UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09599

STATE STREET MASTER FUNDS

(Exact name of registrant as specified in charter)

P.O. Box 5501

Boston, Massachusetts 02206

(Address of principal executive offices)(Zip code)

| | |

| (Name and Address of Agent for Service) | | Copy to: |

Joshua A. Weinberg, Esq. Vice President and Managing Counsel SSGA Funds Management, Inc. One Lincoln Street Boston, Massachusetts 02111 | | Timothy W. Diggins, Esq. Ropes & Gray 800 Boylston Street Boston, Massachusetts 02110-2624 |

Registrant’s telephone number, including area code: (617) 664-7037

Date of fiscal year end: December 31

Date of reporting period: December 31, 2015

| Item 1. | Shareholder Report. |

Annual Report

31 December 2015

State Street Master Funds

State Street Equity 500 Index Portfolio

State Street Master Funds

State Street Equity 500 Index Portfolio

Annual Report

December 31, 2015

Table of Contents

State Street Equity 500 Index Portfolio

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

The State Street Equity 500 Index Portfolio’s (the “Fund”) investment objective is to replicate as closely as possible, before expenses, the performance of the Standard & Poor’s 500 Index (the “S&P 500” or the “Index”). In seeking to achieve this objective, the Fund utilizes a passive management strategy designed to track the performance of the Index. The Fund also employs futures to maintain market exposure and otherwise assist in attempting to replicate the performance of the Index. During the 12-month period ended December 31, 2015 (the “Reporting Period”), the Fund invested in S&P 500 futures contracts to equitize the small amount of cash in the portfolio. Futures performance did not have a material impact on portfolio performance.

For the Reporting Period, the total return for the Fund was 1.41%, and the total return for the Index was 1.38%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. The expenses of managing the Fund, managing cash inflows to and outflows from the Fund and small security misweights contributed to the difference between the Fund’s performance and that of the Index.

After a turbulent January 2015 for equity markets, volatility subsided through the month of February as oil prices stabilized and the aggressive pace of global central bank actions taken the prior month moderated. In March, the Bureau of Labor Statistics reported better than expected employment numbers which potentially increased the likelihood that the U.S Federal Reserve (the “Fed”) would increase interest rates sooner rather than later. This possibility contributed to a selloff of gold and U.S. equities. However, the rout was short lived as news broke that the Fed would allow several large Wall Street banks to initiate or raise their dividends. U.S. equities rallied on the news.

Kicking off the second quarter of 2015, April provided a bumpy ride for investors exposed to a number of recent popular trends in the market. After rising for nine consecutive months on anticipated policy divergence between the Fed and other central banks, the U.S. dollar declined nearly 4% for the month, which reflected in part a softening in U.S. economic data and a later than expected start to Fed interest rate hikes. Global markets entered the month of May 2015 digesting an initial first quarter 2015 GDP report released in April that showed a much lower than expected 0.2% annualized rate of growth in the U.S. Despite the weak U.S. growth data, May opened with global interest rates continuing to rise sharply on the heels of a market selloff that began in late April 2015.

Markets in the third quarter of 2015 were unsettled by a steady stream of worrying headlines from Europe. After the market selloff in August, expectations that the Fed would make good on the median forecast of Fed Board members and bank presidents in June that interest rates would increase in two increments for the remainder of the year beginning in September 2015 were brought into question.

Contributing to a lackluster outcome for 2015 was a challenging environment for U.S. companies’ ability to earn a profit, evidenced by a year over year decline in the earnings of issuers listed on the Index. This falloff in earnings is most significantly attributable to the energy sector where a significant decline in oil prices through the end of September corresponded to a nearly identical decline in energy sector earnings. Excluding the energy sector, aggregate earnings growth for issuers included in the Index remained positive, though still soft given the impact on multinationals of the stronger U.S. dollar and the backdrop of subdued global growth.

1

State Street Master Funds

State Street Equity 500 Index Portfolio

MANAGEMENT DISCUSSION OF FUND PERFORMANCE — (continued)

After being battered to close the third quarter of 2015 on a rapidly deteriorating global growth outlook, equity markets found their footing in October to open the fourth quarter. The shift in market sentiment was aided by new policy commitments from global central banks to provide additional stimulus to combat the effects of a slowing global economy – commitments that were seemingly validated when the International Monetary Fund downgraded its forecast for global growth in early October. The fourth quarter proved a strong one for the Index, which finished positive for the three month period.

On an individual security level, the top positive contributors to the Fund’s performance were: Amazon.com, Inc., Microsoft Corp., and General Electric Co. The top negative contributors to the Fund’s performance were: Kinder Morgan, Inc. Class P, Exxon Mobil Corp., and QUALCOMM Inc.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions, and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

2

State Street Master Funds

State Street Equity 500 Index Portfolio

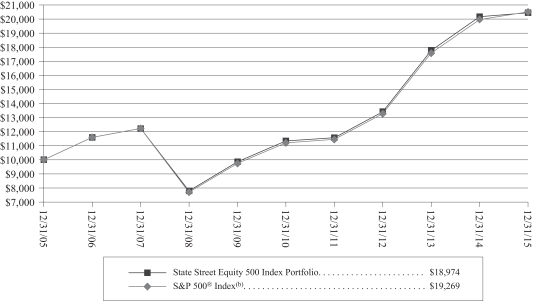

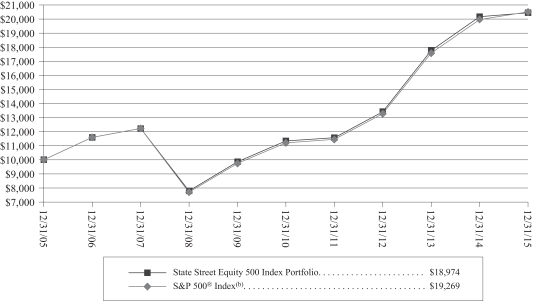

Growth of a $10,000 Investment (a)

Investment Performance (a)

For the Year Ended December 31, 2015

| | | | | | | | | | | | |

| | | Total Return

One Year Ended

December 31, 2015 | | | Total Return

Average Annual

Five Years Ended

December 31, 2015 | | | Total Return

Average Annual

Ten Years Ended

December 31, 2015 | |

| | | | |

State Street Equity 500 Index Portfolio | | | 1.41 | % | | | 12.52 | % | | | 7.28 | % |

| | | | |

S&P 500® Index(b) | | | 1.38 | % | | | 12.56 | % | | | 7.30 | % |

| (a) | Total returns and performance graph information represent past performance and are not indicative of future results, which may be lower or higher than performance data quoted. Investment return and principal value of an investment will fluctuate so that a partner’s share, when redeemed, may be worth more or less than its original cost. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on fund distributions, sales or the redemption of fund shares. |

| (b) | The Standard & Poor’s 500 Composite Stock Price Index (“S&P 500® Index”) is an unmanaged capitalization-weighted index of 500 widely held stocks recognized by investors to be representative of the U.S. stock market in general. It is not possible to invest directly in the S&P 500® Index. |

3

State Street Master Funds

State Street Equity 500 Index Portfolio

Portfolio Statistics (Unaudited)

| | | | |

Portfolio Composition* | | | December 31, 2015 | |

Common Stocks | | | 98.2 | % |

Money Market Fund | | | 2.1 | |

U.S. Government Security | | | 0.2 | |

Liabilities in Excess of Other Assets | | | (0.5 | ) |

Total | | | 100.0 | % |

| | | | |

Top Five Sectors (excluding short-term investments)* | | | December 31, 2015 | |

Information Technology | | | 20.3 | % |

Financials | | | 16.2 | |

Health Care | | | 14.9 | |

Consumer Discretionary | | | 12.7 | |

Consumer Staples | | | 9.9 | |

Industrials | | | 9.9 | |

Total | | | 83.9 | % |

| * | As a percentage of net assets as of the date indicated. The Portfolio’s composition will vary over time. |

See accompanying notes to financial statements.

