SCHEDULE 14A

(RULE 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE SECURITIES

EXCHANGE ACT OF 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement | ¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

RAINMAKER SYSTEMS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 14, 2003

TO THE STOCKHOLDERS OF

RAINMAKER SYSTEMS, INC.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Rainmaker Systems, Inc., a Delaware corporation (the “Company”), will be held on Wednesday, May 14, 2003, at 3:30 p.m. Pacific Daylight Savings Time at the Hilton San Jose South/Scotts Valley, 6001 La Madrona Drive, Scotts Valley, CA 95066, for the following purposes, as more fully described in the Proxy Statement accompanying this Notice:

| | 1. | | To elect two directors to serve on the Company’s Board of Directors for a one-year term ending in the year 2004 or until each director’s successor is duly elected and qualified; |

| | 2. | | To ratify the appointment of Ernst & Young LLP as independent auditors of the Company for the fiscal year ending December 31, 2003; |

| | 3. | | To consider and act upon a proposal to approve the 2003 Stock Incentive Plan; and |

| | 4. | | To transact such other business as may properly come before the meeting or any adjournment or adjournments thereof. |

Only stockholders of record at the close of business on March 31, 2003 are entitled to notice of and to vote at the Annual Meeting. The stock transfer books of the Company will remain open between the record date and the date of the meeting. A list of stockholders entitled to vote at the Annual Meeting will be available for inspection at the executive offices of the Company.

All stockholders are cordially invited to attend the meeting in person. Whether or not you plan to attend, please sign and return the enclosed proxy as promptly as possible in the envelope enclosed for your convenience. Should you receive more than one proxy because your shares are registered in different names and addresses, each proxy should be signed and returned to assure that all your shares will be voted. You may revoke your proxy at any time prior to the Annual Meeting. If you attend the Annual Meeting and vote by ballot, your proxy will be revoked automatically and only your vote at the Annual Meeting will be counted.

Sincerely,

Martin Hernandez

Secretary

Scotts Valley, California

April 16, 2003

YOUR VOTE IS VERY IMPORTANT REGARDLESS OF THE NUMBER OF SHARES YOU OWN. PLEASE READ THE ATTACHED PROXY STATEMENT CAREFULLY; COMPLETE, SIGN AND DATE THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE AND RETURN IT IN THE ENCLOSED ENVELOPE.

Rainmaker Systems, Inc.

1800 Green Hills Road

Scotts Valley, California 95066

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 14, 2003

General

The enclosed proxy (“Proxy”) is solicited on behalf of the Board of Directors of Rainmaker Systems, Inc., a Delaware corporation (the “Company”), for use at the Annual Meeting of Stockholders to be held on Wednesday, May 14, 2003 (the “Annual Meeting”). The Annual Meeting will be held at 3:30 p.m. Pacific Daylight Savings Time at the Hilton San Jose South/Scotts Valley, 6001 La Madrona Drive, Scotts Valley, CA 95066. These proxy solicitation materials were mailed on or about April 16, 2003 to all stockholders entitled to vote at the Annual Meeting.

Voting; Quorum

The specific proposals to be considered and acted upon at the Annual Meeting are summarized in the accompanying Notice and are described in more detail in this Proxy Statement. On March 31, 2003, the record date for determination of stockholders entitled to notice of and to vote at the Annual Meeting, 38,833,593 shares of the Company’s common stock, par value $0.001 (the “Common Stock”), were issued and outstanding. No shares of the Company’s Preferred Stock, par value $0.001, were outstanding.

Although the Company is a Delaware corporation, it is now subject to Section 2115 of the California Corporations Code. Section 2115 provides that corporations that are incorporated in jurisdictions other than California and that meet certain tests are subject to several provisions of the California Corporations Code, to the exclusion of the law of the jurisdiction in which the corporation is incorporated. We recently became subject to Section 2115 with the transfer of the listing of our common stock from the Nasdaq National Market to the Nasdaq SmallCap Market. Consequently, we are now subject to, among other provisions of the California Corporations Code, Section 708 which provides for cumulative voting.

Each holder of shares of Common Stock is entitled to one vote per share held by such holder on March 31, 2003. In voting for directors, however, shares may be voted cumulatively for persons whose names have been placed in nomination prior to the voting for the election of directors, but only if a stockholder present at the 2003 Annual Meeting gives notice at the meeting, prior to the voting for the election of directors, of his or her intention to vote cumulatively. Notice of intention to vote cumulatively may not be given by simply marking and returning a proxy.

If any stockholder gives proper notice of his or her intention to vote cumulatively, then each stockholder eligible to vote will be entitled to cumulate his or her votes and to give any one or more of the nominees whose names have been placed in nomination prior to the voting a number of votes equal to the total number of directors to be elected multiplied by the number of shares that the stockholder is entitled to vote. In addition, the person or persons holding the proxies solicited by our Board of Directors will exercise their cumulative voting

1

rights, at their discretion, to vote the shares they hold in such a way as to ensure the election of as many of the nominees of the Board of Directors as they deem possible. This discretion and authority of the proxy holders may be withheld by checking the box on the proxy card marked “withhold from all nominees.” However, such an instruction will also deny the proxy holders the authority to vote for any or all of the nominees of the Board of Directors, even if cumulative voting is not called for at the 2003 Annual Meeting.

In the election of directors, the two nominees receiving the highest number of affirmative votes shall be elected. Proposal 2 and Proposal 3 must be approved by the affirmative vote of holders of outstanding shares of Common Stock representing a majority of the voting power present in person or represented by proxy at the Annual Meeting and entitled to vote on the subject matter. The presence at the Annual Meeting, either in person or by proxy, of holders of shares of outstanding Common Stock entitled to vote and representing a majority of the voting power of such shares shall constitute a quorum for the transaction of business. Abstentions and shares held by brokers that are present in person or represented by proxy but that are not voted because the brokers were prohibited from exercising discretionary authority (“broker non-votes”) will be counted for the purpose of determining if a quorum is present. Abstentions will be counted towards the tabulation of votes cast on proposals presented to the stockholders and will have the same effect as negative votes, whereas broker non-votes will not be counted for purposes of determining whether a proposal has been approved. The inspector of election appointed for the meeting will tabulate all votes and will separately tabulate affirmative and negative votes, abstentions and broker non-votes.

Proxies

If the enclosed form of Proxy is properly signed and returned, the shares represented thereby will be voted at the Annual Meeting in accordance with the instructions specified thereon. If the Proxy does not specify how the shares represented thereby are to be voted, the Proxy will be voted FOR the election of the two nominees to the Board of Directors listed in the Proxy, unless the authority to vote for the election of any such nominee is withheld and, if no contrary instructions are given, the Proxy will be voted FOR the approval of Proposal 2 and FOR the approval of Proposal 3 described in the accompanying Notice and this Proxy Statement. You may revoke or change your Proxy at any time before the Annual Meeting by filing with the Secretary of the Company at the Company’s principal executive offices, located at 1800 Green Hills Road, Scotts Valley, California 95066, a notice of revocation or another signed Proxy with a later date. You may also revoke your Company’s Proxy by attending the Annual Meeting and voting in person.

Solicitation

The Company will bear the entire cost of the solicitation, including the preparation, assembly, printing and mailing of this Proxy Statement, the Proxy and any additional solicitation materials furnished to the stockholders. Copies of solicitation materials will be furnished to brokerage houses, fiduciaries and custodians holding shares in their names that are beneficially owned by others so that they may forward this solicitation material to such beneficial owners. The Company may reimburse such persons for their costs in forwarding the solicitation materials to such beneficial owners. The original solicitation of proxies by mail may be supplemented by a solicitation by telephone, telegram or any other means by directors, officers or employees of the Company. No additional compensation will be paid to these individuals for any such services. Except as described above, the Company does not presently intend to solicit proxies by any process other than by mail.

