UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

GENTIVA HEALTH SERVICES, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

April 5, 2010

Dear Shareholder:

You are cordially invited to attend the 2010 Annual Meeting of Shareholders of Gentiva Health Services, Inc. to be held on Thursday, May 13, 2010, at 9:30 a.m., at the Renaissance Waverly Hotel, 2450 Galleria Parkway, Atlanta, Georgia 30339.

Details about the meeting, nominees for the Board of Directors and other matters to be acted upon are presented in the Notice of Annual Meeting of Shareholders and the Proxy Statement that follow.

Your vote is important. You may vote by completing, signing, dating and returning the accompanying proxy promptly in the envelope provided, or you may vote on the Internet or by telephone. This will assure that your shares will be represented and voted at the Annual Meeting even if you do not attend.

Thank you for your continued support, and we look forward to greeting you personally at the Annual Meeting if you are able to be present.

| | |

| Sincerely, | | |

| |

| |  |

| Ronald A. Malone | | Tony Strange |

| Chairman | | Chief Executive Officer and President |

GENTIVA HEALTH SERVICES, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 13, 2010

The Annual Meeting of Shareholders of Gentiva Health Services, Inc., a Delaware corporation, will be held on Thursday, May 13, 2010, at 9:30 a.m., at the Renaissance Waverly Hotel, 2450 Galleria Parkway, Atlanta, Georgia 30339, for the following purposes:

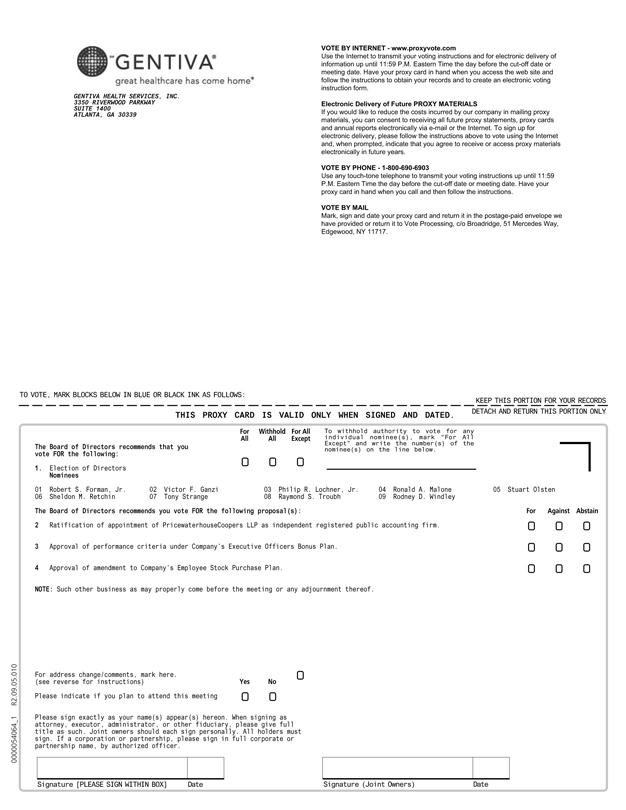

| | (1) | To elect nine directors, each to serve until the 2011 Annual Meeting of Shareholders; |

| | (2) | To consider and vote upon a proposal to ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending January 2, 2011; |

| | (3) | To consider and vote upon a proposal to approve the performance criteria in the Company’s Executive Officers Bonus Plan; |

| | (4) | To consider and vote upon a proposal to amend the Company’s Employee Stock Purchase Plan; and |

| | (5) | To transact such other business as may properly come before the meeting or any adjournments thereof. |

Information relating to the above matters is contained in the attached Proxy Statement. Only shareholders of record at the close of business on March 15, 2010 are entitled to notice of and to vote at the Annual Meeting or any adjournments thereof.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be Held on May 13, 2010: the Notice of Annual Meeting, the Proxy Statement and the 2009 Annual Report to Shareholders of Gentiva Health Services, Inc., including the Annual Report on Form 10-K for the fiscal year ended January 3, 2010, are available at www.proxyvote.com.

By Order of the Board of Directors,

Stephen B. Paige

Senior Vice President, General Counsel

and Secretary

Dated: April 5, 2010

Atlanta, Georgia

IT IS IMPORTANT THAT YOUR SHARES ARE REPRESENTED AT THE MEETING. WHETHER OR NOT YOU PLAN TO ATTEND, PLEASE VOTE BY COMPLETING, SIGNING, DATING AND RETURNING THE ACCOMPANYING PROXY PROMPTLY, OR PLEASE VOTE ON THE INTERNET OR BY TELEPHONE. IF YOU DO ATTEND AND DECIDE TO VOTE IN PERSON, YOU MAY REVOKE YOUR PROXY.

PROXY STATEMENT

GENERAL INFORMATION

Introduction

We are providing this Proxy Statement to the shareholders of Gentiva Health Services, Inc. in connection with the solicitation of proxies by our Board of Directors to be voted at the 2010 Annual Meeting of Shareholders and at any adjournments of that meeting. The 2010 Annual Meeting of Shareholders of Gentiva Health Services, Inc. will be held on Thursday, May 13, 2010, at 9:30 a.m., at the Renaissance Waverly Hotel, 2450 Galleria Parkway, Atlanta, Georgia 30339, for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders. The Board of Directors is soliciting proxies to be used at the Annual Meeting and any adjournment and is furnishing this Proxy Statement and the accompanying proxy in connection with its solicitation. Only shareholders of record at the close of business on March 15, 2010 are entitled to vote at the Annual Meeting. This Proxy Statement and the accompanying proxy are first being sent or given or otherwise made available to shareholders on or about April 5, 2010.

When used in this Proxy Statement, the terms “we,” “us,” “our,” “Gentiva” and the “Company” refer to Gentiva Health Services, Inc.

The securities that can be voted at the Annual Meeting consist of our common stock, $.10 par value per share. At the close of business on March 15, 2010, the record date for determining shareholders entitled to vote at the Annual Meeting, 29,717,940 shares of our common stock were outstanding and entitled to vote at the Annual Meeting. Each share of common stock is entitled to one vote.

Voting Procedures

You may vote by completing, signing, dating and returning the accompanying proxy promptly in the envelope provided, or you may vote on the Internet or by telephone. Any signed proxy cards received with no instructions, whether the cards come from shareholders who are “shareholders of record” (meaning the shares are registered directly in their name), or shareholders who are “beneficial owners” (meaning that the shares are held in a stock brokerage account or by a bank or other nominee), will be voted in accordance with the recommendations of our Board of Directors. Our Board of Directors recommends that you vote FOR all of the nominees to the Board of Directors, FOR ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm, FOR the approval of the performance criteria under our Executive Officers Bonus Plan and FOR the approval of an amendment of our Employee Stock Purchase Plan.

Revocability of Proxies

A shareholder of record who executes and returns a proxy may revoke it at any time before it is voted by giving notice in writing to our Secretary, by subsequently voting on the Internet or by telephone, by granting a subsequent proxy or by appearing in person and voting at the meeting. Any shareholder attending the meeting and entitled to vote may vote in person whether or not the shareholder has previously submitted a proxy. Please note, however, that under the rules of the national stock exchanges, any beneficial owner of our common stock whose shares are held in street name by a member brokerage firm may revoke his or her proxy and vote his or her shares in person at the Annual Meeting only in accordance with applicable rules and procedures of the exchanges as followed by the beneficial owner’s brokerage firm.

1

Quorum; Broker Non-Votes; Abstentions

Quorum: A majority of all the shares of common stock issued and outstanding and entitled to vote at the meeting, present in person or represented by proxy, will constitute a quorum at the Annual Meeting. Proxies marked as abstentions or withhold authority and “broker non-votes” (as explained below) are counted in determining whether a quorum is present.

