UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-09599

STATE STREET MASTER FUNDS

(Exact name of registrant as specified in charter)

One Iron Street, Boston, Massachusetts 02210

(Address of principal executive offices)(Zip code)

| | |

| (Name and Address of Agent for Service) | | Copy to: |

| |

Joshua A. Weinberg, Esq. Managing Director and Managing Counsel c/o SSGA Funds Management, Inc. One Iron Street Boston, Massachusetts 02210 | | Timothy W. Diggins, Esq. Ropes & Gray LLP 800 Boylston Street Boston, Massachusetts 02110-2624 |

Registrant’s telephone number, including area code: (617)664-7037

Date of fiscal year end: December 31

Date of reporting period: December 31, 2018

| Item 1. | Reports to Stockholders. |

Annual Report

December 31, 2018

State Street Master Funds

| State Street Equity 500 Index Portfolio |

The information contained in this report is intended for the general information of shareholders of the Portfolio and shareholders of any fund invested in the Portfolio. Interests in the Portfolio are offered solely to eligible investors in private placement transactions that do not involve any “public offering” within the meaning of Section 4(a)(2) of the 1933 Act. This report is not authorized for distribution (i) to prospective investors in any fund invested in the Portfolio unless preceded or accompanied by a current offering document for such fund or (ii) to prospective eligible investors in the Portfolio unless preceded or accompanied by a current offering document of the Portfolio. Eligible investors in the Portfolio may obtain a current Portfolio offering document by calling 1-800-997-7327. Please read the offering document carefully before investing in the Portfolio.

TABLE OF CONTENTS

The information contained in this report is intended for the general information of shareholders of the Portfolio and shareholders of any fund invested in the Portfolio. Interests in the Portfolio are offered solely to eligible investors in private placement transactions that do not involve any “public offering” within the meaning of Section 4(a)(2) of the 1933 Act. This report is not authorized for distribution (i) to prospective investors in any fund invested in the Portfolio unless preceded or accompanied by a current offering document for such fund or (ii) to prospective eligible investors in the Portfolio unless preceded or accompanied by a current offering document of the Portfolio. Eligible investors in the Portfolio may obtain a current Portfolio offering document by calling 1-800-997-7327. Please read the offering document carefully before investing in the Portfolio.

STATE STREET EQUITY 500 INDEX PORTFOLIO

Management's Discussion of Fund Performance (Unaudited)

The investment objective of the State Street Equity 500 Index Portfolio (the “Portfolio”) is to replicate as closely as possible, before expenses, the performance of the Standard & Poor’s 500 Index (the “S&P 500” or the “Index”). The Portfolio's benchmark is the S&P 500 Index.

For the12-month period ended December 31, 2018 (the “Reporting Period”), the total return for the Portfolio was–4.98% and the Index was–4.38%. The Portfolio and Index returns reflect the reinvestment of dividends and other income. The Portfolio’s performance reflects the expenses of managing the Portfolio, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Fees, cash drag, and the cumulative effect of security misweights contributed to the difference between the Portfolio’s performance and that of the Index.

Equity markets opened the first month of 2018 with an acceleration of positive momentum following up on what was the strongest year for global equity markets since 2009. The sharp rise in yields that accelerated into the end of the month coincided with a reversal in U.S. equities at the end of January, including the first drop of more than 1% in the Index since August. Despite this, the Index returned over 5.7% for the month of January. The fifteen month run of gains for global equity markets and historically low volatility across asset classes came to an abrupt end in February as U.S. equities fell into correction territory for the first time in two years. The release of the January non-farm payrolls report on February 2nd noted that average hourly earnings rose by approximately 2.9% on a year-over-year basis, the highest reading since the beginning of the economic recovery. The release prompted a swift reassessment of government bond yields and a 2.10% selloff in the S&P 500 for the day, a decline larger than any seen the whole of 2017. The next two months followed suit with a drop of 3.69% in February and a drop of 2.54% in March.

Markets took a tentative step forward in April after February and March left the Index in the red to close off the first quarter of 2018. Unlike early February, when rising yields that came close to 3% were widely cited as a catalyst that unnerved equity markets, the gradual rise in yields to 3% in April coincided with generally positive equity market performance. U.S. equity markets managed to post modest gains each month of the second quarter, even as increasing tensions around a possible global trade war contributed to a two week selloff in U.S. shares to close the quarter.

The market environment during the third quarter in many ways mimicked what had already transpired throughout much of 2018. The Index surpassed the 1990s bull market to enter into the longest bull market ever – setting all-time highs along the way. The final tallies on second quarter earnings played their part as S&P 500 companies delivered earnings growth of nearly 25% on a year-over-year basis, with more than 3 out of 4 companies beating expectations. Large cap stocks, as represented by the S&P 500, displayed the most uninterrupted progress during the third quarter – posting an advance of approximately 7.7%.

In what is usually a seasonally favorable period, in Q4 of 2018, US equities exhibited their worst quarterly performance since 2011 when the market was facing debt ceiling negotiations and a credit rating downgrade from Standard & Poor’s. Although volatility prevailed during the entirety of the quarter, October and December were particularly vicious. Both months started out with building optimism based on improved outlooks for trade deals. In October, the United States, Canada and Mexico came to terms on a trade agreement which briefly lifted spirits. Meanwhile, December’s arrival was met with a trade truce between the United States and China based on discussions at the G20 meeting in Argentina. However, a host of factors relating to rising interest rates, economic growth concerns and systematic or algorithmic trading strategies stifled those short-lived rallies and sent the S&P 500 down approximately 13.5% for the quarter. This brought the index to a final return of–4.38% for the year.

The Portfolio invested in futures to achieve the desired exposure during the Reporting Period.

On an individual security level, the top positive contributors to the Fund’s performance during the Reporting Period were: Microsoft Corporation, Amazon.com Inc., and Merck & Co., Inc. The top negative contributors to the Fund’s performance during the Reporting Period were: Facebook, Inc. Class A, General Electric Company, and AT&T Inc.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

1

State Street Equity 500 Index Portfolio

Performance Summary (Unaudited)

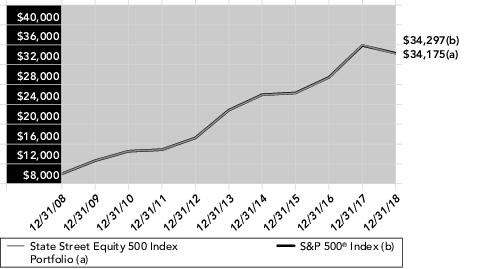

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line graph is based on cumulative total return.

Performance as of December 31, 2018

| | | | | |

| | | Total Return

One Year Ended

December 31, 2018 | Average Annual

Total Return

Five Years Ended

December 31, 2018 | Average Annual

Total Return

Ten Years Ended

December 31, 2018 | |

| | State Street Equity 500 Index Portfolio | (4.98%) | 8.44% | 13.08% | |

| | S&P 500® Index(b) | (4.38%) | 8.49% | 13.12% | |

| | | | | |

| (b) | The S&P 500 Index includes five hundred (500) selected companies, all of which are listed on national stock exchanges and spans over 25 separate industry groups. |

Total returns and performance graph information represent past performance and are not indicative of future results, which may be lower or higher than performance data quoted. Investment return and principal value of an investment will fluctuate so that an investor’s share, when redeemed, may be worth more or less than its original cost. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on fund distributions, sales, or the redemption of fund shares.

See accompanying notes to financial statements.

2

State Street Equity 500 Index Portfolio

PORTFOLIO STATISTICS (UNAUDITED)

Portfolio Composition as of December 31, 2018

| | | |

| | | % of Net Assets | |

| | Common Stocks | 98.0% | |

| | Short-Term Investments | 2.2 | |

| | Liabilities in Excess of Other Assets | (0.2) | |

| | TOTAL | 100.0% | |

(The composition is expressed as a percentage of net assets as of the date indicated. The composition will vary over time.)

Top Five Sectors as of December 31, 2018

| | | |

| | Description | % of Net Assets | |

| | Information Technology | 19.7% | |

| | Health Care | 15.2 | |

| | Financials | 13.1 | |

| | Communication Services | 9.9 | |

| | Consumer Discretionary | 9.7 | |

| | TOTAL | 67.6% | |

(The top five sectors are expressed as a percentage of net assets and may change over time.)

See accompanying notes to financial statements.

