Filed Pursuant to Rule 424(b)(3)

Registration No. 333-176618

PROSPECTUS

Bontan Corporation Inc.

61,102,500 Shares of Common Stock

_____________________________

This prospectus relates to the sale of up to 61,102,500 shares of our common stock by the selling shareholders listed in the table under “Selling Shareholders.” The common shares registered for resale under this registration statement are:

| | · | 29,025,000 common shares; |

| | · | 32,077,500 common shares issuable upon exercise of warrants at an exercise price of USD $0.35 per share; |

We will not receive any proceeds from the sale of the shares offered by the selling stockholders; however, if the warrants are exercised, we will receive the exercise price of the warrants.

The selling stockholders may offer the shares from time to time through public or private transactions at prices related to prevailing market prices, or at privately negotiated prices. Additional information on the selling stockholders, and how they may sell the shares registered hereby, is provided under “Selling Shareholders” and “Plan of Distribution.”

Our common stock is quoted on the Over-the-Counter (OTC) Bulletin Board under the symbol “BNTNF.” The high and low bid prices for our common stock on the OTC Bulletin Board on September 12, 2011 were US$0.07 and US$0.067 per share respectively. These quotations reflect inter-dealer prices, without retail mark-up, mark-down or commissions, and may not represent actual transactions.

Investing in our common shares involves a high degree of risk. See “Risk Factors” beginning on page 10.

Neither the SEC nor any state securities commission has approved or disapproved these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

____________________________

Prospectus dated September 13, 2011

TABLE OF CONTENTS

| | |

| ABOUT THIS PROSPECTUS | 3 |

| | |

| PROSPECTUS SUMMARY | 4 |

| | |

| | |

| RISK FACTORS | 11 |

| | |

| SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS | 19 |

| | |

| IDENTITY OF DIRECTORS, SENIOR MANAGEMENT & ADVISORS | 19 |

| | |

| KEY INFORMATION | 20 |

| | |

| INFORMATION ABOUT BONTAN | 22 |

| | |

| OPERATING AND FINANCIAL REVIEW & PROSPECTUS | 33 |

| | |

| DIRECTORS, SENIOR MANAGEMENT & EMPLOYEES | 44 |

| | |

| MAJOR SHAREHOLDERS & RELATED PARTY TRANSACTIONS | 50 |

| | |

| FINANCIAL INFORMATION | 53 |

| | |

| THE OFFERING AND LISTING | 56 |

| | |

| ADDITIONAL INFORMATION | 63 |

| | |

| QUANTITATIVE & QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 77 |

| | |

| DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES | 80 |

| | |

| ENFORCEABILITY OF CIVIL LIABILITIES | 80 |

| | |

| FINANCIAL STATEMENTS | 81 |

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form F-1 that we filed with the U.S. Securities and Exchange Commission, or the SEC, using a “shelf” registration process. Under this process, the selling shareholders listed in the table commencing on page 59 may, from time to time, sell the offered securities described in this prospectus in one or more offerings, up to a total of 61,102,500 common shares. No shares are being registered hereunder for sale by Bontan.

We have not authorized any broker, dealer, salesperson or other person to give any information or to make any representation regarding any of the securities offered hereby. You should rely only on the information contained or incorporated by reference in this prospectus and applicable prospectus supplement.

This prospectus does not constitute an offer to sell or the solicitation of an offer to buy the securities in any jurisdiction in which an offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make an offer or solicitation. You should assume that the information contained in this prospectus is accurate only as of any date on the front cover page.

This prospectus does not contain all of the information included in the registration statement and the exhibits thereto. This prospectus includes statements that summarize the contents of contracts and other documents that are filed as exhibits to the registration statement. These statements do not necessarily describe the full contents of such documents, and you should refer to those documents for a complete description of these matters. It is important for you to read and consider all information contained in this prospectus and any prospectus supplement, together with the additional information described below under the heading “Where You Can Find More Information.”

In this prospectus, references to “Bontan,” “our company,” “we,” “us” and “our” are to Bontan Corporation Inc. and its consolidated subsidiaries, unless the context suggests otherwise. References to “U.S. dollars” or “USD $” are to the lawful currency of the United States, and references to “CDN $” or “$” are to the lawful currency of Canada. All financial information set forth in this prospectus is expressed in Canadian dollars, except where otherwise indicated.

PROSPECTUS SUMMARY

This summary highlights the key information contained in this prospectus. Because it is a summary, it does not contain all the information you should consider before investing in our common shares. You should read carefully this entire prospectus; including the section entitled “Risk Factors” and the financial statements included elsewhere this prospectus.

About Bontan

We invest in the exploration and development of oil and gas wells. We focus on partnering with established developers and operators. We have never had any oil and gas operations and do not currently own any oil and gas properties with proven reserves. We currently own a 5.23% indirect working interest in two drilling licenses in the Levantine Basin, approximately 40 kilometers off the west coast of Israel. The two drilling licenses, Petroleum License 347 (“Myra”) and Petroleum License 348 (“Sara”), cover approximately 198,000 acres. We currently own no other property interests.

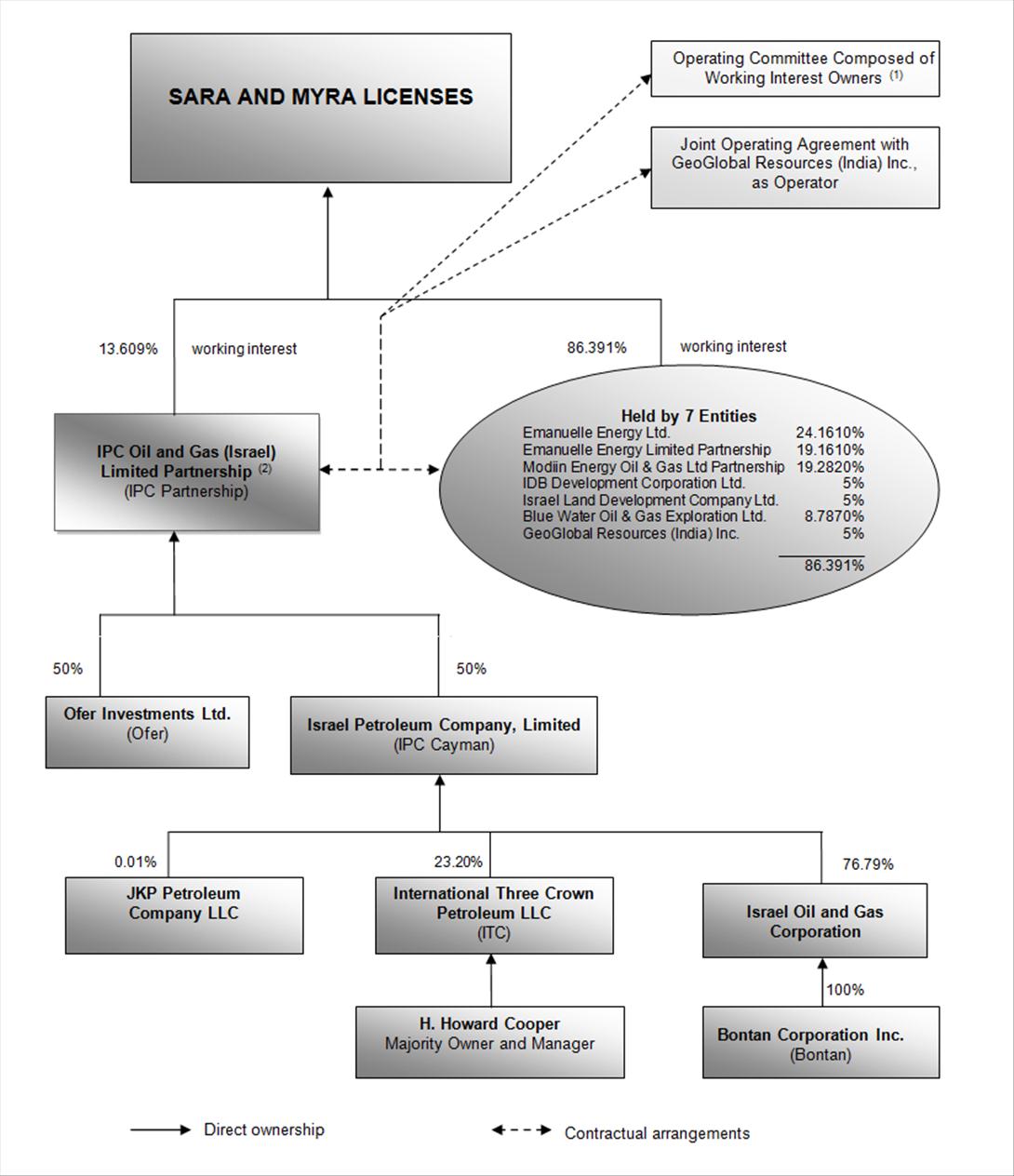

Bontan’s interest is held through its 76.79% equity interest in Israel Petroleum Company, Limited or IPC Cayman, a Cayman Islands limited company. IPC Cayman owns 50% of I.P.C. Oil and Gas (Israel), Limited Partnership, (“IPC Partnership”) which is the registered holder of 13.609% interest in the above licenses.

