UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-9603

AMERICAN BEACON SELECT FUNDS

(Exact name of registrant as specified in charter)

220 East Las Colinas Boulevard, Suite 1200

Irving, Texas 75039

(Address of principal executive offices)-(Zip code)

GENE L. NEEDLES, JR., PRESIDENT

220 East Las Colinas Boulevard, Suite 1200

Irving, Texas 75039

(Name and address of agent for service)

Registrant’s telephone number, including area code: (817)391-6100

Date of fiscal year end: December 31, 2019

Date of reporting period: December 31, 2019

FormN-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule30e-1 under the Investment Company Act of 1940 (17 CFR270.30e-1). The Commission may use the information provided on FormN-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by FormN-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in FormN-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

About American Beacon Advisors

Since 1986, American Beacon Advisors, Inc. has offered a variety of products and investment advisory services to numerous institutional and retail clients, including a variety of mutual funds, corporate cash management, and separate account management.

Our clients include defined benefit plans, defined contribution plans, foundations, endowments, corporations, financial planners, and other institutional investors. With American Beacon Advisors, you can put the experience of a multi-billion dollar asset management firm to work for your company.

U.S. GOVERNMENT MONEY MARKET SELECT FUND

You could lose money by investing in the American Beacon U.S. Government Money Market Select Fund. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The Fund’s sponsor has no legal obligation to provide financial support to the Fund, and you should not expect that the sponsor will provide financial support to the Fund at any time. Please see the prospectus for a complete discussion of the Fund’s risks. There can be no assurances that the investment objectives of this Fund will be met.

Any opinions herein, including forecasts, reflect our judgment as of the end of the reporting period and are subject to change. Each advisor’s strategies and each Fund’s portfolio composition will change depending on economic and market conditions. This report is not a complete analysis of market conditions, and, therefore, should not be relied upon as investment advice. Although economic and market information has been compiled from reliable sources, American Beacon Advisors, Inc. makes no representation as to the completeness or accuracy of the statements contained herein.

American Beacon Select Funds | December 31, 2019 |

Contents

President’s Message

| | |

| | Dear Shareholders, In recent months, you’ve likely seen and heard news reports about disruptive headwinds in the global economy –including the U.S. trade war with China and its toll on the global economy, slowing global growth, the Federal Reserve’s series of rate cuts, Brexit, disruptions in the Middle East and protests in Hong Kong – and watched a flood of reaction in the world’s markets. As Peter L. Bernstein said in his treatise on risk,Against the Gods: The Remarkable Story of Risk, published by John Wiley & Sons, Inc. in September 1998, “Volatility is a proxy for uncertainty and must be accommodated in measuring investment risk.” During times of economic uncertainty and market volatility, fear of loss can be a powerful emotion – one that drives many investors to making short-term decisions subject to a variety of potential error-leading biases. Unfortunately, some short-term investment decisions may create more volatility rather than mitigate it. |

Instead of dwelling on the markets’ short-term reaction to waves of negative global news, we encourage investors to focus on the horizon instead. Long-term investing isn’t about identifying and anticipating the next big market move, it is about identifying the right investment products for riding out those moves. As a long-term investor, you should keep in mind the three Ds: direction, discipline and diversification.

| u | | Direction: Achieving your long-term financial goals requires an individualized plan of action. You may want your plan to provide some measure of protection against periods of geopolitical turmoil, economic uncertainty, market volatility and job insecurity. Your plan should be reviewed annually and be adjusted in the event your long-range needs change. |

| u | | Discipline:Long-term, systematic participation in an investment portfolio requires your resolution to stay the course. Spending time in the market – rather than trying to time the market – may place you in a better position to reach your long-term financial goals. |

| u | | Diversification: By investing in different investment styles and asset classes, you may be able to help mitigate financial risks across your investment portfolio. By allocating your investment portfolio according to your risk-tolerance level, you may be better positioned to weather storms and achieve your long-term financial goals. |

Since 1986, American Beacon has endeavored to provide investors with a disciplined approach to realizing long-term financial goals. As a manager of managers, we strive to provide investment products that may enable investors to participate during market upswings while potentially insulating against market downswings.

Many of thesub-advisors to our mutual funds pursue upside capture and/or downside protection using proprietary strategies. The investment teams behind our mutual funds seek to produce consistent, long-term results rather than focus only on short-term movements in the markets. In managing our investment products, we emphasize identifying opportunities that offer the potential for long-term rewards.

Our management approach is more than a concept; it’s the cornerstone of our culture. And we strive to apply it at every turn as we seek to provide a well-diversified line of investment solutions to help our shareholders seek long-term rewards while mitigating volatility and risk.

Thank you for your continued interest in American Beacon. For additional information about our investment products or to access your account information, please visit our website atwww.americanbeaconfunds.com.

Best Regards,

Gene L. Needles, Jr.

President

American Beacon Select Funds

1

Market Overview

December 31, 2019 (Unaudited)

After a tumultuous end to 2018, the financial markets recovered nicely during 2019. Although many of the headwinds that plagued investor sentiment in the fourth quarter of 2018 remained – including U.S.-China trade uncertainty, no resolution on Brexit and a continued slowdown in global growth – the markets took solace in solid domestic economic growth and a more accommodative Federal Reserve (the “Fed”).

U.S.-China trade relations dominated the headlines throughout the year. After many starts and stops, the two countries finally reached an agreement on the first phase of a trade deal in December. Equity markets rose on the positive trade news and the yield curve steepened, reflecting expectations for stronger growth and potentially higher inflation. When all was said and done, the year ended with stock markets near record highs and the U.S. Treasury curve steeper but lower than where it began the year.

The U.S. economy continued to grow in 2019, breaking the record for the longest domestic expansion in history. Although trade uncertainty resulted in a contraction in manufacturing, steady growth in the services sector helped to offset the slowdown. Consumer spending remained resilient, buoyed by strong labor market conditions. The U.S. added an average of 176,000 jobs per month during the year, while the unemployment rate fell from 3.9% at the end of 2018 to a half-century low of 3.5% by the end of 2019. Job security kept confidence high and allowed consumers to shrug off trade uncertainty. Activity in the housing market continued to pick up steam as financially secure Americans caught the home-buying bug. While existing home sales were constrained by lean inventories, solid demand boosted new home sales and housing starts.

Although the U.S. economy continued to roll, global growth remained lackluster. China’s economy languished as the trade dispute took its toll on exports, and national demand stayed sluggish. Economic growth stalled in Europe, too, led by a slump in German manufacturing. The U.K. also continued to flounder under Brexit uncertainty and political turmoil. Japan did not fare any better, as weakness in manufacturing and exports – particularly to China – continued to hinder growth despite significant government support to prop up the economy.

The International Monetary Fund (“IMF”) global growth forecast for 2019 was recently revised down to 2.9%; however, the institution expects a modest rebound in growth in 2020 as thede-escalation of tensions between the U.S. and China leads to a recovery in trade and investment. In addition, the IMF expects central banks to keep supporting their respective economies, which should help to further stabilize growth and buoy financial conditions.

The Fed continued to do its part to support domestic growth during the year. After raising rates in 2018, the Federal Open Market Committee (“FOMC”) reversed course in 2019 and embarked on what it deemed a“mid-cycle adjustment” to monetary policy. The Fed cut interest rates by 25 basis points at each of the July, September and October FOMC meetings, resulting in a target federal funds range of 1.50% to 1.75%. While FOMC members acknowledged that domestic growth remained solid, they cited slowing global growth and trade uncertainty as reasons for the change in policy. After the October rate cut, the Fed signaled a break in the easing cycle by indicating that the current stance of monetary policy was likely to remain appropriate. Markets reacted favorably to the news as Federal Reserve Board Chair Jerome Powell did a good job effectively communicating the pause while emphasizing that the Fed stands ready to act if the economic outlook deteriorates. Following this guidance, the Fed held rates steady at the December FOMC meeting, and thedot-plot forecast suggested that a majority of FOMC members expected rates to remain unchanged throughout 2020.

