UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-9603

AMERICAN BEACON SELECT FUND

(Exact name of registrant as specified in charter)

4151 Amon Carter Boulevard, MD 2450

Fort Worth, Texas 76155

(Address of principal executive offices)-(Zip code)

Gene L. Needles, Jr., PRESIDENT

4151 Amon Carter Boulevard, MD 2450

Fort Worth, Texas 76155

(Name and address of agent for service)

Registrant’s telephone number, including area code: (817) 967-3509

Date of fiscal year end: December 31, 2012

Date of reporting period: December 31, 2012

| ITEM 1. | REPORT TO STOCKHOLDERS. |

December 31, 2012 December 31, 2011 MONEY MARKET SELECT FUND U.S. GOVERNMENT MONEY MARKET SELECT FUND Report Annual

About American Beacon Advisors

Since 1986, American Beacon Advisors has offered a variety of products and investment advisory services to numerous institutional and retail clients, including a variety of mutual funds, corporate cash management, and separate account management.

Our clients include defined benefit plans, defined contribution plans, foundations, endowments, corporations, financial planners, and other institutional investors. With American Beacon Advisors, you can put the experience of a multi-billion dollar asset management firm to work for your company.

Any opinions herein, including forecasts, reflect our judgment as of the end of the reporting period and are subject to change. Each advisor’s strategies and each Fund’s portfolio composition will change depending on economic and market conditions. This report is not a complete analysis of market conditions, and therefore, should not be relied upon as investment advice. Although economic and market information has been compiled from reliable sources, American Beacon Advisors, Inc. makes no representation as to the completeness or accuracy of the statements contained herein.

| | |

| American Beacon Funds | | December 31, 2012 |

Dear Shareholders,

American Beacon Advisors is well-known for the actively managed equity mutual funds we oversee, but we also recognize that many investors are looking for a less volatile place to put their money. Our firm’s roots as a pension manager make us uniquely qualified to manage fixed-income instruments prudently and effectively.

These skills are often overlooked, considering our full line of investing vehicles, but we’re proud of the rigor we bring to our money market funds. In volatile times, it’s important to have a steady, experienced hand at the tiller for these types of vehicles. For the 12 months ended December 31, 2012:

| | • | | American Beacon Money Market Select Fund returned 0.19%. |

| | • | | American Beacon U.S. Government Money Market Select Fund returned 0.09%. |

We’re hopeful that the year ahead will be less turbulent than 2012. But regardless of what is to come, American Beacon remains focused on seeking opportunities and meeting market challenges to deliver the type of consistency in performance and service that our shareholders value.

Thank you for your continued investment in the American Beacon Funds. For additional information about the Select Funds or to access your account information, please visit our website at www.americanbeaconfunds.com.

| | |

| |

| | Best Regards,

Gene L. Needles, Jr. President American Beacon Select Funds |

1

Market Overview

December 31, 2012 (Unaudited)

Over the course of 2012, the global economic focus gradually shifted away from the problems in Europe and more toward the issues here at home – a recovery that still had not reached full speed, a changing role for the Federal Reserve (“Fed”), the uncertainty of the presidential election and the prospect of sending the economy over the fiscal cliff at year’s end.

There were signs of improvement for the U.S. economy early in the year. Positive job growth drove down the unemployment rate, and business and consumer spending picked up as confidence in the recovery increased. The housing market also showed signs of life as sales increased, property values began to stabilize and mortgage rates held near record lows.

“Eurogeddon” dominated headlines during the second quarter. European leaders came together at the end of June for another European Union summit meeting, which eased immediate tensions in the financial markets by approving the bailout of Spanish banks and establishing some broad goals toward greater fiscal and political union.

The third quarter of 2012 became all about monetary policy easing. Whether through asset purchases or interest rate cuts, central bankers across the globe dug into their policy toolkits in an effort to stimulate growth. As a result, equity markets rallied and credit spreads tightened during the quarter on the hope that this global easing cycle would succeed in accelerating economic growth.

Ongoing stress in the eurozone prompted the European Central Bank to unveil its long-awaited, much-anticipated bond buying program in September. The primary goal of the operation was to reduce sovereign debt yields, making the issuance of new debt more feasible.

Meanwhile, back in the U.S., a lackluster labor market motivated the Fed to embark on a third round of quantitative easing (QE). To support a stronger economic recovery and stimulate job growth, the Fed began purchasing mortgage-backed securities at a pace of $40 billion per month. In

contrast to past QE programs, this round of asset purchases was open-ended, allowing the Fed to do more if labor market conditions do not improve. The Fed also extended its pledge to keep rates exceptionally low through mid-2015. Chairman Ben Bernanke was quick to point out, however, that this does not mean that the Fed expects the economy to be weak through 2015.

The housing market recovery continued to gain momentum during the quarter. Consumer confidence and spending also improved as rising home values and stock prices resulted in higher household net worth.

With Europe relatively quiet, fiscal cliff talk took center stage during the fourth quarter. Congress battled to the brink over tax increases and spending cuts, and investor sentiment fluctuated daily as news of potential deals came and went. In the end, a compromise was struck that permanently extended the Bush-era tax cuts for households with incomes below $450,000 and delayed the automatic spending cuts that were set to go into effect at year-end. While no “grand bargain” was reached, investors were relieved that the fiscal cliff debacle was finally over and equity markets surged into the New Year.

As the country focused on the political wrangling in Washington, the U.S. economy continued to quietly chug along the road to recovery. Job growth progressed at a moderate pace, holding the unemployment rate steady at just below 8%. Although business investment was subdued, consumer spending accelerated during the quarter as shoppers refused to let Washington dampen their holiday spirit. In addition, record low mortgage rates and rising home values spurred home buyers into action. Inventories declined, foreclosures slowed, and construction spending increased as the recovery in the housing market gained traction.

Despite this positive momentum, gross domestic product growth remains subpar and unemployment is still too high, which is why U.S. monetary policy remains highly accommodative. At the December Fed Open Market Committee meeting, the Fed announced that it would conduct

2

Market Overview

December 31, 2012 (Unaudited)

outright purchases of longer-term Treasury securities at a pace of about $45 billion per month beginning in January. These purchases replace Operation Twist, which expired at year-end, and are in addition to the $40 billion per month in mortgage-backed security purchases the Fed began under QE3. The purchases are open-ended with the goal of holding long-term rates low until the outlook for the labor market improves substantially. The Fed also replaced its pledge to keep rates exceptionally low through “at least mid-2015” with “at least as long as the unemployment rate remains above 6.5%” and medium-term inflation remains below 2.5%.

3

American Beacon Money Market Select FundSM

Performance Overview

December 31, 2012 (Unaudited)

Politics and the domestic economy took center stage during 2012. The uncertainty of the presidential election, the fiscal cliff, unemployment rate and housing all were main topics of discussion.

As we approached the end of the year the Federal Reserve Bank (Fed) embarked on a third round of quantitative easing (QE) in an effort to promote lower long-term interest rates until the labor market begins to show signs of substantial improvement. The Fed maintained its 0% to 0.25% fed funds target throughout the year and replaced its pledge to keep the federal funds rate exceptionally low “at least through mid-2015” with “at least as long as the unemployment rate remains above 6.5%”.

With credit quality and liquidity continuing to be a priority, the American Beacon Money Market Select Fund’s primary strategy for the year was to buy high quality, short-term money market instruments and overnight investments. The strategies implemented during the year enabled the Fund to outperform its Lipper peer group.

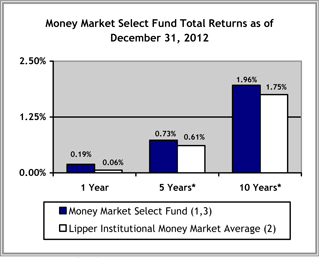

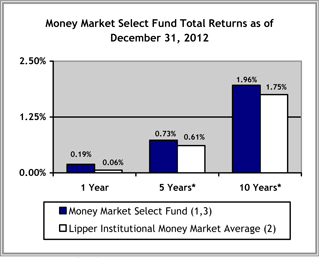

For the twelve months ended December 31, 2012, the total return of the American Beacon Money Market Select Fund (the “Fund”) was 0.19%. The Fund outperformed the Lipper Institutional Money Market Average return of 0.06% by 13 basis points (0.13%). Based on annualized total returns, Lipper Analytical Services ranked the Fund 16th among 293, 47th among 261 and 16th among 171 Institutional Money Market Funds for the one-year, five-year, and ten-year periods ended December 31, 2012, respectively.

| | | | | | | | | | | | |

| | | Annualized Total Returns

As of 12/31/2012 | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Money Market Select Fund (1,3) | | | 0.19 | % | | | 0.73 | % | | | 1.96 | % |

