Exhibit A

POLICY AND PROCEDURES WITH RESPECT TO

RELATED PERSON TRANSACTIONS

The Company’s Board of Directors (the “Board”) recognizes that Related Person Transactions (as defined below) can present heightened risks of conflicts of interest or improper valuation or the perception thereof. Accordingly, the Company’s general policy is to avoid Related Person Transactions. Nevertheless, the Company recognizes that there are situations where Related Person Transactions might be in, or might not be inconsistent with, the best interests of the Company and its stockholders. These situations could include (but are not limited to) situations where the Company might obtain products or services of a nature, quantity or quality, or on other terms, that are not readily available from alternative sources or when the Company provides products or services to Related Persons (as defined below) on an arm’s length basis on terms comparable to those provided to unrelated third parties or on terms comparable to those provided to employees generally. The Company, therefore, has adopted the procedures set forth below for the review, approval or ratification of Related Person Transactions.

This Policy has been approved by the Board. The Corporate Governance Committee (the “Committee”) will review and may recommend to the Board amendments to this Policy from time to time.

| B. | | Related Person Transactions |

For the purposes of this Policy, a “Related Person Transaction” is a transaction, arrangement or relationship, including any indebtedness or guarantee of indebtedness, (or any series of similar transactions, arrangements or relationships) in which the Company (including any of its subsidiaries) was, is or will be a participant and the amount involved exceeds $120,000, and in which any Related Person had, has or will have a direct or indirect material interest.

For purposes of this Policy, a “Related Person” means:

| 1. | | any person who is, or at any time since the beginning of the Company’s last fiscal year was, a director or executive officer (i.e. members of the Senior Management Committee and the Controller) of the Company, Progress Energy Carolinas, Inc., or Progress Energy Florida, Inc. or a nominee to become a director of the Company, Progress Energy Carolinas, Inc., or Progress Energy Florida, Inc.; |

| |

| 2. | | any person who is known to be the beneficial owner of more than 5% of any class of the voting securities of the Company or its subsidiaries; |

| |

| 3. | | any immediate family member of any of the foregoing persons, which means any child, stepchild, parent, stepparent, spouse, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law of the director, executive officer, nominee or more than 5% beneficial owner, and any person (other than a tenant or employee) sharing the household of such director, executive officer, nominee or more than 5% beneficial owner; and |

| |

| 4. | | any firm, corporation or other entity in which any of the foregoing persons is employed or is a general partner or principal or in a similar position or in which such person has a 5% or greater beneficial ownership interest. |

A-1

| Progress Energy Proxy Statement |

| 1. | | The Board has determined that the Committee is best suited to review and approve Related Person Transactions. Accordingly, at each calendar year’s first regularly scheduled Committee meeting, management shall recommend Related Person Transactions to be entered into by the Company for that calendar year, including the proposed aggregate value of such transactions if applicable. After review, the Committee shall approve or disapprove such transactions and at each subsequently scheduled meeting, management shall update the Committee as to any material change to those proposed transactions. |

| |

| 2. | | In determining whether to approve or disapprove each related person transaction, the Committee will consider various factors, including the following: |

- the identity of the related person;

- the nature of the related person’s interest in the particular transaction;

- the approximate dollar amount involved in the transaction;

- the approximate dollar value of the related person’s interest in the transaction;

- whether the related person’s interest in the transaction conflicts with his obligations to the Company and its shareholders;

- whether the transaction will provide the related person with an unfair advantage in his dealings with the Company; and

