QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrantý

Filed by a Party other than the Registranto

| Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

Magna Entertainment Corp.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies: |

| | | (2) | | Aggregate number of securities to which transaction applies: |

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | (4) | | Proposed maximum aggregate value of transaction: |

| | | (5) | | Total fee paid: |

o |

|

Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid: |

| | | (2) | | Form, Schedule or Registration Statement No.: |

| | | (3) | | Filing Party: |

| | | (4) | | Date Filed: |

Exhibit 99.1

MAGNA ENTERTAINMENT CORP.

2004

NOTICE OF ANNUAL MEETING

AND

PROXY STATEMENT

Tuesday, May 4, 2004

at 4:00 p.m.

Design Exchange

234 Bay Street

Toronto-Dominion Centre

Toronto, Ontario, Canada

MEC Guest Card |

We are pleased to offer you two free passes that will allow you free general admission to any of our racetracks and off-track betting facilities for an unlimited number of visits. The passes expire May 31, 2005. To receive your passes, please complete and return this card (no facsimiles will be accepted). |

Name:

|

Mailing Address:

|

|

Please allow four weeks for delivery. |

Your privacy is important to us. Your name and mailing address are being collected to aid in administering the MEC Guest Card program, and will not be used for any other purpose, nor will they be disclosed without your prior consent, except as required by law. |

|

|

Magna Entertainment Corp.

337 Magna Drive

Aurora, Ontario,

Canada L4G 7K1

Tel (905) 726-2462

Fax (905) 726-7172

|

March 26, 2004

Dear Fellow Stockholder:

On behalf of our Board of Directors and management, it is my pleasure to invite you to MEC's Annual Meeting of Stockholders on Tuesday, May 4, 2004, beginning at 4:00 p.m., at the Design Exchange in Toronto. The Notice of Annual Meeting and Proxy Statement accompanying this letter fully describe the business to be transacted at the meeting.

At the Annual Meeting, we will report to you on MEC's performance during 2003, our first quarter results for 2004 and our vision for the future. I welcome this opportunity to have a discussion with MEC's stockholders and I look forward to your comments and questions.

In appreciation of your investment in MEC, we are pleased, once again, to offer to you an opportunity to obtain two free passes for general admission to any of our racetracks and off-track betting facilities. The passes are good for an unlimited number of visits over the next year. Please detach, complete and mail the enclosed postcard if you wish to take advantage of this offer.

I look forward to seeing many of you on May 4th. For those of you who are unable to attend in person, please visit our website at www.magnaentertainment.com to view a webcast of the Annual Meeting.

|

|

Sincerely,

|

| | | Jim McAlpine

President and Chief Executive Officer |

NOTICE OF ANNUAL MEETING

The Annual Meeting of Stockholders of Magna Entertainment Corp. ("MEC") will be held on Tuesday, May 4, 2004, beginning at 4:00 p.m. local time, at the Design Exchange, 234 Bay Street, Toronto-Dominion Centre, Toronto, Ontario, Canada, to consider and take action upon the following matters described in the accompanying Proxy Statement:

- (1)

- the election of nine directors for the ensuing year;

- (2)

- the ratification of the appointment, by the Audit Committee of the Board of Directors, of Ernst & Young LLP as MEC's auditors for the fiscal year ending December 31, 2004; and

- (3)

- such other matters as may properly come before the meeting.

The Board of Directors has determined that owners of record of MEC's Class A Subordinate Voting Stock and Class B Stock at the close of business on Friday, March 19, 2004 are entitled to notice of and to vote at the meeting, and at any adjournment(s) thereof.

|

|

By Order of the Board of Directors

|

| | | Gary M. Cohn

Vice-President, Special Projects and Secretary |

Magna Entertainment Corp.

337 Magna Drive

Aurora, Ontario

Canada L4G 7K1

March 26, 2004 |

|

|

YOUR VOTE IS IMPORTANT

To vote your shares, please complete, sign and date the enclosed proxy form or voting instruction card, as applicable, and return it in the enclosed postage-paid envelope. Please see "GENERAL INFORMATION — Holders of Class A Subordinate Voting Stock and Class B Stock".

TABLE OF CONTENTS

| | Page

|

|---|

| GENERAL INFORMATION | | 1 |

| | Holders of Class A Subordinate Voting Stock and Class B Stock | | 1 |

| ITEM A — ELECTION OF DIRECTORS (Item A on the Proxy Form) | | 2 |

| | Nominees | | 2 |

| | Vote Required | | 4 |

| MANAGEMENT | | 4 |

| | Officers | | 4 |

| SECURITY OWNERSHIP | | 5 |

| THE BOARD OF DIRECTORS AND COMMITTEES OF THE BOARD | | 8 |

| | Executive Committee | | 8 |

| | Corporate Governance, Human Resources and Compensation Committee | | 8 |

| | Audit Committee | | 9 |

| | Special Independent Committee | | 9 |

| | Nomination Process | | 9 |

| | Code of Conduct | | 9 |

| | Directors' Compensation | | 9 |

| | Compensation Committee Interlocks and Insider Participation | | 10 |

| | Certain Relationships and Related Transactions | | 10 |

| EXECUTIVE COMPENSATION | | 12 |

| | Summary Compensation Table | | 12 |

| | Option Grants in Last Fiscal Year | | 13 |

| | Fiscal Year-End Option Values | | 13 |

| | Employment Agreements and Termination of Employment Agreements | | 13 |

| | Long-Term Incentive Plan | | 14 |

| | Section 16(a) Beneficial Ownership Reporting Compliance | | 16 |

| | Comparative Stock Performance Graph | | 16 |

| CORPORATE GOVERNANCE, HUMAN RESOURCES AND COMPENSATION COMMITTEE REPORT | | 17 |

| AUDIT COMMITTEE REPORT | | 19 |

| ITEM B — RATIFICATION OF APPOINTMENT OF AUDITORS (Item B on the Proxy Form) | | 20 |

| | Principal Accountant Fees and Services | | 20 |

| | Ratification of Appointment of Ernst & Young LLP as Auditors | | 20 |

| | Vote Required | | 21 |

| ADDITIONAL INFORMATION | | 21 |

| | Other Action at the Meeting | | 21 |

| | Cost of Solicitation | | 21 |

| | Stockholder Proposals for 2005 Annual Meeting | | 21 |

| | 2003 Annual Report on Form 10-K | | 21 |

i

PROXY STATEMENT

GENERAL INFORMATION

This Proxy Statement is furnished in connection with a solicitation of proxies by the Board of Directors of Magna Entertainment Corp. ("MEC" or the "Company") for use at MEC's Annual Meeting of Stockholders to be held on May 4, 2004, and at any adjournment(s) thereof. The solicitation of proxies provides all stockholders who are entitled to vote on matters that come before the meeting with an opportunity to do so whether or not they attend the meeting in person. This Proxy Statement and the related proxy form are first being mailed to MEC's stockholders on or about April 5, 2004.

Holders of Class A Subordinate Voting Stock and Class B Stock

Owners of record of MEC's Class A Subordinate Voting Stock and Class B Stock at the close of business on March 19, 2004 are entitled to notice of and to vote at the Annual Meeting. Such owners of the Class A Subordinate Voting Stock are entitled to one vote for each share held and such owners of the Class B Stock are entitled to 20 votes for each share held.

As of March 19, 2004, MEC had authorized 310,000,000 shares of Class A Subordinate Voting Stock, par value $0.01 per share, of which 48,878,796 were issued and outstanding, and 90,000,000 shares of Class B Stock, par value $0.01 per share, of which 58,466,056 were issued and outstanding. The owners of a majority of such issued and outstanding shares, present in person or represented by proxy, will constitute a quorum for the transaction of business at the Annual Meeting.

If your shares are registered in your name with MEC's transfer agent, you are considered to be the owner of record of those shares and these proxy materials are being sent to you directly. If you wish to give your proxy to someone other than the three persons named as proxies on the enclosed form you must strike out all three names appearing on the enclosed proxy form and insert the name of another person or persons (not more than three). The signed proxy form must be presented at the Annual Meeting by the person or persons representing you.

If your shares are held in a brokerage account or in the name of another nominee, you are considered the beneficial owner of shares held in street name, and these proxy materials are being forwarded to you together with a voting instruction card. As the beneficial owner, you have the right to direct your broker, trustee or nominee how to vote your shares. Since a beneficial owner is not the owner of record, you may not vote these shares in person at the meeting unless you obtain a "legal proxy" from the broker, trustee or nominee that holds your shares, giving you the right to vote the shares at the Annual Meeting. Your broker, trustee or nominee has enclosed or provided voting instructions for you to use in directing the broker, trustee or nominee how to vote your shares.