In addition to IPC Cayman, our major joint venture partners in the offshore Israel project include Emanuelle Energy Limited and IDB-DT Energy (2010) Ltd. Mr. Ofer Nimrodi controls Emanuelle Energy Ltd., and is a director and CEO of Tel Aviv-based Israel Land Development Company Ltd. IDB-DT Energy (2010) Ltd. Is a joint venture of IDB Development Corporation Ltd., which is affiliated with Avraham Livnat Company, and Du-Tzah Ltd., which is affiliated with Manor Holdings and Yitzak “Zachi” Sultan. Our rights and the rights of our joint venture partners in the Myra and Sara licenses have been approved and registered by the Israeli Petroleum Commissioner on June 17, 2010. In this document we sometimes refer to Emanuelle Energy Ltd. and IDB-DT Energy (2010) Ltd as the “Lead Investors.” Geoglobal Resources (India) Inc. has been appointed operator for the Myra and Sara licenses.

The following table shows ownership of the rights in the Myra and Sara licenses registered with the Ministry of National Infrastructures of the State of Israel as at August 10, 2010:

Myra License (400000 dunams) Validity 14/07/2008 - 13/07/2012

* Emanuelle Energy Limited. Modiin Energy Limited Partnership Emanuelle Energy Oil & Gas Limited Partnership I.P.C. Oil and Gas (Israel) Limited Partnership Blue Water Oil & Gas Exploration Limited GeoGlobal Resources (India) Inc. IDB Development Corporation Limited Israel Land Development Company Limited | 24.1610 % 19.2820 % 19.1610 % 13.6090 % 8.7870 % 5.0000 % 5.0000 % 5.0000 % |

Sara License (400000 dunams) 07/2008 - 13/07/2012

* Emanuelle Energy Limited. Modiin Energy Limited Partnership Emanuelle Energy Oil & Gas Limited Partnership I.P.C. Oil and Gas (Israel) Limited Partnership Blue Water Oil & Gas Exploration Limited GeoGlobal Resources (India) Inc. IDB Development Corporation Limited Israel Land Development Company Limited | 24.1610 % 19.2820 % 19.1610 % 13.6090 % 8.7870 % 5.0000 % 5.0000 % 5.0000 % |

Note: (a) I.P.C. Oil and Gas (Israel) Limited Partnership (or IPC Partnership) is currently owned 50% by IPC Cayman and 50% by Ofer Investments Ltd. We own 76.79% of IPC Cayman. Hence our indirect working interest in the above licenses is 5.23% (13.609 x 50% x76.79%). This interest may decrease further if Geoglobal Resources (India) Ltd. exercises its option to acquire an additional 2.5% working interest in the licenses pro rata from the Lead Invsetors and IPC Cayman.

(b) We undersrand that recently Blue Water Oil & Gas Exploration Limited failed to fulfil its financial obligationunder a cash call and as a result forfeited its interest to Emanuelle Energy Limited and Modiin Energy Limited Partnership. We have however not received any written confirmation of this matter. It also does not affect our interest in the two licenses.

The following diagram illustrates the ownership structure with respect to the Myra and Sara licenses as of the date of this prospectus.

_______________________________________

(1) Currently, the Operating Committee has 4 members: H. Howard Cooper (IPC Cayman), Ohad Marani (Emanuelle Energy Ltd.), Ron Maor (Modiin Energy Limited Partnership), and a representative of GeoGlobal Resources (India) Inc.

(2) ITC is the general partner of IPC Partnership.

The following table shows the overriding royalty interests held by various parties in the Myra and Sara licenses:

| Name of Holder | Percentage Interest |

| Royalty Trust for the benefit of the shareholders of PetroMed Corporation as of March 25, 2010 | 3.0% |

| East Mediterranean Exploration Company Ltd. | 4.5% |

| Three Crown Petroleum LLC – an affiliate of ITC | 0.5% |

| Ofer Energy Enterprises LP | 0.5% |

| Israel Land Development Company Ltd. | 1.33% |

| IDB-DT (2010) Energy Ltd | 0.138% |

| Modiin Energy Limited Partnership | 0.532% |

| TOTAL OVERRIDING ROYALTY INTERESTS | 10.5% |

Our goal is to advance the offshore Israel project to the drilling stage aggressively, as prudent financing will allow us to determine the presence of oil or natural gas. If we are successful in doing so, we believe our joint venture partners can attract the attention of the existing oil and gas companies already operating in the region or new oil and gas companies to enter into a development agreement.

We were incorporated under the laws of the Province of Ontario in 1973. Since April 2003, we have been focused on participating in oil and gas exploration, development and exploitation projects worldwide by acquiring joint venture, indirect and direct participation interests and working interests in those projects. During the fiscal year 2006, we sold our indirect participation interest in an oil exploration project and wrote off our working interest in a gas project owing to a dry test well. Since 2006, we have been pursuing and evaluating various business opportunities in the oil and gas sector. We currently have only one oil and gas project.

Our principal office is located at 47 Avenue Road, Suite 200, Toronto, Ontario M5R 2G3 and our telephone number is 416-929-1806.

Background and Status of Offshore Israel Project

In November 2009, IPC Cayman initially acquired a 95.5% interest in the Myra and Sara drilling licenses and an exploration permit, Petroleum Preliminary Permit 199 (“Benjamin”), from PetroMed Corporation, a Beliz corporation. The transfer of rights was subject to approval by the Israeli Petroleum Commissioner. Disputes arose among PetroMed Corporation, IPC Cayman, us and others regarding the transfer of rights in the two drilling licenses and the exploration permit. To settle the disputes and to ensure that the future of the offshore Israel project is not jeopardized, we and IPC Cayman accepted an offer from two Israeli investors with significant financial and local influence to join the project as major partners. On March 25, 2010, International Three Crown Petroleum LLC or ITC, a Colorado limited liability company, IPC Cayman, PetroMed Corporation, Emanuelle Energy Ltd., IDB-DT Energy (2010) Ltd. and others entered into an Allocation of Rights and Settlement Agreement. This agreement provides for, among other things:

| | · | The dismissal of certain lawsuits and mutual release of claims among the parties; |

| | · | The payment by the Lead Investors of: (i) $10.5 million to Western Geco International Ltd. for the release of 2D and 3D seismic data relating to the Myra and Sara licenses, and (ii) $5.7 million to settle various disputes with PetroMed Corporation and to acquire its control. |

| | · | A new allocation of working interests in the offshore Israel project as follows: 14.325% to IPC Cayman; 27.15% to IDB-DT Energy (2010) Ltd.; and 54.025% to Emanuelle Energy Ltd.; |

| | · | With respect to IPC Cayman’s 14.325% working interest, an allocation of 11% to Bontan and 3.325% to International Three Crown Petroleum LLC; |

| | · | For purposes of the application to effect the transfer of rights in the Myra and Sara licenses, the Lead Investors to prove (without incurring any actual monetary obligation) the financial capability requirement under Israel Petroleum Law in respect of IPC Cayman’s interest in the licenses; |

| | · | The grant of overriding royalty interests, totaling 11.5%, to certain persons; |

| | · | The cancellation of the common shares and warrants of Bontan issued to PetroMed Corporation in November 2009; and |

| | · | The formation of a steering committee composed of two representatives of the Lead Investors and one representative of IPC Cayman, to manage the project with respect to the Myra and Sara licenses. |

In a letter dated May 16, 2010, Petroleum Commissioner confirmed that the two licenses are fully valid and approved changes in the work plan submitted by the steering committee. The Petroleum Commissioner approved deadlines for submitting various work plans between July 15, 2010 and March 31, 2011. With respect to the financial capability requirement for approval of the transfer of rights, the Petroleum Commissioner has indicated that the joint venture partners must demonstrate liquidity equal to at least half of the cost of the first well drilling, which he estimates to be approximately USD $50 million.