While the Fed may be taking a pause in cutting rates, they have not fully taken their foot off the accelerator. The Fed resumed balance sheet expansion in October in response to a demand for bank reserves. Short-term borrowing rates surged at the end of the third quarter due to a liquidity crunch in overnight repurchase markets. To avoid another such episode, the Fed began conducting a series of repo operations to help ensure funding for overnight loans stayed within the federal funds target range. In addition, the FOMC announced on October 11 that the Fed would begin purchasing Treasury bills at a pace of $60 billion per month to help ensure ample reserves. The purchases are expected to continue through the second quarter of 2020 as the Fed tries to calibrate the appropriate level of reserves that banks require to function properly. Although Mr. Powell reiterated that these purchases were not another round of quantitative easing, the markets viewed the additional liquidity as a sign of further stimulus.

2

American Beacon U.S. Government Money Market Select FundSM

Performance Overview

December 31, 2019 (Unaudited)

The labor market continued to be a bright spot during 2019. The unemployment rate improved from 3.9% at the end of 2018 to 3.5% by the end of the year. In addition, trade tensions with China diminished towards the end of the year as the first phase of the trade agreement is expected to be signed in January. Also, the Federal Reserve Bank (“Fed”) reversed course during the year and lowered the fed funds target three times. As a result, equity markets rallied and ended the year at new highs. As we head into 2020, it appears the Fed will be on hold for the foreseeable future while monitoring economic developments to determine appropriate monetary policy.

At the July Federal Open Market Committee (“FOMC”) meeting, the Fed lowered the fed funds rate for the first time in 2019 by 25 basis points (0.25%) to a target range of2.00%-2.25%. The Fed continued to lower the fed funds rate by 25 basis points at the next two FOMC meetings, bringing the fed funds target range to1.50%-1.75% in October, which is where it remained the rest of the year. The language coming out of the FOMC indicates they think we are in a good place now and don’t anticipate additional monetary changes any time soon.

During the year, the American Beacon U.S. Government Money Market Select Fund’s primary strategy was to buy fixed rate agencies/treasuries, floating rate agencies along with overnight repurchase agreements. The strategies implemented during the year enabled the Fund to outperform its Lipper peer group.

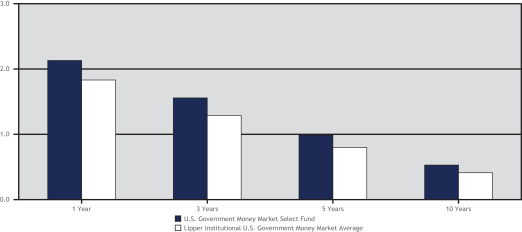

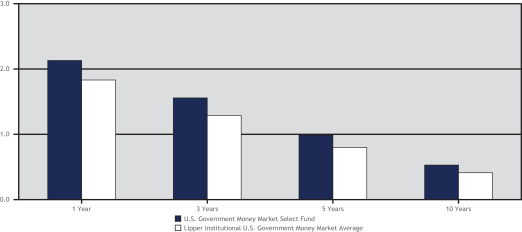

For the twelve months ended December 31, 2019, the total return of the American Beacon U.S. Government Money Market Select Fund was 2.13%. The Fund outperformed the Lipper Institutional U.S. Government Money Market Average return of 1.84% by 29 basis points (0.29%). Based on annualized total returns, Lipper Analytical Services ranked the Fund 5th among 220, 5th among 155 and 6th among 144 Institutional U.S. Government Money Market Funds for theone-year, five-year, andten-year periods ended December 31, 2019, respectively.

Total Returns for the Period ended December 31, 2019

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Returns for the Period Ended December 31, 2019 | | | | | | |

| | | | | | |

| | | Ticker | | 1 Year | | 3 Years | | 5 Years | | 10 Years | | Value of $10,000 12/31/2009- 12/31/2019 |

U.S. Government Money Market Select Fund (1,3) | | AAOXX | | | | 2.13 | % | | | | 1.56 | % | | | | 0.99 | % | | | | 0.53 | % | | | $ | 10,539 | |

Lipper Institutional U.S. Government Money Market Average (2) | | | | | | 1.84 | % | | | | 1.27 | % | | | | 0.79 | % | | | | 0.40 | % | | | $ | 10,417 | |

| | Performance shown is historical and is not indicative of future returns. Investment returns will vary, and shares may be worth more or less at redemption than at original purchase. An investment in the Fund is neither insured nor guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of an investment at $1.00 per share it is possible to lose money by investing in the Fund. Fund performance in the table above does not reflect the deduction of taxes a shareholder would pay on distributions or the redemption of shares. |

| 1. | A portion of the fees charged to the Fund was waived from Fund inception to 2014, and a portion was partially recovered in 2016. Performance prior to waiving fees was lower than the actual returns shown for the5-year and10-year periods. |

3

American Beacon U.S. Government Money Market Select FundSM

Performance Overview

December 31, 2019 (Unaudited)

| 2. | The Lipper Institutional U.S. Government Money Market Average is calculated by taking an arithmetic average of the returns of the mutual funds in the Lipper Institutional U.S. Government Money Market Funds category. Lipper is an independent mutual fund research and ranking service. |

| 3. | The Total Annual Fund Operating Expense ratio set forth in the most recent Fund prospectus was 0.13%. The expense ratio may vary from the expense ratio presented in other sections of this report that are based on expenses incurred during the period covered by this report. |

| | | | |

| Fund Statistics as of December 31, 2019 | |

| 7-day Current Yield* | | | 1.52% | |

| 7-day Effective Yield* | | | 1.53% | |

| Weighted Average Maturity | | | 22 Days | |

| Weighted Average Life | | | 117 Days | |

| Standard & Poor’s Rating** | | | AAAm | |

| | | | |

| Asset Allocation as of December 31, 2019 (% of net assets) | |

| U.S. Government Agency Obligations | | | 59.7 | |

| Government Agency Repurchase Agreements | | | 39.4 | |

| U.S. Treasury Obligations | | | 0.6 | |

| Investment Companies | | | 0.3 | |

| | | | |

| Effective Maturity Distribution (%) | |

| 1 to 7 Days | | | 51.3 | |

| 8 to 30 Days | | | 28.2 | |

| 31 to 90 Days | | | 14.9 | |

| 91 to 185 Days | | | 5.6 | |

| * | Annualized Yield is a more accurate reflection of the Fund’s current earnings than total return. Theseven-day yields refer to the income generated by an investment in the Fund over aseven-day period. This income is then annualized. |

| | The seven day effective yield is calculated similarly, but the income earned is assumed to have been reinvested. The effective yield will be slightly higher than the current yield because of the compounding effect of this assumed reinvestment. |

| ** | Standard & Poor’s (S&P) Rating: The fund is not sponsored, endorsed, sold or promoted by S&P, and S&P makes no representation regarding the advisability of investing in the fund. The credit rating is a forward-looking opinion about a fund’s potential capacity to maintain stable principal or stable net asset value. The rating is an opinion of the date expressed and not a statement of fact or recommendation to purchase, hold or sell any security. Standard & Poor’s rates the creditworthiness of money market funds from AAAm (highest) to Dm (lowest). For more information on S&P’s rating methodology, please visit www.standardandpoors.com and select “Understanding Ratings” under Ratings Resources on the home page. |

4

American Beacon U.S. Government Money Market Select FundSM

Expense Examples

December 31, 2019 (Unaudited)

Fund Expense Example

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption fees, if applicable, and (2) ongoing costs, including management fees and other Fund expenses. The Examples are intended to help you understand the ongoing cost (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Examples are based on an investment of $1,000 invested at the beginning of the period in each Class and held for the entire period from July 1, 2019 through December 31, 2019.

