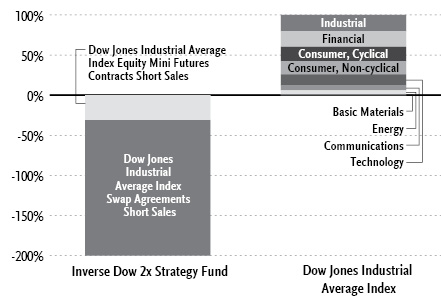

DOW 2x STRATEGY FUND | 43 |

INVERSE DOW 2x STRATEGY FUND | 50 |

RUSSELL 2000® 2x STRATEGY FUND | 57 |

INVERSE RUSSELL 2000® 2x STRATEGY FUND | 64 |

NOTES TO FINANCIAL STATEMENTS | 71 |

OTHER INFORMATION | 85 |

INFORMATION ON BOARD OF TRUSTEES AND OFFICERS | 88 |

GUGGENHEIM INVESTMENTS PRIVACY NOTICE | 93 |

| | THE RYDEX FUNDS SEMI-ANNUAL REPORT | 1 |

Dear Shareholder:

Security Investors, LLC (the “Investment Adviser”) is pleased to present the semi-annual shareholder report for a selection of our funds (the “Fund” or “Funds”). This report covers performance for the six-month period ended September 30, 2019.

The Investment Adviser is part of Guggenheim Investments, which represents the investment management businesses of Guggenheim Partners, LLC (“Guggenheim”), a global, diversified financial services firm.

Guggenheim Funds Distributors, LLC is the distributor of the Funds. Guggenheim Funds Distributors, LLC is affiliated with Guggenheim and the Investment Adviser.

We encourage you to read the Economic and Market Overview section of the report, which follows this letter.

We are committed to providing innovative investment solutions and appreciate the trust you place in us.

Sincerely,

Security Investors, LLC

October 31, 2019

Read a prospectus and summary prospectus (if available) carefully before investing. It contains the investment objectives, risks, charges, expenses, and other information, which should be considered carefully before investing. Obtain a prospectus and summary prospectus (if available) at guggenheiminvestments.com or call 800.820.0888.

This material is not intended as a recommendation or as investment advice of any kind, including in connection with rollovers, transfers, and distributions. Such material is not provided in a fiduciary capacity, may not be relied upon for or in connection with the making of investment decisions, and does not constitute a solicitation of an offer to buy or sell securities. All content has been provided for informational or educational purposes only and is not intended to be and should not be construed as legal or tax advice and/or a legal opinion. Always consult a financial, tax and/ or legal professional regarding your specific situation.

Inverse and leveraged Funds are not suitable for all investors. ● These Funds should be utilized only by investors who (a) understand the risks associated with the use of leverage, (b) understand the consequences of seeking daily leveraged investment results, (c) understand the risk of shorting, and (d) intend to actively monitor and manage their investments. ● The more a Fund invests in leveraged instruments, the more the leverage will magnify any gains or losses on those investments. ● Inverse Funds involve certain risks, which include increased volatility due to the Funds’ possible use of short sales of securities and derivatives, such as options and futures. ● The Funds’ use of derivatives, such as futures, options, and swap agreements, may expose the Funds’ shareholders to additional risks that they would not be subject to if they invested directly in the securities underlying those derivatives. ● Short-selling involves increased risks and costs. You risk paying more for a security than you received from its sale. ● Leveraged and inverse Funds seek to provide investment results that match the performance of a specific benchmark, before fees and expenses, on a daily basis. Because the Funds seek to track the performance of their benchmark on a daily basis, mathematical compounding, especially with respect to those Funds that use leverage as part of their investment strategy, may prevent a Fund from correlating with the monthly, quarterly, annual, or other period performance of its benchmark. Due to the compounding of daily returns, leveraged and inverse Funds’ returns over periods other than one day will likely differ in amount and possibly direction from the benchmark return for the same period. For those Funds that consistently apply leverage, the value of the Fund’s shares will tend to increase or decrease more than the value of any increase or decrease in its benchmark index. The Funds rebalance their portfolios on a daily basis, increasing exposure in response to that day’s gains or reducing exposure in response to that day’s losses. Daily rebalancing will impair a Fund’s performance if the benchmark experiences volatility. Investors should monitor their leveraged and inverse Funds’ holdings consistent with their strategies, as frequently as daily. ● For more on these and other risks, please read the prospectus.

2 | THE RYDEX FUNDS SEMI-ANNUAL REPORT | |

ECONOMIC AND MARKET OVERVIEW (Unaudited) | September 30, 2019 |

Economic data has been mixed over the past few months. On the positive side, we saw a pickup in the housing market as measured by housing starts and home sales, which could be a delayed response to lower mortgage rates. Industrial production had the strongest month-over-month gain in a year, partially boosted by an increase in oil production in Hurricane Barry’s wake. The unemployment rate fell to a 50-year low of 3.5% in September 2019, despite a continued moderation in payroll gains.

On the negative side, the Institute for Supply Management (“ISM”) Manufacturing Index plunged to the weakest reading since June 2009. The ISM Non-Manufacturing Index also came in well below expectations, the lowest since August 2016. Within both the manufacturing and non-manufacturing ISM indexes, analysts look at the employment component of the survey for an early read on other labor market indicators. Here we find more cause for concern: The non-manufacturing survey’s employment component is now barely above 50 while the manufacturing employment sub-index stands at 46.3, well into contraction territory. Combined, the outlook for output and hiring has dimmed, signaling trouble ahead for consumers.

Retail sales have been steady, but Commerce Department data showed that total consumer spending on goods and services increased only 0.1% month-over-month in August 2019, the smallest gain in six months. It is hard to identify the primary reason why consumers may already be turning more conservative on spending. Income growth looks steady, the equity market is higher year-to-date, and rates are lower, all of which should be boosting consumer confidence. Sentiment surveys, however, show that fewer consumers believe now is a good time to buy homes, vehicles, and household durables, and headline consumer confidence measures have ticked down. We believe trade policy and political concerns are weighing on sentiment, and these headwinds are set to ramp up further. Additional U.S. tariffs on China are due to take effect on December 15, 2019 and the U.S. House of Representatives is pressing forward with its impeachment inquiry into President Trump.

Guggenheim’s dashboard of U.S. recession indicators continues to point to a recession beginning as early as the first half of 2020, and we think the economic data is corroborating this view. Two of the more notable indicators pointing to high recession risk are the three-month/10-year U.S. Treasury yield curve, which has been inverted for 16 consecutive weeks through period end, and the Leading Economic Indicators Index which has slowed from a year-over-year growth rate of 6.6% in September 2018 to 1.1% as of August 2019. The indicators Guggenheim tracks as part of our recession probability model indicate a nearly 50% chance that a recession will come before mid-2020, and a 70% chance that it will arrive by mid-2021.

Over the period, the U.S. Treasury curve continued its overall flattening trend, as the difference between the two-year U.S. Treasury and 10-year U.S. Treasury narrowed to 5 basis points. Equity markets remained volatile, buoyed by a 25 basis point cut in July and September 2019 by the U.S. Federal Reserve (the “Fed”) and relatively strong U.S. economic data, but weighed down by trade war uncertainty and fears of a global slowdown.

With downside risks growing, markets have become more sensitive to the Fed’s communications about the future stance of monetary policy. Despite the two rate cuts, Fed policymakers are deeply divided. It is still unclear whether the Fed will deliver the aggressive and preemptive policy action that would prolong the current expansion.

As it relates to risk-taking, we are not confident that the Fed would succeed in easing credit conditions if conditions were to tighten materially. The Fed may act too late, or its actions may have little impact given that low rates this year have largely failed to stimulate growth. With credit spreads still relatively tight on a historical basis, we believe it is prudent to remain up in quality as we await better opportunities to deploy capital in riskier credit sectors in the coming downturn.

For the six-month period ended September 30, 2019, the Standard & Poor’s 500® (“S&P 500”) Index* returned 6.08%. The MSCI Europe-Australasia-Far East (“EAFE”) Index* returned 2.93%. The return of the MSCI Emerging Markets Index* was -3.40%.

In the bond market, the Bloomberg Barclays U.S. Aggregate Bond Index* posted a 5.42% return for the period, while the Bloomberg Barclays U.S. Corporate High Yield Index* returned 3.87%. The return of the ICE Bank of America (“BofA”) Merrill Lynch 3-Month U.S. Treasury Bill Index* was 1.20% for the six-month period.

The opinions and forecasts expressed may not actually come to pass. This information is subject to change at any time, based on market and other conditions, and should not be construed as a recommendation of any specific security or strategy.

| | THE RYDEX FUNDS SEMI-ANNUAL REPORT | 3 |

ECONOMIC AND MARKET OVERVIEW (Unaudited)(concluded) | September 30, 2019 |

*Index Definitions:

The following indices are referenced throughout this report. Indices are unmanaged and not available for direct investment. Index performance does not reflect transaction costs, fees, or expenses.

Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including U.S. Treasuries, government-related and corporate securities, mortgage-backed securities or “MBS” (agency fixed-rate and hybrid adjustable-rate mortgage, or “ARM”, pass-throughs), asset-backed securities (“ABS”), and commercial mortgage-backed securities (“CMBS”) (agency and non-agency).

Bloomberg Barclays U.S. Corporate High Yield Index measures the U.S. dollar-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB +/BB + or below.

Dow Jones Industrial Average® (“DJIA”) is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the Nasdaq.

ICE BofA Merrill Lynch 3-Month U.S. Treasury Bill Index is an unmanaged market Index of U.S. Treasury securities maturing in 90 days that assumes reinvestment of all income.

MSCI EAFE Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada.

MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market performance in the global emerging markets.

NASDAQ-100® Index includes 100 of the largest domestic and international non-financial securities listed on The Nasdaq Stock Market based on market capitalization. The Index reflects companies across major industry groups including computer hardware and software, telecommunications, retail/wholesale trade and biotechnology. It does not contain securities of financial companies including investment companies.

Russell 2000® Index measures the performance of the small-cap segment of the U.S. equity universe.

S&P 500® is a broad-based index, the performance of which is based on the performance of 500 widely held common stocks chosen for market size, liquidity, and industry group representation.

4 | THE RYDEX FUNDS SEMI-ANNUAL REPORT | |

A BRIEF NOTE ON THE COMPOUNDING OF RETURNS (Unaudited) | |

Many of the Funds described in this report are benchmarked daily to leveraged and/or inverse leveraged versions of published indices. To properly evaluate the performance of these funds, it is essential to understand the effect of mathematical compounding on their respective returns.