- whether the transaction will affect the related person’s ability to act in the best interests of the Company and its shareholders

| The Committee will only approve those related person transactions that are in, or are not inconsistent with, the best interests of the Company and its shareholders. |

| |

| 3. | | In the event management recommends any further Related Person Transactions subsequent to the first calendar year meeting, such transactions may be presented to the Committee for approval at the next Committee meeting. In these instances in which the Legal Department, in consultation with the President and Chief Operating Officer, determines that it is not practicable or desirable for the Company to wait until the next Committee meeting, any further Related Person Transactions shall be submitted to the Chair of the Committee (who will possess delegated authority to act between Committee meetings). The Chair of the Committee shall report to the Committee at the next Committee meeting any approval under this Policy pursuant to his/her delegated authority. |

| |

| 4. | | No member of the Committee shall participate in any review, consideration or approval of any Related Person Transaction with respect to which such member or any of his or her immediate family members is the Related Person. The Committee (or the Chair) shall approve only those Related Person Transactions that are in, or are not inconsistent with, the best interests of the Company and its stockholders, as the Committee (or the Chair) determines in good faith. The Committee or Chair, as applicable, shall convey the decision to the President and Chief Operating Officer, who shall convey the decision to the appropriate persons within the Company. |

A-2

| D. | | Ratification Procedures |

In the event the Company’s Chief Executive Officer, President and Chief Operating Officer, Chief Financial Officer or General Counsel becomes aware of a Related Person Transaction that has not been previously approved or previously ratified under this Policy, said officer shall immediately notify the Committee or Chair of the Committee, and the Committee or Chair shall consider all of the relevant facts and circumstances regarding the Related Person Transaction. Based on the conclusions reached, the Committee or the Chair shall evaluate all options, including but not limited to ratification, amendment, termination or recession of the Related Person Transaction, and determine how to proceed.

| E. | | Review of Ongoing Transactions |

At the Committee’s first meeting of each calendar year, the Committee shall review any previously approved or ratified Related Person Transactions that remain ongoing and have a remaining term of more than six months or remaining amounts payable to or receivable from the Company of more than $120,000. Based on all relevant facts and circumstances, taking into consideration the Company’s contractual obligations, the Committee shall determine if it is in the best interests of the Company and its stockholders to continue, modify or terminate the Related Person Transaction.

All Related Person Transactions are to be disclosed in the filings of the Company, Progress Energy Carolinas, Inc. or Progress Energy Florida, Inc., as applicable, with the Securities and Exchange Commission as required by the Securities Act of 1933 and the Securities Exchange Act of 1934 and related rules. Furthermore, all Related Person Transactions shall be disclosed to the Corporate Governance Committee of the Board and any material Related Person Transaction shall be disclosed to the full Board of Directors.

The material features of this Policy shall be disclosed in the Company’s annual report on Form 10-K or in the Company’s proxy statement, as required by applicable laws, rules and regulations.

A-3

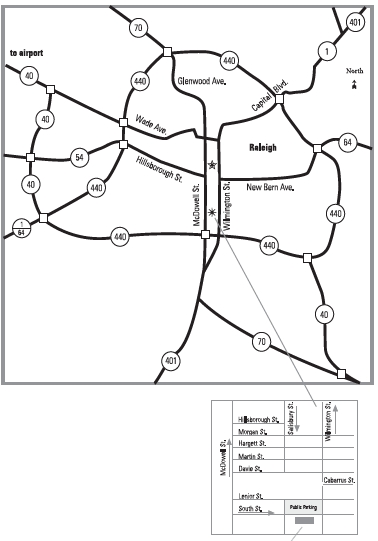

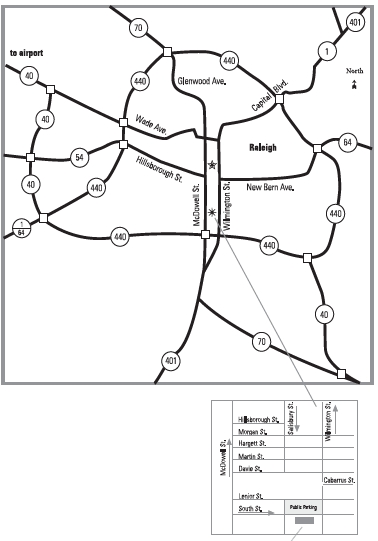

Directions to Progress Energy’s

2010 Annual Shareholders’ Meeting

Progress Energy Center for the Performing Arts

2 E. South Street, Raleigh, North Carolina

|

| Progress Energy Center for the Performing Arts |

| 002CS-61034 |

| |

MR A SAMPLE

DESIGNATION (IF ANY)

ADD 1

ADD 2

ADD 3

ADD 4

ADD 5

ADD 6 | |

| Electronic Voting Instructions |

You can vote by Internet or telephone!

