UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| | |

¨ Preliminary Proxy Statement x Definitive Proxy Statement ¨ Definitive Additional Materials | | ¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

|

¨ Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12 |

BLUE COAT SYSTEMS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 |

(Set forth the amount on which the filing fee is calculated and state how it was determined):

| | (4) | Proposed maximum aggregate value of transaction: |

¨ | Fee paid previously with preliminary materials. |

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

BLUE COAT SYSTEMS, INC.

420 North Mary Avenue

Sunnyvale, California 94085

TO THE STOCKHOLDERS OF BLUE COAT SYSTEMS, INC.:

You are cordially invited to attend the Annual Meeting of Stockholders of Blue Coat Systems, Inc. (the “Company”), which will be held at the Company’s headquarters located at 420 North Mary Avenue, Sunnyvale, California 94085, on Thursday, October 2, 2008, at 4:00 p.m., local time.

Details of the business to be conducted at the Annual Meeting are given in the attached Proxy Statement and Notice of Annual Meeting of Stockholders.

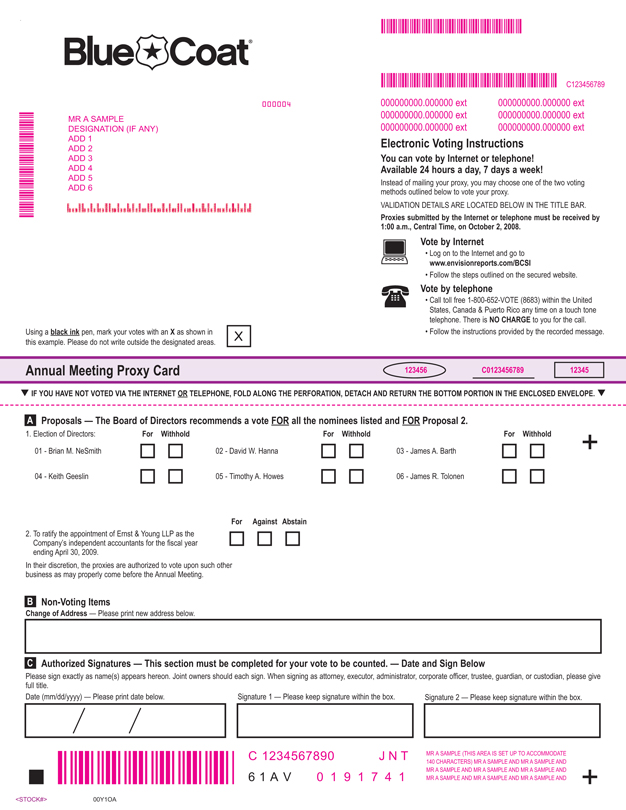

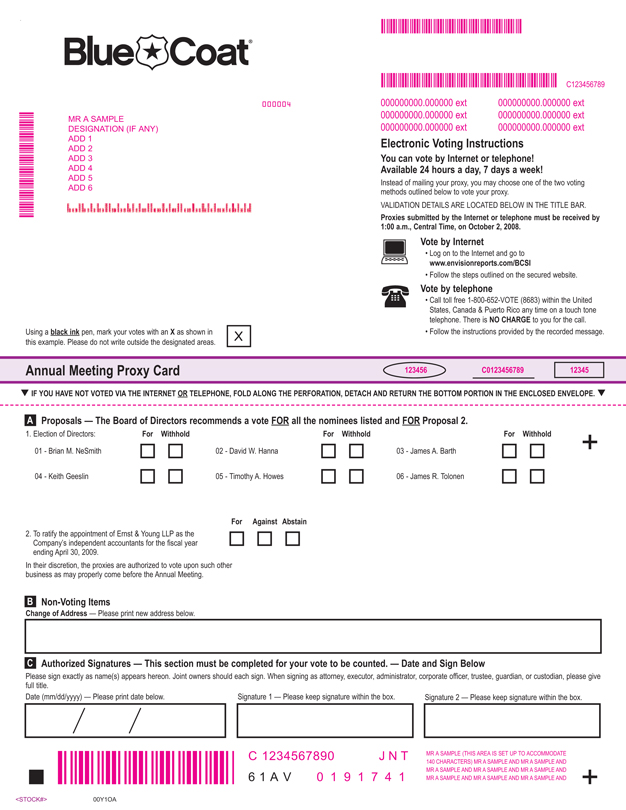

It is important that your shares be represented and voted at the meeting.WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE COMPLETE, SIGN, DATE, AND PROMPTLY RETURN THE ACCOMPANYING PROXY IN THE ENCLOSED POSTAGE-PAID ENVELOPE OR VOTE BY TELEPHONE OR THE INTERNET BY FOLLOWING THE INSTRUCTIONS SET FORTH ON THE PROXY. Returning the proxy or voting by telephone or on the Internet does NOT deprive you of your right to attend the Annual Meeting. If you decide to attend the Annual Meeting and wish to change your proxy vote, you may do so automatically by voting in person at the meeting. However, if your shares are held for you by a broker, bank or other nominee, you must obtain a proxy from that nominee and bring it with you to hand in with your ballot, in order to be able to vote your shares at the meeting.

On behalf of the Board of Directors, I express our appreciation for your continued interest in the affairs of the Company. We look forward to seeing you at the Annual Meeting.

Sincerely,

/s/ Brian M. NeSmith

Brian M. NeSmith

President and

Chief Executive Officer

Sunnyvale, California

August 22, 2008

BLUE COAT SYSTEMS, INC.

420 North Mary Avenue

Sunnyvale, California 94085

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON OCTOBER 2, 2008

The Annual Meeting of Stockholders (the “Annual Meeting”) of Blue Coat Systems, Inc. (the “Company”) will be held at the Company’s headquarters located at 420 North Mary Avenue, Sunnyvale, California 94085, on Thursday, October 2, 2008, at 4:00 p.m. local time for the following purposes:

| | 1. | to elect six directors of the Board of Directors to serve until the next Annual Meeting or until their successors have been duly elected and qualified; |

| | 2. | to ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending April 30, 2009; and |

| | 3. | to transact such other business as may properly come before the meeting or any adjournments or postponements thereof. |

These items of business are more fully described in the Proxy Statement accompanying this notice.

This Notice of Annual Meeting of Stockholders, the Proxy Statement and the Company’s Annual Report on Form 10-K for the fiscal year ended April 30, 2008 are available at www.edocumentview.com/bcsi. Information on our website, other than these materials, is not a part of these proxy solicitation materials.

Only stockholders of record at the close of business on August 21, 2008 are entitled to notice of, and to vote at, the Annual Meeting and at any adjournments or postponements thereof. A list of such stockholders will be available for inspection at the Company’s headquarters located at 420 North Mary Avenue, Sunnyvale, California, during ordinary business hours for ten days prior to the Annual Meeting.

BY ORDER OF THE BOARD OF DIRECTORS,

/s/ Betsy E. Bayha

Betsy E. Bayha

Senior Vice President, General Counsel and Secretary

Sunnyvale, California

August 22, 2008

|

IMPORTANT WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE COMPLETE, SIGN, DATE, AND PROMPTLY RETURN THE ACCOMPANYING PROXY IN THE ENCLOSED POSTAGE-PAID ENVELOPE OR VOTE BY TELEPHONE OR THE INTERNET BY FOLLOWING THE INSTRUCTIONS SET FORTH ON THE ACCOMPANYING PROXY. YOU MAY REVOKE YOUR PROXY OR YOUR VOTE BY TELEPHONE OR THE INTERNET AT ANY TIME PRIOR TO THE ANNUAL MEETING. IF YOU ARE THE RECORD HOLDER OF THE SHARES AND ATTEND THE ANNUAL MEETING, YOU MAY CHANGE YOUR PROXY VOTE AUTOMATICALLY BY VOTING IN PERSON AT THE MEETING. |

BLUE COAT SYSTEMS, INC.

420 North Mary Avenue

Sunnyvale, California 94085

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON OCTOBER 2, 2008

GENERAL INFORMATION

These proxy materials are furnished in connection with the solicitation of proxies by the Board of Directors (the “Board of Directors” or the “Board”) of Blue Coat Systems, Inc., a Delaware corporation (the “Company”), for the Annual Meeting of Stockholders (the “Annual Meeting”) to be held at the Company’s headquarters located at 420 North Mary Avenue, Sunnyvale, California 94085, on Thursday, October 2, 2008, at 4:00 p.m. local time, and at any adjournments or postponements of the Annual Meeting. These proxy materials were first mailed to stockholders on or about August 26, 2008.

