UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-9603

AMERICAN BEACON SELECT FUNDS

(Exact name of registrant as specified in charter)

220 East Las Colinas Boulevard, Suite 1200

Irving, Texas 75039

(Address of principal executive offices)-(Zip code)

Gene L. Needles, Jr., PRESIDENT

220 East Las Colinas Boulevard, Suite 1200

Irving, Texas 75039

(Name and address of agent for service)

Registrant’s telephone number, including area code: (817) 391-6100

Date of fiscal year end: December 31, 2017

Date of reporting period: December 31, 2017

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

About American Beacon Advisors

Since 1986, American Beacon Advisors has offered a variety of products and investment advisory services to numerous institutional and retail clients, including a variety of mutual funds, corporate cash management, and separate account management.

Our clients include defined benefit plans, defined contribution plans, foundations, endowments, corporations, financial planners, and other institutional investors. With American Beacon Advisors, you can put the experience of a multi-billion dollar asset management firm to work for your company.

U.S. GOVERNMENT MONEY MARKET SELECT FUND

You could lose money by investing in the American Beacon U.S. Government Money Market Select Fund. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The Fund’s sponsor has no legal obligation to provide financial support to the Fund, and you should not expect that the sponsor will provide financial support to the Fund at any time. Please see the prospectus for a complete discussion of the Fund’s risks. There can be no assurances that the investment objectives of this Fund will be met.

Any opinions herein, including forecasts, reflect our judgment as of the end of the reporting period and are subject to change. Each advisor’s strategies and each Fund’s portfolio composition will change depending on economic and market conditions. This report is not a complete analysis of market conditions, and, therefore, should not be relied upon as investment advice. Although economic and market information has been compiled from reliable sources, American Beacon Advisors, Inc. makes no representation as to the completeness or accuracy of the statements contained herein.

American Beacon Select Funds | December 31, 2017 |

Contents

President’s Message

| | |

| | Dear Shareholders, At American Beacon, we are proud to offer a broad range of equity, fixed- income and alternative mutual fund products for institutions and individuals. Our mutual funds – which span the domestic, international, global, frontier and emerging markets – are sub-advised by experienced portfolio managers who employ distinctive investment processes to manage assets through a variety of economic and market conditions. Together, we work diligently to help our clients and shareholders meet their long-term financial goals. Institutional wisdom, enduring value. Since our inception as a pension fiduciary in 1986, American Beacon has focused on identifying and overseeing institutional investment managers and portfolio risk management. In 1987, we leveraged our size and experience to launch a series of sub-advised, multi- |

manager mutual funds providing individual investors access to many of the same institutional managers as our pension clients. Following the financial crisis in 2008, we saw that investors were looking for unique solutions from managers who were not necessarily mainstream. In 2010, we began offering mutual funds from single managers with distinctive investment styles or asset classes. As we continue to expand our family of funds, our solutions- based approach provides innovative investments.

Guiding principles. Our “manager of managers” philosophy is built on a long-standing history of innovative thinking, discipline and consistency in applying our solutions-based approach. As a manager of managers, our goal is to engage the most effective money managers for each asset class, investment style or market strategy – whether through a single sub-advisor or a combination of sub-advisors. Because we take our fiduciary responsibilities very seriously, our thorough manager evaluation and selection process is rigorous and ongoing. Our guiding principles – predictability, style consistency, competitive pricing and long-term relationships – provide a strong foundation for our due-diligence process. Our broad range of mutual funds helps investors navigate the economic storms and market downturns in the U.S. and abroad. Our years of experience evaluating sub-advisors have led us to identify and partner with asset managers who have adhered to their disciplined processes for many years and through multiple market cycles.

Focus on asset protection and risk mitigation. We strive to provide innovative, long-term products without gimmicks. From offering some of the first multi-manager funds, one of the first retirement-income funds and the first open-end mutual fund in the U.S. to focus primarily on frontier-market debt, our robust history includes applying a disciplined, solutions-based approach to our product development process to help protect assets and mitigate risk.

Thank you for your continued interest in American Beacon. For additional information about our funds or to access your account information, please visit our website at www.americanbeaconfunds.com.

Best Regards,

Gene L. Needles, Jr.

President

American Beacon Funds

1

Market Overview

December 31, 2017 (Unaudited)

The post-election economic optimism that took hold of markets at the end of 2016 continued throughout 2017. Escalating North Korean provocations, ongoing political discord and a series of destructive hurricanes were not enough to derail the U.S. economy. The U.S. added more than 2 million jobs during the year, and the unemployment rate dropped to a 16-year low of 4.1%. As labor-market slack diminished, wages continued to steadily increase – albeit not at the pace expected with the economy running close to full employment. Nonetheless, the healthy job market translated into higher consumer confidence and a pickup in household spending. Business investment also increased as corporate earnings rose. The uptick in consumer and business demand led to further expansion in both the manufacturing and service sectors. Housing demand also remained strong, but inventory shortages and rising property values limited the sector’s upward momentum. On the whole, economic data came in stronger than last year, resulting in an acceleration of growth in 2017.

Solid economic growth enabled the Federal Reserve (the “Fed”) to continue on its path to normalization during the year. Keeping with its forecast, the Fed hiked rates three times in 2017. It raised rates by 25 basis points (0.25%) at each of the March, June and December meetings, resulting in a target range for the federal funds rate of 1.25% to 1.50% by year-end. Given expectations that the economic expansion will continue, the Fed’s December projection materials showed that it is forecasting three rate hikes in 2018. While there was concern among some Fed members about the stubbornly low level of inflation, most believed the tightening labor market may lead to higher inflation over the medium term, thus warranting the additional rate increases.

In addition to raising rates, the Fed finally began reducing its balance sheet after nearly a decade of quantitative easing. The Fed embarked on its balance-sheet reduction plan in October with the goal of decreasing the reinvestment of securities gradually over an extended period. Thus far, this measured approach to reducing accommodation has had a limited effect on financial-market conditions.

The year ended with the market focused on two things – the appointment of a new leader for the Federal Reserve Board and tax reform. After much rumor and speculation, President Trump nominated Jerome Powell as Fed chair in November. Mr. Powell is a current Fed governor and was a popular choice among market participants as he is expected to continue the Fed’s measured approach to policy normalization. With the Fed chair nomination decided, market focus returned to tax reform. After much political wrangling, Congress came through on their promise and passed sweeping tax legislation in December. Equity markets soared to new highs on the news while U.S. Treasury yields backed up in anticipation that stronger growth would green light additional rate increases from the Fed.

2

American Beacon U.S. Government Money Market Select FundSM

Performance Overview

December 31, 2017 (Unaudited)

The labor market continued to be a bright spot during 2017. The unemployment rate improved from 4.7% at the end of 2016 to 4.1% by the end of the year, leading to an increase in consumer confidence and a pickup in spending. As we approached the end of the year, a tax reform bill was passed and equity markets soared to new highs. As we head into 2018, the Fed will be monitoring economic developments closely in an effort to determine appropriate monetary policy.

At the December Federal Open Market Committee (the “FOMC”) meeting, the Fed raised the fed funds rate by 25 basis points to a target range of 1.25%-1.50% and forecasted three additional 25 basis point rate increases for 2018. This was the third 25 basis point increase in the fed funds rate for the year. The language coming out of the FOMC continues to indicate a gradual path to normalizing monetary policy. The committee felt that a slightly firmer path for rates was appropriate given the continued improvement in labor market conditions and increased confidence that inflation was moving toward their 2% objective.

During the year, the American Beacon U.S. Government Money Market Select Fund’s primary strategy was to buy short-dated agencies, both fixed and variable rate, and overnight repurchase agreements. The strategies implemented during the year enabled the Fund to outperform its Lipper peer group.

