UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | |

¨ Preliminary Proxy Statement x Definitive Proxy Statement ¨ Definitive Additional Materials | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

¨ Soliciting Material Pursuant to Section 240.14a-12 |

BLUE COAT SYSTEMS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

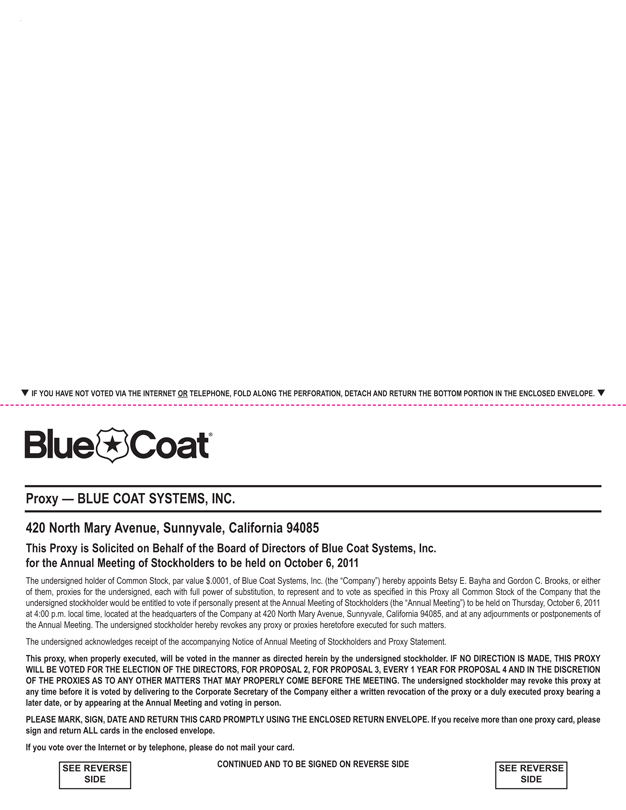

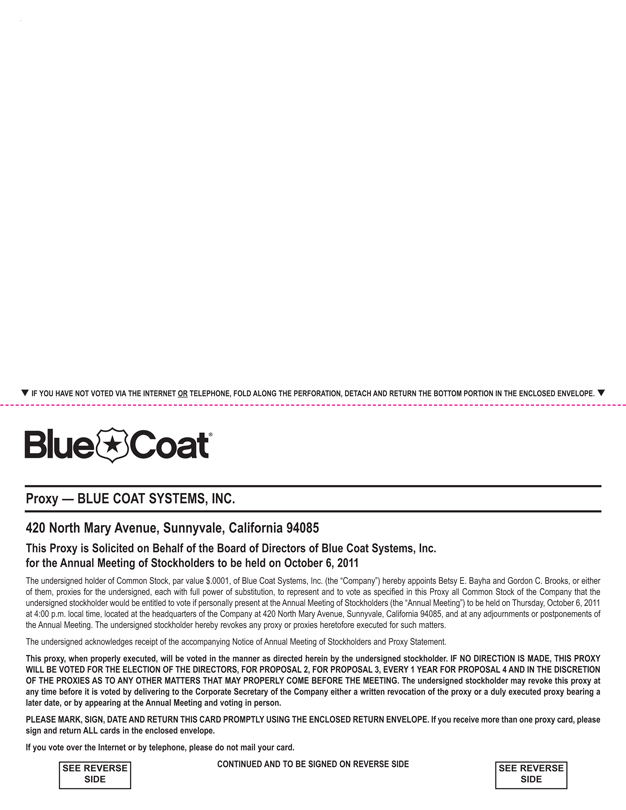

BLUE COAT SYSTEMS, INC.

420 North Mary Avenue

Sunnyvale, California 94085

TO THE STOCKHOLDERS OF BLUE COAT SYSTEMS, INC.:

You are cordially invited to attend the Annual Meeting of Stockholders of Blue Coat Systems, Inc. (the “Company”), which will be held at the Company’s headquarters located at 420 North Mary Avenue, Sunnyvale, California 94085, on Thursday, October 6, 2011, at 4:00 p.m., local time.

Details of the business to be conducted at the Annual Meeting are given in the attached Proxy Statement and Notice of Annual Meeting of Stockholders.

It is important that your shares be represented and voted at the meeting.WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE COMPLETE, SIGN, DATE, AND PROMPTLY RETURN THE ACCOMPANYING PROXY IN THE ENCLOSED POSTAGE-PAID ENVELOPE OR VOTE BY TELEPHONE OR THE INTERNET BY FOLLOWING THE INSTRUCTIONS SET FORTH ON THE PROXY. Returning the proxy or voting by telephone or on the Internet does NOT deprive you of your right to attend the Annual Meeting. If you decide to attend the Annual Meeting and wish to change your proxy vote, you may do so automatically by voting in person at the meeting. However, if your shares are held for you by a broker, bank or other nominee, you must obtain a proxy from that nominee and bring it with you to hand in with your ballot, in order to be able to vote your shares at the meeting.

On behalf of the Board of Directors, I express our appreciation for your continued interest in the affairs of the Company. We look forward to seeing you at the Annual Meeting.

|

Sincerely, |

/s/ David W. Hanna |

| David W. Hanna |

| Chairman of the Board of Directors |

Sunnyvale, California

August 29, 2011

BLUE COAT SYSTEMS, INC.

420 North Mary Avenue

Sunnyvale, California 94085

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON OCTOBER 6, 2011

The Annual Meeting of Stockholders (the “Annual Meeting”) of Blue Coat Systems, Inc. (the “Company”) will be held at the Company’s headquarters located at 420 North Mary Avenue, Sunnyvale, California 94085, on Thursday, October 6, 2011, at 4:00 p.m. local time for the following purposes:

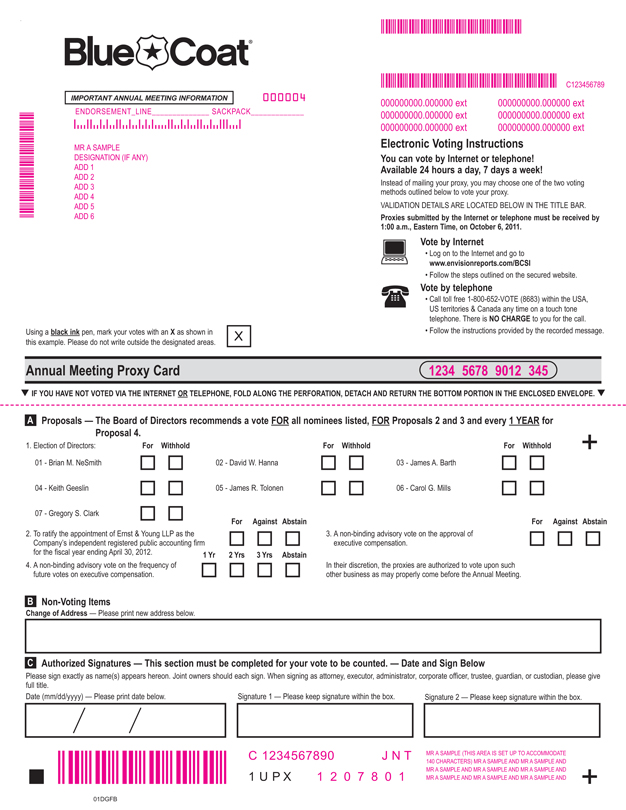

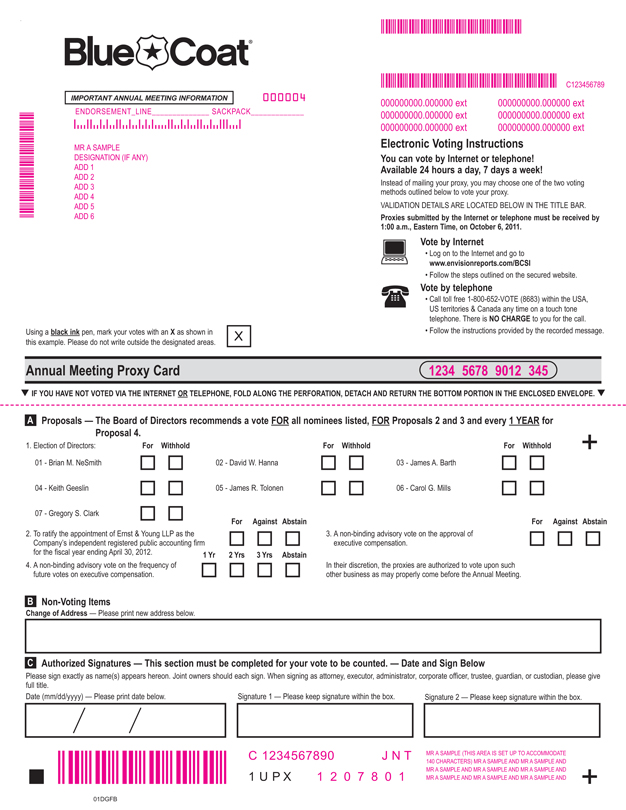

| | 1. | To elect seven directors of the Board of Directors to serve until the next Annual Meeting or until their successors have been duly elected and qualified; |

| | 2. | To ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending April 30, 2012; |

| | 3. | To hold a non-binding advisory vote regarding executive compensation; |

| | 4. | To hold a non-binding advisory vote on the frequency of future votes regarding executive compensation; and |

| | 5. | To transact such other business as may properly come before the meeting or any adjournments or postponements thereof. |

These items of business are more fully described in the Proxy Statement accompanying this notice.

