- TDY Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

Teledyne Technologies (TDY) PRE 14APreliminary proxy

Filed: 28 Feb 25, 4:56pm

☑ Filed by the Registrant | ☐ Filed by a Party other than the Registrant |

☒ Preliminary Proxy Statement | ||||

☐ Confidential, for Use of the Commission Only (as permitted byRule 14a-6(e)(2)) | ||||

☐ Definitive Proxy Statement | ||||

☐ Definitive Additional Materials | ||||

☐ Soliciting Material Pursuant toSection 240.14a-11c orSection 240.14a-12 | ||||

TELEDYNE TECHNOLOGIES INCORPORATED | ||||

| (Name of Registrant as Specified In Its Charter) | ||||

| (Name of Person(s) Filing Proxy Statement) | ||||

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): | ||||

☑ | No fee required. | |||

☐ | Fee paid previously with preliminary materials | |||

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and0-11 | |||

Teledyne Technologies Incorporated 1049 Camino Dos Rios Thousand Oaks, CA 91360 |  |

March __, 2025

Dear Stockholder:

We are pleased to invite you to attend the 2025 Annual Meeting of Stockholders of Teledyne Technologies Incorporated (the “Company”) to be held virtually on Wednesday, April 23, 2025 at 9:15 a.m. Pacific Time. You will be able to attend and participate in the Annual Meeting online, vote your shares electronically and submit your questions during the meeting by visiting: https://meetnow.global/MWVQNXS on the meeting date and at the time described in the accompanying Proxy Statement. There is no physical location for the Annual Meeting.

This booklet includes the Notice of Meeting as well as the Company’s Proxy Statement.

We know that you may be unable to attend the virtual Annual Meeting. The proxies that we solicit give you the opportunity to vote on all matters that are scheduled to come before the Annual Meeting. Whether or not you plan to attend, you can be sure that your shares are represented by promptly voting and submitting your proxy by phone or by Internet as described in the following materials, or if you request that proxy materials be mailed to you, by completing, signing, dating, and returning your proxy card enclosed with those materials in the postage-paid envelope provided to you.

Thank you for your investment in our Company. We look forward to your attendance virtually at the 2025 Annual Meeting.

Sincerely,

Robert Mehrabian

Executive Chairman

Teledyne Technologies Incorporated

Notice of Annual Meeting of Stockholders

Meeting Date: April 23, 2025 Time: 9:15 a.m. Pacific Time |

Meeting Access: Virtual Stockholder Meeting

|

Record Date: March 3, 2025 |

Agenda

Stockholders will be asked to vote upon the following proposals at the Annual Meeting:

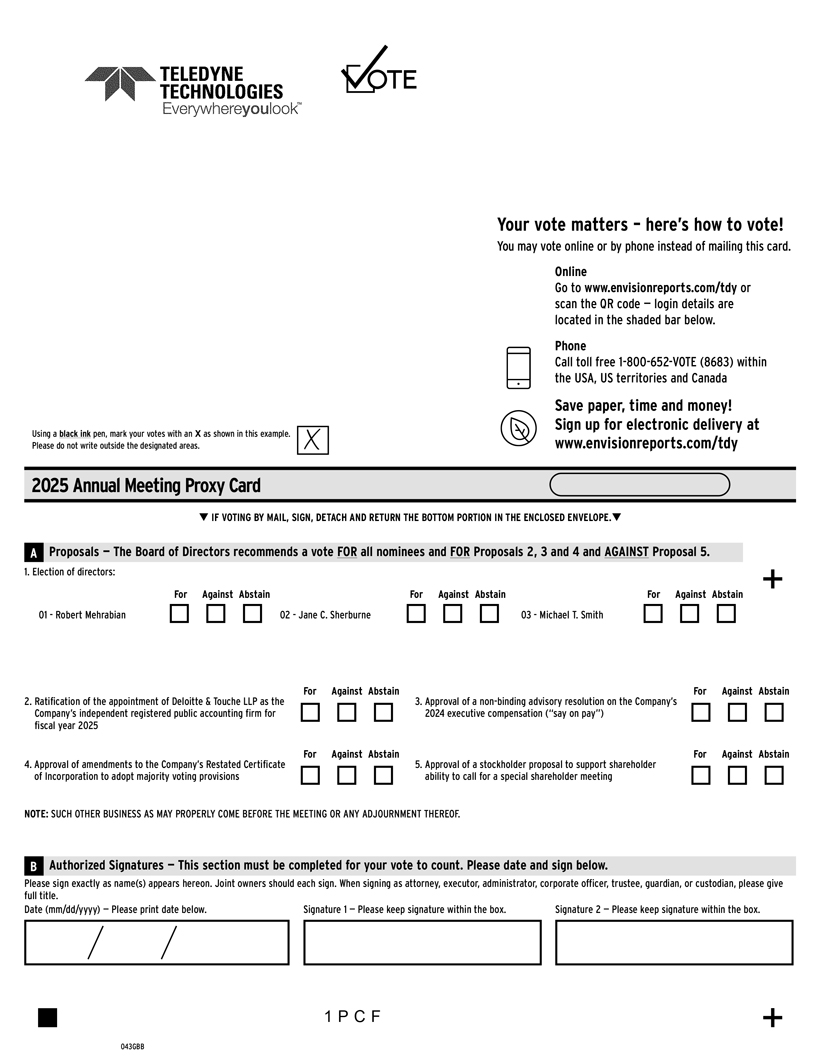

| 1) | To elect each of the three Class II director nominees identified in the accompanying Proxy Statement for a two-year term, or until the successor to such director nominee is elected and duly qualified; |

| 2) | To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for fiscal year 2025; |

| 3) | To vote, on a non-binding, advisory basis, to approve the Company’s 2024 executive compensation; |

| 4) | To vote on a proposal to approve amendments to the Company’s Restated Certificate of Incorporation to adopt majority voting provisions; |

| 5) | To vote on a stockholder proposal to support shareholder ability to call for a special shareholder meeting; and |

| 6) | To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

The 2025 Proxy Statement and the 2024 Annual Report to Stockholders are available at www.envisionreports.com/tdy

To access the virtual Annual Meeting, go to https://meetnow.global/MWVQNXS before the scheduled start time. Online access to the meeting will begin at 9:00 a.m. Pacific Time. Teledyne’s proxy materials are currently available at www.envisionreports.com/tdy.

Attending the Virtual Annual Meeting as a Stockholder of Record

If you were a holder of record of common stock of Teledyne at the close of business on March 3, 2025 (the “Record Date”) (i.e., you held your shares in your own name as reflected in the records of our transfer agent, Computershare), you can attend the meeting by accessing https://meetnow.global/MWVQNXS and entering the 15-digit control number on the Proxy Card or Notice of Availability of Proxy Materials you previously received.

Registering to Attend the Virtual Annual Meeting as a Beneficial Owner

If you were a beneficial holder of record of common stock of Teledyne as of the Record Date (i.e., you hold your shares in “street name” through an intermediary, such as a bank or broker), you must register in advance to virtually attend the Annual Meeting. To register, you must obtain a legal proxy, executed in your favor, from the holder of record and submit proof of your legal proxy reflecting the number of shares of Teledyne common stock you held as of the Record Date, along with your name and email address, to Computershare. Please forward the email from your broker, or attach an image of your legal proxy to legalproxy@computershare.com. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m. Eastern, on April 18, 2025. You will then receive a confirmation of your registration, with a control number, by email from Computershare. At the time of the meeting, go to https://meetnow.global/MWVQNXS and enter your control number.

Asking Questions

If you are attending the meeting as a stockholder of record or registered beneficial owner, questions can be submitted by accessing the meeting center at https://meetnow.global/MWVQNXS, entering your control number, and clicking on the message icon in the upper right hand corner of the page. Questions will be answered after the meeting by following up directly with the stockholder of record or the registered beneficial owner. Please include your email address with your question so that we may follow up with you.

Voting Shares

If you have not already voted your shares in advance, you will be able to vote your shares electronically during the Annual Meeting by clicking on the “Vote” tab on the Meeting Center site. Whether or not you plan to attend the Annual Meeting, we urge you to vote and submit your proxy in advance of the meeting by one of the methods described in the proxy materials for the Annual Meeting.

Attending the Annual Meeting as a Guest

If you would like to enter the meeting as a guest in listen-only mode, click on the “Guest” tab after entering the meeting center at https://meetnow.global/MWVQNXS and enter the information requested on the following screen.