3

STATE STREET MASTER FUNDS

STATE STREET EQUITY 500 INDEX PORTFOLIO

SCHEDULE OF INVESTMENTS

December 31, 2018

| Security Description | | | Shares | | Value |

| COMMON STOCKS — 98.0% | | | | | |

| COMMUNICATION SERVICES — 9.9% | | | | | |

Activision Blizzard, Inc.

| | | 47,700 | | $2,221,389 |

Alphabet, Inc. Class A (a)

| | | 19,123 | | 19,982,770 |

Alphabet, Inc. Class C (a)

| | | 19,645 | | 20,344,558 |

AT&T, Inc.

| | | 465,200 | | 13,276,808 |

Cars.com, Inc. (a)

| | | 1 | | 22 |

CBS Corp. Class B

| | | 20,418 | | 892,675 |

CenturyLink, Inc.

| | | 62,587 | | 948,193 |

Charter Communications, Inc. Class A (a)

| | | 11,400 | | 3,248,658 |

Comcast Corp. Class A

| | | 289,330 | | 9,851,686 |

Discovery, Inc. Class A (a)(b)

| | | 9,497 | | 234,956 |

Discovery, Inc. Class C (a)

| | | 20,660 | | 476,833 |

DISH Network Corp. Class A (a)

| | | 15,100 | | 377,047 |

Electronic Arts, Inc. (a)

| | | 19,021 | | 1,500,947 |

Facebook, Inc. Class (a)

| | | 153,307 | | 20,097,015 |

Interpublic Group of Cos., Inc.

| | | 23,128 | | 477,131 |

Netflix, Inc. (a)

| | | 27,896 | | 7,466,643 |

News Corp. Class A

| | | 28,814 | | 327,039 |

News Corp. Class B

| | | 7,500 | | 86,625 |

Omnicom Group, Inc. (b)

| | | 14,950 | | 1,094,938 |

Take-Two Interactive Software, Inc. (a)

| | | 7,600 | | 782,344 |

TripAdvisor, Inc. (a)

| | | 7,215 | | 389,177 |

Twenty-First Century Fox, Inc. Class A

| | | 67,809 | | 3,262,969 |

Twenty-First Century Fox, Inc. Class B

| | | 31,200 | | 1,490,736 |

Twitter, Inc. (a)

| | | 45,500 | | 1,307,670 |

Verizon Communications, Inc.

| | | 263,951 | | 14,839,325 |

Viacom, Inc. Class B

| | | 24,341 | | 625,564 |

Walt Disney Co.

| | | 94,893 | | 10,405,017 |

| | | | | | 136,008,735 |

| CONSUMER DISCRETIONARY — 9.7% | | | | | |

Advance Auto Parts, Inc.

| | | 4,300 | | 677,078 |

Amazon.com, Inc. (a)

| | | 26,302 | | 39,504,815 |

Aptiv PLC

| | | 16,181 | | 996,264 |

AutoZone, Inc. (a)

| | | 1,588 | | 1,331,284 |

Best Buy Co., Inc.

| | | 16,013 | | 848,048 |

Booking Holdings, Inc. (a)

| | | 3,008 | | 5,181,039 |

BorgWarner, Inc.

| | | 13,223 | | 459,367 |

CarMax, Inc. (a)(b)

| | | 11,997 | | 752,572 |

Carnival Corp.

| | | 24,649 | | 1,215,196 |

Chipotle Mexican Grill, Inc. (a)

| | | 1,614 | | 696,909 |

D.R. Horton, Inc.

| | | 22,479 | | 779,122 |

Darden Restaurants, Inc.

| | | 8,117 | | 810,564 |

Dollar General Corp.

| | | 16,287 | | 1,760,299 |

Dollar Tree, Inc. (a)

| | | 15,782 | | 1,425,430 |

eBay, Inc. (a)

| | | 59,258 | | 1,663,372 |

Expedia Group, Inc.

| | | 7,923 | | 892,526 |

Foot Locker, Inc.

| | | 8,000 | | 425,600 |

Ford Motor Co.

| | | 251,860 | | 1,926,729 |

| Security Description | | | Shares | | Value |

Gap, Inc.

| | | 15,364 | | $395,777 |

Garmin, Ltd.

| | | 7,360 | | 466,035 |

General Motors Co.

| | | 84,577 | | 2,829,101 |

Genuine Parts Co.

| | | 9,220 | | 885,304 |

Goodyear Tire & Rubber Co.

| | | 14,413 | | 294,169 |

H&R Block, Inc. (b)

| | | 12,851 | | 326,030 |

Hanesbrands, Inc. (b)

| | | 23,400 | | 293,202 |

Harley-Davidson, Inc.

| | | 10,385 | | 354,336 |

Hasbro, Inc. (b)

| | | 7,628 | | 619,775 |

Hilton Worldwide Holdings, Inc.

| | | 18,700 | | 1,342,660 |

Home Depot, Inc.

| | | 72,010 | | 12,372,758 |

Kohl's Corp.

| | | 11,188 | | 742,212 |

L Brands, Inc.

| | | 15,246 | | 391,365 |

Leggett & Platt, Inc.

| | | 9,844 | | 352,809 |

Lennar Corp. Class A

| | | 18,125 | | 709,594 |

LKQ Corp. (a)

| | | 20,800 | | 493,584 |

Lowe's Cos., Inc.

| | | 51,012 | | 4,711,468 |

Macy's, Inc.

| | | 17,961 | | 534,879 |

Marriott International, Inc. Class A

| | | 17,852 | | 1,938,013 |

Mattel, Inc. (a)(b)

| | | 17,143 | | 171,259 |

McDonald's Corp.

| | | 49,115 | | 8,721,351 |

MGM Resorts International

| | | 31,800 | | 771,468 |

Michael Kors Holdings, Ltd. (a)

| | | 8,886 | | 336,957 |

Mohawk Industries, Inc. (a)

| | | 4,169 | | 487,606 |

Newell Brands, Inc. (b)

| | | 26,350 | | 489,846 |

NIKE, Inc. Class B

| | | 81,002 | | 6,005,488 |

Nordstrom, Inc. (b)

| | | 7,756 | | 361,507 |

Norwegian Cruise Line Holdings, Ltd. (a)

| | | 12,900 | | 546,831 |

O'Reilly Automotive, Inc. (a)

| | | 5,220 | | 1,797,403 |

PulteGroup, Inc.

| | | 16,443 | | 427,354 |

PVH Corp.

| | | 4,751 | | 441,605 |

Ralph Lauren Corp.

| | | 3,436 | | 355,489 |

Ross Stores, Inc.

| | | 23,344 | | 1,942,221 |

Royal Caribbean Cruises, Ltd.

| | | 11,300 | | 1,105,027 |

Starbucks Corp.

| | | 79,292 | | 5,106,405 |

Tapestry, Inc.

| | | 19,000 | | 641,250 |

Target Corp.

| | | 33,744 | | 2,230,141 |

Tiffany & Co.

| | | 6,581 | | 529,836 |

TJX Cos., Inc.

| | | 78,550 | | 3,514,327 |

Tractor Supply Co.

| | | 8,274 | | 690,383 |

Ulta Salon Cosmetics & Fragrance, Inc. (a)

| | | 3,600 | | 881,424 |

Under Armour, Inc. Class A (a)(b)

| | | 14,376 | | 254,024 |

Under Armour, Inc. Class C (a)(b)

| | | 14,478 | | 234,109 |

VF Corp.

| | | 20,128 | | 1,435,931 |

Whirlpool Corp.

| | | 4,559 | | 487,220 |

Wynn Resorts, Ltd.

| | | 6,259 | | 619,078 |

Yum! Brands, Inc.

| | | 19,790 | | 1,819,097 |

| | | | | | 133,803,922 |

| CONSUMER STAPLES — 7.3% | | | | | |

Altria Group, Inc.

| | | 119,570 | | 5,905,562 |

See accompanying notes to financial statements.

4

STATE STREET MASTER FUNDS

STATE STREET EQUITY 500 INDEX PORTFOLIO

SCHEDULE OF INVESTMENTS (continued)

December 31, 2018

| Security Description | | | Shares | | Value |

Archer-Daniels-Midland Co.

| | | 35,692 | | $1,462,301 |

British American Tobacco PLC ADR

| | | 1 | | 32 |

Brown-Forman Corp. Class B

| | | 10,827 | | 515,149 |

Campbell Soup Co. (b)

| | | 12,083 | | 398,618 |

Church & Dwight Co., Inc.

| | | 16,200 | | 1,065,312 |

Clorox Co.

| | | 8,179 | | 1,260,711 |

Coca-Cola Co.

| | | 244,222 | | 11,563,912 |

Colgate-Palmolive Co.

| | | 55,679 | | 3,314,014 |

Conagra Brands, Inc.

| | | 32,051 | | 684,609 |

Constellation Brands, Inc. Class A

| | | 10,576 | | 1,700,832 |

Costco Wholesale Corp.

| | | 28,234 | | 5,751,548 |

Coty, Inc. Class A (a)

| | | 28,940 | | 189,846 |

Estee Lauder Cos., Inc. Class A

| | | 14,363 | | 1,868,626 |

General Mills, Inc.

| | | 37,022 | | 1,441,637 |

Hershey Co.

| | | 8,615 | | 923,356 |

Hormel Foods Corp. (b)

| | | 15,998 | | 682,795 |

J.M. Smucker Co.

| | | 7,355 | | 687,619 |

Kellogg Co.

| | | 15,907 | | 906,858 |

Kimberly-Clark Corp.

| | | 22,373 | | 2,549,180 |

Kraft Heinz Co.

| | | 40,251 | | 1,732,403 |

Kroger Co.

| | | 51,310 | | 1,411,025 |

Lamb Weston Holdings, Inc.

| | | 9,400 | | 691,464 |

McCormick & Co., Inc.

| | | 8,061 | | 1,122,414 |

Molson Coors Brewing Co. Class B

| | | 11,409 | | 640,730 |

Mondelez International, Inc. Class A

| | | 94,294 | | 3,774,589 |

Monster Beverage Corp. (a)

| | | 25,487 | | 1,254,470 |

PepsiCo, Inc.

| | | 89,938 | | 9,936,350 |

Philip Morris International, Inc.

| | | 98,587 | | 6,581,668 |

Procter & Gamble Co.

| | | 158,913 | | 14,607,283 |

Sysco Corp.

| | | 30,735 | | 1,925,855 |

Tyson Foods, Inc. Class A

| | | 19,191 | | 1,024,799 |

Walmart, Inc.

| | | 91,599 | | 8,532,447 |

Walgreens Boots Alliance, Inc.

| | | 51,713 | | 3,533,549 |

| | | | | | 99,641,563 |

| ENERGY — 5.2% | | | | | |

Anadarko Petroleum Corp.

| | | 32,944 | | 1,444,265 |

Apache Corp.

| | | 24,970 | | 655,463 |

Baker Hughes a GE Co.

| | | 33,794 | | 726,571 |

Cabot Oil & Gas Corp.

| | | 26,722 | | 597,237 |

Chevron Corp.

| | | 121,934 | | 13,265,200 |

Cimarex Energy Co.

