UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-09597

LORD ABBETT STOCK APPRECIATION FUND

(Exact name of Registrant as specified in charter)

90 Hudson Street, Jersey City, NJ 07302

(Address of principal executive offices) (Zip code)

Thomas R. Phillips, Esq., Vice President & Assistant Secretary

90 Hudson Street, Jersey City, NJ 07302

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 201-6984

Date of fiscal year end: 7/31

Date of reporting period: 7/31/2011

| Item 1: | Report(s) to Shareholders. |

2011

LORD ABBETT

ANNUAL

REPORT

Lord Abbett

Stock Appreciation Fund

For the fiscal year ended July 31, 2011

Lord Abbett Stock Appreciation Fund

Annual Report

For the fiscal year ended July 31, 2011

From left to right: Robert S. Dow, Director and Chairman of the Lord Abbett Funds; E. Thayer Bigelow, Independent Lead Director of the Lord Abbett Funds; and Daria L. Foster, Director and President of the Lord Abbett Funds.

Dear Shareholders: We are pleased to provide you with this overview of the performance of the Lord Abbett Stock Appreciation Fund for the fiscal year ended July 31, 2011. On this page and the following pages, we discuss the major factors that influenced performance. For detailed and more timely information about the Fund, please visit our Website at www.lordabbett.com, where you also can access the quarterly commentaries by the Fund’s portfolio managers.

Thank you for investing in Lord Abbett mutual funds. We value the trust that you place in us and look forward to serving your investment needs in the years to come.

Best regards,

Robert S. Dow

Chairman

For the fiscal year ended July 31, 2011, the Fund returned 21.39%, reflecting performance at the net asset value (NAV) of Class A shares, with all distributions reinvested, compared to its benchmark, the Russell 1000® Growth Index1, which returned 24.75% over the same period.

The 12-month period was positive for equities, as expanding corporate earnings supported higher market prices. In recent months, however, factors such as the ongoing European debt crisis, the tsunami in Japan, and stubbornly high unemployment in the United States have led to greater market volatility. Our overweight of cyclical companies-those more closely tied to economic expansion-detracted from performance as slower economic growth became more apparent to market participants.

Although our holdings within the technology sector posted a double-digit average return, our performance within the group was hampered by a handful of networking names, and we were not able to keep pace with the index in this category. Shares of Finisar Corp., a producer of optical communications

1

components and subsystems, declined as demand from Chinese equipment vendors slowed. Equinix, Inc., which manages centers for offsite data storage, declined in October 2010 after the company lowered earnings guidance and cited increasing pricing pressure.

Stock selection within the financials sector also detracted from Fund performance relative to the index. Shares of Bank of America Corp. declined during the period as uncertainty persisted about ongoing capital requirements. Shares of Lazard Ltd., an investment banking and asset management firm, declined as merger and acquisition activity was not as robust as investors had expected.

Stock selection within the consumer discretionary sector contributed to Fund performance. Shares of online retailer Amazon.com, Inc. appreciated as the firm’s retail Website gained market share and demand accelerated for the Kindle e-book reader. Teen apparel retailer Abercrombie & Fitch Co. also contributed to performance as the firm continued to successfully implement a multiyear plan to open new stores in international locations and to expand direct-to-consumer distribution.

The materials sector also contributed to Fund performance during the period. Chemical company Huntsman Corp., which has exposure to a variety of cyclical end markets, benefitted from strong pricing and better than expected demand. LyondellBasell Ind., a leading plastics, chemicals and refining company, has realized efficiencies from the merger of Lyondell Chemical Co. and Basell and is benefiting from the spread between crude oil and natural gas.

The Fund’s portfolio is actively managed and, therefore, its holdings and the weightings of a particular issuer or particular sector as a percentage of portfolio assets are subject to change. Sectors may include many industries.

1 The Russell 1000® Growth Index measures the performance of those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values.

Unless otherwise specified, indexes reflect total return, with all dividends reinvested. Indexes are unmanaged, do not reflect the deduction of fees or expenses, and are not available for direct investment.

Important Performance and Other Information

Performance data quoted in the following pages reflect past performance and are no guarantee of future results. Current performance may be higher or lower than the performance quoted. The investment return and principal value of an investment in the Fund will fluctuate so that shares, on any given day or when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by calling Lord Abbett at 888-522-2388 or referring to www.lordabbett.com.

During the certain periods shown, expense waivers and reimbursements were in place. Without such expense waivers and reimbursements, the Fund’s returns would have been lower.

Except where noted, comparative Fund performance does not account for the deduction of sales charges and would be different if sales charges were included. The Fund offers several classes of shares with distinct pricing options. For a full description of the differences in pricing alternatives, please see the Fund’s prospectus.

2

The annual commentary above discusses the views of the Fund’s management and various portfolio holdings of the Fund as of July 31, 2011. These views and portfolio holdings may have changed after this date. Information provided in the commentary is not a recommendation to buy or sell securities. Because the Fund’s portfolio is actively managed and may change significantly, the Fund may no longer own the securities described above or may have otherwise changed its positions in the securities. For more recent information about the Fund’s portfolio holdings, please visit www.lordabbett.com.

A Note about Risk: See Notes to Financial Statements for a discussion of investment risks. For a more detailed discussion of the risks associated with the Fund, please see the Fund’s prospectus.

Mutual funds are not insured by the FDIC, are not deposits or other obligations of, or guaranteed by, banks, and are subject to investment risks including possible loss of principal amount invested.

3

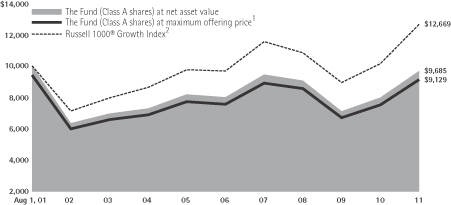

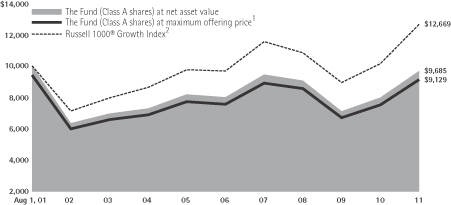

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the Russell 1000® Growth Index, assuming reinvestment of all dividends and distributions. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During certain periods, expenses of the Fund have been waived or reimbursed by Lord Abbett; without such waiver or reimbursement of expenses, the Fund’s returns would have been lower. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable

Sales Charge for the Periods Ended July 31, 2011

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | | | Life of Class | |

Class A3 | | | 14.37% | | | | 2.64% | | | | -0.91% | | | | – | |

Class B4 | | | 16.55% | | | | 3.03% | | | | -0.83% | | | | – | |

Class C5 | | | 20.55% | | | | 3.20% | | | | -0.93% | | | | – | |

Class F6 | | | 21.61% | | | | – | | | | – | | | | -1.38% | |

Class I7 | | | 21.83% | | | | 4.23% | | | | -0.10% | | | | – | |

Class P7 | | | 21.61% | | | | 3.91% | | | | -0.21% | | | | – | |

Class R28 | | | 21.76% | | | | – | | | | – | | | | -1.30% | |

Class R39 | | | 21.27% | | | | – | | | | – | | | | -1.76% | |

1 Reflects the deduction of the maximum initial sales charge of 5.75%.

2 Performance of the unmanaged index does not reflect any fees or expenses. The performance of the index is not necessarily representative of the Fund’s performance.

3 Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 5.75% applicable to Class A shares, with all dividends and distributions reinvested for the periods shown ended July 31, 2011, is calculated using the SEC-required uniform method to compute such return.

4 Performance reflects the deduction of a CDSC of 4% for 1 year, 1% for 5 years and 0% for 10 years. Class B shares automatically convert to Class A shares after approximately 8 years.

(There is no initial sales charge for automatic conversions.) All returns for periods greater than 8 years reflect this conversion.

5 The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance is at net asset value.

6 Class F shares commenced operations and performance for the Class began on September 28, 2007. Performance is at net asset value.

7 Performance is at net asset value.

8 Class R2 shares commenced operations and performance for the Class began on September 28, 2007. Performance is at net asset value.

9 Class R3 shares commenced operations and performance for the Class began on September 28, 2007. Performance is at net asset value.

4

Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments (these charges vary among the share classes); and (2) ongoing costs, including management fees; distribution and service (12b-1) fees (these charges vary among the share classes); and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (February 1, 2011 through July 31, 2011).