The shares represented by a properly signed and returned proxy form or voting instruction card, as applicable, will be voted as specified by the stockholder on such form. If a proxy form or voting instruction card, as applicable, is signed and returned but no specification is made, the shares will be voted "FOR" the election of all nominees for director (Item A) and "FOR" the ratification of the appointment of Ernst & Young LLP as MEC's independent auditors (Item B). If you are a share owner of record, a proxy may be revoked at any time before it is voted by providing notice of such revocation in writing to the Corporate Secretary's Office (at MEC's address set forth in the Notice of Annual Meeting accompanying this Proxy Statement), by submission of another proxy properly signed by such stockholder and bearing a later date, or by voting in person at the Annual Meeting. For shares you hold beneficially in street name, please see the instructions accompanying your voting instruction card regarding how to revoke or change your vote.

Abstentions, where applicable, are not counted as votes "FOR" or "AGAINST" a proposal, but are counted in determining a quorum.

It is the policy of MEC that any proxy, ballot or other voting material that identifies the particular vote of a stockholder will be kept confidential, except in the event of a contested proxy solicitation or as may be required by law. Such documents are available for examination only by the scrutineers, or inspectors of election, and certain persons associated with processing proxy forms and tabulating the vote, although MEC may be informed whether or not a particular stockholder has voted and will have access to each proxy, ballot or other voting material.

ITEM A — ELECTION OF DIRECTORS

(Item A on the Proxy Form)

MEC's Restated Certificate of Incorporation provides that, unless otherwise approved by ordinary resolution by the holders of the Class A Subordinate Voting Stock and the holders of the Class B Stock, each voting separately as a class, (i) a majority of the directors of MEC shall be individuals who are not officers or employees of MEC or persons related to such officers or employees and (ii) at least two of the directors of MEC shall be individuals who are not directors, officers or employees of MEC or its affiliates, including Magna International Inc. ("Magna International") and MI Developments Inc. ("MI Developments"), or persons related to such officers, employees or directors. MEC's bylaws provide that the number of directors of MEC shall be not less than one and not more than fifteen, and that the number of directors and the number of directors to be elected at the Annual Meeting each shall be determined from time to time by resolution of the Board of Directors. The Board of Directors has fixed nine as the number of directors of MEC to be elected at the Annual Meeting. Each director elected at the Annual Meeting will serve for a term expiring at the 2005 Annual Meeting of Stockholders, expected to be held in April or May 2005, or until his or her successor has been duly elected and qualified or his or her earlier resignation or removal.

Nominees

The individuals nominated as directors to be elected at the Annual Meeting are all incumbent directors of MEC. Certain information regarding each nominee is set forth below, including age (as of January 1, 2004), principal occupation, a brief account of business experience during at least the last five years, and certain other directorships currently held and the year in which the individual was first elected a director of MEC.

Each nominee for director has consented to being named in this Proxy Statement and to serve if elected. It is the intention of the persons named in the enclosed proxy to vote for the election of the nominees listed on the following pages unless otherwise instructed on the proxy form. If you do not wish your shares to be voted for particular nominees, please strike out the names of the exceptions in Item A on the proxy form.

If at the time of the Annual Meeting one or more of the nominees is no longer available or able to serve, shares represented by the proxies will be voted for the remaining nominees and for any substitute nominee or nominees designated by the Board of Directors or, if none, the size of the Board will be reduced. The Board of Directors knows of no reason why any of the nominees would be unavailable or unable to serve.

The persons nominated for election to the Board of Directors, all of whom are incumbent directors, are as follows:

Name

| | Age

| | Position

|

|---|

| Frank Stronach (1)(2)(3) | | 71 | | Chairman and Director (since 1999) |

| Brian V. Tobin (2) | | 49 | | Vice-Chairman and Director (since March 2004) |

| Jim McAlpine (3) | | 57 | | President and Chief Executive Officer and Director (since 2001) |

| Jerry D. Campbell (4)(5) | | 63 | | Director (since 2000) |

| William G. Davis (2)(3)(6) | | 74 | | Director (since 2000) |

| Louis E. Lataif (5)(6) | | 65 | | Director (since 2002) |

| Edward C. Lumley (1)(3)(4) | | 64 | | Director (since 2000) |

| William J. Menear (4)(5) | | 58 | | Director (since 2002) |

| Gino Roncelli (5)(6) | | 69 | | Director (since 2000) |

- (1)

- Currently a director of Magna International

- (2)

- Currently a director of MI Developments

- (3)

- Member of Executive Committee

- (4)

- Member of Audit Committee

- (5)

- Member of Special Independent Committee

- (6)

- Member of Corporate Governance, Human Resources and Compensation Committee

2

Frank Stronach serves as Chairman of MEC. Mr. Stronach has been a director since November 1999. Since 1971, Mr. Stronach has been the Chairman of Magna International* , which he founded over 40 years ago. He is also the founder and Chairman of MI Developments*. Mr. Stronach is actively involved in racing and breeding thoroughbred horses in California, Florida, Kentucky, New York, Ontario and elsewhere. In addition to his role as Chairman of Magna International* and MI Developments*, Mr. Stronach currently serves on the board of directors of Breeders' Cup Limited.

(* Magna International, MI Developments and Intier Automotive Inc. are affiliates of MEC.)

Brian V. Tobin has been a director and Vice-Chairman of MEC since March 2004. Mr. Tobin was appointed Chief Executive Officer of MI Developments*, a real estate operating company, in March 2004. He has been a director of MI Developments* since August 29, 2003. Mr. Tobin was a Strategic Advisor to Fraser, Milner, Casgrain LLP, a Canadian law firm, from January 2002 to March 2004. Mr. Tobin served as the Federal Minister of Industry from October 2000 to January 2002. He served as the Premier of Newfoundland and Labrador (1996 to 2000), prior to which time he was Federal Minister of Fisheries and Oceans (1993 to 1996) and a member of Canadian Parliament (1980 to 1996). Mr. Tobin is also a director of Lions Gate Entertainment Corporation and Clarke Inc., Co-Chair of an advisory council to the Innu Healing Foundation and a member of the Board of the Canadian Youth Business Foundation.

Jim McAlpine serves as President and Chief Executive Officer of MEC. Mr. McAlpine has been a director since February 2001. Mr. McAlpine currently serves on the board of directors of the NTRA (National Thoroughbred Racing Association) and the TRA (Thoroughbred Racing Associations of North America, Inc.). Prior to joining MEC in January 2001, Mr. McAlpine was the President of McAlpine Ford Lincoln Sales Ltd., an automobile dealership in Aurora, Ontario that he established in 1990. From 1984 to 1989, Mr. McAlpine was Chief Financial Officer of Magna International* and he also served as Vice-Chairman of Magna International* from April 1988 to October 1989.

Jerry D. Campbell has been a director since March 2000 and was President and Chief Executive Officer of MEC from March to August 2000 and Vice-Chairman of MEC from August 2000 to April 2002. Prior to joining MEC, Mr. Campbell served as Chairman of the Board and Chief Executive Officer of Republic Bancorp Inc. from its establishment in April 1986 to December 1999, and he still serves as its Chairman of the Board.

William G. Davis has been a director since March 2000. Mr. Davis has served as Counsel to Torys LLP, an international law firm, since 1985. Mr. Davis is the former Premier of the Province of Ontario (1971 to 1985). Mr. Davis is also a director of MI Developments*, First American Financial Corporation and First American Title Insurance Company, Magellan Aerospace Corporation, St. Lawrence Cement, BPO Properties Ltd. and Home Capital Group Inc. He is Vice-Chairman of the International Advisory Council of Power Corporation of Canada. From June 1985 to December 2003, Mr. Davis was also a director of Magna International*.

Louis E. Lataif has been a director since October 2002. Mr. Lataif has served as Dean of the School of Management at Boston University since 1991. Mr. Lataif is also a director of Interaudi Bank, Great Lakes Chemical Corporation, Group 1 Automotive, Inc., Intier Automotive Inc.*, Sanyo Electric Co. Ltd. and The Iacocca Foundation.

