SCHEDULE 14A (RULE 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE SECURITIES

EXCHANGE ACT OF 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement ¨ Confidential, for Use of the Commission (as permitted by Rule 14A-6(e)(2)) |

| x | | Definitive Proxy Statement |

¨ | | Definitive Additional Materials |

¨ | | Soliciting Material Pursuant to Rule 14A-11(c) or Rule 14A-12 |

RAINMAKER SYSTEMS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

¨ | | Fee computed on table below per Exchange Act Rules 14A-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

¨ | | Fee paid previously with preliminary materials: |

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 15, 2002

TO THE STOCKHOLDERS OF

RAINMAKER SYSTEMS, INC.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Rainmaker Systems, Inc., a Delaware corporation (the “Company”), will be held on Wednesday, May 15, 2002, at 8:30 a.m. Pacific Daylight Savings Time at the UCSC Inn & Conference Center, 611 Ocean Street, Santa Cruz, California, 95060, for the following purposes, as more fully described in the Proxy Statement accompanying this Notice:

| | 1. | | To elect one director to serve on the Company’s Board of Directors for a three-year term ending in the year 2005 or until his successor is duly elected and qualified; |

| | 2. | | To ratify the appointment of Ernst & Young LLP as independent auditors of the Company for the fiscal year ending December 31, 2002; and |

| | 3. | | To transact such other business as may properly come before the meeting or any adjournment or adjournments thereof. |

Only stockholders of record at the close of business on April 3, 2002 are entitled to notice of and to vote at the Annual Meeting. The stock transfer books of the Company will remain open between the record date and the date of the meeting. A list of stockholders entitled to vote at the Annual Meeting will be available for inspection at the executive offices of the Company.

All stockholders are cordially invited to attend the meeting in person. Whether or not you plan to attend, please sign and return the enclosed proxy as promptly as possible in the envelope enclosed for your convenience. Should you receive more than one proxy because your shares are registered in different names and addresses, each proxy should be signed and returned to assure that all your shares will be voted. You may revoke your proxy at any time prior to the Annual Meeting. If you attend the Annual Meeting and vote by ballot, your proxy will be revoked automatically and only your vote at the Annual Meeting will be counted.

Scotts Valley, California

April 11, 2002

YOUR VOTE IS VERY IMPORTANT REGARDLESS OF THE NUMBER OF SHARES YOU OWN. PLEASE READ THE ATTACHED PROXY STATEMENT CAREFULLY; COMPLETE, SIGN AND DATE THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE AND RETURN IT IN THE ENCLOSED ENVELOPE.

Rainmaker Systems, Inc.

1800 Green Hills Road

Scotts Valley, California 95066

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 15, 2002

General

The enclosed proxy (“Proxy”) is solicited on behalf of the Board of Directors of Rainmaker Systems, Inc., a Delaware corporation (the “Company”), for use at the Annual Meeting of Stockholders to be held on Wednesday, May 15, 2002 (the “Annual Meeting”). The Annual Meeting will be held at 8:30 a.m. Pacific Daylight Savings Time at the UCSC Inn & Conference Center, 611 Ocean Street, Santa Cruz, California 95060. These proxy solicitation materials were mailed on or about April 19, 2002 to all stockholders entitled to vote at the Annual Meeting.

Voting; Quorum

The specific proposals to be considered and acted upon at the Annual Meeting are summarized in the accompanying Notice and are described in more detail in this Proxy Statement. On April 3, 2002, the record date for determination of stockholders entitled to notice of and to vote at the Annual Meeting, 38,656,944 shares of the Company’s common stock, par value $0.001 (the “Common Stock”), were issued and outstanding. No shares of the Company’s Preferred Stock, par value $0.001, were outstanding. Each holder of shares of Common Stock is entitled to one vote per share held by such holder on April 3, 2002.

In the election of directors, the one nominee receiving the highest number of affirmative votes shall be elected. Proposal 2 must be approved by the affirmative vote of holders of outstanding shares of Common Stock representing a majority of the voting power present in person or represented by proxy at the Annual Meeting and entitled to vote on the subject matter. The presence at the Annual Meeting, either in person or by proxy, of holders of shares of outstanding Common Stock entitled to vote and representing a majority of the voting power of such shares shall constitute a quorum for the transaction of business. Abstentions and shares held by brokers that are present in person or represented by proxy but that are not voted because the brokers were prohibited from exercising discretionary authority (“broker non-votes”) will be counted for the purpose of determining if a quorum is present. Abstentions will be counted towards the tabulation of votes cast on proposals presented to the stockholders and will have the same effect as negative votes, whereas broker non-votes will not be counted for purposes of determining whether a proposal has been approved. The inspector of election appointed for the meeting will tabulate all votes and will separately tabulate affirmative and negative votes, abstentions and broker non-votes.

1

Proxies

If the enclosed form of Proxy is properly signed and returned, the shares represented thereby will be voted at the Annual Meeting in accordance with the instructions specified thereon. If the Proxy does not specify how the shares represented thereby are to be voted, the Proxy will be voted FOR the election of the one nominee to the Board of Directors listed in the Proxy, unless the authority to vote for the election of any such nominee is withheld and, if no contrary instructions are given, the Proxy will be voted FOR the approval of Proposal 2 described in the accompanying Notice and this Proxy Statement. You may revoke or change your Proxy at any time before the Annual Meeting by filing with the Secretary of the Company at the Company’s principal executive offices, located at 1800 Green Hills Road, Scotts Valley, California 95066, a notice of revocation or another signed Proxy with a later date. You may also revoke your Company’s Proxy by attending the Annual Meeting and voting in person.

Solicitation

The Company will bear the entire cost of the solicitation, including the preparation, assembly, printing and mailing of this Proxy Statement, the Proxy and any additional solicitation materials furnished to the stockholders. Copies of solicitation materials will be furnished to brokerage houses, fiduciaries and custodians holding shares in their names that are beneficially owned by others so that they may forward this solicitation material to such beneficial owners. The Company may reimburse such persons for their costs in forwarding the solicitation materials to such beneficial owners. The original solicitation of proxies by mail may be supplemented by a solicitation by telephone, telegram or any other means by directors, officers or employees of the Company. No additional compensation will be paid to these individuals for any such services. Except as described above, the Company does not presently intend to solicit proxies by any process other than by mail.

Deadline for Receipt of Stockholder Proposals

Proposals of stockholders of the Company that are intended to be presented by such stockholders at next year’s Annual Meeting of Stockholders must be received by us no later than January 15, 2003 in order that they may be considered at that meeting. The date by which stockholder proposals must be received by the Company for inclusion in our proxy statement and form of proxy for next year’s Annual Meeting of Stockholders is also January 15, 2003.

2

MATTERS TO BE CONSIDERED AT ANNUAL MEETING

PROPOSAL ONE: ELECTION OF DIRECTORS

General

The Company’s Certificate of Incorporation provides for a classified Board of Directors consisting of three classes of directors with staggered three-year terms, with each class consisting, as nearly as possible, of one-third of the total number of directors. The Board currently consists of five persons. The class whose term of office expires at the Annual Meeting currently consists of one director. The director elected to this class will serve for a term of three years, expiring at the 2005 Annual Meeting of Stockholders or until his successor has been duly elected and qualified. The nominee listed below is currently a director of the Company. If this proposal is approved, the Board will consist of five persons, with two classes consisting of two directors each and the third class consisting of one director.