Actual Expenses

For each class of the Fund, the first line of the applicable table on the following page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading titled “Expenses Paid During Period 2/1/11 –7/31/11” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each class of the Fund, the second line of the applicable table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

5

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | |

| | | Beginning

Account

Value | | | Ending

Account

Value | | | Expenses

Paid During

Period† | |

| | | 2/1/11 | | | 7/31/11 | | | 2/1/11 -

7/31/11 | |

Class A | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,001.60 | | | $ | 7.20 | |

Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,017.63 | | | $ | 7.25 | |

Class B | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 998.20 | | | $ | 10.31 | |

Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,014.48 | | | $ | 10.39 | |

Class C | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 998.20 | | | $ | 9.76 | |

Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,015.02 | | | $ | 9.84 | |

Class F | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,001.60 | | | $ | 5.96 | |

Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,018.84 | | | $ | 6.01 | |

Class I | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,003.20 | | | $ | 5.46 | |

Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,019.34 | | | $ | 5.51 | |

Class P | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,003.20 | | | $ | 6.01 | |

Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,018.80 | | | $ | 6.06 | |

Class R2 | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,001.60 | | | $ | 5.36 | |

Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,019.44 | | | $ | 5.41 | |

Class R3 | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 7.79 | |

Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,017.01 | | | $ | 7.85 | |

| † | | For each class of the Fund, net expenses are equal to the annualized expense ratio for such class (1.45% for Class A, 2.08% for Class B, 1.97% for Class C, 1.20% for Class F, 1.10% for Class I, 1.21% for Class P, 1.08% for Class R2 and 1.57% for Class R3) multiplied by the average account value over the period, multiplied by 181/365 (to reflect one-half year period). |

Portfolio Holdings Presented by Sector

July 31, 2011

| | | | | | | | | | | | |

| Sector* | | %** | | | | | Sector* | | %** | |

Consumer Discretionary | | | 16.26% | | | | | Industrials | | | 12.84% | |

Consumer Staples | | | 2.99% | | | | | Information Technology | | | 33.03% | |

Energy | | | 13.45% | | | | | Materials | | | 7.91% | |

Financials | | | 4.63% | | | | | Short-Term Investment | | | 0.41% | |

Health Care | | | 8.48% | | | | | Total | | | 100.00% | |

| * | | A sector may comprise several industries. |

| ** | | Represents percent of total investments. |

6

Schedule of Investments

July 31, 2011

| | | | | | | | |

| Investments | | Shares | | | Fair

Value

(000) | |

| COMMON STOCKS 100.31% | |

|

| Aerospace & Defense 3.60% | |

| Boeing Co. (The) | | | 13,988 | | | $ | 986 | |

| Honeywell International, Inc. | | | 50,914 | | | | 2,704 | |

| Precision Castparts Corp. | | | 14,910 | | | | 2,406 | |

| United Technologies Corp. | | | 11,774 | | | | 975 | |

| | | | | | | | |

| Total | | | | | | | 7,071 | |

| | | | | | | | |

|

| Auto Components 0.58% | |

| Johnson Controls, Inc. | | | 30,855 | | | | 1,140 | |

| | | | | | | | |

|

| Beverages 0.42% | |

| Coca-Cola Co. (The) | | | 12,231 | | | | 832 | |

| | | | | | | | |

|

| Biotechnology 1.06% | |

| Alexion Pharmaceuticals, Inc.* | | | 22,054 | | | | 1,253 | |

| Dendreon Corp.* | | | 22,666 | | | | 836 | |

| | | | | | | | |

| Total | | | | | | | 2,089 | |

| | | | | | | | |

|

| Capital Markets 2.56% | |

| Ameriprise Financial, Inc. | | | 23,085 | | | | 1,249 | |

| BlackRock, Inc. | | | 5,406 | | | | 965 | |

| Franklin Resources, Inc. | | | 15,424 | | | | 1,958 | |

| Lazard Ltd. Class A | | | 25,200 | | | | 847 | |

| | | | | | | | |

| Total | | | | | | | 5,019 | |

| | | | | | | | |

|

| Chemicals 5.12% | |

| Celanese Corp. Series A | | | 29,195 | | | | 1,610 | |

| Dow Chemical Co. (The) | | | 52,597 | | | | 1,834 | |

| Huntsman Corp. | | | 48,744 | | | | 931 | |

| Kronos Worldwide, Inc. | | | 25,102 | | | | 777 | |

LyondellBasell Industries NV Class A (Netherlands)(a) | | | 48,564 | | | | 1,916 | |

| Monsanto Co. | | | 29,534 | | | | 2,170 | |

| Praxair, Inc. | | | 7,929 | | | | 822 | |

| | | | | | | | |

| Total | | | | | | | 10,060 | |

| | | | | | | | |

| | | | | | | | |

| Investments | | Shares | | | Fair

Value

(000) | |

| Commercial Banks 0.57% | |

PNC Financial Services Group, Inc. (The) | | | 20,547 | | | $ | 1,116 | |

| | | | | | | | |

|

| Communications Equipment 3.68% | |

| Aruba Networks, Inc.* | | | 32,009 | | | | 735 | |

| Ciena Corp.* | | | 28,852 | | | | 446 | |

| Juniper Networks, Inc.* | | | 33,107 | | | | 774 | |

| QUALCOMM, Inc. | | | 96,143 | | | | 5,267 | |

| | | | | | | | |

| Total | | | | | | | 7,222 | |

| | | | | | | | |

|

| Computers & Peripherals 11.58% | |

| Apple, Inc.* | | | 35,808 | | | | 13,982 | |

| EMC Corp.* | | | 132,282 | | | | 3,450 | |

| International Business Machines Corp. | | | 12,512 | | | | 2,275 | |

| NetApp, Inc.* | | | 32,231 | | | | 1,532 | |

| Teradata Corp.* | | | 27,325 | | | | 1,502 | |

| | | | | | | | |

| Total | | | | | | | 22,741 | |

| | | | | | | | |

|

| Construction & Engineering 0.62% | |

| Fluor Corp. | | | 19,043 | | | | 1,210 | |

| | | | | | | | |

|

| Diversified Financial Services 0.95% | |

| JPMorgan Chase & Co. | | | 45,900 | | | | 1,857 | |

| | | | | | | | |

|

| Electrical Equipment 1.72% | |

| Cooper Industries plc | | | 19,482 | | | | 1,019 | |

| Emerson Electric Co. | | | 28,378 | | | | 1,393 | |

| Rockwell Automation, Inc. | | | 13,454 | | | | 966 | |

| | | | | | | | |

| Total | | | | | | | 3,378 | |

| | | | | | | | |

|

| Electronic Equipment, Instruments & Components 0.68% | |

| Agilent Technologies, Inc.* | | | 31,546 | | | | 1,330 | |

| | | | | | | | |

|

| Energy Equipment & Services 6.78% | |

| Cameron International Corp.* | | | 44,750 | | | | 2,504 | |

| Halliburton Co. | | | 74,072 | | | | 4,054 | |

| National Oilwell Varco, Inc. | | | 20,730 | | | | 1,670 | |

See Notes to Financial Statements.

7

Schedule of Investments (continued)