Broker Non-Vote: Under applicable regulations, if a broker holds shares on your behalf, and you do not instruct your broker how to vote those shares on a matter considered “routine,” the broker may generally vote your shares for you. A “broker non-vote” occurs when a broker has not received voting instructions from you on a “non-routine” matter, in which case the broker does not have authority to vote your shares with respect to such matter. We believe that Proposals 1, 3 and 4 are “non-routine” matters and as such the broker is not authorized to vote your shares on such proposals absent instructions from you. A “broker non-vote” will not be considered a vote for or a vote against a proposal but will have the effect of reducing the number of affirmative votes required to achieve a majority vote.

Abstentions; Withhold Authority: Proxies marked as abstentions with respect to a proposal will have the effect of a vote against that proposal. Proxies marked to withhold authority to vote for a director will be counted in determining whether a quorum is present but will have no other effect on the election of directors.

Inspector of Election:Broadridge Financial Solutions, Inc. will count the votes and provide an Inspector of Election at the Annual Meeting.

Additional Matters

Gentiva’s principal executive offices are located at 3350 Riverwood Parkway, Suite 1400, Atlanta, Georgia 30339. Gentiva was incorporated in Delaware in August 1999.

We are making available or mailing to you a copy of our 2009 Annual Report to Shareholders, including a copy of our Form 10-K for the fiscal year ended January 3, 2010, with this Notice of Annual Meeting and Proxy Statement. Copies also are available on the website www.proxyvote.com. The Annual Report and Form 10-K are not deemed part of the soliciting material for the proxy.

If you would like directions to attend the Annual Meeting and vote in person, please call us at (770) 951-6450.

PROPOSAL 1

ELECTION OF DIRECTORS

All our directors stand for election on an annual basis and serve a one year term upon election. In addition, any director elected by the Board of Directors to fill a newly created directorship or to fill a vacancy on the Board of Directors will hold office for a term ending at the next annual meeting of shareholders after the director’s election or until such director’s successor shall have been duly elected and qualified.

Our Board of Directors currently consists of nine members, Robert S. Forman, Jr., Victor F. Ganzi, Philip R. Lochner, Jr., Ronald A. Malone, Stuart Olsten, Sheldon M. Retchin, Tony Strange, Raymond S. Troubh and Rodney D. Windley, all of whom are standing for re-election at this year’s Annual Meeting. Each has consented to serve another term as a director if re-elected. The Compensation, Corporate Governance and Nominating Committee of the Board of Directors recommended the slate of nine nominees to the Board of Directors for its approval. The Board has recommended the slate of nine nominees to the shareholders for approval at the Annual Meeting.

2

The vote of a plurality of the shares of common stock present or represented and entitled to vote at the Annual Meeting is required for election as a director. Proxies will be voted at the meeting for the election as directors of the nine nominees, unless authority to do so is withheld.If for any reason any of the nominees is not a candidate when the election occurs (which is not expected), the proxies may be voted for a substitute nominee or nominees.

The Board of Directors recommends that you vote FOR the election of Robert S. Forman, Jr., Victor F. Ganzi, Philip R. Lochner, Jr., Ronald A. Malone, Stuart Olsten, Sheldon M. Retchin, Tony Strange, Raymond S. Troubh and Rodney D. Windley.

Information as to Nominees for Director

The following information, as reported to us, is shown below for each nominee for director: name, age and principal occupation; period during which the nominee has served as a director; position, if any, with us; certain business experience; other directorships held; and any committees of our Board of Directors on which the nominee serves. We also include the specific attributes and experience of a nominee on which our Board focused in nominating that individual for election as director.

Robert S. Forman, Jr.

Mr. Forman has served as a director of Gentiva and a member of the Audit Committee of the Board since September 2009. Mr. Forman was the founder, president and chief executive officer of IMI Systems, Inc., an international computer consulting firm specializing in the design and implementation of service order and billing systems in the telecommunications industry. In 1995, Olsten Corporation acquired IMI Systems, Inc., and Mr. Forman was an executive vice president of Olsten Corporation until 1997. Since leaving Olsten, Mr. Forman served on the boards of several private information technology consulting companies. He currently serves on the Advisory Board of Rensselaer Polytechnic Institute’s IT School. Mr. Forman is 70 years old. In nominating Mr. Forman for election as a director, our Board focused on his past experience as a founder and chief executive officer of IMI Systems, Inc., a computer consulting firm, and his rich and extensive background in technology as important attributes and experience for his continuing to serve as one of our directors.

Victor F. Ganzi

Mr. Ganzi has served as a director of Gentiva since November 1999 and as Lead Director of the Board since May 2009. He has served as a member of the Audit Committee of the Board since November 1999, serving as chairman of that Committee from November 1999 to May 2009, and has served as chairman of the Compensation, Corporate Governance and Nominating Committee of the Board since May 2009, having served as a member of predecessor committees of that Committee since May 2008. He served as a director of Olsten Corporation from 1998 until March 2000. He was president and chief executive officer of The Hearst Corporation, a private diversified communications company with interests in magazine, newspaper and business publishing, television and radio stations and cable programming networks, from June 2002 to June 2008. He is a director, chairman of the audit committee and member of the corporate governance and nominating committee of Towers Watson & Co. and was a director of Hearst-Argyle Television, Inc. from 1997 to 2008 and a director of Wyeth from 2005 to 2009. Mr. Ganzi is 63 years old. In nominating Mr. Ganzi for election as a director, our Board focused on his past experience as chief executive officer, chief financial officer and chief legal officer of The Hearst Corporation and the knowledge of the Company that he has gained and shared from serving as a director and member of our Audit Committee since 1999 as important attributes and experience for his continuing to serve as one of our directors.

Philip R. Lochner, Jr.

Mr. Lochner has served as a director of Gentiva and a member of the Compensation, Corporate Governance and Nominating Committee of the Board since September 2009. Mr. Lochner currently is a director and member

3

of the audit committee and the director affairs/corporate governance committee of CLARCOR Inc., a director and member of the audit committee and the governance and public responsibility committee of CMS Energy Corporation and a director and member of the audit committee and the nominating and governance committee of Crane Co. During the past five years, at various times, Mr. Lochner was a director of Apria Healthcare Group Inc., GTECH Holdings Corporation, Monster Worldwide, Inc. and Solutia Inc. From 1991 until 1998, Mr. Lochner was senior vice president and chief administrative officer of Time Warner Inc. Prior to that, from 1990 to 1991, he served as a Commissioner of the Securities and Exchange Commission. He has also previously served as a member of the board of governors of the National Association of Securities Dealers and of the American Stock Exchange. Mr. Lochner is 67 years old. In nominating Mr. Lochner for election as a director, our Board focused on his expertise in the area of corporate governance, his prior service as a Commissioner of the Securities and Exchange Commission and his varied service on the boards and board committees of several public companies as important attributes and experience for his continuing to serve as one of our directors.

Ronald A. Malone

Mr. Malone has served as our Chairman of the Board of Directors since June 2002 and as a member of the Clinical Quality Committee of the Board since May 2009. He served as our chief executive officer from June 2002 to December 2008, as our executive vice president from March 2000 to June 2002 and as president of our home health services division from January 2001 to June 2002. Prior to joining Gentiva, he served in various positions with Olsten Corporation including executive vice president of Olsten Corporation and president, Olsten Staffing Services, United States and Canada, from 1999 to March 2000. He is a director of the National Association for Home Care & Hospice and a director and president of the Alliance for Home Health Quality and Innovation. He is a director and chairman of the compensation and management development committee of Hill-Rom Holdings, Inc. and was a director of Hillenbrand Industries, Inc. from 2007 to 2008. Mr. Malone is 55 years old. In nominating Mr. Malone for election as a director, our Board focused on his intimate knowledge of the home health industry, his expertise in pending healthcare reform legislation and his service as our chief executive officer from 2002 through 2008 as important attributes and experience for his continuing to serve as one of our directors.