Available 24 hours a day, 7 days a week! |

Instead of mailing your proxy, you may choose one of the two voting

methods outlined below to vote your proxy. |

| VALIDATION DETAILS ARE LOCATED BELOW IN THE TITLE BAR. |

Proxies submitted by the Internet or telephone must be received by

12:01 a.m., Eastern Daylight Time, on May 12, 2010.

|

| | | Vote by Internet |

| - Log on to the Internet and go to www.envisionreports.com/pgn

- Follow the steps outlined on the secured website.

|

| | | | |

|  | | Vote by telephone |

| Using a black ink pen, mark your votes with an X as shown in this example. Please do not write outside the designated areas. |  | | - Call toll free 1-800-652-VOTE (8683) within the USA, US territories & Canada any time on a touch tone telephone. There is NO CHARGE to you for the call.

- Follow the instructions provided by the recorded message.

|

| Annual Meeting Proxy Card | 1234 5678 9012 345 | |

| 6 IF YOU HAVE NOT VOTED VIA THE INTERNET OR TELEPHONE, FOLD ALONG THE PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE. 6 |

| | | |

| A | Proposals — The Board of Directors recommends a vote FOR all the nominees listed in Proposal 1 and FOR Proposal 2, both of which are sponsored by the Company, and a vote AGAINST Proposal 3, which is sponsored by one of our shareholders. |

| | 1. | Election of Directors: | For | | Against | | Abstain | | | | | For | | Against | | Abstain | | | | | For | | Against | | Abstain | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 01 | - | J. BAKER | ¨ | | ¨ | | ¨ | | 02 | - | J. BOSTIC | ¨ | | ¨ | | ¨ | | 03 | - | H. DELOACH | ¨ | | ¨ | | ¨ | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 04 | - | J. HYLER | ¨ | | ¨ | | ¨ | | 05 | - | W. JOHNSON | ¨ | | ¨ | | ¨ | | 06 | - | R. JONES | ¨ | | ¨ | | ¨ | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 07 | - | W. JONES | ¨ | | ¨ | | ¨ | | 08 | - | M. MARTINEZ | ¨ | | ¨ | | ¨ | | 09 | - | E. MCKEE | ¨ | | ¨ | | ¨ | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 10 | - | J. MULLIN | ¨ | | ¨ | | ¨ | | 11 | - | C. PRYOR | ¨ | | ¨ | | ¨ | | 12 | - | C. SALADRIGAS | ¨ | | ¨ | | ¨ | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 13 | - | T. STONE | ¨ | | ¨ | | ¨ | | 14 | - | A. TOLLISON | ¨ | | ¨ | | ¨ | | | | | | | | | | |

| | | | For | | Against | | Abstain | | | | | | | For | | Against | | Abstain | |

| | 2. | Ratification of the selection of Deloitte & Touche LLP as Progress Energy’s independent registered public accounting firm for 2010. | | ¨ | | ¨ | | ¨ | | | | 3. | Adoption of a “hold-into-retirement” policy for equity awards. | | ¨ | | ¨ | | ¨ | |

| | | | | | | | | | | | | | | | | | | | |

| 4. | In their discretion the proxies are authorized to vote upon such other business that is properly brought before the meeting or any adjournment thereof. | | | | | | | | | | | | | | | | | | |

| | | |

| B | Non-Voting Items |

| Change of Address — Please print new address below. |

|

IF VOTING BY MAIL, YOU MUST COMPLETE SECTIONS A - C ON BOTH SIDES OF THIS CARD.

C 1234567890 J N T

1 U P X 0 2 4 3 4 6 1

2010 Annual Meeting of Progress Energy, Inc. Shareholders

May 12, 2010 at 10:00 a.m.