Guests are allowed to access the meeting but will not be able to ask questions, present proposals or vote. Only Registered Stockholders and Beneficial Stockholders that have already submitted a Legal Proxy to Computershare and have obtained a Control Number (or their authorized representatives) may vote, present proposals and ask questions during the meeting. Please see the questions and answers section of the accompanying Proxy Statement for more information about attending the Annual Meeting. For information about the Company, please visit our website at www.teledyne.com.

By Order of the Board of Directors,

Melanie S. Cibik

Executive Vice President, General Counsel, Chief Compliance Officer

and Secretary

March __, 2025

Your vote is important:

Whether or not you plan to virtually attend the Annual Meeting, please vote as soon as possible by one of the methods described in the proxy materials for the Annual Meeting to ensure that your shares are represented and voted at the Annual Meeting.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be Held on April 23, 2025. The Notice of Annual Meeting, Proxy Statement and 2024 Annual Report are available at: www.envisionreports.com/tdy.

Proxy Statement

DEFINED TERMS In this Proxy Statement, Teledyne Technologies Incorporated is sometimes referred to as the “Company” or “Teledyne”.

|

TELEDYNE TECHNOLOGIES INCORPORATED | 2025 Proxy Statement

Notice of Internet Availability

Pursuant to rules adopted by the U.S. Securities and Exchange Commission (the “SEC”), we have elected to furnish our Proxy Statement and Company’s Annual Report on Form 10-K for the year ended December 29, 2024 (the “2024 Annual Report”) to certain of our stockholders over the Internet, which allows us to reduce costs associated with the Annual Meeting and helps to reduce the environmental impact and costs of printing and distributing paper copies of proxy materials. On or about March __, 2025, the Company will mail to each stockholder (other than those stockholders who previously had requested paper delivery of proxy materials) a Notice of Internet Availability of Proxy Materials containing instructions on how to access and review the proxy materials, including this Proxy Statement and the Company’s 2024 Annual Report online (the “eProxy Notice”). The eProxy Notice also contains instructions on how to request a paper copy of the Proxy Statement and 2024 Annual Report. Stockholders who have previously requested paper delivery of proxy materials will receive printed copies of the Proxy Statement and the 2024 Annual Report, which will be mailed to such stockholders on or about March __, 2025.

Cautionary Statements

Disclosures in this Proxy Statement may contain certain forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and Section 27A of the Securities Act of 1933, as amended (the “Securities Act”). Statements that do not relate strictly to historical or current facts are forward-looking and usually identified by the use of words such as “anticipate,” “estimate,” “approximate,” “expect,” “intend,” “plan,” “believe” and other words of similar meaning in connection with any discussion of future operating or financial matters. Without limiting the generality of the foregoing, forward-looking statements contained in this Proxy Statement include the matters discussed regarding the expectation of performance under compensation plans, and anticipated financial and operational performance of the Company. The forward-looking statements contained in this Proxy Statement involve risks and uncertainties that could cause actual results to differ materially from projected results. Accordingly, investors should not place undue reliance on forward-looking statements as a prediction of actual results. The Company has based these forward-looking statements on current expectations and assumptions about future events, taking into account information currently known to the Company. Although the Company considers these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks and uncertainties, many of which are difficult to predict and are beyond the Company’s control. The risks and uncertainties that may affect the operations, performance and results of the Company’s business and forward-looking statements include, but are not limited to, those set forth in Item 1A, “Risk Factors” in the 2024 Annual Report, and in the other documents the Company files from time to time with the SEC.

Any forward-looking statement speaks only as of the date on which such statement is made, and the Company does not intend to correct or update any forward-looking statements, whether as a result of new information, future events or otherwise.

Incorporation by Reference

Neither the Personnel and Compensation Committee Report nor the Audit Committee Report shall be deemed soliciting material or filed with the SEC and neither of them shall be deemed incorporated by reference into any prior or future filings made by us under the Securities Act or the Exchange Act, except to the extent that we specifically incorporate such information by reference. In addition, this document includes several website addresses and references to our corporate social responsibility (“CSR”) reports. These website addresses are intended to provide inactive, textual references only. The information on these websites and in our CSR reports is not part of this Proxy Statement.

| TELEDYNE TECHNOLOGIES INCORPORATED | 2025 Proxy Statement | 1 |

2025 Proxy Statement Summary

This summary highlights information about the Company and the upcoming Annual Meeting. As it is only a summary, please review the complete Proxy Statement and the Company’s 2024 Annual Report before you vote. References to “Teledyne,” “the Company,” “we,” “us” or “our” refer to Teledyne Technologies Incorporated.

2025 Annual Meeting of Stockholders

Time and Date: | 9:15 a.m. Pacific Time, April 23, 2025 | |

Virtual Meeting Link: | https://meetnow.global/MWVQNXS | |

Record Date and Voting: | Stockholders as of the Record Date, March 3, 2025, are entitled to vote. Each share of common stock is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted on. | |

How to Cast Your Vote

Your vote is important. Please carefully review the proxy materials and vote using one of the following advance voting methods. The deadline for voting by telephone is 11:59 p.m. Eastern Time on April 22, 2025. If you vote by mail, your proxy card must be received before the Annual Meeting. If you hold shares in the Teledyne Technologies Incorporated 401(k) Plan, your voting instructions must be received by 11:59 p.m. Eastern Time on April 18, 2025.

Registered Stockholders | ||||

If you hold shares through our transfer agent, Computershare, please use one of the following options: | ||||

|  |  | ||

Visit www.envisionreports.com/tdy | Call 1-800-652-VOTE (8683) or the number on your proxy card | Sign, date and return your proxy card by mail | ||

Beneficial Owners | ||||

If you hold shares through your bank or brokerage account, please vote by returning the voting instruction card, or by following the instructions for voting via telephone or the Internet, as provided by the bank, broker, or other organization. If you own shares in different accounts or in more than one name, you may receive different voting instructions for each type of ownership. Please vote all of your shares. | ||||

If you are a stockholder of record or a beneficial owner who has a legal proxy to vote the shares, you may choose to vote online at the Annual Meeting. Even if you plan to attend the virtual Annual Meeting, please cast your vote as soon as possible. See the “Questions and Answers About the Meeting and Voting” section for more details.

| 2 | TELEDYNE TECHNOLOGIES INCORPORATED | 2025 Proxy Statement |

2025 Proxy Statement Summary (continued)

Voting Matters and Board Recommendations

|

| Board’s Voting Recommendation | Page Reference (for more detail) | ||||

ITEM 1. | Election of three Class II directors for a two-year term expiring at the 2027 Annual Meeting |

✓ FOR each director nominee | 12 | |||

ITEM 2. | Ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for fiscal year 2025 |

✓ FOR | 31 | |||

ITEM 3. | Approval of a non-binding advisory resolution on the Company’s executive compensation (“say on pay”) |

✓ FOR | 35 | |||

ITEM 4. | Approval of amendments to the Company’s Restated Certificate of Incorporation to adopt majority voting provisions |

✓ FOR | 36 | |||

ITEM 5. | Stockholder proposal to support shareholder ability to call for a special shareholder meeting |

× AGAINST | 38 | |||

In addition, stockholders will transact such other business as may properly come before the meeting and at any adjournments or postponements of the meeting.

Snapshot of 2025 Director Nominees

We believe that all of our Class II directors who are being nominated for re-election at the Annual Meeting are highly-qualified and vital members of a well-rounded, experienced Board. All director nominees possess high integrity, innovative thinking, a proven record of success, knowledge of corporate governance requirements and practices, and commitment to sustainability and Teledyne’s core values of respect, integrity, responsibility and citizenship.

| TELEDYNE TECHNOLOGIES INCORPORATED | 2025 Proxy Statement | 3 |

2025 Proxy Statement Summary (continued)

The following table provides summary information about each director nominee standing for election to the Board for a two-year term expiring at the 2027 Annual Meeting. As further described below, our director nominees represent a diverse range of backgrounds and overall experience.