July 31, 2011

| | | | | | | | |

| Investments | | Shares | | | Fair

Value

(000) | |

| Energy Equipment & Services (continued) | |

| Schlumberger Ltd. | | | 56,270 | | | $ | 5,085 | |

| | | | | | | | |

| Total | | | | | | | 13,313 | |

| | | | | | | | |

|

| Food & Staples Retailing 1.24% | |

| Costco Wholesale Corp. | | | 18,339 | | | | 1,435 | |

| Walgreen Co. | | | 25,464 | | | | 994 | |

| | | | | | | | |

| Total | | | | | | | 2,429 | |

| | | | | | | | |

|

| Health Care Equipment & Supplies 1.67% | |

| Intuitive Surgical, Inc.* | | | 3,729 | | | | 1,494 | |

| St. Jude Medical, Inc. | | | 38,528 | | | | 1,791 | |

| | | | | | | | |

| Total | | | | | | | 3,285 | |

| | | | | | | | |

|

| Health Care Providers & Services 1.92% | |

| Humana, Inc. | | | 12,016 | | | | 896 | |

| McKesson Corp. | | | 15,649 | | | | 1,269 | |

| UnitedHealth Group, Inc. | | | 32,335 | | | | 1,605 | |

| | | | | | | | |

| Total | | | | | | | 3,770 | |

| | | | | | | | |

|

| Health Care Technology 0.76% | |

| Cerner Corp.* | | | 22,474 | | | | 1,494 | |

| | | | | | | | |

|

| Hotels, Restaurants & Leisure 3.34% | |

| Las Vegas Sands Corp.* | | | 33,495 | | | | 1,580 | |

Marriott International, Inc. Class A | | | 17,592 | | | | 572 | |

| MGM Resorts International* | | | 99,022 | | | | 1,496 | |

| Wynn Resorts Ltd. | | | 13,712 | | | | 2,107 | |

| Yum! Brands, Inc. | | | 15,276 | | | | 807 | |

| | | | | | | | |

| Total | | | | | | | 6,562 | |

| | | | | | | | |

|

| Household Durables 0.45% | |

| Tempur-Pedic International, Inc.* | | | 12,197 | | | | 878 | |

| | | | | | | | |

|

| Information Technology Services 2.44% | |

| Accenture plc Class A (Ireland)(a) | | | 21,246 | | | | 1,257 | |

Cognizant Technology Solutions Corp. Class A* | | | 13,630 | | | | 952 | |

| | | | | | | | |

| Investments | | Shares | | | Fair

Value

(000) | |

| MasterCard, Inc. Class A | | | 8,483 | | | $ | 2,572 | |

| | | | | | | | |

| Total | | | | | | | 4,781 | |

| | | | | | | | |

|

| Internet & Catalog Retail 3.64% | |

| Amazon.com, Inc.* | | | 24,093 | | | | 5,361 | |

| Netflix, Inc.* | | | 3,565 | | | | 948 | |

| priceline.com, Inc.* | | | 1,540 | | | | 828 | |

| | | | | | | | |

| Total | | | | | | | 7,137 | |

| | | | | | | | |

|

| Internet Software & Services 5.45% | |

| Baidu, Inc. ADR* | | | 11,822 | | | | 1,857 | |

| eBay, Inc.* | | | 71,372 | | | | 2,337 | |

| Google, Inc. Class A* | | | 9,978 | | | | 6,024 | |

| Linkedln Corp. Class A* | | | 4,784 | | | | 483 | |

| | | | | | | | |

| Total | | | | | | | 10,701 | |

| | | | | | | | |

|

| Life Sciences Tools & Services 0.58% | |

| Thermo Fisher Scientific, Inc.* | | | 18,959 | | | | 1,139 | |

| | | | | | | | |

|

| Machinery 6.00% | |

| Caterpillar, Inc. | | | 23,352 | | | | 2,307 | |

| Cummins, Inc. | | | 19,998 | | | | 2,097 | |

| Danaher Corp. | | | 19,207 | | | | 943 | |

| Dover Corp. | | | 30,735 | | | | 1,859 | |

| Eaton Corp. | | | 27,641 | | | | 1,325 | |

| Joy Global, Inc. | | | 14,911 | | | | 1,401 | |

| SPX Corp. | | | 13,119 | | | | 987 | |

| Trinity Industries, Inc. | | | 29,072 | | | | 866 | |

| | | | | | | | |

| Total | | | | | | | 11,785 | |

| | | | | | | | |

|

| Media 1.19% | |

| Viacom, Inc. Class B | | | 48,200 | | | | 2,334 | |

| | | | | | | | |

|

| Metals & Mining 2.13% | |

| Cliffs Natural Resources, Inc. | | | 19,113 | | | | 1,717 | |

| Freeport-McMoRan Copper & Gold, Inc. | | | 46,513 | | | | 2,463 | |

| | | | | | | | |

| Total | | | | | | | 4,180 | |

| | | | | | | | |

See Notes to Financial Statements.

8

Schedule of Investments (continued)

July 31, 2011

| | | | | | | | |

| Investments | | Shares | | | Fair

Value

(000) | |

| Multi-Line Retail 0.91% | |

| Nordstrom, Inc. | | | 35,730 | | | $ | 1,792 | |

| | | | | | | | |

|

| Oil, Gas & Consumable Fuels 6.77% | |

| Apache Corp. | | | 16,426 | | | | 2,032 | |

| CONSOL Energy, Inc. | | | 26,250 | | | | 1,407 | |

| Continental Resources, Inc.* | | | 15,361 | | | | 1,054 | |

| EOG Resources, Inc. | | | 9,416 | | | | 960 | |

| Exxon Mobil Corp. | | | 35,433 | | | | 2,827 | |

| Occidental Petroleum Corp. | | | 23,216 | | | | 2,279 | |

| Peabody Energy Corp. | | | 15,252 | | | | 877 | |

| Pioneer Natural Resources Co. | | | 8,786 | | | | 817 | |

| Southwestern Energy Co.* | | | 23,248 | | | | 1,036 | |

| | | | | | | | |

| Total | | | | | | | 13,289 | |

| | | | | | | | |

|

| Paper & Forest Products 0.71% | |

| International Paper Co. | | | 47,094 | | | | 1,399 | |

| | | | | | | | |

|

| Personal Products 0.80% | |

| Estee Lauder Cos., Inc. (The) Class A | | | 15,049 | | | | 1,579 | |

| | | | | | | | |

|

| Pharmaceuticals 2.54% | |

| Allergan, Inc. | | | 21,563 | | | | 1,753 | |

| Novo Nordisk AS ADR | | | 10,519 | | | | 1,284 | |

| Watson Pharmaceuticals, Inc.* | | | 29,004 | | | | 1,947 | |

| | | | | | | | |

| Total | | | | | | | 4,984 | |

| | | | | | | | |

|

| Professional Services 0.50% | |

| Robert Half International, Inc. | | | 35,465 | | | | 971 | |

| | | | | | | | |

|

| Real Estate Management & Development 0.59% | |

| CB Richard Ellis Group, Inc. Class A* | | | 52,994 | | | | 1,155 | |

| | | | | | | | |

|

| Road & Rail 0.50% | |

| CSX Corp. | | | 39,648 | | | | 974 | |

| | | | | | | | |

| | | | | | | | |

| Investments | | Shares | | | Fair

Value

(000) | |

| Semiconductors & Semiconductor Equipment 2.44% | |

| Altera Corp. | | | 39,697 | | | $ | 1,623 | |

| Broadcom Corp. Class A* | | | 32,131 | | | | 1,191 | |

| Cypress Semiconductor Corp.* | | | 53,625 | | | | 1,104 | |

| Micron Technology, Inc.* | | | 119,332 | | | | 879 | |

| | | | | | | | |

| Total | | | | | | | 4,797 | |

| | | | | | | | |

|

| Software 7.00% | |

| Ariba, Inc.* | | | 41,124 | | | | 1,360 | |

| Citrix Systems, Inc.* | | | 37,796 | | | | 2,723 | |

| Electronic Arts, Inc.* | | | 55,079 | | | | 1,225 | |

| Informatica Corp.* | | | 19,023 | | | | 973 | |

| Oracle Corp. | | | 89,485 | | | | 2,736 | |

| salesforce.com, Inc.* | | | 8,049 | | | | 1,165 | |

| TIBCO Software, Inc.* | | | 42,961 | | | | 1,119 | |

| VMware, Inc. Class A* | | | 24,245 | | | | 2,433 | |

| | | | | | | | |

| Total | | | | | | | 13,734 | |

| | | | | | | | |

|

| Specialty Retail 3.92% | |

| Abercrombie & Fitch Co. Class A | | | 28,590 | | | | 2,091 | |

| Bed Bath & Beyond, Inc.* | | | 13,309 | | | | 778 | |

| Dick’s Sporting Goods, Inc.* | | | 26,413 | | | | 977 | |

| Limited Brands, Inc. | | | 41,470 | | | | 1,570 | |

| Ross Stores, Inc. | | | 14,748 | | | | 1,118 | |

| TJX Companies, Inc. (The) | | | 21,091 | | | | 1,166 | |

| | | | | | | | |

| Total | | | | | | | 7,700 | |

| | | | | | | | |

|

| Textiles, Apparel & Luxury Goods 2.35% | |

| Coach, Inc. | | | 29,824 | | | | 1,925 | |

| NIKE, Inc. Class B | | | 20,128 | | | | 1,815 | |

| PVH Corp. | | | 12,200 | | | | 873 | |

| | | | | | | | |

| Total | | | | | | | 4,613 | |

| | | | | | | | |

See Notes to Financial Statements.

9

Schedule of Investments (concluded)

July 31, 2011

| | | | | | | | |

| Investments | | Shares | | | Fair

Value

(000) | |

| Tobacco 0.55% | |

| Philip Morris International, Inc. | | | 15,164 | | | $ | 1,079 | |

| | | | | | | | |

Total Common Stocks (cost $168,155,910) | | | | | | | 196,919 | |

| | | | | | | | |

| | |

| | | Principal Amount (000) | | | | |

| SHORT-TERM INVESTMENT 0.42% | |

| | |

| Repurchase Agreement | | | | | | | | |

| Repurchase Agreement dated 7/29/2011, 0.01% due 8/1/2011 with Fixed Income Clearing Corp. collateralized by $840,000 of Federal Home Loan Mortgage Corp. at 0.05% due 12/20/2011; value: $839,580; proceeds: $820,759 (cost $820,758) | | $ | 821 | | | | 821 | |

| | | | | | | | |

Total Investments in Securities 100.73% (cost $168,976,668) | | | | | | | 197,740 | |

| | | | | | | | |

| Liabilities in Excess of Other Assets (0.73%) | | | | | | | (1,427 | ) |

| | | | | | | | |

| Net Assets 100.00% | | | | | | $ | 196,313 | |

| | | | | | | | |

| | |

| ADR | | American Depositary Receipt. |

| * | | Non-income producing security. |

| (a) | | Foreign security traded in U.S. dollars. |

See Notes to Financial Statements.