Each returned Proxy can only be voted for the number of persons nominated (one). Unless individual stockholders specify otherwise, each returned Proxy will be voted FOR the election of the one nominee who is listed below. If, however, the nominee named herein is unable to serve or declines to serve at the time of the Annual Meeting, the persons named in the enclosed Proxy will exercise discretionary authority to vote for substitutes. The nominee for election has agreed to serve if elected, and management has no reason to believe that the nominee will be unavailable to serve.

Nominee for Term Ending Upon the 2005 Annual Meeting of Stockholders

Andrew T. Sheehan, 44, has served as a director of the Company since February 1999. Mr. Sheehan is a General Partner of ABS Capital Partners (“ABS”), a private equity firm focused on investments in enterprise software and services companies since April 1998. Prior to joining ABS, Mr. Sheehan was Managing Director of DB Alex Brown, an investment bank from 1985 to 1988. In addition to serving as a director for the Company, Mr. Sheehan currently serves on the Board of Directors of @Road, Inc., a provider of mobile resource management solutions and several privately held companies.

Continuing Directors for Term Ending Upon the 2003 Annual Meeting of Stockholders

Michael Silton, 37, has served as a director of the Company since inception. Mr. Silton has served as President and Chief Executive Officer of the Company since October 1997 and the Company’s Chairman of the Board since inception. In 1991, he founded the Company’s former business UniDirect, which specialized in the direct marketing and sales of business software.

Robert Leff, 55, has served as a director of the Company since 1996. Mr. Leff co-founded Merisel, Inc. (formerly Softsel Computer Products, Inc.) in 1980, a wholesale distributor of computer products, and served as its President from 1980 to 1985 and its Co-Chairman from 1985 to 1994. From 1985 to 1994, Mr. Leff held various senior executive positions. Mr. Leff is now a strategic and financial consultant to start-up and growth stage companies in the personal computer industry.

Continuing Directors for Term Ending Upon the 2004 Annual Meeting of Stockholders

Alok Mohan, 53, has served as a director of the Company since 1996. Mr. Mohan is currently the Chairman of the Board of Directors of Tarantella, Inc. Prior to that appointment, he served as Chief Executive Officer of Santa Cruz Operations, Inc. (“SCO”) from July 1995 until April 1998. Prior to that, Mr. Mohan served as Senior Vice President, Operations and Chief Financial Officer of SCO. Prior to joining SCO, Mr. Mohan was employed with NCR Corporation (“NCR”), a business software and services company, where he served as Vice President of Strategic Planning and Controller from July 1993 to May 1994. From January 1990 until July 1993, Mr. Mohan served as Vice President and General Manager of the Workstation Products Division at NCR. Mr. Mohan also serves on the Board of Directors for Caldera International, Inc., and various private companies.

3

James Richardson,54, has served as director of the Company since 2001. Mr. Richardson served as Senior Vice President and Chief Financial Officer of WebTrends Corporation, which merged with NetIQ Corporation in March of 2001. Prior to joining WebTrends, Mr. Richardson was Vice President and Chief Financial Officer at Network General Corporation from April 1994 to January 1998. From June 1992 to March 1994, Mr. Richardson was Vice President and Chief Financial Officer of Logic Modeling Corporation, now a division of Synopsis, and Vice President and Chief Financial Officer of Advanced Logic Research.

Board Committees and Meetings

The Board of Directors held seven meetings during the fiscal year ended December 31, 2001 (the “2001 Fiscal Year”). The Board of Directors has an audit committee and a compensation committee. Each director attended or participated in 75% or more of the aggregate of (i) the total number of meetings of the Board of Directors and (ii) the total number of meetings held by all committees of the Board on which such director served during the 2001 Fiscal Year. The Board of Directors also consulted informally with management from time to time and acted by written consent at various times without a meeting during the 2001 Fiscal Year.

Audit Committee. The audit committee consists of Andrew T. Sheehan, Alok Mohan and Robert Leff. The audit committee reviews and monitors the corporate financial reporting and external audit of the Company, including, among other things, the Company’s control functions, the results and scope of the annual audit and other services provided by the Company’s independent auditors and the Company’s compliance with legal matters that have a significant impact on the Company’s financial reports. The audit committee also consults with the Company’s management and the Company’s independent auditors prior to the presentation of financial statements to stockholders and, as appropriate, initiates inquiries into various aspects of the Company’s financial affairs. In addition, the audit committee is responsible for considering and recommending the appointment of, and reviewing fee arrangements with, the Company’s independent auditors. The audit committee was formed in May 1999 and held four meetings during the 2001 Fiscal Year. Members of the audit committee are elected by the Board of Directors and serve one-year terms. The Annual Report of the Audit Committee appears hereafter under “Report of the Audit Committee of the Board of Directors”.

Compensation Committee. The compensation committee consists of Andrew T. Sheehan, Alok Mohan and Robert Leff. The compensation committee reviews and approves salaries, benefits and bonuses for the Chief Executive Officer, Chief Financial Officer and other executive officers of the Company. It reviews and recommends to the Board of Directors on matters relating to employee compensation and benefit plans. The compensation committee also administers the Company’s stock plans. The compensation committee was formed in May 1999 and held one meeting during the 2001 Fiscal Year. The Annual Report of the Compensation Committee appears hereafter under “Report of the Compensation Committee of the Board of Directors”.

Director Compensation

In May 2001, Robert Leff, Alok Mohan and Andrew T. Sheehan were each granted an option to purchase 20,000 shares of Common Stock at an exercise price of $0.84 per share. In May 2001, James Richardson was granted an option to purchase 100,000 shares of Common Stock at an exercise price of $0.81 per share. The Company’s directors did not receive cash compensation for their services on the Board during the first three quarters of the 2001 Fiscal Year. For the fourth quarter of 2001, all outside directors, excluding Andrew T. Sheehan, were paid $5,000 in quarterly fees for the fourth quarter, $1,000 per board meeting attended during the fourth quarter, and $500 per committee meeting attended during the fourth quarter. Annually, each non-employee Board member who continues to serve as a non-employee Board member after the Annual Meeting of Stockholders, including each of the Company’s current non-employee Board members, will automatically be granted an option to purchase 20,000 shares of Common Stock at an exercise price equal to the fair market value per share of the Common Stock on date of such Annual Meeting, provided such individual has served on the Board for at least six months.

4

Required Vote

The one nominee receiving the highest number of affirmative votes of the outstanding shares of Common Stock, present or represented and entitled to be voted for such nominee, shall be elected as director. The Proxies cannot be voted for a greater number of persons than one.

Recommendation of the Board of Directors

The Board of Directors recommends that the stockholders vote FOR the election of the nominee listed above.

PROPOSAL TWO: RATIFICATION OF ERNST & YOUNG LLP AS INDEPENDENT AUDITORS

Audit services of Ernst & Young LLP (“Ernst & Young”) during the 2001 Fiscal Year included the examination of our financial statements and services related to filings with the Securities and Exchange Commission (“SEC”) and other regulatory bodies. Fees for the last annual audit, which included quarterly review procedures, were $228,000 and all other fees were $46,000, including audit related services of $20,000 and non-audit services of $26,000. There were no fees paid to Ernst & Young related to financial information systems design and implementation. Audit related services generally include fees for accounting consultations and SEC registration statements. Non-audit services generally include tax return preparation fees and tax planning consultations.

