UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

FOR ANNUAL AND TRANSITION REPORTS PURSUANT TO SECTIONS 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Mark One)

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2005

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 1-15371

iSTAR FINANCIAL INC.

(Exact name of registrant as specified in its charter)

Maryland | 95-6881527 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer

Identification Number) |

1114 Avenue of the Americas, 27th Floor

New York, NY | 10036 |

(Address of principal executive offices) | (Zip code) |

Registrant’s telephone number, including area code: (212) 930-9400

Securities registered pursuant to Section 12(b) of the Act:

Title of each class: Name of Exchange on which registered: | Name of Exchange on which registered: |

Common Stock, $0.001 par value | New York Stock Exchange |

8.000% Series D Cumulative Redeemable | New York Stock Exchange |

Preferred Stock, $0.001 par value | |

7.875% Series E Cumulative Redeemable | New York Stock Exchange |

Preferred Stock, $0.001 par value | |

7.800% Series F Cumulative Redeemable

Preferred Stock, $0.001 par value | New York Stock Exchange |

7.650% Series G Cumulative Redeemable

Preferred Stock, $0.001 par value | New York Stock Exchange |

7.500% Series I Cumulative Redeemable

Preferred Stock, $0.001 par value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark whether the registrant: (i) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (ii) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer or a non-accelerated filer (as defined in Exchange Act Rule 12-b-2).

Large accelerated filer x a large accelerated filer, Accelerated filer or a non-accelerated filer o Non-accelerated filer o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes x No o

As of June 30, 2005 the aggregate market value of the common stock, $0.001 par value per share of iStar Financial Inc. (“Common Stock”), held by non-affiliates(1) of the registrant was approximately $4.3 billion, based upon the closing price of $41.59 on the New York Stock Exchange composite tape on such date.

As of February 28, 2006, there were 114,681,387 shares of Common Stock outstanding.

(1) For purposes of this Annual Report only, includes all outstanding Common Stock other than Common Stock held directly by the registrant’s directors and executive officers.

DOCUMENTS INCORPORATED BY REFERENCE

1. Portions of the registrant’s definitive proxy statement for the registrant’s 2006 Annual Meeting, to be filed within 120 days after the close of the registrant’s fiscal year, are incorporated by reference into Part III of this Annual Report on Form 10-K.

PART I

Item 1. Business

Explanatory Note for Purposes of the “Safe Harbor Provisions” of Section 21E of the Securities Exchange Act of 1934, as amended

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, which involve certain risks and uncertainties. Forward-looking statements are included with respect to, among other things, iStar Financial Inc.’s (the “Company’s”) current business plan, business strategy and portfolio management. The Company’s actual results or outcomes may differ materially from those anticipated. Important factors that the Company believes might cause such differences are discussed in the cautionary statements presented under the caption “Risk Factors” in Item 1a of this Form 10-K or otherwise accompany the forward-looking statements contained in this Form 10-K. In assessing all forward-looking statements, readers are urged to read carefully all cautionary statements contained in this Form 10-K.

Overview

iStar Financial Inc. is the leading publicly traded finance company focused on the commercial real estate industry. The Company primarily provides custom tailored financing to high end private and corporate owners of real estate, including senior and mezzanine real estate debt, senior and mezzanine corporate capital, and corporate net lease financing. The Company, which is taxed as a real estate investment trust (“REIT”), seeks to deliver strong dividends and superior risk-adjusted returns on equity to shareholders by providing innovative and value added financing solutions to its customers.

Our two primary lines of business are lending and corporate tenant leasing. The lending business is primarily comprised of senior and subordinated loans that typically range in size from $20 million to $150 million and have maturities generally ranging from three to ten years. These loans may be either fixed rate (based on the U.S. Treasury rate plus a spread) or variable rate (based on LIBOR plus a spread) and are structured to meet the specific financing needs of the borrowers. We also provide senior and subordinated capital to corporations engaged in real estate or real estate related businesses. These financings may be either secured or unsecured, typically range in size from $20 million to $150 million and have maturities generally ranging from five to ten years. As part of the lending business, the Company also acquires whole loans and loan participations which present attractive risk-reward opportunities. Acquired loan positions typically range in size from $20 million to $100 million.

The Company’s corporate tenant leasing business provides capital to corporations and other owners who control facilities leased to single creditworthy customers. The Company’s net leased assets are generally mission critical headquarters or distribution facilities that are subject to long-term leases with public companies, many of which are rated corporate credits, and many of which provide for most expenses at the facility to be paid by the corporate customer on a triple net lease basis. Corporate tenant lease, or CTL, transactions have initial terms generally ranging from 15 to 20 years and typically range in size from $20 million to $150 million.

The Company began its business in 1993 through private investment funds formed to capitalize on inefficiencies in the real estate finance market. In March 1998, these funds contributed their assets to the Company’s predecessor in exchange for a controlling interest in that company. The Company later acquired its former external advisor in exchange for shares of the Company’s common stock (‘‘Common Stock’’) and converted its organizational form to a Maryland corporation. As part of the conversion to a Maryland corporation, the Company replaced its former dual class common share structure with a single class of Common Stock. The Company’s Common Stock began trading on the New York Stock Exchange on November 4, 1999. Prior to this date, the Company’s common stock was traded on the American Stock Exchange. Since that time, the Company has grown by originating new lending and leasing transactions, as

2

well as through corporate acquisitions, including the acquisition in 1999 of TriNet Corporate Realty Trust, Inc. (“TriNet”).

Investment Strategy

The Company’s investment strategy targets specific sectors of the real estate and corporate credit markets in which it believes it can deliver innovative, custom-tailored and flexible financial solutions to its customers, thereby differentiating its financial products from those offered by other capital providers.

The Company has implemented its investment strategy by:

· Focusing on the origination of large, structured mortgage, corporate and lease financings where customers require flexible financial solutions and “one-call” responsiveness post-closing.

· Avoiding commodity businesses in which there is significant direct competition from other providers of capital such as conduit lending and investment in commercial or residential mortgage-backed securities.

· Developing direct relationships with borrowers and corporate customers as opposed to sourcing transactions solely through intermediaries.

· Adding value beyond simply providing capital by offering borrowers and corporate customers specific lending expertise, flexibility, certainty of closing and a continuing relationship beyond the closing of a particular financing transaction.

· Taking advantage of market anomalies in the real estate financing markets when the Company believes credit is mispriced by other providers of capital, such as the spread between lease yields and the yields on corporate customers’ underlying credit obligations.

The Company seeks to invest in a mix of portfolio financing transactions to create asset diversification and single-asset financings for properties with strong, long-term competitive market positions. The Company’s credit process focuses on:

· Building diversification by asset type, property type, obligor, loan/lease maturity and geography.

· Financing commercial real estate assets in major metropolitan markets.

· Underwriting assets using conservative assumptions regarding collateral value and future property performance.

· Focusing on replacement costs as the long-term determinant of real estate values.

· Stress testing potential investments for adverse economic and real estate market conditions.