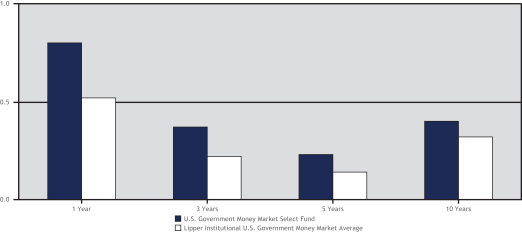

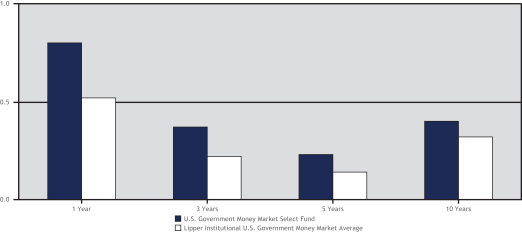

For the twelve months ended December 31, 2017, the total return of the American Beacon U.S. Government Money Market Select Fund was 0.80%. The Fund outperformed the Lipper Institutional U.S. Government Money Market Average return of 0.52% by 28 basis points (0.28%). Based on annualized total returns, Lipper Analytical Services ranked the Fund 13th among 221, 16th among 179, and 16th among 138 Institutional U.S. Government Money Market Funds for the one-year, five-year, and ten-year periods ended December 31, 2017, respectively.

Total Returns for the Period ended December 31, 2017

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Ticker | | 1 Year | | 3 Years | | 5 Years | | 10 Years |

U.S. Government Money Market Select Fund (1,3) | | AAOXX | | | | 0.80 | % | | | | 0.37 | % | | | | 0.23 | % | | | | 0.40 | % |

Lipper Institutional U.S. Government Money Market Average (2) | | | | | | 0.52 | % | | | | 0.22 | % | | | | 0.14 | % | | | | 0.32 | % |

Performance shown is historical and is not indicative of future returns. Investment returns will vary, and shares may be worth more or less at redemption than at original purchase. An investment in the Fund is neither insured nor guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of an investment at $1.00 per share it is possible to lose money by investing in the Fund. Fund performance in the table above does not reflect the deduction of taxes a shareholder would pay on distributions or the redemption of shares.

3

American Beacon U.S. Government Money Market Select FundSM

Performance Overview

December 31, 2017 (Unaudited)

| 1. | A portion of the fees charged to the Fund has been waived, and a portion was partially recovered in 2016. Performance prior to waiving fees was lower than the actual returns shown. |

| 2. | The Lipper Institutional U.S. Government Money Market Average is calculated by taking an arithmetic average of the returns of the mutual funds in the Lipper Institutional U.S. Government Money Market Funds category. Lipper is an independent mutual fund research and ranking service. |

| 3. | The Total Annual Fund Operating Expense ratio set forth in the most recent Fund prospectus was 0.14%. The expense ratio may vary from the expense ratio presented in other sections of this report that are based on expenses incurred during the period covered by this report. |

| | |

| Fund Statistics as of December 31, 2017 |

| 7-day Current Yield* | | 1.14% |

| 7-day Effective Yield* | | 1.14% |

| Weighted Average Maturity | | 29 Days |

| Weighted Average Life | | 80 Days |

| Standard & Poor’s Rating** | | AAAm |

| * | Annualized. Yield is a more accurate reflection of the Fund’s current earnings than total return. The seven-day yields refer to the income generated by an investment in the Fund over a seven-day period. This income is then annualized. |

The seven day effective yield is calculated similarly, but the income earned is assumed to have been reinvested. The effective yield will be slightly higher than the current yield because of the compounding effect of this assumed reinvestment.

| ** | Standard & Poor’s (S&P) Rating: The Fund is not sponsored, endorsed, sold or promoted by S&P, and S&P makes no representation regarding the advisability of investing in the Fund. The credit rating is a forward-looking opinion about a Fund’s potential capacity to maintain stable principal or stable net asset value. The rating is an opinion of the date expressed and not a statement of fact or recommendation to purchase, hold or sell any security. Standard & Poor’s rates the creditworthiness of money market funds from AAAm (highest) to Dm (lowest). For more information on S&P’s rating methodology, please visit www.standardandpoors.com and select “Understanding Ratings” under Ratings Resources on the home page. |

| | | | |

| Asset Allocation as of December 31, 2017 (% of net assets) | | | | |

| U.S. Government Agency Obligations | | | 55.8 | |

| Government Agency Repurchase Agreements | | | 32.7 | |

| Investment Companies | | | 9.4 | |

| U.S. Treasury Obligations | | | 2.1 | |

| | | | |

| Effective Maturity Distribution (%) | | | | |

| 1 to 7 Days | | | 54.1 | |

| 8 to 30 Days | | | 16.2 | |

| 31 to 90 Days | | | 24.7 | |

| 91 to 182 Days | | | 5.0 | |

4

American Beacon U.S. Government Money Market Select FundSM

Expense Examples

December 31, 2017 (Unaudited)

Fund Expense Example

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption fees, if applicable, and (2) ongoing costs, including management fees and other Fund expenses. The Examples are intended to help you understand the ongoing cost (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Examples are based on an investment of $1,000 invested at the beginning of the period in each Class and held for the entire period from July 1, 2017 through December 31, 2017.

Actual Expenses

The “Actual” lines of the tables provide information about actual account values and actual expenses. You may use the information on this page, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = $8.60), then multiply the result by the “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The “Hypothetical” lines of the tables provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the Fund’s actual return). You may compare the ongoing costs of investing in the Fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs charged by the Fund, such as sales charges (loads) or redemption fees, as applicable. Similarly, the expense examples for other funds do not reflect any transaction costs charged by those funds, such as sales charges (loads), redemption fees or exchange fees. Therefore, the “Hypothetical” lines of the tables are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. If you were subject to any transaction costs during the period, your costs would have been higher.

5

American Beacon U.S. Government Money Market Select FundSM

Expense Examples

December 31, 2017 (Unaudited)

| | | | | | | | | | | | | | | |

| American Beacon U.S. Government Money Market Select Fund | |

| | | Beginning Account Value

7/1/2017 | | Ending Account Value

12/31/2017 | | Expenses Paid During

Period

7/1/2017-12/31/2017* |

| Select Class | | | | | | | | | | | | | | | |

| Actual | | | | $1,000.00 | | | | | $1,004.90 | | | | | $0.66 | |

| Hypothetical** | | | | $1,000.00 | | | | | $1,024.60 | | | | | $0.66 | |

| * | Expenses are equal to the Fund’s annualized net expense ratios for the six-month period of 0.13% for the Select Class, multiplied by the average account value over the period, multiplied by the number derived by dividing the number of days in the most recent fiscal half-year (184) by days in the year (365) to reflect the half-year period. |

| ** | 5% return before expenses. |

6

American Beacon Select FundsSM

Report of Independent Registered Public Accounting Firm

To the Shareholders and the Board of Trustees of American Beacon U.S. Government Money Market Select Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of American Beacon U.S. Government Money Market Select Fund (the “Fund”) (the only fund constituting American Beacon Select Funds (the “Trust”)), including the schedule of investments, as of December 31, 2017, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund (the only fund constituting American Beacon Select Funds) at December 31, 2017, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and its financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Trust’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Trust in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Trust is not required to have, nor were we engaged to perform, an audit of the Trust’s internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Trust’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2017, by correspondence with the custodian and brokers. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor for one or more American Beacon investment companies since 1987.