PURPOSE OF MEETING

The specific proposals to be considered and acted upon at the Annual Meeting are summarized in the accompanying Notice of Annual Meeting of Stockholders. Each proposal is described in more detail in this Proxy Statement.

VOTING RIGHTS AND SOLICITATION OF PROXIES

Only holders of the Company’s common stock (“Common Stock”) are entitled to vote at the Annual Meeting. At the close of business on August 21, 2008, the record date for determining the holders of Common Stock entitled to vote at the Annual Meeting (the “Record Date”), there were 38,656,007 shares of Common Stock outstanding. Each holder of a share of Common Stock is entitled to one vote per share. All votes will be tabulated by the inspector of elections appointed for the meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes.

Quorum Required

The Company’s bylaws provide that the holders of a majority of the votes represented by the Common Stock issued and outstanding, and entitled to vote at the Annual Meeting, present in person or represented by proxy, shall constitute a quorum for the transaction of business at the Annual Meeting. Abstentions and broker non-votes will be counted as present for the purpose of determining the presence of a quorum. Broker non-votes occur with respect to a particular (non-routine) matter when a nominee, such as a financial institution, returns a proxy, but is not permitted to vote on that matter without receiving voting instructions (via proxy vote) from the beneficial owner and instructions are not given.

Votes Required

Proposal 1. Directors are elected by a plurality of the affirmative votes cast by those shares present in person, or represented by proxy, and entitled to vote at the Annual Meeting. The six (6) nominees for director receiving the highest number of affirmative votes will be elected. Abstentions and broker non-votes will not be counted as having been voted for purposes of the election of directors. Stockholders may not cumulate votes in the election of directors.

1

Proposal 2. Ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending April 30, 2009 requires the affirmative vote of a majority of those shares present in person, or represented by proxy, and cast either affirmatively or negatively at the Annual Meeting. Abstentions and broker non-votes will not be counted as having been voted on the proposal.

Voting of Shares

Whether or not you are able to attend the Company’s Annual Meeting, you are urged to complete and return the enclosed proxy, which is solicited by the Company’s Board of Directors and which will be voted as you direct on your proxy when properly completed. In the event no directions are specified, such proxies will be voted FOR the Nominees of the Board of Directors (as set forth in Proposal No. 1) and FOR Proposal No. 2. The Company knows of no other matters to be presented at the Annual Meeting. However, if any other matters are properly presented, the proxy holders shall be authorized to vote the shares represented by proxies according to their best judgment. Proxies will extend to, and be voted at, any adjournment or postponement of the Annual Meeting.

You may revoke or change your proxy at any time before the Annual Meeting. To do this, send a written notice of revocation or another signed proxy with a later date to the Secretary of the Company at the Company’s principal executive office before the beginning of the Annual Meeting. You may also automatically revoke your proxy by attending the Annual Meeting and voting in person. All shares represented by a valid proxy received prior to the Annual Meeting will be voted. Please note that if your shares are held of record by a broker, bank or other nominee and if you provide instructions to that nominee on a form received from the nominee, you may revoke or change your voting instructions only by contacting the nominee who holds your shares. You may not vote in person at the Annual Meeting unless you obtain a legal proxy from the broker, bank or other nominee. In such event, your attendance at the Annual Meeting will not, by itself, revoke prior voting instructions.

Solicitation of Proxies

The Company will bear the entire cost of solicitation, including the preparation, assembly, printing, and mailing of this Proxy Statement, the proxy card, and any additional solicitation materials furnished to stockholders. Copies of solicitation materials will be furnished to brokerage houses, fiduciaries, and custodians holding shares in their names that are beneficially owned by others so that they may forward these solicitation materials to such beneficial owners. The Company may reimburse those persons for their costs of forwarding the solicitation materials to such beneficial owners. The original solicitation of proxies by mail may be supplemented by solicitation by telephone, facsimile or other means by the Company’s directors, officers, or employees acting without special compensation. The Company has engaged The Proxy Advisory Group, LLC, to assist in the solicitation of proxies and provide related advice and informational support, for a services fee and the reimbursement of customary disbursements that are not expected to exceed $10,000 in the aggregate.

Special Note About Outstanding Shares and Stock Dividend

On August 16, 2007, the Company’s Board of Directors approved a two-for-one forward stock split of the Company’s Common Stock. The stock split was effected by the issuance of a stock dividend of one share of Common Stock for each share of Common Stock issued and outstanding as of the record date of September 13, 2007. The Company began trading on the NASDAQ Global Market on a split-adjusted basis on October 4, 2007. All references to numbers of shares of Common Stock in this Proxy Statement are stated on a split-adjusted basis.

NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS

The Notice of Annual Meeting of Stockholders, this Proxy Statement and the Company’s Annual Report on Form 10-K for the fiscal year ended April 30, 2008 are available at www.edocumentview.com/bcsi. Information on our website, other than these materials, is not a part of these proxy solicitation materials.

2

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Six (6) directors are being nominated for re-election to the Board of Directors by the holders of the Company’s Common Stock (the “Nominees”). These directors are Brian M. NeSmith, David W. Hanna, James A. Barth, Timothy A. Howes, Keith Geeslin and James R. Tolonen. The proxy holders intend to vote all proxies received by them in the accompanying form FOR the Nominees listed below, unless otherwise instructed. In the event any Nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee who may be designated by the Company’s present Board of Directors to fill the vacancy. As of the date of this Proxy Statement, the Board of Directors is not aware of any Nominee who is unable or will decline to serve as a director. The six (6) nominees receiving the highest number of affirmative votes of the shares entitled to vote at the Annual Meeting will be elected directors of the Company to serve until the next Annual Meeting or until their successors have been duly elected and qualified.

The Company’s Corporate Governance Guidelines provide that the size of its Board may be from five (5) to nine (9) directors. By resolution of the Board, the Company presently has established the size of its Board as six (6) directors; however, it anticipates increasing the size of the Board should it identify an appropriate candidate who is willing to serve on the Board. All directors are elected annually.

Nominees for Directors

Set forth below are the name, age, position of and biographical information about each Nominee, as of the date of this Proxy Statement.

| | | | |

Nominees | | Age | | Position(s) and Office(s) Held with the Company |

Brian M. NeSmith | | 46 | | President, Chief Executive Officer and Director |

David W. Hanna | | 69 | | Chairman of the Board and Director |

James A. Barth | | 65 | | Director |

Keith Geeslin | | 55 | | Director |

Timothy A. Howes | | 44 | | Director |

James R. Tolonen | | 59 | | Director |

Brian M. NeSmithhas served as President, Chief Executive Officer and a director of the Company since March 1999. From December 1997 to March 1999, Mr. NeSmith served as Vice President of Nokia IP, Inc., a security router company, which acquired Ipsilon Networks, Inc., an IP switching company, where Mr. NeSmith served as Chief Executive Officer from May 1995 to December 1997. From October 1987 to April 1995, Mr. NeSmith held several positions at Newbridge Networks Corporation, a networking equipment manufacturer, including Vice President and General Manager of the VIVID group. Mr. NeSmith holds a B.S. in Electrical Engineering from the Massachusetts Institute of Technology.

David W. Hanna has served as a director of the Company since October 1996 and as Chairman of the Board of Directors of the Company since February 2001. From December 1998 to March 1999, Mr. Hanna also served as the Company’s interim President and Chief Executive Officer. Mr. Hanna has served as Chairman of the Board of Tropos Networks, Inc., a provider of metro-scale wireless mesh network systems, since January 2002 and also served as that company’s Chief Executive Officer from January 2002 to January 2004. Mr. Hanna also served as Chairman of the Board of Internet America, Inc., a provider of dial-up Internet access, from October 2004 to June 2005. From March 1998 to March 2000, Mr. Hanna served as President and Chief Executive Officer of Sage Software, Inc., a financial software company. Mr. Hanna served as President and Chief Executive Officer of State of the Art, Inc., a financial software developer, from November 1993 until March 1998. In addition, Mr. Hanna has served as Chairman, CEO and/or President of The Hanna Group since 1984; Hanna Capital Management since 1998; and Hanna Ventures since 1999. Mr. Hanna holds a B.S. in Business Administration from the University of Arizona.