10

Statement of Assets and Liabilities

July 31, 2011

| | | | |

ASSETS: | | | | |

Investments in securities, at fair value (cost $168,976,668) | | $ | 197,739,987 | |

Receivables: | | | | |

Investment securities sold | | | 4,925,352 | |

Interest and dividends | | | 73,328 | |

Capital shares sold | | | 56,699 | |

Prepaid expenses and other assets | | | 27,630 | |

Total assets | | | 202,822,996 | |

LIABILITIES: | | | | |

Payables: | | | | |

Investment securities purchased | | | 5,779,646 | |

Capital shares reacquired | | | 326,946 | |

Management fee | | | 129,507 | |

12b-1 distribution fees | | | 98,763 | |

Trustees’ fees | | | 25,425 | |

Fund administration | | | 6,907 | |

To affiliates (See Note 3) | | | 7,648 | |

Accrued expenses and other liabilities | | | 134,732 | |

Total liabilities | | | 6,509,574 | |

NET ASSETS | | $ | 196,313,422 | |

COMPOSITION OF NET ASSETS: | | | | |

Paid-in capital | | $ | 216,634,836 | |

Accumulated net investment loss | | | (19,205 | ) |

Accumulated net realized loss on investments and foreign currency related transactions | | | (49,065,528 | ) |

Net unrealized appreciation on investments | | | 28,763,319 | |

Net Assets | | $ | 196,313,422 | |

See Notes to Financial Statements.

11

Statement of Assets and Liabilities (concluded)

July 31, 2011

| | | | |

| | | | |

Net assets by class: | | | | |

Class A Shares | | $ | 98,079,692 | |

Class B Shares | | $ | 13,698,348 | |

Class C Shares | | $ | 30,408,430 | |

Class F Shares | | $ | 4,205,474 | |

Class I Shares | | $ | 47,300,904 | |

Class P Shares | | $ | 694 | |

Class R2 Shares | | $ | 11,626 | |

Class R3 Shares | | $ | 2,608,254 | |

Outstanding shares by class

(unlimited number of authorized shares of beneficial interest): | | | | |

Class A Shares | | | 15,993,608 | |

Class B Shares | | | 2,406,599 | |

Class C Shares | | | 5,345,226 | |

Class F Shares | | | 678,938 | |

Class I Shares | | | 7,563,157 | |

Class P Shares | | | 112.205 | |

Class R2 Shares | | | 1,871 | |

Class R3 Shares | | | 427,393 | |

Net asset value, offering and redemption price per share

(Net assets divided by outstanding shares): | | | | |

Class A Shares-Net asset value | | | $6.13 | |

Class A Shares-Maximum offering price

(Net asset value plus sales charge of 5.75%) | | | $6.50 | |

Class B Shares-Net asset value | | | $5.69 | |

Class C Shares-Net asset value | | | $5.69 | |

Class F Shares-Net asset value | | | $6.19 | |

Class I Shares-Net asset value | | | $6.25 | |

Class P Shares-Net asset value | | | $6.19 | |

Class R2 Shares-Net asset value | | | $6.21 | |

Class R3 Shares-Net asset value | | | $6.10 | |

See Notes to Financial Statements.

12

Statement of Operations

For the Year Ended July 31, 2011

| | | | |

Investment income: | | | | |

Dividends (net of foreign withholding taxes of $3,704) | | $ | 2,412,479 | |

Interest | | | 1,393 | |

Total investment income | | | 2,413,872 | |

Expenses: | | | | |

Management fee | | | 1,459,952 | |

12b-1 distribution plan-Class A | | | 347,730 | |

12b-1 distribution plan-Class B | | | 158,633 | |

12b-1 distribution plan-Class C | | | 295,307 | |

12b-1 distribution plan-Class F | | | 4,008 | |

12b-1 distribution plan-Class P | | | 4 | |

12b-1 distribution plan-Class R2 | | | 67 | |

12b-1 distribution plan-Class R3 | | | 8,019 | |

Shareholder servicing | | | 335,846 | |

Registration | | | 93,142 | |

Subsidy (See Note 3) | | | 78,090 | |

Fund administration | | | 77,864 | |

Professional | | | 52,593 | |

Reports to shareholders | | | 30,124 | |

Custody | | | 7,807 | |

Trustees’ fees | | | 6,315 | |

Other | | | 11,866 | |

Gross expenses | | | 2,967,367 | |

Expense reductions (See Note 7) | | | (207 | ) |

Management fee waived (See Note 3) | | | (12,239 | ) |

Net expenses | | | 2,954,921 | |

Net investment loss | | | (541,049 | ) |

Net realized and unrealized gain: | | | | |

Net realized gain on investments and foreign currency related transactions | | | 33,087,178 | |

Net change in unrealized appreciation/depreciation on investments and translation of assets and liabilities denominated in foreign currencies | | | 2,727,345 | |

Net realized and unrealized gain | | | 35,814,523 | |

Net Increase in Net Assets Resulting From Operations | | $ | 35,273,474 | |

See Notes to Financial Statements.

13

Statements of Changes in Net Assets

| | | | | | | | |

| INCREASE (DECREASE) IN NET ASSETS | | For the Year Ended

July 31, 2011 | | | For the Year Ended

July 31, 2010 | |

Operations: | | | | | | | | |

Net investment loss | | $ | (541,049 | ) | | $ | (1,147,874 | ) |

Net realized gain on investments and foreign currency related transactions | | | 33,087,178 | | | | 12,517,787 | |

Net change in unrealized appreciation/depreciation on investments and translation of assets and liabilities denominated in foreign currencies | | | 2,727,345 | | | | 10,514,403 | |

Net increase in net assets resulting from operations | | | 35,273,474 | | | | 21,884,316 | |

Capital share transactions (Net of share conversions) (See Note 11): | | | | | |

Net proceeds from sales of shares | | | 43,317,892 | | | | 28,345,570 | |

Cost of shares reacquired | | | (51,825,243 | ) | | | (59,483,820 | ) |

Net decrease in net assets resulting from

capital share transactions | | | (8,507,351 | ) | | | (31,138,250 | ) |

Net increase (decrease) in net assets | | | 26,766,123 | | | | (9,253,934 | ) |

NET ASSETS: | | | | | | | | |

Beginning of year | | $ | 169,547,299 | | | $ | 178,801,233 | |

End of year | | $ | 196,313,422 | | | $ | 169,547,299 | |

Accumulated net investment loss | | $ | (19,205 | ) | | $ | (20,793 | ) |

See Notes to Financial Statements.

14

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

| | | Class A Shares | |

| | | Year Ended 7/31 | |

| | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

Per Share Operating Performance | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | | $5.05 | | | | $4.50 | | | | $5.74 | | | | $5.98 | | | | $5.07 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Investment operations: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment loss(a) | | | (.01 | ) | | | (.02 | ) | | | – | (b) | | | (.03 | ) | | | (.04 | ) |

| | | | | |

Net realized and unrealized gain (loss) | | | 1.09 | | | | .57 | | | | (1.24 | ) | | | (.21 | ) | | | .95 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total from investment operations | | | 1.08 | | | | .55 | | | | (1.24 | ) | | | (.24 | ) | | | .91 | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | | $6.13 | | | | $5.05 | | | | $4.50 | | | | $5.74 | | | | $5.98 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total Return(c) | | | 21.39 | % | | | 12.22 | % | | | (21.60 | )% | | | (4.01 | )% | | | 17.95 | % |

| | | | | |

Ratios to Average Net Assets: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Expenses, excluding expense reductions and including management fee waived and expenses reimbursed | | | 1.45 | % | | | 1.48 | % | | | 1.50 | % | | | 1.50 | % | | | 1.50 | % |

| | | | | |

Expenses, including expense reductions, management fee waived and expenses reimbursed | | | 1.45 | % | | | 1.48 | % | | | 1.50 | % | | | 1.50 | % | | | 1.50 | % |

| | | | | |

Expenses, excluding expense reductions, management fee waived and expenses reimbursed | | | 1.45 | % | | | 1.55 | % | | | 1.70 | % | | | 1.56 | % | | | 1.61 | % |

| | | | | |

Net investment loss | | | (.20 | )% | | | (.48 | )% | | | (.10 | )% | | | (.50 | )% | | | (.62 | )% |

| | | | | |

| Supplemental Data: | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | | $98,080 | | | | $90,029 | | | | $96,736 | | | | $119,321 | | | | $120,513 | |

| | | | | |

Portfolio turnover rate | | | 135.46 | % | | | 84.12 | % | | | 160.11 | % | | | 174.14 | % | | | 158.74 | % |

| (a) | | Calculated using average shares outstanding during the year. |

| (b) | | Amount is less than $.01. |

| (c) | | Total return does not consider the effects of sales loads and assumes the reinvestment of all distributions. |

See Notes to Financial Statements.