Dallas, Texas

February 28, 2018

7

American Beacon U.S. Government Money Market Select FundSM

Schedule of Investments

December 31, 2017

| | | | | | | | | | | | | | | |

| | | Principal Amount | | | | Value |

| | | | | | | | | | | | | | | |

| SHORT-TERM INVESTMENTS - 99.99% | | | | | | | | | | | | | | | |

| U.S. Government Agency Obligations - 55.78% | | | | | | | | | | | | | | | |

Federal Farm Credit Bank, | | | | | | | | | | | | | | | |

1.521%, Due 1/17/2018, (1 mo. USD LIBOR + 0.030%)A | | | $ | 15,000,000 | | | | | | | | | $ | 14,999,601 | |

1.618%, Due 2/2/2018, (1 mo. USD LIBOR + 0.050%)A | | | | 5,000,000 | | | | | | | | | | 4,999,492 | |

1.512%, Due 2/9/2018, (1 mo. USD LIBOR + 0.080%)A | | | | 10,000,000 | | | | | | | | | | 9,999,993 | |

1.702%, Due 2/23/2018, (1 mo. USD LIBOR + 0.150%)A | | | | 17,000,000 | | | | | | | | | | 16,999,568 | |

1.582%, Due 2/26/2018, (1 mo. USD LIBOR + 0.030%)A | | | | 5,000,000 | | | | | | | | | | 4,998,924 | |

1.342%, Due 3/5/2018 | | | | 50,000,000 | | | | | | | | | | 49,884,500 | |

1.328%, Due 3/20/2018 | | | | 10,000,000 | | | | | | | | | | 9,971,725 | |

1.319%, Due 4/9/2018, (3 mo. USD LIBOR - 0.030%)A | | | | 5,000,000 | | | | | | | | | | 5,002,011 | |

1.541%, Due 4/16/2018, (1 mo. USD LIBOR + 0.050%)A | | | | 5,000,000 | | | | | | | | | | 4,999,056 | |

1.403%, Due 5/9/2018, (3 mo. USD LIBOR)A | | | | 5,000,000 | | | | | | | | | | 5,002,668 | |

1.426%, Due 9/28/2018, (3 mo. USD LIBOR - 0.260%)A | | | | 5,000,000 | | | | | | | | | | 5,000,000 | |

1.263%, Due 11/14/2018, (3 mo. USD LIBOR - 0.150%)A | | | | 5,000,000 | | | | | | | | | | 4,999,709 | |

1.104%, Due 4/3/2019, (3 mo. USD LIBOR - 0.230%)A | | | | 10,000,000 | | | | | | | | | | 9,998,583 | |

1.349%, Due 6/12/2019, (1 mo. USD LIBOR - 0.095%)A | | | | 30,000,000 | | | | | | | | | | 29,994,644 | |

1.354%, Due 7/12/2019, (1 mo. USD LIBOR - 0.090%)A | | | | 16,000,000 | | | | | | | | | | 15,996,457 | |

1.410%, Due 10/18/2019, (U.S. Federal Funds Rate - 0.010%)A | | | | 15,000,000 | | | | | | | | | | 14,999,192 | |

Federal Home Loan Bank, | | | | | | | | | | | | | | | |

1.067%, Due 1/2/2018 | | | | 25,000,000 | | | | | | | | | | 24,999,271 | |

1.070%, Due 1/3/2018 | | | | 20,000,000 | | | | | | | | | | 19,998,830 | |

1.078%, Due 1/3/2018 | | | | 10,000,000 | | | | | | | | | | 9,999,411 | |

1.089%, Due 1/3/2018 | | | | 10,000,000 | | | | | | | | | | 9,999,406 | |

1.098%, Due 1/3/2018 | | | | 36,200,000 | | | | | | | | | | 36,197,828 | |

1.108%, Due 1/3/2018 | | | | 10,000,000 | | | | | | | | | | 9,999,394 | |

1.118%, Due 1/3/2018 | | | | 7,600,000 | | | | | | | | | | 7,599,536 | |

1.094%, Due 1/5/2018 | | | | 6,000,000 | | | | | | | | | | 5,999,283 | |

1.095%, Due 1/5/2018 | | | | 15,000,000 | | | | | | | | | | 14,998,205 | |

1.108%, Due 1/5/2018 | | | | 4,000,000 | | | | | | | | | | 3,999,516 | |

1.107%, Due 1/10/2018 | | | | 15,000,000 | | | | | | | | | | 14,995,916 | |

1.108%, Due 1/10/2018 | | | | 15,000,000 | | | | | | | | | | 14,995,912 | |

1.278%, Due 1/10/2018 | | | | 15,000,000 | | | | | | | | | | 14,995,275 | |

1.320%, Due 2/9/2018 | | | | 10,000,000 | | | | | | | | | | 9,985,917 | |

1.252%, Due 2/23/2018 | | | | 14,539,000 | | | | | | | | | | 14,512,672 | |

1.302%, Due 2/26/2018, (3 mo. USD LIBOR - 0.160%)A | | | | 5,000,000 | | | | | | | | | | 5,000,000 | |

1.333%, Due 3/12/2018 | | | | 10,000,000 | | | | | | | | | | 9,974,528 | |

1.353%, Due 3/14/2018 | | | | 10,000,000 | | | | | | | | | | 9,973,400 | |

1.353%, Due 3/15/2018 | | | | 20,000,000 | | | | | | | | | | 19,946,061 | |

1.323%, Due 3/16/2018 | | | | 10,000,000 | | | | | | | | | | 9,973,278 | |

1.328%, Due 3/16/2018 | | | | 10,000,000 | | | | | | | | | | 9,973,175 | |

1.333%, Due 3/16/2018 | | | | 10,000,000 | | | | | | | | | | 9,973,072 | |

1.363%, Due 3/16/2018 | | | | 10,000,000 | | | | | | | | | | 9,972,456 | |

1.363%, Due 3/23/2018 | | | | 10,000,000 | | | | | | | | | | 9,969,850 | |

1.399%, Due 3/27/2018 | | | | 15,000,000 | | | | | | | | | | 14,951,302 | |

1.359%, Due 3/28/2018 | | | | 10,000,000 | | | | | | | | | | 9,968,108 | |

1.345%, Due 4/4/2018 | | | | 13,000,000 | | | | | | | | | | 12,955,670 | |

1.072%, Due 4/12/2018, (3 mo. USD LIBOR - 0.285%)A | | | | 5,000,000 | | | | | | | | | | 5,000,000 | |

1.131%, Due 5/2/2018, (3 mo. USD LIBOR - 0.250%)A | | | | 10,000,000 | | | | | | | | | | 9,999,767 | |

1.347%, Due 5/2/2018 | | | | 10,000,000 | | | | | | | | | | 9,955,633 | |

1.341%, Due 5/4/2018, (3 mo. USD LIBOR - 0.050%)A | | | | 8,410,000 | | | | | | | | | | 8,410,262 | |

1.347%, Due 5/4/2018 | | | | 10,000,000 | | | | | | | | | | 9,954,900 | |

1.440%, Due 5/18/2018 | | | | 8,000,000 | | | | | | | | | | 7,957,073 | |

1.321%, Due 6/1/2018, (3 mo. USD LIBOR - 0.160%)A | | | | 5,000,000 | | | | | | | | | | 5,000,000 | |

1.502%, Due 6/13/2018 | | | | 26,800,000 | | | | | | | | | | 26,621,624 | |

1.532%, Due 6/20/2018 | | | | 4,000,000 | | | | | | | | | | 3,971,667 | |

1.154%, Due 1/18/2019, (3 mo. USD LIBOR - 0.200%)A | | | | 5,000,000 | | | | | | | | | | 5,000,525 | |

1.347%, Due 2/6/2019, (1 mo. USD LIBOR - 0.045%)A | | | | 5,000,000 | | | | | | | | | | 5,000,000 | |

1.358%, Due 2/7/2019, (1 mo. USD LIBOR - 0.045%)A | | | | 5,000,000 | | | | | | | | | | 5,000,000 | |

1.294%, Due 5/24/2019, (3 mo. USD LIBOR - 0.160%)A | | | | 5,200,000 | | | | | | | | | | 5,198,594 | |

1.425%, Due 7/19/2019, (1 mo. USD LIBOR - 0.070%)A | | | | 25,000,000 | | | | | | | | | | 24,999,282 | |

1.380%, Due 11/13/2019, (1 mo. USD LIBOR - 0.080%)A | | | | 10,000,000 | | | | | | | | | | 9,997,062 | |

See accompanying notes

8

American Beacon U.S. Government Money Market Select FundSM

Schedule of Investments

December 31, 2017

| | | | | | | | | | | | | | | |

| | | Principal Amount | | | | Value |

| | | | | | | | | | | | | | | |

| SHORT-TERM INVESTMENTS - 99.99% (continued) | | | | | | | | | | | | | | | |

| U.S. Government Agency Obligations - 55.78% (continued) | | | | | | | | | | | | | | | |

Federal National Mortgage Association, | | | | | | | | | | | | | | | |

1.269%, Due 1/10/2018 | | | $ | 20,000,000 | | | | | | | | | $ | 19,993,750 | |

1.326%, Due 1/11/2018, (3 mo. USD LIBOR - 0.030%)A | | | | 10,000,000 | | | | | | | | | | 10,000,000 | |