4

State Street Master Funds

State Street Equity 500 Index Portfolio

Schedule of Investments

December 31, 2015

| | | | | | | | |

Security Description | | Shares | | | Value | |

| | | | | | | | |

COMMON STOCKS – 98.2% | | | | | | | | |

Consumer Discretionary – 12.7% | |

Advance Auto Parts, Inc. | | | 6,700 | | | $ | 1,008,417 | |

Amazon.com, Inc.(a) | | | 33,702 | | | | 22,778,845 | |

AutoNation, Inc.(a) | | | 7,269 | | | | 433,669 | |

AutoZone, Inc.(a) | | | 2,588 | | | | 1,920,063 | |

Bed Bath & Beyond, Inc.(a) | | | 14,630 | | | | 705,898 | |

Best Buy Co., Inc. | | | 25,813 | | | | 786,006 | |

BorgWarner, Inc. | | | 21,223 | | | | 917,470 | |

Cablevision Systems Corp. Class A | | | 18,012 | | | | 574,583 | |

CarMax, Inc.(a) | | | 18,797 | | | | 1,014,474 | |

Carnival Corp. | | | 40,349 | | | | 2,198,214 | |

CBS Corp. Class B, NVDR | | | 38,493 | | | | 1,814,175 | |

Chipotle Mexican Grill, Inc.(a) | | | 2,814 | | | | 1,350,298 | |

Coach, Inc. | | | 26,700 | | | | 873,891 | |

Comcast Corp. Class A | | | 215,065 | | | | 12,136,118 | |

D.R. Horton, Inc. | | | 29,279 | | | | 937,806 | |

Darden Restaurants, Inc. | | | 9,917 | | | | 631,118 | |

Delphi Automotive PLC | | | 25,581 | | | | 2,193,059 | |

Discovery Communications, Inc. Class A(a) | | | 12,597 | | | | 336,088 | |

Discovery Communications, Inc. Class C(a) | | | 23,197 | | | | 585,028 | |

Dollar General Corp. | | | 25,487 | | | | 1,831,751 | |

Dollar Tree, Inc.(a) | | | 19,382 | | | | 1,496,678 | |

Expedia, Inc. | | | 10,923 | | | | 1,357,729 | |

Ford Motor Co. | | | 338,760 | | | | 4,773,128 | |

Fossil Group, Inc.(a) | | | 3,917 | | | | 143,206 | |

GameStop Corp. Class A | | | 9,878 | | | | 276,979 | |

Gap, Inc. | | | 19,364 | | | | 478,291 | |

Garmin, Ltd. | | | 11,460 | | | | 425,968 | |

General Motors Co. | | | 126,077 | | | | 4,287,879 | |

Genuine Parts Co. | | | 14,220 | | | | 1,221,356 | |

Goodyear Tire & Rubber Co. | | | 23,813 | | | | 777,971 | |

H&R Block, Inc. | | | 20,651 | | | | 687,885 | |

Hanesbrands, Inc. | | | 36,500 | | | | 1,074,195 | |

Harley-Davidson, Inc. | | | 15,285 | | | | 693,786 | |

Harman International Industries, Inc. | | | 6,105 | | | | 575,152 | |

Hasbro, Inc. | | | 9,128 | | | | 614,862 | |

Home Depot, Inc. | | | 110,610 | | | | 14,628,173 | |

Interpublic Group of Cos., Inc. | | | 36,328 | | | | 845,716 | |

Johnson Controls, Inc. | | | 54,906 | | | | 2,168,238 | |

Kohl’s Corp. | | | 15,788 | | | | 751,982 | |

L Brands, Inc. | | | 23,046 | | | | 2,208,268 | |

Leggett & Platt, Inc. | | | 12,244 | | | | 514,493 | |

Lennar Corp. Class A | | | 15,425 | | | | 754,437 | |

Lowe’s Cos., Inc. | | | 81,312 | | | | 6,182,964 | |

Macy’s, Inc. | | | 25,761 | | | | 901,120 | |

Marriott International, Inc. Class A | | | 17,797 | | | | 1,193,111 | |

Mattel, Inc. | | | 32,943 | | | | 895,061 | |

McDonald’s Corp. | | | 80,815 | | | | 9,547,484 | |

Michael Kors Holdings, Ltd.(a) | | | 15,186 | | | | 608,351 | |

Mohawk Industries, Inc.(a) | | | 5,669 | | | | 1,073,652 | |

Netflix, Inc.(a) | | | 37,096 | | | | 4,243,040 | |

Newell Rubbermaid, Inc. | | | 24,251 | | | | 1,068,984 | |

News Corp. Class A | | | 28,814 | | | | 384,955 | |

News Corp. Class B | | | 15,000 | | | | 209,400 | |

NIKE, Inc. Class B | | | 119,002 | | | | 7,437,625 | |

Nordstrom, Inc. | | | 10,656 | | | | 530,775 | |

| | | | | | | | |

O’Reilly Automotive, Inc.(a) | | | 8,920 | | | | 2,260,506 | |

Omnicom Group, Inc. | | | 19,950 | | | | 1,509,417 | |

Priceline Group, Inc.(a) | | | 4,408 | | | | 5,619,980 | |

PulteGroup, Inc. | | | 27,643 | | | | 492,598 | |

PVH Corp. | | | 7,251 | | | | 534,036 | |

Ralph Lauren Corp. | | | 5,436 | | | | 606,005 | |

Ross Stores, Inc. | | | 35,944 | | | | 1,934,147 | |

Royal Caribbean Cruises, Ltd. | | | 14,600 | | | | 1,477,666 | |

Scripps Networks Interactive, Inc. Class A | | | 8,863 | | | | 489,326 | |

Signet Jewelers, Ltd. | | | 7,400 | | | | 915,306 | |

Staples, Inc. | | | 55,534 | | | | 525,907 | |

Starbucks Corp. | | | 130,992 | | | | 7,863,450 | |

Starwood Hotels & Resorts Worldwide, Inc. | | | 14,744 | | | | 1,021,464 | |

Target Corp. | | | 54,844 | | | | 3,982,223 | |

TEGNA, Inc. | | | 19,952 | | | | 509,175 | |

Tiffany & Co. | | | 10,881 | | | | 830,111 | |

Time Warner Cable, Inc. | | | 24,774 | | | | 4,597,807 | |

Time Warner, Inc. | | | 71,580 | | | | 4,629,079 | |

TJX Cos., Inc. | | | 57,275 | | | | 4,061,370 | |

Tractor Supply Co. | | | 11,074 | | | | 946,827 | |

TripAdvisor, Inc.(a) | | | 8,815 | | | | 751,479 | |

Twenty-First Century Fox, Inc. Class A | | | 102,309 | | | | 2,778,712 | |

Twenty-First Century Fox, Inc. Class B | | | 38,400 | | | | 1,045,632 | |

Under Armour, Inc. Class A(a) | | | 16,476 | | | | 1,328,130 | |

Urban Outfitters, Inc.(a) | | | 9,239 | | | | 210,187 | |

VF Corp. | | | 28,228 | | | | 1,757,193 | |

Viacom, Inc. Class B | | | 29,841 | | | | 1,228,256 | |

Walt Disney Co. | | | 133,593 | | | | 14,037,952 | |

Whirlpool Corp. | | | 7,259 | | | | 1,066,129 | |

Wyndham Worldwide Corp. | | | 11,446 | | | | 831,552 | |

Wynn Resorts, Ltd. | | | 6,959 | | | | 481,493 | |

Yum! Brands, Inc. | | | 36,990 | | | | 2,702,120 | |

| | | | | | | | |

| | | | | | | 203,085,100 | |

| | | | | | | | |

Consumer Staples – 9.9% | | | | | | | | |

Altria Group, Inc. | | | 171,270 | | | | 9,969,627 | |

Archer-Daniels-Midland Co. | | | 55,192 | | | | 2,024,442 | |

Brown-Forman Corp. Class B | | | 8,861 | | | | 879,720 | |

Campbell Soup Co. | | | 14,283 | | | | 750,572 | |

Church & Dwight Co., Inc. | | | 11,400 | | | | 967,632 | |

Clorox Co. | | | 11,279 | | | | 1,430,516 | |

Coca-Cola Co. | | | 343,722 | | | | 14,766,297 | |

Coca-Cola Enterprises, Inc. | | | 17,013 | | | | 837,720 | |

Colgate-Palmolive Co. | | | 78,279 | | | | 5,214,947 | |

ConAgra Foods, Inc. | | | 38,551 | | | | 1,625,310 | |

Constellation Brands, Inc. Class A | | | 15,476 | | | | 2,204,401 | |

Costco Wholesale Corp. | | | 38,634 | | | | 6,239,391 | |

CVS Health Corp. | | | 97,627 | | | | 9,544,992 | |

Dr. Pepper Snapple Group, Inc. | | | 16,303 | | | | 1,519,440 | |

Estee Lauder Cos., Inc. Class A | | | 18,963 | | | | 1,669,882 | |

General Mills, Inc. | | | 51,922 | | | | 2,993,822 | |

Hershey Co. | | | 13,815 | | | | 1,233,265 | |

Hormel Foods Corp. | | | 11,049 | | | | 873,755 | |

J.M. Smucker Co. | | | 10,655 | | | | 1,314,188 | |

Kellogg Co. | | | 23,507 | | | | 1,698,851 | |

Keurig Green Mountain, Inc. | | | 10,589 | | | | 952,798 | |

Kimberly-Clark Corp. | | | 31,773 | | | | 4,044,703 | |

See accompanying notes to financial statements.

5

State Street Master Funds

State Street Equity 500 Index Portfolio

Schedule of Investments — (continued)

