UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

BONTAN CORPORATION INC.

THREE MONTHS ENDED JUNE 30, 2011

MANAGEMENT’S DISCUSSION AND ANALYSIS

Prepared as at September 26, 2011

Index

| Overview | 3 |

| Summary of Results | 3 |

| Number of Common shares, options and warrants | 3 |

�� Business Environment | 4 |

| Risk Factors | 4 |

| Forward Looking Statements | 4 |

| Business Plan | 4 |

Results of Operations | 5 |

Liquidity and Capital Resources | 8 |

| Working Capital | 8 |

| Operating Cash Flows | 8 |

| Investing Cash Flows | 9 |

| Financing Cash Flows | 11 |

| Key Contractual Obligations | 11 |

| Off balance sheet arrangements | 11 |

Transactions with Related Parties | 12 |

Financial and Derivative Instruments | 12 |

International Financial Reporting Standards | 14 |

Use of Estimates and Judgments | 15 |

Future Accounting Pronouncements | 15 |

Internal Controls over Financial Reporting | 16 |

Public Securities Filings | 16 |

Management Discussion and Analysis

The following discussion and analysis by management of the financial condition and financial results for Bontan Corporation Inc. for the three months ended June 30, 2011 should be read in conjunction with the unaudited Consolidated Financial Statements for the three months ended June 30, 2011. The Company’s financial statements have been prepared in accordance with

International Financial Reporting Standard 1 (“IFRS”), “First-time Adoption of International Financial Reporting Standards,” and with International Accounting Standard 34, “Interim Financial Reporting,” as issued by the International Accounting Standards Board. Previously, the company prepared its interim and annual consolidated financial statements in accordance with Canadian Generally Accepted Accounting Principles (“GAAP”). Unless otherwise noted, 2010 comparative information has been prepared in accordance with IFRS. Canadian GAAP now comprises IFRS. The adoption of IFRS has not had an impact on the company’s operations and/or strategic decisions.

This management discussion and analysis is prepared by management as at September 26, 2011. The Company’s auditors have not reviewed it.

In this report:

| a. | The words “us”, “we”, “our”, “the Company” and “Bontan” have the same meaning unless otherwise stated and refer to Bontan Corporation Inc. and its subsidiary. |

| b. | Our indirect working interest in two drilling licenses offshore Israel is sometimes referred to as “Israel project” |

| c. | Our subsidiary, Israel Petroleum Company, Ltd Cayman is referred to as “IPC Cayman” |

Overview

Summary of Results

The following table summarizes financial information for the quarter ended June 30, 2011 and the preceding seven quarters: (All amounts in ‘000 CDN$ except net loss per share, which are actual amounts)

| | Prepared under IFRS | Prepared under Canadian GAAP |

| Quarter ended | Jun. 30 | Mar. 31 | Dec. 31 | Sept. 30 | Jun. 30 | Mar. 31 | Dec. 31 | Sept. 30 | |

| | 2011 | 2011 | 2010 | 2010 | 2010 | 2010 | 2009 | 2009 | |

| Total Revenue | - | - | - | - | - | - | - | - | |

| Net loss | (874) | (3,728) | (1,065) | (1,329) | (486) | (3,927) | (630) | (763) | |

| Working capital | 756 | 1,707 | 1,167 | 960 | 1,085 | 372 | (10,907) | 1,564 | |

| Shareholder’s equity | 7,737 | 8,688 | 8,364 | 8,323 | 8,448 | 6,900 | 6,809 | 1,572 | |

| Net loss per share - basic and diluted | $(0.01) | $(0.05) | $(0.01) | $(0.02) | $(0.01) | $(0.09) | $(0.01) | $(0.02) | |

| | | | | | | | | | |

| | | | | | | | | | | |

Number of common shares, options and warrants

These are as follows:

| | As at June 30, 2011 AND September 26, 2011 |

| Shares issued and outstanding | 78,664,076 |

| Warrants issued and outstanding (a) | 73,071,420 |

| Options granted but not yet exercised (b) | 5,775,000 |

| (a) | Warrants are convertible into equal number of common shares of the Company within two to five years of their issuance, at average exercise price of $0.26. These warrants have weighted average remaining contractual life of 3.35 years. |

| (b) | Options are exercisable into equal number of common shares at an average exercise price of US$0.18 and have a weighted average remaining contractual life of approximately 3.37 years. |

Business Environment

Risk factors

Please refer to the Annual Report in the form F-20 for the fiscal 2011 for detailed information as the economic and industry factors that are substantially unchanged.

Forward looking statements

Certain statements contained in this report are forward-looking statements. All statements, other than statements of historical facts, included herein or incorporated by reference herein, including without limitation, statements regarding our business strategy, plans and objectives of management for future operations and those statements preceded by, followed by or that otherwise include the words “believe”, “expects”, “anticipates”, “intends”, “estimates” or similar expressions or variations on such expressions are forward-looking statements. We can give no assurances that such forward-looking statements will prove to be correct.

Each forward-looking statement reflects our current view of future events and is subject to risks, uncertainties and other factors that could cause actual results to differ materially from any results expressed or implied by our forward-looking statements.

Risks and uncertainties include, but are not limited to:

| · | Our lack of substantial operating history; |

| · | The success of the exploration prospects, in which we have interests; |

| · | The impact of competition; |

| · | The enforceability of legal rights; |

| · | The volatility of oil and gas prices; |

| · | Weather and unforeseen operating hazards; |

Important factors that could cause the actual results to differ materially from our expectations are disclosed in more detail under the “Risk Factors” in our Annual report for fiscal 2011. Our forward-looking statements are expressly qualified in their entirety by this cautionary statement.

Currently we do not hold interests in any exploration projects and have no reserves as defined in Canadian National Instrument 51-101 Standards of Disclosure for Oil and Gas Activities ("NI 51-101"). All information contained herein regarding resources is references to undiscovered resources under NI 51-101, whether stated or not.

Business plan

We invest in the exploration and development of oil and gas wells. We focus on partnering with established developers and operators. We have never had any oil and gas operations and do not currently own any oil and gas properties with proven reserves.

In fiscal 2010, we acquired indirect working interest, which is currently 5.23%, in two licenses for drilling oil and gas in offshore location in Israel. Currently there are several disputes with the management of our subsidiary, IPC Cayman surrounding our rights to this property. As explained later, these disputes are being contested in courts in Israel and Cayman Islands.

We are therefore currently focused on resolving the disputes. There are also efforts in progress in out of court settlement with the management of IPC Cayman. These actions may result in us selling our interest on terms acceptable to us. If this happens, then we will invest the cash acquired through sale into other business opportunities. On the other hand, if we are successful in preserving our working interest, we will focus on participating in the future development of these two licenses.

Results of operations

| Three months ended June 30 | 2011 | 2010 |

| | In 000’s CDN$ |

| Income | - | - |

| Expenses | (874) | (544) |

| | (874) | (544) |

| Non-controlling interests | - | 58 |

| Net loss for period | (874) | (486) |

| Deficit at end of period | (41,864) | (37,748) |

Overview

During the three months ended June 30, 2011, we were primarily busy with various litigation matters involving legal actions against the management of IPC Cayman and others to prevent them from rolling our interest in an Israeli shell without our consent and also to enable us to call a shareholder meeting of IPC Cayman so that we could protect our interest as a majority shareholder. Further details of these actions are elaborated later in this report.

The key events during the quarter ended June 30, 2011, relating to the Israeli project, were as follows:

| a. | The Operator signed a letter of intent with a drilling contractor in April 2011. |

| b. | The Operator signed in April 2011 an assignment agreement with a third party to acquire drilling rig and associated services to be available in December 2011. |

| c. | In May 2011, the Petroleum commissioner approved to extend validity of the Sara and Myra licenses to July 13, 2012. |

| d. | Operator reported in July 2011 extracts from a prospective resource assessment as of June 15, 2011 conducted by an independent firm of Geologists. |

During the three months ended June 30, 2010, our indirect working interest in the two off shore drilling licenses was registered, an operator was appointed, a definite exploration work plan for the licenses was submitted and approved by the Israeli Ministry of National Infrastructure (“MNI”) and further work on the 3-D seismic data began. We also completed a private placement which began in November 2009.