3

James A. Barth has served as a director of the Company since January 2005. Since September 2007 Mr. Barth has been Chief Financial Officer and a director of Proximex Corporation, a developer of intelligent surveillance management software. From September 2004 to September 2007, Mr. Barth was co-founder, Chief Executive Officer and a director of Proximex Corporation. From March 1999 to September 2004, Mr. Barth was Chief Financial Officer of NetIQ Corporation, a provider of integrated systems and security management software solutions. He was also Vice President and then Senior Vice President of Finance and Administration during this period. From November 1997 until it was sold to Sterling Software in March 1999, Mr. Barth served as Vice President and Chief Financial Officer of Interlink Computer Sciences, Inc., a developer of enterprise networking software designed for the IBM mainframe platform. From 1980 to November 1997, Mr. Barth served as Chief Financial Officer at several other high technology companies, including eleven years at Rational Software Corporation, a provider of integrated software tools. Mr. Barth holds a B.S. in Business Administration from the University of California at Los Angeles and is a Certified Public Accountant.

Keith Geeslinhas served as a director of the Company since June 2006. Mr. Geeslin has been a partner at Francisco Partners, a private equity firm, since January 2004. Prior to joining Francisco Partners, Mr. Geeslin spent 19 years with the Sprout Group, a venture capital firm. Mr. Geeslin joined Sprout in 1984, became a General Partner in 1988, and became Sprout’s Managing Partner in 2000. Earlier in his career, he was the general manager of a division of Tymshare, Inc., a provider of public computer and network services, and held various positions at its Tymnet subsidiary from 1980 to 1984. He was also previously a staff member of the U.S. Senate Commerce Committee. Mr. Geeslin serves on the board of directors of CommVault Systems, Inc., Hypercom Corporation and Synaptics Incorporated. Mr. Geeslin holds a B.S. in Electrical Engineering and an M.S. in Engineering-Economic Systems, both from Stanford University, as well as an M.A. in Philosophy, Politics and Economics from Oxford University.

Timothy A. Howes,Ph.D. has served as a director of the Company since December 2005. Dr. Howes is Vice President and Chief Technology Officer of HP Software, a division of Hewlett Packard Co. He has held this position since September 2007. Prior to HP, he was a co-founder of Opsware Inc., a data center automation software company, where he served as Chief Technical Officer and in a number of senior executive roles from the Company’s founding in September 1999 to its sale to HP in September 2007. Prior to co-founding Opsware, Dr. Howes served as Vice President of Technology at America Online, Inc., a global Internet and media company, from April 1999 to September 1999. From February 1998 to April 1999, Dr. Howes was Chief Technology Officer of the Server Product division at Netscape Communications, an Internet company. From April 1996 to February 1998, Dr. Howes was Principal Engineer and Architect of several server products at Netscape Communications. From September 1994 to April 1996, Dr. Howes was Project Director, Principal Investigator and Senior Systems Research Programmer at the University of Michigan. Dr. Howes holds a Ph.D. in computer science, a M.S.E. in Computer Science and Engineering, and a B.S.E. in Aerospace Engineering from the University of Michigan.

James R. Tolonen has served as a director of the Company since May 2008. Mr. Tolonen most recently served as the Senior Group Vice President and Chief Financial Officer of Business Objects, S.A. a company which provided enterprise software solutions. He was responsible for all of its finance and administration functions commencing in January 2003 until its acquisition by SAP AG in January 2008. Mr. Tolonen served as the Chief Financial Officer and Chief Operating Officer and a member of the board of directors of IGN Entertainment Inc., an Internet media and service provider focused on the videogame market, from October 1999 to December 2002; as President and Chief Financial Officer of Cybermedia, a PC end user security and performance software provider, from April 1998 to September 1998; and as Chief Financial Officer of Novell, Inc., an enterprise software provider, from June 1989 to April 1998. Mr. Tolonen holds a Bachelor of Science degree in Mechanical Engineering and a Master of Business Administration from the University of Michigan. Mr. Tolonen is also a Certified Public Accountant.

4

Each of Messrs. Barth, Geeslin, Hanna, NeSmith and Tolonen and Dr. Howes was recommended for nomination by the Nominating/Corporate Governance Committee, and was nominated for election by the full Board of Directors. The Board of Directors previously nominated Mr. Geeslin pursuant to an agreement the Company entered into with certain entities affiliated with Francisco Partners and Sequoia Capital in June 2006, as described under “Certain Relationships and Related Transactions—Transactions with Francisco Partners,” below. That agreement expired in December 2007. There are no other arrangements between any director or nominee and any other person pursuant to which the director or nominee was selected. Each nominee is an incumbent director.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE NOMINEES LISTED HEREIN, AND PROXIES RECEIVED BY THE COMPANY WILL BE SO VOTED UNLESS STOCKHOLDERS SPECIFY A CONTRARY CHOICE IN THEIR PROXIES.

Board Committee Membership and Functions

The Board of Directors has four (4) standing committees: the Audit Committee, the Compensation Committee, the Stock Option Committee, and the Nominating/Corporate Governance Committee.

The current membership of the standing committees is as follows:

| | | | | | | | |

Board Member | | Audit | | Compensation | | Stock Option | | Nominating/Corporate

Governance |

Brian M. NeSmith | | | | | | X | | |

David W. Hanna | | | | | | | | Chairman |

James A. Barth | | Chairman | | | | | | X |

Keith Geeslin | | | | Chairman | | X | | |

Timothy A. Howes | | X | | X | | | | |

James R. Tolonen | | X | | | | | | |

Audit Committee. The Audit Committee of the Board of Directors (the “Audit Committee”) serves as the representative of the Board of Directors for general oversight of the Company’s financial accounting and reporting processes and the audits of the Company’s financial statements, oversight of the independence of its independent auditor, oversight of its system of internal controls, and oversight of its process for monitoring compliance with laws and regulations and its Code of Business Conduct. The Audit Committee annually appoints an independent registered public accounting firm to audit the Company’s financial statements. In addition, the Audit Committee approves the scope of the annual audits and fees to be paid to the Company’s auditors. During the fiscal year ended April 30, 2008 (“fiscal 2008”), the Audit Committee held five (5) meetings and acted twice by unanimous written consent in lieu of a meeting.

The Audit Committee most recently reviewed and reassessed the adequacy of its Audit Committee Charter in May 2008, and found it satisfactory. As a result of that finding, it recommended to the Board of Directors that no changes be made. That recommendation was adopted. A copy of the current Audit Committee Charter is available under the heading “Corporate Governance” of the Investor Relations section of the Company’s website at http://www.bluecoat.com/aboutus/investor_relations.

Three non-management directors currently comprise the Audit Committee: Mr. Barth, Dr. Howes and Mr. Tolonen. Mr. Tolonen joined the Audit Committee on May 21, 2008. Mr. Hanna was a member of the Audit Committee during fiscal 2008 and until May 21, 2008. Mr. Barth served as Chairman of the Audit Committee during fiscal 2008 and continues to serve as Chairman of the Audit Committee.

5

The Company’s Board of Directors has determined that each of Mr. Barth and Mr. Tolonen qualifies as an “audit committee financial expert,” as defined by Item 407(d)(5) of Regulation S-K of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In addition, the Board of Directors has determined that each member of the Audit Committee (i) is independent as defined in applicable NASDAQ rules; (ii) meets the criteria for independence set forth in Rule 10A-3(b)(1) under the Exchange Act; (iii) has not participated in the preparation of the financial statements of the Company or any current subsidiary of the Company at any time during the past three years; and (iv) is able to read and understand fundamental financial statements, including a company’s balance sheet, income statement, and cash flow statement. Additionally, the Board of Directors has determined that each of Mr. Barth and Mr. Tolonen has past employment experience in finance or accounting, requisite professional certification in accounting, or other comparable experience or background that results in the individual’s financial sophistication, including being or having been a chief executive officer, chief financial officer or other senior officer with financial oversight responsibilities.

Compensation Committee. The Compensation Committee of the Board of Directors (the “Compensation Committee”) reviews the performance of the Company’s executive officers, establishes compensation programs for the executive officers (including salary and short and long term incentive programs), and reviews the overall compensation programs of the Company. The Compensation Committee also administers the Company’s stock incentive plans and awards. During fiscal 2008, the Compensation Committee held fourteen (14) meetings and acted once by unanimous written consent in lieu of a meeting.

Two non-management directors currently comprise the Compensation Committee: Mr. Geeslin, who was elected to the Compensation Committee on May 23, 2008, and Dr. Howes, who joined the Compensation Committee on May 21, 2008. Mr. Hanna was a member of the Compensation Committee during fiscal 2008 and until May 21, 2008. Mr. Barth served as a member of the Compensation Committee during fiscal 2008 until May 23, 2007, when he was replaced Mr. Geeslin.