December 31, 2015

| | | | | | | | |

Security Description | | Shares | | | Value | |

| | | | | | | | |

COMMON STOCKS – (continued) | |

Consumer Staples – (continued) | |

Kraft Heinz Co. | | | 52,651 | | | $ | 3,830,887 | |

Kroger Co. | | | 84,410 | | | | 3,530,870 | |

McCormick & Co., Inc. | | | 9,561 | | | | 818,039 | |

Mead Johnson Nutrition Co. | | | 17,868 | | | | 1,410,679 | |

Molson Coors Brewing Co. Class B | | | 13,709 | | | | 1,287,549 | |

Mondelez International, Inc. Class A | | | 140,494 | | | | 6,299,751 | |

Monster Beverage Corp.(a) | | | 13,847 | | | | 2,062,649 | |

PepsiCo, Inc. | | | 128,138 | | | | 12,803,549 | |

Philip Morris International, Inc. | | | 136,187 | | | | 11,972,199 | |

Procter & Gamble Co. | | | 239,361 | | | | 19,007,657 | |

Reynolds American, Inc. | | | 72,192 | | | | 3,331,661 | |

Sysco Corp. | | | 43,535 | | | | 1,784,935 | |

Tyson Foods, Inc. Class A | | | 26,091 | | | | 1,391,433 | |

Wal-Mart Stores, Inc. | | | 138,099 | | | | 8,465,469 | |

Walgreens Boots Alliance, Inc. | | | 76,913 | | | | 6,549,526 | |

Whole Foods Market, Inc. | | | 32,487 | | | | 1,088,314 | |

| | | | | | | | |

| | | | | | | 158,391,438 | |

| | | | | | | | |

Energy – 6.3% | | | | | | | | |

Anadarko Petroleum Corp. | | | 44,144 | | | | 2,144,515 | |

Apache Corp. | | | 31,770 | | | | 1,412,812 | |

Baker Hughes, Inc. | | | 36,294 | | | | 1,674,968 | |

Cabot Oil & Gas Corp. | | | 38,322 | | | | 677,916 | |

Cameron International Corp.(a) | | | 17,767 | | | | 1,122,874 | |

Chesapeake Energy Corp. | | | 45,894 | | | | 206,523 | |

Chevron Corp. | | | 165,234 | | | | 14,864,451 | |

Cimarex Energy Co. | | | 7,742 | | | | 691,980 | |

Columbia Pipeline Group, Inc. | | | 37,878 | | | | 757,560 | |

ConocoPhillips | | | 107,403 | | | | 5,014,646 | |

CONSOL Energy, Inc. | | | 18,673 | | | | 147,517 | |

Devon Energy Corp. | | | 34,750 | | | | 1,112,000 | |

Diamond Offshore Drilling, Inc. | | | 5,854 | | | | 123,519 | |

Ensco PLC Class A | | | 19,189 | | | | 295,319 | |

EOG Resources, Inc. | | | 47,963 | | | | 3,395,301 | |

EQT Corp. | | | 12,943 | | | | 674,719 | |

Exxon Mobil Corp. | | | 366,072 | | | | 28,535,312 | |

FMC Technologies, Inc.(a) | | | 17,509 | | | | 507,936 | |

Halliburton Co. | | | 75,967 | | | | 2,585,917 | |

Helmerich & Payne, Inc. | | | 10,974 | | | | 587,658 | |

Hess Corp. | | | 22,344 | | | | 1,083,237 | |

Kinder Morgan, Inc. | | | 157,376 | | | | 2,348,050 | |

Marathon Oil Corp. | | | 63,789 | | | | 803,103 | |

Marathon Petroleum Corp. | | | 47,302 | | | | 2,452,136 | |

Murphy Oil Corp. | | | 14,562 | | | | 326,917 | |

National Oilwell Varco, Inc. | | | 33,841 | | | | 1,133,335 | |

Newfield Exploration Co.(a) | | | 12,285 | | | | 400,000 | |

Noble Energy, Inc. | | | 36,495 | | | | 1,201,780 | |

Occidental Petroleum Corp. | | | 67,535 | | | | 4,566,041 | |

ONEOK, Inc. | | | 18,404 | | | | 453,843 | |

Phillips 66 | | | 40,592 | | | | 3,320,426 | |

Pioneer Natural Resources Co. | | | 12,424 | | | | 1,557,721 | |

Range Resources Corp. | | | 14,541 | | | | 357,854 | |

Schlumberger, Ltd. | | | 111,272 | | | | 7,761,222 | |

Southwestern Energy Co.(a) | | | 37,344 | | | | 265,516 | |

Spectra Energy Corp. | | | 60,741 | | | | 1,454,139 | |

Tesoro Corp. | | | 9,949 | | | | 1,048,326 | |

Transocean, Ltd. | | | 27,890 | | | | 345,278 | |

Valero Energy Corp. | | | 42,086 | | | | 2,975,901 | |

| | | | | | | | |

Williams Cos., Inc. | | | 58,010 | | | | 1,490,857 | |

| | | | | | | | |

| | | | | | | 101,879,125 | |

| | | | | | | | |

Financials – 16.2% | | | | | | | | |

ACE, Ltd. | | | 28,667 | | | | 3,349,739 | |

Affiliated Managers Group, Inc.(a) | | | 4,976 | | | | 794,966 | |

Aflac, Inc. | | | 37,737 | | | | 2,260,446 | |

Allstate Corp. | | | 34,067 | | | | 2,115,220 | |

American Express Co. | | | 74,052 | | | | 5,150,317 | |

American International Group, Inc. | | | 108,032 | | | | 6,694,743 | |

American Tower Corp. REIT | | | 36,882 | | | | 3,575,710 | |

Ameriprise Financial, Inc. | | | 15,963 | | | | 1,698,782 | |

Aon PLC | | | 24,582 | | | | 2,266,706 | |

Apartment Investment & Management Co. Class A | | | 15,865 | | | | 635,076 | |

Assurant, Inc. | | | 6,346 | | | | 511,107 | |

AvalonBay Communities, Inc. REIT | | | 11,929 | | | | 2,196,487 | |

Bank of America Corp. | | | 916,466 | | | | 15,424,123 | |

Bank of New York Mellon Corp. | | | 93,991 | | | | 3,874,309 | |

BB&T Corp. | | | 67,939 | | | | 2,568,774 | |

Berkshire Hathaway, Inc. Class B(a) | | | 164,819 | | | | 21,762,701 | |

BlackRock, Inc. | | | 11,118 | | | | 3,785,901 | |

Boston Properties, Inc. REIT | | | 12,921 | | | | 1,647,944 | |

Capital One Financial Corp. | | | 46,868 | | | | 3,382,932 | |

CBRE Group, Inc. Class A(a) | | | 25,008 | | | | 864,777 | |

Charles Schwab Corp. | | | 105,889 | | | | 3,486,925 | |

Chubb Corp. | | | 19,396 | | | | 2,572,685 | |

Cincinnati Financial Corp. | | | 13,605 | | | | 805,008 | |

Citigroup, Inc. | | | 262,293 | | | | 13,573,663 | |

CME Group, Inc. | | | 28,992 | | | | 2,626,675 | |

Comerica, Inc. | | | 15,117 | | | | 632,344 | |

Crown Castle International Corp. REIT | | | 29,642 | | | | 2,562,551 | |

Discover Financial Services | | | 38,377 | | | | 2,057,775 | |

E*TRADE Financial Corp.(a) | | | 25,589 | | | | 758,458 | |

Equinix, Inc. REIT | | | 5,338 | | | | 1,614,211 | |

Equity Residential REIT | | | 32,838 | | | | 2,679,252 | |

Essex Property Trust, Inc. REIT | | | 5,555 | | | | 1,329,923 | |

Fifth Third Bancorp | | | 71,754 | | | | 1,442,255 | |

Franklin Resources, Inc. | | | 32,151 | | | | 1,183,800 | |

General Growth Properties, Inc. REIT | | | 50,542 | | | | 1,375,248 | |

Goldman Sachs Group, Inc. | | | 35,088 | | | | 6,323,910 | |

Hartford Financial Services Group, Inc. | | | 36,830 | | | | 1,600,632 | |

HCP, Inc. REIT | | | 40,777 | | | | 1,559,313 | |

Host Hotels & Resorts, Inc. REIT | | | 66,359 | | | | 1,017,947 | |

Huntington Bancshares, Inc. | | | 71,765 | | | | 793,721 | |

Intercontinental Exchange, Inc. | | | 9,425 | | | | 2,415,251 | |

Invesco, Ltd. | | | 38,289 | | | | 1,281,916 | |

Iron Mountain, Inc. REIT | | | 19,374 | | | | 523,292 | |

JPMorgan Chase & Co. | | | 321,872 | | | | 21,253,208 | |

KeyCorp | | | 75,079 | | | | 990,292 | |

Kimco Realty Corp. REIT | | | 37,316 | | | | 987,381 | |

Legg Mason, Inc. | | | 9,115 | | | | 357,581 | |

Leucadia National Corp. | | | 27,909 | | | | 485,338 | |

See accompanying notes to financial statements.

6

State Street Master Funds

State Street Equity 500 Index Portfolio

Schedule of Investments — (continued)