3

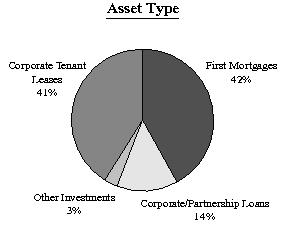

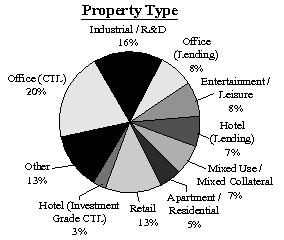

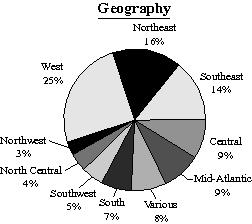

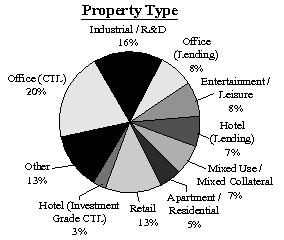

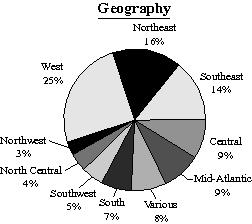

The Company seeks to maintain an investment portfolio which is diversified by asset type, underlying property type and geography. As of December 31, 2005, based on current gross carrying values, the Company’s total investment portfolio has the following characteristics:

4

Since the Company’s inception, substantially all of its investments have been in assets and with customers based in the United States and the Company has conducted its operations exclusively from the United States. In the first quarter of 2006, the Company opened a subsidiary in London, England which at the time had only one employee. The Company will use its London office to source investment opportunities abroad, primarily in Europe; however, the Company does not expect that non-U.S. investments will represent a material portion of its assets over the next 12 months.

The Company’s Underwriting Process

The Company discusses and analyzes investment opportunities during regular weekly meetings which are attended by all of its investment professionals, as well as representatives from its legal, risk management and capital markets areas. The Company has developed a process for screening potential investments called the Six Point Methodologysm. Through this process the Company evaluates an investment opportunity prior to beginning its formal due diligence process by: (1) evaluating the source of the opportunity; (2) evaluating the quality of the collateral or corporate credit, as well as its market or industry dynamics; (3) evaluating the equity or corporate sponsor; (4) determining whether it can implement an appropriate legal and financial structure for the transaction given its risk profile; (5) performing an alternative investment test; and (6) evaluating the liquidity of the investment and its ability to match fund the asset.

The Company has an intensive underwriting process in place for all potential investments. This process provides for comprehensive feedback and review by all disciplines within the Company, including investments, credit, risk management, legal/structuring and capital markets. Participation is encouraged from all professionals throughout the entire origination process, from the initial consideration of the opportunity, through the Six Point Methodologysm and into the preparation and distribution of a comprehensive memorandum for the Company’s internal and/or Board of Directors investment committees.

Commitments of less than $10.0 million can be approved by the Chairman and Chief Executive Officer. Commitments between $10.0 million and $75.0 million require the unanimous consent of the Company’s internal investment committee, consisting of senior management representatives from each of the Company’s key disciplines. For commitments between $75.0 million and $150.0 million, the further approval of the investment committee of the Company’s board of directors’ (the “Board of Directors”) is also required. All commitments of $150.0 million or more must be approved by a majority vote of the Board of Directors. In addition, strategic investments such as a corporate merger or an acquisition of another business entity (other than a corporate net lease financing) or any other material transaction in an amount over $75.0 million involving the Company’s entry into a new line of business, must be approved by a majority vote of the Board of Directors.

Financing Strategy

The Company has access to a wide range of debt and equity capital resources to finance its investment and growth strategies. At December 31, 2005, the Company had over $2.4 billion of tangible book equity capital and a total market capitalization of approximately $10.4 billion. The Company believes that its size and track record are competitive advantages in obtaining attractive financing for its businesses.

The Company seeks to maximize risk-adjusted returns on equity and financial flexibility by accessing a variety of public and private debt and equity capital sources. While the Company believes that it is important to maintain diverse sources of funding, in 2003 it began to emphasize unsecured funding sources of debt, such as long-term unsecured corporate debt. The Company believes that unsecured debt is more cost-effective, flexible and efficient than secured debt. The Company’s current sources of debt capital include:

· Long-term, unsecured corporate debt.

· A combined $2.2 billion of capacity under its unsecured and secured revolving credit facilities at year end.

5

· Subordinated debt in the form of trust preferred securities.

· Individual mortgages secured by certain of the Company’s assets.

The Company’s business model is premised on significantly lower leverage than many other commercial finance companies. In this regard, the Company seeks to:

· Maintain a prudent corporate leverage level based upon the Company’s mix of business and appropriate leverage levels for each of its primary business lines.

· Maintain a large tangible equity base and conservative credit statistics.

· Match fund assets and liabilities.

A more detailed discussion of the Company’s current capital resources is provided in Item 7—“Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.”

Hedging Strategy

The Company has variable-rate lending assets and variable-rate debt obligations. These assets and liabilities create a natural hedge against changes in variable interest rates. This means that, as interest rates increase, the Company earns more on its variable-rate lending assets and pays more on its variable-rate debt obligations and, conversely, as interest rates decrease, the Company earns less on its variable-rate lending assets and pays less on its variable-rate debt obligations. When the Company’s variable-rate debt obligations exceed its variable-rate lending assets, the Company utilizes derivative instruments to limit the impact of changing interest rates on its net income. The Company’s policy requires that we manage our fixed/floating rate exposure such that a 100 basis point move in short term interest rates would have no more than a 2.5% impact on our quarterly adjusted earnings. The Company does not use derivative instruments to hedge assets or for speculative purposes. The derivative instruments the Company uses are typically in the form of interest rate swaps and interest rate caps. Interest rate swaps effectively change variable-rate debt obligations to fixed-rate debt obligations. In addition, when appropriate the Company enters into interest rate swaps that convert fixed-rate debt to variable rate in order to mitigate the risk of changes in fair value of the fixed-rate debt obligations. Interest rate caps effectively limit the maximum interest rate on variable-rate debt obligations.

Developing an effective strategy for dealing with movements in interest rates is complex and no strategy can completely insulate the Company from risks associated with such fluctuations. There can be no assurance that the Company’s hedging activities will have the desired beneficial impact on its results of operations or financial condition.

During 2005, the Company entered into foreign currency hedges to mitigate the risk of loss due to currency fluctuations on its lending investments denominated in foreign currencies. The foreign currency exchange risk and the derivatives the Company uses to mitigate these risks are not significant to the Company’s financial statements.

The primary risks from the Company’s use of derivative instruments is the risk that a counterparty to a hedging arrangement could default on its obligation and the risk that the Company may have to pay certain costs, such as transaction fees or breakage costs, if a hedging arrangement is terminated by it. As a matter of policy, the Company enters into hedging arrangements with counterparties that are large, creditworthy financial institutions typically rated at least A/A2 by S&P and Moody’s Investors Service, respectively. The Company’s hedging strategy is monitored by its Audit Committee on behalf of its Board of Directors and may be changed by the Board of Directors without shareholder approval.

A more detailed discussion of the Company’s hedging policy is provided in Item 7—“Managements Discussion and Analysis of Financial Conditions and Results of Operations—Liquidity and Capital Resources.”

6

Business

Real Estate Lending

The Company primarily provides structured financing to high-end private and corporate owners of real estate, including senior and mezzanine real estate debt and senior and mezzanine corporate capital.

As of December 31, 2005, the Company’s loan portfolio is comprised of:

| | Current

Carrying

Value | | %

of Total | |

| | (In thousands) | | | |

First mortgages | | | $ | 3,136,880 | | | | 67 | % | |

Junior first mortgages | | | 407,053 | | | | 9 | % | |

Corporate loans/Other | | | 1,164,858 | | | | 25 | % | |

Gross carrying value | | | $ | 4,708,791 | | | | 100 | % | |

Reserve for loan losses | | | (46,876 | ) | | | | | |

Total carrying value, net | | | $ | 4,661,915 | | | | | | |

As more fully discussed in Note 3 to the Company’s Consolidated Financial Statements, the Company continually monitors borrower performance and completes a detailed, loan-by-loan formal credit review on a quarterly basis. After having originated or acquired over $16.9 billion of investment transactions over its twelve-year history through December 31, 2005, the Company and its private investment fund predecessors have experienced minimal actual losses on their lending investments.