Nominee | Age | Independent | Director Since | Committee Memberships | ||||||

|

Robert Mehrabian

Executive Chairman of the Company |

83 |

No |

1999 |

| |||||

|

Jane C. Sherburne

Principal of Sherburne PLLC and Former Senior Executive Vice President, General Counsel and Corporate Secretary of The Bank of New York Mellon Corporation

|

74 |

Yes |

2014 |

• Audit Committee

• Personnel and Compensation Committee | |||||

|

Michael T. Smith

Retired Chairman of the Board and Chief Executive Officer of Hughes Electronics Corporation |

81 |

Yes |

2001 |

• Lead Director

• Nominating and Governance Committee (Chair)

• Audit Committee |

Board Composition

The Board regularly assesses the composition of its members and nominees as part of its annual evaluation process. We believe that our 11 directors represent a diverse and broad range of attributes, qualifications, experiences, and skills to provide an effective mix of viewpoints and knowledge.

Director nominees are selected on the basis of, among other criteria, experience, knowledge, skills, expertise, integrity, diversity, ability to make independent analytical inquiries, understanding of, or familiarity with, the Company’s business products or markets or similar business products or markets and willingness to devote adequate time and effort to Board responsibilities. The Nominating and Governance Committee and the Board believe that a diverse Board leads to improved Company performance by encouraging new ideas, expanding the knowledge base available to management and fostering a boardroom culture that promotes innovation and vigorous deliberation. Consequently, when evaluating potential nominees, the Nominating and Governance Committee considers individual characteristics that may bring diversity to the Board, including gender, race, national origin, age, professional background, unique skill sets and areas of expertise.

| 4 | TELEDYNE TECHNOLOGIES INCORPORATED | 2025 Proxy Statement |

2025 Proxy Statement Summary (continued)

Governance Highlights

We are committed to good corporate governance, which promotes the long-term interests of stockholders, strengthens Board and management accountability and helps build public trust in the Company. Our corporate governance practices, highlighted below, are described in greater detail in the “Corporate Governance” section of this Proxy Statement.

Board Practices | ||

Board Independence | ✓ 10 out of 11 current Board members are independent.

✓ Lead independent director. | |

Board Leadership | ✓ The Executive Chairman presides at meetings of stockholders and Board meetings.

✓ The lead independent director presides during the Board’s executive sessions. | |

Board Composition | ✓ Our current directors have a diverse mix of skills, experience, and backgrounds, as specifically described under “Item 1 Election of Directors.”

✓ All director nominees exhibit certain key characteristics and skills, including high integrity, financial literacy, leadership experience, and business acumen, as further described under “Director Qualification, Skills, and Attributes.”

✓ Three out of our 11 directors are women, and two directors are ethnically diverse. | |

Board Committees | ✓ Fully independent Audit, Personnel and Compensation, and Nominating and Governance Committees.

✓ Each committee has a written charter available on our website. | |

Board Accountability | ✓ Simple majority voting in uncontested director elections.

✓ If not elected, a director must tender their resignation to the Board for its consideration.

✓ Annual “say-on-pay” vote.

✓ Annual stockholder ratification of the Audit Committee’s selection of the independent auditor.

✓ One share, one vote.

✓ No poison pill.

✓ Proxy access bylaw.

✓ Board declassification is in process and the Board will be fully declassified in 2027. | |

Board Engagement | ✓ Attendance:

• Directors’ attendance at annual meetings of stockholders is expected absent good reason.

• In 2024, all directors attended at least 75% of the aggregate number of meetings of the Board and Board committees of which they were members.

✓ Our independent directors meet in regularly scheduled executive sessions without management present. | |

| TELEDYNE TECHNOLOGIES INCORPORATED | 2025 Proxy Statement | 5 |

2025 Proxy Statement Summary (continued)

Board Effectiveness | ||

Board Evaluation and Assessments | ✓ Annual Board and Board committee self-evaluation process.

✓ Annual Board assessment of corporate governance best practices. | |

Stockholder Access to Directors | ✓ Stockholders may contact our Board as a whole, individual directors (including the lead independent director), or management by mail. | |

Board Oversight of Risk | ✓ Full Board is responsible for risk oversight and the Board committees oversee certain key risks.

✓ The Board oversees management in its assessment and mitigation of risks, and in taking appropriate risks. | |

Succession Planning | ✓ The Board actively monitors our management succession and development plans.

✓ At least annually, the Executive Chairman discusses succession planning with the Personnel and Compensation Committee and the Board. | |

Social Responsibility | ✓ Management regularly updates the Nominating and Governance Committee on social responsibility matters.

✓ Today, approximately 30 percent of our Section 16 executive officers and 30 percent of our directors are women. | |

Alignment with Stockholder Interests | ||

Clawback and Anti-Hedging and Pledging Policies | ✓ We have a formal policy related to the “clawback” of incentive compensation in the event of a financial restatement, as required by the NYSE listing rules, and any incentive compensation or other equity award or cash bonus in the event of fraud or criminal misconduct.

✓ Our insider trading policy prohibits short sales of our stock, buying or selling put or call options on our stock, holding our stock in a margin account, pledging our stock as collateral for a loan, or entering into hedging or monetization transactions with respect to our stock, in each case without prior advance approval from our Executive Vice President, General Counsel, Chief Compliance Officer and Secretary (no such advance approvals were granted to directors or named executives in 2024). | |

Stock Ownership | ✓ Robust stock ownership guidelines:

• The Executive Chairman, the Chief Executive Officer and the President and Chief Operating Officer must retain equity equal in value to five times their base salaries.

• Each of the other named executive officers must retain equity equal in value to three times their respective base salaries.

• Each of our directors must retain equity equal in value to five times the annual director retainer. | |

| 6 | TELEDYNE TECHNOLOGIES INCORPORATED | 2025 Proxy Statement |

2025 Proxy Statement Summary (continued)

Alignment with Stockholder Interests | ||

Corporate Responsibility | ✓ We are committed to acting as a good corporate citizen and operating sustainably.

✓ Our Global Code of Ethical Business Conduct and other policies and information related to corporate social responsibility can be found at www.teledyne.com under “Who We Are” — “Corporate Governance.”

✓ In our Corporate Social Responsibility (“CSR”) report we disclose and highlight some of Teledyne’s most recent efforts focused on Environmental, Social and Governance (“ESG”) and sustainability, and which is available on our website at www.teledyne.com under “Who We Are” — “Corporate Social Responsibility.” | |

Core Values

Corporate responsibility is part of our overall culture. Our four Core Values – Integrity, Respect, Responsibility, and Citizenship – guide the decisions we make as an organization. Any employee or third party doing business for or with Teledyne may report any ethical concern or suspected misconduct online at www.teledyne.ethicspoint.com or call the Ethics Hotline at (877) 666-6968.

| TELEDYNE TECHNOLOGIES INCORPORATED | 2025 Proxy Statement | 7 |

Board Composition and Practices

Information and Meetings

The Board of Directors directs the management of the business and affairs of the Company as provided in our Fifth Amended and Restated Bylaws (“Bylaws”) and pursuant to the Delaware General Corporation Law (“DGCL”). Members of the Board stay informed about our business through discussions with the senior management and other officers and managers of the Company and its subsidiaries, by reviewing information provided to them and participating in Board and committee meetings.

We encourage, but do not require, that all our directors attend all meetings of the Board of Directors, all committee meetings for all committees on which the directors serve and the annual stockholders meeting. In fiscal year 2024, the Board held six meetings. During 2024, all directors attended at least 75% of the aggregate number of meetings of the Board and Board committees of which they were members. All directors attended the 2024 Annual Meeting of Stockholders virtually.

Number of Directors

The Board of Directors determines the number of directors, which under our Bylaws must consist of not less than four members and not more than 12 members. The Board has currently fixed the number at 11 members. On January 22, 2025, Teledyne announced that director Charles Crocker will retire at the end of his term, immediately prior to the 2025 Annual Meeting. Upon Charles Cocker’s retirement, the number has been fixed at ten Board members.

Director Terms

As approved at the 2024 Annual Meeting of Stockholders, our Restated Certificate of Incorporation was amended in 2024 to declassify the Board. Prior to the amendment, the directors were divided into three classes and the directors in each class served for a three-year term. The directors elected at the 2024 Annual Meeting were elected to serve a full three-year term. The directors to be elected at the 2025 Annual Meeting will be elected to serve a two-year term. The directors to be elected at the 2026 Annual Meeting will be elected to serve a one-year term. At the 2027 Annual Meeting and at each annual meeting of stockholders thereafter, all directors will be elected annually.