The audit committee, composed entirely of non-employee directors, recommended to the Board of Directors that Ernst & Young be appointed as independent auditors. As our independent auditors, Ernst & Young would audit our financial statements for the 2002 Fiscal Year and perform audit-related services and consultation in connection with various accounting and financial reporting matters. Ernst & Young also performs certain non-audit services for the Company.

The Board of Directors approved the selection of Ernst & Young as independent auditors for the 2002 Fiscal Year and is asking the stockholders for ratification of their selection. A representative of Ernst & Young is expected to be present at the Annual Meeting, will have the opportunity to make a statement if he or she desires to do so, and will be available to respond to appropriate questions.

Required Vote

The affirmative vote of a majority of the shares represented and voting at the Annual Meeting is required to ratify the selection of Ernst & Young. In the event that the stockholders do not approve the selection of Ernst & Young, the Board of Directors will reconsider the appointment of the independent auditors. Even if the selection is ratified, the Board of Directors in its discretion may direct the appointment of a different independent auditing firm at any time during the year if the Board of Directors believes that such a change would be in the best interests of the Company and its stockholders.

Recommendation of the Board of Directors

The Board of Directors recommends that the stockholders vote FOR the ratification of the selection of Ernst & Young LLP to serve as the Company’s independent auditors for the fiscal year ending December 31, 2002.

OTHER MATTERS

The Company knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters properly come before the Annual Meeting, it is the intention of the persons named in the enclosed form of Proxy to vote the shares they represent as the Board of Directors may recommend. Discretionary authority with respect to such other matters is granted by the execution of the enclosed Proxy.

5

OWNERSHIP OF SECURITIES

The following table sets forth certain information as of February 28, 2002 regarding the ownership of the Company’s Common Stock by:

| | • | | each person who is known by the Company to beneficially own more than five percent of the Company’s Common Stock; |

| | • | | each Named Executive Officer; |

| | • | | each of the Company’s directors; |

| | • | | all of the Company’s directors and executive officers as a group. |

Beneficial ownership is determined in accordance with the rules and regulations of the Securities and Exchange Commission. Shares subject to options that are exercisable currently or within 60 days of February 28, 2002 are deemed to be outstanding and beneficially owned by the person for the purpose of computing share and percentage ownership of that person. They are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person. Except as indicated in the footnotes to this table and as affected by applicable community property laws, all persons listed have sole voting and investment power for all shares shown as beneficially owned by them. Unless otherwise indicated, all addresses for the stockholders set forth below is c/o Rainmaker Systems, Inc., 1800 Green Hills Road, Scotts Valley, California 95066.

Name of Beneficial Owner

| | Number of Shares Beneficially Owned (Including the Number of Shares Shown in the Second Column)

| | Number of Shares Beneficially Owned as a Result of Options Exercisable Within 60 Days of February 28, 2002

| | Percentage of Shares Outstanding

| |

ABS Capital Partners III, L.P. 505 Sansome Street, Suite 1550 San Francisco, California 94111 | | 11,707,248 | | — | | 30.3 | % |

| Michael Silton (1) | | 5,876,307 | | 124,999 | | 15.2 | |

| Laurel James (2) | | 3,133,096 | | — | | 8.1 | |

| Martin Hernandez | | 364,164 | | 354,164 | | * | |

| Ritch Haselden | | 97,394 | | 93,394 | | * | |

| Tina Lally | | 149,349 | | 110,703 | | * | |

| Diane Brundage (6) | | — | | — | | * | |

| Robert Leff | | 423,916 | | 11,916 | | 1.1 | |

| Andrew T. Sheehan (4) | | 1,916 | | 1,916 | | * | |

| Alok Mohan (5) | | 256,916 | | 236,916 | | * | |

| James Richardson (3) | | 62,500 | | 37,500 | | * | |

All directors and executive officers as a group

(9 persons) | | 7,232,462 | | 971,508 | | 18.3 | % |

| (1) | | Includes 15,000 shares held by Michael Silton as Trustee of the Petra Silton Children’s Trust. |

| (2) | | Includes 3,133,096 shares held by Laurel F. James, Trustee of the Laurel Ann James Grantor Trust dated July 3, 1997. |

| (3) | | Includes 10,000 shares held by Mr. Richardson’s investment retirement account. |

| (4) | | Mr. Sheehan is a managing member of ABS Capital Partners III, LLC, which is a general partner of ABS Capital Partners III, L.P. Mr. Sheehan disclaims beneficial ownership of all shares held by ABS Capital Partners III, L.P. except to the extent of his pecuniary interest therein. |

6

| (5) | | Mr. Mohan is the Chairman of Tarantella, Inc. Mr. Mohan disclaims beneficial ownership of all shares held by Tarantella except to the extent of his pecuniary interest therein. |

| (6) | | Ms. Brundage joined the Company in February 2002 and does not beneficially own any shares as of February 28, 2002. |

7

EXECUTIVE COMPENSATION AND OTHER INFORMATION

Executive Officers

The following table provides certain information with respect to our directors, executive officers and certain key employees:

Name

| | Age

| | Position

|

| Michael Silton | | 37 | | Chairman of the Board, President and Chief Executive Officer |

| Martin Hernandez | | 44 | | Chief Operating Officer, acting Chief Financial Officer and Secretary |

| Ritch Haselden | | 36 | | Vice President, Outsource Services |

| Tina Lally | | 30 | | Vice President, Marketing |

| Diane Brundage | | 47 | | Vice President, Sales |

Michael Silton has served as President and Chief Executive Officer since October 1997 and Chairman of the Board since inception. In 1991, he founded Rainmaker’s former business UniDirect, which specialized in the direct marketing and sales of business software.

Martin Hernandez joined Rainmaker in October 1999 as Chief Financial Officer and has served as Chief Operating Officer since August 2000. He is also the Secretary and acting Chief Financial Officer. From May 1994 to October 1999, Mr. Hernandez held senior positions at Silicon Graphics, Inc., most recently as Director, Finance-Worldwide Sales and Marketing, and Director, Finance and Operations for the company’s Cosmo Software subsidiary. From April 1991 to March 1994, he served as Director, Corporate Planning/Operations and Investor Relations for Meris Laboratories, Inc. From October 1988 to April 1991, Mr. Hernandez was a Senior Accountant with PricewaterhouseCoopers LLP.

Ritch Haselden was promoted to Vice President, Outsource Services, in January 2001. Mr. Haselden has been with Rainmaker since March 1998 in various senior management positions and has been responsible for the Outsource Division since June 2000. Prior to joining Rainmaker, Mr. Haselden served as Senior Sales Account Executive at Pacific Bell from 1991 to March 1998 and prior to that, he served as Technical Sales Representative for Apple Computer.

Tina Lally has served as Vice President, Marketing since April 1999. Since joining Rainmaker in March 1994 as a member of our sales team, Ms. Lally has held various positions, including Director of Creative Services from February 1998 to April 1999.