Income

We had no revenue during the three months ended June 30, 2011 and 2010.

Expenses

The overall analysis of the expenses is as follows:

| | Three months ended June 30 |

| | 2011 | 2010 |

| | | |

| Operating expenses | 56,664 | 126,088 |

| Consulting fee & payroll | 122,487 | 221,101 |

| Exchange gains | (2,284) | (43,345) |

| Loss on disposal of short term investments | 14,540 | - |

| Write down of short term investments | 343,750 | - |

| Professional fees | 338,388 | 239,987 |

| | 873,545 | 543,831 |

Operating Expenses

| | Three months ended June 30, |

| | 2011 | 2010 |

Travel, meals and promotion | $ 6,258 | $ 32,669 |

| Shareholders information | 30,739 | 43,273 |

| other | 19,667 | 50,146 |

| | $ 56,664 | $ 126,088 |

Travel, meals and promotions

As explained earlier, our primary focus during the three months to June 30, 2011 was on handing various litigation matters. This explains significant reduction in expenses compared to the same period in the previous fiscal year.

Shareholder information

Shareholder information costs comprise investor and media relations fee, costs of holding annual general meeting of the shareholders and various regulatory filing fees.

Major cost consists of media relation and investor relation services provided by Current Capital Corp. under contracts dated July 1, 2004, which are being renewed automatically unless canceled in writing by a 30-day notice for a total monthly fee of US$10,000. Current Capital Corp. is a shareholder Corporation where the Chief Executive and Financial Officer of the Company provide accounting services.

During the three months ended June 30, 2010, the Company incurred higher filing fees due to various filings in connection with the registration statements and an increased number of press releases due to the Israel project. Significant changes in the exchange rates between the Canadian and US dollar, also contributed to difference in investor and media relation fees.

Management believes that such services are essential to ensure our existing shareholder base and prospective investors/brokers and other interested parties are constantly kept in contact and their comments and concerns are brought to the attention of the management on a timely basis.

Other operating costs

These costs include rent, telephone, Internet, transfer agents fees and other general and administration costs.

Consulting fees and payroll

| Three months ended June 30 | 2011 | 2010 |

| | | |

| Fees settled in common shares | $7,171 | $ 22,868 |

| Fees settled in cash | 106,065 | 185,821 |

| Payroll | 9,251 | 12,412 |

| | | |

| | $122,487 | $ 221,101 |

Consulting fees related to fees paid to the CEO and two other consultants and two members of the audit committee. There has not been any change in fees during the periods in fiscal 2010 and 2011.

In addition, during the three months ended June 30, 2010, two new consultants’ fees were settled in shares. Mr. John Robinson, a consultant, was paid his fee of $ 25,500 in cash while in the past his fee used to be settled in shares and IPC Cayman paid consulting fees of $80,153. This explains higher fees in that period.

Exchange (gain) loss

| Exchange differences related to translation losses arising from converting foreign currency balances, mainly in US dollar into Canadian dollar, which is the functional and presentation currency, on consolidation. |

| The company had payables in US dollar which, due to improved Canadian dollar against US dollar resulted in small gain on conversion at June 30, 2011. |

| The Company settled all its US dollar short term loans and most of its payables and accruals in April 2010 when Canadian dollar was almost in parity with the US dollar. Canadian dollar weakened subsequently to 1.06 per US dollar at June 30, 2010, as a result our US dollar cash, short term investment holdings and receivable gave rise to an exchange gain of approximately $ 43,000. |

Write off of Short term Investments

As at June 30, 2011, the Company’s short term investment portfolio included three marketable securities whose market price showed continued declining trend which the management believed would unlikely to improve in the near future. The carrying costs of these securities were therefore written down by $343,750 which amount was considered to have impaired.

Loss on disposal of short term investments

The disposal of short term investments, during the three months ended June 30, 2011, was mainly caused by the need for additional cash to meet increasing litigation costs.

During the quarter ended June 30, 2010, there were no movements in the short term investment portfolio.

Professional fees

Professional fees for the three months ended June 30, 2011 consisted of audit and accounting fees of approximately $17,000 and legal fees of approximately $ 321,000.

Legal fees primarily consisted of fees incurred by the Company for its legal actions against Shaldieli and IPC Cayman management as discussed elsewhere in this report.

The Company expects its legal costs to increase as various lawsuits come up for hearing in Israel and Cayman Island courts.

During the three months ended June 30, 2010, audit fee of $ 15,000 was accrued on the basis of $ 60,000 annual fee. Additional charges of $ 5,500 were billed by the external auditors in connection with their work on F-1 registration and other non-audit matters.$17,880 was charged by the IPC Cayman sole director for bookkeeping services, $132,000 was charged by IPC accountants.

During the above period, legal costs were approximately $ 69,000 in connection with various matters – F-1 registration of the units issued under private placement, defending legal suits from PetroMed and EastMed, and general advice in connection with the Israeli project.

Liquidity and Capital Resources

Working Capital

As at June 30, 2011, the Company had a net working capital of approximately $0.8 million compared to a working capital of approximately $1.7 million as at March 31, 2011.

Almost entire working capital at June 30, 2011 and March 31, 2011 was in the form of cash and short term investments.

Cash on hand as at June 30, 2011 was approximately $100,000 compared to $348,000 as at March 31, 2011. Cash was primarily used on the operating and legal expenses which increased significantly due to various legal actions.

Bontan’s cash requirement for the next twelve months will largely depend on how quickly the various legal actions are resolved either in courts or through settlement. If litigations continue, we estimate our cash requirement for working capital to be around $ 1 million. If we succeed in retaining our interest in the Israeli property, we will be required to contribute our share in exploratory well costs beyond $ 28 million, which at this stage cannot be reasonably estimated. In such case, however, we believe that the Company will be able to attract additional cash either through holders of options and warrants exercising their conversion rights or through new private placement. If however, we are able to sell our interest through negotiated settlement or any other means; we will use the funds in acquiring new business opportunities. The Company’s financials for the three months ended June 30, 2011 include a going concern note to reflect this situation.

Operating cash flow

During the three months ended June 30, 2011, operating activities required net cash outflow of approximately $ 0.5 million, which was met from the available cash and proceeds from the sale of short term marketable securities.

During the quarter ended June 30, 2010, operating activities required net cash out flow of approximately $ 1.1 million, which was met from the available cash and proceeds from the private placement.

The company expects its operating cash requirements to increase as explained elsewhere in the report; the Company has launched several legal actions which will require significant cash as explained above.

Investing cash flows

During the three months ended June 30, 2011, the company received net proceeds totalling $245,200 from the sale of its short term investments.

During the quarter ended June 30, 2010, the company paid approximately US$ 658,000 on the Israeli project on acquiring an additional 1% working interest and legal and other related expenses. Our short term investment portfolio had no activities during the period.

Acquisition of Oil and Gas Properties

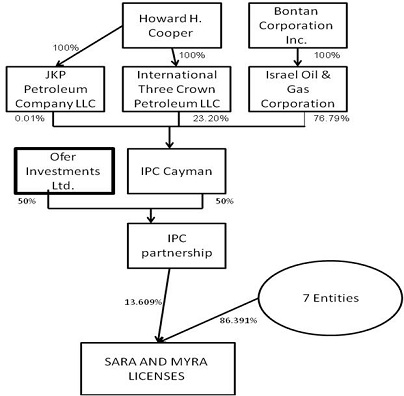

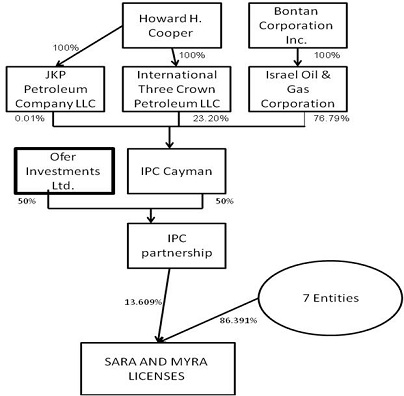

The Company currently holds indirect 5.23% working interest in the Israeli property. This is held by way of the Company’s equity interest of 76.79% in IPC Cayman which holds 50% equity interest in IPC limited partnership in Israel (“IPC Israel”). IPC Israel is the registered holder of 13.609% interest in two licenses to drill oil and gas offshore Israel.