Deadline for Receipt of Stockholder Proposals

The date by which stockholder proposals must be received by the Company for inclusion in our proxy statement and form of proxy for the 2004 Annual Meeting is January 14, 2004. Proposals of stockholders of the Company that are intended to be presented by such stockholders at next year’s Annual Meeting of Stockholders must also be received by us no later than January 14, 2004, in order that they may be considered at that meeting. The proxy solicited by the Board of Directors for the 2004 Annual Meeting of Stockholders will confer discretionary authority to vote on any proposal presented by a stockholder at that meeting for which the Company has not been provided with notice on or prior to this date.

2

MATTERS TO BE CONSIDERED AT ANNUAL MEETING

PROPOSAL ONE: ELECTION OF DIRECTORS

General

The Company’s Certificate of Incorporation provides for a classified Board of Directors consisting of three classes of directors with staggered three-year terms, with each class consisting, as nearly as possible, of one-third of the total number of directors. The Board currently consists of five persons and the class whose term of office expires at the Annual Meeting currently consists of two directors. As set forth above under the caption “Voting; Quorum,” the Company is now subject to Section 2115 of the California Corporations Code which makes it subject to certain provisions of California General Corporation Law. Accordingly, the Company may no longer have a classified board and each class of directors will cease to be a separate class upon the expiration of its current term. As a result, the term of the two members of our Board of Directors to be elected at the Annual Meeting is one year, expiring at the 2004 Annual Meeting of Stockholders or until each director’s successor has been duly elected and qualified, and the remaining terms of our remaining members of our Board of Directors will remain one and two years, respectively. The nominees listed below are currently directors of the Company.

Each returned Proxy can only be voted for the number of persons nominated (two). Unless individual stockholders specify otherwise, each returned Proxy will be voted FOR the election of the two nominees who are listed below. If, however, the nominees named herein are unable to serve or decline to serve at the time of the Annual Meeting, the persons named in the enclosed Proxy will exercise discretionary authority to vote for substitutes. The nominees for election have agreed to serve if elected, and management has no reason to believe that the nominees will be unavailable to serve.

Nominees for Term Ending Upon the 2004 Annual Meeting of Stockholders

Michael Silton, 38, has served as a director of the Company since inception. Mr. Silton has served as President and Chief Executive Officer of the Company since October 1997 and the Company’s Chairman of the Board since inception. In 1991, he founded the Company’s former business UniDirect, which specialized in the direct marketing and sales of business software.

Robert Leff, 56, has served as a director of the Company since 1996. Mr. Leff co-founded Merisel, Inc. (formerly Softsel Computer Products, Inc.) in 1980, a wholesale distributor of computer products, and served as its President from 1980 to 1985 and its Co-Chairman from 1985 until he retired from Merisel, Inc. in 1994. Since 1994, Mr. Leff has been a strategic and financial consultant to start-up and growth stage companies in the personal computer industry. In March 2001, while Mr. Leff served on the Board of Directors and as acting Chief Executive Officer of Hiho Technologies, Inc., Hiho Technologies, Inc. completed an assignment for the benefit of creditors.

Continuing Directors for Term Ending Upon the 2004 Annual Meeting of Stockholders

Alok Mohan, 54, has served as a director of the Company since 1996. Mr. Mohan is currently the Chairman of the Board of Directors of Tarantella, Inc. Prior to that appointment, he served as Chief Executive Officer of Santa Cruz Operations, Inc. (“SCO”) from July 1995 until April 1998. Prior to that, from May 1994 to July 1995, Mr. Mohan served as Senior Vice President, Operations and Chief Financial Officer of SCO. Prior to joining SCO, Mr. Mohan was employed with NCR Corporation (“NCR”), a business software and services company, where he served as Vice President of Strategic Planning and Controller from July 1993 to May 1994. From January 1990 until July 1993, Mr. Mohan served as Vice President and General Manager of the Workstation Products Division at NCR. Mr. Mohan also serves on the Board of Directors for various private companies.

James Richardson,55,has served as director of the Company since 2001. Mr. Richardson is currently a consultant to various high technology companies and serves on the Board of Directors for Digimarc Corporation,

3

Plumtree Software, Inc. and various private companies. From July 1998 to June 2001, he served as Senior Vice President and Chief Financial Officer of WebTrends Corporation, which merged with NetIQ Corporation in March of 2001. Prior to joining WebTrends, Mr. Richardson was Senior Vice President and Chief Financial Officer at Network General Corporation from April 1994 to January 1998. From June 1992 to March 1994, Mr. Richardson was Vice President and Chief Financial Officer of Logic Modeling Corporation, now a division of Synopsis, and Vice President and Chief Financial Officer of Advanced Logic Research.

Continuing Directors for Term Ending Upon the 2005 Annual Meeting of Stockholders

Phillip Clough, 41, has served as a director of the Company since February 2003. Mr. Clough is a Venture Partner of ABS Capital Partners (“ABS”), a private equity firm focused on investments in enterprise software and services companies since 2001. Prior to joining ABS, Mr. Clough was President and Chief Executive Officer of Sitel Corporation from 1997 to 2001. In addition to serving as a director for the Company, Mr. Clough currently serves on the Board of Directors of various other private companies.

Board Committees and Meetings

The Board of Directors held 5 meetings and agreed to take action by unanimous written consent 5 times during the fiscal year ended December 31, 2002 (the “2002 Fiscal Year”). The Board of Directors has an audit committee and a compensation committee. Each director attended or participated in 75% or more of the aggregate of (i) the total number of meetings of the Board of Directors and (ii) the total number of meetings held by all committees of the Board on which such director served during the 2002 Fiscal Year. The Board of Directors also consulted informally with management.

Audit Committee. The audit committee consists of Robert Leff, Alok Mohan and James Richardson. The audit committee oversees the Company’s accounting and financial reporting policies and internal controls, reviews and monitors the corporate financial reporting and external audit of the Company, including, among other things, the results and scope of the annual audit and other services provided by the Company’s independent auditors and the Company’s compliance with legal matters that have a significant impact on the Company’s financial reports. The audit committee also consults with the Company’s management and the Company’s independent auditors prior to the presentation of financial statements to stockholders and, as appropriate, initiates inquiries into various aspects of the Company’s financial affairs. In addition, the audit committee is responsible for considering and recommending the appointment of, and reviewing fee arrangements with, the Company’s independent auditors. The audit committee was formed in May 1999 and held four meetings during the 2002 Fiscal Year. Members of the audit committee are elected by the Board of Directors and serve one-year terms. The Annual Report of the Audit Committee appears hereafter under “Report of the Audit Committee of the Board of Directors.” The Board of Directors adopted a written charter for the audit committee in 2000. A copy of the audit committee charter, which was amended by the Board of Directors in March 2003, is attached as Exhibit A hereto. The Board of Directors has determined that each of the members of the audit committee is an “independent director” as defined in Rule 4200 of the Marketplace Rules of the National Association of Securities Dealers, Inc.

Compensation Committee. The compensation committee consists of Robert Leff, Alok Mohan and James Richardson. The compensation committee reviews and approves salaries, benefits and bonuses for the Chief Executive Officer, Chief Financial Officer and other executive officers of the Company. It reviews and recommends to the Board of Directors on matters relating to employee compensation and benefit plans. The compensation committee also administers the Company’s stock plans. The compensation committee was formed in May 1999 and agreed to take action by unanimous written consent six times during the 2002 Fiscal Year. The Annual Report of the Compensation Committee appears hereafter under “Report of the Compensation Committee of the Board of Directors on Executive Compensation.”