15

Financial Highlights (continued)

| | | | | | | | | | | | | | | | | | | | |

| | | Class B Shares | |

| | | Year Ended 7/31 | |

| | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

Per Share Operating Performance | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | | $4.72 | | | | $4.23 | | | | $5.43 | | | | $5.70 | | | | $4.86 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Investment operations: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment loss(a) | | | (.04 | ) | | | (.05 | ) | | | (.03 | ) | | | (.07 | ) | | | (.07 | ) |

| | | | | |

Net realized and unrealized gain (loss) | | | 1.01 | | | | .54 | | | | (1.17 | ) | | | (.20 | ) | | | .91 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total from investment operations | | | .97 | | | | .49 | | | | (1.20 | ) | | | (.27 | ) | | | .84 | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | | $5.69 | | | | $4.72 | | | | $4.23 | | | | $5.43 | | | | $5.70 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total Return(b) | | | 20.55 | % | | | 11.58 | % | | | (22.10 | )% | | | (4.74 | )% | | | 17.28 | % |

| | | | | |

Ratios to Average Net Assets: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Expenses, excluding expense reductions and including management fee waived and expenses reimbursed | | | 2.09 | % | | | 2.13 | % | | | 2.15 | % | | | 2.15 | % | | | 2.15 | % |

| | | | | |

Expenses, including expense reductions, management fee waived and expenses reimbursed | | | 2.09 | % | | | 2.13 | % | | | 2.15 | % | | | 2.15 | % | | | 2.15 | % |

| | | | | |

Expenses, excluding expense reductions, management fee waived and expenses reimbursed | | | 2.10 | % | | | 2.20 | % | | | 2.35 | % | | | 2.21 | % | | | 2.26 | % |

| | | | | |

Net investment loss | | | (.81 | )% | | | (1.13 | )% | | | (.75 | )% | | | (1.16 | )% | | | (1.27 | )% |

| | | | | |

| Supplemental Data: | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | | $13,698 | | | | $16,683 | | | | $20,890 | | | | $31,989 | | | | $34,012 | |

| | | | | |

Portfolio turnover rate | | | 135.46 | % | | | 84.12 | % | | | 160.11 | % | | | 174.14 | % | | | 158.74 | % |

| (a) | | Calculated using average shares outstanding during the year. |

| (b) | | Total return does not consider the effects of sales loads and assumes the reinvestment of all distributions. |

See Notes to Financial Statements.

16

Financial Highlights (continued)

| | | | | | | | | | | | | | | | | | | | |

| | | Class C Shares | |

| | | Year Ended 7/31 | |

| | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

Per Share Operating Performance | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | | $4.72 | | | | $4.23 | | | | $5.43 | | | | $5.69 | | | | $4.86 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Investment operations: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment loss(a) | | | (.04 | ) | | | (.05 | ) | | | (.03 | ) | | | (.07 | ) | | | (.07 | ) |

| | | | | |

Net realized and unrealized gain (loss) | | | 1.01 | | | | .54 | | | | (1.17 | ) | | | (.19 | ) | | | .90 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total from investment operations | | | .97 | | | | .49 | | | | (1.20 | ) | | | (.26 | ) | | | .83 | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | | $5.69 | | | | $4.72 | | | | $4.23 | | | | $5.43 | | | | $5.69 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total Return(b) | | | 20.55 | % | | | 11.58 | % | | | (22.10 | )% | | | (4.57 | )% | | | 17.08 | % |

| | | | | |

Ratios to Average Net Assets: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Expenses, excluding expense reductions and including management fee waived and expenses reimbursed | | | 2.03 | % | | | 2.13 | % | | | 2.15 | % | | | 2.15 | % | | | 2.15 | % |

| | | | | |

Expenses, including expense reductions, management fee waived and expenses reimbursed | | | 2.03 | % | | | 2.13 | % | | | 2.15 | % | | | 2.15 | % | | | 2.15 | % |

| | | | | |

Expenses, excluding expense reductions, management fee waived and expenses reimbursed | | | 2.04 | % | | | 2.20 | % | | | 2.35 | % | | | 2.21 | % | | | 2.26 | % |

| | | | | |

Net investment loss | | | (.78 | )% | | | (1.13 | )% | | | (.75 | )% | | | (1.15 | )% | | | (1.28 | )% |

| | | | | |

| Supplemental Data: | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | | $30,408 | | | | $30,295 | | | | $35,198 | | | | $50,103 | | | | $45,041 | |

| | | | | |

Portfolio turnover rate | | | 135.46 | % | | | 84.12 | % | | | 160.11 | % | | | 174.14 | % | | | 158.74 | % |

| (a) | | Calculated using average shares outstanding during the year. |

| (b) | | Total return does not consider the effects of sales loads and assumes the reinvestment of all distributions. |

See Notes to Financial Statements.

17

Financial Highlights (continued)

| | | | | | | | | | | | | | | | |

| | | Class F Shares | |

| | | Year Ended 7/31 | | | 9/28/2007(a)

to

7/31/2008 | |

| | | 2011 | | | 2010 | | | 2009 | | |

Per Share Operating Performance | | | | | | | | | |

Net asset value, beginning of period | | | $5.09 | | | | $4.52 | | | | $5.75 | | | | $6.53 | |

| | | | | | | | | | | | | | | | |

| | | | |

Investment operations: | | | | | | | | | | | | | | | | |

| | | | |

Net investment income (loss)(b) | | | – | (c) | | | (.01 | ) | | | – | (c) | | | (.02 | ) |

| | | | |

Net realized and unrealized gain (loss) | | | 1.10 | | | | .58 | | | | (1.23 | ) | | | (.76 | ) |

| | | | | | | | | | | | | | | | |

| | | | |

Total from investment operations | | | 1.10 | | | | .57 | | | | (1.23 | ) | | | (.78 | ) |

| | | | | | | | | | | | | | | | |

Net asset value, end of period | | | $6.19 | | | | $5.09 | | | | $4.52 | | | | $5.75 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Return(d) | | | 21.61 | % | | | 12.61 | % | | | (21.39 | )% | | | (11.94 | )%(e) |

| | | | |

Ratios to Average Net Assets: | | | | | | | | | | | | | | | | |

| | | | |

Expenses, excluding expense reductions and including management fee waived and expenses reimbursed | | | 1.20 | % | | | 1.23 | % | | | 1.25 | % | | | 1.02 | %(e) |

| | | | |

Expenses, including expense reductions, management fee waived and expenses reimbursed | | | 1.20 | % | | | 1.23 | % | | | 1.25 | % | | | 1.02 | %(e) |

| | | | |

Expenses, excluding expense reductions, management fee waived and expenses reimbursed | | | 1.20 | % | | | 1.29 | % | | | 1.45 | % | | | 1.10 | %(e) |

| | | | |

Net investment income (loss) | | | (.01 | )% | | | (.23 | )% | | | .05 | % | | | (.33 | )%(e) |

| | | | |

| Supplemental Data: | | | | | | | | | | | | |

Net assets, end of period (000) | | | $4,205 | | | | $2,617 | | | | $1,980 | | | | $654 | |

| | | | |

Portfolio turnover rate | | | 135.46 | % | | | 84.12 | % | | | 160.11 | % | | | 174.14 | % |

| (a) | | Commencement of operations was 9/28/2007, SEC effective date was 9/14/2007 and date shares first became available to the public was 10/1/2007. |

| (b) | | Calculated using average shares outstanding during the period. |

| (c) | | Amount less than $.01. |

| (d) | | Total return assumes the reinvestment of all distributions. |

See Notes to Financial Statements.

18

Financial Highlights (continued)

| | | | | | | | | | | | | | | | | | | | |

| | | Class I Shares | |

| | | Year Ended 7/31 | |

| | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

Per Share Operating Performance | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | | $5.13 | | | | $4.56 | | | | $5.79 | | | | $6.01 | | | | $5.08 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Investment operations: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income (loss)(a) | | | .01 | | | | (.01 | ) | | | .01 | | | | (.01 | ) | | | (.02 | ) |

| | | | | |

Net realized and unrealized gain (loss) | | | 1.11 | | | | .58 | | | | (1.24 | ) | | | (.21 | ) | | | .95 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total from investment operations | | | 1.12 | | | | .57 | | | | (1.23 | ) | | | (.22 | ) | | | .93 | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | | $6.25 | | | | $5.13 | | | | $4.56 | | | | $5.79 | | | | $6.01 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total Return(b) | | | 21.83 | % | | | 12.50 | % | | | (21.24 | )% | | | (3.66 | )% | | | 18.31 | % |

| | | | | |

Ratios to Average Net Assets: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Expenses, excluding expense reductions and including management fee waived and expenses reimbursed | | | 1.10 | % | | | 1.13 | % | | | 1.15 | % | | | 1.15 | % | | | 1.15 | % |

| | | | | |

Expenses, including expense reductions, management fee waived and expenses reimbursed | | | 1.10 | % | | | 1.13 | % | | | 1.15 | % | | | 1.15 | % | | | 1.15 | % |

| | | | | |

Expenses, excluding expense reductions, management fee waived and expenses reimbursed | | | 1.10 | % | | | 1.19 | % | | | 1.35 | % | | | 1.21 | % | | | 1.25 | % |

| | | | | |

Net investment income (loss) | | | .11 | % | | | (.15 | )% | | | .25 | % | | | (.16 | )% | | | (.29 | )% |

| | | | | |

| Supplemental Data: | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | | $47,301 | | | | $29,241 | | | | $23,962 | | | | $23,883 | | | | $54,603 | |

| | | | | |

Portfolio turnover rate | | | 135.46 | % | | | 84.12 | % | | | 160.11 | % | | | 174.14 | % | | | 158.74 | % |

| (a) | | Calculated using average shares outstanding during the year. |

| (b) | | Total return assumes the reinvestment of all distributions. |

See Notes to Financial Statements.