Geoglobal Resources (India) Inc. has been appointed operator for the Myra and Sara licenses. The operator is a wholly owned subsidiary of Geoglobal Resources Inc., a public company headquartered in Calgary, Alberta. The operator has acquired a 5% working interest in the Myra and Sara licenses pro rata from the Lead Investors and IPC Cayman for USD $1.2 million which at that time decreased our indirect working interest to 10.45%. The operator also will have an option to acquire an additional 2.5% working interest in one or both licenses pro rata from the Lead Investors and IPC Cayman.

On May 20, 2010, the joint venture partners submitted an application to the Israeli Petroleum Commissioner to approve the transfer and registration of the rights in the Myra and Sara licenses. On June 16, 2010, the Commissioner approved the application and registered the interests in the two licenses in favour of the joint venture partners.

The Benjamin permit originally held by PetroMed Corporation and acquired by IPC Cayman expired in February 2010 because the required seismic data was not timely submitted to the Petroleum Commissioner. The Israeli Ministry of Petroleum invited new applications for three licenses covering the same area as the original Benjamin permit. The Lead Investors and IPC Cayman paid for and obtained the required 2D seismic data for this application and submitted an application for only one of the licenses, Michael license on May 20, 2010. On June 16, 2010, the Ministry of Petroleum notified the Lead Investors that the application of Michael license was not accepted.

Under the Allocation of Rights and Settlement Agreement, we are required to prove financial capability of approximately $12 million on or before December 1, 2010 to our joint venture partners to cover our share of the cost of the two test wells. On October 13, 2010, IPC Cayman and IPC Partnership signed a Partnership Subscription and Contribution Agreement with Ofer Investments Ltd., an Israeli company, and Ofer Energy Enterprises LP (together, “Ofer”). Under this agreement, Ofer agreed to contribute up to US$ 28 million towards the IPC Partnership’s share of the cost of drilling of the initial two exploratory wells under the Sara and Myra licenses and related exploration costs in exchange for a 50% limited partnership interest in IPC Partnership and certain voting and management rights related to IPC Partnership. We believe Ofer’s contribution under the agreement satisfies our financial capability requirement under the Allocation of Rights and Settlement Agreement. However, Mr. Cooper has communicated to us that we have not satisfied our financial commitments under the Contribution Agreement, and has raised this matter as a counterclaim in the legal action described under “Financial Information – Legal Proceedings.”

To the extent required by law, the consent of the Israeli Petroleum Commissioner is a condition precedent to the grant of rights to Ofer under the Ofer agreement. If such consent is required but not obtained by December 31, 2011, then (i) Ofer may terminate the Ofer agreement and IPC Partnership will be required to make a restitution payment to Ofer by June 30, 2013 in an amount equal to the capital contributions actually made by Ofer plus 10% interest from the date of each such contribution or (ii) IPC Partnership may terminate the Ofer agreement and IPC Partnership will be required to make the restitution payment referenced in (i) within seven days of the notice of termination. The agreement also provides that ITC and Ofer will use their best efforts to establish, no later than December 31, 2010, a new Israeli entity to replace ITC as the general partner of IPC Partnership. To date, we are not aware of any new Israel entity that has replaced ITC.

On October 25, 2010, IPC Cayman entered into an agreement with Shaldieli Ltd., an Israeli public shell company (“Shaldieli”), for IPC Cayman to acquire 90% of Shaldieli’s common equity in exchange for IPC Cayman’s 50% interest in IPC Partnership. As the majority stockholder of IPC Cayman, we believe the proposed Shaldieli transaction is subject to our approval. Bontan has never given this approval and does not consider the proposed Shaldieli transaction to be beneficial to Bontan and its shareholders for several reasons, including the following:

| · | 10% of the Shaldieli shares are reserved for existing Shaldieli shareholders without any contribution of funds to the business. This will result in dilution of our indirect interest, which could exceed 20% if the options proposed to be issued in the transaction are exercised. |

| · | Mr. Cooper will be chairman and president of Shaldieli without our vote or approval as the majority stockholder of IPC Cayman. |

| · | The proposed transaction structure provides no proper safeguards to Bontan regarding future activities of Shaldieli and the Shaldieli board structure. |

| · | The proposed Shaldieli transaction appears to involve numerous conflicts of interest and related party transactions with Mr. Cooper and his affiliates, including issues concerning his remuneration, status as a director, option rights, annual grants, and right to a percentage of the profits of Shaldieli. |

The Shaldieli transaction is also subject to approval by Shaldieli’s shareholders and to Israeli regulatory approvals. The complete details of the Shaldieli transaction are not known to us. Shaldieli shareholders approved the Shaldieli transaction on July 26, 2011 but, as far as we are aware, the Israel Securities Authority has not yet cleared the proposed transaction. We have not been provided with copies of any communication that Shaldieli might have had with the Israel Securities Authority and therefore are not aware of the issues raised, if any, by the Israel Securities Authority.

On November 8, 2010, joint operating agreements dated October 6, 2010 relating to each of the Myra and Sara licenses were signed by the joint venture partners and GeoGlobal, as operator. The agreements contain substantially similar provisions that relate to the rights and obligations of the parties with regard to operations under the licenses, including joint exploration, appraisal, development, production and disposition of oil and natural gas produced from the areas covered by the licenses.

Under the joint operating agreements, an operating committee is created to supervise and direct operations and activities carried out by the operator with respect to each license. The operating committee (which we understand replaces the steering committee created by the Allocation of Rights and Settlement Agreement) will be comprised of representatives of each joint venture partner holding a working interest. Decisions of the operating committee are determined by an affirmative vote of two or members representing at least 51% of the working interests; provided that the vote must include the affirmative vote of Emanuelle Energy Ltd., Emanuelle Energy Oil and Gas Limited Partnership, Israel Land Development Company Ltd., IDB Development Corporation Ltd., and Modiin Energy Limited Partnership as long as each of them holds at least 50% of its original working interest. Currently, we understand that there are four members on the operating committee – one each from IDB-DT Energy (2010) Ltd., Emanuelle Energy Ltd., GeoGlobal Resources (India) Inc., and IPC Cayman. Mr. Howard Cooper currently represents IPC Cayman. While we own 76.79% of IPC Cayman, we agreed to have IPC Cayman’s representative on the operating committee be appointed by ITC. We believed at that time that ITC’s representative would be Mr. Howard Cooper. Mr. Cooper has significant experience in handling oil and gas projects and has been actively involved in developing of the offshore Israel project.

Each joint operating agreement designates GeoGlobal as the operator and contains provisions regarding the rights of the other parties to the agreement to remove GeoGlobal as operator (with or without cause) and to repurchase portions of its working interest under various stages of the project with varying amounts of reimbursement for amounts paid by GeoGlobal. The parties have agreed to indemnify the operator for any claim, loss, liability or expense arising out of or resulting from operations under the applicable license, except for actions taken by senior supervisory personnel which constitute gross negligence or willful misconduct.

Recent developments on the Israel project include the following:

| a. | The operator signed a letter of intent with a drilling contractor in April 2011. |

| b. | The operator signed in April 2011 an assignment agreement with a third party to acquire a drilling rig and associated services to be available in December 2011. |

| c. | In May 2011, the Petroleum Commissioner approved to extend validity of the Sara and Myra licenses to July 13, 2012. |

| d. | A 3D analysis was completed in July 2011. |

Litigation Matters

We currently are in litigation with Mr. Howard Cooper, ITC, IPC Cayman and other parties relating to costs incurred and compliance with the terms of the Contribution and Assignment Agreement and Stockholders Agreement as well as the proposed Shaldieli transaction. Beginning in January 2011, we commenced legal actions against them and other parties in Israel seeking, among other things, temporary and permanent injunctions against completion of the Shaldieli transaction, monetary damages in the amount of approximately USD $7 million, remedies relating to the governance of IPC Cayman and Shaldieli, remedies against Mr. Cooper’s position in IPC Cayman, and an injunction against the payment of USD $4 million to ITC or Mr. Cooper from funds to be raised by Shaldeili. In January 2011, IPC Cayman and ITC filed a counterclaim against Bontan for monetary damages in the amount of approximately USD $5 million and for an order cancelling our shares in IPC Cayman. The court in Israel has denied our petitions for a temporay injunction against completion of the Shaldieli transaction. However, with respect to the proposed payment of USD $4 million to ITC or Mr. Cooper from Shaldieli’s future fund raising, the court ruled that no distributon is permitted until Bontan or the court agrees. The court also ruled that we are entitled to audit the financial books and records of IPC Cayman; including the details of the USD $4 million that ITC claims is owed to it by IPC Cayman. The other claims raised in the legal actions are still pending.

