UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811- 09525

Rydex Dynamic Funds

(Exact name of registrant as specified in charter)

702 King Farm Boulevard, Suite 200

Rockville, Maryland 20850

(Address of principal executive offices) (Zip code)

Amy J. Lee

Rydex Dynamic Funds

702 King Farm Boulevard, Suite 200

Rockville, Maryland 20850

(Name and address of agent for service)

Registrant's telephone number, including area code: 1-301-296-5100

Date of fiscal year end: March 31

Date of reporting period: April 1, 2021 - September 30, 2021

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The registrant’s semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows:

9.30.2021

Rydex Funds Semi-Annual Report

Domestic Equity Funds |

S&P 500® 2x Strategy Fund | | |

Inverse S&P 500® 2x Strategy Fund | | |

NASDAQ-100® 2x Strategy Fund | | |

Inverse NASDAQ-100® 2x Strategy Fund | | |

Dow 2x Strategy Fund | | |

Inverse Dow 2x Strategy Fund | | |

Russell 2000® 2x Strategy Fund | | |

Inverse Russell 2000® 2x Strategy Fund | | |

GuggenheimInvestments.com | DYN-SEMI-0921x0322 |

| | |

DEAR SHAREHOLDER | 2 |

ECONOMIC AND MARKET OVERVIEW | 4 |

A BRIEF NOTE ON THE COMPOUNDING OF RETURNS | 6 |

ABOUT SHAREHOLDERS’ FUND EXPENSES | 7 |

S&P 500® 2x STRATEGY FUND | 10 |

INVERSE S&P 500® 2x STRATEGY FUND | 22 |

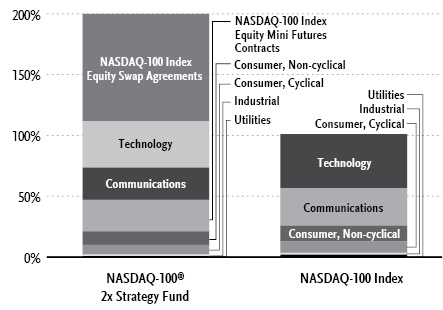

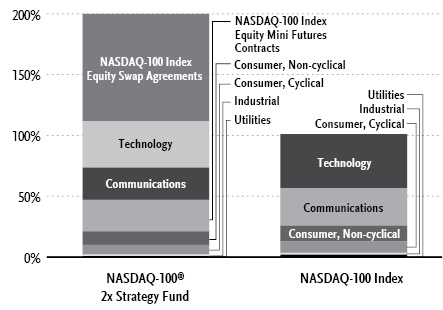

NASDAQ-100® 2x STRATEGY FUND | 29 |

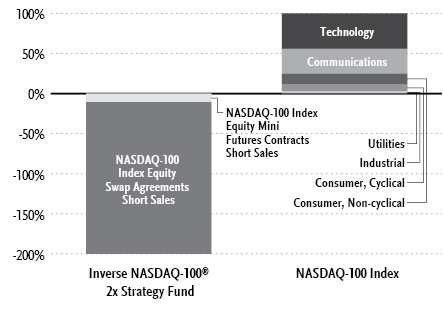

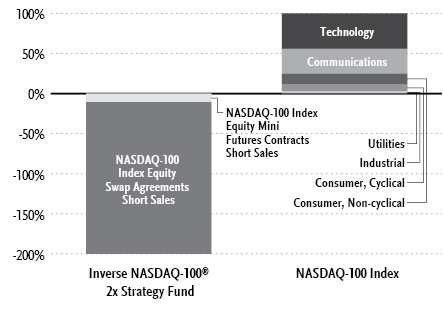

INVERSE NASDAQ-100® 2x STRATEGY FUND | 37 |

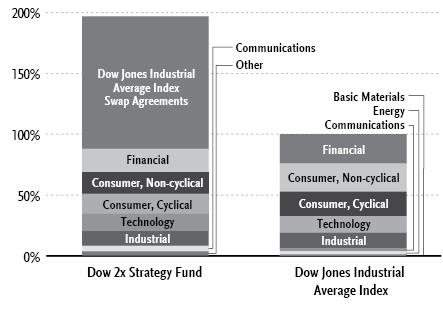

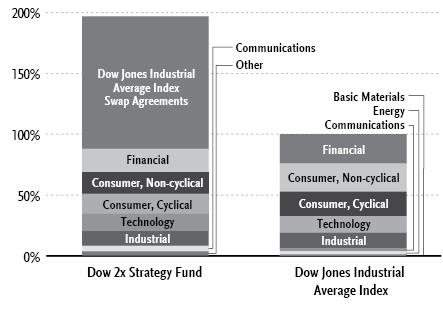

DOW 2x STRATEGY FUND | 44 |

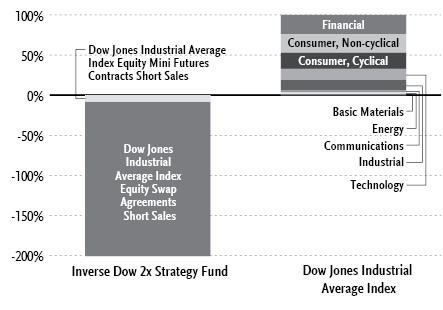

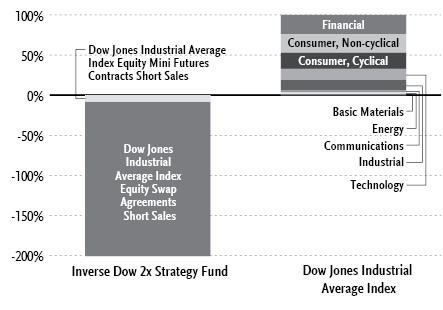

INVERSE DOW 2x STRATEGY FUND | 51 |

RUSSELL 2000® 2x STRATEGY FUND | 58 |

INVERSE RUSSELL 2000® 2x STRATEGY FUND | 66 |

NOTES TO FINANCIAL STATEMENTS | 73 |

OTHER INFORMATION | 87 |

INFORMATION ON BOARD OF TRUSTEES AND OFFICERS | 92 |

GUGGENHEIM INVESTMENTS PRIVACY NOTICE | 97 |

LIQUIDITY RISK MANAGEMENT PROGRAM | 100 |

| | THE RYDEX FUNDS SEMI-ANNUAL REPORT | 1 |

Dear Shareholder:

Security Investors, LLC (the “Investment Adviser”) is pleased to present the semi-annual shareholder report for a selection of our funds (the “Fund” or “Funds”). This report covers performance for the six-month period ended September 30, 2021.

The Investment Adviser is part of Guggenheim Investments, which represents the investment management businesses of Guggenheim Partners, LLC (“Guggenheim”), a global, diversified financial services firm.

Guggenheim Funds Distributors, LLC is the distributor of the Funds. Guggenheim Funds Distributors, LLC is affiliated with Guggenheim and the Investment Adviser.

We encourage you to read the Economic and Market Overview section of the report, which follows this letter.

We are committed to providing innovative investment solutions and appreciate the trust you place in us.

Sincerely,

Security Investors, LLC

October 31, 2021

Read a prospectus and summary prospectus (if available) carefully before investing. It contains the investment objectives, risks, charges, expenses and other information, which should be considered carefully before investing. Obtain a prospectus and summary prospectus (if available) at guggenheiminvestments.com or call 800.820.0888.

This material is not intended as a recommendation or as investment advice of any kind, including in connection with rollovers, transfers, and distributions. Such material is not provided in a fiduciary capacity, may not be relied upon for or in connection with the making of investment decisions, and does not constitute a solicitation of an offer to buy or sell securities. All content has been provided for informational or educational purposes only and is not intended to be and should not be construed as legal or tax advice and/or a legal opinion. Always consult a financial, tax and/or legal professional regarding your specific situation.

COVID-19. The outbreak of COVID-19 and the current recovery underway has caused disruption to consumer demand, economic output, and supply chains. There are still travel restrictions, quarantines, and disparate global vaccine distributions. As with other serious economic disruptions, governmental authorities and regulators are responding to this crisis with significant fiscal and monetary policy changes. These include providing direct capital infusions into companies, introducing new monetary programs, and considerably lowering interest rates. In some cases, these responses resulted in negative interest rates and higher inflation. These actions, including their possible unexpected or sudden reversal or potential ineffectiveness, could further increase volatility in securities and other financial markets, reduce market liquidity, continue to cause higher inflation, heighten investor uncertainty, and adversely affect the value of the Funds’ investments and the performance of the Funds. The duration and extent of COVID-19 over the long term cannot be reasonably estimated at this time. The ultimate impact of COVID-19 and the extent to which COVID-19 impacts the Funds will depend on future developments, which are highly uncertain and difficult to predict. Management continues to monitor and evaluate this situation.

2 | THE RYDEX FUNDS SEMI-ANNUAL REPORT | |

Inverse and leveraged Funds are not suitable for all investors. ● These Funds should be utilized only by investors who (a) understand the risks associated with the use of leverage, (b) understand the consequences of seeking daily leveraged investment results, (c) understand the risk of shorting, and (d) intend to actively monitor and manage their investments. ● The more a Fund invests in leveraged instruments, the more the leverage will magnify any gains or losses on those investments. ● Inverse Funds involve certain risks, which include increased volatility due to the Funds’ possible use of short sales of securities and derivatives, such as options and futures. ● The Funds’ use of derivatives, such as futures, options and swap agreements, may expose the Funds’ shareholders to additional risks that they would not be subject to if they invested directly in the securities underlying those derivatives. ● Short-selling involves increased risks and costs. You risk paying more for a security than you received from its sale. ● Leveraged and inverse Funds seek to provide investment results that match the performance of a specific benchmark, before fees and expenses, on a daily basis. Because the Funds seek to track the performance of their benchmark on a daily basis, mathematical compounding, especially with respect to those Funds that use leverage as part of their investment strategy, may prevent a fund from correlating with the monthly, quarterly, annual or other period performance of its benchmark. Due to the compounding of daily returns, leveraged and inverse Funds’ returns over periods other than one day will likely differ in amount and possibly direction from the benchmark return for the same period. For those Funds that consistently apply leverage, the value of the fund’s shares will tend to increase or decrease more than the value of any increase or decrease in its benchmark index. The Funds rebalance their portfolios on a daily basis, increasing exposure in response to that day’s gains or reducing exposure in response to that day’s losses. Daily rebalancing will impair a fund’s performance if the benchmark experiences volatility. Investors should monitor their leveraged and inverse Funds’ holdings consistent with their strategies, as frequently as daily. ● It is important to note that the Funds are not guaranteed by the U.S. government. ● For more on these and other risks, please read the prospectus.

| | THE RYDEX FUNDS SEMI-ANNUAL REPORT | 3 |

ECONOMIC AND MARKET OVERVIEW (Unaudited) | September 30, 2021 |

In the six months ending September 30, 2021, the equity market experienced a relatively steady upward climb that reversed amid seasonal pressures, inflation worry, and market uncertainty about the economic damage brought about by the potential emergence of new COVID variants.

Treasury yields posted their biggest rise in months following the Federal Open Market Committee (“FOMC”) meeting in September, at which Chair Powell noted that inflation would be higher and last longer than previously expected. The 10-year U.S. Treasury was still down slightly for the period.