Diane Brundagejoined Rainmaker in February 2002 as Vice President of Sales. Before joining Rainmaker, Ms. Brundage was Senior Vice President of Sales, Marketing & Customer Service for Creative Planet, from September 2000 to February 2002. From January 1996 to September 1998, she served as Vice President and General Manager of Compaq Computer Corp.’s Multivendor Customer Services organization. Ms. Brundage also spent 13 years at Apple Computer, Inc. in a variety of senior field sales and corporate marketing roles.

8

Summary of Cash and Certain Other Compensation

The following table provides certain summary information concerning the compensation earned by the Company’s Chief Executive Officer and each of the three other most highly compensated executive officers of the Company whose aggregate salary and bonus for the 2001 Fiscal Year were in excess of $100,000, for services rendered in all capacities to the Company for the fiscal years ended December 31, 2001, 2000, and 1999. (The rules of the SEC require that the Company provide compensation information for the four most highly compensated executive officers employed by the Company as of the end of the 2001 Fiscal Year in addition to the Chief Executive Officer. However, there were only three executive officers employed by the Company in addition to the Chief Executive Officer as of December 31, 2001.) The following table also includes such summary information for two additional individuals who would have been among the four other most highly compensated executive officers of the Company but for the fact that such individuals were not serving as executive officers of the Company at the end of the 2001 Fiscal Year. The listed individuals are hereinafter referred to as the “Named Executive Officers”.

Summary Compensation Table

| | | Year

| | | Salary

| | Bonus

| | | Other Annual Compensation (10)(11)

| | | Long-Term Compensation Awards

| | All Other Compensation (7)(11)

| |

| | | | | | Securities Underlying Options(#)

| |

Michael Silton Chairman, President and

Chief Executive Officer | | 2001 2000 1999 | | | $ | 275,278 275,000 252,141 | | $ | 84,675 48,126 216,344 | | | $ | 37,575 46,579 — | (1) (1) | | 400,000 — — | | $ | 3,918 4,925 5,108 | (2) (2) (2) |

|

Martin Hernandez (3) Chief Operating Officer,

acting Chief Financial Officer and Secretary | | 2001 2000 1999 | | | $ | 210,000 199,938 35,809 | | $ | 207,484 28,500 — | | | | — — — | | | 400,000 200,000 300,000 | | $ | 7,271 2,219 — | (4) (4) |

|

Ritch Haselden Vice President, Outsource Services | | 2001 2000 1999 | (8) | | $ | 132,046 114,173 — | | $ | 147,863 118,997 — | (5) (6) | | | — — — | | | 135,000 115,000 — | | $ | 1,589 1,175 — | |

|

Tina Lally Vice President, Marketing | | 2001 2000 1999 | | | $ | 110,006 110,006 101,581 | | $ | 100,893 39,973 31,036 | | | | — — — | | | 85,000 75,000 75,100 | | $ | 2,259 1,921 1,515 | |

|

Robert Mason (9) Vice President, Business Services | | 2001 2000 1999 | | | $ | 191,805 215,465 233,266 | | $ | 37,611 15,000 33,908 | | | | — — — | | | 20,000 30,000 50,000 | | $ | — — — | |

|

Richard Marotta (9) Vice President, Sales Engineering | | 2001 2000 1999 | | | $ | 196,684 215,465 233,266 | | $ | 54,135 15,000 33,908 | | | | — — — | | | 20,000 30,000 50,000 | | $ | — 1,528 2,500 | |

| (1) | | Includes $24,000 for automobile allowance. |

| (2) | | In 2001, this amount includes $3,055 in premiums paid for term life insurance policies and the remaining amount consists of Company contributions made to the Company’s 401(k) Plan, which match salary deferral contributions made by Mr. Silton to such plan. In 2000, this amount includes $3,055 in premiums paid for term life insurance policies and the remaining amount consists of Company contributions made to the Company’s 401(k) Plan. In 1999, this amount includes $3,055 in premiums paid for term life insurance policies and the remaining amount consists of Company contributions made to the Company’s 401(k) Plan. |

9

| (3) | | Served as Chief Financial Officer and Secretary as of October 1999. Appointed to Chief Operating Officer in August 2000. |

| (4) | | In 2001, this amount includes $1,700 in premiums paid for term life insurance policy, $3,446 in premiums paid for disability insurance policy, and the remaining amount consists of Company contributions made to the Company’s 401(k) Plan which match salary deferral contributions made by Mr. Hernandez to such plan. In 2000, this amount consists of Company contributions made to the Company’s 401(k) Plan. |

| (5) | | Consists of commissions. |

| (6) | | Includes $40,970 in commissions. |

| (7) | | Except for Mr. Silton and Mr. Hernandez, such other compensation consists solely of Company contributions made to the Company’s 401(k) Plan, which match salary deferral contributions made by each named executive officer to such plan. |

| (8) | | Mr. Haselden joined Rainmaker in March 1998. Mr. Haselden’s total salary and bonus for the fiscal year ended December 31, 1999 was greater than $100,000; however, Mr. Haselden was not an executive officer and also was not among the four other highly compensated executive officers of the Company. |

| (9) | | Mr. Mason and Mr. Marotta left the Company in October 2001. |

| (10) | | The compensation table includes other annual compensation in the form of perquisites and other personal benefits exceeding the lesser of $50,000 or 10% of the total annual salary and bonus earned by each of the Named Executive Officers in each of the fiscal years ended December 31, 2001, 2000, and 1999. (Any lesser amounts are not required to be included.) |

| (11) | | In previous years, amounts shown under the “Other Annual Compensation” column or the “All Other Compensation” column may have been included in the “Salary” column or omitted. |

10

Option/SAR Grants in Last Fiscal Year

The following table contains information concerning the stock options granted to the Named Executive Officers during the 2001 Fiscal Year. All the grants were made under the Company’s 1999 Stock Incentive Plan. No stock appreciation rights were granted to the Named Executive Officers during such fiscal year.

| | | Individual Grants

| | Potential Realization Value at Assumed Annual Rates of Stock Price Appreciation for Option Term (5)

|

| | | Number of Securities Underlying Options Granted (1)

| | % of Total Options Granted to Employees in 2001

| | | Exercise Price Per Share (2)

| | Expiration Date

| |

Name

| | | | | | 5%

| | 10%

|

| Michael Silton (4)(6) | | 274,997 | | 14.5 | % | | $ | 1.13 | | 1/02/11 | | $ | 194,562 | | $ | 493,059 |

| Michael Silton (4)(6)(7) | | 125,003 | | 6.6 | % | | | 1.13 | | 1/02/11 | | | 88,440 | | | 224,125 |

| Martin Hernandez (4)(6)(7) | | 391,667 | | 20.7 | % | | | 1.13 | | 1/02/11 | | | 227,107 | | | 702,243 |

| Martin Hernandez (4)(6) | | 8,333 | | 0.4 | % | | | 1.13 | | 1/02/11 | | | 5,896 | | | 14,941 |

| Ritch Haselden (4) | | 43,750 | | 2.3 | % | | | 1.88 | | 1/15/11 | | | 51,589 | | | 130,737 |

| Ritch Haselden (4)(6) | | 39,010 | | 2.1 | % | | | 0.22 | | 11/08/11 | | | 5,275 | | | 13,367 |