Lipper Institutional Money Market Average (2) | | | 0.06 | % | | | 0.61 | % | | | 1.75 | % |

| 1. | Performance shown is historical and is not indicative of future returns. Investment returns will vary, and shares may be worth more or less at redemption than at original purchase. An investment in these Funds is neither insured nor guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Funds seek to preserve the value of an investment at $1.00 per share it is possible to lose money by investing in the Funds. Fund performance in the table above does not reflect the deduction of taxes a shareholder would pay on distributions or the redemption of shares. |

| 2. | The Lipper Institutional Money Market Average is calculated by taking an arithmetic average of the returns of the mutual funds in the Lipper Institutional Money Market Funds category. Lipper is an independent mutual fund research and ranking service. |

| 3. | The total annual Fund operating expense ratio set forth in the most recent Fund prospectus was 0.16%. The expense ratio above may vary from the expense ratio presented in other sections of this report that are based on expenses incurred during the period covered by this report. |

4

American Beacon Money Market Select FundSM

Performance Overview

December 31, 2012 (Unaudited)

Statistics as of December 31, 2012

| | | | |

7-day Current Yield* | | | 0.15 | % |

7-day Effective Yield* | | | 0.15 | % |

30-day Yield* | | | 0.16 | % |

Weighted Avg. Maturity | | | 33 Days | |

Standard & Poor’s Rating | | | AAAm | |

| * | Annualized. You may call 1-800-231-4252 to obtain the Fund’s current seven-day yields. Yield is a more accurate reflection of the Fund’s current earnings than total returns. |

Top Ten Issuers as of December 31, 2012

| | | | |

| | | % of

Net Assets | |

BNP Paribas Securities Corp Tri-Party Repo. | | | 4.9 | % |

Credit Suisse Securities (USA) LLC Tri-Party Repo. | | | 4.9 | % |

Deutsche Bank Securities Inc. Tri-Party Repo | | | 4.9 | % |

JPMorgan Securities, LLC Tri-Party Repo | | | 4.9 | % |

Merrill Lynch, Pierce, Fenner & Smith, Inc

Tri-Party Repo | | | 4.9 | % |

RBC Capital Markets LLC Tri-Party Repo | | | 4.9 | % |

TD Securities (USA) LLC Tri-Party Repo | | | 4.9 | % |

Bank of Tokyo Mitsubishi UFJ, Ltd | | | 4.6 | % |

Standard Chartered Bank | | | 4.6 | % |

Wells Fargo Securities LLC Tri-Party Repo. | | | 4.6 | % |

Asset Allocation as of December 31, 2012

| | | | |

| | | % of

Net Assets | |

Financial Co. Commercial Paper | | | 42.06 | % |

Other Repurchase Agreements | | | 38.66 | % |

Asset-Backed Commercial Paper | | | 13.75 | % |

Government Agency Repurchase Agreements | | | 3.57 | % |

Certificates of Deposit | | | 1.97 | % |

Liabilities, Net of Other Assets | | | (0.01 | %) |

5

American Beacon U.S. Government Money Market Select FundSM

Performance Overview

December 31, 2012 (Unaudited)

Politics and the domestic economy took center stage during 2012. The uncertainty of the presidential election, the fiscal cliff, unemployment rate and housing all were main topics of discussion.

As we approached the end of the year the Federal Reserve Bank (Fed) embarked on a third round of quantitative easing (QE) in an effort to promote lower long-term interest rates until the labor market begins to show signs of substantial improvement. The Fed maintained its 0% to 0.25% fed funds target throughout the year and replaced its pledge to keep the federal funds rate exceptionally low “at least through mid-2015” with “at least as long as the unemployment rate remains above 6.5%”.

During the year, the American Beacon U.S. Government Money Market Select Fund’s primary strategy was to buy short-dated agencies, both fixed and variable rate, and overnight investments. The strategies implemented during the year enabled the Fund to outperform its Lipper peer group.

For the twelve months ended December 31, 2012, the total return of the American Beacon U.S. Government Money Market Select Fund (the “Fund”) was 0.09%. The Fund outperformed the Lipper Institutional U.S. Government Money Market Average return of 0.01% by 8 basis points (0.08%). Based on annualized total returns, Lipper Analytical Services ranked the Fund 1st among 169, 10th among 130 and 1st among 86 Institutional U.S. Government Money Market Funds for the one-year, five-year, and ten-year periods ended December 31, 2012, respectively.

| | | | | | | | | | | | |

| | | Annualized Total Returns | |

| | | As of 12/31/2012 | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

U.S. Government Money Market Select Fund (1,2,4) | | | 0.09 | % | | | 0.56 | % | | | 1.85 | % |

Lipper Institutional U.S. Government Money Market Average (3) | | | 0.01 | % | | | 0.46 | % | | | 1.65 | % |

| 1. | Performance shown is historical and is not indicative of future returns. Investment returns will vary, and shares may be worth more or less at redemption than at original purchase. An investment in these Funds is neither insured nor guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Funds seek to preserve the value of an investment at $1.00 per share it is possible to lose money by investing in the Funds. Fund performance in the table above does not reflect the deduction of taxes a shareholder would pay on distributions or the redemption of shares. |

| 2. | A portion of the fees charged to the Fund has been waived. Performance prior to waiving fees was lower than the actual returns shown. |

| 3. | The Lipper Institutional U.S. Government Money Market Average is calculated by taking an arithmetic average of the returns of the mutual funds in the Lipper Institutional U.S. Government Money Market Funds category. Lipper is an independent mutual fund research and ranking service. |

| 4. | The total annual Fund operating expense ratio set forth in the most recent Fund prospectus was 0.17%. The expense ratio above may vary from the expense ratio presented in other sections of this report that are based on expenses incurred during the period covered by this report. |

6

American Beacon U.S. Government Money Market Select FundSM

Performance Overview

December 31, 2012 (Unaudited)

Statistics as of December 31, 2012

| | | | |

7-day Current Yield* | | | 0.10 | % |

7-day Effective Yield* | | | 0.10 | % |

30-day Yield* | | | 0.10 | % |

Weighted Avg. Maturity | | | 19 Days | |

Standard & Poor’s Rating | | | AAAm | |

| * | Annualized. You may call 1-800-231-4252 to obtain the Fund’s current seven-day yields. Yield is a more accurate reflection of the Fund’s current earnings than total returns. |

Asset Allocation as of December 31, 2012

| | | | |

| | | % of

Net Assets | |

Government Agency Repurchase Agreements | | | 58.63 | % |

U.S. Government and Government Agency Obligations | | | 28.80 | % |

Other Repurchase Agreements | | | 12.59 | % |

Liabilities, Net of Other Assets | | | -0.02 | % |

7

American Beacon Select FundsSM

Fund Expenses

December 31, 2012 (Unaudited)

Fund Expense Example

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees, administrative service fees, and other Fund expenses. The examples below are intended to help you understand the ongoing cost (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2012 through December 31, 2012.

Actual Expenses

The “Actual” lines of the table provide information about actual account values and actual expenses. You may use the information in these lines, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the “Actual” line under the heading “Expenses Paid During Period” for the applicable Fund to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The “Hypothetical” lines of the table provide information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not a Fund’s actual return).

You may compare the ongoing costs of investing in a Fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs charged by the Funds. Similarly, the expense examples for other funds do not reflect any transaction costs charged by those funds, such as sales charges (loads), redemption fees or exchange fees. Therefore, the “Hypothetical” lines of the table are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. If you were subject to any transaction costs during the period, your costs would have been higher.

| | | | | | | | | | | | |

| | | Beginning

Account

Value

7/1/12 | | | Ending

Account

Value

12/31/12 | | | Expenses

paid During

Period*

7/1/12-

12/31/12 | |

Money Market | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,000.92 | | | $ | 0.70 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,024.43 | | | $ | 0.71 | |

U.S. Government Money Market | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,000.47 | | | $ | 0.75 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,024.38 | | | $ | 0.76 | |

| * | Expenses are equal to the Fund’s annualized expense ratios for the six-month period of 0.14% and 0.15% for the Money Market Select Fund and U.S. Government Money Market Select Funds respectively, multiplied by the average account value over the period, multiplied by the number derived by dividing the number of days in the most recent fiscal half-year (184) by days in the year (366) to reflect the half-year period. |

8

American Beacon Select FundsSM

Report of Independent Registered Public Accounting Firm

To the Shareholders and the Board of Trustees of American Beacon Money Market Select Fund and American Beacon U.S. Government Money Market Select Fund:

We have audited the accompanying statements of assets and liabilities, including the schedules of investments, of the American Beacon Money Market Select Fund and the American Beacon U.S. Government Money Market Select Fund (two of the funds constituting the American Beacon Select Funds) (collectively, the “Funds”), as of December 31, 2012, and the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Funds’ internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of each Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2012, by correspondence with the custodian and brokers or by other appropriate auditing procedures where replies from brokers were not received. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the American Beacon Money Market Select Fund and the American Beacon U.S. Government Money Market Select Fund at December 31, 2012, the results of their operations for the year then ended, the changes in their net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Dallas, Texas