This Notice of Annual Meeting of Stockholders, the Proxy Statement and the Company’s Annual Report on Form 10-K are available at www.edocumentview.com/bcsi. Information on our website, other than these materials, is not a part of these proxy solicitation materials.

Only stockholders of record at the close of business on August 17, 2011 are entitled to notice of, and to vote at, the Annual Meeting and at any adjournments or postponements thereof. A list of such stockholders will be available for inspection at the Company’s headquarters located at 420 North Mary Avenue, Sunnyvale, California, during ordinary business hours for ten days prior to the Annual Meeting.

|

BY ORDER OF THE BOARD OF DIRECTORS, |

/s/ Betsy E. Bayha |

| Betsy E. Bayha |

| Senior Vice President, General Counsel and Secretary |

Sunnyvale, California

August 29, 2011

|

IMPORTANT WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE COMPLETE, SIGN, DATE, AND PROMPTLY RETURN THE ACCOMPANYING PROXY IN THE ENCLOSED POSTAGE-PAID ENVELOPE OR VOTE BY TELEPHONE OR THE INTERNET BY FOLLOWING THE INSTRUCTIONS SET FORTH ON THE ACCOMPANYING PROXY. YOU MAY REVOKE YOUR PROXY OR YOUR VOTE BY TELEPHONE OR THE INTERNET AT ANY TIME PRIOR TO THE ANNUAL MEETING. IF YOU ARE THE RECORD HOLDER OF THE SHARES AND ATTEND THE ANNUAL MEETING, YOU MAY CHANGE YOUR PROXY VOTE AUTOMATICALLY BY VOTING IN PERSON AT THE MEETING. |

BLUE COAT SYSTEMS, INC.

420 North Mary Avenue

Sunnyvale, California 94085

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON OCTOBER 6, 2011

GENERAL INFORMATION

These proxy materials are furnished in connection with the solicitation of proxies by the Board of Directors (the “Board of Directors” or the “Board”) of Blue Coat Systems, Inc., a Delaware corporation (the “Company”), for the Annual Meeting of Stockholders (the “Annual Meeting”) to be held at the Company’s headquarters located at 420 North Mary Avenue, Sunnyvale, California 94085, on Thursday, October 6, 2011, at 4:00 p.m. local time, and at any adjournments or postponements of the Annual Meeting. These proxy materials were first mailed to stockholders on or about September 1, 2011.

PURPOSE OF MEETING

The specific proposals to be considered and acted upon at the Annual Meeting are summarized in the accompanying Notice of Annual Meeting of Stockholders. Each proposal is described in more detail in this Proxy Statement.

VOTING RIGHTS AND SOLICITATION OF PROXIES

Only holders of the Company’s common stock (“Common Stock”) are entitled to vote at the Annual Meeting. At the close of business on August 17, 2011, the record date for determining the holders of Common Stock entitled to vote at the Annual Meeting (the “Record Date”), there were 42,287,789 shares of Common Stock outstanding. Each holder of a share of Common Stock is entitled to one vote per share. All votes will be tabulated by the inspector of elections appointed for the meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes.

Quorum Required

The Company’s bylaws provide that the holders of a majority of the votes represented by the Common Stock issued and outstanding, and entitled to vote at the Annual Meeting, present in person or represented by proxy, shall constitute a quorum for the transaction of business at the Annual Meeting. Abstentions and broker non-votes will be counted as present for the purpose of determining the presence of a quorum. Broker non-votes occur with respect to a particular (non-routine) matter when a nominee, such as a financial institution, returns a proxy, but is not permitted to vote on that matter without receiving voting instructions (via proxy vote) from the beneficial owner and instructions are not given.

Votes Required

Proposal 1. Directors are elected by a plurality of the affirmative votes cast by those shares present in person, or represented by proxy, and entitled to vote at the Annual Meeting. The seven nominees for director receiving the highest number of affirmative votes will be elected. Abstentions and broker non-votes will not be counted as having been voted for purposes of the election of directors. Stockholders may not cumulate votes in the election of directors.

1

Proposal 2. Ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending April 30, 2012 requires the affirmative vote of a majority of those shares present in person, or represented by proxy, and cast either affirmatively or negatively at the Annual Meeting. Abstentions will have the same effect as votes against the proposal. Broker non-votes will not have an effect on the outcome of the proposal.

Proposal 3. The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) requires that we provide our stockholders with the opportunity to vote to approve, on an advisory or non-binding basis, the compensation of our named executive officers as disclosed in this proxy statement under the compensation disclosure rules of the Securities and Exchange Commission, including the disclosures under “Executive Compensation—Compensation Discussion and Analysis,” the compensation tables, and the narrative discussion following the compensation tables. This proposal, commonly known as a “Say on Pay” proposal, provides our stockholders the opportunity to express their views on the compensation paid to our named executive officers. Abstentions and broker non-votes will not be counted as having been voted for purposes of this proposal.

Proposal 4. The Dodd-Frank Act also requires that we provide our stockholders with the opportunity to vote, on an advisory or non-binding basis, on how frequently we should seek future advisory votes on the compensation of our named executive officers. By voting on this proposal, stockholders may indicate whether they would prefer an advisory vote on named executive officer compensation every year, every other year, or every three years, or they may abstain. Abstentions and broker non-votes will not be counted as having been voted for purposes of this proposal.

Voting of Shares

Whether or not you are able to attend the Company’s Annual Meeting, you are urged to complete and return the enclosed proxy, which is solicited by the Company’s Board of Directors and which will be voted as you direct on your proxy when properly completed. In the event no directions are specified, such proxies will be voted FOR the Nominees of the Board of Directors (as set forth in Proposal No. 1), FOR Proposal No. 2, FOR Proposal No. 3 and, with respect to Proposal No. 4, the option providing for an annual vote. The Company knows of no other matters to be presented at the Annual Meeting. However, if any other matters are properly presented, the proxy holders shall be authorized to vote the shares represented by proxies according to their best judgment. Proxies will extend to, and be voted at, any adjournment or postponement of the Annual Meeting.

You may revoke or change your proxy at any time before the Annual Meeting. To do this, send a written notice of revocation or another signed proxy with a later date to the Secretary of the Company at the Company’s principal executive office before the beginning of the Annual Meeting. You may also automatically revoke your proxy by attending the Annual Meeting and voting in person. All shares represented by a valid proxy received prior to the Annual Meeting will be voted.

Please note that if your shares are held of record by a broker, bank or other nominee and if you provide instructions to that nominee on a form received from the nominee, you may revoke or change your voting instructions only by contacting the nominee who holds your shares. You may not vote in person at the Annual Meeting unless you obtain a legal proxy from the broker, bank or other nominee. In such event, your attendance at the Annual Meeting will not, by itself, revoke prior voting instructions.

Solicitation of Proxies

The Company will bear the entire cost of solicitation, including the preparation, assembly, printing, and mailing of this Proxy Statement, the proxy card, and any additional solicitation materials furnished to stockholders. Copies of solicitation materials will be furnished to brokerage houses, fiduciaries, and custodians holding shares in their names that are beneficially owned by others so that they may forward these solicitation

2

materials to such beneficial owners. The Company may reimburse those persons for their costs of forwarding the solicitation materials to such beneficial owners. The original solicitation of proxies by mail may be supplemented by solicitation by telephone, facsimile or other means by the Company’s directors, officers, or employees acting without special compensation. The Company has engaged Alliance Advisors, LLC to assist in the solicitation of proxies and provide related advice and informational support, for a services fee and the reimbursement of customary disbursements that are not expected to exceed $12,000 in the aggregate.

NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS

The Notice of Annual Meeting of Stockholders, this Proxy Statement and the Company’s Annual Report on Form 10-K for the fiscal year ended April 30, 2011 are available at www.edocumentview.com/bcsi. Information on our website, other than these materials, is not a part of these proxy solicitation materials.