Actual Expenses

The “Actual” lines of the tables provide information about actual account values and actual expenses. You may use the information on this page, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = $8.60), then multiply the result by the “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The “Hypothetical” lines of the tables provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the Fund’s actual return). You may compare the ongoing costs of investing in the Fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs charged by the Fund, such as sales charges (loads) or redemption fees, as applicable. Similarly, the expense examples for other funds do not reflect any transaction costs charged by those funds, such as sales charges (loads), redemption fees or exchange fees. Therefore, the “Hypothetical” lines of the tables are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. If you were subject to any transaction costs during the period, your costs would have been higher.

5

American Beacon U.S. Government Money Market Select FundSM

Expense Examples

December 31, 2019 (Unaudited)

| | | | | | | | | | | | | | | |

| American Beacon U.S. Government Money Market Select Fund | |

| | | |

| | | Beginning Account Value

7/1/2019 | | Ending Account Value

12/31/2019 | | Expenses Paid During

Period

7/1/2019-12/31/2019* |

| Select Class | | | | | | | | | | | | | | | |

| Actual | | | | $1,000.00 | | | | | $1,009.60 | | | | | $0.71 | |

| Hypothetical** | | | | $1,000.00 | | | | | $1,024.50 | | | | | $0.71 | |

| * | Expenses are equal to the Fund’s annualized net expense ratios for thesix-month period of 0.14% for the Select Class, multiplied by the average account value over the period, multiplied by the number derived by dividing the number of days in the most recent fiscal half-year (184) by days in the year (365) to reflect the half-year period. |

| ** | 5% return before expenses. |

6

American Beacon U.S. Government Money Market Select FundSM

Report of Independent Registered Public Accounting Firm

To the Shareholders and the Board of Trustees of American Beacon U.S. Government Money Market Select Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of American Beacon U.S. Government Money Market Select Fund (the “Fund”) (the only fund constituting American Beacon Select Funds (the “Trust”)), including the schedule of investments, as of December 31, 2019, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund at December 31, 2019, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and its financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Trust’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Trust in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Trust is not required to have, nor were we engaged to perform, an audit of the Trust’s internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Trust’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2019, by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor for one or more American Beacon investment companies since 1987.

Dallas, Texas

February 28, 2020

7

American Beacon U.S. Government Money Market Select FundSM

Schedule of Investments

December 31, 2019

| | | | | | | | | | | | | | | |

| | | |

| | | Principal Amount | | | | Fair Value |

| | | | | | | |

| | | |

| SHORT-TERM INVESTMENTS - 99.96% | | | | | | |

| | | |

| U.S. Government Agency Obligations - 59.70% | | | | | | |

| Federal Farm Credit Banks, | | | | | | | | | | | | | | | |

1.580%, Due 2/5/2020, (U.S. Federal Funds Rate + 0.030%)A | | | $ | 15,000,000 | | | | | | | | | $ | 14,999,928 | |

1.670%, Due 2/18/2020, (U.S. Federal Funds Rate + 0.120%)A | | | | 20,000,000 | | | | | | | | | | 19,999,805 | |

1.719%, Due 2/28/2020,(3-mo. USD LIBOR - 0.190%)A | | | | 10,000,000 | | | | | | | | | | 10,000,000 | |

1.705%, Due 4/15/2020,(1-mo. USD LIBOR - 0.035%)A | | | | 10,000,000 | | | | | | | | | | 10,000,000 | |

1.755%, Due 5/29/2020,(1-mo. USD LIBOR - 0.050%)A | | | | 10,000,000 | | | | | | | | | | 9,999,792 | |

1.755%, Due 7/20/2020,(1-mo. USD LIBOR - 0.010%)A | | | | 10,000,000 | | | | | | | | | | 9,999,454 | |

1.703%, Due 8/6/2020,(3-mo. USD LIBOR - 0.205%)A | | | | 10,000,000 | | | | | | | | | | 9,995,252 | |

1.765%, Due 9/10/2020,(1-mo. USD LIBOR + 0.050%)A | | | | 5,000,000 | | | | | | | | | | 4,999,907 | |

1.827%, Due 1/26/2021,(1-mo. USD LIBOR + 0.035%)A | | | | 10,000,000 | | | | | | | | | | 9,998,546 | |

1.845%, Due 1/28/2021,(1-mo. USD LIBOR + 0.040%)A | | | | 10,000,000 | | | | | | | | | | 10,000,000 | |

1.856%, Due 2/1/2021,(1-mo. USD LIBOR + 0.075%)A | | | | 5,000,000 | | | | | | | | | | 4,999,987 | |

1.670%, Due 2/9/2021, (U.S. Federal Funds Rate + 0.120%)A | | | | 5,000,000 | | | | | | | | | | 4,999,548 | |

1.790%, Due 2/16/2021,(1-mo. USD LIBOR + 0.050%)A | | | | 10,000,000 | | | | | | | | | | 9,995,237 | |

1.826%, Due 3/1/2021,(1-mo. USD LIBOR + 0.045%)A | | | | 10,000,000 | | | | | | | | | | 9,999,640 | |

1.875%, Due 4/21/2021,(1-mo. USD LIBOR + 0.090%)A | | | | 10,000,000 | | | | | | | | | | 10,000,000 | |

1.764%, Due 5/5/2021,(1-mo. USD LIBOR + 0.060%)A | | | | 10,000,000 | | | | | | | | | | 9,995,890 | |

1.776%, Due 5/13/2021,(1-mo. USD LIBOR + 0.035%)A | | | | 20,000,000 | | | | | | | | | | 19,999,452 | |

1.815%, Due 6/28/2021,(1-mo. USD LIBOR + 0.010%)A | | | | 13,900,000 | | | | | | | | | | 13,892,406 | |

1.740%, Due 7/16/2021B | | | | 8,475,000 | | | | | | | | | | 8,467,984 | |

1.905%, Due 7/28/2021,(1-mo. USD LIBOR + 0.100%)A | | | | 10,000,000 | | | | | | | | | | 10,000,000 | |

| Federal Home Loan Banks, | | | | | | | | | | | | | | | |

1.715%, Due 1/3/2020 | | | | 6,300,000 | | | | | | | | | | 6,299,410 | |

1.734%, Due 1/8/2020 | | | | 10,000,000 | | | | | | | | | | 9,996,689 | |

1.731%, Due 1/15/2020 | | | | 5,000,000 | | | | | | | | | | 4,996,694 | |

2.048%, Due 1/17/2020 | | | | 12,000,000 | | | | | | | | | | 11,989,333 | |

1.695%, Due 1/22/2020 | | | | 4,270,000 | | | | | | | | | | 4,265,853 | |

2.074%, Due 1/22/2020 | | | | 5,000,000 | | | | | | | | | | 4,994,097 | |

1.720%, Due 1/23/2020,(1-mo. USD LIBOR - 0.065%)A | | | | 10,000,000 | | | | | | | | | | 10,000,000 | |

1.669%, Due 1/24/2020 | | | | 5,000,000 | | | | | | | | | | 4,994,761 | |

1.680%, Due 1/24/2020 | | | | 20,000,000 | | | | | | | | | | 19,978,917 | |

2.100%, Due 1/29/2020 | | | | 5,000,000 | | | | | | | | | | 4,992,028 | |

1.598%, Due 2/7/2020 | | | | 13,122,000 | | | | | | | | | | 13,100,826 | |

1.916%, Due 2/7/2020 | | | | 4,375,000 | | | | | | | | | | 4,366,569 | |

1.601%, Due 2/11/2020 | | | | 10,000,000 | | | | | | | | | | 9,982,063 | |

1.603%, Due 2/12/2020 | | | | 10,000,000 | | | | | | | | | | 9,981,625 | |

1.597%, Due 2/19/2020 | | | | 5,000,000 | | | | | | | | | | 4,989,322 | |

1.639%, Due 2/26/2020 | | | | 5,000,000 | | | | | | | | | | 4,987,478 | |

1.617%, Due 3/6/2020 | | | | 6,800,000 | | | | | | | | | | 6,780,478 | |

1.629%, Due 3/9/2020 | | | | 5,000,000 | | | | | | | | | | 4,984,889 | |

1.586%, Due 3/10/2020 | | | | 7,300,000 | | | | | | | | | | 7,278,173 | |

1.598%, Due 3/11/2020 | | | | 10,000,000 | | | | | | | | | | 9,969,472 | |

1.600%, Due 3/20/2020 | | | | 6,800,000 | | | | | | | | | | 6,776,572 | |

1.613%, Due 3/20/2020 | | | | 5,000,000 | | | | | | | | | | 4,982,609 | |

1.615%, Due 4/15/2020 | | | | 5,000,000 | | | | | | | | | | 4,976,885 | |

1.616%, Due 4/27/2020 | | | | 10,000,000 | | | | | | | | | | 9,948,488 | |

1.634%, Due 5/6/2020 | | | | 10,000,000 | | | | | | | | | | 9,944,000 | |

1.729%, Due 5/8/2020,(3-mo. USD LIBOR - 0.175%)A | | | | 5,890,000 | | | | | | | | | | 5,889,913 | |