Stuart Olsten

Mr. Olsten has served as a director of Gentiva since November 1999, as a member of the Audit Committee of the Board since May 2008 and as a member of the Clinical Quality Committee of the Board and the Compensation, Corporate Governance and Nominating Committee of the Board since May 2009. He served as a director of Olsten Corporation from 1986 until March 2000. From 1990 to March 2000, at various times, he served as Olsten Corporation’s chairman of the board of directors, vice chairman and president. From 2001 to March 2007, Mr. Olsten was the chairman of the operating board of MaggieMoo’s International, LLC and was its president and chief executive officer from July 2003 through December 2003. Mr. Olsten serves on the boards of private online employment service companies ChumBonus, LLC, HireReach, Inc., IvyExec, Inc. and HarQen, Inc. He is on the Advisory Board of the Syracuse University School of Management. Mr. Olsten is 57 years old. In nominating Mr. Olsten for election as a director, our Board focused on his extensive background in employment services and the knowledge of the Company that he has gained and shared from serving as a director since 1999 as important attributes and experience for his continuing to serve as one of our directors.

Sheldon M. Retchin, M.D., M.S.P.H.

Dr. Retchin has served as a director of Gentiva and a member of the Clinical Quality Committee of the Board since September 2009. Since 2003, Dr. Retchin has served as the chief executive officer of the Virginia Commonwealth University Health System in Richmond, Virginia, and as vice president for health sciences at Virginia Commonwealth University. The Virginia Commonwealth University Health System is a large academic health center in Central Virginia and delivers primary and tertiary health care to the mid-atlantic region. Dr. Retchin is a professor in the departments of internal medicine, gerontology and health administration and is a national expert in health policy and health care delivery, with special expertise on the costs, quality and

4

alternative financing strategies for the Medicare program. He has over 80 publications on the costs and quality of care and has had appointments on numerous national panels regarding health care and the health professional workforce. Dr. Retchin is 60 years old. In nominating Dr. Retchin for election as a director, our Board focused on his clinical and executive leadership in the health care field and his recognized expertise in health policy and health care delivery, especially regarding Medicare programs, as important attributes and experience for his continuing to serve as one of our directors.

Tony Strange

Mr. Strange has served as a director of Gentiva and as our chief executive officer since January 2009 and as our president since November 2007. He served as chief operating officer of the Company from November 2007 to May 2009 and as executive vice president of the Company and president of our home health division from February 2006 to November 2007. From 2001 to February 2006, Mr. Strange served as president and chief operating officer of The Healthfield Group, Inc. Mr. Strange joined Healthfield in 1990 and served in other capacities, including regional manager, vice president of development and chief operating officer, until being named president in 2001. Mr. Strange is 47 years old. In nominating Mr. Strange for election as a director, our Board focused on his leadership and execution as our chief executive officer in growing the Company and setting and communicating the proper cultural and behavioral tone as important attributes and experience for his continuing to serve as one of our directors.

Raymond S. Troubh

Mr. Troubh has served as a director of Gentiva since November 1999, as a member of the Audit Committee of the Board since May 2000, serving as chairman of that Committee since May 2009, and as a member of the Compensation, Corporate Governance and Nominating Committee of the Board and its predecessor committees since November 1999. He served as a director of Olsten Corporation from 1993 until March 2000. He has been a financial consultant for more than five years. He is a director, chairman of the compensation committee and member of the audit committee of Diamond Offshore Drilling Inc., a director and member of the compensation committee of General American Investors Company, and a director, chairman of the nominating and corporate governance committee and a member of the audit committee of Wendy’s/Arby’s Group, Inc. He was a director of Petrie Stores Liquidating Trust from 1994 to 2006, a director of Portland General Electric Co. from 2004 to 2005, a director of Sun Times Media Group from 2006 to 2007 and a director of WHX Corporation from 1992 to 2005. Mr. Troubh is 83 years old. In nominating Mr. Troubh for election as a director, our Board focused on his seasoned experience from having served on the boards and board committees of varied public companies, his vision and expertise in matters of corporate governance, his former selection as Director of the Year by the National Association of Corporate Directors and the knowledge of the Company that he has gained and shared as a director and member of our Audit Committee and Compensation, Corporate Governance and Nominating Committee since 1999 as important attributes and experience for his continuing to serve as one of our directors.

Rodney D. Windley

Mr. Windley has served as a director of Gentiva since February 2006, when he was elected to the Board and appointed vice chairman of the Board in connection with the completion of our acquisition of The Healthfield Group, Inc. He has served as a member of the Clinical Quality Committee of the Board since May 2008, serving as chairman since May 2009. Mr. Windley, Healthfield’s founder, had served as its chairman and chief executive officer since its inception in 1986 until the completion of the acquisition. Mr. Windley is the chairman of Prom Queen, LLC, a private real estate holding and restaurant development company, chairman of RDW Ventures, LLC, a private equity firm, and chairman of Gulf Coast Hatteras, Inc., a private yacht and sport fishing dealership. Mr. Windley is president of the Georgia Association for Home Care and is also chair emeritus of Fragile Kids Foundation, Inc., having started the charity in 1992. Mr. Windley is 62 years old. In nominating Mr. Windley for election as a director, our Board focused on his past experience as founder and chief executive officer of Healthfield, his financial and entrepreneurial background and his expansive knowledge of the health care industry as important attributes and experience for his continuing to serve as one of our directors.

5

CORPORATE GOVERNANCE

Independent Directors

In accordance with the listing standards of The Nasdaq Stock Market, Inc. (“Nasdaq”), we ensure that at least a majority of our Board is independent under the Nasdaq definition of independence, and that the members of the Board as a group maintain the requisite qualifications under Nasdaq listing standards for populating the Audit Committee and the Compensation, Corporate Governance and Nominating Committee. The Compensation, Corporate Governance and Nominating Committee and the Board of Directors have determined that Robert S. Forman, Jr., Victor F. Ganzi, Philip R. Lochner, Jr., Stuart Olsten, Sheldon M. Retchin and Raymond S. Troubh do not have any relationship that would interfere with the exercise of independent judgment in carrying out their responsibilities as directors and are independent in accordance with Nasdaq listing standards. In addition, we define “independent director” in the charters of the Audit Committee and the Compensation, Corporate Governance and Nominating Committee, both of which may be found on our website at www.gentiva.com under the Investors section. Each member of the Audit Committee and the Compensation, Corporate Governance and Nominating Committee is independent in accordance with the Nasdaq listing standards and, in the case of a member of the Audit Committee, in accordance with the rules of the Securities and Exchange Commission, and satisfies the definition of “independent director” set forth in the respective committee charter.

The independent directors generally meet in executive session on the dates when regularly scheduled Board meetings are held. Mr. Ganzi, the Board’s Lead Director, presides over the executive sessions of the independent directors.

Our Board also has adopted Corporate Governance Guidelines, which are posted on our website at www.gentiva.com under the Investors section.

Meetings of the Board and its Committees

Our Board of Directors currently consists of nine members. During the past fiscal year, the Board held 12 meetings. In May 2009, the Board combined a separate Compensation Committee and a separate Corporate Governance and Nominating Committee into a single committee, the Compensation, Corporate Governance and Nominating Committee. The Board now has three standing committees, an Audit Committee, a Clinical Quality Committee and a Compensation, Corporate Governance and Nominating Committee, whose principal functions are briefly described below. Except for Mr. Malone’s service as a member of the Clinical Quality Committee, none of the members of any committee is an employee or officer of Gentiva, and, except for Mr. Malone’s service as a member of the Clinical Quality Committee and for Mr. Windley’s service as chairman and a member of the Clinical Quality Committee, each member of each committee is “independent”.

During 2009, each incumbent director attended at least 75% of the aggregate number of meetings held by the Board and all committees on which the director served during the period that the director served. All of our Board members who were nominated for election at our 2009 Annual Meeting attended the 2009 Annual Meeting, except for one director. It is our policy to encourage our Board members to attend the Annual Meeting.