4

Director Compensation

On January 10, 2002, Robert Leff, Alok Mohan, and James Richardson were granted options to purchase 176,000, 176,000 and 100,000 shares of Common Stock, respectively, at an exercise price of $0.28 per share and on May 15, 2002, Robert Leff, Alok Mohan and James Richardson were each granted an option to purchase 20,000 shares of Common Stock at an exercise price of $0.46 per share. For 2002, all outside directors were paid $5,000 in quarterly fees for each quarter of service as a director, $1,000 per Board meeting attended during the year and $500 per committee meeting attended during the year. Annually, each non-employee Board member who continues to serve as a non-employee Board member after the Annual Meeting of Stockholders, including each of the Company’s current non-employee Board members, will automatically be granted an option to purchase 20,000 shares of Common Stock at an exercise price equal to the fair market value per share of the Common Stock on the date of such Annual Meeting, provided such individual has served on the Board for at least six months.

Required Vote

The two nominees receiving the highest number of affirmative votes of the outstanding shares of Common Stock, present or represented and entitled to be voted for such nominees, shall be elected as directors. The Proxies cannot be voted for a greater number of persons than two.

Recommendation of the Board of Directors

The Board of Directors recommends that the stockholders vote FOR the election of the nominees listed above.

PROPOSAL TWO: RATIFICATION OF ERNST & YOUNG LLP AS INDEPENDENT AUDITORS

Audit services of Ernst & Young LLP (“Ernst & Young”) during the 2002 Fiscal Year included the examination of our financial statements and services related to filings with the Securities and Exchange Commission (“SEC”) and other regulatory bodies. Following are the fees incurred by the Company for services rendered by Ernst & Young during the 2002 Fiscal Year:

Audit Fees

Fees for the last annual audit, which included quarterly review procedures, were $243,000.

Financial Information Systems Design and Implementation Fees

There were no financial information systems design and implementation fees paid by the Company to Ernst & Young in fiscal 2002.

All Other Fees

All other fees were $37,000, all of which were for non-audit services, including primarily tax return preparation and tax planning consultations.

The audit committee, composed entirely of independent directors, recommended to the Board of Directors that Ernst & Young be appointed as independent auditors. As our independent auditors, Ernst & Young will audit our financial statements for the 2003 fiscal year and perform audit-related services in connection with various accounting and financial reporting matters. Ernst & Young may perform certain non-audit services for the Company, subject to preapproval by the audit committee.

The Board of Directors approved the selection of Ernst & Young as independent auditors for the 2003 fiscal year and is asking the stockholders for ratification of their selection. A representative of Ernst & Young is

5

expected to be present at the Annual Meeting, will have the opportunity to make a statement if he or she desires to do so, and will be available to respond to appropriate questions.

Required Vote

The affirmative vote of a majority of the shares represented and voting at the Annual Meeting is required to ratify the selection of Ernst & Young. In the event that the stockholders do not approve the selection of Ernst & Young, the Board of Directors will reconsider the appointment of the independent auditors. Even if the selection is ratified, the Board of Directors in its discretion may direct the appointment of a different independent auditing firm at any time during the year if the Board of Directors believes that such a change would be in the best interests of the Company and its stockholders.

Recommendation of the Board of Directors

The Board of Directors recommends that the stockholders vote FOR the ratification of the selection of Ernst & Young LLP to serve as the Company’s independent auditors for the fiscal year ending December 31, 2003.

PROPOSAL THREE: TO APPROVE THE 2003 STOCK INCENTIVE PLAN

General

The stockholders are being asked to approve the implementation of the Company’s 2003 Stock Incentive Plan (the “2003 Plan”) under which 7,173,524 shares of Common Stock will initially be reserved for issuance. The 2003 Plan will be a successor plan to the Company’s existing 1999 Stock Incentive Plan (the “1999 Plan”); however, the 2003 Plan, if approved, will differ from the 1999 Plan as follows: (i) the use of loans from the Company to exercise stock options or purchase stock will be prohibited, (ii) the term of the 2003 Plan will continue until March 31, 2013, and (iii) stock options which are granted under the 2003 Plan will be treated as performance-based compensation for purposes of Section 162(m) of the Internal Revenue Code. If approved, the 2003 Plan will allow the Company to continue to provide key employees (including officers and directors), non-employee Board members and independent consultants and advisors in the Company’s service the opportunity to acquire a meaningful equity interest in the Company as an incentive for them to remain in service, while maintaining the Company’s ability to deduct the compensation which is deemed as having been paid to such plan participants upon the exercise of non-statutory stock options and the disqualifying disposition of incentive stock options granted under the 2003 Plan. The Board believes that such equity incentives are a significant factor in the Company’s ability to attract and retain the key individuals who are essential to the Company’s growth and financial success. Additionally, the Board believes that maintaining the 2003 Plan’s exemption under Code Section 162(m) for performance-based compensation is a financial benefit to the Company long-term.

The following is a summary of the principal features of the 2003 Plan. The summary, however, does not purport to be a complete description of all the provisions of the 2003 Plan. The 2003 Plan is attached to this Proxy Statement as Exhibit B. Any stockholder of the Company who wishes to obtain a copy of the actual plan document may do so upon written request to the Company’s Secretary at the Company’s principal executive offices located at 1800 Green Hills Road, Scotts Valley, California 95066.

The Company has submitted a permit application for the 2003 Plan to the California Department of Corporations in order to comply with the requirements of the California securities laws. As a condition to approval of such application, the Department of Corporations may require changes to the 2003 Plan. The granting of any options and the issuance of any shares of Common Stock under the 2003 Plan shall be subject to the Company’s procurement of such permit.

Unless otherwise noted, the terms of the 1999 Plan are identical to those of the 2003 Plan.

6

Description of 2003 Plan

Plan Adoption

The 2003 Plan was adopted by the Board in April 2003 and serves as a successor to the 1999 Plan. Upon approval of this proposal, the 2003 Plan will commence on the second trading day following the 2003 Annual Meeting. The 1999 Plan was originally adopted by the Board in October 1999 and approved by the stockholders in October 1999. The 1999 Plan became effective in connection with the initial public offering of the Common Stock and serves as the successor to the Company’s 1995 Stock Option/Stock Issuance Plan and 1998 Stock Option/Stock Issuance Plan (the “Predecessor Plans”). Each option outstanding under the Predecessor Plans was incorporated into the 1999 Plan, and no further option grants have been made under the Predecessor Plans since the 1999 Plan became effective.

Plan Structure

The 2003 Plan is divided into five (5) separate equity incentive programs: (i) the Discretionary Option Grant Program, (ii) the Salary Investment Option Grant Program, (iii) the Stock Issuance Program, (iv) the Automatic Option Grant Program and (v) the Director Fee Option Grant Program. The Salary Investment Option Grant and Director Fee Option Grant Programs will not be implemented until such time as the Compensation Committee deems appropriate. The principal features of each of the five programs are described below.

Plan Administration

The Compensation Committee of the Board will have exclusive authority to administer the Discretionary Option Grant Program and the Stock Issuance Program with respect to all eligible individuals. However, the Board may also appoint a secondary committee of one or more Board members to have separate but concurrent authority to make option grants and stock issuances under those programs to all eligible individuals other than the Company’s executive officers and non-employee Board members. The term “Plan Administrator,” as used in this Proposal Three, will mean either the Compensation Committee or any secondary committee, to the extent each such entity is acting within the scope of its administrative jurisdiction under the 2003 Plan. The Compensation Committee will also have the exclusive authority to select the executive officers and other highly compensated employees who may participate in the Salary Investment Option Grant Program. Grants under the Salary Investment Option Grant Program, the Director Fee Option Grant Program or the Automatic Grant Program for the non-employee Board members will be made in compliance with the express provisions of each such program.

Eligibility

Employees (including officers), non-employee Board members, and independent consultants and advisors in the service of the Company or its parent and subsidiaries (whether now existing or subsequently established) will be eligible to participate in the Discretionary Option Grant and Stock Issuance Programs. Executive officers and other highly compensated employees may also be eligible to participate in the Salary Investment Option Grant Program. Non-employee Board members will also be eligible to participate in the Automatic Option Grant Program and the Director Fee Option Grant Program.