3

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Seven directors are being nominated for re-election to the Board of Directors by the holders of the Company’s Common Stock (the “Nominees”). These directors are Brian M. NeSmith, David W. Hanna, James A. Barth, Keith Geeslin, Carol G. Mills and James R. Tolonen and, if he commences employment prior to the meeting date, Gregory S. Clark. The proxy holders intend to vote all proxies received by them in the accompanying form FOR the Nominees listed below, unless otherwise instructed. In the event any Nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee designated by the Company’s present Board of Directors to fill the vacancy. As of the date of this Proxy Statement, the Board of Directors is not aware of any Nominee who is unable or will decline to serve as a director. The seven nominees receiving the highest number of affirmative votes of the shares entitled to vote at the Annual Meeting will be elected directors of the Company to serve until the next Annual Meeting or until their successors have been duly elected and qualified.

The Company’s Corporate Governance Guidelines provide that the size of its Board may be from five to nine directors. By resolution of the Board, the Company presently has established the size of its Board as seven directors. All directors are elected annually.

Nominees for Directors

Set forth below are the name, age, position of and biographical information about each Nominee, as of the date of this Proxy Statement.

| | | | |

Nominees | | Age | | Position(s) and Office(s) Held with the Company |

Gregory S. Clark | | 46 | | |

Brian M. NeSmith | | 49 | | Director |

David W. Hanna | | 72 | | Chairman of the Board and Director |

James A. Barth | | 68 | | Director |

Keith Geeslin | | 58 | | Director |

Carol G. Mills | | 58 | | Director |

James R. Tolonen | | 62 | | Director |

Gregory S. Clarkwill be appointed to the Board of Directors, effective upon his employment with the Company, which presently is anticipated to commence on September 12, 2011. Mr. Clark served as Chief Executive Officer of Mincom, a leading global provider of software and services to asset-intensive industries, from May 2008 until its acquisition by the ABB Group on July 29, 2011. Prior to Mincom, he served as President and Chief Executive Officer of E2open, a leader in ERP-agnostic global supply chain integration from early 2003 to May 2008, and served as Chief Technology Officer of E2open from its inception in 2001 until early 2003. Earlier in his career, Mr. Clark was the IBM Distinguished Engineer responsible for IBM’s security technology and served as a vice president at IBM’s Tivoli Systems, Inc. Before joining IBM, he founded the security software firm, Dascom, Inc., which was sold to IBM Corporation in 1999. Mr. Clark previously held senior roles with AT&T, UNIX System Laboratories and Stallion Technologies. Mr. Clark holds a BSc degree in Physics from Griffith University in Brisbane, Australia. Mr. Clark brings to the Board extensive experience in product development and operations. He has expertise in security technology and in cloud-based and networking technologies. Also, the Board believes it is important to have the Company’s Chief Executive Officer serve on the Board to bring in-depth perspective on the Company’s current operations, strategy, financial condition and competitive position.

Brian M. NeSmithhas served as a director of the Company since March 1999. Mr. NeSmith served as President and Chief Executive Officer of the Company from March 1999 to August 2010. Effective September 1, 2010, Mr. NeSmith was appointed to the newly created role of Chief Product Officer, and was directly responsible for overseeing our product strategy and development until May 4, 2011, when Mr. NeSmith ceased to serve as an executive officer. Mr. NeSmith’s employment with the Company terminated on June 30, 2011, but he

4

continues to serve on the Board of Directors. From December 1997 to March 1999, Mr. NeSmith served as Vice President of Nokia IP, Inc., a security router company, which acquired Ipsilon Networks, Inc., an IP switching company, where Mr. NeSmith served as Chief Executive Officer from May 1995 to December 1997. From October 1987 to April 1995, Mr. NeSmith held several positions at Newbridge Networks Corporation, a networking equipment manufacturer, including Vice President and General Manager of its VIVID group. Mr. NeSmith holds a B.S. in Electrical Engineering from the Massachusetts Institute of Technology. His extensive background with the Company provides continuity to the Board and enables him to bring a historical perspective to discussions of the Company’s strategies and plans. As well, his extensive technical experience and background and his knowledge of the Company’s technology and products provides value to the board in understanding and addressing the Company’s strategy.

David W. Hanna has served as a director of the Company since October 1996 and as Chairman of the Board of Directors of the Company since February 2001. From December 1998 to March 1999, Mr. Hanna also served as the Company’s interim President and Chief Executive Officer. Mr. Hanna has served as Chairman of the Board of Tropos Networks, Inc., a provider of metro-scale wireless mesh network systems, since January 2002 and also served as that company’s Chief Executive Officer from January 2002 to January 2004. Mr. Hanna also served as Chairman of the Board of Internet America, Inc., a provider of dial-up Internet access, from October 2004 to June 2005. From March 1998 to March 2000, Mr. Hanna served as President and Chief Executive Officer of Sage Software, Inc., a financial software company. Mr. Hanna served as President and Chief Executive Officer of State of the Art, Inc., a financial software developer, from November 1993 until March 1998. In addition, Mr. Hanna has served as Chairman, CEO and/or President of The Hanna Group since 1984; Hanna Capital Management since 1998; and Hanna Ventures since 1999. Mr. Hanna holds a B.S. in Business Administration from the University of Arizona. In addition to his experience as a corporate executive, Mr. Hanna also has extensive experience in sales of technology equipment and sales strategy and participates in many of the Company’s sales management events and sales strategy sessions, which enables him to provide advice to the Board and to Company management in the area of sales and marketing. As well, his extensive background with the Company provides continuity to the Board and enables him to bring a historical perspective to discussions of the Company’s strategies and plans.

James A. Barth has served as a director of the Company since January 2005. Since September 2007, Mr. Barth has been Chief Financial Officer and a director of Proximex Corporation, a developer of intelligent surveillance management software. From September 2004 to September 2007, Mr. Barth was co-founder, Chief Executive Officer and a director of Proximex Corporation. From March 1999 to September 2004, Mr. Barth was Chief Financial Officer of NetIQ Corporation, a provider of integrated systems and security management software solutions. He was also Vice President and then Senior Vice President of Finance and Administration during this period. From November 1997 until it was sold to Sterling Software in March 1999, Mr. Barth served as Vice President and Chief Financial Officer of Interlink Computer Sciences, Inc., a developer of enterprise networking software designed for the IBM mainframe platform. From 1980 to November 1997, Mr. Barth served as Chief Financial Officer at several other high technology companies, including eleven years at Rational Software Corporation, a provider of integrated software tools. Mr. Barth holds a B.S. in Business Administration from the University of California at Los Angeles and is a Certified Public Accountant (currently inactive). Mr. Barth brings extensive financial, operational and accounting experience, including practical experience as a former chief financial officer of various enterprise software companies, to the Board and to the Audit Committee. Mr. Barth also advises on matters of accounting theory and corporate governance. As an audit committee member, he works closely with the Company’s Finance department to provide oversight on matters affecting revenue, risk, public reporting and accounting.

Keith Geeslinhas served as a director of the Company since June 2006. Mr. Geeslin has been a partner at Francisco Partners, a private equity firm, since January 2004. Prior to joining Francisco Partners, Mr. Geeslin spent 19 years with the Sprout Group, a venture capital firm. Mr. Geeslin joined Sprout in 1984, became a General Partner in 1988, and became Sprout’s Managing Partner in 2000. Earlier in his career, he was the general manager of a division of Tymshare, Inc., a provider of public computer and network services, and held various

5

positions at its Tymnet subsidiary from 1980 to 1984. He was also previously a staff member of the U.S. Senate Commerce Committee. Mr. Geeslin serves on the board of directors of CommVault Systems, Inc. and Synaptics Incorporated. He served as a director of Hypercom Corporation from April 2008 to August 2011. Mr. Geeslin holds a B.S. in Electrical Engineering and an M.S. in Engineering-Economic Systems, both from Stanford University, as well as an M.A. in Philosophy, Politics and Economics from Oxford University. With his extensive venture capital and private equity experience, Mr. Geeslin contributes to the Board an investor’s perspective on financial and strategic matters. His service as an outside director of other entities enables him to provide valuable insight on governance and business strategy.

