QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrantý

Filed by a Party other than the Registranto

| Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

Magna Entertainment Corp.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies: |

| | | (2) | | Aggregate number of securities to which transaction applies: |

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | (4) | | Proposed maximum aggregate value of transaction: |

| | | (5) | | Total fee paid: |

o |

|

Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid: |

| | | (2) | | Form, Schedule or Registration Statement No.: |

| | | (3) | | Filing Party: |

| | | (4) | | Date Filed: |

MAGNA ENTERTAINMENT CORP.

2005

NOTICE OF ANNUAL MEETING

AND

PROXY STATEMENT

Monday, May 2, 2005

at 11:00 a.m.

Le Royal Meridien King Edward Hotel

Vanity Fair Ballroom

37 King Street East

Toronto, Ontario, Canada

|

|

Magna Entertainment Corp.

337 Magna Drive

Aurora, Ontario,

Canada L4G 7K1

Tel (905) 726-2462

Fax (905) 726-7172

|

April 1, 2005

Dear Stockholder:

On behalf of our Board of Directors and management, it is my pleasure to invite you to MEC's Annual Meeting of Stockholders on Monday, May 2, 2005, beginning at 11:00 a.m., in the Vanity Fair Ballroom at Le Royal Meridien King Edward Hotel. The Notice of Annual Meeting and Proxy Statement accompanying this letter fully describe the business to be transacted at the meeting.

At the Annual Meeting, we will report to you on MEC's performance during 2004, our first quarter results for 2005 and our vision for the future. I welcome this opportunity to have a discussion with MEC's stockholders and I look forward to your comments and questions.

In appreciation of your investment in MEC, we are pleased, once again, to offer to you an opportunity to obtain two free passes for general admission to any of our racetracks and off-track betting facilities. The passes are good for an unlimited number of visits over the next year. Please detach, complete and mail the enclosed postcard if you wish to take advantage of this offer.

I look forward to seeing many of you on May 2nd. For those of you who are unable to attend in person, please visit our website at www.magnaentertainment.com to view a webcast of the Annual Meeting. Your vote is important. If you are unable to attend the meeting, please complete the enclosed proxy form or voting instruction card, as applicable, and return it as directed.

|

|

Sincerely,

|

| | | W. Thomas Hodgson

President and Chief Executive Officer |

NOTICE OF ANNUAL MEETING

The Annual Meeting of Stockholders of Magna Entertainment Corp. ("MEC") will be held on Monday, May 2, 2005, beginning at 11:00 a.m. local time, at Le Royal Meridien King Edward Hotel, 37 King Street East, Toronto, Ontario, Canada, to consider and take action upon the following matters described in the accompanying Proxy Statement:

- (1)

- the election of ten directors for the ensuing year;

- (2)

- the ratification of the appointment, by the Audit Committee of the Board of Directors, of Ernst & Young LLP as MEC's auditors for the fiscal year ending December 31, 2005;

- (3)

- the stockholder proposal of Howard Lipsitz; and

- (4)

- such other matters as may properly come before the meeting.

The Board of Directors has determined that owners of record of MEC's Class A Subordinate Voting Stock and Class B Stock at the close of business on Tuesday, March 15, 2005 are entitled to notice of and to vote at the meeting, and at any adjournment(s) thereof.

|

|

By Order of the Board of Directors

|

| | | Lee Jackson,

Secretary |

Magna Entertainment Corp.

337 Magna Drive

Aurora, Ontario

Canada L4G 7K1

April 1, 2005 |

|

|

YOUR VOTE IS IMPORTANT

To vote your shares, please complete, sign and date the enclosed proxy form or voting instruction card, as applicable, and return it in the enclosed postage-paid envelope. Please see "GENERAL INFORMATION — Holders of Class A Subordinate Voting Stock and Class B Stock".

TABLE OF CONTENTS

| | Page

|

|---|

| GENERAL INFORMATION | | 1 |

| | Holders of Class A Subordinate Voting Stock and Class B Stock | | 1 |

| ITEM A — ELECTION OF DIRECTORS (Item A on the Proxy Form) | | 2 |

| | Nominees | | 2 |

| | Vote Required | | 4 |

| MANAGEMENT | | 4 |

| | Officers | | 4 |

| SECURITY OWNERSHIP | | 5 |

| THE BOARD OF DIRECTORS AND COMMITTEES OF THE BOARD | | 8 |

| | Corporate Governance, Human Resources and Compensation Committee | | 8 |

| | Audit Committee | | 8 |

| | Special Independent Committee | | 9 |

| | Special Committee of Independent Directors | | 9 |

| | Nomination Process | | 9 |

| | Code of Conduct | | 10 |

| | Directors' Compensation | | 10 |

| | Compensation Committee Interlocks and Insider Participation | | 10 |

| | Certain Relationships and Related Transactions | | 10 |

| EXECUTIVE COMPENSATION | | 13 |

| | Summary Compensation Table | | 13 |

| | Option Grants in Last Fiscal Year | | 14 |

| | Fiscal Year-End Option Values | | 14 |

| | Employment Agreements and Termination of Employment Agreements | | 14 |

| | Long-Term Incentive Plan | | 16 |

| | Section 16(a) Beneficial Ownership Reporting Compliance | | 17 |

| | Comparative Stock Performance Graph | | 18 |

| CORPORATE GOVERNANCE, HUMAN RESOURCES AND COMPENSATION COMMITTEE REPORT | | 18 |

| AUDIT COMMITTEE REPORT | | 20 |

| ITEM B — RATIFICATION OF APPOINTMENT OF AUDITORS (Item B on the Proxy Form) | | 21 |

| | Principal Accountant Fees and Services | | 21 |

| | Ratification of Appointment of Ernst & Young LLP as Auditors | | 21 |

| | Vote Required | | 22 |

| ITEM C — STOCKHOLDER PROPOSAL OF HOWARD LIPSITZ | | 23 |

| ADDITIONAL INFORMATION | | 25 |

| | Other Action at the Meeting | | 25 |

| | Cost of Solicitation | | 25 |

| | Stockholder Proposals for 2006 Annual Meeting | | 26 |

| | 2004 Annual Report on Form 10-K | | 26 |

i

PROXY STATEMENT

GENERAL INFORMATION

This Proxy Statement is furnished in connection with a solicitation of proxies by the Board of Directors of Magna Entertainment Corp. ("MEC" or the "Company") for use at MEC's Annual Meeting of Stockholders to be held on May 2, 2005, and at any adjournment(s) thereof. The solicitation of proxies provides all stockholders who are entitled to vote on matters that come before the meeting with an opportunity to do so whether or not they attend the meeting in person. This Proxy Statement and the related proxy form are first being mailed to MEC's stockholders on or about April 5, 2005.

Holders of Class A Subordinate Voting Stock and Class B Stock

Owners of record of MEC's Class A Subordinate Voting Stock and Class B Stock at the close of business on March 15, 2005 are entitled to notice of and to vote at the Annual Meeting. Such owners of the Class A Subordinate Voting Stock are entitled to one vote for each share held and such owners of the Class B Stock are entitled to 20 votes for each share held.

As of March 15, 2005, MEC had authorized 310,000,000 shares of Class A Subordinate Voting Stock, par value $0.01 per share, of which 48,878,796 were issued and outstanding, and 90,000,000 shares of Class B Stock, par value $0.01 per share, of which 58,466,056 were issued and outstanding. The owners of a majority of such issued and outstanding shares, present in person or represented by proxy, will constitute a quorum for the transaction of business at the Annual Meeting.

If your shares are registered in your name with MEC's transfer agent, you are considered to be the owner of record of those shares and these proxy materials are being sent to you directly. If you wish to give your proxy to someone other than the three persons named as proxies on the enclosed form you must strike out all three names appearing on the enclosed proxy form and insert the name of another person or persons (not more than three). The signed proxy form must be presented at the Annual Meeting by the person or persons representing you.

If your shares are held in a brokerage account or in the name of another nominee, you are considered the beneficial owner of shares held in street name, and these proxy materials are being forwarded to you together with a voting instruction card. As the beneficial owner, you have the right to direct your broker, trustee or nominee how to vote your shares. Since a beneficial owner is not the owner of record, you may not vote these shares in person at the meeting unless you obtain a "legal proxy" from the broker, trustee or nominee that holds your shares, giving you the right to vote the shares at the Annual Meeting. Your broker, trustee or nominee has enclosed or provided voting instructions for you to use in directing the broker, trustee or nominee how to vote your shares.