The relevant tree structure of the holdings in the various companies, prior to the Shaldieli Transaction, is as follows:

BontanBontan’s working interest is

76.79% of 50% of 13.609% = 5.23%

The key events that happened during the three months ended June 30, 2011 have been detailed under “overview” section of this report.

Pending Disputes

Note 20 of the fiscal 2011 audited financial statements, provides details of various lawsuits being filed against Shaldieli, its key shareholders, Mr. Howard Cooper and his company, International Three Crown Petroleum LLC.

The following are additional actions taken since April 1, 2011

Actions taken in Israel

On April 14, 2011, Bontan filed an amended Statement of Claim to the Statement of Claim initially filed on January 12, 2011. The amended Statement of Claim includes a claim in the amount of NIS 25 million (approximately US$7 million) against all of the Defendants, a claim for a declaratory remedy and permanent injunctions, a claim for the production of accounts and other remedies relating to the governance of IPC Cayman and Shaldieli; the Shaldieli transaction should go through remedies against Mr. Cooper’s position in IPC Cayman, and other remedies.

A first pre-trial hearing in this case was held on June 5, 2011. The Court was informed of the following:

a. Shaldieli’s lawyer informed that Shaldieli encountered certain problems with the Israeli SEC “due to pressures by Bontan,” but that they had now overcome these problems and were ready to prepare the necessary new documents required and call for a shareholders’ meeting.

b. IPC’s lawyer informed that there was one capital call which required IPC to put about US$ 220,000. The capital call was in connection with a decision to conduct a third drilling test. The Judge asked if more funding was expected and was told that it was not known at the moment.

c. Bontan’s lawyer told the judge that all this was news to us because we have not been provided with any information and we did not receive any request for a cash call.

The judge set 90 days for discovery and interrogatory proceedings and the next pre-trial is scheduled for October 9, 2011.

On July 5, 2011, we filed another application for the temporary injunction against Shaldieli Ltd., Mr. Yaron Yenni, Upswing Capital Ltd., Asia Development (A.D.B.M.) Ltd, International Three Crown Petroleum LLC (ITC) and Howard Cooper. The application sought an injunction against the planned transaction and in the alternative, an injunction against the payment of US$4 million out of the fundraising which is planned to take place by Shaldieli towards coverage of IPC Cayman’s costs (including US$2 million return of loan to ITC). We asked the court to order that funds raised by Shaldieli could only be used for the purposes of the drilling in the licenses, or set in escrow pending other resolution of the court and should not be used to fund private litigation costs.

In the hearing on the above renewed application held on July 25, 2011, the court did not grant a temporary injunction against the Shaldieli transaction. However, with respect to the proposed payment to ITC or Howard Cooper in an amount of US$4 million out of Shaldieli’s future fund raising, the court ruled that no distribution is permitted until either Bontan agrees or the court so orders. In any case, the court ruled that Bontan may object to any proposed distribution to ITC or Howard Cooper within 30 days of being notified of an intention to do so. The court also ruled that Bontan is entitled to audit the financial books and records of IPC Cayman, including the details of the US$4 million claimed by ITC as owed to it by IPC Cayman.

Actions taken in Cayman Islands

On April 28, 2011, we filed a summons against IPC Cayman and ITC for unreasonably withholding the consent and refusing to register two share transfer requests and asking court to pass an order for such transfers. The purpose of this action is to enable Bontan to call for a shareholders’ meeting of IPC Cayman to discuss among other things, the management of IPC Cayman. The hearing of this was originally scheduled on August 18, 2011. However, ITC and Mr. Cooper’s lawyer requested a hearing on August 8, 2011 and asked the judge to postpone all hearings until lawsuits in Israel were decided. The judge however was not convinced and asked them to present full arguments on October 3, 2011. The hearing of our application is postponed until after October 3, 2011.

Short term investments

The company’s short term investment at June 30, 2011 consisted of four securities of Canadian junior resource public companies whose carrying costs, after writing off impairment of $343,750, was approximately $1.1 million and their market value on that date was approximately $1.2 million.

The Company had short term investments at a carrying cost of approximately $ 4 million as at June 30, 2010 – of which $3.8 million or 95% was held in Canadian currency and the balance 5% was held in US currency. All of the investments were in 13 public companies. These investments were stated at their fair value of approximately $ 1.4 million as at June 30, 2010 and the difference representing unrealised loss of approximately $2.6 million was transferred to accumulated other comprehensive loss and included under shareholders equity.

One of the holdings accounted for approximately 60% (40% as at March 31, 2011) of the market value of the short term investments as at June 30, 2011.

Financing cash flows

There were no cash flows from financing activities generated for the three months ended June 30, 2011.

During the three months ended June 30, 2010, the Company raised a net of $ 2 million in private placement which began in November 2009 and ended on April 30, 2010.This private placement required issuance of 12.7 million additional common shares of the company and 13.9 million warrants and a finder’s fee of 10% in cash and warrants.

The funds raised were spent in settling all short term loans of approximately $ 1.1 million and the balance was used towards working capital.

Key Contractual obligations

The only contractual obligation as at June 30, 2011 related to the commitment to cover our share of the exploration costs on the two exploration wells to be drilled on the Israeli property on or before July 2011. These costs are expected to be covered by $ 28 million payable by Ofer brothers who acquired 50% of the working interest from our subsidiary, IPC Cayman.

Off balance sheet arrangements

At June 30, 2011 and 2010, the Company did not have any off balance sheet arrangements, including any relationships with unconsolidated entities or financial partnership to enhance perceived liquidity.

As explained in note 2(d) to the financial statements for the three months ended June 30, 2011, the Company de-consolidated IPC Cayman financials due to loss of control and power to govern the financial and operating policies. The company owns 76.79% equity interest in IPC Cayman. The Company maintains that it has no further financial obligations towards IPC Cayman except to the extent of our share in the exploration costs of the Israeli project in excess of $28 million as explained under Key contractual obligations section of this report.

Transactions with related parties

Transactions with related parties are incurred in the normal course of business and are measured at the exchange amount. Related party transactions and balances have been listed in Note 12 of the consolidated unaudited financial statements for the three months ended June 30 2011.

Given below is background information on some of the key related parties and transactions with them:

| 1. | Current Capital Corp. (CCC). CCC is a related party in following ways – |

| a. | Director/President of CCC, Mr. John Robinson is a consultant with Bontan |

| b. | CCC provides media and investor relation services to Bontan under a consulting contract. |

| c. | Chief Executive and Financial Officer of Bontan is providing services to CCC. |

| d. | CCC and John Robinson hold significant shares, options and warrants in Bontan. |

CCC also charged a finder’s fee at the rate of 10% of the gross money raised for the Company through issuance of shares and warrants under private placements. In addition,

| 2. | Mr. Kam Shah is a director of the Company and also provides services as chief executive and financial officer under a five-year contract. The compensation is decided by the board on an annual basis and is usually given in the form of shares and options. |

| 3. | Mr. Terence Robinson was Chairman of the Board and Chief Executive Officer of the Company since October 1, 1991. He resigned from the Board on May 17, 2004 but continues with the Company as a key consultant. He advises the board in the matters of shareholders relations, fund raising campaigns, introduction and evaluation of investment opportunities and overall operating strategies for the Company. |

Financial and derivative Instruments

Fair Value

| | June 30, 2011 | March31, 2011 |

| | Carrying value | Fair value | Carrying value | Fair value |

| Financial assets | | | | |

| Cash | 100,304 | 100,304 | 348,464 | 348,464 |

| Other receivable | 127,254 | 127,254 | 114,069 | 114,069 |

| Short term investments | 1,128,562 | 1,219,111 | 2,118,724 | 1,359,431 |

| Financial liabilities | | | | |

| Accounts payable and accrued liabilities | 690,926 | 690,926 | 663,577 | 663,577 |

Fair value estimates are made at a specific point in time, based on relevant market information and information about financial instruments. These estimates are subject to and involve uncertainties and matters of significant judgment, therefore cannot be determined with precision. Changes in assumptions could significantly affect the estimates.