1.281%, Due 1/31/2018 | | | | 11,969,000 | | | | | | | | | | 11,956,433 | |

1.279%, Due 2/7/2018 | | | | 17,000,000 | | | | | | | | | | 16,977,985 | |

1.316%, Due 3/7/2018 | | | | 10,000,000 | | | | | | | | | | 9,976,636 | |

1.314%, Due 3/19/2018 | | | | 10,000,000 | | | | | | | | | | 9,972,408 | |

1.353%, Due 3/21/2018 | | | | 15,000,000 | | | | | | | | | | 14,956,221 | |

1.592%, Due 3/21/2018, (3 mo. USD LIBOR - 0.050%)A | | | | 15,000,000 | | | | | | | | | | 15,000,336 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Total U.S. Government Agency Obligations (Cost $804,653,553) | | | | | | | | | | | | | | 804,653,553 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| U.S. Treasury Obligations - 2.07% (Cost $29,909,845) | | | | | | | | | | | | | | | |

U.S. Treasury Bills, 1.358%, Due 3/22/2018 | | | | 30,000,000 | | | | | | | | | | 29,909,845 | |

| | | | | | | | | | | | | | | |

| | | |

| | | Shares | | | | |

| Investment Companies - 9.42% | | | | | | | | | | | | | | | |

Blackrock Liquidity Funds Fed Fund Portfolio, Institutional Class, 1.160%B | | | | 47,966,569 | | | | | | | | | | 47,966,569 | |

Deutsche Government Cash Fund, Institutional Class, 1.200%B | | | | 49,147,210 | | | | | | | | | | 49,147,210 | |

Morgan Stanley Government Portfolio, Institutional Class, 1.200%B | | | | 38,807,409 | | | | | | | | | | 38,807,409 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Total Investment Companies (Cost $135,921,188) | | | | | | | | | | | | | | 135,921,188 | |

| | | | | | | | | | | | | | | |

| | | |

| | | Principal Amount | | | | |

| Government Agency Repurchase Agreements - 32.72% | | | | | | | | | | | | | | | |

BNP Paribas Securities Corp., 1.400%, Acquired on 12/29/2017, Due 01/02/2018, at $100,000,000 (Held at Bank of New York Mellon, Collateralized by U.S. Government Agency Obligations, Valued at $102,000,000, 2.00% - 7.50%, 01/01/2028 - 04/20/2047) | | | $ | 100,000,000 | | | | | | | | | | 100,000,000 | |

Credit Agricole CIB, 1.400%, Acquired on 12/29/2017, Due 01/02/2018, at $47,000,000 (Held at Bank of New York Mellon, Collateralized by U.S. Treasury Obligations, Valued at $48,880,095, 3.50%, 02/15/2018) | | | | 47,000,000 | | | | | | | | | | 47,000,000 | |

Goldman Sachs & Co., 1.300%, Acquired on 12/29/2017, Due 01/02/2018, at $55,000,000 (Held at Bank of New York Mellon, Collateralized by U.S. Government Agency Obligations, Valued at $56,100,000, 3.50% - 6.00%, 11/01/2027 - 12/01/2047) | | | | 55,000,000 | | | | | | | | | | 55,000,000 | |

RBC Capital Markets LLC, 1.380%, Acquired on 12/29/2017, Due 01/02/2018, at $200,000,000 (Held at Bank of New York Mellon, Collateralized by U.S. Government Agency Obligations, Valued at $204,000,001, 2.50% - 4.50%, 12/01/2032 - 12/01/2047) | | | | 200,000,000 | | | | | | | | | | 200,000,000 | |

TD Securities (USA) LLC, 1.420%, Acquired on 12/27/2017, Due 01/03/2018, at $70,000,000 (Held at Bank of New York Mellon, Collateralized by U.S. Treasury Obligations, Valued at $71,400,003, 0.13% - 0.38%, 04/15/2020 - 07/15/2023) | | | | 70,000,000 | | | | | | | | | | 70,000,000 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Total Government Agency Repurchase Agreements (Cost $472,000,000) | | | | | | | | | | | | | | 472,000,000 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

TOTAL INVESTMENTS - 99.99% (Cost $1,442,484,586) | | | | | | | | | | | | | | 1,442,484,586 | |

OTHER ASSETS, NET OF LIABILITIES - 0.01% | | | | | | | | | | | | | | 180,073 | |

| | | | | | | | | | | | | | | |

TOTAL NET ASSETS - 100.00% | | | | | | | | | | | | | $ | 1,442,664,659 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Percentages are stated as a percent of net assets. All rates represent either the annualized yield at the date of purchase, or the stated coupon rate, or, for floating and adjustable rate securities, the rate at period end. | | | | | | | | | | | | | | | |

A Variable, floating, or adjustable rate securities with an interest rate that changes periodically. Rates are periodically reset with rates that are based on a predetermined benchmark such as a widely followed interest rate such as T-bills, LIBOR or PRIME plus a fixed spread. The interest rate disclosed reflects the rate in effect on December 31, 2017.

B 7-day yield.

LIBOR - London Interbank Offered Rate.

LLC - Limited Liability Company.

USD - United States Dollar.

See accompanying notes

9

American Beacon U.S. Government Money Market Select FundSM

Schedule of Investments

December 31, 2017

The Fund’s investments are summarized by level based on the inputs used to determine their values. As of December 31, 2017, the investments were classified as described below:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

U.S. Government Money Market Select Fund | | Level 1 | | | | | | Level 2 | | | | | | Level 3 | | | | | | Total | |

Assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

U.S. Government Agency Obligations | | $ | - | | | | | | | $ | 804,653,553 | | | | | | | $ | - | | | | | | | $ | 804,653,553 | |

U.S. Treasury Obligations | | | - | | | | | | | | 29,909,845 | | | | | | | | - | | | | | | | | 29,909,845 | |

Investment Companies | | | 135,921,188 | | | | | | | | - | | | | | | | | - | | | | | | | | 135,921,188 | |

Government Agency Repurchase Agreements | | | - | | | | | | | | 472,000,000 | | | | | | | | - | | | | | | | | 472,000,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Investments in Securities - Assets | | $ | 135,921,188 | | | | | | | $ | 1,306,563,398 | | | | | | | $ | - | | | | | | | $ | 1,442,484,586 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

U.S. GAAP requires all transfers between any levels to be disclosed. The end of period timing recognition has been adopted for the transfers between levels of the Fund’s assets and liabilities. During the period ended December 31, 2017, there were no transfers between levels.

See accompanying notes

10

American Beacon U.S. Government Money Market Select FundSM

Statement of Assets and Liabilities

December 31, 2017

| | | | |

Assets: | |

Investments in securities, at amortized cost† | | $ | 970,484,586 | |

Repurchase agreements, at cost# | | | 472,000,000 | |

Dividends and interest receivable | | | 424,757 | |

Receivable for fund shares sold | | | 525,924 | |

Prepaid expenses | | | 856 | |

| | | | |

Total assets | | | 1,443,436,123 | |

| | | | |

Liabilities: | | | | |

Dividends payable | | | 464,036 | |

Management and sub-advisory fees payable (Note 2) | | | 137,005 | |

Transfer agent fees payable | | | 157 | |

Custody and fund accounting fees payable | | | 106,161 | |

Professional fees payable | | | 37,712 | |

Payable for prospectus and shareholder reports | | | 3,920 | |

Other liabilities | | | 22,473 | |

| | | | |

Total liabilities | | | 771,464 | |

| | | | |

Net assets | | $ | 1,442,664,659 | |

| | | | |

Analysis of net assets: | | | | |

Paid-in-capital | | $ | 1,442,664,571 | |

Undistributed net investment income | | | 88 | |

| | | | |

Net assets | | $ | 1,442,664,659 | |

| | | | |

Shares outstanding at no par value (unlimited shares authorized) | | | 1,442,664,579 | |