December 31, 2015

| | | | | | | | |

Security Description | | Shares | | | Value | |

| | | | | | | | |

COMMON STOCKS – (continued) | |

Financials – (continued) | |

Lincoln National Corp. | | | 23,510 | | | $ | 1,181,613 | |

Loews Corp. | | | 23,212 | | | | 891,341 | |

M&T Bank Corp. | | | 14,234 | | | | 1,724,876 | |

Macerich Co. REIT | | | 12,245 | | | | 988,049 | |

Marsh & McLennan Cos., Inc. | | | 44,434 | | | | 2,463,865 | |

McGraw Hill Financial, Inc. | | | 23,198 | | | | 2,286,859 | |

MetLife, Inc. | | | 97,826 | | | | 4,716,191 | |

Moody’s Corp. | | | 15,534 | | | | 1,558,682 | |

Morgan Stanley | | | 133,155 | | | | 4,235,661 | |

Nasdaq, Inc. | | | 9,225 | | | | 536,618 | |

Navient Corp. | | | 35,041 | | | | 401,219 | |

Northern Trust Corp. | | | 17,910 | | | | 1,291,132 | |

People’s United Financial, Inc. | | | 28,734 | | | | 464,054 | |

Plum Creek Timber Co., Inc. REIT | | | 15,886 | | | | 758,080 | |

PNC Financial Services Group, Inc. | | | 44,542 | | | | 4,245,298 | |

Principal Financial Group, Inc. | | | 22,826 | | | | 1,026,714 | |

Progressive Corp. | | | 50,052 | | | | 1,591,654 | |

Prologis, Inc. REIT | | | 46,747 | | | | 2,006,381 | |

Prudential Financial, Inc. | | | 38,137 | | | | 3,104,733 | |

Public Storage REIT | | | 13,052 | | | | 3,232,980 | |

Realty Income Corp. REIT | | | 20,700 | | | | 1,068,741 | |

Regions Financial Corp. | | | 124,443 | | | | 1,194,653 | |

Simon Property Group, Inc. REIT | | | 27,335 | | | | 5,315,017 | |

SL Green Realty Corp. REIT | | | 9,000 | | | | 1,016,820 | |

State Street Corp.(b) | | | 34,247 | | | | 2,272,631 | |

SunTrust Banks, Inc. | | | 46,082 | | | | 1,974,153 | |

Synchrony Financial(a) | | | 74,871 | | | | 2,276,827 | |

T Rowe Price Group, Inc. | | | 21,520 | | | | 1,538,465 | |

Torchmark Corp. | | | 11,284 | | | | 644,993 | |

Travelers Cos., Inc. | | | 27,798 | | | | 3,137,282 | |

Unum Group | | | 19,924 | | | | 663,270 | |

US Bancorp | | | 145,530 | | | | 6,209,765 | |

Ventas, Inc. REIT | | | 29,803 | | | | 1,681,783 | |

Vornado Realty Trust REIT | | | 16,246 | | | | 1,623,950 | |

Wells Fargo & Co. | | | 406,446 | | | | 22,094,405 | |

Welltower, Inc. REIT | | | 31,581 | | | | 2,148,455 | |

Weyerhaeuser Co. REIT | | | 47,681 | | | | 1,429,476 | |

Willis Group Holdings PLC | | | 400 | | | | 19,428 | |

XL Group PLC | | | 28,120 | | | | 1,101,742 | |

Zions Bancorp | | | 18,258 | | | | 498,443 | |

| | | | | | | | |

| | | | | | | 259,467,614 | |

| | | | | | | | |

Health Care – 14.9% | | | | | | | | |

Abbott Laboratories | | | 130,859 | | | | 5,876,878 | |

AbbVie, Inc. | | | 141,963 | | | | 8,409,888 | |

Aetna, Inc. | | | 30,215 | | | | 3,266,846 | |

Agilent Technologies, Inc. | | | 30,375 | | | | 1,269,979 | |

Alexion Pharmaceuticals, Inc.(a) | | | 19,527 | | | | 3,724,775 | |

Allergan PLC | | | 34,726 | | | | 10,851,875 | |

AmerisourceBergen Corp. | | | 17,452 | | | | 1,809,947 | |

Amgen, Inc. | | | 66,491 | | | | 10,793,484 | |

Anthem, Inc. | | | 23,219 | | | | 3,237,657 | |

Baxalta, Inc. | | | 48,545 | | | | 1,894,711 | |

Baxter International, Inc. | | | 45,145 | | | | 1,722,282 | |

Becton, Dickinson and Co. | | | 18,204 | | | | 2,805,054 | |

Biogen, Inc.(a) | | | 19,647 | | | | 6,018,858 | |

Boston Scientific Corp.(a) | | | 121,577 | | | | 2,241,880 | |

| | | | | | | | |

Bristol-Myers Squibb Co. | | | 146,812 | | | | 10,099,198 | |

C.R. Bard, Inc. | | | 6,462 | | | | 1,224,161 | |

Cardinal Health, Inc. | | | 28,124 | | | | 2,510,629 | |

Celgene Corp.(a) | | | 69,265 | | | | 8,295,176 | |

Cerner Corp.(a) | | | 27,563 | | | | 1,658,466 | |

Cigna Corp. | | | 23,011 | | | | 3,367,200 | |

DaVita HealthCare Partners, Inc.(a) | | | 15,472 | | | | 1,078,553 | |

DENTSPLY International, Inc. | | | 11,766 | | | | 715,961 | |

Edwards Lifesciences Corp.(a) | | | 19,290 | | | | 1,523,524 | |

Eli Lilly & Co. | | | 86,057 | | | | 7,251,163 | |

Endo International PLC(a) | | | 18,600 | | | | 1,138,692 | |

Express Scripts Holding Co.(a) | | | 59,247 | | | | 5,178,780 | |

Gilead Sciences, Inc. | | | 126,346 | | | | 12,784,952 | |

HCA Holdings, Inc.(a) | | | 26,500 | | | | 1,792,195 | |

Henry Schein, Inc.(a) | | | 7,600 | | | | 1,202,244 | |

Humana, Inc. | | | 13,217 | | | | 2,359,367 | |

Illumina, Inc.(a) | | | 12,900 | | | | 2,476,091 | |

Intuitive Surgical, Inc.(a) | | | 3,152 | | | | 1,721,496 | |

Johnson & Johnson | | | 243,341 | | | | 24,995,988 | |

Laboratory Corp. of America Holdings(a) | | | 8,247 | | | | 1,019,659 | |

Mallinckrodt PLC(a) | | | 10,300 | | | | 768,689 | |

McKesson Corp. | | | 20,031 | | | | 3,950,714 | |

Medtronic PLC | | | 123,904 | | | | 9,530,696 | |

Merck & Co., Inc. | | | 245,998 | | | | 12,993,614 | |

Mylan NV(a) | | | 34,207 | | | | 1,849,573 | |

Patterson Cos., Inc. | | | 6,459 | | | | 292,011 | |

PerkinElmer, Inc. | | | 9,732 | | | | 521,343 | |

Perrigo Co. PLC | | | 13,114 | | | | 1,897,596 | |

Pfizer, Inc. | | | 543,248 | | | | 17,536,045 | |

Quest Diagnostics, Inc. | | | 12,958 | | | | 921,832 | |

Regeneron Pharmaceuticals, Inc.(a) | | | 6,758 | | | | 3,668,715 | |

St. Jude Medical, Inc. | | | 25,753 | | | | 1,590,763 | |

Stryker Corp. | | | 28,195 | | | | 2,620,443 | |

Tenet Healthcare Corp.(a) | | | 7,852 | | | | 237,916 | |

Thermo Fisher Scientific, Inc. | | | 34,812 | | | | 4,938,082 | |

UnitedHealth Group, Inc. | | | 83,222 | | | | 9,790,236 | |

Universal Health Services, Inc. Class B | | | 7,800 | | | | 932,022 | |

Varian Medical Systems, Inc.(a) | | | 9,131 | | | | 737,785 | |

Vertex Pharmaceuticals, Inc.(a) | | | 21,048 | | | | 2,648,470 | |

Waters Corp.(a) | | | 6,815 | | | | 917,163 | |

Zimmer Biomet Holdings, Inc. | | | 15,027 | | | | 1,541,620 | |

Zoetis, Inc. | | | 41,228 | | | | 1,975,646 | |

| | | | | | | | |

| | | | | | | 238,178,583 | |

| | | | | | | | |

Industrials – 9.9% | | | | | | | | |

3M Co. | | | 53,543 | | | | 8,065,718 | |

ADT Corp. | | | 14,656 | | | | 483,355 | |

Allegion PLC | | | 7,237 | | | | 477,063 | |

American Airlines Group, Inc. | | | 53,800 | | | | 2,278,430 | |

AMETEK, Inc. | | | 21,701 | | | | 1,162,957 | |

Boeing Co. | | | 54,724 | | | | 7,912,543 | |

Caterpillar, Inc. | | | 52,055 | | | | 3,537,658 | |

CH Robinson Worldwide, Inc. | | | 13,082 | | | | 811,346 | |

Cintas Corp. | | | 6,822 | | | | 621,143 | |

CSX Corp. | | | 84,159 | | | | 2,183,926 | |

Cummins, Inc. | | | 13,544 | | | | 1,192,007 | |

Danaher Corp. | | | 51,678 | | | | 4,799,853 | |

Deere & Co. | | | 27,554 | | | | 2,101,544 | |

See accompanying notes to financial statements.

7

State Street Master Funds

State Street Equity 500 Index Portfolio

Schedule of Investments — (continued)