19

Financial Highlights (continued)

| | | | | | | | | | | | | | | | | | | | |

| | | Class P Shares | |

| | | Year Ended 7/31 | |

| | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

Per Share Operating Performance | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | | $5.09 | | | | $4.53 | | | | $5.77 | | | | $6.02 | | | | $5.11 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Investment operations: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment loss(a) | | | – | (b) | | | (.02 | ) | | | – | (b) | | | (.04 | ) | | | (.04 | ) |

| | | | | |

Net realized and unrealized gain (loss) | | | 1.10 | | | | .58 | | | | (1.24 | ) | | | (.21 | ) | | | .95 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total from investment operations | | | 1.10 | | | | .56 | | | | (1.24 | ) | | | (.25 | ) | | | .91 | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | | $6.19 | | | | $5.09 | | | | $4.53 | | | | $5.77 | | | | $6.02 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total Return(c) | | | 21.61 | % | | | 12.36 | % | | | (21.49 | )% | | | (4.15 | )% | | | 17.81 | % |

| | | | | |

Ratios to Average Net Assets: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Expenses, excluding expense reductions and including management fee waived and expenses reimbursed | | | 1.26 | % | | | 1.40 | % | | | 1.51 | % | | | 1.55 | % | | | 1.60 | % |

| | | | | |

Expenses, including expense reductions, management fee waived and expenses reimbursed | | | 1.26 | % | | | 1.40 | % | | | 1.51 | % | | | 1.55 | % | | | 1.60 | % |

| | | | | |

Expenses, excluding expense reductions, management fee waived and expenses reimbursed | | | 1.26 | % | | | 1.57 | % | | | 1.70 | % | | | 1.61 | % | | | 1.70 | % |

| | | | | |

Net investment loss | | | (.03 | )% | | | (.35 | )% | | | (.08 | )% | | | (.67 | )% | | | (.72 | )% |

| | | | | |

| Supplemental Data: | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | | $1 | | | | $1 | | | | $2 | | | | $3 | | | | $11 | |

| | | | | |

Portfolio turnover rate | | | 135.46 | % | | | 84.12 | % | | | 160.11 | % | | | 174.14 | % | | | 158.74 | % |

| (a) | | Calculated using average shares outstanding during the year. |

| (b) | | Amount is less than $.01. |

| (c) | | Total return assumes the reinvestment of all distributions. |

See Notes to Financial Statements.

20

Financial Highlights (continued)

| | | | | | | | | | | | | | | | |

| | | Class R2 Shares | |

| | | Year Ended 7/31 | | | 9/28/2007(a)

to

7/31/2008 | |

| | | 2011 | | | 2010 | | | 2009 | | |

Per Share Operating Performance | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $5.10 | | | | $4.53 | | | | $5.75 | | | | $6.53 | |

| | | | | | | | | | | | | | | | |

| | | | |

Investment operations: | | | | | | | | | | | | | | | | |

| | | | |

Net investment income (loss)(b) | | | .01 | | | | (.01 | ) | | | .01 | | | | (.01 | ) |

| | | | |

Net realized and unrealized gain (loss) | | | 1.10 | | | | .58 | | | | (1.23 | ) | | | (.77 | ) |

| | | | | | | | | | | | | | | | |

| | | | |

Total from investment operations | | | 1.11 | | | | .57 | | | | (1.22 | ) | | | (.78 | ) |

| | | | | | | | | | | | | | | | |

Net asset value, end of period | | | $6.21 | | | | $5.10 | | | | $4.53 | | | | $5.75 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Return(c) | | | 21.76 | % | | | 12.58 | % | | | (21.22 | )% | | | (11.94 | )%(d) |

| | | | |

Ratios to Average Net Assets: | | | | | | | | | | | | | | | | |

| | | | |

Expenses, excluding expense reductions and including management fee waived and expenses reimbursed | | | 1.08 | % | | | 1.15 | % | | | 1.12 | % | | | .98 | %(d) |

| | | | |

Expenses, including expense reductions, management fee waived and expenses reimbursed | | | 1.08 | % | | | 1.15 | % | | | 1.12 | % | | | .98 | %(d) |

| | | | |

Expenses, excluding expense reductions, management fee waived and expenses reimbursed | | | 1.68 | % | | | 1.75 | % | | | 1.92 | % | | | 1.03 | %(d) |

| | | | |

Net investment income (loss) | | | .16 | % | | | (.18 | )% | | | .27 | % | | | (.12 | )%(d) |

| | | | |

| Supplemental Data: | | | | | | | | | | | | |

Net assets, end of period (000) | | | $12 | | | | $10 | | | | $7 | | | | $9 | |

| | | | |

Portfolio turnover rate | | | 135.46 | % | | | 84.12 | % | | | 160.11 | % | | | 174.14 | % |

| (a) | | Commencement of operations was 9/28/2007, SEC effective date was 9/14/2007 and date shares first became available to the public was 10/1/2007. |

| (b) | | Calculated using average shares outstanding during the period. |

| (c) | | Total return assumes the reinvestment of all distributions. |

See Notes to Financial Statements.

21

Financial Highlights (concluded)

| | | | | | | | | | | | | | | | |

| | | Class R3 Shares | |

| | | Year Ended 7/31 | | | 9/28/2007(a)

to

7/31/2008 | |

| | | 2011 | | | 2010 | | | 2009 | | |

Per Share Operating Performance | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $5.03 | | | | $4.49 | | | | $5.73 | | | | $6.53 | |

| | | | | | | | | | | | | | | | |

| | | | |

Investment operations: | | | | | | | | | | | | | | | | |

| | | | |

Net investment loss(b) | | | (.03 | ) | | | (.04 | ) | | | (.01 | ) | | | (.02 | ) |

| | | | |

Net realized and unrealized gain (loss) | | | 1.10 | | | | .58 | | | | (1.23 | ) | | | (.78 | ) |

| | | | | | | | | | | | | | | | |

| | | | |

Total from investment operations | | | 1.07 | | | | .54 | | | | (1.24 | ) | | | (.80 | ) |

| | | | | | | | | | | | | | | | |

Net asset value, end of period | | | $6.10 | | | | $5.03 | | | | $4.49 | | | | $5.73 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Return(c) | | | 21.27 | % | | | 12.03 | % | | | (21.64 | )% | | | (12.25 | )%(d) |

| | | | |

Ratios to Average Net Assets: | | | | | | | | | | | | | | | | |

| | | | |

Expenses, excluding expense reductions and including management fee waived and expenses reimbursed | | | 1.58 | % | | | 1.59 | % | | | 1.63 | % | | | 1.24 | %(d) |

| | | | |

Expenses, including expense reductions, management fee waived and expenses reimbursed | | | 1.58 | % | | | 1.59 | % | | | 1.63 | % | | | 1.24 | %(d) |

| | | | |

Expenses, excluding expense reductions, management fee waived and expenses reimbursed | | | 1.58 | % | | | 1.59 | % | | | 1.83 | % | | | 1.30 | %(d) |

| | | | |

Net investment loss | | | (.45 | )% | | | (.84 | )% | | | (.23 | )% | | | (.40 | )%(d) |

| | | | |

| Supplemental Data: | | | | | | | | | | | | |

Net assets, end of period (000) | | | $2,608 | | | | $673 | | | | $27 | | | | $34 | |

| | | | |

Portfolio turnover rate | | | 135.46 | % | | | 84.12 | % | | | 160.11 | % | | | 174.14 | % |

| (a) | | Commencement of operations was 9/28/2007, SEC effective date was 9/14/2007 and date shares first became available to the public was 10/1/2007. |

| (b) | | Calculated using average shares outstanding during the period. |

| (c) | | Total return assumes the reinvestment of all distributions. |

See Notes to Financial Statements.

22

Notes to Financial Statements

1. ORGANIZATION

Lord Abbett Stock Appreciation Fund (the “Fund”) is registered under the Investment Company Act of 1940, as amended (the “Act”), as a diversified, open-end management investment company. The Fund was organized as a Delaware statutory trust on September 29, 1999.