Net assets | | $ | 1,442,664,659 | |

Net asset value, offering and redemption price per share | | $ | 1.00 | |

| |

† Cost of investments in unaffiliated securities | | $ | 970,484,586 | |

# Cost of repurchase agreements | | $ | 472,000,000 | |

See accompanying notes

11

American Beacon U.S. Government Money Market Select FundSM

Statement of Operations

For the year ended December 31, 2017

| | | | |

Investment income: | |

Dividend income from unaffiliated securities | | $ | 364,211 | |

Interest income | | | 13,584,995 | |

| | | | |

Total investment income | | | 13,949,206 | |

| | | | |

Expenses: | |

Management and sub-advisory fees (Note 2) | | | 1,484,299 | |

Transfer agent fees | | | 3,053 | |

Custody and fund accounting fees | | | 160,831 | |

Professional fees | | | 82,601 | |

Registration fees and expenses | | | 23,061 | |

Prospectus and shareholder report expenses | | | 19,832 | |

Trustee fees (Note 2) | | | 84,474 | |

Other expenses | | | 48,419 | |

| | | | |

Total expenses | | | 1,906,570 | |

| | | | |

Net investment income | | | 12,042,636 | |

| | | | |

|

Realized gain (loss): | |

Net realized gain from: | | | | |

Investments in unaffiliated securities | | | 118 | |

| | | | |

Net gain from investments | | | 118 | |

| | | | |

Net increase in net assets resulting from operations | | $ | 12,042,754 | |

| | �� | | |

See accompanying notes

12

American Beacon U.S. Government Money Market Select FundSM

Statement of Changes in Net Assets

| | | | | | | | | | | | |

| | | Year Ended

December 31, 2017 | | | | | | Year Ended

December 31, 2016 | |

Increase (decrease) in net assets: | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | |

Net investment income | | $ | 12,042,636 | | | | | | | $ | 2,864,057 | |

Net realized gain from investments in unaffiliated securities | | | 118 | | | | | | | | 7,464 | |

| | | | | | | | | | | | |

Net increase in net assets resulting from operations | | | 12,042,754 | | | | | | | | 2,871,521 | |

| | | | | | | | | | | | |

Distributions to shareholders: | |

Net investment income | | | (12,042,636 | ) | | | | | | | (2,864,052 | ) |

Net realized gain from investments | | | (118 | ) | | | | | | | (7,464 | ) |

| | | | | | | | | | | | |

Net distributions to shareholders | | | (12,042,754 | ) | | | | | | | (2,871,516 | ) |

| | | | | | | | | | | | |

|

Capital share transactions (Note 8): | |

Proceeds from sales of shares | | | 8,673,437,107 | | | | | | | | 7,038,793,552 | |

Reinvestment of dividends and distributions | | | 8,516,884 | | | | | | | | 2,126,022 | |

Cost of shares redeemed | | | (8,681,403,875 | ) | | | | | | | (5,840,435,071 | ) |

| | | | | | | | | | | | |

Net increase in net assets from capital share transactions | | | 550,116 | | | | | | | | 1,200,484,503 | |

| | | | | | | | | | | | |

Net increase in net assets | | | 550,116 | | | | | | | | 1,200,484,508 | |

| | | | | | | | | | | | |

Net assets: | |

Beginning of period | | | 1,442,114,543 | | | | | | | | 241,630,035 | |

| | | | | | | | | | | | |

End of period* | | $ | 1,442,664,659 | | | | | | | $ | 1,442,114,543 | |

| | | | | | | | | | | | |

*Includes undistributed net investment income | | $ | 88 | | | | | | | $ | 88 | |

| | | | | | | | | | | | |

See accompanying notes

13

American Beacon U.S. Government Money Market Select FundSM

Notes to Financial Statements

December 31, 2017

1. Organization and Significant Accounting Policies

American Beacon Select Funds (the “Trust”) is organized as a Massachusetts business trust. The Fund, a series within the Trust, is registered under the Investment Company Act of 1940 (the “Act”) as a diversified, open-end management investment company. As of December 31, 2017, the Trust consists of one active series, which is presented in this filing: American Beacon U.S. Government Money Market Select Fund (the “Fund”).

American Beacon Advisors, Inc. (the “Manager”) is a wholly-owned subsidiary of Resolute Investment Managers, Inc., which is indirectly owned by investment funds affiliated with Kelso & Company, L.P. and Estancia Capital Management, LLC, and was organized in 1986 to provide business management, advisory, administrative, and asset management consulting services to the Trust and other investors.

Other Matters

As of April 29, 2016, the Fund, in accordance with amendments to the money market rules adopted by the Securities and Exchange Commission, converted to a “government money market fund” as defined in or interpreted under Rule 2a-7 under the Act, as amended. “Government money market funds” are exempt from requirements that permit money market funds to impose a liquidity fee and/or temporary redemption gates. This conversion may have required additional changes to the Fund’s investment strategies and operations and may negatively affect the Fund’s expense, liquidity, yield, and return potential.

Recently Adopted Accounting Pronouncements

In October 2016, the SEC adopted amendments to rules under the Investment Company Act of 1940 (“final rules”) intended to modernize the reporting and disclosure of information by registered investment companies. The final rules amend Regulation S-X and require funds to provide standardized, enhanced derivative disclosure in fund financial statements in a format designed for individual investors. The amendments to Regulation S-X also update the disclosures for other investments and investments in and advances to affiliates and amend the rules regarding the general form and content of fund financial statements. The compliance date for the amendments to Regulation S-X is August 1, 2017, and has been adopted accordingly.

Significant Accounting Policies

The following is a summary of significant accounting policies, consistently followed by the Fund in preparation of the financial statements. The Fund is considered an investment company and accordingly, follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standard Codification Topic 946, Financial Services Investment Companies, a part of Generally Accepted Accounting Principles (“U.S. GAAP”).

Security Transactions and Investment Income

Security transactions are recorded on the trade date of the security purchase or sale. The Fund may purchase securities with delivery or payment to occur at a later date. At the time the Fund enters into a commitment to purchase a security, the transaction is recorded, and the value of the security is reflected in the Net Asset Value (“NAV”). The value of the security may vary with market fluctuations.

Interest income for the Fund is earned from settlement date, recorded on the accrual basis, and adjusted, if necessary, for amortization of premiums or accretion of discounts on investment grade short-term securities and zero coupon instruments. For financial and tax reporting purposes, realized gains and losses are determined on the basis of specific lot identification.

14

American Beacon U.S. Government Money Market Select FundSM

Notes to Financial Statements

December 31, 2017

Dividends to Shareholders

Dividends from net investment income and net short-term capital gain, if any, are accrued daily and paid monthly. Dividends to shareholders are determined in accordance with federal income tax regulations, which may differ in amount and character from net investment income and realized gains recognized for purposes of U.S. GAAP.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results may differ from those estimated.

Other

Under the Trust’s organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust. In the normal course of business, the Trust enters into contracts that provide indemnification to the other party or parties against potential costs or liabilities. The Trust’s maximum exposure under these arrangements is dependent on claims that may be made in the future and, therefore, cannot be estimated. The Trust has had no prior claims or losses pursuant to any such agreement.

2. Transactions with Affiliates

Management Agreement

The Fund and the Manager are parties to a Management Agreement that obligated the Manager to provide investment advisory, fund management, and administrative services to the Fund. As compensation for performing the duties under the Management Agreement, the Manager receives from the Fund an annualized fee of 0.10% of the Fund’s average daily net assets. Management fees paid by the Fund for the year ended December 31, 2017 were $1,484,299.

Expense Reimbursement Plan

The Fund has adopted an Expense Reimbursement Plan whereby the Manager may seek repayment of such fee reductions and expense reimbursements. Under the policy, the Manager can be reimbursed by the Fund for any contractual or voluntary fee reductions or expense reimbursements if reimbursement to the Manager (a) occurs within three years after the Manager’s own waiver or reimbursement and (b) does not cause the Fund’s annual operating expenses to exceed the lesser of the contractual percentage limit in effect at the time of the waiver/reimbursement or time of recoupment. During the year ended December 31, 2017 there were no waived fees, expenses reimbursed, or recouped expenses.

The carryover of excess expenses potentially reimbursable to the Manager, but not recorded as a liability for the Fund is $20,818 and $8,983 expiring in 2018 and 2019, respectively. The Fund did not record a liability for potential reimbursements, due to the current assessment that a reimbursement is unlikely.