February 28, 2013

9

American Beacon Money Market Select FundSM

Schedule of Investments

December 31, 2012

| | | | | | | | |

| | | Par Amount | | | Fair Value | |

| | | (000’s) | | | (000’s) | |

ASSET-BACKED COMMERCIAL PAPER - 13.75% | | | | | | | | |

Atlantis One Funding Corp., 0.32%, Due 2/5/2013 A | | $ | 35,000 | | | $ | 34,990 | |

Kells Funding LLC, | | | | | | | | |

0.30%, Due 1/7/2013 A B | | | 19,600 | | | | 19,599 | |

0.29%, Due 3/14/2013 A B | | | 15,000 | | | | 14,991 | |

Old Line Funding LLC, 0.22%, Due 4/18/2013 A B | | | 35,000 | | | | 34,977 | |

| | | | | | | | |

Total Asset-Backed Commercial Paper (Cost $104,557) | | | | | | | 104,557 | |

| | | | | | | | |

CERTIFICATE OF DEPOSIT - 1.97% (Cost $15,000) | | | | | | | | |

Canadian Imperial Bank of Commerce NY, 0.32%, Due 1/9/2013 | | | 15,000 | | | | 15,000 | |

| | | | | | | | |

FINANCIAL COMPANY COMMERCIAL PAPER - 42.06% | | | | | | | | |

Australia and New Zealand Banking Group Ltd., 0.215%, Due 3/21/2013 A | | | 15,000 | | | | 14,993 | |

Bank of Nova Scotia, 0.23%, Due 3/25/2013 | | | 35,000 | | | | 34,981 | |

Bank of Tokyo Mitsubishi, 0.26%, Due 2/12/2013 | | | 35,000 | | | | 34,989 | |

Commonwealth Bank of Australia, 0.215%, Due 3/15/2013 A | | | 35,000 | | | | 34,985 | |

DNB Bank ASA, | | | | | | | | |

0.25%, Due 1/25/2013 A | | | 15,000 | | | | 14,998 | |

0.25%, Due 3/7/2013 A | | | 15,000 | | | | 14,993 | |

Nordea North America, Inc., | | | | | | | | |

0.25%, Due 3/4/2013 | | | 20,000 | | | | 19,991 | |

0.25%, Due 4/4/2013 | | | 15,000 | | | | 14,990 | |

Standard Chartered Bank, 0.28%, Due 2/1/2013 A | | | 35,000 | | | | 34,992 | |

Sumitomo Mitsui Banking Corp., 0.25%, Due 1/18/2013 A | | | 30,000 | | | | 29,996 | |

Svenska Handelsbanken Inc., 0.25%, Due 3/14/2013 A | | | 35,000 | | | | 34,983 | |

Toyota Motor Credit Corp., 0.26%, Due 2/19/2013 | | | 35,000 | | | | 34,988 | |

| | | | | | | | |

Total Financial Company Commercial Paper (Cost $319,879) | | | | | | | 319,879 | |

| | | | | | | | |

GOVERNMENT AGENCY REPURCHASE AGREEMENTS - 3.57% | | | | | | | | |

Goldman Sachs & Co., 0.30%, acquired 12/31/2012, Due on 1/2/2013 at $27,118 (Held at Bank of New York Mellon, Collateralized by U.S Government Agency Obligations valued at $27,660, 3.00% - 6.00%, 12/20/2020 - 9/1/2038) | | | 27,118 | | | | 27,118 | |

| | | | | | | | |

OTHER REPURCHASE AGREEMENTS - 38.66% | | | | | | | | |

BNP Paribas Securities Corp., 0.35%, acquired 12/31/2012, Due on 1/2/2013 at $37,000 (Held at Bank of New York Mellon, Collateralized by Corporate Obligations valued at $40,688, 3.13% - 11.88%, 4/8/2013 - 12/16/2099) | | | 37,000 | | | | 37,000 | |

Credit Suisse Securities (USA) LLC, 0.22%, acquired 12/31/2012, Due on 1/2/2013 at $37,000 (Held at JPMorgan Chase, Collateralized by Equity Securities and Corporate Obligations valued at $38,854, 2.00% - 7.46%, 2/27/2014 - 1/3/2042)B | | | 37,000 | | | | 37,000 | |

Deutsche Bank Securities, Inc., 0.25%, acquired on 12/31/2012, Due on 1/2/2013 at $37,000 (Held at Bank of New York Mellon, Collateralized by Equity Securities valued at $40,700) | | | 37,000 | | | | 37,000 | |

JPMorgan Securities, LLC, 0.32%, acquired on 12/31/2012, Due on 1/2/2013 at $16,000 (Held at JPMorgan Chase, Collateralized by Mortgage Loan Obligations valued at $16,801, 0.46% - 6.46%, 12/25/2037 - 9/1/2047)B | | | 16,000 | | | | 16,000 | |

JPMorgan Securities, LLC, 0.31%, acquired on 11/28/2012, Due on 1/2/2013 at $ 21,000 (Held at JPMorgan Chase, Collateralized by Mortgage Loan Obligations valued at $22,050, 0.61% - 9.00%, 10/23/2017 - 11/25/2049)B | | | 21,000 | | | | 21,000 | |

Merrill Lynch, Pierce, Fenner & Smith, Inc., 0.22%, acquired on 12/31/2012, Due on 1/2/2013 at $37,000 (Held at Bank of New York Mellon, Collateralized by Equity Securities valued at $40,700) | | | 37,000 | | | | 37,000 | |

RBC Capital Markets LLC, 0.28%, acquired on 12/26/2012, Due on 1/2/2013 at $37,000 (Held at Bank of New York Mellon, Collateralized by Municipal Obligations valued at $38,850, 0.00% - 8.50%, 1/15/2013 - 6/15/2050)B | | | 37,000 | | | | 37,000 | |

TD Securities (USA) LLC, 0.14%, acquired on 12/31/2012, Due on 1/2/2013 at $37,000 (Held at Bank of New York Mellon, Collateralized by U.S Corporate Obligations valued at $39,136, 2.00% - 7.00%, 2/4/2013 - 3/1/2037)B | | | 37,000 | | | | 37,000 | |

See accompanying notes

10

American Beacon Money Market Select FundSM

Schedule of Investments

December 31, 2012

| | | | | | | | |

| | | Par Amount | | | Fair Value | |

| | | (000’s) | | | (000’s) | |

Wells Fargo Securities LLC, 0.27%, acquired on 12/31/2012, Due on 1/2/2013 at $35,000 (Held at Bank of New York Mellon, Collateralized by Corporate Obligations valued at $36,721, 0.00% - 12.00%, 2/5/2013 - 11/1/2046)B | | $ | 35,000 | | | $ | 35,000 | |

| | | | | | | | |

Total Other Repurchase Agreements (Cost $294,000) | | | | | | | 294,000 | |

| | | | | | | | |

TOTAL INVESTMENTS - 100.01% (Cost $760,554) | | | | | | | 760,554 | |

LIABILITIES, NET OF OTHER ASSETS - (0.01%) | | | | | | | (51 | ) |

| | | | | | | | |

TOTAL NET ASSETS - 100.00% | | | | | | $ | 760,503 | |

| | | | | | | | |

Percentages are stated as a percent of net assets.