1.605%, Due 5/13/2020 | | | | 5,000,000 | | | | | | | | | | 4,970,999 | |

1.644%, Due 5/13/2020 | | | | 5,000,000 | | | | | | | | | | 4,970,260 | |

1.615%, Due 6/26/2020 | | | | 5,000,000 | | | | | | | | | | 4,961,158 | |

1.655%, Due 3/12/2021, (SOFR + 0.115%)A | | | | 5,000,000 | | | | | | | | | | 4,999,690 | |

1.615%, Due 6/11/2021, (SOFR + 0.075%)A | | | | 5,000,000 | | | | | | | | | | 4,993,146 | |

1.615%, Due 7/8/2021, (SOFR + 0.075%)A | | | | 7,300,000 | | | | | | | | | | 7,289,482 | |

| Federal Home Loan Mortgage Corp., | | | | | | | | | | | | | | | |

1.674%, Due 1/22/2020 | | | | 6,667,000 | | | | | | | | | | 6,660,606 | |

1.654%, Due 3/27/2020 | | | | 5,000,000 | | | | | | | | | | 4,980,650 | |

1.592%, Due 4/17/2020 | | | | 5,000,000 | | | | | | | | | | 4,976,817 | |

1.991%, Due 1/21/2020 | | | | 10,000,000 | | | | | | | | | | 9,989,167 | |

See accompanying notes

8

American Beacon U.S. Government Money Market Select FundSM

Schedule of Investments

December 31, 2019

| | | | | | | | | | | | | | | |

| | | |

| | | Principal Amount | | | | Fair Value |

| | | | | | | |

| | | |

| SHORT-TERM INVESTMENTS - 99.96% (continued) | | | | | | |

| | | |

| U.S. Government Agency Obligations - 59.70% (continued) | | | | | | |

| Federal National Mortgage Association, 1.580%, Due 1/29/2021, (SOFR + 0.040%)A | | | $ | 5,000,000 | | | | | | | | | $ | 4,995,691 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Total U.S. Government Agency Obligations (Cost $477,577,638) | | | | | | | | | | | | | | 477,577,638 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | |

| U.S. Treasury Obligations - 0.62% (Cost $4,993,796) | | | | | | |

| U.S. Treasury Bill, 2.080%, Due 1/23/2020 | | | | 5,000,000 | | | | | | | | | | 4,993,796 | |

| | | | | | | | | | | | | | | |

| | | |

| | | Shares | | | | |

| | | | | | | |

| | | |

| Investment Companies - 0.26% | | | | | | |

| BlackRock Liquidity Federal Fund, Institutional Class, 1.53%C | | | | 130,308 | | | | | | | | | | 130,308 | |

| Morgan Stanley Institutional Liquidity Funds - Government Portfolio, Institutional Class, 1.52%C | | | | 1,964,598 | | | | | | | | | | 1,964,598 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Total Investment Companies (Cost $2,094,906) | | | | | | | | | | | | | | 2,094,906 | |

| | | | | | | | | | | | | | | |

| | | |

| | | Principal Amount | | | | |

| | | | | | | |

| | | |

| Government Agency Repurchase Agreements - 39.38% | | | | | | |

Bank of America, N.A., 1.550%, Acquired on 12/31/2019, Due 1/2/2020, at $150,000,000 (Held at Bank of New York Mellon, Collateralized by a U.S. Government Agency Obligation, Valued at $153,000,000, 4.000%, 2/1/2045) | | | $ | 150,000,000 | | | | | | | | | | 150,000,000 | |

Goldman Sachs & Co., 1.520%, Acquired on 12/31/2019, Due 1/2/2020, at $40,000,000 (Held at Bank of New York Mellon, Collateralized by U.S. Government Agency Obligations, Valued at $40,800,000,3.500%-4.000%,10/1/2029-1/1/2048) | | | | 40,000,000 | | | | | | | | | | 40,000,000 | |

RBC Capital Markets LLC, 1.550%, Acquired on 12/31/2019, Due 1/2/2020, at $125,000,000 (Held at Bank of New York Mellon, Collateralized by U.S. Government Agency Obligations, Valued at $127,500,000,2.500%-5.500%,11/1/2023-04/20/2067) | | | | 125,000,000 | | | | | | | | | | 125,000,000 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Total Government Agency Repurchase Agreements (Cost $315,000,000) | | | | | | | | | | | | | | 315,000,000 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Total Short-Term Investments (Cost $799,666,340) | | | | | | | | | | | | | | 799,666,340 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

TOTAL INVESTMENTS - 99.96% (Cost $799,666,340) | | | | | | | | | | | | | | 799,666,340 | |

OTHER ASSETS, NET OF LIABILITIES - 0.04% | | | | | | | | | | | | | | 291,620 | |

| | | | | | | | | | | | | | | |

TOTAL NET ASSETS - 100.00% | | | | | | | | | | | | | $ | 799,957,960 | |

| | | | | | | | | | | | | | | |

| | | | | | | |

| Percentages are stated as a percent of net assets. | |

| | | | | | | |

| All rates represent either the annualized yield at the date of purchase, or the stated coupon rate, or, for floating and adjustable rate securities, the rate at period end. | | | | | | | | | | | | | | | |

A Variable, floating, or adjustable rate securities with an interest rate that changes periodically. Rates are periodically reset with rates that are based on a predetermined benchmark such as a widely followed interest rate such asT-bills, LIBOR or PRIME plus a fixed spread. The interest rate disclosed reflects the rate in effect on December 31, 2019.

B Coupon rate may change based on changes of the underlying collateral or prepayments of principal. The coupon rate shown represents the rate at period end.

C7-day yield.

LIBOR - London Interbank Offered Rate.

LLC - Limited Liability Company.

PRIME - A rate, charged by banks, based on the U.S. Federal Funds rate.

SOFR - Secured Overnight Financing Rate.

USD - United States Dollar.

See accompanying notes

9

American Beacon U.S. Government Money Market Select FundSM

Schedule of Investments

December 31, 2019

The Fund’s investments are summarized by level based on the inputs used to determine their values. As of December 31, 2019, the investments were classified as described below:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

U.S. Government Money Market Select Fund | | Level 1 | | | | | | Level 2 | | | | | | Level 3 | | | | | | Total | |

Assets | |

U.S. Government Agency Obligations | | $ | - | | | | | | | $ | 477,577,638 | | | | | | | $ | - | | | | | | | $ | 477,577,638 | |

U.S. Treasury Obligations | | | - | | | | | | | | 4,993,796 | | | | | | | | - | | | | | | | | 4,993,796 | |

Investment Companies | | | 2,094,906 | | | | | | | | - | | | | | | | | - | | | | | | | | 2,094,906 | |

Government Agency Repurchase Agreements | | | - | | | | | | | | 315,000,000 | | | | | | | | - | | | | | | | | 315,000,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Investments in Securities - Assets | | $ | 2,094,906 | | | | | | | $ | 797,571,434 | | | | | | | $ | - | | | | | | | $ | 799,666,340 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

U.S. GAAP requires transfers between all levels to/from level 3 be disclosed. During the year ended December 31, 2019, there were no transfers into or out of Level 3.