Edward C. Lumley has been a director since March 2000. Mr. Lumley has served as Vice-Chairman of BMO Nesbitt Burns Inc. (and its predecessor company, Burns Fry Limited), a full-service investment bank, since 1991. Mr. Lumley is also a director of Air Canada, BCE Inc., Canadian National Railway Company, Dollar Thrifty Automotive Group Inc., Magna International* and Intier Automotive Inc.*

William J. Menear has been a director since October 2002. From September 2001 to June 2003, Mr. Menear was a partner of Canec International Ltd., a transatlantic mergers and acquisitions advisory company. Since 1999, Mr. Menear has been President and Chief Executive Officer of William Menear & Associates Limited, a business advisory firm operating in the area of mergers and acquisitions and strategic financial advice, and from 1995 to 1999, was a Managing Director of Scotia Capital Inc., an investment bank. Prior to joining Scotia Capital Inc., Mr. Menear was a Senior Vice-President, Corporate Banking with Scotiabank from 1970 to 1995. Mr. Menear is a former Chairman of the Board of the Orthopaedic and Arthritic Hospital, Toronto (1982 to 1992).

3

Gino Roncelli has been a director since March 2000. Mr. Roncelli has served as the Chief Executive Officer of Roncelli Plastics Inc., a non-metallic machining company, since 1969.

Vote Required

The affirmative vote of a majority of the votes cast with respect to the shares of Class A Subordinate Voting Stock and Class B Stock, voting together as a single class, present or represented and entitled to vote at the Annual Meeting is required for the election of each nominee for director.

MI Developments, as the holder, directly or indirectly, of all the outstanding shares of Class B Stock, has indicated that it intends to vote all such shares"FOR" the election of each nominee for director.

The Board of Directors recommends that the stockholders vote "FOR" the election of each nominee for director.

MANAGEMENT

The executive officers and other officers of MEC are as follows:

Name

| | Age

| | Position

|

|---|

| Frank Stronach | | 71 | | Chairman |

| Brian V. Tobin | | 49 | | Vice-Chairman |

| Jim McAlpine | | 57 | | President and Chief Executive Officer |

| Donald Amos | | 59 | | Executive Vice-President and Chief Operating Officer |

| Blake S. Tohana | | 37 | | Executive Vice-President and Chief Financial Officer |

| Gary M. Cohn | | 43 | | Vice-President, Special Projects and Secretary |

| Frank DeMarco, Jr. | | 78 | | Vice-President, Regulatory Affairs |

| Douglas R. Tatters | | 43 | | Vice-President and Controller |

|

|

|---|

| Frank Stronach | — See "Item A — Election of Directors — Nominees". |

| Brian V. Tobin | — See "Item A — Election of Directors — Nominees". |

| Jim McAlpine | — See "Item A — Election of Directors — Nominees". |

Donald Amos serves as Executive Vice-President and Chief Operating Officer of MEC. From October 2002 to November 2003, Mr. Amos served as Executive Vice-President, Human Resources of MEC. Prior to joining MEC as its Executive Vice-President and Chief Operating Officer in August 2000, Mr. Amos served in various capacities within Magna International* and one of its subsidiaries since 1984, and most recently, held the position of Executive Vice-President, Administration and Human Resources of Magna International* from October 1994 to May 2000. Mr. Amos has extensive experience breeding and racing thoroughbred and standardbred horses.

(* Magna International is an affiliate of MEC.)

Blake S. Tohana serves as Executive Vice-President and Chief Financial Officer of MEC. Prior to joining MEC in that capacity in July 2003, Mr. Tohana held various executive positions with Fireworks Entertainment Inc. ("Fireworks Entertainment") from August 1997 to July 2003. Most recently, he served as Executive Vice-President, Corporate Development of Fireworks Entertainment and, prior to that, he served as Chief Financial Officer of Fireworks Entertainment.

4

Gary M. Cohn serves as Vice-President, Special Projects and Secretary of MEC. From September 1996 to November 2000, Mr. Cohn was Vice-President and General Counsel of various subsidiaries of Magna International*. Prior to that time, he was a partner in the Canadian law firm of Heenan Blaikie since January 1995.

(* Magna International and Decoma International Inc. are affiliates of MEC.)

Frank DeMarco, Jr. serves as Vice-President, Regulatory Affairs of MEC and Executive Director, General Counsel and Secretary of Los Angeles Turf Club, Incorporated, which is an indirect, wholly-owned subsidiary of MEC. Mr. DeMarco has been a practicing attorney in Los Angeles County since 1951 and has been the Executive Director, General Counsel and Secretary of Los Angeles Turf Club, Incorporated since April 1998.

Douglas R. Tatters serves as Vice-President and Controller of MEC. Prior to joining MEC in March 2001, Mr. Tatters worked as a consultant with Decoma International Inc.*, a subsidiary of Magna International*, for approximately six months. From September 1998 to June 2000, he served as Vice-President, Operations and Finance of Mumby & Associates Ltd., a large manufacturer and distributor of paint sundry products. Immediately prior to that, he was the Controller of Magna International* from February 1996 to September 1998.

SECURITY OWNERSHIP

The following tables set forth certain information as of March 19, 2004 with respect to beneficial ownership of MEC by (a) any entity or person known by MEC to be the beneficial owner of more than five percent of the outstanding shares of MEC's Class A Subordinate Voting Stock and Class B Stock and (b) each director, nominee for director and executive officer (including the Named Executive Officers listed below in the Summary Compensation Table) and all executive officers and directors of MEC as a group.

To MEC's knowledge, except as indicated in the footnotes to these tables or pursuant to applicable community property laws, the persons named in the following tables have sole voting and investment power with respect to the shares of MEC's Class A Subordinate Voting Stock and Class B Stock indicated.

For information regarding MEC's equity compensation plans, please see "Executive Compensation — Long-Term Incentive Plan".

5

(a) Security Ownership of Beneficial Owners of more than 5% of the Company's Voting Securities

Class of Securities

| | Name and Address of

Beneficial Owner

| | Amount and Nature of Beneficial Ownership

| | Percentage

of

Class

|

|---|

| Class B Stock | | MI Developments Inc. (1)(2)

455 Magna Drive

Aurora, Ontario L4G 7A9 | | 58,466,056 | | 100% |

| Class A Subordinate Voting Stock | | Bank Austria Creditanstalt AG (3)

A-1030 Vienna

Vordere Zollanlsstrasse 13 | | 10,638,298 | | 17.9% |

| Class A Subordinate Voting Stock | | David A. Rocker (4)

c/o Rocker Partners, L.P.

Suite 1759, 45 Rockefeller Plaza

New York, NY 10111 | | 4,547,796 | | 9.3% |

| Class A Subordinate Voting Stock | | MI Developments Inc. (2)

455 Magna Drive

Aurora, Ontario L4G 7A9 | | 4,362,328 | | 9.0% |

| Class A Subordinate Voting Stock | | Fair Enterprise Limited (5)

1 Seaton Place

St. Helier

Jersey JE4 8YJ

Channel Islands | | 3,682,515 | | 7.5% |

| Class A Subordinate Voting Stock | | Amaranth LLC (6)

One American Lane

Greenwich, CT 06831 | | 3,032,354 | | 5.9% |

| Class A Subordinate Voting Stock | | Credit Suisse First Boston (7)

Uetlibergstrasse 231, P.O. Box 900

CH 8070 Zurich | | 2,767,712 | | 5.4% |

- (1)

- MI Developments directly owns 53,253,145 or 91.1% of these shares of MEC's Class B Stock. The remaining shares of Class B Stock are owned through a direct wholly-owned subsidiary of MI Developments. MI Developments is entitled to vote approximately 96% of the votes attaching to MEC's outstanding voting securities.

- (2)

- The Stronach Trust controls MI Developments through the right to direct the votes attaching to Class B shares of MI Developments which carry a majority of the votes attaching to the outstanding voting shares of MI Developments. The Class B shares of MI Developments are held by 445327 Ontario Inc., all of the shares of which are held by the Stronach Trust. Mr. Frank Stronach is the sole director of 445327 Ontario Inc. and Chairman of MI Developments and MEC. Mr. Stronach, together with three members of his family, are the trustees of the Stronach Trust. Mr. Stronach is also a member of the class of potential beneficiaries under the Stronach Trust.

- (3)

- Bank Austria Creditanstalt AG and Bayerische Hypo-und Vereinsbank Aktiengesellschaft beneficially own an aggregate of 10,638,298 shares of Class A Subordinate Voting Stock as of December 31, 2003. This group is deemed to beneficially own such shares by virtue of its ownership of $75 million principal amount of MEC's 8.55% Convertible Subordinated Notes due June 15, 2010, which are convertible into 10,638,298 shares of Class A Subordinate Voting Stock.