Reports circulating in September about the inability of Evergrande, China’s second largest real estate development company, to repay an installment on its approximately $300 billion in debt sparked panic in credit markets in Asia. There was chatter about an Evergrande bankruptcy, a la Lehman Brothers, that would ignite a conflagration that could ravage China’s debt-reliant economy and spread across the world, triggering another global financial crisis. Others saw echoes of the collapse of Long-Term Capital Management, the highly leveraged hedge fund that collapsed in 1998 and required a bailout and debt rewind managed by the Federal Reserve (the “Fed”) to quell fears of a global financial meltdown.

As the month of September progressed and the Chinese government stepped in with liquidity and behind-the-scenes pressure on state-owned and state-backed enterprises to purchase Evergrande assets, tensions eased, but the question remains as to what ultimately will become of Evergrande. The most likely outcome is a “controlled fire” approach in which the government attempts to limit the contagion of Evergrande’s woes by propping up the company until its debts are restructured and reshuffled, its projects completed by others, and its properties sold off.

As Evergrande troubles captured the world’s attention, the September FOMC meeting made it clear that the Fed was not overly worried, at least not enough to push back its forecasted rate hikes. In fact, the tone of the meeting was somewhat hawkish, with the month’s Summary of Economic Projections revealing that half the committee members penciled in a rate hike for 2022. That would give them a policy option should elevated inflation turn out to be less temporary than expected. It also implies that a tapering of asset purchases would be completed sooner rather than later—a timetable corroborated when Chair Powell gave the strongest indication yet that tapering may start in November and for the first time suggested that asset purchases could conclude by mid-2022.

Markets reacted favorably to the Fed’s relatively sanguine view of the Evergrande situation, perhaps breathing a sigh of relief that it considers the problem insufficiently dangerous either to warrant action or to delay the normalization of rates in the United States. Interestingly, in place of several instances of the word “transitory” in the four previous FOMC press conference transcripts, the September transcript included no mention of the word, which may help explain the hawkish tilt to the meeting. Regarding the path for rates, half of FOMC members now see at least one hike in 2022, up from 39 percent in June. The median FOMC participant now sees in excess of six cumulative hikes through 2024, signaling an acknowledgement of intensifying supply side pressures and a labor market that could be at full employment within the next year.

For the six-month period ended September 30, 2021, the S&P 500® Index* returned 9.18%. The MSCI Europe-Australasia-Far East (“EAFE”) Index* returned 4.70%. The return of the MSCI Emerging Markets Index* was -3.45%.

In the bond market, the Bloomberg U.S. Aggregate Bond Index* posted a 1.88% return for the six-month period, while the Bloomberg U.S. Corporate High Yield Index* returned 3.65%. The return of the ICE Bank of America (“BofA”) Merrill Lynch 3-Month U.S. Treasury Bill Index* was 0.01% for the six-month period.

The opinions and forecasts expressed may not actually come to pass. This information is subject to change at any time, based on market and other conditions, and should not be construed as a recommendation of any specific security or strategy.

4 | THE RYDEX FUNDS SEMI-ANNUAL REPORT | |

ECONOMIC AND MARKET OVERVIEW (Unaudited)(concluded) | September 30, 2021 |

*Index Definitions:

The following indices are referenced throughout this report. Indices are unmanaged and not available for direct investment. Index performance does not reflect transaction costs, fees, or expenses.

Bloomberg U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including U.S. Treasuries, government-related and corporate securities, mortgage-backed securities or “MBS” (agency fixed-rate and hybrid adjustable-rate mortgage, or “ARM”, pass-throughs), asset-backed securities (“ABS”), and commercial mortgage-backed securities (“CMBS”) (agency and non-agency).

Bloomberg U.S. Corporate High Yield Index measures the U.S. dollar-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB +/BB + or below.

Dow Jones Industrial Average® is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the Nasdaq.

ICE BofA Merrill Lynch 3-Month U.S. Treasury Bill Index is an unmanaged market Index of U.S. Treasury securities maturing in 90 days that assumes reinvestment of all income.

MSCI EAFE Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada.

MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market performance in the global emerging markets.

NASDAQ-100® Index includes 100 of the largest domestic and international non-financial securities listed on The Nasdaq Stock Market based on market capitalization. The Index reflects companies across major industry groups including computer hardware and software, telecommunications, retail/wholesale trade and biotechnology. It does not contain securities of financial companies including investment companies.

Russell 2000® Index measures the performance of the small-cap segment of the U.S. equity universe.

S&P 500® is a broad-based index, the performance of which is based on the performance of 500 widely held common stocks chosen for market size, liquidity, and industry group representation.

| | THE RYDEX FUNDS SEMI-ANNUAL REPORT | 5 |

A BRIEF NOTE ON THE COMPOUNDING OF RETURNS (Unaudited) | |

The Funds described in this report are benchmarked daily to leveraged and/or inverse leveraged versions of published indices. To properly evaluate the performance of these funds, it is essential to understand the effect of mathematical compounding on their respective returns.

Because of the nonlinear effects of leverage applied over time, it is possible for a fund to perform in-line with its benchmark for several individual periods in a row, yet seem to trail the benchmark over the entire period on a cumulative basis. It is also possible that a fund that performs in-line with its benchmark on a daily basis may seem to outperform its benchmark over longer periods.

An Example of Compounding

For example, consider a hypothetical fund that is designed to produce returns that correspond to 150% of an index. On the first day of a period, the index rises from a level of 100 to a level of 106, producing a 6.0% gain and an expectation that the fund will rise by 9.0%. On the same day, the fund’s net asset value per share (“NAV”) increases from $10.00 to $10.90 for a gain of 9.0% — in line with its benchmark.

On day two, assume the index falls from 106 to 99 for a loss of about 6.6%. The fund, as expected, falls 9.9% to a price of $9.82. On each day, the fund performed exactly in line with its benchmark, but for the two-day period, the fund was down 1.8%, while the index was down only 1.0%. Without taking into account the daily compounding of returns, one would expect the fund to lose 1.5% and would see the fund as trailing by 0.3% when in fact it had performed perfectly. This example is summarized in the table below.

| Index

Level | Index

Performance | Fund

Expectation | Fund

NAV | Fund

Performance | Assessment |

Start | 100 | | | $ 10.00 | | |

Day 1 | 106 | 6.0% | 9.0% | $ 10.90 | 9.0% | In line |

Day 2 | 99 | -6.6% | -9.9% | $ 9.82 | -9.9% | In line |

Cumulative | | -1.0% | -1.5% | | -1.8% | -0.3% |

As illustrated by this simple example, the effect of leverage can make it difficult to form expectations or judgments about fund performance given only the returns of the unleveraged index.

Because certain funds seek to track the performance of their benchmark on a daily basis, mathematical compounding, especially with respect to those funds that use leverage as part of their investment strategy, may prevent a fund from correlating with the monthly, quarterly, annual or other period performance of its benchmark. Due to the compounding of daily returns, leveraged and inverse funds’ returns over periods other than one day will likely differ in amount and possibly direction from the benchmark return for the same period. Investors should monitor their leveraged and inverse funds’ holdings to ensure that they are consistent with their strategies, as frequently as daily. For those funds that consistently apply leverage, the value of the fund’s shares will tend to increase or decrease more than the value of any increase or decrease in its benchmark index. For more on correlation, leverage and other risks, please read the prospectus.

In general, any change in direction in an index will produce compounding that seems to work against an investor. Were the index to move in the same direction (either up or down) for two or more periods in a row, the compounding of those returns would work in an investor’s favor, causing the fund to seemingly beat its benchmark.

As a general rule of thumb, more leverage in a fund will magnify the compounding effect, while less leverage will generally produce results that are more in line with expectations. In addition, periods of high volatility in an underlying index will also cause the effects of compounding to be more pronounced, while lower volatility will produce a more muted effect.

6 | THE RYDEX FUNDS SEMI-ANNUAL REPORT | |

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited) | |

All mutual funds have operating expenses, and it is important for our shareholders to understand the impact of costs on their investments. Shareholders of a fund incur two types of costs: (i) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, other distributions, and exchange fees, and (ii) ongoing costs, including management fees, administrative services, and shareholder reports, among others. These ongoing costs, or operating expenses, are deducted from a fund’s gross income and reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets, which is known as the expense ratio. The following examples are intended to help investors understand the ongoing costs (in dollars) of investing in a fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 made at the beginning of the period and held for the entire six-month period beginning March 31, 2021 and ending September 30, 2021.

The following tables illustrate the Funds’ costs in two ways:

Table 1. Based on actual Fund return: This section helps investors estimate the actual expenses paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the fifth column shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. Investors may use the information here, together with the amount invested, to estimate the expenses paid over the period. Simply divide the Fund’s account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number provided under the heading “Expenses Paid During Period.”

Table 2. Based on hypothetical 5% return: This section is intended to help investors compare a fund’s cost with those of other mutual funds. The table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses paid during the period. The example is useful in making comparisons because the U.S. Securities and Exchange Commission (the “SEC”) requires all mutual funds to calculate expenses based on the 5% return. Investors can assess a fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

The calculations illustrated above assume no shares were bought or sold during the period. Actual costs may have been higher or lower, depending on the amount of investment and the timing of any purchases or redemptions.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) on purchase payments, and contingent deferred sales charges (“CDSC”) on redemptions, if any. Therefore, the second table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

More information about the Funds’ expenses, including annual expense ratios for periods up to five years (subject to the Fund’s inception date), can be found in the Financial Highlights section of this report. For additional information on operating expenses and other shareholder costs, please refer to the appropriate Fund prospectus.