| Ritch Haselden (4)(6) | | 16,250 | | 0.9 | % | | | 1.88 | | 1/15/11 | | | 19,162 | | | 48,559 |

| Ritch Haselden (4)(6) | | 35,990 | | 1.9 | % | | | 0.22 | | 11/08/11 | | | 4,866 | | | 12,332 |

| Tina Lally (3) | | 3,172 | | 0.2 | % | | | 2.00 | | 2/19/11 | | | 3,990 | | | 10,111 |

| Tina Lally (4) | | 20,313 | | 1.1 | % | | | 0.22 | | 6/18/11 | | | 2,747 | | | 6,960 |

| Tina Lally (3) | | 6,828 | | 0.4 | % | | | 2.00 | | 2/19/11 | | | 8,588 | | | 21,764 |

| Tina Lally (4) | | 54,687 | | 2.9 | % | | | 0.22 | | 11/08/11 | | | 7,394 | | | 18,739 |

| Robert Mason (3) | | 20,000 | | 1.1 | % | | | 2.00 | | 2/19/11 | | | 25,156 | | | 63,750 |

| Richard Marotta (3) | | 20,000 | | 1.1 | % | | | 2.00 | | 2/19/11 | | | 25,156 | | | 63,750 |

| (1) | | To the extent not already vested, all of these options will become vested in the event of a merger in which more than 50% of the Company’s outstanding securities are transferred to persons different from those persons who are the Company’s stockholders prior to the merger or upon the sale of substantially all the Company’s assets in complete liquidation or dissolution. This acceleration feature does not apply in the event that the options are assumed by the successor corporation in the merger or are replaced with a cash incentive program. |

| (2) | | The exercise price may be paid in cash or in shares of Common Stock valued at fair market value on the exercise date. Alternatively, the option may be exercised through a cashless exercise procedure pursuant to which the optionee provides irrevocable instructions to a brokerage firm to sell the purchased shares and to remit to the Company, out of the sale proceeds, an amount equal to the exercise price plus all applicable withholding taxes. The compensation committee may also assist an optionee in the exercise of an option by (i) authorizing a loan from the Company in a principal amount not to exceed the aggregate exercise price plus any tax liability incurred in connection with the exercise or (ii) permitting the optionee to pay the option price in installments over a period of years upon terms established by the compensation committee. |

| (3) | | Options were granted under the Company’s 1999 Stock Option/Stock Issuance Plan and vest and become exercisable as follows: |

| | • | | 12.5% upon the completion of six months of employment from the date of grant, and |

| | • | | 2.4% upon the completion of each month of employment thereafter such that after the next 42 months of employment, all options will have vested. |

The date of grant of these options is 10 years prior to the expiration date.

11

| (4) | | Options were granted under the Company’s 1999 Stock Option/Stock Issuance Plan and vest and become exercisable as follows: |

| | • | | 25% upon the completion of one year of employment from the date of grant, and |

| | • | | 2.1% upon the completion of each month of employment thereafter such that after the next 36 months of employment, all options will have vested. |

The date of grant of these options is 10 years prior to the expiration date.

| (5) | | The potential realizable value is calculated based on the ten-year term of the option at its time of grant. It is calculated based on assumed annualized rates of stock price appreciation from the exercise price at the date of grant of 5% and 10% (compounded annually) over the full term of the grant with appreciation determined as of the expiration date. The 5% and 10% assumed rates of appreciation are mandated by the rules of the Securities and Exchange Commission and do not represent the Company’s estimate or projections of future common stock prices. Actual gains, if any, on stock option exercises are dependent on the future performance of the Common Stock and overall stock market conditions. The amounts reflected in the table may not necessarily be achieved. |

| (6) | | As part of the Company’s Stock Option Exchange Program, these options were tendered and cancelled on January 24, 2002. |

| (7) | | For Mr. Silton and Mr. Hernandez with respect to their non-qualified options, they shall have not less than twelve months to exercise such option per the change of control provision in their employment agreements. |

12

Aggregated Option Exercises and Fiscal Year End Values

The following table provides information, with respect to the Named Executive Officers, concerning the exercise of options during the 2001 Fiscal Year and unexercised options held by them at the end of that fiscal year. None of the Named Executive Officers exercised any stock appreciation rights during the 2001 Fiscal Year and no stock appreciation rights were held by the Named Executive Officers at the end of such year.

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR END VALUES

| | | Shares Acquired on Exercise (#)

| | Value Realized ($)(1)

| | Number of Securities Underlying Unexercised Options (#)

| | Value of Unexercised in-the-Money Options at Fiscal Year End ($)(2)

|

Name

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

| Michael Silton | | — | | | — | | — | | 400,000 | | | — | | | — |

| Martin Hernandez | | — | | | — | | 212,499 | | 687,501 | | | — | | | — |

| Ritch Haselden | | — | | | — | | 63,002 | | 213,218 | | | — | | $ | 2,625 |

| Robert Mason | | 274,000 | | $ | 38,783 | | 343,211 | | — | | $ | 33,440 | | | — |

| Richard Marotta | | 156,880 | | | 46,361 | | 240,749 | | — | | | — | | | — |

| Tina Lally | | — | | | — | | 96,251 | | 155,703 | | | — | | | 2,625 |

| (1) | | Based upon the market price of the purchased shares on the exercise date less the option exercise price paid for those shares. |

| (2) | | Based upon the market price of $0.25 per share, determined on the basis of the closing sales price per share of the Company’s Common Stock on the Nasdaq National Market on the last day of the 2001 Fiscal Year, less the option exercise price payable per share. |

Employment Contracts, Termination of Employment and Change in Control Arrangements

The Company currently has employment agreements with Michael Silton, President and Chief Executive Officer and Martin Hernandez, Chief Operating Officer and acting Chief Financial Officer.

The employment agreement for Mr. Silton generally provides that if Mr. Silton’s employment is constructively terminated or terminated by the Company without cause, then Mr. Silton shall receive, with no duty to mitigate, the following: (i) an amount equal to one and three-quarter times Mr. Silton’s base salary and target annual bonus, to be paid in twenty-one equal monthly payments, (ii) up to twelve months of health and life insurance benefits, and (iii) continued vesting of all unvested stock options up to twenty-one months. Mr. Silton’s stated base salary and target annual bonus as of December 31, 2001 are each $275,000.

The employment agreement for Mr. Hernandez generally provides that if Mr. Hernandez’s employment is constructively terminated or terminated by the Company without cause, then Mr. Hernandez shall receive, with no duty to mitigate, the following: (i) an amount equal to one and one-quarter times Mr. Hernandez’s base salary and target annual bonus, to be paid in fifteen equal monthly payments, (ii) up to twelve months of health and life insurance benefits, and (iii) continued vesting of all unvested stock options up to fifteen months. Mr. Hernandez’s stated base salary and target annual bonus as of December 31, 2001 are each $210,000.

To the extent not already vested, the Company’s options will become vested in the event of a merger in which more than 50% of the Company’s outstanding securities are transferred to persons different from those persons who are the Company’s stockholders prior to the merger or upon the sale of substantially all the Company’s assets in complete liquidation or dissolution. This acceleration feature does not apply in the event that the options are assumed by the successor corporation in the merger or are replaced with a cash incentive program. Mr. Silton and Mr. Hernandez shall have not less than twelve months to exercise their non-qualified options.