| | | 6,042 | | 372,489 |

Concho Resources, Inc. (a)

| | | 12,300 | | 1,264,317 |

ConocoPhillips

| | | 73,203 | | 4,564,207 |

Devon Energy Corp.

| | | 30,550 | | 688,597 |

Diamondback Energy, Inc.

| | | 9,700 | | 899,190 |

EOG Resources, Inc.

| | | 37,063 | | 3,232,264 |

Exxon Mobil Corp.

| | | 270,972 | | 18,477,581 |

Halliburton Co.

| | | 56,167 | | 1,492,919 |

Helmerich & Payne, Inc.

| | | 7,974 | | 382,274 |

Hess Corp.

| | | 16,544 | | 670,032 |

HollyFrontier Corp.

| | | 10,400 | | 531,648 |

Kinder Morgan, Inc.

| | | 117,476 | | 1,806,781 |

| Security Description | | | Shares | | Value |

Marathon Oil Corp.

| | | 55,089 | | $789,976 |

Marathon Petroleum Corp.

| | | 44,584 | | 2,630,902 |

National Oilwell Varco, Inc.

| | | 24,341 | | 625,564 |

Newfield Exploration Co. (a)

| | | 12,385 | | 181,564 |

Noble Energy, Inc.

| | | 32,895 | | 617,110 |

Occidental Petroleum Corp.

| | | 47,935 | | 2,942,250 |

ONEOK, Inc.

| | | 26,304 | | 1,419,101 |

Phillips 66

| | | 27,392 | | 2,359,821 |

Pioneer Natural Resources Co.

| | | 10,924 | | 1,436,724 |

Schlumberger, Ltd.

| | | 89,093 | | 3,214,475 |

TechnipFMC PLC

| | | 29,109 | | 569,954 |

Valero Energy Corp.

| | | 27,686 | | 2,075,619 |

Williams Cos., Inc.

| | | 76,410 | | 1,684,841 |

| | | | | | 71,618,936 |

| FINANCIALS — 13.1% | | | | | |

Affiliated Managers Group, Inc.

| | | 3,376 | | 328,957 |

Aflac, Inc.

| | | 49,574 | | 2,258,591 |

Allstate Corp.

| | | 22,467 | | 1,856,448 |

American Express Co.

| | | 44,552 | | 4,246,697 |

American International Group, Inc.

| | | 57,032 | | 2,247,631 |

Ameriprise Financial, Inc.

| | | 9,463 | | 987,653 |

Aon PLC

| | | 15,682 | | 2,279,536 |

Arthur J Gallagher & Co.

| | | 12,000 | | 884,400 |

Assurant, Inc.

| | | 3,946 | | 352,930 |

Bank of America Corp.

| | | 582,066 | | 14,342,106 |

Bank of New York Mellon Corp.

| | | 58,891 | | 2,771,999 |

BB&T Corp.

| | | 50,039 | | 2,167,690 |

Berkshire Hathaway, Inc. Class B (a)

| | | 124,619 | | 25,444,707 |

BlackRock, Inc.

| | | 7,718 | | 3,031,785 |

Brighthouse Financial, Inc. (a)

| | | 7,075 | | 215,646 |

Capital One Financial Corp.

| | | 29,968 | | 2,265,281 |

Cboe Global Markets, Inc.

| | | 7,500 | | 733,725 |

Charles Schwab Corp.

| | | 77,189 | | 3,205,659 |

Chubb, Ltd.

| | | 29,241 | | 3,777,352 |

Cincinnati Financial Corp.

| | | 9,205 | | 712,651 |

Citigroup, Inc.

| | | 155,593 | | 8,100,172 |

Citizens Financial Group, Inc.

| | | 28,500 | | 847,305 |

CME Group, Inc.

| | | 22,992 | | 4,325,255 |

Comerica, Inc.

| | | 11,017 | | 756,758 |

Discover Financial Services

| | | 22,277 | | 1,313,898 |

E*TRADE Financial Corp.

| | | 16,989 | | 745,477 |

Everest Re Group, Ltd.

| | | 2,700 | | 587,952 |

Fifth Third Bancorp

| | | 41,054 | | 966,001 |

First Republic Bank

| | | 10,500 | | 912,450 |

Franklin Resources, Inc.

| | | 17,151 | | 508,699 |

Goldman Sachs Group, Inc.

| | | 21,988 | | 3,673,095 |

Hartford Financial Services Group, Inc.

| | | 22,230 | | 988,124 |

Huntington Bancshares, Inc.

| | | 70,265 | | 837,559 |

Intercontinental Exchange, Inc.

| | | 36,125 | | 2,721,296 |

Invesco, Ltd.

| | | 28,289 | | 473,558 |

Jefferies Financial Group, Inc.

| | | 17,509 | | 303,956 |

JPMorgan Chase & Co.

| | | 212,172 | | 20,712,231 |

KeyCorp

| | | 64,479 | | 953,000 |

See accompanying notes to financial statements.

5

STATE STREET MASTER FUNDS

STATE STREET EQUITY 500 INDEX PORTFOLIO

SCHEDULE OF INVESTMENTS (continued)

December 31, 2018

| Security Description | | | Shares | | Value |

Lincoln National Corp.

| | | 14,310 | | $734,246 |

Loews Corp.

| | | 16,912 | | 769,834 |

M&T Bank Corp.

| | | 9,234 | | 1,321,662 |

Marsh & McLennan Cos., Inc.

| | | 32,534 | | 2,594,587 |

MetLife, Inc.

| | | 64,526 | | 2,649,438 |

Moody's Corp.

| | | 11,034 | | 1,545,201 |

Morgan Stanley

| | | 84,955 | | 3,368,466 |

MSCI, Inc.

| | | 6,000 | | 884,580 |

Nasdaq, Inc.

| | | 6,925 | | 564,872 |

Northern Trust Corp.

| | | 13,910 | | 1,162,737 |

People's United Financial, Inc.

| | | 22,434 | | 323,723 |

PNC Financial Services Group, Inc.

| | | 29,642 | | 3,465,446 |

Principal Financial Group, Inc.

| | | 15,726 | | 694,617 |

Progressive Corp.

| | | 37,852 | | 2,283,611 |

Prudential Financial, Inc.

| | | 26,937 | | 2,196,712 |

Raymond James Financial, Inc.

| | | 7,800 | | 580,398 |

Regions Financial Corp.

| | | 68,043 | | 910,415 |

S&P Global, Inc.

| | | 15,998 | | 2,718,700 |

State Street Corp. (c)

| | | 24,347 | | 1,535,565 |

SunTrust Banks, Inc.

| | | 29,782 | | 1,502,204 |

SVB Financial Group (a)

| | | 3,500 | | 664,720 |

Synchrony Financial

| | | 42,871 | | 1,005,754 |

T Rowe Price Group, Inc.

| | | 15,120 | | 1,395,878 |

Torchmark Corp.

| | | 6,384 | | 475,800 |

Travelers Cos., Inc.

| | | 17,298 | | 2,071,436 |

Unum Group

| | | 14,124 | | 414,963 |

US Bancorp

| | | 98,130 | | 4,484,541 |

Wells Fargo & Co.

| | | 270,146 | | 12,448,328 |

Willis Towers Watson PLC

| | | 8,379 | | 1,272,435 |

Zions Bancorp

| | | 12,058 | | 491,243 |

| | | | | | 180,370,342 |

| HEALTH CARE — 15.2% | | | | | |

Abbott Laboratories

| | | 112,849 | | 8,162,368 |

AbbVie, Inc.

| | | 95,863 | | 8,837,610 |

ABIOMED, Inc. (a)

| | | 2,800 | | 910,112 |

Agilent Technologies, Inc.

| | | 20,275 | | 1,367,751 |

Alexion Pharmaceuticals, Inc. (a)

| | | 14,427 | | 1,404,613 |

Align Technology, Inc. (a)

| | | 4,500 | | 942,435 |

Allergan PLC

| | | 20,426 | | 2,730,139 |

AmerisourceBergen Corp.

| | | 10,552 | | 785,069 |

Amgen, Inc.

| | | 40,591 | | 7,901,850 |

Anthem, Inc.

| | | 16,419 | | 4,312,122 |

Baxter International, Inc.

| | | 31,070 | | 2,045,027 |

Becton Dickinson and Co.

| | | 17,177 | | 3,870,322 |

Biogen, Inc. (a)

| | | 12,947 | | 3,896,011 |

Boston Scientific Corp. (a)

| | | 87,477 | | 3,091,437 |

Bristol-Myers Squibb Co.

| | | 105,112 | | 5,463,722 |

Cardinal Health, Inc.

| | | 18,624 | | 830,630 |

Celgene Corp. (a)

| | | 45,065 | | 2,888,216 |

Centene Corp. (a)

| | | 13,100 | | 1,510,430 |

Cerner Corp. (a)

| | | 20,963 | | 1,099,300 |

Cigna Corp.

| | | 24,385 | | 4,631,169 |

Cooper Cos., Inc.

| | | 3,300 | | 839,850 |

CVS Health Corp.

| | | 82,933 | | 5,433,770 |

| Security Description | | | Shares | | Value |

Danaher Corp.

| | | 39,478 | | $4,070,971 |

DaVita, Inc. (a)

| | | 9,072 | | 466,845 |

DENTSPLY SIRONA, Inc.

| | | 14,366 | | 534,559 |

Edwards Lifesciences Corp. (a)

| | | 13,490 | | 2,066,263 |

Eli Lilly & Co.

| | | 60,057 | | 6,949,796 |

Gilead Sciences, Inc.

| | | 82,346 | | 5,150,742 |

HCA Healthcare, Inc.

| | | 17,300 | | 2,152,985 |

Henry Schein, Inc. (a)

| | | 9,700 | | 761,644 |

Hologic, Inc. (a)

| | | 17,600 | | 723,360 |

Humana, Inc.