Because of the nonlinear effects of leverage applied over time, it is possible for a fund to perform in-line with its benchmark for several individual periods in a row, yet seem to trail the benchmark over the entire period on a cumulative basis. It is also possible that a fund that performs in-line with its benchmark on a daily basis may seem to outperform its benchmark over longer periods.

An Example of Compounding

For example, consider a hypothetical fund that is designed to produce returns that correspond to 150% of an index. On the first day of a period, the index rises from a level of 100 to a level of 106, producing a 6.0% gain and an expectation that the fund will rise by 9.0%. On the same day, the fund’s net asset value per share (“NAV”) increases from $10.00 to $10.90 for a gain of 9.0% — in line with its benchmark.

On day two, assume the index falls from 106 to 99 for a loss of about 6.6%. The fund, as expected, falls 9.9% to a price of $9.82. On each day, the fund performed exactly in line with its benchmark, but for the two-day period, the fund was down 1.8%, while the index was down only 1.0%. Without taking into account the daily compounding of returns, one would expect the fund to lose 1.5% and would see the fund as trailing by 0.3% when in fact it had performed perfectly. This example is summarized in the table below.

| Index

Level | Index

Performance | Fund

Expectation | Fund

NAV | Fund

Performance | Assessment |

Start | 100 | | | $ 10.00 | | |

Day 1 | 106 | 6.0% | 9.0% | $ 10.90 | 9.0% | In line |

Day 2 | 99 | -6.6% | -9.9% | $ 9.82 | -9.9% | In line |

Cumulative | | -1.0% | -1.5% | | -1.8% | -0.3% |

As illustrated by this simple example, the effect of leverage can make it difficult to form expectations or judgments about fund performance given only the returns of the unleveraged index.

Because certain funds seek to track the performance of their benchmark on a daily basis, mathematical compounding, especially with respect to those funds that use leverage as part of their investment strategy, may prevent a fund from correlating with the monthly, quarterly, annual or other period performance of its benchmark. Due to the compounding of daily returns, leveraged and inverse funds’ returns over periods other than one day will likely differ in amount and possibly direction from the benchmark return for the same period. Investors should monitor their leveraged and inverse funds’ holdings to ensure that they are consistent with their strategies, as frequently as daily. For those funds that consistently apply leverage, the value of the fund’s shares will tend to increase or decrease more than the value of any increase or decrease in its benchmark index. For more on correlation, leverage and other risks, please read the prospectus.

In general, any change in direction in an index will produce compounding that seems to work against an investor. Were the index to move in the same direction (either up or down) for two or more periods in a row, the compounding of those returns would work in an investor’s favor, causing the fund to seemingly beat its benchmark.

As a general rule of thumb, more leverage in a fund will magnify the compounding effect, while less leverage will generally produce results that are more in line with expectations. In addition, periods of high volatility in an underlying index will also cause the effects of compounding to be more pronounced, while lower volatility will produce a more muted effect.

| | THE RYDEX FUNDS SEMI-ANNUAL REPORT | 5 |

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited) | |

All mutual funds have operating expenses, and it is important for our shareholders to understand the impact of costs on their investments. Shareholders of a fund incur two types of costs: (i) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, other distributions, and exchange fees, and (ii) ongoing costs, including management fees, administrative services, and shareholder reports, among others. These ongoing costs, or operating expenses, are deducted from a fund’s gross income and reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets, which is known as the expense ratio. The following examples are intended to help investors understand the ongoing costs (in dollars) of investing in a fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 made at the beginning of the period and held for the entire six-month period beginning March 31, 2019 and ending September 30, 2019.

The following tables illustrate the Funds’ costs in two ways:

Table 1. Based on actual Fund return: This section helps investors estimate the actual expenses paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the fifth column shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. Investors may use the information here, together with the amount invested, to estimate the expenses paid over the period. Simply divide the Fund’s account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number provided under the heading “Expenses Paid During Period.”

Table 2. Based on hypothetical 5% return: This section is intended to help investors compare a fund’s cost with those of other mutual funds. The table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses paid during the period. The example is useful in making comparisons because the U.S. Securities and Exchange Commission (the “SEC”) requires all mutual funds to calculate expenses based on the 5% return. Investors can assess a fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

The calculations illustrated above assume no shares were bought or sold during the period. Actual costs may have been higher or lower, depending on the amount of investment and the timing of any purchases or redemptions.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) on purchase payments, and contingent deferred sales charges (“CDSC”) on redemptions, if any. Therefore, the second table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

More information about the Funds’ expenses, including annual expense ratios for periods up to five years (subject to the Fund’s inception date), can be found in the Financial Highlights section of this report. For additional information on operating expenses and other shareholder costs, please refer to the appropriate Fund prospectus.

6 | THE RYDEX FUNDS SEMI-ANNUAL REPORT | |

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited)(continued) | |

| Expense

Ratio1 | Fund

Return | Beginning

Account Value

March 31, 2019 | Ending

Account Value

September 30, 2019 | Expenses

Paid During

Period2 |

Table 1. Based on actual Fund return3 | | | | | |

S&P 500® 2x Strategy Fund | | | | | |

A-Class | 1.84% | 8.80% | $ 1,000.00 | $ 1,088.00 | $ 9.63 |

C-Class | 2.58% | 8.39% | 1,000.00 | 1,083.90 | 13.48 |

H-Class | 1.84% | 8.81% | 1,000.00 | 1,088.10 | 9.63 |

Inverse S&P 500® 2x Strategy Fund | | | | | |

A-Class | 1.83% | (10.94%) | 1,000.00 | 890.60 | 8.67 |

C-Class | 2.59% | (11.27%) | 1,000.00 | 887.30 | 12.25 |

H-Class | 1.84% | (10.94%) | 1,000.00 | 890.60 | 8.72 |

NASDAQ-100® 2x Strategy Fund | | | | | |

A-Class | 1.88% | 7.12% | 1,000.00 | 1,071.20 | 9.76 |

C-Class | 2.63% | 6.72% | 1,000.00 | 1,067.20 | 13.63 |

H-Class | 1.88% | 7.12% | 1,000.00 | 1,071.20 | 9.76 |

Inverse NASDAQ-100® 2x Strategy Fund | | | | | |

A-Class | 1.87% | (11.84%) | 1,000.00 | 881.60 | 8.82 |

C-Class | 2.62% | (12.13%) | 1,000.00 | 878.70 | 12.34 |

H-Class | 1.87% | (11.84%) | 1,000.00 | 881.60 | 8.82 |

Dow 2x Strategy Fund | | | | | |

A-Class | 1.87% | 6.83% | 1,000.00 | 1,068.30 | 9.70 |

C-Class | 2.62% | 6.44% | 1,000.00 | 1,064.40 | 13.56 |

H-Class | 1.88% | 6.81% | 1,000.00 | 1,068.10 | 9.75 |

Inverse Dow 2x Strategy Fund | | | | | |

A-Class | 1.86% | (9.37%) | 1,000.00 | 906.30 | 8.89 |

C-Class | 2.61% | (9.65%) | 1,000.00 | 903.50 | 12.45 |

H-Class | 1.88% | (9.25%) | 1,000.00 | 907.50 | 8.99 |

Russell 2000® 2x Strategy Fund | | | | | |

A-Class | 1.86% | (4.22%) | 1,000.00 | 957.80 | 9.13 |

C-Class | 2.61% | (4.59%) | 1,000.00 | 954.10 | 12.79 |

H-Class | 1.89% | (4.32%) | 1,000.00 | 956.80 | 9.27 |

Inverse Russell 2000® 2x Strategy Fund | | | | | |

A-Class | 1.88% | (1.53%) | 1,000.00 | 984.70 | 9.35 |

C-Class | 2.63% | (1.92%) | 1,000.00 | 980.80 | 13.06 |

H-Class | 1.93% | (1.63%) | 1,000.00 | 983.70 | 9.60 |

| | THE RYDEX FUNDS SEMI-ANNUAL REPORT | 7 |

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited)(concluded) | |

| Expense

Ratio1 | Fund

Return | Beginning

Account Value

March 31, 2019 | Ending

Account Value

September 30, 2019 | Expenses

Paid During

Period2 |

Table 2. Based on hypothetical 5% return (before expenses) | | | | |

S&P 500® 2x Strategy Fund | | | | | |

A-Class | 1.84% | 5.00% | $ 1,000.00 | $ 1,015.84 | $ 9.30 |

C-Class | 2.58% | 5.00% | 1,000.00 | 1,012.13 | 13.01 |

H-Class | 1.84% | 5.00% | 1,000.00 | 1,015.84 | 9.30 |

Inverse S&P 500® 2x Strategy Fund | | | | | |

A-Class | 1.83% | 5.00% | 1,000.00 | 1,015.89 | 9.25 |

C-Class | 2.59% | 5.00% | 1,000.00 | 1,012.08 | 13.06 |

H-Class | 1.84% | 5.00% | 1,000.00 | 1,015.84 | 9.30 |

NASDAQ-100® 2x Strategy Fund | | | | | |

A-Class | 1.88% | 5.00% | 1,000.00 | 1,015.64 | 9.50 |

C-Class | 2.63% | 5.00% | 1,000.00 | 1,011.88 | 13.26 |

H-Class | 1.88% | 5.00% | 1,000.00 | 1,015.64 | 9.50 |

Inverse NASDAQ-100® 2x Strategy Fund | | | | | |

A-Class | 1.87% | 5.00% | 1,000.00 | 1,015.69 | 9.45 |

C-Class | 2.62% | 5.00% | 1,000.00 | 1,011.93 | 13.21 |

H-Class | 1.87% | 5.00% | 1,000.00 | 1,015.69 | 9.45 |

Dow 2x Strategy Fund | | | | | |

A-Class | 1.87% | 5.00% | 1,000.00 | 1,015.69 | 9.45 |

C-Class | 2.62% | 5.00% | 1,000.00 | 1,011.93 | 13.21 |

H-Class | 1.88% | 5.00% | 1,000.00 | 1,015.64 | 9.50 |

Inverse Dow 2x Strategy Fund | | | | | |

A-Class | 1.86% | 5.00% | 1,000.00 | 1,015.74 | 9.40 |

C-Class | 2.61% | 5.00% | 1,000.00 | 1,011.98 | 13.16 |

H-Class | 1.88% | 5.00% | 1,000.00 | 1,015.64 | 9.50 |

Russell 2000® 2x Strategy Fund | | | | | |

A-Class | 1.86% | 5.00% | 1,000.00 | 1,015.74 | 9.40 |

C-Class | 2.61% | 5.00% | 1,000.00 | 1,011.98 | 13.16 |

H-Class | 1.89% | 5.00% | 1,000.00 | 1,015.59 | 9.55 |

Inverse Russell 2000® 2x Strategy Fund | | | | | |

A-Class | 1.88% | 5.00% | 1,000.00 | 1,015.64 | 9.50 |

C-Class | 2.63% | 5.00% | 1,000.00 | 1,011.88 | 13.26 |

H-Class | 1.93% | 5.00% | 1,000.00 | 1,015.39 | 9.75 |

1 | Annualized. |

2 | Expenses are equal to the Fund’s annualized expense ratio, net of any applicable fee waivers, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). |

3 | Actual cumulative return at net asset value for the period March 31, 2019 to September 30, 2019. |

8 | THE RYDEX FUNDS SEMI-ANNUAL REPORT | |

PERFORMANCE REPORT AND FUND PROFILE (Unaudited) | September 30, 2019 |

S&P 500® 2x STRATEGY FUND

OBJECTIVE: Seeks to provide investment results that match, before fees and expenses, the performance of a specific benchmark on a daily basis. The Fund’s current benchmark is 200% of the performance of the S&P 500® Index (the “underlying index”). The Fund does not seek to achieve its investment objective over a period of time greater than one day.