Share Reserve

The maximum number of shares of Common Stock that can be issued under the 2003 Plan is 7,173,524. This amount will be increased on the first trading day in January each year, beginning in January 2004, by an amount equal to four percent (4%) of the total number of shares of Common Stock outstanding on the last trading day in December of the last prior year, but in no event will this annual increase exceed 3,000,000 shares. The share reserve under the 1999 Plan is 14,671,433, of which 7,253,524 shares remain available for issuance as of March 31, 2003. Under the terms of the 1999 Plan, this amount was increased on the first trading day in January

7

each year, beginning in January 2001, by an amount equal to four percent (4%) of the total number of shares of Common Stock outstanding on the last trading day in December of the last prior year, but in no event was this annual increase to exceed 3,000,000 shares; however, upon the second trading day following stockholder approval of this proposal, no further options will be granted or stock issuances made under the 1999 Plan.

In no event may any one individual participating in the 2003 Plan be granted stock options, separately exercisable stock appreciation rights or receive direct stock issuances for more than 1,000,000 shares of Common Stock in the aggregate during each calendar year under the 2003 Plan. Stockholder approval of this Proposal will also constitute approval of such limitation for purposes of Section 162(m) of the Internal Revenue Code.

The shares of Common Stock issuable under the 2003 Plan may be drawn from shares of authorized but unissued Common Stock or from shares of Common Stock that the Company acquires, including shares purchased on the open market. Shares subject to any outstanding options under the 1999 Plan that expire or otherwise terminate prior to exercise will not be available for subsequent issuance under the 2003 Plan. In addition, unvested shares issued under the 1999 Plan that the Company subsequently purchases, at the option exercise or direct issue price paid per share, pursuant to the Company’s repurchase rights under the 1999 Plan will not be available for subsequent issuance.

In the event any change is made to the Common Stock issuable under the 2003 Plan by reason of any stock split, stock dividend, combination of shares, merger, reorganization, consolidation, recapitalization, exchange of shares, or other change in capitalization of the Company affecting the outstanding shares of Common Stock as a class without the Company’s receipt of consideration, appropriate adjustments will be made to (i) the maximum number and/or class of securities issuable under the 2003 Plan (including the maximum amount of the annual increase), (ii) the maximum number and/or class of securities for which any one individual may be granted stock options, separately exercisable stock appreciation rights or direct stock issuances under the 2003 Plan, (iii) the class and/or number of securities and price per share in effect under each outstanding option granted under the 2003 Plan, and (iv) the class and/or number of securities for which automatic option grants are to be subsequently made to new and continuing non-employee Board members under the Automatic Option Grant Program. The adjustments to the outstanding options will prevent the dilution or enlargement of benefits thereunder.

As of March 31, 2003, no options were outstanding under the 2003 Plan; however, under the 1999 Plan, options for 4,570,056 shares were outstanding, 2,847,853 shares were issued and 7,253,524 shares remained available for future option grants and stock issuances.

Discretionary Option Grant Program

Grants

The Plan Administrator will have complete discretion under the Discretionary Option Grant Program to determine which eligible individuals are to receive option grants, the time or times when those grants are to be made, the number of shares subject to each such grant, the status of any granted option as either an incentive stock option or a non-statutory option under the federal tax laws, the maximum term for which any granted option is to remain outstanding and, generally, the vesting schedule to be in effect for the option grant.

Price and Exercisability

Each granted option will have an exercise price per share not less than 100% of the fair market value per share of Common Stock on the option grant date, and no granted option will have a term in excess of 10 years. The shares subject to each option will generally become exercisable for fully-vested shares in a series of installments over a specified period of service measured from the grant date. However, one or more options may be structured so that they are immediately exercisable for any or all of the option shares. The shares acquired

8

under such immediately-exercisable options will normally be unvested and subject to repurchase by the Company, at the exercise price paid per share, if the optionee ceases service with the Company prior to vesting in those shares.

The exercise price may be paid in cash or in shares of common stock or through a same-day sale program pursuant to which a brokerage firm is to effect an immediate sale of the shares purchased under the option and pay over to the Company, out of the sale proceeds available on the settlement date, sufficient funds to cover the exercise price for the purchased shares plus all applicable withholding taxes.

No optionee will have any stockholder rights with respect to the option shares until such optionee has exercised the option and paid the exercise price for the purchased shares. Options will generally not be assignable or transferable other than by will or the laws of inheritance and, during the optionee’s lifetime, the option may be exercised only by such optionee. However, the Plan Administrator may allow non-statutory options to be transferred or assigned during the optionee’s lifetime to one or more members of the optionee’s immediate family or to a trust established exclusively for one or more such family members or to the optionee’s former spouse, to the extent such transfer or assignment is in furtherance of the optionee’s estate plan or pursuant to a domestic relations order. The optionee may also designate one or more beneficiaries to automatically receive his or her outstanding options at death.

Termination of Service

Upon cessation of service, the optionee will have a limited period of time in which to exercise his or her outstanding options for any shares in which the optionee is vested at that time. Under no circumstances may an option be exercised after the specified expiration date of the option term. The Plan Administrator will have complete discretion to extend the period following the optionee’s cessation of service during which his or her outstanding options may be exercised and/or to accelerate the exercisability or vesting of such options in whole or in part.

Corporate Transaction

In the event of a Corporate Transaction (defined below), each outstanding option under the Discretionary Option Grant Program that will not be assumed by the successor corporation or otherwise replaced with a cash incentive program that preserves the existing option spread on the unvested option shares will automatically accelerate in full, except to the extent the Company’s repurchase rights with respect to those shares are to be assigned to the successor corporation. The Plan Administrator will have the discretion to structure one or more option grants under the Discretionary Option Grant Program so that those options or shares will automatically vest in the event the individual’s service is subsequently terminated within a specified period (not to exceed 18 months) following a Corporate Transaction in which those options do not otherwise vest on an accelerated basis. The Plan Administrator may also structure one or more option grants under the Discretionary Option Grant Program so that those options and will automatically vest in full upon a Corporate Transaction.

A Corporate Transaction includes one or more of the following stockholder-approved transactions to which the Company is a party: (i) a merger or consolidation in which securities possessing more than 50% of the total combined voting power of the Company’s outstanding securities are transferred to a person or persons different from the persons holding those securities immediately prior to such transaction, or (ii) the sale, transfer or other disposition of all or substantially all of the Company’s assets in complete liquidation or dissolution of the Company.

Change in Control

The Plan Administrator will have the discretionary authority to provide for automatic acceleration of outstanding options under the Discretionary Option Grant Program in connection with a Change in Control, with

9

such acceleration or vesting to occur either at the time of the Change in Control or upon the subsequent termination of the participant’s service within a designated period, not to exceed 18 months following the effective date of such Change in Control.

A Change in Control will be deemed to occur under the 2003 Plan upon: (i) the acquisition of more than 50% of the Company’s outstanding voting stock pursuant to a tender or exchange offer made directly to the Company’s stockholders or (ii) a change in the composition of the Board of Directors over a period of 36 months or less such that a majority of the Board members ceases, by reason of one or more contested elections for Board membership, to be comprised of individuals who either (a) have been members of the Board continuously since the beginning of such period or (b) have been elected or nominated for election as Board members during such period by at least a majority of the Board members described in clause (a) who were still in office at the time such election or nominations was approved by the Board. In addition, the Plan Administrator can provide acceleration of outstanding options upon other events, including other transactions and other types of terminations.

The acceleration of vesting in the event of a change in the ownership or control of the Company is intended to provide employees with an incentive to remain in employment during periods when there is potential for a change in control of the Company and to consider transactions that might result in the termination of their employment, but may, under certain circumstances, have the effect of discouraging a merger proposal, a takeover attempt or other efforts to gain control of the Company.