| | | 8,817 | | 2,525,894 |

IDEXX Laboratories, Inc. (a)

| | | 5,400 | | 1,004,508 |

Illumina, Inc. (a)

| | | 9,300 | | 2,789,349 |

Incyte Corp. (a)

| | | 11,900 | | 756,721 |

Intuitive Surgical, Inc. (a)

| | | 7,256 | | 3,475,044 |

IQVIA Holdings, Inc. (a)

| | | 10,000 | | 1,161,700 |

Johnson & Johnson

| | | 171,641 | | 22,150,271 |

Laboratory Corp. of America Holdings (a)

| | | 6,447 | | 814,643 |

McKesson Corp.

| | | 12,231 | | 1,351,159 |

Medtronic PLC

| | | 85,704 | | 7,795,636 |

Merck & Co., Inc.

| | | 165,798 | | 12,668,625 |

Mettler-Toledo International, Inc. (a)

| | | 1,600 | | 904,928 |

Mylan NV (a)

| | | 34,707 | | 950,972 |

Nektar Therapeutics (a)

| | | 10,700 | | 351,709 |

PerkinElmer, Inc.

| | | 7,032 | | 552,364 |

Perrigo Co. PLC

| | | 8,714 | | 337,668 |

Pfizer, Inc.

| | | 368,648 | | 16,091,485 |

Quest Diagnostics, Inc.

| | | 8,458 | | 704,298 |

Regeneron Pharmaceuticals, Inc. (a)

| | | 5,058 | | 1,889,163 |

ResMed, Inc.

| | | 9,500 | | 1,081,765 |

Stryker Corp.

| | | 20,195 | | 3,165,566 |

Thermo Fisher Scientific, Inc.

| | | 25,912 | | 5,798,846 |

UnitedHealth Group, Inc.

| | | 61,622 | | 15,351,273 |

Universal Health Services, Inc. Class B

| | | 5,300 | | 617,768 |

Varian Medical Systems, Inc. (a)

| | | 6,031 | | 683,373 |

Vertex Pharmaceuticals, Inc. (a)

| | | 16,348 | | 2,709,027 |

Waters Corp. (a)

| | | 5,015 | | 946,080 |

WellCare Health Plans, Inc. (a)

| | | 3,100 | | 731,879 |

Zimmer Biomet Holdings, Inc.

| | | 13,427 | | 1,392,648 |

Zoetis, Inc.

| | | 30,228 | | 2,585,703 |

| | | | | | 209,171,183 |

| INDUSTRIALS — 9.0% | | | | | |

3M Co.

| | | 37,043 | | 7,058,173 |

Alaska Air Group, Inc.

| | | 8,200 | | 498,970 |

Allegion PLC

| | | 5,437 | | 433,383 |

American Airlines Group, Inc. (b)

| | | 24,400 | | 783,484 |

AMETEK, Inc.

| | | 15,101 | | 1,022,338 |

AO Smith Corp.

| | | 9,700 | | 414,190 |

Arconic, Inc.

| | | 28,263 | | 476,514 |

Boeing Co.

| | | 33,624 | | 10,843,740 |

C.H. Robinson Worldwide, Inc.

| | | 8,582 | | 721,660 |

Caterpillar, Inc.

| | | 37,555 | | 4,772,114 |

See accompanying notes to financial statements.

6

STATE STREET MASTER FUNDS

STATE STREET EQUITY 500 INDEX PORTFOLIO

SCHEDULE OF INVESTMENTS (continued)

December 31, 2018

| Security Description | | | Shares | | Value |

Cintas Corp.

| | | 5,722 | | $961,239 |

Copart, Inc. (a)

| | | 13,200 | | 630,696 |

CSX Corp.

| | | 50,859 | | 3,159,870 |

Cummins, Inc.

| | | 9,844 | | 1,315,552 |

Deere & Co.

| | | 20,954 | | 3,125,708 |

Delta Air Lines, Inc.

| | | 39,466 | | 1,969,353 |

Dover Corp.

| | | 8,545 | | 606,268 |

Eaton Corp. PLC

| | | 28,199 | | 1,936,143 |

Emerson Electric Co.

| | | 40,469 | | 2,418,023 |

Equifax, Inc.

| | | 7,595 | | 707,322 |

Expeditors International of Washington, Inc.

| | | 11,844 | | 806,458 |

Fastenal Co.

| | | 17,642 | | 922,500 |

FedEx Corp.

| | | 15,750 | | 2,540,948 |

Flowserve Corp.

| | | 9,555 | | 363,281 |

Fluor Corp.

| | | 9,256 | | 298,043 |

Fortive Corp.

| | | 19,281 | | 1,304,552 |

Fortune Brands Home & Security, Inc.

| | | 10,100 | | 383,699 |

General Dynamics Corp.

| | | 17,789 | | 2,796,609 |

General Electric Co.

| | | 560,249 | | 4,241,085 |

Harris Corp.

| | | 7,498 | | 1,009,606 |

Honeywell International, Inc.

| | | 47,003 | | 6,210,036 |

Huntington Ingalls Industries, Inc.

| | | 2,800 | | 532,868 |

IHS Markit, Ltd. (a)

| | | 23,400 | | 1,122,498 |

Illinois Tool Works, Inc.

| | | 19,571 | | 2,479,450 |

Ingersoll-Rand PLC

| | | 15,116 | | 1,379,033 |

Jacobs Engineering Group, Inc.

| | | 7,057 | | 412,552 |

JB Hunt Transport Services, Inc.

| | | 5,500 | | 511,720 |

Johnson Controls International PLC

| | | 58,993 | | 1,749,142 |

Kansas City Southern

| | | 7,004 | | 668,532 |

L3 Technologies, Inc.

| | | 5,165 | | 896,954 |

Lockheed Martin Corp.

| | | 15,890 | | 4,160,638 |

Masco Corp.

| | | 17,839 | | 521,612 |

Nielsen Holdings PLC

| | | 23,375 | | 545,339 |

Norfolk Southern Corp.

| | | 17,268 | | 2,582,257 |

Northrop Grumman Corp.

| | | 11,186 | | 2,739,451 |

PACCAR, Inc.

| | | 21,435 | | 1,224,796 |

Parker-Hannifin Corp.

| | | 8,414 | | 1,254,864 |

Pentair PLC

| | | 11,791 | | 445,464 |

Quanta Services, Inc.

| | | 9,993 | | 300,789 |

Raytheon Co.

| | | 18,436 | | 2,827,161 |

Republic Services, Inc.

| | | 13,414 | | 967,015 |

Robert Half International, Inc.

| | | 6,974 | | 398,913 |

Rockwell Automation, Inc.

| | | 7,479 | | 1,125,440 |

Rollins, Inc.

| | | 9,450 | | 341,145 |

Roper Technologies, Inc.

| | | 6,735 | | 1,795,012 |

Snap-on, Inc.

| | | 3,572 | | 518,976 |

Southwest Airlines Co.

| | | 31,927 | | 1,483,967 |

Stanley Black & Decker, Inc.

| | | 9,650 | | 1,155,491 |

Textron, Inc.

| | | 14,806 | | 680,928 |

TransDigm Group, Inc. (a)

| | | 3,100 | | 1,054,186 |

Union Pacific Corp.

| | | 47,338 | | 6,543,532 |

| Security Description | | | Shares | | Value |

United Continental Holdings, Inc. (a)

| | | 14,200 | | $1,188,966 |

United Parcel Service, Inc. Class B

| | | 44,255 | | 4,316,190 |

United Rentals, Inc. (a)

| | | 5,600 | | 574,168 |

United Technologies Corp.

| | | 51,879 | | 5,524,076 |

Verisk Analytics, Inc. (a)

| | | 10,300 | | 1,123,112 |

W.W. Grainger, Inc.

| | | 2,712 | | 765,760 |

Waste Management, Inc.

| | | 24,704 | | 2,198,409 |

Xylem, Inc.

| | | 11,434 | | 762,877 |

| | | | | | 123,604,840 |

| INFORMATION TECHNOLOGY — 19.7% | | | | | |

Accenture PLC Class A

| | | 40,482 | | 5,708,367 |

Adobe, Inc. (a)

| | | 31,213 | | 7,061,629 |

Advanced Micro Devices, Inc. (a)(b)

| | | 57,400 | | 1,059,604 |

Akamai Technologies, Inc. (a)

| | | 10,234 | | 625,093 |

Alliance Data Systems Corp.

| | | 2,904 | | 435,832 |

Amphenol Corp. Class A

| | | 19,280 | | 1,562,066 |

Analog Devices, Inc.

| | | 23,970 | | 2,057,345 |

ANSYS, Inc. (a)

| | | 5,600 | | 800,464 |

Apple, Inc.

| | | 288,564 | | 45,518,085 |

Applied Materials, Inc.

| | | 63,553 | | 2,080,725 |

Arista Networks, Inc. (a)

| | | 3,100 | | 653,170 |

Autodesk, Inc. (a)

| | | 14,270 | | 1,835,265 |

Automatic Data Processing, Inc.

| | | 28,265 | | 3,706,107 |

Broadcom, Inc.

| | | 26,635 | | 6,772,748 |

Broadridge Financial Solutions, Inc.

| | | 7,000 | | 673,750 |

Cadence Design Systems, Inc. (a)

| | | 18,500 | | 804,380 |

Cisco Systems, Inc.

| | | 286,629 | | 12,419,635 |

Citrix Systems, Inc.

| | | 8,578 | | 878,902 |

Cognizant Technology Solutions Corp. Class A

| | | 36,627 | | 2,325,082 |

Corning, Inc.

| | | 53,050 | | 1,602,640 |

DXC Technology Co.

| | | 18,191 | | 967,215 |

F5 Networks, Inc. (a)

| | | 3,759 | | 609,071 |

Fidelity National Information Services, Inc.

| | | 21,186 | | 2,172,624 |

Fiserv, Inc. (a)

| | | 26,184 | | 1,924,262 |

FleetCor Technologies, Inc. (a)

| | | 5,800 | | 1,077,176 |

FLIR Systems, Inc.

| | | 8,239 | | 358,726 |

Fortinet, Inc. (a)

| | | 9,200 | | 647,956 |

Gartner, Inc. (a)(b)

| | | 6,000 | | 767,040 |

Global Payments, Inc.

| | | 10,575 | | 1,090,600 |

Hewlett Packard Enterprise Co.

| | | 89,363 | | 1,180,485 |

HP, Inc.

| | | 102,163 | | 2,090,255 |

Intel Corp.

| | | 291,020 | | 13,657,569 |

International Business Machines Corp.

| | | 58,447 | | 6,643,670 |

Intuit, Inc.

| | | 16,526 | | 3,253,143 |

IPG Photonics Corp. (a)

| | | 2,500 | | 283,225 |

Jack Henry & Associates, Inc.

| | | 4,900 | | 619,948 |

Juniper Networks, Inc.

| | | 22,844 | | 614,732 |

See accompanying notes to financial statements.