Despite the Company’s historical track record of having minimal credit losses and loans on non-accrual status, the Company considers it prudent to reflect reserves for loan losses on a portfolio basis based upon the Company’s assessment of general market conditions, the Company’s internal risk management policies and credit risk rating system, industry loss experience, the Company’s assessment of the likelihood of delinquencies or defaults and the value of the collateral underlying its investments. Accordingly, since its first full quarter operating its current business as a public company (the quarter ended June 30, 1998), management has reflected quarterly provisions for loan losses in its operating results.

As of December 31, 2005, the Company’s loan portfolio has the following characteristics:

Investment Class | | | | Collateral Types | | # of

Loans

In Class | | Current

Carrying

Value(1) | | Current

Principal

Balance

Outstanding | | Weighted

Average

Stated

Pay Rate(2)(3) | | Weighted

Average First

Dollar

Current

Loan-to-

Value(4) | | Weighted

Average Last

Dollar

Current

Loan-to-

Value(4) | |

| | (In thousands) | |

First Mortgages | | Office/Residential/Retail/

Industrial, R&D/

Mixed Use/

Hotel/Entertainment,

Leisure/Other | | | 112 | | | $ | 3,136,880 | | | $ | 3,174,179 | | | | 8.79 | % | | | 1 | % | | | 64 | % | |

Junior First Mortgages(5) | | Office/Residential/Retail/

Industrial, R&D/Entertainment,

Leisure /Mixed

Use/Hotel/Other | | | 19 | | | 407,053 | | | 413,873 | | | | 9.81 | % | | | 44 | % | | | 65 | % | |

Corporate Loans/Other | | Office/Residential/Retail/

Industrial, R&D/

Mixed Use/

Hotel/Entertainment,

Leisure/Other | | | 48 | | | 1,164,858 | | | 1,183,280 | | | | 9.34 | % | | | 48 | % | | | 68 | % | |

Total/Weighted Average | | | | | 179 | | | $ | 4,708,791 | | | $ | 4,771,332 | | | | 9.01 | % | | | 16 | % | | | 65 | % | |

7

Explanatory Notes:

(1) Where Current Carrying Value differs from Current Principal Balance Outstanding, the difference represents unamortized amount of acquired premiums, discounts or deferred loan fees.

(2) All variable-rate loans assume a one-month LIBOR rate of 4.39% (the actual one-month LIBOR rate at December 31, 2005). As of December 31, 2005, two loans with a combined carrying value of $27.0 million have a stated accrual rate that exceeds the stated pay rate.

(3) The Company’s GAAP yield is generally higher than stated pay rate due to amortization of loan fees and purchase discounts on certain loans.

(4) Weighted average ratio of first and last dollar current loan carrying value to underlying collateral value using third-party appraisal or the Company’s internal valuation.

(5) Junior first mortgages represent promissory notes secured by first mortgages which are junior to other promissory notes secured by the same first mortgage.

Summary of Interest Characteristics

As more fully discussed in Item 7—“Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources” as well as in Item 7a—“Quantitative and Qualitative Disclosures about Market Risk,” the Company utilizes certain interest rate risk management techniques, including both asset/liability matching and certain other hedging techniques, in order to mitigate the Company’s exposure to interest rate risks.

As of December 31, 2005, the Company’s loan portfolio has the following interest rate characteristics:

| | Current

Carrying

Value | | %

of Total | |

| | (In thousands) | | | |

Fixed-rate loans | | | $ | 1,839,152 | | | | 39 | % | |

Variable-rate loans | | | 2,869,639 | | | | 61 | % | |

Gross carrying value | | | $ | 4,708,791 | | | | 100 | % | |

Summary of Prepayment Terms

The Company is exposed to risks of prepayment on its loan assets, and generally seeks to protect itself from such risks by structuring its loans with prepayment restrictions and/or penalties.

As of December 31, 2005, the Company’s loan portfolio has the following call protection characteristics:

| | Current

Carrying

Value | | %

of Total | |

| | (In thousands) | | | |

Fixed prepayment penalties or minimum whole-dollar profit | | | $ | 1,408,344 | | | | 30 | % | |

Substantial lock-out for original term(1) | | | 1,166,664 | | | | 25 | % | |

Yield maintenance | | | 176,253 | | | | 4 | % | |

Total loans with call protection | | | 2,751,261 | | | | 58 | % | |

Currently open to prepayment with no penalty | | | 1,957,530 | | | | 42 | % | |

Gross carrying value | | | $ | 4,708,791 | | | | 100 | % | |

Explanatory Note:

(1) For the purpose of this table, the Company has assumed a substantial lock-out to mean at least three years.

8

Summary of Lending Business Maturities

As of December 31, 2005, the Company’s loan portfolio has the following maturity characteristics:

Year of Maturity | | | | Number of

Transactions

Maturing | | Current

Carrying

Value | | %

of Total | |

| | | | | (In thousands) | | | | |

2006 | | | 25 | | | $ | 878,241 | | | 19 | % | |

2007 | | | 18 | | | 649,688 | | | 14 | % | |

2008 | | | 33 | | | 976,441 | | | 21 | % | |

2009 | | | 22 | | | 814,625 | | | 17 | % | |

2010 | | | 13 | | | 335,769 | | | 7 | % | |

2011 | | | 14 | | | 243,153 | | | 5 | % | |

2012 | | | 6 | | | 108,785 | | | 2 | % | |

2013 | | | 7 | | | 97,764 | | | 2 | % | |

2014 | | | 7 | | | 141,200 | | | 3 | % | |

2015 | | | 2 | | | 105,095 | | | 3 | % | |

2016 and thereafter | | | 32 | | | 358,030 | | | 8 | % | |

Total | | | 179 | | | $ | 4,708,791 | | | 100 | % | |

Weighted average maturity | | | | | | 3.8 years | | | | | |

Corporate Tenant Leasing

The Company pursues the origination of CTL transactions by structuring purchase/leasebacks and by acquiring facilities subject to existing long-term net leases. In a typical purchase/leaseback transaction, the Company purchases a corporation’s facility and leases it back to that corporation subject to a long-term net lease. This structure allows the corporate customer to reinvest the proceeds from the sale of its facilities into its core business, while the Company capitalizes on its structured financing expertise.

The Company’s net leased assets are generally mission-critical headquarters or distribution facilities that are subject to long-term leases with public companies, many of which are rated corporate credits and many of which provide for most expenses at the facility to be paid by the corporate customer on a triple net lease basis. CTL transactions have initial terms generally ranging from 15 to 20 years and typically range in size from $20 million to $150 million.

The Company generally intends to hold its CTL assets for long-term investment. However, subject to certain tax restrictions, the Company may dispose of an asset if it deems the disposition to be in the Company’s best interests and may either reinvest the disposition proceeds, use the proceeds to reduce debt, or distribute the proceeds to shareholders.

The Company typically seeks general-purpose real estate with residual values that represent a discount to current market values and replacement costs. Under a typical net lease agreement, the corporate customer agrees to pay a base monthly operating lease payment and all facility operating expenses (including taxes, maintenance and insurance).

The Company generally seeks corporate customers with the following characteristics:

· Established companies with stable core businesses or market leaders in growing industries.

· Investment-grade credit strength or appropriate credit enhancements if corporate credit strength is not sufficient on a stand-alone basis.

· Commitment to the facility as a mission-critical asset to their on-going businesses.

9

As of December 31, 2005, the Company had 155 corporate customers operating in more than 20 major industry sectors, including automotive, finance, healthcare, recreation, technology and telecommunications. The majority of these customers represent well-recognized national and international companies, such as Federal Express, IBM, Nike, Nokia, Verizon and the U.S. Government.