The Fund’s investment objective is long-term capital growth. The Fund has eight classes of shares: Class A, B, C, F, I, P, R2 and R3, each with different expenses and dividends. A front-end sales charge is normally added to the net asset value (“NAV”) for Class A shares. There is no front-end sales charge in the case of Class B, C, F, I, P, R2 and R3 shares, although there may be a contingent deferred sales charge (“CDSC”) in certain cases as follows: Class A shares purchased without a sales charge and redeemed before the first day of the month in which the one-year anniversary of the purchase falls (subject to certain exceptions as set forth in the Fund’s prospectus); Class B shares redeemed before the sixth anniversary of purchase; and Class C shares redeemed before the first anniversary of purchase. Class B shares will automatically convert to Class A shares on the 25th day of the month (or, if the 25th day is not a business day, the next business day thereafter) following the eighth anniversary of the day on which the purchase order was accepted. The Fund’s Class P shares are closed to substantially all investors, with certain exceptions as set forth in the Fund’s prospectus. The Fund no longer issues Class B shares for purchase.

The preparation of the financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

2. SIGNIFICANT ACCOUNTING POLICIES

| (a) | | Investment Valuation–Securities actively traded on any recognized U.S. or non-U.S. exchange or on The NASDAQ Stock Market LLC are valued at the last sale price or official closing price on the exchange or system on which they are principally traded. Events occurring after the close of trading on non-U.S. exchanges may result in adjustments to the valuation of foreign securities to more accurately reflect their fair value as of the close of regular trading on the New York Stock Exchange LLC. The Fund may rely on an independent fair valuation service in adjusting the valuations of foreign securities. Unlisted equity securities are valued at the last quoted sale price or, if no sale price is available, at the mean between the most recently quoted bid and asked prices. Securities for which market quotations are not readily available are valued at fair value as determined by management and approved in good faith by the Board of Trustees. Short-term securities with 60 days or less remaining to maturity are valued using the amortized cost method, which approximates current fair value. |

| (b) | | Security Transactions–Security transactions are recorded as of the date that the securities are purchased or sold (trade date). Realized gains and losses on sales of portfolio securities are calculated using the identified-cost method. Realized and unrealized gains (losses) are allocated to each class of shares based upon the relative proportion of net assets at the beginning of the day. |

23

Notes to Financial Statements (continued)

| (c) | | Investment Income–Dividend income is recorded on the ex-dividend date. Interest income is recorded on the accrual basis as earned. Discounts are accreted and premiums are amortized using the effective interest method and are included in Interest income on the Statement of Operations. Withholding taxes on foreign dividends have been provided for in accordance with the applicable country’s tax rules and rates. Investment income is allocated to each class of shares based upon the relative proportion of net assets at the beginning of the day. |

| (d) | | Income Taxes–It is the policy of the Fund to meet the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all taxable income and capital gains to its shareholders. Therefore, no income tax provision is required. |

The Fund files U.S. federal and various state and local tax returns. No income tax returns are currently under examination. The statute of limitations on the Fund’s U.S. federal tax returns filed remains open for the fiscal years ended July 31, 2008 through July 31, 2011. The statutes of limitations on the Fund’s state and local tax returns may remain open for an additional year depending upon the jurisdiction.

| (e) | | Expenses–Expenses, excluding class-specific expenses, are allocated to each class of shares based upon the relative proportion of net assets at the beginning of the day. Class A, B, C, F, P, R2 and R3 shares bear their class-specific share of all expenses and fees relating to the Fund’s 12b-1 Distribution Plan. |

| (f) | | Foreign Transactions–The books and records of the Fund are maintained in U.S. dollars and transactions denominated in foreign currencies are recorded in the Fund’s records at the rate prevailing when earned or recorded. Asset and liability accounts that are denominated in foreign currencies are adjusted daily to reflect current exchange rates and any unrealized gain (loss) is included in Net change in unrealized appreciation on investments and translation of assets and liabilities denominated in foreign currencies on the Fund’s Statement of Operations. The resultant exchange gains and losses upon settlement of such transactions are included in Net realized gain on investments and foreign currency related transactions on the Fund’s Statement of Operations. The Fund does not isolate that portion of the results of operations arising as a result of changes in the foreign exchange rates from the changes in market prices of the securities. |

| (g) | | Repurchase Agreements–The Fund may enter into repurchase agreements with respect to securities. A repurchase agreement is a transaction in which a Fund acquires a security and simultaneously commits to resell that security to the seller (a bank or securities dealer) at an agreed-upon price on an agreed-upon date. The Fund requires at all times that the repurchase agreement be collateralized by cash, or by securities of the U.S. Government, its agencies, its instrumentalities, or U.S. Government sponsored enterprises having a value equal to, or in excess of, the value of the repurchase agreement (including accrued interest). If the seller of the agreement defaults on its obligation to repurchase the underlying securities at a time when the fair value of these securities has declined, the Fund may incur a loss upon disposition of the securities. |

| (h) | | Fair Value Measurements–Fair value is defined as the price that the Fund would receive upon selling an investment or transferring a liability in an orderly transaction to an independent buyer in the principal or most advantageous market of the investment. A three-tier hierarchy is used to maximize the use of observable market data and minimize the use of |

24

Notes to Financial Statements (continued)

| | unobservable inputs and to establish classification of fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk – for example, the risk inherent in a particular valuation technique used to measure fair value (such as a pricing model) and/or the risk inherent in the inputs to the valuation technique. Inputs may be observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability. Observable inputs are based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability. Unobservable inputs are based on the best information available in the circumstances. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below: |

| | • | | Level 1 - unadjusted quoted prices in active markets for identical investments; |

| | • | | Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.); and |

| | • | | Level 3 - significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used as of July 31, 2011 in valuing the Fund’s investments carried at fair value:

| | | | | | | | | | | | | | | | |

| Investment Type* | | Level 1

(000) | | | Level 2

(000) | | | Level 3

(000) | | | Total

(000) | |

Common Stocks | | $ | 196,919 | | | $ | – | | | $ | – | | | $ | 196,919 | |

Repurchase Agreement | | | – | | | | 821 | | | | – | | | | 821 | |

Total | | $ | 196,919 | | | $ | 821 | | | $ | – | | | $ | 197,740 | |

| * | | See Schedule of Investments for fair values in each industry. |

3. MANAGEMENT FEE AND OTHER TRANSACTIONS WITH AFFILIATES

Management Fee

The Fund has a management agreement with Lord, Abbett & Co. LLC (“Lord Abbett”), pursuant to which Lord Abbett supplies the Fund with investment management services and executive and other personnel, provides office space and pays for ordinary and necessary office and clerical expenses relating to research and statistical work and supervision of the Fund’s investment portfolio.

The management fee is based on the Fund’s average daily net assets at the following annual rate:

| | | | |

First $1 billion | | | .75% | |

Next $1 billion | | | .70% | |

Over $2 billion | | | .65% | |

For the fiscal year ended July 31, 2011, the effective management fee, net of waivers, was at an annualized rate of .74% of the Fund’s average daily net assets.

25

Notes to Financial Statements (continued)

In addition, Lord Abbett provides certain administrative services to the Fund pursuant to an Administrative Services Agreement in return for a fee at an annual rate of .04% of the Fund’s average daily net assets.

For the period August 1, 2010 through November 30, 2011, Lord Abbett has contractually agreed to waive all or a portion of its management fee and, if necessary, reimburse the Fund’s other expenses, to the extent necessary so that the total net annual operating expenses for each class, excluding 12b-1 fees, do not exceed an annual rate of 1.10%. This agreement may be terminated only upon approval of the Fund’s Board of Trustees.

The Fund, along with certain other funds managed by Lord Abbett (collectively, the “Underlying Funds”), has entered into a Servicing Arrangement with Lord Abbett Diversified Equity Strategy Fund and Lord Abbett Growth & Income Strategy Fund of Lord Abbett Investment Trust (each, a “Fund of Funds”), pursuant to which each Underlying Fund pays a portion of the expenses (excluding management fees and distribution and service fees) of each Fund of Funds in proportion to the average daily value of the Underlying Fund shares owned by each Fund of Funds. Amounts paid pursuant to the Servicing Arrangement are included in Subsidy expense on the Fund’s Statement of Operations and Payable to affiliates on the Fund’s Statement of Assets and Liabilities.

As of July 31, 2011, the percentages of the Fund’s outstanding shares owned by Lord Abbett Diversified Equity Strategy Fund and Lord Abbett Growth & Income Strategy Fund were 9.36% and 11.99%, respectively.