| | THE RYDEX FUNDS SEMI-ANNUAL REPORT | 7 |

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited)(continued) | |

| Expense

Ratio1 | Fund

Return | Beginning

Account Value

March 31, 2021 | Ending

Account Value

September 30, 2021 | Expenses

Paid During

Period2 |

Table 1. Based on actual Fund return3 | | | | | |

S&P 500® 2x Strategy Fund | | | | | |

A-Class | 1.75% | 16.97% | $ 1,000.00 | $ 1,169.70 | $ 9.52 |

C-Class | 2.51% | 16.52% | 1,000.00 | 1,165.20 | 13.62 |

H-Class | 1.75% | 16.97% | 1,000.00 | 1,169.70 | 9.52 |

Inverse S&P 500® 2x Strategy Fund | | | | | |

A-Class | 1.75% | (18.18%) | 1,000.00 | 818.20 | 7.98 |

C-Class | 2.50% | (18.51%) | 1,000.00 | 814.90 | 11.37 |

H-Class | 1.76% | (18.13%) | 1,000.00 | 818.70 | 8.02 |

NASDAQ-100® 2x Strategy Fund | | | | | |

A-Class | 1.79% | 23.91% | 1,000.00 | 1,239.10 | 10.05 |

C-Class | 2.54% | 23.44% | 1,000.00 | 1,234.40 | 14.23 |

H-Class | 1.79% | 23.91% | 1,000.00 | 1,239.10 | 10.05 |

Inverse NASDAQ-100® 2x Strategy Fund | | | | | |

A-Class | 1.76% | (24.15%) | 1,000.00 | 758.50 | 7.76 |

C-Class | 2.51% | (24.43%) | 1,000.00 | 755.70 | 11.05 |

H-Class | 1.79% | (24.14%) | 1,000.00 | 758.60 | 7.89 |

Dow 2x Strategy Fund | | | | | |

A-Class | 1.79% | 5.13% | 1,000.00 | 1,051.30 | 9.20 |

C-Class | 2.54% | 4.73% | 1,000.00 | 1,047.30 | 13.04 |

H-Class | 1.79% | 5.13% | 1,000.00 | 1,051.30 | 9.20 |

Inverse Dow 2x Strategy Fund | | | | | |

A-Class | 1.76% | (9.20%) | 1,000.00 | 908.00 | 8.42 |

C-Class | 2.50% | (9.58%) | 1,000.00 | 904.20 | 11.93 |

H-Class | 1.80% | (9.29%) | 1,000.00 | 907.10 | 8.61 |

Russell 2000® 2x Strategy Fund | | | | | |

A-Class | 1.79% | (3.37%) | 1,000.00 | 966.30 | 8.82 |

C-Class | 2.53% | (3.73%) | 1,000.00 | 962.70 | 12.45 |

H-Class | 1.81% | (3.38%) | 1,000.00 | 966.20 | 8.92 |

Inverse Russell 2000® 2x Strategy Fund | | | | | |

A-Class | 1.77% | (5.79%) | 1,000.00 | 942.10 | 8.62 |

C-Class | 2.52% | (6.19%) | 1,000.00 | 938.10 | 12.24 |

H-Class | 1.82% | (6.15%) | 1,000.00 | 938.50 | 8.84 |

8 | THE RYDEX FUNDS SEMI-ANNUAL REPORT | |

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited)(concluded) | |

| Expense

Ratio1 | Fund

Return | Beginning

Account Value

March 31, 2021 | Ending

Account Value

September 30, 2021 | Expenses

Paid During

Period2 |

Table 2. Based on hypothetical 5% return (before expenses) | | | | |

S&P 500® 2x Strategy Fund | | | | | |

A-Class | 1.75% | 5.00% | $ 1,000.00 | $ 1,016.29 | $ 8.85 |

C-Class | 2.51% | 5.00% | 1,000.00 | 1,012.48 | 12.66 |

H-Class | 1.75% | 5.00% | 1,000.00 | 1,016.29 | 8.85 |

Inverse S&P 500® 2x Strategy Fund | | | | | |

A-Class | 1.75% | 5.00% | 1,000.00 | 1,016.29 | 8.85 |

C-Class | 2.50% | 5.00% | 1,000.00 | 1,012.53 | 12.61 |

H-Class | 1.76% | 5.00% | 1,000.00 | 1,016.24 | 8.90 |

NASDAQ-100® 2x Strategy Fund | | | | | |

A-Class | 1.79% | 5.00% | 1,000.00 | 1,016.09 | 9.05 |

C-Class | 2.54% | 5.00% | 1,000.00 | 1,012.33 | 12.81 |

H-Class | 1.79% | 5.00% | 1,000.00 | 1,016.09 | 9.05 |

Inverse NASDAQ-100® 2x Strategy Fund | | | | | |

A-Class | 1.76% | 5.00% | 1,000.00 | 1,016.24 | 8.90 |

C-Class | 2.51% | 5.00% | 1,000.00 | 1,012.48 | 12.66 |

H-Class | 1.79% | 5.00% | 1,000.00 | 1,016.09 | 9.05 |

Dow 2x Strategy Fund | | | | | |

A-Class | 1.79% | 5.00% | 1,000.00 | 1,016.09 | 9.05 |

C-Class | 2.54% | 5.00% | 1,000.00 | 1,012.33 | 12.81 |

H-Class | 1.79% | 5.00% | 1,000.00 | 1,016.09 | 9.05 |

Inverse Dow 2x Strategy Fund | | | | | |

A-Class | 1.76% | 5.00% | 1,000.00 | 1,016.24 | 8.90 |

C-Class | 2.50% | 5.00% | 1,000.00 | 1,012.53 | 12.61 |

H-Class | 1.80% | 5.00% | 1,000.00 | 1,016.04 | 9.10 |

Russell 2000® 2x Strategy Fund | | | | | |

A-Class | 1.79% | 5.00% | 1,000.00 | 1,016.09 | 9.05 |

C-Class | 2.53% | 5.00% | 1,000.00 | 1,012.38 | 12.76 |

H-Class | 1.81% | 5.00% | 1,000.00 | 1,015.99 | 9.15 |

Inverse Russell 2000® 2x Strategy Fund | | | | | |

A-Class | 1.77% | 5.00% | 1,000.00 | 1,016.19 | 8.95 |

C-Class | 2.52% | 5.00% | 1,000.00 | 1,012.43 | 12.71 |

H-Class | 1.82% | 5.00% | 1,000.00 | 1,015.94 | 9.20 |

1 | Annualized and excludeds expenses of the underlying funds in which the Funds invest, if any. |

2 | Expenses are equal to the Fund’s annualized expense ratio, net of any applicable fee waivers, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). |

3 | Actual cumulative return at net asset value for the period March 31, 2021 to September 30, 2021. |

| | THE RYDEX FUNDS SEMI-ANNUAL REPORT | 9 |

PERFORMANCE REPORT AND FUND PROFILE (Unaudited) | September 30, 2021 |

S&P 500® 2x STRATEGY FUND

OBJECTIVE: Seeks to provide investment results that match, before fees and expenses, the performance of a specific benchmark on a daily basis. The Fund’s current benchmark is 200% of the performance of the S&P 500® Index (the “underlying index”). The Fund does not seek to achieve its investment objective over a period of time greater than one day.

Holdings Diversification (Market Exposure as % of Net Assets)

“Holdings Diversification (Market Exposure as % of Net Assets)” excludes any temporary cash investments.

Inception Dates: |

A-Class | September 1, 2004 |

C-Class | November 27, 2000 |

H-Class | May 19, 2000 |

Ten Largest Holdings (% of Total Net Assets) |

Apple, Inc. | 5.1% |

Microsoft Corp. | 4.9% |

Amazon.com, Inc. | 3.3% |

Facebook, Inc. — Class A | 1.9% |

Alphabet, Inc. — Class A | 1.9% |

Alphabet, Inc. — Class C | 1.7% |

Tesla, Inc. | 1.4% |

NVIDIA Corp. | 1.2% |

Berkshire Hathaway, Inc. — Class B | 1.2% |

JPMorgan Chase & Co. | 1.1% |

Top Ten Total | 23.7% |

| | |

“Ten Largest Holdings” excludes any temporary cash or derivative investments. |

Average Annual Returns*

Periods Ended September 30, 2021

| 6 Month† | 1 Year | 5 Year | 10 Year |

A-Class Shares | 16.97% | 61.49% | 26.97% | 28.26% |

A-Class Shares with sales charge‡ | 11.41% | 53.82% | 25.74% | 27.63% |

C-Class Shares | 16.52% | 60.29% | 26.02% | 27.31% |

C-Class Shares with CDSC§ | 15.52% | 59.29% | 26.02% | 27.31% |

H-Class Shares | 16.97% | 61.48% | 26.96% | 28.24% |

S&P 500 Index | 9.18% | 30.00% | 16.90% | 16.63% |

* | The performance data above represents past performance that is not predictive of future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Returns are historical and include changes in principal and reinvested dividends and capital gains and do not reflect the effect of taxes. The S&P 500 Index is an unmanaged index and, unlike the Fund, has no management fees or operating expenses to reduce its reported return. |

† | 6 month returns are not annualized. |

‡ | Fund returns are calculated using the maximum sales charge of 4.75%. |

§ | Fund returns include a CDSC of 1% if redeemed within 12 months of purchase. |