Trustee Fees and Expenses

As compensation for their service to the Trust, the American Beacon Funds and the American Beacon Institutional Funds Trust, each Trustee receives an annual retainer of $120,000, plus $10,000 for each Board of Trustees (the “Board”) meeting attended in person or via teleconference, $2,500 for attendance by Committee members at meetings of the Audit Committee and the Investment Committee, and $1,500 for attendance by Committee members at meetings of the Nominating and Governance Committee, plus reimbursement of reasonable expenses incurred in attending Board meetings, Committee meetings, and relevant educational seminars. The

15

American Beacon U.S. Government Money Market Select FundSM

Notes to Financial Statements

December 31, 2017

Trustees also may be compensated for attendance at special Board and/or Committee meetings from time to time. The Board Chairman receives an additional annual retainer of $50,000 as well as a single $10,000 fee each quarter for his attendance at the committee meetings. The Chairpersons of the Audit Committee and the Investment Committee each receive an additional annual retainer of $25,000 and the Chairman of the Nominating and Governance Committee receives an additional annual retainer of $10,000. These expenses are allocated on a prorated basis to each Fund of the Trusts according to its respective net assets.

Concentration of Ownership

From time to time, the Fund may have a concentration of one or more accounts constituting a significant percentage of shares outstanding. Investment activities by holders of accounts that represent a significant ownership of more than 5% of the Fund’s outstanding shares could have a material impact on the Fund. As of December 31, 2017, 90% of the Fund’s outstanding shares were held by affiliated American Beacon Funds.

3. Security Valuation and Fair Value Measurements

The Fund values its investments and computes the NAV per share at the close of the New York Stock Exchange (the “Exchange”), normally 4:00 p.m. Eastern Time, each day that the Exchange is open for business. In accordance with Rule 2a-7 under the Act, money market securities, with the exception of repurchase agreements, are valued at amortized cost, which approximates fair value; repurchase agreements are valued based on par. Securities for which amortized cost is deemed not to reflect fair value are stated at fair value as determined in good faith by the Valuation Committee, established by the Board. In the event that a deviation of 1⁄2 of 1% or more exists between the $1.00 per share price of a Fund, calculated at amortized cost, and the price per share calculated by reference to market quotations, or if there is any other deviation that the Board believes would result in a material dilution to shareholders or purchasers, the Board will promptly consider the appropriate action that should be initiated.

Investments in open-end mutual funds are valued at the closing NAV per share of the mutual fund on the day of valuation.

Valuation Inputs

Various inputs may be used to determine the fair value of the Fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

| | | | |

| Level 1 | | - | | Quoted prices in active markets for identical securities. |

| | |

| Level 2 | | - | | Prices determined using other significant observable inputs. These may include quoted prices for similar securities, interest rates, prepayment speeds, credit risk, and others. |

| | |

| Level 3 | | - | | Prices determined using other significant unobservable inputs. Unobservable inputs reflect the Fund’s own assumptions about the factors market participants would use in pricing an investment. |

Level 1 and Level 2 trading assets and trading liabilities, at fair value

Money market securities are valued using amortized cost, in accordance with rules under the 1940 Act. Generally, amortized cost approximates the current value of a security, but since the value is not obtained from a quoted price in an active market, such securities are reflected as Level 2.

Investments in registered open-end investment management companies will be valued based upon the NAVs of such investments and are categorized as Level 1 of the fair value hierarchy.

16

American Beacon U.S. Government Money Market Select FundSM

Notes to Financial Statements

December 31, 2017

4. Securities and Other Investments

Other Government Money Market Fund Securities

The Fund at times may invest in shares of other government money market funds. Investments in the securities of other government money market funds may involve duplication of advisory fees and certain other expenses. By investing in another government money market fund, the Fund becomes a shareholder of that government money market fund. As a result, Fund shareholders indirectly will bear the Fund’s proportionate share of the fees and expenses paid by shareholders of the other government money market fund, in addition to the fees and expenses Fund shareholders directly bear in connection with the Fund’s own operations. These other fees and expenses are reflected as Acquired Fund Fees and Expenses and are included in the Fees and Expenses Table for the Fund in its Prospectus, if applicable. Investment in other government money market funds may involve the payment of substantial premiums above the value of such issuer’s portfolio securities.

Although a money market fund is designed to be a relatively low risk investment, it is not free of risk. Despite the short maturities and high credit quality of a money market fund’s investments, increases in interest rates and deteriorations in the credit quality of the instruments the money market fund has purchased may reduce the money market fund’s yield and can cause the price of a money market security to decrease. In addition, a money market fund is subject to the risk that the value of an investment may be eroded over time by inflation.

Repurchase Agreements

A repurchase agreement is a fixed-income security in the form of an agreement between a Fund as purchaser and an approved counterparty as seller. The agreement is backed by collateral in the form of securities and/or cash transferred by the seller to the buyer to be held by an eligible third-party custodian. Under the agreement, a Fund acquires securities from the seller and the seller simultaneously commits to repurchase the securities at an agreed upon price and date, normally within a week. The price for the seller to repurchase the securities is greater than a Fund’s purchase price, reflecting an agreed upon “interest rate” that is effective for the period of time the purchaser’s money is invested in the security. During the term of the repurchase agreement, a Fund monitors on a daily basis the market value of the collateral subject to the agreement and, if the market value of the securities falls below the seller’s repurchase amount provided under the repurchase agreement, the seller is required to transfer additional securities or cash collateral equal to the amount by which the market value of the securities falls below the repurchase amount. Repurchase agreements may exhibit the economic characteristics of loans by a Fund.

The obligation of the seller under the repurchase agreement is not guaranteed, and there is a risk that the seller may fail to repurchase the underlying securities, whether because of the seller’s bankruptcy or otherwise. In such event, a Fund would attempt to exercise its rights with respect to the underlying collateral, including possible sale of the securities. A Fund may incur various expenses in connection with the exercise of its rights and may be subject to various delays and risks of loss, including (a) possible declines in the value of the underlying collateral, (b) possible reduction in levels of income and (c) lack of access to the collateral if held through a third-party custodian and possible inability to enforce the Fund’s rights. The Board has established procedures pursuant to which the Manager monitors the creditworthiness of the counterparties with which the Fund enters into repurchase agreement transactions.

The Fund may enter into repurchase agreements with member banks of the Federal Reserve System or registered broker-dealers who, in the opinion of the Manager, present a minimal risk of default during the term of the agreement. The underlying securities which serve as collateral for repurchase agreements typically include U.S. Government and agency securities. There is no percentage restriction on the Fund’s ability to enter into repurchase agreements with terms of seven days or less.

As of December 31, 2017, the Fund had investments in repurchase agreements with a gross value of $472,000,000 as disclosed in the Schedule of Investments and the Statement of Assets and Liabilities.

17

American Beacon U.S. Government Money Market Select FundSM

Notes to Financial Statements

December 31, 2017

U.S. Government Agency Securities

U.S. Government agency securities are issued or guaranteed by the U.S. Government or its agencies or instrumentalities. Some obligations issued by U.S. Government agencies and instrumentalities are supported by the full faith and credit of the U.S. Treasury; others by the right of the issuer to borrow from the U.S. Treasury; others by discretionary authority of the U.S. Government to purchase certain obligations of the agency or instrumentality; and others only by the credit of the agency or instrumentality. U.S. Government securities bear fixed, floating or variable rates of interest. While the U.S. Government currently provides financial support to certain U.S. Government-sponsored agencies or instrumentalities, no assurance can be given that it will always do so, since it is not so obligated by law. U.S. Government securities include U.S. Treasury bills, notes and bonds, Federal Home Loan Bank (“FHLB”) obligations, Federal Farm Credit Bank (“FFCB”) obligations, U.S. Government agency obligations and repurchase agreements secured thereby. U.S. Government agency securities are subject to credit risk and interest rate risk.