Audit Committee

The principal functions and responsibilities of the Audit Committee include:

| | • | | overseeing our internal control structure, financial reporting and legal and compliance programs; |

| | • | | discussing guidelines and policies with respect to our financial risk assessment and risk management policies with management; |

| | • | | reviewing and selecting the independent registered public accounting firm to audit our consolidated financial statements; |

6

| | • | | receiving and acting on reports and comments from our independent registered public accounting firm and approving the firm’s fees; |

| | • | | reviewing critical accounting principles and estimates employed in our financial reporting; |

| | • | | reviewing our annual audited consolidated financial statements and unaudited quarterly financial statements with management and our independent registered public accounting firm and recommending inclusion of the audited financial statements in our annual report on Form 10-K and the unaudited financial statements in our quarterly reports on Form 10-Q; |

| | • | | maintaining direct lines of communication with the Board of Directors and our management, internal auditing staff and independent registered public accounting firm; and |

| | • | | reporting to the Board of Directors a summary of its findings and recommendations. |

Mr. Troubh serves as the chairman, and Messrs. Forman, Ganzi and Olsten serve as members, of the Audit Committee. The Committee met seven times in 2009. The Board of Directors has adopted a written charter for the Audit Committee, which is posted on our website at www.gentiva.com under the Investors section. The Audit Committee has been established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Board of Directors has determined that each member of the Audit Committee is “independent” under the heightened independence standards required for members of the Audit Committee by the Nasdaq listing standards, the rules of the Securities and Exchange Commission and the Audit Committee Charter. The Board of Directors has also determined that Victor F. Ganzi is an “audit committee financial expert,” as that term is defined by rules and regulations of the Securities and Exchange Commission.

Clinical Quality Committee

The principal functions and responsibilities of the Clinical Quality Committee include:

| | • | | providing oversight of our clinical leadership in the development of leading edge clinical strategies and practices; |

| | • | | monitoring our performance against established internal and external benchmarking regarding clinical performance and outcomes; |

| | • | | facilitating the development of industry best practices based on internal and external data comparisons; |

| | • | | fostering enhanced awareness of our clinical performance by the Board of Directors and external sources; |

| | • | | establishing a long term, strategic clinical vision for Gentiva; and |

| | • | | reporting to the Board of Directors a summary of its findings and recommendations. |

Mr. Windley serves as the chairman, and Messrs. Malone and Olsten and Dr. Retchin serve as members, of the Clinical Quality Committee. The Committee met three times in 2009. The Board of Directors has adopted a written charter for the Clinical Quality Committee, which is posted on our website at www.gentiva.com under the Investors section.

Compensation, Corporate Governance and Nominating Committee

The principal functions and responsibilities of the Compensation, Corporate Governance and Nominating Committee include:

| | • | | overseeing and administering our executive compensation policies, plans and practices and establishing and adjusting from time to time compensation for our Chief Executive Officer and our other executive officers; |

7

| | • | | administering and authorizing the issuance of stock options, stock awards and other awards under our 2004 Equity Incentive Plan and awards under our Executive Officers Bonus Plan; |

| | • | | overseeing succession planning for our Chief Executive Officer and other key executives; |

| | • | | advising the Board on trends in compensation programs for directors, with a view towards aligning such compensation with shareholder interests; |

| | • | | monitoring and safeguarding the independence of our Board of Directors; |

| | • | | seeking, considering and recommending qualified candidates for election as directors and recommending a slate of nominees for election by the shareholders at the Annual Meeting, subject to the approval of the Board of Directors; and |

| | • | | reporting to the Board of Directors a summary of its findings and recommendations. |

Mr. Ganzi currently serves as chairman, and Messrs. Lochner, Olsten and Troubh serve as members, of the Compensation, Corporate Governance and Nominating Committee. The Committee met 11 times in 2009, including meetings of the separate Compensation Committee and separate Corporate Governance and Nominating Committee prior to May 2009. The Board of Directors has adopted a written charter for the Compensation, Corporate Governance and Nominating Committee, which is posted on our website at www.gentiva.com under the Investors section. The Board has determined that each of the members of the Committee is an “independent director” as defined under Nasdaq listing standards, is a “non-employee director” as defined in the charter and in Rule 16b-3 under the Exchange Act, and is an “outside director” as defined under Section 162(m) of the Internal Revenue Code and related regulations.

Compensation Committee Process

Our Compensation, Corporate Governance and Nominating Committee is responsible for determining the compensation of our Chief Executive Officer and our other executive officers. The Committee is responsible for administering and authorizing awards under our Executive Officers Bonus Plan, establishing goals and objectives relevant to executive compensation, and evaluating our executive officers’ performance. The Committee is also responsible for advising the Board of Directors about trends in director compensation and proposing guidelines regarding director compensation matters. The Committee makes recommendations to our Board of Directors regarding our incentive compensation and equity compensation plans and approves awards under our equity compensation plans. The Committee also oversees our benefit plans and evaluates any proposed new retirement or executive benefit plans. The Committee may delegate its plan administrative duties and has delegated certain authority to administer Gentiva’s Employee Stock Purchase Plan to our Benefits Plan Administrative Committee, which is appointed by the Board of Directors.

The Compensation, Corporate Governance and Nominating Committee has sole authority, without full Board action, to retain and terminate outside advisors, such as compensation consultants. In 2009, the firm of Frederic W. Cook & Co., Inc. was again engaged by the Committee to provide information and recommendations regarding executive officer compensation, including equity grants, as discussed in more detail in the Compensation Discussion and Analysis below.

The Compensation, Corporate Governance and Nominating Committee generally receives proposals and information from its compensation consultant and from the Chief Executive Officer for its consideration regarding executive compensation. As discussed below in the Compensation Discussion and Analysis, our Chief Executive Officer worked closely with the Committee to maintain an open dialogue regarding our goals, progress towards achievement of those goals and expectations for future performance, and made recommendations regarding the compensation of our executive officers other than himself.

Early in the year, the Compensation, Corporate Governance and Nominating Committee generally reviews our executive officers’ compensation, approves any salary increases (unless approved at the end of the prior year)

8

and equity grants, evaluates and approves discretionary profit sharing contributions and the annual bonus awards for the prior year, and establishes the performance goals for the upcoming year. Throughout the year, the Committee oversees recruiting for executive positions and approves compensation for newly hired or promoted executives. The Committee also reviews our general employee benefit plans and approves changes as needed. At the end of the year, the Committee generally meets to review executive compensation and discuss potential compensation to be approved for the following year, and may approve salary increases or other compensation items for the following year.

Compensation Risk Assessment

The Compensation, Corporate Governance and Nominating Committee has evaluated our compensation program to ensure that our policies and practices do not create risks that are reasonably likely to have a material adverse effect on Gentiva.

The potential for excessive risk taking in our annual cash incentive program has been minimized by our:

| | • | | setting performance goals for our executive officers and other employee participants that generally include quantitative and qualitative criteria, some of which would conflict with taking excessive risks to achieve short-term gain; and |

| | • | | retaining the ability to utilize negative discretion in determining annual cash incentive awards if an executive officer or other employee participant takes unnecessary or inappropriate risks. |

The other two principal elements of our compensation program—base salaries and equity awards—are either risk neutral or help lower risk. Annual base salary increases for our executive officers and other employees are based on a number of factors that reward performance that improves Gentiva’s business and reputation for clinical excellence, but are tempered by the employee’s historical compensation as well as competitive market data. Our equity incentive awards vest or are earned over several years. The potential compensation an executive officer or other participating employee can receive through equity incentive awards is generally tied directly to appreciation of our stock price and/or other performance metrics. The Committee believes that this discourages taking excessive risk for a short-term gain because it is incompatible with maximizing the value of equity incentive awards over the long-term.

Compensation Committee Interlocks and Insider Participation

None of the directors on the Compensation, Corporate Governance and Nominating Committee is or was formerly an officer or employee of Gentiva or had any relationship or related party transaction requiring disclosure under the rules of the Securities and Exchange Commission. None of our executive officers serves as a member of the board of directors or compensation committee of any entity that has one or more of its executive officers serving as a member of our Board of Directors or Compensation, Corporate Governance and Nominating Committee.