In April 2011, we filed a legal action in the Cayman Islands to obtain a court order to effect our share transfer request which would then enable us to call a meeting of the shareholders of IPC Cayman to discuss management of IPC Cayman. The hearing of this was originally scheduled on August 18, 2011. However, ITC and Mr. Cooper’s lawyer requested a hearing on August 8, 2011 and asked the judge to postpone all hearings until lawsuits in Israel were decided.The judge however was not convinced and asked them to present full arguments on October 3, 2011. The hearing of our application is postponed until after October 3, 2011.

There can be no assurance as to when these disputes, including the counterclaim, will be resolved or how much time and resources it will take to resolve the disputes, nor can we predict the final outcome or financial impact of resolving them. The legal actions, if they continue, will result in substantial costs and diversion of resources. An adverse outcome in the Israeli action could cause us to lose our interest in the licenses and write off our investments. For a description of the legal proceedings, see “Financial Information –Legal Proceedings.”

Manager of IPC Cayman

International Three Crown Petroleum LLC (“ITC”) is the sole director of IPC Cayman and the general partner of IPC Partnership, and is representing our interest in the offshore Israel project through participation in the steering committee. ITC owns a 23.20% equity interest and JKP Petroleum Company LLC (“JKP”) owns a 0.01% equity interest in IPC Cayman. The majority member and principal of ITC and JKP is H. Howard Cooper. Under a Stockholders Agreement, ITC cannot be removed other than for willful misconduct that adversely affects the offshore Israel project or in the event of a transfer of ownership of ITC, such that Mr. Howard Cooper is no longer the managing member.

H. Howard Cooper is currently the manager of ITC. Mr. Cooper is also the manager of Power Petroleum LLC. ITC was formed by Mr. Cooper in 2005 to identify and purchase oil and gas leases, primarily in the U.S. Rocky Mountain Region. Power Petroleum, which was formed by Mr. Cooper in 2007, puts drilling prospects together in Colorado, Montana, Utah and North Dakota. From 1996 until February 2005, Mr. Cooper was the chairman of the board of directors of Teton Energy Corporation, a U.S. publicly traded company formerly known as Teton Petroleum Company. Mr. Cooper also served as president and CEO of Teton from 1996 until May 2003. During his tenure with Teton, Teton primarily engaged in oil and gas exploration, development, and production in Western Siberia, Russia.

The Stockholders Agreement provides that IPC Cayman will pay ITC a monthly management fee of $20,000 for its services as director of IPC Cayman and reimburse reasonable out-of-pocket expenses incurred by the director on behalf of IPC Cayman. In connection with any farmout, sale or other transfer of all or a portion of the offshore Israel project, ITC will receive a disposition fee equal to the product of 5% of our percentage ownership interest in IPC Cayman and the total cash proceeds received by us or our shareholders in such transaction. In addition, ITC will receive a warrant to purchase a number of our common shares which is equal to the product of 5% of our percentage ownership interest in IPC Cayman and the fair market value of all consideration received by us in such transaction, divided by the market price of one common share as of the date of issuance of the warrant. The exercise price of the warrant will be equal to the market price.

The Offering

This prospectus relates to the sale of up to 61,102,500 shares of our common stock, including 32,077,500 shares issuable upon the exercise of warrants, by the selling shareholders listed in this prospectus. We issued the shares and warrants to the selling stockholders in connection with the acquisition of our indirect working interest in the offshore Israel project and the subsequent funding of the project. We will not receive any proceeds from the sale of the shares offered by the selling stockholders. We may receive proceeds from the exercise of the warrants, if and when exercised on a cash basis.

RISK FACTORS

You should carefully consider the following risks in addition to the other information set forth in this prospectus before making any investment in our stock. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may also adversely affect our business. If any of these risks actually occur, the price of our stock could decline and you could lose part or all of your investment.

Risks Related to our Business

We have a history of operating losses and may never achieve profitability in the future.

We have incurred significant operating losses. It is unlikely that we will generate significant revenues while we seek to complete our exploration and development activities in the offshore Israel project. As of March 31, 2011 we had an accumulated deficit of approximately $41 million. We do not have any proved reserves or current production of oil or gas. Our success is substantially dependent upon on the successful exploration, drilling and development of the offshore Israel project. We cannot assure you that we will be profitable in the future.

Our consolidated financial statements for the year ended March 31, 2011 have been prepared assuming that we will continue as a going concern, however, there can be no assurance that we will be able to do so. Our ability to continue as a going concern is dependent upon our ability to access sufficient capital to defend out interest in the offshore Israel project, complete exploration and development activities, identify commercial oil and gas reserves and ultimately achieve profitable operations. These financial statements do not reflect the adjustments to the carrying values of assets and liabilities and the reported expenses and balance sheet classifications that would be necessary if we were unable to realize our assets and settle our liabilities as a going concern in the normal course of operations. Such adjustments could be material.

An adverse outcome, and the substantial costs, with respect to our pending lawsuits with Mr. Cooper could have a material adverse effect on our business, financial condition and results of operations.

We currently are in litigation with Mr. Howard Cooper, ITC and IPC Cayman as regards costs incurred and compliance with the terms of the Contribution and Assignment Agreement and Stockholders Agreement as well as the proposed Shaldieli transaction. We are also trying to resolve these disputes through negotiation. There is no guarantee that legal actions taken so far will result in our favour or negotiations will be successful or favorable to us. The outcome of the disputes or the litigation cannot be predicted. These legal actions, if they continue, will result in substantial costs and diversion of resources. An adverse outcome in these disputes could cause us to lose our interest in the licenses and write off our investments.

IPC Cayman is a newly formed development stage company with no operating history.

IPC Cayman, the company in which we acquired a 76.79% equity interest, is newly formed and has no operating history. Its operations will be subject to all of the risks inherent in exploration stage companies with no revenues or operating history. Its potential for success must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered in connection with a new business, especially the oil and natural gas exploration business. No assurance can be given that any particular investment return will be achieved.

We will be substantially dependent upon our joint venture partners to develop the offshore Israel project.

We will be substantially dependent on IPC Cayman and our other joint venture partners and their respective affiliates to develop the offshore Israel project. We will not control the management or operations of the offshore Israel project.

Investments in joint ventures may, under certain circumstances, involve risks not present were a third party not involved, including the possibility that joint venture partners might become bankrupt or fail to fund their share of financial commitments.

Joint venture partners may have economic or other business interests or goals which are inconsistent with our business interests or goals, and may be in a position to take actions contrary to our interests or objectives, and they may have competing interests in our markets that could create conflict of interest issues. Such investments may also have the potential risk of impasses on decisions, such as a sale, because neither we nor our joint venture partners would have full control over the joint venture. Disputes between us and our joint venture partners may result in litigation or arbitration that would increase our expenses and prevent our officers and/or directors from focusing their time and effort on our business. Our investment in the offshore Israel project may exceed returns from the project.

We cannot control activities on properties or drilling locations that we do not operate and are unable to control their proper operation and profitability.

We do not operate any of the properties in which we own an interest, and we own an indirect minority interest in the properties. As a result, we have limited ability to exercise influence over, and control the risks associated with, the operations of these properties. The failure of an operator of our wells to adequately perform operations, an operator’s breach of the applicable agreements or an operator’s failure to act in ways that are in our best interests could adversely affect us from realizing our target returns for those properties. The success and timing of exploration and development activities on properties operated by others therefore will depend upon a number of factors outside of our control, including:

| | • | the nature and timing of drilling and operational activities; |

| | • | the timing and amount of capital expenditures; |

| | • | the operator’s expertise and financial resources; |

| | • | the approval of other participants in drilling wells; and |

| | • | the operator’s selection of suitable technology. |

Drilling on the Myra and Sara licenses must commence by January 1, 2012 or the licenses could be forfeited.