U.S. Treasury Obligations

U.S. Treasury obligations include bills (initial maturities of one year or less), notes (initial maturities between two and ten years), and bonds (initial maturities over ten years) issued by the U.S. Treasury, Separately Traded Registered Interest and Principal component parts of such obligations, known as “STRIPS”, and inflation-indexed securities. The prices of these securities (like all debt securities) change between issuance and maturity in response to fluctuating market interest rates and credit ratings. The principal and interest components of selected securities are traded independently under the STRIPS program. Under the STRIPS program, the principal and interest components are individually numbered and separately issued by the U.S. Treasury at the request of depository financial institutions, which then trade the component parts independently.

Variable or Floating Rate Obligations

The interest rates payable on certain fixed-income securities in which the Fund may invest are not fixed and may fluctuate based upon changes in market rates. A variable rate obligation has an interest rate which is adjusted at predesignated periods in response to changes in the market rate of interest on which the interest rate is based. Variable and floating rate obligations are less effective than fixed rate instruments at locking in a particular yield. Nevertheless, such obligations may fluctuate in value in response to interest rate changes if there is a delay between changes in market interest rates and the interest reset date for the obligation, or for other reasons.

The terms of the variable or floating rate demand instruments that a Fund may purchase provide that interest rates are adjustable at intervals ranging from daily up to 397 calendar days, and the adjustments are based upon current market levels, the prime rate of a bank or other appropriate interest rate adjustment index as provided in the respective instruments. Some of these instruments are payable on demand on a daily basis or on not more than seven days’ notice. Others, such as instruments with quarterly or semi-annual interest rate adjustments, may be put back to the issuer on designated days, usually on not more than thirty days’ notice. Still others are automatically called by the issuer unless the Fund instructs otherwise.

The Fund may consider the maturity of a long-term variable or floating rate demand instrument to be shorter than its ultimate stated maturity under specified conditions. The acquisition of variable or floating rate demand notes for a Fund must also meet the requirements of rules issued by the SEC applicable to the use of the amortized cost method of securities valuation, specifically Rule 2a-7 under the 1940 Act. The Fund will also consider the liquidity of the market for variable and floating rate instruments, and in the event that such instruments are illiquid, the Fund’s investments in such instruments will be subject to the limitation on illiquid investments.

18

American Beacon U.S. Government Money Market Select FundSM

Notes to Financial Statements

December 31, 2017

Pursuant to Rule 2a-7 under the Act, variable or floating rate obligations may be deemed to have maturities shorter than their stated maturities as follows:

(1) An obligation that is issued or guaranteed by the U.S. Government or any agency thereof which has a variable rate of interest readjusted no less frequently than every 397 days will be deemed by the Fund to have a maturity equal to the period remaining until the next readjustment of the interest rate. A U.S. Government security that is a floating rate security shall be deemed to have a remaining maturity of one day.

(2) A variable rate obligation, the principal amount of which must unconditionally be paid in 397 days or less, will be deemed by the Fund to have a maturity equal to the earlier of the period remaining until the next readjustment of the interest rate or the period remaining until the principal amount can be recovered through demand.

(3) A floating rate obligation, the principal amount of which must unconditionally be paid in 397 days or less, will be deemed by the Fund to have a maturity of one day, except for purposes of determining the Fund’s weighted average life, in which case it shall be deemed to have a maturity equal to the period remaining until the principal amount can be recovered through demand.

(4) A variable rate obligation that is subject to a demand feature will be deemed by the Fund to have a maturity equal to the longer of the period remaining until the next readjustment of the interest rate or the period remaining until the principal amount can be recovered through demand.

(5) A floating rate obligation that is subject to a demand feature will be deemed by the Fund to have a maturity equal to the period remaining until the principal amount can be recovered through demand. As used above, an obligation is “subject to a demand feature” when the Fund is entitled to receive the approximate amortized cost of the security plus accrued interest, if any, at the later of the time of exercise or the settlement of the transaction, paid within 397 calendar days of exercise.

5. Principal Risks

Investing in the Fund may involve certain risks including, but not limited to, those described below.

Credit Risk

The value of a security held by the Fund may decline if the security’s credit quality, or that of the security’s issuer or provider of credit support, is downgraded or credit quality otherwise falls. A decline in the credit rating of an individual security held by the Fund may have an adverse impact on its price. Rating agencies might not always change their credit rating on an issuer or security in a timely manner to reflect events that could affect the issuer’s ability to make timely payments on its obligations. As with any money market fund, there is the risk that the issuers or guarantors of securities owned by the Fund, including securities issued by U.S. Government agencies, which are not backed by the full faith and credit of the U.S. Government, will default on the payment of principal or interest or the obligation to repurchase securities from the Fund. This could cause the Fund’s NAV to decline below $1.00 per share.

Interest Rate Risk

There is a risk that a decline in short-term interest rates would lower the Fund’s yield and the return on your investment, which may have an adverse effect on the Fund’s ability to provide a positive yield to its shareholders. Changes in interest rates also may change the resale value of the instruments held in the Fund’s portfolio. Generally, the value of investments with interest rate risk will move in the opposite direction as movements in interest rates. When interest rates go up, the market values of previously issued money market instruments generally decline and may have an adverse effect on the Fund’s ability to maintain a stable $1.00

19

American Beacon U.S. Government Money Market Select FundSM

Notes to Financial Statements

December 31, 2017

share price. The Federal Reserve raised the federal funds rate in December 2016, March 2017, June 2017 and December 2017 and has signaled additional increases in 2018. Interest rates may rise, perhaps significantly and/or rapidly, potentially resulting in substantial losses to the Fund.

Liquidity Risk

From time to time, certain securities held by the Fund may become less liquid in response to market developments or adverse credit events that may affect issuers or guarantors of a security. An inability to sell a portfolio position at favorable times or prices can adversely affect the Fund’s ability to maintain a $1.00 share price. In addition, the Fund may experience difficulty satisfying redemption requests within the time periods stated in the “Redemption Policies” section of the Fund’s Prospectus because of unusual market conditions, an unusually high volume of redemption requests or other reasons.

Market Risk

Since the financial crisis that started in 2008, the U.S. and many foreign economies continue to experience its after-effects, which have resulted, and may continue to result, in fixed-income instruments experiencing unusual liquidity issues, increased price volatility and, in some cases, credit downgrades and increased likelihood of default. These events have reduced the willingness and ability of some lenders to extend credit, and have made it more difficult for some borrowers to obtain financing on attractive terms, if at all. In addition, global economies and financial markets are becoming increasingly interconnected, which increases the possibilities that conditions in one country or region might adversely impact issuers in a different country or region. The severity or duration of adverse economic conditions may also be affected by policy changes made by governments or quasi-governmental organizations.

In addition, political events within the U.S. and abroad may affect investor and consumer confidence and may adversely impact financial markets and the broader economy, perhaps suddenly and to a significant degree. High public debt in the U.S. and other countries creates ongoing systemic and market risks and policymaking uncertainty. Because the impact on the markets has been widespread, it may be difficult to identify both risks and opportunities using past models of the interplay of market forces, or to predict the duration of these market conditions. Interest rates have been unusually low in recent years in the U.S. and abroad. Because there is little precedent for this situation, it is difficult to predict the impact on various markets of a significant rate increase, whether brought about by U.S. policy makers or by dislocations in world markets. In addition, there is a risk that the prices of goods and services in the U.S. and many foreign economies may decline over time, known as deflation (the opposite of inflation). Deflation may have an adverse effect on stock prices and creditworthiness and may make defaults on debt more likely.

Net Asset Value Risk

There is no assurance that the Fund will meet its investment objective of maintaining a stable price of $1.00 per share on a continuous basis. Furthermore, there can be no assurance that the Fund’s affiliates will purchase distressed assets from the Fund, make capital infusions, enter into capital support agreements or take other actions to ensure that the Fund maintains a net asset value of $1.00 per share.

Other Investment Companies Risk

The Fund may invest in shares of other government money market funds. To the extent that the Fund invest in shares of other government money market funds, the Fund will indirectly bear the fees and expenses charged by those investment companies in addition to the Fund’s direct fees and expenses and will be subject to the risks associated with investments in those funds.

20

American Beacon U.S. Government Money Market Select FundSM

Notes to Financial Statements

December 31, 2017

Redemption Risk

The Fund could experience a loss when selling securities to meet redemption requests by shareholders. The risk of loss increases if the redemption requests are unusually large or frequent or occur in times of overall market turmoil or declining prices.