Consideration of Director Nominees

The Compensation, Corporate Governance and Nominating Committee will consider recommendations for director nominees from an array of sources, including members of our Board, management and shareholders. Shareholders who would like the Compensation, Corporate Governance and Nominating Committee to consider a prospective candidate should submit the candidate’s name, biographical data and qualifications, as well as a written statement from the individual of his or her consent to be named as a candidate and, if nominated and elected, to serve as a director, to Gentiva’s Secretary, Gentiva Health Services, Inc., 3350 Riverwood Parkway, Suite 1400, Atlanta, Georgia 30339. Submissions of names (and other required information) by shareholders of prospective candidates for consideration by the Committee for nomination and election at our 2011 Annual Meeting of Shareholders must be received in writing by us at the above address on or after October 8, 2010 and on or before December 8, 2010. The Committee reserves the right to request additional information from the candidate to assist the Committee in the evaluation process.

9

The Compensation, Corporate Governance and Nominating Committee believes that all members of the Board should have the highest professional and personal ethics and values and have a record of outstanding ability and sound judgment. Directors should be committed to enhancing shareholder value and have sufficient time to attend meetings and participate effectively on the Board. Each director is expected to represent the interests of all shareholders.

While there is no firm requirement of minimum qualifications or skills that a director candidate must possess, the Compensation, Corporate Governance and Nominating Committee seeks candidates with a diversity of background and experience as it deems appropriate given the then current needs of the Board and will evaluate director candidates based on a number of factors, including their independence, business judgment, leadership ability, experience in developing and analyzing business strategies, experience in the health care industry, strategic vision and financial literacy, and, for incumbent directors, their past performance. All members of the Board may interview the final candidates. The same identifying and evaluating procedures apply to all candidates for director nomination, including candidates submitted by shareholders.

In 2009, the Committee identified three areas of expertise where it was desired to strengthen the Board: technology background, corporate governance experience and clinical leadership. The Committee sought director candidates who had diversity of background and experience in these areas. The Committee retained and paid a fee to an executive search firm to assist in identifying and evaluating potential nominees for director. On September 3, 2009, the Board of Directors elected Robert S. Forman, Jr., Philip R. Lochner, Jr. and Sheldon M. Retchin as directors to fill vacancies in the Board. Messrs. Forman and Lochner had been identified and recommended by non-management directors of the Board and were subsequently interviewed by the Committee’s executive search firm. Dr. Retchin had been identified and recommended and was interviewed by the executive search firm.

Once the Compensation, Corporate Governance and Nominating Committee has evaluated the director candidates as described above, it recommends the slate of nominees to the Board of Directors for its approval. The Board then recommends the slate of nominees to the shareholders for their approval at the next annual meeting of shareholders.

Board Leadership Structure and Role in Risk Oversight

Our Chief Executive Officer, Tony Strange, is a member of our Board of Directors but is not Chairman of the Board, nor does he serve on any Board committees. Our former Chief Executive Officer, Ronald Malone, continues to serve as our executive Chairman of the Board. Our Board has an independent Lead Director, Victor Ganzi. Among other responsibilities, the Lead Director:

| | • | | convenes and chairs regular and special executive sessions of the independent directors; |

| | • | | serves as liaison between the independent directors and the Chairman of the Board and the Chief Executive Officer; |

| | • | | presides at meetings of the Board in the absence of the Chairman and Vice Chairman; and |

| | • | | performs such other duties as agreed by the Board or the independent directors from time to time. |

We believe that our leadership structure is appropriate given the independent leadership that our Board has in the form of our Lead Director.

The Board administers its risk oversight function through the Audit Committee of the Board. Through its charter, the Audit Committee is charged, among other things, with:

| | • | | overseeing the Company’s compliance programs and meeting with the Company’s Chief Compliance Officer; |

10

| | • | | reviewing with the Company’s General Counsel on a regular basis all material litigation and other significant legal matters; |

| | • | | meeting with the Company’s independent auditors, internal auditors and financial management and reviewing the scope of audit procedures of the proposed audit and, at the completion of the audit, meeting again with the independent auditors to review audit results; and |

| | • | | in turn, reporting to the Board at regular intervals on the Committee’s activities. |

Shareholder Communications

The Board of Directors has established a process for shareholders to send communications to the Board. Shareholders may communicate with the Board generally or with a specific director at any time by writing to Gentiva’s Secretary, Gentiva Health Services, Inc., 3350 Riverwood Parkway, Suite 1400, Atlanta, Georgia 30339. The Secretary will forward communications to the director to whom they are addressed, or, if addressed to the Board generally, to the chair of the Compensation, Corporate Governance and Nominating Committee.

Code of Ethics and Corporate Governance Guidelines

We have adopted two codes of ethics, a Code of Ethics for Senior Financial Officers (including the Chief Executive Officer) and a Code of Business Conduct and Ethics, the latter being applicable to all of our employees, officers and directors. The codes are designed to promote honest and ethical conduct by our employees, officers and directors, and each is posted on our website at www.gentiva.com under the Investors section.

We have also adopted Corporate Governance Guidelines, which address, among other things, director and Board responsibilities to the Company and its shareholders; Lead Director responsibilities and independent director sessions; and director qualification standards, including “independence” requirements. The Corporate Governance Guidelines are also posted on our website at www.gentiva.com under the Investors section.

11

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of March 15, 2010, the record date for our Annual Meeting (unless otherwise indicated), the amount of beneficial ownership of our common stock held by:

| | • | | our executive officers who are named in the Summary Compensation Table; |

| | • | | each current director and nominee for director; |

| | • | | each beneficial owner of more than five percent of our common stock; and |

| | • | | all of our executive officers and directors as a group. |

For the purpose of the table, a person or group of persons is deemed to have “beneficial ownership” of any shares that such person or group has the right to acquire within 60 days after March 15, 2010 through the exercise of stock options or exchange or conversion rights, but such shares are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person.

| | | | | |

Name of Beneficial Owner | | Amount of Shares

of Common Stock and

Nature of Beneficial

Ownership(1)(2)(3)(4) | | Percent of Class

Owned (if more

than 1%) | |

John N. Camperlengo | | 9,205 | | — | |

Ronald A. Malone | | 657,873 | | 2.2 | % |

Stephen B. Paige | | 88,639 | | — | |

John R. Potapchuk | | 267,635 | | — | |

Tony Strange(5) | | 427,424 | | 1.4 | % |

Charlotte A. Weaver | | 2,400 | | — | |

Robert S. Forman, Jr.(6) | | 1,697 | | — | |

Victor F. Ganzi | | 78,612 | | — | |

Philip R. Lochner, Jr. | | 1,672 | | — | |

Stuart Olsten(7) | | 235,573 | | — | |

Sheldon M. Retchin | | 1,672 | | — | |

Raymond S. Troubh(8) | | 186,221 | | — | |

Rodney D. Windley(9) | | 917,687 | | 3.1 | % |

BlackRock, Inc.(10)

40 East 52nd Street

New York, NY 10022 | | 2,216,536 | | 7.5 | % |

Lord, Abbett & Co. LLC(11)

90 Hudson Street

Jersey City, NJ 07302 | | 2,084,264 | | 7.0 | % |

Royce & Associates, LLC(12)

745 Fifth Avenue

New York, NY 10151 | | 2,073,353 | | 7.0 | % |

The Vanguard Group, Inc.(13)

100 Vanguard Blvd.

Malvern, PA 19355 | | 1,622,152 | | 5.5 | % |

All executive officers and directors as a group (13 persons)(14) | | 2,790,648 | | 9.0 | % |

| (1) | Unless otherwise indicated, the shareholders identified in this table have sole voting and investment power with respect to the shares beneficially owned by them. |