December 31, 2015

| | | | | | | | |

Security Description | | Shares | | | Value | |

| | | | | | | | |

COMMON STOCKS – (continued) | |

Industrials – (continued) | |

Delta Air Lines, Inc. | | | 67,166 | | | $ | 3,404,645 | |

Dover Corp. | | | 13,745 | | | | 842,706 | |

Dun & Bradstreet Corp. | | | 3,545 | | | | 368,432 | |

Eaton Corp. PLC | | | 40,999 | | | | 2,133,588 | |

Emerson Electric Co. | | | 55,269 | | | | 2,643,516 | |

Equifax, Inc. | | | 10,495 | | | | 1,168,828 | |

Expeditors International of Washington, Inc. | | | 17,144 | | | | 773,194 | |

Fastenal Co. | | | 25,742 | | | | 1,050,788 | |

FedEx Corp. | | | 23,350 | | | | 3,478,916 | |

Flowserve Corp. | | | 13,755 | | | | 578,810 | |

Fluor Corp. | | | 13,156 | | | | 621,226 | |

General Dynamics Corp. | | | 25,689 | | | | 3,528,641 | |

General Electric Co. | | | 830,049 | | | | 25,856,026 | |

Honeywell International, Inc. | | | 68,303 | | | | 7,074,142 | |

Illinois Tool Works, Inc. | | | 28,271 | | | | 2,620,156 | |

Ingersoll-Rand PLC | | | 24,016 | | | | 1,327,845 | |

Jacobs Engineering Group, Inc.(a) | | | 11,757 | | | | 493,206 | |

JB Hunt Transport Services, Inc. | | | 8,500 | | | | 623,560 | |

Kansas City Southern | | | 9,704 | | | | 724,598 | |

L-3 Communications Holdings, Inc. | | | 7,265 | | | | 868,240 | |

Lockheed Martin Corp. | | | 23,249 | | | | 5,048,520 | |

Masco Corp. | | | 31,639 | | | | 895,384 | |

Nielsen Holdings PLC | | | 31,775 | | | | 1,480,715 | |

Norfolk Southern Corp. | | | 27,168 | | | | 2,298,141 | |

Northrop Grumman Corp. | | | 15,886 | | | | 2,999,436 | |

PACCAR, Inc. | | | 31,635 | | | | 1,499,499 | |

Parker-Hannifin Corp. | | | 12,014 | | | | 1,165,118 | |

Pentair PLC | | | 16,891 | | | | 836,611 | |

Pitney Bowes, Inc. | | | 18,021 | | | | 372,134 | |

Precision Castparts Corp. | | | 11,878 | | | | 2,755,815 | |

Quanta Services, Inc.(a) | | | 17,693 | | | | 358,283 | |

Raytheon Co. | | | 26,136 | | | | 3,254,716 | |

Republic Services, Inc. | | | 20,014 | | | | 880,416 | |

Robert Half International, Inc. | | | 11,874 | | | | 559,740 | |

Rockwell Automation, Inc. | | | 10,879 | | | | 1,116,294 | |

Rockwell Collins, Inc. | | | 10,800 | | | | 996,840 | |

Roper Technologies, Inc. | | | 8,435 | | | | 1,600,879 | |

Ryder System, Inc. | | | 5,655 | | | | 321,374 | |

Snap-on, Inc. | | | 5,172 | | | | 886,636 | |

Southwest Airlines Co. | | | 56,927 | | | | 2,451,277 | |

Stanley Black & Decker, Inc. | | | 12,750 | | | | 1,360,807 | |

Stericycle, Inc.(a) | | | 8,204 | | | | 989,402 | |

Textron, Inc. | | | 26,206 | | | | 1,100,914 | |

Tyco International PLC | | | 39,336 | | | | 1,254,425 | |

Union Pacific Corp. | | | 74,138 | | | | 5,797,592 | |

United Continental Holdings, Inc.(a) | | | 32,000 | | | | 1,833,600 | |

United Parcel Service, Inc. Class B | | | 61,455 | | | | 5,913,815 | |

United Rentals, Inc.(a) | | | 8,900 | | | | 645,606 | |

United Technologies Corp. | | | 72,827 | | | | 6,996,490 | |

Verisk Analytics, Inc.(a) | | | 14,200 | | | | 1,091,696 | |

Waste Management, Inc. | | | 35,904 | | | | 1,916,196 | |

WW Grainger, Inc. | | | 5,512 | | | | 1,116,676 | |

Xylem, Inc. | | | 13,834 | | | | 504,941 | |

| | | | | | | | |

| | | | | | | 158,108,594 | |

| | | | | | | | |

| | | | | | | | |

Information Technology – 20.3% | |

Accenture PLC Class A | | | 55,182 | | | | 5,766,519 | |

Activision Blizzard, Inc. | | | 46,200 | | | | 1,788,402 | |

Adobe Systems, Inc.(a) | | | 43,413 | | | | 4,078,217 | |

Akamai Technologies, Inc.(a) | | | 16,234 | | | | 854,395 | |

Alliance Data Systems Corp.(a) | | | 5,304 | | | | 1,466,927 | |

Alphabet, Inc. Class C(a) | | | 26,045 | | | | 19,765,030 | |

Alphabet, Inc. Class A(a) | | | 25,523 | | | | 19,857,149 | |

Amphenol Corp. Class A | | | 25,880 | | | | 1,351,712 | |

Analog Devices, Inc. | | | 26,718 | | | | 1,478,040 | |

Apple, Inc. | | | 490,064 | | | | 51,584,137 | |

Applied Materials, Inc. | | | 99,753 | | | | 1,862,388 | |

Autodesk, Inc.(a) | | | 19,970 | | | | 1,216,772 | |

Automatic Data Processing, Inc. | | | 39,365 | | | | 3,335,003 | |

Avago Technologies, Ltd. | | | 22,918 | | | | 3,326,548 | |

Broadcom Corp. Class A | | | 49,835 | | | | 2,881,460 | |

CA, Inc. | | | 24,759 | | | | 707,117 | |

Cisco Systems, Inc. | | | 443,429 | | | | 12,041,314 | |

Citrix Systems, Inc.(a) | | | 14,978 | | | | 1,133,086 | |

Cognizant Technology Solutions Corp. Class A(a) | | | 53,927 | | | | 3,236,699 | |

Corning, Inc. | | | 110,150 | | | | 2,013,542 | |

CSRA, Inc. | | | 13,232 | | | | 396,960 | |

eBay, Inc.(a) | | | 99,458 | | | | 2,733,106 | |

Electronic Arts, Inc.(a) | | | 26,721 | | | | 1,836,267 | |

EMC Corp. | | | 171,574 | | | | 4,406,020 | |

F5 Networks, Inc.(a) | | | 6,159 | | | | 597,177 | |

Facebook, Inc. Class A(a) | | | 199,107 | | | | 20,838,539 | |

Fidelity National Information Services, Inc. | | | 23,086 | | | | 1,399,012 | |

First Solar, Inc.(a) | | | 6,849 | | | | 451,965 | |

Fiserv, Inc.(a) | | | 20,842 | | | | 1,906,209 | |

FLIR Systems, Inc. | | | 11,839 | | | | 332,321 | |

Harris Corp. | | | 9,998 | | | | 868,826 | |

Hewlett Packard Enterprise Co. | | | 151,063 | | | | 2,296,158 | |

HP, Inc. | | | 163,963 | | | | 1,941,322 | |

Intel Corp. | | | 415,420 | | | | 14,311,219 | |

International Business Machines Corp. | | | 78,647 | | | | 10,823,400 | |

Intuit, Inc. | | | 24,526 | | | | 2,366,759 | |

Juniper Networks, Inc. | | | 27,944 | | | | 771,254 | |

KLA-Tencor Corp. | | | 12,673 | | | | 878,873 | |

Lam Research Corp. | | | 14,181 | | | | 1,126,255 | |

Linear Technology Corp. | | | 20,421 | | | | 867,280 | |

MasterCard, Inc. Class A | | | 87,349 | | | | 8,504,299 | |

Microchip Technology, Inc. | | | 19,906 | | | | 926,425 | |

Micron Technology, Inc.(a) | | | 88,228 | | | | 1,249,308 | |

Microsoft Corp. | | | 702,177 | | | | 38,956,780 | |

Motorola Solutions, Inc. | | | 13,128 | | | | 898,612 | |

NetApp, Inc. | | | 28,943 | | | | 767,858 | |

NVIDIA Corp. | | | 43,612 | | | | 1,437,451 | |

Oracle Corp. | | | 279,470 | | | | 10,209,039 | |

Paychex, Inc. | | | 28,631 | | | | 1,514,294 | |

PayPal Holdings, Inc.(a) | | | 98,558 | | | | 3,567,800 | |

Qorvo, Inc.(a) | | | 13,600 | | | | 692,240 | |

QUALCOMM, Inc. | | | 134,385 | | | | 6,717,234 | |

Red Hat, Inc.(a) | | | 16,430 | | | | 1,360,568 | |

salesforce.com, Inc.(a) | | | 54,205 | | | | 4,249,672 | |

SanDisk Corp. | | | 17,006 | | | | 1,292,286 | |

Seagate Technology PLC | | | 29,076 | | | | 1,065,926 | |

Skyworks Solutions, Inc. | | | 17,300 | | | | 1,329,159 | |

Symantec Corp. | | | 63,103 | | | | 1,325,163 | |

See accompanying notes to financial statements.

8

State Street Master Funds

State Street Equity 500 Index Portfolio

Schedule of Investments — (continued)