7

STATE STREET MASTER FUNDS

STATE STREET EQUITY 500 INDEX PORTFOLIO

SCHEDULE OF INVESTMENTS (continued)

December 31, 2018

| Security Description | | | Shares | | Value |

Keysight Technologies, Inc. (a)

| | | 12,000 | | $744,960 |

KLA-Tencor Corp.

| | | 9,873 | | 883,535 |

Lam Research Corp.

| | | 9,581 | | 1,304,645 |

Mastercard, Inc. Class A

| | | 57,949 | | 10,932,079 |

Maxim Integrated Products, Inc.

| | | 17,800 | | 905,130 |

Microchip Technology, Inc. (b)

| | | 15,006 | | 1,079,232 |

Micron Technology, Inc. (a)

| | | 70,928 | | 2,250,545 |

Microsoft Corp.

| | | 494,777 | | 50,254,500 |

Motorola Solutions, Inc.

| | | 10,428 | | 1,199,637 |

NetApp, Inc.

| | | 16,843 | | 1,005,022 |

NVIDIA Corp.

| | | 38,912 | | 5,194,752 |

Oracle Corp.

| | | 162,770 | | 7,349,065 |

Paychex, Inc.

| | | 21,131 | | 1,376,685 |

PayPal Holdings, Inc. (a)

| | | 75,858 | | 6,378,899 |

Qorvo, Inc. (a)

| | | 7,600 | | 461,548 |

QUALCOMM, Inc. (b)

| | | 77,585 | | 4,415,362 |

Red Hat, Inc. (a)

| | | 11,330 | | 1,990,001 |

salesforce.com, Inc. (a)

| | | 48,505 | | 6,643,730 |

Seagate Technology PLC

| | | 15,076 | | 581,783 |

Skyworks Solutions, Inc.

| | | 11,800 | | 790,836 |

Symantec Corp.

| | | 39,403 | | 744,520 |

Synopsys, Inc. (a)

| | | 9,400 | | 791,856 |

TE Connectivity, Ltd.

| | | 21,649 | | 1,637,314 |

Texas Instruments, Inc.

| | | 61,106 | | 5,774,517 |

Total System Services, Inc.

| | | 10,899 | | 885,980 |

VeriSign, Inc. (a)

| | | 6,920 | | 1,026,167 |

Visa, Inc. Class A

| | | 112,040 | | 14,782,558 |

Western Digital Corp.

| | | 19,506 | | 721,137 |

Western Union Co.

| | | 27,940 | | 476,656 |

Xerox Corp.

| | | 15,823 | | 312,662 |

Xilinx, Inc.

| | | 16,042 | | 1,366,297 |

| | | | | | 270,800,196 |

| MATERIALS — 2.7% | | | | | |

Air Products & Chemicals, Inc.

| | | 14,007 | | 2,241,820 |

Albemarle Corp. (b)

| | | 7,100 | | 547,197 |

Avery Dennison Corp.

| | | 5,818 | | 522,631 |

Ball Corp.

| | | 21,216 | | 975,512 |

Celanese Corp. Series A

| | | 8,600 | | 773,742 |

CF Industries Holdings, Inc.

| | | 14,730 | | 640,902 |

DowDuPont, Inc.

| | | 146,132 | | 7,815,139 |

Eastman Chemical Co.

| | | 8,972 | | 655,943 |

Ecolab, Inc.

| | | 16,165 | | 2,381,913 |

FMC Corp.

| | | 8,622 | | 637,683 |

Freeport-McMoRan, Inc.

| | | 90,364 | | 931,653 |

International Flavors & Fragrances, Inc. (b)

| | | 6,280 | | 843,216 |

International Paper Co.

| | | 25,408 | | 1,025,467 |

Linde PLC

| | | 35,029 | | 5,465,925 |

LyondellBasell Industries NV Class A

| | | 20,652 | | 1,717,420 |

Martin Marietta Materials, Inc. (b)

| | | 4,055 | | 696,933 |

Mosaic Co.

| | | 20,816 | | 608,035 |

Newmont Mining Corp.

| | | 33,373 | | 1,156,374 |

Nucor Corp.

| | | 20,306 | | 1,052,054 |

Packaging Corp. of America

| | | 6,300 | | 525,798 |

| Security Description | | | Shares | | Value |

PPG Industries, Inc.

| | | 15,488 | | $1,583,338 |

Sealed Air Corp.

| | | 11,269 | | 392,612 |

Sherwin-Williams Co.

| | | 5,187 | | 2,040,877 |

Vulcan Materials Co.

| | | 8,390 | | 828,932 |

WestRock Co.

| | | 16,448 | | 621,077 |

| | | | | | 36,682,193 |

| REAL ESTATE — 2.9% | | | | | |

Alexandria Real Estate Equities, Inc. REIT

| | | 6,700 | | 772,108 |

American Tower Corp. REIT

| | | 28,382 | | 4,489,749 |

Apartment Investment & Management Co. Class A, REIT

| | | 9,765 | | 428,488 |

AvalonBay Communities, Inc. REIT

| | | 9,129 | | 1,588,902 |

Boston Properties, Inc. REIT

| | | 9,821 | | 1,105,354 |

CBRE Group, Inc. Class A (a)

| | | 20,108 | | 805,124 |

Crown Castle International Corp. REIT

| | | 26,642 | | 2,894,121 |

Digital Realty Trust, Inc. REIT

| | | 13,300 | | 1,417,115 |

Duke Realty Corp. REIT

| | | 22,500 | | 582,750 |

Equinix, Inc. REIT

| | | 5,138 | | 1,811,453 |

Equity Residential REIT

| | | 24,138 | | 1,593,349 |

Essex Property Trust, Inc. REIT

| | | 4,455 | | 1,092,411 |

Extra Space Storage, Inc. REIT

| | | 7,500 | | 678,600 |

Federal Realty Investment Trust REIT

| | | 4,600 | | 542,984 |

HCP, Inc. REIT

| | | 31,277 | | 873,567 |

Host Hotels & Resorts, Inc. REIT

| | | 48,759 | | 812,813 |

Iron Mountain, Inc. REIT

| | | 18,074 | | 585,778 |

Kimco Realty Corp. REIT

| | | 23,116 | | 338,649 |

Macerich Co. REIT

| | | 7,245 | | 313,564 |

Mid-America Apartment Communities, Inc. REIT

| | | 6,900 | | 660,330 |

Prologis, Inc. REIT

| | | 40,546 | | 2,380,861 |

Public Storage REIT

| | | 9,452 | | 1,913,179 |

Realty Income Corp. REIT

| | | 18,100 | | 1,141,024 |

Regency Centers Corp. REIT

| | | 10,499 | | 616,081 |

SBA Communications Corp. REIT (a)

| | | 7,100 | | 1,149,419 |

Simon Property Group, Inc. REIT

| | | 19,435 | | 3,264,886 |

SL Green Realty Corp. REIT

| | | 6,100 | | 482,388 |

UDR, Inc. REIT

| | | 17,800 | | 705,236 |

Ventas, Inc. REIT

| | | 22,403 | | 1,312,592 |

Vornado Realty Trust REIT

| | | 10,446 | | 647,965 |

Welltower, Inc. REIT

| | | 23,881 | | 1,657,580 |

Weyerhaeuser Co. REIT

| | | 49,998 | | 1,092,956 |

| | | | | | 39,751,376 |

| UTILITIES — 3.3% | | | | | |

AES Corp.

| | | 43,759 | | 632,755 |

Alliant Energy Corp.

| | | 14,700 | | 621,075 |

Ameren Corp.

| | | 16,456 | | 1,073,425 |

American Electric Power Co., Inc.

| | | 31,543 | | 2,357,524 |

See accompanying notes to financial statements.