Directors’ Change in Status and Resignation Policy

Our Change in Status and Resignation Policy requires a director to offer to tender his or her resignation if such director has a change in professional status, subject to the Board accepting the resignation. It also requires a director nominee standing for election at a meeting of stockholders to submit a contingent resignation in writing to the Chairman of the Nominating and Governance Committee prior to the meeting, which resignation becomes effective only if the director is not elected by a majority of votes cast and the Board accepts the resignation, as more fully described under “Majority Voting for Directors” on page 12.

Board Structure

The Board of Directors currently consists of 11 directors, ten of whom are considered independent under existing rules of the NYSE and the SEC. Mr. Crocker, who has served as a director since 2001, has notified the Company of his intent to cease being a member of the Board at the 2025 Annual Meeting. Immediately prior to the 2025 Annual Meeting, the size of the Board will be reduced to ten. The Board thanks Mr. Crocker for his sage advice and dedicated service to the Company and its stockholders.

The Chairman of the Board, Dr. Mehrabian, is also our Executive Chairman and our former Chairman, President and Chief Executive Officer, and therefore is not considered an independent director. The Executive Chairman presides at meetings of stockholders and Board meetings. The Board has formally designated Michael T. Smith, one of our independent directors, to serve as the lead director. Our non-management directors meet in

| 8 | TELEDYNE TECHNOLOGIES INCORPORATED | 2025 Proxy Statement |

Board Composition and Practices (continued)

executive session without management (including the Executive Chairman and Chief Executive Officer) on a regularly scheduled basis, with the lead director presiding in such sessions. In addition, the Board’s three standing committees consist solely of independent directors.

The Board made the decision to separate the roles of the Executive Chairman and the Chief Executive Officer in 2024 to further succession planning and also to allow the Executive Chairman to focus his efforts on strategy, technology, mergers and acquisitions and margin expansion programs. The Board believes that its current leadership structure effectively allocates authority, responsibility and oversight between management and the independent members of the Board, thus ensuring the Board’s ability to carry out its roles and responsibilities on behalf of the Company’s stockholders.

The functions of the Board are carried out by the full Board, and when delegated, by the Board committees. Each director is a full and equal participant in the major strategic and policy decisions of our Company and the Executive Chairman has no greater or lesser vote on matters considered by the Board.

| TELEDYNE TECHNOLOGIES INCORPORATED | 2025 Proxy Statement | 9 |

Executive Officers

The following table sets forth information regarding our current executive officers who are required to file reports under Section 16 of the Exchange Act. Biographical information for Robert Mehrabian, our Executive Chairman, is included with the director biographies.

Executive Officers | Age | Principal Occupations Last 5 Years | ||

Edwin Roks

Chief Executive Officer | 60 | Dr. Roks has been Chief Executive Officer of Teledyne since January 1, 2024. Prior to that he was Executive Vice President of Teledyne and President, Teledyne Digital Imaging Segment (Teledyne’s largest segment) since May 2021. Prior to that he was Vice President of Teledyne and Group President — Teledyne Digital Imaging, Teledyne DALSA and Teledyne e2v since March 2017. | ||

Stephen F. Blackwood

Executive Vice President and Chief Financial Officer | 62 | Mr. Blackwood has been Executive Vice President and Chief Financial Officer since February 18, 2025. He was Senior Vice President and Chief Financial Officer from December 2023 and prior to that had been Senior Vice President, Strategic Sourcing, Tax and Treasurer since January 1, 2019. Prior to that he was Vice President and Treasurer of Teledyne for more than five years. | ||

George C. Bobb III

President and Chief Operating Officer | 50 | Mr. Bobb has been President and Chief Operating Officer of Teledyne since January 1, 2024. Prior to serving in this role, Mr. Bobb was Segment President of Teledyne’s Aerospace and Defense Electronics Segment, and had executive leadership responsibility for the Marine Instrumentation group, the Engineered Systems Segment, Teledyne Scientific & Imaging, and Teledyne’s Information Technology function. He was Executive Vice President of Teledyne from July 2023 through December 2023, and prior to that Senior Vice President of Teledyne since October 2021. Prior to that he was Vice President of Teledyne and President of the Aerospace and Defense Electronics Segment since July 2019. He was President of Teledyne Controls LLC from April 2018 to October 2021. Prior to that he held other executive and legal positions at Teledyne, including Chief Compliance Officer. | ||

Jason VanWees

Vice Chairman | 53 | Mr. VanWees has been Vice Chairman of Teledyne since October 15, 2021. Prior to that, he was Executive Vice President since January 1, 2019 and Senior Vice President, Strategy and Mergers & Acquisitions since July 2013. Prior to that, he held various executive positions at Teledyne for more than five years. | ||

| 10 | TELEDYNE TECHNOLOGIES INCORPORATED | 2025 Proxy Statement |

Executive Officers (continued)

Executive Officers | Age | Principal Occupations Last 5 Years | ||

Melanie S. Cibik

Executive Vice President, General Counsel, Chief Compliance Officer and Secretary | 65 | Miss Cibik has been Executive Vice President of Teledyne since January 1, 2024, General Counsel and Secretary of Teledyne since September 2012, and Chief Compliance Officer since August 2016. She was Senior Vice President of Teledyne from September 2012 through December 2023. Prior to that she held executive and legal positions at Teledyne for more than five years. Miss Cibik was a director of OPUS Bank from August 2019 to June 1, 2020, when it was acquired by Pacific Premier Bancorp, Inc. | ||

Cynthia Belak

Senior Vice President and Controller | 68 | Ms. Belak has been Senior Vice President and Controller of Teledyne since February 18, 2025. She was Vice President and Controller from May 2015 and prior to that had been Vice President, Risk Assurance since January 2012. Prior to that she held other finance positions at Teledyne since January 2010. | ||

| TELEDYNE TECHNOLOGIES INCORPORATED | 2025 Proxy Statement | 11 |

Item 1 on Proxy Card — Election of Directors

The Board, upon the recommendation of the Nominating and Governance Committee, has nominated the following Class II directors for election at this year’s Annual Meeting, to hold office for two-year terms until the 2027 Annual Meeting: Robert Mehrabian, Jane C. Sherburne and Michael T. Smith. All of the nominees currently serve as directors on the Board and were last elected to the Board by the Company’s stockholders at the 2022 Annual Meeting. Each director nominee has agreed to be named in this Proxy Statement.

If a nominee becomes unable to serve, the proxies may vote for a Board-designated substitute or the Board may reduce the number of directors. The Board has no reason to believe that any nominee will be unable to serve.

Majority Voting for Directors

Our Bylaws and Change in Status and Resignation Policy for Directors provide a majority voting standard for election of directors in uncontested elections. Each director will be elected by the affirmative vote of a majority of the votes cast, meaning that the number of votes cast “FOR” a director nominee exceeds fifty percent (50%) of the number of votes cast with respect to that director’s election. The Board has adopted a policy whereby all director nominees must submit a contingent resignation in writing to the Chairman of the Nominating and Governance Committee. The resignation becomes effective only if the director is not elected by a majority of votes cast and the Board accepts the resignation. The Nominating and Governance Committee or another committee appointed by the Board will recommend to the Board whether to accept or reject the resignation or whether other action should be taken. The Board will act on such committee’s recommendation and publicly disclose its decision and the rationale behind it within 90 days following the date of the certification of the election results. The director who was not elected by a majority of votes cast will not participate in the Board’s decision with respect to such resignation. If the number of nominees exceeds the number of directors to be elected, the nominees who receive the highest number of votes cast will be elected.

Unless otherwise instructed, the individuals named as proxies in the proxy card will vote each proxy received by them for the election of the three named nominees. You may withhold authority for the proxies to vote your shares on, or vote against, any or all of the nominees by following the instructions on your proxy card.

Director Nominees

The Board has affirmatively determined that each of the nominees qualifies for election under the Company’s criteria for evaluation of directors (see “Director Qualifications, Skills, and Attributes”). The following pages include biographical information about each of our directors (including the director nominees) and their specific experiences, qualifications, skills, and attributes that have led the Board and the Nominating and Governance Committee to conclude that they should serve as directors on the Board. In addition, the Board has determined that each non-employee director nominee qualifies as an independent director under the applicable NYSE listing standards.

| 12 | TELEDYNE TECHNOLOGIES INCORPORATED | 2025 Proxy Statement |

Item 1 on Proxy Card — Election of Directors (continued)

Director Qualification, Skills, and Attributes

Our directors have substantial leadership, management, and industry experience and expertise in various fields. Four of our 11 directors self-identify as having diverse characteristics (race, gender, ethnicity, sexual orientation or cultural background). This diversity of experience and background of our directors, illustrated in the skills matrix and director nominees’ biographies that follow, is brought to bear in Board deliberations, during which multiple perspectives are considered in developing dynamic solutions to achieve our strategic priorities to reduce complexity, drive returns, and advance sustainably.