- (4)

- Mr. David A. Rocker has sole dispositive and voting power over the aggregate amount of these shares. The entities comprising this group and their respective beneficial holdings of Class A Subordinate Voting Stock as of December 31, 2003 are: Rocker Partners, L.P. (3,122,667 shares), Compass Holdings, Ltd. (1,315,380 shares) and Helmsman Holdings, Ltd. (109,949 shares).

- (5)

- All of the shares of Fair Enterprise Limited are held by Bergenie Anstalt, an estate planning vehicle for the Stronach family. Mr. Frank Stronach shares control or direction over these shares. The members of the family of Mr. Stronach are among the class of possible beneficiaries under this anstalt.

- (6)

- Amaranth LLC (previously Amaranth L.L.C.) and Mr. Nicholas M. Maounis beneficially own 3,032,354 shares of Class A Subordinate Voting Stock as of December 31, 2003. Mr. Maounis is the controlling person of Amaranth Advisors LLC and the Trading Advisor of Amaranth LLC. Mr. Maounis is therefore deemed to share beneficial ownership of the shares beneficially owned by Amaranth LLC by virtue of his power to direct the vote and/or direct the disposition of securities owned by Amaranth LLC. This group is deemed to

6

beneficially own such shares by virtue of its ownership of $25.775 million principal amount of MEC's 71/4% Convertible Subordinated Notes due December 15, 2009, which are convertible into 3,032,354 shares of Class A Subordinate Voting Stock.

- (7)

- Credit Suisse First Boston beneficially owns 2,767,712 shares of Class A Subordinate Voting Stock as of December 31, 2003. It is deemed to beneficially own such shares at least partly by virtue of its ownership of MEC Convertible Subordinated Notes which are convertible into shares of Class A Subordinate Voting Stock.

(b) Security Ownership of Directors and Executive Officers

| | Amount and Nature of Beneficial Ownership

|

| |

| |

|---|

Name of Beneficial Owner

| | Class A Subordinate Voting Stock (1)

|

| | Percentage

of

Class

| | Class B Stock

|

| | Percentage

of

Class

| |

|---|

| Frank Stronach | | 9,710,481 | (2) | | 19.5 | % | 58,466,056 | (3) | | 100 | % |

| Brian V. Tobin | | Nil | | | Nil | | Nil | | | Nil | |

| Jim McAlpine | | 505,000 | | | 1.0 | % | Nil | | | Nil | |

| Donald Amos (4) | | 422,582 | | | (5 | ) | Nil | | | Nil | |

| Blake S. Tohana | | 20,000 | | | (5 | ) | Nil | | | Nil | |

| Jerry D. Campbell (6) | | 245,831 | | | (5 | ) | Nil | | | Nil | |

| William G. Davis | | 21,347 | | | (5 | ) | Nil | | | Nil | |

| Louis E. Lataif | | 8,435 | | | (5 | ) | Nil | | | Nil | |

| Edward C. Lumley | | 31,547 | | | (5 | ) | Nil | | | Nil | |

| William J. Menear | | 8,435 | | | (5 | ) | Nil | | | Nil | |

| Gino Roncelli (7) | | 158,300 | | | (5 | ) | Nil | | | Nil | |

All executive officers and directors as a group

(11 persons) | | 11,131,958 | | | 22.0 | % | 58,466,056 | (3) | | 100 | % |

- (1)

- Includes the following number of shares of Class A Subordinate Voting Stock issuable upon the exercise of outstanding stock options which may be exercised within 60 days of March 19, 2004: Mr. Stronach: 1,000,000; Mr. McAlpine: 400,000; Mr. Amos: 300,000; Mr. Tohana: 20,000; Mr. Davis: 10,000; Mr. Lataif: 4,000; Mr. Lumley: 10,000; Mr. Menear: 4,000; Mr. Roncelli: 10,000; all executive officers and directors as a group, 1,758,000 shares.

- (2)

- 4,362,328 of these shares are registered in the name of MI Developments. See Note 2 above under "Security Ownership of Beneficial Owners of more than 5% of the Company's Voting Securities." 3,682,515 of these shares are registered in the name of Fair Enterprise Limited, an associate of Mr. Stronach. See Note 5 above under "Security Ownership of Beneficial Owners of more than 5% of the Company's Voting Securities." 440,862 of these shares are registered in the name of The Canada Trust Company, trustee of the Magna Deferred Profit Sharing Plan (Canada) of Magna International. As Chairman of Magna International, Mr. Stronach has the right to direct the trustee in regard to voting and disposing of these shares. 206,428 of these shares are registered in the name of The Employees Deferred Profit Sharing Plan (U.S.) of Magna International. Mr. Stronach is one of the trustees of this plan, but is not a beneficiary. 18,348 of these shares are registered in the name of 865714 Ontario Inc., which is a separate vehicle incorporated for the acquisition of Magna International shares and the sale thereof to the management team of Magna International. Magna International has the right to direct the disposition of these shares.

- (3)

- MI Developments directly owns 53,253,145 or 91.1% of these shares of MEC's Class B Stock. The remaining shares of Class B Stock are owned through a direct wholly-owned subsidiary of MI Developments. MI Developments is entitled to vote approximately 96% of the votes attaching to MEC's outstanding voting securities. See Note 2 above under "Security Ownership of Beneficial Owners of more than 5% of the Company's Voting Securities."

- (4)

- Of these holdings, 120,482 shares of Class A Subordinate Voting Stock are owned directly and 2,100 are owned by Mr. Amos' wife.

- (5)

- These shares represent less than 1% of the class.

- (6)

- Of these holdings, 225,588 shares of Class A Subordinate Voting Stock are owned directly, 11,225 are owned jointly by Mr. Campbell and his wife, 4,009 are owned by Mr. Campbell's wife, and 5,009 are owned indirectly through two wholly-owned corporations, Post It Stables, Inc. and Volar Corp.

- (7)

- Of these holdings, 11,300 shares of Class A Subordinate Voting Stock are owned directly, 67,000 are owned indirectly through Roncelli Plastics Inc., an associate of Mr. Roncelli, and 70,000 are owned by the Roncelli Family Trust, an associate of Mr. Roncelli.

7

THE BOARD OF DIRECTORS AND COMMITTEES OF THE BOARD

The business of MEC is managed under the direction of the Board of Directors (the "Board"). The Board held seven meetings during fiscal year 2003. All current directors of MEC (other than Mr. Tobin who became a director in March 2004) attended at least 75% of the meetings of the Board and Committees of which they were members during fiscal year 2003, except for Frank Stronach (who attended four of the seven Board meetings). While MEC does not have a formal, written attendance policy requiring directors to attend its Annual Meeting of Stockholders, the Board encourages directors to attend the Annual Meeting. Six members of the Board attended the 2003 Annual Meeting.

MEC does not have a formal process for stockholders to send communications to the Board. In view of the infrequency of stockholder communications with the Board, the Board does not believe that a formal process is necessary, but any stockholder may submit written communications to the Board by sending them to Magna Entertainment Corp., 337 Magna Drive, Aurora, Ontario, Canada L4G 7K1, Attention: Corporate Secretary's Office, whereupon such communications will be forwarded to the Board as a group or to the individual director or directors addressed.

MEC is a "controlled company" as defined in the Nasdaq Marketplace Rules because MI Developments controls a majority of the votes attaching to MEC's outstanding voting stock. As a result, under the Nasdaq Marketplace Rules, MEC is only required to establish and maintain one committee of the Board, the Audit Committee. Pursuant to the Nasdaq Marketplace Rules, MEC's Audit Committee is required to be composed solely of independent directors, but neither the Board nor any other committee of the Board is required to meet the other director independence requirements set forth in the Nasdaq Marketplace Rules.

Because of the number of matters requiring Board consideration, to make the most effective use of individual Board members' capabilities, the Board has established four committees to devote attention to specific subjects and to assist it in the discharge of its responsibilities. The functions of these committees, their current members and the number of meetings held during 2003 are described below. In addition, commencing in October 2003, the non-management members of the Board have met independently on a quarterly basis.