A summary of the Company’s risk exposures as it relates to financial instruments are reflected below:

i) Credit risk

Credit risk is the risk of loss associated with a counter-party’s inability to fulfill its payment obligations. The credit risk is attributable to various financial instruments, as noted below. The credit risk is limited to the carrying value amount carried on the statement of financial position.

| a. | Cash and cash equivalents – Cash and cash equivalents are held with major financial institutions in Canada and therefore the risk of loss is minimal. |

| b. | Trade and other receivables – The Company is not exposed to major credit risk attributable to customers. A significant portion of this amount is due from the Canadian government. |

c. Short term Investments – The Company has exposure for this balance at June 30, 2011 of approximately $1.2 million (March 31, 2011 - $1.9 million). These investments are in junior Canadian public companies and are valued at their quoted market prices on reporting dates.

ii) Liquidity risk

The Company monitors its liquidity position regularly to assess whether it has the funds necessary to fulfill planned exploration commitments on its petroleum and natural gas properties or that viable options are available to fund such commitments from new equity issuances or alternative sources such as farm-out agreements. However, as an exploration company at an early stage of development and without significant internally generated cash flows, there are inherent liquidity risks, including the possibility that additional financing may not be available to the Company, or that actual exploration expenditures may exceed those planned. The current uncertainty in global markets and pending litigations could have an impact on the Company’s future ability to access capital on terms that are acceptable to the Company. There can be no assurance that required financing will be available to the Company. If adequate financing is not available, the Company may be required to relinquish rights to certain of its interests.

iii) Market price risk

Market risk primarily arises from the Company’s short term investments in marketable securities which accounted for approximately 14% of total assets of the Company as at June 30, 2011 (20% as at March 31, 2011). Further, the Company’s holding in one Canadian marketable security accounted for approximately 56% (March 31, 2011: 40%) of the total short term investment in marketable securities as at June 30, 2011.

The Management tries to mitigate this risk by monitoring all its investments daily with experienced consultants and ensuring that investments are made in companies which are financially stable with viable businesses.

iv) Concentration risk

Concentration risks exist in cash and cash equivalents because significant balances are maintained with one financial institution and a brokerage firm. The risk is mitigated because the financial institutions are international banks and the brokerage firm is a well-known Canadian brokerage firm with a good market reputation and has all its assets backed up by a major Canadian bank. The Company’s key asset is the indirect working interest in two off shore drilling licenses is located in Israel.

v) Currency risk

The Company operates primarily in Canada and substantially all of its activities including cash and short term investments are denominated in Canadian dollars. However, costs incurred on exploration and evaluation relating to its interest in the Israeli project and expected potential returns, if any, would be denominated in US dollars. The Company is therefore exposed to fluctuations in the exchange rate between the US and Canadian dollar.

The fluctuation of the US dollar in relation to the Canadian dollar will consequently impact the loss of the Company and may also affect the value of the Company’s assets and the amount of shareholders’ equity.

Comparative foreign exchange rates are as follows:

| | June 30, 2011 | March 31, 2011 | June 30, 2010 |

| One US Dollar to CDN Dollar | 0.9643 | 0.9718 | 1.0606 |

The Company has not entered into any agreements or purchased any foreign currency hedging arrangements to hedge possible currency risks at this time.

The balances in US Dollar as at June 30, 2011 were as follows: (all figures in 000’ CDN$ equivalent)

| Cash, receivable & short term investments | $ 63 |

| Accounts payable and accrual | (358) |

| Net liabilities | $ (295) |

Based on the above net exposure, a 5% depreciation of the Canadian dollar against US dollar will increase the net liabilities by $14,750 while a 5% appreciation of the Canadian dollar against US dollar will decrease the net liabilities by $ 14,750.

International Financial Reporting Standards

Effective January 1, 2011, Canadian public companies were required to adopt International Financial Reporting Standards (“IFRS”) which include comparatives for 2010. The Company's accounting policies are provided in Note 3 to the interim financial statements for the three month period ended June 30, 2011. In addition, Note 16 to the interim financial statements presents reconciliations between the Company's fiscal 2011 Previous GAAP results and its 2011 IFRS results. The reconciliations include the statement of financial position or balance sheet as at April 1, 2010, June 30, 2010 and March 31, 2011. There were no changes in the statements of operations and comprehensive income (loss) for these periods.

On transition to IFRS, on April 1, 2010, Bontan used certain exemptions allowed under IFRS 1 First Time Adoption of International Reporting Standards that required no changes to Previous GAAP. Bontan also re-stated certain other amounts to align itself with the new IFRS standards.

The exemptions used and changes were as follows:

(i) Business combinations

The Company has applied the business combinations exemption in IFRS 1 to not apply IFRS 3 retrospectively to past business combinations. Accordingly, the Company has not restated business combinations that took place prior to April 1, 2010.

(ii) Share-based payments

The Company elected to apply the share-based payment exemption to awards that vested prior to April 1, 2010. There were no unvested awards at the date of transition to IFRS.

(iii) Oil and gas property cost basis

The Company followed a “full cost” approach under the Previous GAAP and capitalized the cost of oil and gas properties and related exploration costs until the properties were placed into production, sold or abandoned on a geographical country basis. These costs would be amortized over the estimated useful life of the properties following the commencement of production. Cost includes both the cash consideration as well as the fair market value of any securities issued on the acquisition of petroleum and natural gas properties. Properties acquired under option agreements or joint ventures, whereby payments were made at the sole discretion of the Company, were recorded in the accounts at such time as the payments were made. The proceeds from property options granted reduced the cost of the related property and any excess over cost is applied to income.

The full cost approach is no longer permitted upon transition to IFRS. The Company has elected to apply the first-time adoption exemption for full cost oil and gas entities where the carrying value of oil and gas assets at the date of transition to IFRS is measured on a deemed costs basis. Exploration and evaluation assets are reclassified from the Previous GAAP full cost pool to intangible exploration and evaluation assets at the amount that was recorded under Previous GAAP.

Use of Estimates and Judgments

The preparation of financial statements in conformity with IFRS requires management to make judgments, estimates and assumptions that affect the application of accounting policies and the reported amounts of assets, liabilities, income and expenses. Actual results may differ from these estimates.

Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognized in the year in which the estimates are revised and in any future years affected. Significant areas where estimation uncertainty and critical judgments are applied include valuation of financial instruments, valuation of property, plant and equipment, impairment losses, depletion and depreciation, and measurement of stock based compensation.

Future Accounting Pronouncements

Standards issued but not yet effective up to the date of issuance of the Company‘s consolidated financial statements are listed below. This listing is of standards and interpretations issued which the Company reasonably expects to be applicable at a future date. The Company intends to adopt those standards when they become effective.

IFRS 7 - “Financial Instruments: Disclosures” enhances disclosure about transfers of financial assets.

IFRS 9 – “Financial Instruments” addresses the classification and measurement of financial assets.

IFRS 10 – “Consolidated Financial Statements” builds on existing principles and standards and identifies the concept of control as the determining factor in whether an entity should be included within the consolidated financial statements of the parent company.

IFRS 11 – “Joint Arrangements” establishes the principles for financial reporting by entities when they have an interest in arrangements that are jointly controlled.

IFRS 12 – “Disclosure of Interest in Other Entities” provides the disclosure requirements for interests held in other entities including joint arrangements, associates, special purpose entities and other off balance sheet entities.

IFRS 13 – “Fair Value Measurement” defines fair value, requires disclosure about fair value measurements and provides a framework for measuring fair value when it is required or permitted within the IFRS standards.