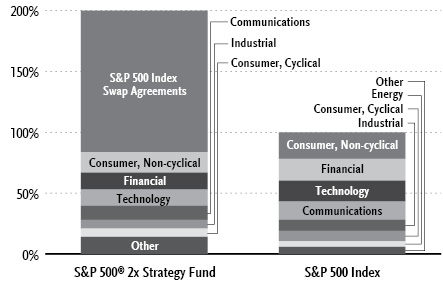

Holdings Diversification (Market Exposure as % of Net Assets)

“Holdings Diversification (Market Exposure as % of Net Assets)” excludes any temporary cash investments.

Inception Dates: |

A-Class | September 1, 2004 |

C-Class | November 27, 2000 |

H-Class | May 19, 2000 |

Ten Largest Holdings (% of Total Net Assets) |

Microsoft Corp. | 3.3% |

Apple, Inc. | 3.0% |

Amazon.com, Inc. | 2.3% |

Facebook, Inc. — Class A | 1.3% |

Berkshire Hathaway, Inc. — Class B | 1.3% |

JPMorgan Chase & Co. | 1.2% |

Alphabet, Inc. — Class C | 1.2% |

Alphabet, Inc. — Class A | 1.2% |

Johnson & Johnson | 1.1% |

Procter & Gamble Co. | 1.0% |

Top Ten Total | 16.9% |

| | |

“Ten Largest Holdings” excludes any temporary cash or derivative investments. |

Average Annual Returns*

Periods Ended September 30, 2019

| 6 Month† | 1 Year | 5 Year | 10 Year |

A-Class Shares | 8.80% | 0.65% | 16.53% | 21.57% |

A-Class Shares with sales charge‡ | 3.63% | (4.13%) | 15.40% | 20.98% |

C-Class Shares | 8.39% | (0.11%) | 15.66% | 20.68% |

C-Class Shares with CDSC§ | 7.39% | (1.11%) | 15.66% | 20.68% |

H-Class Shares | 8.81% | 0.63% | 16.52% | 21.56% |

S&P 500 Index | 6.08% | 4.25% | 10.84% | 13.24% |

* | The performance data above represents past performance that is not predictive of future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Returns are historical and include changes in principal and reinvested dividends and capital gains and do not reflect the effect of taxes. The S&P 500 Index is an unmanaged index and, unlike the Fund, has no management fees or operating expenses to reduce its reported return. |

† | 6 month returns are not annualized. |

‡ | Fund returns are calculated using the maximum sales charge of 4.75%. |

§ | Fund returns include a CDSC of 1% if redeemed within 12 months of purchase. |