Repurchase Agreement Risk

The obligations of a counterparty to a repurchase agreement are not guaranteed. The Fund permits various forms of securities as collateral whose values fluctuate and are issued or guaranteed by the U.S. Government. There are risks that a counterparty may default at a time when the collateral has declined in value, or a counterparty may become insolvent, which may affect the Fund’s right to control the collateral. Repurchase agreements are subject to credit risk.

U.S. Government Securities and Government-Sponsored Enterprises Risk

A security backed by the U.S. Treasury or the full faith and credit of the United States is guaranteed by the applicable entity only as to the timely payment of interest and principal when held to maturity. The market prices for such securities are not guaranteed and will fluctuate. Securities held by the Fund that are issued by government-sponsored enterprises, such as the Fannie Mae, Freddie Mac, FHLB, FFCB, and the Tennessee Valley Authority are not guaranteed by the U.S. Treasury and are not backed by the full faith and credit of the U.S. Government and no assurance can be given that the U.S. Government will provide financial support if these organizations do not have the funds to meet future payment obligations. U.S. Government securities and securities of government sponsored entities are also subject to credit risk, interest rate risk and market risk.

Yield and Securities Selection Risk

The yield paid by the Fund will vary and may be affected by the Manager’s decisions regarding the Fund’s dollar-weighted average maturity (“WAM”) and dollar-weighted average life (“WAL”). If the Manager sets the Fund’s maturity target in a manner that does not correlate with the movement of interest rate trends it could have an adverse effect on the Fund’s yield. Income from the Fund may be at rates less than inflation.

Offsetting Assets and Liabilities

The Fund is party to Master Repurchase Agreements (“Master Repo Agreements”) that govern transactions between the Fund and selected counterparties. The Master Repo Agreements contain provisions for, among other things, initiation, income payments, events of default, and maintenance of collateral for Repurchase Agreements. The Fund has elected not to offset qualifying financial instruments on the Statement of Assets and Liabilities, as such financial instruments are presented on a gross basis. The impacts of netting arrangements that provide the right to offset are detailed below. The net amount represents the net receivable or payable that would be due from or to the counterparty in the event of default. Exposure from borrowings and other financing agreements such as repurchase

21

American Beacon U.S. Government Money Market Select FundSM

Notes to Financial Statements

December 31, 2017

agreements can only be netted across transactions governed by the same Master Repo Agreement with the same legal entity. All amounts reported below represent the balance as of the report date, December 31, 2017.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Gross Amounts Not Offset in the Statement

of Assets and Liabilities | |

Counterparty | | Net Amount of Assets

Presented in the Statement

of Assets and Liabilities | | | | | | Financial

Instruments(1) | | | | | | Non-Cash Collateral

Received | | | | | | Cash Collateral

Received | | | | | | Net Amount | |

| BNP Paribas Securities Corp. | | $ | 100,000,000 | | | | | | | $ | (100,000,000 | ) | | | | | | $ | - | | | | | | | $ | - | | | | | | | $ | - | |

| Credit Agricole CIB | | | 47,000,000 | | | | | | | | (47,000,000 | ) | | | | | | | - | | | | | | | | - | | | | | | | | - | |

| Goldman Sachs & Co. | | | 55,000,000 | | | | | | | | (55,000,000 | ) | | | | | | | - | | | | | | | | - | | | | | | | | - | |

| RBC Capital Markets LLC | | | 200,000,000 | | | | | | | | (200,000,000 | ) | | | | | | | - | | | | | | | | - | | | | | | | | - | |

| TD Securities (USA) LLC | | | 70,000,000 | | | | | | | | (70,000,000 | ) | | | | | | | - | | | | | | | | - | | | | | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | 472,000,000 | | | | | | | $ | (472,000,000 | ) | | | | | | $ | - | | | | | | | $ | - | | | | | | | $ | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(1) Excess of collateral received from the individual counterparty is not shown for financial reporting purposes. Collateral with a value of $482,380,099 has been received in connection with these transactions.

6. Federal Income and Excise Taxes

It is the policy of the Fund to qualify as a regulated investment company (“RIC”), by complying with all applicable provisions of Subchapter M of the Internal Revenue Code, as amended, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes. For federal income tax purposes, the Fund is treated as a single entity for the purpose of determining such qualification.

The Fund does not have any unrecorded tax liabilities in the accompanying financial statements. Each of the tax years in the four year period ended December 31, 2017 remain subject to examination by the Internal Revenue Service. If applicable, the Fund recognizes interest accrued related to unrecognized tax benefits in interest expense and penalties in “Other expenses” on the Statement of Operations.

Dividends are categorized in accordance with income tax regulations which may treat certain transactions differently than U.S. GAAP. Accordingly, the character of distributions and composition of net assets for tax purposes may differ from those reflected in the accompanying financial statements.

The tax character of distributions paid were as follows:

| | | | | | | | | | | | |

| | | U.S. Government Money Market

Select Fund | |

| | | Year Ended

December 31, 2017 | | | | | | Year Ended

December 31, 2016 | |

Distributions paid from: | | | | | | | | | | | | |

Ordinary incomeA | | $ | 12,042,754 | | | | | | | $ | 2,871,516 | |

| | | | | | | | | | | | |

Total distributions paid | | $ | 12,042,754 | | | | | | | $ | 2,871,516 | |

| | | | | | | | | | | | |

*For tax purposes, short-term capital gains are considered ordinary income distributions.

22

American Beacon U.S. Government Money Market Select FundSM

Notes to Financial Statements

December 31, 2017

As of December 31, 2017 the components of distributable earnings (deficits) on a tax basis were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Fund | | Tax Cost | | | | | | Unrealized

Appreciation | | | | | | Unrealized

(Depreciation) | | | | | | Net Unrealized

Appreciation

(Depreciation) | |

| U.S. Government Money Market Select | | $ | 1,442,484,586 | | | | | | | $ | - | | | | | | | $ | - | | | | | | | $ | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Fund | | Net Unrealized

Appreciation

(Depreciation) | | | | | | Undistributed

Ordinary Income | | | | | | Undistributed

Long-Term

Capital Gains | | | | | | Accumulated

Capital and

Other (Losses) | | | | | | Other Temporary

Differences | | | | | | Distributable

Earnings | |

| U.S. Government Money Market Select | | $ | - | | | | | | | $ | 302 | | | | | | | $ | - | | | | | | | $ | - | | | | | | | $ | (214 | ) | | | | | | $ | 88 | |

Under the Regulated Investment Company Modernization Act of 2010 (“RIC MOD”), net capital losses recognized by the Fund in taxable years beginning after December 22, 2010 are carried forward indefinitely and retain their character as short-term and/or long-term losses.

For the year ended December 31, 2017, the Fund did not have any capital loss carryforwards.

7. Borrowing Arrangements

Effective November 16, 2017, the Fund, along with certain other funds managed by the Manager (“Participating Funds”), entered into a committed revolving line of credit (the “Committed Line”) agreement with State Street Bank and Trust Company (the “Bank”) to be used to facilitate portfolio liquidity. The maximum borrowing amount under the Committed Line is $50 million with interest at a rate equal to the higher of (a) one-month London Inter-Bank Offered Rate (“LIBOR”) plus 1.25% per annum or (b) the Federal Funds rate plus 1.25% per annum on amounts borrowed. Each of the Participating Funds will pay a commitment fee at a rate of 0.25% per annum on the unused portion of the Committed Line amount. The Committed Line expires November 15, 2018, unless extended by the Bank or terminated by the Participating Funds in accordance with the agreement.

Effective November 16, 2017, the Fund, along with certain other Participating Funds managed by the Manager, entered into an uncommitted discretionary demand revolving line of credit (the “Uncommitted Line”) agreement with the Bank to be used to facilitate portfolio liquidity. The maximum borrowing amount under the Uncommitted Line is $50 million with interest at a rate equal to the higher of (a) one-month LIBOR plus 1.25% per annum or (b) the Federal Funds rate. The Uncommitted Line expires November 15, 2018, unless extended by the Bank or terminated by the Participating Funds in accordance with the agreement.