Because the skills matrix below is a summary, it does not include all of the qualifications, skills, attributes and, experiences that each director offers.

Attributes, Experience and Skills |  |  |  |  |  |  |  |  |  |  |  | |||||||||||

Age | 86 | 80 | 57 | 79 | 73 | 83 | 59 | 74 | 62 | 81 | 80 | |||||||||||

Diversity(a) |

|

| ✓ |

|

|

| ✓ | ✓ | ✓ |

|

| |||||||||||

CEO/C-Suite | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||

Financial and Accounting |

|

|

| ✓ |

|

| ✓ |

|

|

|

| |||||||||||

Legal and Compliance |

|

|

| ✓ |

|

|

| ✓ | ✓ |

|

| |||||||||||

Governance and ESG |

|

|

| ✓ | ✓ |

|

| ✓ | ✓ | ✓ | ✓ | |||||||||||

Banking |

|

|

|

| ✓ | ✓ |

| ✓ |

|

| ✓ | |||||||||||

Government, Defense or Military | ✓ | ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| |||||||||||

Energy |

|

|

|

| ✓ |

|

|

|

|

| ✓ | |||||||||||

Information and Cybersecurity |

| ✓ |

|

|

|

| ✓ | ✓ | ✓ |

|

| |||||||||||

Other Industry | ✓ | ✓ | ✓ |

| ✓ | ✓ | ✓ |

| ✓ | ✓ | ✓ | |||||||||||

| (a) | Self-identifies as having diverse characteristics (race, gender, ethnicity, sexual orientation or cultural background). |

Additional background information about the nominees and continuing directors follows, including the specific experiences, qualifications, attributes and skills that the Board believes qualifies each of the below named individuals to serve as a director of the Company, considering the Company’s business and structure.

Background information about the director nominees, including the business experience, individual skills and qualifications that each director contributes to the Board’s effectiveness as a whole, are described on the following pages.

| TELEDYNE TECHNOLOGIES INCORPORATED | 2025 Proxy Statement | 13 |

Item 1 on Proxy Card — Election of Directors (continued)

Nominees — For Terms Expiring at 2027 Annual Meeting (Class II)

Robert Mehrabian

Executive Chairman of the Company

Director since 1999

Age: 83 | Robert Mehrabian is Executive Chairman of Teledyne Technologies Incorporated. He was Chairman, President and Chief Executive Officer from October 15, 2021 to December 31, 2023. Prior to that he was Teledyne’s Executive Chairman starting on January 1, 2019, and before that he was Chairman, President and Chief Executive Officer starting in 2000 (and was President and Chief Executive Officer since Teledyne’s formation in 1999). Prior to the spin-off of the Company by Allegheny Technologies Incorporated (ATI) in November 1999, Dr. Mehrabian was the President and Chief Executive Officer of ATI’s Aerospace and Electronics segment since July 1999 and had served ATI in various senior executive capacities since July 1997. Before joining ATI, Dr. Mehrabian served as President of Carnegie Mellon University. From 1992 until April 2014, he served as a director of PPG Industries, Inc. Dr. Mehrabian served as a director of Mellon Financial Corporation from 1994 to 2007 and served as director of its successor The Bank of New York Mellon Corporation until April 2011. He is a member of The National Academy of Engineering.

The following experience, qualifications, attributes and/or skills led the Board to conclude that Dr. Mehrabian should serve as a director: his leadership skills acquired while serving as the Company’s Chairman, Chief Executive Officer and President, previously held senior executive level positions at public companies and at academic institutions, his service on public company boards, and his extensive knowledge and understanding of the Company’s business, operations, technology, products and services. | |||||||||||

| 14 | TELEDYNE TECHNOLOGIES INCORPORATED | 2025 Proxy Statement |

Item 1 on Proxy Card — Election of Directors (continued)

Jane C. Sherburne

Principal of Sherburne PLLC and Former Senior Executive Vice President, General Counsel and Corporate Secretary of The Bank of New York Mellon Corporation

Director since 2014

Age: 74

|

Jane C. Sherburne is currently principal of Sherburne PLLC, a legal consulting firm providing strategic advice in crisis environments and in connection with regulatory policy developments. From May 2010 to July 2014, Ms. Sherburne served as Senior Executive Vice President, General Counsel and Corporate Secretary of The Bank of New York Mellon Corporation. Ms. Sherburne served as Senior Executive Vice President, General Counsel and Corporate Secretary of Wachovia Corporation from June 2008 to January 2009, during which time Wachovia merged with Wells Fargo & Company. From December 2006 to June 2008, Ms. Sherburne was General Counsel of Citigroup Inc.’s Global Consumer Business. From July 2001 to December 2006, Ms. Sherburne was Deputy General Counsel of Citigroup, Inc. Until July 2001, Ms. Sherburne was a litigation partner at the Washington, D.C. law firm of Wilmer, Cutler & Pickering, having joined the firm in 1984. Ms. Sherburne interrupted her private practice from 1994 to 1997 to serve as Special Counsel to the President in the Clinton White House. From June 2015 to November 1, 2023, Ms. Sherburne served as an independent director on the boards of HSBC USA, HSBC Bank USA, HSBC Finance Corporation and HSBC North America, all of which are indirect wholly-owned subsidiaries of HSBC Holdings plc, a global banking and financial services organization. She currently serves on the board of Perella Weinberg Partners, a global advisory and asset management firm, and chairs its Compensation Committee. Ms. Sherburne was a member of the Board of the National Women’s Law Center until July 2024 and is Chair of the Board of Negotiation Strategies Institute, a member of the Executive Committee of the Lawyers’ Committee for Civil Rights Under Law, a member of the Committee for Economic Development and a member of the American Law Institute. Ms. Sherburne is a member of our Audit Committee and our Personnel and Compensation Committee.

The following experience, qualifications, attributes and/or skills led the Board to conclude that Ms. Sherburne should serve as a director: her professional background and experience, current and previously held senior executive level positions, senior level experience in positions in the federal government, and her extensive experience in policy, compliance, corporate governance and government matters and in regulated industries. | |||||||

| TELEDYNE TECHNOLOGIES INCORPORATED | 2025 Proxy Statement | 15 |

Item 1 on Proxy Card — Election of Directors (continued)

Michael T. Smith

Retired Chairman of the Board and Chief Executive Officer of Hughes Electronics Corporation

Director since 2001

Age: 81 |

Michael T. Smith is the retired Chairman of the Board and Chief Executive Officer of Hughes Electronics Corporation, having held such positions from October 1997 until May 2001. Mr. Smith was a director of FLIR Systems, Inc., which produced infrared cameras, thermal imaging software and temperature measurement devices, from 2002 until its acquisition by Teledyne in May 2021. He is also a director of Zero Gravity Solutions, Inc., an agricultural biotechnology company, and the Livingston Group of Companies, an investment bank and broker/dealer. Mr. Smith was a director of WABCO Holdings, a supplier to the automotive industry, from 2009 until 2020, a director of Ingram Micro Corporation, a technology sales, marketing and logistics company, from 2001 until June 2014, Alliant Techsystems, Inc. (ATK), an advanced weapon and space systems company, from 1997 to 2009, and Anteon International Corporation, an information technology and systems engineering solutions company, from 2005 to 2006. Mr. Smith is a member of the Council of Chief Executives and the former chairman of the Aerospace Industries Association, an industry trade organization, and is a charter member of the Electronic Industries Foundation Leadership Council. Mr. Smith is the Chair of our Nominating and Governance Committee and a member of our Audit Committee. Mr. Smith is also our Lead Director.