The shares represented by a properly signed and returned proxy form or voting instruction card, as applicable, will be voted as specified by the stockholder on such form. If a proxy form or voting instruction card, as applicable, is signed and returned but no specification is made, the shares will be voted "FOR" the election of all nominees for director (Item A), "FOR" the ratification of the appointment of Ernst & Young LLP as MEC's independent auditors (Item B) and "AGAINST" the stockholder proposal of Howard Lipsitz (Item C). If you are a share owner of record, a proxy may be revoked at any time before it is voted by providing notice of such revocation in writing to the Corporate Secretary's Office (at MEC's address set forth in the Notice of Annual Meeting accompanying this Proxy Statement), by submission of another proxy properly signed by such stockholder and bearing a later date, or by voting in person at the Annual Meeting. For shares you hold beneficially in street name, please see the instructions accompanying your voting instruction card regarding how to revoke or change your vote.

Abstentions, where applicable, are not counted as votesFOR orAGAINST a proposal, but are counted in determining a quorum.

It is the policy of MEC that any proxy, ballot or other voting material that identifies the particular vote of a stockholder will be kept confidential, except in the event of a contested proxy solicitation or as may be required by law. Such documents are available for examination only by the scrutineers, or inspectors of election, and certain persons associated with processing proxy forms and tabulating the vote, although MEC may be informed whether or not a particular stockholder has voted and will have access to each proxy, ballot or other voting material.

ITEM A — ELECTION OF DIRECTORS

(Item A on the Proxy Form)

MEC's Restated Certificate of Incorporation provides that, unless otherwise approved by ordinary resolution by the holders of the Class A Subordinate Voting Stock and the holders of the Class B Stock, each voting separately as a class, (i) a majority of the directors of MEC shall be individuals who are not officers or employees of MEC or persons related to such officers or employees and (ii) at least two of the directors of MEC shall be individuals who are not directors, officers or employees of MEC or its affiliates, including Magna International Inc. ("Magna International") and MI Developments Inc. ("MI Developments"), or persons related to such officers, employees or directors. MEC's bylaws provide that the number of directors of MEC shall be not less than one and not more than fifteen, and that the number of directors and the number of directors to be elected at the Annual Meeting each shall be determined from time to time by resolution of the Board of Directors. The Board of Directors has fixed ten as the number of directors of MEC to be elected at the Annual Meeting. Each director elected at the Annual Meeting will serve for a term expiring at the 2006 Annual Meeting of Stockholders, expected to be held in April or May 2006, or until his or her successor has been duly elected and qualified or his or her earlier resignation or removal.

Nominees

The individuals nominated as directors to be elected at the Annual Meeting are all incumbent directors of MEC. Certain information regarding each nominee is set forth below, including age (as of January 1, 2005), principal occupation, a brief account of business experience during at least the last five years, and certain other directorships currently held and the year in which the individual was first elected a director of MEC.

Each nominee for director has consented to being named in this Proxy Statement and to serve if elected. It is the intention of the persons named in the enclosed proxy to vote for the election of the nominees listed on the following pages unless otherwise instructed on the proxy form. If you do not wish your shares to be voted for particular nominees, please strike out the name(s) of the person(s) for whom you do not wish to vote in Item A on the proxy form.

If at the time of the Annual Meeting one or more of the nominees is no longer available or able to serve, shares represented by the proxies will be voted for the remaining nominees and for any substitute nominee or nominees designated by the Board of Directors or, if none, the size of the Board will be reduced. The Board of Directors knows of no reason why any of the nominees would be unavailable or unable to serve. The persons nominated for election to the Board of Directors, all of whom are incumbent directors, are as follows:

Name

| | Age

| | Position

|

|---|

| Frank Stronach (1)(2) | | 72 | | Chairman and Director (since 1999) |

| Jim McAlpine | | 58 | | Vice-Chairman, Corporate Development (since March 2005) and Director (since 2001) |

| Dennis Mills (2) | | 58 | | Vice-Chairman and Director (since November 2004) |

| W. Thomas Hodgson | | 52 | | President and Chief Executive Officer (since March 2005) |

| John Barnett (3) | | 60 | | Director (since November 2004) |

| Jerry D. Campbell (3)(4) | | 64 | | Director (since 2000) |

| Louis E. Lataif (4)(5) | | 66 | | Director (since 2002) |

| Edward C. Lumley (1) (5) | | 65 | | Director (since 2000) |

| William J. Menear (3)(4) | | 59 | | Director (since 2002) |

| Gino Roncelli (4)(5) | | 70 | | Director (since 2000) |

- (1)

- Currently a director of Magna International

- (2)

- Currently a director of MI Developments

- (3)

- Member of Audit Committee

- (4)

- Member of Special Independent Committee

- (5)

- Member of Corporate Governance, Human Resources and Compensation Committee

2

Frank Stronach serves as Chairman of MEC. Mr. Stronach has been a director since November 1999. Since 1971, Mr. Stronach has been the Chairman of Magna International*, a supplier of automotive systems and components, which he founded over 40 years ago. He is also the founder and Chairman of MI Developments*, a real estate company and parent of MEC. Mr. Stronach is actively involved in racing and breeding thoroughbred horses in California, Florida, Kentucky, New York, Ontario and elsewhere. In addition to his role as Chairman of Magna International* and MI Developments*, Mr. Stronach currently serves on the board of directors of Breeders' Cup Limited.

Jim McAlpine serves as Vice-Chairman, Corporate Development since March 2005 and was President and Chief Executive officer of MEC from January 2001 to March 2005. Mr. McAlpine has been a director since February 2001. Mr. McAlpine currently serves on the board of directors of the NTRA (National Thoroughbred Racing Association), the TRA (Thoroughbred Racing Associations of North America, Inc.) and Equibase Company, LLC. Prior to joining MEC in January 2001, Mr. McAlpine was the President of McAlpine Ford Lincoln Sales Ltd., an automobile dealership in Aurora, Ontario that he established in 1990. From 1984 to 1989, Mr. McAlpine was Chief Financial Officer of Magna International* and he also served as Vice-Chairman of Magna International* from April 1988 to October 1989.

Dennis Mills serves as Vice-Chairman of MEC and has been a director since November 2004. Mr. Mills is also Vice-Chairman of the Board of Directors of MI Developments*. Mr. Mills is a former Vice-President of Magna International* from 1984 to 1987 and served as a Member of Parliament in Canada's federal government from 1988 to 2004. While a Member of Parliament, Mr. Mills was the Parliamentary Secretary to the Minister of Industry from 1993 to 1996 and the Parliamentary Secretary to the Minister of Consumer and Corporate Affairs from 1993 to 1995.

W. Thomas Hodgson serves as President and Chief Executive Officer of MEC since March 2005. Mr. Hodgson has been a director since March 2005. Prior to joining MEC, Mr. Hodgson was President of Strategic Analysis Corporation, a business consultancy firm, from November 2002 until March 2005. Prior to that, Mr. Hodgson was a consultant to the Chief Executive Officer of IDEAGlobal Ltd., a financial research company, from October 2001 to September 2002. From November 1999 to September 2001, Mr. Hodgson was Executive Vice-President and Chief Operating Officer and then President and Chief Executive Officer at GlobalNetFinancial.com, a financial services company.

John Barnett has been a director since November 2004. Mr. Barnett has been the President and Chief Executive Officer and a director of Rothmans, Benson & Hedges Inc., a tobacco company, since June 1999 and President and Chief Executive Officer and a director of Rothmans Inc. since November 1998.

Jerry D. Campbell has been a director since March 2000 and was President and Chief Executive Officer of MEC from March to August 2000 and Vice-Chairman of MEC from August 2000 to April 2002. Prior to joining MEC, Mr. Campbell served as Chairman of the Board and Chief Executive Officer of Republic Bancorp Inc., a bank holding company, from its establishment in April 1986 to December 1999, and he still serves as its Chairman of the Board.

Louis E. Lataif has been a director since October 2002. Mr. Lataif has served as Dean of the School of Management at Boston University since 1991. Mr. Lataif is also a director of Interaudi Bank, Great Lakes Chemical Corporation, Group 1 Automotive, Inc., Intier Automotive Inc.*, Sanyo Electric Co. Ltd. and The Iacocca Foundation.