Executive Committee

The Executive Committee, which was established by the Board on September 19, 2000, is composed of Frank Stronach, Jim McAlpine, William G. Davis and Edward C. Lumley (who joined the Committee on March 21, 2003). The Executive Committee meets on an "as needed" basis between meetings of the full Board of Directors. It is empowered to exercise the power of the Board of Directors in managing the business affairs and property of MEC, subject to limitations imposed by law and the Board. The Executive Committee is not empowered to approve an acquisition, a capital expenditure or a financial commitment that exceeds an amount greater than ten per cent of the book value of MEC's shareholders' equity. The Executive Committee did not meet as a committee during fiscal year 2003.

Corporate Governance, Human Resources and Compensation Committee

The Corporate Governance, Human Resources and Compensation Committee is composed of William G. Davis (Chairman), Louis E. Lataif and Gino Roncelli. The Corporate Governance, Human Resources and Compensation Committee administers MEC's Long-Term Incentive Plan. It also reviews and makes recommendations to the Board with respect to all direct and indirect compensation, benefits and perquisites of MEC's President and Chief Executive Officer, Chief Financial Officer, Chief Operating Officer and certain other senior management employees, and MEC's policies regarding management benefits and perquisites. This Committee is also generally responsible for developing MEC's approach to corporate governance issues, including MEC's relationship with Magna International and MI Developments, and assessing the effectiveness of the system of corporate governance employed by MEC as a whole. The Corporate Governance, Human Resources and Compensation Committee held two meetings during fiscal year 2003.

8

Audit Committee

The Audit Committee is composed of William J. Menear (Chairman), Jerry D. Campbell (who replaced Peter M. George on April 30, 2003) and Edward C. Lumley. Each member of the Audit Committee is "independent" as currently required by the Nasdaq Marketplace Rules. In addition, the Board of Directors has determined that William J. Menear is an "audit committee financial expert" as defined by Item 401 of Regulation S-K. Since Mr. Campbell was the President and Chief Executive Officer of MEC from March 2000 to August 2000, he did not satisfy the definition in the Nasdaq Marketplace Rules of an "independent director" at the date of his appointment to the Audit Committee. However, since Mr. Campbell was neither a current employee of MEC, nor an immediate family member of such an employee, his appointment to MEC's Audit Committee was permitted under the Nasdaq Marketplace Rules, subject to compliance with the other applicable terms of such rules.

The Audit Committee is established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended, and is responsible for the appointment, engagement and oversight of the work of the independent auditors of MEC. In accordance with its Charter, the Audit Committee also has considerable general authority in relation to the oversight of MEC's financial affairs, as well as specific responsibility to review MEC's quarterly and annual financial statements and the related Management's Discussion and Analysis of Results of Operations and Financial Position ("MD&A") and to report thereon to the Board. In addition, the Audit Committee reviews MEC's internal financial and accounting controls and procedures, reviews the selection, use and application of accounting policies and practices, and examines and considers various other matters in relation to the internal and external audits of MEC's accounts and its financial reporting process and system of internal controls. The Audit Committee held six meetings during fiscal year 2003.

Special Independent Committee

The Special Independent Committee is composed of Gino Roncelli (Chairman), Jerry D. Campbell (who joined the Committee on February 24, 2004), Louis E. Lataif and William J. Menear. This Committee was initially established on August 1, 2001 with a mandate to review proposed real estate transactions between MEC (or any of its subsidiaries) and Magna International and its subsidiaries. On February 24, 2004, the mandate of this Committee was expanded to cover all proposed transactions between MEC and MI Developments, Magna International or any of their respective subsidiaries. The Special Independent Committee did not meet as a committee during fiscal year 2003.

Nomination Process

Since MEC is a "controlled company" (as discussed above), MEC is not required to have, and does not have, a nominating committee or other committee of the Board performing similar functions. Nominees for director of MEC are considered and approved by the full Board.

Code of Conduct

MEC is in the process of finalizing a Code of Business Conduct (the "Code") that will apply to all of MEC's directors, officers and employees. The Code will fulfill the Code of Ethics requirements under Item 406 of Regulation S-K. On or before May 4, 2004, a copy of the Code will be available on MEC's website at www.magnaentertainment.com/Investor Relations and will be provided without charge to any person upon request in writing to the Corporate Secretary's Office, Magna Entertainment Corp., 337 Magna Drive, Aurora, Ontario, Canada L4G 7K1.

Directors' Compensation

Directors who are not officers or employees of MEC or any of its affiliates were paid an annual retainer of $15,000 in cash and 4,000 shares of Class A Subordinate Voting Stock for their service as directors in 2003, together with a meeting fee of $1,000 for attendance at each meeting of the Board. Such directors are also paid an annual committee retainer of $4,000 (Committee Chairmen also receive an $8,000 annual retainer) and a meeting fee of $1,000 for attendance at each meeting of each Committee of the Board on which they

9

serve. Compensation for Board and Committee work and travel days ($1,500 per day) and for the execution of written resolutions ($250) is also provided to directors who are not officers or employees. In addition, each director receives certain stock options as set forth below under "EXECUTIVE COMPENSATION — Long-Term Incentive Plan — Nonqualified Stock Options."

Compensation Committee Interlocks and Insider Participation

The members of the Corporate Governance, Human Resources and Compensation Committee for fiscal year 2003 were William G. Davis, Louis E. Lataif and Gino Roncelli. Mr. Davis was also a director of MI Developments during part of fiscal year 2003. Messrs. Davis, Lataif and Roncelli are not and have never been officers or employees of MEC or any of its subsidiaries. In addition, there are no compensation committee interlocks between MEC and other entities involving MEC's executive officers and board members who serve as executive officers of such entities.

Certain Relationships and Related Transactions

We have employment agreements with certain of our officers. See "Executive Compensation — Employment Agreements and Termination of Employment Agreements" below.

On August 19, 2003, the shareholders of Magna International approved the spin off of its wholly-owned subsidiary, MI Developments. As a result of the spin off transaction, MI Developments acquired Magna International's controlling interest in MEC. MEC and MI Developments operate as separate public companies each having its own board of directors and management team.

MI Developments is a real estate operating company engaged in the ownership, development, management, leasing, acquisition and expansion of industrial and commercial real estate properties located in Canada, Europe, the United States and Mexico. Virtually all of MI Developments' income-producing properties are under long-term leases to Magna International and its subsidiaries.

MI Developments was incorporated under the laws of Ontario, Canada. The Class A subordinate voting shares of MI Developments are listed for trading on the New York Stock Exchange and the Toronto Stock Exchange ("TSX"). MI Developments' Class B shares are listed on the TSX. MI Developments is the sole holder of MEC's Class B Stock (directly and indirectly), which means that MI Developments is entitled to exercise approximately 96% of the total votes attached to all MEC's outstanding stock. MI Developments is therefore able to elect all the directors of MEC and to control MEC.

MEC's Corporate Constitution requires that a minimum of two directors be individuals who are not MEC officers or employees, or officers, directors or employees of any of MEC's affiliates including MI Developments and Magna International, or persons related to any such officers, employees or directors. The Corporate Constitution also requires that a majority of MEC's directors be individuals who are not MEC officers or employees or individuals related to these persons.

MI Developments is able to elect all MEC's directors and controls MEC. Therefore, MI Developments is able to cause MEC to effect certain corporate transactions without the consent of MEC's minority stockholders, subject to applicable law and the fiduciary duties of MEC's directors and officers. In addition, MI Developments is able to cause or prevent a change in control of MEC. The Stronach Trust controls MI Developments through the right to direct the votes attaching to Class B shares of MI Developments which carry a majority of the votes attaching to the outstanding voting shares of MI Developments. Mr. Frank Stronach, the Chairman of MEC and MI Developments, together with three members of his family, are the trustees of the Stronach Trust. Mr. Stronach is also a member of the class of potential beneficiaries of the Stronach Trust.

Magna International has made a commitment to its shareholders that it will not, during the period ending May 31, 2006, without the prior consent of the holders of a majority of Magna International's Class A

10

subordinate voting shares: (i) make any further debt or equity investment in, or otherwise give financial assistance to, MEC or any of MEC's subsidiaries; or (ii) invest in any non-automotive-related businesses or assets other than through its investment in MEC. Magna International's commitment is contained in a Forbearance Agreement, dated as of February 8, 2000, between MEC and Magna International and of which Magna International's shareholders are express third-party beneficiaries.

Pursuant to a conditional sale agreement, Magna International transferred land in Aurora, Ontario to MEC in 1999. A portion of this property was sold to an affiliate of Magna International in December 2002 (see below), with MEC retaining the balance of the property. The conditional sale agreement is subject to certain conditions, including approval from the relevant governmental authorities to sever the land from adjoining land. If these conditions are not satisfied by June 5, 2004, and Magna International retains ownership of this Aurora land, Magna International must return to MEC the purchase price paid with interest from the date of payment. Prior to completion of this conditional sale, the land is being leased to MEC by Magna International for a nominal amount.