8

STATE STREET MASTER FUNDS

STATE STREET EQUITY 500 INDEX PORTFOLIO

SCHEDULE OF INVESTMENTS (continued)

December 31, 2018

| Security Description | | | Shares | | Value |

American Water Works Co., Inc.

| | | 11,300 | | $1,025,701 |

CenterPoint Energy, Inc.

| | | 31,335 | | 884,587 |

CMS Energy Corp.

| | | 18,801 | | 933,470 |

Consolidated Edison, Inc.

| | | 19,600 | | 1,498,616 |

Dominion Energy, Inc.

| | | 42,068 | | 3,006,179 |

DTE Energy Co.

| | | 11,439 | | 1,261,722 |

Duke Energy Corp.

| | | 45,891 | | 3,960,393 |

Edison International

| | | 21,305 | | 1,209,485 |

Entergy Corp.

| | | 12,200 | | 1,050,054 |

Evergy, Inc.

| | | 16,499 | | 936,648 |

Eversource Energy

| | | 20,243 | | 1,316,605 |

Exelon Corp.

| | | 61,959 | | 2,794,351 |

FirstEnergy Corp.

| | | 29,729 | | 1,116,324 |

NextEra Energy, Inc.

| | | 30,257 | | 5,259,272 |

NiSource, Inc.

| | | 23,078 | | 585,027 |

NRG Energy, Inc.

| | | 19,998 | | 791,921 |

PG&E Corp. (a)

| | | 33,712 | | 800,660 |

Pinnacle West Capital Corp.

| | | 6,556 | | 558,571 |

PPL Corp.

| | | 44,756 | | 1,267,937 |

Public Service Enterprise Group, Inc.

| | | 32,336 | | 1,683,089 |

SCANA Corp.

| | | 9,501 | | 453,958 |

Sempra Energy

| | | 17,724 | | 1,917,559 |

Southern Co.

| | | 64,984 | | 2,854,097 |

WEC Energy Group, Inc.

| | | 20,287 | | 1,405,078 |

Xcel Energy, Inc.

| | | 33,700 | | 1,660,399 |

| | | | | | 44,916,482 |

TOTAL COMMON STOCKS

(Cost $455,091,918)

| | | | | 1,346,369,768 |

| | | | |

| SHORT-TERM INVESTMENTS — 2.2% | | | |

State Street Institutional U.S. Government Money Market Fund, Class G Shares 2.31% (d) (e)

| | 27,348,182 | 27,348,182 |

| Security Description | | | Shares | | Value |

State Street Navigator Securities Lending Portfolio II (c) (f)

| | | 2,502,193 | | $2,502,193 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $29,850,375)

| | | | | 29,850,375 |

TOTAL INVESTMENTS — 100.2%

(Cost $484,942,293)

| | | | | 1,376,220,143 |

LIABILITIES IN EXCESS OF OTHER ASSETS — (0.2)%

| | | | | (2,427,692) |

NET ASSETS — 100.0%

| | | | | $1,373,792,451 |

| (a) | Non-income producing security. |

| (b) | All or a portion of the shares of the security are on loan at December 31, 2018. |

| (c) | The Portfolio invested in an affiliated entity. Amounts related to these transactions during the period ended December 31, 2018 are shown in the Affiliate Table below. |

| (d) | The Portfolio invested in certain money market funds managed by SSGA Funds Management, Inc. Amounts related to these transactions during the period ended December 31, 2018 are shown in the Affiliate Table below. |

| (e) | The rate shown is the annualized seven-day yield at December 31, 2018. |

| (f) | Investment of cash collateral for securities loaned. |

| ADR | =American Depositary Receipt |

| REIT | =Real Estate Investment Trust |

At December 31, 2018, open futures contracts purchased were as follows:

| Description | | Number of

Contracts | | Expiration

Date | | Notional

Amount | | Value | | Unrealized

Appreciation/

Depreciation |

| E-Mini S&P 500 Index (long) | | 218 | | 03/15/2019 | | $28,521,589 | | $27,306,680 | | $(1,214,909) |

During the period ended December 31, 2018, average notional value related to futures contracts was $30,118,992 or2% of net assets.

See accompanying notes to financial statements.

9

STATE STREET MASTER FUNDS

STATE STREET EQUITY 500 INDEX PORTFOLIO

SCHEDULE OF INVESTMENTS (continued)

December 31, 2018

The following table summarizes the value of thePortfolio's investments according to the fair value hierarchy as of December 31, 2018.

| Description | | Level 1 –

Quoted Prices | | Level 2 –

Other Significant

Observable Inputs | | Level 3 –

Significant

Unobservable Inputs | | Total |

| ASSETS: | | | | | | | | |

| INVESTMENTS: | | | | | | | | |

Common Stocks

| | $1,346,369,768 | | $— | | $— | | $1,346,369,768 |

Short-Term Investments

| | 29,850,375 | | — | | — | | 29,850,375 |

TOTAL INVESTMENTS

| | $1,376,220,143 | | $— | | $— | | $1,376,220,143 |

LIABILITIES:

| | | | | | | | |

| OTHER FINANCIAL INSTRUMENTS: | | | | | | | | |

Futures Contracts(a)

| | (1,214,909) | | — | | — | | (1,214,909) |

TOTAL OTHER FINANCIAL INSTRUMENTS:

| | $(1,214,909) | | $— | | $— | | $(1,214,909) |

| (a) | Futures Contracts are valued at unrealized appreciation (depreciation). |

Affiliate Table

| | Number of

Shares Held

at

12/31/17 | | Value at

12/31/17 | | Cost of

Purchases | | Proceeds

from

Shares Sold | | Realized

Gain (Loss) | | Change in

Unrealized

Appreciation/

Depreciation | | Number of

Shares Held

at

12/31/18 | | Value at

12/31/18 | | Dividend

Income | | Capital

Gains

Distributions |

State Street Corp.

| 25,847 | | $2,522,926 | | $168,671 | | $324,786 | | $204,164 | | $(1,035,410) | | 24,347 | | $1,535,565 | | $43,170 | | $— |

State Street Institutional U.S. Government Money Market Fund, Class G Shares

| 27,556,254 | | 27,556,254 | | 252,651,950 | | 252,860,022 | | — | | — | | 27,348,182 | | 27,348,182 | | 460,985 | | — |

State Street Navigator Securities Lending Government Money Market Portfolio

| 818,690 | | 818,690 | | 32,435,236 | | 30,751,733 | | — | | — | | 2,502,193 | | 2,502,193 | | 11,485 | | — |

Total

| | | $30,897,870 | | $285,255,857 | | $283,936,541 | | $204,164 | | $(1,035,410) | | | | $31,385,940 | | $515,640 | | $— |

See accompanying notes to financial statements.

10

STATE STREET MASTER FUNDS

STATE STREET EQUITY 500 INDEX PORTFOLIO

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2018

| ASSETS | |

Investments in unaffiliated issuers, at value*

| $1,344,834,203 |

Investments in affiliated issuers, at value

| 31,385,940 |

Total Investments

| 1,376,220,143 |

Cash at broker

| 2,731,182 |

Cash

| 244 |

Receivable for investments sold

| 461,847 |

Dividends receivable — unaffiliated issuers

| 1,539,706 |

Dividends receivable — affiliated issuers

| 62,317 |

Securities lending income receivable — unaffiliated issuers

| 1,236 |

Securities lending income receivable — affiliated issuers

| 445 |

Receivable from Adviser

| 3,701 |

TOTAL ASSETS

| 1,381,020,821 |

| LIABILITIES | |

Payable upon return of securities loaned

| 2,502,193 |

Payable for investments purchased

| 3,468,683 |

Payable to broker – accumulated variation margin on open futures contracts

| 1,213,915 |

Advisory fee payable

| 43,579 |

TOTAL LIABILITIES

| 7,228,370 |

NET ASSETS

| $1,373,792,451 |

| COST OF INVESTMENTS: | |

Investments in unaffiliated issuers

| $454,306,739 |

Investments in affiliated issuers

| 30,635,554 |

Total cost of investments

| $484,942,293 |

* Includes investments in securities on loan, at value

| $14,346,572 |

See accompanying notes to financial statements.

11

STATE STREET MASTER FUNDS

STATE STREET EQUITY 500 INDEX PORTFOLIO

STATEMENT OF OPERATIONS

For the Year Ended December 31, 2018

| INVESTMENT INCOME | |

Interest income — unaffiliated issuers

| $10,093 |

Dividend income — unaffiliated issuers

| 30,925,473 |

Dividend income — affiliated issuers

| 504,155 |

Unaffiliated securities lending income

| 19,079 |

Affiliated securities lending income

| 11,485 |

Foreign taxes withheld

| (120,794) |

TOTAL INVESTMENT INCOME (LOSS)

| 31,349,491 |

| EXPENSES | |

Advisory fee

| 701,914 |

TOTAL EXPENSES

| 701,914 |

NET INVESTMENT INCOME (LOSS)

| $30,647,577 |

| REALIZED AND UNREALIZED GAIN (LOSS) | |

| Net realized gain (loss) on: | |

Investments — unaffiliated issuers

| 149,701,126 |

Investments — affiliated issuers

| 204,164 |

Futures contracts

| (826,985) |

Net realized gain (loss)

| 149,078,305 |

| Net change in unrealized appreciation/depreciation on: | |

Investments — unaffiliated issuers

| (235,611,250) |

Investments — affiliated issuers

| (1,035,410) |

Futures contracts

| (1,704,289) |

Net change in unrealized appreciation/depreciation

| (238,350,949) |

NET REALIZED AND UNREALIZED GAIN (LOSS)

| (89,272,644) |

NET INCREASE (DECREASE) IN NET ASSETS FROM OPERATIONS

| $(58,625,067) |

See accompanying notes to financial statements.

12

STATE STREET MASTER FUNDS

STATE STREET EQUITY 500 INDEX PORTFOLIO

STATEMENTS OF CHANGES IN NET ASSETS

| | Year Ended

12/31/18 | | Year Ended

12/31/17 |

| INCREASE (DECREASE) IN NET ASSETS FROM OPERATIONS: | | | |

Net investment income (loss)

| $30,647,577 | | $31,216,140 |

Net realized gain (loss)

| 149,078,305 | | 96,690,402 |

Net change in unrealized appreciation/depreciation

| (238,350,949) | | 183,011,705 |

Net increase (decrease) in net assets resulting from operations

| (58,625,067) | | 310,918,247 |

| FROM BENEFICIAL INTEREST TRANSACTIONS: | | | |

Contributions

| 70,287,455 | | 44,261,255 |

Withdrawals

| (317,119,601) | | (194,742,512) |

Net increase (decrease) in net assets from capital transactions

| (246,832,146) | | (150,481,257) |

Net increase (decrease) in net assets during the period

| (305,457,213) | | 160,436,990 |

Net assets at beginning of period

| 1,679,249,664 | | 1,518,812,674 |

NET ASSETS AT END OF PERIOD

| $1,373,792,451 | | $1,679,249,664 |

See accompanying notes to financial statements.