IAS 27 – “Separate Financial Statements” revised the existing standard which addresses the presentation of parent company financial statements that are not consolidated financial statements.

IAS 28 – “Investments in Associate and Joint Ventures” revised the existing standard and prescribes the accounting for investments and sets out the requirements for the application of the equity method when accounting for investments in associates and joint ventures.

The Company has not completed its evaluation of the effect of adopting these standards on its financial statements.

Internal Controls over Financial Reporting

Our Chief Executive Officer who also serves as Chief Financial Officer (“CEO”) is primarily responsible in establishing and maintaining controls and procedures concerning disclosure of material information and their timely reporting in consultation and under direct supervision of the audit committee which comprises two independent directors. CEO is assisted by one employee. We therefore do not have an effective internal controls and procedures due to lack of segregation of duties. However, given the size and nature of our current operations and involvement of independent directors in the process significantly reduce the risk factors associated with the lack of segregation of duties.

The CEO has instituted a system of disclosure controls for the Company to ensure proper and complete disclosure of material information. The limited number of consultants and direct involvement of the CEO facilitates access to real time information about developments in the business for drafting disclosure documents. All documents are circulated to the board of directors and audit committee according to the disclosure time-lines.

Public securities filings

Additional information, including the Company’s annual information form in the Form 20-F annual report is filed with the Canadian Securities Administrators at www.sedar.com and with the United States Securities and Exchange Commission and can be viewed at www.edgar.com.

Bontan Corporation Inc.

Consolidated Financial Statements

For the Three Months Ended June 30, 2011 and 2010

(Canadian Dollars)

(UNAUDITED – see Notice to Reader dated September 26, 2011)

| Index | |

| | |

| Notice to Reader issued by the Management | 2 |

| | |

| Consolidated Balance Sheets | 3 |

| | |

| Consolidated Statements of Operations and Comprehensive Income (Loss) | 4 |

| | |

| Consolidated Statements of Shareholders’ Equity | 5 |

| | |

Consolidated Statement of Cash Flows | 6 |

| Notes to Consolidated Financial Statements | 7-32 |

BONTAN CORPORATION INC.

NOTICE TO READER OF THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS

The accompanying consolidated financial statements for Bontan Corporation Inc. for the three months ended June 30, 2011 have been prepared by management in accordance with International Financial Reporting Standards, consistently applied. These consolidated financial statements have not been reviewed by the auditors of the Company.

These financial statements are presented on the accrual basis of accounting. Accordingly, a precise determination of many assets and liabilities is dependent upon future events. Therefore, estimates and approximations have been made using careful judgement. Recognizing that the management is responsible for both the integrity and objectivity of the financial statements, management is satisfied that these financial statements have been fairly presented.

September 26, 2011

Bontan Corporation Inc.

Consolidated Balance Sheets (Unaudited)

(Canadian Dollars)

(Unaudited – see Notice to Reader dated September 26, 2011)

| As at, | | | | Note | June 30, 2011 | March 31, 2011 | April 1, 2010 |

| Assets | | | | | | | |

| Current | | | | | | | |

| Cash | | | | | $100,304 | $348,464 | $2,350,526 |

| Short term investments | | 4,12(vii) | 1,219,111 | 1,900,400 | 1,359,431 |

| Prepaid consulting services | | | - | 7,171 | 50,792 |

| Other receivables | | | | 127,254 | 114,069 | 129,869 |

| | | | | | | | |

| | | | | | $1,446,669 | $2,370,104 | $3,890,618 |

| Office equipment and furniture | | | $8,396 | $8,956 | $8,802 |

| Exploration and evaluation expenditures | 5 | $6,972,740 | $6,972,740 | $6,520,367 |

| | | | | | $8,427,805 | $9,351,800 | $10,419,787 |

| Liabilities and shareholders' equity | | | | |

| Current liabilities | | | | | | |

| Accounts payable and accrued liabilities | 12(vi) | $690,926 | $663,577 | $2,453,910 |

| Short term loans | | | | - | - | 1,065,578 |

| Total current liabilities | | | $690,926 | $663,577 | $3,519,488 |

| Shareholders' Equity | | | | | | |

| Capital stock | | | 6 | $36,078,140 | $36,078,140 | $35,298,257 |

| Warrants | | | | 8 | 8,677,551 | 8,677,551 | 7,343,886 |

| Contributed surplus | | | | 4,755,077 | 4,755,077 | 4,573,748 |

| Accumulated other comprehensive loss | | 90,548 | 168,347 | (2,696,213) |

| Deficit | | | | | (41,864,437) | (40,990,892) | (37,262,565) |

| | | | | | (41,773,889) | (40,822,545) | (39,958,778) |

| Total shareholders' equity | | | $7,736,879 | $8,688,223 | $7,257,113 |

| Non-controlling interests | | | $ - | $ - | $(356,814) |

| Total equity | | | | $7,736,879 | $8,688,223 | $6,900,299 |

| | | | | | $8,427,805 | $9,351,800 | $10,419,787 |

| Going concern (note 2(c)) | | | | | |

| Commitments and Contingent Liabilities (Note 11) | | | |

| Related Party Transactions (Note 12) | | | | |

Approved by the Board ”Kam Shah” Director ”Dean Bradley” Director

(signed) (signed)

The accompanying notes are an integral part of these consolidated financial statements.

Bontan Corporation Inc.

Consolidated Statements of Operations and Comprehensive Income (Loss)

(Canadian Dollars)

(Unaudited – see Notice to Reader dated September 26, 2011)

| For the three months ended June 30, | Note | 2011 | 2010 |

| Income | | | |

| | | | |

| | | - | - |

| Expenses | | | |

| Professional fees | | 338,388 | 239,987 |

| Consulting fees | 10,11(b,( c),(d) & (f),12(v) | 113,236 | 208,689 |

| Shareholders information | 11(a),12(i) | 30,739 | 43,273 |

| Travel, meals and promotions | 12(iv) | 6,258 | 32,669 |

| Office and general | | 8,050 | 28,649 |

| Payroll | | 9,251 | 12,412 |

| Rent | | 6,335 | 6,390 |

| Communication | | 3,133 | 5,475 |

| Transfer agents fees | | 1,193 | 4,817 |

| Bank charges and interest | | 396 | 4,235 |

| Amortization | | 560 | 580 |

| Write down of short term investments | | 343,750 | - |

| Loss on disposal of short term investments | | 14,540 | - |

| Exchange gain | | (2,284) | (43,345) |

| | | 873,545 | 543,831 |

| | | (873,545) | (543,831) |

| Non-controlling interest | | - | 58,170 |

| Net loss for the period | | (873,545) | (485,661) |

| | | | |

| Other comprehensive income (loss): | | | |

| Unrealized gain for the period on short term investments, net of tax considered available for sale | | 265,951 | 21,737 |

| Impairment loss on short term investments transferred to net income | | (343,750) | - |

| Other comprehensive income (loss) | | (77,799) | 21,737 |

| Comprehensive loss for the period | | (951,344) | (463,924) |

| Basic and diluted loss per share information | | | |

| Net Loss per share | 9 | $(0.01) | $(0.01) |

The accompanying notes are an integral part of these consolidated financial statements.

Bontan Corporation Inc.