All rates represent either the annualized yield at the date of purchase, or the stated coupon rate, or, for floating and adjustable rate securities, the rate at period end.

| A | Security exempt from registration under the Securities Act of 1933. These securities may be resold to qualified institutional buyers pursuant to Rule 144A. At the period end, the value of these securities amounted to $284,497 or 37.41% of net assets. The Fund has no right to demand registration of these securities. |

| B | Limited Liability Company. |

See accompanying notes

11

American Beacon U.S. Government Money Market Select FundSM

Schedule of Investments

December 31, 2012

| | | | | | | | |

| | | Par Amount | | | Fair Value | |

| | | (000’s) | | | (000’s) | |

U.S. GOVERNMENT AND GOVERNMENT AGENCY OBLIGATIONS - 28.80% | | | | | | | | |

Federal Home Loan Bank, | | | | | | | | |

0.32%, Due 2/5/2013 A | | $ | 5,000 | | | $ | 5,000 | |

0.37%, Due 2/25/2013 A | | | 7,300 | | | | 7,301 | |

0.23%, Due 5/17/2013 | | | 5,000 | | | | 5,001 | |

0.20%, Due 5/24/2013 | | | 5,000 | | | | 5,000 | |

0.17%, Due 7/9/2013 | | | 5,000 | | | | 4,999 | |

0.21%, Due 7/12/2013 | | | 5,000 | | | | 5,000 | |

0.29%, Due 11/8/2013 | | | 4,000 | | | | 4,003 | |

Federal Home Loan Mortgage Corp., 0.36%, Due 1/10/2013 A | | | 15,000 | | | | 15,001 | |

Federal National Mortgage Association, 0.221%, Due 5/17/2013 | | | 7,300 | | | | 7,302 | |

Straight A Funding LLC, 0.18%, Due 1/15/2013 B | | | 10,000 | | | | 9,999 | |

| | | | | | | | |

Total U.S. Government and Government Agency Obligations (Cost $68,606) | | | | | | | 68,606 | |

| | | | | | | | |

GOVERNMENT AGENCY REPURCHASE AGREEMENTS - 58.63% | | | | | | | | |

Barclays Capital, Inc., 0.18%, acquired on 12/31/2012, Due on 1/2/2013 at $30,000 (Held at Bank of New York Mellon, Collateralized by a U.S Treasury Obligations valued at $30,600, 2.13%, 5/31/2015) | | | 30,000 | | | | 30,000 | |

BNP Paribas Securities Corp., 0.18%, acquired on 12/31/2012, Due on 1/2/2013 at $35,000 (Held at Bank of New York Mellon, Collateralized by U.S Government Agency Obligations valued at $35,700, 0.00% - 8.00%, 1/20/2026 - 9/20/2062) | | | 35,000 | | | | 35,000 | |

Deutsche Bank Securities, Inc., 0.25%, acquired on 12/31/2012, Due on 1/2/2013 at $40,000 (Held at Bank of New York Mellon, Collateralized by a U.S Government Agency Obligations valued at $40,800, 2.50%, 10/2/2037) | | | 40,000 | | | | 40,000 | |

Goldman Sachs & Co., 0.30%, acquired on 12/31/2012, Due on 1/2/2013 at $24,669 (Held at Bank of New York Mellon, Collateralized by U.S Government Agency Obligations valued at $25,163, 3.50% - 5.00%, 12/1/2025 - 9/1/2042) | | | 24,669 | | | | 24,669 | |

Goldman Sachs & Co., 0.20%, acquired on 12/26/2012, Due on 1/2/2013 at $10,000 (Held at Bank of New York Mellon, Collateralized by U.S Government Agency Obligations valued at $10,200, 1.62% - 12.50%, 1/1/2013 - 11/1/2048) | | | 10,000 | | | | 10,000 | |

| | | | | | | | |

Total Government Agency Repurchase Agreements (Cost $139,669) | | | | | | | 139,669 | |

| | | | | | | | |

OTHER REPURCHASE AGREEMENTS - 12.59% | | | | | | | | |

BNP Paribas Securities Corp., 0.35%, acquired on 12/31/2012, Due on 1/2/2013 at $10,000 (Held at Bank of New York Mellon, Collateralized by Corporate Obligations valued at $11,001, 5.13% - 8.75%, 11/26/2013 - 8/1/2049) | | | 10,000 | | | | 10,000 | |

Deutsche Bank Securities, Inc., 0.25%, acquired on 12/31/2012, Due on 1/2/2013 at $10,000 (Held at Bank of New York Mellon, Collateralized by Equity Securities valued at $11,000) | | | 10,000 | | | | 10,000 | |

JPMorgan Securities, LLC, 0.32%, acquired on 12/31/2012, Due on 1/2/2013 at $10,000 (Held at JPMorgan Chase, Collateralized by Mortgage Loan Obligations valued at $10,502, 0.51% - 6.42%, 2/25/2035 - 12/25/2037)B | | | 10,000 | | | | 10,000 | |

| | | | | | | | |

Total Other Repurchase Agreements (Cost $30,000) | | | | | | | 30,000 | |

| | | | | | | | |

TOTAL INVESTMENTS - 100.02% (Cost $238,275) | | | | | | | 238,275 | |

LIABILITIES, NET OF OTHER ASSETS - (0.02%) | | | | | | | (39 | ) |

| | | | | | | | |

TOTAL NET ASSETS - 100.00% | | | | | | $ | 238,236 | |

| | | | | | | | |

Percentages are stated as a percent of net assets.

All rates represent either the annualized yield at the date of purchase, or the stated coupon rate, or, for floating and adjustable rate securities, the rate at period end.

| A | The coupon rate shown on floating or adjustable rate securities represents the rate at period end. The due date on these types of securities reflects the final maturity date. |

| B | Limited Liability Company. |

See accompanying notes

12

American Beacon Select FundsSM

Statements of Assets and Liabilities

December 31, 2012 (in thousands, except share and per share amounts)

| | | | | | | | |

| | | Money Market | | | U.S. Government

Money Market | |

Assets: | | | | | | | | |

Investments in securities, at fair value | | $ | 439,436 | | | $ | 68,606 | |

Repurchase agreements, at fair value | | | 321,118 | | | | 169,669 | |

Receivable for fund shares sold | | | 39 | | | | — | |

Dividends and interest receivable | | | 34 | | | | 30 | |

Prepaid expenses | | | 6 | | | | 2 | |

| | | | | | | | |

Total assets | | | 760,633 | | | | 238,307 | |

| | | | | | | | |

Liabilities: | | | | | | | | |

Payable for fund shares redeemed | | | 1 | | | | — | |

Management and investment advisory fees payable | | | 60 | | | | 17 | |

Dividends payable | | | 5 | | | | 17 | |

Administrative service and service fees payable | | | 7 | | | | 2 | |

Professional fees payable | | | 11 | | | | 10 | |

Custody and fund accounting fees payable | | | 9 | | | | 4 | |

Transfer agent fees payable | | | 7 | | | | 2 | |

Trustee fees payable | | | 10 | | | | 5 | |

Payable for prospectus and shareholder reports | | | 3 | | | | 5 | |

Dues and subscriptions payable | | | 17 | | | | 9 | |

| | | | | | | | |

Total liabilities | | | 130 | | | | 71 | |

| | | | | | | | |

Net Assets | | $ | 760,503 | | | $ | 238,236 | |

| | | | | | | | |

Analysis of Net Assets: | | | | | | | | |

Paid-in-capital | | | 760,502 | | | | 238,236 | |

Undistributed net investment income | | | 1 | | | | — | |

| | | | | | | | |

Net assets | | $ | 760,503 | | | $ | 238,236 | |

| | | | | | | | |

Shares outstanding at no par value (unlimited shares authorized) | | | 760,503,101 | | | | 238,235,845 | |

Net Assets (not in thousands) | | $ | 760,503,101 | | | $ | 238,235,844 | |

Net asset value, offering and redemption price per share | | $ | 1.00 | | | $ | 1.00 | |

| | |

A Cost of investments in securities | | $ | 439,436 | | | $ | 68,606 | |

B Cost of repurchase agreements | | | 321,118 | | | | 169,669 | |

See accompanying notes

13

American Beacon Select FundsSM

Statements of Operations

For the Year ended December 31, 2012 (in thousands)

| | | | | | | | |

| | | Money Market | | | U.S. Government

Money Market | |

Investment Income: | | | | | | | | |

Dividend income | | $ | 75 | | | $ | 14 | |

Interest income | | | 2,183 | | | | 544 | |

| | | | | | | | |

Net investment income | | | 2,258 | | | | 558 | |

| | | | | | | | |

Fund Expenses: | | | | | | | | |

Management and investment advisory fees (Note 2) | | | 655 | | | | 211 | |

Custodian fees | | | 84 | | | | 28 | |

Administrative service fees (Note 2) | | | 73 | | | | 24 | |

Transfer agent fees | | | 27 | | | | 11 | |

Professional fees | | | 51 | | | | 40 | |

Printing expense | | | 12 | | | | 7 | |

Trustee expense | | | 58 | | | | 19 | |

Insurance expense | | | 17 | | | | 5 | |

Other expenses | | | 2 | | | | 4 | |

| | | | | | | | |

Total expenses | | | 979 | | | | 349 | |

| | | | | | | | |

Net fees waived and expenses reimbursed (Note 2) | | | — | | | | (9 | ) |

| | | | | | | | |

Net expenses | | | 979 | | | | 340 | |

| | | | | | | | |

Net investment income | | | 1,279 | | | | 218 | |

| | | | | | | | |

Realized Gains: | | | | | | | | |

Net realized gain from investments | | | 37 | | | | 4 | |

| | | | | | | | |

Net gain from investments | | | 37 | | | | 4 | |

| | | | | | | | |

Net increase in net assets resulting from operations | | $ | 1,316 | | | $ | 222 | |

| | | | | | | | |

See accompanying notes

14

American Beacon Select FundsSM

Statements of Changes in Net Assets (in thousands)

| | | | | | | | | | | | | | | | |

| | | Money Market | | | U.S. Government Money Market | |

| | | Year Ended December 31, | | | Year Ended December 31, | |

| | | 2012 | | | 2011 | | | 2012 | | | 2011 | |

Increase in Net Assets: | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | |

Net investment income | | $ | 1,279 | | | $ | 895 | | | $ | 218 | | | $ | 140 | |

Net realized gain from investments | | | 37 | | | | 24 | | | | 4 | | | | 1 | |

| | | | | | | | | | | | | | | | |

Net increase in net assets resulting from operations | | | 1,316 | | | | 919 | | | | 222 | | | | 141 | |

| | | | | | | | | | | | | | | | |

Distributions to Shareholders: | | | | | | | | | | | | | | | | |

Net investment income | | | (1,332 | ) | | | (842 | ) | | | (218 | ) | | | (140 | ) |

Net realized gain from investments | | | (37 | ) | | | (24 | ) | | | (4 | ) | | | (1 | ) |

| | | | | | | | | | | | | | | | |

Distributions to shareholders | | | (1,369 | ) | | | (866 | ) | | | (222 | ) | | | (141 | ) |

| | | | | | | | | | | | | | | | |

Capital Share Transactions (at $1.00 per share): | | | | | | | | | | | | | | | | |

Proceeds from sales of shares | | | 615,720 | | | | 329,726 | | | | 1,376,977 | | | | 2,059,170 | |

Reinvestment of dividends and distributions | | | 1,246 | | | | 780 | | | | 20 | | | | 19 | |

Cost of shares redeemed | | | (518,919 | ) | | | (313,607 | ) | | | (1,392,537 | ) | | | (2,130,108 | ) |

| | | | | | | | | | | | | | | | |

Net increase (decrease) in net assets | | | 98,047 | | | | 16,899 | | | | (15,540 | ) | | | (70,919 | ) |

| | | | | | | | | | | | | | | | |

Net increase (decrease) in net assets | | | 97,994 | | | | 16,952 | | | | (15,540 | ) | | | (70,919 | ) |

| | | | | | | | | | | | | | | | |

Net Assets: | | | | | | | | | | | | | | | | |

Beginning of period | | | 662,509 | | | | 645,557 | | | | 253,776 | | | | 324,695 | |

| | | | | | | | | | | | | | | | |

End of Period* | | $ | 760,503 | | | $ | 662,509 | | | $ | 238,236 | | | $ | 253,776 | |

| | | | | | | | | | | | | | | | |

* Includes undistributed net investment income of | | $ | 1 | | | $ | 53 | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

See accompanying notes

15

American Beacon Select FundsSM

Notes to Financial Statements

December 31, 2012

1. Organization and Significant Accounting Policies

American Beacon Select Funds (the “Trust”) is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended (the “Act”), as a diversified, open-end management investment company. These financial statements and notes to the financial statements relate to the American Beacon Money Market Select Fund (the “Money Market Fund”) and American Beacon U.S. Government Money Market Select Fund (the “Government Fund”)(each a “Fund” and collectively, the “Funds”), each a series of the Trust.

American Beacon Advisors, Inc. (the “Manager”) is a wholly-owned subsidiary of Lighthouse Holdings, Inc., and was organized in 1986 to provide business management, advisory, administrative and asset management consulting services to the Trust and other investors.

New Accounting Pronouncements

In May 2011, the Financial Accounting Standards Board (“FASB”) issued an Accounting Standards Update (“ASU”) ASU No. 2011-04 “Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. Generally Accepted Accounting Principles (“U.S. GAAP”) and the International Financial Reporting Standards (“IFRS”)”. ASU No. 2011-04 amends FASB ASC Topic 820, Fair Value Measurements and Disclosures, to establish common requirements for measuring fair value and for disclosing information about fair value measurements in accordance with U.S. GAAP and IFRS. ASU No. 2011-04 is effective for fiscal years beginning after December 15, 2011 and for the interim period July 1, 2012 to December 31, 2012.

Management has evaluated the implications of these changes and determined that the impact of the new guidance will only affect the disclosure requirements related to the financial statements. However, as the Fund did not hold any Level 3 investments as of December 31, 2012, the financial statement disclosures were not affected.

2. Transactions with Affiliates

Management Agreement

The Trust and the Manager are parties to a Management Agreement that obligates the Manager to provide or oversee the provisions of all investment advisory and portfolio management services. The Manager serves as the sole investment advisor to the Funds. As compensation for performing the duties required under the Management Agreement, the Manager receives 0.09% of the average daily net assets of the Funds. To the extent and for such periods of time that a Fund invests all of its investable assets in another registered investment company pursuant to a master-feeder arrangement, then the Fund will not pay a management fee.

Administrative Services Agreement

The Manager and the Trust entered into an Administrative Services Agreement which obligates the Manager to provide or oversee administrative services to the Funds. As compensation for performing the duties required under the Administrative Services Agreement, the Manager receives an annualized fee of 0.01% of the average daily net assets of the Funds. To the extent and for such period of time that a Fund invests all of its investable assets in another registered investment company pursuant to a master-feeder arrangement, then the Fund will not pay administrative services fees.

Expense Reimbursement Plan

The Manager voluntarily agreed to reimburse the Government Fund for certain expenses. During the year ended December 31, 2012, the Manager reimbursed expenses totaling $8,810.

16

American Beacon Select FundsSM

Notes to Financial Statements

December 31, 2012

The Funds have adopted an Expense Reimbursement Plan whereby the Manager may seek repayment of expenses reimbursed for a period of up to three years. However, reimbursement will occur only if a Fund’s average net assets have grown or expenses have declined sufficiently to allow reimbursement without causing its expense ratio to exceed the previously agreed upon contractual expense limit.

The carryover of excess expenses potentially reimbursable to the Manager, but not recorded as a liability for the Government Fund is $13,786, expiring in 2013. The Government Fund did not record a liability for these potential reimbursements due to the current assessment that a reimbursement for the year ended December 31, 2012, is unlikely.

3. Security Valuation and Fair Value Measurements

Each Fund values its investments and computes the net asset value per share each day that the New York Stock Exchange is open for business. In accordance with Rule 2a-7 under the Act, money market securities are valued at amortized cost, which approximates fair value. Securities for which amortized cost is deemed not to reflect fair value are stated at fair value as determined in good faith by the Valuation Committee, established by the Trust’s Board of Trustees (the “Board”). In the event that a deviation of 1/2 of 1% or more exists between the $1.00 per share price of a Fund, calculated at amortized cost, and the price per share calculated by reference to market quotations, or if there is any other deviation that the Board believes would result in a material dilution to shareholders or purchasers, the Board will promptly consider the appropriate action that should be initiated.

Valuation Inputs

Various inputs may be used to determine the fair value of the Funds’ investments. These inputs are summarized in three broad levels for financial statement purposes.

| | |

Level 1 - | | Quoted prices in active markets for identical securities. |

| |

Level 2 - | | Prices determined using other significant observable inputs. These may include quoted prices for similar securities, interest rates, prepayment speeds, credit risk, and others. Level 2 securities are fixed income securities that are valued using observable inputs as stated above. |

| |

Level 3 - | | Prices determined using other significant unobservable inputs. Unobservable inputs reflect the Fund’s own assumptions about the factors market participants would use in pricing an investment, and would be based on the best information available. |

Observable inputs are those based on market data obtained from sources independent of the fund, and unobservable inputs reflect the fund’s own assumptions based on the best information available. The input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level. For example, securities held by a money market fund are generally high quality and liquid; however, they are reflected as Level 2 because the inputs used to determine fair value are not quoted prices in an active market.

17

American Beacon Select FundsSM

Notes to Financial Statements

December 31, 2012

The Funds’ investments are summarized by level based on the inputs used to determine their values. U.S. GAAP also requires all transfer between levels to be disclosed. The end of period timing recognition has been adopted for the transfer between levels of the Funds’ asset and liabilities. At December 31, 2012, the investments were classified as described below (in thousands):

| | | | | | | | | | | | | | | | |

Money Market Fund | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Asset-Backed Commercial Paper | | $ | — | | | $ | 104,557 | | | $ | — | | | $ | 104,557 | |

Certificate of Deposit | | | — | | | | 15,000 | | | | — | | | | 15,000 | |

Financial Company Commercial Paper | | | — | | | | 319,879 | | | | — | | | | 319,879 | |

Government Agency Repurchase Agreements | | | | | | | 27,118 | | | | | | | | 27,118 | |

Repurchase Agreements | | | — | | | | 294,000 | | | | — | | | | 294,000 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities | | $ | — | | | $ | 760,554 | | | $ | — | | | $ | 760,554 | |

| | | | | | | | | | | | | | | | |

| | | | |

Government Fund | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

U.S. Government and U.S. Agency Obligations | | $ | — | | | $ | 68,606 | | | $ | — | | | $ | 68,606 | |

Government Agency Repurchase Agreements | | | — | | | | 139,669 | | | | — | | | | 139,669 | |

Other Repurchase Agreements | | | — | | | | 30,000 | | | | — | | | | 30,000 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities | | $ | — | | | $ | 238,275 | | | $ | — | | | $ | 238,275 | |

| | | | | | | | | | | | | | | | |

During the year ended December 31, 2012, there were no transfers between levels.