| | THE RYDEX FUNDS SEMI-ANNUAL REPORT | 9 |

SCHEDULE OF INVESTMENTS (Unaudited) | September 30, 2019 |

S&P 500® 2x STRATEGY FUND | |

| | Shares | | | Value | |

COMMON STOCKS† - 77.5% |

| | | | | | | | | |

Consumer, Non-cyclical - 16.8% |

Johnson & Johnson | | | 12,156 | | | $ | 1,572,743 | |

Procter & Gamble Co. | | | 11,527 | | | | 1,433,728 | |

Merck & Company, Inc. | | | 11,793 | | | | 992,735 | |

Coca-Cola Co. | | | 17,725 | | | | 964,949 | |

UnitedHealth Group, Inc. | | | 4,365 | | | | 948,602 | |

Pfizer, Inc. | | | 25,475 | | | | 915,317 | |

PepsiCo, Inc. | | | 6,440 | | | | 882,924 | |

Abbott Laboratories | | | 8,140 | | | | 681,074 | |

Medtronic plc | | | 6,179 | | | | 671,163 | |

PayPal Holdings, Inc.* | | | 5,420 | | | | 561,458 | |

Philip Morris International, Inc. | | | 7,166 | | | | 544,114 | |

Thermo Fisher Scientific, Inc. | | | 1,845 | | | | 537,393 | |

Amgen, Inc. | | | 2,762 | | | | 534,475 | |

AbbVie, Inc. | | | 6,810 | | | | 515,653 | |

Eli Lilly & Co. | | | 3,913 | | | | 437,591 | |

Danaher Corp. | | | 2,941 | | | | 424,769 | |

Bristol-Myers Squibb Co. | | | 7,534 | | | | 382,049 | |

CVS Health Corp. | | | 5,990 | | | | 377,789 | |

Gilead Sciences, Inc. | | | 5,833 | | | | 369,696 | |

Mondelez International, Inc. — Class A | | | 6,642 | | | | 367,435 | |

Altria Group, Inc. | | | 8,604 | | | | 351,904 | |

Celgene Corp.* | | | 3,264 | | | | 324,115 | |

Automatic Data Processing, Inc. | | | 1,999 | | | | 322,679 | |

Stryker Corp. | | | 1,478 | | | | 319,691 | |

Becton Dickinson and Co. | | | 1,243 | | | | 314,429 | |

Colgate-Palmolive Co. | | | 3,952 | | | | 290,512 | |

Intuitive Surgical, Inc.* | | | 531 | | | | 286,703 | |

Anthem, Inc. | | | 1,178 | | | | 282,838 | |

S&P Global, Inc. | | | 1,134 | | | | 277,807 | |

Zoetis, Inc. | | | 2,200 | | | | 274,098 | |

Cigna Corp. | | | 1,739 | | | | 263,963 | |

Boston Scientific Corp.* | | | 6,416 | | | | 261,067 | |

Allergan plc | | | 1,511 | | | | 254,286 | |

Kimberly-Clark Corp. | | | 1,585 | | | | 225,149 | |

Global Payments, Inc. | | | 1,382 | | | | 219,738 | |

Edwards Lifesciences Corp.* | | | 958 | | | | 210,674 | |

Illumina, Inc.* | | | 677 | | | | 205,957 | |

Baxter International, Inc. | | | 2,352 | | | | 205,729 | |

Estee Lauder Companies, Inc. — Class A | | | 1,019 | | | | 202,730 | |

Vertex Pharmaceuticals, Inc.* | | | 1,184 | | | | 200,593 | |

Biogen, Inc.* | | | 850 | | | | 197,897 | |

Sysco Corp. | | | 2,363 | | | | 187,622 | |

Constellation Brands, Inc. — Class A | | | 770 | | | | 159,606 | |

Humana, Inc. | | | 622 | | | | 159,027 | |

Moody’s Corp. | | | 749 | | | | 153,418 | |

General Mills, Inc. | | | 2,780 | | | | 153,234 | |

HCA Healthcare, Inc. | | | 1,225 | | | | 147,514 | |

Zimmer Biomet Holdings, Inc. | | | 946 | | | | 129,857 | |

IQVIA Holdings, Inc.* | | | 839 | | | | 125,330 | |

IHS Markit Ltd.* | | | 1,847 | | | | 123,527 | |

Verisk Analytics, Inc. — Class A | | | 753 | | | | 119,079 | |

Tyson Foods, Inc. — Class A | | | 1,357 | | | | 116,892 | |

McKesson Corp. | | | 852 | | | | 116,434 | |

FleetCor Technologies, Inc.* | | | 399 | | | | 114,425 | |

IDEXX Laboratories, Inc.* | | | 397 | | | | 107,956 | |

Hershey Co. | | | 686 | | | | 106,323 | |

Archer-Daniels-Midland Co. | | | 2,565 | | | | 105,344 | |

Monster Beverage Corp.* | | | 1,782 | | | | 103,463 | |

Cintas Corp. | | | 382 | | | | 102,414 | |

Regeneron Pharmaceuticals, Inc.* | | | 368 | | | | 102,083 | |

Alexion Pharmaceuticals, Inc.* | | | 1,033 | | | | 101,172 | |

Corteva, Inc. | | | 3,449 | | | | 96,572 | |

Kroger Co. | | | 3,679 | | | | 94,845 | |

ResMed, Inc. | | | 662 | | | | 89,443 | |

McCormick & Company, Inc. | | | 567 | | | | 88,622 | |

Clorox Co. | | | 579 | | | | 87,933 | |

Church & Dwight Company, Inc. | | | 1,138 | | | | 85,623 | |

Centene Corp.* | | | 1,905 | | | | 82,410 | |

Kraft Heinz Co. | | | 2,866 | | | | 80,062 | |

Equifax, Inc. | | | 557 | | | | 78,353 | |

Laboratory Corporation of America Holdings* | | | 450 | | | | 75,600 | |

Kellogg Co. | | | 1,145 | | | | 73,681 | |

Teleflex, Inc. | | | 213 | | | | 72,367 | |

Conagra Brands, Inc. | | | 2,241 | | | | 68,754 | |

Cooper Companies, Inc. | | | 228 | | | | 67,716 | |

Quest Diagnostics, Inc. | | | 620 | | | | 66,359 | |

Cardinal Health, Inc. | | | 1,373 | | | | 64,792 | |

Hologic, Inc.* | | | 1,231 | | | | 62,153 | |

Incyte Corp.* | | | 822 | | | | 61,017 | |

Align Technology, Inc.* | | | 335 | | | | 60,608 | |

WellCare Health Plans, Inc.* | | | 232 | | | | 60,127 | |

Gartner, Inc.* | | | 415 | | | | 59,341 | |

JM Smucker Co. | | | 525 | | | | 57,760 | |

AmerisourceBergen Corp. — Class A | | | 700 | | | | 57,631 | |

MarketAxess Holdings, Inc. | | | 174 | | | | 56,985 | |

Hormel Foods Corp. | | | 1,279 | | | | 55,931 | |

Universal Health Services, Inc. — Class B | | | 374 | | | | 55,633 | |

Dentsply Sirona, Inc. | | | 1,033 | | | | 55,069 | |

Brown-Forman Corp. — Class B | | | 838 | | | | 52,610 | |

Varian Medical Systems, Inc.* | | | 419 | | | | 49,899 | |

Molson Coors Brewing Co. — Class B | | | 865 | | | | 49,737 | |

Lamb Weston Holdings, Inc. | | | 671 | | | | 48,795 | |

Mylan N.V.* | | | 2,376 | | | | 46,997 | |

United Rentals, Inc.* | | | 355 | | | | 44,247 | |

Avery Dennison Corp. | | | 388 | | | | 44,065 | |

Henry Schein, Inc.* | | | 683 | | | | 43,371 | |

ABIOMED, Inc.* | | | 209 | | | | 37,179 | |

Campbell Soup Co. | | | 777 | | | | 36,457 | |

Perrigo Company plc | | | 627 | | | | 35,043 | |

Nielsen Holdings plc | | | 1,638 | | | | 34,808 | |

Robert Half International, Inc. | | | 541 | | | | 30,112 | |

DaVita, Inc.* | | | 446 | | | | 25,453 | |

Quanta Services, Inc. | | | 655 | | | | 24,759 | |

Rollins, Inc. | | | 649 | | | | 22,112 | |

H&R Block, Inc. | | | 924 | | | | 21,825 | |

Nektar Therapeutics* | | | 807 | | | | 14,700 | |

Coty, Inc. — Class A | | | 1,355 | | | | 14,241 | |

Total Consumer, Non-cyclical | | | | | | | 24,734,733 | |

| | | | | | | | | |

10 | THE RYDEX FUNDS SEMI-ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

SCHEDULE OF INVESTMENTS (Unaudited)(continued) | September 30, 2019 |

S&P 500® 2x STRATEGY FUND | |

| | Shares | | | Value | |

Financial - 13.9% |

Berkshire Hathaway, Inc. — Class B* | | | 9,031 | | | $ | 1,878,629 | |

JPMorgan Chase & Co. | | | 14,727 | | | | 1,733,221 | |

Visa, Inc. — Class A | | | 7,954 | | | | 1,368,167 | |

Bank of America Corp. | | | 38,585 | | | | 1,125,524 | |

Mastercard, Inc. — Class A | | | 4,112 | | | | 1,116,696 | |

Wells Fargo & Co. | | | 18,467 | | | | 931,475 | |

Citigroup, Inc. | | | 10,405 | | | | 718,777 | |

American Tower Corp. — Class A REIT | | | 2,039 | | | | 450,884 | |

American Express Co. | | | 3,133 | | | | 370,571 | |

U.S. Bancorp | | | 6,605 | | | | 365,521 | |

CME Group, Inc. — Class A | | | 1,649 | | | | 348,500 | |

Chubb Ltd. | | | 2,099 | | | | 338,863 | |

Goldman Sachs Group, Inc. | | | 1,490 | | | | 308,773 | |

PNC Financial Services Group, Inc. | | | 2,051 | | | | 287,468 | |

Crown Castle International Corp. REIT | | | 1,915 | | | | 266,204 | |

Prologis, Inc. REIT | | | 2,907 | | | | 247,735 | |

Morgan Stanley | | | 5,785 | | | | 246,846 | |

BlackRock, Inc. — Class A | | | 541 | | | | 241,091 | |

Intercontinental Exchange, Inc. | | | 2,581 | | | | 238,149 | |

Marsh & McLennan Companies, Inc. | | | 2,332 | | | | 233,317 | |

Equinix, Inc. REIT | | | 391 | | | | 225,529 | |

Charles Schwab Corp. | | | 5,358 | | | | 224,125 | |

American International Group, Inc. | | | 4,007 | | | | 223,190 | |

Simon Property Group, Inc. REIT | | | 1,419 | | | | 220,867 | |

Aon plc | | | 1,086 | | | | 210,217 | |

Progressive Corp. | | | 2,693 | | | | 208,034 | |

Capital One Financial Corp. | | | 2,166 | | | | 197,063 | |

BB&T Corp. | | | 3,529 | | | | 188,343 | |

Bank of New York Mellon Corp. | | | 3,951 | | | | 178,625 | |

Aflac, Inc. | | | 3,410 | | | | 178,411 | |

Travelers Companies, Inc. | | | 1,199 | | | | 178,279 | |

MetLife, Inc. | | | 3,666 | | | | 172,889 | |

Public Storage REIT | | | 692 | | | | 169,727 | |

Welltower, Inc. REIT | | | 1,866 | | | | 169,153 | |

Prudential Financial, Inc. | | | 1,852 | | | | 166,587 | |

Allstate Corp. | | | 1,516 | | | | 164,759 | |

SunTrust Banks, Inc. | | | 2,045 | | | | 140,696 | |

Equity Residential REIT | | | 1,606 | | | | 138,534 | |

AvalonBay Communities, Inc. REIT | | | 643 | | | | 138,457 | |

SBA Communications Corp. REIT | | | 521 | | | | 125,639 | |

Ventas, Inc. REIT | | | 1,716 | | | | 125,319 | |

Digital Realty Trust, Inc. REIT | | | 960 | | | | 124,618 | |

T. Rowe Price Group, Inc. | | | 1,085 | | | | 123,961 | |

Discover Financial Services | | | 1,466 | | | | 118,878 | |

Willis Towers Watson plc | | | 594 | | | | 114,624 | |

Realty Income Corp. REIT | | | 1,466 | | | | 112,413 | |

State Street Corp. | | | 1,716 | | | | 101,570 | |

Hartford Financial Services Group, Inc. | | | 1,665 | | | | 100,916 | |

Essex Property Trust, Inc. REIT | | | 303 | | | | 98,975 | |

M&T Bank Corp. | | | 616 | | | | 97,309 | |

Synchrony Financial | | | 2,811 | | | | 95,827 | |

Weyerhaeuser Co. REIT | | | 3,431 | | | | 95,039 | |

Northern Trust Corp. | | | 990 | | | | 92,387 | |

Fifth Third Bancorp | | | 3,364 | | | | 92,106 | |

Ameriprise Financial, Inc. | | | 603 | | | | 88,701 | |

Boston Properties, Inc. REIT | | | 662 | | | | 85,835 | |

KeyCorp | | | 4,621 | | | | 82,439 | |

CBRE Group, Inc. — Class A* | | | 1,549 | | | | 82,113 | |

Cincinnati Financial Corp. | | | 700 | | | | 81,669 | |

HCP, Inc. REIT | | | 2,262 | | | | 80,595 | |

Alexandria Real Estate Equities, Inc. REIT | | | 522 | | | | 80,409 | |

Arthur J Gallagher & Co. | | | 857 | | | | 76,761 | |

First Republic Bank | | | 775 | | | | 74,942 | |

Citizens Financial Group, Inc. | | | 2,059 | | | | 72,827 | |

Regions Financial Corp. | | | 4,596 | | | | 72,709 | |

Extra Space Storage, Inc. REIT | | | 592 | | | | 69,157 | |

Mid-America Apartment Communities, Inc. REIT | | | 525 | | | | 68,255 | |

Principal Financial Group, Inc. | | | 1,194 | | | | 68,225 | |

Huntington Bancshares, Inc. | | | 4,780 | | | | 68,211 | |

UDR, Inc. REIT | | | 1,349 | | | | 65,399 | |

Loews Corp. | | | 1,198 | | | | 61,673 | |

Cboe Global Markets, Inc. | | | 514 | | | | 59,064 | |

Host Hotels & Resorts, Inc. REIT | | | 3,362 | | | | 58,129 | |

Duke Realty Corp. REIT | | | 1,665 | | | | 56,560 | |

Lincoln National Corp. | | | 922 | | | | 55,615 | |

Regency Centers Corp. REIT | | | 772 | | | | 53,646 | |

Nasdaq, Inc. | | | 531 | | | | 52,755 | |

Everest Re Group Ltd. | | | 188 | | | | 50,025 | |

SVB Financial Group* | | | 237 | | | | 49,521 | |

E*TRADE Financial Corp. | | | 1,105 | | | | 48,277 | |

Raymond James Financial, Inc. | | | 569 | | | | 46,920 | |

Vornado Realty Trust REIT | | | 729 | | | | 46,415 | |

Comerica, Inc. | | | 688 | | | | 45,401 | |

Western Union Co. | | | 1,952 | | | | 45,228 | |

Globe Life, Inc. | | | 462 | | | | 44,241 | |

Federal Realty Investment Trust REIT | | | 321 | | | | 43,701 | |

Iron Mountain, Inc. REIT | | | 1,322 | | | | 42,820 | |

Kimco Realty Corp. REIT | | | 1,944 | | | | 40,591 | |

Franklin Resources, Inc. | | | 1,299 | | | | 37,489 | |

Zions Bancorp North America | | | 815 | | | | 36,284 | |

Apartment Investment & Management Co. — Class A REIT | | | 686 | | | | 35,768 | |