See accompanying notes

10

American Beacon U.S. Government Money Market Select FundSM

Statement of Assets and Liabilities

December 31, 2019

| | | | |

Assets: | |

Investments in securities, at amortized cost† | | $ | 484,666,340 | |

Repurchase agreements, at cost# | | | 315,000,000 | |

Dividends and interest receivable | | | 349,966 | |

Receivable for fund shares sold | | | 219,281 | |

Prepaid expenses | | | 30,428 | |

| | | | |

Total assets | | | 800,266,015 | |

| | | | |

Liabilities: | |

Payable for fund shares redeemed | | | 4 | |

Dividends payable | | | 105,108 | |

Management andsub-advisory fees payable (Note 2) | | | 79,666 | |

Transfer agent fees payable (Note 2) | | | 1,732 | |

Custody and fund accounting fees payable | | | 26,414 | |

Professional fees payable | | | 56,868 | |

Registration fees payable | | | 33,543 | |

Payable for prospectus and shareholder reports | | | 4,720 | |

| | | | |

Total liabilities | | | 308,055 | |

| | | | |

Net assets | | $ | 799,957,960 | |

| | | | |

Analysis of net assets: | |

Paid-in-capital | | $ | 799,957,872 | |

Total distributable earnings (deficits) | | | 88 | |

| | | | |

Net assets | | $ | 799,957,960 | |

| | | | |

Shares outstanding at no par value (unlimited shares authorized) | | | 799,957,879 | |

Net assets | | $ | 799,957,960 | |

Net asset value, offering and redemption price per share | | $ | 1.00 | |

| |

† Cost of investments in securities | | $ | 484,666,340 | |

# Cost of repurchase agreements | | $ | 315,000,000 | |

See accompanying notes

11

American Beacon U.S. Government Money Market Select FundSM

Statement of Operations

For the year ended December 31, 2019

| | | | |

Investment income: | |

Dividend income from unaffiliated securities | | $ | 328,265 | |

Interest income | | | 26,223,443 | |

| | | | |

Total investment income | | | 26,551,708 | |

| | | | |

Expenses: | |

Management andsub-advisory fees (Note 2) | | | 1,174,746 | |

Transfer agent fees | | | 34,918 | |

Custody and fund accounting fees | | | 123,262 | |

Professional fees | | | 105,042 | |

Registration fees and expenses | | | 16,176 | |

Prospectus and shareholder report expenses | | | 16,736 | |

Trustee fees (Note 2) | | | 53,778 | |

Other expenses | | | 36,432 | |

| | | | |

Total expenses | | | 1,561,090 | |

| | | | |

Net investment income | | | 24,990,618 | |

| | | | |

|

Realized gain (loss): | |

Net realized gain from: | | | | |

Investments in unaffiliated securities | | | 4,633 | |

| | | | |

Net gain from investments | | | 4,633 | |

| | | | |

Net increase in net assets resulting from operations | | $ | 24,995,251 | |

| | | | |

See accompanying notes

12

American Beacon U.S. Government Money Market Select FundSM

Statement of Changes in Net Assets

| | | | | | | | | | | | |

| | | Year Ended

December 31, 2019 | | | | | | Year Ended

December 31, 2018 | |

Increase (decrease) in net assets: | |

Operations: | |

Net investment income | | $ | 24,990,618 | | | | | | | $ | 26,272,017 | |

Net realized gain (loss) from investments in unaffiliated securities | | | 4,633 | | | | | | | | (10,618 | ) |

| | | | | | | | | | | | |

Net increase in net assets resulting from operations | | | 24,995,251 | | | | | | | | 26,261,399 | |

| | | | | | | | | | | | |

Distributions to shareholders: | |

Total retained earnings | | | (24,995,251 | ) | | | | | | | (26,261,399 | ) |

| | | | | | | | | | | | |

Net distributions to shareholders | | | (24,995,251 | ) | | | | | | | (26,261,399 | ) |

| | | | | | | | | | | | |

|

Capital share transactions (Note 8): | |

Proceeds from sales of shares | | | 7,103,976,045 | | | | | | | | 7,310,614,650 | |

Reinvestment of dividends and distributions | | | 21,132,578 | | | | | | | | 21,085,743 | |

Cost of shares redeemed | | | (7,236,873,197 | ) | | | | | | | (7,862,642,518 | ) |

| | | | | | | | | | | | |

Net (decrease) in net assets from capital share transactions | | | (111,764,574 | ) | | | | | | | (530,942,125 | ) |

| | | | | | | | | | | | |

Net (decrease) in net assets | | | (111,764,574 | ) | | | | | | | (530,942,125 | ) |

| | | | | | | | | | | | |

Net assets: | |

Beginning of period | | | 911,722,534 | | | | | | | | 1,442,664,659 | |

| | | | | | | | | | | | |

End of period | | $ | 799,957,960 | | | | | | | $ | 911,722,534 | |

| | | | | | | | | | | | |

See accompanying notes

13

American Beacon U.S. Government Money Market Select FundSM

Notes to Financial Statements

December 31, 2019

1. Organization and Significant Accounting Policies

American Beacon Select Funds (the “Trust”) is organized as a Massachusetts business trust. The Fund, a series within the Trust, is registered under the Investment Company Act of 1940, as amended (the “Act”), as a diversified,open-end management investment company. As of December 31, 2019, the Trust consists of one active series, which is presented in this filing: American Beacon U.S. Government Money Market Select Fund (the “Fund”).

American Beacon Advisors, Inc. (the “Manager”) is a Delaware corporation and a wholly-owned subsidiary of Resolute Investment Managers, Inc. (“RIM”) organized in 1986 to provide business management, advisory, administrative, and asset management consulting services to the Trust and other investors. The Manager is registered as an investment advisor under the Investment Advisers Act of 1940, as amended (the “Advisers Act”). RIM is, in turn, a wholly-owned subsidiary of Resolute Acquisition, Inc., which is a wholly-owned subsidiary of Resolute Topco, Inc., a wholly-owned subsidiary of Resolute Investment Holdings, LLC (“RIH”). RIH is owned primarily by Kelso Investment Associates VIII, L.P., KEP VI, LLC and Estancia Capital Partners L.P., investment funds affiliated with Kelso & Company, L.P. (“Kelso”) or Estancia Capital Management, LLC (“Estancia”), which are private equity firms.

Recently Adopted Accounting Pronouncements

In March 2017, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update(“ASU”) 2017-08,Premium Amortization of Purchased Callable Debt Securities. The amendments in the ASU shorten the premium amortization period on a purchased callable debt security from the security’s contractual life to the earliest call date. It is anticipated that this change will enhance disclosures by reducing losses recognized when a security is called on an earlier date. This ASU is effective for fiscal years beginning after December 15, 2018, and has been updated accordingly with no material impact on the financial statements and other disclosures.

In August 2018, the FASB issued ASU2018-13,Fair Value Measurement (“Topic 820”). The amendments in the ASU impact disclosure requirements for fair value measurement. It is anticipated that this change will enhance the effectiveness of disclosures in the notes to the financial statements. This ASU is effective for fiscal years beginning after December 15, 2019. Early adoption is permitted and can include the entire standard or certain provisions that exclude or amend disclosures. For the year ended December 31, 2019, the Fund has chosen to adopt the standard. The adoption of this ASU guidance did not have a material impact on the financial statements and other disclosures.

Significant Accounting Policies

The following is a summary of significant accounting policies, consistently followed by the Fund in preparation of the financial statements. The Fund is considered an investment company and accordingly, follows the investment company accounting and reporting guidance of the FASB Accounting Standards Codification Topic 946,Financial Services – Investment Companies,a part of Generally Accepted Accounting Principles (“U.S. GAAP”).

Security Transactions and Investment Income

Security transactions are recorded as of the trade date for financial reporting purposes. Securities purchased or sold on a when-issued or delayed-delivery basis may be settled beyond a standard settlement period for the security after the trade date.