Edward C. Lumley has been a director since March 2000. Mr. Lumley has served as Vice-Chairman of BMO Nesbitt Burns Inc. (and its predecessor company, Burns Fry Limited), a full-service investment bank, since 1991. Mr. Lumley is also a director of BCE Inc., Canadian National Railway Company, Dollar Thrifty Automotive Group Inc., Magna International* and Intier Automotive Inc.*

(* Magna International, MI Developments and Intier Automotive Inc. are affiliates of MEC.)

3

William J. Menear has been a director since October 2002. From September 2001 to June 2003, Mr. Menear was a partner of Canec International Ltd., a transatlantic mergers and acquisitions advisory company. Since 1999, Mr. Menear has been President and Chief Executive Officer of William Menear & Associates Limited, a business advisory firm operating in the area of mergers and acquisitions and strategic financial advice, and from 1995 to 1999, was a Managing Director of Scotia Capital Inc., an investment bank. Prior to joining Scotia Capital Inc., Mr. Menear was a Senior Vice-President, Corporate Banking with Scotiabank from 1970 to 1995. Mr. Menear is a former Chairman of the Board of the Orthopaedic and Arthritic Hospital, Toronto (1982 to 1992). Mr. Menear is also a director of Dover Industries Limited.

Gino Roncelli has been a director since March 2000. Mr. Roncelli has served as the Chief Executive Officer of Roncelli Plastics Inc., a non-metallic machining company, since 1969.

Vote Required

The affirmative vote of a majority of the votes cast with respect to the shares of Class A Subordinate Voting Stock and Class B Stock, voting together as a single class, present or represented and entitled to vote at the Annual Meeting is required for the election of each nominee for director.

MI Developments, as the holder, directly or indirectly, of all the outstanding shares of Class B Stock, has indicated that it intends to vote all such shares"FOR" the election of each nominee for director.

The Board of Directors recommends that the stockholders vote "FOR" the election of each nominee for director.

MANAGEMENT

Officers

The executive officers and other officers of MEC are as follows:

Name

| | Age

| | Position

|

|---|

| Frank Stronach | | 72 | | Chairman |

| Jim McAlpine | | 58 | | Vice-Chairman, Corporate Development |

| W. Thomas Hodgson | | 52 | | President and Chief Executive Officer |

| Donald Amos | | 60 | | Executive Vice-President and Chief Operating Officer |

| Blake S. Tohana | | 38 | | Executive Vice-President and Chief Financial Officer |

| Frank DeMarco, Jr. | | 79 | | Vice-President, Regulatory Affairs |

| Mary Lyn Seymour | | 36 | | Controller |

| Lee David Jackson | | 34 | | Secretary |

| |

|

|---|

| Frank Stronach | | — See "Item A — Election of Directors — Nominees". |

| W. Thomas Hodgson | | — See "Item A — Election of Directors — Nominees". |

| Jim McAlpine | | — See "Item A — Election of Directors — Nominees". |

Donald Amos serves as Executive Vice-President and Chief Operating Officer of MEC since November 2003. From October 2002 to November 2003, Mr. Amos served as Executive Vice-President, Human Resources of MEC. Prior to joining MEC as its Executive Vice-President and Chief Operating Officer in August 2000, Mr. Amos served in various capacities within Magna International* and one of its subsidiaries since 1984, and most recently, held the position of Executive Vice-President, Administration and Human Resources of Magna International* from October 1994 to May 2000. Mr. Amos has extensive experience breeding and racing thoroughbred and standardbred horses.

Blake S. Tohana serves as Executive Vice-President and Chief Financial Officer of MEC. Prior to joining MEC in that capacity in July 2003, Mr. Tohana held various executive positions with Fireworks Entertainment Inc., a subsidiary of CanWest Global Communications Corp., from August 1997 to July 2003. Most recently, he served as Executive Vice-President, Corporate Development of Fireworks Entertainment and, prior to that, he served as Chief Financial Officer of Fireworks Entertainment.

(* Magna International, MI Developments and Intier Automotive Inc. are affiliates of MEC.)

4

Frank DeMarco, Jr. serves as Vice-President, Regulatory Affairs of MEC and Executive Director, General Counsel and Secretary of Los Angeles Turf Club, Incorporated, which is an indirect, wholly-owned subsidiary of MEC. Mr. DeMarco has been a practicing attorney in Los Angeles County since 1951 and has been the Executive Director, General Counsel and Secretary of Los Angeles Turf Club, Incorporated since April 1998.

Mary Lyn Seymour has served as Controller of MEC since September 2004. Prior to becoming Controller, Ms. Seymour served as Director of Finance at MEC from May 2001 to September 2004. Prior to joining MEC, Ms. Seymour held various accounting positions leading up to Senior Manager with PriceWaterhouseCoopers LLP from September 1990 to May 2001.

Lee D. Jackson has served as Secretary of MEC since November 2004. Previously, Mr. Jackson was Legal Counsel of MEC since September 2003. Prior to joining MEC, Mr. Jackson was an Associate Lawyer with the law firm of McCarthy Tétrault LLP from July 2002 to September 2003 and prior to that, he was an Associate Lawyer with the law firm of Brobeck, Phleger & Harrison, LLP from September 1999 to July 2002.

SECURITY OWNERSHIP

The following tables set forth certain information as of March 21, 2005 with respect to beneficial ownership of MEC by (a) any entity or person known by MEC to be the beneficial owner of more than five percent of the outstanding shares of MEC's Class A Subordinate Voting Stock and Class B Stock and (b) each director, nominee for director and executive officer (including the Named Executive Officers listed below in the Summary Compensation Table) and all executive officers and directors of MEC as a group.

To MEC's knowledge, except as indicated in the footnotes to these tables or pursuant to applicable community property laws, the persons named in the following tables have sole voting and investment power with respect to the shares of MEC's Class A Subordinate Voting Stock and Class B Stock indicated.

For information regarding MEC's equity compensation plans, please see "Executive Compensation — Long-Term Incentive Plan".

5

(a) Security Ownership of Beneficial Owners of more than 5% of the Company's Voting Securities

Class of Securities

| | Name and Address of Beneficial Owner

| | Amount and Nature of Beneficial Ownership

| | Percentage of Class

|

|---|

| Class B Stock | | MI Developments Inc. (1)(2)

455 Magna Drive

Aurora, Ontario L4G 7A9 | | 58,466,056 | | 100% |

| Class A Subordinate Voting Stock | | Bank Austria Creditanstalt AG (3)

A-1030 Vienna

Vordere Zollanlsstrasse 13 | | 10,638,298 | | 17.9% |

| Class A Subordinate Voting Stock | | MI Developments Inc. (2)

455 Magna Drive

Aurora, Ontario L4G 7A9 | | 4,362,328 | | 9.0% |

| Class A Subordinate Voting Stock | | Fair Enterprise Limited (4)

1 Seaton Place

St. Helier

Jersey JE4 8YJ

Channel Islands | | 3,682,515 | | 7.5% |

| Class A Subordinate Voting Stock | | Hotchkis and Wiley Capital

Management LLS | | 3,054,700 | | 6.2% |

- (1)

- MI Developments directly owns 53,253,145 or 91.1% of these shares of MEC's Class B Stock. The remaining shares of Class B Stock are owned through a direct wholly-owned subsidiary of MI Developments. MI Developments is entitled to vote approximately 96% of the votes attaching to MEC's outstanding voting securities.

- (2)

- The Stronach Trust controls MI Developments through the right to direct the votes attaching to Class B shares of MI Developments which carry a majority of the votes attaching to the outstanding voting shares of MI Developments. The Class B shares of MI Developments are held by 445327 Ontario Limited, all of the shares of which are held by the Stronach Trust. Mr. Frank Stronach is the exclusive representative for voting the shares of MI Developments Inc. held by 445327 Ontario Limited solely in the manner directed by the Stronach Trust and is the Chairman of MI Developments and MEC. Mr. Stronach, together with three members of his family, are the trustees of the Stronach Trust. Mr. Stronach is also a member of the class of potential beneficiaries under the Stronach Trust.

- (3)

- Bank Austria Creditanstalt AG and Bayerische Hypo-und Vereinsbank Aktiengesellschaft beneficially own an aggregate of 10,638,298 shares of Class A Subordinate Voting Stock as of December 31, 2003. This group is deemed to beneficially own such shares by virtue of its ownership of $75 million principal amount of MEC's 8.55% Convertible Subordinated Notes due June 15, 2010, which are convertible into 10,638,298 shares of Class A Subordinate Voting Stock.