As of December 31, 2005, the Company’s CTL portfolio has the following tenant credit characteristics:

| | Annualized In-Place

Operating

Lease Income(3) | | % of In-Place

Operating

Lease

Income | |

| | (In thousands) | | | |

Investment grade(1) | | | $ | 115,338 | | | | 33 | % | |

Implied investment grade(2) | | | 22,111 | | | | 6 | % | |

Non-investment grade | | | 92,598 | | | | 27 | % | |

Unrated | | | 115,411 | | | | 33 | % | |

Total | | | $ | 345,458 | | | | 100 | % | |

Explanatory Notes:

(1) A customer’s credit rating is considered “Investment Grade” if the tenant or its guarantor has a published senior unsecured credit rating of Baa3/BBB- or above by one or more of the three national rating agencies.

(2) A customer’s credit rating is considered “Implied Investment Grade” if it is 100% owned by an investment-grade parent or it has no published ratings, but has credit characteristics that the Company believes warrant an investment grade senior unsecured credit rating. Examples at December 31, 2005 include Hewlett-Packard Co. and Volkswagen of America, Inc.

(3) Reflects annualized GAAP operating lease income for the leases in-place at December 31, 2005.

Risk Management Strategies. The Company believes that diligent risk management of its CTL assets is an essential component of its long-term strategy. There are several ways to optimize the performance and maximize the value of CTL assets. The Company monitors its portfolio for changes that could affect the performance of the markets, credits and industries in which it has invested. As part of this monitoring, the Company’s risk management group reviews market, customer and industry data and frequently inspects its facilities. In addition, the Company attempts to develop strong relationships with its large corporate customers, which provide a source of information concerning the customers’ facilities needs. These relationships allow the Company to be proactive in obtaining early lease renewals and in conducting early marketing of assets where the customer has decided not to renew.

10

As of December 31, 2005, the Company owned 376 office and industrial, entertainment, medical and retail facilities principally subject to net leases to 154 customers, comprising 34.8 million square feet in 39 states. The Company also has a portfolio of 17 hotels under a long-term master lease with a single customer. Information regarding the Company’s CTL assets as of December 31, 2005 is set forth below:

SIC Code | | # of

Leases | | % of In-Place

Operating Lease

Income(1) | | % of Total

Revenue(2) | |

48 | | Communications | | | 8 | | | | 10.5 | % | | | 4.6 | % | |

73 | | Business Services | | | 16 | | | | 10.1 | % | | | 4.4 | % | |

79 | | Amusement and Recreation Services | | | 4 | | | | 9.7 | % | | | 4.2 | % | |

70 | | Hotels, Rooming, Housing & Lodging | | | 5 | | | | 7.5 | % | | | 3.3 | % | |

55 | | Automotive Dealers and Gasoline Service Stations | | | 30 | | | | 7.5 | % | | | 3.3 | % | |

62 | | Security and Commodity Brokers | | | 1 | | | | 6.3 | % | | | 2.8 | % | |

35 | | Industrial/Commercial Machinery, incl. Computers | | | 14 | | | | 6.2 | % | | | 2.7 | % | |

37 | | Transportation Equipment | | | 7 | | | | 6.0 | % | | | 2.6 | % | |

36 | | Electronic & Other Elec. Equipment | | | 14 | | | | 5.7 | % | | | 2.5 | % | |

30 | | Rubber and Misc. Plastics Products | | | 2 | | | | 5.0 | % | | | 2.2 | % | |

78 | | Motion Pictures | | | 3 | | | | 2.8 | % | | | 1.2 | % | |

50 | | Wholesale Trade—Durable Goods | | | 8 | | | | 2.2 | % | | | 1.0 | % | |

42 | | Motor Freight Transp. & Warehousing | | | 3 | | | | 2.0 | % | | | 0.9 | % | |

80 | | Healthcare Services | | | 17 | | | | 2.0 | % | | | 0.9 | % | |

64 | | Insurance Agents, Brokers & Service | | | 3 | | | | 1.9 | % | | | 0.8 | % | |

63 | | Insurance Carriers | | | 4 | | | | 1.7 | % | | | 0.8 | % | |

58 | | Eating and Drinking Places | | | 14 | | | | 1.7 | % | | | 0.8 | % | |

91 | | Executive, Legislative and General Gov't. | | | 3 | | | | 1.6 | % | | | 0.7 | % | |

87 | | Engineering, Accounting & Research Services | | | 6 | | | | 1.2 | % | | | 0.5 | % | |

45 | | Airports, Flying Fields & Terminal Services | | | 1 | | | | 1.1 | % | | | 0.5 | % | |

| | Various | | | 20 | | | | 7.3 | % | | | 3.1 | % | |

| | Total | | | 183 | | | | 100.0 | % | | | | | |

Explanatory Notes:

(1) Reflects annualized GAAP operating lease income for leases in place at December 31, 2005.

(2) Reflects annualized GAAP operating lease income for leases in place at December 31, 2005 as a percentage of annualized total revenue for the quarter ended December 31, 2005.

11

As of December 31, 2005, lease expirations on the Company’s CTL assets, including facilities owned by the Company’s joint ventures, are as follows:

Year of Lease Expiration | | | | Number of

Leases

Expiring | | Annualized In-Place

Operating Lease

Income(1) | | % of In-Place

Operating

Lease

Income | | % of Total

Revenue(2) | |

| | (In thousands) | | | |

2006 | | | 14 | | | | $ | 20,879 | | | | 6.0 | % | | | 2.6 | % | |

2007 | | | 14 | | | | 32,591 | | | | 9.4 | % | | | 4.1 | % | |

2008 | | | 5 | | | | 9,644 | | | | 2.8 | % | | | 1.2 | % | |

2009 | | | 5 | | | | 6,382 | | | | 1.9 | % | | | 0.8 | % | |

2010 | | | 13 | | | | 13,443 | | | | 3.9 | % | | | 1.7 | % | |

2011 | | | 6 | | | | 3,548 | | | | 1.0 | % | | | 0.5 | % | |

2012 | | | 14 | | | | 21,291 | | | | 6.2 | % | | | 2.7 | % | |

2013 | | | 9 | | | | 6,566 | | | | 1.9 | % | | | 0.8 | % | |

2014 | | | 27 | | | | 21,710 | | | | 6.3 | % | | | 2.7 | % | |

2015 | | | 6 | | | | 9,738 | | | | 2.8 | % | | | 1.2 | % | |

2016 and thereafter | | | 70 | | | | 199,666 | | | | 57.8 | % | | | 25.2 | % | |

Total | | | 183 | | | | $ | 345,458 | | | | 100.0 | % | | | | | |

Weighted average

remaining lease term | | | | | | | 11.0 years | | | | | | | | | | |

Explanatory Notes:

(1) Reflects annualized GAAP operating lease income for leases in-place at December 31, 2005.

(2) Reflects annualized GAAP operating lease income for leases in-place at December 31, 2005 as a percentage of annualized total revenue for the quarter ended December 31, 2005.

Policies with Respect to Other Activities

The Company’s investment, financing and conflicts of interests policies are managed under the ultimate supervision of the Company’s Board of Directors. The Board of Directors can amend, revise or eliminate these policies at any time without a vote of shareholders. At all times, the Company intends to make investments in a manner consistent with the requirements of the Internal Revenue Code of 1986, as amended (the “Code”) for the Company to qualify as a REIT.

Investment Restrictions or Limitations

The Company does not have any prescribed allocation among investments or product lines. Instead, the Company focuses on corporate and real estate credit underwriting to develop an in-depth analysis of the risk/reward ratios in determining the pricing and advisability of each particular transaction.