10 | THE RYDEX FUNDS SEMI-ANNUAL REPORT | |

SCHEDULE OF INVESTMENTS (Unaudited) | September 30, 2021 |

S&P 500® 2x STRATEGY FUND | |

| | Shares | | | Value | |

COMMON STOCKS† - 84.0% |

| | | | | | | | | |

Technology - 19.8% |

Apple, Inc. | | | 87,712 | | | $ | 12,411,248 | |

Microsoft Corp. | | | 41,974 | | | | 11,833,310 | |

NVIDIA Corp. | | | 13,919 | | | | 2,883,460 | |

Adobe, Inc.* | | | 2,661 | | | | 1,531,991 | |

salesforce.com, Inc.* | | | 5,426 | | | | 1,471,640 | |

Intel Corp. | | | 22,660 | | | | 1,207,325 | |

Accenture plc — Class A | | | 3,542 | | | | 1,133,157 | |

Broadcom, Inc. | | | 2,291 | | | | 1,110,975 | |

Texas Instruments, Inc. | | | 5,157 | | | | 991,227 | |

Intuit, Inc. | | | 1,526 | | | | 823,292 | |

QUALCOMM, Inc. | | | 6,300 | | | | 812,574 | |

Oracle Corp. | | | 9,201 | | | | 801,683 | |

Advanced Micro Devices, Inc.* | | | 6,775 | | | | 697,148 | |

International Business Machines Corp. | | | 5,006 | | | | 695,484 | |

ServiceNow, Inc.* | | | 1,106 | | | | 688,231 | |

Applied Materials, Inc. | | | 5,105 | | | | 657,167 | |

Analog Devices, Inc. | | | 3,004 | | | | 503,110 | |

Lam Research Corp. | | | 796 | | | | 453,043 | |

Micron Technology, Inc. | | | 6,288 | | | | 446,322 | |

Fidelity National Information Services, Inc. | | | 3,450 | | | | 419,796 | |

Fiserv, Inc.* | | | 3,329 | | | | 361,196 | |

Autodesk, Inc.* | | | 1,229 | | | | 350,474 | |

Activision Blizzard, Inc. | | | 4,344 | | | | 336,182 | |

NXP Semiconductor N.V. | | | 1,481 | | | | 290,083 | |

KLA Corp. | | | 853 | | | | 285,337 | |

MSCI, Inc. — Class A | | | 460 | | | | 279,836 | |

Roper Technologies, Inc. | | | 589 | | | | 262,771 | |

Synopsys, Inc.* | | | 852 | | | | 255,097 | |

Microchip Technology, Inc. | | | 1,531 | | | | 234,993 | |

Cadence Design Systems, Inc.* | | | 1,546 | | | | 234,126 | |

Electronic Arts, Inc. | | | 1,590 | | | | 226,178 | |

Fortinet, Inc.* | | | 757 | | | | 221,074 | |

Cognizant Technology Solutions Corp. — Class A | | | 2,936 | | | | 217,881 | |

Xilinx, Inc. | | | 1,382 | | | | 208,668 | |

Paychex, Inc. | | | 1,789 | | | | 201,173 | |

HP, Inc. | | | 6,710 | | | | 183,586 | |

ANSYS, Inc.* | | | 487 | | | | 165,799 | |

Zebra Technologies Corp. — Class A* | | | 298 | | | | 153,595 | |

Skyworks Solutions, Inc. | | | 922 | | | | 151,927 | |

Paycom Software, Inc.* | | | 268 | | | | 132,861 | |

Monolithic Power Systems, Inc. | | | 241 | | | | 116,808 | |

Cerner Corp. | | | 1,651 | | | | 116,429 | |

NetApp, Inc. | | | 1,251 | | | | 112,290 | |

Broadridge Financial Solutions, Inc. | | | 649 | | | | 108,149 | |

Tyler Technologies, Inc.* | | | 228 | | | | 104,572 | |

Hewlett Packard Enterprise Co. | | | 7,294 | | | | 103,939 | |

Qorvo, Inc.* | | | 621 | | | | 103,825 | |

Teradyne, Inc. | | | 921 | | | | 100,546 | |

Take-Two Interactive Software, Inc.* | | | 651 | | | | 100,300 | |

Western Digital Corp.* | | | 1,712 | | | | 96,625 | |

Seagate Technology Holdings plc | | | 1,170 | | | | 96,548 | |

Akamai Technologies, Inc.* | | | 909 | | | | 95,072 | |

Ceridian HCM Holding, Inc.* | | | 753 | | | | 84,803 | |

Leidos Holdings, Inc. | | | 791 | | | | 76,039 | |

Citrix Systems, Inc. | | | 694 | | | | 74,515 | |

PTC, Inc.* | | | 590 | | | | 70,676 | |

Jack Henry & Associates, Inc. | | | 415 | | | | 68,085 | |

DXC Technology Co.* | | | 1,407 | | | | 47,289 | |

IPG Photonics Corp.* | | | 200 | | | | 31,680 | |

Total Technology | | | | | | | 48,033,210 | |

| | | | | | | | | |

Consumer, Non-cyclical - 16.8% |

Johnson & Johnson | | | 14,704 | | | | 2,374,696 | |

UnitedHealth Group, Inc. | | | 5,267 | | | | 2,058,028 | |

Procter & Gamble Co. | | | 13,558 | | | | 1,895,409 | |

PayPal Holdings, Inc.* | | | 6,563 | | | | 1,707,758 | |

Pfizer, Inc. | | | 31,316 | | | | 1,346,901 | |

Thermo Fisher Scientific, Inc. | | | 2,197 | | | | 1,255,212 | |

Abbott Laboratories | | | 9,902 | | | | 1,169,723 | |

PepsiCo, Inc. | | | 7,720 | | | | 1,161,165 | |

Coca-Cola Co. | | | 21,699 | | | | 1,138,547 | |

Danaher Corp. | | | 3,549 | | | | 1,080,458 | |

AbbVie, Inc. | | | 9,870 | | | | 1,064,677 | |

Merck & Company, Inc. | | | 14,139 | | | | 1,061,980 | |

Eli Lilly & Co. | | | 4,435 | | | | 1,024,707 | |

Medtronic plc | | | 7,506 | | | | 940,877 | |

Philip Morris International, Inc. | | �� | 8,705 | | | | 825,147 | |

Moderna, Inc.* | | | 1,961 | | | | 754,710 | |

Bristol-Myers Squibb Co. | | | 12,412 | | | | 734,418 | |

Amgen, Inc. | | | 3,172 | | | | 674,526 | |

Intuitive Surgical, Inc.* | | | 664 | | | | 660,116 | |

CVS Health Corp. | | | 7,370 | | | | 625,418 | |

S&P Global, Inc. | | | 1,346 | | | | 571,902 | |

Zoetis, Inc. | | | 2,647 | | | | 513,889 | |

Anthem, Inc. | | | 1,362 | | | | 507,754 | |

Stryker Corp. | | | 1,875 | | | | 494,475 | |

Gilead Sciences, Inc. | | | 7,003 | | | | 489,160 | |

Automatic Data Processing, Inc. | | | 2,363 | | | | 472,411 | |

Altria Group, Inc. | | | 10,300 | | | | 468,856 | |

Mondelez International, Inc. — Class A | | | 7,807 | | | | 454,211 | |

Becton Dickinson and Co. | | | 1,604 | | | | 394,295 | |

Edwards Lifesciences Corp.* | | | 3,482 | | | | 394,197 | |

Estee Lauder Companies, Inc. — Class A | | | 1,295 | | | | 388,409 | |

Cigna Corp. | | | 1,900 | | | | 380,304 | |

Colgate-Palmolive Co. | | | 4,711 | | | | 356,057 | |

Regeneron Pharmaceuticals, Inc.* | | | 587 | | | | 355,241 | |

Boston Scientific Corp.* | | | 7,953 | | | | 345,081 | |

HCA Healthcare, Inc. | | | 1,377 | | | | 334,225 | |

Illumina, Inc.* | | | 819 | | | | 332,195 | |

Moody’s Corp. | | | 905 | | | | 321,375 | |

IDEXX Laboratories, Inc.* | | | 475 | | | | 295,402 | |

Dexcom, Inc.* | | | 540 | | | | 295,304 | |

Humana, Inc. | | | 718 | | | | 279,410 | |

Align Technology, Inc.* | | | 410 | | | | 272,826 | |

Vertex Pharmaceuticals, Inc.* | | | 1,449 | | | | 262,834 | |

IHS Markit Ltd. | | | 2,226 | | | | 259,596 | |

Global Payments, Inc. | | | 1,641 | | | | 258,589 | |

IQVIA Holdings, Inc.* | | | 1,070 | | | | 256,308 | |

Kimberly-Clark Corp. | | | 1,881 | | | | 249,120 | |

Biogen, Inc.* | | | 832 | | | | 235,448 | |

SEE NOTES TO FINANCIAL STATEMENTS. | THE RYDEX FUNDS SEMI-ANNUAL REPORT | 11 |

SCHEDULE OF INVESTMENTS (Unaudited)(continued) | September 30, 2021 |

S&P 500® 2x STRATEGY FUND | |

| | Shares | | | Value | |

Baxter International, Inc. | | | 2,792 | | | $ | 224,561 | |

Sysco Corp. | | | 2,857 | | | | 224,274 | |

ResMed, Inc. | | | 813 | | | | 214,266 | |

Centene Corp.* | | | 3,257 | | | | 202,944 | |

General Mills, Inc. | | | 3,386 | | | | 202,551 | |

Constellation Brands, Inc. — Class A | | | 940 | | | | 198,049 | |

Archer-Daniels-Midland Co. | | | 3,124 | | | | 187,471 | |

Monster Beverage Corp.* | | | 2,097 | | | | 186,276 | |

Cintas Corp. | | | 489 | | | | 186,143 | |

Verisk Analytics, Inc. — Class A | | | 901 | | | | 180,443 | |

West Pharmaceutical Services, Inc. | | | 413 | | | | 175,335 | |

Equifax, Inc. | | | 681 | | | | 172,579 | |

Corteva, Inc. | | | 4,101 | | | | 172,570 | |

McKesson Corp. | | | 864 | | | | 172,264 | |

Zimmer Biomet Holdings, Inc. | | | 1,166 | | | | 170,656 | |

Kroger Co. | | | 3,798 | | | | 153,553 | |

Laboratory Corporation of America Holdings* | | | 540 | | | | 151,978 | |

Gartner, Inc.* | | | 467 | | | | 141,912 | |

United Rentals, Inc.* | | | 404 | | | | 141,776 | |

Kraft Heinz Co. | | | 3,758 | | | | 138,370 | |

Hershey Co. | | | 812 | | | | 137,431 | |

Tyson Foods, Inc. — Class A | | | 1,647 | | | | 130,014 | |

Catalent, Inc.* | | | 951 | | | | 126,549 | |

FleetCor Technologies, Inc.* | | | 461 | | | | 120,445 | |

Charles River Laboratories International, Inc.* | | | 281 | | | | 115,960 | |

STERIS plc | | | 557 | | | | 113,784 | |

Cooper Companies, Inc. | | | 275 | | | | 113,660 | |

Clorox Co. | | | 686 | | | | 113,608 | |

Church & Dwight Company, Inc. | | | 1,371 | | | | 113,204 | |

McCormick & Company, Inc. | | | 1,392 | | | | 112,794 | |

PerkinElmer, Inc. | | | 626 | | | | 108,479 | |

Bio-Techne Corp. | | | 217 | | | | 105,152 | |

Hologic, Inc.* | | | 1,416 | | | | 104,515 | |

AmerisourceBergen Corp. — Class A | | | 836 | | | | 99,860 | |

Quest Diagnostics, Inc. | | | 682 | | | | 99,101 | |

Teleflex, Inc. | | | 261 | | | | 98,279 | |

Avery Dennison Corp. | | | 463 | | | | 95,938 | |

Viatris, Inc. | | | 6,754 | | | | 91,517 | |

Kellogg Co. | | | 1,428 | | | | 91,278 | |

Conagra Brands, Inc. | | | 2,683 | | | | 90,873 | |

Bio-Rad Laboratories, Inc. — Class A* | | | 120 | | | | 89,514 | |

MarketAxess Holdings, Inc. | | | 212 | | | | 89,186 | |

Quanta Services, Inc. | | | 777 | | | | 88,438 | |