- (4)

- All of the shares of Fair Enterprise Limited are held by Bergenie Anstalt, an estate planning vehicle for the Stronach family. The members of the family of Mr. Stronach are among the class of possible indirect beneficiaries under this anstalt. Mr. Frank Stronach shares control or direction over the shares of MEC held by Fair Enterprise.

6

(b) Security Ownership of Directors and Executive Officers as of March 21, 2005

| | Amount and Nature of Beneficial Ownership

|

| |

| |

|---|

Name of Beneficial Owner

| | Class A Subordinate Voting Stock (1)

|

| | Percentage

of

Class

| | Class B Stock

|

| | Percentage

of

Class

| |

|---|

| Frank Stronach | | 9,710,481 | (2) | | 19.5 | % | 58,466,056 | (3) | | 100 | % |

| Jim McAlpine | | 605,000 | | | 1.0 | % | Nil | | | Nil | |

| W. Thomas Hodgson | | 60,000 | | | (5 | ) | Nil | | | Nil | |

| Donald Amos (4) | | 422,582 | | | (5 | ) | Nil | | | Nil | |

| Blake S. Tohana | | 40,000 | | | (5 | ) | Nil | | | Nil | |

| John R. Barnett | | 2,415 | | | (5 | ) | Nil | | | Nil | |

| Jerry D. Campbell (6) | | 250,321 | | | (5 | ) | Nil | | | Nil | |

| Louis E. Lataif | | 12,925 | | | (5 | ) | Nil | | | Nil | |

| Edward C. Lumley | | 36,037 | | | (5 | ) | Nil | | | Nil | |

| William J. Menear | | 12,925 | | | (5 | ) | Nil | | | Nil | |

| Dennis Mills | | 20,000 | | | | | Nil | | | Nil | |

| Gino Roncelli (7) | | 162,790 | | | (5 | ) | Nil | | | Nil | |

| All executive officers and directors as a group (11 persons) | | 11,335,476 | | | 22.0 | % | 58,466,056 | (3) | | 100 | % |

- (1)

- Includes the following number of shares of Class A Subordinate Voting Stock issuable upon the exercise of outstanding stock options which may be exercised within 60 days of March 21, 2005: Mr. Stronach: 1,000,000; Mr. Hodgson 60,000, Mr. McAlpine: 500,000; Mr. Amos: 300,000; Mr. Tohana: 40,000; Mr. Barnett: 2,000; Mr. Campbell, 2,000; Mr. Lataif: 6,000; Mr. Lumley: 12,000; Mr. Menear: 6,000; Mr. Mills 20,000, Mr. Roncelli: 12,000; all executive officers and directors as a group, 1,960,000 shares.

- (2)

- 4,362,328 of these shares are registered in the name of MI Developments. See Note 2 above under "Security Ownership of Beneficial Owners of more than 5% of the Company's Voting Securities". 3,682,515 of these shares are registered in the name of Fair Enterprise Limited. See Note 4 above under "Security Ownership of Beneficial Owners of more than 5% of the Company's Voting Securities." 440,862 of these shares are registered in the name of The Canada Trust Company, trustee of the Magna Deferred Profit Sharing Plan (Canada) of Magna International. As Chairman of Magna International, Mr. Stronach has the right to direct the trustee in regard to voting and disposing of these shares. 206,428 of these shares are registered in the name of The Employees Deferred Profit Sharing Plan (U.S.) of Magna International. Mr. Stronach is one of the trustees of this plan, but is not a beneficiary. 18,348 of these shares are registered in the name of 865714 Ontario Inc., which is a separate vehicle incorporated for the acquisition of Magna International shares and the sale thereof to the management team of Magna International. Magna International has the right to direct the disposition of these shares.

- (3)

- MI Developments directly owns 53,253,145 or 91.1% of these shares of MEC's Class B Stock. The remaining shares of Class B Stock are owned through a direct wholly-owned subsidiary of MI Developments. MI Developments is entitled to vote approximately 96% of the votes attaching to MEC's outstanding voting securities. See Note 2 above under "Security Ownership of Beneficial Owners of more than 5% of the Company's Voting Securities."

- (4)

- Of these holdings, 120,482 shares of Class A Subordinate Voting Stock are owned directly and 2,100 are owned by Mr. Amos' wife.

- (5)

- These shares represent less than 1% of the class.

- (6)

- Of these holdings, 228,078 shares of Class A Subordinate Voting Stock are owned directly, 11,225 are owned jointly by Mr. Campbell and his wife, 4,009 are owned by Mr. Campbell's wife, and 5,009 are owned indirectly through two wholly-owned corporations, Post It Stables, Inc. and Volar Corp.

- (7)

- Of these holdings, 13,790 shares of Class A Subordinate Voting Stock are owned directly, 67,000 are owned indirectly through Roncelli Plastics Inc., an associate of Mr. Roncelli, and 70,000 are owned by the Roncelli Family Trust, an associate of Mr. Roncelli.

7

THE BOARD OF DIRECTORS AND COMMITTEES OF THE BOARD

The business of MEC is managed under the direction of the Board of Directors (the "Board"). The Board held nine meetings during fiscal year 2004. All current directors of MEC (other than Messrs. Barnett and Mills, who became directors in November 2004 and Mr. Hodgson, who became a director in March 2005) attended at least 75% of the meetings of the Board and Committees of which they were members during fiscal year 2004, except for Frank Stronach (who attended six of the nine Board meetings). While MEC does not have a formal, written attendance policy requiring directors to attend its Annual Meeting of Stockholders, the Board encourages directors to attend the Annual Meeting. All members of the Board attended the 2004 Annual Meeting.

MEC does not have a formal process for stockholders to send communications to the Board. In view of the infrequency of stockholder communications with the Board, the Board does not believe that a formal process is necessary, but any stockholder may submit written communications to the Board by sending them to Magna Entertainment Corp., 337 Magna Drive, Aurora, Ontario, Canada L4G 7K1, Attention: Corporate Secretary's Office, whereupon such communications will be forwarded to the Board as a group or to the individual director or directors addressed.

MEC is a "controlled company" as defined in the Nasdaq Marketplace Rules because MI Developments controls a majority of the votes attaching to MEC's outstanding voting stock. As a result, under the Nasdaq Marketplace Rules, MEC is only required to establish and maintain one committee of the Board, the Audit Committee. Pursuant to the Nasdaq Marketplace Rules, MEC's Audit Committee is required to be composed solely of independent directors, but neither the Board nor any other committee of the Board is required to meet the other director independence requirements set forth in the Nasdaq Marketplace Rules, except that the independent directors are required to meet on a regular basis. Commencing in October 2003, the non-management members of the Board have met independently on a quarterly basis.

Because of the number of matters requiring Board consideration, to make the most effective use of individual Board members' capabilities, the Board has established three standing committees to devote attention to specific subjects and to assist it in the discharge of its responsibilities. The functions of these committees, their current members and the number of meetings held during 2004 are described below. In addition, one special committee of the Board was established to deal with specific transactions in 2004, a description of this committee, its members and the number of meetings held during 2004 are described below.

Corporate Governance, Human Resources and Compensation Committee

The Corporate Governance, Human Resources and Compensation Committee is composed of Edward C. Lumley (who filled the vacancy created by W. Davis in August 2004) (Chairman), Louis E. Lataif and Gino Roncelli. The Corporate Governance, Human Resources and Compensation Committee administers MEC's Long-Term Incentive Plan. It also reviews and makes recommendations to the Board with respect to all direct and indirect compensation, benefits and perquisites of MEC's President and Chief Executive Officer, Chief Financial Officer, Chief Operating Officer and certain other senior management employees, and MEC's policies regarding management benefits and perquisites. This Committee is also generally responsible for developing MEC's approach to corporate governance issues, including MEC's relationship with Magna International and MI Developments, and assessing the effectiveness of the system of corporate governance employed by MEC as a whole. The Corporate Governance, Human Resources and Compensation Committee held two meetings during fiscal year 2004.

Audit Committee

The Audit Committee is composed of William J. Menear (Chairman), Jerry D. Campbell and John R. Barnett (who replaced Edward C. Lumley in February 2005). Each member of the Audit Committee is "independent" as currently required by the Nasdaq Marketplace Rules. In addition, the Board of Directors has determined that each of William J. Menear and John Barnett is an "audit committee financial expert" as defined by Item 401 of Regulation S-K. Since Mr. Campbell was the President and Chief Executive Officer of MEC from March 2000 to August 2000, he did not satisfy the definition in the Nasdaq Marketplace Rules of an

8

"independent director" at the date of his appointment to the Audit Committee. However, since Mr. Campbell was neither a current employee of MEC, nor an immediate family member of such an employee, his appointment to MEC's Audit Committee was permitted under the Nasdaq Marketplace Rules, subject to compliance with the other applicable terms of such rules.