December 31, 2015

| | | | | | | | |

Security Description | | Shares | | | Value | |

| | | | | | | | |

COMMON STOCKS – (continued) | |

Information Technology – (continued) | |

TE Connectivity, Ltd. | | | 34,549 | | | $ | 2,232,211 | |

Teradata Corp.(a) | | | 12,813 | | | | 338,519 | |

Texas Instruments, Inc. | | | 87,506 | | | | 4,796,204 | |

Total System Services, Inc. | | | 13,399 | | | | 667,270 | |

VeriSign, Inc.(a) | | | 8,020 | | | | 700,627 | |

Visa, Inc. Class A | | | 170,040 | | | | 13,186,602 | |

Western Digital Corp. | | | 19,647 | | | | 1,179,802 | |

Western Union Co. | | | 42,240 | | | | 756,518 | |

Xerox Corp. | | | 76,492 | | | | 813,110 | |

Xilinx, Inc. | | | 23,142 | | | | 1,086,980 | |

Yahoo!, Inc.(a) | | | 74,037 | | | | 2,462,471 | |

| | | | | | | | |

| | | | | | | 325,177,807 | |

| | | | | | | | |

Materials – 2.7% | | | | | | | | |

Air Products & Chemicals, Inc. | | | 17,407 | | | | 2,264,825 | |

Airgas, Inc. | | | 5,840 | | | | 807,789 | |

Alcoa, Inc. | | | 111,089 | | | | 1,096,448 | |

Avery Dennison Corp. | | | 7,818 | | | | 489,876 | |

Ball Corp. | | | 12,658 | | | | 920,616 | |

CF Industries Holdings, Inc. | | | 19,730 | | | | 805,181 | |

Dow Chemical Co. | | | 98,190 | | | | 5,054,821 | |

E.I. du Pont de Nemours & Co. | | | 76,594 | | | | 5,101,160 | |

Eastman Chemical Co. | | | 12,072 | | | | 814,981 | |

Ecolab, Inc. | | | 23,665 | | | | 2,706,803 | |

FMC Corp. | | | 13,422 | | | | 525,203 | |

Freeport-McMoRan, Inc. | | | 92,164 | | | | 623,950 | |

International Flavors & Fragrances, Inc. | | | 6,480 | | | | 775,267 | |

International Paper Co. | | | 34,308 | | | | 1,293,412 | |

LyondellBasell Industries NV Class A | | | 31,452 | | | | 2,733,179 | |

Martin Marietta Materials, Inc. | | | 6,155 | | | | 840,650 | |

Monsanto Co. | | | 37,994 | | | | 3,743,169 | |

Mosaic Co. | | | 27,716 | | | | 764,685 | |

Newmont Mining Corp. | | | 42,973 | | | | 773,084 | |

Nucor Corp. | | | 26,606 | | | | 1,072,222 | |

Owens-Illinois, Inc.(a) | | | 13,263 | | | | 231,042 | |

PPG Industries, Inc. | | | 23,188 | | | | 2,291,438 | |

Praxair, Inc. | | | 24,600 | | | | 2,519,040 | |

Sealed Air Corp. | | | 18,969 | | | | 846,017 | |

Sherwin-Williams Co. | | | 6,987 | | | | 1,813,825 | |

Vulcan Materials Co. | | | 10,990 | | | | 1,043,720 | |

WestRock Co. | | | 23,948 | | | | 1,092,508 | |

| | | | | | | | |

| | | | | | | 43,044,911 | |

| | | | | | | | |

Telecommunication Services – 2.4% | |

AT&T, Inc. | | | 541,318 | | | | 18,626,752 | |

CenturyLink, Inc. | | | 50,273 | | | | 1,264,869 | |

Frontier Communications Corp. | | | 83,838 | | | | 391,524 | |

Level 3 Communications, Inc.(a) | | | 25,600 | | | | 1,391,616 | |

Verizon Communications, Inc. | | | 358,051 | | | | 16,549,117 | |

| | | | | | | | |

| | | | | | | 38,223,878 | |

| | | | | | | | |

Utilities – 2.9% | | | | | | | | |

AES Corp. | | | 57,259 | | | | 547,969 | |

AGL Resources, Inc. | | | 10,502 | | | | 670,133 | |

Ameren Corp. | | | 21,056 | | | | 910,251 | |

American Electric Power Co., Inc. | | | 43,843 | | | | 2,554,732 | |

CenterPoint Energy, Inc. | | | 38,135 | | | | 700,159 | |

CMS Energy Corp. | | | 24,501 | | | | 883,996 | |

| | | | | | | | |

Consolidated Edison, Inc. | | | 24,600 | | | | 1,581,042 | |

Dominion Resources, Inc. | | | 52,768 | | | | 3,569,228 | |

DTE Energy Co. | | | 15,039 | | | | 1,205,977 | |

Duke Energy Corp. | | | 59,591 | | | | 4,254,201 | |

Edison International | | | 28,905 | | | | 1,711,465 | |

Entergy Corp. | | | 15,800 | | | | 1,080,088 | |

Eversource Energy | | | 26,443 | | | | 1,350,444 | |

Exelon Corp. | | | 76,859 | | | | 2,134,374 | |

FirstEnergy Corp. | | | 39,729 | | | | 1,260,601 | |

NextEra Energy, Inc. | | | 40,257 | | | | 4,182,300 | |

NiSource, Inc. | | | 27,678 | | | | 539,998 | |

NRG Energy, Inc. | | | 30,098 | | | | 354,253 | |

Pepco Holdings, Inc. | | | 20,759 | | | | 539,942 | |

PG&E Corp. | | | 43,712 | | | | 2,325,041 | |

Pinnacle West Capital Corp. | | | 11,056 | | | | 712,891 | |

PPL Corp. | | | 59,956 | | | | 2,046,298 | |

Public Service Enterprise Group, Inc. | | | 44,936 | | | | 1,738,574 | |

SCANA Corp. | | | 13,901 | | | | 840,871 | |

Sempra Energy | | | 20,824 | | | | 1,957,664 | |

Southern Co. | | | 80,484 | | | | 3,765,846 | |

TECO Energy, Inc. | | | 18,350 | | | | 489,028 | |

WEC Energy Group, Inc. | | | 26,587 | | | | 1,364,179 | |

Xcel Energy, Inc. | | | 41,700 | | | | 1,497,447 | |

| | | | | | | | |

| | | | | | | 46,768,992 | |

| | | | | | | | |

TOTAL COMMON STOCKS

(Cost $661,325,777) | | | | | | | 1,572,326,042 | |

| | | | | | | | |

SHORT-TERM INVESTMENTS – 2.3% | | | | | |

Money Market Fund – 2.1% | |

State Street Institutional U.S. Government Money Market Fund, Premier Class 0.07%(c)(d) | | | 32,967,587 | | | | 32,967,587 | |

| | | | | | | | |

| | |

| | | Principal

Amount | | | | |

U.S. Government Security – 0.2% | | | | | |

U.S. Treasury Bill

0.02% due 3/10/2016(c)(e) | | | 3,860,000 | | | | 3,859,852 | |

| | | | | | | | |

| | | | | | | 3,859,852 | |

| | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $36,827,439) | | | | 36,827,439 | |

| | | | | | | | |

TOTAL INVESTMENTS – 100.5%

(Cost $698,153,216(f)) | | | | 1,609,153,481 | |

Liabilities in Excess of Other Assets – (0.5)% | | | | | | | (7,555,049 | ) |

| | | | | | | | |

NET ASSETS – 100.0% | | | | | | $ | 1,601,598,432 | |

| | | | | | | | |

| (a) | Non-income producing security |

| (b) | Affiliated issuer (Note 4). |

| (c) | The rate shown is the annualized seven-day yield at December 31, 2015. |

| (d) | Affiliated fund managed by SSGA Funds Management, Inc. (Note 4). |

| (e) | All or part of this security has been designated as collateral for futures contracts. |

| (f) | Cost of investments shown approximates cost for federal income tax purposes. Gross unrealized appreciation and gross unrealized |

See accompanying notes to financial statements.

9

State Street Master Funds

State Street Equity 500 Index Portfolio

Schedule of Investments — (continued)

December 31, 2015

| | depreciation of investments at December 31, 2015 was $930,121,776 and $19,121,511, respectively, resulting in net unrealized appreciation of investments of $911,000,265. |

| REIT | Real Estate Investment Trust |

At December 31, 2015, open futures contracts purchased were as follows:

| | | | | | | | | | | | | | | | |

Futures Contracts | | Expiration

Date | | | Number of

Contracts | | | Notional

Value | | | Unrealized

Appreciation

(Depreciation) | |

S&P 500 Financial Futures Contracts (long) | | | 03/18/2016 | | | | 303 | | | $ | 30,836,310 | | | $ | 350,235 | |

| | | | | | | | | | | | | | | | |

Total | | | | | | | | | | | | | | $ | 350,235 | |

| | | | | | | | | | | | | | | | |

See accompanying notes to financial statements.

10

State Street Master Funds

State Street Equity 500 Index Portfolio

Statement of Assets and Liabilities

December 31, 2015

| | | | |

Assets | | | | |

Investments in unaffiliated issuers at value

(identified cost $664,024,354) | | $ | 1,573,913,263 | |

Investments in non-controlled affiliates at value

(identified cost $34,128,862) (Note 4) | | | 35,240,218 | |

| | | | |

Total investments at value (identified cost $698,153,216) | | | 1,609,153,481 | |

Cash | | | 19,331 | |

Receivable for investments sold | | | 18,336 | |

Dividends and interest receivable | | | 2,074,120 | |

Dividend receivable from non-controlled affiliates (Note 4) | | | 11,644 | |

Receivable from Investment Adviser | | | 8,108 | |

| | | | |

Total assets | | | 1,611,285,020 | |

| | | | |

Liabilities | | | | |

Payable for investments purchased | | | 9,129,540 | |

Payable to broker – variation margin on open futures contracts | | | 290,882 | |

Management fees payable (Note 4) | | | 266,166 | |

| | | | |

Total liabilities | | | 9,686,588 | |

| | | | |

Net Assets | | $ | 1,601,598,432 | |

| | | | |

See accompanying notes to financial statements.

11

State Street Master Funds

State Street Equity 500 Index Portfolio

Statement of Operations

Year Ended December 31, 2015

| | | | |

Investment Income | | | | |

Dividend income – unaffiliated issuers (net of foreign taxes withheld of $178,756) | | $ | 55,432,202 | |

Dividend income – non-controlled affiliated issuer | | | 124,033 | |

Interest income | | | 342 | |

| | | | |

Total investment income | | | 55,556,577 | |

| | | | |

Expenses | | | | |

Management fees (Note 4) | | | 1,219,468 | |

Other expenses | | | 32,875 | |

| | | | |

Total expenses | | | 1,252,343 | |

Less: Expenses waived by the Adviser (Note 4) | | | (8,108 | ) |

| | | | |

Net expenses | | | 1,244,235 | |

| | | | |

Net Investment Income (Loss) | | | 54,312,342 | |

| | | | |

Realized and Unrealized Gain (Loss) | | | | |

Net realized gain (loss) on: | | | | |

Investments – unaffiliated issuers | | | 587,355,932 | |

Futures contracts | | | (135,361 | ) |

| | | | |

Net realized gain (loss) | | | 587,220,571 | |

| | | | |

Net change in net unrealized appreciation/(depreciation) on: | | | | |

Investments | | | (588,153,644 | ) |

Futures contracts | | | (2,031,823 | ) |

| | | | |

Net change in unrealized appreciation/(depreciation) | | | (590,185,467 | ) |

| | | | |

Net realized and unrealized gain (loss) on investments and future contracts | | | (2,964,896 | ) |

| | | | |

Net Increase (Decrease) in Net Assets Resulting From Operations | | $ | 51,347,446 | |

| | | | |

See accompanying notes to financial statements.

12

State Street Master Funds

State Street Equity 500 Index Portfolio

Statements of Changes in Net Assets

| | | | | | | | |

| | | Year Ended

December 31, 2015 | | | Year Ended

December 31, 2014 | |

Increase (Decrease) in Net Assets From Operations: | | | | | | | | |

Net investment income (loss) | | $ | 54,312,342 | | | $ | 54,845,406 | |

Net realized gain (loss) on investments and futures contracts | | | 587,220,571 | | | | 17,844,354 | |

Net change in net unrealized appreciation (depreciation) on investments and futures contracts | | | (590,185,467 | ) | | | 279,107,499 | |

| | | | | | | | |

Net increase (decrease) in net assets from operations | | | 51,347,446 | | | | 351,797,259 | |

| | | | | | | | |

Capital Transactions: | | | | | | | | |

Contributions | | | 240,295,137 | | | | 353,779,321 | |

Withdrawals | | | (369,462,446 | ) | | | (185,039,609 | ) |

In-kind redemptions (Note 7) | | | (1,189,904,577 | ) | | | (390,808,177 | ) |

| | | | | | | | |

Net increase (decrease) in net assets from capital transactions | | | (1,319,071,886 | ) | | | (222,068,465 | ) |

| | | | | | | | |

Net Increase (Decrease) in Net Assets | | | (1,267,724,440 | ) | | | 129,728,794 | |

Net Assets | | | | | | | | |

Beginning of year | | | 2,869,322,872 | | | | 2,739,594,078 | |

| | | | | | | | |

End of year | | $ | 1,601,598,432 | | | $ | 2,869,322,872 | |

| | | | | | | | |

See accompanying notes to financial statements.

13

State Street Master Funds

State Street Equity 500 Index Portfolio

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended

12/31/15 | | | Year Ended

12/31/14 | | | Year Ended

12/31/13 | | | Year Ended

12/31/12 | | | Year Ended

12/31/11 | |

Supplemental Data and Ratios: | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 1,601,598 | | | $ | 2,869,323 | | | $ | 2,739,594 | | | $ | 2,055,241 | | | $ | 1,825,528 | |

Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

Expenses before waiver and payments by affiliates | | | 0.045 | % | | | 0.045 | % | | | 0.045 | % | | | 0.045 | % | | | 0.045 | % |

Expenses net of waiver and payments by affiliates | | | 0.045 | % | | | 0.045 | % | | | 0.045 | % | | | 0.045 | % | | | 0.045 | % |

Net investment income | | | 2.00 | % | | | 1.98 | % | | | 2.05 | % | | | 2.26 | % | | | 2.04 | % |

Portfolio turnover rate | | | 7 | % | | | 2 | %(a) | | | 4 | %(a) | | | 9 | %(a) | | | 15 | %(a) |

Total return(b) | | | 1.41 | % | | | 13.62 | % | | | 32.30 | % | | | 15.97 | % | | | 2.03 | % |

| (a) | The portfolio turnover rate excludes in-kind security transactions (Note 7). |

| (b) | Results represent past performance and are not indicative of future results. |

See accompanying notes to financial statements.