The Company believes that it is not, and intends to conduct its operations so as not to become, regulated as an investment company under the Investment Company Act. The Investment Company Act generally exempts entities that are “primarily engaged in purchasing or otherwise acquiring mortgages and other liens on and interests in real estate” (collectively, “Qualifying Interests”). The Company intends to rely on current interpretations of the Securities and Exchange Commission in an effort to qualify for this exemption. Based on these interpretations, the Company, among other things, must maintain at least 55% of its assets in Qualifying Interests and at least 25% of its assets in real estate-related assets (subject to reduction to the extent the Company invests more than 55% of its assets in Qualifying Interests). Generally, the Company’s senior mortgages, CTL assets and certain of its subordinated mortgages constitute Qualifying Interests. Subject to the limitations on ownership of certain types of assets and the

12

gross income tests imposed by the Code, the Company also may invest in the securities of other REITs, other entities engaged in real estate activities or other issuers, including for the purpose of exercising control over such entities.

Competition

The Company operates in a highly competitive market. See Item 1a Risk Factors: “We compete with a variety of financing sources for our customers,” for a discussion of how we may be affected by competition.

Regulation

The operations of the Company are subject, in certain instances, to supervision and regulation by state and federal governmental authorities and may be subject to various laws and judicial and administrative decisions imposing various requirements and restrictions, which, among other things: (1) regulate credit granting activities; (2) establish maximum interest rates, finance charges and other charges; (3) require disclosures to customers; (4) govern secured transactions; and (5) set collection, foreclosure, repossession and claims-handling procedures and other trade practices. Although most states do not regulate commercial finance, certain states impose limitations on interest rates and other charges and on certain collection practices and creditor remedies and require licensing of lenders and financiers and adequate disclosure of certain contract terms. The Company is also required to comply with certain provisions of the Equal Credit Opportunity Act that are applicable to commercial loans.

In the judgment of management, existing statutes and regulations have not had a material adverse effect on the business conducted by the Company. However, it is not possible to forecast the nature of future legislation, regulations, judicial decisions, orders or interpretations, nor their impact upon the future business, financial condition or results of operations or prospects of the Company.

The Company has elected and expects to continue to make an election to be taxed as a REIT under Section 856 through 860 of the Code. As a REIT, the Company must currently distribute, at a minimum, an amount equal to 90% of its taxable income. In addition, the Company must distribute 100% of its taxable income to avoid paying corporate federal income taxes. REITs are also subject to a number of organizational and operational requirements in order to elect and maintain REIT status. These requirements include specific share ownership tests and assets and gross income composition tests. If the Company fails to qualify as a REIT in any taxable year, the Company will be subject to federal income tax (including any applicable alternative minimum tax) on its taxable income at regular corporate tax rates. Even if the Company qualifies for taxation as a REIT, the Company may be subject to state and local income taxes and to federal income tax and excise tax on its undistributed income.

The American Jobs Creation Act

The American Jobs Creation Act of 2004 (the “Act”) was enacted on October 22, 2004. The Act modifies the manner in which the Company applies the gross income and asset test requirements under the Code. With respect to the asset tests, the Act expands the types of securities that qualify as “straight debt” for purposes of the 10% value limitation. The Act also clarifies that certain types of debt instruments, including loans to individuals or estates and securities of a REIT, are not “securities” for purposes of the 10% value limitation. With respect to the gross income tests, the Act provides that for the Company’s taxable years beginning on or after January 1, 2005, except to the extent provided by Treasury regulations, its income from certain hedging transactions that are clearly identified as hedges under Section 1221 of the Code, including gain from the sale or disposition of such a transaction, will be excluded from gross income for purposes of the 95% gross income test, to the extent the transaction hedges any indebtedness incurred or to be incurred by the trust to acquire or carry real estate.

13

The Act also sets forth rules that permit a REIT to avoid disqualification for de minimis failures (as defined in the Act) to satisfy the 5% and 10% value limitations under the asset tests if the REIT either disposes of the assets within six months after the last day of the quarter in which the REIT identifies the failure (or such other time period prescribed by the Treasury), or otherwise meets the requirements of such asset tests by the end of such time period. In addition, if a REIT fails to meet any of the asset test requirements for a particular quarter, and the de minimis exception described above does not apply, the REIT may cure such failure if the failure was due to reasonable cause and not to willful neglect, the REIT identifies such failure to the IRS and disposes of the assets that caused the failure within six months after the last day of the quarter in which the identification occurred, and the REIT pays a tax with respect to the failure equal to the greater of: (i) $50,000; or (ii) an amount determined (pursuant to Treasury regulations) by multiplying the highest rate of tax for corporations under Section 11 of the Code, by the net income generated by the assets for the period beginning on the first date of the failure and ending on the date the REIT has disposed of the assets (or otherwise satisfies the requirements). In addition to the foregoing, the Act also provides that if a REIT fails to satisfy one or more requirements for REIT qualification, other than by reason of a failure to comply with the provisions of the reasonable cause exception to the gross income tests and the provisions described above with respect to failure to comply with the asset tests, the REIT may retain its REIT qualification if the failures are due to reasonable cause and not willful neglect, and if the REIT pays a penalty of $50,000 for each such failure. The provisions described in this paragraph will only apply to the Company’s taxable years beginning on or after January 1, 2005.

Code of Conduct

The Company has adopted a code of business conduct for all of its employees and directors, including the Company’s chief executive officer, chief financial officer, other executive officers and personnel. A copy of the Company’s code of conduct is incorporated by reference in this Annual Report on Form 10-K as Exhibit 14.0 and is also available on the Company’s website at www.istarfinancial.com. The Company intends to post on its website material changes to, or waivers from, its code of conduct, if any, within two days of any such event. The Company’s code of conduct was originally adopted in February 2000 and was amended in October 2002 to reflect changes in the NYSE’s corporate governance guidelines. As of December 31, 2005, there were no waivers or further changes since adoption of the current code of conduct in October 2002.

Employees

As of February 28, 2006, the Company had 181 employees and believes its relationships with its employees to be good. The Company’s employees are not represented by a collective bargaining agreement.

Other

In addition to this Annual Report, the Company files quarterly and special reports, proxy statements and other information with the SEC. All documents are filed with the SEC and are available free of charge on the Company’s corporate website, which is www.istarfinancial.com. Effective as of January 1, 2003, through the Company’s website, the Company makes available free of charge its annual proxy statement, Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those Reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after the Company electronically files such material with, or furnishes it to, the SEC. You may also read and copy any document filed at the public reference facilities at 100 F Street, N.E., Washington, D.C. 25049. Please call the SEC at (800) SEC-0330 for further information about the public reference facilities. These documents also may be accessed

14

through the SEC’s electronic data gathering, analysis and retrieval system (“EDGAR”) via electronic means, including the SEC’s homepage on the internet at www.sec.gov.

Item 1a. Risk Factors

In addition to the other information in this document, you should consider carefully the following risk factors in evaluating an investment in our securities. Any of these risks or the occurrence of any one or more of the uncertainties described below could have a material adverse effect on our financial condition and the performance of our business. For purposes of these risk factors, the terms “we,” “our” and “us” refer to the Company and its consolidated subsidiaries, unless the context indicates otherwise.

We Are Subject to Risks Relating to Our Lending Business.

We may suffer a loss if the value of real property or other assets securing our loans deteriorates.

The majority of our loans are secured by real property and are fully or substantially non-recourse. In the event of a default by a borrower on a non-recourse loan, we will only have recourse to the real estate-related assets (including escrowed funds and reserves) collateralizing the loan. For this purpose, we consider loans made to special purpose entities formed solely for the purpose of holding and financing particular assets to be non-recourse loans. We sometimes also make loan investments, often referred to as “mezzanine loans,” that are secured by equity interests in the borrowing entities. There can be no assurance that the value of the assets securing our loans will not deteriorate over time due to factors beyond our control, including acts or omissions by owners or managers of the assets. Mezzanine loans are subject to the additional risk that other lenders may be directly secured by the real estate assets of the borrowing entity. As of December 31, 2005, 86.96% of our loans were non-recourse, based upon the gross carrying value of our loan assets. Any losses we may suffer on such loans could have a material adverse affect on our financial performance, the prices of our securities and our ability to pay dividends

We may suffer a loss if a borrower or guarantor defaults on recourse obligations under our loans.