13

STATE STREET EQUITY 500 INDEX PORTFOLIO

FINANCIAL HIGHLIGHTS

Selected data for a share outstanding throughout each period

| | Year

Ended

12/31/18 | | Year

Ended

12/31/17 | | Year

Ended

12/31/16 | | Year

Ended

12/31/15 | | Year

Ended

12/31/14 |

Total return (a)

| (4.98)% | | 22.42%(b) | | 11.90% | | 1.41% | | 13.62% |

| Ratios and Supplemental Data: | | | | | | | | | |

Net assets, end of period (in 000s)

| $1,373,792 | | $1,679,250 | | $1,518,813 | | $1,601,598 | | $2,869,323 |

| Ratios to average net assets: | | | | | | | | | |

Total expenses

| 0.05% | | 0.05% | | 0.05% | | 0.05% | | 0.050% |

Net expenses

| 0.05% | | 0.05% | | 0.04% | | 0.05% | | 0.05% |

Net investment income (loss)

| 1.96% | | 1.98% | | 2.18% | | 2.00% | | 1.98% |

Portfolio turnover rate

| 4% | | 2% | | 5% | | 7%(c) | | 2%(c) |

| (a) | Results represent past performance and are not indicative of future results. Total return for periods of less than one year are not annualized. |

| (b) | Reflects a non-recurring litigation payment received by the Portfolio from State Street Corp., an affiliate, which amounted to less than $0.01 per share outstanding as of March 8, 2017. This payment resulted in an increase to total return less than of 0.005% for the period ended December 31, 2017. |

| (c) | Portfolio turnover rate excludes in-kind security transactions. |

See accompanying notes to financial statements.

14

STATE STREET EQUITY 500 INDEX PORTFOLIO

NOTES TO FINANCIAL STATEMENTS

December 31, 2018

1. Organization

State Street Master Funds (the “Trust”), a Massachusetts business trust registered under the Investment Company Act of 1940, as amended (“1940 Act”), is an open-end management investment company.

As of December 31, 2018, the Trust consists of six (6) series (and corresponding classes, each of which have the same rights and privileges, including voting rights), each of which represents a separate series of beneficial interest in the Trust. The State Street Equity 500 Index Portfolio (the “Portfolio”) is authorized to issue an unlimited number of non transferable beneficial interests. The financial statements herein relate only to:

| Fund | Commencement of Operations | Diversification Classification |

| State Street Equity 500 Index Portfolio | March 1, 2000 | Diversified |

Under the Trust’s organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust enters into contracts with service providers that contain general indemnification clauses. The Trust’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Trust that have not yet occurred.

2. Summary of Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Trust in the preparation of its financial statements:

The preparation of financial statements in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”) requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates. The Portfolio is an investment company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies.

Security Valuation

The Portfolio's investments are valued at fair value each day that the New York Stock Exchange (“NYSE”) is open and, for financial reporting purposes, as of the report date should the reporting period end on a day that the NYSE is not open. Fair value is generally defined as the price a fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. By its nature, a fair value price is a good faith estimate of the valuation in a current sale and may not reflect an actual market price. The investments of the Portfolio are valued pursuant to the policy and procedures developed by the Oversight Committee (the “Committee”) and approved by the Board of Trustees of the Trust (the “Board”). The Committee provides oversight of the valuation of investments for the Portfolio. The Board has responsibility for overseeing the determination of the fair value of investments.

Valuation techniques used to value the Portfolio's investments by major category are as follows:

• Equity investments traded on a recognized securities exchange for which market quotations are readily available are valued at the last sale price or official closing price, as applicable, on the primary market or exchange on which they trade. Equity investments traded on a recognized exchange for which there were no sales on that day are valued at the last published sale price or at fair value.

• Investments in registered investment companies (including money market funds) or other unitized pooled investment vehicles that are not traded on an exchange are valued at that day’s published net asset value (“NAV”) per share or unit.

• Exchange-traded futures contracts are valued at the closing settlement price on the primary market on which they are traded most extensively. Exchange-traded futures contracts traded on a recognized exchange for which there were no sales on that day are valued at the last reported sale price obtained from independent pricing services or brokers or at fair value.

STATE STREET EQUITY 500 INDEX PORTFOLIO

NOTES TO FINANCIAL STATEMENTS (continued)

December 31, 2018

In the event prices or quotations are not readily available or that the application of these valuation methods results in a price for an investment that is deemed to be not representative of the fair value of such investment, fair value will be determined in good faith by the Committee, in accordance with the valuation policy and procedures approved by the Board.

Various inputs are used in determining the value of the Portfolio's investments.

The Portfolio values its assets and liabilities at fair value using a fair value hierarchy consisting of three broad levels that prioritize the inputs to valuation techniques giving the highest priority to readily available unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements) when market prices are not readily available or reliable. The categorization of a value determined for an investment within the hierarchy is based upon the pricing transparency of the investment and is not necessarily an indication of the risk associated with investing in it.

The three levels of the fair value hierarchy are as follows:

• Level 1 – Unadjusted quoted prices in active markets for an identical asset or liability;

• Level 2 – Inputs other than quoted prices included within Level 1 that are observable for the asset or liability either directly or indirectly, including quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not considered to be active, inputs other than quoted prices that are observable for the asset or liability (such as exchange rates, financing terms, interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market-corroborated inputs; and

• Level 3 – Unobservable inputs for the asset or liability, including the Committee’s assumptions used in determining the fair value of investments.

The value of the Portfolio’s investments according to the fair value hierarchy as of December 31, 2018 is disclosed in the Portfolio’s Schedule of Investments.

Investment Transactions and Income Recognition

Investment transactions are accounted for on trade date for financial reporting purposes. Realized gains and losses from the sale or disposition of investments are determined using the identified cost method. Dividend income and capital gain distributions, if any, are recognized on the ex-dividend date, or when the information becomes available, net of any foreign taxes withheld at source, if any. Interest income is recorded daily on an accrual basis. Non-cash dividends received in the form of stock are recorded as dividend income at fair value.

Distributions received by the Portfolio may include a return of capital that is estimated by management. Such amounts are recorded as a reduction of the cost of investments or reclassified to capital gains.

All of the net investment income and realized and unrealized gains and losses from the security transactions of the Portfolio are allocated pro rata among the partners in the Portfolio on a daily basis based on each partner’s daily ownership percentage.

Expenses

Certain expenses, which are directly identifiable to a specific Portfolio, are applied to that Portfolio within the Trust. Other expenses which cannot be attributed to a specific Portfolio are allocated in such a manner as deemed equitable, taking into consideration the nature and type of expense and the relative net assets of the Portfolio within the Trust.

Foreign Taxes

The Portfolio may be subject to foreign taxes (a portion of which may be reclaimable) on income, stock dividends, realized and unrealized capital gains on investments or certain foreign currency transactions. Foreign taxes are recorded in accordance with SSGA Funds Management, Inc.’s (the “Adviser” or “SSGA FM”) understanding of the applicable foreign tax regulations and rates that exist in the foreign jurisdictions in which the Portfolio invests. These foreign taxes, if any, are paid by the

STATE STREET EQUITY 500 INDEX PORTFOLIO

NOTES TO FINANCIAL STATEMENTS (continued)

December 31, 2018

Portfolio and are reflected in the Statement of Operations, if applicable. Foreign taxes payable or deferred as of December 31, 2018, if any, are disclosed in the Portfolio’s Statement of Assets and Liabilities.

3. Derivative Financial Instruments

Futures Contracts

The Portfolio may enter into futures contracts to meet its objectives. A futures contract is a standardized, exchange-traded agreement to buy or sell a financial instrument at a set price on a future date. Upon entering into a futures contract, the Portfolio is required to deposit with the broker, cash or securities in an amount equal to the minimum initial margin requirements of the clearing house. Subsequent payments are made or received by the Portfolio equal to the daily change in the contract value, accumulated, exchange rates, and or other transactional fees. The accumulation of those payments are recorded as variation margin receivable or payable with a corresponding offset to unrealized gains or losses. The Portfolio recognizes a realized gain or loss when the contract is closed.

Losses may arise if the value of a futures contract decreases due to unfavorable changes in the market rates or values of the underlying instrument during the term of the contract or if the counterparty does not perform under the contract. The use of futures contracts also involves the risk that the movements in the price of the futures contracts do not correlate with the movement of the assets underlying such contracts.

For the period ended December 31, 2018, the Portfolio entered into futures contracts for cash equitization, to reduce tracking error and to facilitate daily liquidity.