ABIOMED, Inc.* | | | 253 | | | | 82,357 | |

Cardinal Health, Inc. | | | 1,621 | | | | 80,175 | |

J M Smucker Co. | | | 605 | | | | 72,618 | |

Incyte Corp.* | | | 1,048 | | | | 72,081 | |

Dentsply Sirona, Inc. | | | 1,221 | | | | 70,879 | |

Brown-Forman Corp. — Class B | | | 1,021 | | | | 68,417 | |

Hormel Foods Corp. | | | 1,574 | | | | 64,534 | |

Robert Half International, Inc. | | | 625 | | | | 62,706 | |

Henry Schein, Inc.* | | | 780 | | | | 59,405 | |

Universal Health Services, Inc. — Class B | | | 424 | | | | 58,669 | |

Lamb Weston Holdings, Inc. | | | 811 | | | | 49,771 | |

Molson Coors Beverage Co. — Class B | | | 1,052 | | | | 48,792 | |

Campbell Soup Co. | | | 1,134 | | | | 47,413 | |

Organon & Co. | | | 1,416 | | | | 46,431 | |

Rollins, Inc. | | | 1,264 | | | | 44,657 | |

DaVita, Inc.* | | | 375 | | | | 43,597 | |

Nielsen Holdings plc | | | 2,004 | | | | 38,457 | |

Total Consumer, Non-cyclical | | | | | | | 40,851,856 | |

| | | | | | | | | |

Communications - 13.8% |

Amazon.com, Inc.* | | | 2,433 | | | | 7,992,502 | |

Facebook, Inc. — Class A* | | | 13,315 | | | | 4,518,978 | |

Alphabet, Inc. — Class A* | | | 1,682 | | | | 4,496,861 | |

Alphabet, Inc. — Class C* | | | 1,574 | | | | 4,195,198 | |

Walt Disney Co.* | | | 10,149 | | | | 1,716,906 | |

Netflix, Inc.* | | | 2,472 | | | | 1,508,760 | |

Comcast Corp. — Class A | | | 25,583 | | | | 1,430,857 | |

Cisco Systems, Inc. | | | 23,538 | | | | 1,281,173 | |

Verizon Communications, Inc. | | | 23,124 | | | | 1,248,927 | |

AT&T, Inc. | | | 39,880 | | | | 1,077,159 | |

Booking Holdings, Inc.* | | | 229 | | | | 543,616 | |

Charter Communications, Inc. — Class A* | | | 708 | | | | 515,113 | |

T-Mobile US, Inc.* | | | 3,276 | | | | 418,542 | |

Twitter, Inc.* | | | 4,457 | | | | 269,158 | |

eBay, Inc. | | | 3,631 | | | | 252,972 | |

Match Group, Inc.* | | | 1,546 | | | | 242,707 | |

Motorola Solutions, Inc. | | | 946 | | | | 219,775 | |

Corning, Inc. | | | 4,293 | | | | 156,652 | |

Etsy, Inc.* | | | 707 | | | | 147,028 | |

CDW Corp. | | | 768 | | | | 139,791 | |

ViacomCBS, Inc. — Class B | | | 3,384 | | | | 133,702 | |

Expedia Group, Inc.* | | | 812 | | | | 133,087 | |

VeriSign, Inc.* | | | 544 | | | | 111,525 | |

Arista Networks, Inc.* | | | 313 | | | | 107,559 | |

Omnicom Group, Inc. | | | 1,198 | | | | 86,807 | |

NortonLifeLock, Inc. | | | 3,247 | | | | 82,149 | |

Interpublic Group of Companies, Inc. | | | 2,199 | | | | 80,638 | |

Fox Corp. — Class A | | | 1,806 | | | | 72,439 | |

Lumen Technologies, Inc. | | | 5,556 | | | | 68,839 | |

F5 Networks, Inc.* | | | 337 | | | | 66,989 | |

DISH Network Corp. — Class A* | | | 1,390 | | | | 60,409 | |

News Corp. — Class A | | | 2,185 | | | | 51,413 | |

Juniper Networks, Inc. | | | 1,816 | | | | 49,976 | |

Discovery, Inc. — Class C* | | | 1,696 | | | | 41,162 | |

Fox Corp. — Class B | | | 828 | | | | 30,735 | |

Discovery, Inc. — Class A*,1 | | | 944 | | | | 23,959 | |

News Corp. — Class B | | | 680 | | | | 15,796 | |

Total Communications | | | | | | | 33,589,859 | |

| | | | | | | | | |

Financial - 12.8% |

Berkshire Hathaway, Inc. — Class B* | | | 10,354 | | | | 2,826,021 | |

JPMorgan Chase & Co. | | | 16,690 | | | | 2,731,986 | |

Visa, Inc. — Class A | | | 9,426 | | | | 2,099,641 | |

Bank of America Corp. | | | 41,361 | | | | 1,755,774 | |

Mastercard, Inc. — Class A | | | 4,866 | | | | 1,691,811 | |

Wells Fargo & Co. | | | 22,936 | | | | 1,064,460 | |

Citigroup, Inc. | | | 11,321 | | | | 794,508 | |

Morgan Stanley | | | 8,153 | | | | 793,368 | |

12 | THE RYDEX FUNDS SEMI-ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

SCHEDULE OF INVESTMENTS (Unaudited)(continued) | September 30, 2021 |

S&P 500® 2x STRATEGY FUND | |

| | Shares | | | Value | |

Goldman Sachs Group, Inc. | | | 1,883 | | | $ | 711,831 | |

American Tower Corp. — Class A REIT | | | 2,542 | | | | 674,672 | |

BlackRock, Inc. — Class A | | | 799 | | | | 670,089 | |

Charles Schwab Corp. | | | 8,385 | | | | 610,763 | |

American Express Co. | | | 3,594 | | | | 602,103 | |

Prologis, Inc. REIT | | | 4,129 | | | | 517,900 | |

PNC Financial Services Group, Inc. | | | 2,374 | | | | 464,449 | |

U.S. Bancorp | | | 7,536 | | | | 447,940 | |

Truist Financial Corp. | | | 7,456 | | | | 437,294 | |

Marsh & McLennan Companies, Inc. | | | 2,830 | | | | 428,547 | |

Chubb Ltd. | | | 2,451 | | | | 425,199 | |

Crown Castle International Corp. REIT | | | 2,414 | | | | 418,394 | |

Capital One Financial Corp. | | | 2,492 | | | | 403,629 | |

Equinix, Inc. REIT | | | 501 | | | | 395,855 | |

CME Group, Inc. — Class A | | | 2,006 | | | | 387,920 | |

Intercontinental Exchange, Inc. | | | 3,145 | | | | 361,109 | |

Aon plc — Class A | | | 1,261 | | | | 360,356 | |

Progressive Corp. | | | 3,268 | | | | 295,394 | |

American International Group, Inc. | | | 4,777 | | | | 262,209 | |

Public Storage REIT | | | 851 | | | | 252,832 | |

MetLife, Inc. | | | 4,068 | | | | 251,118 | |

T. Rowe Price Group, Inc. | | | 1,268 | | | | 249,416 | |

Simon Property Group, Inc. REIT | | | 1,835 | | | | 238,495 | |

Bank of New York Mellon Corp. | | | 4,436 | | | | 229,962 | |

Digital Realty Trust, Inc. REIT | | | 1,578 | | | | 227,942 | |

Prudential Financial, Inc. | | | 2,160 | | | | 227,232 | |

SVB Financial Group* | | | 328 | | | | 212,177 | |

Travelers Companies, Inc. | | | 1,394 | | | | 211,902 | |

Allstate Corp. | | | 1,652 | | | | 210,316 | |

Discover Financial Services | | | 1,673 | | | | 205,528 | |

SBA Communications Corp. REIT | | | 612 | | | | 202,309 | |

Welltower, Inc. REIT | | | 2,360 | | | | 194,464 | |

First Republic Bank | | | 985 | | | | 189,987 | |

CBRE Group, Inc. — Class A* | | | 1,875 | | | | 182,550 | |

Aflac, Inc. | | | 3,447 | | | | 179,692 | |

State Street Corp. | | | 2,042 | | | | 172,998 | |

AvalonBay Communities, Inc. REIT | | | 780 | | | | 172,879 | |

Arthur J Gallagher & Co. | | | 1,155 | | | | 171,691 | |

Ameriprise Financial, Inc. | | | 635 | | | | 167,716 | |

Willis Towers Watson plc | | | 721 | | | | 167,604 | |

Fifth Third Bancorp | | | 3,858 | | | | 163,734 | |

Synchrony Financial | | | 3,182 | | | | 155,536 | |

Equity Residential REIT | | | 1,903 | | | | 153,991 | |

Weyerhaeuser Co. REIT | | | 4,188 | | | | 148,967 | |

Alexandria Real Estate Equities, Inc. REIT | | | 774 | | | | 147,888 | |

Realty Income Corp. REIT | | | 2,175 | | | | 141,070 | |

Hartford Financial Services Group, Inc. | | | 1,939 | | | | 136,215 | |

Huntington Bancshares, Inc. | | | 8,247 | | | | 127,499 | |

Nasdaq, Inc. | | | 654 | | | | 126,235 | |

Northern Trust Corp. | | | 1,164 | | | | 125,491 | |

Extra Space Storage, Inc. REIT | | | 747 | | | | 125,489 | |

Ventas, Inc. REIT | | | 2,198 | | | | 121,352 | |

Mid-America Apartment Communities, Inc. REIT | | | 648 | | | | 121,014 | |

Essex Property Trust, Inc. REIT | | | 363 | | | | 116,066 | |

KeyCorp | | | 5,342 | | | | 115,494 | |

Regions Financial Corp. | | | 5,332 | | | | 113,625 | |

Citizens Financial Group, Inc. | | | 2,380 | | | | 111,812 | |

M&T Bank Corp. | | | 719 | | | | 107,376 | |

Duke Realty Corp. REIT | | | 2,113 | | | | 101,149 | |

Healthpeak Properties, Inc. REIT | | | 3,010 | | | | 100,775 | |

Cincinnati Financial Corp. | | | 837 | | | | 95,602 | |

Raymond James Financial, Inc. | | | 1,034 | | | | 95,418 | |

Principal Financial Group, Inc. | | | 1,394 | | | | 89,774 | |

Boston Properties, Inc. REIT | | | 794 | | | | 86,030 | |

UDR, Inc. REIT | | | 1,559 | | | | 82,596 | |

Cboe Global Markets, Inc. | | | 596 | | | | 73,821 | |

Brown & Brown, Inc. | | | 1,306 | | | | 72,418 | |

Kimco Realty Corp. REIT | | | 3,427 | | | | 71,110 | |

Iron Mountain, Inc. REIT | | | 1,617 | | | | 70,259 | |

Lincoln National Corp. | | | 987 | | | | 67,856 | |

Host Hotels & Resorts, Inc. REIT* | | | 3,988 | | | | 65,124 | |

Loews Corp. | | | 1,135 | | | | 61,210 | |

Comerica, Inc. | | | 748 | | | | 60,214 | |

Regency Centers Corp. REIT | | | 854 | | | | 57,500 | |

W R Berkley Corp. | | | 783 | | | | 57,300 | |

Zions Bancorp North America | | | 905 | | | | 56,010 | |

Everest Re Group Ltd. | | | 223 | | | | 55,924 | |

Assurant, Inc. | | | 329 | | | | 51,900 | |

Franklin Resources, Inc. | | | 1,573 | | | | 46,750 | |

Globe Life, Inc. | | | 523 | | | | 46,563 | |

Federal Realty Investment Trust REIT | | | 391 | | | | 46,134 | |

Invesco Ltd. | | | 1,907 | | | | 45,978 | |

Western Union Co. | | | 2,270 | | | | 45,899 | |

People’s United Financial, Inc. | | | 2,390 | | | | 41,753 | |

Vornado Realty Trust REIT | | | 888 | | | | 37,305 | |

Total Financial | | | | | | | 31,093,258 | |