Interest income for the Fund is earned from settlement date, recorded on the accrual basis, and adjusted, if necessary, for amortization of premiums or accretion of discounts on investment grade short-term securities and zero coupon instruments. For financial and tax reporting purposes, realized gains and losses are determined based on specific lot identification.

14

American Beacon U.S. Government Money Market Select FundSM

Notes to Financial Statements

December 31, 2019

Dividends to Shareholders

Dividends from net investment income and net short-term capital gain, if any, are accrued daily and paid monthly. Dividends to shareholders are determined in accordance with federal income tax regulations, which may differ in amount and character from net investment income and realized gains recognized for purposes of U.S. GAAP.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results may differ from those estimated.

Other

Under the Trust’s organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust. In the normal course of business, the Trust enters into contracts that provide indemnification to the other party or parties against potential costs or liabilities. The Trust’s maximum exposure under these arrangements is dependent on claims that may be made in the future and, therefore, cannot be estimated. The Trust has had no prior claims or losses pursuant to any such agreement.

2. Transactions with Affiliates

Management Agreement

The Fund and the Manager are parties to a Management Agreement that obligates the Manager to provide investment advisory, fund management, and administrative services to the Fund. As compensation for performing the duties under the Management Agreement, the Manager receives from the Fund an annualized fee of 0.10% of the Fund’s average daily net assets. Management fees paid by the Fund for the year ended December 31, 2019 were $1,174,746.

Expense Reimbursement Plan

The Manager contractually agreed to reduce fees and/or reimburse expenses for the Fund to the extent that total operating expenses exceeded the Fund’s historical expense caps. The Fund has adopted an Expense Reimbursement Plan whereby the Manager may seek repayment of such fee reductions and expense reimbursements. Under the policy, the Manager can be reimbursed by the Fund for any contractual or voluntary fee reductions or expense reimbursements if reimbursement to the Manager (a) occurs within three years from the Manager’s waiver/reimbursement and (b) does not cause the Fund’s annual operating expenses to exceed the lesser of the contractual percentage limit in effect at the time of the waiver/reimbursement or time of recoupment. During the year ended December 31, 2019 there were no waived fees, expenses reimbursed, or recouped expenses.

Trustee Fees and Expenses

As compensation for their service to the American Beacon Funds Complex, including the Trust (collectively, the “Trusts”), each Trustee is compensated from the Trusts as follows: (1) an annual retainer of $120,000; (2) meeting attendance fee (for attendance in person or via teleconference) of (a) $12,000 for in person attendance, or $5,000 for telephonic attendance, by Board members for each regularly scheduled or special Board meeting, (b) $2,500 for attendance by Committee members at meetings of the Audit Committee and the Investment Committee, (c) $1,500 for attendance by Committee members at meetings of the Nominating and Governance Committee; and (d) $2,500 for attendance by Board members for each special telephonic Board

15

American Beacon U.S. Government Money Market Select FundSM

Notes to Financial Statements

December 31, 2019

meeting; and (3) reimbursement of reasonable expenses incurred in attending Board meetings, Committee meetings, and relevant educational seminars. The Trustees also may be compensated for attendance at special Board and/or Committee meetings from time to time. For her service as Board Chair, Ms. Cline receives an additional annual retainer of $50,000. Although she attends several committee meetings at each quarterly Board meeting, she receives only a single $2,500 fee each quarter for her attendance at those meetings. The chairpersons of the Audit Committee and the Investment Committee each receive an additional annual retainer of $25,000 and the Chair of the Nominating and Governance Committee receives an additional annual retainer of $15,000.

Concentration of Ownership

From time to time, the Fund may have a concentration of one or more accounts constituting a significant percentage of shares outstanding. Investment activities by holders of accounts that represent a significant ownership of more than 5% of the Fund’s outstanding shares could have a material impact on the Fund. As of December 31, 2019, 90% of the Fund’s outstanding shares were held by affiliated American Beacon Funds.

3. Security Valuation and Fair Value Measurements

The Fund values its investments and computes the NAV per share at the close of the New York Stock Exchange (the “Exchange”), normally 4:00 p.m. Eastern Time, each day that the Exchange is open for business. In accordance with Rule2a-7 under the Act, money market securities, with the exception of repurchase agreements, are valued at amortized cost, which approximates fair value; repurchase agreements are valued based on par. Securities for which amortized cost is deemed not to reflect fair value are stated at fair value as determined in good faith by the Valuation Committee, established by the Trust’s Board of Trustees (the “Board”). In the event that a deviation of1⁄2 of 1% or more exists between the $1.00 per share price of a Fund, calculated at amortized cost, and the price per share calculated by reference to market quotations, or if there is any other deviation that the Board believes would result in a material dilution to shareholders or purchasers, the Board will promptly consider the appropriate action that should be initiated.

Investments inopen-end mutual funds are valued at the closing NAV per share of the mutual fund on the day of valuation.

Valuation Inputs

Various inputs may be used to determine the fair value of the Fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

| | | | |

| Level 1 | | - | | Quoted prices in active markets for identical securities. |

| | |

| Level 2 | | - | | Prices determined using other significant observable inputs. These may include quoted prices for similar securities, interest rates, prepayment speeds, credit risk, and others. |

| | |

| Level 3 | | - | | Prices determined using other significant unobservable inputs. Unobservable inputs reflect the Fund’s own assumptions about the factors market participants would use in pricing an investment. |

Level 1 and Level 2 trading assets and trading liabilities, at fair value

Money market securities are valued using amortized cost, in accordance with rules under the Act. Generally, amortized cost approximates the current value of a security, but since the value is not obtained from a quoted price in an active market, such securities are reflected as Level 2.

Investments in registeredopen-end investment management companies will be valued based upon the NAVs of such investments and are categorized as Level 1 of the fair value hierarchy.

16

American Beacon U.S. Government Money Market Select FundSM

Notes to Financial Statements

December 31, 2019

4. Securities and Other Investments

Other Government Money Market Fund Securities

The Fund, at times, may invest in shares of other government money market funds. Investments in the securities of other government money market funds may involve duplication of advisory fees and certain other expenses. By investing in another government money market fund, the Fund becomes a shareholder of that government money market fund. As a result, Fund shareholders indirectly will bear the Fund’s proportionate share of the fees and expenses paid by shareholders of the other government money market fund, in addition to the fees and expenses Fund shareholders directly bear in connection with the Fund’s own operations. These other fees and expenses are reflected as Acquired Fund Fees and Expenses and are included in the Fees and Expenses Table for the Fund in its Prospectus, if applicable. Investment in other government money market funds may involve the payment of substantial premiums above the value of such issuer’s portfolio securities.

Although a money market fund is designed to be a relatively low risk investment, it is not free of risk. Despite the short maturities and high credit quality of a money market fund’s investments, increases in interest rates and deteriorations in the credit quality of the instruments the money market fund has purchased may reduce the money market fund’s yield and can cause the price of a money market security to decrease. In addition, a money market fund is subject to the risk that the value of an investment may be eroded over time by inflation.

Repurchase Agreements

A repurchase agreement is a fixed-income security in the form of an agreement between a Fund as purchaser and an approved counterparty as seller. The agreement is backed by collateral in the form of securities and/or cash transferred by the seller to the buyer to be held by an eligible third-party custodian. Under the agreement, a Fund acquires securities from the seller and the seller simultaneously commits to repurchase the securities at an agreed upon price and date, normally within a week. The price for the seller to repurchase the securities is greater than a Fund’s purchase price, reflecting an agreed upon “interest rate” that is effective for the period of time the purchaser’s money is invested in the security. During the term of the repurchase agreement, a Fund monitors on a daily basis the market value of the collateral subject to the agreement and, if the market value of the securities falls below the seller’s repurchase amount provided under the repurchase agreement, the seller is required to transfer additional securities or cash collateral equal to the amount by which the market value of the securities falls below the repurchase amount. Repurchase agreements may exhibit the economic characteristics of loans by a Fund.