Assurant, Inc. | | | 282 | | | | 35,481 | |

SL Green Realty Corp. REIT | | | 380 | | | | 31,065 | |

Invesco Ltd. | | | 1,774 | | | | 30,052 | |

People’s United Financial, Inc. | | | 1,837 | | | | 28,722 | |

Unum Group | | | 961 | | | | 28,561 | |

Alliance Data Systems Corp. | | | 189 | | | | 24,217 | |

Affiliated Managers Group, Inc. | | | 233 | | | | 19,420 | |

Macerich Co. REIT1 | | | 507 | | | | 16,016 | |

Total Financial | | | | | | | 20,371,381 | |

| | | | | | | | | |

Technology - 13.4% |

Microsoft Corp. | | | 35,167 | | | | 4,889,268 | |

Apple, Inc. | | | 19,566 | | | | 4,382,197 | |

Intel Corp. | | | 20,404 | | | | 1,051,418 | |

Adobe, Inc.* | | | 2,236 | | | | 617,695 | |

salesforce.com, Inc.* | | | 4,039 | | | | 599,549 | |

International Business Machines Corp. | | | 4,080 | | | | 593,314 | |

Accenture plc — Class A | | | 2,935 | | | | 564,547 | |

Oracle Corp. | | | 10,140 | | | | 558,004 | |

SEE NOTES TO FINANCIAL STATEMENTS. | THE RYDEX FUNDS SEMI-ANNUAL REPORT | 11 |

SCHEDULE OF INVESTMENTS (Unaudited)(continued) | September 30, 2019 |

S&P 500® 2x STRATEGY FUND | |

| | Shares | | | Value | |

Texas Instruments, Inc. | | | 4,300 | | | $ | 555,732 | |

Broadcom, Inc. | | | 1,833 | | | | 506,036 | |

NVIDIA Corp. | | | 2,805 | | | | 488,266 | |

QUALCOMM, Inc. | | | 5,599 | | | | 427,092 | |

Fidelity National Information Services, Inc. | | | 2,825 | | | | 375,047 | |

Intuit, Inc. | | | 1,198 | | | | 318,596 | |

Fiserv, Inc.* | | | 2,629 | | | | 272,338 | |

Micron Technology, Inc.* | | | 5,084 | | | | 217,849 | |

Applied Materials, Inc. | | | 4,255 | | | | 212,325 | |

Analog Devices, Inc. | | | 1,701 | | | | 190,053 | |

Activision Blizzard, Inc. | | | 3,533 | | | | 186,967 | |

Lam Research Corp. | | | 666 | | | | 153,919 | |

Cognizant Technology Solutions Corp. — Class A | | | 2,544 | | | | 153,314 | |

Autodesk, Inc.* | | | 1,011 | | | | 149,325 | |

Advanced Micro Devices, Inc.* | | | 4,998 | | | | 144,892 | |

Electronic Arts, Inc.* | | | 1,357 | | | | 132,742 | |

HP, Inc. | | | 6,825 | | | | 129,129 | |

Paychex, Inc. | | | 1,473 | | | | 121,920 | |

KLA Corp. | | | 734 | | | | 117,036 | |

Xilinx, Inc. | | | 1,163 | | | | 111,532 | |

Microchip Technology, Inc. | | | 1,096 | | | | 101,829 | |

Cerner Corp. | | | 1,466 | | | | 99,937 | |

Synopsys, Inc.* | | | 692 | | | | 94,977 | |

Hewlett Packard Enterprise Co. | | | 6,013 | | | | 91,217 | |

ANSYS, Inc.* | | | 387 | | | | 85,666 | |

Cadence Design Systems, Inc.* | | | 1,290 | | | | 85,243 | |

MSCI, Inc. — Class A | | | 390 | | | | 84,923 | |

Western Digital Corp. | | | 1,363 | | | | 81,290 | |

Maxim Integrated Products, Inc. | | | 1,249 | | | | 72,330 | |

Akamai Technologies, Inc.* | | | 760 | | | | 69,449 | |

Broadridge Financial Solutions, Inc. | | | 526 | | | | 65,450 | |

Take-Two Interactive Software, Inc.* | | | 521 | | | | 65,302 | |

Skyworks Solutions, Inc. | | | 791 | | | | 62,687 | |

Seagate Technology plc | | | 1,090 | | | | 58,631 | |

NetApp, Inc. | | | 1,096 | | | | 57,551 | |

Citrix Systems, Inc. | | | 567 | | | | 54,727 | |

Leidos Holdings, Inc. | | | 623 | | | | 53,503 | |

Jack Henry & Associates, Inc. | | | 355 | | | | 51,819 | |

Fortinet, Inc.* | | | 654 | | | | 50,201 | |

Qorvo, Inc.* | | | 542 | | | | 40,184 | |

DXC Technology Co. | | | 1,207 | | | | 35,607 | |

Xerox Holdings Corp. | | | 877 | | | | 26,231 | |

IPG Photonics Corp.* | | | 164 | | | | 22,238 | |

Total Technology | | | | | | | 19,731,094 | |

| | | | | | | | | |

Communications - 11.5% |

Amazon.com, Inc.* | | | 1,914 | | | | 3,322,532 | |

Facebook, Inc. — Class A* | | | 11,080 | | | | 1,973,126 | |

Alphabet, Inc. — Class C* | | | 1,392 | | | | 1,696,848 | |

Alphabet, Inc. — Class A* | | | 1,380 | | | | 1,685,173 | |

AT&T, Inc. | | | 33,655 | | | | 1,273,505 | |

Verizon Communications, Inc. | | | 19,050 | | | | 1,149,858 | |

Walt Disney Co. | | | 8,296 | | | | 1,081,135 | |

Cisco Systems, Inc. | | | 19,553 | | | | 966,114 | |

Comcast Corp. — Class A | | | 20,890 | | | | 941,721 | |

Netflix, Inc.* | | | 2,017 | | | | 539,790 | |

Booking Holdings, Inc.* | | | 196 | | | | 384,672 | |

Charter Communications, Inc. — Class A* | | | 745 | | | | 307,029 | |

Twitter, Inc.* | | | 3,559 | | | | 146,631 | |

eBay, Inc. | | | 3,631 | | | | 141,536 | |

Motorola Solutions, Inc. | | | 763 | | | | 130,023 | |

T-Mobile US, Inc.* | | | 1,456 | | | | 114,689 | |

Corning, Inc. | | | 3,597 | | | | 102,586 | |

VeriSign, Inc.* | | | 480 | | | | 90,542 | |

Expedia Group, Inc. | | | 644 | | | | 86,560 | |

CDW Corp. | | | 665 | | | | 81,955 | |

Omnicom Group, Inc. | | | 1,002 | | | | 78,457 | |

Symantec Corp. | | | 2,619 | | | | 61,887 | |

CBS Corp. — Class B | | | 1,507 | | | | 60,838 | |

Arista Networks, Inc.* | | | 251 | | | | 59,969 | |

CenturyLink, Inc. | | | 4,522 | | | | 56,435 | |

Fox Corp. — Class A | | | 1,632 | | | | 51,465 | |

Juniper Networks, Inc. | | | 1,593 | | | | 39,427 | |

Discovery, Inc. — Class C* | | | 1,598 | | | | 39,343 | |

Viacom, Inc. — Class B | | | 1,630 | | | | 39,169 | |

F5 Networks, Inc.* | | | 277 | | | | 38,896 | |

Interpublic Group of Companies, Inc. | | | 1,783 | | | | 38,441 | |

DISH Network Corp. — Class A* | | | 1,108 | | | | 37,749 | |

News Corp. — Class A | | | 1,776 | | | | 24,722 | |

Fox Corp. — Class B | | | 748 | | | | 23,592 | |

Discovery, Inc. — Class A*,1 | | | 728 | | | | 19,387 | |

TripAdvisor, Inc.* | | | 484 | | | | 18,721 | |

News Corp. — Class B | | | 561 | | | | 8,019 | |

Total Communications | | | | | | | 16,912,542 | |

| | | | | | | | | |

Industrial - 7.2% |

Boeing Co. | | | 2,462 | | | | 936,717 | |

Honeywell International, Inc. | | | 3,314 | | | | 560,729 | |

Union Pacific Corp. | | | 3,245 | | | | 525,625 | |

United Technologies Corp. | | | 3,736 | | | | 510,039 | |

Lockheed Martin Corp. | | | 1,145 | | | | 446,618 | |

3M Co. | | | 2,650 | | | | 435,660 | |

United Parcel Service, Inc. — Class B | | | 3,216 | | | | 385,341 | |

General Electric Co. | | | 40,195 | | | | 359,343 | |

Caterpillar, Inc. | | | 2,591 | | | | 327,269 | |

Northrop Grumman Corp. | | | 725 | | | | 271,723 | |

CSX Corp. | | | 3,676 | | | | 254,636 | |

Raytheon Co. | | | 1,283 | | | | 251,712 | |

Deere & Co. | | | 1,450 | | | | 244,586 | |

Norfolk Southern Corp. | | | 1,213 | | | | 217,928 | |

L3Harris Technologies, Inc. | | | 1,028 | | | | 214,482 | |

Illinois Tool Works, Inc. | | | 1,356 | | | | 212,201 | |

Waste Management, Inc. | | | 1,798 | | | | 206,770 | |

General Dynamics Corp. | | | 1,078 | | | | 196,983 | |

Emerson Electric Co. | | | 2,833 | | | | 189,414 | |

Roper Technologies, Inc. | | | 479 | | | | 170,811 | |

Johnson Controls International plc | | | 3,665 | | | | 160,857 | |

FedEx Corp. | | | 1,105 | | | | 160,855 | |

Eaton Corporation plc | | | 1,934 | | | | 160,812 | |

TE Connectivity Ltd. | | | 1,547 | | | | 144,149 | |

Ingersoll-Rand plc | | | 1,113 | | | | 137,133 | |

Amphenol Corp. — Class A | | | 1,370 | | | | 132,205 | |

TransDigm Group, Inc. | | | 229 | | | | 119,233 | |

12 | THE RYDEX FUNDS SEMI-ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

SCHEDULE OF INVESTMENTS (Unaudited)(continued) | September 30, 2019 |

S&P 500® 2x STRATEGY FUND | |

| | Shares | | | Value | |

Cummins, Inc. | | | 727 | | | $ | 118,261 | |

Ball Corp. | | | 1,529 | | | | 111,326 | |

Agilent Technologies, Inc. | | | 1,425 | | | | 109,198 | |

Parker-Hannifin Corp. | | | 592 | | | | 106,921 | |

Stanley Black & Decker, Inc. | | | 699 | | | | 100,943 | |

AMETEK, Inc. | | | 1,052 | | | | 96,595 | |

Fortive Corp. | | | 1,360 | | | | 93,242 | |

Vulcan Materials Co. | | | 609 | | | | 92,105 | |

Rockwell Automation, Inc. | | | 539 | | | | 88,827 | |

Republic Services, Inc. — Class A | | | 975 | | | | 84,386 | |