The Compensation Committee most recently reviewed and reassessed the adequacy of its Compensation Committee Charter in May 2008. As a result of that review, a revised charter was adopted by the Board of Directors upon recommendation of the Compensation Committee. A copy of the current Compensation Committee Charter is available under the heading “Corporate Governance” of the Investor Relations section of the Company’s website at http://www.bluecoat.com/aboutus/investor_relations.

The Chief Executive Officer (“CEO”), Chief Financial Officer and General Counsel of the Company generally attend Compensation Committee meetings and provide input to the Compensation Committee with respect to issues affecting compensation, key responsibilities, corporate objectives, and equity plan management and compliance. As discussed in the “Compensation Discussion and Analysis,” below, the CEO makes recommendations to the Compensation Committee regarding the compensation of the Company’s executives and participates in discussions of such compensation. From time to time other members of management and company personnel may attend Compensation Committee meetings to provide presentations and where subject matters involving their expertise are discussed. No member of management is present during discussions of his or her performance or compensation, and no member of management (including the CEO) is present during deliberations and voting with respect to the CEO’s performance or compensation.

The Compensation Committee may retain, at the Company’s expense, independent compensation consultants. During fiscal 2008, the Compensation Committee engaged Radford Surveys + Consulting, a business unit of Aon Corporation (“Radford”), as an independent compensation consultant to assist it in developing the program for director compensation for fiscal 2009. Radford also assisted management in developing a peer group for compensation benchmarking purposes.

6

The Compensation Committee Charter provides that the Compensation Committee may delegate its authority to one or more subcommittees. As of the date of this Proxy Statement, the committee has not delegated such authority. However, the authority of the Compensation Committee overlaps, in part, with that of the Stock Option Committee, which was established by the Board of Directors and has more limited authority.

Stock Option Committee. The Stock Option Committee of the Board of Directors (the “Stock Option Committee”) is authorized to approve certain equity awards under the Company’s 2007 Stock Incentive Plan and any other equity incentive plans approved by the Board of Directors. The Stock Option Committee may only approve awards (a) to individuals who are not directors or executive officers and who do not directly report to a Stock Option Committee member, and (b) where the award per grantee does not exceed 40,000 shares (in the event of options or stock appreciation rights) or 10,000 shares (in the event of restricted stock or stock units). Two directors currently comprise the Stock Option Committee, each of whom was a member of the Stock Option Committee during fiscal 2008: Mr. NeSmith, who is the Company’s CEO, and Mr. Geeslin, who is not a member of management. During fiscal 2008, the Stock Option Committee held one (1) meeting and acted by unanimous written consent in lieu of a meeting on eleven (11) occasions. A copy of the current Stock Option Committee Charter is available under the heading “Corporate Governance” of the Investor Relations section of the Company’s website at www.bluecoat.com/aboutus/investor_relations.

Nominating/Corporate Governance Committee. The Nominating/Corporate Governance Committee of the Board of Directors (the “Nominating/Corporate Governance Committee”) oversees the nomination of directors for service on the Board of Directors and its committees, reviews and considers developments in corporate governance practices, and recommends to the Board of Directors policies and procedures with respect to corporate governance. During fiscal 2008, the Nominating/Corporate Governance Committee held four (4) meetings.

Two non-management directors currently comprise the Nominating/Corporate Governance Committee: Messrs. Barth and Hanna, each of whom was a member of the Nominating/Corporate Governance Committee during fiscal 2008.

The Nominating/Corporate Governance Committee most recently reviewed and reassessed the adequacy of its Nominating/Corporate Governance Committee Charter in May 2008, and found it satisfactory. As a result of that finding, it recommended to the Board of Directors that no changes be made. A copy of the current Nominating /Corporate Governance Committee Charter is available under the heading “Corporate Governance” of the Investor Relations section of the Company’s website at http://www.bluecoat.com/aboutus/investor_relations.

Special Committees. From time to time, the Board of Directors may establish special purpose committees to address specific matters or issues, such as litigation. In fiscal 2007, the Company established a Special Committee in connection with the investigation of its historical stock option practices and subsequent restatement, which is described in Part I, Item 2, “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Background of the Stock Option Investigation, Findings, Restatement of Consolidated Financial Statements, Remedial Measures and Related Proceedings” in the Company’s Annual Report on Form 10-K for fiscal 2006, which was filed with the SEC on March 28, 2007. The Company is also subject to various litigation and other proceedings arising out of the matters addressed in that investigation. These proceedings are discussed in Part 1, Item 3 of the Company’s Annual Report on Form 10-K for fiscal 2008, which was filed with the SEC on June 30, 2008. The Company recently established a new Special Committee, comprised of directors Keith Geeslin and James Tolonen, to address certain matters involved in these proceedings. When this Proxy Statement references matters that relate to the Stock Option Investigation, it is referencing the matters discussed in this paragraph.

7

Nomination Process

When reviewing a potential candidate for nomination as director, including an incumbent whose term is expiring, the Nominating/Corporate Governance Committee will consider the perceived needs of the Board of Directors; the candidate’s relevant background, experience, skills and expected contributions; and the qualification standards established from time to time by the Nominating/Corporate Governance Committee. With respect to such standards, the Nominating/Corporate Governance Committee’s goal is to assemble a Board of Directors that has diversity of experience at policy-making levels in business, government, education and technology, and in areas that are relevant to the Company’s global activities. In addition, the Nominating/Corporate Governance Committee believes that members of the Board of Directors should possess the highest personal and professional ethics, integrity and values, and be committed to representing the long-term interests of the Company’s stockholders. They must have an inquisitive and objective perspective and mature judgment. They also must have experience in positions with a high degree of responsibility and be leaders in the companies or institutions with which they are affiliated. In addition to the benefits of diverse viewpoints, the Nominating/Corporate Governance Committee may take into account the ability of a candidate to work constructively with the other directors. Members of the Board of Directors will be expected to rigorously prepare for, attend, and participate in all meetings of the Board of Directors and applicable committees. Other than the foregoing, there are no stated minimum criteria for director nominees, although the Nominating/Corporate Governance Committee may consider such other factors, from time to time, as it deems are in the best interests of the Company and its stockholders.

The Nominating/Corporate Governance Committee will consider candidates for directors proposed by directors or management, and will evaluate any such candidates against the criteria and pursuant to the policies and procedures set forth above. If the Nominating/Corporate Governance Committee believes that the Board of Directors requires additional candidates for nomination, it may engage, as appropriate, a third party search firm to assist in identifying qualified candidates. The Nominating/Corporate Governance Committee used the services of Schweichler Price & Partners, Inc. in connection with the search that identified James R. Tolonen as a candidate for director. As part of the nominating process, all incumbent directors and non-incumbent nominees are required to submit a completed form of directors’ and officers’ questionnaire and incumbent directors may be required to participate in a peer-assessment process. The nomination process may also include interviews and additional background and reference checks for non-incumbent nominees, at the discretion of the Nominating/Corporate Governance Committee. Each director and several members of management interviewed Mr. Tolonen prior to his being proposed as a candidate for election to the Company’s Board of Directors.

The Nominating/Corporate Governance Committee also will consider properly submitted stockholder candidates for membership on the Board of Directors. Any stockholder of the Company wishing to submit a candidate for the Nominating/Corporate Governance Committee’s consideration must provide a written notice recommending the candidate to the Corporate Secretary of Blue Coat Systems, Inc. at 420 North Mary Avenue, Sunnyvale, CA 94085 or by fax at 1 408-220-2175 (with a confirmation copy sent by mail). The written notice must include the candidate’s name, biographical data and qualifications and attach a written consent from the candidate agreeing to be named as a nominee and to serve as a director if elected. Candidates recommended by the Company’s stockholders will be evaluated against the same criteria and under the same policies and procedures applicable to the evaluation of candidates proposed by directors or management.

Meetings and Attendance

During fiscal 2008, the Board of Directors held seventeen (17) meetings. Each of the directors participated in at least 75% of the aggregate of (i) the total number of meetings of the Board of Directors and (ii) the total number of meetings of a committee of the Board of Directors on which each such director then served. The independent members of the Board of Directors regularly meet in executive session.

8

The Company encourages attendance by members of the Board of Directors at the Company’s annual meeting of stockholders. At the Company’s 2007 Annual Meeting of Stockholders (held on October 2, 2007), each member of the Board of Directors was in attendance and available for questions.