The obligation of the seller under the repurchase agreement is not guaranteed, and there is a risk that the seller may fail to repurchase the underlying securities, whether because of the seller’s bankruptcy or otherwise. In such event, a Fund would attempt to exercise its rights with respect to the underlying collateral, including possible sale of the securities. A Fund may incur various expenses in connection with the exercise of its rights and may be subject to various delays and risks of loss, including (a) possible declines in the value of the underlying collateral, (b) possible reduction in levels of income and (c) lack of access to the securities collateral (if held through a third-party custodian) and possible inability to enforce the Fund’s rights. The Board has established procedures pursuant to which the Manager monitors the creditworthiness of the counterparties with which the Fund enters into repurchase agreement transactions.

The Fund may enter into repurchase agreements with counterparties who, in the opinion of the Manager, present a minimal risk of default during the term of the agreement. The underlying securities which serve as collateral for repurchase agreements typically include U.S. Government and agency securities. There is no percentage restriction on the Fund’s ability to enter into repurchase agreements that are collateralized fully and that the Manager deems to be with counterparties who are creditworthy without consideration of the value of the collateral.

17

American Beacon U.S. Government Money Market Select FundSM

Notes to Financial Statements

December 31, 2019

As of December 31, 2019, the Fund had investments in repurchase agreements with a gross value of $315,000,000 as disclosed in the Schedule of Investments and the Statement of Assets and Liabilities.

U.S. Government Agency Securities

U.S. Government agency securities are issued or guaranteed by the U.S. Government or its agencies or instrumentalities. Some obligations issued by U.S. Government agencies and instrumentalities are supported by the full faith and credit of the U.S. Treasury; others by the right of the issuer to borrow from the U.S. Treasury; others by discretionary authority of the U.S. Government to purchase certain obligations of the agency or instrumentality; and others only by the credit of the agency or instrumentality. U.S. Government securities bear fixed, floating or variable rates of interest. While the U.S. Government currently provides financial support to certain U.S. Government-sponsored agencies or instrumentalities, no assurance can be given that it will always do so, since it is not so obligated by law. U.S. Government securities include U.S. Treasury bills, notes and bonds, Federal Home Loan Bank (“FHLB”) obligations, Federal Farm Credit Bank (“FFCB”) obligations, U.S. Government agency obligations and repurchase agreements secured thereby. U.S. Government agency securities are subject to credit risk and interest rate risk.

U.S. Treasury Obligations

U.S. Treasury obligations include bills (initial maturities of one year or less), notes (initial maturities between two and ten years), and bonds (initial maturities over ten years) issued by the U.S. Treasury, Separately Traded Registered Interest and Principal component parts of such obligations, known as “STRIPS”, and inflation-indexed securities. The prices of these securities (like all debt securities) change between issuance and maturity in response to fluctuating market interest rates and credit ratings. The principal and interest components of selected securities are traded independently under the STRIPS program. Under the STRIPS program, the principal and interest components are individually numbered and separately issued by the U.S. Treasury at the request of depository financial institutions, which then trade the component parts independently.

Variable or Floating Rate Obligations

The interest rates payable on certainfixed-income securities in which the Fund may invest are not fixed and may fluctuate based upon changes in market rates. A variable rate obligation has an interest rate which is adjusted at predesignated periods in response to changes in the market rate of interest on which the interest rate is based. Variable and floating rate obligations are less effective than fixed rate instruments at locking in a particular yield. Nevertheless, such obligations may fluctuate in value in response to interest rate changes if there is a delay between changes in market interest rates and the interest reset date for the obligation, or for other reasons.

The terms of the variable or floating rate demand instruments that a Fund may purchase provide that interest rates are adjustable at intervals ranging from daily up to 397 calendar days, and the adjustments are based upon current market levels, the prime rate of a bank or other appropriate interest rate adjustment index as provided in the respective instruments. Some of these instruments are payable on demand on a daily basis or on not more than seven days’ notice. Others, such as instruments with quarterly or semi-annual interest rate adjustments, may be put back to the issuer on designated days, usually on not more than thirty days’ notice. Still others are automatically called by the issuer unless the Fund instructs otherwise.

The Fund may consider the maturity of a long-term variable or floating rate demand instrument to be shorter than its ultimate stated maturity under specified conditions. The acquisition of variable or floating rate demand notes for a Fund must also meet the requirements of rules issued by the SEC applicable to the use of the amortized cost method of securities valuation, specifically Rule2a-7 under the Act. The Fund will also consider the liquidity of the market for variable and floating rate instruments, and in the event that such instruments are illiquid, the Fund’s investments in such instruments will be subject to the limitation on illiquid investments.

18

American Beacon U.S. Government Money Market Select FundSM

Notes to Financial Statements

December 31, 2019

Pursuant to Rule2a-7 under the Act, variable or floating rate obligations may be deemed to have maturities shorter than their stated maturities as follows:

(1) An obligation that is issued or guaranteed by the U.S. Government or any agency thereof which has a variable rate of interest readjusted no less frequently than every 397 days will be deemed by the Fund to have a maturity equal to the period remaining until the next readjustment of the interest rate. A U.S. Government security that is a floating rate security shall be deemed to have a remaining maturity of one day.

(2) A variable rate obligation, the principal amount of which must unconditionally be paid in 397 days or less, will be deemed by the Fund to have a maturity equal to the earlier of the period remaining until the next readjustment of the interest rate or the period remaining until the principal amount can be recovered through demand.

(3) A floating rate obligation, the principal amount of which must unconditionally be paid in 397 days or less, will be deemed by the Fund to have a maturity of one day, except for purposes of determining the Fund’s weighted average life, in which case it shall be deemed to have a maturity equal to the period remaining until the principal amount can be recovered through demand.

(4) A variable rate obligation that is subject to a demand feature will be deemed by the Fund to have a maturity equal to the longer of the period remaining until the next readjustment of the interest rate or the period remaining until the principal amount can be recovered through demand.

(5) A floating rate obligation that is subject to a demand feature will be deemed by the Fund to have a maturity equal to the period remaining until the principal amount can be recovered through demand. As used above, an obligation is “subject to a demand feature” when the Fund is entitled to receive the approximate amortized cost of the security plus accrued interest, if any, at the later of the time of exercise or the settlement of the transaction, paid within 397 calendar days of exercise.

5. Principal Risks

Investing in the Fund may involve certain risks including, but not limited to, those described below.

Credit Risk

The value of a security held by the Fund may decline if the security’s credit quality, or that of the security’s issuer or provider of credit support is downgraded or their credit quality otherwise falls. A decline in the credit rating of an individual security held by the Fund may have an adverse impact on its price and make it difficult for the Fund to sell it. Ratings represent a rating agency’s opinion regarding the quality of the security and are not a guarantee of quality. Rating agencies might not always change their credit rating on an issuer or security in a timely manner to reflect events that could affect the issuer’s ability to make timely payments on its obligations. As with any money market fund, there is the risk that the issuers or guarantors of securities owned by the Fund, including securities issued by U.S. Government agencies, which are not backed by the full faith and credit of the U.S. Government, will default on the payment of principal or interest or the obligation to repurchase securities from the Fund. This could cause the Fund’s NAV to decline below $1.00 per share.

Interest Rate Risk

There is a risk that a decline in short-term interest rates would lower the Fund’s yield and the return on your investment, which may have an adverse effect on the Fund’s ability to provide a positive yield to its shareholders. Changes in interest rates also may change the resale value of the instruments held in the Fund’s portfolio. Generally, the value of investments with interest rate risk will move in the opposite direction to movements in interest rates. When interest rates go up, the market values of previously issued money market

19

American Beacon U.S. Government Money Market Select FundSM

Notes to Financial Statements

December 31, 2019

instruments generally decline and may have an adverse effect on the Fund’s ability to maintain a stable $1.00 share price. The Federal Reserve has raised the federal funds rate several times since December 2015 and may continue to increase rates in the future. Interest rates may rise, perhaps significantly and/or rapidly, potentially resulting in substantial losses to the Fund.