| | | | | | | | | |

Consumer, Cyclical - 8.1% |

Tesla, Inc.* | | | 4,532 | | | | 3,514,475 | |

Home Depot, Inc. | | | 5,939 | | | | 1,949,536 | |

Walmart, Inc. | | | 7,982 | | | | 1,112,531 | |

Costco Wholesale Corp. | | | 2,469 | | | | 1,109,445 | |

NIKE, Inc. — Class B | | | 7,139 | | | | 1,036,797 | |

McDonald’s Corp. | | | 4,171 | | | | 1,005,670 | |

Lowe’s Companies, Inc. | | | 3,948 | | | | 800,891 | |

Starbucks Corp. | | | 6,586 | | | | 726,502 | |

Target Corp. | | | 2,763 | | | | 632,091 | |

TJX Companies, Inc. | | | 6,739 | | | | 444,639 | |

General Motors Co.* | | | 8,109 | | | | 427,425 | |

Ford Motor Co.* | | | 21,917 | | | | 310,345 | |

Chipotle Mexican Grill, Inc. — Class A* | | | 157 | | | | 285,351 | |

Dollar General Corp. | | | 1,319 | | | | 279,813 | |

O’Reilly Automotive, Inc.* | | | 385 | | | | 235,258 | |

Marriott International, Inc. — Class A* | | | 1,528 | | | | 226,282 | |

Aptiv plc* | | | 1,511 | | | | 225,094 | |

Ross Stores, Inc. | | | 1,995 | | | | 217,156 | |

Hilton Worldwide Holdings, Inc.* | | | 1,557 | | | | 205,695 | |

AutoZone, Inc.* | | | 120 | | | | 203,759 | |

Yum! Brands, Inc. | | | 1,651 | | | | 201,934 | |

Walgreens Boots Alliance, Inc. | | | 4,010 | | | | 188,670 | |

Cummins, Inc. | | | 802 | | | | 180,097 | |

Southwest Airlines Co.* | | | 3,305 | | | | 169,976 | |

SEE NOTES TO FINANCIAL STATEMENTS. | THE RYDEX FUNDS SEMI-ANNUAL REPORT | 13 |

SCHEDULE OF INVESTMENTS (Unaudited)(continued) | September 30, 2021 |

S&P 500® 2x STRATEGY FUND | |

| | Shares | | | Value | |

Fastenal Co. | | | 3,210 | | | $ | 165,668 | |

Copart, Inc.* | | | 1,189 | | | | 164,938 | |

PACCAR, Inc. | | | 1,939 | | | | 153,026 | |

DR Horton, Inc. | | | 1,821 | | | | 152,909 | |

Delta Air Lines, Inc.* | | | 3,574 | | | | 152,288 | |

Lennar Corp. — Class A | | | 1,534 | | | | 143,705 | |

Caesars Entertainment, Inc.* | | | 1,192 | | | | 133,838 | |

Best Buy Company, Inc. | | | 1,259 | | | | 133,089 | |

Tractor Supply Co. | | | 639 | | | | 129,468 | |

Dollar Tree, Inc.* | | | 1,296 | | | | 124,053 | |

VF Corp. | | | 1,820 | | | | 121,922 | |

CarMax, Inc.* | | | 910 | | | | 116,444 | |

Carnival Corp.* | | | 4,460 | | | | 111,545 | |

Royal Caribbean Cruises Ltd.* | | | 1,252 | | | | 111,365 | |

Ulta Beauty, Inc.* | | | 306 | | | | 110,441 | |

Darden Restaurants, Inc. | | | 728 | | | | 110,270 | |

Domino’s Pizza, Inc. | | | 206 | | | | 98,254 | |

Pool Corp. | | | 224 | | | | 97,308 | |

Genuine Parts Co. | | | 800 | | | | 96,984 | |

MGM Resorts International | | | 2,234 | | | | 96,397 | |

WW Grainger, Inc. | | | 244 | | | | 95,907 | |

Bath & Body Works, Inc. | | | 1,479 | | | | 93,221 | |

NVR, Inc.* | | | 19 | | | | 91,088 | |

United Airlines Holdings, Inc.* | | | 1,808 | | | | 86,007 | |

Advance Auto Parts, Inc. | | | 366 | | | | 76,454 | |

LKQ Corp.* | | | 1,510 | | | | 75,983 | |

American Airlines Group, Inc.* | | | 3,616 | | | | 74,200 | |

Whirlpool Corp. | | | 350 | | | | 71,351 | |

Las Vegas Sands Corp.* | | | 1,920 | | | | 70,272 | |

Live Nation Entertainment, Inc.* | | | 736 | | | | 67,071 | |

PulteGroup, Inc. | | | 1,450 | | | | 66,584 | |

Hasbro, Inc. | | | 723 | | | | 64,506 | |

Penn National Gaming, Inc.* | | | 876 | | | | 63,475 | |

BorgWarner, Inc. | | | 1,339 | | | | 57,858 | |

Tapestry, Inc. | | | 1,558 | | | | 57,677 | |

Mohawk Industries, Inc.* | | | 312 | | | | 55,349 | |

Norwegian Cruise Line Holdings Ltd.* | | | 2,067 | | | | 55,210 | |

Wynn Resorts Ltd.* | | | 588 | | | | 49,833 | |

Newell Brands, Inc. | | | 2,115 | | | | 46,826 | |

PVH Corp.* | | | 399 | | | | 41,013 | |

Alaska Air Group, Inc.* | | | 699 | | | | 40,962 | |

Hanesbrands, Inc. | | | 1,950 | | | | 33,462 | |

Leggett & Platt, Inc. | | | 745 | | | | 33,406 | |

Ralph Lauren Corp. — Class A | | | 272 | | | | 30,203 | |

Gap, Inc. | | | 1,202 | | | | 27,285 | |

Under Armour, Inc. — Class A* | | | 1,054 | | | | 21,270 | |

Under Armour, Inc. — Class C* | | | 1,164 | | | | 20,393 | |

Total Consumer, Cyclical | | | | | | | 19,780,210 | |

| | | | | | | | | |

Industrial - 6.5% |

Honeywell International, Inc. | | | 3,856 | | | | 818,552 | |

United Parcel Service, Inc. — Class B | | | 4,068 | | | | 740,783 | |

Raytheon Technologies Corp. | | | 8,422 | | | | 723,955 | |

Union Pacific Corp. | | | 3,642 | | | | 713,868 | |

Boeing Co.* | | | 3,077 | | | | 676,755 | |

General Electric Co. | | | 6,131 | | | | 631,677 | |

Caterpillar, Inc. | | | 3,058 | | | | 587,044 | |

3M Co. | | | 3,232 | | | | 566,957 | |

Deere & Co. | | | 1,586 | | | | 531,421 | |

Lockheed Martin Corp. | | | 1,377 | | | | 475,203 | |

CSX Corp. | | | 12,592 | | | | 374,486 | |

Eaton Corporation plc | | | 2,226 | | | | 332,364 | |

Illinois Tool Works, Inc. | | | 1,601 | | | | 330,815 | |

Norfolk Southern Corp. | | | 1,379 | | | | 329,926 | |

Waste Management, Inc. | | | 2,164 | | | | 323,215 | |

Emerson Electric Co. | | | 3,339 | | | | 314,534 | |

Northrop Grumman Corp. | | | 841 | | | | 302,886 | |

FedEx Corp. | | | 1,374 | | | | 301,305 | |

Johnson Controls International plc | | | 3,978 | | | | 270,822 | |

Agilent Technologies, Inc. | | | 1,695 | | | | 267,013 | |

General Dynamics Corp. | | | 1,296 | | | | 254,055 | |

TE Connectivity Ltd. | | | 1,832 | | | | 251,387 | |

Carrier Global Corp. | | | 4,846 | | | | 250,829 | |

L3Harris Technologies, Inc. | | | 1,122 | | | | 247,109 | |

Amphenol Corp. — Class A | | | 3,341 | | | | 244,661 | |

Trane Technologies plc | | | 1,327 | | | | 229,107 | |

Parker-Hannifin Corp. | | | 721 | | | | 201,606 | |

Otis Worldwide Corp. | | | 2,384 | | | | 196,155 | |

Rockwell Automation, Inc. | | | 648 | | | | 190,538 | |

TransDigm Group, Inc.* | | | 292 | | | | 182,375 | |

Mettler-Toledo International, Inc.* | | | 129 | | | | 177,680 | |

Keysight Technologies, Inc.* | | | 1,029 | | | | 169,054 | |

Ball Corp. | | | 1,824 | | | | 164,105 | |

AMETEK, Inc. | | | 1,291 | | | | 160,097 | |

Stanley Black & Decker, Inc. | | | 910 | | | | 159,532 | |

Old Dominion Freight Line, Inc. | | | 524 | | | | 149,854 | |

Generac Holdings, Inc.* | | | 353 | | | | 144,260 | |

Fortive Corp. | | | 2,002 | | | | 141,281 | |

Republic Services, Inc. — Class A | | | 1,174 | | | | 140,951 | |

Kansas City Southern | | | 508 | | | | 137,485 | |

Garmin Ltd. | | | 849 | | | | 131,986 | |

Vulcan Materials Co. | | | 741 | | | | 125,348 | |

Dover Corp. | | | 804 | | | | 125,022 | |

Xylem, Inc. | | | 1,006 | | | | 124,422 | |

Waters Corp.* | | | 343 | | | | 122,554 | |

Martin Marietta Materials, Inc. | | | 348 | | | | 118,905 | |

Trimble, Inc.* | | | 1,405 | | | | 115,561 | |

Ingersoll Rand, Inc.* | | | 2,263 | | | | 114,078 | |

Expeditors International of Washington, Inc. | | | 949 | | | | 113,054 | |

Teledyne Technologies, Inc.* | | | 260 | | | | 111,691 | |

Amcor plc | | | 8,612 | | | | 99,813 | |

Jacobs Engineering Group, Inc. | | | 728 | | | | 96,482 | |

Westinghouse Air Brake Technologies Corp. | | | 1,056 | | | | 91,038 | |

IDEX Corp. | | | 424 | | | | 87,747 | |

Textron, Inc. | | | 1,252 | | | | 87,402 | |

J.B. Hunt Transport Services, Inc. | | | 470 | | | | 78,593 | |

Masco Corp. | | | 1,381 | | | | 76,714 | |

Westrock Co. | | | 1,491 | | | | 74,297 | |

Packaging Corporation of America | | | 531 | | | | 72,981 | |

Fortune Brands Home & Security, Inc. | | | 770 | | | | 68,853 | |

Howmet Aerospace, Inc. | | | 2,156 | | | | 67,267 | |

Pentair plc | | | 926 | | | | 67,255 | |

14 | THE RYDEX FUNDS SEMI-ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

SCHEDULE OF INVESTMENTS (Unaudited)(continued) | September 30, 2021 |

S&P 500® 2x STRATEGY FUND | |

| | Shares | | | Value | |

Allegion plc | | | 501 | | | $ | 66,222 | |

CH Robinson Worldwide, Inc. | | | 736 | | | | 64,032 | |

Snap-on, Inc. | | | 301 | | | | 62,894 | |

Sealed Air Corp. | | | 837 | | | | 45,859 | |

A O Smith Corp. | | | 744 | | | | 45,436 | |

Huntington Ingalls Industries, Inc. | | | 224 | | | | 43,246 | |

Total Industrial | | | | | | | 15,904,454 | |

| | | | | | | | | |

Energy - 2.4% |

Exxon Mobil Corp. | | | 23,646 | | | | 1,390,858 | |

Chevron Corp. | | | 10,802 | | | | 1,095,863 | |

ConocoPhillips | | | 7,479 | | | | 506,852 | |

EOG Resources, Inc. | | | 3,261 | | | | 261,760 | |

Schlumberger N.V. | | | 7,811 | | | | 231,518 | |

Marathon Petroleum Corp. | | | 3,565 | | | | 220,353 | |

Pioneer Natural Resources Co. | | | 1,267 | | | | 210,968 | |

Kinder Morgan, Inc. | | | 10,887 | | | | 182,140 | |

Williams Companies, Inc. | | | 6,786 | | | | 176,029 | |

Phillips 66 | | | 2,446 | | | | 171,293 | |