Consolidated Statement of Shareholders’ Equity

(Canadian Dollars)

For the three months ended June 30, 2011

(Unaudited – see Notice to Reader dated September 26, 2011)

| | Number of Shares | Capital Stock | Warrants | Contributed surplus | Accumulated Deficit | Accumulated other comprehensive loss | Shareholders' Equity |

| Balance April 1, 2010 | 65,229,076 | $35,298,257 | $7,343,886 | $4,573,748 | $(37,262,565) | $(2,696,213) | $7,257,113 |

| subscription received in fiscal 2010 reversed on issuance of shares | | (303,480) | | | | | (303,480) |

| Issued under private placement | 12,700,000 | 2,564,925 | | | | | 2,564,925 |

| Finder fee | | (256,493) | | | | | (256,493) |

| Value of warrants issued under private placement | | (1,232,145) | 1,232,145 | | | | - |

| Value of warrants issued as finder’s fee | | (123,214) | 123,214 | | | | - |

| Issued under 2009 Consultant stock compensation plan | 135,000 | 48,093 | | | | | 48,093 |

| Issued on exercise of warrants | 600,000 | 60,503 | | | | | 60,503 |

| Value of warrants exercised | | 21,694 | (21,694) | | | | - |

| Unrealised gain on short term investments ,net of tax, considered available for sale | | | | | | 2,864,560 | 2,864,560 |

| Value of options issued | | | | 181,329 | | | 181,329 |

| Net loss for period | | | | | (3,728,327) | | (3,728,327) |

| Balance, March 31, 2011 | 78,664,076 | $36,078,140 | $8,677,551 | $4,755,077 | $(40,990,892) | $168,347 | $8,688,223 |

| Unrealised loss on short term investments ,net of tax, considered available for sale | | | | | | (77,799) | (77,799) |

| Net loss for period | | | | | (873,545) | | (873,545) |

| Balance, June 30, 2011 | 78,664,076 | $36,078,140 | $8,677,551 | $4,755,077 | $(41,864,437) | $90,548 | $7,736,879 |

The accompanying notes are an integral part of these consolidated financial statements.

Bontan Corporation Inc.

Consolidated Statements of Cash Flows

(Canadian Dollars)

(Unaudited – see Notice to Reader dated September 26, 2011)

| For the three months ended June 30, | Note | 2011 | 2010 |

| Cash flows from operating activities | | | |

| Net loss for period | | $(873,545) | $(485,661) |

| non-controlling interests | | - | (58,170) |

| Amortization of office equipment and furniture | | 560 | 580 |

| Write down of short term investments | | 343,750 | - |

| Loss on disposal of short term investments | | 14,540 | - |

| Consulting fees settled for common shares | 10 | 7,171 | 22,868 |

| Net change in working capital components | | | |

| Other receivables | | (13,185) | (441,216) |

| Accounts payable and accrued liabilities | | 27,349 | (574,824) |

| | | $(493,360) | $(1,536,423) |

| Cash flow from(into) investing activities | | | |

| Purchase of office equipment and furniture | | - | (1,897) |

| Acquisition of oil & gas properties | | - | (658,279) |

| Net proceeds from sale of short term investments | | 245,200 | - |

| | | $245,200 | $(660,176) |

| Cash flow from financing activities | | | |

| Short term loan | | - | (1,239,531) |

| Common shares issued net of issuance costs | | - | 2,029,855 |

| | | $- | $790,324 |

| Decrease in cash during period | | (248,160) | (1,406,275) |

| Cash at beginning of period | | 348,464 | 2,350,526 |

| Cash at end of period | | $100,304 | $944,251 |

| Supplemental disclosures | | | |

| Non-cash operating activities | | | |

Consulting fees settled for common shares and | 10 | (7,171) | (22,868) |

| options and expensed during the period |

Consulting fees prepaid in shares | | - | (68,029) |

| | | $(7,171) | $(90,897) |

The accompanying notes are an integral part of these consolidated financial statements.

Bontan Corporation Inc.

Notes to Consolidated Financial Statements

(Canadian Dollars)

June 30, 2011 and 2010

(Unaudited – see Notice to Reader dated September 26, 2011)

1. NATURE OF OPERATIONS

Bontan Corporation Inc. (“the Company”) is incorporated in Ontario and its head office is located at 47 Avenue Road, Suite 200, Toronto, Ontario, Canada. The Company is a diversified natural resource company that invests in oil and gas exploration and development.

The Company holds an indirect 5.23% working interest in two off-shore drilling licenses in the Levantine Basin, approximately forty kilometres off the West coast of Israel.

The Company does not currently own any oil and gas properties with proven reserves.

2. BASIS OF PRESENTATION AND ADOPTION OF IFRS

| (a) | Statement of compliance |

These consolidated interim financial statements are unaudited and have been prepared in accordance with IAS 34 ‘Interim Financial Reporting’ (“IAS 34”) using accounting policies consistent with the International Financial Reporting Standards (“IFRS”) issued by the International Accounting Standards Board (“IASB”) and Interpretations of the International Financial Reporting Interpretations Committee (“IFRIC”) in which the Company expects to adopt for its annual 2012 consolidated financial statements. Subject to certain transition elections disclosed in Note 16, the Company has consistently applied the same accounting policies in its opening IFRS Balance Sheet at April 1, 2010 and throughout all periods presented, as if these policies had always been in effect. Note 16 discloses the impact of the transition to IFRS on the Company‘s reported financial position, financial performance and cash flows, including the nature and effect of significant changes in accounting policies from those used in the Company‘s consolidated financial statements for the year ended March 31, 2011.

The policies applied in these condensed interim consolidated financial statements are based on IFRS issued and outstanding as of September 26, 2011, the date the Board of Directors approved the statements. Any subsequent changes to IFRS that are given effect in the Company’s annual consolidated financial statements for the year ending March 31, 2012 could result in restatement of these interim consolidated financial statements, including the transition adjustments recognized on change-over to IFRS.

The condensed interim consolidated financial statements should be read in conjunction with the Company’s previous Canadian GAAP annual consolidated financial statements for the year ended March 31, 2011.

The Company has no requirement to report on segments as it operates as only one segment.

(b) Basis of presentation

The financial statements have been prepared on the historical cost basis except for certain non-current assets and financial instruments, which are measured at fair value, as explained in the significant accounting policies set out in Note 3. The comparative figures presented in these interim consolidated financial statements are in accordance with IFRS and have not been audited.

Bontan Corporation Inc.

Notes to Consolidated Financial Statements

(Canadian Dollars)

June 30, 2011 and 2010

(Unaudited – see Notice to Reader dated September 26, 2011)

2. BASIS OF PRESENTATION AND ADOPTION OF IFRS - continued

(c) Going concern

Management has prepared these consolidated interim financial statements on an assumption of a going concern, which contemplates that assets will be realized and liabilities discharged in the normal course of business as they come due. To this point, all operational activities and the overhead costs have been funded from the available cash and short term investments and by equity issuances.

The Company has a working capital of approximately $ 0.7 million and accumulated deficit of approximately $ 41.9 million. While the Company’s commitment to meet its share of the exploration and development obligations under its current project is covered to the extent of US $28 million, it is still responsible for its share of any cost overruns. Further, the Company has entered into extensive litigation with the minority shareholder and manager of its subsidiary, IPC Cayman, to protect its interest in the project. Litigations are still in progress and may involve further substantial legal costs, which cannot be reasonably estimated at this stage.

The Company will have to secure new cash resources to meet these obligations. Management is currently evaluating and pursuing funding alternatives, including additional farm-out agreements and new equity issuances. While the management has so far been successful in raising the required equity financing, there is no assurance that these initiatives will continue to be successful. Uncertainty in global capital markets and pending litigations could have a negative impact on the Company’s ability to access capital in the future.

The Company's ability to continue as a going concern is dependent upon its ability to access sufficient capital to defend its interest, complete exploration and development activities, identify commercial oil and gas reserves and to ultimately have profitable operations. These financial statements do not reflect the adjustments to the carrying values of assets and liabilities and the reported expenses and balance sheet classifications that would be necessary if the Company was unable to realize its assets and settle its liabilities as a going concern, in the normal course of operations. Such adjustments could be material.

(d) Consolidation

The consolidated interim financial statements include the accounts of the Company and of the following subsidiaries:

| a. | Israel Oil & Gas Corporation, a wholly owned subsidiary |

| b. | 1843343 Ontario Inc., a wholly owned subsidiary incorporated in Ontario on January 31, 2011 and has no activity since its inception. |

Israel Oil & Gas Corporation owns 76.79% equity interest in Israel Petroleum Company Limited (“IPC Cayman”), a Cayman Island limited company incorporated on November 12, 2009. Effective May 18, 2010, the Company deconsolidated IPC Cayman financials due to loss of control and power to govern the financial and operating policies.

All inter-company balances and transactions have been eliminated on consolidation.