Liquidity Risk

From time to time, certain securities held by the Fund may become less liquid in response to market developments or adverse credit events that may affect issuers or guarantors of a security. An inability to sell a portfolio position at favorable times or prices can adversely affect the Fund’s ability to maintain a $1.00 share price. In addition, the Fund may experience difficulty satisfying redemption requests within the time periods stated in the “Redemption Policies” section of the Fund’s Prospectus because of unusual market conditions, an unusually high volume of redemption requests or other reasons.

Market Risk

In recent periods, fixed income instruments have experienced unusual liquidity issues, increased price volatility and, in some cases, credit downgrades and increased likelihood of default. These events have reduced the willingness and ability of some lenders to extend credit, and have made it more difficult for some borrowers to obtain financing on attractive terms, if at all. In addition, global economies and financial markets are becoming increasingly interconnected, which increases the possibilities that conditions in one country or region might adversely impact issuers in a different country or region. A rise in protectionist trade policies, risks associated with the United Kingdom’s vote to leave the European Union, the risk of a “trade war” between the United States and China, and the possibility of changes to some international trade agreements, could affect the economies of many nations, including the United States, in ways that cannot necessarily be foreseen at the present time. The severity or duration of adverse economic conditions may also be affected by policy changes made. The severity or duration of adverse economic conditions may also be affected by policy changes made by governments or quasigovernmental organizations. In addition, political and governmental events within the U.S. and abroad may affect investor and consumer confidence and may adversely impact financial markets and the broader economy, perhaps suddenly and to a significant degree. High public debt in the U.S. and other countries creates ongoing systemic and market risks and policymaking uncertainty. Because the impact on the markets has been widespread, it may be difficult to identify both risks and opportunities using past models of the interplay of market forces, or to predict the duration of these market conditions. Interest rates have been unusually low in recent years in the U.S. and abroad. Because there is little precedent for this situation, it is difficult to predict the impact on various markets of a significant rate increase, whether brought about by U.S. policy makers or by dislocations in world markets. In addition, there is a risk that the prices of goods and services in the U.S. and many foreign economies may decline over time, known as deflation (the opposite of inflation). Deflation may have an adverse effect on stock prices and creditworthiness and may make defaults on debt more likely.

Mortgage-Related Securities Risk

Mortgage-related and asset-backed securities are subject to market risks for fixed-income securities, which include, but are not limited to: credit risk, interest rate risk, prepayment risk and extension risk. The value of these securities will be influenced by the factors affecting the housing market and the assets underlying such securities. As a result, during periods of difficult or frozen credit markets, significant changes in interest rates, or deteriorating economic conditions, mortgage-related securities may decline in value, face valuation difficulties, become more volatile and/or become illiquid. Additionally, during such periods and also under normal conditions, these securities are also subject to prepayment and call risk. Gains and losses associated with prepayments will increase/decrease the income available for distributions by the Fund and the Fund’s yield. When mortgages and other obligations are prepaid and when securities are called, the Fund may have to reinvest in securities with a lower yield or fail to recover additional amounts (i.e., premiums) paid for securities with higher interest rates, resulting in an unexpected capital loss and/or a decrease in the amount of dividends and yield. In periods of rising

20

American Beacon U.S. Government Money Market Select FundSM

Notes to Financial Statements

December 31, 2019

interest rates, the Fund may be subject to extension risk, and may receive principal later than expected. As a result, in periods of rising interest rates, the Fund may exhibit additional volatility. Some of these securities may receive little or no collateral protection from the underlying assets and are thus subject to the risk of default. Moreover, declines in the credit quality of the issuers of mortgage-related securities or instability in the markets for such securities may affect the value and liquidity of such securities, which could result in losses to the Fund. Additionally, certain mortgage-related securities may include securities backed by pools of loans made to “subprime” borrowers or borrowers with blemished credit histories; the risk of defaults is generally higher in the case of mortgage pools that include such subprime mortgages.

Net Asset Value Risk

There is no assurance that the Fund will meet its investment objective of maintaining a stable price of $1.00 per share on a continuous basis. Furthermore, there can be no assurance that the Fund’s affiliates will purchase distressed assets from the Fund, make capital infusions, enter into capital support agreements or take other actions to ensure that the Fund maintains a NAV of $1.00 per share.

Other Investment Companies Risk

The Fund may invest in shares of other government money market funds. To the extent that the Fund invest in shares of other government money market funds, the Fund will indirectly bear the fees and expenses charged by those investment companies in addition to the Fund’s direct fees and expenses and will be subject to the risks associated with investments in those Funds.

Redemption Risk

The Fund could experience a loss when selling securities to meet redemption requests by shareholders. The risk of loss increases if the redemption requests are unusually large or frequent or occur in times of overall market turmoil or declining prices.

Repurchase Agreement Risk

The obligations of a counterparty to a repurchase agreement are not guaranteed. The Fund permits various forms of securities as collateral whose values fluctuate and are issued or guaranteed by the U.S. Government. There are risks that a counterparty may default at a time when the collateral has declined in value, or a counterparty may become insolvent, which may affect the Fund’s right to control the collateral. Repurchase agreements are subject to credit risk.

U.S. Government Securities and Government-Sponsored Enterprises Risk

A security backed by the U.S. Treasury or the full faith and credit of the United States is guaranteed by the applicable entity only as to the timely payment of interest and principal when held to maturity. The market prices for such securities are not guaranteed and will fluctuate. Additionally, circumstances could arise that would prevent the payment of interest or principal. This could result in losses to the Fund. Investments in securities issued by government-sponsored enterprises are debt obligations issued by agencies and instrumentalities of the U.S. Government. These obligations vary in the level of support they receive from the U.S. Government. They may be: (i) supported by the full faith and credit of the U.S. Treasury, such as those of the Government National Mortgage Association (‘‘GNMA’’); (ii) supported by the right of the issuer to borrow from the U.S. Treasury, such as those of the Federal Home Loan Bank and the Federal Farm Credit Banks; (iii) supported by the discretionary authority of the U.S. Government to purchase the agency obligations, such as those of Fannie Mae and Freddie Mac or (iv) supported only by the credit of the issuer, such as those of the Federal Farm Credit Bureau. The U.S. Government may choose not to provide financial support to U.S. Government-sponsored agencies or instrumentalities if it is not legally obligated to do so, in which case, if the issuer defaulted, to the extent the Fund holds securities of such issuer, it might not be able to recover its investment from the U.S. Government.

21

American Beacon U.S. Government Money Market Select FundSM

Notes to Financial Statements

December 31, 2019

Variable and Floating Rate Securities Risk

The coupons on certain fixed income securities in which a Fund may invest are not fixed and may fluctuate based upon changes in market rates. The coupon on a floating rate security is generally based on an interest rate such as a money-market index, LIBOR or a Treasury bill rate. Such securities are subject to interest rate risk and may fluctuate in value in response to interest rate changes if there is a delay between changes in market interest rates and the interest reset date for the obligation, or for other reasons. As short-term interest rates decline, the coupons on variable and floating rate securities typically decrease. Alternatively, during periods of rising interest rates, changes in the coupons of variable and floating rate securities may lag behind changes in market rates or may have limits on the maximum increases in the coupon rates. The value of variable and floating rate securities may decline if their coupons do not rise as much, or as quickly, as interest rates in general. Conversely, variable and floating rate securities will not generally increase in value if interest rates decline. Variable and floating rate securities are less effective at locking in a particular yield and are subject to credit risk.

Yield and Securities Selection Risk

The yield paid by the Fund will vary and may be affected by the Manager’s decisions regarding the Fund’s dollar-weighted average maturity (“WAM”) and dollar-weighted average life (“WAL”). If the Manager sets the Fund’s maturity target in a manner that does not correlate with the movement of interest rate trends it could have an adverse effect on the Fund’s yield. Income from the Fund may be at rates less than inflation.

Offsetting Assets and Liabilities