12

| (2) | Includes beneficial ownership of the following number of shares that may be acquired upon exercise of presently exercisable stock options under our 1999 Stock Incentive Plan and 2004 Equity Incentive Plan: Mr. Malone—641,638; Mr. Paige—80,500; Mr. Potapchuk—219,399; Mr. Strange—152,500; and Mr. Olsten—17,500. |

| (3) | Includes beneficial ownership of the following number of whole shares acquired and currently held under our Employee Stock Purchase Plan, as amended: Mr. Camperlengo—1,405; Mr. Malone—16,235; Mr. Paige—8,139; Mr. Potapchuk—13,324; and Mr. Strange—5,060. |

| (4) | Includes beneficial ownership of the following number of shares representing the equivalent of units deferred under our Stock & Deferred Compensation Plan for Non-Employee Directors: Mr. Forman—1,672; Mr. Ganzi—25,979; Mr. Lochner—1,672; Mr. Olsten—25,979; Dr. Retchin—1,672; Mr. Troubh—22,949; and Mr. Windley—10,458. |

| (5) | In addition to the shares referred to in footnotes (2) and (3), Mr. Strange’s holdings include 184,202 shares owned directly and 85,622 shares held by RT Management, LLC with respect to which Mr. Strange shares voting and investment power with Rodney D. Windley, Vice Chairman of our Board of Directors. Mr. Strange is a co-manager of RT Management, LLC and owns approximately 75% of the interest in the shares held by RT Management, LLC. Mr. Strange disclaims beneficial ownership in the shares held in RT Management, LLC, except to the extent of his pecuniary interest therein. |

| (6) | In addition to the shares referred to in footnote (4), Mr. Forman’s holdings include 25 shares owned by his wife, as to which shares he disclaims beneficial ownership. |

| (7) | In addition to the shares referred to in footnotes (2) and (4), Mr. Olsten’s holdings include 191,794 shares owned directly and 300 shares owned by his wife, as to which shares he disclaims beneficial ownership. |

| (8) | In addition to the shares referred to in footnote (4), Mr. Troubh’s holdings include 93,524 shares owned directly and 69,748 shares owned indirectly and held in a limited partnership in which Mr. Troubh has an approximate 22% interest and of which he is the general partner. |

| (9) | In addition to the shares referred to in footnote (4), Mr. Windley’s holdings include 58,763 shares owned directly, 762,804 shares owned indirectly through five grantor retained annuity trusts and 85,662 shares held by RT Management, LLC with respect to which Mr. Windley shares voting and investment power with Tony Strange, our Chief Executive Officer and President. Mr. Windley is a co-manager of RT Management, LLC and owns approximately 25% of the interest in the shares held by RT Management, LLC. Mr. Windley disclaims beneficial interest in the shares held in RT Management, LLC, except to the extent of his pecuniary interest therein. |

| (10) | The amount shown and the following information are derived from the Schedule 13G, filed with the Securities and Exchange Commission on January 29, 2010, by BlackRock, Inc. (“BlackRock”), reporting beneficial ownership as of December 31, 2009. According to the Schedule 13G, BlackRock reported beneficial ownership of 2,216,536 shares of our common stock with sole voting and dispositive power as to all of the shares. These shares had been owned by Barclays Global Investors, NA and certain of its affiliates (collectively referred to as the “BGI Entities”.) On December 1, 2009, BlackRock acquired the BGI Entities from Barclays Bank PLC, resulting in substantially all of the BGI entities being included as subsidiaries of BlackRock for purposes of Schedule 13G reports. |

| (11) | The amount shown and the following information are derived from the Schedule 13G, filed with the Securities and Exchange Commission on February 12, 2010, by Lord, Abbett & Co. LLC (“Lord Abbett”), reporting beneficial ownership as of December 31, 2009. According to the Schedule 13G, Lord Abbett reported beneficial ownership of 2,084,264 shares of our common stock, with sole dispositive power as to all of the shares and sole voting power as to 1,826,364 of the shares. Securities reported as being beneficially owned by Lord Abbett, a registered investment advisor, are held on behalf of investment advisory clients, which may include investment companies registered under the Investment Company Act of 1940, employee benefit plans, pension funds or other institutional clients. |

| (12) | The amount shown and the following information are derived from the Schedule 13G, filed with the Securities and Exchange Commission on January 25, 2010, by Royce & Associates, LLC (“Royce”), reporting beneficial ownership as of December 31, 2009. According to the Schedule 13G, Royce reported beneficial ownership of 2,073,353 shares of our common stock with sole voting and dispositive power as to all of the shares. |

13

| (13) | The amount shown and the following information are derived from the Schedule 13G, filed with the Securities and Exchange Commission on February 8, 2010, by The Vanguard Group, Inc. (“Vanguard”), reporting beneficial ownership as of December 31, 2009. According to the Schedule 13G, Vanguard reported beneficial ownership of 1,622,152 shares, and had sole voting power as to 38,950 of the shares, sole dispositive power as to 1,583,202 of the shares and shared dispositive power as to 38,950 of the shares. |

| (14) | Includes 1,588,730 shares owned directly and indirectly by current executive officers and directors, 1,111,537 shares that may be acquired upon exercise of presently exercisable stock options and 90,381 shares representing shares deferred as share units. |

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Overview

Through our compensation program and each element in the program, we seek to attract, motivate and retain executive officers and to align the interests of our executive officers with the interests of our shareholders. At the same time, we also seek to reinforce and support the objectives, priorities and core values of Gentiva, including providing superior quality care, ensuring a culture of compliance, and treating all employees and patients with respect.

The principal elements of our compensation program are as follows:

| | • | | annual cash incentive opportunities, and |

We also provide our executive officers with certain other benefits and perquisites that are discussed below under “Other Compensation.” The Compensation, Corporate Governance and Nominating Committee of our Board of Directors (the “Committee”) oversees our executive compensation program.

In 2009, we continued our focus from previous years on recruiting and retaining our personnel, growing and developing internal personnel resources, including succession planning for key executive positions, and achieving our financial, operational and clinical goals. We also placed emphasis in managing key technology initiatives and transitioning our headquarters to Atlanta, Georgia. Consequently, the Committee included these considerations in its evaluations of our executive officers’ performance and individual merit.

As discussed in more detail below, our focus on succession planning was reflected at our most senior management level in late 2008 and into 2009. In November 2008, we announced that, effective January 1, 2009, Mr. Tony Strange would be promoted to Chief Executive Officer and elected as a director, with our former Chief Executive Officer and Chairman of the Board, Mr. Ronald A. Malone, continuing to serve as our executive Chairman of the Board of Directors. Since our fiscal year began on December 29, 2008, Mr. Malone served as our Chief Executive Officer for three days during the 2009 fiscal year.

Independent Compensation Consultant and Peer Group Analysis

In 2009, the Committee again engaged Frederic W. Cook & Co., Inc. as its independent compensation consultant to provide the Committee with competitive market data for its consideration and to assist the Committee in setting compensation for our executive officers. The Committee’s independent compensation consultant did not provide any other services for management or the Company in 2009. The Committee annually evaluates, with the assistance of its consultant, the composition of the peer group that it uses for analysis of competitive market data. In formulating executive compensation for the 2009 fiscal year, the Committee

14

conducted its annual review of the peer group in December 2008 and adjusted the peer group to consist of companies that it believes align well with Gentiva’s business, operations and size, focusing on companies that provide services similar in nature to those provided by Gentiva. The peer group for evaluating 2009 compensation consisted of the following companies:

| | |

Amedisys, Inc. | | Healthways, Inc. |

AMN Healthcare Services, Inc. | | LHC Group, Inc. |

Apria Healthcare Group, Inc.* | | Lincare Holdings, Inc. |

Catalyst Health Solutions, Inc. | | MEDNAX (formerly Pediatrix Medical Group, Inc.) |

Chemed Corporation | | National HealthCare Corporation |

Cross Country Healthcare, Inc. | | Odyssey Healthcare, Inc. |

Five Star Quality Care, Inc. | | Parexel International Corporation |

| | PSS World Medical, Inc. |

| | * | Apria Healthcare was acquired as part of a going-private transaction in October 2008, and compensation data was derived from its 2008 proxy statement. |

Although market data is the principal factor that we considered to understand competitive compensation, industry trends and best practices regarding various compensation developments, in 2009 we did not follow a particular benchmark with regard to competitive data. This decision was based in large part upon our desire for flexibility in designing our compensation program. Instead, the competitive data provided us with a general gauge with which to assess current market compensation levels and practices. In addition, we do not use any particular benchmark or guideline for the mix of various elements of compensation, although we take into consideration market trends. As discussed in more detail below, along with competitive data, the Committee considered an analysis of historical compensation paid to each of the executive officers over the prior five years (or such shorter time as the individual had been employed by us), including base salary, annual incentive awards at both target and actual amounts, Black-Scholes valuations of annual long-term incentive awards and other compensation.