Valero Energy Corp. | | | 2,283 | | | | 161,111 | |

Occidental Petroleum Corp. | | | 4,955 | | | | 146,569 | |

ONEOK, Inc. | | | 2,489 | | | | 144,337 | |

Devon Energy Corp. | | | 3,517 | | | | 124,889 | |

Hess Corp. | | | 1,539 | | | | 120,211 | |

Baker Hughes Co. | | | 4,627 | | | | 114,426 | |

Enphase Energy, Inc.* | | | 752 | | | | 112,777 | |

Halliburton Co. | | | 4,974 | | | | 107,538 | |

Diamondback Energy, Inc. | | | 951 | | | | 90,031 | |

Marathon Oil Corp. | | | 4,404 | | | | 60,203 | |

Cabot Oil & Gas Corp. — Class A | | | 2,232 | | | | 48,568 | |

APA Corp. | | | 2,111 | | | | 45,239 | |

Total Energy | | | | | | | 5,723,533 | |

| | | | | | | | | |

Utilities - 2.1% |

NextEra Energy, Inc. | | | 10,957 | | | | 860,344 | |

Duke Energy Corp. | | | 4,297 | | | | 419,344 | |

Southern Co. | | | 5,914 | | | | 366,491 | |

Dominion Energy, Inc. | | | 4,516 | | | | 329,758 | |

Exelon Corp. | | | 5,462 | | | | 264,033 | |

American Electric Power Company, Inc. | | | 2,794 | | | | 226,817 | |

Sempra Energy | | | 1,784 | | | | 225,676 | |

Xcel Energy, Inc. | | | 3,007 | | | | 187,937 | |

Public Service Enterprise Group, Inc. | | | 2,824 | | | | 171,982 | |

American Water Works Company, Inc. | | | 1,014 | | | | 171,407 | |

Eversource Energy | | | 1,919 | | | | 156,897 | |

WEC Energy Group, Inc. | | | 1,762 | | | | 155,408 | |

Consolidated Edison, Inc. | | | 1,974 | | | | 143,293 | |

DTE Energy Co. | | | 1,082 | | | | 120,870 | |

PPL Corp. | | | 4,299 | | | | 119,856 | |

Edison International | | | 2,121 | | | | 117,652 | |

Ameren Corp. | | | 1,436 | | | | 116,316 | |

Entergy Corp. | | | 1,122 | | | | 111,426 | |

FirstEnergy Corp. | | | 3,040 | | | | 108,285 | |

CMS Energy Corp. | | | 1,618 | | | | 96,643 | |

AES Corp. | | | 3,722 | | | | 84,973 | |

CenterPoint Energy, Inc. | | | 3,312 | | | | 81,475 | |

Evergy, Inc. | | | 1,281 | | | | 79,678 | |

Alliant Energy Corp. | | | 1,398 | | | | 78,260 | |

Atmos Energy Corp. | | | 731 | | | | 64,474 | |

NRG Energy, Inc. | | | 1,367 | | | | 55,815 | |

NiSource, Inc. | | | 2,192 | | | | 53,112 | |

Pinnacle West Capital Corp. | | | 630 | | | | 45,587 | |

Total Utilities | | | | | | | 5,013,809 | |

| | | | | | | | | |

Basic Materials - 1.7% |

Linde plc | | | 2,884 | | | | 846,108 | |

Sherwin-Williams Co. | | | 1,353 | | | | 378,475 | |

Air Products and Chemicals, Inc. | | | 1,236 | | | | 316,552 | |

Ecolab, Inc. | | | 1,390 | | | | 289,982 | |

Freeport-McMoRan, Inc. | | | 8,200 | | | | 266,746 | |

Newmont Corp. | | | 4,463 | | | | 242,341 | |

Dow, Inc. | | | 4,165 | | | | 239,737 | |

DuPont de Nemours, Inc. | | | 2,922 | | | | 198,667 | |

PPG Industries, Inc. | | | 1,326 | | | | 189,631 | |

International Flavors & Fragrances, Inc. | | | 1,391 | | | | 186,004 | |

Nucor Corp. | | | 1,640 | | | | 161,524 | |

Albemarle Corp. | | | 653 | | | | 142,987 | |

LyondellBasell Industries N.V. — Class A | | | 1,476 | | | | 138,523 | |

International Paper Co. | | | 2,183 | | | | 122,073 | |

Celanese Corp. — Class A | | | 621 | | | | 93,547 | |

Eastman Chemical Co. | | | 758 | | | | 76,361 | |

Mosaic Co. | | | 1,931 | | | | 68,975 | |

CF Industries Holdings, Inc. | | | 1,201 | | | | 67,040 | |

FMC Corp. | | | 719 | | | | 65,832 | |

Total Basic Materials | | | | | | | 4,091,105 | |

| | | | | | | | | |

Total Common Stocks | | | | |

(Cost $159,563,378) | | | | | | | 204,081,294 | |

| | | | | | | | | |

| | | Face

Amount | | | | | |

U.S. TREASURY BILLS†† - 4.3% |

U.S. Treasury Bills |

0.05% due 12/09/212,3 | | $ | 4,100,000 | | | | 4,099,801 | |

0.04% due 12/09/212,3 | | | 3,925,000 | | | | 3,924,810 | |

0.03% due 12/09/212,3 | | | 1,550,000 | | | | 1,549,925 | |

0.04% due 10/07/213 | | | 1,018,000 | | | | 1,017,995 | |

Total U.S. Treasury Bills | | | | |

(Cost $10,592,254) | | | | | | | 10,592,531 | |

| | | | | | | | | |

FEDERAL AGENCY NOTES†† - 0.1% |

Federal Farm Credit Bank |

3.50% due 10/15/25 | | | 150,000 | | | | 150,199 | |

Total Federal Agency Notes | | | | |

(Cost $152,021) | | | | | | | 150,199 | |

| | | | | | | | | |

REPURCHASE AGREEMENTS††,4 - 11.6% |

J.P. Morgan Securities LLC

issued 09/30/21 at 0.05%

due 10/01/212 | | | 15,860,898 | | | | 15,860,898 | |

BofA Securities, Inc.

issued 09/30/21 at 0.02%

due 10/01/212 | | | 6,162,768 | | | | 6,162,768 | |

SEE NOTES TO FINANCIAL STATEMENTS. | THE RYDEX FUNDS SEMI-ANNUAL REPORT | 15 |

SCHEDULE OF INVESTMENTS (Unaudited)(continued) | September 30, 2021 |

S&P 500® 2x STRATEGY FUND | |

| | | Face

Amount | | | Value | |

Barclays Capital, Inc.

issued 09/30/21 at 0.03%

due 10/01/212 | | $ | 6,162,767 | | | $ | 6,162,767 | |

| Total Repurchase Agreements | | | | | | | | |

| (Cost $28,186,433) | | | | | | | 28,186,433 | |

| | | | | | | | | |

| | | | Shares | | | | | |

| SECURITIES LENDING COLLATERAL†,5 - 0.0% |

| Money Market Fund |

First American Government Obligations Fund — Class Z, 0.02%6 | | | 15,288 | | | | 15,288 | |

| Total Securities Lending Collateral | | | | | | | | |

| (Cost $15,288) | | | | | | | 15,288 | |

| | | | | | | | | |

| Total Investments - 100.0% | | | | | | | | |

| (Cost $198,509,374) | | | | | | $ | 243,025,745 | |

| Other Assets & Liabilities, net - 0.0% | | | | | | | (87,961 | ) |

| Total Net Assets - 100.0% | | | | | | $ | 242,937,784 | |

Total Return Swap Agreements |

Counterparty | Index | Type | | Financing

Rate | | Payment

Frequency | | Maturity

Date | | Units | | | Notional

Amount | | | Value and

Unrealized

Depreciation | |

OTC Equity Index Swap Agreements†† |

BNP Paribas | S&P 500 Index | Pay | | 0.64% (1 Month USD LIBOR + 0.55%) | | At Maturity | | 11/04/21 | | 883 | | | $ | 3,804,291 | | | $ | (152,930 | ) |

Barclays Bank plc | S&P 500 Index | Pay | | 0.50% (U.S. Secured Overnight Financing Rate + 0.45%) | | At Maturity | | 11/03/21 | | 21,173 | | | | 91,205,158 | | | | (2,869,204 | ) |

Goldman Sachs International | S&P 500 Index | Pay | | 0.53% (Federal Funds Rate + 0.45%) | | At Maturity | | 11/04/21 | | 43,287 | | | | 186,460,371 | | | | (3,325,912 | ) |

| | | | | | | | | | | | | | $ | 281,469,820 | | | $ | (6,348,046 | ) |

* | Non-income producing security. |

† | Value determined based on Level 1 inputs — See Note 4. |

†† | Value determined based on Level 2 inputs — See Note 4. |

1 | All or a portion of this security is on loan at September 30, 2021 — See Note 7. |

2 | All or a portion of this security is pledged as equity index swap collateral at September 30, 2021. |

3 | Rate indicated is the effective yield at the time of purchase. |

4 | Repurchase Agreements — See Note 6. |

5 | Securities lending collateral — See Note 7. |

6 | Rate indicated is the 7-day yield as of September 30, 2021. |

| | LIBOR — London Interbank Offered Rate |

| | plc — Public Limited Company |

| | REIT — Real Estate Investment Trust |

| | |

| | See Sector Classification in Other Information section. |

16 | THE RYDEX FUNDS SEMI-ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

SCHEDULE OF INVESTMENTS (Unaudited)(concluded) | September 30, 2021 |

S&P 500® 2x STRATEGY FUND | |

The following table summarizes the inputs used to value the Fund’s investments at September 30, 2021 (See Note 4 in the Notes to Financial Statements):

Investments in Securities (Assets) | | Level 1

Quoted

Prices | | | Level 2

Significant

Observable

Inputs | | | Level 3

Significant

Unobservable

Inputs | | | Total | |

Common Stocks | | $ | 204,081,294 | | | $ | — | | | $ | — | | | $ | 204,081,294 | |

U.S. Treasury Bills | | | — | | | | 10,592,531 | | | | — | | | | 10,592,531 | |

Federal Agency Notes | | | — | | | | 150,199 | | | | — | | | | 150,199 | |

Repurchase Agreements | | | — | | | | 28,186,433 | | | | — | | | | 28,186,433 | |

Securities Lending Collateral | | | 15,288 | | | | — | | | | — | | | | 15,288 | |

Total Assets | | $ | 204,096,582 | | | $ | 38,929,163 | | | $ | — | | | $ | 243,025,745 | |

Investments in Securities (Liabilities) | | Level 1

Quoted

Prices | | | Level 2

Significant

Observable

Inputs | | | Level 3

Significant

Unobservable

Inputs | | | Total | |

Equity Index Swap Agreements** | | $ | — | | | $ | 6,348,046 | | | $ | — | | | $ | 6,348,046 | |

** | This derivative is reported as unrealized appreciation/depreciation at period end. |

SEE NOTES TO FINANCIAL STATEMENTS. | THE RYDEX FUNDS SEMI-ANNUAL REPORT | 17 |

S&P 500® 2x STRATEGY FUND | |

STATEMENT OF ASSETS AND LIABILITIES (Unaudited) |

September 30, 2021 |

Assets: |

Investments, at value - including $14,923 of securities loaned (cost $170,322,941) | | $ | 214,839,312 | |