Carol G. Mills has served as a director of the Company since January 2009. Ms. Mills presently serves as our Interim CEO, a position she has held since August 16, 2011 (and which she is anticipated to hold until Mr. Clark joins the Company). She served as Executive Vice President and General Manager, Infrastructure Products Group, of Juniper Networks, Inc., a provider of networking and security solutions, from November 2004 until February 2006. Prior to joining Juniper Networks, Ms. Mills was an independent consultant from 2003 until November 2004. From July 1998 to 2002, Ms. Mills was the President and Chief Executive Officer of Acta Technology, Inc., an enterprise data infrastructure company that was acquired by Business Objects in late 2002. From 1993 to 1998, Ms. Mills was Vice President and General Manager of the Enterprise Server Group at the Hewlett-Packard Company, a computer and electronics company. Prior to 1993, Ms. Mills held several other executive positions at Hewlett-Packard Company. Ms. Mills currently serves on the Board of Directors of Tekelec Corporation and is chairperson of its executive compensation committee, and is a member of its nominating and corporate governance committee. Ms. Mills is also the Executive Chairperson of Xactly Corporation, a private software company. She served as a director of Adobe Systems Inc. from June 1998 to April 2011. Ms. Mills holds a M.B.A. from Harvard Business School and a B.A. in Economics from Smith College. Ms. Mills is our first female Board member, and brings significant management experience in technology-based firms and extensive experience in public company executive and equity compensation, as well as governance matters, to the Board.

James R. Tolonen has served as a director of the Company since May 2008. Mr. Tolonen served as the Senior Group Vice President and Chief Financial Officer of Business Objects, S.A. a company which provided enterprise software solutions. He was responsible for all of its finance and administration functions commencing in January 2003 until its acquisition by SAP AG in January 2008. Mr. Tolonen served as the Chief Financial Officer and Chief Operating Officer and a member of the board of directors of IGN Entertainment Inc., an Internet media and service provider focused on the videogame market, from October 1999 to December 2002. He served as President and Chief Financial Officer of Cybermedia, a PC end user security and performance software provider, from April 1998 to September 1998, and as a member of its Board of Directors from August 1996 to September 1998. Mr. Tolonen served as Chief Financial Officer of Novell, Inc., an enterprise software provider, from June 1989 to April 1998. He has been a member of the Board of Directors of Taleo Corporation, an on-demand workforce talent management software company, since August 2010, and serves on its Audit Committee. Mr. Tolonen holds a B.S. in Mechanical Engineering and a M.B.A. from the University of Michigan. Mr. Tolonen is also a Certified Public Accountant. Mr. Tolonen brings extensive financial, operational and accounting experience, including practical experience as a former chief financial officer of several enterprise software companies, to the Board and to the Audit Committee. As an audit committee member, he works closely with the Company’s Finance department to provide oversight on matters affecting revenue, risk, public reporting and accounting.

Each of Ms. Mills and Messrs. Barth, Clark, Geeslin, Hanna, NeSmith and Tolonen was recommended for nomination by the Nominating/Corporate Governance Committee, and was nominated for election by the full Board of Directors. There are no arrangements between any director or nominee and any other person pursuant to which the director or nominee was selected. As of the date of this Proxy Statement, each of Ms. Mills and Messrs. Barth, Geeslin, Hanna, NeSmith and Tolonen are incumbent directors. It is anticipated that Mr. Clark will fill an existing vacancy on the Board of Directors when he commences employment with the Company and will be an incumbent director at the time of the meeting.

6

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE NOMINEES LISTED HEREIN, AND PROXIES RECEIVED BY THE COMPANY WILL BE SO VOTED UNLESS THE STOCKHOLDER SPECIFIES A CONTRARY CHOICE IN THE PROXY.

7

Board Leadership Structure and Committee Composition

The Company has separated the position of Chairman of the Board and Chief Executive Officer since the Company first became a public reporting company in 1999. The Company believes that this is the appropriate leadership structure, as it permits our Chief Executive Officer to focus his or her attention on running the business and developing corporate strategy, while our Chairman of the Board provides independent leadership to the Board of Directors in performing its advisory, governance and oversight functions.

The Board of Directors has four (4) standing committees: the Audit Committee, the Compensation Committee, the Stock Option Committee, and the Nominating/Corporate Governance Committee.

The membership of the standing committees as of the date of this Proxy Statement is as follows:

| | | | | | | | |

Board Member | | Audit | | Compensation | | Stock Option | | Nominating/

Corporate

Governance |

David W. Hanna | | | | | | | | Chairman |

James A. Barth | | Chairman | | | | | | X |

Keith Geeslin | | X | | X | | | | |

Carol G. Mills | | | | | | X | | |

James R. Tolonen | | X | | Chairman | | X | | |

Mr. NeSmith currently is not a member of any of the standing committees of the Board of Directors.

Audit Committee. The Audit Committee of the Board of Directors (the “Audit Committee”) assists the Board of Directors in overseeing the Company’s accounting and financial reporting processes and the audits of the Company’s financial statements, including monitoring the integrity of the Company’s financial statements and the independence and performance of the Company’s independent registered public accounting firm. The Audit Committee appoints and oversees an independent registered public accounting firm to audit the Company’s financial statements. In addition, the Audit Committee approves the scope of the annual audits and fees to be paid to the Company’s independent registered public accounting firm. During the fiscal year ended April 30, 2011 (“fiscal 2011”), the Audit Committee held ten meetings.

The Audit Committee regularly reviews and reassesses the adequacy of its Audit Committee Charter. A copy of the current Audit Committee Charter is available under the heading “Corporate Governance” of the Investor Relations section of the Company’s website at http://www.bluecoat.com/company/corporate-investor.

Three non-management directors currently comprise the Audit Committee: Mr. Barth, Mr. Geeslin and Mr. Tolonen. Mr. Barth served as Chairman of the Audit Committee during fiscal 2011 and continues to serve as Chairman of the Audit Committee.

The Company’s Board of Directors has determined that each of Mr. Barth and Mr. Tolonen qualifies as an “audit committee financial expert,” as defined by Item 407(d)(5) of Regulation S-K of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In addition, the Board of Directors has determined that each member of the Audit Committee (i) is independent as defined in applicable NASDAQ rules; (ii) meets the criteria for independence set forth in Rule 10A-3(b)(1) under the Exchange Act; (iii) has not participated in the preparation of the financial statements of the Company or any current subsidiary of the Company at any time during the past three years; and (iv) is able to read and understand fundamental financial statements, including a company’s balance sheet, income statement and cash flow statement. Additionally, the Board of Directors has determined that each of Mr. Barth and Mr. Tolonen has past employment experience in finance or accounting, requisite professional certification in accounting or other comparable experience or background that results in his financial sophistication, including being or having been a chief executive officer, chief financial officer or other senior officer with financial oversight responsibilities.

8

Compensation Committee. The Compensation Committee of the Board of Directors (the “Compensation Committee”) reviews the performance of the Company’s executive officers, establishes and oversees the compensation program for the executive officers (including salary and short and long-term incentive programs) and reviews and oversees the overall compensation programs of the Company. The Compensation Committee also administers the Company’s various stock incentive plans. During fiscal 2011, the Compensation Committee held 15 meetings.

Two non-management directors currently comprise the Compensation Committee: Mr. Geeslin and Mr. Tolonen. Ms. Mills was a member of the Compensation Committee and served as Chairman of the Compensation Committee during fiscal 2011 and continuing until August 16, 2011, when she resigned from the Compensation Committee in order to serve as the Company’s Interim CEO. Mr. Tolonen was appointed to serve as Chairman of the Compensation Committee on August 16, 2011.

The Compensation Committee regularly reviews and assesses the adequacy of its Compensation Committee Charter. A copy of the current Compensation Committee Charter is available under the heading “Corporate Governance” of the Investor Relations section of the Company’s website at http://www.bluecoat.com/company/corporate-investor.

The Chief Executive Officer (the “CEO”), General Counsel and Vice President, Human Resources of the Company generally attend portions of Compensation Committee meetings and provide input to the Compensation Committee with respect to matters affecting compensation, key responsibilities, corporate objectives and equity plan management and compliance. As discussed in the “Compensation Discussion and Analysis,” below, the CEO makes recommendations to the Compensation Committee regarding the compensation of the Company’s executives (other than himself) and participates in discussions of such compensation. From time to time, other members of management and Company personnel may attend Compensation Committee meetings to provide presentations and where subject matters involving their expertise are discussed. No member of management is present during discussions of his or her performance or compensation, and no member of management (including the CEO) is present during deliberations and voting with respect to the CEO’s performance or compensation.

The Compensation Committee may retain, at the Company’s expense, one or more independent compensation consultants. During fiscal 2011, the Compensation Committee was advised by Compensia, Inc., a national compensation consulting firm, with respect to the Company’s employee equity strategy, executive compensation program and director compensation program. Compensia assisted the Compensation Committee by providing survey research, peer data, equity analysis and other materials that were used by the committee in connection with its review and determination of fiscal 2011 executive compensation and in connection with the solicitation of proxies in fiscal 2010. Compensia has served as the Compensation Committee’s compensation consultant since August 2009. The Compensation Committee has reviewed and is satisfied with the qualifications, performance and independence of Compensia. Compensia provides no services to the Company, other than its services for the Compensation Committee.