Stock Appreciation Rights

The Plan Administrator is authorized to issue two types of stock appreciation rights in connection with option grants made under the Discretionary Option Grant Program:

Tandem stock appreciation rights provide the holders with the right to surrender all or part of an unexercised option for an appreciation distribution from the Company equal in amount to the excess of (a) the fair market value of the shares of Common Stock subject to the surrendered option over (b) the aggregate exercise price payable for those shares. Such appreciation distribution may, at the discretion of the Plan Administrator, be made in cash, shares of Common Stock or a combination of both.

Limited stock appreciation rights may be granted to officers of the Company as part of their option grants. Any option with such a limited stock appreciation right may be surrendered to the Company upon the successful completion of a Hostile Take-Over of the Company. In return for the surrendered option, the officer will be entitled to a cash distribution from the Company in an amount per surrendered share equal to the excess of (a) the Take-Over Price per share over (b) the exercise price payable for such share.

For purposes of such option cash-out provisions, the following definitions are in effect under the 2003 Plan:

Hostile Take-Over: the direct or indirect acquisition by any person or related group of persons (other than the Company or its affiliates) of securities possessing more than 50% of the total combined voting power of the Company’s outstanding securities pursuant to a tender or exchange offer made directly to the Company’s stockholders which the Board does not recommend that such stockholders accept.

Take-Over Price: the greater of (A) the fair market value of the shares of Common Stock subject to the surrendered option, measured on the surrender date in accordance with the valuation provisions of the 2003 Plan described below, or (B) the highest reported price per share paid by the tender offeror in effecting the Hostile Take-Over.

Salary Investment Option Grant Program

In the event the Plan Administrator decides to put this program into effect for one or more calendar years, each of our executive officers and other highly compensated employees selected by the Plan Administrator may

10

elect to reduce his or her base salary for the calendar year by an amount not less than $10,000 nor more than $50,000. Each selected individual who makes such an election will automatically be granted, on the first trading day in January of the calendar year for which his or her salary reduction is to be in effect, an option to purchase that number of shares of common stock determined by dividing the salary reduction amount by two-thirds of the fair market value per share of our common stock on the grant date. The option will have exercise price per share equal to one-third of the fair market value of the option shares on the grant date. As a result, the option will be structured so that the fair market value of the option shares on the grant date less the exercise price payable for those shares will be equal to the amount of the salary reduction. The option will become exercisable in a series of twelve equal monthly installments over the calendar year for which the salary reduction is to be in effect.

Automatic Option Grant Program

Under the Automatic Option Grant Program, non-employee Board members will receive option grants at specified intervals over their period of Board service. The terms and conditions governing the option grants, which may be made under the Automatic Option Grant Program, are summarized below.

Under the Automatic Option Grant Program, each individual who first joins the Board as a non-employee Board member will receive an automatic option grant for 100,000 shares of Common Stock which will be granted on the date the non-employee Board member joins the Board. Each individual who has served as a non-employee Board member for at least six (6) months prior to an Annual Meeting will automatically be granted an option to purchase 20,000 shares of Common Stock on the next trading day following such Annual Meeting.

Each option grant under the Automatic Option Grant Program has an exercise price per share equal to 100% of the fair market value per share of Common Stock on the grant date and a maximum term of 10 years measured from such date, subject to earlier termination upon the optionee’s cessation of Board service. Each option grant under the Automatic Option Grant Program shall be immediately exercisable for all of the option shares. However, any unvested shares shall be subject to repurchase by the Company, at the exercise price paid per share, upon the optionee’s termination of service prior to vesting in such shares. Each initial 100,000-share option vests in a series of eight (8) successive equal quarterly installments upon the director’s completion of each three (3)-month period of service over the twenty-four (24)-month period measured from the grant date. Each annual 20,000-share option grant vests in two successive equal semi-annual installments upon the director’s completion of each six (6)-month period of Board service over the twelve (12)-month period measured from the grant date.

The automatic option grants remain exercisable for a twelve (12)-month period following the non-employee Board member’s cessation of Board service for any reason. During the applicable exercise period, the option may not be exercised for more than the number of shares (if any) for which the option is vested at the time of his or her cessation of Board service.

The shares subject to each automatic option grant immediately vests should any of the following events occur during optionee’s period of Board service: (i) the non-employee Board member’s death or permanent disability or (ii) a Corporate Transaction or Change in Control. In addition, upon the successful completion of a Hostile Take-Over, each automatic option grant may be surrendered to the Company for a cash distribution per surrendered option share in an amount equal to the excess of (a) the Take-Over Price per share over (b) the exercise price payable for such share. Stockholder approval of this Proposal will also constitute pre-approval of each option granted with such surrender right on or after the date of the Annual Meeting and the subsequent exercise of that right in accordance with the foregoing provisions. In addition, non-employee Board members are also eligible to receive option awards under the Discretionary Option Grant Program.

Stock Issuance Program

Shares may be sold under the Stock Issuance Program at a price per share not less than their fair market value, payable in cash or, in the discretion of the Plan Administrator, through a promissory note payable to the

11

Company. Shares may also be issued as a bonus for past services without any cash outlay required of the recipient. Shares of common stock may also be issued under the Stock Issuance Program pursuant to share right awards, which entitle the recipients to receive those shares upon the attainment of designated performance goals or completion of a specified service period. The Plan Administrator will have complete discretion under this program to determine which eligible individuals are to receive such stock issuances or share right awards, the time or times when such issuances or awards are to be made, the number of shares subject to each such issuance or award and, generally, the vesting schedule to be in effect for the stock issuance or share rights award.

The vesting schedule for each stock issuance will generally be determined by the Plan Administrator at the time of issuance. The shares may be fully-vested upon the date of issuance, may vest in one or more installments over the participant’s period of future service or, vesting may be conditioned upon the upon the attainment of performance milestones. Such shares may vest in full prior to such dates in the event of a Corporate Transaction or Change in Control, according to the parameters described for the Discretionary Option Grant Program in “Corporate Transaction” and “Change in Control” sections above or such other terms as the Plan Administrator may specify, and, in addition, the Plan Administrator will have the discretionary authority at any time to accelerate the vesting of any and all share rights awards and all unvested shares outstanding under the Stock Issuance Program.

Outstanding share right awards under the Stock Issuance Program will automatically terminate, and no shares of common stock will actually be issued in satisfaction of those awards, if the performance goals established for such awards are not attained. The Plan Administrator, however, will have the discretionary authority to issue shares of common stock in satisfaction of one or more outstanding share right awards as to which the designated performance goals are not attained.

Director Fee Option Grant Program

If this program is put into effect in the future, then each non-employee board member may elect to apply all or a portion of any cash retainer fee for the year to the acquisition of a below-market option grant. The option grant will automatically be made on the first trading day in January in the year for which the non-employee board member would otherwise be paid the cash retainer fee in the absence of his or her election. The option will have an exercise price per share equal to one-third of the fair market value of the option shares on the grant date, and the number of shares subject to the option will be determined by dividing the amount of the retainer fee applied to the program by two-thirds of the fair market value per share of our common stock on the grant date. As a result, the option will be structured so that the fair market value of the option shares on the grant date less the exercise price payable for those shares will be equal to the portion of the retainer fee applied to that option. The option will become exercisable in a series of twelve equal monthly installments over the calendar year for which the election is in effect. However, the option will become immediately exercisable for all the option shares upon the death or disability of the optionee while serving as a board member.

General Plan Provisions

Valuation

For all valuation purposes under the 2003 Plan, the fair market value per share of common stock on any date will be deemed equal to the closing selling price per share on that date, as reported on the Nasdaq SmallCap Market or, in the future if the Common Stock is traded on any other stock exchange, the fair market value will be deemed equal to the closing selling price per share on that date, as reported on such stock exchange. On March 31, 2003, the closing selling price per share was $0.65.