Code of Business Conduct

The Company’s Board of Directors has adopted a Code of Business Conduct, which outlines the principles of legal and ethical business conduct under which the Company does business. The Code of Business Conduct is applicable to all of the Company’s directors, officers and employees. The Code of Business Conduct is available under the heading “Corporate Governance” of the Investor Relations section of the Company’s website at http://www.bluecoat.com/aboutus/investor_relations. Upon request to the Company’s Secretary, the Company will provide a copy of the Code of Business Conduct free of charge. Any substantive amendment of the Code of Business Conduct, and any waiver of the Code of Business Conduct for executive officers or directors, will be made only after approval by the Company’s Board of Directors or a committee of the Board, and will be disclosed on the Company’s Web site. In addition, any such waiver will be disclosed within four days on a Form 8-K filed with the Securities and Exchange Commission (the “SEC”) if then required by applicable rules and regulations.

Independence of Directors

The Company’s Board of Directors has reviewed the criteria for determining the independence of the Company’s directors under NASDAQ Rule 4200, Item 407(a) of Regulation S-K and the Company’s Corporate Governance Guidelines. It has affirmatively determined that each of Messrs. Barth, Geeslin, Hanna and Tolonen and Dr. Howes is independent under such criteria. Accordingly, during fiscal 2008 and continuing through the date of this Proxy Statement, the Company’s Board of Directors has been comprised of a substantial majority of directors who qualify as independent directors under the rules adopted by the SEC and NASDAQ, as supplemented by the Company’s Corporate Governance Guidelines.

In considering the independence of the Company’s directors, the Board of Directors specifically addressed those matters disclosed in “Certain Relationships and Related Transactions,” below. Except as disclosed in that section, there were no specific transactions, relationships or arrangements that were considered by the Board of Directors in determining the independence of any of the Company’s directors.

AUDIT COMMITTEE REPORT

The Audit Committee serves as the representative of the Board of Directors for general oversight of the Company’s financial accounting and reporting processes and the audits of the Company’s financial statements, oversight of the independence of its independent registered public accounting firm, oversight of its system of internal controls, and oversight of its process for monitoring compliance with laws and regulations and its Code of Business Conduct. The Audit Committee annually appoints an independent registered public accounting firm to audit the financial statements of the Company. In addition, the Audit Committee approves the plan and scope of the annual audits and fees to be paid to the Company’s auditors, and meets with the auditors on a regular basis without management present. The Company’s management has primary responsibility for preparing the Company’s financial statements and for managing its financial reporting process, and internal controls and procedures designed to reasonably assure compliance with accounting standards, applicable laws and regulations. The Company’s independent registered public accounting firm, Ernst & Young LLP (“Ernst & Young”), is responsible for expressing an opinion on the conformity of the Company’s audited financial statements to generally accepted accounting principles and on its assessment of the effectiveness of the Company’s internal control over financial reporting. The Audit Committee serves a board-level oversight role in which it provides advice, counsel and direction to management on the basis of the information it receives, its discussions with management and the independent auditors, and the experience of the Audit Committee’s members in business, financial and accounting matters.

9

In this context, the Audit Committee hereby reports as follows:

| | • | | The Audit Committee reviewed and discussed the audited financial statements with the Company’s management and Ernst & Young. |

| | • | | The Audit Committee discussed with Ernst & Young the matters required to be discussed by Statement on Auditing Standards (“SAS”) No. 61, as amended (Codification of Statements on Auditing Standards, AU 380), SAS 99 (Consideration of Fraud in a Financial Statement Audit), and other topics as required by the SEC and Public Company Accounting Oversight Board (“PCAOB”). |

| | • | | The Audit Committee has received the written disclosures and the letter from Ernst & Young required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), as adopted by the PCAOB in Rule 3600T, and has discussed with Ernst & Young their independence. On that basis, the Audit Committee believes that Ernst & Young is independent. |

Aggregate fees for professional services rendered for the Company by Ernst & Young for the fiscal years ended April 30, 2008 and 2007, were:

| | | | | | |

| | | April 30, |

| | | 2008 | | 2007 |

Audit Fees | | $ | 1,747,339 | | $ | 1,344,258 |

Fees for Audit of Restated Financial Statements and Review of the Special Committee’s Internal Stock Option Investigation under the Direction of the Audit Committee and Related Activities | | | -0- | | | 1,037,000 |

| | | | | | |

Total Audit Fees | | | 1,747,339 | | | 2,381,258 |

Audit-Related Fees | | | 29,095 | | | 99,500 |

Tax Fees | | | 10,926 | | | -0- |

| | | | | | |

TOTAL | | $ | 1,787,360 | | $ | 2,480,758 |

| | | | | | |

Audit fees for the fiscal years ended April 30, 2008 and 2007 were for professional services rendered for the annual audit of the Company’s consolidated financial statements, including the audit of the Company’s internal control over financial reporting, the reviews of the Company’s quarterly reports on Form 10-Q, statutory audits required in international locations, and consents. Fees for the review of the Special Committee’s internal stock option investigation under the direction of the Audit Committee and related activities were for Ernst & Young’s audit of the Company’s restated consolidated financial statements for fiscal years 2005 and 2004, which were included in the Company’s Annual Reports on Form 10-K for each of the fiscal years ended April 30, 2007 and 2006. Audit Related Fees for the fiscal year ended April 30, 2007 were for audit activity in connection with the Company’s acquisition of the NetCache business from Network Appliance on September 11, 2006 and the Company’s acquisition of Permeo, Inc. on March 3, 2006. Audit-Related Fees for the fiscal year ended April 30, 2008 were for audit activity in connection with the Company’s acquisition of Packeteer, Inc., which was completed on June 6, 2008; the Company’s Fiscal 2007 Tender Offer to the Company’s employees that had been granted stock options with an exercise price less than fair market value when awarded;and the Company’s response to an SEC comment letter, dated February 20, 2008. Tax fees for the fiscal year ended April 30, 2008 were for services related to tax compliance.

The Audit Committee has adopted pre-approval policies and procedures for audit and non-audit services. All audit, audit-related, tax and permissible non-audit services are approved in advance by the Audit Committee to assure they do not impair the independence of the Company’s independent registered public accountants. When considered necessary, management prepares an estimate of fees for the service and submits the estimate to the Audit Committee for its review and pre-approval. Any modifications to the estimates will be submitted to the Audit Committee for pre-approval at the next regularly scheduled Audit Committee meeting, or if action is required sooner, to the Chairman of the Audit Committee. All fees paid to the Company’s independent registered public accounting firm during fiscal years 2008 and 2007 were in accordance with this pre-approval policy.

10

Based on the Audit Committee’s discussions with management and Ernst & Young, and the Audit Committee’s review of the representations of management and the report of Ernst & Young to the Audit Committee, the Audit Committee recommended, and the Board of Directors subsequently approved, the inclusion of the Company’s audited financial statements in the Company’s Annual Report on Form 10-K for the fiscal year ended April 30, 2008, for filing with the Securities and Exchange Commission. The Audit Committee also approved the selection of Ernst & Young as the Company’s independent registered public accounting firm for the fiscal year ending April 30, 2009.

Submitted by the following members of the Audit Committee:

James A. Barth

Timothy A. Howes

James R. Tolonen

Compensation Committee Interlocks and Insider Participation

The members of the Compensation Committee during fiscal 2008 were Messrs. Geeslin and Hanna. Dr. Howes was appointed to the Compensation Committee on May 21, 2008, replacing Mr. Hanna. Neither Dr. Howes nor Mr. Geeslin was at any time an officer or employee of the Company; Mr. Hanna served as the Company’s interim President and Chief Executive Officer from December 11, 1998 to March 2, 1999, prior to the establishment of the Compensation Committee in September 1999. None of the Company’s executive officers serve as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of the Company’s Board of Directors or Compensation Committee.

Communication with the Board of Directors

Interested parties, including stockholders, may contact the Board of Directors or any committee of the Board of Directors by sending correspondence to the attention of Corporate Secretary, c/o Blue Coat Systems, Inc., 420 North Mary Avenue, Sunnyvale, California 94085. Any mail received by the Corporate Secretary will then be forwarded to the members of the Board of Directors or the appropriate committee for further action, if necessary. The non-management directors have requested that the Corporate Secretary not forward to them advertisements, solicitations for periodicals or other subscriptions, and other similar communications.