Our joint venture must commence test well drilling on one of the Myra and Sara licenses on or before January 1, 2012 or the licenses could be forfeited. Drilling on the second well on the remaining license must commence immediately on completion of the first well drilling. If our joint venture fails to drill timely wells before the license expiration, we will lose the drilling opportunities and our investment in the expired licenses.

Prospects that our joint venture decides to drill may not yield natural gas or oil in commercially viable quantities.

The joint venture is conducting seismic surveys and other geological and geophysical analysis to identify and develop prospects in the areas covered by the Myra and Sara licenses. A prospect is a property on which indications of natural gas and oil have been identified based on available seismic and geological information and analyses. The prospects will require substantial additional seismic data processing and interpretation. However, the use of seismic data and other technologies and the study of data in the same and nearby areas will not enable the joint venture to know conclusively prior to drilling and testing whether natural gas or oil will be present or, if present, whether natural gas or oil will be present in sufficient quantities to recover drilling or completion costs or to be economically viable. If the seismic and other data are inconclusive or unsatisfactory, the joint venture may not be able to attract industry partners to conduct exploratory drilling on its properties.

There is currently no infrastructure to market oil or gas if hydrocarbons are discovered.

The Myra and Sara licenses are located in an area of the eastern Mediterranean where there has not previously been production of oil and gas. Accordingly, there is not currently any infrastructure in place to market oil or gas if hydrocarbons are discovered. The Israeli government will have to approve the installation of infrastructure, and the construction of infrastructure will require significant capital investment.

Failure to fund capital expenditures could adversely affect our properties interests.

The oil and gas industry is capital intensive. The joint venture’s exploration and development activities will require substantial capital expenditures to meet requirements in the licenses. We will be responsible to the extent of our share of IPC Cayman’s commitment for drilling and related exploration costs in excess of US$ 28 million for the initial two exploratory wells under the Myra and Sara licenses as well as the costs of any subsequent wells.

We do not expect that debt financing will be available to us or any of our joint venture partners to support exploratory operations of the type required to establish commercial viability of the properties. Cash flows from the offshore Israel project will be subject to a number of variables, such as the success of drilling operations, production levels from successful wells, prices of crude oil and natural gas, availability of infrastructure and markets, and costs of services and equipment. In addition, our joint venture partners could seek farmout arrangements with third parties. These farmouts could result in us giving up a substantial interest in the oil and gas properties, comprising two licenses for offshore exploration for gas and/or oil, we have acquired. If we or IPC Cayman are not able to fund our or its share of capital expenditures, our interests in the properties might be reduced or forfeited as a result.

Market conditions could impede access to capital or increase the cost of capital, which could significantly impede development of the offshore Israel project.

The oil and gas industry is cyclical in nature and tends to reflect general economic conditions. Recent and continuing disruptions and volatility in the global financial markets may, among other things, make it more difficult for us and our joint venture partners to obtain, or increase the cost of obtaining, capital and financing for the offshore Israel project. Access to additional capital may not be available on acceptable terms or at all. Difficulties in obtaining capital and financing or increased costs for obtaining capital and financing could significantly delay development of our property interests.

Our business is not geographically diversified.

Our property interests are located off the west coast of Israel. We currently own no other working interests, leases or properties. As a result, our current business will be concentrated in the same geographic region. Our success or failure will be dependent upon the drilling and production results of any wells identified on the offshore Israel properties.

We face significant competition and many of our competitors have resources in excess of our available resources.

The oil and natural gas industry is highly competitive. We face intense competition from a large number of independent, technology-driven companies as well as both major and other independent crude oil and natural gas companies in a number of areas such as:

| | · | seeking to acquire desirable producing properties or new leases for future exploration; |

| | · | marketing our crude oil and natural gas production; |

| | · | seeking to acquire the equipment and expertise necessary to operate and develop properties; and |

| | · | attracting and retaining employees with certain skills. |

Many of our competitors have financial, technical and other resources substantially in excess of those available to us. This highly competitive environment could have an adverse impact on our business.

Risks of Oil and Natural Gas Investments

Oil and natural gas investments are highly risky.

The selection of prospects for oil and natural gas drilling, the drilling, ownership and operation of oil and natural gas wells and the ownership of non-operating interests in oil and natural gas properties are highly speculative. There is a possibility you will lose all or substantially all of your investment in us. We cannot predict whether any prospect will produce oil or natural gas or commercial quantities of oil and natural gas, nor can we predict the amount of time it will take to recover any oil or natural gas we do produce. Drilling activities may be unprofitable, not only from non-productive wells but also from wells that do not produce oil or natural gas in sufficient quantities or quality to return a profit.

Oil and natural gas prices are volatile and a reduction in these prices could adversely affect our financial condition and results of operations.

The price we may receive for oil or natural gas production from wells, in which we have an interest, will significantly affect our revenue, cash flow, access to capital and future growth. Historically, the markets for oil and natural gas have been volatile and are likely to continue to be volatile in the future. The markets and prices for oil and natural gas depend on numerous factors beyond our control. These factors include:

| | · | changes in supply and demand for oil and natural gas; |

| | · | actions taken by foreign oil and gas producing nations; |

| | · | political conditions and events (including political instability or armed conflict) in oil or natural gas producing regions; |

| | · | the level of global oil and natural gas inventories and oil refining capacity; |

| | · | the price and level of imports of foreign oil and natural gas; |

| | · | the price and availability of alternative fuels; |

| | · | the availability of pipeline capacity and infrastructure; |

| | · | the availability of oil transportation and refining capacity; |

| | · | weather conditions; |

| | · | speculation as to future prices of oil and natural gas and speculative trading of oil or natural gas futures contracts; |

| | · | domestic and foreign governmental regulations and taxes; and |

| | · | global economic conditions. |

The effect of these factors is magnified by the concentration of our interests in Israel, where some of these forces could have disproportionate impact, such as war, terrorist acts or civil disturbances, changes in regulations and taxation policies by the Israeli government, exchange rate fluctuations, laws and policies of Israel affecting foreign investment, trade and business conduct and the availability of pipeline capacity and infrastructure.

A significant or extended decline in oil and natural gas prices may have a material adverse effect on our and IPC Cayman’s financial condition, results of operations, liquidity, ability to finance planned capital expenditures or ability to secure funding from industry partners.

Exploration, development and production of oil and natural gas are high risk activities with many uncertainties that could adversely affect our financial condition and results of operations.

The joint venture’s drilling and operating activities will be subject to many risks, including the risk that commercially productive wells will not be discovered. Drilling activities may be unprofitable, not only from dry holes but also from productive wells that do not generate sufficient revenues to return a profit. In addition, drilling and producing operations may be curtailed, delayed or canceled as a result of other factors, including:

| | · | environmental hazards, such as natural gas leaks, pipeline ruptures and spills; |

| | · | fires; |

| | · | explosions, blowouts and cratering; |

| | · | unexpected or unusual formations; |

| | · | pressures; |

| | · | facility or equipment malfunctions; |

| | · | unexpected operational events; |

| | · | shortages of skilled personnel; |

| | · | shortages or delivery delays of drilling rigs and equipment; |

| | · | compliance with environmental and other regulatory requirements; |

| | · | adverse weather conditions; and |

| | · | natural disasters. |

Any of these risks could adversely affect operations or result in substantial losses as a result of personal injury or loss of life; severe damage to or destruction of property and equipment; pollution; environmental contamination; repair and remediation costs; loss of wells; and regulatory fines and penalties. Uninsured liabilities could have a material adverse effect on our financial condition and results of operations.

We will be subject to various governmental regulations which may result on material liabilities and costs.

Political developments and laws and regulations will affect the offshore Israel project. In particular, price controls, taxes and other laws relating to the oil and natural gas industry, changes in these laws and changes in administrative regulations have affected and in the future could affect oil and natural gas production, operations and economics. We cannot predict how agencies or courts in the State of Israel will interpret existing laws and regulations or the effect these adoptions and interpretations may have on our business or financial condition.

We and our joint venture partners are subject to laws and regulations promulgated by the State of Israel relating to the exploration for, and the development, production and marketing of, oil and natural gas, as well as safety matters. Legal requirements can change and are subject to interpretation and we are unable to predict the ultimate cost of compliance with these requirements or their effect on the offshore Israel project. We and our joint venture partners may be required to make significant expenditures to comply with governmental laws and regulations.