13

Compensation Committee Interlocks and Insider Participation

The compensation committee of the Company’s Board of Directors currently consists of Robert Leff, Andrew T. Sheehan and Alok Mohan.

None of the Company’s executive officers serve as a member of the Board of Directors or compensation committee of any entity that has one or more of its executive officers serving as a member of the Company’s Board of Directors or compensation committee. No current member of the Company’s compensation committee has ever been an officer or employee of the Company.

2001 Option Exchange Program

In November 2001, the compensation committee of our board of directors authorized the implementation of an option exchange program pursuant to which our current employees, including executive officers, would have the opportunity to exchange their outstanding options to purchase shares of our common stock for new stock option grants to be made to them at a later date. The program was implemented because competition for key employees in our industry is intense, and the use of significant stock options for retention and motivation of such personnel is pervasive in high technology industries. The compensation committee of our board believes that stock options are a critical component of the compensation package we offer to our employees in order to promote long-term retention, motivate high levels of performance and incentivise employee contributions to our success.

By implementing an option exchange program whereby the outstanding options under our 1999 Stock Incentive Plan (the “1999 Plan”), our 1998 Stock Option/Stock Issuance Plan or our 1995 Stock Option/Stock Issuance Plan (collectively, the “Plans”) could be exchanged for new options that will be granted at a later date with an exercise price equal to the fair market value of our common stock on that grant date, the compensation committee intended to provide our employees with the opportunity to acquire new options that over time may have a greater potential to increase in value, and thereby create better incentives for our employees to remain with us and contribute to the attainment of our business and financial objectives and the creation of value for all of our stockholders.

As a result of the option exchange program authorized by the compensation committee, all our current employees, including executive officers, were given the opportunity to exchange their outstanding stock options under our Plans, if those options had exercise prices of $.40 per share or more, for new replacement options to be granted under our 1999 Stock Incentive Plan on or following July 25, 2002. Options for approximately 3,439,920 shares of common stock were eligible for participation in the option exchange program. Of this total, options for 2,158,070 shares were held by our executive officers. At the conclusion of the option exchange program on January 24, 2002, we accepted for exchange and cancelled options to purchase an aggregate of 2,533,866 shares of our common stock, which represented 73.7% of the total number of shares covered by the options subject to the option exchange program. As a result, we expect to issue new replacement options to purchase approximately 2,533,866 shares of common stock on or about July 25, 2002 in exchange for those cancelled options. However, no replacement options will be granted to any employee whose options were cancelled pursuant to the option exchange program, unless that individual continues in our employment through the grant date of the replacement option. Each replacement option will cover the same number of shares subject to the cancelled option to which it relates, adjusted, however, for any stock split, combination or the like occurring prior to the grant date of the replacement options. Each replacement option will have a vesting schedule pursuant to which it will vest and become exercisable in a series of annual and monthly installments upon the optionee’s completion of each year of service over the four-year period measured from the grant date of the tendered option. The exercise price of each replacement option will be equal to the closing price per share of our common stock on the grant date, as that price is reported on the Nasdaq National Market. Each option will have a maximum term of eight years from the grant date, subject to earlier termination upon the optionee’s cessation of employment with us. The terms and conditions of the replacement options will be substantially similar to those of the cancelled options.

14

The table below provides certain information concerning our executive officers that participated in the option exchange program and the options, which were cancelled pursuant to that program. The non-employee members of our board were not eligible to participate in the program.

The following table also normally sets forth certain information concerning the repricing, replacement or cancellation and regrant of options or other equity securities which has occurred after November 17, 1999, the date of our initial public offering, with respect to options held by our executive officers. To date, there have been no repricing, replacement or cancellation and regrant of options other than those tendered and cancelled as part of the Company’s Stock Option Exchange Program.

10-YEAR OPTION REPRICINGS

Name and Principal Position

| | Original Grant Date

| | Number of

Securities Underlying Options/SAR’s Repriced or Amended

| | Market Price of Stock at Time of Cancellation

| | Exercise Price of Stock at Time of Cancellation

| | New Exercise Price

| | | Length of

Original Option Term

(In Years) Remaining

at Date of Cancellation

|

| Michael Silton | | 01/02/01 | | 400,000 | | $ | 0.34 | | $ | 1.13 | | (3 | ) | | 8.92 |

| Chairman, President and Chief Executive Officer | | 01/10/02 | | 200,000 | | | 0.34 | | | 0.28 | | (3 | ) | | 9.94 |

|

| Martin Hernandez | | 11/16/99 | | 300,000 | | $ | 0.34 | | $ | 8.00 | | (3 | ) | | 7.79 |

| Chief Operating Officer, | | 06/19/00 | | 200,000 | | | 0.34 | | | 2.66 | | (3 | ) | | 8.38 |

| acting Chief Financial Officer | | 01/02/01 | | 400,000 | | | 0.34 | | | 1.13 | | (3 | ) | | 8.92 |

| and Secretary | | 01/10/02 | | 100,000 | | | 0.34 | | | 0.28 | | (3 | ) | | 9.94 |

|

| Ritch Haselden | | 03/20/00 | | 15,000 | | $ | 0.34 | | $ | 10.06 | | (3 | ) | | 8.13 |

| Vice President, Outsource Services | | 06/19/00 | | 100,000 | | | 0.34 | | | 2.66 | | (3 | ) | | 8.38 |

| | | 01/15/01 | | 16,250 | | | 0.34 | | | 1.88 | | (3 | ) | | 8.95 |

| | | 11/08/01 | | 75,000 | | | 0.34 | | | 0.22 | | (3 | ) | | 9.77 |

|

| Tina Lally (2) | | — | | — | | | — | | | — | | — | | | — |

| Vice President, Marketing | | | | | | | | | | | | | | | |

|

| Robert Mason (1) | | — | | — | | | — | | | — | | — | | | — |

| Vice President, Business Services | | | | | | | | | | | | | | | |

|

| Richard Marotta (1) | | — | | — | | | — | | | — | | — | | | — |

| Vice President, Sales Engineering | | | | | | | | | | | | | | | |

| (1) | | Mr. Mason and Mr. Marotta left the Company in October 2001 and thus did not participate in the Company’s Stock Option Exchange Program. |

| (2) | | Ms. Lally chose not to participate in the Company’s Stock Option Exchange Program. |

| (3) | | The new exercise price will be the fair market value of the Company’s Common Stock on the date of grant of the new replacement options, which is expected to be on or following July 25, 2002. |

Report of the Compensation Committee of the Board of Directors on Executive Compensation

It is the duty of the compensation committee to review and determine the salaries and bonuses of executive officers of the Company, including the Chief Executive Officer, and to establish the general compensation policies for such individuals. The compensation committee was formed in May 1999.

The compensation committee believes that the compensation programs for the Company’s executive officers should reflect the Company’s performance and the value created for the Company’s stockholders. In addition, the compensation programs should support the short-term and long-term strategic goals and values of the Company and should reward individual contributions to the Company’s success. The Company is engaged in a very competitive industry, and the Company’s success depends upon its ability to attract and retain qualified executives through the competitive compensation packages it offers to such individuals.