The following experience, qualifications, attributes and/or skills led the Board to conclude that Mr. Smith should serve as a director: his professional background and experience, previously held senior executive level positions, his service on other public and private company boards, Teledyne board experience, board attendance and participation, and his extensive experience with companies in the aerospace, defense, engineering, communications and manufacturing sectors. | |||||||

The Board of Directors Recommends

a Vote FOR the Election of the Nominees.

| 16 | TELEDYNE TECHNOLOGIES INCORPORATED | 2025 Proxy Statement |

Item 1 on Proxy Card — Election of Directors (continued)

Continuing Directors — Terms Expiring at 2026 Annual Meeting (Class III)

Kenneth C. Dahlberg

Retired Chairman of the Board and Former Chief Executive Officer of Science Applications International Corporation (SAIC)

Director since 2006

Age: 80 | Kenneth C. Dahlberg served as Chief Executive Officer of Science Applications International Corporation (SAIC), a research and engineering firm specializing in information systems and technology, from November 2003 through September 2009, and served as Chairman of the Board of Directors of SAIC from July 2004 until his retirement in June 2010. Prior to joining SAIC, Mr. Dahlberg served as Executive Vice President of General Dynamics where he was responsible for its Information Systems and Technology Group and prior to that served as President and Chief Operating Officer of Raytheon Systems. Mr. Dahlberg was also a director of Parsons Corp., an engineering, construction, technical and management services firm from 2011 until 2020, and Motorola Solutions, Inc., a provider of communications products and services, from 2011 until 2017. Mr. Dahlberg is a member of our Audit Committee and our Personnel and Compensation Committee.

The following experience, qualifications, attributes and/or skills led the Board to conclude that Mr. Dahlberg should serve as a director: his professional background and experience, previously held senior executive level positions, his service on other public company boards, his Teledyne board experience, board attendance and participation, his extensive experience with companies in the defense industry and his background and experience in design engineering, production, system development and services. | |||||||||||

Michelle A. Kumbier

Senior Vice President and President, Turf & Consumer Products, Briggs & Stratton, LLC

Director since 2020

Age: 57 | Michelle A. Kumbier has been Senior Vice President and President, Turf & Consumer Products, Briggs & Stratton, LLC, a privately held manufacturer and marketer of engines, batteries and outdoor power equipment, since March 2022. She is the former Senior Vice President and Chief Operating Officer of Harley-Davidson Motor Company, a manufacturer of motorcycles and related products, from October 2017 to April 2020. Ms. Kumbier had previously served as Harley-Davidson’s Senior Vice President, Motor Company Product and Operations from May 2015 to October 2017, and held various other executive roles from 1997 to 2015. Prior to joining Harley-Davidson in 1997, Ms. Kumbier began her career at Kohler Company in 1986, where she held a variety of positions in both the plumbing products and engines divisions. Ms. Kumbier has also been a member of the Board of Directors of Abbott Laboratories, a health care products provider, since 2018, and Ryerson Holding Corporation, a value-added processor and distributor of industrial metals, since April 2024. She is a member of the audit committee of Ryerson Holding Corporation and Abbott Laboratories. She was a member of the Board of Directors of Tenneco Inc. from August 2021 to November 2022. Ms. Kumbier is a member of our Audit Committee and the Chair of our Personnel and Compensation Committee. The Board of Directors has considered the executive position and other public company directorships and committee memberships of Ms. Kumbier, and does not believe they interfere or conflict with her effectiveness in relation to her membership on the Company’s Board of Directors or the Audit Committee.

The following experience, qualifications, attributes and/or skills led the Board to conclude that Ms. Kumbier should serve as a director: her professional background and experience, her service on other public company boards and her senior executive level experience in the management of a multinational public manufacturing company, including significant operations, product development, supply chain optimization, business development and strategic planning experience. | |||||||||||

| TELEDYNE TECHNOLOGIES INCORPORATED | 2025 Proxy Statement | 17 |

Item 1 on Proxy Card — Election of Directors (continued)

Robert A. Malone

Executive Chairman of the Board, President and Chief Executive Officer of First Sonora Bancshares, Inc. and Retired Chairman of the Board and President, BP America, Inc.

Director since 2015

Age: 73 | Robert A. Malone has been the Executive Chairman, President and Chief Executive Officer of First Sonora Bancshares, Inc., a privately-held community bank, since 2014. Mr. Malone is also the Executive Chairman of the Board, President and Chief Executive Officer of The First National Bank of Sonora, Texas (d/b/a Sonora Bank), a community bank owned by First Sonora Bancshares, Inc., since 2014. He joined First Sonora Bancshares and Sonora Bank in 2009 as President and Chief Executive Officer. Mr. Malone was an Executive Vice President of BP plc, an integrated oil and gas company, and was Chairman of the Board and President, BP America Inc. from 2006 to 2009. Mr. Malone has been a director of Halliburton Company, a provider products and services to the energy industry, since 2009 and its Lead Director since 2018, and a director of Peabody Energy Corporation, a coal mining company, since 2009, and its Non-Executive Chairman of the Board since 2016. From 2017 to April 2022, he was a director of BP Midstream Partners GP LLC, the general partner of BP Midstream LP, an owner and operator of oil and natural gas pipelines. Mr. Malone is a member of our Audit Committee and our Personnel and Compensation Committee.

The following experience, qualifications, attributes and/or skills led the Board to conclude that Mr. Malone should serve as a director: his professional background and experience, previously held senior executive level positions, his service on other public company boards and his extensive experience with companies in the oil and gas industry and in banking and his expertise in compliance with safety regulations. | |||||||

| 18 | TELEDYNE TECHNOLOGIES INCORPORATED | 2025 Proxy Statement |

Item 1 on Proxy Card — Election of Directors (continued)

Continuing Directors — Terms Expiring at the 2027 Annual Meeting (Class I)

Denise R. Singleton

Chief Legal Officer and Corporate Secretary, North American Operations of the Holcim Group

Director since 2019

Age: 62 | Denise R. Singleton became Chief Legal Officer and Corporate Secretary of the North American operations of the Holcim Group, a global leader in innovative and sustainable building materials, in September 2024. Previously, she was Executive Vice President, General Counsel and Secretary of WestRock Company, a global paper and packaging company, since March 2022. From 2015 to 2022, she was the Senior Vice President, General Counsel and Corporate Secretary of IDEX Corporation, a manufacturer of fluidic systems and specialty engineered products. From March 2011 until October 2015, she served as Senior Vice President, General Counsel, Corporate Secretary and Chief Compliance Officer at SunCoke Energy, Inc., a supplier of high-quality coke used in the blast furnace production of steel, and its controlled company SunCoke Energy Partners, LLP, where she also served on the Board of Directors. Prior to joining SunCoke Energy, Ms. Singleton held several positions at PPG Industries, Inc., a global supplier of paints, coatings and specialty materials, including Assistant General Counsel and Corporate Secretary, Chief Securities and Finance Counsel, Chief M&A Counsel, and General Counsel of the Glass and Fiberglass Division. Prior to joining PPG Industries, Ms. Singleton was a partner at Shaw Pittman, LLP, a law firm. Since 2021, Ms. Singleton has been a director of Phillips 66, a diversified energy manufacturing and logistics company. Ms. Singleton serves on the human resources and compensation committee and the public policy and sustainability committee of the Board of Directors for Phillips 66. In 2019, Ms. Singleton was named to The Legal 500 GC Powerlist that consists of the most influential in-house lawyers in business and was named one of the Most Powerful Women in Corporate America by Black Enterprise magazine. Ms. Singleton was listed as a 2022 Director to Watch by Directors & Boards magazine. In February 2023, she joined the Board of Directors of 50/50 Women on Boards™, a global education and advocacy campaign committed to advancing gender balance and diversity on corporate boards. In September 2023, Ms. Singleton was recognized as an honoree of the 2023 NACD Directorship 100™, an annual recognition of leading corporate directors and corporate governance experts who impact boardroom practices and performance. Ms. Singleton is a member of our Audit Committee and our Nominating and Governance Committee. The Board of Directors has considered the executive position and other public company directorship and committee memberships of Ms. Singleton and does not believe they interfere or conflict with her membership on the Company’s Board of Directors.