We sometimes obtain individual or corporate guarantees from borrowers or their affiliates, which guarantees are not secured. In cases where guarantees are not fully or partially secured, we typically rely on financial covenants from borrowers and guarantors which are designed to require the borrower or guarantor to maintain certain levels of creditworthiness. Where we do not have recourse to specific collateral pledged to satisfy such guarantees or recourse loans, we will only have recourse as an unsecured creditor to the general assets of the borrower or guarantor, some or all of which may be pledged to satisfy other lenders. There can be no assurance that a borrower or guarantor will comply with its financial covenants, or that sufficient assets will be available to pay amounts owed to us under our loans and guarantees. As a result of these factors, we may suffer losses which could have a material adverse affect on our financial performance, the market prices of our securities and our ability to pay dividends.

We may suffer a loss in the event of a default or bankruptcy of a borrower, particularly in cases where the borrower has incurred debt that is senior to our loan.

If a borrower defaults on our loan and the mortgaged real estate or other borrower assets collateralizing our loan are insufficient to satisfy our loan, we may suffer a loss of principal or interest. In the event of a borrower bankruptcy, we may not have full recourse to the assets of the borrower, or the assets of the borrower may not be sufficient to satisfy our loan. In addition, certain of our loans are subordinate to other debt of the borrower. If a borrower defaults on our loan or on debt senior to our loan, or in the event of a borrower bankruptcy, our loan will be satisfied only after the senior debt. Bankruptcy and borrower litigation can significantly increase the time needed for us to acquire underlying collateral in the event of a default, during which time the collateral may decline in value. In addition, there are significant costs and delays associated with the foreclosure process.

15

Our reserves for losses may prove inadequate, which could have a material adverse effect on us.

We maintain and regularly evaluate financial reserves to protect against potential future losses. While we have in many of our loans asset-specific credit protection, including cash reserve accounts, cash deposits and letters of credit which we require that our borrowers fund and/or post at the closing of a transaction in accounts in which we have a security interest, such protections may not be sufficient to protect against all losses. As of December 31, 2005, accumulated loan loss reserves and other asset-specific credit protection represented an aggregate of approximately 6% of the gross book value of our loans. We cannot be certain that our reserves will be adequate over time to protect against potential future losses because of unanticipated adverse changes in the economy or events adversely affecting specific assets, borrowers, industries in which our borrowers operate or markets in which our borrowers or their properties are located. If our reserves for credit losses prove inadequate, we could suffer losses which could have a material adverse affect on our financial performance, the market prices of our securities and our ability to pay dividends.

We are subject to the risk that provisions of our loan agreements may be unenforceable.

Our rights and obligations with respect to our loans are governed by written loan agreements and related documentation. It is possible that a court could determine that one or more provisions of a loan agreement are unenforceable, such as a loan prepayment provision or the provisions governing our security interest in the underlying collateral. If this were to happen with respect to a material asset or group of assets, our financial performance, the market prices of our securities and our ability to pay dividends could be materially adversely affected.

We are subject to the risks associated with loan participations and intercreditor arrangements, such as less than full control rights.

Some of our assets are participating interests in loans in which we share the rights, obligations and benefits of the loan with other participating lenders. Some of our assets are interests in subordinated loans which are subject to intercreditor arrangements with senior lenders. Where debt senior to our loans exists, the presence of intercreditor arrangements may limit our ability to amend our loan documents, assign our loans, accept prepayments, exercise our remedies (through “standstill” periods) and control decisions made in bankruptcy proceedings relating to borrowers. Similarly, a majority of the participating lenders, or the senior lenders, may be able to take actions to which we object but to which we will be bound. We may be adversely affected by such lack of full control.

Prepayments of our loans, particularly during periods of low interest rates, may reduce our recurring income and we also may not receive prepayment penalties.

Borrowers may seek to prepay our loans, particularly during periods when interest rates are low. If loans repay before their maturity, we may not be able to reinvest the proceeds quickly or we may be forced to reinvest the proceeds in lower-yielding assets. Accordingly, prepayments of our assets may reduce the amount of our recurring income and could adversely affect our financial performance. Many of our loans provide that the borrower must pay us a prepayment penalty if the loan is repaid before a specified date. This is often referred to as a “lock-out period.” While prepayment penalties provide us with financial compensation, they represent one-time payments as opposed to recurring income. After the end of the lock-out period, the borrower may prepay the loan without penalty prior to its maturity. As of December 31, 2005, 41.57% of our lending portfolio consisted of loans open to prepayment without penalty.

Increases in interest rates during the term of a loan may adversely impact a borrower’s ability to repay a loan at maturity or to prepay a loan.

If interest rates increase during the term of our loan, a borrower may not be able to obtain the necessary funds to repay our loan at maturity through refinancing. Borrowers may also not be able to

16

obtain refinancing proceeds that would enable them to prepay our loans. Increasing interest rates may hinder a borrower’s ability to refinance our loan because the borrower or the underlying property cannot satisfy the debt service coverage requirements necessary to obtain new financing or because the value of the property has decreased. If a borrower is unable to repay our loan at maturity, we could suffer a loss. If borrowers prepay fewer loans during periods of rising interest rates, we will not be able to reinvest prepayment proceeds in assets with higher interest rates. As a result, our financial performance, the market prices of our securities and our ability to pay dividends could be materially adversely affected.

We Are Subject to Risks Relating to Our Corporate Tenant Lease Business.

We may experience losses if the creditworthiness of our tenants deteriorates and they are unable to meet their obligations under our leases.

We own the properties leased to the tenants of our CTL assets and we receive rents from the tenants during the terms of our leases. A tenant’s ability to pay rent is determined by the creditworthiness of the tenant. If a tenant’s credit deteriorates, the tenant may default on its obligations under our lease and the tenant may also become bankrupt. The bankruptcy or insolvency or other failure to pay of our tenants is likely to adversely affect the income produced by our CTL assets. If a tenant defaults, we may experience delays and incur substantial costs in enforcing our rights as landlord. If a tenant files for bankruptcy, we may not be able to evict the tenant solely because of such bankruptcy or failure to pay. A court, however, may authorize a tenant to reject and terminate its lease with us. In such a case, our claim against the tenant for unpaid, future rent would be subject to a statutory cap that might be substantially less than the remaining rent owed under the lease. In addition, certain amounts paid to us within 90 days prior to the tenant’s bankruptcy filing could be required to be returned to the tenant’s bankruptcy estate. In any event, it is highly unlikely that a bankrupt or insolvent tenant would pay in full amounts it owes us under a lease. In other circumstances, where a tenant’s financial condition has become impaired, we may agree to partially or wholly terminate the lease in advance of the termination date in consideration for a lease termination fee that is likely less than the agreed rental amount. Without regard to the manner in which the lease termination occurs, we are likely to incur additional costs in the form of tenant improvements and leasing commissions in our efforts to lease the space to a new tenant. In any of the foregoing circumstances, our financial performance, the market prices of our securities and our ability to pay dividends could be materially adversely affected.