The Audit Committee is established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended, and is responsible for the appointment, engagement and oversight of the work of the independent auditors of MEC. In accordance with its Charter, the Audit Committee also has considerable general authority in relation to the oversight of MEC's financial affairs, as well as specific responsibility to review MEC's quarterly and annual financial statements and the related Management's Discussion and Analysis of Results of Operations and Financial Position ("MD&A") and to report thereon to the Board. In addition, the Audit Committee reviews MEC's internal financial and accounting controls and procedures, reviews the selection, use and application of accounting policies and practices, and examines and considers various other matters in relation to the internal and external audits of MEC's accounts and its financial reporting process and system of internal controls. Also, in accordance with its Charter, the Audit Committee conducted an annual review of its Charter and made certain changes in February 2005. The amended and restated Charter of the Audit Committee is attached hereto at Appendix A. The Audit Committee held seven meetings during fiscal year 2004.

Special Independent Committee

The Special Independent Committee is a standing committee composed of Gino Roncelli (Chairman), Jerry D. Campbell (who joined the Committee on February 24, 2004), Louis E. Lataif and William J. Menear. This Committee was initially established on August 1, 2001 with a mandate to review proposed real estate transactions between MEC (or any of its subsidiaries) and Magna International and its subsidiaries. On February 24, 2004, the mandate of this Committee was expanded to cover all proposed transactions between MEC and MI Developments, Magna International or any of their respective subsidiaries. The Special Independent Committee met as a committee three times during fiscal year 2004.

Special Committee of Independent Directors

On July 12, 2004, MEC was advised by MI Developments Inc. ("MID") of its intention to make an unsolicited offer to acquire all of the outstanding shares of Class A Subordinate Voting Stock of MEC not currently owned by MID (the "MID Offer"). A special committee of independent directors (the "Special Committee") was asked to evaluate the MID Offer and to make recommendations to MEC's Board of Directors concerning the appropriate response in the circumstances. The initial members of the Special Committee were William J. Menear (Chairman), Jerry D. Campbell, Louis E. Lataif (who resigned from the Special Committee in July 2004) and Gino Roncelli. However, on September 16, 2004, MEC was advised by MID that it had decided not to proceed with the MID Offer. The Special Committee held a total of four formal meetings to address the MID Offer as well as a number of informal discussions among themselves and with their separate legal and financial advisors on a number of other occasions. In October, 2004, the Board of Directors recast the power and authority of the Special Committee to authorize it to review and evaluate proposed financing transactions with MID for Gulfstream Park and The Meadows and to make appropriate recommendations to the Board of Directors of MEC with respect to such proposed financing transactions. On December 9, 2004, after approval from MEC's Board of Directors based, among other things, on a recommendation of the Special Committee, MEC entered into a binding term sheet with MID for project financing for construction projects at Gulfstream Park and The Meadows as well as definitive agreements for the Gulfstream Park construction loan. The Special Committee held a total of ten formal meetings in respect of the financing transactions and members of the Special Committee had informal discussions among themselves and with their separate legal and financial advisors on a number of other occasions. The Special Committee also supervised and provided guidance to members of MEC management engaged in negotiating the financing transactions.

Nomination Process

Since MEC is a "controlled company" (as discussed above), MEC is not required to have, and does not have, a nominating committee or other committee of the Board performing similar functions. Nominees for

9

director of MEC are considered and approved by the full Board and there is no charter applicable to the nominating process (including any policy with respect to consideration of nominees by security holders).

Code of Conduct

MEC adopted a Code of Business Conduct (the "Code") effective May 4, 2004 that applies to all of MEC's directors, officers and employees. The Code fulfills the Code of Ethics requirements under Item 406 of Regulation S-K. A copy of the Code was filed with MEC's Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 14, 2005 and is also available on MEC's website at www.magnaentertainment.com/Investor Relations. A copy of the Code will be provided without charge to any person upon request in writing to the Corporate Secretary's Office, Magna Entertainment Corp., 337 Magna Drive, Aurora, Ontario, Canada L4G 7K1.

Directors' Compensation

Directors who are not officers or employees of MEC or any of its affiliates were paid an annual retainer (or pro rata portion for directors who served less than 12 months in 2004) of $15,000 in cash and 2,490 shares of Class A Subordinate Voting Stock for their service as directors in 2004, together with a fee of $1,000 for attendance at each meeting of the Board. Such directors were also paid an annual committee retainer of $4,000 (Committee Chairmen receive an $8,000 annual retainer) and a fee of $1,000 for attendance at each meeting of each Committee of the Board on which they serve (Committee Chairmen receive a fee of $1,500 for attendance at each meeting). Compensation for Board and Committee work and travel days ($1,500 per day) and for the execution of written resolutions ($250) was also provided to directors who are not officers or employees. In addition, each director receives certain stock options as set forth below under "EXECUTIVE COMPENSATION — Long-Term Incentive Plan — Nonqualified Stock Options."

Compensation Committee Interlocks and Insider Participation

The members of the Corporate Governance, Human Resources and Compensation Committee for fiscal year 2004 were William G. Davis (until August 2004), Louis E. Lataif and Gino Roncelli. Edward C. Lumley succeeded Mr. Davis as Chairman of this committee. Messrs. Davis, Lumley, Lataif and Roncelli are not and have never been officers or employees of MEC or any of its subsidiaries. In addition, there are no compensation committee interlocks between MEC and other entities involving MEC's executive officers and board members who serve as executive officers of such entities.

Certain Relationships and Related Transactions

We have employment agreements with certain of our officers. See "Executive Compensation — Employment Agreements and Termination of Employment Agreements" below.

In 2004, MEC employed Mr. Mills as a consultant under a consulting arrangement that expired on February 29, 2004. Mr. Mills was paid a total of CDN $55,500 for consulting services to MEC in 2004.

MEC pays for its share of an insurance policy that provides, among other coverages, for executive liability of up to $65 million (per occurrence and in the aggregate for all claims made during the policy year) for officers and directors of MI Developments Inc. and its subsidiaries (including MEC and its subsidiaries), subject to a $1 million deductible for executive indemnification.

MEC's bylaws contain provisions that may require MEC to indemnify its directors, and at the option of the Board, any of its officers, employees or agents, against certain liabilities that may arise by reason of their status or service as directors, officers, employees or agents, as permitted by applicable law, and to advance expenses incurred as a result of any proceeding against them that is subject to indemnification under MEC's bylaws. In addition, MEC has entered into an agreement with Messrs. Lataif, Menear, Campbell and Roncelli that provides for the indemnification of these individuals by MEC, to the fullest extent permitted by applicable law, as a result of their role as members of the Special Committee described above or any action alleged to have been taken or omitted in such capacity, and to advance expenses incurred as a result of any proceeding against them that is subject to indemnification under the agreement.

10

On August 19, 2003, the shareholders of Magna International approved the spin off of its wholly-owned subsidiary, MI Developments. As a result of the spin off transaction, MI Developments acquired Magna International's controlling interest in MEC. MEC and MI Developments operate as separate public companies each having its own board of directors and management team.

MI Developments is a real estate operating company engaged in the ownership, development, management, leasing, acquisition and expansion of industrial and commercial real estate properties located in Canada, Europe, the United States and Mexico. Virtually all of MI Developments' income-producing properties are under long-term leases to Magna International and its subsidiaries.

MI Developments was incorporated under the laws of Ontario, Canada. The Class A subordinate voting shares of MI Developments are listed for trading on the New York Stock Exchange and the Toronto Stock Exchange ("TSX"). MI Developments' Class B shares are listed on the TSX. MI Developments is the sole holder of MEC's Class B Stock (directly and indirectly), which means that MI Developments is entitled to exercise approximately 96% of the total votes attached to all MEC's outstanding stock. MI Developments is therefore able to elect all the directors of MEC and to control MEC.

MEC's Corporate Constitution requires that a minimum of two directors be individuals who are not MEC officers or employees, or officers, directors or employees of any of MEC's affiliates, including MI Developments and Magna International, or persons related to any such officers, employees or directors. The Corporate Constitution also requires that a majority of MEC's directors be individuals who are not MEC officers or employees or individuals related to these persons.