Keysight Technologies, Inc.* | | | 864 | | | | 84,024 | |

Mettler-Toledo International, Inc.* | | | 113 | | | | 79,597 | |

Martin Marietta Materials, Inc. | | | 288 | | | | 78,941 | |

Amcor plc | | | 7,482 | | | | 72,950 | |

Waters Corp.* | | | 307 | | | | 68,532 | |

Dover Corp. | | | 670 | | | | 66,705 | |

Xylem, Inc. | | | 829 | | | | 66,005 | |

Kansas City Southern | | | 463 | | | | 61,584 | |

Wabtec Corp. | | | 839 | | | | 60,291 | |

Expeditors International of Washington, Inc. | | | 786 | | | | 58,392 | |

IDEX Corp. | | | 349 | | | | 57,194 | |

Jacobs Engineering Group, Inc. | | | 624 | | | | 57,096 | |

Garmin Ltd. | | | 665 | | | | 56,319 | |

Masco Corp. | | | 1,333 | | | | 55,559 | |

CH Robinson Worldwide, Inc. | | | 624 | | | | 52,903 | |

Textron, Inc. | | | 1,060 | | | | 51,898 | |

Arconic, Inc. | | | 1,784 | | | | 46,384 | |

Packaging Corporation of America | | | 436 | | | | 46,260 | |

Allegion plc | | | 430 | | | | 44,569 | |

PerkinElmer, Inc. | | | 512 | | | | 43,607 | |

J.B. Hunt Transport Services, Inc. | | | 393 | | | | 43,485 | |

Westrock Co. | | | 1,185 | | | | 43,193 | |

Huntington Ingalls Industries, Inc. | | | 190 | | | | 40,240 | |

Snap-on, Inc. | | | 254 | | | | 39,761 | |

Fortune Brands Home & Security, Inc. | | | 644 | | | | 35,227 | |

FLIR Systems, Inc. | | | 625 | | | | 32,869 | |

AO Smith Corp. | | | 637 | | | | 30,391 | |

Sealed Air Corp. | | | 712 | | | | 29,555 | |

Pentair plc | | | 774 | | | | 29,257 | |

Flowserve Corp. | | | 604 | | | | 28,213 | |

Total Industrial | | | | | | | 10,496,636 | |

| | | | | | | | | |

Consumer, Cyclical - 6.7% |

Home Depot, Inc. | | | 5,044 | | | | 1,170,309 | |

Walmart, Inc. | | | 6,550 | | | | 777,354 | |

McDonald’s Corp. | | | 3,498 | | | | 751,056 | |

Costco Wholesale Corp. | | | 2,026 | | | | 583,711 | |

NIKE, Inc. — Class B | | | 5,766 | | | | 541,543 | |

Starbucks Corp. | | | 5,513 | | | | 487,459 | |

Lowe’s Companies, Inc. | | | 3,555 | | | | 390,908 | |

TJX Companies, Inc. | | | 5,568 | | | | 310,360 | |

Target Corp. | | | 2,353 | | | | 251,559 | |

General Motors Co. | | | 5,787 | | | | 216,897 | |

Walgreens Boots Alliance, Inc. | | | 3,494 | | | | 193,253 | |

Dollar General Corp. | | | 1,184 | | | | 188,185 | |

Ross Stores, Inc. | | | 1,680 | | | | 184,548 | |

Ford Motor Co. | | | 18,050 | | | | 165,338 | |

Yum! Brands, Inc. | | | 1,401 | | | | 158,915 | |

Marriott International, Inc. — Class A | | | 1,259 | | | | 156,582 | |

Delta Air Lines, Inc. | | | 2,665 | | | | 153,504 | |

O’Reilly Automotive, Inc.* | | | 352 | | | | 140,275 | |

VF Corp. | | | 1,504 | | | | 133,841 | |

Dollar Tree, Inc.* | | | 1,090 | | | | 124,434 | |

Hilton Worldwide Holdings, Inc. | | | 1,321 | | | | 122,998 | |

AutoZone, Inc.* | | | 113 | | | | 122,562 | |

Southwest Airlines Co. | | | 2,228 | | | | 120,334 | |

PACCAR, Inc. | | | 1,595 | | | | 111,666 | |

Aptiv plc | | | 1,180 | | | | 103,155 | |

Chipotle Mexican Grill, Inc. — Class A* | | | 117 | | | | 98,335 | |

United Airlines Holdings, Inc.* | | | 1,018 | | | | 90,002 | |

Fastenal Co. | | | 2,641 | | | | 86,281 | |

Royal Caribbean Cruises Ltd. | | | 791 | | | | 85,689 | |

DR Horton, Inc. | | | 1,550 | | | | 81,700 | |

Carnival Corp. | | | 1,844 | | | | 80,601 | |

Copart, Inc.* | | | 929 | | | | 74,627 | |

Best Buy Company, Inc. | | | 1,068 | | | | 73,681 | |

Lennar Corp. — Class A | | | 1,310 | | | | 73,164 | |

Ulta Beauty, Inc.* | | | 271 | | | | 67,926 | |

CarMax, Inc.* | | | 763 | | | | 67,144 | |

Genuine Parts Co. | | | 673 | | | | 67,024 | |

Darden Restaurants, Inc. | | | 566 | | | | 66,913 | |

MGM Resorts International | | | 2,402 | | | | 66,584 | |

Hasbro, Inc. | | | 541 | | | | 64,211 | |

WW Grainger, Inc. | | | 204 | | | | 60,619 | |

NVR, Inc.* | | | 16 | | | | 59,478 | |

Advance Auto Parts, Inc. | | | 329 | | | | 54,417 | |

Norwegian Cruise Line Holdings Ltd.* | | | 993 | | | | 51,408 | |

Tractor Supply Co. | | | 549 | | | | 49,652 | |

American Airlines Group, Inc. | | | 1,825 | | | | 49,220 | |

Wynn Resorts Ltd. | | | 446 | | | | 48,489 | |

Tiffany & Co. | | | 501 | | | | 46,408 | |

Whirlpool Corp. | | | 293 | | | | 46,399 | |

LKQ Corp.* | | | 1,420 | | | | 44,659 | |

PulteGroup, Inc. | | | 1,187 | | | | 43,385 | |

Alaska Air Group, Inc. | | | 568 | | | | 36,869 | |

Kohl’s Corp. | | | 733 | | | | 36,401 | |

BorgWarner, Inc. | | | 951 | | | | 34,883 | |

Tapestry, Inc. | | | 1,321 | | | | 34,412 | |

Mohawk Industries, Inc.* | | | 276 | | | | 34,243 | |

Newell Brands, Inc. | | | 1,755 | | | | 32,854 | |

PVH Corp. | | | 341 | | | | 30,086 | |

Harley-Davidson, Inc. | | | 722 | | | | 25,970 | |

Hanesbrands, Inc. | | | 1,665 | | | | 25,508 | |

Leggett & Platt, Inc. | | | 606 | | | | 24,810 | |

Capri Holdings Ltd.* | | | 698 | | | | 23,146 | |

Ralph Lauren Corp. — Class A | | | 239 | | | | 22,817 | |

Macy’s, Inc. | | | 1,423 | | | | 22,113 | |

L Brands, Inc. | | | 1,069 | | | | 20,942 | |

Under Armour, Inc. — Class A* | | | 867 | | | | 17,288 | |

Gap, Inc. | | | 987 | | | | 17,134 | |

Nordstrom, Inc. | | | 492 | | | | 16,566 | |

SEE NOTES TO FINANCIAL STATEMENTS. | THE RYDEX FUNDS SEMI-ANNUAL REPORT | 13 |

SCHEDULE OF INVESTMENTS (Unaudited)(continued) | September 30, 2019 |

S&P 500® 2x STRATEGY FUND | |

| | Shares | | | Value | |

Under Armour, Inc. — Class C* | | | 895 | | | $ | 16,226 | |

Total Consumer, Cyclical | | | | | | | 9,831,030 | |

| | | | | | | | | |

Energy - 3.5% |

Exxon Mobil Corp. | | | 19,488 | | | | 1,376,048 | |

Chevron Corp. | | | 8,744 | | | | 1,037,039 | |

ConocoPhillips | | | 5,113 | | | | 291,339 | |

Schlumberger Ltd. | | | 6,370 | | | | 217,663 | |

Phillips 66 | | | 2,066 | | | | 211,558 | |

EOG Resources, Inc. | | | 2,673 | | | | 198,390 | |

Kinder Morgan, Inc. | | | 8,967 | | | | 184,810 | |

Marathon Petroleum Corp. | | | 3,032 | | | | 184,194 | |

Occidental Petroleum Corp. | | | 4,120 | | | | 183,216 | |

Valero Energy Corp. | | | 1,909 | | | | 162,723 | |

ONEOK, Inc. | | | 1,902 | | | | 140,158 | |

Williams Companies, Inc. | | | 5,582 | | | | 134,303 | |

Pioneer Natural Resources Co. | | | 770 | | | | 96,843 | |

Halliburton Co. | | | 4,034 | | | | 76,041 | |

Hess Corp. | | | 1,192 | | | | 72,092 | |

Baker Hughes a GE Co. | | | 2,989 | | | | 69,345 | |

Diamondback Energy, Inc. | | | 751 | | | | 67,523 | |

Concho Resources, Inc. | | | 926 | | | | 62,875 | |

Noble Energy, Inc. | | | 2,203 | | | | 49,479 | |

TechnipFMC plc | | | 1,933 | | | | 46,663 | |

Marathon Oil Corp. | | | 3,703 | | | | 45,436 | |

Devon Energy Corp. | | | 1,862 | | | | 44,800 | |

Apache Corp. | | | 1,732 | | | | 44,339 | |

National Oilwell Varco, Inc. | | | 1,777 | | | | 37,672 | |

HollyFrontier Corp. | | | 697 | | | | 37,387 | |

Cabot Oil & Gas Corp. — Class A | | | 1,927 | | | | 33,857 | |

Cimarex Energy Co. | | | 467 | | | | 22,388 | |

Helmerich & Payne, Inc. | | | 504 | | | | 20,195 | |

Total Energy | | | | | | | 5,148,376 | |

| | | | | | | | | |

Utilities - 2.8% |

NextEra Energy, Inc. | | | 2,251 | | | | 524,461 | |

Duke Energy Corp. | | | 3,356 | | | | 321,706 | |

Dominion Energy, Inc. | | | 3,786 | | | | 306,817 | |

Southern Co. | | | 4,814 | | | | 297,361 | |

Exelon Corp. | | | 4,475 | | | | 216,187 | |

American Electric Power Company, Inc. | | | 2,274 | | | | 213,051 | |

Sempra Energy | | | 1,265 | | | | 186,727 | |

Xcel Energy, Inc. | | | 2,415 | | | | 156,709 | |

Public Service Enterprise Group, Inc. | | | 2,329 | | | | 144,584 | |

Consolidated Edison, Inc. | | | 1,530 | | | | 144,539 | |

WEC Energy Group, Inc. | | | 1,453 | | | | 138,180 | |

Eversource Energy | | | 1,490 | | | | 127,350 | |

Edison International | | | 1,649 | | | | 124,368 | |

FirstEnergy Corp. | | | 2,487 | | | | 119,948 | |