11

DIRECTOR COMPENSATION

In fiscal 2008, no director of the Company received cash compensation for services provided as a director, including with respect to service on a committee of the Board of Directors, except that Mr. Barth was paid a fee in the amount of $45,000 per annum for serving as Chairman of the Audit Committee. During fiscal 2008, each non-employee director of the Company received automatic option grants to purchase Common Stock under the Company’s 2007 Stock Incentive Plan (the “2007 Plan”). The program in effect during fiscal 2008 provided for the grant of an option to purchase 20,000 shares to each new non-employee director and for the grant of an additional option to purchase 15,000 shares to each new Chairman of the Audit Committee, provided in each case that the director was not previously employed by the Company. These initial grants to new directors vested in equal annual installments over a period of four years. The program also provided for annual option grants to incumbent non-employee directors on the date of each Annual Meeting of Stockholders, as follows: an option to purchase 8,000 shares to each director; an option to purchase 5,000 shares to each Audit Committee member; and an option to purchase 10,000 shares to the Chairman of the Audit Committee. Each annual automatic grant vested in full on the first anniversary of the grant date. The exercise price for each automatic option grant was equal to the fair market value per share of Common Stock on the automatic grant date. The Company does not provide compensation for service on the Board of Directors to directors that are also employees of the Company.

With the assistance of its compensation consultant, Radford, the Compensation Committee reviewed director compensation during the latter part of fiscal 2008. On May 21, 2008, after recommendation by the Compensation Committee, the Board of Directors approved a new compensation program for non-employee members of the Board of Directors for fiscal 2009 (the “Fiscal 2009 Director Compensation Program). The purpose of the revisions was to provide a mix of cash and equity compensation that was better aligned with the practices of similar companies and which would attract qualified candidates to serve on the Board of Directors. The compensation program provides differential compensation and is intended to more highly compensate those roles that place greater demands on directors. Cash compensation is paid quarterly in arrears and is paid in the form of a retainer. No meeting fees are paid.

The Fiscal 2009 Director Compensation Program includes the payment of cash compensation to each non-employee member of the Board of Directors, as follows:

| | | |

Annual Board Member Retainer | | $ | 24,000 |

Annual Chairman of the Board Retainer | | $ | 10,000 |

Annual Retainer for Committee Chairmen | | | |

Audit Committee | | $ | 35,000 |

Compensation Committee | | $ | 10,000 |

Nominating/Corporate Governance Committee | | $ | 5,000 |

Annual Committee Member Retainer | | | |

Audit Committee | | $ | 10,000 |

Compensation Committee | | $ | 8,000 |

Nominating/Corporate Governance Committee | | $ | 5,000 |

A retainer for Committee membership is only paid if an individual does not serve as Chairman of that Committee.

In addition to the establishment of cash compensation, the Fiscal 2009 Director Compensation Program reduces certain automatic stock option grants provided for under the 2007 Plan. It also extends the vesting period of certain automatic grants made under the 2007 Plan from that set forth in the 2007 Plan. The Fiscal 2009 Director Compensation Program provides for the following option grants:

| | • | | An individual who joins the Board of Directors is granted an option to purchase 15,000 shares of Common Stock on the date he or she first joins. |

12

| | • | | Upon the conclusion of each regular annual meeting of the Company’s stockholders, each incumbent director that will continue to serve on the Board of Directors is granted an option to purchase 8,000 shares of Common Stock. |

| | • | | Upon the conclusion of each regular annual meeting of the Company’s stockholders, and in addition to the award for service as a director, each director who will serve as a member of the Audit Committee (but not as the Chairman) is granted an option to purchase 1,000 shares of Common Stock and each director who will serve as Chairman of the Audit Committee is granted an option to purchase 2,000 shares of Common Stock. |

| | • | | As provided in the 2007 Stock Incentive Plan, no award is granted upon the conclusion of a regular annual meeting of the Company’s stockholders to an individual that has received an award for commencement of service on the Board during that calendar year. |

| | • | | Each stock option vests in four equal annual installments over the four-year period commencing on the date of grant. |

13

DIRECTOR COMPENSATION—Fiscal 2008

The following table provides information on the compensation awarded to, earned by, or paid to each person who served as a director during fiscal 2008, other than Mr. NeSmith, who also served as an executive officer.

| | | | | | |

Name | | Fees Earned or

Paid in Cash

($)(1) | | Option Awards

($)(2) | | Total

($) |

James Barth | | 45,000 | | 572,606 | | 617,606 |

Keith Geeslin | | 0 | | 211,276 | | 211,276 |

David Hanna | | 0 | | 304,937 | | 304,937 |

Timothy Howes | | 0 | | 381,040 | | 381,040 |

| (1) | Mr. Barth is the Chairman of the Audit Committee. He received an annual retainer of $45,000 in fiscal 2008 for his service as Chairman. |

| (2) | The amounts in this column represent the dollar amount recognized by the Company for financial statement reporting purposes with respect to all options held by each director during fiscal 2008 in accordance with FAS123R, with the exception that any estimate of forfeitures related to service-based vesting has been disregarded. See Note 6 of the notes to the Company’s consolidated financial statements in its Annual Report on Form 10-K filed on June 30, 2008 for a discussion of all assumptions made by the Company in determining the FAS123R values of its equity awards. For information on the valuation assumptions for grants made prior to fiscal 2006, see the notes in the Company’s financial statements included in its Annual Report on Form 10-K for the respective fiscal year. |

The following table provides additional information on each of the options awarded to the Company’s non-employee directors in fiscal 2008, as well as the options held by the non-employee directors at the end of fiscal 2008.

| | | | | | |

Name | | Grant Date | | Grant Date Fair Value

($)(1) | | Outstanding

Option

Awards

April 30, 2008

(#) |

James A. Barth | | 10/2/07 | | 560,975 | | 102,000 |

Keith Geeslin | | 10/2/07 | | 195,164 | | 36,000 |

David Hanna | | 10/2/07 | | 317,073 | | 114,500 |

Timothy Howes | | 10/2/07 | | 317,073 | | 46,000 |

| (1) | The amounts in this column represent the grant date fair value determined in accordance with FAS123R, with the exception that any estimate of forfeitures related to service-based vesting has been disregarded. See Note 6 of the notes to the Company’s consolidated financial statements in its Annual Report on Form 10-K filed on June 30, 2008 for a discussion of all assumptions made by the Company in determining the grant date fair value of its equity awards. |

14

PROPOSAL NO. 2

RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has appointed Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending April 30, 2009. Although ratification by the Company’s stockholders is not required by law, the Board of Directors has determined that it is desirable to seek ratification of this selection by the stockholders. The affirmative vote of the holders of a majority of shares present or represented by proxy and voting at the Annual Meeting will be required to ratify the appointment of Ernst & Young LLP.

Ernst & Young LLP has audited the Company’s financial statements since 1999. Its representatives are expected to be present at the Annual Meeting, will have the opportunity to make a statement if they desire to do so, and will be available to respond to appropriate questions.

In the event the stockholders fail to ratify the appointment, the Audit Committee will reconsider its selection. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of a different independent audit firm at any time during the year if it determines that such a change would be in the best interests of the Company and its stockholders.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE SELECTION OF ERNST & YOUNG LLP TO SERVE AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING APRIL 30, 2009, AND PROXIES RECEIVED BY THE COMPANY WILL BE SO VOTED UNLESS STOCKHOLDERS SPECIFY A CONTRARY CHOICE IN THEIR PROXIES.

15

EXECUTIVE OFFICERS

The following chart sets forth certain information regarding the executive officers of the Company as of July 31, 2008:

| | | | |

Name | | Age | | Position(s) and Office(s) Held with the Company |

Brian M. NeSmith | | 46 | | President, Chief Executive Officer and Director |

Betsy E. Bayha | | 57 | | Senior Vice President, General Counsel and Secretary |

Kevin T. Biggs | | 50 | | Senior Vice President of Worldwide Sales |

David A. de Simone | | 53 | | Senior Vice President, Corporate Operations |

Bethany J. Mayer | | 46 | | Senior Vice President, Marketing |

Kevin S. Royal | | 44 | | Senior Vice President and Chief Financial Officer |

Brian M. NeSmithhas served as President and Chief Executive Officer and as a director of the Company since March 1999. From December 1997 to March 1999, Mr. NeSmith served as Vice President of Nokia IP, Inc., a security router company, which acquired Ipsilon Networks, Inc., an IP switching company, where Mr. NeSmith served as Chief Executive Officer from May 1995 to December 1997. From October 1987 to April 1995, Mr. NeSmith held several positions at Newbridge Networks Corporation, a networking equipment manufacturer, including Vice President and General Manager of the VIVID group. Mr. NeSmith holds a B.S. in Electrical Engineering from the Massachusetts Institute of Technology.