Security Transactions and Investment Income

Security transactions for the Funds are recorded on the trade date of the security purchase or sale.

Interest income for the Funds is earned from settlement date, recorded on an accrual basis, and adjusted, if necessary, for amortization of premiums or accretion of discounts on investment grade short-term securities and zero coupon instruments. For financial and tax reporting purposes, realized gains and losses are determined on the basis of specific lot identification.

Dividends to Shareholders

Dividends from net investment income and net short-term capital gain, if any, will be declared and paid monthly. Dividends to shareholders are determined in accordance with federal income tax principles that may treat certain transactions differently than U.S. GAAP.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results may differ from those estimated.

Other

Under the Trust’s organizational documents, its officers and trustees are indemnified against certain liability arising out of the performance of their duties to the Trust. In the normal course of business, the Trust enters into contracts that provide indemnification to the other party or parties against potential costs or liabilities. The Trust’s maximum exposure under these arrangements is dependent on claims that may be made in the future and, therefore, cannot be estimated. The Trust has had no prior claims or losses pursuant to any such agreement.

4. Securities and Other Investments

Repurchase Agreements

Under the terms of a repurchase agreement, securities are acquired by the Funds from a securities dealer or a bank that are subject to resale at a later date. Repurchase agreements are fully collateralized by government or non-government securities. All collateral is valued at cost, which approximates fair value and is held at the custodian bank. The collateral is monitored daily by the Manager from reports provided by the custody bank to make the determination that the collateral’s fair value exceeds the carrying value of the repurchase agreement plus accrued interest.

18

American Beacon Select FundsSM

Notes to Financial Statements

December 31, 2012

Restricted Securities

Certain Funds may invest in securities that are subject to legal or contractual restrictions on resale. These securities may be sold privately, but are required to be registered or exempted from such registration before being sold to the public. Private placement securities are generally considered to be restricted except for those securities traded between qualified institutional investors under the provisions of Rule 144A of the Securities Act of 1933. Disposal of restricted securities may involve time-consuming negotiations and expenses, and prompt sale at an acceptable price may be difficult to achieve. Restricted securities outstanding at the period ended December 31, 2012 are disclosed in the Notes to the Schedules of Investments.

5. Federal Income Taxes

It is the policy of each Fund to qualify as a regulated investment company, by complying with all applicable provisions of Subchapter M of the Internal Revenue Code, as amended, and to make distribution of taxable income sufficient to relieve it from substantially all federal income and excise taxes. For federal income tax purposes, each Fund is treated as a single entity for the purpose of determining such qualification.

The Funds do not have any unrecognized tax benefits in the accompanying financial statements. Each of the tax years in the four year period ended December 31, 2012 remains subject to examination by the Internal Revenue Service. If applicable, the Funds recognize interest accrued related to unrecognized tax benefits in interest expense and penalties in “Other expense” on the Statements of Operations.

Dividends are categorized in accordance with income tax regulations which may treat certain transactions differently than U.S. GAAP. Accordingly, the character of distributions and composition of net assets for tax purposes may differ from those reflected in the accompanying financial statements.

The tax character of distributions paid were as follows (in thousands):

| | | | | | | | | | | | | | | | |

| | | Money Market Fund | | | Government Fund | |

| | | Year Ended

December 31, 2012 | | | Year Ended

December 31, 2011 | | | Year Ended

December 31, 2012 | | | Year Ended

December 31, 2011 | |

Distributions paid from: | | | | | | | | | | | | | | | | |

Ordinary income* | | $ | 1,369 | | | $ | 866 | | | $ | 222 | | | $ | 141 | |

| | | | | | | | | | | | | | | | |

Total distributions paid | | $ | 1,369 | | | $ | 866 | | | $ | 222 | | | $ | 141 | |

| | | | | | | | | | | | | | | | |

| * | For tax purposes short-term capital gains distributions are considered ordinary income distributions. |

As of December 31, 2012, the components of distributable earnings or (deficits) on a tax basis were as follows (in thousands):

| | | | | | | | |

| | | Money Market

Fund | | | Government

Fund | |

Cost basis of investments for federal income tax purposes | | $ | 760,544 | | | $ | 238,275 | |

Unrealized appreciation | | | — | | | | — | |

Unrealized depreciation | | | — | | | | — | |

| | | | | | | | |

Net unrealized appreciation or (depreciation) | | | — | | | | — | |

Undistributed ordinary income | | | 1 | | | | — | |

Accumulated long-term gain or (loss) | | | — | | | | — | |

Other temporary differences | | | — | | | | — | |

| | | | | | | | |

Distributable earnings or (deficits) | | $ | 1 | | | $ | — | |

| | | | | | | | |

19

American Beacon Select FundsSM

Notes to Financial Statements

December 31, 2012

Due to inherent differences in the recognition of income, expenses, and realized gains (losses) under U.S. GAAP and federal income tax regulations, permanent differences between book and tax reporting have been identified and appropriately reclassified on the Statement of Assets and Liabilities.

Accordingly, the following amounts represent current year permanent differences derived from nondeductible expenses that have been reclassified as of December 31, 2012 (in thousands):

| | | | |

| | | Money Market

Fund | |

Paid-in-capital | | $ | (1 | ) |

Undistributed net investment income | | | 1 | |

Accumulated net realized gain (loss) | | | — | |

Unrealized appreciation or (depreciation) of investments | | | — | |

On December 22, 2010, the Regulated Investment Company Modernization Act of 2010 (the “RIC MOD”) was enacted, which changed various technical rules governing the tax treatment of regulated investment companies. The changes are generally effective for taxable years beginning after the date of enactment. One of the more prominent changes addresses capital loss carryforwards. Under the RIC MOD, each Fund will be permitted to carry forward capital losses incurred in taxable years beginning after the date of enactment for an unlimited period. However, any losses incurred during those future taxable years will be required to be utilized prior to the losses incurred in pre-enactment taxable years, which carry an expiration date. As a result of this ordering rule, pre-enactment capital loss carryforwards may be more likely to expire unused. Additionally, post-enactment capital loss carryforwards will retain their character as either short-term or long-term capital losses rather than being considered all short-term as permitted under previous regulation.

Finally, the RIC MOD contains several provisions aimed at preserving the character of distributions made by a fiscal year registered investment company (“RIC”) during the portion of its taxable year ending after October 31 or December 31, reducing the circumstances under which a RIC might be required to file amended Forms 1099 to restate previously reported distributions. Except for the simplification provisions related to RIC qualification, the RIC MOD is effective for taxable years beginning after December 22, 2010. The provisions related to RIC qualification are effective for taxable years for which the extended due date of the tax return is after December 22, 2010.

The Funds do not have capital loss carryforwards as of December 31, 2012.

20

American Beacon Money Market Select FundSM

Financial Highlights

(For a share outstanding throughout the period)

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | |

Net asset value, beginning of period | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | |

| | | | | | | | | | | | | | | | | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.00 | B | | | 0.00 | AB | | | 0.00 | AB | | | 0.00 | AB | | | 0.03 | A |

Net realized gain from investments | | | 0.00 | B | | | 0.00 | B | | | 0.00 | B | | | 0.00 | B | | | 0.00 | B |

| | | | | | | | | | | | | | | | | | | | |

Total income from investment operations | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.03 | |

| | | | | | | | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | | | | | | | | |

Dividends of net investment income | | | 0.00 | B | | | 0.00 | B | | | 0.00 | B | | | 0.00 | B | | | (0.03 | ) |

Distributions of net realized gains from investments | | | 0.00 | B | | | 0.00 | B | | | 0.00 | B | | | 0.00 | B | | | 0.00 | B |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | (0.03 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | |

| | | | | | | | | | | | | | | | | | | | |

Total return | | | 0.19 | % | | | 0.14 | % | | | 0.21 | % | | | 0.39 | % | | | 2.73 | % |

| | | | | | | | | | | | | | | | | | | | |

Ratios and supplemental data: | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 760,503 | | | $ | 662,509 | | | $ | 645,557 | | | $ | 643,165 | | | $ | 708,366 | |

Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

Expenses, before reimbursements | | | 0.13 | % | | | 0.13 | %A | | | 0.13 | %A | | | 0.16 | %A | | | 0.12 | %A |