MI Developments is able to elect all MEC's directors and controls MEC. Therefore, MI Developments is able to cause MEC to effect certain corporate transactions without the consent of MEC's minority stockholders, subject to applicable law and the fiduciary duties of MEC's directors and officers. In addition, MI Developments is able to cause or prevent a change in control of MEC. The Stronach Trust controls MI Developments through the right to direct the votes attaching to Class B shares of MI Developments, which carry a majority of the votes attaching to the outstanding voting shares of MI Developments. Mr.��Frank Stronach, the Chairman of MEC and MI Developments, together with three members of his family, are the trustees of the Stronach Trust. Mr. Stronach is also a member of the class of potential beneficiaries of the Stronach Trust.

In September 2004, a subsidiary of MEC entered into an option agreement with MI Developments and one of its subsidiaries to acquire 100% of the shares of the MI Developments subsidiary that owns land in Romulus, Michigan, for $33.5 million, which may serve as the site of MEC's proposed racetrack in Romulus, Michigan. The option expires on June 30, 2005. For this option, MEC paid MID $10 thousand, which if the option is exercised by MEC, would be applied to the purchase price on closing.

In December 2004, certain of MEC's subsidiaries entered into a project financing arrangement with MI Developments for the reconstruction of facilities at Gulfstream Park of $115 million. The project financing is made by way of progress draw advances to fund reconstruction. The loan has a ten-year term from the completion date of the reconstruction project. The anticipated completion date for the Gulfstream Park reconstruction project is the first quarter of 2006. Prior to the completion date, amounts outstanding under the loan will bear interest at a floating rate equal to 2.55% per annum above MI Development's notional cost of borrowing under its floating rate credit facility, compounded monthly (5.8% at December 31, 2004). After the completion date, amounts outstanding under the loan will bear interest at a fixed rate of 10.5% per annum, compounded semi-annually. Prior to January 1, 2008, payment of interest will be deferred. Commencing January 1, 2008, MEC will make monthly blended payments of principal and interest based on a 25-year amortization period commencing on the completion date. The loans contain cross-guarantee, cross-default and cross-collateralization provisions with The Meadows loan described in the paragraph below. The loan is guaranteed by certain subsidiaries of MEC that own and operate The Meadows and is collateralized principally by first-ranking security over the lands forming part of the race track operations at Gulfstream Park and The Meadows and certain lands adjacent to the racetrack operations at Gulfstream Park and over all other assets of Gulfstream Park and The Meadows, excluding licenses and permits. At December 31, 2004,

11

$26.4 million was outstanding under the Gulfstream Park loan. MEC incurred loan origination expenses of $3.0 million, which have been recorded as a reduction of the outstanding loan balance. The loan balance will be accreted to its face value over the term to maturity.

In December 2004, certain of MEC's subsidiaries also entered into a binding term sheet with MI Developments for project financing to fund part of the proposed redevelopment at The Meadows for $77 million. The project financing for The Meadows redevelopment would be on substantially the same terms as the project financing for the Gulfstream Park redevelopment and would be guaranteed by MEC's subsidiary that owns and operates Gulfstream Park and would be cross-guaranteed, cross-defaulted and cross-collateralized with the Gulfstream Park loan described in the preceding paragraph. The Meadows project financing is contingent on a number of events, including the issuance of a license to The Meadows to operate slot machines and additional financing from other sources.

Magna International has made a commitment to its shareholders that it will not, during the period ending May 31, 2006, without the prior consent of the holders of a majority of Magna International's Class A subordinate voting shares: (i) make any further debt or equity investment in, or otherwise give financial assistance to, MEC or any of MEC's subsidiaries; or (ii) invest in any non-automotive-related businesses or assets other than through its investment in MEC. Magna International's commitment is contained in a Forbearance Agreement, dated as of February 8, 2000, between MEC and Magna International and of which Magna International's shareholders are express third-party beneficiaries.

One of MEC's subsidiaries has been named in a class action brought in a United States District Court by various plaintiffs. The plaintiffs in this action claim unspecified compensatory and punitive damages, for restitution and disgorgement of profits, all in relation to forced labor performed by the plaintiffs for such subsidiary and certain other Austrian and German corporate defendants at their facilities in Europe during World War II and certain property right claims. As a result of a reorganization in prior years, MEC acquired the shares of such subsidiary. Under Austrian law, such subsidiary would be jointly and severally liable with the other defendants in such action for the damages awarded in respect of these class action claims. An Austrian subsidiary of Magna International has agreed to indemnify this MEC subsidiary for any damages or expenses associated with this case.

A subsidiary of Magna International has agreed to indemnify MEC in respect of environmental remediation costs and expenses relating to existing conditions at certain of MEC's Austrian real estate properties.

On November 1, 2004, a wholly-owned subsidiary of MEC entered into an access agreement with Magna International and one of its subsidiaries for their use of the golf course and the clubhouse meeting, dining and other facilities at the Magna Golf Club in Aurora, Ontario. The agreement, which expires on December 31, 2014, stipulates an annual fee of $4.2 million (Cdn. $5.0 million) retroactive to January 1, 2004. During the year ended December 31, 2004, MEC recognized $3.9 million of revenues related to this agreement.

On November 1, 2004, a wholly-owned subsidiary of MEC entered into an access agreement with Magna International and one of its subsidiaries for their use of the golf course and the clubhouse meeting, dining and other facilities at Fontana Sports in Oberwaltersdorf, Austria. The agreement, which expires on December 31, 2014 stipulates an annual fee amounting to Euros 2.5 million, retroactive to March 1, 2004. This agreement replaces an access agreement between the parties that expired on March 1, 2004 on substantially the same terms and conditions. During the year ended December 31, 2004, MEC recognized $3.2 million of revenues related to these access agreements.

MEC has granted Magna a right of first refusal to purchase the Company's two golf courses.

During the year ended December 31, 2004, MEC incurred costs of $2.7 million for rent, facilities and central shared services from Magna International and one of its subsidiaries.

12

For more detail about MEC's relationship with Magna International and related transactions, please see "Relationship with Magna International" in MEC's Registration Statement on Form S-1 (No. 333-70520), as amended, which section is incorporated herein by reference.

EXECUTIVE COMPENSATION

The following tables and narratives discuss the compensation paid in fiscal years 2004, 2003 and 2002 to MEC's Chairman, Chief Executive Officer and three other most highly compensated executive officers in 2004 (collectively, the "Named Executive Officers"). The indicated compensation is only for the period the designated executive officer served in such capacity.

Summary Compensation Table

|

|---|

| |

| | Annual Compensation (1)

| | Long-Term Compensation

|

|---|

Name & Principal Position

| | Year

| | Salary

($)

| | Bonus

($)

| | Other Annual Compensation

($)

| | Restricted Stock Awards

($)

| | Securities Underlying Options

(#)

| | LTIP Payout

($)

| | All Other Compensation

($)

|

|---|

|

Frank Stronach

Chairman | | 2004

2003

2003 | | —

—

— | | | | —

—

— | | | | —

—

— | | —

—

— | | —

—

— | | —

—

— | | —

—

— |

|

Jim McAlpine (2)

(Former) President and

Chief Executive Officer | | 2004

2003

2002 | | 409,600

409,600

409,600 | | | | 400,000

600,000

800,000 | | | | —

—

— | | —

—

— | | —

— | | —

—

— | | —

—

— |

|

Donald Amos

Executive Vice-President and

Chief Operating Officer | | 2004

2003

2002 | | 359,600

359,600

359,600 | | | | 350,000

350,000

350,000 | | | | —

—

— | | —

—

— | | —

—

— | | —

—

— | | —

—

— |

|

Blake S. Tohana (3)

Executive Vice-President

and Chief Financial Officer | | 2004

2003

2002 | | 240,141

89,348

— | | (4) | | 96,500

39,700

— | | (4) | | —

—

— | | —

—

— | | —

100,000

— | | —

—

— | | —

—

— |

|

Gerald Noble (5)

(Former) Executive Vice-

President, MEC Media | | 2004

2003

2002 | | 100,669

—

— | | | | 60,777

—

— | | (4) | | —

—

— | | —

—

— | | —

—

— | | —

—

— | | —

—

— |

|

- (1)

- The aggregate amount of perquisites and other personal benefits, securities or property does not exceed the lesser of $50,000 or 10% of the total of annual salary and bonus for any of the Named Executive Officers.

- (2)

- Mr. McAlpine became an executive officer on January 9, 2001.

- (3)

- Mr. Tohana became an executive officer on July 28, 2003.