Repurchase agreements, at value (cost $28,186,433) | | | 28,186,433 | |

Segregated cash with broker | | | 1,818,000 | |

Receivables: |

Fund shares sold | | | 43,589,461 | |

Dividends | | | 112,302 | |

Interest | | | 2,455 | |

Securities lending income | | | 8 | |

Total assets | | | 288,547,971 | |

| | | | | |

Liabilities: |

Overdraft due to custodian bank | | | 9,650 | |

Unrealized depreciation on OTC swap agreements | | | 6,348,046 | |

Payable for: |

Securities purchased | | | 34,723,435 | |

Swap settlement | | | 2,078,747 | |

Fund shares redeemed | | | 1,971,661 | |

Management fees | | | 173,364 | |

Variation margin on futures contracts | | | 100,251 | |

Transfer agent and administrative fees | | | 51,817 | |

Distribution and service fees | | | 50,333 | |

Portfolio accounting fees | | | 28,894 | |

Return of securities lending collateral | | | 15,288 | |

Trustees’ fees* | | | 2,052 | |

Miscellaneous | | | 56,649 | |

Total liabilities | | | 45,610,187 | |

Commitments and contingent liabilities (Note 11) | | | — | |

Net assets | | $ | 242,937,784 | |

| | | | | |

Net assets consist of: |

Paid in capital | | $ | 196,375,738 | |

Total distributable earnings (loss) | | | 46,562,046 | |

Net assets | | $ | 242,937,784 | |

| | | | | |

A-Class: |

Net assets | | $ | 24,727,758 | |

Capital shares outstanding | | | 108,148 | |

Net asset value per share | | $ | 228.65 | |

Maximum offering price per share (Net asset value divided by 95.25%) | | $ | 240.05 | |

| | | | | |

C-Class: |

Net assets | | $ | 3,803,831 | |

Capital shares outstanding | | | 19,893 | |

Net asset value per share | | $ | 191.21 | |

| | | | | |

H-Class: |

Net assets | | $ | 214,406,195 | |

Capital shares outstanding | | | 939,156 | |

Net asset value per share | | $ | 228.30 | |

STATEMENT OF OPERATIONS (Unaudited) |

Six Months Ended September 30, 2021 |

Investment Income: |

Dividends (net of foreign withholding tax of $239) | | $ | 1,193,722 | |

Interest | | | 8,315 | |

Income from securities lending, net | | | 60 | |

Total investment income | | | 1,202,097 | |

| | | | | |

Expenses: |

Management fees | | | 954,102 | |

Distribution and service fees: |

A-Class | | | 30,762 | |

C-Class | | | 16,546 | |

H-Class | | | 230,132 | |

Transfer agent and administrative fees | | | 293,048 | |

Portfolio accounting fees | | | 159,018 | |

Registration fees | | | 105,254 | |

Professional fees | | | 32,723 | |

Custodian fees | | | 13,088 | |

Trustees’ fees* | | | 13,050 | |

Line of credit fees | | | 247 | |

Interest expense | | | 12 | |

Miscellaneous | | | 24,401 | |

Total expenses | | | 1,872,383 | |

Net investment loss | | | (670,286 | ) |

| | | | | |

Net Realized and Unrealized Gain (Loss): |

Net realized gain (loss) on: |

Investments | | | (2,171,602 | ) |

Swap agreements | | | 25,538,149 | |

Futures contracts | | | 1,051,568 | |

Net realized gain | | | 24,418,115 | |

Net change in unrealized appreciation (depreciation) on: |

Investments | | | 12,572,673 | |

Swap agreements | | | (9,560,340 | ) |

Net change in unrealized appreciation (depreciation) | | | 3,012,333 | |

Net realized and unrealized gain | | | 27,430,448 | |

Net increase in net assets resulting from operations | | $ | 26,760,162 | |

* | Relates to Trustees not deemed “interested persons” within the meaning of Section 2(a)(19) of the 1940 Act. |

18 | THE RYDEX FUNDS SEMI-ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

S&P 500® 2x STRATEGY FUND | |

STATEMENTS OF CHANGES IN NET ASSETS |

| | Six Months Ended

September 30, 2021

(Unaudited) | | | Year Ended

March 31,

2021 | |

Increase (Decrease) in Net Assets from Operations: | | | | | | | | |

Net investment loss | | $ | (670,286 | ) | | $ | (736,223 | ) |

Net realized gain on investments | | | 24,418,115 | | | | 65,388,079 | |

Net change in unrealized appreciation (depreciation) on investments | | | 3,012,333 | | | | 37,573,267 | |

Net increase in net assets resulting from operations | | | 26,760,162 | | | | 102,225,123 | |

| | | | | | | | | |

Distributions to shareholders: | | | | | | | | |

A-Class | | | — | | | | (134,008 | ) |

C-Class | | | — | | | | (23,214 | ) |

H-Class | | | — | | | | (1,014,780 | ) |

Total distributions to shareholders | | | — | | | | (1,172,002 | ) |

| | | | | | | | | |

Capital share transactions: | | | | | | | | |

Proceeds from sale of shares | | | | | | | | |

A-Class | | | 5,759,481 | | | | 15,909,187 | |

C-Class | | | 1,594,359 | | | | 6,313,818 | |

H-Class | | | 1,378,112,825 | | | | 1,885,852,911 | |

Distributions reinvested | | | | | | | | |

A-Class | | | — | | | | 125,712 | |

C-Class | | | — | | | | 22,463 | |

H-Class | | | — | | | | 668,694 | |

Cost of shares redeemed | | | | | | | | |

A-Class | | | (5,741,742 | ) | | | (17,285,864 | ) |

C-Class | | | (1,194,364 | ) | | | (8,018,838 | ) |

H-Class | | | (1,310,237,759 | ) | | | (1,926,590,736 | ) |

Net increase (decrease) from capital share transactions | | | 68,292,800 | | | | (43,002,653 | ) |

Net increase in net assets | | | 95,052,962 | | | | 58,050,468 | |

| | | | | | | | | |

Net assets: | | | | | | | | |

Beginning of period | | | 147,884,822 | | | | 89,834,354 | |

End of period | | $ | 242,937,784 | | | $ | 147,884,822 | |

| | | | | | | | | |

Capital share activity: | | | | | | | | |

Shares sold | | | | | | | | |

A-Class | | | 24,574 | | | | 108,871 | |

C-Class | | | 8,279 | | | | 56,853 | |

H-Class | | | 6,046,414 | | | | 12,340,761 | |

Shares issued from reinvestment of distributions | | | | | | | | |

A-Class | | | — | | | | 737 | |

C-Class | | | — | | | | 157 | |

H-Class | | | — | | | | 3,927 | |

Shares redeemed | | | | | | | | |

A-Class | | | (24,752 | ) | | | (118,350 | ) |

C-Class | | | (6,174 | ) | | | (71,701 | ) |

H-Class | | | (5,741,482 | ) | | | (12,605,012 | ) |

Net increase (decrease) in shares | | | 306,859 | | | | (283,757 | ) |

SEE NOTES TO FINANCIAL STATEMENTS. | THE RYDEX FUNDS SEMI-ANNUAL REPORT | 19 |

S&P 500® 2x STRATEGY FUND | |

This table is presented to show selected data for a share outstanding throughout each period and to assist shareholders in evaluating a Fund’s performance for the periods presented.

A-Class | | Six Months Ended

September 30, 2021a | | | Year Ended

March 31,

2021 | | | Year Ended

March 31,

2020 | | | Year Ended

March 31,

2019 | | | Year Ended

March 29,

2018 | | | Year Ended

March 31,

2017 | |

Per Share Data |

Net asset value, beginning of period | | $ | 195.48 | | | $ | 86.56 | | | $ | 117.21 | | | $ | 104.90 | | | $ | 89.56 | | | $ | 67.98 | |

Income (loss) from investment operations: |

Net investment income (loss)b | | | (.71 | ) | | | (.75 | ) | | | .12 | | | | .18 | | | | .07 | | | | (.25 | ) |

Net gain (loss) on investments (realized and unrealized) | | | 33.88 | | | | 110.89 | | | | (28.08 | ) | | | 12.13 | | | | 21.60 | | | | 21.96 | |

Total from investment operations | | | 33.17 | | | | 110.14 | | | | (27.96 | ) | | | 12.31 | | | | 21.67 | | | | 21.71 | |

Less distributions from: |

Net realized gains | | | — | | | | (1.22 | ) | | | (2.69 | ) | | | — | | | | (6.33 | ) | | | (.13 | ) |

Total distributions | | | — | | | | (1.22 | ) | | | (2.69 | ) | | | — | | | | (6.33 | ) | | | (.13 | ) |

Net asset value, end of period | | $ | 228.65 | | | $ | 195.48 | | | $ | 86.56 | | | $ | 117.21 | | | $ | 104.90 | | | $ | 89.56 | |

|

Total Returnc | | | 16.97 | % | | | 127.44 | % | | | (24.76 | %) | | | 11.73 | % | | | 23.92 | % | | | 31.95 | % |

Ratios/Supplemental Data |

Net assets, end of period (in thousands) | | $ | 24,728 | | | $ | 21,176 | | | $ | 10,134 | | | $ | 13,607 | | | $ | 10,259 | | | $ | 10,772 | |

Ratios to average net assets: |

Net investment income (loss) | | | (0.62 | %) | | | (0.51 | %) | | | 0.10 | % | | | 0.16 | % | | | 0.07 | % | | | (0.33 | %) |

Total expenses | | | 1.75 | % | | | 1.81 | % | | | 1.84 | % | | | 1.85 | % | | | 1.77 | % | | | 1.79 | % |

Portfolio turnover rate | | | 284 | % | | | 634 | % | | | 328 | % | | | 367 | % | | | 276 | % | | | 411 | % |

C-Class | | Six Months Ended

September 30, 2021a | | | Year Ended

March 31,

2021 | | | Year Ended

March 31,

2020 | | | Year Ended

March 31,

2019 | | | Year Ended

March 29,

2018 | | | Year Ended

March 31,

2017 | |

Per Share Data |

Net asset value, beginning of period | | $ | 164.10 | | | $ | 73.30 | | | $ | 100.33 | | | $ | 90.47 | | | $ | 78.49 | | | $ | 60.04 | |

Income (loss) from investment operations: |

Net investment income (loss)b | | | (1.32 | ) | | | (1.51 | ) | | | (.60 | ) | | | (.60 | ) | | | (.61 | ) | | | (.72 | ) |

Net gain (loss) on investments (realized and unrealized) | | | 28.43 | | | | 93.53 | | | | (23.74 | ) | | | 10.46 | | | | 18.92 | | | | 19.30 | |

Total from investment operations | | | 27.11 | | | | 92.02 | | | | (24.34 | ) | | | 9.86 | | | | 18.31 | | | | 18.58 | |

Less distributions from: |

Net realized gains | | | — | | | | (1.22 | ) | | | (2.69 | ) | | | — | | | | (6.33 | ) | | | (.13 | ) |

Total distributions | | | — | | | | (1.22 | ) | | | (2.69 | ) | | | — | | | | (6.33 | ) | | | (.13 | ) |

Net asset value, end of period | | $ | 191.21 | | | $ | 164.10 | | | $ | 73.30 | | | $ | 100.33 | | | $ | 90.47 | | | $ | 78.49 | |

|

Total Returnc | | | 16.52 | % | | | 125.76 | % | | | (25.33 | %) | | | 10.90 | % | | | 23.00 | % | | | 30.96 | % |

Ratios/Supplemental Data |