The following tables summarize the value of the Portfolio's derivative instruments as of December 31, 2018, and the related location in the accompanying Statement of Assets and Liabilities and Statement of Operations, presented by primary underlying risk exposure:

| | Liability Derivatives |

| | Interest Rate

Contracts

Risk | | Foreign

Exchange

Contracts

Risk | | Credit

Contracts

Risk | | Equity

Contracts

Risk | | Commodity

Contracts

Risk | | Total |

| State Street Equity 500 Index Portfolio | | | | | | | | | | | |

Futures Contracts

| $— | | $— | | $— | | $(1,213,915) | | $— | | $(1,213,915) |

| | Net Realized Gain (Loss) |

| | Interest Rate

Contracts

Risk | | Foreign

Exchange

Contracts

Risk | | Credit

Contracts

Risk | | Equity

Contracts

Risk | | Commodity

Contracts

Risk | | Total |

| State Street Equity 500 Index Portfolio | | | | | | | | | | | |

Futures Contracts

| $— | | $— | | $— | | $(826,985) | | $— | | $(826,985) |

| | Net Change in Unrealized Appreciation (Depreciation) |

| | Interest Rate

Contracts

Risk | | Foreign

Exchange

Contracts

Risk | | Credit

Contracts

Risk | | Equity

Contracts

Risk | | Commodity

Contracts

Risk | | Total |

| State Street Equity 500 Index Portfolio | | | | | | | | | | | |

Futures Contracts

| $— | | $— | | $— | | $(1,704,289) | | $— | | $(1,704,289) |

STATE STREET EQUITY 500 INDEX PORTFOLIO

NOTES TO FINANCIAL STATEMENTS (continued)

December 31, 2018

4. Fees and Transactions with Affiliates

Advisory, Administrator, Custodian, Sub-Administrator and Transfer Agent Fees

The Portfolio has entered into an Investment Advisory Agreement with SSGA FM. The Adviser is a wholly-owned subsidiary of State Street Global Advisors, Inc., which itself is a wholly-owned subsidiary of State Street Corporation ("State Street"). As compensation for the Adviser’s services to the Portfolio as investment adviser and administrator and State Street’s services to the Portfolio as sub-administrator, custodian and transfer agent (and for assuming ordinary operating expenses of the Portfolio, including ordinary legal and audit expenses), the Portfolio is obligated to pay a fee for the services in the amount of 0.045% of average daily net assets on an annual basis, accrued daily and paid monthly.

Other Transactions with Affiliates - Securities Lending

State Street, an affiliate of the Portfolio, acts as the securities lending agent for the Portfolio, pursuant to an amended and restated securities lending authorization agreement dated January 6, 2017, as amended December 7, 2018.

Proceeds collected by State Street on investment of cash collateral or any fee income are allocated as follows (after deduction of such other amounts payable to State Street under the terms of the securities lending agreement): 85% payable to the Portfolio, and 15% payable to State Street.

In addition, cash collateral from lending activities is invested in the State Street Navigator Securities Lending Portfolio II, an affiliated money market fund, for which SSGA FM serves as investment adviser. See Note 8 for additional information regarding securities lending.

Other Transactions with Affiliates

The Portfolio may invest in affiliated entities, including securities issued by State Street Corporation, affiliated funds, or entities deemed to be affiliates as a result of the Portfolio owning more than five percent of the entity’s voting securities or outstanding shares. Amounts relating to these transactions during the period ended December 31, 2018, are disclosed in the Schedule of Investments.

5. Trustees’ Fees

The fees and expenses of the Trust’s trustees, who are not “interested persons” of the Trust, as defined in the 1940 Act (“Independent Trustees”), are paid directly by the Portfolio. The Independent Trustees are reimbursed for travel and other out-of-pocket expenses in connection with meeting attendance and industry seminars.

6. Investment Transactions

Purchases and sales of investments (excluding in-kind transactions and short term investments) for the period ended December 31, 2018, were as follows:

| | Purchases | | Sales |

State Street Equity 500 Index Portfolio

| $54,027,233 | | $218,883,200 |

7. Income Tax Information

The Portfolio is not required to pay federal income taxes on its net investment income and net capital gains because it is treated as a partnership for federal income tax purposes. All interest, gains and losses of the Portfolio are deemed to have been “passed through” to the Portfolio’s partners in proportion to their holdings in the Portfolio, regardless of whether such items have been distributed by the Portfolio. Each partner is responsible for its tax liability based on its distributive share; therefore, no provision has been made for federal income taxes.

STATE STREET EQUITY 500 INDEX PORTFOLIO

NOTES TO FINANCIAL STATEMENTS (continued)

December 31, 2018

The Portfolio files federal and various state and local tax returns as required. No income tax returns are currently under examination. Generally, the federal returns are subject to examination by the Internal Revenue Service for a period of three years from date of filing, while the state returns may remain open for an additional year depending upon jurisdiction. SSGA FM has analyzed the Portfolio’s tax positions taken on tax returns for all open years and does not believe there are any uncertain tax positions that would require recognition of a tax liability.

As of December 31, 2018, gross unrealized appreciation and gross unrealized depreciation of investments and other financial instruments based on cost for federal income tax purposes were as follows:

| | Tax

Cost | | Gross

Unrealized

Appreciation | | Gross

Unrealized

Depreciation | | Net Unrealized

Appreciation

(Depreciation) |

State Street Equity 500 Index Portfolio

| $536,713,731 | | $916,094,259 | | $77,801,762 | | $838,292,497 |

8. Securities Lending

The Portfolio may lend securities to qualified broker-dealers or institutional investors. The loans are secured at all times by cash, cash equivalents or U.S. government securities in an amount at least equal to the market value of the securities loaned, plus accrued interest and dividends, determined on a daily basis and adjusted accordingly. The value of the collateral with respect to a loaned security may be temporarily more or less than the value of a security due to market fluctuations of securities values. With respect to each loan, if on any U.S. business day the aggregate market value of securities collateral plus cash collateral is less than the aggregate market value of the securities which are subject to the loan, the borrower will be notified to provide additional collateral on the next business day.

The Portfolio will regain record ownership of loaned securities to exercise certain beneficial rights; however, the Portfolio may bear the risk of delay in recovery of, or even loss of rights in the securities loaned should the borrower fail financially. In addition, the Portfolio will bear the risk of loss of any cash collateral that it may invest. The Portfolio receives compensation for lending its securities from interest or dividends earned on the cash, cash equivalents or U.S. government securities held as collateral, net of fee rebates paid to the borrower and net of fees paid to State Street as the lending agent. Additionally, the Portfolio will receive a fee from the borrower for non-cash collateral equal to a percentage of the market value of the loaned securities.

The market value of securities on loan as of December 31, 2018, and the value of the invested cash collateral are disclosed in the Portfolio's Statement of Assets and Liabilities. Non-cash collateral is not disclosed in the Portfolio's Statement of Assets and Liabilities as it is held by the lending agent on behalf of the Portfolio, and the Portfolio does not have the ability to re-hypothecate those securities. Securities lending income, as disclosed in the Portfolio's Statement of Operations, represents the income earned from the non-cash collateral and the investment of cash collateral, net of fee rebates paid to the borrower and net of fees paid to State Street as lending agent.

The following is a summary of the Portfolio’s securities lending agreements and related cash and non-cash collateral received as of December 31, 2018:

| Fund | | Market Value of

Securities on Loan | | Cash

Collateral

Received | | Non-Cash

Collateral

Received* | | Total

Collateral

Received |

State Street Equity 500 Index Portfolio

| | $ 14,346,572 | | $ 2,502,193 | | $ 12,033,927 | | $ 14,536,120 |

| * | The non-cash collateral includes U.S. Treasuries and U.S. Government Agency securities. |

STATE STREET EQUITY 500 INDEX PORTFOLIO

NOTES TO FINANCIAL STATEMENTS (continued)

December 31, 2018

The following table reflects a breakdown of transactions accounted for as secured borrowings, the gross obligation by the type of collateral pledged or securities loaned, and the remaining contractual maturity of those transactions as of December 31, 2018:

| | | | | Remaining Contractual Maturity of the Agreements

As of December 31, 2018 |

| Fund | | Securities

Lending

Transactions | | Overnight

and

Continuous | | <30 Days | | Between

30 & 90

Days | | >90 Days | | Total

Borrowings | | Gross Amount

of Recognized

Liabilities for

Securities Lending Transactions |

State Street Equity 500 Index Portfolio

| | Common Stocks | | $2,502,193 | | $— | | $— | | $— | | $2,502,193 | | $2,502,193 |

9. Line of Credit

The Portfolio and other affiliated funds (each a “Participant” and, collectively, the “Participants”) participate in a $500 million revolving credit facility provided by a syndication of banks under which the Participants may borrow to fund shareholder redemptions. This agreement expires in October 2019 unless extended or renewed.

The Participants are charged an annual commitment fee which is calculated based on the unused portion of the shared credit line. Commitment fees are allocated among each of the Participants based on relative net assets. Commitment fees are ordinary fund operating expenses. A Participant incurs and pays the interest expense related to its borrowing. Interest is calculated at a rate per annum equal to the sum of 1% plus the greater of the New York Fed Bank Rate and 1-month LIBOR rate.

The Portfolio had no outstanding loans as of December 31, 2018.

10. Risks

Concentration Risk

As a result of the Portfolio's ability to invest a large percentage of its assets in obligations of issuers within the same country, state, region, currency or economic sector, an adverse economic, business or political development may affect the value of the Portfolio's investments more than if the Fund were more broadly diversified.

Market and Credit Risk

In the normal course of business, the Portfolio trades financial instruments and enters into transactions where risk of potential loss exists due to changes in the general economic conditions and fluctuations of the market (market risk). Additionally, the Portfolio may also be exposed to credit risk in the event that an issuer or guarantor fails to perform or that an institution or entity with which the Portfolio has unsettled or open transactions defaults.

11. New Accounting Pronouncements

In August 2018, the U.S. Securities and Exchange Commission (the “SEC”) released its Final Rule on Disclosure Update and Simplification (the “Final Rule”) which is intended to simplify an issuer’s disclosure compliance efforts by removing redundant or outdated disclosure requirements without significantly altering the mix of information provided to investors. The Portfolio has adopted the Final Rule for the current period.

12. Subsequent Events

Management has evaluated the impact of all subsequent events on the Portfolio through the date the financial statements were issued and has determined that there were no subsequent events requiring adjustment or disclosure in the financial statements.

STATE STREET MASTER FUNDS

STATE STREET EQUITY 500 INDEX PORTFOLIO

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Owners of Beneficial Interest and Board of Trustees of State Street Equity 500 Index Portfolio

Opinion on the Financial Statements