- (4)

- These figures have been converted from Cdn. dollars to U.S. dollars based on the average monthly foreign exchange rates.

- (5)

- Mr. Noble became an executive officer on September 13, 2004 and ceased to serve as an executive officer on February 7, 2005.

13

|

|---|

Option Grants in Last Fiscal Year

|

|---|

| | Individual Grants

| | Grant Date Value

|

|---|

| |

| | % of Total Options Granted to Employees in Fiscal Year

| |

| |

|

|---|

Name

| | Number of Securities Underlying Options Granted (1)

(#)

| | Exercise or Base Price (2)

($/Share)

| | Expiration Date

| | Grant Date Present Value (3)

($/Share)

|

|---|

|

| Frank Stronach | | — | | — | | — | | — | | — |

|

| Jim McAlpine | | — | | — | | — | | — | | — |

|

| Donald Amos | | — | | — | | — | | — | | — |

|

| Blake S. Tohana | | — | | — | | — | | — | | — |

|

| Gerald Noble | | — | | — | | — | | — | | — |

|

- (1)

- Options granted were options to acquire shares of Class A Subordinate Voting Stock.

- (2)

- The greater of: (i) market price on date of grant, and (ii) net book value per share as of the most recently completed fiscal quarter for which financial results have been publicly announced.

- (3)

- Calculated using the Black-Scholes pricing model. Underlying assumptions used in the calculation include a risk-free interest rate of 2.0 percent per annum, dividend yields of 0.84 percent, volatility factors of the expected market price of 0.534 and an expected life of four years. MEC has elected to illustrate the potential realizable value using the Black-Scholes pricing model as permitted by the rules of the Securities and Exchange Commission. This does not represent MEC's estimate or projection of future stock price or of the assumptions utilized; actual gains, if any, upon future exercise of any of these options will depend on the actual performance of the Class A Subordinate Voting Stock.

- (4)

- Vested as to one-fifth of the securities underlying the options granted on the date of grant and an additional one-fifth on each of the first four anniversaries of the date of grant.

|

|---|

Fiscal Year-End Option Values

|

|---|

| | Number of Securities Underlying Unexercised Options at Fiscal Year-End

(#)

| | Value of Unexercised In-The-Money Options at Fiscal Year-End

($) (1)

|

|---|

Name

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

|

| Frank Stronach (2) | | 1,000,000 | | — | | NIL | | — |

|

| Jim McAlpine (2) | | 400,000 | | 100,000 | | 433,000 | | 108,250 |

|

| Donald Amos (2) | | 300,000 | | — | | NIL | | — |

|

| Blake S. Tohana (2) | | 40,000 | | 60,000 | | NIL | | NIL |

|

| Gerald Noble (2)(3) | | — | | — | | — | | — |

|

- (1)

- The closing sale price of MEC's Class A Subordinate Voting Stock as reported on the Nasdaq National Market on December 31, 2004 was $6.02 per share. Value is calculated by multiplying (a) the difference between $6.02 and the option exercise price by (b) the number of shares of Class A Subordinate Voting Stock underlying the options.

- (2)

- None of these individuals were granted or exercised any options to acquire stock of MEC during the fiscal year ended December 31, 2004.

- (3)

- Mr. Noble became an executive officer on September 13, 2004 and ceased to serve as an executive officer on February 7, 2005.

Employment Agreements and Termination of Employment Agreements

MEC has entered into employment arrangements and agreements with certain executive officers as described below:

MEC has an employment agreement with Mr. Hodgson which provides for a base salary of $300,000, a guaranteed bonus of $200,000 for 2005 (to be superseded by a mutually agreeable bonus arrangement for 2006 onwards), confidentiality obligations, non-competition covenants and a termination provision permitting his employment to be terminated by MEC by giving minimum advance written notice of termination or by paying a retiring allowance instead. Mr. Hodgson's employment agreement also provides for the grant of stock options to purchase 300,000 shares of MEC's Class A Subordinate Voting Stock. The grant of 100,000 of

14

these stock options, with an exercise price of $6.85 per share, was approved by the Corporate Governance, Human Resources and Compensation Committee of MEC's Board of Directors on March 7, 2005. The grant of the remaining 200,000 of these stock options, with an exercise price of $6.01 per share, was approved by the Corporate Governance, Human Resources and Compensation Committee of MEC's Board of Directors on March 21, 2005.

MEC has an employment arrangement with Mr. McAlpine which provides for a base salary of $409,600 per annum, a guaranteed annual bonus of $400,000 (to be superseded by a mutually agreeable profit-sharing arrangement), a discretionary bonus based on personal performance, confidentiality obligations, non-competition covenants and a termination provision permitting his employment to be terminated by MEC by giving minimum advance written notice of termination or by paying a retiring allowance instead. Mr. McAlpine's arrangement also provides for the grant of stock options to purchase 500,000 shares of MEC's Class A Subordinate Voting Stock. The grant of these stock options, with an exercise price of $4.9375 per share, was approved by the Corporate Governance, Human Resources and Compensation Committee of MEC's Board of Directors on February 19, 2001.

MEC has entered into an employment arrangement with Mr. Amos which provides for a base salary of $359,600 per annum, an annual bonus based on a percentage of pre-tax profits (with a guaranteed minimum of $350,000), a discretionary bonus based on personal performance, confidentiality obligations, non-competition covenants and a termination provision permitting his employment to be terminated by MEC by giving minimum advance written notice of termination or by paying a retiring allowance instead. Mr. Amos' contract also provides for the grant of stock options to purchase 300,000 shares of MEC's Class A Subordinate Voting Stock. The grant of these stock options, with an exercise price of $6.07 per share, was approved by the Corporate Governance, Human Resources and Compensation Committee of MEC's Board of Directors on August 14, 2000.

MEC has entered into an employment agreement with Mr. Tohana which provides for a base salary of Cdn. $300,000 per annum, a guaranteed annual bonus of Cdn. $125,000 (to be superseded by a mutually agreeable profit-sharing arrangement), confidentiality obligations, non-competition covenants and a termination provision permitting his employment to be terminated by MEC by giving minimum advance written notice of termination or by paying a retiring allowance instead. Mr. Tohana's contract also provides for the grant of stock options to purchase 100,000 shares of MEC's Class A Subordinate Voting Stock. The grant of these stock options, with an exercise price of $6.93 per share, was approved by the Corporate Governance, Human Resources and Compensation Committee of MEC's Board of Directors on June 24, 2003.

MEC has entered into employment contracts with other members of its senior management. These employment contracts generally provide for base salaries and annual bonuses (in some cases based on a specified percentage of MEC's pre-tax profits before profit sharing), confidentiality obligations and non-competition covenants. Each of these employment contracts provide that MEC may terminate the senior officer's employment by giving minimum advance written notice of termination or by paying a retiring allowance instead. With the approval of the Corporate Governance, Human Resources and Compensation Committee of MEC's Board of Directors, some of MEC's senior officers have received options to acquire shares of MEC's Class A Subordinate Voting Stock at an exercise price equal to or greater than the fair market value of the shares of such stock on the date of grant of the option.

MEC's Corporate Constitution provides that, beginning with the fiscal year commencing January 1, 2004, the aggregate incentive bonuses (which may be paid in cash or deferred for payment in future years or which may be paid in Class A Subordinate Voting Stock) paid or payable to "Corporate Management" (as defined therein) in respect of any fiscal year shall not exceed 6% of MEC's pre-tax profits before profit sharing for that fiscal year.

MEC is not required to make payments under any employment contract or arrangement with its senior officers in the event of a change in control of MEC.

15

Long-Term Incentive Plan

MEC has adopted a long-term incentive plan, referred to as the "Long-Term Incentive Plan", the purposes of which are: (i) to align the interests of MEC's stockholders and the recipients of awards under the Long-Term Incentive Plan by giving recipients of awards an interest in MEC's growth and success; (ii) to enable MEC to attract and retain directors, officers, employees, consultants, independent contractors and agents; and (iii) to motivate these persons to act in MEC's long-term best interests and those of its stockholders. Under the Long-Term Incentive Plan, MEC may grant nonqualified stock options, incentive stock options, free standing stock appreciation rights, tandem stock appreciation rights, restricted stock, bonus stock and performance shares. MEC does not maintain any other equity compensation plan.

The Long-Term Incentive Plan is administered by the Corporate Governance, Human Resources and Compensation Committee (the "Committee") of the Board of Directors, which consists of three outside directors. The members of the Committee serve at the pleasure of the Board of Directors. The following table summarizes MEC's Long-Term Incentive Plan information as of March 21, 2005.