We may be unable to renew leases or relet space on similar terms, or at all, as leases expire or are terminated, or may expend significant capital in our efforts to relet space

As of December 31, 2005, the percentage of our revenues (based on annualized GAAP operating lease income for leases in place at December 31, 2005, as a percentage of annualized total revenue for the quarter ended December 31, 2005) that are subject to expiring leases during each year from 2006 through 2010 is as follows:

2006 | | 2.6 | % |

2007 | | 4.1 | % |

2008 | | 1.2 | % |

2009 | | 0.8 | % |

2010 | | 1.7 | % |

Lease expirations, lease defaults and lease terminations may result in reduced revenues if the lease payments received from replacement corporate tenants are less than the lease payments received from the expiring, defaulting or terminating corporate tenants. Lease defaults by one or more significant corporate tenants, lease terminations by corporate tenants following events of casualty or takings by eminent domain, or the failure of corporate tenants under expiring leases to elect to renew their leases, could cause us to

17

experience long periods of vacancy with no revenue from a facility. In addition, if we need to re-lease a corporate facility, we may need to make significant tenant improvements, including conversions of single tenant buildings to multi-tenant buildings. The loss of revenue from expiring, defaulted or terminated leases, and the costs of capital improvements could materially adversely affect our financial performance, the market prices of our securities and our ability to pay dividends.

Our properties face significant competition which may impede our ability to retain tenants or re-let space when existing tenants vacate.

We face significant competition from other owners, operators and developers of office properties, many of which own properties similar to ours in the markets in which we operate. Such competition may affect our ability to attract and retain tenants and reduce the rents we are able to charge. These competing properties may have vacancy rates higher than our properties, which may result in their owners being willing to rent space at lower rental rates than we or in their owners providing greater tenant improvement allowances or other leasing concessions. This combination of circumstances could adversely affect our financial performance, the market prices of our securities and our ability to pay dividends.

Our ownership interests in corporate facilities are illiquid, hindering our ability to mitigate a loss.

Since our ownership interests in corporate facilities are illiquid, we may lack the necessary flexibility to vary our investment strategy promptly to respond to changes in market conditions. This could have a material adverse effect on our financial performance, the market prices of our securities and our ability to pay dividends.

We Compete With a Variety of Financing Sources for our Customers.

Our markets are highly competitive. Our competitors include finance companies, other REITs, commercial banks and thrift institutions, investment banks and hedge funds. Competition from both traditional competitors and new market entrants has intensified in recent years due to a strong economy, growing marketplace liquidity and increasing recognition of the attractiveness of the commercial real estate finance markets. In addition, the rapid expansion of the securitization markets is dramatically reducing the difficulty in obtaining access to capital, which is the principal barrier to entry into these markets. This trend is further intensifying competition in certain market segments, including increasing competition from specialized securitization lenders which offer aggressive pricing terms. Our competitors seek to compete aggressively on the basis of transaction pricing, terms and structure and we may lose market share to the extent we are unwilling to match our competitors’ pricing, terms and structure in order to maintain interest margins and/or credit standards. To the extent that we match competitors’ pricing, terms or structure, we may experience decreased interest margins and/or increased risk of credit losses, which could have a material adverse effect on our financial performance, the market prices of our securities and our ability to pay dividends.

We Are Subject to Risks Relating to Our Asset Concentration.

As of December 31, 2005, the average size of our lending investments was $28.5 million and the average size of our CTL investments was $28.6 million. Of our annualized revenues for the quarter ended December 31, 2005, 18.9% were derived from our five largest borrowers or corporate customers, collectively. No single loan or CTL investment represents more than 5.0% of our annualized revenues for the fiscal quarter ended December 31, 2005. While our asset base is diversified by product line, asset type, obligor, property type and geographic location, it is possible that if we suffer losses on a portion of our larger assets, our financial performance, the market prices of our securities and our ability to pay dividends could be materially adversely affected.

18

Adverse Changes in General Economic Conditions Can Adversely Affect Our Business.

Our success is dependent upon the general economic conditions in the geographic areas in which a substantial number of our investments are located. Adverse changes in national economic conditions or in the economic conditions of the regions in which we conduct substantial business likely would have an adverse effect on real estate values and, accordingly, our financial performance, the market prices of our securities and our ability to pay dividends business.

In a recession or under other adverse economic conditions, non-earning assets and write-downs are likely to increase as debtors fail to meet their payment obligations. Although we maintain reserves for credit losses and an allowance for doubtful accounts in amounts that we believe are sufficient to provide adequate protection against potential write-downs in our portfolio, these amounts could prove to be insufficient.

A recession or downturn could contribute to a downgrading of our credit ratings. A ratings downgrade likely would increase our funding costs, and could decrease our net investment income, limit our access to the capital markets or result in a decision by the lenders under our existing bank credit facilities not to extend such credit facilities after their expiration. Such results could have a material adverse effect on our financial performance, the market prices of our securities and our ability to pay dividends

An earthquake or terrorist act could adversely affect our business

Approximately 28% of the gross carrying value of our assets as of December 31, 2005, were located in the West and Northwest United States, which are high risk geographical areas for earthquakes. In addition, a significant number of properties collateralizing our loans are located in New York City and other major urban areas which have, in recent years, been high risk geographical areas for terrorism and threats of terrorism. Future earthquakes or acts of terrorism could adversely impact the demand for, and value of, our assets and could also directly impact the value of our assets through damage, destruction or loss, and could thereafter materially impact the availability or cost of insurance to protect against these events. Any earthquake or terrorist attack, whether or not insured, could have a material adverse effect on our financial performance, the market prices of our securities and our ability to pay dividends.

Uninsured losses or losses in excess of our insurance coverage could adversely affect our financial condition and our cash flows

Although we believe our CTL assets and the properties collateralizing our loan assets are adequately covered by insurance, we cannot predict at this time if we or our borrowers will be able to obtain appropriate coverage at a reasonable cost in the future, or if we will be able to continue to pass along all of the costs of insurance to our tenants. In response to the uncertainty in the insurance market following the terrorist attacks of September 11, 2001, the Terrorism Risk Insurance Act of 2002 (“TRIA”) was enacted in November 2002, which established the Terrorism Risk Insurance Program to mandate that insurance carriers offer insurance covering physical damage from terrorist incidents certified by the U.S. government as foreign terrorist acts. Under the Terrorism Risk Insurance Program, the federal government shares in the risk of loss associated with certain future terrorist acts. The Terrorism Risk Insurance Program was scheduled to expire on December 31, 2005. However, on December 22, 2005, the Terrorism Risk Insurance Extension Act of 2005 (the “Extension Act”) was enacted, which extended the duration of the Terrorism Risk Insurance Program until December 31, 2007, while expanding the private sector role and reducing the amount of coverage that the U.S. government is required to provide for insured losses under the program. While the underlying structure of TRIA was left intact, the Extension Act makes some adjustments, including increasing the current insurer deductible from 15% of direct earned premiums to 17.5% for 2006, and to 20% of such premiums in 2007. For losses in excess of the deductible, the federal government still reimburses 90% of the insurer’s loss in 2007. The federal share in the aggregate in any

19

program year may not exceed $100 billion (the insurers will not be liable for any amount that exceeds this cap). Under the Extension Act, losses incurred as a result of an act of terrorism are required to exceed $5.0 million before the program is triggered and compensation is paid under the program, but that amount increases to $50.0 million on April 1, 2006, and to $100.0 million in 2007. As a result, unless we and our borrowers obtain separate coverage for events that do not meet that threshold (which coverage may not be required by the respective loan documents and may not otherwise be obtainable), such events would not be covered. In addition, the recently enacted legislation may subsequently result in increased premiums charged by insurance carriers for terrorism insurance.

We are highly dependent on information systems, and systems failures could significantly disrupt our business.

As a financial services firm, our business is highly dependent on communications and information systems. Any failure or interruption of our systems could cause delays or other problems in our activities, which could have a material adverse effect on our financial performance, the market prices of our securities and our ability to pay dividends.

We Face a Risk of Liability Under Environmental Laws.