Role of the Chief Executive Officer

Mr. Malone, as our Chief Executive Officer through December 31, 2008, worked with the Committee in developing elements of our compensation program in 2009 for executive officers other than himself. Mr. Malone continued to provide support to the Committee and attended several meetings of the Committee in 2009, but beginning on January 1, 2009, Mr. Strange assumed his role as Chief Executive Officer and began working closely with the Committee to maintain an open dialogue regarding our goals, progress towards achievement of those goals and expectations for future performance. Mr. Strange updated the Committee regularly on results and compensation issues at Committee meetings. Mr. Strange also provided the Committee with recommendations regarding compensation for our executive officers other than himself and Mr. Malone.

Tax Considerations

Section 162(m) of the Internal Revenue Code limits our tax deduction for compensation over $1,000,000 paid to our Chief Executive Officer and our three other most highly compensated named executive officers employed at the end of the year (other than our Chief Financial Officer). Compensation that meets the requirements for qualified performance-based compensation under the Internal Revenue Code is not subject to this limit. The Committee takes into account the tax deductibility of compensation for executive officers in decisions regarding our executive compensation program. Accordingly, our equity awards are typically designed to qualify as performance-based compensation exempt from the limit of Section 162(m).

In addition, in 2009, the Committee worked with its independent legal counsel to structure our annual incentive compensation to qualify as performance-based compensation under Section 162(m). However, in order to qualify as performance-based compensation, payments must generally be formulaic, resulting in a loss of

15

flexibility. Therefore, our Committee may provide compensation to our executive officers that may not be deductible in order to compensate executive officers in a manner commensurate with performance and the competitive environment for executive talent. The Committee also desires to maintain the flexibility to provide compensation that the Committee believes more accurately reflects all of the subjective and objective factors that determine an executive’s level of success and deliver value to our shareholders.

Base Salary

Base salary is the most basic form of compensation and is integral to any competitive employment arrangement. The Committee establishes the base salary for our Chief Executive Officer and our other executive officers each year. In setting the base salaries for 2009, the Committee considered the relative importance of each executive officer’s position; the officer’s individual performance and contributions to Gentiva; the officer’s leadership contribution; and the recommendations of Mr. Strange, our Chief Executive Officer beginning January 1, 2009, for the base salaries of officers other than himself and Mr. Malone.

As noted above, the Committee also reviewed historical compensation information for each of the executive officers as part of its analysis in setting base salaries. The Committee used this information to review the historical progression of each executive officer’s compensation and to identify variations in compensation levels among the executive officers. The Committee also considered information provided by its independent compensation consultant, including competitive market data from the peer group. In addition, in analyzing base salary levels, the Committee took into account the fact that we do not provide pension or other supplemental executive retirement plan benefits to our executive officers.

Each of Messrs. Strange, Potapchuk, Paige and Camperlengo and Dr. Weaver received increases effective January 1, 2009 based on the review discussed above. In its consideration of individual performance, the Committee particularly recognized the efforts of the named executive officers in supporting and fostering our corporate culture and an appropriate “tone at the top.” As discussed in more detail below, the increase in base salary for Mr. Strange for 2009 also reflected his expanded role and responsibilities as a result of his promotion to Chief Executive Officer. Mr. Malone’s base salary did not change in 2009, in accordance with the compensation agreed to under his employment agreement, which reflected our expectation that he would continue to serve as an executive Chairman of the Board of Directors even if he was no longer Chief Executive Officer. The base salaries for the named executive officers for 2009, as well as the year-over-year percentage increase, were as follows:

| | | | | | | | | |

Named Executive Officer | | 2009 Base Salary | �� | 2008 Base Salary | | Percentage Increase | |

Ronald Malone | | $ | 750,000 | | $ | 750,000 | | 0.0 | % |

Tony Strange | | $ | 625,000 | | $ | 500,000 | | 25.0 | % |

John Potapchuk | | $ | 416,000 | | $ | 400,000 | | 4.0 | % |

Stephen Paige | | $ | 375,000 | | $ | 360,000 | | 4.2 | % |

Charlotte Weaver | | $ | 255,000 | | $ | 240,000 | | 6.3 | % |

John Camperlengo | | $ | 240,000 | | $ | 230,000 | | 4.3 | % |

Annual Incentive Compensation

Under our compensation program, an important part of each executive officer’s annual cash compensation is provided under our Executive Officers Bonus Plan, and therefore is dependent on achievement of both corporate performance goals and individually tailored performance goals. Corporate performance goals are based on performance criteria included in the Executive Officers Bonus Plan. We believe that this program is part of the basic package provided by companies with whom we compete for executive talent, and thus helps us remain competitive. At the same time, we believe our program motivates our executive officers to meet our objectives and focus on our priorities and core values.

16

Early in each year, based in part on the recommendations from our Chief Executive Officer, the Committee establishes corporate performance goals and individual performance goals for each executive officer, as well as a weighting for each of the goals. The Committee also establishes a target level bonus amount for each executive officer as a percentage of base salary, which is used at the end of the year as the base point for determining any actual bonus payments. In setting the target bonus amounts for 2009, the Committee considered information provided by its independent compensation consultant showing comparable information from the peer group data mentioned above. The target bonus amounts and performance goals for 2009 are described below and in the narrative following the Summary Compensation Table.

For 2009, the Committee set Mr. Malone’s target bonus amount at 100% of base salary, the target bonus level provided under his employment agreement, which is described under the caption “Executive Agreements” below. As discussed in more detail below, the Committee increased Mr. Strange’s target bonus amount in 2009 from 70% to 100% of base salary, taking into account his promotion to Chief Executive Officer as of January 1, 2009, and the corresponding expansion in his responsibilities. The Committee set the target bonus amounts for our other named executive officers after considering recommendations provided by Mr. Strange and the peer group data mentioned above. The target awards for these executives were set at 60% for Mr. Potapchuk and 50% for each of Dr. Weaver and Messrs. Paige and Camperlengo, the same percentages of base salary that were used in 2008. In setting the target levels for the named executive officers, the Committee believed that the 2008 percentages were still appropriate for the executives other than Mr. Strange, particularly in light of the fact that their roles in 2009 were generally the same. The Committee also believes that these levels of annual incentive awards are consistent with the market and provide internal consistency among our executive officers based on their levels of responsibility and contributions to our success.

The actual amount payable for annual bonuses is determined by the Committee after the end of our fiscal year, based on the extent to which performance goals were met or exceeded. For 2009, the Committee set corporate goals that were based on designated categories of growth in net revenues, operating profit margin and operating profit, as well as employee retention goals included in our 2009 business plan. The Committee selected financial goals that reflect key components of our corporate financial performance, to provide added incentives for achievement that benefits our Company and ultimately our shareholders. The Committee selected the retention goals in recognition of their important linkage to quality clinical outcomes for the patients we serve, recognizing both the high cost of employee turnover and the benefits of employee continuity in supporting and providing patient care. In addition, the quantitative measures selected by the Committee reflect the high standards that Gentiva sets for itself in its business plan.