Betsy E. Bayha has served as Senior Vice President, General Counsel and Secretary of the Company since April 2007. Ms. Bayha previously served as Senior Vice President, General Counsel and Secretary of NetIQ Corporation, a provider of integrated systems and security management software solutions, from November 2001 to June 2006, when it was acquired by a consortium of private equity firms. Prior to joining NetIQ, Ms. Bayha was in private practice representing high technology corporations in licensing, corporate and litigation matters for more than 20 years. She was a partner at General Counsel Associates from November 1994 through October 2001, and was a partner at the international law firm of Coudert Brothers from December 1986 through October 1994. Ms. Bayha holds a J.D. from Harvard Law School, an M.A. in public administration from The Ohio State University and a B.A. in economics from Oakland University.

Kevin T. Biggs has served as Senior Vice President, Worldwide Sales of the Company since January 2007. Mr. Biggs joined the Company from International Business Machines, Inc. (“IBM”), a manufacturer of computers and related products, where he held the position of Vice President of New Customer Acquisition from February 2004 to December 2006. Prior to that time, Mr. Biggs served as IBM’s Vice President of Worldwide Sales, IBM Data Management Division, from August 2002 to February 2004; as IBM’s Vice President of Software Sales, IBM Americas West, from April 2002 to August 2002; and as IBM’s Vice President of Software, IBM Latin America, from September 1998 to April 2002. Prior to these executive roles, Mr. Biggs held a number of sales management positions at IBM since joining IBM in 1980. Mr. Biggs holds a B.A. in both Economics and Mathematics from Drury University.

David A. de Simonehas served as Senior Vice President of the Company since September 2003. He has served as Senior Vice President, Corporate Operations of the Company since May 2007. Previously Mr. de Simone served as Senior Vice President, Engineering of the Company from September 2003 to May 2007. From late 2002 to September 2003, Mr. de Simone worked as an independent consultant, providing technical assistance and executive coaching to several clients. From mid 2000 to late 2002, Mr. de Simone served as Vice President of Platform Development for Brocade Communications Systems, a provider of storage area networking products. From February 1989 to May 2000, Mr. de Simone held a number of positions with Tandem Computers, an enterprise computer systems and transaction processing company, and with Compaq Computer Systems, a global computer systems, storage and solutions company, subsequent to its acquisition of Tandem Computers. During the last several years of his tenure with both Compaq and Tandem, Mr. de Simone was Vice President of

16

Clustering Technology, and earlier in his tenure with Tandem he was a Director of Engineering. Mr. de Simone has an additional 11 years of experience in a variety of engineering and operations roles. Mr. de Simone holds a B.S.E.E. from the University of California, Davis.

Bethany J. Mayer has served as Senior Vice President, Worldwide Marketing of the Company since June 2007. Previously Ms. Mayer served as Vice President of Business Planning and Marketing with JDS Uniphase Inc., an optical components company, from February 2007 to June 2007, and as the Chief Marketing Officer for Mirapoint Inc., an e-mail and e-mail security company, from March 2005 to February 2008. Ms. Mayer was Vice President of Marketing and Product Management for Vernier Networks, a network security company, from March 2004 to March 2005, and was Vice President of Product Marketing for Skystream Networks Inc., a video networking company, from March 2000 to March 2004. Prior to those positions, Ms. Mayer held various marketing and product management positions at Cisco Systems, a networking technology company, from September 1993 to March 2000. Ms. Mayer held various operations positions and engineering program positions at Apple Computer Inc., a computer technology company, from January 1990 to September 1993. Ms. Mayer held various positions in engineering program management at Lockheed Martin Inc., an aerospace defense company, from March 1983 to January 1990. Ms. Mayer holds a B.S. in political science from Santa Clara University.

Kevin S. Royalhas served as Senior Vice President and Chief Financial Officer of the Company since May 2005. From January 2002 to April 2005, Mr. Royal served as Chief Financial Officer of Novellus Systems, Inc., a provider of semiconductor manufacturing equipment. Mr. Royal joined Novellus in 1996 and held various senior finance positions, including Vice President Finance and Corporate Controller. Prior to Novellus, Mr. Royal worked for Ernst & Young LLP in their Northern California high technology practice for over 10 years. Mr. Royal received his Bachelor of Business Administration from Harding University and is a Certified Public Accountant in the State of California.

17

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table provides information as of April 30, 2008 with respect to the shares of the Company’s Common Stock that may be issued under the Company’s existing equity compensation plans. The table does not include information with respect to shares subject to outstanding options assumed by the Company in connection with acquisitions of the companies which originally granted those options, as further described in Footnote (5) to the table.

| | | | | | | | | | |

| | | Number of Securities

to Be Issued

upon Exercise of

Outstanding Options,

Warrants and Rights | | | Weighted-Average

Exercise Price of

Outstanding Options,

Warrants and Rights | | | Number of Securities

Remaining Available

for Future Issuance

under Equity

Compensation Plans

(Excluding

Securities Reflected

in Column (a)) | |

Plan Category | | (a) | | | (b) | | | (c) | |

Equity compensation plans approved by security holders (1) | | 4,863,312 | (3) | | $ | 22.99 | (3) | | 4,878,051 | (4) |

Equity compensation plans not approved by security holders (2) | | 834,386 | | | $ | 21.65 | | | 0 | |

| | | | | | | | | | |

Total | | 5,697,698 | | | $ | 22.79 | | | 4,878,051 | |

| | | | | | | | | | |

(1) | Consists of options outstanding under the 1996 Stock Plan, 1999 Stock Incentive Plan, and 1999 Director Option Plan (“Prior Plans”), options granted and shares available under the 2007 Stock Incentive Plan and shares available under the Employee Stock Purchase Plan (“ESPP”). The Prior Plans were terminated upon stockholder approval of the 2007 Stock Incentive Plan, on October 2, 2007. Each year, the number of shares under the ESPP automatically increases by 200,000 shares, or such lesser number of shares as the Board of Directors may determine, on January 31stof that year. During fiscal 2008, 200,000 shares were added to the ESPP. |

| (2) | Consists of options outstanding under the 2000 Supplemental Stock Option Plan (the “Supplemental Plan”), which was implemented by the Board of Directors on February 15, 2000, and the 2007 New Employee Plan (“New Employee Plan”), which was implemented by the Board of Directors on June 12, 2007. These plans were terminated upon stockholder approval of the 2007 Stock Incentive Plan, on October 2, 2007. |

| (3) | Excludes purchase rights accrued under the ESPP. |

| (4) | Includes shares available for future issuance under the ESPP. As of April 30, 2008, there were 1,349,972 shares of Common Stock available for future issuance under the ESPP and 3,528,079 shares of Common Stock available for future awards under the 2007 Stock Incentive Plan. |

| (5) | Table excludes information for equity awards assumed by the Company in business combinations. As of April 30, 2008, a total of 44,864 shares of the Company’s Common Stock were issuable upon exercise of outstanding assumed options. The related weighted average exercise price of those outstanding options was $21.13 per share. In connection with the Company’s acquisition of Packeteer, Inc. on June 6, 2008, the Company assumed the Packeteer, Inc. 1999 Stock Incentive Plan, including 720,774 shares reserved and available for issuance under that plan. The Company may only issue equity awards to former employees of Packeteer, Inc. under that plan, as it has not been approved by the Company’s stockholders. |

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth, as of June 30, 2008, certain information with respect to shares beneficially owned by (i) each person who is known by the Company to be the beneficial owner of more than five percent of any class of the Company’s voting securities, (ii) each of the Company’s directors as of that date, (iii) each of the executive officers named in the Summary Compensation Table below, and (iv) all current directors and executive officers as a group. Beneficial ownership has been determined in accordance with Rule13d-3 under the Securities Exchange Act of 1934. Under this rule, certain shares may be deemed to be beneficially owned by more than one

18

person (if, for example, persons share the power to vote or the power to dispose of the shares). In addition, shares are deemed to be beneficially owned by a person if the person has the right to acquire shares (for example, upon exercise of an option or upon conversion of convertible debt into Common Stock) within sixty (60) days of that date. Shares issuable pursuant to the (i) exercise of stock options and warrants exercisable within sixty (60) days of June 30, 2008, and (ii) conversion of convertible debt convertible within sixty (60) days of June 30, 2008, are deemed outstanding for purposes of computing the percentage of the person holding the options, warrants or convertible debt, but are not outstanding for purposes of computing the percentage of any other person. As a result, the percentage ownership of outstanding shares of any person as shown in the following table does not necessarily reflect the person’s actual voting power at any particular date.