Under various U.S. federal, state and local environmental laws, ordinances and regulations, a current or previous owner of real estate (including, in certain circumstances, a secured lender that succeeds to ownership or control of a property) may become liable for the costs of removal or remediation of certain hazardous or toxic substances at, on, under or in its property. Those laws typically impose cleanup responsibility and liability without regard to whether the owner or control party knew of or was responsible for the release or presence of such hazardous or toxic substances. The costs of investigation, remediation or removal of those substances may be substantial. The owner or control party of a site may be subject to common law claims by third parties based on damages and costs resulting from environmental contamination emanating from a site. Certain environmental laws also impose liability in connection with the handling of or exposure to asbestos-containing materials, pursuant to which third parties may seek recovery from owners of real properties for personal injuries associated with asbestos-containing materials. Absent succeeding to ownership or control of real property, a secured lender is not likely to be subject to any of these forms of environmental liability. Additionally, under our CTL assets we require our tenants to undertake the obligation for environmental compliance and indemnify us from liability with respect thereto. There can be no assurance that our tenants will have sufficient resources to satisfy their obligations to us.

Strategic Investments Involve Risks.

We have made and expect to continue to make strategic investments in complementary businesses. Strategic investments may involve the incurrence of additional debt and contingent liabilities. In addition, we may incur expenses from these investments, or they may require substantial investments of additional capital, before they begin generating anticipated returns. Strategic transactions involve risks, including:

· Difficulties in assimilating the operations, products, technology, information systems and personnel of the acquired business.

· Potentially dilutive issuances of equity securities and the incurrence of additional debt in connection with future acquisitions.

· Diverting management’s attention from other business concerns.

· Difficulties in maintaining uniform standards, controls, procedures and policies.

· Entering markets in which we have limited prior experience.

20

· Losing key employees or customers of the acquired business.

These factors could have a material adverse effect on our financial performance, the market prices of our securities and our ability to pay dividends.

Because We Must Distribute a Portion of Our Income, We Will Continue to Need Additional Debt and/or Equity Capital to Grow.

We generally must distribute at least 90% of our net taxable income to our stockholders to maintain our REIT status. As a result, those earnings will not be available to fund investment activities. We have historically funded our investments by borrowing from financial institutions and raising capital in the public and private capital markets. We expect to continue to fund our investments this way. If we fail to obtain funds from these sources, it could limit our ability to grow, which could have a material adverse effect on the value of our common stock. Our taxable income has historically been lower than the cash flow generated by our business activities, primarily because our taxable income is reduced by non-cash expenses, such as depreciation, depletion and amortization. As a result, our dividend payout ratio as a percentage of our adjusted earnings (see Item 7: “Adjusted Earnings”) has generally been lower than our payout ratio as a percentage of net taxable income.

Our Growth is Dependent on Leverage, Which May Create Other Risks.

Our success is dependent, in part, upon our ability to use of leverage on our balance sheet. Our ability to obtain the leverage necessary for execution of our business plan will ultimately depend upon our ability to maintain interest coverage ratios meeting market underwriting standards that will vary according to lenders’ assessments of our creditworthiness and the terms of the borrowings. As of December 31, 2005, our debt-to-book equity plus accumulated depreciation, depletion and loan loss reserves ratio was 2.1x and our total carrying value of debt obligations outstanding was approximately $5.9 billion. Our charter does not limit the amount of indebtedness which we may incur. Our Board of Directors has overall responsibility for our financing strategy. Stockholder approval is not required for changes to our financing strategy. If our Board of Directors decided to increase our leverage, it could lead to reduced or negative cash flow and reduced liquidity.

The percentage of leverage used will vary depending on our estimate of the stability of our cash flow. To the extent that changes in market conditions cause the cost of such financing to increase relative to the income that can be derived from the assets originated, we may reduce the amount of our leverage. Leverage creates an opportunity for increased net income, but at the same time creates risks. For example, leveraging magnifies changes in our net worth. We will incur leverage only when there is an expectation that it will enhance returns, although there can be no assurance that our use of leverage will prove to be beneficial. Moreover, there can be no assurance that we will be able to meet our debt service obligations and, to the extent that we cannot, we risk the loss of some or all of our assets or a financial loss if we are required to liquidate assets at a commercially inopportune time.

We and our subsidiaries are parties to agreements and debt instruments that restrict future indebtedness and the payment of dividends, including indirect restrictions (through, for example, covenants requiring the maintenance of specified levels of net worth and earnings to debt service ratios) and direct restrictions. As a result, in the event of a deterioration in our financial condition, these agreements or debt instruments could restrict our ability to pay dividends. Moreover, if we fail to pay dividends as required by the Code whether as a result of restrictive covenants in our debt instruments or otherwise, we may lose our qualification as a REIT. For more information regarding the consequences of loss of REIT qualification, please read the risk factor entitled “We May Be Subject to Adverse Consequences if We Fail to Qualify as a REIT.”

21

We Utilize Interest Rate Hedging Arrangements Which May Adversely Affect Our Borrowing Cost and Expose Us to Other Risks.

We have variable rate lending assets and variable rate debt obligations. These assets and liabilities create a natural hedge against changes in variable interest rates. This means that as interest rates increase, we earn more on our variable rate lending assets and pay more on our variable rate debt obligations and, conversely, as interest rates decrease, we earn less on our variable rate lending assets and pay less on our variable rate debt obligations. When our variable rate debt obligations exceed our variable rate lending assets, we utilize derivative instruments to limit the impact of changing interest rates on our net income. We do not use derivative instruments to hedge assets or for speculative purposes. The derivative instruments we use are typically in the form of interest rate swaps and interest rate caps. Interest rate swaps effectively change variable rate debt obligations to fixed rate debt obligations or fixed rate debt obligations to variable rate debt obligations. Interest rate caps effectively limit the maximum interest rate on variable rate debt obligations.

The primary risks from our use of derivative instruments is the risk that a counterparty to a hedging arrangement could default on its obligation and the risk that we may have to pay certain costs, such as transaction fees or breakage costs, if a hedging arrangement is terminated by us. As a matter of policy, we enter into hedging arrangements with counterparties that are large, creditworthy financial institutions typically rated at least “A” and “A2” by S&P and Moody’s Investors Service, respectively. Our hedging strategy is monitored by our Audit Committee on behalf of our Board of Directors and may be changed by the Board of Directors without stockholder approval.

Developing an effective strategy for dealing with movements in interest rates is complex and no strategy can completely insulate us from risks associated with such fluctuations. There can be no assurance that our hedging activities will have the desired beneficial impact on our results of operations or financial condition.

Quarterly Results May Fluctuate and May Not Be Indicative of Future Quarterly Performance.

Our quarterly operating results could fluctuate; therefore, you should not rely on past quarterly results to be indicative of our performance in future quarters. Factors that could cause quarterly operating results to fluctuate include, among others, variations in our investment origination volume, variations in the timing of prepayments, the degree to which we encounter competition in our markets and general economic conditions.

Certain Provisions in Our Charter May Inhibit a Change in Control.

Generally, to maintain our qualification as a REIT under the Code, not more than 50% in value of our outstanding shares of stock may be owned, directly or indirectly, by five or fewer individuals at any time during the last half of our taxable year. The Code defines “individuals” for purposes of the requirement described in the preceding sentence to include some types of entities. Under our charter, no person may own more than 9.8% of our outstanding shares of stock, with some exceptions. The restrictions on transferability and ownership may delay, deter or prevent a change in control or other transaction that might involve a premium price or otherwise be in the best interest of the security holders.

Our charter authorizes our Board of Directors:

1. To cause us to issue additional authorized but unissued shares of common or preferred stock.

2. To classify or reclassify, in one or more series, any of our unissued preferred shares.

3. To set the preferences, rights and other terms of any classified or reclassified securities that we issue.

22

Our Board of Directors May Change Certain of Our Policies Without Stockholder Approval.