14

State Street Master Funds

State Street Equity 500 Index Portfolio

Notes to Financial Statements

December 31, 2015

State Street Master Funds (the “Trust”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), is as an open-end management investment company, and was organized as a Massachusetts business trust on July 27, 1999. The Trust consists of five (5) investment portfolios: State Street Equity 500 Index Portfolio, State Street Money Market Portfolio, State Street Treasury Money Market Portfolio, State Street Treasury Plus Money Market Portfolio and State Street U.S. Government Money Market Portfolio. Financial statements herein relate only to the State Street Equity 500 Index Portfolio (the “Portfolio”) which commenced operations on March 1, 2000.

At December 31, 2015 the following Portfolios were operational: State Street Equity 500 Index Portfolio, State Street Money Market Portfolio, State Street Treasury Money Market Portfolio, State Street Treasury Plus Money Market Portfolio and State Street U.S. Government Money Market Portfolio. The Portfolio is authorized to issue an unlimited number of non-transferable beneficial interests. The Portfolio is treated as a partnership for federal income tax purposes.

The Portfolio’s investment objective is to replicate, as closely as possible, before expenses, the performance of the Standard & Poor’s 500 Index (the “S&P 500® Index”). The Portfolio uses a passive management strategy designed to track the performance of the S&P 500® Index. The S&P 500® Index is a well-known, unmanaged, stock index that includes common stocks of 500 companies from several industrial sectors representing a significant portion of the market value of all stocks publicly traded in the U.S. There is no assurance that the Portfolio will achieve its objective.

Under the Trust’s organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust enters into contracts with service providers that contain general indemnification clauses. The Trust’s maximum exposure under these arrangements is unknown as this could involve future claims that may be made against the Trust that have not yet occurred.

| 2. | | Summary of Significant Accounting Policies |

The following is a summary of significant accounting policies followed by the Portfolio in the preparation of its financial statements:

The preparation of financial statements in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”) requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates. The Portfolio is an investment company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies in Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 946, Financial Services Investment Companies (“ASC 946”).

Security Valuation

The Portfolio’s investments are valued at fair value each day that the Portfolio’s listing exchange is open and, for financial reporting purposes, as of the report date should the reporting period end on a day that the Portfolio’s listing exchange is not open. Fair value is generally defined as the price a fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. By its nature, a fair value price is a good faith estimate of the valuation in a

15

State Street Master Funds

State Street Equity 500 Index Portfolio

Notes to Financial Statements — (continued)

December 31, 2015

current sale and may not reflect an actual market price. The investments of the Portfolio are valued pursuant to the policy and procedures developed by the Oversight Committee (the “Committee”) and approved by the Board of Trustees of the Trust (the “Board”). The Committee provides oversight of the valuation of investments for the Portfolio. The Board has responsibility for determining the fair value of investments. Valuation techniques used to value the Portfolio’s investments by major category are as follows:

| | • | | Equity investments (including registered investment companies that are exchange-traded funds) traded on a recognized securities exchange for which market quotations are readily available are valued at the last sale price or official closing price, as applicable, on the primary market or exchange on which they trade. Equity investments traded on a recognized exchange for which there were no sales on that day are valued at the last published sale price or at fair value. |

| | • | | Investments in registered investment companies (including money market funds) or other unitized pooled investment vehicles that are not traded on an exchange are valued at that day’s published net asset value per share or unit. Money market funds generally value portfolio investments using the amortized cost method as set forth in Rule 2a-7 under the 1940 Act and in accordance with fund procedures to stabilize net asset value. |

| | • | | Debt obligations (both governmental and non-governmental) purchased with greater than sixty days to maturity and not investment grade are valued at last reported evaluated bid prices obtained from independent pricing services or brokers. In determining the value of a fixed income investment, pricing services may use certain information with respect to transactions in such investments, quotations from dealers, pricing matrixes, market transactions in comparable investments, various relationships observed in the market between investments, and calculated yield measures. |

| | • | | Exchange-traded futures contracts are valued at the closing settlement price on the primary market on which they are traded most extensively. Exchange-traded futures contracts traded on a recognized exchange for which there were no sales on that day are valued at the last reported sale price obtained from independent pricing services or brokers or at fair value. |

In the event prices or quotations are not readily available or that the application of these valuation methods results in a price for an investment that is deemed to be not representative of the fair value of such investment, fair value will be determined in good faith by the Committee, in accordance with the valuation policy and procedures approved by the Board.

Fair value pricing could result in a difference between the prices used to calculate the Portfolio’s net asset value and the prices used by the Portfolio’s underlying index, which in turn could result in a difference between the Portfolio’s performance and the performance of the Portfolio’s underlying index. Various inputs are used in determining the value of the Portfolio’s investments. These inputs are categorized into a hierarchy consisting of three broad levels for financial reporting purposes.

The Portfolio values its assets and liabilities at fair value using a hierarchy that prioritizes the inputs to valuation techniques giving the highest priority to readily available unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements) when market prices are not readily available or reliable. The categorization of a value determined for an investment within the hierarchy is based upon the pricing transparency of the investment and is not necessarily an indication of the risk associated with investing in it.

16

State Street Master Funds

State Street Equity 500 Index Portfolio

Notes to Financial Statements — (continued)

December 31, 2015

The three levels of the fair value hierarchy are as follows:

| | • | | Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities; |

| | • | | Level 2 – Inputs other than quoted prices included within Level 1 that are observable for the asset or liability either directly or indirectly, including quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not considered to be active, inputs other than quoted prices that are observable for the asset or liability (such as exchange rates, financing terms, interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market-corroborated inputs; and |

| | • | | Level 3 – Unobservable inputs for the asset or liability, including the Committee’s assumptions used in determining the fair value of investments. |

Changes in valuation techniques may result in transfers in or out of an assigned level within the fair value hierarchy. All transfers are recognized at the end of the reporting period. The Portfolio had no transfers between levels for the year ended December 31, 2015.

The following table summarizes the value of the Portfolio’s investment according to the fair value hierarchy as of December 31, 2015:

| | | | | | | | | | | | | | | | |

| Description | | Level 1 –

Quoted Prices | | | Level 2 –

Other Significant Observable Inputs | | | Level 3 –

Significant Unobservable Inputs | | | Total | |

ASSETS: | | | | | | | | | | | | | | | | |

INVESTMENTS: | | | | | | | | | | | | | | | | |

Common Stocks | | $ | 1,572,326,042 | | | $ | – | | | $ | – | | | $ | 1,572,326,042 | |

U.S. Government Security | | | – | | | | 3,859,852 | | | | – | | | | 3,859,852 | |

Money Market Fund | | | 32,967,587 | | | | – | | | | – | | | | 32,967,587 | |

| | | | | | | | | | | | | | | | |

TOTAL INVESTMENTS | | | 1,605,293,629 | | | | 3,859,852 | | | | – | | | | 1,609,153,481 | |

OTHER FINANCIAL INSTRUMENTS:** | | | | | | | | | | | | | | | | |

Futures contracts* | | | 350,235 | | | | – | | | | – | | | | 350,235 | |

| | | | | | | | | | | | | | | | |

TOTAL INVESTMENTS AND OTHER FINANCIAL INSTRUMENTS | | $ | 1,605,643,864 | | | $ | 3,859,852 | | | $ | – | | | $ | 1,609,503,716 | |

| | | | | | | | | | | | | | | | |

| * | Only unsettled receivable/payable for variation margin is reported within Statement of Assets and Liabilities. |

| ** | Other Financial instruments are derivative investments not reflected in the Schedule of Investments such as futures contracts. |

Investment Transactions and Income Recognition

Investment transactions are accounted for on trade date for financial reporting purposes. Interest income is recorded daily on an accrual basis. All premiums and discounts are amortized or accreted for financial reporting purposes. Non-cash dividends received in the form of stock, if any, are recorded as dividend income at fair value. Distributions received by the Portfolio may include a return of capital that is estimated by management. Such amounts are recorded as a reduction of the cost of investments or reclassified to capital gains. Realized gains and losses from the sale or disposition of investments are determined using the identified cost method.

17

State Street Master Funds

State Street Equity 500 Index Portfolio

Notes to Financial Statements — (continued)

December 31, 2015

All of the net investment income and realized and unrealized gains and losses from the security transactions of the Portfolio are allocated pro rata among the partners in the Portfolio on a daily basis based on each partner’s daily ownership percentage.

Expenses

Certain expenses, which are directly identifiable to a specific portfolio, are applied to that portfolio within the Trust. Other expenses which cannot be attributed to a specific portfolio are allocated in such a manner as deemed equitable, taking into consideration the nature and type of expense and the relative net assets of the portfolios within the Trust.

Futures

The Portfolio may enter into futures contracts to meet its objectives. A futures contract is a standardized, exchange-traded agreement to buy or sell a financial instrument at a set price on a future date. Upon entering into a futures contract, the Portfolio is required to deposit with the broker, cash or securities in an amount equal to the minimum initial margin requirements of the clearing house. Variation margin payments are made or received by the Portfolio each day, depending on the daily fluctuations in the value of the underlying security or index. Such receipt or payment is recorded by the Portfolio for financial statement purposes as part of unrealized gains or losses, and is recorded on the Statement of Assets and Liabilities as Receivable or Payable to broker – variation margin on open futures contracts. The Portfolio recognizes a realized gain or loss when the contract is closed, which is recorded on the Statement of Operations.

The risk of loss in trading futures contracts in some strategies is potentially unlimited. Losses may arise if the value of a futures contract decreases due to unfavorable changes in the market rates or values of the underlying instrument during the term of the contract or if the counterparty does not perform under the contract. The use of futures contracts also involves the risk that the movements in the price of the futures contracts do not correlate the movement of the assets underlying such contracts.