We and our joint venture partners are subject to Israeli environmental laws and regulations. Because of the recent nature of the discoveries in the eastern Mediterranean and the absence of production, there has not been consideration of the impact that operations in this area may have on environmental laws and regulations, which could be changed in ways that could negatively impact the offshore Israel project. The discharge of natural gas, oil, or other pollutants into the air, soil or water may give rise to significant liabilities and may require us and our joint venture partners to incur substantial costs of remediation. In addition, we and our joint venture partners may incur costs and penalties in addressing regulatory agency procedures involving instances of possible non-compliance. The financial implications, if any, cannot be estimated at this stage.

Potential regulations regarding climate change could alter the way the joint venture conducts business.

As awareness of climate change issues increases, governments around the world are beginning to address the matter. This may result in new environmental regulations that may unfavorably impact us and our joint venture partners. The cost of meeting these requirements may have an adverse impact on our financial condition, results of operations and cash flows.

The potential lack of availability or high cost of drilling rigs, equipment, supplies, personnel and other oil field services could adversely affect the joint venture’s ability to execute exploration and development plans on a timely basis and within budget.

From time to time, there is a shortage of drilling rigs, equipment, supplies or qualified personnel in the oil and natural gas industry. During these periods, the costs of rigs, equipment and supplies are substantially greater and their availability may be limited, particularly in international locations that typically have more limited availability of equipment and personnel, such as Israel. During periods of increasing levels of exploration and production in response to strong demand for oil and natural gas, the demand for oilfield services and the costs of these services increase. Additionally, these services may not be available on commercially reasonable terms.

Risks Related to the Manager of IPC Cayman

We have limited control over the management of IPC Cayman.

Under the agreement between us and ITC, we have limited authority to participate in the management of IPC Cayman. Our rights as the holder of a majority of the shares of IPC Cayman include the right to approve:

| | · | Expansion of the scope of IPC Cayman’s business beyond the acquisition, development and potential farmout or sale of the Myra and Sara licenses and Benjamin permit and any license that may be issued in lieu of such permit and any other oil and gas exploration and development activity within the offshore or onshore areas of the State of Israel; |

| | · | Sale or merger of IPC Cayman or sale or other disposition of all or substantially all of the assets of IPC Cayman (other than a sale or farmout to an industry partner in connection with a commitment to conduct exploratory or development operations on the licenses and permit); |

| | · | Admit additional owners to IPC Cayman; |

| | · | Enter into any contract or agreement between IPC Cayman and ITC or any affiliate; |

| | · | Modify any compensation arrangement between IPC Cayman and ITC and any affiliate; and |

| | · | Amend the organizational and internal operating documents of IPC Cayman. |

Other than those specified rights, ITC as the sole director of IPC Cayman will have the right to make operational decisions with respect to matters affecting the exploration and development of the licenses, including farming out or otherwise disposing of interests to third parties who will agree to assume the obligations to conduct required exploratory and development operations at their cost.

We have no control over the management of IPC Oil and Gas (Israel) Limited Partnership (or IPC Partnership).

Iin May 2010. IPC Cayman transferred all of its assets and liabilities to IPC Partnertship without transferring any of the protections given to us in the stockholders agreement and registered IPC Cayman’s interest in the two licenses in the name of IPC Partnership. IPC Cayman became a limited partner and ITC became the general partner of IPC Partnership. These actions were done without our knowledge or consent. As a result, the Company has no control over management of IPC Partnership and we will be subject to unilateral actions of the manager of IPC Cayman, some of which may not be in our best interests.

There is no guarantee that IPC Cayman will make cash distributions to its owners, including us.

Cash distributions are not guaranteed and will depend on future drilling and operating activities and performance of the offshore Israel project. The director of IPC Cayman has the authority to authorize and to make any distributions to its stockholders at such times and in such amounts as the director deems advisable. You may receive little or no return on your investment in us.

Conflicts of interest may arise.

Conflicts of interest may arise because of the relationships between and among IPC Cayman, ITC and us. The interests of ITC may not coincide with the interests of us and our shareholders. In addition, ITC and its majority member, H. Howard Cooper, may experience conflicts of interest in allocating their time and resources between IPC Cayman and other businesses, including other oil and gas projects. The organizational documents do not restrict ITC and its affiliates from engaging in other business activities or specify any minimum amount of time that ITC and its affiliates are required to devote to IPC Cayman.

Risks Related to Ownership of our Stock

There is currently a limited trading market for our common shares.

There currently is a limited public market for our common shares. Further, although our common shares are currently quoted on the OTC Bulletin Board, trading of our common shares may be extremely sporadic. As a result, an investor may find it difficult to sell, or to obtain accurate quotations of the price of, our common shares. There can be no assurance that a more active trading market for our common shares will develop. Accordingly, investors must assume they may have to bear the economic risk of an investment in our common shares for an indefinite period of time.

Risks related to penny stocks.

Our common shares are subject to regulations prescribed by the SEC relating to “penny stock.” These regulations impose additional sales practice requirements on broker-dealers who sell such securities to persons other than established customers and accredited investors (as defined in Rule 501 of the U.S. Securities Act of 1933). These regulations could adversely impact market demand for our shares and adversely impact our trading volume and price.

The issuance of common shares upon the exercise of our outstanding warrants and options will dilute the ownership interest of existing stockholders and increase the number of shares eligible for future resale.

The exercise of some or all of our outstanding warrants and options could significantly dilute the ownership interests of our existing shareholders. As of August 25, 2011, we had outstanding warrants to purchase an aggregate of 73,071,420 common shares and outstanding options to purchase an aggregate of 5,775,000 common shares. To the extent the warrants and options are exercised, additional common shares will be issued and that issuance will increase the number of shares eligible for resale in the public market. The sale of a significant number of shares by our shareholders, or the perception that such sales could occur, could have a depressive effect on the public market price of our common shares.

We expect to raise additional funds by issuing our stock which will dilute your ownership.

We expect that we will likely issue a substantial number of shares of our capital stock in the future. Under these arrangements, we may agree to register the shares for resale soon after their issuance. The sale of additional shares could lower the value of your shares by diluting your ownership interest in us and reducing your voting power. Shareholders have no preemptive rights.

Compliance with the rules established by the SEC pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 are complex. Failure to comply in a timely manner could adversely affect investor confidence and our stock price.

Rules adopted by the SEC pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 require us to perform an annual assessment of our internal controls over financial reporting and certify the effectiveness of those controls. The standards that must be met for management to assess the internal controls over financial reporting as now in effect are complex, and require significant documentation, testing and possible remediation to meet the detailed standards. We may encounter problems or delays in completing activities necessary to make an assessment of our internal controls over financial reporting. If we cannot perform the assessment or certify that our internal controls over financial reporting are effective, investor confidence and share value may be negatively impacted.

Your investment return may be reduced if we lose our foreign private issuer status.

We are a “foreign private issuer,” as such term is defined in Rule 405 under the U.S. Securities Act of 1933, and, therefore, we are not required to file quarterly reports on Form 10-Q or current reports on Form 8-K with the SEC. In addition, the proxy rules and Section 16 reporting and short-swing profit recapture rules are not applicable to us. If we lose our status as a foreign private issuer by our election or otherwise, we will be subject to additional reporting obligations under the Exchange Act which could increase our SEC compliance costs.

We may be treated as a passive foreign investment company for U.S. tax purposes, which could subject United States investors to significant adverse tax consequences.

A foreign corporation will be treated as a passive foreign investment company, or PFIC, for U.S. federal income taxation purposes, if in any taxable year either: (a) 75% or more of its gross income consists of passive income; or (b) 50% or more of the value of the company’s assets is attributable to assets that produce, or are held for the production of, passive income. Based on our current income and assets and our anticipated future operations, we believe that we currently are not a PFIC. U.S. stockholders of a PFIC are subject to a disadvantageous U.S. income tax regime with respect to the income derived by the PFIC, the distributions they receive from the PFIC, and the gain, if any, they derive from the sale or other disposition of their shares in the PFIC. Because PFIC status is a fact-intensive determination made on an annual basis, no assurance can be given that we are not or will not become classified as a PFIC. The PFIC rules are extremely complex. A U.S. person is encouraged to consult his or her U.S. tax advisor before making an investment in our shares.

U.S. shareholders may not be able to enforce civil liabilities against us.