12b-1 Distribution Plan

The Fund has adopted a distribution plan with respect to Class A, B, C, F, P, R2 and R3 shares pursuant to Rule 12b-1 under the Act, which provides for the payment of ongoing distribution and service fees to Lord Abbett Distributor LLC (the “Distributor”), an affiliate of Lord Abbett. The fees are accrued daily at annual rates based upon the Fund’s average daily net assets as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fees* | | Class A | | | Class B | | | Class C | | | Class F | | | Class P | | | Class R2 | | | Class R3 | |

Service | | | .25% | | | | .25% | | | | .25% | | | | – | | | | .25% | | | | .25% | | | | .25% | |

Distribution | | | .10% | | | | .75% | | | | .75% | | | | .10% | | | | .20% | | | | .35% | | | | .25% | |

| * | | The Fund may designate a portion of the aggregate fee as attributable to service activities for purposes of calculating Financial Industry Regulatory Authority, Inc. (“FINRA”) sales charge limitations. |

Class I shares do not have a distribution plan.

Commissions

Distributor received the following commissions on sales of shares of the Fund, after concessions were paid to authorized dealers, for the fiscal year ended July 31, 2011:

| | | | |

Distributor Commissions | | Dealers’ Concessions | |

| $24,369 | | $ | 132,315 | |

Distributor received CDSCs of $19,033 and $4,135 for Class A and Class C shares, respectively, for the fiscal year ended July 31, 2011.

Two Trustees and certain of the Fund’s officers have an interest in Lord Abbett.

26

Notes to Financial Statements (continued)

4. DISTRIBUTIONS AND CAPITAL LOSS CARRYFORWARDS

Dividends from net investment income, if any, are declared and paid at least annually. Taxable net realized gains from investment transactions, reduced by allowable capital loss carryforwards, if any, are declared and distributed to shareholders at least annually. The capital loss carryforward amount, if any, is available to offset future net capital gains. Dividends and distributions to shareholders are recorded on the ex-dividend date. The amounts of dividends and distributions from net investment income and net realized capital gains are determined in accordance with federal income tax regulations, which may differ from accounting principles generally accepted in the United States of America. These book/tax differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the components of net assets based on their federal tax basis treatment; temporary differences do not require reclassification. Dividends and distributions, which exceed earnings and profits for tax purposes, are reported as a tax return of capital.

As of July 31, 2011, the components of accumulated losses on a tax-basis were as follows:

| | | | |

Capital loss carryforwards* | | $ | (48,196,253 | ) |

Temporary differences | | | (25,425 | ) |

Unrealized gains - net | | | 27,900,264 | |

Total accumulated losses - net | | $ | (20,321,414 | ) |

| * | | As of July 31, 2011, the capital loss carryforwards, along with the related expiration dates, were as follows: |

| | | | | | | | |

| 2017 | | 2018 | | | Total | |

| $13,966,584 | | $ | 34,229,669 | | | $ | 48,196,253 | |

As of July 31, 2011, the aggregate unrealized security gains and losses based on cost for U.S. federal income tax purposes were as follows:

| | | | |

Tax cost | | $ | 169,839,723 | |

Gross unrealized gain | | | 32,799,326 | |

Gross unrealized loss | | | (4,899,062 | ) |

Net unrealized security gain | | $ | 27,900,264 | |

The difference between book-basis and tax-basis unrealized gains (losses) is primarily due to wash sales.

Permanent items identified during the fiscal year ended July 31, 2011 have been reclassified among the components of net assets based on their tax basis treatment as follows:

| | | | | | | | |

Accumulated Net

Investment Loss | | Accumulated Net

Realized Loss | | | Paid-in

Capital | |

| $542,637 | | $ | 1,900 | | | $ | (544,537 | ) |

The permanent differences are primarily attributable to the tax treatment of net investment losses.

On December 22, 2010, the Regulated Investment Company Modernization Act of 2010 (the “Modernization Act”) was signed by the President. The Modernization Act includes numerous provisions that generally become effective for taxable years beginning after the date of enactment. Management is currently assessing the impact of the Modernization Act as it relates to the Fund.

27

Notes to Financial Statements (continued)

5. PORTFOLIO SECURITIES TRANSACTIONS

Purchases and sales of investment securities (excluding short-term investments) for the fiscal year ended July 31, 2011 were as follows:

| | | | |

| Purchases | | Sales | |

| $261,802,471 | | $ | 269,103,063 | |

There were no purchases or sales of U.S. Government securities for the fiscal year ended July 31, 2011.

6. TRUSTEES’ REMUNERATION

The Fund’s officers and the two Trustees who are associated with Lord Abbett do not receive any compensation from the Fund for serving in such capacities. Outside Trustees’ fees are allocated among all Lord Abbett-sponsored funds based on the net assets of each fund. There is an equity-based plan available to all outside Trustees under which outside Trustees must defer receipt of a portion of, and may elect to defer receipt of an additional portion of Trustees’ fees. The deferred amounts are treated as though equivalent dollar amounts had been invested in the funds. Such amounts and earnings accrued thereon are included in Trustees’ fees on the Statement of Operations and in Trustees’ fees payable on the Statement of Assets and Liabilities and are not deductible for U.S. federal income tax purposes until such amounts are paid.

7. EXPENSE REDUCTIONS

The Fund has entered into an arrangement with its transfer agent and custodian, whereby credits realized as a result of uninvested cash balances are used to reduce a portion of the Fund’s expenses.

8. LINE OF CREDIT

The Fund and certain other funds managed by Lord Abbett have available an unsecured revolving credit facility (“Facility”) from State Street Bank and Trust Company (“SSB”), to be used for temporary or emergency purposes as an additional source of liquidity to fund redemptions of investor shares. The Facility is renewed annually under terms that depend on market conditions at the time of the renewal. The amount available under the Facility is $200,000,000. Effective December 4, 2009, the annual fee to maintain the Facility (of which each participating fund pays its pro rata share based on the net assets of each participating fund) was .15% of the amount available under the Facility. This amount is included in Other expenses on the Fund’s Statement of Operations. In connection with the annual renewal period that commenced December 4, 2009, the Fund paid an upfront commitment fee of .05%, which was amortized through Other expenses on the Statement of Operations over the annual period of the Facility.

On November 22, 2010, the Fund and certain other funds managed by Lord Abbett entered into a short term extension of the Facility through February 2, 2011. On February 3, 2011, the Facility was renewed for an annual period by the Fund and certain other funds managed by Lord Abbett. The amount available under the Facility remained the same. The annual fee to maintain the Facility was reduced from .15% to .125% and the upfront commitment fee of .05% was removed. Any borrowings under this Facility will bear interest at current market rates as set forth in the credit agreement. As of July 31, 2011, there were no loans outstanding pursuant to this Facility nor was the Facility utilized at any time during the fiscal year ended July 31, 2011.

28

Notes to Financial Statements (continued)

9. CUSTODIAN AND ACCOUNTING AGENT

SSB is the Fund’s custodian and accounting agent. SSB performs custodial, accounting and recordkeeping functions relating to portfolio transactions and calculating the Fund’s NAV.

10. INVESTMENT RISKS

The Fund is subject to the general risks and considerations associated with equity investing, as well as the particular risks associated with growth stocks. The value of an investment in the Fund will fluctuate in response to movements in the equity securities market in general, and to the changing prospects of the individual companies in which the Fund invests. Large growth stocks may perform differently than the market as a whole and other types of stocks, such as small company stocks and bargain stocks. Different types of stocks tend to shift in and out of favor depending on market and economic conditions. Growth stocks tend to be more volatile than other stocks. In addition, if the Fund’s assessment of a company’s value or prospects for meeting or exceeding earnings expectations or market conditions is wrong, it could suffer losses or produce poor performance relative to other funds, even in a rising market.

Due to the Fund’s exposure to foreign companies (and ADRs), the Fund may experience increased market, liquidity, currency, political, information, and other risks.

These factors can affect the Fund’s performance.

11. SUMMARY OF CAPITAL TRANSACTIONS

Transactions in shares of beneficial interest were as follows:

| | | | | | | | | | | | | | | | |

| | | Year Ended

July 31, 2011 | | | Year Ended

July 31, 2010 | |

| Class A Shares | | Shares | | | Amount | | | Shares | | | Amount | |

Shares sold | | | 1,931,417 | | | $ | 11,419,110 | | | | 2,326,589 | | | $ | 11,672,976 | |

Converted from Class B* | | | 232,994 | | | | 1,400,230 | | | | 256,616 | | | | 1,302,480 | |

Shares reacquired | | | (3,987,798 | ) | | | (23,513,147 | ) | | | (6,254,931 | ) | | | (31,620,258 | ) |

Decrease | | | (1,823,387 | ) | | $ | (10,693,807 | ) | | | (3,671,726 | ) | | $ | (18,644,802 | ) |

| | | | |

| Class B Shares | | | | | | | | | | | | |

Shares sold | | | 99,646 | | | $ | 543,713 | | | | 485,707 | | | $ | 2,259,148 | |

Shares reacquired | | | (977,018 | ) | | | (5,262,123 | ) | | | (1,612,928 | ) | | | (7,578,062 | ) |

Converted to Class A* | | | (250,342 | ) | | | (1,400,230 | ) | | | (273,942 | ) | | | (1,302,480 | ) |