DTE Energy Co. | | | 844 | | | | 112,218 | |

Entergy Corp. | | | 916 | | | | 107,502 | |

PPL Corp. | | | 3,327 | | | | 104,767 | |

American Water Works Company, Inc. | | | 832 | | | | 103,359 | |

Ameren Corp. | | | 1,132 | | | | 90,617 | |

CMS Energy Corp. | | | 1,307 | | | | 83,583 | |

Evergy, Inc. | | | 1,085 | | | | 72,218 | |

CenterPoint Energy, Inc. | | | 2,313 | | | | 69,806 | |

Atmos Energy Corp.1 | | | 544 | | | | 61,956 | |

Alliant Energy Corp. | | | 1,094 | | | | 58,999 | |

NiSource, Inc. | | | 1,720 | | | | 51,463 | |

Pinnacle West Capital Corp. | | | 517 | | | | 50,185 | |

AES Corp. | | | 3,058 | | | | 49,968 | |

NRG Energy, Inc. | | | 1,165 | | | | 46,134 | |

Total Utilities | | | | | | | 4,084,763 | |

| | | | | | | | | |

Basic Materials - 1.7% |

Linde plc | | | 2,490 | | | | 482,363 | |

DuPont de Nemours, Inc. | | | 3,434 | | | | 244,879 | |

Ecolab, Inc. | | | 1,153 | | | | 228,340 | |

Air Products & Chemicals, Inc. | | | 1,015 | | | | 225,188 | |

Sherwin-Williams Co. | | | 378 | | | | 207,851 | |

Dow, Inc. | | | 3,423 | | | | 163,106 | |

Newmont Goldcorp Corp. | | | 3,776 | | | | 143,186 | |

PPG Industries, Inc. | | | 1,088 | | | | 128,939 | |

LyondellBasell Industries N.V. — Class A | | | 1,189 | | | | 106,380 | |

International Paper Co. | | | 1,809 | | | | 75,653 | |

Nucor Corp. | | | 1,396 | | | | 71,070 | |

Celanese Corp. — Class A | | | 570 | | | | 69,705 | |

Freeport-McMoRan, Inc. | | | 6,683 | | | | 63,956 | |

International Flavors & Fragrances, Inc.1 | | | 492 | | | | 60,363 | |

FMC Corp. | | | 601 | | | | 52,696 | |

CF Industries Holdings, Inc. | | | 1,006 | | | | 49,495 | |

Eastman Chemical Co. | | | 631 | | | | 46,587 | |

Albemarle Corp.1 | | | 488 | | | | 33,926 | |

Mosaic Co. | | | 1,635 | | | | 33,517 | |

Total Basic Materials | | | | | | | 2,487,200 | |

| | | | | | | | | |

Total Common Stocks | | | | | | | | |

(Cost $98,222,581) | | | | | | | 113,797,755 | |

| | | | | | | | | |

| | | Face

Amount | | | | | |

U.S. TREASURY BILLS†† - 4.1% |

U.S. Treasury Bills | | | | | | | | |

1.82% due 11/21/192 | | $ | 4,758,000 | | | | 4,745,908 | |

1.77% due 11/21/192,3 | | | 1,100,000 | | | | 1,097,204 | |

1.93% due 10/29/192,4 | | | 216,000 | | | | 215,686 | |

Total U.S. Treasury Bills | | | | | | | | |

(Cost $6,058,455) | | | | | | | 6,058,798 | |

| | | | | | | | | |

FEDERAL AGENCY NOTES†† - 3.1% |

Federal Farm Credit Bank | | | | | | | | |

2.15% (U.S. Prime Rate - 2.85%, Rate Floor: 0.00%) due 08/30/225 | | | 4,500,000 | | | | 4,497,445 | |

Total Federal Agency Notes | | | | | | | | |

(Cost $4,500,000) | | | | | | | 4,497,445 | |

| | | | | | | | | |

14 | THE RYDEX FUNDS SEMI-ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

SCHEDULE OF INVESTMENTS (Unaudited)(continued) | September 30, 2019 |

S&P 500® 2x STRATEGY FUND | |

| | Face

Amount | | | Value | |

REPURCHASE AGREEMENTS††,6 - 14.4% |

JPMorgan Chase & Co.

issued 09/30/19 at 2.35%

due 10/01/193 | | $ | 13,175,268 | | | $ | 13,175,268 | |

Bank of America Merrill Lynch

issued 09/30/19 at 2.28%

due 10/01/193 | | | 4,236,727 | | | | 4,236,727 | |

Barclays Capital

issued 09/30/19 at 2.00%

due 10/01/193 | | | 3,813,054 | | | | 3,813,054 | |

Total Repurchase Agreements | | | | | | | | |

(Cost $21,225,049) | | | | | | | 21,225,049 | |

| | | | | | | | | |

| | Shares | | | Value | |

SECURITIES LENDING COLLATERAL†,7 - 0.1% |

Money Market Fund | | | | | | | | |

First American Government Obligations Fund — Class Z, 1.83%8 | | | 141,165 | | | $ | 141,165 | |

Total Securities Lending Collateral | | | | | | | | |

(Cost $141,165) | | | | | | | 141,165 | |

| | | | | | | | | |

Total Investments - 99.2% | | | | | | | | |

(Cost $130,147,250) | | | | | | $ | 145,720,212 | |

Other Assets & Liabilities, net - 0.8% | | | | | | | 1,170,571 | |

Total Net Assets - 100.0% | | | | | | $ | 146,890,783 | |

Futures Contracts |

| |

Description | | Number of

Contracts | | | Expiration

Date | | | Notional

Amount | | | Value and

Unrealized

Appreciation** | |

Equity Futures Contracts Purchased† |

S&P 500 Index Mini Futures Contracts | | | 60 | | | | Dec 2019 | | | $ | 8,933,250 | | | $ | 80 | |

Total Return Swap Agreements |

| |

Counterparty | Index | | Financing

Rate Pay | | Payment

Frequency | | Maturity

Date | | | Units | | | Notional

Amount | | | Value and

Unrealized

Depreciation | |

OTC Equity Index Swap Agreements†† |

Barclays Bank plc | S&P 500 Index | | | 2.36 | % | At Maturity | | | 10/31/19 | | | | 18,792 | | | $ | 55,937,944 | | | $ | (16,537 | ) |

Goldman Sachs International | S&P 500 Index | | | 2.36 | % | At Maturity | | | 10/28/19 | | | | 29,081 | | | | 86,566,454 | | | | (25,221 | ) |

BNP Paribas | S&P 500 Index | | | 2.59 | % | At Maturity | | | 10/29/19 | | | | 9,624 | | | | 28,647,835 | | | | (77,437 | ) |

| | | | | | | | | | | | | | | | | $ | 171,152,233 | | | $ | (119,195 | ) |

* | Non-income producing security. |

** | Includes cumulative appreciation (depreciation). Variation margin is reported within the Statement of Assets and Liabilities. |

† | Value determined based on Level 1 inputs — See Note 4. |

†† | Value determined based on Level 2 inputs — See Note 4. |

1 | All or a portion of this security is on loan at September 30, 2019 — See Note 7. |

2 | Rate indicated is the effective yield at the time of purchase. |

3 | All or a portion of this security is pledged as equity index swap collateral at September 30, 2019. |

4 | All or a portion of this security is pledged as futures collateral at September 30, 2019. |

5 | Variable rate security. Rate indicated is the rate effective at September 30, 2019. In some instances, the effective rate is limited by a minimum rate floor or a maximum rate cap established by the issuer. The settlement status of a position may also impact the effective rate indicated. In some cases, a position may be unsettled at period end and may not have a stated effective rate. In instances where multiple underlying reference rates and spread amounts are shown, the effective rate is based on a weighted average. |

6 | Repurchase Agreements — See Note 6. |

7 | Securities lending collateral — See Note 7. |

8 | Rate indicated is the 7-day yield as of September 30, 2019. |

| | plc — Public Limited Company |

| | REIT — Real Estate Investment Trust |

| | |

| | See Sector Classification in Other Information section. |

SEE NOTES TO FINANCIAL STATEMENTS. | THE RYDEX FUNDS SEMI-ANNUAL REPORT | 15 |

SCHEDULE OF INVESTMENTS (Unaudited)(concluded) | September 30, 2019 |

S&P 500® 2x STRATEGY FUND | |

The following table summarizes the inputs used to value the Fund’s investments at September 30, 2019 (See Note 4 in the Notes to Financial Statements):

Investments in Securities (Assets) | | Level 1

Quoted

Prices | | | Level 2

Significant

Observable

Inputs | | | Level 3

Significant

Unobservable

Inputs | | | Total | |

Common Stocks | | $ | 113,797,755 | | | $ | — | | | $ | — | | | $ | 113,797,755 | |

U.S. Treasury Bills | | | — | | | | 6,058,798 | | | | — | | | | 6,058,798 | |

Federal Agency Notes | | | — | | | | 4,497,445 | | | | — | | | | 4,497,445 | |

Repurchase Agreements | | | — | | | | 21,225,049 | | | | — | | | | 21,225,049 | |

Securities Lending Collateral | | | 141,165 | | | | — | | | | — | | | | 141,165 | |

Equity Futures Contracts** | | | 80 | | | | — | | | | — | | | | 80 | |

Total Assets | | $ | 113,939,000 | | | $ | 31,781,292 | | | $ | — | | | $ | 145,720,292 | |

| | | | | | | | | | | | | | | | |

Investments in Securities (Liabilities) | | Level 1

Quoted

Prices | | | Level 2

Significant

Observable

Inputs | | | Level 3

Significant

Unobservable

Inputs | | | Total | |

Equity Index Swap Agreements** | | $ | — | | | $ | 119,195 | | | $ | — | | | $ | 119,195 | |