For the year ended December 31, 2015, the Portfolio entered into futures contracts for cash equalization and return enhancement.

The following tables summarizes the value of the Portfolio’s derivative instruments as of December 31, 2015 and related location in the accompanying Statement of Assets and Liabilities and Statement of Operations presented by primary underlying risk exposure:

Asset Derivatives(1)

| | | | | | |

| | | Equity Contracts Risk | | Total | |

Futures Contracts | | $350,235 | | $ | 350,235 | |

Transactions in derivative instruments during the year ended December 31, 2015, were as follows:

Realized Gain (Loss)(2)

| | | | | | |

| | | Equity Contracts Risk | | Total | |

Futures Contracts | | $(135,361) | | $ | (135,361 | ) |

18

State Street Master Funds

State Street Equity 500 Index Portfolio

Notes to Financial Statements — (continued)

December 31, 2015

Change in Appreciation (Depreciation)(3)

| | | | | | |

| | | Equity Contracts Risk | | Total | |

Futures Contracts | | $(2,031,823) | | $ | (2,031,823 | ) |

| (1) | Schedule of Investments: Unrealized depreciation on futures contracts. Only unsettled receivable/payable for variation margin amounting to $290,882 is reported within Statement of Assets and Liabilities. |

| (2) | Statement of Operations location: Net realized gain (loss) on: Futures contracts |

| (3) | Statement of Operations location: Net change in unrealized appreciation (depreciation) on: Futures contracts |

The average notional value of futures outstanding contracts during the year ended December 31, 2015 was $57,411,920.

Federal Income Taxes

The Portfolio is not required to pay federal income taxes on its net investment income and net capital gains because it is treated as a partnership for federal income tax purposes. All interest, dividends, gains and losses of the Portfolio are deemed to have been “passed through” to the Portfolio’s partners in proportion to their holdings in the Portfolio, regardless of whether such items have been distributed by the Portfolio. Each partner is responsible for tax liability based on its distributive share; therefore, no provision has been made for federal income taxes.

SSGA Funds Management, Inc. (“SSGA FM” or the “Adviser”) has reviewed the tax positions for open tax years as of December 31, 2015, and has determined that no provision for income tax is required in the Portfolio’s financial statements. The Portfolio’s federal tax returns for the prior three fiscal years, as applicable, remain subject to examination by the Portfolio’s major tax jurisdictions, which include the United States of America and the Commonwealth of Massachusetts. The Portfolio recognizes interest and penalties, if any, related to tax liabilities as income tax expense in the Statement of Operations. No income tax returns are currently under examination. Management has analyzed tax laws and regulations and their applications to the Portfolios’ facts and circumstances and does not believe there are any uncertain tax positions that require recognition of a tax liability.

At December 31, 2015, gross unrealized appreciation and gross unrealized depreciation based on cost for federal income tax purposes were as follows:

| | | | | | | | | | | | | | |

| Tax Cost | | | Gross Unrealized

Appreciation | | | Gross Unrealized

Depreciation | | | Net Unrealized

Appreciation

(Depreciation) | |

| | $770,913,316 | | | $ | 930,502,004 | | | $ | 92,261,839 | | | $ | 838,240,165 | |

| 3. | | Investment Transactions |

For the year ended December 31, 2015, purchases and sales of investment securities (excluding short-term investments) were $172,359,053 and $194,628,702, respectively.

19

State Street Master Funds

State Street Equity 500 Index Portfolio

Notes to Financial Statements — (continued)

December 31, 2015

| 4. | | Fees and Compensation paid to Affiliates and other Related Party Transactions |

Management Fees

The Portfolio has entered into an Investment Advisory Agreement with SSGA FM, a subsidiary of State Street Corporation and an affiliate of State Street Bank and Trust Company (“State Street”), under which SSGA FM directs the investments of the Portfolio in accordance with its investment objective, policies, and limitations.

During the year ended December 31, 2015, SSGA FM voluntarily agreed to waive fees of $8,108.

Effective June 1, 2015, SSGA FM serves as Administrator and State Street serves as Sub-Administrator. The Trust has contracted with State Street to provide custody, sub-administration and transfer agent services to the Portfolio. In compensation for SSGA FM’s services as investment adviser and administrator and for State Street’s services as sub-administrator, custodian and transfer agent (and for assuming ordinary operating expenses of the Portfolio, including ordinary legal, audit and trustees expense), State Street receives a unitary fee, calculated daily, at the annual rate of 0.045% of the Portfolio’s average daily net assets. Prior to June 1, 2015, State Street served as Administrator.

Transactions with Affiliates

The Portfolio invested in an affiliated company, State Street Corp. The Portfolio also invested in the State Street Institutional Liquid Reserves Fund and the State Street Institutional U.S. Government Money Market Fund. Amounts relating to these investments at December 31, 2015, and for the period then ended are:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Security Description | | Number

of shares

held at

12/31/14 | | | Shares

purchased

for the

year ended

12/31/15 | | | Shares

sold

for the

year ended

12/31/15 | | | Number

of shares

held at

12/31/15 | | | Value at

12/31/15 | | | Income

earned

for the

year ended

12/31/15 | | | Realized

gain/loss on

shares sold | |

State Street Corp. | | | 62,947 | | | | 3,700 | | | | 32,400 | | | | 34,247 | | | | 2,272,631 | | | | 76,958 | | | | 1,052,917 | |

State Street Institutional Liquid Reserves Fund, Premier Class | | | 91,116,189 | | | | 233,280,225 | | | | 324,396,414 | | | | – | | | | – | | | | 45,863 | | | | – | |

State Street Institutional U.S. Government Money Market Fund, Premier Class | | | – | | | | 165,704,607 | | | | 132,737,020 | | | | 32,967,587 | | | | 32,967,587 | | | | 1,428 | | | | – | |

The Portfolio may invest in certain money market funds managed by the Adviser, including the State Street Institutional Liquid Reserves Fund – Premier Class (formerly Institutional Class) (“Liquid Reserves Fund”) and State Street Institutional U.S. Government Money Market Fund – Premier Class (“U.S. Government Money Market Fund”), both series of State Street Institutional Investment Trust. The Liquid Reserves Fund and U.S. Government Money Market Fund are feeder funds in a master/feeder fund structure that invests substantially all of its assets in the State Street Money Market Portfolio and the State Street U.S. Government Money Market Portfolio (“Master Portfolios”). The Liquid Reserves Fund and U.S. Government Money Market Fund do not pay an investment advisory fee to the Adviser, but the Master Portfolios in which they invest pay an investment advisory fee to the Adviser. The Liquid Reserves Fund and U.S. Government Money Market Fund intend to declare dividends on shares from net investment income daily and pay them as of the last business day of each month. All income distributions earned by the Portfolio from affiliated money market funds are recorded as dividend income on securities of affiliated issuers in the accompanying Statement of Operations.

20

State Street Master Funds

State Street Equity 500 Index Portfolio

Notes to Financial Statements — (continued)

December 31, 2015

Independent Trustees are compensated on a calendar year basis. Any Trustee who is deemed to be an “interested person” (as defined in the 1940 Act) of the Portfolio does not receive compensation from the Portfolio for his or her service as a Trustee.

Each Independent Trustee receives for his or her services to the Trust, State Street Institutional Investment Trust and SSGA Funds, a $141,500 annual base retainer in addition to $18,000 for each in-person meeting and $2,000 for each telephonic meeting from the Trust. The Co-Chairmen each receive an additional $44,000 annual retainer. The Independent Trustees are reimbursed for travel and other out-of-pocket expenses in connection with meeting attendance as of the date of these financial statements. Trustees’ fees and expenses are allocated among the Trusts and funds overseen by the Trustees in a manner deemed equitable taking into consideration the relative net assets of the funds, subject to a $15,000 minimum per fund. The Trustees were not paid pension or retirement benefits as part of the Trust’s expenses.

Effective October 15, 2015, certain Funds and other affiliated funds (each a “Participant” and, collectively, the “Participants”) share in a $360 million revolving credit facility provided by a syndication of banks. The Participants may borrow for the purpose of meeting shareholder redemption requests that otherwise might require the untimely disposition of securities. The Participants are charged an annual commitment fee which is calculated based on the unused portion of the shared credit line. Commitment fees are allocated among each of the Participants based on relative net assets. Commitment fees are ordinary fund operating expenses and are paid by the Adviser. A Participant incurs and pays the interest expense related to its borrowing. Interest is calculated at a rate per annum equal to the sum of the New York Fed Bank Rate plus 1%. A Participant may borrow up to a maximum of 33% of its assets or a lower amount as may be set forth in the Portfolio’s prospectus. The Portfolio had no outstanding loans during the year ended December 31, 2015.

On August 11, 2014, the State Street Equity 500 Index Fund redeemed its interest in the Portfolio in connection with a transfer of net assets to the State Street Equity 500 Index II Portfolio, a series of State Street Institutional Investment Trust. The transfer consisted of five hundred and three (503) securities totaling $387,955,841 at market value and $2,852,336 in cash, and is disclosed in the Statement of Changes in Net Assets.

On October 30, 2015, five hundred and three (503) securities totaling $1,164,494,980 at market value and $25,409,596 in cash were transferred by way of an in-kind distribution of 41.53% of the net assets of the Portfolio and realized gains of $511,603,703. The transfer is disclosed on the Statement of Changes in Net Assets.

Management has evaluated the impact of all subsequent events on the Portfolio through the date the financial statements were available to be issued and has determined that there were no subsequent events requiring adjustment or disclosure in the financial statements.

21

Report of Independent Registered Public Accounting Firm

To the Board of Trustees and Owners of Beneficial Interest of State Street Master Funds:

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of State Street Equity 500 Index Portfolio (one of the portfolios constituting State Street Master Funds) (the “Portfolio”) as of December 31, 2015, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Portfolio’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Portfolio’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Portfolio’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2015, by correspondence with the custodian and others or by other appropriate auditing procedures where replies from others were not received. We believe that our audits provide a reasonable basis for our opinion.