The Compensation Committee Charter provides that the Compensation Committee may delegate its authority to one or more subcommittees. As of the date of this Proxy Statement, the Compensation Committee has not delegated any such authority. The authority of the Compensation Committee overlaps, however, in part, with that of the Stock Option Committee, which was established by the Board of Directors and has more limited authority.

Stock Option Committee. The Stock Option Committee of the Board of Directors (the “Stock Option Committee”) is authorized to approve certain equity awards under the Company’s 2007 Stock Incentive Plan (the “2007 Plan”). The Stock Option Committee may only approve awards (a) to individuals who are not directors or executive officers and who do not directly report to a Stock Option Committee member, and (b) where the award per grantee does not exceed 40,000 shares of the Company’s common stock (in the event of options or stock

9

appreciation rights) or 10,000 shares of the Company’s common stock (in the event of restricted stock or stock units). Two directors currently comprise the Stock Option Committee: Ms. Mills, who is the Interim CEO; and Mr. Tolonen, who is not a member of management and who was appointed to the Stock Option Committee on August 16, 2011.

The Stock Option Committee regularly reviews and assesses the adequacy of its Stock Option Committee Charter. A copy of the current Stock Option Committee Charter is available under the heading “Corporate Governance” of the Investor Relations section of the Company’s website at www.bluecoat.com/company/corporate-investor.

Nominating/Corporate Governance Committee. The Nominating/Corporate Governance Committee of the Board of Directors (the “Nominating/Corporate Governance Committee”) oversees the nomination of directors for service on the Board of Directors and its committees, reviews and considers developments in corporate governance practices, and recommends to the Board of Directors policies and procedures with respect to corporate governance. During fiscal 2011, the Nominating/Corporate Governance Committee held three meetings.

Two non-management directors currently comprise the Nominating/Corporate Governance Committee: Messrs. Barth and Hanna, each of whom was a member of the Nominating/Corporate Governance Committee during fiscal 2011. Mr. Hanna served as Chairman of the Nominating/Corporate Governance Committee during fiscal 2011 and continues to serve as Chairman of the Nominating/Corporate Governance Committee.

The Nominating/Corporate Governance Committee regularly reviews and reassesses the adequacy of its Nominating/Corporate Governance Committee Charter. A copy of the current Nominating /Corporate Governance Committee Charter is available under the heading “Corporate Governance” of the Investor Relations section of the Company’s website at http://www.bluecoat.com/company/corporate-investor.

Information on the Company’s website, however, does not form a part of this Proxy Statement.

Special Committees. From time to time, the Board of Directors may establish special purpose committees to address specific matters or issues, such as litigation. In its fiscal year ended April 30, 2007 (“fiscal 2007”), the Company established a Special Committee in connection with the investigation of its historical stock option practices and subsequent restatement, which is described in Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Background of the Stock Option Investigation, Findings, Restatement of Consolidated Financial Statements, Remedial Measures and Related Proceedings” in the Company’s Annual Report on Form 10-K for the year ended April 30, 2006 (“fiscal 2006”), which was filed with the Securities and Exchange Commission (the “SEC”) on March 28, 2007. The Company is also subject to various litigation and other proceedings arising out of the matters addressed in that investigation. These proceedings are discussed in Part 1, Item 3 of the Company’s Annual Report on Form 10-K for fiscal 2011, which was filed with the SEC on June 8, 2011. The Company established a new Special Committee, comprised of directors Messrs. Geeslin and Tolonen, on June 25, 2008 to address certain matters involved in these proceedings. Those proceedings were finally resolved in February 2011, and the Special Committee was dissolved on May 24, 2011. When this Proxy Statement references matters that relate to the Stock Option Investigation, it is referencing the matters discussed in this paragraph.

Board’s Role in Risk Oversight

The Board of Directors as a whole has ultimate responsibility for risk oversight and the standing committees of the Board of Directors assist in fulfilling this responsibility. In particular, the Audit Committee oversees risk management in the areas of internal control over financial reporting, disclosure controls and procedures and legal and regulatory compliance. The Audit Committee also reviews with management and the Company’s independent registered public accounting firm the Company’s policies and practices with respect to risk assessment and management, and the Company’s exposure to material financial risk and management’s efforts to

10

monitor and control such exposure. During fiscal 2011, the Audit Committee retained Ernst & Young LLP to perform an enterprise risk assessment, working with and as directed by Company management, and the results of that assessment subsequently were shared with the members of the Board of Directors. The Compensation Committee oversees the Company’s compensation programs and reviews the conduct incented by those programs, including the impact on risk-taking by the Company’s executive officers and employees, as further described below under “Compensation Related Risk.” The Nominating/Corporate Governance Committee oversees the organization, membership and structure of the Board of Directors and the Company’s corporate governance practices. The committee members regularly report to the full Board of Directors on material developments in their areas of oversight.

Board Nomination Process

When reviewing a potential candidate for nomination as director, including incumbents, the Nominating/Corporate Governance Committee will consider the perceived needs of the Board of Directors and the candidate’s relevant background, experience, skills and expected contributions. The Nominating/Corporate Governance Committee’s goal is to assemble a Board of Directors that has diversity of experience at policy-making levels in business, government, and technology, and in areas that are relevant to the Company’s current and evolving global activities. Although the Company does not have an express diversity policy, the Nominating/Corporate Governance Committee considers personal characteristics of a candidate, including gender, ethnicity and age, as relevant to enhance the breadth of perspectives represented on the Board of Directors. The Nominating/Corporate Governance Committee believes that members of the Board of Directors should be able to work constructively with the other directors, possess the highest personal and professional ethics, integrity and values, and be committed to representing the long-term interests of the Company’s stockholders. Members of the Board of Directors must have an inquisitive and objective perspective, mature judgment, and be available to dedicate the time required for service on the Board of Directors. They also must have experience in positions with a high degree of responsibility and be leaders in the companies or institutions with which they are or have been affiliated. Members of the Board of Directors are expected to rigorously prepare for, attend, and participate in all meetings of the Board of Directors and applicable committees. As well, under the Company’s Corporate Governance Guidelines, directors may not serve on more than four additional public company boards of directors, and the Chief Executive Officer may not serve on more than two additional public company boards of directors. Other than the foregoing, there are no stated minimum criteria for director nominees, although the Nominating/Corporate Governance Committee may consider such other factors, from time to time, as it deems are in the best interests of the Company and its stockholders.

The Nominating/Corporate Governance Committee will consider candidates for directors proposed by directors or management, and will evaluate any such candidates against the criteria and pursuant to the policies and procedures set forth above. If the Nominating/Corporate Governance Committee believes that the Board of Directors requires additional candidates for nomination, it may engage, as appropriate, a third party search firm to assist in identifying qualified candidates. As part of the nominating process, all incumbent directors and non-incumbent nominees are required to submit a completed form of directors’ and officers’ questionnaire and incumbent directors may be required to participate in a peer-assessment process. The nomination process may also include interviews and additional background and reference checks for non-incumbent nominees, at the discretion of the Nominating/Corporate Governance Committee.

The Nominating/Corporate Governance Committee also will consider properly submitted stockholder candidates for membership on the Board of Directors. Any stockholder of the Company wishing to submit a candidate for the Nominating/Corporate Governance Committee’s consideration must provide a written notice recommending the candidate to the Corporate Secretary of Blue Coat Systems, Inc. at 420 North Mary Avenue, Sunnyvale, CA 94085 or by fax at 1 408-220-2175 (with a confirmation copy sent by mail). The written notice must include the candidate’s name, biographical data and qualifications and attach a written consent from the candidate agreeing to be named as a nominee and to serve as a director if elected. Candidates recommended by

11

the Company’s stockholders will be evaluated against the same criteria and under the same policies and procedures applicable to the evaluation of candidates proposed by directors or management.

Board Meetings and Attendance

During fiscal 2011, the Board of Directors held 11 meetings. Each of the directors participated in at least 75% of the aggregate of (i) the total number of meetings of the Board of Directors held during the time such director was a member of the Company’s Board of Directors and (ii) the total number of meetings of a committee of the Board of Directors on which each such director then served. The independent members of the Board of Directors regularly meet in executive session.

The Company encourages attendance by members of the Board of Directors at the Company’s annual meeting of stockholders. At the Company’s 2010 Annual Meeting of Stockholders (held on October 7, 2010), each member of the Board of Directors was in attendance and available to respond to questions.