| | | | | |

| | | Shares Beneficially Owned as

of June 30, 2008(1) | |

| | | Common Stock | |

Name of Beneficial Owner | | No. of

Shares | | Percentage

of Class | |

5% shareholders: | | | | | |

Vanguard Group, Inc. (2). | | 2,152,166 | | 5.6 | % |

Glenhill Advisors, LLC (3). | | 2,000,000 | | 5.2 | % |

Barclays Global Investors NA (California) (4) | | 1,942,438 | | 5.0 | % |

Manchester Securities Corp. (5) | | 2,119,460 | | 5.2 | % |

Entities affiliated with Francisco Partners II, LP (6) | | 2,119,460 | | 5.2 | % |

Directors and Executive Officers: | | | | | |

Brian M. NeSmith (7) | | 914,005 | | 2.4 | % |

Kevin T. Biggs (8) | | 99,181 | | * | |

David A. de Simone (9) | | 247,722 | | * | |

Kevin S. Royal (10) | | 81,478 | | * | |

Betsy E. Bayha (11) | | 56,875 | | * | |

James A. Barth (12) | | 74,250 | | * | |

Keith Geeslin(6) | | 2,137,460 | | 5.3 | % |

David W. Hanna (13) | | 438,586 | | 1.1 | % |

Timothy A. Howes (14) | | 34,000 | | * | |

James R. Tolonen (15) | | 5,500 | | * | |

All current directors and executive officers as a group (11 persons) (16) | | 4,118,315 | | 10.0 | % |

| * | Less than 1% of the outstanding shares of Common Stock. |

| (1) | Except as indicated in the footnotes to this table and pursuant to applicable community property laws, each of the persons named in the table has, to the Company’s knowledge, sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned by such person. Unless otherwise indicated, the address of each individual listed in the table is c/o Blue Coat Systems, Inc., 420 North Mary Avenue, Sunnyvale, California 94085. The percentage of beneficial ownership is based on 38,478,992 shares of Common Stock outstanding as of June 30, 2008. |

| (2) | Based on a Schedule 13F filed with the SEC on March 31, 2008. The address of Vanguard Group, Inc. is 100 Vanguard Boulevard, Malvern, PA 19355-2331 |

(3) | Based on the Schedule 13G Filed with the SEC on June 10, 2008. The address of Glenhill Advisors LLC is 598 Madison Avenue 12th floor, New York, NY 10022-1603 |

| (4) | Based on a Schedule 13F filed with the SEC on March 31, 2008. The address of Barclays Global Investors NA (California) is 45 Fremont Street, San Francisco, CA 94105-2228 |

(5) | Includes 1,926,782 shares of Common Stock into which Zero Coupon Convertible Senior Notes due 2013 may be converted within 60 days of June 30, 2008, and 192,678 shares of Common Stock covered by Warrants to purchase Common Stock which may be exercised within 60 days of June 30, 2008, each held by Manchester Securities Corp. The address of Manchester Securities Corp. is 712 Fifth Avenue, 36th Floor, New York, NY 10019. |

19

| (6) | Includes 1,900,674 shares of Common Stock into which Zero Coupon Convertible Senior Notes due 2013 may be converted within 60 days of June 30, 2008, and 190,067 shares of Common Stock covered by Warrants to purchase Common Stock which may be exercised within 60 days of June 30, 2008, each held by Francisco Partners II, L.P. Also includes 26,108 shares of Common Stock into which Zero Coupon Convertible Senior Notes due 2013 may be converted within 60 days of June 30, 2008, and 2,611 shares of Common Stock covered by Warrants to purchase Common Stock which may be exercised within 60 days of June 30, 2008, each held by Francisco Partners Parallel Fund II, L.P. Keith Geeslin is a Partner of Francisco Partners II, L.P. and Francisco Partners Parallel Fund II, L.P. Mr. Geeslin disclaims beneficial ownership of the shares held by these entities, except to the extent of his economic interest in the funds. The number of shares of Common Stock held by Mr. Geeslin also includes 18,000 shares subject to options that are exercisable within 60 days of June 30, 2008. The address of Francisco Partners is One Letterman Drive, Building C, Suite 410, San Francisco, CA 94111. |

| (7) | Includes 103,841 shares subject to options that are exercisable within 60 days of June 30, 2008 and 52,050 restricted shares subject to forfeiture, and 770,000 shares held by the Brian M. and Nancy J. NeSmith Family Trust. |

| (8) | Includes 28,774 shares subject to options that are exercisable within 60 days of June 30, 2008 and 51,140 restricted shares subject to forfeiture. |

| (9) | Includes 186,462 shares subject to options that are exercisable within 60 days of June 30, 2008 and 39,674 restricted shares subject to forfeiture. |

| (10) | Includes 58,937 shares subject to options that are exercisable within 60 days of June 30, 2008 and 18,307 restricted shares subject to forfeiture. |

| (11) | Includes 34,084 shares subject to options that are exercisable within 60 days of June 30, 2008 and 20,000 restricted shares subject to forfeiture. |

| (12) | Includes 70,250 shares subject to options that are exercisable within 60 days of June 30, 2008. |

| (13) | Includes 101,500 shares subject to options that are exercisable within 60 days of June 30, 2008. Also includes 311,284 shares held by the David W. Hanna Trust and 25,802 shares held by Mr. Hanna’s spouse. Mr. Hanna disclaims beneficial ownership of the shares held by others, except to the extent of his economic interest therein. |

| (14) | Includes 23,000 shares subject to options that are exercisable within 60 days of June 30, 2008. |

| (15) | Includes 5,500 shares held by the James R. and Ginger Tolonen Trust. |

| (16) | Includes 643,100 shares subject to options that are exercisable within 60 days of June 30, 2008 and 191,725 restricted shares subject to forfeiture. Also, includes 1,900,674 shares of Common Stock into which Zero Coupon Convertible Senior Notes due 2013 may be converted within 60 days of June 30, 2008, and 190,067 shares of Common Stock covered by Warrants to purchase Common Stock which may be exercised within 60 days of June 30, 2008, each held by Francisco Partners II, L.P. Also includes 26,108 shares of Common Stock into which Zero Coupon Convertible Senior Notes due 2013 may be converted within 60 days of June 30, 2008, and 2,611 shares of Common Stock covered by Warrants to purchase Common Stock which may be exercised within 60 days of June 30, 2008, each held by Francisco Partners Parallel Fund II, L.P. Keith Geeslin is a Partner of Francisco Partners II, L.P. and Francisco Partners Parallel Fund II, L.P. Mr. Geeslin disclaims beneficial ownership of the shares held by these entities, except to the extent of his economic interest in the funds. |

20

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

The members of the Board of Directors, the executive officers of the Company and persons who hold more than 10% of the Company’s outstanding Common Stock are subject to the reporting requirements of Section 16(a) of the Securities Exchange Act of 1934, as amended, which require them to file reports with respect to their ownership of the Company’s Common Stock and their transactions in such Common Stock. The Company has reviewed copies of Section 16(a) reports that it has received from such persons regarding their transactions in Common Stock and their Common Stock holdings for fiscal 2008, together with written representations received from one or more of such persons that no annual Form 5 reports were required to be filed by them for fiscal 2008. Based upon this review, the Company believes that all reporting requirements under Section 16(a) for fiscal 2008 were met in a timely manner by such persons, except that option exercises (and same-day sales) made on August 23, 2007 by Kevin Royal, an executive officer, were reported one day late on four Form 4s.

21

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

The Compensation Committee oversees the Company’s compensation programs. It has the exclusive authority to establish the compensation payable to the Company’s Chief Executive Officer (“CEO”) and other executive officers. In addition, the Compensation Committee approves non-equity incentive programs in which the Company’s executive officers participate and discretionary bonuses made to the Company’s executive officers.

This Compensation Discussion and Analysis explains the Company’s compensation programs, and discusses how they operate, particularly with respect to the Company’s named executive officers. The Company’s “named executive officers” consist of the CEO, the Chief Financial Officer and the three most highly compensated executive officers (other than the CEO or Chief Financial Officer) who were serving as executive officers at the end of fiscal 2008. These are the Company’s Senior Vice President, Corporate Operations; Senior Vice President, Worldwide Sales; and Senior Vice President, General Counsel & Secretary.

Compensation Program Overview