Bontan Corporation Inc.

Notes to Consolidated Financial Statements

(Canadian Dollars)

June 30, 2011 and 2010

(Unaudited – see Notice to Reader dated September 26, 2011)

2. BASIS OF PRESENTATION AND ADOPTION OF IFRS - continued

(e) Functional and presentation currency

The consolidated interim financial statements are presented in Canadian dollar which is also the functional currency of the Company and its subsidiaries.

(f) Use of Estimates and judgments

The preparation of financial statements in conformity with IFRS requires management to make judgments, estimates and assumptions that affect the application of accounting policies and the reported amounts of assets, liabilities, income and expenses. Actual results may differ from these estimates.

Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognized in the year in which the estimates are revised and in any future years affected. Significant areas where estimation uncertainty and critical judgments are applied include valuation of financial instruments, valuation of property, plant and equipment, impairment losses, depletion and depreciation, and measurement of stock based compensation.

| 3. | SIGNIFICANT ACCOUNTING POLICIES |

The accounting policies set out below are expected to be adopted for the year ending March 31, 2012 and have been applied consistently to all periods presented in these condensed interim financial statements, and in preparing the opening IFRS balance sheet at April 1, 2010 for the purpose of transition to IFRS, unless otherwise indicated.

Cash and cash equivalents

Cash and cash equivalents comprise of cash at banks, brokerage firms, on hand and short-term deposits with an original maturity of 90 days or less, readily convertible into a known amount of cash.

Financial instruments

Financial assets

All financial assets are initially recorded at fair value and are designated upon inception into one of the following four categories: held-to-maturity, available-for-sale, loans-and-receivables or at fair value through profit or loss (“FVTPL”).

Financial assets classified as FVTPL are measured at fair value with unrealized gains and losses recognized through earnings. The Company’s cash and cash equivalents are classified as FVTPL.

Financial assets classified as loans-and-receivables are measured at amortized cost. The Company’s trade and other receivables are classified as loans-and-receivables.

Short term investments which consist of marketable securities are designated as “available-for-sale” and are measured at fair value with unrealized gains and losses recorded in other comprehensive income until the security is sold, or if an unrealized loss is considered permanent.

Bontan Corporation Inc.

Notes to Consolidated Financial Statements

(Canadian Dollars)

June 30, 2011 and 2010

(Unaudited – see Notice to Reader dated September 26, 2011)

.

| 3. | SIGNIFICANT ACCOUNTING POLICIES - | Financial instruments - continued |

The purchase or sale of financial assets that require delivery of assets within a time frame established by regulation or convention in the marketplace (regular way trades) are recognized on the settlement date.

Common shares are classified as equity. Incremental costs directly attributable to the issue of common shares and stock options are recognized as a deduction from equity, net of any tax effects.

Transactions costs associated with FVTPL financial assets are expensed as incurred, while transaction costs associated with all other financial assets are included in the initial carrying amount of the asset.

Financial liabilities

All financial liabilities are initially recorded at fair value and designated upon inception as FVTPL or other-financial-liabilities.

Financial liabilities classified as other-financial-liabilities are initially recognized at fair value less directly attributable transaction costs. After initial recognition, other-financial-liabilities are subsequently measured at amortized cost using the effective interest method. The effective interest method is a method of calculating the amortized cost of a financial liability and of allocating interest expense over the relevant period. The effective interest rate is the rate that exactly discounts estimated future cash payments through the expected life of the financial liability, or, where appropriate, a shorter period. The Company’s trade and other payables are classified as other-financial-liabilities.

Financial liabilities classified as FVTPL include financial liabilities held-for-trading and financial liabilities designated upon initial recognition as FVTPL. Derivatives, including separated embedded derivatives are also classified as held-for-trading unless they are designated as effective hedging instruments. Fair value changes on financial liabilities classified as FVTPL are recognized through the statement of comprehensive income. At June 30, 2011 the Company has not classified any financial liabilities as FVTPL.

Impairment of financial assets

The Company assesses at each date of the statement of financial position whether a financial asset is impaired.

Assets carried at amortized cost

If there is objective evidence that an impairment loss on assets carried at amortized cost has been incurred, the amount of the loss is measured as the difference between the asset’s carrying amount and the present value of estimated future cash flows discounted at the financial asset’s original effective interest rate. The carrying amount of the asset is then reduced by the amount of the impairment. The amount of the loss is recognized in profit or loss.

Bontan Corporation Inc.

Notes to Consolidated Financial Statements

(Canadian Dollars)

June 30, 2011 and 2010

(Unaudited – see Notice to Reader dated September 26, 2011)

.

| 3. | SIGNIFICANT ACCOUNTING POLICIES - | Financial instruments - continued |

If, in a subsequent period, the amount of the impairment loss decreases and the decrease can be related objectively to an event occurring after the impairment was recognized, the previously recognized impairment loss is reversed to the extent that the carrying value of the asset does not exceed what the amortized cost would have been had the impairment not been recognized. Any subsequent reversal of an impairment loss is recognized in profit or loss.

In relation to trade receivables, a provision for impairment is made and an impairment loss is recognized in profit and loss when there is objective evidence (such as the probability of insolvency or significant financial difficulties of the debtor) that the Company will not be able to collect all of the amounts due under the original terms of the invoice. The carrying amount of the receivable is reduced through use of an allowance account. Impaired debts are written off against the allowance account when they are assessed as uncollectible.

If an available-for-sale asset is impaired, an amount comprising the difference between its cost and its current fair value, less any impairment loss previously recognized in profit or loss, is transferred from equity to profit or loss. Reversals in respect of equity instruments classified as available-for-sale are not recognized in profit or loss.

| | Oil and natural gas exploration and development expenditures |

Exploration and evaluation costs (“E&E” assets)

All costs incurred prior to obtaining the legal right to explore an area are expensed when incurred.

Generally, costs directly associated with the exploration and evaluation of crude oil and natural gas reserves are initially capitalized. Exploration and evaluation costs are those expenditures for an area where technical feasibility and commercial viability has not yet been demonstrated. These costs generally include unproved property acquisition costs, geological and geophysical costs, sampling and appraisals, drilling and completion costs and capitalized decommissioning costs.

Costs are held in exploration and evaluation until the technical feasibility and commercial viability of the project is established. Amounts are generally reclassified to petroleum and natural gas properties once probable reserves have been assigned to the field. If probable reserves have not been established through the completion of exploration and evaluation activities and there are no future plans for activity in that field, then the exploration and evaluation expenditures are determined to be impaired and the amounts are charged to earnings (loss).

Impairment

| E&E assets are assessed for impairment when facts and circumstances suggest that the carrying amount exceeds the recoverable amount and when they are reclassified as Development and Production (“D&P”) assets. For the purpose of impairment testing, E&E assets are grouped by concession or field with other E&E and D&P assets belonging to the same concession or field. The impairment loss will be calculated as the excess of the carrying value over the recoverable amount of the E&E impairment grouping and any resulting impairment loss is recognized in profit and loss. The recoverable amount is generally determined by reference to the value-in-use, or fair value less costs to sell. In assessing value in use, the estimated future cash flows are discounted to their present value using a pre-tax discount rate that reflects current market assessments of the time value of money and the risks specific to the asset. |

Notes to Consolidated Financial Statements

(Canadian Dollars)

June 30, 2011 and 2010

(Unaudited – see Notice to Reader dated September 26, 2011)

.

| 3. | SIGNIFICANT ACCOUNTING POLICIES - | Oil and natural gas exploration and development expenditures - continued |

Petroleum and natural gas properties

Carrying value

Costs incurred subsequent to the determination of technical feasibility and commercial viability are recognized as petroleum and natural gas properties in the specific asset to which they relate. Petroleum and natural gas properties are stated at cost less accumulated depreciation and depletion and accumulated impairment losses. The initial cost of a petroleum and natural gas property is comprised of its purchase price or construction cost, any costs directly attributable to bringing the asset into operation, the initial estimate of the decommissioning obligation, and for qualifying assets, borrowing costs. The purchase price or construction cost is the aggregate amount paid and the fair value of any other consideration given up to acquire the asset

Depreciation

The net book value of producing assets are depleted on a field-by-field basis using the unit of production method with reference to the ratio of production in the year to the related proved and probable reserves, taking into account estimated future development costs necessary to bring those reserves into production. For purposes of these calculations, production and reserves of natural gas are converted to barrels on an energy equivalent basis.