Code of Business Conduct

The Company’s Board of Directors has adopted a Code of Business Conduct, which outlines the principles of legal and ethical business conduct under which the Company does business. The Code of Business Conduct is applicable to all of the Company’s directors, officers and employees. The Code of Business Conduct is available under the heading “Corporate Governance” of the Investor Relations section of the Company’s website at http://www.bluecoat.com/aboutus/investor_relations. Upon request to the Company’s Secretary, the Company will provide a copy of the Code of Business Conduct free of charge. Any substantive amendment of the Code of Business Conduct, and any waiver of the Code of Business Conduct for executive officers or directors, will be made only after approval by the Company’s Board of Directors or a committee of the Board, and will be disclosed on the Company’s Web site. In addition, any such waiver will be disclosed within four days on a Form 8-K filed with the SEC if then required by applicable rules and regulations.

Independence of Directors

The Company’s Board of Directors has reviewed the criteria for determining the independence of the Company’s directors under NASDAQ Rule 5605, Item 407(a) of Regulation S-K and the Company’s Corporate Governance Guidelines. It has affirmatively determined that each of Messrs. Barth, Geeslin, Hanna and Tolonen and Ms. Mills were independent under such criteria during fiscal 2011. While Messrs. Barth, Geeslin, Hanna and Tolonen have remained independent through the date of this Proxy Statement, the Company’s Board of Directors has determined that Ms. Mills ceased to be independent on August 16, 2011, when she commenced service as Interim CEO. The Board of Directors has determined that as of the date of this Proxy Statement the Board of Directors is comprised of a majority of directors who qualify as independent directors under the rules adopted by the SEC and NASDAQ, as supplemented by the Company’s Corporate Governance Guidelines.

In considering the independence of the Company’s directors, the Board of Directors specifically addressed those matters disclosed in “Certain Relationships and Related Transactions,” below. Except as disclosed in that section, there were no specific transactions, relationships or arrangements that were considered by the Board of Directors in determining the independence of any of the Company’s directors.

12

AUDIT COMMITTEE REPORT

The Audit Committee assists the Board of Directors in overseeing the Company’s accounting and financial reporting processes and the audits of the Company’s financial statements, including monitoring the integrity of the Company’s financial statements and the independence and performance of the Company’s independent registered public accounting firm. The Audit Committee appoints and oversees an independent registered public accounting firm to audit the Company’s financial statements. In addition, the Audit Committee approves the scope of the annual audits and fees to be paid to the Company’s independent registered public accounting firm, and meets with the independent registered public accounting firm on a regular basis without management present. The Company’s management has primary responsibility for preparing the Company’s financial statements and managing its financial reporting process, and for internal controls and procedures designed to reasonably assure compliance with accounting standards, applicable laws and regulations. The Company’s independent registered public accounting firm, Ernst & Young LLP (“Ernst & Young”), is responsible for expressing an opinion on the conformity of the Company’s audited financial statements with U.S. generally accepted accounting principles and on its assessment of the effectiveness of the Company’s internal control over financial reporting. The Audit Committee serves a board-level oversight role in which it provides advice, counsel and direction to management on the basis of the information it receives, its discussions with management and the independent registered public accounting firm, and the experience of the Audit Committee’s members in business, financial and accounting matters.

In this context, the Audit Committee hereby reports as follows:

| | • | | The Audit Committee reviewed and discussed the audited financial statements with the Company’s management and Ernst & Young. |

| | • | | The Audit Committee discussed with Ernst & Young the matters required to be discussed byCodification of Statements on Auditing Standards, AU 380, SAS 99 (Consideration of Fraud in a Financial Statement Audit), and other topics as required by the SEC and Public Company Accounting Oversight Board (“PCAOB”). |

| | • | | The Audit Committee has received the written disclosures and the letter from Ernst & Young required by the PCAOB’s Ethics and Independence Rule 3526 (Communication with Audit Committees Concerning Independence), and has discussed with Ernst & Young their independence. On that basis, the Audit Committee believes that Ernst & Young is independent. |

Aggregate fees for professional services rendered for the Company by Ernst & Young for the fiscal years ended April 30, 2011 and 2010, were:

| | | | | | | | |

| | | April 30, | |

| | | 2011 | | | 2010 | |

Audit Fees | | $ | 1,736,970 | | | $ | 1,761,720 | |

Audit-Related Fees | | | 3,000 | | | | 36,000 | |

Tax Fees | | | 189,424 | | | | 11,204 | |

All Other Fees | | | 141,995 | | | | — | |

| | | | | | | | |

TOTAL | | $ | 2,071,389 | | | $ | 1,808,924 | |

| | | | | | | | |

Audit fees for the fiscal years ended April 30, 2011 and 2010 were for professional services rendered for the annual audit of the Company’s consolidated financial statements, including the audit of the Company’s internal control over financial reporting, the reviews of the Company’s quarterly reports on Form 10-Q, statutory audits required in international locations, and consents filed with various registration statements. Audit-Related Fees for the fiscal year ended April 30, 2011 were for the registration statement filed on Form S-8 related to the registration of the Company’s 2010 Employee Stock Incentive Plan. Audit-Related Fees for the fiscal year ended April 30, 2010 were primarily for audit activity in connection with the Company’s acquisition of a majority

13

interest in S7 Software Solutions Pvt. Ltd. (“S7”), which was completed on January 25, 2010. Tax fees for the fiscal years ended April 30, 2011 and 2010 were for services related to tax compliance and tax advisory services. All other fees for the fiscal year ended April 30, 2011 related primarily to Enterprise Risk and a Global Controllership Organization Assessments. The Audit Committee has adopted pre-approval policies and procedures for audit and non-audit services. All audit, audit-related, tax and permissible non-audit services are approved in advance by the Audit Committee to assure they do not impair the independence of the Company’s independent registered public accounting firm. When considered necessary, management prepares an estimate of fees for the service and submits the estimate to the Audit Committee for its review and pre-approval. Any modifications to the estimates will be submitted to the Audit Committee for pre-approval at the next regularly scheduled Audit Committee meeting, or if action is required sooner, to the Chairman of the Audit Committee. All fees paid to the Company’s independent registered public accounting firm during fiscal 2010 and fiscal 2011 were in accordance with this pre-approval policy.

Based on the Audit Committee’s discussions with management and Ernst & Young, and the Audit Committee’s review of the representations of management and the report of Ernst & Young to the Audit Committee, the Audit Committee recommended, and the Board of Directors subsequently approved, the inclusion of the Company’s audited financial statements in the Company’s Annual Report on Form 10-K for the fiscal year ended April 30, 2011, for filing with the SEC. The Audit Committee also approved the selection of Ernst & Young as the Company’s independent registered public accounting firm for the fiscal year ending April 30, 2012.

Submitted by the following members of the Audit Committee:

James A. Barth

Keith Geeslin

James R. Tolonen

Compensation Committee Interlocks and Insider Participation

The members of the Compensation Committee during fiscal 2011 included Ms. Mills, Mr. Geeslin, Mr. Tolonen and Dr. Howes. Ms. Mills and Mr. Geeslin served on the Compensation Committee during the entire fiscal year. Dr. Howes served on the Compensation Committee until October 7, 2010, when he ceased to serve as a director. Mr. Tolonen has served on the Compensation Committee since November 16, 2010. None of Ms. Mills, Mr. Geeslin, Mr. Tolonen or Dr. Howes was at any time an officer or employee of the Company. None of the Company’s executive officers serve as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of the Company’s Board of Directors or Compensation Committee.

Communication with the Board of Directors

Interested parties, including stockholders, may contact the Board of Directors or any committee of the Board of Directors by sending correspondence to the attention of Corporate Secretary, c/o Blue Coat Systems, Inc., 420 North Mary Avenue, Sunnyvale, California 94085. Any mail received by the Corporate Secretary will then be forwarded to the members of the Board of Directors or the appropriate committee for further action, if necessary. The non-management directors have requested that the Corporate Secretary not forward to them advertisements, solicitations for periodicals or other subscriptions, and other similar communications.

14

DIRECTOR COMPENSATION

Compensation for the non-employee members of the Board of Directors is comprised of a mix of cash and equity compensation to align with the practices of similar companies and attract qualified candidates to serve on the Board of Directors. The director compensation program is intended to more highly compensate those roles that place greater demands on the non-employee directors. The Compensation Committee periodically reviews the director compensation program with its compensation consultant. For fiscal 2011, the Compensation Committee was advised by Compensia with respect to establishing the details of the director compensation program. It then made its recommendations regarding director compensation to the full Board of Directors, which approved the compensation program outlined below.