One of MEC's subsidiaries has been named as a defendant in a class action brought in a United States District Court by various plaintiffs. The plaintiffs in this action claim unspecified compensatory and punitive damages, for restitution and disgorgement of profits, all in relation to forced labor performed by the plaintiffs for such subsidiary and certain other Austrian and German corporate defendants at their facilities in Europe during World War II and certain property right claims. As a result of a reorganization in prior years, MEC acquired the shares of such subsidiary. Under Austrian law, such subsidiary would be jointly and severally liable with the other defendants in such action for the damages awarded in respect of these class action claims. An Austrian subsidiary of Magna International has agreed to indemnify this MEC subsidiary for any damages or expenses associated with this case.

A subsidiary of Magna International has agreed to indemnify MEC in respect of environmental remediation costs and expenses relating to existing conditions at certain of MEC's Austrian real estate properties.

Pursuant to an access arrangement effective as of March 1, 1999, Magna International has paid us an annual fee of 2.5 million Euros (approximately $3.1 million) to access the Fontana Sports golf course and related recreational facilities for Magna International-sponsored corporate and charitable events, as well as for business development purposes. The access fee relating to Fontana Sports was payable until March 1, 2004. Pursuant to an access agreement effective as of January 1, 2001, Magna International has also paid us an annual fee of Cdn. $5.0 million (approximately $3.9 million) to access the Magna Golf Club. The access fee relating to the Magna Golf Club was payable until December 31, 2003. MEC is continuing to explore various means of monetizing or improving the returns from Fontana Sports and the Magna Golf Club. MEC's objective would be to realize at least the net book values of these properties from any sale; however, should it be unable to do so, MEC would consider extending the current access arrangements. To that end, there have been recent negotiations with Magna International, aimed at reaching mutually acceptable terms for the renewal of the access arrangements in respect of these golf courses. The Fontana Sports and Magna Golf Club properties are both subject to rights of first refusal in favor of Magna International if MEC decides to sell either of them.

For more detail about MEC's relationship with Magna International and related transactions, please see "Relationship with Magna International" in MEC's Registration Statement on Form S-1 (No. 333-70520), as amended, which section is incorporated herein by reference.

11

EXECUTIVE COMPENSATION

The following tables and narratives discuss the compensation paid in fiscal years 2003, 2002 and 2001 to MEC's Chairman, Chief Executive Officer and four other most highly compensated executive officers in 2003 (collectively, the "Named Executive Officers"). The indicated compensation is only for the period the designated executive officer served in such capacity.

Summary Compensation Table

|

|---|

|

| Annual Compensation (1)

| Long-Term Compensation

|

|

|---|

Name & Principal Position

| Year

| Salary

($)

| Bonus

($)

| Other Annual Compensation

($)

| Restricted Stock Awards

($)

| Securities Underlying Options

(#)

| LTIP Payout

($)

| All Other Compensation

($)

|

|---|

|

Frank Stronach

Chairman | 2003

2002

2001 | —

—

— | | —

—

— | | —

—

— | —

—

— | —

—

— | | —

—

— | —

—

— |

|

Jim McAlpine (2)

President and Chief

Executive Officer | 2003

2002

2001 | 409,600

409,600

409,600 | | 600,000

800,000

800,000 | | —

—

— | —

—

— | —

—

500,000 | | —

—

— | —

—

— |

|

Donald Amos

Executive Vice-President and

Chief Operating Officer | 2003

2002

2001 | 359,600

359,600

359,600 | | 350,000

350,000

480,565 | | —

—

— | —

—

— | —

—

— | | —

—

— | —

—

— |

|

Blake S. Tohana (3)

Executive Vice-President

and Chief Financial Officer | 2003

2002

2001 | 89,348

—

— | (4) | 39,700

—

— | (4) | —

—

— | —

—

— | 100,000

—

— | | —

—

— | —

—

— |

|

Roman Doroniuk (5)

(Former) Chief Operating

Officer | 2003

2002

2001 | 262,820

—

— | | 350,000

—

— | | —

—

— | —

—

— | 300,000

—

— | (6) | —

—

— | 250,000

—

— |

|

Edward C. Hannah (7)

(Former) Executive Vice-

President, Corporate

Development and General

Counsel | 2003

2002

2001 | 237,990

318,600

182,900 | (4)

(4)

(4) | 233,618

386,600

— | (4)

(4) | —

—

— | —

—

— | —

—

100,000 |

(6) | —

—

— | —

—

— |

|

- (1)

- The aggregate amount of perquisites and other personal benefits, securities or property does not exceed the lesser of $50,000 or 10% of the total of annual salary and bonus for any of the Named Executive Officers.

- (2)

- Mr. McAlpine became an executive officer on January 9, 2001.

- (3)

- Mr. Tohana became an executive officer on July 28, 2003.

- (4)

- These figures have been converted from Cdn. dollars to U.S. dollars based on the average month end foreign exchange rates.

- (5)

- Mr. Doroniuk became an executive officer on April 1, 2003 and ceased to serve as an executive officer on October 30, 2003. The amount shown as "All Other Compensation" represents a $250,000 severance payment.

- (6)

- All of these options were either cancelled or expired unexercised.

- (7)

- Mr. Hannah became an executive officer on June 6, 2001 and ceased to serve as an executive officer on August 29, 2003.

12

|

|---|

Option Grants in Last Fiscal Year

|

|---|

| | Individual Grants

| | Grant Date Value

|

|---|

| |

| | % of Total Options Granted to Employees in Fiscal Year

| |

| |

|

|---|

Name

| | Number of Securities Underlying Options Granted (1)

(#)

| | Exercise or Base Price (2)

($/Share)

| | Expiration Date

| | Grant Date Present Value (3)

($/Share)

|

|---|

|

| Frank Stronach | | — | | — | | — | | — | | — |

|

| Jim McAlpine | | — | | — | | — | | — | | — |

|

| Donald Amos | | — | | — | | — | | — | | — |

|

| Blake S. Tohana | | 100,000 (4) | | 15.9% | | 6.93 | | June 23, 2013 | | 1.50 |

|

| Roman Doroniuk (5) | | 300,000 (4) | | 47.6% | | 6.93 | | June 23, 2013 (6) | | 1.50 |

|

| Edward C. Hannah | | — | | — | | — | | — | | — |

|

- (1)

- Options granted were options to acquire shares of Class A Subordinate Voting Stock.

- (2)

- The greater of: (i) market price on date of grant, and (ii) net book value per share as of the most recently completed fiscal quarter for which financial results have been publicly announced.

- (3)

- Calculated using the Black-Scholes pricing model. Underlying assumptions used in the calculation include a risk-free interest rate of 2.0 percent per annum, dividend yields of 0.84 percent, volatility factors of the expected market price of 0.534 and an expected life of four years. MEC has elected to illustrate the potential realizable value using the Black-Scholes pricing model as permitted by the rules of the Securities and Exchange Commission. This does not represent MEC's estimate or projection of future stock price or of the assumptions utilized; actual gains, if any, upon future exercise of any of these options will depend on the actual performance of the Class A Subordinate Voting Stock.

- (4)

- Vested as to one-fifth of the securities underlying the options granted on the date of grant and an additional one-fifth on each of the first four anniversaries of the date of grant.

- (5)

- Resigned as of October 30, 2003. Mr. Doroniuk's unvested options were cancelled immediately. His vested options expired unexercised on January 30, 2004.

- (6)

- The term of these options was reduced following Mr. Doroniuk's resignation. All of these options were either cancelled or expired unexercised.

|

|---|

Fiscal Year-End Option Values

|

|---|

| | Number of Securities Underlying Unexercised Options at Fiscal Year-End

(#)

| | Value of Unexercised In-The-Money Options at Fiscal Year-End

($) (1)

|

|---|

Name

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

|

| Frank Stronach (2) | | 1,000,000 | | — | | NIL | | — |

|

| Jim McAlpine (2) | | 300,000 | | 200,000 | | 33,750 | | 22,500 |

|

| Donald Amos (2) | | 300,000 | | — | | NIL | | — |

|

| Blake S. Tohana (2) | | 20,000 | | 80,000 | | NIL | | NIL |

|

| Roman Doroniuk (2) | | 60,000 | | — | | NIL | | — |

|

| Edward C. Hannah (2)(3) | | — | | — | | — | | — |

|

- (1)

- The closing sale price of MEC's Class A Subordinate Voting Stock as reported on the Nasdaq National Market on December 31, 2003 was $5.05 per share. Value is calculated by multiplying (a) the difference between $5.05 and the option exercise price by (b) the number of shares of Class A Subordinate Voting Stock underlying the options.