Expenses, net of reimbursements | | | 0.13 | % | | | 0.13 | %A | | | 0.13 | %A | | | 0.16 | %A | | | 0.12 | %A |

Net investment income, before reimbursements | | | 0.18 | % | | | 0.14 | %A | | | 0.21 | %A | | | 0.38 | %A | | | 2.95 | %A |

Net investment income, net of reimbursements | | | 0.18 | % | | | 0.14 | %A | | | 0.21 | %A | | | 0.38 | %A | | | 2.95 | %A |

| A | The per share amounts and ratios reflect income and expenses assuming inclusion of the Fund’s proportionate share of the income and expenses of the American Beacon Master Money Market Portfolio which terminated on September 30, 2011. |

| B | Amount is less than $0.01 per share. |

21

American Beacon U.S. Government Money Market Select FundSM

Financial Highlights

(For a share outstanding throughout the period)

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | |

Net asset value, beginning of period | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | |

| | | | | | | | | | | | | | | | | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.00 | B | | | 0.00 | B | | | 0.00 | B | | | 0.00 | AB | | | 0.02 | A |

Net realized gain from investments | | | 0.00 | B | | | 0.00 | B | | | 0.00 | B | | | 0.00 | B | | | 0.00 | B |

| | | | | | | | | | | | | | | | | | | | |

Total income from investment operations | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.02 | |

| | | | | | | | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | | | | | | | | |

Dividends of net investment income | | | 0.00 | B | | | 0.00 | B | | | 0.00 | B | | | 0.00 | B | | | (0.02 | ) |

Distributions of net realized gains from investments | | | 0.00 | B | | | 0.00 | B | | | 0.00 | B | | | 0.00 | B | | | 0.00 | B |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | (0.02 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | |

| | | | | | | | | | | | | | | | | | | | |

Total return | | | 0.09 | % | | | 0.04 | % | | | 0.13 | % | | | 0.25 | % | | | 2.32 | % |

| | | | | | | | | | | | | | | | | | | | |

Ratios and supplemental data: | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 238,236 | | | $ | 253,776 | | | $ | 324,695 | | | $ | 353,444 | | | $ | 374,550 | |

Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

Expenses, before reimbursements | | | 0.15 | % | | | 0.14 | % | | | 0.14 | % | | | 0.15 | %A | | | 0.13 | %A |

Expenses, net of reimbursements | | | 0.14 | % | | | 0.14 | % | | | 0.13 | % | | | 0.12 | %A | | | 0.12 | %A |

Net investment income, before reimbursements | | | 0.09 | % | | | 0.04 | % | | | 0.12 | % | | | 0.23 | %A | | | 2.69 | %A |

Net investment income, net of reimbursements | | | 0.09 | % | | | 0.04 | % | | | 0.12 | % | | | 0.26 | %A | | | 2.70 | %A |

| A | The per share amounts and ratios reflect income and expenses assuming inclusion of the Fund’s proportionate share of the income and expenses of the American Beacon Master U.S. Government Money Market Portfolio which terminated on May 18, 2009. |

| B | Amount is less than $0.01 per share. |

22

American Beacon Select FundsSM

Privacy Policy and Federal Tax Information

December 31, 2012 (Unaudited)

Privacy Policy

The American Beacon Select Funds recognize and respect the privacy of our shareholders. We are providing this notice to you so you will understand how shareholder information may be collected and used.

We may collect nonpublic personal information about you from one or more of the following sources:

| | • | | information we receive from you on applications or other forms; |

| | • | | information about your transactions with us or our service providers; and |

| | • | | information we receive from third parties. |

We do not disclose any nonpublic personal information about our customers or former customers to anyone, except as permitted by law.

We restrict access to your nonpublic personal information to those employees or service providers who need to know that information to provide products or services to you. To ensure the confidentiality of your nonpublic personal information, we maintain safeguards that comply with federal standards.

Federal Tax Information

Certain tax information regarding the Funds is required to be provided to shareholders upon the distribution of the Funds’ Income for the taxable year ended December 31, 2012. The information and distributions reported herein may differ from information and distributions taxable to the shareholders for the calendar year ended December 31, 2012.

The distributions to shareholders during the tax year ended December 31, 2012 include short-term capital gains of $36,593 and $4,185 for the Money Market Fund and Government Fund, respectively.

Of the ordinary dividends paid to shareholders of the Government Fund during the tax year ended December 31, 2012, 0% were derived from U.S. Treasury Obligations.

Shareholders will receive notification in January 2013 of the applicable tax information necessary to prepare their 2012 income tax returns.

23

Trustees and Officers of the American Beacon Select FundsSM

(Unaudited)

The Trustees and officers of the American Beacon Select Funds (the “Trust”) are listed below, together with their principal occupations during the past five years. Unless otherwise indicated, the address of each person listed below is 4151 Amon Carter Boulevard, MD 2450, Fort Worth, Texas 76155. Each Trustee oversees twenty-six funds in the fund complex that includes the Trust and the American Beacon Funds. The Trust’s Statement of Additional Information contains additional information about the Trustees and is available without charge by calling 1-800-658-5811.

| | | | |

Name, Age and Address | | Position, Term of Office and Length of Time Served with the Trust | | Principal Occupation(s) During Past 5 Years and Current Directorships |

INTERESTED TRUSTEES | | | | |

| | | Term | | |

| | | Lifetime of Trust until removal, resignation or retirement* | | |

| | |

Gerard J. Arpey** (54) | | Trustee since 2012 | | Partner, Emerald Creek Group (private equity firm) (2011-Present); Chairman and Chief Executive Officer, (2003-2011), AMR Corp. and American Airlines; Inc.; Director, S. C. Johnson & Son, Inc. (privately held company) (2008-present); Trustee, American Beacon Funds (2012-Present). |

| | |

Alan D. Feld*** (76) | | Trustee since 1999 | | Sole Shareholder of a professional corporation which is a Partner in the law firm of Akin, Gump, Strauss, Hauer & Feld, LLP (law firm) (1960-Present); Director, Clear Channel Communications (1984-2008); Trustee, American Beacon Mileage Funds (1996-2012); Trustee, American Beacon Funds (1999-Present); Trustee, American Beacon Master Trust (1996-2012). |

| | |

NON-INTERESTED TRUSTEES | | Term | | |

| | Lifetime of Trust until removal, resignation or retirement* | | |

| | |

W. Humphrey Bogart (68) | | Trustee since 2004 | | Trustee, American Beacon Mileage Funds (2004-2012); Trustee, American Beacon Funds (2004-Present); Trustee, American Beacon Master Trust (2004-2012). |

| | |

Brenda A. Cline (52) | | Trustee since 2004 | | Executive Vice President, Chief Financial Officer, Treasurer and Secretary, Kimbell Art Foundation (1993-Present); Trustee, American Beacon Mileage Funds (2004-2012); Trustee, American Beacon Funds (2004-Present); Trustee, American Beacon Master Trust (2004-2012). |

| | |

Eugene J. Duffy (58) | | Trustee since 2008 | | Principal and Executive Vice President, Paradigm Asset Management (1994-Present); Director, Sunrise Bank of Atlanta (2008-Present); Trustee, American Beacon Mileage Funds (2008-2012); Trustee, American Beacon Funds (2008-Present); Trustee, American Beacon Master Trust (2008-2012). |

| | |

Thomas M. Dunning (70) | | Trustee since 2008 | | Chairman Emeritus (2008-Present); Chairman (1998-2008) and Chief Executive Officer (1998-2007), Lockton Dunning Benefits (consulting firm in employee benefits); Board Director, Oncor Electric Delivery Company LLC (2007-Present); Board Member, BancTec (2010-Present); Trustee, American Beacon Mileage Funds (2008-2012); Trustee, American Beacon Funds (2008-Present); Trustee, American Beacon Master Trust (2008-2012). |

| | |

Richard A. Massman (69) | | Trustee since 2004 Chairman since 2008 | | Consultant and General Counsel Emeritus (2009-Present) and Senior Vice President and General Counsel (1994-2009), Hunt Consolidated, Inc. (holding company engaged in oil and gas exploration and production, refining, real estate, farming, ranching and venture capital activities); Trustee, American Beacon Mileage Funds (2004-2012); Trustee, American Beacon Funds (2004-Present); Trustee, American Beacon Master Trust (2004-2012). |

24

Trustees and Officers of the American Beacon Select FundsSM

(Unaudited)

| | | | |

Name, Age and Address | | Position, Term of Office and Length of Time Served with the Trust | | Principal Occupation(s) During Past 5 Years and Current Directorships |