15

General Compensation Policy. The compensation committee’s policy is to provide the Company’s executive officers with compensation opportunities that are based upon their personal performance, the financial performance of the Company and their contribution to that performance, and that are competitive enough to attract and retain highly skilled individuals. Each executive officer’s compensation package is comprised of two elements: (i) salary and bonus that approximates market and (ii) long-term stock-based incentive awards designed to strengthen the mutuality of interests between the executive officers and the Company’s stockholders.

Factors. The principal factors that were taken into account in establishing each executive officer’s compensation package for the 2001 Fiscal Year are described below. The compensation committee may, however, in its discretion apply entirely different factors, such as different measures of financial performance, for future fiscal years.

Base Salary. The base salary for each executive officer is established on the basis of each individual’s personal performance and internal alignment considerations. The compensation committee’s policy is to target base salary levels that approximate market for similar positions at peer companies. In order to determine market salary levels, the compensation committee examined surveys provided by compensation consulting firms, which included companies of similar size in the high technology industry. The compensation committee believes that the Company must remain competitive with these companies in order to recruit and attain key executives. These peer companies provide a broader basis for comparison than our specific competitors in the field of Internet-enabled sales and marketing services for technology companies.

Additionally, each executive officer’s overall compensation includes an equity interest in the Company, as described in more detail below. The philosophy behind this strategy is to have a portion of each executive officer’s total compensation tied to the Company’s performance and stock price appreciation in order to create a greater incentive to increase value for the Company’s stockholders.

Bonuses. Certain of the Company’s executive officers, including the CEO have entered into employment agreements which provide for, in addition to base salary and equity incentives, bonuses to be awarded on the basis of the Company’s attainment of pre-established revenue and net profit goals. It is the intent of the compensation committee to use these bonuses, in conjunction with executives’ other equity incentives, to tie a potentially large portion of the executive’s total compensation to the financial performance of the Company. In addition, in 2001, certain of the company’s executive officers, not including the CEO, received retention bonuses.

Long-Term Incentives. Generally, the compensation committee makes stock option grants annually to certain of the Company’s executive officers. Each grant is designed to align the interests of the executive officer with those of the stockholders and provide each individual with a significant incentive to manage the Company from the perspective of an owner with an equity stake in the business. Each grant allows the officer to acquire shares of the Company’s Common Stock at a fixed price per share (the market price on the grant date) over a specified period of time (up to ten years). Each option generally becomes exercisable in a series of installments over a four-year period, contingent upon the officer’s continued employment with the Company. Accordingly, the option will provide a return to the executive officer only if he remains employed by the Company during the vesting period, and then only if the market price of the shares appreciates over the option term.

The size of the option grant to each executive officer is set by the compensation committee at a level that is intended to create a meaningful opportunity for stock ownership based upon the individual’s current position with the Company, the individual’s personal performance in recent periods and his or her potential for future responsibility and promotion over the option term. The compensation committee also takes into account the number of unvested options held by the executive officer in order to maintain an appropriate level of equity incentive for that individual. The relevant weight given to each of these factors varies from individual to individual. The compensation committee has established certain guidelines with respect to the option grants made to the executive officers, but has the flexibility to make adjustments to those guidelines at its discretion.

16

CEO Compensation. The compensation committee has set the base salary of the CEO at levels that it believes approximates market for base salary levels of chief executive officers of those companies with which the Company competes for executive talent. The companies examined include the peer group detailed in the consulting reports, as described above. Based on this information, Mr. Silton’s base salary was approximately at the median for chief executive officers of peer companies. Additionally, Mr. Silton received a bonus in the amount of $84,675, on the basis of the Company’s attainment of pre-established revenue and net profit goals. His total cash compensation is also at the median for chief executive officers at peer companies.

Compliance with Internal Revenue Code Section 162(m). Section 162(m) of the Internal Revenue Code disallows a deduction by us for compensation exceeding $1.0 million paid to certain executive officers, excluding, among other things, performance based compensation. Because the compensation paid to the executive officers has not approached the limitation, the compensation committee has not had to use any of the available exemptions from the deduction limit. The compensation committee remains aware of the Internal Revenue Code section 162 (m) limitations and the available exemptions, and will address the issue of deductibility when and if circumstances warrant the use of such exemptions.

It is the opinion of the compensation committee that the executive compensation policies and plans provide the necessary total remuneration program to properly align the interests of each executive officer and the interests of the Company’s stockholders through the use of competitive and equitable executive compensation in a balanced and reasonable manner, for both the short and long-term.

Submitted by the compensation committee of the Company’s Board of Directors:

17

Report of the Audit Committee of the Board of Directors

The audit committee of Rainmaker’s Board of Directors currently consists of Andrew T. Sheehan, Alok Mohan and Robert Leff. The audit committee operates under a written charter adopted by the Board of Directors in May 2000. Each member is “independent” within the meaning of the Nasdaq National Market rules. The audit committee recommends to the Board of Directors, subject to shareholder ratification, the selection of the Company’s independent accountants.

Management is responsible for the Company’s internal controls and the financial reporting process. The independent auditors are responsible for performing an independent audit of the Company’s financial statements in accordance with generally accepted auditing standards and expressing an opinion on the conformity of those audited financial statements in accordance with generally accepted accounting principles. The audit committee’s responsibility is to monitor and oversee these processes.

Review With Management. The audit committee has met and held discussions with management regarding the audited financial statements. Management has represented to the audit committee that the Company’s financial statements were prepared in accordance with generally accepted accounting principles.

Review and Discussion with Independent Auditors. The audit committee reviewed with the independent auditors, who are responsible for expressing an opinion on the conformity of those audited financial statements with generally accepted accounting principles, their judgments as to the quality, not just the acceptability, of the Company’s accounting principles and such other matters as are required to be discussed with the audit committee under generally accepted auditing standards. In addition, the audit committee has discussed with the independent auditors the auditors’ independence from management and the Company, including the matters in the written disclosures required by the Independence Standards Board, and considered the compatibility of nonaudit services with the auditors’ independence.

The audit committee discussed with the Company’s independent auditors the overall scope and plans for their respective audits. The audit committee met with the independent auditors, with and without management present, to discuss the results of their examinations, their evaluations of the Company’s internal controls, and the overall quality of the Company’s financial reporting. The audit committee held four meetings during the 2001 Fiscal Year.

Conclusion. In reliance on the reviews and discussions referred to above, the audit committee recommended to the Board of Directors (and the Board of Directors has approved) that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2001 for filing with the Securities and Exchange Commission. The audit committee and the Board of Directors have also recommended, subject to shareholder approval, the selection of the Company’s independent auditors.