- (2)

- None of these individuals exercised any options to acquire stock of MEC during the fiscal year ended December 31, 2003.

- (3)

- Resigned as of August 29, 2003. All options cancelled on August 29, 2003.

Employment Agreements and Termination of Employment Agreements

MEC has entered into employment arrangements and agreements with certain executive officers as described below:

MEC has an employment arrangement with Mr. McAlpine which provides for a base salary of $409,600 per annum, a guaranteed annual bonus of $400,000 (to be superseded by a mutually agreeable profit-sharing arrangement), a discretionary bonus based on personal performance, confidentiality obligations,

13

non-competition covenants and a termination provision permitting his employment to be terminated by MEC by giving minimum advance written notice of termination or by paying a retiring allowance instead. Mr. McAlpine's arrangement also provides for the grant of stock options to purchase 500,000 shares of MEC's Class A Subordinate Voting Stock. The grant of these stock options, with an exercise price of $4.9375 per share, was approved by the Corporate Governance, Human Resources and Compensation Committee of MEC's Board of Directors on February 19, 2001.

MEC has entered into an employment contract with Mr. Amos which provides for a base salary of $359,600 per annum, an annual bonus based on a percentage of pre-tax profits (with a guaranteed minimum of $350,000), a discretionary bonus based on personal performance, confidentiality obligations, non-competition covenants and a termination provision permitting his employment to be terminated by MEC by giving minimum advance written notice of termination or by paying a retiring allowance instead. Mr. Amos' contract also provides for the grant of stock options to purchase 300,000 shares of MEC's Class A Subordinate Voting Stock. The grant of these stock options, with an exercise price of $6.07 per share, was approved by the Corporate Governance, Human Resources and Compensation Committee of MEC's Board of Directors on August 14, 2000.

MEC has entered into an employment contract with Mr. Tohana which provides for a base salary of Cdn. $300,000 per annum, a guaranteed annual bonus of Cdn. $125,000 (to be superseded by a mutually agreeable profit-sharing arrangement), confidentiality obligations, non-competition covenants and a termination provision permitting his employment to be terminated by MEC by giving minimum advance written notice of termination or by paying a retiring allowance instead. Mr. Tohana's contract also provides for the grant of stock options to purchase 100,000 shares of MEC's Class A Subordinate Voting Stock. The grant of these stock options, with an exercise price of $6.93 per share, was approved by the Corporate Governance, Human Resources and Compensation Committee of MEC's Board of Directors on June 24, 2003.

MEC has entered into employment contracts with other members of its senior management. These employment contracts generally provide for base salaries and annual bonuses (in some cases based on a specified percentage of MEC's pre-tax profits before profit sharing), confidentiality obligations and non-competition covenants. Each of these employment contracts provide that MEC may terminate the senior officer's employment by giving minimum advance written notice of termination or by paying a retiring allowance instead. With the approval of the Corporate Governance, Human Resources and Compensation Committee of MEC's Board of Directors, some of MEC's senior officers have received options to acquire shares of MEC's Class A Subordinate Voting Stock at an exercise price equal to or greater than the fair market value of the shares of such stock on the date of grant of the option.

MEC's Corporate Constitution provides that, beginning with the fiscal year commencing January 1, 2004, the aggregate incentive bonuses (which may be paid in cash or deferred for payment in future years or which may be paid in Class A Subordinate Voting Stock) paid or payable to "Corporate Management" (as defined therein) in respect of any fiscal year shall not exceed 6% of MEC's pre-tax profits before profit sharing for that fiscal year.

MEC is not required to make payments under any employment contract or arrangement with its senior officers in the event of a change in control of MEC.

Long-Term Incentive Plan

MEC has adopted a long-term incentive plan, referred to as the "Long-Term Incentive Plan", the purposes of which are: (i) to align the interests of MEC's stockholders and the recipients of awards under the Long-Term Incentive Plan by giving recipients of awards an interest in MEC's growth and success; (ii) to enable MEC to attract and retain directors, officers, employees, consultants, independent contractors and agents; and (iii) to motivate these persons to act in MEC's long-term best interests and those of its stockholders. Under the Long-Term Incentive Plan, MEC may grant nonqualified stock options, incentive stock options, free standing stock appreciation rights, tandem stock appreciation rights, restricted stock, bonus stock and performance shares. MEC does not maintain any other equity compensation plan.

14

The Long-Term Incentive Plan is administered by the Corporate Governance, Human Resources and Compensation Committee (the "Committee") of the Board of Directors, which consists of three outside directors. The members of the Committee serve at the pleasure of the Board of Directors. The following table summarizes MEC's Long-Term Incentive Plan information as of March 19, 2004.

Plan Category

| | Number of securities to be issued

upon exercise of outstanding

options, warrants and rights

(a)

| | Weighted-average exercise

price of outstanding options,

warrants and rights

(b)

| | Number of securities remaining

available for future issuance under

equity compensation plans

(excluding securities reflected

in column (a))

(c)

|

|---|

|

|

|

|

|

|

|

|---|

| Equity compensation plans approved by security holders | | 4,522,500 (1) | | $6.16 | | 3,107,541 (2) |

| Equity compensation plans not approved by security holders | | n/a | | n/a | | n/a |

| Total | | 4,522,500 (1) | | $6.16 | | 3,107,541 (2) |

- (1)

- As of March 19, 2004, there were options outstanding under the Long-Term Incentive Plan for the purchase of these shares.

- (2)

- Of these shares of Class A Subordinate Voting Stock remaining available for issuance under the Long-Term Incentive Plan, 1,763,500 shares are available for issuance pursuant to the grant of new stock options and 1,344,041 are available for issuance as bonus stock awards.

Each of MEC's outside directors was granted a nonqualified stock option to purchase 10,000 shares of Class A Subordinate Voting Stock immediately following such director's election to MEC's Board of Directors, and will be entitled to another such grant immediately following the completion of each five-year period of continuous service as a director. Such stock options vest as to 20% of the shares of Class A Subordinate Voting Stock included in each such grant on the date of such grant, with an additional 20% of the shares vesting on the second, third, fourth and fifth anniversaries of such grant. On March 5, 2000, the Board approved stock options for each of its outside directors then in office to purchase 10,000 shares of Class A Subordinate Voting Stock at an exercise price of $4.875 per share, pursuant to the provisions of the Long-Term Incentive Plan. On November 22, 2002, the Committee approved stock options for two recently appointed outside directors, Louis E. Lataif and William J. Menear, to purchase 10,000 shares of Class A Subordinate Voting Stock each at an exercise price of $6.70 per share.

Incentive stock options may be granted only to MEC's employees and employees of its subsidiaries. If the recipient of an incentive stock option owns more than ten percent of the voting power of all shares of MEC's common stock, the option will not be exercisable later than five years after its grant date and the exercise price of the option will not be less than the greater of (i) the price required by the Internal Revenue Code (currently 110% of the fair market value of MEC's Class A Subordinate Voting Stock on the option's grant date) and (ii) the price of the last traded board lot of shares of MEC's Class A Subordinate Voting Stock sold on the Toronto Stock Exchange prior to the date of grant of the option.

On June 24, 2003, the Committee approved the grant of stock options to Roman Doroniuk, then Chief Operating Officer, and Blake Tohana, Executive Vice-President and Chief Financial Officer, to purchase 300,000 and 100,000 shares, respectively, of Class A Subordinate Voting Stock at an exercise price of $6.93 per share. See "Option Grants in Last Fiscal Year" above.

The Long-Term Incentive Plan permits the Committee to grant bonus stock awards, which are vested upon grant, and restricted stock awards, which are subject to a restriction period. An award of restricted stock may be subject to performance measures during the restriction period. Unless the Committee decides

15

otherwise, the holder of a restricted stock award will have rights as an MEC stockholder, including the right to vote and receive dividends with respect to the shares of restricted stock. Dividends, however, will be subject to the same restrictions that apply to the shares for which the dividend was paid.