Barbara J. McKenna, CFA (49) | | Trustee since 2012 | | Managing Principal, Longfellow Investment Management Company (2005-Present); Trustee, American Beacon Funds (2012-Present). |

| | |

R. Gerald Turner (67) | | Trustee since 2001 | | President, Southern Methodist University (1995-Present); Director, J.C. Penney Company, Inc. (1996-Present); Director, Kronus Worldwide Inc. (chemical manufacturing) (2003-Present); Director, First Broadcasting Investment Partners, LLC (2003-2007); Trustee, American Beacon Mileage Funds (2001-2012); Trustee, American Beacon Funds (2001-Present); Trustee, American Beacon Master Trust (2001-2012). |

| | |

Paul J. Zucconi, CPA (72) | | Trustee since 2008 | | Director, Affirmative Insurance Holdings, Inc. (producer of nonstandard automobile insurance) (2004-Present); Director, Titanium Metals Corporation (producer of titanium melted and mill products) (2002-Present); Director, Torchmark Corporation (life and health insurance products) (2002-Present); Director, Charter Bank (community bank services and products) (2010-2011); Trustee, American Beacon Mileage Funds (2008-2012); Trustee, American Beacon Funds (2008-Present); Trustee, American Beacon Master Trust (2008-2012). |

| | |

OFFICERS | | Term | | |

| | One Year | | |

| | |

Gene L. Needles, Jr. (57) | | President since 2009 Executive Vice President 2009 | | President, CEO and Director (2009-Present), American Beacon Advisors, Inc.; President (2009-Present), President, CEO and Director (2009-Present), Lighthouse Holdings, Inc.; President and CEO (2009-Present), Lighthouse Holdings Parent, Inc.; President (2009-Present), American Beacon Funds; President (2009-Present), American Beacon Mileage Funds; President (2008-2009), Touchstone Investments; President (2003-2007), CEO (2004-2007), AIM Distributors. |

| | |

Rosemary K. Behan (53) | | VP, Secretary and Chief Legal Officer since 2006 | | Vice President, Legal and Compliance, American Beacon Advisors, Inc. (2006-Present); Secretary, American Beacon Advisors, Inc. (2008 – present); Secretary, Lighthouse Holdings, Inc. (2008-Present); Secretary, Lighthouse Holdings Parent, Inc. (2008-Present). |

| | |

Brian E. Brett (52) | | VP since 2004 | | Vice President, Director of Sales, American Beacon Advisors, Inc. (2004-Present). |

| | |

Wyatt L. Crumpler (46) | | VP since 2007 | | Chief Investment Officer (2012-Present), Vice President, Asset Management (2009-2011), and Vice President, Trust Investments (2007-2009), American Beacon Advisors, Inc. |

| | |

Erica Duncan (42) | | VP since 2011 | | Vice President, Marketing and Client Services (2011-Present), American Beacon Advisors, Inc.; Supervisor, Brand Marketing (2010-2011), Invesco; Supervisor, Marketing Communications (2009-2010) and Senior Financial Writer (2004-2009), Invesco AIM. |

| | |

Michael W. Fields (58) | | VP since 1989 | | Chief Fixed Income Officer (2011-Present) and Vice President, Fixed Income Investments, American Beacon Advisors, Inc. (1988-2011); Director, American Beacon Global Funds SPC (2002-2011); Director, American Beacon Global Funds plc (2007-2009). |

| | |

Melinda G. Heika (51) | | Treasurer since 2010 | | Treasurer (2010-Present), and Controller (2005-2009), American Beacon Advisors, Inc.; Treasurer, Lighthouse Holdings, Inc. (2010 – Present); Treasurer, Lighthouse Holdings Parent, Inc. (2010-Present). |

| | |

Terri L. McKinney (49) | | VP since 2010 | | Vice President, Enterprise Services (2009-Present) and Managing Director (2003-2009), American Beacon Advisors, Inc. |

| | |

Jeffrey K. Ringdahl (37) | | VP since 2010 | | Chief Operating Officer, American Beacon Advisors, Inc. (2010-Present); Vice President, Product Management, Touchstone Advisors, Inc. (2007-2010); Senior Director, Business Integration, Fidelity Investments (2005-2007). |

25

Trustees and Officers of the American Beacon Select FundsSM

(Unaudited)

| | | | |

Name, Age and Address | | Position, Term of Office and Length of Time Served with the Trust | | Principal Occupation(s) During Past 5 Years and Current Directorships |

Samuel J. Silver (49) | | VP since 2011 | | Vice President, Fixed Income Investments (2011-Present) and Senior Portfolio Manager, Fixed Income Investments (1999-2011), American Beacon Advisors, Inc. |

| | |

Christina E. Sears (41) | | Chief Compliance Officer since 2004 and Asst. Secretary since 1999 | | Chief Compliance Officer (2004-Present), American Beacon Advisors, Inc. |

| | |

John J. Okray (38) | | Asst. Secretary since 2010 | | Deputy General Counsel (2012-Present) and Assistant General Counsel (2010-2012), American Beacon Advisors, Inc.; Asst. Secretary (2010-Present), Lighthouse Holdings, Inc.; Asst. Secretary (2010-Present), Lighthouse Holdings Parent, Inc.; Vice President, OppenheimerFunds, Inc. (2004-2010). |

| | |

Sonia L. Bates (56) | | Asst. Treasurer since 2011 | | Director, Tax and Financial Reporting (2011-Present) and Manager, Tax and Financial Reporting (2005-2010), American Beacon Advisors, Inc.; Asst. Treasurer (2011-Present), Lighthouse Holdings, Inc.; Asst. Treasurer (2011-Present), Lighthouse Holdings Parent, Inc. |

| * | The Board has adopted a retirement plan that requires Trustees to retire no later than the last day of the calendar year in which they reach the age of 72, provided, however, that the Board may determine to grant one or more annual exemptions to this requirement. |

| ** | Mr. Arpey is deemed to be an “interested person” of the Trust, as defined by the 1940 Act. Mr. Arpey previously served as CEO of AMR Corp., which has a material relationship with the Manager. |

| *** | Mr. Feld is deemed to be an “interested person” of the Trusts, as defined by the 1940 Act. Mr. Feld’s law firm of Akin, Gump, Strauss, Hauer & Feld LLP has provided legal services within the past two fiscal years to the Manager and one or more other Trust’s sub-advisors to the American Beacon Funds. |

26

This page intentionally left blank.

27

This page intentionally left blank.

28

This page intentionally left blank.

29

Delivery of Documents

eDelivery is NOW AVAILABLE – Stop traditional mail delivery and receive your

shareholder reports and summary prospectus on-line. Sign up at

www.americanbeaconfunds.com

If you invest in the Funds through a financial institution, you may be able to receive the Fund’s regulatory mailings, such as the Summary Prospectus, Annual Report and Semi-Annual Report, by e-mail. If you are interested in this option, please go to www.icsdelivery.com and search for your financial institution’s name or contact your financial institution directly.

To obtain more information about the Fund:

| | |

| |  |

| | |

By E-mail: american_beacon.funds@ambeacon.com | | On the Internet: Visit our website at www.americanbeaconfunds.com |

| | |

|

| | |

| |  |

| | |

By Telephone: Call (800) 658-5811 | | By Mail: American Beacon Select Funds P.O. Box 219643 Kansas City, MO 64121 |

| | |

|

| | |

Availability of Quarterly Portfolio Schedules In addition to the Schedule of Investments provided in each semi-annual and annual report, the Fund files a complete schedule of its portfolio holdings with the Securities and Exchange Commission (“SEC”) on Form N-Q as of the first and third fiscal quarters. The Fund’s Forms N-Q are available on the SEC’s website at www.sec.gov. The Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Section, 100 F Street, NE, Washington, D.C. 20549-1520. Information regarding the operation of the SEC’s Public Reference Room may be obtained by calling (202) 551-8090. A complete schedule of the Fund’s portfolio holdings is also available on www.americanbeaconfunds.com approximately five days after the end of each month. | | Availability of Proxy Voting Policy and Records A description of the policies and procedures the Fund uses to determine how to vote proxies relating to portfolio securities is available in the Fund’s Statement of Additional Information, is available free of charge on the Fund’s website www.americanbeaconfunds.com and by calling 1-800-967-9009 or by accessing the SEC’s website at www.sec.gov. The Fund’s proxy voting record for the most recent year ended June 30 is filed annually with the SEC on Form N-PX. The Fund’s Forms N-PX are available on the SEC’s website at www.sec.gov. The Fund’s proxy voting record may also be obtained by calling 1-800-967-9009. |

Fund Service Providers:

| | | | | | | | | | | | |

CUSTODIAN State Street Bank and Trust Boston, Massachusetts | | | | TRANSFER AGENT Boston Financial Data Services Kansas City, Missouri | | | | INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM Ernst & Young LLP Dallas, Texas | | | | DISTRIBUTOR Foreside Fund Services, LLC Portland, Maine |