The following experience, qualifications, attributes and/or skills led the Board to conclude that Ms. Singleton should serve as a director: her professional background and experience, current and previously held senior executive level positions, her service on other public company boards, and her legal, merger and acquisitions, capital markets, financing, compliance, cybersecurity and corporate governance experience at public companies with significant operations across multiple technologies and industries. | |||||||

| TELEDYNE TECHNOLOGIES INCORPORATED | 2025 Proxy Statement | 19 |

Item 1 on Proxy Card — Election of Directors (continued)

Simon M. Lorne

Senior Advisor and Former Vice Chairman and Chief Legal

Director since 2004

Age: 79

|

Simon M. Lorne is a Senior Advisor at Millennium Management LLC, a hedge fund management company. Mr. Lorne joined Millennium Management in 2004 and held roles including Vice Chairman and Chief Legal Officer. From March 1999 to March 2004, prior to the time he became a Teledyne director, Mr. Lorne was a partner with Munger Tolles & Olson, LLP, a law firm whose services Teledyne has used from time to time. Mr. Lorne also previously served as a Managing Director of Citigroup/Salomon Brothers with responsibility for Legal Compliance and Internal Audit, and as the General Counsel at the SEC in Washington, D.C. From 2016 through 2020, Mr. Lorne was Chairman of the Alternative Investment Management Association, a London-based association of investment managers. From 2011 to 2018, Mr. Lorne served on the Advisory Council of the Public Company Accounting Oversight Board. Mr. Lorne is the Chair of our Audit Committee and a member of our Nominating and Governance Committee.

The following experience, qualifications, attributes and/or skills led the Board to conclude that Mr. Lorne should serve as a director: his professional background and experience, current and previously held senior executive level positions, senior level experience at a government regulator, his service on other public and private company boards, his Teledyne board experience, board attendance and participation, and his specialized expertise in finance, mergers and acquisitions, securities laws and corporate governance. | |||||||||||

Vincent J. Morales

Senior Vice President and Chief Financial Officer of PPG Industries, Inc.

Director since 2021

Age: 59 |

Vincent J. Morales is currently Senior Vice President and Chief Financial Officer of PPG Industries, Inc. Mr. Morales joined PPG in 1985, ultimately serving as its Chief Financial Officer since March 2017. During his time at PPG, Mr. Morales progressed through a variety of accounting and finance roles, encompassing controllership, investor relations, treasury, and company-wide business finance. In his current role, Mr. Morales is part of PPG’s three-person Executive Committee that is responsible for establishing and executing the company’s overall strategy, and he has direct oversight of the company’s information technology and M&A organizations. Mr. Morales is a member of our Audit Committee and our Personnel and Compensation Committee.

The following experience, qualifications, attributes and/or skills led the Board to conclude that Mr. Morales should serve as a director: his extensive experience in the management of a multinational public company, including significant finance, accounting, investor relations, operations, cybersecurity, strategic planning and mergers and acquisitions experience. | |||||||||||

| 20 | TELEDYNE TECHNOLOGIES INCORPORATED | 2025 Proxy Statement |

Item 1 on Proxy Card — Election of Directors (continued)

Wesley W. von Schack

Chairman of AEGIS Insurance Services and Former Chairman, President and Chief Executive Officer of Energy East Corporation

Director since 2006

Age: 80

|

Wesley W. von Schack is the Chairman of AEGIS Insurance Services, a property and casualty mutual insurance company, a position he has held since 2007. He served as a director of Edward Lifesciences Corporation, a company engaged in the science of heart valves and hemodynamic monitoring, from 2010 to May 2020. Dr. von Schack served as Chairman, President and Chief Executive Officer of Energy East Corporation, a diversified energy services company, from 1996 to September 2009. Dr. von Schack served as a director of The Bank of New York Mellon Corporation from 2007 through April 2016 and Mellon Financial Corporation from 1989 to 2007. Dr. von Schack is director emeritus of the Gettysburg Foundation, and is a member of the President’s Council — Peconic Land Trust. Dr. von Schack is a member of our Nominating and Governance Committee and our Personnel and Compensation Committee.

The following experience, qualifications, attributes and/or skills led the Board to conclude that Dr. von Schack should serve as a director: his professional background and experience, previously held senior executive level positions, his service on other private and public company boards, his leadership positions at private foundations, his Teledyne board experience, board attendance and participation, and his extensive experience with companies in the energy, banking, financial asset management sectors and in regulated industries. | |||||||||||

Director Retiring at the 2025 Annual Meeting

Charles Crocker

Chairman and Chief Executive Officer, Crocker Capital and Retired Chairman and Chief Executive Officer of BEI Technologies, Inc.

Director since 2001

Age: 86 |

Charles Crocker is the Chairman and Chief Executive Officer of Crocker Capital, a private investment company. Mr. Crocker was the Chief Executive Officer of the Custom Sensors and Technologies Division of Schneider Electric until January 2006. Mr. Crocker was the Chairman and Chief Executive Officer of BEI Technologies, Inc., a diversified technology company, from March 2000 until October 2005, when it was acquired by Schneider Electric. Mr. Crocker served as Chairman, President and Chief Executive Officer of BEI Electronics from October 1995 to September 1997, at which time he became Chairman, President and Chief Executive Officer of BEI Technologies, Inc. From 2014 until 2018, he served as a director of Imageware Systems, Inc., from 2003 until 2014, he served as a director of Franklin Resources, Inc., and from 2010 until August 2012, he served as a director of ConMed Healthcare Management, Inc. Mr. Crocker has been Chairman of the Board of Children’s Hospital in San Francisco, Chairman of the Hamlin School’s Board of Trustees and President of the Foundation of the Fine Arts Museums of San Francisco. Mr. Crocker is a member of our Personnel and Compensation Committee and our Nominating and Governance Committee. Mr. Crocker has notified the Company of his intent to retire and cease being a member of our Board at the end of his term, immediately prior to the 2025 Annual Meeting. | |||||||

| TELEDYNE TECHNOLOGIES INCORPORATED | 2025 Proxy Statement | 21 |

Corporate Governance

Director Independence

In April 2024, our Nominating and Governance Committee assessed, and our Board determined, the independence of each director in accordance with applicable NYSE and SEC rules, as then in effect. To comply with such rules, our Nominating and Governance Committee considered various relationship categories including: whether the director is an employee, amount of stock ownership, and commercial, industrial, banking, consulting, legal, accounting or auditing, charitable and familial relationships, as well as a range of individual circumstances (including social friendships between certain members of the Board). See “Certain Transactions” at page 92. The Nominating and Governance Committee, followed by the Board, determined that each member of our Board of Directors did not have any material relationships with us and was thus independent, except for Dr. Mehrabian, our Executive Chairman. Our management, after reviewing director questionnaires, reported to our Board in February 2025 that information on which the Board based its independence assessment in 2024 had not materially changed. The independent directors are: Charles Crocker, Kenneth C. Dahlberg, Michelle A. Kumbier, Simon M. Lorne, Robert A. Malone, Vincent J. Morales, Jane C. Sherburne, Denise R. Singleton, Michael T. Smith and Wesley W. von Schack.

The Nominating and Governance Committee, followed by the Board, also determined that each member of our Personnel and Compensation Committee is a “non-employee director” within the meaning of Rule 16b-3 under the Exchange Act.

All of the Board’s standing committees consist only of independent directors.

Corporate Governance and Ethics Guidelines

Our Board of Directors has adopted many “best practices” in corporate governance, including separate standing committees of the Board for each of audit, nominating and governance and personnel and compensation matters, charters for each of the committees, and corporate ethics and compliance guidelines.

Our ethics and compliance guidelines for employees are contained in the Global Code of Ethical Business Conduct. These guidelines apply to all of our employees, including our principal executive, financial and accounting officers. Our employees receive annual ethics training, and questionnaires are distributed annually to various personnel to confirm compliance with these guidelines. We also have a specialized code of ethics for financial executives that supplements the employee guidelines. In addition, we have ethics and compliance guidelines for our third-party service providers.

Our Board of Directors has adopted a Directors’ Code of Business Conduct and Ethics. This code is intended to provide guidance to directors to help them recognize and deal with ethical issues, including conflicts of interest, corporate opportunities, fair dealing, compliance with law and proper use of the Company’s assets. It also provides mechanisms to report possible unethical conduct.