Vesting Acceleration

In the event of a Corporate Transaction or Change in Control, the outstanding options under the Discretionary Option Grant Program and the outstanding stock issuances under the Stock Issuance Program may be accelerated according to the terms and conditions of these programs, as described in more detail above.

12

The shares subject to each option under the Salary Investment Option Grant and Director Fee Option Grant Programs will immediately vest upon (i) an acquisition of the Company by merger or asset sale, (ii) the successful completion of a tender offer for more than 50% of the Company’s outstanding voting stock or (iii) a change in the majority of the Board effected through one or more contested elections for Board membership.

The acceleration of vesting in the event of a change in the ownership or control of the Company may be seen as an anti-takeover provision and may have the effect of discouraging a merger proposal, a takeover attempt or other efforts to gain control of the Company.

Cancellation/Regrant

The Plan Administrator will have the authority to effect, with the consent of the affected option holders, the repricing of outstanding options or the cancellation of outstanding options in return for the grant of new options for the same or a different number of option shares with an exercise price per share based upon the fair market value of the common stock on the new grant date.

Special Tax Withholding Election

The Plan Administrator may provide one or more holders of options or unvested share issuances under the 2003 Plan with the right to have the Company withhold a portion of the shares otherwise issuable to such individuals in satisfaction of the withholding taxes to which such individuals may become subject in connection with the exercise of those options or the vesting of those shares. Alternatively, the Plan Administrator may allow such individuals to deliver previously acquired shares of common stock in payment of such withholding tax liability.

Amendment and Termination

The Board may amend or modify the 2003 Plan at any time, subject to any required stockholder approval pursuant to applicable laws and regulations. Unless sooner terminated by the Board, the 2003 Plan will terminate on the earliest of (i) March 31, 2013 (ii) the date on which all shares available for issuance under the 2003 Plan have been issued as fully-vested shares or (iii) the termination of all outstanding options in connection with certain changes in control or ownership of the Company.

New Plan Benefits

As of March 31, 2003, no awards have been granted under the 2003 Plan, the approval of which forms this Proposal No. Three. Since the awards proposed provide various discretionary criteria from which the Plan Administrator may choose to determine awards, it is not possible to determine the awards that will be received by eligible individuals.

FEDERAL INCOME TAX CONSEQUENCES

Option Grants

Options granted under the 2003 Plan may be either incentive stock options, which satisfy the requirements of Section 422 of the Internal Revenue Code, or non-statutory options which are not intended to meet such requirements. The Federal income tax treatment for the two types of options differs as follows:

Incentive Options. The optionee recognizes no taxable income at the time of the option grant, and no taxable income is generally recognized at the time the option is exercised. The optionee will, however, recognize taxable income in the year in which the purchased shares are sold or otherwise made the subject of a disposition.

13

For Federal tax purposes, dispositions are divided into two categories: (i) qualifying and (ii) disqualifying. A qualifying disposition occurs if the sale or other disposition of the shares is made more than two years after the date the option is granted for those shares and more than one year after the date the option is exercised for those shares. If the sale or disposition occurs before these periods are satisfied, then a disqualifying disposition will result.

Upon a qualifying disposition of the shares, the optionee will recognize long-term capital gain in an amount equal to the excess of (i) the amount realized upon the sale or other disposition of the purchased shares over (ii) the exercise price paid for those shares. If there is a disqualifying disposition of the shares, then the excess of (i) the fair market value of the shares on the exercise date over (ii) the exercise price paid for those shares will be taxable as ordinary income to the optionee. Any additional gain or loss recognized upon the disposition will be taxable as a capital gain or loss.

If the optionee makes a disqualifying disposition of the purchased shares, then the Company will be entitled to an income tax deduction, for the taxable year in which such disposition occurs, equal to the excess of (i) the fair market value of such shares on the option exercise date over (ii) the exercise price paid for the shares. In no other instance will the Company be allowed a deduction with respect to the optionee’s disposition of the purchased shares.

Non-Statutory Options. No taxable income is recognized by an optionee upon the grant of a non-statutory option. The optionee will in general recognize ordinary income, in the year in which the option is exercised, equal to the excess of the fair market value of the purchased shares on the exercise date over the exercise price paid for the shares, and the optionee will be required to satisfy the tax withholding requirements applicable to such income.

If the shares acquired upon exercise of the non-statutory option are unvested and subject to repurchase by the Company in the event of the optionee’s termination of service prior to vesting in those shares, then the optionee will not recognize any taxable income at the time of exercise but will have to report as ordinary income, as and when the Company’s repurchase right lapses, an amount equal to the excess of (i) the fair market value of the shares on the date those shares vest over (ii) the exercise price paid for such shares. The optionee may, however, elect under Section 83(b) of the Internal Revenue Code to include as ordinary income in the year of exercise of the option an amount equal to the excess of (i) the fair market value of the purchased shares on the exercise date over (ii) the exercise price paid for those shares. If the Section 83(b) election is made, the optionee will not recognize any additional income as and when the repurchase right lapses.

The Company will be entitled to an income tax deduction equal to the amount of ordinary income recognized by the optionee with respect to the exercised non-statutory option. The deduction will in general be allowed for the taxable year of the Company in which such ordinary income is recognized by the optionee.

Direct Stock Issuance

The tax principles applicable to direct stock issuances under the 2003 Plan will be substantially the same as those summarized above for the exercise of non-statutory option grants.

Deductibility of Executive Compensation

Pursuant to the approval of this Proposal, the Company anticipates that any compensation deemed paid by it in connection with disqualifying dispositions of incentive stock option shares or exercises of non-statutory options under the Discretionary Option Grant or Automatic Option Programs will qualify as performance-based compensation for purposes of Code Section 162(m) and will not have to be taken into account for purposes of the $1.0 million limitation per covered individual on the deductibility of the compensation paid to certain executive officers of the Company. Accordingly, all compensation deemed paid with respect to those options will remain

14

deductible by the Company without limitation under Code Section 162(m). Regardless of the approval of this Proposal, option grants under the Salary Investment and Director Fee Option Grant Programs will not qualify as performance-based compensation, and any income tax deductions attributable to the exercise of those options will be subject to the $1.0 million limitation.

Accounting Treatment

Under Statement of Financial Accounting Standards No. 123 (FAS 123), the Company may elect to account for stock based compensation for financial accounting purposes under either the fair value based method set forth therein or the intrinsic value based method set forth in APB Opinion No. 25. Under the fair value based method, compensation expense is measured at the grant date based on the value of the award and is recognized over the service period, which is usually the vesting period. Under the intrinsic value based method, compensation expense is the excess, if any, of the quoted market price of the stock at grant date or other measurement date over the amount an employee must pay to acquire the stock.

Under APB Opinion No. 25, which the Company has elected to apply to its equity compensation, stock options and other awards granted to employees and non-employee Board members under the 2003 Plan will not result in any compensation expense if the exercise price or investment amount paid for the award is at least 100% of fair market value of the underlying stock on the date of grant and they are not issued in tandem with stock appreciation rights or certain other awards. When using APB 25, under FAS 123, the Company is required to disclose in footnotes to the Company’s financial statements, the fair value of those awards and the pro-forma impact those options and awards would have upon the Company’s reported earnings were the fair value of those options and awards at the time of grant treated as a compensation expense.

Under APB 25, rights to acquire stock under the 2003 Plan at investment prices less than the fair market value of the shares on the grant date result in a compensation expense equal to the excess of such fair market value over the exercise or issue price. The expense is recognized over the period that the option shares or issued shares are to vest. Option grants and other awards which vest or are payable based solely on the achievement of certain performance goals and stock appreciation rights would result in a compensation expense which would be adjusted each reporting period based on the then fair market value of the stock until vesting occurs.