** | This derivative is reported as unrealized appreciation/depreciation at period end. |

16 | THE RYDEX FUNDS SEMI-ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

S&P 500® 2x STRATEGY FUND | |

STATEMENT OF ASSETS AND LIABILITIES (Unaudited) |

September 30, 2019 |

| |

Assets: |

Investments, at value - including $138,821 of securities loaned (cost $108,922,201) | | $ | 124,495,163 | |

Repurchase agreements, at value (cost $21,225,049) | | | 21,225,049 | |

Cash | | | 1,217 | |

Segregated cash with broker | | | 87,809 | |

Receivables: |

Fund shares sold | | | 4,163,412 | |

Dividends | | | 99,848 | |

Variation margin on futures contracts | | | 18,877 | |

Interest | | | 10,597 | |

Securities lending income | | | 12 | |

Total assets | | | 150,101,984 | |

| | | | | |

Liabilities: |

Unrealized depreciation on OTC swap agreements | | | 119,195 | |

Payable for: |

Fund shares redeemed | | | 2,571,679 | |

Return of securities lending collateral | | | 141,165 | |

Management fees | | | 103,825 | |

Swap settlement | | | 97,015 | |

Distribution and service fees | | | 33,359 | |

Transfer agent and administrative fees | | | 28,840 | |

Portfolio accounting fees | | | 17,304 | |

Trustees’ fees* | | | 2,804 | |

Miscellaneous | | | 96,015 | |

Total liabilities | | | 3,211,201 | |

Commitments and contingent liabilities (Note 11) | | | — | |

Net assets | | $ | 146,890,783 | |

| | | | | |

Net assets consist of: |

Paid in capital | | $ | 122,654,466 | |

Total distributable earnings (loss) | | | 24,236,317 | |

Net assets | | $ | 146,890,783 | |

| | | | | |

A-Class: |

Net assets | | $ | 14,728,511 | |

Capital shares outstanding | | | 115,491 | |

Net asset value per share | | $ | 127.53 | |

Maximum offering price per share (Net asset value divided by 95.25%) | | $ | 133.89 | |

| | | | | |

C-Class: |

Net assets | | $ | 3,538,489 | |

Capital shares outstanding | | | 32,538 | |

Net asset value per share | | $ | 108.75 | |

| | | | | |

H-Class: |

Net assets | | $ | 128,623,783 | |

Capital shares outstanding | | | 1,010,039 | |

Net asset value per share | | $ | 127.35 | |

STATEMENT OF OPERATIONS (Unaudited) |

Period Ended September 30, 2019 |

| |

Investment Income: |

Dividends | | $ | 1,054,993 | |

Interest | | | 447,232 | |

Income from securities lending, net | | | 217 | |

Total investment income | | | 1,502,442 | |

| | | | | |

Expenses: |

Management fees | | | 669,149 | |

Distribution and service fees | | | | |

A-Class | | | 17,914 | |

C-Class | | | 29,403 | |

H-Class | | | 160,612 | |

Transfer agent and administrative fees | | | 185,876 | |

Portfolio accounting fees | | | 111,527 | |

Registration fees | | | 84,325 | |

Trustees’ fees* | | | 14,852 | |

Custodian fees | | | 10,101 | |

Line of credit fees | | | 20 | |

Miscellaneous | | | 106,468 | |

Total expenses | | | 1,390,247 | |

Net investment income | | | 112,195 | |

| | | | | |

Net Realized and Unrealized Gain (Loss): |

Net realized gain (loss) on: |

Investments | | | 14,816,730 | |

Swap agreements | | | 7,002,877 | |

Futures contracts | | | (780,678 | ) |

Net realized gain | | | 21,038,929 | |

Net change in unrealized appreciation (depreciation) on: |

Investments | | | (8,313,787 | ) |

Swap agreements | | | (1,374,102 | ) |

Futures contracts | | | (357,263 | ) |

Net change in unrealized appreciation (depreciation) | | | (10,045,152 | ) |

Net realized and unrealized gain | | | 10,993,777 | |

Net increase in net assets resulting from operations | | $ | 11,105,972 | |

* | Relates to Trustees not deemed “interested persons” within the meaning of Section 2(a)(19) of the 1940 Act. |

SEE NOTES TO FINANCIAL STATEMENTS. | THE RYDEX FUNDS SEMI-ANNUAL REPORT | 17 |

S&P 500® 2x STRATEGY FUND | |

STATEMENTS OF CHANGES IN NET ASSETS |

| | Period Ended

September 30,

2019

(Unaudited) | | | Year Ended

March 31,

2019 | |

Increase (Decrease) in Net Assets from Operations: | | | | | | | | |

Net investment income | | $ | 112,195 | | | $ | 160,677 | |

Net realized gain on investments | | | 21,038,929 | | | | 5,392,537 | |

Net change in unrealized appreciation (depreciation) on investments | | | (10,045,152 | ) | | | 4,000,171 | |

Net increase in net assets resulting from operations | | | 11,105,972 | | | | 9,553,385 | |

| | | | | | | | | |

Capital share transactions: | | | | | | | | |

Proceeds from sale of shares | | | | | | | | |

A-Class | | | 5,096,846 | | | | 16,718,124 | |

C-Class | | | 9,839,652 | | | | 38,731,236 | |

H-Class | | | 756,221,466 | | | | 1,737,098,212 | |

Cost of shares redeemed | | | | | | | | |

A-Class | | | (5,118,489 | ) | | | (14,380,814 | ) |

C-Class | | | (11,289,219 | ) | | | (49,968,745 | ) |

H-Class | | | (761,138,504 | ) | | | (1,747,024,905 | ) |

Net decrease from capital share transactions | | | (6,388,248 | ) | | | (18,826,892 | ) |

Net increase (decrease) in net assets | | | 4,717,724 | | | | (9,273,507 | ) |

| | | | | | | | | |

Net assets: | | | | | | | | |

Beginning of period | | | 142,173,059 | | | | 151,446,566 | |

End of period | | $ | 146,890,783 | | | $ | 142,173,059 | |

| | | | | | | | | |

Capital share activity: | | | | | | | | |

Shares sold | | | | | | | | |

A-Class | | | 40,541 | | | | 149,625 | |

C-Class | | | 94,172 | | | | 414,225 | |

H-Class | | | 6,115,625 | | | | 15,576,422 | |

Shares redeemed | | | | | | | | |

A-Class | | | (41,140 | ) | | | (131,337 | ) |

C-Class | | | (103,573 | ) | | | (524,152 | ) |

H-Class | | | (6,168,094 | ) | | | (15,730,485 | ) |

Net decrease in shares | | | (62,469 | ) | | | (245,702 | ) |

18 | THE RYDEX FUNDS SEMI-ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

S&P 500® 2x STRATEGY FUND | |

This table is presented to show selected data for a share outstanding throughout each period and to assist shareholders in evaluating a Fund’s performance for the periods presented.

A-Class | | Period Ended

September 30,

2019a | | | Year Ended

March 31,

2019 | | | Year Ended

March 29,

2018 | | | Year Ended

March 31,

2017 | | | Year Ended

March 31,

2016 | | | Year Ended

March 31,

2015 | |

Per Share Data | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 117.21 | | | $ | 104.90 | | | $ | 89.56 | | | $ | 67.98 | | | $ | 70.18 | | | $ | 58.57 | |

Income (loss) from investment operations: |

Net investment income (loss)b | | | .11 | | | | .18 | | | | .07 | | | | (.25 | ) | | | (.16 | ) | | | (.19 | ) |

Net gain (loss) on investments (realized and unrealized) | | | 10.21 | | | | 12.13 | | | | 21.60 | | | | 21.96 | | | | (1.02 | ) | | | 13.36 | |

Total from investment operations | | | 10.32 | | | | 12.31 | | | | 21.67 | | | | 21.71 | | | | (1.18 | ) | | | 13.17 | |

Less distributions from: |

Net realized gains | | | — | | | | — | | | | (6.33 | ) | | | (.13 | ) | | | (1.02 | ) | | | (1.56 | ) |

Total distributions | | | — | | | | — | | | | (6.33 | ) | | | (.13 | ) | | | (1.02 | ) | | | (1.56 | ) |

Net asset value, end of period | | $ | 127.53 | | | $ | 117.21 | | | $ | 104.90 | | | $ | 89.56 | | | $ | 67.98 | | | $ | 70.18 | |

|

Total Returnc | | | 8.80 | % | | | 11.73 | % | | | 23.92 | % | | | 31.95 | % | | | (1.69 | %) | | | 22.51 | % |

Ratios/Supplemental Data |

Net assets, end of period (in thousands) | | $ | 14,729 | | | $ | 13,607 | | | $ | 10,259 | | | $ | 10,772 | | | $ | 12,011 | | | $ | 13,822 | |

Ratios to average net assets: |

Net investment income (loss) | | | 0.17 | % | | | 0.16 | % | | | 0.07 | % | | | (0.33 | %) | | | (0.23 | %) | | | (0.29 | %) |

Total expenses | | | 1.84 | % | | | 1.85 | % | | | 1.77 | % | | | 1.79 | % | | | 1.76 | % | | | 1.80 | % |

Portfolio turnover rate | | | 114 | % | | | 367 | % | | | 276 | % | | | 411 | % | | | 216 | % | | | 420 | % |

C-Class | | Period Ended

September 30,

2019a | | | Year Ended

March 31,

2019 | | | Year Ended

March 29,

2018 | | | Year Ended

March 31,

2017 | | | Year Ended

March 31,

2016 | | | Year Ended

March 31,

2015 | |

Per Share Data | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 100.33 | | | $ | 90.47 | | | $ | 78.49 | | | $ | 60.04 | | | $ | 62.57 | | | $ | 52.75 | |

Income (loss) from investment operations: |

Net investment income (loss)b | | | (.24 | ) | | | (.60 | ) | | | (.61 | ) | | | (.72 | ) | | | (.59 | ) | | | (.62 | ) |

Net gain (loss) on investments (realized and unrealized) | | | 8.66 | | | | 10.46 | | | | 18.92 | | | | 19.30 | | | | (.92 | ) | | | 12.00 | |

Total from investment operations | | | 8.42 | | | | 9.86 | | | | 18.31 | | | | 18.58 | | | | (1.51 | ) | | | 11.38 | |

Less distributions from: |

Net realized gains | | | — | | | | — | | | | (6.33 | ) | | | (.13 | ) | | | (1.02 | ) | | | (1.56 | ) |