Plan Category

| | Number of securities to be issued

upon exercise of outstanding

options, warrants and rights

(a)

| | Weighted-average exercise

price of outstanding options,

warrants and rights

(b)

| | Number of securities remaining

available for future issuance under

equity compensation plans

(excluding securities reflected

in column (a))

(c)

|

|---|

|

|

|

|

|

|

|

|---|

| Equity compensation plans approved by security holders | | 4,845,500 (1) | | $6.18 | | 2,770,366 (2) |

| Equity compensation plans not approved by security holders | | n/a | | n/a | | n/a |

| Total | | 4,845,500 (1) | | $6.18 | | 2,770,366 (2) |

- (1)

- As of March 21, 2005, there were 3,107,541 options outstanding under the Long-Term Incentive Plan for the purchase of these shares.

- (2)

- Of these shares of Class A Subordinate Voting Stock remaining available for issuance under the Long-Term Incentive Plan, 1,440,500 shares are available for issuance pursuant to the grant of new stock options and 1,329,866 are available for issuance as bonus stock awards.

Each of MEC's outside directors was granted a nonqualified stock option to purchase 10,000 shares of Class A Subordinate Voting Stock following such director's election to MEC's Board of Directors, and will be entitled to another such grant immediately following the completion of each five-year period of continuous service as a director. Such stock options vest as to 20% of the shares of Class A Subordinate Voting Stock included in each such grant on the date of such grant, with an additional 20% of the shares vesting on the second, third, fourth and fifth anniversaries of such grant. On March 5, 2000, the Board approved stock options for each of its outside directors then in office to purchase 10,000 shares of Class A Subordinate Voting Stock at an exercise price of $4.875 per share, pursuant to the provisions of the Long-Term Incentive Plan. On November 22, 2002, the Committee approved stock options for two appointed outside directors, Louis E. Lataif and William J. Menear, to purchase 10,000 shares of Class A Subordinate Voting Stock each at an exercise price of $6.70 per share. On August 4, 2004, the Committee approved the grant of stock options to Brian Tobin, then Vice-Chairman to purchase 50,000 shares of Class A Subordinate Voting Stock at an exercise price of $6.13 per share. Mr. Tobin resigned from MEC's Board of Directors on September 24, 2004 and all of his options to purchase shares of Class A Subordinate Voting Stock were cancelled.

Incentive stock options may be granted only to MEC's employees and employees of its subsidiaries. If the recipient of an incentive stock option owns more than ten percent of the voting power of all shares of MEC's common stock, the option will not be exercisable later than five years after its grant date and the exercise price of the option will not be less than the greater of (i) the price required by the Internal Revenue Code (currently 110% of the fair market value of MEC's Class A Subordinate Voting Stock on the option's grant date) and (ii)

16

the price of the last traded board lot of shares of MEC's Class A Subordinate Voting Stock sold on the Toronto Stock Exchange prior to the date of grant of the option.

See "Option Grants in Last Fiscal Year" above.

The Long-Term Incentive Plan permits the Committee to grant bonus stock awards, which are vested upon grant, and restricted stock awards, which are subject to a restriction period. An award of restricted stock may be subject to performance measures during the restriction period. Unless the Committee decides otherwise, the holder of a restricted stock award will have rights as an MEC stockholder, including the right to vote and receive dividends with respect to the shares of restricted stock. Dividends, however, will be subject to the same restrictions that apply to the shares for which the dividend was paid.

The Long-Term Incentive Plan also permits the Committee to grant performance shares. Each performance share is a right, subject to the attainment of performance measures during a performance period, to receive one share of Class A Subordinate Voting Stock, which may be restricted stock, or the fair market value of the performance share in cash. Before a performance share award is settled in shares of Class A Subordinate Voting Stock, the holder of the award will have no rights as an MEC stockholder with respect to the shares of stock subject to the award. All the terms relating to the satisfaction of performance measures and the termination of the performance period relating to a performance share award, or any cancellation or forfeiture of the performance share award upon the holder's termination of employment with MEC, whether by reason of disability, retirement, death or other termination, shall be contained in the award agreement.

Under the Long-Term Incentive Plan, the vesting or payment of performance share awards and certain awards of restricted stock will be subject to the satisfaction of certain performance objectives and criteria. These objectives and criteria may include one or more of the following: the attainment by a share of Class A Subordinate Voting Stock of a specified fair market value for a specified period of time, earnings per share, return to stockholders (including dividends), return on equity, earnings, revenues, market share, cash flow or cost reduction goals, or any combination of these criteria.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, and Securities and Exchange Commission regulations require MEC's directors, certain officers and greater than ten percent stockholders to file reports of ownership on Form 3 and changes in ownership on Form 4 and Form 5 with the Securities and Exchange Commission.

Based solely on its review of copies of such reports received or written representations from such directors, executive officers and ten percent stockholders, MEC believes that all Section 16(a) filing requirements applicable to its directors, executive officers and ten percent stockholders were complied with during 2004.

17

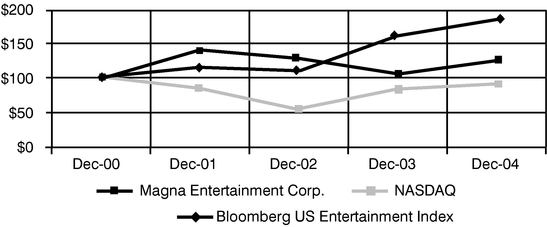

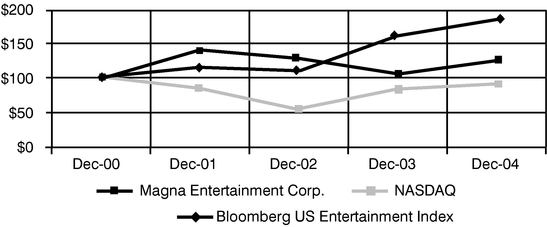

Comparative Stock Performance Graph

The following graph compares the cumulative total shareholder return on MEC's Class A Subordinate Voting Stock to the cumulative total shareholder return of the Nasdaq 100 Market Index and a peer group index. The peer group index used by MEC is the Bloomberg US Entertainment Index, which is a published industry peer index of companies engaged in the entertainment industry. The period of comparison begins with the date that MEC became a public company in February 2000 and ends on December 31, 2004. The graph depicts the results of an investment of $100 in MEC's Class A Subordinate Voting Stock, the Nasdaq 100 Market Index and the Bloomberg US Entertainment Index.

| | Dec-00

| | Dec-01

| | Dec-02

| | Dec-03

| | Dec-04

|

|---|

| Magna Entertainment Corp. | | $ | 100.0 | | $ | 143.6 | | $ | 130.3 | | $ | 107.9 | | $ | 127.4 |

| Bloomberg US Entertainment Index | | $ | 100.0 | | $ | 117.8 | | $ | 112.4 | | $ | 164.6 | | $ | 188.9 |

| Nasdaq 100 Market Index | | $ | 100.0 | | $ | 85.4 | | $ | 57.8 | | $ | 84.1 | | $ | 91.6 |

CORPORATE GOVERNANCE, HUMAN RESOURCES

AND COMPENSATION COMMITTEE REPORT

The Corporate Governance, Human Resources and Compensation Committee of the Board was formed on March 4, 2000. For a discussion of the composition and mandate of this Committee, see "The Board of Directors and Committees of the Board — Corporate Governance, Human Resources and Compensation Committee" above.

MEC has adopted many of the organizational and operating policies and principles utilized by its original parent company, Magna International, for many years, certain of which have been embodied in MEC's Corporate Constitution. MEC's Corporate Constitution balances the interests of stockholders, employees and management by specifically defining the rights of employees (including management) and investors to participate in MEC's profits and growth, and reflects certain operational and compensation philosophies which align employee (including management) and stockholder interests. These philosophies and MEC's Corporate Constitution assist in maintaining an entrepreneurial environment and culture at MEC. MEC wishes this entrepreneurial culture to flourish, and therefore intends to apply compensation philosophies which will enhance its ability to attract, retain and motivate skilled, entrepreneurial employees at all levels of the MEC organization, while assisting in the alignment of the interests of MEC's stockholders and management.

A few of MEC's senior officers (including its Chief Operating Officer) receive a remuneration package consisting of a base salary and an annual incentive bonus based, in part, on direct profit participation.