We are a corporation organized under the laws of the Province of Ontario, Canada. Most of our directors and executive officers are non-residents of the United States. Because a substantial portion of their assets and currently all of our assets are located outside the United States, it may not be possible for you to effect service of process within the United States upon us or those persons. Furthermore, it may not be possible for you to enforce against us or them in the United States, judgments obtained in U.S. courts based upon the civil liability provisions of the U.S. federal securities laws or other laws of the United States. There is doubt as to the enforceability, in original actions in Canadian courts, of liabilities based upon the U.S. federal securities laws and as to the enforceability in Canadian courts of judgments of U.S. courts obtained in actions based upon the civil liability provisions of the U.S. federal securities laws.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus includes forward-looking statements. All statements other than statements of historical facts are forward-looking statements, including statements regarding our future financial position, business strategy, and plans and objectives for future operations. The words “may,” “will,” “believe,” “expect,” “estimate,” “continue,” “anticipate,” “intend” and similar expressions are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy, business operations and financial needs. For a discussion of risk factors affecting our business, see “Risk Factors.”

We do not guarantee that the events anticipated by the forward-looking statements will occur or that they will happen at all. We do not undertake any obligation to update any of the forward-looking statements, except as may be required under federal securities laws.

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

Directors and Management Team

| Name and Position | | Business Address | | Position |

| | | | | |

| Kam Shah | | 47 Avenue Road, Suite 200 Toronto, Ontario, Canada M5R 2G3 | | CEO, CFO and Director |

| Dean Bradley | | 9300 Normandy Blvd., Suite 511 Jacksonville, Florida 32221 | | Director |

| Brett Rees | | 114 Newport Avenue Toronto, Ontario M1L 1J5 | | Director |

| Terence Robinson | | 47 Avenue Road, Suite 200 Toronto, Ontario, Canada M5R 2G3 | | Consultant |

Legal Advisers

Our Canadian legal advisers are Sui & Company, Solicitors, whose business address is The Exchange Tower, Suite 1800, 130 King Street West, Toronto, Ontario M5X 1E3. Our U.S legal advisers are Messerli & Kramer, P.A., whose business address is 1400 Fifth Street Towers, 100 South Fifth Street, Minneapolis, MN 55402.

Auditor

Our auditors are Schwartz Levitsky Feldman LLP, whose business address is 1167 Caledonia Road, Toronto, Ontario M6A 2X1.

OFFER STATISTICS AND EXPECTED TIMETABLE

The common shares offered by this prospectus are registered for the account of the selling shareholders named in this prospectus. There is no expected issue price. The selling shareholders may sell the common shares at fixed prices, at prevailing market prices at the time of sale or at negotiated prices. The approximate date of proposed sale of the common shares is from time to time after the registration statement of which this prospectus forms a part becomes effective, in amounts and on terms determined at the time of the sale.

KEY INFORMATION

Selected Financial Data

The following table presents selected historical consolidated financial data for the periods indicated. The selected financial data for the three fiscal years ended March 31, 2011 and as of March 31, 2011, 2010 and 2009 have been derived from the our audited consolidated financial statements included elsewhere in this prospectus. The selected financial data for the two fiscal years ended March 31, 2008 and as of March 31, 2008 and 2007 have been derived from the our audited consolidated financial statements for those years which are not included in this prospectus.

The historical results are not necessarily indicative of results to be expected in any future period, and interim results may not be indicative of results for the remainder of the year. Our consolidated financial statements are prepared in accordance with generally accepted accounting principles in Canada, or Canadian GAAP. Additional information is presented below to show the differences which would result from the application of U.S. GAAP to our financial statements.

Operating data – Fiscal year ended March 31

| | 2011 | 2010 | 2009 | 2008 | 2007 |

| | | | | | (Restated) |

| | | | | | |

| Revenue | - | - | 7,901 | 73,300 | $93,278 |

| Loss before non-controlling interests | ($3,779,638) | ($4,284,058) | ($689,415) | ($571,799) | ($164,043) |

| Non-controlling interests | $51,311 | $356,814 | $- | $- | $- |

| Net Loss | ($3,728,327) | ($3,927,244) | ($689,415) | ($571,799) | ($164,043) |

| Net loss per share (1) | ($0.05) | ($0.09) | ($0.02) | ($0.02) | ($0.01) |

| Working capital | $1,706,527 | $371,130 | $1,431,495 | $5,173,892 | $6,624,466 |

| Total assets | $9,351,800 | $10,419,787 | $1,592,947 | $5,239,122 | $6,672,918 |

| Capital stock | $36,078,140 | $35,298,257 | $32,854,075 | $32,901,488 | $32,413,811 |

| Warrants | $8,677,551 | $7,343,886 | $2,192,927 | $2,153,857 | $2,215,213 |

| Contributed surplus | $4,755,077 | $4,573,748 | $4,154,266 | $4,077,427 | $4,069,549 |

| Accumulated other comprehensive loss(gain) | $168,347 | ($2,696,213) | ($4,425,018) | ($1,306,768) | |

| Shareholders' equity | $8,688,223 | $6,900,299 | $1,440,929 | $5,180,098 | $6,624,466 |

| Weighted average number of shares outstanding ( 2 ) | 78,469,909 | 42,963,027 | 30,170,743 | 28,840,653 | 27,472,703 |

1. The effect of potential share issuances pursuant to the exercise of options and warrants would be anti-dilutive and, therefore, basic and diluted losses per share are the same.

2. Weighted average number of shares for a year was calculated by dividing the total number of shares outstanding at the end of each of the months by twelve.

Selected Financial Data (U.S. GAAP) – Fiscal year ended March 31

| | 2011 | 2010 | 2009 | 2008 | 2007 |

| | | | | | |

| Loss for year | ($3,728,327) | ($3,927,244) | ($689,415) | ($571,799) | ($52,384) |

| Comprehensive Loss | ($863,767) | ($2,198,439) | ($3,807,665) | ($2,838,269) | $795,658 |

| Loss per share -Basic and diluted | ($0.05) | ($0.09) | ($0.02) | ($0.02) | $0.00 |

| Total assets | $9,351,800 | $10,419,787 | $1,592,947 | $5,239,122 | $7,632,619 |

| Shareholders' equity | $8,688,223 | $6,900,299 | $1,440,929 | $5,180,098 | $7,584,167 |

The Company has not declared or paid any dividends in any of its last five financial years.

The Company has consolidated the results of IPC Cayman, in which Israel Oil & Gas Corporation owns a 76.79% equity interest, for the period from April 1, 2010 up to May 18, 2010 and since then IPC Cayman financials have been de-consolidated due to a loss of control over IPC Cayman’s financial reporting process (see note 25 to our consolidated financial statements). The accounting for this investment is recorded at the lower of the carrying value and the recoverable amount.

Exchange Rates

The exchange rates used herein were obtained from the Bank of Canada. On August 25, 2011, the exchange rate, based on the noon buying rates, for the conversion of Canadian dollars into United States dollars (the “Noon Rate of Exchange”) was CDN $0.9843 = USD $1.

The following table sets out the high and low exchange rates in US dollar for one Canadian dollar for each of the last six months.

| | July 2011 | June 2011 | May 2011 | April 2011 | March 2011 | February 2011 | |

| | | | | | | | |

| High for period | $1.06 | $1.04 | $1.05 | $1.05 | $1.03 | $1.03 | |

| Low for period | $1.03 | $1.01 | $1.02 | $1.03 | $1.01 | $1.00 | |

| | | | | | | | |

The following table sets out the average exchange rates in US dollar for one Canadian dollar for the five most recent fiscal years calculated by using the average of the Noon Rate of Exchange on the last day of each month during the period.

| Year Ended March 31, | 2011 | 2010 | 2009 | 2008 | 2007 |

| Average for the year | 0.98 | 0.92 | 0.89 | 0.97 | 0.88 |

Capitalization and Indebtedness

The following table sets forth our capitalization as of March 31, 2011

| | | | |

| | | | |

| Shareholders' equity: | | | |

| Capital stock | | 36,078,140 | |

| Warrants | | 8,677,551 | |

| Contributed surplus | | 4,755,077 | |

| Accumulated other comprehensive income | | 168,347 | |

| Accumulated deficit | | (40,990,892) | |

| Total equity | | $ 8,688,223 | |

| | | | |

| Total capitalization | | $8,688,223 | |

| | | | |

| Common shares issued and outstanding | | 78,664,076 | |

Reasons for the Offer and Use of Proceeds

This prospectus relates to the resale by the selling stockholders named in this prospectus of up to 29,025,000 common shares; and 32,077,500 common shares issuable upon exercise of warrants at an exercise price of USD $0.35 per share. We issued all of these shares and warrants in transactions exempt from the registration requirements of the Securities Act of 1933, Rule 506 of Regulation D and/or Section 4(2) of the Securities Act of 1933. We will not receive any proceeds for the resale of shares by the selling stockholders. If the 32,077,500 warrants are exercised, we may receive proceeds of up to US$11,227,125. We will use the proceeds for working capital and other general corporate purposes, including for our indirect working interest in the offshore Israel project or any other project where we may be holding any working interest.