Our Board of Directors has adopted Corporate Governance Guidelines. These Corporate Governance Guidelines were initially developed by our Nominating and Governance Committee and are reviewed at least annually by such Committee. These Corporate Governance Guidelines incorporate practices and policies under which our Board has operated since its inception, in addition to many of the requirements of the SEC and the NYSE. Some of the principal subjects covered by the Corporate Governance Guidelines include:

| • | Director qualification standards. |

| • | Director responsibilities. |

| • | Director access to management and independent advisors. |

| • | Director compensation. |

| • | Director orientation and continuing education. |

| • | Management succession. |

| 22 | TELEDYNE TECHNOLOGIES INCORPORATED | 2025 Proxy Statement |

Corporate Governance (continued)

| • | Annual performance evaluation of the Board and its Committees. |

| • | Change in professional status and resignations. |

| • | Role of the lead director. |

| • | Leadership development. |

| • | Evaluation of the performance of the Executive Chairman and the Chief Executive Officer. |

Copies of our Corporate Governance Guidelines, Global Code of Ethical Business Conduct, Code of Ethics for Financial Professionals, Directors’ Code of Business Conduct and Ethics, Code of Conduct for Service Providers, Corporate Governance Guidelines and Committee charters are available on our website at www.teledyne.com under “Who We Are” — “Corporate Governance”. We intend to post any amendments to these documents and any waivers of the provisions thereof related to directors or executive officers on our website. If at any time you would like to receive a paper copy of these documents free-of-charge, please write to Melanie S. Cibik, Executive Vice President, General Counsel, Chief Compliance Officer and Secretary, Teledyne Technologies Incorporated, 1049 Camino Dos Rios, Thousand Oaks, California 91360.

Risk Management Oversight

The risk oversight function of the Board of Directors is carried out by both the Board and the Audit Committee. As provided in its charter, the Audit Committee meets periodically with management to discuss the Company’s major financial and operating risk exposures and the steps, guidelines and policies taken or implemented relating to risk assessment and risk management. Matters of strategic risk are considered by the Board as a whole. At each regularly scheduled meeting of the Audit Committee, our Vice President, Chief Audit Executive reports directly to the Audit Committee on the activities of the Company’s internal audit function. Management also reports to the Audit Committee on legal, finance, accounting, cybersecurity and compliance matters at least quarterly and on tax and information technology matters periodically. Our Executive Vice President, General Counsel and Secretary is also our Chief Compliance Officer, and she reports to our Executive Chairman and our Chief Executive Officer. The Board is provided with reports on legal matters at periodically scheduled meetings and on other matters related to risk oversight on an as needed basis. In addition, the Audit Committee reviews with management the “risk factors” that appear in our Annual Report on Form 10-K prior to its filing.

We have an Enterprise Risk Management Committee to identify significant company risks and determine whether we have appropriate risk management policies, practices and procedures in place. The committee consists of our Vice President, Associate General Counsel and Assistant Secretary (Chair); Executive Vice President and Chief Financial Officer; Executive Vice President, General Counsel, Chief Compliance Officer and Secretary; Senior Vice President – Human Resources and Associate General Counsel; Vice President and Chief Information Officer; and individuals representing various business units. The Chair of the Enterprise Risk Management Committee periodically reports to the Board of Directors on the progress and results of the actions taken by the committee.

Risks Related to Compensation Policies and Practices

The Company and the Personnel and Compensation Committee have undertaken a process to determine whether the Company’s overall compensation program for employees creates incentives for employees to take excessive or unreasonable risks that could materially harm the Company. As part of this process, the Committee received input and analysis from its independent compensation consultant, Exequity LLP, and management prepared a framework of potential risk and evaluated the Company’s compensation policies in the context of this framework. The results of this evaluation were reviewed by and discussed with the Personnel and Compensation Committee.

We believe that several features of our compensation policies for management employees appropriately mitigate such risks, including a balanced mix of long-and short-term compensation incentives, the use of incentive award plans with capped payouts, the use of a diverse mix of performance measures in our incentive award plans and our stock ownership requirements for key officers. In addition, we use our annual business plan as a baseline for our Annual Incentive Plan targets, which the Personnel and Compensation Committee regards

| TELEDYNE TECHNOLOGIES INCORPORATED | 2025 Proxy Statement | 23 |

Corporate Governance (continued)

as setting an appropriate level of risk taking for the Company. We also believe the Company’s internal legal and financial controls appropriately mitigate the probability and potential impact of an individual employee committing the Company to a harmful long-term business transaction in exchange for short-term compensation benefits. In light of these features of our compensation program and these additional controls, our management and our Personnel and Compensation Committee have concluded that the risks arising from our employee compensation policies and practices are not reasonably likely to have a material adverse effect on the Company.

Hedging and Pledging Policy

Our Insider Trading Policy prohibits short sales of our stock, buying or selling put or call options on our stock, holding our stock in a margin account, pledging our stock as collateral for a loan, or entering into hedging or monetization transactions with respect to our stock, in each case without prior advance approval from our Executive Vice President, General Counsel, Chief Compliance Officer and Secretary (no such advance approvals were granted to directors or named executives in 2024). The foregoing prohibitions apply to our directors, executive officers and any employee who participates in our stock option and restricted stock unit programs.

Board Evaluation Process

Every year the Board and each standing committee of the Board assesses its performance. The evaluation process is overseen by the Nominating and Governance Committee and involves separate interviews of each director by internal counsel to solicit feedback on several issues, including:

| • | Board and committee effectiveness, size, composition and frequency of meetings; |

| • | director access to management and the sufficiency and timeliness of information provided by management; |

| • | sufficiency of processes for risk oversight; |

| • | whether directors possess appropriate experience and backgrounds; and |

| • | whether each director contributes to the effectiveness of the Board. |

The results are summarized by the Executive Vice President, General Counsel, Chief Compliance Officer and Secretary and discussed by the Board and each committee in executive session. In addition to providing an opportunity for directors to discuss a wide range of governance-related topics, the evaluation process is used by the Board and each committee to identify opportunities for improvement, make changes to the committee charters, processes and policies, and is linked to our Board’s succession planning activities.

Communications with the Board

Our Corporate Governance Guidelines provide that any interested parties desiring to communicate with our non-management directors, including our lead director, may contact them through our Secretary, Melanie S. Cibik, whose address is: Teledyne Technologies Incorporated, 1049 Camino Dos Rios, Thousand Oaks, California 91360. The Secretary will review each communication received and decide as to whether the communication, or a summary thereof, will be forwarded to the Nominating and Governance Committee or other appropriate Board committee or member.

Stockholder Engagement

We regularly engage with our stockholders to understand their perspectives on Teledyne, including our strategies, financial performance, management, executive compensation and governance. As part of this program, senior management regularly meets with institutional investors. During fiscal year 2024, senior management met with many institutional investors, including the majority of our top 25 investors with actively managed funds, through virtual and in-person investor conferences, virtual and in-person meetings and telephone conferences. Among other topics, the declassification of the Board as approved at the 2024 Annual Meeting of Stockholders was discussed with stockholders.

| 24 | TELEDYNE TECHNOLOGIES INCORPORATED | 2025 Proxy Statement |

Corporate Governance (continued)

Corporate Responsibility

Teledyne continuously operates within our Global Code of Ethical Business Conduct. We firmly believe that improvement is possible only if we measure our performance and constantly raise our standards through ethically oriented practices, including our contributions and commitment to having a positive measurable impact on humanity. Our Global Code of Ethical Business Conduct and other policies and information related to corporate social responsibility can be found at www.teledyne.com under “Who We Are” — “Corporate Governance.”

Environment and Sustainability

The prominence and importance of sustainability and Environmental, Social and Governance (“ESG”) initiatives have increased over the years. In November 2022, we published our second Corporate Social Responsibility (“CSR”) report, in which we disclose and highlight some of Teledyne’s recent efforts focused on sustainability and ESG. We published supplements to the CSR report in 2023 and 2024 to include updated information and data. The CSR report together with its supplements are available under “Who We Are” – “Corporate Social Responsibility” on our website at www.teledyne.com. The CSR report includes data on Teledyne’s combined direct emissions (“Scope 1”) and indirect emissions from purchased energy (“Scope 2”), workplace safety, water usage, waste generation and recycling and workplace demographics. We are also working to achieve compliance with the Corporate Social Responsibility Directive (“CSRD”), an EU law that requires companies to report their environmental and social impact.

In 2021, we compiled the first annual global inventory of our greenhouse gas (“GHG”) emissions (starting with fiscal year 2020) and have developed a GHG monitoring and management plan. We have set a goal to reduce our combined Scope 1 and Scope 2 emissions in company operations, normalized for revenue, by 40% from 2020 levels by the end of 2040. Going forward, we will continue to evaluate our emission reduction goals, while at the same time providing the tools and technologies enabling environmental science and climatology across the globe. More information about our carbon footprint and GHG emission reduction efforts and goals, and the contributions that Teledyne products make to carbon monitoring and environmental and climate science, can be found in our CSR reports.

Human Capital