Under the fair value method of FAS 123, the fair value of any stock option or other stock award (regardless of the exercise or investment consideration) is generally treated as a compensation expense which is recognized over the service period, which is generally the vesting period.

Though the Company has adopted the intrinsic value based method of APB 25, we may later elect to switch to the fair value based method of FAS 123, but not vice versa. On December 31, 2002, FASB issued a final standard, Statement No. 148, which provided transition alternatives for companies that elect to voluntarily switch to the fair value method of expense recognition. Additionally, on November 7, 2002, the International Accounting Standards Board (IASB) issued a proposal which would require companies using IASB standards to recognize, starting in 2004, the value of options as of the date of grant using a formula designed to estimate their fair value. FASB recently stated it will undertake a project to address whether to require that the cost of stock options be treated as an expense under a fair value method and that it expects to publish an exposure draft later in 2003 with the goal of issuing an accounting standard in 2004.

Option grants made to independent consultants (but not non-employee Board members) after December 15, 1998 will result in a direct charge to the Company’s reported earnings based upon the fair value of the option measured initially as of the grant date of that option and then subsequently on the vesting date of each installment of the underlying option shares. No charge will, however, be required for periods before July 1, 2000.

15

Equity Compensation Plan Information

The following table provides information as of December 31, 2002 with respect to the shares of the Company’s Common Stock that may be issued under the Company’s existing equity compensation plans.

| | | Column A

| | | Column B

| | Column C

| |

Plan Category

| | Number of Securities to be issued upon Exercise of Outstanding Options

| | | Weighted Average Exercise Price of Outstanding Options

| | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column A)

| |

Equity Compensation Plans Approved by Stockholders (1) | | 4,390,400 | (2) | | $ | 0.51 | | 7,242,967 | (3) |

Equity Compensation Plans Not Approved by Stockholders | | 0 | | | | N/A | | 0 | |

Total | | 4,390,400 | | | $ | 0.51 | | 7,242,967 | |

| (1) | | Consists solely of the 1999 Plan and the 1999 Employee Stock Purchase Plan. |

| (2) | | Excludes purchase rights accruing under the Company’s 1999 Employee Stock Purchase Plan. Under the Purchase Plan, each eligible employee may purchase up to 1,250 shares of Common Stock at semi-annual intervals on the last U.S. business day of April and October each year at a purchase price per share equal to 85% of the lower of (i) the closing selling price per share of Common Stock on the employee’s entry date into the two-year offering period in which that semi-annual purchase date occurs or (ii) the closing selling price per share on the semi-annual purchase date. |

| (3) | | This total includes the Purchase Plan and the 1999 Plan. The Purchase Plan has a stockholder-approved reserve of 2,164,699 shares, of which 1,361,050 remain available for issuance as of March 31, 2003. The share reserve under the Purchase Plan will automatically increase on the first trading day in January each year, beginning January 2001, by an amount equal to one percent (1%) of the total number of shares of out Common Stock outstanding on the last trading day in December of the last prior year, but in no event will this annual increase exceed 400,000 shares. The maximum number of shares of Common Stock that can be issued under the 1999 Plan is 14,671,433. This amount automatically increased on the first trading day in January each year, beginning in January 2001, by an amount equal to four percent (4%) of the total number of shares of Common Stock outstanding on the last trading day in December of the last prior year, but in no event did this annual increase exceed 3,000,000 shares. The number of shares of Common Stock available for issuance under the 1999 Plan as of March 31, 2003 was 7,253,524. |

Vote Required

The affirmative vote of the holders of a majority of the outstanding voting shares of the Company’s Common Stock present or represented and entitled to vote at the Annual Meeting, is required to approve the 2003 Plan. Should such stockholder approval not be obtained then the 2003 Plan will not be implemented and no option grants or stock issuances will be made under the 2003 Plan. In the event stockholder approval of the 2003 Plan is not obtained, the 1999 Plan will continue under its current terms; however, stock options which are granted under the 1999 Plan going forward will not qualify as performance based compensation under Section 162(m) of the Internal Revenue Code.

Recommendation of Board of Directors

The Board of Directors recommends a vote IN FAVOR of approval of the 2003 Plan.

16

OTHER MATTERS

The Company knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters properly come before the Annual Meeting, it is the intention of the persons named in the enclosed form of Proxy to vote the shares they represent as the Board of Directors may recommend. Discretionary authority with respect to such other matters is granted by the execution of the enclosed Proxy.

OWNERSHIP OF SECURITIES

The following table sets forth certain information as of February 28, 2003, regarding the ownership of the Company’s Common Stock by:

| | • | | each person who is known by the Company to beneficially own more than five percent of the Company’s Common Stock; |

| | • | | each Named Executive Officer (as defined below under “Executive Compensation”); |

| | • | | each of the Company’s directors; |

| | • | | all of the Company’s directors and executive officers as a group. |

Beneficial ownership is determined in accordance with the rules and regulations of the Securities and Exchange Commission. Shares subject to options that are exercisable currently or within 60 days of February 28, 2003, are deemed to be outstanding and beneficially owned by the person for the purpose of computing share and percentage ownership of that person. They are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person. Except as indicated in the footnotes to this table and as affected by applicable community property laws, all persons listed have sole voting and investment power for all shares shown as beneficially owned by them. Unless otherwise indicated, all addresses for the stockholders set forth below is c/o Rainmaker Systems, Inc., 1800 Green Hills Road, Scotts Valley, California 95066.

Name of Beneficial Owner

| | Number of Shares Beneficially Owned (Including the Number of Shares Shown in the Second Column)

| | Number of Shares Owned as a Result of Options Exercisable Within 60 Days of February 28, 2003

| | Percentage of Shares Outstanding

| |

ABS Capital Partners III, L.P. | | 11,707,248 | | — | | 30.1 | % |

400 East Pratt Street, Suite 910 | | | | | | | |

Baltimore, MD 21202 | | | | | | | |

Michael Silton (1) | | 6,038,808 | | 287,500 | | 15.4 | % |

Laurel James (2) | | 2,527,383 | | — | | 6.5 | % |

Martin Hernandez | | 647,913 | | 635,413 | | 1.6 | % |

Robert Leff | | 509,499 | | 97,499 | | 1.3 | % |

Alok Mohan (3) | | 347,499 | | 327,499 | | * | |

James Richardson (4) | | 176,250 | | 151,250 | | * | |

Diane Brundage | | 88,750 | | 87,500 | | * | |

Steven Bonbright (6) | | — | | — | | * | |

Phillip Clough (5) | | — | | — | | * | |

Michael Davison (7) | | — | | — | | * | |

Cynthia Stephens (8) | | — | | — | | * | |

All directors and officers as a group (10 persons) | | 7,808,719 | | 1,586,661 | | 19.3 | % |

| (1) | | Includes 15,000 shares held by Michael Silton as Trustee of the Petra Silton Children’s Trust. |

17

| (2) | | Includes 2,527,383 shares held by Laurel F. James, Trustee of the Laurel Ann James Grantor Trust dated July 3, 1997. |

| (3) | | Excludes 505,767 shares held by Tarantella, Inc., of which Mr. Mohan is the Chairman. Mr. Mohan disclaims beneficial ownership of the 505,767 shares held by Tarantella, Inc. |

| (4) | | Includes 10,000 shares held by Mr. Richardson’s investment retirement account. |

| (5) | | Mr. Clough is a Venture Partner of ABS Capital Partners III, LLC, which is a general partner of ABS Capital Partners III, L.P Mr. Clough disclaims beneficial ownership of all shares held by ABS Capital Partners III, L.P. except to the extent of his pecuniary interest therein. |

| (6) | | Mr. Bonbright joined the Company in February 2003, and does not beneficially own any shares as of February 28, 2003. |

| (7) | | Mr. Davison joined the Company in October 2002, and does not beneficially own any shares as of February 28, 2003. |

| (8) | | Ms. Stephens joined the Company in May 2002, and does not beneficially own any shares as of February 28, 2003. |

18

EXECUTIVE COMPENSATION AND OTHER INFORMATION

Executive Officers

The following table provides certain information with respect to our directors, executive officers and certain key employees:

Name

| | Age

| | Position

|

Michael Silton | | 38 | | Chairman of the Board, President and Chief Executive Officer |

Martin Hernandez | | 45 | | Chief Operating Officer, Chief Financial Officer and Secretary |

Steven Bonbright | | 38 | | Vice President, Client Services |

Diane Brundage | | 48 | | Vice President, Sales |

Michael Davison | | 45 | | Vice President, Product Management and Marketing |

Cynthia Stephens | | 37 | | Vice President, Finance |

Michael Silton has served as President and Chief Executive Officer since October 1997 and Chairman of the Board since inception. In 1991, he founded Rainmaker’s former business UniDirect, which specialized in the direct marketing and sales of business software.