For fiscal 2011, director compensation included the payment of cash compensation to each non-employee member of the Board of Directors, as follows:

| | | | |

Annual Board Member Retainer | | $ | 30,000 | |

Annual Chairman of the Board Retainer | | $ | 10,000 | |

Annual Retainer for Committee Chairmen | | | | |

Audit Committee | | $ | 35,000 | |

Compensation Committee | | $ | 20,000 | |

Nominating/Corporate Governance Committee | | $ | 10,000 | |

Annual Committee Member Retainer (other than for Chairmen) | | | | |

Audit Committee | | $ | 10,000 | |

Compensation Committee | | $ | 10,000 | |

Nominating/Corporate Governance Committee | | $ | 5,000 | |

Cash compensation was paid quarterly in arrears, and no meeting fees were paid. The fiscal 2011 cash compensation arrangements for the non-employee directors were unchanged from fiscal 2010.

The equity compensation arrangements for our non-employee directors was changed in fiscal 2011 from those in place in prior fiscal years. After consulting with Compensia and reviewing market data, the Compensation Committee determined that providing each non-employee director restricted stock units covering a lesser number of shares of the Company’s common stock than the options that had previously been awarded and that vested on an annual basis (as contrasted with the four year vesting of the options) provided a better compensatory result and was better aligned with market practice. As well, the Compensation Committee determined to eliminate the prior practice of basing the number of shares covered by the award on the committee upon which the director served. The Compensation Committee determined that variations in cash compensation should serve to provide the differentiation for varying demands required by different roles and that providing a smaller restricted stock unit award subject to annual vesting better compensates for the annual service provided by non-employee directors. In fiscal 2011, upon the conclusion of the Company’s regular annual meeting of stockholders, restricted stock unit awards covering 3,000 shares of the Company’s common stock were granted to each non-employee director who continued to serve on the Board of Directors following the meeting. These awards will vest (and become non-forfeitable) upon the earlier to occur of the Company’s fiscal 2011 annual meeting of stockholders or one year from the date of the award.

15

DIRECTOR COMPENSATION—Fiscal 2011

The following table provides information on the compensation awarded to, earned by, or paid to each person who served as a non-employee director during fiscal 2011. The compensation of the other members of the Board of Directors, Messrs. Borman and NeSmith, who also served as executive officers of the Company, is reported in the Summary Compensation Table below.

| | | | | | | | | | | | |

Name | | Fees Earned or

Paid in Cash

($) | | | Stock Awards

($)(1) | | | Total ($) | |

James A. Barth | | | 70,000 | | | | 67,710 | | | | 137,710 | |

Keith Geeslin | | | 45,658 | | | | 67,710 | | | | 113,368 | |

Timothy A. Howes | | | 21,739 | | | | 67,412 | (2) | | | 89,151 | |

David W. Hanna | | | 50,000 | | | | 67,710 | | | | 117,710 | |

Carol G. Mills | | | 50,000 | | | | 67,710 | | | | 117,710 | |

James R. Tolonen | | | 44,589 | | | | 67,710 | | | | 112,299 | |

| (1) | The amounts reported in this column represent the aggregate grant date fair value of stock awards granted to the non-employee directors in fiscal 2011 computed in accordance with the authoritative accounting literature for stock-based compensation awards. See Note 9 of the Notes to the Consolidated Financial Statements in the Company’s Annual Report on Form 10-K filed on June 8, 2011 for a discussion of the assumptions made by the Company in determining the grant date fair value of its stock awards. |

| (2) | Dr. Howes did not stand for re-election as a director at the fiscal 2010 annual meeting of stockholders, which was held on October 7, 2010. Immediately prior to that annual meeting, the Board of Directors agreed to accelerate the vesting of his outstanding unvested stock options to purchase 13,500 shares of the Company’s common stock in recognition of Dr. Howes’ service to the Company. As a consequence of that acceleration, the Company recognized incremental compensation expense in the amount of $67,412 in accordance with the authoritative accounting literature for stock-based compensation awards. No stock award was made to Dr. Howes in fiscal 2011. |

The following table provides additional information on each of the restricted stock unit awards granted to the non-employee directors in fiscal 2011, as well as the outstanding stock options and stock awards held by the non-employee directors as of the April 30, 2011, the last day of fiscal 2011.

| | | | | | | | | | | | | | | | |

Name | | Grant Date | | | Stock Awards

Granted

During Fiscal

Year 2011 (#) | | | Outstanding

Options At

April 30, 2011

(#) | | | Outstanding

Stock Awards At

April 30, 2011

(#) | |

James A. Barth | | | 10/07/2010 | | | | 3,000 | | | | 102,000 | | | | 3,000 | |

Keith Geeslin | | | 10/07/2010 | | | | 3,000 | | | | 52,000 | | | | 3,000 | |

Timothy A. Howes (1) | | | — | | | | — | | | | 128,000 | | | | — | |

David W. Hanna | | | 10/07/2010 | | | | 3,000 | | | | 23,000 | | | | 3,000 | |

Carol G. Mills | | | 10/07/2010 | | | | 3,000 | | | | 20,667 | | | | 3,000 | |

James R. Tolonen | | | 10/07/2010 | | | | 3,000 | | | | 24,000 | | | | 3,000 | |

| (1) | Dr. Howes resigned as a director effective October 7, 2010. |

16

PROPOSAL NO. 2

RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has appointed Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending April 30, 2012. Although ratification by the Company’s stockholders is not required by law, the Board of Directors has determined that it is desirable to seek ratification of this selection by the stockholders. The affirmative vote of the holders of a majority of shares present or represented by proxy and voting at the Annual Meeting will be required to ratify the appointment of Ernst & Young LLP.

Ernst & Young LLP has audited the Company’s financial statements since 1999. Its representatives are expected to be present at the Annual Meeting, will have the opportunity to make a statement if they desire to do so, and will be available to respond to appropriate questions.

In the event the stockholders fail to ratify the appointment, the Audit Committee will reconsider its selection. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and its stockholders.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE SELECTION OF ERNST & YOUNG LLP TO SERVE AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING APRIL 30, 2012, AND PROXIES RECEIVED BY THE COMPANY WILL BE SO VOTED UNLESS THE STOCKHOLDER SPECIFIES A CONTRARY CHOICE IN THE PROXY.

17

PROPOSAL NO. 3

ADVISORY VOTE ON EXECUTIVE COMPENSATION

The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) requires that we provide our stockholders with the opportunity to vote to approve, on an advisory and non-binding basis, the compensation of our named executive officers as disclosed in this proxy statement in accordance with the compensation disclosure rules of the Securities and Exchange Commission (“SEC”). This is frequently referred to as a “Say on Pay” vote.

We are asking for stockholder approval of the compensation of our named executive officers as disclosed in this proxy statement in accordance with SEC rules, which consists of the disclosures under “Executive Compensation—Compensation Discussion and Analysis,” the compensation tables and the narrative discussion accompanying the compensation tables. This vote is intended to address the overall compensation of our named executive officers and the policies and practices described in this proxy statement with respect to their compensation, and not any specific item of compensation.

This vote is advisory and non-binding, which means that the vote is not intended to overrule any decision of the Company, the Board of Directors, or the Compensation Committee concerning the compensation of our named executive officers. However, the Compensation Committee, which is responsible for designing and administering our executive compensation program, values the opinions of our stockholders in their vote on this Proposal and will consider the outcome of this vote when making future decisions regarding the compensation of our named executive officers.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS, AS DISCLOSED IN THIS PROXY STATEMENT.

18

PROPOSAL NO. 4

ADVISORY VOTE ON THE FREQUENCY OF HOLDING FUTURE ADVISORY VOTES

ON EXECUTIVE COMPENSATION

As described with respect to Proposal 3 above, our stockholders are being asked to cast an advisory “Say on Pay” vote with respect to the compensation of our named executive officers. The Dodd-Frank Act also requires that we provide our stockholders with the opportunity to vote on how frequently we should conduct these advisory votes in the future. By voting on this proposal, stockholders may indicate whether they would prefer that we conduct future advisory “Say on Pay” votes every year, every other year, or every three years, or to abstain from voting on this Proposal.

The Board of Directors has determined that, at this time, conducting an annual advisory vote on executive compensation is appropriate for the Company and its stockholders, as it will allow our stockholders to provide timely input on the Company’s executive compensation philosophy, policies and practices as disclosed in our proxy statement each year, and is consistent with our efforts to engage in an ongoing dialogue with our stockholders regarding our executive compensation program and corporate governance policies and practices.

The Board of Directors will carefully consider the outcome of the vote when making its decision regarding the frequency of future advisory votes on executive compensation. However, because this vote is advisory and not binding, the Board of Directors may decide that it is in the best interests of our stockholders to hold a future advisory “Say on Pay” votes more or less frequently than the alternative that has been selected by our stockholders.