INFORMATION ON BONTAN

History and Development

We are a Canadian corporation incorporated under the laws of the Province of Ontario in 1973 under the original name of Kamlo Gold Mines Limited. We were inactive until 1985. Between 1986 and 1982, our company was involved in the development of a new technology for the marine propulsion business. During this period, our company went through three name changes.

Between 1993 and 1996, our company was involved in the distribution and manufacture of a snack food. During this period, our company went through two more name changes.

Our company remained inactive after the closure of the snack food business in November 1996 until December 1998 when we changed our name to Dealcheck.com Inc. and agreed on a new business strategy. This strategy focused on investing in new and emerging technology oriented projects and businesses. In 1999, our company raised $3.2 million, which we invested in various projects and companies over the next two years as per the new business strategy of our company. Unfortunately, the IT sector performed poorly since 2001 and new and emerging technology-based businesses suffered significant losses, financial problems and bankruptcies. These factors adversely affected our company’s investments and its profitability. Our company had to write off all its investments by the end of the fiscal 2003.

In April 2003, our company changed its business focus to the natural resource industry and completed a private placement of approximately 8.9 million common shares, raising approximately USD $3.1 million. These funds were primarily invested in projects involving oil and gas exploration and diamond mining projects in Brazil between April 2003 and September 2005,

Diamond mining operations discontinued in December 2004. Our company sold its interest in an oil exploration project in Papua New Guinea in July 2005 for USD $3.2 million. Our company’s cost of this project was approximately USD $1.6 million. Further, in October 2004, our company acquired a working interest in a gas exploration project in Louisiana, USA. Between March 2005 and September 2005, our company invested approximately $3.9 million as its share of exploration costs. The exploration, however, proved a dry well and was therefore abandoned and the costs incurred were fully written off in December 2005.

Since 2006, our company has been actively pursuing oil and gas exploration and development projects We found many projects to be too expensive while others did not meet our technical due diligence. In November 2009, we acquired (through our wholly owned subsidiary) an indirect 71.63% working interest in two drilling licenses and one exploration permit in the Levantine Basin, approximately 40 kilometres off the west coast of Israel. The two drilling licenses, Petroleum License 347 (“Myra”) and Petroleum License 348 (“Sara”), cover approximately 198,000 acres of submerged land, and the exploration permit, Petroleum Preliminary Permit 199 (“Benjamin”), covers approximately 461,000 acres of submerged land adjacent to the land covered by the licenses. Our working interest was held in the form of a 75% equity interest in IPC Cayman, a Cayman Islands limited company that was formed to explore and develop the properties off the coast of Israel. Subsequently, disputes arose with respect to the transfer of rights in the two drilling licenses and the exploration permit to IPC Cayman and the Benjamin permit was lost in February 2010 due to the failure to timely submit the required seismic data to the Israel Petroleum Commissioner. In March 2010, IPC Cayman entered into an Allocation of Rights and Settlement Agreement with the Lead Investors and others under which, among other things, the Lead Investors acquired a greater than 50% working interest in the Myra and Sara licenses for approximately USD $16.2 million. The sale proceeds were used primarily used to pay for the seismic data relating to the two drilling licenses and the permit and to settle various disputes with PetroMed Corporation, the original registered owner of a 95.5% working interest in the two drilling licenses and the permit.

Under the terms of an agreement dated April 14, 2010, International Three Crown Petroleum LLC (or ITC) is deemed to own a 23.21% equity interest in IPC Cayman represented by 2,321 ordinary shares of IPC Cayman and Bontan is deemed to own a 76.79% equity interest in IPC Cayman represented by 7,679 ordinary shares of IPC Cayman. Allied Ventures Incorporated is deemed not to have owned or to ever have owned any equity interest in IPC Cayman.

We currently own an indirect 5.23% working interest in the two drilling licenses through our 76.79% equity interest in IPC Cayman. ITC and an affiliated entity, JKP, own the balance of the 23.21% equity interest in IPC Cayman. IPC Cayman, in turn, owns a 50% limited partnership interest in IPC Partnership, the registered holder of the 13.609% interst in the Myra and Sara licenses.

Our company’s registered office is situated at 47 Avenue Road, Suite 200 Toronto, Ontario, Canada M5R 2G3. We are a reporting issuer in the province of Ontario.

Business Overview

We invest in the exploration and development of oil and gas wells. We focus on partnering with established developers and operators. We have never had any oil and gas operations and do not currently own any oil and gas properties with proven reserves. We are currently focused on the offshore Israel project which currently includes the Myra and Sara licenses. We currently are not seeking to acquire additional property interests in Israel or any other region or to pursue other business opportunities. Our goal is to advance offshore Israel project to the drilling stage aggressively, as prudent financing will allow to determine the presence of oil or natural gas. If we are successful in doing so, we believe our joint venture partners can attract the attention of the existing oil and gas companies already operating in the region or new oil and gas companies to enter into a development agreement or farmout agreement.

Background and Status of Offshore Israel Project

On October 15, 2009, International Three Crown Petroleum LLC (or ITC) entered into an option agreement with PetroMed Corporation under which ITC was granted the right to purchase all of PetroMed Corporation’s rights in the Myra and Sara licenses and the Benjamin permit. On November 18, 2009, the right to purchase was exercised, and as part of the closing, PetroMed Corporation was paid the contractual consideration and PetroMed Corporation provided IPC Cayman, ITC’s designee, with irrevocable deeds of assignment with respect to each of the licenses and permit.

Under Section 76(a) of the Israel Petroleum Law, the permit may be transferred only with the permission of the Petroleum Commissioner and the licenses may be transferred only with the permission of the Petroleum Commissioner and after the Petroleum Commissioner’s consultation with the Petroleum Council. Accordingly, on January 18, 2010, IPC Cayman filed applications with the Petroleum Commissioner to transfer the licenses and permit, with the application to transfer the permit also including an application to be granted a license based on the permit and its attending priority rights.

PetroMed Corporation sent an e-mail to IPC Cayman and the Petroleum Commissioner on January 17, 2010, purporting to ‘rescind’ the PetroMed transaction and has, to the best of IPC Cayman’s knowledge, further addressed the Petroleum Commissioner with claims that the Petroleum Commissioner denies the applications. In addition, IPC Cayman received verbal indication from the Petroleum Commissioner that the permit would lapse at the end of its term on February 5, 2010, and the Petroleum Commissioner would not approve the conversion of the permit into a license. Thereafter, PetroMed Corporation communicated its withdrawal of rescission to the Petroleum Commissioner with respect to the request to transfer the permit and convert it into a license and requested that the Petroleum Commissioner place the request for conversion of the permit before the Petroleum Council.

On January 19, 2010, PetroMed Corporation filed a complaint in the U.S. District Court for the Western District of Washington against Bontan, Howard Cooper and Three Crown Petroleum, LLC. The complaint requested, among other things, rescission of PetroMed Corporation’s assignment of its 95.5% interest in the Myra and Sara licenses and Benjamin permit to IPC Cayman and a declaration that the contracts with the defendants are null and void.

On February 12, 2010, ITC and IPC Cayman filed a complaint in the Denver, Colorado District Court against PetroMed Corporation and other defendants. ITC and IPC Cayman alleged that the defendants were actively interfering with IPC Cayman’s application before the Israel Ministry of Natural Infrastructure for transfer to IPC Cayman of PetroMed Corporation’s 95.5% interest in the Myra and Sara licenses and Benjamin permit. In the lawsuit, ITC and IPC Cayman were seeking, among other matters, temporary, preliminary and permanent injunctive relief in order to avoid real, immediate and irreparable harm to ITC and IPC Cayman resulting from the defendants’ alleged wrongful conduct. The lawsuit also requested damages for defendants’ alleged multiple tortuous acts and materials breaches of contracts, and a declaration of the parties’ rights and obligations under the contracts.