Martin Hernandez joined Rainmaker in October 1999 as Chief Financial Officer and has served as Chief Operating Officer since August 2000. He is also the Secretary. From May 1994 to October 1999, Mr. Hernandez held senior positions at Silicon Graphics, Inc., including Director, Finance—Worldwide Sales and Marketing, and Director, Finance and Operations for the Company’s Cosmo Software subsidiary. From April 1991 to March 1994, he served as Director, Corporate Planning/Operations and Investor Relations for Meris Laboratories, Inc. From October 1988 to April 1991, Mr. Hernandez was an accountant at PricewaterhouseCoopers LLP.

Steven Bonbright joined Rainmaker in February 2003 as Vice President, Client Services. Before joining Rainmaker, Mr. Bonbright was Vice President, Global Inside Sales, for Aspect Communications from September 1998 to July 2002. Prior to that, Mr. Bonbright held various senior sales and marketing positions with Silicon Graphics Incorporated and Schlumberger Technologies.

Diane Brundagejoined Rainmaker in February 2002 as Vice President, Sales. Before joining Rainmaker, Ms. Brundage was Senior Vice President of Sales, Marketing & Customer Service, for Creative Planet from September 2000 to February 2002. Prior to that, from September 1999 to September 2000, Ms. Brundage was Vice President, Sales at Exclaim Technologies, and from September 1998 to August 1999, Ms. Brundage was Vice President and General Manager of Productivity Point International. From January 1996 to September 1998, she served as Vice President and General Manager of Compaq Computer Corp.’s Multivendor Customer Services organization. Ms. Brundage also spent 13 years at Apple Computer, Inc. in a variety of senior field sales and corporate marketing roles.

Michael Davison joined Rainmaker in October 2002 as Vice President, Product Management and Marketing. Prior to joining Rainmaker, Mr. Davison was a self-employed management consultant specializing in business product and marketing strategy services for various clients from September 2001 to September 2002. From March 1998 to August 2001, Mr. Davison was employed at Preview Systems, Inc., in a variety of senior management roles, most recently as Vice President of Planning and Operations.

Cynthia Stephensjoined Rainmaker in May 2002 as Vice President, Finance. From March 2001 to April 2002, Ms. Stephens held various management positions at Calico Commerce, Inc., most recently Vice President, Finance. From February 2000 to March 2001, Ms. Stephens served as Chief Operating Officer and Chief Financial Officer of Quiver, Inc. From August 1997 to January 2000, Ms. Stephens was employed at Infoseek Corporation in a variety of senior management positions, most recently as Chief Financial Officer.

19

Summary of Cash and Certain Other Compensation

The following table provides certain summary information concerning the compensation earned by the Company’s Chief Executive Officer and each of the four other most highly compensated executive officers of the Company whose aggregate salary and bonus for the 2002 Fiscal Year were in excess of $100,000, for services rendered in all capacities to the Company for the fiscal years ended December 31, 2002, 2001 and 2000. The listed individuals are hereinafter referred to as the “Named Executive Officers.” In addition, Mr. Haselden is included in the table because he would have been among the four most highly compensated executive officers on the last day of the 2002 Fiscal Year had he not terminated earlier in the year. Mr. Davison is also included in the table as his annual salary and bonus for the 2002 Fiscal Year would have been in excess of $100,000 had his employment with the Company commenced earlier in the year.

Summary Compensation Table

| | | | | Annual Compensation

| | | Long-Term Compensation

| | |

| | | Year

| | Salary ($)

| | Bonus ($)

| | | Other Annual Compensation ($) (8) (9)

| | | Securities Underlying Options (#)

| | All Other Compensation ($) (6) (9)

|

Michael Silton Chairman, President and Chief Executive Officer | | 2002 2001 2000 | | $ | 275,000 275,278 275,000 | | $ | 186,120 84,675 48,126 | | | $ | 40,232 37,575 46,579 | (1) (1) (1) | | 800,000 400,000 — | | $ | 3,655 3,918 4,925 |

|

Martin Hernandez Secretary, Chief Operating Officer and Chief Financial Officer | | 2002 2001 2000 | | | 210,000 210,000 199,938 | | | 142,128 207,484 28,500 | | | | 32,934 | (2) | | 1,100,000 400,000 200,000 | | | 7,221 7,271 2,219 |

|

Diane Brundage Vice President, Sales | | 2002 | | | 152,115 | | | 34,758 | (3) | | | 20,862 | (3) | | 300,000 | | | 2,285 |

|

Michael Davison Vice President, Product Management and Marketing | | 2002 | | | 25,096 | | | 4,690 | | | | — | | | 175,000 | | | — |

|

Cynthia Stephens Vice President, Finance | | 2002 | | | 89,924 | | | 25,422 | | | | — | | | 175,000 | | | 846 |

|

Ritch Haselden (5) Former Vice President, Outsource Services | | 2002 2001 2000 | | | 81,355 132,046 114,173 | | | 49,106 147,863 118,997 | (4) (4) (4) | | | 6,461 — — | (7) | | 206,250 135,000 115,000 | | | 1,662 1,589 1,175 |

| (1) | | Includes car allowance in the amount of $24,000 in each of 2002, 2001 and 2000, respectively. |

| (2) | | Includes car allowance in the amount of $24,000 and $8,900 related to reimbursement for the payment of taxes. |

| (3) | | Amount reported as bonus consists of commissions and amount reported as all other annual compensation consists of car allowance. |

| (4) | | Includes commissions of $33,288, $147,863 and $49,970 in 2002, 2001 and 2000, respectively. |

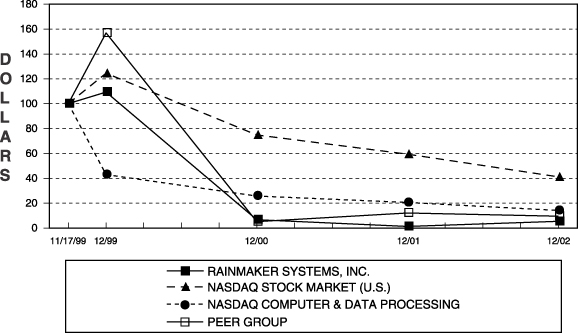

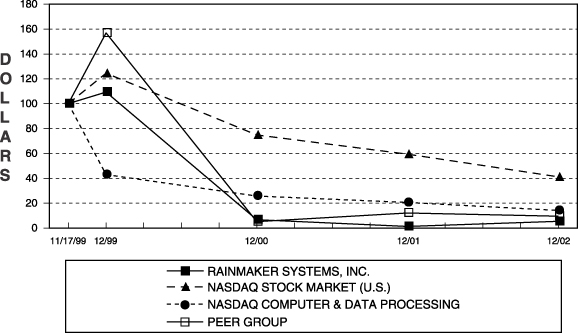

| (5) | | Mr. Haselden’s employment with Rainmaker terminated on August 15, 2002. |