Submitted by the audit committee of the Company’s Board of Directors:

18

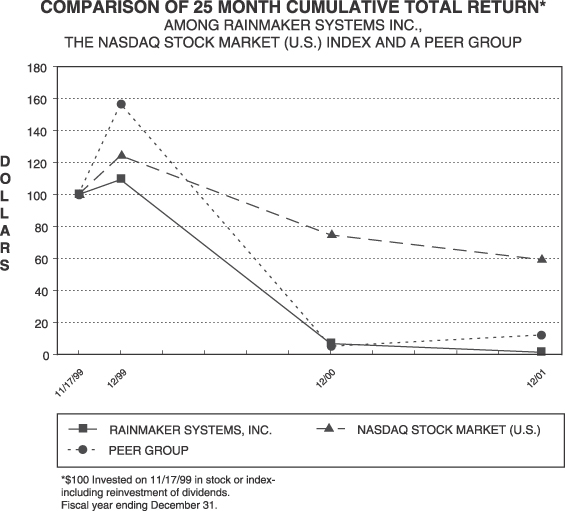

Stock Performance Graph

The graph depicted below shows a comparison of cumulative total stockholder returns for the Company, the Nasdaq Composite Index and an index of peer issuers selected in good faith by the Company which are in a similar line of business as the Company.

| | | Nov 17, 1999 | | Dec 31, 1999 | | Dec 31, 2000 | | Dec 31, 2001 |

| Rainmaker Systems, Inc. | | 100 | | 109.46 | | 6.76 | | 1.35 |

| Nasdaq Composite Index | | 100 | | 124.47 | | 74.91 | | 59.41 |

| Peer Group Index | | 100 | | 156.82 | | 5.27 | | 12.25 |

The graph covers the period from November 17, 1999, the commencement date of the Company’s initial public offering of shares of its Common Stock, to December 31, 2001. The graph assumes that $100 was invested on November 17, 1999 in the Company’s Common Stock at the market closing price of $18.50 per share on November 17, 1999 and in each index, and that all dividends were reinvested. No cash dividends have been declared on the Company’s Common Stock. Stockholder returns over the indicated period should not be considered indicative of future stockholder returns.

The companies included in the index of peer issuers for purposes of the preceding Stock Performance Graph are: Digital Impact, Inc., Intraware, Inc., Digital River, Inc. and Breakaway Solutions, Inc. The returns of each

19

component issuer included in the index of peer issuers are weighted according to the respective issuer’s approximate market capitalization at November 17, 1999.

The preceding Stock Performance Graph, the Compensation Committee Report and the Audit Committee Report are not considered proxy solicitation material and are not deemed filed with the Commission. Notwithstanding anything to the contrary set forth in any of the Company’s previous filings made under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate future filings made by the Company under those statutes, neither the preceding Stock Performance Graph, the Compensation Committee Report, nor the Audit Committee Report is to be incorporated by reference into any such prior filings, nor shall such graph or reports be incorporated by reference into any future filings made by the Company under those statutes.

Certain Transactions

During 2001, Rainmaker purchased inventories and service agreements from a customer who has a board member that also sits on Rainmaker’s Board of Directors. Total purchases amounted to $2.5 million during 2001. At December 31, 2001, Rainmaker owed that customer $861,000 for such purchases. Also during 2001, Rainmaker received marketing development fund reimbursements of $143,000 from that customer. Amounts totaling $81,000 were receivable from that customer at December 31, 2001.

During January through April of 2001 and fiscal year 2000, Rainmaker purchased inventories and service agreements from a stockholder at a total cost of $1.5 million and $5.4 million, respectively. Effective May 2001, this stockholder was acquired and ceased to be a customer. At December 31, 2001 and 2000, Rainmaker owed that stockholder $0 and $817,000 for such purchases, respectively. Also during January through April 2001 and fiscal year 2000, Rainmaker received marketing development fund reimbursements of $50,000 and $630,000 from that stockholder, respectively. A total of $0 and $386,000 was receivable from that stockholder at December 31, 2001 and 2000, respectively.

Compliance with Section 16(a) of the Securities Exchange Act of 1934

The members of the Board of Directors, the executive officers of the Company and persons who hold more than 10% of the Company’s outstanding Common Stock are subject to the reporting requirements of Section 16(a) of the Securities Exchange Act of 1934 which require them to file reports with respect to their ownership of the Common Stock and their transactions in such Common Stock. Based upon (i) the copies of Section 16(a) reports which the Company received from such persons for their 2001 Fiscal Year transactions in the Common Stock and their Common Stock holdings, and (ii) the written representations received from one or more of such persons that no annual Form 5 reports were required to be filed by them for the 2001 Fiscal Year, the Company believes that all reporting requirements under Section 16(a) for such fiscal year were met in a timely manner by its directors, executive officers and greater than 10% beneficial owners.

Annual Report

A copy of the Annual Report of the Company for the 2001 Fiscal Year has been mailed concurrently with this Proxy Statement to all stockholders entitled to notice of and to vote at the Annual Meeting. The Annual Report is not incorporated into this Proxy Statement and is not considered proxy solicitation material.

Form 10-K

The Company filed an Annual Report on Form 10-K with the Commission on March 29, 2002. Stockholders may obtain a copy of this report, free of charge, by writing to Investor Relations, Rainmaker Systems, Inc., 1800 Green Hills Road, Scotts Valley, California 95066.

| Dated: April 11, 2002 | | BY ORDER OF THE BOARD OF DIRECTORS OF RAINMAKER SYSTEMS, INC. |

20

RAINMAKER SYSTEMS, INC.

PROXY

COMMON STOCK

Annual Meeting of Stockholders, May 15, 2002

This Proxy is Solicited on Behalf of the Board of Directors of

Rainmaker Systems, Inc.

The undersigned revokes all previous proxies, acknowledges receipt of the Notice of the Annual Meeting of Stockholders to be held May 15, 2002 and the Proxy Statement and appoints Martin Hernandez and Michael Silton, and each of them, the Proxy of the undersigned, with full power of substitution, to vote all shares of Common Stock of Rainmaker Systems, Inc. (the “Company”) which the undersigned is entitled to vote, either on his or her own behalf or on behalf of any entity or entities, at the Annual Meeting of Stockholders of the Company to be held at the UCSC Inn & Conference Center, 611 Ocean Street, Santa Cruz, California 95060, on May 15, 2002 at 8:30 a.m Pacific Daylight Savings Time, and at any adjournment or postponement thereof, with the same force and effect as the undersigned might or could do if personally present thereat. The shares represented by this Proxy shall be voted in the manner set forth on the reverse side.

| 1. | | To elect one director to serve for a three-year term ending in the year 2005 or until his successor is duly elected and qualified; |

| | | Andrew T. Sheehan | | FOR | | WITHHOLD AUTHORITY TO VOTE |

| | | | | | | | | | |

| |

|

|

| | | For all nominees except as noted above. | | | | |

|

| 2. | | FOR | | AGAINST | | ABSTAIN | | To ratify the appointment of Ernst & Young LLP as independent auditors of the Company for the fiscal year ending December 31, 2002. |

|

| 3. | | | | | | | | In accordance with the discretion of the proxy holders, to act upon all matters incident to the conduct of the meeting and upon other matters as may properly come before the meeting. |

The Board of Directors recommends a vote IN FAVOR OF the director listed above and a vote IN FAVOR OF each of the listed proposals. This Proxy, when properly executed, will be voted as specified above.If no specification is made, this Proxy will be voted IN FAVOR OF the election of the director listed above and IN FAVOR OF the other proposals.

Please print the name(s) appearing on each share

certificate(s) over which you have voting authority:

| | (Print name(s) on certificate) |

Please sign your name: | Date: |

| | (Authorized Signature(s)) |