17

Executive Chairman and Chief Executive Officer

The Committee set the following target performance levels for the 2009 corporate goals for Mr. Malone and Mr. Strange:

| | | | | | | | | | |

2009 Corporate Financial Goals and Results | |

Goal

| | Weight of Goals | | | Target

Performance Level | | Actual Results | | Contribution to

Incentive Performance | |

Growth in net revenues(1): | | 30.0 | % | | 12.6% - 12.8% | | 16.2% | | 44.2 | %(2) |

Operating profit(3) margin: | | 16.7 | % | | 10.2% - 10.4% | | 11.0% | | 26.7 | %(4) |

Operating profit(3): | | 33.3 | % | | $113.8 million | | $126.2 million | | 108.3 | %(5) |

| | | | | | | | | | |

Subtotal | | 80.0 | % | | | | | | 179.2 | % |

| | | | | | | | | | | | |

2009 Corporate Retention Goals and Results | |

Goal | | Weight of Goals | | | Target

Performance Level | | | Actual Results | | | Contribution to

Incentive Performance | |

Retention of administrative employees: | | 6.7 | % | | 80.0 | % | | 86.8 | % | | 9.2 | %(6) |

Retention of sales staff: | | 6.7 | % | | 75.0 | % | | 76.9 | % | | 9.2 | %(7) |

Retention of field staff(8): | | 6.7 | % | | 78.5 | % | | 78.8 | % | | 6.7 | %(9) |

| | | | | | | | | | | | |

Subtotal | | 20.1 | % | | | | | | | | 25.1 | % |

| | | | | | | | | | | | |

Total(10) | | 100 | % | | | | | | | | 204 | % |

| | | | | | | | | | | | |

| (1) | The Committee determined when it set the goals that annual net revenues would be calculated by excluding all items determined to be extraordinary in nature, 2009 acquisitions, discontinued business segments and items related to a change in accounting principle during fiscal 2009. |

| (2) | Contribution to Incentive Performance is based on pre-approved formula of adding 0.83% for each 0.2% over the 12.8% Target Performance Level. |

| (3) | For purposes of setting this corporate goal, operating profit is defined as EBITDA (earnings before interest, taxes, depreciation and amortization) adjusted to exclude: items of gain, loss or expense for fiscal 2009 determined to be extraordinary in nature or related to the disposal of a business segment or related to a change in accounting principle; items of gain, loss or expense for fiscal 2009 related to discontinued operations; and profit or loss attributable to acquisitions during fiscal 2009. |

| (4) | Contribution to Incentive Performance is based on pre-approved formula of adding 3.3% for each 0.2% of operating profit margin over the 10.4% Target Performance Level. |

| (5) | Contribution to Incentive Performance is based on pre-approved formula of adding 2.5% for each whole $500,000 of Operating Profit earned between $113,800,000 and $116,800,000 and an additional 3.3% for each whole $500,000 of Operating Profit earned over $116,800,000. |

| (6) | Contribution to Incentive Performance is based on a pre-approved matrix retention rate for administrative employees greater than 81.1%. |

| (7) | Contribution to Incentive Performance is based on a pre-approved matrix retention rate for sales staff greater than 76%. |

| (8) | Field staff includes nurses, therapists and other clinicians. |

| (9) | Contribution to Incentive Performance is based on a pre-approved matrix retention rate for field staff greater than 78.5% but less than 79.5%. |

| (10) | Totals are rounded to a full percentage point for presentation purposes. |

The annual bonus award for each of Messrs. Malone and Strange was structured, in part, to comply with the requirements of Section 162(m) of the Internal Revenue Code. As a result, the calculation of their bonus awards was based on the level of achievement of the corporate goals as set forth in the above table. The Committee retained discretion to reduce the amount of the award taking into account the achievement of their respective individual goals, as discussed below. The Committee also retained the authority to make a bonus award that does

18

not comply with Section 162(m) if necessary to provide the flexibility to meet our overall compensation and corporate objectives. To the extent that any portion of Mr. Malone’s annual bonus award would not otherwise be deductible by Gentiva under Section 162(m), Mr. Malone must defer payment of that portion in accordance with the terms of his employment agreement. Mr. Malone was not required to defer any portions of his annual bonus for the 2009 fiscal year.

Mr. Malone and Mr. Strange made recommendations to the Committee regarding their individual goals, which were then reviewed and approved by the Committee. The individual goals were based on subjective and objective criteria that were intended to support the corporate financial and retention goals as well as our business plan and strategic focus for the year. The individual goals were based on the following:

| | |

Ronald A. Malone: | | • Effectively represent Gentiva to industry groups, legislators, regulators and other policy makers • Support the acquisition and integration process • Enhance Board of Directors meeting preparation and communications • Enhance development of the Chief Executive Officer and assist him with special projects |

| |

Tony Strange: | | • Plan and implement technology initiatives to support the business • Implement sales growth strategy • Implement acquisition strategy • Enhance clinical delivery system • Consolidate all corporate functions in Atlanta • Set and communicate the proper cultural and behavioral tone at the top • Succession planning for certain executive officer positions • Establish 2010 growth plan • Regular and effective communication with the Board and its committee |

At its meeting on February 25, 2010, the Committee evaluated corporate and individual performance for 2009. The Committee received a written presentation from Mr. Malone and a written and oral presentation from Mr. Strange regarding a self-assessment of their own performance and level of achievement for 2009. In making the award determination, the Committee first reviewed the high level of achievement of the corporate goals as set forth in the above table. The Committee quantitatively determined that the overall weighted average achievement of the corporate goals was 204% of the target levels as also set forth in the above table.

As previously discussed, in order to meet the requirements of Section 162(m), the Committee set the actual bonus award for Messrs. Malone and Strange by starting with the level of achievement of the corporate goals and then exercising negative discretion based on the Committee’s assessment of the achievement of their respective individual goals. The Committee granted Mr. Strange an annual bonus award equal to 200% of his target amount. Because Mr. Strange’s target bonus was 100% of his base salary, 200% is the maximum amount permitted under the Executive Officers Bonus Plan. In making its determination, the Committee noted Mr. Strange’s leadership in repositioning Gentiva as a home health and hospice company as well as the extraordinary financial performance of the Company during his first year as Chief Executive Officer.The Committee granted Mr. Malone an annual bonus award equal to 167% of his target amount, which was identical to the cash amount awarded to Mr. Strange. This determination was based on the Committee’s evaluation of Mr. Malone’s achievement of the corporate goals tempered by his employment agreement, changing job responsibilities and internal equity with the Chief Executive Officer of the Company.

19

Other Named Executive Officers

The Committee set the following target performance levels for the 2009 corporate and individual goals for Dr. Weaver and Messrs. Potapchuk, Paige and Camperlengo:

| | | | | | | | | | |

2009 Corporate Financial Goals and Results | |

Goal | | Weight of Goals | | | Target Performance Level | | Actual Results | | Contribution to

Incentive Performance | |

Growth in net revenues(1): | | 18.0 | % | | 12.6% - 12.8% | | 16.2% | | 26.5 | %(2) |

Operating profit(3) margin: | | 10.0 | % | | 10.2% - 10.4% | | 11.0% | | 16.0 | %(4) |

Operating profit(3): | | 20.0 | % | | $113.8 million | | $126.2 million | | 65.0 | %(5) |

| | | | | | | | | | |

Subtotal | | 48.0 | % | | | | | | 107.5 | % |

| | | | | | | | | | | | |

2009 Corporate Retention Goals and Results | |

Goal | | Weight of Goals | | | Target

Performance Level | | | Actual Results | | | Contribution to

Incentive Performance | |

Retention of administrative employees: | | 4.0 | % | | 80.0 | % | | 86.8 | % | | 5.5 | %(6) |

Retention of sales staff: | | 4.0 | % | | 75.0 | % | | 76.9 | % | | 5.5 | %(7) |

Retention of field staff(8): | | 4.0 | % | | 78.5 | % | | 78.8 | % | | 4.0 | %(9) |

| | | | | | | | | | | | |

Subtotal | | 12.0 | % | | | | | | | | 15.0 | % |

| | | | | | | | | | | | |

2009 Individual Goals and Results | |

Goal | | Weight of Goals | | | Target

Performance Level | | | Actual Results | | | Contribution to

Incentive Performance | |

Individual Goals | | 40.0 | % | | 40.0 | % | | 80.0 | %(10) | | 80.0 | %(10) |

| | | | | | | | | | | | |

Subtotal | | 40.0 | % | | | | | | | | 80.0 | % |

| | | | | | | | | | | | |

Total(11) | | 100 | % | | | | | | | | 202 | % |

| | | | | | | | | | | | |