The proxy card provides our stockholders with the opportunity to select among four options (holding the vote every year, every other year, or every three years, or abstaining). Therefore, you will not be voting to approve or disapprove the recommendation of the Board of Directors.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE OPTION OF EVERY YEAR (“1 YEAR”) AS THE PREFERRED FREQUENCY FOR ADVISORY VOTES ON EXECUTIVE COMPENSATION.

19

EXECUTIVE OFFICERS

Set forth below are the name, age, position of and biographical information about each of the Company’s executive officers, as of the date of this Proxy Statement.

| | | | | | |

Name | | Age | | | Position(s) and Office(s) Held with the Company |

Carol G. Mills (1) | | | 58 | | | Interim CEO and Director |

Gordon C. Brooks | | | 49 | | | Senior Vice President, Chief Financial Officer and Principal Financial and Accounting Officer |

Betsy E. Bayha | | | 60 | | | Senior Vice President, General Counsel and Secretary |

Steve A. Daheb | | | 39 | | | Senior Vice President, Chief Marketing Officer |

| (1) | Carol G. Mills was appointed to serve as the Company’s Interim CEO on August 16, 2011, replacing Michael J. Borman, who had served as President and Chief Executive Officer since September 1, 2010. Gregory S. Clark has been appointed President and Chief Executive Officer, effective upon his employment with the Company, which presently is anticipated to commence on September 12, 2011. |

Carol G. Mills has served as our Interim CEO since August 16, 2011 as a director of the Company since January 2009. She served as Executive Vice President and General Manager, Infrastructure Products Group, of Juniper Networks, Inc., a provider of networking and security solutions, from November 2004 until February 2006. Prior to joining Juniper Networks, Ms. Mills was an independent consultant from 2003 until November 2004. From July 1998 to 2002, Ms. Mills was the President and Chief Executive Officer of Acta Technology, Inc., an enterprise data infrastructure company that was acquired by Business Objects in late 2002. From 1993 to 1998, Ms. Mills was Vice President and General Manager of the Enterprise Server Group at the Hewlett-Packard Company, a computer and electronics company. Prior to 1993, Ms. Mills held several other executive positions at Hewlett-Packard Company. Ms. Mills currently serves on the Board of Directors of Tekelec Corporation and is chairperson of its executive compensation committee, and is a member of its nominating and corporate governance committee. Ms. Mills is also the Executive Chairperson of Xactly Corporation, a private software company. She served as a director of Adobe Systems Inc. from June 1998 to April 2011. Ms. Mills holds a M.B.A. from Harvard Business School and a B.A. in Economics from Smith College. Ms. Mills is our first female Board member, and brings significant management experience in technology-based firms and extensive experience in public company executive and equity compensation, as well as governance matters, to the Board.

Gordon C. Brooks has served as Senior Vice President, Chief Financial Officer and Principal Financial and Accounting Officer of the Company since September 2009. Previously, he served as Vice President, Corporate Finance for VMware, Inc. from May 2009 to August 2009. From August 2008 through April 2009, Mr. Brooks served as Chief Financial Officer of Spikesource, Inc. Mr. Brooks was Senior Vice President of Finance and Corporate Controller of BEA Systems, Inc. (“BEA”) from June 2005 until February 2008, and held various finance positions at BEA from January 2000 through June 2005. Prior to joining BEA, Mr. Brooks held various finance positions. He started his career with Ernst & Young LLP. Mr. Brooks holds a Master of Accounting from the University of Southern California, and a Bachelor of Music in Piano Performance from Notre Dame de Namur University.

Betsy E. Bayha has served as Senior Vice President, General Counsel and Secretary of the Company since April 2007. Ms. Bayha previously served as Senior Vice President, General Counsel and Secretary of NetIQ Corporation, a provider of integrated systems and security management software solutions, from November 2001 to June 2006, when it was acquired by a consortium of private equity firms. Prior to joining NetIQ, Ms. Bayha was in private practice representing high technology corporations in licensing, corporate and litigation matters for more than 20 years. She was a partner at General Counsel Associates from November 1994 through October 2001, and was a partner at the international law firm of Coudert Brothers from December 1986 through October 1994. Ms. Bayha holds a J.D. from Harvard Law School, an M.A. in public administration from The Ohio State University and a B.A. in economics from Oakland University.

20

Steve A. Daheb has served as Senior Vice President, Chief Marketing Officer of the Company since December 13, 2010. Mr. Daheb previously served as Chief Marketing Officer and Senior Vice President of Business Development at Emulex Corporation, a publicly traded leader in converged networking solutions for the data center from November 2008 until assuming his position with the Company. Mr. Daheb served as Senior Vice President, Marketing, OEM Sales and Business Development at Blue Arc Corporation, a privately held developer of storage networking devices, from January 2005 until 2008, and as Vice President, Sales, Marketing and Business Development at Tasman Networks (acquired by Nortel), a privately held developer of WAN routing solutions, from July 2003 to January 2005. From October 2000 to July 2003, Mr. Daheb served as Senior Director, Global Product Marketing and Product Management at Brocade Communications, Inc., a publicly held developer of storage area network technology. From November 1994 to October 2000, Mr. Daheb held various product marketing positions. Mr. Daheb holds a J.D. from Santa Clara University School of Law and a B.A. from the University of California at Davis.

21

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Summary Information about Equity Compensation Plans

The following table provides information as of April 30, 2011 with respect to the shares of the Company’s Common Stock that may be issued under the Company’s existing equity compensation plans, plus certain non-stockholder approved plans and awards assumed in connection with the Company’s acquisition of Packeteer.

| | | | | | | | | | | | |

| | | Number of Securities

to Be Issued upon

Exercise of

Outstanding Options,

Warrants and Rights | | | Weighted-Average

Exercise Price of

Outstanding Options,

Warrants and Rights | | | Number of Securities

Remaining Available

for Future Issuance

under Equity

Compensation Plans

(Excluding

Securities Reflected

in Column (a)) | |

Plan Category | | (a) | | | (b) | | | (c) | |

Equity compensation plans approved by security holders (1) | | | 4,204,365 | (3) | | $ | 19.39 | (4) | | | 6,007,060 | (5) |

Equity compensation plans not approved by security holders (2) | | | 1,341,165 | | | $ | 23.59 | (4) | | | — | |

| | | | | | | | | | | | |

Total | | | 5,545,530 | | | $ | 20.37 | (4) | | | 6,007,060 | |

| | | | | | | | | | | | |

| (1) | Consists of options outstanding under the 1999 Stock Incentive Plan and 1999 Director Option Plan (“Prior Plans”), options and restricted stock units outstanding under the 2007 Plan, and shares available for future awards under the Employee Stock Purchase Plan (“Purchase Plan”) and the 2007 Plan. No future grants may be made under the Prior Plans. |

| | (i) | Equity awards outstanding under the 2000 Supplemental Stock Option Plan (the “Supplemental Plan”), which was implemented by the Board of Directors on February 15, 2000, and the 2007 New Employee Plan (“2007 New Employee Plan”), which was implemented by the Board of Directors on June 12, 2007. These plans were terminated upon stockholder approval of the 2007 Plan, on October 2, 2007. Also includes 100,000 option shares and 25,012 restricted stock units which may become issuable upon vesting under equity awards made to Gordon C. Brooks on September 17, 2009 and December 2, 2009, respectively. |

| | (ii) | Equity awards assumed by the Company in business combinations, including those assumed in the acquisition of Packeteer and awards made to former Packeteer employees under the Packeteer Plan in fiscal 2009 and in May 2009, prior to the termination of the Packeteer Plan. No additional shares of Common Stock can be granted under the Packeteer Plan. |

| | (iii) | Equity awards outstanding under the 2010 New Employee Stock Incentive Plan that was terminated on October 7, 2010. |

| (3) | Includes 3,563,603 shares issuable upon vesting of outstanding options and 640,762 shares issuable upon vesting of outstanding restricted stock units granted under the 2007 Plan and Prior Plans. Excludes purchase rights accrued under the Purchase Plan. |

| (4) | The weighted-average exercise price does not take into account the shares issuable upon vesting of outstanding restricted stock units, which have no exercise price. |

| (5) | Includes shares available for future issuance under the Purchase Plan. As of April 30, 2011, there were 2,772,367 shares of Common Stock available for future issuance under the Purchase Plan and 3,234,693 shares of Common Stock available for future awards under the 2007 Plan. |

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth, as of June 30, 2011, certain information with respect to shares beneficially owned by (i) each person who is known by the Company to be the beneficial owner of more than five percent of any class of the Company’s voting securities, (ii) each of the Company’s directors as of that date, (iii) each of the

22