Other assets are depreciated on a declining basis at rates ranging from 20% to 33%.

Impairment

At the end of each reporting period, the Company reviews the petroleum and natural gas properties for circumstances that indicate that the assets may be impaired. Assets are grouped together into Cash Generating Units (“CGUs”) for the purpose of impairment testing, which is the lowest level at which there are identifiable cash flows that are largely independent of the cash flows of other groups of assets. If any such indication of impairment exists, the Company makes an estimate of its recoverable amount. A CGUs recoverable amount is the higher of its fair value less selling costs and its value in use. In assessing value in use, the estimated future cash flows are discounted to their present value using a pre-tax discount rate that reflects current market assessments of the time value of money and the risks specific to the asset. Value in use is generally computed by reference to the present value of future cash flows expected to be derived from the production of proved and probable reserves.

Fair value less cost to sell is determined as the amount that would be obtained from the sale of a CGU in an arm’s length transaction between knowledgeable and willing parties. The fair value less cost to sell of oil and gas assets is generally determined as the net present value of the estimated future cash flows expected to arise from the continued use of the CGU, including any expansion prospects, and its eventual disposal, using assumptions that an independent market participant may take into account. These cash flows are discounted by an appropriate discount rate which would be applied by such a market participant to arrive at a net present value of the CGU. Where the carrying amount of a CGU exceeds its recoverable amount, the CGU is considered impaired and is written down.

Bontan Corporation Inc.

Notes to Consolidated Financial Statements

(Canadian Dollars)

June 30, 2011 and 2010

(Unaudited – see Notice to Reader dated September 26, 2011)

.

| 3. | SIGNIFICANT ACCOUNTING POLICIES - | Oil and natural gas exploration and development expenditures - Petroleum and natural gas properties - continue |

When the recoverable amount is less than the carrying amount, the asset or CGU is impaired. For impairment losses identified based on a CGU or a group of CGUs, the loss is allocated on a pro rata basis to the assets within the CGU(s). The impairment loss is recognized as an expense in the statement of operations and loss.

At the end of each subsequent reporting period these impairments are assessed for indicators of reversal. Where an impairment loss subsequently reverses, the carrying amount of the asset or CGU is increased to the revised estimate of its recoverable amount, but so that the increased carrying amount does not exceed the carrying amount that would have been determined had no impairment loss been recognized for the asset or CGU in prior years. A reversal of an impairment loss is recognized immediately in the consolidated statement of operations and loss.

Gains and losses on disposal of an item of property, plant and equipment, including oil and natural gas interests, are determined by comparing the proceeds from disposal with the carrying amount of property, plant and equipment and are recognized as separate line items in the consolidated statement of operations.

Foreign currency translation

The functional and presentation currency of the Company is the Canadian dollar. Monetary assets and liabilities are translated at exchange rates in effect at the balance sheet date. Non-monetary assets are translated at exchange rates in effect when they were acquired. Revenue and expenses are translated at the approximate average rate of exchange for the year, except that amortization is translated at the rates used to translate related assets.

The Company’s subsidiaries use the US Dollar as a functional currency. However, these subsidiaries are not self-sustaining but are integrated with Bontan Corporation Inc. since they rely on the Company to fund their operations. Hence, translation gains and losses of these subsidiaries are charged to the consolidated statement of operations.

| | The Company accounts for stock-based compensation granted to directors, officers, employees and consultants using the Black-Scholes option-pricing model to determine the fair value of the plan at grant date. An estimated forfeiture rate is incorporated into the fair value calculated and adjusted to reflect the actual number of options that vest. Stock-based compensation expense is recorded and reflected as stock-based compensation expense over the vesting period with a corresponding amount reflected in contributed surplus. At exercise, the associated amounts previously recorded as contributed surplus are reclassified to common share capital. |

| | The quoted market price of the Company’s shares on the date of issuance under any stock compensation plan is considered as fair value of the shares issued. |

Bontan Corporation Inc.

Notes to Consolidated Financial Statements

(Canadian Dollars)

June 30, 2011 and 2010

(Unaudited – see Notice to Reader dated September 26, 2011)

.

| 3. | SIGNIFICANT ACCOUNTING POLICIES - continued |

Warrants

When the Company issues Units under a private placement comprising common shares and warrants, the Company follows the relative fair value method of accounting for warrants attached to and issued with common shares of the Company. Under this method, the fair value of warrants issued is estimated using a Black-Scholes option pricing model which is added to fair value of the common shares determined using the stock price at the date of issuance and the percentage relative to the fair values determined. The fair value of the common shares and the warrants are proportionately adjusted to the net proceeds received. The fair value is then related to the total of the net proceeds received on issuance of the Common shares.

Revenue from the sale of natural gas, natural gas liquids and crude oil is recognized when the significant risks and rewards of ownership is transferred, which is when title passes to the customer in accordance with the terms of the sales contract. This generally occurs when the product is physically transferred into a pipe, truck or other delivery mechanism.

Revenues from the production of oil and natural gas properties in which the Company has an interest with joint venture partners, are recognized on the basis of the Company’s working interest in those properties (the entitlement method), on receipt of a statement of account from the operators of the properties.

Loss per Share

Basic loss per share is calculated by dividing net loss (the numerator) by the weighted average number of common shares outstanding (the denominator) during the period. Diluted loss per share reflects the dilution that would occur if outstanding stock options and share purchase warrants were exercised or converted into common shares using the treasury stock method and are calculated by dividing net loss applicable to common shares by the sum of the weighted average number of common shares outstanding and all additional common shares that would have been outstanding if potentially dilutive common shares had been issued.

The inclusion of the Company’s stock options and share purchase warrants in the computation of diluted loss per share would have an anti-dilutive effect on loss per share and are therefore excluded from the computation. Consequently, there is no difference between basic loss per share and diluted loss per share.

Income tax expense comprises current and deferred tax. Income tax expense is recognized in profit or loss except to the extent that it relates to items recognized directly in equity, in which case it is recognized in equity.

Current tax is the expected tax payable on the taxable income for the year, using tax rates enacted or substantively enacted at the reporting date, and any adjustments to tax payable in respect of previous years.

Bontan Corporation Inc.

Notes to Consolidated Financial Statements

(Canadian Dollars)

June 30, 2011 and 2010

(Unaudited – see Notice to Reader dated September 26, 2011)

.

| 3. | SIGNIFICANT ACCOUNTING POLICIES - Income taxes - continued |

Deferred tax is recognized using the balance sheet method, providing for temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for taxation purposes. Deferred tax is not recognized on the initial recognition of assets or liabilities in a transaction that is not a business combination. In addition, deferred tax is not recognized for taxable temporary differences arising on the initial recognition of goodwill. Deferred tax is measured at the tax rates that are expected to be applied to temporary differences when they reverse, based on the laws that have been enacted or substantively enacted by the reporting date. Deferred tax assets and liabilities are offset if there is a legally enforceable right to offset, and they relate to income taxes levied by the same tax authority on the same taxable entity, or on different tax entities, but they intend to settle current tax liabilities and assets on a net basis or their tax assets and liabilities will be realized simultaneously.

| | A deferred tax asset is recognized to the extent that it is probable that future taxable profits will be available against which the temporary difference can be utilized. Deferred tax assets are reviewed at each reporting date and are reduced to the extent that it is no longer probable that the related tax benefit will be realized. |

| | Determination of fair value |

A number of the Company’s accounting policies and disclosures required the determination of fair value, both for financial and non-financial assets and liabilities. Fair values have been determined for measurement and/or disclosure purposes based on the following methods. When applicable, further information about the assumptions made in determining fair values is disclosed in the notes specific to that asset or liability.