Progress Energy Center for the Performing Arts

Raleigh, North Carolina

(map located on back of Meeting Notice & Proxy Statement)

Dear Shareholder:

Please take note of the important information enclosed with the Proxy Card. That information relates to the management and operations of your Company and requires your immediate attention and approval. Details are discussed in the enclosed proxy materials. Your vote counts, and you are strongly encouraged to exercise your right to vote your shares. Please mark the boxes on this Proxy Card and indicate how you would like your shares to be voted, then sign the card and return it in the enclosed postage paid envelope. If you prefer, you may vote by telephone or via the Internet by following the instructions in the proxy materials.

If you are a participant in our 401(k) Savings & Stock Ownership Plan, shares allocated to your Plan account will be voted by the Trustee only if you execute and return your proxy, or vote by telephone or via the Internet. Company stock remaining in the ESOP Stock Suspense Account that has not been allocated to employee accounts shall be voted by the Trustee in the same proportion as shares voted by participants in the 401(k) Plan. Plan participants must provide voting instructions on or before 11:59 p.m. Eastern Daylight Time, on May 9, 2010.

If you are a participant in the Savings Plan for Employees of Florida Progress Corporation (the “FPC Savings Plan”), shares allocated to your Plan account will be voted by the Trustee when you execute and return your proxy, or vote by telephone or via the Internet. If no direction is given, your shares will be voted in proportion with the shares held in the FPC Savings Plan and in the best interest of the FPC Savings Plan.

Your vote must be submitted prior to the Annual Meeting of Shareholders to be held on May 12, 2010, unless you plan to vote in person at the Meeting.

Thank you in advance for your prompt consideration of these matters.

| 6IF YOU HAVE NOT VOTED VIA THE INTERNET OR TELEPHONE, FOLD ALONG THE PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE.6 |

| Annual Meeting Proxy Card |

PROGRESS ENERGY, INC.

410 S. Wilmington Street

Raleigh, North Carolina 27601

This Proxy is Solicited on Behalf of the Board of Directors of the Company.

The undersigned hereby appoints William D. Johnson and John R. McArthur, and each of them as Proxies, with full power of substitution, to vote the shares of stock of Progress Energy, Inc. (the “Company”) registered in the name of the undersigned, or which the undersigned has the power to vote, at the Annual Meeting of Shareholders of the Company to be held Wednesday, May 12, 2010, at 10:00 a.m., and at any adjournment thereof, for the election of directors, for the proposals set forth on the reverse side hereof, and upon other matters properly brought before the meeting. The undersigned acknowledges receipt of the notice of said Annual Meeting and the proxy statement.

THIS PROXY WILL BE VOTED AS DIRECTED HEREIN BY THE UNDERSIGNED SHAREHOLDER(S). UNLESS OTHERWISE SPECIFIED, THIS PROXY WILL BE VOTED FOR THE ELECTION OF ALL THE NOMINEES FOR DIRECTOR AND FOR PROPOSAL 2 AND AGAINST PROPOSAL 3, ALL AS SET FORTH IN THE PROXY STATEMENT. THE NOMINEES FOR DIRECTOR ARE: J. BAKER, J. BOSTIC, H. DELOACH, J. HYLER, W. JOHNSON, R. JONES, W. JONES, M. MARTINEZ, E. MCKEE, J. MULLIN, C. PRYOR, C. SALADRIGAS, T. STONE AND A. TOLLISON. IF ANY DIRECTOR BECOMES UNAVAILABLE, THE PROXIES WILL VOTE FOR A SUBSTITUTE DESIGNATED BY THE BOARD.

PLEASE VOTE, DATE AND SIGN AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE.

| C | | Authorized Signatures — This section must be completed for your vote to be counted. — Date and Sign Below |

| Please sign exactly as name(s) appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, corporate officer, trustee, guardian, or custodian, please give full title. |

Date (mm/dd/yyyy) — Please print date below. Signature 1 — Please keep signature within the box. Signature 2 — Please keep signature within the box.

IF VOTING BY MAIL, YOU MUST COMPLETE SECTIONS A - C ON BOTH SIDES OF THIS CARD.