The Long-Term Incentive Plan also permits the Committee to grant performance shares. Each performance share is a right, subject to the attainment of performance measures during a performance period, to receive one share of Class A Subordinate Voting Stock, which may be restricted stock, or the fair market value of the performance share in cash. Before a performance share award is settled in shares of Class A Subordinate Voting Stock, the holder of the award will have no rights as an MEC stockholder with respect to the shares of stock subject to the award. All the terms relating to the satisfaction of performance measures and the termination of the performance period relating to a performance share award, or any cancellation or forfeiture of the performance share award upon the holder's termination of employment with MEC, whether by reason of disability, retirement, death or other termination, shall be contained in the award agreement.

Under the Long-Term Incentive Plan, the vesting or payment of performance share awards and certain awards of restricted stock will be subject to the satisfaction of certain performance objectives and criteria. These objectives and criteria may include one or more of the following: the attainment by a share of Class A Subordinate Voting Stock of a specified fair market value for a specified period of time, earnings per share, return to stockholders (including dividends), return on equity, earnings, revenues, market share, cash flow or cost reduction goals, or any combination of these criteria.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, and Securities and Exchange Commission regulations require MEC's directors, certain officers and greater than ten percent stockholders to file reports of ownership on Form 3 and changes in ownership on Form 4 and Form 5 with the Securities and Exchange Commission.

Based solely on its review of copies of such reports received or written representations from such directors, executive officers and ten percent stockholders, MEC believes that all Section 16(a) filing requirements applicable to its directors, executive officers and ten percent stockholders were complied with during 2003.

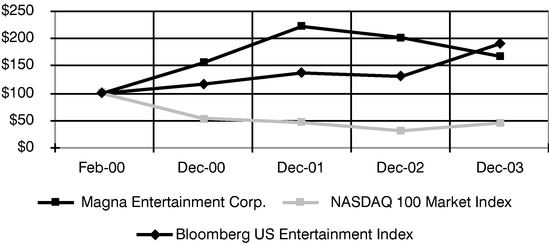

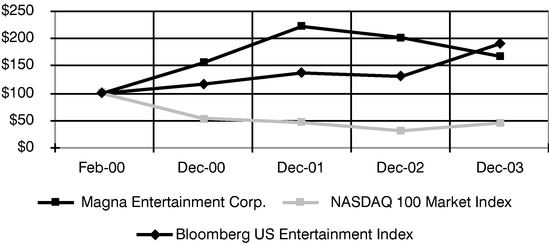

Comparative Stock Performance Graph

The following graph compares the cumulative total shareholder return on MEC's Class A Subordinate Voting Stock to the cumulative total shareholder return of the Nasdaq 100 Market Index and a peer group index. The peer group index used by MEC is the Bloomberg US Entertainment Index, which is a published industry peer index of companies engaged in the entertainment industry. The period of comparison begins with the date that MEC became a public company in February 2000 and ends on December 31, 2003. The

16

graph depicts the results of an investment of $100 in MEC's Class A Subordinate Voting Stock, the Nasdaq 100 Market Index and the Bloomberg US Entertainment Index.

| | Feb-00

| | Dec-00

| | Dec-01

| | Dec-02

| | Dec-03

|

|---|

| Magna Entertainment Corp. | | $ | 100.00 | | $ | 155.10 | | $ | 222.71 | | $ | 202.17 | | $ | 167.37 |

| Bloomberg US Entertainment Index | | $ | 100.00 | | $ | 116.69 | | $ | 137.40 | | $ | 131.15 | | $ | 192.02 |

| Nasdaq 100 Market Index | | $ | 100.00 | | $ | 54.38 | | $ | 46.42 | | $ | 31.45 | | $ | 45.73 |

CORPORATE GOVERNANCE, HUMAN RESOURCES

AND COMPENSATION COMMITTEE REPORT

The Corporate Governance, Human Resources and Compensation Committee of the Board was formed on March 4, 2000. For a discussion of the composition and mandate of this Committee, see "The Board of Directors and Committees of the Board — Corporate Governance, Human Resources and Compensation Committee" above.

MEC has adopted many of the organizational and operating policies and principles utilized by its original parent company, Magna International, for many years, certain of which have been embodied in MEC's Corporate Constitution. MEC's Corporate Constitution balances the interests of stockholders, employees and management by specifically defining the rights of employees (including management) and investors to participate in MEC's profits and growth, and reflects certain operational and compensation philosophies which align employee (including management) and stockholder interests. These philosophies and MEC's Corporate Constitution assist in maintaining an entrepreneurial environment and culture at MEC. MEC wishes this entrepreneurial culture to flourish, and therefore intends to apply compensation philosophies which will enhance its ability to attract, retain and motivate skilled, entrepreneurial employees at all levels of the MEC organization, while assisting in the alignment of the interests of MEC's stockholders and management.

A few of MEC's senior officers (including its Chief Operating Officer) receive a remuneration package consisting of a base salary and an annual incentive bonus based, in part, on direct profit participation.

This Committee, in accordance with its mandate, is required to consider and apply, among other things, the historical operating philosophies and policies of MEC, including MEC's Corporate Constitution, direct profit participation and use of stock options and other stock rights granted under the Long-Term Incentive Plan, to align the interests of management and stockholders and to create shareholder value. This Committee, therefore, applies the following criteria in determining or reviewing recommendations for compensation for management, including where applicable, the executive officers of MEC:

Base Salaries. Base salaries should not be customarily increased on an annual basis. As a result, fixed compensation costs are contained, with increased financial rewards coming principally from variable incentive compensation.

17

Incentive Compensation. The amount of direct profit participation and, therefore, the amount of compensation "at risk," increases with the level of performance and/or responsibility. Due to the variable nature of profit participation, incentive cash compensation should generally be reduced in cyclical or other down periods due to reduced profits. As a result, executive officers are encouraged to emphasize consistent profitability over the medium to long term to sustain stable levels of annual compensation.

Under MEC's Corporate Constitution, beginning with the fiscal year commencing January 1, 2004, the aggregate incentive bonuses paid or payable to "Corporate Management" (as defined in the Corporate Constitution) in respect of any fiscal year shall not exceed 6% of "Pre-Tax Profits Before Profit Sharing" (as defined in the Corporate Constitution) for such year.

Long-Term Incentives. Upon the grant of options under the Long-Term Incentive Plan, extended vesting and exercise periods are sometimes used to encourage option recipients to remain as employees or senior officers over the long term. MEC has never repriced stock options or entered into any equity monetization arrangements.

Chief Executive Officer Compensation. Jim McAlpine was appointed President and Chief Executive Officer on January 9, 2001. The employment arrangements of Mr. McAlpine, which were reviewed and approved by this Committee, provide for a base salary of $409,600 per year, a guaranteed annual bonus of $400,000 and a discretionary bonus based on personal performance. Mr. McAlpine was awarded a $200,000 discretionary bonus, with the approval of this Committee, in recognition of his efforts and contribution to the growth and development of MEC during fiscal 2003. This Committee remains mindful of the significant amount of executive talent needed to successfully face the many challenges of building a company such as MEC, but is also conscious that profit levels must be taken into account in setting the incentive compensation of the Chief Executive Officer.

Written Employment Contracts. MEC generally uses written employment contracts with its executive officers and other members of management to reflect the terms of their employment, including compensation, severance, stock ownership (if applicable), confidentiality and non-competition arrangements.

The annual, long-term and other compensation referred to in the Summary Compensation Table above for the Named Executive Officers reflect the compensation and benefits provided to them under their respective employment contracts and arrangements. MEC does not provide personal loans to its executives.

MEC believes that its objectives for growth, financial returns and growth in shareholder value require that it offer meaningful financial rewards for its executive and senior officers which are contingent on the continued profitability of the Company.

Corporate Governance, Human Resources and Compensation Committee Members

18

AUDIT COMMITTEE REPORT

The Audit Committee's duties and responsibilities are set forth in a written charter (the "Audit Committee Charter") adopted by the Board of Directors (the "Board"). The Board approved a revised Audit Committee Charter in March 2003. The Audit Committee annually reviews its charter, assesses its adequacy and recommends such revisions to the Board as it considers necessary or advisable.

The Audit Committee has reviewed and discussed with management MEC's audited financial statements and management's discussion and analysis of results of operations and financial position as of and for the fiscal year ended December 31, 2003.

The Audit Committee has discussed with MEC's independent public accountants, Ernst & Young LLP (the "Independent Auditors"), the matters required to be discussed by Statement on Auditing Standards No. 61,Communication With Audit Committees, as amended.